Form 10-K: 0001493152-23-010029 compared to 0001493152-22-007862

0001713210

false

FY

Yes

Yes

P2Y

P2Y

0001713210

20212022-01-01

20212022-12-31

0001713210

20212022-06-30

0001713210

2022-03-232023-03-23

0001713210

2022-12-31

0001713210

2021-12-31

0001713210

2020-12-31

0001713210

20202021-01-01

2020-12-31

0001713210

us-gaap:CommonStockMember

2019-12-31

0001713210

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001713210

us-gaap:RetainedEarningsMember

2019-12-31

0001713210

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-12-31

0001713210

us-gaap:NoncontrollingInterestMember

2019-12-31

0001713210

2019-12-312021-12-31

0001713210

us-gaap:CommonStockMember

2020-12-31

0001713210

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001713210

us-gaap:RetainedEarningsMember

2020-12-31

0001713210

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0001713210

us-gaap:NoncontrollingInterestMember

2020-12-31

0001713210

2020-12-31

0001713210

us-gaap:CommonStockMember

2020-01-01

2020-12-312021-12-31

0001713210

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-312021-12-31

0001713210

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-312021-12-31

0001713210

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-01-01

2020-12-312021-12-31

0001713210

us-gaap:NoncontrollingInterestMember

2020-01-01

2020-12-312021-12-31

0001713210

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001713210

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001713210

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001713210

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-01-01

2021-12-31

0001713210

us-gaap:NoncontrollingInterestMember

2021-01-01

2021-12-31

0001713210

us-gaap:CommonStockMember

20212022-01-01

2022-12-31

0001713210

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001713210

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001713210

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001713210

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-12-31

0001713210

us-gaap:CommonStockMember

2022-12-31

0001713210

us-gaap:AdditionalPaidInCapitalMember

20212022-12-31

0001713210

us-gaap:RetainedEarningsMember

20212022-12-31

0001713210

us-gaap:AccumulatedOtherComprehensiveIncomeMember

20212022-12-31

0001713210

us-gaap:NoncontrollingInterestMember

20212022-12-31

0001713210

AATP:AgapeATPInternationalHoldingLimitedMember

20212022-12-31

0001713210

AATP:ShareExchangeAgreementMember

AATP:MrHowKokChoongMember

2020-05-07

2020-05-08

0001713210

AATP:SubsidiaryCompanyTwoMember

2020-05-08

0001713210

AATP:SubsidiaryCompanyFiveMember

2021-11-11

0001713210

AATP:ShareExchangeAgreementMember

AATP:MrHowKokChoongMember

2020-05-08

0001713210

AATP:SubsidiaryCompanyMember

20212022-01-01

20212022-12-31

0001713210

AATP:SubsidiaryCompanyMember

20212022-12-31

0001713210

AATP:SubsidiaryCompanyOneMember

20212022-01-01

20212022-12-31

0001713210

AATP:SubsidiaryCompanyOneMember

20212022-12-31

0001713210

AATP:SubsidiaryCompanyTwoMember

20212022-01-01

20212022-12-31

0001713210

AATP:SubsidiaryCompanyTwoMember

20212022-12-31

0001713210

AATP:SubsidiaryCompanyThreeMember

20212022-01-01

20212022-12-31

0001713210

AATP:SubsidiaryCompanyFourMember

20212022-01-01

20212022-12-31

0001713210

AATP:SubsidiaryCompanyFourMember

20212022-12-31

0001713210

AATP:SubsidiaryCompanyFiveMember

20212022-01-01

20212022-12-31

0001713210

AATP:SubsidiaryCompanyFiveMember

20212022-12-31

0001713210

AATP:HealthAndWellnessProductsMemberHealthAndWellnessServicesMember

20212022-01-01

20212022-12-31

0001713210

AATP:HealthAndWellnessServicesMember

2021-01-01

2021-12-31

0001713210

AATP:HealthAndWellnessServicesMemberus-gaap:ShippingAndHandlingMember

20202022-01-01

20202022-12-31

0001713210

us-gaap:ShippingAndHandlingMember

2021-01-01

2021-12-31

0001713210

us-gaap:ShippingAndHandlingMember

2020-01-01

2020-12-31

0001713210

AATP:SocialSecurityOrganizationMember

2021-01-01

2021-12-31

0001713210

AATP:SocialSecurityOrganizationMember

AATP:MYRCurrencyMember

2020-01-01

20202022-01-01

2022-12-31

0001713210

AATP:EmployeesProvidentFundMember

srt:MinimumMember

2021-01-01

20212022-01-01

2022-12-31

0001713210

AATP:EmployeesProvidentFundMember

srt:MaximumMember

2022-01-01

2022-12-31

0001713210

AATP:EmploymentInsuranceSystemMember

2021-01-01

2021-12-31

0001713210

AATP:EmploymentInsuranceSystemMember

AATP:MYRCurrencyMember

2021-01-01

20212022-01-01

2022-12-31

0001713210

AATP:HumanResourceDevelopmentFundMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:ComputerEquipmentMember

srt:MinimumMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:ComputerEquipmentMember

srt:MaximumMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:FurnitureAndFixturesMember

srt:MinimumMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:FurnitureAndFixturesMember

srt:MaximumMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:LeaseholdImprovementsMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:VehiclesMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:ComputerSoftwareIntangibleAssetMember

2021-01-01

20212022-01-01

2022-12-31

0001713210

AATP:SurvivorSelectMember

2022-01-01

2022-12-31

0001713210

AATP:SurvivorSelectMember

2021-01-01

2021-12-31

0001713210

AATP:SurvivorSelectMemberEnergizedMineralConcentrateMember

20202022-01-01

20202022-12-31

0001713210

AATP:EnergizedMineralConcentrateMember

2021-01-01

2021-12-31

0001713210

AATP:EnergizedMineralConcentrateMemberIonizedCalMagMember

20202022-01-01

20202022-12-31

0001713210

AATP:IonizedCalMagMember

2021-01-01

2021-12-31

0001713210

AATP:IonizedCalMagMemberOmegaBlendMember

20202022-01-01

20202022-12-31

0001713210

AATP:OmegaBlendMember

2021-01-01

2021-12-31

0001713210

AATP:OmegaBlendMemberBetaMaxxMember

20202022-01-01

20202022-12-31

0001713210

AATP:BetaMaxxMember

2021-01-01

2021-12-31

0001713210

AATP:BetaMaxxMemberVegeFruitFiberMember

20202022-01-01

20202022-12-31

0001713210

AATP:VegeFruitFiberMember

2021-01-01

2021-12-31

0001713210

AATP:VegeFruitFiberMemberIronMember

20202022-01-01

20202022-12-31

0001713210

AATP:IronMember

2021-01-01

2021-12-31

0001713210

AATP:IronMemberYoungFormulaMember

20202022-01-01

20202022-12-31

0001713210

AATP:YoungFormulaMember

2021-01-01

2021-12-31

0001713210

AATP:YoungFormulaMemberOrganicYouthCarCleansingBarMember

20202022-01-01

20202022-12-31

0001713210

AATP:OrganicYouthCareCleansingBarMemberOrganicYouthCarCleansingBarMember

2021-01-01

2021-12-31

0001713210

AATP:OrganicYouthCareCleansingBarMemberATPRMITOPlusMember

20202022-01-01

20202022-12-31

0001713210

AATP:MitogizeMemberATPRMITOPlusMember

2021-01-01

2021-12-31

0001713210

AATP:MitogizeMemberLipomaskMember

20202022-01-01

20202022-12-31

0001713210

AATP:NoOneMEDMemberLipomaskMember

2021-01-01

2021-12-31

0001713210

AATP:NoOneMEDMemberEnergetiqueMember

20202022-01-01

20202022-12-31

0001713210

AATP:EnergetiqueMember

2021-01-01

2021-12-31

0001713210

AATP:EnergetiqueMemberTrimPlusMember

20202022-01-01

20202022-12-31

0001713210

AATP:TrimPlusMember

2021-01-01

2021-12-31

0001713210

AATP:TrimPlusMemberProductHealthTherapiesMember

2020-01-01

20202022-01-01

2022-12-31

0001713210

AATP:ProductHealthTherapiesMember

2021-01-01

2021-12-31

0001713210

AATP:OthersMember

2022-01-01

2022-12-31

0001713210

AATP:OthersMember

2021-01-01

2021-12-31

0001713210

us-gaap:ProductMember

2022-01-01

2022-12-31

0001713210

us-gaap:ProductMember

2021-01-01

2021-12-31

0001713210

us-gaap:ProductMemberAATP:PeriodEndMYRMember

2020-01-01

2020-12-312022-12-31

0001713210

AATP:PeriodEndMYRMember

2021-12-31

0001713210

AATP:PeriodEndMYRMemberPeriodEndHKDMember

20202022-12-31

0001713210

AATP:PeriodEndHKDMember

2021-12-31

0001713210

AATP:PeriodEndHKDMemberPeriodAverageMYRMember

2020-12-312022-01-01

2022-12-31

0001713210

AATP:PeriodAverageMYRMember

2021-01-01

2021-12-31

0001713210

AATP:PeriodAverageMYRMemberPeriodAverageHKDMember

20202022-01-01

20202022-12-31

0001713210

AATP:PeriodAverageHKDMember

2021-01-01

2021-12-31

0001713210

AATP:PeriodAverageHKDMemberSubsidiaryCompanyThreeMember

2020-01-01

2020-12-312022-12-31

0001713210

AATP:SubsidiaryCompanyThreeMemberus-gaap:VariableIncomeInterestRateMember

20212022-12-31

0001713210

us-gaap:VariableIncomeInterestRateMember

2021-12-31

0001713210

us-gaap:VariableIncomeInterestRateMember

2020-12-312022-01-01

2022-12-31

0001713210

us-gaap:VariableIncomeInterestRateMember

2021-01-01

2021-12-31

0001713210

us-gaap:VariableIncomeInterestRateMember

2020-01-01

2020-12-31

0001713210

AATP:ShareExchangeAgreementMember

AATP:MrHowKokChoongMember

AATP:AgapeSuperiorLivingSdnBhdMember

2020-05-08

0001713210

AATP:ShareExchangeAgreementMember

AATP:MrHowKokChoongMember

AATP:AgapeSuperiorLivingSdnBhdMember

2020-06-29

2020-07-02

0001713210

AATP:ShareExchangeAgreementMember

AATP:MrHowKokChoongMember

AATP:AgapeSuperiorLivingSdnBhdMember

2020-01-01

2020-03-31

0001713210

AATP:ShareExchangeAgreementMember

AATP:MrHowKokChoongMember

AATP:AgapeSuperiorLivingSdnBhdMember

2020-03-31

0001713210

AATP:MrHowKokChoongMember

2020-03-31

0001713210

AATP:ShareExchangeAgreementMember

AATP:MrHowKokChoongMember

AATP:AgapeSuperiorLivingSdnBhdMember

2020-01-01

2020-12-31

0001713210

srt:MinimumMember

2021srt:MinimumMember

2022-12-31

0001713210

srt:MaximumMember

20212022-12-31

0001713210

AATP:ComputerAndOfficeEquipmentMember

2022-12-31

0001713210

AATP:ComputerAndOfficeEquipmentMember

2021-12-31

0001713210

AATP:ComputerAndOfficeEquipmentMemberus-gaap:FurnitureAndFixturesMember

20202022-12-31

0001713210

us-gaap:FurnitureAndFixturesMember

2021-12-31

0001713210

us-gaap:FurnitureAndFixturesMemberLeaseholdImprovementsMember

20202022-12-31

0001713210

us-gaap:LeaseholdImprovementsMember

2021-12-31

0001713210

us-gaap:LeaseholdImprovementsMemberAATP:VehicleMember

20202022-12-31

0001713210

AATP:VehicleMember

2021-12-31

0001713210

AATP:VehicleMember

2020-12-31

0001713210

AATP:GreenproCapitalCorpMember

2018-05-17

0001713210

AATP:GreenproCapitalCorpMember

2018-07-30

0001713210

AATP:GreenproCapitalCorpMember

2018-10-16

0001713210

2022-07-18

2022-07-19

0001713210

AATP:GreenproCapitalCorpMember

2022-12-31

0001713210

AATP:GreenproCapitalCorpMember

2022-07-19

0001713210

AATP:DSwissIncMember

2020-11-03

0001713210

AATP:DSwissIncMember

2020-12-09

0001713210

AATP:SEATechVenturesCorpMember

2021-09-27

0001713210

srt:DirectorMember

2021-12-31

0001713210

srt:MaximumMember

2019-03-10

0001713210

srt:MinimumMember

2019-03-10

0001713210

AATP:MrHowKokChoongMember

2021-12-31

0001713210

AATP:UnreservedSdnBhdMember

2020-03-03

0001713210

AATP:MrHowKokChoongMember

2019-12-31

0001713210

2020-01-01

2020-03-31

0001713210

AATP:MrHowKokChoongMember

2020-03-31

0001713210

AATP:PhoenixPlusCorpMember

2019-04-03

0001713210

us-gaap:CommonStockMember

AATP:PhoenixPlusCorpMember

2019-04-03

0001713210

AATP:DirectorsOfUnreservedInvestmentMemberus-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2021-12-3105-18

2023-03-09

0001713210

AATP:DirectorsOfUnreservedInvestmentMemberPhoenixPlusCorpMember

20202022-12-31

0001713210

AATP:PhoenixPlusCorpMember

2021-12-31

0001713210

AATP:PhoenixPlusCorpMember

2020-12-31TH3TechnologySdnBhdMember

2022-01-01

2022-12-31

0001713210

AATP:TH3TechnologySdnBhdMember

2021-01-01

2021-12-31

0001713210

AATP:TH3TechnologySdnBhdMember

2022-12-31

0001713210

AATP:TH3TechnologySdnBhdMember

2021-12-31

0001713210

AATP:DSYBeautySdnBhdMember

2022-01-01

2022-12-31

0001713210

AATP:DSYBeautySdnBhdMember

2021-01-01

2021-12-31

0001713210

AATP:DSYBeautySdnBhdMember

2022-12-31

0001713210

AATP:DSYBeautySdnBhdMember

2021-12-31

0001713210

AATP:AgapeATPAsiaLimitedMember

2022-01-01

2022-12-31

0001713210

AATP:AgapeATPAsiaLimitedMember

2021-01-01

2021-12-31

0001713210

AATP:AgapeATPAsiaLimitedMember

2020-01-01

2020-12-312022-12-31

0001713210

AATP:AgapeATPAsiaLimitedMember

2021-12-31

0001713210

AATP:AgapeATPAsiaLimitedMemberHostastaySdnBhdMember

2020-12-312022-01-01

2022-12-31

0001713210

AATP:HostastaySdnBhdMember

2021-01-01

2021-12-31

0001713210

AATP:HostastaySdnBhdMember

2020-01-01

2020-12-312022-12-31

0001713210

AATP:HostastaySdnBhdMember

2021-12-31

0001713210

AATP:HostastaySdnBhdMemberCTANutriceuticalsSdnBhdMember

2020-12-312022-01-01

2022-12-31

0001713210

AATP:THThreeTechnologySdnBhdMemberCTANutriceuticalsSdnBhdMember

2021-01-01

2021-12-31

0001713210

AATP:THThreeTechnologySdnBhdMemberCTANutriceuticalsSdnBhdMember

2020-01-01

2020-12-312022-12-31

0001713210

AATP:THThreeTechnologySdnBhdMemberCTANutriceuticalsSdnBhdMember

2021-12-31

0001713210

AATP:THThreeTechnologySdnBhdMember

2020-12-31

0001713210

AATP:AgapeSuperiorLivingPtyLtdMemberCTANutriceuticalsAsiaSdnBhdOneMember

20202022-01-01

20202022-12-31

0001713210

AATP:AgapeSuperiorLivingPtyLtdMember

2021-12-31

0001713210

AATP:AgapeSuperiorLivingPtyLtdMember

2020-12-31

0001713210

AATP:AgapeSuperiorLivingPtyLtdASLPLMemberCTANutriceuticalsAsiaSdnBhdOneMember

2021-01-01

2021-12-31

0001713210

AATP:AgapeSuperiorLivingPtyLtdASLPLMember

2020CTANutriceuticalsAsiaSdnBhdOneMember

2022-12-31

0001713210

AATP:CTANutriceuticalsAsiaSdnBhdOneMember

2021-12-31

0001713210

AATP:DSYBeautySdnBhdOneMember

2022-01-01

20202022-12-31

0001713210

AATP:VettonsSdnBhdOneMemberDSYBeautySdnBhdOneMember

2021-01-01

2021-12-31

0001713210

AATP:VettonsSdnBhdOneMemberDSYBeautySdnBhdOneMember

2020-01-01

2020-12-312022-12-31

0001713210

AATP:HostastaySdnBhdOneMemberDSYBeautySdnBhdOneMember

2021-12-31

0001713210

AATP:HowKokChoongMember

20202022-01-01

20202022-12-31

0001713210

AATP:HowKokChoongMember

2021-01-01

2021-12-31

0001713210

srt:ChiefExecutiveOfficerMemberAATP:HowKokChoongMember

2022-12-31

0001713210

AATP:HowKokChoongMember

2021-12-31

0001713210

AATP:DSYWellnessandLongevityCenterSdnBhdTwoMember

2022-01-01

2022-12-31

0001713210

AATP:DSYWellnessandLongevityCenterSdnBhdTwoMember

2021-01-01

2021-12-31

0001713210

AATP:HostastaySdnBhdHostastayMember

2021-01-01

2021-12-31

0001713210

AATP:HostastaySdnBhdHostastayMember

2022-01-01

2022-12-31

0001713210

AATP:CTANutriceuticalsAsiaSdnBhdMember

2022-01-01

2022-12-31

0001713210

AATP:CTANutriceuticalsAsiaSdnBhdMember

2021-01-01

2021-12-31

0001713210

AATP:DSYWellnessAndLongevityCenterSdnBhdMember

srt:ChiefExecutiveOfficerMember

20202022-01-01

20202022-12-31

0001713210

AATP:DSYWellnessAndLongevityCenterSdnBhdMember

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-12-31

0001713210

AATP:DSYWellnessAndLongevityCenterSdnBhdMember

20202022-01-01

20202022-12-31

0001713210

AATP:DSYWellnessAndLongevityCenterSdnBhdMember

2021-01-01

2021-12-31

0001713210

AATP:AgapeSuperiorLivingPtyLtdASLPLMemberHowKokChoongMember

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-12-31

0001713210

AATP:HowKokChoongMember

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-12-31

0001713210

AATP:AgapeSuperiorLivingPtyLtdASLPLMember

srt:ChiefExecutiveOfficerMemberRedboyPictureSdnBhdMember

20202022-01-01

20202022-12-31

0001713210

AATP:HowKokChoongMemberRedboyPictureSdnBhdMember

2021-01-01

2021-12-31

0001713210

AATP:HowKokChoongMemberDSYWellnessAndLongevityCenterSdnBhdThreeMember

20202022-01-01

20202022-12-31

0001713210

AATP:HostastaySdnBhdOneMember

2021-01-01

2021-12-31

0001713210

AATP:HostastaySdnBhdOneMember

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-12-31

0001713210

AATP:HostastaySdnBhdOneMember

srt:ChiefExecutiveOfficerMember

2020-01-01

2020-12-31

0001713210

AATP:AgapeSuperiorLivingMember

2020-05-01

2020-05-31

0001713210

AATP:AgapeSuperiorLivingMember

2021-06-30

0001713210

AATP:AgapeSuperiorLivingMember

2021-01-01

2021-06-30

0001713210

AATP:AgapeSuperiorLivingMember

2020-06-29

2020-07DSYWellnessAndLongevityCenterSdnBhdThreeMember

2021-01-01

2021-12-31

0001713210

AATP:ShareForfeitureAgreementsMember

AATP:HowKokChoongTalentLimitedMember

2021-01-01

2021-12-31

0001713210

AATP:ShareForfeitureAgreementsMember

AATP:HowKokChoongTalentLimitedMember

AATP:ShareholdersMember

2021-01-01

2021-12-31

0001713210

AATP:ShareForfeitureAgreementsMember

AATP:HKCHoldingsSdnBhdMember

2021-01-01

2021-12-31

0001713210

AATP:ShareForfeitureAgreementsMember

2021-01-01

2021-12-31

0001713210

AATP:ShareForfeitureAgreementsMember

AATP:HowKokChoongTalentLimitedMember

2022-01-01

2022-12-31

0001713210

AATP:ShareForfeitureAgreementsMember

2022-01-01

2022-12-31

0001713210

country:MY

2022-01-01

2022-12-31

0001713210

country:MY

2021-01-01

2021-12-31

0001713210

country:MYHK

20202022-01-01

20202022-12-31

0001713210

country:HK

2021-01-01

2021-12-31

0001713210

country:HK

2020-01-01

2020-12-31

0001713210

us-gaap:StateAndLocalJurisdictionMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:ForeignCountryMember

20212022-01-01

20212022-12-31

0001713210

us-gaap:DomesticCountryMembercountry:US

2021-01-01

2021-12-312022-12-31

0001713210

country:US

2021-12-31

0001713210

country:USus-gaap:DomesticCountryMember

2020-12-312021-01-01

2021-12-31

0001713210

AATP:LabuanMember

2018-12-28

2019-01-02

0001713210

country:MY

20212022-12-31

0001713210

country:MY

2020-12-31

0001713210

AATP:UnutilizedMember

2021-12-31

0001713210

AATP:UnutilizedMemberTwoThousandTwentyEightMember

2020-12-312022-12-31

0001713210

AATP:TwoThousandTwentyNineMember

2022-12-31

0001713210

AATP:TwoThousandThirtyMember

2022-12-31

0001713210

AATP:AATPLBASLSEAAndWATPMember

2022-01-01

2022-12-31

0001713210

AATP:AATPHKMember

2021-01-01

2021-12-31

0001713210

AATP:AATPLBASLSEAWATPAndDSYMember

2021-01-01

2021-12-31

0001713210

AATP:AATPHKMemberNoCustomerMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2020-01-01

2020-12-31

0001713210

AATP:AATPLBASLSEAAndWATPMember

2020-01-01

20202022-01-01

2022-12-31

0001713210

AATP:NoCustomerMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2021-01-01

2021-12-31

0001713210

AATP:NoCustomerMember

us-gaap:RevenueFromContractWithCustomerMemberus-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

AATP:FiveIndividualCustomersMember

20202022-01-01

20202022-12-31

0001713210

us-gaap:AccountsReceivableMember

AATP:ECommerceCompanyMemberAATP:VendorOneMember

us-gaap:CustomerConcentrationRiskMemberCostOfGoodsTotalMember

AATP:VendorOneMemberus-gaap:SupplierConcentrationRiskMember

2020-01-01

20202022-01-01

2022-12-31

0001713210

AATP:VendorTwoMember

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

2022-01-01

2022-12-31

0001713210

AATP:VendorThreeMember

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

2022-01-01

2022-12-31

0001713210

AATP:VendorOneMember

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

2021-01-01

2021-12-31

0001713210

AATP:VendorTwoMember

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

2021-01-01

2021-12-31

0001713210

AATP:VendorOneMember

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

2020-01-01

2020-12-31

0001713210

AATP:VendorTwoMember

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

2020-01-01

2020-12-31

0001713210

AATP:DSwissIncMember

2020DSwissIncMember

2021-1201-01

20202021-12-31

0001713210

AATP:DSwissIncMember

20202021-1112-3031

0001713210

us-gaap:SupplierConcentrationRiskMember

us-gaap:CostOfGoodsTotalMember

AATP:VendorOneMember

AATP:DSwissIncMember

2022-01-01

2022-12-31

0001713210

us-gaap:SupplierConcentrationRiskMember

us-gaap:CostOfGoodsTotalMember

AATP:VendorOneMember

AATP:DSwissIncMember

2021-01-01

2021-12-31

0001713210

AATP:VendorOneMember

us-gaap:CostOfGoodsTotalMemberAccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

AATP:DSwissIncMember

2022-01-01

2022-12-31

0001713210

AATP:VendorTwoMember

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

2020-01-01

20202022-01-01

2022-12-31

0001713210

AATP:VendorThreeMember

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

2022-01-01

2022-12-31

0001713210

AATP:VendorMember

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

2022-01-01

2022-12-31

0001713210

us-gaap:SupplierConcentrationRiskMember

us-gaap:AccountsPayableMember

AATP:OneVendorMember

2021-01-01

20212022-01-01

2022-12-31

0001713210

us-gaap:SupplierConcentrationRiskMember

us-gaap:CostOfGoodsTotalMember

AATP:OneSalesDistributorMember

2022-01-01

2022-12-31

0001713210

us-gaap:SupplierConcentrationRiskMember

us-gaap:CostOfGoodsTotalMember

AATP:OneSalesDistributorMember

2021-01-01

2021-12-31

0001713210

us-gaap:SupplierConcentrationRiskMember

us-gaap:CostOfGoodsTotalMember

AATP:NoSalesDistributorMember

2020-01-01

2020-12-31

0001713210

AATP:AgapeSuperiorLivingMember

2020-04-01

0001713210

2021-05-30

2021-05-31

0001713210

AATP:TrainingCenterMember

2021-05-30

2021-05-31

0001713210

2021-05-31

0001713210

AATP:AgapeSuperiorLivingMember

2021-05-31

0001713210

AATP:AgapeSuperiorLivingMember

2021-10-01

0001713210

2021-1211-3101

0001713210

AATP:COVIDNineteenImpactMemberAgapeSuperiorLivingMember

2021-01-01

2021-12-31

0001713210

us-gaap:SubsequentEventMember

AATP:MrHowKokChoongMember

AATP:ShareForfeitureAgreementMember

2022-01-01

2022-01-202022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:MYR

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

The Fiscal Year Ended December 31, 20212022

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from _____________________________

Commission

File Number 333-220144

AGAPE

ATP CORPORATION

(Exact

name of registrant issuer as specified in its charter)

| Nevada |

|

36-4838886 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

1705

– 1708, Level 17, Tower 2, Faber Towers, Jalan Desa Bahagia,

Taman

Desa, 58100 Kuala Lumpur, Malaysia.

(Address

of principal executive offices, including zip code)

Registrant’s

phone number, including area code

(60)

192230099

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act:

Common

Stock, $0.0001 par value

(Title

of Class)

The

OTC Market – Pink Sheets

(Name

of exchange on which registered)

Securities

registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (section 232.405 of this chapter) during the preceding twelve months (or shorter period that the registrant was

required to submit and post such files). YES ☒ NO ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

Large

Accelerated Filer ☐ Accelerated Filer ☐ Non-accelerated Filer ☒ Smaller reporting company ☒

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Emerging

growth Company ☒☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The

aggregate market value of the Company’s common stock held by non-affiliates computed by reference to the closing bid price of the

Company’s common stock, as of the last business day of the registrant’s most recently completed second fiscal quarter:

$914293,950809,575710.

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

|

Outstanding

at March 23, 2023 |

| Common

Stock, $0.0001 par value |

|

75,452,012 |

AGAPE

ATP CORPORATION

FORM

10-K

For

the Fiscal Year Ended December 31, 20202022

Index

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather

are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,”

“intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these

words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are

subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause

actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| |

● |

The

availability and adequacy of our cash flow to meet our requirements; |

| |

|

|

| |

● |

Economic,

competitive, demographic, business and other conditions in our local and regional markets; |

| |

|

|

| |

● |

Changes

or developments in laws, regulations or taxes in our industry; |

| |

|

|

| |

● |

Actions

taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial

and other governmental authorities; |

| |

|

|

| |

● |

Competition

in our industry; |

| |

|

|

| |

● |

The

loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| |

|

|

| |

● |

Changes

in our business strategy, capital improvements or development plans; |

| |

|

|

| |

● |

The

availability of additional capital to support capital improvements and development; and |

| |

|

|

| |

● |

Other

risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This

report should be read completely and with the understanding that actual future results may be materially different from what we expect.

The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration

of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change

in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events

or otherwise.

Use

of Defined Terms

Except

as otherwise indicated by the context, references in this Report to:

| |

● |

The

“Company,” “we,” “us,” or “our,” “Agape” are references to Agape ATP

Corporation, a Nevada corporation. |

| |

|

|

| |

● |

“Common

Stock” refers to the common stock, par value $0.0001, of the Company; |

| |

|

|

| |

● |

“Malaysia”

is Malaysia; |

| |

|

|

| |

● |

“U.S.

dollar,” “$” and “US$” refer to the legal currency of the United States; |

| |

|

|

| |

● |

“RM”

and “Ringgit” are to the legal currency of Malaysia; |

| |

|

|

| |

● |

“Securities

Act” refers to the Securities Act of 1933, as amended; and |

| |

|

|

| |

● |

“Exchange

Act” refers to the Securities Exchange Act of 1934, as amended. |

PART

I

ITEM

1. BUSINESS

1.

ORGANIZATION AND BUSINESS BACKGROUND

Agape

ATP Corporation, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on June 1, 2016.

Agape

ATP Corporation operates through its subsidiaries, namely, Agape ATP Corporation (“AATP LB”), a company incorporated in Labuan,

Malaysia, and Agape Superior Living Sdn. Bhd. (“ASL”), a company incorporated in Malaysia. .

Agape

ATP Corporation, incorporated in Labuan, Malaysia, is an investment holding company with 100% equity interest in Agape ATP International

Holding Limited (“AATP HK”), a company incorporated in Hong Kong.

On

May 8, 2020, the Company entered into a Share Exchange Agreement with Mr. How Kok Choong, CEO and director of the Company to acquire

9,590,596 ordinary shares, no par value, equivalent to approximately 99.99% of the equity interest in Agape Superior Living Sdn. Bhd.,

a network marketing entity incorporated in Malaysia.

Agape

Superior Living Sdn. Bhd. is a limited company incorporated on August 8, 2003, under the laws of Malaysia.

On

September 11, 2020, the Company incorporated Wellness ATP International Holdings Sdn, Bhd. (“WATP”), a wholly owned subsidiary

under the laws of Malaysia, to pursue the business of promoting wellness and wellbeing lifestyle of the community by providing services

that includes online editorials, programs, events and campaigns on how to achieve positive wellness and lifestyle.

On

November 11, 2021, Agape ATP Corporation (Labuan) formed a joint-venture entity, DSY Wellness International Sdn. Bhd. (“DSY Wellness”)

with an independent third party which Agape ATP Corporation (Labuan) owns 60% of the equity interest, to pursue the business of providing

complementary health therapies.

The

Company and its subsidiaries are principally engaged in the Health and Wellness Industry. The principal activity of the Company is to

supply high-quality health and wellness products, including supplements to assist in cell metabolism, detoxification, blood circulation,

anti-aging and products designed to improve the overall health system of the human body and various wellness programs.

The

accompanying consolidated financial statements reflect the activities of the Company, AATP LB, AATP HK, WATP, ASL and its variable interest

entity (“VIE”), Agape S.E.A. Sdn. Bhd. (“SEA”) (See Note 3), and DSY Wellness.

Details

of the Company’s subsidiaries:

| | |

Subsidiary company name | |

Place and date of incorporation | |

Particulars of issued capital | |

Principal activities | |

Proportional of ownership interest and voting power held | |

| | |

| |

| |

| |

| |

| |

| 1. | |

Agape ATP Corporation | |

Labuan,

March 6, 2017 | |

100 shares of ordinary share of US$1 each | |

Investment holding | |

| 100 | % |

| | |

| |

| |

| |

| |

| | |

| 2. | |

Agape ATP International Holding Limited | |

Hong Kong,

June 1, 2017 | |

1,000,000 shares of ordinary share of HK$1 each | |

Wholesaling of health and wellness products; and health solution advisory services | |

| 100 | % |

| | |

| |

| |

| |

| |

| | |

| 3. | |

Agape Superior Living Sdn. Bhd. | |

Malaysia,

August 8, 2003 | |

9,590,598 shares of ordinary share of RM1 each | |

Health and wellness products and health solution advisory services via network marketing | |

| 99.99 | % |

| | |

| |

| |

| |

| |

| | |

| 4. | |

Agape S.E.A. Sdn. Bhd. | |

Malaysia,

March 4, 2004 | |

2 shares of ordinary share of RM1 each | |

VIE of Agape Superior Living Sdn. Bhd. | |

| VIE | |

| | |

| |

| |

| |

| |

| | |

| 5. | |

Wellness ATP International Holdings Sdn, Bhd | |

Malaysia,

September 11, 2020 | |

100 shares of ordinary share of RM1 each | |

The promotion of wellness and wellbeing lifestyle of the community by providing services that includes online editorials, programs, events and campaigns | |

| 100 | % |

| | |

| |

| |

| |

| |

| | |

| 6. | |

DSY Wellness International Sdn Bhd. | |

Malaysia,

November 11, 2021 | |

1,000 shares of ordinary share of RM1 each | |

Provision of complementary health therapies | |

| 60 | % |

Business

Overview

Agape

ATP Corporation isWe

are a company that providesprovider of health and wellness products and health solution advisory services to our clients. The Company

primarily focus its efforts on attracting customers in Malaysia. Its advisory services center on the “ATP Zeta Health Program”,

which is a health program designed to effectively prevent diseases caused by polluted environments, unhealthy dietary intake and unhealthy

lifestyles, and promotion of health. The program aims to promote improved health and longevity in our clients through a combination of

modern medicine, proper nutrition and advice from skilled nutritionists and/or dieticians.

In

order to strengthen the Company’s supply chain, on May 8, 2020, the Company has successfully acquired approximately 99.99% of ASL,

with the goal of securing an established network marketing sales channel that has been established in Malaysia for the past 15 years.

ASL has been offering the Company’s ATP Zeta Health Program as part of its product lineup. As such, the acquisition creates synergy

in the Company’s operation by boosting the Company’s retail and marketing capabilities. Theadvisory services in the Malaysian market. We newly acquired subsidiary allows

the Company to fulfill itspursue our mission of “helping people

to create health and wealth” by providing a financially rewarding business opportunity to distributors and quality products to distributors

and customers who seek a healthy lifestyle. We believe the quality of our products coupled with the effectiveness of our distribution

network have been the primary reasons for our success and will allow us to pursue future business expansion. In order to further our

supply chain, on May 8, 2020, we acquired 99.99% of Agape Superior Living Sdn Bhd, with the goal of securing an established network marketing

sales channel that has been in existence in Malaysia for the past 15 years. On September 11, 2020, the Company incorporated Wellness

ATP International Holdings Sdn. Bhd., a wholly owned subsidiary in Malaysia, with the aim to pursue the business of promoting wellness

and wellbeing lifestyle of the community through the provision of services including online editorials, programs, events and campaigns

on how to achieve positive wellness and lifestyle.

Via

ASL,On

September 15, 2020, Wellness ATP International Holdings Sdn. Bhd. entered into a business collaboration agreement with ASL the Company offers three series of programs which consist of different services andto carry out

certain wellness programs.

We

currently offer three series of products: ATP Zeta Health Program, ÉNERGÉTIQUE and BEAUNIQUE.

The Our ATP Zeta Health Program

is a health program designed to promote health and general wellbeing designed to prevent healthassist in the elimination of various diseases caused by polluted environmentsenvironmental pollutants, unhealthy dietary intake

and unhealthy lifestyles. The program aims to promote improved health and longevity through a combination of modern health supplements,

proper nutrition and advice from skilled dieticians as well as trained members and

distributors.

The. Our ÉNERGÉTIQUE series aims to provide a total dermal solution for a

healthy skin beginning from the cellular level. The series is comprised of the Energy Mask series, Hyaluronic Acid Serum and Mousse Facial

Cleanser.

The Our BEAUNIQUE product series focuses on the research of our diet’s impact on modifying gene expressions in order to address genetic

variations and deliver a personalized nutrigenomic solution for every individual.

The

Company deems creating public awareness on wellness and wellbeing lifestyle as essential to enhance the provision of its health solution

advisory services; and therefore, incorporated WATP. Upon its establishment, WATP started collaborating with ASL to carry out various

wellness programs.

To

further its reach in the Health and Wellness Industry, onOn

November 11, 2021, Agape ATP Corporation (Labuan) formed a joint-venture entity, DSY Wellness International Sdn. Bhd. (“DSY Wellness”)

with an independent third partyMr. Steve Yap, following which Agape ATP Corporation (Labuan) owns 60% of the equity interest, to pursue the business of providing

complementary health therapies. The establishment of DSY Wellness is a further expansion of our business into the health and wellness

industry. Mr. Steve Yap readily owns 33 proprietary formulas for treating non-communicable disease which he has agreed to bring into

the company for joint commercialization. Mr. Steve Yap also has existing clients receiving traditional complimentary medicine or “TCM”

in Indonesia and China.

Our

Products

Our

Products

We

offer three series of products: (i) ATP Zeta Health Program, (ii) ÉNERGÉTIQUE and (iii) BEAUNIQUE.

Our

ATP Zeta Health Program is a health program designed to promote health and general wellbeing, as well as to prevent diseases caused by

polluted environments, unhealthy dietary intake and unhealthy lifestyles. At its core, the ATP Zeta Super Health Program is focused upon

biological energy, Adenosine Triphosphate (ATP), at the cellular level. The stimulation of ATP production at the cellular level can increase

an individual’s metabolic rate in order to promote and maintain normal and healthy functioning of the body’s systems. Our

program emphasizes nutrient absorption through the membrane ion channel in order to provide complete and balanced nutrients to improve

cellular health. Thus, ATP Zeta Super Health Program provides ionized and high zeta potential (high bioavailability) nutrients to enhance

the absorption at the cellular level.

Our

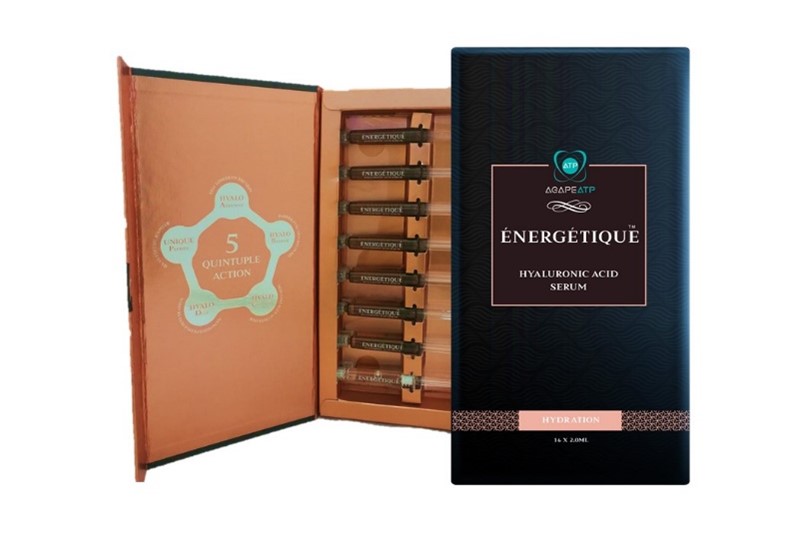

ÉNERGÉTIQUE product series is comprised of ÉNERGÉTIQUE Mask series, Hyaluronic Acid Serum and Mousse Facial

Cleanser.

The

ÉNERGÉTIQUE Mask series is formulated with triple action natural ingredients and advanced technology. The innovative combination

of award-winning patented liposome encapsulating the customized fast acting patented essence, produces micro-particle liposome which,

when combined with collagen peptide Tencel film, creates an effective formulation that benefits the skin at the cellular level. The ÉNERGÉTIQUE

series aims to provide a total dermal solution for healthy skin beginning at the cellular level. There are three types of face masks

in the ÉNERGÉTIQUE Mask Series, each addressing a specific skin condition. They are: N°1 Med-Hydration, N°2 Med-Whitening

and N°3 Med-Firming. Advanced genetic analysis and clinical trials conducted revealed the benefits and efficacy of the patented functional

essence. The ÉNERGÉTIQUE Mask Series has clinically shown deep penetration of liposomal essence into deep skin layers within

5 minutes application, in order to deliver immediate, deep-reaching and long-lasting benefits of skin hydration, whitening, and firming.

The

ÉNERGÉTIQUE Hyaluronic Acid Serum is formulated with four functional hyaluronic acid and a unique peptide. It is a scientifically

advanced and intensive quintuple action serum designed to promote skin hydration, reparation and regeneration to enhance skin viscoelasticity

for improved skin firmness.

The

ÉNERGÉTIQUE Mousse Facial Cleanser is formulated with the mildest surface-active agents available on the market. It takes

the form of a unique mousse like-foam that delivers a comfortable and soft feeling to the skin during and after use without compromising

the moisturizing level and viscoelastic properties of the skin. Its PH-balanced formula is suitable for all skin types for an effortless

cleansing routine.

Our

BEAUNIQUE product series focuses on the research of our diet’s impact on modifying gene expressions in order to address genetic

variations and deliver a personalized nutrigenomic solution for every individual.

ATP

Zeta Health Program

The

following is a list of our ATP Zeta Health Program products:

ATP1s

Survivor Select

ATP1s

Survivor Select contains various essential nutrients required by the human body to maintain the normal metabolism, which includes productions

of biological energy (ATP). Effective production of ATP enhances both physical as well as mental health, and helps the body to build

up resistance to diseases.

It

helps to

Benefits:

| |

● |

StimulateStimulates

instant bio-energy production at the cellular level to ensure sufficient supply of bio energy for body cell. |

| |

● |

PromotePromotes

better metabolism at the cellular level. |

| |

● |

PromotePromotes

healthy and optimal growth of bones system, teeth structure and muscle tissue of children. |

| |

● |

ImproveImproves

the digestion and nutrient absorption powers of body cell. |

| |

● |

PromotePromotes

cell detoxification and repair capabilities in order to enhance cell self-healing ability. |

ATP2

Energized Mineral Concentrate

The

ATP2

is a nutritional supplement made from the finest plant substances and also is a proprietary formulation of a super-energized colloidal

concentrate developed from a dibase solution. Its formula supports and enhances nutritional biochemical activities.

It

helps to

Benefits:

| |

● |

SupportSupports

and enhance nutritional biochemical activities (nutrient absorption and waste metabolism). |

| |

● |

BreakBreaks

down or oxidised toxins and waste material to promote cellular detoxification and improve blood circulation. |

| |

● |

IncreaseIncreases

cellular respiration and energy production to reduce fatigue and maintain energy level. |

| |

● |

IncreaseIncreases

oxygen level in body cells to create a high oxygen environment in the body, which possibly help to prevent the growth of harmful

pathogens that contribute to diseases. |

| |

● |

ProvideProvides

sufficient antioxidants that act as a superior scavenger of free radicals, to strengthen the body cells resistance against oxidative

damages. |

ATP3

Ionized Cal-Mag

ATP3

Ionized Cal-Mag is a specialized calcium and magnesium minerals supplement that is designed to transform into ionic form completely before

entering the body. This is compatible to the cellular ion channel theory, that all cellular metabolisms are dependent on ionic transmission

to achieve the highest absorption rate. This product was tested for its nanoparticle by the National Measurement Institute of Australian

Government, with proven content of nanosized calcium and magnesium that has better absorption and bio-availability.

It

helps toBenefits:

| |

● |

StrengthenStrengthens

the bone system and promote better bone development. |

| |

● |

StrengthenStrengthens

the teeth structure and prevent teeth damages. |

| |

● |

ProvideProvides

abundant of ionic calcium and magnesium to prevent chronic diseases through better blood circulation and acid-base regulation. |

| |

● |

PromotePromotes

better relaxing of nervous system and regulations of neurotransmitters which helps to enhance sleep quality. |

| |

● |

PromotePromotes

better relaxing of muscle to prevent muscle soreness and cramps. |

ATP4

Omega Blend

ATP4

Omega Blend is a proprietary oil blend that is rich in undamaged polyunsaturated essential fatty acid, which is fully extracted from

plant-based ingredients. It provides a bio-effective balance of both essential fatty acids, Omega 3 and Omega 6 which are the important

structural components of cell membranes that cannot be synthesized by humans.

It

helps toBenefits:

| |

● |

RegulateRegulates

cholesterol and triglycerides levels to promote better blood circulation. |

| |

● |

RegulateRegulates

inflammation, the unifying component of many diseases, and enhance cell repairing activities. |

| |

● |

RegulateRegulates

hormones production and functions in the body through supplies of the balanced ratio of Omega 3 and Omega 6. |

| |

● |

PromotePromotes

healthy functioning of the brain through the maintenance of healthy impulse transmission in brain cells that is crucial for memory

and learning ability. |

ATP5

BetaMaxx

ATP5

BetaMaxx is derived from the cell wall of premium food-grade baker’s yeast and is a medical breakthrough result of more than 50

years of intensive research and studies by scientists and physicians. This product combines the immunostimulatory properties of perfectly

molecularly structured beta 1-3, 1-6-D-glucan with other immunomodulating compounds that work in perfect synergy to make ATP5 a unique

and effective natural product. It is a 100% natural immune enhancer, safe and does not cause any allergic reactions.

It

helps toBenefits:

| |

● |

StrengthenStrengthens

the function of immune cells to build up a better immune response of body for external and internal protections |

| |

● |

PromotePromotes

better cell repairing and regulate inflammatory responses in wound healing. |

| |

● |

EnhanceEnhances

the function of immune cell against damages caused by radiation. |

| |

● |

Helps

to normalize blood sugar levels. |

AGN-Vege

Fruit Fiber

AGN-Vege

Fruit Fiber is the special nutrition-based formula for intestines and stomach. It consists of four most essential components for gastrointestinal

health effects such as fiber, probiotic the “friendly bacteria”, prebiotic fructooligosaccharides (FOS) as well as digestive

enzymes.

It

helps toBenefits:

| |

● |

PromotePromotes

better bowel movement and prevent low-fiber diet-induced constipation. |

| |

● |

MaintainMaintains

bowel health. FOS helps increase intestinal bifidobacteria and helps maintain a good intestinal environment. |

| |

● |

SlowSlows

the absorption of sugar and lipid into the bloodstream which helps improve blood sugar and cholesterol level. |

| |

● |

InduceInduces

better satiety, which results in reduced total food intake and helps in achieving an ideal weight management. |

AGP1-Iron

AGP1-Iron

is the purest and most advanced Colloidal Iron that is sourced from the remains of an ancient rainforest which contains the most active

plant-based element from nature. The colloidal nanosized iron provides high zeta potential promotes better absorptivity and cellular

iron uptake through the ion channel.

It

helps toBenefits:

| |

● |

PromotePromotes

better hemoglobin production to improve iron deficiency anemia. |

| |

● |

Iron

is a component of hemoglobin in red blood cell which carries oxygen to all part of the body. Therefore, it helps to improve blood

circulation and prevent some oxygen deficiency symptoms through enhancement of oxygen delivery and nutrient circulation as well as

toxins excretion. |

| |

● |

Iron

is a factor in red blood cell formation. It promotes hemoglobin production hence is suitable especially for women and individual

who experienced accidental bleedings. |

YFA-Young

Formula

YFA-Young

Formula is a 100% natural unique formula, a combination of amino acid, vitamins, and minerals and is the best anti-aging and youthful

maintenance supplement. It stimulates the pituitary gland to release endocrine hormones such as human growth hormone (HGH) to stimulate

synergies thus achieving the efficacy of anti-ageing through the promotion of cells vitality and strengthening of organ function.

It

helps toBenefits:

| |

● |

EnhanceEnhances

the production of bio-energy ATP and metabolism, which aids in reducing body fat accumulation and promote strong muscles building. |

| |

● |

StimulateStimulates

the production of collagen to restore skin elasticity and reduce wrinkles. |

| |

● |

ReduceReduces

pigmentation and dark spots on face caused by hormonal imbalances. |

| |

● |

HGH

builds and repairs tissues and thus has an effect on hair cells at the hair root to promote healthy hair growth. |

| |

● |

EnhanceEnhances

memory and cardiovascular function and prevent various chronic diseases due to HGH deficiency. |

BEAUNIQUE

Mito+ and Mitogize

TheWe

discontinued ATP Regal Mitogize on October 1, 2019. In its stead, an enhanced formula, the BEAUNIQUE Mito+ iswas introduced in November

2019. As a strong antioxidant drink with great flavor and taste., Thethe preeminence of BEAUNIQUE Mito+ is its ability to further protect

and stimulate mitochondria (the powerhouse ofmembrane-bound organelles which produces energy for cells) in cellular energy (ATP) production with the

added advantage of lessfewer total sugars and calories. The new formula comprisesis comprised of 11 Superfoodfood groups, including potent mangosteen skin

extract. Backed by advanced scientific research and tested on 88 nutrigenomic profileprofiles, the new formulation revealed enhanced antioxidant

properties. 96.34% DPPH Radical Scavenging activity., an approximate 22% increase compared to Mitogize.

It

PromotesBenefits:

| |

Cellular

health |

| |

● |

Effective

antioxidants to protect from cellular oxidative damages. |

| |

|

|

| |

Immune

health |

| |

● |

EnhanceEnhanced

adaptive immune response. |

| |

● |

AntiProvides

anti-inflammatory functionality. |

| |

● |

StrengthenStrengthens

immunity against bacteria and viruses. |

| |

|

|

| |

Metabolic

health |

| |

● |

ReduceReduces

the risk of obesity. |

| |

● |

ReduceReduces

the risk of vascular diseases. |

| |

● |

ReduceReduces

the risk of Type II Diabetic. |

| |

|

|

| |

Brain

health |

| |

● |

ReduceReduces

the risk of neurodegenerative diseases. |

| |

|

|

| |

Skin

health |

| |

● |

Systemic

photoprotection. |

| |

● |

ReduceReduces

dark spot formation. |

| |

● |

Alleviates

skin wrinkle and inflammation induced by UV-B irradiation. |

ORYC-Organic

Youth Care Cleansing Bar

ORYC-Organic

Youth Care Cleansing Bar is a natural, organic cleansing soap for skin. It contains pure Australian-accredited natural and organic plant

oils acting as a high quality and natural skin lubricant. It maintains the softness of the skin while promoting skin beauty and radiance.

It

helps

Benefits:

| |

● |

With

its biodynamic avocado oil and vanilla extract, remove impurities, leaving skin clear, fresh and clean. |

| |

● |

With

its biodynamic, coconut, almond and olive oil, moisturize and texturize the skin to prevent skin drying. |

| |

● |

In

acting as natural anti-bacterial and anti-inflammatory agents, reduce the risks of skin infections and allergies. |

*References

alluding to the efficacy and effects of our products are based on client testimonials.

Beauty

Products

The

Company’s ENERGETIQUE series aim to provide a total dermal solution for a healthy skin beginning from the cellular level. The series

is comprised of Energy Mask, Hyaluronic Acid Serum and Mousse Facial Cleanser.

ENERGY

MASK SERIESÉNERGÉTIQUE

The

Company’s Energetique Mask Series is formulated with triple action natural ingredients and advanced technologies. The innovative

combination of award-winning patented liposome encapsulating the customized fast acting patented essence, produces micro-particle liposome

which, combined with collagen peptide Tencel film, creates an effective formulation that benefits the skin at the cellular level.following is a list of our ÉNERGÉTIQUE products:

There

are three types of face masks in the Energetique Mask Series, each to suit a different skin requirement. They are: N°1 Med-Hydration;

N°2 Med-Whitening; N°3 Med-Firming. Advanced genetic analysis and clinical trials conducted revealed the benefits and efficacies

of the patented functional essence. The Energetique Mask Series has clinically shown deep penetration of liposomal essence into deep

skin layers within 5 minutes of the application to deliver immediate, deep-reaching and long-lasting benefit of skin hydration, whitening,

and firming.

N°1

Med-Hydration

Formulated

with the patented Sea Grape (Caulerpa lentillifera) extract, the N°1 Med-Hydration enhances skin moisture and luminosity.

This treatment effectively improves the moisture content of the inner skin layer and rejuvenate the skin barrier function to avoid moisture

loss.

It

helpsBenefits:

| |

● |

lockingLocking

the skin moisture and nutrients, strengthening the skin barrier function and boosting the skin’s moisture level. |

| |

● |

to

increaseIncreases

the skin’s natural moisturizing factor (PCA) and skin layer glycoprotein connectivity to maintain the skin’s moisture. |

| |

● |

toEffectively

effectively retainretains water, provides moisturization, restores skin elasticity, and promotes the growth of fibroblasts for moisturization, removes

dryness, regains skin’s elasticity and smoothness. |

| |

● |

immensely

in deliveringDelivers

an instant boost of skin moisture content up to 45.7% in just 5 minutes of application and synergistically ensuring a profound and

long-lasting skin moisturization and hydration. |

hydratio n.

N°2

Med-Whitening

Formulated

with patented Peach Blossom Stem Cell Extract, the N°2 Med-Whitening has clinically shown its efficacy in inhibiting the melanin

synthesis, down-regulating the melanin synthesis gene, boosting skin moisture level and protecting skin against UV radiation.

It

helpsBenefits:

| |

● |

in

suppressingSuppresses

melanin production and fight against UV radiation to protect skin cells and result in whitening effect. |

| |

● |

to

stimulateStimulates

interstitial hyperplasia cell and helps in increasing the moisturizing ceramide by 7.4 times in order to remove skin roughness and

smoothing skin. |

| |

● |

to

enhanceEnhances

the skin brightness up to 6.3% in just 5 minutes of application and synergistically rejuvenate a profound and long-lasting skin ability

in anti-UV damage. |

N°3

Med-Firming

Formulated

with the patented Djulis (Chenopodium formosanum Koidz) Seed Extract, the native cereal plant in Taiwan and traditionally called “ruby

of cereals.” The formulation is clinically proven to be effective in stimulation of collagen secretion and anti-advances glycation

end-products (AGEs) reducing the glycation of skin collagen, provide protection and maintenance of the basal skin collagen production.

It

helpsBenefits:

| |

● |

to

suppressSuppresses

the skin collagen glycation process, reduces collagen loss, and enhancing collagen secretion. |

| |

● |

repairingRepairs

the dead skin tissue, smooth wrinkles to restore the smoothness and health of the skin. |

| |

● |

preventingPrevents

wrinkles formation and providing the essential skin moisture content. |

| |

● |

to

boostBoosts

skin elasticity by up to 14.4%. and improve sagging skin by 135 in just 5 minutes of application. |

ÉNERGÉTIQUE

Hyaluronic Acid (HA) Serum

Formulated

with four functional hyaluronic acid and a unique peptide, this scientifically advanced and intensive quintuple action serum proven to

deliver 5Rs dermal benefits. Filled in an innovative yet convenient and hygienics syringe packaging, this HA serum also ensure consumer-perceivable

benefits for every skin type.

Benefits:

| |

● |

REBALANCE

- HydrateHydrates the skin surface by forming a protection layer and keep skin moisturized even after cleansing |

| |

● |

RECOVER

– RepairRepairs the out-balanced lamellar layer to act as barrier to prevent skin moisture from evaporation |

| |

● |

REGENERATE

- PromotePromotes the production of Type I pro-collagen and boost skin’s own production of Hyaluronic Acid up to 3 times |

| |

● |

REHYDRATE

- Nano-sized particles with high capacity of water-holding allow deep penetration and bestows moisture from inside the skin. Long-lasting

moisture retention up to 72 hours |

| |

● |

REMODELLING

- Proven to increase skin firmness +200% (cheek, under-eye and neck). Enhance skin viscoelasticity to improves skin roughness |

ÉNERGÉTIQUE

Mousse Facial Cleanser

Formulated

with the mildest surface-active agents available on the market, this facial cleanser was designed to deliver a distinct A to E cleansing

benefits to consumers. The unique mousse like-foam delivers a comfortable and soft feeling of the skin during and after use without compromising

the moisturizing level and viscoelastic properties of the skin.

Benefits:

| |

A1. |

All

Skin Type |

| |

|

|

| |

|

|

a.● |

Hypoallergenic |

| |

|

|

b.● |

Non-comedogenic |

| |

|

|

|

|

| |

B2. |

Balance |

| |

|

|

| |

|

|

a.● |

pH-balanced

formula with buffer capacity at pH 5.5 of the skin. |

Benefits

| |

C. |

Comfortable |

| |

|

|

| |

3. |

Comfortable |

| |

|

|

| |

|

a. |

● |

Mild

to skin and eyes without irritating or drying your skin |

| |

|

|

b.● |

Comfortable

and soft feeling – prolonged comfortable to skin before and after use. Accidental consuming would not be harmful to

your body. |

|

|

|

|

|

| |

D4. |

Dense |

| |

|

|

| |

|

|

a.● |

Mousse-like

foam very fine porous foam and smooth skin-feel during use |

| |

|

|

|

|

| |

E5. |

Effortlessly |

| |

|

|

| |

|

|

a.● |

Easily

remove light makeup, dirt and impurities. |

| |

|

|

b.● |

Easy

to rinse with no residual. |

Unique

Characteristics via NutrigenomicBEAUNIQUE

The

Company’s BEAUNIQUE product series focuses on the research of our diet’s impact on modifying gene expressions in order to

address genetic variations and deliver a personalized nutrigenomic solutionsolutions for every individual.

Trim+:

Trim+

is the first product launched under this series, which utilizes the advanced technology to extract the patented active ingredients in foods.

Trim+ has been scientifically proven to be effective in inhibiting the activities of carbohydrates digestive enzymes, which results in

a reduction of the breakdown and absorption of sugars.

It

helps to:

Benefits:

| |

● |

ReduceReduces

total carbohydrates calories intake with the scientifically proven effect on weight management. |

| |

● |

RegulateRegulates

blood sugar levels with scientifically proven efficacy. |

| |

● |

ImproveImproves

cellular uptake of sugars for bioenergy ATP production. |

| |

● |

MaintainMaintains

insulin hormone balance, and helps prevent diabetes. |

| |

● |

ImproveImproves

blood lipids composition,compositions and helps prevent cardiovascular disease. |

FutureDSY

PlansWellness

As

at the date of this report, the number of COVID-19 cases have hit over 447 million worldwide with approximately 6.0 million lives lost.

It

has been approximately 2 years since the declaration of the COVID-19 pandemic, the lethargy brought about by the pandemic to the world

populace, countries and governments is immense.

As

of March 2022, Malaysia stands at position 26 as the country with the highest COVID-19 cases as recorded under the coronavirus statistics

of the “worldometer”. Total COVID-19 cases in Malaysia hit approximately 3.6 million and associated fatality of 33, 228.

These figures are huge relative to the small size economy of the country. We

are witnessing the adverse impact on the purchasing power of consumers in Malaysia, where

our products are mainly sold as a direct result of the prolonged pandemic. Revenue of ASL, our subsidiary that is principally involved

in network marketing decreased significantly for the year ended December 31, 2021 as compared to

the same period in 2020.

Our

immediate plans will be: (i) to bring the operational activities of ASL to pre-pandemic levels, to record higher revenue and profits.

As businesses continues to be digitized, we will further capitalize on the e-commerce trading platform provided by Vettons Sdn. Bhd.

to perform e-marketing and e-trading of our products to members, as well as online e-recruitment of new members; and (ii) to activate

WATP whose principal activity is in promoting wellness and wellbeing lifestyle of the community by providing services that includes online

editorials, programs, events and campaigns on how to achieve positive wellness and lifestyle. We will focus on developing customer centric

programs, prioritizing high level engagements for a speedier and more tangible outcome.

On

November 11, 2021, Agape ATP Corporation (Labuan) formed a joint-venture entity, DSY Wellness International Sdn

On

November 11, 2021, Agape ATP Corporation (Labuan) formed a joint-venture entity, DSY Wellness with Mr. Bhd. (“DSY Wellness”)

with an independent third partySteve Yap following which Agape

ATP Corporation (Labuan) owns 60% of the equity interest, to pursue the business of providing complementary health therapies. The establishment

of DSY Wellness is a further expansion of our business into the health and wellness industry. The independent

third party readily owns 33 proprietary formulas for treating non-communicable disease which he has agreed to bring into the company

for joint commercialization. The independent third party also has existing clients receiving

traditional complimentary medicine or “TCM” in Indonesia and Thailand. DSY Wellness offers health consultancy

and advice, as well as nutritional supplements at medical dosages, as prescribed by in-house nutritional practitioners.

While

the COVID-19 pandemic subsists, we will concentrate our resources in developing our businesses in Malaysia where most of our activities

are concentrated. DSY Wellness will expand its businesses in the state of Penang and Johor in the short term. At time opportune, when

the pandemic has subsided or is over and restrictions on travelling between nations are uplifted, service centers will be set up in Indonesia

and Thailand. Together with ASL and WATP, this has the potential for the development of wellness tourism. As the products and services

offerings of the Company widens beyond the sale of health products via network marketing, any overseas expansion could generate multiplier

effect to the Company’s income and profitability, which the Company will capitalize. It is the Company’s ultimate aim to

partake in all the lucrative areas of the health and wellness ecosystem as far as possible, to carve a niche in the health and wellness

industry.

Marketing

Leveraging

on information technology, we will continue to build our brand image to create brand awareness to penetrate the marketplace and attract

customers. For the Company’s network marketing business, we have a corporate website which introduces and promotes our products

and services, enable e-trading and e-recruitment of members. Going forward, we will use our corporate website more extensively to market

all our products and services. We will utilize marketing related search engines to attract potential clients to our website. In financial

year 2020, we have also synched-up with Vettons Sdn. Bhd, an e-merchant to further our reach through e-commerce. On

February 1, 2021, Mr. How Kok Choong, the CEO and director of the Company, was appointed as the non-executive Chairman of Vettons

Sdn Bhd. Vettons Sdn. Bhd became our related party since then.

Additionally,

we will explore other online methods to enhance brand awareness that are impactful for community building for our other ventures in the

health and wellness industry such as referral programs, develop contents for guest publishing, social media contests, etc. We will be

social focus in the selection of social networks for our social media marketing, and where appropriate infographics will be used and

influence marketing will be employed.

With

the incorporation of DSY Wellness, much cross-selling and up-selling will be deployed for a more comprehensive products and services

offerings to our customers. As discussed above, the multiplier effect of a wide products and services offerings to the Company’s

revenue stream and bottom line is huge.

Competition

The

health and wellness industry, with a focus on health supplements in particular in Malaysia, where we operate, is rather competitive.

Our focus is on the mature group of customers, i.e. adults ranging in age from 18-65 years old. We face competition from various retail

health supplement providers, pharmacies, and Multi-Level Marketing Companies which supply health supplement products, such as Bio-Life

Marketing Sdn Bhd, Elken Group, Usana Group, BMS Organics, NHF Group and their respective affiliates. These competitors are generating

significant traffic to their marketing websites; and have established brand recognition and financial resources.

Our

Business Model

We

believe that the principal competitive factors indirect-selling channel is ideally suited to marketing our type of market include the quality of health supplements, the efficacies of the

health supplements, strength and depth of relationships with clients, the ability to identify the changing needs and requirements of

prospective clients, and the scope of services. Through utilizing our competitive strengths, we believe that we have a competitive edge

over other competitors due to the breadth of our product offerings, one stop convenience, pricing, our services, our reputation and product

safety. As discussed, the prolonged pandemic has eroded much of the purchasing power ofproducts, because sales of health solution and personal care

products are strengthened by ongoing personal contact between retail consumers and distributors. This personal contact may enhance consumers’

nutritional and health education and motivate consumers to begin and maintain wellness and weight management programs. In addition, by

using our products themselves, distributors can provide first-hand testimonials of product effectiveness, which can serve as a powerful

sales tool.

We

are focused on building and maintaining our distributor network by offering financially rewarding and flexible career opportunities through

the sale of quality, innovative products to health-conscious consumers. We believe the income opportunity provided by our bonus program

appeals to a broad cross-section of our members, particularly those seeking to supplement family income, start a home business or pursue

entrepreneurial, full and part-time, employment opportunities. Our distributors, who are all independent third parties, profit from selling

our products and also earning bonuses through performance of their network group, the establishment of their own network group and the

performance of distributors recruited under their own network group. Top performing distributors with their own physical stores may also

become stockists of the company, whereby they enjoy benefits such as maintaining a certain amount of the Company’s inventory in