UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Citigroup Inc.

388 Greenwich Street

New York, New York 10013

March 18, 2025

Dear Stockholder:

We cordially invite you to attend Citi’s 2025 Annual Meeting, which will be held on Tuesday, April 29, 2025, at 9:00 a.m. Eastern Time. This year’s Annual Meeting will be held in a virtual format through a live webcast to facilitate stockholder attendance regardless of location and reduce the carbon footprint of Citi’s activities. Details relating to the Annual Meeting logistics are provided in this 2025 Proxy Statement and at www.virtualshareholdermeeting.com/CITI2025.

At the Annual Meeting, stockholders will vote on a number of important matters. Please take the time to carefully read each of the proposals described in the Proxy Statement.

Thank you for your support of Citi.

Sincerely,

John C. Dugan

Chair of the Board

| 4 |

2025 Board Letter to Stockholders

Citi made substantial progress in 2024 toward achieving key strategic goals.

One such goal is organizational simplification. Citi delivered on its announced plan to refocus the firm around five interconnected businesses – Services, Markets, Banking, Wealth, and U.S. Personal Banking (USPB) – the heads of which now report directly to the CEO. This powerfully simple organizational structure has significantly improved transparency and accountability for each of these businesses, not just to our CEO, but also to the Board and to you, our stockholders. In addition, the reorganization eliminated regional structures and unnecessary layers of management, resulting in a new, flatter management model. This is helping to make Citi a simpler, better controlled firm that can operate faster, improve client service, and unlock shareholder value.

Another strategic goal is business simplification. Here the firm continued to execute its plan to exit consumer banking businesses in 14 markets outside the United States. Citi has now closed sales in nine of those markets, and the wind-downs of its consumer businesses in China and South Korea, and of its overall presence in Russia, are nearly complete. In addition, the firm is currently in the midst of the sales process for its consumer business in Poland. Most notably, at the end of 2024, Citi successfully separated its consumer, small, and middle-market banking businesses in Mexico (Banamex) from the firm’s institutional business – a significant undertaking and critical accomplishment toward executing an initial public offering of Banamex stock.

The firm also embarked on a number of important initiatives in 2024 to significantly grow its businesses. For example, Citi and American Airlines announced the extension and expansion of their long-standing partnership, with Citi becoming the exclusive issuer of the AAdvantage co-branded card portfolio, beginning in 2026; this will facilitate significant growth of Citi’s Branded Cards business in the years ahead. Another example is the exclusive agreement that Citi and Apollo Global Management Inc. entered into to form a landmark $25 billion private credit, direct lending program. This program will significantly enhance access for Citi’s corporate financial sponsor clients to the large private lending capital pool.

On the key strategic goal of transformation of Citi’s risk management and controls, the firm also made progress, but not as much as intended. As a result, in July 2024, the Federal Reserve Board and Office of the Comptroller of the Currency took further regulatory actions in connection with the 2020 Consent Orders. Citi’s management has acknowledged that, despite making important progress in advancing some areas of the transformation, there were other areas where Citi did not make enough progress, such as in its data quality management and related governance and regulatory reporting. This is reflected in the lower payout of the final tranche of the Transformation Bonus Program, as detailed later in the proxy, consistent with the Board’s responsibility to hold management accountable for its performance. Citi’s Board, acting through its Transformation Oversight Committee, is intently focused on overseeing management’s achievement of significantly improved progress on the transformation in 2025 and beyond.

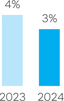

Overall, Citi’s progress on its strategic goals contributed to the firm’s much improved financial performance in 2024. Each of the firm’s five businesses reported year-over-year increases in revenues. The firm, as well as each of the five businesses, achieved positive operating leverage for the full year. Citi’s 2024 net income was up approximately 40 percent; revenues (excluding divestitures) were up 5 percent; tangible book

Citi 2025 Proxy Statement

| 5 |

value per share was up 4 percent; and Citi returned $6.7 billion to stockholders through dividends and stock repurchases. In addition, the key metric for stockholders of Total Shareholder Return increased by 42 percent in 2024.

While Return on Tangible Common Equity (RoTCE) also improved in 2024 – by approximately 210 basis points to 7 percent – management announced that, due to a necessary increase in firm investments, its target RoTCE for 2026 is now between 10 and 11 percent, somewhat lower than Citi’s previous target. The Board believes that this is a realistic reduction, and also strongly agrees with management’s assertion that the 2026 RoTCE target is a waypoint, not a destination. Management’s focus is on improving returns well above that level, and to hold themselves accountable for doing so. Your Board will hold management accountable for this as well.

Thank you for your ongoing support of Citi. Dialogue with stockholders is a fundamental feature of a well-governed organization, and we will continue to make it a priority. Please write with any concerns or suggestions to: Citigroup Inc. Board of Directors, c/o Brent J. McIntosh, Chief Legal Officer and Corporate Secretary, 388 Greenwich Street, New York, NY 10013.

| Titi Cole | Jane N. Fraser | Gary M. Reiner |

| Ellen M. Costello | Duncan P. Hennes | Diana L. Taylor |

| Grace E. Dailey | Peter B. Henry | James S. Turley |

| Barbara J. Desoer | S. Leslie Ireland | Casper W. von Koskull |

| John C. Dugan | Renée J. James |

A WORD OF APPRECIATION

| Barbara J. Desoer, who will be retiring from our Board in April, has had

a long and distinguished career with the Company. Ms. Desoer served in management as CEO of Citibank, N.A. from April 2014 to April 2019

and, for the last six years, has served on our Board and as Chair of the Board of Directors of Citibank, N.A. We thank her for her many

outstanding contributions. Leslie Ireland, who has determined not to stand for re-election, has served on the Citi and Citibank Boards since 2017. From her distinguished career in the U.S. Department of Treasury and the Office of National Intelligence, she brought extensive knowledge and experience of cybersecurity and threat intelligence to our Boards and our Technology Committee. We appreciate her service and will miss her valuable perspectives. |

www.citigroup.com

| 6 |

This page intentionally left blank.

| 7 |

Notice of Annual Meeting of Stockholders

Citigroup

Inc.

388 Greenwich Street

New York, New York 10013

Dear Stockholder:

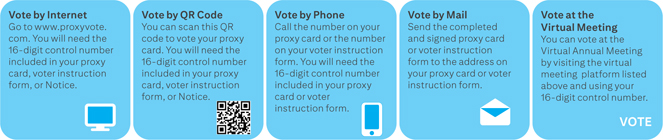

Citi’s Annual Stockholders’ Meeting will be held on Tuesday, April 29, 2025, at 9:00 a.m. Eastern Time (E.T.) through a virtual meeting platform. Please go to the “Register for Meeting” link at www.proxyvote.com to register for the meeting. Live audio of the 2025 Annual Meeting will be webcast at www.citigroup.com. You or your proxyholder can participate, vote, ask questions, and examine the rules of the meeting during the Virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/CITI2025 and using your 16-digit control number. Electronic entry to the meeting will begin at 8:45 a.m. E.T. and the meeting will begin promptly at 9:00 a.m. E.T. If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/CITI2025.

At the meeting, stockholders will be asked to: 1. elect the 12 directors listed in Proposal 1, 2. ratify the selection of Citi’s independent registered public accounting firm for 2025, 3. consider an advisory vote to approve our 2024 executive compensation, 4. approve additional shares for the Citigroup 2019 Stock Incentive Plan, 5. act on certain stockholder proposals, each if properly presented, and 6. consider any other business properly brought before the meeting, or any adjournment or postponement thereof, by or at the direction of the Board of Directors. |

Citi has utilized the Securities and Exchange Commission (SEC) rule allowing companies to furnish proxy materials to their stockholders over the Internet. This process allows us to expedite our stockholders’ receipt of proxy materials, lower the costs of distribution, and reduce the environmental impact of our 2025 Annual Meeting.

In accordance with this rule, on March 18, 2025, a notice of the 2025 Annual Meeting containing a Notice of Internet Availability of Proxy Materials (Notice) was sent to current stockholders as of March 3, 2025, the record date for Citi’s 2025 Annual Meeting. The Notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you received a Notice and would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the Notice.

By order of the Board of Directors,

Brent

J. McIntosh

Corporate Secretary

March 18, 2025

www.citigroup.com

| 8 |

This page intentionally left blank.

| 9 |

Contents

FORWARD-LOOKING STATEMENTS

Certain statements in this Proxy Statement are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not based on historical facts but instead represent Citi’s and its management’s beliefs regarding future events. Such statements are based on management’s current expectations and are subject to risks, uncertainties and changes in circumstances. These statements are not guarantees of future results or occurrences. Actual results, performance or outcomes may differ materially from those expressed in or implied by any of these forward-looking statements due to a variety of factors, including, among others, various challenges related to Citi’s transformation, including significant execution and regulatory complexities and uncertainties, global socio-demographic and economic trends, energy prices, consumer and client behavior, physical and transition risks associated with climate change, our ability to gather and verify data regarding environmental impacts, our ability to successfully implement various initiatives throughout the Company within expected time frames, and technological innovations and challenges, including the ability of our partners or potential partners as well as their suppliers to successfully implement initiatives and produce or scale new technologies under expected time frames. Other factors that could cause actual results, performance, outcomes or financial condition to differ materially from those described in forward-looking statements can be found in this report and in Citi’s filings with the SEC, including without limitation the “Risk Factors” section of Citi’s 2024 Annual Report on Form 10-K (2024 Annual Report on Form 10-K) filed with the SEC on February 21, 2025. Any forward-looking statements made by or on behalf of Citi speak only as to the date they are made, and Citi does not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date that the forward-looking statements were made. Website references are provided for convenience only, and the information contained on such websites is not incorporated into nor does it constitute a part of this Proxy Statement.

www.citigroup.com

| 10 |

Proxy Statement Highlights

|

Voting Items Proposal 1: Election of Directors (Pages 44-64) The Board recommends you vote FOR each nominee Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm (Pages 66-67) The Board recommends you vote FOR this proposal Proposal 3: Advisory Vote to Approve Our 2024 Executive Compensation (Pages 68-111) The Board recommends you vote FOR this proposal Proposal 4: Approval of Additional Shares for the Citigroup 2019 Stock Incentive Plan (Pages 112-121) The Board recommends you vote FOR this proposal Stockholder Proposals 5-8 (Pages 122-131) The Board recommends you vote AGAINST each of the stockholder proposals |

|

Meeting and (For additional information, please see About the 2025 Annual Meeting starting on page 133.) |

||

|

Date and Time April 29, 2025, 9:00 a.m. E.T. |

|

|

Record Date March 3, 2025 |

|

|

Voting Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each Director nominee and one vote for each of the other proposals to be voted on. |

|

|

Admission Procedures Please register to attend Citi’s 2025 Annual Meeting.

Please go to the “Register for Meeting” link at www.proxyvote.com to register for the virtual meeting. Go to www.virtualshareholder |

|

|

Board and Corporate Governance Highlights Citi’s Board of Directors Nominees The nominees for the Board of Directors each have the qualifications and experience to guide Citi’s strategy and oversee management’s execution of that strategic vision. Citi’s Board of Directors consists of individuals with the skills and backgrounds necessary to oversee Citi’s efforts on delivering sustainable, client-led revenue growth while operating within a complex financial and regulatory environment. |

||

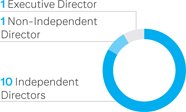

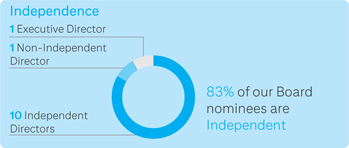

| Independence | ||

|

83% of our Board Nominees are Independent. | |

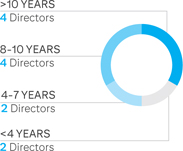

| Board Refreshment | ||

|

The average board tenure of our nominees is 8 years, and 4 nominees have served for more than 10 years. There have been 3 new Directors elected within the past 5 years. | |

| Board Nominee Composition | ||

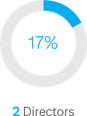

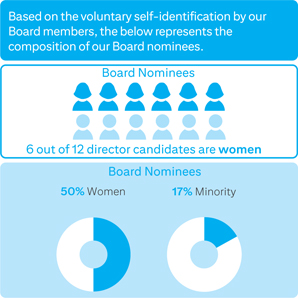

| Women | Minority | Based on the voluntary self-identification by our Board members, the graphs disclose the composition of the Board nominees. |

|

|

|

Citi 2025 Proxy Statement

| Proxy Statement Highlights | 11 |

Citi’s Board of Directors Nominees

| Name and Primary Qualifications |

Age | Director Since |

Principal Occupation and Other Current Public Company Directorships |

Citi Committees | |||||

| A | CPC | E | NGP | RM | T | ||||

Titi Cole

|

52 | 2025 |

Former Head of Legacy Franchises,

Citigroup Inc. |

● | ● | ||||

Ellen M. Costello

|

70 | 2016 | Former President and CEO, BMO Financial Corporation, and Former U.S. Country Head, BMO Financial Group |

● | ● | ||||

Grace E. Dailey

|

64 | 2019 | Former Senior Deputy Comptroller for Bank Supervision Policy and Chief National Bank Examiner, Office of the Comptroller of the Currency |

● | ● | ||||

John C. Dugan

|

69 | 2017 | Chair, Citigroup Inc. | ● | ● | ● | ● | ||

Jane N. Fraser

|

57 | 2020 | Chief Executive Officer, Citigroup Inc. | ||||||

Duncan P. Hennes

|

68 | 2013 | Co-Founder and Partner, Atrevida Partners, LLC Board: RenaissanceRe Holdings Ltd. |

● | ● | ● | ● | ||

Peter B. Henry

|

55 | 2015 | Class of 1984 Senior Fellow, Hoover Institution, and Senior Fellow, Freeman Spogli Institute for International Studies, Stanford University Boards: Nike, Inc. and Analog Devices, Inc. |

● | ● | ||||

Renée J. James

|

60 | 2016 | Founder, Chair and CEO, Ampere Computing | ● | ● | ● | ● | ||

Gary M. Reiner

|

70 | 2013 | Former Operating Partner, General Atlantic LLC Board: Hewlett Packard Enterprise Company |

● | ● | ● | |||

Diana L. Taylor

|

70 | 2009 | Former Superintendent of Banks, State of New York Board: Brookfield Corporation |

● | ● | ● | |||

James S. Turley

|

69 | 2013 | Former Chairman and CEO, Ernst & Young Boards: Emerson Electric Co., Northrop Grumman Corporation, and Precigen, Inc. |

● | ● | ● | |||

Casper W. von Koskull

|

64 | 2023 | Former President and Group Chief Executive Officer, Nordea Bank Abp |

● | ● | ● | |||

Qualifications

|

Compensation |  |

Human Capital Management | |

|

Corporate Governance |  |

International Business or Economics | |

|

Environmental and Sustainability |

|

Legal, Regulatory and Compliance | |

|

Financial Reporting |  |

Risk Management | |

|

Financial Services |  |

Technology, Cybersecurity and Data Management |

| ● | committee member |

| ● | committee chair |

| A | Audit |

| CPC | Compensation, Performance Management and Culture |

| E | Executive |

| NGP | Nomination, Governance and Public Affairs |

| RM | Risk Management |

| T | Technology |

www.citigroup.com

| 12 | Proxy Statement Highlights |

Stakeholder Engagement

2024 Stakeholder Engagement

| Citi’s Senior Leadership, Board members, and Corporate Governance and Investor Relations teams engage a broad range of stakeholders throughout the year to help each understand Citi’s overall corporate strategy, financial and operational performance and governance practices, as well as the progress we are making on our transformation. These interactions reflect our commitment to active and transparent communication with all types of stakeholders and serves as an important channel for Citi to receive feedback. |

| Who we engage with: | How we engage them: | Where are they focused: | |||||||||||

|

● Institutional stockholders, including portfolio managers and analysts ● Individual stockholders, including holders of retail-focused preferred shares ● Sell-side research analysts, both equity and credit ● Stewardship teams ● Fixed income investors and analysts ● Credit rating agencies ● Environmental and Sustainability rating firms ● Citi offers to meet with all stockholders who submit proposals for Citi’s annual meetings to discuss their concerns |

● Quarterly earnings calls ● Inquiries to Investor Relations from both current and prospective investors ● Fireside chats and presentations at conferences ● 2024 Services Investor Day ● Small group and 1x1 investor meetings ● Proxy Roadshow ● Governance and Sustainability Roadshow ● Quarterly fixed income presentations on website ● Sustainability/Climate reports |

● Financial and operational performance ● Overall progress on transformation, including risk and controls ● Recent regulatory developments ● Geopolitical uncertainty ● Current competitive landscape ● Human capital management ● Risk management ● Culture and organizational simplification ● Executive Compensation ● Board Governance |

| In 2024, our stakeholder engagement initiatives included: | ||

|

● Board Equity Investor Engagement: The Governance Team, Board Members and senior leadership conducted engagements with ~37% of our total outstanding shares in Spring 2024 ● Additional Equity Investor Engagement: Senior leadership and Investor Relations conducted 269 engagements throughout the year, including 60% of our top 50 shareholders; these shareholders represent over 42% of our common stock Ø Senior Leadership: Engaged with equity investors in 77 interactions over the year, including participation in 10 conferences Ø Investor Relations: Engaged in 192 interactions over the course of the year ● Other Engagements, including sell-side analysts, fixed income investors and rating agencies: Senior leadership and Investor Relations conducted 389 engagements throughout the year, providing ongoing dialogue and transparency across the entire investment community Ø Senior Leadership: Engaged in 30 interactions with rating agencies and fixed income investors Ø Investor Relations: 219 interactions across equity sell-side analysts and 140 across fixed income investors and rating agencies |

Citi 2025 Proxy Statement

| 13 |

Executive Compensation and Human Capital Resources and Management Highlights

Summary of 2024 Executive Compensation Decisions

This Proxy Statement provides detailed information concerning our executive compensation program, and the alignment between our performance and the compensation we paid to our executive officers named in this Proxy Statement (NEOs), beginning on page 68. The following supplements that discussion by summarizing the principal executive compensation decisions we made for 2024.

As used throughout this Proxy Statement, Tangible Book Value per Share (TBVPS), Return on Tangible Common Equity (RoTCE) and Revenues Excluding Divestitures are each non-GAAP financial measures. See Annex A for a reconciliation of those non-GAAP financial measures to their corresponding GAAP financial measures. As used throughout this Proxy Statement, the terms Operating Leverage, Book Value per Share, Diluted EPS, Return on Assets, Total Payout Ratio, Income from Continuing Operations Before Taxes, Return on Common Equity, Average Tangible Common Equity, RoTCE, Revenues Excluding Divestitures and TBVPS have the meanings assigned to them in Annex A.

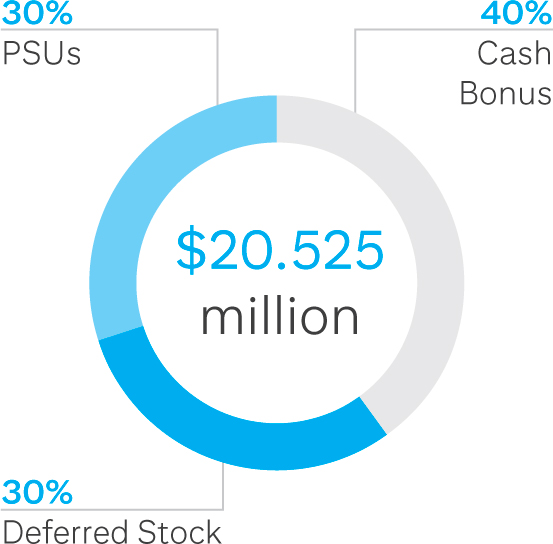

CEO Compensation

The Compensation, Performance Management and Culture Committee (Compensation Committee) set Ms. Fraser’s total compensation for 2024 at $34.5 million, consisting of a base salary of $1.5 million and an incentive award of $33 million. In setting the amount of Ms. Fraser’s incentive award, the Compensation Committee considered the strength of Ms. Fraser’s strategic vision, Citi’s 2024 operational efforts and results, Ms. Fraser’s exemplary leadership, absolute and relative total stockholder returns (TSR), and an analysis of competitive market levels of pay for CEOs of peer companies.

As Citi’s CEO since early 2021, Ms. Fraser has taken bold steps to improve Citi — fixing a complicated risk-taking organization with a truly global presence and running the organization differently than it has been run in the past. Her leadership is strong, stable and transparent as the firm addresses many challenges and adjusts to significant changes in an intensely competitive environment. The full Board of Directors recognizes the high degree of difficulty of the task and the specific and tangible positive change in multiple aspects of the organization that have resulted from Ms. Fraser’s efforts, and the Compensation Committee reflected this view in its pay decision.

Financial Performance

Citi delivered strong financial performance in 2024, demonstrating that our strategy is delivering overall improved financial performance. Each of Citi’s five businesses — Services, Markets, Banking, Wealth and U.S. Personal Banking (USPB) — reported year-over-year increases in revenues in 2024. The firm, as well as each of the five businesses, also achieved positive Operating Leverage for the full year. The firm’s 2024 net income was up 37%, revenues were up 3% (5% excluding divestitures), tangible book value per share was up 4% and RoTCE was up 210 basis points, in each case from 2023. Citi’s CET1 Capital Ratio was up to 13.6%. Citi also returned $6.7 billion to common stockholders in 2024 through dividends and stock repurchases.

Risk and Control

Citi made steady and meaningful progress in remediating the issues addressed in the Consent Orders (as defined on page 30) with the Federal Reserve Board (FRB) and the Office of the Comptroller of the Currency (OCC), most notably in risk management, modernization and resiliency. However, as we have stated before, this is a multiyear endeavor. It requires that we address decades of underinvestment in Citi’s infrastructure, which has a direct impact on data quality. Of course, transformation efforts of this scale involve significant complexities and uncertainties and results are not linear.

www.citigroup.com

| 14 | Executive Compensation and Human Capital Resources and Management Highlights |

In 2024, the firm did not make as much progress as intended, and the FRB and OCC entered into Civil Money Penalty Consent Orders with Citi and Citibank, N.A. (CBNA) in the amounts of approximately $61 million and $75 million, respectively, related to the Consent Orders (collectively the Civil Money Penalty Consent Orders). In addition, the OCC and CBNA entered into an amendment to the OCC Consent Order (as defined on page 30) that includes a requirement that Citi formalize a process to determine whether sufficient resources are being appropriately allocated toward achieving timely and sustainable compliance with the OCC’s Consent Order. In response, Citi has made changes to the governance and structure of its data program and has increased the level of investment in the program.

On balance, and taking into account the Civil Money Penalty Consent Orders, the Compensation Committee recognized that overall the organization has made substantial progress in our transformation under Ms. Fraser’s leadership. Most notably, Ms. Fraser has established a new leadership structure to increase accountability and enable the completion of regulatory and other aspects of our transformation work. Ms. Fraser has focused appropriately on retaining strategic decision makers and providing them with the resources needed to execute our plans, as well as dedicating appropriate direct personal attention to the effort and involvement in solving our most pressing challenges.

Leadership and Talent

Our ability to recruit industry leaders to the firm and to retain our own talent depends on our ability to convincingly communicate a vision for our organization and the opportunity for success in the near term. Our recent successes in recruitment and retention are attributable in significant part to Ms. Fraser’s having communicated such a vision. We summarize the evolution of our leadership team during Ms. Fraser’s tenure on page 70.

Organizational Simplification – Our Business

Citi has significantly advanced our strategic goal of organizational simplification as presented at our 2022 Investor Day. One part of that initiative involved refocusing our firm around five interconnected businesses — Services, Markets, Banking, Wealth and USPB — each with a clear path to accelerating growth, gaining share and increasing returns. Additionally, since announcing our intention to exit consumer banking across 14 markets in Asia, Europe, the Middle East and Mexico as part of our strategic refresh, we closed sales in nine of those markets, and the wind-downs of Citi’s consumer businesses in China and Korea and overall presence in Russia are nearly complete. Most notably, at the end of 2024 we successfully separated our consumer, small and middle-market banking businesses in Mexico (Banamex) from our institutional business, a significant undertaking and critical accomplishment in our path to executing an initial public offering of Banamex stock. We are currently in the midst of the sales process for our consumer business in Poland.

Organizational Simplification – Our Operating Model

A second part of our organizational simplification initiative involved rethinking our operating model to better align with our target business mix. During 2024 we finalized a new, flatter management model, eliminating layers and regional structures, and enhancing leadership accountability in each of our interconnected businesses to help make Citi a simpler, better-controlled firm that can operate faster, improve client service and unlock value for stockholders.

Conclusion

Under Ms. Fraser’s leadership Citi has formulated a strong strategic direction, demonstrated its significant financial and operational achievements, including progress concerning the Consent Orders despite the Civil Money Penalty Consent Orders, simplified and restructured the overall business platform, and registered important accomplishments in attracting and retaining the talent needed to continue these successes.

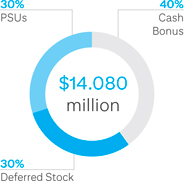

As in 2023, Ms. Fraser’s incentive compensation for 2024 was delivered in three parts. First, 35% was delivered in the form of deferred Citi common stock awards. Second, 15% was paid in cash at the beginning of 2025. Third, the remaining 50% of Ms. Fraser’s incentive compensation was delivered in the form of Performance Share Units (PSUs). Overall, 85% of Ms. Fraser’s incentive compensation was equity-based, and 59% of the equity-based compensation was delivered in the form of PSUs to align Ms. Fraser’s compensation with the creation of long-term stockholder value.

Citi 2025 Proxy Statement

| Executive Compensation and Human Capital Resources and Management Highlights | 15 |

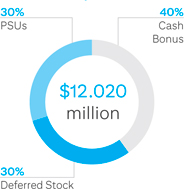

Other Executive Compensation

Transformation Bonus Program

To incentivize effective execution in connection with the Consent Order programs and to drive change in Citi’s risk and control environment and culture, in August 2021 the Compensation Committee approved a transformation bonus program (Transformation Bonus Program). A description of the Transformation Bonus Program was included in our 2022 Proxy Statement. Additional information related to the Transformation Bonus Program can be found in the supplemental solicitation materials Citi filed with the SEC in 2022 (which can be accessed at www.citigroup.com). Ms. Fraser has not been eligible to participate in the Transformation Bonus Program.

As discussed on page 14, in July 2024 the FRB and OCC took further regulatory actions in connection with the Consent Orders. Citi has acknowledged that, despite making good progress in simplifying our firm and remediating the Consent Orders, there were areas where we have not made progress quickly enough, such as in our data quality management related to governance and regulatory reporting. These areas impacted the award metrics and thus had an impact on the payout of tranche 3 of the Transformation Bonus Program.

Following the completion of the third and final performance measurement period under the Transformation Bonus Program, the Compensation Committee determined that the payout for the period ending on December 31, 2024 would be down, consistent with Citi’s fourth quarter 2024 earnings call and 2024 Annual Report on Form 10-K, and set the Performance Achievement Percentage at 53%.

The terms and conditions of the Transformation Bonus Program were not changed for 2024. In approving the Transformation Bonus Program, the Compensation Committee did not intend that it would be a replacement, substitution or make-up for any other compensation amount, nor does the Compensation Committee expect to make other special awards related to our transformation efforts in the future.

For further information concerning the Transformation Bonus Program see pages 89 to 91.

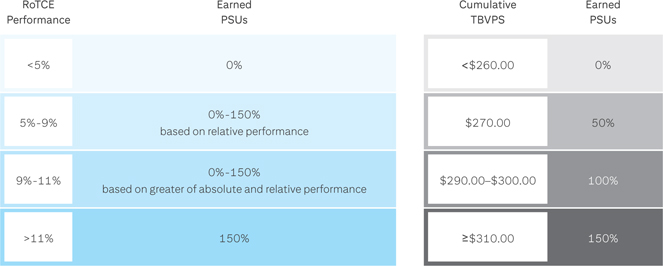

Performance Share Units

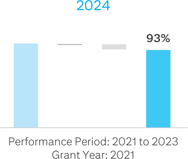

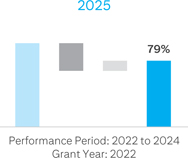

As described on page 88, the Compensation Committee determined that 66.4% of the target number of shares subject to PSUs granted as part of our 2021 incentive compensation awards were earned for the three-year performance period from 2022 through 2024. Cumulative TSR for the performance period was 12.5%. The resulting payout value was equal to 78.9% of initial value, reflecting the impact of both financial performance and TSR, as compared to a 93% payout for the prior three-year performance period, from 2021 through 2023, related to 2020 incentive compensation awards.

Citi delivers a portion of incentive compensation for our Executive Management Team (EMT) in the form of PSUs. For 2024, we expanded the use of PSUs in our compensation program by extending the use of PSUs to Citi Operating Team members. Formed during 2023, that team includes the EMT and, as of December 31, 2024, an additional 11 executives.

Human Capital Resources and Management

Citi strives to deliver to its full potential by focusing on its strategic priority of attracting and retaining highly qualified and motivated employees. Citi’s vision remains — to be the preeminent banking partner for institutions with cross-border needs, a global leader in wealth management and a valued personal bank in the U.S. Citi is structured around five core interconnected businesses—Services, Markets, Banking, Wealth and USPB, a centralized client organization to strengthen how Citi delivers for clients across the Company and an international unit to oversee the local delivery of the Company’s services and products to clients in each of the markets where Citi has an on-the-ground presence to serve and support large and mid-sized companies. Citi seeks to enhance the competitive strength of its workforce through the following efforts:

www.citigroup.com

| 16 | Executive Compensation and Human Capital Resources and Management Highlights |

| ● | Continuously innovating its efforts to recruit, train, develop, compensate, promote and engage employees |

| ● | Actively seeking and listening to diverse perspectives at all levels of the organization |

| ● | Providing compensation programs that are competitive in the market and aligned to strategic objectives |

Workforce Size and Distribution

As of December 31, 2024, Citi employed approximately 229,000 people in more than 90 countries. The Company’s workforce is constantly evolving and developing, benefiting from a strong mix of internal and external hiring into new and existing positions. In 2024, Citi welcomed over 24,000 new employees in addition to 39,700 roles filled by existing employees through internal mobility, including promotions. Citi also maintains connections with former employees through its alumni network, and in 2024, welcomed more than 3,400 individuals back to Citi.

The following table presents the geographic distribution of Citi’s employees by segment, component and gender:

| Segment or component(1)(2) (in thousands) | North America | International(3) | Total(4) | Women | Men | |||||||

| Services | 4 | 20 | 24 | 51.8 | % | 48.2 | % | |||||

| Markets | 3 | 6 | 9 | 38.8 | 61.2 | |||||||

| Banking | 2 | 6 | 8 | 43.5 | 56.5 | |||||||

| Wealth | 5 | 7 | 12 | 50.9 | 49.1 | |||||||

| USPB | 19 | 2 | 21 | 64.1 | 35.9 | |||||||

| All Other, including Legacy Franchises, Operations and Technology, and Global Staff Functions | 53 | 102 | 155 | 47.6 | 52.4 | |||||||

| Total | 86 | 143 | 229 | 49.2 | % | 50.8 | % |

| (1) | Employee distribution is based on business and region, which may not reflect where the employee physically resides. |

| (2) | See Note 3 to our consolidated financial statements included in our 2024 Annual Report on Form 10-K for compensation by reportable segment. Compensation expense related to services provided by employees in the Corporate/Other unit within All Other is allocated to each respective reportable segment, as applicable, through non-compensation expense. |

| (3) | Mexico is included in International. |

| (4) | Part-time employees represented less than 1.0% of Citi’s global workforce. |

Talent Management

Citi is committed to a workforce consisting of the best talent from the broadest pools available to drive innovation and best serve its clients, customers and communities.

Driving a Culture of Excellence and Accountability

Citi’s talent and culture initiatives focus on fostering a culture of excellence and accountability that is supported by strong risk and controls management.

Citi’s Leadership Principles of “taking ownership, delivering with pride and succeeding together” (Leadership Principles) have been reinforced through a behavioral science-led campaign, Citi’s New Way, which reinforces the key working habits that support Citi’s leadership culture.

Citi’s performance management approach emphasizes the Leadership Principles through a four-pillar system, evaluating what employees deliver against financial, risk and controls, and client and franchise goals, as well as how employees deliver from a leadership perspective. The performance management and incentive compensation processes, policies and frameworks promote accountability and consistency, in particular for risk and controls.

Citi’s culture initiatives are also supported by changes in the way Citi identifies, assesses, develops and promotes talent, particularly at the most senior levels of the organization.

Citi 2025 Proxy Statement

| Executive Compensation and Human Capital Resources and Management Highlights | 17 |

Workforce Development

Citi’s numerous programmatic offerings aim to reinforce its culture and values, foster understanding of compliance requirements and develop competencies required to deliver excellence to its clients. Citi encourages career growth and development by offering broad and diverse opportunities to employees, including the following:

| · | Providing a range of internal development and rotational programs to employees at all levels, including an extensive leadership curriculum, allowing the opportunity to build the skills needed to transition to supervisory and managerial roles. Citi’s tuition assistance program further enables employees in North America to pursue their educational goals. |

| · | Continuing to focus on internal talent development and aims to provide employees with career growth opportunities. There was a total of 39,700 mobility opportunities filled in 2024. These opportunities are particularly important as Citi focuses on providing career paths for its internal talent base as part of its efforts to increase organic growth within the organization. |

| · | Continuing to encourage all employees to create developmental plans and consider the competencies and skills they need to develop in order to achieve their career aspirations. In 2023, Citi launched a “Development 365” campaign that drove significant increases in the number of employees across Citi who had developmental plans and conversations with their managers. |

Pay Transparency and Pay Equity

Citi has continued its effort to support its global workforce, including taking actions with respect to pay equity.

Citi values pay transparency and has taken significant action to provide managers and other employees with greater clarity about Citi’s compensation philosophy. Citi has introduced market-based salary structures and bonus opportunity guidelines in various countries worldwide, and posts salary ranges on all external U.S. job postings, which align with strategic objectives of pay equity and transparency.

In addition, Citi has focused on measuring and addressing pay equity within the organization.

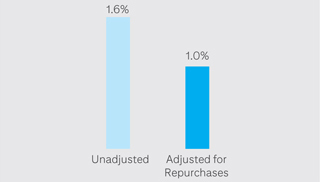

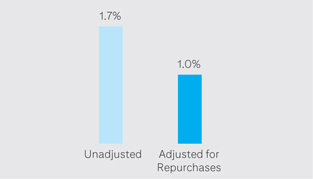

In 2018, Citi was the first major U.S. financial institution to publicly release the results of a pay equity review comparing its compensation of women to that of men, as well as U.S. minorities to U.S. non-minorities. Since 2018, Citi has continued to be transparent about pay equity, including disclosing its unadjusted or “raw” pay gap for both women and U.S. minorities. The raw pay gap measures the difference in median compensation, which is affected by representation of women and U.S. minorities in senior and higher-paying roles. The adjusted pay gap is a true measure of pay equity, or “like for like,” that compares the compensation of women to men and U.S. minorities to non-minorities when adjusting for factors such as job function, title/level and geography.

Citi’s annual pay equity analysis for 2024 determined that on an adjusted basis global gender and U.S. racial pay gaps are in each case less than 1%. The raw pay gap analysis determined that the median pay for women globally is 79% of the median for men globally and the median pay for U.S. minorities is 100% of the median for U.S. non-minorities.

Benefits and Well-being

Citi is proud to provide a wide range of benefits that support its employees’ mental, social, physical and financial well-being through various life stages and events. Such benefits contribute to Citi’s ability to attract, engage and retain employees.

Among the benefits Citi offers are mental health counseling for employees and their family members, access to onsite medical care clinics, fitness centers, subsidized gym memberships and virtual physical therapy in several locations, and leave programs, including parental and caregiver leaves in certain locations to continue to support employees and their families.

In addition, Citi was the first major U.S. bank to publicly embrace a flexible, hybrid work model, which Citi fully implemented across the organization. Most of Citi’s employees now work in hybrid roles, working remotely up to two days a week.

www.citigroup.com

| 18 |

Ethics, Conduct and Culture Highlights

At Citi, our mission is to serve as a trusted partner to our clients by responsibly providing financial services that enable growth and economic progress. We foster a culture of ethics through our governance framework, programs and efforts that embed our culture and expectations for behavior throughout the organization, and collaboration with key stakeholders outside Citi to improve Citi’s and the banking industry’s culture.

Code of Conduct Highlights

| ● | Employees are required to report concerns about conduct or situations that may put our company or our customers at risk. |

| ● | We do not tolerate discrimination, harassment, retaliation, or intimidation of any kind that breaches our policies or is unlawful. |

| ● | Citi prohibits any form of retaliatory action against anyone who raises concerns or questions regarding ethics or discrimination. |

| ● | Citi employees are required to respect the personal beliefs, cultures, identity, and values of every individual, and to be respectful of different backgrounds and points of view. |

| ● | Citi employees are required to provide fair and equitable access to goods, products, services, facilities, privileges, advantages, or accommodations and make decisions regarding their provision based on objective criteria. |

Governance over Culture

The cornerstone of our approach to culture is our governance framework, which begins with a strong “tone from the top” starting with the Citigroup Board of Directors. Citi’s Compensation, Performance Management and Culture Committee of the Board oversees senior management’s sustained focus on efforts to foster a culture of ethics, appropriate conduct, and accountability throughout Citi. For more information, please see the Compensation, Performance Management and Culture Committee Charter, which is set forth on Citi’s website at www.citigroup.com. Click on “Investors,” then “Corporate Governance,” and then “Citigroup Board of Directors’ Committee Charters.”

With oversight from the Compensation, Performance Management and Culture Committee, senior management has undertaken a number of efforts in support of Citi’s culture, including developing Citi’s Mission and Value Proposition and Leadership Principles. On an ongoing basis, the Compensation, Performance Management and Culture Committee remains responsible for overseeing senior management’s efforts to reinforce sound ethics, responsible conduct and principled culture within Citi, which includes:

| ● | overseeing efforts to enhance and communicate Citi’s principles relating to ethics and responsible conduct, and its expectations of employee behavior, including their expression in Citi’s tone from the top and Citi’s Mission and Value Proposition, evaluating management’s progress, and providing feedback on these efforts; |

| ● | overseeing management’s efforts to support Citi’s desired culture and ethical decision-making in the organization, evaluating management’s progress and providing feedback on these efforts; and |

| ● | reviewing Citi’s Code of Conduct and Code of Ethics for Financial Professionals. |

Programs and Efforts that Embed our Culture

To promote a culture of ethics and appropriate conduct, Citi focuses on empowering individuals by establishing global policies, programs, and processes that embed our values throughout the organization and guide and support our employees in making ethical decisions and adhering to Citi’s standards of conduct. Under the oversight of, and with input and feedback from, the Compensation, Performance Management and Culture Committee, senior management has prioritized a number of efforts to further embed our values and conduct expectations into the organization. The following are a few examples of our programs and associated efforts to set, reinforce, and embed our culture at Citi:

| ● | Communications and awareness efforts concerning our Mission and Value Proposition, including Citi-wide videos from senior management articulating our core principles and providing examples of these principles in action. |

| ● | Embedding the Leadership Principles into key aspects of our employee life cycle, such as hiring and performance reviews. |

| ● | Training of employees on key culture-related themes, including our Code of Conduct, ethical decision-making, and the importance of leadership. |

Citi 2025 Proxy Statement

| 19 |

Sustainability Highlights

Citi recognizes that energy transition, energy security and economic growth are not mutually exclusive and must be addressed simultaneously. Citi works on executing its climate commitments and with clients to prioritize global energy security, while giving consideration to other sustainable development objectives. We support our clients in financing their transition to low-carbon business models, as well as continuing to support clients who supply ample and affordable energy to meet the world’s current and future needs.

| $1 Trillion Sustainable Finance Goal Citi has a goal to finance and facilitate $1 trillion in sustainable finance by 2030. This activity includes environmental solutions such as renewable energy, energy efficiency, sustainable transportation and circular economy and social finance including affordable housing, economic inclusion, food security and healthcare. On an annual basis, Citi reports financial progress toward this goal as well as the associated environmental and social impacts within our global environmental and social reporting. |

|

Climate Initiatives ● Set 2030 interim emissions reduction targets for aluminum, aviation, cement and shipping sectors in addition to updating Citi’s existing interim targets for the auto manufacturing, energy and power sectors to include facilitated emissions. In total, Citi has established emissions targets for ten sectoral portfolios. ● Through climate risk and net zero analysis, in 2024 Citi continued to review client activities and engage with them as appropriate to understand their climate risk profiles and their transition plans, including where applicable, how they plan to adapt to and/or manage climate-related risks and how we can support them. ● Executed a learning program focused on climate, sustainability and Citi’s net zero commitment to upskill first line banking teams, Risk and Global Functions, while continuing to engage employees in training through the Sustainability Learning Center. |

|

Sustainable Operations Citi also purchases voluntary third-party verified carbon credits consisting of a portfolio of nature-based, energy efficiency and methane destruction credits in an amount equivalent to our Scope 1 direct GHG emissions. |

www.citigroup.com

| 20 |

Corporate Governance

Citi continually strives to maintain the highest standards of ethical conduct: reporting results with accuracy and transparency and maintaining full compliance with the laws, rules, and regulations that govern Citi’s businesses. Citi is active in implementing governance practices that are at the leading edge of best practices. Below is a compilation of Citi’s Corporate Governance initiatives:

| Good Governance |

● | Citi has an Independent Chair; the By-Laws provide that if Citi does not have an Independent Chair of the Board, the Board is required to elect a lead independent Director; |

| ● | The Board of Directors has a Transformation Oversight Committee, an ad hoc committee, to provide oversight of Citi’s efforts to improve its Risk and Control environment. (Please see page 31 to review additional disclosure regarding the Transformation Oversight Committee); and | |

| ● | Citi’s Compensation, Performance Management and Culture Committee has oversight of Citi’s efforts to ensure ethical behavior in Citi’s culture, business practices, and employees. | |

| Stockholder Rights |

● | Citi’s By-Laws provide that stockholders holding at least 15% of the outstanding common stock have the right to call a special meeting; |

| ● | No super majority vote provisions in our Restated Certificate of Incorporation; | |

| ● | Annual election of all Directors; | |

| ● | Majority vote standard for uncontested Director elections; | |

| ● | Proxy Access By-Law; and | |

| ● | Stockholders may act by written consent. | |

| Executive and Director Compensation |

● | Strong executive compensation governance practices, including clawback policies and a requirement that executive officers must hold a substantial amount of vested Citi common stock for at least one year after they cease being executive officers; |

| ● | Stock ownership commitment for the Board and executive officers; and | |

| ● | Members of Citi’s Board of Directors and Citi’s executive officers (i.e., Section 16 Insiders) are not permitted to hedge their Citi securities or pledge their Citi securities as collateral for a loan. For more information, please see Citi’s Hedging Policies on pages 39-40. | |

| Political Activity |

● | Political Engagement Report (formerly Citi’s Political Activities Statement) includes significant disclosure about our lobbying practices, policies and oversight; |

| ● | Nomination, Governance and Public Affairs Committee has responsibility for overseeing management with respect to Citi’s trade association payments, for political contributions and lobbying activities; and | |

| ● | Transparency on practices around political contributions and trade and business associations through: | |

| Ø a link on our website to federal, state, and international government websites where our lobbying activities are reported; | ||

| Ø requiring trade and business associations that make independent expenditures, to which Citi pays dues, to attest that no portion of such payments from Citi is used for such activities; and | ||

| Ø listing on Citi’s website the names of our significant trade and business associations in which membership dues total $50,000 or more, and the associations’ allocated portion of the dues attributable to lobbying during the calendar year. |

Citi 2025 Proxy Statement

| COrporate governance | 21 |

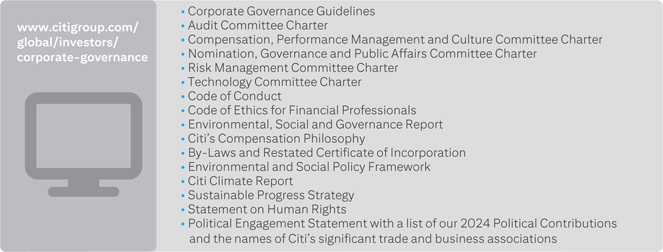

Corporate Governance Materials Available on Citi’s Website

In addition to our Corporate Governance Guidelines, other information relating to corporate governance at Citi is available in the Corporate Governance section of our website at www.citigroup.com. Click on “Investors” and then “Corporate Governance.”

Citi stockholders may obtain printed copies of these documents by writing to Citigroup Inc., Corporate Governance, 388 Greenwich Street, 17th Floor, New York, New York 10013.

Annual Report

If you received these proxy materials by mail, you should have also received Citi’s Annual Report to Stockholders for 2024 with them. Citi’s Annual Report to Stockholders for 2024 is also available on Citi’s website at www.citigroup.com. Alternatively, we will promptly send a copy of Citi’s Annual Report to Stockholders for 2024 to you without charge upon request by mail to Citi’s Corporate Secretary, Brent J. McIntosh, at 388 Greenwich Street, New York, New York 10013. We urge you to read these documents carefully. In accordance with the SEC’s rules, the Five-Year Performance Graph appears in the 2024 Annual Report on Form 10-K, which is included in Citi’s Annual Report to Stockholders for 2024.

Corporate Governance Guidelines

Citi’s Corporate Governance Guidelines (the Guidelines) embody many of our long-standing practices, policies, and procedures, which are the foundation of our commitment to best practices. The Guidelines are reviewed at least annually, and revised as necessary, to continue to reflect best practices. The full text of the Guidelines, as approved by the Board, is set forth on Citi’s website at www.citigroup.com. Click on “Investors,” then “Corporate Governance,” and then “Corporate Governance Guidelines.” The Guidelines outline the responsibilities, operations, qualifications, and composition of the Board. The following summarizes certain provisions of the Guidelines.

Director Independence

Our goal is that at least two-thirds of the members of the Board be independent. Descriptions of our independence criteria and the results of the Board’s independence determinations are set forth below.

Board Committees

The Guidelines require that all members of the following committees of the Board be independent: Audit; Compensation, Performance Management and Culture; and Nomination, Governance and Public Affairs. Committee members are appointed by the Board upon the recommendation of the Nomination, Governance and Public Affairs Committee. Committee membership and Chairs are appointed by and may be removed by the Board at the recommendation of the Nomination, Governance and Public Affairs Committee. The Board and each Committee have the power to retain and dismiss independent legal, financial, or other advisors, as they may deem necessary, without consulting or obtaining the approval of management.

www.citigroup.com

| 22 | Corporate Governance |

Additional Board Service

In accordance with Citi’s Corporate Governance Guidelines, subject to the discretion of the Nomination, Governance and Public Affairs Committee, a Director may not serve on more than five for-profit public company boards, including Citi’s Board, and a Director who is the Chief Executive Officer of a public company may not serve on more than three for-profit public company boards, including Citi’s Board. Members of the Audit Committee may not serve on more than three public company audit committees, including Citi’s Audit Committee. The number of other for-profit public and non-public company boards and not-for-profit boards on which a Director may serve, including leadership positions on such for-profit and not-for-profit boards, is subject to review and approval by the Nomination, Governance and Public Affairs Committee, in order to ensure that each Director is able to devote sufficient time to performing his or her duties as a Director. This review is performed annually and the full Board, based on a recommendation of the Nomination, Governance and Public Affairs Committee, determines whether each Nominee can, based on his or her outside board commitments, including committee memberships and leadership positions, devote sufficient time to performing his or her duties as a Director of Citi. In addition to the annual review, if a director is considering joining a for-profit board, the Director must advise the Nomination, Governance and Public Affairs Committee, which will consider whether, after joining such board and any of its committees, as well as assuming any leadership positions, the Director can continue to devote sufficient time to performing his or her duties as a Director of Citi. In addition, under the Corporate Governance Guidelines, Board members are required to disclose significant changes in professional responsibilities, including assuming a significant role in a not-for-profit entity, to the Nomination, Governance and Public Affairs Committee for consideration.

No Board nominee serves on more than four for-profit public company boards, and no Audit Committee member serves on more than three public company audit committees. Our CEO does not sit on any for-profit company boards besides Citi. For the 2025 slate of nominees for Citi’s Board, Citi’s Board of Directors, based on a recommendation of the Nomination, Governance and Public Affairs Committee, has determined, that upon consideration of the number of for-profit public and non-public company boards and not-for-profit boards on which each Director serves, including committee memberships and leadership positions on each of such for-profit and not-for-profit boards, that each nominee is able to devote sufficient time to performing his or her duties as a Director of Citi.

Change in Status or Responsibilities

If a Director has a substantial change in professional responsibilities, occupation, or business association, he or she is required to notify the Nomination, Governance and Public Affairs Committee and to offer his or her resignation from the Board. The Nomination, Governance and Public Affairs Committee will evaluate the facts and circumstances and make a recommendation to the Board whether to accept the resignation or request that the Director continue to serve on the Board. If a Director assumes a significant role in a not-for-profit entity, he or she is asked to notify the Nomination, Governance and Public Affairs Committee.

Attendance at Meetings

Directors are expected to attend Board meetings and meetings of the Committees on which they serve, and the Annual Meeting of Stockholders. All of the Directors then in office attended Citi’s 2024 Virtual Annual Meeting.

Evaluation of Board and Board Committee Performance

The Nomination, Governance and Public Affairs Committee conducts an annual self-evaluation of the Board’s performance in accordance with the format approved by the Committee. The self-evaluation includes an assessment of whether the Board’s composition is appropriate for carrying out its duties. Each standing committee (other than the Executive Committee) conducts an annual self-evaluation of its performance as provided in its charter. The results of the Board and committee self-evaluations are reported to the Board. See Board and Board Committee Self-Assessment Process on page 29 for further information.

Citi 2025 Proxy Statement

| Corporate Governance | 23 |

Directors Access to Senior Management and Director Orientation

Directors have full and free access to senior management and other employees of Citi. New Directors are provided with an orientation program to familiarize them with Citi’s businesses and functions, as well as its legal, compliance, regulatory, and risk profile. Citi provides educational sessions on a variety of topics throughout the year for all members of the Board. These sessions are designed to allow Directors to develop a deeper understanding of, for example, each of Citi’s five lines of business.

Succession Planning

The Board reviews the Compensation, Performance Management and Culture Committee’s report on the performance of senior executives to evaluate whether they are providing the highest quality leadership for Citi. The Board also works with the Nomination, Governance and Public Affairs Committee to evaluate potential successors to the CEO. With respect to regular succession of the CEO and senior management, Citi’s Board evaluates internal, and, when appropriate, external candidates. To find external candidates, Citi seeks input from the members of the Board, senior management, and recruiting firms. To develop internal candidates, Citi engages in a number of practices, formal and informal, designed to familiarize the Board with Citi’s talent pool. The formal process involves an annual talent review conducted by senior management at which the Board studies the most promising members of senior management. The Board learns about each person’s experience, skills, areas of expertise, accomplishments, and goals. This review is conducted at a regularly scheduled Board meeting on an annual basis. In addition, members of senior management are periodically asked to make presentations to the Board at Board meetings and Board strategy sessions. These presentations are made by senior managers of the various business units as well as those who serve in corporate functions. The purpose of the formal review and other interaction is to familiarize Board members with the talent pool inside and outside Citi from which the Board would be able to choose successors to the CEO and evaluate succession for other senior managers as necessary from time to time.

Charitable Contributions

If a Director, or an immediate family member who shares the Director’s household, serves as a director, trustee, or executive officer of a foundation, university, or other not-for-profit organization, and such entity receives contributions from Citi and/or the Citi Foundation, such contributions must be reported to the Nomination, Governance and Public Affairs Committee at least annually.

Insider Investments and Transactions

Members of Citi’s Board of Directors and Citi’s executive officers (i.e., Section 16 Insiders) are not permitted to hedge their Citi securities or to pledge their Citi securities as collateral for a loan. The Guidelines restrict certain financial transactions between Citi and its subsidiaries on the one hand and Directors, senior management, and their immediate family members on the other. Personal loans from Citi or its subsidiaries to Citi’s Directors and its most senior executives, or immediate family members who share any such person’s household, are prohibited, except for margin loans to employees of a broker-dealer subsidiary of Citi, mortgage loans, home equity loans, consumer loans, credit cards, and overdraft checking privileges, all made on market terms in the ordinary course of business. See Certain Transactions and Relationships, Compensation Committee Interlocks, and Insider Participation on pages 37-39.

The Guidelines prohibit investments or transactions by Citi or its executive officers and those immediate family members who share an executive officer’s household in a partnership or other privately held entity in which an outside Director is a principal, or in a publicly traded company in which an outside Director owns or controls more than a 10% interest. Directors and those immediate family members who share the Director’s household are not permitted to receive initial public offering allocations. Directors and their immediate family members may participate in Citi-sponsored investment activities, provided they are offered on the same terms as those offered to similarly situated non-affiliated persons. Under certain circumstances, or with the approval of the appropriate committee, members of senior management may participate in certain Citi-sponsored investment opportunities. Finally, there is a prohibition on certain investments by Directors and executive officers in third-party entities when the opportunity comes solely as a result of their position with Citi.

www.citigroup.com

| 24 | Corporate Governance |

Director Independence

The Board has adopted categorical standards to assist the Board in evaluating the independence of each of its Directors. The categorical standards, which are set forth below, describe various types of relationships that could potentially exist between a Director or an immediate family member of a Director and Citi, and set thresholds at which such relationships would be deemed to be material. Provided that no relationship or transaction exists that would disqualify a Director under the categorical standards and no other relationships or transactions exist of a type not specifically mentioned in the categorical standards that, in the Board’s opinion, taking into account all facts and circumstances, would impair a Director’s ability to exercise his or her independent judgment, the Board, based on the recommendation of the Nomination, Governance and Public Affairs Committee, will deem such person to be independent.

The Nomination, Governance and Public Affairs Committee reviewed certain information obtained from Directors’ responses to a questionnaire asking about their relationships with Citi, and those of their immediate family members and primary business or charitable affiliations and other potential conflicts of interest, as well as certain data collected by Citi’s businesses related to transactions, relationships, or arrangements between Citi on the one hand and a Director, immediate family member of a Director, or a primary business or charitable affiliation of a Director, on the other. The Nomination, Governance and Public Affairs Committee also reviewed certain relationships or transactions between the Directors or immediate family members of the Directors or their primary business or charitable affiliations and Citi and determined that the relationships or transactions complied with the Corporate Governance Guidelines and the related categorical standards. The Board, based on the recommendation of the Nomination, Governance and Public Affairs Committee, determined that, applying the Guidelines and standards, which are intended to comply with the NYSE corporate governance rules, and all other applicable laws, rules, and regulations, each of the below Director nominees standing for re-election is independent. The Board also determined that Barbara J. Desoer and S. Leslie Ireland are independent.

|

● Ellen M. Costello ● Grace E. Dailey ● John C. Dugan ● Duncan P. Hennes |

● Peter B. Henry ● Renée J. James ● Gary M. Reiner ● Diana L. Taylor |

● James S. Turley ● Casper W. von Koskull |

The Board has determined that Jane N. Fraser, our Chief Executive Officer, and Titi Cole, the former Head of Legacy Franchises at Citi, are not independent.

Independence Standards

To be considered independent, a Director must meet the following categorical standards as adopted by our Board and reflected in our Corporate Governance Guidelines. In addition, there are other independence standards under NYSE corporate governance rules that apply to all directors and certain independence standards under SEC, Federal Reserve Board, and Federal Deposit Insurance Corporation (FDIC) rules that apply to specific committees.

Citi 2025 Proxy Statement

| Corporate Governance | 25 |

Categorical Standards

Advisory, Consulting and Employment Arrangements

| ● | During any 12-month period within the last three years, neither a Director nor any Immediate Family Member of a Director shall have received more than $120,000 in direct compensation from Citi, other than amounts paid (a) pursuant to Citi’s Amended and Restated Compensation Plan for Non-Employee Directors, (b) pursuant to a pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service) or (c) to an Immediate Family Member of a Director who is a non-executive employee of Citi or one of its subsidiaries. | ||

| ● | In addition, no member of the Audit Committee may accept a direct or indirect consulting, advisory or other compensatory fee from Citi or one of its subsidiaries, other than (a) fees for service as a member of the Board of Directors of Citi or one of its subsidiaries (including committees thereof) or (b) receipt of fixed amounts of compensation under a Citi retirement plan, including deferred compensation, for prior service with Citi, provided that such compensation is not contingent in any way on continued service. | ||

| Business Relationships | |||

| ● | All business relationships, lending relationships, deposit and other banking relationships between the Company and a Director’s primary business affiliation or the primary business affiliation of an immediate family member of a Director must be made in the ordinary course of business and on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. | ||

| ● | In addition, the aggregate amount of payments for property or services in any of the last three fiscal years by the Company to, and to the Company from, any company of which a Director is an executive officer or employee or where an immediate family member of a Director is an executive officer, must not exceed the greater of $1 million or 2% of such other company’s consolidated gross revenues in any single fiscal year. | ||

| ● | Loans may be made or maintained by the Company to a Director’s primary business affiliation or the primary business affiliation of an immediate family member of a Director, only if the loan (i) is made in the ordinary course of business of the Company or one of its subsidiaries, is of a type that is generally made available to other customers, and is on market terms, or terms that are no more favorable than those offered to other customers; (ii) complies with applicable law, including the Sarbanes-Oxley Act of 2002 (Sarbanes-Oxley), Regulation O of the FRB, and the Federal Deposit Insurance Corporation (FDIC) Guidelines; (iii) when made does not involve more than the normal risk of collectability or present other unfavorable features; and (iv) is not classified by the Company as Substandard (II) or worse, as defined by the Office of the Comptroller of the Currency in its “Rating Credit Risk” Comptroller’s Handbook. | ||

|

Charitable Contributions | |||

| Annual contributions in any of the last three calendar years from the Company and/or the Citi Foundation to a charitable organization of which a Director, or an immediate family member who shares the Director’s household, serves as a Director, trustee, or executive officer (other than the Citi Foundation and other charitable organizations sponsored by the Company) may not exceed the greater of $250,000 or 10% of the charitable organization’s annual consolidated gross revenue. | |||

| Employment/Affiliations | |||

| ● | A Director shall not: | ||

| (i) | be or have been an employee of the Company within the last three years; | ||

| (ii) | be part of, or within the past three years have been part of, an interlocking directorate in which a current executive officer of the Company serves or has served on the compensation committee of a company that concurrently employs or employed the Director as an executive officer; or | ||

| (iii) | be or have been affiliated with or employed by (a) Citi’s present or former primary outside auditor or (b) any other outside auditor of Citi and personally worked on Citi’s audit, in each case within the three-year period following the auditing relationship. | ||

www.citigroup.com

| 26 | Corporate Governance |

| ● | A Director may not have an immediate family member who: | ||

| (i) | is an executive officer of the Company or has been within the last three years; | ||

| (ii) | is, or within the past three years has been, part of an interlocking directorate in which a current executive officer of the Company serves or has served on the compensation committee of a company that concurrently employs or employed such immediate family member as an executive officer; or | ||

| (iii) | (a) is a current partner of Citi’s primary outside auditor, or a current employee of Citi’s primary outside auditor and personally works on Citi’s audit, or (b) was within the last three years (but is no longer) a partner or employee of Citi’s primary auditor and personally worked on Citi’s audit within that time. | ||

|

Immaterial Relationships and Transactions | |||

| The Board may determine that a Director is independent notwithstanding the existence of an immaterial relationship or transaction between Citi and (i) the Director, (ii) an immediate family member of the Director or (iii) the Director’s or immediate family member’s business or charitable affiliations, provided Citi’s Proxy Statement includes a specific description of such relationship as well as the basis for the Board’s determination that such relationship does not preclude a determination that the Director is independent. Relationships or transactions between Citi and (i) the Director, (ii) an immediate family member of the Director or (iii) the Director’s or immediate family member’s business or charitable affiliations that comply with the Corporate Governance Guidelines, including, but not limited to, the Director Independence Standards that are part of the Corporate Governance Guidelines and the sections titled Financial Services, Personal Loans and Investments/Transactions, are deemed to be categorically immaterial and do not require disclosure in the Proxy Statement (unless such relationship or transaction is required to be disclosed pursuant to Item 404 of SEC Regulation S-K). | |||

| Definitions | |||

| For purposes of these Corporate Governance Guidelines, (i) the term “immediate family member” means a Director’s or executive officer’s (designated as such pursuant to Section 16 of the Securities Exchange Act of 1934, as amended (Exchange Act)) spouse, parents, step-parents, children, step-children, siblings, mother- and father-in law, sons- and daughters-in-law, and brothers- and sisters-in-law and any person (other than a tenant or domestic employee) who shares the Director’s household; (ii) the term “Primary Business Affiliation” means an entity of which the Director or executive officer, or an immediate family member of such a person, is an officer, partner or employee or in which the Director, executive officer or immediate family member owns directly or indirectly at least a 5% equity interest; and (iii) the term “Related Party Transaction” means any financial transaction, arrangement or relationship in which (a) the aggregate amount involved will or may be expected to exceed $120,000 in any fiscal year, (b) Citi is a participant, and (c) any Related Person (any Director, any executive officer of Citi, any nominee for Director, any shareholder owning in excess of 5% of the total equity of Citi, and any immediate family member of any such person) has or will have a direct or indirect material interest. | |||

Citi 2025 Proxy Statement

| Corporate Governance | 27 |

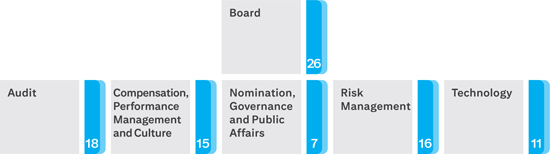

Meetings of the Board of Directors and Committees

The Board of Directors met 26 times in 2024. Citi’s standing Board Committees met as follows: the Audit Committee met 18 times, the Compensation, Performance Management and Culture Committee met 15 times, the Nomination, Governance and Public Affairs Committee met 7 times, the Risk Management Committee met 16 times, and the Technology Committee met 11 times. The Executive Committee did not meet in 2024.

During 2024, independent members of the Board served on and/or chaired one or more ad hoc committees, including the Transformation Oversight Committee, or served on an international subsidiary board. In addition, Mses. Costello, Dailey, Fraser, Ireland, and Taylor and Messrs. Hennes and Turley served on the Board of Directors of Citibank, N.A., which is a wholly owned subsidiary of Citi.

Each incumbent Director attended at least 75% of the meetings of the Board and of the standing committees of which he or she was a member during 2024.

Meetings of Non-Management Directors

Citi’s non-management Directors meet in executive session without any management Directors in attendance whenever the full Board convenes for a regularly scheduled meeting. During 2024, Mr. Dugan presided at each executive session of the non-management Directors.

Board Leadership Structure

Citi

currently has an independent Chair separate from the CEO, a structure that has been in place since 2009. The Board believes it is

important to maintain flexibility in its Board leadership structure and has had in place different leadership structures in the

past, depending on the Company’s needs at the time, but firmly supports having an independent Director in a Board leadership

position at all times. Accordingly, Citi’s Board, on December 15, 2009, adopted a By-Law amendment that provides that if Citi

does not have an Independent Chair, the Board will elect a lead independent Director having similar duties to an independent Chair,

including leading the executive sessions of the non-management Directors at Board meetings. Citi’s Chair provides independent

leadership of the Board. Having an independent Chair or Lead Director enables non-management Directors to raise issues and concerns for Board consideration

without immediately involving management. The Chair or Lead Director also serves as a liaison between the Board and senior

management and regularly meets with Citi’s stockholders, stakeholders, and regulators on behalf of the Company. Citi’s

Board has determined that the current structure, an independent Chair separate from the CEO, is the most appropriate structure at

this time, while ensuring that, at all times, there will be an independent Director in a Board leadership position. The Board

believes its approach to risk oversight, which includes: (i) a report at every regular Board meeting from the Chief Risk Officer on

significant risk matters for discussion with the Board, (ii) a standing Risk Management Committee of the Board, and (iii) a direct

reporting line of the Chief Risk Officer to the Risk Management Committee, that enables the Board to choose many leadership

structures without experiencing a material impact on its oversight of risk.