(State of incorporation) | (I.R.S. Employer Identification No.) | ||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Accelerated filer ☐ | |||||

Non-accelerated filer ☐ | Smaller reporting company | ||||

Emerging growth company | |||||

| Page | ||||||||

| Country | Location | Products | ||||||||||||

| China | Kunshan | Sheet | ||||||||||||

Qinhuangdao(1) | Sheet and Plate | |||||||||||||

| Hungary | Székesfehérvár | Sheet, Plate, Slabs and Billets | ||||||||||||

| United Kingdom | Birmingham | Plate | ||||||||||||

| United States | Davenport, IA | Sheet and Plate | ||||||||||||

| Danville, IL | Sheet and Plate | |||||||||||||

| Hutchinson, KS | Sheet and Plate | |||||||||||||

| Lancaster, PA | Sheet and Plate | |||||||||||||

| Alcoa, TN | Sheet and Plate | |||||||||||||

| Country | Location | Products | ||||||||||||

| Canada | Lethbridge, Alberta | Architectural Systems | ||||||||||||

| France | Merxheim(1) | Architectural Products | ||||||||||||

| United Kingdom | Runcorn | Architectural Systems | ||||||||||||

| United States | Springdale, AR | Architectural Systems | ||||||||||||

| Visalia, CA | Architectural Systems | |||||||||||||

| Eastman, GA | Architectural Products | |||||||||||||

| Bloomsburg, PA | Architectural Systems | |||||||||||||

| Cranberry, PA | Architectural Systems | |||||||||||||

| Country | Location | Products | ||||||||||||

| Germany | Hannover(1) | Extrusions | ||||||||||||

| United States | Lafayette, IN | Extrusions | ||||||||||||

Massena, NY(2) | Extrusions | |||||||||||||

Region | Percentage of Total Population | ||||

Americas | 74% | ||||

Europe, Middle East and Africa | 18% | ||||

Asia | 8% | ||||

Total % | Management3 % | Executive4 % | |||||||||

Women1 | 17.7% | 25.8% | 30.0% | ||||||||

Minorities2 | 25.6% | 13.1% | 20.0% | ||||||||

Name | Age | Position | ||||||||||||

Timothy D. Myers | 57 | Chief Executive Officer | ||||||||||||

Erick R. Asmussen | 56 | Executive Vice President and Chief Financial Officer | ||||||||||||

| Daniel G. Fayock | 48 | Executive Vice President, Chief Legal Officer and Secretary | ||||||||||||

Melissa M. Miller | 51 | Executive Vice President and Chief Human Resources Officer | ||||||||||||

| Diana B. Perreiah | 58 | Executive Vice President, Rolled Products North America | ||||||||||||

Mark J. Vrablec | 62 | Executive Vice President and Chief Commercial Officer | ||||||||||||

| Robert L. Woodall | 56 | Executive Vice President, Rolled Products International and Extrusions | ||||||||||||

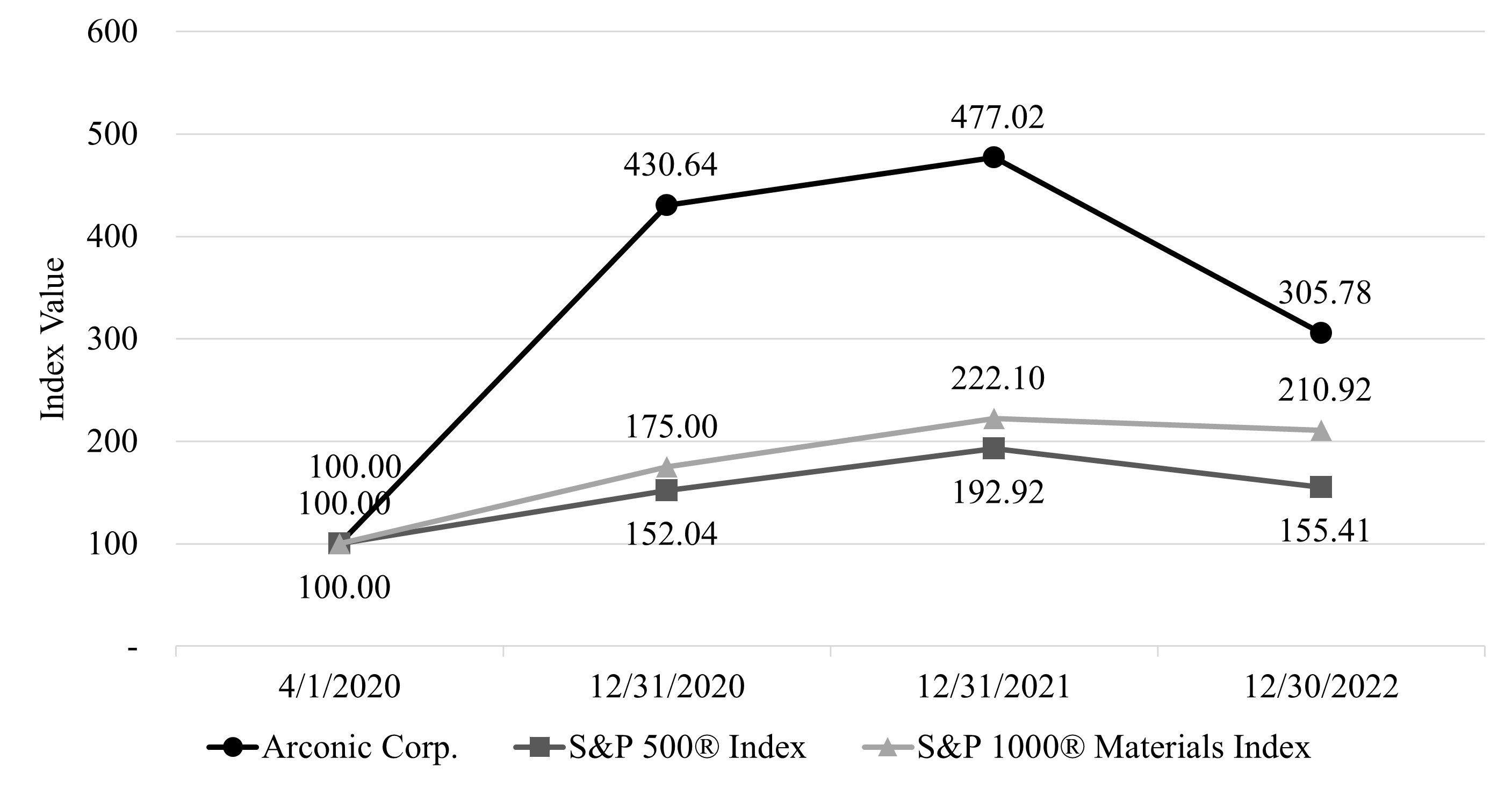

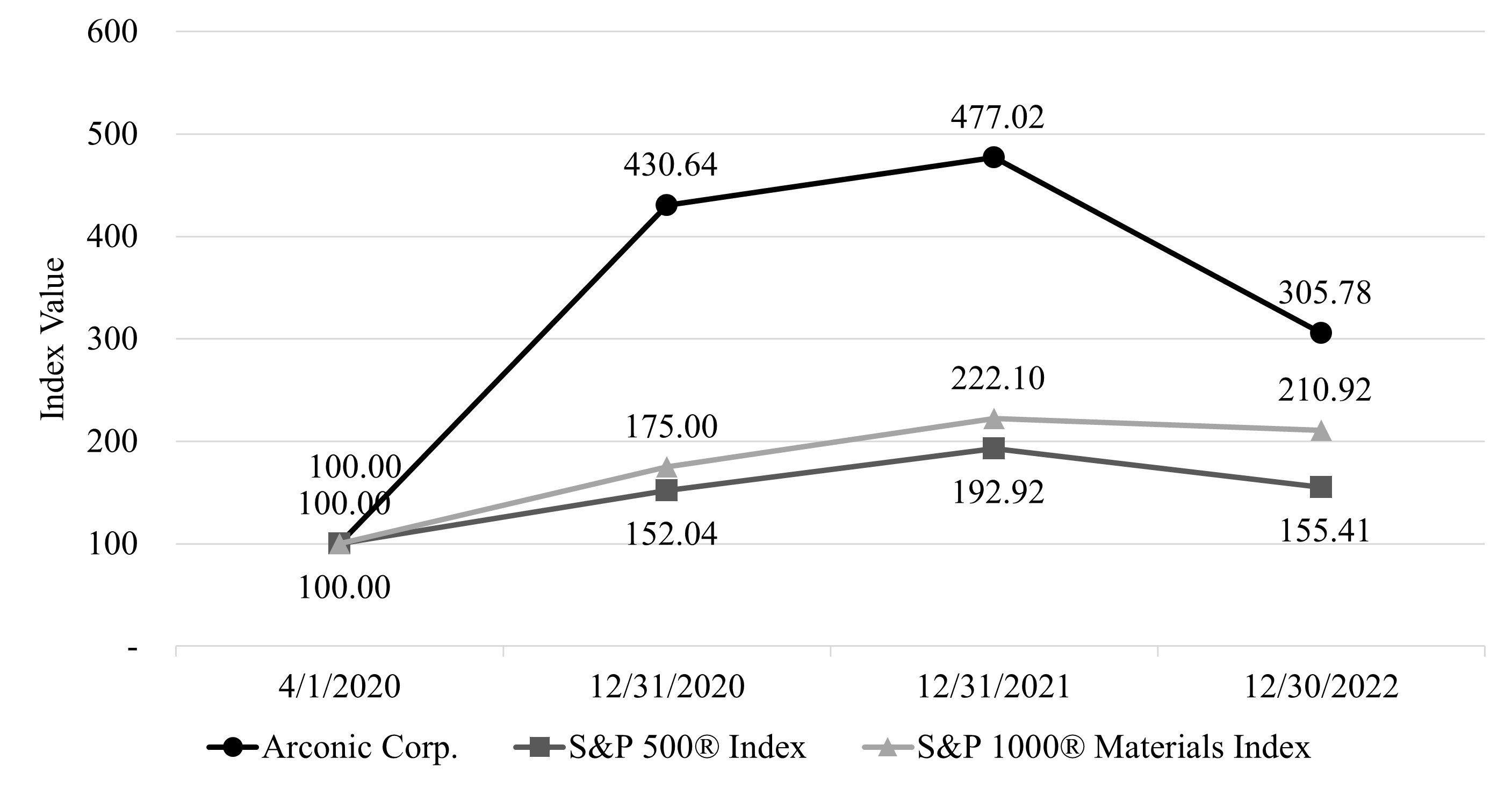

| April 1, 2020 | December 31, 2020 | December 31, 2021 | December 31, 2022 | |||||||||||

Arconic Corporation | $ | 100.00 | $ | 430.64 | $ | 477.02 | $ | 305.78 | ||||||

S&P 500® Index | 100.00 | 152.04 | 192.92 | 155.41 | ||||||||||

S&P 1000® Materials Index | 100.00 | 175.00 | 222.10 | 210.92 | ||||||||||

| Period | Total number of shares purchased | Average price paid per share | Total number of shares purchased as part of publicly announced plans or programs* | Approximate dollar value of shares that may yet be purchased under the plans or programs* | ||||||||||||||||||||||

| October 1 - October 31, 2022 | — | $ | — | — | $ | — | ||||||||||||||||||||

| November 1 - November 30, 2022 | 468,979 | $ | 21.59 | 468,979 | $ | 190,000,000 | ||||||||||||||||||||

| December 1 - December 31, 2022 | 1,602,856 | $ | 22.56 | 1,602,856 | $ | 154,000,000 | ||||||||||||||||||||

| Total for quarter ended December 31, 2022 | 2,071,835 | 2,071,835 | ||||||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Third-party sales | $ | 7,313 | $ | 6,187 | $ | 4,335 | ||||||||||||||

| Intersegment sales | 44 | 33 | 19 | |||||||||||||||||

| Total sales | $ | 7,357 | $ | 6,220 | $ | 4,354 | ||||||||||||||

| Segment Adjusted EBITDA | $ | 581 | $ | 655 | $ | 527 | ||||||||||||||

| Third-party aluminum shipments (kmt) | 1,372 | 1,404 | 1,179 | |||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Third-party sales | $ | 1,245 | $ | 1,011 | $ | 963 | ||||||||||||||

| Segment Adjusted EBITDA | $ | 195 | $ | 130 | $ | 137 | ||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Third-party sales | $ | 409 | $ | 306 | $ | 381 | ||||||||||||||

| Segment Adjusted EBITDA | $ | (47) | $ | (28) | $ | (16) | ||||||||||||||

| Third-party aluminum shipments (kmt) | 38 | 35 | 40 | |||||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

Total Segment Adjusted EBITDA | $ | 729 | $ | 757 | $ | 648 | ||||||||||||||

| Unallocated amounts: | ||||||||||||||||||||

Corporate expenses(1) | (29) | (33) | (24) | |||||||||||||||||

| Stock-based compensation expense | (15) | (22) | (23) | |||||||||||||||||

Metal price lag(2) | 17 | (16) | (27) | |||||||||||||||||

Unrealized gains on mark-to-market hedging instruments and derivatives | 6 | — | — | |||||||||||||||||

| Provision for depreciation and amortization | (237) | (253) | (251) | |||||||||||||||||

Impairment of goodwill | — | (65) | — | |||||||||||||||||

Restructuring and other charges(3),(4) | (456) | (624) | (188) | |||||||||||||||||

Other(5) | (62) | (36) | (55) | |||||||||||||||||

Operating (loss) income | (47) | (292) | 80 | |||||||||||||||||

| Interest expense | (104) | (100) | (118) | |||||||||||||||||

Other expenses, net | (41) | (67) | (70) | |||||||||||||||||

Benefit (Provision) for income taxes | 11 | 62 | (1) | |||||||||||||||||

| Net income attributable to noncontrolling interest | (1) | — | — | |||||||||||||||||

Consolidated net loss attributable to Arconic(1) | $ | (182) | $ | (397) | $ | (109) | ||||||||||||||

| Total | 2023 | 2024-2025 | 2026-2027 | Thereafter | |||||||||||||||||||||||||

| Operating activities: | |||||||||||||||||||||||||||||

| Raw material purchase obligations* | $ | 966 | $ | 880 | $ | 86 | $ | — | $ | — | |||||||||||||||||||

| Energy-related purchase obligations | 83 | 15 | 29 | 22 | 17 | ||||||||||||||||||||||||

| Other purchase obligations | 37 | 14 | 10 | 6 | 7 | ||||||||||||||||||||||||

| Operating leases | 137 | 40 | 55 | 23 | 19 | ||||||||||||||||||||||||

| Interest related to debt | 408 | 97 | 173 | 110 | 28 | ||||||||||||||||||||||||

| Pension contributions - funded plans | 367 | 38 | 148 | 181 | — | ||||||||||||||||||||||||

| Pension benefit payments - unfunded plans | 71 | 7 | 14 | 14 | 36 | ||||||||||||||||||||||||

| Other postretirement benefit payments | 261 | 27 | 54 | 53 | 127 | ||||||||||||||||||||||||

| Layoff and other restructuring payments | 1 | 1 | — | — | — | ||||||||||||||||||||||||

| Uncertain tax positions | — | — | — | — | — | ||||||||||||||||||||||||

| Financing activities: | |||||||||||||||||||||||||||||

| Debt | 1,600 | — | 700 | — | 900 | ||||||||||||||||||||||||

| Dividends to stockholders | — | — | — | — | — | ||||||||||||||||||||||||

| Investing activities: | |||||||||||||||||||||||||||||

| Capital projects | 208 | 154 | 51 | 3 | — | ||||||||||||||||||||||||

| Totals | $ | 4,139 | $ | 1,273 | $ | 1,320 | $ | 412 | $ | 1,134 | |||||||||||||||||||

/s/ Timothy D. Myers | ||

| Timothy D. Myers Chief Executive Officer | ||

/s/ Erick R. Asmussen | ||

| Erick R. Asmussen Executive Vice President and Chief Financial Officer | ||

February 21, 2023 | ||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| $ | $ | $ | ||||||||||||||||||

Cost of goods sold (exclusive of expenses below) | ||||||||||||||||||||

| Selling, general administrative, and other expenses | ||||||||||||||||||||

| Research and development expenses | ||||||||||||||||||||

| Provision for depreciation and amortization | ||||||||||||||||||||

| Operating (loss) income | ( | ( | ||||||||||||||||||

| Loss before income taxes | ( | ( | ( | |||||||||||||||||

| ( | ( | |||||||||||||||||||

| Net loss | ( | ( | ( | |||||||||||||||||

| Less: Net income attributable to noncontrolling interest | ||||||||||||||||||||

| Net loss attributable to Arconic Corporation | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Basic | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Diluted | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Arconic Corporation | Noncontrolling interest | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | ( | $ | $ | $ | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||||||||||||||||||||||

| Change in unrecognized net actuarial loss and prior service cost/benefit related to pension and other postretirement benefits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustments | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net change in unrecognized losses on cash flow hedges | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Other comprehensive income, net of tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Comprehensive (loss) income | $ | ( | $ | $ | $ | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||

| December 31, | 2022 | 2021 | ||||||||||||

| Assets | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Other receivables | ||||||||||||||

| Total current assets | ||||||||||||||

| Other noncurrent assets | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| Liabilities | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable, trade | $ | $ | ||||||||||||

| Accrued compensation and retirement costs | ||||||||||||||

| Taxes, including income taxes | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Other noncurrent liabilities | ||||||||||||||

| Total liabilities | ||||||||||||||

| Equity | ||||||||||||||

| Arconic Corporation stockholders’ equity: | ||||||||||||||

| Additional capital | ||||||||||||||

| Accumulated deficit | ( | ( | ||||||||||||

| ( | ( | |||||||||||||

| ( | ( | |||||||||||||

| Total Arconic Corporation stockholders’ equity | ||||||||||||||

| Total equity | ||||||||||||||

| Total liabilities and equity | $ | $ | ||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Operating Activities | ||||||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Adjustments to reconcile net loss to cash provided from (used for) operations: | ||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||

| ( | ( | ( | ||||||||||||||||||

| Other | ( | |||||||||||||||||||

| Changes in assets and liabilities, excluding effects of acquisitions, divestitures, and foreign currency translation adjustments: | ||||||||||||||||||||

| ( | ( | |||||||||||||||||||

| (Increase) Decrease in inventories | ( | ( | ||||||||||||||||||

| (Increase) in prepaid expenses and other current assets | ( | ( | ( | |||||||||||||||||

| (Decrease) Increase in accounts payable, trade | ( | |||||||||||||||||||

| Increase (Decrease) in accrued expenses | ( | ( | ||||||||||||||||||

| Increase in taxes, including income taxes | ||||||||||||||||||||

| ( | ( | ( | ||||||||||||||||||

| (Increase) Decrease in noncurrent assets | ( | ( | ||||||||||||||||||

| Increase in noncurrent liabilities | ||||||||||||||||||||

| Cash provided from (used for) operations | ( | |||||||||||||||||||

| Financing Activities | ||||||||||||||||||||

| Net transfers from former parent company | ||||||||||||||||||||

| — | ( | |||||||||||||||||||

| ( | ( | ( | ||||||||||||||||||

| ( | ||||||||||||||||||||

| ( | ( | |||||||||||||||||||

| Other | ( | ( | ||||||||||||||||||

| Cash (used for) provided from financing activities | ( | |||||||||||||||||||

| Investing Activities | ||||||||||||||||||||

| Capital expenditures | ( | ( | ( | |||||||||||||||||

| ( | ||||||||||||||||||||

| Other | ||||||||||||||||||||

| Cash used for investing activities | ( | ( | ( | |||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | ( | |||||||||||||||||||

| Net change in cash and cash equivalents and restricted cash | ( | ( | ||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||

| Common shares outstanding | Common stock | Additional capital | Accumulated deficit | Treasury stock | Parent Company net investment | Accumulated other comprehensive income (loss) | Noncontrolling interest | Total equity | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2019 | — | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||

| Net (loss) income | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Change in ParentCo contribution | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

Separation-related adjustments | — | — | — | — | ( | ( | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| ( | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | ( | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ( | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

Other | — | — | ( | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | ( | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||

| Net (loss) income | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ( | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other | — | — | ( | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | ( | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||

| 2020 | |||||||||||

Selling, general administrative, and other expenses* | $ | ||||||||||

| Provision for depreciation and amortization | |||||||||||

Other (income), net | ( | ||||||||||

| Structures | Machinery and equipment | ||||||||||

| Rolled Products | |||||||||||

| Building and Construction Systems | |||||||||||

| Extrusions | |||||||||||

| Software | Other intangible assets | ||||||||||

| Rolled Products | — | ||||||||||

| Building and Construction Systems | |||||||||||

| Extrusions | |||||||||||

| For the year ended December 31, | Rolled Products | Building and Construction Systems | Extrusions | Total | ||||||||||||||||||||||

| 2022 | ||||||||||||||||||||||||||

| Ground Transportation | $ | $ | $ | $ | ||||||||||||||||||||||

| Packaging | ||||||||||||||||||||||||||

| Building and Construction | ||||||||||||||||||||||||||

| Aerospace | ||||||||||||||||||||||||||

| Industrial Products and Other | ||||||||||||||||||||||||||

| Total end-market revenue | $ | $ | $ | $ | ||||||||||||||||||||||

| 2021 | ||||||||||||||||||||||||||

| Ground Transportation | $ | $ | $ | $ | ||||||||||||||||||||||

| Packaging | ||||||||||||||||||||||||||

| Building and Construction | ||||||||||||||||||||||||||

| Aerospace | ||||||||||||||||||||||||||

| Industrial Products and Other | ||||||||||||||||||||||||||

| Total end-market revenue | $ | $ | $ | $ | ||||||||||||||||||||||

| 2020 | ||||||||||||||||||||||||||

| Ground Transportation | $ | $ | $ | $ | ||||||||||||||||||||||

| Packaging | ||||||||||||||||||||||||||

| Building and Construction | ||||||||||||||||||||||||||

| Aerospace | ||||||||||||||||||||||||||

| Industrial Products and Other | ||||||||||||||||||||||||||

| Total end-market revenue | $ | $ | $ | $ | ||||||||||||||||||||||

| Rolled Products | Building and Construction Systems | Extrusions | Total | ||||||||||||||||||||

| 2022 | |||||||||||||||||||||||

| Sales: | |||||||||||||||||||||||

| Third-party sales | $ | $ | $ | $ | |||||||||||||||||||

| Intersegment sales | |||||||||||||||||||||||

| Total sales | $ | $ | $ | $ | |||||||||||||||||||

Segment Adjusted EBITDA | $ | $ | $ | ( | $ | ||||||||||||||||||

| Provision for depreciation and amortization | $ | $ | $ | $ | |||||||||||||||||||

| 2021 | |||||||||||||||||||||||

| Sales: | |||||||||||||||||||||||

| Third-party sales | $ | $ | $ | $ | |||||||||||||||||||

| Intersegment sales | |||||||||||||||||||||||

| Total sales | $ | $ | $ | $ | |||||||||||||||||||

Segment Adjusted EBITDA | $ | $ | $ | ( | $ | ||||||||||||||||||

| Provision for depreciation and amortization | $ | $ | $ | $ | |||||||||||||||||||

| 2020 | |||||||||||||||||||||||

| Sales: | |||||||||||||||||||||||

| Third-party sales | $ | $ | $ | $ | |||||||||||||||||||

| Intersegment sales | |||||||||||||||||||||||

| Total sales | $ | $ | $ | $ | |||||||||||||||||||

Segment Adjusted EBITDA | $ | $ | $ | ( | $ | ||||||||||||||||||

| Provision for depreciation and amortization | $ | $ | $ | $ | |||||||||||||||||||

| 2022 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

Segment assets(1) | $ | $ | $ | $ | |||||||||||||||||||

| Supplemental information: | |||||||||||||||||||||||

| Capital expenditures | |||||||||||||||||||||||

| Goodwill | |||||||||||||||||||||||

| 2021 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

Segment assets(2) | $ | $ | $ | $ | |||||||||||||||||||

| Supplemental information: | |||||||||||||||||||||||

| Capital expenditures | |||||||||||||||||||||||

| Goodwill | |||||||||||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Sales: | ||||||||||||||||||||

| Total segment sales | $ | $ | $ | |||||||||||||||||

| Elimination of intersegment sales | ( | ( | ( | |||||||||||||||||

| Other | ( | ( | ||||||||||||||||||

| Consolidated sales | $ | $ | $ | |||||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

Total Segment Adjusted EBITDA | $ | $ | $ | |||||||||||||||||

| Unallocated amounts: | ||||||||||||||||||||

Corporate expenses(1) | ( | ( | ( | |||||||||||||||||

| ( | ( | ( | ||||||||||||||||||

Metal price lag(2) | ( | ( | ||||||||||||||||||

| Provision for depreciation and amortization | ( | ( | ( | |||||||||||||||||

| ( | ||||||||||||||||||||

| ( | ( | ( | ||||||||||||||||||

Other(5) | ( | ( | ( | |||||||||||||||||

Operating (loss) income | ( | ( | ||||||||||||||||||

| ( | ( | ( | ||||||||||||||||||

| ( | ( | ( | ||||||||||||||||||

| ( | ||||||||||||||||||||

| Net income attributable to noncontrolling interest | ( | |||||||||||||||||||

Consolidated net loss attributable to Arconic(1) | $ | ( | $ | ( | $ | ( | ||||||||||||||

| December 31, | 2022 | 2021 | ||||||||||||

| Assets: | ||||||||||||||

| Total segment assets | $ | $ | ||||||||||||

| Unallocated amounts: | ||||||||||||||

| Cash and cash equivalents | ||||||||||||||

| Prepaid expenses and other current assets | ||||||||||||||

| Fair value of hedging instruments and derivatives | ||||||||||||||

| Corporate fixed assets, net | ||||||||||||||

| Operating lease right-of-use assets | ||||||||||||||

| Other noncurrent assets | ||||||||||||||

| Other | ||||||||||||||

| Consolidated assets | $ | $ | ||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Sales: | ||||||||||||||||||||

| United States | $ | $ | $ | |||||||||||||||||

| Russia* | ||||||||||||||||||||

| China | ||||||||||||||||||||

| Hungary* | ||||||||||||||||||||

| France | ||||||||||||||||||||

| United Kingdom | ||||||||||||||||||||

| Other | ||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||

| December 31, | 2022 | 2021 | ||||||||||||

| Long-lived assets: | ||||||||||||||

| United States | $ | $ | ||||||||||||

| China | ||||||||||||||

| Russia* | ||||||||||||||

| Hungary | ||||||||||||||

| United Kingdom | ||||||||||||||

| France | ||||||||||||||

| Other | ||||||||||||||

| $ | $ | |||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| $ | $ | $ | ( | ||||||||||||||

Asset impairments | |||||||||||||||||

| Layoff costs | |||||||||||||||||

Other* | |||||||||||||||||

| Reversals of previously recorded layoff and other costs | ( | ( | ( | ||||||||||||||

| Restructuring and other charges | $ | $ | $ | ||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Rolled Products | $ | $ | $ | ( | ||||||||||||||||

| Building and Construction Systems | ( | |||||||||||||||||||

| Extrusions | ( | |||||||||||||||||||

| Segment total | ( | |||||||||||||||||||

| Corporate | ||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||

| Layoff costs | Other costs | Total | |||||||||||||||

| Reserve balances at December 31, 2019 | $ | $ | $ | ||||||||||||||

Separation-related adjustments(1) | |||||||||||||||||

| Cash payments | ( | ( | ( | ||||||||||||||

| Restructuring charges | |||||||||||||||||

Other(2) | ( | ( | ( | ||||||||||||||

| Reserve balances at December 31, 2020 | |||||||||||||||||

| Cash payments | ( | ( | ( | ||||||||||||||

| Restructuring charges | |||||||||||||||||

Other(2) | ( | ( | ( | ||||||||||||||

Reserve balances at December 31, 2021 | |||||||||||||||||

| Cash payments | ( | ( | ( | ||||||||||||||

| Restructuring charges | |||||||||||||||||

Other(2) | ( | ( | |||||||||||||||

Reserve balances at December 31, 2022(3) | $ | $ | $ | ||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Amount charged to expense | $ | $ | $ | |||||||||||||||||

| Amount capitalized | ||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| $ | $ | $ | ||||||||||||||||||

| Foreign currency (gains) losses, net | ( | |||||||||||||||||||

| Net loss from asset sales | ||||||||||||||||||||

| Interest income | ( | ( | ( | |||||||||||||||||

| Other, net | ( | ( | ||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||

| Pension benefits | Other postretirement benefits | |||||||||||||||||||||||||

| December 31, | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||

| Change in benefit obligation | ||||||||||||||||||||||||||

| Benefit obligation at beginning of year | $ | $ | $ | $ | ||||||||||||||||||||||

| Service cost | ||||||||||||||||||||||||||

| Interest cost | ||||||||||||||||||||||||||

| Amendments | ( | |||||||||||||||||||||||||

Actuarial gains(1) | ( | ( | ( | ( | ||||||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | ||||||||||||||||||||||

| Settlements | ( | ( | ||||||||||||||||||||||||

| Foreign currency translation impact | ( | ( | ||||||||||||||||||||||||

| Divestitures | ( | |||||||||||||||||||||||||

Benefit obligation at end of year(2) | $ | $ | $ | $ | ||||||||||||||||||||||

| Change in plan assets | ||||||||||||||||||||||||||

| Fair value of plan assets at beginning of year | $ | $ | $ | $ | ||||||||||||||||||||||

| Actual return on plan assets | ( | |||||||||||||||||||||||||

| Employer contributions | ||||||||||||||||||||||||||

| Benefits paid | ( | ( | ||||||||||||||||||||||||

| Settlements | ( | ( | ||||||||||||||||||||||||

| Foreign currency translation impact | ( | ( | ||||||||||||||||||||||||

| Administrative expenses | ( | |||||||||||||||||||||||||

Fair value of plan assets at end of year(2) | $ | $ | $ | $ | ||||||||||||||||||||||

Funded status(2) | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Amounts recognized on the Consolidated Balance Sheet: | ||||||||||||||||||||||||||

| Noncurrent assets | $ | $ | $ | $ | ||||||||||||||||||||||

| Current liabilities | ( | ( | ( | ( | ||||||||||||||||||||||

| Noncurrent liabilities | ( | ( | ( | ( | ||||||||||||||||||||||

| Net amount recognized | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Amounts recognized in Accumulated Other Comprehensive Loss (pretax): | ||||||||||||||||||||||||||

| Net actuarial loss | $ | $ | $ | $ | ||||||||||||||||||||||

| Prior service cost (benefit) | ( | ( | ||||||||||||||||||||||||

| Net amount recognized | $ | $ | $ | ( | $ | |||||||||||||||||||||

| Other changes in plan assets and benefit obligations recognized in Other Comprehensive Income (pretax): | ||||||||||||||||||||||||||

| Net actuarial gain | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Amortization of net actuarial loss (includes settlements) | ( | ( | ( | ( | ||||||||||||||||||||||

| Prior service cost (benefit) | ( | |||||||||||||||||||||||||

| Amortization of prior service (cost) benefit | ( | |||||||||||||||||||||||||

| Total | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Pension benefits | ||||||||||||||

| December 31, | 2022 | 2021 | ||||||||||||

| The projected benefit obligation and accumulated benefit obligation for all defined benefit pension plans was as follows: | ||||||||||||||

| Projected benefit obligation | $ | $ | ||||||||||||

| Accumulated benefit obligation | ||||||||||||||

| The aggregate projected benefit obligation and fair value of plan assets for defined benefit pension plans with projected benefit obligations in excess of plan assets was as follows: | ||||||||||||||

| Projected benefit obligation | ||||||||||||||

| Fair value of plan assets | ||||||||||||||

| The aggregate accumulated benefit obligation and fair value of plan assets for defined benefit pension plans with accumulated benefit obligations in excess of plan assets was as follows: | ||||||||||||||

| Accumulated benefit obligation | ||||||||||||||

| Fair value of plan assets | ||||||||||||||

Pension benefits(1) | Other postretirement benefits | |||||||||||||||||||||||||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||||

| Service cost | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Interest cost | ||||||||||||||||||||||||||||||||||||||

| Expected return on plan assets | ( | ( | ( | |||||||||||||||||||||||||||||||||||

Amortization of net actuarial loss | ||||||||||||||||||||||||||||||||||||||

| Amortization of prior service benefit | ( | ( | ( | |||||||||||||||||||||||||||||||||||

Settlements(2) | ||||||||||||||||||||||||||||||||||||||

Net periodic benefit cost(3) | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Benefit obligations | Net periodic benefit cost | ||||||||||||||||||||||||||||

| December 31, | For the year ended December 31, | ||||||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | 2020 | |||||||||||||||||||||||||

| Discount rate—pension plans | % | % | % | % | % | ||||||||||||||||||||||||

| Discount rate—other postretirement benefit plans | |||||||||||||||||||||||||||||

| Rate of compensation increase—pension plans | |||||||||||||||||||||||||||||

| Expected long-term rate of return on plan assets—pension plans | — | — | |||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||

| Health care cost trend rate assumed for next year | % | % | ||||||||||||

| Rate to which the cost trend rate gradually declines | % | % | ||||||||||||

| Year that the rate reaches the rate at which it is assumed to remain | ||||||||||||||

| Plan assets at December 31, | ||||||||||||||||||||

| Asset class | Policy maximum | 2022 | 2021 | |||||||||||||||||

| Equities | % | % | ||||||||||||||||||

| Fixed income | ||||||||||||||||||||

| Other investments | ||||||||||||||||||||

| Total | % | % | ||||||||||||||||||

| December 31, 2022 | Level 1 | Level 2 | Level 3 | Net Asset Value | Total | |||||||||||||||||||||||||||

| Equities: | ||||||||||||||||||||||||||||||||

| Equity securities | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Long/short equity hedge funds | ||||||||||||||||||||||||||||||||

| Private equity | ||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| Fixed Income: | ||||||||||||||||||||||||||||||||

| Intermediate and long duration government/credit | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| Other investments: | ||||||||||||||||||||||||||||||||

| Real estate | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Discretionary and systematic macro hedge funds | ||||||||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

Total* | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| December 31, 2021 | Level 1 | Level 2 | Level 3 | Net Asset Value | Total | |||||||||||||||||||||||||||

| Equities: | ||||||||||||||||||||||||||||||||

| Equity securities | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Long/short equity hedge funds | ||||||||||||||||||||||||||||||||

| Private equity | ||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| Fixed Income: | ||||||||||||||||||||||||||||||||

| Intermediate and long duration government/credit | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| Other investments: | ||||||||||||||||||||||||||||||||

| Real estate | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Discretionary and systematic macro hedge funds | ||||||||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

Total* | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| For the year ended December 31, | Pension benefits | Other postretirement benefits | ||||||||||||

| 2023 | $ | $ | ||||||||||||

| 2024 | ||||||||||||||

| 2025 | ||||||||||||||

| 2026 | ||||||||||||||

| 2027 | ||||||||||||||

| 2028 through 2032 | ||||||||||||||

| $ | $ | |||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Domestic - United States | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Foreign | ( | |||||||||||||||||||

| $ | ( | $ | ( | $ | ( | |||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Current: | ||||||||||||||||||||

| U.S. federal* | $ | $ | $ | |||||||||||||||||

| Foreign | ||||||||||||||||||||

| U.S. state and local | ||||||||||||||||||||

| Deferred: | ||||||||||||||||||||

| U.S. federal* | ( | ( | ( | |||||||||||||||||

| Foreign | ( | ( | ||||||||||||||||||

| U.S. state and local | ( | ( | ( | |||||||||||||||||

| ( | ( | ( | ||||||||||||||||||

| Total | $ | ( | $ | ( | $ | |||||||||||||||

| For the year ended December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| U.S. federal statutory rate | % | % | % | |||||||||||||||||

| Taxes on foreign operations - rate differential | ( | |||||||||||||||||||

Other taxes related to foreign operations(1) | ( | ( | ( | |||||||||||||||||

| U.S. state and local taxes, including federal benefit | ||||||||||||||||||||

Statutory tax rate and law changes | ( | ( | ||||||||||||||||||

| Changes in valuation allowances | ( | ( | ||||||||||||||||||

Non-taxable income - indemnification liability(2) | ||||||||||||||||||||

Subsidiary recapitalizations and reorganizations | ( | ( | ||||||||||||||||||

| Impairment of goodwill | ( | |||||||||||||||||||

| ( | ||||||||||||||||||||

| Changes in uncertain tax positions | ( | |||||||||||||||||||

| Stock-based compensation | ||||||||||||||||||||

| ( | ||||||||||||||||||||

Write-off of deferred tax assets due to remote utilization(3) | ( | |||||||||||||||||||

| Non-deductible officer compensation | ( | ( | ||||||||||||||||||

| Other | ( | ( | ( | |||||||||||||||||

| Effective tax rate | % | % | ( | % | ||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||

| December 31, | Deferred tax assets | Deferred tax liabilities | Deferred tax assets | Deferred tax liabilities | ||||||||||||||||||||||

| Employee benefits | $ | $ | $ | $ | ||||||||||||||||||||||

| Tax loss carryforwards | — | — | ||||||||||||||||||||||||

Deferred income/expense* | ||||||||||||||||||||||||||

| Interest | — | — | ||||||||||||||||||||||||

| Operating lease right-of-use assets and liabilities | ||||||||||||||||||||||||||

| Loss provisions | — | — | ||||||||||||||||||||||||

Inventory accounting method change* | — | — | ||||||||||||||||||||||||

| Depreciation | ||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||

| Valuation allowance | ( | — | ( | — | ||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||

| December 31, 2022 | Expires within 10 years | Expires within 11-20 years | No expiration(1) | Other(2) | Total | |||||||||||||||||||||||||||

| Tax loss carryforwards | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Employee benefits | ||||||||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||

| Valuation allowance | ( | ( | ( | ( | ||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Balance at beginning of year | $ | $ | $ | |||||||||||||||||

Establishment of new allowances(1) | ||||||||||||||||||||

Net change to existing allowances(2) | ( | ( | ||||||||||||||||||

| Separation-related adjustments | ||||||||||||||||||||

| Acquisitions and divestitures | ( | ( | ||||||||||||||||||

Release of allowances(3) | ( | |||||||||||||||||||

| Foreign currency translation | ( | ( | ||||||||||||||||||

| Balance at end of year | $ | $ | $ | |||||||||||||||||

| December 31, | 2022 | 2021 | 2020 | |||||||||||||||||

| Balance at beginning of year | $ | $ | $ | |||||||||||||||||

| Additions for tax positions of prior years | ||||||||||||||||||||

| Reductions for tax positions of prior years* | ( | |||||||||||||||||||

| Settlements with tax authorities | ( | |||||||||||||||||||

| Foreign currency translation | ( | ( | ||||||||||||||||||

| Balance at end of year | $ | $ | $ | |||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Weighted-average shares outstanding – basic | ||||||||||||||||||||

| Effect of dilutive share equivalents: | ||||||||||||||||||||

| Stock options | ||||||||||||||||||||

| Stock units | ||||||||||||||||||||

| Weighted-average shares outstanding – diluted | ||||||||||||||||||||

| Anti-dilutive share equivalents: | ||||||||||||||||||||

| Stock units | ||||||||||||||||||||

| Stock options*: | ||||||||||||||||||||

| In-the-money | ||||||||||||||||||||

| Out-of-the-money | ||||||||||||||||||||

| Stock options | Stock units | |||||||||||||||||||||||||

| Number of options | Weighted average exercise price | Number of units | Weighted average FMV per unit | |||||||||||||||||||||||

| Outstanding, January 1, 2022 | $ | $ | ||||||||||||||||||||||||

| Granted | ||||||||||||||||||||||||||

| Exercised | ( | — | — | |||||||||||||||||||||||

Converted(1) | — | — | ( | |||||||||||||||||||||||

| Expired or forfeited | ( | ( | ||||||||||||||||||||||||

Performance share adjustment(2) | — | — | ( | |||||||||||||||||||||||

| Outstanding, December 31, 2022 | ||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Balance at beginning of period | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Establishment of additional defined benefit plans | ( | |||||||||||||||||||

| ( | ||||||||||||||||||||

| Other comprehensive income: | ||||||||||||||||||||

| Unrecognized net actuarial loss and prior service cost/benefit | ( | |||||||||||||||||||

| Tax (expense) benefit | ( | ( | ||||||||||||||||||

| Total Other comprehensive income (loss) before reclassifications, net of tax | ( | |||||||||||||||||||

Amortization of net actuarial loss and prior service cost/benefit(1) | ||||||||||||||||||||

Tax expense(2) | ( | ( | ( | |||||||||||||||||

Total amount reclassified from Accumulated other comprehensive loss, net of tax(5) | ||||||||||||||||||||

| Total Other comprehensive income | ||||||||||||||||||||

| Balance at end of period | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Foreign currency translation | ||||||||||||||||||||

| Balance at beginning of period | $ | $ | $ | |||||||||||||||||

| ( | ||||||||||||||||||||

| Other comprehensive (loss) income: | ||||||||||||||||||||

Foreign currency translation(3) | ( | ( | ||||||||||||||||||

Net amount reclassified to earnings from Accumulated other comprehensive income(3),(5) | ||||||||||||||||||||

| Total Other comprehensive (loss) income | ( | ( | ||||||||||||||||||

| Balance at end of period | $ | ( | $ | $ | ||||||||||||||||

| Balance at beginning of period | $ | ( | $ | $ | ||||||||||||||||

| ( | ||||||||||||||||||||

| Other comprehensive income (loss): | ||||||||||||||||||||

| Net change from periodic revaluations | ( | ( | ||||||||||||||||||

| Tax (expense) benefit | ( | |||||||||||||||||||

| Total Other comprehensive income (loss) before reclassifications, net of tax | ( | ( | ||||||||||||||||||

Net amount reclassified to earnings: | ||||||||||||||||||||

Aluminum(4) | ( | |||||||||||||||||||

Energy(4) | ( | |||||||||||||||||||

Alloying materials(4) | ( | |||||||||||||||||||

Sub-total | ( | |||||||||||||||||||

Tax benefit (expense)(2) | ( | ( | ||||||||||||||||||

Total amount reclassified from Accumulated other comprehensive income, net of tax(5) | ( | |||||||||||||||||||

| Total Other comprehensive income (loss) | ( | |||||||||||||||||||

| Balance at end of period | $ | $ | ( | $ | ||||||||||||||||

| Accumulated other comprehensive loss | $ | ( | $ | ( | $ | ( | ||||||||||||||

| December 31, | 2022 | 2021 | ||||||||||||

| Finished goods | $ | $ | ||||||||||||

| Work-in-process | ||||||||||||||

| Purchased raw materials | ||||||||||||||

| Operating supplies | ||||||||||||||

| $ | $ | |||||||||||||

| December 31, | 2022 | 2021 | ||||||||||||

| Land and land rights | $ | $ | ||||||||||||

| Structures: | ||||||||||||||

| Rolled Products* | ||||||||||||||

| Building and Construction Systems | ||||||||||||||

| Extrusions | ||||||||||||||

| Other | ||||||||||||||

| Machinery and equipment: | ||||||||||||||

| Rolled Products* | ||||||||||||||

| Building and Construction Systems | ||||||||||||||

| Extrusions | ||||||||||||||

| Other | ||||||||||||||

| Less: accumulated depreciation and amortization | ||||||||||||||

| Construction work-in-progress | ||||||||||||||

| $ | $ | |||||||||||||

| Rolled Products | Building and Construction Systems | Extrusions | Total | ||||||||||||||||||||

| Balances at December 31, 2020: | |||||||||||||||||||||||

| Goodwill | $ | $ | $ | $ | |||||||||||||||||||

| Accumulated impairment losses | ( | ( | |||||||||||||||||||||

| Goodwill, net | |||||||||||||||||||||||

| ( | ( | ||||||||||||||||||||||

| Translation | ( | ( | ( | ||||||||||||||||||||

| Balances at December 31, 2021: | |||||||||||||||||||||||

| Goodwill | |||||||||||||||||||||||

| Accumulated impairment losses | ( | ( | ( | ||||||||||||||||||||

| Goodwill, net | |||||||||||||||||||||||

| ( | ( | ||||||||||||||||||||||

| Translation | ( | ( | ( | ||||||||||||||||||||

| Balances at December 31, 2022: | |||||||||||||||||||||||

| Goodwill | |||||||||||||||||||||||

| Accumulated impairment losses | ( | ( | ( | ||||||||||||||||||||

| Goodwill, net | $ | $ | $ | $ | |||||||||||||||||||

| December 31, 2022 | Gross carrying amount | Accumulated amortization | Net carrying amount | |||||||||||||||||

| Computer software* | $ | $ | ( | $ | ||||||||||||||||

| Patents and licenses | ( | |||||||||||||||||||

| Other | ( | |||||||||||||||||||

| Total other intangible assets | $ | $ | ( | $ | ||||||||||||||||

| December 31, 2021 | Gross carrying amount | Accumulated amortization | Net carrying amount | |||||||||||||||||

| Computer software | $ | $ | ( | $ | ||||||||||||||||

| Patents and licenses | ( | |||||||||||||||||||

| Other | ( | |||||||||||||||||||

| Total other intangible assets | $ | $ | ( | $ | ||||||||||||||||

| December 31, | 2022 | |||||||

| 2023 | $ | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| Thereafter | ||||||||

| Total lease payments | $ | |||||||

| Less: imputed interest | ||||||||

| Present value of lease liabilities | $ | |||||||

| December 31, | 2022 | 2021 | ||||||||||||

| 6.00% Notes, due 2025 | $ | $ | ||||||||||||

| 6.125% Notes, due 2028 | ||||||||||||||

| Unamortized discounts and deferred financing costs | ( | ( | ||||||||||||

| $ | $ | |||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Interest, net of amount capitalized | $ | $ | $ | ||||||||||||||

| Income taxes, net of amount refunded | |||||||||||||||||

November 14, 2022 | December 31, 2021 | |||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Receivables from customers | ||||||||||||||

| Inventories | ||||||||||||||

| Properties, plants, and equipment, net | ||||||||||||||

| Accounts payable, trade | ||||||||||||||

| January 1, 2022 through November 14, 2022 | For the year ended December 31, 2021 | |||||||||||||

Third-party sales* | $ | $ | ||||||||||||

| Segment Adjusted EBITDA | ||||||||||||||

Guarantees(1) | Letters of Credit(2) | Surety Bonds(3) | ||||||||||||||||||||||||||||||

| Issuer | Beneficiary | Amount | Expiration Date | Amount | Expiration Date | Amount | Expiration Date | |||||||||||||||||||||||||

| Arconic | Third-parties | $ | 2023-2029 | $ | 2023 | $ | 2023-2024 | |||||||||||||||||||||||||

| Howmet | Arconic | — | 2023 | 2023 | ||||||||||||||||||||||||||||

| Alcoa Corporation | Arconic | Open term | — | 2024 | ||||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||

| December 31, | Carrying value | Fair value | Carrying value | Fair value | ||||||||||||||||||||||

| Cash and cash equivalents | $ | $ | $ | $ | ||||||||||||||||||||||

| Hedging instruments and derivatives - assets | ||||||||||||||||||||||||||

| Hedging instruments and derivatives - liabilities | ||||||||||||||||||||||||||

| Long-term debt | ||||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Cash flow hedges | |||||||||||||||||||||||||||||||||||

| Aluminum | $ | kmt | $ | ||||||||||||||||||||||||||||||||

| Alloying materials* | ( | kmt | |||||||||||||||||||||||||||||||||

| Marked-to-market | |||||||||||||||||||||||||||||||||||

| Aluminum | kmt | kmt | |||||||||||||||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Cash flow hedges | |||||||||||||||||||||||||||||||||||

| Aluminum* | $ | ( | kmt | $ | kmt | ||||||||||||||||||||||||||||||

| Energy | MMBtu | MMBtu | |||||||||||||||||||||||||||||||||

| Alloying materials | kmt | kmt | |||||||||||||||||||||||||||||||||

| Marked-to-market | |||||||||||||||||||||||||||||||||||

| Aluminum | kmt | kmt | |||||||||||||||||||||||||||||||||

| Energy | MMBtu | ||||||||||||||||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Unrealized | ||||||||||||||||||||

| Other comprehensive loss | ||||||||||||||||||||

| Aluminum | $ | $ | ( | $ | ( | |||||||||||||||

| Energy | ( | |||||||||||||||||||

| Alloying materials | ( | |||||||||||||||||||

| $ | $ | ( | $ | ( | ||||||||||||||||

Realized* | ||||||||||||||||||||

| Sales | ||||||||||||||||||||

| Aluminum | $ | $ | ( | $ | ||||||||||||||||

| Cost of goods sold | ||||||||||||||||||||

| Aluminum | ( | ( | ||||||||||||||||||

| Energy | ( | |||||||||||||||||||

| Alloying materials | ( | |||||||||||||||||||

| $ | $ | ( | $ | ( | ||||||||||||||||

| Exhibit Number | Exhibit Description | |||||||

10.4(b) + | ||||||||

10.5(a) + | ||||||||

10.5(b) + | ||||||||

10.5(c) + | ||||||||

10.6(a) + | ||||||||

10.6(b) + | ||||||||

10.6(c) + | ||||||||

10.7 + | ||||||||

10.8 + | ||||||||

10.9 + | ||||||||

10.10(a) + | ||||||||

10.10(b) + | ||||||||

10.11(a) + | ||||||||

10.11(b) + | ||||||||

10.12 + | ||||||||

10.13 + | ||||||||

10.14 + | ||||||||

10.15(a) + | ||||||||

10.15(b) + | ||||||||

10.15(c) + | ||||||||

10.15(d) + | ||||||||

10.15(e) + | ||||||||

10.15(f) + | ||||||||

10.15(g) + | ||||||||

| Exhibit Number | Exhibit Description | |||||||

10.15(h) + | ||||||||

10.15(i) + | ||||||||

10.15(j) + | ||||||||

10.15(k) + | ||||||||

10.15(l) + | ||||||||

10.18 + | ||||||||

10.19 + | ||||||||

| 101.INS | Inline XBRL Instance Document | |||||||

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | |||||||

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |||||||

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | |||||||

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document | |||||||

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |||||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) | |||||||

February 21, 2023 | By | /s/ Mary E. Zik | ||||||

| Mary E. Zik | ||||||||

| Vice President and Controller (Also signing as Principal Accounting Officer) | ||||||||

| Signature | Title | Date | ||||||

| /s/ Timothy D. Myers | February 21, 2023 | |||||||

| Timothy D. Myers | Chief Executive Officer and Director (Principal Executive Officer) | |||||||

| /s/ Erick R. Asmussen | February 21, 2023 | |||||||

| Erick R. Asmussen | Executive Vice President and Chief Financial Officer (Principal Financial Officer) | |||||||

| *By | /s/ Daniel G. Fayock | ||||

| Daniel G. Fayock | |||||

Death or Disability: a Restricted Share Unit held by a Participant, who dies while an Employee or who is permanently and totally disabled while an Employee, is not forfeited but vests and is paid on the original stated vesting date set forth in paragraph 2. | |||||||||||

Change in Control: a Restricted Share Unit vests if a Replacement Award is not provided following certain Change in Control events, as described in the Plan. If the Change in Control qualifies as a “change in control event” within the meaning of Treas. Reg. § 1.409A-3(i)(5), the vested Restricted Share Unit will be paid to the Participant within 30 days following the Change in Control. If the Change in Control does not so qualify, the vested Restricted Share Unit will be paid to the Participant on the original stated vesting date set forth in paragraph 2. | |||||||||||

Termination Following Change in Control: as further described in the Plan, if a Replacement Award is provided following a Change in Control, but within 24 months of such Change in Control the Participant’s employment is terminated without Cause (as defined in the Company’s Change in Control Severance Plan) or by the Participant for Good Reason (as defined in the Company’s Change in Control Severance Plan), the Replacement Award will vest and will be paid to the Participant on the original stated vested date set forth in paragraph 2. | |||||||||||

Retirement: a Restricted Share Unit is not forfeited if it is held by a Participant who retires at least 6 months after the grant date under a Company or Subsidiary plan (or if there is no Company or Subsidiary plan, a government retirement plan) in which the Participant is eligible for an immediate payment of a retirement benefit. In such event, the Restricted Share Unit vests and is paid in accordance with the original vesting schedule of the grant set forth in paragraph 2. Immediate commencement of a deferred vested pension benefit under a Company or Subsidiary retirement plan is not considered a retirement for these purposes. | |||||||||||

Divestiture: if a Restricted Share Unit is held by a Participant who is to be terminated from employment with the Company or a Subsidiary as a result of a divestiture of a business or a portion of a business of the Company and the Participant either becomes an employee of (or is leased or seconded to) the entity acquiring the business on the date of the closing, or the Participant is not offered employment with the entity acquiring the business and is terminated by the Company or a Subsidiary within 90 days of the closing of the sale, then, at the discretion of the Chief Executive Officer of the Company, the Restricted Share Unit will not be forfeited and will vest and be paid in accordance with the original vesting schedule set forth in paragraph 2. For purposes of this paragraph, employment by “the entity acquiring the business” includes employment by a subsidiary or affiliate of the entity acquiring the business; and “divestiture of a business” means the sale of assets or stock resulting in the sale of a going concern. “Divestiture of a business” does not include a plant shut down or other termination of a business. | |||||||||||

| • | The Participant will have the right to receive from 0% to 200% of the number of Shares indicated on the grant date, based on achievement of performance goals established by the Committee for that Award. | ||||||||||

| • | The performance period is three fiscal years of the Company. Attainment of performance goals for the three-year period will be determined or certified, as applicable, by the Committee on a date as soon as practicable following the end of the performance period (the “Determination Date”). | ||||||||||

| • | Notwithstanding paragraph 2 of the Award Agreement, the vesting date of the Award shall be the later of the date set forth in paragraph 2 and the Determination Date. To vest in the Award, the Participant must remain employed with the Company or a Subsidiary until such vesting date, except as otherwise set forth in paragraph 4. In any case, except where settlement of the Award is made upon a Change in Control within the meaning of Treas. Reg. § 1.409A-3(i)(5), in no event will settlement of the Award occur outside of the time period set forth in paragraph 2. | ||||||||||

| • | In the event of termination of the Participant’s employment with the Company (including its Subsidiaries) before the vesting of the Restricted Share Unit by reason of death, disability, retirement or divestiture, each as described in paragraph 4, settlement of the Restricted Share Unit will be based on the extent to which the performance goals established by the Committee have been attained following the end of the performance period. | ||||||||||

| • | In the event of a Change in Control, the performance feature of the Award will cease to apply and the Award will be converted into a time-based award in accordance with the formula set forth in Section 12(a)(v) of the Plan. The vesting and settlement of such Award will then be governed in accordance with paragraph 4. | ||||||||||

| Name | U.S. State or Country of Organization | ||||

Arconic Architectural Products LLC* | Delaware | ||||

| Arconic Architectural Products SAS | France | ||||

| Arconic China Investment Company Ltd. | China | ||||

| Arconic China Processing LLC | Delaware | ||||

Arconic Davenport LLC* | Delaware | ||||

| Arconic Extrusions Hannover GmbH | Germany | ||||

| Arconic France Holding SAS | France | ||||

| Arconic Hungary Finance Kft | Hungary | ||||

| Arconic Kofem Mill Products Kft | Hungary | ||||

| Arconic Kunshan Aluminum Products Company, Ltd. | China | ||||

Arconic Lafayette LLC* | Delaware | ||||

Arconic Lancaster Corp.* | Delaware | ||||

| Arconic Manufacturing GB Limited | United Kingdom | ||||

Arconic Massena LLC* | Delaware | ||||

| Arconic Nederland Holding B.V. | Netherlands | ||||

| Arconic Qinhuangdao Aluminum Industries Co., Ltd. | China | ||||

| Arconic Technologies LLC | Delaware | ||||

Arconic Tennessee LLC* | Delaware | ||||

| Arconic UK Finance | United Kingdom | ||||

| Arconic UK Holdings Limited | United Kingdom | ||||

Kawneer Commercial Windows LLC* | Pennsylvania | ||||

| Kawneer Company Canada Limited* | Canada | ||||

Kawneer Company, Inc.* | Delaware | ||||

| Kawneer France SAS | France | ||||

| Kawneer Nederland B.V. | Netherlands | ||||

| Kawneer U.K. Limited | United Kingdom | ||||

Pimalco, Inc.* | Arizona | ||||

/s/ William F. Austen | /s/ Christopher L. Ayers | |||||||

| William F. Austen | Christopher L. Ayers | |||||||

/s/ Margaret S. Billson | /s/ Jacques Croisetiere | |||||||

| Margaret S. Billson | Jacques Croisetiere | |||||||

/s/ Elmer L. Doty | /s/ Carol S. Eicher | |||||||

| Elmer L. Doty | Carol S. Eicher | |||||||

/s/ Frederick A. Henderson | /s/ Ellis A. Jones | |||||||

| Frederick A. Henderson | Ellis A. Jones | |||||||

/s/ Timothy D. Myers | /s/ E. Stanley O’Neal | |||||||

| Timothy D. Myers | E. Stanley O’Neal | |||||||

| /s/ Jeffrey Stafeil | ||

| Jeffrey Stafeil | ||

| /s/ Timothy D. Myers | ||

| Timothy D. Myers | ||

| Chief Executive Officer | ||

| /s/ Erick R. Asmussen | ||

| Erick R. Asmussen | ||

| Executive Vice President and Chief Financial Officer | ||

| Date: | February 21, 2023 | /s/ Timothy D. Myers | ||||||

| Timothy D. Myers | ||||||||

| Chief Executive Officer | ||||||||

| Date: | February 21, 2023 | /s/ Erick R. Asmussen | ||||||

| Erick R. Asmussen | ||||||||

| Executive Vice President, Chief Financial Officer | ||||||||

Audit Information |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Audit Information [Abstract] | |

| Auditor Name | PricewaterhouseCoopers LLP |

| Auditor Location | Pittsburgh, Pennsylvania |

| Auditor Firm ID | 238 |

Consolidated Balance Sheet (Parenthetical) - USD ($) $ in Millions |

Dec. 31, 2022 |

Dec. 31, 2021 |

|---|---|---|

| Statement of Financial Position [Abstract] | ||

| Accounts receivable, allowances | $ 1 | $ 1 |

The Separation and Basis of Presentation |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Organization, Consolidation and Presentation of Financial Statements [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Separation and Basis of Presentation | Basis of Presentation Arconic Corporation (“Arconic” or the “Company”) is a manufacturer of fabricated aluminum products, including sheet and plate, extrusions, and architectural products and systems, with a primary focus on the ground transportation, aerospace, building and construction, industrial products, and packaging end markets. The Company has 20 primary operating locations in 7 countries around the world, situated in the United States, Canada, China, France, Germany, Hungary, and the United Kingdom. Arconic’s previous operations in Russia were divested in November 2022 (see Note S). In the 2022 fourth quarter, Arconic recorded an adjustment of $9 in Cost of goods sold to increase its environmental reserves to correct the accrual related to anticipated costs associated with the Company’s obligations to perform future operations, maintenance, and monitoring (OM&M) activities, as required by federal, state, and/or local environmental agencies, at several environmental remediation sites. The adjustment was derived from a site-by-site analysis based upon OM&M plans submitted to respective environmental regulatory agencies, and resulted in extending the time horizon for OM&M costs. Management has concluded that the impact was not material to any previously reported periods. In the 2022 first quarter, the Company recorded a net gain of $3 in Cost of goods sold related to the unrealized impact associated with the change in the estimated fair value of natural gas supply contracts now determined to be derivatives (see Note U). This amount was comprised of an unrealized loss of $5 for the 2022 first quarter, an unrealized gain of $6 for the 2021 annual period, and an unrealized gain of $2 for the 2020 fourth quarter. The out-of-period amounts were not material to any interim or annual period. References in these Notes to (i) “ParentCo” refer to Arconic Inc., a Delaware corporation, and its consolidated subsidiaries (through March 31, 2020, at which time it was renamed Howmet Aerospace Inc. (“Howmet”)), and (ii) “2016 Separation Transaction” refer to the November 1, 2016 separation of Alcoa Inc., a Pennsylvania corporation, into two standalone, publicly-traded companies, Arconic Inc. and Alcoa Corporation. The Separation. On April 1, 2020 (the “Separation Date”), ParentCo separated into two standalone, publicly-traded companies, Arconic and Howmet, effective at 12:01 a.m. Eastern Daylight Time (the “Separation”). The spin-off company, Arconic, comprised the rolled aluminum products, aluminum extrusions, and architectural products operations of ParentCo, as well as the Latin America extrusions operations sold in April 2018, (collectively, the “Arconic Corporation Businesses”). The existing publicly-traded company, Howmet, continued to own the engine products, engineered structures, fastening systems, and forged wheels operations (collectively, the “Howmet Aerospace Businesses”). ParentCo common stockholders of record as of the close of business on March 19, 2020 (the “Record Date”) received one share of Arconic common stock for every four shares of ParentCo common stock (the “Separation Ratio”) held as of the Record Date (ParentCo paid cash to its common stockholders in lieu of fractional shares). To effect the Separation, ParentCo undertook a series of transactions to separate the net assets and certain legal entities of ParentCo, resulting in a cash payment of $728 to ParentCo by Arconic from a portion of the aggregate net proceeds of previously executed financing arrangements (see Note Q). In connection with the Separation, 109,021,376 shares of Arconic common stock were distributed to ParentCo stockholders. This was determined by applying the Separation Ratio to the 436,085,504 shares of ParentCo’s outstanding common stock as of the Record Date. “Regular-way” trading of Arconic’s common stock began with the opening of the New York Stock Exchange on April 1, 2020 under the ticker symbol “ARNC.” Arconic’s common stock has a par value of $0.01 per share. In connection with the Separation, Arconic and Howmet entered into several agreements to implement the legal and structural separation between the two companies; govern the relationship between Arconic and Howmet after the completion of the Separation; and allocate between Arconic and Howmet various assets, liabilities, and obligations, including, among other things, employee benefits, environmental liabilities, intellectual property, and tax-related assets and liabilities. These agreements included a Separation and Distribution Agreement, Tax Matters Agreement, Employee Matters Agreement, and certain Patent, Know-How, Trade Secret License and Trademark License Agreements. The Separation and Distribution Agreement identified the assets to be transferred, the liabilities to be assumed, and the contracts to be transferred to each of Arconic and Howmet as part of the Separation, and provided for when and how these transfers and assumptions were to occur. ParentCo incurred costs to evaluate, plan, and execute the Separation, and Arconic was allocated a pro rata portion of these costs based on segment revenue (see Cost Allocations below). ParentCo recognized $38 from January 1, 2020 through March 31, 2020 (the “2020 Pre-Separation Period”) for such costs, of which $18 was allocated to Arconic. The allocated amounts were included in Selling, general administrative, and other expenses on the accompanying Statement of Consolidated Operations. Basis of Presentation. The Consolidated Financial Statements of Arconic are prepared in conformity with accounting principles generally accepted in the United States of America (GAAP). In accordance with GAAP, certain situations require management to make estimates based on judgments and assumptions, which may affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements. They also may affect the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates upon subsequent resolution of identified matters. These estimates are based on historical experience and, in some cases, assumptions based on current and future market experience. Management has made its best estimates using all relevant information available at the time. Principles of Consolidation. The Consolidated Financial Statements of the Company include the accounts of Arconic and companies in which Arconic has a controlling interest. Intercompany transactions have been eliminated. Management evaluates whether an Arconic entity or interest is a variable interest entity and whether the Company is the primary beneficiary. Consolidation is required if both of these criteria are met. Arconic does not have any variable interest entities requiring consolidation. Prior to the Separation Date, the Company did not operate as a separate, standalone entity. Arconic’s operations were included in ParentCo’s financial results. Accordingly, in all periods prior to the Separation Date, the accompanying Consolidated Financial Statements were prepared from ParentCo’s historical accounting records and were presented on a standalone basis as if the Arconic Corporation Businesses had been conducted independently from ParentCo. Such Consolidated Financial Statements include the historical operations that were considered to comprise the Arconic Corporation Businesses, as well as certain assets and liabilities that were historically held at ParentCo’s corporate level but were specifically identifiable or otherwise attributable to the Arconic Corporation Businesses. ParentCo’s net investment in these operations was reflected as Parent Company net investment on the accompanying Consolidated Financial Statements. All significant transactions and accounts within the Arconic Corporation Businesses were eliminated. All significant intercompany transactions between ParentCo and the Arconic Corporation Businesses were included within Parent Company net investment on the accompanying Consolidated Financial Statements. Cost Allocations. The description and information on cost allocations is applicable for all periods prior to the Separation Date presented in the accompanying Consolidated Financial Statements. The Consolidated Financial Statements of Arconic include general corporate expenses of ParentCo that were not historically charged to the Arconic Corporation Businesses for certain support functions that were provided on a centralized basis, such as expenses related to finance, audit, legal, information technology, human resources, communications, compliance, facilities, employee benefits and compensation, and research and development activities. These general corporate expenses were reported on the accompanying Statement of Consolidated Operations within Cost of goods sold, Selling, general administrative and other expenses, and Research and development expenses. These expenses were allocated to the Arconic Corporation Businesses on the basis of direct usage when identifiable, with the remainder allocated based on the Arconic Corporation Businesses’ segment revenue as a percentage of ParentCo’s total segment revenue, as reported in the respective periods. All external debt not directly attributable to the Arconic Corporation Businesses was excluded from the Company’s Consolidated Balance Sheet. Financing costs related to these debt obligations were allocated to the Arconic Corporation Businesses based on the ratio of capital invested by ParentCo in the Arconic Corporation Businesses to the total capital invested by ParentCo in both the Arconic Corporation Businesses and the Howmet Aerospace Businesses and were included on the accompanying Statement of Consolidated Operations within Interest expense. The following table reflects the allocations described above:

_____________________ *In the 2020 Pre-Separation Period, amount includes an allocation of $18 for costs incurred by ParentCo associated with the Separation (see The Separation above). Management believes the assumptions regarding the allocation of ParentCo’s general corporate expenses and financing costs were reasonable. Nevertheless, the Company’s Consolidated Financial Statements may not include all of the actual expenses that would have been incurred and may not reflect Arconic’s consolidated results of operations, financial position, and cash flows had it been a standalone company during the periods prior to the Separation Date. Actual costs that would have been incurred if Arconic had been a standalone company would depend on multiple factors, including organizational structure, capital structure, and strategic decisions made in various areas, including information technology and infrastructure. Transactions between the Arconic Corporation Businesses and ParentCo, including sales to the Howmet Aerospace Businesses, were considered to be effectively settled for cash at the time the transaction was recorded. The total net effect of the settlement of these transactions was reported on the accompanying Statement of Consolidated Cash Flows as a financing activity and on Arconic’s Consolidated Balance Sheet as Parent Company net investment. Cash Management. Prior to the Separation Date, cash was managed centrally with certain net earnings reinvested locally and working capital requirements met from existing liquid funds. Accordingly, the cash and cash equivalents held by ParentCo at the corporate level were not attributed to the Arconic Corporation Businesses in any period presented in the accompanying Consolidated Financial Statements that was prior to the Separation Date. Only cash amounts specifically attributable to the Arconic Corporation Businesses were reported in the accompanying Consolidated Financial Statements for any period presented that was prior to the Separation Date. Transfers of cash, both to and from ParentCo’s centralized cash management system, were reported as a component of Parent Company net investment on Arconic’s Consolidated Balance Sheet and as a financing activity on the accompanying Statement of Consolidated Cash Flows.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Summary of Significant Accounting Policies |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounting Policies [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Summary of Significant Accounting Policies | B. Summary of Significant Accounting Policies Cash Equivalents. Cash equivalents are highly liquid investments purchased with an original maturity of three months or less. In all periods prior to the Separation Date, the cash and cash equivalents held by ParentCo at the corporate level were not attributed to the Arconic Corporation Businesses. Only cash amounts specifically attributable to the Arconic Corporation Businesses were reported on the Company’s Consolidated Financial Statements. Inventory Valuation. Inventories are carried at the lower of cost and net realizable value, with cost for most inventories determined under the average cost method. The cost of certain non-U.S. inventories is determined under the first in, first out (FIFO) method. Properties, Plants, and Equipment. Properties, plants, and equipment are recorded at cost. Also, interest related to the construction of qualifying assets is capitalized as part of the construction costs. Depreciation is recorded on the straight-line method at rates based on the estimated useful lives of the assets. The following table details the weighted-average useful lives of structures and machinery and equipment by reporting segment (numbers in years):