UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) of the SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) of the SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-00267

ALLEGHENY ENERGY, INC.

(Name of Registrant)

| Maryland | 13-5531602 | |

| (State of Incorporation) | (IRS Employer Identification Number) | |

| 800 Cabin Hill Drive, Greensburg, Pennsylvania |

||

| 15601 | ||

| (Address of Principal Executive Offices) | (Zip Code) |

(724) 837-3000

(Telephone Number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $1.25 per share |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

| Large accelerated filer x |

Accelerated filer | ¨ | ||||||

| Non-accelerated filer ¨ |

Smaller reporting company | ¨ | ||||||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the outstanding common stock, other than shares held by persons who may be deemed affiliates of the registrant, as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $3,440,110,307. As of December 31, 2010, 169,973,542 shares of the common stock, par value of $1.25 per share, of the registrant were outstanding.

GLOSSARY

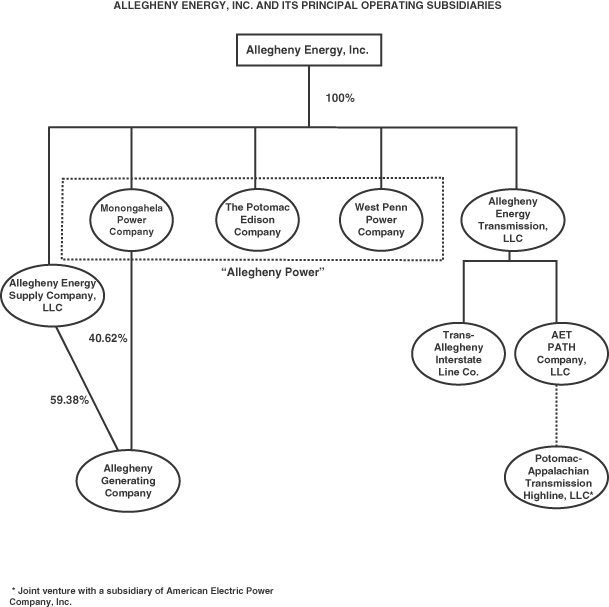

| I. | The following abbreviations and terms are used in this report to identify Allegheny Energy, Inc. and its subsidiaries: |

| AE |

Allegheny Energy, Inc., a diversified utility holding company | |

| AESC |

Allegheny Energy Service Corporation, a subsidiary of AE | |

| AE Supply |

Allegheny Energy Supply Company, LLC, an unregulated generation subsidiary of AE | |

| AGC |

Allegheny Generating Company, a generation subsidiary of AE Supply and Monongahela | |

| Allegheny |

Allegheny Energy, Inc., together with its consolidated subsidiaries | |

| Distribution Companies |

Monongahela, Potomac Edison and West Penn, which collectively do business as Allegheny Power | |

| Monongahela |

Monongahela Power Company, a regulated subsidiary of AE | |

| PATH, LLC |

Potomac-Appalachian Transmission Highline, LLC, a joint venture between Allegheny and a subsidiary of American Electric Power Company, Inc. | |

| PATH-Allegheny |

PATH Allegheny Transmission Company, LLC | |

| PATH-WV |

PATH West Virginia Transmission Company, LLC | |

| Potomac Edison |

The Potomac Edison Company, a regulated subsidiary of AE | |

| TrAIL Company |

Trans-Allegheny Interstate Line Company | |

| West Penn |

West Penn Power Company, a regulated subsidiary of AE |

| II. | The following abbreviations and acronyms are used in this report to identify entities and terms relevant to Allegheny’s business and operations: |

| Clean Air Act |

Clean Air Act of 1970 | |

|

CO2 |

Carbon dioxide | |

| EPA |

United States Environmental Protection Agency | |

| Exchange Act |

Securities Exchange Act of 1934, as amended | |

| FERC |

Federal Energy Regulatory Commission, an independent commission within the United States Department of Energy | |

| FirstEnergy |

FirstEnergy Corp. | |

| FPA |

Federal Power Act | |

| FTRs |

Financial Transmission Rights | |

| GAAP |

Generally accepted accounting principles used in the United States of America | |

| kW |

Kilowatt, which is equal to 1,000 watts | |

| kWh |

Kilowatt-hour, a unit of electric energy equivalent to one kW operating for one hour | |

| Maryland PSC |

Maryland Public Service Commission | |

| MW |

Megawatt, which is equal to 1,000,000 watts | |

| MWh |

Megawatt-hour, a unit of electric energy equivalent to one MW operating for one hour | |

| NERC |

North American Electric Reliability Corporation | |

|

NOX |

Nitrogen Oxide | |

| NSR |

The New Source Performance Review Standards, or “New Source Review,” applicable to facilities deemed “new” sources of emissions by the EPA | |

| OVEC |

Ohio Valley Electric Corporation | |

| PATH |

Potomac-Appalachian Transmission Highline | |

| Pennsylvania PUC |

Pennsylvania Public Utility Commission | |

| PJM |

PJM Interconnection, L.L.C., a regional transmission organization | |

| PLR |

Provider-of-last-resort | |

| PURPA |

Public Utility Regulatory Policies Act of 1978 | |

| RPM |

Reliability Pricing Model, which is PJM’s capacity market | |

| RTEP |

Regional Transmission Expansion Plan, the process by which PJM identifies transmission system upgrades and enhancements to provide for the operational, economic and reliability requirements of PJM customers. | |

| RTO |

Regional Transmission Organization | |

| Scrubbers |

Flue-gas desulfurization equipment | |

| SEC |

Securities and Exchange Commission | |

|

SO2 |

Sulfur dioxide | |

| SOS |

Standard Offer Service | |

| T&D |

Transmission and distribution | |

| TrAIL |

Trans-Allegheny Interstate Line | |

| Virginia SCC |

Virginia State Corporate Commission | |

| West Virginia PSC |

Public Service Commission of West Virginia |

i

ii

| Item 1. |

1 | |||||

| 1 | ||||||

| 8 | ||||||

| 10 | ||||||

| 11 | ||||||

| 12 | ||||||

| 16 | ||||||

| 18 | ||||||

| 19 | ||||||

| 32 | ||||||

| 39 | ||||||

| Item 1A. |

40 | |||||

| Item 1B. |

52 | |||||

| Item 2. |

53 | |||||

| Item 3. |

53 | |||||

| Item 4. |

56 | |||||

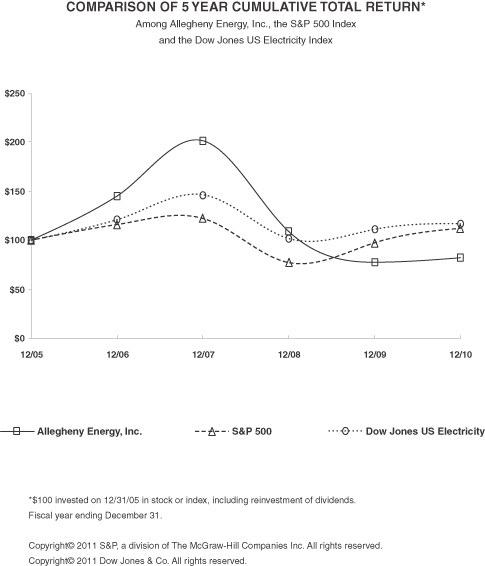

| Item 5. |

Market For The Registrant’s Common Equity and Related Stockholder Matters |

57 | ||||

| Item 6. |

59 | |||||

| Item 7. |

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations |

60 | ||||

| Item 7A. |

96 | |||||

| Item 8. |

97 | |||||

| Item 9. |

Changes In And Disagreements With Accountants On Accounting And Financial Disclosure |

182 | ||||

| Item 9A. |

182 | |||||

| Item 9B. |

183 | |||||

| Item 10. |

188 | |||||

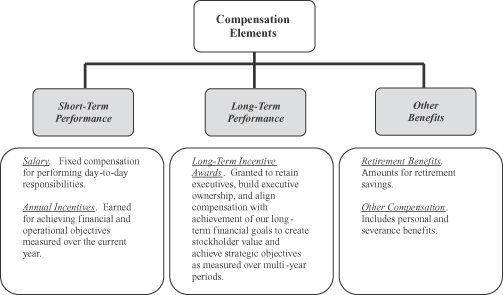

| Item 11. |

193 | |||||

| Item 12. |

Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters |

222 | ||||

| Item 13. |

224 | |||||

| Item 14. |

226 | |||||

| Item 15. |

227 | |||||

| 228 | ||||||

iii

PART I

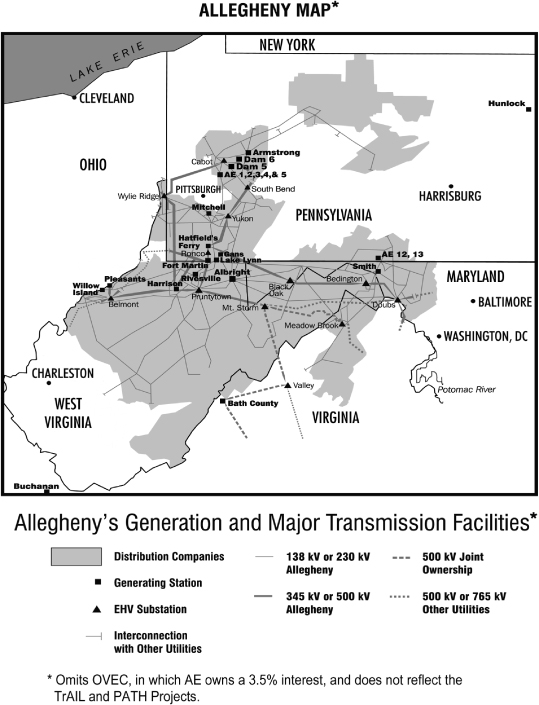

Allegheny is an integrated energy business. Allegheny owns and operates electric generation facilities primarily in Pennsylvania, West Virginia and Maryland. Additionally, Allegheny owns transmission assets in Pennsylvania, West Virginia, Maryland and Virginia and provides distribution services to customers in Pennsylvania, West Virginia and Maryland. AE, Allegheny’s parent holding company, was incorporated in Maryland in 1925. Allegheny operates its business primarily through AE’s various directly and indirectly owned subsidiaries.

Allegheny’s operations are organized into two business segments:

| • | The Merchant Generation segment includes Allegheny’s merchant power generation operations, including the operations of AE Supply and AGC. |

| • | The Regulated Operations segment includes all of Allegheny’s regulated operations, including its electric T&D operations and transmission expansion projects, as well as Monongahela’s power generation operations. |

See consolidated financial statement Note 1, “Business, Basis of Presentation and Significant Accounting Policies,” and Note 13, “Segment Information,” to Allegheny’s consolidated financial statements.

Proposed Merger with FirstEnergy

On February 10, 2010, AE entered into an Agreement and Plan of Merger (as amended on June 4, 2010, the “Merger Agreement”) with FirstEnergy and Element Merger Sub, Inc. (“Merger Sub”), a wholly owned subsidiary of FirstEnergy, pursuant to which, and subject to certain conditions, Merger Sub will merge with and into AE (the “Merger”), with AE continuing as the surviving corporation and becoming a wholly owned subsidiary of FirstEnergy.

AE stockholders and FirstEnergy shareholders approved various proposals related to the Merger in separate shareholder meetings on September 14, 2010. The Virginia SCC approved the proposed Merger on September 9, 2010, the West Virginia PSC and FERC approved the Merger on December 16, 2010, and the Maryland PSC approved the Merger, subject to certain conditions, on January 18, 2011. Additionally, on January 7, 2011, the U.S. Department of Justice (the “DOJ”) notified AE and FirstEnergy that it had completed its review of the proposed Merger pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and closed its investigation.

Pursuant to the Merger Agreement, completion of the Merger remains subject to, among other customary closing conditions, approval by the Pennsylvania PUC. In October 2010, AE and FirstEnergy filed with the Pennsylvania PUC a comprehensive settlement that addresses the issues raised by a majority of the parties to the merger proceedings in Pennsylvania. AE and FirstEnergy currently anticipate completing the Merger in the first quarter of 2011. See “Regulatory Framework Affecting Allegheny,” “Risk Factors” and Note 2, “Merger Agreement,” to Allegheny’s consolidated financial statements.

The Merchant Generation Segment

The principal companies and operations in AE’s Merchant Generation segment include the following:

| • | AE Supply was formed in Delaware in 1999. AE Supply owns, operates and manages electric generation facilities. AE Supply also purchases and sells energy and energy-related commodities. As of |

1

| December 31, 2010, AE Supply owned or contractually controlled 7,015 MWs of generation capacity. See “Electric Facilities.” |

AE Supply markets its electric generation capacity to various customers and markets, including certain of its affiliates, and uses both derivative and nonderivative contracts to manage its portfolio of contracts. AE Supply’s portfolio management and trading activities involve the use of physical commodity inventories and a variety of instruments, such as forward contracts, futures contracts, swap agreements and similar instruments. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and consolidated financial statement Note 14, “Fair Value Measurements, Derivative Instruments and Hedging Activities,” to Allegheny’s consolidated financial statements.

AE Supply was contractually obligated to provide West Penn with most of the power necessary to meet its PLR obligations in Pennsylvania through December 31, 2010, when West Penn’s generation caps in Pennsylvania expired, and has contracts of varying length with West Penn to serve a portion of its load beyond January 1, 2011. In addition, AE Supply has contracts with Potomac Edison to supply portions of the power necessary to serve Potomac Edison’s Maryland customer load that range in length from three to 29 months. AE Supply had total operating revenues of $1.8 billion in 2010.

| • | AGC was incorporated in Virginia in 1981. As of December 31, 2010, AGC was owned approximately 59% by AE Supply and approximately 41% by Monongahela. AGC’s sole asset is a 40% undivided interest in the Bath County, Virginia pumped-storage hydroelectric generation facility and its connecting transmission facilities. All of AGC’s revenues are derived from sales of its 1,109 MW share of generation capacity from the Bath County generation facility to AE Supply and Monongahela. AGC had total operating revenues of $64.2 million in 2010. See “Electric Facilities.” |

All of Allegheny’s generation facilities are located within PJM’s competitive wholesale market. AE Supply and Monongahela sell into the PJM market the power that they generate and purchase from the PJM market the power necessary to meet their contractual obligations to supply power. See “Fuel, Power and Resource Supply” and “Regulatory Framework Affecting Allegheny.”

During 2010, the Merchant Generation segment had total operating revenues of $1.8 billion and net income of $163.1 million. As of December 31, 2010, the Merchant Generation segment held approximately $4.5 billion of identifiable assets. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and consolidated financial statement Note 13, “Segment Information,” to Allegheny’s consolidated financial statements.

The Regulated Operations Segment

The principal companies and operations in Allegheny’s Regulated Operations segment include the following:

| • | The Distribution Companies include Monongahela, Potomac Edison and West Penn. Each of the Distribution Companies is a public utility company and does business under the trade name Allegheny Power. Allegheny Power’s principal business is the operation of electric public utility systems. In April 2002, the Distribution Companies transferred functional control over their transmission systems to PJM. As an RTO, PJM coordinates the movement of electricity over the transmission grid in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia. |

| • | Monongahela was incorporated in Ohio in 1924. It conducts an electric T&D business that serves approximately 385,500 customers in northern West Virginia in a service area of approximately 13,000 square miles with a population of approximately 784,900. Monongahela sold 10.7 million MWhs of electricity to retail customers in 2010. |

2

Monongahela also owns generation assets, which are included in the Regulated Operations segment. As of December 31, 2010, Monongahela owned or contractually controlled 2,737 MWs of generation capacity. Monongahela’s generation capacity supplies its electric T&D business. In addition, Monongahela is contractually obligated to provide Potomac Edison with the power that it needs to meet its load obligations in West Virginia. Monongahela had total operating revenues of $907.6 million in 2010. See “Electric Facilities.”

| • | Potomac Edison was incorporated in Maryland in 1923 and was also incorporated in Virginia in 1974. It operates an electric T&D system in portions of West Virginia and Maryland. On June 1, 2010, Potomac Edison sold its electric distribution operations (while retaining its transmission operations) in Virginia (the “Virginia distribution business”) to Rappahannock Electric Cooperative (“Rappahannock”) and Shenandoah Valley Electric Cooperative (“Shenandoah” and, together with Rappahannock, the “Co-Ops”) for cash proceeds of approximately $317 million. Effective December 31, 2010, Potomac Edison purchased Shenandoah’s West Virginia distribution assets for approximately $14.5 million, subject to certain post-closing adjustments. Potomac Edison now serves approximately 383,700 customers in a service area of about 5,182 square miles with a population of approximately 850,600. Potomac Edison had total operating revenues of $914.9 million and sold 11.7 million MWhs of electricity to retail customers in 2010. See “Regulatory Framework Affecting Allegheny,” “Risk Factors” and Note 4, “Sale of Virginia Distribution Business,” to Allegheny’s consolidated financial statements. |

| • | West Penn was incorporated in Pennsylvania in 1916. It operates an electric T&D system in southwestern, south-central and northern Pennsylvania. West Penn serves approximately 716,100 customers in a service area of about 10,400 square miles with a population of approximately 1.5 million. West Penn had total operating revenues of $1.6 billion and sold 20 million MWhs of electricity to retail customers in 2010. |

| • | TrAIL Company was incorporated in Maryland and Virginia in 2006. In June 2006, PJM, which manages a regional planning process for transmission expansion, approved an RTEP designed to maintain the reliability of the transmission grid in the mid-Atlantic region. The transmission expansion plan includes TrAIL, a new 500 kV transmission line that will extend from southwestern Pennsylvania through West Virginia to a point of interconnection with Virginia Electric and Power Company, a subsidiary of Dominion Resources, in northern Virginia. PJM designated Allegheny to construct the portion of the line that will be located in the Distribution Companies’ PJM zone. TrAIL Company was formed in connection with the management and financing of transmission expansion projects, including this project (the “TrAIL Project”), and will build, own and operate the new transmission line. TrAIL Company currently expects that the new line will be completed and placed in service no later than June 2011. TrAIL Company had total operating revenues of $137 million in 2010. See “Capital Expenditures” and “Regulatory Framework Affecting Allegheny.” |

| • | PATH, LLC was formed in Delaware in 2007 following PJM authorization to construct PATH through its RTEP process. As currently proposed, PATH is a new, 765 kV transmission line that will extend from a substation owned by American Electric Power Company (“AEP”) near St. Albans, West Virginia, to a new substation near New Market, Maryland. PATH, LLC, which was formed in connection with the management and financing of this project (the “PATH Project”), is a series limited liability company. The “West Virginia Series” is owned equally by Allegheny and a subsidiary of AEP. The “Allegheny Series” is 100% owned by Allegheny. Each Series will, through one or more operating subsidiaries, build, own and operate a portion of the line. Construction of the line remains subject to siting approval by the relevant state utility commissions, among other matters. See “Capital Expenditures,” “Risk Factors” and “Regulatory Framework Affecting Allegheny.” |

During 2010, the Regulated Operations segment had operating revenues of $3.4 billion and net income of $247.7 million. As of December 31, 2010, the Regulated Operations segment held approximately $7.5 billion of

3

identifiable assets. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 13, “Segment Information,” to Allegheny’s consolidated financial statements.

Shared Services

AESC was incorporated in Maryland in 1963 and is a service company for Allegheny. AESC employs substantially all of the Allegheny personnel who provide services to AE and its subsidiaries, including among others, AE Supply, AGC, the Distribution Companies, TrAIL Company, PATH, LLC and their respective subsidiaries. These companies reimburse AESC at cost for services provided to them by AESC’s employees. AESC had 4,211 employees as of December 31, 2010.

Certain Recent Initiatives and Developments

During 2010, Allegheny’s strategy has been to focus on its core businesses, which management believes is enabling Allegheny to take advantage of its regional presence, operational expertise and knowledge of its markets to add shareholder value, while pursuing completion of its proposed Merger with FirstEnergy. Significant recent initiatives and developments include, among others:

| • | Proposed Merger with FirstEnergy. AE entered into its Merger Agreement with FirstEnergy and Merger Sub on February 10, 2010. Pursuant to the Merger Agreement, and subject to certain conditions, Merger Sub will merge with and into AE, with AE continuing as the surviving corporation and becoming a wholly owned subsidiary of FirstEnergy. |

Throughout 2010, Allegheny and First Energy worked to obtain the approval of their respective shareholders and the federal and state regulatory approvals necessary for completion of the Merger. AE’s stockholders and FirstEnergy’s shareholders approved various proposals related to the Merger in separate shareholder meetings held on September 14, 2010. On December 16, 2010, FERC approved the proposed Merger, and on January 7, 2010, the DOJ notified AE and FirstEnergy that it had completed its review of the proposed Merger pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and closed its investigation. The Merger was approved by the Virginia SCC on September 9, 2010, by the West Virginia PSC on December 16, 2010 and by the Maryland PSC, subject to certain conditions, on January 18, 2011. Completion of the proposed Merger remains subject to approval by the Pennsylvania PUC, with which AE and FirstEnergy have filed a comprehensive settlement that addresses the issues raised by the majority of the parties to the merger proceedings. AE currently anticipates completing the Merger in the first quarter of 2011. See “Regulatory Framework Affecting Allegheny,” “Risk Factors” and Note 2, “Merger Agreement,” to Allegheny’s consolidated financial statements.

| • | Transmission Expansion. During 2010, Allegheny completed construction of its new transmission operations center in West Virginia while continuing construction of TrAIL, which is nearing completion and is expected to be placed into service no later than June 2011. Primary jurisdiction for authorization to construct the PATH Project lies with the state public utility commission in the states in which the lines are proposed to be located. Applications for authorization to construct the PATH Project are pending in Maryland and Virginia, where decisions are expected in the third quarter of 2011, and in West Virginia, where a decision is expected in February 2012. See “Capital Expenditures,” “Regulatory Framework Affecting Allegheny,” “Risk Factors,” and Note 6, “Transmission Expansion,” to Allegheny’s consolidated financial statements. |

| • | Sale of Virginia Distribution Business. On June 1, 2010, Potomac Edison completed the sale of its electric distribution business in Virginia to Rappahannock Electric Cooperative and Shenandoah Valley Electric Cooperative for cash proceeds of approximately $317 million. See “Regulatory Matters Affecting Allegheny” and Note 4, “Sale of Virginia Distribution Business,” to Allegheny’s consolidated financial statements. |

4

| • | West Virginia Base Rate Increase. In June 2010, the West Virginia PSC approved a $40 million annualized base rate increase effective June 29, 2010 for Monongahela and Potomac Edison, with an additional $20 million annualized base rate increase effective in January 2011. The approved settlement also provides for: a deferral of February 2010 storm restoration expenses in West Virginia over a maximum five-year period; a decrease of $20 million in ENEC rates effective January 2011, which amount is deferred for later recovery in 2012; and a moratorium on filing for further increases in base rates before December 1, 2011, except under specified circumstances. |

| • | Liquidity Enhancement. During 2010, Allegheny refinanced or repaid certain existing debt, while working to enhance the liquidity of certain of it operating subsidiaries. |

Specifically, in January 2010, TrAIL Company refinanced its existing construction loan through the issuance of $450 million aggregate principal amount of 4.0% senior unsecured notes due 2015 and obtained a new, $350 million unsecured revolving credit facility that matures in 2013.

Also in January 2010, Monongahela repaid its $110 million in outstanding 7.36% medium-term notes, and in July 2010, AE Supply redeemed all $150.5 million of its outstanding 7.80% medium term notes due in 2011. In May 2010, AE entered into a new $250 million senior unsecured revolving credit facility that replaced its previous $376 million revolving credit facility, which was scheduled to mature in May 2011. Also in 2010, West Penn, Potomac Edison and AGC obtained new three-year senior unsecured revolving credit facilities for $200 million, $150 million and $50 million, respectively, in addition to the $1 billion three-year senior unsecured revolving credit facility and $110 million three-year, senior unsecured revolving credit facility that AE Supply and Monongahela obtained, respectively in 2009.

In addition to these transactions, Allegheny continues to take other steps, such as managing and controlling operations and maintenance expense and otherwise prudently managing cash, to maintain and improve its liquidity position. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Risk Factors” and Note 9, “Capitalization and Debt,” to Allegheny’s consolidated financial statements.

| • | Environmental Compliance and Risk Management. Allegheny continues its work to effectively manage its environmental compliance efforts to ensure continuing compliance with applicable federal and state regulations while controlling its compliance costs, reducing emissions levels and minimizing its risk exposure. |

During the latter part of 2009, Allegheny completed a significant, multi-year effort to install Scrubbers at its Fort Martin and Hatfield’s Ferry generating facilities. Now in-service, the Scrubbers will reduce overall SO2 emissions at these two facilities by more than 95%. In addition to this initiative, Allegheny completed the elimination of a partial Scrubber bypass at its Pleasants generating facility in 2007 and is currently evaluating pollution control projects at other facilities. Although applicable environmental regulations and initiatives, including but not limited to air and water quality issues and climate change concerns, continue to present Allegheny with significant challenges, all of Allegheny’s supercritical coal generating units are scrubbed and a significant amount of SO2 and mercury emissions have been eliminated. See “Risk Factors,” “Capital Expenditures” and “Environmental Matters.”

| • | Energy Efficiency and Conservation. Through its Watt Watchers program, Allegheny has implemented a number of initiatives to encourage energy efficiency and conservation among its customers, in addition to its long-standing portfolio of existing energy conservation initiatives. |

During 2010, Allegheny continued to pursue initiatives in response to Pennsylvania’s Act 129 and Maryland’s EmPOWER Maryland program, both of which establish demand-side reduction goals and have required, among other things, that affected utilities file with the relevant state utility commissions specific plans describing the demand-side management programs that they propose to implement in order to reach those goals, as well as separate plans for the implementation of advanced, or “smart,” metering. During 2009, the Maryland PSC approved and provided for cost recovery with respect to Potomac Edison’s proposed demand-side management programs in Maryland, and the Pennsylvania

5

PUC largely approved West Penn’s proposed portfolio of energy efficiency and conservation programs. In both Maryland and Pennsylvania, Allegheny’s proposed advanced infrastructure and metering proposals remain subject to regulatory review. See “Regulatory Matters Affecting Allegheny.”

| • | Transition to Market-Based Rates. Each of the states in Allegheny’s service territory, other than West Virginia, has, to some extent, taken steps to deregulate its electric utility industry, although Virginia has essentially reversed deregulation plans. Pennsylvania and Maryland instituted customer choice. Generation rate caps for West Penn’s retail customers in Pennsylvania expired at the end of 2010, and in 2009, West Penn began to conduct auctions to procure a portion of its generation needs to serve its Pennsylvania customers beginning January 1, 2011 pursuant to its default service plan as approved by the Pennsylvania PUC. West Penn has procured 80% of the generation supply needed to serve its residential customers in 2011, over 90% of the generation supply needed to serve its small and medium non-residential customers in 2011 and 100% of the generation supply needed to serve its largest non-residential customers who select the fixed price default service provider option in 2011. |

In Maryland, residential customers who did not opt out of Potomac Edison’s Maryland PSC-approved transition plan began paying a surcharge in June 2007 that, with the expiration of residential rate caps and the move to market-based rates on January 1, 2009, converted to a credit on customers’ bills, such that funds collected via the surcharge in 2007 and 2008 were returned to customers to mitigate the effect of the rate cap expiration until December 2010. Potomac Edison conducts rolling auctions to procure its power supply for its Maryland customers, and AE Supply is serving a portion of Potomac Edison’s Maryland customers pursuant to contracts that range in length from three to 29 months that were awarded to AE Supply as a result of the auction process. Suppliers that are not affiliated with Potomac Edison also were awarded contracts for portions of Potomac Edison’s Maryland load. See “Competition,” “Regulatory Matters Affecting Allegheny,” “Risk Factors” and “Rates and Regulation,” to Allegheny’s consolidated financial statements.

| • | Customer Satisfaction. Allegheny considers customer satisfaction to be a high performance metric and strives to maintain and improve customer satisfaction. Allegheny continues to see high levels of satisfaction among its customers. For example, a leading independent survey firm has ranked Allegheny first in commercial and industrial satisfaction in the northeastern United States for the last six consecutive years, and another firm ranked Allegheny in the top third nationally for residential customer satisfaction. |

6

Where You Can Find More Information

AE files or furnishes Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and other information with or to the SEC. You may read and copy any document that AE files with the SEC at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. These SEC filings are also available to the public from the SEC’s website at http://www.sec.gov.

The Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, statements of changes in beneficial ownership and other SEC filings, and any amendments to those reports, that AE files with or furnishes to the SEC under the Exchange Act are made available free of charge on AE’s website at http://www.alleghenyenergy.com as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. AE’s website and the information contained therein are not incorporated into this report.

7

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this report contains a number of forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties. Forward-looking statements often may be identified by the use of words such as anticipate, expect, project, intend, plan, believe and words and terms of similar substance used in connection with any discussion of future plans, actions or events. However, the absence of these or similar words does not mean that any particular statement is not forward-looking. Forward-looking statements herein may relate to, among other matters:

| • | regulatory issues, including but not limited to environmental regulation and state rate regulation; |

| • | financing plans; |

| • | market demand and prices for energy, capacity, coal and natural gas; |

| • | the cost and availability of raw materials, including coal, and Allegheny’s ability to enter into, modify and enforce long-term fuel purchase agreements; |

| • | power supply contracts; |

| • | results of litigation; |

| • | results of operations; |

| • | internal controls and procedures; |

| • | capital expenditures; |

| • | status and condition of plants and equipment; |

| • | changes in technology and their effects on the competitiveness of Allegheny’s generation facilities; |

| • | work stoppages by Allegheny’s unionized employees; |

| • | capacity purchase commitments; and |

| • | Allegheny’s proposed Merger with FirstEnergy. |

There can be no assurance that actual results will not differ materially from expectations. Actual results have varied materially and unpredictably from past expectations. Factors that could cause actual results to differ materially include, among others, the following:

| • | the results of regulatory proceedings, including proceedings related to rates; |

| • | plant performance and unplanned outages; |

| • | volatility and changes in the price and demand for energy and capacity and changes in the value of FTRs; |

| • | volatility and changes in the price of coal, natural gas and other energy-related commodities, as well as transportation costs; |

| • | Allegheny’s ability to enter into, modify and enforce long term fuel purchase agreements; |

| • | the effectiveness of Allegheny’s risk management policies and procedures; |

| • | the ability and willingness of counterparties to satisfy their financial and performance obligations; |

| • | changes in the weather and other natural phenomena; |

| • | changes in Allegheny’s requirements for, and the availability and price of, emission allowances; |

| • | changes in industry capacity, development and other activities by Allegheny’s competitors; |

8

| • | changes in market rules, including changes to PJM’s participant rules and tariffs, and defaults by other market participants; |

| • | the loss of any significant customers or suppliers; |

| • | changes in both customer usage and customer switching behavior and their resulting effects on existing and future load requirements; |

| • | the impact of government-mandated energy consumption initiatives, as well as general trends in resource conservation; |

| • | dependence on other electric transmission and gas transportation systems and their constraints on availability; |

| • | the reliability of Allegheny’s own system and its ongoing compliance with NERC reliability standards; |

| • | environmental regulations; |

| • | changes in other laws and regulations applicable to Allegheny, its markets or its activities; |

| • | changes in the underlying inputs and assumptions, including market conditions, used to estimate the fair values of commodity contracts; |

| • | the effect of accounting pronouncements issued periodically by accounting standard-setting bodies; |

| • | the likelihood and timing of the completion of the proposed Merger with FirstEnergy, the terms and conditions of remaining required regulatory approvals of the proposed Merger, the impact of the proposed Merger on Allegheny’s employees and potential diversion of management’s time and attention from ongoing business during this time period; |

| • | difficulties in obtaining regulatory authorizations on a timely basis; |

| • | disruptions in the financial markets and changes in access to capital markets; |

| • | the availability of credit; |

| • | actions of rating agencies; |

| • | inflationary or deflationary trends and interest rate trends; |

| • | general economic and business conditions, including the effects of the current recession; and |

| • | other risks, including the effects of global instability, terrorism and war. |

For a more detailed discussion of certain risk factors affecting Allegheny’s risk profile, see “Risk Factors.”

9

ALLEGHENY’S SALES AND REVENUES

Merchant Generation

The Merchant Generation segment generated 32,051 million kWhs and 26,004 million kWhs of electricity in 2010 and 2009, respectively. The segment’s revenues were composed of the following:

| Revenues (in millions) |

2010 | 2009 | ||||||

| PJM energy revenue |

$ | 1,240.2 | $ | 936.5 | ||||

| PJM capacity revenue |

403.6 | 356.2 | ||||||

| Power hedge revenues |

80.4 | 213.5 | ||||||

| Other |

34.4 | 102.4 | ||||||

| Total operating revenues |

$ | 1,758.6 | $ | 1,608.6 | ||||

Regulated Operations

The Regulated Operations segment sold 42,389 million kWhs and 42,040 million kWhs of electricity to retail customers in 2010 and 2009, respectively. The segment’s operating revenues were composed of the following:

| Revenues (in millions) |

2010 | 2009 | ||||||

| Retail electric: |

||||||||

| Generation and ancillary |

$ | 2,500.3 | $ | 2,280.0 | ||||

| Transmission |

118.4 | 118.6 | ||||||

| Distribution |

698.9 | 661.7 | ||||||

| Total retail electric |

3,317.6 | 3,060.3 | ||||||

| Transmission services and bulk power: |

||||||||

| PJM revenue, net |

(151.6 | ) | (198.8 | ) | ||||

| Warrior Run generation revenue |

64.5 | 52.7 | ||||||

| Transmission and other |

171.7 | 100.1 | ||||||

| Total transmission Services and bulk power |

84.6 | (46.0 | ) | |||||

| Other |

38.1 | 36.9 | ||||||

| Total operating revenues |

$ | 3,440.3 | $ | 3,051.2 | ||||

For more information regarding each segment’s revenues and operating results, as well as intersegment revenues and costs eliminated in Allegheny’s consolidated financial statements, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 13, “Segment Information,” to Allegheny’s consolidated financial statements.

10

Actual capital expenditures for 2010 and estimated capital expenditures for 2011 and 2012 are shown on a cash basis in the following table. The scope, amounts and timing of capital projects and related expenditures are subject to continuing review and adjustment, and actual capital expenditures may vary from these estimates.

| Actual | Projected | |||||||||||

| (in millions) |

2010 | 2011 | 2012 | |||||||||

| Transmission and distribution: |

||||||||||||

| TrAIL and TrAIL Company projects (a) |

$ | 510.7 | $ | 123.5 | $ | 46.9 | ||||||

| PATH (b) |

23.9 | 33.6 | 456.9 | |||||||||

| Smart meter procurement and installation (c) |

16.4 | 12.0 | 4.9 | |||||||||

| Other transmission and distribution |

218.0 | 315.7 | 377.6 | |||||||||

| Total transmission and distribution |

769.0 | 484.8 | 886.3 | |||||||||

| Environmental: |

||||||||||||

| Fort Martin Scrubbers |

16.1 | — | — | |||||||||

| Hatfield Scrubbers |

16.1 | — | — | |||||||||

| Other environmental |

71.8 | 115.4 | 217.0 | |||||||||

| Total environmental |

104.0 | 115.4 | 217.0 | |||||||||

| Generation projects, excluding environmental projects included above |

81.7 | 121.6 | 72.7 | |||||||||

| Other |

4.3 | — | — | |||||||||

| Total capital expenditures |

$ | 959.0 | $ | 721.8 | $ | 1,176.0 | ||||||

| (a) | TrAIL has a target completion date of June 2011 and an estimated cost, excluding AFUDC, of approximately $990 million. TrAIL Company is also engaged in other transmission projects. |

| (b) | Allegheny’s share of the estimated cost of the PATH Project is approximately $1.4 billion. Actual 2010 includes approximately $8 million in capital expenditures related to Allegheny’s portion of the West Virginia Series of PATH, LLC and approximately $16 million in capital expenditures related to PATH-Allegheny. |

| (c) | Consists of expenditures related to Allegheny’s procurement and installation of smart meters to comply with Pennsylvania’s Act 129. See “Regulatory Framework Affecting Allegheny” for additional information, including West Penn’s current plans to decelerate its previous smart meter deployment schedule. |

11

Generation Capacity

Allegheny’s owned or controlled generation capacity, other than the capacity owned and controlled by Monongahela, is included in the Merchant Generation segment. Monongahela’s generation is included in the Regulated Operations segment.

Nominal Maximum Operational Generation Capacity

| Stations |

Units | Total MW |

Merchant Generation Segment (MW) |

Regulated Operations Segment (MW) |

Commencement Dates (a) |

|||||||||||||||

| Supercritical Coal Fired (Steam): |

||||||||||||||||||||

| Harrison (Haywood, WV) |

3 | 1,983 | 1,576 | 407 | 1972-74 | |||||||||||||||

| Hatfield’s Ferry (Masontown, PA) |

3 | 1,710 | 1,710 | 1969-71 | ||||||||||||||||

| Pleasants (Willow Island, WV) |

2 | 1,300 | 1,200 | 100 | 1979-80 | |||||||||||||||

| Fort Martin (Maidsville, WV) |

2 | 1,107 | 1,107 | 1967-68 | ||||||||||||||||

| Other Coal Fired (Steam): |

||||||||||||||||||||

| Armstrong (Adrian, PA) |

2 | 356 | 356 | 1958-59 | ||||||||||||||||

| Albright (Albright, WV) |

3 | 292 | 292 | 1952-54 | ||||||||||||||||

| Mitchell (Courtney, PA) |

1 | 288 | 288 | 1963 | ||||||||||||||||

| Willow Island (Willow Island, WV) |

2 | 243 | 243 | 1949-60 | ||||||||||||||||

| Rivesville (Rivesville, WV) |

2 | 126 | 126 | 1943-51 | ||||||||||||||||

| R. Paul Smith (Williamsport, MD) |

2 | 116 | 116 | 1947-58 | ||||||||||||||||

| OVEC (Cheshire, OH) (Madison, IN) (b) |

11 | 78 | 67 | 11 | ||||||||||||||||

| Pumped-Storage and Hydro: |

||||||||||||||||||||

| Bath County (Warm Springs, VA) (c) |

6 | 1,109 | 658 | 451 | 1985; 2001 | |||||||||||||||

| Lake Lynn (Lake Lynn, PA) (d) |

4 | 52 | 52 | 1926 | ||||||||||||||||

| Allegheny Lock & Dam 5 (Freeport, PA) (e) |

2 | 6 | 6 | 1987 | ||||||||||||||||

| Allegheny Lock & Dam 6 (Freeport, PA) (e) |

2 | 7 | 7 | 1989 | ||||||||||||||||

| AE Supply/Green Valley Hydro (f) |

21 | 6 | 6 | Various | ||||||||||||||||

| Gas Fired: |

||||||||||||||||||||

| AE Nos. 3, 4 & 5 (Springdale, PA) |

3 | 540 | 540 | 2003 | ||||||||||||||||

| AE Nos. 1 & 2 (Springdale, PA) |

2 | 88 | 88 | 1999 | ||||||||||||||||

| AE Nos. 8 & 9 (Gans, PA) |

2 | 88 | 88 | 2000 | ||||||||||||||||

| AE Nos. 12 & 13 (Chambersburg, PA) |

2 | 88 | 88 | 2001 | ||||||||||||||||

| Buchanan (Oakwood, VA) (g) |

2 | 43 | 43 | 2002 | ||||||||||||||||

| Hunlock CT (Hunlock Creek, PA) |

1 | 44 | 44 | 2000 | ||||||||||||||||

| Oil-Fired (Steam): |

||||||||||||||||||||

| Mitchell (Courtney, PA) |

1 | 82 | 82 | 1949 | ||||||||||||||||

| Total Capacity |

9,752 | 7,015 | 2,737 | |||||||||||||||||

| (a) | When more than one year is listed as a commencement date for a particular generation facility, the dates refer to the years in which operations commenced for the different units at that generation facility. |

| (b) | The amount attributed to OVEC represents capacity entitlement through AE’s ownership of OVEC shares. AE holds a 3.5% equity stake in, and is a sponsoring company of, OVEC. OVEC supplies power to its sponsoring companies under an intercompany power agreement. |

12

| (c) | This figure represents capacity entitlement through ownership of AGC. |

| (d) | AE Supply has a license for Lake Lynn through 2024. |

| (e) | AE Supply purchased hydroelectric generation facilities at Allegheny Lock and Dam Nos. 5 & 6 in December 2009. See Note 15, “Purchase of Hydroelectric Generation Facilities,” to Allegheny’s consolidated financial statements. |

| (f) | The licenses for AE Supply hydroelectric facilities Dam No. 4 and Dam No. 5, located in West Virginia and Maryland, will expire in November 2024. The licenses for the Green Valley, Shenandoah, Warren, Luray and Newport facilities located in Virginia run through 2024. |

| (g) | Buchanan Energy Company of Virginia, LLC (“Buchanan”) is a subsidiary of AE Supply. CNX Gas Corporation and Buchanan have equal ownership interests in Buchanan Generation LLC (“Buchanan Generation”). AE Supply operates and dispatches 100% of Buchanan Generation’s 86 MWs. |

PURPA Capacity

The following table shows generation capacity, in addition to that reflected in the table above, that is available to the Distribution Companies through state utility commission-approved arrangements pursuant to PURPA. PURPA requires electric utility companies, such as the Distribution Companies, to interconnect with, provide back-up electric service to and purchase electric capacity and energy from qualifying small power production and cogeneration facilities, although electric utilities are no longer required to enter into any new contractual obligation to purchase energy from a qualifying facility if FERC finds that the facility has non-discriminatory access to a functioning wholesale market and open-access transmission. The capacity purchases reflected in this table are reflected in the results of the Regulated Operations segment.

| PURPA Capacity (MW) | ||||||||||||||||||||

| PURPA Stations (a) |

Project Total |

Monongahela | Potomac Edison |

West Penn |

Contract Termination Date |

|||||||||||||||

| Coal Fired (Steam) |

||||||||||||||||||||

| AES Warrior Run (Cumberland, MD) (b) |

180 | 180 | 2030 | |||||||||||||||||

| AES Beaver Valley (Monaca, PA) |

125 | 125 | 2016 | |||||||||||||||||

| Grant Town (Grant Town, WV) |

80 | 80 | 2036 | |||||||||||||||||

| West Virginia University (Morgantown, WV) |

50 | 50 | 2027 | |||||||||||||||||

| Hydro: |

||||||||||||||||||||

| Hannibal Lock and Dam (New Martinsville, WV) |

31 | 31 | 2034 | |||||||||||||||||

| Total PURPA Capacity |

466 | 161 | 180 | 125 | ||||||||||||||||

| (a) | AE Supply purchased hydroelectric generating facilities at Allegheny Lock and Dam Nos. 5 & 6, previously PURPA stations with generating capacity of 13 MW, in December 2009. |

| (b) | As required under the terms of a Maryland restructuring settlement, Potomac Edison offers the 180 MW output of the AES Warrior Run project to the wholesale market and will continue to do so for the term of the AES Warrior Run contract, which ends on February 10, 2030. Revenue received from the sale reduces the AES Warrior Run surcharge paid by Maryland customers. |

13

Transmission and Distribution Facilities

The following table sets forth the existing miles of T&D lines and the number of substations of the Distribution Companies and AGC as of December 31, 2010:

| Underground | Above- Ground |

Total Miles |

Total Miles Consisting of 500-Kilovolt (kV) Lines |

Number of Transmission and Distribution Substations |

||||||||||||||||

| Monongahela |

950 | 22,397 | 23,347 | 251 | 241 | |||||||||||||||

| Potomac Edison (a) |

4,625 | 13,607 | 18,232 | 174 | 200 | |||||||||||||||

| West Penn |

3,100 | 24,257 | 27,357 | 276 | 505 | |||||||||||||||

| AGC (b) |

— | 87 | 87 | 87 | 1 | |||||||||||||||

| Total |

8,675 | 60,348 | 69,023 | 788 | 947 | |||||||||||||||

| (a) | Reflects the June 2010 sale of Potomac Edison’s Virginia distribution business. |

| (b) | Total Bath County transmission lines, of which AGC owns an undivided 40% interest and Virginia Electric and Power Company owns the remainder. |

The Distribution Companies’ transmission network has 12 extra-high-voltage (345 kV and above) and 36 lower-voltage interconnections with neighboring utility systems.

14

15

FUEL, POWER AND RESOURCE SUPPLY

Coal Supply

Allegheny primarily uses Northern Appalachian coal at its coal-fired generating facilities. Most of Allegheny’s coal purchase agreements contain specified prices and include price adjustment provisions related to changes in specified cost indices, as well as to specific events, such as changes in regulations that affect the coal industry.

Developments and operational factors affecting Allegheny’s coal suppliers, including increased costs, transportation constraints, safety issues and operational difficulties, may have negative effects on coal supplier performance. See “Risk Factors.”

Merchant Generation. AE Supply consumed approximately 12.4 million tons of coal in 2010 at an average price of approximately $57.56 per ton delivered. Allegheny purchased these fuels primarily from mines in Pennsylvania, West Virginia and Ohio. However, Allegheny also purchases coal from other regions, and blends coal from the Powder River Basin with eastern bituminous coal at one of its generating facilities.

Historically, AE Supply has purchased a majority of its coal from a limited number of suppliers. Of AE Supply’s coal purchases in 2010, 60% came from subsidiaries of three companies, the largest of which represented 25% of the total tons purchased.

As of February 1, 2011, AE Supply had commitments for the delivery of more than 97% of the coal that AE Supply expects to consume in 2011. Excluding volumes that are priced annually based on market conditions, AE Supply also had commitments for the delivery of approximately 67% of its anticipated coal needs for 2012 and for approximately 58%, 56% and 40% of its anticipated coal needs for 2013, 2014 and 2015, respectively.

Regulated Operations. Monongahela consumed approximately 4.5 million tons of coal in 2010 at an average price of approximately $63.23 per ton delivered. Monongahela purchased these fuels primarily from mines in Pennsylvania, West Virginia and Ohio. However, Monongahela also purchases coal from other regions, and blends coal from the Powder River Basin with eastern bituminous coal at certain of its generating facilities.

Historically, Monongahela has purchased a majority of its coal from a limited number of suppliers. Of Monongahela’s coal purchases in 2010, 62% came from subsidiaries of three companies, the largest of which represented 27% of the total tons purchased.

As of February 1, 2011, Monongahela had commitments for the delivery of more than 98% of the coal that Monongahela expects to consume in 2011. Excluding volumes that are priced annually based on market conditions, Monongahela also had commitments for the delivery of approximately 66% of its anticipated coal needs for 2012 and for approximately 49%, 51% and 21% of its anticipated coal needs for 2013, 2014 and 2015, respectively.

Natural Gas Supply

AE Supply purchases natural gas to supply its natural gas-fired generation facilities. In 2010, AE Supply purchased its natural gas requirements principally in the spot market.

AE Supply has an agreement under a FERC-approved tariff with Kern River Gas Transmission Company for the firm transportation of 45,122 decatherms of natural gas per day from Opal, Wyoming to southern California. The transportation agreement runs through April 30, 2018. AE Supply continues to manage this obligation by monitoring market conditions and pursuing commercial transactions that will enable it to maximize the value of the agreement.

16

Electric Power

Allegheny reorganized its corporate structure in response to electric utility deregulation within its service area between 1999 and 2001. The Distribution Companies, with the exception of Monongahela, do not produce their own power. Potomac Edison transferred all of its generation assets to AE Supply in 2000. West Penn transferred all of its generation assets to AE Supply in 1999. Monongahela transferred the portion of its generation assets dedicated to its previously-owned Ohio service territory to AE Supply in 2001. Effective as of January 1, 2007, Monongahela and AE Supply completed an intra-company transfer of assets that realigned generation ownership and contractual obligations within the Allegheny system (the “Asset Swap”). See “Regulatory Framework Affecting Allegheny.”

Pennsylvania instituted retail customer choice in 1996 and transitioned to market-based, rather than cost-based pricing for generation. West Penn is the PLR for those Pennsylvania customers who do not choose an alternate supplier or whose alternate supplier does not deliver or who choose to return to West Penn service. West Penn’s generation rates were capped at various levels through the end of its transition period on December 31, 2010. Prior to the end of the transition period, AE Supply was contractually obligated to provide West Penn with most of the power necessary to meet its PLR obligations in Pennsylvania. In July 2008, the Pennsylvania PUC approved West Penn’s proposed power procurement plan, pursuant to which West Penn has begun to procure its post-transition period power requirements through a combination of competitively bid contracts and spot market purchases. West Penn has procured 80% of the generation supply needed to serve its residential customers in 2011, over 90% of the generation supply needed to serve its small and medium non-residential customers in 2011, and 100% of the generation supply needed to serve its largest non-residential customers who select the fixed-price default service provider option in 2011.

Prior to January 1, 2007, AE Supply sold power to Potomac Edison to serve customers in Potomac Edison’s West Virginia service territory. In connection with the Asset Swap, Monongahela assumed the obligation to supply power to Potomac Edison to meet its West Virginia load obligations through 2027. Monongahela sells the power that it generates from its West Virginia jurisdictional assets into the PJM market and purchases from the PJM market the power necessary to meet its West Virginia jurisdictional customer load and contractual obligations to provide power, including its obligations to supply power to Potomac Edison.

AE Supply serves a portion of Potomac Edison’s Maryland customers pursuant to contracts that range in length from three to 29 months. These contracts were awarded to AE Supply as a result of a competitive bidding process in Maryland. Suppliers that are not affiliated with Potomac Edison also were awarded contracts for portions of Potomac Edison’s Maryland load pursuant to the competitive bidding process. In Maryland, Potomac Edison conducts rolling auctions to procure its power supply.

17

Each of the states in Allegheny’s service territory, other than West Virginia has, to some extent, taken steps to deregulate its electric utility industry. Pennsylvania and Maryland instituted customer choice and have transitioned to market-based, rather than cost-based pricing for generation. Virginia undertook to deregulate the provision of generation services beginning in 1999, but subsequent legislation resulted in the re-regulation of these services in January 2009 for most customers. Potomac Edison sold its Virginia distribution business in June 2010, as a result of which, Allegheny no longer has retail customers in Virginia.

In April 2009, West Penn began to conduct auctions to procure a portion of its generation needs to serve its Pennsylvania customers beginning January 1, 2011 pursuant to its default service plan as approved by the Pennsylvania PUC. West Penn has procured 80% of the generation supply needed to serve its residential customers in 2011, over 90% of the generation supply needed to serve its small and medium non-residential customers in 2011 and 100% of the generation supply needed to serve its largest non-residential customers who select the fixed price default service provider option in 2011.

AE Supply is serving a portion of Potomac Edison’s Maryland customers pursuant to contracts that range in length from three to 29 months. These contracts were awarded to AE Supply as a result of competitive bidding processes in Maryland. Suppliers that are not affiliated with Potomac Edison also were awarded contracts for portions of Potomac Edison’s Maryland load pursuant to the competitive bidding process. In Maryland, Potomac Edison conducts rolling auctions to procure its power supply. In Virginia, AE Supply had contracts to serve a majority of the customer load in Potomac Edison’s former distribution service territory for the term June 1, 2009 through June 30, 2011 that it acquired as a result of a competitive solicitation. With Potomac Edison’s sale of its Virginia distribution business, these contracts were assigned to Old Dominion Electric Cooperative, a Virginia utility aggregation cooperative, on behalf of the new jurisdictional owners. See “Regulatory Framework Affecting Allegheny,” “Risk Factors” and Note 5, “Rates and Regulation,” to Allegheny’s consolidated financial statements.

18

REGULATORY FRAMEWORK AFFECTING ALLEGHENY

The interstate transmission services and wholesale power sales of the Distribution Companies, TrAIL Company, PATH, LLC, AE Supply and AGC are regulated by FERC under the FPA. The Distribution Companies’ local distribution service and sales at the retail level are subject to state regulation. In addition, Allegheny is subject to numerous other local, state and federal laws, regulations and rules. See “Risk Factors.”

Federal Regulation and Rate Matters

FERC, Competition and RTOs

Allegheny’s generation and transmission businesses are significantly influenced by the actions of FERC through policies, regulations and orders issued pursuant to the FPA. The FPA gives FERC exclusive jurisdiction over the rates, terms and conditions of wholesale sales and transmission of electricity in interstate commerce. Entities, such as the Distribution Companies, TrAIL Company, the operating subsidiaries of PATH, LLC, AE Supply and AGC, that sell electricity at wholesale or own or operate transmission facilities are subject to FERC jurisdiction and must file their rates, terms and conditions for such sales or services with FERC. Rates for wholesale sales of electricity may be either cost-based or market-based. Rates for use of transmission facilities are determined on a cost basis.

FERC’s authority under the FPA, as it pertains to Allegheny’s generation and transmission businesses, also includes, but is not limited to: licensing of hydroelectric projects; transmission interconnections with other electric facilities; transfers of public utility property; mergers, acquisitions and consolidation of public utility systems and companies; issuance of certain securities and assumption of certain liabilities; accounting and methods of depreciation; transmission reliability; siting of certain transmission facilities; allocation of transmission rights; relationships between holding companies and their public utility affiliates; availability of books and records; and holding of a director or officer position at more than one public utility or specified company.

FERC’s policies, regulations and orders encourage competition among wholesale sellers of electricity. To support competition, FERC requires public utilities that own transmission facilities to make such facilities available on a non-discriminatory, open-access basis and to comply with standards of conduct that prevent transmission-owning utilities from giving their affiliated sellers of electricity preferential access to the transmission system and transmission information. To further competition, FERC encourages transmission-owning utilities to participate in regional transmission organizations (“RTOs”) such as PJM, by transferring functional control over their transmission facilities to RTOs.

All of Allegheny’s generation assets and power supply obligations are located within the PJM market, and PJM maintains functional control over the transmission facilities owned by the Distribution Companies and TrAIL Company. PJM operates a competitive wholesale electricity market and coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia. PJM is also responsible for developing and implementing the RTEP for the PJM region to ensure reliability of the electric grid and promote market efficiency. In addition, PJM determines the requirements for, and manages the process of, interconnecting new and expanded generation facilities to the grid. Changes in the PJM tariff, operating agreement, policies and/or market rules could adversely affect Allegheny’s financial results. See “Risk Factors.”

Transmission Rate Design. FERC actions with respect to the transmission rate design within PJM may impact the Distribution Companies. Beginning in July 2003, FERC issued a series of orders related to transmission rate design for the PJM and Midwest Independent Transmission System Operator (“Midwest ISO”) regions. Specifically, FERC ordered the elimination of multiple and additive (i.e., “pancaked”) rates and called for the implementation of a long-term rate design for these regions. In November 2004, FERC rejected long-term

19

regional rate proposals, concluding that neither the rate design proposals nor the existing PJM rate design had been shown to be just and reasonable. FERC ordered the continuation of the existing PJM zonal “license plate” rate design and the implementation of a transition charge for these regions during a 16-month transition period commencing on December 1, 2004 and ending on March 31, 2006. On May 21, 2010, FERC denied all requests for rehearing with regard to transmission rate design within the PJM region. A petition for review of this order and the underlying orders has been filed with the United States Court of Appeals for the District of Columbia Circuit. Allegheny cannot predict the outcome of this proceeding or whether it will have a material impact on its business or financial position.

During the now-expired transition period, the Distribution Companies were both payers and payees of transition charges. Following an evidentiary hearing, an administrative law judge issued an initial decision finding the methodologies used to develop the transition charges to be deficient. On May 21, 2010, FERC issued an order on the initial decision, which reversed in part and affirmed in part the initial decision. On August 19, 2010, the Distribution Companies and other PJM transmission owners filed tariff sheets with FERC to reflect certain adjustments in the transition charges directed by the May 21, 2010 order. Several parties have requested rehearing of the May 21, 2010 order on the initial decision and have protested the August 19, 2010 filing. Allegheny cannot predict the outcome of this proceeding or whether it will have a material impact on its business or financial position.

In April 2007, FERC issued an order addressing transmission rate design within the PJM region. In the order, FERC directed the continuation of the zonal “license plate” rate design for all existing transmission facilities within the PJM region, the allocation of costs of new, centrally-planned transmission facilities operating at or above 500 kV on a region-wide “postage stamp” or “socialized” basis, and the development of a detailed “beneficiary pays” methodology for the allocation of costs of new transmission facilities below 500 kV. Subsequently, FERC approved a detailed “beneficiary pays” methodology developed through settlement discussions among several parties to the underlying FERC proceedings. On August 6, 2009, the U. S. Court of Appeals for the Seventh Circuit remanded this decision to FERC for further justification with regard to the allocation of costs for new 500 kV and above transmission facilities but denied petitions for review relating to FERC’s decision with regard to the pricing of existing transmission facilities. On January 21, 2010, FERC issued an order establishing a paper hearing in response to the Seventh Circuit’s remand. On April 13, 2010, PJM submitted to FERC information required by the order. The Distribution Companies submitted comments in response to the information provided by PJM on May 28, 2010. Allegheny cannot predict the outcome of this proceeding or whether it will have a material impact on its business or financial position.

Under the zonal “license plate” rate design for existing transmission facilities, costs associated with such facilities are allocated on a load ratio share basis to load serving entities, such as local distribution utilities, located within the transmission owner’s PJM transmission zone. As a result of this rate design, the load serving entity does not pay for the cost of transmission facilities located in other PJM transmission zones even if the load serving entity engages in transactions that rely on transmission facilities located in other zones. The region-wide “postage stamp” or “socialized” rate design for new, centrally-planned transmission facilities operating at or above 500 kV results in charging all load serving entities within the PJM region a uniform rate based on the aggregated costs of such transmission facilities within the PJM region irrespective of whether the transmission service provided to the load serving entity requires the actual use of such facilities. For the “beneficiary pays” methodology, the costs of new facilities under 500 kV are allocated to load serving entities based on a methodology that considers several factors but is not premised upon the proximity of the load serving entity to the new facilities or the zone in which the new facilities are located.

In January 2008, FERC accepted a compliance filing submitted by certain PJM and Midwest ISO transmission owners establishing the transmission pricing methodology for transactions involving transmission service originating in the PJM region or the Midwest ISO region and terminating in the other region. The methodology maintains the existing rate design for such transactions under which PJM and Midwest ISO treat transactions that source in one region and sink in the other region the same as transactions that source and sink entirely in one of the regions. These inter-regional transactions are assessed only the applicable zonal charge of

20

the zone in which the transaction sinks and no charge is assessed in the zone of the region where the transaction originates. Judicial review of FERC’s order in this matter is pending. Allegheny cannot predict the outcome of these proceedings or whether they will have a material impact on its business or financial position.

Wholesale Markets. In August 2005, PJM filed at FERC to replace its capacity market with a new Reliability Pricing Model, or “RPM,” to address reliability concerns. On April 20, 2006, FERC issued an initial order that found PJM’s capacity market to be unjust and unreasonable and set a process to resolve features of the RPM that needed to be analyzed further before it could determine whether the RPM is a just and reasonable capacity market process. FERC ordered the implementation of settlement procedures in this proceeding, and AE Supply and the Distribution Companies joined in a settlement agreement that was filed with FERC on September 29, 2006. The settlement agreement created a locational capacity market in PJM, in which PJM procures needed capacity resources through auctions held three years in advance at prices and in quantities determined by an administratively established demand curve. Under the settlement agreement, capacity needs in PJM are met either through purchases made in the proposed auctions or through commitments by load serving entities (“LSEs”) to self-supply their capacity needs. On December 22, 2006, FERC conditionally approved the settlement agreement, the implementation of which began with the 2007-2008 PJM planning year. Base year capacity auctions were held in April, July and October of 2007, in January and May of 2008 and May of 2009. On June 25, 2007 and again on November 11, 2007, FERC issued orders denying pending requests for rehearing of the December 22, 2006 order and affirming its acceptance of the RPM settlement agreement. Several parties have appealed FERC’s orders approving the RPM settlement, and those appeals are currently pending at the United States Court of Appeals for the District of Columbia Circuit. On May 30, 2008, several parties naming themselves the “RPM Buyers” filed a complaint at FERC seeking a retroactive reduction in the RPM clearing prices for several RPM auctions that have already been conducted. On September 19, 2008, FERC issued an order denying the RPM Buyers’ complaint. In June 2009, FERC denied requests for rehearing of the September 19, 2008 order. The Maryland PSC and New Jersey Board of Public Utilities appealed FERC’s order denying the RPM Buyers’ complaint to the United States Court of Appeals for the District of Columbia Circuit, which denied the petition for review on February 8, 2011.

PJM Calculation Error. In March 2010, the Midwest ISO filed two complaints at FERC against PJM relating to a previously-reported modeling error in PJM’s system that impacted the manner in which market-to-market power flow calculations were made between PJM and the Midwest ISO since April 2005. The Midwest ISO claimed that this error resulted in PJM underpaying the Midwest ISO by approximately $130 million over the time period in question. Additionally, the Midwest ISO alleged that PJM did not properly trigger market-to-market settlements between PJM and the Midwest ISO during times when it was required to do so, which the Midwest ISO claimed may have cost it $5 million or more. As PJM market participants, AE Supply and Monongahela may be liable for a portion of any refunds ordered in this case. PJM, Allegheny and other PJM market participants filed responses to the Midwest ISO complaints and PJM filed a related complaint at FERC against the Midwest ISO claiming that the Midwest ISO improperly called for market-to-market settlements several times during the same time period covered by the two Midwest ISO complaints filed against PJM, which PJM claimed may have cost PJM market participants $25 million or more. On January 4, 2011, an Offer of Settlement was filed at FERC that, if approved, would resolve all pending issues in the dispute. The Offer of Settlement calls for the withdrawal of all pending complaints with no payments being made by any parties. Initial comments on the Offer of Settlement were filed at FERC on January 24, 2011.

Reliability Standards. FERC has the authority to oversee the establishment and enforcement of mandatory reliability standards designed to assure the reliable operation of the bulk power system. FERC certified NERC as the Electric Reliability Organization responsible for developing and enforcing continent-wide reliability standards. NERC has established, and FERC has approved, reliability standards that impose certain operating, record-keeping and reporting requirements on the Distribution Companies, TrAIL Company, PATH, LLC, AE Supply and AGC.

While NERC is charged with establishing and enforcing appropriate reliability standards, it has delegated their day-to-day implementation and enforcement to eight regional oversight entities, including ReliabilityFirst Corporation (“ReliabilityFirst”). These regional oversight entities are responsible for developing regional reliability

21

standards that are consistent with NERC’s standards. Each regional entity has its own compliance program designed to monitor, assess and enforce compliance with the applicable reliability standards through compliance audits, self-reporting and exception reporting mechanisms, self certifications, compliance violation investigations, periodic data submissions and complaint processes. Allegheny is a member of ReliabilityFirst, participates in the NERC and ReliabilityFirst stakeholder processes and monitors and manages its operations in response to the ongoing development, implementation and enforcement of relevant reliability standards. Allegheny has been, and will continue to be, subject to routine audits with respect to its compliance with applicable reliability standards and has settled certain related issues. In addition, ReliabilityFirst is currently conducting certain violation investigations with regard to matters of compliance by Allegheny. The results of these investigations have not had, and are not expected to have, any material impact on Allegheny’s operations or the results thereof. See “Risk Factors.”

Transmission Expansion

TrAIL Project. TrAIL is a new, 500kV transmission line currently under construction that will extend from southwest Pennsylvania through West Virginia and into northern Virginia. TrAIL is scheduled to be completed and placed in service no later than June 2011.

PATH Project. The PATH Project is comprised of a 765 kV transmission line that is proposed to extend from West Virginia through Virginia and into Maryland, modifications to an existing substation in Putnam County, West Virginia, and the construction of new substations in Hardy County, West Virginia and Frederick County, Maryland.

PJM initially authorized construction of PATH in June 2007 and, on June 17, 2010, requested that PATH, LLC proceed with all efforts related to the PATH Project, including state regulatory proceedings, assuming a required in-service date of June 1, 2015. In December 2010, PJM advised that its 2011 Load Forecast Report included load projections that are different from previous forecasts and that may have an impact on the proposed in-service date for the PATH Project. If after further analysis PJM determines that the PATH Project is not required by June 2015 to address potential NERC reliability violations, it may delay the required in-service date for PATH to a later date or indefinitely, or it may suspend or cancel the project. Construction of the PATH Project remains subject to permitting and various state regulatory approvals.

Allegheny and a subsidiary of AEP formed PATH, LLC to facilitate the construction of the PATH Project. PATH, LLC submitted a filing to FERC under Section 205 of the FPA in December 2007 to implement a formula rate tariff effective March 1, 2008. The filing also included a request for certain incentive rate treatments. In February 2008, FERC issued an order setting the cost of service formula rate to calculate annual revenue requirements for the project and granting the following incentives:

| • | a return on equity of 14.3%; |

| • | a return on CWIP; |

| • | recovery of prudently incurred start-up business and administrative costs incurred prior to the time the rates go into effect; and |

| • | recovery of prudently incurred development and construction costs if the PATH Project is abandoned as a result of factors beyond the control of PATH, LLC. |

In December 2008, PATH, LLC submitted to FERC a settlement of the formula rate and protocols with the active parties that resolves all issues set for hearing. The return on equity was not included in the settlement because it was authorized by the February 2008 order and not set for hearing. On November 19, 2010, FERC approved the settlement, set the base return on equity for hearing and reaffirmed its prior authorization of a return on CWIP, recovery of start-up costs and recovery of abandonment costs. In the order, FERC also granted a 1.5% return on equity incentive adder and 0.50% return on equity adder for RTO participation. These adders will be applied to the base return on equity determined as a result of the hearing. PATH, LLC is currently engaged in settlement discussions with the staff of FERC and intervenors regarding resolution of the base return on equity. Allegheny cannot predict the outcome of this proceeding or whether it will have a material impact on its operating results. See “Risk Factors.”

22

PURPA

The Public Utility Regulatory Policies Act of 1978 (“PURPA”) requires electric utility companies, such as the Distribution Companies, to interconnect with, provide back-up electric service to and purchase electric capacity and energy from qualifying small power production and cogeneration facilities, although, as a result of changes in the FPA arising out of the Energy Policy Act, electric utilities are no longer required to enter into any new contractual obligation to purchase energy from a qualifying facility if FERC finds that the facility has non-discriminatory access to a functioning wholesale market and open-access transmission.