| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| Title of Each Class | Trading Symbol(s) | Name of Exchange on which Registered | ||||||

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||||||||||

☒ | Smaller Reporting Company | |||||||||||||

| Emerging Growth Company | ||||||||||||||

| Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs | ||||||||||||||||||||||

January 1, 2022 through December 31, 2022 (1) | 579 | $ | 21.00 | — | — | |||||||||||||||||||||

| Total | 579 | $ | 21.00 | — | ||||||||||||||||||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net cash used in operating activities from continuing operations | $ | (27,064) | $ | (23,115) | |||||||

| Net cash from (used in) investing activities from continuing operations | (85,249) | 58,396 | |||||||||

| Net cash from (used in) financing activities from continuing operations | 46,779 | (4,884) | |||||||||

| Total cash flows relating to continuing operations | $ | (65,534) | $ | 30,397 | |||||||

| Net cash from operating activities from discontinued operations | $ | — | $ | 5,439 | |||||||

| Net cash from investing activities from discontinued operations | — | 511 | |||||||||

| Net cash from (used in) financing activities from discontinued operations | — | 80 | |||||||||

| Total cash flows relating to discontinued operations | $ | — | $ | 6,030 | |||||||

| Exhibit Number | Description | |||||||

| Separation Agreement, dated as of December 21, 2012, between Altisource Asset Management Corporation and Altisource Portfolio Solutions S.A. (incorporated by reference to Exhibit 2.1 of the Registrant's Current Report on Form 8-K filed with the SEC on December 28, 2012). | ||||||||

| Amended and Restated Articles of Incorporation of Altisource Asset Management Corporation (incorporated by reference to Exhibit 3.1 of the Registrant's Current Report on Form 8-K filed with the SEC on January 5, 2017). | ||||||||

| Fifth Amended and Restated Bylaws of Altisource Asset Management Corporation (incorporated by reference to Exhibit 3.2 of the Registrant's Current Report on Form 8-K filed with the SEC on July 6, 2022). | ||||||||

| Certificate of Designations establishing the Company’s Series A Convertible Preferred Stock (incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K filed with the SEC on March 19, 2014). | ||||||||

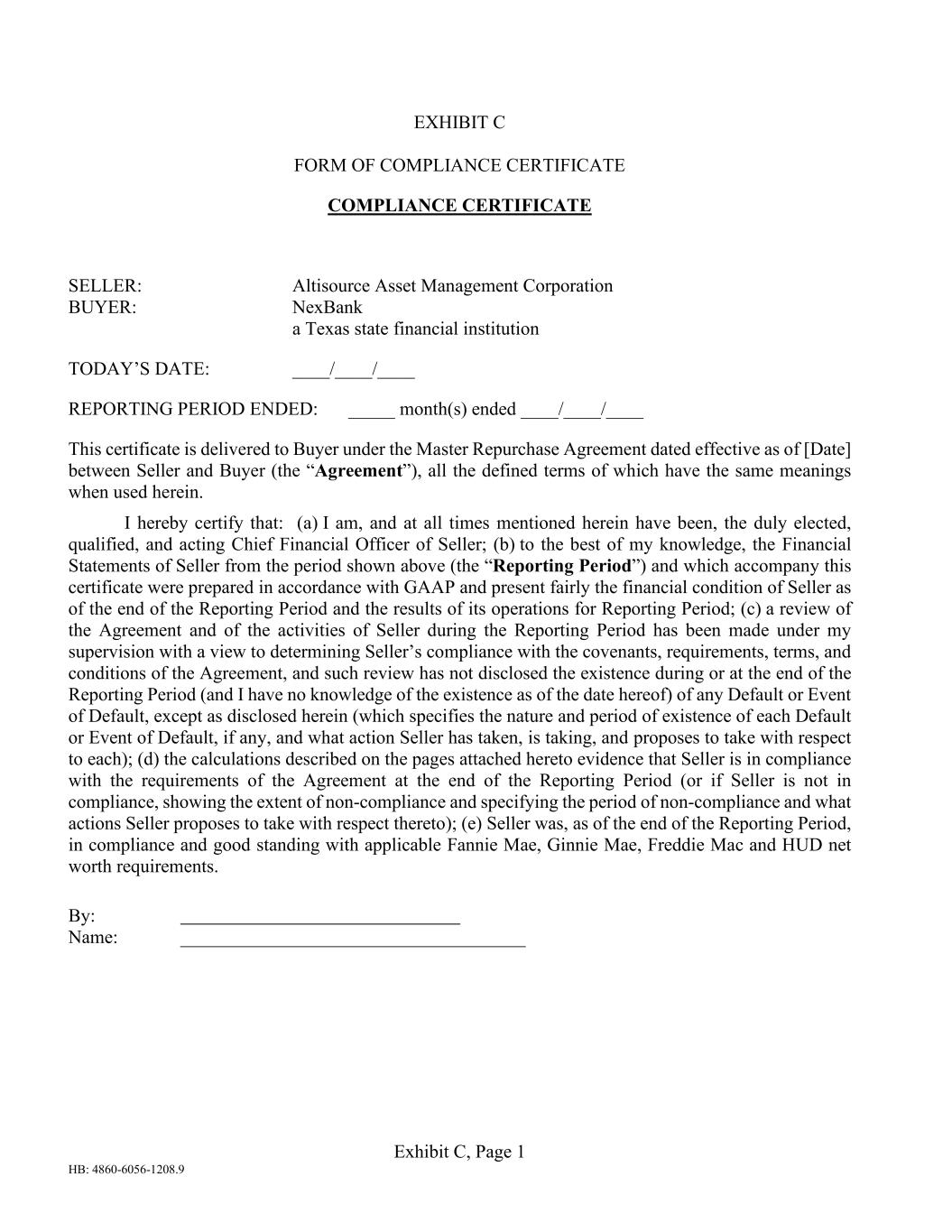

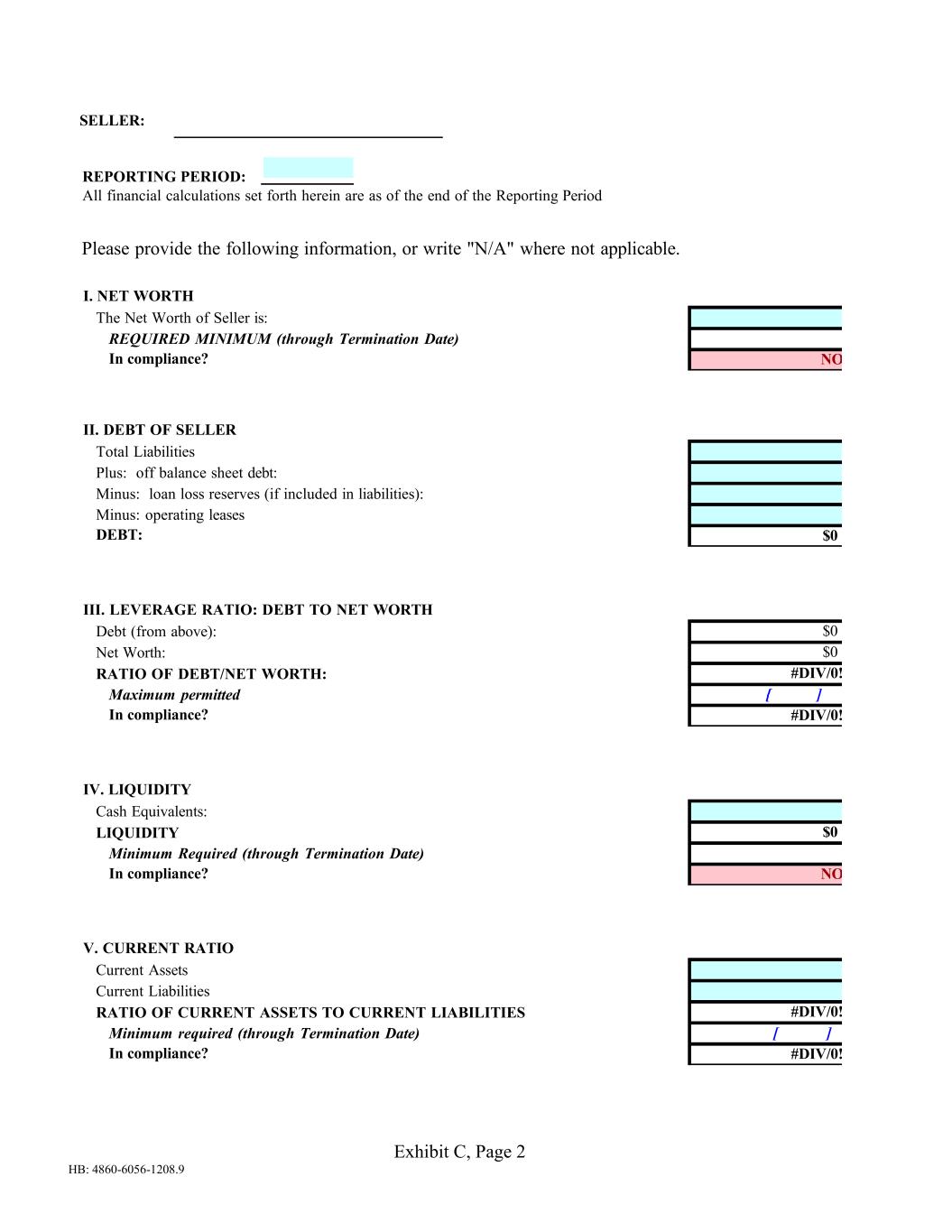

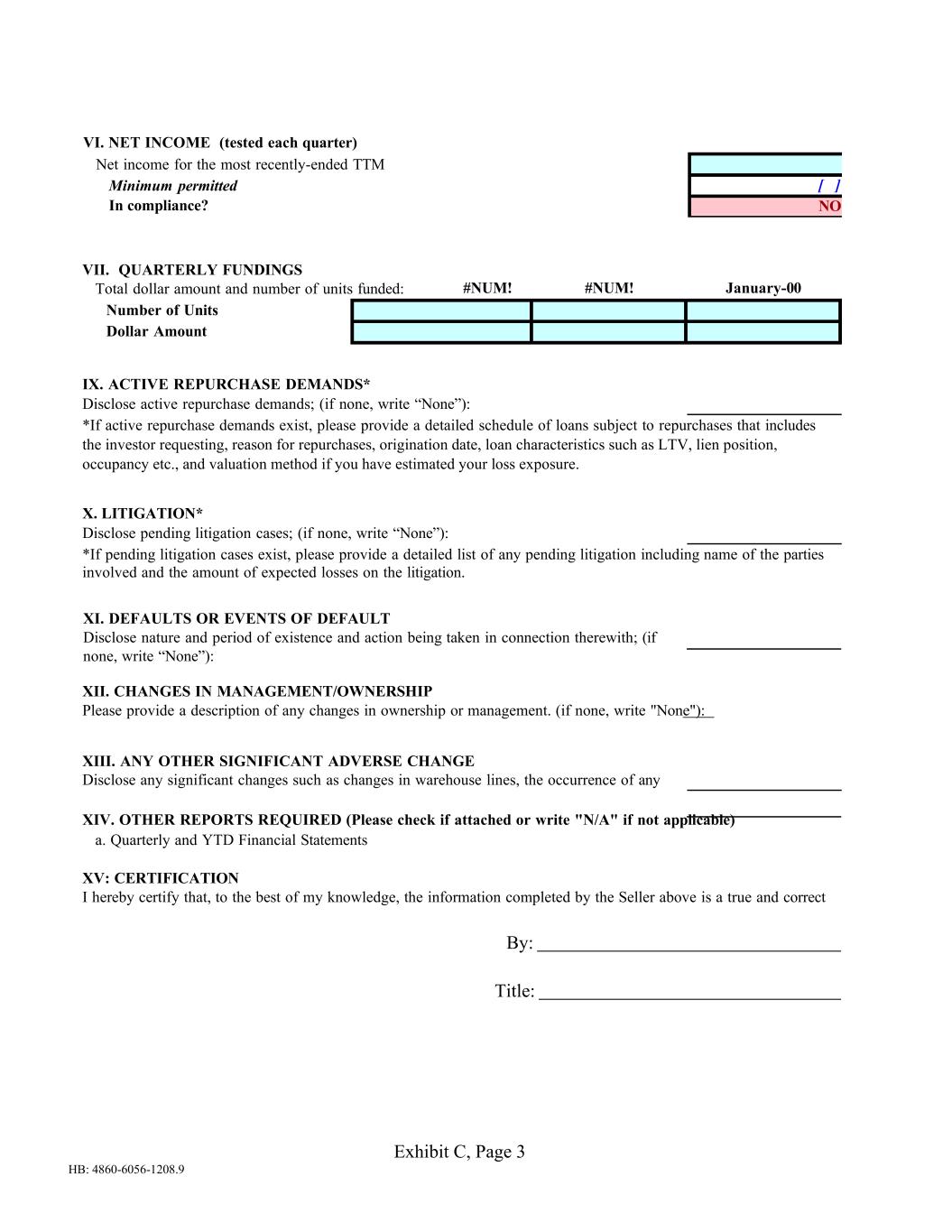

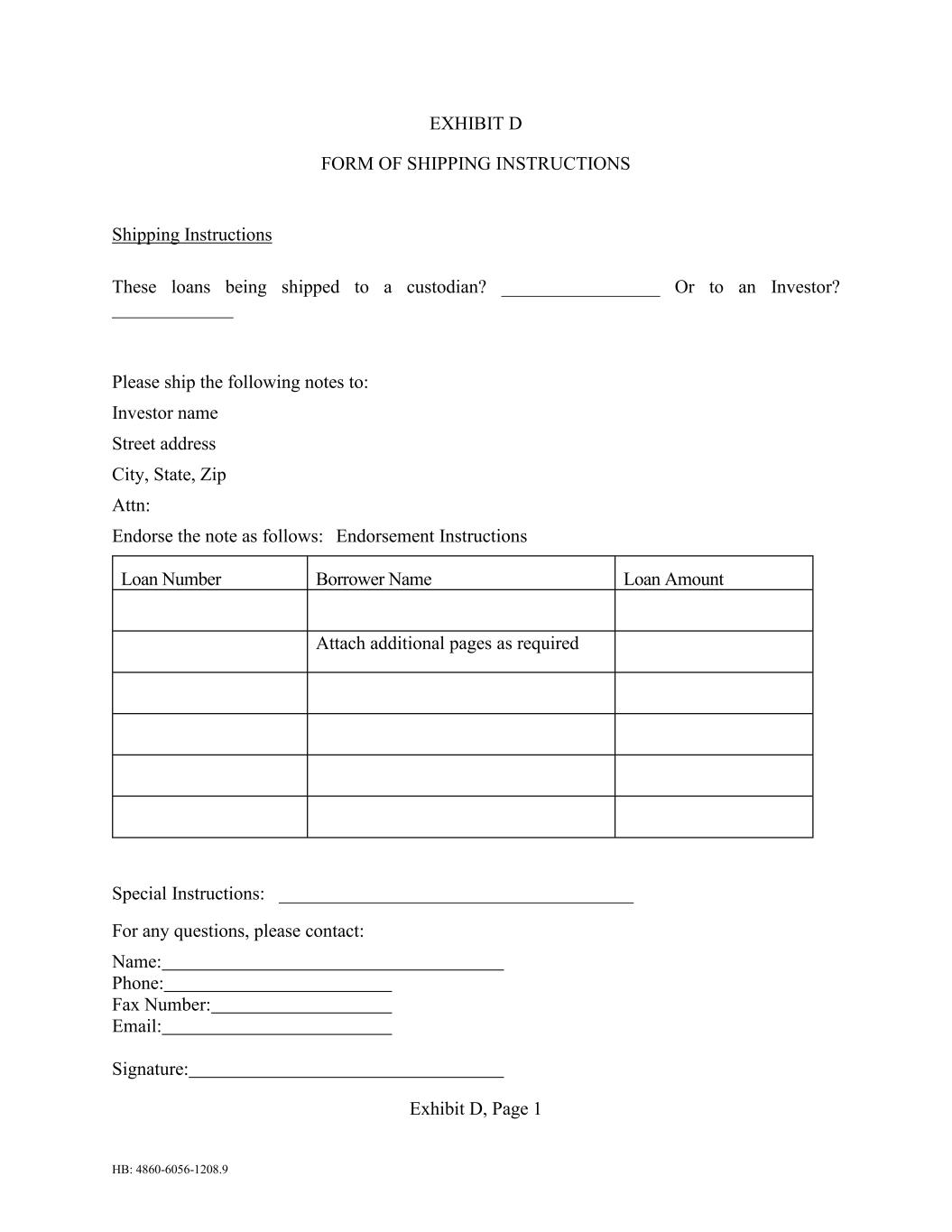

| Master Repurchase Agreement between Altisource Asset Management Corporation and Grapetree Lending LLC and NexBank, dated December 2, 2022 (portions redacted). | ||||||||

4.1* | Description of Registrant's Securities. | |||||||

10.1† | Altisource Asset Management Corporation 2012 Equity Incentive Plan (incorporated by reference to Exhibit 10.11 of the Registrant's Amendment No. 4 to Form 10 filed with the SEC on December 18, 2012). | |||||||

| Amended and Restated Asset Management Agreement, dated as of May 7, 2019, by and among Front Yard Residential Corporation, Front Yard Residential, L.P. and Altisource Asset Management Corporation (incorporated by reference to Exhibit 10.1 of the Registrant's Current Report on Form 8-K filed with the SEC on May 8, 2019). | ||||||||

| Asset Management Agreement, dated March 31, 2015, among Front Yard Residential Corporation (f/k/a Altisource Residential Corporation), Front Yard Residential L.P. (f/k/a Altisource Residential, L.P.) and Altisource Asset Management Corporation (incorporated by reference to Exhibit 10.1 of the Registrant's Current Report on Form 8-K filed with the SEC on April 2, 2015). | ||||||||

| Amendment to Asset Management Agreement, dated April 7, 2015, among Front Yard Residential Corporation (f/k/a Altisource Residential Corporation), Front Yard Residential L.P. (f/k/a Altisource Residential, L.P.) and Altisource Asset Management Corporation (incorporated by reference to Exhibit 10.1 of the Registrant's Current Report on Form 8-K filed with the SEC on April 13, 2015). | ||||||||

10.5† | Altisource Asset Management Corporation 2016 Preferred Stock Plan (incorporated by reference to Exhibit 10.22 of the Registrant's Annual Report on Form 10-K filed with the SEC on March 1, 2017). | |||||||

10.6† | Form of Preferred Stock Agreement under 2016 Employee Preferred Stock Plan (incorporated by reference to Exhibit 10.1 of the Registrant's Current Report on Form 8-K filed with the SEC on January 5, 2017). | |||||||

10.8† | Altisource Asset Management Corporation 2020 Equity Incentive Plan (incorporated by reference to Exhibit 4.3 of the Registrant's Form S-8 filed with the SEC on December 21, 2020). | |||||||

10.9† | Employment Agreement of Stephen R. Krallman, dated as of May 24, 2021. (incorporated by reference to Exhibit 10.1 to the Registrant's Current Report on Form 8-K filed with the SEC on June 28, 2021). | |||||||

| Employment Agreement of Jason Kopcak, dated as of March 16, 2022. (incorporated by reference to Exhibit 10.1 to the Registrant's Current Report on Form 8-K filed with the SEC on March 18, 2022.) | ||||||||

| Settlement Agreement dated as of February 17, 2021, between Altisource Asset Management Corporation and Putnam Focused Equity Fund, a series of Putnam Funds Trust, dated as of February 17, 2021 (incorporated by reference to Exhibit 10.1 to the Registrant's Current Report on Form 8-K filed with the SEC on February 18, 2021). | ||||||||

Settlement Agreement dated as of August 27, 2021, between Altisource Asset Management Corporation and Ithan Creek Master Investors (Cayman) L.P., Bay Pond Investors (Bermuda) L.P., Bay Pond Partners, L.P. and Wellington Management Company LLP (together, the “Wellington Parties”). (incorporated by reference to Exhibit 10.1 to the Registrant's Current Report on Form 8-K filed with the SEC on August 30, 2021). | ||||||||

21* | Schedule of Subsidiaries. | |||||||

23* | Consent of Ernst & Young LLP. | |||||||

24* | Power of Attorney (incorporated by reference to the signature page of this Annual Report on Form 10-K). | |||||||

31.1* | Certification of CEO Pursuant to Section 302 of the Sarbanes-Oxley Act. | |||||||

31.2* | Certification of CFO Pursuant to Section 302 of the Sarbanes-Oxley Act. | |||||||

| Exhibit Number | Description | |||||||

32.1** | Certification of CEO Pursuant to Section 906 of the Sarbanes-Oxley Act. | |||||||

32.2** | Certification of CFO Pursuant to Section 906 of the Sarbanes-Oxley Act. | |||||||

| 101.INS* | XBRL Instance Document. | |||||||

| 101.SCH* | XBRL Taxonomy Extension Schema Document. | |||||||

| 101.CAL* | XBRL Taxonomy Extension Calculation Linkbase Document. | |||||||

| 101.DEF* | XBRL Taxonomy Extension Definition Linkbase Document. | |||||||

| 101.LAB* | XBRL Extension Label Linkbase Document. | |||||||

| 101.PRE* | XBRL Taxonomy Extension Presentation Linkbase Document. | |||||||

| Altisource Asset Management Corporation | ||||||||||||||

| Date: | March 27, 2023 | By: | /s/ Jason Kopcak | |||||||||||

| Jason Kopcak | ||||||||||||||

| Chief Executive Officer | ||||||||||||||

| Date: | March 27, 2023 | By: | /s/ Stephen Ramiro Krallman | |||||||||||

| Stephen Ramiro Krallman | ||||||||||||||

| Chief Financial Officer | ||||||||||||||

| Signature | Title | Date | ||||||||||||

| /s/ John P. de Jongh, Jr. | Director | March 27, 2023 | ||||||||||||

| John P. de Jongh, Jr. | ||||||||||||||

| /s/ Ricardo C. Byrd | Director | March 27, 2023 | ||||||||||||

| Ricardo C. Byrd | ||||||||||||||

| /s/ John A. Engerman | Director | March 27, 2023 | ||||||||||||

| John A. Engerman | ||||||||||||||

| /s/ Jason Kopcak | Director and Chief Executive Officer | March 27, 2023 | ||||||||||||

| Jason Kopcak | ||||||||||||||

| /s/ Stephen Ramiro Krallman | Chief Financial Officer (Principal Financial Officer, Principal Accounting Officer and Secretary) | March 27, 2023 | ||||||||||||

| Stephen Ramiro Krallman | ||||||||||||||

| Loans Held for Sale or Investment, at Fair Value | ||||||||

Description of the Matter | The Company’s loans held for sale or investment, at fair value (collectively, the “loans receivable, at fair value”) totaled $94.7 million in aggregate as of December 31, 2022, inclusive of accrued interest. As more fully described in Note 2 to the consolidated financial statements, the Company has elected the fair value option to measure its loans receivable, at fair value on a recurring basis at each reporting period end. The loans receivable, at fair value were valued as of December 31, 2022 using a discounted cash flow model to estimate the net present value of the future cash flows expected from each loan. Auditing management’s estimate of the fair value of the Company’s loans receivable, at fair value involved a high degree of subjectivity in evaluating management’s assumptions due to the significant estimation required in determining fair value. Specifically, the estimated fair value of the loans receivable, at fair value is sensitive to changes in the discount rate applied to the net present value of future cash flows expected from each loan. | |||||||

How We Addressed the Matter in Our Audit | Our audit procedures related to the valuation of the loans receivable, at fair value, included, among others, evaluating the reasonableness of the Company’s use of the income approach to estimate fair value, testing the mathematical accuracy of the valuation models and calculations, and testing the completeness and accuracy of the data inputs used in the valuation of the loans held as of the balance sheet date. Also, with the assistance of our valuation specialists, we evaluated the discount rate assumption and concluded fair values of the loans held as of the balance sheet date. | |||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| ASSETS | |||||||||||

| Loans held for sale, at fair value | $ | $ | |||||||||

| Loans held for investment, at fair value | |||||||||||

| Cash and cash equivalents | |||||||||||

| Restricted cash | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND EQUITY | |||||||||||

| Liabilities | |||||||||||

| Accrued expenses and other liabilities | $ | $ | |||||||||

| Lease liabilities | |||||||||||

| Credit facility | |||||||||||

| Total liabilities | |||||||||||

| Redeemable preferred stock: | |||||||||||

Preferred stock, $ | |||||||||||

| Stockholders' deficit: | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Retained earnings | |||||||||||

| Accumulated other comprehensive income | |||||||||||

Treasury stock, at cost, | ( | ( | |||||||||

| Total stockholders' deficit | ( | ( | |||||||||

| Total Liabilities and Equity | $ | $ | |||||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Revenues: | |||||||||||

| Loan interest income | $ | $ | |||||||||

| Loan fee income | |||||||||||

| Servicing fee revenue | |||||||||||

| Total revenues | |||||||||||

| Expenses: | |||||||||||

| Salaries and employee benefits | |||||||||||

| Legal fees | |||||||||||

| Professional fees | |||||||||||

| General and administrative | |||||||||||

| Servicing and asset management expense | |||||||||||

| Acquisition charges | |||||||||||

| Interest expense | |||||||||||

| Direct loan expense | |||||||||||

| Loan sales and marketing expense | |||||||||||

| Total expenses | |||||||||||

| Other income (expense): | |||||||||||

| Change in fair value of loans | ( | ||||||||||

| Change in fair value of equity securities | |||||||||||

| Gain on sale of equity securities | |||||||||||

| Dividend income | |||||||||||

| Other | |||||||||||

| Total other (expense) income | ( | ||||||||||

| Net loss from continuing operations before income tax | ( | ( | |||||||||

| Income tax expense | |||||||||||

| Net loss from continuing operations | $ | ( | $ | ( | |||||||

Gain on discontinued operations (net of income tax expense of $ | |||||||||||

| Net loss attributable to common stockholders | $ | ( | $ | ( | |||||||

| Continuing operations earnings per share | |||||||||||

| Net loss from continuing operations | ( | ( | |||||||||

| Gain on preferred stock transaction | |||||||||||

| Numerator for earnings per share from continuing operations | $ | ( | $ | ||||||||

| Discontinued operations earnings per share | |||||||||||

| Net income from discontinued operations | $ | $ | |||||||||

| Earnings per share of common stock - Basic: | |||||||||||

| Continuing operations | $ | ( | $ | ||||||||

| Discontinued operations | |||||||||||

| Total | $ | ( | $ | ||||||||

| Weighted average common stock outstanding | |||||||||||

| Earnings per share of common stock - Diluted: | |||||||||||

| Continuing operations | $ | ( | $ | ||||||||

| Discontinued operations | |||||||||||

| Total | $ | ( | $ | ||||||||

| Weighted average common stock outstanding | |||||||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Other comprehensive loss: | |||||||||||

| Currency translation adjustments, net | ( | ( | |||||||||

| Total other comprehensive loss | ( | ( | |||||||||

| Comprehensive loss | $ | ( | $ | ( | |||||||

| Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Treasury Stock | Total Stockholders' Deficit | |||||||||||||||||||||||||||||||||||||||

| Number of Shares | Amount | |||||||||||||||||||||||||||||||||||||||||||

| December 31, 2020 | $ | $ | $ | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||||||||||||||||

| Common shares issued under share-based compensation plans, net of employee tax withholdings | ( | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Shares withheld for taxes upon vesting of restricted stock | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||

| Share-based compensation, net of tax | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Currency translation adjustments, net | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||

| Acquisition and disposition of subsidiaries | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Preferred stock conversion | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||

| December 31, 2021 | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| Common shares issued under share-based compensation plans, net of employee tax withholdings | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Treasury shares repurchased | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||

| Share-based compensation, net of tax | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Currency translation adjustments, net | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||

| Preferred stock conversion | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||

| December 31, 2022 | $ | $ | $ | $ | $ | ( | $ | ( | ||||||||||||||||||||||||||||||||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Operating activities: | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Less: Income from discontinued operations, net of tax | |||||||||||

| Loss from continuing operations | ( | ( | |||||||||

| Adjustments to reconcile net loss from continuing operations to net cash used in operating activities: | |||||||||||

| Depreciation | |||||||||||

| Share-based compensation | |||||||||||

| Amortization of operating lease right-of-use assets | |||||||||||

| Change in fair value of loans | |||||||||||

| Dividend income | ( | ||||||||||

| Change in fair value of securities | ( | ||||||||||

| Gain on securities | ( | ||||||||||

| Changes in operating assets and liabilities, net of effects from discontinued operations and acquisitions of subsidiaries: | |||||||||||

| Originations of held for sale loans | ( | ||||||||||

| Principal payments on held for sale loans | |||||||||||

| Additional fundings of held for sale loans | ( | ||||||||||

| Interest receivable | ( | ||||||||||

| Amortization of deferred financing fees | |||||||||||

| Other assets and liabilities | ( | ( | |||||||||

| Receivable from Front Yard | |||||||||||

| Net cash used in continuing operations | ( | ( | |||||||||

| Net cash provided by discontinued operations | |||||||||||

Net cash used in operating activities | ( | ( | |||||||||

| Investing activities: | |||||||||||

| Website development | ( | ||||||||||

| Purchase of loans held for investment | ( | ||||||||||

| Additional fundings of loans held for investment | ( | ||||||||||

| Principal payments on loans held for investment | |||||||||||

| Purchase of equity securities | ( | ||||||||||

| Dividends received | |||||||||||

| Proceeds from sale of interest in equity securities | |||||||||||

| Investment in property and equipment | ( | ( | |||||||||

| Net cash (used in) provided by continuing operations | ( | ||||||||||

| Net cash provided by discontinued operations | |||||||||||

Net cash (used in) provided by investing activities | ( | ||||||||||

| Financing activities: | |||||||||||

| Conversion of preferred stock | ( | ( | |||||||||

| Proceeds from borrowed funds | |||||||||||

| Repayment of borrowed funds | ( | ( | |||||||||

| Deferred financing fees | ( | ||||||||||

| Proceeds and payment of tax withholding on exercise of stock options, net | |||||||||||

| Shares withheld for taxes upon vesting of restricted stock | ( | ||||||||||

| Net payment from subsidiaries included in disposal group | ( | ||||||||||

| Repurchase of common stock | ( | ||||||||||

| Net cash provided by (used in) continuing operations | ( | ||||||||||

| Net cash provided by discontinued operations | |||||||||||

Net cash provided by (used in) financing activities | ( | ||||||||||

| Net change in cash and cash equivalents | ( | ||||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | ||||||||||

| Consolidated cash, cash equivalents and restricted cash, beginning of period | |||||||||||

| Consolidated cash, cash equivalents and restricted, end of the period | $ | $ | |||||||||

| Supplemental disclosure of cash flow information (continuing and discontinued operations): | |||||||||||

| Cash paid for interest | $ | $ | |||||||||

| Income taxes paid | |||||||||||

| Right-of-use lease assets recognized - operating leases | |||||||||||

| Operating lease liabilities recognized | |||||||||||

| Reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Consolidated cash and cash equivalents | $ | $ | |||||||||

| Year ended December 31, | ||||||||

| 2021 | ||||||||

| Other income from discontinued operations: | ||||||||

| Gain on disposal | $ | |||||||

| Total other income from discontinued operations | ||||||||

| Net income from discontinued operations before income taxes | ||||||||

| Income tax expense | ||||||||

| Net income from discontinued operations | $ | |||||||

| Year ended December 31, | ||||||||

| 2021 | ||||||||

| Total operating cash flows from discontinued operations | $ | |||||||

| Total investing cash flows from discontinued operations | ||||||||

| Total financing cash flows from discontinued operations | ||||||||

| Held for Sale | Held for Investment | |||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | December 31, 2022 | December 31, 2021 | |||||||||||||||||||||||

| Total loan commitments | $ | $ | $ | $ | ||||||||||||||||||||||

Less: construction holdbacks (1) | ( | ( | ||||||||||||||||||||||||

| Total principal outstanding | ||||||||||||||||||||||||||

| Change in fair value of loans | ( | ( | ||||||||||||||||||||||||

| Total loans at fair value | $ | $ | $ | $ | ||||||||||||||||||||||

| Loans Held for Sale | Loans Held for Investment | ||||||||||||||||

| Balance at | December 31, 2021 | $ | $ | ||||||||||||||

| Acquisitions | |||||||||||||||||

| Originations | |||||||||||||||||

| Additional fundings | |||||||||||||||||

| Interest receivable | |||||||||||||||||

| Payoffs and repayments | ( | ( | |||||||||||||||

| Fair value adjustment | ( | ( | |||||||||||||||

| Balance at | December 31, 2022 | $ | $ | ||||||||||||||

| State | Commitment | Percent of Portfolio | |||||||||||||||

| Florida | $ | % | |||||||||||||||

| New York | % | ||||||||||||||||

| New Jersey | % | ||||||||||||||||

| California | % | ||||||||||||||||

| Washington | % | ||||||||||||||||

| Connecticut | % | ||||||||||||||||

| Texas | % | ||||||||||||||||

| Illinois | % | ||||||||||||||||

| Other | % | ||||||||||||||||

| Total | $ | % | |||||||||||||||

| December 31, 2022 | Carrying | Fair Value Measurements Using | ||||||||||||||||||||||||

| (In thousands) | Value | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Loans held for sale | $ | $ | $ | $ | ||||||||||||||||||||||

| Loans held for investment | ||||||||||||||||||||||||||

| Total measured | $ | $ | $ | $ | ||||||||||||||||||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Equity securities: | |||||||||||

| Investment gains on securities sold during the period | $ | $ | |||||||||

| Front Yard common stock: | |||||||||||

| Investment gains on securities sold during the period | |||||||||||

| Total change in fair value of equity securities and Front Yard common stock | $ | $ | |||||||||

| Operating Lease Liabilities | |||||

| 2022 | $ | ||||

| 2023 | |||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| Total lease payments | |||||

| Less: interest | |||||

| Lease liabilities | $ | ||||

| Number of Options | Weighted Average Exercise Price per Share | |||||||||||||

| December 31, 2020 | ||||||||||||||

Forfeited/expired (1) | ( | |||||||||||||

| December 31, 2021 | ||||||||||||||

Exercised (2) | ( | $ | ||||||||||||

| December 31, 2022 | ||||||||||||||

| Number of Shares | Weighted Average Grant Date Fair Value | |||||||||||||

| December 31, 2020 | ||||||||||||||

| Granted | ||||||||||||||

Vested (1) | ( | |||||||||||||

| Forfeited/expired | ( | |||||||||||||

| December 31, 2021 | ||||||||||||||

| Granted | ||||||||||||||

Vested (1) | ( | |||||||||||||

| December 31, 2021 | $ | |||||||||||||

| December 31, 2022 | ||||||||

| Stock options outstanding | ||||||||

| Possible future issuances under share-based compensation plans | ||||||||

| Year ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| U.S. Virgin Islands | $ | ( | $ | ( | ||||||||||

| Other | ( | |||||||||||||

| Loss before income taxes | $ | ( | $ | ( | ||||||||||

| Year ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Current | ||||||||||||||

| Federal | $ | $ | ||||||||||||

| State | ||||||||||||||

| International | ||||||||||||||

| Total current tax expense | ||||||||||||||

| Deferred | ||||||||||||||

| Federal | ( | |||||||||||||

| State | ||||||||||||||

| International | ( | |||||||||||||

| Total deferred tax expense (benefit) | ( | |||||||||||||

| Total tax expense | $ | $ | ||||||||||||

| December 31, 2022 | December 31, 2021 | |||||||||||||

| Deferred tax assets: | ||||||||||||||

| Stock compensation | $ | $ | ||||||||||||

| Accrued expenses | ||||||||||||||

Net operating losses (1) | ||||||||||||||

| Lease liabilities | ||||||||||||||

| Other | ||||||||||||||

| Gross deferred tax assets | ||||||||||||||

| Deferred tax liability: | ||||||||||||||

| Right-of-use lease assets | ||||||||||||||

| Investments | ||||||||||||||

| Gross deferred tax liabilities | ||||||||||||||

| Net deferred tax asset before valuation allowance | ||||||||||||||

| Valuation allowance | ( | ( | ||||||||||||

| Deferred tax asset, net | $ | $ | ||||||||||||

| Year ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| U.S. Virgin Islands income tax rate | % | % | ||||||||||||

| EDC benefits in the USVI | ( | ( | ||||||||||||

| Foreign tax rate differential | ( | ( | ||||||||||||

| Subpart F income | ( | |||||||||||||

| Permanent and other | ( | ( | ||||||||||||

| Share-based compensation | ( | |||||||||||||

| Valuation allowance | ( | ( | ||||||||||||

| Foreign Tax Credit | ||||||||||||||

| Other Adjustments | ( | |||||||||||||

| Effective income tax rate | ( | % | ( | % | ||||||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Numerator | |||||||||||

| Continuing operations: | |||||||||||

| Net loss from continuing operations | $ | ( | $ | ( | |||||||

| Gain on preferred stock transactions | |||||||||||

| Numerator for basic and diluted EPS from continuing operations – net income (loss) from continuing operations attributable to common stockholders | $ | ( | $ | ||||||||

| Discontinued operations: | |||||||||||

| Numerator for basic and diluted EPS from discontinued operations - net gain from discontinued operations | $ | ||||||||||

| Total: | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Gain on preferred stock transactions | |||||||||||

| Numerator for basic and diluted EPS - net income attributable to common stockholders | ( | ||||||||||

| Denominator | |||||||||||

| Weighted average common stock outstanding – basic | |||||||||||

| Weighted average common stock outstanding – diluted | |||||||||||

| Earnings (loss) per share of common stock – basic: | |||||||||||

| Continuing operations - basic | $ | ( | $ | ||||||||

| Discontinued operations - basic | |||||||||||

| Earnings per basic common share | $ | ( | $ | ||||||||

| Earnings (loss) per share of common stock – diluted: | |||||||||||

| Continuing operations - diluted | $ | ( | $ | ||||||||

| Discontinued operations - diluted | |||||||||||

| Earnings per diluted common share | $ | ( | $ | ||||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Denominator | |||||||||||

| Stock options | |||||||||||

| Restricted stock | |||||||||||

| Preferred stock, if converted | |||||||||||

Name of Entity | Jurisdiction of Incorporation | |||||||

AAMC US, Inc. | Delaware | |||||||

Altisource Consulting S.á r.l | Luxembourg | |||||||

Finsight Business Solutions Private Ltd. | India | |||||||

NewSource Reinsurance Company Ltd. | Bermuda | |||||||

AAMC Real Estate Strategies Offshore Fund 1 (Cayman), LP (f/k/a AAMC EBO Offshore Fund 1 (Cayman), LP) | Cayman Islands | |||||||

| Alternative Lending Group LLC | Delaware | |||||||

| Grapetree Lending LLC | U.S. Virgin Islands | |||||||

| Shoys Lending LLC | U.S. Virgin Islands | |||||||

| Premieria LLC | U.S. Virgin Islands | |||||||

| St. Croix Servicing LLC | U.S. Virgin Islands | |||||||

| Alternative Residential Credit LLC | Delaware | |||||||

Date: | March 27, 2023 | By: | /s/ | Jason Kopcak | ||||||||||

Jason Kopcak | ||||||||||||||

Chief Executive Officer | ||||||||||||||

Date: | March 27, 2023 | By: | /s/ | Stephen Ramiro Krallman | ||||||||||

Stephen Ramiro Krallman | ||||||||||||||

Chief Financial Officer | ||||||||||||||

Date: | March 27, 2023 | By: | /s/ | Jason Kopcak | ||||||||||

Jason Kopcak | ||||||||||||||

Chief Executive Officer | ||||||||||||||

Date: | March 27, 2023 | By: | /s/ | Stephen Ramiro Krallman | ||||||||||

Stephen Ramiro Krallman | ||||||||||||||

Chief Financial Officer | ||||||||||||||

Audit Information |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Auditor Information [Abstract] | |

| Auditor Firm ID | 42 |

| Auditor Name | Ernst & Young LLP |

| Auditor Location | Atlanta, Georgia |

Consolidated Balance Sheets (Parenthetical) - USD ($) |

Dec. 31, 2022 |

Dec. 31, 2021 |

|---|---|---|

| Statement of Financial Position [Abstract] | ||

| Preferred stock, par value (in USD per share) | $ 0.01 | $ 0.01 |

| Preferred stock, shares issued (in shares) | 250,000 | 250,000 |

| Preferred stock, shares outstanding (in shares) | 144,212 | 150,000 |

| Preferred stock, redemption amount | $ 144,212,000 | $ 150,000,000 |

| Common stock, par value (in USD per share) | $ 0.01 | $ 0.01 |

| Common stock, shares authorized (in shares) | 5,000,000 | 5,000,000 |

| Common stock, shares issued (in shares) | 3,432,294 | 3,416,541 |

| Common stock, shares outstanding (in shares) | 1,783,862 | 2,055,561 |

| Treasury stock, shares (in shares) | 1,648,432 | 1,360,980 |

Consolidated Statements of Operations (Parenthetical) $ in Thousands |

12 Months Ended |

|---|---|

|

Dec. 31, 2022

USD ($)

| |

| Income Statement [Abstract] | |

| Income tax expense related to disposal | $ 1,272 |

Consolidated Statements of Comprehensive Income (Loss) - USD ($) $ in Thousands |

12 Months Ended | |

|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

|

| Statement of Comprehensive Income [Abstract] | ||

| Net loss | $ (15,934) | $ (6,004) |

| Other comprehensive loss: | ||

| Currency translation adjustments, net | (34) | (6) |

| Total other comprehensive loss | (34) | (6) |

| Comprehensive loss | $ (15,968) | $ (6,010) |

Organization and Basis of Presentation |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Organization, Consolidation and Presentation of Financial Statements [Abstract] | |

| Organization and Basis of Presentation | 1. Organization and Basis of Presentation Altisource Asset Management Corporation (“we,” “our,” “us,” “AAMC,” or the “Company”) was incorporated in the U.S. Virgin Islands (“USVI”) on March 15, 2012 (our “inception”), and commenced operations as an asset manager on December 21, 2012. As disclosed in our public filings, the Company’s prior business operations ceased in the first week of 2021. The Company previously operated as the external manager for Front Yard Residential Corporation (“Front Yard”), a public real estate investment trust (“REIT”) focused on acquiring and managing quality, affordable, single-family rental (“SFR”) properties throughout the United States. During 2021, AAMC engaged in a comprehensive assessment to either internally develop a new business operation or acquire a separate operating company. A range of industries were analyzed, including, but not limited to, real estate, lending cryptocurrency, block-chain technology and insurance operations. Outside professional firms, including among others, Cowen and Company, LLC, an investment bank, and Norton Rose Fulbright LLP, a global law practice, were engaged to provide due diligence, legal and valuation expertise to assist in our search. As of March 2022, the Company created the Alternative Lending Group (“ALG”), to generate alternative private credit loans through Direct to Borrower Lending, Wholesale Originations, and Correspondent Loan Acquisitions. The initial operations of ALG entail the following: •Build out a niche origination platform as well as a loan acquisition team; •Fund the originated or acquired alternative loans from a combination of Company equity and existing or future lines of credit; •Sell the originated and acquired alternative loans through forward commitment and repurchase contracts; •Leverage senior management’s expertise in this space; and •Utilize AAMC’s existing operations in India to drive controls and cost efficiencies. ALG's primary sources of income is derived from mortgage banking activities generated through the origination and acquisition of loans, and their subsequent sale or securitization as well as net interest income from loans while held on the balance sheet for investment. In addition, the Company has determined to focus operations solely on ALG for the foreseeable future. Based on current market conditions in the cryptocurrency industry the Company does not believe the timing is right to deploy resources to the cryptocurrency ATM business until the cryptocurrency market has reached some type of stabilization. Basis of presentation and use of estimates The accompanying audited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). Certain prior year amounts have been reclassified for consistency with the current year presentation. These reclassifications had no effect on the reported results of operations. All wholly owned subsidiaries are included, and all intercompany accounts and transactions have been eliminated. The Company changed its balance sheet presentation from classified (distinguishing between short-term and long-term accounts) to unclassified (no such distinction) in the second quarter of 2022. This change was prompted by the Company’s strategic decision to launch an alternative lending operation, ALG, in March 2022, as described above. The presentation of an unclassified balance sheet is consistent with that of the Company’s peers within the lending industry. Further, the previous classified presentation was not utilized to derive any metric by which the Company is measured or will be measured on a prospective basis. As the Company is now presenting an unclassified balance sheet, reclassification adjustments have been made to the historical Consolidated Balance Sheets at December 31, 2021 in order for it to conform with the current unclassified presentation. Use of estimates The preparation of consolidated financial statements in conformity with U.S. GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. Loans held for sale or investment, carried at fair market value We originate and purchase alternative loans. These loans will either be classified as held for investment or held for sale depending upon the determination of management. We have elected to measure these alternative loans at fair value on a loan by loan basis. This option is available when we first recognize a financial asset. Subsequent changes in the fair value of these loans will be recorded in our Consolidated Statements of Operations in the period of the change. Purchased loans, also known as correspondent loans, can be bought with a net strip interest component in that the seller of the loan will receive an agreed upon percentage of the coupon interest generated from the sold loan. This strip component is reflected as service and asset management expense on the Consolidated Statements of Operations. A fair value measurement represents the price at which an orderly transaction would occur between willing market participants at the measurement date. We estimate the fair values of the loans held for investment or sale based on available inputs from the marketplace. The market for the loans that we have or will invest in is generally illiquid. Establishing fair values for illiquid assets is inherently subjective and is often dependent upon our estimates and modeling assumptions. In circumstances where relevant market inputs cannot be obtained, increased analysis and management judgment are required to estimate fair value. This generally requires us to establish internal assumptions about future cash flows and appropriate risk-adjusted discount rates. Regardless of the valuation inputs we apply, the objective of fair value measurement for assets is unchanged from what it would be if markets were operating at normal activity levels and/or transactions were orderly; that is, to determine the current exit price. Interest for these loans is recognized as revenue based on the stated coupon when earned and deemed collectible or until a loan becomes more than 90 days past due, at which point the loan is placed on nonaccrual status and any accrued interest is reversed against interest income. When a seriously delinquent loan previously placed on nonaccrual status has been cured, meaning all delinquent principal and interest have been remitted by the borrower, the loan will be placed back on accrual status. Interest accrued as of period end is included within loans held for sale, at fair value or loans held for investment, at fair value in the Consolidated Balance Sheets as applicable. Redeemable Preferred stock Issuance of Series A Convertible Preferred Stock in 2014 Private Placement During the first quarter of 2014, we issued 250,000 shares of convertible preferred stock for $250.0 million to institutional investors. Under the Certificate of Designations of the Series A Shares (the “Certificate”), we have the option to redeem all of the Series A Shares on March 15, 2020 and on each successive five-year anniversary of March 15, 2020 thereafter. In connection with these same redemption dates, each holder of our Series A Shares has the right to give notice requesting us to redeem all of the Series A Shares held by such holder out of legally available funds. In accordance with the terms of the Certificate, if we have legally available funds to redeem all, but not less than all, of the Series A Shares requested to be redeemed on a redemption date, we will deliver to those holders who have requested redemption in accordance with the Certificate a notice of redemption. If we do not have legally available funds to redeem all, but not less than all, of the Series A Shares requested to be redeemed on a redemption date, we will not provide a notice of redemption. The redemption right will be exercisable in connection with each redemption date every five years until the mandatory redemption date in 2044. If we are required to redeem all of the holder’s Series A Shares, we are required to do so for cash at a price equal to $1,000 per share (the issuance price) out of funds legally available therefor. Due to the redemption provisions of the Series A Shares, we classify these shares as mezzanine equity, outside of permanent stockholders' equity. The holders of our Series A Shares are not entitled to receive dividends with respect to their Series A Shares. The Series A Shares are convertible into shares of our common stock at a conversion price of $1,250 per share (or an exchange rate of 0.8 shares of common stock for Series A Share), subject to certain anti-dilution adjustments. Upon certain change of control transactions or upon the liquidation, dissolution or winding up of the Company, holders of the Series A Shares will be entitled to receive an amount in cash per Series A Share equal to the greater of: (i) $1,000 plus the aggregate amount of cash dividends paid on the number of shares of common stock into which such Series A Shares were convertible on each ex-dividend date for such dividends; and (ii) The number of shares of common stock into which the Series A Shares are then convertible multiplied by the then-current market price of the common stock. The Certificate confers no voting rights to holders, except with respect to matters that materially and adversely affect the voting powers, rights or preferences of the Series A Shares or as otherwise required by applicable law. With respect to the distribution of assets upon the liquidation, dissolution or winding up of the Company, the Series A Shares rank senior to our common stock and on parity with all other classes of preferred stock that may be issued by us in the future. The Series A Shares are recorded net of issuance costs, which were amortized on a straight-line basis through the first potential redemption date in March 2020. Between January 31, 2020 and February 3, 2020, we received purported notices from all of the holders of our Series A Shares requesting us to redeem an aggregate of $250.0 million liquidation preference of our Series A Shares on March 15, 2020. We did not have legally available funds to redeem all, but not less than all, of the Series A Shares on March 15, 2020. As a result, we do not believe, under the terms of the Certificate, that we were obligated to redeem any of the Series A Shares under the Certificate. Current Litigation –Luxor (plaintiff) v. AAMC (defendant) On February 3, 2020, Luxor filed a complaint in the Supreme Court of the State of New York, County of New York, against AAMC for breach of contract, specific performance, unjust enrichment, and related damages and expenses. The complaint alleges that AAMC’s position that it will not redeem any of Luxor’s Series A Shares on the March 15, 2020 redemption date is a material breach of AAMC’s redemption obligations under the Certificate. Luxor seeks an order requiring AAMC to redeem its Series A Shares, recovery of no less than $144,212,000 in damages, which is equal to the amount Luxor would receive if AAMC redeemed all of Luxor’s Series A Shares at the redemption price of $1,000 per share set forth in the Certificate, as well as payment of its costs and expenses in the lawsuit. In the alternative, Luxor seeks a return of its initial purchase price of $150,000,000 for the Series A Shares, as well as payment of its costs and expenses in the lawsuit. On May 25, 2020, Luxor’s complaint was amended to add Putnam Equity Spectrum Fund and Putnam Capital Spectrum Fund (collectively, “Putnam”), which also invested in the Series A Shares, as plaintiff. On June 12, 2020, AAMC moved to dismiss the Amended Complaint in favor of AAMC’s first-filed declaratory judgment action in the U.S. Virgin Islands. On August 3, 2020, the court denied AAMC’s motion to dismiss. On February 23, 2021, in accordance with the terms of the Putnam Agreement described below, Putnam agreed to discontinue all claims against AAMC with prejudice related to the Series A shares. Luxor and AAMC have completed discovery in the action. AAMC and Luxor each filed summary judgment motions on July 19, 2022 and replies to those motions on August 18, 2022 and September 15, 2022. On December 1, 2022, having heard oral arguments on the summary judgment motions, the court denied both parties’ motions. AAMC And Luxor have filed an appeal and cross-appeal, respectively, from the trial court’s ruling in the Appellate Division - First Department, of the Supreme Court of the State of New York. By stipulation of the parties, the appeal and cross-appeal shall be perfected and briefed for the June 2023 term. AAMC’s brief as Defendant-Appellant-Cross-Respondent was filed on February 22, 2023. Luxor’s brief as Plaintiff-Appellee-Cross-Appellant is due to be filed by April 6, 2023. AAMC’s reply brief is due April 21, 2023. Luxor’s reply brief is due May 8, 2023. AAMC continues to pursue its strategic business initiatives despite this litigation. If Luxor were to prevail in its lawsuit, our liquidity could be materially and adversely affected. –AAMC (plaintiff) v. Nathaniel Redleaf (defendant) On October 31, 2022, AAMC filed a complaint with demand for jury trial in the Superior Court of the Virgin Islands, Division of St. Croix, against Nathaniel Redleaf alleging breach of fiduciary duty to AAMC. Mr. Redleaf was a member of AAMC’s Board of Directors for five years and the Company’s complaint alleges that he breached his fiduciary duty, by among other things, disclosing AAMC’s confidential information to Luxor. AAMC seeks a number of remedies, including compensatory damages, disgorgement of any benefit received by Luxor or Mr. Redleaf as a result of such breaches. On January 4, 2023, this action was removed to the United States District Court of the Virgin Islands, Division of St. Croix. On February 28, 2023, defendant Redleaf filed a motion to dismiss the complaint. AAMC’s opposition to defendant’s motion is due on April 4, 2023. Settlement Activities On February 17, 2021, the Company entered into a settlement agreement dated as of February 17, 2021 (the “Putnam Agreement”) with Putnam. Pursuant to the Putnam Agreement, AAMC and Putnam exchanged all of Putnam’s 81,800 Series A Shares for 288,283 shares of AAMC’s common stock. Additionally, AAMC paid Putnam $1,636,000 within business days of the effective date of the Putnam Agreement and $1,227,000 on the one-year anniversary of the effective date of the Putnam Agreement, and in return Putnam released AAMC from all claims related to the Series A Shares and enter into a voting rights agreement as more fully described in the Putnam Agreement. Finally, AAMC granted to Putnam a most favored nations provision with respect to future settlements of the Series A Shares. As a result of this settlement, we recognized a one-time gain directly to Additional paid in capital of $71.9 million in the first quarter of 2021. On August 27, 2021, the Company entered into a settlement agreement (the “Wellington Agreement”) with certain funds managed by Wellington Management Company LLP (collectively, “Wellington”). Under the Wellington Agreement, the Company paid Wellington $2,093,000 in exchange for 18,200 Series A Shares ($18.2 million of liquidation preference) held by Wellington, and in return Wellington agreed to release AAMC from all claims related to the Series A Shares. As a result of this settlement, we recognized a one-time gain directly to Additional paid in capital of $16.1 million gain in the third quarter of 2021. On January 6, 2022, the Company entered into a settlement agreement (the "Settlement Agreement") with two institutional investors. Under the Settlement Agreement, the Company paid the institutional investors approximately $665 thousand in cash in exchange for 5,788 Series A Shares ($5.79 million of liquidation preference) held by the institutional investors. As a result of this settlement, the Company recognized a one-time gain directly to Additional paid in capital of approximately $5.1 million in the first quarter of 2022. On July 18, 2022, the Company entered into an agreement (the "Purchase Agreement") with Putnam in which the Company repurchased 286,873 shares of common stock of the Company owned by Putnam (the "Putnam Shares"). The aggregate purchase price of the Putnam Shares was $2,868,730, or $10 per share. Pursuant to the Purchase Agreement, the Company and Putnam also agreed to terminate the most favored nation clause granted to Putnam in the Putnam Agreement. The Company and Putnam also agreed to terminate all of Putnam's shareholder voting obligations included in the Putnam Agreement. 2016 Employee Preferred Stock Plan On May 26, 2016, the 2016 Employee Preferred Stock Plan (the “Employee Preferred Stock Plan”) was approved by our stockholders. Pursuant to the Employee Preferred Stock Plan, the Company may grant one or more series of non-voting preferred stock, par value $0.01 per share, in the Company to induce certain employees to become employed and remain employees of the Company in the USVI, and any of its future USVI subsidiaries, to encourage ownership of shares in the Company by such USVI employees and to provide additional incentives for such employees to promote the success of the Company’s business. Pursuant to our stockholder approval of the Employee Preferred Stock Plan, on December 29, 2016, the Company authorized 14 additional series of preferred stock of the Company, consisting of Series B Preferred Stock, Series C Preferred Stock, Series D Preferred Stock, Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock, Series H Preferred Stock, Series I Preferred Stock, Series J Preferred Stock, Series K Preferred Stock, Series L Preferred Stock, Series M Preferred Stock, Series N Preferred Stock and Series O Preferred Stock, and each series shall consist of up to an aggregate of 1,000 shares. We have issued shares of preferred stock under the Employee Preferred Stock Plan to certain of our USVI employees. These shares of preferred stock are mandatorily redeemable by us in the event of the holder's termination of service with the Company for any reason. At December 31, 2022 and 2021, we had 3,200 and 1,200 and shares outstanding, respectively, and we included the redemption value of these shares of $32,000 and $12,000 respectively, within accounts payable and accrued liabilities in our Consolidated Balance Sheets. In December 2022 and January 2021, our Board of Directors declared and paid an aggregate $0.4 million and of $1.6 million, respectively, of dividends on these shares of preferred stock. Such dividends are included in salaries and employee benefits in our Consolidated Statements of Operations. Recently issued accounting standards Recently issued accounting standards adopted In December 2019, the FASB issued ASU 2019-12, “Income Taxes - Simplifying the Accounting for Income Taxes (Topic 740),” which is intended to simplify various aspects related to accounting for income taxes. ASU 2019-12 removes certain exceptions to the general principles in Topic 740 and also clarifies and amends existing guidance to improve consistent application. Our adoption of this standard in the first quarter of 2022 did not have a material impact on our financial statements. Recently issued accounting standards not yet adopted In March 2020, the FASB issued ASU No. 2020-04, “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting,” which provides practical expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform if certain criteria are met. The expedients and exceptions provided by the amendments in this update apply only to contracts, hedging relationships, and other transactions that reference the London interbank offered rate (“LIBOR”) or another reference rate expected to be discontinued as a result of reference rate reform. These amendments are not applicable to contract modifications made and hedging relationships entered into or evaluated after December 31, 2022. ASU No. 2020-04 is effective as of March 12, 2020 through December 31, 2022 and may be applied to contract modifications and hedging relationships from the beginning of an interim period that includes or is subsequent to March 12, 2020. In December 2022, the FASB extended the temporary accounting rules under Topic 848 from December 31, 2022 to December 31, 2024. We will adopt this standard when LIBOR is discontinued. We are evaluating the impact the new standard will have on our consolidated financial statements and related disclosures, but do not anticipate a material impact. Recent accounting pronouncements pending adoption not discussed above or in the 2021 Form 10-K are either not applicable or will not have, or are not expected to have a material impact on our consolidated financial position, results of operations, or cash flows.

|

Summary of Significant Accounting Policies |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Accounting Policies [Abstract] | |

| Summary of Significant Accounting Policies | 2. Summary of Significant Accounting Policies Cash equivalents We consider highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. Certain account balances exceed FDIC insurance coverage and, as a result, there is a concentration of credit risk related to amounts on deposit in excess of FDIC insurance coverage. To mitigate this risk, we maintain our cash and cash equivalents at large national or international banking institutions. Restricted cash We have designated restricted cash when appropriate within our Consolidated Balance Sheets. Consolidations The consolidated financial statements include the accounts of AAMC and its consolidated subsidiaries, which include the voting interest entities in which we are determined to have a controlling financial interest. Our voting interest entities consist entirely of our wholly owned subsidiaries. We also consider variable interest entities (“VIEs”) for consolidation where we are the primary beneficiary. We had no VIEs or potential VIEs as of and for the years ended December 31, 2022 or 2021. Earnings per share Basic earnings per share is computed by dividing net income or loss, less amortization of preferred stock issuance costs, by the weighted average common stock outstanding during the period. Diluted earnings per share is computed by dividing net income or loss by the weighted average common stock outstanding for the period plus the dilutive effect of (i) stock options and restricted stock outstanding using the treasury stock method and (ii) Series A Preferred Shares using the if-converted method. Weighted average common stock outstanding - basic excludes the impact of unvested restricted stock since dividends paid on such restricted stock are non-participating. Any gain on settlement of preferred shares, which is recorded directly to equity, is included in the numerators for our earnings per share calculations. Fair value of financial instruments We designate fair value measurements into three levels based on the lowest level of substantive input used to make the fair value measurement. Those levels are as follows: •Level 1 - Quoted prices in active markets for identical assets or liabilities. •Level 2 - Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the related assets or liabilities. •Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Income taxes Income taxes are provided for using the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted rates expected to apply to taxable income in the years in which management expects those temporary differences to be recovered or settled. The effect on deferred taxes of a change in tax rates is recognized in income in the period in which the change occurs. Subject to our judgment, we reduce a deferred tax asset by a valuation allowance if it is “more likely than not” that some or the entire deferred tax asset will not be realized. Tax laws are complex and subject to different interpretations by the taxpayer and respective governmental taxing authorities. Significant judgment is required in evaluating tax positions, and we recognize tax benefits only if it is more likely than not that a tax position will be sustained upon examination by the appropriate taxing authority. For all temporary differences, we have considered the potential future sources of taxable income against which they may be realized. In so doing, we have taken into account temporary differences that we expect to reverse in future years and those where it is unlikely. Where it is more likely than not that there will not be potential future taxable income to offset a temporary difference, a valuation allowance has been recorded. Lastly, the Company accounts for the tax on global intangible low-taxed income (“GILTI”) as incurred and therefore has not recorded deferred taxes related to GILTI on its foreign subsidiaries. Leases On January 1, 2019, we adopted ASU 2016-02, including various associated updates and amendments, which together comprise the requirements for lease accounting under ASC 842. ASC 842 fundamentally changes accounting for operating leases by requiring lessees to recognize a liability to make lease payments and a right-of-use asset over the term of the lease. We also adopted the “package of practical expedients,” which permits us not to reassess our prior conclusions about lease identification, lease classification and initial direct costs under the new standard. We also elected the short-term lease exemption for all leases that qualify; as a result, we will not recognize right-of-use assets or lease liabilities for leases with a term of less than 12 months at inception. We lease office space under three operating leases. Our office leases are generally for terms of to five years and typically include renewal options, which we consider when determining our lease right-of-use assets and lease liabilities to the extent that a renewal option is reasonably certain of being exercised. Along with rents, we are generally required to pay common area maintenance, property taxes and insurance, each of which vary from period to period and are therefore expensed as incurred. Other assets Other assets includes leasehold improvements; furniture, fixtures and equipment; deferred tax assets, refunds due and miscellaneous other assets. The cost basis of fixed assets is depreciated using the straight-line method over an estimated useful life of to five years based on the nature of the components. Revenue recognition Interest revenue is recognized based on the stated coupon when earned and deemed collectible or until a loan becomes more than 90 days past due, at which point the loan is place on nonaccrual status and any accrued interest is reversed against interest revenue. Upon a nonaccrual loan being reinstated, meaning all delinquent principal and interest payments have been remitted by the borrower, the loan will be placed back on accrual status. Interest accrued as of period end is included within loans for sale, at fair value, or loans held for investment, at fair value, in the Consolidated Balance Sheets as applicable. Loan fees represent origination fees charged to borrowers and are recognized to revenue upon the origination date of the loan. Share-based compensation We amortize the grant date fair value of restricted stock as expense on a straight-line basis over the service period with an offsetting increase in stockholders' equity. The grant date fair value of awards with only service-based vesting conditions is determined based upon the share price on the grant date. We recognize share-based compensation expense related to (i) awards to employees in salaries and employee benefits and (ii) awards to Directors or non-employees in general and administrative expense in our Consolidated Statements of Operations. Forfeitures of share-based awards are recognized as they occur. Treasury stock We account for repurchased common stock under the cost method and include such treasury stock as a component of total stockholders’ equity. We have repurchased shares of our common stock (i) under our Board approval to repurchase up to $300.0 million in shares of our common stock and (ii) upon our withholding of shares of our common stock to satisfy tax withholding obligations in connection with the vesting of our restricted stock.

|

Discontinued Operations |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discontinued Operations and Disposal Groups [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discontinued Operations | 3. Discontinued Operations Our primary client prior to December 31, 2020 had been Front Yard Residential Corporation (“Front Yard”), a public real estate investment trust (“REIT”) focused on acquiring and managing quality, affordable single-family rental (“SFR”) properties throughout the United States. All of our revenue for all periods presented prior to December 31, 2021 was generated through our asset management agreements with Front Yard. On August 13, 2020, AAMC and Front Yard entered into a Termination and Transition Agreement (the “Termination Agreement”), pursuant to which the Company and Front Yard have agreed to effectively internalize the asset management function of Front Yard. The Termination Agreement provided that the Amended AMA would terminate following a transition period to enable the internalization of Front Yard’s asset management function, allow for the assignment of certain vendor contracts and implement the transfer of certain employees to Front Yard and the training of required replacement employees at each company. In addition, Front Yard acquired the equity interests of AAMC's Indian subsidiary, the equity interests of AAMC's Cayman Islands subsidiary, the right to solicit and hire designated AAMC employees that oversaw the management of Front Yard's business and other assets of AAMC that were used in connection with the operation of Front Yard's business. The transition period ended at the close of business, December 31, 2020, the time that AAMC and Front Yard mutually agreed that all required transition activities had been successfully completed (the “Termination Date”). On the Termination Date, the Amended AMA terminated, and the Company completed the assignment of our lease in Charlotte, North Carolina to Front Yard. Additionally, on December 31, 2020, we completed the sale of our Cayman Islands subsidiary. On January 1, 2021, in connection with the Termination Agreement, the Company completed the sale of our India subsidiary, the gain on this sale, net of taxes was $6.2 million. The Company had no assets and liabilities related to our discontinued operations that constituted the Disposal Group at December 31, 2022. The following table details the components comprising net income from our discontinued operations for the year ended December 31, 2021. ($ in thousands):

The following table details cash flow information related to our discontinued operations for the year ended December 31, 2021. ($ in thousands):

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans Held for Sale or Investment at Fair Value |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair Value Disclosures [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans Held for Sale or Investment at Fair Value | 4. Loans Held for Sale or Investment at Fair Value Our loan portfolio consists of business purpose loans secured by single family, multifamily and commercial real estate that were acquired from third party originators or issued by us. The composition of the loan portfolio by classification as of December 31, 2022 and 2021, respectively, is summarized in the table below ($ in thousands):

(1) Construction holdbacks include in process accounts such as payments, advances, interest reserve, accrued interest and other accounts. The loan portfolio consists of 128 loans at December 31, 2022, with a weighted average coupon of 9.4%, of which the Company receives a net yield of 8.5% after taking into account the strip interest to the sellers of the loans. The weighted average life of the portfolio is approximately 8.2 months. 19 loans represent 60% of the total principal outstanding at December 31, 2022. There was one loan on nonaccrual status or 90 days or more past due at December 31, 2022, with a carrying value of $0.6 million. The table below represents activity within the loan portfolio by classification for the period shown ($ in thousands):

The composition of the total loan commitment by state as of December 31, 2022 is summarized below ($ in thousands):

For financial reporting purposes of our alternative loans, we follow a fair value hierarchy established under GAAP, as described in Note 2, that is used to determine the fair value of financial instruments. This hierarchy prioritizes relevant market inputs in order to determine an “exit price” at the measurement date, or at the price at which an asset could be sold or a liability could be transferred in an orderly process that is not a forced liquidation or distressed sale. In certain cases, inputs used to measure fair value fall into different levels of the fair value hierarchy. In such cases, the level at which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement. Our assessment of the significance of a particular input requires judgment and considers factors specific to the asset or liability being measured. The following table presents the assets that are reported at fair value on a recurring basis as of December 31, 2022, as well as the fair value of hierarchy of the valuation inputs used to measure fair value. We did not have any assets that were reported at fair value as of December 31, 2021. We did not have any liabilities to report at fair value on a recurring basis as of December 31, 2022.

The estimated fair value for our business purpose loans is determined using the discounted cash flow model (“DCF”) to estimate the net present value of the future cash flows expected from each loan. For performing loans, the DCF is based on the future expected cash flows of each loan in accordance with its contractual terms net of the strip component. Cash flows for performing loans with construction holdbacks incorporate the draws to complete the required improvements to the underlying property securing the loan. For nonaccrual loans, the estimated cash flows are based on the current fair value of the collateral of the loans, in which the Company will utilize a third-party appraisal to determine the fair value (Level 3). On a loan by loan basis, the weighted average discount rate range utilized for the DCF applied to the net yield to be received by the Company was 11.4% which is greater than the overall yield on the portfolio of 7.7%, resulting in the decrease in value of the portfolio at December 31, 2022. The determination of the discount rate was based on analysis of the current interest rates charged for business purpose loans in conjunction with the increase in rates for other underlying base rates such as the 10-year U.S. treasury bond and the 30 day Secured Overnight Financing Rate ("SOFR") (Level 3). As of December 31, 2022, the Company had no securities outstanding. We did not transfer any assets from one level to another level during the years ended December 31, 2022 and 2021, respectively.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Equity Securities |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments, Debt and Equity Securities [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity Securities | 5. Equity Securities Investment gains/losses for December 31, 2022 and 2021, are summarized as follows ($ in thousands):

Investment gains and losses include unrealized gains and losses from changes in fair values during the period on positions that we owned in 2021. As reflected in the Consolidated Statements of Cash Flows, total proceeds from sales of securities during December 31, 2021 was $152.8 million which consisted of proceeds from sales of Front Yard common stock of $47.5 million and $105.3 million in proceeds from sales of securities. No proceeds from sales of securities were received in 2022 because no investments were held. In the preceding table, investment gains/losses on equity securities sold during the period reflect the difference between the sales proceeds and the fair value of the equity securities sold at the beginning of the applicable period.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Borrowings |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Debt Disclosure [Abstract] | |