| Title of Class | Number of Shares Outstanding | ||||

Class A common shares, par value US$0.000079365 per share | |||||

Class B common shares, par value US$0.000079365 per share | |||||

| Page | |||||

F- 2 | |||||

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2022 | 2021 | 2020 | ||||||||||||||||||||

(US$)(1) | (R$) | ||||||||||||||||||||||

| (in millions, except amounts per share) | |||||||||||||||||||||||

Statement of profit or loss data: | |||||||||||||||||||||||

| Net revenue from transaction activities and other services | 501.6 | 2,617.4 | 1,626.9 | 1,144.1 | |||||||||||||||||||

| Net revenue from subscription services and equipment rental | 337.5 | 1,760.9 | 1,071.9 | 388.0 | |||||||||||||||||||

| Financial income | 888.9 | 4,638.0 | 1,877.7 | 1,647.0 | |||||||||||||||||||

| Other financial income | 109.7 | 572.6 | 247.3 | 140.7 | |||||||||||||||||||

Total revenue and income | 1,837.8 | 9,588.9 | 4,823.8 | 3,319.8 | |||||||||||||||||||

| Cost of services | (511.7) | (2,669.8) | (1,713.8) | (769.9) | |||||||||||||||||||

| Administrative expenses | (214.9) | (1,121.4) | (813.3) | (392.5) | |||||||||||||||||||

| Selling expenses | (289.6) | (1,511.2) | (1,012.5) | (505.9) | |||||||||||||||||||

| Financial expenses, net | (673.6) | (3,514.7) | (1,269.1) | (339.8) | |||||||||||||||||||

| Mark-to-market on equity securities designated at FVPL | (163.5) | (853.1) | (1,264.2) | — | |||||||||||||||||||

| Other operating expenses, net | (58.0) | (302.5) | (185.9) | (177.1) | |||||||||||||||||||

| Loss on investment in associates | (0.7) | (3.6) | (10.4) | (6.9) | |||||||||||||||||||

Profit (loss) before income taxes | (74.2) | (387.3) | (1,445.6) | 1,127.7 | |||||||||||||||||||

| Income tax and social contribution | (26.7) | (139.1) | 68.2 | (290.2) | |||||||||||||||||||

Net income (loss) for the year | (100.9) | (526.4) | (1,377.3) | 837.4 | |||||||||||||||||||

| Net income (loss) attributable to non-controlling interests | (1.3) | (7.0) | (18.5) | (16.6) | |||||||||||||||||||

| Net income (loss) attributable to owners of the parent | (99.5) | (519.4) | (1,358.8) | 854.1 | |||||||||||||||||||

Basic earnings (loss) per share(2) | (0.32) | (1.67) | (4.40) | 2.95 | |||||||||||||||||||

Diluted earnings (loss) per share(2) | (0.32) | (1.67) | (4.40) | 2.91 | |||||||||||||||||||

| Other data: | |||||||||||||||||||||||

Adjusted net income (loss) (in millions)(3) | 100.7 | 525.5 | 84.7 | 958.2 | |||||||||||||||||||

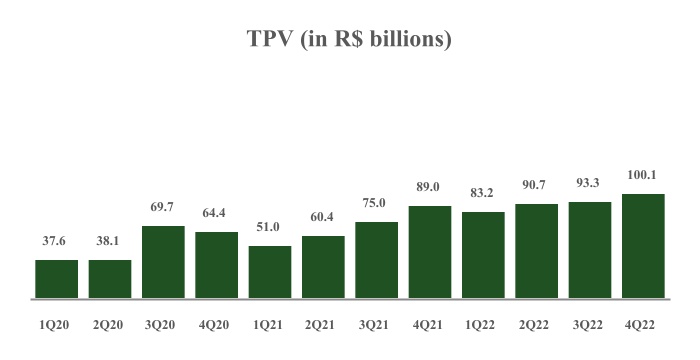

| TPV (in billions) | 70.4 | 367.4 | 275.4 | 209.9 | |||||||||||||||||||

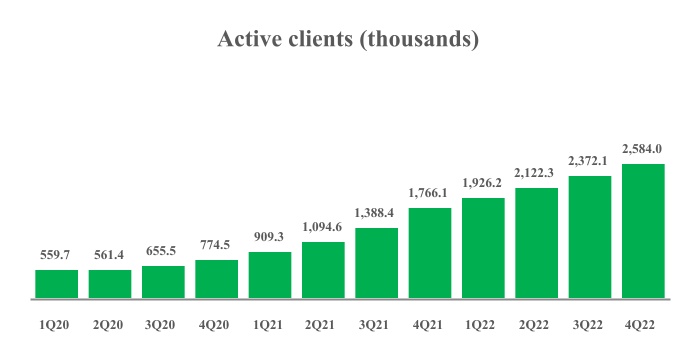

Active clients (in thousands)(4) | n.a. | 2,584.0 | 1,766.1 | 774.5 | |||||||||||||||||||

(1) | For convenience purposes only, amounts in reais for the year ended December 31, 2022 have been translated to U.S. dollars using an exchange rate of R$ 5.2177 to US$1.00, the commercial selling rate for U.S. dollars as of December 31, 2022 as reported by the Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. | ||||

(2) | Calculated by dividing net income or loss for the year attributed to the owners of the parent, adjusted for losses allocated to contractual rights and participating instruments, by the weighted average number of ordinary shares outstanding during the year. See note 15 to our audited consolidated financial statements included elsewhere in this annual report. | ||||

(3) | In the table below, we have provided a reconciliation of adjusted net income (loss) to our net income (loss) for the year, the most directly comparable financial measure calculated and presented in accordance with IFRS. Note that in the second quarter of 2022, we have stopped adjusting the financial expenses related to our bond in our adjusted results. As such, for comparability reasons, we have made this change retrospectively in the tables of this section. | ||||

(4) | Considers clients that have transacted at least once over the preceding 90 days, except for TON active clients which consider clients that have transacted once in the preceding 12 months. | ||||

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2022 | 2021 | 2020 | ||||||||||||||||||||

(US$ millions)(a) | (R$ millions) | ||||||||||||||||||||||

Net income (loss) for the year | (100.9) | (526.4) | (1,377.3) | 837.4 | |||||||||||||||||||

Share-based compensation expenses(b) | 24.9 | 129.8 | 66.9 | 120.7 | |||||||||||||||||||

Amortization of fair value adjustment on intangibles related to acquisitions(c) | 26.6 | 138.6 | 89.1 | 17.2 | |||||||||||||||||||

Fair value adjustments of assets whose control was acquired(d) | — | — | (15.8) | (3.0) | |||||||||||||||||||

Mark-to-market related to the investment in Banco Inter(g) | 163.5 | 853.1 | 1,264.2 | — | |||||||||||||||||||

Other income/expenses(e) | (3.4) | (17.8) | 118.3 | 30.8 | |||||||||||||||||||

Pre-tax subtotal(g) | 110.6 | 577.3 | 145.4 | 1,003.2 | |||||||||||||||||||

Tax effect on adjustments(f) | (9.9) | (51.8) | (60.6) | (45.0) | |||||||||||||||||||

Adjusted net income(g) | 100.7 | 525.5 | 84.7 | 958.2 | |||||||||||||||||||

(a) | For convenience purposes only, amounts in reais for the year ended December 31, 2022 have been translated to U.S. dollars using an exchange rate of R$5.2177 to US$1.00, the commercial selling rate for U.S. dollars as of December 31, 2022 as reported by the Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. | ||||

(b) | Consists of expenses related to the vesting of one-time pre-IPO pool of share-based compensation as well as non-recurring long term incentive plans. See “Item 5. Operating and Financial Review and Prospects—A. Operating results—Description of Principal Line Items—Other operating expenses, net—Liability-classified share-based compensation expense” and note 22 to our consolidated financial statements for further information. | ||||

(c) | Consists of expenses resulting from the changes of the fair value adjustments as a result of the application of the acquisition method. | ||||

(d) | Consists of the gain on re-measurement of our previously held equity interest in Linked Gourmet (2020), VHSYS (2021) and Collact (2021) to fair value upon the date control was acquired. | ||||

(e) | Consists of the fair value adjustment related to associates call option, M&A and Bond expenses, earn-out interests related to acquisitions, gains/losses in the sale of companies, dividends from Linx, organizational restructuring and restructuring of debt instruments. See notes 4.1.2 and 21 to our consolidated financial statements for further information. | ||||

(f) | Represents the tax effect of pre-tax items excluded from adjusted net income (loss). The tax effect of pre-tax items excluded from adjusted net income (loss) is computed using the statutory rate related to the jurisdiction that was impacted by the adjustment after taking into account the impact of permanent differences and valuation allowances, if applicable. | ||||

(g) | In the second quarter of 2022, we have stopped adjusting the financial expenses related to our bond in our adjusted results. As such, for comparability reasons, we have made this change retrospectively in the tables of this section. | ||||

As of December 31,(2) | |||||||||||||||||||||||

| 2022 | 2022 | 2021 | 2020 | ||||||||||||||||||||

(US$ millions)(1) | (R$ millions) | ||||||||||||||||||||||

Statement of financial position data: | |||||||||||||||||||||||

Assets | |||||||||||||||||||||||

Current assets | |||||||||||||||||||||||

Cash and cash equivalents and short-term investments | 951.8 | 4,966.4 | 6,488.7 | 10,575.0 | |||||||||||||||||||

Accounts receivable from card issuers | 3,966.2 | 20,694.5 | 19,286.6 | 16,307.2 | |||||||||||||||||||

| Financial assets from banking solution | 759.1 | 3,960.9 | 2,346.5 | 714.9 | |||||||||||||||||||

Other current assets | 198.8 | 1,037.4 | 1,822.7 | 1,677.7 | |||||||||||||||||||

Total current assets | 5,876.0 | 30,659.2 | 29,944.5 | 29,274.8 | |||||||||||||||||||

| Intangible assets | 1,654.4 | 8,632.3 | 8,277.5 | 1,039.9 | |||||||||||||||||||

Other non-current assets | 566.1 | 2,953.9 | 3,875.0 | 1,434.0 | |||||||||||||||||||

Total non-current assets | 2,220.6 | 11,586.2 | 12,152.6 | 2,473.8 | |||||||||||||||||||

Total assets | 8,096.6 | 42,245.4 | 42,097.0 | 31,748.7 | |||||||||||||||||||

Liabilities and Equity | |||||||||||||||||||||||

Current liabilities | |||||||||||||||||||||||

Accounts payable to merchants | 3,177.4 | 16,578.7 | 15,723.3 | 8,848.0 | |||||||||||||||||||

| Deposits from banking customers | 771.2 | 4,023.7 | 2,201.9 | 900.5 | |||||||||||||||||||

| Obligations to FIDC quota holders | 186.9 | 975.2 | 1,294.8 | 1,960.1 | |||||||||||||||||||

| Loans and financing | 354.1 | 1,847.4 | 2,578.8 | 1,184.7 | |||||||||||||||||||

Other current liabilities | 335.2 | 1,749.1 | 991.1 | 487.0 | |||||||||||||||||||

Total current liabilities | 4,824.8 | 25,174.1 | 22,789.8 | 13,380.4 | |||||||||||||||||||

Non-current liabilities | |||||||||||||||||||||||

| Accounts payable to merchants | 6.9 | 35.8 | 3.2 | — | |||||||||||||||||||

Obligations to FIDC quota holders | — | — | 932.4 | 2,414.4 | |||||||||||||||||||

| Loans and financing | 522.9 | 2,728.5 | 3,556.5 | 524.4 | |||||||||||||||||||

Other non-current liabilities | 260.1 | 1,357.0 | 1,187.9 | 437.5 | |||||||||||||||||||

Total non-current liabilities | 789.9 | 4,121.3 | 5,679.9 | 3,376.3 | |||||||||||||||||||

Total liabilities | 5,614.6 | 29,295.4 | 28,469.8 | 16,756.6 | |||||||||||||||||||

Total equity | 2,481.9 | 12,950.0 | 13,627.2 | 14,992.0 | |||||||||||||||||||

Total liabilities and equity | 8,096.6 | 42,245.4 | 42,097.0 | 31,748.7 | |||||||||||||||||||

(1) | For convenience purposes only, amounts in reais for the year ended December 31, 2022 have been translated to U.S. dollars using an exchange rate of R$5.2177 to US$1.00, the commercial selling rate for U.S. dollars as of December 31, 2022 as reported by the Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted at that or any other exchange rate. See “—Exchange Rates” for further information about recent fluctuations in exchange rates. | ||||

(2) | The purchase price allocation was concluded for SimplesVet and VHSYS acquisitions on March 31, 2022, for the Linx acquisition on June 30, 2022 and for Collact and Trampolin acquisitons on September 30, 2022. Therefore, retrospective adjustments were made in the Statement of financial position as of December 31, 2021 in accordance with IFRS 3. | ||||

| Year | Period-end | Average(1) | Low | High | ||||||||||||||||||||||

| 2018 | 3.8748 | 3.6558 | 3.1391 | 4.1879 | ||||||||||||||||||||||

| 2019 | 4.0307 | 3.9461 | 3.6519 | 4.2602 | ||||||||||||||||||||||

| 2020 | 5.1967 | 5.1578 | 4.0213 | 5.9372 | ||||||||||||||||||||||

| 2021 | 5.5805 | 5.3956 | 4.9206 | 5.8397 | ||||||||||||||||||||||

| 2022 | 5.2177 | 5.1655 | 4.6175 | 5.7042 | ||||||||||||||||||||||

| Month | Period-end | Average(2) | Low | High | ||||||||||||||||||||||

October 2022 | 5.2570 | 5.2503 | 5.1411 | 5.3454 | ||||||||||||||||||||||

November 2022 | 5.2941 | 5.2747 | 5.0360 | 5.4655 | ||||||||||||||||||||||

December 2022 | 5.2177 | 5.2424 | 5.1445 | 5.3406 | ||||||||||||||||||||||

January 2023 | 5.0993 | 5.2007 | 5.0767 | 5.4459 | ||||||||||||||||||||||

February 2023 | 5.2078 | 5.1717 | 4.9901 | 5.2526 | ||||||||||||||||||||||

March 2023 | 5.0804 | 5.2115 | 5.0804 | 5.2981 | ||||||||||||||||||||||

April 2023 (through April 23, 2023) | 5.0497 | 5.0123 | 4.9097 | 5.0834 | ||||||||||||||||||||||

Source: Brazilian Central Bank. | |||||

(1) | Represents the average of the exchange rates on the closing of each business day during the year. | ||||

(2) | Represents the average of the exchange rates on the closing of each business day during the month. | ||||

| Solution | Description | Features and Benefits | ||||||||||||

| POS Capture Solutions | Our POS operating systems enable in-store merchants to accept a variety of credit cards, debit cards and other APMs, through POS hardware devices. | •Facilitates safe chip and pin payments •Easy and user-friendly interface •Lower processing times •Universe of applications that enable alternative types of services •Effective and efficient single deployment rollout of updates across the entire merchant base •Continuous and real-time, remote monitoring of connectivity and integrity of machines •Connectivity solutions such as 3G, Bluetooth and/or Wi-Fi enabled •Enable merchants to accept Pix through QR Code | ||||||||||||

| Pix QR Code | Our Pix QR Code solution enables merchants to accept Pix payments already integrated with the POS and thus enabling merchants to reconcile these transactions together with card receivables. | •Easy and user-friendly interface •Low processing times •Transactions can be easily reconciled together with receivables from card transactions | ||||||||||||

| e-Commerce Gateway | Full-featured e-commerce gateway that seamlessly connects e-commerce merchants to the acquirers of their choice, enabling them to accept a wide variety of electronic payment options. Our clients are provided with a set of robust analytics, reporting and auditing capabilities through their portals. | •Increased conversion rates •Easy, user-friendly consumer checkout interface •Merchant management portal •Merchant acquirer agnostic with connections to all major providers in Brazil •Secure transactions utilizing proprietary encryption and tokenization technologies •Accepts all major payment schemes and APMs in Brazil •API-based with simple, public documentation enabling self-directed customer integration | ||||||||||||

| Point of Sale Gateway | In-store gateway for the point-of-sale that connects merchants to the acquirers of their choice enabling a wide array of payment options including traditional and APM methods. It also offers clients the ability to integrate their POS with other business management software, such as inventory and tax management solutions. | •Customizable rules that give merchants the ability to split transaction volume between multiple acquirers •Integrates with other business management software solutions to provide enhanced business analytics for our merchants | ||||||||||||

| PSP Platform | We have a sophisticated PSP solution with a quick and simple API integration, enabling omni-channel players and marketplaces to accept a wide array of electronic payments through multiple channels. With a large basket of features and products, clients are equipped with the tools and features they need to grow and manage their business. | •Comprehensive set of solutions for marketplaces •Increased conversion rates •Easy, user-friendly consumer checkout interface. •Merchant management portal •Merchant acquirer agnostic with connections to all providers in Brazil •Secure transactions utilizing proprietary encryption and tokenization technologies •Built-in anti-fraud capabilities •Accepts all major payment schemes and APMs in Brazil •API based with simple, public documentation enabling self-directed customer integration | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| Omni-Channel Merchant Acquiring | We are a fully licensed, end-to-end omni-channel merchant acquiring solution. With a large basket of features and products, clients are equipped with the tools they need to accept a wide array of electronic payments and effectively and efficiently manage their transaction receivables. Clients can integrate to our platform through multiple channels. | •Efficient and secure •Simple APIs for quick and seamless connection with integrated partners •Acceptance of global and regional payment schemes along with local meal voucher schemes, and other APMs •Higher conversion rates •Data reconciliation •Soft-descriptor code which allows merchants to write customizable client fields in transaction data •Built-in anti-fraud capabilities •Enables merchants to accept Pix transactions | ||||||||||||

| Split Payments | Enables merchants and marketplaces to predetermine multiple accounts for receiving the settlement of their transactions. Through customizable splitting rules, consumer payments can be routed and deposited instantly to multiple parties. | •Fully customizable rules that simplify and automate cash settlement for multiple parties linked within a single transaction •Settles directly to different bank accounts | ||||||||||||

| Web Checkout | Frictionless e-checkout that simplifies the buying experience leading to increased client conversion. | •Frictionless interface •Improves client experience and conversion rates | ||||||||||||

| Automated Retrial | Proprietary automated retry technology that helps to drastically reduce lost business from failed transactions, many of which are caused by payment scheme and third-party systems involved in a payment transaction. This is achieved by instantly reprocessing the transaction utilizing predetermined rules that could be reprocessed via another acquirer. | •Increased conversion rates •Fully configurable rules that allow the merchant to redirect failed payments to other acquirers •Automated email reminders to consumers to attempt to recapture failed purchase attempts | ||||||||||||

| One-Click Buy | Encrypts and stores consumer payment methods in a secure virtual account that facilitates quick and easy one-click payments | •Saves client data in a secure manner •Simplifies the payment process for consumers | ||||||||||||

| Recurring Billing | Simplifies and automates our clients’ businesses by allowing periodic and recurring billing, such as subscription services, in a simple and fully customizable manner. | •Simplifies and automates recurring charges •Fully customizable and flexible rules that incorporate installment features, pre and post payment settings and specific pre-programmed payments based on calendar dates and exceptions | ||||||||||||

| Multi-Buyer Payment—Bill Split | Enables consumers to make group payments easier for their customers. This solution allows a single purchase to be billed, and paid, to multiple consumers. | •Omni-channel offering for both digital service providers and online merchants •Simple and user-friendly functionality leading to improved consumer loyalty for our clients •Emails receipt to each consumer involved in the purchase | ||||||||||||

| Multi-Payment Acceptance | Enables a consumer to pay for a single invoice using multiple payment methods such as multiple debit and/or credit cards along with other alternative methods such as payment slips (boletos). | •Omni-channel offering for both digital service providers and online merchants •Simple and user-friendly functionality leading to improved consumer loyalty for our clients | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| Social Commerce | Provides merchants and digital service providers with the ability to request payments from their customers via WhatsApp, SMS text or an email link. | •Simplifies the card-not-present Mail Order Telephone Order payment process for transactions where the buyer and seller are in separate locations •Integrates with other solutions such as Multi-Buyer Payments or Multi-Payment Acceptance | ||||||||||||

| Digital Banking | Fully digital banking platform, integrated to our acquiring solution, that enables merchants to get paid and manage their finances more effectively. This platform can provide the automation of cash management through a direct integration with the client’s ERP. | •Single API integration •Allows cash management automation through integration to ERP and other business automation software •TED/DOC bank transfers •Pix transactions •Boleto generation •Bill payment •Prepaid Cards •Payment link | ||||||||||||

| Working Capital Solutions | Omni-channel cash management solution that allows clients to accelerate the payment of their future receivables, including installment-based receivables up to 12 months. Clients can request and predetermine the payment of their receivables via their client portal, directly on their mobile application, POS device, via email, or over the phone with our dedicated receivables prepayment team. | •Fully customizable a la carte payment options that gives clients complete control over when they get paid •Ability to automate anticipating receivables payments with simple rules that can be set up quickly and easily in the client portal | ||||||||||||

| SMB Credit Solutions | Allows our clients to contract, monitor and payback loans by fully integrating our credit solution within our payments platform. In 2021, we interrupted our working capital product and we should start disbursing by the end of 2023. | •Self-service functionality pre-approved clients can order credit through the merchant portal •Transparent pricing and no hidden fees •Clients payback loans as a percentage of their credit card receivables, paying according to a monthly fixed installment. | ||||||||||||

| Insurance | Our insurance solutions offer financial protection to clients related to life, health and store insurance. We act as a broker only, not taking insurance risk. | •Our life insurance offers several coverages, including critical illness and COVID-19 •Our business property insurance has a user-friendly hiring and payment model through the amortization of receivables, with no grace period •Payment of insurances can be made without bureaucracy through receivables or debit on payment account •Humanized customer service from hiring to the need of customer support | ||||||||||||

| App Store for POSs | We have an application in our POS devices that can provide additional software features to a merchant’s point-of-sale through our open, cloud-based Mamba App store. This enables third-party app developers to deploy new complementary solutions to the point-of-sale for merchants and consumers, such as mobile phone top-up, bill pay, and APM acceptance. | •App Store enables third-party app developers to create and deploy new app solutions •Easily connects to third-party platforms •Developer friendly •Ability for merchants to integrate more robust transaction reporting | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| Data Reporting and Merchant Portal | Gives merchants full transparency and enterprise-level insight into their transactions in a simplified and easy manner with fully customizable dashboards and automated reporting functionality. | •Simple and user-friendly •Robust reporting functionality •Receivables management tools that help merchants better understand and manage their cash flows •Accessible via the web or mobile app | ||||||||||||

| Integrated Financial Platform | Provides merchants with a complete financial platform, integrating payments, banking and credit into a single dashboard, simplifying our clients’ financial management, eliminating bureaucracy and increasing transparency. | •Simple and user-friendly •Integrates payments, banking and credit solutions into a single dashboard •Simplifies financial management | ||||||||||||

| Registry of Receivables Platform (TAG) | Financial Market Infrastructure (FMI) authorized by the Brazilian Central Bank to operate as a Trade Repository for card receivables (credit and debit), captured through physical or online transactions. TAG enables creditors to safely buy merchants' card receivables or take it as collateral. | •Technology driven and transparent, cloud based and full-API easily integrable (API RESTful and SDK pack), offering public documentation (open source) •Ready to process high volumes of data (JSon and API Streaming) •Is the only FMI in the market that actively calculates for acquirers and sub acquirers how much they must settle, considering the contract effects registered in Trade Repositories •Offers personalized support through an efficient and close onboarding process of clients, human support from 8am until 10pm and active monitoring 24/7 | ||||||||||||

| Trampolin | Trampolin is a banking-as-a-service fintech that has developed a software that allows other companies to offer banking functionality on their own systems and/or offer white label digital wallet applications. | •Plug & play digital bank •Allows clients to create and offer innovative financial services •Modular platform allows for flexibility in serving different sectors of the economy •Based on financial APIs and mobile apps, allowing for flexibility and scalability •Customized interfaces •Offers technical support ranging from APIs to regulatory. •Allows monitoring through a customized dashboard | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| VHSYS | VHSYS is an omni-channel, cloud-based, API driven, POS and ERP platform built to serve a wide array of service and retail businesses. The fully self-service platform consists of over 40 applications such as order and sales management, invoicing, dynamic inventory management, cash and payments management, CRM, mobile messaging, along with multi-marketplace, logistics, and e-commerce integrations amongst others. | •Customizable and fully integrated customer dashboards that give merchants a complete snapshot of their business • Robust reporting applications to help the client manage their business •End-to-end integration of operations, payment transactions, accounting and compliance reporting | ||||||||||||

| Tablet Cloud | Tablet Cloud is a white label Point of Sale and simple ERP application focused on less sophisticated SMBs, which runs on smart POS and tablet solutions, giving business owners complete control over their cash register and inventory in a fully mobile device while having a robust ERP platform accessible online. | •Applications are acquired a la carte based on each business’s particular needs and preferences, built to scale with growth of business •Online and offline browser features, along with mobile, smart POS and tablet functionality | ||||||||||||

| Trinks | Trinks is a SaaS ERP and booking app which allows beauty and aesthetics service providers to manage all their operations. The system automates key components of service providers’ functions such as client appointments, work schedules, inventory control and supplier contacts. | •Integrated with Stone to allow the split of card payments between the salon and its employees •Online booking of client appointment •Work schedules •Inventory controls | ||||||||||||

| Menew | Menew is an ERP/POS software for food service with a strong regional presence in the northeast of Brazil and an expanding operation throughout the country. | •Connects merchants to a set of suppliers, allowing them to run their businesses in a consolidated platform •Provides a white-label delivery app for its merchants and has a seamless integrated solution with payments | ||||||||||||

| MLabs | MLabs is an SMB social media management platform. Its purpose is to be the best cost-effective platform to make social media actions more effective and consequently increase the online presence of their clients. MLabs functionalities are focused on the specific needs of SMBs, using a variety of methods to help them reduce content production costs, optimize media investments and increase efficiency in the operations of social media management. | •Scheduling Posts in different formats and social networks •Interact with followers in inbox, direct and comments from all social networks in a single screen •MLabs Studio helps clients make posts with image bank, filters, masks and much more •Reports to understand the audience and monitor competitors | ||||||||||||

| Questor | Questor is a management system for accounting offices and integrated cloud ERP offering for SMBs. Their almost 6,600 accounting clients serve more than 600,000 businesses across the whole country. | •Bookkeeping, fiscal and payroll module for accountants to do their customers’ accounts •Back office routine for accounting offices •Version for companies that do their own accounting, tax and payroll | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| Sponte | Sponte is a leading provider of cloud ERP solutions for schools, with 4,800 clients in the segment and 2.0 million students, in an underpenetrated sector in terms of both payments and software. | •Fully cloud based ERP for schools and language academies •Student billing management (reoccurring via Card or “Boleto”) •Student report card management •Communication focused App for parents, children and schools to follow students daily routine | ||||||||||||

| SimplesVet | SimplesVet is an ERP solution for veterinary clinics, pet shops and autonomous veterinarians. | •Simple interface, with all information in a single place •Complete financial management •Automatic messages to increase customer loyalty •Seamless and integrated interface for websites •Support through online chat •Client portal to access data on their pet | ||||||||||||

| APP | APP is a software management company, focused on the hotel segment. | •Fully cloud-based solution for hotels •System integrated with reference companies in the segment •Agile, simple, and intuitive solution, available anywhere •24/7 technical support, with product specialists and accounts executives to accompany the clients’ journey | ||||||||||||

| ClinicWeb | ClinicWeb is Vitta’s ERP for medical clinics in Brazil, helping professionals from the health segment to manage their appointments, patient’s files, finance and marketing. | •Easy to manage the appointments, finance and marketing. •Offers online scheduling and telemedicine. | ||||||||||||

| Reclame Aqui | Reclame Aqui is a free public platform for consumers to complain about a product or service with a private interface for companies to respond to those complaints. | •Offers SaaS Solutions to B2B clients such as CRM tools, verified badges, brand pages and reviews •Integration with e-commerce platforms •One of the main symbols of legitimacy for businesses | ||||||||||||

| Nodis | Nodis is an app that helps clients digitize their businesses connecting them to the biggest marketplaces of the country such as Magalu, Americanas and Shoptime. Through one single portal, the merchant can control its catalog, manage the orders and shipping online. | •Registration and management of all orders in one place •Easy to manage the store online: sales, storage control, prices and complaints •No adhesion or monthly fee charged •Specialist sales team and accessible customer service | ||||||||||||

| Neomode | Neomode offers a sales channel and white label commerce app platform with integration to ERP, POS, e-commerce and gateways. | •Development and supply of solutions that integrate online channels and physical stores in the omnichannel concept •Agnostic and cloud-based solution | ||||||||||||

| Mercadapp | Mercadapp is a digital product that offers an APP and e-commerce for supermarkets which is integrated with POS and ERP. | •Helps supermarkets create their own app and e-commerce as additional sales channels •Offers complete data and reports about consumer behavior •Provides CRM-like features such as the organization of groups of consumers with similar behaviors to offer advantages and promotions | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| RH Software | RH Software is an ERP for dental clinics, helping dentists better manage their businesses through features specifically designed for their needs. | •Booking of client appointment •Clients’ history accessible in all appointments with complete dental chart •Develops relationship and communication with clients through a marketing tool integrated into the clinic management system | ||||||||||||

| Plugg.to | Plugg.To integrates inventory, products and orders between the marketplaces and e-commerce platforms, POSs and ERPs in the market. | •Enables merchants to offer their products on multiple marketplaces seamlessly by integrating their virtual store and ERP with marketplace •Offers more than 70 marketplaces ready to start selling, from the largest and best known to niche markets •Catalog management with real-time synchronization •Automatic invoice issuer •Complete report generation for detailed analyses | ||||||||||||

| HubCount | Hubcount is a technology company focused on offering solutions for accounting offices and large corporations. | •Automation of accounting BI, dashboards and indicators •Automated financial statements and balance sheet consolidation •Provides financial analysis with specific parameterization in the Customer’s or HubCount’s model | ||||||||||||

| Reconciliation, TEF and QR | Software solutions that streamline the complex process of reconciling payments transactions, and managing cash flow. These powerful tools enable our clients, from brick and mortar SMBs to large online enterprises, to accept, reconcile and monitor transactional data from all payment solutions providers, such as merchant acquirers, e-wallets and gateways, giving transparency of fees paid, discounts/chargebacks, and taxes at the individual transaction level, in a single dashboard. | •Straightforward reporting and easy-to-use tools that assist merchants in resolving flagged inconsistencies in their transactions •Acceptance of new payment methods and natively integrated with client ERP systems •Automates the process of receivables management, such as downloading data from payments providers, reconciling transactions, and uploading information to a client’s ERP system | ||||||||||||

| Advertising | Engine designed to help industries and manufacturers improve their return on investment, or ROI, of their online advertising expenditures | •Industries and manufacturers to reach customers with significant buying potential at the right time through the largest online stores •The advertising engine allows publishers to monetize their websites through highly relevant ads for branded products, stores, and sales partners | ||||||||||||

| Analytics | Allows retailers to access graphs, benchmarks, product performance, user information, employee performance and other management tools. | •Designed to help retailers monitor in real time the day-to-day of running a business | ||||||||||||

| CRM | Designed to help our customers to manage their sales processes more efficiently, integrate marketing campaigns and content into their sales processes more efficiently and deliver high-quality service to their customers. | •Provides information to increase acquisition and retention and to maximize quality of service to the brand’s consumers. •Provides information to also allow our customers to appeal to new customers as well as re-acquire and reactivate inactive customers through marketing campaigns, loyalty programs and corporate gift cards. | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| Connectivity | Suite of customized solutions to help retailers connect their consumers, protect their data and connect their network through a single point of contact. | •Technology team that monitors, manages and provides support seven days a week •We are able to interconnect headquarters and branches across the country with secure and high-performance dedicated links, through which many critical and high-value add retail services are transferred, particularly those that are cloud-based | ||||||||||||

| E-commerce platform | Our e-commerce services consist of the receipt of (i) wholesale orders and the monitoring of sales targets, (ii) directed sales to the final consumer and (iii) an interactive electronic catalog with information about inventory and prices, among others, that are integrated to the ERP system. | •Designed to enable our customers to offer consistent, relevant and personalized cross-channel shopping through catalog, merchandising, marketing, research and guided navigation, personalization, automated recommendations, and live help capabilities •Designed to enable our customers to strengthen customer loyalty, improve brand value, achieve better results of operations, enhance customer service and improve response times in online and traditional commercial settings | ||||||||||||

| Human Capital Management | Humanus integrates all Human Resources procedures, allowing the organization of activities, processes, and information in a safe and reliable way. | •Offers a Payroll solution composed of the essential modules for Personnel Department routines and “eSocial” •Online training platform for training employees •Increases efficiency in recruitment processes •The solution is totally customizable to meet the particularities of each business | ||||||||||||

| MID-E | Middleware application used to connect the Linx systems with the Brazilian tax authorities for the purpose of issuing an electronic invoice (NFe), and electronic consumer receipt (NFCe), in an integrated manner. | •MID-e Portal provides the retailer access to monitor the status and cancellation of electronic documents, registration certificates and information dashboards, as well as a complete control panel that displays all rejected invoices in real time •The platform is completely digital, and updates quickly, facilitating tax management. Explanatory charts also help the retailer analyze data and information accurately | ||||||||||||

| Mobility | Internally named “Smart POS.” Via smartphones or tablets, customers are served in a fast and customized manner, with no lines and far more interaction with the variety of products offered in the store. We offer solutions for different retail segments using features such as the virtual catalog, lookbook combinations, inventory query, pre-sale and sale record, waitlist and closure of service. | •Mobile solutions are offered in cloud and are integrated with our other software •These offerings focus on cross-selling within our existing customer base | ||||||||||||

| OMS | By using our OMS technology, retailers can meet orders originating from any channel, regardless of where the product is located. | •Multi-channel purchasing processes that integrate stores, franchises and distribution centers, thereby providing a single channel for our customers •Inventory shortage decrease and generates more consumer traffic and increased sales | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| Point of Sale and ERP | Software solutions for our customers’ in-store terminals where sales transactions occur. In the vast majority of cases, these solutions are integrated with our own ERP software. Solutions for more than 10 retail segments. | •Expertise in all processes and legislation linked to the specific retail segment in which our customers operate, seeking to adapt our POS profile to each customer •Integrates many departments of a company, enabling the automation and storage of all business information •Serves customers from the most varied retail verticals, such as clothing, footwear, accessories, food service, car dealerships, construction materials, department stores, among many others | ||||||||||||

| Promo | Platform that facilitates the planning of promotions in a unified way, seeking to achieve the best results in each campaign, based on the needs of a retailer’s business. | •Helps to create promotions with diverse personalization criteria including: segmentation by audience, schedule, type of client, payment method, combos, birthdays, progressive discount vouchers and gifts | ||||||||||||

| Reshop | Multichannel platform designed for complete campaign management that works seamlessly with the retailer’s POS capturing real-time data. | •Offers the best practices for the retailer to achieve a higher rate of sales satisfaction | ||||||||||||

| Search and recommendation | Internally named “Linx Impulse.” Our search solution uses machine learning and proprietary algorithms that best fit the customer. | •Ensure that customers find the products they desire through e-commerce channels •Impact click through rates, or CTR, conversion rates and revenues per session | ||||||||||||

| Solution | Description | Features and Benefits | ||||||||||||

| Delivery Much | Delivery Much is a food delivery marketplace company focused on small-and-midsize cities, with a similar and synergistic expansion approach to ours. Delivery Much generates more sales to restaurants using their consumer client base. | •B2C app to choose, order and pay online for food delivery •API with restaurants ERPs/POS to make the operations easier on the delivery management. | ||||||||||||

| Cappta | Cappta offers offline gateway, also called TEF, in which merchants can have efficiency gains and agility in the processes related to cash closing and conciliation of receivables as the payment’s system is directly integrated with goods and services sold in the store. | •Avoids errors while conciliating receivables •Decreases the time of cash closing •Guarantees transactions’ information are sent to the acquirer with the best package of fees and services to the card’s scheme. | ||||||||||||

| PinPag | PinPag is specialized in means of payments and offers. | •Reinforces the financial platform for retailers, especially car dealership management. | ||||||||||||

| CreditInfo Caribbean (Stone CI) | CreditInfo is a credit bureau provider, having as main products credit reports, credit scores, monitoring, international business reports and a suite of value-added services, with three operational countries in the Caribbean. | •International experience in building and analyzing data for risk management, especially credit •Main credit bureau in some Caribbean regions •New ways and vehicles to create database analyses •Platform of solutions that facilitate and accelerate the decision making process | ||||||||||||

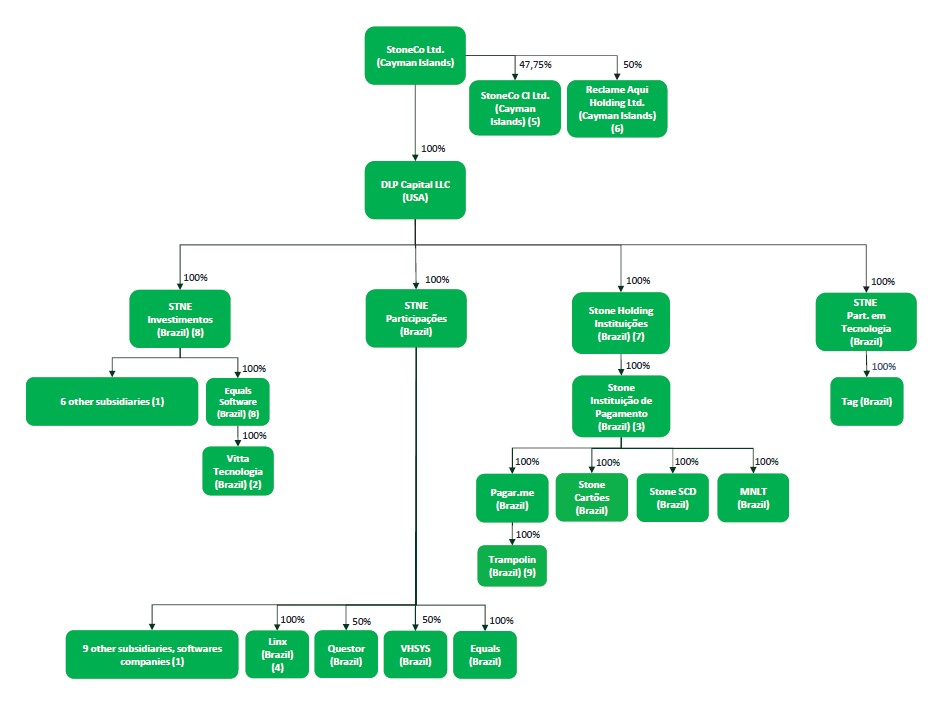

(1) | For more details on the subsidiaries, please refer to Item 4 – Group Information on the Notes to consolidated financial statements. | ||||

(2) | Vitta has subsidiaries, in which we have 100% of equity interest. Please refer to Item 4 – Group Information on the Notes to consolidated financial statements for more details. | ||||

(3) | Formerly “Stone Pagamentos S.A.”. We changed our corporate name due to Resolution No. 80/2021 of Brazilian Central Bank. | ||||

(4) | 17 other subsidiaries, including software companies. Please refer to Item 4 – Group Information on the Notes to consolidated financial statements for more details. | ||||

(5) | 42.25% of StoneCo CI are held by InfoCapital EhF and 10% are held by CS2 Invest PTY Ltd. In addition, through the investment in StoneCo CI, we hold 47.75% interest in Creditinfo Jamaica Ltd., Creditinfo Guyana Inc. and Creditadvice Barbados Ltda. (our wholly owned subsidiary). Please refer to Item 4 – Group Information on the Notes to consolidated financial statements for more details. | ||||

(6) | 50% of Reclame Aqui Holding Ltd. are held by VLP Holding Ltd. Reclame Aqui Holding Ltd. has subsidiaries, in which we have 50% of equity interest. Please refer to Item 4 – Group Information on the Notes to consolidated financial statements for more details. | ||||

(7) | Stone Holding Instituições S.A. was incorporated due to a requirement of Brazilian Central Bank, in order to maintain the control of Stone Instituição de Pagamento held by Brazilian company. | ||||

(8) | STNE Investimentos S.A. and Equals Software S.A. were incorporated due to our corporate reorganization. | ||||

(9) | Trampolin was merged into Pagar.me on April 2023. This merger is in process to be registered before the commercial registry. | ||||

| For the Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

Real growth (contraction) in gross domestic product | 2.90 | % | 5.00 | % | (3.30) | % | |||||||||||

Inflation (IGP-M)(1) | 5.45 | % | 17.78 | % | 23.14 | % | |||||||||||

Inflation (IPCA)(2) | 5.79 | % | 10.06 | % | 4.52 | % | |||||||||||

Long-term interest rates—TJLP (average)(3) | 6.78 | % | 4.80 | % | 4.87 | % | |||||||||||

CDI interest rate(4) | 12.45 | % | 4.46 | % | 2.77 | % | |||||||||||

Period-end exchange rate—reais per US$1.00 | R$5.2177 | R$5.5805 | R$5.1967 | ||||||||||||||

Average exchange rate—reais per US$1.00(5) | R$5.1655 | R$5.3956 | R$5.1578 | ||||||||||||||

Appreciation (depreciation) of the real vs. US$ in the period(6) | 7.00 | % | (6.90) | % | (22.44) | % | |||||||||||

Unemployment rate(7) | 9.30 | % | 11.10 | % | 13.80 | % | |||||||||||

Source: FGV, IBGE, Central Bank and B3. | |||||

(1) | Inflation (IGP-M) is the general market price index measured by the FGV. | ||||

(2) | Inflation (IPCA) is a broad consumer price index measured by the IBGE. | ||||

(3) | TJLP is the Brazilian long-term interest rate (average of monthly rates for the period). | ||||

(4) | The CDI (certificado de depósito interbancário) interest rate is an average of interbank overnight rates in Brazil, accumulated during the corresponding period. | ||||

(5) | Average of the exchange rate on each business day of the year. | ||||

(6) | Comparing the US$ closing selling exchange rate as reported by the Central Bank at the end of the period’s last day with the day immediately prior to the first day of the period discussed. | ||||

(7) | Average unemployment rate for year as measured by the IBGE. | ||||

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2021 | Variation (R$) | Variation (%) | ||||||||||||||||||||

| R$ millions, except amounts per share | |||||||||||||||||||||||

Statement of profit or loss data: | |||||||||||||||||||||||

Net revenue from transaction activities and other services | 2,617.4 | 1,626.9 | 990.6 | 60.9 | % | ||||||||||||||||||

Net revenue from subscription services and equipment rental | 1,760.9 | 1,071.9 | 689.0 | 64.3 | % | ||||||||||||||||||

Financial income | 4,638.0 | 1,877.7 | 2,760.3 | 147.0 | % | ||||||||||||||||||

Other financial income | 572.6 | 247.3 | 325.3 | 131.5 | % | ||||||||||||||||||

Total revenue and income | 9,588.9 | 4,823.8 | 4,765.2 | 98.8 | % | ||||||||||||||||||

Cost of services | (2,669.8) | (1,713.8) | (955.9) | 55.8 | % | ||||||||||||||||||

Administrative expenses | (1,121.4) | (813.3) | (308.0) | 37.9 | % | ||||||||||||||||||

Selling expenses | (1,511.2) | (1,012.5) | (498.7) | 49.3 | % | ||||||||||||||||||

| Mark-to-market on equity securities designated at FVPL | (853.1) | (1,264.2) | 411.2 | (32.5) | % | ||||||||||||||||||

Financial expenses, net | (3,514.7) | (1,269.1) | (2,245.7) | 177.0 | % | ||||||||||||||||||

Other operating expenses, net | (302.5) | (185.9) | (116.6) | 62.7 | % | ||||||||||||||||||

Loss on investment in associates | (3.6) | (10.4) | 6.8 | (65.6) | % | ||||||||||||||||||

Profit (loss) before income taxes | (387.3) | (1,445.6) | 1,058.3 | (73.2) | % | ||||||||||||||||||

Income tax and social contribution | (139.1) | 68.2 | (207.3) | n.m. | |||||||||||||||||||

Profit (loss) for the year | (526.4) | (1,377.3) | 851.0 | (61.8) | % | ||||||||||||||||||

Profit (loss) for the year | |||||||||||||||||||||||

Attributable to owners of the parent | (519.4) | (1,358.8) | 839.4 | (61.8) | % | ||||||||||||||||||

Attributable to non-controlling interests | (7.0) | (18.5) | 11.6 | (62.3) | % | ||||||||||||||||||

Basic profit (loss) per share for the year attributable to owners of the parent (R$) | (1.67) | (4.40) | 2.73 | (62.1) | % | ||||||||||||||||||

Diluted profit (loss) per share for the year attributable to owners of the parent (R$) | (1.67) | (4.40) | 2.73 | (62.1) | % | ||||||||||||||||||

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2021 | Variation (R$) | Variation (%) | ||||||||||||||||||||

| R$ millions, except amounts per share | |||||||||||||||||||||||

TPV (in billions) | 367.4 | 275.4 | 92.0 | 33.4 | % | ||||||||||||||||||

Active clients (in thousands) | 2,584.0 | 1,766.1 | 817.9 | 46.3 | % | ||||||||||||||||||

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2022 | 2021 | Variation (R$) | Variation (%) | ||||||||||||||||||||

| R$ millions, except amounts per share | |||||||||||||||||||||||

Net revenue from transaction activities and other services | 2,617.4 | 1,626.9 | 990.6 | 60.9 | % | ||||||||||||||||||

Net revenue from subscription services and equipment rental | 1,760.9 | 1,071.9 | 689.0 | 64.3 | % | ||||||||||||||||||

Financial income | 4,638.0 | 1,877.7 | 2,760.3 | 147.0 | % | ||||||||||||||||||

Other financial income | 572.6 | 247.3 | 325.3 | 131.5 | % | ||||||||||||||||||

Total revenue and income | 9,588.9 | 4,823.8 | 4,765.2 | 98.8 | % | ||||||||||||||||||

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2021 | 2020 | Variation (R$) | Variation (%) | ||||||||||||||||||||

| R$ millions, except amounts per share | |||||||||||||||||||||||

Statement of profit or loss data: | |||||||||||||||||||||||

Net revenue from transaction activities and other services | 1,626.9 | 1,144.1 | 482.8 | 42.2 | % | ||||||||||||||||||

Net revenue from subscription services and equipment rental | 1,071.9 | 388.0 | 683.9 | 176.3 | % | ||||||||||||||||||

Financial income | 1,877.7 | 1,647.0 | 230.7 | 14.0 | % | ||||||||||||||||||

Other financial income | 247.3 | 140.7 | 106.6 | 75.8 | % | ||||||||||||||||||

Total revenue and income | 4,823.8 | 3,319.8 | 1,504.0 | 45.3 | % | ||||||||||||||||||

Cost of services | (1,713.8) | (769.9) | (943.9) | 122.6 | % | ||||||||||||||||||

Administrative expenses | (813.3) | (392.5) | (420.8) | 107.2 | % | ||||||||||||||||||

Selling expenses | (1,012.6) | (505.9) | (506.7) | 100.2 | % | ||||||||||||||||||

| Mark-to-market on equity securities designated at FVPL | (1,264.2) | — | (1,264.2) | 100.0 | % | ||||||||||||||||||

Financial expenses, net | (1,269.1) | (339.8) | (929.3) | 273.5 | % | ||||||||||||||||||

Other operating expenses, net | (185.9) | (177.1) | (8.8) | 5.0 | % | ||||||||||||||||||

Loss on investment in associates | (10.4) | (6.9) | (3.5) | 50.7 | % | ||||||||||||||||||

Profit (loss) before income taxes | (1,445.5) | 1,127.7 | (2,573.2) | (228.2) | % | ||||||||||||||||||

Income tax and social contribution | 68.2 | (290.2) | 358.4 | (123.5) | % | ||||||||||||||||||

Profit (loss) for the year | (1,377.3) | 837.4 | (2,214.7) | (264.5) | % | ||||||||||||||||||

Profit (loss) for the year | |||||||||||||||||||||||

Attributable to owners of the parent | (1,358.8) | 854.1 | (2,212.9) | (259.1) | % | ||||||||||||||||||

Attributable to non-controlling interests | (18.5) | (16.6) | (1.9) | 11.4 | % | ||||||||||||||||||

Basic profit (loss) per share for the year attributable to owners of the parent (R$) | (R$4.40) | R$2.95 | (R$7.35) | (249.2) | % | ||||||||||||||||||

Diluted profit (loss) per share for the year attributable to owners of the parent (R$) | (R$4.40) | R$2.91 | (R$7.31) | (251.2) | % | ||||||||||||||||||

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2021 | 2020 | Variation (R$) | Variation (%) | ||||||||||||||||||||

| R$ millions, except amounts per share | |||||||||||||||||||||||

TPV (in billions) | 275.4 | 209.9 | 65.5 | 31.2 | % | ||||||||||||||||||

Active clients (in thousands)* | 1,766.1 | 774.5 | 991.6 | 128.0 | % | ||||||||||||||||||

| * | In our 2020 reporting, we did not consider TON clients in our reported numbers. Therefore, such numbers differ from the current reported numbers. | ||||

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2021 | 2020 | Variation (R$) | Variation (%) | ||||||||||||||||||||

| R$ millions, except amounts per share | |||||||||||||||||||||||

Net revenue from transaction activities and other services | 1,626.9 | 1,144.1 | 482.8 | 42.2 | % | ||||||||||||||||||

Net revenue from subscription services and equipment rental | 1,071.9 | 388.0 | 683.9 | 176.3 | % | ||||||||||||||||||

Financial income | 1,877.7 | 1,647.0 | 230.7 | 14.0 | % | ||||||||||||||||||

Other financial income | 247.3 | 140.7 | 106.6 | 75.8 | % | ||||||||||||||||||

Total revenue and income | 4,823.8 | 3,319.8 | 1,504.0 | 45.3 | % | ||||||||||||||||||

| For the Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| R$ millions | |||||||||||||||||

Liquidity and Capital Resources: | |||||||||||||||||

Cash and cash equivalents | 1,512.6 | 4,495.6 | 2,447.0 | ||||||||||||||

| Net cash provided by operating activities | 1,683.7 | 3,606.9 | 56.5 | ||||||||||||||

Net cash used in investing activities | (1,871.1) | (2,977.2) | (5,809.0) | ||||||||||||||

Net cash provided by / (used in) financing activities | (2,810.1) | 1,419.4 | 7,216.2 | ||||||||||||||

Foreign exchange in cash equivalents | 14.5 | (0.5) | 15.0 | ||||||||||||||

| Total change in cash and cash equivalents | (2,983.0) | 2,048.6 | 1,478.7 | ||||||||||||||

| Average annual interest rate % | Maturity | Current portion | Non-current portion | As of December 31, 2022 Amount (R$ million) | As of December 31, 2021 Amount (R$ million) | ||||||||||||||||||

Obligations to FIDC AR III quota holders(i) | CDI Rate* + 1.50% | Aug/23 | 952.7 | — | 952.8 | 2,206.0 | |||||||||||||||||

Obligations to FIDC TAPSO quota holders(ii) | CDI Rate* + 1.80% | Feb/23 | 22.5 | — | 22.5 | 21.1 | |||||||||||||||||

| Obligations to FIDC quota holders | 975.2 | — | 975.3 | 2,227.1 | |||||||||||||||||||

Leases(iii) | 105.1% to 151.8% of CDI Rate* | Jan/23 to Jun/29 | 55.6 | 144.6 | 200.1 | 273.5 | |||||||||||||||||

Bonds(iv) | 3.95% USD | Jun/28 | 4.0 | 2,583.9 | 2,587.9 | 2,764.6 | |||||||||||||||||

Bank borrowings(v) | CDI + 0.95%. to CDI + 1.44% | Three to eighteen months | 1,787.8 | — | 1,787.8 | 2,697.6 | |||||||||||||||||

Debentures(vi) | 101.4% of CDI Rate* | Jul/22 | — | — | — | 399.5 | |||||||||||||||||

| Loans and financing | 1,847.4 | 2,728.5 | 4,575.8 | 6,135.2 | |||||||||||||||||||

Total Debt | 2,822.6 | 2,728.5 | 5,551.1 | 8,362.3 | |||||||||||||||||||

* | “CDI Rate” means the Brazilian interbank deposit (Certificado de Depósito Interbancário) rate, which is an average of interbank overnight rates in Brazil, the average rate of 2022 was 12.38% (2021 – 4.42%). | ||||

(i) | Obligations to FIDC AR III quota holders In August 2020, the first series of FIDC AR III senior quotas was issued, with an amount of up to R$2,500.0 million, and maturity in 2023. They were issued for 36 months, with a grace period of 15 months to repay the principal amount. During the grace period, the payment of interest was made every three months. After this period, the amortization of the principal and the payment of interest was made every three months. The benchmark return rate is CDI + 1.5% per year. Payments mainly refer to the amortization of the principal and the payment of interest of the first series of FIDC AR III. | ||||

(ii) | Obligations to FIDC TAPSO quota holders In March 2021, we negotiated an amendment of the contract to postpone the payment date of the principal to March 2022 and the benchmark return rate became 100% of the CDI + 1.50% per year. In February 2022, we negotiated an amendment of the contract to postpone the payment date of the principal to March 2023 and the benchmark return rate became 100% of the CDI + 1.80% per year | ||||

(iii) | Leases We have lease contracts for various items of offices, vehicles and software in its operations. Our obligations under its leases are secured by the lessor’s title to the leased assets. Generally, we are restricted from assigning and subleasing the leased assets. | ||||

(iv) | Bonds In June 2021, we issued our inaugural dollar bonds, raising US$500 million in 7-year notes with a final yield of 3.95%. The total issuance was R$2,510.4 million (R$2,477.4 million net of the offering transaction costs, which will be amortized over the course of the debt). See “Item 5. Operating and Financial Review and Prospects—B. Liquidity and capital resources—Issuance of Inaugural Bonds.” | ||||

(v) | Bank borrowings In the years 2022 and 2021, we issued CCBs (Bank Credit Notes). The principal and the interests of this type of loan are paid at maturity, which is between three to eighteen months. The proceeds of these loans were used mainly for the prepayment of receivables. As of December 31, 2022, the outstanding was R$1,787.8 million. | ||||

(vi) | Debentures On June 12, 2019 Stone Instituição de Pagamento S.A. (formerly Stone Pagamentos) approved the issuance of simple, secured and non-convertible debentures, sole series, for public distribution, with restricted distribution efforts, as amended, in the total amount of up to R$400.0 million, received between June and July, maturing in 2022. The Debentures are secured by Stone Instituição de Pagamento’ (formerly Stone Pagamentos) accounts receivable from card issuers and bear interest at a rate of 109.0% of the CDI rate. | ||||

Payments Due By Period(1) | |||||||||||||||||||||||||||||

| Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||||||||||||

| (R$ millions) | |||||||||||||||||||||||||||||

Debt and FIDC quota holder obligations | 7,477 | 3,228 | 332 | 1,192 | 2,725 | ||||||||||||||||||||||||

Leases(2) | 200 | 56 | 99 | 40 | 5 | ||||||||||||||||||||||||

Total | 7,677 | 3,284 | 431 | 1,232 | 2,730 | ||||||||||||||||||||||||

(1) | Amounts refer to contractual undiscounted cash flows. | ||||

(2) | Consists of office leases, software leases and lease and insurance costs for motorcycles used by our Green Angels. | ||||

Payments Due By Period(1) | |||||||||||||||||||||||||||||

| Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||||||||||||

| (R$ millions) | |||||||||||||||||||||||||||||

Debt and FIDC quota holder obligations | 9,981 | 4,320 | 1,900 | 836 | 2,925 | ||||||||||||||||||||||||

Leases(2) | 181 | 48 | 69 | 25 | 39 | ||||||||||||||||||||||||

Total | 10,162 | 4,368 | 1,969 | 861 | 2,964 | ||||||||||||||||||||||||

(1) | Amounts refer to contractual undiscounted cash flows. | ||||

(2) | Consists of office leases, software leases and lease and insurance costs for motorcycles used by our Green Angels. | ||||

| Outstanding quotas held by the Group | ||||||||

| Fundo de Investimento em Direitos Creditórios - Bancos Emissores de Cartão de Crédito - Stone III ("FIDC AR III") | 100% of subordinated quotas representing approximately 21% of total (subordinated and senior and/or mezzanine) quotas | |||||||

| Tapso Fundo de Investimento em Direitos Creditórios ("FIDC TAPSO") | 100% of subordinated quotas representing approximately 99% of total (subordinated and senior and/or mezzanine) quotas | |||||||

| Tapso II Fundo de Investimento em Direitos Creditórios ("FIDC TAPSO II") | 100% of subordinated quotas representing total quotas | |||||||

| SOMA Fundo de Investimentos em Direitos Creditórios Não Padronizados ("FIDC SOMA") | 100% of subordinated quotas representing total quotas | |||||||

| SOMA III Fundo de Investimentos em Direitos Creditórios Não Padronizados ("FIDC SOMA III") | 100% of subordinated quotas representing total quotas | |||||||

| Stoneco exclusivo Fundo de Investimento em Cotas de Fundo de Investimento Multimercado Crédito Privado ("FIC FIM STONECO") | 100% of all outstanding quotas of a single class | |||||||

| Retail Renda Fixa Crédito Privado Fundo de Investimento ("Fundo Retail") | 100% of all outstanding quotas of a single class | |||||||

| Estimated useful lives (years) | |||||

| Pin Pads & POS | 5 | ||||

| IT equipment | 3 – 10 | ||||

| Facilities | 3 – 14 | ||||

| Property | 34 | ||||

| Furniture and fixtures | 3 – 10 | ||||

| Machinery and equipment | 5 – 14 | ||||

| Vehicles and airplanes | 2 – 10 | ||||

| Estimated useful lives (years) | |||||

| Software | 3 – 10 | ||||

| Customer relationship | 2 – 34.5 | ||||

| Trademarks and patents | 7 – 30.9 | ||||

| Non-compete agreement | 5 | ||||

| Licenses | 1 – 5 | ||||

| Name | Age | Position | ||||||||||||

André Street de Aguiar(1) | 38 | Director and Chairman | ||||||||||||

Conrado Engel(1) | 65 | Director and Vice Chairman | ||||||||||||

Diego Fresco Gutiérrez(2)(3) | 53 | Director | ||||||||||||

Luciana Ibiapina Lira Aguiar(2) | 49 | Director | ||||||||||||

| Luiz André Barroso | 59 | Director | ||||||||||||

Mauricio Luis Luchetti(1)(2) | 64 | Director | ||||||||||||

Patricia Regina Verderesi Schindler(3) | 52 | Director | ||||||||||||

Thiago dos Santos Piau(3) | 33 | Director | ||||||||||||

(1) | Member of our People and Compensation Committee. | ||||

(2) | Member of our Audit Committee. | ||||

(3) | Member of our Finance and Risks Committee. | ||||

| Name | Age | Position | ||||||||||||

| Augusto Barbosa Estellita Lins | 60 | President | ||||||||||||

| Caio Fiuza | 45 | Chief Operation Officer (Financial Platform Division) | ||||||||||||

| Diego Salgado | 39 | Treasurer Officer | ||||||||||||

| Gilsinei Valcir Hansen | 49 | Chief Operation Officer (Software Division) | ||||||||||||

| João Bernartt | 43 | Chief Information Officer | ||||||||||||

| Lia Machado de Matos | 46 | Chief Strategy Officer | ||||||||||||

| Marcus Fontoura | 50 | Chief Technology Officer | ||||||||||||

| Mateus Scherer Schwening | 27 | Vice President of Finance | ||||||||||||

| Pedro Zinner | 49 | Chief Executive Officer | ||||||||||||

| Rafael Martins Pereira | 37 | Investor Relations Executive Officer | ||||||||||||

| Sandro Bassili | 53 | Chief People and Management Officer | ||||||||||||

| Silvio José Morais | 60 | Interim Chief Financial Officer | ||||||||||||

| Tatiana Malamud | 53 | Chief Legal and Compliance Officer | ||||||||||||

| Vinícius do Nascimento Carrasco | 46 | Chief Economist and Regulatory Affairs Executive Officer | ||||||||||||

| Board Diversity Matrix (as of December 31, 2022) | |||||||||||||||||||||||

| Country of Principal Executive Offices | Cayman Islands | ||||||||||||||||||||||

| Foreign Private Issuer | Yes (the Cayman Islands) | ||||||||||||||||||||||

| Disclosure Prohibited under Home Country Law | No | ||||||||||||||||||||||

| Total Number of Directors | 8 | ||||||||||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | ||||||||||||||||||||

| Part I: Gender Identity | |||||||||||||||||||||||

| Directors | 2 | 6 | 0 | 0 | |||||||||||||||||||

| Part II: Demographic Background | |||||||||||||||||||||||

| Underrepresented Individual in Home Country Jurisdiction | 0 | 1 | 0 | 0 | |||||||||||||||||||

| LGBTQ+ | 0 | 0 | 0 | 0 | |||||||||||||||||||

| Did not Disclose Demographic Background | 2 | 5 | 0 | 0 | |||||||||||||||||||

| Number of Employees | % of Total | Number of Employees | ||||||||||||||||||||||||

| Function | 2022 | 2021 | 2020 | |||||||||||||||||||||||

Administrative | 2,199 | 13.2 | % | 2,189 | 1,019 | |||||||||||||||||||||

Operations | 4,839 | 29.0 | % | 5,115 | 2,356 | |||||||||||||||||||||

Technology and Product Development | 4,608 | 27.6 | % | 4,194 | 1,479 | |||||||||||||||||||||

Sales and Marketing | 5,039 | 30.2 | % | 6,187 | 4,125 | |||||||||||||||||||||

Total | 16,685 | 100% | 17,685 | 8,979 | ||||||||||||||||||||||

| Shares Beneficially Owned | % of Total Voting Power(1) | ||||||||||||||||||||||||||||

| Class A | Class B | ||||||||||||||||||||||||||||

| Shares | % | Shares | % | ||||||||||||||||||||||||||

André Street(2) | 4,245,285 | 1.44% | 16,925,909 | 90.27% | 36.02% | ||||||||||||||||||||||||

| Augusto Barbosa Estellita Lins | * | * | — | — | * | ||||||||||||||||||||||||

| Caio Fiuza | * | * | — | — | * | ||||||||||||||||||||||||

| Conrado Engel | — | — | — | — | — | ||||||||||||||||||||||||

| Diego Fresco Gutierrez | — | — | — | — | — | ||||||||||||||||||||||||

| Diego Salgado | — | — | — | — | — | ||||||||||||||||||||||||

| Gilsinei Valcir Hansen | * | * | — | — | * | ||||||||||||||||||||||||

| João Bernartt | — | — | — | — | — | ||||||||||||||||||||||||

| Lia Machado de Matos | * | * | — | — | * | ||||||||||||||||||||||||

| Luciana Ibiapina Lira Aguiar | — | — | — | — | — | ||||||||||||||||||||||||

| Marcus Fontoura | — | — | — | — | — | ||||||||||||||||||||||||

| Mateus Scherer Schwening | * | * | — | — | * | ||||||||||||||||||||||||

| Mauricio Luis Luchetti | * | * | — | — | * | ||||||||||||||||||||||||

| Patricia Regina Verderesi Schindler | — | — | — | — | — | ||||||||||||||||||||||||

Pedro Henrique Cavallieri Franceschi (3) | — | — | — | — | — | ||||||||||||||||||||||||

| Pedro Zinner | * | * | — | — | * | ||||||||||||||||||||||||

| Rafael Martins Pereira | * | * | — | — | * | ||||||||||||||||||||||||

| Sandro Bassili | * | * | — | — | * | ||||||||||||||||||||||||

| Silvio José Morais | * | * | — | — | * | ||||||||||||||||||||||||

| Tatiana Malamud | — | — | — | — | — | ||||||||||||||||||||||||

| Thiago dos Santos Piau | * | * | — | — | * | ||||||||||||||||||||||||

| Vinícius do Nascimento Carrasco | * | * | — | — | * | ||||||||||||||||||||||||

All directors and senior management as a group (22 persons) | 6,563,765 | 2.23% | 16,925,909 | 90.27% | 36.50% | ||||||||||||||||||||||||

| * | Each of these directors and officers beneficially owns less than 1% of the total number of outstanding Class A common shares. | ||||

(1) | Percentage of total voting power represents voting power with respect to all of our Class A common shares and Class B common shares, as a single class. Holders of our Class B common shares are entitled to 10 votes per share, whereas holders of our Class A common shares are entitled to one vote per share. | ||||

(2) | Shares beneficially owned consists of (i) 1,286,022 Class B and 3,737,449 Class A Common Shares held of record by VCK Investment Fund Limited (SAC) A (“VCK A”), a segregated account of VCK Investment Fund Limited (SAC) (“VCK”), (ii) 683,926 Class B and 507,836 Class A common shares held of record by Cakubran Holdings Ltd., a company controlled by VCK A and (iii) 14,955,142 Class B Common Shares held of record by HR Holdings, LLC, a company controlled by ACP Investments Ltd. — Arpex Capital, in turn jointly controlled by VCK A. Mr Street may be deemed to have voting and dispositive power over the shares of HR Holdings, LLC and Cakubran Holdings Ltd. | ||||

(3) | Pedro Franceschi presented his resignation from our Board in April 2023. Luiz André Barroso was appointed as a member of our Board of Directors in April 2023. | ||||

| Shares Beneficially Owned | % of Total Voting Power(1) | ||||||||||||||||||||||||||||

| Class A | Class B | ||||||||||||||||||||||||||||

| Shares | % | Shares | % | ||||||||||||||||||||||||||

5% Shareholders | |||||||||||||||||||||||||||||

HR Holdings LLC(2) | — | — | % | 14,955,142 | 79.77 | % | 31.05 | % | |||||||||||||||||||||

Madrone Partners L.P.(3) | 25,339,276 | 8.61 | % | — | — | 5.26 | % | ||||||||||||||||||||||

BlackRock, Inc.(4) | 22,305,392 | 7.58 | % | — | — | 4.63 | % | ||||||||||||||||||||||

The Pontes Family Trust (5) | 76,449 | 0.03 | % | 1,823,680 | 9.73 | % | 3.80 | % | |||||||||||||||||||||

VCK Investment Fund Limited (SAC A) (6) | 3,737,449 | 1.27 | % | 1,286,022 | 6.86 | % | 3.45 | % | |||||||||||||||||||||

(1) | Percentage of total voting power represents voting power with respect to all of our Class A common shares and Class B common shares, as a single class. Holders of our Class B common shares are entitled to 10 votes per share, whereas holders of our Class A common shares are entitled to one vote per share. | ||||

(2) | Mr. Street may be deemed to have voting and dispositive power over the shares of HR Holdings LLC and Cakubran Holdings Ltd that are distributed as follows (i) 683,926 Class B and 507,836 Class A Common shares held of record by Cakubran Holdings Ltd., a company controlled by VCK Investment Fund Limited (SAC A), and (ii) 14,955,142 Class B Common shares held of record by HR Holdings LLC, a company also controlled by VCK A. Please refer to footnote 6 for additional information around VCK A. The business address of HR Holdings LLC is 108 West 13th Street, Wilmington, Delaware 19801 - New Castle. The business address of Cakubran Holdings Ltd is Intertrust Corporate Services (Cayman) Limited, 190, Elgin Avenue, George Town, Grand Cayman KY1-9005, Cayman Islands. | ||||

(3) | The information in the above table concerning Madrone Partners L.P. was obtained from a Schedule 13F filed with the Securities and Exchange Commission by Madrone Partners L.P. on December 31, 2022 reporting beneficial ownership at December 31, 2022. Consists of common shares held of record by Madrone Partners, L.P. Madrone Capital Partners, LLC is the general partner of Madrone Partners, L.P. Thomas Patterson, Greg Penner and Jameson McJunkin are managing members of Madrone Capital Partners, LLC and may be deemed to have voting and dispositive power over the shares held by Madrone Partners, L.P. The address of each of these entities is 1149 Chestnut Street, Suite 200, Menlo Park, CA 94025. | ||||

(4) | The information in the above table concerning BlackRock, Inc. was obtained from a Schedule 13G filed with the Securities and Exchange Commission by BlackRock, Inc.. on February 3, 2023 reporting beneficial ownership at December 31, 2022. BlackRock, Inc. beneficially owns 22,305,392 of our common shares; has sole voting power with respect to 21,040,643 shares, and sole dispositive power with respect to 22,305,392 shares. The address of BlackRock, Inc.'s principal business office is 55 East 52nd Street, New York, NY 10055. | ||||

(5) | VITI Jersey Limited Partnership (“VITI”) is the record holder of 8,452,383 Class A Common shares. VITI is a limited partnership, the sole limited partner of which is Vistra Trust Company (Jersey) Limited acting in its capacity as trustee of the Old Bridges Trust. The general partner of VITI is also wholly owned by the trustee of the Old Bridges Trust. The Old Bridges Trust was settled by Mr. Pontes, who retains a right of revocation over the Old Bridges Trust and is therefore the ultimate beneficial owner of the assets of the Old Bridges Trust. Vistra Trust Company (Jersey) Limited also acts in capacity as trustee of The Pontes Family Trust, which is the beneficial owner of 1,823,680 Class B common shares and 76,449 Class A common shares. The Pontes Family Trust was settled by Mr. Pontes, who retains a right of revocation over The Pontes Family Trust and is therefore the ultimate beneficial owner of the assets of the Pontes Family Trust, however share voting and investment power lies with the trustees of The Pontes Family Trust. Mr. Pontes also holds interests in 230,822 Class A Common shares through TCB Investments Limited Partnership (“TCB”), a Bahamian limited partnership. The business address of VITI is 4th Floor, St Paul's Gate, 22/24 New Street, St Helier, Jersey JE14TR. The business address of TCB is 2nd Floor, Goodman's Bay Corporate CentreWest Bay Street,P.O. Box SP-61567Nassau, Bahamas. The address of Old Bridges Trust and The Pontes Family Trust is 4th Floor, St Paul's Gate, 22/24 New Street, St Helier, Jersey JE14TR. | ||||

(6) | Mr Street is the primary investor of VCK Investment Fund Limited (SAC) A ("VCK A"), a segregated account of VCK Investment Fund Limited (SAC) ("VCK") which is the owner of 1,286,022 Class B and 3,737,449 Class A Common Shares held of record by VCK Investment Fund Limited (SAC) A (“VCK A”), a segregated account of VCK Investment Fund Limited (SAC) (“VCK”). The business address of VCK A is 2nd floor Bahamas Financial Centre, Shirley & Charlotte Streets, Nassau, Bahamas. | ||||

| Risk Factor | Asset/ Liability | VaR 1 day (thousand) | VaR 10 days (thousand) | VaR 60 days (thousand) | ||||||||||||||||||||||

| Interest rates | Account receivables from credit card issuers | 123 | 491 | 575 | ||||||||||||||||||||||

| Foreign currency exchange | US$ denominated assets/liabilities/derivatives | 764 | 2,443 | 6,881 | ||||||||||||||||||||||

Equity price(i) | Traded securities | 19,355 | 43,730 | 99,469 | ||||||||||||||||||||||

(i) | We held equity stakes of Banco Inter S.A. (B3: BIDI3; BIDI4; BIDI11). The VaR figures are calculated based on historical data and are suited to estimate the potential financial loss incurred by us using a level of confidence of 95% on normal market conditions. | ||||

| Notional in US$ | Notional in R$ | Pay rate in local currency | Trade date | Due date | Fair value as of December 31, 2022 – Asset (Liability) | Loss recognized in income for the twelve months ended December 31, 2022 | Loss recognized in OCI for the twelve months ended December 31, 2022 | |||||||||||||||||||||||||||||||||||||

| (in US$ million) | ||||||||||||||||||||||||||||||||||||||||||||

| 50,000 | 248,500 | CDI + 2.94% | June 23, 2021 | June 16, 2028 | (15.3) | (46.2) | (22.5) | |||||||||||||||||||||||||||||||||||||

| 50,000 | 247,000 | CDI + 2.90% | June 24, 2021 | June 16, 2028 | (14.8) | (52.8) | (22.2) | |||||||||||||||||||||||||||||||||||||

| 50,000 | 248,500 | CDI + 2.90% | June 24, 2021 | June 16, 2028 | (16.0) | (45.4) | (21.8) | |||||||||||||||||||||||||||||||||||||

| 75,000 | 375,263 | CDI + 2.99% | June 30, 2021 | June 16, 2028 | (26.2) | (53.8) | (31.7) | |||||||||||||||||||||||||||||||||||||

| 50,000 | 250,700 | CDI + 2.99% | June 30, 2021 | June 16, 2028 | (17.8) | (38.4) | (21.0) | |||||||||||||||||||||||||||||||||||||

| 50,000 | 250,110 | CDI + 2.98% | June 30, 2021 | June 16, 2028 | (17.4) | (45.6) | (21.1) | |||||||||||||||||||||||||||||||||||||

| 25,000 | 127,353 | CDI + 2.99% | July 15, 2021 | June 16, 2028 | (10.4) | (30.2) | (10.0) | |||||||||||||||||||||||||||||||||||||

| 25,000 | 127,353 | CDI + 2.99% | July 15, 2021 | June 16, 2028 | (10.5) | (23.5) | (10.0) | |||||||||||||||||||||||||||||||||||||

| 50,000 | 259,890 | CDI + 2.96% | July 16, 2021 | June 16, 2028 | (24.8) | (39.2) | (18.6) | |||||||||||||||||||||||||||||||||||||

| 25,000 | 131,025 | CDI + 3.00% | 06/ago/21 | June 16, 2028 | (12.1) | (30.4) | (9.7) | |||||||||||||||||||||||||||||||||||||

| 25,000 | 130,033 | CDI + 2.85% | 10/ago/21 | June 16, 2028 | (12.9) | (30.4) | (9.3) | |||||||||||||||||||||||||||||||||||||

| 25,000 | 130,878 | CDI + 2.81% | 11/ago/21 | June 16, 2028 | (12.8) | (23.3) | (9.4) | |||||||||||||||||||||||||||||||||||||

| Net amount | (190.9) | (459.3) | (207.2) | |||||||||||||||||||||||||||||||||||||||||

| Companies | Date of operation | Total assets | Percentage of StoneCo.'s total assets | Liquid assets | Percentage of StoneCo.'s net assets | |||||||||||||||||||||||||||

| (R$ millions) | (%) | (R$ millions) | (%) | |||||||||||||||||||||||||||||

| Reclame Aqui Group | February 17, 2022 | 83.1 | 0.20% | 65.5 | 0.51% | |||||||||||||||||||||||||||

Hubcount Tecnologia S.A. | August 31, 2022 | 1.5 | 0.01% | 0.7 | 0.01% | |||||||||||||||||||||||||||

| Total | 84.6 | 0.21% | 66.2 | 0.52% | ||||||||||||||||||||||||||||

| Companies | Date of operation | Net revenue | Percentage of net revenue - StoneCo | Net income (loss) for the period | Percentage Net income (loss) for the period - StoneCo | |||||||||||||||||||||||||||

| (R$ millions) | (%) | (R$ millions) | (%) | |||||||||||||||||||||||||||||

| Reclame Aqui Group | February 17, 2022 | 75.9 | 0.79 | % | 5.4 | (1.03) | % | |||||||||||||||||||||||||

Hubcount Tecnologia S.A. | August 31, 2022 | 2.1 | 0.02 | % | 0.2 | (0.04) | % | |||||||||||||||||||||||||

| Total | 78.0 | 0.81 | % | 5.6 | (1.07) | % | ||||||||||||||||||||||||||

| 2022 | 2021 | ||||||||||

| (in thousands of reais) | |||||||||||

Audit fees | 6,482.1 | 6,970.1 | |||||||||

Audit-related fees | — | 400.0 | |||||||||

Total | 6,482.1 | 7,370.1 | |||||||||

| 4.21 | |||||

| 4.23 | StoneCo. Ltd. Long-Term Incentive Plan (incorporated herein by reference to Exhibit 99 to the Company’s Registration Statement on Form S-8 (File No. 333-265382) filed with the SEC on June 2, 2022). | ||||

4.24* | |||||

| 4.25* | |||||

| 8.1* | |||||

| 12.1* | |||||

| 12.2* | |||||

| 13.1* | |||||

| 13.2* | |||||

| 15.1* | |||||

| 101.INS* | Inline XBRL Instance Document | ||||

| 101.SCH* | Inline XBRL Taxonomy Extension Schema Document | ||||

| 101.CAL* | Inline XBRL Taxonomy Extension Calculation Linkbase Document | ||||

| 101.DEF* | Inline XBRL Taxonomy Extension Definition Linkbase Document | ||||

| 101.LAB* | Inline XBRL Taxonomy Extension Label Linkbase Document | ||||

| 101.PRE* | Inline XBRL Taxonomy Extension Presentation Linkbase Document | ||||

| 104* | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) | ||||

| * | Filed with this Annual Report on Form 20-F. | ||||

| ** | In accordance with Rule 402 of Regulation S-T, the information in this exhibit shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. | ||||