| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. | ||||

| o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. | |||||||

| For the transition period from __________ to __________ | ||||||||

| COMMISSION FILE NUMBER | ||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||||||||||

| ☒ | Smaller Reporting Company | ☐ | ||||||||||||

| Emerging Growth Company | ||||||||||||||

| Page Number | |||||

PART I | |||||

Item 1. Business | |||||

Item IA. Risk Factors | |||||

Item 2. Properties | |||||

Item 3. Legal Proceedings | |||||

Item 4. Mine Safety Disclosures | |||||

PART II | |||||

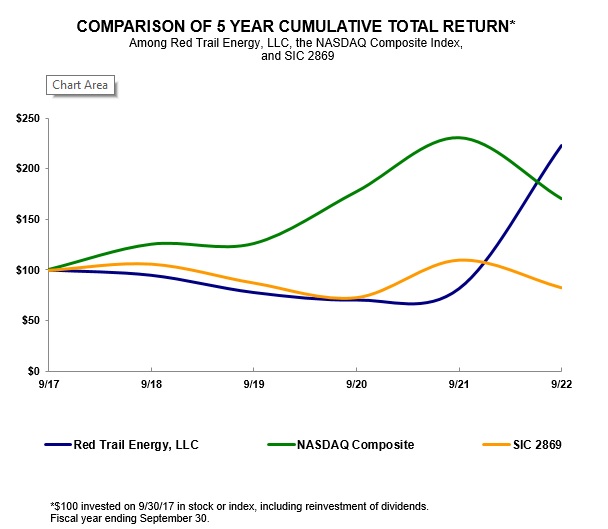

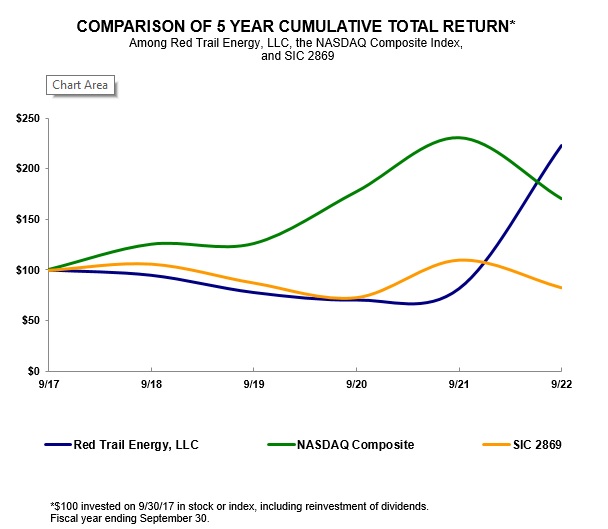

Item 5. Market for Registrant's Common Equity, Related Member Matters and Issuer Purchases of Equity Securities | |||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations | |||||

Item 7A. Quantitative and Qualitative Disclosures About Market Risk | |||||

Item 8. Financial Statements and Supplementary Data | |||||

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||

Item 9A. Controls and Procedures | |||||

Item 9B. Other Information | |||||

PART III | |||||

Item 10. Directors, Executive Officers and Corporate Governance | |||||

Item 11. Executive Compensation | |||||

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Member Matters | |||||

Item 13. Certain Relationships and Related Transactions, and Director Independence | |||||

Item 14. Principal Accountant Fees and Services | |||||

PART IV | |||||

Item 15. Exhibits and Financial Statement Schedules | |||||

SIGNATURES | |||||

| Product | Fiscal Year 2022 | Fiscal Year 2021 | Fiscal Year 2020 | |||||||||||||||||

| Ethanol | 77.2 | % | 76.9 | % | 76.1 | % | ||||||||||||||

| Distillers Grains | 16.5 | % | 17.8 | % | 19.4 | % | ||||||||||||||

| Corn Oil | 5.7 | % | 4.4 | % | 4.0 | % | ||||||||||||||

| Company | Current Capacity (MMgy) | Percent of Total Industry Capacity | ||||||||||||

| POET Biorefining | 2,811 | 16.1 | % | |||||||||||

| Valero Renewable Fuels | 1,747 | 10.0 | % | |||||||||||

| Archer Daniels Midland | 1,613 | 9 | % | |||||||||||

| Green Plains Renewable Energy | 958 | 5.5 | % | |||||||||||

| TOTAL | 7,129 | 40.7 | % | |||||||||||

| Quarter | Low Price | High Price | Average Price | # of Units Traded | ||||||||||||||||||||||

2021 1st | $ | 0.95 | $ | 0.99 | $ | 0.97 | 45,000 | |||||||||||||||||||

2021 2nd | $ | 0.93 | $ | 0.93 | $ | 0.93 | 10,000 | |||||||||||||||||||

2021 3rd | $ | 0.93 | $ | 1.00 | $ | 0.95 | 366,000 | |||||||||||||||||||

2021 4th | $ | 1.03 | $ | 1.34 | $ | 1.20 | 50,000 | |||||||||||||||||||

2022 1st | $ | 1.45 | $ | 1.92 | $ | 1.76 | 70,000 | |||||||||||||||||||

2022 2nd | $ | 2.00 | $ | 2.50 | $ | 2.13 | 57,457 | |||||||||||||||||||

2022 3rd | $ | 2.00 | $ | 2.25 | $ | 2.21 | 217,875 | |||||||||||||||||||

2022 4th | $ | 2.10 | $ | 2.25 | $ | 2.21 | 126,052 | |||||||||||||||||||

| Year Ended September 30, 2022 | Year Ended September 30, 2021 | ||||||||||||||||||||||

| Statement of Operations Data | Amount | % | Amount | % | |||||||||||||||||||

| Revenues | $ | 217,135,121 | 100.00 | $ | 119,084,611 | 100.00 | |||||||||||||||||

| Cost of Goods Sold | 190,828,171 | 87.88 | 104,115,501 | 87.43 | |||||||||||||||||||

| Gross Profit | 26,306,950 | 12.12 | 14,969,110 | 12.57 | |||||||||||||||||||

| General and Administrative Expenses | 3,801,583 | 1.75 | 3,239,245 | 2.72 | |||||||||||||||||||

| Operating Income | 22,505,367 | 10.36 | 11,729,865 | 9.85 | |||||||||||||||||||

| Other Income | 6,991,313 | 3.22 | 895,814 | 0.75 | |||||||||||||||||||

| Net Income | $ | 29,496,680 | 13.58 | $ | 12,625,679 | 10.60 | |||||||||||||||||

| Year Ended September 30, 2022 | Year Ended September 30, 2021 | |||||||||||||

| Production: | ||||||||||||||

| Ethanol sold (gallons) | 66,268,466 | 51,893,094 | ||||||||||||

| Dried distillers grains sold (tons) | 94,077 | 62,904 | ||||||||||||

| Modified distillers grains sold (tons) | 121,043 | 127,718 | ||||||||||||

| Corn oil sold (pounds) | 18,466,990 | 12,472,550 | ||||||||||||

| Revenues: | ||||||||||||||

| Ethanol average price per gallon (net of hedging) | $ | 2.52 | $ | 1.74 | ||||||||||

| Dried distillers grains average price per ton | 231.16 | 178.06 | ||||||||||||

| Modified distillers grains average price per ton | 114.76 | 78.46 | ||||||||||||

| Corn oil average price per pound | 0.66 | 0.41 | ||||||||||||

| Primary Inputs: | ||||||||||||||

| Corn ground (bushels) | 22,338,824 | 17,717,130 | ||||||||||||

Natural gas (MMBtu) | 1,571,101 | 1,261,294 | ||||||||||||

| Costs of Primary Inputs: | ||||||||||||||

| Corn average price per bushel (net of hedging) | $ | 6.77 | $ | 4.46 | ||||||||||

| Natural gas average price per MMBtu (net of hedging) | 6.13 | 2.77 | ||||||||||||

| Other Costs (per gallon of ethanol sold): | ||||||||||||||

| Chemical and additive costs | $ | 0.085 | $ | 0.083 | ||||||||||

| Denaturant cost | 0.051 | 0.035 | ||||||||||||

| Electricity cost | 0.052 | 0.045 | ||||||||||||

| Direct labor cost | 0.072 | 0.080 | ||||||||||||

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | ||||||||||||||||||||||

| Statement of Operations Data | Amount | % | Amount | % | |||||||||||||||||||

| Revenues | $ | 119,084,611 | 100.00 | $ | 94,175,793 | 100.00 | |||||||||||||||||

| Cost of Goods Sold | 104,115,501 | 87.43 | 90,134,689 | 95.71 | |||||||||||||||||||

| Gross Profit (Loss) | 14,969,110 | 12.57 | 4,041,104 | 4.29 | |||||||||||||||||||

| General and Administrative Expenses | 3,239,245 | 2.72 | 4,329,824 | 4.60 | |||||||||||||||||||

| Operating Loss | 11,729,865 | 9.85 | (288,720) | (0.31) | |||||||||||||||||||

| Other Income (Expense) | 895,814 | 0.75 | 295,308 | 0.31 | |||||||||||||||||||

| Net Profit (Loss) | $ | 12,625,679 | 10.60 | $ | 6,588 | 0.01 | |||||||||||||||||

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | |||||||||||||

| Production: | ||||||||||||||

| Ethanol sold (gallons) | 51,893,094 | 56,510,517 | ||||||||||||

| Industrial ethanol sold (gallons) | — | 1,130,347 | ||||||||||||

| Dried distillers grains sold (tons) | 62,904 | 91,073 | ||||||||||||

| Modified distillers grains sold (tons) | 127,718 | 109,691 | ||||||||||||

| Corn oil sold (pounds) | 12,472,550 | 15,385,430 | ||||||||||||

| Revenues: | ||||||||||||||

| Ethanol average price per gallon (net of hedging) | $ | 1.74 | $ | 1.20 | ||||||||||

| Industrial ethanol average price per gallon | — | 3.27 | ||||||||||||

| Dried distillers grains average price per ton | 178.06 | 128.63 | ||||||||||||

| Modified distillers grains average price per ton | 78.46 | 59.20 | ||||||||||||

| Corn oil average price per pound | 0.41 | 0.24 | ||||||||||||

| Primary Inputs: | ||||||||||||||

| Corn ground (bushels) | 17,717,130 | 21,346,380 | ||||||||||||

Natural gas (MMBtu) | 1,261,294 | 1,425,450 | ||||||||||||

| Costs of Primary Inputs: | ||||||||||||||

| Corn average price per bushel (net of hedging) | $ | 4.46 | $ | 2.98 | ||||||||||

| Natural gas average price per MMBtu (net of hedging) | 2.77 | 2.06 | ||||||||||||

| Other Costs (per gallon of ethanol sold): | ||||||||||||||

| Chemical and additive costs | $ | 0.083 | $ | 0.077 | ||||||||||

| Denaturant cost | 0.035 | 0.030 | ||||||||||||

| Electricity cost | 0.045 | 0.042 | ||||||||||||

| Direct labor cost | 0.080 | 0.067 | ||||||||||||

| 2022 | 2021 | |||||||||||||

| Net cash provided by operating activities | $ | 24,059,078 | $ | 19,721,836 | ||||||||||

| Net cash (used in) investing activities | (20,328,018) | (23,053,910) | ||||||||||||

| Net cash provided by (used in) financing activities | 2,205,711 | (2,565,171) | ||||||||||||

| Net increase (decrease) in cash | $ | 5,936,771 | $ | (5,897,245) | ||||||||||

| Cash and equivalents, end of period | $ | 11,152,015 | $ | 5,215,244 | ||||||||||

| 2021 | 2020 | |||||||||||||

| Net cash provided by operating activities | $ | 19,721,836 | $ | 3,292,949 | ||||||||||

| Net cash (used in) investing activities | (23,053,910) | (8,871,441) | ||||||||||||

| Net cash (used in) financing activities | (2,565,171) | 6,168,912 | ||||||||||||

| Net increase (decrease) in cash | $ | (5,897,245) | $ | 590,420 | ||||||||||

| Cash and equivalents, end of period | $ | 5,215,244 | $ | 11,112,489 | ||||||||||

| Contractual Obligations: | Total | Less than 1 Yr | 1-3 Years | 3-5 Years | |||||||||||||||||||

| Long-term debt obligations * | $ | 19,160,917 | $ | 18,747,058 | $ | 413,859 | $ | — | |||||||||||||||

| Corn purchases * | 14,195,255 | 14,195,255 | — | — | |||||||||||||||||||

| Water purchases | 1,484,000 | 424,000 | 1,060,000 | — | |||||||||||||||||||

| Operating lease obligations | 405,631 | 271,968 | 130,546 | 3,117 | |||||||||||||||||||

| Finance leases | 9,867 | 4,576 | 5,291 | — | |||||||||||||||||||

| Total | $ | 35,255,670 | $ | 33,642,857 | $ | 1,609,696 | $ | 3,117 | |||||||||||||||

| Estimated Volume Requirements for the next 12 months (net of forward and futures contracts) | Unit of Measure | Hypothetical Adverse Change in Price | Approximate Adverse Change to Income | ||||||||||||||||||||

| Ethanol | 63,900,000 | Gallons | 10 | % | $ | (14,697,000) | |||||||||||||||||

| Corn | 20,600,000 | Bushels | 10 | % | $ | (14,008,000) | |||||||||||||||||

| Natural gas | 1,664,000 | MMBtu | 10 | % | $ | (1,464,000) | |||||||||||||||||

| Estimated Volume Requirements for the next 12 months (net of forward and futures contracts) | Unit of Measure | Hypothetical Adverse Change in Price | Approximate Adverse Change to Income | ||||||||||||||||||||

| Ethanol | 63,900,000 | Gallons | 10 | % | $ | (13,419,000) | |||||||||||||||||

| Corn | 17,135,000 | Bushels | 10 | % | $ | (11,138,000) | |||||||||||||||||

| Natural gas | 1,664,000 | MMBtu | 10 | % | $ | (649,000) | |||||||||||||||||

| ASSETS | September 30, 2022 | September 30, 2021 | ||||||||||||

| Current Assets | ||||||||||||||

| Cash and equivalents | $ | $ | ||||||||||||

| Restricted cash | ||||||||||||||

| Accounts receivable, net, primarily related party | ||||||||||||||

| Commodities derivative instruments, at fair value | ||||||||||||||

| Inventory | ||||||||||||||

| Prepaid expenses | ||||||||||||||

| Total current assets | ||||||||||||||

| Property, Plant and Equipment | ||||||||||||||

| Land | ||||||||||||||

| Land improvements | ||||||||||||||

| Buildings | ||||||||||||||

| Plant and equipment and railroad | ||||||||||||||

| Construction in progress | ||||||||||||||

| Less accumulated depreciation | ||||||||||||||

| Net property, plant and equipment | ||||||||||||||

| Other Assets | ||||||||||||||

| Right of use operating lease assets, net | ||||||||||||||

| Investment in RPMG | ||||||||||||||

| Patronage equity | ||||||||||||||

| Deposits | ||||||||||||||

| Total other assets | ||||||||||||||

| Total Assets | $ | $ | ||||||||||||

| LIABILITIES AND MEMBERS' EQUITY | September 30, 2022 | September 30, 2021 | ||||||||||||

| Current Liabilities | ||||||||||||||

| Disbursements in excess of bank balances | $ | $ | ||||||||||||

| Accounts payable | ||||||||||||||

| Accrued expenses | ||||||||||||||

| Commodities derivative instruments, at fair value | ||||||||||||||

| Accrued loss on firm purchase commitments (see note 5) | ||||||||||||||

| Customer deposits | ||||||||||||||

| Current maturities of notes payable | ||||||||||||||

| Current portion of operating lease liabilities | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Long-Term Liabilities | ||||||||||||||

| Notes payable, less current maturities | ||||||||||||||

| Long-term operating lease liabilities | ||||||||||||||

| Total long-term liabilities | ||||||||||||||

| Commitments and Contingencies (Notes 5, 6, 8, 10 and 14) | ||||||||||||||

Members’ Equity ( | ||||||||||||||

| Total Liabilities and Members’ Equity | $ | $ | ||||||||||||

| Year Ended | Year Ended | Year Ended | |||||||||||||||

| September 30, 2022 | September 30, 2021 | September 30, 2020 | |||||||||||||||

| Revenues, primarily related party | $ | $ | $ | ||||||||||||||

| Cost of Goods Sold | |||||||||||||||||

| Cost of goods sold | |||||||||||||||||

| Lower of cost or net realizable value adjustment | |||||||||||||||||

| Loss on firm purchase commitments | |||||||||||||||||

| Total Cost of Goods Sold | |||||||||||||||||

| Gross Profit | |||||||||||||||||

| General and Administrative Expenses | |||||||||||||||||

| Operating Income (Loss) | ( | ||||||||||||||||

| Other Income (Expense) | |||||||||||||||||

| Interest income | |||||||||||||||||

| Other income | |||||||||||||||||

| Interest expense | ( | ( | ( | ||||||||||||||

| Total other income (expense), net | |||||||||||||||||

| Net Income | $ | $ | $ | ||||||||||||||

| Weighted Average Units Outstanding | |||||||||||||||||

| Basic | |||||||||||||||||

| Diluted | |||||||||||||||||

| Net Income (Loss) Per Unit | |||||||||||||||||

| Basic | $ | $ | $ | ||||||||||||||

| Diluted | $ | $ | $ | ||||||||||||||

| Class A Member Units | Treasury Units | ||||||||||||||||||||||||||||||||||||||||

| Units (a) | Amount | Additional Paid in Capital | Accumulated Retained Earnings | Units | Amount | Total Member Equity | |||||||||||||||||||||||||||||||||||

| Balances - September 30, 2019 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||

| Units Issued | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Units repurchased and retired | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Distribution | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Net Income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Balances - September 30, 2020 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||

| Units Issued | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Units repurchased and retired | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Distribution | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||

| Net Income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Balances - September 30, 2021 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||

| Units Issued | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Units repurchased and retired | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Distribution | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||

| Net Income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Balances - September 30, 2022 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||

| (a) - Amounts shown represent member units outstanding. | |||||||||||||||||||||||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | |||||||||||||||

| September 30, 2022 | September 30, 2021 | September 30, 2020 | |||||||||||||||

| Cash Flows from Operating Activities | |||||||||||||||||

| Net income | $ | $ | $ | ||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| (Gain) loss on disposal of fixed assets | ( | ||||||||||||||||

| Change in fair value of derivative instruments | ( | ||||||||||||||||

| Accrued purchase commitment losses (gains) | ( | ||||||||||||||||

| Lower of cost or net realizable value adjustment | |||||||||||||||||

| Loss on firm purchase commitments | |||||||||||||||||

| Noncash patronage equity | ( | ( | ( | ||||||||||||||

| Loan forgiveness | ( | ( | |||||||||||||||

| Change in operating assets and liabilities: | |||||||||||||||||

| Accounts receivable, net, primarily related party | ( | ||||||||||||||||

| Inventory | ( | ( | ( | ||||||||||||||

| Prepaid expenses | ( | ( | ( | ||||||||||||||

| Customer deposits | ( | ||||||||||||||||

| Accounts payable and accrued expenses | ( | ||||||||||||||||

| Net cash provided by operating activities | |||||||||||||||||

| Cash Flows from Investing Activities | |||||||||||||||||

| Proceeds from disposal of fixed assets | |||||||||||||||||

| Capital expenditures | ( | ( | ( | ||||||||||||||

| Net cash (used in) investing activities | ( | ( | ( | ||||||||||||||

| Cash Flows from Financing Activities | |||||||||||||||||

| Disbursements in excess of bank balances | ( | ||||||||||||||||

| Dividends paid | ( | ( | |||||||||||||||

| Proceeds from notes payable | |||||||||||||||||

| Debt and finance lease repayments | ( | ( | ( | ||||||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||||||||

| Net Increase (Decrease) in Cash, Cash Equivalents and Restricted Cash | ( | ||||||||||||||||

| Cash, Cash Equivalents and Restricted Cash - Beginning of Period | |||||||||||||||||

| Cash, Cash Equivalents and Restricted Cash - End of Period | $ | $ | $ | ||||||||||||||

| Reconciliation of Cash, Cash Equivalents and Restricted Cash | |||||||||||||||||

| Cash and cash equivalents | $ | $ | $ | ||||||||||||||

| Restricted Cash | |||||||||||||||||

| Total Cash, Cash Equivalents and Restricted Cash | $ | $ | $ | ||||||||||||||

| Supplemental Disclosure of Cash Flow Information | |||||||||||||||||

| Interest paid | $ | $ | $ | ||||||||||||||

| Noncash Investing and Financing Activities | |||||||||||||||||

| Finance lease asset acquired | $ | $ | $ | ||||||||||||||

| Operating lease asset acquired | $ | $ | $ | ||||||||||||||

| Capital expenditures in accounts payable | $ | $ | $ | ||||||||||||||

| Capitalized Interest | $ | $ | $ | ||||||||||||||

| Minimum Years | Maximum Years | |||||||

| Land improvements | ||||||||

| Buildings | ||||||||

| Plant and equipment | ||||||||

| Railroad | ||||||||

| Revenues | For the twelve months ended September 30, 2022 (audited) | For the twelve months ended September 30, 2021 (audited) | For the twelve months ended September 30, 2020 (audited) | |||||||||||||||||

| Ethanol, E85 and Industrial Ethanol | $ | $ | $ | |||||||||||||||||

| Distillers Grains | ||||||||||||||||||||

| Syrup | ||||||||||||||||||||

| Corn Oil | ||||||||||||||||||||

| Other | ||||||||||||||||||||

| Total revenue from contracts with customers | $ | $ | $ | |||||||||||||||||

| For the twelve months ended September 30, 2022 (audited) | For the twelve months ended September 30, 2021 (audited) | For the twelve months ended September 30, 2020 (audited) | ||||||||||||||||||

| Accounts receivable | $ | $ | $ | |||||||||||||||||

| Customer deposits | $ | $ | $ | |||||||||||||||||

| As of: | September 30, 2022 | September 30, 2021 | ||||||||||||||||||||||||||||||

| Contract Type | # of Contracts | Notional Amount (Qty) | Fair Value | # of Contracts | Notional Amount (Qty) | Fair Value | ||||||||||||||||||||||||||

| Corn options | bushels | $ | ( | bushels | $ | |||||||||||||||||||||||||||

| Soybean oil options | gal | ( | gal | |||||||||||||||||||||||||||||

| Total fair value | $ | ( | $ | |||||||||||||||||||||||||||||

| Amounts are recorded separately on the balance sheet - negative numbers represent liabilities | ||||||||||||||||||||||||||||||||

| Derivatives not designated as hedging instruments: | ||||||||||||||

| Balance Sheet - as of September 30, 2022 | Asset | Liability | ||||||||||||

| Commodity derivative instruments, at fair value | $ | $ | ||||||||||||

| Total derivatives not designated as hedging instruments for accounting purposes | $ | $ | ||||||||||||

| Balance Sheet - as of September 30, 2021 | Asset | Liability | ||||||||||||

| Commodity derivative instruments, at fair value | $ | $ | ||||||||||||

| Total derivatives not designated as hedging instruments for accounting purposes | $ | $ | ||||||||||||

| Statement of Operations Income/(expense) | Location of gain (loss) in fair value recognized in income | Amount of gain (loss) recognized in income during the year ended September 30, 2022 | Amount of gain (loss) recognized in income during the year ended September 30, 2021 | Amount of gain (loss) recognized in income during the year ended September 30, 2020 | ||||||||||||||||||||||

| Corn derivative instruments | Cost of Goods Sold | $ | $ | $ | ( | |||||||||||||||||||||

| Ethanol derivative instruments | Revenue | |||||||||||||||||||||||||

| Natural gas derivative instruments | Cost of Goods Sold | ( | ( | |||||||||||||||||||||||

| Total | $ | $ | $ | ( | ||||||||||||||||||||||

| As of | September 30, 2022 | September 30, 2021 | ||||||||||||

| Raw materials, including corn, chemicals and supplies | $ | $ | ||||||||||||

| Work in process | ||||||||||||||

| Finished goods, including ethanol and distillers grains | ||||||||||||||

| Spare parts | ||||||||||||||

| Total inventory | $ | $ | ||||||||||||

| For the year ended September 30, 2022 | For the year ended September 30, 2021 | For the year ended September 30, 2020 | ||||||||||||||||||

| Loss on firm purchase commitments | $ | $ | $ | |||||||||||||||||

| Loss on lower of cost or net realizable value adjustment for inventory on hand | ||||||||||||||||||||

| Total loss on lower of cost or market adjustments | $ | $ | $ | |||||||||||||||||

| Schedule of debt maturities for the twelve months ended September 30 | Totals | |||||||

| 2023 | $ | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| Total | $ | |||||||

| Fair Value Measurement Using | |||||||||||||||||||||||||||||

| Carrying Amount as of September 30, 2022 | Fair Value as of September 30, 2022 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Commodities derivative instruments | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Fair Value Measurement Using | |||||||||||||||||||||||||||||

| Carrying Amount as of September 30, 2021 | Fair Value as of September 30, 2021 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Commodities derivative instruments | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| As of | September 30, 2022 | September 30, 2021 | |||||||||

| Equipment | $ | $ | |||||||||

| Less accumulated amortization | ( | ( | |||||||||

| Net equipment under finance lease | $ | $ | |||||||||

| Operating Leases | Financing Leases | |||||||||||||

| 2023 | $ | $ | ||||||||||||

| 2024 | ||||||||||||||

| 2025 | ||||||||||||||

| 2026 | ||||||||||||||

| 2027 | ||||||||||||||

| Total minimum lease commitments | $ | $ | ||||||||||||

| Less amount representing interest | ||||||||||||||

| Present value of minimum lease commitments included in notes payable on the balance sheet | $ | |||||||||||||

| September 30, 2022 | September 30, 2021 | ||||||||||||||||

| Balance Sheet | |||||||||||||||||

| Accounts receivable | $ | $ | |||||||||||||||

| Accounts Payable | |||||||||||||||||

| Accrued Expenses | |||||||||||||||||

| For the year ended September 30, 2022 | For the year ended September 30, 2021 | For the year ended September 30, 2020 | |||||||||||||||

| Statement of Operations | |||||||||||||||||

| Revenues | $ | $ | $ | ||||||||||||||

| Cost of goods sold | |||||||||||||||||

| General and administrative | |||||||||||||||||

| Other income /expense | |||||||||||||||||

| Inventory Purchases | $ | $ | $ | ||||||||||||||

| Year Ended September 30, 2022 | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||

| Gross profit (loss) | ( | |||||||||||||

| Operating income (loss) | ( | |||||||||||||

| Net income (loss) | ( | |||||||||||||

| Net income (loss) per unit-basic and diluted | ( | |||||||||||||

| Year Ended September 30, 2021 | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||

| Gross profit (loss) | ( | |||||||||||||

| Operating income (loss) | ( | |||||||||||||

| Net income (loss) | ( | |||||||||||||

| Net income (loss) per unit-basic and diluted | ( | |||||||||||||

| Year Ended September 30, 2020 | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||

| Gross profit (loss) | ( | ( | ||||||||||||

| Operating income (loss) | ( | ( | ||||||||||||

| Net income (loss) | ( | ( | ||||||||||||

| Net income (loss) per unit-basic and diluted | ( | ( | ||||||||||||

| Exhibit No. | Exhibit | Filed Herewith | Incorporated by Reference | ||||||||||||||

| 3.1 | Filed as Exhibit 3.1 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 3.2 | Filed as exhibit 3.1 to our Current Report on Form 8-K on August 6, 2008. (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 4.1 | Filed as Exhibit 4.1 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 4.2 | Filed as Exhibit 4.2 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 4.3 | Filed as Exhibit 4.3 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2021 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.1 | Filed as Exhibit 10.1 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.2 | Filed as Exhibit 10.10 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.3 | Filed as Exhibit 10.12 to the registrant's registration statement on Form 10-12G/A-3 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.4 | Filed as Exhibit 10.12 at Exhibit D to the registrant's registration statement on Form 10-12G/A-3 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.5 | Filed as Exhibit 10.19 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.6 | Filed as Exhibit 10.20 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.7 | Filed as Exhibit 10.21 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.8 | Filed as Exhibit 10.28 to the registrant's registration statement on Form 10-12G (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.9 | Filed as Exhibit 10.29 to the registrant's second amended registration statement on Form 10-12G/A (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.10 | Filed as Exhibit 10.30 to the registrant's second amended registration statement on Form 10-12G/A (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.11 | Filed as Exhibit 10.31 to the registrant's second amended registration statement on Form 10-12G/A (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.12 | Filed as Exhibit 10.34 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.13 | Filed as Exhibit 10.36 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.14 | Filed as Exhibit 10.37 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.15 | Filed as Exhibit 10.38 to our Annual Report on Form 10-K for the year ended December 31, 2006. (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.16 | Filed as Exhibit 10.41 to our Annual Report on Form 10-K for the year ended December 31, 2007 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.17 | Filed as Exhibit 10.42 to our Annual Report on Form 10-K for the year ended December 31, 2007 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.18 | Filed as Exhibit 10.44 to our Annual Report on Form 10-K for the year ended December 31, 2007 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.19 | Filed as Exhibit 10.1 to our Quarterly Report on Form 10-Q for the quarter ended March 31, 2008 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.20 | Filed as exhibit 99.1 to our Current Report on Form 8-K filed with the SEC on August 13, 2008 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.21 | Filed as exhibit 4.2 to our Current Report on Form 8-K filed with the SEC on June 1, 2009 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.22 | Filed as Exhibit 10.2 to our Quarterly Report on Form 10-Q for the quarter ended September 30, 2009 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.23 | Filed as Exhibit 10.1 to our Quarterly Report on Form 10-Q for the quarter ended June 30, 2010 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.24 | Filed as Exhibit 99.1 to our Current Report on Form 8-K filed with the SEC on December 20, 2010 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.25 | Filed as Exhibit 10.56 to our Current Report on Form 10-K for the fiscal year ended December 31, 2010 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.26 | Filed as Exhibit 99.2 to our Current Report on Form 8-K dated June 1, 2011 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.27 | Filed as Exhibit 10.1 to our Current Report on Form 10-Q for the quarter ended June 30, 2011 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.28 | Filed as Exhibit 10.60 to our Current Report on Form 10-K for the transition period ended September 30, 2011 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.29 | Filed as Exhibit 10.1 to our Current Report on Form 10-Q for the quarter ended March 31, 2012 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.30 | Filed as Exhibit 10.62 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2012 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.31 | Filed as Exhibit 10.63 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2012 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.32 | Filed as Exhibit 10.64 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2012 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.33 | Filed as Exhibit 10.31 to our Annual report on Form 10-K for the fiscal year ended September 30, 2013 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.34 | Filed as Exhibit 10.32 to our Annual report on Form 10-K for the fiscal year ended September 30, 2014 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.35 | Filed as Exhibit 10.1 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.36 | Filed as Exhibit 10.2 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.37 | Filed as Exhibit 10.3 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.38 | Filed as Exhibit 10.4 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.39 | Filed as Exhibit 10.5 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2015 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.40 | Filed as Exhibit 10.1 to our Quarterly report on Form 10-Q for the quarter ended March 31, 2017 and incorporated by reference herein. | ||||||||||||||||

| 10.41 | Filed as Exhibit 10.1 to our Quarterly report on Form 10-Q for the quarter ended December 31, 2019 and incorporated by reference herein. | ||||||||||||||||

| 10.42 | Filed as Exhibit 10.2 to our Quarterly report on Form 10-Q for the quarter ended December 31, 2019 and incorporated by reference herein. | ||||||||||||||||

| 10.43 | Filed as Exhibit 10.3 to our Quarterly report on Form 10-Q for the quarter ended December 31, 2019 and incorporated by reference herein. | ||||||||||||||||

| 10.44 | Filed as Exhibit 10.4 to our Quarterly report on Form 10-Q for the quarter ended December 31, 2019 and incorporated by reference herein. | ||||||||||||||||

| 10.45 | Filed as Exhibit 10.1 to our Quarterly Report on Form 10-Q for the quarter ended December 31, 2020 (000-52033) and incorporated by reference herein. | ||||||||||||||||

| 10.46 | Filed as Exhibit 10.2 to our Quarterly Report on Form 10-Q for the quarter ended December 31, 2020 (000-52033) and incorporated by reference herein | ||||||||||||||||

| 31.1 | X | ||||||||||||||||

| 31.2 | X | ||||||||||||||||

| 32.1 | X | ||||||||||||||||

| 32.2 | X | ||||||||||||||||

| 101.INS | Inline XBRL Instance Document | X | |||||||||||||||

| 101.SCH | Inline XBRL Schema Document | X | |||||||||||||||

| 101.CAL | Inline XBRL Calculation Document | X | |||||||||||||||

| 101.LAB | Inline XBRL Labels Linkbase Document | X | |||||||||||||||

| 101.PRE | Inline XBRL Presentation Linkbase Document | X | |||||||||||||||

| 101.DEF | Inline XBRL Definition Linkbase Document | X | |||||||||||||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in the Interactive Data Files submitted as Exhibit 101) | ||||||||||||||||

| RED TRAIL ENERGY, LLC | |||||||||||

| Date: | December 29, 2022 | /s/ Gerald Bachmeier | |||||||||

| Gerald Bachmeier | |||||||||||

| President and Chief Executive Officer | |||||||||||

| (Principal Executive Officer) | |||||||||||

| Date: | December 29, 2022 | /s/ Jodi Johnson | |||||||||

| Jodi Johnson | |||||||||||

| Chief Financial Officer | |||||||||||

| (Principal Financial and Accounting Officer) | |||||||||||

| Date: | December 29, 2022 | /s/ Gerald Bachmeier | |||||||||

| Gerald Bachmeier, Chief Executive Officer and President | |||||||||||

| (Principal Executive Officer) | |||||||||||

| Date: | December 29, 2022 | /s/ Jodi Johnson | |||||||||

| Jodi Johnson, Chief Financial Officer and Treasurer | |||||||||||

| (Principal Financial Officer) | |||||||||||

| Date: | December 29, 2022 | /s/ Sid Mauch | |||||||||

| Sid Mauch, Chairman and Governor | |||||||||||

| Date: | December 29, 2022 | /s/ Syd Lawler | |||||||||

| Syd Lawler, Governor | |||||||||||

| Date: | December 29, 2022 | /s/ Ambrose Hoff | |||||||||

| Ambrose Hoff, Secretary and Governor | |||||||||||

| Date: | December 29, 2022 | /s/ Ron Aberle | |||||||||

| Ron Aberle, Governor | |||||||||||

| Date: | December 29, 2022 | /s/ Mike Appert | |||||||||

| Mike Appert, Governor | |||||||||||

| Date: | December 29, 2022 | /s/ Frank Kirschenheiter | |||||||||

| Frank Kirschenheiter, Governor | |||||||||||

| Date: | December 29, 2022 | /s/ William A. Price | |||||||||

| William A. Price, Governor | |||||||||||

| Date: | December 29, 2022 | /s/ Gerald Bachmeier | |||||||||

Gerald Bachmeier Chief Executive Officer | |||||||||||

| Date: | December 29, 2022 | /s/ Jodi Johnson | |||||||||

Jodi Johnson Chief Financial Officer | |||||||||||

| /s/ Gerald Bachmeier | ||||||||

| Gerald Bachmeier | ||||||||

| Chief Executive Officer | ||||||||

| Dated: | December 29, 2022 | |||||||

| /s/ Jodi Johnson | ||||||||

| Jodi Johnson | ||||||||

| Chief Financial Officer | ||||||||

| Dated: | December 29, 2022 | |||||||

Balance Sheets Parenthetical - shares |

Sep. 30, 2022 |

Sep. 30, 2021 |

|---|---|---|

| Members’ Equity, Units issued and outstanding | 40,148,160 | 40,148,160 |

Statements of Operations - USD ($) |

12 Months Ended | ||

|---|---|---|---|

Sep. 30, 2022 |

Sep. 30, 2021 |

Sep. 30, 2020 |

|

| Revenues, primarily related party | $ 217,135,121 | $ 119,084,611 | $ 94,175,793 |

| Cost of Goods Sold | |||

| Cost of goods sold | 189,606,091 | 103,667,724 | 89,676,395 |

| Lower of cost or market inventory adjustment | 337,080 | 263,777 | 241,294 |

| Loss on firm purchase commitments | 885,000 | 184,000 | 217,000 |

| Total Cost of Goods Sold | 190,828,171 | 104,115,501 | 90,134,689 |

| Gross Profit | 26,306,950 | 14,969,110 | 4,041,104 |

| General and Administrative Expenses | 3,801,583 | 3,239,245 | 4,329,824 |

| Operating Income | 22,505,367 | 11,729,865 | (288,720) |

| Interest Income, Other | 31,524 | 55,691 | 117,143 |

| Other Income (Expense) | |||

| Other income | 6,983,063 | 890,818 | 187,626 |

| Interest expense | (23,274) | (50,695) | (9,461) |

| Total other income (expense), net | 6,991,313 | 895,814 | 295,308 |

| Net Income | $ 29,496,680 | $ 12,625,679 | $ 6,588 |

| Weighted Average Units Outstanding, Basic | 40,148,160 | 40,148,160 | 40,148,160 |

| Weighted Average Units Outstanding, Diluted | 40,148,160 | 40,148,160 | 40,148,160 |

| Net Income (Loss) Per Unit, Basic | $ 0.73 | $ 0.31 | $ 0 |

| Net Income (Loss) Per Unit, Diluted | $ 0.73 | $ 0.31 | $ 0 |

Statements of Changes in Members' Equity - USD ($) |

Total |

Common Stock [Member] |

Additional Paid-in Capital [Member] |

Retained Earnings [Member] |

Treasury Stock [Member] |

|||

|---|---|---|---|---|---|---|---|---|

| Members' Equity at Sep. 30, 2019 | $ (60,574,264) | $ (39,044,595) | $ (75,541) | $ (21,613,668) | $ (159,540) | |||

| Balance, Units at Sep. 30, 2019 | 40,148,160 | [1] | 140,000 | |||||

| Increase (Decrease) in Members' Equity [Roll Forward] | ||||||||

| Net Income | 6,588 | 6,588 | ||||||

| Balance, Units at Sep. 30, 2020 | 40,148,160 | 140,000 | ||||||

| Members' Equity at Sep. 30, 2020 | (60,580,852) | $ (39,044,595) | (75,541) | (21,620,256) | $ (159,540) | |||

| Increase (Decrease) in Members' Equity [Roll Forward] | ||||||||

| Net Income | 12,625,679 | 12,625,679 | ||||||

| Distribution | (3,211,856) | (3,211,856) | ||||||

| Balance, Units at Sep. 30, 2021 | 40,148,160 | 140,000 | ||||||

| Members' Equity at Sep. 30, 2021 | (69,994,675) | $ (39,044,595) | (75,541) | (31,034,079) | $ (159,540) | |||

| Increase (Decrease) in Members' Equity [Roll Forward] | ||||||||

| Net Income | 29,496,680 | 29,496,680 | ||||||

| Distribution | (13,650,220) | (13,650,220) | ||||||

| Balance, Units at Sep. 30, 2022 | 40,148,160 | 140,000 | ||||||

| Members' Equity at Sep. 30, 2022 | $ (85,841,135) | $ (39,044,595) | $ (75,541) | $ (46,880,539) | $ (159,540) | |||

| ||||||||

Summary of Significant Accounting Policies |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sep. 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounting Policies [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Summary of Significant Accounting Policies | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Nature of Business Red Trail Energy, LLC, a North Dakota limited liability company (the “Company”), owns and operates a 50 million gallon annual name-plate production ethanol plant near Richardton, North Dakota (the “Plant”). The Plant commenced production on January 1, 2007. Fuel grade ethanol, distillers grains and corn oil are the Company's primary products. All products are marketed and sold primarily within the continental United States. Accounting Estimates Management uses estimates and assumptions in preparing these financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities and the reported revenues and expenses. Significant items subject to such estimates and assumptions include the useful lives of property, plant and equipment, inventory and allowance for doubtful accounts. Actual results could differ from those estimates. Cash and Equivalents The Company considers all highly liquid debt instruments purchased with an initial maturity of three months or less to be cash equivalents. The carrying value of cash and equivalents approximates fair value. Balances in excess of federally insured limits are not covered by FDIC insurance. Restricted cash is cash deposited in our margin account with our commodities broker related to our risk management positions. Investment in RPMG RPMG is a subsidiary of Renewable Products Marketing Group, LLC ("RPMG, LLC"). We own approximately 5.6% of RPMG, LLC which allows us to realize favorable marketing fees for our products and allows us to share in the profits generated by RPMG, LLC. Our ownership interest in RPMG, LLC also entitles us to a seat on its board of directors which is filled by Gerald Bachmeier, our Chief Executive Officer. The Company accounts for the investment in RPMG at cost minus impairment. Accounts Receivable and Concentration of Credit Risk The Company generates accounts receivable from sales of ethanol, distillers grains and corn oil. The Company has entered into agreements with RPMG, Inc. (“RPMG”) for the marketing and distribution of the Company's ethanol, corn oil and dried distiller's grains. Under the terms of the marketing agreement, RPMG bears the risk of loss of nonpayment by their customers. The Company markets its modified distiller's grains internally. For sales of modified distiller's grains and industrial ethanol, credit is extended based on evaluation of a customer's financial condition and collateral is not required. Accounts receivable are due 30 days from the invoice date. Accounts outstanding longer than the contractual payment terms are considered past due. Internal follow up procedures are followed accordingly. Interest is charged on past due accounts. All receivables are stated at amounts due from customers net of any allowance for doubtful accounts. The Company determines its allowance by considering a number of factors, including the length of time trade accounts receivable are past due, the Company's previous loss history, the customer's perceived current ability to pay its obligation to the Company, and the condition of the general economy and the industry as a whole. The Company writes off accounts receivable when they become uncollectible, and payments subsequently received on such receivables are credited to the allowance for doubtful accounts. The Company has an allowance for doubtful accounts of $78,503 and $386,850 at September 30, 2022 and 2021, respectively. Inventory Corn is the primary raw material and, along with other raw materials and supplies, is stated at the lower of cost or net realizable value on a first-in, first-out (FIFO) basis. Work in process and finished goods, which consists of ethanol, distillers grains and corn oil produced, is stated at the lower of average cost or net realizable value. Spare parts inventory is valued at lower of cost or net realizable value on a FIFO basis. Patronage Equity The Company receives, from certain vendors organized as cooperatives, patronage dividends, which are based on several criteria, including the vendor's overall profitability and the Company's purchases from the vendor. Patronage equity typically represents the Company's share of the vendor's undistributed current earnings which will be paid in either cash or equity interests to the Company at a future date. Investments in cooperatives are stated at cost, plus unredeemed patronage refunds received in the form of capital stock and are included in Other Assets on the Company's balance sheet. Derivative Instruments The Company enters into derivative transactions to hedge its exposure to commodity and interest rate price fluctuations. The Company is required to record these derivatives in the balance sheet at fair value. In order for a derivative to qualify as a hedge, specific criteria must be met and appropriate documentation maintained. Gains and losses from derivatives that do not qualify as hedges, or are undesignated, must be recognized immediately in earnings. If the derivative does qualify as a hedge, depending on the nature of the hedge, changes in the fair value of the derivative will be either offset against the change in fair value of the hedged assets, liabilities, or firm commitments through earnings or recognized in other comprehensive income until the hedged item is recognized in earnings. Changes in the fair value of undesignated derivatives related to corn are recorded in costs of goods sold within the statements of operations. Changes in the fair value of undesignated derivatives related to ethanol are recorded in revenue within the statements of operations. Additionally the Company is required to evaluate its contracts to determine whether the contracts are derivatives. Certain contracts that literally meet the definition of a derivative may be exempted as “normal purchases or normal sales.” Normal purchases and normal sales are contracts that provide for the purchase or sale of something other than a financial instrument or derivative instrument that will be delivered in quantities expected to be used or sold over a reasonable period in the normal course of business. Certain corn, ethanol, and distillers grain contracts that meet the requirement of normal purchases or sales are documented as normal and exempted from the accounting and reporting requirements, and therefore, are not marked to market in our financial statements. Firm Purchase Commitments The Company typically enters into fixed price contracts to purchase corn to ensure an adequate supply of corn to operate its plant. The Company will generally seek to use exchange traded futures, options or swaps as an offsetting economic hedge position. The Company closely monitors the number of bushels hedged using this strategy to avoid an unacceptable level of margin exposure. Contract prices are analyzed by management at each period end and, if necessary, valued at the lower of cost or net realizable value in the balance sheets. Revenue Recognition The Company generally sells ethanol and related products pursuant to marketing agreements. The Company recognizes revenue from sales of ethanol and co-products at the point in time when the performance obligations in the contract are met, which is when the customer obtains control of such products and typically occurs upon shipment depending on the terms of the underlying contracts. Revenue is measured as the amount of consideration expected to be received in exchange for transferring goods or providing services. In some instances, the Company enters into contracts with customers that contain multiple performance obligations to deliver volumes of co-products over a contractual period of less than 12 months. The Company allocates the transaction price to each performance obligation identified in the contract based on relative standalone selling prices and recognizes the related revenue as control of each individual product is transferred to the customer in satisfaction of the corresponding performance obligation. Revenues are shown net of any fees incurred under the terms of the Company's agreements for the marketing and sale of ethanol and related products. Revenues are also shown net of any discounts given for sales of modified distillers grains. Long-lived Assets Property, plant, and equipment are stated at cost. Depreciation is provided over estimated useful lives by use of the straight line method. Maintenance and repairs are expensed as incurred. Major improvements and betterments are capitalized. For the year ended September 30, 2022 the Company capitalized $38.5 million in assets related to the CCS Project and $9.8 million in assets related to the Industrial Alcohol Project. The present values of finance lease obligations are classified as a liability and the related assets are included in property, plant and equipment. Amortization of equipment under finance leases is included in depreciation expense. Depreciation is computed using the straight-line method over the following estimated useful lives:

Depreciation expense included in cost of goods sold is $4,027,744 for the year ended September 30, 2022, $4,832,462 for the year ended September 30, 2021 and $4,722,077 for the year ended September 30, 2020. Depreciation expense included in general and administrative expenses is $299,962 for the year ended September 30, 2022, $89,069 for the year ended September 30, 2021, and $77,590 for the year ended September 30, 2020. Long-lived assets, such as property, plant, and equipment, and purchased intangible assets subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If circumstances require a long-lived asset be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by an asset to the carrying value of the asset. If the carrying value of the long-lived asset is not recoverable on an undiscounted cash flow basis, impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques including, but not limited to, discounted cash flow models, quoted market values and third-party independent appraisals. Fair Value Measurements The Company has adopted guidance for accounting for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements on a recurring basis. The Company has adopted guidance for fair value measurement related to nonfinancial items that are recognized and disclosed at fair value in the financial statements on a nonrecurring basis. The guidance establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows: · Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. · Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the asset or liability. · Level 3 inputs are unobservable inputs for the asset or liability. The level in the fair value hierarchy within which a fair measurement in its entirety falls is based on the lowest level input that is significant to the fair value measurement in its entirety. Except for those assets and liabilities which are required by authoritative accounting guidance to be recorded at fair value in our balance sheets, the Company has elected not to record any other assets or liabilities at fair value. No events occurred during the fiscal years ended September 30, 2022 and 2021 that required adjustment to the recognized balances of assets or liabilities, which are recorded at fair value on a nonrecurring basis. Fair Value of Financial Instruments The carrying amounts of cash and cash equivalents, accounts receivable, and accounts payable approximate their fair values because of their short-term nature. The fair values of notes payable approximates the carrying value based on estimated discounted future cash flows using the current rates at which similar loans would be made. Income Taxes The Company is treated as a partnership for federal and state income tax purposes and generally does not incur income taxes. Instead, its earnings and losses are included in the income tax returns of the members. Therefore, no provision or liability for federal or state income taxes has been included in these financial statements. Differences between financial statement basis of assets and tax basis of assets is primarily related to depreciation, derivatives, inventory, compensation and capitalization and amortization of organization and start-up costs for tax purposes, whereas these costs are expensed for financial statement purposes. The Company has evaluated whether it has any significant tax uncertainties that would require recognition or disclosure. Primarily due to its partnership tax status, the Company does not have any significant tax uncertainties that would require recognition or disclosure. The Company's policy is to recognize interest expense and penalties related to uncertain tax positions as incurred. Net Income Per Unit Net income (loss) per unit is calculated on a basic and fully diluted basis using the weighted average units outstanding during the period. Recently Adopted Accounting Pronouncements Measurement of Credit Losses on Financial Instruments In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments.” ASU 2016-13 adds a current expected credit loss (“CECL”) impairment model to U.S. GAAP that is based on expected losses rather than incurred losses. Modified retrospective adoption is required with any cumulative-effect adjustment recorded to retained earnings as of the beginning of the period of adoption. ASU 2016-13 is effective for fiscal years beginning after December 15, 2019, including interim periods within the year of adoption. Early adoption is permitted for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Effective October 1, 2020, the Company adopted ASU 2016-13 using the modified retrospective approach, which had no impact on adoption. Environmental Liabilities The Company's operations are subject to environmental laws and regulations adopted by various governmental entities in the jurisdiction in which it operates. These laws require the Company to investigate and remediate the effects of the release or disposal of materials at its location. Accordingly, the Company has adopted policies, practices and procedures in the areas of pollution control, occupational health and the production, handling, storage and use of hazardous materials to prevent material, environmental or other damage, and to limit the financial liability which could result from such events. Environmental liabilities, if any, are recorded when the liability is probable and the costs can reasonably be estimated. The Company is not aware of any environmental liabilities identified as of September 30, 2022.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nature of Operations | Nature of Business Red Trail Energy, LLC, a North Dakota limited liability company (the “Company”), owns and operates a 50 million gallon annual name-plate production ethanol plant near Richardton, North Dakota (the “Plant”). The Plant commenced production on January 1, 2007. Fuel grade ethanol, distillers grains and corn oil are the Company's primary products. All products are marketed and sold primarily within the continental United States.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Concentrations |

12 Months Ended |

|---|---|

Sep. 30, 2022 | |

| Risks and Uncertainties [Abstract] | |

| Concentrations | CONCENTRATIONS Coal and Natural Gas In previous years coal was an important input to our manufacturing process. During the second quarter of our 2015 fiscal year we converted the energy source for our ethanol plant to natural gas. As a result, we do not anticipate using coal to fire the ethanol plant in the future and changes in the price or availability of coal will not impact our operations. However, we maintain the equipment necessary to operate the ethanol plant using coal as the fuel source which management believes could benefit us in the future, especially if natural gas prices increase or natural gas is not available at the ethanol plant. The Company signed a sales agreement with Rainbow Gas Company to supply natural gas to the plant through October 2023. The Company's intentions are to run the plant on natural gas and renew the supply agreement with its current natural gas supplier. Sales We are substantially dependent upon RPMG for the purchase, marketing, and distribution of our ethanol, DDGS, and corn oil. RPMG purchases 100% of the ethanol, DDGS, and corn oil produced at our plant, all of which is marketed and distributed to its customers. Therefore, we are highly dependent on RPMG for the successful marketing of our ethanol, DDGS, and corn oil. In the event that our relationship with RPMG is interrupted or terminated for any reason, we believe that we could locate another entity to market the ethanol, DDGS, and corn oil. However, any interruption or termination of this relationship could temporarily disrupt the sale and production of ethanol, DDGS, and corn oil and adversely affect our business and operations and potentially result in a higher cost to the Company. Amounts due from RPMG represent approximately 53% and 85% of the Company's outstanding trade receivables balance at September 30, 2022 and 2021, respectively. Approximately 90%, 93%, and 93% of revenues are comprised of sales to RPMG for the years ended September 30, 2022, September 30, 2021 and September 30, 2020, respectively.

|

Revenue |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sep. 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue from Contract with Customer [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue | REVENUE Revenue Recognition The Company recognizes revenue from sales of ethanol and co-products at the point in time when the performance obligations in the contract are met, which is when the customer obtains control of such products and typically occurs upon shipment (depending on the terms of the underlying contracts.) Revenue is measured as the amount of consideration expected to be received in exchange for transferring goods or providing services. In some instances, the Company enters into contracts with customers that contain multiple performance obligations to deliver specified volumes of co-products over a contractual period of less than 12 months. In such instances, the Company allocates the transaction price to each performance obligation identified in the contract based on relative standalone selling prices and recognizes the related revenue when control of each individual product is transferred to the customer in satisfaction of the corresponding performance obligation. Revenue by Source The following table disaggregates revenue by major source for the twelve months ended September 30, 2022, 2021, and 2020.

Shipping and Handling Costs We account for shipping and handling activities related to contracts with customers as costs to fulfill our promises to transfer the associated products. Accordingly, we record customer payments associated with shipping and handling costs as a component of revenue and classify such costs as a component of cost of goods sold. Customer Deposits Customer deposits are contract liabilities for payments in excess of revenue recognized. Customer deposits are recognized when modified distillers grains customers make prepayments on their contracts. The beginning and ending balances for accounts receivable and customer deposits were as follows for the twelve months ended September 30, 2022, 2021, and 2020.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Derivative Instruments |

12 Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sep. 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative Instruments and Hedging Activities Disclosure [Abstract] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative Instruments | DERIVATIVE INSTRUMENTS Commodity Contracts As part of its hedging strategy, the Company may enter into ethanol, soybean, soybean oil, natural gas, and corn commodity-based derivatives in order to protect cash flows from fluctuations caused by volatility in commodity prices in order to protect gross profit margins from potentially adverse effects of market and price volatility on ethanol sales, corn oil sales, and corn purchase commitments where the prices are set at a future date. These derivatives are not designated as effective hedges for accounting purposes. For derivative instruments that are not accounted for as hedges, or for the ineffective portions of qualifying hedges, the change in fair value is recorded through earnings in the period of change. Ethanol derivative and soybean oil derivative fair market value gains or losses are included in the results of operations and are classified as revenue and corn derivative and natural gas derivative changes in fair market value are included in cost of goods sold.

The following tables provide details regarding the Company's derivative financial instruments at September 30, 2022 and September 30, 2021:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Inventory |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sep. 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inventory Disclosure [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inventory | INVENTORY Inventory is valued at lower of cost or net realizable value. Inventory values as of September 30, 2022 and September 30, 2021 were as follows:

Lower of cost or net realizable value adjustments for the years ended September 30, 2022, and 2021 and 2019 were as follows:

The Company has entered into forward corn purchase contracts under which it is required to take delivery at the contract price. At the time the contracts were created, the price of the contract approximated market price. Subsequent changes in market conditions could cause the contract prices to become higher or lower than market prices. As of September 30, 2022 and 2021, the average price of corn purchased under certain fixed price contracts, that had not yet been delivered, was greater than approximated market price. Based on this information, the Company has an estimated loss on firm purchase commitments of $885,000 and $184,000 for the fiscal years ended September 30, 2022 and 2021, respectively. The loss is recorded in “Loss on firm purchase commitments” on the statements of operations. The amount of the loss was determined by applying a methodology similar to that used in the impairment valuation with respect to inventory. Given the uncertainty of future ethanol prices, this loss may or may not be recovered, and further losses on the outstanding purchase commitments could be recorded in future periods. The Company recorded inventory valuation impairments of $337,080 and $263,777 for the fiscal years ended September 30, 2022 and 2021, respectively. The impairments, as applicable, were attributable primarily to decreases in market prices of corn and ethanol. The inventory valuation impairment was recorded in “Lower of cost or net realizable value adjustment” on the statements of operations.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fair Value Measurements |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sep. 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair Value Disclosures [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair Value Measurements | FAIR VALUE MEASUREMENTS The following table provides information on those assets and liabilities that are measured at fair value on a recurring basis as of September 30, 2022 and September 30, 2021, respectively.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Leases |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sep. 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leases [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||