UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file

number: 811-03364

EMPOWER FUNDS, INC.

(Exact name of registrant as specified in charter)

8515 E. Orchard Road, Greenwood Village, Colorado 80111

(Address of principal executive offices)

Jonathan

Kreider

President and Chief Executive Officer

Empower Funds,

Inc.

8515 E. Orchard Road

Greenwood Village, Colorado 80111

(Name and address of agent for service)

Registrant's telephone number, including area code: (866)

831-7129

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. REPORTS TO STOCKHOLDERS

EMPOWER FUNDS, INC.

Empower High Yield Bond Fund (Formerly Great-West High Yield

Bond Fund)

(Institutional Class and Investor Class)

Annual Report

December 31, 2022

This report and the financial statements attached are

submitted for general information and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein is to be considered an offer of the sale of shares of the Fund. Such

offering is made only by the prospectus of the Fund, which includes details as to offering price and other information.

Management Discussion

The Fund’s sub-adviser is Putnam Investment Management,

LLC (“Putnam”)

Fund Performance

For the twelve-month period ended December 31, 2022, the

Fund (Investor Class shares) returned -11.80%, relative to a -10.48% return for the J.P. Morgan Developed High Yield Index, and a 12.72% return for its composite index (an 80% weighting to the ICE BofA U.S. High Yield Index and a 20% weighting to

the ICE BofA All U.S. Convertible Index), the Fund’s benchmark indexes.

Putnam

Commentary

The first quarter kicked off 2022

with significant news flow, leaving investors to consider what may come in the year ahead. Russia invaded Ukraine on February 24th, only adding to already troubling inflation, and the Federal Reserve (the “Fed”) began their hiking cycle

in March. These broader macro implications weighed significantly on risk assets. The S&P 500® Index and Dow Jones Industrial Average both ended the quarter down over 4%, while technology stocks fared significantly worse with the Nasdaq

closing the quarter down roughly 9%. Treasuries sold-off and the curve flattened as the Fed raised rates 25 basis points (“bps”) at their mid-March meeting, The 2s/10s U.S. Treasury curve ended the quarter flat and moved into marginally

negative territory as April began. In this environment, high yield posted negative returns for the quarter.

The second quarter closed out one of the weakest first

halves of a year in history. Ultimately, there was no place to hide as both equity and bond markets saw broad-based losses due to stubbornly high inflation, increasingly hawkish central bank rhetoric, and geopolitical tensions stemming from

Russia’s invasion of Ukraine. Similar to the first quarter, Treasury rates sold off and the curve flattened as the Fed raised rates by 50 bps at their May meeting and 75 bps at their June meeting, the largest rate hike since 1994. The 2s/10s

U.S. Treasury curve briefly inverted at the beginning of the quarter, but ultimately ended the quarter +6 bps. Higher interest rates and geopolitical tensions continued to weigh on the corporate credit market with high yield corporate spreads

widening 220 bps. As a result, high yield posted negative returns for the quarter.

The volatility experienced in the first half of the year

carried over to the third quarter, as markets moved in dramatic fashion. The first half of the quarter began on positive footing with market participants comforted by a belief that inflation had peaked, while markets began to price in the

probability of rate cuts in 2023. However, the sentiment began to shift following Fed Chair Powell’s comments at the Jackson Hole symposium in late August. Risk assets sold off once again and Treasury rates rose meaningfully across the curve

as the risk of a recession ratcheted up further. The Fed continued to hike at an aggressive pace, raising rates by 75 bps at their July and September meetings. Given the Fed’s continued hawkish rhetoric, Treasury rates sold-off significantly,

the curve flattened and inverted, and the 10-year reached above 4% intra-day for the first time since 2010. In this environment, high yield posted marginally negative returns for the quarter.

Fixed income markets eked out a modest gain in the fourth

quarter, as optimism grew that the pace of Fed policy tightening would slow into 2023. Optimism improved in early November when the September consumer price index report showed a larger than expected decline in the pace of inflation and the Fed

signaled it was considering slowing the pace of future interest rate hikes while measuring the impact of previous hikes. Meanwhile, the European Central Bank continued its hiking cycle, and the Bank of England also raised its benchmark rate. In

December, the Fed scaled back its monetary tightening with

a 50 bps rate hike after four 75 bps hikes. Still, Fed Chair Jerome Powell

noted that rate hikes would continue in 2023. Amid this backdrop most bond indices produced modest positive gains in the final quarter of the year. High yield corporate credit fared better in the quarter, as credit spreads tightened.

The U.S. high yield default rate (including distressed

exchanges) ended the year at 1.65% (+129 bps year-over-year). Total high yield new issue supply in 2022 only amounted to $106.5 billion (down almost 80%), while high yield funds reported an outflow of -$47 billion from the asset class. Given

expected further tightening of monetary policy and higher interest rates, volatility may continue in fixed income markets.

On an absolute basis, both the high yield and convertible

allocations generated negative returns but each outperformed their respective benchmarks on a gross basis. At the sector level, top contributors to relative returns included security selection within technology, diversified media, and services. On

the other hand, overweight positioning and security selection within broadcasting, plus underweight exposure and security selection within metals & mining and telecommunications, detracted from relative returns. At the issuer level, overweight

positioning to Antero Resources contributed to relative returns on the heels of rising oil prices throughout the first half of the year. Additionally, avoidance of Ligado Networks and overweight positioning to EQT contributed to relative returns. On

the other hand, positioning to Ford Motor was the largest detractor from relative returns due to declining auto sales and the negative impacts of continued inflation on the auto industry. Overweight positioning to Apollo Global Management (Embarq)

and Audacy detracted from relative returns as well.

The views and opinions in this report were current as of

December 31, 2022 and are subject to change at any time. They are not guarantees of performance or investment results and should not be taken as investment advice. Fund holdings are subject to change at any time. Fund returns are net of fees unless

otherwise noted.

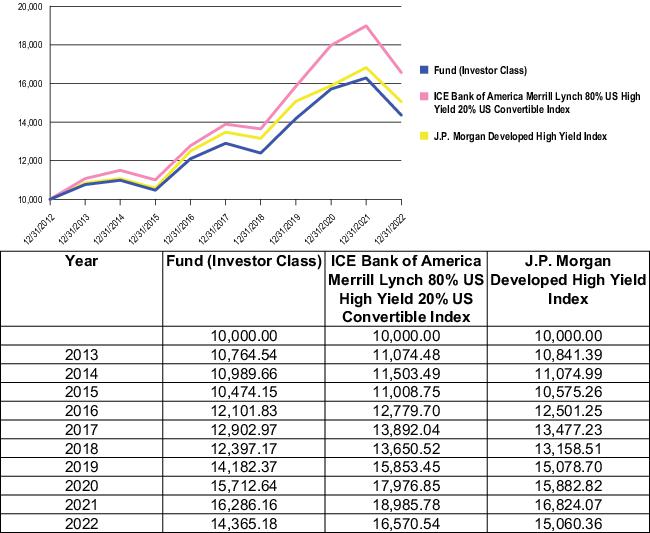

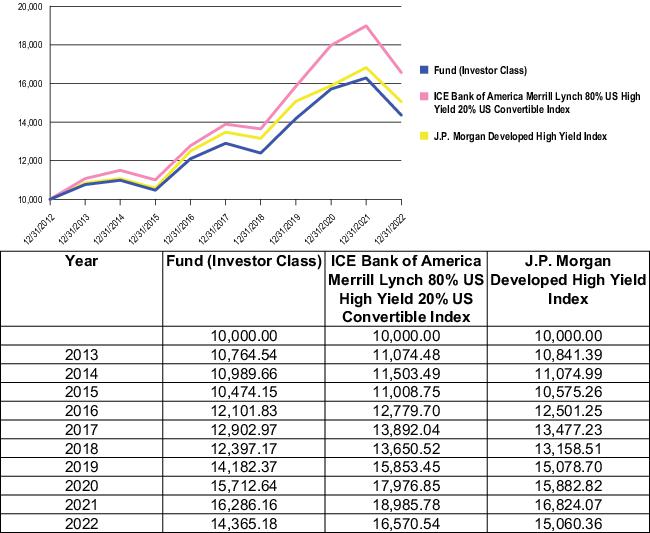

Growth of $10,000

(unaudited)

This graph compares the value of a

hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records) with the performance of the Fund’s benchmark index. Results include the reinvestment of all dividends and

capital gains distributions. Past performance is no guarantee of future results. The graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance does not include any

fees or expenses of variable insurance contracts, individual retirement accounts (“IRA(s)”), qualified retirement plans or college savings programs. If such fees and expenses were included, returns would be lower.

Note: Performance for the Institutional Class shares may vary

due to their differing fee structure. See returns table below.

Average Annual Total Returns for the Periods Ended December 31,

2022 (unaudited)

| |

One

Year |

Five

Year |

Ten

Year / Since

Inception(a) |

| Institutional

Class |

-11.61%

|

2.51%

|

3.43%

|

| Investor

Class |

-11.80%

|

2.17%

|

3.69%

|

| (a)

Institutional Class inception date was May 1, 2015. |

Results include the reinvestment of all dividends and

capital gains distributions. Past performance is no guarantee of future results. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance does not include any

fees or expenses of variable insurance contracts, IRAs, qualified retirement plans or college savings programs. If such fees and expenses were included, returns would be lower.

Summary of Investments by Ratings as of December 31, 2022

(unaudited)

| Rating

|

Percentage

of

Fund Investments |

| A3

|

0.24%

|

| Baa1

|

0.62

|

| Baa2

|

0.44

|

| Baa3

|

3.89

|

| Ba1

|

6.05

|

| Ba2

|

13.15

|

| Ba3

|

12.08

|

| B1

|

12.62

|

| B2

|

10.66

|

| B3

|

9.74

|

| CCC,

CC, C |

0.87

|

| Equities

|

3.38

|

| Not

Rated |

19.09

|

| Short

Term Investments |

7.17

|

| Total

|

100.00%

|

Shareholder Expense Example

(unaudited)

As a shareholder of the Fund, you incur

two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs

with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at

the beginning of the period and held for the entire period (July 1, 2022 to December 31, 2022).

Actual Expenses

The first row of the table below provides information about

actual account values and actual expenses. You may use the information in this row, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600

account value divided by $1,000 = 8.6), then multiply the result by the number in the first row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second row of the table below provides information

about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and

expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical

example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant

to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second row of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In

addition, if these transactional costs were included, your costs would have been higher.

| |

Beginning

Account Value |

|

Ending

Account Value |

|

Expenses

Paid

During Period* |

| |

(07/01/22)

|

|

(12/31/22)

|

|

(07/01/22

– 12/31/22) |

| Institutional

Class |

|

|

|

|

|

| Actual

|

$1,000.00

|

|

$1,031.72

|

|

$3.79

|

Hypothetical

(5% return before expenses) |

$1,000.00

|

|

$1,021.48

|

|

$3.77

|

| Investor

Class |

|

|

|

|

|

| Actual

|

$1,000.00

|

|

$1,031.99

|

|

$5.58

|

Hypothetical

(5% return before expenses) |

$1,000.00

|

|

$1,019.71

|

|

$5.55

|

| *

Expenses are equal to the Fund's annualized expense ratio of 0.74% for the Institutional Class shares and 1.09% for the Investor Class shares, multiplied by the average account value over the period, multiplied by 184/365 days to reflect the

one-half year period. Performance does not include any fees or expenses of variable insurance contracts, IRAs, qualified retirement plans or college savings programs, if applicable. If such fees or expenses

were included, returns would be lower. |

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| BANK

LOANS |

| $ 334,900

|

Adient

US LLC(b)

7.63%, 04/08/2028

1-mo. LIBOR + 3.24% |

$ 330,365

|

| 1,200,000

|

American

Airlines Inc(b)

8.99%, 04/20/2028

3-mo. LIBOR + 4.22% |

1,192,950

|

| |

Asurion

LLC(b) |

|

| 403,835

|

7.63%,07/31/2027

1-mo. LIBOR + 3.24% |

399,796

|

| 935,000

|

9.63%,01/20/2029

1-mo. LIBOR + 5.24% |

721,509

|

|

936,732 |

BMC

Software Inc(b)

8.13%, 10/02/2025

1-mo. LIBOR + 3.74% |

894,579 |

| 2,226,978

|

Brand

Industrial Services Inc(b)

8.03%, 06/21/2024

3-mo. LIBOR + 3.27% |

2,009,291

|

| |

Cengage

Learning Inc(b) |

|

| 759,263

|

9.87%,07/13/2026

6-mo. LIBOR + 2.68% |

681,167

|

| 460,007

|

9.87%,07/14/2026

6-mo. LIBOR + 2.67% |

412,692

|

| 995,273

|

Clarios

Global LP(b)

7.63%, 04/30/2026

1-mo. LIBOR + 3.24% |

952,228

|

| 1,285,431

|

Clear

Channel Outdoor Holdings Inc(b)

7.91%, 08/21/2026

3-mo. LIBOR + 3.14% |

1,164,279

|

| 741,910

|

CP

Atlas Buyer Inc(b)

7.88%, 11/23/2027

1-mo. LIBOR + 3.49% |

647,913

|

| 951,562

|

CQP

Holdco LP(b)

8.48%, 06/05/2028

3-mo. LIBOR + 3.71% |

946,011

|

| 292,050

|

Diamond

BC BV(b)

7.16%, 09/29/2028

3-mo. LIBOR + 2.40% |

281,974

|

| 1,673,068

|

DirectV

Financing LLC(b)

9.38%, 08/02/2027

1-mo. LIBOR + 4.99% |

1,622,615

|

| 715,000

|

Entercom

Media Corp \ CBS Radio(b)(c)

6.84%, 11/17/2024

1-mo. LIBOR + 2.45% |

504,075

|

| 138,600

|

Filtration

Group Corp(b)

7.88%, 10/21/2028

1-mo. LIBOR + 3.49% |

135,853

|

| 267,956

|

Garda

World Security Corp(b)

8.93%, 10/30/2026

3-mo. LIBOR + 4.16% |

260,084

|

| 304,423

|

GFL

Environmental Inc(b)

7.41%, 05/30/2025

3-mo. LIBOR + 2.65% |

304,233

|

| 330,750

|

Global

Medical Response Inc(b)

8.42%, 10/02/2025

1-mo. LIBOR + 4.03% |

231,250

|

| 676,782

|

Granite

US Holdings Corp(b)

8.75%, 09/30/2026

3-mo. LIBOR + 3.98% |

675,513

|

| Principal

Amount(a) |

|

Fair

Value |

| Bank

Loans — (continued) |

| $ 309,488

|

Greeneden

Holdings II LLC(b)

8.38%, 12/01/2027

1-mo. LIBOR + 3.99% |

$ 296,489

|

| |

iHeartCommunications

Inc(b) |

|

| 146,371

|

7.38%,05/01/2026

1-mo. LIBOR + 2.99% |

133,838

|

| 1,295,190

|

7.63%,05/01/2026

1-mo. LIBOR + 3.24% |

1,191,979

|

|

674,777 |

Klockner

Pentaplast of America Inc(b)

8.26%, 02/04/2026

6-mo. LIBOR + 3.12% |

596,335 |

|

916,304 |

LBM

Acquisition LLC(b)

7.12%, 12/17/2027

6-mo. LIBOR + 1.98% |

790,948 |

| 2,307,323

|

MajorDrive

Holdings IV LLC(b)

8.81%, 06/01/2028

3-mo. LIBOR + 4.04% |

2,163,115

|

| 1,913,095

|

Mauser

Packaging Solutions Holding Co(b)

7.37%, 04/03/2024

1-mo. LIBOR + 2.98% |

1,864,584

|

| 610,000

|

Neptune

Bidco US Inc(b)

5.50%, 04/11/2029

3-mo. SOFR + 0.91% |

547,475

|

| 975,150

|

Olympus

Water US Holding Corp(b)

8.50%, 11/09/2028

3-mo. LIBOR + 3.73% |

933,977

|

| 244,352

|

One

Call Corp(b)

9.88%, 04/22/2027

3-mo. LIBOR + 5.11% |

200,979

|

| 2,418,213

|

PECF

USS Intermediate Holding III Corp(b)

8.63%, 12/15/2028

1-mo. LIBOR + 4.24% |

2,009,131

|

| 2,340,899

|

PetsMart

LLC(b)

8.13%, 02/11/2028

1-mo. LIBOR + 3.74% |

2,289,692

|

| 529,650

|

Polaris

Newco LLC(b)

8.73%, 06/02/2028

3-mo. LIBOR + 3.96% |

482,171

|

| 852,841

|

Precisely

Software Inc(b)

8.36%, 04/24/2028

3-mo. LIBOR + 3.59% |

705,726

|

| 635,000

|

Proofpoint

Inc(b)

10.98%, 08/31/2029

3-mo. LIBOR + 6.21% |

607,484

|

| 2,426,539

|

Rocket

Software Inc(b)

8.63%, 11/28/2025

1-mo. LIBOR + 4.24% |

2,328,466

|

| 459,604

|

Starfruit

Finco BV(b)

7.16%, 10/01/2025

3-mo. LIBOR + 2.40% |

452,480

|

| 1,923,790

|

Terrier

Media Buyer Inc(b)

8.23%, 12/17/2026

3-mo. LIBOR + 3.46% |

1,797,026

|

| 775,000

|

TIBCO

Software Inc(b)

9.18%, 03/30/2029

3-mo. SOFR + 4.59% |

712,516

|

| |

UKG

Inc(b) |

|

| 727,151

|

7.00%,05/03/2026

3-mo. LIBOR + 2.23% |

689,521

|

See Notes to Financial Statements.

Annual Report - December 31, 2022

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| Bank

Loans — (continued) |

| $ 403,878

|

7.00%,05/04/2026

3-mo. LIBOR + 2.23% |

$ 383,684

|

| 1,243,161

|

United

AirLines Inc(b)

8.11%, 04/21/2028

3-mo. LIBOR + 3.34% |

1,223,478

|

|

486,906 |

Vertiv

Group Corp(b)

6.89%, 03/02/2027

1-mo. LIBOR + 2.50% |

468,890 |

|

313,630 |

White

Cap Buyer LLC(b)

8.07%, 10/19/2027

1-mo. SOFR + 3.71% |

302,697

|

TOTAL

BANK LOANS — 7.47%

(Cost $39,459,408) |

$

37,541,058 |

| CORPORATE

BONDS AND NOTES |

| Basic

Materials — 4.71% |

| 1,640,000

|

ArcelorMittal

SA

7.00%, 10/15/2039

|

1,664,338

|

| 140,000

|

ATI

Inc

5.88%, 12/01/2027

|

133,880

|

| 240,000

|

Avient

Corp(d)

7.13%, 08/01/2030

|

234,608

|

| 990,000

|

Axalta

Coating Systems LLC(d)(e)

3.38%, 02/15/2029

|

816,914

|

| 504,000

|

Big

River Steel LLC / BRS Finance Corp(d)

6.63%, 01/31/2029

|

480,174

|

| |

Celanese

US Holdings LLC |

|

| 490,000

|

6.17%,

07/15/2027 |

483,300

|

| 1,185,000

|

6.33%,

07/15/2029 |

1,151,395

|

| |

Commercial

Metals Co |

|

| 465,000

|

4.13%,

01/15/2030 |

411,458

|

| 1,410,000

|

4.38%,

03/15/2032 |

1,226,596

|

| |

Compass

Minerals International Inc(d) |

|

| 235,000

|

4.88%,

07/15/2024 |

225,894

|

| 1,015,000

|

6.75%,

12/01/2027 |

974,400

|

| 845,000

|

Constellium

SE(d)

5.63%, 06/15/2028

|

780,966

|

| 1,540,000

|

First

Quantum Minerals Ltd(d)

6.88%, 03/01/2026

|

1,458,413

|

| 1,550,000

|

Freeport-McMoRan

Inc

5.45%, 03/15/2043

|

1,398,162

|

| 1,010,000

|

Herens

Holdco SARL(d)

4.75%, 05/15/2028

|

754,884

|

| 700,000

|

Ingevity

Corp(d)

3.88%, 11/01/2028

|

601,906

|

| 990,000

|

Mercer

International Inc

5.13%, 02/01/2029

|

827,650

|

| |

Novelis

Corp(d) |

|

| 740,000

|

4.75%,

01/30/2030 |

656,058

|

| 1,180,000

|

3.88%,

08/15/2031 |

963,343

|

| 1,125,000

|

Olympus

Water US Holding Corp(d)

4.25%, 10/01/2028

|

913,335

|

| 1,725,000

|

SCIH

Salt Holdings Inc(d)

4.88%, 05/01/2028

|

1,480,179

|

| Principal

Amount(a) |

|

Fair

Value |

| Basic

Materials — (continued) |

| $1,815,000

|

Sylvamo

Corp(d)

7.00%, 09/01/2029

|

$

1,727,543 |

|

865,000 |

Trinseo

Materials Operating SCA / Trinseo Materials Finance Inc(d)

5.13%, 04/01/2029

|

560,278 |

| 1,125,000

|

Tronox

Inc(d)

4.63%, 03/15/2029

|

935,156 |

| |

WR

Grace Holdings LLC(d) |

|

| 1,080,000

|

5.63%,

10/01/2024 |

1,063,800

|

| 1,495,000

|

4.88%,

06/15/2027 |

1,324,764

|

|

500,000 |

5.63%,

08/15/2029 |

403,635

|

| |

|

23,653,029

|

| Communications

— 11.36% |

| 250,000

|

Altice

Financing SA(d)

5.00%, 01/15/2028

|

201,250

|

| |

Altice

France SA(d) |

|

| 665,000

|

5.50%,

01/15/2028 |

520,775

|

| 560,000

|

5.13%,

07/15/2029 |

419,856

|

| 2,140,000

|

5.50%,

10/15/2029 |

1,631,814

|

| 2,840,000

|

Arches

Buyer Inc(d)

4.25%, 06/01/2028

|

2,221,168

|

| |

CCO

Holdings LLC / CCO Holdings Capital Corp |

|

| 2,710,000

|

5.38%,

06/01/2029(d) |

2,450,572

|

| 1,540,000

|

4.75%,

03/01/2030(d) |

1,328,119

|

| 590,000

|

4.25%,

02/01/2031(d) |

473,248

|

| 1,665,000

|

4.50%,

05/01/2032 |

1,325,340

|

| 1,935,000

|

Clear

Channel Outdoor Holdings Inc(d)

5.13%, 08/15/2027

|

1,676,677

|

| 180,000

|

CommScope

Inc(d)

6.00%, 03/01/2026

|

166,120

|

| 2,660,000

|

CSC

Holdings LLC(d)

5.38%, 02/01/2028

|

2,144,625

|

| 1,215,000

|

Directv

Financing LLC / Directv Financing Co-Obligor Inc(d)

5.88%, 08/15/2027

|

1,087,012

|

| |

DISH

DBS Corp |

|

| 310,000

|

5.88%,

11/15/2024 |

288,063

|

| 520,000

|

7.75%,

07/01/2026 |

419,323

|

| 1,570,000

|

5.25%,

12/01/2026(d) |

1,322,466

|

| 810,000

|

5.75%,

12/01/2028(d) |

646,481

|

| 855,000

|

5.13%,

06/01/2029 |

551,569

|

| |

Frontier

Communications Holdings LLC(d) |

|

| 2,290,000

|

5.88%,

10/15/2027 |

2,126,425

|

| 1,160,000

|

8.75%,

05/15/2030 |

1,179,429

|

| 470,000

|

Gen

Digital Inc(d)

6.75%, 09/30/2027

|

460,600

|

| 2,515,000

|

Gray

Escrow II Inc(d)

5.38%, 11/15/2031

|

1,812,435

|

| |

iHeartCommunications

Inc |

|

| 252

|

8.38%,

05/01/2027(e) |

214

|

| 1,720,000

|

5.25%,

08/15/2027(d) |

1,456,983

|

| |

Level

3 Financing Inc(d) |

|

| 770,000

|

4.63%,

09/15/2027 |

641,025

|

| 1,570,000

|

4.25%,

07/01/2028 |

1,236,689

|

See Notes to Financial Statements.

Annual Report - December 31, 2022

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| Communications

— (continued) |

| $1,050,000

|

Lumen

Technologies Inc(d)(e)

4.50%, 01/15/2029

|

$ 724,722

|

| |

Match

Group Holdings II LLC(d) |

|

| 1,187,000

|

5.00%,

12/15/2027 |

1,092,040

|

| 910,000

|

4.63%,

06/01/2028 |

811,229

|

| 160,000

|

4.13%,

08/01/2030(e) |

130,619

|

| 1,410,000

|

3.63%,

10/01/2031(e) |

1,081,278

|

| 2,875,000

|

McGraw-Hill

Education Inc(d)

5.75%, 08/01/2028

|

2,416,064

|

| 325,000

|

Millennium

Escrow Corp(d)

6.63%, 08/01/2026

|

208,017

|

| |

Netflix

Inc |

|

| 45,000

|

5.88%,

02/15/2025 |

45,567

|

| 385,000

|

4.88%,

04/15/2028 |

371,751

|

| 1,330,000

|

5.88%,

11/15/2028 |

1,347,995

|

| |

News

Corp(d) |

|

| 1,240,000

|

3.88%,

05/15/2029 |

1,075,564

|

| 720,000

|

5.13%,

02/15/2032 |

655,200

|

| |

Scripps

Escrow II Inc(d) |

|

| 1,745,000

|

3.88%,

01/15/2029 |

1,400,363

|

| 480,000

|

5.38%,

01/15/2031(e) |

384,724

|

| |

Sirius

XM Radio Inc(d) |

|

| 2,415,000

|

4.00%,

07/15/2028 |

2,101,774

|

| 315,000

|

4.13%,

07/01/2030 |

259,941

|

| 1,810,000

|

3.88%,

09/01/2031 |

1,412,106

|

| 965,000

|

Spanish

Broadcasting System Inc(d)

9.75%, 03/01/2026

|

554,875

|

| 2,760,000

|

Sprint

Capital Corp

6.88%, 11/15/2028

|

2,864,714

|

| 1,260,000

|

Sprint

LLC

7.63%, 03/01/2026

|

1,325,906

|

| 1,479,000

|

T-Mobile

USA Inc

2.88%, 02/15/2031

|

1,222,139

|

| 1,250,000

|

Townsquare

Media Inc(d)

6.88%, 02/01/2026

|

1,109,377

|

| 1,335,000

|

TripAdvisor

Inc(d)

7.00%, 07/15/2025

|

1,319,027

|

| |

Univision

Communications Inc(d) |

|

| 990,000

|

6.63%,

06/01/2027 |

955,162

|

| 595,000

|

7.38%,

06/30/2030 |

568,642

|

| 1,310,000

|

Urban

One Inc(d)

7.38%, 02/01/2028

|

1,107,356

|

| 1,435,000

|

Virgin

Media Finance PLC(d)

5.00%, 07/15/2030

|

1,150,956

|

| 905,000

|

VZ

Secured Financing BV(d)

5.00%, 01/15/2032

|

735,422

|

| 940,000

|

Ziggo

Bond Co BV(d)

6.00%, 01/15/2027

|

874,595

|

| |

|

57,095,403

|

| Consumer,

Cyclical — 12.68% |

| |

1011778

BC Unlimited Liability Co / New Red Finance Inc(d) |

|

| 555,000

|

3.88%,

01/15/2028 |

496,473

|

| 260,000

|

4.38%,

01/15/2028 |

232,806

|

| 2,150,000

|

4.00%,

10/15/2030 |

1,741,092

|

| Principal

Amount(a) |

|

Fair

Value |

| Consumer,

Cyclical — (continued) |

| |

Allison

Transmission Inc(d) |

|

| $ 720,000

|

4.75%,

10/01/2027 |

$ 667,684

|

| 1,660,000

|

3.75%,

01/30/2031 |

1,365,350

|

| |

American

Airlines Inc / AAdvantage Loyalty IP Ltd(d) |

|

| 405,000

|

5.50%,

04/20/2026 |

389,467

|

| 405,000

|

5.75%,

04/20/2029 |

370,152

|

| |

American

Builders & Contractors Supply Co Inc(d) |

|

| 780,000

|

4.00%,

01/15/2028 |

695,916

|

| 835,000

|

3.88%,

11/15/2029 |

682,571

|

| |

Asbury

Automotive Group Inc(d) |

|

| 180,000

|

4.63%,

11/15/2029 |

151,675

|

| 90,000

|

5.00%,

02/15/2032 |

74,043

|

| |

Bath

& Body Works Inc |

|

| 47,000

|

9.38%,

07/01/2025(d) |

50,064

|

| 885,000

|

7.50%,

06/15/2029(e) |

873,672

|

| 900,000

|

6.63%,

10/01/2030(d) |

844,563

|

| 910,000

|

6.75%,

07/01/2036 |

799,799

|

| |

Beacon

Roofing Supply Inc(d) |

|

| 225,000

|

4.50%,

11/15/2026(e) |

210,168

|

| 740,000

|

4.13%,

05/15/2029 |

614,934

|

| |

Boyd

Gaming Corp |

|

| 635,000

|

4.75%,

12/01/2027(e) |

591,426

|

| 1,540,000

|

4.75%,

06/15/2031(d) |

1,339,800

|

| 1,960,000

|

Caesars

Resort Collection LLC / CRC Finco Inc(d)

5.75%, 07/01/2025

|

1,918,656

|

| |

Carnival

Corp(d) |

|

| 1,070,000

|

10.50%,

02/01/2026 |

1,075,093

|

| 1,210,000

|

5.75%,

03/01/2027 |

863,988

|

| 1,465,000

|

CDI

Escrow Issuer Inc(d)

5.75%, 04/01/2030

|

1,313,269

|

| |

Cinemark

USA Inc(d) |

|

| 75,000

|

8.75%,

05/01/2025 |

75,736

|

| 1,040,000

|

5.88%,

03/15/2026 |

866,275

|

| 971,000

|

Clarios

Global LP(d)

6.75%, 05/15/2025

|

973,244

|

| 1,440,000

|

Delta

Air Lines Inc / SkyMiles IP Ltd(d)

4.75%, 10/20/2028

|

1,353,561

|

| 860,000

|

Everi

Holdings Inc(d)

5.00%, 07/15/2029

|

738,711

|

| 1,205,000

|

Fertitta

Entertainment LLC / Fertitta Entertainment Finance Co Inc(d)

4.63%, 01/15/2029

|

1,019,713

|

| 1,070,000

|

Ford

Motor Co(e)

7.45%, 07/16/2031

|

1,093,660

|

| |

Ford

Motor Credit Co LLC |

|

| 1,000,000

|

5.13%,

06/16/2025 |

961,342

|

| 1,000,000

|

5.11%,

05/03/2029(e) |

905,545

|

| 8,410,000

|

4.00%,

11/13/2030 |

6,903,264

|

| 760,000

|

Hanesbrands

Inc(d)

4.63%, 05/15/2024

|

736,081

|

| 1,915,000

|

Hilton

Domestic Operating Co Inc

4.88%, 01/15/2030

|

1,735,392

|

See Notes to Financial Statements.

Annual Report - December 31, 2022

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| Consumer,

Cyclical — (continued) |

| $2,120,000

|

Hilton

Worldwide Finance LLC / Hilton Worldwide Finance Corp

4.88%, 04/01/2027

|

$

2,017,875 |

|

865,000 |

IRB

Holding Corp(d)

7.00%, 06/15/2025

|

862,838 |

|

115,000 |

KFC

Holding Co / Pizza Hut Holdings LLC / Taco Bell of America LLC(d)

4.75%, 06/01/2027

|

110,400 |

| 1,655,000

|

Kontoor

Brands Inc(d)

4.13%, 11/15/2029

|

1,350,662

|

| 2,190,000

|

Levi

Strauss & Co(d)

3.50%, 03/01/2031

|

1,738,181

|

| |

Live

Nation Entertainment Inc(d) |

|

| 985,000

|

5.63%,

03/15/2026 |

931,503

|

| 1,030,000

|

6.50%,

05/15/2027 |

1,007,907

|

| 70,000

|

4.75%,

10/15/2027(e) |

62,323

|

| |

Macy's

Retail Holdings LLC(d) |

|

| 110,000

|

5.88%,

03/15/2030 |

95,450

|

| 440,000

|

6.13%,

03/15/2032 |

369,833

|

| |

Mattel

Inc(d) |

|

| 80,000

|

3.38%,

04/01/2026 |

73,552

|

| 385,000

|

5.88%,

12/15/2027 |

377,647

|

| 1,410,000

|

3.75%,

04/01/2029 |

1,238,438

|

| 400,000

|

NCL

Corp Ltd(d)

5.88%, 02/15/2027

|

346,520

|

| |

Newell

Brands Inc |

|

| 220,000

|

4.88%,

06/01/2025 |

213,950

|

| 2,260,000

|

4.45%,

04/01/2026 |

2,126,197

|

| 1,245,000

|

Penn

Entertainment Inc(d)

5.63%, 01/15/2027

|

1,128,891

|

| 500,000

|

PetSmart

Inc / PetSmart Finance Corp(d)

4.75%, 02/15/2028

|

452,754

|

| 140,000

|

Raptor

Acquisition Corp / Raptor Co-Issuer LLC(d)

4.88%, 11/01/2026

|

124,376

|

| |

Royal

Caribbean Cruises Ltd(d) |

|

| 805,000

|

5.50%,

08/31/2026 |

677,206

|

| 230,000

|

9.25%,

01/15/2029 |

236,348

|

| |

Scotts

Miracle-Gro Co(e) |

|

| 750,000

|

4.50%,

10/15/2029 |

607,500

|

| 1,700,000

|

4.38%,

02/01/2032 |

1,281,290

|

| 2,060,000

|

Staples

Inc(d)

7.50%, 04/15/2026

|

1,773,001

|

| |

Station

Casinos LLC(d) |

|

| 1,225,000

|

4.50%,

02/15/2028 |

1,064,993

|

| 985,000

|

4.63%,

12/01/2031 |

790,141

|

| 1,130,000

|

Sugarhouse

HSP Gaming Prop Mezz LP / Sugarhouse HSP Gaming Finance Corp(d)

5.88%, 05/15/2025

|

1,054,830

|

| |

United

Airlines Inc(d) |

|

| 170,000

|

4.38%,

04/15/2026 |

157,577

|

| 375,000

|

4.63%,

04/15/2029 |

326,511

|

| 490,000

|

Univar

Solutions USA Inc(d)

5.13%, 12/01/2027

|

464,692

|

| 1,610,000

|

Victoria's

Secret & Co(d)(e)

4.63%, 07/15/2029

|

1,264,011

|

| Principal

Amount(a) |

|

Fair

Value |

| Consumer,

Cyclical — (continued) |

| $1,110,000

|

Wynn

Las Vegas LLC / Wynn Las Vegas Capital Corp(d)(e)

5.25%, 05/15/2027

|

$

1,001,743 |

| |

Wynn

Resorts Finance LLC / Wynn Resorts Capital Corp(d) |

|

| 115,000

|

7.75%,

04/15/2025 |

114,362

|

| 1,365,000

|

5.13%,

10/01/2029 |

1,169,982

|

| |

Yum!

Brands Inc |

|

| 2,115,000

|

4.75%,

01/15/2030(d) |

1,940,512

|

| 195,000

|

3.63%,

03/15/2031 |

163,508

|

| 305,000

|

5.38%,

04/01/2032(e) |

282,506

|

| |

|

63,725,195

|

| Consumer,

Non-Cyclical — 10.89% |

| 204,000

|

1375209

BC Ltd(d)

9.00%, 01/30/2028

|

198,645

|

| 325,000

|

180

Medical Inc(d)

3.88%, 10/15/2029

|

279,403

|

| 1,880,000

|

ADT

Security Corp(d)

4.13%, 08/01/2029

|

1,598,857

|

| |

Albertsons

Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC(d) |

|

| 390,000

|

7.50%,

03/15/2026 |

398,245

|

| 2,705,000

|

4.88%,

02/15/2030 |

2,414,104

|

| 1,405,000

|

Allied

Universal Holdco LLC / Allied Universal Finance Corp / Atlas Luxco 4 SARL

4.63%, 06/01/2028(d) |

1,157,395

|

| |

Bausch

Health Cos Inc(d) |

|

| 1,125,000

|

6.13%,

02/01/2027 |

775,834

|

| 1,725,000

|

4.88%,

06/01/2028 |

1,097,172

|

| 363,000

|

11.00%,

09/30/2028 |

283,084

|

| 72,000

|

14.00%,

10/15/2030 |

42,743

|

| 1,545,000

|

Block

Inc(e)

3.50%, 06/01/2031

|

1,232,794

|

| 1,000,000

|

Carriage

Services Inc(d)

4.25%, 05/15/2029

|

794,098

|

| |

Centene

Corp |

|

| 925,000

|

4.63%,

12/15/2029 |

845,298

|

| 785,000

|

3.00%,

10/15/2030 |

643,503

|

| |

Charles

River Laboratories International Inc(d) |

|

| 395,000

|

3.75%,

03/15/2029 |

349,338

|

| 1,180,000

|

4.00%,

03/15/2031 |

1,020,700

|

| |

CHS

/ Community Health Systems Inc(d) |

|

| 210,000

|

8.00%,

03/15/2026 |

191,187

|

| 155,000

|

5.63%,

03/15/2027 |

132,906

|

| 2,415,000

|

6.00%,

01/15/2029 |

2,020,099

|

| 1,370,000

|

5.25%,

05/15/2030 |

1,033,031

|

| 1,245,000

|

Elanco

Animal Health Inc

6.40%, 08/28/2028

|

1,184,630

|

| 1,295,000

|

Garda

World Security Corp(d)

4.63%, 02/15/2027

|

1,143,459

|

| |

Gartner

Inc(d) |

|

| 1,140,000

|

3.63%,

06/15/2029 |

1,001,741

|

| 650,000

|

3.75%,

10/01/2030(e) |

560,279

|

See Notes to Financial Statements.

Annual Report - December 31, 2022

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| Consumer,

Non-Cyclical — (continued) |

| |

HCA

Inc |

|

| $ 855,000

|

5.38%,

09/01/2026 |

$ 845,490

|

| 630,000

|

5.63%,

09/01/2028 |

626,429

|

| 1,405,000

|

3.50%,

09/01/2030 |

1,211,779

|

| 1,475,000

|

Herc

Holdings Inc(d)

5.50%, 07/15/2027

|

1,375,806

|

| 2,190,000

|

Jazz

Securities Designated Activity Co(d)

4.38%, 01/15/2029

|

1,951,618

|

| |

Lamb

Weston Holdings Inc(d) |

|

| 975,000

|

4.88%,

05/15/2028 |

923,813

|

| 975,000

|

4.13%,

01/31/2030 |

861,120

|

| 2,415,000

|

Medline

Borrower LP(d)

3.88%, 04/01/2029

|

1,946,393

|

| 1,690,000

|

Neptune

Bidco US Inc(d)(e)

9.29%, 04/15/2029

|

1,592,825

|

| 1,825,000

|

NESCO

Holdings II Inc(d)

5.50%, 04/15/2029

|

1,596,875

|

| 255,000

|

Option

Care Health Inc(d)

4.38%, 10/31/2029

|

223,051

|

| |

Organon

& Co / Organon Foreign Debt Co-Issuer BV(d) |

|

| 1,255,000

|

4.13%,

04/30/2028 |

1,111,177

|

| 200,000

|

5.13%,

04/30/2031 |

173,176

|

| |

Owens

& Minor Inc(d) |

|

| 1,175,000

|

4.50%,

03/31/2029(e) |

936,828

|

| 1,260,000

|

6.63%,

04/01/2030 |

1,082,844

|

| |

Prime

Security Services Borrower LLC / Prime Finance Inc(d) |

|

| 200,000

|

3.38%,

08/31/2027 |

172,637

|

| 365,000

|

6.25%,

01/15/2028 |

332,208

|

| |

Sabre

GLBL Inc(d) |

|

| 1,240,000

|

9.25%,

04/15/2025 |

1,235,197

|

| 250,000

|

7.38%,

09/01/2025 |

240,260

|

| |

Service

Corp International |

|

| 290,000

|

7.50%,

04/01/2027 |

295,455

|

| 710,000

|

5.13%,

06/01/2029 |

665,643

|

| 145,000

|

3.38%,

08/15/2030 |

117,872

|

| 2,110,000

|

4.00%,

05/15/2031 |

1,777,096

|

| 1,150,000

|

Shift4

Payments LLC / Shift4 Payments Finance Sub Inc(d)

4.63%, 11/01/2026

|

1,086,509

|

| 965,000

|

Spectrum

Brands Inc(d)

5.00%, 10/01/2029

|

835,136

|

| |

Tenet

Healthcare Corp |

|

| 149,000

|

4.63%,

07/15/2024 |

145,313

|

| 1,230,000

|

4.88%,

01/01/2026(d) |

1,163,141

|

| 1,855,000

|

5.13%,

11/01/2027(d) |

1,725,595

|

| 3,010,000

|

4.25%,

06/01/2029(d) |

2,607,563

|

| 1,820,000

|

6.13%,

06/15/2030(d) |

1,734,096

|

| |

Teva

Pharmaceutical Finance Netherlands III BV |

|

| 245,000

|

6.00%,

04/15/2024 |

240,120

|

| 1,725,000

|

6.75%,

03/01/2028(e) |

1,681,875

|

| 2,015,000

|

5.13%,

05/09/2029(e) |

1,794,452

|

| |

|

54,707,937

|

| Principal

Amount(a) |

|

Fair

Value |

| Energy

— 12.71% |

| $ 345,000

|

Antero

Midstream Partners LP / Antero Midstream Finance Corp(d)

7.88%, 05/15/2026

|

$ 349,232

|

| 1,446,000

|

Antero

Resources Corp(d)

7.63%, 02/01/2029

|

1,453,962

|

| |

Apache

Corp |

|

| 1,045,000

|

4.38%,

10/15/2028 |

940,564

|

| 1,095,000

|

5.10%,

09/01/2040 |

907,440

|

| |

Buckeye

Partners LP |

|

| 805,000

|

3.95%,

12/01/2026 |

720,233

|

| 750,000

|

4.50%,

03/01/2028(d) |

659,247

|

| 445,000

|

5.85%,

11/15/2043 |

331,560

|

| 2,775,000

|

Callon

Petroleum Co(d)(e)

7.50%, 06/15/2030

|

2,539,125

|

| |

Cheniere

Energy Partners LP |

|

| 760,000

|

4.00%,

03/01/2031 |

647,034

|

| 570,000

|

3.25%,

01/31/2032 |

452,983

|

| 1,965,000

|

Chord

Energy Corp(d)

6.38%, 06/01/2026

|

1,913,772

|

| |

Comstock

Resources Inc(d) |

|

| 1,020,000

|

6.75%,

03/01/2029 |

920,550

|

| 665,000

|

5.88%,

01/15/2030 |

571,700

|

| |

Continental

Resources Inc |

|

| 520,000

|

4.50%,

04/15/2023 |

518,742

|

| 375,000

|

5.75%,

01/15/2031(d) |

349,073

|

| |

DCP

Midstream Operating LP |

|

| 485,000

|

5.63%,

07/15/2027 |

481,101

|

| 1,170,000

|

6.75%,

09/15/2037(d) |

1,179,346

|

| |

Devon

Energy Corp |

|

| 390,000

|

7.88%,

09/30/2031 |

440,090

|

| 275,000

|

7.95%,

04/15/2032 |

312,102

|

| 1,540,000

|

Encino

Acquisition Partners Holdings LLC(d)

8.50%, 05/01/2028

|

1,407,545

|

| 3,345,000

|

Endeavor

Energy Resources LP / EER Finance Inc(d)

5.75%, 01/30/2028

|

3,202,904

|

| 2,120,000

|

Energy

Transfer LP(f)

6.63%, Perpetual

|

1,574,100

|

| 2,110,000

|

EnLink

Midstream LLC(d)

5.63%, 01/15/2028

|

2,009,771

|

| 930,000

|

EQT

Corp(e)

7.00%, 02/01/2030

|

964,522

|

| |

Hess

Midstream Operations LP(d) |

|

| 1,010,000

|

5.63%,

02/15/2026 |

983,826

|

| 510,000

|

5.13%,

06/15/2028 |

471,595

|

| 1,240,000

|

4.25%,

02/15/2030 |

1,060,102

|

| 480,000

|

5.50%,

10/15/2030 |

439,131

|

| 1,610,000

|

Holly

Energy Partners LP / Holly Energy Finance Corp(d)

5.00%, 02/01/2028

|

1,465,915

|

| 100,000

|

Kinder

Morgan Inc

7.80%, 08/01/2031

|

111,514

|

| 1,315,000

|

Kinetik

Holdings LP(d)

5.88%, 06/15/2030

|

1,233,185

|

| 2,309,000

|

Nabors

Industries Inc(d)

9.00%, 02/01/2025

|

2,337,836

|

See Notes to Financial Statements.

Annual Report - December 31, 2022

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| Energy

— (continued) |

| |

Occidental

Petroleum Corp |

|

| $1,830,000

|

6.63%,

09/01/2030 |

$ 1,891,085

|

| 1,385,000

|

6.13%,

01/01/2031 |

1,397,728

|

| 4,460,000

|

6.45%,

09/15/2036 |

4,549,200

|

| 2,610,000

|

6.20%,

03/15/2040 |

2,554,135

|

| 1,145,000

|

Patterson-UTI

Energy Inc

5.15%, 11/15/2029

|

1,026,228

|

| |

Permian

Resources Operating LLC(d) |

|

| 502,000

|

5.38%,

01/15/2026 |

456,963

|

| 2,870,000

|

6.88%,

04/01/2027 |

2,704,223

|

| |

Precision

Drilling Corp(d) |

|

| 2,235,000

|

7.13%,

01/15/2026 |

2,162,362

|

| 105,000

|

6.88%,

01/15/2029 |

97,756

|

| 2,235,000

|

Rockcliff

Energy II LLC(d)

5.50%, 10/15/2029

|

2,044,913

|

| 225,000

|

Seventy

Seven Energy Inc(g)(h)(i)

6.63%, 11/15/2025

|

23

|

| |

SM

Energy Co |

|

| 865,000

|

5.63%,

06/01/2025 |

830,392

|

| 1,435,000

|

6.75%,

09/15/2026 |

1,393,170

|

| 210,000

|

6.50%,

07/15/2028(e) |

201,342

|

| |

Southwestern

Energy Co |

|

| 1,455,000

|

5.38%,

02/01/2029 |

1,348,872

|

| 1,690,000

|

5.38%,

03/15/2030 |

1,541,312

|

| 470,000

|

4.75%,

02/01/2032 |

401,657

|

| |

Tallgrass

Energy Partners LP / Tallgrass Energy Finance Corp(d) |

|

| 1,958,000

|

5.50%,

01/15/2028 |

1,736,433

|

| 315,000

|

6.00%,

12/31/2030 |

272,390

|

| |

USA

Compression Partners LP / USA Compression Finance Corp |

|

| 915,000

|

6.88%,

04/01/2026 |

877,750

|

| 390,000

|

6.88%,

09/01/2027 |

364,650

|

| |

Venture

Global Calcasieu Pass LLC(d) |

|

| 740,000

|

3.88%,

08/15/2029 |

647,500

|

| 1,945,000

|

3.88%,

11/01/2033 |

1,588,870

|

| 885,000

|

Viper

Energy Partners LP(d)

5.38%, 11/01/2027

|

840,317

|

| |

|

63,879,073

|

| Financial

— 5.07% |

| 345,000

|

AG

Issuer LLC(d)

6.25%, 03/01/2028

|

317,040

|

| 1,360,000

|

Alliant

Holdings Intermediate LLC / Alliant Holdings Co-Issuer(d)

4.25%, 10/15/2027

|

1,218,054

|

| |

Ally

Financial Inc |

|

| 110,000

|

5.75%,

11/20/2025 |

106,562

|

| 1,780,000

|

8.00%,

11/01/2031(e) |

1,837,576

|

| 655,000

|

AmWINS

Group Inc(d)

4.88%, 06/30/2029

|

555,536

|

| 1,275,000

|

Cobra

AcquisitionCo LLC(d)

6.38%, 11/01/2029

|

752,250

|

| Principal

Amount(a) |

|

Fair

Value |

| Financial

— (continued) |

| $ 200,000

|

Credit

Suisse Group AG(d)(f)

6.38%, Perpetual

|

$ 143,334

|

|

230,000 |

Dresdner

Funding Trust I(d)

8.15%, 06/30/2031

|

236,900 |

| |

Freedom

Mortgage Corp(d) |

|

| 330,000

|

8.13%,

11/15/2024 |

303,600

|

| 1,149,000

|

8.25%,

04/15/2025 |

1,033,499

|

| 730,000

|

6.63%,

01/15/2027 |

568,123

|

| |

goeasy

Ltd(d) |

|

| 130,000

|

5.38%,

12/01/2024 |

124,709

|

| 1,060,000

|

4.38%,

05/01/2026 |

938,100

|

| |

Icahn

Enterprises LP / Icahn Enterprises Finance Corp |

|

| 745,000

|

6.25%,

05/15/2026 |

715,868

|

| 2,505,000

|

5.25%,

05/15/2027 |

2,293,578

|

| 195,000

|

4.38%,

02/01/2029 |

164,902

|

| |

iStar

Inc REIT |

|

| 1,110,000

|

4.25%,

08/01/2025 |

1,087,716

|

| 2,120,000

|

5.50%,

02/15/2026 |

2,114,552

|

| |

Ladder

Capital Finance Holdings LLLP / Ladder Capital Finance Corp REIT(d) |

|

| 110,000

|

5.25%,

10/01/2025 |

103,349

|

| 1,270,000

|

4.25%,

02/01/2027 |

1,066,837

|

| 1,015,000

|

4.75%,

06/15/2029 |

819,470

|

| 393,000

|

Lloyds

Banking Group PLC(f)

7.50%, Perpetual

|

380,896

|

| |

Nationstar

Mortgage Holdings Inc(d) |

|

| 1,415,000

|

5.50%,

08/15/2028 |

1,153,807

|

| 1,170,000

|

5.75%,

11/15/2031 |

909,675

|

| |

OneMain

Finance Corp |

|

| 240,000

|

7.13%,

03/15/2026 |

228,211

|

| 1,190,000

|

6.63%,

01/15/2028 |

1,095,788

|

| 1,760,000

|

5.38%,

11/15/2029(e) |

1,439,505

|

| |

PennyMac

Financial Services Inc(d) |

|

| 380,000

|

5.38%,

10/15/2025 |

342,465

|

| 1,035,000

|

5.75%,

09/15/2031 |

820,770

|

| 1,515,000

|

PHH

Mortgage Corp(d)

7.88%, 03/15/2026

|

1,345,827

|

| 805,000

|

Realogy

Group LLC / Realogy Co-Issuer Corp(d)

5.75%, 01/15/2029

|

608,894

|

| 140,000

|

Service

Properties Trust REIT

7.50%, 09/15/2025

|

133,410

|

| |

Societe

Generale SA(d)(f) |

|

| 330,000

|

4.75%,

Perpetual(e) |

279,707

|

| 295,000

|

5.38%,

Perpetual |

238,990

|

| |

|

25,479,500

|

| Industrial

— 8.99% |

| |

Amsted

Industries Inc(d) |

|

| 320,000

|

5.63%,

07/01/2027 |

303,571

|

| 845,000

|

4.63%,

05/15/2030 |

720,362

|

See Notes to Financial Statements.

Annual Report - December 31, 2022

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| Industrial

— (continued) |

| |

Ardagh

Metal Packaging Finance USA LLC / Ardagh Metal Packaging Finance PLC(d)(e) |

|

| $ 275,000

|

3.25%,

09/01/2028 |

$ 233,597

|

| 1,765,000

|

4.00%,

09/01/2029 |

1,398,811

|

|

600,000 |

Ardagh

Packaging Finance PLC / Ardagh Holdings USA Inc(d)

4.13%, 08/15/2026

|

519,722 |

| 1,000,000

|

Ball

Corp

EUR, 1.50%, 03/15/2027

|

944,669 |

|

305,000 |

Berry

Global Inc(d)

5.63%, 07/15/2027

|

297,540 |

|

750,000 |

Boise

Cascade Co(d)

4.88%, 07/01/2030

|

652,783 |

| |

Bombardier

Inc(d) |

|

| 450,000

|

7.50%,

03/15/2025 |

445,641

|

| 1,780,000

|

7.88%,

04/15/2027(e) |

1,726,557

|

| |

Builders

FirstSource Inc(d) |

|

| 915,000

|

4.25%,

02/01/2032 |

741,816

|

| 425,000

|

6.38%,

06/15/2032 |

399,180

|

| 375,000

|

Camelot

Return Merger Sub Inc(d)

8.75%, 08/01/2028

|

344,111

|

| |

Chart

Industries Inc(d) |

|

| 765,000

|

7.50%,

01/01/2030 |

769,047

|

| 150,000

|

9.50%,

01/01/2031 |

153,842

|

| 1,630,000

|

Covanta

Holding Corp(d)

4.88%, 12/01/2029

|

1,335,410

|

| 666,000

|

Crown

Cork & Seal Co Inc

7.38%, 12/15/2026

|

685,654

|

| |

GFL

Environmental Inc(d) |

|

| 1,665,000

|

4.00%,

08/01/2028 |

1,423,575

|

| 670,000

|

3.50%,

09/01/2028 |

589,039

|

| 115,000

|

4.75%,

06/15/2029 |

100,654

|

| 1,175,000

|

Graphic

Packaging International LLC(d)

3.75%, 02/01/2030

|

998,725

|

| 1,855,000

|

Great

Lakes Dredge & Dock Corp(d)

5.25%, 06/01/2029

|

1,442,077

|

| 1,710,000

|

Howmet

Aerospace Inc

3.00%, 01/15/2029

|

1,453,500

|

| 2,500,000

|

Imola

Merger Corp(d)

4.75%, 05/15/2029

|

2,169,034

|

| 630,000

|

Intelligent

Packaging Ltd Finco Inc / Intelligent Packaging Ltd Co-Issuer LLC(d)

6.00%, 09/15/2028

|

507,761

|

| 700,000

|

JELD-WEN

Inc(d)(e)

4.88%, 12/15/2027

|

526,869

|

| 935,000

|

Louisiana-Pacific

Corp(d)

3.63%, 03/15/2029

|

807,696

|

| 1,690,000

|

Madison

IAQ LLC(d)

4.13%, 06/30/2028

|

1,413,229

|

| |

Masonite

International Corp(d) |

|

| 170,000

|

5.38%,

02/01/2028 |

157,184

|

| 1,440,000

|

3.50%,

02/15/2030 |

1,164,854

|

| Principal

Amount(a) |

|

Fair

Value |

| Industrial

— (continued) |

| |

Mauser

Packaging Solutions Holding Co(d) |

|

| $ 215,000

|

5.50%,

04/15/2024 |

$ 209,055

|

| 450,000

|

8.50%,

04/15/2024 |

440,981

|

|

495,000 |

MIWD

Holdco II LLC / MIWD Finance Corp(d)

5.50%, 02/01/2030

|

394,094 |

| 1,565,000

|

Roller

Bearing Co of America Inc(d)

4.38%, 10/15/2029

|

1,353,255

|

| |

Sensata

Technologies BV(d) |

|

| 2,560,000

|

4.00%,

04/15/2029 |

2,208,000

|

| 280,000

|

5.88%,

09/01/2030 |

265,363

|

| 1,285,000

|

Sensata

Technologies Inc(d)

3.75%, 02/15/2031

|

1,057,092

|

| |

Standard

Industries Inc(d) |

|

| 870,000

|

5.00%,

02/15/2027 |

802,778

|

| 1,250,000

|

4.75%,

01/15/2028 |

1,124,862

|

| 820,000

|

4.38%,

07/15/2030 |

668,238

|

| 590,000

|

3.38%,

01/15/2031 |

443,977

|

| 905,000

|

Terex

Corp(d)

5.00%, 05/15/2029

|

813,369

|

| 695,000

|

TK

Elevator Midco GmbH

EUR, 4.38%, 07/15/2027

|

658,181

|

| |

TransDigm

Inc |

|

| 1,255,000

|

6.25%,

03/15/2026(d) |

1,237,668

|

| 175,000

|

6.38%,

06/15/2026(e) |

170,267

|

| 1,135,000

|

5.50%,

11/15/2027 |

1,065,822

|

| 780,000

|

4.63%,

01/15/2029 |

685,831

|

| 2,775,000

|

4.88%,

05/01/2029 |

2,420,494

|

| 1,435,000

|

TTM

Technologies Inc(d)(e)

4.00%, 03/01/2029

|

1,230,577

|

| 2,080,000

|

Vertiv

Group Corp(d)

4.13%, 11/15/2028

|

1,768,000

|

| |

WESCO

Distribution Inc(d) |

|

| 460,000

|

7.13%,

06/15/2025 |

465,756

|

| 1,230,000

|

7.25%,

06/15/2028 |

1,245,958

|

| |

|

45,156,128

|

| Technology

— 2.63% |

| 1,195,000

|

Boxer

Parent Co Inc(d)

7.13%, 10/02/2025

|

1,162,151

|

| 1,065,000

|

CDW

LLC / CDW Finance Corp

3.25%, 02/15/2029

|

907,050

|

| 640,000

|

Central

Parent Inc / Central Merger Sub Inc(d)(e)

7.25%, 06/15/2029

|

625,998

|

| 1,195,000

|

Clarivate

Science Holdings Corp(d)

3.88%, 07/01/2028

|

1,035,343

|

| 2,005,000

|

Cloud

Software Group Holdings Inc(d)

6.50%, 03/31/2029

|

1,688,774

|

| 2,010,000

|

Crowdstrike

Holdings Inc

3.00%, 02/15/2029

|

1,695,967

|

| 1,835,000

|

NCR

Corp(d)

5.13%, 04/15/2029

|

1,534,653

|

| |

Twilio

Inc |

|

| 2,005,000

|

3.63%,

03/15/2029(e) |

1,628,862

|

See Notes to Financial Statements.

Annual Report - December 31, 2022

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| Technology

— (continued) |

| $ 410,000

|

3.88%,

03/15/2031 |

$ 325,276

|

| 3,135,000

|

ZoomInfo

Technologies LLC / ZoomInfo Finance Corp(d)

3.88%, 02/01/2029

|

2,634,599

|

| |

|

13,238,673

|

| Utilities

— 1.33% |

| |

Calpine

Corp(d) |

|

| 1,890,000

|

4.50%,

02/15/2028 |

1,685,839

|

| 470,000

|

4.63%,

02/01/2029 |

403,285

|

| 155,000

|

5.00%,

02/01/2031 |

130,030

|

| |

NRG

Energy Inc |

|

| 190,000

|

3.75%,

06/15/2024(d) |

182,996

|

| 196,000

|

6.63%,

01/15/2027 |

194,344

|

| 730,000

|

5.25%,

06/15/2029(d) |

644,400

|

| 1,365,000

|

3.88%,

02/15/2032(d) |

1,025,183

|

| 185,000

|

Pacific

Gas & Electric Co(h)

2.95%, 03/01/2026

|

169,553

|

| 390,000

|

Vistra

Corp(d)(f)

7.00%, Perpetual

|

354,874

|

| |

Vistra

Operations Co LLC(d) |

|

| 1,875,000

|

5.00%,

07/31/2027 |

1,740,175

|

| 190,000

|

4.30%,

07/15/2029 |

171,161

|

| |

|

6,701,840

|

TOTAL

CORPORATE BONDS AND NOTES — 70.37%

(Cost $399,420,487) |

$353,636,778

|

| CONVERTIBLE

BONDS |

| Communications

— 3.54% |

| 1,674,000

|

Airbnb

Inc(j)

6.70%, 03/15/2026

|

1,377,702

|

| 941,000

|

Booking

Holdings Inc(e)

0.75%, 05/01/2025

|

1,253,322

|

| |

DISH

Network Corp |

|

| 699,000

|

19.18%,

12/15/2025(j) |

445,962

|

| 696,000

|

3.38%,

08/15/2026 |

436,044

|

| 1,523,000

|

Etsy

Inc

0.25%, 06/15/2028

|

1,300,337

|

| 756,000

|

Fiverr

International Ltd(j)

8.46%, 11/01/2025

|

609,663

|

| |

Liberty

Media Corp |

|

| 370,000

|

1.38%,

10/15/2023 |

455,655

|

| 657,000

|

2.75%,

12/01/2049(d)(e) |

598,856

|

| 676,000

|

0.50%,

12/01/2050(d) |

674,145

|

| 773,000

|

Liberty

Media Corp / Liberty Formula One(d)

2.25%, 08/15/2027

|

738,601

|

| 924,000

|

Match

Group Financeco 2 Inc(d)

0.88%, 06/15/2026

|

818,318

|

| 1,733,000

|

Okta

Inc

0.38%, 06/15/2026

|

1,455,720

|

| 1,552,000

|

Palo

Alto Networks Inc

0.38%, 06/01/2025

|

2,291,528

|

| 877,000

|

Perficient

Inc

0.13%, 11/15/2026

|

677,482

|

| Principal

Amount(a) |

|

Fair

Value |

| Communications

— (continued) |

| $1,396,000

|

Snap

Inc(j)

9.96%, 05/01/2027

|

$ 975,106

|

|

765,000 |

Spotify

USA Inc(j)

7.55%, 03/15/2026

|

615,825 |

|

628,000 |

TechTarget

Inc(d)(j)

8.02%, 12/15/2026

|

476,652 |

| 1,319,000

|

Uber

Technologies Inc(e)(j)

6.33%, 12/15/2025

|

1,110,936

|

|

697,000 |

Upwork

Inc(e)

0.25%, 08/15/2026

|

522,652 |

|

663,000 |

Wayfair

Inc

0.63%, 10/01/2025

|

428,630 |

|

553,000 |

Zillow

Group Inc

2.75%, 05/15/2025

|

525,903

|

| |

|

17,789,039

|

| Consumer,

Cyclical — 2.38% |

| 458,000

|

Burlington

Stores Inc(e)

2.25%, 04/15/2025

|

526,700

|

| 984,000

|

Cheesecake

Factory Inc

0.38%, 06/15/2026

|

806,265

|

| 964,000

|

DraftKings

Holdings Inc(j)

11.84%, 03/15/2028

|

596,234

|

| 1,432,000

|

Ford

Motor Co(j)

1.87%, 03/15/2026

|

1,351,092

|

| 890,000

|

IMAX

Corp

0.50%, 04/01/2026

|

750,637

|

| 587,000

|

JetBlue

Airways Corp

0.50%, 04/01/2026

|

427,968

|

| 1,149,000

|

Liberty

TripAdvisor Holdings Inc(d)

0.50%, 06/30/2051

|

823,833

|

| 333,000

|

National

Vision Holdings Inc

2.50%, 05/15/2025

|

456,904

|

| |

NCL

Corp Ltd |

|

| 431,000

|

5.38%,

08/01/2025 |

434,664

|

| 1,094,000

|

2.50%,

02/15/2027(d) |

784,945

|

| 671,000

|

Patrick

Industries Inc

1.75%, 12/01/2028

|

543,510

|

| 557,000

|

Royal

Caribbean Cruises Ltd(d)

6.00%, 08/15/2025

|

699,592

|

| 1,187,000

|

Shake

Shack Inc(j)

10.05%, 03/01/2028

|

781,194

|

| 1,542,000

|

Southwest

Airlines Co(e)

1.25%, 05/01/2025

|

1,851,942

|

| 1,213,000

|

Vail

Resorts Inc(j)

2.60%, 01/01/2026

|

1,125,057

|

| |

|

11,960,537

|

| Consumer,

Non-Cyclical — 3.29% |

| 634,000

|

Alnylam

Pharmaceuticals Inc(d)

1.00%, 09/15/2027

|

686,305

|

| 442,000

|

Ascendis

Pharma A/S(d)

2.25%, 04/01/2028

|

452,180

|

| 722,000

|

Beauty

Health Co(d)(e)

1.25%, 10/01/2026

|

545,832

|

| |

Block

Inc |

|

| 547,000

|

0.13%,

03/01/2025 |

520,334

|

| 1,062,000

|

0.25%,

11/01/2027 |

800,482

|

See Notes to Financial Statements.

Annual Report - December 31, 2022

EMPOWER FUNDS, INC.

EMPOWER HIGH YIELD BOND FUND

Schedule of Investments

As of December 31, 2022

| Principal

Amount(a) |

|

Fair

Value |

| Consumer,

Non-Cyclical — (continued) |

| $ 707,000

|

Brookdale

Senior Living Inc

2.00%, 10/15/2026

|

$ 528,924

|

|

842,000 |

Chegg

Inc(j)

7.49%, 09/01/2026

|

660,465 |

|

532,000 |

CONMED

Corp(d)

2.25%, 06/15/2027

|

484,652 |

| 1,647,000

|

Dexcom

Inc(e)

0.25%, 11/15/2025

|

1,791,112

|

| 1,425,000

|

Exact

Sciences Corp

0.38%, 03/01/2028

|

1,116,915

|

|

333,000 |

Guardant

Health Inc(j)

12.47%, 11/15/2027

|

207,093 |

| |

Halozyme

Therapeutics Inc |

|

| 852,000

|

0.25%,

03/01/2027(e) |

824,843

|

| 192,000

|

1.00%,

08/15/2028(d) |

226,200

|

| 688,000

|

Innoviva

Inc

2.50%, 08/15/2025

|

700,728

|

| 544,000

|

Insmed

Inc

0.75%, 06/01/2028

|

448,800

|

| 497,000

|

Insulet

Corp

0.38%, 09/01/2026

|

701,764

|

| 928,000

|

Ironwood

Pharmaceuticals Inc

1.50%, 06/15/2026

|

1,012,100

|

| 634,000

|

Jazz

Investments I Ltd

2.00%, 06/15/2026

|

753,667

|

| 833,000

|

Lantheus

Holdings Inc(d)

2.63%, 12/15/2027

|

838,748

|

| 637,000

|

Pacira

BioSciences Inc

0.75%, 08/01/2025

|

573,698

|

| 126,000

|

Repligen

Corp

0.38%, 07/15/2024

|

201,991

|

| |

Sarepta

Therapeutics Inc |

|

| 231,000

|

1.50%,

11/15/2024 |

431,508

|

| 368,000

|

1.25%,

09/15/2027(d) |

424,120

|

| 860,000

|

Shift4

Payments Inc(j)

0.32%, 12/15/2025

|

851,937

|

| 975,000

|

Teladoc

Health Inc(e)

1.25%, 06/01/2027

|

748,990

|

| |

|

16,533,388

|

| Energy

— 1.06% |

| 746,000

|

Enphase

Energy Inc(j)

(2.80%), 03/01/2028

|

872,372

|

| 331,000

|

EQT

Corp

1.75%, 05/01/2026

|

768,582

|

| 775,000

|

NextEra

Energy Partners LP(d)(j)

0.21%, 11/15/2025

|

770,350

|

| 565,000

|

Northern

Oil & Gas Inc(d)

3.63%, 04/15/2029

|

607,375

|

| 620,000

|

Pioneer

Natural Resources Co

0.25%, 05/15/2025

|

1,445,840

|

| 699,000

|

SolarEdge

Technologies Inc(e)(j)

(7.18%), 09/15/2025

|

867,809

|

| |

|

5,332,328

|

| Financial

— 0.14% |

| 1,020,629

|

SoFi

Technologies Inc(d)(j)

12.16%, 10/15/2026

|

698,621

|

| Principal

Amount(a) |

|

Fair

Value |

| Industrial

— 0.44% |

| $ 701,000

|

Axon

Enterprise Inc(d)

0.50%, 12/15/2027

|

$ 694,691

|

| 1,043,000

|

John

Bean Technologies Corp

0.25%, 05/15/2026

|

895,415 |

|

505,000 |

Middleby

Corp

1.00%, 09/01/2025

|

593,628

|

| |

|

2,183,734

|

| Technology

— 3.37% |

|

822,000 |

3D

Systems Corp(j)

12.03%, 11/15/2026

|

560,604 |

| 1,145,000

|

Akamai

Technologies Inc

0.38%, 09/01/2027

|

1,102,635

|

| 1,142,000

|

Bentley

Systems Inc

0.38%, 07/01/2027

|

929,588

|

| |

Bill.com

Holdings Inc(j) |

|

| 486,000

|

(2.42%),

12/01/2025 |

497,178

|

| 627,000

|

6.23%,

04/01/2027 |

495,644

|

| 461,000

|

Box

Inc(j)

(7.81%), 01/15/2026

|

604,602

|

| 537,000

|

Ceridian

HCM Holding Inc

0.25%, 03/15/2026

|

470,681

|

| 1,109,000

|

Cloudflare

Inc(j)

6.26%, 08/15/2026

|

903,835

|

| 230,000

|

Confluent

Inc(j)

8.02%, 01/15/2027

|

173,650

|

| 802,000

|

CyberArk

Software Ltd(j)

(2.93%), 11/15/2024

|

848,654

|

| 579,000

|

Datadog

Inc

0.13%, 06/15/2025

|

631,834

|

| 540,000

|

DigitalOcean

Holdings Inc(j)

8.62%, 12/01/2026

|

403,650

|

| 702,000

|

Envestnet

Inc

0.75%, 08/15/2025

|

633,555

|

| 834,000

|

Everbridge

Inc(j)

5.55%, 03/15/2026

|

707,899

|

| 332,000

|

HubSpot

Inc

0.38%, 06/01/2025

|

409,024

|

| 531,000

|

Impinj

Inc

1.13%, 05/15/2027

|

637,200

|

| 803,000

|

Lumentum

Holdings Inc

0.50%, 12/15/2026

|

688,572

|

| 581,000

|

MongoDB

Inc

0.25%, 01/15/2026

|

681,222

|

| 694,000

|

ON

Semiconductor Corp(j)

(5.66%), 05/01/2027

|

919,550

|

| 959,000

|

RingCentral

Inc(j)

7.58%, 03/01/2025

|

823,541

|

| 1,498,000