| State or other jurisdiction of incorporation or organization | I.R.S. Employer Identification No. | ||||||||||||||||

| Address of principal executive offices | Zip code | ||||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| None | ||

| PART I | PAGE | |||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | Principal Accountant Fees and Services | |||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

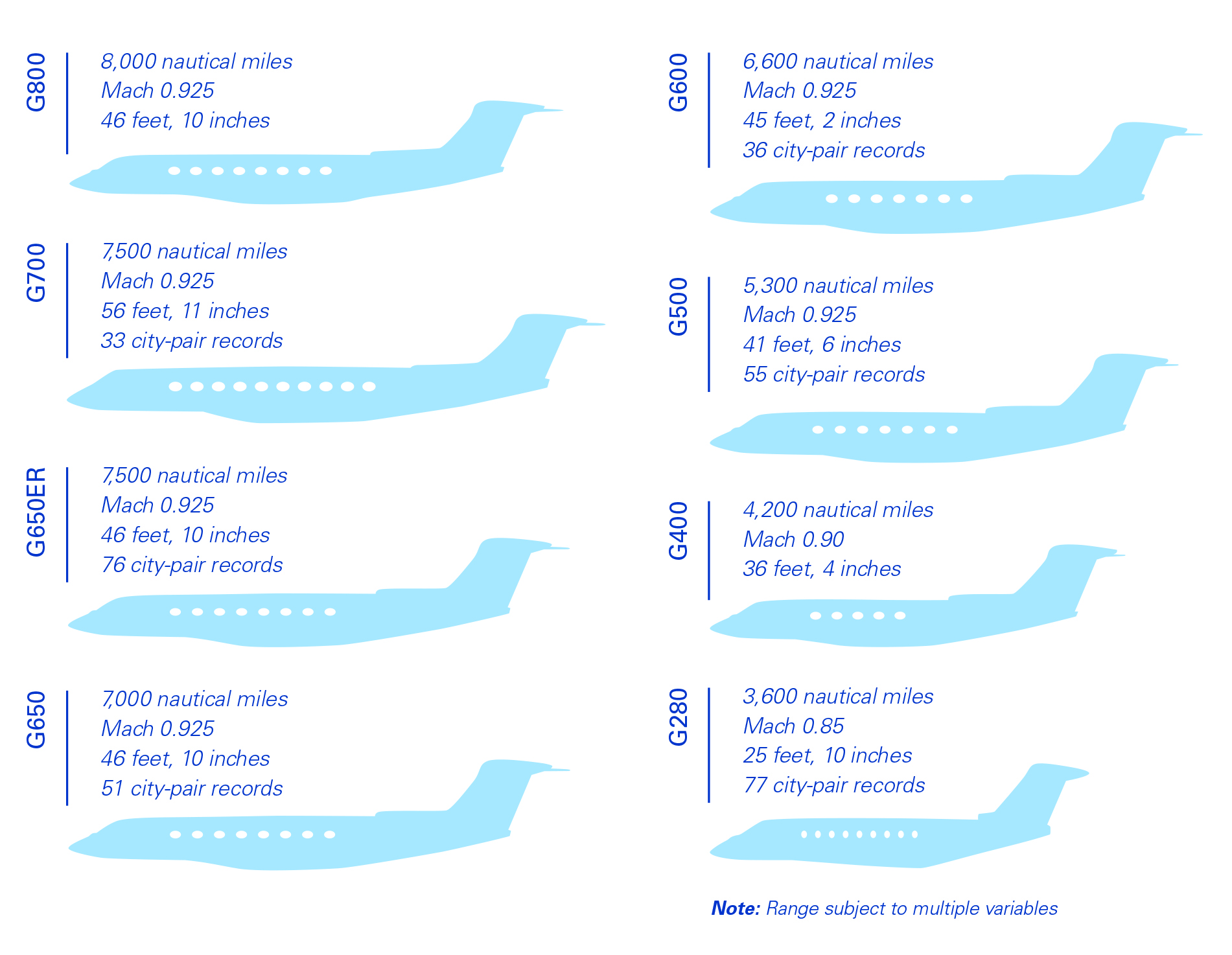

| Aircraft manufacturing | $ | 5,876 | $ | 5,864 | $ | 6,115 | |||||||||||

| Aircraft services | 2,691 | 2,271 | 1,960 | ||||||||||||||

| Total Aerospace | $ | 8,567 | $ | 8,135 | $ | 8,075 | |||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

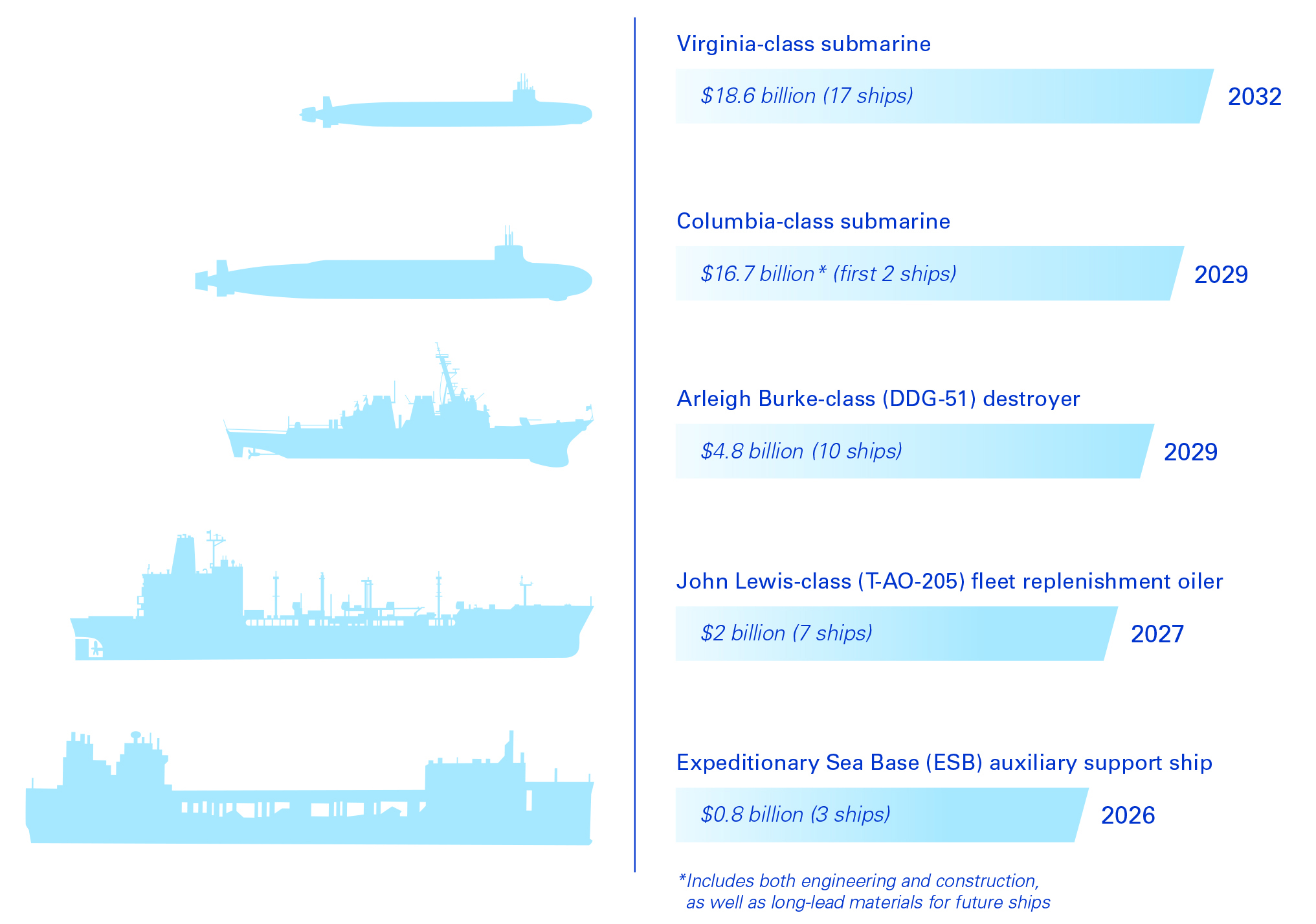

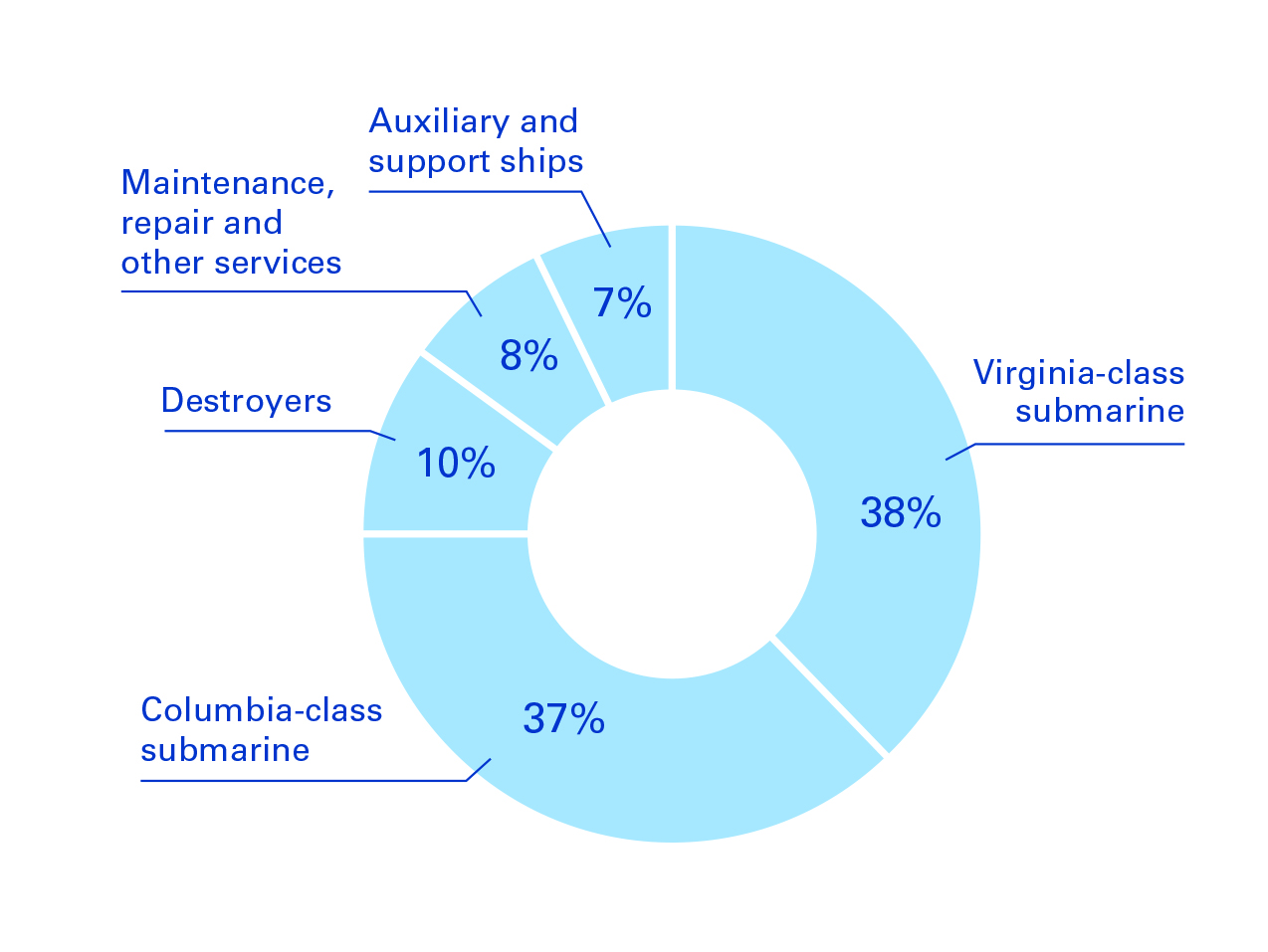

| Nuclear-powered submarines | $ | 7,310 | $ | 7,117 | $ | 6,938 | |||||||||||

| Surface ships | 2,561 | 2,328 | 2,055 | ||||||||||||||

| Repair and other services | 1,169 | 1,081 | 986 | ||||||||||||||

| Total Marine Systems | $ | 11,040 | $ | 10,526 | $ | 9,979 | |||||||||||

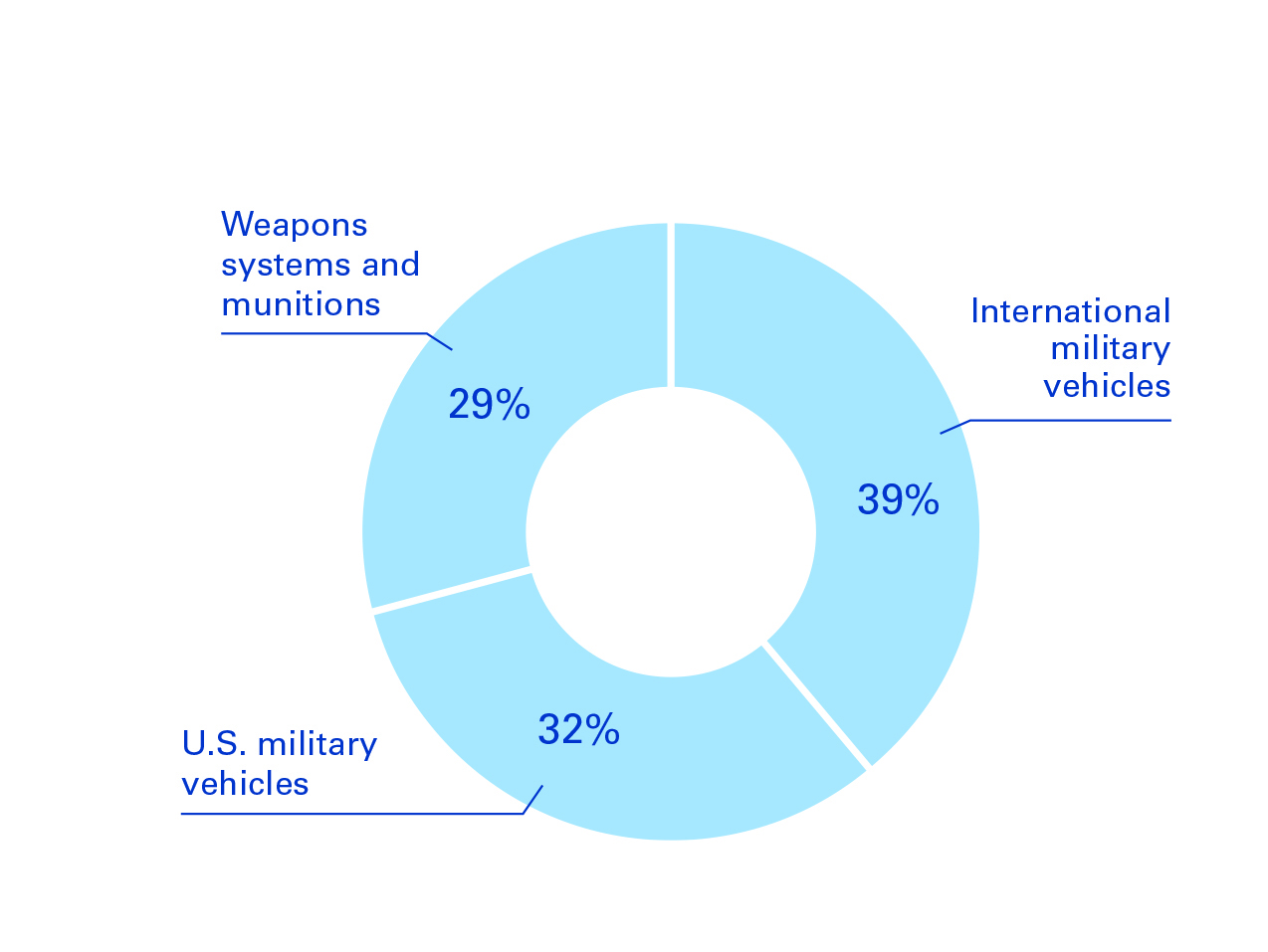

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

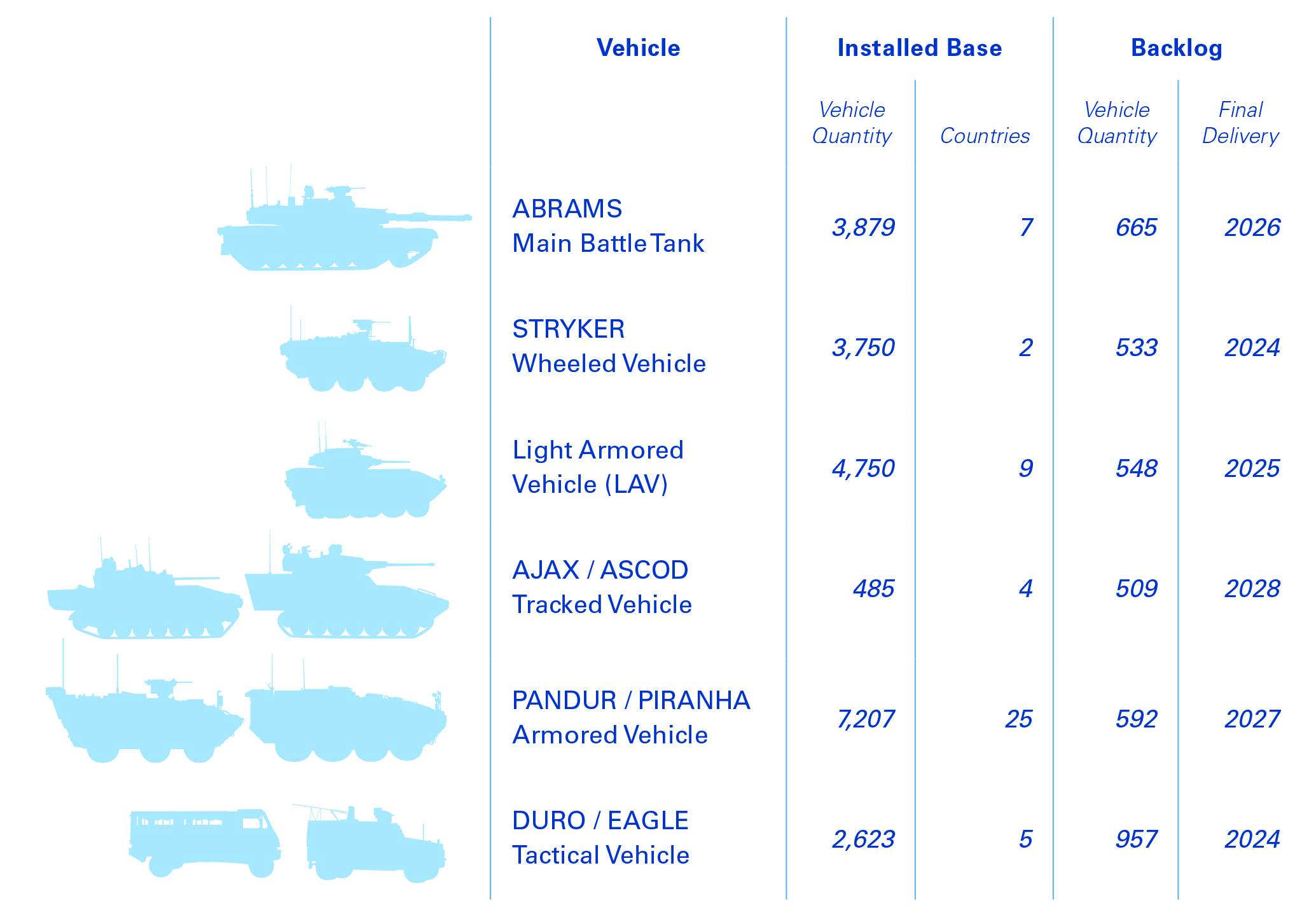

| Military vehicles | $ | 4,581 | $ | 4,699 | $ | 4,687 | |||||||||||

| Weapons systems, armament and munitions | 2,024 | 2,006 | 1,991 | ||||||||||||||

| Engineering and other services | 703 | 646 | 545 | ||||||||||||||

| Total Combat Systems | $ | 7,308 | $ | 7,351 | $ | 7,223 | |||||||||||

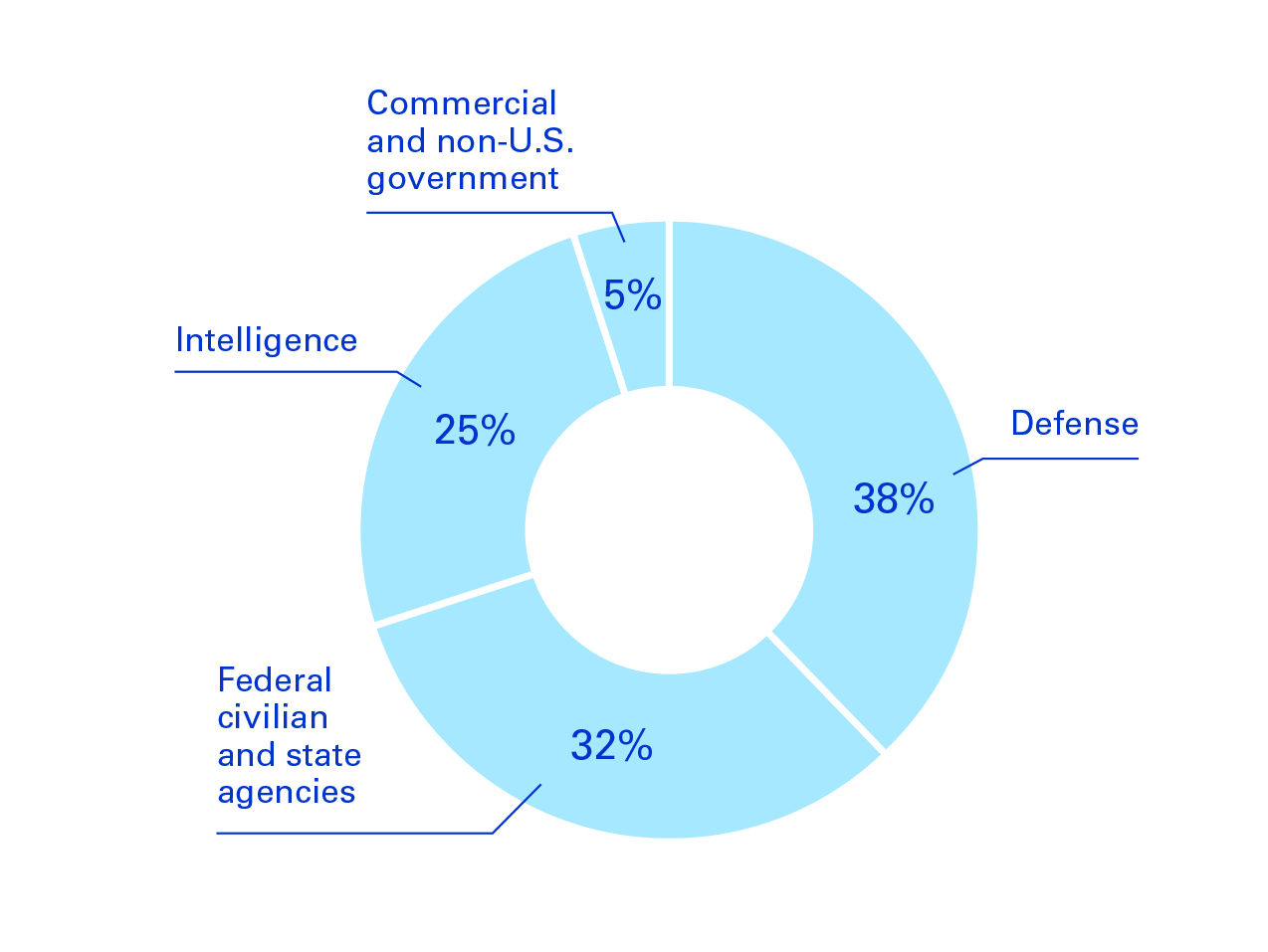

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| IT services | $ | 8,195 | $ | 8,069 | $ | 7,892 | |||||||||||

| C5ISR solutions | 4,297 | 4,388 | 4,756 | ||||||||||||||

| Total Technologies | $ | 12,492 | $ | 12,457 | $ | 12,648 | |||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| DoD | $ | 22,250 | $ | 21,386 | $ | 20,840 | |||||||||||

| Non-DoD | 4,808 | 4,862 | 4,726 | ||||||||||||||

| Foreign military sales (FMS)* | 633 | 598 | 737 | ||||||||||||||

| Total U.S. government | $ | 27,691 | $ | 26,846 | $ | 26,303 | |||||||||||

| % of total revenue | 70 | % | 70 | % | 69 | % | |||||||||||

| (Square feet in millions) | Company-owned Facilities | Leased Facilities | Government-owned Facilities | Total | |||||||||||||||||||

| Aerospace | 5.9 | 9.4 | 0.5 | 15.8 | |||||||||||||||||||

| Marine Systems | 8.7 | 4.5 | — | 13.2 | |||||||||||||||||||

| Combat Systems | 6.5 | 4.7 | 4.9 | 16.1 | |||||||||||||||||||

| Technologies | 3.1 | 7.9 | 0.9 | 11.9 | |||||||||||||||||||

| Total square feet | 24.2 | 26.5 | 6.3 | 57.0 | |||||||||||||||||||

| Name, Position and Office | Age | ||||

| Jason W. Aiken – Executive Vice President, Technologies and Chief Financial Officer since January 2023; Senior Vice President and Chief Financial Officer, January 2014 - December 2022; Vice President of the company and Chief Financial Officer of Gulfstream Aerospace Corporation, September 2011 - December 2013; Vice President and Controller, April 2010 - August 2011; Staff Vice President, Accounting, July 2006 - March 2010 | 50 | ||||

| Christopher J. Brady – Vice President of the company and President of General Dynamics Mission Systems since January 2019; Vice President, Engineering of General Dynamics Mission Systems, January 2015 - December 2018; Vice President, Engineering of General Dynamics C4 Systems, May 2013 - December 2014; Vice President, Assured Communications Systems of General Dynamics C4 Systems, August 2004 - May 2013 | 60 | ||||

Mark L. Burns – Vice President of the company and President of Gulfstream Aerospace Corporation since July 2015; Vice President of the company since February 2014; President, Product Support of Gulfstream Aerospace Corporation, June 2008 - June 2015 | 63 | ||||

Danny Deep – Vice President of the company and President of General Dynamics Land Systems since April 2020; Chief Operating Officer of General Dynamics Land Systems, September 2018 - April 2020; Vice President of General Dynamics Land Systems – Canada, January 2011 - September 2018 | 53 | ||||

| Gregory S. Gallopoulos – Senior Vice President, General Counsel and Secretary since January 2010; Vice President and Deputy General Counsel, July 2008 - January 2010; Managing Partner of Jenner & Block LLP, January 2005 - June 2008 | 63 | ||||

| M. Amy Gilliland – Senior Vice President of the company since April 2015; President of General Dynamics Information Technology since September 2017; Deputy for Operations of General Dynamics Information Technology, April 2017 - September 2017; Senior Vice President, Human Resources and Administration, April 2015 - March 2017; Vice President, Human Resources, February 2014 - March 2015; Staff Vice President, Strategic Planning, January 2013 - February 2014; Staff Vice President, Investor Relations, June 2008 - January 2013 | 48 | ||||

| Kevin M. Graney – Vice President of the company and President of Electric Boat Corporation since October 2019; Vice President of the company and President of NASSCO, January 2017 - October 2019; Vice President and General Manager of NASSCO, November 2013 - January 2017 | 59 | ||||

| Kimberly A. Kuryea – Senior Vice President, Human Resources and Administration since April 2017; Vice President and Controller, September 2011 - March 2017; Chief Financial Officer of General Dynamics Advanced Information Systems, November 2007 - August 2011; Staff Vice President, Internal Audit, March 2004 - October 2007 | 55 | ||||

| William A. Moss – Vice President and Controller since April 2017; Staff Vice President, Internal Audit, May 2015 - March 2017; Staff Vice President, Accounting, August 2010 - May 2015 | 59 | ||||

| Phebe N. Novakovic – Chairman and Chief Executive Officer since January 2013; President and Chief Operating Officer, May 2012 - December 2012; Executive Vice President, Marine Systems, May 2010 - May 2012; Senior Vice President, Planning and Development, July 2005 - May 2010; Vice President, Strategic Planning, October 2002 - July 2005 | 65 | ||||

| Mark C. Roualet – Executive Vice President, Combat Systems, since March 2013; Vice President of the company and President of General Dynamics Land Systems, October 2008 - March 2013; Senior Vice President and Chief Operating Officer of General Dynamics Land Systems, July 2007 - October 2008 | 64 | ||||

| Robert E. Smith – Executive Vice President, Marine Systems, since July 2019; Vice President of the company and President of Jet Aviation, January 2014 - July 2019; Vice President and Chief Financial Officer of Jet Aviation, July 2012 - January 2014 | 55 | ||||

Total Number of Shares Purchased as Part of Publicly Announced Program | Maximum Number of Shares That May Yet Be Purchased Under the Program | |||||||||||||||||||||||||

| Period | Total Number of Shares | Average Price per Share | ||||||||||||||||||||||||

| Shares Purchased Pursuant to Share Buyback Program | ||||||||||||||||||||||||||

| 10/3/22-10/30/22 | — | $ | — | — | 7,150,564 | |||||||||||||||||||||

| 10/31/22-11/27/22 | 441,286 | 249.14 | 441,286 | 6,709,278 | ||||||||||||||||||||||

| 11/28/22-12/31/22 | — | — | — | 6,709,278 | ||||||||||||||||||||||

| Shares Delivered or Withheld Pursuant to Restricted Stock Vesting* | ||||||||||||||||||||||||||

| 10/3/22-10/30/22 | 776 | 213.77 | ||||||||||||||||||||||||

| 10/31/22-11/27/22 | 498 | 249.13 | ||||||||||||||||||||||||

| 11/28/22-12/31/22 | 728 | 253.72 | ||||||||||||||||||||||||

| 443,288 | $ | 249.09 | ||||||||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | Variance | ||||||||||||||||||||

| Revenue | $ | 39,407 | $ | 38,469 | $ | 938 | 2.4 | % | |||||||||||||||

| Operating costs and expenses | (35,196) | (34,306) | (890) | 2.6 | % | ||||||||||||||||||

| Operating earnings | 4,211 | 4,163 | 48 | 1.2 | % | ||||||||||||||||||

| Operating margin | 10.7 | % | 10.8 | % | |||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | Variance | ||||||||||||||||||||

| Revenue | $ | 8,567 | $ | 8,135 | $ | 432 | 5.3 | % | |||||||||||||||

| Operating earnings | 1,130 | 1,031 | 99 | 9.6 | % | ||||||||||||||||||

| Operating margin | 13.2 | % | 12.7 | % | |||||||||||||||||||

| Gulfstream aircraft deliveries (in units) | 120 | 119 | 1 | 0.8 | % | ||||||||||||||||||

| Aircraft services | $ | 420 | |||

| Aircraft manufacturing | 12 | ||||

| Total increase | $ | 432 | |||

| Aircraft manufacturing | $ | 123 | |||

| Aircraft services | 89 | ||||

| G&A/other expenses | (113) | ||||

| Total increase | $ | 99 | |||

| Year Ended December 31 | 2022 | 2021 | Variance | ||||||||||||||||||||

| Revenue | $ | 11,040 | $ | 10,526 | $ | 514 | 4.9 | % | |||||||||||||||

| Operating earnings | 897 | 874 | 23 | 2.6 | % | ||||||||||||||||||

| Operating margin | 8.1 | % | 8.3 | % | |||||||||||||||||||

| U.S. Navy ship construction | $ | 577 | |||

| U.S. Navy ship engineering, repair and other services | (63) | ||||

| Total increase | $ | 514 | |||

| Year Ended December 31 | 2022 | 2021 | Variance | ||||||||||||||||||||

| Revenue | $ | 7,308 | $ | 7,351 | $ | (43) | (0.6) | % | |||||||||||||||

| Operating earnings | 1,075 | 1,067 | 8 | 0.7 | % | ||||||||||||||||||

| Operating margin | 14.7 | % | 14.5 | % | |||||||||||||||||||

| International military vehicles | $ | (318) | |||

| U.S. military vehicles | 282 | ||||

| Weapons systems and munitions | (7) | ||||

| Total decrease | $ | (43) | |||

| Year Ended December 31 | 2022 | 2021 | Variance | ||||||||||||||||||||

| Revenue | $ | 12,492 | $ | 12,457 | $ | 35 | 0.3 | % | |||||||||||||||

| Operating earnings | 1,227 | 1,275 | (48) | (3.8) | % | ||||||||||||||||||

| Operating margin | 9.8 | % | 10.2 | % | |||||||||||||||||||

| IT services | $ | 126 | |||

| C5ISR* solutions | (91) | ||||

| Total increase | $ | 35 | |||

| Year Ended December 31 | 2022 | 2021 | Variance | ||||||||||||||||||||

| Revenue: | |||||||||||||||||||||||

| Products | $ | 23,022 | $ | 22,428 | $ | 594 | 2.6 | % | |||||||||||||||

| Services | 16,385 | 16,041 | 344 | 2.1 | % | ||||||||||||||||||

| Operating Costs: | |||||||||||||||||||||||

| Products | $ | (18,981) | $ | (18,524) | $ | (457) | 2.5 | % | |||||||||||||||

| Services | (13,804) | (13,537) | (267) | 2.0 | % | ||||||||||||||||||

| Ship construction | $ | 577 | |||

| Other, net | 17 | ||||

| Total increase | $ | 594 | |||

| Aircraft services | $ | 420 | |||

| Other, net | (76) | ||||

| Total increase | $ | 344 | |||

| Funded | Unfunded | Total Backlog | Estimated Potential Contract Value | Total Estimated Contract Value | |||||||||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||||||||

| Aerospace | $ | 19,077 | $ | 439 | $ | 19,516 | $ | 685 | $ | 20,201 | |||||||||||||||||||

| Marine Systems | 26,246 | 19,453 | 45,699 | 3,672 | 49,371 | ||||||||||||||||||||||||

| Combat Systems | 12,726 | 525 | 13,251 | 5,364 | 18,615 | ||||||||||||||||||||||||

| Technologies | 9,100 | 3,571 | 12,671 | 26,889 | 39,560 | ||||||||||||||||||||||||

| Total | $ | 67,149 | $ | 23,988 | $ | 91,137 | $ | 36,610 | $ | 127,747 | |||||||||||||||||||

| December 31, 2021 | |||||||||||||||||||||||||||||

| Aerospace | $ | 15,878 | $ | 415 | $ | 16,293 | $ | 1,657 | $ | 17,950 | |||||||||||||||||||

| Marine Systems | 23,678 | 21,177 | 44,855 | 4,271 | 49,126 | ||||||||||||||||||||||||

| Combat Systems | 12,584 | 509 | 13,093 | 6,936 | 20,029 | ||||||||||||||||||||||||

| Technologies | 9,005 | 4,348 | 13,353 | 26,997 | 40,350 | ||||||||||||||||||||||||

| Total | $ | 61,145 | $ | 26,449 | $ | 87,594 | $ | 39,861 | $ | 127,455 | |||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | |||||||||

| Net cash provided by operating activities | $ | 4,579 | $ | 4,271 | |||||||

| Net cash used by investing activities | (1,489) | (882) | |||||||||

| Net cash used by financing activities | (3,471) | (4,590) | |||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Net cash provided by operating activities | $ | 4,579 | $ | 4,271 | $ | 3,858 | |||||||||||

| Capital expenditures | (1,114) | (887) | (967) | ||||||||||||||

| Free cash flow | $ | 3,465 | $ | 3,384 | $ | 2,891 | |||||||||||

| Cash flows as a percentage of net earnings: | |||||||||||||||||

| Net cash provided by operating activities | 135 | % | 131 | % | 122 | % | |||||||||||

| Free cash flow | 102 | % | 104 | % | 91 | % | |||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Net earnings | $ | 3,390 | $ | 3,257 | $ | 3,167 | |||||||||||

| After-tax interest expense | 309 | 340 | 386 | ||||||||||||||

| After-tax amortization expense | 235 | 254 | 280 | ||||||||||||||

| Net operating profit after taxes | $ | 3,934 | $ | 3,851 | $ | 3,833 | |||||||||||

| Average invested capital | $ | 31,260 | $ | 32,270 | $ | 32,431 | |||||||||||

| Return on invested capital | 12.6 | % | 11.9 | % | 11.8 | % | |||||||||||

| Year Ended December 31 | 2022 | ||||

| Revenue | $ | 14,246 | |||

| Operating costs and expenses, excluding G&A | (12,310) | ||||

| Net earnings | 840 | ||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| Cash and equivalents | $ | 540 | $ | 925 | |||||||

| Other current assets | 4,279 | 3,149 | |||||||||

| Noncurrent assets | 4,164 | 3,597 | |||||||||

| Total assets | $ | 8,983 | $ | 7,671 | |||||||

| Short-term debt and current portion of long-term debt | $ | 1,250 | $ | 999 | |||||||

| Other current liabilities | 3,392 | 3,190 | |||||||||

| Long-term debt | 9,189 | 10,424 | |||||||||

| Other noncurrent liabilities | 3,814 | 3,844 | |||||||||

| Total liabilities | $ | 17,645 | $ | 18,457 | |||||||

| (Dollars in millions) | 2022 | 2021 | |||||||||

| Recognized | $ | (133) | $ | (1) | |||||||

| Unrecognized | (90) | (196) | |||||||||

| Year Ended December 31 | |||||||||||||||||

| (Dollars in millions, except per-share amounts) | 2022 | 2021 | 2020 | ||||||||||||||

| Revenue: | |||||||||||||||||

| Products | $ | $ | $ | ||||||||||||||

| Services | |||||||||||||||||

| Operating costs and expenses: | |||||||||||||||||

| Products | ( | ( | ( | ||||||||||||||

| Services | ( | ( | ( | ||||||||||||||

| General and administrative (G&A) | ( | ( | ( | ||||||||||||||

| ( | ( | ( | |||||||||||||||

| Operating earnings | |||||||||||||||||

| Other, net | |||||||||||||||||

| Interest, net | ( | ( | ( | ||||||||||||||

| Earnings before income tax | |||||||||||||||||

| Provision for income tax, net | ( | ( | ( | ||||||||||||||

| Net earnings | $ | $ | $ | ||||||||||||||

| Earnings per share | |||||||||||||||||

| Basic | $ | $ | $ | ||||||||||||||

| Diluted | $ | $ | $ | ||||||||||||||

| Year Ended December 31 | ||||||||||||||||||||

| (Dollars in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Net earnings | $ | $ | $ | |||||||||||||||||

| Changes in unrealized cash flow hedges | ( | ( | ||||||||||||||||||

| Foreign currency translation adjustments | ( | ( | ||||||||||||||||||

| Changes in retirement plans’ funded status | ( | |||||||||||||||||||

| Other comprehensive (loss) income, pretax | ( | |||||||||||||||||||

| (Provision) benefit for income tax, net | ( | ( | ||||||||||||||||||

| Other comprehensive (loss) income, net of tax | ( | |||||||||||||||||||

| Comprehensive income | $ | $ | $ | |||||||||||||||||

| December 31 | |||||||||||

| (Dollars in millions) | 2022 | 2021 | |||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and equivalents | $ | $ | |||||||||

| Accounts receivable | |||||||||||

| Unbilled receivables | |||||||||||

| Inventories | |||||||||||

| Other current assets | |||||||||||

| Total current assets | |||||||||||

| Noncurrent assets: | |||||||||||

| Property, plant and equipment, net | |||||||||||

| Intangible assets, net | |||||||||||

| Goodwill | |||||||||||

| Other assets | |||||||||||

| Total noncurrent assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Short-term debt and current portion of long-term debt | $ | $ | |||||||||

| Accounts payable | |||||||||||

| Customer advances and deposits | |||||||||||

| Other current liabilities | |||||||||||

| Total current liabilities | |||||||||||

| Noncurrent liabilities: | |||||||||||

| Long-term debt | |||||||||||

| Other liabilities | |||||||||||

| Commitments and contingencies (see Note M) | |||||||||||

| Total noncurrent liabilities | |||||||||||

| Shareholders’ equity: | |||||||||||

| Common stock | |||||||||||

| Surplus | |||||||||||

| Retained earnings | |||||||||||

| Treasury stock | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Total shareholders’ equity | |||||||||||

| Total liabilities and shareholders’ equity | $ | $ | |||||||||

| Year Ended December 31 | |||||||||||||||||

| (Dollars in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Cash flows from operating activities – continuing operations: | |||||||||||||||||

| Net earnings | $ | $ | $ | ||||||||||||||

| Adjustments to reconcile net earnings to net cash from operating activities: | |||||||||||||||||

| Depreciation of property, plant and equipment | |||||||||||||||||

| Amortization of intangible and finance lease right-of-use assets | |||||||||||||||||

| Equity-based compensation expense | |||||||||||||||||

| Deferred income tax benefit | ( | ( | ( | ||||||||||||||

| (Increase) decrease in assets, net of effects of business acquisitions: | |||||||||||||||||

| Accounts receivable | |||||||||||||||||

| Unbilled receivables | ( | ( | ( | ||||||||||||||

| Inventories | ( | ||||||||||||||||

| Increase (decrease) in liabilities, net of effects of business acquisitions: | |||||||||||||||||

| Accounts payable | ( | ||||||||||||||||

| Customer advances and deposits | ( | ||||||||||||||||

| Income taxes payable | ( | ( | ( | ||||||||||||||

| Other, net | ( | ( | |||||||||||||||

| Net cash provided by operating activities | |||||||||||||||||

| Cash flows from investing activities: | |||||||||||||||||

| Capital expenditures | ( | ( | ( | ||||||||||||||

| Other, net | ( | ( | |||||||||||||||

| Net cash used by investing activities | ( | ( | ( | ||||||||||||||

| Cash flows from financing activities: | |||||||||||||||||

| Dividends paid | ( | ( | ( | ||||||||||||||

| Purchases of common stock | ( | ( | ( | ||||||||||||||

| Repayment of fixed-rate notes | ( | ( | ( | ||||||||||||||

| Proceeds from commercial paper, gross (maturities greater than 3 months) | |||||||||||||||||

| Repayment of commercial paper, gross (maturities greater than 3 months) | ( | ( | |||||||||||||||

| Proceeds from fixed-rate notes | |||||||||||||||||

| Repayment of floating-rate notes | ( | ( | |||||||||||||||

| Proceeds from (repayment of) credit facility, net | ( | ||||||||||||||||

| Other, net | ( | ||||||||||||||||

| Net cash used by financing activities | ( | ( | ( | ||||||||||||||

| Net cash provided (used) by discontinued operations | ( | ( | |||||||||||||||

| Net (decrease) increase in cash and equivalents | ( | ( | |||||||||||||||

| Cash and equivalents at beginning of year | |||||||||||||||||

| Cash and equivalents at end of year | $ | $ | $ | ||||||||||||||

| Common Stock | Retained | Treasury | Accumulated Other Comprehensive | Total Shareholders’ | |||||||||||||||||||||||||||||||

| (Dollars in millions) | Par | Surplus | Earnings | Stock | Loss | Equity | |||||||||||||||||||||||||||||

| December 31, 2019 | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||

| Net earnings | — | — | — | — | |||||||||||||||||||||||||||||||

| Cash dividends declared | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Equity-based awards | — | — | — | ||||||||||||||||||||||||||||||||

| Shares purchased | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | |||||||||||||||||||||||||||||||

| Other | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| December 31, 2020 | ( | ( | |||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | |||||||||||||||||||||||||||||||

| Cash dividends declared | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Equity-based awards | — | — | — | ||||||||||||||||||||||||||||||||

| Shares purchased | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | |||||||||||||||||||||||||||||||

| December 31, 2021 | ( | ( | |||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | |||||||||||||||||||||||||||||||

| Cash dividends declared | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Equity-based awards | — | — | — | ||||||||||||||||||||||||||||||||

| Shares purchased | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Other | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| December 31, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Interest expense | $ | $ | $ | ||||||||||||||

| Interest income | ( | ( | ( | ||||||||||||||

| Interest expense, net | $ | $ | $ | ||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Revenue | $ | $ | $ | ||||||||||||||

| Operating earnings | |||||||||||||||||

| Diluted earnings per share | $ | $ | $ | ||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Aircraft manufacturing | $ | $ | $ | ||||||||||||||

| Aircraft services | |||||||||||||||||

| Total Aerospace | |||||||||||||||||

| Nuclear-powered submarines | |||||||||||||||||

| Surface ships | |||||||||||||||||

| Repair and other services | |||||||||||||||||

| Total Marine Systems | |||||||||||||||||

| Military vehicles | |||||||||||||||||

| Weapons systems, armament and munitions | |||||||||||||||||

| Engineering and other services | |||||||||||||||||

| Total Combat Systems | |||||||||||||||||

| Information technology (IT) services | |||||||||||||||||

| C5ISR* solutions | |||||||||||||||||

| Total Technologies | |||||||||||||||||

| Total revenue | $ | $ | $ | ||||||||||||||

| Year Ended December 31, 2022 | Aerospace | Marine Systems | Combat Systems | Technologies | Total Revenue | ||||||||||||||||||||||||

| Fixed-price | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Cost-reimbursement | |||||||||||||||||||||||||||||

| Time-and-materials | |||||||||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Year Ended December 31, 2021 | |||||||||||||||||||||||||||||

| Fixed-price | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Cost-reimbursement | |||||||||||||||||||||||||||||

| Time-and-materials | |||||||||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Year Ended December 31, 2020 | |||||||||||||||||||||||||||||

| Fixed-price | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Cost-reimbursement | |||||||||||||||||||||||||||||

| Time-and-materials | |||||||||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Year Ended December 31, 2022 | Aerospace | Marine Systems | Combat Systems | Technologies | Total Revenue | ||||||||||||||||||||||||

| U.S. government: | |||||||||||||||||||||||||||||

| Department of Defense (DoD) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Non-DoD | |||||||||||||||||||||||||||||

| Foreign military sales (FMS) | |||||||||||||||||||||||||||||

| Total U.S. government | |||||||||||||||||||||||||||||

| U.S. commercial | |||||||||||||||||||||||||||||

| Non-U.S. government | |||||||||||||||||||||||||||||

| Non-U.S. commercial | |||||||||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Year Ended December 31, 2021 | |||||||||||||||||||||||||||||

| U.S. government: | |||||||||||||||||||||||||||||

| DoD | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Non-DoD | |||||||||||||||||||||||||||||

| FMS | |||||||||||||||||||||||||||||

| Total U.S. government | |||||||||||||||||||||||||||||

| U.S. commercial | |||||||||||||||||||||||||||||

| Non-U.S. government | |||||||||||||||||||||||||||||

| Non-U.S. commercial | |||||||||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Year Ended December 31, 2020 | |||||||||||||||||||||||||||||

| U.S. government: | |||||||||||||||||||||||||||||

| DoD | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Non-DoD | |||||||||||||||||||||||||||||

| FMS | |||||||||||||||||||||||||||||

| Total U.S. government | |||||||||||||||||||||||||||||

| U.S. commercial | |||||||||||||||||||||||||||||

| Non-U.S. government | |||||||||||||||||||||||||||||

| Non-U.S. commercial | |||||||||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Basic weighted average shares outstanding | |||||||||||||||||

| Dilutive effect of stock options and restricted stock/RSUs* | |||||||||||||||||

| Diluted weighted average shares outstanding | |||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Current: | |||||||||||||||||

| U.S. federal | $ | $ | $ | ||||||||||||||

| State | |||||||||||||||||

| Foreign | |||||||||||||||||

| Total current | |||||||||||||||||

| Deferred: | |||||||||||||||||

| U.S. federal | ( | ( | ( | ||||||||||||||

| State | ( | ( | ( | ||||||||||||||

| Foreign | ( | ||||||||||||||||

| Total deferred | ( | ( | ( | ||||||||||||||

| Provision for income taxes, net | $ | $ | $ | ||||||||||||||

| Net income tax payments | $ | $ | $ | ||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Statutory federal income tax rate | % | % | % | ||||||||||||||

| Domestic tax credits | ( | ( | ( | ||||||||||||||

| Equity-based compensation | ( | ( | ( | ||||||||||||||

| Foreign-derived intangible income | ( | ( | ( | ||||||||||||||

| State tax on commercial operations, net of federal benefits | |||||||||||||||||

| Global impact of international operations | ( | ||||||||||||||||

| Tax impact of restructuring | ( | ||||||||||||||||

| Other, net | ( | ( | ( | ||||||||||||||

| Effective income tax rate | % | % | % | ||||||||||||||

| December 31 | 2022 | 2021 | |||||||||

| Retirement benefits | $ | $ | |||||||||

| Lease liabilities | |||||||||||

| Tax loss and credit carryforwards | |||||||||||

| Salaries and wages | |||||||||||

| Workers’ compensation | |||||||||||

| Other | |||||||||||

| Deferred assets | |||||||||||

| Valuation allowances | ( | ( | |||||||||

| Net deferred assets | $ | $ | |||||||||

| Intangible assets | $ | ( | $ | ( | |||||||

| Property, plant and equipment | ( | ( | |||||||||

| Lease right-of-use assets | ( | ( | |||||||||

| Contract accounting methods | ( | ( | |||||||||

| Capital Construction Fund qualified ships | ( | ( | |||||||||

| Other | ( | ( | |||||||||

| Deferred liabilities | $ | ( | $ | ( | |||||||

| Net deferred tax liability | $ | ( | $ | ( | |||||||

| December 31 | 2022 | 2021 | |||||||||

| Deferred tax asset | $ | $ | |||||||||

| Deferred tax liability | ( | ( | |||||||||

| Net deferred tax liability | $ | ( | $ | ( | |||||||

| December 31 | 2022 | 2021 | |||||||||

| Non-U.S. government | $ | $ | |||||||||

| U.S. government | |||||||||||

| Commercial | |||||||||||

| Total accounts receivable | $ | $ | |||||||||

| December 31 | 2022 | 2021 | |||||||||

| Unbilled revenue | $ | $ | |||||||||

| Advances and progress billings | ( | ( | |||||||||

| Net unbilled receivables | $ | $ | |||||||||

| December 31 | 2022 | 2021 | |||||||||

| Work in process | $ | $ | |||||||||

| Raw materials | |||||||||||

| Finished goods | |||||||||||

| Pre-owned aircraft | |||||||||||

| Total inventories | $ | $ | |||||||||

| Aerospace | Marine Systems | Combat Systems | Technologies | Total Goodwill | |||||||||||||||||||||||||

| December 31, 2020 (a) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Acquisitions (b) | |||||||||||||||||||||||||||||

| Other (c) | ( | ( | ( | ||||||||||||||||||||||||||

| December 31, 2021 (a) | |||||||||||||||||||||||||||||

| Acquisitions | |||||||||||||||||||||||||||||

| Other (c) | ( | ( | ( | ( | |||||||||||||||||||||||||

| December 31, 2022 (a) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Gross Carrying Amount (a) | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount (a) | Accumulated Amortization | Net Carrying Amount | ||||||||||||||||||

| December 31 | 2022 | 2021 | |||||||||||||||||||||

| Contract and program intangible assets (b) | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||

| Trade names and trademarks | ( | ( | |||||||||||||||||||||

| Technology and software | ( | ( | |||||||||||||||||||||

| Other intangible assets | ( | ( | |||||||||||||||||||||

| Total intangible assets | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||

| Intangible Asset | Range of Amortization Life | |||||||

| Contract and program intangible assets | ||||||||

| Trade names and trademarks | ||||||||

| Technology and software | ||||||||

| Other intangible assets | ||||||||

| Year Ended December 31 | Amortization Expense | ||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| December 31 | 2022 | 2021 | |||||||||

| Machinery and equipment | $ | $ | |||||||||

| Buildings and improvements | |||||||||||

| Construction in process | |||||||||||

| Land and improvements | |||||||||||

| Total PP&E | |||||||||||

| Accumulated depreciation | ( | ( | |||||||||

| PP&E, net | $ | $ | |||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Finance lease cost: | |||||||||||||||||

| Amortization of ROU assets | $ | $ | $ | ||||||||||||||

| Interest on lease liabilities | |||||||||||||||||

| Operating lease cost | |||||||||||||||||

| Short-term lease cost | |||||||||||||||||

| Variable lease cost | |||||||||||||||||

| Sublease income | ( | ( | ( | ||||||||||||||

| Total lease costs, net | $ | $ | $ | ||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Cash paid for amounts included in the measurement of lease liabilities: | |||||||||||||||||

| Operating cash flows from operating leases | $ | $ | $ | ||||||||||||||

| Operating cash flows from finance leases | |||||||||||||||||

| Financing cash flows from finance leases | |||||||||||||||||

| ROU assets obtained in exchange for lease liabilities: | |||||||||||||||||

| Operating leases | |||||||||||||||||

| Finance leases | |||||||||||||||||

| December 31 | 2022 | 2021 | |||||||||

| Weighted-average remaining lease term: | |||||||||||

| Operating leases | |||||||||||

| Finance leases | |||||||||||

| Weighted-average discount rate: | |||||||||||

| Operating leases | % | % | |||||||||

| Finance leases | % | % | |||||||||

| Year Ended December 31 | Operating Leases | Finance Leases | |||||||||

| 2023 | $ | $ | |||||||||

| 2024 | |||||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| Thereafter | |||||||||||

| Total future lease payments | |||||||||||

| Less imputed interest | |||||||||||

| Present value of future lease payments | |||||||||||

| Less current portion of lease liabilities | |||||||||||

| Long-term lease liabilities | $ | $ | |||||||||

| ROU assets | $ | $ | |||||||||

| Operating Leases | Finance Leases | ||||||||||

| Current portion of lease liabilities | $ | $ | |||||||||

| Long-term lease liabilities | |||||||||||

| ROU assets | |||||||||||

| December 31 | 2022 | 2021 | ||||||||||||

| Fixed-rate notes due: | Interest rate: | |||||||||||||

| November 2022 | $ | $ | ||||||||||||

| May 2023 | ||||||||||||||

| August 2023 | ||||||||||||||

| November 2024 | ||||||||||||||

| April 2025 | ||||||||||||||

| May 2025 | ||||||||||||||

| June 2026 | ||||||||||||||

| August 2026 | ||||||||||||||

| April 2027 | ||||||||||||||

| November 2027 | ||||||||||||||

| May 2028 | ||||||||||||||

| April 2030 | ||||||||||||||

| June 2031 | ||||||||||||||

| April 2040 | ||||||||||||||

| June 2041 | ||||||||||||||

| November 2042 | ||||||||||||||

| April 2050 | ||||||||||||||

| Other | ||||||||||||||

| Total debt principal | ||||||||||||||

| Less unamortized debt issuance costs and discounts | ||||||||||||||

| Total debt | ||||||||||||||

| Less current portion | ||||||||||||||

| Long-term debt | $ | $ | ||||||||||||

| Year Ended December 31 | Debt Principal | ||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| Thereafter | |||||

| Total debt principal | $ | ||||

| December 31 | 2022 | 2021 | |||||||||

| Salaries and wages | $ | $ | |||||||||

| Dividends payable | |||||||||||

| Lease liabilities | |||||||||||

| Workers’ compensation | |||||||||||

| Retirement benefits | |||||||||||

| Other | |||||||||||

| Total other current liabilities | $ | $ | |||||||||

| Retirement benefits | $ | $ | |||||||||

| Customer deposits on commercial contracts | |||||||||||

| Lease liabilities | |||||||||||

| Other | |||||||||||

| Total other liabilities | $ | $ | |||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Beginning balance | $ | $ | $ | ||||||||||||||

| Warranty expense | |||||||||||||||||

| Payments | ( | ( | ( | ||||||||||||||

| Adjustments | ( | ||||||||||||||||

| Ending balance | $ | $ | $ | ||||||||||||||

| Changes in Unrealized Cash Flow Hedges | Foreign Currency Translation Adjustments | Changes in Retirement Plans’ Funded Status | AOCL | |||||||||||

| December 31, 2019 | $ | $ | $ | ( | $ | ( | ||||||||

| Other comprehensive income, pretax | ( | |||||||||||||

| Benefit from income tax, net | ( | |||||||||||||

| Other comprehensive income, net of tax | ( | |||||||||||||

| December 31, 2020 | ( | ( | ||||||||||||

| Other comprehensive income, pretax | ( | ( | ||||||||||||

| Provision for income tax, net | ( | ( | ||||||||||||

| Other comprehensive income, net of tax | ( | ( | ||||||||||||

| December 31, 2021 | ( | ( | ||||||||||||

| Other comprehensive loss, pretax | ( | ( | ( | |||||||||||

| Provision for income tax, net | ( | ( | ||||||||||||

| Other comprehensive loss, net of tax | ( | ( | ( | |||||||||||

| December 31, 2022 | $ | $ | $ | ( | $ | ( | ||||||||

| Revenue (a) | Operating Earnings | Revenue from U.S. Government | |||||||||||||||||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||

| Aerospace | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||

| Marine Systems | |||||||||||||||||||||||||||||||||||

| Combat Systems | |||||||||||||||||||||||||||||||||||

| Technologies | |||||||||||||||||||||||||||||||||||

| Corporate (b) | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||

| Identifiable Assets | Capital Expenditures | Depreciation and Amortization | |||||||||||||||||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||

| Aerospace | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||

| Marine Systems | |||||||||||||||||||||||||||||||||||

| Combat Systems | |||||||||||||||||||||||||||||||||||

| Technologies | |||||||||||||||||||||||||||||||||||

| Corporate | |||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||

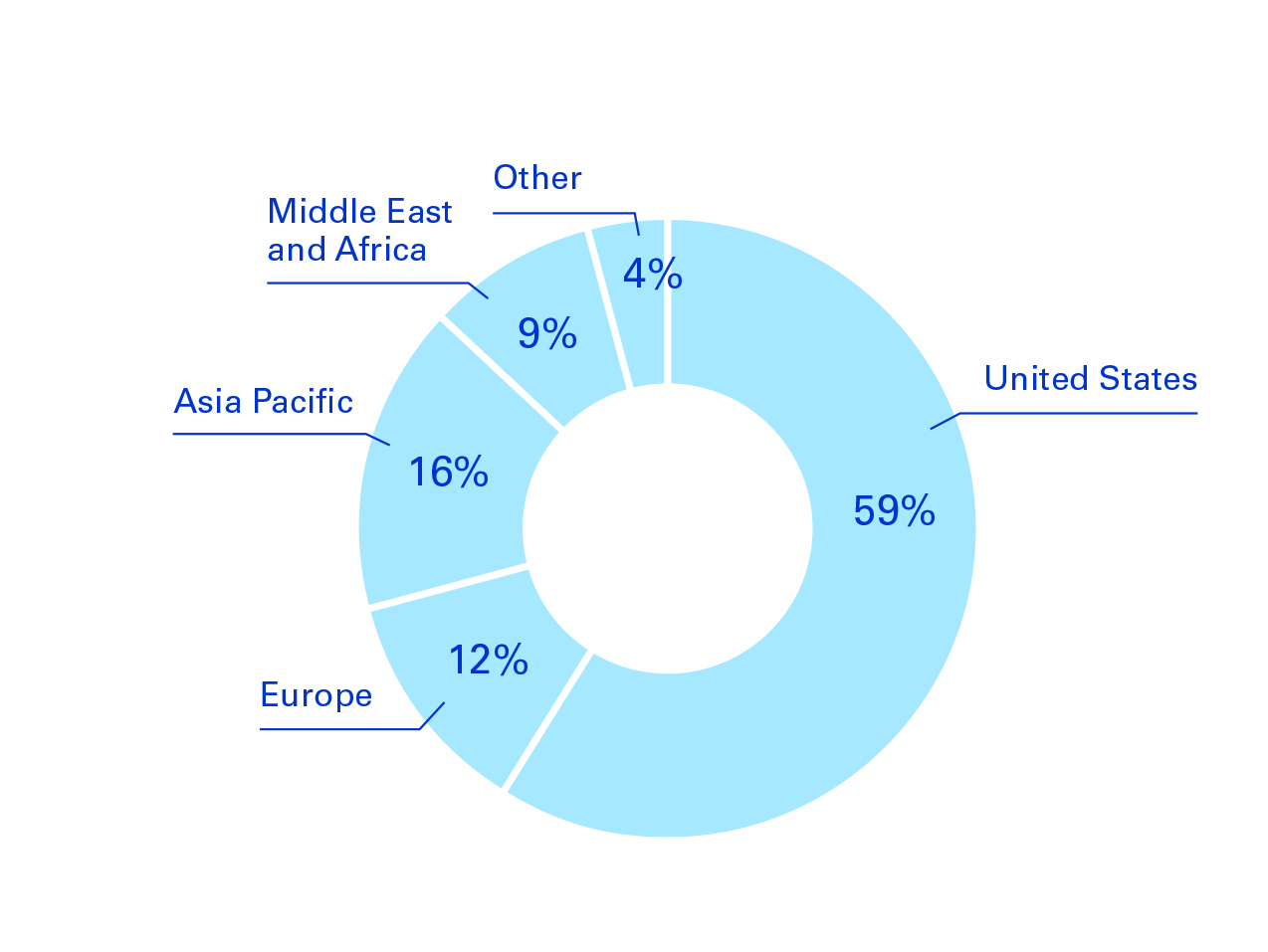

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| North America: | |||||||||||||||||

| United States | $ | $ | $ | ||||||||||||||

| Other | |||||||||||||||||

| Total North America | |||||||||||||||||

| Europe | |||||||||||||||||

| Asia/Pacific | |||||||||||||||||

| Africa/Middle East | |||||||||||||||||

| South America | |||||||||||||||||

| Total revenue | $ | $ | $ | ||||||||||||||

| Carrying Value | Fair Value | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||||||||||||||||

| Financial Assets (Liabilities) | December 31, 2022 | ||||||||||||||||||||||||||||

| Measured at fair value: | |||||||||||||||||||||||||||||

| Marketable securities held in trust: | |||||||||||||||||||||||||||||

| Cash and equivalents | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Available-for-sale debt securities | |||||||||||||||||||||||||||||

| Commingled equity funds | |||||||||||||||||||||||||||||

| Commingled fixed-income funds | |||||||||||||||||||||||||||||

| Other investments | |||||||||||||||||||||||||||||

| Cash flow hedge assets | |||||||||||||||||||||||||||||

| Cash flow hedge liabilities | ( | ( | ( | ||||||||||||||||||||||||||

Measured at amortized cost: | |||||||||||||||||||||||||||||

| Short- and long-term debt principal | ( | ( | ( | ||||||||||||||||||||||||||

| December 31, 2021 | |||||||||||||||||||||||||||||

| Measured at fair value: | |||||||||||||||||||||||||||||

| Marketable securities held in trust: | |||||||||||||||||||||||||||||

| Cash and equivalents | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Available-for-sale debt securities | |||||||||||||||||||||||||||||

| Equity securities | |||||||||||||||||||||||||||||

| Other investments | |||||||||||||||||||||||||||||

| Cash flow hedge assets | |||||||||||||||||||||||||||||

| Cash flow hedge liabilities | ( | ( | ( | ||||||||||||||||||||||||||

Measured at amortized cost: | |||||||||||||||||||||||||||||

| Short- and long-term debt principal | ( | ( | ( | ||||||||||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Stock options | $ | $ | $ | ||||||||||||||

| Restricted stock/RSUs | |||||||||||||||||

| Total equity-based compensation expense, net of tax | $ | $ | $ | ||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Expected volatility | |||||||||||||||||

| Weighted average expected volatility | % | % | % | ||||||||||||||

| Expected term (in months) | |||||||||||||||||

| Risk-free interest rate | |||||||||||||||||

| Expected dividend yield | % | % | % | ||||||||||||||

| In Shares and Dollars | Shares Under Option | Weighted Average Exercise Price Per Share | |||||||||

| Outstanding on December 31, 2021 | $ | ||||||||||

| Granted | |||||||||||

| Exercised | ( | ||||||||||

| Forfeited/canceled | ( | ||||||||||

| Outstanding on December 31, 2022 | $ | ||||||||||

| Vested and expected to vest on December 31, 2022 | $ | ||||||||||

| Exercisable on December 31, 2022 | $ | ||||||||||

| Weighted Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value | ||||||||||

| Outstanding | $ | ||||||||||

| Vested and expected to vest | |||||||||||

| Exercisable | |||||||||||

| In Shares and Dollars | Shares/ Share-Equivalent Units | Weighted Average Grant-Date Fair Value Per Share | |||||||||

| Nonvested at December 31, 2021 | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Forfeited | ( | ||||||||||

| Nonvested at December 31, 2022 | $ | ||||||||||

| Pension Benefits | Other Post-retirement Benefits | ||||||||||

| 2023 | $ | $ | |||||||||

| 2024 | |||||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| 2028-2032 | |||||||||||

| Pension Benefits | |||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Service cost | $ | $ | $ | ||||||||||||||

| Interest cost | |||||||||||||||||

| Expected return on plan assets | ( | ( | ( | ||||||||||||||

| Net actuarial loss | |||||||||||||||||

| Prior service credit | ( | ( | ( | ||||||||||||||

| Settlement/curtailment/other | |||||||||||||||||

| Net annual benefit (credit) cost | $ | ( | $ | ( | $ | ||||||||||||

| Other Post-retirement Benefits | |||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Service cost | $ | $ | $ | ||||||||||||||

| Interest cost | |||||||||||||||||

| Expected return on plan assets | ( | ( | ( | ||||||||||||||

| Net actuarial gain | ( | ( | |||||||||||||||

| Prior service cost (credit) | ( | ||||||||||||||||

| Settlement/curtailment/other | ( | ||||||||||||||||

| Net annual benefit credit | $ | ( | $ | ( | $ | ( | |||||||||||

| Pension Benefits | Other Post-retirement Benefits | ||||||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Change in Benefit Obligation | |||||||||||||||||||||||

| Benefit obligation at beginning of year | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Service cost | ( | ( | ( | ( | |||||||||||||||||||

| Interest cost | ( | ( | ( | ( | |||||||||||||||||||

| Amendments | ( | ||||||||||||||||||||||

| Actuarial gain | |||||||||||||||||||||||

| Settlement/curtailment/other | |||||||||||||||||||||||

| Benefits paid | |||||||||||||||||||||||

| Benefit obligation at end of year | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Change in Plan/Trust Assets | |||||||||||||||||||||||

| Fair value of assets at beginning of year | $ | $ | $ | $ | |||||||||||||||||||

| Actual return on plan assets | ( | ( | |||||||||||||||||||||

| Employer contributions | |||||||||||||||||||||||

| Settlement/curtailment/other | ( | ( | |||||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | |||||||||||||||||||

| Fair value of assets at end of year | $ | $ | $ | $ | |||||||||||||||||||

| Funded status at end of year | $ | ( | $ | ( | $ | $ | ( | ||||||||||||||||

| Pension Benefits | Other Post-retirement Benefits | ||||||||||||||||||||||

| December 31 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Noncurrent assets | $ | $ | $ | $ | |||||||||||||||||||

| Current liabilities | ( | ( | ( | ( | |||||||||||||||||||

| Noncurrent liabilities | ( | ( | ( | ( | |||||||||||||||||||

| Net (liability) asset recognized | $ | ( | $ | ( | $ | $ | ( | ||||||||||||||||

| Pension Benefits | Other Post-retirement Benefits | ||||||||||||||||||||||

| December 31 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Net actuarial loss (gain) | $ | $ | $ | ( | $ | ( | |||||||||||||||||

| Prior service (credit) cost | ( | ( | |||||||||||||||||||||

| Total amount recognized in AOCL, pretax | $ | $ | $ | ( | $ | ( | |||||||||||||||||

| Pension Benefits | Other Post-retirement Benefits | ||||||||||||||||||||||

| Year Ended December 31 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Net actuarial gain | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Prior service (credit) cost | ( | ( | ( | ||||||||||||||||||||

| Amortization of: | |||||||||||||||||||||||

| Net actuarial (loss) gain from prior years | ( | ( | |||||||||||||||||||||

| Prior service credit (cost) | ( | ||||||||||||||||||||||

| Settlement/curtailment/other | ( | ( | |||||||||||||||||||||

| Change in AOCL, pretax | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| December 31 | 2022 | 2021 | |||||||||

| PBO | $ | ( | $ | ( | |||||||

| Fair value of plan assets | |||||||||||

| Pension Benefits | Other Post-retirement Benefits | ||||||||||||||||||||||

| December 31 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| ABO | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Fair value of plan assets | |||||||||||||||||||||||

| Assumptions on December 31 | 2022 | 2021 | |||||||||

| Pension Benefits | |||||||||||

| Benefit obligation discount rate | % | % | |||||||||

| Rate of increase in compensation levels | % | % | |||||||||

| Other Post-retirement Benefits | |||||||||||

| Benefit obligation discount rate | % | % | |||||||||

| Health care cost trend rate: | |||||||||||

| Trend rate for next year | % | % | |||||||||

| Ultimate trend rate | % | % | |||||||||

| Year rate reaches ultimate trend rate | |||||||||||

| Assumptions for Year Ended December 31 | 2022 | 2021 | 2020 | ||||||||||||||

| Pension Benefits | |||||||||||||||||

| Discount rates: | |||||||||||||||||

| Benefit obligation | % | % | % | ||||||||||||||

| Service cost | % | % | % | ||||||||||||||

| Interest cost | % | % | % | ||||||||||||||

| Expected long-term rate of return on assets | % | % | % | ||||||||||||||

| Rate of increase in compensation levels | % | % | % | ||||||||||||||

| Other Post-retirement Benefits | |||||||||||||||||

| Discount rates: | |||||||||||||||||

| Benefit obligation | % | % | % | ||||||||||||||

| Service cost | % | % | % | ||||||||||||||

| Interest cost | % | % | % | ||||||||||||||

| Expected long-term rate of return on assets | % | % | % | ||||||||||||||

Fair Value | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | ||||||||||||||||||||

| Asset Category | December 31, 2022 | ||||||||||||||||||||||

| Cash and equivalents | $ | $ | $ | $ | |||||||||||||||||||

| Commingled funds: | |||||||||||||||||||||||

| Equity funds | |||||||||||||||||||||||

| Fixed-income funds | |||||||||||||||||||||||

| Real estate funds | |||||||||||||||||||||||

| Other investments: | |||||||||||||||||||||||

| Insurance deposit contracts | |||||||||||||||||||||||

| Retirement annuity contracts | |||||||||||||||||||||||

| Total plan assets in fair value hierarchy | $ | $ | $ | $ | |||||||||||||||||||

| Plan assets measured using NAV as a practical expedient*: | |||||||||||||||||||||||

| Real estate funds | |||||||||||||||||||||||

| Hedge funds | |||||||||||||||||||||||

| Equity funds | |||||||||||||||||||||||

| Total pension plan assets | $ | ||||||||||||||||||||||

Fair Value | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | ||||||||||||||||||||

| Asset Category | December 31, 2021 | ||||||||||||||||||||||

| Cash and equivalents | $ | $ | $ | $ | |||||||||||||||||||

| Commingled funds: | |||||||||||||||||||||||

| Equity funds | |||||||||||||||||||||||

| Fixed-income funds | |||||||||||||||||||||||

| Real estate funds | |||||||||||||||||||||||

| Equity securities (a): | |||||||||||||||||||||||

| U.S. companies | |||||||||||||||||||||||

| Non-U.S. companies | |||||||||||||||||||||||

| Fixed-income securities: | |||||||||||||||||||||||

| Corporate bonds (b) | |||||||||||||||||||||||

| Treasury securities | |||||||||||||||||||||||

| Other investments: | |||||||||||||||||||||||

| Insurance deposit contracts | |||||||||||||||||||||||

| Retirement annuity contracts | |||||||||||||||||||||||

| Total plan assets in fair value hierarchy | $ | $ | $ | $ | |||||||||||||||||||

| Plan assets measured using NAV as a practical expedient (c): | |||||||||||||||||||||||

| Real estate funds | |||||||||||||||||||||||

| Hedge funds | |||||||||||||||||||||||

| Equity funds | |||||||||||||||||||||||

| Total pension plan assets | $ | ||||||||||||||||||||||

Fair Value | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | |||||||||||||||

| Asset Category (a) | December 31, 2022 | ||||||||||||||||

| Cash and equivalents | $ | $ | $ | ||||||||||||||

| Commingled funds: | |||||||||||||||||

| Equity funds | |||||||||||||||||

| Fixed-income funds | |||||||||||||||||

| Fixed-income securities | |||||||||||||||||

| Total plan assets in fair value hierarchy | $ | $ | $ | ||||||||||||||

| Plan assets measured using NAV as a practical expedient (b): | |||||||||||||||||

| Real estate funds | |||||||||||||||||

| Hedge funds | |||||||||||||||||

| Total other post-retirement benefit plan assets | $ | ||||||||||||||||

Fair Value | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | |||||||||||||||

| Asset Category (a) | December 31, 2021 | ||||||||||||||||

| Cash and equivalents | $ | $ | $ | ||||||||||||||

| Commingled funds: | |||||||||||||||||

| Equity funds | |||||||||||||||||

| Fixed-income funds | |||||||||||||||||

| Real estate funds | |||||||||||||||||

| Equity securities | |||||||||||||||||

| Fixed-income securities | |||||||||||||||||

| Total plan assets in fair value hierarchy | $ | $ | $ | ||||||||||||||

| Plan assets measured using NAV as a practical expedient (b): | |||||||||||||||||

| Real estate funds | |||||||||||||||||

| Hedge funds | |||||||||||||||||

| Total other post-retirement benefit plan assets | $ | ||||||||||||||||

| Insurance Deposits Contracts | Retirement Annuity Contracts | Private Equity Investments | Real Estate Funds | Total Level 3 Assets | |||||||||||||||||||||||||

| December 31, 2020 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Transfers out of Level 3 | ( | ( | ( | ||||||||||||||||||||||||||

| Actual return on plan assets: | |||||||||||||||||||||||||||||

| Unrealized gains (losses), net | ( | ||||||||||||||||||||||||||||

| Purchases, sales and settlements, net | ( | ( | |||||||||||||||||||||||||||

| December 31, 2021 | |||||||||||||||||||||||||||||

| Actual return on plan assets: | |||||||||||||||||||||||||||||

| Unrealized losses, net | ( | ( | ( | ||||||||||||||||||||||||||

| Realized losses, net | ( | ( | |||||||||||||||||||||||||||

| Purchases, sales and settlements, net | |||||||||||||||||||||||||||||

| December 31, 2022 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| /s/ KPMG LLP | ||||||||

| /s/ Phebe N. Novakovic | /s/ Jason W. Aiken | ||||||||||

| Phebe N. Novakovic | Jason W. Aiken | ||||||||||

| Chairman and Chief Executive Officer | Executive Vice President, Technologies | ||||||||||

| and Chief Financial Officer | |||||||||||

| /s/ KPMG LLP | ||||||||

| McLean, Virginia | ||||||||

| February 7, 2023 | ||||||||

| Consolidated Statement of Earnings | ||

| Consolidated Statement of Comprehensive Income | ||

| Consolidated Balance Sheet | ||

| Consolidated Statement of Cash Flows | ||

| Consolidated Statement of Shareholders’ Equity | ||

| Notes to Consolidated Financial Statements (A to S) | ||

| Exhibit Number | Description | ||||

| 3.1 | |||||

| 3.2 | |||||

| 4.1 | |||||

| 4.2 | |||||

| 4.3 | |||||

| 4.4 | |||||

| 4.5 | |||||

| 4.6 | |||||

| 4.7 | |||||

| 4.8 | |||||

| 4.9 | |||||

| 4.10 | |||||

| 10.1* | |||||

| 10.2* | |||||

| 10.3* | |||||

| 10.4* | |||||

| 10.5* | |||||

| 10.6* | |||||

| 10.7* | |||||

| 10.8* | |||||

| 10.9* | |||||

| 10.10* | |||||

| 10.11* | |||||

| 10.12* | |||||

| 10.13* | |||||

| 10.14* | |||||

| 10.15* | |||||

| 10.16* | |||||

| 10.17* | |||||

| 10.18* | |||||

| 10.19* | |||||

| 10.20* | |||||

| 10.21* | |||||

| 10.22* | |||||

| 10.23* | |||||

| 21 | |||||

| 22 | |||||

| 23 | |||||

| 24 | |||||

| 31.1 | |||||

| 31.2 | |||||

| 32.1 | |||||

| 32.2 | |||||

101.INS | Inline eXtensible Business Reporting Language (XBRL) Instance Document – the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | ||||

101.SCH | Inline XBRL Taxonomy Extension Schema Document** | ||||

101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document** | ||||

101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document** | ||||

101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document** | ||||

101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document** | ||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document and contained in Exhibit 101) | ||||

| GENERAL DYNAMICS CORPORATION | ||||||||

| by | /s/ William A. Moss | |||||||

| William A. Moss | ||||||||

| Vice President and Controller | ||||||||

Dated: February 7, 2023 | ||||||||

| /s/ Phebe N. Novakovic | Chairman, Chief Executive Officer and Director | ||||

| Phebe N. Novakovic | (Principal Executive Officer) | ||||

| /s/ Jason W. Aiken | Executive Vice President, Technologies and Chief Financial Officer | ||||

| Jason W. Aiken | (Principal Financial Officer) | ||||

| /s/ William A. Moss | Vice President and Controller | ||||

| William A. Moss | (Principal Accounting Officer) | ||||

| * | |||||

| Richard D. Clarke | Director | ||||

| * | |||||

| James S. Crown | Director | ||||

| * | |||||

| Rudy F. deLeon | Director | ||||

| * | |||||

| Cecil D. Haney | Director | ||||

| * | |||||

| Mark M. Malcolm | Director | ||||

| * | |||||

| James N. Mattis | Director | ||||

| * | |||||

| C. Howard Nye | Director | ||||

| * | |||||

| Catherine B. Reynolds | Director | ||||

| * | |||||

Laura J. Schumacher | Director | ||||

| * | |||||

Robert K. Steel | Director | ||||

| * | |||||

John G. Stratton | Director | ||||

| * | |||||

Peter A. Wall | Director | ||||

| /s/ Gregory S. Gallopoulos | |||||||||||

| Gregory S. Gallopoulos | |||||||||||

| Senior Vice President, General Counsel and Secretary | |||||||||||

| Exhibit 21 | ||||||||

| GENERAL DYNAMICS CORPORATION | ||||||||

| SUBSIDIARIES | ||||||||

| AS OF JANUARY 31, 2023 | ||||||||

| Subsidiaries of General Dynamics Corporation (Parent and Registrant) | Place of Incorporation | Percent of Voting Power | ||||||

| American Overseas Marine Company, LLC | Delaware | 100 | ||||||

| Applied Physical Sciences Corp. | Connecticut | 100 | ||||||

| ARMA Global Corporation | Florida | 100 | ||||||

| Avion Logistics Limited | Hong Kong | 100 | ||||||

| Avjet Corporation | California | 100 | ||||||

| Bath Iron Works Canada, LLC | Delaware | 100 | ||||||

| Bath Iron Works Corporation | Maine | 100 | ||||||

| Blueprint Technologies, Inc. | Virginia | 100 | ||||||

| Braintree I Maritime Corp. | Delaware | 100 | ||||||

| Braintree II Maritime Corp. | Delaware | 100 | ||||||

| Braintree III Maritime Corp. | Delaware | 100 | ||||||

| Braintree IV Maritime Corp. | Delaware | 100 | ||||||

| Braintree V Maritime Corp. | Delaware | 100 | ||||||

| Concord I Maritime Corporation | Delaware | 100 | ||||||

| Concord II Maritime Corporation | Delaware | 100 | ||||||

| Concord III Maritime Corporation | Delaware | 100 | ||||||

| Concord IV Maritime Corporation | Delaware | 100 | ||||||

| Concord V Maritime Corporation | Delaware | 100 | ||||||

| Convair Aircraft Corporation | Delaware | 100 | ||||||

| Convair Corporation | Delaware | 100 | ||||||

| CSC Computer Sciences Egypt LLC | Egypt | 100 | ||||||

| CSC Computer Sciences Venezuela, S.A. | Venezuela | 100 | ||||||

| CSRA (Costa Rica) S.A. | Costa Rica | 100 | ||||||

| CSRA (Guyana) Inc. | Guyana | 100 | ||||||

| CSRA (Middle East) LLC | Virginia | 100 | ||||||

| CSRA Argentina S.R.L. | Argentina | 100 | ||||||

| CSRA Bahamas Limited | Bahamas | 100 | ||||||

| CSRA Bahrain W.L.L. | Bahrain | 100 | ||||||

| CSRA Belgium SRL | Belgium | 100 | ||||||

| CSRA BH d.o.o. | Bosnia and Herzegovina | 100 | ||||||

| CSRA Bolivia S.R.L. | Bolivia | 100 | ||||||

| CSRA Brasil Servicos de Tecnologia Ltda. | Brazil | 100 | ||||||

| CSRA Canada Inc. | Canada | 100 | ||||||

| CSRA Caribbean Inc. | Nevada | 100 | ||||||

| CSRA Chile SpA | Chile | 100 | ||||||

| CSRA Colombia SAS | Colombia | 100 | ||||||

| CSRA Consular Services Holding Company LLC | Nevada | 100 | ||||||

| CSRA Consular Services Inc. | Nevada | 100 | ||||||

| CSRA Consular Services India Private Limited | India | 100 | ||||||

| CSRA France SARL | France | 100 | ||||||

| CSRA Honduras, Sociedad Anonima | Honduras | 100 | ||||||

| CSRA Information Technology Spain, SL | Spain | 100 | ||||||

| CSRA Ireland Limited | Ireland | 100 | ||||||

| CSRA Italy S.R.L. | Italy | 100 | ||||||

| CSRA Kosovo L.L.C. | Kosovo | 100 | ||||||

| CSRA LATAM LLC | Virginia | 100 | ||||||

| CSRA Mexico S. de R.L. de C.V. | Mexico | 100 | ||||||

| CSRA Netherlands B.V. | Netherlands | 100 | ||||||

| CSRA Nicaragua, Sociedad Anonima | Nicaragua | 100 | ||||||

| CSRA Peru S.R.L. | Peru | 100 | ||||||

| CSRA Senegal SARL | Senegal | 100 | ||||||

| CSRA South Africa (Pty) Ltd | South Africa | 100 | ||||||

| CSRA State and Local Solutions LLC | Nevada | 100 | ||||||

| CSRA Trinidad & Tobago Limited | Trinidad and Tobago | 100 | ||||||

| CSRA Turkey Bilisim Teknolojileri Limited Sirketi | Turkey | 100 | ||||||

| CSRA Uruguay S.R.L. | Uruguay | 100 | ||||||

| CSRA Visa Services Israel Ltd. | Israel | 100 | ||||||

| CSRAIT - Information Services Portugal, Unipessoal LDA | Portugal | 100 | ||||||

| Customer Services Ecuador CSRA S.A. | Ecuador | 100 | ||||||

| DynPort Vaccine Company, LLC | Virginia | 100 | ||||||

| Eagle Enterprise, Inc. | Delaware | 100 | ||||||

| EB Groton Engineering, Inc. | Delaware | 100 | ||||||

| EBV Explosives Environmental Company | Delaware | 100 | ||||||

| ELCS-CZ, s.r.o. | Czech Republic | 100 | ||||||

| Electric Boat - Australia, LLC | Delaware | 100 | ||||||

| Electric Boat - UK, LLC | Delaware | 100 | ||||||

| Electric Boat Canada, LLC | Delaware | 100 | ||||||

| Electric Boat Corporation | Delaware | 100 | ||||||

| Electric Boat France, LLC | Delaware | 100 | ||||||

| Electrocom, Inc. | Delaware | 100 | ||||||

| Expro Finance Inc. | Canada | 100 | ||||||

| ForeSight Technology Services, LLC | Virginia | 100 | ||||||

| Freeman United Coal Mining Company, LLC | Delaware | 100 | ||||||

| GD Arabia Limited | Saudi Arabia | 100 | ||||||

| GD European Land Systems - Steyr GmbH | Austria | 100 | ||||||

| GD European Land Systems Holding GmbH | Austria | 100 | ||||||

| General Dynamics - OTS (Global), Inc. | Delaware | 100 | ||||||

| General Dynamics AIS Australia Pty Ltd | Australia | 100 | ||||||

| General Dynamics Canadian Finance Inc. | Canada | 100 | ||||||

| General Dynamics Canadian Holdings Inc. | Canada | 100 | ||||||

| General Dynamics Commercial Cyber Services, LLC | Virginia | 100 | ||||||

| General Dynamics European Finance Limited | England and Wales | 100 | ||||||

| General Dynamics European Land Systems - Austria GmbH | Austria | 100 | ||||||

| General Dynamics European Land Systems – Bridge Systems GmbH | Germany | 100 | ||||||

| General Dynamics European Land Systems - Czech s.r.o. | Czech Republic | 100 | ||||||

| General Dynamics European Land Systems - Deutschland GmbH | Germany | 100 | ||||||

| General Dynamics European Land Systems - FWW GmbH | Germany | 100 | ||||||

| General Dynamics European Land Systems - Mowag GmbH | Switzerland | 100 | ||||||

| General Dynamics European Land Systems Botswana Proprietary Ltd. | Botswana | 100 | ||||||

| General Dynamics European Land Systems Denmark ApS | Denmark | 100 | ||||||

| General Dynamics European Land Systems Romania S.R.L. | Romania | 100 | ||||||

| General Dynamics European Land Systems, S.L. | Spain | 100 | ||||||

| General Dynamics Global Force, LLC | Delaware | 100 | ||||||

| General Dynamics Global Holdings Limited | England and Wales | 100 | ||||||

| General Dynamics Global Imaging Technologies, LLC | Delaware | 100 | ||||||

| General Dynamics Government Satellite Services, LLC | Delaware | 100 | ||||||

| General Dynamics Government Systems Corporation | Delaware | 100 | ||||||

| General Dynamics Government Systems Overseas Corporation | Delaware | 100 | ||||||

| General Dynamics Information Technology, Inc. | Virginia | 100 | ||||||

| General Dynamics International Corporation | Delaware | 100 | ||||||

| General Dynamics Land Systems - Australia Pty. Ltd. | Australia | 100 | ||||||

| General Dynamics Land Systems - Canada Corporation | Canada | 100 | ||||||

| General Dynamics Land Systems - Canada Services Inc. | Canada | 100 | ||||||

| General Dynamics Land Systems - Canadian Services Limited | Canada | 100 | ||||||

| General Dynamics Land Systems - Force Protection Inc. | Nevada | 100 | ||||||

| General Dynamics Land Systems – Global LLC | Delaware | 100 | ||||||

| General Dynamics Land Systems Customer Service & Support Company | Texas | 100 | ||||||

| General Dynamics Land Systems Holdings LLC | Delaware | 100 | ||||||

| General Dynamics Land Systems Inc. | Delaware | 100 | ||||||

| General Dynamics Limited | England and Wales | 100 | ||||||

| General Dynamics Marine Systems, Inc. | Delaware | 100 | ||||||

| General Dynamics Mission Systems Asia-Pacific SDN BHD | Brunei | 100 | ||||||

| General Dynamics Mission Systems International Limited | England and Wales | 100 | ||||||

| General Dynamics Mission Systems Overseas Company, LLC | Delaware | 100 | ||||||

| General Dynamics Mission Systems, Inc. | Delaware | 100 | ||||||

| General Dynamics Mission Systems – Italy S.R.L. | Italy | 100 | ||||||

| General Dynamics Motion Control, LLC | Delaware | 100 | ||||||

| General Dynamics One Source, LLC | Delaware | 100 | ||||||

| General Dynamics Ordnance and Tactical Systems - Canada Inc. | Canada | 100 | ||||||

| General Dynamics Ordnance and Tactical Systems - Canada Valleyfield Inc. | Canada | 100 | ||||||

| General Dynamics Ordnance and Tactical Systems - Simunition Operations, Inc. | Delaware | 100 | ||||||

| General Dynamics Ordnance and Tactical Systems, Inc. | Virginia | 100 | ||||||

| General Dynamics OTS (Aerospace), Inc. | Washington | 100 | ||||||

| General Dynamics OTS (California), Inc. | California | 100 | ||||||

| General Dynamics OTS (DRI), Inc. | Alabama | 100 | ||||||

| General Dynamics OTS (Niceville), Inc. | Florida | 100 | ||||||

| General Dynamics OTS (Wilkes Barre), LLC | Pennsylvania | 100 | ||||||

| General Dynamics Overseas Systems and Services Corporation | Delaware | 100 | ||||||

| General Dynamics Properties, Inc. | Delaware | 100 | ||||||

| General Dynamics Robotic Systems, Inc. | Delaware | 100 | ||||||

| General Dynamics Satellite Communication Services, LLC | Delaware | 100 | ||||||

| General Dynamics Saudi Holdings, S.L. | Spain | 100 | ||||||

| General Dynamics Shared Resources, LLC | Delaware | 100 | ||||||

| General Dynamics Support Services Company | Delaware | 100 | ||||||

| General Dynamics Swiss Financial Management Limited | England and Wales | 100 | ||||||

| General Dynamics United Kingdom Limited | England and Wales | 100 | ||||||

| General Dynamics Worldwide Holdings, Inc. | Delaware | 100 | ||||||

| General Dynamics-OTS, Inc. | Delaware | 100 | ||||||

| GM GDLS Defense Group, L.L.C. | Delaware | 100 | ||||||

| GPS Source, Inc. | Colorado | 100 | ||||||

| Gulfstream 100 Holdings LLC | Delaware | 100 | ||||||

| Gulfstream Aerospace Corporation (CA) | California | 100 | ||||||

| Gulfstream Aerospace Corporation (DE) | Delaware | 100 | ||||||

| Gulfstream Aerospace Corporation (GA) | Georgia | 100 | ||||||

| Gulfstream Aerospace Corporation (OK) | Oklahoma | 100 | ||||||

| Gulfstream Aerospace Corporation of Texas | Texas | 100 | ||||||

| Gulfstream Aerospace Hong Kong Limited | Hong Kong | 100 | ||||||

| Gulfstream Aerospace LLC | Delaware | 100 | ||||||

| Gulfstream Aerospace LP | Texas | 100 | ||||||

| Gulfstream Aerospace Services Corporation | Delaware | 100 | ||||||

| Gulfstream Aerospace, Ltd. | England and Wales | 100 | ||||||

| Gulfstream Aerospace, Sociedad de Responsabilidad Limitada de Capital Variable (S. de R.L. de C.V.) | Mexico | 100 | ||||||

| Gulfstream Austria, GmbH | Austria | 100 | ||||||

| Gulfstream Do Brasil Servicos De Suporte E Manutencao A Aeronaves Ltda. | Brazil | 100 | ||||||

| Gulfstream International Corporation | Delaware | 100 | ||||||

| Gulfstream Leasing LLC | Georgia | 100 | ||||||

| Gulfstream Product Support Corporation | Delaware | 100 | ||||||

| Gulfstream Services Corporation | Georgia | 100 | ||||||

| Gulfstream Tennessee Corporation | Delaware | 100 | ||||||

| Gulfstream-California, Inc. | Delaware | 100 | ||||||

| Hawker Pacific Asia Holdings Pte Ltd | Singapore | 100 | ||||||

| Information Services Consulting Limited | England and Wales | 100 | ||||||

| Interiores Aereos S.A. de C.V. | Mexico | 100 | ||||||

| International Manufacturing Technologies, Inc. | California | 100 | ||||||

| Janteq Australia PTY Limited | Australia | 100 | ||||||

| Janteq Corp. | Maryland | 100 | ||||||

| Jet Aviation (Asia Pacific) Pte Ltd | Singapore | 100 | ||||||

| Jet Aviation (Bermuda) Ltd. | Bermuda | 100 | ||||||

| Jet Aviation (Hong Kong) Ltd. | Hong Kong | 100 | ||||||

| Jet Aviation (Malaysia) MRO SDN BHD | Malaysia | 100 | ||||||

| Jet Aviation (Malaysia) SDN, BHD | Malaysia | 100 | ||||||

| Jet Aviation 125 Services, LLC | Delaware | 100 | ||||||

| Jet Aviation AG | Switzerland | 100 | ||||||

| Jet Aviation Airservices Limited | Hong Kong | 100 | ||||||

| Jet Aviation Australia Pty Ltd | Australia | 100 | ||||||

| Jet Aviation Bozeman, LLC | Montana | 100 | ||||||

| Jet Aviation Business Jets (Hong Kong) Limited | Hong Kong | 100 | ||||||

| Jet Aviation Business Jets AG | Switzerland | 100 | ||||||

| Jet Aviation Business Jets FZCO | UAE | 100 | ||||||

| Jet Aviation Business Jets San Marino S.R.L. | San Marino | 100 | ||||||

| Jet Aviation Business Jets Singapore Pte Ltd | Singapore | 100 | ||||||

| Jet Aviation California, LLC | California | 100 | ||||||

| Jet Aviation Dulles, LLC | Delaware | 100 | ||||||

| Jet Aviation Flight Services, Inc. | Maryland | 100 | ||||||

| Jet Aviation France SAS | France | 100 | ||||||

| Jet Aviation French Polynesia | French Polynesia | 100 | ||||||

| Jet Aviation Holding GmbH | Switzerland | 100 | ||||||

| Jet Aviation Holdings USA, Inc. | Delaware | 100 | ||||||

| Jet Aviation Houston, Inc. | Texas | 100 | ||||||

| Jet Aviation International, Inc. | Florida | 100 | ||||||

| Jet Aviation Malaga SA | Spain | 100 | ||||||

| Jet Aviation Management AG | Switzerland | 100 | ||||||

| Jet Aviation Netherlands B.V. | Netherlands | 100 | ||||||

| Jet Aviation New Caledonia | New Caledonia | 100 | ||||||

| Jet Aviation NZ Limited | New Zealand | 100 | ||||||

| Jet Aviation of America, Inc. | Maryland | 100 | ||||||

| Jet Aviation Opa Locka, LLC | Florida | 100 | ||||||

| Jet Aviation Savannah Holding, LLC | Delaware | 100 | ||||||

| Jet Aviation Scottsdale LLC | Arizona | 100 | ||||||

| Jet Aviation Services GmbH | Germany | 100 | ||||||

| Jet Aviation St. Louis, Inc. | Missouri | 100 | ||||||

| Jet Aviation Staffing, LLC | Delaware | 100 | ||||||

| Jet Aviation Teterboro, L.P. | New Jersey | 100 | ||||||

| Jet Aviation Texas, Inc. | Texas | 100 | ||||||

| Jet Aviation/Palm Beach, Inc. | Florida | 100 | ||||||

| Jet Aviation Vienna GmbH | Austria | 100 | ||||||

| Longreach Energy, LLC | Delaware | 100 | ||||||

| Material Service Resources Company, LLC | Delaware | 100 | ||||||

| Mediaware International Pty Ltd | Australia | 100 | ||||||

| Metro Machine Corp. | Virginia | 100 | ||||||

| Midwest Properties Sales, LLC | Delaware | 100 | ||||||

| NASSCO Holdings Incorporated | Delaware | 100 | ||||||

| National Steel and Shipbuilding Company | Nevada | 100 | ||||||

| Newberry Holdings, LLC | Virginia | 100 | ||||||

| Pazo’s Fuel Services, Inc. | Puerto Rico | 100 | ||||||

| Plane 79, LLC | Delaware | 100 | ||||||

| Praxis Engineering Technologies, LLC | Delaware | 100 | ||||||

| Progeny Systems, LLC | Virginia | 100 | ||||||

| Proyectos Prohumane Mexico, S.A. de C.V. | Mexico | 100 | ||||||

| Quincy Maritime Corporation III | Delaware | 100 | ||||||

| Santa Barbara Sistemas S.A. | Spain | 100 | ||||||

| Savannah Air Center, LLC | Georgia | 100 | ||||||

| Southern Illinois Recovery, Inc. | Delaware | 100 | ||||||

| St. Marks Powder, Inc. | Delaware | 100 | ||||||

| Tecnologias Internacionales de Manufactura S.A. de C.V. | Mexico | 100 | ||||||

| The Depth of Ideas for General Trading, LLC | Iraq | 100 | ||||||

| Vangent Servicios de Mexico, S.A. de C.V. | Mexico | 100 | ||||||

| Vulnerability Research Labs, LLC | Delaware | 100 | ||||||

| /s/ RICHARD D. CLARKE | /s/ C. HOWARD NYE | |||||||

| Richard D. Clarke | C. Howard Nye | |||||||

| /s/ JAMES S. CROWN | /s/ CATHERINE B. REYNOLDS | |||||||

| James S. Crown | Catherine B. Reynolds | |||||||

| /s/ RUDY F. DELEON | /s/ LAURA J. SCHUMACHER | |||||||

| Rudy F. deLeon | Laura J. Schumacher | |||||||

| /s/ CECIL D. HANEY | /s/ ROBERT K. STEEL | |||||||

| Cecil D. Haney | Robert K. Steel | |||||||

| /s/ MARK M. MALCOLM | /s/ JOHN G. STRATTON | |||||||

| Mark M. Malcolm | John G. Stratton | |||||||

| /s/ JAMES N. MATTIS | /s/ PETER A. WALL | |||||||

| James N. Mattis | Peter A. Wall | |||||||

| February 7, 2023 | /s/ Phebe N. Novakovic | ||||

| Phebe N. Novakovic | |||||

| Chairman and Chief Executive Officer | |||||

| February 7, 2023 | /s/ Jason W. Aiken | ||||

| Jason W. Aiken | |||||

| Executive Vice President, Technologies and Chief Financial Officer | |||||

| February 7, 2023 | /s/ Phebe N. Novakovic | ||||

| Phebe N. Novakovic | |||||

| Chairman and Chief Executive Officer | |||||

| February 7, 2023 | /s/ Jason W. Aiken | ||||

| Jason W. Aiken | |||||

| Executive Vice President, Technologies and Chief Financial Officer | |||||

Audit Information |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Auditor Information [Abstract] | |

| Auditor Firm ID | 185 |

| Auditor Location | McLean, VA |

| Auditor Name | KPMG LLP |

Consolidated Statement of Earnings - USD ($) $ in Millions |

12 Months Ended | ||

|---|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

|

| Revenue: | |||

| Revenue | $ 39,407 | $ 38,469 | $ 37,925 |

| Operating costs and expenses: | |||

| General and administrative (G&A) | (2,411) | (2,245) | (2,192) |

| Operating costs and expenses, Total | (35,196) | (34,306) | (33,792) |

| Operating earnings | 4,211 | 4,163 | 4,133 |

| Other, net | 189 | 134 | 82 |

| Interest, net | (364) | (424) | (477) |

| Earnings before income tax | 4,036 | 3,873 | 3,738 |

| Provision for income tax, net | (646) | (616) | (571) |

| Net earnings | $ 3,390 | $ 3,257 | $ 3,167 |

| Earnings per share | |||

| Basic (in dollars per share) | $ 12.31 | $ 11.61 | $ 11.04 |

| Diluted (in dollars per share) | $ 12.19 | $ 11.55 | $ 11.00 |

| Products | |||

| Revenue: | |||

| Revenue | $ 23,022 | $ 22,428 | $ 22,188 |

| Operating costs and expenses: | |||

| Cost of sales | (18,981) | (18,524) | (18,192) |

| Services | |||

| Revenue: | |||

| Revenue | 16,385 | 16,041 | 15,737 |

| Operating costs and expenses: | |||

| Cost of sales | $ (13,804) | $ (13,537) | $ (13,408) |

Consolidated Statement of Comprehensive Income - USD ($) $ in Millions |

12 Months Ended | ||

|---|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

|

| Statement of Comprehensive Income [Abstract] | |||

| Net earnings | $ 3,390 | $ 3,257 | $ 3,167 |

| Changes in unrealized cash flow hedges | (190) | (174) | 366 |

| Foreign currency translation adjustments | (278) | (103) | 353 |

| Changes in retirement plans’ funded status | 241 | 2,365 | (453) |

| Other comprehensive (loss) income, pretax | (227) | 2,088 | 266 |

| (Provision) benefit for income tax, net | (5) | (458) | 2 |

| Other comprehensive (loss) income, net of tax | (232) | 1,630 | 268 |

| Comprehensive income | $ 3,158 | $ 4,887 | $ 3,435 |

Consolidated Statement of Cash Flows - USD ($) $ in Millions |

12 Months Ended | ||

|---|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

|

| Cash flows from operating activities – continuing operations: | |||

| Net earnings | $ 3,390 | $ 3,257 | $ 3,167 |

| Adjustments to reconcile net earnings to net cash from operating activities: | |||

| Depreciation of property, plant and equipment | 586 | 568 | 523 |

| Amortization of intangible and finance lease right-of-use assets | 298 | 322 | 355 |

| Equity-based compensation expense | 165 | 126 | 128 |

| Deferred income tax benefit | (178) | (66) | (127) |

| (Increase) decrease in assets, net of effects of business acquisitions: | |||

| Accounts receivable | 46 | 138 | 371 |

| Unbilled receivables | (256) | (410) | (116) |

| Inventories | (980) | 405 | 502 |

| Increase (decrease) in liabilities, net of effects of business acquisitions: | |||

| Accounts payable | 224 | 194 | (215) |

| Customer advances and deposits | 2,082 | 354 | (707) |

| Income taxes payable | (436) | (45) | (39) |

| Other, net | (362) | (572) | 16 |

| Net cash provided by operating activities | 4,579 | 4,271 | 3,858 |

| Cash flows from investing activities: | |||

| Capital expenditures | (1,114) | (887) | (967) |

| Other, net | (375) | 5 | (7) |

| Net cash used by investing activities | (1,489) | (882) | (974) |

| Cash flows from financing activities: | |||

| Dividends paid | (1,369) | (1,315) | (1,240) |

| Purchases of common stock | (1,229) | (1,828) | (587) |

| Proceeds from commercial paper, gross (maturities greater than 3 months) | 0 | 1,997 | 420 |

| Repayment of commercial paper, gross (maturities greater than 3 months) | 0 | (1,997) | (420) |

| Proceeds from fixed-rate notes | 0 | 1,497 | 3,960 |

| Proceeds from (repayment of) credit facility, net | 0 | 6 | (441) |