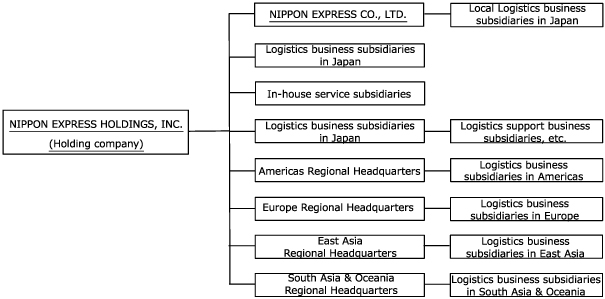

3. Holding company structure post-transition

After the transition to a holding company structure, Nippon Express, the business holding company until this point in time, will continue to act as the core operating company of the group. The main role of Nippon Express, however, will be to drive the group’s logistics business in Japan and global businesses originating from Japan. Our overseas logistics businesses will be led by regional headquarters companies in cooperation with the holding company, which will provide global headquarters functions. The roles of the logistics support business companies will be separated into functional companies providing services within the group and logistics support operating companies that provide customer-facing logistics-related services. These logistics support operating companies will develop businesses that add new value in logistics and help the group advance to higher levels in logistics. Further, as announced in the “Notice Concerning Commencement of Consideration on Security Transportation Business Spin-Off” released on April 28, 2021, the security business is being considered to be spun off from Nippon Express as a specialized business. If, as a result of the deliberation, a spin-off is to be implemented, the timing, method, and other details will be announced as soon as they are determined.

4. Transition method and procedures

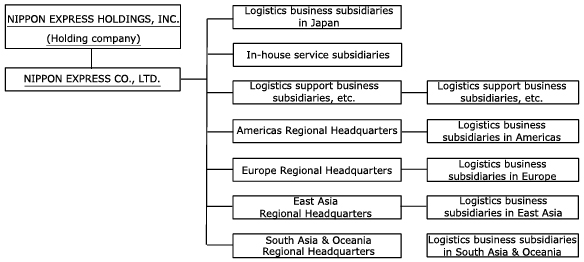

The company intends to transition to a holding company structure via the method as shown below.

A. Step 1: Establish holding company via share transfer

Establish a holding company effective January 4, 2022 via share transfer, making Nippon Express Co., Ltd. a wholly owned subsidiary of the holding company.

B. Step 2: Structure subsequent to establishment of holding company via share transfer (group business reorganization)

Subsequent to the share transfer taking effect, Nippon Express Co., Ltd. subsidiaries will become direct subsidiaries of the new holding company to form a group management structure to fully achieve the purpose of the transition to a holding company structure. Details of this restructuring are still under consideration with the option of company split, etc., and specific details and timing will be announced as soon as they are determined.