| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| (Commission File Number) | ||

| Xcel Energy Inc. | ||||||||

| (Exact name of registrant as specified in its charter) | ||||||||

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

| (Registrant’s Telephone Number, Including Area Code) | |||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| PART I | ||||||||

| Item 1 — | ||||||||

| Item 1A — | ||||||||

| Item 1B — | ||||||||

| Item 2 — | ||||||||

| Item 3 — | ||||||||

| Item 4 — | ||||||||

| PART II | ||||||||

| Item 5 — | ||||||||

| Item 6 — | ||||||||

| Item 7 — | ||||||||

| Item 7A — | ||||||||

| Item 8 — | ||||||||

| Item 9 — | ||||||||

| Item 9A — | ||||||||

| Item 9B — | ||||||||

| Item 9C — | ||||||||

| PART III | ||||||||

| Item 10 — | ||||||||

| Item 11 — | ||||||||

| Item 12 — | ||||||||

| Item 13 — | ||||||||

| Item 14 — | ||||||||

| PART IV | ||||||||

| Item 15 — | ||||||||

| Item 16 — | ||||||||

ITEM 1 — BUSINESS | ||

| Xcel Energy Inc.’s Subsidiaries and Affiliates (current and former) | |||||

| Capital Services | Capital Services, LLC | ||||

| Eloigne | Eloigne Company | ||||

| e prime | e prime inc. | ||||

| NSP-Minnesota | Northern States Power Company, a Minnesota corporation | ||||

| NSP System | The electric production and transmission system of NSP-Minnesota and NSP-Wisconsin operated on an integrated basis and managed by NSP-Minnesota | ||||

| NSP-Wisconsin | Northern States Power Company, a Wisconsin corporation | ||||

| Operating companies | NSP-Minnesota, NSP-Wisconsin, PSCo and SPS | ||||

| PSCo | Public Service Company of Colorado | ||||

| SPS | Southwestern Public Service Co. | ||||

| Utility subsidiaries | NSP-Minnesota, NSP-Wisconsin, PSCo and SPS | ||||

| WGI | WestGas InterState, Inc. | ||||

| WYCO | WYCO Development, LLC | ||||

| Xcel Energy | Xcel Energy Inc. and its subsidiaries | ||||

| Federal and State Regulatory Agencies | |||||

| CPUC | Colorado Public Utilities Commission | ||||

| DOC | Minnesota Department of Commerce | ||||

| DOE | United States Department of Energy | ||||

| DOT | United States Department of Transportation | ||||

| EPA | United States Environmental Protection Agency | ||||

| FERC | Federal Energy Regulatory Commission | ||||

| IRS | Internal Revenue Service | ||||

| MPCA | Minnesota Pollution Control Agency | ||||

| MPUC | Minnesota Public Utilities Commission | ||||

| NDPSC | North Dakota Public Service Commission | ||||

| NERC | North American Electric Reliability Corporation | ||||

| NMPRC | New Mexico Public Regulation Commission | ||||

| NRC | Nuclear Regulatory Commission | ||||

| PHMSA | Pipeline and Hazardous Materials Safety Administration | ||||

| PSCW | Public Service Commission of Wisconsin | ||||

| PUCT | Public Utility Commission of Texas | ||||

| SDPUC | South Dakota Public Utility Commission | ||||

| SEC | Securities and Exchange Commission | ||||

| TCEQ | Texas Commission on Environmental Quality | ||||

| Electric, Purchased Gas and Resource Adjustment Clauses | |||||

| CIP | Conservation improvement program | ||||

| DSM | Demand side management | ||||

| ECA | Retail electric commodity adjustment | ||||

| FCA | Fuel clause adjustment | ||||

| GCA | Gas cost adjustment | ||||

| GUIC | Gas utility infrastructure cost rider | ||||

| RES | Renewable energy standard | ||||

| Other | |||||

| AFUDC | Allowance for funds used during construction | ||||

| AMT | Alternative minimum tax | ||||

| ALJ | Administrative Law Judge | ||||

| ARO | Asset retirement obligation | ||||

| ASC | Financial Accounting Standards Board Accounting Standards Codification | ||||

| ATM | At-the-market | ||||

| BART | Best available retrofit technology | ||||

| C&I | Commercial and Industrial | ||||

| CapX2020 | Alliance of electric cooperatives, municipals and investor-owned utilities in the upper Midwest involved in a joint transmission line planning and construction effort | ||||

| CCR | Coal combustion residuals | ||||

| CCR Rule | Final rule (40 CFR 257.50 - 257.107) published by the EPA regulating the management, storage and disposal of CCRs as a nonhazardous waste | ||||

| CDD | Cooling degree-days | ||||

| CEO | Chief executive officer | ||||

| CFO | Chief financial officer | ||||

| CIG | Colorado Interstate Gas Company, LLC | ||||

| CON | Certificate of Need | ||||

| CSPV | Crystalline Silicon Photovoltaic | ||||

| CWIP | Construction work in progress | ||||

| D.C. Circuit | United States Court of Appeals for the District of Columbia Circuit | ||||

| DECON | Decommissioning method where radioactive contamination is removed and safely disposed of at a requisite facility or decontaminated to a permitted level | ||||

| DRIP | Dividend Reinvestment Program | ||||

| EEI | Edison Electric Institute | ||||

| EIP | Energy Impact Partners | ||||

| EMANI | European Mutual Association for Nuclear Insurance | ||||

| EPS | Earnings per share | ||||

| ETR | Effective tax rate | ||||

| FTR | Financial transmission right | ||||

| GAAP | Generally accepted accounting principles | ||||

| GE | General Electric | ||||

| GHG | Greenhouse gas | ||||

| HDD | Heating degree-days | ||||

| INPO | Institute of Nuclear Power Operations | ||||

| IPP | Independent power producing entity | ||||

| IRA | Inflation Reduction Act | ||||

| ISO | Independent System Operator | ||||

| ITC | Investment Tax Credit | ||||

| LP&L | Lubbock Power & Light | ||||

| MEC | Mankato Energy Center | ||||

| MGP | Manufactured gas plant | ||||

| MISO | Midcontinent Independent System Operator, Inc. | ||||

| Native load | Demand of retail and wholesale customers that a utility has an obligation to serve under statute or contract | ||||

| NAV | Net asset value | ||||

| NEIL | Nuclear Electric Insurance Ltd. | ||||

| NOL | Net operating loss | ||||

| NOPR | Notice of proposed rulemaking | ||||

| NOx | Nitrogen Oxides | ||||

| O&M | Operating and maintenance | ||||

| OATT | Open Access Transmission Tariff | ||||

| PFAS | Per- and PolyFluoroAlkyl Substances | ||||

| PI | Prairie Island nuclear generating plant | ||||

| Post-65 | Post-Medicare | ||||

| PPA | Purchased power agreement | ||||

| Pre-65 | Pre-Medicare | ||||

| PTC | Production tax credit | ||||

| REC | Renewable energy credit | ||||

| RFP | Request for proposal | ||||

| ROE | Return on equity | ||||

| ROU | Right-of-use | ||||

| RTO | Regional Transmission Organization | ||||

| S&P | Standard & Poor’s Global Ratings | ||||

| SERP | Supplemental executive retirement plan | ||||

SO2 | Sulfur dioxide | ||||

| SPP | Southwest Power Pool, Inc. | ||||

| TCA | Transmission cost adjustment | ||||

| TCJA | 2017 federal tax reform enacted as Public Law No: 115-97, commonly referred to as the Tax Cuts and Jobs Act | ||||

| THI | Temperature-humidity index | ||||

| TO | Transmission owner | ||||

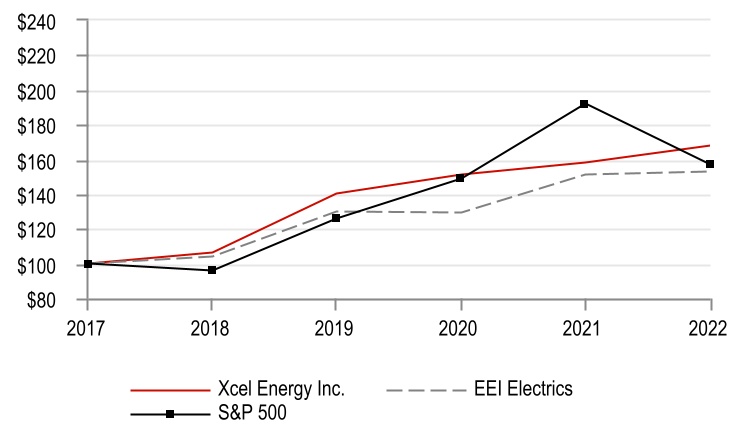

| TSR | Total shareholder return | ||||

| VaR | Value at Risk | ||||

| VIE | Variable interest entity | ||||

| WACC | Weighted Average Cost of Capital | ||||

| Measurements | |||||

| Bcf | Billion cubic feet | ||||

| KV | Kilovolts | ||||

| KWh | Kilowatt hours | ||||

| MMBtu | Million British thermal units | ||||

| MW | Megawatts | ||||

| MWh | Megawatt hours | ||||

Where to Find More Information | ||

Forward-Looking Statements | ||

Overview | ||

| Subsidiary / Affiliate | Function | |||||||

| NSP-Minnesota | Electric & Gas | |||||||

| NSP-Wisconsin | Electric & Gas | |||||||

| PSCo | Electric & Gas | |||||||

| SPS | Electric | |||||||

| WGI | Interstate gas pipeline | |||||||

| WYCO | Gas storage and transportation | |||||||

| Other Subsidiaries | See Note 1 to the consolidated financial statements for further information | |||||||

| Utility Subsidiary Overview | ||||||||

| Electric customers | 3.8 million | |||||||

| Natural gas customers | 2.1 million | |||||||

| Total assets | $61.1 billion | |||||||

| Electric generating capacity | 20,897 MW | |||||||

| Natural gas storage capacity | 53.5 Bcf | |||||||

| Electric transmission lines (conductor miles) | 110,000 miles | |||||||

| Electric distribution lines (conductor miles) | 213,000 miles | |||||||

| Natural gas transmission lines | 2,200 miles | |||||||

| Natural gas distribution lines | 37,000 miles | |||||||

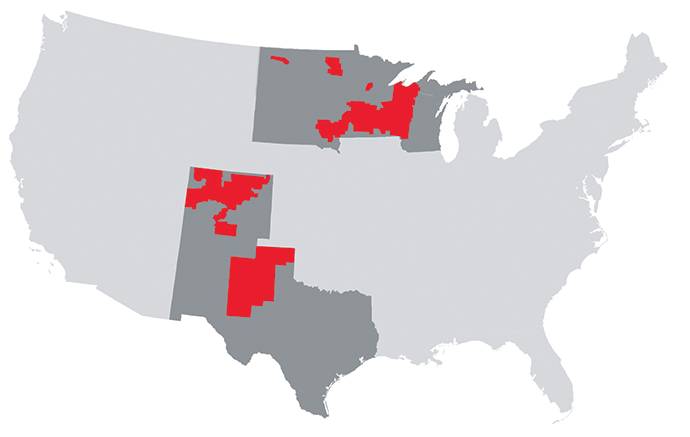

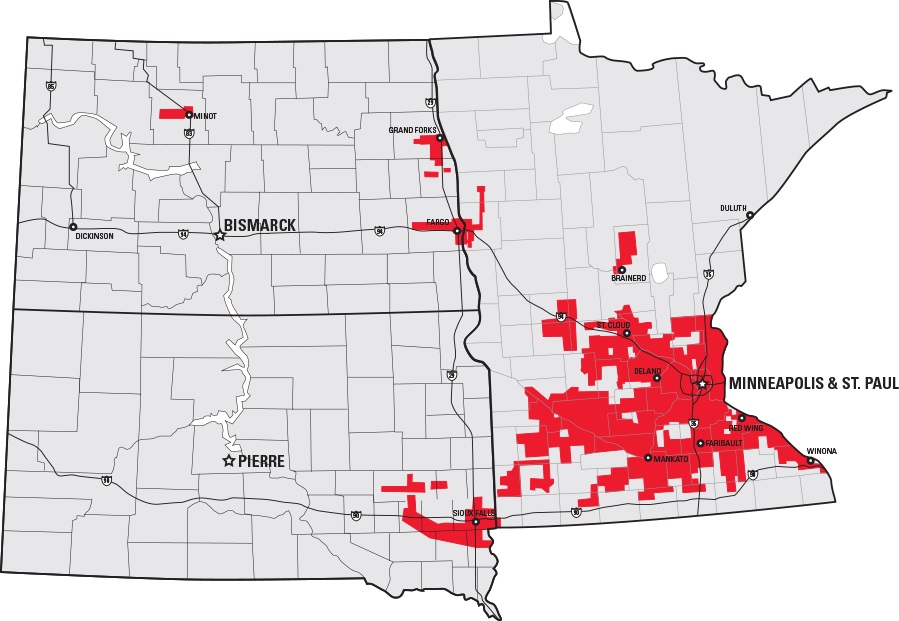

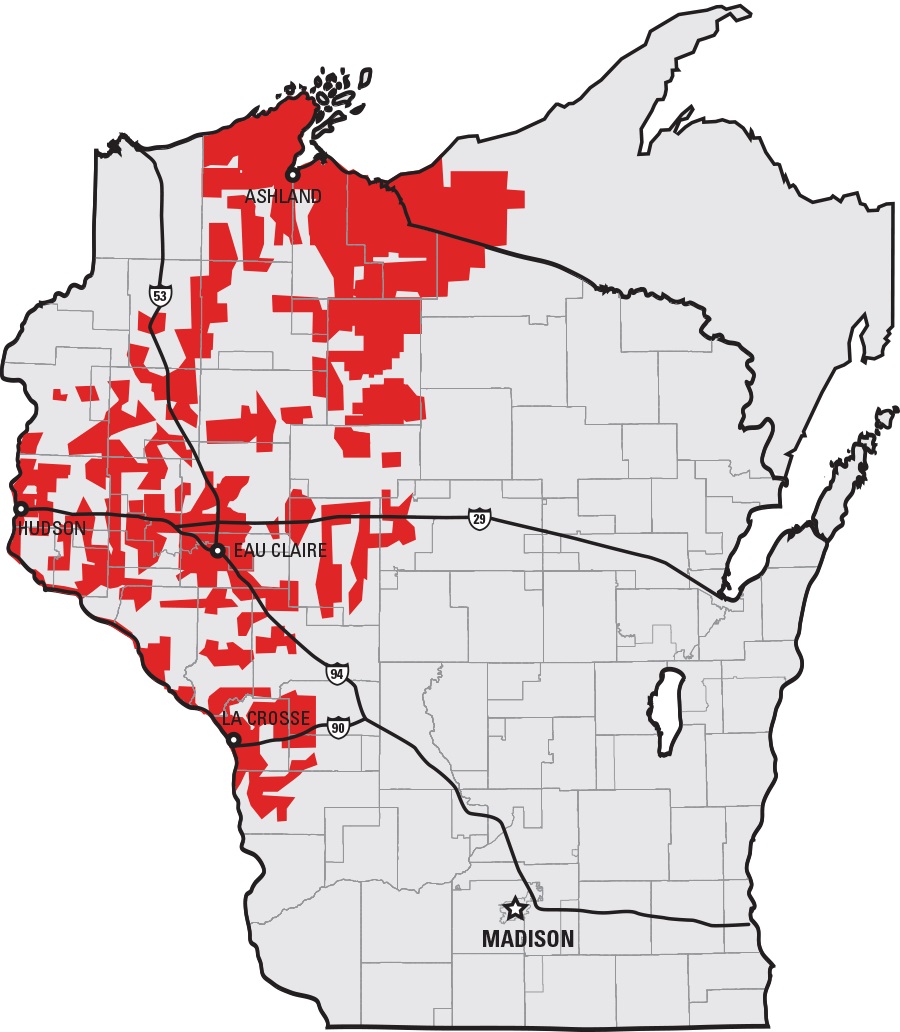

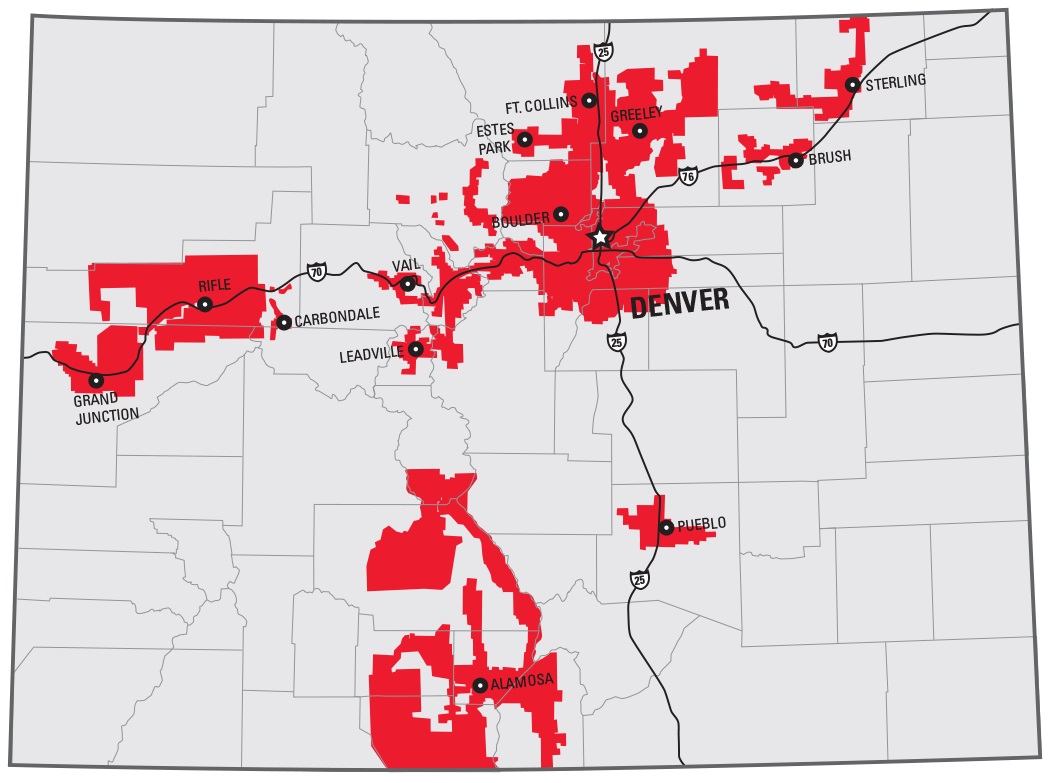

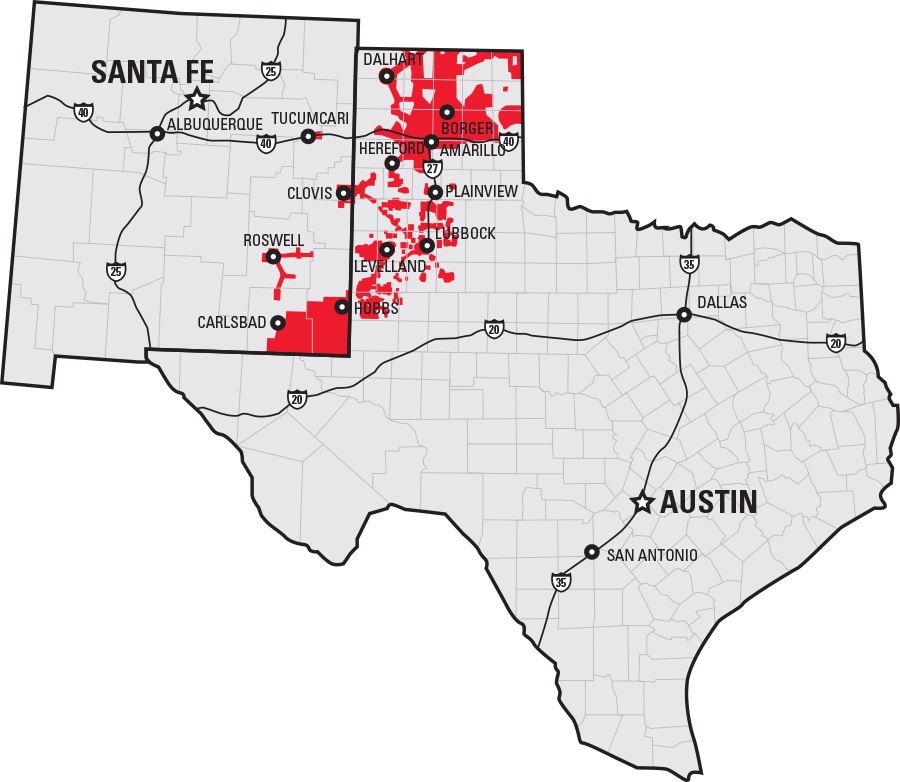

| Service Territory | |||||||||||

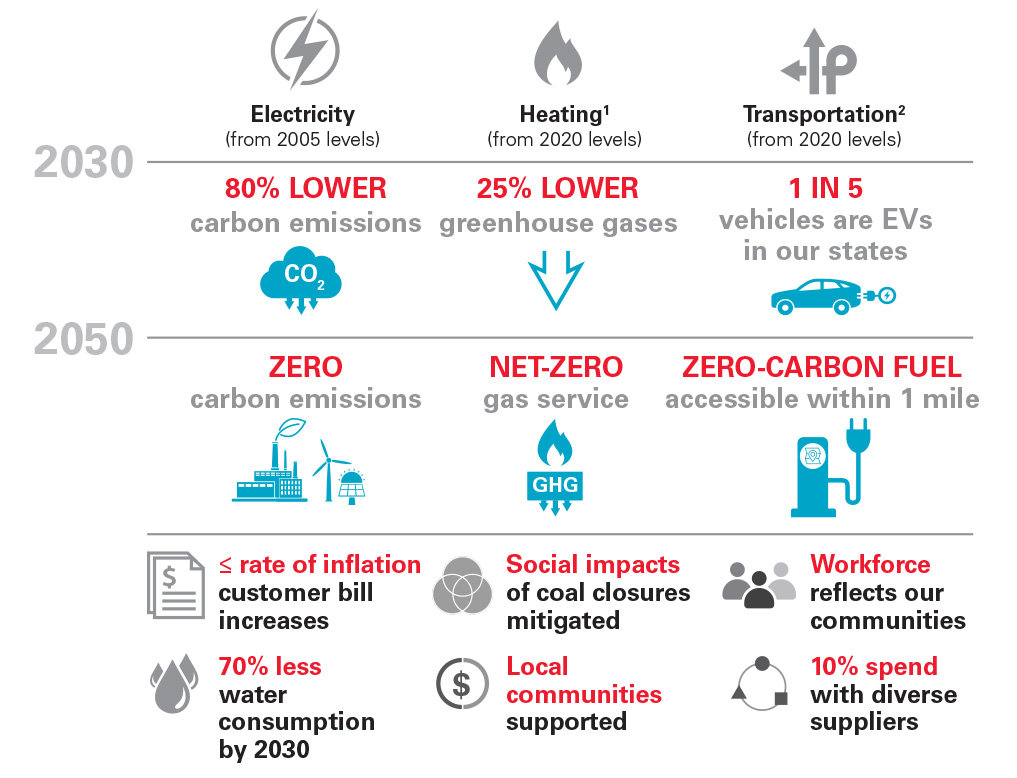

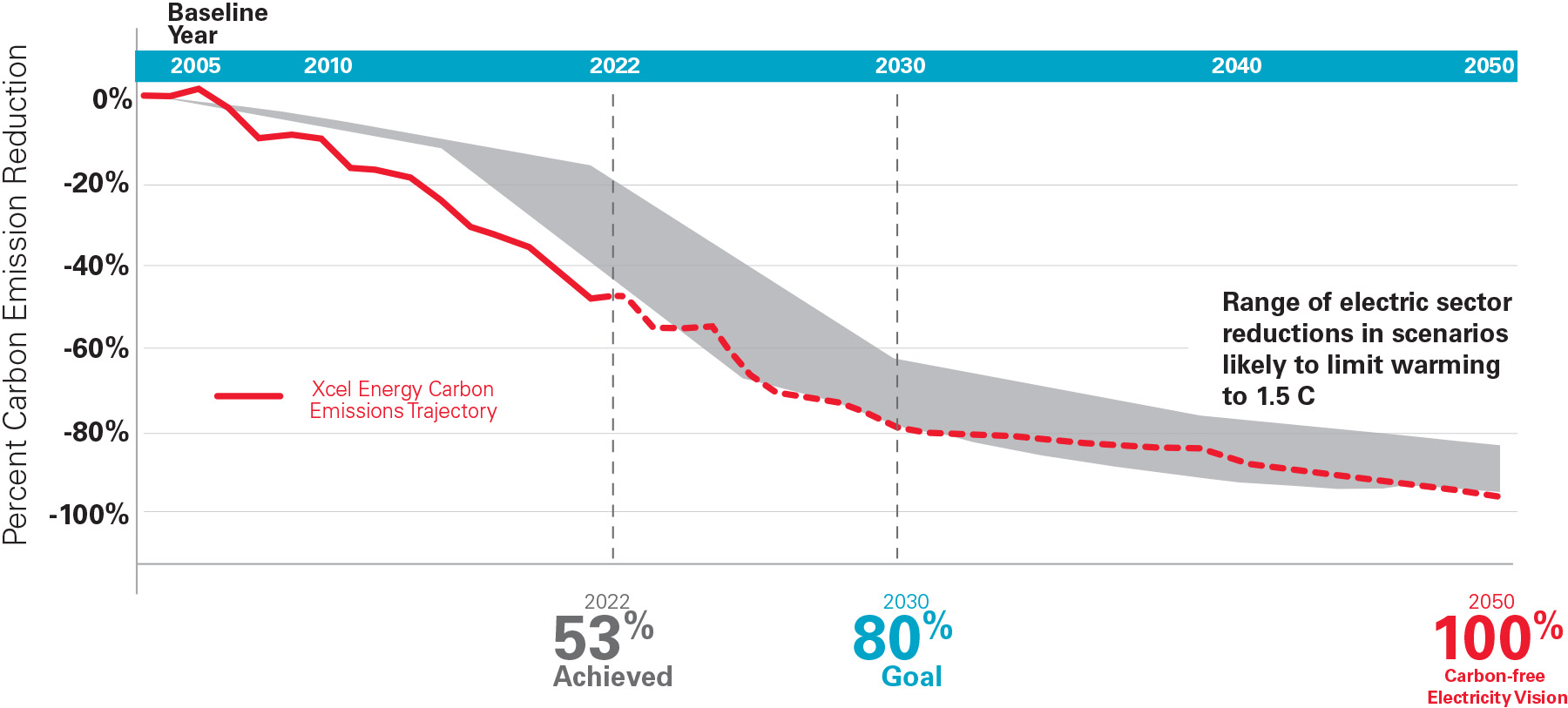

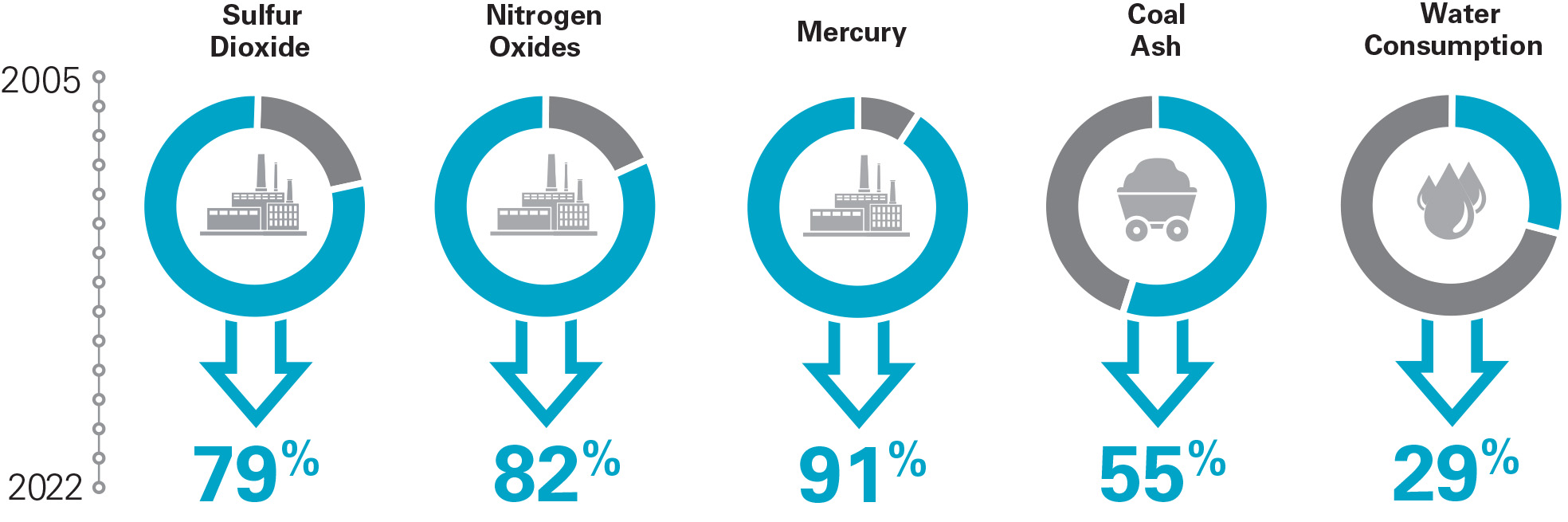

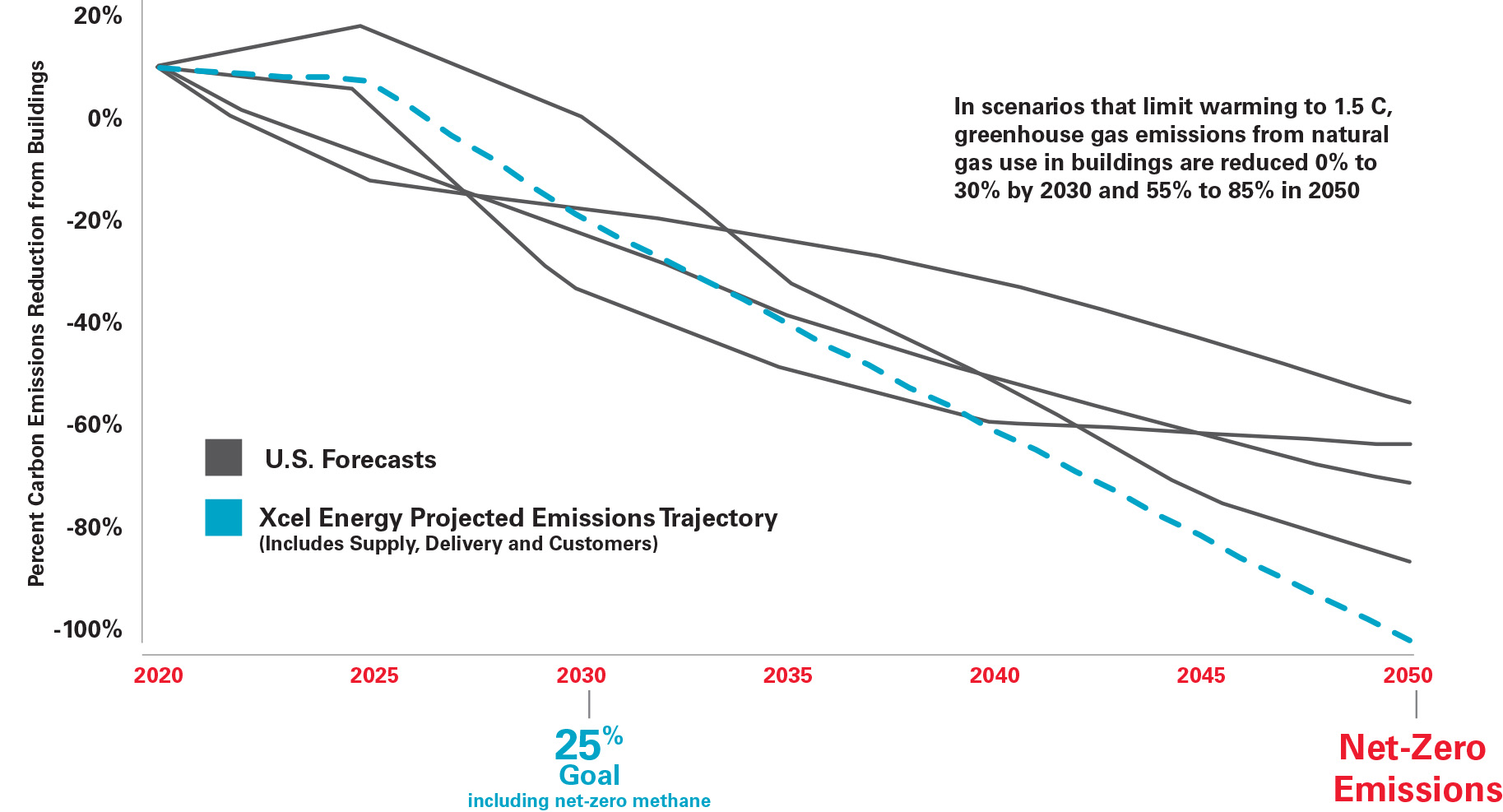

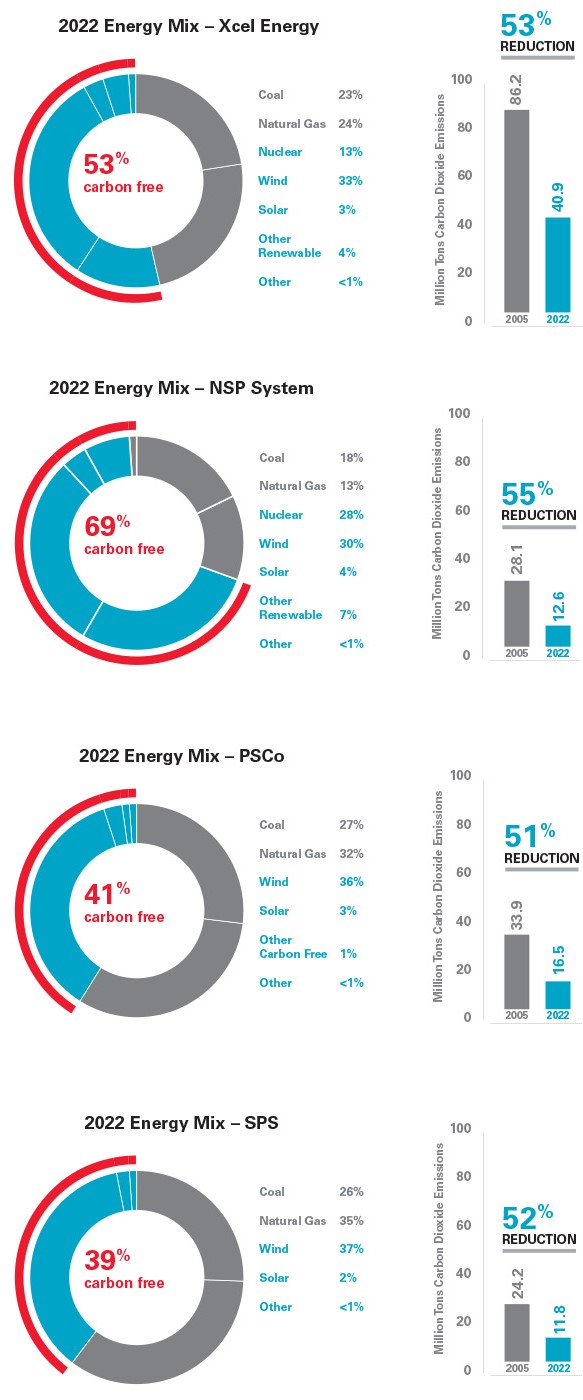

Strategy | ||

| LEAD THE CLEAN ENERGY TRANSITION | ENHANCE THE CUSTOMER EXPERIENCE | KEEP BILLS LOW | ||||||

| Female | Ethnically Diverse | |||||||

| Board of Directors | 33 | % | 17 | % | ||||

| CEO direct reports | 33 | 22 | ||||||

| Management | 25 | 12 | ||||||

| Employees | 24 | 18 | ||||||

| New hires | 35 | 24 | ||||||

| Interns (hired throughout 2022) | 32 | 25 | ||||||

| Employee Turnover | Retirement Eligibility | |||||||||||||

| Bargaining | 7 | % | Within next 5 years | 24 | % | |||||||||

| Non-Bargaining | 15 | Within next 10 years | 35 | |||||||||||

Overall (a) | 11 | |||||||||||||

|  |  |  | ||||||||

| Fortune | Human Rights Campaign | Ethisphere | GI Jobs | ||||||||

| World’s Most Admired Companies | Best Places to Work for LGBTQ Equality | World’s Most Ethical Companies | Military Friendly Employer | ||||||||

NSP-Minnesota | |||||||||||||||||

| |||||||||||||||||

| Electric customers | 1.5 million | NSP-Minnesota conducts business in Minnesota, North Dakota and South Dakota and has electric operations in all three states including the generation, purchase, transmission, distribution and sale of electricity. NSP-Minnesota and NSP-Wisconsin electric operations are managed on the NSP System. NSP-Minnesota also purchases, transports, distributes and sells natural gas to retail customers and transports customer-owned natural gas in Minnesota and North Dakota. | |||||||||||||||

| Natural gas customers | 0.5 million | ||||||||||||||||

| Total assets | $23.7 billion | ||||||||||||||||

| Rate Base (estimated) | $15.1 billion | ||||||||||||||||

| ROE (net income / average stockholder's equity) | 8.76% | ||||||||||||||||

| Electric generating capacity | 8,949 MW | ||||||||||||||||

| Gas storage capacity | 17.1 Bcf | ||||||||||||||||

| Electric transmission lines (conductor miles) | 33,000 miles | ||||||||||||||||

| Electric distribution lines (conductor miles) | 82,000 miles | ||||||||||||||||

| Natural gas transmission lines | 78 miles | ||||||||||||||||

| Natural gas distribution lines | 11,000 miles | ||||||||||||||||

NSP-Wisconsin | |||||||||||||||||

| |||||||||||||||||

| Electric customers | 0.3 million | NSP-Wisconsin conducts business in Wisconsin and Michigan and generates, transmits, distributes and sells electricity. NSP-Minnesota and NSP-Wisconsin electric operations are managed on the NSP System. NSP-Wisconsin also purchases, transports, distributes and sells natural gas to retail customers and transports customer-owned natural gas. | |||||||||||||||

| Natural gas customers | 0.1 million | ||||||||||||||||

| Total assets | $3.4 billion | ||||||||||||||||

| Rate Base (estimated) | $2.1 billion | ||||||||||||||||

| ROE (net income / average stockholder's equity) | 10.57% | ||||||||||||||||

| Electric generating capacity | 548 MW | ||||||||||||||||

| Gas storage capacity | 4.3 Bcf | ||||||||||||||||

| Electric transmission lines (conductor miles) | 12,000 miles | ||||||||||||||||

| Electric distribution lines (conductor miles) | 28,000 miles | ||||||||||||||||

| Natural gas transmission lines | 3 miles | ||||||||||||||||

| Natural gas distribution lines | 3,000 miles | ||||||||||||||||

PSCo | |||||||||||||||||

| |||||||||||||||||

| Electric customers | 1.6 million | PSCo conducts business in Colorado and generates, purchases, transmits, distributes and sells electricity. PSCo also purchases, transports, distributes and sells natural gas to retail customers and transports customer-owned natural gas. | |||||||||||||||

| Natural gas customers | 1.5 million | ||||||||||||||||

| Total assets | $23.6 billion | ||||||||||||||||

| Rate Base (estimated) | $14.9 billion | ||||||||||||||||

| ROE (net income / average stockholder's equity) | 8.23% | ||||||||||||||||

| Electric generating capacity | 6,151 MW | ||||||||||||||||

| Gas storage capacity | 32.1 Bcf | ||||||||||||||||

| Electric transmission lines (conductor miles) | 25,000 miles | ||||||||||||||||

| Electric distribution lines (conductor miles) | 79,000 miles | ||||||||||||||||

| Natural gas transmission lines | 2,000 miles | ||||||||||||||||

| Natural gas distribution lines | 24,000 miles | ||||||||||||||||

| SPS | |||||||||||||||||

| |||||||||||||||||

SPS conducts business in Texas and New Mexico and generates, purchases, transmits, distributes and sells electricity. | |||||||||||||||||

| Electric customers | 0.4 million | ||||||||||||||||

| Total assets | $9.7 billion | ||||||||||||||||

| Rate Base (estimated) | $6.7 billion | ||||||||||||||||

| ROE (net income / average stockholder's equity) | 9.36% | ||||||||||||||||

| Electric generating capacity | 5,249 MW | ||||||||||||||||

| Electric transmission lines (conductor miles) | 41,000 miles | ||||||||||||||||

| Electric distribution lines (conductor miles) | 24,000 miles | ||||||||||||||||

Operations Overview | ||

Electric Operations | ||

| Electric Operations (percentage of total) | Sales Volume | Number of Customers | Revenues | |||||||||||||||||

| Residential | 23 | % | 86 | % | 29 | % | ||||||||||||||

| C&I | 55 | 12 | 48 | |||||||||||||||||

| Other | 22 | 2 | 23 | |||||||||||||||||

| 2022 | 2021 | |||||||||||||

| KWh sales per retail customer | 24,285 | 23,968 | ||||||||||||

| Revenue per retail customer | $ | 2,513 | $ | 2,405 | ||||||||||

| Residential revenue per KWh | 13.41 | ¢ | 12.94 | ¢ | ||||||||||

| C&I revenue per KWh | 9.02 | ¢ | 8.73 | ¢ | ||||||||||

| Total retail revenue per KWh | 10.35 | ¢ | 10.03 | ¢ | ||||||||||

| Utility Subsidiary | 2022 | 2021 | ||||||||||||||||||||||||

| Wind Farms | Capacity (MW) (a) | Wind Farms | Capacity (MW) (b) | |||||||||||||||||||||||

| NSP System | 16 | 2,352 | 14 | 2,031 | ||||||||||||||||||||||

| PSCo | 2 | 1,059 | 2 | 1,059 | ||||||||||||||||||||||

| SPS | 2 | 984 | 2 | 984 | ||||||||||||||||||||||

| Total | 20 | 4,395 | 18 | 4,074 | ||||||||||||||||||||||

| Utility Subsidiary | 2022 | 2021 | ||||||||||||||||||||||||

| PPAs | Range (MW) | PPAs | Range (MW) | |||||||||||||||||||||||

| NSP System | 129 | 1 — 206 | 128 | 1 — 206 | ||||||||||||||||||||||

| PSCo | 17 | 23 — 301 | 17 | 23 — 301 | ||||||||||||||||||||||

| SPS | 17 | 1 — 250 | 17 | 1 — 250 | ||||||||||||||||||||||

| Utility Subsidiary | 2022 | 2021 | ||||||||||||

| NSP System | 4,515 | 3,997 | ||||||||||||

| PSCo | 4,082 | 4,085 | ||||||||||||

| SPS | 2,548 | 2,548 | ||||||||||||

| Utility Subsidiary | 2022 | 2021 | ||||||||||||

| NSP System | $ | 18 | $ | 25 | ||||||||||

| PSCo | 11 | 17 | ||||||||||||

| SPS | 13 | 17 | ||||||||||||

| Utility Subsidiary | 2022 | 2021 | ||||||||||||

| NSP System | $ | 37 | $ | 37 | ||||||||||

| PSCo | 38 | 35 | ||||||||||||

| SPS | 27 | 27 | ||||||||||||

| Project | Utility Subsidiary | Capacity (MW) | |||||||||||||||

| Dakota Range | NSP-Minnesota | 298 | (a)(b) | ||||||||||||||

| Nobles Repower | NSP-Minnesota | 200 | (a)(b) | ||||||||||||||

| Rock Aetna | NSP-Minnesota | 20 | (a)(b) | ||||||||||||||

| Various PPAs | Various | 220 | (c) | ||||||||||||||

| Project | Utility Subsidiary | Capacity (MW) | Estimated Completion | ||||||||||||||||||||

| Northern Wind | NSP-Minnesota | 100 | 2023 | (a) | |||||||||||||||||||

| Grand Meadow Repower | NSP-Minnesota | 100 | 2023 | ||||||||||||||||||||

| Border Winds Repower | NSP-Minnesota | 150 | 2025 | ||||||||||||||||||||

| Pleasant Valley Repower | NSP-Minnesota | 200 | 2025 | ||||||||||||||||||||

| Type | Utility Subsidiary | Capacity (MW) | ||||||||||||

| Distributed Generation | NSP System | 1,074 | ||||||||||||

| Utility-Scale | NSP System | 269 | ||||||||||||

| Distributed Generation | PSCo | 848 | ||||||||||||

| Utility-Scale | PSCo | 732 | ||||||||||||

| Distributed Generation | SPS | 20 | ||||||||||||

| Utility-Scale | SPS | 192 | ||||||||||||

| Total | 3,135 | |||||||||||||

| Utility Subsidiary | 2022 | 2021 | ||||||||||||

| NSP System | $ | 79 | $ | 90 | ||||||||||

| PSCo | 69 | 67 | ||||||||||||

| SPS | 62 | 61 | ||||||||||||

| Utility Subsidiary | Nuclear | |||||||||||||

| NSP System | Cost | Percent | ||||||||||||

| 2022 | $ | 0.76 | 51 | % | ||||||||||

| 2021 | 0.77 | 50 | ||||||||||||

| Year | Utility Subsidiary | Plant Unit | Capacity (MW) | ||||||||||||||||||||

| 2023 | NSP-Minnesota | Sherco 2 | 682 | ||||||||||||||||||||

| 2024 | SPS | Harrington (a) | 1,018 | ||||||||||||||||||||

| 2025 | PSCo | Comanche 2 | 335 | ||||||||||||||||||||

| 2025 | PSCo | Craig 1 | 42 | (b) | |||||||||||||||||||

| 2025 | PSCo | Pawnee (c) | 505 | ||||||||||||||||||||

| 2026 | NSP-Minnesota | Sherco 1 | 680 | ||||||||||||||||||||

| 2027 | PSCo | Hayden 2 | 98 | (b) | |||||||||||||||||||

| 2028 | PSCo | Hayden 1 | 135 | (b) | |||||||||||||||||||

| 2028 | PSCo | Craig 2 | 40 | (b) | |||||||||||||||||||

| 2028 | NSP-Minnesota | A.S. King | 511 | ||||||||||||||||||||

| 2030 | NSP-Minnesota | Sherco 3 | 517 | (b) | |||||||||||||||||||

| 2030 | PSCo | Comanche 3 | 500 | (b) | |||||||||||||||||||

| 2034 | SPS | Tolk 1 (d) | 532 | ||||||||||||||||||||

| 2034 | SPS | Tolk 2 (d) | 535 | ||||||||||||||||||||

Coal (a) | ||||||||||||||

| Utility Subsidiary | Cost | Percent | ||||||||||||

| NSP System | ||||||||||||||

| 2022 | $ | 2.27 | 37 | % | ||||||||||

| 2021 | 1.95 | 34 | ||||||||||||

| PSCo | ||||||||||||||

| 2022 | 1.48 | 55 | ||||||||||||

| 2021 | 1.43 | 62 | ||||||||||||

| SPS | ||||||||||||||

| 2022 | 2.37 | 59 | ||||||||||||

| 2021 | 2.07 | 66 | ||||||||||||

| Natural Gas | ||||||||||||||

| Utility Subsidiary | Cost | Percent | ||||||||||||

| NSP System | ||||||||||||||

| 2022 | $ | 7.58 | 12 | % | ||||||||||

2021 (a) | 4.98 | 16 | ||||||||||||

| PSCo | ||||||||||||||

| 2022 | 7.09 | 45 | ||||||||||||

2021 (a) | 8.38 | 38 | ||||||||||||

| SPS | ||||||||||||||

| 2022 | 5.87 | 41 | ||||||||||||

2021 (a) | 6.72 | 34 | ||||||||||||

| System Peak Demand (MW) | ||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||

NSP System | 9,245 | June 20 | 8,837 | June 9 | ||||||||||||||||||||||

| PSCo | 6,821 | Sept. 6 | 6,958 | July 28 | ||||||||||||||||||||||

| SPS | 4,280 | July 19 | 4,054 | Aug. 9 | ||||||||||||||||||||||

| Natural Gas Operations | ||

| Natural Gas (percentage of total) | Deliveries | Number of Customers | Revenues | |||||||||||||||||

| Residential | 38 | % | 92 | % | 59 | % | ||||||||||||||

| C&I | 24 | 8 | 32 | |||||||||||||||||

| Transportation and other | 38 | <1 | 9 | |||||||||||||||||

| 2022 | 2021 | |||||||||||||

| MMBtu sales per retail customer | 116 | 114 | ||||||||||||

| Revenue per retail customer | $ | 1,318 | $ | 917 | ||||||||||

| Residential revenue per MMBtu | 11.97 | 8.61 | ||||||||||||

| C&I revenue per MMBtu | 10.45 | 7.20 | ||||||||||||

| Transportation and other revenue per MMBtu | 1.16 | 1.20 | ||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||

| Utility Subsidiary | MMBtu | Date | MMBtu | Date (a) | ||||||||||||||||||||||

| NSP-Minnesota | 867,385 | Feb. 12 | 899,133 | Feb. 11 | ||||||||||||||||||||||

| NSP-Wisconsin | 187,961 | Jan. 6 | 167,656 | Feb. 11 | ||||||||||||||||||||||

| PSCo | 2,243,552 | Dec. 22 | 2,316,283 | Feb. 14 | ||||||||||||||||||||||

| Utility Subsidiary | 2022 | 2021 (a) | ||||||||||||

| NSP-Minnesota | $ | 7.00 | $ | 7.48 | ||||||||||

| NSP-Wisconsin | 6.68 | 7.11 | ||||||||||||

| PSCo | 6.33 | 6.06 | ||||||||||||

| General | ||

| Governmental Regulations | ||

| Capital Spending and Financing | ||

Information about our Executive Officers (a) | ||||||||||||||||||||

| Name | Age (b) | Current and Recent Positions | Time in Position | |||||||||||||||||

| Robert C. Frenzel | 52 | Chairman of the Board of Directors, Xcel Energy Inc. | December 2021 — Present | |||||||||||||||||

| President and Chief Executive Officer and Director, Xcel Energy Inc. | August 2021 — Present | |||||||||||||||||||

| Chief Executive Officer, NSP-Minnesota, NSP-Wisconsin, PSCo, and SPS | August 2021 — Present | |||||||||||||||||||

| President and Chief Operating Officer, Xcel Energy Inc. | March 2020 — August 2021 | |||||||||||||||||||

| Executive Vice President, Chief Financial Officer, Xcel Energy Inc. | May 2016 — March 2020 | |||||||||||||||||||

Senior Vice President and Chief Financial Officer, Luminant, a subsidiary of Energy Future Holdings Corp. (c) | February 2012 — April 2016 | |||||||||||||||||||

| Brett C. Carter | 56 | Executive Vice President, Group President, Utilities, and Chief Customer Officer, Xcel Energy Inc. | March 2022 — Present | |||||||||||||||||

| Executive Vice President and Chief Customer and Innovation Officer, Xcel Energy Inc. | May 2018 — March 2022 | |||||||||||||||||||

| Senior Vice President and Shared Services Executive, Bank of America, an institutional investment bank and financial services company | October 2015 — May 2018 | |||||||||||||||||||

| Patricia Correa | 49 | Senior Vice President, Chief Human Resources Officer, Xcel Energy Inc. | February 2022 — Present | |||||||||||||||||

| Senior Vice President, Human Resources, Eaton Corporation, a power management company | July 2019 — January 2022 | |||||||||||||||||||

| Vice President, Human Resources, Eaton Corporation | March 2016 — July 2019 | |||||||||||||||||||

| Timothy O’Connor | 63 | Executive Vice President, Chief Operations Officer, Xcel Energy Inc. | August 2021 — Present | |||||||||||||||||

| Executive Vice President, Chief Generation Officer, Xcel Energy Inc. | March 2020 — August 2021 | |||||||||||||||||||

| Senior Vice President, Chief Nuclear Officer, Xcel Energy Services Inc | February 2013 — March 2020 | |||||||||||||||||||

| Frank Prager | 60 | Senior Vice President, Strategy, Security and External Affairs and Chief Sustainability Officer, Xcel Energy Inc. | March 2022 — Present | |||||||||||||||||

| Senior Vice President, Strategy, Planning and External Affairs, Xcel Energy Inc. | March 2020 — March 2022 | |||||||||||||||||||

| Vice President, Policy and Federal Affairs, Xcel Energy Services Inc. | January 2015 — March 2020 | |||||||||||||||||||

| Amanda Rome | 42 | Executive Vice President, Chief Legal and Compliance Officer, Xcel Energy Inc. | June 2022 — Present | |||||||||||||||||

| Executive Vice President, General Counsel, Xcel Energy Inc. | June 2020 — June 2022 | |||||||||||||||||||

| Vice President and Deputy General Counsel, Xcel Energy Services Inc. | October 2019 — June 2020 | |||||||||||||||||||

| Managing Attorney, Xcel Energy Services Inc. | July 2018 — October 2019 | |||||||||||||||||||

| Rotational Position, Xcel Energy Services Inc. | January 2018 — July 2018 | |||||||||||||||||||

| Lead Assistant General Counsel, Xcel Energy Services Inc. | July 2015 — January 2018 | |||||||||||||||||||

| Brian J. Van Abel | 41 | Executive Vice President, Chief Financial Officer, Xcel Energy Inc. | March 2020 — Present | |||||||||||||||||

| Senior Vice President, Finance and Corporate Development, Xcel Energy Services Inc. | September 2018 — March 2020 | |||||||||||||||||||

| Vice President, Treasurer, Xcel Energy Services Inc. | July 2015 — September 2018 | |||||||||||||||||||

ITEM 1A — RISK FACTORS | ||

ITEM 1B — UNRESOLVED STAFF COMMENTS | ||

ITEM 2 — PROPERTIES | ||

NSP-Minnesota Station, Location and Unit at Dec. 31, 2022 | Fuel | Installed | MW (a) | ||||||||||||||||||||

| Steam: | |||||||||||||||||||||||

| A.S. King-Bayport, MN, 1 Unit | Coal | 1968 | 511 | ||||||||||||||||||||

| Sherco-Becker, MN | |||||||||||||||||||||||

| Unit 1 | Coal | 1976 | 680 | ||||||||||||||||||||

| Unit 2 | Coal | 1977 | 682 | ||||||||||||||||||||

| Unit 3 | Coal | 1987 | 517 | (b) | |||||||||||||||||||

| Monticello, MN, 1 Unit | Nuclear | 1971 | 617 | ||||||||||||||||||||

| PI-Welch, MN | |||||||||||||||||||||||

| Unit 1 | Nuclear | 1973 | 521 | ||||||||||||||||||||

| Unit 2 | Nuclear | 1974 | 519 | ||||||||||||||||||||

| Various locations, 4 Units | Wood/Refuse | Various | 36 | (c) | |||||||||||||||||||

| Combustion Turbine: | |||||||||||||||||||||||

| Angus Anson-Sioux Falls, SD, 3 Units | Natural Gas | 1994 - 2005 | 327 | ||||||||||||||||||||

| Black Dog-Burnsville, MN, 3 Units | Natural Gas | 1987 - 2018 | 494 | ||||||||||||||||||||

| Blue Lake-Shakopee, MN, 6 Units | Natural Gas | 1974 - 2005 | 447 | ||||||||||||||||||||

| High Bridge-St. Paul, MN, 3 Units | Natural Gas | 2008 | 530 | ||||||||||||||||||||

| Inver Hills-Inver Grove Heights, MN, 6 Units | Natural Gas | 1972 | 252 | ||||||||||||||||||||

| Riverside-Minneapolis, MN, 3 Units | Natural Gas | 2009 | 454 | ||||||||||||||||||||

| Various locations, 7 Units | Natural Gas | Various | 10 | ||||||||||||||||||||

| Wind: | |||||||||||||||||||||||

| Blazing Star 1-Lincoln County, MN, 100 Units | Wind | 2020 | 200 | (d) | |||||||||||||||||||

| Blazing Star 2-Lincoln County, MN, 100 Units | Wind | 2021 | 200 | (d) | |||||||||||||||||||

| Border-Rolette County, ND, 75 Units | Wind | 2015 | 148 | (d) | |||||||||||||||||||

| Community Wind North-Lincoln County, MN, 12 Units | Wind | 2020 | 26 | (d) | |||||||||||||||||||

| Courtenay Wind-Stutsman County, ND, 100 Units | Wind | 2016 | 190 | (d) | |||||||||||||||||||

| Crowned Ridge 2-Grant County, SD, 88 Units | Wind | 2020 | 192 | (d) | |||||||||||||||||||

| Dakota Range, SD, 72 Units | Wind | 2022 | 298 | (d) | |||||||||||||||||||

| Foxtail-Dickey County, ND, 75 Units | Wind | 2019 | 150 | (d) | |||||||||||||||||||

| Freeborn-Freeborn County, MN, 100 Units | Wind | 2021 | 200 | (d) | |||||||||||||||||||

| Grand Meadow-Mower County, MN, 67 Units | Wind | 2008 | 99 | (d) | |||||||||||||||||||

| Jeffers-Cottonwood County, MN, 20 Units | Wind | 2020 | 43 | (d) | |||||||||||||||||||

| Lake Benton-Pipestone County, MN, 44 Units | Wind | 2019 | 99 | (d) | |||||||||||||||||||

| Mower-Mower County, MN, 43 Units | Wind | 2021 | 91 | (d) | |||||||||||||||||||

Nobles-Nobles County, MN, 133 Units (e) | Wind | 2010 | 200 | (d) | |||||||||||||||||||

| Pleasant Valley-Mower County, MN, 100 Units | Wind | 2015 | 196 | (d) | |||||||||||||||||||

| Rock Aetna - Murray County, MN, 8 Units | Wind | 2022 | 20 | (d) | |||||||||||||||||||

| Total | 8,949 | ||||||||||||||||||||||

NSP-Wisconsin Station, Location and Unit at Dec. 31, 2022 | Fuel | Installed | MW (a) | ||||||||||||||||||||

| Steam: | |||||||||||||||||||||||

| Bay Front-Ashland, WI, 2 Units | Wood/Natural Gas | 1948 - 1956 | 41 | ||||||||||||||||||||

| French Island-La Crosse, WI, 2 Units | Wood/Refuse | 1940 - 1948 | 16 | (b) | |||||||||||||||||||

| Combustion Turbine: | |||||||||||||||||||||||

| French Island-La Crosse, WI, 2 Units | Oil | 1974 | 122 | ||||||||||||||||||||

| Wheaton-Eau Claire, WI, 5 Units | Natural Gas/Oil | 1973 | 234 | ||||||||||||||||||||

| Hydro: | |||||||||||||||||||||||

| Various locations, 62 Units | Hydro | Various | 135 | ||||||||||||||||||||

| Total | 548 | ||||||||||||||||||||||

PSCo Station, Location and Unit at Dec. 31, 2022 | Fuel | Installed | MW (a) | ||||||||||||||||||||

| Steam: | |||||||||||||||||||||||

| Comanche-Pueblo, CO | |||||||||||||||||||||||

| Unit 2 | Coal | 1975 | 335 | ||||||||||||||||||||

| Unit 3 | Coal | 2010 | 500 | (b) | |||||||||||||||||||

| Craig-Craig, CO, 2 Units | Coal | 1979 - 1980 | 82 | (c) | |||||||||||||||||||

Hayden-Hayden, CO, 2 Units | Coal | 1965 - 1976 | 233 | (d) | |||||||||||||||||||

| Pawnee-Brush, CO, 1 Unit | Coal | 1981 | 505 | ||||||||||||||||||||

| Cherokee-Denver, CO, 1 Unit | Natural Gas | 1968 | 310 | ||||||||||||||||||||

| Combustion Turbine: | |||||||||||||||||||||||

| Blue Spruce-Aurora, CO, 2 Units | Natural Gas | 2003 | 264 | ||||||||||||||||||||

| Cherokee-Denver, CO, 3 Units | Natural Gas | 2015 | 576 | ||||||||||||||||||||

| Fort St. Vrain-Platteville, CO, 6 Units | Natural Gas | 1972 - 2009 | 973 | ||||||||||||||||||||

Manchief, CO, 2 Units (e) | Natural Gas | 2000 | 250 | ||||||||||||||||||||

| Rocky Mountain-Keenesburg, CO, 3 Units | Natural Gas | 2004 | 580 | ||||||||||||||||||||

| Various locations, 8 Units | Natural Gas | Various | 251 | ||||||||||||||||||||

| Hydro: | |||||||||||||||||||||||

| Cabin Creek-Georgetown, CO | |||||||||||||||||||||||

| Pumped Storage, 2 Units | Hydro | 1967 | 210 | ||||||||||||||||||||

| Various locations, 6 Units | Hydro | Various | 23 | ||||||||||||||||||||

| Wind: | |||||||||||||||||||||||

| Rush Creek, CO, 300 units | Wind | 2018 | 582 | (f) | |||||||||||||||||||

| Cheyenne Ridge, CO, 229 units | Wind | 2020 | 477 | (f) | |||||||||||||||||||

| Total | 6,151 | ||||||||||||||||||||||

SPS Station, Location and Unit at Dec. 31, 2022 | Fuel | Installed | MW (a) | ||||||||||||||||||||

| Steam: | |||||||||||||||||||||||

| Cunningham-Hobbs, NM, 2 Units | Natural Gas | 1957 - 1965 | 225 | ||||||||||||||||||||

| Harrington-Amarillo, TX, 3 Units | Coal | 1976 - 1980 | 1,018 | ||||||||||||||||||||

| Jones-Lubbock, TX, 2 Units | Natural Gas | 1971 - 1974 | 486 | ||||||||||||||||||||

| Maddox-Hobbs, NM, 1 Unit | Natural Gas | 1967 | 112 | ||||||||||||||||||||

| Nichols-Amarillo, TX, 3 Units | Natural Gas | 1960 - 1968 | 457 | ||||||||||||||||||||

| Plant X-Earth, TX, 3 Units | Natural Gas | 1952 - 1964 | 298 | ||||||||||||||||||||

| Tolk-Muleshoe, TX, 2 Units | Coal | 1982 - 1985 | 1,067 | ||||||||||||||||||||

| Combustion Turbine: | |||||||||||||||||||||||

| Cunningham-Hobbs, NM, 2 Units | Natural Gas | 1997 | 207 | ||||||||||||||||||||

| Jones-Lubbock, TX, 2 Units | Natural Gas | 2011 - 2013 | 334 | ||||||||||||||||||||

| Maddox-Hobbs, NM, 1 Unit | Natural Gas | 1963 - 1976 | 61 | ||||||||||||||||||||

| Wind: | |||||||||||||||||||||||

| Hale-Plainview, TX, 239 Units | Wind | 2019 | 477 | (b) | |||||||||||||||||||

| Sagamore-Dora, NM, 240 Units | Wind | 2020 | 507 | (b) | |||||||||||||||||||

| Total | 5,249 | ||||||||||||||||||||||

| Conductor Miles | NSP-Minnesota | NSP-Wisconsin | PSCo | SPS | ||||||||||||||||||||||

| Transmission | ||||||||||||||||||||||||||

| 500 KV | 2,915 | — | — | — | ||||||||||||||||||||||

| 345 KV | 12,183 | 2,457 | 5,418 | 11,676 | ||||||||||||||||||||||

| 230 KV | 2,300 | — | 12,141 | 9,829 | ||||||||||||||||||||||

| 161 KV | 626 | 1,795 | — | — | ||||||||||||||||||||||

| 138 KV | — | — | 92 | — | ||||||||||||||||||||||

| 115 KV | 8,033 | 1,829 | 5,011 | 14,905 | ||||||||||||||||||||||

| Less than 115 KV | 6,537 | 5,571 | 1,839 | 4,469 | ||||||||||||||||||||||

| Total Transmission | 32,594 | 11,652 | 24,501 | 40,879 | ||||||||||||||||||||||

| Distribution | ||||||||||||||||||||||||||

| Less than 115 KV | 82,024 | 27,817 | 79,331 | 23,538 | ||||||||||||||||||||||

| Total | 114,618 | 39,469 | 103,832 | 64,417 | ||||||||||||||||||||||

| NSP-Minnesota | NSP-Wisconsin | PSCo | SPS | |||||||||||||||||||||||

| Substations | 352 | 206 | 238 | 457 | ||||||||||||||||||||||

| Miles | NSP-Minnesota | NSP-Wisconsin | PSCo | SPS | WGI | |||||||||||||||||||||||||||

| Transmission | 78 | 3 | 2,067 | 20 | 11 | |||||||||||||||||||||||||||

| Distribution | 10,902 | 2,570 | 23,542 | — | — | |||||||||||||||||||||||||||

ITEM 3 — LEGAL PROCEEDINGS | ||

ITEM 4 — MINE SAFETY DISCLOSURES | ||

ITEM 5 — MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. | ||

ITEM 6 — [RESERVED] | ||

| ITEM 7 — MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

Results of Operations | ||

| 2022 | 2021 | |||||||||||||

| Diluted Earnings (Loss) Per Share | GAAP and Ongoing Diluted EPS | GAAP and Ongoing Diluted EPS | ||||||||||||

| PSCo | $ | 1.33 | $ | 1.22 | ||||||||||

| NSP-Minnesota | 1.23 | 1.12 | ||||||||||||

| SPS | 0.64 | 0.59 | ||||||||||||

| NSP-Wisconsin | 0.23 | 0.20 | ||||||||||||

| Earnings from equity method investments — WYCO | 0.04 | 0.05 | ||||||||||||

Regulated utility (a) | 3.47 | 3.18 | ||||||||||||

| Xcel Energy Inc. and Other | (0.29) | (0.22) | ||||||||||||

Total (a) | $ | 3.17 | $ | 2.96 | ||||||||||

| 2022 vs. 2021 | ||||||||

| Diluted Earnings (Loss) Per Share | Dec. 31 | |||||||

| GAAP and ongoing diluted EPS — 2021 | $ | 2.96 | ||||||

| Components of change — 2022 vs. 2021 | ||||||||

| Higher electric revenues, net of electric fuel and purchased power | 0.89 | |||||||

| Higher natural gas revenues, net of cost of natural gas sold and transported | 0.16 | |||||||

Lower ETR (a) | 0.15 | |||||||

| Higher depreciation and amortization | (0.40) | |||||||

| Higher O&M expenses | (0.24) | |||||||

| Higher interest expense | (0.15) | |||||||

| Higher taxes (other than income taxes) | (0.08) | |||||||

| Other (net) | (0.12) | |||||||

| GAAP and ongoing diluted EPS — 2022 | $ | 3.17 | ||||||

| 2022 | 2021 | |||||||||||||

| ROE | GAAP and Ongoing ROE | GAAP and Ongoing ROE | ||||||||||||

| PSCo | 8.23 | % | 8.23 | % | ||||||||||

| NSP-Minnesota | 8.76 | 8.45 | ||||||||||||

| SPS | 9.36 | 9.22 | ||||||||||||

| NSP-Wisconsin | 10.57 | 9.92 | ||||||||||||

| Operating Companies | 8.74 | 8.58 | ||||||||||||

| Xcel Energy | 10.76 | 10.58 | ||||||||||||

| 2022 vs. Normal | 2021 vs. Normal | 2022 vs. 2021 | |||||||||||||||

| HDD | 6.5 | % | (6.6) | % | 13.0 | % | |||||||||||

| CDD | 23.7 | 12.2 | 16.1 | ||||||||||||||

| THI | 5.6 | 26.8 | (15.8) | ||||||||||||||

| 2022 vs. Normal | 2021 vs. Normal | 2022 vs. 2021 | |||||||||||||||

| Retail electric | $ | 0.138 | $ | 0.096 | $ | 0.042 | |||||||||||

| Decoupling and sales true-up | (0.061) | (0.066) | 0.005 | ||||||||||||||

| Electric total | $ | 0.077 | $ | 0.030 | $ | 0.047 | |||||||||||

| Firm natural gas | 0.037 | (0.025) | 0.062 | ||||||||||||||

| Total | $ | 0.114 | $ | 0.005 | $ | 0.109 | |||||||||||

| 2022 vs. 2021 | ||||||||||||||||||||||||||||||||

| PSCo | NSP-Minnesota | SPS | NSP-Wisconsin | Xcel Energy | ||||||||||||||||||||||||||||

| Actual | ||||||||||||||||||||||||||||||||

| Electric residential | (1.5) | % | (1.2) | % | 6.5 | % | 1.1 | % | (0.1) | % | ||||||||||||||||||||||

| Electric C&I | — | 1.7 | 8.9 | 3.3 | 3.3 | |||||||||||||||||||||||||||

| Total retail electric sales | (0.5) | 0.8 | 8.4 | 2.6 | 2.3 | |||||||||||||||||||||||||||

| Firm natural gas sales | 5.4 | 18.3 | N/A | 17.3 | 10.1 | |||||||||||||||||||||||||||

| 2022 vs. 2021 | ||||||||||||||||||||||||||||||||

| PSCo | NSP-Minnesota | SPS | NSP-Wisconsin | Xcel Energy | ||||||||||||||||||||||||||||

| Weather-normalized | ||||||||||||||||||||||||||||||||

| Electric residential | (3.6) | % | (0.2) | % | 0.8 | % | — | % | (1.3) | % | ||||||||||||||||||||||

| Electric C&I | (0.3) | 2.1 | 8.4 | 3.4 | 3.2 | |||||||||||||||||||||||||||

| Total retail electric sales | (1.4) | 1.3 | 6.9 | 2.4 | 1.8 | |||||||||||||||||||||||||||

| Firm natural gas sales | (3.1) | 5.5 | N/A | 5.8 | 0.1 | |||||||||||||||||||||||||||

| (Millions of Dollars) | 2022 | 2021 | ||||||||||||

| Electric revenues | $ | 12,123 | $ | 11,205 | ||||||||||

| Electric fuel and purchased power | (5,005) | (4,733) | ||||||||||||

| Electric margin | $ | 7,118 | $ | 6,472 | ||||||||||

| (Millions of Dollars) | 2022 vs. 2021 | |||||||

| Regulatory rate outcomes (Minnesota, Colorado, Texas, New Mexico and Wisconsin) | $ | 506 | ||||||

Revenue recognition for the Texas rate case surcharge (a) | 85 | |||||||

Sales and demand (b) | 80 | |||||||

| Non-fuel riders | 64 | |||||||

| Wholesale transmission (net) | 50 | |||||||

| Estimated impact of weather (net of decoupling/sales true-up) | 33 | |||||||

| PTCs flowed back to customers (offset by lower ETR) | (150) | |||||||

| Other (net) | (22) | |||||||

| Total increase | $ | 646 | ||||||

| (Millions of Dollars) | 2022 | 2021 | ||||||||||||

| Natural gas revenues | $ | 3,080 | $ | 2,132 | ||||||||||

| Cost of natural gas sold and transported | (1,910) | (1,081) | ||||||||||||

| Natural gas margin | $ | 1,170 | $ | 1,051 | ||||||||||

| (Millions of Dollars) | 2022 vs. 2021 | |||||||

| Regulatory rate outcomes (Minnesota, Colorado, Wisconsin, North Dakota) | $ | 61 | ||||||

| Estimated impact of weather | 46 | |||||||

| Conservation revenue (offset in expenses) | 13 | |||||||

| Infrastructure and integrity riders | 9 | |||||||

| Winter Storm Uri disallowances | (20) | |||||||

| Other (net) | 10 | |||||||

| Total increase | $ | 119 | ||||||

| Contribution (Millions of Dollars) | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Xcel Energy Inc. financing costs | $ | (153) | $ | (129) | ||||||||||

Venture Holdings (a) | 5 | 21 | ||||||||||||

| Xcel Energy Inc. taxes and other results | (12) | (12) | ||||||||||||

| Total Xcel Energy Inc. and other costs | $ | (160) | $ | (120) | ||||||||||

| Contribution (Diluted Earnings (Loss) Per Share) | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Xcel Energy Inc. financing costs | $ | (0.28) | $ | (0.24) | ||||||||||

Venture Holdings (a) | 0.01 | 0.04 | ||||||||||||

| Xcel Energy Inc. taxes and other results | (0.02) | (0.02) | ||||||||||||

| Total Xcel Energy Inc. and other costs | $ | (0.29) | $ | (0.22) | ||||||||||

| Public Utility Regulation | ||

| Regulatory Body / RTO | Additional Information | |||||||

| MPUC | Retail rates, services, security issuances, property transfers, mergers, disposition of assets, affiliate transactions, and other aspects of electric and natural gas operations. Reviews and approves Integrated Resource Plans for meeting future energy needs. Certifies the need and siting for generating plants greater than 50 MW and transmission lines greater than 100 KV in Minnesota. Reviews and approves natural gas supply plans. | |||||||

| NDPSC | Retail rates, services and other aspects of electric and natural gas operations. Reviews and approves Integrated Resource Plans for meeting future energy needs. Regulatory authority over generation and transmission facilities, along with the siting and routing of new generation and transmission facilities in North Dakota. Pipeline safety compliance. | |||||||

| SDPUC | Retail rates, services and other aspects of electric operations. Regulatory authority over generation and transmission facilities, along with the siting and routing of new generation and transmission facilities in South Dakota. Pipeline safety compliance. | |||||||

| FERC | Wholesale electric operations, hydroelectric licensing, accounting practices, wholesale sales for resale, transmission of electricity in interstate commerce, compliance with NERC electric reliability standards, asset transfers and mergers, and natural gas transactions in interstate commerce. | |||||||

| MISO | NSP-Minnesota is a transmission owning member of the MISO RTO and operates within the MISO RTO and wholesale markets. NSP-Minnesota makes wholesale sales in other RTO markets at market-based rates. NSP-Minnesota and NSP-Wisconsin also make wholesale electric sales at market-based prices to customers outside of their balancing authority as jointly authorized by the FERC. | |||||||

| DOT | Pipeline safety compliance. | |||||||

| Minnesota Office of Pipeline Safety | Pipeline safety compliance. | |||||||

| Mechanism | Additional Information | |||||||

CIP Rider (a) | Recovers costs of conservation and DSM programs in Minnesota. | |||||||

| Environmental Improvement Rider | Recovers costs of environmental improvement projects in Minnesota. | |||||||

| Renewable Development Fund | Allocates money collected from customers to support research and development of emerging renewable energy projects and technologies in Minnesota. | |||||||

| RES | Recovers cost of renewable generation in Minnesota. | |||||||

| Renewable Energy Rider | Recovers cost of renewable generation in North Dakota. | |||||||

| Transmission Cost Recovery | Recovers costs for investments in Minnesota, North Dakota, and South Dakota for electric transmission and distribution grid modernization. | |||||||

| Infrastructure Rider | Recovers costs for investments in generation in South Dakota. | |||||||

| FCA | Recovers prudently incurred costs of fuel related items and purchased energy (Minnesota, North Dakota and South Dakota). | |||||||

| Purchased Gas Adjustment | Provides for prospective monthly rate adjustments in Minnesota and North Dakota for costs of purchased natural gas, transportation and storage service. Includes a true-up process for difference between projected and actual costs. | |||||||

| GUIC Rider | Recovers costs for transmission and distribution pipeline integrity management programs, including funding for pipeline assessments, deferred costs for sewer separation and pipeline integrity management programs in Minnesota. The statute authorizing the GUIC Rider is set to expire June 30, 2023. | |||||||

| Sales True-up | NSP-Minnesota has historically had a sales true-up mechanism for all electric customer classes which ended in 2021. We are requesting implementation of a new sales true-up mechanism for 2022 - 2024. These mechanisms mitigate the impact of changes to sales levels as compared to a baseline. | |||||||

| (Amounts in Millions) | 2022 | 2023 | 2024 | Total | ||||||||||||||||||||||

| Rate request (annual increase) | $ | 234 | $ | 94 | $ | 170 | $ | 498 | ||||||||||||||||||

| Rate base | 10,923 | 11,425 | 11,902 | N/A | ||||||||||||||||||||||

| 2022 | 2023 | 2024 | ||||||||||||||||||

| NSP-Minnesota’s filed base revenue request | $ | 396 | $ | 546 | $ | 677 | ||||||||||||||

| Recommended adjustments: | ||||||||||||||||||||

| Rate base and rate of return | (72) | (65) | (65) | |||||||||||||||||

| MISO capacity credits | (66) | (112) | (111) | |||||||||||||||||

| Sales forecast update | (51) | — | — | |||||||||||||||||

| Monticello and wind farm life extension | (21) | (54) | (51) | |||||||||||||||||

| PTC forecast | (28) | (1) | (1) | |||||||||||||||||

| Property tax | (14) | (23) | (34) | |||||||||||||||||

| Prepaid pension asset and liability | (13) | (21) | (32) | |||||||||||||||||

| O&M expenses | (37) | (39) | (44) | |||||||||||||||||

| Sherco 3 and King remaining life | — | 29 | 28 | |||||||||||||||||

| Other, net | (23) | (33) | (43) | |||||||||||||||||

| Total adjustments | (325) | (319) | (353) | |||||||||||||||||

| Total proposed revenue change | $ | 71 | $ | 227 | $ | 324 | ||||||||||||||

| Regulatory Body / RTO | Additional Information | |||||||

| PSCW | Retail rates, services and other aspects of electric and natural gas operations. Certifies the need for new generating plants and electric transmission lines before the facilities may be sited and built. The PSCW has a biennial base rate filing requirement. By June of each odd numbered year, NSP-Wisconsin must submit a rate filing for the test year beginning the following January. Pipeline safety compliance. | |||||||

| Michigan Public Service Commission | Retail rates, services and other aspects of electric and natural gas operations. Certifies the need for new generating plants and electric transmission lines before the facilities may be sited and built. Pipeline safety compliance. | |||||||

| FERC | Wholesale electric operations, hydroelectric generation licensing, accounting practices, wholesale sales for resale, transmission of electricity in interstate commerce, compliance with NERC electric reliability standards, asset transactions and mergers and natural gas transactions in interstate commerce. | |||||||

| MISO | NSP-Wisconsin is a transmission owning member of the MISO RTO that operates within the MISO RTO and wholesale energy market. NSP-Wisconsin and NSP-Minnesota are jointly authorized by the FERC to make wholesale electric sales at market-based prices. | |||||||

| DOT | Pipeline safety compliance. | |||||||

| Mechanism | Additional Information | |||||||

| Annual Fuel Cost Plan | NSP-Wisconsin does not have an automatic electric fuel adjustment clause. Under Wisconsin rules, utilities submit a forward-looking annual fuel cost plan to the PSCW. Once the PSCW approves the plan, utilities defer the amount of any fuel cost under-recovery or over-recovery in excess of a 2% annual tolerance band, for future rate recovery or refund. Approval of a fuel cost plan and any rate adjustment for refund or recovery of deferred costs is determined by the PSCW. Rate recovery of deferred fuel cost is subject to an earnings test based on the most recently authorized ROE. Under-collections that exceed the 2% annual tolerance band may not be recovered if the utility earnings for that year exceed the authorized ROE. | |||||||

| Power Supply Cost Recovery Factors | NSP-Wisconsin’s retail electric rate schedules for Michigan customers include power supply cost recovery factors, based on 12-month projections. After each 12-month period, a reconciliation is submitted whereby over-recoveries are refunded and any under-recoveries are collected from customers. | |||||||

| Wisconsin Energy Efficiency Program | The primary energy efficiency program is funded by the utilities, but operated by independent contractors subject to oversight by the PSCW and utilities. NSP-Wisconsin recovers these costs from customers. | |||||||

| Purchased Gas Adjustment | A retail cost-recovery mechanism to recover the actual cost of natural gas, transportation, and storage services. | |||||||

| Natural Gas Cost-Recovery Factor (MI) | NSP-Wisconsin’s natural gas rates for Michigan customers include a natural gas cost-recovery factor, based on 12-month projections and trued-up to actual amounts on an annual basis. | |||||||

| Regulatory Body / RTO | Additional Information on Regulatory Authority | |||||||

| CPUC | Retail rates, accounts, services, issuance of securities and other aspects of electric, natural gas and steam operations. Reviews and approves Integrated Resource Plans for meeting future energy needs. Certifies the need and siting for generating plans greater than 50 MW. Pipeline safety compliance. | |||||||

| FERC | Wholesale electric operations, accounting practices, hydroelectric licensing, wholesale sales for resale, transmission of electricity in interstate commerce, compliance with the NERC electric reliability standards, asset transactions and mergers and natural gas transactions in interstate commerce. Wholesale electric sales at cost-based prices to customers inside PSCo’s balancing authority area and at market-based prices to customers outside PSCo’s balancing authority area. PSCo holds a FERC certificate that allows it to transport natural gas in interstate commerce without PSCo becoming subject to full FERC jurisdiction. | |||||||

| RTO | PSCo is not presently a member of an RTO and does not operate within an RTO energy market. However, PSCo does make certain sales to other RTO’s, including SPP and participates in a joint dispatch agreement with neighboring utilities. | |||||||

| DOT | Pipeline safety compliance. | |||||||

| Mechanism | Additional Information | |||||||

| ECA | Recovers fuel and purchased energy costs. Short-term sales margins are shared with customers. The ECA is revised quarterly. | |||||||

| Purchased Capacity Cost Adjustment | Recovers purchased capacity payments. | |||||||

| Steam Cost Adjustment | Recovers fuel costs to operate the steam system. The Steam Cost Adjustment rate is revised quarterly. | |||||||

| DSM Cost Adjustment | Recovers electric and gas DSM, interruptible service costs and performance initiatives for achieving energy savings goals. | |||||||

| RES Adjustment | Recovers the incremental costs of compliance with the RES with a maximum of 1% of the customer’s bill. | |||||||

| Colorado Energy Plan Adjustment | Recovers the early retirement costs of Comanche units 1 and 2 to a maximum of 1% of the customer’s bill. | |||||||

| Wind Cost Adjustment | Recovers costs for customers who choose renewable resources. | |||||||

| Transmission Cost Adjustment | Recovers costs for transmission investment between rate cases. | |||||||

| FCA | PSCo recovers fuel and purchased energy costs from wholesale electric customers through a fuel cost adjustment clause approved by the FERC. Wholesale customers pay production costs through a forecasted formula rate subject to true-up. | |||||||

| GCA | Recovers costs of purchased natural gas and transportation and is revised quarterly to allow for changes in natural gas rates. | |||||||

| Pipeline system integrity adjustment | Recovers costs for transmission and distribution pipeline integrity management programs (rider ended on Dec. 31, 2022). | |||||||

| Decoupling | Mechanism to true-up revenue to a baseline amount for residential (excluding lighting and demand) and metered non-demand small C&I classes. | |||||||

| Transportation Electrification Plan | Recovers costs associated with the investment in and adoption of transportation electrification infrastructure. | |||||||

| Regulatory Body / RTO | Additional Information | |||||||

| PUCT | Retail electric operations, rates, services, construction of transmission or generation and other aspects of SPS’ electric operations. The municipalities in which SPS operates in Texas have original jurisdiction over rates in those communities. The municipalities’ rate setting decisions are subject to PUCT review. Reviews and approves Integrated Resource Plans for meeting future energy needs | |||||||

| NMPRC | Retail electric operations, retail rates and services and the construction of transmission or generation. | |||||||

| FERC | Wholesale electric operations, accounting practices, wholesale sales for resale, the transmission of electricity in interstate commerce, compliance with NERC electric reliability standards, asset transactions and mergers, and natural gas transactions in interstate commerce. | |||||||

| SPP RTO and SPP Integrated and Wholesale Markets | SPS is a transmission owning member of the SPP RTO and operates within the SPP RTO and SPP integrated and wholesale markets. SPS is authorized to make wholesale electric sales at market-based prices. | |||||||

| DOT | Pipeline safety compliance. | |||||||

| Mechanism | Additional Information | |||||||

| Distribution Cost Recovery Factor | Recovers distribution costs not included in rates in Texas. | |||||||

| Energy Efficiency Cost Recovery Factor | Recovers costs for energy efficiency programs in Texas. | |||||||

| Energy Efficiency Rider | Recovers costs for energy efficiency programs in New Mexico. | |||||||

| Fuel and Purchased Power Cost Adjustment Clause | Adjusts monthly to recover actual fuel and purchased power costs in New Mexico. | |||||||

| Power Cost Recovery Factor | Allows recovery of purchased power costs not included in Texas rates. | |||||||

| Renewable Portfolio Standards | Recovers deferred costs for renewable energy programs in New Mexico. | |||||||

| Transmission Cost Recovery Factor | Recovers certain transmission infrastructure improvement costs and changes in wholesale transmission charges not included in Texas base rates. | |||||||

| Fixed Fuel and Purchased Recovery Factor | Provides for the over- or under-recovery of energy expenses in Texas. Regulations require refunding or surcharging over- or under- recovery amounts, including interest, when they exceed 4% of the utility’s annual fuel and purchased energy costs on a rolling 12-month basis if this condition is expected to continue. | |||||||

| Wholesale Fuel and Purchased Energy Cost Adjustment | SPS recovers fuel and purchased energy costs from its wholesale customers through a monthly wholesale fuel and purchased energy cost adjustment clause accepted by the FERC. Wholesale customers also pay the jurisdictional allocation of production costs. | |||||||

| Electric Vehicle Rider | Recovers costs of the Transportation Electrification Plan in New Mexico. | |||||||

| Advanced Metering System Surcharge | Recovers costs incurred in deployment of the Advanced Metering System in Texas. | |||||||

| Consulting Fee Rider | Recovers consulting fees and carrying charges incurred by SPS on behalf of the PUCT. | |||||||

| (Millions of Dollars) | Year Ended Dec. 31, 2022 | |||||||

| Revenue surcharge accrual | $ | 85 | ||||||

| Depreciation and amortization | (43) | |||||||

| O&M expenses | (16) | |||||||

| Interest expense | (12) | |||||||

| Taxes other than income taxes | (10) | |||||||

| Fuel and purchased power | (2) | |||||||

| Other | ||

| Utility Subsidiary | Jurisdiction | Regulatory Status | ||||||

| NSP-Minnesota | Minnesota | In 2021, the MPUC allowed recovery of $179 million of costs (with no financing charge) starting in September 2021, pending a prudency review. The C&I class ($82 million) will be recovered over 27 months and the residential class ($97 million) will be recovered over a 63-month recovery period. In August 2022, the MPUC approved recovery of Uri storm costs with a $19 million disallowance. | ||||||

| PSCo | Colorado | In May 2021, PSCo filed a request with the CPUC to recover $263 million in weather-related electric costs, $287 million in incremental natural gas costs and $4 million in incremental steam costs over 24 months with no financing charge. In July 2022, the CPUC approved a partial settlement providing full recovery of fuel costs, with the exception of an $8 million disallowance, over 24 months for electric and 30 months for natural gas customers. | ||||||

| SPS | Texas | In 2021, SPS filed to recover $88 million of Winter Storm Uri costs over 24 months, as part of the Texas fuel surcharge filing, with total under-recovered costs of $121 million. In April 2022, interim rates designed to recover $121 million over 30 months were approved, subject to PUCT approval through the triennial Fuel Reconciliation proceeding. In July 2022, the intervenors filed recommendations. The Texas Industrial Energy Consumers and PUCT staff recommended disallowances of approximately $10 million (off-system sales margins). The Office of Public Utility Counsel recommended disallowances of approximately $15 million (off-system sales margins and adjustment to energy loss factors). The Alliance of Xcel Municipalities recommended disallowances of approximately $100 million (natural gas storage, contracted capability and off-system sales margins). In November 2022, the ALJs found that costs were prudently incurred and recommended no disallowances. A final PUCT decision is anticipated in the first quarter of 2023. | ||||||

Critical Accounting Policies and Estimates | ||

| Pension Costs | ||||||||||||||

| (Millions of Dollars) | +1% | -1% | ||||||||||||

Rate of return (a) | $ | (11) | $ | 26 | ||||||||||

Discount rate (a) | $ | 1 | $ | 8 | ||||||||||

Derivatives, Risk Management and Market Risk | ||

| Futures / Forwards Maturity | ||||||||||||||||||||||||||||||||

| (Millions of Dollars) | Less Than 1 Year | 1 to 3 Years | 4 to 5 Years | Greater Than 5 Years | Total Fair Value | |||||||||||||||||||||||||||

NSP-Minnesota (a) | $ | (8) | $ | (6) | $ | (7) | $ | (2) | $ | (23) | ||||||||||||||||||||||

NSP-Minnesota (b) | 5 | (4) | — | (3) | (2) | |||||||||||||||||||||||||||

PSCo (a) | 10 | 3 | 3 | — | 16 | |||||||||||||||||||||||||||

PSCo (b) | (56) | (15) | 8 | — | (63) | |||||||||||||||||||||||||||

| $ | (49) | $ | (22) | $ | 4 | $ | (5) | $ | (72) | |||||||||||||||||||||||

| Options Maturity | ||||||||||||||||||||||||||||||||

| (Millions of Dollars) | Less Than 1 Year | 1 to 3 Years | 4 to 5 Years | Greater Than 5 Years | Total Fair Value | |||||||||||||||||||||||||||

NSP-Minnesota (b) | $ | — | $ | — | $ | — | $ | 15 | $ | 15 | ||||||||||||||||||||||

PSCo (b) | 40 | 7 | — | — | 47 | |||||||||||||||||||||||||||

| $ | 40 | $ | 7 | $ | — | $ | 15 | $ | 62 | |||||||||||||||||||||||

| (Millions of Dollars) | 2022 | 2021 | ||||||||||||

| Fair value of commodity trading net contracts outstanding at Jan. 1 | $ | (33) | $ | (54) | ||||||||||

| Contracts realized or settled during the period | (15) | (54) | ||||||||||||

| Commodity trading contract additions and changes during the period | 38 | 75 | ||||||||||||

| Fair value of commodity trading net contracts outstanding at Dec. 31 | $ | (10) | $ | (33) | ||||||||||

| (Millions of Dollars) | Year Ended Dec. 31 | Average | High | Low | ||||||||||||||||||||||

| 2022 | $ | 2 | $ | 1 | $ | 5 | $ | — | ||||||||||||||||||

| 2021 | $ | 1 | $ | 2 | $ | 52 | $ | 1 | ||||||||||||||||||

Liquidity and Capital Resources | ||

| (Millions of Dollars) | Twelve Months Ended Dec. 31 | |||||||

| Cash provided by operating activities — 2021 | $ | 2,189 | ||||||

| Components of change — 2022 vs. 2021 | ||||||||

| Higher net income | 139 | |||||||

| Non-cash transactions | 257 | |||||||

| Changes in working capital | (300) | |||||||

| Changes in net regulatory and other assets and liabilities | 1,647 | |||||||

| Cash provided by operating activities — 2022 | $ | 3,932 | ||||||

| (Millions of Dollars) | Twelve Months Ended Dec. 31 | |||||||

| Cash used in investing activities — 2021 | $ | (4,287) | ||||||

| Components of change — 2022 vs. 2021 | ||||||||

| Increased capital expenditures | (394) | |||||||

| Other investing activities | 28 | |||||||

| Cash used in investing activities — 2022 | $ | (4,653) | ||||||

| (Millions of Dollars) | Twelve Months Ended Dec. 31 | |||||||

| Cash provided by financing activities — 2021 | $ | 2,135 | ||||||

| Components of change — 2022 vs. 2021 | ||||||||

| Lower debt issuances | (1,159) | |||||||

| Higher repayments of long-term debt | (184) | |||||||

| Lower proceeds from issuance of common stock | (44) | |||||||

| Higher dividends paid to shareholders | (77) | |||||||

| Other financing activities | (5) | |||||||

| Cash provided by financing activities — 2022 | $ | 666 | ||||||

| Payments Due by Period (as of Dec. 31, 2022) | ||||||||||||||||||||||||||||||||

| (Millions of Dollars) | Total | Less than 1 Year | 1 to 3 Years | 3 to 5 Years | After 5 Years | |||||||||||||||||||||||||||

| Long-term debt, principal and interest payments | $ | 39,750 | $ | 2,059 | $ | 3,492 | $ | 2,714 | $ | 31,485 | ||||||||||||||||||||||

| Finance lease obligations | 228 | 10 | 20 | 17 | 181 | |||||||||||||||||||||||||||

Operating leases obligations (a) | 1,457 | 264 | 506 | 287 | 400 | |||||||||||||||||||||||||||

Unconditional purchase obligations (b) | 5,129 | 1,899 | 1,475 | 921 | 834 | |||||||||||||||||||||||||||

Other long-term obligations, including current portion (c) | 111 | 53 | 35 | 23 | — | |||||||||||||||||||||||||||

| Other short-term obligations | 436 | 436 | — | — | — | |||||||||||||||||||||||||||

| Short-term debt | 813 | 813 | — | — | — | |||||||||||||||||||||||||||

| Total contractual cash obligations | $ | 47,924 | $ | 5,534 | $ | 5,528 | $ | 3,962 | $ | 32,900 | ||||||||||||||||||||||

| Actual | Base Capital Forecast (Millions of Dollars) | |||||||||||||||||||||||||||||||||||||||||||

| By Regulated Utility | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2023 - 2027 Total | |||||||||||||||||||||||||||||||||||||

| PSCo | $ | 1,940 | $ | 2,140 | $ | 2,440 | $ | 2,550 | $ | 1,980 | $ | 2,190 | $ | 11,300 | ||||||||||||||||||||||||||||||

| NSP-Minnesota | 1,980 | 2,000 | 2,400 | 2,530 | 2,200 | 2,580 | 11,710 | |||||||||||||||||||||||||||||||||||||

| SPS | 610 | 710 | 780 | 720 | 770 | 900 | 3,880 | |||||||||||||||||||||||||||||||||||||

| NSP-Wisconsin | 370 | 540 | 570 | 500 | 450 | 540 | 2,600 | |||||||||||||||||||||||||||||||||||||

Other (a) | (10) | 10 | 10 | (30) | 10 | 10 | 10 | |||||||||||||||||||||||||||||||||||||

| Total base capital expenditures | $ | 4,890 | $ | 5,400 | $ | 6,200 | $ | 6,270 | $ | 5,410 | $ | 6,220 | $ | 29,500 | ||||||||||||||||||||||||||||||

| Actual | Base Capital Forecast (Millions of Dollars) | |||||||||||||||||||||||||||||||||||||||||||

| By Function | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2023 - 2027 Total | |||||||||||||||||||||||||||||||||||||

| Electric distribution | $ | 1,370 | $ | 1,610 | $ | 1,790 | $ | 1,680 | $ | 2,000 | $ | 2,450 | $ | 9,530 | ||||||||||||||||||||||||||||||

| Electric transmission | 960 | 1,280 | 1,650 | 1,890 | 1,690 | 1,900 | 8,410 | |||||||||||||||||||||||||||||||||||||

| Electric generation | 720 | 710 | 910 | 900 | 560 | 650 | 3,730 | |||||||||||||||||||||||||||||||||||||

| Natural gas | 730 | 740 | 730 | 760 | 650 | 680 | 3,560 | |||||||||||||||||||||||||||||||||||||

| Other | 700 | 780 | 840 | 570 | 510 | 540 | 3,240 | |||||||||||||||||||||||||||||||||||||

| Renewables | 410 | 280 | 280 | 470 | — | — | 1,030 | |||||||||||||||||||||||||||||||||||||

| Total base capital expenditures | $ | 4,890 | $ | 5,400 | $ | 6,200 | $ | 6,270 | $ | 5,410 | $ | 6,220 | $ | 29,500 | ||||||||||||||||||||||||||||||

| (Millions of Dollars) | ||||||||

| Funding Capital Expenditures | ||||||||

Cash from operations (a) | $ | 20,540 | ||||||

New debt (b) | 8,210 | |||||||

| Equity through the DRIP and benefit program | 425 | |||||||

| Other equity | 325 | |||||||

| Base capital expenditures 2023 - 2027 | $ | 29,500 | ||||||

| Maturing Debt | $ | 3,800 | ||||||

| (Millions of Dollars) | Dec. 31, 2022 | Dec. 31, 2021 | ||||||||||||

| Fair value of pension assets | $ | 2,685 | $ | 3,670 | ||||||||||

Projected pension obligation (a) | 2,871 | 3,718 | ||||||||||||

| Funded status | $ | (186) | $ | (48) | ||||||||||

| Pension Assumptions | 2022 | 2021 | ||||||||||||

| Discount rate | 5.80 | % | 3.08 | % | ||||||||||

| Expected long-term rate of return | 6.93 | 6.49 | ||||||||||||

| (Millions of Dollars) | Facility (a) | Drawn (b) | Available | Cash | Liquidity | |||||||||||||||||||||||||||

| Xcel Energy Inc. | $ | 1,500 | $ | 328 | $ | 1,172 | $ | 6 | $ | 1,178 | ||||||||||||||||||||||

| PSCo | 700 | 123 | 577 | 5 | 582 | |||||||||||||||||||||||||||

| NSP-Minnesota | 700 | 186 | 514 | 6 | 520 | |||||||||||||||||||||||||||

| SPS | 500 | 91 | 409 | 2 | 411 | |||||||||||||||||||||||||||

| NSP-Wisconsin | 150 | 29 | 121 | 2 | 123 | |||||||||||||||||||||||||||

| Total | $ | 3,550 | $ | 757 | $ | 2,793 | $ | 21 | $ | 2,814 | ||||||||||||||||||||||

| (Millions of Dollars) | Security | Amount | Anticipated Timing | |||||||||||||||||

| Xcel Energy Inc. | Senior Unsecured Bonds | $ | 500 | Third Quarter | ||||||||||||||||

| PSCo | First Mortgage Bonds | 700 | Second Quarter | |||||||||||||||||

| SPS | First Mortgage Bonds | 100 | Third Quarter | |||||||||||||||||

| NSP-Minnesota | First Mortgage Bonds | 750 | Second Quarter | |||||||||||||||||

| NSP-Wisconsin | First Mortgage Bonds | 125 | Second Quarter | |||||||||||||||||

ITEM 7A — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | ||

ITEM 8 — FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | ||

| /s/ ROBERT C. FRENZEL | /s/ BRIAN J. VAN ABEL | |||||||||||||

| Robert C. Frenzel | Brian J. Van Abel | |||||||||||||

| Chairman, President, Chief Executive Officer and Director | Executive Vice President, Chief Financial Officer | |||||||||||||

| Feb. 23, 2023 | Feb. 23, 2023 | |||||||||||||

/s/ | ||

| February 23, 2023 | ||

| We have served as the Company’s auditor since 2002. | ||

| Year Ended Dec. 31 | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Operating revenues | ||||||||||||||||||||

| Electric | $ | $ | $ | |||||||||||||||||

| Natural gas | ||||||||||||||||||||

| Other | ||||||||||||||||||||

| Total operating revenues | ||||||||||||||||||||

| Operating expenses | ||||||||||||||||||||

| Electric fuel and purchased power | ||||||||||||||||||||

| Cost of natural gas sold and transported | ||||||||||||||||||||

| Cost of sales — other | ||||||||||||||||||||

| Operating and maintenance expenses | ||||||||||||||||||||

| Conservation and demand side management expenses | ||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||

| Taxes (other than income taxes) | ||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||

| Operating income | ||||||||||||||||||||

| Other (expense) income, net | ( | ( | ||||||||||||||||||

| Earnings from equity method investments | ||||||||||||||||||||

| Allowance for funds used during construction — equity | ||||||||||||||||||||

| Interest charges and financing costs | ||||||||||||||||||||

Interest charges — includes other financing costs of $ | ||||||||||||||||||||

| Allowance for funds used during construction — debt | ( | ( | ( | |||||||||||||||||

| Total interest charges and financing costs | ||||||||||||||||||||

| Income before income taxes | ||||||||||||||||||||

| Income tax benefit | ( | ( | ( | |||||||||||||||||

| Net income | $ | $ | $ | |||||||||||||||||

| Weighted average common shares outstanding: | ||||||||||||||||||||

| Basic | ||||||||||||||||||||

| Diluted | ||||||||||||||||||||

| Earnings per average common share: | ||||||||||||||||||||

| Basic | $ | $ | $ | |||||||||||||||||

| Diluted | ||||||||||||||||||||

| See Notes to Consolidated Financial Statements | ||||||||||||||||||||

| Year Ended Dec. 31 | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Net income | $ | $ | $ | |||||||||||||||||

| Other comprehensive income | ||||||||||||||||||||

| Pension and retiree medical benefits: | ||||||||||||||||||||

Net pension and retiree medical gains (losses) arising during the period, net of tax of $ | ( | |||||||||||||||||||

Reclassification of losses to net income, net of tax of $ | ||||||||||||||||||||

| Derivative instruments: | ||||||||||||||||||||

Net fair value increase (decrease), net of tax of $ | ( | |||||||||||||||||||

Reclassification of losses to net income, net of tax of $ | ||||||||||||||||||||

| Total other comprehensive income | ||||||||||||||||||||

| Total comprehensive income | $ | $ | $ | |||||||||||||||||

| See Notes to Consolidated Financial Statements | ||||||||||||||||||||

| Year Ended Dec. 31 | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Operating activities | |||||||||||||||||

| Net income | $ | $ | $ | ||||||||||||||

| Adjustments to reconcile net income to cash provided by operating activities: | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Nuclear fuel amortization | |||||||||||||||||

| Deferred income taxes | ( | ( | ( | ||||||||||||||

| Allowance for equity funds used during construction | ( | ( | ( | ||||||||||||||

| Earnings from equity method investments | ( | ( | ( | ||||||||||||||

| Dividends from equity method investments | |||||||||||||||||

| Provision for bad debts | |||||||||||||||||

| Share-based compensation expense | |||||||||||||||||

| Changes in operating assets and liabilities: | |||||||||||||||||

| Accounts receivable | ( | ( | ( | ||||||||||||||

| Accrued unbilled revenues | ( | ( | ( | ||||||||||||||

| Inventories | ( | ( | ( | ||||||||||||||

| Other current assets | ( | ( | ( | ||||||||||||||

| Accounts payable | ( | ||||||||||||||||

| Net regulatory assets and liabilities | ( | ( | |||||||||||||||

| Other current liabilities | ( | ||||||||||||||||

| Pension and other employee benefit obligations | ( | ( | ( | ||||||||||||||

| Other, net | ( | ( | ( | ||||||||||||||

| Net cash provided by operating activities | |||||||||||||||||

| Investing activities | |||||||||||||||||

| Capital/construction expenditures | ( | ( | ( | ||||||||||||||

| Sale of MEC | |||||||||||||||||

| Purchase of investment securities | ( | ( | ( | ||||||||||||||

| Proceeds from the sale of investment securities | |||||||||||||||||

| Other, net | ( | ( | |||||||||||||||

| Net cash used in investing activities | ( | ( | ( | ||||||||||||||

| Financing activities | |||||||||||||||||

| (Repayments of) proceeds from short-term borrowings, net | ( | ( | |||||||||||||||

| Proceeds from issuances of long-term debt | |||||||||||||||||

| Repayments of long-term debt | ( | ( | ( | ||||||||||||||

| Proceeds from issuance of common stock | |||||||||||||||||

| Dividends paid | ( | ( | ( | ||||||||||||||

| Other, net | ( | ( | ( | ||||||||||||||

| Net cash provided by financing activities | |||||||||||||||||

| Net change in cash and cash equivalents | ( | ( | |||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | |||||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | $ | $ | ||||||||||||||

| Supplemental disclosure of cash flow information: | |||||||||||||||||

| Cash paid for interest (net of amounts capitalized) | $ | ( | $ | ( | $ | ( | |||||||||||

| Cash (paid) received for income taxes, net | ( | ( | |||||||||||||||

| Supplemental disclosure of non-cash investing and financing transactions: | |||||||||||||||||

| Accrued property, plant and equipment additions | $ | $ | $ | ||||||||||||||

| Inventory transfers to property, plant and equipment | |||||||||||||||||

| Operating lease right-of-use assets | |||||||||||||||||

| Allowance for equity funds used during construction | |||||||||||||||||

| Issuance of common stock for reinvested dividends and/or equity awards | |||||||||||||||||

| See Notes to Consolidated Financial Statements | |||||||||||||||||

| Dec. 31 | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Assets | ||||||||||||||

| Current assets | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Accounts receivable, net | ||||||||||||||

| Accrued unbilled revenues | ||||||||||||||

| Inventories | ||||||||||||||

| Regulatory assets | ||||||||||||||

| Derivative instruments | ||||||||||||||

| Prepaid taxes | ||||||||||||||

| Prepayments and other | ||||||||||||||

| Total current assets | ||||||||||||||

| Property, plant and equipment, net | ||||||||||||||

| Other assets | ||||||||||||||

| Nuclear decommissioning fund and other investments | ||||||||||||||

| Regulatory assets | ||||||||||||||

| Derivative instruments | ||||||||||||||

| Operating lease right-of-use assets | ||||||||||||||

| Other | ||||||||||||||

| Total other assets | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| Liabilities and Equity | ||||||||||||||

| Current liabilities | ||||||||||||||

| Current portion of long-term debt | $ | $ | ||||||||||||

| Short-term debt | ||||||||||||||

| Accounts payable | ||||||||||||||

| Regulatory liabilities | ||||||||||||||

| Taxes accrued | ||||||||||||||

| Accrued interest | ||||||||||||||

| Dividends payable | ||||||||||||||

| Derivative instruments | ||||||||||||||

| Operating lease liabilities | ||||||||||||||

| Other | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Deferred credits and other liabilities | ||||||||||||||

| Deferred income taxes | ||||||||||||||

| Deferred investment tax credits | ||||||||||||||

| Regulatory liabilities | ||||||||||||||

| Asset retirement obligations | ||||||||||||||

| Derivative instruments | ||||||||||||||

| Customer advances | ||||||||||||||

| Pension and employee benefit obligations | ||||||||||||||

| Operating lease liabilities | ||||||||||||||

| Other | ||||||||||||||

| Total deferred credits and other liabilities | ||||||||||||||

| Commitments and contingencies | ||||||||||||||

| Capitalization | ||||||||||||||

| Long-term debt | ||||||||||||||

Common stock — | ||||||||||||||

| Additional paid in capital | ||||||||||||||

| Retained earnings | ||||||||||||||

| Accumulated other comprehensive loss | ( | ( | ||||||||||||

| Total common stockholders’ equity | ||||||||||||||

| Total liabilities and equity | $ | $ | ||||||||||||

| See Notes to Consolidated Financial Statements | ||||||||||||||

| Common Stock Issued | Retained Earnings | Accumulated Other Comprehensive Loss | Total Common Stockholders’ Equity | ||||||||||||||||||||||||||||||||

| Shares | Par Value | Additional Paid In Capital | |||||||||||||||||||||||||||||||||

| Balance at Dec. 31, 2019 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Net income | |||||||||||||||||||||||||||||||||||

Dividends declared on common stock ($ | ( | ( | |||||||||||||||||||||||||||||||||

| Issuances of common stock | |||||||||||||||||||||||||||||||||||

| Repurchases of common stock | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Share-based compensation | ( | ||||||||||||||||||||||||||||||||||

| Adoption of ASC Topic 326 | ( | ( | |||||||||||||||||||||||||||||||||

| Balance at Dec. 31, 2020 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Net Income | |||||||||||||||||||||||||||||||||||

| Other comprehensive loss | |||||||||||||||||||||||||||||||||||

Dividends declared on common stock ($ | ( | ( | |||||||||||||||||||||||||||||||||

| Issuances of common stock | |||||||||||||||||||||||||||||||||||

| Share-based compensation | ( | ||||||||||||||||||||||||||||||||||

| Balance at Dec. 31, 2021 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Net income | |||||||||||||||||||||||||||||||||||

| Other comprehensive income | |||||||||||||||||||||||||||||||||||

Dividends declared on common stock ($ | ( | ( | |||||||||||||||||||||||||||||||||

| Issuances of common stock | |||||||||||||||||||||||||||||||||||

| Share-based compensation | ( | ||||||||||||||||||||||||||||||||||

| Balance at Dec. 31, 2022 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| See Notes to Consolidated Financial Statements | |||||||||||||||||||||||||||||||||||

1. Summary of Significant Accounting Policies | ||

| Nonregulated Subsidiary | Purpose | |||||||

| Eloigne | Invests in rental housing projects that qualify for low-income housing tax credits. | |||||||

| Capital Services | Procures equipment for construction of renewable generation facilities at other subsidiaries. | |||||||

| Venture Holdings | Invests in limited partnerships, including EIP funds with portfolios of investments in energy technology companies. | |||||||

| Nicollet Project Holdings | Invests in nonregulated assets such as the Minnesota community solar gardens. | |||||||

| Direct Subsidiary | ||

| Xcel Energy Wholesale Group Inc. | ||

| Xcel Energy Market Holdings Inc. | ||

| Xcel Energy Ventures Inc. | ||

| Xcel Energy Retail Holdings Inc. | ||

| Xcel Energy Communication Group, Inc. | ||

| Xcel Energy International Inc. | ||

| Xcel Energy Transmission Holding Company, LLC | ||

| Nicollet Holdings Company, LLC | ||

| Xcel Energy Nuclear Services Holdings, LLC | ||

| Xcel Energy Services Inc. | ||