REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended | Commission File Number | |||||||

Not Applicable | ||||||||||||||

(Province or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||||||||||||

Annual Information Form | Audited annual financial statements | ||||||||||

| Common Shares outstanding | |||||

| 0 (Nil) | Series A Preferred Shares | ||||

| 0 (Nil) | Series B Preferred Shares | ||||

| ☒ | ☐ | No | |||||||||

| ☒ | ☐ | No | |||||||||

Year ended December 31, 2022 | Year ended December 31, 2021 | |||||||

Audit Fees(1) | $ | 1,934,012 | $ | 1,604,867 | ||||

Audit-Related Fees(2) | $ | 362,950 | $ | 321,147 | ||||

Tax Fees(3) | $ | 18,618 | $ | 21,351 | ||||

| All Other Fees | $ | — | $ | — | ||||

Total | $ | 2,315,580 | $ | 1,947,365 | ||||

HYDRO ONE INC. | ||||||||||||||

By: | /s/ David Lebeter | |||||||||||||

Name: David Lebeter | ||||||||||||||

Title: President and Chief Executive Officer | ||||||||||||||

Exhibit Number | Description | |||||||

2022 Annual Information Form dated February 14, 2023 for the fiscal year ended December 31, 2022. | ||||||||

Consolidated Financial Statements as at December 31, 2022 and December 31, 2021 and for the years then ended, and the accompanying auditors’ report. | ||||||||

Management’s Discussion and Analysis for the fiscal year ended December 31, 2022. | ||||||||

Consent of KPMG LLP (KPMG LLP, Toronto, ON, Canada, Auditor Firm ID: | ||||||||

Certification of Chief Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a) of the U.S. Securities Exchange Act of 1934, as amended. | ||||||||

Certification of Chief Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a) of the U.S. Securities Exchange Act of 1934, as amended. | ||||||||

Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | ||||||||

Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | ||||||||

| 101 | Interactive Data File (formatted as Inline XBRL). | |||||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). | |||||||

Cost of Service ($) | + | Return on Equity ($) | = | Revenue Requirement ($) | ||||||||||

| MTN Series | Aggregate Principal Amount | Issuance Date | ||||||

| Series 52 Notes due 2028 | $750 million | October 27, 2022 | ||||||

| Series 53 Notes due 2029 | $300 million | January 27, 2023 | ||||||

| Series 54 Notes due 2033 | $450 million | January 27, 2023 | ||||||

| Series 55 Notes due 2053 | $300 million | January 27, 2023 | ||||||

| Rating Agency | Short-term Debt Rating | Long-term Debt Rating | ||||||

| DBRS Limited (“DBRS”) | R-1 (low) | A (high) | ||||||

| Moody’s Investors Service (“Moody’s”) | Prime-2 | A3 | ||||||

| S&P Global Ratings (“S&P”) | A-1 (low) | A- | ||||||

| Note | Issue Date | Principal Amount (million)($) | Sale Price ($) / $100 principal amount | Gross Proceeds ($) | ||||||||||

| Series 52 Notes (4.91%) due 2028 | October 27, 2022 | 750 | 99.998 | 749,985,000 | ||||||||||

| Series 53 Notes (3.93%) due 2029 | January 27, 2023 | 300 | 99.986 | 299,958,000 | ||||||||||

| Series 54 Notes (4.16%) due 2033 | January 27, 2023 | 450 | 99.984 | 449,928,000 | ||||||||||

| Series 55 Notes (4.46%) due 2053 | January 27, 2023 | 300 | 99.984 | 299,952,000 | ||||||||||

| Name, Province or State and Country of Residence | Age | Position/Title | Independent Board Member | Principal Occupation | Committees | ||||||||||||

William Sheffield (1) Ontario, Canada | 74 | Interim President and CEO and Director | Interim President and CEO | ||||||||||||||

Chris Lopez Alberta, Canada | 48 | CFO | CFO | ||||||||||||||

Paul Harricks Ontario, Canada | 68 | Chief Legal Officer | Chief Legal Officer | ||||||||||||||

Megan Telford Ontario, Canada | 48 | Chief Human Resources Officer | Chief Human Resources Officer | ||||||||||||||

David Lebeter(2) Ontario, Canada | 63 | Chief Operating Officer | Chief Operating Officer | ||||||||||||||

Timothy Hodgson Ontario, Canada | 62 | Director and Chair of the Board | Yes | Director | |||||||||||||

Cherie Brant Ontario, Canada | 48 | Director | Yes | Partner, Borden Ladner Gervais LLP | Governance & Regulatory Committee, Indigenous Peoples, Safety & Operations Committee | ||||||||||||

Blair Cowper-Smith(3) Ontario, Canada | 74 | Director | Yes | Director | Audit Committee; Human Resources Committee | ||||||||||||

David Hay New Brunswick, Canada | 67 | Director | Yes | Managing Director, Delgatie Incorporated | Governance & Regulatory Committee; Indigenous Peoples, Safety & Operations Committee (Chair) | ||||||||||||

Stacey Mowbray(4) Ontario, Canada | 60 | Director | Yes | Director | Audit Committee (Chair); Indigenous Peoples, Safety & Operations Committee | ||||||||||||

Mark Podlasly(6) British Columbia, Canada | 57 | Director | Yes | Director | Audit Committee; Human Resources Committee | ||||||||||||

Russel Robertson(3) Ontario, Canada | 75 | Director | Yes | Director | Audit Committee; Human Resources Committee | ||||||||||||

| Melissa Sonberg Québec, Canada | 62 | Director | Yes | Adjunct Professor, McGill University | Audit Committee; Human Resources Committee (Chair) | ||||||||||||

Susan Wolburgh Jenah(3) (5) Ontario, Canada | 67 | Director | Yes | Director | Governance & Regulatory Committee (Chair); Indigenous Peoples, Safety & Operations Committee | ||||||||||||

|  | |||||||

| David Lebeter | Christopher Lopez | |||||||

| President and Chief Executive Officer | Chief Financial Officer | |||||||

1 |  | |||||||

2 |  | |||||||

3 |  | |||||||

Year ended December 31 (millions of Canadian dollars, except per share amounts) | 2022 | 2021 | ||||||||||||

| Revenues | ||||||||||||||

Distribution (includes $ | ||||||||||||||

Transmission (includes $ | ||||||||||||||

| Costs | ||||||||||||||

Purchased power (includes $ | ||||||||||||||

Operation, maintenance and administration (Note 28) | ||||||||||||||

Depreciation, amortization and asset removal costs (Note 4) | ||||||||||||||

| Income before financing charges and income tax expense | ||||||||||||||

Financing charges (Note 5) | ||||||||||||||

| Income before income tax expense | ||||||||||||||

Income tax expense (Note 6) | ||||||||||||||

| Net income | ||||||||||||||

Other comprehensive income (Note 7) | ||||||||||||||

| Comprehensive income | ||||||||||||||

| Net income attributable to: | ||||||||||||||

Noncontrolling interest (Note 27) | ||||||||||||||

| Common shareholder | ||||||||||||||

| Comprehensive income attributable to: | ||||||||||||||

Noncontrolling interest (Note 27) | ||||||||||||||

| Common shareholder | ||||||||||||||

Earnings per common share (Note 25) | ||||||||||||||

| Basic | $ | $ | ||||||||||||

| Diluted | $ | $ | ||||||||||||

4 |  | |||||||

As at December 31 (millions of Canadian dollars) | 2022 | 2021 | ||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | ||||||||

Accounts receivable (Note 8) | ||||||||

Due from related parties (Note 28) | ||||||||

Other current assets (Note 9) | ||||||||

Property, plant and equipment (Note 10) | ||||||||

| Other long-term assets: | ||||||||

Regulatory assets (Note 12) | ||||||||

Deferred income tax assets (Note 6) | ||||||||

Intangible assets (Note 11) | ||||||||

| Goodwill | ||||||||

Other assets (Note 13) | ||||||||

| Total assets | ||||||||

| Liabilities | ||||||||

| Current liabilities: | ||||||||

Short-term notes payable (Notes 16, 18) | ||||||||

Long-term debt payable within one year (Notes 16, 17, 18) | ||||||||

Accounts payable and other current liabilities (Note 14) | ||||||||

Due to related parties (Note 28) | ||||||||

| Long-term liabilities: | ||||||||

Long-term debt (Notes 16, 17) | ||||||||

Regulatory liabilities (Note 12) | ||||||||

Deferred income tax liabilities (Note 6) | ||||||||

Other long-term liabilities (Note 15) | ||||||||

| Total liabilities | ||||||||

Contingencies and Commitments (Notes 30, 31) | ||||||||

Subsequent Events (Note 33) | ||||||||

Noncontrolling interest subject to redemption (Note 27) | ||||||||

| Equity | ||||||||

Common shares (Note 23) | ||||||||

| Retained earnings | ||||||||

| Accumulated other comprehensive income (loss) | ( | |||||||

| Hydro One shareholder’s equity | ||||||||

Noncontrolling interest (Note 27) | ||||||||

| Total equity | ||||||||

|  | |||||||

| Timothy Hodgson | Stacey Mowbray | |||||||

| Chair | Chair, Audit Committee | |||||||

5 |  | |||||||

Year ended December 31, 2022 (millions of Canadian dollars) | Common Shares | Retained Earnings | Accumulated Other Comprehensive Income | Hydro One Shareholder’s Equity | Non- controlling Interest (Note 27) | Total Equity | ||||||||||||||

January 1, 2022 | ( | |||||||||||||||||||

| Net income | — | — | ||||||||||||||||||

Other comprehensive income (Note 7) | — | — | — | |||||||||||||||||

Distributions to noncontrolling interest (Note 27) | — | — | — | — | ( | ( | ||||||||||||||

Dividends on common shares (Note 24) | — | ( | — | ( | — | ( | ||||||||||||||

| December 31, 2022 | ||||||||||||||||||||

Year ended December 31, 2021 (millions of Canadian dollars) | Common Shares | Retained Earnings | Accumulated Other Comprehensive Loss | Hydro One Shareholder’s Equity | Non- controlling Interest (Note 27) | Total Equity | ||||||||||||||

January 1, 2021 | ( | |||||||||||||||||||

| Net income | — | — | ||||||||||||||||||

Other comprehensive income (Note 7) | — | — | — | |||||||||||||||||

Distributions to noncontrolling interest (Note 27) | — | — | — | — | ( | ( | ||||||||||||||

Dividends on common shares (Note 24) | — | ( | — | ( | — | ( | ||||||||||||||

| December 31, 2021 | ( | |||||||||||||||||||

6 |  | |||||||

Year ended December 31 (millions of Canadian dollars) | 2022 | 2021 | ||||||||||||

| Operating activities | ||||||||||||||

| Net income | ||||||||||||||

| Environmental expenditures | ( | ( | ||||||||||||

| Adjustments for: | ||||||||||||||

Depreciation and amortization (Note 4) | ||||||||||||||

| Regulatory assets and liabilities | ||||||||||||||

| Deferred income tax expense | ||||||||||||||

| Other | ||||||||||||||

Changes in non-cash balances related to operations (Note 29) | ( | |||||||||||||

| Net cash from operating activities | ||||||||||||||

| Financing activities | ||||||||||||||

| Long-term debt issued | ||||||||||||||

| Long-term debt repaid | ( | ( | ||||||||||||

| Short-term notes issued | ||||||||||||||

| Short-term notes repaid | ( | ( | ||||||||||||

Dividends paid (Note 24) | ( | ( | ||||||||||||

| Distributions paid to noncontrolling interest | ( | ( | ||||||||||||

| Costs to obtain financing | ( | ( | ||||||||||||

| Net cash used in financing activities | ( | ( | ||||||||||||

| Investing activities | ||||||||||||||

Capital expenditures (Note 29) | ||||||||||||||

| Property, plant and equipment | ( | ( | ||||||||||||

| Intangible assets | ( | ( | ||||||||||||

Capital contributions received (Note 29) | ||||||||||||||

| Other | ||||||||||||||

| Net cash used in investing activities | ( | ( | ||||||||||||

| Net change in cash and cash equivalents | ( | ( | ||||||||||||

| Cash and cash equivalents, beginning of year | ||||||||||||||

| Cash and cash equivalents, end of year | ||||||||||||||

7 |  | |||||||

8 |  | |||||||

9 |  | |||||||

10 |  | |||||||

11 |  | |||||||

Average | Rate | ||||||||||

Service Life | Range | Average | |||||||||

Property, plant and equipment: | |||||||||||

Transmission | % | ||||||||||

Distribution | % | ||||||||||

Communication | % | ||||||||||

Administration and service | % | ||||||||||

Intangible assets | % | ||||||||||

12 |  | |||||||

13 |  | |||||||

14 |  | |||||||

15 |  | |||||||

| Guidance | Date issued | Description | Effective date | Impact on Hydro One | |||||||||||||

| ASU 2020-06 | August 2020 | The update addresses the complexity associated with applying US GAAP for certain financial instruments with characteristics of liabilities and equity. The amendments reduce the number of accounting models for convertible debt instruments and convertible preferred stock. | January 1, 2022 | No impact upon adoption | |||||||||||||

| ASU 2021-05 | July 2021 | The amendments are intended to align lease classification requirements for lessors under Topic 842 with Topic 840's practice. | January 1, 2022 | No impact upon adoption | |||||||||||||

| ASU 2021-10 | November 2021 | The update addresses diversity on the recognition, measurement, presentation and disclosure of government assistance received by business entities. | January 1, 2022 | No impact upon adoption | |||||||||||||

| Guidance | Date issued | Description | Effective date | Anticipated Impact on Hydro One | |||||||||||||

| ASU 2021-08 | October 2021 | The amendments address how to determine whether a contractual obligation represents a liability to be recognized by the acquirer in a business combination. | January 1, 2023 | No expected impact upon adoption | |||||||||||||

| ASU 2022-02 | March 2022 | The amendments eliminate the troubled debt restructuring (TDR) accounting model for entities that have adopted Topic 326 Financial Instrument – Credit Losses and modifies the guidance on vintage disclosure requirements to require disclosure of current-period gross write-offs by year of origination. | January 1, 2023 | Upon adoption, the Company will disclose the current period gross write-offs by year of origination relating to its accounts receivable | |||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | |||||||||||||||

Depreciation of property, plant and equipment1 | |||||||||||||||||

| Amortization of intangible assets | |||||||||||||||||

| Amortization of regulatory assets | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Asset removal costs | |||||||||||||||||

16 |  | |||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Interest on long-term debt | ||||||||||||||

| Interest on short-term notes | ||||||||||||||

| Interest on regulatory accounts | ||||||||||||||

Realized (gain) loss on cash flow hedges (interest-rate swap agreements) (Notes 7, 17) | ( | |||||||||||||

| Other | ||||||||||||||

| Less: Interest capitalized on construction and development in progress | ( | ( | ||||||||||||

| DTA carrying charges | ( | |||||||||||||

| Interest earned on cash and cash equivalents | ( | ( | ||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Income before income tax expense | ||||||||||||||

Income tax expense at statutory rate of | ||||||||||||||

| Increase (decrease) resulting from: | ||||||||||||||

| Net temporary differences recoverable in future rates charged to customers: | ||||||||||||||

Impact of DTA Implementation Decision1 | ||||||||||||||

| Capital cost allowance in excess of depreciation and amortization | ( | ( | ||||||||||||

| Overheads capitalized for accounting but deducted for tax purposes | ( | ( | ||||||||||||

| Interest capitalized for accounting but deducted for tax purposes | ( | ( | ||||||||||||

| Pension and post-retirement benefit contributions in excess of pension expense | ( | ( | ||||||||||||

| Environmental expenditures | ( | ( | ||||||||||||

| Other | ( | |||||||||||||

| Net temporary differences attributable to regulated business | ( | ( | ||||||||||||

| Net permanent differences | ( | |||||||||||||

| Total income tax expense | ||||||||||||||

| Effective income tax rate | % | % | ||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Current income tax expense | ||||||||

| Deferred income tax expense | ||||||||

| Total income tax expense | ||||||||

17 |  | |||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Deferred income tax assets | ||||||||

| Post-retirement and post-employment benefits expense in excess of cash payments | ||||||||

| Pension obligations | ||||||||

| Regulatory assets and liabilities | ||||||||

| Non-capital losses | ||||||||

| Non-depreciable capital property | ||||||||

| Tax credit carryforwards | ||||||||

| Investment in subsidiaries | ||||||||

| Environmental expenditures | ||||||||

| Less: valuation allowance | ( | ( | ||||||

| Total deferred income tax assets | ||||||||

| Deferred income tax liabilities | ||||||||

| Capital cost allowance in excess of depreciation and amortization | ||||||||

| Pension assets | ||||||||

| Regulatory assets and liabilities | ||||||||

| Other | ||||||||

| Total deferred income tax liabilities | ||||||||

| Net deferred income tax liabilities | ( | ( | ||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Long-term: | ||||||||

| Deferred income tax assets | ||||||||

| Deferred income tax liabilities | ( | ( | ||||||

| Net deferred income tax liabilities | ( | ( | ||||||

Year of expiry (millions of dollars) | 2022 | 2021 | ||||||

| 2035 | ||||||||

| 2036 | ||||||||

| 2037 | ||||||||

| 2038 | ||||||||

| 2039 | ||||||||

| 2040 | ||||||||

| 2041 | ||||||||

| 2042 | ||||||||

| Total losses | ||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | |||||||||||||||

Gain on cash flow hedges (interest-rate swap agreements) (Notes 5, 17)1 | |||||||||||||||||

Gain on transfer of other post-employment benefits (OPEB) (Note 19) | |||||||||||||||||

| Other | |||||||||||||||||

18 |  | |||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Accounts receivable - billed | ||||||||

| Accounts receivable - unbilled | ||||||||

| Accounts receivable, gross | ||||||||

| Allowance for doubtful accounts | ( | ( | ||||||

| Accounts receivable, net | ||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | |||||||||

| Allowance for doubtful accounts – beginning | ( | ( | |||||||||

| Write-offs | |||||||||||

| Additions to allowance for doubtful accounts | ( | ( | |||||||||

| Allowance for doubtful accounts – ending | ( | ( | |||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

Regulatory assets (Note 12) | ||||||||

| Prepaid expenses and other assets | ||||||||

| Materials and supplies | ||||||||

Derivative assets (Note 17) | ||||||||

As at December 31, 2022 (millions of dollars) | Property, Plant and Equipment | Accumulated Depreciation | Construction in Progress | Total | ||||||||||

| Transmission | ||||||||||||||

| Distribution | ||||||||||||||

| Communication | ||||||||||||||

| Administration and service | ||||||||||||||

| Easements | ||||||||||||||

As at December 31, 2021 (millions of dollars) | Property, Plant and Equipment | Accumulated Depreciation | Construction in Progress | Total | ||||||||||

| Transmission | ||||||||||||||

| Distribution | ||||||||||||||

| Communication | ||||||||||||||

| Administration and service | ||||||||||||||

| Easements | ||||||||||||||

19 |  | |||||||

As at December 31, 2022 (millions of dollars) | Intangible Assets | Accumulated Amortization | Development in Progress | Total | ||||||||||

| Computer applications software | ||||||||||||||

| Other | ||||||||||||||

As at December 31, 2021 (millions of dollars) | Intangible Assets | Accumulated Amortization | Development in Progress | Total | ||||||||||

| Computer applications software | ||||||||||||||

| Other | ||||||||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Regulatory assets: | ||||||||

| Deferred income tax regulatory asset | ||||||||

| Post-retirement and post-employment benefits - non-service cost | ||||||||

| Environmental | ||||||||

| Deferred tax asset sharing | ||||||||

| Stock-based compensation | ||||||||

| Conservation and Demand Management (CDM) variance | ||||||||

| Rural and Remote Rate Protection (RRRP) variance | ||||||||

| Pension benefit regulatory asset | ||||||||

| Foregone revenue deferral | ||||||||

| Other | ||||||||

| Total regulatory assets | ||||||||

| Less: current portion | ( | ( | ||||||

| Regulatory liabilities: | ||||||||

| Post-retirement and post-employment benefits | ||||||||

| Pension benefit regulatory liability | ||||||||

| Tax rule changes variance | ||||||||

| Earnings sharing mechanism deferral | ||||||||

| Retail settlement variance account (RSVA) | ||||||||

| External revenue variance | ||||||||

| Asset removal costs cumulative variance | ||||||||

| Pension cost differential | ||||||||

| Capitalized overhead tax variance | ||||||||

| Green energy expenditure variance | ||||||||

| Deferred income tax regulatory liability | ||||||||

| Other | ||||||||

| Total regulatory liabilities | ||||||||

| Less: current portion | ( | ( | ||||||

20 |  | |||||||

21 |  | |||||||

22 |  | |||||||

As at December 31 (millions of dollars) | 2022 | 2021 | |||||||||

Deferred pension assets (Note 19) | |||||||||||

Right-of-Use assets (Note 22) | |||||||||||

| Other long-term assets | |||||||||||

23 |  | |||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Accrued liabilities | ||||||||

| Accounts payable | ||||||||

Regulatory liabilities (Note 12) | ||||||||

| Accrued interest | ||||||||

Environmental liabilities (Note 20) | ||||||||

Lease obligations (Note 22) | ||||||||

Derivative liabilities (Note 17) | ||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

Post-retirement and post-employment benefit liability (Note 19) | ||||||||

Environmental liabilities (Note 20) | ||||||||

Lease obligations (Note 22) | ||||||||

Asset retirement obligations (Note 21) | ||||||||

Due to related parties (Note 28) | ||||||||

| Long-term accounts payable | ||||||||

Pension benefit liability (Note 19) | ||||||||

| Other long-term liabilities | ||||||||

| (millions of dollars) | Maturity | Total Amount | Amount Drawn | ||||||||

| Revolving standby credit facilities | June 20271 | ||||||||||

24 |  | |||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Hydro One long-term debt (a) | ||||||||

| HOSSM long-term debt (b) | ||||||||

| Add: Net unamortized debt premiums | ||||||||

| Less: Unamortized deferred debt issuance costs | ( | ( | ||||||

| Total long-term debt | ||||||||

25 |  | |||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Current liabilities: | ||||||||

| Long-term debt payable within one year | ||||||||

| Long-term liabilities: | ||||||||

| Long-term debt | ||||||||

| Total long-term debt | ||||||||

| Long-Term Debt Principal Repayments | Interest Payments | Weighted-Average Interest Rate | |||||||||

| (millions of dollars) | (millions of dollars) | (%) | |||||||||

| Year 1 | |||||||||||

| Year 2 | |||||||||||

| Year 3 | |||||||||||

| Year 4 | |||||||||||

| Year 5 | |||||||||||

| Years 6-10 | |||||||||||

| Thereafter | |||||||||||

26 |  | |||||||

| 2022 | 2022 | 2021 | 2021 | |||||||||||

As at December 31 (millions of dollars) | Carrying Value | Fair Value | Carrying Value | Fair Value | ||||||||||

| Long-term debt, including current portion | ||||||||||||||

As at December 31, 2022 (millions of dollars) | Carrying Value | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||

| Assets: | |||||||||||||||||

Derivative instruments (Note 9) | |||||||||||||||||

| Cash flow hedges, including current portion | 5 | 5 | — | 5 | — | ||||||||||||

| Liabilities: | |||||||||||||||||

| Long-term debt, including current portion | |||||||||||||||||

As at December 31, 2021 (millions of dollars) | Carrying Value | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||

| Liabilities: | |||||||||||||||||

| Long-term debt, including current portion | |||||||||||||||||

Derivative instruments (Note 14) | |||||||||||||||||

| Cash flow hedges, including current portion | |||||||||||||||||

27 |  | |||||||

28 |  | |||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Short-term notes payable | ||||||||

| Long-term debt payable within one year | ||||||||

| Less: cash and cash equivalents | ( | ( | ||||||

| Long-term debt | ||||||||

| Common shares | ||||||||

| Retained earnings | ||||||||

| Total capital | ||||||||

29 |  | |||||||

Pension Benefits | Post-Retirement and Post-Employment Benefits | |||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | 2022 | 2021 | ||||||||||

| Change in projected benefit obligation | ||||||||||||||

| Projected benefit obligation, beginning of year | ||||||||||||||

| Current service cost | ||||||||||||||

| Employee contributions | ||||||||||||||

| Interest cost | ||||||||||||||

| Benefits paid | ( | ( | ( | ( | ||||||||||

| Net actuarial loss | ( | ( | ( | ( | ||||||||||

Transfers from other plans1 | ||||||||||||||

| Projected benefit obligation, end of year | ||||||||||||||

| Change in plan assets | ||||||||||||||

| Fair value of plan assets, beginning of year | ||||||||||||||

| Actual return on plan assets | ( | |||||||||||||

| Benefits paid | ( | ( | ( | ( | ||||||||||

| Employer contributions | ||||||||||||||

| Employee contributions | ||||||||||||||

| Administrative expenses | ( | ( | ||||||||||||

| Fair value of plan assets, end of year | ||||||||||||||

| Unfunded (funded) status | ( | |||||||||||||

30 |  | |||||||

Pension Benefits | Post-Retirement and Post-Employment Benefits | |||||||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | 2022 | 2021 | ||||||||||

Other assets1 | ||||||||||||||

| Deferred pension assets | ||||||||||||||

| Accrued liabilities | ||||||||||||||

| Pension benefit liability | ||||||||||||||

| Post-retirement and post-employment benefit liability | ||||||||||||||

| Net unfunded (funded) status | ( | |||||||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| PBO | ||||||||

| ABO | ||||||||

| Fair value of plan assets | ||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Current service cost | ||||||||||||||

| Interest cost | ||||||||||||||

| Expected return on plan assets, net of expenses | ( | ( | ||||||||||||

| Prior service cost amortization | ||||||||||||||

| Amortization of actuarial losses | ||||||||||||||

| Net periodic benefit costs | ||||||||||||||

Charged to results of operations1 | ||||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Current service cost | ||||||||||||||

| Interest cost | ||||||||||||||

| Prior service cost amortization | ||||||||||||||

| Amortization of actuarial losses | ( | ( | ||||||||||||

| Net periodic benefit costs | ||||||||||||||

Charged to results of operations1,2 | ||||||||||||||

31 |  | |||||||

Pension Benefits | Post-Retirement and Post-Employment Benefits | |||||||||||||

| Year ended December 31 | 2022 | 2021 | 2022 | 2021 | ||||||||||

| Significant assumptions: | ||||||||||||||

| Weighted average discount rate | % | % | % | % | ||||||||||

| Rate of compensation scale escalation (long-term) | % | % | % | % | ||||||||||

| Rate of cost of living increase | % | % | % | % | ||||||||||

Rate of increase in health care cost trends1 | % | % | ||||||||||||

| Year ended December 31 | 2022 | 2021 | ||||||

| Pension Benefits: | ||||||||

| Weighted average expected rate of return on plan assets | % | % | ||||||

| Weighted average discount rate | % | % | ||||||

| Rate of compensation scale escalation (long-term) | % | % | ||||||

| Rate of cost of living increase | % | % | ||||||

Average remaining service life of employees (years) | ||||||||

| Post-Retirement and Post-Employment Benefits: | ||||||||

| Weighted average discount rate | % | % | ||||||

| Rate of compensation scale escalation (long-term) | % | % | ||||||

| Rate of cost of living increase | % | % | ||||||

Average remaining service life of employees (years) | ||||||||

Rate of increase in health care cost trends1 | % | % | ||||||

| As at December 31 | 2022 | 2021 | ||||||

| Life expectancy at age 65 for a member currently at: | (years) | (years) | ||||||

| Age 65 - male | ||||||||

| Age 65 - female | ||||||||

| Age 45 - male | ||||||||

| Age 45 - female | ||||||||

32 |  | |||||||

(millions of dollars) | Pension Benefits | Post-Retirement and Post-Employment Benefits | ||||||

| 2023 | ||||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| 2028 through to 2032 | ||||||||

| Total estimated future benefit payments through to 2032 | ||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Pension Benefits: | ||||||||

| Net actuarial gain for the year | ( | ( | ||||||

| Amortization of actuarial losses | ( | ( | ||||||

Amortization of prior service cost | ( | ( | ||||||

| ( | ( | |||||||

| Post-Retirement and Post-Employment Benefits: | ||||||||

| Actuarial gain for the year | ( | ( | ||||||

| Amortization of actuarial losses | ( | ( | ||||||

| ( | ( | |||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Pension Benefits: | ||||||||

| Actuarial loss (gain) | ( | |||||||

| Post-Retirement and Post-Employment Benefits: | ||||||||

| Actuarial gain | ( | ( | ||||||

33 |  | |||||||

| Actual (%) | Target Allocation (%) | Range Allocation (%) | |||||||||

| Equity securities | |||||||||||

| Debt securities | |||||||||||

| Real Estate and Infrastructure | |||||||||||

As at December 31, 2022 (millions of dollars) | Level 1 | Level 2 | Level 3 | Total | ||||||||||

| Pooled funds | ||||||||||||||

| Cash and cash equivalents | ||||||||||||||

| Short-term securities | ||||||||||||||

| Derivative instruments | ||||||||||||||

| Corporate shares - Canadian | ||||||||||||||

| Corporate shares - Foreign | ||||||||||||||

| Bonds and debentures - Canadian | ||||||||||||||

| Bonds and debentures - Foreign | ||||||||||||||

Total fair value of plan assets1 | ||||||||||||||

| Derivative instruments | ||||||||||||||

Total fair value of plan liabilities1 | ||||||||||||||

As at December 31, 2021 (millions of dollars) | Level 1 | Level 2 | Level 3 | Total | ||||||||||

| Pooled funds | ||||||||||||||

| Cash and cash equivalents | ||||||||||||||

| Short-term securities | ||||||||||||||

| Derivative instruments | ||||||||||||||

| Corporate shares - Canadian | ||||||||||||||

| Corporate shares - Foreign | ||||||||||||||

| Bonds and debentures - Canadian | ||||||||||||||

| Bonds and debentures - Foreign | ||||||||||||||

Total fair value of plan assets1 | ||||||||||||||

| Derivative instruments | ||||||||||||||

Total fair value of plan liabilities1 | ||||||||||||||

34 |  | |||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Fair value, beginning of year | ||||||||

| Realized and unrealized gains | ||||||||

| Purchases | ||||||||

| Sales and disbursements | ( | ( | ||||||

| Fair value, end of year | ||||||||

35 |  | |||||||

Year ended December 31, 2022 (millions of dollars) | PCB | LAR | Total | ||||||||

| Environmental liabilities - beginning | |||||||||||

| Interest accretion | |||||||||||

| Expenditures | ( | ( | ( | ||||||||

| Revaluation adjustment | ( | ||||||||||

| Environmental liabilities - ending | |||||||||||

| Less: current portion | ( | ( | ( | ||||||||

Year ended December 31, 2021 (millions of dollars) | PCB | LAR | Total | ||||||||

| Environmental liabilities - beginning | |||||||||||

| Interest accretion | |||||||||||

| Expenditures | ( | ( | ( | ||||||||

| Revaluation adjustment | |||||||||||

| Environmental liabilities - ending | |||||||||||

| Less: current portion | ( | ( | ( | ||||||||

As at December 31, 2022 (millions of dollars) | PCB | LAR | Total | ||||||||

| Undiscounted environmental liabilities | |||||||||||

| Less: discounting environmental liabilities to present value | ( | ( | |||||||||

| Discounted environmental liabilities | |||||||||||

As at December 31, 2021 (millions of dollars) | PCB | LAR | Total | ||||||||

| Undiscounted environmental liabilities | |||||||||||

| Less: discounting environmental liabilities to present value | ( | ( | |||||||||

| Discounted environmental liabilities | |||||||||||

(millions of dollars) | |||||

| 2023 | |||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| Thereafter | |||||

36 |  | |||||||

37 |  | |||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Lease expense | ||||||||||||||

| Lease payments made | ||||||||||||||

| As at December 31 | 2022 | 2021 | ||||||||||||

Weighted-average remaining lease term1 (years) | ||||||||||||||

| Weighted-average discount rate | % | % | ||||||||||||

| (millions of dollars) | ||||||||||||||

| 2023 | ||||||||||||||

| 2024 | ||||||||||||||

| 2025 | ||||||||||||||

| 2026 | ||||||||||||||

| 2027 | ||||||||||||||

| Thereafter | ||||||||||||||

| Total undiscounted minimum lease payments | ||||||||||||||

| Less: discounting minimum lease payments to present value | ( | |||||||||||||

| Total discounted minimum lease payments | ||||||||||||||

| (millions of dollars) | ||||||||||||||

| 2022 | ||||||||||||||

| 2023 | ||||||||||||||

| 2024 | ||||||||||||||

| 2025 | ||||||||||||||

| 2026 | ||||||||||||||

| Thereafter | ||||||||||||||

| Total undiscounted minimum lease payments | ||||||||||||||

| Less: discounting minimum lease payments to present value | ( | |||||||||||||

| Total discounted minimum lease payments | ||||||||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

38 |  | |||||||

39 |  | |||||||

Year ended December 31, 2022 | Share Grants (number of common shares) | Weighted-Average Price | |||||||||

| Share grants outstanding - beginning | $ | ||||||||||

Vested and issued1 | ( | ||||||||||

| Forfeited | ( | $ | |||||||||

| Share grants outstanding - ending | $ | ||||||||||

Year ended December 31, 2021 | Share Grants (number of common shares) | Weighted-Average Price | |||||||||

| Share grants outstanding - beginning | $ | ||||||||||

Vested and issued1 | ( | ||||||||||

| Forfeited | ( | $ | |||||||||

| Share grants outstanding - ending | $ | ||||||||||

Year ended December 31 (number of DSUs) | 2022 | 2021 | ||||||||||||

| DSUs outstanding - beginning | ||||||||||||||

| Granted | ||||||||||||||

| Settled | ( | |||||||||||||

| DSUs outstanding - ending | ||||||||||||||

Year ended December 31 (number of DSUs) | 2022 | 2021 | ||||||||||||

| DSUs outstanding - beginning | ||||||||||||||

| Granted | ||||||||||||||

| Paid | ( | |||||||||||||

| DSUs outstanding - ending | ||||||||||||||

40 |  | |||||||

| PSUs | RSUs | |||||||||||||

Year ended December 31 (number of units) | 2022 | 2021 | 2022 | 2021 | ||||||||||

| Units outstanding - beginning | ||||||||||||||

| Vested and issued | ( | ( | ||||||||||||

| Settled | ( | |||||||||||||

| Units outstanding - ending | ||||||||||||||

Year ended December 31 (number of RSUs) | 2022 | 2021 | ||||||||||||

| RSUs outstanding - beginning | ||||||||||||||

| Granted | ||||||||||||||

| Vested and issued | ( | |||||||||||||

| Settled | ( | |||||||||||||

| Forfeited | ( | |||||||||||||

| RSUs outstanding - ending | ||||||||||||||

41 |  | |||||||

| Number of Stock Options | Weighted-average exercise price | |||||||

| Stock options outstanding - January 1, 2021 | $ | |||||||

Exercised1 | ( | $ | ||||||

| Stock options outstanding - December 31, 2021 | $ | |||||||

| Stock options outstanding - December 31, 2022 | ||||||||

Year ended December 31, 2022 (millions of dollars) | Temporary Equity | Equity | Total | |||||||||||

| Noncontrolling interest - beginning | ||||||||||||||

| Distributions to noncontrolling interest | ( | ( | ( | |||||||||||

| Net income attributable to noncontrolling interest | ||||||||||||||

| Noncontrolling interest - ending | ||||||||||||||

Year ended December 31, 2021 (millions of dollars) | Temporary Equity | Equity | Total | |||||||||||

| Noncontrolling interest - beginning | ||||||||||||||

| Distributions to noncontrolling interest | ( | ( | ( | |||||||||||

| Net income attributable to noncontrolling interest | ||||||||||||||

| Noncontrolling interest - ending | ||||||||||||||

Year ended December 31, 2022 (millions of dollars) | Temporary Equity | Equity | Total | |||||||||||

| Noncontrolling interest - beginning | ||||||||||||||

| Distributions to noncontrolling interest | ( | ( | ( | |||||||||||

| Net income attributable to noncontrolling interest | ||||||||||||||

| Noncontrolling interest - ending | ||||||||||||||

42 |  | |||||||

Year ended December 31, 2021 (millions of dollars) | Temporary Equity | Equity | Total | |||||||||||

| Noncontrolling interest - beginning | ||||||||||||||

| Distributions to noncontrolling interest | ( | ( | ( | |||||||||||

| Net income attributable to noncontrolling interest | ||||||||||||||

| Noncontrolling interest - ending | ||||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Noncontrolling interest - beginning | ||||||||||||||

| Distributions to noncontrolling interest | ( | ( | ||||||||||||

| Net income attributable to noncontrolling interest | ||||||||||||||

| Noncontrolling interest - ending | ||||||||||||||

Year ended December 31 (millions of dollars) | |||||||||||||||||

| Related Party | Transaction | 2022 | 2021 | ||||||||||||||

| IESO | Power purchased | ||||||||||||||||

| Revenues for transmission services | |||||||||||||||||

| Amounts related to electricity rebates | |||||||||||||||||

| Distribution revenues related to rural rate protection | |||||||||||||||||

| Distribution revenues related to supply of electricity to remote northern communities | |||||||||||||||||

| Funding received related to CDM programs | |||||||||||||||||

| OPG | Power purchased | ||||||||||||||||

| Revenues related to provision of services and supply of electricity | |||||||||||||||||

| Capital contribution received from OPG | |||||||||||||||||

| Costs related to the purchase of services | |||||||||||||||||

| OEFC | Power purchased from power contracts administered by the OEFC | ||||||||||||||||

| OEB | OEB fees | ||||||||||||||||

| Hydro One Limited | Dividends paid | ||||||||||||||||

| Stock-based compensation costs | |||||||||||||||||

| Cost recovery for services provided | |||||||||||||||||

| Acronym | Services received – costs expensed | ||||||||||||||||

| Revenues for services provided | |||||||||||||||||

| HOBSI | Increase (decrease) in capital contribution from HOBSI | ( | |||||||||||||||

| Revenues for services provided | |||||||||||||||||

43 |  | |||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Accounts receivable | ( | |||||||||||||

| Due from related parties | ( | |||||||||||||

Materials and supplies (Note 9) | ( | |||||||||||||

Prepaid expenses and other assets (Note 9) | ( | ( | ||||||||||||

Other long-term assets (Note 13) | ( | |||||||||||||

| Accounts payable | ( | |||||||||||||

Accrued liabilities (Note 14) | ||||||||||||||

| Due to related parties | ( | ( | ||||||||||||

Accrued interest (Note 14) | ( | |||||||||||||

Long-term accounts payable and other long-term liabilities (Note 15) | ||||||||||||||

| Post-retirement and post-employment benefit liability | ||||||||||||||

| ( | ||||||||||||||

Year ended December 31, 2022 (millions of dollars) | Property, Plant and Equipment | Intangible Assets | Total | ||||||||||||||||||||

| Capital investments | ( | ( | ( | ||||||||||||||||||||

| Reconciling items | |||||||||||||||||||||||

| Cash outflow for capital expenditures | ( | ( | ( | ||||||||||||||||||||

Year ended December 31, 2021 (millions of dollars) | Property, Plant and Equipment | Intangible Assets | Total | ||||||||||||||||||||

| Capital investments | ( | ( | ( | ||||||||||||||||||||

| Reconciling items | ( | ||||||||||||||||||||||

| Cash outflow for capital expenditures | ( | ( | ( | ||||||||||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Net interest paid | ||||||||||||||

| Income taxes paid | ||||||||||||||

44 |  | |||||||

As at December 31, 2022 (millions of dollars) | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Thereafter | ||||||||||||||

| Outsourcing and other agreements | ||||||||||||||||||||

| Long-term software/meter agreement | ||||||||||||||||||||

45 |  | |||||||

As at December 31, 2022 (millions of dollars) | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Thereafter | ||||||||||||||

Operating Credit Facilities1 | ||||||||||||||||||||

Letters of credit2 | ||||||||||||||||||||

Guarantees3 | ||||||||||||||||||||

46 |  | |||||||

Year ended December 31, 2022 (millions of dollars) | Transmission | Distribution | Other | Consolidated | ||||||||||

| Revenues | ||||||||||||||

| Purchased power | ||||||||||||||

| Operation, maintenance and administration | ||||||||||||||

| Depreciation, amortization and asset removal costs | ||||||||||||||

| Income (loss) before financing charges and income tax expense | ( | |||||||||||||

| Capital investments | ||||||||||||||

Year ended December 31, 2021 (millions of dollars) | Transmission | Distribution | Other | Consolidated | ||||||||||

| Revenues | ||||||||||||||

| Purchased power | ||||||||||||||

| Operation, maintenance and administration | ||||||||||||||

| Depreciation, amortization and asset removal costs | ||||||||||||||

| Income (loss) before financing charges and income tax expense | ( | |||||||||||||

| Capital investments | ||||||||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Transmission | ||||||||

| Distribution | ||||||||

| Other | ||||||||

| Total assets | ||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Transmission | ||||||||

| Distribution | ||||||||

| Total goodwill | ||||||||

47 |  | |||||||

Year ended December 31 (millions of dollars, except as otherwise noted) | 2022 | 2021 | Change | ||||||||

| Revenues | 7,740 | 7,185 | 7.7 | % | |||||||

| Purchased power | 3,724 | 3,579 | 4.1 | % | |||||||

Revenues, net of purchased power1 | 4,016 | 3,606 | 11.4 | % | |||||||

| Operation, maintenance and administration (OM&A) costs | 1,226 | 1,081 | 13.4 | % | |||||||

| Depreciation, amortization and asset removal costs | 957 | 913 | 4.8 | % | |||||||

| Financing charges | 478 | 453 | 5.5 | % | |||||||

| Income tax expense | 290 | 179 | 62.0 | % | |||||||

| Net income to common shareholder of Hydro One | 1,057 | 972 | 8.7 | % | |||||||

| Basic earnings per common share (EPS) | $7,431 | $6,834 | 8.7 | % | |||||||

| Diluted EPS | $7,431 | $6,834 | 8.7 | % | |||||||

| Net cash from operating activities | 2,185 | 2,108 | 3.7 | % | |||||||

Funds from operations (FFO)1 | 2,181 | 2,031 | 7.4 | % | |||||||

| Capital investments | 2,108 | 2,104 | 0.2 | % | |||||||

| Assets placed in-service | 2,258 | 1,746 | 29.3 | % | |||||||

Transmission: Average monthly Ontario 60-minute peak demand (MW) | 20,368 | 19,915 | 2.3 | % | |||||||

Distribution: Electricity distributed to Hydro One customers (GWh) | 30,803 | 29,966 | 2.8 | % | |||||||

As at December 31 | 2022 | 2021 | ||||||

Debt to capitalization ratio2 | 55.1 | % | 55.2 | % | ||||

1 |  | |||||||

| Year ended December 31 | 2022 | 2021 | ||||||

| Transmission | 27 | % | 25 | % | ||||

| Distribution | 73 | % | 75 | % | ||||

| Other | — | % | — | % | ||||

| Year ended December 31 | 2022 | 2021 | ||||||

| Transmission | 52 | % | 51 | % | ||||

| Distribution | 48 | % | 49 | % | ||||

| Other | — | % | — | % | ||||

| As at December 31 | 2022 | 2021 | ||||||

| Transmission | 60 | % | 60 | % | ||||

| Distribution | 38 | % | 38 | % | ||||

| Other | 2 | % | 2 | % | ||||

| As at and for the year ended December 31 | 2022 | 2021 | |||||||||||||||

Electricity transmitted1 (MWh) | 137,569,865 | 133,844,210 | |||||||||||||||

Transmission lines spanning the province (circuit-kilometres) | 29,910 | 30,023 | |||||||||||||||

Rate base (millions of dollars) | 14,450 | 13,745 | |||||||||||||||

Capital investments (millions of dollars) | 1,209 | 1,320 | |||||||||||||||

Assets placed in-service (millions of dollars) | 1,405 | 1,008 | |||||||||||||||

2 |  | |||||||

| As at and for the year ended December 31 | 2022 | 2021 | |||||||||||||||

Electricity distributed to Hydro One customers (GWh) | 30,803 | 29,966 | |||||||||||||||

Electricity distributed through Hydro One lines (GWh)1 | 40,875 | 40,433 | |||||||||||||||

Distribution lines spanning the province (circuit-kilometres) | 125,013 | 124,825 | |||||||||||||||

Distribution customers (number of customers) | 1,492,404 | 1,476,491 | |||||||||||||||

Rate base (millions of dollars) | 9,155 | 8,854 | |||||||||||||||

Capital investments (millions of dollars) | 899 | 784 | |||||||||||||||

Assets placed in-service (millions of dollars) | 853 | 738 | |||||||||||||||

3 |  | |||||||

4 |  | |||||||

Year ended December 31 (millions of dollars, except as otherwise noted) | 2022 | 2021 | Change | |||||||||||

| Transmission | 2,080 | 1,826 | 13.9 | % | ||||||||||

| Distribution | 5,660 | 5,359 | 5.6 | % | ||||||||||

| Total revenues | 7,740 | 7,185 | 7.7 | % | ||||||||||

| Transmission | 2,080 | 1,826 | 13.9 | % | ||||||||||

Distribution revenues, net of purchased power1 | 1,936 | 1,780 | 8.8 | % | ||||||||||

Total revenues, net of purchased power1 | 4,016 | 3,606 | 11.4 | % | ||||||||||

Transmission: Average monthly Ontario 60-minute peak demand (MW) | 20,368 | 19,915 | 2.3 | % | ||||||||||

Distribution: Electricity distributed to Hydro One customers (GWh) | 30,803 | 29,966 | 2.8 | % | ||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | Change | |||||||||||

| Transmission | 464 | 414 | 12.1 | % | ||||||||||

| Distribution | 744 | 664 | 12.0 | % | ||||||||||

| Other | 18 | 3 | 500.0 | % | ||||||||||

| 1,226 | 1,081 | 13.4 | % | |||||||||||

5 |  | |||||||

6 |  | |||||||

Year ended December 31 (millions of dollars, except per share amounts) | 2022 | 2021 | 2020 | ||||||||||||||||||||

| Revenues | 7,740 | 7,185 | 7,250 | ||||||||||||||||||||

| Net income to common shareholder of Hydro One | 1,057 | 972 | 1,792 | ||||||||||||||||||||

| Basic EPS | $7,431 | $6,834 | $12,599 | ||||||||||||||||||||

| Diluted EPS | $7,431 | $6,834 | $12,599 | ||||||||||||||||||||

| Dividends per common share declared | $4,584 | $4,359 | $7 | ||||||||||||||||||||

As at December 31 (millions of dollars) | 2022 | 2021 | 2020 | ||||||||||||||||||||

| Total assets | 31,290 | 30,221 | 30,133 | ||||||||||||||||||||

Total non-current financial liabilities1 | 12,649 | 12,640 | 12,387 | ||||||||||||||||||||

7 |  | |||||||

Quarter ended (millions of dollars, except EPS and ratio) | Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | Sep 30, 2021 | Jun 30, 2021 | Mar 31, 2021 | |||||||||||||||||||||

| Revenues | 1,851 | 2,022 | 1,830 | 2,037 | 1,768 | 1,903 | 1,712 | 1,802 | |||||||||||||||||||||

| Purchased power | 895 | 963 | 852 | 1,014 | 914 | 933 | 838 | 894 | |||||||||||||||||||||

Revenues, net of purchased power1 | 956 | 1,059 | 978 | 1,023 | 854 | 970 | 874 | 908 | |||||||||||||||||||||

| Net income to common shareholder | 181 | 308 | 256 | 312 | 159 | 302 | 240 | 271 | |||||||||||||||||||||

| Basic and diluted EPS | $ | 1,273 | $ | 2,165 | $ | 1,800 | $ | 2,193 | $ | 1,118 | $ | 2,123 | $1,687 | $1,905 | |||||||||||||||

Earnings coverage ratio2 | 3.4 | 3.4 | 3.3 | 3.3 | 3.1 | 3.1 | 3.0 | 3.0 | |||||||||||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | Change | ||||||||

| Transmission | 1,405 | 1,008 | 39.4 | % | |||||||

| Distribution | 853 | 738 | 15.6 | % | |||||||

| Total assets placed in-service | 2,258 | 1,746 | 29.3 | % | |||||||

8 |  | |||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | Change | ||||||||

| Transmission | |||||||||||

| Sustaining | 897 | 906 | (1.0 | %) | |||||||

| Development | 214 | 296 | (27.7 | %) | |||||||

| Other | 98 | 118 | (16.9 | %) | |||||||

| 1,209 | 1,320 | (8.4 | %) | ||||||||

| Distribution | |||||||||||

| Sustaining | 433 | 332 | 30.4 | % | |||||||

| Development | 383 | 332 | 15.4 | % | |||||||

| Other | 83 | 120 | (30.8 | %) | |||||||

| 899 | 784 | 14.7 | % | ||||||||

| Total capital investments | 2,108 | 2,104 | 0.2 | % | |||||||

9 |  | |||||||

Project Name | Location | Type | Anticipated In-Service Date | Estimated Cost | Capital Cost To Date | ||||||||||||

| (year) | (millions of dollars) | ||||||||||||||||

| Development Projects: | |||||||||||||||||

| Barrie Area Transmission Upgrade | Barrie-Innisfil Southern Ontario | Upgraded transmission line and stations | 2023 | 125 | 62 | ||||||||||||

East-West Tie Station Expansion1 | Northern Ontario | New transmission connection and station expansion | 2024 | 191 | 182 | ||||||||||||

Waasigan Transmission Line2 | Thunder Bay-Atikokan-Dryden Northwestern Ontario | New transmission line and station expansion | 2024 | 68 | 38 | ||||||||||||

Chatham to Lakeshore Transmission Line3 | Southwestern Ontario | New transmission line and station expansion | 2025 | 268 | 30 | ||||||||||||

St. Clair Transmission Line4 | Southwestern Ontario | New transmission line and station expansion | 2025 | 38 | 48 | ||||||||||||

Longwood to Lakeshore Transmission Line5 | Southwestern Ontario | New transmission line and station expansion | TBD | TBD | TBD | ||||||||||||

Second Longwood to Lakeshore Transmission Line5 | Southwestern Ontario | New transmission line and station expansion | TBD | TBD | TBD | ||||||||||||

Lakeshore to Windsor Transmission Line5 | Southwestern Ontario | New transmission line and station expansion | TBD | TBD | TBD | ||||||||||||

| Sustainment Projects: | |||||||||||||||||

| Beck #2 Transmission Station Circuit Breaker Replacement | Niagara area Southwestern Ontario | Station sustainment | 2023 | 135 | 113 | ||||||||||||

| Cherrywood Transmission Station Circuit Breaker Replacement | Pickering Central Ontario | Station sustainment | 2023 | 115 | 90 | ||||||||||||

| Bruce B Switching Station Circuit Breaker Replacement | Tiverton Southwestern Ontario | Station sustainment | 2024 | 185 | 166 | ||||||||||||

| Middleport Transmission Station Circuit Breaker Replacement | Middleport Southwestern Ontario | Station sustainment | 2025 | 184 | 117 | ||||||||||||

| Lennox Transmission Station Circuit Breaker Replacement | Napanee Southeastern Ontario | Station sustainment | 2026 | 152 | 116 | ||||||||||||

| Esplanade x Terauley Underground Cable Replacement | Toronto Southwestern Ontario | Line sustainment | 2026 | 117 | 11 | ||||||||||||

10 |  | |||||||

By business segment: (millions of dollars) | 2023 | 2024 | 2025 | 2026 | 2027 | |||||||||||||||

Transmission1 | 1,565 | 1,547 | 1,446 | 1,475 | 1,539 | |||||||||||||||

| Distribution | 924 | 1,027 | 1,043 | 1,001 | 989 | |||||||||||||||

Total capital investments3 | 2,489 | 2,574 | 2,489 | 2,476 | 2,528 | |||||||||||||||

By category: (millions of dollars) | 2023 | 2024 | 2025 | 2026 | 2027 | |||||||||||||||

| Sustainment | 1,534 | 1,658 | 1,629 | 1,548 | 1,480 | |||||||||||||||

Development1 | 691 | 710 | 669 | 730 | 891 | |||||||||||||||

Other2 | 264 | 206 | 191 | 198 | 157 | |||||||||||||||

Total capital investments3 | 2,489 | 2,574 | 2,489 | 2,476 | 2,528 | |||||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||

| Net cash from operating activities | 2,185 | 2,108 | ||||||

| Net cash used in financing activities | (190) | (294) | ||||||

| Net cash used in investing activities | (2,036) | (2,027) | ||||||

| Decrease in cash and cash equivalents | (41) | (213) | ||||||

11 |  | |||||||

12 |  | |||||||

| Rating Agency | Short-term Debt Rating | Long-term Debt Rating | ||||||

| DBRS | R-1 (low) | A (high) | ||||||

| Moody's | Prime-2 | A3 | ||||||

| S&P | A-1 (low) | A- | ||||||

13 |  | |||||||

As at December 31, 2022 (millions of dollars) | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | ||||||||||||

Contractual obligations (due by year) | |||||||||||||||||

| Long-term debt - principal repayments | 13,376 | 731 | 1,450 | 500 | 10,695 | ||||||||||||

| Long-term debt - interest payments | 8,087 | 512 | 996 | 940 | 5,639 | ||||||||||||

| Short-term notes payable | 1,374 | 1,374 | — | — | — | ||||||||||||

Pension contributions1 | 510 | 91 | 204 | 215 | — | ||||||||||||

| Environmental and asset retirement obligations | 138 | 28 | 40 | 4 | 66 | ||||||||||||

Outsourcing and other agreements | 208 | 184 | 10 | 1 | 13 | ||||||||||||

| Lease obligations | 56 | 12 | 20 | 17 | 7 | ||||||||||||

| Long-term software/meter agreement | 32 | 12 | 15 | 2 | 3 | ||||||||||||

| Total contractual obligations | 23,781 | 2,944 | 2,735 | 1,679 | 16,423 | ||||||||||||

Other commercial commitments (by year of expiry) | |||||||||||||||||

Operating Credit Facilities2 | 2,300 | — | — | 2,300 | — | ||||||||||||

Letters of credit3 | 188 | 186 | 2 | — | — | ||||||||||||

Guarantees4 | 475 | 475 | — | — | — | ||||||||||||

| Total other commercial commitments | 2,963 | 661 | 2 | 2,300 | — | ||||||||||||

14 |  | |||||||

| Hydro One Networks - Transmission | Hydro One Networks - Distribution | |||||||||||||

Year | Rate Base | Revenue Requirement | Rate Base | Revenue Requirement | ||||||||||

| 2023 | $14,534 million | $1,952 million | $9,460 million | $1,727 million | ||||||||||

| 2024 | $15,342 million | $2,073 million | $9,979 million | $1,813 million | ||||||||||

| 2025 | $16,271 million | $2,168 million | $10,573 million | $1,886 million | ||||||||||

| 2026 | $17,148 million | $2,277 million | $11,153 million | $1,985 million | ||||||||||

| 2027 | $17,940 million | $2,362 million | $11,656 million | $2,071 million | ||||||||||

15 |  | |||||||

16 |  | |||||||

| Regular Employees | Non-Regular Employees | Total | |||||||||

Power Workers' Union (PWU)1 | 3,801 | 839 | 4,640 | ||||||||

Society of United Professionals (Society) | 1,776 | 41 | 1,817 | ||||||||

Canadian Union of Skilled Workers (CUSW) and construction building trade unions | — | 169 | 169 | ||||||||

| Total employees represented by unions | 5,577 | 1,049 | 6,626 | ||||||||

| Management and non-represented employees | 810 | 23 | 833 | ||||||||

Total employees2 | 6,387 | 1,072 | 7,459 | ||||||||

December 31 (number of units) | 2022 | 2021 | |||||||||

| Management DSUs | 118,505 | 90,240 | |||||||||

| Director DSUs | 99,939 | 80,813 | |||||||||

| Society RSUs | 34,619 | 68,005 | |||||||||

17 |  | |||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | |||||||||||||||

| Net cash from operating activities | 2,185 | 2,108 | |||||||||||||||

| Changes in non-cash balances related to operations | 6 | (69) | |||||||||||||||

| Distributions to noncontrolling interest | (10) | (8) | |||||||||||||||

| FFO | 2,181 | 2,031 | |||||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | |||||||||||||||

| Revenues | 7,740 | 7,185 | |||||||||||||||

| Less: Purchased power | 3,724 | 3,579 | |||||||||||||||

| Revenues, net of purchased power | 4,016 | 3,606 | |||||||||||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | |||||||||||||||

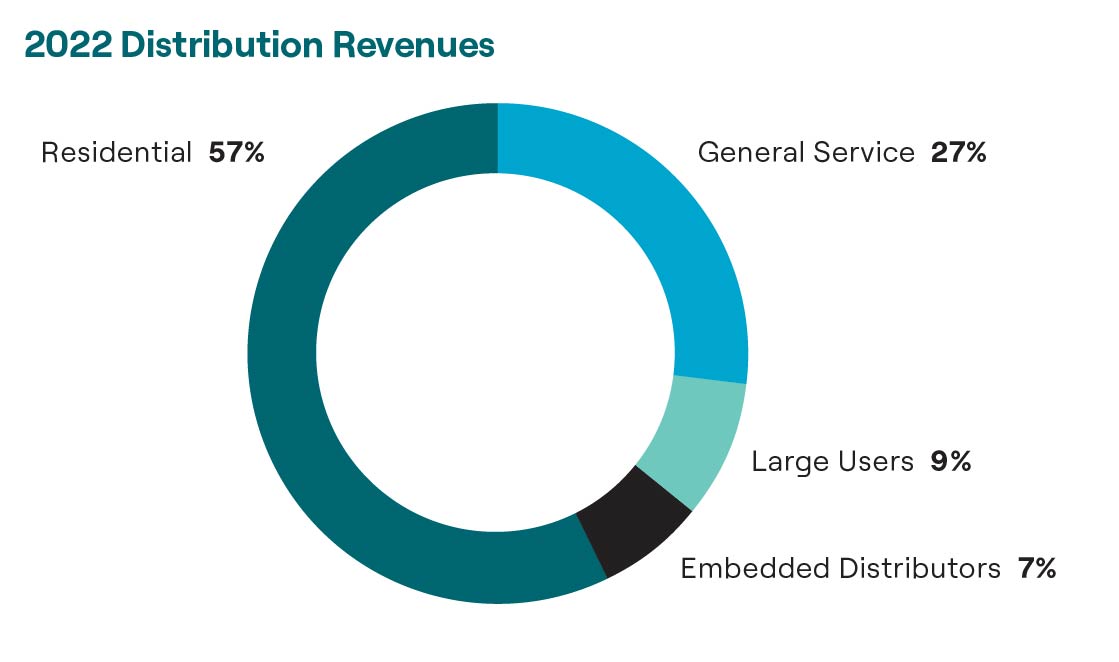

| Distribution revenues | 5,660 | 5,359 | |||||||||||||||

| Less: Purchased power | 3,724 | 3,579 | |||||||||||||||

| Distribution revenues, net of purchased power | 1,936 | 1,780 | |||||||||||||||

Quarter ended (millions of dollars) | Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | Sep 30, 2021 | Jun 30, 2021 | Mar 31, 2021 | ||||||||||||||||||

| Revenues | 1,851 | 2,022 | 1,830 | 2,037 | 1,768 | 1,903 | 1,712 | 1,802 | ||||||||||||||||||

| Less: Purchased power | 895 | 963 | 852 | 1,014 | 914 | 933 | 838 | 894 | ||||||||||||||||||

| Revenues, net of purchased power | 956 | 1,059 | 978 | 1,023 | 854 | 970 | 874 | 908 | ||||||||||||||||||

Quarter ended (millions of dollars) | Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | Sep 30, 2021 | Jun 30, 2021 | Mar 31, 2021 | ||||||||||||||||||

| Distribution revenues | 1,370 | 1,459 | 1,314 | 1,517 | 1,347 | 1,395 | 1,263 | 1,354 | ||||||||||||||||||

| Less: Purchased power | 895 | 963 | 852 | 1,014 | 914 | 933 | 838 | 894 | ||||||||||||||||||

| Distribution revenues, net of purchased power | 475 | 496 | 462 | 503 | 433 | 462 | 425 | 460 | ||||||||||||||||||

18 |  | |||||||

Year ended December 31 (millions of dollars) | 2022 | 2021 | ||||||||||||

| Short-term notes payable | 1,374 | 1,045 | ||||||||||||

| Less: cash and cash equivalents | (458) | (499) | ||||||||||||

| Long-term debt (current portion) | 733 | 603 | ||||||||||||

| Long-term debt (long-term portion) | 12,606 | 12,593 | ||||||||||||

| Total debt (A) | 14,255 | 13,742 | ||||||||||||

| Shareholder's equity (excluding noncontrolling interest) | 11,596 | 11,172 | ||||||||||||

| Total debt plus shareholder's equity (B) | 25,851 | 24,914 | ||||||||||||

| Debt-to-capitalization ratio (A/B) | 55.1 | % | 55.2 | % | ||||||||||

Quarter ended (millions of dollars) | Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | Sep 30, 2021 | Jun 30, 2021 | Mar 31, 2021 | ||||||||||||||||||

| Net income to common shareholder | 181 | 308 | 256 | 312 | 159 | 302 | 240 | 271 | ||||||||||||||||||

| Income tax expense | 41 | 101 | 68 | 80 | 54 | 71 | 27 | 27 | ||||||||||||||||||

| Financing charges | 125 | 121 | 118 | 114 | 122 | 116 | 101 | 114 | ||||||||||||||||||

| Earnings before income taxes and financing charges attributable to common shareholder | 347 | 530 | 442 | 506 | 335 | 489 | 368 | 412 | ||||||||||||||||||

Twelve months ended (millions of dollars) | Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | Sep 30, 2021 | Jun 30, 2021 | Mar 31, 2021 | ||||||||||||||||||

| Earnings before income taxes and financing charges attributable to common shareholder (A) | 1,825 | 1,813 | 1,772 | 1,698 | 1,604 | 1,579 | 1,516 | 1,526 | ||||||||||||||||||

Quarter ended (millions of dollars) | Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | Sep 30, 2021 | Jun 30, 2021 | Mar 31, 2021 | ||||||||||||||||||

| Financing charges | 125 | 121 | 118 | 114 | 122 | 116 | 101 | 114 | ||||||||||||||||||

| Capitalized interest | 16 | 16 | 16 | 15 | 16 | 15 | 16 | 13 | ||||||||||||||||||

| Financing charges and capitalized interest | 141 | 137 | 134 | 129 | 138 | 131 | 117 | 127 | ||||||||||||||||||

Twelve months ended (millions of dollars) | Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | Sep 30, 2021 | Jun 30, 2021 | Mar 31, 2021 | ||||||||||||||||||

| Financing charges and capitalized interest (B) | 541 | 538 | 532 | 515 | 513 | 505 | 502 | 516 | ||||||||||||||||||

| Earnings coverage ratio = A/B | 3.4 | 3.4 | 3.3 | 3.3 | 3.1 | 3.1 | 3.0 | 3.0 | ||||||||||||||||||

19 |  | |||||||

Year ended December 31 (millions of dollars) | |||||||||||||||||

| Related Party | Transaction | 2022 | 2021 | ||||||||||||||

| IESO | Power purchased | 2,374 | 2,238 | ||||||||||||||

| Revenues for transmission services | 2,062 | 1,832 | |||||||||||||||

| Amounts related to electricity rebates | 1,031 | 1,065 | |||||||||||||||

| Distribution revenues related to rural rate protection | 247 | 245 | |||||||||||||||

| Distribution revenues related to supply of electricity to remote northern communities | 35 | 35 | |||||||||||||||

| Funding received related to CDM programs | 3 | 1 | |||||||||||||||

| OPG | Power purchased | 20 | 13 | ||||||||||||||

| Revenues related to provision of services and supply of electricity | 7 | 7 | |||||||||||||||

| Capital contribution received from OPG | 5 | 3 | |||||||||||||||

| Costs related to the purchase of services | 2 | 2 | |||||||||||||||

| OEFC | Power purchased from power contracts administered by the OEFC | 2 | 1 | ||||||||||||||

| OEB | OEB fees | 10 | 8 | ||||||||||||||

| Hydro One Limited | Dividends paid | 652 | 620 | ||||||||||||||

| Stock-based compensation costs | 5 | 6 | |||||||||||||||

| Cost recovery for services provided | 7 | 7 | |||||||||||||||

| Acronym | Services received – costs expensed | 26 | 24 | ||||||||||||||

| Revenues for services provided | 2 | 2 | |||||||||||||||

| HOBSI | Increase (decrease) in capital contribution from HOBSI | (2) | 3 | ||||||||||||||

| Revenues for services provided | 1 | — | |||||||||||||||

20 |  | |||||||

21 |  | |||||||

22 |  | |||||||

23 |  | |||||||

24 |  | |||||||

25 |  | |||||||

26 |  | |||||||

27 |  | |||||||

28 |  | |||||||

29 |  | |||||||

30 |  | |||||||

31 |  | |||||||

| Guidance | Date issued | Description | Effective date | Impact on Hydro One | |||||||||||||

| ASU 2020-06 | August 2020 | The update addresses the complexity associated with applying US GAAP for certain financial instruments with characteristics of liabilities and equity. The amendments reduce the number of accounting models for convertible debt instruments and convertible preferred stock. | January 1, 2022 | No impact upon adoption | |||||||||||||

| ASU 2021-05 | July 2021 | The amendments are intended to align lease classification requirements for lessors under Topic 842 with Topic 840's practice. | January 1, 2022 | No impact upon adoption | |||||||||||||

| ASU 2021-10 | November 2021 | The update addresses diversity on the recognition, measurement, presentation and disclosure of government assistance received by business entities. | January 1, 2022 | No impact upon adoption | |||||||||||||

| Guidance | Date issued | Description | Effective date | Anticipated Impact on Hydro One | |||||||||||||

| ASU 2021-08 | October 2021 | The amendments address how to determine whether a contractual obligation represents a liability to be recognized by the acquirer in a business combination. | January 1, 2023 | No expected impact upon adoption | |||||||||||||

| ASU 2022-02 | March 2022 | The amendments eliminate the troubled debt restructuring (TDR) accounting model for entities that have adopted Topic 326 Financial Instrument – Credit Losses and modifies the guidance on vintage disclosure requirements to require disclosure of current-period gross write-offs by year of origination. | January 1, 2023 | Upon adoption, the Company will disclose the current period gross write-offs by year of origination relating to its accounts receivable | |||||||||||||

32 |  | |||||||

Three months ended December 31 (millions of dollars, except EPS) | 2022 | 2021 | Change | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Distribution | 1,370 | 1,347 | 1.7 | % | |||||||||||||||||||

| Transmission | 481 | 421 | 14.3 | % | |||||||||||||||||||

| 1,851 | 1,768 | 4.7 | % | ||||||||||||||||||||

| Costs | |||||||||||||||||||||||

| Purchased power | 895 | 914 | (2.1 | %) | |||||||||||||||||||

| OM&A | |||||||||||||||||||||||

| Distribution | 223 | 163 | 36.8 | % | |||||||||||||||||||

| Transmission | 148 | 107 | 38.3 | % | |||||||||||||||||||

| Other | 8 | 3 | 166.7 | % | |||||||||||||||||||

| 379 | 273 | 38.8 | % | ||||||||||||||||||||

| Depreciation, amortization and asset removal costs | 229 | 244 | (6.1 | %) | |||||||||||||||||||

| 1,503 | 1,431 | 5.0 | % | ||||||||||||||||||||

| Income before financing charges and income tax expense | 348 | 337 | 3.3 | % | |||||||||||||||||||

| Financing charges | 125 | 122 | 2.5 | % | |||||||||||||||||||

| Income before income tax expense | 223 | 215 | 3.7 | % | |||||||||||||||||||

| Income tax expense | 41 | 54 | (24.1 | %) | |||||||||||||||||||

| Net income | 182 | 161 | 13.0 | % | |||||||||||||||||||

| Net income to common shareholder of Hydro One | 181 | 159 | 13.8 | % | |||||||||||||||||||

| Basic and Diluted EPS | $1,273 | $1,118 | 13.9 | % | |||||||||||||||||||

| Assets Placed In-Service | |||||||||||||||||||||||

| Distribution | 326 | 257 | 26.8 | % | |||||||||||||||||||

| Transmission | 761 | 526 | 44.7 | % | |||||||||||||||||||

| 1,087 | 783 | 38.8 | % | ||||||||||||||||||||

| Capital Investments | |||||||||||||||||||||||

| Distribution | 253 | 218 | 16.1 | % | |||||||||||||||||||

| Transmission | 310 | 303 | 2.3 | % | |||||||||||||||||||

| 563 | 521 | 8.1 | % | ||||||||||||||||||||

33 |  | |||||||

34 |  | |||||||

35 |  | |||||||

36 |  | |||||||

37 |  | |||||||

| KPMG LLP is a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. KPMG Canada provides services to KPMG LLP. | ||

Date: February 14, 2023 | /s/ David Lebeter | |||||||

| David Lebeter | ||||||||

| President and Chief Executive Officer | ||||||||

Date: February 14, 2023 | /s/ Christopher Lopez | ||||||||||

Christopher Lopez | |||||||||||

| Chief Financial Officer | |||||||||||

Date: February 14, 2023 | /s/ David Lebeter | |||||||

| David Lebeter | ||||||||

| President and Chief Executive Officer | ||||||||

Date: February 14, 2023 | /s/ Christopher Lopez | ||||||||||

Christopher Lopez | |||||||||||

| Chief Financial Officer | |||||||||||

Audit Information |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Audit Information [Abstract] | |

| Auditor Name | Chartered Professional Accountants, Licensed Public Accountants |

| Auditor Location | Toronto, Canada |

| Auditor Firm ID | 85 |

Consolidated Statements of Operations and Comprehensive Income (Parenthetical) - CAD ($) $ in Millions |

12 Months Ended | |

|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

|

| Revenues | $ 7,740 | $ 7,185 |

| Purchased power | 3,724 | 3,579 |

| Related Party [Member] | ||

| Purchased power | 2,396 | 2,252 |

| Distribution [Member] | ||

| Revenues | 5,660 | 5,359 |

| Distribution [Member] | Related Party [Member] | ||

| Revenues | 288 | 286 |

| Transmission [Member] | ||

| Revenues | 2,080 | 1,826 |

| Transmission [Member] | Related Party [Member] | ||

| Revenues | $ 2,066 | $ 1,835 |

Consolidated Statements of Changes in Equity - CAD ($) $ in Millions |

Total |

Hydro One [Member] |

Common Stock [Member] |

Retained Earnings [Member] |

Accumulated Other Comprehensive Income [Member] |

Non-controlling Interest [Member] |

|---|---|---|---|---|---|---|

| Beginning balance at Dec. 31, 2020 | $ 10,876 | $ 10,804 | $ 2,957 | $ 7,877 | $ (30) | $ 72 |

| Increase (Decrease) in Stockholders' Equity [Roll Forward] | ||||||

| Net income (loss) | 978 | 972 | 972 | 6 | ||

| Other comprehensive income (Note 7) | 16 | 16 | 16 | |||

| Distributions to noncontrolling interest (Note 27) | (10) | (10) | ||||

| Dividends on common shares (Note 24) | (620) | (620) | (620) | |||

| Ending balance at Dec. 31, 2021 | 11,240 | 11,172 | 2,957 | 8,229 | (14) | 68 |

| Increase (Decrease) in Stockholders' Equity [Roll Forward] | ||||||

| Net income (loss) | 1,063 | 1,057 | 1,057 | 6 | ||

| Other comprehensive income (Note 7) | 19 | 19 | 19 | |||

| Distributions to noncontrolling interest (Note 27) | (8) | (8) | ||||

| Dividends on common shares (Note 24) | (652) | (652) | 652 | |||

| Ending balance at Dec. 31, 2022 | $ 11,662 | $ 11,596 | $ 2,957 | $ 8,634 | $ 5 | $ 66 |

Description of the Business |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Organization, Consolidation and Presentation of Financial Statements [Abstract] | |

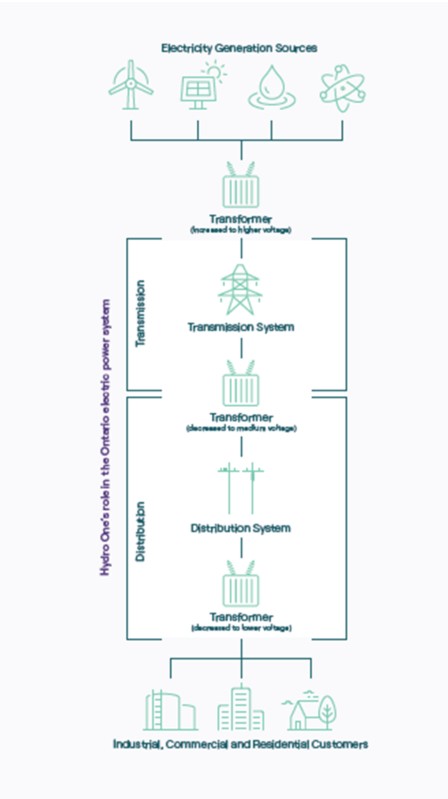

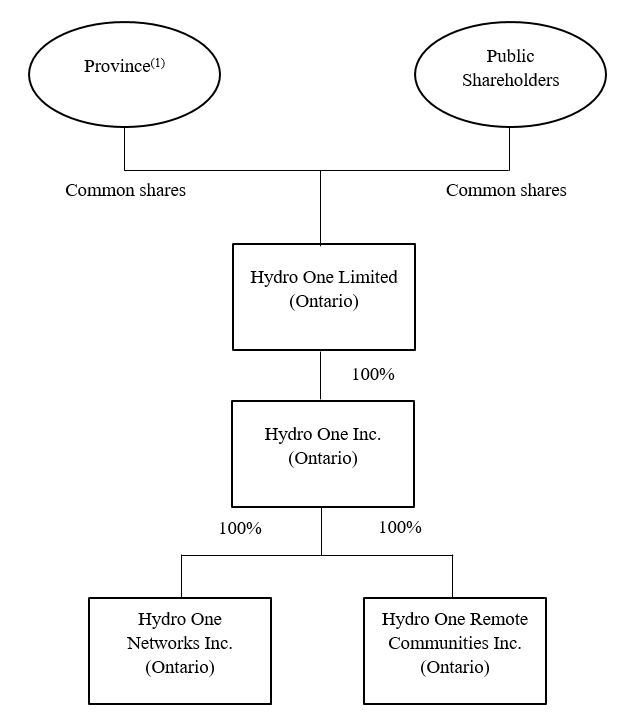

| Description of the Business | DESCRIPTION OF THE BUSINESS Hydro One Inc. (Hydro One or the Company) was incorporated on December 1, 1998, under the Business Corporations Act (Ontario) and is wholly-owned by Hydro One Limited. The principal businesses of Hydro One are the transmission and distribution of electricity to customers within Ontario. Rate Setting The Company's transmission business consists of the transmission system operated by its subsidiaries, which include Hydro One Networks Inc. (Hydro One Networks) and Hydro One Sault Ste. Marie LP (HOSSM), as well as an approximately 66% interest in B2M Limited Partnership (B2M LP), and an approximately 55% interest in Niagara Reinforcement Limited Partnership (NRLP). Hydro One’s distribution business consists of the distribution systems operated by its subsidiaries, Hydro One Networks, and Hydro One Remote Communities Inc. (Hydro One Remotes). Transmission On March 7, 2019, the Ontario Energy Board (OEB) issued its reconsideration decision (DTA Decision) with respect to Hydro One's rate-setting treatment of the benefits of the deferred tax asset (DTA) resulting from the transition from the payments in lieu of tax regime to tax payments under the federal and provincial tax regimes. On July 16, 2020, the Ontario Divisional Court rendered its decision (ODC Decision) on the Company's appeal of the OEB's DTA Decision. On April 8, 2021, the OEB rendered its decision and order (DTA Implementation Decision) regarding the recovery of the DTA amounts allocated to ratepayers for the 2017 to 2022 period. See Note 12 - Regulatory Assets and Liabilities for additional details. On April 23, 2020, the OEB rendered its decision on Hydro One Networks' 2020-2022 transmission rate application (2020-2022 Transmission Decision). On July 16, 2020, the OEB issued its final rate order for the 2020-2022 transmission rates approving a revenue requirement of $1,630 million, $1,701 million and $1,772 million for 2020, 2021 and 2022, respectively. On July 30, 2020, the OEB issued its decision for Uniform Transmission Rates (UTRs). The 2020 UTRs that were put in place on an interim basis on January 1, 2020 continued for the remainder of 2020 in light of the COVID-19 pandemic. On December 17, 2020, the OEB issued its decision and order setting the final 2021 UTRs effective January 1, 2021, which included the approval of a -year disposition period for Hydro One Network's 2020 foregone revenue including interest, beginning on January 1, 2021. On July 31, 2019, B2M LP filed a transmission rate application for 2020-2024. On January 16, 2020, the OEB approved the 2020 base revenue requirement of $33 million, and a revenue cap escalator index for 2021 to 2024. On October 25, 2019, NRLP filed its revenue cap incentive rate application for 2020-2024. On December 19, 2019, the OEB approved NRLP’s proposed 2020 revenue requirement of $9 million on an interim basis effective January 1, 2020. On April 9, 2020, final OEB approval was received. HOSSM is under a 10-year deferred rebasing period for years 2017-2026, as approved in the OEB Mergers Acquisitions Amalgamations and Divestitures (MAAD) decision dated October 13, 2016. On August 5, 2021 Hydro One Networks filed a custom joint rate application (JRAP) for 2023-2027 transmission and distribution rates. On November 29, 2022 the OEB approved the application and issued its rate order for 2023-2027 transmission rates approving revenue requirement for Hydro One Networks' Transmission Business of $1,952 million for 2023, $2,073 million for 2024, $2,168 million for 2025, $2,277 million for 2026 and $2,362 million for 2027. Distribution In March 2017, Hydro One Networks filed an application with the OEB for 2018-2022 distribution rates. On March 7, 2019, the OEB rendered its decision on the distribution rates application. In accordance with the OEB decision, the Company filed its draft rate order reflecting updated revenue requirements of $1,459 million for 2018, $1,498 million for 2019, $1,532 million for 2020, $1,578 million for 2021, and $1,624 million for 2022. On June 11, 2019, the OEB approved the rate order confirming these updated revenue requirements. On August 28, 2017, Hydro One Remotes filed a distribution rate application for 2018-2022. On April 12, 2018 the OEB approved Hydro One Remotes' 2018 revenue requirement of $54 million effective May 1, 2018, with a price cap escalator index for 2019-2022. On November 3, 2020, Hydro One Remote Communities filed an application with the OEB seeking approval for a 2% increase to 2020 base rates, effective May 1, 2021, which was subsequently updated to 2.2% in accordance with the OEB’s 2021 inflation parameters for electricity distributors issued on November 9, 2020. On March 25, 2021, the OEB approved Hydro One Remote Communities’ application for rates and other charges to be effective May 1, 2021. On November 3, 2021, Hydro One Remotes filed an application with the OEB seeking approval for a 2.2% increase to 2021 base rates, effective May 1, 2022. The application was subsequently updated to request a 3.3% increase to 2021 base rates to reflect the OEB’s annually updated inflation parameters for electricity distributors for 2022. On March 24, 2022, the OEB approved the application for rates and other charges which became effective on May 1, 2022. On August 5, 2021 Hydro One Networks filed a JRAP for 2023-2027 transmission and distribution rates. On November 29, 2022, as part of the approval of the JRAP application, the OEB issued its rate order for 2023-2027 distribution rates approving revenue requirement for Hydro One Networks' Distribution Business of $1,727 million for 2023, $1,813 million for 2024, $1,886 million for 2025, $1,985 million for 2026 and $2,071 million for 2027.

|

Significant Accounting Policies |

12 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||