ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| State or other jurisdiction of incorporation or organization | I.R.S. Employer Identification No. | ||||

| Address of principal executive offices | Zip Code | ||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

Large accelerated filer | o | ☑ | |||||||||

Non-accelerated filer | o | Smaller reporting company | |||||||||

Emerging growth company | |||||||||||

| Page | ||||||||

| Period | Total number of Shares Purchased(1) | Average Price Paid per Share(2) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares That May Yet Be Purchased Under the Plans or Programs (in thousands) | ||||||||||||||||||||||

October 1, 2022 through October 31, 2022 | 665,397 | $ | 19.57 | 665,397 | $ | 73,275 | ||||||||||||||||||||

November 1, 2022 through November 30, 2022 | 245,623 | $ | 17.27 | 245,623 | $ | 69,033 | ||||||||||||||||||||

| December 1, 2022 through December 31, 2022 | — | — | — | $ | — | |||||||||||||||||||||

| Total | 911,020 | 911,020 | ||||||||||||||||||||||||

| (1) | On September 7, 2022, our board of directors authorized the commencement of a share repurchase program, which authorizes us to purchase up to $100.0 million of shares of our Class A common stock from time to time through open market purchases, in privately negotiated transactions or by other means, including through the use of trading plans intended to qualify under Rule 10b5-1 under the Exchange Act. Open market repurchases are expected to be structured to occur within the pricing volume requirements of Rule 10b-18. The timing and total amount of stock repurchases will depend upon, business, economic and market conditions, corporate and regulatory requirements, prevailing stock prices, restrictions under the terms of our loan agreements and other relevant considerations. The repurchase program terminates on December 31, 2024, and may be modified, suspended or discontinued at any time at our discretion. The program does not obligate the Company to acquire any amount of Class A common stock. | ||||

| (2) | Average price paid per share includes costs associated with the repurchases. | ||||

| Year ended December 31, | Period over Period Change | ||||||||||||||||||||||

| (in thousands) | 2022 | 2021 | ($) | (%) | |||||||||||||||||||

| Service revenue | $ | 960,489 | $ | 760,703 | $ | 199,786 | 26.3 | % | |||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Cost of services | 558,761 | 431,736 | 127,025 | 29.4 | % | ||||||||||||||||||

| Selling, general, and administrative expense | 260,003 | 335,312 | (75,309) | (22.5) | % | ||||||||||||||||||

| Depreciation | 37,915 | 29,038 | 8,877 | 30.6 | % | ||||||||||||||||||

| Amortization of intangible assets | 19,882 | 18,847 | 1,035 | 5.5 | % | ||||||||||||||||||

| Loss on disposal of assets | 31 | 52 | (21) | (40.4) | % | ||||||||||||||||||

| Total operating expenses | 876,592 | 814,985 | 61,607 | 7.6 | % | ||||||||||||||||||

| Operating income (loss) | 83,897 | (54,282) | 138,179 | NM | |||||||||||||||||||

| Other expense | 7,443 | 177 | 7,266 | NM | |||||||||||||||||||

| Financing expenses | 11,921 | 6,504 | 5,417 | 83.3 | % | ||||||||||||||||||

| Income (loss) before income taxes | 64,533 | (60,963) | 125,496 | NM | |||||||||||||||||||

| Provision for (benefit from) income taxes | 24,111 | (2,265) | 26,376 | NM | |||||||||||||||||||

| Net income (loss) | $ | 40,422 | $ | (58,698) | $ | 99,120 | NM | ||||||||||||||||

| Year ended December 31, | Period over Period Change | ||||||||||||||||||||||

| (in thousands) | 2022 | 2021 | ($) | (%) | |||||||||||||||||||

Digital Customer Experience | $ | 637,587 | $ | 486,679 | $ | 150,908 | 31.0 | % | |||||||||||||||

Trust and Safety | 178,409 | 169,080 | 9,329 | 5.5 | % | ||||||||||||||||||

AI Services | 144,493 | 104,944 | 39,549 | 37.7 | % | ||||||||||||||||||

Service revenue | $ | 960,489 | $ | 760,703 | $ | 199,786 | 26.3 | % | |||||||||||||||

| Year ended December 31, | Period over Period Change | ||||||||||||||||||||||

| (in thousands) | 2022 | 2021 | ($) | (%) | |||||||||||||||||||

Philippines | $ | 504,361 | $ | 402,340 | $ | 102,021 | 25.4 | % | |||||||||||||||

United States | 252,457 | 246,642 | 5,815 | 2.4 | % | ||||||||||||||||||

| India | 102,561 | 56,216 | 46,345 | 82.4 | % | ||||||||||||||||||

Rest of World | 101,110 | 55,505 | 45,605 | 82.2 | % | ||||||||||||||||||

Service revenue | $ | 960,489 | $ | 760,703 | $ | 199,786 | 26.3 | % | |||||||||||||||

| Year ended December 31, | Period over Period Change | ||||||||||||||||||||||

| (in thousands) | 2021 | 2020 | ($) | (%) | |||||||||||||||||||

Philippines | $ | 402,340 | $ | 267,687 | $ | 134,653 | 50.3 | % | |||||||||||||||

United States | 246,642 | 171,476 | 75,166 | 43.8 | % | ||||||||||||||||||

| India | 56,216 | 16,069 | 40,147 | 249.8 | % | ||||||||||||||||||

Rest of World | 55,505 | 22,814 | 32,691 | 143.3 | % | ||||||||||||||||||

Service revenue | $ | 760,703 | $ | 478,046 | $ | 282,657 | 59.1 | % | |||||||||||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

Top ten clients | 58 | % | 62 | % | |||||||

Top twenty clients | 72 | % | 76 | % | |||||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

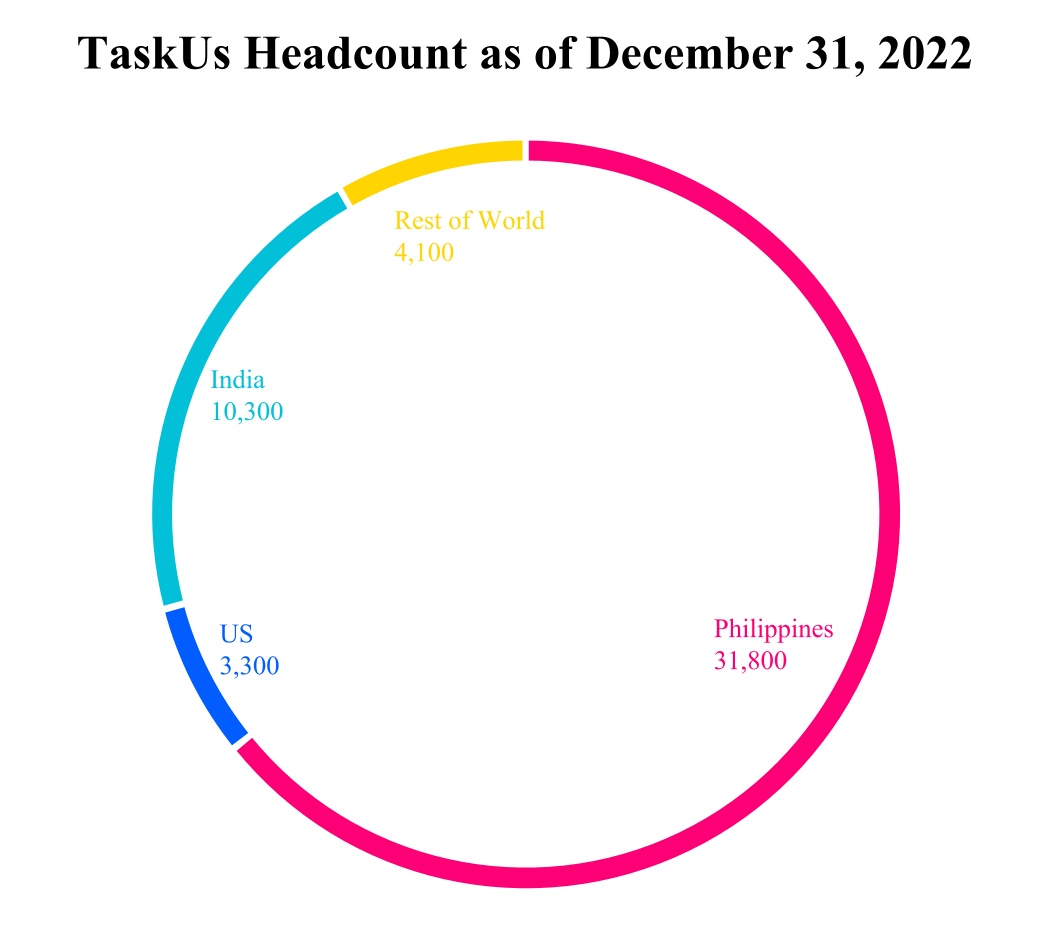

Headcount (approx. at period end)(1) | 49,500 | 40,100 | |||||||||

Net revenue retention rate(2) | 114 | % | 141 | % | |||||||

| Year ended December 31, | Period over Period Change | ||||||||||||||||||||||

| (in thousands, except %) | 2022 | 2021 | ($) | (%) | |||||||||||||||||||

Net Income (loss) | $ | 40,422 | $ | (58,698) | $ | 99,120 | NM | ||||||||||||||||

Amortization of intangible assets | 19,882 | 18,847 | 1,035 | 5.5 | % | ||||||||||||||||||

Transaction costs(1) | 953 | 6,969 | (6,016) | (86.3) | % | ||||||||||||||||||

Earn-out consideration(2) | 9,729 | — | 9,729 | 100.0 | % | ||||||||||||||||||

Foreign currency losses(3) | 7,967 | 809 | 7,158 | NM | |||||||||||||||||||

Loss on disposal of assets | 31 | 52 | (21) | (40.4) | % | ||||||||||||||||||

COVID-19 related expenses(4) | — | 6,105 | (6,105) | (100.0) | % | ||||||||||||||||||

Severance costs(5) | 821 | — | 821 | 100.0 | % | ||||||||||||||||||

Natural disaster costs(6) | — | 442 | (442) | (100.0) | % | ||||||||||||||||||

Phantom shares bonus(7) | — | 129,362 | (129,362) | (100.0) | % | ||||||||||||||||||

Teammate IPO bonus(8) | — | 4,361 | (4,361) | (100.0) | % | ||||||||||||||||||

Stock-based compensation expense(9) | 69,452 | 46,384 | 23,068 | 49.7 | % | ||||||||||||||||||

Tax impacts of adjustments(10) | (6,442) | (25,244) | 18,802 | (74.5) | % | ||||||||||||||||||

| Adjusted Net Income | $ | 142,815 | $ | 129,389 | $ | 13,426 | 10.4 | % | |||||||||||||||

Net Income (loss) Margin(11) | 4.2 | % | (7.7) | % | |||||||||||||||||||

Adjusted Net Income Margin(11) | 14.9 | % | 17.0 | % | |||||||||||||||||||

| (1) | Represents non-recurring professional service fees primarily related to the acquisition of heloo in 2022 and the preparation for public offerings that have been expensed during the period in 2021. | ||||

| (2) | Represents earn-out consideration recognized as compensation expense related to the acquisition of heloo. | ||||

| (3) | Realized and unrealized foreign currency losses (gains) include the effect of fair market value changes of forward contracts and remeasurement of U.S. dollar-denominated accounts to foreign currency. | ||||

| (4) | Represents incremental expenses incurred that are directly attributable to the COVID-19 pandemic. | ||||

| (5) | Represents severance payments as a result of certain cost optimization measures we undertook during the period to restructure support roles. | ||||

| (6) | Represents one-time costs associated with emergency housing, transportation costs and bonuses for our employees in connection with the natural disaster related to the severe winter storm in Texas in February 2021. | ||||

| (7) | Represents expense for one-time, non-recurring payments of $127.5 million to vested phantom shareholders in connection with the completion of the IPO, as well as associated payroll tax and 401(k) contributions. | ||||

| (8) | Represents expense for non-recurring bonus payments to certain employees in connection with the completion of the IPO. | ||||

| (9) | Represents stock-based compensation expense associated with equity-classified awards, as well as associated payroll tax. | ||||

| (10) | Represents tax impacts of adjustments to net income (loss) which resulted in a tax benefit during the period, including phantom shares bonus related to the IPO, and stock-based compensation expense and earn-out consideration after the IPO. | ||||

| (11) | Net Income (Loss) Margin represents net income (loss) divided by service revenue and Adjusted Net Income Margin represents Adjusted Net Income divided by service revenue. | ||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| GAAP diluted EPS | $ | 0.39 | $ | (0.62) | |||||||

Per share adjustments to net income (loss)(1) | 1.00 | 1.98 | |||||||||

Per share adjustments for GAAP anti-dilutive shares(2) | — | (0.10) | |||||||||

| Adjusted EPS | $ | 1.39 | $ | 1.26 | |||||||

| Weighted-average common stock outstanding – diluted | 102,603,179 | 94,832,137 | |||||||||

GAAP anti-dilutive shares(2) | — | 7,476,384 | |||||||||

| Adjusted weighted-average shares outstanding | 102,603,179 | 102,308,521 | |||||||||

| (1) | Reflects the aggregate adjustments made to reconcile net income (loss) to Adjusted Net Income, as noted in the above table, divided by the GAAP diluted weighted-average number of shares outstanding for the relevant period. | ||||

| (2) | Reflects the impact of awards that were anti-dilutive to GAAP diluted EPS since we were in a net loss position, and therefore not included in the calculation, but would be dilutive to Adjusted EPS and are therefore included in the calculation. | ||||

| Year ended December 31, | Period over Period Change | ||||||||||||||||||||||

| (in thousands, except %) | 2022 | 2021 | ($) | (%) | |||||||||||||||||||

Net Income (loss) | $ | 40,422 | $ | (58,698) | 99,120 | NM | |||||||||||||||||

| Provision for (benefit from) income taxes | 24,111 | (2,265) | 26,376 | NM | |||||||||||||||||||

| Financing expenses | 11,921 | 6,504 | 5,417 | 83.3 | % | ||||||||||||||||||

| Depreciation | 37,915 | 29,038 | 8,877 | 30.6 | % | ||||||||||||||||||

| Amortization of intangible assets | 19,882 | 18,847 | 1,035 | 5.5 | % | ||||||||||||||||||

| EBITDA | 134,251 | (6,574) | 140,825 | NM | |||||||||||||||||||

Transaction costs(1) | 953 | 6,969 | (6,016) | (86.3) | % | ||||||||||||||||||

Earn-out consideration(2) | 9,729 | — | 9,729 | 100.0 | % | ||||||||||||||||||

Foreign currency losses(3) | 7,967 | 809 | 7,158 | NM | |||||||||||||||||||

| Loss on disposals of assets | 31 | 52 | (21) | (40.4) | % | ||||||||||||||||||

COVID-19 related expenses(4) | — | 6,105 | (6,105) | (100.0) | % | ||||||||||||||||||

Severance costs(5) | 821 | — | 821 | 100.0 | % | ||||||||||||||||||

Natural disaster costs(6) | — | 442 | (442) | (100.0) | % | ||||||||||||||||||

Phantom shares bonus(7) | — | 129,362 | (129,362) | (100.0) | % | ||||||||||||||||||

Teammate IPO bonus(8) | — | 4,361 | (4,361) | (100.0) | % | ||||||||||||||||||

Stock-based compensation expense(9) | 69,452 | 46,384 | 23,068 | 49.7 | % | ||||||||||||||||||

| Adjusted EBITDA | $ | 223,204 | $ | 187,910 | $ | 35,294 | 18.8 | % | |||||||||||||||

Net Income Margin(10) | 4.2 | % | (7.7) | % | |||||||||||||||||||

Adjusted EBITDA Margin(10) | 23.2 | % | 24.7 | % | |||||||||||||||||||

| (1) | Represents non-recurring professional service fees primarily related to the acquisition of heloo in 2022 and the preparation for public offerings that have been expensed during the period in 2021. | ||||

| (2) | Represents earn-out consideration recognized as compensation expense related to the acquisition of heloo. | ||||

| (3) | Realized and unrealized foreign currency losses (gains) include the effect of fair market value changes of forward contracts and remeasurement of U.S. dollar-denominated accounts to foreign currency. | ||||

| (4) | Represents incremental expenses incurred that are directly attributable to the COVID-19 pandemic. | ||||

| (5) | Represents severance payments as a result of certain cost optimization measures we undertook during the period to restructure support roles. | ||||

| (6) | Represents one-time costs associated with emergency housing, transportation costs and bonuses for our employees in connection with the natural disaster related to the severe winter storm in Texas in February 2021. | ||||

| (7) | Represents expense for one-time, non-recurring payments of $127.5 million to vested phantom shareholders in connection with the completion of the IPO, as well as associated payroll tax and 401(k) contributions. | ||||

| (8) | Represents expense for non-recurring bonus payments to certain employees in connection with the completion of the IPO. | ||||

| (9) | Represents stock-based compensation expense associated with equity-classified awards, as well as associated payroll tax. | ||||

| (10) | Net Income (Loss) Margin represents net income (loss) divided by service revenue and Adjusted EBITDA Margin represents Adjusted EBITDA divided by service revenue. | ||||

| Year ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net cash provided by (used in) operating activities | $ | 147,095 | $ | (32,674) | |||||||

| Purchase of property and equipment | (43,758) | (59,363) | |||||||||

| Free Cash Flow | $ | 103,337 | $ | (92,037) | |||||||

Conversion of Adjusted EBITDA(1) | 46.3 | % | (49.0) | % | |||||||

| (1) | Conversion of Adjusted EBITDA represents Free Cash Flow divided by Adjusted EBITDA. | ||||

| Year ended December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Net cash provided by (used in) operating activities | $ | 147,095 | $ | (32,674) | |||||||

| Net cash used in investing activities | (67,993) | (59,363) | |||||||||

| Net cash provided by (used in) financing activities | (4,035) | 54,390 | |||||||||

| Payments Due by Period | |||||||||||||||||

| (in thousands) | Total | Current | Noncurrent | ||||||||||||||

Long-term debt obligations | $ | 269,325 | $ | 3,712 | $ | 265,613 | |||||||||||

Operating lease obligations | 49,560 | 13,528 | 36,032 | ||||||||||||||

Technology solution obligations | 37,954 | 17,042 | 20,912 | ||||||||||||||

Total | $ | 356,839 | $ | 34,282 | $ | 322,557 | |||||||||||

| Page(s) | |||||

Report of Independent Registered Public Accounting Firm ( | |||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| Assets | |||||||||||

Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

Accounts receivable, net of allowance for doubtful accounts of $ | |||||||||||

Other receivables | |||||||||||

Prepaid expenses | |||||||||||

Income tax receivable | |||||||||||

Other current assets | |||||||||||

Total current assets | |||||||||||

Noncurrent assets: | |||||||||||

Property and equipment, net | |||||||||||

| Operating lease right-of-use assets | |||||||||||

Deferred tax assets | |||||||||||

Intangibles | |||||||||||

Goodwill | |||||||||||

Other noncurrent assets | |||||||||||

Total noncurrent assets | |||||||||||

Total assets | $ | $ | |||||||||

| Liabilities and Shareholders’ Equity | |||||||||||

Liabilities: | |||||||||||

Current liabilities: | |||||||||||

Accounts payable and accrued liabilities | $ | $ | |||||||||

Accrued payroll and employee-related liabilities | |||||||||||

Current portion of debt | |||||||||||

| Current portion of operating lease liabilities | |||||||||||

| Current portion of income tax payable | |||||||||||

Deferred revenue | |||||||||||

Deferred rent | |||||||||||

Total current liabilities | |||||||||||

Noncurrent liabilities: | |||||||||||

Income tax payable | |||||||||||

Long-term debt | |||||||||||

| Operating lease liabilities | |||||||||||

Deferred rent | |||||||||||

Accrued payroll and employee-related liabilities | |||||||||||

Deferred tax liabilities | |||||||||||

| Other noncurrent liabilities | |||||||||||

Total noncurrent liabilities | |||||||||||

Total liabilities | |||||||||||

Commitments and Contingencies (See Note 10) | |||||||||||

Shareholders’ equity: | |||||||||||

Class A common stock, $ | |||||||||||

Class B convertible common stock, $ | |||||||||||

Additional paid-in capital | |||||||||||

Accumulated deficit | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

Treasury stock, at cost with | ( | ||||||||||

Total shareholders’ equity | |||||||||||

Total liabilities and shareholders’ equity | $ | $ | |||||||||

| Year ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| $ | $ | $ | |||||||||||||||

| Operating expenses: | |||||||||||||||||

| Cost of services | |||||||||||||||||

| Selling, general, and administrative expense | |||||||||||||||||

| Depreciation | |||||||||||||||||

| Amortization of intangible assets | |||||||||||||||||

| Loss on disposal of assets | |||||||||||||||||

| Contingent consideration | |||||||||||||||||

| Total operating expenses | |||||||||||||||||

| Operating income (loss) | ( | ||||||||||||||||

| Other expense (income) | ( | ||||||||||||||||

| Financing expenses | |||||||||||||||||

| Income (loss) before income taxes | ( | ||||||||||||||||

| Provision for (benefit from) income taxes | ( | ||||||||||||||||

| Net income (loss) | $ | $ | ( | $ | |||||||||||||

| Net income (loss) per common share: | |||||||||||||||||

| Basic | $ | $ | ( | $ | |||||||||||||

| Diluted | $ | $ | ( | $ | |||||||||||||

| Weighted-average number of common shares outstanding: | |||||||||||||||||

| Basic | |||||||||||||||||

| Diluted | |||||||||||||||||

| Year ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Net income (loss) | $ | $ | ( | $ | |||||||||||||

Retirement benefit reserves | ( | ( | |||||||||||||||

Foreign currency translation adjustments | ( | ( | |||||||||||||||

| Comprehensive income (loss) | $ | $ | ( | $ | |||||||||||||

| Capital stock and additional paid-in capital | Accumulated deficit | Accumulated other comprehensive income (loss) | Total shareholders’ equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class A common stock | Class B convertible common stock | Additional paid-in capital | Treasury stock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance as of December 31, 2019 | $ | $ | $ | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

Balance as of December 31, 2020 | $ | $ | $ | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock in the initial public offering, net of offering costs | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conversion of common stock | ( | ( | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for settlement of equity awards | — | — | ( | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares withheld related to net share settlement | ( | ( | — | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

Distribution of dividends ($ | — | — | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Balance as of December 31, 2021 | $ | $ | $ | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for settlement of equity awards | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares withheld related to net share settlement | ( | ( | — | — | ( | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued in acquisition of heloo | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase of treasury stock | — | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Balance as of December 31, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

Cash flows from operating activities: | |||||||||||||||||

| Net income (loss) | $ | $ | ( | $ | |||||||||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||||||||

Depreciation | |||||||||||||||||

Amortization of intangibles | |||||||||||||||||

Amortization of debt financing fees | |||||||||||||||||

| Loss on disposal of assets | |||||||||||||||||

Provision for losses on accounts receivable | |||||||||||||||||

| Unrealized foreign exchange losses (gains) on forward contracts | ( | ||||||||||||||||

Deferred taxes | ( | ( | ( | ||||||||||||||

| Stock-based compensation expense | |||||||||||||||||

Changes in operating assets and liabilities: | |||||||||||||||||

Accounts receivable | ( | ( | ( | ||||||||||||||

Other receivables, prepaid expenses, and other current assets | ( | ( | ( | ||||||||||||||

| Operating lease right-of-use assets | |||||||||||||||||

Other noncurrent assets | ( | ( | ( | ||||||||||||||

Accounts payable and accrued liabilities | |||||||||||||||||

Accrued payroll and employee-related liabilities | |||||||||||||||||

Operating lease liabilities and deferred rent | ( | ( | |||||||||||||||

Income tax payable | |||||||||||||||||

Deferred revenue | ( | ||||||||||||||||

| Other noncurrent liabilities | ( | ||||||||||||||||

| Net cash provided by (used in) operating activities | ( | ||||||||||||||||

Cash flows from investing activities: | |||||||||||||||||

Purchase of property and equipment | ( | ( | ( | ||||||||||||||

| Acquisition, net of cash acquired | ( | ||||||||||||||||

| Investment in loan receivable | ( | ||||||||||||||||

| Net cash used in investing activities | ( | ( | ( | ||||||||||||||

Cash flows from financing activities: | |||||||||||||||||

Proceeds from borrowings, Revolving credit facility | |||||||||||||||||

| Proceeds from long-term debt | |||||||||||||||||

Payments on long-term debt | ( | ( | ( | ||||||||||||||

| Payments for debt financing fees | ( | ( | |||||||||||||||

| Proceeds from issuance of common stock, net of underwriters’ fees | |||||||||||||||||

| Proceeds from employee stock plans | |||||||||||||||||

| Payments for offering costs | ( | ||||||||||||||||

| Payments for taxes related to net share settlement | ( | ( | |||||||||||||||

| Payments for treasury stock purchases | ( | ||||||||||||||||

Distribution of dividends | ( | ||||||||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||||||||

| Increase (decrease) in cash and cash equivalents | ( | ||||||||||||||||

Effect of exchange rate changes on cash | ( | ( | |||||||||||||||

Cash and cash equivalents at beginning of period | |||||||||||||||||

Cash and cash equivalents at end of period | $ | $ | $ | ||||||||||||||

Supplemental cash flow information: | |||||||||||||||||

| Cash paid for interest | $ | $ | $ | ||||||||||||||

Cash paid for taxes, net of refunds | $ | $ | $ | ||||||||||||||

Noncash operating, investing and financing activities: | |||||||||||||||||

Accrued capital expenditures | $ | $ | $ | ||||||||||||||

Noncash reclass for customer-billed equipment | $ | $ | $ | ||||||||||||||

| Service revenue percentage | ||||||||||||||||||||

| Year ended December 31, | ||||||||||||||||||||

| Customer | 2022 | 2021 | 2020 | |||||||||||||||||

A | % | % | % | |||||||||||||||||

B | Less than 10% | % | % | |||||||||||||||||

| Accounts receivable percentage | ||||||||||||||

| Customer | December 31, 2022 | December 31, 2021 | ||||||||||||

A | % | % | ||||||||||||

B | % | % | ||||||||||||

| (in thousands) | ||||||||

Cash consideration(1) | $ | |||||||

Holdback cash consideration(2) | ||||||||

Equity consideration(3) | ||||||||

| Total consideration | $ | |||||||

| (1) | Represents cash consideration paid to the sellers to complete the acquisition. | ||||

| (2) | Represents consideration, which was retained by the Company as security to satisfy sellers' obligations for potential future contractual claims arising under the terms of the purchase agreement; provided that the amount of the holdback shall not serve as any limitation on the indemnification obligations of the sellers under the purchase agreement. The holdback is payable to the sellers, net of any such claims, | ||||

| (3) | Comprised of | ||||

| (in thousands) | Preliminary | Measurement Period Adjustments | Final | |||||||||||||||||

| Cash and cash equivalents | $ | $ | — | $ | ||||||||||||||||

| Intangibles | — | |||||||||||||||||||

| Goodwill | ||||||||||||||||||||

| Other assets acquired | ( | |||||||||||||||||||

| Total assets | $ | $ | $ | |||||||||||||||||

| Total liabilities assumed | $ | $ | — | $ | ||||||||||||||||

| Net assets acquired | $ | $ | $ | |||||||||||||||||

| (in thousands, except useful lives) | Estimated Fair Value | Estimated Useful Life in Years | ||||||||||||

| Customer relationships | $ | |||||||||||||

| Trade name | ||||||||||||||

| Total | $ | |||||||||||||

| Year ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

Digital Customer Experience | $ | $ | $ | ||||||||||||||

Trust and Safety | |||||||||||||||||

AI Services | |||||||||||||||||

Service revenue | $ | $ | $ | ||||||||||||||

| Year ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

Philippines | $ | $ | $ | ||||||||||||||

United States | |||||||||||||||||

| India | |||||||||||||||||

Rest of World | |||||||||||||||||

| Service revenue | $ | $ | $ | ||||||||||||||

| Year ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Balance, beginning of year | $ | $ | $ | ||||||||||||||

| Provision for credit losses | |||||||||||||||||

| Uncollectible receivables written-off | ( | ( | ( | ||||||||||||||

| Balance, end of year | $ | $ | $ | ||||||||||||||

| Year ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Total notional amount of settled forward contracts | $ | $ | $ | ||||||||||||||

| Realized losses (gains) from settlement of forward contracts | $ | $ | $ | ( | |||||||||||||

| Total notional amount of outstanding forward contracts | $ | $ | $ | ||||||||||||||

| Unrealized foreign exchange losses (gains) on forward contracts | $ | ( | $ | $ | |||||||||||||

December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

| Fair value measurements using | Total Gross Fair Value | Effect of Counter-party Netting | Net Amounts on Balance Sheet | Effect of Master Netting Arrangements | Net Amounts | ||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Level 1 inputs | Level 2 inputs | Level 3 inputs | ||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||

| Money market funds | $ | $ | $ | $ | $ | — | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||

Forward contract receivable | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||

Forward contract payable | $ | $ | $ | $ | $ | ( | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||||

| December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||

| Fair value measurements using | Total Gross Fair Value | Effect of Counter-party Netting | Net Amounts on Balance Sheet | Effect of Master Netting Arrangements | Net Amounts | ||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Level 1 inputs | Level 2 inputs | Level 3 inputs | ||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||

Forward contract payable | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| (in thousands) | December 31, 2022 | December 31, 2021 | |||||||||

Leasehold improvements | $ | $ | |||||||||

Technology and computers | |||||||||||

Furniture and fixtures | |||||||||||

Construction in process | |||||||||||

Other property and equipment | |||||||||||

Property and equipment, gross | |||||||||||

Accumulated depreciation | ( | ( | |||||||||

Property and equipment, net | $ | $ | |||||||||

| (in thousands) | December 31, 2022 | December 31, 2021 | |||||||||

Philippines | $ | $ | |||||||||

United States | |||||||||||

| India | |||||||||||

Rest of World | |||||||||||

Property and equipment, net | $ | $ | |||||||||

| (in thousands) | |||||

Balance as of December 31, 2020 | $ | ||||

Balance as of December 31, 2021 | |||||

| Acquisition of heloo | |||||

| Foreign currency translation | ( | ||||

Balance as of December 31, 2022 | $ | ||||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Weighted-Average Years Remaining | Intangibles, Gross | Accumulated Amortization | Intangibles, Net | Intangibles, Gross | Accumulated Amortization | Intangibles, Net | ||||||||||||||||||||||||||||||||||

| Customer relationships | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||

| Trade name | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Other intangibles | ( | ||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||

| (in thousands) | |||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

Thereafter | |||||

Total | $ | ||||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||

| (in thousands) | Current | Noncurrent | Total | Current | Noncurrent | Total | |||||||||||||||||||||||||||||

Term Loan | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

Revolver | |||||||||||||||||||||||||||||||||||

Less: Debt financing fees | ( | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||||

Total | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| (in thousands) | |||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

Total | $ | ||||

| December 31, 2022 | ||||||||

| Weighted average remaining lease term | ||||||||

| Weighted average discount rate | % | |||||||

| (in thousands) | Year Ended December 31, 2022 | |||||||

| Cash paid for amounts included in the measurement of operating lease liabilities | ||||||||

| ROU assets obtained in exchange for operating lease liabilities | ||||||||

| (in thousands) | ||||||||

| 2023 | $ | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| Thereafter | ||||||||

| Total lease payments | ||||||||

| Less: interest | ( | |||||||

| Total lease liabilities | $ | |||||||

| (in thousands) | |||||

| 2022 | $ | ||||

| 2023 | |||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

Thereafter | |||||

Total | $ | ||||

| Number of options | Weighted-average exercise price | Weighted-average remaining contractual term (years) | Aggregate intrinsic value (in thousands) | ||||||||||||||||||||

Outstanding at January 1, 2022 | $ | $ | |||||||||||||||||||||

Granted | $ | ||||||||||||||||||||||

| Exercised | ( | $ | |||||||||||||||||||||

Forfeited, cancelled or expired | ( | $ | |||||||||||||||||||||

Outstanding at December 31, 2022 | $ | $ | |||||||||||||||||||||

Vested and exercisable at December 31, 2022 | $ | $ | |||||||||||||||||||||

Vested and exercisable at December 31, 2022 and expected to vest thereafter | $ | $ | |||||||||||||||||||||

| Year ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Dividend yield (%) | % | % | % | ||||||||||||||

| Expected volatility (%) | % | ||||||||||||||||

| Risk-free interest rate (%) | |||||||||||||||||

| Expected term (years) | |||||||||||||||||

| Number of RSUs | Weighted-average grant date fair value | ||||||||||

Outstanding at January 1, 2022 | $ | ||||||||||

Granted | $ | ||||||||||

| Released | ( | $ | |||||||||

Cancelled | ( | $ | |||||||||

Unvested and Outstanding at December 31, 2022 | $ | ||||||||||

| Dividend yield (%) | % | ||||

| Expected volatility (%) | % | ||||

| Risk-free interest rate (%) | |||||

| Year ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Cost of services | $ | $ | $ | ||||||||||||||

| Selling, general, and administrative expense | |||||||||||||||||

| Total | $ | $ | $ | ||||||||||||||

| Year ended December 31, | |||||||||||||||||

(in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| United States | $ | $ | ( | $ | |||||||||||||

Foreign | |||||||||||||||||

| Income (loss) before income taxes | $ | $ | ( | $ | |||||||||||||

| Year ended December 31, | |||||||||||||||||

(in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

Current: | |||||||||||||||||

Federal | $ | $ | $ | ||||||||||||||

State | |||||||||||||||||

Foreign | |||||||||||||||||

| Total current tax expense | |||||||||||||||||

Deferred: | |||||||||||||||||

Federal | ( | ( | ( | ||||||||||||||

State | ( | ( | ( | ||||||||||||||

Foreign | ( | ( | ( | ||||||||||||||

| Total deferred tax expense (benefit) | ( | ( | ( | ||||||||||||||

| Total provision for (benefit from) income taxes | $ | $ | ( | $ | |||||||||||||

| (in thousands) | December 31, 2022 | December 31, 2021 | |||||||||

Deferred Tax Assets | |||||||||||

Accruals | $ | $ | |||||||||

Allowances and reserves | |||||||||||

| Deferred rent | |||||||||||

Intercompany payable | |||||||||||

Foreign Tax Credit | |||||||||||

State taxes | |||||||||||

| Stock-based compensation expense | |||||||||||

Deferred revenue | |||||||||||

Fixed assets | |||||||||||

Unrealized foreign exchange gain/loss | |||||||||||

| Section 163(j) interest limitation | |||||||||||

| Operating lease liabilities | |||||||||||

Other | |||||||||||

Total deferred tax assets | $ | $ | |||||||||

Deferred Tax Liabilities | |||||||||||

Intangibles | ( | ( | |||||||||

| Operating lease right-of-use assets | ( | ||||||||||

Fixed assets | ( | ||||||||||

Unrealized foreign exchange gain/loss | ( | ||||||||||

Total deferred tax liabilities | $ | ( | $ | ( | |||||||

Net deferred tax liabilities | $ | ( | $ | ( | |||||||

| Year ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

Federal tax rate | % | % | % | ||||||||||||||

State taxes, net of federal benefit | ( | ||||||||||||||||

Other permanent differences | ( | ||||||||||||||||

| Nondeductible officers’ compensation | ( | ||||||||||||||||

GILTI Inclusion | ( | ||||||||||||||||

FDII | ( | ( | |||||||||||||||

RTP | ( | ||||||||||||||||

| Nondeductible transaction costs | ( | ||||||||||||||||

| Stock-based compensation expense | ( | ||||||||||||||||

Foreign jurisdiction income tax holiday | ( | ( | |||||||||||||||

Foreign tax credit | ( | ( | |||||||||||||||

Foreign tax rate differential | |||||||||||||||||

| Tax credits | |||||||||||||||||

FIN48 | |||||||||||||||||

| BEAT | |||||||||||||||||

| Earn-out consideration | |||||||||||||||||

Other adjustments | ( | ( | |||||||||||||||

Effective tax rate | % | % | % | ||||||||||||||

| Year ended December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

Uncertain tax benefit balance as of beginning of period | $ | $ | |||||||||

Gross increases/(decreases) - tax positions for current period | |||||||||||

Gross increases/(decreases) - tax position in prior periods | ( | ( | |||||||||

Uncertain tax benefit balance as of end of period | $ | $ | |||||||||

| Year ended December 31, | |||||||||||||||||

| (in thousands, except share and per share data) | 2022 | 2021 | 2020 | ||||||||||||||

Numerator: | |||||||||||||||||

| Net income (loss) available to common shareholders | $ | $ | ( | $ | |||||||||||||

Denominator: | |||||||||||||||||

Weighted-average common shares outstanding - basic | |||||||||||||||||

| Effect of dilutive securities | |||||||||||||||||

| Weighted-average common shares outstanding - diluted | |||||||||||||||||

Net income (loss) per common share: | |||||||||||||||||

Basic | $ | $ | ( | $ | |||||||||||||

Diluted | $ | $ | ( | $ | |||||||||||||

| Exhibit No. | Exhibit Description | |||||||

| 3.1 | ||||||||

| 3.2 | ||||||||

| 4.1 | ||||||||

| 10.1 | ||||||||

| 10.2 | ||||||||

10.3† | ||||||||

10.4† | ||||||||

10.5† | ||||||||

10.6† | ||||||||

10.7† | ||||||||

10.8† | ||||||||

10.9† | ||||||||

10.10† | ||||||||

| 10.11 | ||||||||

10.12† | ||||||||

10.13† | ||||||||

10.14† | ||||||||

10.15† | ||||||||

10.16† | ||||||||

| 10.17 | ||||||||

| 10.18 | ||||||||

10.19† | ||||||||

10.20† | ||||||||

10.21† | ||||||||

10.22† | ||||||||

10.23† | ||||||||

10.24† | ||||||||

10.25† | ||||||||

10.26† | ||||||||

10.27† | ||||||||

10.28† | Amended and Restated Credit Agreement, dated as of September 25, 2019 and as amended and restated on September 7, 2022, among TU MidCo, Inc., TU BidCo, Inc., the guarantors party thereto from time to time, JPMorgan Chase Bank, N.A., as administrative agent, collateral agent, swing line lender and an L/C issuer, and the lenders and L/C issuers party thereto from time to time (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed on November 8, 2022). | |||||||

10.29†* | ||||||||

10.30†* | ||||||||

10.31†* | ||||||||

| 10.32†* | ||||||||

| 10.33†* | ||||||||

| 10.34†* | ||||||||

| 10.35†* | ||||||||

| 21.1* | ||||||||

| 23.1* | ||||||||

| 31.1* | ||||||||

| 31.2* | ||||||||

| 32.1** | ||||||||

| 32.2** | ||||||||

| 99.1* | ||||||||

| 101.INS | XBRL Instance Document– the instance document does not appear in the interactive data file because its XBRL tags are embedded within the inline XBRL document | |||||||

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | |||||||

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |||||||

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document | |||||||

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |||||||

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | |||||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | |||||||

TASKUS, INC. | ||||||||

By: | /s/ Bryce Maddock | |||||||

| Name: Bryce Maddock | ||||||||

Title: Chief Executive Officer | ||||||||

| Signature | Title | Date | ||||||||||||

| /s/ Bryce Maddock | Chief Executive Officer and Director (principal executive officer) | March 6, 2023 | ||||||||||||

Bryce Maddock | ||||||||||||||

| /s/ Jaspar Weir | President and Director | March 6, 2023 | ||||||||||||

| Jaspar Weir | ||||||||||||||

| /s/ Balaji Sekar | Chief Financial Officer (principal financial officer) | March 6, 2023 | ||||||||||||

| Balaji Sekar | ||||||||||||||

| /s/ Steve Amaya | Senior Vice President—Finance (principal accounting officer) | March 6, 2023 | ||||||||||||

| Steven Amaya | ||||||||||||||

| /s/ Amit Dixit | Director | March 6, 2023 | ||||||||||||

Amit Dixit | ||||||||||||||

| /s/ Michelle Gonzalez | Director | March 6, 2023 | ||||||||||||

Michelle Gonzalez | ||||||||||||||

| /s/ Jill A. Greenthal | Director | March 6, 2023 | ||||||||||||

Jill A. Greenthal | ||||||||||||||

| /s/ Susir Kumar | Director | March 6, 2023 | ||||||||||||

Susir Kumar | ||||||||||||||

| /s/ Mukesh Mehta | Director | March 6, 2023 | ||||||||||||

| Mukesh Mehta | ||||||||||||||

| /s/ Jacqueline D. Reses | Director | March 6, 2023 | ||||||||||||

| Jacqueline D. Reses | ||||||||||||||

| /s/ Kelly Tuminelli | Director | March 6, 2023 | ||||||||||||

| Kelly Tuminelli | ||||||||||||||

| Current Base Salary | $30,000.00 | ||||

| New Base Salary | $40,000.00 | ||||

| Bonus | $0 | ||||

| Current Base Salary | $30,000.00 | ||||

| New Base Salary | $40,000.00 | ||||

| Bonus | $0 | ||||

| Name of Subsidiary | Jurisdiction of Incorporation or Organization | ||||

| TU MidCo, Inc. | Delaware | ||||

| TU BidCo, Inc. | Delaware | ||||

| TaskUs Holdings, Inc. | Delaware | ||||

| LizardBear Tasking Inc. | Philippines | ||||

| Ridiculously Good Outsourcing, Inc. | Canada | ||||

| TaskUs Colombia SAS | Colombia | ||||

| TaskUs Greece Single Member Private Company | Greece | ||||

| TaskUs India Private Limited | India | ||||

| TaskUs Ireland Private Limited | Ireland | ||||

| TaskUs Limited | United Kingdom | ||||

| TaskUs USA, LLC | Delaware | ||||

| TaskUs Holdings, Inc., Taiwan Branch | Taiwan | ||||

| TaskUs, S.A. de C.V. | Mexico | ||||

| TaskUs Japan, G.K. | Japan | ||||

| TaskUs Outsourcing Japan, G.K. | Japan | ||||

| TaskUs Outsourcing Philippines Inc. | Philippines | ||||

| TaskUs Malaysia Sdn, Bhd. | Malaysia | ||||

| TaskUs Croatia d.o.o. | Croatia | ||||

| TaskUs SB d.o.o. Beograd | Serbia | ||||

Date: March 6, 2023 | |||||

| /s/ Bryce Maddock | |||||

| Bryce Maddock | |||||

| Chief Executive Officer | |||||

| (Principal Executive Officer) | |||||

Date: March 6, 2023 | |||||

| /s/ Balaji Sekar | |||||

| Balaji Sekar | |||||

| Chief Financial Officer | |||||

| (Principal Financial Officer) | |||||

| /s/ Bryce Maddock | |||||

| Bryce Maddock | |||||

| Chief Executive Officer | |||||

| (Principal Executive Officer) | |||||

| /s/ Balaji Sekar | |||||

| Balaji Sekar | |||||

| Chief Financial Officer | |||||

| (Principal Financial Officer) | |||||

Audit Information |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Audit Information [Abstract] | |

| Auditor Name | KPMG LLP |

| Auditor Location | Los Angeles, California |

| Auditor Firm ID | 185 |

Consolidated Balance Sheets (Parenthetical) - USD ($) $ in Thousands |

Dec. 31, 2022 |

Dec. 31, 2021 |

|---|---|---|

| Allowance for doubtful accounts | $ 3,422 | $ 1,819 |

| Treasury stock (in shares) | 1,649,931 | 0 |

| Class A common stock | ||

| Common stock, par value (in usd per share) | $ 0.01 | $ 0.01 |

| Common stock, shares authorized (in shares) | 2,500,000,000 | 2,500,000,000 |

| Common stock, shares issued (in shares) | 29,257,651 | 27,431,264 |

| Common stock, shares outstanding (in shares) | 27,607,720 | 27,431,264 |

| Class B convertible common stock | ||

| Common stock, par value (in usd per share) | $ 0.01 | $ 0.01 |

| Common stock, shares authorized (in shares) | 250,000,000 | 250,000,000 |

| Common stock, shares issued (in shares) | 70,032,694 | 70,032,694 |

| Common stock, shares outstanding (in shares) | 70,032,694 | 70,032,694 |

Consolidated Statements of Comprehensive Income (Loss) - USD ($) $ in Thousands |

12 Months Ended | ||

|---|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

|

| Statement of Comprehensive Income [Abstract] | |||

| Net income (loss) | $ 40,422 | $ (58,698) | $ 34,533 |

| Retirement benefit reserves | (98) | (55) | 329 |

| Foreign currency translation adjustments | (8,386) | (5,524) | 2,775 |

| Comprehensive income (loss) | $ 31,938 | $ (64,277) | $ 37,637 |

Consolidated Statements of Shareholders’ Equity (Parenthetical) |

12 Months Ended |

|---|---|

|

Dec. 31, 2021

$ / shares

| |

| Statement of Stockholders' Equity [Abstract] | |

| Distribution of dividends (in usd per share) | $ 0.55 |

Description of Business and Organization |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Organization, Consolidation and Presentation of Financial Statements [Abstract] | |

| Description of Business and Organization | Description of Business and Organization TaskUs, Inc. (formerly known as TU TopCo, Inc.) (“TaskUs” and, together with its subsidiaries, the “Company,” “we,” “us” or “our”) was formed by investment funds affiliated with Blackstone Inc. (“Blackstone”) as a vehicle for the acquisition of TaskUs Holdings, Inc. (formerly known as TaskUs, Inc.) (“TaskUs Holdings”) on October 1, 2018 (the “Blackstone Acquisition”). Prior to the Blackstone Acquisition, TaskUs had no operations and TaskUs Holdings operated as a standalone entity. TaskUs, Inc. was incorporated in Delaware in July 2018, and is headquartered in New Braunfels, Texas. The Company is a provider of outsourced digital services and next-generation customer experience to the world’s most innovative companies, helping its clients represent, protect and grow their brands. The Company’s global, omni-channel delivery model is focused on providing its clients three key services - Digital Customer Experience, Trust and Safety (formerly known as Content Security) and Artificial Intelligence (“AI”) Services (formerly known as AI Operations). The Company has designed its platform to enable it to rapidly scale and benefit from its clients’ growth. Through its agile and responsive operational model, the Company delivers services from multiple delivery sites that span globally from the United States, Philippines, India and other parts of the world. The Company’s major service offerings are described in more detail below: •Digital Customer Experience: Principally consists of omni-channel customer care services, primarily delivered through digital (non-voice) channels. •Trust and Safety: Principally consists of review and disposition of user and advertiser generated visual, text and audio content for purposes which include removal or labeling of policy violating, offensive or misleading content. Also included in this area are our offerings for risk management, compliance, identity management and fraud. •AI Services: Principally consists of high-quality data labeling services, annotation, context relevance and transcription services performed for the purpose of training and tuning machine learning algorithms, enabling them to develop cutting-edge AI systems.

|

Summary of Significant Accounting Policies |

12 Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounting Policies [Abstract] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Summary of Significant Accounting Policies | Summary of Significant Accounting Policies (a) Basis of Presentation The accounting and reporting policies of the Company are in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). The acquisition of Parsec d.o.o. and Q Experience d.o.o. (collectively, “heloo”) was completed on April 15, 2022; therefore, the Company’s consolidated financial statements only include heloo’s results since April 15, 2022. The accompanying financial statements and related notes to the financial statements give retroactive effect to the stock split for all periods presented. See Note 13, “Shareholders’ Equity” for additional information. The Company has made certain reclassifications to prior period consolidated financial statements to conform to current period presentation. India, which was previously included in Rest of World, is now reported separately within revenue disaggregation by geographical location and property and equipment by geographic location. (b) Use of Estimates The preparation of consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Significant items subject to such estimates and assumptions include the determination of useful lives and impairment of fixed assets; allowances for doubtful accounts and other receivables; the valuation of deferred tax assets; the measurement of lease liabilities and right-of-use assets; valuation of forward contracts; valuation of stock-based compensation; valuation of acquired intangible assets and goodwill, as well as related impairment assessments, and reserves for income tax uncertainties and other contingencies. (c) Principles of consolidation The accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation. The Company has no involvement with variable interest entities. (d) Segments Operating segments are components of a company for which separate financial information is available that is evaluated regularly by the chief operating decision-maker (“CODM”) in deciding on how to allocate resources and in assessing performance. The Company’s CODM is the chief executive officer (“CEO”). The CEO reviews financial information presented on an entity level basis for purposes of making operating decisions and assessing financial performance. Therefore, the Company has determined that it operates in a single operating and reportable segment. (e) Concentration Risk Most of the Company’s customers are located in the United States. Customers outside of the United States are concentrated in Europe. For the years ended December 31, 2022, 2021 and 2020, the following customers represented greater than 10% of the Company’s service revenue:

For the years ended December 31, 2022 and 2021, the following customers represented greater than 10% of the Company’s accounts receivable: