falseFY20230000050493YesYesNoNo29716290000050493us-gaap:AdditionalPaidInCapitalMember2020-09-252021-09-250000050493us-gaap:RetainedEarningsMember2023-09-300000050493us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000050493us-gaap:RetainedEarningsMember2022-09-240000050493us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-240000050493us-gaap:RetainedEarningsMember2021-09-250000050493us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-250000050493us-gaap:RetainedEarningsMember2020-09-240000050493us-gaap:AdditionalPaidInCapitalMember2020-09-240000050493us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-240000050493us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-09-300000050493us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-09-300000050493us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-09-240000050493us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-09-240000050493us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-09-250000050493us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-09-250000050493us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-09-240000050493us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-09-240000050493imkta:SecuredDebtMaturingOctober2027Member2017-09-300000050493us-gaap:OperatingSegmentsMemberimkta:PerishablesMember2022-09-252023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:NonFoodsMember2022-09-252023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:GroceryMember2022-09-252023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:GasolineMember2022-09-252023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:PerishablesMember2021-09-262022-09-240000050493us-gaap:OperatingSegmentsMemberimkta:NonFoodsMember2021-09-262022-09-240000050493us-gaap:OperatingSegmentsMemberimkta:GroceryMember2021-09-262022-09-240000050493us-gaap:OperatingSegmentsMemberimkta:GasolineMember2021-09-262022-09-240000050493us-gaap:OperatingSegmentsMemberimkta:PerishablesMember2020-09-252021-09-250000050493us-gaap:OperatingSegmentsMemberimkta:NonFoodsMember2020-09-252021-09-250000050493us-gaap:OperatingSegmentsMemberimkta:GroceryMember2020-09-252021-09-250000050493us-gaap:OperatingSegmentsMemberimkta:GasolineMember2020-09-252021-09-250000050493us-gaap:LandMember2023-09-300000050493us-gaap:BuildingMember2023-09-300000050493us-gaap:LandMember2022-09-240000050493us-gaap:BuildingMember2022-09-240000050493srt:MinimumMemberus-gaap:TransportationEquipmentMember2023-09-300000050493srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2023-09-300000050493srt:MinimumMemberus-gaap:EquipmentMember2023-09-300000050493srt:MaximumMemberus-gaap:TransportationEquipmentMember2023-09-300000050493srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2023-09-300000050493srt:MaximumMemberus-gaap:EquipmentMember2023-09-300000050493us-gaap:TransportationEquipmentMember2023-09-300000050493us-gaap:LeaseholdImprovementsMember2023-09-300000050493us-gaap:LandMember2023-09-300000050493us-gaap:EquipmentMember2023-09-300000050493us-gaap:ConstructionInProgressMember2023-09-300000050493us-gaap:BuildingMember2023-09-300000050493imkta:FinanceLeaseRightOfUseAssetsMember2023-09-300000050493us-gaap:TransportationEquipmentMember2022-09-240000050493us-gaap:LeaseholdImprovementsMember2022-09-240000050493us-gaap:LandMember2022-09-240000050493us-gaap:EquipmentMember2022-09-240000050493us-gaap:ConstructionInProgressMember2022-09-240000050493us-gaap:BuildingMember2022-09-240000050493imkta:FourZeroOneKMember2023-09-300000050493imkta:FourZeroOneKMember2022-09-240000050493us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-252023-09-300000050493us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-262022-09-240000050493us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-252021-09-250000050493us-gaap:CashFlowHedgingMember2022-09-252023-09-300000050493us-gaap:CashFlowHedgingMember2021-09-262022-09-240000050493us-gaap:CashFlowHedgingMember2023-09-300000050493us-gaap:RetainedEarningsMember2022-09-252023-09-300000050493us-gaap:RetainedEarningsMember2021-09-262022-09-240000050493us-gaap:RetainedEarningsMember2020-09-252021-09-250000050493us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:InterestRateSwapMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberimkta:SecuredNotesPayableAndOtherMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberimkta:NonQualifiedRetirementPlanMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberimkta:FacilityBondsMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:InterestRateSwapMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberimkta:SecuredNotesPayableAndOtherMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberimkta:NonQualifiedRetirementPlanMember2023-09-300000050493us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberimkta:FacilityBondsMember2023-09-300000050493imkta:InvestmentProfitSharingPlanMember2023-09-300000050493us-gaap:LineOfCreditMember2023-09-300000050493us-gaap:LetterOfCreditMember2023-09-300000050493imkta:NewFinancingLeasesMember2023-09-300000050493us-gaap:CommonClassBMemberus-gaap:RetainedEarningsMember2022-09-252023-09-300000050493us-gaap:CommonClassAMemberus-gaap:RetainedEarningsMember2022-09-252023-09-300000050493us-gaap:CommonClassBMemberus-gaap:RetainedEarningsMember2021-09-262022-09-240000050493us-gaap:CommonClassAMemberus-gaap:RetainedEarningsMember2021-09-262022-09-240000050493us-gaap:CommonClassBMemberus-gaap:RetainedEarningsMember2020-09-252021-09-250000050493us-gaap:CommonClassAMemberus-gaap:RetainedEarningsMember2020-09-252021-09-250000050493imkta:SecuredDebtMaturingJanuary2030Memberus-gaap:InterestRateSwapMember2023-09-300000050493us-gaap:InterestRateSwapMember2023-09-300000050493imkta:SecuredDebtMaturingJanuary2030Memberus-gaap:InterestRateSwapMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-09-300000050493us-gaap:InterestRateSwapMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:RetailSegmentMember2022-09-252023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:OtherSegmentMember2022-09-252023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:RetailSegmentMember2021-09-262022-09-240000050493us-gaap:OperatingSegmentsMemberimkta:OtherSegmentMember2021-09-262022-09-240000050493us-gaap:OperatingSegmentsMemberimkta:RetailSegmentMember2020-09-252021-09-250000050493us-gaap:OperatingSegmentsMemberimkta:OtherSegmentMember2020-09-252021-09-250000050493imkta:NonqualifiedInvestmentPlanMember2022-09-252023-09-300000050493imkta:InvestmentProfitSharingPlanMember2022-09-252023-09-300000050493imkta:CashBonusesMember2022-09-252023-09-300000050493imkta:NonqualifiedInvestmentPlanMember2021-09-262022-09-240000050493imkta:InvestmentProfitSharingPlanMember2021-09-262022-09-240000050493imkta:CashBonusesMember2021-09-262022-09-240000050493imkta:NonqualifiedInvestmentPlanMember2020-09-252021-09-250000050493imkta:InvestmentProfitSharingPlanMember2020-09-252021-09-250000050493imkta:CashBonusesMember2020-09-252021-09-250000050493us-gaap:NotesPayableToBanksMember2023-09-300000050493us-gaap:NotesPayableToBanksMember2022-09-240000050493imkta:MayRedeemPriorToJune152026Memberimkta:SeniorNotes2Member2022-09-252023-09-300000050493us-gaap:DebtInstrumentRedemptionPeriodTwoMember2022-09-252023-09-300000050493us-gaap:DebtInstrumentRedemptionPeriodThreeMember2022-09-252023-09-300000050493us-gaap:DebtInstrumentRedemptionPeriodOneMember2022-09-252023-09-300000050493us-gaap:DebtInstrumentRedemptionPeriodFourMember2022-09-252023-09-300000050493imkta:RecoveryZoneFacilityBondMember2022-09-252023-09-300000050493imkta:SeniorNotes2Member2021-06-300000050493imkta:SecuredDebtMaturingJanuary2030Member2019-12-310000050493imkta:RecoveryZoneFacilityBondMember2010-12-310000050493us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-09-252023-09-300000050493us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-09-252023-09-300000050493us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-09-262022-09-240000050493us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-09-262022-09-240000050493us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-09-252021-09-250000050493us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-09-252021-09-250000050493us-gaap:CommonClassBMember2023-09-300000050493us-gaap:CommonClassAMember2023-09-300000050493us-gaap:CommonClassBMember2022-09-240000050493us-gaap:CommonClassAMember2022-09-240000050493us-gaap:CommonClassBMember2021-09-262022-09-240000050493us-gaap:CommonClassAMember2021-09-262022-09-240000050493us-gaap:CommonClassBMember2020-09-252021-09-250000050493us-gaap:CommonClassAMember2020-09-252021-09-2500000504932020-09-240000050493us-gaap:OperatingSegmentsMemberimkta:RetailSegmentMember2023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:OtherSegmentMember2023-09-300000050493us-gaap:IntersegmentEliminationMember2023-09-300000050493us-gaap:OperatingSegmentsMemberimkta:RetailSegmentMember2022-09-240000050493us-gaap:OperatingSegmentsMemberimkta:OtherSegmentMember2022-09-240000050493us-gaap:IntersegmentEliminationMember2022-09-240000050493us-gaap:OperatingSegmentsMemberimkta:RetailSegmentMember2021-09-250000050493us-gaap:OperatingSegmentsMemberimkta:OtherSegmentMember2021-09-250000050493us-gaap:IntersegmentEliminationMember2021-09-2500000504932021-09-250000050493imkta:SecuredDebtMaturingJanuary2030Memberus-gaap:InterestRateSwapMember2022-09-252023-09-300000050493us-gaap:InterestRateSwapMember2022-09-252023-09-300000050493us-gaap:WorkersCompensationInsuranceMember2023-09-300000050493us-gaap:GeneralLiabilityMember2023-09-300000050493imkta:EmployeeGroupInsuranceMember2023-09-300000050493us-gaap:WorkersCompensationInsuranceMember2022-09-240000050493us-gaap:GeneralLiabilityMember2022-09-240000050493imkta:EmployeeGroupInsuranceMember2022-09-240000050493us-gaap:CommonClassBMember2022-09-252023-09-300000050493us-gaap:CommonClassAMember2022-09-252023-09-300000050493imkta:ChairmanOfBoardMember2022-09-252023-09-300000050493stpr:VA2022-09-252023-09-300000050493stpr:TN2022-09-252023-09-300000050493stpr:SC2022-09-252023-09-300000050493stpr:NC2022-09-252023-09-300000050493stpr:GA2022-09-252023-09-300000050493stpr:AL2022-09-252023-09-300000050493srt:MinimumMember2022-09-252023-09-300000050493srt:MaximumMember2022-09-252023-09-300000050493imkta:RecoveryZoneFacilityBondMember2023-09-300000050493imkta:SeniorNotes2Member2023-09-300000050493imkta:RecoveryZoneFacilityBondMember2023-09-300000050493imkta:SeniorNotes2Member2022-09-240000050493imkta:RecoveryZoneFacilityBondMember2022-09-2400000504932021-09-262022-09-2400000504932020-09-252021-09-250000050493imkta:MayRedeemPriorToJune152024Memberimkta:SeniorNotes2Member2022-09-252023-09-3000000504932023-09-3000000504932022-09-2400000504932023-03-250000050493us-gaap:CommonClassBMember2023-11-270000050493us-gaap:CommonClassAMember2023-11-2700000504932022-09-252023-09-30imkta:segmentiso4217:USDxbrli:sharesimkta:propertyimkta:itemxbrli:pureiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2023

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File Number 0-14706

INGLES MARKETS, INCORPORATED

(Exact name of registrant as specified in its charter)

| |

| |

North Carolina | 56-0846267 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

2913 U.S. Hwy. 70 West, Black Mountain, NC | 28711 |

(Address of principal executive offices) | (Zip Code) |

|

Registrant’s telephone number including area code: (828) 669-2941 |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, $0.05 par value per share | IMKTA | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES NO x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES NO x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO .

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES x NO .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

Large accelerated filer Non-accelerated filer o | | Accelerated filer o Smaller reporting company Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. YES x NO

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES NO x.

As of March 25, 2023, the aggregate market value of voting stock held by non-affiliates of the registrant, based on the closing sales price of the Class A Common Stock on The NASDAQ Global Select Market on March 25, 2023, was approximately $1.29 billion. As of November 27, 2023, the registrant had 14,527,075 shares of Class A Common Stock outstanding and 4,467,301 shares of Class B Common Stock outstanding.

Certain information required in Part III hereof is incorporated by reference to the Proxy Statement for the registrant’s 2024 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A no later than 120 days after the end of the fiscal year covered by this report.

Ingles Markets, Incorporated

Annual Report on Form 10-K

September 30, 2023

| | |

| | Page |

| PART I | |

Item 1. | Business | 5 |

Item 1A. | Risk Factors | 10 |

Item 1B. | Unresolved Staff Comments | 13 |

Item 1C. | Cybersecurity | 13 |

Item 2. | Properties | 13 |

Item 3. | Legal Proceedings | 14 |

Item 4. | Mine Safety Disclosures | 14 |

| PART II | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | 14 |

Item 6. | [Reserved] | 16 |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 16 |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risks | 22 |

Item 8. | Financial Statements and Supplementary Data | 22 |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 23 |

Item 9A. | Controls and Procedures | 23 |

Item 9B. | Other Information | 24 |

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 24 |

| PART III | |

Item 10. | Directors, Executive Officers and Corporate Governance | 24 |

Item 11. | Executive Compensation | 24 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 24 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 24 |

Item 14. | Principal Accountant Fees and Services | 24 |

| PART IV | |

Item 15. | Exhibits and Financial Statement Schedules | 24 |

Item 16. | Form 10-K Summary | 26 |

| Report of Independent Registered Public Accounting Firm PCAOB ID No. 34 | 27 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K of Ingles Markets, Incorporated (“Ingles” or the “Company”) contains certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact included in this Annual Report on Form 10-K, including the statements under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere regarding the Company’s strategy, future operations, financial position, estimated revenues, projected costs, projections, prospects, plans and objectives of management, are forward-looking statements. The words “expect”, “anticipate”, “intend”, “plan”, “likely”, “goal”, “believe”, “seek”, “will”, “may”, “would”, “should” and similar expressions are intended to identify forward-looking statements. While these forward-looking statements and the related assumptions are made in good faith and reflect the Company’s current judgment regarding the direction of the Company’s business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested or described by such forward-looking statements. Such statements are based upon a number of assumptions and estimates that are inherently subject to significant risks and uncertainties, many of which are beyond the Company’s control. Some of these assumptions inevitably will not materialize, and unanticipated events will occur which will affect the Company’s results. Some important factors (but not necessarily all factors) that affect the Company’s revenues, financial position, growth strategies, profitability and operating results, or that otherwise could cause actual results to differ materially from those expressed in or implied by any forward-looking statement, include:

business and economic conditions generally in the Company’s operating area, including inflation or deflation;

shortages of labor, distribution capacity, and some product outages;

inflation in food, labor and fuel prices;

the Company’s ability to successfully implement our expansion and operating strategies;

a resurgence of the COVID-19 pandemic;

pricing pressures and other competitive factors, including online-based procurement of products the Company sells;

sudden or significant changes in the availability of fuel and retail fuel prices;

the maturation of new and expanded stores;

general concerns about food safety;

the Company’s ability to manage technology and data security;

the availability and terms of financing;

increases in costs, including food, utilities, labor and other goods and services significant to the Company’s operations;

success or failure in the ownership and development of real estate;

changes in the laws and government regulations applicable to the Company;

disruptions in the efficient distribution of food products;

changes in accounting pronouncements that could impact the Company’s reported financial results and compliance with various debt agreements; and

other risks and uncertainties, including those described under the caption “Risk Factors” in Item 1A of this Annual Report on Form 10-K.

Consequently, actual events affecting the Company and the impact of such events on the Company’s operations may vary significantly from those described in this Annual Report on Form 10-K. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date hereof. The Company does not undertake and specifically declines any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments, except to the extent required by applicable law.

PART I

Item 1. BUSINESS

General

Ingles Markets, Incorporated, a North Carolina corporation (collectively with its subsidiaries, “Ingles,” or the “Company,” “we,” “us” or “our”), is a leading supermarket chain in the southeast United States and operates a total of 198 supermarkets in North Carolina (75), Georgia (65), South Carolina (35), Tennessee (21), Virginia (1) and Alabama (1).

The Company remodels, expands and relocates stores in these communities and builds stores in new locations to retain and grow its customer base while retaining a high level of customer service and convenience. Ingles supermarkets offer customers a wide variety of nationally advertised food products, including grocery, meat and dairy products, produce, frozen foods and other perishables, and non-food products. Non-food products include fuel centers, pharmacies, health and beauty care products and general merchandise. The Company also offers quality private label items and locally-sourced items throughout its market areas.

The Company believes that customer service and convenience, modern stores and competitive prices on a broad selection of quality merchandise are essential to developing and retaining a loyal customer base. The Company has an ongoing renovation and expansion plan to add stores in its target markets and modernize the appearance and layout of its existing stores. The Company’s new and remodeled supermarkets provide an enhanced level of customer convenience in order to accommodate the lifestyle of today’s shoppers. Design features of the Company’s modern stores focus on selling products in perishable departments featuring local organic and home meal replacement items, in-store pharmacies, on-premises fuel centers, and an expanded selection of food and non-food items. The Company offers online ordering of its products for pickup at its stores.

Substantially all of the Company’s stores are located within 280 miles of the Company’s warehouse and distribution facilities, near Asheville, North Carolina. The Company operates 1.65 million square feet of warehouse and distribution facilities. These facilities supply the Company’s supermarkets with approximately 57% of the goods the Company sells. The remaining 43% is purchased from third parties and is generally delivered directly to the stores. The close proximity of the Company’s purchasing and distribution operations to its stores facilitates the timely distribution of consistently high quality perishable and non-perishable items.

To further ensure product quality, the Company also owns and operates a milk processing and packaging plant that supplies approximately 72% of the milk products sold by the Company’s supermarkets as well as a variety of organic milk, fruit juices and bottled water products. In addition, the milk processing and packaging plant sells approximately 81% of its products to other retailers, food service distributors and grocery warehouses in 17 states, which provides the Company with an additional source of revenue.

The Company owns 167 of its supermarkets, either in free-standing stores or as the anchor tenant in an owned shopping center. The Company also owns 29 undeveloped sites suitable for a free-standing store or development by the Company or a third party. The Company’s owned real estate is generally located in the same geographic region as its supermarkets.

As of September 30, 2023, Mr. Robert P. Ingle II, our Chairman, beneficially owned approximately 72.2% of the combined voting power and 22.9% of the total number of shares of the Company’s outstanding Class A and Class B Common Stock (in each case including stock held by the Company’s Investment/Profit Sharing Plan and Trust of which Mr. Ingle II serves as one of the trustees). Beneficial ownership is calculated in accordance with Rule 13d-3 promulgated under the Exchange Act. The Company became publicly traded in September 1987. The Company’s Class A Common Stock is listed on The NASDAQ Global Select Market under the symbol “IMKTA.” The Company’s Class B Common Stock is not publicly listed or traded.

The Company was incorporated in 1965 under the laws of the State of North Carolina. Its principal mailing address is P.O. Box 6676, Asheville, North Carolina 28816, and its telephone number is 828-669-2941. The Company’s website is www.ingles-markets.com. Information on, or accessible through, the Company’s website is not a part of and is not incorporated by reference into this Annual Report on Form 10-K. The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments and supplements to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge on the Company’s website as soon as reasonably practicable after they are filed with or furnished to the Securities and Exchange Commission.

Use of our Website and Social Media to Distribute Material Company Information

We use our website as a channel of distribution for important Company information. We routinely post on our website important information, including press releases and financial information, which may be accessed by selecting the “Corporate” sections of www.ingles-markets.com. We also use our website to expedite public access to time-critical information regarding our Company in advance of or in lieu of distributing a press release or a filing with the SEC disclosing the same information. Therefore, investors should look to the Corporate sections of our website for important and time-critical information. Visitors to our website can also register to receive financial information press releases. Information contained on, or accessible through, our website is not a part of and is not incorporated by reference into this Annual Report on Form 10-K.

Business

The Company operates one primary business segment, retail grocery. Information about the Company’s operations is as follows (for information regarding the Company’s industry segments, see Note 11, “Segment Information” to the Consolidated Financial Statements contained in this Annual Report on Form 10-K):

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Fiscal Year Ended September |

| | (dollars in millions) |

| | 2023 | | 2022 | | 2021 |

Revenues from unaffiliated customers: | | | | | | | | | | | | | | | |

Grocery | | $ | 2,062.4 | | | | $ | 1,940.4 | | | | $ | 1,762.9 | | |

Non-foods | | | 1,326.9 | | | | | 1,204.5 | | | | | 1,136.3 | | |

Perishables | | | 1,482.1 | | | | | 1,445.0 | | | | | 1,349.1 | | |

Fuel | | | 792.5 | | | | | 885.8 | | | | | 583.7 | | |

Total retail | | | 5,663.9 | | 96.1% | | | 5,475.7 | | 96.4% | | | 4,832.0 | | 96.9% |

Other | | | 228.9 | | 3.9% | | | 203.1 | | 3.6% | | | 156.0 | | 3.1% |

| | $ | 5,892.8 | | 100.0% | | $ | 5,678.8 | | 100.0% | | $ | 4,988.0 | | 100.0% |

Income from operations: | | | | | | | | | | | | | | | |

Retail | | $ | 263.2 | | 90.0% | | $ | 353.0 | | 93.7% | | $ | 327.6 | | 93.6% |

Other | | | 29.1 | | 10.0% | | | 23.9 | | 6.3% | | | 22.5 | | 6.4% |

| | | 292.3 | | 100.0% | | | 376.9 | | 100.0% | | | 350.1 | | 100.0% |

Other income, net | | | 8.3 | | | | | 5.9 | | | | | 2.9 | | |

Interest expense | | | 22.1 | | | | | 21.5 | | | | | 24.3 | | |

Loss on early extinguishment of debt | | | — | | | | | — | | | | | 1.1 | | |

Income before income taxes | | $ | 278.5 | | | | $ | 361.3 | | | | $ | 327.6 | | |

The “Grocery” category includes grocery, dairy and frozen foods.

The “Non-foods” category includes alcoholic beverages, tobacco, pharmacy, and health/beauty/cosmetic products.

The “Perishables” category includes meat, produce, deli and bakery.

The “Other” category consists of fluid dairy operations and shopping center rentals.

Supermarket Operations

At September 30, 2023, the Company operated 189 supermarkets under the name “Ingles,” and nine supermarkets under the name “Sav-Mor” with locations in western North Carolina, western South Carolina, northern Georgia, eastern Tennessee, southwestern Virginia and northeastern Alabama. The “Sav-Mor” store concept accommodates smaller shopping areas and carries dry groceries, dairy, fresh meat and produce, all of which are displayed in a modern, readily accessible environment.

The following table sets forth certain information with respect to the Company’s supermarket operations.

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Number of Supermarkets | | Percentage of Total |

| | at Fiscal | | Net Sales for Fiscal |

| | Year Ended September | | Year Ended September |

| | 2023 | | 2022 | | 2021 | | 2023 | | 2022 | | 2021 |

North Carolina | | 75 | | 75 | | 75 | | 41% | | 41% | | 41% |

South Carolina | | 35 | | 35 | | 35 | | 19% | | 19% | | 19% |

Georgia | | 65 | | 65 | | 65 | | 32% | | 32% | | 32% |

Tennessee | | 21 | | 21 | | 21 | | 8% | | 8% | | 8% |

Virginia | | 1 | | 1 | | 1 | | — | | — | | — |

Alabama | | 1 | | 1 | | 1 | | — | | — | | — |

| | 198 | | 198 | | 198 | | 100% | | 100% | | 100% |

The Company believes that today’s supermarket customers focus on convenience, quality and value in an attractive store environment. As a result, the Company’s shopping experience combines a high level of customer service, convenience-oriented quality product offerings and low overall pricing. The Company’s modern stores provide products and services such as home meal replacement items, delicatessens, bakeries, floral departments, greeting cards and broad selections of local organic, beverage and health-related items. At September 30, 2023, the Company operated 114 pharmacies and 108 fuel stations, in each case at the Company’s grocery store locations. The Company plans to continue to incorporate these departments in substantially all future new and remodeled stores. The Company trains its associates to provide friendly service and to actively address the needs of customers. These associates reinforce the Company’s distinctive service-oriented image.

Selected statistics on the Company’s supermarket operations are presented below:

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Fiscal Year Ended September |

| | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Weighted Average Sales Per Store (000’s) (1) | | $ | 28,565 | | $ | 27,622 | | $ | 23,926 | | $ | 22,215 | | $ | 20,189 |

Total Square Feet at End of Year (000’s) | | | 11,403 | | | 11,342 | | | 11,342 | | | 11,256 | | | 11,247 |

Average Total Square Feet per Store | | | 57,589 | | | 57,281 | | | 57,281 | | | 57,138 | | | 56,806 |

Average Square Feet of Selling Space per Store (2) | | | 40,313 | | | 40,097 | | | 40,097 | | | 39,997 | | | 39,765 |

Weighted Average Sales per Square Foot of

Selling Space (1) (2) | | | 709 | | | 689 | | | 609 | | | 568 | | | 516 |

(1)Weighted average sales per store include the effects of increases in square footage due to the opening of replacement stores and the expansion of stores through remodeling during the periods indicated, and fuel sales.

(2)Selling space is estimated to be 70% of total interior store square footage.

Merchandising

The Company’s merchandising strategy is designed to create a comprehensive and satisfying shopping experience that blends value and customer service with variety, quality and convenience. Management believes that this strategy fosters a loyal customer base by establishing a reputation for providing high quality products and a variety of specialty departments.

The Company’s stores carry a broad selection of quality meats, produce and other perishables. The Company offers a wide variety of fresh and non-perishable organic products, including organic milk produced by the Company’s fluid dairy plant. The Company’s market areas contain numerous providers of quality local products, which is in line with current customer preferences for goods produced where they live. Management believes that customers perceive supermarkets offering a broad array of products and time-saving services as part of a solution to today’s lifestyle demands. Accordingly, a principal component of the Company’s merchandising strategy is to design stores that enhance the shopping experience. The Company operates fuel stations at 108 of its store locations.

A selection of prepared foods and home meal replacements are featured throughout Ingles’ deli, bakery, produce and meat departments to provide customers with easy meal alternatives that they can eat at home or in the store. Many stores offer daily selections of home meal replacement items, such as rotisserie chicken and pork, international foods, fried chicken and other entrees, sandwiches, pre-packaged salads, sushi, cut fruit and prepared fresh vegetables. The bakery offers an expanded selection of baked goods and self-service options. Ingles bakes most of its items on site, including bread baked daily, cakes made to order in various sizes, donuts and other pastries. The deli offers salad, chicken wing and olive bars, an expanded offering of cheeses, gourmet items and home meal replacement items. The Company also provides its customers with an expanded selection of frozen food items (including organics) to meet the increasing demands of its customers.

The Ingles Curbside service allows customers to order any product in the Company’s stores online. The order is picked by store associates and loaded into the customer’s vehicle. This service is currently offered at 129 of the Company’s stores, with additional stores expected to be added each month.

Ingles’ private labels cover a broad range of products throughout the store, such as milk, bread, organic products, soft drinks and canned goods. Ingles believes that private label sales help promote customer loyalty and provide a value-priced alternative to national brands.

The Company seeks to maintain a reputation for providing friendly service, quality merchandise and customer value and for its commitment to locally-sourced products and community involvement. The Company employs various advertising and promotional strategies to reinforce the quality and value of its products. The Company promotes these attributes using traditional advertising vehicles including radio, television, direct mail and newspapers, as well as electronic and social media. The Ingles Advantage Card is designed to foster customer loyalty by providing information to better understand the Company’s customers’ shopping patterns. The Ingles Advantage Card provides customers with special discounts throughout the Company’s stores and fuel stations.

Purchasing and Distribution

The Company currently supplies approximately 57% of its supermarkets’ inventory requirements from its modern warehouse and distribution facilities. The Company has 1.65 million square feet of office, warehouse and distribution facilities at its headquarters near Asheville, North Carolina. The Company believes that its warehouse and distribution facilities contain sufficient capacity for the continued expansion of its store base for the foreseeable future.

The Company’s centrally managed purchasing and distribution operations provide several advantages, including the ability to negotiate and reduce the cost of merchandise, decrease overhead costs and better manage its inventory at both the warehouse and store level. From time to time, the Company engages in advance purchasing on high-turnover inventory items to take advantage of special prices offered by manufacturers for limited periods, or to ensure adequate product supply during tight distribution market conditions.

The remaining 43% of the Company’s inventory requirements, primarily beverages, pharmacy, fuel, bread and snack foods, are supplied directly to the Company’s supermarkets by local distributors and manufacturers.

Goods from the warehouse and distribution facilities and the milk processing and packaging plant are distributed to the Company’s stores by a fleet of 183 tractors and 864 trailers that the Company owns, operates and maintains. The Company invests on an ongoing basis in the maintenance, upgrade and replacement of its tractor and trailer fleet. The Company also operates truck servicing and fuel storage facilities at its warehouse and distribution facilities. The Company reduces its overall distribution costs by capitalizing on back-haul opportunities (contracting with third parties to transport their merchandise on our trucks that would otherwise be empty).

The effects of the COVID-19 pandemic, which began in March 2020, have eased considerably over the fiscal year ended September 30, 2023, but the earlier portion of the pandemic substantially impacted supermarket operations, and some effects have continued through the fiscal year ended September 30, 2023. At the onset of the COVID-19 pandemic, the Company implemented several enhanced cleaning and social distancing protocols designed to keep our customers and our associates safe and continued to monitor and update its protocols as the pandemic evolved. Since March 2020, the Company’s stores have experienced increased customer traffic and occasional product shortages due to supply chain issues. The currently tight labor market has impacted the Company’s ability to attract and retain qualified store personnel, but these impacts have not materially affected our operations. The economy has continued to recover from the effects of the pandemic, which has included inflation not seen in decades. Inflation impacts product costs, labor costs and the cost of other goods used by the Company, which could negatively impact our results of Operations.

While the COVID-19 pandemic was officially declared to have ended in May 2023, at the present time, we cannot predict how long and to what extent the ongoing effects of the pandemic and inflation will impact our sales and financial performance.

The Company receives product recall information from various subscription, government and vendor sources. Upon receipt of recall information, the Company immediately contacts each of its stores to have the recalled product removed from the shelves and disposed of as instructed. The Company may also use social media to communicate product recall information to the public. The Company has a policy of refunding and/or replacing any goods returned by customers. The details of this policy are posted inside each of the Company’s stores.

Store Development, Expansion and Remodeling

The Company believes that the appearance and design of its stores are integral components of its customers’ shopping experience and aims to develop one of the most modern supermarket chains in the industry. The ongoing modernization of the Company’s store base involves (i) the construction of new stores with continuously updated designs, and (ii) the replacement, remodeling or expansion of existing stores. The Company’s goal is to maintain clean, well-lit stores with attractive architectural and display features that enhance the image of its stores as catering to the changing lifestyle needs of quality-conscious consumers who demand increasingly diverse product offerings. The construction of new stores by independent contractors is closely monitored and controlled by the Company. During fiscal year 2023, the Company slowed some of its new store and remodeling plans due to inflation and supply chain issues in building materials and equipment, as well as due to the tight labor market conditions for construction labor. As described above, we cannot currently predict how long these conditions will persist, but the Company has continued to build and remodel stores albeit at what management believes will be a temporarily slower pace.

The Company renovates and remodels stores in order to increase customer traffic and sales, respond to existing customer demand, compete effectively against new stores opened by competitors and support its quality image merchandising strategy. The Company decides to complete a remodel of an existing store based on its evaluation of the competitive landscape of the local marketplace. A remodel or expansion provides the quality of facilities and product offerings identical to that of a new store, capitalizing upon the existing customer base. The Company retains the existing customer base by keeping the store in operation during the entire remodeling process. The Company may elect to relocate, rather than remodel, certain stores where relocation provides a more convenient location for its customers.

The following table sets forth, for the fiscal years indicated, the Company’s new store development and store remodeling activities and the effect this program has had on the average size of its stores:

| | | | | | | | | | |

| | | | | | | | | | |

| | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Number of Stores: | | | | | | | | | | |

Opened | | — | | — | | 2 | | — | | 1 |

Closed | | — | | — | | 1 | | 1 | | 3 |

Stores open at end of period | | 198 | | 198 | | 198 | | 197 | | 198 |

Size of Stores: | | | | | | | | | | |

Less than 42,000 sq. ft. | | 45 | | 46 | | 46 | | 46 | | 48 |

42,000 up to 51,999 sq. ft. | | 22 | | 22 | | 22 | | 22 | | 22 |

52,000 up to 61,999 sq. ft. | | 47 | | 47 | | 47 | | 47 | | 47 |

At least 62,000 sq. ft. | | 84 | | 83 | | 83 | | 82 | | 81 |

Average store size (sq. ft.) | | 57,589 | | 57,281 | | 57,281 | | 57,138 | | 56,806 |

The Company’s ability to open new stores is subject to many factors, including the acquisition of satisfactory sites, as well as zoning limitations and other government regulations. In addition, the Company continually reviews its expansion, remodeling and replacement plans, which are subject to change. See the “Liquidity and Capital Resources” section included in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s capital expenditures.

Competition

The supermarket industry is highly competitive and characterized by narrow profit margins. The degree of competition the Company’s stores encounter varies by location, primarily based on the size of the community in which the store is located and its proximity to other communities. The Company’s principal competitors are, in alphabetical order, Aldi, Inc., Earth Fare, Inc, Food City (K-VA-T Food Stores, Inc.), Food Lion (Koninlijke Ahold Delhaize America N.V.), The Fresh Market, Inc., Harris Teeter (owned by The Kroger Co.), The Kroger Co., Lidl (Lidl Stiftung & Co. KG), Publix Super Markets, Inc., Sprouts Farmers Market, Inc., Target Corporation, Whole Foods Market, and Wal-Mart Stores, Inc. Increasingly over the last few years, competition for consumers’ food dollars has intensified due to the addition of, or increase in, food sections by many types of retailers (physical and online) and by restaurants.

Supermarket chains generally compete based on location, quality of products, service, price, convenience, product variety, online ordering/delivery capabilities, and store condition.

The Company believes its competitive advantages include convenient locations, the quality of service it provides its customers, competitive pricing, product variety, quality and a pleasant shopping environment, which is enhanced by its ongoing modernization program.

By concentrating its operations within a relatively small geographic region, the Company is also positioned to monitor its markets and the needs of its customers more carefully within those markets. The Company’s senior executives live and work in the Company’s operating region, thereby allowing management to quickly identify changes in needs and customer preference. Because of the Company’s size, store managers have direct access to senior corporate management and can receive quick decisions regarding requested changes in operations. The Company can then move quickly to adjust its business in response to changes in the market and customer needs.

The Company’s management monitors competitive activity and regularly reviews and periodically adjusts the Company’s marketing and business strategies as management deems appropriate considering existing conditions in the Company’s region. The Company’s ability to remain competitive in its changing markets will depend in part on its ability to pursue its expansion and renovation programs and its response to remodeling and new store openings by its competitors.

Seasonality

Sales in the grocery segment of the Company’s business are subject to slight seasonal variances due to holiday related sales and sales during portions of the year in which customers return to seasonal homes. Sales are traditionally higher in the Company’s first fiscal quarter due to the inclusion of sales related to Thanksgiving and Christmas. The Company’s second fiscal quarter traditionally has the lowest sales of the year, unless Easter falls in that quarter. In the third and fourth quarters, sales are affected by the return of customers to seasonal homes in the Company’s market area.

The Company’s fluid dairy operations have a slight seasonal variation to the extent of its sales into the grocery industry. The Company’s real estate operations are not subject to seasonal variations.

Human Capital

At September 30, 2023, the Company had approximately 26,420 associates, of which 93% were supermarket personnel. Approximately 56% of supermarket personnel work on a part-time basis. Management considers labor relations to be good. The Company values its associates and believes that associate loyalty and enthusiasm are key elements of its operating performance. The Company has responded to the tight labor market by increasing resources devoted to associate recruitment and retention, and by expanding the ways in which it markets itself to prospective associates; however, competition for labor has become more intense, resulting in higher costs to attract and retain associates.

The Company has various programs to ensure adequate store staffing levels at any given time during the week. Store managers are given tools to assist in scheduling and levels of staffing. We provide flexible scheduling to accommodate the needs of our full and part-time associates, and we also provide incentives for associates based on the achievement of operating and safety goals. The Company has made technology investments to allow efficient remote work environments for associates that do not work in our stores or distribution center.

Trademarks and Licenses

The Company employs various trademarks and service marks in its business, the most important of which are its own “Laura Lynn” and “Harvest Farms” private label trademarks, “The Ingles Advantage” service mark, and the “Ingles” service mark. These service

marks and the trademarks are federally registered in the United States pursuant to applicable intellectual property laws and are the property of Ingles. The Company believes it has all material licenses and permits necessary to conduct its business.

The current expiration dates for significant trade and service marks are as follows: “Ingles” – December 9, 2025; “Laura Lynn” – March 13, 2024; “Harvest Farms Organic” – August 5, 2024; and “The Ingles Advantage” – August 30, 2025. Each registration may be renewed for an additional ten-year term prior to its expiration. The Company intends to timely file all renewals. Each of the Company’s trademark license agreements has a one year term which, with respect to one license, is automatically renewed annually, unless the owner of the trademark provides notice of termination prior to the expiration date and, with respect to the other licenses, are renewed periodically by letter from the licensor.

Environmental Matters

Under applicable environmental laws, the Company may be responsible for remediation of environmental conditions and may be subject to associated liabilities relating to its stores and other buildings and the land on which such stores and other buildings are situated (including responsibility and liability related to its operation of its gas stations and the storage of fuel in underground storage tanks), regardless of whether the Company leases or owns the stores, other buildings or land in question and regardless of whether such environmental conditions were created by the Company or by a prior owner or tenant. The presence of contamination from hazardous or toxic substances, or the failure to properly remediate such contaminated property, may adversely affect the Company’s ability to sell or rent such real property or to borrow using such real property as collateral. The Company typically conducts an environmental review prior to acquiring or leasing new stores, other buildings or raw land.

Federal, state and local governments could enact laws or regulations concerning environmental matters that affect the Company’s operations or facilities or increase the cost of producing or distributing the Company’s products. The Company believes that it currently conducts its operations, and in the past has conducted its operations, in substantial compliance with applicable environmental laws. The Company, however, cannot predict the environmental liabilities that may result from legislation or regulations adopted in the future, the effect of which could be retroactive. Nor can the Company predict how existing or future laws and regulations will be administered or interpreted or what environmental conditions may be found to exist at its facilities or at other properties where the Company or its predecessors have arranged for the disposal of hazardous substances.

The Company strives to employ sound environmental operating policies, including recycling packaging, recycling wooden pallets, and re-circulating some water used in its car washes. The Company offers reusable shopping bags to its customers and will pack groceries in bags brought in by its customers. The Company’s store modernization plans include energy efficient lighting and refrigeration equipment.

Government Regulation

The Company is subject to regulation by a variety of governmental agencies, including, but not limited to, the U.S. Food and Drug Administration, the U.S. Department of Agriculture, the Occupational Safety and Health Administration, and other federal, state and local agencies. The Company’s stores are also subject to local laws regarding zoning, land use and the sale of alcoholic beverages and tobacco products. The Company believes that its locations are in material compliance with such laws and regulations. The Company is not aware of any proposed regulations that would materially affect the Company’s business, financial condition, or results of operations.

Item 1A. RISK FACTORS

Below is a series of risk factors that may materially affect the Company’s business, financial condition and results of operation. The Company operates in a continually changing business environment, and new risk factors emerge from time to time. The following information should be read together with other information contained in this Annual Report on Form 10-K, including the consolidated financial statements and the notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Risks Related to Our Business and Industry

The Company’s warehouse and distribution center and milk processing and packaging plant, as well as all of the Company’s stores, are concentrated in the Southeastern United States, which makes it vulnerable to economic downturns, natural disasters and other adverse conditions or other catastrophic events in this region.

The Company operates in the southeastern United States, and its performance is therefore heavily influenced by economic developments in the Southeast region. The Company’s headquarters, warehouse and distribution center and milk processing and packaging plant are located in North Carolina and all of the Company’s stores are located in the Southeast region. As a result, the Company’s business may be more susceptible to regional factors than the operations of more geographically diversified competitors. These factors include, among others, changes in the economy, weather conditions, demographics and population.

Various aspects of the Company’s business are subject to federal, state and local laws and various operating regulations. The Company’s compliance with these regulations may require additional capital expenditures and could adversely affect the Company’s ability to conduct the Company’s business as planned.

The Company is subject to federal, state and local laws and regulations relating to zoning, land use, workplace safety, public health, community right-to-know, beer and wine sales, country of origin labeling of food products, pharmaceutical sales and fuel station operations. Furthermore, the Company’s business is regulated by a variety of governmental agencies, including, but not limited to, the U.S. Food and Drug Administration, the U.S. Department of Agriculture, and the Occupational Safety and Health Administration. Employers are also subject to laws governing their relationship with employees, including minimum wage requirements, overtime, working conditions, insurance coverage, disabled access, and work permit requirements. Recent and proposed regulation has had or may have a future impact on the cost of insurance benefits for associates and on the cost of processing debit and credit card transactions. Compliance with, or changes in, these laws could reduce the revenue and profitability of the Company’s supermarkets and could otherwise adversely affect the Company’s business, financial condition or results of operations.

The Company is affected by certain operating costs which could increase or fluctuate considerably.

The Company depends on qualified associates to operate the Company’s stores. A shortage of qualified associates could require the Company to enhance the Company’s wage and benefit package in order to better compete for and retain qualified associates, and the Company may not be able to recover these increased labor costs through price increases charged to customers, which could significantly increase the Company’s operating costs.

The Company is self-insured for workers’ compensation, general liability and group medical and dental benefits. Risks and uncertainties are associated with self-insurance; however, the Company has limited its exposure by maintaining excess liability coverage. Self-insurance liabilities are established based on claims filed and estimates of claims incurred but not reported. The estimates are based on data provided by the respective claims administrators and analyses performed by actuaries engaged by the Company. These estimates can fluctuate if historical trends are not predictive of the future. The majority of the Company’s properties are self-insured for casualty losses and business interruption; however, liability coverage is maintained.

Energy and utility costs have been volatile in recent years. The Company attempts to increase its energy efficiency during store construction and remodeling using energy-saving equipment and construction.

Our business, financial condition and results of operations may be materially adversely affected by a resurgence of the COVID-19

pandemic.

The unprecedented global outbreak of the novel coronavirus (COVID-19) that began in the first quarter of 2020 has adversely impacted economic activity and conditions worldwide, including workforces, liquidity, capital markets, consumer behavior, supply chains and macroeconomic conditions. While the COVID-19 pandemic was officially declared to have ended in May 2023,and while the direct effects of the COVID-19 pandemic on our business have significantly lessened during the fiscal year ended September 30, 2023, some effects have continued through the fiscal year ended September 30, 2023, and we may continue to be impacted by the continuing effects of the COVID-19 pandemic, including resurgences and variants of COVID-19 or outbreaks of any new viruses or contagions. These impacts may include difficulties and delays in sourcing, transporting and stocking products: inabilities to staff our stores and warehouse and distribution facilities at adequate levels to conduct our operations, resulting in store closures or operating hour reductions; and incurring significant costs in support of our front-line store team members for enhanced benefits, safety measures and government-mandated wage increases.

The extent to which a future COVID-19 outbreak could impact our business and operating results in the future depends on future developments that are highly uncertain and cannot be accurately predicted, including new information that may emerge concerning COVID-19 and variants of the virus and the actions to contain or treat their impact, as well as the impact of any new federal, state and local mandates or other regulations associated with COVID-19.

The Company is subject to risks related to information systems and data security.

The Company’s business is dependent on information technology systems. These complex systems are an important part of ongoing operations. If the Company were to experience disruption in these systems, did not maintain existing systems properly, or did not implement new systems appropriately, operations could suffer. The Company is currently undergoing a systematic program to enhance its information technology abilities.

The Company has implemented procedures to protect its information technology systems and data necessary to conduct ongoing operations. The Company cannot, however, be certain that all these systems and data are entirely free from vulnerability to attack.

Compliance with tougher privacy and information security laws and standards, including protection of customer debit and credit card information, may result in higher investments in technology and changes to operational processes.

In recent years, more industry transactions have been online for ordering and fulfillment. This trend places a higher reliance on effective and efficient information systems.

The Company is affected by the availability and wholesale price of fuel and retail fuel prices, all of which can fluctuate quickly and considerably.

The Company operates fuel stations at 108 of its store locations. While the Company obtains gasoline and diesel fuel from several different suppliers, long-term disruption in the availability and wholesale price of fuel for resale could have a material adverse effect on the Company’s business, financial condition and/or results of operations.

Fluctuating fuel costs could adversely affect the Company’s operating costs which depend on fuel for the Company’s fleet of tractors and trailers which distribute goods from the Company’s distribution facility and for the Company’s fluid dairy operations.

Furthermore, fluctuating fuel costs could have an adverse effect on the Company’s total fuel sales (both in terms of dollars and gallons sold), the profitability of fuel sales, and the Company’s plans to develop additional fuel centers. Also, retail gas price volatility could diminish customer usage of fueling centers and, thus, adversely affect customer traffic at the Company’s stores.

The Company’s industry is highly competitive. If the Company is unable to compete effectively, the Company’s financial condition and results of operations could be materially affected.

The supermarket industry is highly competitive and continues to be characterized by intense price competition, increasing fragmentation of retail formats, entry of non-traditional competitors (both physical and online) and market consolidation. Furthermore, some of the Company’s competitors have greater financial resources and could use these financial resources to take measures, such as altering product mix, reducing prices, home/in-store fulfillment, or online ordering which could adversely affect the Company’s competitive position.

Disruptions in the efficient distribution of food products to the Company’s warehouse and stores may adversely affect the Company’s business.

The Company’s business could be adversely affected by disruptions in the efficient distribution of food products to the Company’s warehouse and stores. Such disruptions could be caused by, among other things, adverse weather conditions, fuel availability, shortage of truck drivers, food contamination recalls and civil unrest in foreign countries in which the Company’s suppliers do business.

The Company’s operations are subject to economic conditions that impact consumer spending.

The Company’s results of operations are sensitive to changes in overall economic conditions that impact consumer spending, including discretionary spending. Future economic conditions such as employment levels, business conditions, interest rates, energy and fuel costs and tax rates could reduce consumer spending or change consumer purchasing habits. A general reduction in the level of consumer spending or the Company’s inability to respond to shifting consumer attitudes regarding products, store location and other factors could adversely affect the Company’s business, financial condition and/or results of operations.

Inflation could impact the Company’s operations.

The following table from the United States Bureau of Labor Statistics lists annualized changes in the Consumer Price Index that could have an effect on the Company’s operations. One of the Company’s significant costs is labor, which increases with general inflation. Inflation or deflation in energy costs affects the Company’s fuel sales, distribution expenses and plastic supply costs. During fiscal year 2023, inflation reached its highest level in a number of years, impacting food costs, transportation costs, and labor costs.

| | | | | | |

| | | | | | |

| | Twelve Months Ended |

| | September 30, | | September 24, |

| | 2023 | | 2022 |

All items | | 3.7 | % | | 8.2 | % |

Food at home | | 2.4 | % | | 13.0 | % |

Energy | | (0.5) | % | | 19.8 | % |

Risk Related to Ownership of Our Common Stock

The Company’s principal stockholder, Robert P. Ingle II, has the ability to elect a majority of the Company’s directors, appoint new members of management and approve many actions requiring stockholder approval.

Mr. Ingle II’s beneficial ownership represented approximately 72.2% of the combined voting power of all classes of the Company’s capital stock as of September 30, 2023. As a result, Mr. Ingle II has the power to elect a majority of the Company’s directors and approve any action requiring the approval of the holders of the Company’s Class A Common Stock and Class B Common Stock, including adopting certain amendments to the Company’s charter and approving mergers or sales of substantially all of the Company’s assets. Beneficial ownership is calculated in accordance with Rule 13d-3 promulgated under the Exchange Act.

The Company is a controlled company under NASDAQ Rules. As a result, the Company is exempt from certain of NASDAQ’s corporate governance policies, including the requirements that the majority of Directors be independent (as defined in NASDAQ Rules), and that the Company have a nominating committee for Director candidates.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Item 1C. CYBERSECURITY

Not currently applicable.

Item 2. PROPERTIES

Owned Properties

The Company owns 167 of its supermarkets either as free-standing locations or in shopping centers where it is the anchor tenant. The Company also owns 29 undeveloped sites which are suitable for a free-standing store or shopping center development. The Company owns numerous outparcels and other acreage located adjacent to the shopping centers and supermarkets it owns. Real estate owned by the Company is generally located in the same geographic regions as its supermarkets.

The shopping centers owned by the Company contain an aggregate of 8.6 million square feet of leasable space, of which 4.1 million square feet is used by the Company’s supermarkets. The remainder of the leasable space in these shopping centers is leased or held for lease by the Company to third-party tenants. A breakdown by size of the shopping centers owned and operated by the Company is as follows:

| | |

| | |

Size | | Number |

Less than 50,000 square feet | | 19 |

50,000 – 100,000 square feet | | 37 |

More than 100,000 square feet | | 37 |

Total | | 93 |

The Company owns a 1,649,000 square foot facility, which is strategically located between Interstate 40 and Highway 70 near Asheville, North Carolina, as well as the 119 acres of land on which it is situated. The facility includes the Company’s headquarters and its warehouse and distribution facility. The property also includes truck servicing and fuel storage facilities. The Company also owns a 139,000 square foot warehouse on 21 acres of land approximately one mile from its main warehouse and distribution facility.

The Company’s milk processing and packaging subsidiary, Milkco, Inc., owns a 140,000 square foot manufacturing and storage facility in Asheville, North Carolina. In addition to the plant, the 20-acre property includes truck cleaning and fuel storage facilities.

Certain long-term debt of the Company is secured by the owned properties. See Note 7, “Long-Term Debt” to the Consolidated Financial Statements of this Annual Report on Form 10-K for further details.

Leased Properties

The Company operates supermarkets at 31 locations leased from various unaffiliated third parties. The Company has six owned store buildings that are on ground leases. The Company leases one other former supermarket location, which is subleased to a third party. The majority of these leases require the Company to pay property taxes, utilities, insurance, repairs and certain other expenses incidental to occupation of the premises. In addition to base rent, most leases contain provisions that require the Company to pay additional percentage rent (ranging from 0.75% to 1.50%) if sales exceed a specified amount.

Rental rates generally range from $3.00 to $7.77 per square foot. During fiscal 2023, 2022 and 2021, the Company paid cash supermarket rent of $9.4 million, $10.0 million and $10.3 million, respectively. These amounts exclude property taxes, utilities, insurance, repairs, other expenses, and non-cash rent adjustments. The following table summarizes lease expiration dates as of September 30, 2023, with respect to the initial and any renewal option terms of leased supermarkets properties:

| | |

| | |

Year of Expiration | | Number of |

(Including Renewal Terms) | | Leases Expiring |

2023-2034 | | 5 |

2035-2049 | | 1 |

2050 or after | | 26 |

Management believes that the long-term rent stability provided by these leases is a valuable asset of the Company.

Item 3. LEGAL PROCEEDINGS

Various legal proceedings and claims arising in the ordinary course of business are pending against the Company. In the opinion of management, the ultimate liability, if any, from all pending legal proceedings and claims would not materially affect the Company’s business, financial condition, results of operations or cash flows.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

The Company has two classes of Common Stock: Class A and Class B. Class A Common Stock is listed on The NASDAQ Global Select Market under the symbol “IMKTA”. There is no public market for the Company’s Class B Common Stock. Under the terms of the Company’s Articles of Incorporation, a holder of Class B Common Stock may convert any or all of the holder’s shares of Class B Common Stock into an equal number of shares of Class A Common Stock at any time. For additional information regarding the voting powers, preferences and relative rights of the Class A Common Stock and Class B Common Stock, please see Note 8, “Stockholders’ Equity” to the Consolidated Financial Statements contained in this Annual Report on Form 10-K.

As of November 27, 2023, there were approximately 315 holders of record of the Company’s Class A Common Stock and 90 holders of record of the Company’s Class B Common Stock.

Dividends

The Company has paid cash dividends on its Common Stock in each of the past 39 fiscal years, except for the 1984 fiscal year when the Company paid a 3% stock dividend. During both fiscal 2023 and fiscal 2022, the Company paid annual dividends totaling $0.66 per share of Class A Common Stock and $0.60 per share of Class B Common Stock, paid in quarterly installments of $0.165 and $0.15 per share, respectively. The Company’s last dividend payment was made on October 19, 2023 to common stockholders of record on October 12, 2023. For additional information regarding the dividend rights of the Class A Common Stock and Class B Common Stock, please see Note 8, “Stockholders’ Equity” to the Consolidated Financial Statements of this Annual Report on Form 10-K.

The Company expects to continue paying regular cash dividends on a quarterly basis. However, the Board of Directors periodically reconsiders the declaration of dividends. The Company pays these dividends at the discretion of the Board of Directors. The continuation of these payments, the amount of such dividends, and the form in which the dividends are paid (cash or stock) depends upon the results of operations, the financial condition of the Company and other factors which the Board of Directors deems relevant. The payment of cash dividends is also subject to restrictions contained in certain financing arrangements. Such restrictions are summarized in Note 7, “Long-Term Debt” to the Consolidated Financial Statements of this Annual Report on Form 10-K.

Repurchase of Equity Securities

None.

Stock Performance Graph

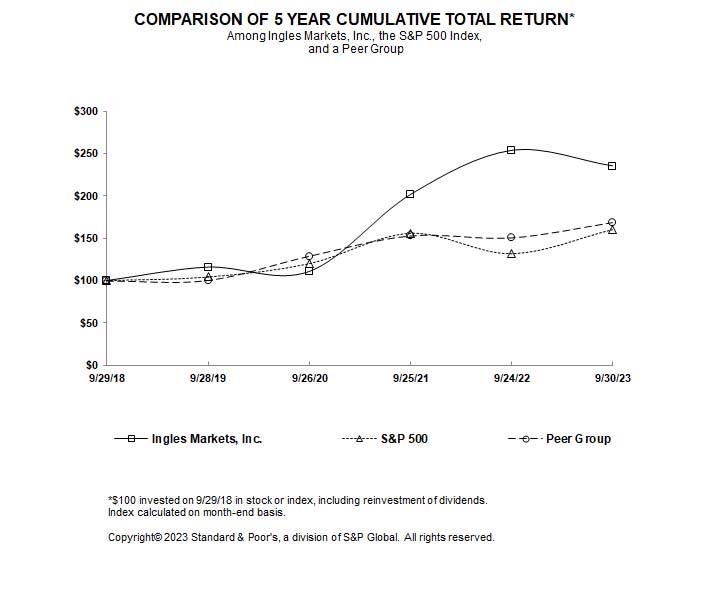

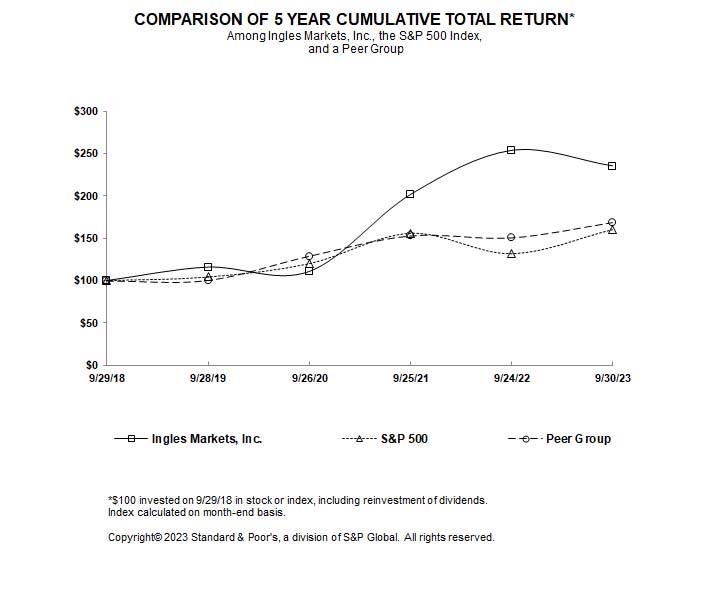

Set forth below are a graph and accompanying table comparing the five-year cumulative total stockholder return on the Class A Common Stock with the five-year cumulative total return of (i) the S&P 500 Comprehensive-Last Trading Day Index and (ii) a peer group of companies in the Company's line of business. The 2023 peer group consists of the following companies: Koninklijke Ahold Delhaize N.V., Weis Markets, Inc., The Kroger Co., Supervalu Inc., SpartanNash Co., Sprouts Farmers Markets, Inc., and Village Super Market, Inc.

The comparisons cover the five-years ended September 30, 2023 and assume that $100 was invested after the close of the market on September 29, 2018, and that dividends were reinvested quarterly. Returns of the companies included in the peer group reflected below have been weighted according to each company’s stock market capitalization at the beginning of each section for which a return is presented.

INGLES MARKETS, INCORPORATED

COMPARATIVE RETURN TO STOCKHOLDERS

INDEXED RETURNS OF INITIAL $100 INVESTMENT*

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Company/Index | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 |

Ingles Markets, Incorporated Class A Common Stock | | $ | 115.89 | | $ | 110.67 | | $ | 201.35 | | $ | 253.47 | | $ | 235.26 |

S&P 500 Comprehensive – Last Trading Day Index | | $ | 104.25 | | $ | 120.05 | | $ | 156.07 | | $ | 131.92 | | $ | 160.44 |

Peer Group | | $ | 100.62 | | $ | 128.92 | | $ | 152.76 | | $ | 150.51 | | $ | 168.35 |

*Assumes $100 invested in the Class A Common Stock of Ingles Markets, Incorporated after the close of the market on September 29, 2018.

The foregoing stock performance information, including the graph, shall not be deemed to be “soliciting material” or to be filed with the Securities and Exchange Commission.

Item 6. [Reserved]

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Ingles is a leading supermarket chain in the Southeast United States and operates a total of 198 supermarkets in North Carolina (75), Georgia (65), South Carolina (35), Tennessee (21), Virginia (1) and Alabama (1). Ingles supermarkets offer customers a wide variety of nationally advertised food products, including grocery, meat and dairy products, produce, frozen foods and other perishables and non-food products. Non-food products include fuel centers, pharmacies, health/beauty/cosmetic products and general merchandise. The Company offers quality private label items in most of its departments. In addition, the Company focuses on selling products to its customers through the development of certified organic products, bakery departments and prepared foods including delicatessen sections. As of September 30, 2023, the Company operated 114 in-store pharmacies and 108 fuel stations. Ingles also operates a fluid dairy and earns shopping center rentals.

Critical Accounting Policies and Estimates

Critical accounting policies are those accounting policies that management believes are important to the presentation of Ingles’ financial condition and results of operations, and require management’s most difficult, subjective or complex judgments, often as a result of the need to estimate the effect of matters that are inherently uncertain. Estimates are based on historical experience and other factors believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Management estimates, by their nature, involve judgments regarding future uncertainties, and actual results may therefore differ materially from these estimates.

Self-Insurance

The Company is self-insured for workers’ compensation, general liability, and group medical and dental benefits. Risks and uncertainties are associated with self-insurance; however, the Company has limited its exposure by maintaining excess liability coverage of $1,000,000 per occurrence for workers’ compensation and for general liability, and $500,000 per covered person for medical care benefits for a policy year. Self-insurance liabilities are established based on claims filed and estimates of claims incurred but not reported. The estimates are based on data provided by the respective claims administrators which is then applied to appropriate actuarial methods. These estimates can fluctuate if historical trends are not predictive of the future. The majority of the Company’s properties are self-insured for casualty losses and business interruption; however, liability coverage is maintained. The Company’s self-insurance reserves totaled $32.9 million and $31.0 million for employee group insurance, workers’ compensation insurance and general liability insurance at September 30, 2023 and September 24, 2022, respectively. These amounts were inclusive of expected recoveries from excess cost insurance or other sources that are recorded as receivables of $4.3 million at September 30, 2023 and $4.0 million at September 24, 2022.

Asset Impairments

The Company accounts for the impairment of long-lived assets in accordance with Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 360. Asset groups are primarily comprised of our individual store and shopping center properties. For assets to be held and used, the Company tests for impairment using undiscounted cash flows and calculates the amount of impairment using discounted cash flows. For assets held for sale, impairment is recognized based on the excess of remaining book value over expected recovery value. The recovery value is the fair value as determined by independent quotes or expected sales prices developed by internal associates, net of costs to sell. Estimates of future cash flows and expected sales prices are judgments based upon the Company’s experience and knowledge of local operations and cash flows that are projected for several years into the future. These estimates can fluctuate significantly due to changes in real estate market conditions, the economic environment, capital

spending decisions and inflation. The Company monitors the carrying value of long-lived assets for potential impairment each quarter based on whether any indicators of impairment have occurred.

Vendor Allowances