UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

(Exact Name of Registrant as Specified in its Charter)

(Former name or former address, if changed since last report.)

| (State of incorporation) | (Commission File Number) | (IRS

Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered under Section 12(g) of the Exchange Act: None

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name

of each exchange on which registered | ||

| N/A | N/A | N/A |

SECTION 2 – Financial Information

Item 2.01 - Completion of Acquisition or Disposition of Assets

On March 20, 2023, Flowerkist Skin Care and Cosmetics, Inc., a Nevada corporation (“we”, “us”, “Buyer” or the “Company”) entered into an Asset Purchase Agreement (the “APA”) with Flowerkist, Inc., a Nevada Corporation (“Seller”) pursuant to which the Company purchased certain assets previously utilized in the operation of Seller’s business. This is a related party transaction.

Assets Purchased:

| 1) | Products and inventory that include CBD enhanced skincare and cosmetics products (MSRP $1,660,000), Branding Trademarks and Logos that were transferred from Flowerkist, Inc. to Flowerkist Skin Care and Cosmetics, Inc. The acquisition includes the commercial website “Flowerkist.com” along with merchant processing and fulfillment agreements. |

| 2) | Revenue Share agreement of 5% of ProVEDA’s non adjusted gross revenues, with a future value of up to $7,800,000. |

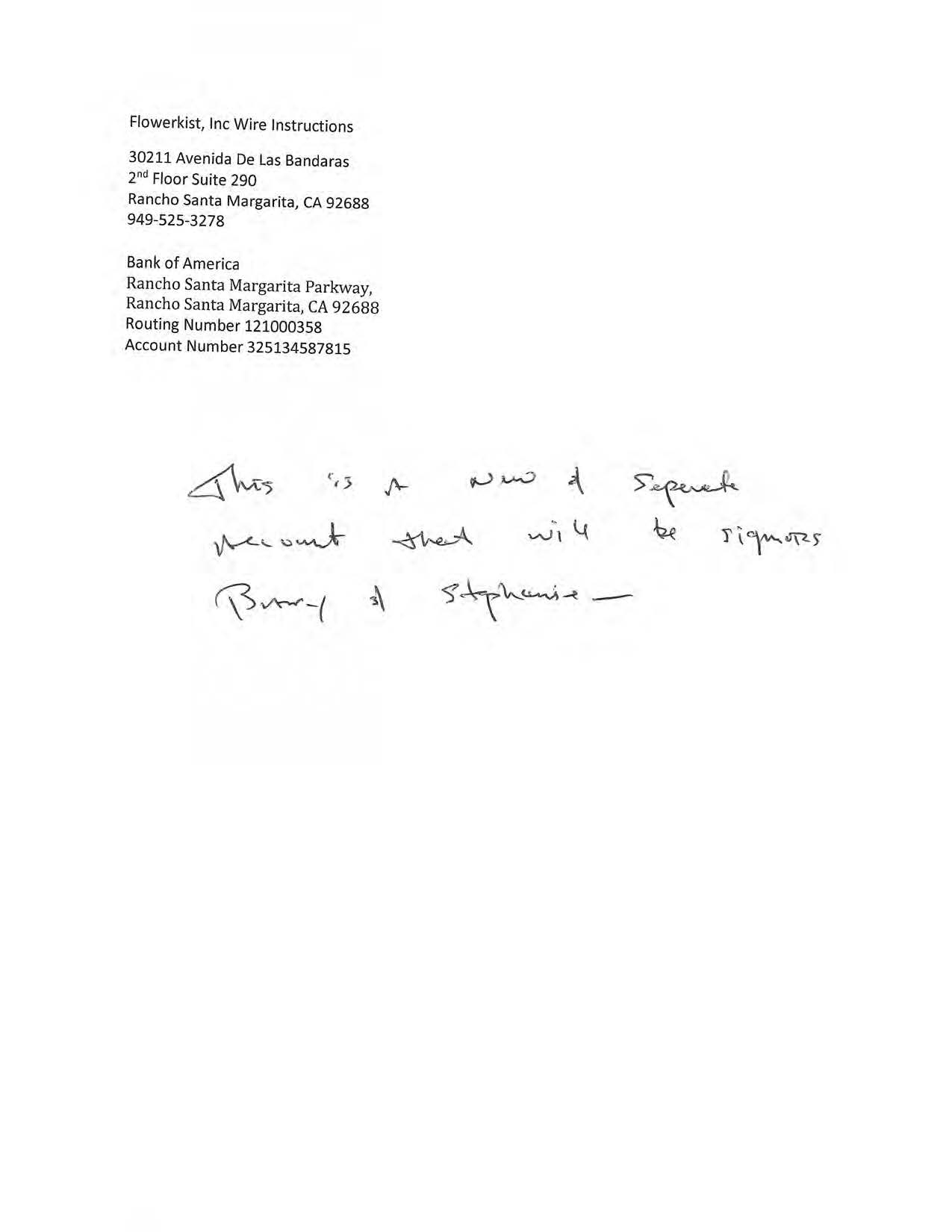

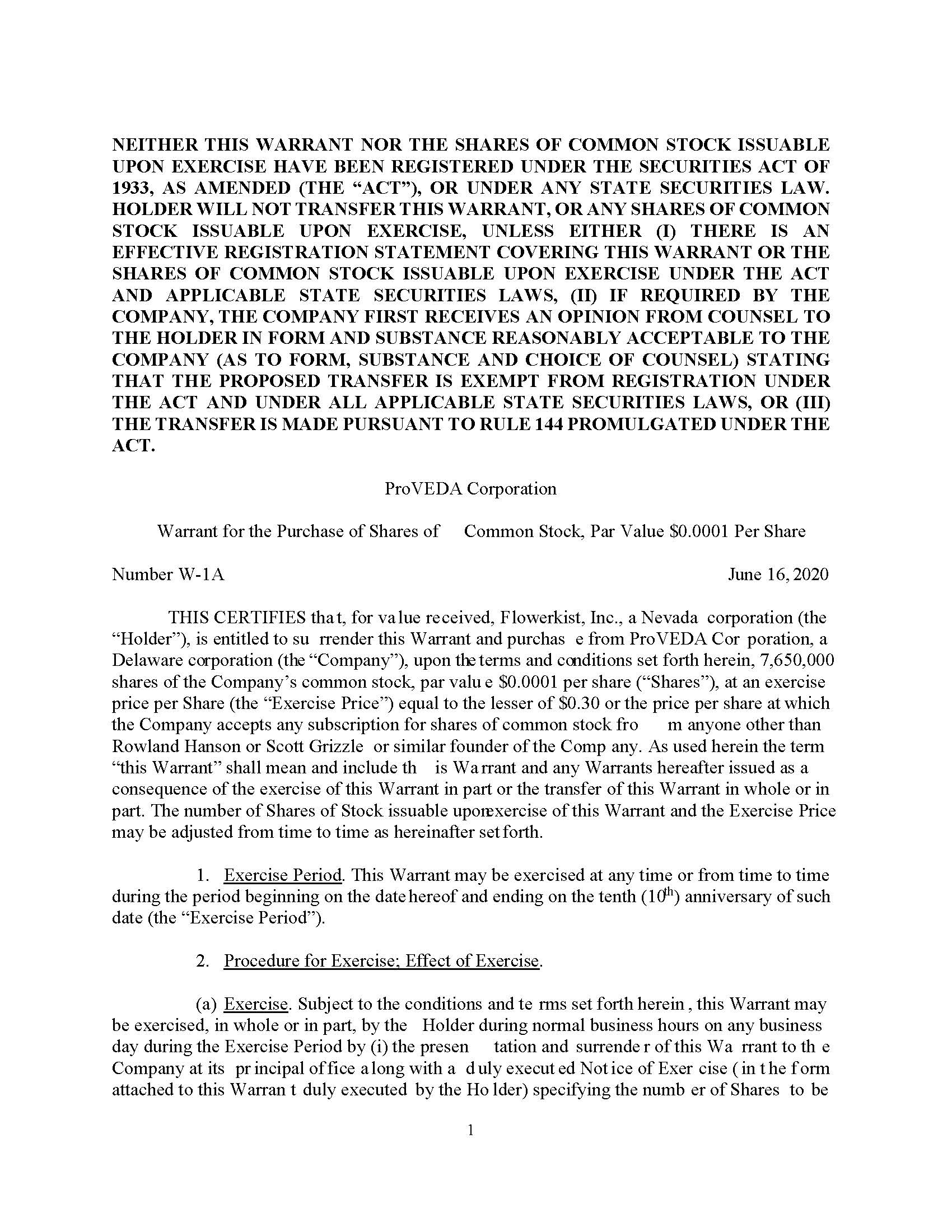

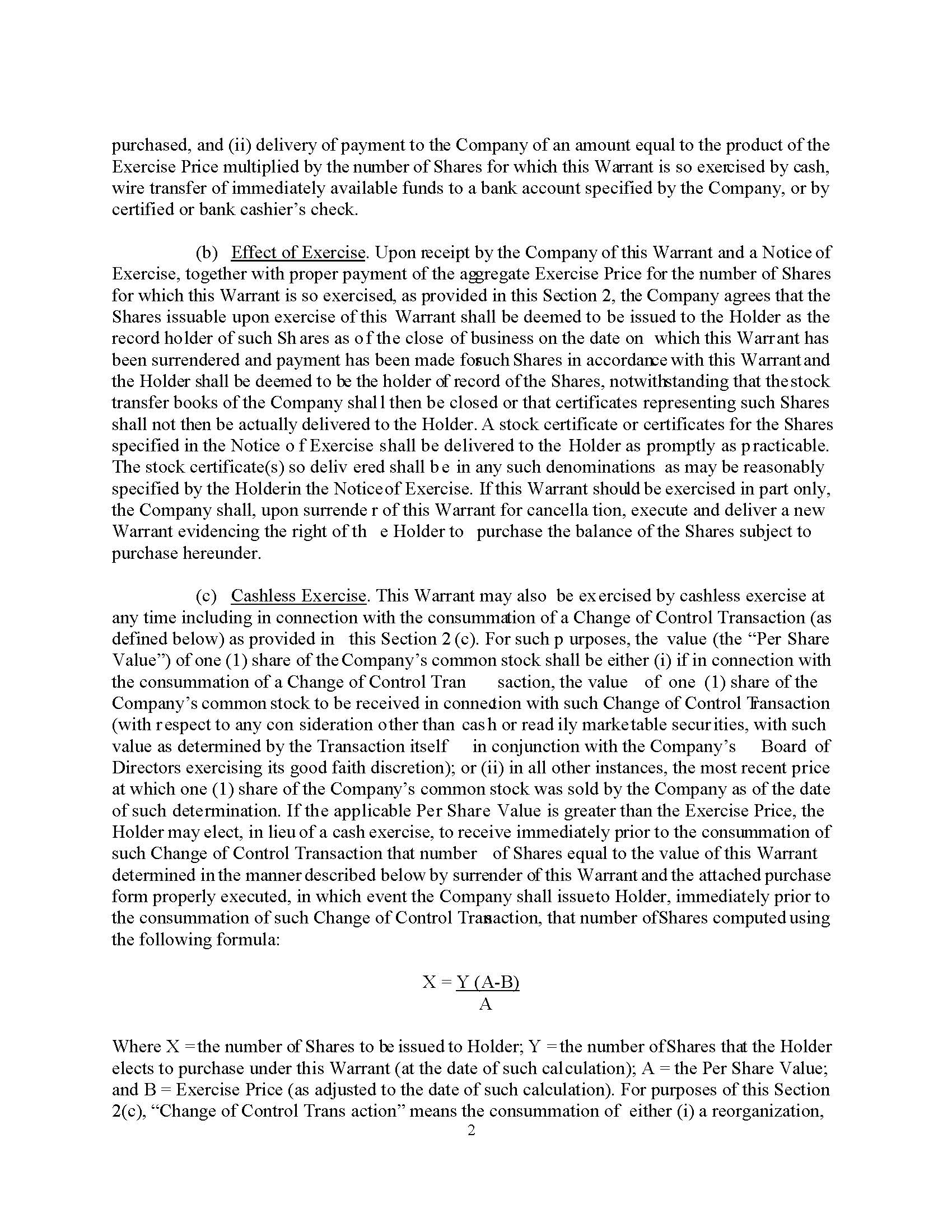

| 3) | Warrants to acquire 7,650,000 shares of ProVEDA at an exercise price of $0.30, currently valued at $0.90 per share, valuing these warrants at $4,590,000, at current price. |

All the purchased assets will be transferred in title and ownership to Flowerkist Skin Care and Cosmetics, Inc., effective immediately. Flowerkist Skin Care and Cosmetics, Inc. will start marketing and selling these products as soon as practicable.

The purchase price of $4,465,000 will be paid with issuance of restricted stocks of OTC: FKST, to current shareholders of the Seller. The purchase price was determined by applying a discount to the full value of assets to reflect wholesale price, taking into consideration the future risk, business, and market conditions.

SECTION 5 – Corporate Governance and Management

Item 5.06 - Change in Shell Company Status

Flowerkist Skin Care and Cosmetics, Inc. (the “Company”) was previously a shell company.

Effective March 20, 2023, the Company’s status as a shell company has changed and is no longer a shell company. The reason the company believes it is no longer a shell company under the SEC definition is as follows:

On March 20, 2023, the Company acquired substantial assets (specified in item 2.01 of this filing) from Flowerkist, Inc. a Nevada Corporation, that will trigger the Company to become an operating company with significant assets causing it to cease being a Shell company.

It is noteworthy that SEC’s Rule 405’s two-part test is conjunctive, meaning that two items must be present at the same time to qualify as a shell company. While the SEC’s Act Rule 405 defines a shell company as one that has no or nominal operations, “and” either (a) no or nominal assets or (b) assets consisting solely of cash and cash equivalents; or (c) assets consisting of any amount of cash and cash equivalents and nominal other assets. The Company’s operations by virtue of its acquisition of the business assets described herein are not nominal, as the Company now owns inventory, intellectual property, services, and vendor contracts included in the assets purchased. As per SEC’s Rule 405, the Company therefore qualifies to be removed from the Shell status.

SECTION 9 – Financial Statements and Exhibits

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits:

| 99.1 | Asset Purchase Agreement between Flowerkist Skin Care and Cosmetics, Inc. and Flowerkist, Inc. dated March 20, 2023. |

| 99.2 | Asset Purchase Agreement between ProVEDA Corporation and Flowerkist, Inc. dated June 16, 2020. |

| 99.3 | Flowerkist, Inc. – Product and Market Presentation |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Date: March 22, 2023 | Flowerkist Skin Care and Cosmetics, Inc. | |

| By: | /s/ Barry Clark | |

| Barry Clark | ||

| Chief Executive Officer | ||

2

Exhibit 99.1

ASSET PURCHASE AGREEMENT

between

FLOWERKIST Skin Care and Cosmetics, Inc.

and

FLOWERKIST, INC.

This Asset Purchase Agreement (this “Agreement”), dated as of March 20th, 2023, is entered into between Flowerkist, Inc. a Nevada Company, (“Seller”) and Flowerkist Skin Care and Cosmetics, Inc., (OTC PINK: FKST) a Nevada Corporation (“Buyer”). As used herein the terms “Parties” shall be used to refer to the seller and buyer jointly.

RECITALS

WHEREAS, Seller wishes to sell and assign to Buyer, and Buyer wishes to purchase and assume from Seller, the rights and obligations of Seller to the Assets and the Assumed Liabilities (as defined herein), subject to the terms and conditions set forth herein;

WHEREAS, Subject to and in accordance with the terms and conditions of this Agreement, Buyer agrees to purchase the Branding, Website, Inventory, and ProVeda Contracts (“Assets”) from Seller as defined in the disclosure schedule (“Disclosure Schedule”), and Seller agrees to sell the Assets to the Buyer. Seller represents and warrants to Buyer that it has full rights to the Assets and the Buyer will have the right to the Assets free and clear of all liens and encumbrances. This transaction is a related party transaction.

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

ARTICLE

I

Purchase and Sale

Section 1.01 Purchase and Sale of Assets. Subject to the terms and conditions set forth herein, Seller shall sell, assign, transfer, convey and deliver to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title and interest in the Assets set forth on Section 1.01, and ProVeda Contracts set forth in Section 3.06, of the Disclosure Schedule attached hereto free and clear of any mortgage, pledge, lien, charge, security interest, claim or other encumbrance (“Encumbrance”).

Section 1.02 Excluded Assets. There are no assets that are excluded from the Assets (the “Excluded Assets”).

Section 1.03 No Liabilities/Assumption of Liabilities. Subject to the terms and conditions set forth herein, Buyer shall assume and agree to pay, perform and discharge the liabilities and obligations set forth on Section 1.03 of the Disclosure Schedules/arising after the

Closing (as defined herein) under the Assets, but only to the extent that such liabilities and obligations do not relate to any breach, default or violation by Seller on or prior to the Closing] (collectively, the “Assumed Liabilities”). Other than the Assumed Liabilities, Buyer shall not assume any liabilities or obligations of Seller of any kind, whether known or unknown, contingent, matured or otherwise, whether currently existing or hereinafter created.

Section 1.04 Purchase Price. The aggregate purchase price for the Assets shall be $4,465,000 (the “Purchase Price”) divided proportionally among all current shareholders of Flowerkist Inc., totalling $4,465,000 in restricted common stock of Buyer (OTC PINK: FKST). The Buyer shall pay the Purchase Price to Seller as defined in Section 1.04 disclosure schedule (“Disclosure Schedule”) to equal in value to $4,465,000 to be issued as Restricted shares of Buyer (OTC PINK: FKST). Shares to be issued within 90 days of completion of closing and once all closing deliverables are received by the Buyer.

Section 1.05 Allocation of Purchase Price. Seller and Buyer agree to allocate the Purchase Price among the Assets for all purposes (including tax and financial accounting) [in accordance with Section 1.05 of the Disclosure Schedules/as agreed by their respective accountants, negotiating in good faith on their behalf]. Buyer and Seller shall file all tax returns (including amended returns and claims for refund) and information reports in a manner consistent with such allocation.

Section 1.06 Withholding Tax. Buyer shall be entitled to deduct and withhold from the Purchase Price all taxes that Buyer may be required to deduct and withhold under any applicable tax law. All such withheld amounts shall be treated as delivered to Seller hereunder.

ARTICLE

II

Closing

Section 2.01 Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place simultaneously with the execution of this Agreement on the date of this Agreement (the “Closing Date”). The consummation of the transactions contemplated by this Agreement shall be deemed to occur at 12:01 a.m. on the Closing Date.

Section 2.02 Closing Deliverables.

(a) At the Closing, Seller shall deliver to Buyer the following:

(i) a bill of sale in form and substance satisfactory to Buyer (the “Bill of Sale”) and duly executed by Seller, transferring the Assets to Buyer, free and clear of any and all liens, encumbrances, security interests, debts or taxes of any nature whatsoever. The Seller shall also produce an Affidavit of Title indicating the Seller’s authority to sell and transfer the Business Name and its assets. Finally, the Seller shall execute and deliver an assignment of the Nevada Corporation and assumed name of the Business to the Buyer and any other documents necessary to finalize this Agreement.;

2

(ii) an assignment and assumption agreement in form and substance satisfactory to Buyer (the “Assignment and Assumption Agreement”) and duly executed by Seller, effecting the assignment to and assumption by Buyer of the Assets and the Assumed Liabilities;

(iii) assignments in form and substance satisfactory to Buyer (the “Intellectual Property Assignments”) and duly executed by Seller, transferring all of Seller’s right, title and interest in and to the trademark registrations and applications, patents and patent applications, copyright registrations and applications, and domain name registrations included in the Assets/Purchased IP (as defined herein). These assignments to include domain names, web site content, hemp research permits, hemp cultivation permits, hemp strain approval documentation, and permitted site leases to Buyer;

(iv) an Assignment and Assumption of Lease in form and substance satisfactory to Buyer (the “Assignment and Assumption of Lease”) and duly executed by Seller;

(v) copies of all consents, approvals, waivers and authorizations referred to in Section 3.02 of the Disclosure Schedules;

(vi) a certificate pursuant to Treasury Regulations Section 1.1445-2(b) that Seller is not a foreign person within the meaning of Section 1445 of the Internal Revenue Code duly executed by Seller;

(vii) tax clearance certificates from the taxing authorities in the jurisdictions that impose taxes on Seller or where Seller has a duty to file tax returns in connection with the transactions contemplated by this Agreement and evidence of the payment in full or other satisfaction of any taxes owed by Seller in those jurisdictions;

(viii) a certificate of the Secretary or Assistant Secretary (or equivalent officer) of Seller certifying as to (A) the resolutions of the board of directors of Seller, duly adopted and in effect, which authorize the execution, delivery and performance of this Agreement and the transactions contemplated hereby; and (B) the names and signatures of the officers of Seller authorized to sign this Agreement and the documents to be delivered hereunder;

(ix) such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Buyer, as may be required to give effect to this Agreement; and

(b) At the Closing, Buyer shall deliver to Seller the following:

(i) the Assignment and Assumption Agreement duly executed by Buyer;

3

(ii) copies of all consents and authorizations referred to in Section 4.02 of the Disclosure Schedules;

(iii) a certificate of the Secretary or Assistant Secretary (or equivalent officer) of Buyer certifying as to (A) the resolutions of the board of directors of Buyer, duly adopted and in effect, which authorize the execution, delivery and performance of this Agreement and the transactions contemplated hereby; and (B) the names and signatures of the officers of Buyer authorized to sign this Agreement and the documents to be delivered hereunder.

ARTICLE

III

Representations and warranties of seller

Seller represents and warrants to Buyer that the statements contained in this ARTICLE III are true and correct as of the date hereof. For purposes of this ARTICLE III, “Seller’s knowledge,” “knowledge of Seller” and any similar phrases shall mean the actual or constructive knowledge of any director or officer of Seller, after due inquiry.

Section 3.01 Organization and Authority of Seller; Enforceability. Seller is a corporation duly organized, validly existing and in good standing under the laws of the state of Nevada. Seller has full corporate power and authority to enter into this Agreement and the documents to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution, delivery and performance by Seller of this Agreement and the documents to be delivered hereunder and the consummation of the transactions contemplated hereby have been duly authorized by all requisite corporate action on the part of Seller. This Agreement and the documents to be delivered hereunder have been duly executed and delivered by Seller, and (assuming due authorization, execution and delivery by Buyer) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Seller, enforceable against Seller in accordance with their respective terms.

Section 3.02 No Conflicts; Consents. The execution, delivery and performance by Seller of this Agreement and the documents to be delivered hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict with the certificate of incorporation, by-laws or other organizational documents of Seller; (b) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule or regulation applicable to Seller or the Assets; (c) conflict with, or result in (with or without notice or lapse of time or both) any violation of, or default under, or give rise to a right of termination, acceleration or modification of any obligation or loss of any benefit under any contract or other instrument to which Seller is a party or to which any of the Assets are subject; or (d) result in the creation or imposition of any Encumbrance on the Assets. No consent, approval, waiver or authorization is required to be obtained by Seller from any person or entity (including any governmental authority) in connection with the execution, delivery and performance by Seller of this Agreement and the consummation of the transactions contemplated hereby.

4

Section 3.03 Title to Assets. Seller owns and has good title to the Assets, free and clear of Encumbrances.

Section 3.04 Condition of Assets. The Assets and tangible personal property included in the Assets are in good condition and are adequate for the uses to which they are being put, and none of such Assets or tangible personal property are in need of maintenance or repairs except for ordinary, routine maintenance and repairs that are not material in nature or cost.

Section 3.05 Intellectual Property.

(a) “Intellectual Property” means any and all of the following in any jurisdiction throughout the world: (i) trademarks and service marks, including all applications and registrations and the goodwill connected with the use of and symbolized by the foregoing; (ii) copyrights, including all applications and registrations related to the foregoing; (iii) trade secrets and confidential know-how; (iv) patents and patent applications; (v) websites and internet domain name registrations; and (vi) other intellectual property and related proprietary rights, interests and protections (including all rights to sue and recover and retain damages, costs and attorneys’ fees for past, present and future infringement and any other rights relating to any of the foregoing).

(b) Section 3.05(b) of the Disclosure Schedules lists all Intellectual Property included in the Assets (“Purchased IP”). Seller owns or has adequate, valid and enforceable rights to use all the Purchased IP, free and clear of all Encumbrances. Seller is not bound by any outstanding judgment, injunction, order or decree restricting the use of the Purchased IP or restricting the licensing thereof to any person or entity. With respect to the registered Intellectual Property listed on Section 3.05(b) of the Disclosure Schedules, (i) all such Intellectual Property is valid, subsisting and in full force and effect; and (ii) Seller has paid all maintenance fees and made all filings required to maintain Seller’s ownership thereof. For all such registered Intellectual Property, Section 3.05(b) of the Disclosure Schedules lists (A) the jurisdiction where the application or registration is located; (B) the application or registration number; and (C) the application or registration date.

(c) Seller’s prior and current use of the Purchased IP has not and does not infringe, violate, dilute or misappropriate the Intellectual Property of any person or entity and there are no claims pending or threatened by any person or entity with respect to the ownership, validity, enforceability, effectiveness or use of the Purchased IP. No person or entity is infringing, misappropriating, diluting or otherwise violating any of the Purchased IP, and neither Seller nor any affiliate of Seller has made or asserted any claim, demand or notice against any person or entity alleging any such infringement, misappropriation, dilution or other violation.

Section 3.06 Assigned Contracts. Section 3.06 of the Disclosure Schedules includes each contract included in the Assets and being assigned to and assumed by Buyer (the “Assigned Contracts”). Each Assigned Contract is valid and binding on Seller in accordance with its terms and is in full force and effect. None of Seller or, to Seller’s knowledge, any other party thereto is in breach of or default under (or is alleged to be in breach of or default under) or has provided or

5

received any notice of any intention to terminate, any Assigned Contract. No event or circumstance has occurred that, with or without notice or lapse of time or both, would constitute an event of default under any Assigned Contract or result in a termination thereof or would cause or permit the acceleration or other changes of any right or obligation or the loss of benefit thereunder. Complete and correct copies of each Assigned Contract have been made available to Buyer. There are no disputes pending or threatened under any Assigned Contract.

Section 3.07 Permits. Section 3.07 of the Disclosure Schedules lists all permits, licenses, franchises, approvals, authorizations, registrations, certificates, variances and similar rights obtained from governmental authorities included in the Assets (the “Transferred Permits”). The Transferred Permits are valid and in full force and effect. All fees and charges with respect to such Transferred Permits as of the date hereof have been paid in full. No event has occurred that, with or without notice or lapse of time or both, would reasonably be expected to result in the revocation, suspension, lapse or limitation of any Transferred Permit.

Section 3.08 Non-foreign Status. Seller is not a “foreign person” as that term is used in Treasury Regulations Section 1.1445-2.

Section 3.09 Compliance With Laws Seller has complied, and is now complying, with all applicable federal, state and local laws and regulations applicable to ownership and use of the Assets.

Section 3.10 Legal Proceedings. There is no claim, action, suit, proceeding or governmental investigation (“Action”) of any nature pending or, to Seller’s knowledge, threatened against or by Seller (a) relating to or affecting the Assets [or the Assumed Liabilities]; or (b) that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

Section 3.11 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Seller.

Section 3.12 Full Disclosure. No representation or warranty by Seller in this Agreement and no statement contained in the Disclosure Schedules to this Agreement or any certificate or other document furnished or to be furnished to Buyer pursuant to this Agreement contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained therein, in light of the circumstances in which they are made, not misleading.

ARTICLE

IV

Representations and warranties of buyer

Buyer represents and warrants to Seller that the statements contained in this ARTICLE IV are true and correct as of the date hereof. For purposes of this ARTICLE IV, “Buyer’s knowledge,” “knowledge of Buyer” and any similar phrases shall mean the actual or constructive knowledge of any director or officer of Buyer, after due inquiry.

6

Section 4.01 Organization and Authority of Buyer; Enforceability. Buyer is a corporation duly organized, validly existing and in good standing under the laws of the state of Nevada. Buyer has full corporate power and authority to enter into this Agreement and the documents to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution, delivery and performance by Buyer of this Agreement and the documents to be delivered hereunder and the consummation of the transactions contemplated hereby have been duly authorized by all requisite corporate action on the part of Buyer. This Agreement and the documents to be delivered hereunder have been duly executed and delivered by Buyer, and (assuming due authorization, execution and delivery by Seller) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms.

Section 4.02 No Conflicts; Consents. The execution, delivery and performance by Buyer of this Agreement and the documents to be delivered hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict with the certificate of incorporation, by-laws or other organizational documents of Buyer; or (b) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule or regulation applicable to Buyer. No consent, approval, waiver or authorization is required to be obtained by Buyer from any person or entity (including any governmental authority) in connection with the execution, delivery and performance by Buyer of this Agreement and the consummation of the transactions contemplated hereby.

Section 4.03 Legal Proceedings. There is no Action of any nature pending or, to Buyer’s knowledge, threatened against or by Buyer that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

Section 4.04 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Buyer.

ARTICLE

V

Covenants

Section 5.01 Public Announcements. Unless otherwise required by applicable law or stock exchange requirements, neither party shall make any public announcements regarding this Agreement or the transactions contemplated hereby without the prior written consent of the other party (which consent shall not be unreasonably withheld or delayed).

Section 5.02 Transfer Taxes. All transfer, documentary, sales, use, stamp, registration, value added and other such taxes and fees (including any penalties and interest) incurred in connection with this Agreement and the documents to be delivered hereunder shall be borne and paid by Seller when due. Seller shall, at its own expense, timely file any tax return or other document with respect to such taxes or fees (and Buyer shall cooperate with respect thereto as necessary).

7

Section 5.03 Further Assurances. Following the Closing, each of the Parties hereto shall execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement and the documents to be delivered hereunder.

ARTICLE

VI

Indemnification

Section 6.01 Survival. All representations, warranties, covenants and agreements contained herein and all related rights to indemnification shall survive the Closing.

Section 6.02 Indemnification By Seller. Seller shall defend, indemnify and hold harmless Buyer, its affiliates and their respective stockholders, directors, officers and employees from and against all claims, judgments, damages, liabilities, settlements, losses, costs and expenses, including attorneys’ fees and disbursements, arising from or relating to:

(a) any inaccuracy in or breach of any of the representations or warranties of Seller contained in this Agreement or any document to be delivered hereunder;

(b) any breach or non-fulfillment of any covenant, agreement or obligation to be performed by Seller pursuant to this Agreement or any document to be delivered hereunder; or

(c) any Excluded Asset and/or Excluded Liability.

Section 6.03 Indemnification By Buyer. Buyer shall defend, indemnify and hold harmless Seller, its affiliates and their respective stockholders, directors, officers and employees from and against all claims, judgments, damages, liabilities, settlements, losses, costs and expenses, including attorneys’ fees and disbursements, arising from or relating to:

(a) any inaccuracy in or breach of any of the representations or warranties of Buyer contained in this Agreement or any document to be delivered hereunder;

(b) any breach or non-fulfillment of any covenant, agreement or obligation to be performed by Buyer pursuant to this Agreement or any document to be delivered hereunder; or

(c) any Assumed Liability.

Section 6.04 Indemnification Procedures. Whenever any claim shall arise for indemnification hereunder, the party entitled to indemnification (the “Indemnified Party”) shall promptly provide written notice of such claim to the other party (the “Indemnifying Party”). In connection with any claim giving rise to indemnity hereunder resulting from or arising out of any Action by a person or entity who is not a party to this Agreement, the Indemnifying Party, at its sole cost and expense and upon written notice to the Indemnified Party, may assume the defense of any such Action with counsel reasonably satisfactory to the Indemnified Party. The Indemnified

8

Party shall be entitled to participate in the defense of any such Action, with its counsel and at its own cost and expense. If the Indemnifying Party does not assume the defense of any such Action, the Indemnified Party may, but shall not be obligated to, defend against such Action in such manner as it may deem appropriate, including, but not limited to, settling such Action, after giving notice of it to the Indemnifying Party, on such terms as the Indemnified Party may deem appropriate and no action taken by the Indemnified Party in accordance with such defense and settlement shall relieve the Indemnifying Party of its indemnification obligations herein provided with respect to any damages resulting therefrom. The Indemnifying Party shall not settle any Action without the Indemnified Party’s prior written consent (which consent shall not be unreasonably withheld or delayed).

Section 6.05 Tax Treatment of Indemnification Payments. All indemnification payments made by Seller under this Agreement shall be treated by the Parties as an adjustment to the Purchase Price for tax purposes, unless otherwise required by law.

Section 6.06 Effect of Investigation. Buyer’s right to indemnification or other remedy based on the representations, warranties, covenants and agreements of Seller contained herein will not be affected by any investigation conducted by Buyer with respect to, or any knowledge acquired by Buyer at any time, with respect to the accuracy or inaccuracy of or compliance with, any such representation, warranty, covenant or agreement.

Section 6.07 Cumulative Remedies. The rights and remedies provided in this ARTICLE VI are cumulative and are in addition to and not in substitution for any other rights and remedies available at law or in equity or otherwise.

ARTICLE

VII

Miscellaneous

Section 7.01 Expenses. All costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the party incurring such costs and expenses.

Section 7.02 Notices. All notices, requests, consents, claims, demands, waivers and other communications hereunder shall be in writing and shall be deemed to have been given (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by facsimile or e-mail of a PDF document (with confirmation of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after normal business hours of the recipient; or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid. Such communications must be sent to the respective Parties at the following addresses (or at such other address for a party as shall be specified in a notice given in accordance with this Section 7.02):

| If to Seller: | Stephanie Parker |

| Email: stephanie@flowerkist.com | |

| Attention: Stephanie Parker |

9

| If to Buyer: | Barry Clark |

| Email: barry@flowerkist.com | |

| Attention: Barry Clark |

Section 7.03 Headings. The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section 7.04 Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

Section 7.05 Entire Agreement. This Agreement and the documents to be delivered hereunder constitute the sole and entire agreement of the Parties to this Agreement with respect to the subject matter contained herein, and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of any inconsistency between the statements in the body of this Agreement and the documents to be delivered hereunder, the Exhibits and Disclosure Schedules (other than an exception expressly set forth as such in the Disclosure Schedules), the statements in the body of this Agreement will control.

Section 7.06 Successors and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the Parties hereto and their respective successors and permitted assigns. Neither party may assign its rights or obligations hereunder without the prior written consent of the other party, which consent shall not be unreasonably withheld or delayed. No assignment shall relieve the assigning party of any of its obligations hereunder.

Section 7.07 No Third-party Beneficiaries. Except as provided in ARTICLE VI, this Agreement is for the sole benefit of the Parties hereto and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other person or entity any legal or equitable right, benefit or remedy of any nature whatsoever under or by reason of this Agreement.

Section 7.08 Amendment and Modification. This Agreement may only be amended, modified or supplemented by an agreement in writing signed by each party hereto.

Section 7.09 Waiver. No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No waiver by any party shall operate or be construed as a waiver in respect of any failure, breach or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any right, remedy, power or privilege arising from this Agreement shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

10

Section 7.10 Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Nevada without giving effect to any choice or conflict of law provision or rule (whether of the State of Nevada or any other jurisdiction).

Section 7.11 Submission to Jurisdiction. Any legal suit, action or proceeding arising out of or based upon this Agreement or the transactions contemplated hereby may be instituted in the federal courts of the United States of America or the courts of the State of Nevada, and each party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action or proceeding.

Section 7.12 Waiver of Jury Trial. Each party acknowledges and agrees that any controversy which may arise under this Agreement is likely to involve complicated and difficult issues and, therefore, each such party irrevocably and unconditionally waives any right it may have to a trial by jury in respect of any legal action arising out of or relating to this Agreement or the transactions contemplated hereby. In the event of any dispute arising out of or relating to the subject matter of this Agreement, the matter shall be submitted to the confidential binding arbitration under the auspices of the American arbitration association and arbitration shall be held in Las Vegas, Nevada.

The Parties further agree not to take any action that will result directly or indirectly in the disclosure of the existence of any dispute arising hereunder.

Section 7.13 Specific Performance. The Parties agree that irreparable damage would occur if any provision of this Agreement were not performed in accordance with the terms hereof and that the Parties shall be entitled to specific performance of the terms hereof, in addition to any other remedy to which they are entitled at law or in equity.

Section 7.14 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

{Signature Page Follows}

11

IN WITNESS WHEREOF, the Parties hereto have caused this Agreement to be executed as of the date first written above by their respective officers thereunto duly authorized.

| Flowerkist, Inc. | ||

| (Seller) | ||

| By | /s/ Stephanie Parker | |

| Name: | Stephanie Parker | |

| Title: | President | |

| Date: | 3/20/23 | |

| Flowerkist Skin Care and Cosmetics, Inc. | ||

| (Buyer) | ||

| By | /s/ Barry Clark | |

| Name: | Barry Clark | |

| Title: | CEO | |

| Date: | March 20, 2023 | |

12

Disclosure Schedule

Section 1.01 – Assets.

| - | Branding - Flowerkist trademark, Flowerkist logo, Flowerkist mark |

| - | Website - Flowerkist.com URL: https://flowerkist.com/ |

| - | Inventory - |

| ○ | All current inventory held at Medallion Enterprises (Current inventory list is attached) at 70% discount to current MSRP value. |

Section 1.02 – Excluded Assets

| - | None |

Section 1.03 – Assumed Liabilities

| - | Buyer shall assume and agree to pay, perform and discharge the liabilities and obligations set forth below OR those which arise after the Closing. |

Section 1.04 – Allocation of Purchase Price

| ○ | Allocated proportionally to all current shareholders of Flowerkist, Inc. (current shareholder list is attached) |

| ○ | Restricted stocks to be issued proportionally to all shareholders of Flowerkist Inc., at stock price determined by Registration offering price. The total value of shares issued to total the selling price. |

| ■ | Total shares issued = $4,465,000 (purchase price)/Registration price (of the “Buyer”) |

| ■ | Conversion from Flowerkist share to FKST share = Total shares issued/Total OS in Flowerkist, Inc (the “Seller”) |

| ○ | Shares to be issued at the registration of Regulation A or S1. |

Section 3.06 – ProVeda Contracts

| ○ | ProVeda Royalty agreement – 5% of ProVEDA revenue to 10M at 70% discount to future value (with a residual value of $7.8M). (Flowerkist/ProVEDA APA is attached) |

| ○ | ProVEDA Warrants – Warrant to purchase 7.65M shares of ProVEDA at $0.30 (currently trading at $0.90/share) at 70% discount (Flowerkist/ProVEDA APA is attached) |

Section 3.07 – Permits.

| - | List all permits, licenses, franchises, approvals, authorizations, registrations, certificates, variances and similar rights obtained from governmental authorities included in the Assets |

| ○ | None |

13

Exhibit 99.2

Exhibit 99.3

REVERSE THE APPEARANCE OF AGING CBD - INFUSED SKINCARE CBD - INFUSED COSMETICS NON - INVASIVE BODY CONTOURING

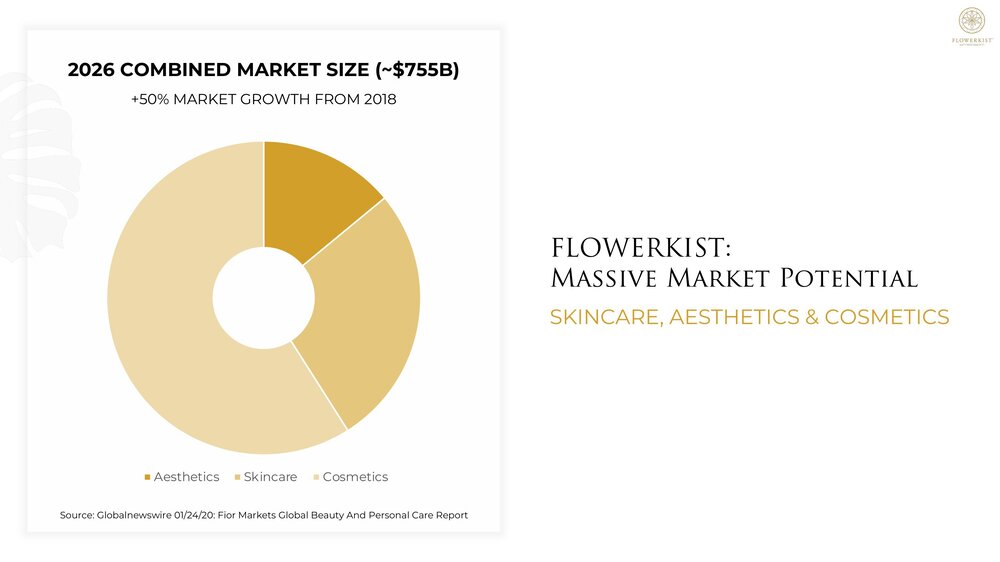

FLOWERKIST: Massive Market Potential SKINCARE, AESTHETICS & COSMETICS Source: Globalnewswire 01/24/20: Fior Markets Global Beauty And Personal Care Report Aesthetics Skincare Cosmetics 2026 COMBINED MARKET SIZE (~$755B) +50% MARKET GROWTH FROM 2018

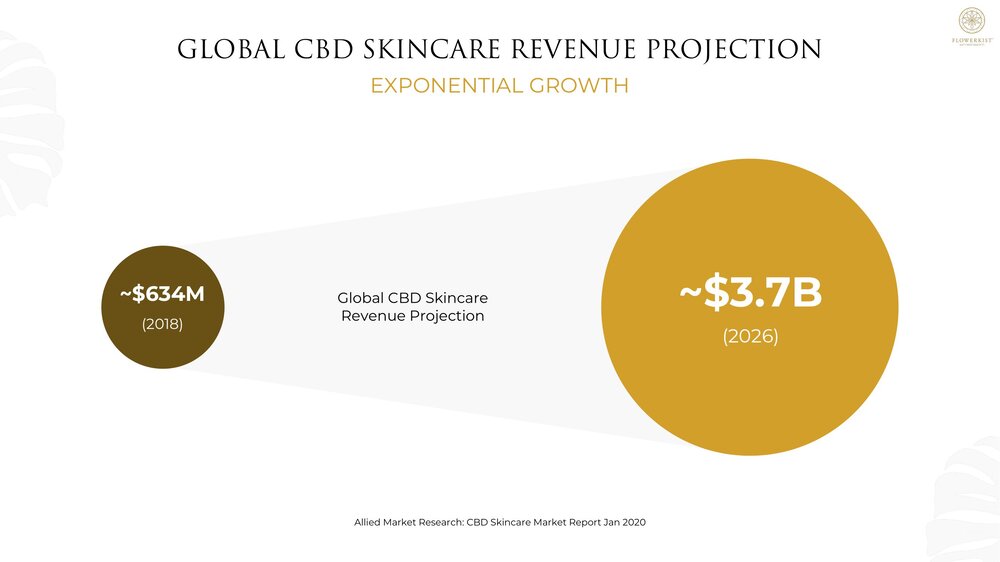

GLOBAL CBD SKINCARE REVENUE PROJECTION EXPONENTIAL GROWTH Allied Market Research: CBD Skincare Market Report Jan 2020 ~$3.7B (2026) ~$634M (2018) Global CBD Skincare Revenue Projection

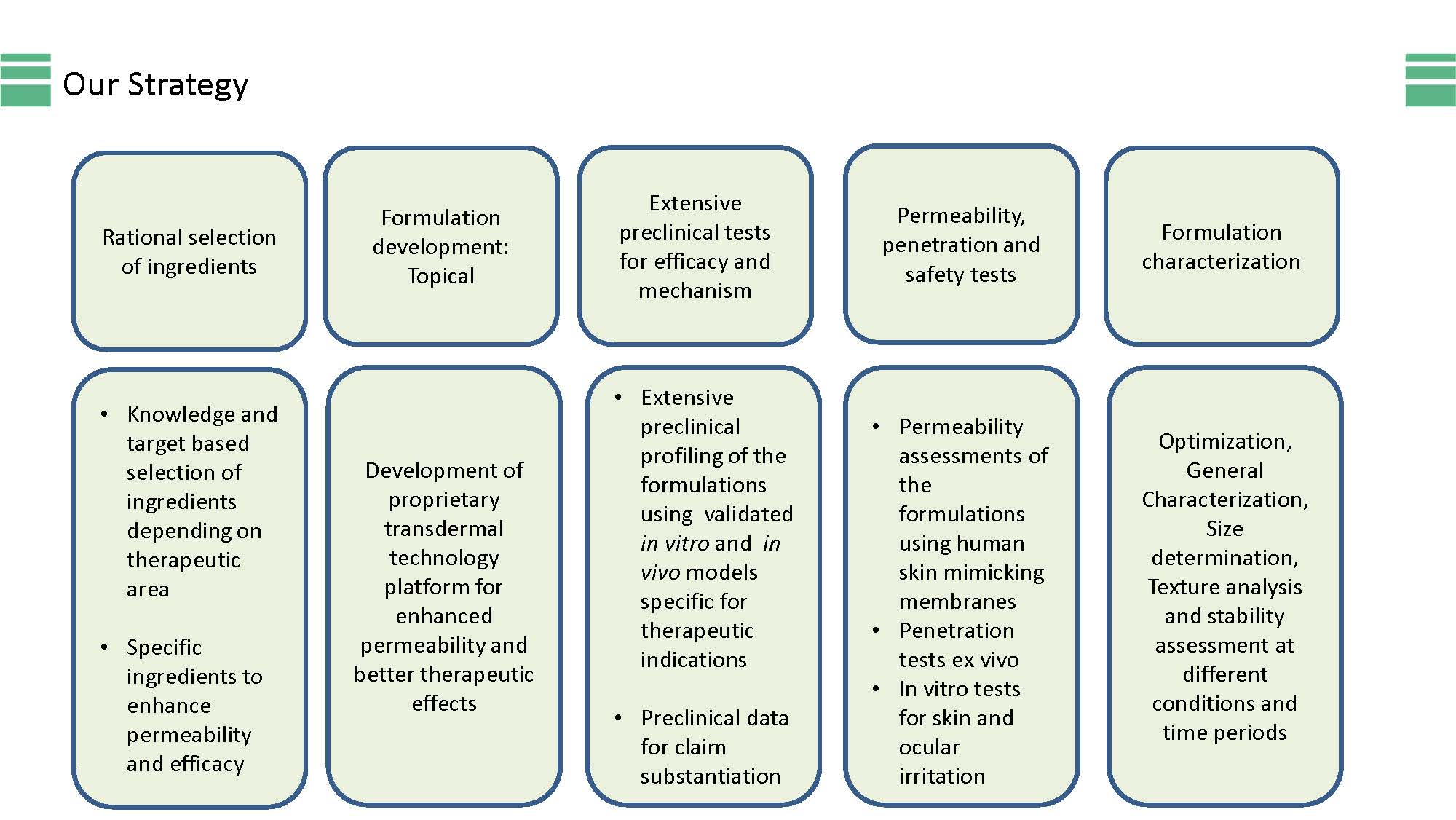

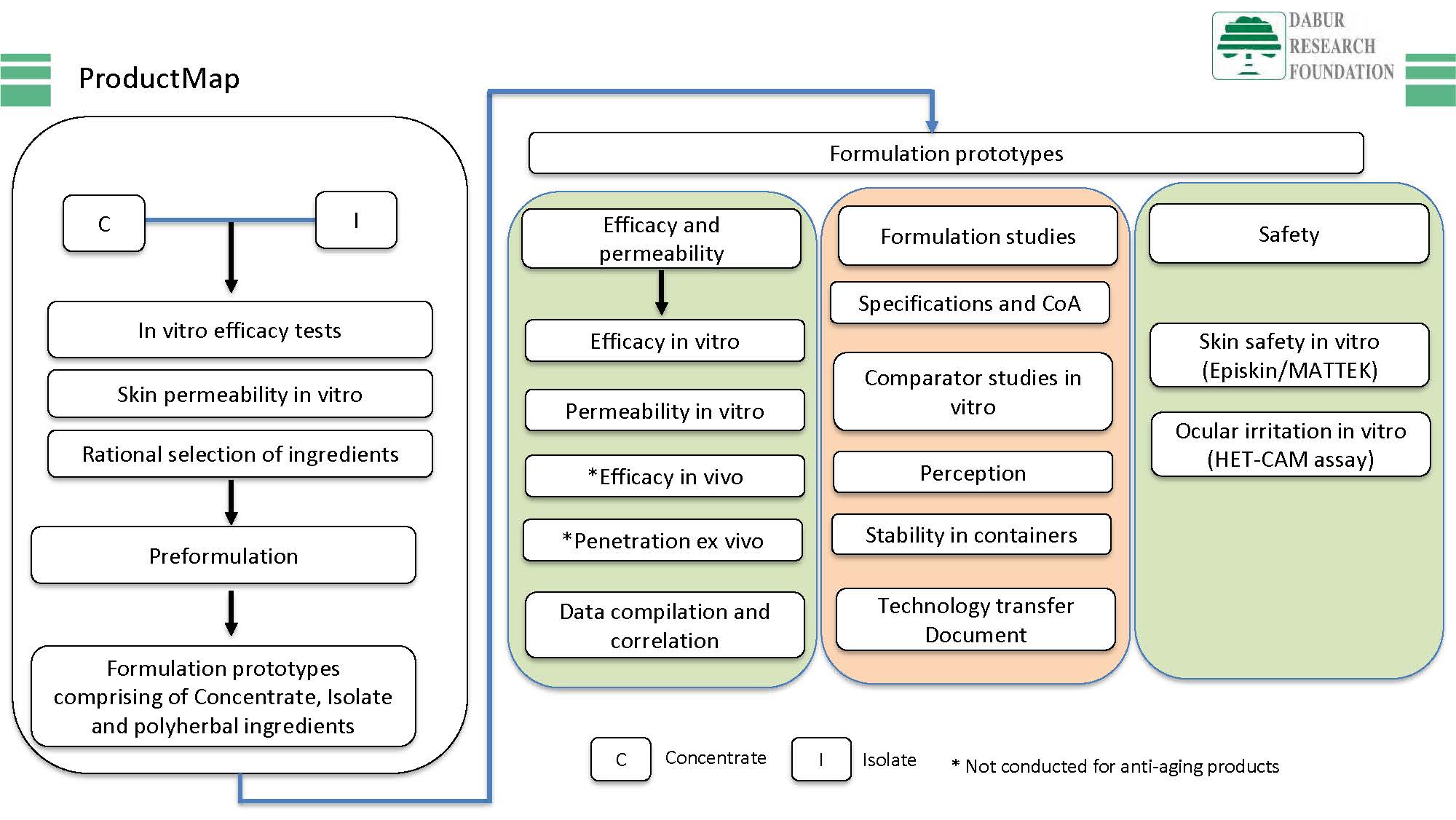

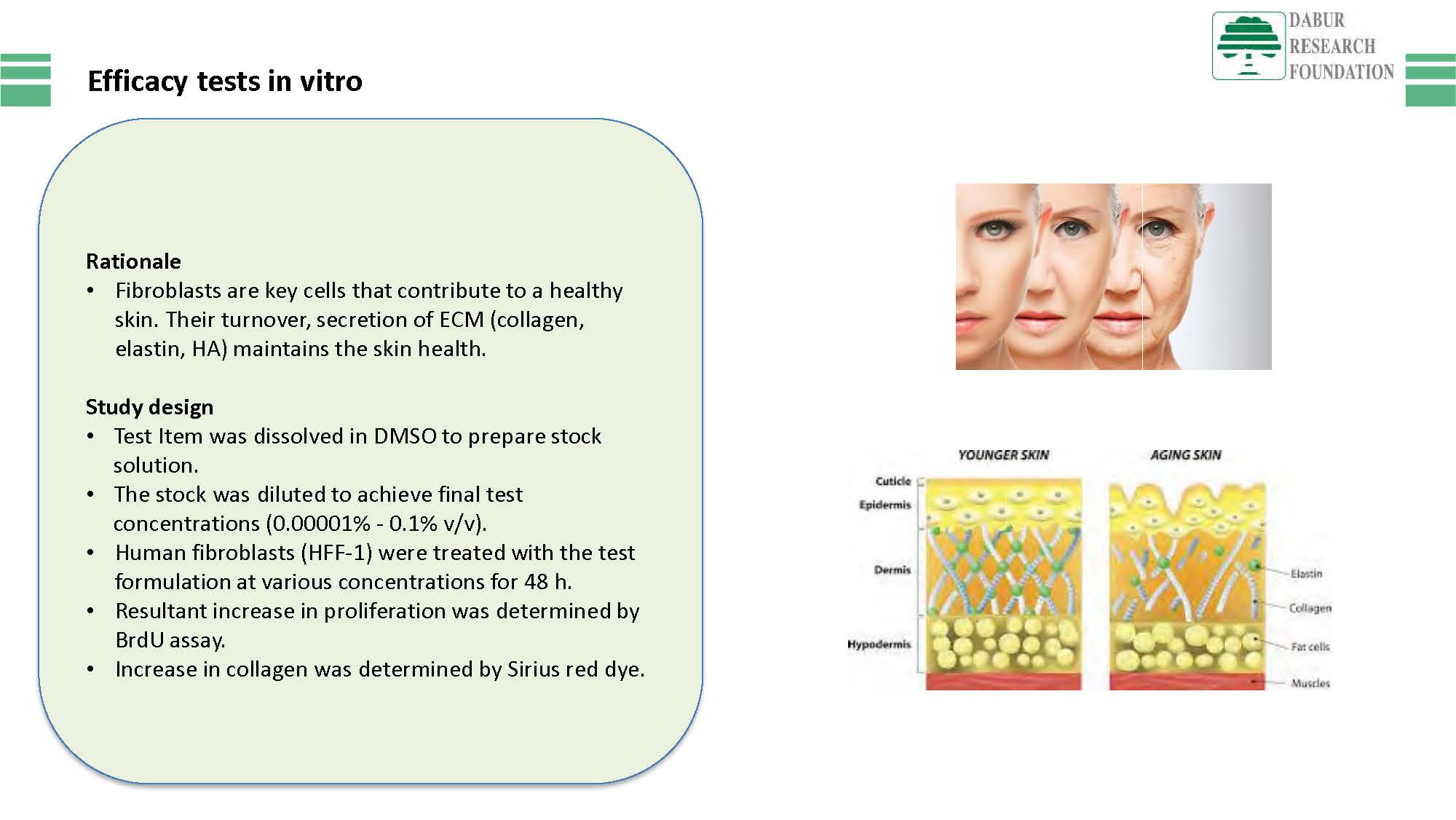

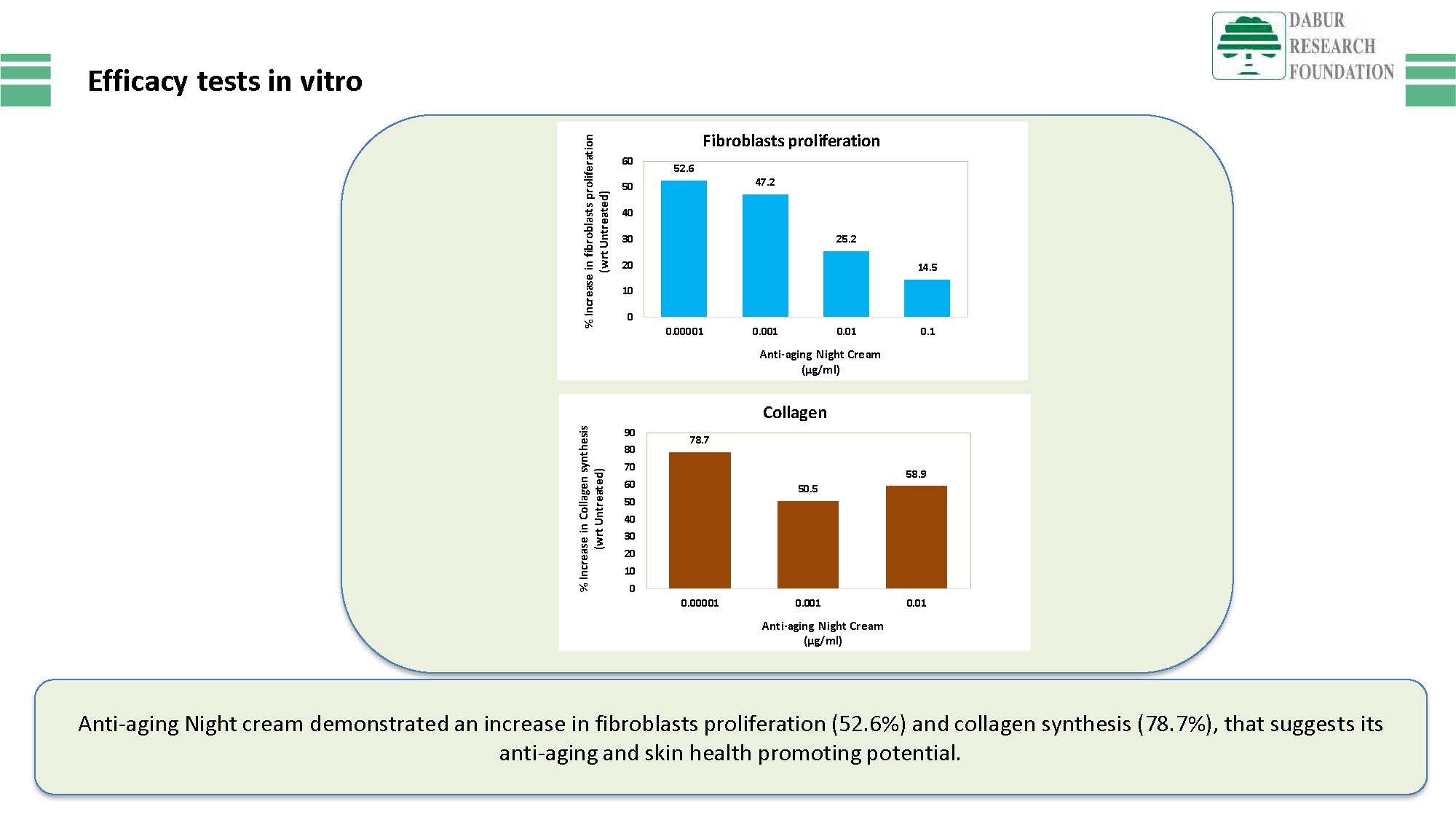

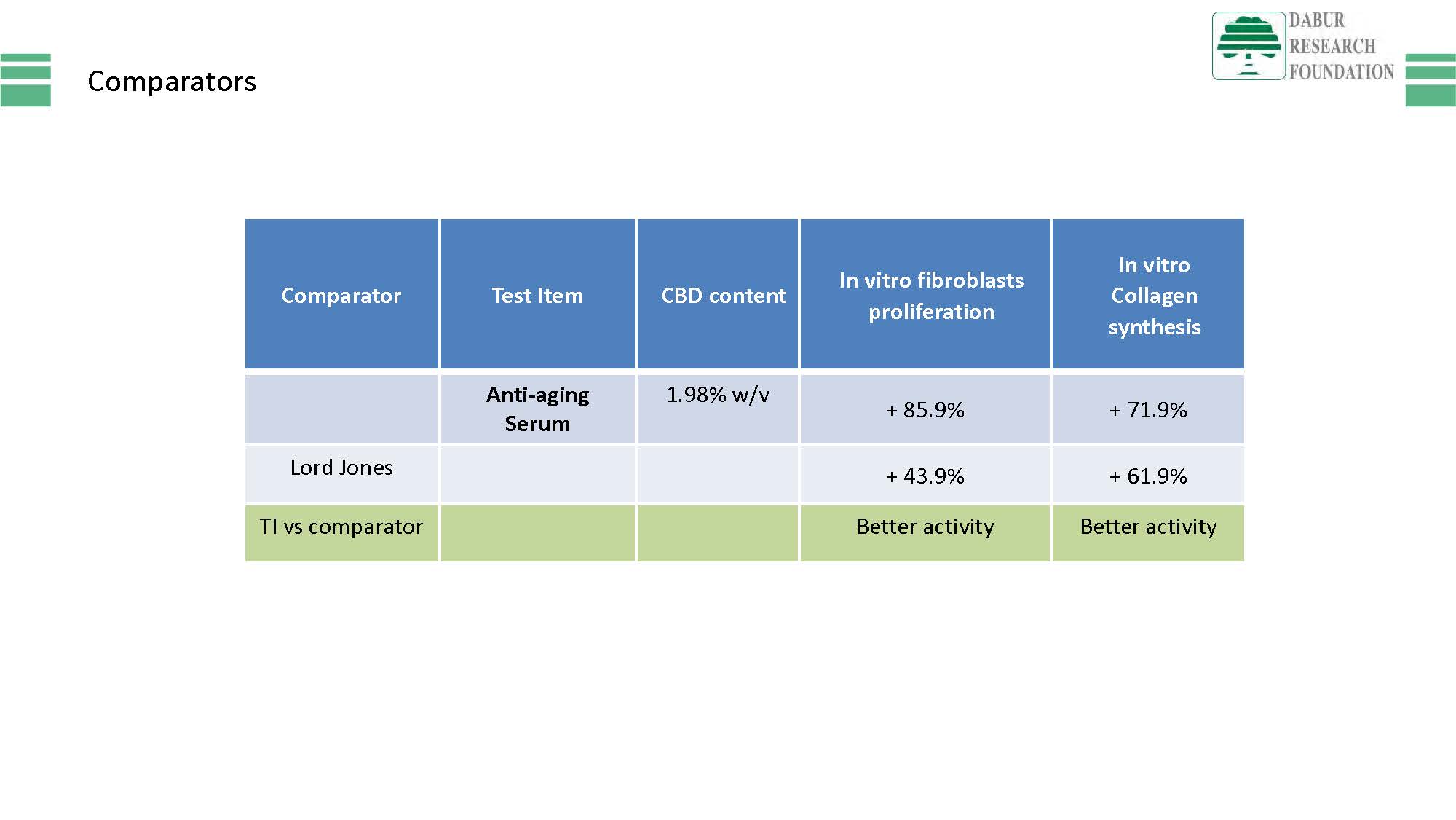

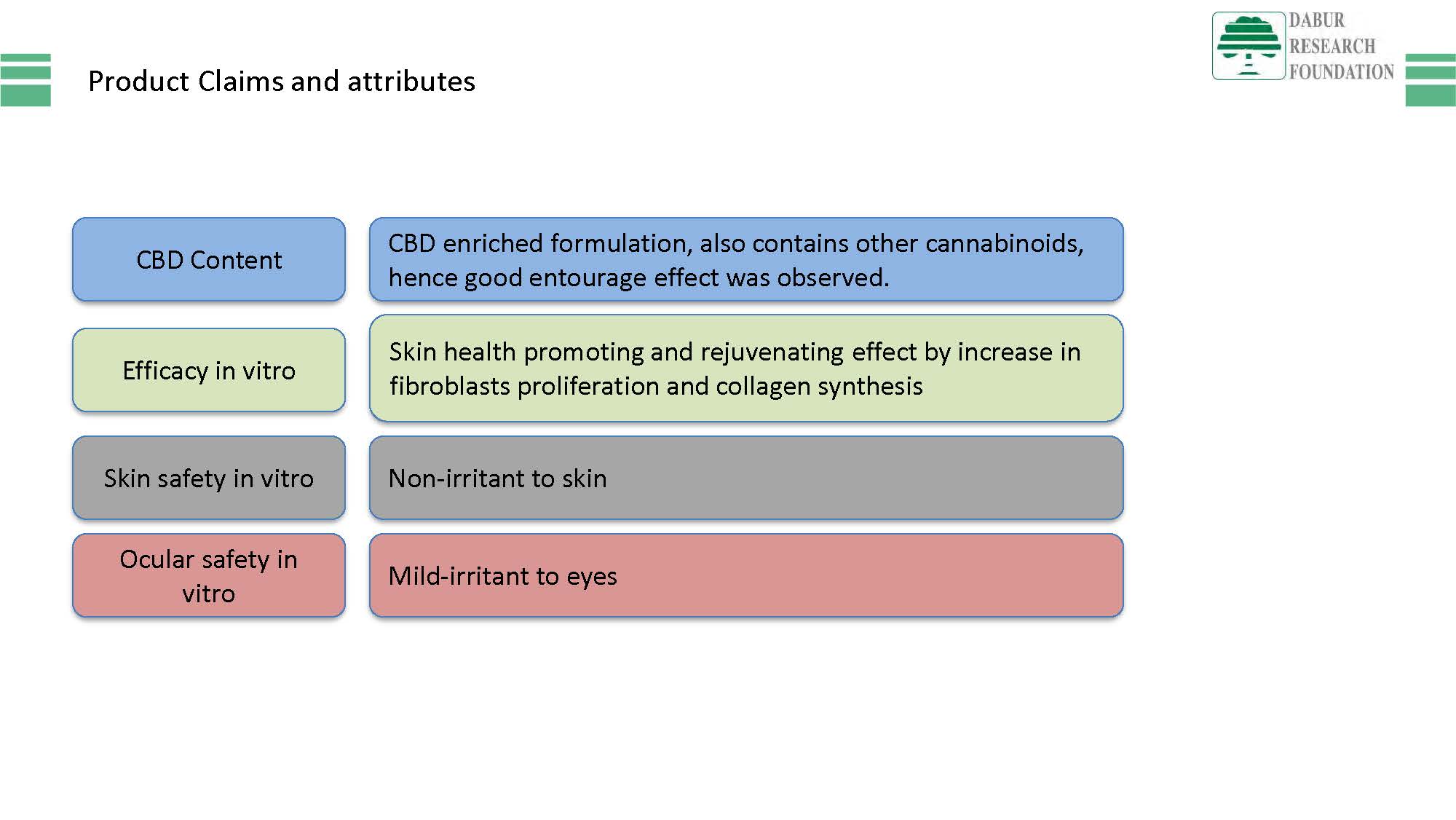

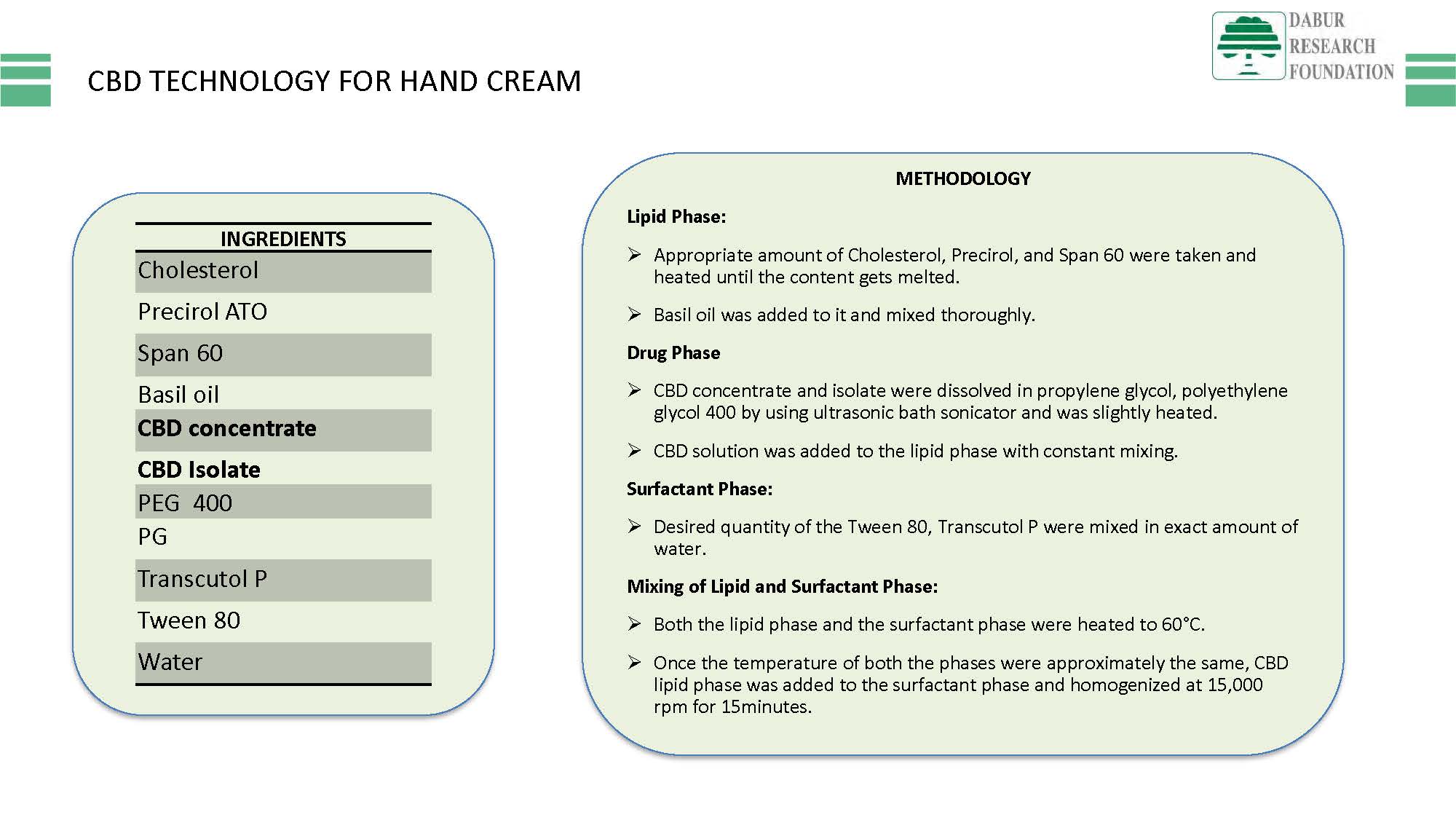

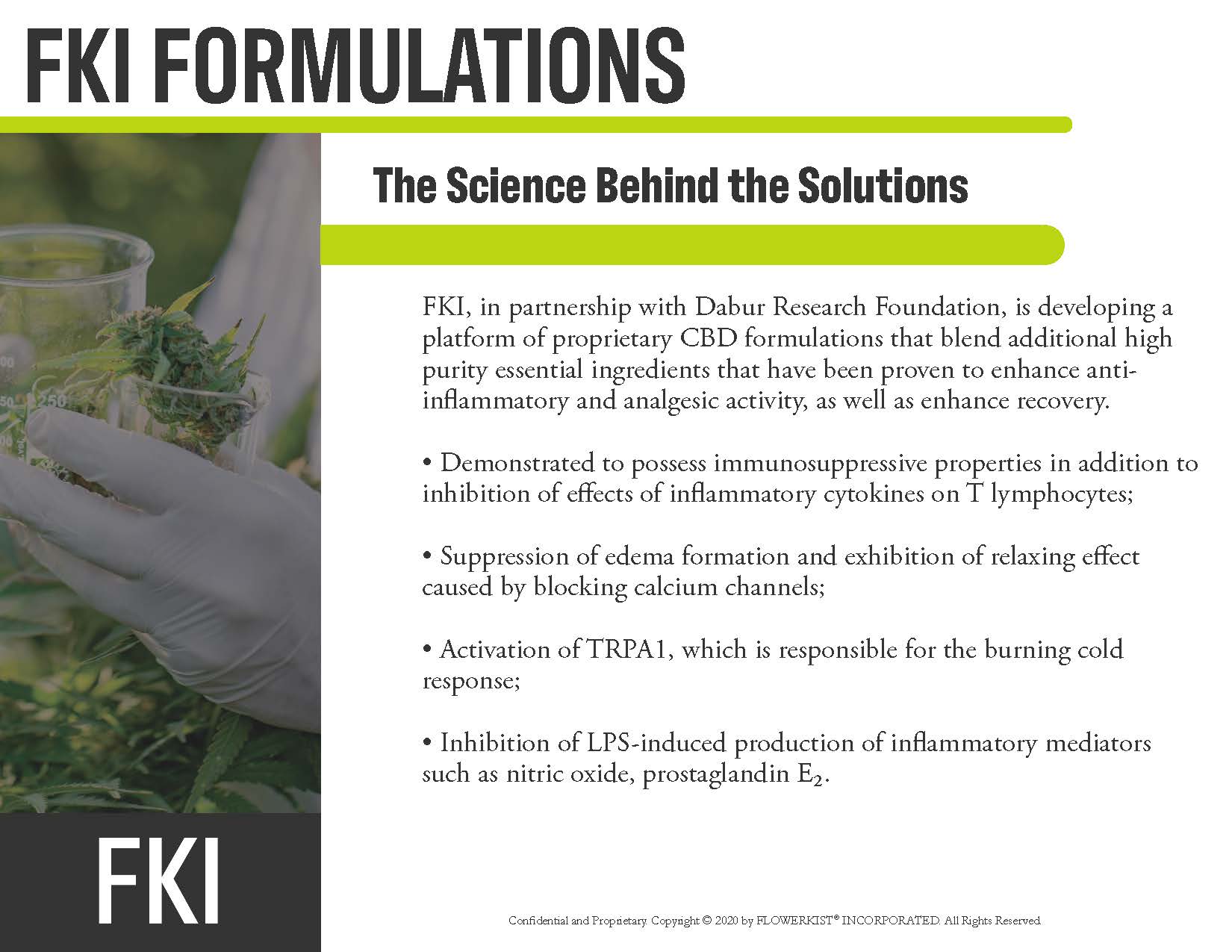

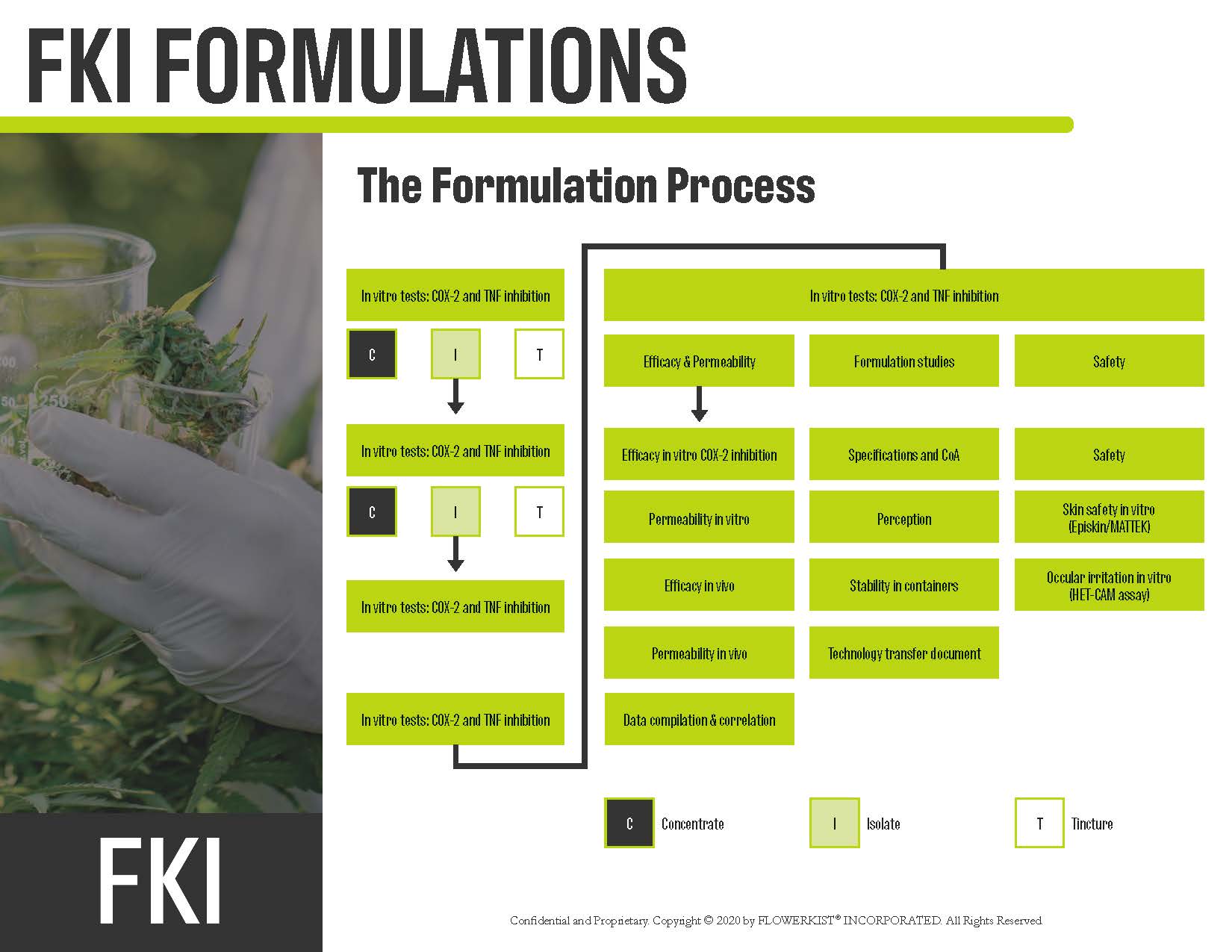

WORLD CLASS PARTNER - R&D DABUR RESEARCH FOUNDATION Dabur is a wholly - owned subsidiary of Dabur India Limited, an NSE - listed world leader in Ayurvedic medicine and one of the largest natural consumer products companies in India. Dabur studies and leverages the biology of CBD to develop proven, high - quality products for skin health.

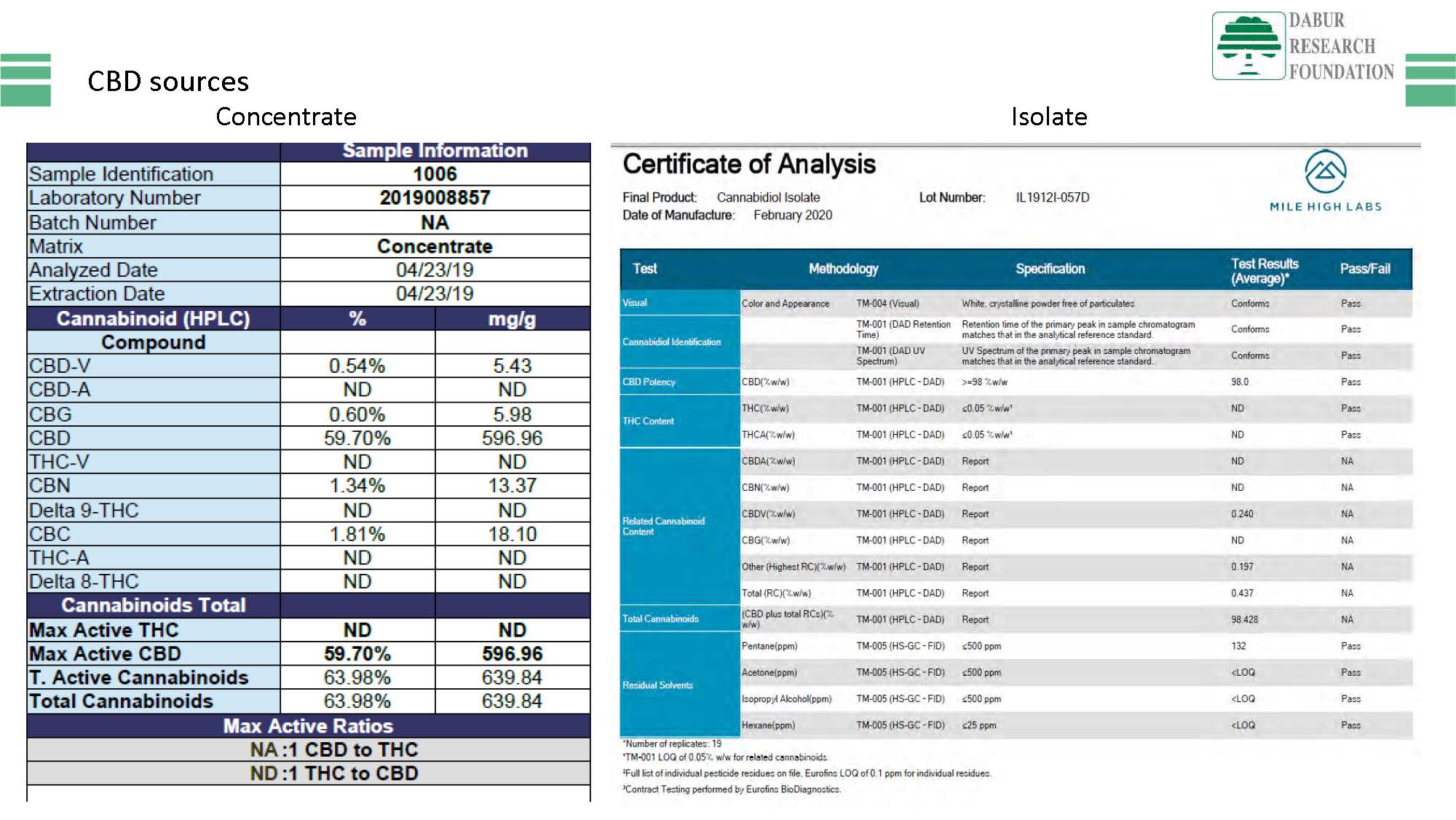

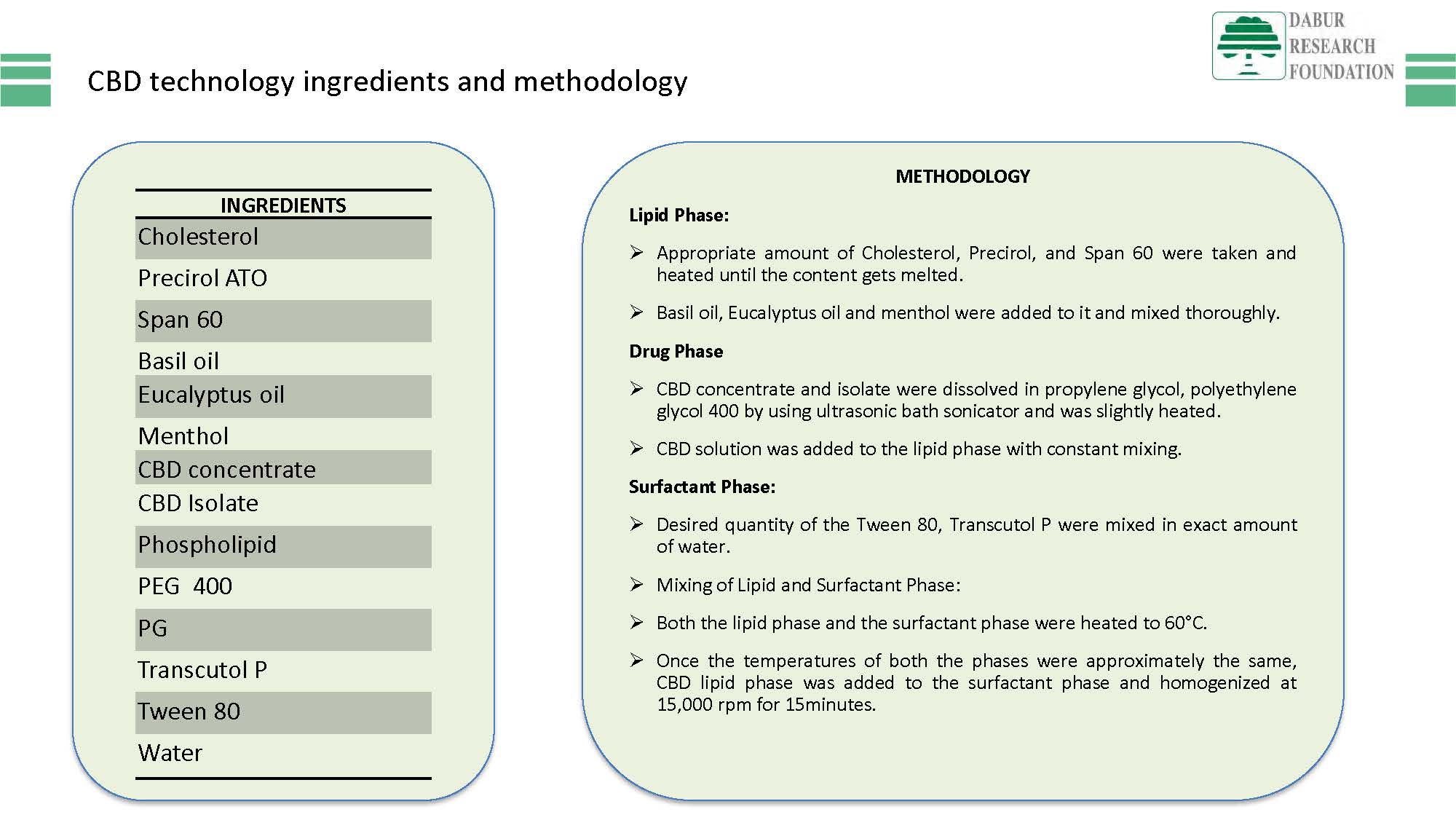

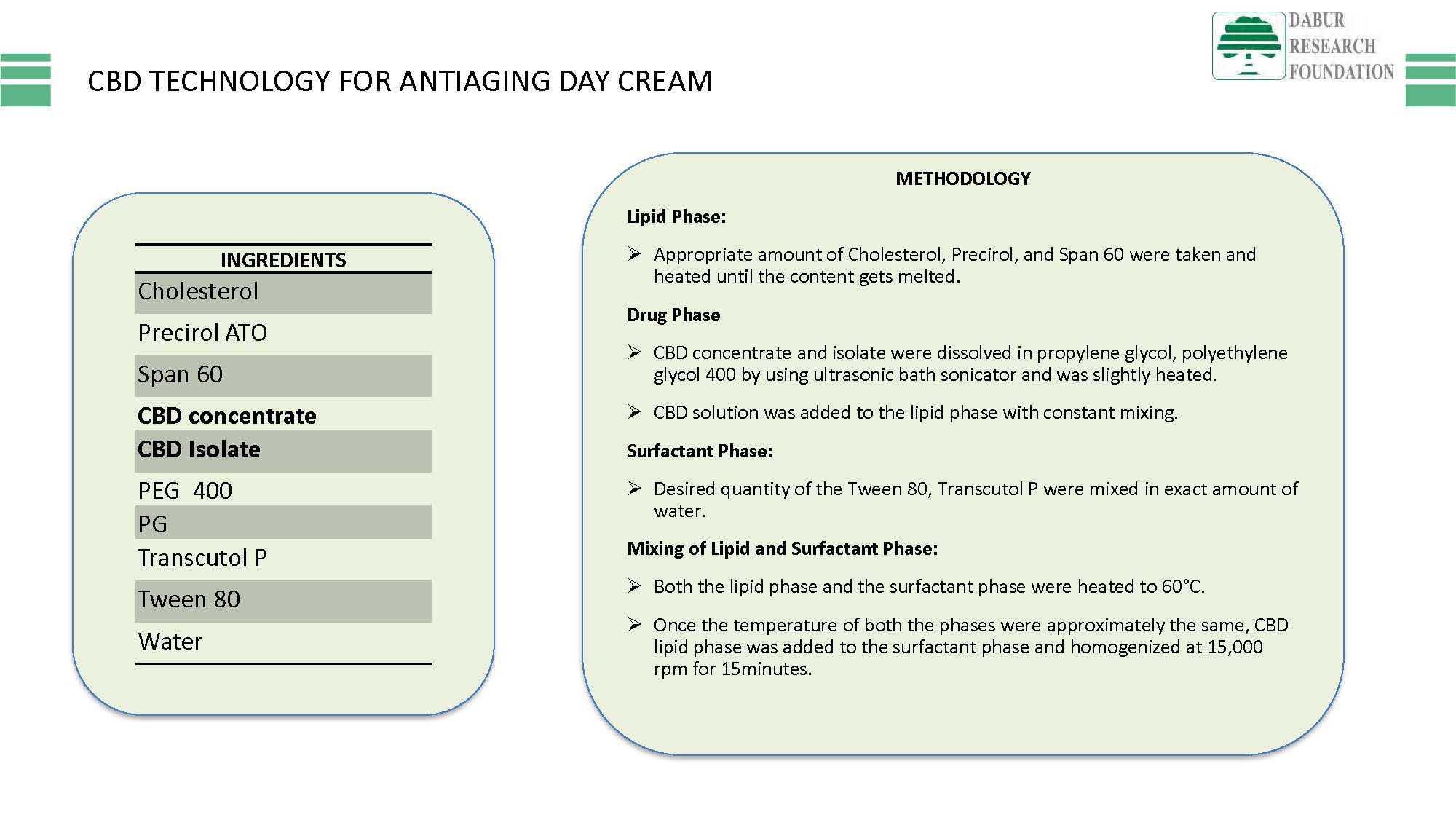

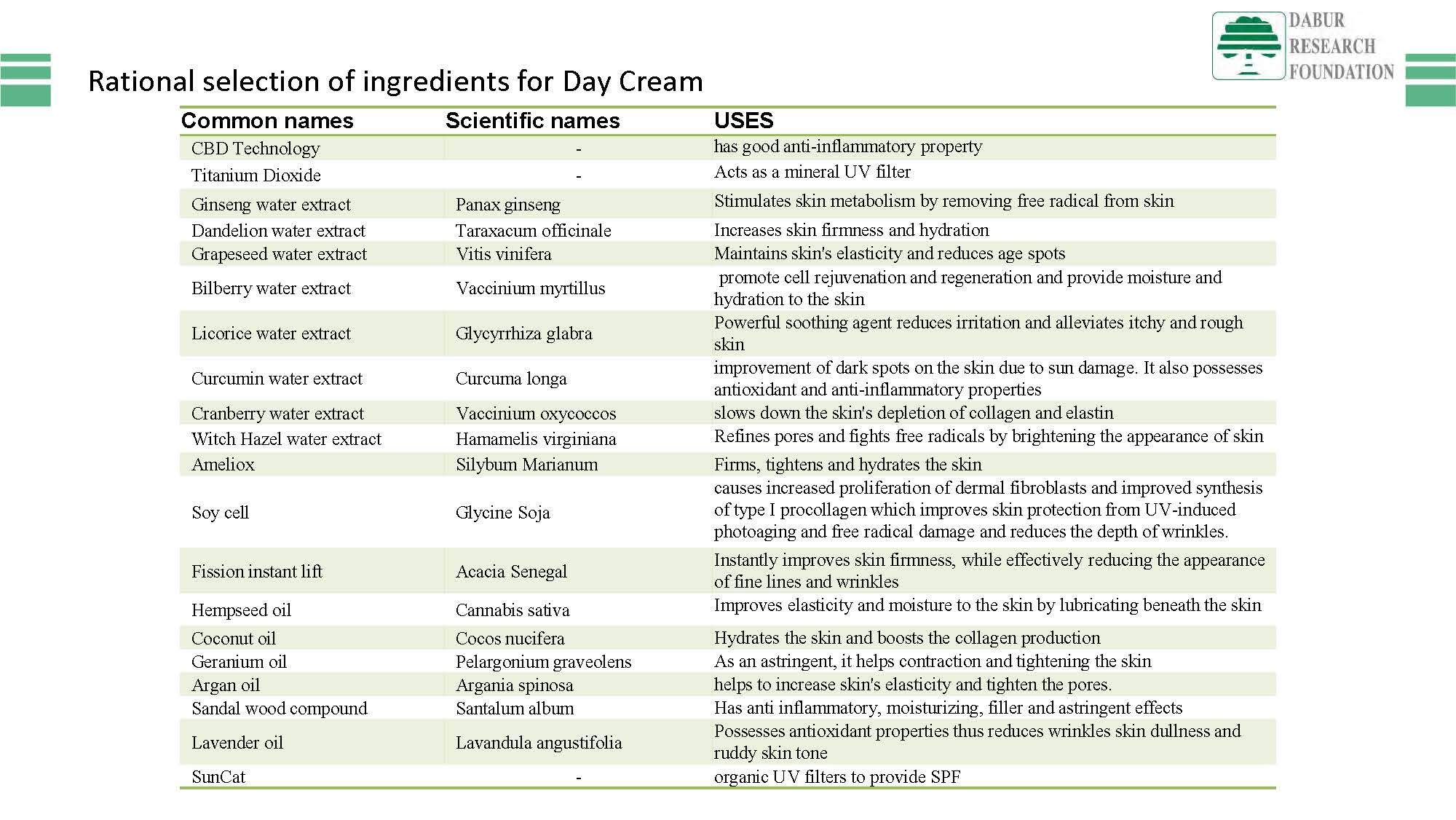

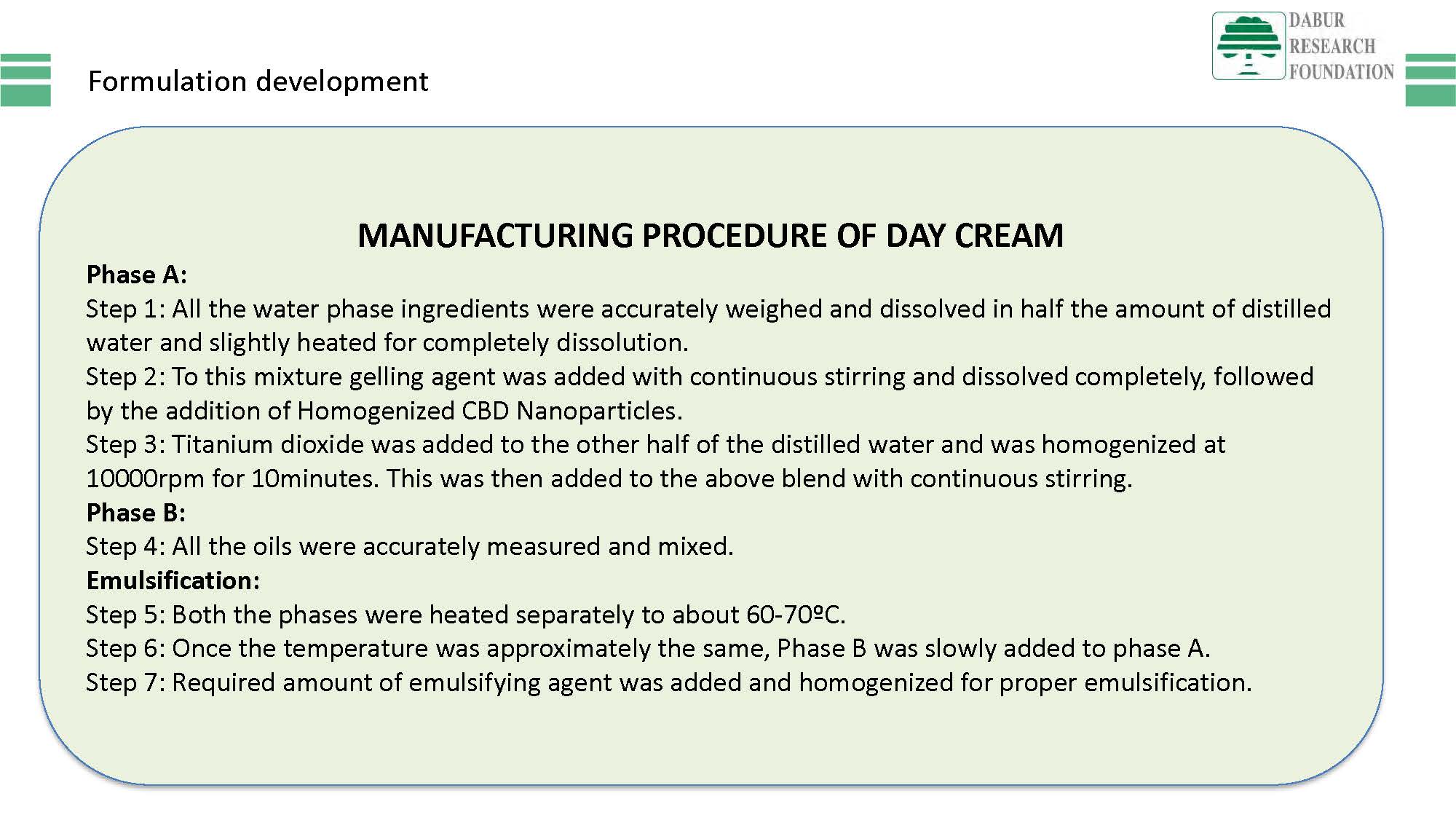

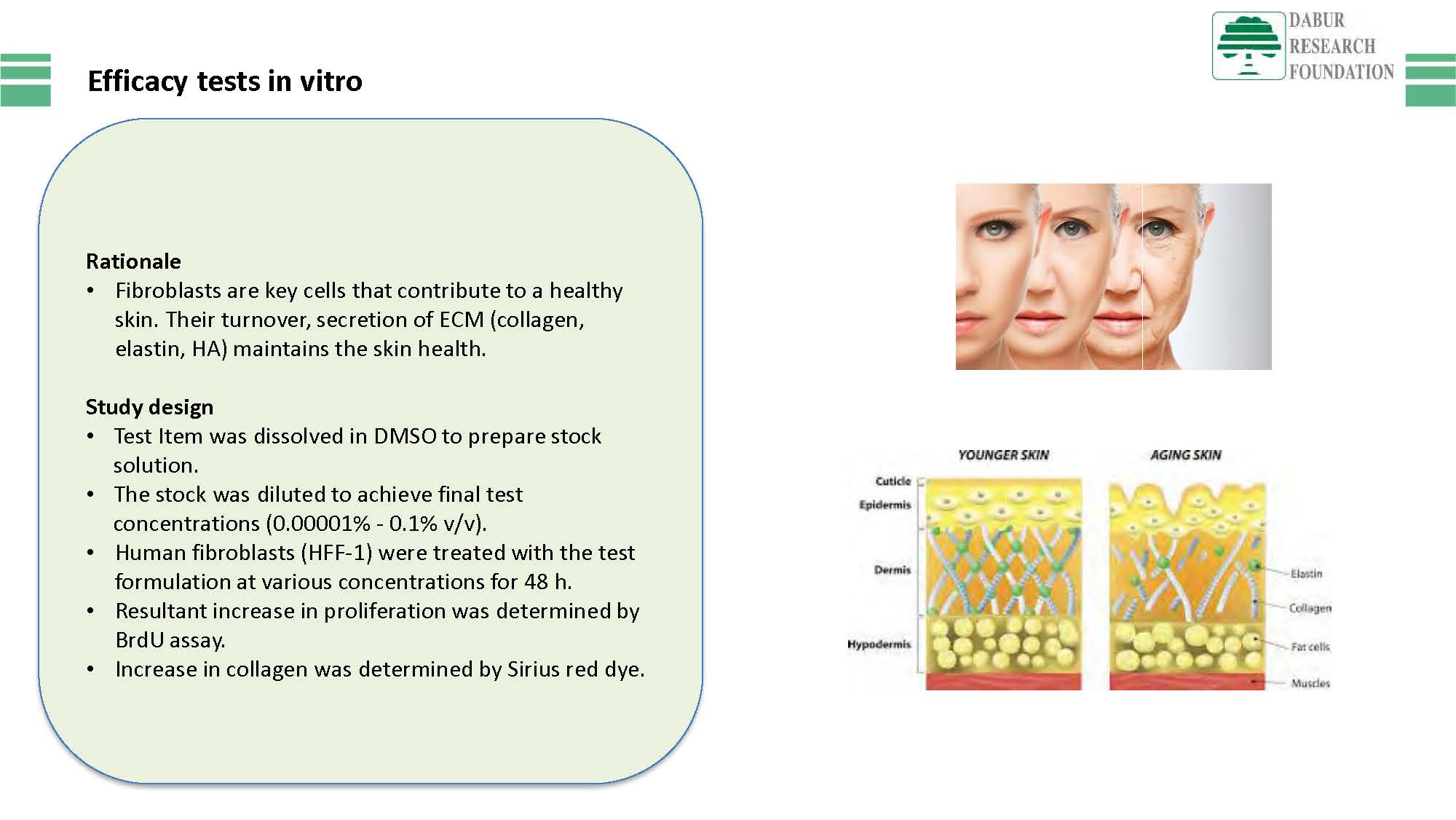

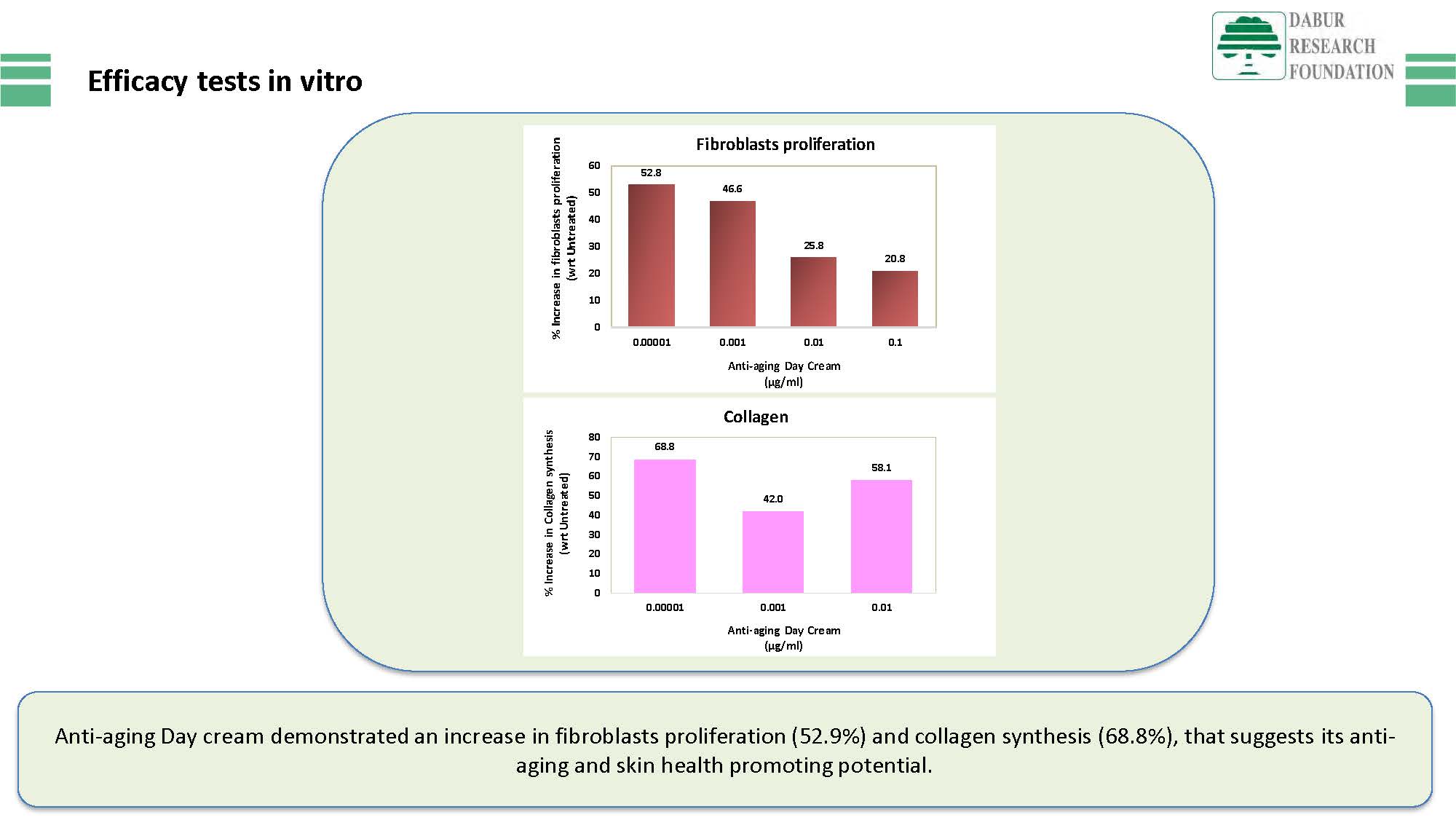

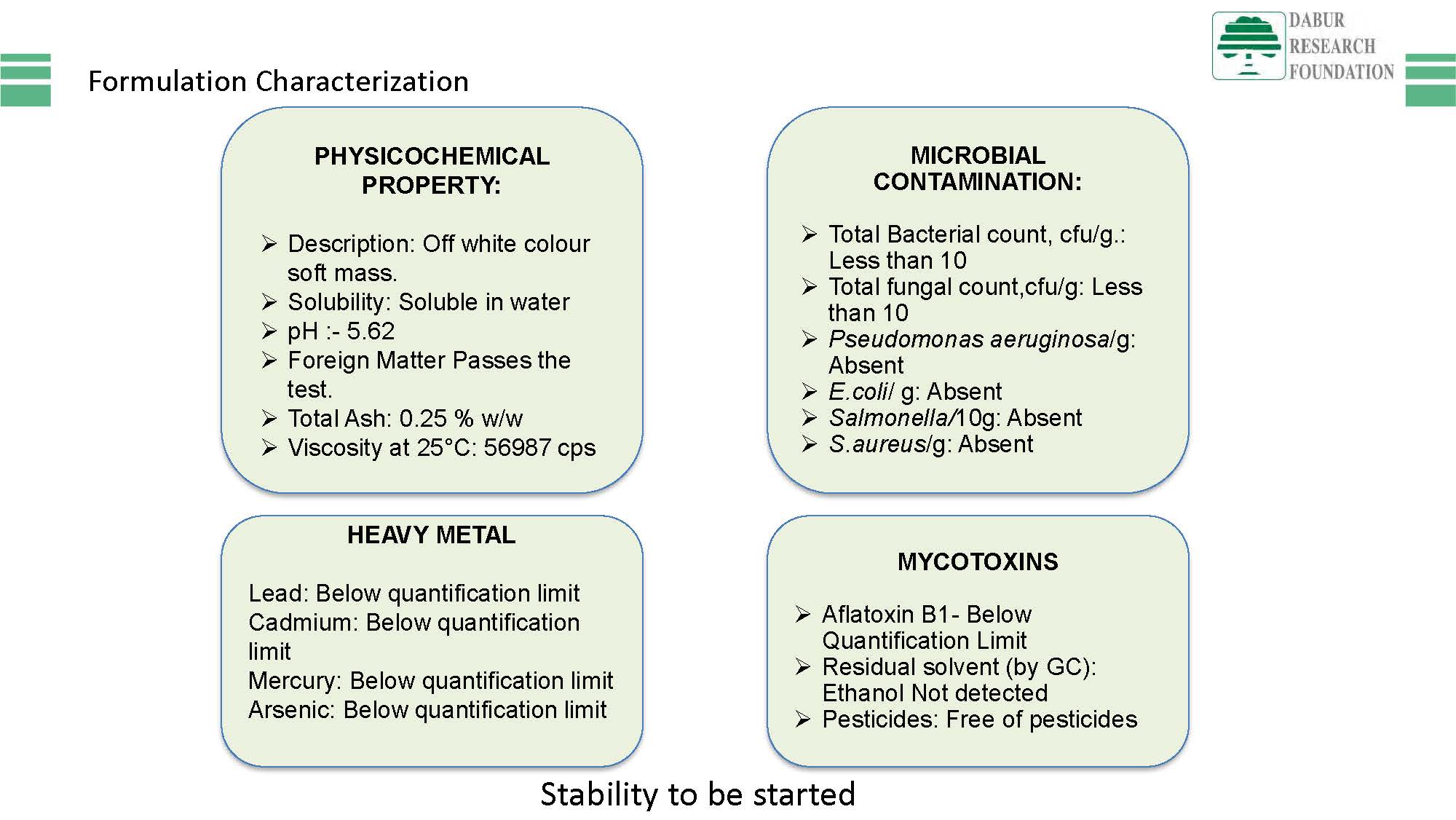

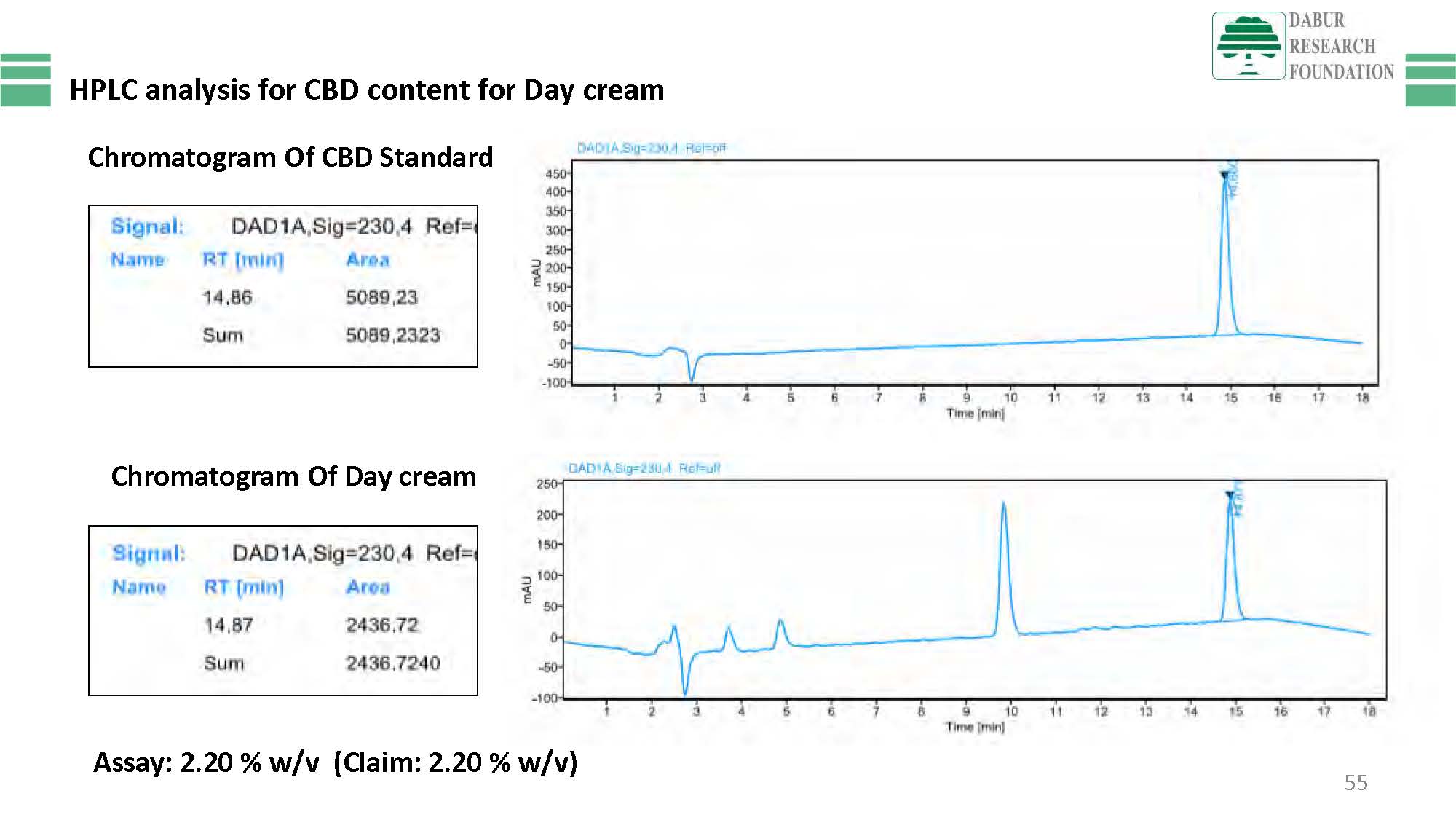

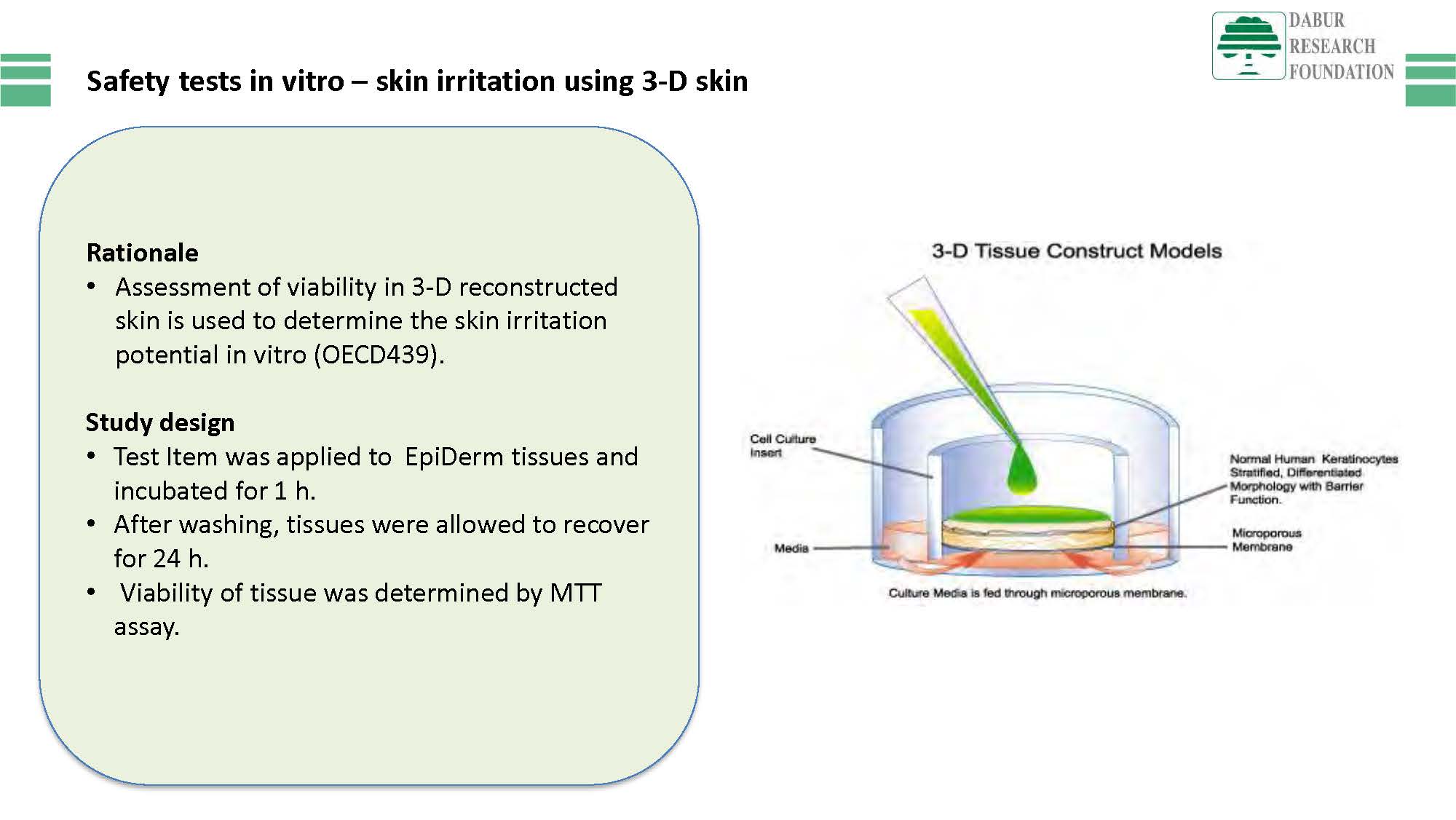

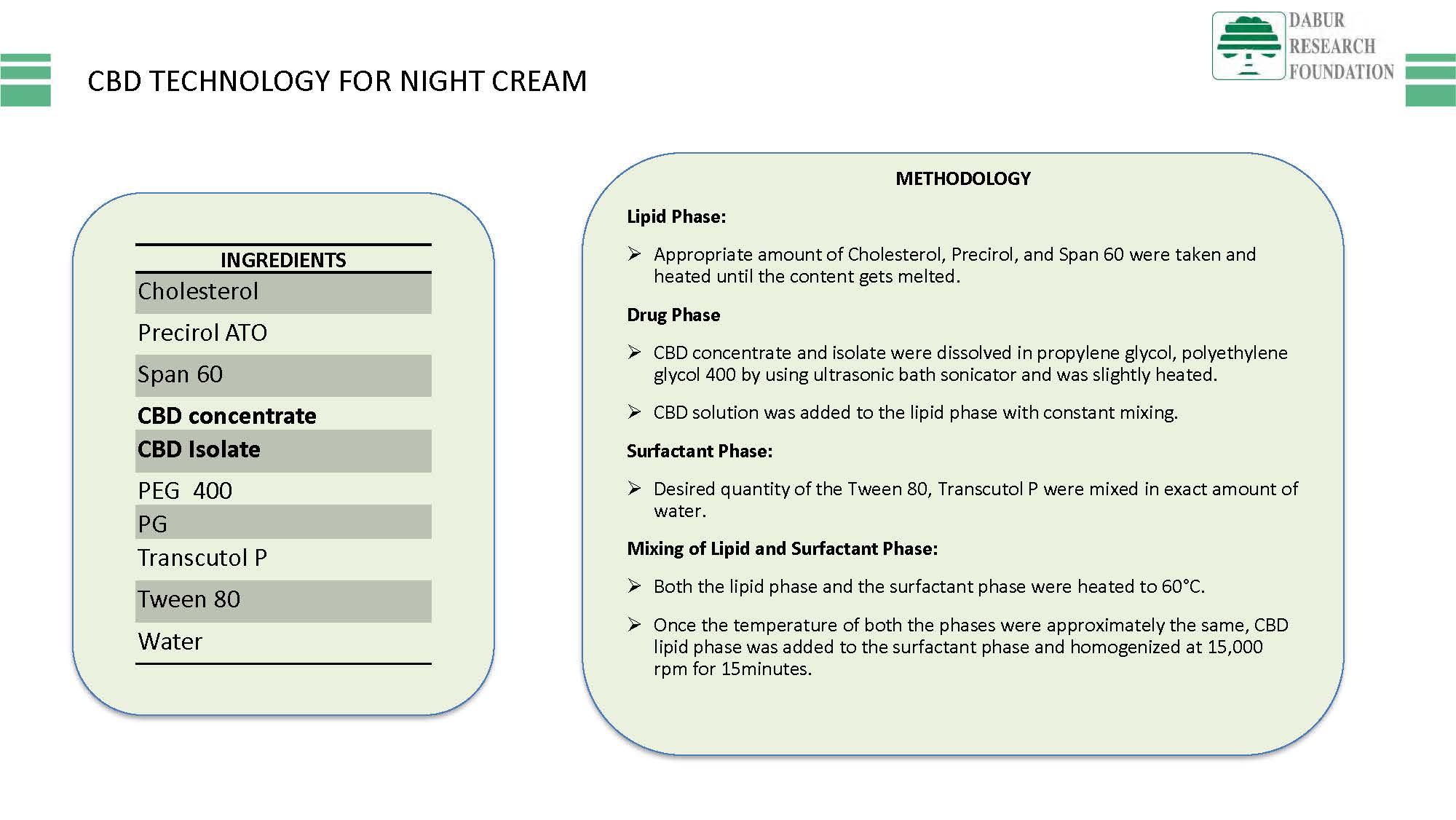

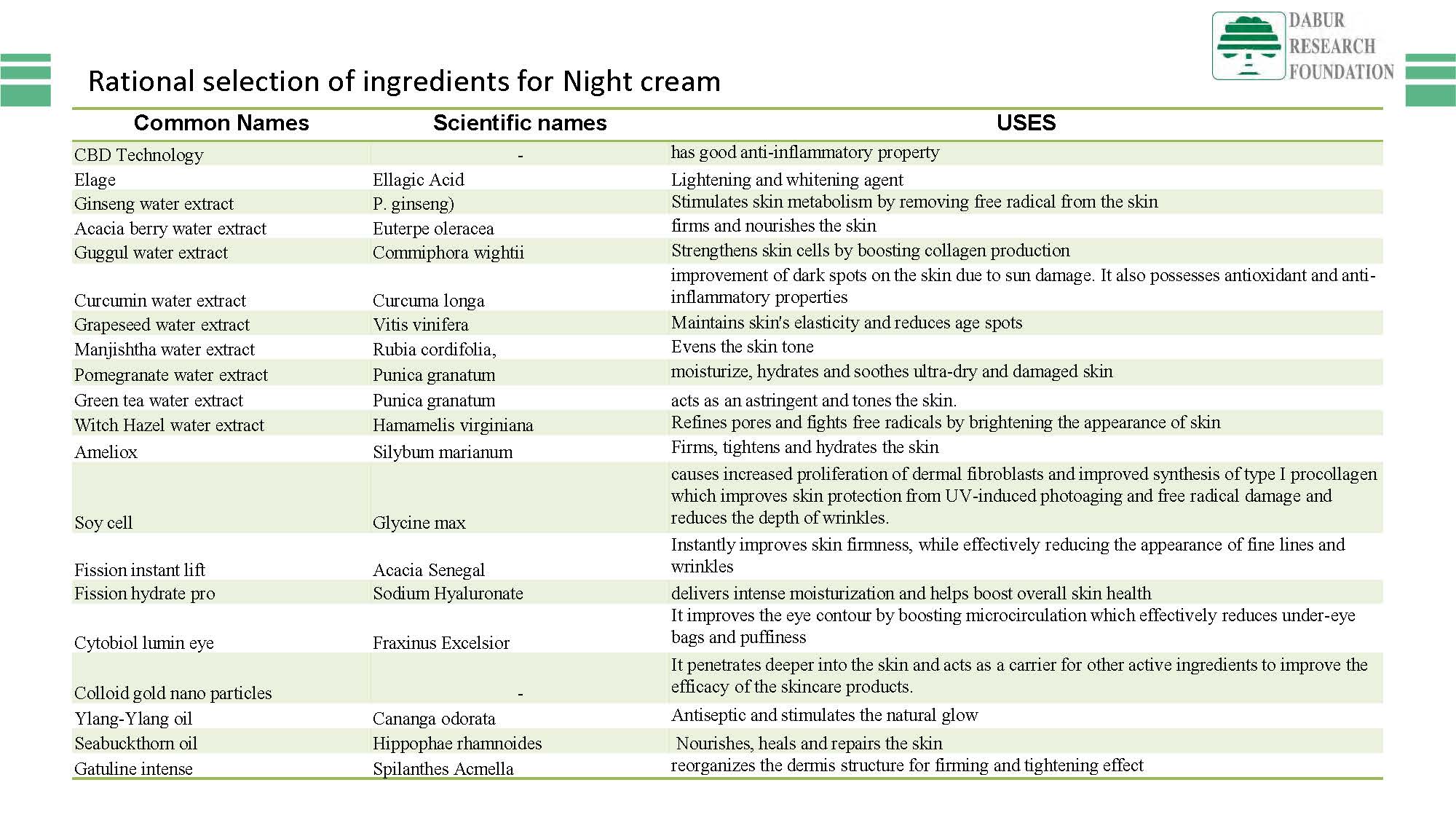

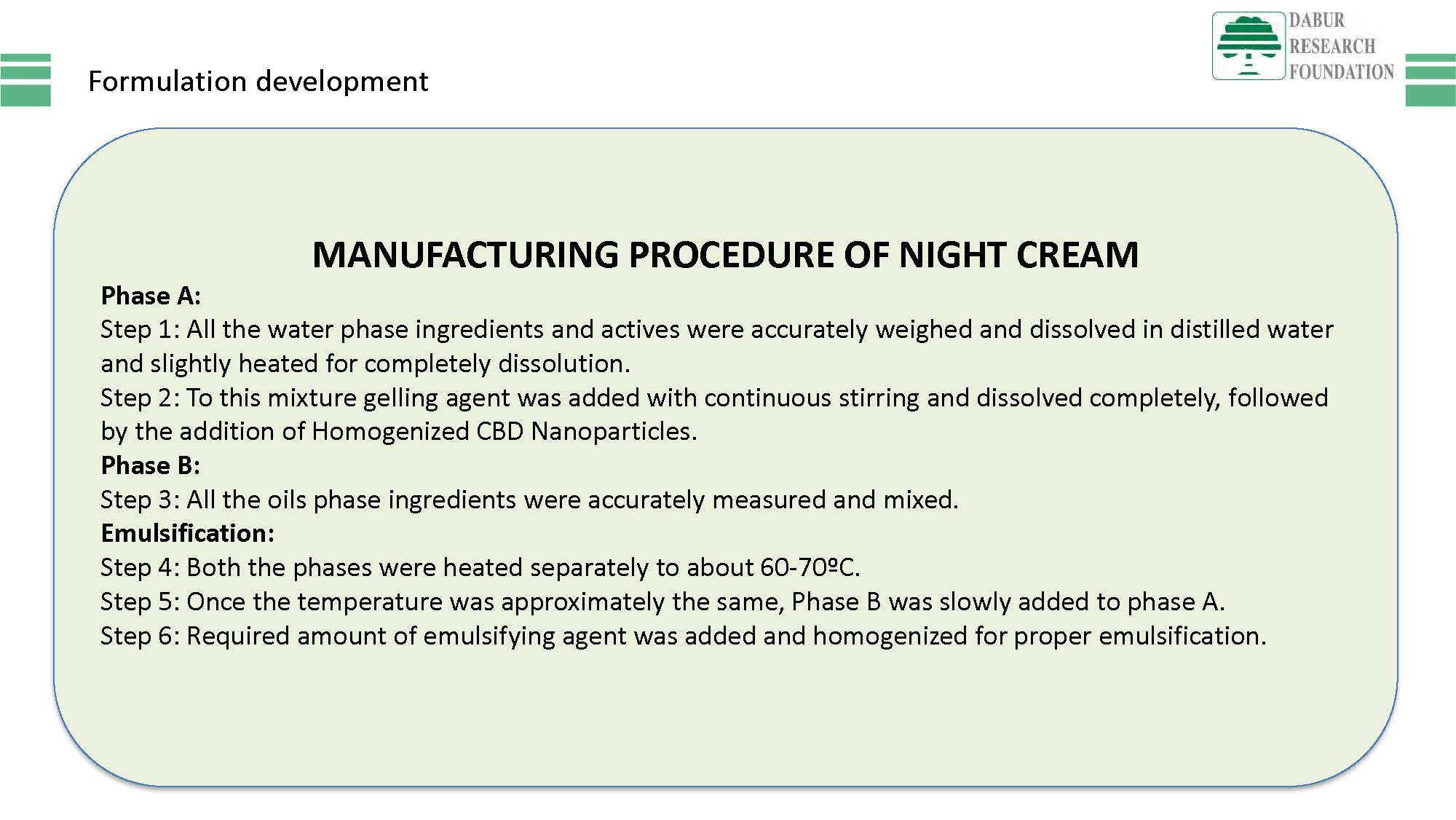

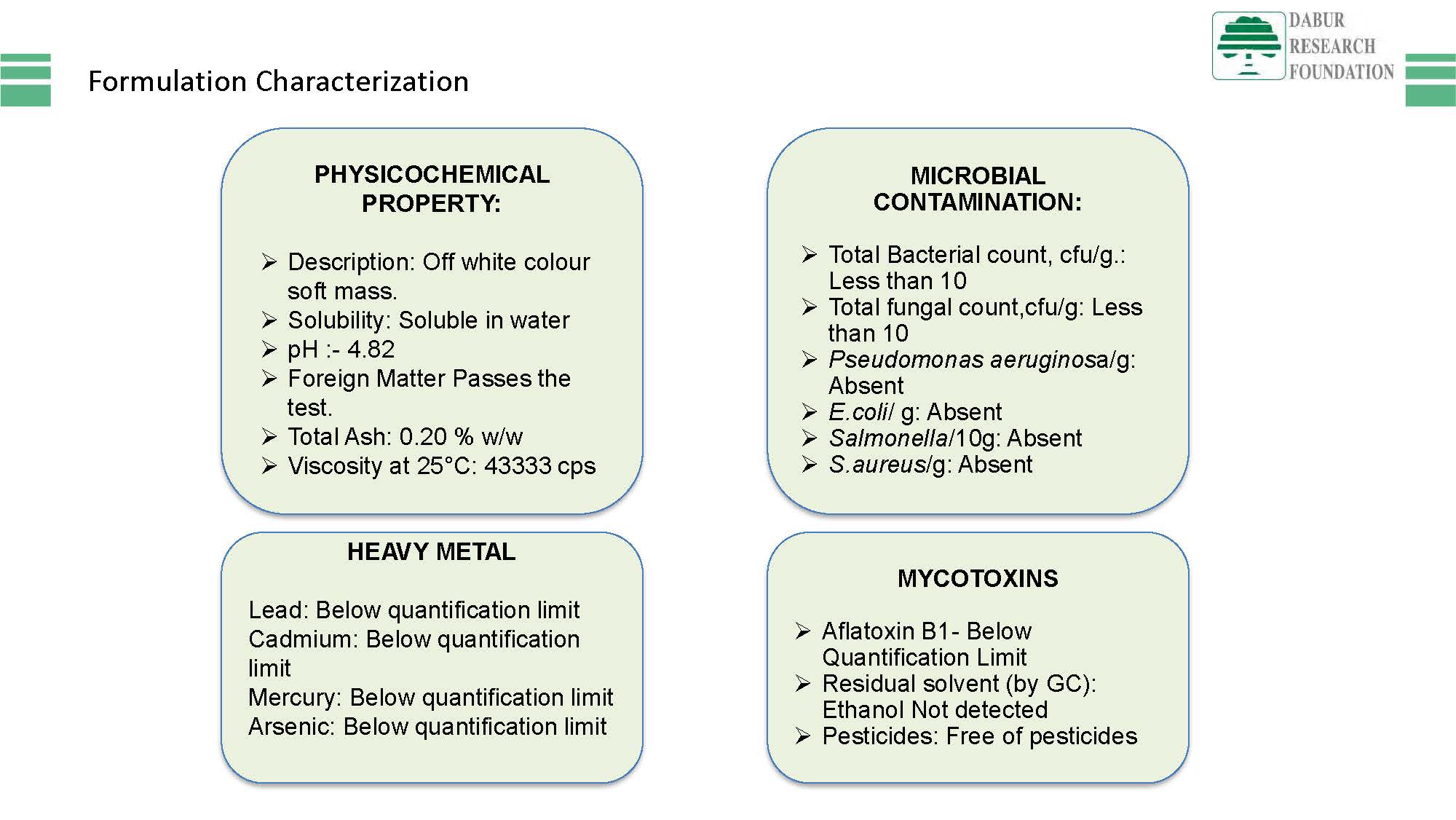

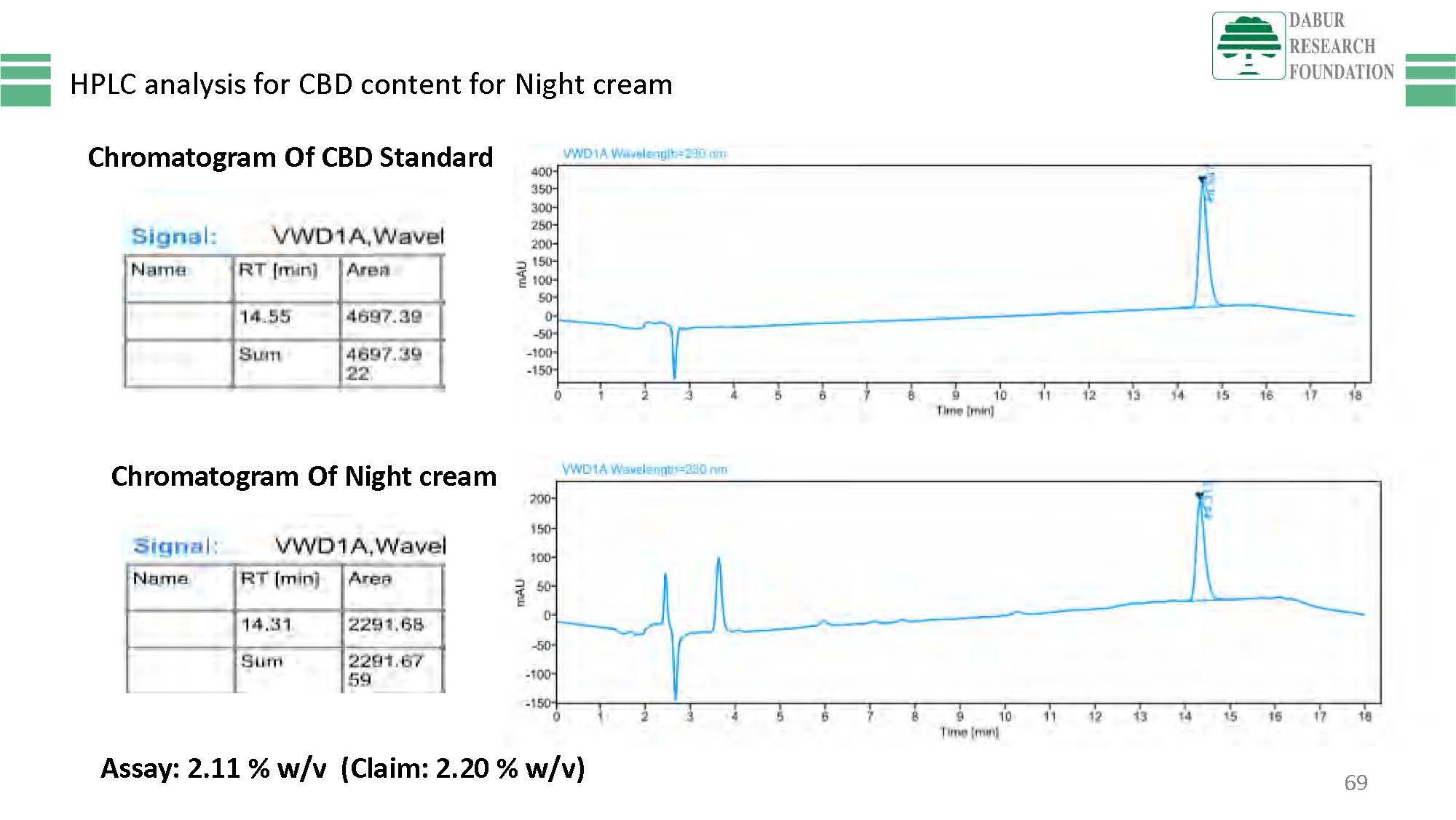

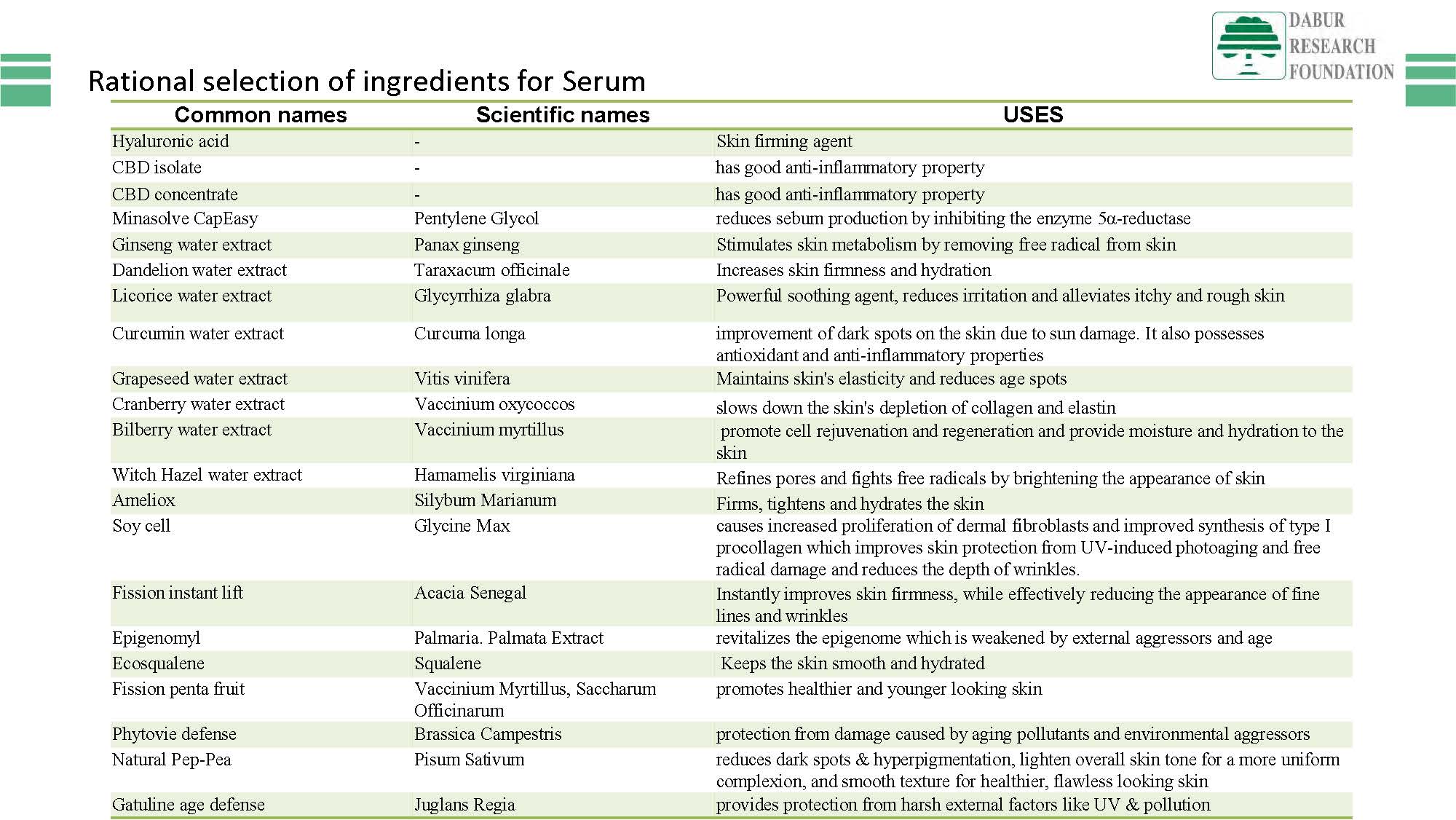

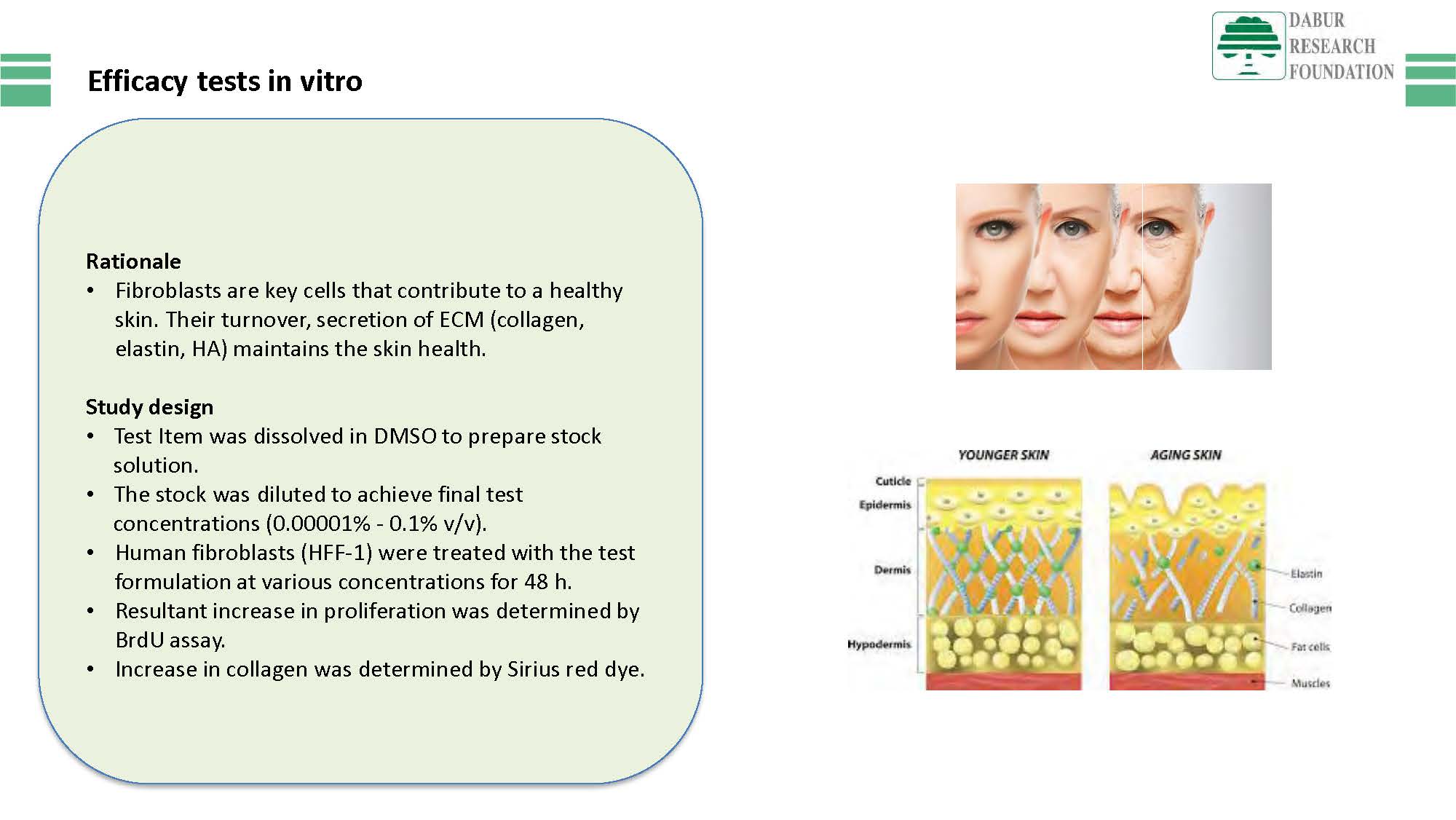

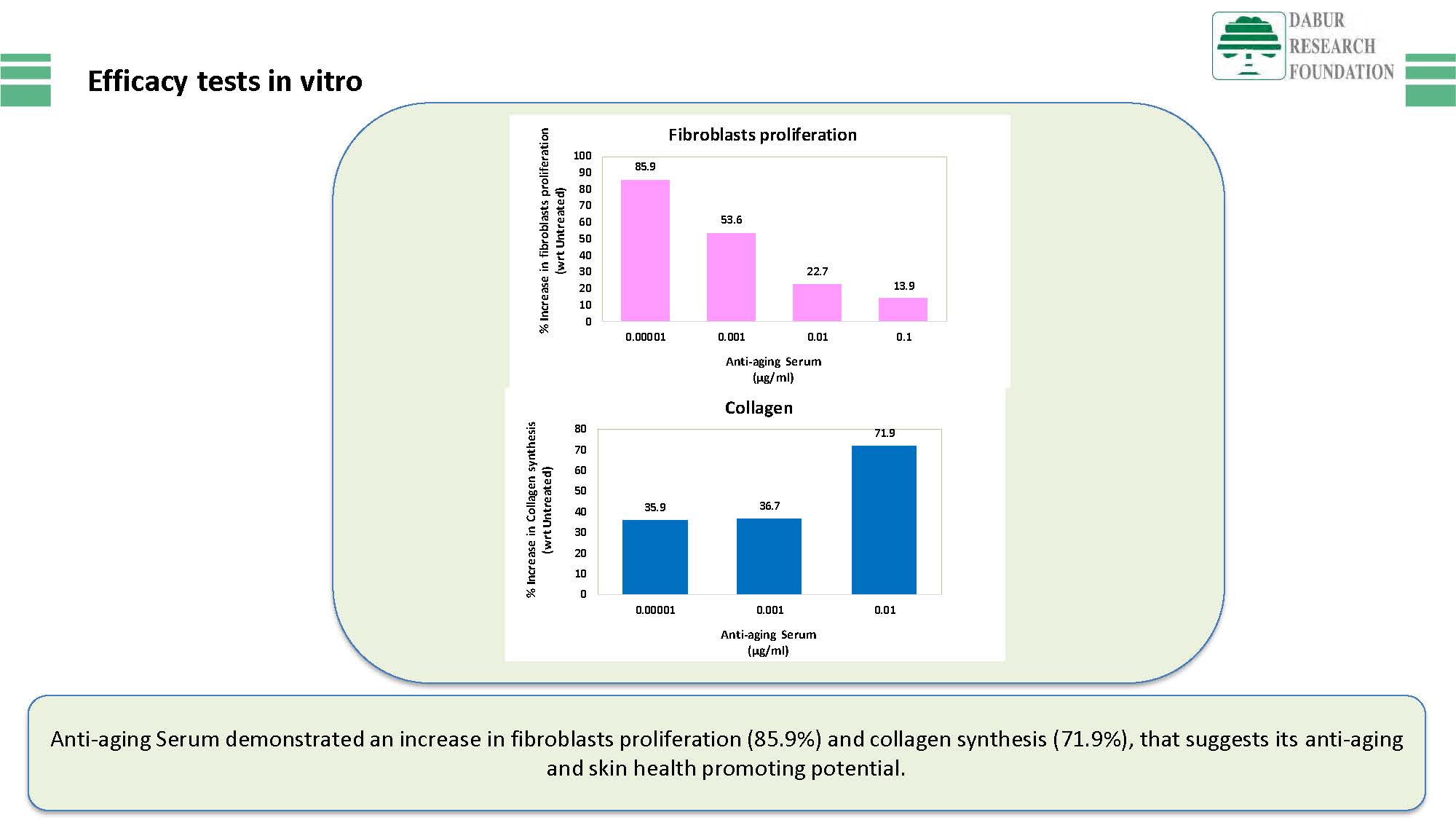

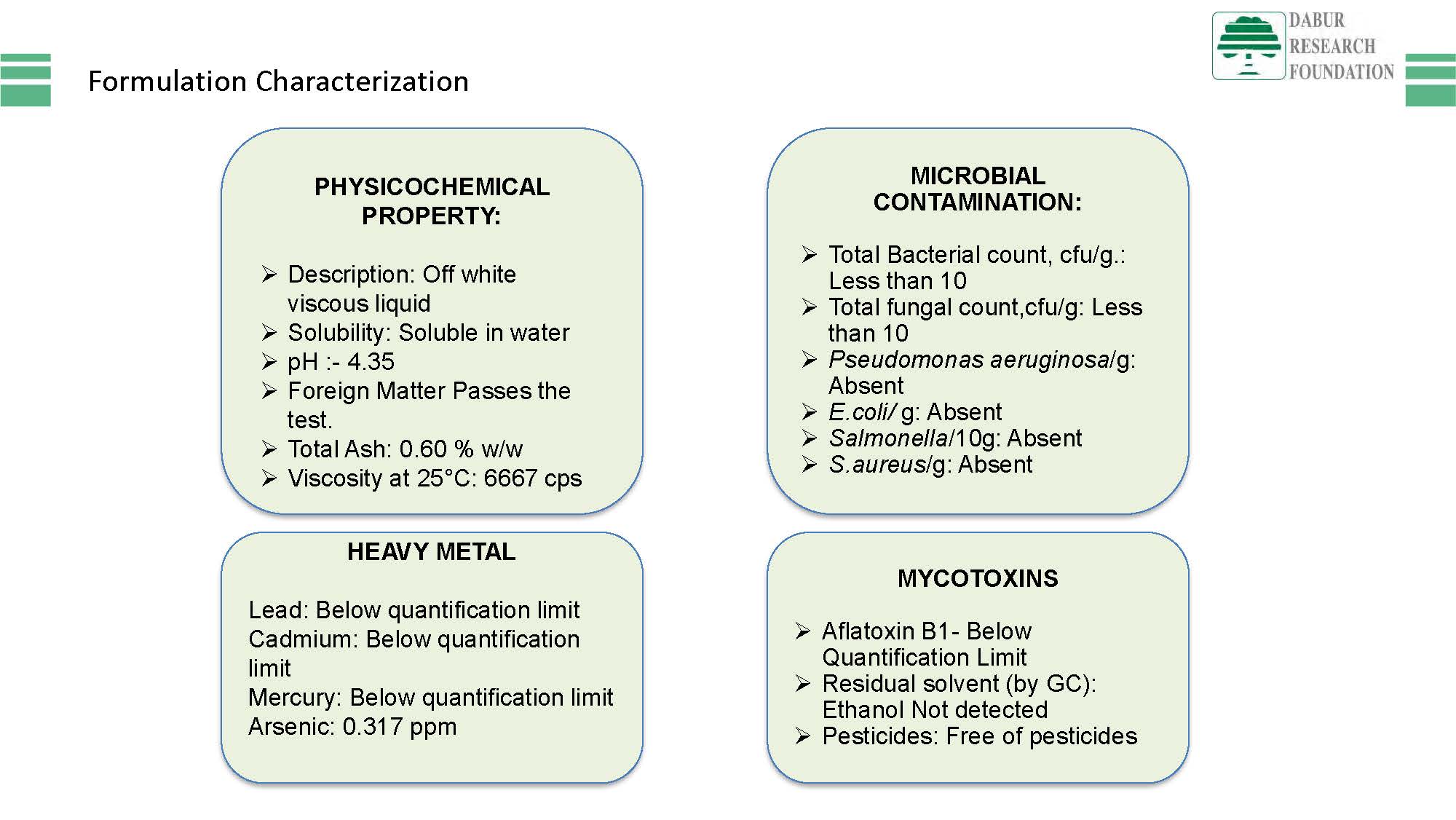

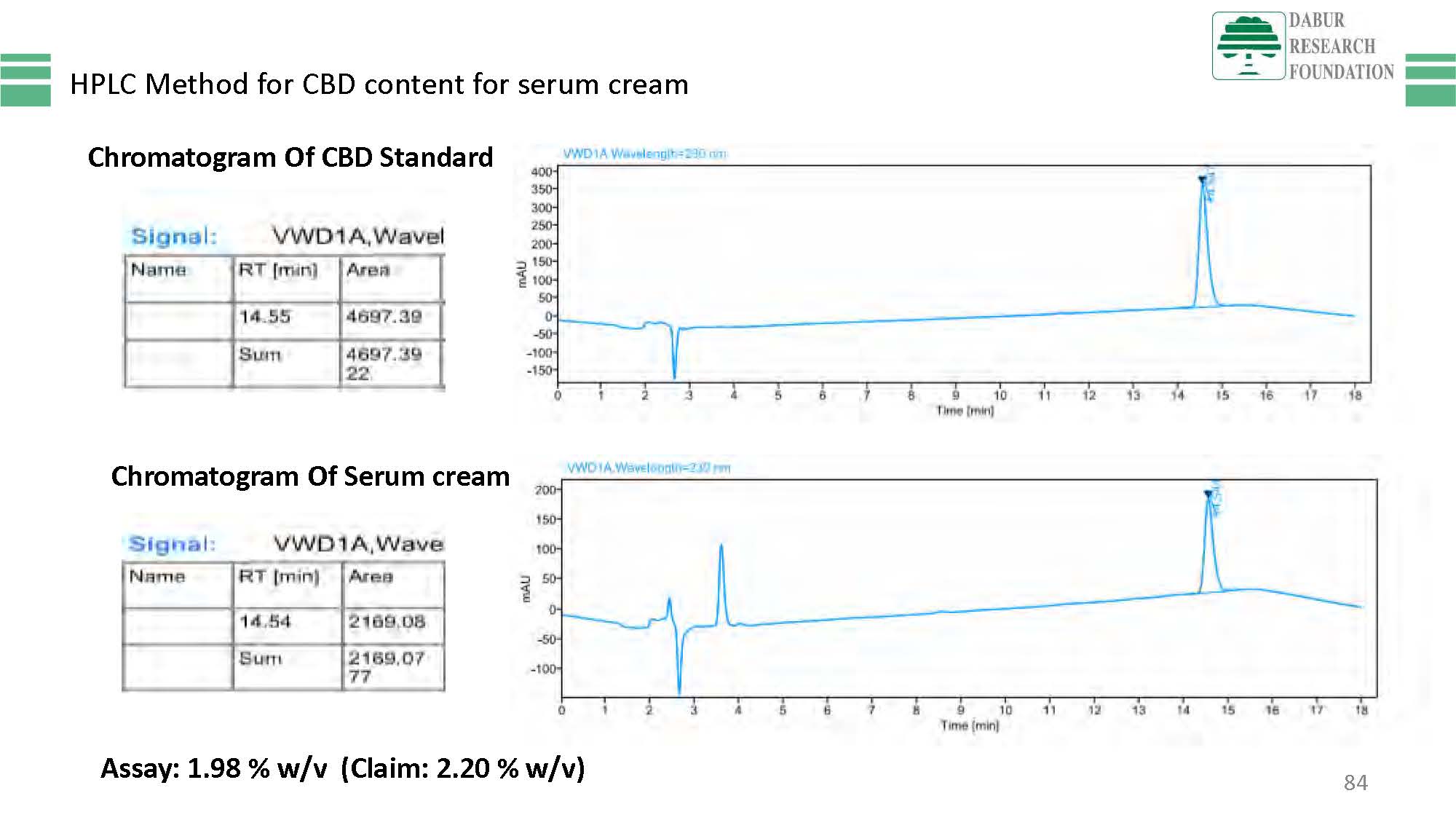

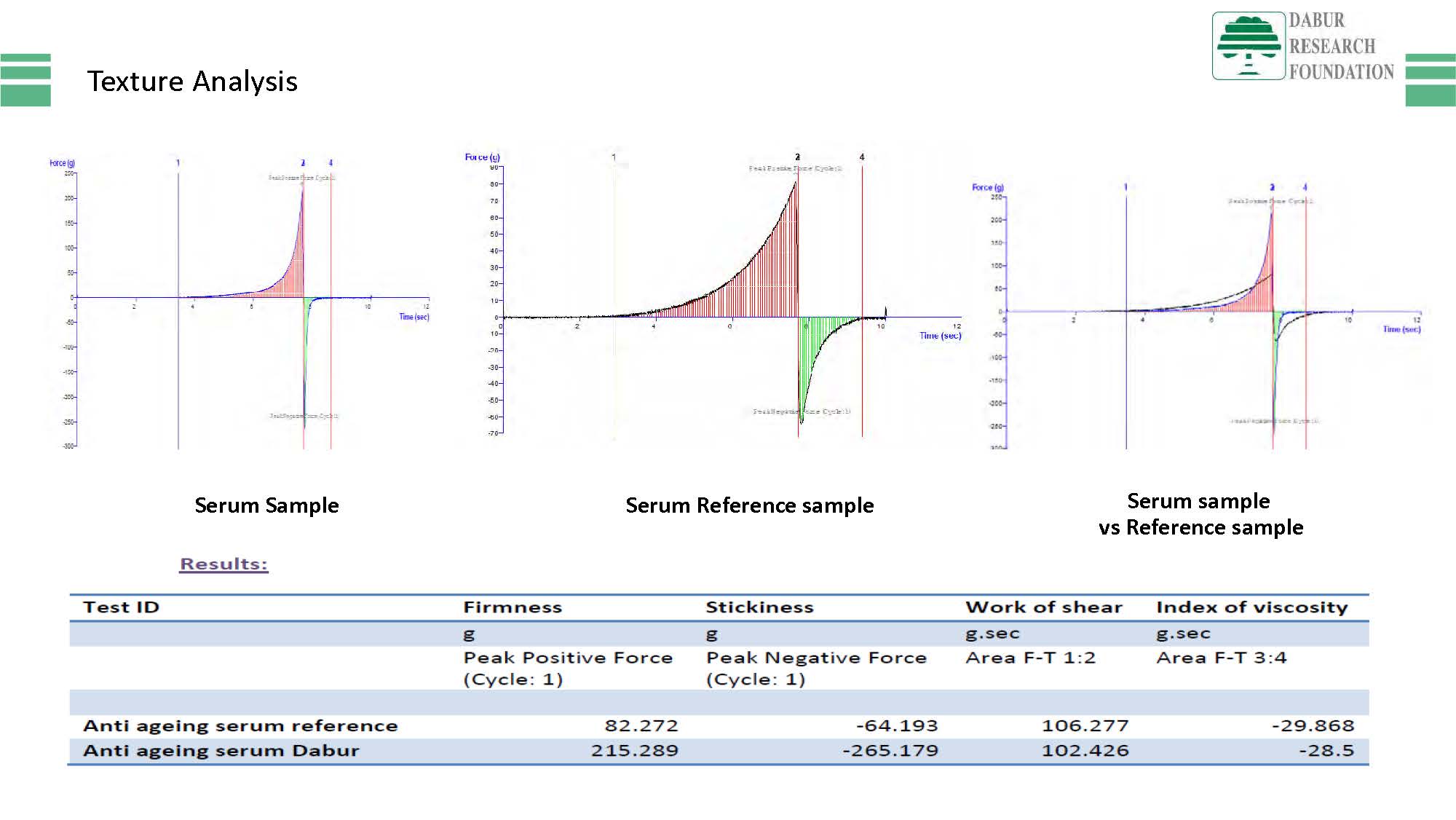

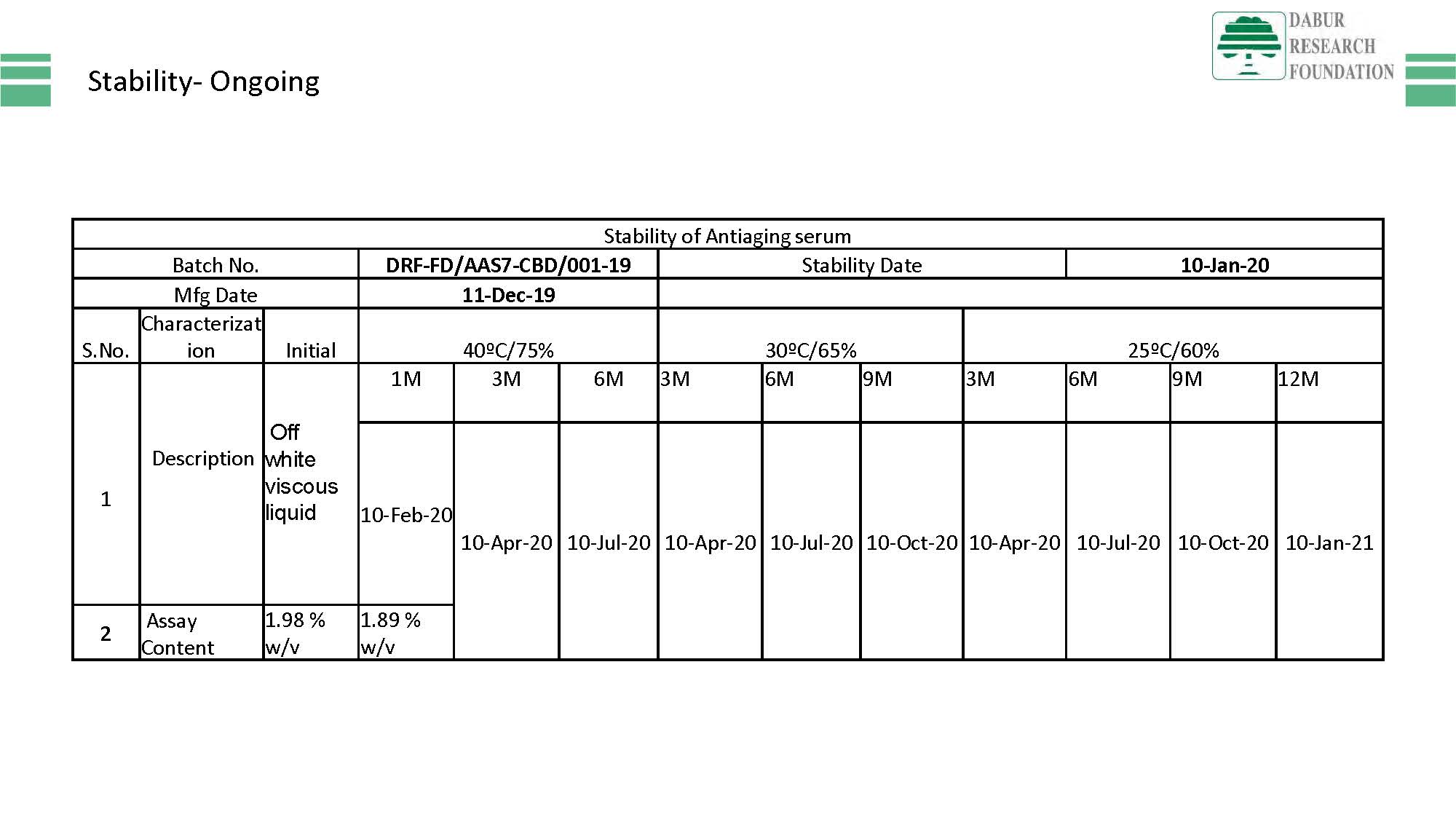

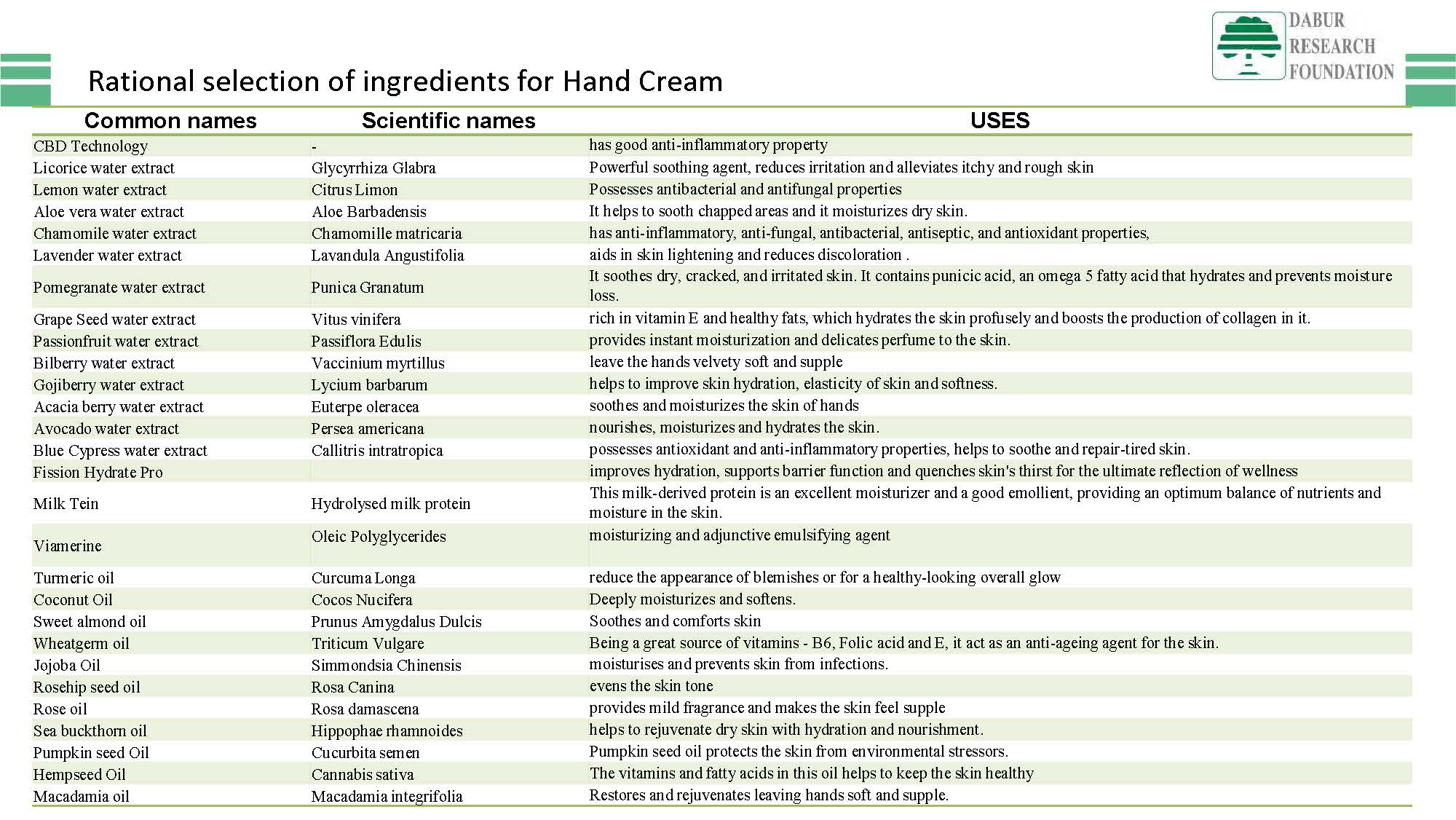

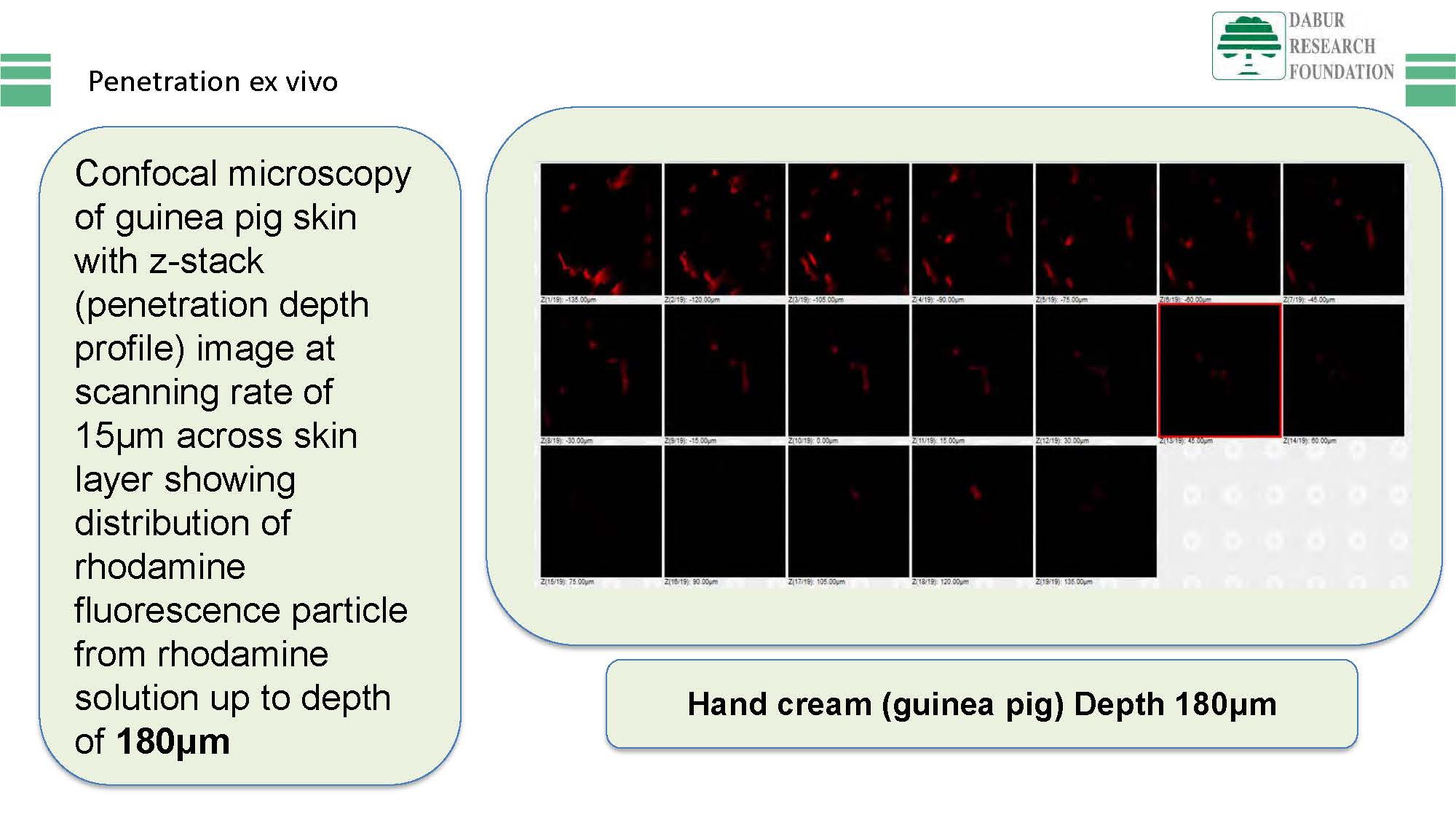

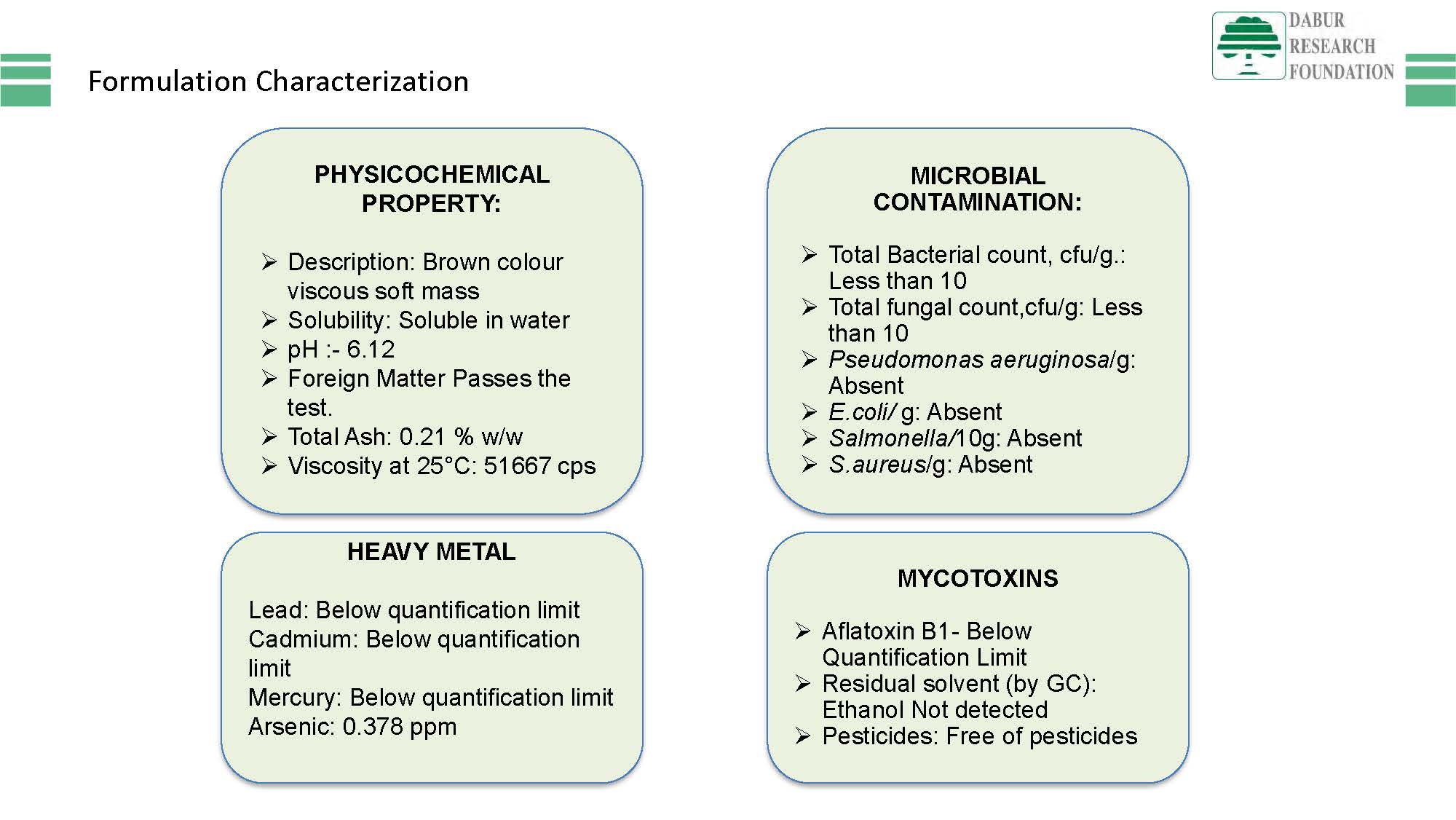

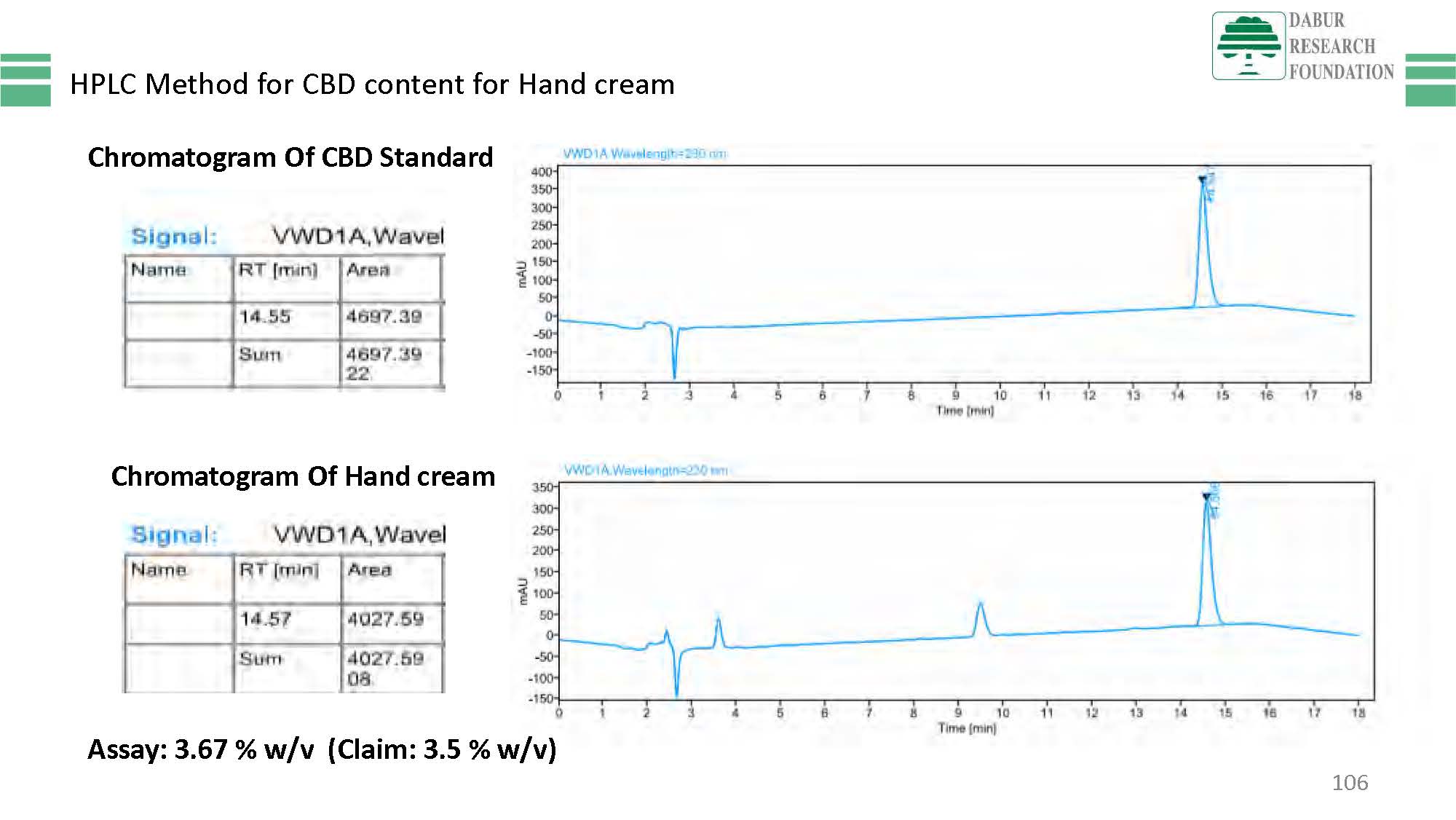

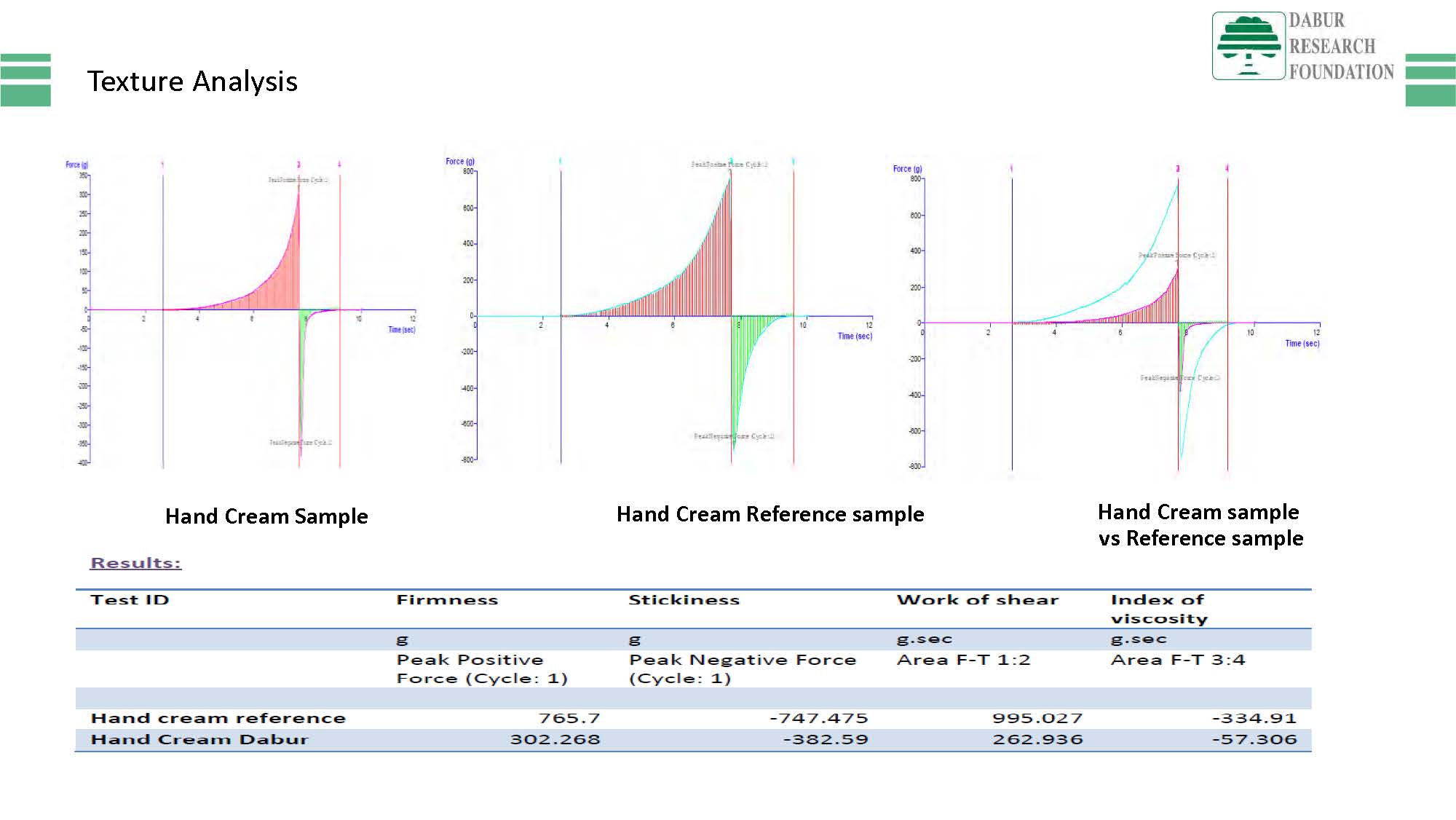

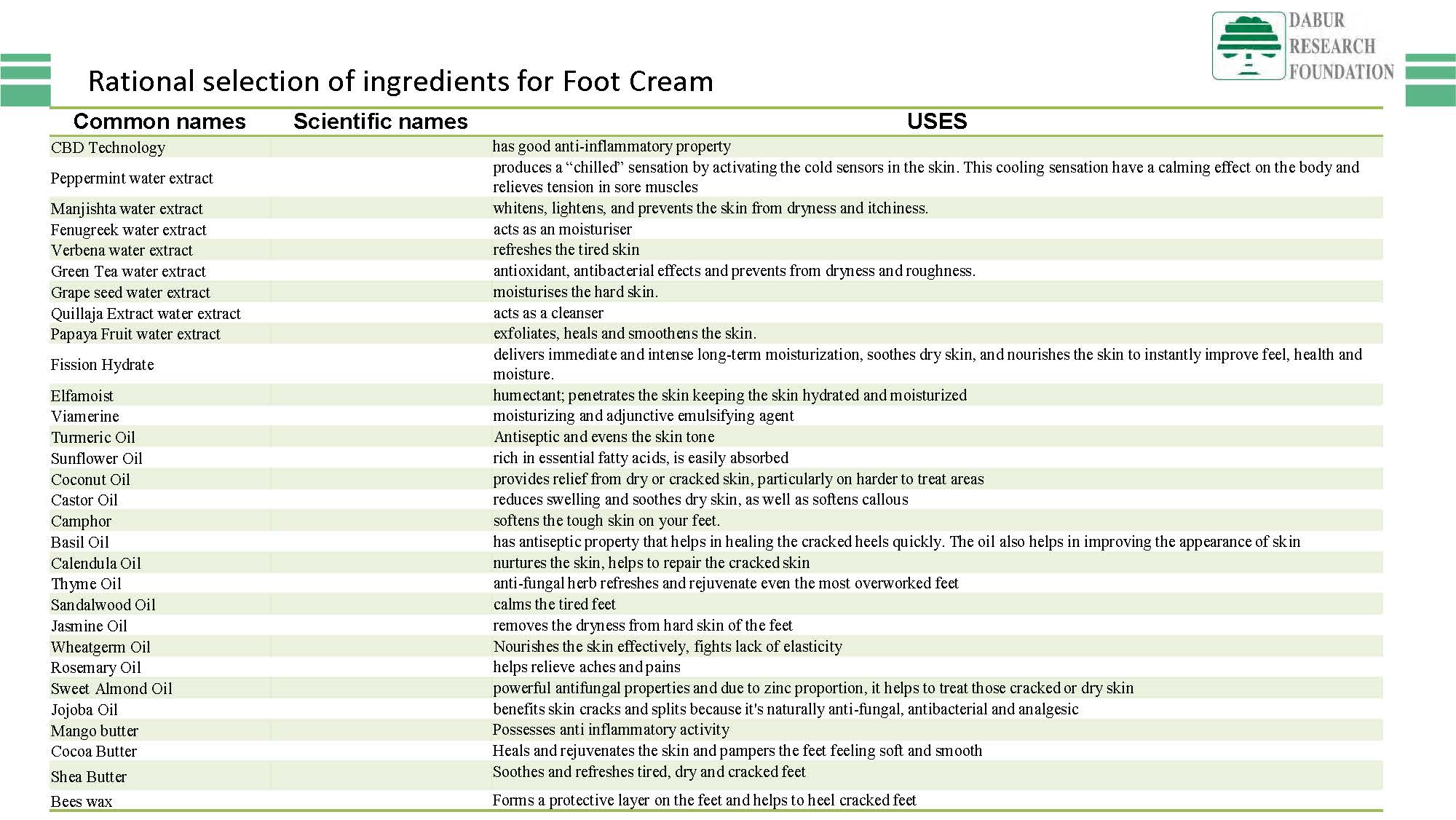

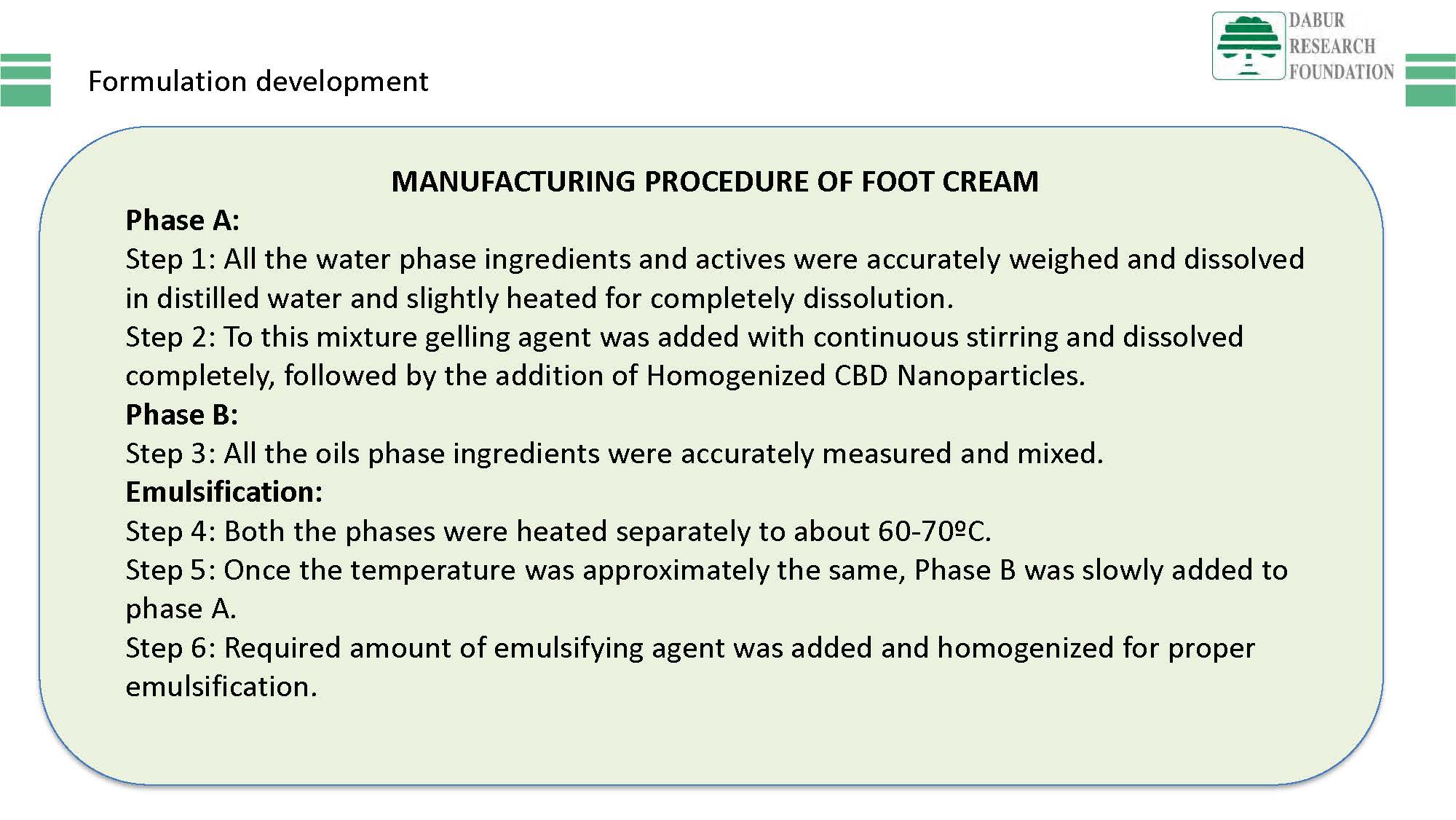

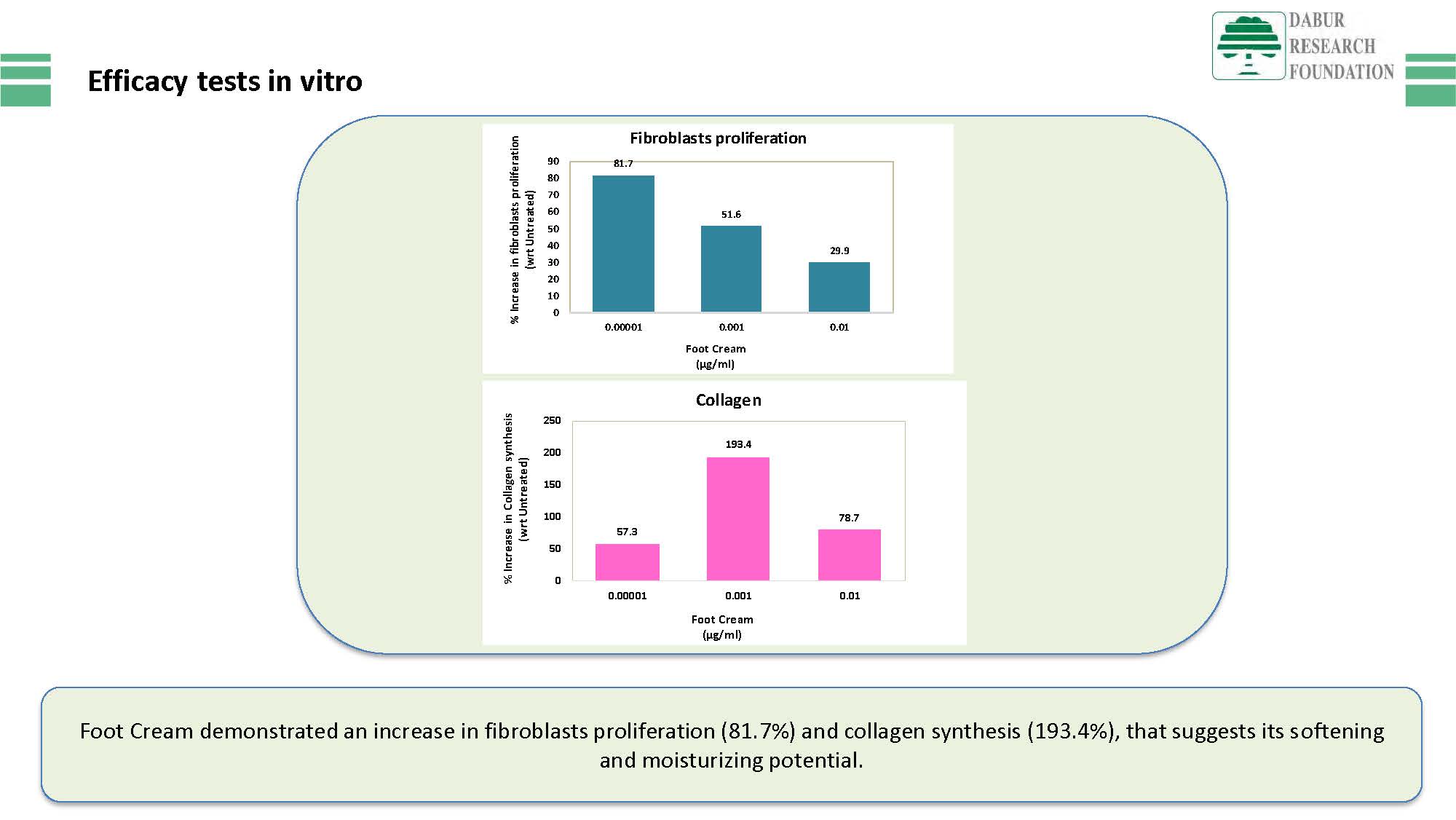

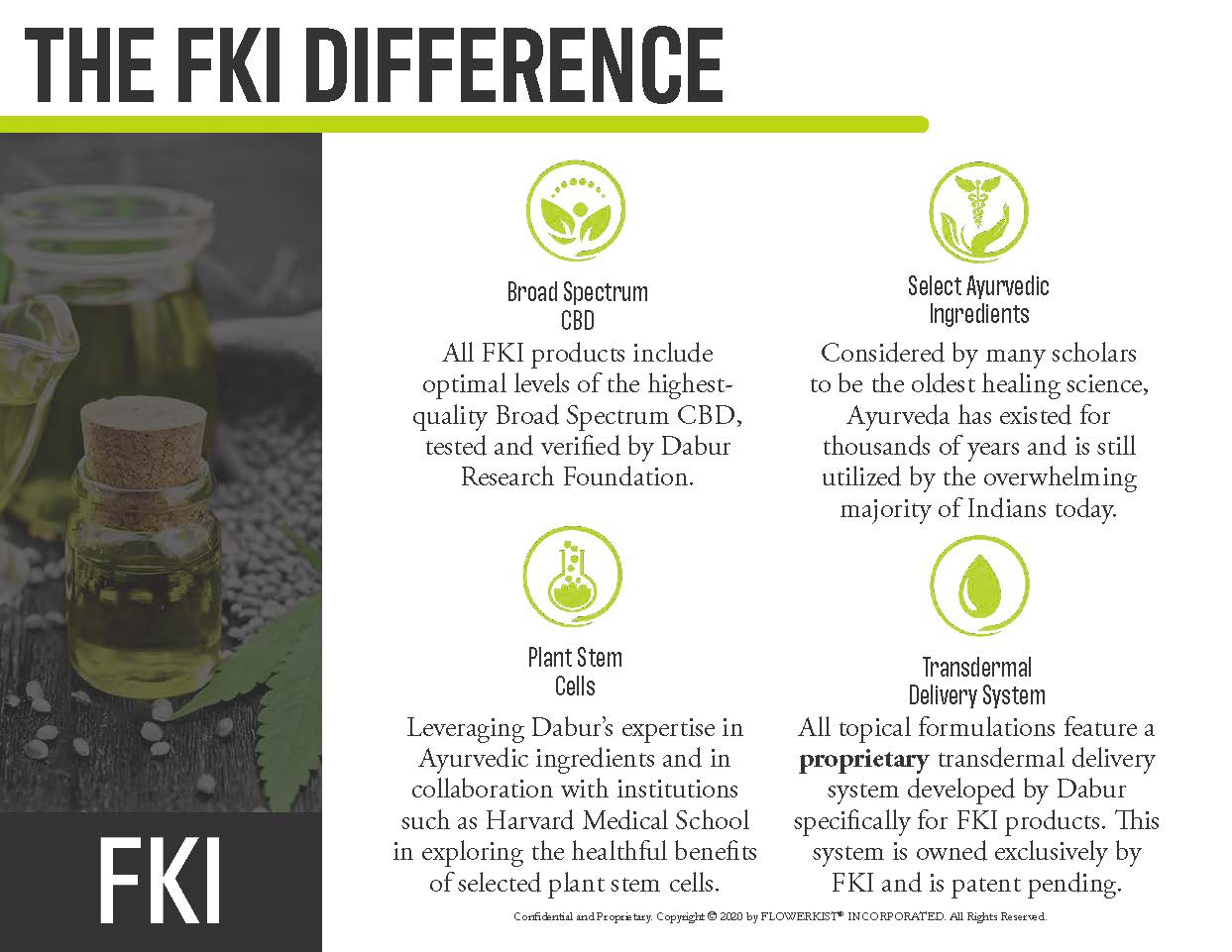

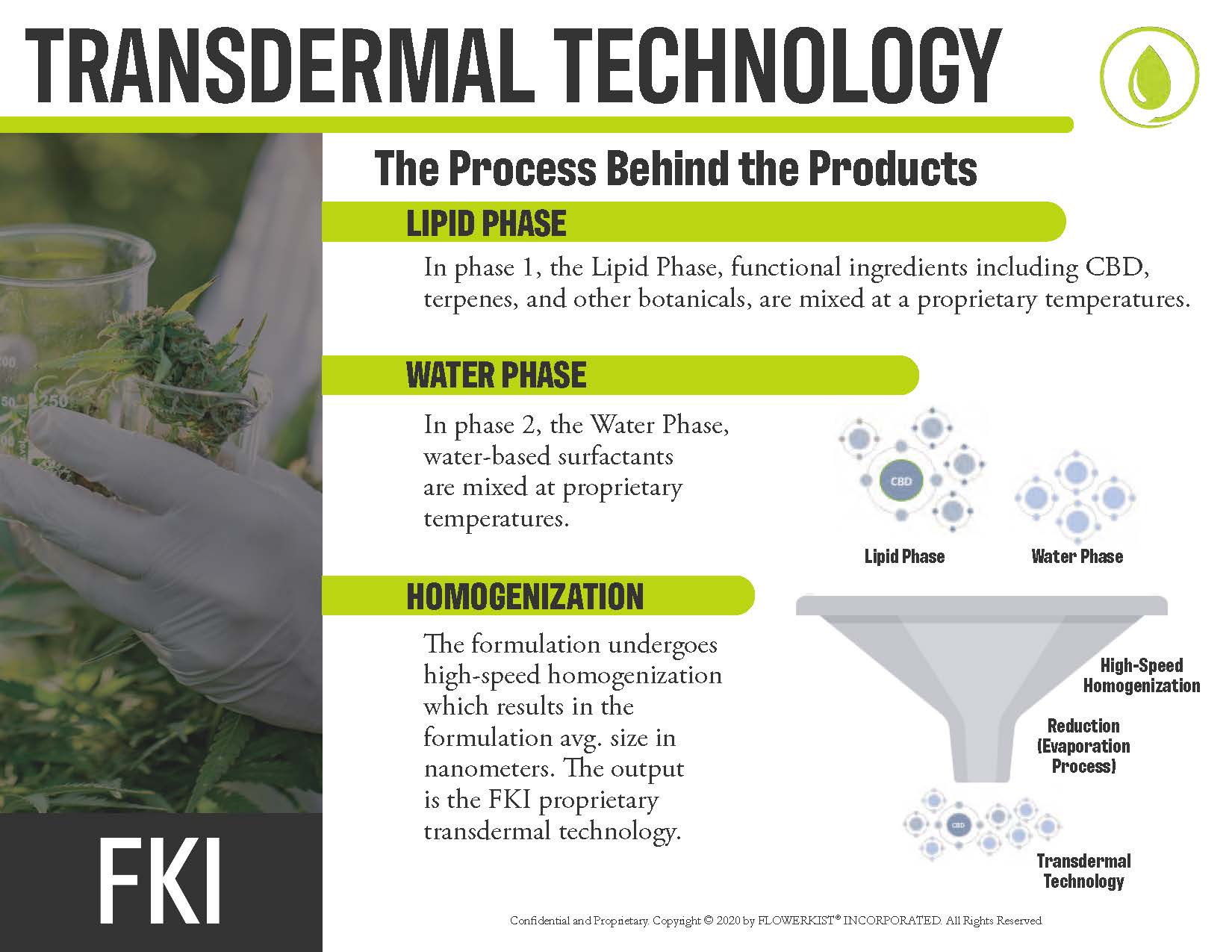

All topical formulations feature a proprietary patent pending transdermal delivery system developed by Dabur specifically for FLOWERKIST products. SUPERIOR SKINCARE INGREDIENTS All FLOWERKIST Œ products include optimal levels of the highest - quality broad - spectrum CBD, tested and verified by Dabur Research Foundation . Considered by many scholars to be the oldest healing science, Ayurveda has existed for thousands of years with proven skin health benefits. Leveraging Dabur’s expertise in Ayurvedic ingredients and in collaboration with institutions such as Harvard Medical School in exploring the healthful benefits of selected plant stem cells. All topical formulations feature a proprietary patent pending transdermal delivery system developed by Dabur specifically for FLOWERKIST products.

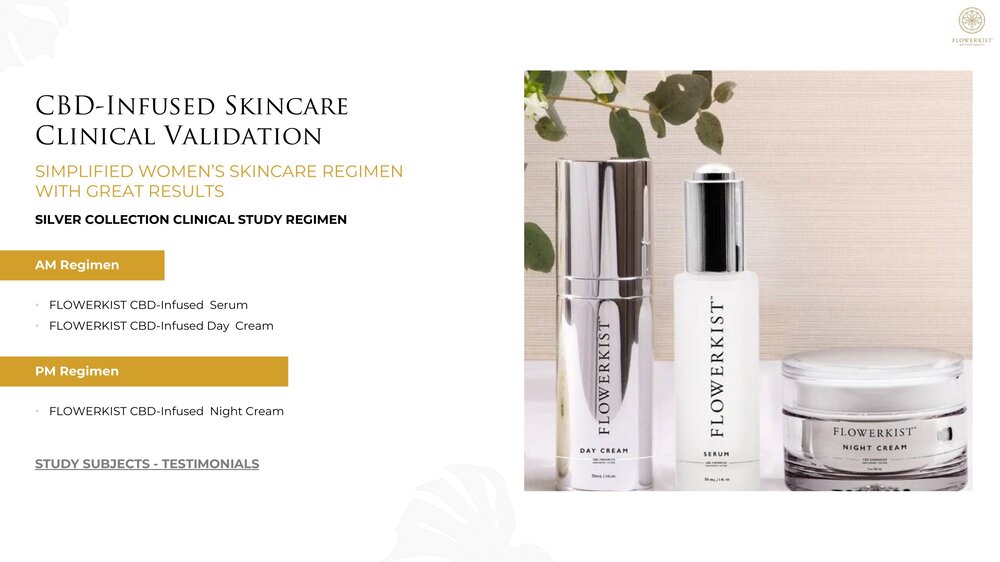

CBD - Infused Skincare Clinical Validation SIMPLIFIED WOMEN’S SKINCARE REGIMEN WITH GREAT RESULTS SILVER COLLECTION CLINICAL STUDY REGIMEN AM Regimen • FLOWERKIST CBD - Infused Serum • FLOWERKIST CBD - Infused Day Cream PM Regimen • FLOWERKIST CBD - Infused Night Cream STUDY SUBJECTS - TESTIMONIALS

CBD - INFUSED SKINCARE CLINICAL VALIDATION ROBUST CLINICAL STUDY PROTOCOL Before/After (60 days) photos taken for all subjects: front, right side and left side of face. Facial measurement areas: wrinkles, texture, pores, UV spots, brown spots, and red areas. TruSkin Age ℠ measurement system utilized for clinical study subjects. Skin analysis: VISIA Facial Imaging System for Clinical Research by Canfield. Canfield Visia Complexion Analysis - Gold Standard System

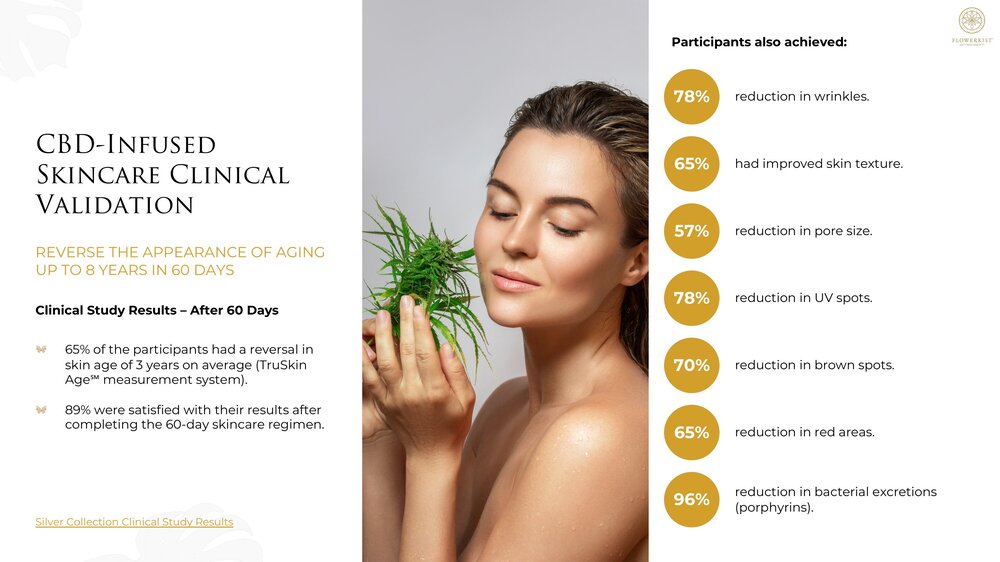

CBD - Infused Skincare Clinical Validation REVERSE THE APPEARANCE OF AGING UP TO 8 YEARS IN 60 DAYS Clinical Study Results – After 60 Days 65% of the participants had a reversal in skin age of 3 years on average (TruSkin Age ℠ measurement system). 89% were satisfied with their results after completing the 60 - day skincare regimen. 78% reduction in wrinkles. 65% had improved skin texture. 57% reduction in pore size. 78% reduction in UV spots. 70% reduction in brown spots. 65% reduction in red areas. 96% reduction in bacterial excretions (porphyrins). Participants also achieved: Silver Collection Clinical Study Results

SKINCARE PIPELINE ASSETS The potential to slow, stop, or reverse the skin aging cycle. Unique and super premium skincare market opportunity. Men’s Skincare Line Mitochondria Skincare Developed and ready for clinical testing. • Men likely to achieve excellent clinical results. Men’s skincare is a high growth skincare segment.

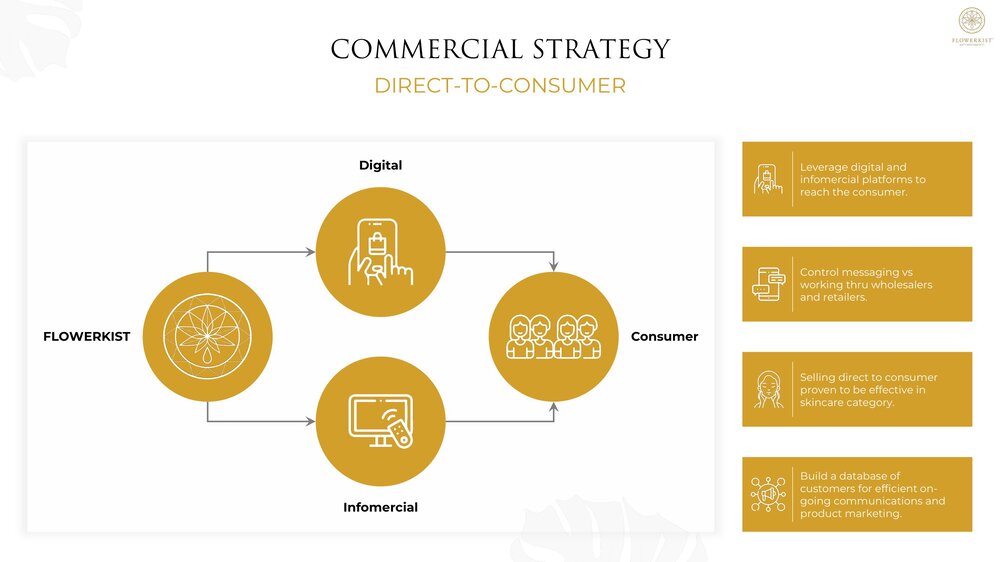

COMMERCIAL STRATEGY DIRECT - TO - CONSUMER Leverage digital and infomercial platforms to reach the consumer. Control messaging vs working thru wholesalers and retailers. Selling direct to consumer proven to be effective in skincare category. Build a database of customers for efficient on - going communications and product marketing. FLOWERKIST Consumer Digital Infomercial

WORLD CLASS PARTNER – DTC INFOMERCIAL Leader in direct response marketing with more than 30 years of experience providing enormously successful infomercials and Direct - to - Consumer creatives for offline and online platforms. No. 1 in Direct - to - Consumer Marketing Produced more than 600 direct - to - consumer campaigns. Over $6 billion in product sales. #1 market share of successful campaigns on air.

PREMIUM CBD - INFUSED COSMETICS PERFECT UPSELL TO OUR CBD - INFUSED SKINCARE CUSTOMERS LipLuxe Crystal Plumping Lip Gloss Sheer Plumping Lipstick Luxe Ultra - Fine Facial Mist Nutrient - Rich Beauty Oil

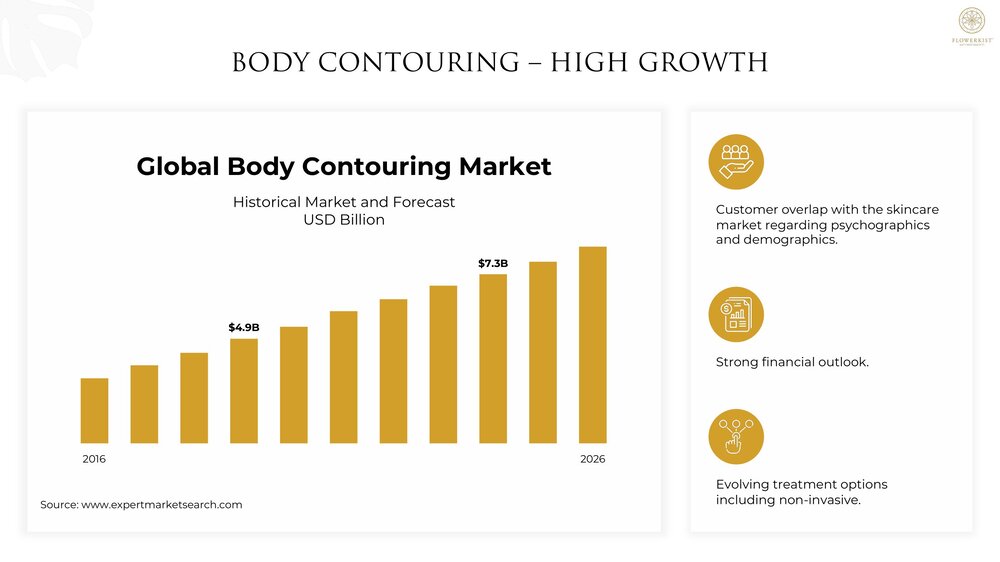

BODY CONTOURING – HIGH GROWTH Global Body Contouring Market Historical Market and Forecast USD Billion $7.3B $4.9B Source: www.expertmarketsearch.com Customer overlap with the skincare market regarding psychographics and demographics. Strong financial outlook. Evolving treatment options including non - invasive. 2016 2026

NON - INVASIVE BODY CONTOURING: SECURING RIGHTS TO PROPRIETARY ALL - NATURAL TOPICAL CREAM WITH CLINICALLY PROVEN RESULTS FOR BODY CONTOURING AND REDUCTION OF CELLULITE Demand for non - invasive body contouring exploding. America and Brazil with options for S. Korea, Japan, Australia and India. Aligns with direct - to - consumer sales strategy. High probability that consumers for Flowerkist CBD - infused skincare will be consumers for non - invasive body contouring. 01 02 03 04

Cellulite Treatment Strong Topical Product Growth Expanding customer group seeking cellulite treatment options. Lucrative market segment. Evolving treatment options with strong topical product growth.

ADDITIONAL HIGH VALUE ASSETS PROVEDA OWNERSHIP & ROYALTY FLOWERKIST PUBLIC SHELL ProVEDA is an emerging CBD - enhanced therapeutic products company. FLOWERKIST Royalty: • 5% of ProVeda gross sales to $10M total payout. FLOWERKIST Ownership: • Warrant to purchase 7.65M shares at $0.30 per share. • ProVEDA currently raising funds at $0.90 per share. FLOWERKIST owns a fully reporting clean public shell company valued at up to $500,000. Shell provides potential liquidity for FLOWERKIST investors.

COMPANY BOARD OF DIRECTORS EXTENSIVE SKINCARE AND BUSINESS DEVELOPMENT EXPERTISE Rowland Hanson Chairman & Director Founder & CEO The HMC Company Vice President Corp. Comm Microsoft Corporation Global Vice President of Marketing Neutrogena Stephanie Parker Co - founder, President & Director Co - founder Regal Barrington Strategic Planning Regal Barrington Mastery Events Coordinator Tony Robbins Fran Heitkamp COO & Director Owner & CEO Farmers Insurance in Grand Forks Owner & CEO Neo Fiber Optics, LLC Chief Operating Officer Sensi Media Group

REVERSE THE APPEARANCE OF AGING CBD - INFUSED SKINCARE CBD - INFUSED COSMETICS NON - INVASIVE BODY CONTOURING

Cover |

Mar. 20, 2023 |

|---|---|

| Cover [Abstract] | |

| Document Type | 8-K |

| Amendment Flag | false |

| Document Period End Date | Mar. 20, 2023 |

| Entity File Number | 333-157783 |

| Entity Registrant Name | Flowerkist Skin Care and Cosmetics, Inc. |

| Entity Central Index Key | 0001458023 |

| Entity Tax Identification Number | 26-4083754 |

| Entity Incorporation, State or Country Code | NV |

| Entity Address, Address Line One | 30211 Avendia De Las Banderas |

| Entity Address, Address Line Two | Suite 200 |

| Entity Address, City or Town | Rancho Santa Margarita |

| Entity Address, State or Province | CA |

| Entity Address, Postal Zip Code | 92688 |

| City Area Code | (949) |

| Local Phone Number | 525-3278 |

| Written Communications | false |

| Soliciting Material | false |

| Pre-commencement Tender Offer | false |

| Pre-commencement Issuer Tender Offer | false |

| Entity Emerging Growth Company | true |

| Elected Not To Use the Extended Transition Period | false |

| Entity Information, Former Legal or Registered Name | 3D Makerjet, Inc. |

{

"instance": {

"flowerkist_8k.htm": {

"axisCustom": 0,

"axisStandard": 0,

"baseTaxonomies": {

"http://xbrl.sec.gov/dei/2022": 22

},

"contextCount": 1,

"dts": {

"inline": {

"local": [

"flowerkist_8k.htm"

]

},

"labelLink": {

"local": [

"mrjtd-20230320_lab.xml"

]

},

"presentationLink": {

"local": [

"mrjtd-20230320_pre.xml"

]

},

"schema": {

"local": [

"mrjtd-20230320.xsd"

],

"remote": [

"http://www.xbrl.org/2003/xbrl-instance-2003-12-31.xsd",

"http://www.xbrl.org/2003/xbrl-linkbase-2003-12-31.xsd",

"http://www.xbrl.org/2003/xl-2003-12-31.xsd",

"http://www.xbrl.org/2003/xlink-2003-12-31.xsd",

"http://www.xbrl.org/2005/xbrldt-2005.xsd",

"http://www.xbrl.org/2006/ref-2006-02-27.xsd",

"http://www.xbrl.org/lrr/role/negated-2009-12-16.xsd",

"http://www.xbrl.org/lrr/role/net-2009-12-16.xsd",

"https://www.xbrl.org/2020/extensible-enumerations-2.0.xsd",

"https://www.xbrl.org/dtr/type/2020-01-21/types.xsd",

"https://xbrl.fasb.org/srt/2022/elts/srt-2022.xsd",

"https://xbrl.fasb.org/srt/2022/elts/srt-roles-2022.xsd",

"https://xbrl.fasb.org/srt/2022/elts/srt-types-2022.xsd",

"https://xbrl.fasb.org/srt/2022q3/srt-sup-2022q3.xsd",

"https://xbrl.fasb.org/us-gaap/2022/elts/us-gaap-2022.xsd",

"https://xbrl.fasb.org/us-gaap/2022/elts/us-roles-2022.xsd",

"https://xbrl.fasb.org/us-gaap/2022/elts/us-types-2022.xsd",

"https://xbrl.fasb.org/us-gaap/2022q3/us-gaap-sup-2022q3.xsd",

"https://xbrl.sec.gov/country/2022/country-2022.xsd",

"https://xbrl.sec.gov/dei/2022/dei-2022.xsd"

]

}

},

"elementCount": 60,

"entityCount": 1,

"hidden": {

"http://xbrl.sec.gov/dei/2022": 2,

"total": 2

},

"keyCustom": 0,

"keyStandard": 22,

"memberCustom": 0,

"memberStandard": 0,

"nsprefix": "MRJTD",

"nsuri": "http://flowerkist.com/20230320",

"report": {

"R1": {

"firstAnchor": {

"ancestors": [

"span",

"b",

"span",

"p",

"body",

"html"

],

"baseRef": "flowerkist_8k.htm",

"contextRef": "From2023-03-20to2023-03-20",

"decimals": null,

"first": true,

"lang": "en-US",

"name": "dei:DocumentType",

"reportCount": 1,

"unique": true,

"unitRef": null,

"xsiNil": "false"

},

"groupType": "document",

"isDefault": "true",

"longName": "00000001 - Document - Cover",

"menuCat": "Cover",

"order": "1",

"role": "http://flowerkist.com/role/Cover",

"shortName": "Cover",

"subGroupType": "",

"uniqueAnchor": {

"ancestors": [

"span",

"b",

"span",

"p",

"body",

"html"

],

"baseRef": "flowerkist_8k.htm",

"contextRef": "From2023-03-20to2023-03-20",

"decimals": null,

"first": true,

"lang": "en-US",

"name": "dei:DocumentType",

"reportCount": 1,

"unique": true,

"unitRef": null,

"xsiNil": "false"

}

}

},

"segmentCount": 0,

"tag": {

"dei_AmendmentDescription": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Description of changes contained within amended document.",

"label": "Amendment Description"

}

}

},

"localname": "AmendmentDescription",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "stringItemType"

},

"dei_AmendmentFlag": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true when the XBRL content amends previously-filed or accepted submission.",

"label": "Amendment Flag"

}

}

},

"localname": "AmendmentFlag",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_AnnualInformationForm": {

"auth_ref": [

"r14"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag with value true on a form if it is an annual report containing an annual information form.",

"label": "Annual Information Form"

}

}

},

"localname": "AnnualInformationForm",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_AuditedAnnualFinancialStatements": {

"auth_ref": [

"r14"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag with value true on a form if it is an annual report containing audited financial statements.",

"label": "Audited Annual Financial Statements"

}

}

},

"localname": "AuditedAnnualFinancialStatements",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_CityAreaCode": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Area code of city",

"label": "City Area Code"

}

}

},

"localname": "CityAreaCode",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_CountryRegion": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Region code of country",

"label": "Country Region"

}

}

},

"localname": "CountryRegion",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_CoverAbstract": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Cover page.",

"label": "Cover [Abstract]"

}

}

},

"localname": "CoverAbstract",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"xbrltype": "stringItemType"

},

"dei_CurrentFiscalYearEndDate": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "End date of current fiscal year in the format --MM-DD.",

"label": "Current Fiscal Year End Date"

}

}

},

"localname": "CurrentFiscalYearEndDate",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "gMonthDayItemType"

},

"dei_DocumentAccountingStandard": {

"auth_ref": [

"r13"

],

"lang": {

"en-us": {

"role": {

"documentation": "The basis of accounting the registrant has used to prepare the financial statements included in this filing This can either be 'U.S. GAAP', 'International Financial Reporting Standards', or 'Other'.",

"label": "Document Accounting Standard"

}

}

},

"localname": "DocumentAccountingStandard",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "accountingStandardItemType"

},

"dei_DocumentAnnualReport": {

"auth_ref": [

"r11",

"r13",

"r14"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true only for a form used as an annual report.",

"label": "Document Annual Report"

}

}

},

"localname": "DocumentAnnualReport",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_DocumentFiscalPeriodFocus": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Fiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.",

"label": "Document Fiscal Period Focus"

}

}

},

"localname": "DocumentFiscalPeriodFocus",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "fiscalPeriodItemType"

},

"dei_DocumentFiscalYearFocus": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "This is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.",

"label": "Document Fiscal Year Focus"

}

}

},

"localname": "DocumentFiscalYearFocus",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "gYearItemType"

},

"dei_DocumentPeriodEndDate": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "For the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.",

"label": "Document Period End Date"

}

}

},

"localname": "DocumentPeriodEndDate",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "dateItemType"

},

"dei_DocumentPeriodStartDate": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "The start date of the period covered in the document, in YYYY-MM-DD format.",

"label": "Document Period Start Date"

}

}

},

"localname": "DocumentPeriodStartDate",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "dateItemType"

},

"dei_DocumentQuarterlyReport": {

"auth_ref": [

"r12"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true only for a form used as an quarterly report.",

"label": "Document Quarterly Report"

}

}

},

"localname": "DocumentQuarterlyReport",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_DocumentRegistrationStatement": {

"auth_ref": [

"r0"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true only for a form used as a registration statement.",

"label": "Document Registration Statement"

}

}

},

"localname": "DocumentRegistrationStatement",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_DocumentShellCompanyEventDate": {

"auth_ref": [

"r13"

],

"lang": {

"en-us": {

"role": {

"documentation": "Date of event requiring a shell company report.",

"label": "Document Shell Company Event Date"

}

}

},

"localname": "DocumentShellCompanyEventDate",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "dateItemType"

},

"dei_DocumentShellCompanyReport": {

"auth_ref": [

"r13"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true for a Shell Company Report pursuant to section 13 or 15(d) of the Exchange Act.",

"label": "Document Shell Company Report"

}

}

},

"localname": "DocumentShellCompanyReport",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_DocumentTransitionReport": {

"auth_ref": [

"r15"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true only for a form used as a transition report.",

"label": "Document Transition Report"

}

}

},

"localname": "DocumentTransitionReport",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_DocumentType": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "The type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.",

"label": "Document Type"

}

}

},

"localname": "DocumentType",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "submissionTypeItemType"

},

"dei_DocumentsIncorporatedByReferenceTextBlock": {

"auth_ref": [

"r3"

],

"lang": {

"en-us": {

"role": {

"documentation": "Documents incorporated by reference.",

"label": "Documents Incorporated by Reference [Text Block]"

}

}

},

"localname": "DocumentsIncorporatedByReferenceTextBlock",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "textBlockItemType"

},

"dei_EntityAddressAddressLine1": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Address Line 1 such as Attn, Building Name, Street Name",

"label": "Entity Address, Address Line One"

}

}

},

"localname": "EntityAddressAddressLine1",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityAddressAddressLine2": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Address Line 2 such as Street or Suite number",

"label": "Entity Address, Address Line Two"

}

}

},

"localname": "EntityAddressAddressLine2",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityAddressAddressLine3": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Address Line 3 such as an Office Park",

"label": "Entity Address, Address Line Three"

}

}

},

"localname": "EntityAddressAddressLine3",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityAddressCityOrTown": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Name of the City or Town",

"label": "Entity Address, City or Town"

}

}

},

"localname": "EntityAddressCityOrTown",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityAddressCountry": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "ISO 3166-1 alpha-2 country code.",

"label": "Entity Address, Country"

}

}

},

"localname": "EntityAddressCountry",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "countryCodeItemType"

},

"dei_EntityAddressPostalZipCode": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Code for the postal or zip code",

"label": "Entity Address, Postal Zip Code"

}

}

},

"localname": "EntityAddressPostalZipCode",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityAddressStateOrProvince": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Name of the state or province.",

"label": "Entity Address, State or Province"

}

}

},

"localname": "EntityAddressStateOrProvince",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "stateOrProvinceItemType"

},

"dei_EntityBankruptcyProceedingsReportingCurrent": {

"auth_ref": [

"r6"

],

"lang": {

"en-us": {

"role": {

"documentation": "For registrants involved in bankruptcy proceedings during the preceding five years, the value Yes indicates that the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court; the value No indicates the registrant has not. Registrants not involved in bankruptcy proceedings during the preceding five years should not report this element.",

"label": "Entity Bankruptcy Proceedings, Reporting Current"

}

}

},

"localname": "EntityBankruptcyProceedingsReportingCurrent",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_EntityCentralIndexKey": {

"auth_ref": [

"r2"

],

"lang": {

"en-us": {

"role": {

"documentation": "A unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK.",

"label": "Entity Central Index Key"

}

}

},

"localname": "EntityCentralIndexKey",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "centralIndexKeyItemType"

},

"dei_EntityCommonStockSharesOutstanding": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Indicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.",

"label": "Entity Common Stock, Shares Outstanding"

}

}

},

"localname": "EntityCommonStockSharesOutstanding",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "sharesItemType"

},

"dei_EntityCurrentReportingStatus": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Indicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.",

"label": "Entity Current Reporting Status"

}

}

},

"localname": "EntityCurrentReportingStatus",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "yesNoItemType"

},

"dei_EntityEmergingGrowthCompany": {

"auth_ref": [

"r2"

],

"lang": {

"en-us": {

"role": {

"documentation": "Indicate if registrant meets the emerging growth company criteria.",

"label": "Entity Emerging Growth Company"

}

}

},

"localname": "EntityEmergingGrowthCompany",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_EntityExTransitionPeriod": {

"auth_ref": [

"r19"

],

"lang": {

"en-us": {

"role": {

"documentation": "Indicate if an emerging growth company has elected not to use the extended transition period for complying with any new or revised financial accounting standards.",

"label": "Elected Not To Use the Extended Transition Period"

}

}

},

"localname": "EntityExTransitionPeriod",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_EntityFileNumber": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Commission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.",

"label": "Entity File Number"

}

}

},

"localname": "EntityFileNumber",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "fileNumberItemType"

},

"dei_EntityFilerCategory": {

"auth_ref": [

"r2"

],

"lang": {

"en-us": {

"role": {

"documentation": "Indicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure.",

"label": "Entity Filer Category"

}

}

},

"localname": "EntityFilerCategory",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "filerCategoryItemType"

},

"dei_EntityIncorporationStateCountryCode": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Two-character EDGAR code representing the state or country of incorporation.",

"label": "Entity Incorporation, State or Country Code"

}

}

},

"localname": "EntityIncorporationStateCountryCode",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "edgarStateCountryItemType"

},

"dei_EntityInformationFormerLegalOrRegisteredName": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Former Legal or Registered Name of an entity",

"label": "Entity Information, Former Legal or Registered Name"

}

}

},

"localname": "EntityInformationFormerLegalOrRegisteredName",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityInteractiveDataCurrent": {

"auth_ref": [

"r16"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).",

"label": "Entity Interactive Data Current"

}

}

},

"localname": "EntityInteractiveDataCurrent",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "yesNoItemType"

},

"dei_EntityPrimarySicNumber": {

"auth_ref": [

"r14"

],

"lang": {

"en-us": {

"role": {

"documentation": "Primary Standard Industrial Classification (SIC) Number for the Entity.",

"label": "Entity Primary SIC Number"

}

}

},

"localname": "EntityPrimarySicNumber",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "sicNumberItemType"

},

"dei_EntityPublicFloat": {

"auth_ref": [],

"crdr": "credit",

"lang": {

"en-us": {

"role": {

"documentation": "The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.",

"label": "Entity Public Float"

}

}

},

"localname": "EntityPublicFloat",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "monetaryItemType"

},

"dei_EntityRegistrantName": {

"auth_ref": [

"r2"

],

"lang": {

"en-us": {

"role": {

"documentation": "The exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC.",

"label": "Entity Registrant Name"

}

}

},

"localname": "EntityRegistrantName",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityShellCompany": {

"auth_ref": [

"r2"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act.",

"label": "Entity Shell Company"

}

}

},

"localname": "EntityShellCompany",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_EntitySmallBusiness": {

"auth_ref": [

"r2"

],

"lang": {

"en-us": {

"role": {

"documentation": "Indicates that the company is a Smaller Reporting Company (SRC).",

"label": "Entity Small Business"

}

}

},

"localname": "EntitySmallBusiness",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "booleanItemType"

},

"dei_EntityTaxIdentificationNumber": {

"auth_ref": [

"r2"

],

"lang": {

"en-us": {

"role": {

"documentation": "The Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS.",

"label": "Entity Tax Identification Number"

}

}

},

"localname": "EntityTaxIdentificationNumber",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "employerIdItemType"

},

"dei_EntityVoluntaryFilers": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Indicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.",

"label": "Entity Voluntary Filers"

}

}

},

"localname": "EntityVoluntaryFilers",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "yesNoItemType"

},

"dei_EntityWellKnownSeasonedIssuer": {

"auth_ref": [

"r17"

],

"lang": {

"en-us": {

"role": {

"documentation": "Indicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A.",

"label": "Entity Well-known Seasoned Issuer"

}

}

},

"localname": "EntityWellKnownSeasonedIssuer",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "yesNoItemType"

},

"dei_Extension": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Extension number for local phone number.",

"label": "Extension"

}

}

},

"localname": "Extension",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},

"dei_LocalPhoneNumber": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Local phone number for entity.",

"label": "Local Phone Number"

}

}

},

"localname": "LocalPhoneNumber",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://flowerkist.com/role/Cover"

],

"xbrltype": "normalizedStringItemType"

},