| UNITED STATES SECURITIES AND EXCHANGE COMMISSION | ||||||||

| Washington, D.C. 20549 | ||||||||

Form | ||||||||

| (Mark One) | |||||

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the Fiscal Year Ended | |||||

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to . | |||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| þ | Accelerated filer | ¨ | ||||||||||||||||||

| Non-accelerated filer | ¨ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ | |||||||||||||||||||

| TABLE OF CONTENTS | ||||||||

| Page | ||||||||

| PART 1. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

| Abbreviation | Term | |||||||

| API | Application Programming Interface | |||||||

| ATM Program | At-the-market equity offering program | |||||||

| BEAT | Base erosion and anti-abuse tax | |||||||

| CFPB | Consumer Financial Protection Bureau was created by the Dodd-Frank Act to issue and enforce consumer protection initiatives governing financial products and services, including money transfer services, in the U.S. | |||||||

| CID | Civil Investigative Demand | |||||||

| Consent Order | Stipulated Order for Compensatory Relief and Modified Order for Permanent Injunction | |||||||

| Corridor | With regard to a money transfer transaction, the originating "send" location and the designated "receive" location are referred to as a corridor | |||||||

| COVID-19 | Coronavirus disease | |||||||

| Digital Channel | Transactions in which either the send transaction, receive transaction or both occur through one of the Company's digital properties such as moneygram.com, the native mobile application or virtual agents | |||||||

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act | |||||||

| DPA | Deferred Prosecution Agreement dated November 9, 2012 by and between MoneyGram International, Inc and the United States Department of Justice and the United States Attorney's Office for the Middle District of Pennsylvania, as amended. | |||||||

| Face Value | Principal amount of each completed transaction, excluding any transaction fees | |||||||

| FCPA | Foreign Corrupt Practices Act | |||||||

| Fitch | Fitch Ratings, Inc. | |||||||

| FPP | Financial Paper Products | |||||||

| FTC | Federal Trade Commission | |||||||

| GFT | Global Funds Transfer | |||||||

| IRS | Internal Revenue Service | |||||||

| LIBOR | London Interbank Offered Rate | |||||||

| Merger | Merger Sub will merge with and into the Company | |||||||

| Merger Agreement | On February 14, 2022, the Company, entered into an Agreement and Plan of Merger | |||||||

| Merger Sub | Mobius Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Parent | |||||||

| MDP | Madison Dearborn Partners, LLC, a Delaware limited liability company | |||||||

| MGO | MoneyGram Online | |||||||

| Moody's | Moody's Investor Service | |||||||

| MPSI | MoneyGram Payment Systems, Inc. | |||||||

| Non-U.S. dollar | The impact of non-U.S. dollar exchange rate fluctuations on the Company's financial results is typically calculated as the difference between current period activity translated using the current period's exchange rates and the comparable prior-year period's exchange rates; this method is used to calculate the impact of changes in non-U.S. dollar exchange rates on revenues, commissions and other operating expenses for all countries where the functional currency is not the U.S. dollar. | |||||||

| NYAG | New York State Office of the Attorney General | |||||||

| NYDFS | New York Department of Financial Services | |||||||

| OFAC | U.S. Treasury Department's Office of Foreign Assets Control | |||||||

| Parent | Mobius Parent Corp. | |||||||

| Pension | The Company’s Pension Plan and SERPs | |||||||

| Pension Plan | Defined benefit pension plan | |||||||

| Postretirement Benefits | Defined benefit postretirement plan | |||||||

| P2P | Peer-to-peer | |||||||

| Receiver | Person receiving a money transfer transaction | |||||||

| Retail Channel | Transactions in which both the send transaction and receive transaction occur at one of the Company's physical agent locations | |||||||

| Ripple Warrants | Warrants issued by the Company in connection with the SPA with Ripple | |||||||

| ROU | Right-of-use | |||||||

| SERPs | Supplemental executive retirement plans | |||||||

| S&P | Standard & Poor's | |||||||

| SEC | U.S. Securities and Exchange Commission | |||||||

| SPA | Securities Purchase Agreement | |||||||

| USDC | USD Coin | |||||||

| U.S. DOJ | U.S. Department of Justice, Criminal Division, Money Laundering and Asset Recovery Section | |||||||

| U.S. GAAP | Accounting principles generally accepted in the United States of America | |||||||

| U.S. Judge | United States Judge for the Middle District of Pennsylvania | |||||||

| TCJA | Tax Cuts and Jobs Act | |||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| GFT | ||||||||||||||||||||

| Money transfer | 91 | % | 93 | % | 91 | % | ||||||||||||||

| Bill payment | 3 | % | 3 | % | 4 | % | ||||||||||||||

| FPP | ||||||||||||||||||||

| Money order | 3 | % | 3 | % | 3 | % | ||||||||||||||

| Official check | 3 | % | 1 | % | 2 | % | ||||||||||||||

| Total revenue | 100 | % | 100 | % | 100 | % | ||||||||||||||

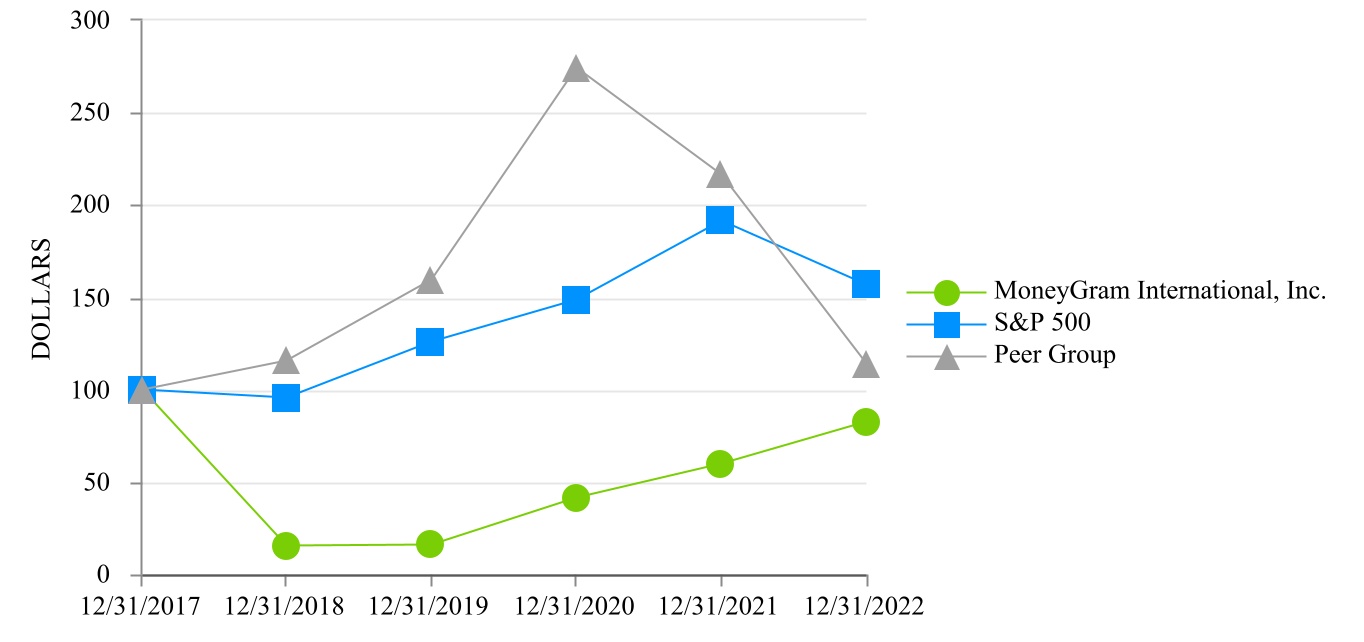

| 12/31/2017 | 12/31/2018 | 12/31/2019 | 12/31/2020 | 12/31/2021 | 12/31/2022 | |||||||||||||||||||||||||||||||||

| MoneyGram International, Inc. | $ | 100.00 | $ | 15.17 | $ | 15.93 | $ | 41.46 | $ | 59.86 | $ | 82.63 | ||||||||||||||||||||||||||

| S&P 500 | $ | 100.00 | $ | 95.62 | $ | 125.72 | $ | 148.85 | $ | 191.58 | $ | 156.89 | ||||||||||||||||||||||||||

| Peer Group | $ | 100.00 | $ | 115.83 | $ | 159.33 | $ | 274.20 | $ | 216.31 | $ | 113.96 | ||||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Revenue | ||||||||||||||

| Fee and other revenue | $ | 1,272.2 | $ | 1,275.8 | ||||||||||

| Investment revenue | 37.9 | 7.8 | ||||||||||||

| Total revenue | 1,310.1 | 1,283.6 | ||||||||||||

| Cost of revenue | ||||||||||||||

| Commissions and other fee expense | 610.7 | 622.7 | ||||||||||||

| Investment commissions expense | 21.9 | 0.9 | ||||||||||||

| Direct transaction expense | 57.6 | 60.5 | ||||||||||||

| Total cost of revenue | 690.2 | 684.1 | ||||||||||||

| Gross profit | 619.9 | 599.5 | ||||||||||||

| Operating expenses | ||||||||||||||

| Compensation and benefits | 228.0 | 227.8 | ||||||||||||

| Transaction and operations support | 187.2 | 179.1 | ||||||||||||

| Occupancy, equipment and supplies | 59.8 | 61.9 | ||||||||||||

| Depreciation and amortization | 51.7 | 57.0 | ||||||||||||

| Total operating expenses | 526.7 | 525.8 | ||||||||||||

| Operating income | 93.2 | 73.7 | ||||||||||||

| Other expenses | ||||||||||||||

| Interest expense | 49.4 | 69.5 | ||||||||||||

| Loss on early extinguishment of debt | — | 44.1 | ||||||||||||

| Other non-operating expense | 4.0 | 3.7 | ||||||||||||

| Total other expenses | 53.4 | 117.3 | ||||||||||||

| Income (loss) before income taxes | 39.8 | (43.6) | ||||||||||||

| Income tax expense (benefit) | 5.6 | (5.7) | ||||||||||||

| Net income (loss) | $ | 34.2 | $ | (37.9) | ||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Money transfer revenue | $ | 1,190.3 | $ | 1,189.2 | ||||||||||

| Bill payment revenue | 35.6 | 39.6 | ||||||||||||

| Total revenue | 1,225.9 | 1,228.8 | ||||||||||||

| Cost of revenue | 668.2 | 683.2 | ||||||||||||

| Gross profit | $ | 557.7 | $ | 545.6 | ||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Money order revenue | $ | 44.1 | $ | 40.9 | ||||||||||

| Official check revenue | 40.1 | 13.9 | ||||||||||||

| Total revenue | 84.2 | 54.8 | ||||||||||||

| Investment commissions expense | 22.0 | 0.9 | ||||||||||||

| Gross profit | $ | 62.2 | $ | 53.9 | ||||||||||

| (Amounts in millions, except percentages) | 2022 | 2021 | ||||||||||||

| Income (loss) before income taxes | $ | 39.8 | $ | (43.6) | ||||||||||

| Interest expense | 49.4 | 69.5 | ||||||||||||

| Depreciation and amortization | 51.7 | 57.0 | ||||||||||||

| Signing bonus amortization | 50.1 | 56.4 | ||||||||||||

| EBITDA | 191.0 | 139.3 | ||||||||||||

| Significant items impacting EBITDA: | ||||||||||||||

| Stock-based, contingent, incentive compensation and other | 15.8 | 7.3 | ||||||||||||

| Merger-related costs | 7.7 | — | ||||||||||||

| Severance and related costs | 1.9 | 0.2 | ||||||||||||

| Legal and contingent matters | 1.9 | 14.1 | ||||||||||||

| Restructuring and reorganization costs | (0.9) | 9.4 | ||||||||||||

| Loss on early extinguishment of debt | — | 44.1 | ||||||||||||

| Compliance enhancement program | — | 2.9 | ||||||||||||

| Direct monitor costs | — | 4.9 | ||||||||||||

| Adjusted EBITDA | $ | 217.4 | $ | 222.2 | ||||||||||

| Adjusted EBITDA | $ | 217.4 | $ | 222.2 | ||||||||||

| Cash payments for interest | (47.5) | (51.8) | ||||||||||||

| Cash (payments) refunds for taxes, net | (13.7) | (5.7) | ||||||||||||

| Cash payments for capital expenditures | (53.8) | (41.4) | ||||||||||||

| Cash payments for agent signing bonuses | (36.9) | (36.0) | ||||||||||||

| Adjusted Free Cash Flow | $ | 65.5 | $ | 87.3 | ||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Cash and cash equivalents | $ | 172.1 | $ | 155.2 | ||||||||||

| Settlement assets: | ||||||||||||||

| Settlement cash and cash equivalents | $ | 1,499.1 | $ | 1,895.7 | ||||||||||

| Receivables, net | 1,107.0 | 700.4 | ||||||||||||

| Interest-bearing investments | 998.1 | 992.3 | ||||||||||||

| Available-for-sale investments | 3.0 | 3.0 | ||||||||||||

| Total settlement assets | $ | 3,607.2 | $ | 3,591.4 | ||||||||||

| Payment service obligations | $ | (3,607.2) | $ | (3,591.4) | ||||||||||

| (Amounts in millions, except percentages) | 2022 | 2021 | ||||||||||||

8.571% Term Loan due 2026 | $ | 380.0 | $ | 384.0 | ||||||||||

5.375% Senior Secured Notes due 2026 | 415.0 | 415.0 | ||||||||||||

| Total debt at face value | 795.0 | 799.0 | ||||||||||||

| Unamortized debt issuance costs and debt discounts | (9.6) | (12.3) | ||||||||||||

| Total debt, net | $ | 785.4 | $ | 786.7 | ||||||||||

| Payments due by period | ||||||||||||||||||||||||||||||||

| (Amounts in millions) | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||||||||||||||

Debt, including interest payments (1) | $ | 955.7 | $ | 49.3 | $ | 99.9 | $ | 806.5 | $ | — | ||||||||||||||||||||||

Non-cancellable leases (2) | 55.3 | 9.1 | 17.4 | 13.8 | 15.0 | |||||||||||||||||||||||||||

Signing bonuses (3) | 35.9 | 19.5 | 14.1 | — | — | |||||||||||||||||||||||||||

Marketing (4) | 102.5 | 37.5 | 65.0 | — | — | |||||||||||||||||||||||||||

Unrecognized tax benefits (5) | 9.1 | 2.9 | — | — | — | |||||||||||||||||||||||||||

| Total contractual cash obligations | $ | 1,158.5 | $ | 118.3 | $ | 196.4 | $ | 820.3 | $ | 15.0 | ||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Net cash provided by operating activities | $ | 85.7 | $ | 37.1 | ||||||||||

| Net cash used in investing activities | (62.6) | (44.5) | ||||||||||||

| Net cash used in financing activities | (402.8) | (21.0) | ||||||||||||

| Net change in cash and cash equivalents and settlement cash and cash equivalents | $ | (379.7) | $ | (28.4) | ||||||||||

| (Amounts in millions, except percentages and financial institutions) | Number of Financial Institutions (1) | Amount | Percent of Investment Portfolio | |||||||||||||||||

| Cash held on-hand at owned retail locations | N/A | $ | — | — | % | |||||||||||||||

| Cash equivalents collateralized by securities issued by U.S. government agencies | 1 | — | — | % | ||||||||||||||||

| Available-for-sale investments issued by U.S. government agencies | N/A | 1.5 | — | % | ||||||||||||||||

Cash, cash equivalents and interest-bearing investments at institutions rated AAA (2) | 1 | 49.6 | 2 | % | ||||||||||||||||

| Cash, cash equivalents and interest-bearing investments at institutions rated AA | 5 | 140.0 | 5 | % | ||||||||||||||||

| Cash, cash equivalents and interest-bearing investments at institutions rated A | 15 | 1,551.1 | 58 | % | ||||||||||||||||

| Cash, cash equivalents and interest-bearing investments at institutions rated BBB | 2 | — | — | % | ||||||||||||||||

| Cash, cash equivalents and interest-bearing investments at institutions rated below BBB | 4 | 424.8 | 16 | % | ||||||||||||||||

| Asset-backed and other securities | N/A | 1.5 | — | % | ||||||||||||||||

| Investment portfolio held within the U.S. | 28 | 2,168.5 | 81 | % | ||||||||||||||||

| Cash held on-hand at owned retail locations | N/A | 20.3 | 1 | % | ||||||||||||||||

| Cash, cash equivalents and interest-bearing investments held at institutions rated AA | 7 | 187.1 | 7 | % | ||||||||||||||||

| Cash, cash equivalents and interest-bearing investments at institutions rated A | 15 | 144.9 | 5 | % | ||||||||||||||||

| Cash, cash equivalents and interest-bearing investments at institutions rated below A | 50 | 151.5 | 6 | % | ||||||||||||||||

| Investment portfolio held outside the U.S. | 72 | 503.8 | 19 | % | ||||||||||||||||

| Total investment portfolio | $ | 2,672.3 | 100 | % | ||||||||||||||||

| Basis Point Change in Interest Rates | ||||||||||||||||||||||||||||||||||||||

| Down | Down | Down | Up | Up | Up | |||||||||||||||||||||||||||||||||

| (Amounts in millions) | 200 | 100 | 50 | 50 | 100 | 200 | ||||||||||||||||||||||||||||||||

| Investment revenue | $ | (17.7) | $ | (8.8) | $ | (4.4) | $ | 4.4 | $ | 8.8 | $ | 17.7 | ||||||||||||||||||||||||||

| Investment commissions expense | 12.4 | 5.9 | 2.8 | (2.8) | (5.9) | (12.4) | ||||||||||||||||||||||||||||||||

| Interest expense | 3.5 | 1.7 | 0.9 | (0.9) | (1.7) | (3.5) | ||||||||||||||||||||||||||||||||

| Change in pretax income | $ | (1.8) | $ | (1.2) | $ | (0.7) | $ | 0.7 | $ | 1.2 | $ | 1.8 | ||||||||||||||||||||||||||

| Basis Point Change in Interest Rates | ||||||||||||||||||||||||||||||||||||||

| Down | Down | Down | Up | Up | Up | |||||||||||||||||||||||||||||||||

| (Amounts in millions) | 200 | 100 | 50 | 50 | 100 | 200 | ||||||||||||||||||||||||||||||||

| Investment revenue | $ | (33.1) | $ | (16.1) | $ | (7.5) | $ | 9.5 | $ | 18.1 | $ | 35.1 | ||||||||||||||||||||||||||

| Investment commissions expense | 23.7 | 11.4 | 5.2 | (6.2) | (12.4) | (24.7) | ||||||||||||||||||||||||||||||||

| Interest expense | 6.9 | 3.5 | 1.7 | (1.7) | (3.5) | (6.9) | ||||||||||||||||||||||||||||||||

| Change in pretax income | $ | (2.5) | $ | (1.2) | $ | (0.6) | $ | 1.6 | $ | 2.2 | $ | 3.5 | ||||||||||||||||||||||||||

| (a) (1) | The financial statements listed in the "Index to Financial Statements" are filed as part of this 2022 Form 10-K. | ||||

| (2) | All financial statement schedules are omitted because they are not applicable or the required information is included in the Consolidated Financial Statements or notes thereto listed in the "Index to Financial Statements." | ||||

| (3) | Exhibits are filed with this 2022 Form 10-K or incorporated herein by reference as listed in the accompanying Exhibit Index. | ||||

| (b) (1) | The following exhibits are filed or incorporated by reference herein in response to Item 601 of Regulation S-K. The Company files Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K pursuant to the Securities Exchange Act of 1934 under Commission File No. 1-31950. | ||||

Exhibit Number | Description | |||||||

| 2.1 | ||||||||

| 3.1 | ||||||||

| 3.2 | ||||||||

| 3.3 | ||||||||

| 3.4 | ||||||||

| 3.5 | ||||||||

| 3.6 | ||||||||

| 3.7 | ||||||||

| 4.1 | ||||||||

| 4.2 | ||||||||

| 4.3 | ||||||||

| 4.4 | ||||||||

| 4.5 | ||||||||

| 4.6 | ||||||||

Exhibit Number | Description | |||||||

| 10.1 | ||||||||

| 10.2 | ||||||||

| 10.3† | ||||||||

| 10.4† | ||||||||

10.5*† | ||||||||

| 10.6† | ||||||||

| 10.7† | ||||||||

| 10.8† | ||||||||

| 10.9† | ||||||||

| 10.10† | ||||||||

| 10.11† | ||||||||

| 10.12† | ||||||||

| 10.13+ | ||||||||

| 10.14+ | ||||||||

| 10.15+ | ||||||||

| 10.16 | ||||||||

| 10.17 | ||||||||

| 10.18 | ||||||||

| 10.19 | ||||||||

| 10.20 | ||||||||

Exhibit Number | Description | |||||||

| 10.21*** | ||||||||

| 10.22*** | ||||||||

| 10.23*† | ||||||||

| 10.24† | ||||||||

| 10.25† | ||||||||

| 10.26 | ||||||||

| 10.27 | ||||||||

| 10.28 | ||||||||

| 10.29† | ||||||||

| 10.30† | ||||||||

| 10.31† | ||||||||

| 10.32† | ||||||||

| 10.33* | ||||||||

| 10.34* | ||||||||

| 10.35* | ||||||||

| 10.36* | ||||||||

| 10.37* | ||||||||

| 10.38* | ||||||||

| 21* | ||||||||

| 23* | ||||||||

| 24* | ||||||||

| 31.1* | ||||||||

| 31.2* | ||||||||

| 32.1** | ||||||||

| 32.2** | ||||||||

Exhibit Number | Description | |||||||

| 101* | The following materials from MoneyGram's Annual Report on Form 10-K for the year ended December 31, 2022, formatted in iXBRL (Inline eXtensible Business Reporting Language): (i) Consolidated Balance Sheets, (ii) Consolidated Statements of Operations, (iii) Consolidated Statements of Comprehensive (Loss) Income, (iv) Consolidated Statements of Stockholders' Deficit, (v) Consolidated Statements of Cash Flows and (vi) Notes to the Consolidated Financial Statements. | |||||||

| 104* | Cover Page Interactive Data File (formatted in iXBRL (Inline eXtensible Business Reporting Language) and contained in Exhibit 101). | |||||||

| * | Filed herewith. | |||||||

| ** | Furnished herewith. | |||||||

| *** | Portions of this exhibit have been omitted because they are both not material and would be competitively harmful if publicly disclosed. | |||||||

| † | Indicates management contract or compensatory plan or arrangement. | |||||||

| + | Confidential information has been omitted from this Exhibit and has been filed separately with the SEC pursuant to a confidential treatment request under Rule 24b-2. | |||||||

| MoneyGram International, Inc. | |||||||||||||||||

| (Registrant) | |||||||||||||||||

| Date: | February 24, 2023 | By: | /S/ W. ALEXANDER HOLMES | ||||||||||||||

| W. Alexander Holmes | |||||||||||||||||

| Chairman and Chief Executive Officer (Principal Executive Officer) | |||||||||||||||||

| /s/ W. Alexander Holmes | Chairman and Chief Executive Officer (Principal Executive Officer) | February 24, 2023 | ||||||||||||

| W. Alexander Holmes | ||||||||||||||

| /s/ Brian Johnson | Chief Financial Officer (Principal Financial Officer) | February 24, 2023 | ||||||||||||

| Brian Johnson | ||||||||||||||

| /s/ Christopher Russell | Chief Accounting Officer (Principal Accounting Officer) | February 24, 2023 | ||||||||||||

| Christopher Russell | ||||||||||||||

| Directors | ||||||||||||||

| Antonio O. Garza | Alka Gupta | |||||||||||||

| Francisco Lorca | Michael P. Rafferty | |||||||||||||

| Julie E. Silcock | W. Bruce Turner | |||||||||||||

| Peggy Vaughan | ||||||||||||||

| By: | /s/ Robert L. Villaseñor | February 24, 2023 | ||||||||||||||||||

| Robert L. Villaseñor | ||||||||||||||||||||

| Attorney-in-fact | ||||||||||||||||||||

F-2 | |||||

Reports of Independent Registered Public Accounting Firm (KPMG LLP, Dallas, Texas, Auditor Firm ID: | F-3 | ||||

F-6 | |||||

F-7 | |||||

F-8 | |||||

F-9 | |||||

F-11 | |||||

F-12 | |||||

F-12 | |||||

F-13 | |||||

F-19 | |||||

F-20 | |||||

F-22 | |||||

F-23 | |||||

F-24 | |||||

F-25 | |||||

F-25 | |||||

F-26 | |||||

F-31 | |||||

F-33 | |||||

F-35 | |||||

F-37 | |||||

F-39 | |||||

F-39 | |||||

F-41 | |||||

F-41 | |||||

| AS OF DECEMBER 31, | ||||||||||||||

| (Amounts in millions, except share data) | 2022 | 2021 | ||||||||||||

| ASSETS | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Settlement assets | ||||||||||||||

| Property and equipment, net | ||||||||||||||

| Goodwill | ||||||||||||||

| Right-of-use assets | ||||||||||||||

| Other assets | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| LIABILITIES | ||||||||||||||

| Payment service obligations | $ | $ | ||||||||||||

| Debt, net | ||||||||||||||

| Pension and other postretirement benefits | ||||||||||||||

| Lease liabilities | ||||||||||||||

| Accounts payable and other liabilities | ||||||||||||||

| Total liabilities | ||||||||||||||

COMMITMENTS AND CONTINGENCIES (NOTE 14) | ||||||||||||||

| STOCKHOLDERS' DEFICIT | ||||||||||||||

Common stock, $ | ||||||||||||||

| Additional paid-in capital | ||||||||||||||

| Retained loss | ( | ( | ||||||||||||

| Accumulated other comprehensive loss | ( | ( | ||||||||||||

Treasury stock: | ( | ( | ||||||||||||

| Total stockholders' deficit | ( | ( | ||||||||||||

| Total liabilities and stockholders' deficit | $ | $ | ||||||||||||

| FOR THE YEARS ENDED DECEMBER 31, | ||||||||||||||||||||

| (Amounts in millions, except share data) | 2022 | 2021 | 2020 | |||||||||||||||||

| REVENUE | ||||||||||||||||||||

| Fee and other revenue | $ | $ | $ | |||||||||||||||||

| Investment revenue | ||||||||||||||||||||

| Total revenue | ||||||||||||||||||||

| COST OF REVENUE | ||||||||||||||||||||

| Commissions and other fee expense | ||||||||||||||||||||

| Investment commissions expense | ||||||||||||||||||||

| Direct transaction expense | ||||||||||||||||||||

| Total cost of revenue | ||||||||||||||||||||

| GROSS PROFIT | ||||||||||||||||||||

| OPERATING EXPENSES | ||||||||||||||||||||

| Compensation and benefits | ||||||||||||||||||||

Transaction and operations support (1) | ||||||||||||||||||||

| Occupancy, equipment and supplies | ||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||

| OPERATING INCOME | ||||||||||||||||||||

| Other expenses | ||||||||||||||||||||

| Interest expense | ||||||||||||||||||||

| Loss on early extinguishment of debt | ||||||||||||||||||||

| Other non-operating expense | ||||||||||||||||||||

| Total other expenses | ||||||||||||||||||||

| Income (loss) before income taxes | ( | |||||||||||||||||||

| Income tax expense (benefit) | ( | |||||||||||||||||||

| NET INCOME (LOSS) | $ | $ | ( | $ | ( | |||||||||||||||

| EARNINGS (LOSS) PER COMMON SHARE | ||||||||||||||||||||

| Basic | $ | $ | ( | $ | ( | |||||||||||||||

| Diluted | $ | $ | ( | $ | ( | |||||||||||||||

| Weighted-average outstanding common shares and equivalents used in computing loss per share | ||||||||||||||||||||

| Basic | ||||||||||||||||||||

| Diluted | ||||||||||||||||||||

| FOR THE YEARS ENDED DECEMBER 31, | ||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| NET INCOME (LOSS) | $ | $ | ( | $ | ( | |||||||||||||||

| OTHER COMPREHENSIVE (LOSS) INCOME | ||||||||||||||||||||

Net change in unrealized holding gain (loss) on available-for-sale securities arising during the period net of tax (expense) benefits of $( | ( | |||||||||||||||||||

Net change in pension liability due to amortization of prior service cost and net actuarial loss, net of tax benefit of $ | ||||||||||||||||||||

Pension settlement gain, net of tax benefit of $ | ( | |||||||||||||||||||

Valuation adjustment for pension and postretirement benefits, net of tax expense (benefit) of $ | ( | |||||||||||||||||||

Unrealized non-U.S. dollar translation adjustments, net of tax (benefit) expense of $ | ( | ( | ||||||||||||||||||

| Other comprehensive (loss) income | ( | ( | ||||||||||||||||||

| COMPREHENSIVE INCOME (LOSS) | $ | $ | ( | $ | ( | |||||||||||||||

| FOR THE YEARS ENDED DECEMBER 31, | ||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||||||||||

| Net income (loss) | $ | $ | ( | $ | ( | |||||||||||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||

| Signing bonus amortization | ||||||||||||||||||||

| Change in right-of-use assets | ||||||||||||||||||||

| Deferred income tax expense (benefit) | ( | |||||||||||||||||||

| Amortization of debt discount and debt issuance costs | ||||||||||||||||||||

| Loss on early extinguishment of debt | ||||||||||||||||||||

| Non-cash compensation and pension expense | ||||||||||||||||||||

| Signing bonus payments | ( | ( | ( | |||||||||||||||||

| Change in other assets | ( | ( | ( | |||||||||||||||||

| Change in lease liabilities | ( | ( | ( | |||||||||||||||||

| Change in accounts payable and other liabilities | ( | ( | ||||||||||||||||||

| Other non-cash items, net | ( | |||||||||||||||||||

| Net cash provided by operating activities | ||||||||||||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||||||||||

| Payments for capital expenditures | ( | ( | ( | |||||||||||||||||

| Proceeds from available-for-sale investments | ||||||||||||||||||||

| Purchases of interest-bearing investments | ( | ( | ( | |||||||||||||||||

| Proceeds from interest-bearing investments | ||||||||||||||||||||

| Purchase of equity investments | ( | ( | ||||||||||||||||||

| Sale of equity investments | ||||||||||||||||||||

| Net cash used in investing activities | ( | ( | ( | |||||||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||||||||||

| Transaction costs for issuance and amendment of debt | ( | |||||||||||||||||||

| Proceeds from issuance of debt | ||||||||||||||||||||

| Principal payments on debt | ( | ( | ( | |||||||||||||||||

| Prepayment call premium | ( | |||||||||||||||||||

| Proceeds from revolving credit facility | ||||||||||||||||||||

| Payments on revolving credit facility | ( | |||||||||||||||||||

| Change in receivables, net | ( | ( | ||||||||||||||||||

| Change in payment service obligations | ( | |||||||||||||||||||

| Net proceeds from stock issuance | ||||||||||||||||||||

| Stock repurchases | ( | |||||||||||||||||||

| Payments to tax authorities for stock-based compensation | ( | ( | ( | |||||||||||||||||

| Net cash (used in) provided by financing activities | ( | ( | ||||||||||||||||||

| NET CHANGE IN CASH AND CASH EQUIVALENTS AND SETTLEMENT CASH AND CASH EQUIVALENTS | ( | ( | ||||||||||||||||||

| CASH AND CASH EQUIVALENTS AND SETTLEMENT CASH AND CASH EQUIVALENTS—Beginning of year | ||||||||||||||||||||

| CASH AND CASH EQUIVALENTS AND SETTLEMENT CASH AND CASH EQUIVALENTS—End of year | $ | $ | $ | |||||||||||||||||

| FOR THE YEARS ENDED DECEMBER 31, | ||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Cash payments for interest | $ | $ | $ | |||||||||||||||||

| Cash payments (refunds) for taxes, net | $ | $ | $ | ( | ||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Settlement cash and cash equivalents | ||||||||||||||

| Cash and cash equivalents and settlement cash and cash equivalents | $ | $ | ||||||||||||

| (Amounts in millions) | Preferred Stock | Common Stock | Additional Paid-In Capital | Retained Loss | Accumulated Other Comprehensive Loss | Treasury Stock | Total | |||||||||||||||||||||||||||||||||||||

| January 1, 2020 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation activity | — | — | ( | — | ||||||||||||||||||||||||||||||||||||||||

| Preferred stock - series D conversion | ( | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| December 31, 2020 | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation activity | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Exercise of Ripple Warrants | — | ( | — | — | — | |||||||||||||||||||||||||||||||||||||||

| ATM Equity Offering | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Stock repurchases | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||

| December 31, 2021 | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation activity | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Exercise of Lender Warrants | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||

| December 31, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Beginning balance | $ | $ | $ | |||||||||||||||||

| Provision | ||||||||||||||||||||

| Write-offs, net of recoveries | ( | ( | ( | |||||||||||||||||

| Ending balance | $ | $ | $ | |||||||||||||||||

| Type of Asset | Useful Life | |||||||

| Computer hardware | ||||||||

| Computer software | ||||||||

| Signage | ||||||||

| Equipment at agent locations | ||||||||

| Office furniture and equipment | ||||||||

| Leasehold improvements | ||||||||

| Type of Intangible Asset | Useful Life | |||||||

| Contractual and customer relationships | ||||||||

| Non-compete agreements | ||||||||

| Developed technology | ||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Settlement assets: | ||||||||||||||

| Settlement cash and cash equivalents | $ | $ | ||||||||||||

| Receivables, net | ||||||||||||||

| Interest-bearing investments | ||||||||||||||

| Available-for-sale investments | ||||||||||||||

| $ | $ | |||||||||||||

| Payment service obligations | $ | ( | $ | ( | ||||||||||

| (Amounts in millions) | Level 2 | Level 3 | Total | |||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||

| Financial assets: | ||||||||||||||||||||

| Available-for-sale investments: | ||||||||||||||||||||

| Residential mortgage-backed securities | $ | $ | $ | |||||||||||||||||

| Asset-backed and other securities | ||||||||||||||||||||

| Forward contracts | ||||||||||||||||||||

| Total financial assets | $ | $ | $ | |||||||||||||||||

| Financial liabilities: | ||||||||||||||||||||

| Forward contracts | $ | $ | $ | |||||||||||||||||

| December 31, 2021 | ||||||||||||||||||||

| Financial assets: | ||||||||||||||||||||

| Available-for-sale investments: | ||||||||||||||||||||

| Residential mortgage-backed securities | $ | $ | $ | |||||||||||||||||

| Asset-backed and other securities | ||||||||||||||||||||

| Forward contracts | ||||||||||||||||||||

| Total financial assets | $ | $ | $ | |||||||||||||||||

| Financial liabilities: | ||||||||||||||||||||

| Forward contracts | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Beginning balance | $ | $ | $ | |||||||||||||||||

| Change in unrealized gains (losses) | ( | |||||||||||||||||||

| Ending balance | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||||||||||||||

Carrying value | Fair value | Carrying value | Fair value | |||||||||||||||||||||||

| Term Loan | $ | $ | $ | $ | ||||||||||||||||||||||

| Senior Secured Notes | $ | $ | $ | $ | ||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Cash and cash equivalents and settlement cash and cash equivalents | $ | $ | ||||||||||||

| Interest-bearing investments | ||||||||||||||

| Available-for-sale investments | ||||||||||||||

| Total investment portfolio | $ | $ | ||||||||||||

| (Amounts in millions) | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||||||||

| Residential mortgage-backed securities | $ | $ | $ | $ | ||||||||||||||||||||||

| Asset-backed and other securities | ||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| December 31, 2021 | ||||||||||||||||||||||||||

| Residential mortgage-backed securities | $ | $ | $ | $ | ||||||||||||||||||||||

| Asset-backed and other securities | ||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||||||||||||||

| (Dollar amounts in millions) | Number of Securities | Fair Value | Percent of Investments | Number of Securities | Fair Value | Percent of Investments | ||||||||||||||||||||||||||||||||

| Investment grade | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| Below investment grade | % | % | ||||||||||||||||||||||||||||||||||||

| Total | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Net realized non-U.S. dollar (loss) gain | $ | ( | $ | ( | $ | |||||||||||||||

| Net gain (loss) from the related forward contracts | ( | |||||||||||||||||||

| Net gain (loss) from the related forward contracts | $ | $ | ( | $ | ||||||||||||||||

| (Amounts in millions) | Gross Amount of Recognized Assets | Gross Amount of Offset | Cash Collateral Posted | Net Amount of Assets Presented on the Consolidated Balance Sheets | |||||||||||||||||||||||||||||||||||||||||||

| Balance Sheet Location | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||||||||||||||||||

| "Other assets" | $ | $ | $ | ( | $ | ( | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||

| (Amounts in millions) | Gross Amount of Recognized Liabilities | Gross Amount of Offset | Cash Collateral Received | Net Amount of Liabilities Presented on the Consolidated Balance Sheets | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance Sheet Location | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||||||||||||||||||||

| "Accounts payable and other liabilities" | $ | $ | $ | ( | $ | ( | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Computer hardware and software | $ | $ | ||||||||||||

| Signage | ||||||||||||||

| Equipment at agent locations | ||||||||||||||

| Office furniture and equipment | ||||||||||||||

| Leasehold improvements | ||||||||||||||

| Total property and equipment | ||||||||||||||

| Accumulated depreciation and amortization | ( | ( | ||||||||||||

| Total property and equipment, net | $ | $ | ||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||||||||||||||

| (Amounts in millions) | Gross Carrying Value | Accumulated Amortization | Net Carrying Value | Gross Carrying Value | Accumulated Amortization | Net Carrying Value | ||||||||||||||||||||||||||||||||

| Contractual and customer relationships | $ | $ | ( | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||

| Developed technology | ( | |||||||||||||||||||||||||||||||||||||

| Total finite-intangible assets | $ | $ | ( | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||

| (Amounts in millions, except percentages) | 2022 | 2021 | ||||||||||||

| $ | $ | |||||||||||||

| Total debt at face value | ||||||||||||||

| Unamortized debt issuance costs and debt discounts | ( | ( | ||||||||||||

| Total debt, net | $ | $ | ||||||||||||

| Pension Plan | SERPs | Postretirement Benefits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net periodic benefit expense (income): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discount rate for benefit obligation | % | % | % | % | % | % | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Discount rate for interest cost | % | % | % | % | % | % | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Expected return on plan assets | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash balance interest crediting rate | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rate of compensation increase | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Medical trend rate: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-65 initial healthcare cost trend rate | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Post-65 initial healthcare cost trend rate | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre and post-65 ultimate healthcare cost trend rate | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ultimate healthcare cost trend rate is reached for pre/post-65, respectively | — | — | — | — | — | — | 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Benefit obligation: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discount rate | % | % | % | % | % | % | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Cash balance interest crediting rate | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rate of compensation increase | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Medical trend rate: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-65 initial healthcare cost trend rate | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Post-65 initial healthcare cost trend rate | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre and post-65 ultimate healthcare cost trend rate | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ultimate healthcare cost trend rate is reached for pre/post-65 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Amounts in millions) | Level 3 | Total | ||||||||||||

| December 31, 2022 | ||||||||||||||

| Real estate | $ | $ | ||||||||||||

| Total investments in the fair value hierarchy | ||||||||||||||

Investments measured at net asset value (1) | ||||||||||||||

| Total financial assets | $ | |||||||||||||

| December 31, 2021 | ||||||||||||||

| Real estate | $ | $ | ||||||||||||

| Total investments in the fair value hierarchy | ||||||||||||||

Investments measured at net asset value (1) | ||||||||||||||

| Total financial assets | $ | |||||||||||||

| (Amounts in millions) | Fair Value | Redemptions Frequency (if currently eligible) | Redemption Notice Period | |||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||

| Money market fund | $ | Daily | Same day | |||||||||||||||||

| Multi-asset credit fund | ||||||||||||||||||||

| Equity and fixed income securities | ||||||||||||||||||||

| Investments measured at net asset value | $ | |||||||||||||||||||

| December 31, 2021 | ||||||||||||||||||||

| Money market fund | $ | N/A | N/A | |||||||||||||||||

| Multi-asset credit fund | ||||||||||||||||||||

| Equity and fixed income securities | ||||||||||||||||||||

| Investments measured at net asset value | $ | |||||||||||||||||||

| Pension | Postretirement Benefits | |||||||||||||||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||||

| Interest cost | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Expected return on plan assets | ( | ( | ( | |||||||||||||||||||||||||||||||||||

| Amortization of net actuarial loss | ||||||||||||||||||||||||||||||||||||||

| Settlement gain | ( | |||||||||||||||||||||||||||||||||||||

| Amortization of prior service cost | ||||||||||||||||||||||||||||||||||||||

| Net periodic benefit expense | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| (Amounts in millions) | Pension | Postretirement Benefits | ||||||||||||

| 2022 | ||||||||||||||

| Net actuarial gain | $ | ( | $ | |||||||||||

| Amortization of net actuarial loss | ( | |||||||||||||

| Settlement gain | 0.5 | |||||||||||||

| Total recognized in other comprehensive loss | ( | |||||||||||||

| Total recognized in net periodic benefit expense | ||||||||||||||

| Total recognized in other comprehensive loss and net periodic benefit expense | $ | ( | $ | |||||||||||

| 2021 | ||||||||||||||

| Net actuarial gain | $ | ( | $ | |||||||||||

| Amortization of net actuarial loss | ( | ( | ||||||||||||

| Total recognized in other comprehensive loss | ( | ( | ||||||||||||

| Total recognized in net periodic benefit expense | ||||||||||||||

| Total recognized in other comprehensive loss and net periodic benefit expense | $ | ( | $ | |||||||||||

| 2020 | ||||||||||||||

| Net actuarial loss (gain) | ( | |||||||||||||

| Amortization of net actuarial loss | ( | ( | ||||||||||||

| Amortization of prior service cost | ( | |||||||||||||

| Total recognized in other comprehensive income | ( | |||||||||||||

| Total recognized in net periodic benefit expense | ||||||||||||||

| Total recognized in other comprehensive income and net periodic benefit expense | $ | $ | ( | |||||||||||

| Pension | Postretirement Benefits | Total | ||||||||||||||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||||||||||

| Change in benefit obligation: | ||||||||||||||||||||||||||||||||||||||

| Benefit obligation at the beginning of the year | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Actuarial (gain) loss | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||

| Benefit obligation at the end of the year | ||||||||||||||||||||||||||||||||||||||

| Change in plan assets: | ||||||||||||||||||||||||||||||||||||||

| Fair value of plan assets at the beginning of the year | ||||||||||||||||||||||||||||||||||||||

| Actual return on plan assets | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||

| Employer contributions | ||||||||||||||||||||||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||

| Fair value of plan assets at the end of the year | ||||||||||||||||||||||||||||||||||||||

| Unfunded status at the end of the year | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Pension | Postretirement Benefits | Total | ||||||||||||||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss: | ||||||||||||||||||||||||||||||||||||||

| Net actuarial loss, net of tax | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Pension | Postretirement Benefits | |||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||

| Accumulated benefit obligation | $ | $ | $ | $ | ||||||||||||||||||||||

| Fair value of plan assets | $ | $ | $ | $ | ||||||||||||||||||||||

| (Amounts in millions) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028-2032 | ||||||||||||||||||||||||||||||||

| Pension | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Postretirement benefits | ||||||||||||||||||||||||||||||||||||||

| Common Stock | ||||||||||||||||||||||||||

| Authorized | Issued | Outstanding | Treasury Stock | |||||||||||||||||||||||

| January 1, 2020 | ||||||||||||||||||||||||||

| Release for restricted stock units | — | |||||||||||||||||||||||||

| Preferred stock - series D conversion | — | |||||||||||||||||||||||||

| December 31, 2020 | ||||||||||||||||||||||||||

| ATM equity offering | — | — | ||||||||||||||||||||||||

| Exercise of Ripple Warrants | — | — | ||||||||||||||||||||||||

| Release for restricted stock units | — | |||||||||||||||||||||||||

| Exercise of Second Lien Warrants | — | |||||||||||||||||||||||||

| Stock repurchases | — | — | ( | |||||||||||||||||||||||

| December 31, 2021 | ||||||||||||||||||||||||||

| Exercise of lender warrants | — | |||||||||||||||||||||||||

| Release for restricted stock units | — | |||||||||||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||||||||

| (Amounts in millions) | Net Unrealized Gains on Securities Classified as Available-for-sale, Net of Tax | Cumulative non-U.S. dollar Translation Adjustments, Net of Tax | Pension and Postretirement Benefits Adjustment, Net of Tax | Total | ||||||||||||||||||||||

| January 1, 2020 | $ | $ | ( | $ | ( | $ | ( | |||||||||||||||||||

| Other comprehensive loss before reclassification | ( | ( | ||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive loss | ||||||||||||||||||||||||||

| Net current year other comprehensive income | ( | ( | ||||||||||||||||||||||||

| December 31, 2020 | ( | ( | ( | |||||||||||||||||||||||

| Other comprehensive income before reclassification | ( | ( | ||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive loss | ||||||||||||||||||||||||||

| Net current year other comprehensive income | ( | ( | ||||||||||||||||||||||||

| December 31, 2021 | ( | ( | ( | |||||||||||||||||||||||

| Other comprehensive loss before reclassification | ( | ( | ||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive loss | ||||||||||||||||||||||||||

| Net current year other comprehensive loss | ( | ( | ||||||||||||||||||||||||

| December 31, 2022 | $ | $ | ( | $ | ( | $ | ( | |||||||||||||||||||

| Shares | Weighted-Average Exercise Price | Weighted-Average Remaining Contractual Term | Aggregate Intrinsic Value (in millions) | |||||||||||||||||||||||

| Options outstanding at December 31, 2021 | $ | $ | ||||||||||||||||||||||||

| Forfeited/Expired | ( | $ | ||||||||||||||||||||||||

| Options outstanding, vested or expected to vest, and exercisable at December 31, 2022 | $ | $ | ||||||||||||||||||||||||

| Total Shares | Weighted-Average Grant-Date Fair Value | Weighted-Average Remaining Contractual Term | Aggregate Intrinsic Value (in millions) | |||||||||||||||||||||||

| Restricted stock units outstanding at December 31, 2021 | $ | $ | ||||||||||||||||||||||||

| Granted | ||||||||||||||||||||||||||

| Vested | ( | |||||||||||||||||||||||||

| Forfeited | ( | |||||||||||||||||||||||||

| Restricted stock units outstanding at December 31, 2022 | $ | $ | ||||||||||||||||||||||||

| Restricted stock units vested and deferred at December 31, 2022 | $ | $ | ||||||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

Weighted-average grant-date fair value of restricted stock units vested during the year | $ | $ | $ | |||||||||||||||||

| Total intrinsic value of vested and converted shares | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| U.S. | $ | $ | ( | $ | ( | |||||||||||||||

| Foreign | ||||||||||||||||||||

| Income (loss) before income taxes | $ | $ | ( | $ | ||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Current: | ||||||||||||||||||||

| Federal | $ | $ | $ | ( | ||||||||||||||||

| State | ( | ( | ||||||||||||||||||

| Foreign | ||||||||||||||||||||

| Current income tax expense | ||||||||||||||||||||

| Deferred: | ||||||||||||||||||||

| Federal | ( | |||||||||||||||||||

| State | ( | ( | ||||||||||||||||||

| Foreign | ( | ( | ||||||||||||||||||

| Deferred income tax expense (benefit) | ( | |||||||||||||||||||

| Income tax expense (benefit) | $ | $ | ( | $ | ||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Income tax expense (benefit) at statutory federal income tax rate | $ | $ | ( | $ | ||||||||||||||||

| Tax effect of: | ||||||||||||||||||||

| State income tax, net of federal income tax effect | ( | ( | ( | |||||||||||||||||

| Valuation allowances | ( | |||||||||||||||||||

| International taxes | ||||||||||||||||||||

| Other net permanent differences | ||||||||||||||||||||

| U.S. general business credits | ( | ( | ( | |||||||||||||||||

| Change in unrecognized tax benefits | ( | ( | ||||||||||||||||||

| Stock-based compensation | ( | ( | ||||||||||||||||||

| BEAT | ( | |||||||||||||||||||

| U.S. taxation of foreign earnings | ( | |||||||||||||||||||

| Other | ||||||||||||||||||||

| Income tax expense (benefit) | $ | $ | ( | $ | ||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| Deferred tax assets: | ||||||||||||||

| Basis difference in revalued investments | $ | $ | ||||||||||||

| Tax loss carryovers | ||||||||||||||

| Tax credit carryovers | ||||||||||||||

| Postretirement benefits and other employee benefits | ||||||||||||||

| Bad debt and other reserves | ||||||||||||||

| Lease liabilities | ||||||||||||||

Depreciation & amortization | ||||||||||||||

| Interest expense carryovers | ||||||||||||||

| Other | ||||||||||||||

| Valuation allowances | ( | ( | ||||||||||||

| Total deferred tax assets | ||||||||||||||

| Deferred tax liability: | ||||||||||||||

| Depreciation and amortization and other | ( | ( | ||||||||||||

| Lease right-of-use assets | ( | ( | ||||||||||||

| Total deferred tax liability | ( | ( | ||||||||||||

| Net deferred tax liability | $ | ( | $ | ( | ||||||||||

| (Amounts in millions) | Expiration Date | Amount | ||||||||||||

| U.S. capital loss carry-forwards | 2023 - 2026 | $ | ||||||||||||

| U.S. net operating loss carry-forwards | 2025 - Indefinite | $ | ||||||||||||

| U.S. tax credit carry-forwards | 2024- 2042 | $ | ||||||||||||

| U.S. interest expense carry-forwards | Indefinite | $ | ||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Beginning balance | $ | $ | $ | |||||||||||||||||

| Additions based on tax positions related to prior years | ||||||||||||||||||||

| Additions based on tax positions related to current year | ||||||||||||||||||||

| Settlements with cash or attributes | ( | ( | ||||||||||||||||||

| Reductions for tax positions of prior years and other | ( | ( | ||||||||||||||||||

| Ending balance | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Basic and diluted common shares outstanding | ||||||||||||||||||||

| Shares related to restricted stock units | ||||||||||||||||||||

| Diluted common shares outstanding | ||||||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Shares related to stock options | ||||||||||||||||||||

| Shares related to restricted stock units | ||||||||||||||||||||

| Shares related to Ripple Warrants | ||||||||||||||||||||

| Shares excluded from the computation | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Revenue from Walmart as a percentage of GFT revenue | < | % | % | |||||||||||||||||

| Revenue from Walmart as a percentage of FPP revenue | % | % | % | |||||||||||||||||

| Revenue from Walmart as a percentage of total revenue | < | % | % | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

GFT revenue | ||||||||||||||||||||

| Money transfer revenue | $ | $ | $ | |||||||||||||||||

| Bill payment revenue | ||||||||||||||||||||

| Total GFT revenue | ||||||||||||||||||||

| FPP revenue | ||||||||||||||||||||

| Money order revenue | ||||||||||||||||||||

| Official check revenue | ||||||||||||||||||||

| Total FPP revenue | ||||||||||||||||||||

| Total revenue | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| GFT gross profit | $ | $ | $ | |||||||||||||||||

FPP gross profit (1) | ||||||||||||||||||||

| Total gross profit | ||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||

| Total operating income | ||||||||||||||||||||

| Interest expense | ||||||||||||||||||||

| Loss on early extinguishment of debt | ||||||||||||||||||||

| Other non-operating expense | ||||||||||||||||||||

| Income (loss) before income taxes | $ | $ | ( | $ | ||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| GFT | $ | $ | $ | |||||||||||||||||

| FPP | ||||||||||||||||||||

| Total depreciation and amortization | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| GFT | $ | $ | $ | |||||||||||||||||

| FPP | ||||||||||||||||||||

| Total capital expenditures | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | ||||||||||||

| GFT | $ | $ | ||||||||||||

| FPP | ||||||||||||||

| Other | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| U.S. | $ | $ | $ | |||||||||||||||||

| International | ||||||||||||||||||||

| Total revenue | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| GFT revenue | ||||||||||||||||||||

| Money transfer fee revenue | $ | $ | $ | |||||||||||||||||

| Bill payment services fee revenue | ||||||||||||||||||||

| Other revenue | ||||||||||||||||||||

| Total GFT fee and other revenue | $ | $ | $ | |||||||||||||||||

| FPP revenue | ||||||||||||||||||||

| Money order fee revenue | ||||||||||||||||||||

| Official check outsourcing services fee revenue | ||||||||||||||||||||

| Other revenue | ||||||||||||||||||||

| Total FPP fee and other revenue | ||||||||||||||||||||

| Investment revenue | ||||||||||||||||||||

| Total revenue | $ | $ | $ | |||||||||||||||||

| Timing of revenue recognition: | ||||||||||||||||||||

| Services and products transferred at a point in time | $ | $ | $ | |||||||||||||||||

| Products transferred over time | ||||||||||||||||||||

| Total revenue from services and products | ||||||||||||||||||||

| Investment revenue | ||||||||||||||||||||

| Other revenue | ||||||||||||||||||||

| Total revenue | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

Buildings, equipment and vehicle leases | $ | $ | $ | |||||||||||||||||

| Short-term and variable lease cost | ||||||||||||||||||||

Total lease cost | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Cash paid for amounts included in the measurement of operating lease liabilities | $ | $ | $ | |||||||||||||||||

| ROU assets obtained in exchange for lease obligations | $ | $ | $ | |||||||||||||||||

| (Amounts in millions) | Future Minimum Lease Payments | |||||||

| 2023 | $ | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| Thereafter | ||||||||

| Total | ||||||||

| Less: present value discount | ( | |||||||

| Lease liability - operating | $ | |||||||

Vesting Date | Cumulative Percentage Vested | |||||||||||||

__________ | ____ | % | ||||||||||||

__________ | ____ | % | ||||||||||||

__________ | ______. | % | ||||||||||||

| Vesting Date | Cumulative Percentage Vested | |||||||||||||

| _____ | % | |||||||||||||

| _____ | % | |||||||||||||

| ______ | % | |||||||||||||

| Entity | Jurisdiction | |||||||

| 1 | MIL Overseas Limited | United Kingdom | ||||||

| 2 | MIL Overseas Nigeria Limited | Nigeria | ||||||

| 3 | Money Globe Payment Institution S.A. | Greece | ||||||

| 4 | MoneyGram Consulting (Shanghai) Co. Ltd. | China | ||||||

| 5 | MoneyGram GmbH | Germany | ||||||

| 6 | MoneyGram India Private Limited | India | ||||||

| 7 | MoneyGram International B.V. | Netherlands | ||||||

| 8 | MoneyGram International Holdings Limited | United Kingdom | ||||||

| 9 | MoneyGram International Limited | United Kingdom | ||||||

| 10 | MoneyGram International Payment Systems, Inc. | Delaware, USA | ||||||

| 11 | MoneyGram International Pte. Ltd. | Singapore | ||||||

| 12 | MoneyGram International SA | Belgium | ||||||

| 13 | MoneyGram Mexico S.A. de C.V. | Mexico | ||||||

| 15 | MoneyGram Overseas (Pty) Limited | South Africa | ||||||

| 16 | MoneyGram Payment Systems Brasil LTDA | Brazil | ||||||

| 17 | MoneyGram Payment Systems Canada, Inc. | Canada | ||||||

| 18 | MoneyGram Payment Systems Greece S.A. | Greece | ||||||

| 19 | MoneyGram Payment Systems Hong Kong Limited | Hong Kong | ||||||

| 20 | MoneyGram Payment Systems Ireland Limited | Ireland | ||||||

| 21 | MoneyGram Payment Systems Italy S.r.l. | Italy | ||||||

| 22 | MoneyGram Payment Systems Malaysia Sdn. Bhd | Malaysia | ||||||

| 14 | MoneyGram Payment Systems Netherlands B.V. | Netherlands | ||||||

| 23 | MoneyGram Payment Systems Philippines, Inc. | Philippines | ||||||

| 25 | MoneyGram Payment Systems Spain S.A. | Spain | ||||||

| 26 | MoneyGram Payment Systems Worldwide, Inc. | Delaware, USA | ||||||

| 27 | MoneyGram Payment Systems, Inc. | Delaware, USA | ||||||

| 24 | MoneyGram Poland sp. Z.o.o. | Poland | ||||||

| 28 | MoneyGram Turkey Ödeme Hizmetleri Anonim Şirketi | Turkey | ||||||

| 29 | MPS France S.A.S. | France | ||||||

| 30 | MPSG Holdings Limited | United Kingdom | ||||||

| 31 | MPSG International Limited | Dubai | ||||||

| 32 | MPSG Limited | United Kingdom | ||||||

| 33 | PT MoneyGram Payment Systems Indonesia | Indonesia | ||||||

| 34 | Travelers Express Company (P.R.), Inc. | Puerto Rico | ||||||

| 35 | MoneyGram Payment Systems Chile SpA | Chile | ||||||

/s/ Antonio O. Garza | |||||||||||

Antonio O. Garza | |||||||||||

/s/ Alka Gupta | |||||||||||

Alka Gupta | |||||||||||

/s/ Francisco Lorca | |||||||||||

Francisco Lorca | |||||||||||

/s/ Michael P. Rafferty | |||||||||||

Michael P. Rafferty | |||||||||||

/s/ Julie E. Silcock | |||||||||||

Julie E. Silcock | |||||||||||

/s/ W. Bruce Turner | |||||||||||

W. Bruce Turner | |||||||||||

/s/ Peggy Vaughan | |||||||||||

Peggy Vaughan | |||||||||||

| Date: | February 24, 2023 | /s/ W. Alexander Holmes | |||||||||

| W. Alexander Holmes | |||||||||||

| Chairman and Chief Executive Officer | |||||||||||

| (Principal Executive Officer) | |||||||||||

| Date: | February 24, 2023 | /s/ Brian Johnson | |||||||||

| Brian Johnson | |||||||||||

| Chief Financial Officer | |||||||||||

| (Principal Financial Officer) | |||||||||||

| Date: | February 24, 2023 | /s/ W. Alexander Holmes | |||||||||

| W. Alexander Holmes | |||||||||||

| Chairman and Chief Executive Officer | |||||||||||

| (Principal Executive Officer) | |||||||||||

| Date: | February 24, 2023 | /s/ Brian Johnson | |||||||||

| Brian Johnson | |||||||||||

| Chief Financial Officer | |||||||||||

| (Principal Financial Officer) | |||||||||||

Audit Information |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Audit Information [Abstract] | |

| Auditor Name | KPMG LLP |

| Auditor Location | Dallas, Texas |

| Auditor Firm ID | 185 |

Condensed Consolidated Balance Sheets (Parenthetical) - $ / shares |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2019 |

|---|---|---|---|

| Preferred Stock, Shares Authorized | 7,000,000 | ||

| Common stock, par value (usd per share) | $ 0.01 | $ 0.01 | |

| Common stock, shares authorized (shares) | 162,500,000 | 162,500,000 | |

| Common Stock, Shares, Issued | 98,964,065 | 92,305,011 | |

| Treasury stock (shares) | 2,337,633 | 1,579,029 | |

| D Stock | |||

| Participating convertible preferred stock, par value (usd per share) | $ 0.01 | $ 0.01 | |

| Preferred Stock, Shares Authorized | 200,000 | ||

| Participating convertible preferred stock, shares issued (shares) | 71,282 |

Condensed Consolidated Statements of Operations (Parenthetical) $ in Millions |

12 Months Ended |

|---|---|

|

Dec. 31, 2020

USD ($)

| |

| Affiliated Entity | |

| Market development fees | $ 50.2 |

Consolidated Statements of Comprehensive Loss (Parenthetical) - USD ($) $ in Millions |

12 Months Ended | ||

|---|---|---|---|

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

|

| Statement of Comprehensive Income [Abstract] | |||

| OCI, Debt Securities, Available-for-Sale, Unrealized Holding Gain (Loss), before Adjustment, Tax | $ (0.2) | $ (0.1) | $ 0.1 |

| Net change in pension liability, tax | 0.5 | 0.6 | 0.5 |

| Other Comprehensive Income (Loss), Pension and Other Postretirement Benefit Plans, Plan Amendments, Tax Effect | (0.1) | ||

| Tax benefit, net | 1.7 | 0.4 | (1.0) |

| Unrealized foreign currency translation gains (losses), tax | $ 0.0 | $ 0.0 | $ 0.2 |

Consdensed Consolidated Statements of Stockholders' Deficit - USD ($) shares in Millions, $ in Millions |

Total |

Preferred Stock |

Common Stock |

Additional Paid-In Capital |

Retained Loss |

Accumulated Other Comprehensive Loss |

Treasury Stock |

|---|---|---|---|---|---|---|---|

| Beginning Balance at Dec. 31, 2019 | $ (240.4) | $ 183.9 | $ 0.7 | $ 1,116.9 | $ (1,460.1) | $ (63.5) | $ (18.3) |

| Increase (Decrease) in Stockholders' Equity [Roll Forward] | |||||||

| Net loss | (7.9) | (7.9) | |||||

| Stock-based compensation activity | $ 6.2 | $ 6.6 | (7.3) | $ 6.9 | |||

| Stock Issued During Period, Shares, Conversion of Convertible Securities | 0.0 | (183.9) | 172.5 | 11.4 | |||

| Other comprehensive loss | $ 5.1 | 5.1 | |||||

| Ending Balance at Dec. 31, 2020 | (237.0) | $ 0.0 | 0.7 | $ 1,296.0 | (1,475.3) | (58.4) | $ 0.0 |

| Increase (Decrease) in Stockholders' Equity [Roll Forward] | |||||||

| Net loss | (37.9) | (37.9) | |||||

| Stock-based compensation activity | 3.3 | 7.3 | (0.2) | (3.8) | |||

| Exercise of Ripple Warrants | 0.0 | 0.1 | (0.1) | ||||

| ATM Equity Offering | 97.2 | 0.1 | 97.1 | ||||

| Stock repurchases | (6.2) | (6.2) | |||||

| Other comprehensive loss | (4.4) | (4.4) | |||||

| Ending Balance at Dec. 31, 2021 | (185.0) | 0.0 | 0.9 | 1,400.3 | (1,513.4) | (62.8) | (10.0) |

| Increase (Decrease) in Stockholders' Equity [Roll Forward] | |||||||

| Net loss | 34.2 | 34.2 | |||||

| Stock-based compensation activity | 6.9 | 15.0 | (8.1) | ||||

| Exercise of Lender Warrants | 0.2 | 0.1 | 0.1 | ||||

| Other comprehensive loss | (2.1) | (2.1) | |||||

| Ending Balance at Dec. 31, 2022 | $ (145.8) | $ 0.0 | $ 1.0 | $ 1,415.3 | $ (1,479.2) | $ (64.9) | $ (18.0) |

Description of the Business and Basis of Presentation |

12 Months Ended |

|---|---|

Dec. 31, 2022 | |

| Description of the Business and Basis of Presentation [Abstract] | |

| Description of the Business and Basis of Presentation | References to "MoneyGram," the "Company," "we," "us" and "our" are to MoneyGram International, Inc. and its subsidiaries. Nature of Operations — MoneyGram offers products and services under its two reporting segments: GFT and FPP. The GFT segment provides global money transfer services and bill payment services to consumers through two primary distribution channels: retail and digital. Through our Retail Channel, we offer services through third-party agents, including retail chains, independent retailers, post offices and other financial institutions. Additionally, we have limited Company-operated retail locations. We offer services through MGO, digital partnerships, direct transfers to bank accounts, mobile wallets and card solutions, such as Visa Direct, as part of our Digital Channel. The FPP segment provides official check outsourcing services and money orders through financial institutions and agent locations. Basis of Presentation — The accompanying consolidated financial statements of MoneyGram are prepared in conformity with generally accepted accounting principles in the United States of America ("U.S. GAAP"). The Consolidated Balance Sheets are unclassified due to the timing uncertainty surrounding the payment of settlement obligations. Impact of COVID-19 Pandemic On Our Financial Statements — The global spread of COVID-19 and the unprecedented impact of the COVID-19 pandemic is complex and ever-evolving. In March 2020, the World Health Organization declared COVID-19 a global pandemic and recommended extensive containment and mitigation measures worldwide. The outbreak reached all regions in which we do business, and governmental authorities around the world implemented numerous measures attempting to contain and mitigate the effects of the virus, including travel bans and restrictions, border closings, quarantines, shelter-in-place orders, shutdowns, limitations or closures of non-essential businesses, school closures and social distancing requirements. The global spread of COVID-19 and its subsequent variants, in combination with the government actions taken in response to the virus have caused and may continue to cause significant economic and business disruption, volatility, financial uncertainty and a continued significant global economic downturn. This has had and may continue to have, a negative impact on the mobility of the global workforce, our agents, customers, consumer spending and global financial markets. Even after the initial impact of the COVID-19 pandemic has subsided, we may continue to experience adverse impacts to our business as a result of inflation, economic weakness and lower disposable income. Therefore, the Company cannot reasonably estimate the future impact at this time. There were no other material impacts to our Consolidated Financial Statements as of and for the year ended December 31, 2022, based on the Company's assessment of its estimates. As additional information becomes available to us, our future assessment of these estimates, including our expectations at the time regarding the duration, scope and severity of the pandemic, as well as other factors, could materially and adversely impact our Consolidated Financial Statements in the future. Use of Estimates — The preparation of these financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates and assumptions are based on historical experience, future expectations, impact of the COVID-19 pandemic and other factors and assumptions the Company believes to be reasonable under the circumstances. These estimates and assumptions are reviewed on an ongoing basis and are revised when necessary. Changes in estimates are recorded in the period of change. Actual amounts may differ from these estimates. Principles of Consolidation — The Consolidated Financial Statements include the accounts of MoneyGram International, Inc. and its subsidiaries. Intercompany profits, transactions and account balances have been eliminated in consolidation. The Company participates in various trust arrangements (special purpose entities or "SPEs") related to official check processing agreements with financial institutions and structured investments within the investment portfolio. As the Company is the primary beneficiary and bears the primary burden of any losses, the SPEs are consolidated in the Consolidated Financial Statements. The assets and obligations of the SPEs are recorded on the Consolidated Balance Sheets in a manner consistent with the assets and obligations of the Company. Presentation — In 2021, the Company changed its presentation to disclose "Gross profit" in the Consolidated Statements of Operations. The presentation of gross profit is intended to supplement investors with an understanding of our operating performance. Gross profit is calculated as total revenue less commissions and direct transaction expenses. These expenses were previously included within "Operating expenses" and are now presented within "Cost of revenue" in the Consolidated Statements of Operations. The change in presentation was applied retrospectively to all years presented in the Consolidated Statements of Operations and it had no effect on Operating income, Net loss or Loss per share. The Consolidated Balance Sheets, Consolidated Statements of Comprehensive Loss, Consolidated Statements of Stockholders' Deficit and Consolidated Statements of Cash Flows are not affected by this change in presentation. Merger Update — On February 14, 2022, we entered into a Merger Agreement by and among the Company, Parent and an affiliate of MDP, and Merger Sub. The Merger Agreement provides that, subject to the terms and conditions set forth in the Merger Agreement, Merger Sub will merge with and into the Company. Following the Merger, the Company will become a subsidiary of Parent. At the effective time of the Merger, each outstanding share of common stock will be automatically canceled and converted into the right to receive $11.00 in cash. On May 23, 2022, the Company held a virtual-only special meeting of stockholders related to the Merger Agreement and stockholders approved and adopted the Merger Agreement. To date, money transmission regulators in all applicable U.S. states and territories have provided their approval or non-objection of the transaction. In addition, the parties have obtained all but one approval from international money transmission regulators and have received approval from the Financial Conduct Authority ("FCA") in the United Kingdom and the National Bank of Belgium where MoneyGram holds its European license. While, the waiting period under the Hart-Scott-Rodino ("HSR") Antitrust Improvements Act of 1976 had previously expired, the parties recently refiled the application as the existing approval was set to expire. The new HSR waiting period is set to expire on March 13, 2023. The final regulatory approval is to be issued by the Reserve Bank of India (“RBI”). The RBI is the issuer of MoneyGram’s Money Transfer Service Scheme ("MTSS") license in India. Since the Company and MDP signed the Merger Agreement, the RBI issued a new Circular covering approval requirements related to Payment System Operators ("PSO") such as the Company. The Merger will be one of the first PSOs undergoing a sale since the Circular was issued. As a result, the process has been taking longer than originally anticipated. MoneyGram has been in active dialogue with the RBI and the Central Government of India regarding its review of the Merger. Prior to closing, the parties will engage in a financing marketing period which, pursuant to the merger agreement, may last for as long as fifteen consecutive business days. Closing would occur within a matter of days after completing the marketing period. The parties have agreed to extend the end date beyond February 14, 2023, in accordance with the Merger Agreement, to May 14, 2023. In light of the timing and factors discussed above, the parties now expect to close the Merger either late in the first quarter or early in the second quarter of 2023.

|

Summary of Significant Accounting Policies |

12 Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounting Policies [Abstract] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||