Exhibit 99.1

January 2023 JP Morgan Presentation

Forward Looking Statements and Non-GAAP Financial Information 2 This

presentation contains statements about Bristol-Myers Squibb Company’s (the “Company”) future financial results, plans, business development strategy, anticipated clinical trials, results and regulatory approvals that constitute

forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. All statements that are not statements of historical facts are, or may be deemed to be, forward-looking

statements. Actual results may differ materially from those expressed in, or implied by, these statements as a result of various factors, including, but not limited to, (i) new laws and regulations, (ii) our ability to obtain, protect and

maintain market exclusivity rights and enforce patents and other intellectual property rights, (iii) our ability to achieve expected clinical, regulatory and contractual milestones on expected timelines or at all, (iv) difficulties or delays

in the development and commercialization of new products, (v) difficulties or delays in our clinical trials and the manufacturing, distribution and sale of our products, (vi) adverse outcomes in legal or regulatory proceedings, (vii) risks

relating to acquisitions, divestitures, alliances, joint ventures and other portfolio actions and (viii) political and financial instability, including changes in general economic conditions. These and other important factors are discussed in

the Company’s most recent annual report on Form 10-K and reports on Forms 10-Q and 8-K. These documents are available on the U.S. Securities and Exchange Commission’s website, on the Company’s website or from Bristol-Myers Squibb Investor

Relations. No forward-looking statements can be guaranteed. In addition, any forward-looking statements and clinical data included herein are presented only as of the date hereof. Except as otherwise required by applicable law, the Company

undertakes no obligation to publicly update any of the provided information, whether as a result of new information, future events, changed circumstances or otherwise. This presentation includes certain non-generally accepted accounting

principles (“GAAP”) financial measures that we use to describe the Company’s performance. The non-GAAP financial measures are provided as supplemental information and are presented because management has evaluated the Company’s financial

results both including and excluding the adjusted items or the effects of foreign currency translation, as applicable, and believes that the non-GAAP financial measures presented portray the results of the Company’s baseline performance,

supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods. In addition, non-GAAP operating

margin, which is gross profit less marketing, selling and administrative expense and research and development expense excluding certain specified items as a percentage of revenues, is relevant and useful for investors because it allows

investors to view performance in a manner similar to the method used by our management and makes it easier for investors, analysts and peers to compare our operating performance to other companies in our industry. This presentation also

provides certain revenues and expenses excluding the impact of foreign exchange (“Ex-FX”). We calculate foreign exchange impacts by converting our current-period local currency financial results using the prior period average currency rates

and comparing these adjusted amounts to our current-period results. Ex-FX financial measures are not accounted for according to GAAP because they remove the effects of currency movements from GAAP results. The non-GAAP information presented

herein provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the

usefulness of these measures for comparisons with such other companies. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. An explanation of

these non-GAAP financial measures and a reconciliation to the most directly comparable financial measure are available on our website at www.bms.com/investors. Also note that a reconciliation of forward-looking non-GAAP operating margin is

not provided because a comparable GAAP measure is not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. Namely, we are not, without

unreasonable effort, able to reliably predict the impact of the unwind of inventory purchase price adjustments, accelerated depreciation and impairment of property, plant and equipment and intangible assets, and stock compensation resulting

from acquisition-related equity awards, or currency exchange rates. In addition, the Company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. These items are uncertain,

depend on various factors and may have a material impact on our future GAAP results.

Our Strategic Foundation 3 A differentiated biopharma company focused on

innovative medicines for patients with cancer and other serious diseases BEST OF BIOTECH BEST OF PHARMA Leading scientific innovation Collaborating at center of the biotech ecosystem Leveraging global scale and agility Driven by the

best people

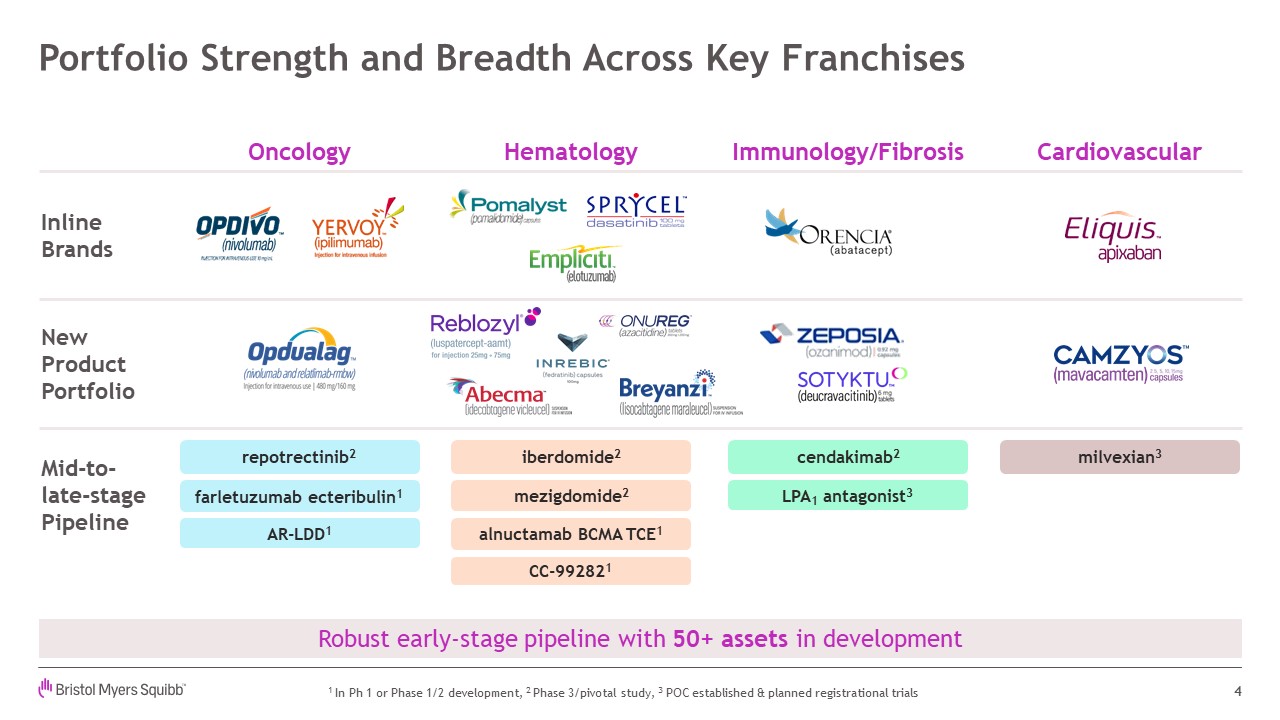

Cardiovascular Portfolio Strength and Breadth Across Key

Franchises 4 NewProductPortfolio Robust early-stage pipeline with 50+ assets in development iberdomide2 milvexian3 cendakimab2 InlineBrands Mid-to- late-stage Pipeline mezigdomide2 alnuctamab BCMA TCE1 repotrectinib2 LPA1

antagonist3 AR-LDD1 CC-992821 1 In Ph 1 or Phase 1/2 development, 2 Phase 3/pivotal study, 3 POC established & planned registrational trials farletuzumab ecteribulin1 Hematology Immunology/Fibrosis Oncology

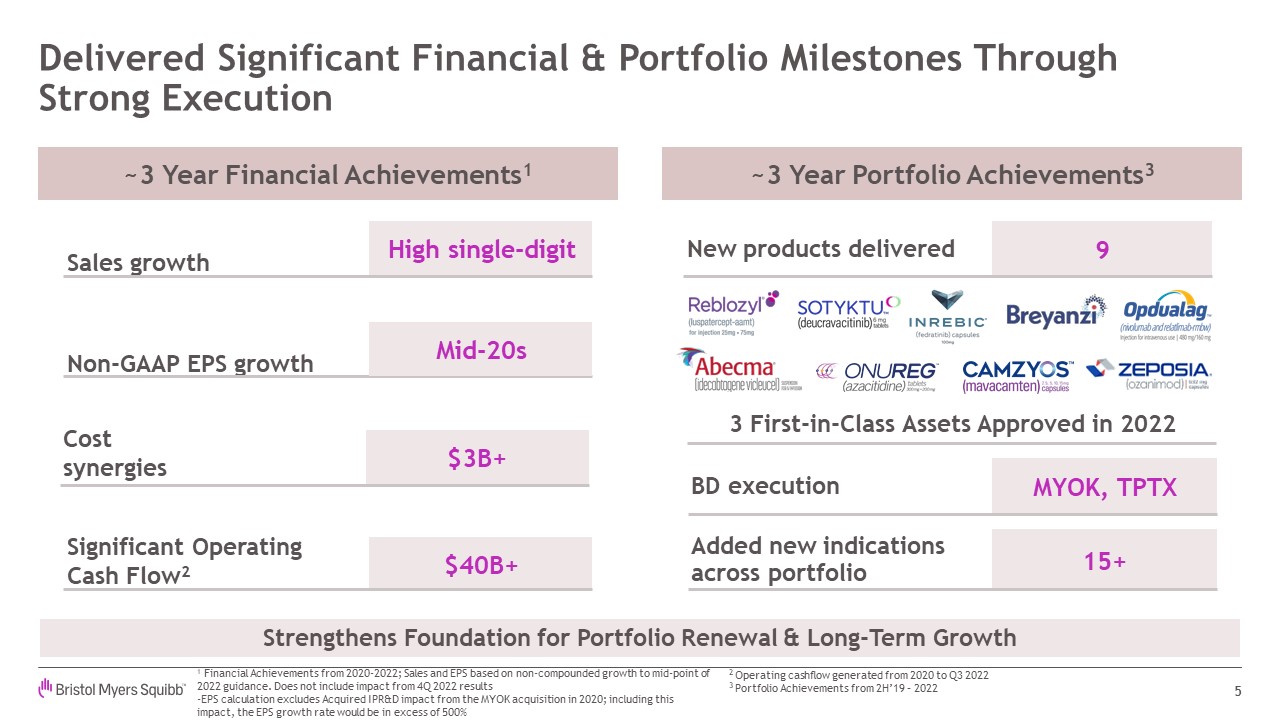

MYOK, TPTX 15+ Delivered Significant Financial & Portfolio Milestones

Through Strong Execution 5 Sales growth High single-digit Non-GAAP EPS growth Mid-20s Cost synergies $3B+ $40B+ Significant Operating Cash Flow2 3 First-in-Class Assets Approved in 2022 BD execution Added new indications

across portfolio 9 New products delivered ~3 Year Financial Achievements1 ~3 Year Portfolio Achievements3 Strengthens Foundation for Portfolio Renewal & Long-Term Growth 1 Financial Achievements from 2020-2022; Sales and EPS based

on non-compounded growth to mid-point of 2022 guidance. Does not include impact from 4Q 2022 results -EPS calculation excludes Acquired IPR&D impact from the MYOK acquisition in 2020; including this impact, the EPS growth rate would be

in excess of 500% 2 Operating cashflow generated from 2020 to Q3 2022 3 Portfolio Achievements from 2H’19 – 2022

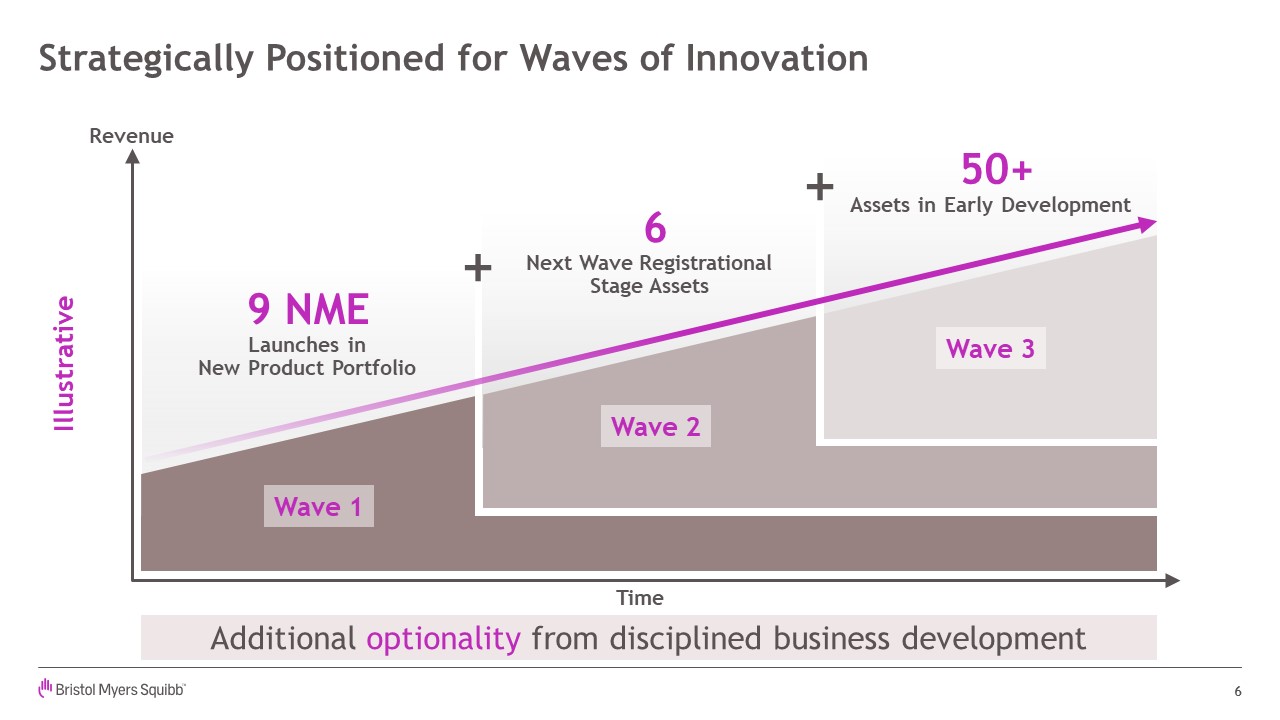

Strategically Positioned for Waves of Innovation 6 Additional optionality from

disciplined business development 9 NMELaunches inNew Product Portfolio 6Next Wave RegistrationalStage Assets 50+Assets in Early Development Revenue Time Wave 1 Wave 2 Wave 3 Illustrative

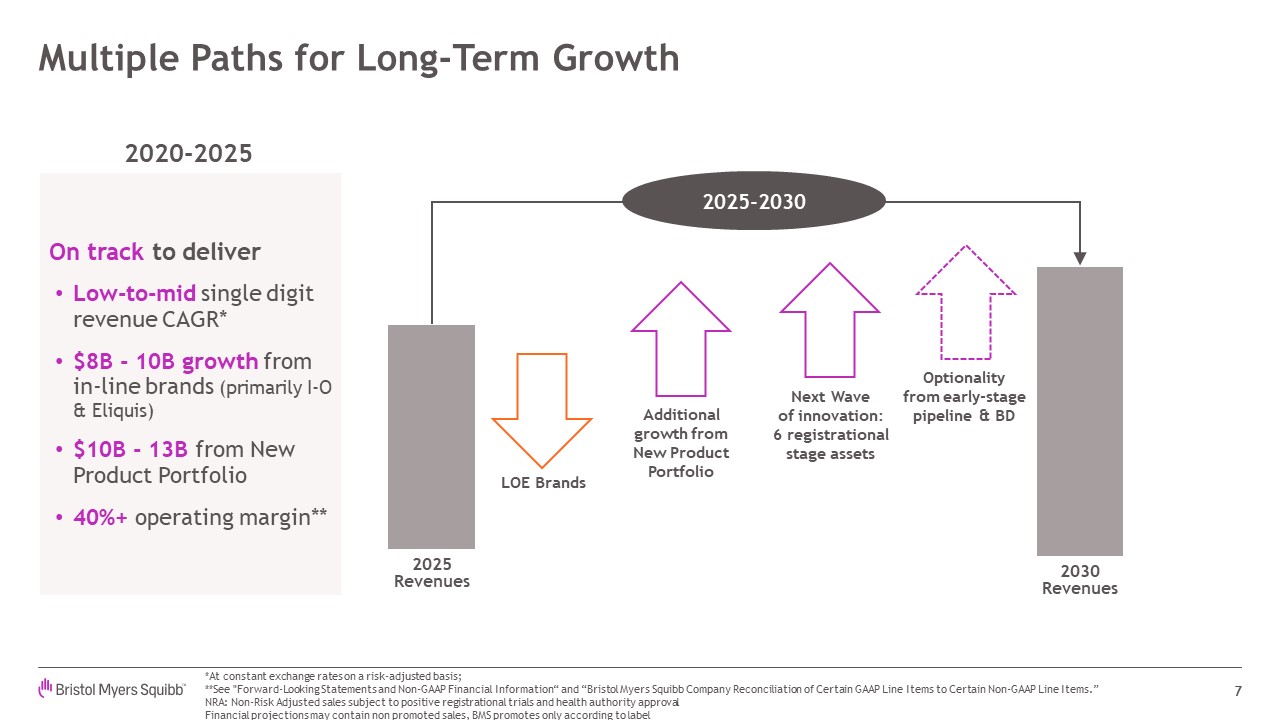

Multiple Paths for Long-Term Growth 7 2020-2025 On track to deliver

Low-to-mid single digit revenue CAGR* $8B - 10B growth from in-line brands (primarily I-O & Eliquis) $10B - 13B from New Product Portfolio 40%+ operating margin** 2025 Revenues LOE Brands 2030Revenues Additionalgrowth fromNew

Product Portfolio Next Waveof innovation: 6 registrational stage assets Optionality from early-stage pipeline & BD 2025-2030 *At constant exchange rates on a risk-adjusted basis; **See "Forward-Looking Statements and Non-GAAP

Financial Information“ and “Bristol Myers Squibb Company Reconciliation of Certain GAAP Line Items to Certain Non-GAAP Line Items.” NRA: Non-Risk Adjusted sales subject to positive registrational trials and health authority approval

Financial projections may contain non promoted sales, BMS promotes only according to label

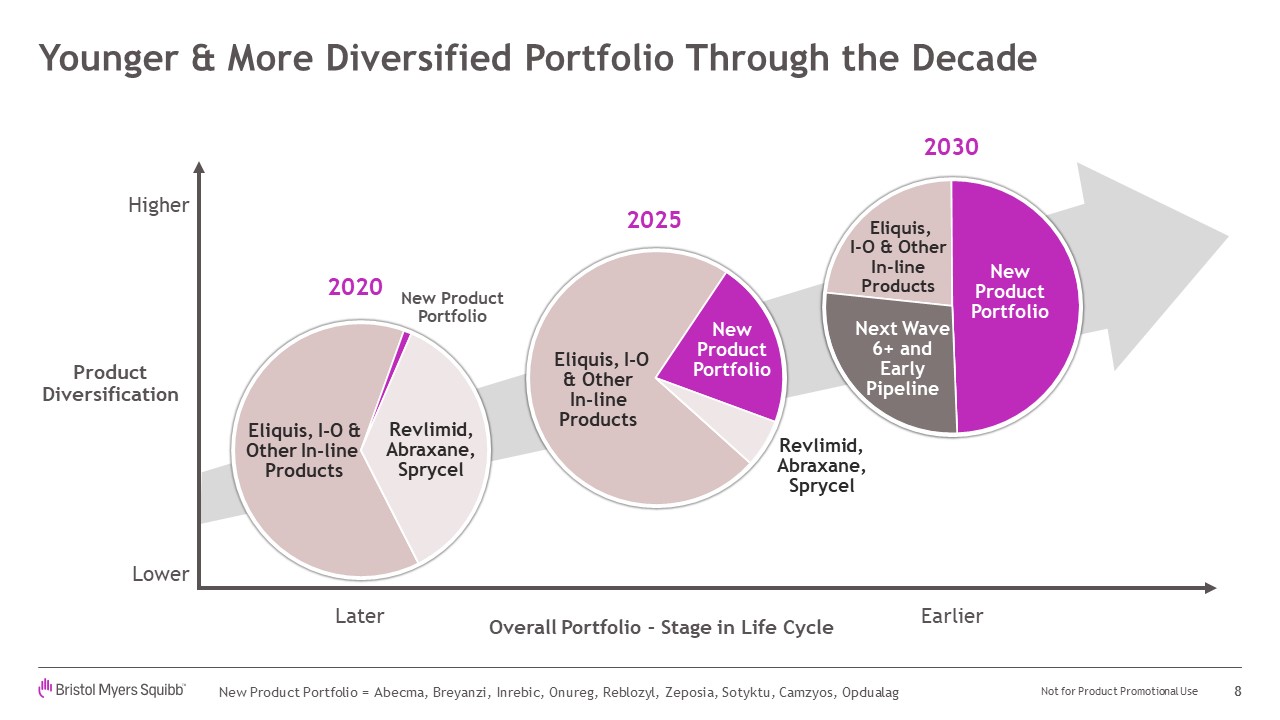

Younger & More Diversified Portfolio Through the Decade 8 Not for Product

Promotional Use New Product Portfolio = Abecma, Breyanzi, Inrebic, Onureg, Reblozyl, Zeposia, Sotyktu, Camzyos, Opdualag Overall Portfolio – Stage in Life Cycle ProductDiversification Later Earlier NewProductPortfolio New

ProductPortfolio Revlimid, Abraxane, Sprycel Revlimid, Abraxane, Sprycel Higher Lower 2020 2025 NewProductPortfolio Next Wave 6+ and Early Pipeline 2030 Eliquis, I-O & Other In-line Products Eliquis, I-O & Other In-line

Products Eliquis, I-O & Other In-line Products

Well Positioned for Portfolio Renewal & Long-Term Growth 9 1. Portfolio

renewal well-underway: 9 new launches 2. Next wave of innovation: 6 registrational stage pipeline assets 3. Optionality from early-stage pipeline & BD

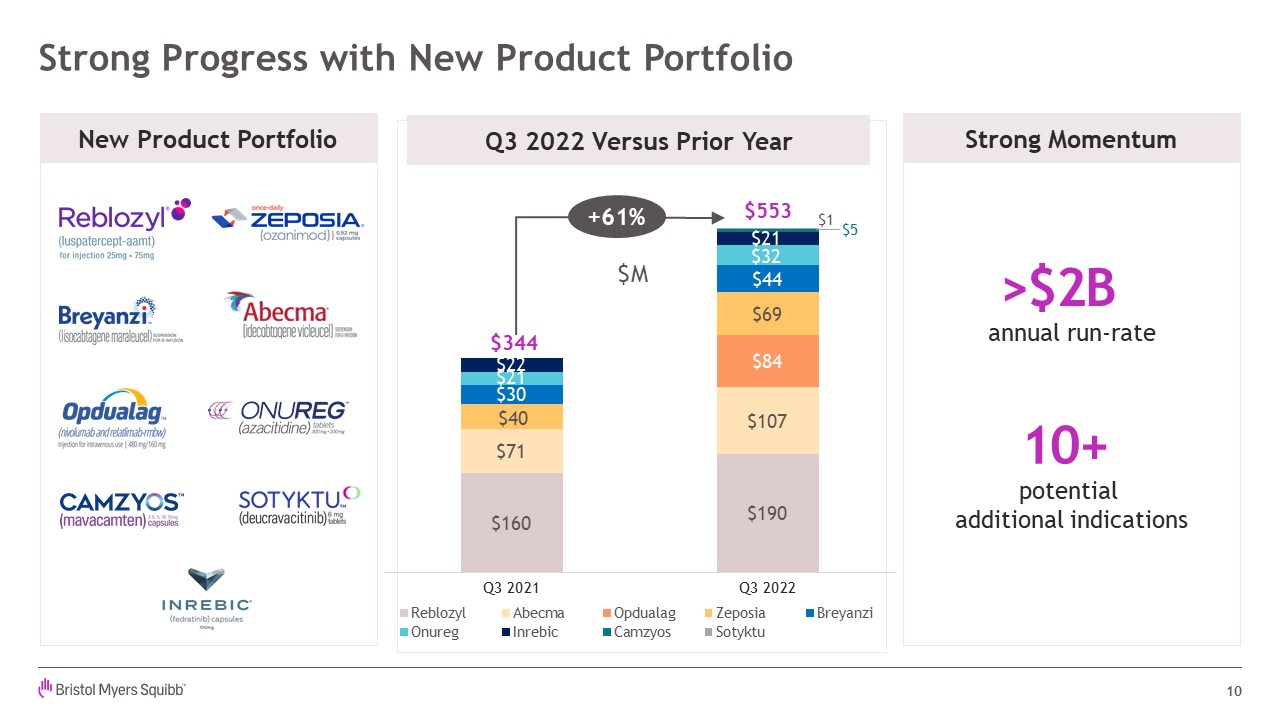

Strong Progress with New Product Portfolio 10 >$2B annual run-rate 10+

potential additional indications New Product Portfolio Strong Momentum $5 $1 +61% Q3 2022 Versus Prior Year

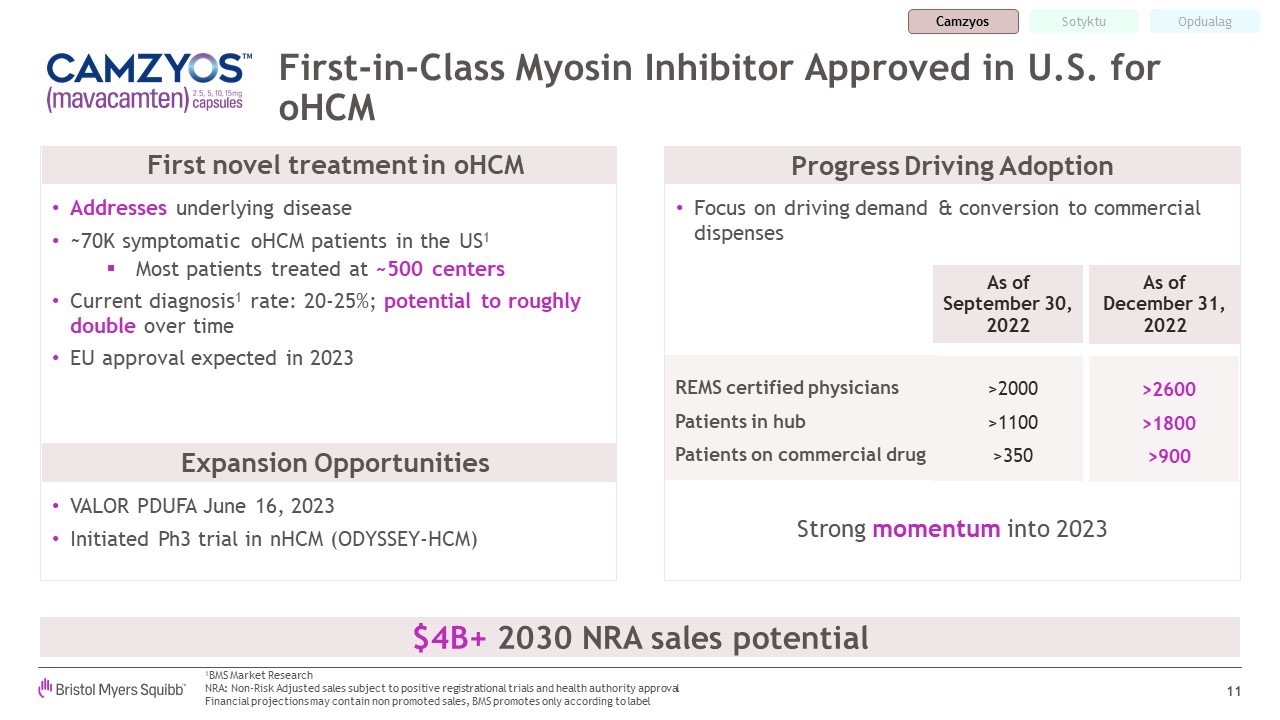

First-in-Class Myosin Inhibitor Approved in U.S. for oHCM 11 Strong momentum

into 2023 VALOR PDUFA June 16, 2023 Initiated Ph3 trial in nHCM (ODYSSEY-HCM) $4B+ 2030 NRA sales potential Progress Driving Adoption 1BMS Market Research NRA: Non-Risk Adjusted sales subject to positive registrational trials and health

authority approvalFinancial projections may contain non promoted sales, BMS promotes only according to label Addresses underlying disease ~70K symptomatic oHCM patients in the US1 Most patients treated at ~500 centers Current diagnosis1

rate: 20-25%; potential to roughly double over time EU approval expected in 2023 REMS certified physicians Patients in hub Patients on commercial drug >2000 >1100 >350 >2600 >1800 >900 As of September 30, 2022 As

of December 31, 2022 Focus on driving demand & conversion to commercial dispenses First novel treatment in oHCM Expansion Opportunities Camzyos Opdualag Sotyktu

First-in-Class Selective Allosteric TYK2 Inhibitor 12 U.S. Approval September

2022 – EU expected 2023 TRx equivalent = commercial and bridge prescriptions NRA: Non-Risk Adjusted sales subject to positive registrational trials and health authority approvalFinancial projections may contain non promoted sales, BMS

promotes only according to label Focus on building volume to secure broader access in 2024 25-30%** of new oral prescriptions in the first few months of launch >2,000* TRx equivalent since launch Roughly evenly split between

systemic-naïve, Otezla-experienced & biologic-experienced Strong InitialVolume GrowingMarket Share Broad Sourceof Business Superior efficacy of once-daily, oral SOTYKTU vs. twice-daily Otezla in improving skin clearance for

moderate-to-severe plaque psoriasis Well-demonstrated safety and tolerability profile with no Boxed Warning $4B+ 2030 NRA sales potential Camzyos Opdualag Sotyktu *As of December 31, 2022 **Based on brand impact through October 2022

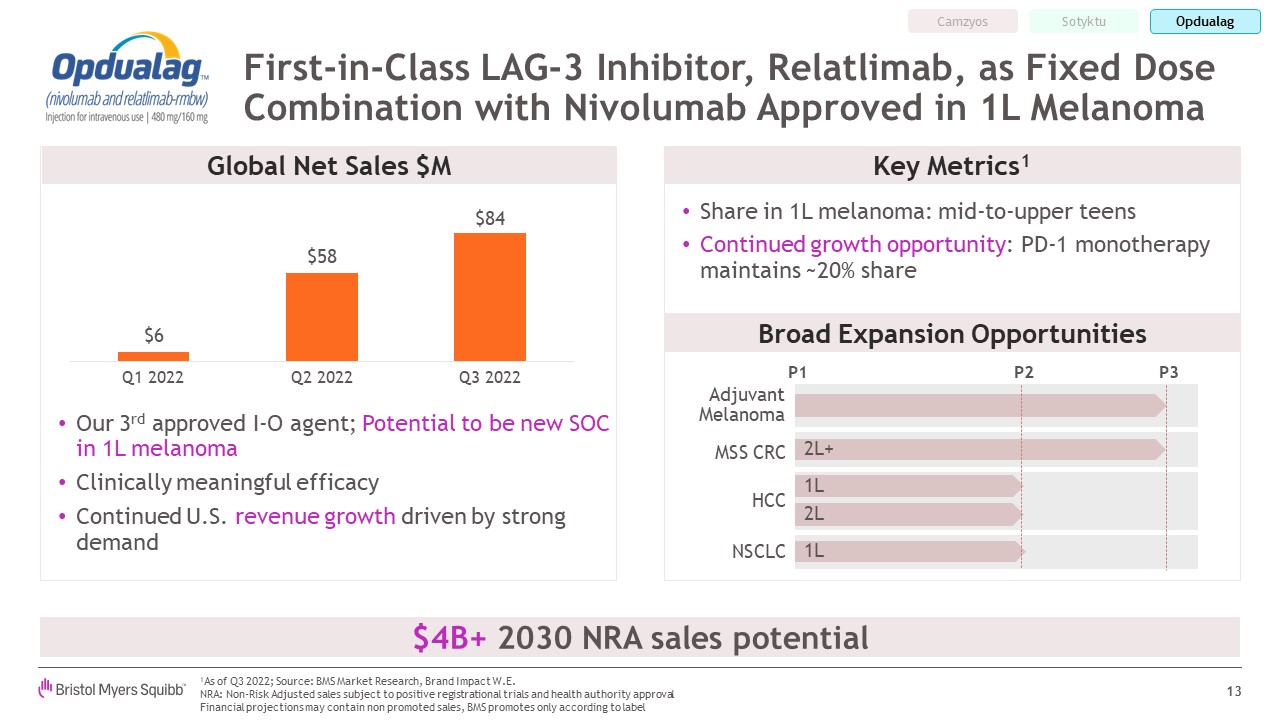

First-in-Class LAG-3 Inhibitor, Relatlimab, as Fixed Dose Combination with

Nivolumab Approved in 1L Melanoma 13 Our 3rd approved I-O agent; Potential to be new SOC in 1L melanoma Clinically meaningful efficacy Continued U.S. revenue growth driven by strong demand Broad Expansion Opportunities Share in 1L

melanoma: mid-to-upper teens Continued growth opportunity: PD-1 monotherapy maintains ~20% share 1As of Q3 2022; Source: BMS Market Research, Brand Impact W.E. NRA: Non-Risk Adjusted sales subject to positive registrational trials and

health authority approvalFinancial projections may contain non promoted sales, BMS promotes only according to label Global Net Sales $M P1 P2 P3 Adjuvant Melanoma HCC 1L 2L+ MSS CRC 2L 1L NSCLC Key Metrics1 $4B+ 2030 NRA sales

potential Camzyos Sotyktu Opdualag

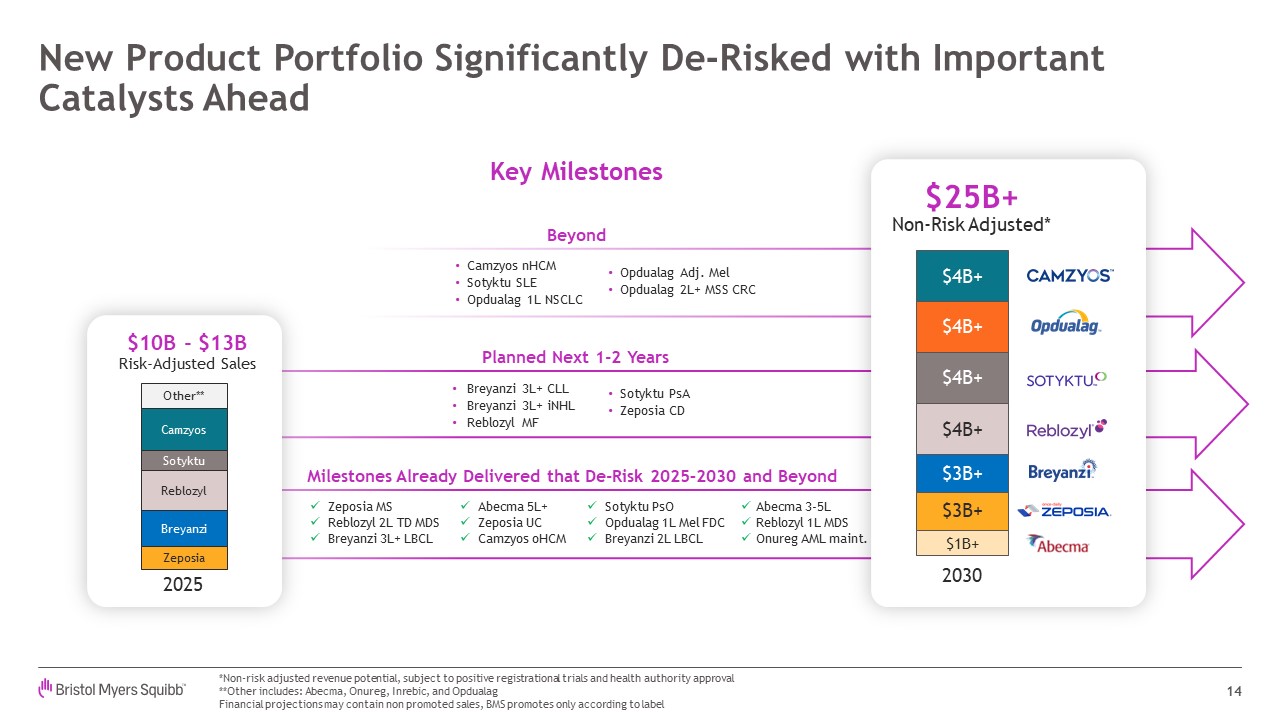

Camzyos nHCM Sotyktu SLE Opdualag 1L NSCLC Breyanzi 3L+ CLL Breyanzi 3L+

iNHL Reblozyl MF Planned Next 1-2 Years Sotyktu PsA Zeposia CD Milestones Already Delivered that De-Risk 2025–2030 and Beyond Zeposia MS Reblozyl 2L TD MDS Breyanzi 3L+ LBCL Abecma 5L+ Zeposia UC Camzyos oHCM Sotyktu PsO Opdualag

1L Mel FDC Breyanzi 2L LBCL Abecma 3-5L Reblozyl 1L MDS Onureg AML maint. New Product Portfolio Significantly De-Risked with Important Catalysts Ahead 14 *Non-risk adjusted revenue potential, subject to positive registrational trials

and health authority approval **Other includes: Abecma, Onureg, Inrebic, and Opdualag Financial projections may contain non promoted sales, BMS promotes only according to

label Camzyos Reblozyl Breyanzi Zeposia Sotyktu Other** 2025 $10B - $13BRisk-Adjusted Sales $25B+ Non-Risk Adjusted* 2030 $4B+ $4B+ $4B+ $4B+ $3B+ $3B+ $1B+ Key Milestones Beyond Opdualag Adj. Mel Opdualag 2L+ MSS CRC

Well Positioned for Portfolio Renewal & Long-Term Growth 15 1. Portfolio

renewal well-underway: 9 new launches 2. Next wave of innovation: 6 registrational stage pipeline assets 3. Optionality from early-stage pipeline & BD

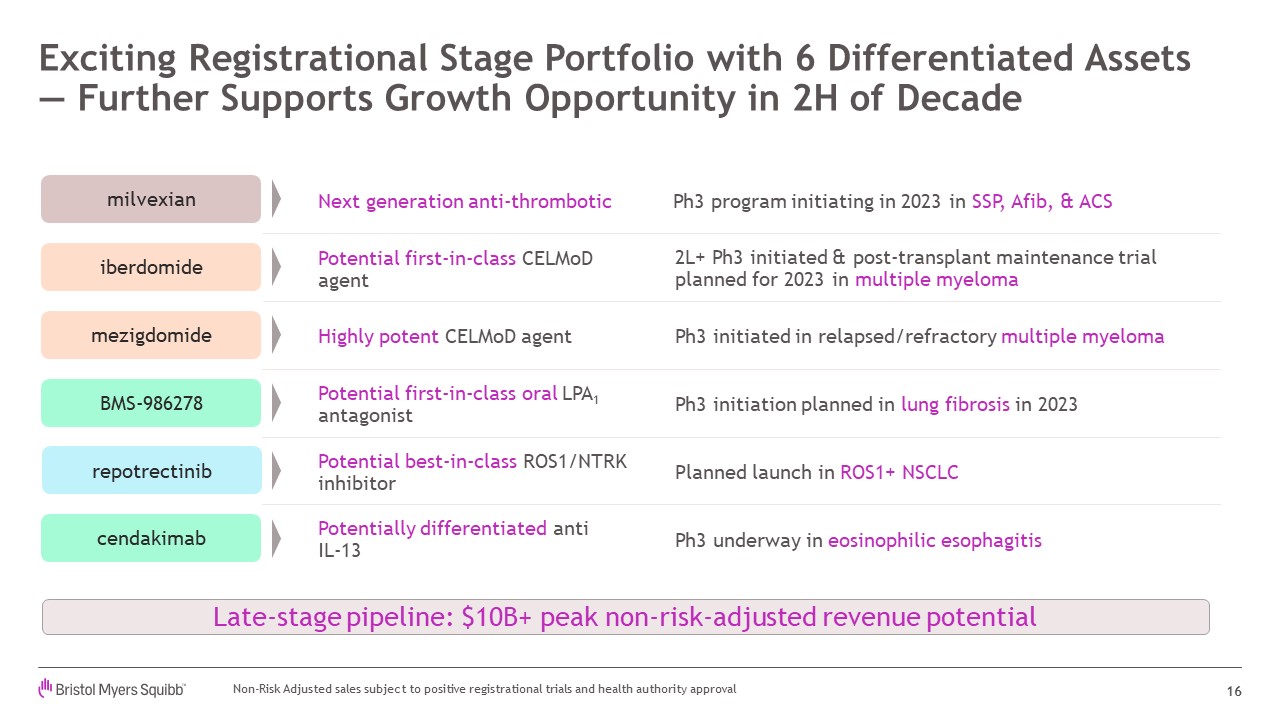

Exciting Registrational Stage Portfolio with 6 Differentiated Assets — Further

Supports Growth Opportunity in 2H of Decade 16 Next generation anti-thrombotic Ph3 program initiating in 2023 in SSP, Afib, & ACS milvexian Planned launch in ROS1+ NSCLC Potential best-in-class ROS1/NTRK

inhibitor repotrectinib Potential first-in-class oral LPA1 antagonist BMS-986278 Ph3 initiation planned in lung fibrosis in 2023 Potentially differentiated anti IL-13 cendakimab Ph3 underway in eosinophilic esophagitis Potential

first-in-class CELMoD agent iberdomide 2L+ Ph3 initiated & post-transplant maintenance trial planned for 2023 in multiple myeloma Highly potent CELMoD agent Ph3 initiated in relapsed/refractory multiple

myeloma mezigdomide Late-stage pipeline: $10B+ peak non-risk-adjusted revenue potential Non-Risk Adjusted sales subject to positive registrational trials and health authority approval

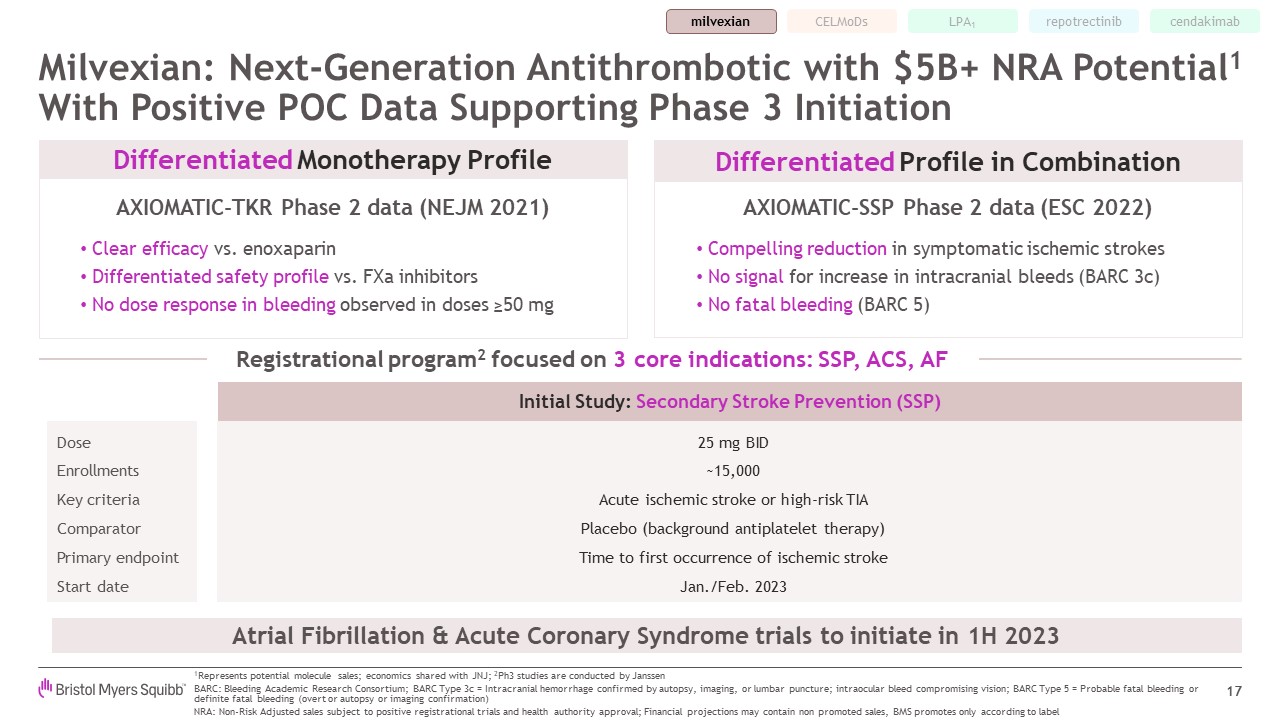

LPA1 cendakimab repotrectinib CELMoDs Milvexian: Next-Generation

Antithrombotic with $5B+ NRA Potential1 With Positive POC Data Supporting Phase 3 Initiation 17 Differentiated Monotherapy Profile AXIOMATIC-TKR Phase 2 data (NEJM 2021) Clear efficacy vs. enoxaparin Differentiated safety profile vs. FXa

inhibitors No dose response in bleeding observed in doses ≥50 mg AXIOMATIC-SSP Phase 2 data (ESC 2022) Compelling reduction in symptomatic ischemic strokes No signal for increase in intracranial bleeds (BARC 3c) No fatal bleeding (BARC

5) Differentiated Profile in Combination 1Represents potential molecule sales; economics shared with JNJ; 2Ph3 studies are conducted by Janssen BARC: Bleeding Academic Research Consortium; BARC Type 3c = Intracranial hemorrhage confirmed

by autopsy, imaging, or lumbar puncture; intraocular bleed compromising vision; BARC Type 5 = Probable fatal bleeding or definite fatal bleeding (overt or autopsy or imaging confirmation) NRA: Non-Risk Adjusted sales subject to positive

registrational trials and health authority approval; Financial projections may contain non promoted sales, BMS promotes only according to label Dose Enrollments Key criteria Comparator Primary endpoint Start date 25 mg

BID ~15,000 Acute ischemic stroke or high-risk TIA Placebo (background antiplatelet therapy) Time to first occurrence of ischemic stroke Jan./Feb. 2023 Initial Study: Secondary Stroke Prevention (SSP) Registrational program2 focused on

3 core indications: SSP, ACS, AF Atrial Fibrillation & Acute Coronary Syndrome trials to initiate in 1H 2023 milvexian

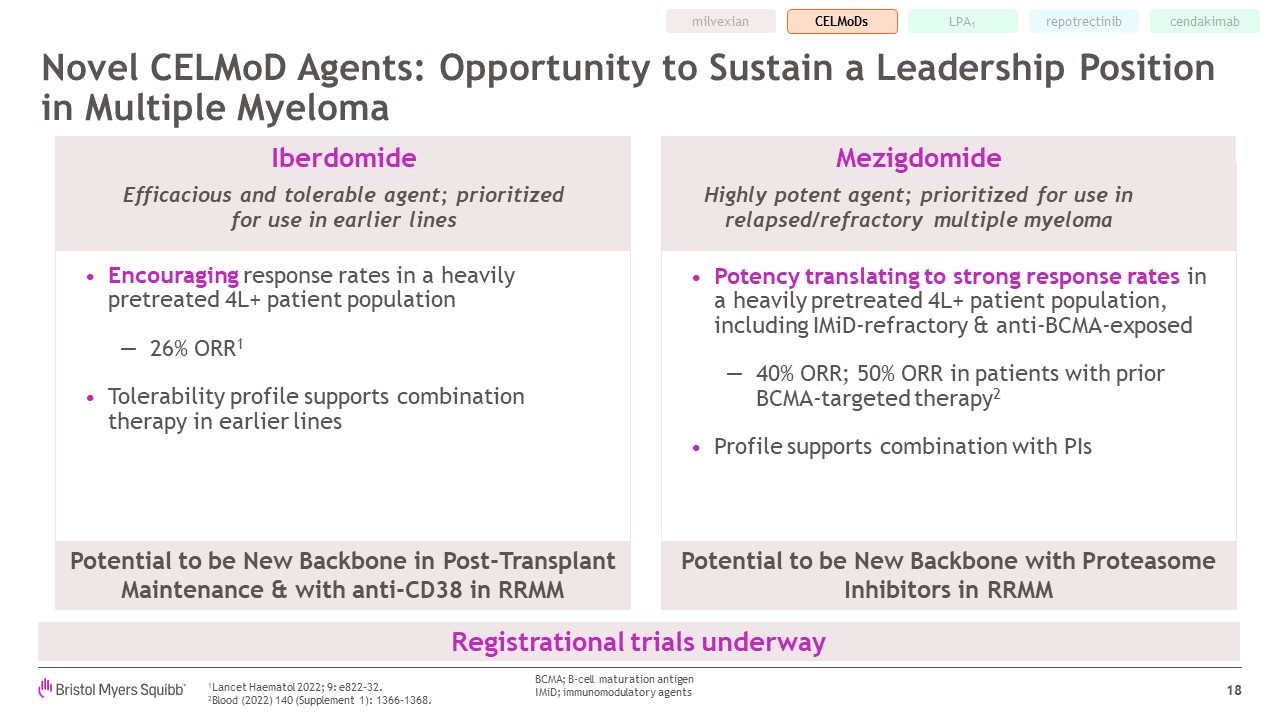

Novel CELMoD Agents: Opportunity to Sustain a Leadership Position in Multiple

Myeloma 18 Potency translating to strong response rates in a heavily pretreated 4L+ patient population, including IMiD-refractory & anti-BCMA-exposed 40% ORR; 50% ORR in patients with prior BCMA-targeted therapy2 Profile supports

combination with PIs LPA1 milvexian cendakimab Registrational trials underway Encouraging response rates in a heavily pretreated 4L+ patient population 26% ORR1 Tolerability profile supports combination therapy in earlier

lines Iberdomide Efficacious and tolerable agent; prioritized for use in earlier lines Mezigdomide Highly potent agent; prioritized for use in relapsed/refractory multiple myeloma Potential to be New Backbone in Post-Transplant

Maintenance & with anti-CD38 in RRMM Potential to be New Backbone with Proteasome Inhibitors in RRMM 1Lancet Haematol 2022; 9: e822–32. 2Blood (2022) 140 (Supplement 1): 1366–1368. BCMA; B-cell maturation antigen IMiD;

immunomodulatory agents repotrectinib CELMoDs

LPA1 Antagonist (BMS-986278): First-in-Class Novel Treatment for Lung

Fibrosis 19 IPF is a fatal lung disease with median 3-5 years survival In 2021, >700,000 adults living with IPF globally1 Worldwide sales2 of 2 approved agents $3B+ Significant Unmet Need and Market Development Plans LPA1 is central

to the pathogenesis of fibrotic diseases BMS-986278 demonstrates compelling efficacy and favorable safety profile BMS-986278 LPA production is stimulated by lung injury LPA activates LPA1 expressed on fibroblasts Excessive collagen

secreted by fibroblasts leads to fibrosis Lung Injury ALVEOLUS 1DataMonitor, IPF Pharma Intelligence Market Spotlight, Feb-2022 2Source: Evaluate Pharma; 2021 WW Esbriet & Ofev sales (USD) LPA1; lysophosphatidic acid receptor 1 IPF;

idiopathic pulmonary fibrosis PPF; progressive pulmonary fibrosis Phase 2 IPF positive data in house (2H 2022) & PPF cohort ongoing Planning to initiate Phase 3 program in 2023 milvexian cendakimab repotrectinib CELMoDs LPA1

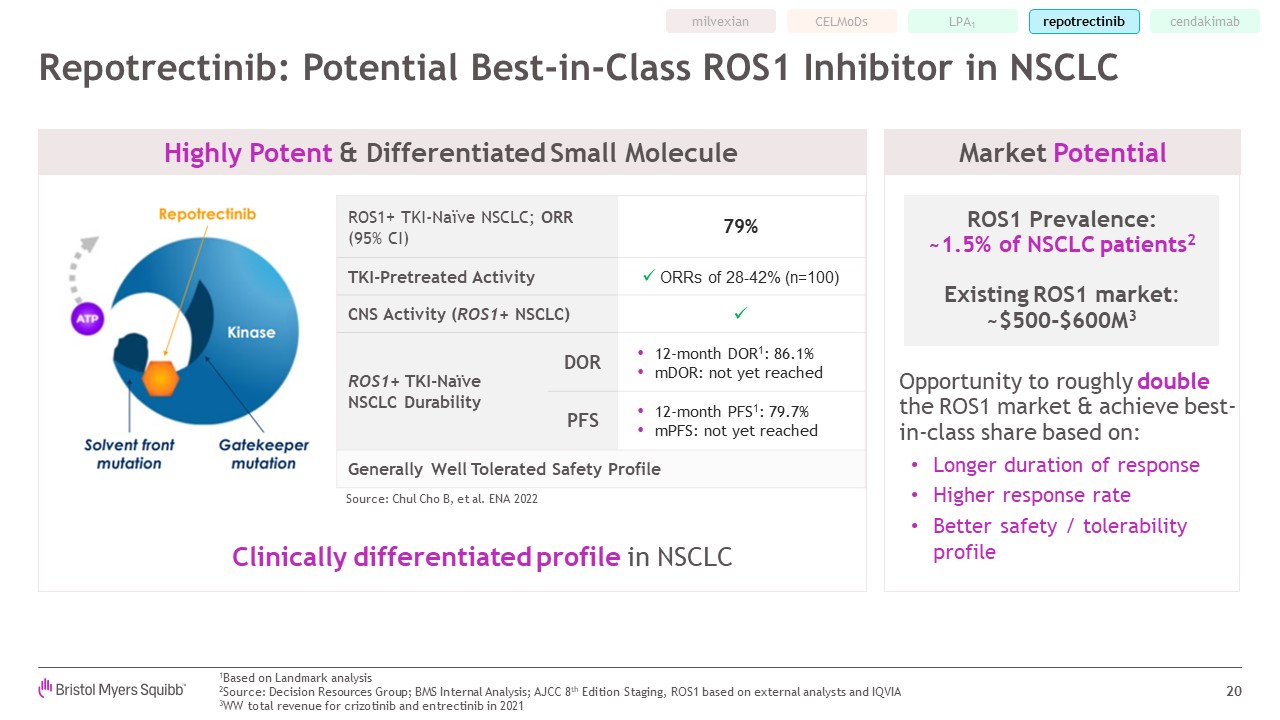

LPA1 Clinically differentiated profile in NSCLC Repotrectinib: Potential

Best-in-Class ROS1 Inhibitor in NSCLC 20 ROS1 Prevalence:~1.5% of NSCLC patients2 Existing ROS1 market:~$500-$600M3 Opportunity to roughly double the ROS1 market & achieve best-in-class share based on: Longer duration of

response Higher response rate Better safety / tolerability profile ROS1+ TKI-Naïve NSCLC; ORR (95% CI) 79% TKI-Pretreated Activity ORRs of 28-42% (n=100) CNS Activity (ROS1+ NSCLC) ROS1+ TKI-NaïveNSCLC Durability DOR 12-month

DOR1: 86.1% mDOR: not yet reached PFS 12-month PFS1: 79.7% mPFS: not yet reached Generally Well Tolerated Safety Profile Favorable Safety Profile Source: Chul Cho B, et al. ENA 2022 Market Potential Highly Potent & Differentiated

Small Molecule 1Based on Landmark analysis 2Source: Decision Resources Group; BMS Internal Analysis; AJCC 8th Edition Staging, ROS1 based on external analysts and IQVIA 3WW total revenue for crizotinib and entrectinib in

2021 milvexian cendakimab CELMoDs repotrectinib

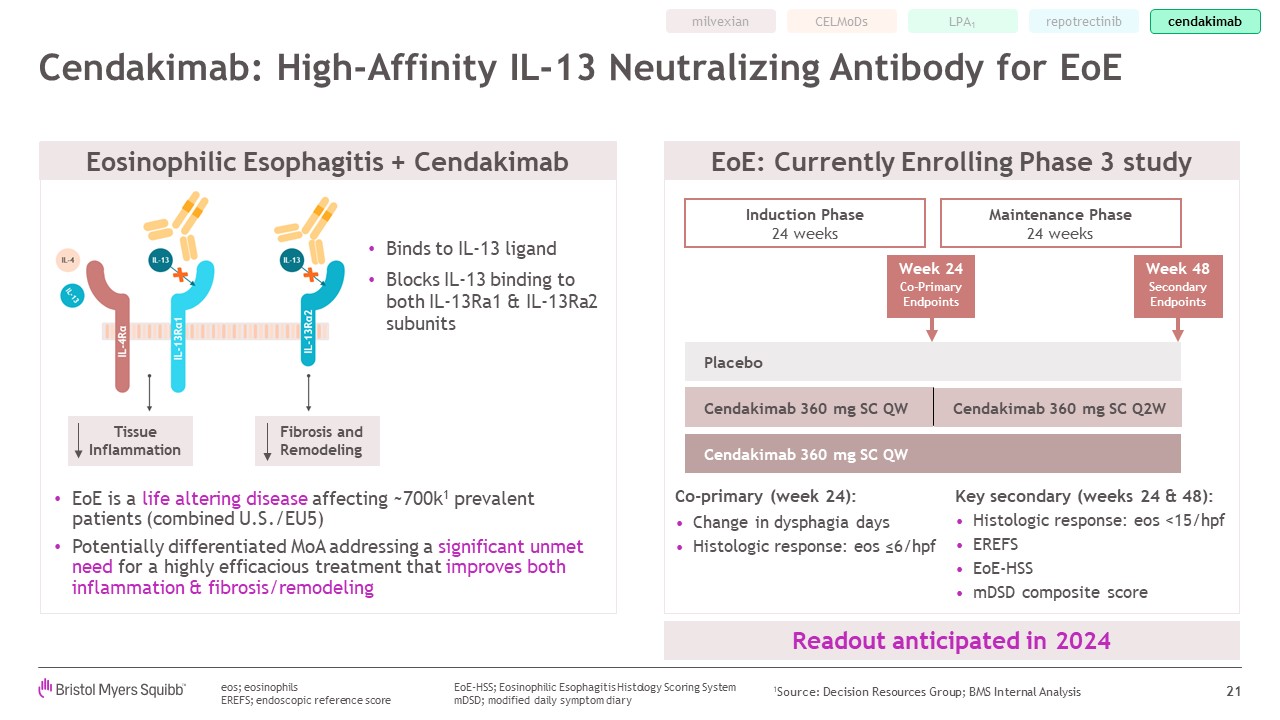

EoE is a life altering disease affecting ~700k1 prevalent patients (combined

U.S./EU5) Potentially differentiated MoA addressing a significant unmet need for a highly efficacious treatment that improves both inflammation & fibrosis/remodeling Cendakimab: High-Affinity IL-13 Neutralizing Antibody for

EoE 21 Co-primary (week 24): Change in dysphagia days Histologic response: eos ≤6/hpf Key secondary (weeks 24 & 48): Histologic response: eos <15/hpf EREFS EoE-HSS mDSD composite score EoE: Currently Enrolling Phase 3

study eos; eosinophils EREFS; endoscopic reference score Week 24 Co-Primary Endpoints Week 48 Secondary Endpoints Cendakimab 360 mg SC Q2W Placebo Cendakimab 360 mg SC QW Cendakimab 360 mg SC QW Induction Phase 24

weeks Maintenance Phase 24 weeks Binds to IL-13 ligand Blocks IL-13 binding to both IL-13Ra1 & IL-13Ra2 subunits Eosinophilic Esophagitis + Cendakimab Fibrosis and Remodeling Tissue Inflammation Readout anticipated in

2024 EoE-HSS; Eosinophilic Esophagitis Histology Scoring System mDSD; modified daily symptom diary milvexian repotrectinib CELMoDs LPA1 cendakimab 1Source: Decision Resources Group; BMS Internal Analysis

Well Positioned for Portfolio Renewal & Long-Term Growth 22 1. Portfolio

renewal well-underway: 9 new launches 2. Next wave of innovation: 6 registrational stage pipeline assets 3. Optionality from early-stage pipeline & BD

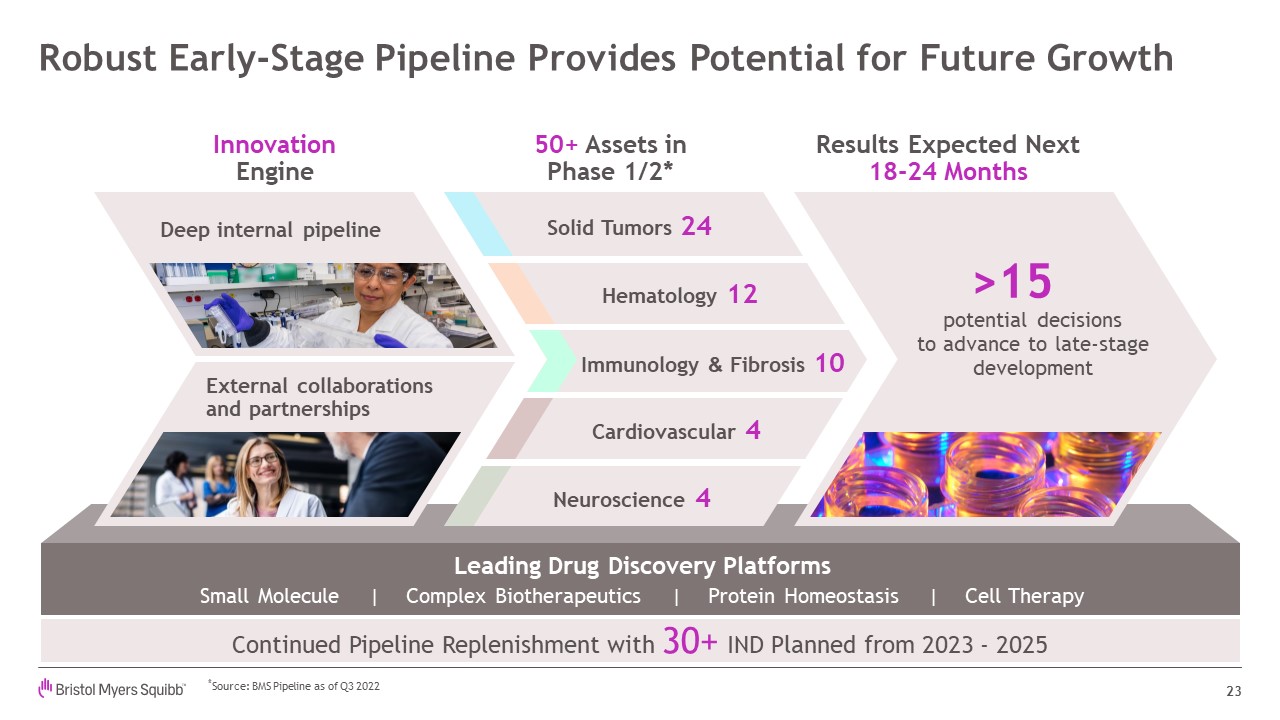

Robust Early-Stage Pipeline Provides Potential for Future Growth 23 50+ Assets

inPhase 1/2* Results Expected Next 18-24 Months InnovationEngine Small Molecule | Complex Biotherapeutics | Protein Homeostasis | Cell Therapy Leading Drug Discovery Platforms Solid Tumors 24 Hematology 12 Immunology & Fibrosis

10 Cardiovascular 4 Neuroscience 4 Deep internal pipeline External collaborations and partnerships >15 potential decisionsto advance to late-stagedevelopment Continued Pipeline Replenishment with 30+ IND Planned from 2023 -

2025 *Source: BMS Pipeline as of Q3 2022

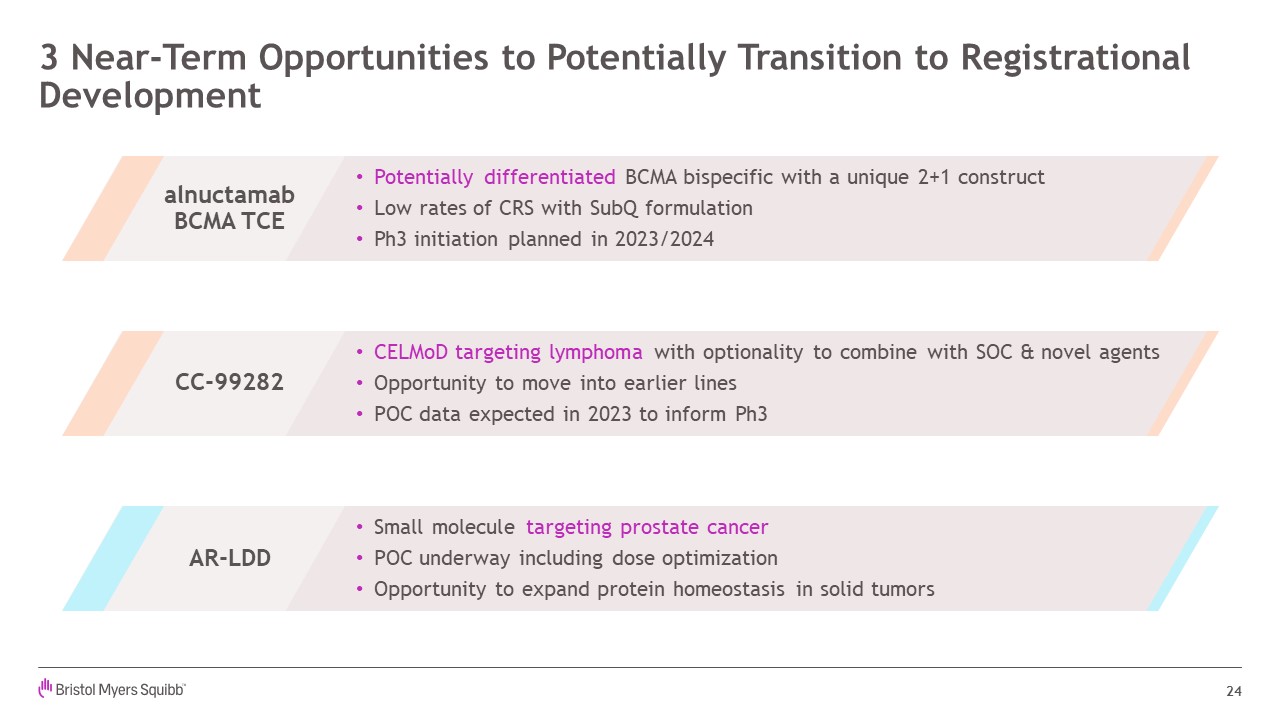

3 Near-Term Opportunities to Potentially Transition to Registrational

Development 24 CELMoD targeting lymphoma with optionality to combine with SOC & novel agents Opportunity to move into earlier lines POC data expected in 2023 to inform Ph3 CC-99282 Potentially differentiated BCMA bispecific with a

unique 2+1 construct Low rates of CRS with SubQ formulation Ph3 initiation planned in 2023/2024 alnuctamabBCMA TCE AR-LDD Small molecule targeting prostate cancer POC underway including dose optimization Opportunity to expand protein

homeostasis in solid tumors

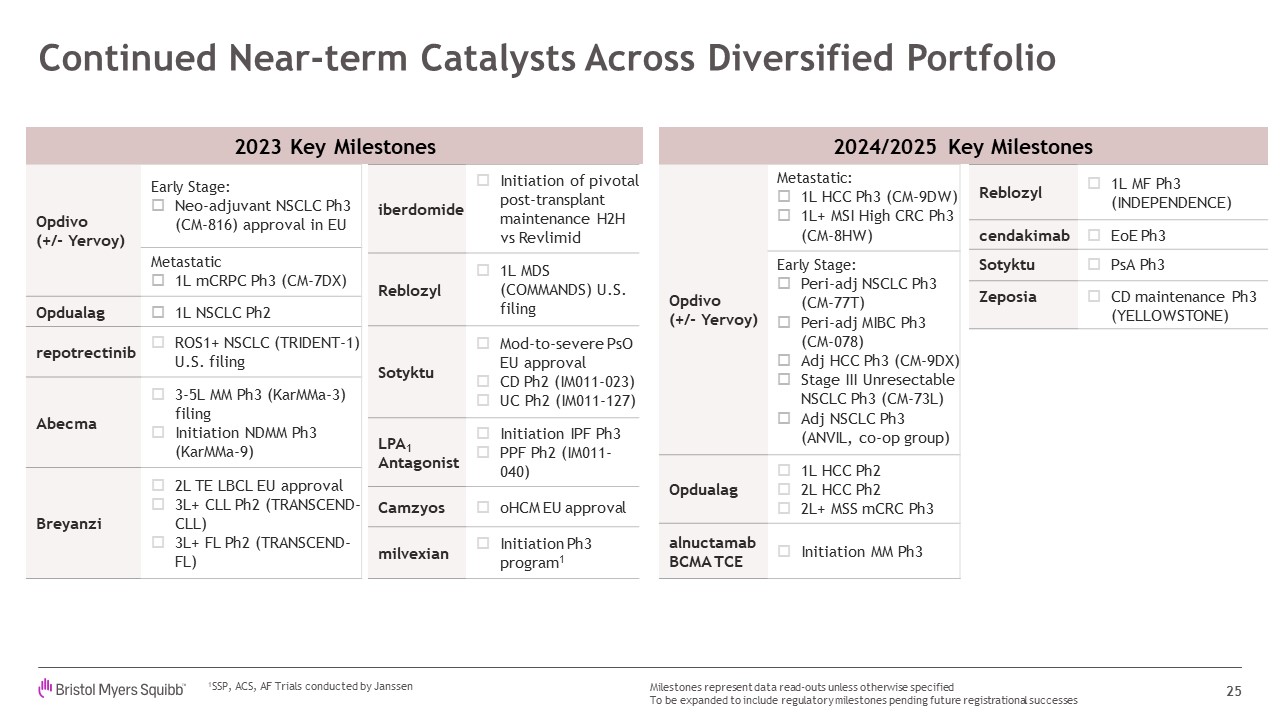

2023 Key Milestones Opdivo (+/- Yervoy) Early Stage: Neo-adjuvant NSCLC

Ph3 (CM-816) approval in EU Metastatic 1L mCRPC Ph3 (CM-7DX) Opdualag 1L NSCLC Ph2 repotrectinib ROS1+ NSCLC (TRIDENT-1) U.S. filing Abecma 3-5L MM Ph3 (KarMMa-3) filing Initiation NDMM Ph3 (KarMMa-9) Breyanzi 2L TE LBCL EU

approval 3L+ CLL Ph2 (TRANSCEND-CLL) 3L+ FL Ph2 (TRANSCEND-FL) Continued Near-term Catalysts Across Diversified Portfolio 25 Milestones represent data read-outs unless otherwise specified To be expanded to include regulatory

milestones pending future registrational successes iberdomide Initiation of pivotal post-transplant maintenance H2H vs Revlimid Reblozyl 1L MDS (COMMANDS) U.S. filing Sotyktu Mod-to-severe PsO EU approval CD Ph2 (IM011-023) UC

Ph2 (IM011-127) LPA1 Antagonist Initiation IPF Ph3 PPF Ph2 (IM011-040) Camzyos oHCM EU approval milvexian Initiation Ph3 program1 2024/2025 Key Milestones Opdivo (+/- Yervoy) Metastatic: 1L HCC Ph3 (CM-9DW) 1L+ MSI High CRC

Ph3 (CM-8HW) Early Stage: Peri-adj NSCLC Ph3 (CM-77T) Peri-adj MIBC Ph3 (CM-078) Adj HCC Ph3 (CM-9DX) Stage III Unresectable NSCLC Ph3 (CM-73L) Adj NSCLC Ph3 (ANVIL, co-op group) Opdualag 1L HCC Ph2 2L HCC Ph2 2L+ MSS mCRC

Ph3 alnuctamab BCMA TCE Initiation MM Ph3 Reblozyl 1L MF Ph3 (INDEPENDENCE) cendakimab EoE Ph3 Sotyktu PsA Ph3 Zeposia CD maintenance Ph3 (YELLOWSTONE) 1SSP, ACS, AF Trials conducted by Janssen

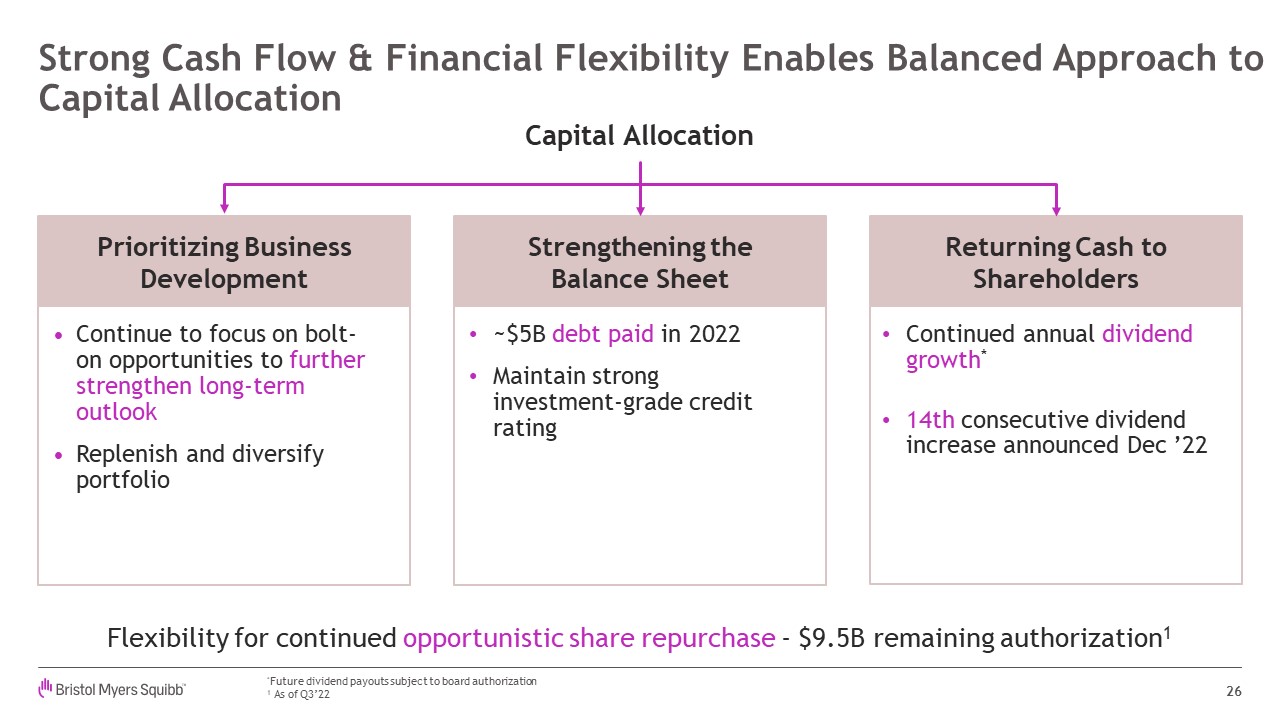

Strong Cash Flow & Financial Flexibility Enables Balanced Approach to

Capital Allocation 26 *Future dividend payouts subject to board authorization 1 As of Q3’22 Prioritizing Business Development Strengthening theBalance Sheet Returning Cash to Shareholders Continue to focus on bolt-on

opportunities to further strengthen long-term outlook Replenish and diversify portfolio ~$5B debt paid in 2022 Maintain strong investment-grade credit rating Continued annual dividend growth* 14th consecutive dividend increase

announced Dec ’22 Capital Allocation Flexibility for continued opportunistic share repurchase - $9.5B remaining authorization1

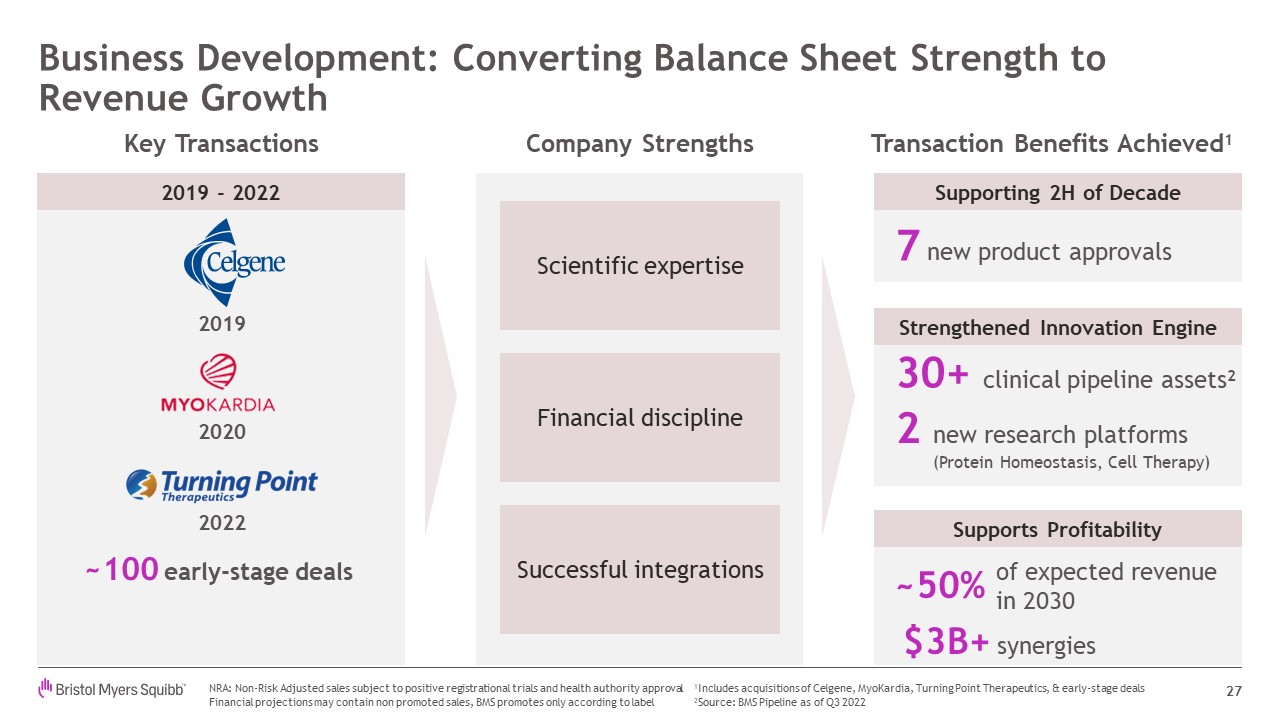

Business Development: Converting Balance Sheet Strength to Revenue

Growth 27 7 new product approvals 30+ clinical pipeline assets2 2 new research platforms (Protein Homeostasis, Cell Therapy) of expected revenue in 2030 Company Strengths Transaction Benefits Achieved1 Supporting 2H of

Decade Strengthened Innovation Engine Supports Profitability Key Transactions ~100 early-stage deals 2019 2020 2022 Scientific expertise Financial discipline Successful integrations 2019 - 2022 $3B+ synergies NRA: Non-Risk

Adjusted sales subject to positive registrational trials and health authority approval Financial projections may contain non promoted sales, BMS promotes only according to label 1Includes acquisitions of Celgene, MyoKardia, Turning

Point Therapeutics, & early-stage deals 2Source: BMS Pipeline as of Q3 2022 ~50%

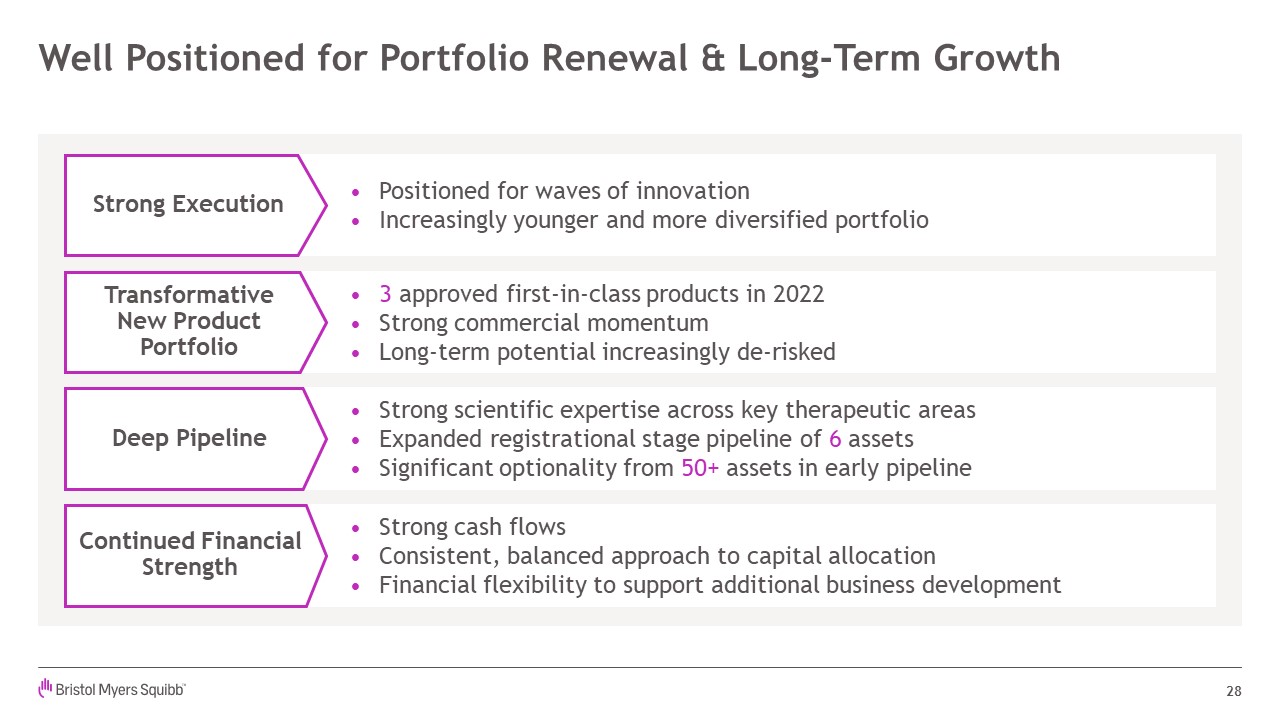

Well Positioned for Portfolio Renewal & Long-Term

Growth 28 Positioned for waves of innovation Increasingly younger and more diversified portfolio Strong scientific expertise across key therapeutic areas Expanded registrational stage pipeline of 6 assets Significant optionality

from 50+ assets in early pipeline 3 approved first-in-class products in 2022 Strong commercial momentum Long-term potential increasingly de-risked Strong cash flows Consistent, balanced approach to capital allocation Financial

flexibility to support additional business development Strong Execution TransformativeNew Product Portfolio Deep Pipeline Continued Financial Strength

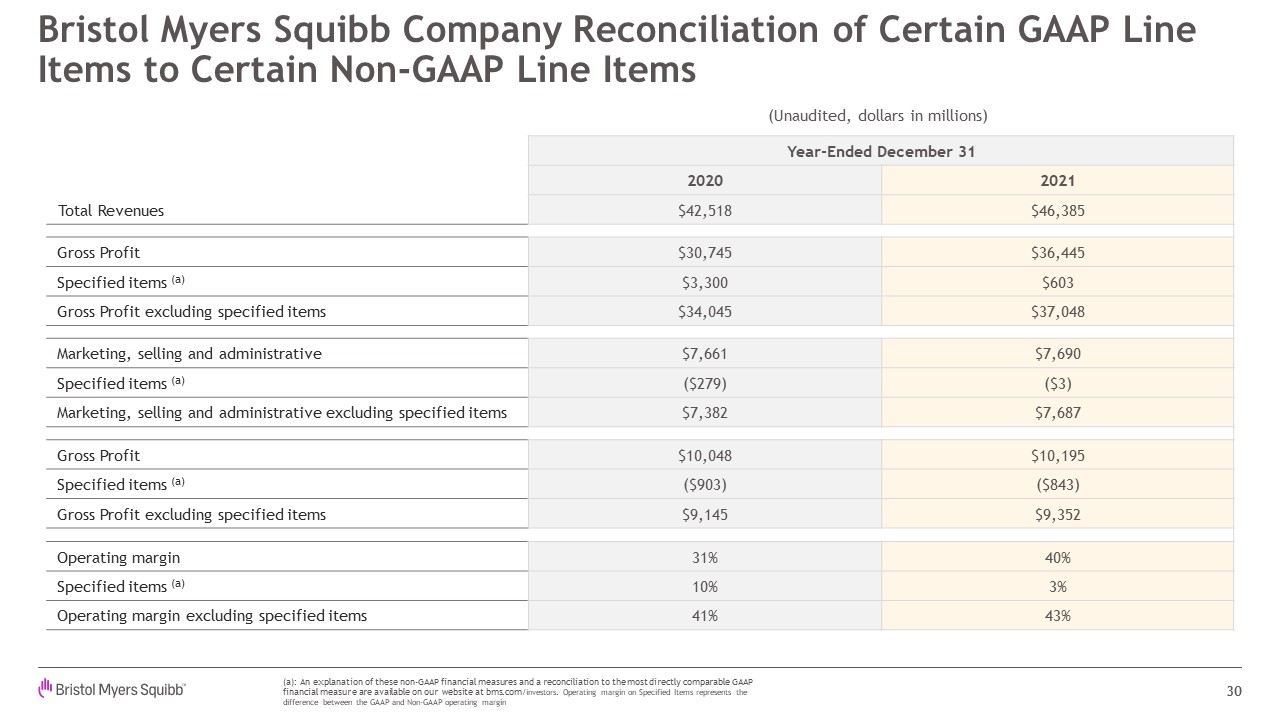

Year-Ended December 31 2020 2021 2021 Total

Revenues $42,518 $46,385 Gross Profit $30,745 $36,445 Specified items (a) $3,300 $603 Gross Profit excluding specified items $34,045 $37,048 Marketing, selling and administrative $7,661 $7,690 Specified items

(a) ($279) ($3) Marketing, selling and administrative excluding specified items $7,382 $7,687 Gross Profit $10,048 $10,195 Specified items (a) ($903) ($843) Gross Profit excluding specified items $9,145 $9,352 Operating

margin 31% 40% Specified items (a) 10% 3% Operating margin excluding specified items 41% 43% Bristol Myers Squibb Company Reconciliation of Certain GAAP Line Items to Certain Non-GAAP Line Items 30 (a): An explanation of

these non-GAAP financial measures and a reconciliation to the most directly comparable GAAP financial measure are available on our website at bms.com/investors. Operating margin on Specified Items represents the difference between the

GAAP and Non-GAAP operating margin (Unaudited, dollars in millions)

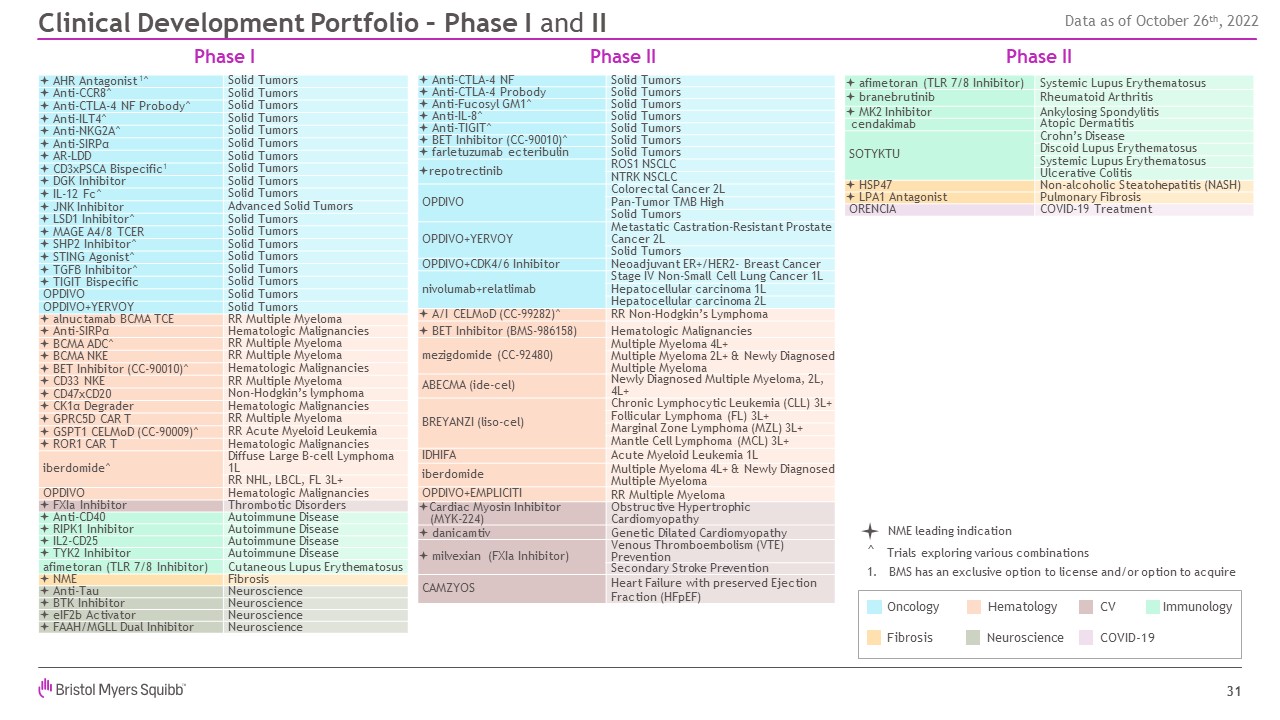

Phase I Clinical Development Portfolio – Phase I and II NME leading

indication Hematology Neuroscience Oncology Fibrosis Immunology CV COVID-19 ^ Trials exploring various combinations 1. BMS has an exclusive option to license and/or option to acquire ª Anti-CTLA-4 NF Solid Tumors ª

Anti-CTLA-4 Probody Solid Tumors ª Anti-Fucosyl GM1^ Solid Tumors ª Anti-IL-8^ Solid Tumors ª Anti-TIGIT^ Solid Tumors ª BET Inhibitor (CC-90010)^ Solid Tumors ª farletuzumab ecteribulin Solid Tumors ªrepotrectinib ROS1

NSCLC NTRK NSCLC OPDIVO Colorectal Cancer 2L Pan-Tumor TMB High Solid Tumors OPDIVO+YERVOY Metastatic Castration-Resistant Prostate Cancer 2L Solid Tumors OPDIVO+CDK4/6 Inhibitor Neoadjuvant ER+/HER2- Breast

Cancer nivolumab+relatlimab Stage IV Non-Small Cell Lung Cancer 1L Hepatocellular carcinoma 1L Hepatocellular carcinoma 2L ª A/I CELMoD (CC-99282)^ RR Non-Hodgkin’s Lymphoma ª BET Inhibitor (BMS-986158) Hematologic

Malignancies mezigdomide (CC-92480) Multiple Myeloma 4L+ Multiple Myeloma 2L+ & Newly Diagnosed Multiple Myeloma ABECMA (ide-cel) Newly Diagnosed Multiple Myeloma, 2L, 4L+ BREYANZI (liso-cel) Chronic Lymphocytic Leukemia

(CLL) 3L+ Follicular Lymphoma (FL) 3L+ Marginal Zone Lymphoma (MZL) 3L+ Mantle Cell Lymphoma (MCL) 3L+ IDHIFA Acute Myeloid Leukemia 1L iberdomide Multiple Myeloma 4L+ & Newly Diagnosed Multiple Myeloma OPDIVO+EMPLICITI RR

Multiple Myeloma ªCardiac Myosin Inhibitor (MYK-224) Obstructive Hypertrophic Cardiomyopathy ª danicamtiv Genetic Dilated Cardiomyopathy ª milvexian (FXIa Inhibitor) Venous Thromboembolism (VTE) Prevention Secondary Stroke

Prevention CAMZYOS Heart Failure with preserved Ejection Fraction (HFpEF) ª afimetoran (TLR 7/8 Inhibitor) Systemic Lupus Erythematosus ª branebrutinib Rheumatoid Arthritis ª MK2 Inhibitor Ankylosing

Spondylitis cendakimab Atopic Dermatitis SOTYKTU Crohn’s Disease Discoid Lupus Erythematosus Systemic Lupus Erythematosus Ulcerative Colitis ª HSP47 Non-alcoholic Steatohepatitis (NASH) ª LPA1 Antagonist Pulmonary

Fibrosis ORENCIA COVID-19 Treatment Phase II Phase II 31 ª AHR Antagonist 1^ Solid Tumors ª Anti-CCR8^ Solid Tumors ª Anti-CTLA-4 NF Probody^ Solid Tumors ª Anti-ILT4^ Solid Tumors ª Anti-NKG2A^ Solid Tumors ª

Anti-SIRPα Solid Tumors ª AR-LDD Solid Tumors ª CD3xPSCA Bispecific1 Solid Tumors ª DGK Inhibitor Solid Tumors ª IL-12 Fc^ Solid Tumors ª JNK Inhibitor Advanced Solid Tumors ª LSD1 Inhibitor^ Solid Tumors ª MAGE A4/8

TCER Solid Tumors ª SHP2 Inhibitor^ Solid Tumors ª STING Agonist^ Solid Tumors ª TGFβ Inhibitor^ Solid Tumors ª TIGIT Bispecific Solid Tumors OPDIVO Solid Tumors OPDIVO+YERVOY Solid Tumors ª alnuctamab BCMA TCE RR

Multiple Myeloma ª Anti-SIRPα Hematologic Malignancies ª BCMA ADC^ RR Multiple Myeloma ª BCMA NKE RR Multiple Myeloma ª BET Inhibitor (CC-90010)^ Hematologic Malignancies ª CD33 NKE RR Multiple Myeloma ª

CD47xCD20 Non-Hodgkin’s lymphoma ª CK1α Degrader Hematologic Malignancies ª GPRC5D CAR T RR Multiple Myeloma ª GSPT1 CELMoD (CC-90009)^ RR Acute Myeloid Leukemia ª ROR1 CAR T Hematologic Malignancies iberdomide^ Diffuse

Large B-cell Lymphoma 1L RR NHL, LBCL, FL 3L+ OPDIVO Hematologic Malignancies ª FXIa Inhibitor Thrombotic Disorders ª Anti-CD40 Autoimmune Disease ª RIPK1 Inhibitor Autoimmune Disease ª IL2-CD25 Autoimmune Disease ª TYK2

Inhibitor Autoimmune Disease afimetoran (TLR 7/8 Inhibitor) Cutaneous Lupus Erythematosus ª NME Fibrosis ª Anti-Tau Neuroscience ª BTK Inhibitor Neuroscience ª eIF2b Activator Neuroscience ª FAAH/MGLL Dual

Inhibitor Neuroscience Data as of October 26th, 2022

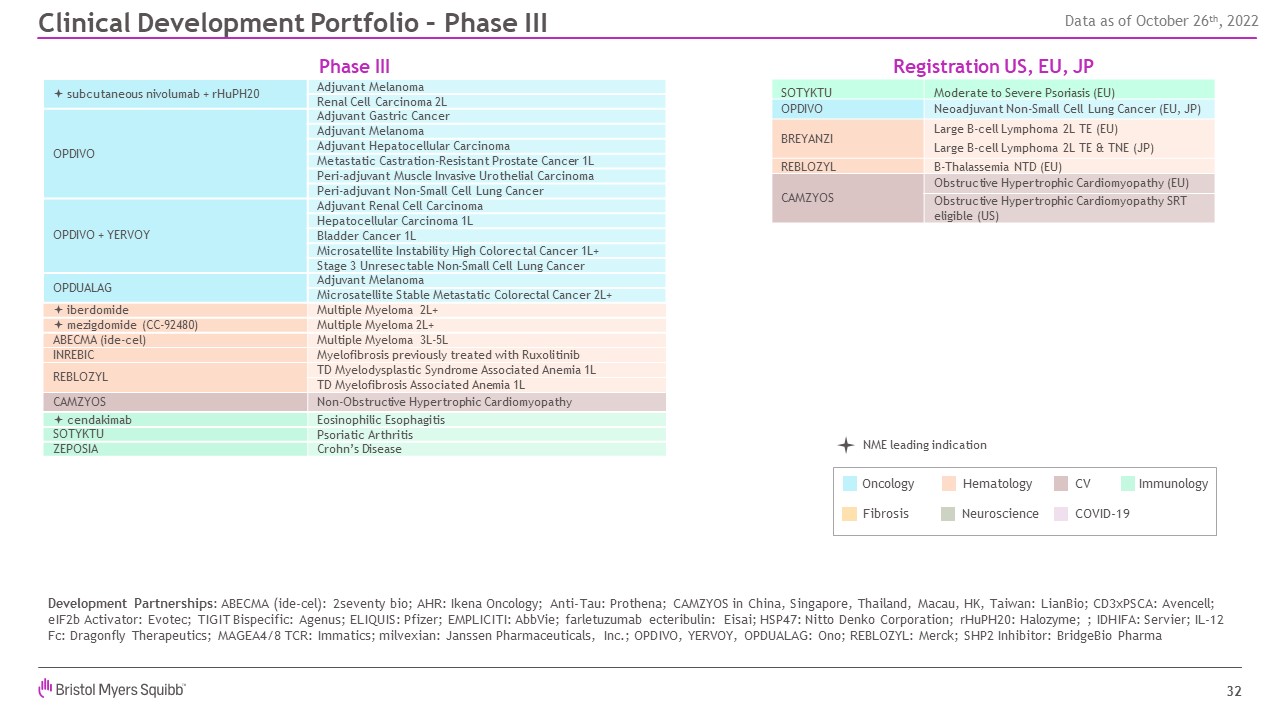

32 Development Partnerships: ABECMA (ide-cel): 2seventy bio; AHR: Ikena

Oncology; Anti-Tau: Prothena; CAMZYOS in China, Singapore, Thailand, Macau, HK, Taiwan: LianBio; CD3xPSCA: Avencell; eIF2b Activator: Evotec; TIGIT Bispecific: Agenus; ELIQUIS: Pfizer; EMPLICITI: AbbVie; farletuzumab ecteribulin: Eisai;

HSP47: Nitto Denko Corporation; rHuPH20: Halozyme; ; IDHIFA: Servier; IL-12 Fc: Dragonfly Therapeutics; MAGEA4/8 TCR: Immatics; milvexian: Janssen Pharmaceuticals, Inc.; OPDIVO, YERVOY, OPDUALAG: Ono; REBLOZYL: Merck; SHP2 Inhibitor:

BridgeBio Pharma Registration US, EU, JP Clinical Development Portfolio – Phase III Phase III ª subcutaneous nivolumab + rHuPH20 Adjuvant Melanoma Renal Cell Carcinoma 2L OPDIVO Adjuvant Gastric Cancer Adjuvant

Melanoma Adjuvant Hepatocellular Carcinoma Metastatic Castration-Resistant Prostate Cancer 1L Peri-adjuvant Muscle Invasive Urothelial Carcinoma Peri-adjuvant Non-Small Cell Lung Cancer OPDIVO + YERVOY Adjuvant Renal Cell

Carcinoma Hepatocellular Carcinoma 1L Bladder Cancer 1L Microsatellite Instability High Colorectal Cancer 1L+ Stage 3 Unresectable Non-Small Cell Lung Cancer OPDUALAG Adjuvant Melanoma Microsatellite Stable Metastatic

Colorectal Cancer 2L+ ª iberdomide Multiple Myeloma 2L+ ª mezigdomide (CC-92480) Multiple Myeloma 2L+ ABECMA (ide-cel) Multiple Myeloma 3L-5L INREBIC Myelofibrosis previously treated with Ruxolitinib REBLOZYL TD

Myelodysplastic Syndrome Associated Anemia 1L TD Myelofibrosis Associated Anemia 1L CAMZYOS Non-Obstructive Hypertrophic Cardiomyopathy ª cendakimab Eosinophilic Esophagitis SOTYKTU Psoriatic Arthritis ZEPOSIA Crohn’s

Disease SOTYKTU Moderate to Severe Psoriasis (EU) OPDIVO Neoadjuvant Non-Small Cell Lung Cancer (EU, JP) BREYANZI Large B-cell Lymphoma 2L TE (EU) Large B-cell Lymphoma 2L TE & TNE (JP) REBLOZYL B-Thalassemia NTD

(EU) CAMZYOS Obstructive Hypertrophic Cardiomyopathy (EU) Obstructive Hypertrophic Cardiomyopathy SRT eligible (US) NME leading indication Hematology Neuroscience Oncology Fibrosis Immunology CV COVID-19 Data as of October

26th, 2022

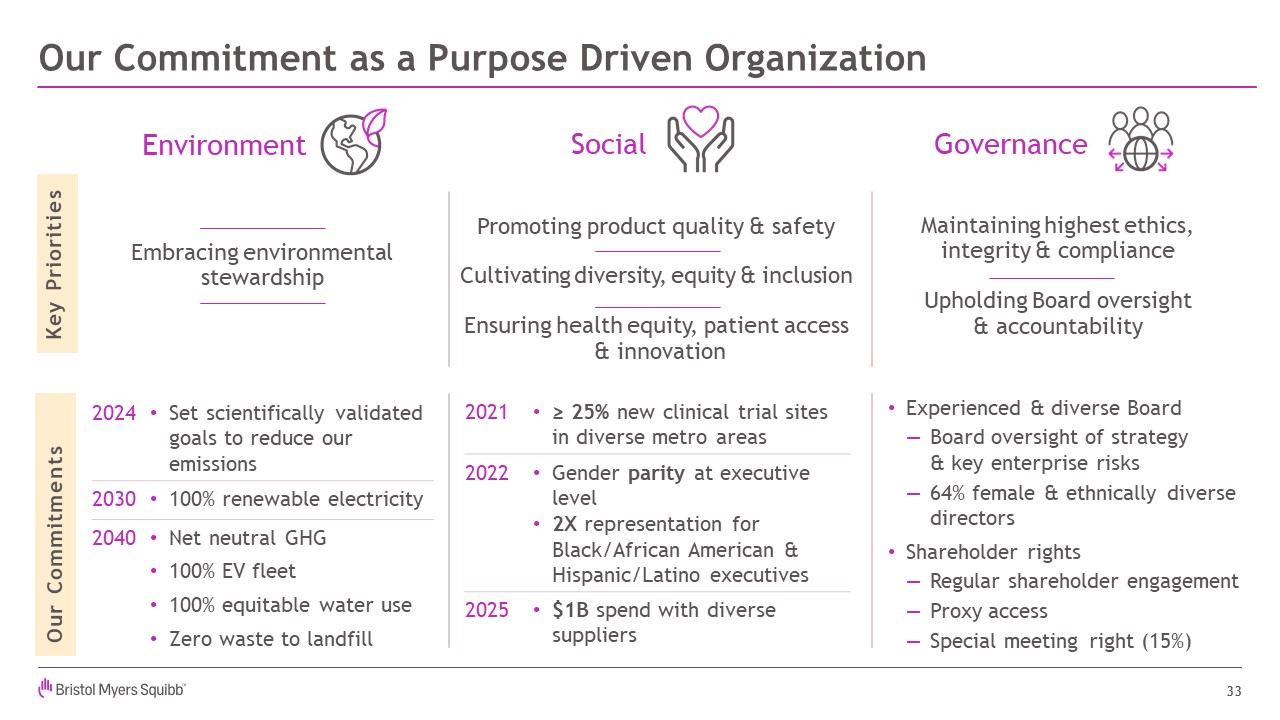

Our Commitment as a Purpose Driven Organization 33 Embracing

environmental stewardship Experienced & diverse Board Board oversight of strategy& key enterprise risks 64% female & ethnically diverse directors Shareholder rights Regular shareholder engagement Proxy access

Special meeting right (15%) Environment Governance Social Key Priorities Our Commitments 2021 ≥ 25% new clinical trial sites in diverse metro areas 2022 Gender parity at executive level 2X representation for Black/African

American & Hispanic/Latino executives 2025 $1B spend with diverse suppliers 2024 Set scientifically validated goals to reduce our emissions 2030 100% renewable electricity 2040 Net neutral GHG 100% EV fleet 100% equitable

water use Zero waste to landfill Maintaining highest ethics, integrity & compliance Upholding Board oversight & accountability Promoting product quality & safety Cultivating diversity, equity & inclusion Ensuring

health equity, patient access & innovation

Strong Cash Flow & Financial Flexibility Enables Balanced Approach to

Capital Allocation 25 *Future dividend payouts subject to board authorization 1 As of Q3’22 Prioritizing Business Development Strengthening theBalance Sheet Returning Cash to Shareholders Continue to focus on bolt-on opportunities to

further strengthen long-term outlook Replenish and diversify portfolio ~$5B debt paid in 2022 Maintain strong investment-grade credit rating Continued annual dividend growth* 14th consecutive dividend increase announced Dec

’22 Capital Allocation Flexibility for continued opportunistic share repurchase - $9.5B remaining authorization1