| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

| Registrant's telephone number including area code | ||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| ☒ | Accelerated filer | ☐ | ||||||||||||||||||

| Non-accelerated filer | ¨ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

| PAGE | ||||||||

| PART I | ||||||||

| Item 1 | ||||||||

| Item 1A | ||||||||

| Item 1B | ||||||||

| Item 2 | ||||||||

| Item 3 | ||||||||

| Item 4 | ||||||||

| PART II | ||||||||

| Item 5 | ||||||||

| Item 6 | ||||||||

| Item 7 | ||||||||

| Item 7A | ||||||||

| Item 8 | ||||||||

| Item 9 | ||||||||

| Item 9A | ||||||||

| Item 9B | ||||||||

| Item 9C | ||||||||

| PART III | ||||||||

| Item 10 | ||||||||

| Item 11 | ||||||||

| Item 12 | ||||||||

| Item 13 | ||||||||

| Item 14 | ||||||||

| PART IV | ||||||||

| Item 15 | ||||||||

| Item 16 | ||||||||

| Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | |||||||||||||||||||||||||||

| Weighted average | 83.2 | % | 78.7 | % | 75.3 | % | 72.7 | % | 69.6 | % | 70.5 | % | 72.5 | % | 73.5 | % | 73.4 | % | 74.6 | % | 76.4 | % | 77.1 | % | ||||||||||||||

| Quarter end | 82.2 | % | 77.8 | % | 75.0 | % | 71.5 | % | 70.6 | % | 72.6 | % | 74.2 | % | 74.5 | % | 75.0 | % | 76.6 | % | 78.4 | % | 78.1 | % | ||||||||||||||

| Jan 2022 | Feb 2022 | Mar 2022 | Apr 2022 | May 2022 | Jun 2022 | Jul 2022 | Aug 2022 | Sep 2022 | Oct 2022 | Nov 2022 | Dec 2022 | Jan 2023 | |||||||||||||||||||||||||||||

| Weighted average | 73.4 | % | 73.3 | % | 73.6 | % | 73.9 | % | 74.6 | % | 75.2 | % | 75.9 | % | 76.4 | % | 76.9 | % | 77.2 | % | 77.0 | % | 77.0 | % | 76.6 | % | |||||||||||||||

| Month end | 74.2 | % | 74.4 | % | 75.0 | % | 75.3 | % | 76.2 | % | 76.6 | % | 77.1 | % | 77.9 | % | 78.4 | % | 78.2 | % | 78.1 | % | 78.1 | % | 77.6 | % | |||||||||||||||

| Communities | Units | % of Total Units | Average Number of Units per Community | |||||||||||||||||||||||

| Independent Living | 68 | 12,569 | 22.1 | % | 185 | |||||||||||||||||||||

| Assisted Living and Memory Care | 554 | 34,407 | 60.5 | % | 62 | |||||||||||||||||||||

| CCRCs | 19 | 5,191 | 9.1 | % | 273 | |||||||||||||||||||||

| All Other | 32 | 4,725 | 8.3 | % | 148 | |||||||||||||||||||||

| Total | 673 | 56,892 | 100.0 | % | 85 | |||||||||||||||||||||

| (in thousands) | Resident Fee and Management Fee Revenue | % of Total | ||||||||||||

| Independent Living | $ | 507,793 | 19.5 | % | ||||||||||

| Assisted Living and Memory Care | 1,755,092 | 67.6 | % | |||||||||||

| CCRCs | 322,644 | 12.4 | % | |||||||||||

| All Other | 12,020 | 0.5 | % | |||||||||||

| Total resident fee and management fee revenue | $ | 2,597,549 | 100.0 | % | ||||||||||

| Number of Communities | ||||||||||||||||||||||||||||||||

| State | Units | Owned | Leased | Managed | Total | |||||||||||||||||||||||||||

| Texas | 8,018 | 56 | 19 | 11 | 86 | |||||||||||||||||||||||||||

| Florida | 6,083 | 43 | 29 | — | 72 | |||||||||||||||||||||||||||

| California | 5,214 | 27 | 15 | 2 | 44 | |||||||||||||||||||||||||||

| North Carolina | 3,401 | 7 | 50 | — | 57 | |||||||||||||||||||||||||||

| Colorado | 3,367 | 13 | 11 | 5 | 29 | |||||||||||||||||||||||||||

| Ohio | 2,887 | 15 | 14 | 6 | 35 | |||||||||||||||||||||||||||

| Illinois | 2,816 | 3 | 9 | 1 | 13 | |||||||||||||||||||||||||||

| Washington | 2,705 | 13 | 18 | — | 31 | |||||||||||||||||||||||||||

| Arizona | 2,054 | 17 | 9 | — | 26 | |||||||||||||||||||||||||||

| Oregon | 1,805 | 12 | 11 | — | 23 | |||||||||||||||||||||||||||

| Michigan | 1,678 | 9 | 22 | — | 31 | |||||||||||||||||||||||||||

| Tennessee | 1,506 | 16 | 6 | 1 | 23 | |||||||||||||||||||||||||||

| New York | 1,498 | 10 | 9 | 2 | 21 | |||||||||||||||||||||||||||

| Kansas | 1,117 | 8 | 10 | — | 18 | |||||||||||||||||||||||||||

| New Jersey | 1,024 | 7 | 5 | — | 12 | |||||||||||||||||||||||||||

| Virginia | 964 | 7 | 3 | — | 10 | |||||||||||||||||||||||||||

| Massachusetts | 899 | 3 | 3 | — | 6 | |||||||||||||||||||||||||||

| Pennsylvania | 766 | 7 | 3 | — | 10 | |||||||||||||||||||||||||||

| Alabama | 732 | 4 | — | — | 4 | |||||||||||||||||||||||||||

| Oklahoma | 688 | 3 | 15 | — | 18 | |||||||||||||||||||||||||||

| Georgia | 656 | 8 | — | — | 8 | |||||||||||||||||||||||||||

| South Carolina | 611 | 4 | 6 | 1 | 11 | |||||||||||||||||||||||||||

| Louisiana | 606 | 6 | — | 1 | 7 | |||||||||||||||||||||||||||

| Connecticut | 590 | 2 | 3 | — | 5 | |||||||||||||||||||||||||||

| Idaho | 548 | 6 | 1 | — | 7 | |||||||||||||||||||||||||||

| Minnesota | 538 | — | 12 | — | 12 | |||||||||||||||||||||||||||

| Wisconsin | 485 | 5 | 7 | — | 12 | |||||||||||||||||||||||||||

| Missouri | 479 | 2 | — | 1 | 3 | |||||||||||||||||||||||||||

| New Mexico | 426 | 2 | 1 | — | 3 | |||||||||||||||||||||||||||

| Rhode Island | 396 | 3 | — | — | 3 | |||||||||||||||||||||||||||

| Mississippi | 386 | 5 | — | — | 5 | |||||||||||||||||||||||||||

| Indiana | 373 | 4 | 4 | — | 8 | |||||||||||||||||||||||||||

| Maryland | 359 | 3 | — | 1 | 4 | |||||||||||||||||||||||||||

| Arkansas | 332 | 4 | — | — | 4 | |||||||||||||||||||||||||||

| Nevada | 257 | 4 | — | — | 4 | |||||||||||||||||||||||||||

| Kentucky | 163 | 2 | — | — | 2 | |||||||||||||||||||||||||||

| Delaware | 105 | 2 | — | — | 2 | |||||||||||||||||||||||||||

| Vermont | 101 | 1 | — | — | 1 | |||||||||||||||||||||||||||

| West Virginia | 93 | 1 | — | — | 1 | |||||||||||||||||||||||||||

| New Hampshire | 90 | 1 | — | — | 1 | |||||||||||||||||||||||||||

| Montana | 76 | 1 | — | — | 1 | |||||||||||||||||||||||||||

| Total | 56,892 | 346 | 295 | 32 | 673 | |||||||||||||||||||||||||||

| December 2022 occupancy rate (weighted average) | 76.4 | % | 78.0 | % | 74.3 | % | 76.8 | % | ||||||||||||||||||||||||

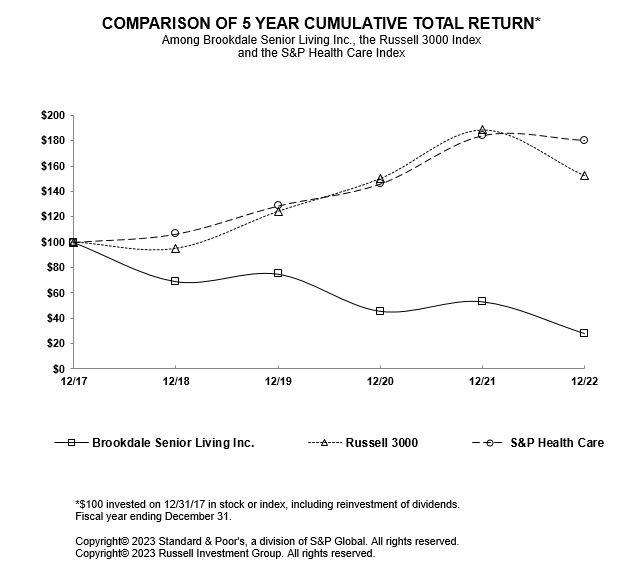

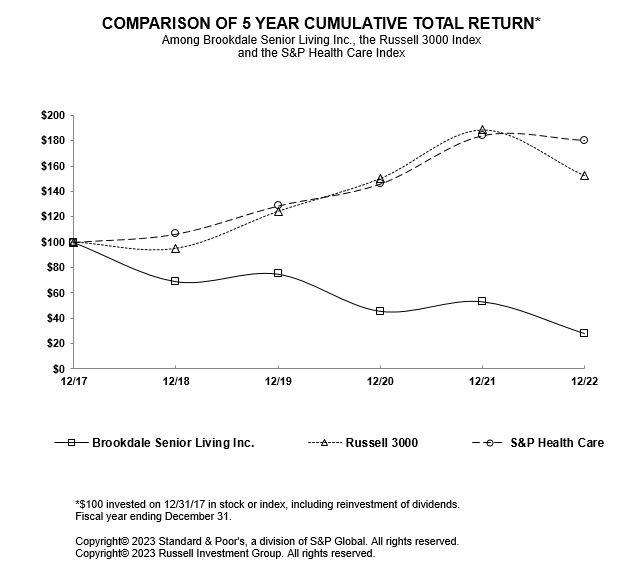

| 12/17 | 12/18 | 12/19 | 12/20 | 12/21 | 12/22 | |||||||||||||||||||||||||||||||||

| Brookdale Senior Living Inc. | $ | 100.00 | $ | 69.07 | $ | 74.95 | $ | 45.67 | $ | 53.20 | $ | 28.14 | ||||||||||||||||||||||||||

| Russell 3000 | 100.00 | 94.76 | 124.15 | 150.08 | 188.60 | 152.37 | ||||||||||||||||||||||||||||||||

| S&P Health Care | 100.00 | 106.47 | 128.64 | 145.93 | 184.07 | 180.47 | ||||||||||||||||||||||||||||||||

| Period | Total Number of Shares Purchased (1) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (in thousands) (2) | ||||||||||||||||||||||

| 10/1/2022 - 10/31/2022 | — | $ | — | — | $ | 44,026 | ||||||||||||||||||||

| 11/1/2022 - 11/30/2022 | 3,366 | $ | 3.14 | — | $ | 44,026 | ||||||||||||||||||||

| 12/1/2022 - 12/31/2022 | — | $ | — | — | $ | 44,026 | ||||||||||||||||||||

| Total | 3,366 | $ | 3.14 | — | ||||||||||||||||||||||

| Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | |||||||||||||||||||||||||||

| Weighted average | 83.2 | % | 78.7 | % | 75.3 | % | 72.7 | % | 69.6 | % | 70.5 | % | 72.5 | % | 73.5 | % | 73.4 | % | 74.6 | % | 76.4 | % | 77.1 | % | ||||||||||||||

| Quarter end | 82.2 | % | 77.8 | % | 75.0 | % | 71.5 | % | 70.6 | % | 72.6 | % | 74.2 | % | 74.5 | % | 75.0 | % | 76.6 | % | 78.4 | % | 78.1 | % | ||||||||||||||

| Jan 2022 | Feb 2022 | Mar 2022 | Apr 2022 | May 2022 | Jun 2022 | Jul 2022 | Aug 2022 | Sep 2022 | Oct 2022 | Nov 2022 | Dec 2022 | Jan 2023 | |||||||||||||||||||||||||||||

| Weighted average | 73.4 | % | 73.3 | % | 73.6 | % | 73.9 | % | 74.6 | % | 75.2 | % | 75.9 | % | 76.4 | % | 76.9 | % | 77.2 | % | 77.0 | % | 77.0 | % | 76.6 | % | |||||||||||||||

| Month end | 74.2 | % | 74.4 | % | 75.0 | % | 75.3 | % | 76.2 | % | 76.6 | % | 77.1 | % | 77.9 | % | 78.4 | % | 78.2 | % | 78.1 | % | 78.1 | % | 77.6 | % | |||||||||||||||

| Years Ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Resident fee revenue attributable to Health Care Services and disposed communities | $ | 6,578 | $ | 202,337 | $ | 437,598 | |||||||||||

| Facility operating expense attributable to Health Care Services and disposed communities | 6,408 | 199,366 | 455,435 | ||||||||||||||

| Years Ended December 31, | Increase (Decrease) | ||||||||||||||||||||||

| (in thousands) | 2022 | 2021 | Amount | Percent | |||||||||||||||||||

| Total resident fees and management fees revenue | $ | 2,597,549 | $ | 2,564,446 | $ | 33,103 | 1.3 | % | |||||||||||||||

| Other operating income | 80,469 | 12,368 | 68,101 | NM | |||||||||||||||||||

| Facility operating expense | 2,083,605 | 2,075,863 | 7,742 | 0.4 | % | ||||||||||||||||||

| Net income (loss) | (238,340) | (99,364) | 138,976 | 139.9 | % | ||||||||||||||||||

| Adjusted EBITDA | 241,305 | 138,476 | 102,829 | 74.3 | % | ||||||||||||||||||

| (in thousands, except communities, units, occupancy, RevPAR, and RevPOR) | Years Ended December 31, | Increase (Decrease) | |||||||||||||||||||||

| 2022 | 2021 | Amount | Percent | ||||||||||||||||||||

| Resident fees | $ | 2,585,529 | $ | 2,369,684 | $ | 215,845 | 9.1 | % | |||||||||||||||

| Other operating income | $ | 80,469 | $ | 9,263 | $ | 71,206 | NM | ||||||||||||||||

| Facility operating expense | $ | 2,083,605 | $ | 1,904,410 | $ | 179,195 | 9.4 | % | |||||||||||||||

| Number of communities (period end) | 641 | 646 | (5) | (0.8) | % | ||||||||||||||||||

| Total average units | 52,320 | 52,840 | (520) | (1.0) | % | ||||||||||||||||||

| RevPAR | $ | 4,113 | $ | 3,734 | $ | 379 | 10.1 | % | |||||||||||||||

| Occupancy rate (weighted average) | 75.4 | % | 71.5 | % | 390 | bps | n/a | ||||||||||||||||

| RevPOR | $ | 5,457 | $ | 5,221 | $ | 236 | 4.5 | % | |||||||||||||||

| Same Community Operating Results and Data | |||||||||||||||||||||||

| Resident fees | $ | 2,495,297 | $ | 2,263,996 | $ | 231,301 | 10.2 | % | |||||||||||||||

| Other operating income | $ | 77,627 | $ | 8,423 | $ | 69,204 | NM | ||||||||||||||||

| Facility operating expense | $ | 1,991,277 | $ | 1,803,891 | $ | 187,386 | 10.4 | % | |||||||||||||||

| Number of communities | 632 | 632 | — | — | % | ||||||||||||||||||

| Total average units | 50,553 | 50,555 | (2) | — | % | ||||||||||||||||||

| RevPAR | $ | 4,113 | $ | 3,732 | $ | 381 | 10.2 | % | |||||||||||||||

| Occupancy rate (weighted average) | 75.4 | % | 71.5 | % | 390 | bps | n/a | ||||||||||||||||

| RevPOR | $ | 5,453 | $ | 5,220 | $ | 233 | 4.5 | % | |||||||||||||||

| (in thousands, except communities, units, occupancy, RevPAR, and RevPOR) | Years Ended December 31, | Increase (Decrease) | |||||||||||||||||||||

| 2022 | 2021 | Amount | Percent | ||||||||||||||||||||

| Resident fees | $ | 507,793 | $ | 475,538 | $ | 32,255 | 6.8 | % | |||||||||||||||

| Other operating income | $ | 10,906 | $ | 1,512 | $ | 9,394 | NM | ||||||||||||||||

| Facility operating expense | $ | 359,749 | $ | 330,942 | $ | 28,807 | 8.7 | % | |||||||||||||||

| Number of communities (period end) | 68 | 68 | — | — | % | ||||||||||||||||||

| Total average units | 12,569 | 12,556 | 13 | 0.1 | % | ||||||||||||||||||

| RevPAR | $ | 3,367 | $ | 3,156 | $ | 211 | 6.7 | % | |||||||||||||||

| Occupancy rate (weighted average) | 77.0 | % | 74.2 | % | 280 | bps | n/a | ||||||||||||||||

| RevPOR | $ | 4,371 | $ | 4,252 | $ | 119 | 2.8 | % | |||||||||||||||

| Same Community Operating Results and Data | |||||||||||||||||||||||

| Resident fees | $ | 501,115 | $ | 470,072 | $ | 31,043 | 6.6 | % | |||||||||||||||

| Other operating income | $ | 10,649 | $ | 1,492 | $ | 9,157 | NM | ||||||||||||||||

| Facility operating expense | $ | 353,334 | $ | 326,695 | $ | 26,639 | 8.2 | % | |||||||||||||||

| Number of communities | 67 | 67 | — | — | % | ||||||||||||||||||

| Total average units | 12,379 | 12,376 | 3 | — | % | ||||||||||||||||||

| RevPAR | $ | 3,373 | $ | 3,165 | $ | 208 | 6.6 | % | |||||||||||||||

| Occupancy rate (weighted average) | 77.0 | % | 74.2 | % | 280 | bps | n/a | ||||||||||||||||

| RevPOR | $ | 4,384 | $ | 4,269 | $ | 115 | 2.7 | % | |||||||||||||||

| (in thousands, except communities, units, occupancy, RevPAR, and RevPOR) | Years Ended December 31, | Increase (Decrease) | |||||||||||||||||||||

| 2022 | 2021 | Amount | Percent | ||||||||||||||||||||

| Resident fees | $ | 1,755,092 | $ | 1,589,721 | $ | 165,371 | 10.4 | % | |||||||||||||||

| Other operating income | $ | 60,630 | $ | 5,963 | $ | 54,667 | NM | ||||||||||||||||

| Facility operating expense | $ | 1,435,764 | $ | 1,301,364 | $ | 134,400 | 10.3 | % | |||||||||||||||

| Number of communities (period end) | 554 | 559 | (5) | (0.9) | % | ||||||||||||||||||

| Total average units | 34,555 | 34,977 | (422) | (1.2) | % | ||||||||||||||||||

| RevPAR | $ | 4,230 | $ | 3,787 | $ | 443 | 11.7 | % | |||||||||||||||

| Occupancy rate (weighted average) | 75.1 | % | 70.7 | % | 440 | bps | n/a | ||||||||||||||||

| RevPOR | $ | 5,636 | $ | 5,357 | $ | 279 | 5.2 | % | |||||||||||||||

| Same Community Operating Results and Data | |||||||||||||||||||||||

| Resident fees | $ | 1,737,704 | $ | 1,558,719 | $ | 178,985 | 11.5 | % | |||||||||||||||

| Other operating income | $ | 60,207 | $ | 5,751 | $ | 54,456 | NM | ||||||||||||||||

| Facility operating expense | $ | 1,412,729 | $ | 1,271,372 | $ | 141,357 | 11.1 | % | |||||||||||||||

| Number of communities | 550 | 550 | — | — | % | ||||||||||||||||||

| Total average units | 34,204 | 34,204 | — | — | % | ||||||||||||||||||

| RevPAR | $ | 4,234 | $ | 3,798 | $ | 436 | 11.5 | % | |||||||||||||||

| Occupancy rate (weighted average) | 75.1 | % | 70.7 | % | 440 | bps | n/a | ||||||||||||||||

| RevPOR | $ | 5,641 | $ | 5,376 | $ | 265 | 4.9 | % | |||||||||||||||

| (in thousands, except communities, units, occupancy, RevPAR, and RevPOR) | Years Ended December 31, | Increase (Decrease) | |||||||||||||||||||||

| 2022 | 2021 | Amount | Percent | ||||||||||||||||||||

| Resident fees | $ | 322,644 | $ | 304,425 | $ | 18,219 | 6.0 | % | |||||||||||||||

| Other operating income | $ | 8,933 | $ | 1,788 | $ | 7,145 | NM | ||||||||||||||||

| Facility operating expense | $ | 288,092 | $ | 272,104 | $ | 15,988 | 5.9 | % | |||||||||||||||

| Number of communities (period end) | 19 | 19 | — | — | % | ||||||||||||||||||

| Total average units | 5,196 | 5,307 | (111) | (2.1) | % | ||||||||||||||||||

| RevPAR | $ | 5,138 | $ | 4,753 | $ | 385 | 8.1 | % | |||||||||||||||

| Occupancy rate (weighted average) | 73.4 | % | 70.6 | % | 280 | bps | n/a | ||||||||||||||||

| RevPOR | $ | 6,997 | $ | 6,733 | $ | 264 | 3.9 | % | |||||||||||||||

| Same Community Operating Results and Data | |||||||||||||||||||||||

| Resident fees | $ | 256,478 | $ | 235,205 | $ | 21,273 | 9.0 | % | |||||||||||||||

| Other operating income | $ | 6,771 | $ | 1,180 | $ | 5,591 | NM | ||||||||||||||||

| Facility operating expense | $ | 225,214 | $ | 205,824 | $ | 19,390 | 9.4 | % | |||||||||||||||

| Number of communities | 15 | 15 | — | — | % | ||||||||||||||||||

| Total average units | 3,970 | 3,975 | (5) | (0.1) | % | ||||||||||||||||||

| RevPAR | $ | 5,384 | $ | 4,931 | $ | 453 | 9.2 | % | |||||||||||||||

| Occupancy rate (weighted average) | 74.0 | % | 70.6 | % | 340 | bps | n/a | ||||||||||||||||

| RevPOR | $ | 7,279 | $ | 6,987 | $ | 292 | 4.2 | % | |||||||||||||||

| (in thousands) | Years Ended December 31, | Increase (Decrease) | |||||||||||||||||||||

| 2022 | 2021 | Amount | Percent | ||||||||||||||||||||

| Management fees | $ | 12,020 | $ | 20,598 | $ | (8,578) | (41.6) | % | |||||||||||||||

| Reimbursed costs incurred on behalf of managed communities | 147,361 | 181,445 | (34,084) | (18.8) | % | ||||||||||||||||||

| Costs incurred on behalf of managed communities | 147,361 | 181,445 | (34,084) | (18.8) | % | ||||||||||||||||||

| General and administrative expense | 168,594 | 184,916 | (16,322) | (8.8) | % | ||||||||||||||||||

| Facility operating lease expense | 165,294 | 174,358 | (9,064) | (5.2) | % | ||||||||||||||||||

| Depreciation and amortization | 347,444 | 337,613 | 9,831 | 2.9 | % | ||||||||||||||||||

| Asset impairment | 29,618 | 23,003 | 6,615 | 28.8 | % | ||||||||||||||||||

| Loss (gain) on sale of communities, net | (73,850) | — | 73,850 | NM | |||||||||||||||||||

| Loss (gain) on facility operating lease termination, net | — | (2,003) | (2,003) | NM | |||||||||||||||||||

| Interest income | 6,935 | 1,349 | 5,586 | NM | |||||||||||||||||||

| Interest expense | 204,717 | 195,140 | 9,577 | 4.9 | % | ||||||||||||||||||

Gain (loss) on debt modification and extinguishment, net | (1,357) | (1,932) | (575) | (29.8) | % | ||||||||||||||||||

| Equity in earnings (loss) of unconsolidated ventures | (10,782) | 10,394 | (21,176) | NM | |||||||||||||||||||

| Non-operating gain (loss) on sale of assets, net | 595 | 288,835 | (288,240) | (99.8) | % | ||||||||||||||||||

| Other non-operating income (loss) | 12,114 | 5,903 | 6,211 | 105.2 | % | ||||||||||||||||||

| Benefit (provision) for income taxes | 1,559 | 8,163 | (6,604) | (80.9) | % | ||||||||||||||||||

| Years Ended December 31, | Increase (Decrease) | ||||||||||||||||||||||

| (in thousands) | 2022 | 2021 | Amount | Percent | |||||||||||||||||||

| Net cash provided by (used in) operating activities | $ | 3,281 | $ | (94,634) | $ | 97,915 | NM | ||||||||||||||||

| Net cash provided by (used in) investing activities | (67,429) | 181,457 | (248,886) | NM | |||||||||||||||||||

| Net cash provided by (used in) financing activities | 100,382 | (113,657) | 214,039 | NM | |||||||||||||||||||

Net increase (decrease) in cash, cash equivalents, and restricted cash | 36,234 | (26,834) | 63,068 | NM | |||||||||||||||||||

| Cash, cash equivalents, and restricted cash at beginning of year | 438,314 | 465,148 | (26,834) | (5.8) | % | ||||||||||||||||||

| Cash, cash equivalents, and restricted cash at end of year | $ | 474,548 | $ | 438,314 | $ | 36,234 | 8.3 | % | |||||||||||||||

| Adjusted Free Cash Flow | $ | (201,385) | $ | (286,694) | $ | 85,309 | 29.8 | % | |||||||||||||||

| (in millions) | |||||

Community-level capital expenditures, net (1) | $ | 138.7 | |||

Corporate capital expenditures, net (2) | 29.5 | ||||

Non-development capital expenditures, net (3) | 168.2 | ||||

| Development capital expenditures, net | 6.2 | ||||

| Total capital expenditures, net | $ | 174.4 | |||

Years Ending December 31, | Long-term Debt | Weighted Rate | ||||||

| 2023 | $ | 73,176 | 6.47 | % | ||||

| 2024 | 310,214 | 4.70 | % | |||||

| 2025 | 573,885 | 6.41 | % | |||||

| 2026 | 304,779 | 2.64 | % | |||||

| 2027 | 959,872 | 5.53 | % | |||||

| Thereafter | 1,658,082 | 4.81 | % | |||||

| Total obligations | 3,880,008 | 5.08 | % | |||||

| Less amount representing deferred financing costs, net | (29,866) | |||||||

| Total | $ | 3,850,142 | ||||||

Years Ending December 31, | Community Count | Total Units | ||||||||||||

| 2023 | 35 | 1,468 | ||||||||||||

| 2024 | 7 | 904 | ||||||||||||

| 2025 | 121 | 10,289 | ||||||||||||

| 2026 | 41 | 1,994 | ||||||||||||

| 2027 | 24 | 2,555 | ||||||||||||

| Thereafter | 67 | 3,360 | ||||||||||||

| Total | 295 | 20,570 | ||||||||||||

| Years Ending December 31, | Operating Lease Payments | Financing Lease Payments | Total Minimum Lease Payments | ||||||||

| 2023 | $ | 233.4 | $ | 48.6 | $ | 282.0 | |||||

| 2024 | 219.3 | 49.3 | 268.6 | ||||||||

| 2025 | 217.5 | 37.2 | 254.7 | ||||||||

| 2026 | 102.7 | 37.9 | 140.6 | ||||||||

| 2027 | 99.6 | 5.8 | 105.4 | ||||||||

| Thereafter | 135.3 | 24.2 | 159.5 | ||||||||

| Total minimum lease payments | $ | 1,007.8 | $ | 203.0 | $ | 1,210.8 | |||||

| Payments Due during the Years Ending December 31, | |||||||||||||||||||||||||||||||||||||||||

| (in millions) | 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | Total | ||||||||||||||||||||||||||||||||||

Principal on long-term debt(1) | $ | 73.2 | $ | 310.2 | $ | 573.9 | $ | 304.8 | $ | 959.9 | $ | 1,658.0 | $ | 3,880.0 | |||||||||||||||||||||||||||

Interest on long-term debt(2) | 196.8 | 190.9 | 167.0 | 140.5 | 113.8 | 140.8 | 949.8 | ||||||||||||||||||||||||||||||||||

| Long-term debt obligations | 270.0 | 501.1 | 740.9 | 445.3 | 1,073.7 | 1,798.8 | 4,829.8 | ||||||||||||||||||||||||||||||||||

Lease obligations(3) | 282.0 | 268.6 | 254.7 | 140.6 | 105.4 | 159.5 | 1,210.8 | ||||||||||||||||||||||||||||||||||

| Total long-term debt and lease obligations | $ | 552.0 | $ | 769.7 | $ | 995.6 | $ | 585.9 | $ | 1,179.1 | $ | 1,958.3 | $ | 6,040.6 | |||||||||||||||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Operating lease right-of-use assets | $ | 13.7 | $ | 16.6 | $ | 76.3 | |||||||||||

| Property, plant and equipment and leasehold intangibles, net | 15.9 | 6.4 | 29.3 | ||||||||||||||

| Total | $ | 29.6 | $ | 23.0 | $ | 105.6 | |||||||||||

| Years Ended December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Net income (loss) | $ | (238,340) | $ | (99,364) | |||||||

| Provision (benefit) for income taxes | (1,559) | (8,163) | |||||||||

| Equity in (earnings) loss of unconsolidated ventures | 10,782 | (10,394) | |||||||||

| Loss (gain) on debt modification and extinguishment, net | 1,357 | 1,932 | |||||||||

| Non-operating loss (gain) on sale of assets, net | (595) | (288,835) | |||||||||

| Other non-operating (income) loss | (12,114) | (5,903) | |||||||||

| Interest expense | 204,717 | 195,140 | |||||||||

| Interest income | (6,935) | (1,349) | |||||||||

| Income (loss) from operations | (42,687) | (216,936) | |||||||||

| Depreciation and amortization | 347,444 | 337,613 | |||||||||

| Asset impairment | 29,618 | 23,003 | |||||||||

| Loss (gain) on sale of communities, net | (73,850) | — | |||||||||

| Loss (gain) on facility operating lease termination, net | — | (2,003) | |||||||||

| Operating lease expense adjustment | (34,896) | (23,280) | |||||||||

| Non-cash stock-based compensation expense | 14,466 | 16,270 | |||||||||

| Transaction and organizational restructuring costs | 1,210 | 3,809 | |||||||||

Adjusted EBITDA(1) | $ | 241,305 | $ | 138,476 | |||||||

| Years Ended December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Net cash provided by (used in) operating activities | $ | 3,281 | $ | (94,634) | |||||||

| Net cash provided by (used in) investing activities | (67,429) | 181,457 | |||||||||

| Net cash provided by (used in) financing activities | 100,382 | (113,657) | |||||||||

Net increase (decrease) in cash, cash equivalents, and restricted cash | $ | 36,234 | $ | (26,834) | |||||||

| Net cash provided by (used in) operating activities | $ | 3,281 | $ | (94,634) | |||||||

| Distributions from unconsolidated ventures from cumulative share of net earnings | (561) | (6,191) | |||||||||

| Changes in operating lease assets and liabilities for lease termination | — | 2,380 | |||||||||

| Changes in assets and liabilities for lessor capital expenditure reimbursements under operating leases | (13,718) | (30,965) | |||||||||

| Non-development capital expenditures, net | (168,166) | (137,410) | |||||||||

| Payment of financing lease obligations | (22,221) | (19,874) | |||||||||

Adjusted Free Cash Flow(1) | $ | (201,385) | $ | (286,694) | |||||||

Increase in Index (in basis points) | Annual Interest Expense Increase (1) (in millions) | |||||||

| 100 | $ | 4.4 | ||||||

| 200 | 6.1 | |||||||

| 500 | 10.9 | |||||||

| 1,000 | 17.5 | |||||||

| PAGE | |||||

Report of Independent Registered Public Accounting Firm (PCAOB ID: | |||||

Report of Independent Registered Public Accounting Firm (PCAOB ID: | |||||

| Evaluation of Property, Plant and Equipment and Leasehold Intangibles, Net and Operating Lease Right-of-Use Assets for Impairment | |||||

| Description of the Matter | As of December 31, 2022, the Company's consolidated balance sheet included property, plant and equipment and leasehold intangibles, net and operating lease right-of-use assets of $4.5 billion and $0.6 billion, respectively. As discussed in Notes 2 and 5 to the consolidated financial statements, property, plant and equipment and leasehold intangibles, net and operating lease right-of-use assets are routinely evaluated for indicators of impairment. For property, plant and equipment and leasehold intangibles, net and operating lease right-of-use assets with indicators of impairment, the Company compares the estimated undiscounted future cash flows of each long-lived asset group to its carrying amount. If the long-lived asset group's carrying amount exceeds its estimated undiscounted future cash flows, the fair value of the long-lived asset group is then estimated by management and compared to its carrying amount. An impairment charge is recognized on these long-lived assets when carrying amount exceeds fair value. Auditing management's evaluation of property, plant and equipment and leasehold intangibles, net and operating lease right-of-use assets for impairment was complex and involved a high degree of subjectivity due to the significant estimation required to determine the estimated undiscounted future cash flows and fair values of long-lived asset groups where indicators of impairment were determined to be present. In particular, the future cash flows and fair value estimates were sensitive to significant assumptions including the estimation of revenue and expense growth rates and capitalization rates, which are affected by expectations about future market or economic conditions. | ||||

| How We Addressed the Matter in Our Audit | We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the Company's process to evaluate property, plant and equipment and leasehold intangibles, net and operating lease right-of-use assets for impairment, including controls over management's review of the significant assumptions described above. To test the Company's evaluation of long-lived asset groups for impairment, we performed audit procedures that included, among others, assessing the methodologies used to estimate future cash flows and estimate fair values, testing the significant assumptions used to develop the estimates of future cash flows and fair values, and testing the completeness and accuracy of the underlying data used by the Company in its analysis. We compared the significant assumptions used by management to current industry and economic trends and evaluated whether changes to the Company's business and other relevant factors would affect the significant assumptions. The evaluation of the Company's methodology and key assumptions was performed with the assistance of our valuation specialists. We assessed the historical accuracy of the Company's estimates and performed sensitivity analyses of significant assumptions to evaluate the changes in the undiscounted future cash flows and fair values of the long-lived asset groups that would result from changes in the key assumptions. | ||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Marketable securities | |||||||||||

| Restricted cash | |||||||||||

| Accounts receivable, net | |||||||||||

| Assets held for sale | |||||||||||

| Prepaid expenses and other current assets, net | |||||||||||

| Total current assets | |||||||||||

| Property, plant and equipment and leasehold intangibles, net | |||||||||||

| Operating lease right-of-use assets | |||||||||||

| Restricted cash | |||||||||||

| Investment in unconsolidated ventures | |||||||||||

| Goodwill | |||||||||||

| Deferred tax asset | |||||||||||

| Other assets, net | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and Equity | |||||||||||

| Current liabilities | |||||||||||

| Current portion of long-term debt | $ | $ | |||||||||

| Current portion of financing lease obligations | |||||||||||

| Current portion of operating lease obligations | |||||||||||

| Trade accounts payable | |||||||||||

| Accrued expenses | |||||||||||

| Refundable fees and deferred revenue | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt, less current portion | |||||||||||

| Financing lease obligations, less current portion | |||||||||||

| Operating lease obligations, less current portion | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

Preferred stock, $ | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in-capital | |||||||||||

Treasury stock, at cost; | ( | ( | |||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total Brookdale Senior Living Inc. stockholders' equity | |||||||||||

| Noncontrolling interest | |||||||||||

| Total equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

| For the Years Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Resident fees | $ | $ | $ | ||||||||||||||

| Management fees | |||||||||||||||||

| Reimbursed costs incurred on behalf of managed communities | |||||||||||||||||

| Other operating income | |||||||||||||||||

| Total revenue and other operating income | |||||||||||||||||

Facility operating expense (excluding facility depreciation and amortization of $ | |||||||||||||||||

General and administrative expense (including non-cash stock-based compensation expense of $ | |||||||||||||||||

| Facility operating lease expense | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Asset impairment | |||||||||||||||||

| Loss (gain) on sale of communities, net | ( | ||||||||||||||||

| Loss (gain) on facility operating lease termination, net | ( | ( | |||||||||||||||

| Costs incurred on behalf of managed communities | |||||||||||||||||

| Income (loss) from operations | ( | ( | ( | ||||||||||||||

| Interest income | |||||||||||||||||

| Interest expense: | |||||||||||||||||

| Debt | ( | ( | ( | ||||||||||||||

| Financing lease obligations | ( | ( | ( | ||||||||||||||

| Amortization of deferred financing costs | ( | ( | ( | ||||||||||||||

| Change in fair value of derivatives | ( | ( | |||||||||||||||

| Gain (loss) on debt modification and extinguishment, net | ( | ( | |||||||||||||||

| Equity in earnings (loss) of unconsolidated ventures | ( | ( | |||||||||||||||

| Non-operating gain (loss) on sale of assets, net | |||||||||||||||||

| Other non-operating income (loss) | |||||||||||||||||

| Income (loss) before income taxes | ( | ( | |||||||||||||||

| Benefit (provision) for income taxes | ( | ||||||||||||||||

| Net income (loss) | ( | ( | |||||||||||||||

| Net (income) loss attributable to noncontrolling interest | ( | ||||||||||||||||

| Net income (loss) attributable to Brookdale Senior Living Inc. common stockholders | $ | ( | $ | ( | $ | ||||||||||||

| Net income (loss) per share attributable to Brookdale Senior Living Inc. common stockholders: | |||||||||||||||||

| Basic | $ | ( | $ | ( | $ | ||||||||||||

| Diluted | $ | ( | $ | ( | $ | ||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||

| Basic | |||||||||||||||||

| Diluted | |||||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Total equity, balance at beginning of period | $ | $ | $ | ||||||||||||||

| Common stock: | |||||||||||||||||

| Balance at beginning of period | $ | $ | $ | ||||||||||||||

| Issuance of common stock under Associate Stock Purchase Plan | — | — | |||||||||||||||

| Restricted stock and restricted stock units, net | ( | ( | |||||||||||||||

| Shares withheld for employee taxes | ( | ( | ( | ||||||||||||||

| Balance at end of period | $ | $ | $ | ||||||||||||||

| Additional paid-in-capital: | |||||||||||||||||

| Balance at beginning of period | $ | $ | $ | ||||||||||||||

| Compensation expense related to restricted stock grants | |||||||||||||||||

| Issuance of common stock under Associate Stock Purchase Plan | — | ||||||||||||||||

| Issuance of tangible equity units, net of issuance costs | — | — | |||||||||||||||

| Purchase of capped call transactions | — | ( | — | ||||||||||||||

| Issuance of warrants | — | — | |||||||||||||||

| Restricted stock and restricted stock units, net | ( | ||||||||||||||||

| Shares withheld for employee taxes | ( | ( | ( | ||||||||||||||

| Other, net | — | ||||||||||||||||

| Balance at end of period | $ | $ | $ | ||||||||||||||

| Treasury stock: | |||||||||||||||||

| Balance at beginning of period | $ | ( | $ | ( | $ | ( | |||||||||||

| Purchase of treasury stock | — | — | ( | ||||||||||||||

| Balance at end of period | $ | ( | $ | ( | $ | ( | |||||||||||

| Accumulated deficit: | |||||||||||||||||

| Balance at beginning of period | $ | ( | $ | ( | $ | ( | |||||||||||

| Cumulative effect of change in accounting principle | — | — | ( | ||||||||||||||

| Net income (loss) | ( | ( | |||||||||||||||

| Balance at end of period | $ | ( | $ | ( | $ | ( | |||||||||||

| Noncontrolling interest: | |||||||||||||||||

| Balance at beginning of period | $ | $ | $ | ||||||||||||||

| Net income (loss) attributable to noncontrolling interest | ( | ( | |||||||||||||||

| Noncontrolling interest distribution | ( | — | — | ||||||||||||||

| Balance at end of period | $ | $ | $ | ||||||||||||||

| Total equity, balance at end of period | $ | $ | $ | ||||||||||||||

| Common stock share activity | |||||||||||||||||

| Outstanding shares of common stock: | |||||||||||||||||

| Balance at beginning of period | |||||||||||||||||

| Issuance of common stock under Associate Stock Purchase Plan | — | ||||||||||||||||

| Restricted stock and restricted stock units, net | ( | ( | |||||||||||||||

| Shares withheld for employee taxes | ( | ( | ( | ||||||||||||||

| Purchase of treasury stock | — | — | ( | ||||||||||||||

| Balance at end of period | |||||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Cash Flows from Operating Activities | |||||||||||||||||

| Net income (loss) | $ | ( | $ | ( | $ | ||||||||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||||||||

| Loss (gain) on debt modification and extinguishment, net | ( | ||||||||||||||||

| Depreciation and amortization, net | |||||||||||||||||

| Asset impairment | |||||||||||||||||

| Equity in (earnings) loss of unconsolidated ventures | ( | ||||||||||||||||

| Distributions from unconsolidated ventures from cumulative share of net earnings | |||||||||||||||||

| Amortization of entrance fees | ( | ( | ( | ||||||||||||||

| Proceeds from deferred entrance fee revenue | |||||||||||||||||

| Deferred income tax (benefit) provision | ( | ( | ( | ||||||||||||||

| Operating lease expense adjustment | ( | ( | ( | ||||||||||||||

| Change in fair value of derivatives | ( | ||||||||||||||||

| Loss (gain) on sale of assets, net | ( | ( | ( | ||||||||||||||

| Loss (gain) on facility operating lease termination, net | ( | ( | |||||||||||||||

| Non-cash stock-based compensation expense | |||||||||||||||||

| Property and casualty insurance income | ( | ( | ( | ||||||||||||||

| Changes in operating assets and liabilities: | |||||||||||||||||

| Accounts receivable, net | ( | ||||||||||||||||

| Prepaid expenses and other assets, net | ( | ( | |||||||||||||||

| Trade accounts payable and accrued expenses | ( | ( | |||||||||||||||

| Refundable fees and deferred revenue | ( | ( | |||||||||||||||

| Operating lease assets and liabilities for lessor capital expenditure reimbursements | |||||||||||||||||

| Operating lease assets and liabilities for lease termination | ( | ||||||||||||||||

| Net cash provided by (used in) operating activities | ( | ||||||||||||||||

| Cash Flows from Investing Activities | |||||||||||||||||

| Change in lease security deposits and lease acquisition deposits, net | ( | ||||||||||||||||

| Purchase of marketable securities | ( | ( | ( | ||||||||||||||

| Sale and maturities of marketable securities | |||||||||||||||||

| Capital expenditures, net of related payables | ( | ( | ( | ||||||||||||||

| Acquisition of assets | ( | ( | |||||||||||||||

| Investment in unconsolidated ventures | ( | ( | ( | ||||||||||||||

| Distributions received from unconsolidated ventures | |||||||||||||||||

| Proceeds from sale of assets, net | |||||||||||||||||

| Proceeds from notes receivable | |||||||||||||||||

| Other | ( | ||||||||||||||||

| Net cash provided by (used in) investing activities | ( | ( | |||||||||||||||

| Cash Flows from Financing Activities | |||||||||||||||||

| Proceeds from debt | |||||||||||||||||

| Repayment of debt and financing lease obligations | ( | ( | ( | ||||||||||||||

| Proceeds from line of credit | |||||||||||||||||

| Repayment of line of credit | ( | ||||||||||||||||

| Proceeds from issuance of tangible equity units | |||||||||||||||||

| Purchase of treasury stock, net of related payables | ( | ||||||||||||||||

| Purchase of capped call transactions | ( | ||||||||||||||||

| Payment of financing costs, net of related payables | ( | ( | ( | ||||||||||||||

| Payments of employee taxes for withheld shares | ( | ( | ( | ||||||||||||||

| Other | ( | ( | |||||||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||||||||

| Net increase (decrease) in cash, cash equivalents, and restricted cash | ( | ||||||||||||||||

| Cash, cash equivalents, and restricted cash at beginning of period | |||||||||||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | $ | $ | ||||||||||||||

| Asset Category | Estimated Useful Life (in years) | |||||||

| Buildings and improvements | ||||||||

| Furniture and equipment | ||||||||

| Resident lease intangibles | ||||||||

| Years Ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Resident fees | |||||||||||||||||

| Assisted Living and Memory Care | $ | $ | $ | ||||||||||||||

| CCRCs | ( | ||||||||||||||||

| Senior housing resident fees | $ | $ | $ | ||||||||||||||

| Facility operating expense | |||||||||||||||||

| Assisted Living and Memory Care | $ | $ | $ | ||||||||||||||

| CCRCs | |||||||||||||||||

| Senior housing facility operating expense | $ | $ | $ | ||||||||||||||

| ($ in thousands) | |||||

| Current notional balance | $ | ||||

| Weighted average fixed cap rate | % | ||||

| Earliest maturity date | 2023 | ||||

| Latest maturity date | 2025 | ||||

| Weighted average remaining term | |||||

| Estimated asset fair value (included in other assets, net) at December 31, 2022 | $ | ||||

| Estimated asset fair value (included in other assets, net) at December 31, 2021 | $ | ||||

| ($ in thousands) | |||||

| Current notional balance | $ | ||||

| Fixed interest rate | % | ||||

| Remaining term | |||||

| Estimated asset fair value (included in other assets, net) at December 31, 2022 | $ | ||||

| For the Years Ended December 31, | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Operating lease right-of-use assets | $ | $ | $ | ||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | |||||||||||||||||

| Investment in unconsolidated ventures | |||||||||||||||||

| Assets held for sale | |||||||||||||||||

| Asset impairment | $ | $ | $ | ||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Private pay | % | % | % | ||||||||||||||

| Government reimbursement | % | % | % | ||||||||||||||

| Other third-party payor programs | % | % | % | ||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Balance at beginning of period | $ | $ | $ | ||||||||||||||

| Provision within facility operating expense | |||||||||||||||||

| Write-offs | ( | ( | ( | ||||||||||||||

| Recoveries and other | |||||||||||||||||

| Balance at end of period | $ | $ | $ | ||||||||||||||

| As of December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Land | $ | $ | |||||||||

| Buildings and improvements | |||||||||||

| Furniture and equipment | |||||||||||

| Resident and leasehold operating intangibles | |||||||||||

| Construction in progress | |||||||||||

| Assets under financing leases and leasehold improvements | |||||||||||

| Property, plant and equipment and leasehold intangibles | |||||||||||

| Accumulated depreciation and amortization | ( | ( | |||||||||

| Property, plant and equipment and leasehold intangibles, net | $ | $ | |||||||||

| December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

Fixed mortgage notes payable due 2024 through 2047; weighted average interest rate of | $ | $ | |||||||||

Variable mortgage notes payable due 2023 through 2030; weighted average interest rate of | |||||||||||

Convertible notes payable due October 2026; interest rate of | |||||||||||

Tangible equity units senior amortizing notes due November 2025; interest rate of | |||||||||||

| Deferred financing costs, net | ( | ( | |||||||||

| Total long-term debt | |||||||||||

| Current portion | |||||||||||

| Total long-term debt, less current portion | $ | $ | |||||||||

Year Ending December 31, | Long-term Debt | Weighted Rate | ||||||

| 2023 | $ | % | ||||||

| 2024 | % | |||||||

| 2025 | % | |||||||

| 2026 | % | |||||||

| 2027 | % | |||||||

| Thereafter | % | |||||||

| Total obligations | % | |||||||

| Less amount representing deferred financing costs, net | ( | |||||||

| Total | $ | |||||||

| Years Ended December 31, | |||||||||||||||||

Operating Leases (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Facility operating expense | $ | $ | $ | ||||||||||||||

| Facility lease expense | |||||||||||||||||

| Operating lease expense | |||||||||||||||||

Operating lease expense adjustment (1) | |||||||||||||||||

| Changes in operating lease assets and liabilities for lessor capital expenditure reimbursements | ( | ( | ( | ||||||||||||||

| Operating net cash outflows from operating leases | $ | $ | $ | ||||||||||||||

| Years Ended December 31, | |||||||||||||||||

Financing Leases (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Depreciation and amortization | $ | $ | $ | ||||||||||||||

| Interest expense: financing lease obligations | |||||||||||||||||

| Financing lease expense | $ | $ | $ | ||||||||||||||

| Operating cash outflows from financing leases | $ | $ | $ | ||||||||||||||

| Financing cash outflows from financing leases | |||||||||||||||||

| Changes in financing lease assets and liabilities for lessor capital expenditure reimbursement | ( | ( | ( | ||||||||||||||

| Total net cash outflows from financing leases | $ | $ | $ | ||||||||||||||

| Year Ending December 31, | Operating Leases | Financing Leases | |||||||||

| 2023 | $ | $ | |||||||||

| 2024 | |||||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| Thereafter | |||||||||||

| Total lease payments | |||||||||||

| Purchase option liability and non-cash gain on future sale of property | |||||||||||

| Imputed interest and variable lease payments | ( | ( | |||||||||

| Total lease obligations | $ | $ | |||||||||

| (in thousands, except value per unit) | Equity Component | Debt Component | Total | ||||||||||||||

| Value per unit | $ | $ | $ | ||||||||||||||

| Gross proceeds | $ | $ | $ | ||||||||||||||

| Less: underwriters' discount | ( | ( | ( | ||||||||||||||

| Proceeds from issuance of Units | $ | $ | $ | ||||||||||||||

| Less: issuance costs | ( | ( | ( | ||||||||||||||

| Net proceeds | $ | $ | $ | ||||||||||||||

| Applicable Market Value | Common Stock Issued | ||||

| Equal to or greater than the threshold appreciation price | |||||

| Less than the threshold appreciation price, but greater than the reference price | $ | ||||

| Less than or equal to the reference price | |||||

| As of December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Insurance reserves | $ | $ | |||||||||

| Employee compensation | |||||||||||

| Real estate taxes | |||||||||||

| Paid time off | |||||||||||

| Interest | |||||||||||

| Utilities | |||||||||||

| Income taxes payable | |||||||||||

| Deferred payroll taxes (Note 3) | |||||||||||

| Other | |||||||||||

| Total | $ | $ | |||||||||

| (in thousands, except value per share and unit) | Number of Restricted Stock Units and Stock Awards | Weighted Average Grant Date Fair Value | |||||||||

| Outstanding on January 1, 2020 | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Cancelled/forfeited | ( | ||||||||||

| Outstanding on December 31, 2020 | |||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Cancelled/forfeited | ( | ||||||||||

| Outstanding on December 31, 2021 | |||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Cancelled/forfeited | ( | ||||||||||

| Outstanding on December 31, 2022 | |||||||||||

| (in thousands, except for weighted average amounts) | Restricted Stock Unit and Stock Award Grants | Weighted Average Grant Date Fair Value | Total Grant Date Fair Value | ||||||||||||||

| Three months ended March 31, 2022 | $ | $ | |||||||||||||||

| Three months ended June 30, 2022 | $ | $ | |||||||||||||||

| Three months ended September 30, 2022 | $ | $ | |||||||||||||||

| Three months ended December 31, 2022 | $ | $ | |||||||||||||||

| Years Ended December 31, | |||||||||||||||||

| (in thousands, except for per share amounts) | 2022 | 2021 | 2020 | ||||||||||||||

| Net income (loss) attributable to Brookdale Senior Living Inc. common stockholders | $ | ( | $ | ( | $ | ||||||||||||

| Weighted average common shares outstanding | |||||||||||||||||

| Weighted average minimum shares issuable under purchase contracts | |||||||||||||||||

| Weighted average shares outstanding - basic | |||||||||||||||||

| Effect of dilutive securities | |||||||||||||||||

| Restricted stock and restricted stock units | |||||||||||||||||

| Warrants | |||||||||||||||||

| Weighted average shares outstanding - diluted | |||||||||||||||||

| Net income (loss) per share attributable to Brookdale Senior Living Inc. common stockholders - basic | $ | ( | $ | ( | $ | ||||||||||||

| Net income (loss) per share attributable to Brookdale Senior Living Inc. common stockholders - diluted | $ | ( | $ | ( | $ | ||||||||||||

| As of December 31, | |||||||||||||||||

| (in millions) | 2022(1) | 2021(1) | 2020 | ||||||||||||||

| Restricted stock and restricted stock units | |||||||||||||||||

| Warrants | |||||||||||||||||

| Incremental shares issuable under purchase contracts | |||||||||||||||||

| Convertible senior notes | |||||||||||||||||

| Total | |||||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Federal: | |||||||||||||||||

| Current | $ | ( | $ | $ | |||||||||||||

| Deferred | |||||||||||||||||

| Total federal | |||||||||||||||||

| State: | |||||||||||||||||

| Current | ( | ( | |||||||||||||||

| Deferred (included in federal above) | |||||||||||||||||

| Total state | ( | ( | |||||||||||||||

| Total | $ | $ | $ | ( | |||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Tax benefit (provision) at U.S. statutory rate | $ | $ | $ | ( | |||||||||||||

| State taxes, net of federal income tax | ( | ||||||||||||||||

| Valuation allowance | ( | ||||||||||||||||

| Goodwill derecognition | ( | ||||||||||||||||

| Stock compensation | ( | ( | ( | ||||||||||||||

| Other | ( | ( | ( | ||||||||||||||

| Total | $ | $ | $ | ( | |||||||||||||

| As of December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Deferred income tax assets: | |||||||||||

| Operating loss carryforwards | $ | $ | |||||||||

| Operating lease obligations | |||||||||||

| Tax credits | |||||||||||

| Accrued expenses | |||||||||||

| Intangible assets | |||||||||||

| Financing lease obligations | |||||||||||

| Capital loss carryforward | |||||||||||

| Other | |||||||||||

| Total gross deferred income tax asset | |||||||||||

| Valuation allowance | ( | ( | |||||||||

| Net deferred income tax assets | |||||||||||

| Deferred income tax liabilities: | |||||||||||

| Operating lease right-of-use assets | ( | ( | |||||||||

| Property, plant and equipment | ( | ( | |||||||||

| Investment in unconsolidated ventures | ( | ( | |||||||||

| Total gross deferred income tax liability | ( | ( | |||||||||

| Net deferred tax asset (liability) | $ | $ | |||||||||

| Additions | ||||||||||||||||||||||||||||||||

| Year Ended | Balance at beginning of period | Charged to costs and expenses | Charged to other accounts | Deductions | Balance at end of period | |||||||||||||||||||||||||||

| December 31, 2020 | $ | $ | ( | (1) | $ | $ | $ | |||||||||||||||||||||||||

| December 31, 2021 | $ | $ | ( | (2) | $ | $ | $ | |||||||||||||||||||||||||

| December 31, 2022 | $ | $ | (3) | $ | $ | $ | ||||||||||||||||||||||||||

| For the Years Ended December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Balance at beginning of period | $ | $ | |||||||||

| Additions for tax positions related to the current year | |||||||||||

| Reductions for tax positions related to prior years | ( | ( | |||||||||

| Balance at end of period | $ | $ | |||||||||

| (in thousands) | For the Years Ended December 31, | ||||||||||||||||

| Supplemental Disclosure of Cash Flow Information: | 2022 | 2021 | 2020 | ||||||||||||||

| Interest paid | $ | $ | $ | ||||||||||||||

| Income taxes paid, net of refunds | $ | ( | $ | $ | |||||||||||||

| Capital expenditures, net of related payables: | |||||||||||||||||

| Capital expenditures - non-development, net | $ | $ | $ | ||||||||||||||

| Capital expenditures - development, net | |||||||||||||||||

| Capital expenditures - non-development - reimbursable | |||||||||||||||||

| Trade accounts payable | ( | ( | |||||||||||||||

| Net cash paid | $ | $ | $ | ||||||||||||||

| Acquisition of communities from Healthpeak: | |||||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | $ | $ | $ | ||||||||||||||

| Operating lease right-of-use assets | ( | ||||||||||||||||

| Financing lease obligations | |||||||||||||||||

| Operating lease obligations | |||||||||||||||||

| Loss (gain) on debt modification and extinguishment, net | ( | ||||||||||||||||

| Net cash paid | $ | $ | $ | ||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Acquisition of other assets: | |||||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | $ | $ | $ | ||||||||||||||

| Financing lease obligations | |||||||||||||||||

| Net cash paid | $ | $ | $ | ||||||||||||||

| Proceeds from HCS Sale, net: | |||||||||||||||||

| Accounts receivable, net | $ | $ | ( | $ | |||||||||||||

| Property, plant and equipment and leasehold intangibles, net | ( | ||||||||||||||||

| Operating lease right-of-use assets | ( | ||||||||||||||||

| Investment in unconsolidated ventures | |||||||||||||||||

| Goodwill | ( | ||||||||||||||||

| Prepaid expenses and other assets, net | ( | ||||||||||||||||

| Trade accounts payable | |||||||||||||||||

| Accrued expenses | |||||||||||||||||

| Refundable fees and deferred revenue | |||||||||||||||||

| Operating lease obligations | |||||||||||||||||

| Other liabilities | |||||||||||||||||

| Non-operating loss (gain) on sale of assets, net | ( | ||||||||||||||||

| Net cash received | $ | $ | ( | $ | |||||||||||||

| Proceeds from sale of CCRC Venture, net: | |||||||||||||||||

| Investment in unconsolidated ventures | $ | $ | $ | ( | |||||||||||||

| Current portion of long-term debt | |||||||||||||||||

| Other liabilities | |||||||||||||||||

| Non-operating loss (gain) on sale of assets, net | ( | ||||||||||||||||

| Net cash received | $ | $ | $ | ( | |||||||||||||

| Proceeds from sale of other assets, net: | |||||||||||||||||

| Prepaid expenses and other assets, net | $ | ( | $ | ( | $ | ( | |||||||||||

| Assets held for sale | ( | ( | ( | ||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | ( | ( | ( | ||||||||||||||

| Other liabilities | ( | ( | |||||||||||||||

| Non-operating loss (gain) on sale of assets, net | ( | ( | ( | ||||||||||||||

| Net cash received | $ | ( | $ | ( | $ | ( | |||||||||||

| Master Agreement with Ventas: | |||||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | $ | $ | $ | ( | |||||||||||||

| Operating lease right-of-use assets | ( | ||||||||||||||||

| Other assets, net | ( | ||||||||||||||||

| Long-term debt | |||||||||||||||||

| Financing lease obligations | |||||||||||||||||

| Operating lease obligations | |||||||||||||||||

| Additional paid-in-capital | ( | ||||||||||||||||

| Net cash paid | $ | $ | $ | ||||||||||||||

| Supplemental Schedule of Non-cash Operating, Investing and Financing Activities: | |||||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Assets designated as held for sale: | |||||||||||||||||

| Assets held for sale | $ | $ | $ | ||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | ( | ( | |||||||||||||||

| Net | $ | $ | $ | ||||||||||||||

| Healthpeak master lease modification: | |||||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | $ | $ | $ | ( | |||||||||||||

| Operating lease right-of-use assets | |||||||||||||||||

| Financing lease obligations | |||||||||||||||||

| Operating lease obligations | ( | ||||||||||||||||

| Net | $ | $ | $ | ||||||||||||||

| Gain on sale for master lease amendment: | |||||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | $ | ( | $ | $ | |||||||||||||

| Operating lease right-of-use assets | |||||||||||||||||

| Financing lease obligations | |||||||||||||||||

| Operating lease obligations | ( | ||||||||||||||||

| Loss (gain) on sale of communities, net | ( | ||||||||||||||||

| Net | $ | $ | $ | ||||||||||||||

| Other non-cash lease transactions, net: | |||||||||||||||||

| Property, plant and equipment and leasehold intangibles, net | |||||||||||||||||

| Operating lease right-of-use assets | ( | ||||||||||||||||

| Operating lease obligations | ( | ( | |||||||||||||||

| Financing lease obligations | ( | ( | ( | ||||||||||||||

| Other liabilities | ( | ||||||||||||||||

| Loss (gain) on facility operating lease termination, net | ( | ||||||||||||||||

| Net | $ | $ | $ | ||||||||||||||

| December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Current: | |||||||||||

| Real estate tax and property insurance escrows | $ | $ | |||||||||

| Replacement reserve escrows | |||||||||||

| Interest rate cap escrows | |||||||||||

| Other | |||||||||||

| Subtotal | |||||||||||

| Long term: | |||||||||||

| Insurance deposits | |||||||||||

| CCRCs escrows | |||||||||||

| Debt service reserve | |||||||||||

| Letters of credit collateral | |||||||||||

| Subtotal | |||||||||||

| Total | $ | $ | |||||||||

| December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Reconciliation of cash, cash equivalents, and restricted cash: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Long-term restricted cash | |||||||||||

| Total cash, cash equivalents, and restricted cash | $ | $ | |||||||||

| For the Years Ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Revenue and other operating income: | |||||||||||||||||

Independent Living (1)(2) | $ | $ | $ | ||||||||||||||

Assisted Living and Memory Care (1)(2) | |||||||||||||||||

CCRCs (1)(2) | |||||||||||||||||

All Other (3) | |||||||||||||||||

Health Care Services (1)(2) | |||||||||||||||||

| Total revenue and other operating income | $ | $ | $ | ||||||||||||||

Segment operating income:(4) | |||||||||||||||||

| Independent Living | $ | $ | $ | ||||||||||||||

| Assisted Living and Memory Care | |||||||||||||||||

| CCRCs | |||||||||||||||||

| All Other | |||||||||||||||||

| Health Care Services | |||||||||||||||||

| Total segment operating income | |||||||||||||||||

| General and administrative expense (including non-cash stock-based compensation expense) | |||||||||||||||||

| Facility operating lease expense: | |||||||||||||||||

| Independent Living | |||||||||||||||||

| Assisted Living and Memory Care | |||||||||||||||||

| CCRCs | |||||||||||||||||

| Corporate and All Other | |||||||||||||||||

| Depreciation and amortization: | |||||||||||||||||

| Independent Living | |||||||||||||||||

| Assisted Living and Memory Care | |||||||||||||||||

| CCRCs | |||||||||||||||||

| Corporate and All Other | |||||||||||||||||

| Health Care Services | |||||||||||||||||

| Asset impairment: | |||||||||||||||||

| Independent Living | |||||||||||||||||

| Assisted Living and Memory Care | |||||||||||||||||

| CCRCs | |||||||||||||||||

| Corporate and All Other | |||||||||||||||||

| Loss (gain) on sale of communities, net | ( | ||||||||||||||||

| Loss (gain) on facility operating lease termination, net | ( | ( | |||||||||||||||

| Income (loss) from operations | $ | ( | $ | ( | $ | ( | |||||||||||

| Total interest expense: | |||||||||||||||||

| Independent Living | $ | $ | $ | ||||||||||||||

| Assisted Living and Memory Care | |||||||||||||||||

| CCRCs | |||||||||||||||||

| Corporate and All Other | |||||||||||||||||

| $ | $ | $ | |||||||||||||||

| Total capital expenditures for property, plant and equipment, and leasehold intangibles: | |||||||||||||||||

| Independent Living | $ | $ | $ | ||||||||||||||

| Assisted Living and Memory Care | |||||||||||||||||

| CCRCs | |||||||||||||||||

| Corporate and All Other | |||||||||||||||||

| Health Care Services | |||||||||||||||||

| $ | $ | $ | |||||||||||||||

| As of December 31, | |||||||||||

| (in thousands) | 2022 | 2021 | |||||||||

| Total assets: | |||||||||||

Independent Living (5) | $ | $ | |||||||||

| Assisted Living and Memory Care | |||||||||||

| CCRCs | |||||||||||

| Corporate and All Other | |||||||||||

Total assets(5) | $ | $ | |||||||||

| For the Years Ended December 31, | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Independent Living | $ | $ | $ | ||||||||||||||

| Assisted Living and Memory Care | |||||||||||||||||

| CCRCs | |||||||||||||||||

| Health Care Services | |||||||||||||||||

| Total other operating income | $ | $ | $ | ||||||||||||||

| Number of securities to be issued upon exercise of outstanding options, warrants, and rights | Weighted average exercise price of outstanding options, warrants, and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||||||||||||||

| Plan category | (a) (1) | (b) | (c) | |||||||||||||||||

Equity compensation plans approved by security holders (2) | $ | 5,465,190 | $ | — | $ | 7,750,168 | ||||||||||||||

Equity compensation plans not approved by security holders (3) | — | — | 35,936 | |||||||||||||||||

| Total | $ | 5,465,190 | — | $ | 7,786,104 | |||||||||||||||

| 10.6 | ||||||||

| 10.7 | ||||||||

| 10.8 | ||||||||

| 10.9 | ||||||||

| 10.10 | ||||||||

| 10.11 | ||||||||

| 10.12 | ||||||||

| 10.13 | ||||||||

| 10.14 | ||||||||

| 10.15 | ||||||||

| 10.16 | ||||||||

| 10.17 | ||||||||

| 10.18 | ||||||||

| 10.19 | ||||||||

| 10.20 | ||||||||

| 10.21 | ||||||||

| 21 | ||||||||

| 23 | ||||||||

| 31.1 | ||||||||

| 31.2 | ||||||||

| 32 | ||||||||

101.SCH | Inline XBRL Taxonomy Extension Schema Document. | |||||||

101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document. | |||||||

101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document. | |||||||

101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document. | |||||||

101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document. | |||||||

| 104 | The cover page from the Company's Annual Report on Form 10-K for the year ended December 31, 2022, formatted in Inline XBRL (included in Exhibit 101). | |||||||

| BROOKDALE SENIOR LIVING INC. | |||||||||||

| By: | /s/ Lucinda M. Baier | ||||||||||

| Name: | Lucinda M. Baier | ||||||||||

| Title: | President and Chief Executive Officer | ||||||||||

| Date: | February 22, 2023 | ||||||||||

| Signature | Title | Date | ||||||||||||

| /s/ Guy P. Sansone | Non-Executive Chairman of the Board | February 22, 2023 | ||||||||||||

| Guy P. Sansone | ||||||||||||||

| /s/ Lucinda M. Baier | President, Chief Executive Officer and Director | February 22, 2023 | ||||||||||||

| Lucinda M. Baier | (Principal Executive Officer) | |||||||||||||

| /s/ Steven E. Swain | Executive Vice President and Chief Financial Officer | February 22, 2023 | ||||||||||||

| Steven E. Swain | (Principal Financial Officer) | |||||||||||||

| /s/ Dawn L. Kussow | Senior Vice President and Chief Accounting Officer | February 22, 2023 | ||||||||||||

| Dawn L. Kussow | (Principal Accounting Officer) | |||||||||||||

| /s/ Jordan R. Asher | Director | February 22, 2023 | ||||||||||||

| Jordan R. Asher | ||||||||||||||

| /s/ Marcus E. Bromley | Director | February 22, 2023 | ||||||||||||

| Marcus E. Bromley | ||||||||||||||

| /s/ Frank M. Bumstead | Director | February 22, 2023 | ||||||||||||

| Frank M. Bumstead | ||||||||||||||

| /s/ Victoria L. Freed | Director | February 22, 2023 | ||||||||||||

| Victoria L. Freed | ||||||||||||||

| /s/ Denise W. Warren | Director | February 22, 2023 | ||||||||||||

| Denise W. Warren | ||||||||||||||

| /s/ Lee S. Wielansky | Director | February 22, 2023 | ||||||||||||

| Lee S. Wielansky | ||||||||||||||

| Subsidiary | Jurisdiction of Incorporation or Formation | ||||

| Abingdon Place of Gastonia Limited Partnership | NC | ||||

| AH Battery Park Owner, LLC | DE | ||||

| AH Illinois Huntley Member, LLC | OH | ||||

| AH Illinois Huntley Owner, LLC | OH | ||||

| AH Illinois Owner, LLC | DE | ||||

| AH North Carolina Owner, LLC | DE | ||||

| AH Ohio Columbus Owner, LLC | DE | ||||

| AH Pennsylvania Owner, LP | OH | ||||

| AH Texas CGP, Inc. | OH | ||||

| AH Texas Owner Limited Partnership SL | OH | ||||

| AHC ALS FM Holding Company, LLC | DE | ||||

| AHC Bayside, Inc. | DE | ||||

| AHC Exchange Corporation | DE | ||||

| AHC Florham Park, LLC | DE | ||||

| AHC Kansas II, Inc. | DE | ||||

| AHC Monroe Township, LLC | DE | ||||

| AHC PHN I, Inc. | DE | ||||

| AHC Properties, Inc. | DE | ||||

| AHC Purchaser, Inc. | DE | ||||

| AHC Purchaser Parent, LLC | DE | ||||

| AHC Richland Hills, LLC | DE | ||||

| AHC Shoreline, LLC | DE | ||||

| AHC Southland Lakeland, LLC | DE | ||||

| AHC Southland Melbourne, LLC | FL | ||||

| AHC Southland Ormond Beach, LLC | DE | ||||

| AHC Sterling House of Brighton, LLC | DE | ||||

| AHC Sterling House of Corsicana, LLC | DE | ||||

| AHC Sterling House of Greenville, LLC | DE | ||||

| AHC Sterling House of Harbison, LLC | DE | ||||

| AHC Sterling House of Jacksonville, LLC | DE | ||||

| AHC Sterling House of Lewisville, LLC | DE | ||||

| AHC Sterling House of Mansfield, LLC | DE | ||||

| AHC Sterling House of Newark, LLC | DE | ||||

| AHC Sterling House of Panama City, LLC | DE | ||||

| AHC Sterling House of Port Charlotte, LLC | DE | ||||

| AHC Sterling House of Punta Gorda, LLC | DE | ||||

| AHC Sterling House of Venice, LLC | DE | ||||

| AHC Sterling House of Weatherford, LLC | DE | ||||

| AHC Trailside, LLC | DE | ||||

| AHC Villas of Albany Residential, LLC | DE | ||||

| AHC Villas of the Atrium, LLC | DE | ||||

| AHC Villas Wynwood of Courtyard Albany, LLC | DE | ||||

| AHC Villas Wynwood of River Place, LLC | DE | ||||

| AHC Wynwood of Rogue Valley, LLC | DE | ||||

| Alabama Somerby, LLC | DE | ||||

| ALS Clare Bridge, Inc. | DE | ||||

| ALS Holdings, Inc. | DE | ||||

| ALS Kansas, Inc. | DE | ||||

| ALS Leasing, Inc. | DE | ||||

| ALS National, Inc. | DE | ||||

| ALS National SPE I, Inc. | DE | ||||

| ALS North America, Inc. | DE | ||||

| ALS Properties Holding Company, LLC | DE | ||||

| ALS Properties Tenant I, LLC | DE | ||||

| ALS Properties Tenant II, LLC | DE | ||||

| ALS Stonefield, Inc. | DE | ||||

| ALS Venture II, Inc. | DE | ||||

| ALS Wisconsin Holdings, Inc. | DE | ||||

| ALS Wovenhearts, Inc. | DE | ||||

| Alternative Living Services Home Care, Inc. | NY | ||||

| Alternative Living Services New York, Inc. | DE | ||||

| American Retirement Corporation | TN | ||||

| ARC Aurora, LLC | TN | ||||

| ARC Bahia Oaks, Inc. | TN | ||||

| ARC Bay Pines, Inc. | TN | ||||

| ARC Belmont, LLC | TN | ||||

| ARC Boca Raton, Inc. | TN | ||||

| ARC Boynton Beach, LLC | TN | ||||

| ARC Brookmont Terrace, Inc. | TN | ||||

| ARC Carriage Club of Jacksonville, Inc. | TN | ||||

| ARC Cleveland Park, LLC | TN | ||||

| ARC Corpus Christi, LLC | TN | ||||

| ARC Countryside, LLC | TN | ||||

| ARC Deane Hill, LLC | TN | ||||

| ARC Delray Beach, LLC | TN | ||||

| ARC Epic Holding Company, Inc. | TN | ||||

| ARC Epic OpCo Holding Company, Inc. | DE | ||||

| ARC FM Holding Company, LLC | DE | ||||

| ARC Fort Austin Properties, LLC | TN | ||||

| ARC Freedom, LLC | TN | ||||

| ARC Freedom Square Management, Inc. | TN | ||||

| ARC Greenwood Village, Inc. | TN | ||||

| ARC Hampton Post Oak, Inc. | TN | ||||

| ARC Heritage Club, Inc. | TN | ||||

| ARC Holland, Inc. | TN | ||||

| ARC Holley Court, LLC | TN | ||||

| ARC Holley Court Management, Inc. | TN | ||||

| ARC Homewood Corpus Christi, LLC | DE | ||||

| ARC Homewood Victoria, Inc. | TN | ||||

| ARC Lakeway ALF Holding Company, LLC | DE | ||||

| ARC Lakeway SNF, LLC | TN | ||||

| ARC Lakewood, LLC | TN | ||||

| ARC LP Holdings, LLC | TN | ||||

| ARC Management Corporation | TN | ||||

| ARC Management, LLC | TN | ||||

| ARC Naples, LLC | TN | ||||

| ARC North Chandler, LLC | TN | ||||

| ARC Oakhurst, Inc. | TN | ||||

| ARC Parklane, Inc. | TN | ||||

| ARC Partners II, Inc. | TN | ||||

| ARC Pearland, LP | TN | ||||

| ARC Pecan Park, LP | TN | ||||

| ARC Pecan Park Padgett, Inc. | TN | ||||

| ARC Peoria II, Inc. | TN | ||||

| ARC Peoria, LLC | TN | ||||

| ARC Pinegate, LP | TN | ||||

| ARC Post Oak, LP | TN | ||||

| ARC Richmond Heights, LLC | TN | ||||

| ARC Richmond Heights SNF, LLC | TN | ||||

| ARC Rossmoor, Inc. | TN | ||||

| ARC Santa Catalina, Inc. | TN | ||||

| ARC SCC, Inc. | TN | ||||

| ARC Scottsdale, LLC | TN | ||||

| ARC Shadowlake, LP | TN | ||||

| ARC Shavano, LP | TN | ||||

| ARC Shavano Park, Inc. | TN | ||||

| ARC Somerby Holdings, LLC | TN | ||||

| ARC Spring Shadow, LP | TN | ||||

| ARC Sweet Life Rosehill, LLC | TN | ||||

| ARC Sweet Life Shawnee, LLC | TN | ||||

| ARC Tarpon Springs, Inc. | TN | ||||

| ARC Tennessee GP, Inc. | TN | ||||

| ARC Victoria, LP | TN | ||||

| ARC Westlake Village, Inc. | TN | ||||

| ARC Westlake Village SNF, LLC | DE | ||||

| ARC Westover Hills, LP | TN | ||||

| ARC Willowbrook, LLC | TN | ||||

| ARC Wilora Assisted Living, LLC | TN | ||||

| ARC Wilora Lake, Inc. | TN | ||||

| ARCLP Charlotte, LLC | TN | ||||

| ARCPI Holdings, Inc. | DE | ||||

| Asheville Manor, LP | NC | ||||

| Assisted Living Properties, Inc. | KS | ||||

| BAH CA, LLC | DE | ||||

| Batus, LLC | DE | ||||

| BKD Adrian PropCo, LLC | DE | ||||

| BKD AGC, Inc. | DE | ||||

| BKD Alabama Operator, LLC | DE | ||||

| BKD Alabama SNF, LLC | DE | ||||

| BKD Altamonte Springs, LLC | DE | ||||

| BKD Apache Junction Operator, LLC | DE | ||||

| BKD Apache Junction PropCo, LLC | DE | ||||

| BKD Arbors of Santa Rosa, LLC | DE | ||||

| BKD Archer 10, LLC | DE | ||||

| BKD Archer 3, LLC | DE | ||||

| BKD Archer 4, LLC | DE | ||||

| BKD Archer 5, LLC | DE | ||||

| BKD Archer 6, LLC | DE | ||||

| BKD Archer 7, LLC | DE | ||||

| BKD Archer 8, LLC | DE | ||||

| BKD Archer 9, LLC | DE | ||||

| BKD Ballwin, LLC | DE | ||||

| BKD Belle Meade, LLC | DE | ||||

| BKD Bossier City Operator, LLC | DE | ||||

| BKD Bossier City Propco, LLC | DE | ||||

| BKD BRE Knight Member Holding, LLC | DE | ||||

| BKD BRE Knight Member, LLC | DE | ||||

| BKD Brentwood at Niles, LLC | DE | ||||

| BKD Brookdale Marketplace, LLC | DE | ||||

| BKD Brookdale Place of Brookfield, LLC | DE | ||||

| BKD Brookfield Opco, LLC | DE | ||||

| BKD Carrollton Operator, LLC | DE | ||||

| BKD Carrollton Propco, LLC | DE | ||||

| BKD CCRC OpCo HoldCo Member, LLC | DE | ||||

| BKD CCRC PropCo HoldCo Member, LLC | DE | ||||

| BKD Chambrel Holding, LLC | DE | ||||

| BKD Chandler Operator, LLC | DE | ||||

| BKD Chandler PropCo, LLC | DE | ||||

| BKD Charleston South Carolina, LLC | DE | ||||

| BKD Clare Bridge and Sterling House of Battle Creek, LLC | DE | ||||

| BKD Clare Bridge of Beaverton, LLC | DE | ||||

| BKD Clare Bridge of Brookfield, LLC | DE | ||||

| BKD Clare Bridge of Dublin, LLC | DE | ||||

| BKD Clare Bridge of Meridian, LLC | DE | ||||

| BKD Clare Bridge of Oklahoma City SW, LLC | DE | ||||

| BKD Clare Bridge of Olympia, LLC | DE | ||||

| BKD Clare Bridge of Spokane, LLC | DE | ||||

| BKD Clare Bridge of Troutdale, LLC | DE | ||||

| BKD Clare Bridge of Wichita, LLC | DE | ||||

| BKD Clare Bridge Place Brookfield, LLC | DE | ||||

| BKD College Place, LLC | DE | ||||

| BKD Conway SC, LLC | DE | ||||

| BKD Corona, LLC | DE | ||||

| BKD Cortona Park, LLC | DE | ||||

| BKD Emeritus EI, LLC | DE | ||||

| BKD Employee Services RIDEA 49, LLC | DE | ||||

| BKD Englewood Colorado, LLC | DE | ||||

| BKD Finance Holdco, LLC | DE | ||||

| BKD FM Holding Company, LLC | DE | ||||

| BKD FM Nine Holdings, LLC | DE | ||||

| BKD FM PNC Holding Company I, LLC | DE | ||||

| BKD FM PNC Holding Company II, LLC | DE | ||||

| BKD FM PNC Holding Company III, LLC | DE | ||||

| BKD FM21 Holdings I, LLC | DE | ||||

| BKD FM21 Holdings II, LLC | DE | ||||

| BKD FM21 Holdings III, LLC | DE | ||||

| BKD FM7 HoldCo CA, LLC | DE | ||||

| BKD FM7 HoldCo MI CO, LLC | DE | ||||

| BKD FM7 HoldCo VA, LLC | DE | ||||

| BKD Folsom, LLC | DE | ||||

| BKD Franklin, LLC | DE | ||||

| BKD Freedom Plaza Arizona Peoria, LLC | DE | ||||

| BKD Gaines Ranch, LLC | DE | ||||

| BKD Gallatin, LLC | DE | ||||

| BKD Gardens Tarzana Propco, LLC | DE | ||||

| BKD GC FM Holdings, LLC | DE | ||||

| BKD Germantown, LLC | DE | ||||

| BKD Goodlettsville PropCo, LLC | DE | ||||

| BKD GV Investor, LLC | DE | ||||

| BKD Hamilton Wolfe San Antonio, LLC | DE | ||||

| BKD Harrisburg Opco, LLC | DE | ||||

| BKD Hartwell, LLC | DE | ||||

| BKD HB Acquisition Sub, Inc. | DE | ||||

| BKD HCR Master Lease 3 Tenant, LLC | DE | ||||

| BKD Hillside Holdco, LLC | DE | ||||

| BKD Hillside, LLC | DE | ||||

| BKD Hillside Opco, LLC | DE | ||||

| BKD Homewood Corpus Christi Propco, LLC | DE | ||||

| BKD Horsham, LLC | DE | ||||

| BKD Illinois Retail, LLC | DE | ||||

| BKD Island Lake Holdings, LLC | DE | ||||

| BKD Island Lake, LLC | DE | ||||

| BKD Jones Farm, LLC | DE | ||||

| BKD Kettleman Lane, LLC | DE | ||||

| BKD Kingsport, LLC | DE | ||||

| BKD Lake Orienta, LLC | DE | ||||

| BKD Lawrenceville, LLC | DE | ||||

| BKD Lebanon/Southfield, LLC | DE | ||||

| BKD Lodi, LLC | DE | ||||

| BKD Lubbock GP, LLC | DE | ||||

| BKD Management Holdings FC, Inc. | DE | ||||

| BKD Minnetonka Assisted Living, LLC | DE | ||||

| BKD Murray, LLC | DE | ||||

| BKD Nashville Office Bistro, LLC | DE | ||||

| BKD New England Bay, LLC | DE | ||||

| BKD Newnan, LLC | DE | ||||

| BKD North Chandler, LLC | DE | ||||

| BKD North Gilbert, LLC | DE | ||||

| BKD North Glendale, LLC | DE | ||||

| BKD Northampton OpCo, LLC | DE | ||||

| BKD Northport Operator, LLC | DE | ||||

| BKD Northport Propco, LLC | DE | ||||

| BKD Northport Propco Member, LLC | DE | ||||

| BKD Oak Park, LLC | DE | ||||

| BKD Oklahoma Management, LLC | DE | ||||

| BKD Ormond Beach Propco, LLC | DE | ||||

| BKD Oswego, LLC | DE | ||||

| BKD Owatonna, LLC | DE | ||||

| BKD Palm Beach Gardens, LLC | DE | ||||

| BKD Paradise Valley Propco, LLC | DE | ||||

| BKD Parkplace, LLC | DE | ||||

| BKD Patriot Heights, LLC | DE | ||||

| BKD Pearland, LLC | DE | ||||

| BKD Personal Assistance Services, LLC | DE | ||||

| BKD PHS Investor, LLC | DE | ||||

| BKD Project 3 Holding Co, LLC | DE | ||||

| BKD Project 3 Manager, LLC | DE | ||||

| BKD Richmond Place Propco, LLC | DE | ||||

| BKD River Road, LLC | DE | ||||

| BKD Roanoke PropCo, LLC | DE | ||||

| BKD Rome Operator, LLC | DE | ||||

| BKD Rome PropCo, LLC | DE | ||||

| BKD Sakonnet Bay, LLC | DE | ||||

| BKD San Marcos South, LLC | DE | ||||

| BKD Shadowlake, LLC | DE | ||||

| BKD Sherwood Odessa, LLC | DE | ||||

| BKD Shoreline, LLC | DE | ||||

| BKD Skyline PropCo, LLC | DE | ||||

| BKD South Bay, LLC | DE | ||||

| BKD Southpaw Holdco, LLC | DE | ||||

| BKD Sparks, LLC | DE | ||||