Exhibit 6.5

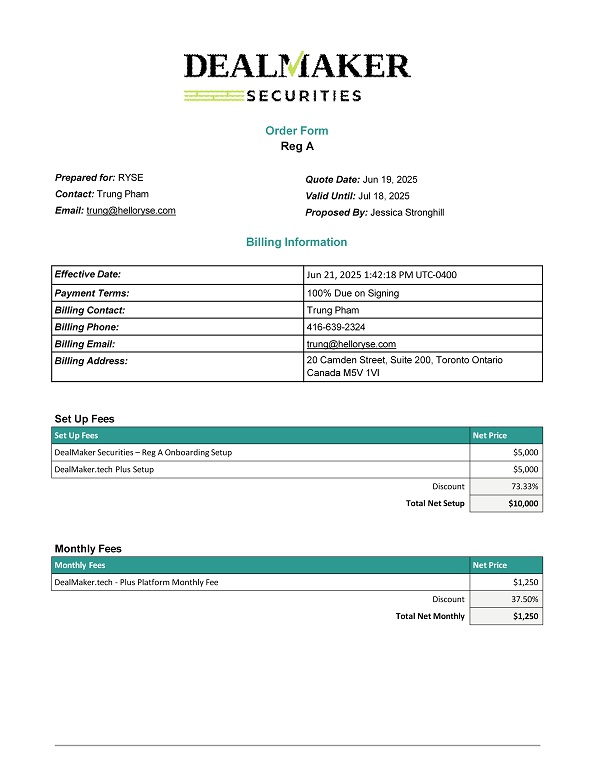

Order Form Reg A Prepared for: RYSE Contact: Trung Pham Email: trung@helloryse.com Quote Date: Jun 19, 2025 Valid Until: Jul 18, 2025 Proposed By: Jessica Stronghill Billing Information Jun 21, 2025 1:42:18 PM UTC - 0400 Effective Date: 100% Due on Signing Payment Terms: Trung Pham Billing Contact: 416 - 639 - 2324 Billing Phone: trung@helloryse.com Billing Email: 20 Camden Street, Suite 200, Toronto Ontario Canada M5V 1VI Billing Address: Set Up Fees Net Price Set Up Fees $5,000 DealMaker Securities – Reg A Onboarding Setup $5,000 DealMaker.tech Plus Setup 73.33% Discount Total Net Setup $10,000 Monthly Fees Net Price Monthly Fees $1,250 DealMaker.tech - Plus Platform Monthly Fee 37.50% Discount Total Net Monthly $1,250

This Order Form sets forth the terms of service by which a number of separate DealMaker affiliates are engaged to provide services to Customer (collectively, the “ Services ”) . By its signature below in each applicable section, Customer hereby agrees to the terms of service of each company referenced in such section . Unless otherwise specified above, the Services shall commence on the date hereof . By proceeding with its order, Customer agrees to be bound contractually with each respective company . The Applicable Terms of Service include and contain, among other things, warranty disclaimers, liability limitations and use limitations . In particular, Customer understands and agrees that it is carrying out a self - hosted capital raise and bears primary responsibility for the success of its own raise . No DealMaker entity is ever responsible for the success of Customer’s campaign and no guarantees or representations are ever in place with respect to (i) capital raised (ii) investor solicitation or (iii) completion of investor transactions with Customers . Customer agrees and acknowledges that online capital formation is uncertain, and that nothing in this agreement prevents Customer from pursuing concurrent or sequential alternative forms of capital formation . Customer should use its discretion in choosing to engage the vendors described in this Agreement and agrees that such entities bear no responsibility to Customer with respect to raising capital . There shall be no force or effect to any different terms other than as described or referenced herein (including all terms included or incorporated by reference) except as entered into by one of the companies referenced herein and Customer in writing. A summary of Services purchased is described in the Schedule "Summary of Compensation" attached. The applicable Terms of Service are described on the Schedules thereafter, and are incorporated herein. Services NEVER include providing any investment advice nor any investment recommendations to any investor. RYSE Trung Pham Name CEO Title Signature Jun 21, 2025 1:42:18 PM UTC - 0400 Date

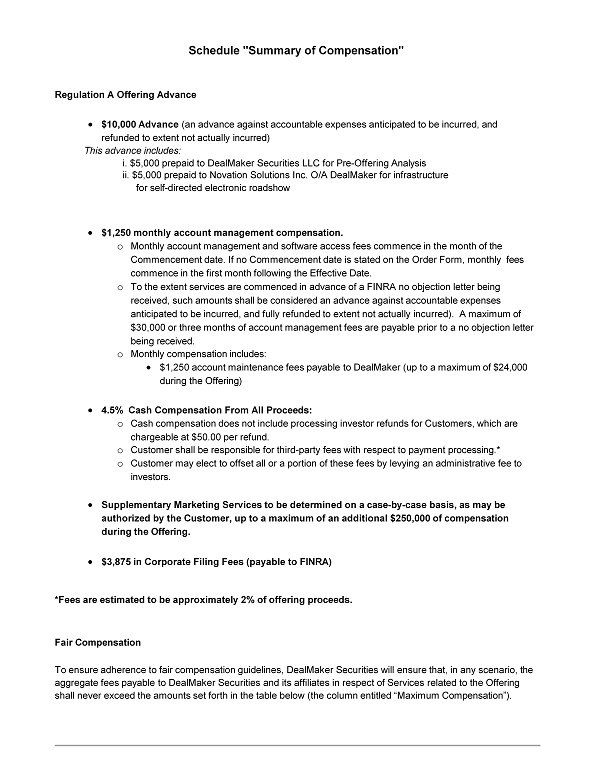

Schedule "Summary of Compensation" Regulation A Offering Advance $10,000 Advance (an advance against accountable expenses anticipated to be incurred, and refunded to extent not actually incurred) This advance includes: i. $5,000 prepaid to DealMaker Securities LLC for Pre - Offering Analysis ii. $5,000 prepaid to Novation Solutions Inc. O/A DealMaker for infrastructure for self - directed electronic roadshow $1,250 monthly account management compensation. o Monthly account management and software access fees commence in the month of the Commencement date. If no Commencement date is stated on the Order Form, monthly fees commence in the first month following the Effective Date. o To the extent services are commenced in advance of a FINRA no objection letter being received, such amounts shall be considered an advance against accountable expenses anticipated to be incurred, and fully refunded to extent not actually incurred). A maximum of $30,000 or three months of account management fees are payable prior to a no objection letter being received. o Monthly compensation includes: $1,250 account maintenance fees payable to DealMaker (up to a maximum of $24,000 during the Offering) 4.5% Cash Compensation From All Proceeds: o Cash compensation does not include processing investor refunds for Customers, which are chargeable at $50.00 per refund. o Customer shall be responsible for third - party fees with respect to payment processing.* o Customer may elect to offset all or a portion of these fees by levying an administrative fee to investors. Supplementary Marketing Services to be determined on a case - by - case basis, as may be authorized by the Customer, up to a maximum of an additional $250,000 of compensation during the Offering. $3,875 in Corporate Filing Fees (payable to FINRA) *Fees are estimated to be approximately 2% of offering proceeds. Fair Compensation To ensure adherence to fair compensation guidelines, DealMaker Securities will ensure that, in any scenario, the aggregate fees payable to DealMaker Securities and its affiliates in respect of Services related to the Offering shall never exceed the amounts set forth in the table below (the column entitled “Maximum Compensation”).

If the Offering is fully subscribed, the maximum amount of underwriting compensation will be $1,037,500. *In the event that the Financial Industry Regulatory Authority (“FINRA”) Department of Corporate Finance does not issue a no objection letter for the Offering, all DMS Fees are fully refundable other than services actually rendered.

Schedule "Broker Dealer Services” (DealMaker Securities LLC) Pre - Offering Analysis Reviewing Customer, its affiliates, executives and other parties as described in Rule 262 of Regulation A, and consulting with Customer regarding the same. Pre - Offering Consulting for Self - Directed Electronic Roadshow Reviewing with Customer on best business practices regarding raise in light of current market conditions and prior self - directed capital raises Reviewing with Customer on question customization for investor questionnaire, selection of webhosting services, and template for campaign page Advising Customer on compliance of marketing material and other communications with the public with applicable legal standards and requirements Providing advice to Customer on content of Form 1A and Revisions Provide extensive, review, training, and advice to Customer and Customer personnel on how to configure and use electronic platform powered by DealMaker.tech Assisting in the preparation of SEC and FINRA filings Working with the Client’s SEC counsel in providing information to the extent necessary Advisory, Compliance and Consulting Services During the Offering Reviewing investor information, including identity verification, performing AML (Anti - Money Laundering) and other compliance background checks, and providing Customer with information on an investor in order for Customer to determine whether to accept such investor into the Offering; If necessary, discussions with the Customer regarding additional information or clarification on an Customer - invited investor; Coordinating with third party agents and vendors in connection with performance of services; Reviewing each investor’s subscription agreement to confirm such investor’s participation in the offering and provide a recommendation to the company whether or not to accept the subscription agreement for the investor’s participation; Contracting and/or notifying the company, if needed, to gather additional information or clarification on an investor; Providing ongoing advice to Customer on compliance of marketing material and other communications with the public, including with respect to applicable legal standards and requirements; Reviewing with Customer regarding any material changes to the Form 1A which may require an amended filing; and Reviewing third party provider work - product with respect to compliance with applicable rules and regulations. Customer hereby engages and retains DealMaker Securities LLC, a registered Broker - Dealer, to provide the applicable services described above. Customer hereby agrees to the terms set forth in the DealMaker Securities Terms, with compensation described on Schedule "Summary of Compensation" hereto.

Customer Signature Schedule “DealMaker.tech Subscription Platform and Shareholder Services Online Portal” During the Offering, Subscription Processing and Payments Functionality Creation and maintenance of deal portal powered by DealMaker.tech software with fully - automated tracking, signing, and reconciliation of investment transactions Full analytics suite to track all aspects of the offering and manage the conversion of prospective investors into actual investors. Apart from the Offering, Shareholder Management via DealMaker Shareholder Services Access to DM Shareholder Management Technology to provide corporate updates, announce additional financings, and track engagement Document - sharing functionality to disseminate share certificates, tax documentation, and other files to investors Monthly compensation is payable to DealMaker.tech while the client has engaged DealMaker Shareholder Services Subscription Management and DM Shareholder Management Technology is provided by Novation Solutions Inc. O/A DealMaker. Customer hereby agrees to the terms set forth in the DealMaker Terms of Service with compensation described on Schedule "Summary of Compensation" hereto.

Customer Signature DEALMAKER TERMS OF SERVICE These Terms of Services (“Terms”) govern access to the software and services provided by any of the DealMaker entities such as Novation Solutions Inc., O/A DealMaker ( “DealMaker.tech” ), DealMaker Reach, LLC ( “DM Reach” ), DealMaker Securities LLC ( “DMS” ) and DealMaker Transfer Agent LLC, O/A DealMaker Shareholder Services ( “DMTA” ) (individually, each a “DealMaker Entity” and collectively, the “DealMaker Entities” ). Each of the entities may be referred to as “DealMaker” or the “Company” in these Terms. These Terms have legal implications. It is important that you read these terms carefully, and consult legal counsel if you determine that is appropriate, in order to understand these Terms. The Terms, together with the DealMaker order form from which this page was linked ( “Order Form” ), form an agreement between the Customer (as defined in the order form) and the applicable DealMaker entit(ies) being engaged for technology or services (each an “Agreement” ). Each of these Agreements may be referred to as “an Agreement” or “the Agreement” in these Terms. Each Agreement contains, among other things, warranty disclaimers, liability limitations and use limitations. Each Agreement also contains an arbitration provision which is enforceable against the parties and may impact your rights and obligations. By signing the Order Form and using the DealMaker Entity services described in such Order Form, Customer accepts and agrees to be bound by these Terms. These Terms apply to all DealMaker Entities unless a DealMaker Entity is explicitly excluded or alternative terms are supplemented, as indicated below. 1. Definitions “Account” means Investment funds deposited in Customer’s account with a financial institution by (i) Customer’s investors directly, funded via wire or check or (ii) a third party payment processor, prior to the Closing of any transaction involving such investments. “Closing” means the resolution of all applicable AML - related exceptions or discrepancies identified through any searches provided by third parties through Company or otherwise identified by or to Company for all

transactions associated with an investment and the acceptance by the Customer of the investment associated with such transactions. “Closing Date” means the date of each Closing. “Commencement Date” occurs in the month the Customer begins paying monthly subscription fees. If no Commencement Date is stated on the Order Form, monthly subscription fees are payable in the month following the Effective Date. “Customer Payment Processing Account“ means a Customer’s account with a third party payment processor into which Customer deposits investment funds. “DM Shareholder Management Technology” means DealMaker’s investor communication functionality technology and/or services provided by DealMaker.tech. “Effective Date” is the date the Agreement is signed. “Escrow Account” means Customer’s third party escrow account into which Customer directs investment funds from Investors. “Improvements” means any improvements, updates, variations, modifications, alterations, additions, error corrections, enhancements, functional changes or other changes to the Software, including, without limitation: (i) improvements or upgrades to improve software efficiency and maintainability; (ii) improvements or upgrades to improve operational integrity and efficiency; (iii) changes or modifications to correct errors; and (iv) additional licensed computer programs to otherwise update the Software. “Intended Purpose” means Customer’s use of the Software to raise capital online via technology or services provided by DealMaker.tech. “Offerings” refers to online capital formation transactions completed by Company’s Customers or Customer’s clients, using the Software. “Software” means the DealMaker cloud - based software program developed by Company, including its features, functionality, performance, application and use, any related printed, electronic and online documentation, manuals, training aids, user guides, system administration documentation and any other files that may accompany the Software used by the Customer. “TOS” means the DealMaker.tech website terms of service located at https://www.dealmaker.tech/terms. 2. Term and Termination 1. Term Unless otherwise stated in the Order Form, the Agreement will remain in effect from the Effective Date until the first day of the month following the completion of an Offering (“Term”). The Term for DMTA is set forth in the DMTA terms.

2. Renewal 1. Activation Fees : Unless otherwise specified in the Order Form, activation fees do not renew . Activation fees are one - time fees . These may also be referred to as “Launch Expenses” or “Setup,” if they precede the Offering launch or commencement of Services 2. Monthly Subscription Fees : Unless otherwise specified in the Order Form, Monthly Subscription Fees (“Subscription Fee”) automatically renew each month. 3. DM Shareholder Management Technology Fees : DM Shareholder Management Technology is a service offered by DealMaker.tech. Unless otherwise specified in the DealMaker.tech or DMTA fee schedules to your Order Form, fees for use of the DM Shareholder Management Technology, when applicable, will automatically renew each month and the services can be canceled within any month upon written notice, effective the month following cancellation of DealMaker.tech services, except for DMTA Customers. Cancellation of fees for use of DM Shareholder Management Technology for DMTA customers is governed by the DMTA terms. 4. DealMaker Transactional Fees are incurred at the time of each transaction and charged on a per use basis, as specified in the Order Form. 3. Termination 1. Termination for Cause . Customer or any DealMaker Entity may terminate this Agreement immediately for Cause, as to any or all Subscription services. “Cause” includes a determination that a party is acting, or have acted, in a way that has negatively reflected on or impacted, or may negatively reflect on or impact the other party, its prospects, or its customers, including without limitation in a way that violates or causes a violation of applicable law or regulation. Upon termination for cause, there are no additional fees incurred. All prepaid unused fees would be returned. 2. Otherwise, an Agreement may only be terminated as follows: a. Material Breach : A party may terminate this Agreement upon sixty (60) days written notice if the breaching party fails to perform or observe any material term, covenant, or condition to be performed or observed by it under this Agreement and such failure continues to be unremedied after sixty (60) days’ written notice of such failure from Company to Customer. If the breach has not been cured within the sixty day period, the non - breaching party may terminate this Agreement forthwith and may immediately exercise any one or more of the remedies available to it under the Terms of this Agreement, in addition to any remedy available at law. b. Customer Default . If Customer defaults in performing its obligations under an Agreement, Company may terminate this Agreement (i) upon written notice if any material representation or warranty made by Customer proves to be incorrect at any time in any material respect or (ii) upon written notice, in order to comply with a legal requirement, if such compliance cannot be timely achieved using commercially reasonable efforts, after Company has

provided Customer with as much notice as practicable. c. Right of Termination – Insolvency/Bankruptcy : A party may terminate an Agreement immediately, if the other party becomes the subject of a petition in bankruptcy or any other proceeding relating to insolvency, cessation of business, liquidation or assignment for the benefit of creditors, reorganization or other relief, or is adjudged bankrupt or insolvent or has entered against it a final and unappealable order for relief, under any bankruptcy, insolvency, or other similar law. In the event of Company insolvency, all of the Customer’s assets are immediately released. (collectively, “Termination Reasons” ) Other than the Termination Reasons, unless explicitly stated otherwise, an Agreement may not otherwise be terminated prior to the end of the Term. 3. The termination of an Agreement as described herein shall not exclude the availability of any other remedies. Any delay or failure by either party to exercise, in whole or in part, any right, power, remedy or privilege shall not be construed as a waiver or limitation to exercise, in whole or in part, such right, power, remedy or privilege. 4. All terms of an Agreement, which should reasonably survive termination, shall survive, including, without limitation, confidentiality, limitations of liability and indemnities, arbitration and the obligation to pay fees relating to services provided by the DealMaker Entity prior to termination. 3. Payment & Billing DealMaker shall be compensated as set out in the Order Form. Unless otherwise specified in the schedules to the Order Form, Customer will be invoiced on a monthly basis. Payment will be automatically debited from the Customer’s bank account or credit card on file, with a receipt to be automatically delivered. Invoices will be available for the Customer to review upon request. In the event that any Customer payment fails, in respect of any invoice due and payable to a DealMaker Entity ( “Arrears” ), Customer must re – connect its bank account or update credit card within fourteen (14) days and submit payment for any Arrears. Unless Arrears are cleared and accounts are brought back into good standing within 14 days, automated payouts and reconciliation reporting will be disabled. In the event the Arrears are not cleared or accounts are not brought back into good standing within 30 days, all services will be paused until payment is received and the Customer’s bank account or credit card authorization is restored. DealMaker reserves the right to debit from Customer’s payment account in respect of any Arrears aged beyond thirty days unless the Customer disputes the charges in writing. 4. Intellectual Property 1. Title . Company retains title to and sole ownership of the Software and all Improvements. 2. Cloud - Based Software . The Software is cloud based. As such, the source and object code are located on servers outside of the Customer’s premises. Customer shall have no access to the facilities at which the Software is hosted. 3. Intellectual Property . All Intellectual Property, Intellectual Property Rights and distribution rights associated with or arising from Company’s Confidential Information including but not limited to the Software, remain exclusively with Company. “Intellectual Property” includes, without limitation, with

respect to all DealMaker Products: all technical data, designs, specifications, software, data, drawings, plans, reports, patterns, models, prototypes, demonstration units, practices, inventions, methods and related technology, processes or other information, and all rights therein, including, without limitation, patents, copyrights, industrial designs, trade - marks and any registrations or applications for the same and all other rights of intellectual property therein, including any rights that arise from the above items being treated by the parties as trade secrets (the rights being “Intellectual Property Rights.” ) 4. Restrictions. 1. Customer may not: (i) modify, enhance, reverse - engineer, decompile, disassemble or create derivative forms of the Software; (ii) copy the Software; (iii) sell, sub - license, lease, transmit, distribute or otherwise transfer rights in/to the Software; (iv) allow third - party use of the Software installed at the Site; or (v) pledge, hypothecate, alienate or otherwise encumber the Software to any third party. 2. Use of the Software is restricted to the Intended Purpose only. Customer agrees not to engage in any activity restricted by the TOS or transfer any information restricted by the TOS. 3. Customer acknowledges that unauthorized reproduction or distribution of the Software is expressly prohibited by law, and may result in civil and criminal penalties. Violators may be prosecuted. Customer may not reverse engineer, decompile, disassemble or otherwise attempt to discover the source code of the Software, DealMaker website or any part thereof, except and only to the extent that such activity is expressly permitted by applicable law notwithstanding this limitation. 5. Customer represents and warrants that any Customer assets or materials provided and the intended use thereof in accordance with the terms of each Agreement, will not infringe, violate, or misappropriate any third party rights, including without limitation, any copyrights, trademarks, trade secrets, privacy, publicity, or other proprietary or intellectual property rights. 6. Customer represents and warrants that Customer will not to bid on or use any DealMaker Entity trademarks, brand names, or any variations thereof in Customer’s paid search advertising campaigns. This includes, but is not limited to, Google AdWords, Bing Ads, and other search engine marketing platforms. Unless otherwise provided for in the Agreement, Customer shall not: 1. bid on or use our trademarks as keywords in Customer’s paid search campaigns; 2. include DealMaker Entity trademarks in Customer’s ad copy, display URL, or landing page URL; or 3. use any misspellings, variations, or confusingly similar terms to DealMaker Entity trademarks in Customer’s paid search activities; DealMaker reserves the right to monitor and enforce compliance with these trademark bidding restrictions. 5. Confidential Information

1. “Confidential Information” means any and all confidential or proprietary information of DealMaker or Customer, including affiliates thereof, which has been or may be disclosed by one party to this Agreement ( “Disclosing Party”) to the other party (“Receiving Party”), at any time prior to and during the Agreement Term, including, without limitation, the names of employees and owners, the names or other personally identifiable information of customers, business and marketing information, technology, know - how, ideas, reports, techniques, methods, processes, uses, composites, skills, and configurations, intellectual property of any kind and all documentation provided by investors in the Offering. Without limiting the generality of the foregoing, DealMaker’s Confidential Information includes: (i) the Software; (ii) the computer code underlying the Software, including source and compiled code and all associated documentation and files; (iii) information relating to the performance or quality of the Software and services provided by the DealMaker Entity; (iv) the details of any technical assistance provided to Customer during the Term; (v) any other products or service made available to Customer by DealMaker during the Agreement Term; and (vi) information regarding DealMaker’s business operations including its research and development activities. All work product, pricing, Agreement terms and process information of either party exchanged with the other party to perform the terms of the Agreement is agreed to be Confidential Information, except that any logos or marketing references are not Confidential Information. 2. “Confidential Information” does not include information that: (i) is or has become generally known to the public without any action by the non - disclosing party; (ii) was known by either party prior to entering into the Agreement; (iii) was independently determined by either party; or (iv) was disclosed to the relevant party without restriction by a third party who, to the best of such party's knowledge and belief, had no obligation not to disclose such information. 3. Neither party may disclose Confidential Information without the express written consent of the other party, except as specifically contemplated in this Agreement. 4. Trade Secrets. Notwithstanding anything to the contrary herein, with respect to Confidential Information that constitutes a trade secret under the laws of any jurisdiction, such rights and obligations shall survive such expiration or termination until, if ever, such Confidential Information loses its trade secret protection other than due to an act or omission of the receiving Party or its Representatives. 5. By executing this Agreement, the Customer is providing written consent for DealMaker to disclose Confidential Information but only to the extent required to carry out the terms of this Agreement. Customer’s investors will be required to sign - in to the DealMaker.tech portal and agree to the DealMaker.tech TOS. The parties agree that this process shall not constitute a disclosure of “Confidential Information” as described in this section. 6. Notwithstanding anything in this section, Customer and DealMaker hereby agree that each party may use the other party’s logo for promotional purposes ( “Logo Use” ). The parties acknowledge that Logo Use does not include the use of any descriptive copy, all of which must be approved by Customer and DealMaker in writing. Except as provided for in this paragraph, nothing contained in this Agreement will be construed as granting Customer or DealMaker any right, title or interest in or to any or to use any of the other party’s Confidential Information. Customer or DealMaker may terminate Logo Use at any time, with or without cause, upon written notice to the other party. For any Customer conducting a public offering on the DealMaker platform (i.e. Regulation A or Regulation CF offerings), in which the offering is already in the public domain, Customer agrees that DealMaker may disclose Customer name and offering proceeds to third party data aggregators for the purpose of generating industry reports. Industry reports shall not include publication of Customer name or the amount raised. 7. Authorized Disclosure . Each party may, without the consent of the other party, disclose Confidential Information to the extent reasonably necessary to comply with applicable regulatory demands or orders in

connection with the purpose for which the Customer enters into this Agreement. Each party may disclose the existence of this Agreement and any relationship between the parties. 6. Exclusion of Warranties 1. Except as expressly stated in this Agreement, DealMaker makes no representations or warranties or covenants to Customer, either express or implied, with respect to the Software, services provided by the DealMaker Entity or with respect to any Confidential Information disclosed to Customer. DealMaker specifically disclaims any implied warranty or condition of non - infringement, merchantable quality or fitness for a particular purpose. Customer acknowledges that the Software is in continuous development and that it has been advised by DealMaker to undertake its own due diligence with respect to all matters arising from this Agreement. All services are provided on an "as is" and "as available" basis without any warranties, express or implied, including, without limitation, implied warranties of merchantability or fitness for a particular purpose, and DealMaker expressly disclaims all warranties. Customer agrees and understands that no DealMaker entity has any fiduciary duty to Customer. 2. No Improvements . Company is under no obligation to provide Improvements to the Software during the Term. 3. Any Improvements Gratuitous . Any Improvements provided by DealMaker to Customer from time to time during the Term shall be, unless otherwise stated, construed as being provided on a purely gratuitous basis and shall not give rise to any right or entitlement on the part of Customer, except as otherwise specifically provided in this Agreement. Any Improvements so provided shall be governed by the same terms and conditions applicable to the Software, as described herein, unless otherwise outlined in a fee schedule or addendum to this Agreement. 4. No Future Entitlement. Nothing in this Agreement shall be construed as creating any obligation on DealMaker to continue to develop, commercialize, offer, make available or support (i) the Software; or (ii) any feature, functionality or Improvement as may be encompassed in the Software from time to time during the Term, beyond the duration of the Term. 5. Company Templates and Samples are Provided with No Warranties . Customer may request access to DealMaker’s templates and resources to help organize and set up an offering or any communications related thereto. These resources may include template communications, educational packages, resources for the management of administrative and collaborative tasks, and best practices observed from other offerings and industries. Customer acknowledges and agrees that, by providing access to any documents, training, or resources, DealMaker is not rendering and shall not be deemed to have rendered any legal, tax, investment, or financial planning advice. Customer shall, as it deems necessary or advisable, consult its own legal, tax, investment, or financial planning advisers. All templates and samples are provided with no warranties whatsoever and by making use of such materials, Customer is agreeing to voluntarily assume any liability with respect thereto. 7. Limitation and Exclusion of Liability Unless otherwise specified herein, in no event is DealMaker’s liability for any damages on any basis, in contract, tort or otherwise, of any kind and nature whatsoever, arising in respect of this Agreement, howsoever caused, including damages of any kind and nature caused by DealMaker’s negligence or by a breach of contract or any other breach of duty whatsoever, to exceed the fees actually paid to DealMaker by Customer during the Term. Customer acknowledges that DealMaker has set its fees

under this Agreement in reliance on the limitations and exclusions of liability set forth in this Agreement and such reliance forms an essential basis of this Agreement. 8. Indemnification Applicability of Indemnification Clause: Customers of DMTA are bound by the separate indemnification clauses applying only to DMTA. 1. Indemnification by Customer . Customer shall indemnify and hold each DealMaker Entity, its affiliates and their respective members, officers, directors and agents ( “Indemnified Parties” ) harmless from any and all actual or direct losses, liabilities, claims, demands, judgements, arbitrations awards, settlements, damages, direct fees, costs and expenses ( including attorney fees and costs) (collectively “Losses” ), resulting from or arising out of any third party suits, actions, claims, demands, investigations or similar proceedings (collectively “Claim” ) to the extent they are based upon (i) a breach of this Agreement by Customer, (ii) the wrongful acts or omissions of Customer, (iii) Customer, or Customer’s clients’ engagement with DealMaker and any actions taken in conjunction therewith, including but no limited to usage of the Software, whether or not such activities are in accordance with Intended Usage or (iv) the Offering. “Losses” includes, losses arising from payment processing which are losses arising from chargebacks, clawbacks, payment reversals, fraudulent charges, insufficient credit, unauthorized charges, claims of Customer or third parties regarding payment disputes, and any other problems relating to card or ACH payments made for the benefit of Customer ( “Payment Processing Losses” ). 2. Indemnification by Company. The applicable DealMaker Entity shall indemnify and hold Customer, Customer’s affiliates and Customer’s representatives and agents harmless from any Losses resulting from or arising out of Claims to the extent they are based upon (i) such DealMaker Entity’s breach of this Agreement (ii) the negligence, fraud, bad faith or willful misconduct of the DealMaker Entity or (iii) DealMaker Entity’s failure to comply with any applicable laws in the performance of its obligations under this Agreement. 3. Indemnification Procedure . If any proceeding is commenced against a party entitled to indemnification under this section, prompt notice of the proceeding shall be given to the party obligated to provide such indemnification. The indemnifying party shall be entitled to take control of the defense, investigation or settlement of the Proceedings and the indemnified party agrees to reasonably cooperate, at the indemnifying party’s cost in ensuing investigations, defense or settlement. The indemnifying party shall reimburse the indemnified party for all expenses (including reasonable fees, disbursements and other charges of counsel) as they are incurred in connection with investigating, preparing, pursuing, defending, or settling a Claim (including without limitation any shareholder or derivative action); provided, however, that indemnifying party will not be liable to indemnify and hold harmless or reimburse an indemnified party pursuant to this paragraph to the extent that an arbitrator (or panel of arbitrators) or court of competent jurisdiction will have determined by a final non - appealable judgment that such Claim resulted from the gross negligence or willful misconduct of such indemnified party. The Indemnifying Party will not settle, compromise or consent to the entry of a judgment in any pending or threatened Claim unless such settlement, compromise or consent includes a release of the indemnified parties satisfactory to the indemnified parties. 4. Indemnified Party Limitation Of Liability . In no event shall the Indemnified Parties be liable or obligated in any manner for any consequential, exemplary or punitive damages or lost profits incurred by Customer arising from or relating to the Agreement, an Offering, or any actions or inactions taken by an

Indemnified Parties in connection with the Agreement, and the Customer agrees not to seek or claim any such damages under any circumstances. 8.5. Recovery of Payment Processing Losses. Notwithstanding anything to the contrary in this Agreement, upon Company giving Customer prior written notice of no less than five business days, DealMaker.tech shall have the right, in its sole discretion, to request Customer reimburse Company for Payment Processing Losses from Customer Account or from Customer’s Payment Processing Account, unless prohibited by law. Customer acknowledges and agrees that recovery of Losses from Customer’s Payment Processing Account will not serve as any limitation on the indemnification obligations of Customer under this Agreement or any remedy or claim that Company may be entitled to pursue against Customer in respect of such Losses. 9. Third Party Services Customer may request introductions to DealMaker’s network of partners and vendors for the purpose of sourcing additional services (including but not limited to, a call center, marketing support, investment relations). Unless otherwise specified in writing, all engagements with third parties in this respect are to be made directly between the Customer and the vendor at the Customer’s discretion. Customer acknowledges and agrees that, by making such introductions, DealMaker is not recommending and shall not be deemed to have recommended any partner or vendor’s products or services or to have assumed any responsibility for Customer’s selection of any partner or vendor or procurement of such products or services. Without limiting any other protection of DealMaker under this Agreement and notwithstanding anything to the contrary, DealMaker shall bear no responsibility or liability whatsoever in connection with any third party services provided by a vendor engaged by Customer, the decision to engage such vendors rests solely with the management of the Customer on the terms contracted between the Customer and such parties. 10. Escrow Customer acknowledges that if Customer opens a third - party escrow account (either by Customer’s choice or as necessary to comply with applicable laws or regulations) in connection with the Company services, Customer will apply for escrow account with a DealMaker - approved escrow provider. 11. Customer Obligations 1. General 1. Customer shall be responsible for providing Offering terms to its subscribers. Such disclosure shall include, but is not limited to the following material information: a method of Customer valuation, a description of the security available in the Offering, the risks related to the investment, whether there are existing investors and any additional capital expectations. 2. Customer is solely responsible for ensuring that the funds raised in the Offering are used, allocated or invested in accordance with the use of funds described in the Offering disclosure.

3. Customer acknowledges that following the final closing for the Offering, Customer will have sufficient liquidity (from the proceeds raised in the Offering or alternate Customer funds) to sustain Customer operations for that period of time which is clearly identified in the Offering disclosure or alternatively, until the next Customer funding round. 4. Nothing in this Agreement shall be construed to relieve the managers or officers of Customer from the performance of their respective duties or limit the exercise of their powers in accordance with the Customer's bylaws, operating and constituent documents, written supervisory procedures, applicable law or otherwise. The Customer bears ultimately responsibility for all decisions with regard to any matter upon which Company has rendered its services. The Company shall not, and shall have no authority to control Customer or Customer's day - to - day operations, whether through the performance of the Company's duties hereunder or otherwise. The Customer's directors, managers, officers and employees shall retain all responsibility for Customer, and its operations as and to the extent required by Customer’s bylaws, operating and constituent documents, and applicable law. In furtherance and not in limitation of the above, and notwithstanding any other provision of this Agreement or of any other agreement, understanding or document that purports to have any contrary effect or meaning, the DealMaker shall not control, or have the right to control, directly or indirectly, the wages, hours, or terms and conditions of employment of the Customer. 2. Privacy. 1. Notwithstanding any other provision of this Agreement, Customer shall not take or direct any action that would contravene, or cause the other party to contravene, applicable legislation that addresses the protection of individuals’ personal information (collectively, “Privacy Laws” ). Customer shall, prior to transferring or causing to be transferred personal information to Company, obtain and retain required consents of the relevant individuals to the collection, use and disclosure of their personal information, or shall have determined that such consents either have previously been given upon which the parties can rely or are not required under the Privacy Laws, including any consents required from third parties pursuant to applicable Privacy Laws. 2. Customer acknowledges that, when used for an Offering, the Customer’s personalized Software dashboard ( “Software Dashboard” ) will contain personal identifying information ( “PII” ) of Customer’s investors. Customer is solely responsible for ensuring compliance with all applicable Privacy Laws when Customer (a) downloads and stores any PII obtained from the Software Dashboard and (b) provides Customer’s representatives with access to the Software Dashboard. 3. Customer is solely responsible for notifying Company when any Customer representative is no longer working for the Customer and/or authorized to access the Software Dashboard for the Offering. 11.2.4 Customer shall cause all third parties with access to PII obtained from the Software Dashboard to execute agreements acknowledging the third parties’ obligation to comply with applicable Privacy Laws. 11.2.5. Customer has implemented and continually monitors and enforces an agreement or policy with its Customer representatives, employees and agents that addresses (i) confidentiality and security provisions for all data, including data obtained through the Software Dashboard and (ii) permitted and impermissible use of this data.

11.3. Bad Actor Checks Customer agrees to provide DealMaker Entity with documentation verifying completion of bad actor checks in compliance with all applicable regulations ( “Bad Actor Checks” ). Customer shall provide DealMaker Entity with a copy of Customer’s Bad Actor Checks within thirty (30) days of the Effective Date of this Agreement, failing which, DealMaker Entity shall notify Customer in writing that it shall take steps to complete Customer’s Bad Actor Checks at Customer’s sole expense. 12. General Terms 1. Publications. Each party acknowledges that its name, logo(s) and a description of the general nature of this Agreement may be used in any press release, public announcement or public communication during and following the Term. Without limiting the generality of the foregoing, Company may publish such information on its websites and in its promotional materials. 2. General Cooperation . The parties shall with reasonable diligence do all such things and provide all such reasonable assurances and execute all such documents, agreements and other instruments as may reasonably be necessary for the purpose of carrying out the provisions and intent of any Agreement. The parties further acknowledge that the implementation of each Agreement will require the co - operation and assistance of each of them. 3. No Books And Records Obligations . Any and all obligations of Customer related to the storage of books and records remains the sole obligation of Customer. Company expressly disclaims any and all responsibility with respect to any regulatory or industry requirements with respect to the Customer’s obligations related to record keeping and maintenance. 4. Survival. These terms shall continue in effect until the expiration or termination of the Agreement, whichever is earlier. The provisions of these Terms of Service which should by their nature survive expiration or termination of this Agreement shall so survive. 5. Currency. All currencies referred to herein are in US dollars. 6. Amendment and Waiver . Amendments to any Agreement, including any schedule or attachment hereto, shall be enforceable only if in writing and signed by authorized representatives of each of the applicable parties. A party does not waive any right under this Agreement by failing to insist on compliance with any of the terms of this Agreement or by failing to exercise any right hereunder. No waiver of any breach of any terms or provisions of this Agreement is effective or binding unless made in writing and signed by the authorized representative of each of the parties. 7. Assignment : No party may assign an Agreement or any of its rights or obligations hereunder without the prior written consent of the other party, such consent not to be unreasonably withheld. 8. Inurement . Each Agreement inures to the benefit of and is binding on each of the parties and their respective successors and permitted assignees, heirs and legal representatives.

9. Force Majeure . Excluding any obligations of a party to pay monies due hereunder, neither party will be responsible for any delay or failure in its performance or obligations under this Agreement due to causes beyond its reasonable control, including, without limitation, labor disputes, strikes, civil disturbances, government actions, fire, floods, acts of God, war, terrorism, or other similar occurrences (each, a “Force Majeure Event” ); provided that the party affected by such Force Majeure Event (a) is without fault in causing such delay or failure, (b) notifies the other party of the circumstances causing the Force Majeure Event, and (c) takes commercially reasonable steps to eliminate the delay or failure and resume performance as soon as practicable. 10. Governing Law. Each Agreement is made in New York governed by and construed in accordance with the laws of the state of New York and the federal laws applicable therein. In connection with each Agreement, the Parties attorn to the jurisdiction of the courts of the State of New York. 11. Arbitration . Any and all controversies, claims, or disputes arising out of or relating to each Agreement, or the interpretation, performance, or breach thereof, including the scope or applicability of this provision to arbitrate ( “Dispute” ) shall be referred to senior management of the parties for good faith discussion and resolution. In the event the parties cannot resolve any Dispute informally, then such Dispute shall be submitted to confidential, final, and binding arbitration with venue in New York, NY, pursuant to the rules of the American Arbitration Association. 1. Arbitration Procedure . The arbitration shall take place in New York. The arbitration shall be before a single, neutral arbitrator who is a former or retired New York state or federal court judge. The arbitration may be initiated by any party by giving to the other party written notice requesting arbitration, which notice shall also include a statement of the claims asserted and the facts upon which the claims are based. Customer and Company each consent to this method of dispute resolution, as well as jurisdiction, and consent to this being a convenient forum for any such claim or dispute and waive any right it may have to object to either the method or jurisdiction for such claim or dispute. In the event of any dispute among the parties, the prevailing party shall be entitled to recover damages plus reasonable costs and attorney’s fees and the decision of the arbitrator shall be final, binding and enforceable in any court. 2. Compelling Arbitration . Any party may bring an action in any court of competent jurisdiction to compel arbitration under this Agreement and to enforce an arbitration award. Notwithstanding this arbitration provision, either party shall be entitled to seek injunctive relief (unless otherwise precluded by any other provision of this Agreement) from any court of competent jurisdiction. If for any reason an action proceeds in court rather than in arbitration, it shall be brought exclusively in a state or federal court of competent jurisdiction located in New York and the parties expressly consent to personal jurisdiction and venue therein and expressly waive any right to trial by jury. 3. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES ALL RIGHT TO TRIAL BY JURY IN ANY LITIGATION, ACTION, PROCEEDING, CROSS - CLAIM, OR COUNTERCLAIM IN ANY COURT (WHETHER BASED ON CONTRACT, TORT, OR OTHERWISE) ARISING OUT OF, RELATING TO OR IN CONNECTION WITH (I) THIS AGREEMENT OR THE VALIDITY, PERFORMANCE, INTERPRETATION, COLLECTION OR ENFORCEMENT HEREOF OR (II) THE ACTIONS OF THE PARTIES IN THE NEGOTIATION, AUTHORIZATION, EXECUTION, DELIVERY, ADMINISTRATION, PERFORMANCE OR ENFORCEMENT HEREOF. 12. Entire Agreement : Each Agreement including all schedules thereto, constitutes the entire agreement between the parties concerning the applicable subject matter and supersedes all prior or collateral agreements, communications, presentations, representations, understandings, negotiations and

discussions, oral or written. 13. Headings : Headings are inserted for the convenience of the parties only and are not to be considered when interpreting this Agreement. 14. Number and Gender. Words importing the singular mean the plural and vice versa. Words in the masculine gender include the feminine gender and vice versa. 15. Severability. If any term, covenant, condition or provision of an Agreement is held by a court or arbitrator(s) of competent jurisdiction to be invalid, void or unenforceable, it is the parties' intent that such provision be reduced in scope by the court or arbitrator(s) only to the extent deemed necessary by that court or arbitrator(s) to render the provision reasonable and enforceable and the remainder of the provisions of this Agreement will in no way be affected, impaired or invalidated as a result. 16. Notices. Any notice required to be given pursuant to an Agreement shall be in writing and delivered by electronic mail, addressed to the appropriate party. Any notice given is deemed to have been received on the date on which it was delivered if a business day, or, failing that, on the next business day. 17. Testimonials. Customer acknowledges that DealMaker’s materials may from time to time include testimonials, real world experiences and insights or opinions about other people’s experiences with DealMaker ( “Examples” ) and that this information is for illustration purposes only. Customer further acknowledges that campaigns are affected by a variety of factors including but not limited to time, external global events, varying business plans, different industries, and that these Examples are in no way a representation or guarantee that current or future customers will achieve the same or similar results. DealMaker Additional Terms Applicable to Certain DealMaker.tech Services: Third Party Payment Processing, AML/KYC Background Checks, Accreditation Verification and Analytics, Marketing Review Tool. The following sections of the Terms only apply to those DealMaker.tech Customers who purchase the specific services noted. 13. Background Checks: AML compliance and “clearing” DealMaker’s integrated AML searches are tools provided to Customer to assist Customer (or its agents) in complying with applicable obligations related to KYC/AML regulations. Company is not engaged to perform and will not perform, and shall not be deemed responsible for performing, any services related to reviewing or analyzing search results, sources of funds or wealth, or making any determination as to whether Customer has complied with its obligations under applicable anti - money laundering legislation and regulations or as to whether any prospective investor poses any risk of money laundering, terrorist financing, or other criminal or suspicious activity. Customer and/or its agents (including counsel or broker dealer as applicable) shall bear primary responsibility to determine compliance with applicable AML legislation and regulation and shall assist in the clearing of any AML exceptions. Customer’s KYC/AML clearing obligations may require Customer to undertake efforts to ensure that individual and corporate investors provide applicable identity verification, explanations of adverse regulatory/disciplinary/bankruptcy history or media reports, confirmation of false positive results, or other documents or information required for AML purposes. DealMaker.tech’s AML searches are limited by capabilities and design of products and services of the third parties DealMaker.tech engages to perform

such searches, including limitations on the search methodology, matching logic, data sources, and information accuracy. 14. Regulation D, 506(c) Accredited Investor Verification 1. Customer may engage either Company or a third party (each a "Reviewer" ) to assist Customer in complying with applicable obligations related to accredited investor verification pursuant to Rule 506(c) of Regulation D promulgated under the Securities Act ( “Regulation D” ). If Reviewer is Company, Company shall review investor submissions and uploaded documentation on the DealMaker portal and make a determination as to whether Customer has complied with its obligations to verify accredited investors (as defined by Rule 501 of Regulation D promulgated under the Securities Act) ( “DM Verification” ). Customer acknowledges that Company may contact investor for the purpose of accredited investor verification and that Customer has obtained investor’s consent to receive communications from Company and/or DealMaker regarding investor’s accreditation verification. If Reviewer is a third party, Company will not perform, and shall not be deemed responsible for performing, any services related to reviewing or analyzing search results, sources of funds or wealth, or making any determination as to whether Customer has complied with its obligations to verify accredited investors (as defined by Rule 501 of Regulation D promulgated under the Securities Act). 2. Company does not make and hereby disclaims any warranty, expressed or implied with respect to the information provided through DM Verification. Company does not guarantee or warrant the correctness, merchantability, or fitness for a particular purpose of the information provided through DM Verification. Customer acknowledges that: 1. DM Verification shall not include accreditation verification of non - U.S. investors ( “foreign accredited investors” ) who may be subject to foreign accreditation verification requirements. 2. DM Verification is conducted using a variety of third party database searches, public record services and user submissions. Company cannot represent or warrant that the data provided will be 100% accurate, complete or up to date. The data is time sensitive and Company provides the information as is. Public records may be incomplete, out of date or have errors. 3. The results of a DM Verification search for any type of personal verification should be interpreted cautiously. Criminal and civil record search results may not provide a complete or accurate representation of a person's criminal background or civil judgment history. Records are available for the majority, but not all, of states and counties. Records can be incomplete, contain inaccuracies or false matches. 4. Company is not a consumer reporting agency as defined in the Fair Credit Reporting Act ( "FCRA" ), and the information in DealMaker.tech’s databases has not been collected in whole or in part for the purpose of furnishing consumer reports, as defined in the FCRA. CUSTOMER SHALL NOT USE DM VERIFICATION SERVICES AS A FACTOR IN (1) ESTABLISHING AN INDIVIDUAL'S ELIGIBILITY FOR PERSONAL CREDIT OR INSURANCE OR ASSESSING RISKS ASSOCIATED WITH EXISTING CONSUMER CREDIT OBLIGATIONS, (2) EVALUATING AN INDIVIDUAL FOR EMPLOYMENT, PROMOTION, REASSIGNMENT OR RETENTION, OR (3) ANY OTHER PERSONAL BUSINESS TRANSACTION WITH ANOTHER INDIVIDUAL.

5. Customer assumes all risks arising from its use or disclosure of DM Verification information Company provides to Customer. 6. DM Verification Services are provided in English only. Customer acknowledges that data provided in any other language will require a certified translation which Customer shall pay for, or alternatively, reject the investment. 7. Notwithstanding anything in the DealMaker Terms of Service, Customer agrees that it shall indemnify, defend and hold harmless Company, its officers, directors, employees and agents, and the entities that have contributed information to or provided services for DM Verification against any and all direct or indirect losses, claims, demands, expenses (including attorneys' fees and cost) or liabilities of whatever nature or kind arising out of Customer’s use of the information provided by DM Verification and Customer’s use or distribution of any information obtained therefrom, except for losses caused exclusively and directly by Company’s gross negligence, fraud, bad faith or wilful misconduct. 8. THE DM VERIFICATION SERVICES AND INFORMATION ARE PROVIDED "AS - IS" AND "AS AVAILABLE" AND NEITHER COMPANY NOR ANY OF ITS DATA SUPPLIERS REPRESENTS OR WARRANTS THAT THE INFORMATION IS CURRENT, COMPLETE OR ACCURATE. COMPANY HEREBY DISCLAIMS ALL REPRESENTATIONS AND WARRANTIES REGARDING THE PERFORMANCE OF THE WEBSITE OR OUR SERVICES, AND THE ACCURACY, CURRENCY, OR COMPLETENESS OF THE INFORMATION, INCLUDING (WITHOUT LIMITATION) ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE . Customer acknowledges that these disclaimers are an integral part of this Agreement, and that Company would not provide DM Verification services if Customer did not agree to these disclaimers . 15. Third - Party Payment Processing 1. For the processing of electronic payments (including bank - to - bank payments, credit card, etc.), the Company may submit material(s) and or application(s) to partner third - party payment processors on behalf of the Customer. Upon approval, the Company will enable the partner processors’ intake form/system within the Customer’s online DealMaker.tech portal. 2. Customer acknowledges that Company makes no guarantee that Customer will be approved by any third party, and approval is subject to each third party’s sole discretion, including, to the extent applicable, its due diligence and compliance policies and procedures. Use of payment processing service(s) is further contingent on the mutual acceptance by Company and Customer of each third party’s respective terms, service agreements, and fees (including fees for merchant processing account and ongoing maintenance, which may be applied on a per - issuer basis) to be included as an addendum to this Agreement and/or presented to Customer for acceptance at the time Customer engages third party, and as updated from time to time. Note holdback periods may apply for electronic payment transfer methods, as enforced by processors. Company shall not be deemed responsible for delivery or any interruption or cessation of any services provided by any third party. 3. All transactions must clear prior to being made available to Customer. US Federal regulations provide investors with 60 days to recall funds. Customer remains liable to immediately and without protestation or delay return any funds recalled by investors for whatever reason.

4. Customer agrees that funds deposited into Customer’s Account shall remain in Customer’s Account and shall not be withdrawn by Customer or a person authorized by Customer, from the Customer’s Account prior to Closing. 5. Company reserves the right to deny, suspend or terminate participation of any investor in the offering to the extent Company, in its sole discretion, deems it advisable or necessary to comply with applicable laws or to eliminate practices that are not consistent with laws, rules, regulations, best practices, or the protection of its reputation. 6. Holdbacks. The Customer hereby acknowledges that certain terms apply in respect of electronic or credit card payment to cover against charge - backs and/or rescission ( “Chargeback” ). Chargeback windows can vary in duration and amount. For this reason, a holdback is applied to all funds processed online and deposited in Customer Payment Processing Account. Company shall have the right, in its sole discretion, to revise the amount and duration of any holdback. Unless otherwise advised in writing prior to the Effective Date, the holdback is 5.00% of payments processed, for a ninety (90) day period. 7. In the event that a Customer’s investor disputes, through their financial institution, a subscription payment made using electronic or credit card payments (“Chargeback Dispute”) , Customer acknowledges that: 1. If the Chargeback Dispute is initiated by a subscriber before the Customer has accepted the subscriber’s investment, the Company shall refund the subscriber, and no further action will be taken. 2. If the Chargeback Dispute is initiated by a subscriber after the Customer has accepted the subscriber’s investment, the Company shall: 1. notify the Customer within twenty - four (24) hours of the Chargeback Dispute; and 2. Provide Customer with five (5) business days to resolve the Chargeback Dispute directly with the subscriber. 3. If, after (5) business days, the subscriber and Customer fail to resolve the Chargeback Dispute, Company will submit evidence contesting the Chargeback Dispute, on behalf of the Customer. 4. Customer agrees to promptly notify Company upon receipt of any Chargeback Dispute notifications, provide all necessary information and documentation requested by the Company to support the Chargeback Dispute and refrain from directly engaging with the payment processor or any other third party regarding the Chargeback Dispute. 5. Customer acknowledges that contesting a Chargeback Dispute may require the Company to share certain transaction details with third party payment processors. The Customer agrees to (a) only share information necessary to contest the Chargeback Dispute and (b) comply with all applicable data protection and privacy laws when handling Customer data and providing Customer data to Company related to the Chargeback Dispute.

6. For the avoidance of doubt, although the Company will make best efforts to represent the Customer in contesting a Chargeback Dispute, Company shall not be liable for and bares no responsibility whatsoever for: 1. The outcome of the Chargeback Dispute; 2. Any fees or penalties imposed by payment processors or financial institutions as a result of the Chargeback or Chargeback Dispute; or 3. Any loss of revenue or business opportunity resulting from the Chargeback or Chargeback Dispute. 16. Analytics 1. Data and Analytics . Company reserves the right to collect data relating to Customer’s usage of the Software during the Term. Without limiting the generality of the foregoing, Company may collect information relating to: (i) Software use (including the number of users, duration of usage sessions, and number of transactions initiated or completed using the Software); (ii) error information (including error messages and any feedback text submitted via any in - application feedback form); (iii) performance data (including software run time); (iv) user experience information (including time spent on each page of the user interface); and (v) license status information (including confirmation of license activation status). Customer shall have the right to access and use data relating to its usage of the Software for its own purposes, as available through the online dashboard or other reports provided by Company. 17. Marketing Review Tool 1. DealMaker’s integrated third party marketing review tool is made available to Customer (or its agents) to review Customer’s marketing materials and assist Customer in complying with applicable marketing regulations ( “Marketing Review Tool” ). If reviewer is Company, Customer may request that a DealMaker Entity assistant Customer with uploading documentation into the Marketing Review Tool but Company will not perform, and shall not be deemed responsible for performing, any services related to reviewing or analyzing search results. Company is not engaged to perform and will not perform, and shall not be deemed responsible for making any determination as to whether Customer has complied with its obligations under applicable marketing regulations based on information provided by the Marketing Review Tool. Customer and/or its agents (if so designated) shall be responsible for reviewing the results, and determining compliance with applicable marketing legislation and regulations. 2. Use of the Marketing Review Tool is contingent upon Customer’s acceptance of third party provider’s terms and fees (if applicable) to be presented to the Customer at the time Customer initiates engagement with the Marketing Review Tool. 3. Company does not make and hereby disclaims any warranty, express or implied with respect to the information provided through the Marketing Review Tool. Customer acknowledges that (i) Company does not guarantee or warrant the correctness, merchantability or fitness for a particular purpose of the information provided through Marketing Review Tool; (ii) Marketing Review Tool is PROVIDED "AS - IS" AND "AS AVAILABLE" AND NEITHER COMPANY NOR ANY OF ITS THIRD PARTY SUPPLIER REPRESENTS OR WARRANTS THAT THE INFORMATION IS CURRENT, COMPLETE OR ACCURATE; and (iii) Customer assumes all risks arising from Company or its agents’ use of the Marketing Review Tool.

17.4. Notwithstanding anything in the DealMaker Terms of Service, Customer agrees that it shall indemnify, defend and hold harmless Company, its officers, directors, employees and agents, and affiliates that have contributed information to or provided services related to the Marketing Review Tool against any and all direct or indirect losses, claims, demands, expenses (including attorneys' fees and cost) or liabilities of whatever nature or kind arising out of Customer’s or its agent’s use of the Marketing Review Tool and Customer’s use or distribution of any information obtained therefrom. Enterprise Customer Terms For DealMaker Customers who have signed an Enterprise Order Form, the Terms apply, as well as the following additional terms. If you are not an Enterprise Customer, these additional terms do not apply to you: 18. Definitions “Enterprise Customer” means a Customer that has entered into an Enterprise Order Form. “License” means the Company’s grant to Enterprise Customer of a non - exclusive, non - transferable license for use of the Software by an unlimited number of individual users. Company will designate a DealMaker Enterprise Account to Enterprise Customers with a License. “Intended Purpose” For the purposes of this section, Intended Purpose also includes usage by issuers invited by Enterprise Customer to use Enterprise Customer’s Enterprise Account for the above - described purpose . “Software” as it pertains to this section, shall also include any related printed, electronic and online documentation, manuals, training aids, user guides, system administration documentation and any other files that may accompany the Software licensed by Enterprise Customer. 19. SLA 1. It is expressly understood and agreed that the Company shall determine its capacity to offer consulting services, only to such extent and at such times and places as may be mutually convenient to the parties. Company shall be free to provide similar services to such other business enterprises or activities as the Company may deem fit without any limitation or restriction whatsoever. 20. Licensed Intermediary Terms. If Enterprise Customer is a licensed Intermediary (as defined below), the following additional terms apply: A. Books and Records Books and Records. Any and all obligations of Customer related to the storage of books and records including but not limited to, obligations in accordance with Sections 17(a)(1), 17(a)(3) and 17(a)(4) of the Securities Exchange Act of 1934 ( "Exchange Act" or "SEA") remain the sole obligation of Customer and its

clients. Company expressly disclaims any and all responsibility with respect to any regulatory or industry requirements with respect to the Customer and its clients’ obligations related to record keeping and maintenance. B. Regulation CF Offerings i. Obligations of the Customer (acting as an Licensed Intermediary): Where Customer using the Software has been engaged by its client to (i) act as a Broker - Dealer and a licensed Intermediary pursuant to Regulation CF, 17 C.F.R. Part 227 (the “Regulation CF” ), or (ii) act as a registered Funding Portal and licensed Intermediary pursuant to Regulation CF, in a transaction involving the offer or sale of securities in reliance on section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)), Customer shall comply with the requirements of Regulation CF ( “Licensed Intermediary” ). For greater certainty, this includes the requirements that Customer shall: 1. Register with the Securities and Exchange Commission ( “Commission” ) as either (i) a broker or (ii) a Funding Portal under section 15(b) of the Exchange Act (15 U.S.C. 78o(b)), pursuant to Regulation CF, † 227.400; 2. If registering with the Commission as a Funding Portal, refrain from: a. Offering investment advice or recommendations; b. Soliciting purchases, sales or offers to buy the securities displayed on its platform; c. Compensate employees, agents, or other persons for such solicitation or based on the sale of securities displayed or referenced on the DealMaker platform; or d. Hold, manage, possess, or otherwise handle investor funds or securities. (Regulation CF, † 227.300(2)(c)) 3. Verify that no director, officer or partner of Customer, or any person occupying a similar status or performing a similar function has a prohibited “financial interest in an issuer” as the term is defined in Regulation CF, † 227.300(b); 4. Have a reasonable basis for believing that Customer’s client seeking to initiate an offering of securities under the Regulation has a reasonable basis for keeping accurate records of security holders and is not disqualified to offer securities pursuant to Regulation CF, † 227.301(c); 5. Make available to SEC and to the public, the disclosure required by Regulation CF, † 227.201 and † 227.303; 6. Provide educational materials to all investors, pursuant to Regulation CF, † 227.302(b); 7. Verify that Customer’s clients are not disqualified from offering securities pursuant to Regulation CF, † 227.100(b);

8. Only accept an Investor into an offering after (1) the Investor opens an account with Customer, (2) the Investor consents to electronic delivery and the review of the educational materials regarding the offering and (3) Customer has a reasonable basis to believe that the Investor meets the investment limitations in Regulation CF pursuant to Regulation CF, † 227.302 and † 227.303.; 9. Provide communication channels by which Investors who have opened accounts can communicate with one another and with representatives of the Customer about offerings made available through the Customer or its clients, pursuant to Regulation CF, † 227.303(c); and 10. Provide Investors the opportunity to reconsider their investment decision and to cancel their investment commitment until 48 hours prior to the new offering deadline, pursuant to Regulation CF † 227.304 11. Provide Investors with notice of material changes as described in Regulation CF, † 227.304 ( “Notice” ), including but not limited to notice that the investor's investment commitment will be canceled unless the investor reconfirms his or her investment commitment within five business days of receipt of the Notice. 12. If registering with the Commission as a Funding Portal, comply with the Conditional Safe Harbor provisions in Regulation CF, † 227.402; and 13. If registering with the Commission as a Funding Portal, implement written policies and procedures reasonably designed to achieve compliance with federal securities laws and the rules and regulations thereunder, relating to its business as a Funding Portal, as required by Regulation CF, † 227 . 402 (a) . 14. If registering with the Commission as a Funding Portal, manage any reconciliation or reporting questions with the Issuer directly. ( “Regulation CF Requirements” ) For greater certainty, the parties acknowledge that Company shall bear no responsibility for or liability whatsoever in connection with the Regulation CF Requirements and Customer shall be solely responsible for ensuring that Customer and its clients comply with Regulation CF. Further Assurances. When Customer or its clients use the Software for an offering in reliance on Regulation CF, Customer shall verify that: 1. The issuer has filed a Form C Offering Statement with the SEC, as described in Regulation CF, † 227.203(a), prior to making an offering to the public pursuant to Regulation CF; 2. Issuer complies with marketing and advertising requirements of Regulation CF, † 227.204; 3. Provider is notified of any investor who, having received Customer's Notice pursuant to Regulation CF † 227.304, opts - out of their investment and whose investment must therefore be refunded; 4. Signed and funded subscription agreements, executed by investors who have cleared AML/KYC, are reviewed by the Customer prior to countersignature;

5. The aggregate amount of all securities sold to all Investors by the Issuer in a single offering during a 12 month period shall not exceed $5,000,000; and 6. Non - accredited Investors (as defined by Rule 501, CFR † 230.301) investing in the offering pursuant to Regulation CF do not exceed the maximum investment permitted in a 12 month period per Regulation CF, † 227.100. Payments To Escrow. Customer acknowledges that it shall direct all payments from Investors in respect of a Regulation CF offering to Issuer’s Escrow Account. Customer is responsible for (1) applying for escrow account with a DealMaker - selected Escrow Provider; (2) configuring instructions on the DealMaker platform to ensure that all payments are directed to the appropriate Escrow Account; (3) using the DealMaker.tech application to manage closings pursuant to the DealMaker user guide and (4) coordinating with the escrow company managing the Escrow Account to disburse funds upon request from the issuer. C. Regulation A/A+ Offerings Obligations of the Customer. Where Customer has been engaged by its client as a broker - dealer in connection with an offering pursuant to Regulation A, 17 C.F.R. Parts 230.251 - 230.263 ( “Regulation A” ), the Customer shall verify that: 1. Customer shall complete a reasonable due diligence ensuring no anti - fraud or civil liabilities provisions of federal securities laws have been violated. As such, Customer shall maintain a Due Diligence file including the Issuer Agreement (or Selling Agreement); organizational, constating, financial, and administrative support to accept such Issuer engagement; and Issuer’s Offering Memoranda, Subscription Document. Further, the Due Diligence folder shall evidence the collection of such documents in a form as described in Customer’s Written Supervisory Procedures (“WSPs”). Customer shall create and maintain customer files, including new account, accredited investor, or qualified purchaser questionnaires, including Investor attestations. 2. Issuer has filed a Form 1 - A Offering Statement with the SEC, as described in Regulation A, † 230.252 and † 239.90, prior to making an offering to the public pursuant to Regulation A; 3. Issuer complies with marketing and advertising requirements of 17 C.F.R. Part II, Securities and Exchange Commission and the SRO, FINRA, including but not limited to, setting up the issuer landing page for the Offering website. 4. Signed and funded subscription agreements, executed by investors who have cleared AML/KYC, are reviewed by the Customer and a recommendation is made by Customer to Issuer regarding countersignature. 5. Prior to enabling countersignature: a. Issuer has provided written confirmation to Customer that it has BlueSky notice filed in each state, as applicable depending on the states in which the securities are offered and whether the offering is conducted pursuant to Tier 1 or Tier 2 of Regulation A † 230.252; and b. For the first 25 days of an offering, Customer will monitor investors until the issuer has provided written confirmation that all state BlueSky requirements have been met for the 53 US jurisdictions.

6. Issuer and Issuer counsel have taken the steps required to review non - US investors, as required by the applicable international regulations.

DEALMAKER SECURITIES LLC (“DMS”) CUSTOMER TERMS For any DealMaker Securities Customer, the following additional terms also apply: Broker - Dealer Agreement. These terms and conditions for DealMaker Securities LLC ( “DMS Terms” ), along with the Order Form and schedules attached to the Order Form create a binding agreement by and between the Customer who has signed the Order Form ( “DMS Customer” ), and DealMaker Securities LLC, a FINRA - registered Broker - Dealer ( “DMS” )(the “DMS Agreement” ), as of the Effective Date. DMS Customer may also be considered a Customer of the other DealMaker Entities, depending on the services the Customer purchases. DMS is a registered broker - dealer providing services in the equity and debt securities market, including offerings conducted via SEC approved exemptions such as Rules 506(b) and 506(c) of Regulation D under the Securities Act of 1933 (the “Securities Act” ); Regulation A under the Securities Act ( “Regulation A” ); Regulation CF under the Securities Act ( “Regulation CF” ) and others. DMS Customer is offering securities directly to the public in an offering exempt from registration under either Regulation A or Regulation CF (the “Offering” ). DMS Customer recognizes the benefit of having DMS provide advisory and other services as described herein, on the terms hereof. Capitalized terms used but not defined in these DMS Terms have the meanings set forth in the Order Form or the Terms. In the event of a conflict between the Terms and the DMS Terms, the DMS Terms shall control. 1. Appointment & Termination DMS Customer hereby engages and retains DMS to provide operations and compliance services at Customer’s discretion/ subject to DMS’s approval as a FINRA - registered broker - dealer. DMS Customer acknowledges that DMS obligations hereunder are subject to (a) DMS’s acceptance of DMS Customer as a customer following DMS’s due diligence review and (b) if applicable, issuance by the Financial Industry Regulatory Authority (“FINRA”) Department of Corporate Finance of a no objection letter for the Offering. In addition to the Termination Reasons, DMS may terminate this DMS Agreement if, at any time after the commencement of DMS’s due diligence of the potential DMS Customer, DMS reasonably believes that is not advisable to proceed with the contemplated Offering. 2. Services