UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION

STATEMENT UNDER SECTION 14(d)(4) OF THE

SECURITIES EXCHANGE ACT OF 1934

AIRGAS, INC.

(Name of Subject Company)

AIRGAS, INC.

(Name of Person Filing Statement)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

009363102

(CUSIP Number of Class of Securities)

Robert H. Young, Jr.

Senior Vice President, General Counsel and Secretary

Airgas, Inc.

259 North Radnor-Chester Rd.

Radnor, PA 19087-5283

(610) 687-5253

(Name, address and telephone numbers of person authorized to receive notices and

communications on behalf of the persons filing statement)

With copies to:

Daniel A. Neff, Esq.

David A. Katz, Esq.

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

(212) 403-1000

| ¨ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

| ITEM 1. |

SUBJECT COMPANY INFORMATION. | 1 | ||

| ITEM 2. |

IDENTITY AND BACKGROUND OF FILING PERSON. | 1 | ||

| ITEM 3. |

PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS. | 5 | ||

| ITEM 4. |

THE SOLICITATION OR RECOMMENDATION. | 9 | ||

| ITEM 5. |

PERSONS/ASSETS RETAINED, EMPLOYED, COMPENSATED OR USED. | 24 | ||

| ITEM 6. |

INTEREST IN SECURITIES OF THE SUBJECT COMPANY. | 24 | ||

| ITEM 7. |

PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS. | 25 | ||

| ITEM 8. |

ADDITIONAL INFORMATION. | 25 | ||

| ITEM 9. |

EXHIBITS. | 30 |

| ITEM 1. | SUBJECT COMPANY INFORMATION |

Name and Address

The name of the subject company to which this Solicitation/Recommendation Statement on Schedule 14D-9 (together with any exhibits attached hereto, this “Statement”) relates is Airgas, Inc., a Delaware corporation (“Airgas” or the “Company”). Airgas’ principal executive offices are located at 259 North Radnor-Chester Road, Radnor, Pennsylvania 19087-5283. Airgas’ telephone number at this address is (610) 687-5253.

Securities

The title of the class of equity securities to which this Statement relates is Airgas’ Common Stock, par value $0.01 per share, including the associated rights to purchase shares of Series C Junior Participating Preferred Stock (“Rights,” and together with the Airgas Common Stock, the “Airgas Common Shares”), issued pursuant to the Rights Agreement, dated as of May 8, 2007, between Airgas and The Bank of New York, as Rights Agent (the “Rights Agreement”). As of February 3, 2010, there were 82,729,623 Airgas Common Shares outstanding.

| ITEM 2. | IDENTITY AND BACKGROUND OF FILING PERSON |

Name and Address

The name, business address and business telephone number of Airgas, which is the subject company and the person filing this Statement, are set forth in Item 1 above.

Tender Offer

This Statement relates to the tender offer by Air Products Distribution, Inc. (“AP Sub”), a Delaware corporation and wholly owned subsidiary of Air Products and Chemicals, Inc. (“Air Products”), to purchase all of the outstanding Airgas Common Shares at a price of $60.00 per share, net to the seller in cash, without interest and less any required withholding taxes. The tender offer is being made on the terms and subject to the conditions described in the Tender Offer Statement on Schedule TO (together with the exhibits thereto, the “Schedule TO”), filed by Air Products and AP Sub with the Securities and Exchange Commission (the “SEC”) on February 11, 2010. The value of the consideration offered, together with all of the terms and conditions applicable to the tender offer, is referred to in this Statement as the “Offer.”

Air Products has stated that the purpose of the Offer is to acquire control of, and the entire equity interest in, Airgas. Air Products has indicated that it intends, as soon as practicable after the consummation of the Offer, to seek to consummate a merger of Airgas and AP Sub (or one of its or Air Products’ subsidiaries) (the “Second-Step Merger”). Air Products has also stated that it intends to nominate, and solicit proxies for the election of, a slate of nominees for election at Airgas’ 2010 annual meeting of stockholders (the “Airgas Annual Meeting”). In addition, whether or not Air Products proposes a merger or other business combination with Airgas and whether or not its nominees are elected at the Airgas Annual Meeting, the Schedule TO states that Air Products intends, as soon as practicable after consummation of the Offer, to seek maximum representation on the Board of Directors of Airgas (the “Airgas Board”) and, promptly after the consummation of the Offer, to request that some or all of the current members of the Airgas Board resign and that Air Products’ designees be elected to fill the vacancies so created.

1

The Offer is subject to numerous conditions, which include the following, among others:

| • | The “Minimum Tender Condition” – there being validly tendered and not withdrawn before the expiration of the Offer a number of Airgas Common Shares that, together with the shares then owned by Air Products and its subsidiaries, represents at least a majority of the total number of Airgas Common Shares outstanding on a fully diluted basis, |

| • | The “Rights Condition” – the Airgas Board redeeming the Rights or Air Products being satisfied, in its sole discretion, that the Rights have been invalidated or are otherwise inapplicable to the Offer and the Second-Step Merger, |

| • | The “Section 203 Condition” – the Airgas Board having approved the Offer and the Second-Step Merger under Section 203 of the Delaware General Corporation Law (“Section 203”) or Air Products’ being satisfied, in its sole discretion, that Section 203 is inapplicable to the Offer and the Second-Step Merger, |

| • | The “Certificate Condition” – the Airgas Board having approved the Offer and the Second-Step Merger under Article 6 of Airgas’ Amended and Restated Certificate of Incorporation (the “Airgas Certificate”) or Air Products’ being satisfied, in its sole discretion, that Article 6 of the Airgas Certificate is inapplicable to the Offer and the Second-Step Merger, |

| • | The “HSR Condition” – the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), applicable to the purchase of shares under the Offer having expired or been terminated as described in the Schedule TO, and |

| • | The “Impairment Condition” – Airgas not having entered into or effectuated any agreement or transaction with any person or entity having the effect of impairing AP Sub’s or Air Products’ ability to acquire Airgas or otherwise diminishing the expected value to Air Products of the acquisition of Airgas. |

In addition, Air Products is not required to consummate the Offer and may terminate or amend the Offer if at any time any of the following conditions exist, which conditions may be asserted by Air Products or AP Sub in their sole discretion regardless of the circumstances giving rise to any such condition failing to be satisfied:

| • | there is threatened, instituted or pending any action or proceeding by any person before any court or governmental authority or agency challenging or seeking to restrain or prohibit the making of the Offer, seeking to obtain material damages in connection with the Offer, seeking to restrain or prohibit the exercise of Air Products’ full rights of ownership of Air Products’ or Airgas’ business, seeking to require divestiture by Air Products of any Airgas Common Shares, seeking any material diminution in the benefits expected to be derived by Air Products from the transactions contemplated by the Offer, adversely affecting the financing of the Offer or that otherwise, in Air Products’ reasonable judgment, has or may have material adverse significance with respect to either the value of Airgas or any of its subsidiaries or affiliates or the value of the Airgas Common Shares to Air Products (the “No Lawsuits Condition”), |

| • | any action is taken, or any statute, rule, regulation, interpretation, judgment, injunction, order or decree is proposed, enacted, enforced, promulgated, amended, issued or deemed applicable to Air Products, AP Sub or any of their subsidiaries or affiliates, the Offer, the acceptance for payment of or payment for Airgas Common Shares, or any merger or other business combination involving Airgas, by any court, government or agency (other than the application of the waiting period of the HSR Act to the Offer or to any such merger or other business combination), that, in Air Products’ reasonable judgment, does or may, directly or indirectly, result in any of the consequences referred to in the bullet point immediately above (the “No Diminution of Benefits Condition”), |

2

| • | there occurs any decline in either the Dow Jones Industrial Average, the Standard and Poor’s Index of 500 Industrial Companies or the NASDAQ-100 Index by an amount in excess of 15%, measured from the close of business on February 4, 2010 (the “Market Index Condition”), |

| • | any change occurs or is threatened (or any development occurs or is threatened involving a prospective change) in the business, assets, liabilities, financial condition, capitalization, operations, results of operations or prospects of Airgas or any of its affiliates that, in Air Products’ reasonable judgment, is or may be materially adverse to Airgas or any of its affiliates, or Air Products becomes aware of any facts that, in its reasonable judgment, have or may have material adverse significance with respect to either the value of Airgas or any of its affiliates or the value of the Airgas Common Shares to Air Products, |

| • | there occurs (a) any change in the general political, market, economic or financial conditions in the United States or abroad that, in Air Products’ reasonable judgment, could have a material adverse effect on the business, assets, liabilities, financial condition, capitalization, operations, results of operations or prospects of Airgas and its subsidiaries, taken as a whole, (b) any material adverse change (or development or threatened development involving a prospective material adverse change) in United States dollars or any other currency exchange rates or a suspension of, or a limitation on, the markets therefor, (c) any limitation (whether or not mandatory) by any governmental authority or agency on, or any other event that, in Air Products’ reasonable judgment, may adversely affect the extension of credit by banks or other financial institutions, (d) any general suspension of trading in, or limitation on prices for, securities on any national securities exchange or in the over-the-counter market, (e) the declaration of a banking moratorium or any suspension of payments in respect of banks in the United States, (f) the commencement of a war, armed hostilities or other international or national calamity directly or indirectly involving the United States or any attack on, outbreak or act of terrorism involving the United States, or (g) in the case of any of the foregoing existing as of the close of business on February 4, 2010, a material acceleration or worsening thereof (together with the condition in the bullet point immediately above this bullet point, the “No Material Adverse Effect Condition”), |

| • | any other person publicly proposes or makes a tender or exchange offer for some or all of the Airgas Common Shares or enters into any agreement or makes any proposal with respect to a tender or exchange offer, merger, consolidation or other business combination with Airgas, or has acquired or proposes to acquire more than 5% of any class or series of capital stock of Airgas, or any person that filed a Schedule 13D or 13G with the SEC prior to February 4, 2010 acquires or proposes to acquire beneficial ownership of additional Airgas Common Shares constituting 1% or more of any such class or series, or any person files a Notification and Report Form under the HSR Act or makes a public announcement reflecting an intent to acquire Airgas or any assets or securities of Airgas (the “Stockholder Ownership Condition”), |

| • | Airgas or any of its subsidiaries has split, combined or otherwise changed, or authorized or proposed the split, combination or other change of, the Airgas Common Shares or its capitalization, acquired or caused a reduction in the number of outstanding Airgas Common Shares, issued or sold any Airgas Common Shares, declared or paid any dividends, or altered any material term of any outstanding security or issued or sold any debt security, |

| • | Airgas has authorized or recommended or announced its intent to enter into an agreement with respect to or effected any merger or business combination, acquisition or disposition of assets or relinquishment of any material contract or other rights not in the ordinary course of business, or enters into any agreement or arrangement with any person that, in Air Products’ reasonable judgment, has or may have material adverse significance with respect to either the value of Airgas or any of its subsidiaries or the value of the Airgas Common Shares to Air Products, |

3

| • | Airgas has adopted or amended any employment, severance, change of control, retention or other similar agreement other than in the ordinary course of business, or adopted or amended any such agreements or plans so as to provide for increased benefits to officers, directors, employees or consultants as a result of or in connection with the Offer, |

| • | Airgas has amended or proposed any amendment to the Airgas Certificate or bylaws (the conditions in this bullet point and the immediately preceding three bullet points referred to together as the “No Material Change Condition”), |

| • | Air Products becomes aware (a) that any material contractual right of Airgas has been impaired or otherwise adversely affected or that any material amount of indebtedness of Airgas has been accelerated or has otherwise become due or become subject to acceleration prior to its stated due date in connection with the Offer or the consummation by Air Products of a business combination with Airgas, or (b) of any covenant, term or condition in any instrument or agreement of Airgas that, in Air Products’ reasonable judgment, has or may have material adverse significance with respect to either the value of Airgas or any of its affiliates or the value of the Airgas Common Shares to Air Products or any of its affiliates (including any event of default that may ensue in connection with the Offer, the acceptance for payment of or payment for some or all of the Airgas Common Shares by Air Products or the consummation of a business combination between Air Products and Airgas) (the “No Adverse Effect on Contracts Condition”), |

| • | Air Products or any of its affiliates enters into a definitive agreement or announces an agreement in principle with Airgas providing for a merger or other similar business combination with Airgas or the purchase of securities or assets of Airgas, or Air Products and Airgas reach any other agreement or understanding pursuant to which it is agreed that the Offer will be terminated, |

| • | Airgas or any of its subsidiaries shall have (a) granted to any person proposing a merger or other business combination with or involving Airgas or any of its subsidiaries or the purchase of securities or assets of Airgas or any of its subsidiaries any type of option, warrant or right which, in Air Products’ reasonable judgment, constitutes a “lock-up” device (including a right to acquire or receive any Airgas Common Shares or other securities, assets or business of Airgas or any of its subsidiaries) or (b) paid or agreed to pay any cash or other consideration to any party in connection with or in any way related to any such business combination or purchase or |

| • | any required approval, permit, authorization, extension, action or non-action, waiver or consent of any governmental authority or agency shall not have been obtained on terms satisfactory to Air Products and AP Sub or any waiting period or extension thereof imposed by any government or governmental authority or agency with respect to the Offer shall not have expired. |

For a full description of the conditions to the Offer, please see Annex A attached hereto. The foregoing summary of the conditions to the Offer does not purport to be complete and is qualified in its entirety by reference to the contents of Annex A attached hereto.

The Schedule TO states that the principal executive offices of Air Products are located at 7201 Hamilton Boulevard, Allentown, Pennsylvania, 18195-1501 and that the telephone number of its principal executive offices is (610) 481-4911.

4

| ITEM 3. | PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS |

Except as described in this Statement or in the excerpts from the Airgas Definitive Proxy Statement on Schedule 14A, dated and filed with the SEC on July 13, 2009 (the “2009 Proxy Statement”), relating to the 2009 Annual Meeting of Stockholders, which excerpts are filed as Exhibit (e)(1) to this Statement and incorporated herein by reference, as of the date of this Statement, there are no material agreements, arrangements or understandings, nor any actual or potential conflicts of interest, between Airgas or any of its affiliates, on the one hand, and (i) Airgas or any of its executive officers, directors or affiliates, or (ii) AP Sub, Air Products or any of their respective executive officers, directors or affiliates, on the other hand. Exhibit (e)(1) is incorporated herein by reference and includes the following sections from the 2009 Proxy Statement: “Compensation of Directors,” “Compensation Discussion and Analysis,” “Executive Compensation,” “Certain Relationships and Related Transactions” and “Security Ownership.”

Any information contained in the pages from the 2009 Proxy Statement incorporated by reference herein shall be deemed modified or superseded for purposes of this Statement to the extent that any information contained herein modifies or supersedes such information.

Relationship with Air Products

According to the Schedule TO, as of February 11, 2010, Air Products was the beneficial owner of 1,508,255 Airgas Common Shares, representing approximately 1.8% of the outstanding Airgas Common Shares.

Airgas has a long-term take-or-pay supply agreement, in effect through August 31, 2017, with Air Products to supply Airgas with bulk liquid nitrogen, oxygen and argon. Additionally, Airgas purchases helium and hydrogen gases from Air Products under long-term take-or-pay supply agreements. Based on the volume of fiscal 2010 purchases, the Air Products supply agreements represent approximately $55 million annually in liquid bulk gas purchases.

Consideration Payable Pursuant to the Offer and the Second-Step Merger

If the Airgas directors and executive officers were to tender any Airgas Common Shares they own pursuant to the Offer, they would receive the same cash consideration on the same terms and conditions as the other Airgas stockholders. As of February 19, 2010, the Airgas directors and executive officers owned an aggregate of 8,404,200 Airgas Common Shares. If the Airgas directors and executive officers were to tender all of such Airgas Common Shares for purchase pursuant to the Offer and those Airgas Common Shares were accepted for purchase by Air Products, the Airgas directors and executive officers would receive an aggregate of approximately $504 million in cash. To the knowledge of Airgas, none of the Airgas directors and executive officers currently intend to tender shares held of record or beneficially owned by such person for purchase pursuant to the Offer.

As of February 19, 2010, the Airgas directors and executive officers held options to purchase an aggregate of 2,480,683 Airgas Common Shares, with exercise prices ranging from $8.99 to $60.84 and an aggregate weighted average exercise price of $32.24 per share, 1,699,708 of which were vested and exercisable as of that date. Any Airgas stock options held by the Airgas directors and executive officers were issued pursuant to the 1997 Stock Option Plan, the 1997 Directors’ Stock Option Plan and the 2006 Amended and Restated Equity Incentive Plan, filed as Exhibits (e)(2), (e)(3) and (e)(4), respectively, to this Statement, and incorporated herein by reference (collectively, the “Plans”). Under the Plans, consummation of the Offer would constitute a change of control of Airgas, and upon a change of control of Airgas, unvested options to purchase 780,975 Airgas Common Shares held by the Airgas directors and executive offers would vest.

5

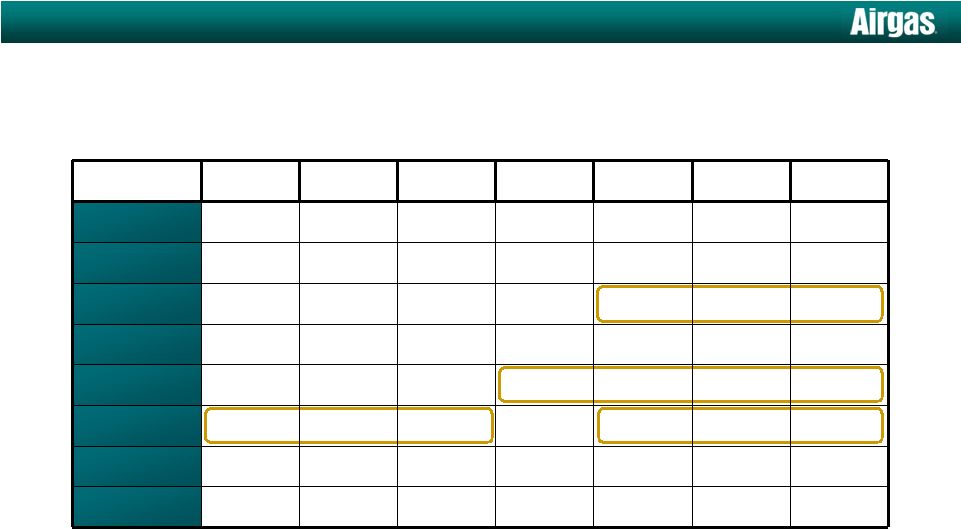

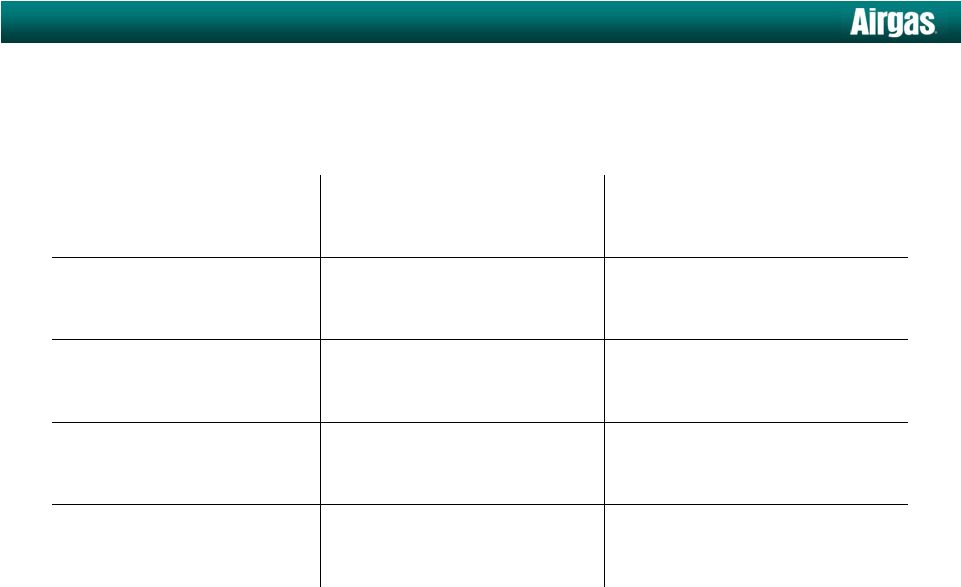

The following table summarizes, with respect to (1) each Airgas director, (2) each Airgas Named Executive Officer, and (3) all executive officers (other than the Named Executive Officers) (the “Other Executive Officers”) as a group, the aggregate, positive difference in value between $60 and the per share exercise prices (the “Spread Value”) of the options to purchase Airgas Common Shares held by such directors and executive officers as of February 19, 2010:

| Name |

Airgas Common Shares Subject to Unvested Options (#) |

Aggregate Spread Value of Unvested Options ($) |

Airgas Common Shares Subject to Vested Options (#) |

Aggregate Spread Value of Vested Options ($) |

||||||||

| Peter McCausland Chairman and Chief Executive Officer |

331,250 | 4,160,500 | 633,750 | 21,353,550 | ||||||||

| W. Thacher Brown Director |

— | — | 66,500 | 2,019,035 | ||||||||

| Paula A. Sneed Director |

— | — | 66,500 | 2,019,035 | ||||||||

| James W. Hovey Director |

— | — | 66,500 | 2,019,035 | ||||||||

| Richard C. Ill Director |

— | — | 41,000 | 874,185 | ||||||||

| David M. Stout Director |

— | — | 66,500 | 2,019,035 | ||||||||

| Lee M. Thomas Director |

— | — | 57,500 | 1,600,435 | ||||||||

| John C. van Roden, Jr. Director |

— | — | 25,540 | 346,643 | ||||||||

| Ellen C. Wolf Director |

— | — | 11,773 | 225,769 | ||||||||

| Michael L. Molinini Executive Vice President and Chief Operating Officer |

104,025 | 1,422,433 | 132,475 | 4,332,499 | ||||||||

| Robert M. McLaughlin Senior Vice President and Chief Financial Officer |

63,550 | 768,689 | 70,950 | 2,178,173 | ||||||||

| Leslie J. Graff Senior Vice President, Corporate Development |

46,125 | 610,589 | 80,545 | 2,606,215 | ||||||||

| B. Shaun Powers Division President – East |

42,000 | 533,533 | 101,900 | 3,544,491 | ||||||||

| All Other Executive Officers as a |

194,025 | 2,421,196 | 278,275 | 9,078,819 | ||||||||

Potential Severance and Change in Control Benefits

Airgas has entered into change of control agreements (the “COC Agreements”) with Messrs. McCausland, Graff, McLaughlin, Molinini and Powers, and three other executive officers. The terms of the COC Agreements provide salary and benefit continuation if (1) there is a change of control of Airgas and (2) Airgas terminates a covered executive’s employment without cause or if the executive terminates employment for good reason, in each case within three years following a change of control (a “Qualifying Termination”). Good reason includes a material diminution of position, a material decrease in base compensation, a material breach of any employment agreement, or a material change in location. The Offer, if consummated, would constitute a change of control for purposes of each of the COC Agreements.

6

Under the COC Agreements, in the event of a Qualifying Termination, an executive would be entitled to:

| • | a lump-sum payment equal to two times the sum of (1) the executive’s annual base salary at the time of termination, or, if greater, at the time the change of control occurred, plus (2) the bonus amount last paid to the executive prior to the occurrence of the change of control under the Airgas annual executive bonus plan; |

| • | continuation of health and welfare benefits for up to three years; and |

| • | vesting of all stock options and restricted stock. |

The cash and non-cash amounts payable under the COC Agreements and under any other arrangements with Airgas are limited to the maximum amount permitted without the imposition of an excise tax under the Internal Revenue Code (the “Severance Cap”). Generally, the Severance Cap would limit an executive’s benefits under a COC Agreement to 2.99 times the executive’s average annual compensation for the preceding five years. The above description of the COC Agreements is qualified in its entirety by reference to the COC Agreement filed as Exhibit (e)(5) to this Statement and incorporated herein by reference.

Under an arrangement with Mr. McCausland originally entered into in 1992, which was amended and restated on May 29, 2009 (the “Amended and Restated Executive Severance Agreement”), in the event Mr. McCausland experiences a Qualifying Termination, he is entitled to a payment equal to two times his annual base salary, in addition to any severance payments and benefits under his COC Agreement. The aggregate payments and benefits to Mr. McCausland under the COC Agreement and the Amended and Restated Executive Severance Agreement are subject to the Severance Cap. The above description of the Amended and Restated Executive Severance Agreement is qualified in its entirety by reference to the Amended and Restated Executive Severance Agreement filed as Exhibit (e)(6) to this Statement and incorporated herein by reference.

The Airgas, Inc. Severance Pay Plan (the “Severance Pay Plan”) provides severance benefits to all Airgas employees, including the executive officers covered by the COC Agreements (other than Mr. McCausland), in the event of a termination of employment due to (1) a lack of work, (2) a reorganization of the Airgas business, (3) the closing of all or a portion of the executive’s principal workplace or (4) economic conditions. Benefits under the Severance Pay Plan include two weeks of notice pay plus one week of salary for each completed year of service, up to a maximum of 24 weeks of salary. In addition, under the Severance Pay Plan, an eligible participant will be entitled to continued health and welfare benefits during the severance period at the same cost that Airgas employees pay. Benefits under the plan are not available to an executive officer if the executive officer is eligible for similar benefits under a separate severance agreement with Airgas, such as a COC Agreement.

7

The following table presents, with respect to (1) each Airgas Named Executive Officer, and (2) with respect to all Other Executive Officers as a group, an estimate of the amounts of severance benefits payable in the event of a Qualifying Termination, estimated as of February 19, 2010. For a quantification of the Spread Value of vested and unvested options to purchase Airgas Common Shares based on a $60 per share value, see the table above under the heading “Consideration Payable Pursuant to the Offer and the Second-Step Merger.”

| Name |

Severance Payments ($) | Health and Welfare Benefits ($) | ||

| Peter McCausland Chairman and Chief Executive Officer |

4,550,000 | 17,152 | ||

| Michael L. Molinini Executive Vice President and Chief Operating Officer |

1,192,969 | 17,152 | ||

| Robert M. McLaughlin Senior Vice President and Chief Financial Officer |

841,207 | 25,807 | ||

| Leslie J. Graff Senior Vice President, Corporate Development |

693,591 | 25,807 | ||

| B. Shaun Powers, Division President – East |

797,922 | 25,807 | ||

| All Other Executive Officers as a group (five individuals) |

2,142,996 | 83,707 | ||

Directors’ Compensation

Under the Airgas director compensation policy, only directors who are not employees of Airgas receive compensation for their services as directors. Non-employee directors receive an annual retainer of $25,000, plus a fee of $1,500 for each Board or committee meeting attended. The Chairmen of the Governance and Compensation Committee and the Finance Committee also receive an additional $3,000 annual retainer, and the Chairman of the Audit Committee receives an additional $5,000 annual retainer. A majority of the directors’ compensation is in the form of immediately exercisable stock options with an exercise price of each option equal to the closing price of Airgas Common Shares on the date of grant. Airgas also reimburses its non-employee directors for their out-of-pocket expenses incurred in connection with attendance at Board, committee and stockholder meetings, and other company business.

Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law (the “DGCL”) permits Airgas to indemnify any of its directors or officers against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement, incurred in defense of any action (other than an action by or in the right of Airgas) arising by reason of the fact that he is or was an officer or director of Airgas if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of Airgas and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. Section 145 also permits Airgas to indemnify any such officer or director against expenses incurred in an action by or in the right of Airgas if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of Airgas, except in respect of any matter as to which such person is adjudged to be liable to Airgas, in which case court approval must be sought for indemnification. This statute requires indemnification of such officers and directors against expenses to the extent they may be successful in defending any such action. This statute provides that it is not exclusive of other indemnification that may be granted by the Airgas by-laws, a vote of stockholders or disinterested directors, agreement or otherwise. The statute permits purchase of liability insurance by the registrant on behalf of officers and directors, and Airgas has purchased such insurance.

Article VII of the Airgas bylaws requires indemnification to the fullest extent permitted by, and in the manner permissible under, the laws of the State of Delaware to any person made, or threatened to be made, a

8

party to an action or proceeding, whether criminal, civil, administrative or investigative, by reason of the fact that he, his testator or intestate is or was a director or officer of Airgas or any predecessor of Airgas or served any other enterprise as a director or officer at the request of Airgas or any predecessor of Airgas. The indemnification provided for in Article VII is expressly not exclusive of any other rights to which any director or officer may be entitled apart from the provisions of that Article.

| ITEM 4. | THE SOLICITATION OR RECOMMENDATION |

Solicitation/Recommendation

After careful consideration, including review of the terms and conditions of the Offer in consultation with Airgas’ financial and legal advisors, the Airgas Board, by unanimous vote at a meeting on February 20, 2010, determined that the Offer is inadequate to Airgas’ stockholders and that the Offer is not in the best interests of Airgas’ stockholders. Accordingly, for the reasons described in more detail below, the Airgas Board unanimously recommends that Airgas’ stockholders reject the Offer and NOT tender their Airgas Common Shares to AP Sub pursuant to the Offer. Please see “– Reasons for Recommendation” below for further detail.

If you have tendered your Airgas Common Shares, you can withdraw them. For assistance in withdrawing your Airgas Common Shares, you can contact your broker or Airgas’ information agent, Innisfree M&A Incorporated, at the address and phone number below.

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Stockholders may call toll-free: (877) 687-1875

Banks and brokers may call collect: (212) 750-5833

Copies of the press release and letters to Airgas’ stockholders, employees and customers relating to the recommendation of the Airgas Board to reject the Offer are filed as Exhibits (a)(1), (a)(2), (a)(3) and (a)(5) hereto and are incorporated herein by reference. A copy of the “FAQ” circulated to Airgas’ employees is filed as Exhibit (a)(4) hereto and is incorporated herein by reference.

Background of the Offer and Reasons for Recommendation

Background of the Offer

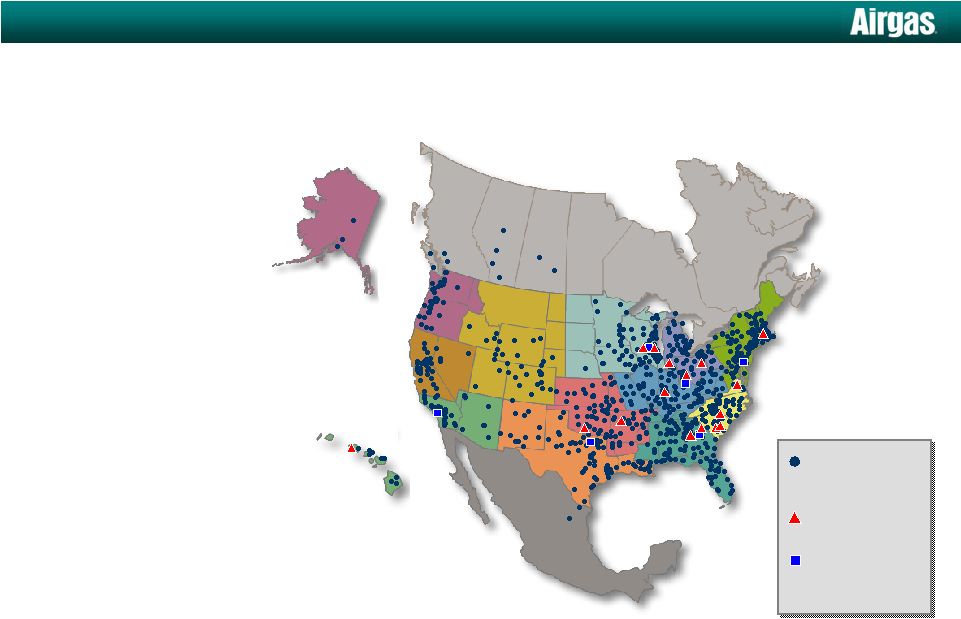

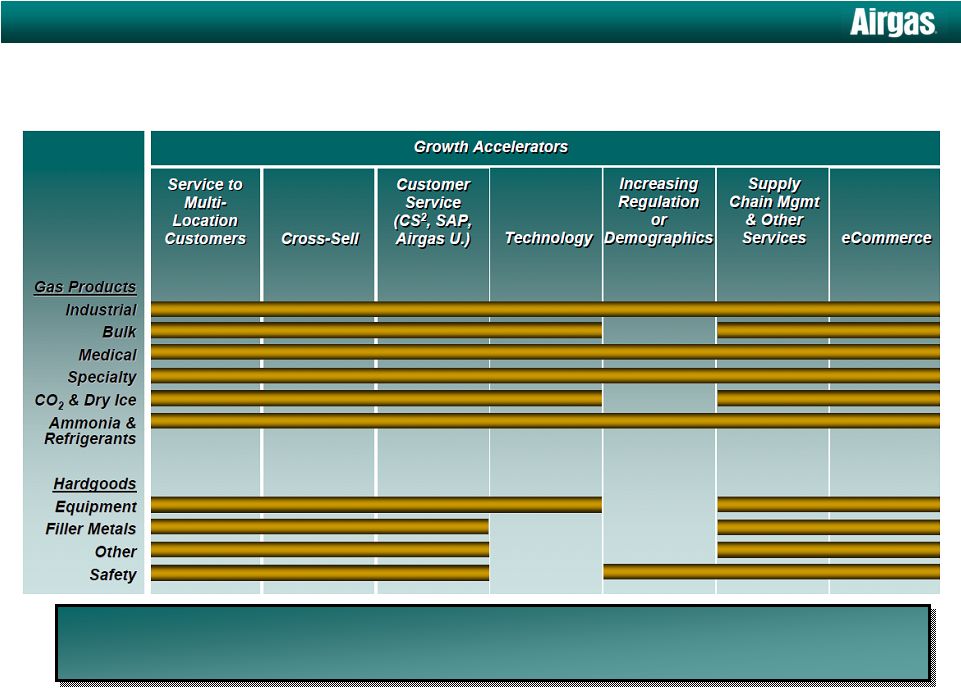

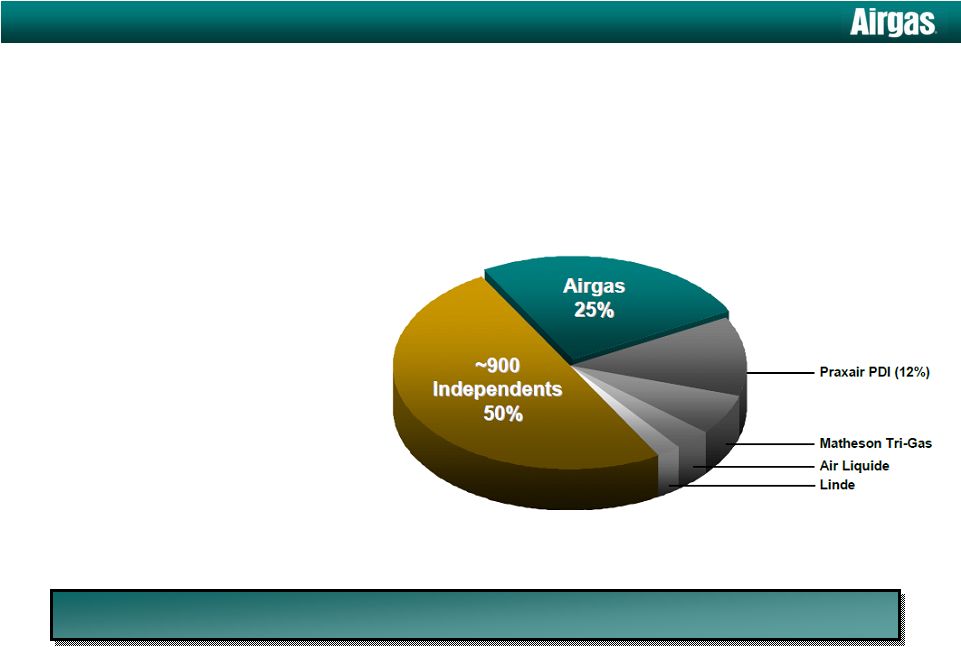

Airgas was founded by Chairman and Chief Executive Officer Peter McCausland in 1982, and became a publicly traded company in 1986. Through approximately 400 acquisitions and internal growth, including the acquisition from Air Products of its U.S. packaged gas business in 2002 in connection with Air Products’ exit from that business, Airgas has become the largest U.S. distributor of industrial, medical, and specialty gases and related hardgoods, such as welding supplies, and has built the largest national distribution network in the packaged gas industry. Airgas has also become a leading U.S. distributor of safety products, the largest U.S. producer of nitrous oxide and dry ice, the largest liquid carbon dioxide producer in the Southeast, and a leading distributor of process chemicals, refrigerants and ammonia products. Airgas’ more than 14,000 employees work in more than 1,100 locations including branches, cylinder fill plants, air separation plants, production facilities, specialty gas laboratories and regional distribution centers to serve a diversified customer base.

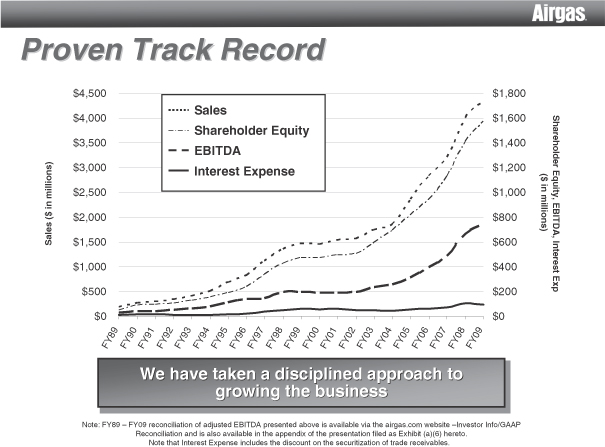

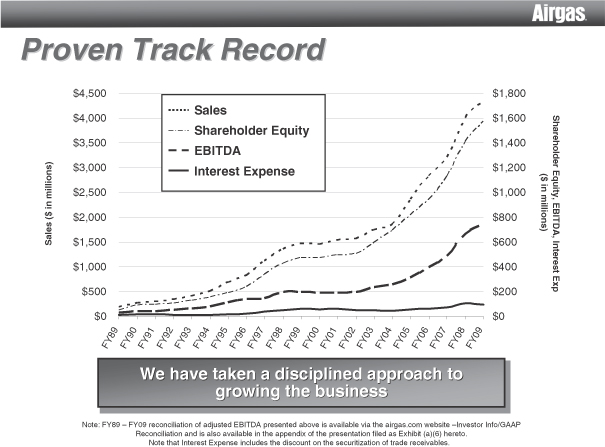

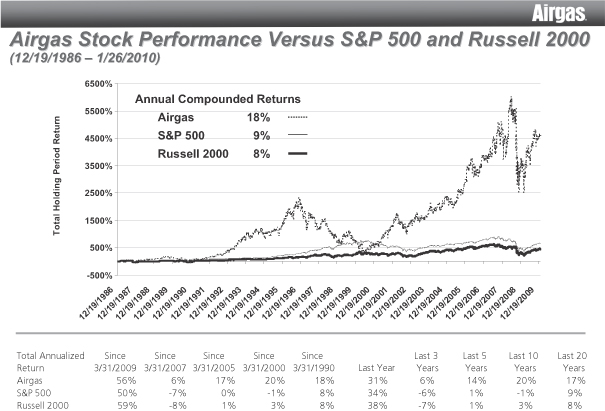

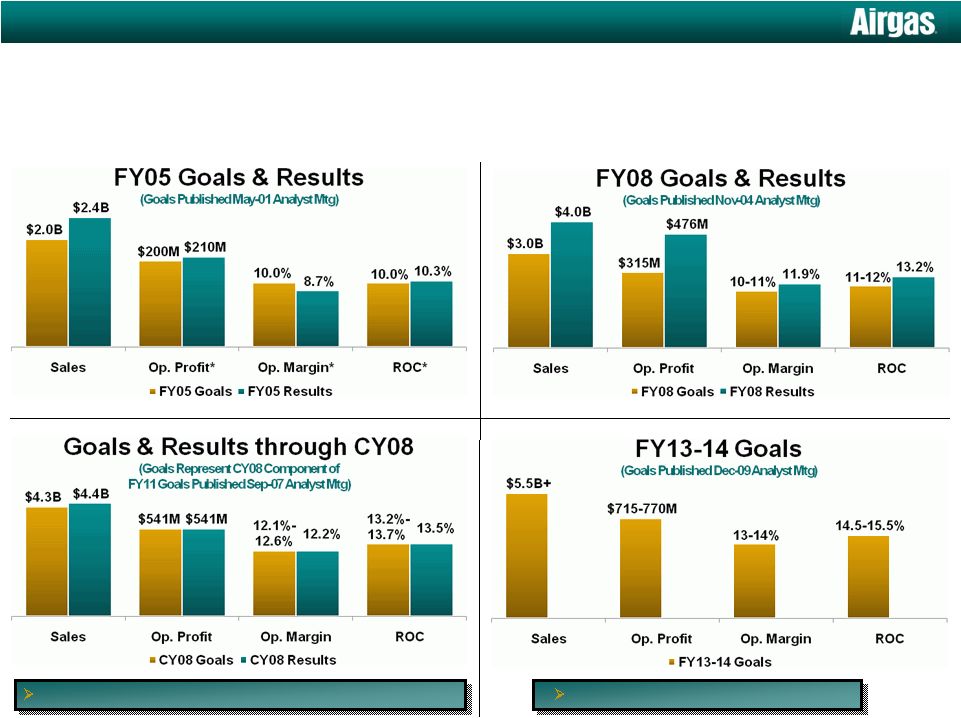

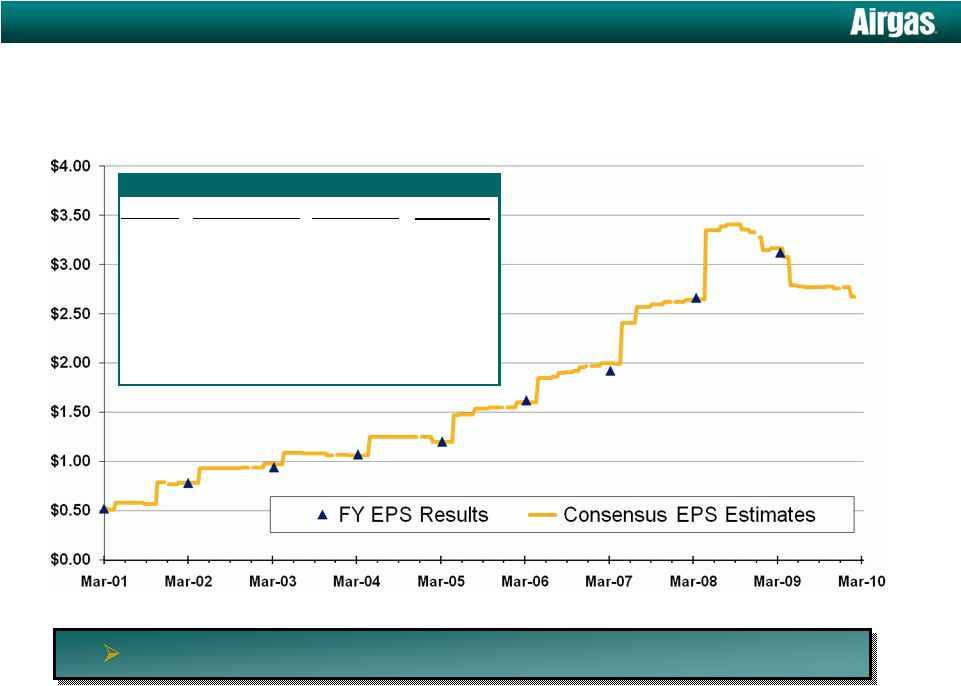

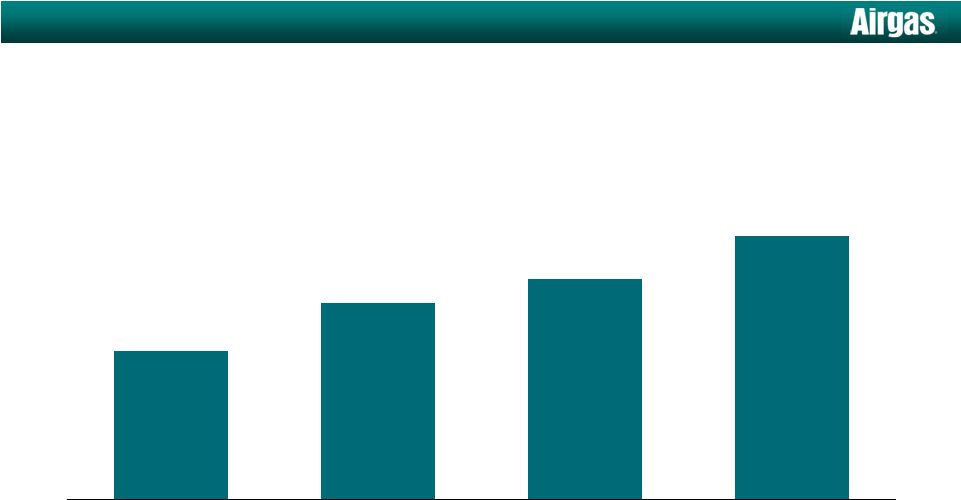

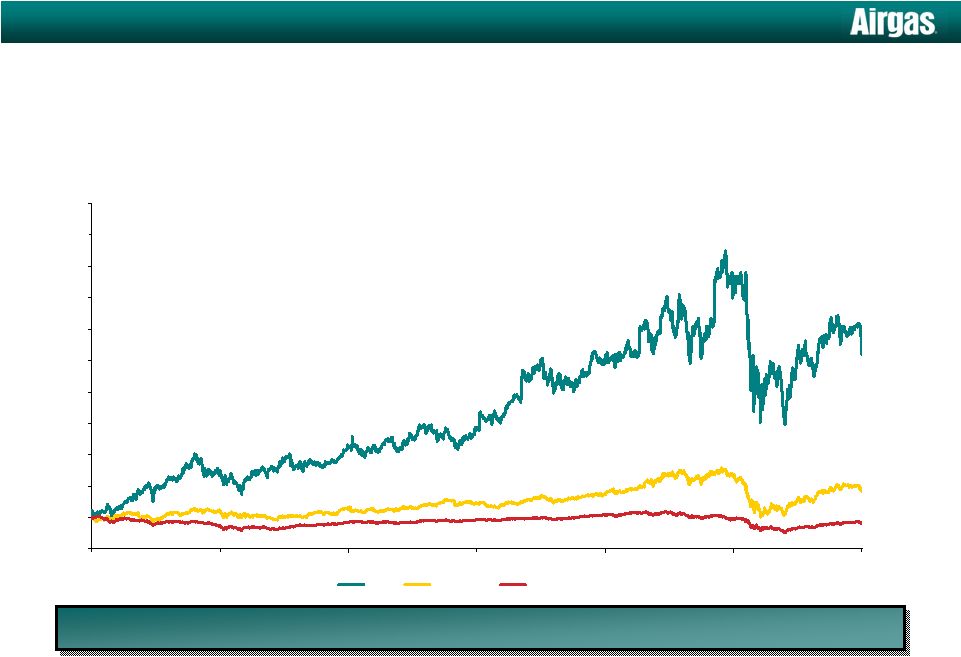

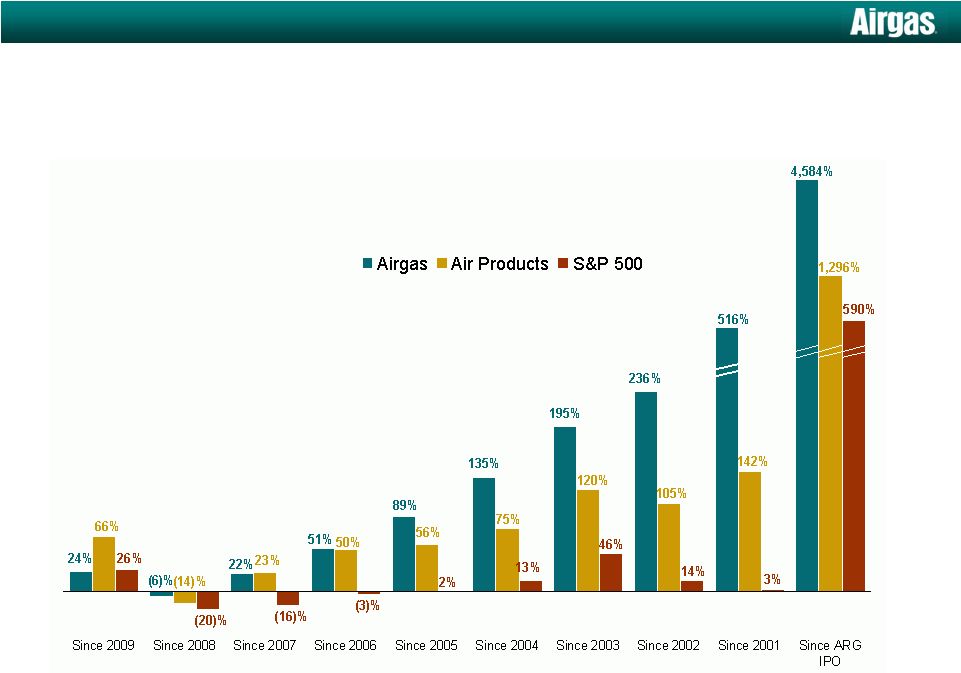

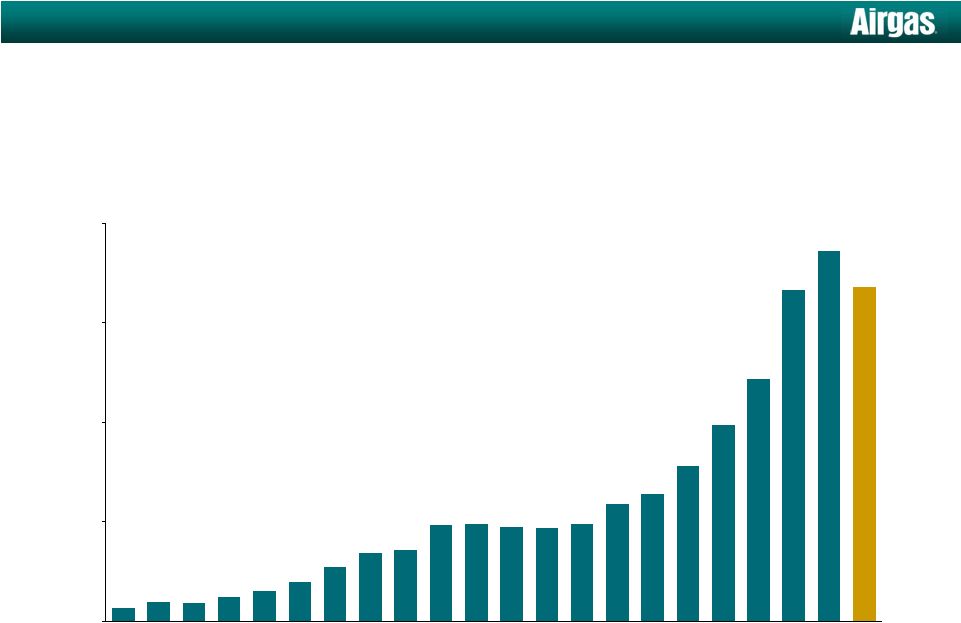

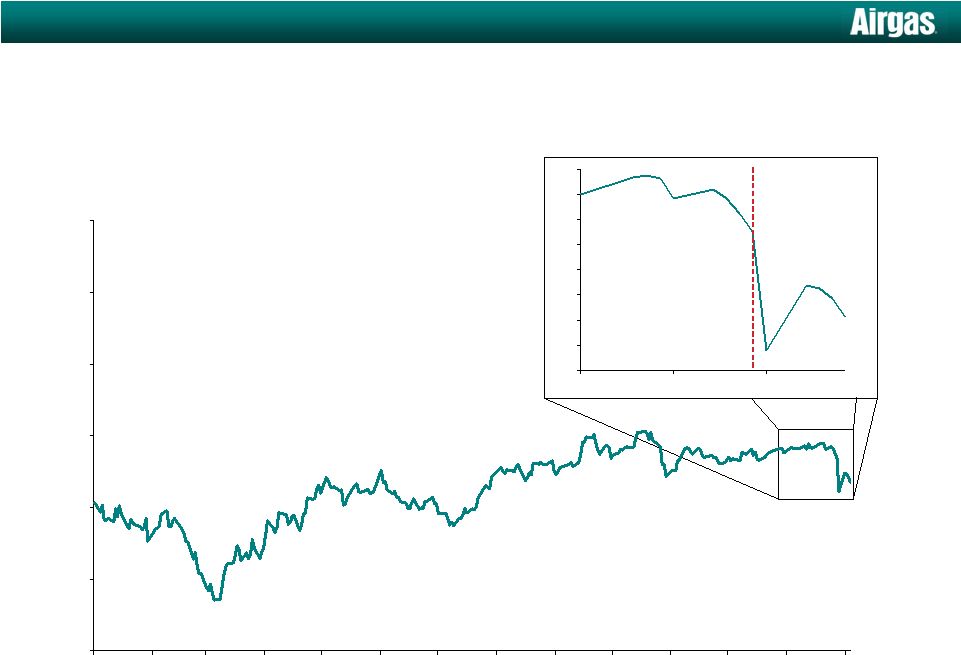

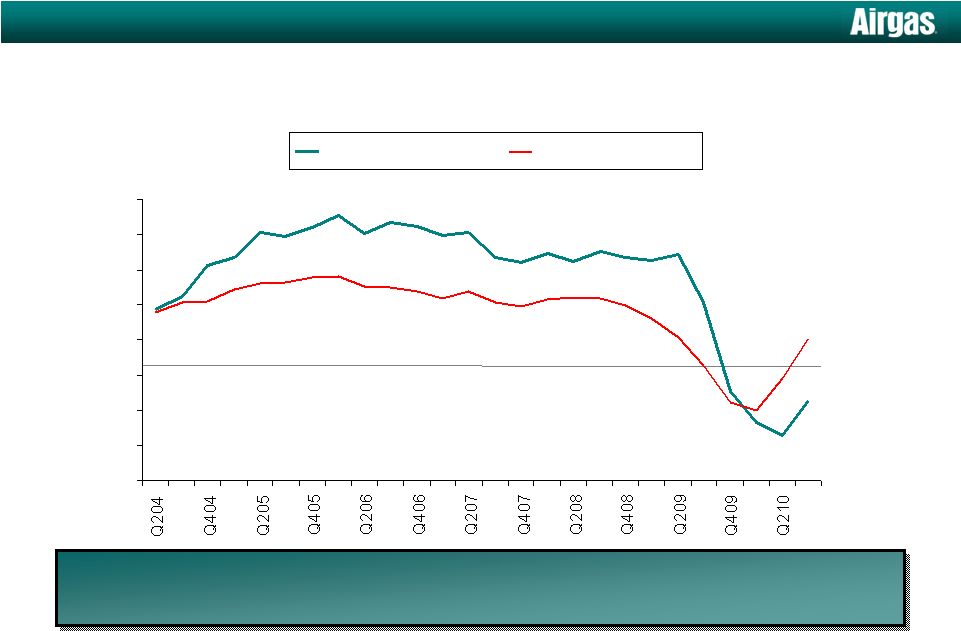

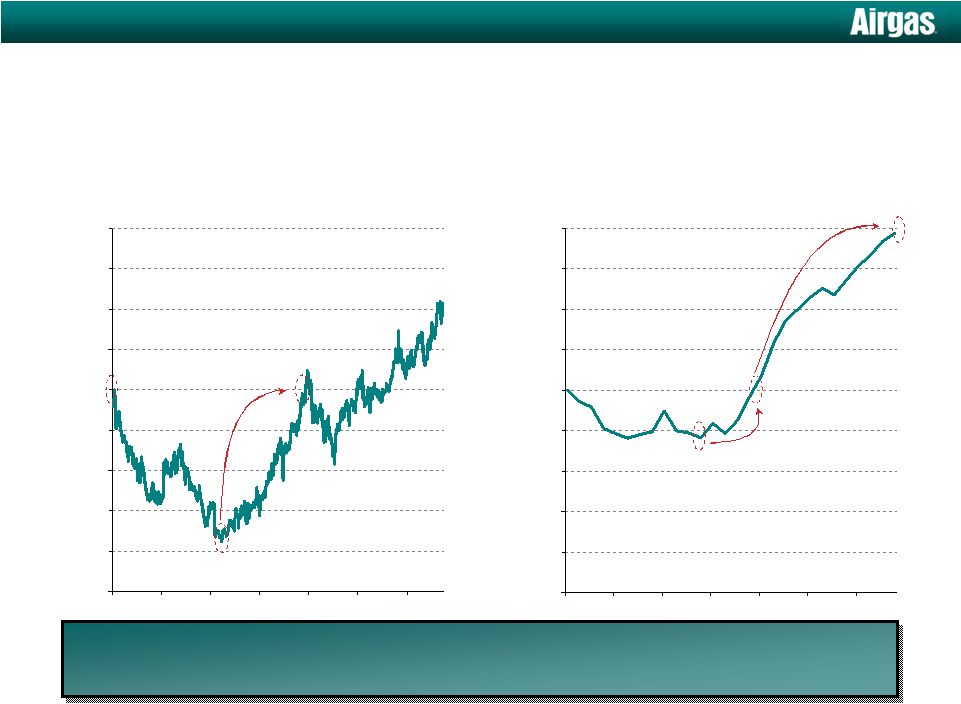

Airgas has delivered superior value to its stockholders since its initial public offering in 1986, with a cumulative total stockholder return (defined as stock price appreciation plus dividends reinvested) of 4,201%1 since that time. This performance represents a compound annual growth rate of total stockholder return of 18% and places Airgas ahead of 94% of companies in the S&P 500 index. We believe that this consistently high growth has been achieved because of our entrepreneurial, service-oriented culture and decentralized management structure. The following charts demonstrate Airgas’ proven track record.

| 1 | Market data as of market close on February 4, 2010, one day prior to Air Products’ publicly disclosing its unsolicited proposal. |

9

10

11

In mid-October 2009, John McGlade, the Chairman, President and Chief Executive Officer of Air Products, contacted Mr. McCausland and requested to meet without identifying the topic of the meeting. In response to Mr. McGlade’s request, Mr. McCausland met with Mr. McGlade at Airgas’ headquarters on October 15, at which time Mr. McGlade made an unsolicited oral proposal to Mr. McCausland to acquire Airgas for $60 per share on an all-stock basis. Mr. McCausland replied that, while his personal view was that the proposal was inadequate and that it would be a poor time for Airgas to enter into any merger transaction, any decision regarding the proposal would rest with the Airgas Board. Mr. McGlade stated twice during the meeting that Air Products would not proceed on a hostile basis.

Following the meeting with Mr. McGlade, Mr. McCausland telephoned W. Thacher Brown, Airgas’ presiding director at that time, informed him of Mr. McGlade’s unsolicited verbal proposal and discussed whether to convene a special meeting of the Airgas Board in advance of the Airgas Board meeting that had previously been scheduled for November 5 - 7. Mr. McCausland and Mr. Brown decided to discuss the unsolicited proposal with the Airgas Board at the previously scheduled upcoming meeting.

On October 31, 2009, Mr. McGlade telephoned Mr. McCausland to reiterate his proposal and his expectation that it would be presented to, and considered by, the Airgas Board.

At the Airgas Board’s meeting held from November 5 through November 7, 2009, the Airgas Board considered and discussed Airgas’ strategic direction and reviewed Airgas’ five-year strategic and financial plan, which was a product of Airgas’ regular planning process that began in July and was completed in October. In addition, during the meeting, the Airgas Board discussed Air Products’ unsolicited proposal. After careful consideration of presentations by management and advice from its legal advisors and a review of discussions with the Company’s financial advisors, the Airgas Board unanimously concluded that Air Products’ unsolicited proposal grossly undervalued Airgas and, accordingly, that the Airgas Board had no interest in proceeding to discuss further the proposal with Air Products. Mr. McCausland telephoned Mr. McGlade and informed him of the Airgas Board’s determination.

On November 20, 2009, Mr. McGlade telephoned Mr. McCausland and informed Mr. McCausland that he would be sending Mr. McCausland a letter. Mr. McCausland replied that Mr. McGlade stated at their meeting on October 15th that Air Products would not proceed on a hostile basis, to which Mr. McGlade responded that he was under pressure from the Air Products’ board of directors.

On November 20, 2009, Mr. McGlade sent a letter to Mr. McCausland making an unsolicited proposal to acquire Airgas for $60 per share on an all-stock basis, and requesting a meeting with Airgas and its advisors as soon as possible to move expeditiously toward consummating a transaction. The full text of this letter is set forth as Exhibit (a)(7) and is incorporated by reference herein.

On November 25, 2009, Mr. McCausland wrote to Mr. McGlade indicating that the Airgas Board would consider Air Products’ stock-for-stock proposal at its upcoming meeting in early December.

On December 7, 2009, the Airgas Board met to consider Air Products’ unsolicited stock-for-stock proposal. After careful consideration of presentations by management, advice from its legal advisors and financial information and analyses provided to the Company by its financial advisors, the Airgas Board unanimously concluded that Air Products’ unsolicited stock-for-stock proposal grossly undervalued Airgas, was opportunistic and offered an unattractive currency. Accordingly, the Airgas Board unanimously rejected the proposal and concluded that no purpose would be served by meeting with Air Products to discuss further the $60 per share proposal made by Air Products.

In a December 8, 2009 letter to Mr. McGlade, Mr. McCausland confirmed that the Airgas Board had considered Air Products’ unsolicited stock-for-stock proposal and had determined that the proposal was not in the best interest of Airgas’ stockholders and should not be pursued, on the grounds that it grossly undervalues Airgas, proposed an unattractive currency, ignored regulatory issues raised by a combination of the companies and because Airgas’ Board questioned Air Products’ ability to manage Airgas’ business, given Air Products’

12

decision to exit that very line of business just seven years earlier. The letter also informed Air Products that Airgas objected to the law firm Cravath, Swaine & Moore LLP representing Air Products in connection with any possible acquisition of Airgas, and that Airgas had no intention of waiving or ignoring the conflict created thereby. The text of the letter is set forth below:

Dear John:

The Board of Directors of Airgas has considered your letter of November 20, 2009.

As you know, the Airgas Board carefully considered the same proposal several weeks ago and concluded that the proposed stock-for-stock acquisition of Airgas by Air Products is not in the best interests of our shareholders and should not be pursued. We have again carefully reviewed your proposal and have consulted with our legal and financial advisors. At the meeting called to review your November 20 letter, the Board again unanimously authorized me to advise you that it believes that Air Products is grossly undervaluing Airgas and offering a currency that is not attractive. The Board has no interest in pursuing Air Products’ unsolicited proposal.

We can certainly understand why Air Products would find an acquisition of Airgas to be appealing to Air Products and its shareholders. Over the last five and ten year periods, Airgas’ stock has consistently and significantly outperformed Air Products’ stock, having risen 83% over the last five years (vs. 44% for Air Products’ stock) and 387% over the last ten years (vs. 166% for Air Products’ stock). Airgas continues to effectively execute its business plan and is operating well in a difficult environment. We have taken a number of actions that position us to perform even better as the economy improves. Airgas’ management and its Board are extremely enthusiastic about our company’s prospects and are confident of achieving shareholder returns well in excess of what can be derived from Air Products’ proposal.

We also have concerns about Air Products’ ability to effectively manage our business, a business that your company exited just seven years ago. The consistently high growth that we have been able to achieve over many years owes much to our entrepreneurial, service-oriented culture and decentralized management structure. The organizational and management structure at Air Products conflicts with ours and would likely reduce rather than create value.

Your letter ignores any mention of the regulatory issues that a combination of our two companies would raise. These issues would slow the process considerably. In this regard, we note that Air Products failed to obtain U.S. antitrust clearance in its last attempt to acquire a major American industrial gas competitor.

While not a factor in our decision, it is important to mention that the advisors representing your company have serious conflicts of interest that we have no intention of waiving or ignoring. Cravath, Swaine & Moore has served as Airgas’ counsel for financing matters continuously for the past eight years. They have advised us as recently as October (presumably while working with your company on its approach to us) on matters relating to our outstanding indebtedness and our future financing plans. Your legal and financial advisors, from the services they have rendered very recently to Airgas, well understand that the next several months are important ones for our company with respect to its financing plans. It is disturbing that the key advisors on Airgas’ financing team are now representing an adverse party in a potentially hostile transaction.

The Board of Directors of Airgas reiterates the response which I conveyed to you several weeks ago. We are not interested in pursuing your company’s proposal and do not believe that any purpose would be served by a meeting.

Very truly yours,

/s/ Peter McCausland

13

On December 17, 2009, Mr. McGlade sent a letter to Mr. McCausland revising Air Products’ prior $60 per share stock-for-stock proposal, proposing to acquire Airgas for $62 per share with consideration including up to 50% cash. Mr. McGlade stated in the letter that “the timing for this combination is excellent,” citing the fact that “the economy is just beginning to emerge from recession” and Air Products’ belief that waiting “may make the combination less attractive in the future.” Mr. McGlade also stated that Air Products and its advisors formally requested to meet with Airgas and its advisors “as soon as possible” and that the companies “move expeditiously to consummate a transaction.” Mr. McGlade objected to Airgas’ characterization of Air Products’ performance and other aspects of Mr. McCausland’s December 8th letter. The full text of Mr. McGlade’s letter is set forth as Exhibit (a)(8) and is incorporated by reference herein.

On December 21, the Airgas Board met to discuss Air Products’ revised $62 unsolicited proposal and reviewed information provided by management, advice from its legal advisors and financial information and analyses provided to the Company by its financial advisors. On January 4, 2010, the Airgas Board met again to resume consideration of the revised $62 proposal as well as Air Products’ request to meet as soon as possible to move expeditiously to consummate a transaction. After careful consideration of presentations by management, advice from its legal advisors and financial information and analyses provided to the Company by its financial advisors, the Airgas Board unanimously concluded that Air Products’ revised $62 unsolicited proposal, at least half of which was to be paid in Air Products stock, grossly undervalued Airgas and its prospects for continued growth and shareholder value creation. Accordingly, the Airgas Board concluded that no purpose would be served by meeting with Air Products to explore further its unsolicited $62 per share proposal. Mr. McCausland sent the following letter to Mr. McGlade informing him of the determination of the Airgas Board:

Dear John:

Our Board of Directors met and thoroughly considered the proposal set forth in your December 17 letter. It is their unanimous view that the Air Products proposal grossly undervalues Airgas. Therefore, the Board is not interested in pursuing your company’s proposal and continues to believe that there is no reason to meet.

Airgas’ management has consistently created long-term shareholder value, as measured by stock price appreciation and total shareholder returns (stock price appreciation plus dividends).

| • | In every cumulative annual period since 2000, measured from the first of each calendar year to Dec 31, 2009, Airgas’ stock price has consistently outperformed Air Products’ with the exception of 2009. |

| • | Airgas’ stock price appreciated 80% over the last five years and 415% over the last ten years, compared to just 40% and 145% for Air Products’ shares over the same periods. |

| • | Airgas has achieved total cumulative shareholder returns of 22%, 89%, and 434% over the last three, five and ten years respectively, versus Air Products’ 23%, 56% and 197%. From the time of its initial public offering in December 1986, Airgas’ total shareholder return has exceeded 4,400% as compared to approximately 1,300% for Air Products over the same period. |

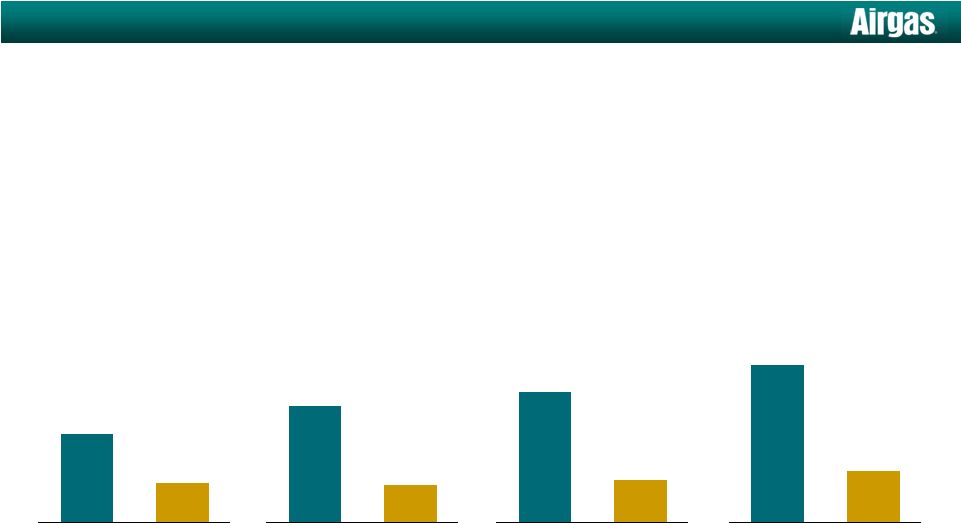

Airgas’ entrepreneurial culture and customer-centric business model produced operating performance superior to that of Air Products through the last cycle, in expanding and contracting economic conditions. From CY2001 through CY2008, Airgas generated a 24% compound annual growth rate in operating income from continuing operations, compared to Air Products’ 8%.

Airgas’ associates, with the support of our Board of Directors and shareholders, have built the most valuable independent industrial gas company in the world. We have an outstanding performance record, and strong prospects for organic and acquisition growth in the coming years. Air Products’ unsolicited approach is simply an opportunistic attempt to buy Airgas at a bargain price, exploiting a brief anomaly

14

in the historic comparative equity market performance of our two companies, just as the economy begins its recovery. Recent performance alone is not indicative of what our respective companies are capable of achieving. Under the terms of Air Products’ proposal, our shareholders would sacrifice real value and opportunity, and exchange a dynamic growth stock for one that has significantly underperformed Airgas stock over an extended period of time.

While we agree that the benefits of a letter writing campaign between our two companies have been exhausted, we strongly disagree with many of the assertions in your December 17th letter. In particular, we believe that a combination of our two companies could destroy rather than create value; that you underestimate the seriousness of your advisors’ conflicts; and that your characterization of my one conversation with you is inaccurate and misleading.

Air Products’ proposal grossly undervalues Airgas and its prospects for continued growth and shareholder value creation. Accordingly, our Board of Directors is not interested in pursuing your company’s proposal.

Sincerely yours,

/s/ Peter McCausland

Peter McCausland

Chairman and CEO

On February 1, 2010, Air Products’ legal advisor from Cravath telephoned Airgas’ legal advisor, and stated that it was important that a meeting occur between Air Products and Airgas within days rather than weeks, and that it would be best for Air Products’ stockholders, Airgas’ stockholders—as well as “for Peter”—for the parties to reach agreement rapidly on a negotiated sale of Airgas to Air Products. Airgas’ legal advisor stated that they would consult with Airgas regarding the request for a meeting and that any decision whether to meet rested with Airgas.

Later on February 1, representatives of J.P. Morgan, Air Products’ financial advisor, contacted an Airgas financial advisor, and also requested a meeting within days. A representative of J.P. Morgan also requested that the Airgas Board be involved in the decision as to whether to meet with Air Products. During the call, representatives of J.P. Morgan also said that a private negotiation would be better for Airgas, its management and Air Products. Airgas’ financial advisor replied that they would promptly relay Air Products’ urgent request for a meeting to Airgas.

In each of their respective conversations, both the Airgas legal advisor and the Airgas financial advisor noted that, in light of the Airgas Board’s views concerning Air Products’ prior unsolicited proposals, the Airgas directors may well conclude that the last price proposed by Air Products would not represent a sensible basis to hold any meeting to discuss a possible transaction.

On February 2, 2010, Airgas’ financial advisors telephoned Air Products’ financial advisor to inform them that the Airgas Board would evaluate their request to meet at Airgas’ regularly scheduled Board meeting early in the week of February 8th.

Rather than waiting for the response requested from the Airgas Board, Mr. McGlade sent a letter to Mr. McCausland on February 4, 2010 with an unsolicited proposal to acquire Airgas for a reduced price of $60 per share on an all-cash basis. The letter stated again that “the timing for this combination is ideal,” noting that the economy was beginning to emerge from recession, and stated that the proposal offered Airgas stockholders “immediate liquidity.” The letter also stated that Air Products had decided to inform Airgas’ stockholders of its proposal. The full text of this letter is set forth as Exhibit (a)(9) and is incorporated by reference herein.

Also on February 4, Air Products filed an action against Airgas and members of the Airgas Board in the Delaware Chancery Court, alleging breach of fiduciary duty by Airgas’ Board in rejecting Air Products’

15

unsolicited proposals and seeking declaratory and injunctive relief. Please see “Additional Information—Litigation Matters” for more information. Air Products’ complaint stated that Air Products owned 1,508,255 Airgas Common Shares, which Air Products later disclosed that it had acquired in open market purchases from January 20 through February 4 at average daily prices ranging from $43.77 to $49.25. On February 5, 2010, Air Products publicly disclosed its February 4 letter.

The Airgas Board met on the morning of February 5, the fourth occasion on which its members discussed and considered the various unsolicited proposals of Air Products, to consider Air Products’ $60 per share public proposal and, among other matters, to discuss Air Products’ most recent letter. Also on February 5, Airgas commenced litigation against its long-time counsel, Cravath, Swaine & Moore LLP, in the Court of Common Pleas of Philadelphia County, Pennsylvania, seeking damages and an order requiring Cravath to withdraw from its representation of Air Products in connection with its attempted takeover of Airgas based on Cravath’s prior representation of Airgas. Please see “Additional Information—Litigation Matters” for more information.

In a meeting held on February 8 and 9, the Airgas Board again discussed and considered Air Products’ unsolicited proposal, and after careful consideration of presentations by management and its financial advisors, and advice from its legal advisors, unanimously determined that the proposal grossly undervalued Airgas and its future prospects and was not in the best interests of Airgas stockholders. Accordingly, the Airgas Board unanimously rejected the proposal and concluded that no purpose would be served by proceeding to meet with Air Products to discuss the inadequate proposal. On February 9, Mr. McCausland sent the following letter to Mr. McGlade informing him of the Airgas Board’s determination:

Dear John:

The Board of Directors of Airgas has received your letter dated February 4, 2010 proposing that Air Products acquire all of the outstanding shares of Airgas for $60 per share in cash. At a meeting held yesterday and today, the Board of Directors carefully reviewed your company’s latest proposal with the assistance of its financial advisors, Goldman, Sachs & Co. and Bank of America Merrill Lynch, and its legal counsel. After thorough consideration, it is the unanimous view of the Airgas Board of Directors that your unsolicited proposal very significantly undervalues Airgas and its future prospects. Accordingly, the Airgas Board unanimously rejects Air Products’ $60 per share proposal. Moreover, as we informed you in our letter dated January 4, 2010, your company’s prior $62 per share proposal also grossly undervalues Airgas.

Airgas is the largest and most valuable packaged gas business in the world with an unrivaled platform. Airgas continues to effectively execute its business plan and is operating well in a difficult environment. We have taken a number of actions that position us to perform even better as the economy improves. Moreover, Airgas and its stockholders are poised to realize the significant benefits that will result from the substantial infrastructure investment and industry consolidation achieved by Airgas over the last decade. Our country is just beginning to emerge from the worst recession since the Great Depression and your undervalued proposal would deprive our stockholders of the greater value that they will receive simply with the passage of time.

As you are undoubtedly aware, due to the nature of our customers and markets, historically our business has emerged from recession later, but with much greater upside, than yours. Airgas’ management and its Board are extremely enthusiastic about our company’s prospects and are confident of achieving stockholder returns well in excess of what can be derived from Air Products’ unsolicited and opportunistic proposal.

We note that in your presentation dated February 5th, you state that “Timing is excellent” as a justification for pursuing Air Products’ unsolicited proposal at this time. We agree that the “timing is excellent” — for Air Products — but it is a terrible time for Airgas stockholders to sell their company. We

16

can certainly understand why Air Products would find an opportunistic acquisition of Airgas to be appealing to Air Products and its stockholders. However, it makes no sense for the Airgas stockholders to transfer the future value of Airgas to Air Products at a bargain basement price.

Over the last five and ten year periods preceding the public disclosure of your company’s latest proposal, Airgas’ stock has consistently and significantly outperformed Air Products’ stock, having risen 75% over the last five years (vs. 25% for Air Products’ stock) and 471% over the last ten years (vs. 139% for Air Products’ stock). It is in light of this history that we consider your increasingly urgent demands to negotiate concerning Air Products’ various proposals, which in our Board’s unanimous view grossly undervalue our company and its prospects. If the nascent recovery continues and the growth which we anticipate — and are starting to see in our business — were to become reflected in our stock price, Air Products would no longer be able to claim that “timing is excellent.”

Airgas’ business differs significantly from Air Products and your packaged gas operations in Europe have considerably different characteristics than our packaged gas business in the United States. In contrast to your European business, our U.S. business operates in a highly competitive marketplace which demands distribution of numerous products and services to provide value to our customers. Your company exited that business just eight years ago, selling it to us when it was in disarray. The consistently high growth that we have been able to achieve over many years owes much to our entrepreneurial, service-oriented culture and decentralized management structure. We are, at our core, a “people” business which has succeeded by effectively motivating our more than 14,000 associates. We believe, based upon our own extensive experiences with Air Products, that the acquisition you are proposing would reduce rather than enhance stockholder value.

We understand that market credibility is paramount and Airgas has, over time, performed significantly better than Air Products on almost any metric, often exceeding market expectations. But we believe that how a company conducts its business is important too. You have chosen legal and financial advisors that have conflicts, even after we expressed our strong objections. That is wholly inappropriate and why we commenced litigation against your legal advisor. We have an affirmative obligation to protect Airgas stockholders and this includes taking the necessary steps to protect our stockholders against grossly undervalued proposals. Our board, which collectively beneficially owns more than 10% of the outstanding common stock, is focused solely on the best interests of our stockholders.

Our Board of Directors, our management team and our thousands of associates are dedicated to creating value for all of our stockholders and that is exactly what we will continue to do by executing on our strategic plan.

Very truly yours,

/s/ Peter McCausland

On February 11, 2010, Air Products and AP Sub commenced the Offer at the same $60.00 price per share in cash as the proposal described in Air Products’ letter dated February 4. On the same day, Airgas issued a press release requesting that its stockholders take no action in response to the Offer and informing its stockholders that the Airgas Board, in consultation with its independent financial and legal advisors, intends to advise stockholders of its formal position regarding the Offer within ten business days by making available to stockholders and filing with the SEC a solicitation/recommendation statement on Schedule 14D-9.

On February 20, 2010, the Airgas Board met to review the terms of the Offer with the assistance of its financial advisors, Merrill Lynch, Pierce, Fenner & Smith Incorporated (which we refer to as Bank of America Merrill Lynch) and Goldman, Sachs & Co. (which we refer to as Goldman Sachs), and legal advisor, Wachtell, Lipton, Rosen & Katz. During this meeting Bank of America Merrill Lynch and Goldman Sachs each rendered an oral opinion to the Airgas Board, subsequently confirmed in writing, that as of February 20, 2010 and based

17

upon and subject to the factors and assumptions set forth in the written opinions, the consideration proposed to be paid to the holders of Airgas Common Shares (other than AP Sub and its affiliates) pursuant to the Offer was inadequate from a financial point of view to such holders. At the meeting, the Airgas Board unanimously reconfirmed its prior determination that the Offer grossly undervalues Airgas and is not in the best interests of Airgas and its stockholders. Accordingly, the Airgas Board unanimously determined to recommend that the Airgas stockholders reject the Offer and not tender their Airgas Common Shares into the Offer. The full text of the respective written opinions of Bank of America Merrill Lynch and Goldman Sachs, each dated February 20, 2010, and each of which sets forth the assumptions made, procedures followed, matters considered and limitations on the review undertaken in connection with such opinion, are attached as Annexes B and C, respectively. Bank of America Merrill Lynch and Goldman Sachs provided their respective opinions for the information and assistance of the Airgas Board in connection with its consideration of the Offer. The opinions of Bank of America Merrill Lynch and Goldman Sachs are not a recommendation as to whether or not any holder of Airgas Common Shares should tender such Airgas Common Shares in connection with the Offer or any other matter.

Reasons for Recommendation

In reaching the conclusions and in making the recommendation described above, the Airgas Board consulted with Airgas’ management and financial and legal advisors, and took into account numerous factors, including but not limited to the factors listed below.

The Airgas Board believes that the Offer grossly undervalues Airgas in light of Airgas’ extraordinary track record and growth prospects, that the Offer’s timing is extremely opportunistic, and that regulatory concerns and the Offer’s litany of conditions create significant uncertainty as to when – if ever – Airgas stockholders would receive consideration under the Offer. In addition, Air Products’ tactics are calculated to divert attention from the Offer’s serious deficiencies. The Airgas Board is confident that Airgas will, consistent with its history, deliver greater value to its stockholders by executing its strategic plan than would be obtained under the Offer.

| I) | The Offer grossly undervalues Airgas |

The Board believes that the Offer grossly undervalues Airgas as it does not reflect the underlying value of Airgas’ assets, operations and strategic plan, including its industry-leading position, unrivaled platform and future growth prospects. Since its founding, Airgas has delivered extraordinary results for its stockholders and, by virtue of its industry position, strategic direction, management and culture, Airgas is poised to continue to provide extraordinary results for its stockholders. Thus, the Board believes that the Offer is disadvantageous to Airgas stockholders:

| • | The Offer does not reflect the value inherent in Airgas’ future prospects. The Airgas Board has carefully reviewed, and in November approved, our Company’s five-year strategic and financial plan, which was the product of our customary planning process, which for the current plan commenced in July 2009 and was completed in October 2009. The Airgas Board has a high degree of confidence in management’s plans and in the strategic planning process. This confidence is supported by Airgas’ history of achieving or exceeding its strategic plans over many years and through many business cycles. |

The Board believes that the value to stockholders reflected in the Company’s current strategic plan, derived by applying present value calculations to Airgas’ projected future stock prices, is equal to or greater than the value achievable for stockholders with the Offer. The standalone values of Airgas from executing its strategic plan considered by the Airgas Board do not give effect to any control premium. The Airgas Board’s belief has been corroborated by industry analysts and financial commentators who have issued reports and made statements that the Offer significantly undervalues Airgas’ prospects. Thus, our Board believes that Airgas will deliver more value to Airgas stockholders by operating the business in accordance with the current strategic plan than by accepting the Offer.

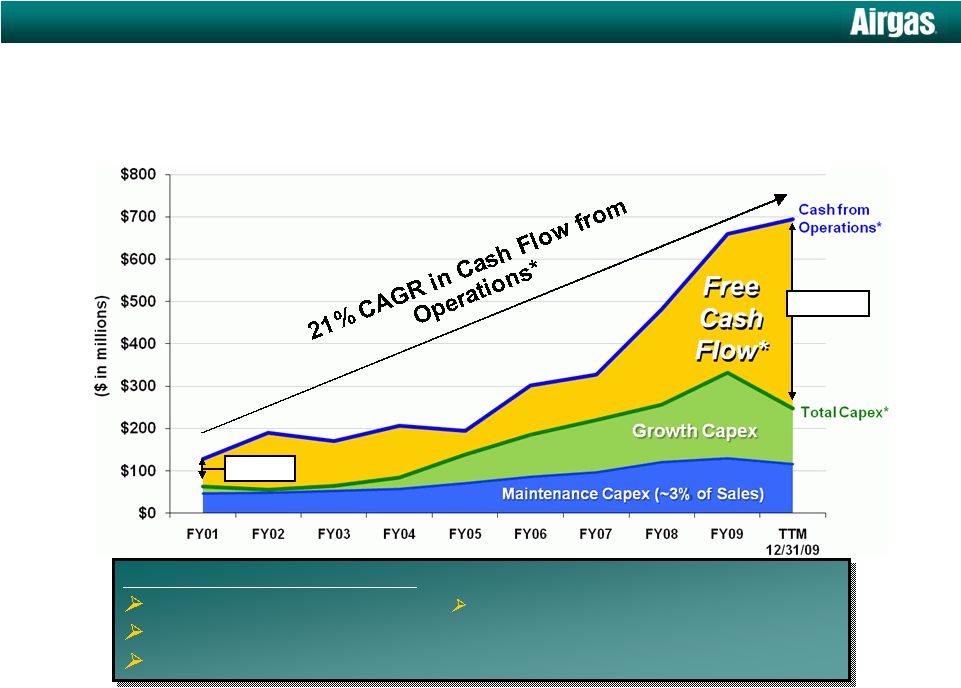

18

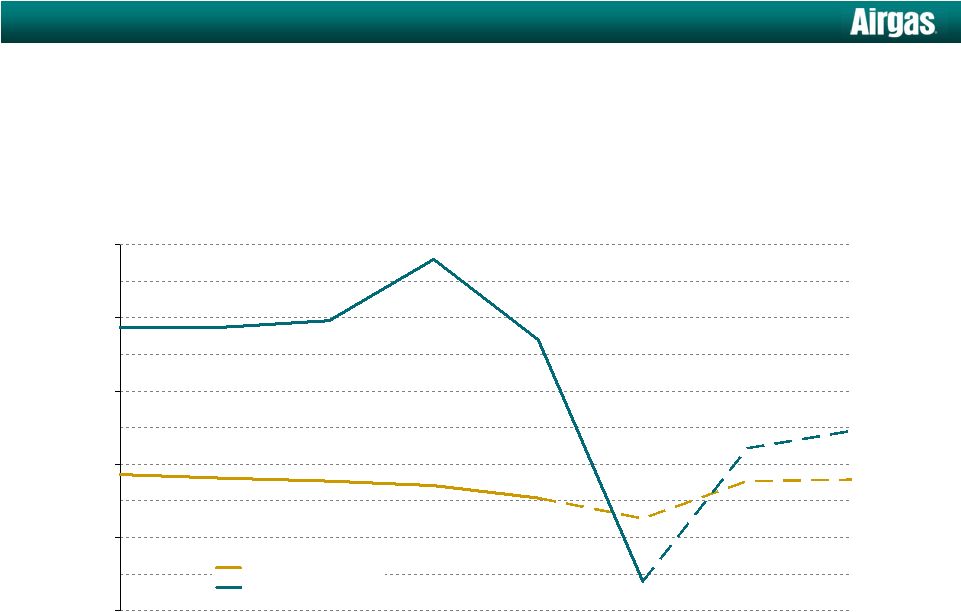

| • | Airgas’ extraordinary historical results provide the Board confidence as to Airgas’ future. Airgas has delivered superior value to its stockholders since its initial public offering in 1986, with a cumulative total stockholder return (defined as stock price appreciation plus dividends reinvested) of 4,201%2 since that time, which represents a compound annual growth rate of 18% and places Airgas ahead of 94% of companies in the S&P 500 index. Our record of sustained growth for the calendar years 2001-2009 is similarly stellar: the compound annual growth rate during that period for revenues, EBITDA, adjusted cash from operations3 and diluted earnings per share are 11%, 17%, 21% and 20%, respectively. Importantly, the drivers of our historical success remain in place to enable our Company to continue its extraordinary performance. |

A comparison of Airgas’ performance to Air Products’ is also instructive. With the exception of the 2009 calendar year, in every cumulative annual period since 2000, measured from the first of each calendar year to December 31, 2009, Airgas’ stock price has consistently outperformed that of Air Products. Airgas’ stock price appreciated 80% over the last five years and 415% over the last ten years, compared to just 40% and 145% for Air Products’ shares over the same periods. In addition, Airgas has achieved total cumulative stockholder returns of 89% and 435% over the last five and ten years, respectively, versus Air Products’ 56% and 198%. Airgas has also significantly outperformed Air Products in compound annual growth rate of revenue and earnings per share since 2001. For the calendar years 2001 through 2008, Airgas generated a 24% compound annual growth rate in operating income from continuing operations, compared to Air Products’ 8%.

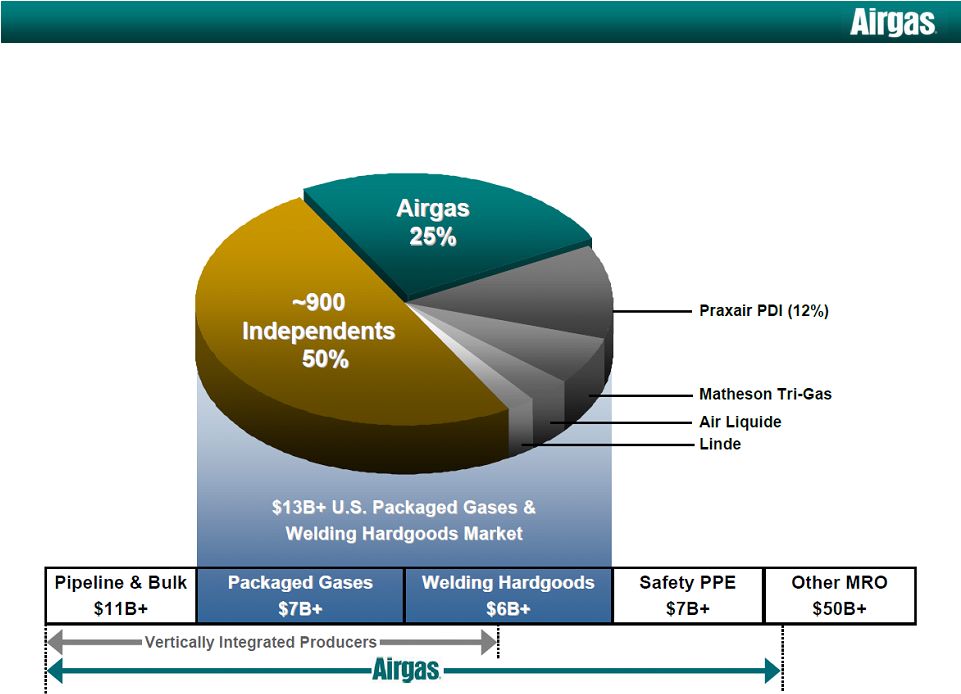

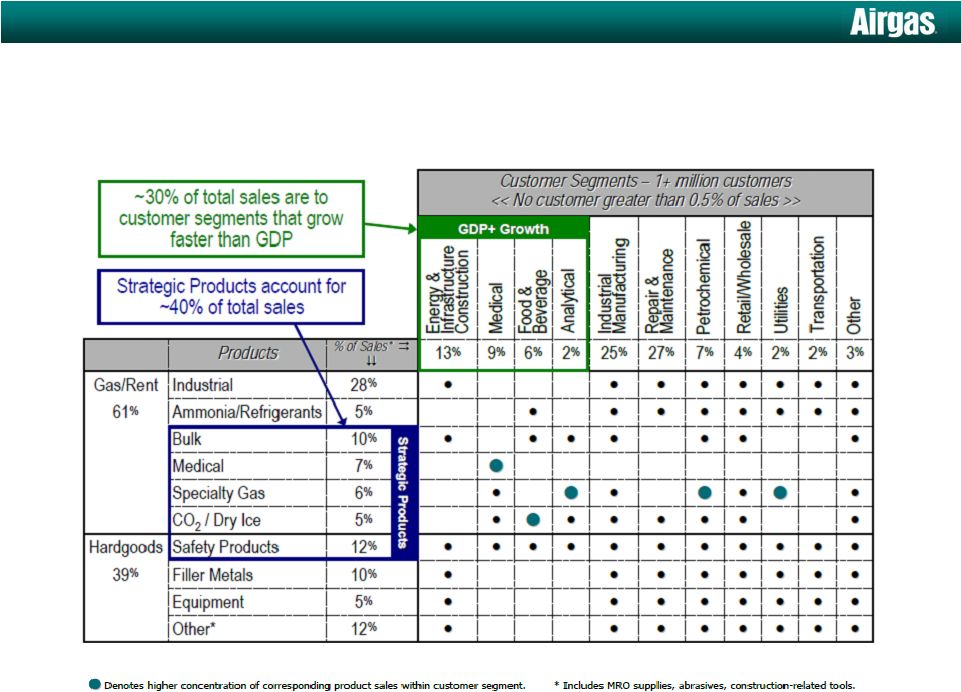

| • | The Offer does not reflect the value of Airgas as the largest and most valuable packaged gas business in the world with an unrivaled platform. Airgas is the largest U.S. distributor of industrial, medical and specialty gases (delivered in “packaged” or cylinder form) and hardgoods, such as welding equipment and supplies. The U.S. remains the largest market for these products in the world and even Air Products has publicly acknowledged its expectations that North America will account for more than a quarter of global GDP growth in the next five years. Airgas’ position in its industry is preeminent and the Company is poised to continue to enhance stockholder value through organic growth and acquisitions. Airgas’ national scale, strong local presence and broad product and service offerings deliver a compelling value proposition to its diversified customer base in a very attractive market. |

| • | Airgas has a unique culture that propels its success. We believe that Airgas’ record of successful growth and excellent results for our stockholders, sustained over many years, has been achieved because of our entrepreneurial, service-oriented culture and decentralized management structure. A major contributor to these results has been our “ownership culture,” as exemplified by our Board’s ownership of more than 10% of the outstanding Airgas Common Shares, and by the fact that many of our associates have invested in Airgas through 401(k) accounts, the Employee Stock Purchase Plan and personal accounts. This ownership culture is one of Airgas’ distinctive strengths. |

We believe that our directors’ substantial investment in the Company is a very positive factor, affirming their faith in our Company and indicating that their interests are aligned with the interests of the other stockholders. As a result of our ownership culture, our directors, management and associates are highly incentivized to maximize stockholder value.

| 2 | Market data as of market close on February 4, 2010, one day prior to Air Products’ publicly disclosing its unsolicited proposal. |

| 3 | Reconciliation of adjusted cash from operations is available on the airgas.com website –Investor Info/GAAP Reconciliation and is also available in the appendix of the presentation filed as Exhibit (a)(6) hereto. |

19

| II) | The timing of the Offer is extremely opportunistic |

The Board believes that the timing of the Offer is extremely opportunistic and disadvantageous to Airgas stockholders:

| • | The timing of the Offer is extremely opportunistic. Airgas’ EBITDA has increased every year over the prior year for the past 22 years preceding the 2009 recession, with only a few very minor exceptions. The timing of the Offer seeks to exploit Airgas’ only significant decline in annual EBITDA in 22 years, |

| as can be seen in the chart entitled “Proven Track Record” under “—Background of the Offer”, as well as a 10% stock price decline in a single trading day (January 29) attributable to, in our view, a significant market overreaction to a 2 cent miss in quarterly earnings guidance. We believe that Air Products—whose fiscal 2009 earnings were more than 20% below the low end of its initial guidance for that year—clearly understands this, but is attempting to create and seize an opportunity by incorrectly attributing great significance to our most recent quarterly results. The Airgas Board believes the difference between the $0.67 low-end of earnings guidance and the reported $0.65 of adjusted earnings per share4 for Airgas’ most recently completed quarter does not affect Airgas’ earnings capacity or intrinsic value. |

| • | Airgas historically lags going into and out of recessionary periods and emerges with significant upside. Over the past decade, Airgas has made a substantial investment in infrastructure and achieved the preeminent position in a consolidating industry. Historically, Airgas has emerged strongly from recessionary periods, as evidenced by a 346% increase in the trading price of Airgas Common Shares in the 22 months from June 2000. Airgas’ same-store sales are now beginning to rebound, and the most recently completed quarter reflected the first sequential improvement in daily sales in a year. Airgas and its stockholders are poised to realize significant benefits as the economy emerges from the worst recession since the Great Depression, making this precisely the wrong time to sell Airgas. |

| • | Air Products’ tactics seek to disadvantage Airgas stockholders. We believe Air Products’ extreme urgency in launching the Offer—an offer which in our view cannot be completed for many months—reflects its desire to act when the claimed premium would appear attractive. For example, the average closing price of Airgas shares in January and February before public announcement of Air Products’ $60 proposal was $47.34; the average daily prices which Air Products paid in their open market purchases of Airgas shares prior to the decline in stock price on January 29 was between $47.09 and $49.25 per share. Thus, when the Airgas closing price was $43.53 on February 4, Air Products acted to take advantage of a temporary valuation anomaly in its attempt to transfer the future value of Airgas to Air Products at a bargain basement price. |

| • | Air Products well knows that the risk to the success of its Offer increases dramatically as Airgas resumes the growth and success which have been the hallmarks of its performance over its history. Air Products has repeatedly declared that “the timing for this combination is ideal” and “the timing for this combination is excellent... [t]he economy is just beginning to emerge from recession...” The timing is excellent for Air Products—but very poor for Airgas stockholders—in light of the depressed value of the Airgas Common Shares prior to the announcement of the Offer. We believe that Air Products decided that it could not wait any longer to launch its Offer because the improving economic conditions that Air Products observed were at risk of soon becoming reflected in Airgas’ stock price. |

| III) | Airgas has received inadequacy opinions from its financial advisors |

The Airgas Board considered the fact that Bank of America Merrill Lynch and Goldman Sachs each rendered an opinion to the Airgas Board, subsequently confirmed in writing, that as of February 20, 2010 and based upon and subject to the factors and assumptions set forth in the written opinions, the consideration

| 4 | Airgas’ adjusted earnings per diluted share of $0.65 for the three months ended December 31, 2009 is the sum of the following: (1) earnings per share of $0.56, (2) a debt extinguishment charge of $0.05, and (3) a multi-employer pension plan withdrawal charge of $0.04. Please see Airgas’ Current Report on Form 8-K filed with the Commission on January 28, 2010 for more information. |

20

proposed to be paid to the holders of Airgas Common Shares (other than AP Sub or its affiliates) pursuant to the Offer was inadequate from a financial point of view to such holders. The full text of the respective written opinions of Bank of America Merrill Lynch and Goldman Sachs, each dated February 20, 2010, and each of which sets forth the assumptions made, procedures followed, matters considered and limitations on the review undertaken in connection with such opinion, are attached as Annexes B and C, respectively. Bank of America Merrill Lynch and Goldman Sachs provided their respective opinions for the information and assistance of the Airgas Board in connection with its consideration of the Offer. The opinions of Bank of America Merrill Lynch and Goldman Sachs are not a recommendation as to whether or not any holder of Airgas Common Shares should tender such Airgas Common Shares in connection with the Offer or any other matter.

| IV) | The Offer is highly uncertain and would provide considerably deferred value |

The Board believes that the Offer is highly uncertain and would require a significant amount of time to complete, even under the most favorable circumstances.

| • | The Offer is subject to significant regulatory concerns. Despite Air Products’ public statements designed to minimize the regulatory risks of its Offer, those regulatory risks are significant. In Airgas’ view, the Offer is highly likely to result in the issuance of a “second request” by United States antitrust authorities under the HSR Act. A second request could result in a substantial delay before Airgas stockholders would receive the “certain” value which Air Products claims to be offering. Thus, any comparison of the “current” value which Air Products claims to be offering against the benefits of Airgas’ continued operations must take into account both the time value of money and the likelihood, in our Board’s view, that Airgas’ historically excellent performance will resume. |

| • | The regulatory concerns are amplified because Air Products failed to clear regulatory hurdles in its last attempt to acquire a major American industrial gas company. In 2000, Air Products abandoned its offer to acquire the U.S. operations of The BOC Group following its failure to obtain antitrust clearance—despite publicly claiming it had “developed a detailed divestiture plan that addressed the competitive issues.” Notwithstanding Air Products’ failure to obtain U.S. antitrust clearance in its last attempt to acquire a major American industrial gas company, the Offer does not contain a commitment that Air Products will take all actions necessary to obtain the approvals required to consummate the proposed acquisition. Therefore, the carefully crafted statement in Air Products’ Offer that Air Products is “prepared to make appropriate divestitures” to obtain necessary regulatory approvals provides little comfort. These concerns are exacerbated by Air Products’ history and by the many subjective and “hair trigger” conditions set forth in their Offer, as described below. |

| V) | The quantity and nature of the Offer’s conditions create major uncertainty and risk |

The Board believes that the numerous conditions set forth in the Offer create significant uncertainty and risk as to whether the Offer can be completed and the timing for completion.

| • | The Offer contains an extraordinarily lengthy list of conditions. As described under Item 2 and in Annex A of the Offer, the Offer is subject to numerous conditions, including, among others, the following conditions: |

| – | the Impairment Condition, |

| – | No Material Adverse Effect Condition, |

| – | the Market Index Condition, |

| – | the No Lawsuits Condition, |

| – | the No Diminution of Benefits Condition, |

| – | the No Material Change Condition, |

| – | the No Adverse Effect on Contracts Condition, |

| – | the Stockholder Ownership Condition, |

| – | the Minimum Tender Condition, |

| – | the Rights Plan Condition, |

21

| – | the Section 203 Condition, |

| – | the Certificate Condition, and |

| – | the HSR Condition. |

| • | Airgas stockholders have no assurance that the Offer will ever be completed. The Offer is illusory, as some of the Offer’s conditions will not be satisfied as a result of Airgas’ publicly disclosed documents and previously announced plans, while others are subject to de minimis materiality standards and can be invoked by Air Products in its sole discretion. The illusory nature of the Offer is illustrated by the condition that will not be satisfied if Airgas pays its already-declared regular quarterly dividend. On January 28, 2010, Airgas raised its quarterly cash dividend to $0.22 per share, which was Airgas’ fifth dividend increase in the past three years. Payment of this dividend, which was publicly announced prior to the Offer to be payable on March 31, 2010 to stockholders of record as of March 15, 2010 (which dividend declaration is described in Air Products’ Schedule TO), will enable Air Products to terminate its Offer pursuant to its terms. Another example of the Offer’s illusory nature is that Air Products, under the terms of the Offer, is permitted to terminate the Offer if any indebtedness of Airgas is subject to acceleration or otherwise adversely affected in connection with the Offer—notwithstanding that Airgas’ publicly available debt instruments, such as its credit agreement, provide for acceleration and/or similar rights in the event that the Offer is consummated. In addition, many of the conditions to the Offer are subject to Air Products’ sole discretion and many establish a de minimis materiality standard making it easy for Air Products to claim that a condition is not satisfied and terminate the Offer. Indeed, Air Products would have the right to declare a condition not satisfied even if the failure to be satisfied was caused by the action or inaction of Air Products. |

| VI) | Air Products’ tactics have been designed to distract and divert attention from the grossly inadequate and highly opportunistic nature of its Offer |