| Underlying supplement no. 19-I To the prospectus dated April 13, 2023 and the prospectus supplement dated April 13, 2023 |

Registration Statement Nos. 333-270004 and 333-270004-01 Dated April 13, 2023 Rule 424(b)(2) |

JPMorgan Chase & Co.

Notes Linked to the J.P. Morgan Tactical Blend Index

JPMorgan Chase Financial Company LLC

Notes, Fully and Unconditionally Guaranteed by JPMorgan Chase & Co., Linked to the J.P. Morgan Tactical Blend Index

This document (the “Underlying Supplement”) contains information about the J.P. Morgan Tactical Blend Index (the “Index”), which information has been provided by J.P. Morgan Securities LLC (“JPMS”, JPMS together with its affiliates and individually referred to herein as “J.P. Morgan”) solely in its capacity as the sponsor of the Index (in such capacity, the “Index Sponsor”) and the calculation agent of the Index (in such capacity, the “Index Calculation Agent”). The Index, its constituents and certain relevant “Risk Factors” are described in further detail within this Underlying Supplement and are qualified in their entirety by the index rules formulated by JPMS (the “Rules”), which are appended hereto. The Index is the intellectual property of JPMS, and JPMS reserves all rights with respect to its ownership of the Index. The Index is reported by Bloomberg L.P. under the ticker symbol “JPUSTACB Index.” Please read the information under the section titled “Important Information” below before reading any other material in this Underlying Supplement.

The Index attempts to provide a dynamic rules-based allocation to the excess return performance of an Equity Constituent (as defined herein) and one of two Defensive Constituents (each as defined herein), less a daily Index adjustment of 0.85% per annum.

The issuer of the notes, as specified in the relevant terms supplement, is referred to in this underlying supplement as the “Issuer.” The Issuer will be either JPMorgan Chase & Co. or JPMorgan Chase Financial Company LLC. For notes issued by JPMorgan Chase Financial Company LLC, JPMorgan Chase & Co., in its capacity as guarantor of those notes, is referred to in this product supplement as the “Guarantor.”

This underlying supplement describes the Index, the relationship between JPMorgan Chase & Co., JPMorgan Chase Financial Company LLC and the sponsor of the Index and terms that will apply generally to notes linked in whole or in part to an Index and provides other information. This underlying supplement supplements the terms described in the accompanying product supplement, the prospectus supplement and the prospectus. A separate term sheet or pricing supplement, as the case may be, will describe terms that apply to specific issuances of the notes. These term sheets and pricing supplements are referred to generally in this underlying supplement as terms supplements. If the terms described in the relevant terms supplement are inconsistent with those described in this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus, the terms described in the relevant terms supplement will control. In addition, if this underlying supplement and the accompanying product supplement or another accompanying underlying supplement contain information relating to the Index, the information contained in the document with the most recent date will control.

Investing in the notes involves a number of risks. See “Risk Factors” beginning on page S-2 of the prospectus supplement, “Risk Factors” in the accompanying product supplement and “Risk Factors” beginning on page US-4 of this underlying supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus. Any representation to the contrary is a criminal offense.

The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

April 13, 2023

TABLE OF CONTENTS

Page

The Issuer and the Guarantor (if applicable) have not authorized anyone to provide any information other than that contained or incorporated by reference in the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus with respect to the notes offered by the relevant terms supplement and with respect to the Issuer and the Guarantor (if applicable). The Issuer and the Guarantor (if applicable) take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The relevant terms supplement, together with this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus, will contain the terms of the notes and will supersede all other prior or contemporaneous oral statements as well as any other written materials, including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials of the Issuer. The information in each of the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus may be accurate only as of the date of that document.

The notes are not appropriate for all investors and involve a number of risks and important legal and tax consequences that should be discussed with your professional advisers. You should be aware that the regulations of Financial Industry Regulatory Authority, Inc., or FINRA, and the laws of certain jurisdictions (including regulations and laws that require brokers to ensure that investments are suitable for their customers) may limit the availability of the notes. The relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus do not constitute an offer to sell or a solicitation of an offer to buy the notes under any circumstances in which that offer or solicitation is unlawful.

The notes are not commodity futures contracts or swaps and are not regulated under the Commodity Exchange Act of 1936, as amended (the “Commodity Exchange Act”). The notes are offered pursuant to an exemption from regulation under the Commodity Exchange Act, commonly known as the hybrid instrument exemption, that is available to securities that have one or more payments indexed to the value, level or rate of one or more commodities, as set out in section 2(f) of that statute. Accordingly, you are not afforded any protection provided by the Commodity Exchange Act or any regulation promulgated by the Commodity Futures Trading Commission.

In this underlying supplement, “we,” “us” and “our” refer to the Issuer, unless the context requires otherwise, and “JPMorgan Financial” refers to JPMorgan Chase Financial Company LLC. To the extent applicable, each index described in this underlying supplement is deemed to be one of the “Indices” referred to in the accompanying product supplement.

The J.P. Morgan Tactical Blend Index (the “Index”) was developed and is maintained and calculated by J.P. Morgan Securities LLC (“JPMS”). The description of the Index and methodology included in this document (the “Underlying Supplement”) is based on rules formulated by JPMS (the “Rules”). The Rules, and not this description, will govern the calculation and constitution of the Index and other decisions and actions related to its maintenance. The Rules in effect as of the date of this Underlying Supplement are attached as Annex A to this Underlying Supplement. The Index is the intellectual property of JPMS, and JPMS reserves all rights with respect to its ownership of the Index. The Index is reported by Bloomberg L.P. under the ticker symbol “JPUSTACB Index.”

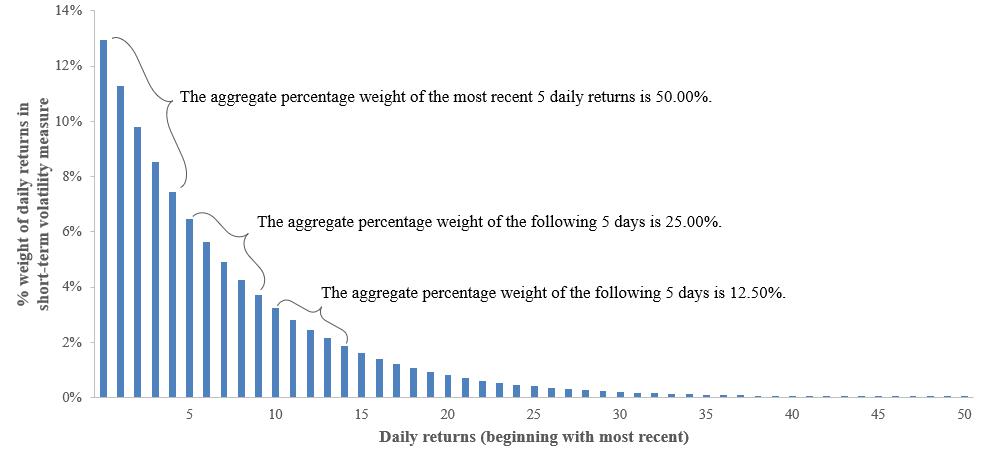

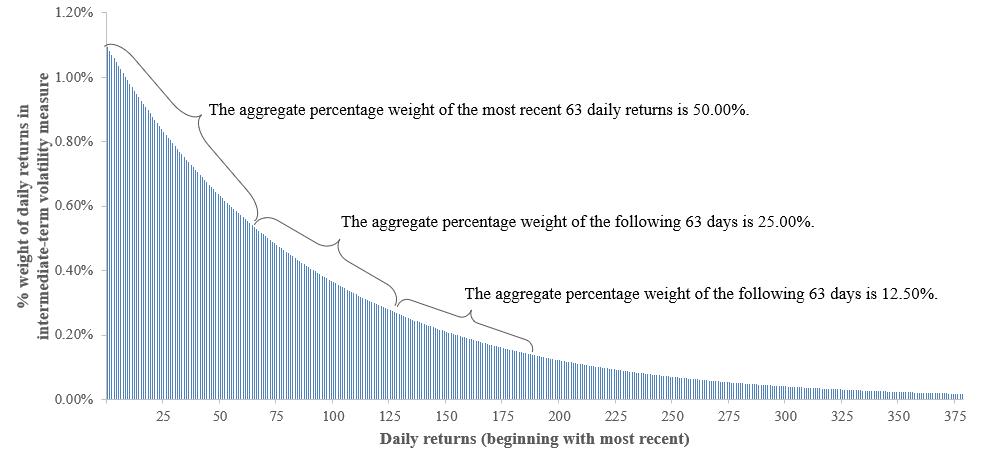

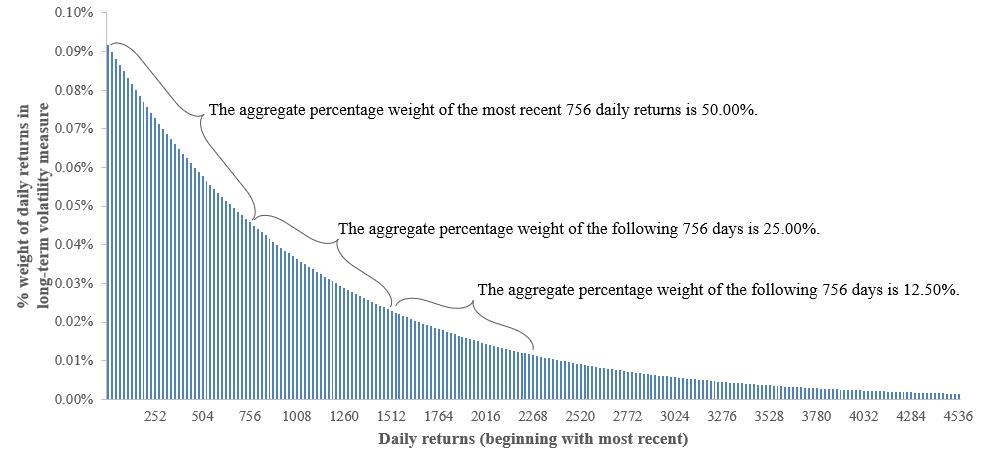

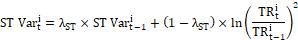

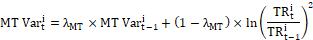

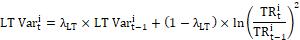

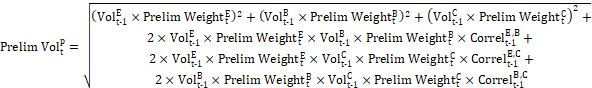

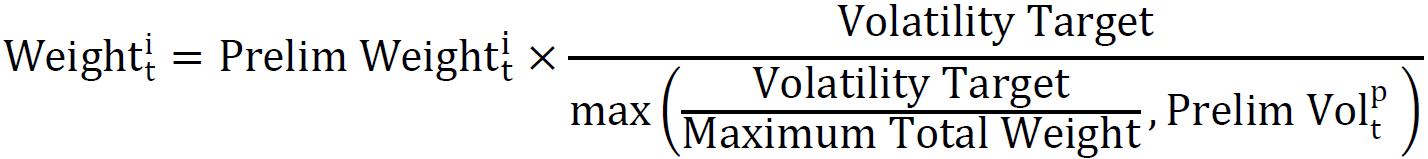

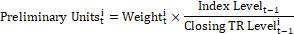

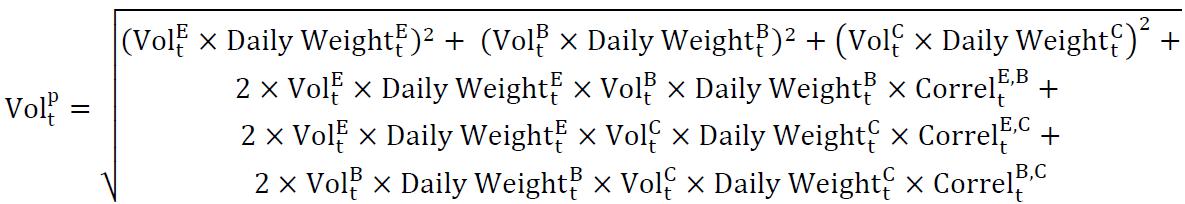

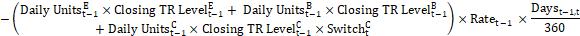

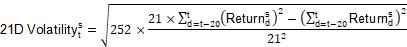

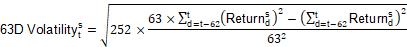

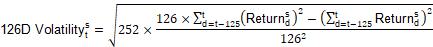

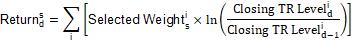

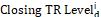

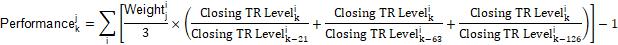

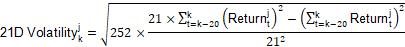

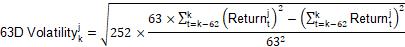

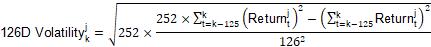

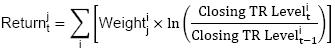

The Index attempts to provide a dynamic rules-based allocation to the excess return performance of the J.P. Morgan U.S. Low Volatility Index (Total Return) (the “Equity Constituent”) and one of the following two “Defensive Constituents”: (1) the J.P. Morgan Core Bond Index (the “Bond Constituent”) and (2) the Invesco DB US Dollar Index Bullish Fund (the “Currency Constituent”), less a daily Index adjustment of 0.85% per annum (the “Index Adjustment”). The selected Defensive Constituent is determined based on a momentum signal; and changes from one Defensive Constituent to the other are implemented over a period of up to 5 days, subject to changes in the signal during the period. The Index targets a volatility level of 5.0% (the “Target Volatility”), subject to a maximum total weight of 150% (the “Maximum Total Weight”); however, because the methodology used to calculate the realized volatility of the Index is based on the highest volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized volatility of the Index on an annualized basis is expected to be lower than its target volatility of 5.0%. The Equity Constituent, the Bond Constituent and the Currency Constituent are individually referred to herein as a “Portfolio Constituent”.

| · | The Equity Constituent. The Equity Constituent is an index that applies a rules-based methodology to seek to track the total return of a portfolio of stocks selected from the components of the Solactive United States 1000 Index, with stocks with the highest realized volatility excluded, with weightings selected to seek sector diversification and with a weighting preference for stocks with lower realized volatility. There is, however, no assurance that the Index will exhibit lower volatility or provide higher risk-weighted returns than the Solactive United States 1000 Index or any other index or strategy. For additional information about the Equity Constituent, see “Background on the J.P. Morgan U.S. Low Volatility Index (Total Return)” below. |

| · | The Defensive Constituents. The Index Calculation Agent selects a Defensive Constituent for inclusion in the Index (the “Selected Defensive Constituent”) based on the price momentum of the Bond Constituent: |

| · | The Bond Constituent is an index that applies a rules-based methodology to evaluate recent market conditions and allocate exposure dynamically across up to ten (10) exchange-traded funds (“ETFs”) that each track a U.S. dollar fixed income sector. For additional information about the Bond Constituent, see “Background on the J.P. Morgan Core Bond Index” below. |

| · | The Currency Constituent is an ETF that generally seeks to track changes in the level of the Deutsche Bank Long USD Currency Portfolio Index–Excess ReturnTM (the “DB Dollar Index”) by establishing long positions in ICE U.S. Dollar Index (“USDX®”) futures contracts designed to replicate the performance of taking a long position in the U.S. dollar against a basket of six (6) currencies composed of the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc. The DB Dollar Index is intended to provide a general indication of the international value of the U.S. dollar relative to this basket of currencies and is composed solely of long positions in the USDX® futures contracts. All else being equal, the Currency Constituent increases when the U.S. dollar appreciates and decreases in value when the trade-weighted basket of currencies strengthen against the U.S. dollar. For additional information about the Currency Constituent, see “Background on the Invesco DB US Dollar Index Bullish Fund” below. |

US-1

The Index provides a balanced exposure to the Portfolio Constituents and rebalances from time to time based on the price momentum of the Bond Constituent and the realized volatility of the underlying notional portfolio.

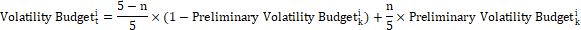

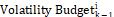

Determining the Selected Defensive Constituent. The price momentum of the Bond Constituent on a given Index Business Day is calculated by comparing the closing level of the Bond Constituent on such day against the closing level on the Index Business Days that is sixty (60) days prior to such day (the “60-Day Price Momentum Signal”). If the Bond Constituent exhibits a positive 60-Day Price Momentum Signal on any given Index Business Day and on each of the two (2) Index Business Days preceding such day, then the Bond Constituent will be identified as the Selected Defensive Constituent for such day. However, if the Bond Constituent exhibits a negative or neutral 60-Day Price Momentum Signal on any given Index Business Day and on each of the two (2) Index Business Days preceding such day, then the Currency Constituent will be identified as the Selected Defensive Constituent for such day. In either scenario, if the 60-Day Price Momentum Signal on such day is not repeated on both of the two (2) preceding Index Business Days, then the Selected Defensive Constituent will be whichever one was last selected. Whenever the Selected Defensive Constituent changes from the Bond Constituent to the Currency Constituent (and vice versa) (each, a “Defensive Constituent Switch Day”), the Index will rebalance its exposure to the Portfolio Constituents starting on the immediately following Index Business Day and ending on the Index Business Day after the earlier of (y) the next Defensive Constituent Switch Day and (z) the Index Business Day for which the volatility budget of each Defensive Constituent as of such day is equal to the preliminary volatility budget of such Defensive Constituent calculated as of the Defensive Constituent Switch Day, up to a maximum of five (5) days. In addition, the Index will rebalance its exposure to the Portfolio Constituents on any other Index Business Day where the volatility of the notional portfolio underlying the Index is less than four point five percent (4.5%) or greater than five point five percent (5.5%), calculated as of the immediately preceding Index Business Day.

Considerations Relating to the Volatility of the Portfolio Constituents. Under normal market conditions, the Equity Constituent’s realized volatility has tended to be relatively more variable than the realized volatility of the Defensive Constituents. Consequently, the Index methodology may be more likely to allocate exposure to the Selected Defensive Constituent during periods of relatively higher market volatility and to shift exposure from the Selected Defensive Constituent to the Equity Constituent under market conditions exhibiting relatively lower market volatility. In addition, because the Index methodology calculates realized volatility over periods ranging from 5 days to three years and allocates a greater proportion to the Selected Defensive Constituent during periods of greater equity market volatility, the Index has tended to exhibit an annualized realized volatility that is lower than the Target Volatility of 5.0%.

In general, equity markets have historically been more likely to outperform fixed-income and U.S. dollar currency markets during periods of relatively lower market volatility and to underperform fixed-income and U.S. dollar currency markets during periods of relatively higher market volatility. However, there can be no assurance that the Index allocation strategy will achieve its intended results or that the Index will outperform any alternative index or strategy that might reference the Portfolio Constituents. Past performance should not be considered indicative of future performance.

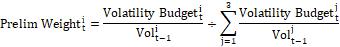

The Index seeks to allocate risk between the Equity Constituent and the Selected Defensive Constituent such that the risk associated with each of the Equity Constituent and the Selected Defensive Constituent is approximately equal by measuring the volatility of each Portfolio Constituent and setting the weight of such Portfolio Constituent in inverse proportion to its volatility. Therefore, all else being equal, a lower realized volatility for a Portfolio Constituent will generally result in a higher weight for that Portfolio Constituent, while a higher realized volatility will generally result in a lower weight. Under normal market conditions, because the Bond Constituent generally attempts to allocate to a portfolio with a realized volatility less than or equal to 5.0%, and the historical realized volatility of the Currency Constituent has generally ranged from 6.0% to 9.0%, the Equity Constituent’s realized volatility has tended to be significantly higher than those of the Defensive Constituents. Furthermore, because the methodology used to calculate the realized volatility of the Index is based on the highest volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized volatility of the Index on an annualized basis is more likely to be lower than the Target Volatility of 5.0% than it is likely to be higher, which has the effect of further lowering the weight of the Equity Constituent. Past performance should not be considered indicative of future performance. Consequently, the Index may have significant exposure for an extended period of time to the Selected

US-2

Defensive Constituent, and that exposure may be greater, perhaps significantly greater, than its exposure to the Equity Constituent. However, the returns of the Selected Defensive Constituent may be significantly lower than the returns of the Equity Constituent, and possibly even negative while the returns of the Equity Constituent are positive, which will adversely affect the level of the Index.

Furthermore, under circumstances where the Equity Constituent’s realized volatility is significantly higher than that of the Selected Defensive Constituent, the performance of the Index is expected to be influenced to a greater extent by the performance of the Equity Constituent than by the performance of the Bond Constituent, unless the weight of the Selected Defensive Constituent is significantly greater than the weight of the Equity Constituent. Consequently, even in cases where the allocation to the Selected Defensive Constituent is greater than the allocation to the Equity Constituent, the Index may be influenced to a greater extent by the performance of the Equity Constituent than by the performance of the Selected Defensive Constituent because, under some conditions, the greater allocation to the Selected Defensive Constituent will not be sufficiently large to offset the greater realized volatility of the Equity Constituent.

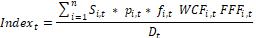

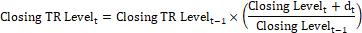

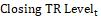

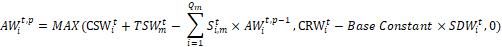

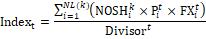

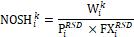

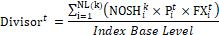

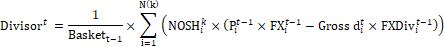

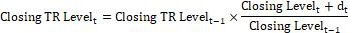

Calculating the level of the Index. On any given day, the closing level of the Index (the “Index Level”) reflects the weighted excess return performance of the Portfolio Constituents (i.e., the total return performance less the notional financing cost) less the daily deduction of 0.85% per annum. The Index Level was set equal to 100.00 on November 24, 2006, the base date of the Index. The Index Calculation Agent began calculating the Index on a live basis on March 30, 2023.

The Index provides “excess return” exposure to the Portfolio Constituents because of the daily deduction of a notional financing cost, which is calculated by reference to the Effective Federal Funds Rate, from the performance of the Portfolio Constituents. The Effective Federal Funds Rate is a measure of the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight, calculated as the volume-weighted median of overnight federal funds transactions reported by U.S. banks and U.S. branches and agencies of non-U.S. banks, and is quoted on the basis of an assumed year of 360 days.

JPMS is currently the sponsor of the Index (in such capacity, the “Index Sponsor”) and the calculation agent of the Index (in such capacity, the “Index Calculation Agent”).

See “The J.P. Morgan Tactical Blend Index” in this Underlying Supplement for additional information about the Index.

The Index is described as a notional or synthetic portfolio because there is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. The Index merely identifies certain reference assets, the performance of which will be used as a reference point for calculating the Index Level. The Index is subject to an eighty-five basis point (0.85%) per annum daily deduction that will reduce its performance.

No assurance can be given that the investment strategy used to construct the Index will achieve its intended results or that the Index will be successful or will outperform any alternative index or strategy that might reference the Portfolio Constituents (as defined herein). Furthermore, no assurance can be given that the realized volatility of the Index will approximate its Target Volatility. The actual realized volatility of the Index may be greater or less than the Target Volatility.

If the aggregate weight of the Portfolio Constituents in the Index is less than 100%, the Index will not be fully invested, and any uninvested portion will earn no return. The daily deduction of 0.85% per annum is fully applied in calculating the Index Level, even when the Index is not fully invested.

The Index is described as a “notional” or “synthetic” portfolio of assets because there is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. The Index merely references certain assets, the performance of which will be used as a reference point for calculating the Index Level.

US-3

Capitalized terms used in this section without definition are as defined in “Summary” above.

Risks Relating to the Index

JPMS, as the Index Sponsor and the Index Calculation Agent, may adjust the Index in a way that affects its level, and JPMS has no obligation to consider any person’s interests.

JPMS, an affiliate of JPMorgan Chase & Co., currently acts as the Index Sponsor and the Index Calculation Agent and is responsible for calculating and maintaining the Index and developing the guidelines and policies governing its composition and calculation. In performing these duties, JPMS may have interests adverse to the interests of investors in an investment or instrument referencing the Index, particularly where JPMS, as the Index Sponsor and the Index Calculation Agent, is entitled to exercise discretion. The Rules may be amended at any time by the Index Sponsor, in its sole discretion. The Rules also permit the use of discretion by the Index Sponsor and the Index Calculation Agent in relation to the Index in specific instances, including, but not limited to, the determination of whether to replace a Portfolio Constituent with a substitute or successor upon the occurrence of certain events affecting that Portfolio Constituent, the selection of any substitute or successor and the determination of the levels to be used in the event of market disruptions that affect the ability of the Index Calculation Agent to calculate and publish the levels of the Index and the interpretation of the Rules. Although JPMS, acting as the Index Sponsor and the Index Calculation Agent, will make all determinations and take all action in relation to the Index acting in good faith and in a commercially reasonable manner, it should be noted that JPMS may have interests adverse to the interests of investors in an investment or instrument referencing the Index and the policies and judgments for which JPMS is responsible could have an impact, positive or negative, on the level of the Index and therefore on the value of any investment or instrument linked to the Index.

Although judgments, policies and determinations concerning the Index are made by JPMS, JPMorgan Chase & Co., as the ultimate parent company of JPMS, ultimately controls JPMS. JPMS has no obligation to consider any person’s interests in taking any actions that might affect the value of any investment or instrument linked to the Index. Furthermore, the inclusion of any Portfolio Constituent in the Index is not an investment recommendation by JPMS of that Portfolio Constituent or any of the securities underlying that Portfolio Constituent. See “The J.P. Morgan Tactical Blend Index.”

The Index is subject to a 0.85% per annum daily deduction and the deduction of a notional financing cost.

One way in which the Index may differ from a typical index is that its level will be subject to a 0.85% per annum daily deduction and the deduction from the performance of each Portfolio Constituent of a notional financing cost calculated by reference to the Effective Federal Funds Rate. The Index Adjustment and the notional financing cost will be deducted daily. As a result of the deduction of the Index Adjustment and the notional financing cost, the level of the Index will trail the value of a hypothetical identically constituted notional portfolio from which no such Index Adjustment or cost is deducted.

The Effective Federal Funds Rate is a measure of the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight, calculated as the volume-weighted median of overnight federal funds transactions reported by U.S. banks and U.S. branches and agencies of non-U.S. banks, and is quoted on the basis of an assumed year of 360 days. The Effective Federal Funds Rate will be affected by many factors, including, among others described under “— Risks Relating to the Notional Financing Cost” below, the monetary policy of the Federal Reserve. The Effective Federal Funds Rate has fluctuated significantly over time. For example, on July 3, 2000, the Effective Federal Funds Rate was 7.03%, on May 12, 2022, the Effective Federal Funds Rate was 0.83% and on March 23, 2023, the Effective Federal Funds Rate was 4.58%. The Federal Reserve raised its federal funds target rate over periods in the past and may do so again in the future. Any increase in the Effective Federal Funds Rate, whether due to the Federal Reserve decisions to raise interest rates (specifically, its

US-4

federal funds target rate) or otherwise, will increase the adverse effect of the notional financing cost on performance of the Index.

The deduction of the Index Adjustment and the notional financing cost will place a significant drag on the performance of the Index, potentially offsetting positive returns of the Portfolio Constituents, exacerbating negative returns of the Portfolio Constituents and causing the level of the Index to decline steadily if the total returns of the Portfolio Constituents are relatively flat. In particular, under market conditions where the yield curve is relatively flat (meaning that there is little difference between longer-term and shorter-term interest rates), the notional financing cost alone may be expected to largely or entirely offset the yields on the securities held by the ETFs included in the Bond Constituent (each, a “Bond Constituent ETF”) and/or the yield on the Currency Constituent. The Index will not appreciate unless the total returns of the Portfolio Constituents are sufficient to offset the negative effects of the Index Adjustment and the notional financing cost, and then only to the extent that the total returns of the Portfolio Constituents are greater than the deducted amounts. As a result of these deductions, the level of the Index may decline even if the total returns of the Portfolio Constituents are positive.

The Index may not be successful or outperform any alternative strategy that might be employed in respect of the Portfolio Constituents.

The Index follows a notional rules-based proprietary strategy that operates on the basis of pre-determined rules. Under this strategy, the Index seeks to maintain an annualized realized volatility approximately equal to the Target Volatility of 5.0% by rebalancing its exposures to the Portfolio Constituents from time to time based on the realized portfolio volatility and the price momentum of the Bond Constituent. By seeking to maintain an annualized realized volatility approximately equal to the Target Volatility, the Index may underperform an alternative strategy that seeks to maintain a higher annualized realized volatility or an alternative strategy that does not seek to maintain a level volatility.

No assurance can be given that the investment strategy on which the Index is based will be successful or that the Index will outperform any alternative strategy that might be employed in respect of the Portfolio Constituents.

The Index may not approximate the Target Volatility.

No assurance can be given that the Index will maintain an annualized realized volatility that approximates the Target Volatility. The actual realized volatility of the Index may be greater or less than the Target Volatility. The Index seeks to maintain an annualized realized volatility approximately equal to the Target Volatility of 5.0% by rebalancing its exposures to the Portfolio Constituents from time to time based on the realized portfolio volatility. However, there is no guarantee that trends exhibited by the realized portfolio volatility will continue in the future. The volatility of a notional portfolio on any day may change quickly and unexpectedly. In addition, because the methodology used to calculate the realized volatility of the Index is based on the highest volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized volatility of the Index on an annualized basis is more likely to be lower than the Target Volatility of 5.0% than it is likely to be higher, which may adversely affect the level of the Index.

The Index should not be compared to any other index or strategy sponsored by any affiliates of JPMorgan Chase & Co. (each, a “J.P. Morgan Index”) and cannot necessarily be considered a revised, enhanced or modified version of any other J.P. Morgan Index.

The Index follows a notional rules-based proprietary strategy that may have objectives, features and/or constituents that are similar to those of other J.P. Morgan Indices. No assurance can be given that these similarities will form a basis for comparison between the Index and any other J.P. Morgan Index, and no assurance can be given that the Index would be more successful than or outperform any other J.P. Morgan Index. The Index operates independently and does not necessarily revise, enhance, modify or seek to outperform any other J.P. Morgan Index.

US-5

The Index may be significantly uninvested.

The weighting methodology of the Index may result in an aggregate weight of less than 100% on any day. If the Index tracks a notional portfolio with an aggregate weight that is less than 100%, the Index will not be fully invested, and any uninvested portion will earn no return. The Index may be significantly uninvested on any given day, and will realize only a portion of any gains due to appreciation of the Portfolio Constituents on any such day. The daily deduction of the Index Adjustment is fully applied in calculating the Index Level, even when the Index is not fully invested.

A significant portion of the Index’s exposure may be allocated to the Selected Defensive Constituent.

Under normal market conditions, the Equity Constituent has tended to exhibit a realized volatility that is higher than the Target Volatility and that is higher than the realized volatility of each of the Defensive Constituents in general over time. As a result, the Index will generally need to reduce its exposure to the Equity Constituent in order to approximate the Target Volatility. Furthermore, because the methodology used to calculate the realized volatility of the Index is based on the highest volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized volatility of the Index on an annualized basis is more likely to be lower than the Target Volatility of 5.0% than it is likely to be higher, which has the effect of further lowering the weight of the Equity Constituent. Therefore, the Index may have significant exposure for an extended period of time to the Selected Defensive Constituent, and that exposure may be greater, perhaps significantly greater, than its exposure to the Equity Constituent. However, the returns of the Selected Defensive Constituent may be significantly lower than the returns of the Equity Constituent, and possibly even negative while the returns of the Equity Constituent are positive, which will adversely affect the level of the Index.

The Index may be more heavily influenced by the performance of the Equity Constituent than the performance of the Selected Defensive Constituent in general over time.

Under normal market conditions, the Equity Constituent’s realized volatility has been relatively more variable and has tended to be significantly higher than those of the Defensive Constituents. Under these circumstances, the Index is generally expected to be more heavily weighted towards the Selected Defensive Constituent. Furthermore, because the methodology used to calculate the realized volatility of the Index is based on the highest volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized volatility of the Index on an annualized basis is more likely to be lower than the Target Volatility of 5.0% than it is likely to be higher, which has the effect of further lowering the weight of the Equity Constituent. However, under circumstances where the Equity Constituent’s realized volatility is significantly higher than that of the Selected Defensive Constituent, the performance of the Index is expected to be influenced to a greater extent by the performance of the Equity Constituent than by the performance of the Selected Defensive Constituent, even if the weight of the Selected Defensive Constituent is significantly greater than the weight of the Equity Constituent.

Consequently, even in cases where the allocation to the Selected Defensive Constituent is greater than the allocation to the Equity Constituent, the Index may be influenced to a greater extent by the performance of the Equity Constituent than by the performance of the Selected Defensive Constituent because, under some conditions, the greater allocation to the Selected Defensive Constituent will not be sufficiently large to offset the greater realized volatility of the Equity Constituent.

Accordingly, the level of the Index may decline if the value of the Equity Constituent declines, even if the value of the Selected Defensive Constituent increases at the same time. See also “— Changes in the values of the Portfolio Constituents may offset each other” below.

Correlation of performances between the Portfolio Constituents may reduce the performance of the Index.

Performances of the Portfolio Constituents may become highly correlated from time to time, including, but not limited to, a period in which there is a substantial decline in the level or the price of the Portfolio Constituents. High correlation during periods of negative returns among Portfolio Constituents could have an adverse effect on the performance of the Index.

US-6

Changes in the values of the Portfolio Constituents may offset each other.

Price movements among the Portfolio Constituents may not correlate with each other. At a time when the value of one Portfolio Constituent increases, the value of the other Portfolio Constituents may not increase as much or may decline. Therefore, in calculating the level of the Index, increases in the value of one Portfolio Constituent may be moderated, or more than offset, by lesser increases or declines in the value of the other Portfolio Constituent, which will adversely affect the level of the Index.

Hypothetical back-tested data relating to the Index do not represent actual historical data and are subject to inherent limitations.

Hypothetical back-tested performance measures of the Index are purely theoretical and do not represent the actual historical performance of the Index and have not been verified by an independent third party. Hypothetical back-tested performance measures have inherent limitations. Alternative modelling techniques might produce significantly different results and may prove to be more appropriate. The use of alternative “proxy” performance information in the calculation of hypothetical back-tested weights and levels may have resulted in different, perhaps significantly different, weights and higher levels than would have resulted from the use of actual performance information of the Portfolio Constituents. Past performance, and especially hypothetical back-tested performance, is not indicative of future results. This type of information has inherent limitations and investors in an investment or instrument linked to this Index should carefully consider these limitations before placing reliance on such information. Hypothetical back-tested performance is derived by means of the retroactive application of a back-tested model that has been designed with the benefit of hindsight. See also “The J.P. Morgan Tactical Blend Index — Additional Information about Hypothetical Back-tested Performance Data” below.

If the value of a Portfolio Constituent changes, the level of the Index may not change in the same manner.

Changes in the value of any Portfolio Constituent may not result in a comparable change in the level of the Index or the market value of any investment or instrument linked to the Index.

The Index comprises notional assets and liabilities.

The exposure of the Index to its Portfolio Constituents is purely notional and will exist solely in the records maintained by or on behalf of the Index Calculation Agent. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Consequently, there will be no claim against any of the reference assets that compose the Index.

The Index has a very limited operating history and may perform in unanticipated ways.

The Index was established on March 30, 2023 and therefore has a very limited operating history. Past performance should not be considered indicative of future performance.

The Index is subject to market risks.

The performance of the Index is dependent in part on the performance of its Portfolio Constituents. As a consequence, any investment or instrument linked to the Index is exposed to the performance of the Portfolio Constituents. Geopolitical and other events (e.g., wars, terrorism or natural disasters) may disrupt securities and currency markets and adversely affect global economies and markets, thereby adversely affecting the performance of the Portfolio Constituents and the Index.

The investment strategy used to construct the Index involves rebalancing from time to time.

The Index is subject to rebalancing from time to time based on the realized portfolio volatility and the price momentum of the Bond Constituent. For this purpose, the price momentum of the Bond Constituent on a given Index Business Day is calculated based on the 60-Day Price Momentum Signal. If the Bond Constituent exhibits a positive 60-Day Price Momentum Signal on any given Index Business Day and on each of the two (2) Index Business Days preceding such day, then the Bond Constituent will be identified as the Selected Defensive Constituent for such day. However, if the Bond Constituent exhibits a negative

US-7

or neutral 60-Day Price Momentum Signal on any given Index Business Day and on each of the two (2) Index Business Days preceding such day, then the Currency Constituent will be identified as the Selected Defensive Constituent for such day. In either scenario, if the 60-Day Price Momentum Signal on such day is not repeated on both of the two (2) preceding Index Business Days, then the Selected Defensive Constituent will be whichever one was last selected. Following each Defensive Constituent Switch Day, the Index will rebalance its exposure to the Portfolio Constituents starting on the immediately following Index Business Day and ending on the Index Business Day after the earlier of (y) the next Defensive Constituent Switch Day and (z) the Index Business Day for which the volatility budget of each Defensive Constituent as of such day is equal to the preliminary volatility budget of such Defensive Constituent calculated as of the Defensive Constituent Switch Day, up to a maximum of five (5) days. In addition, the Index will rebalance its exposure to the Portfolio Constituents on any other Index Business Day where the volatility of the notional portfolio underlying the Index is less than four point five percent (4.5%) or greater than five point five percent (5.5%), calculated as of the immediately preceding Index Business Day. By contrast, a notional portfolio that does not rebalance from time to time in this manner could see greater compounded gains over time through exposure to a consistently and rapidly appreciating portfolio consisting of the relevant Portfolio Constituents. Therefore, the return on any investment or instrument linked to the Index may be less than the return on an alternative investment in the relevant Portfolio Constituents that is not subject to rebalancing. No assurance can be given that the investment strategy used to construct the Index will outperform any alternative investment in the Portfolio Constituents of the Index.

The Index determines the Selected Defensive Constituent based on the momentum of the Bond Constituent.

The Index determines the Selected Defensive Constituent based on the momentum of the Bond Constituent. If the Bond Constituent exhibits a positive 60-Day Price Momentum Signal, and this continue for the following two (2) days, then the Selected Defensive Constituent as of the last day will be the Bond Constituent. However, if the Bond Constituent exhibits a negative or neutral 60-Day Price Momentum Signal, and this continue for the following two (2) days, then the Selected Defensive Constituent as of the last day will be the Currency Constituent. In either scenario, if the 60-Day Price Momentum Signal on such last day is not repeated on the preceding two (2) days, then the Selected Defensive Constituent will be whichever one was last selected. The momentum strategy generally seeks to benefit from positive trends in the returns of the Bond Constituent, and allocate to the Currency Constituent when the momentum signal for the Bond Constituent is not positive. As such, the allocation to the Bond Constituent is based in part on the recent performance of the Bond Constituent ETFs. However, there is no guarantee that recent performance trends will continue in the future. Moreover, in circumstances where the Bond Constituent exhibits a negative or neutral 60-Day Price Momentum Signal, there is no assurance that the Currency Constituent will outperform the Bond Constituent.

In addition, due to the momentum investment strategy to determine the Selected Defensive Constituent, the Index may fail to realize gains that could occur as a result of obtaining exposures to financial instruments that have experienced negative returns, but which subsequently experience a recovery or a sudden spike in positive returns. As a result, if market conditions do not represent a continuation of prior observed trends, the level of the Index, which is rebalanced based on prior trends, may decline.

There are risks associated with the momentum investment strategy underlying the rebalancing methodology of the Index.

The rebalancing methodology of the Index reflects a momentum investment strategy and seeks to provide exposure to positive price momentum of the Bond Constituent through its rebalancing process. Momentum investing generally seeks to capitalize on positive trends in the returns of financial instruments. If the Bond Constituent exhibits a positive 60-Day Price Momentum Signal, and this continue for the following two (2) days, then the Bond Constituent will be included in the Index as the Selected Defensive Constituent. However, if the Bond Constituent exhibits a negative or neutral 60-Day Price Momentum Signal, and this continue for the following two (2) days, then the Index will generally rebalance to switch its exposure from the Bond Constituent to the Currency Constituent as the Selected Defensive Constituent. In non-trending, sideways markets, the Index will maintain the Selected Defensive Constituent last selected

US-8

and may be subject to “whipsaws.” A whipsaw occurs when the market reverses and does the opposite of what is indicated by the trend indicator, resulting in a trading loss during the particular period.

Furthermore, due to the “long-only” construction of the Index, the weight of each Portfolio Constituent will not fall below zero at any time even if the Selected Defensive Constituent has displayed a negative recent performance period. Moreover, once a selected portfolio has been identified and implemented, the Index will track the performance of the Selected Defensive Constituent until the next re-weighting, even when the values of that Selected Defensive Constituent is trending downwards or when the Selected Defensive Constituent is otherwise performing significantly worse than its recent performance, or than the other Defensive Constituent.

A Portfolio Constituent may be replaced by a substitute index or ETF upon the occurrence of certain extraordinary events.

As described under “The J.P. Morgan Tactical Blend Index — Succession and Extraordinary Events” below, following the occurrence of certain extraordinary events with respect to a Portfolio Constituent, the affected Portfolio Constituent may be replaced by a substitute index or ETF. These extraordinary events generally include events that could materially interfere with the ability of market participants to transact in positions with respect to the Index (including positions with respect to any Portfolio Constituent or the reference index of any Portfolio Constituent). See “The J.P. Morgan Tactical Blend Index — Extraordinary Events” below for a summary of events that could trigger an extraordinary event.

The changing of a Portfolio Constituent may affect the performance of the Index, and therefore, the return on any investment or instrument linked to the Index, as the replacement Portfolio Constituent may perform significantly better or worse than the original Portfolio Constituent. For example, the substitute or successor Portfolio Constituent may have higher fees or worse performance than the original Portfolio Constituent. Moreover, the policies of the sponsor of the substitute index or ETF concerning the methodology and calculation of the substitute index or ETF, including decisions regarding additions, deletions or substitutions of the assets underlying the substitute index or ETF, could affect the level or price of the substitute index or ETF and therefore the performance of the Index. The performance of the Index could also be affected if the sponsor of a substitute index or the sponsor of the reference index of a substitute ETF discontinues or suspends calculation or dissemination of the relevant index, in which case it may become difficult to determine the performance of the Index. The sponsor of the substitute index or ETF will have no obligation to consider any person’s interests in calculating or revising such substitute index or ETF.

The Index seeks to allocate notional exposure between the Equity Constituent and the Selected Defensive Constituent so that the risk associated with each constituent is roughly equal. However, the Index methodology may not be successful at achieving “risk-parity” among the Portfolio Constituents.

The Index is subject to rebalancing from time to time in part based on the realized portfolio volatility and seeks to weight the notional exposure to the Equity Constituent and the Selected Defensive Constituent such that the risk associated with each of the Equity Constituent and the Selected Defensive Constituent is approximately equal. This is accomplished by measuring the realized volatility of each of the Equity Constituent and the Selected Defensive Constituent and setting the weight of the Equity Constituent and the Selected Defensive Constituent in inverse proportion to its respective volatility. Therefore, all else being equal, a lower realized volatility for a Portfolio Constituent will generally result in a higher weight for that Portfolio Constituent, while a higher realized volatility will generally result in a lower weight. However, there can be no assurance that historical trends in volatility will continue in the future. Thus, the realized volatility of the Portfolio Constituents in the future could differ significantly from their historical volatility. Furthermore, because the Index adjusts its notional exposure to the Portfolio Constituents only on Rebalancing Days (as defined below), the Index will not be able to adjust its notional exposure to the Portfolio Constituents to account for any change in volatility until a subsequent Rebalancing Day. As a result, the Index may not successfully weight the notional exposure to the Portfolio Constituents such that the risks associated with the Equity Constituent and the Selected Defensive Constituent are approximately equal. In this circumstance, the Index may not be able to maintain “risk-parity” between the Equity Constituent and the

US-9

Selected Defensive Constituent between Rebalancing Days, which may adversely affect the level of the Index and the return on any instrument linked to the performance of the Index.

The Portfolio Constituents will likely be unequally weighted in the Index.

In seeking to achieve roughly equal risk allocation between the Equity Constituent and the Selected Defensive Constituent, the Equity Constituent and the Selected Defensive Constituent will likely be unequally weighted. All else being equal, the performance of the Portfolio Constituent with the higher weighting will influence the performance of the Index to a greater degree than the performance of the Portfolio Constituent with lower weighting. If the Portfolio Constituent with the higher weighting perform poorly, its poor performance could negate or diminish the effect on the performance of the Index of any positive performance by the lower-weighted Portfolio Constituent.

Risks Relating to the Equity Constituent

JPMS, the sponsor, constituent stock determination agent and disruption determination agent of the Equity Constituent, and Solactive AG (“Solactive”), the calculation agent of the Equity Constituent, may adjust the Equity Constituent in a way that affects its level, and JPMS and Solactive have no obligation to consider any person’s interests.

JPMS currently acts as the sponsor, constituent stock determination agent and disruption determination agent of the Equity Constituent and is responsible for maintaining the Equity Constituent and developing the guidelines and policies governing its composition and calculation. Solactive currently acts as the calculation agent of the Equity Constituent and is responsible for calculating the Equity Constituent and determining any adjustments upon the occurrence of corporation actions or other corporate events. In performing these duties, JPMS and Solactive may have interests adverse to the interests of investors in an investment or instrument linked to the Index, which may affect the performance of the Index, particularly where JPMS, as the sponsor, constituent stock determination agent and disruption determination agent of the Equity Constituent, and Solactive, as the calculation agent of the Equity Constituent, are entitled to exercise discretion. The rules governing the Equity Constituent may be amended at any time by its sponsor, in its sole discretion. The rules also permit the use of discretion by the sponsor, calculation agent, constituent stock determination agent and disruption determination agent of the Equity Constituent in relation to the Equity Constituent in specific instances, including, but not limited to, the determination of whether to make an adjustment upon the occurrence of a corporation action or other corporate event and any adjustment to be made; whether to replace the Base Reference Index (as defined under “Background on the J.P. Morgan U.S. Low Volatility Index (Total Return)” below) with a substitute or successor upon the occurrence of certain events affecting the Base Reference Index and the selection of any substitute or successor; whether a market disruption has occurred; and the interpretation of the rules governing the Equity Constituent. Although JPMS, acting as the sponsor, constituent stock determination agent and disruption determination agent of the Equity Constituent, and Solactive, acting as the calculation agent of the Equity Constituent, will make all determinations and take all action in relation to the Equity Constituent acting in good faith, it should be noted that JPMS and Solactive may have interests adverse to the interests of investors in an investment or instrument linked to the Index and the policies and judgments for which JPMS or Solactive is responsible could have an impact, positive or negative, on the level of the Index.

JPMS has no obligation to consider any person’s interests in taking any actions that might affect the performance of the Index. Furthermore, the inclusion of any component in the Equity Constituent is not an investment recommendation by JPMS of that component. See “Background on the J.P. Morgan U.S. Low Volatility Index (Total Return).”

There is no assurance that the strategy employed by the Equity Constituent will be successful.

The Equity Constituent is an index that applies a rules-based methodology to seeks to track the total return of a portfolio of stocks selected from the components of the Base Reference Index, with stocks with the highest realized volatility excluded, with weightings selected to seek sector diversification and with a weighting preference for stocks with lower realized volatility. There is, however, no assurance that the Equity Constituent will exhibit lower volatility or provide higher risk-weighted returns than the Base Reference Index or any other index or strategy. It is possible that the stock selection and weighting

US-10

methodology of the Equity Constituent will adversely affect its return. Stocks that have exhibited low realized volatility may in the future exhibit higher realized volatility, and no assurance can be provided that stocks that have exhibited relatively lower realized volatility may underperform stocks that have exhibited relatively higher realized volatility. In addition, there can be no assurance that the Equity Constituent will be diversified at all or consistent with the needs of any investor in an investment or instrument linked to the Index.

The Equity Constituent should not be compared to any other index or strategy sponsored by any of JPMorgan Chase & Co.’s affiliates and cannot necessarily be considered a revised, enhanced or modified version of any other J.P. Morgan Index.

The Equity Constituent follows a notional rules-based proprietary strategy that may have objectives, features and/or constituents that are similar to those of other J.P. Morgan Indices. No assurance can be given that these similarities will form a basis for comparison between the Equity Constituent and any other J.P. Morgan Index, and no assurance can be given that the Equity Constituent would be more successful than or outperform any other J.P. Morgan Index. The Equity Constituent operates independently and does not necessarily revise, enhance, modify or seek to outperform any other J.P. Morgan Index.

Hypothetical back-tested data relating to the Equity Constituent do not represent actual historical data and are subject to inherent limitations.

Hypothetical back-tested performance measures of the Equity Constituent are purely theoretical and do not represent the actual historical performance of the Equity Constituent. Hypothetical back-tested performance measures have inherent limitations. Alternative modelling techniques might produce significantly different results and may prove to be more appropriate. Past performance, and especially hypothetical back-tested performance, is not indicative of future results. This type of information has inherent limitations and investors in an investment or instrument linked to this Index should carefully consider these limitations before placing reliance on such information. Hypothetical back-tested performance is derived by means of the retroactive application of a back-tested model that has been designed with the benefit of hindsight.

If the values of the components of the Equity Constituent included in the Equity Constituent change, the level of the Equity Constituent and the performance of the Index may not change in the same manner.

Changes in the values of the components of the Equity Constituent included in the Equity Constituent may not result in a comparable change in the level of the Equity Constituent or the performance of the Index.

The Equity Constituent comprises notional assets and liabilities.

The exposures to the components of the Equity Constituent are purely notional and will exist solely in the records maintained by or on behalf of the index calculation agent of the Equity Constituent. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Consequently, any investor in an investment or instrument linked to this Index will not have any claim against any of the reference assets that compose the Equity Constituent.

The Equity Constituent has a limited operating history and may perform in unanticipated ways.

The Equity Constituent was established on February 24, 2023 and therefore has a limited operating history. Past performance should not be considered indicative of future performance.

The Equity Constituent methodology may be modified upon the occurrence of certain extraordinary events.

As described under “Background on the J.P. Morgan U.S. Low Volatility Index (Total Return) — Extraordinary Events” below, certain extraordinary events may affect the ability of the sponsor, calculation agent, constituent determination agent and disruption determination agent of the Equity Constituent to reference data sources including the optimization software, the Base Reference Index and other sources

US-11

referenced by the Equity Constituent. As described in the rules governing the Equity Constituent, upon the occurrence of any of those extraordinary events, if practicable, a successor or replacement may be identified and the rules governing the Equity Constituent will be amended accordingly, provided that the sponsor of the Equity Constituent may, in its discretion, at any time and without notice, terminate the calculation or publication of the Equity Constituent, including, without limitation, subsequent to the occurrence of an extraordinary event. The sponsor of the Equity Constituent is under no obligation to continue the calculation and publication of the Equity Constituent.

The Equity Constituent is subject to market risks.

The performance of the Equity Constituent is dependent on the total return performance of the its component securities. As a consequence, any investment or instrument linked to the Index is exposed to the total return performance of the components of the Equity Constituent.

Risks Relating to the Bond Constituent

JPMS, the sponsor and calculation agent of the Bond Constituent, may adjust the Bond Constituent in a way that affects its level, and JPMS has no obligation to consider any person’s interests.

JPMS currently acts as the sponsor and calculation agent of the Bond Constituent and is responsible for calculating and maintaining the Bond Constituent and developing the guidelines and policies governing its composition and calculation. In performing these duties, JPMS may have interests adverse to the interests of investors in an investment or instrument linked to the Index, which may affect the performance of the Index, particularly where JPMS, as the sponsor and calculation agent of the Bond Constituent, is entitled to exercise discretion. The rules governing the Bond Constituent may be amended at any time by the calculation agent of the Bond Constituent, in its sole discretion. The rules also permit the use of discretion by the sponsor and the determination of whether to replace a Bond Constituent ETF with a substitute or successor upon the occurrence of certain events affecting that Bond Constituent ETF, the selection of any substitute or successor and calculation agent of the Bond Constituent in relation to the Bond Constituent in specific instances, including, but not limited to, the determination of the levels to be used in the event of market disruptions that affect the ability of the calculation agent of the Bond Constituent to calculate and publish the levels of the Bond Constituent and the interpretation of the rules governing the Bond Constituent. Although JPMS, acting as the sponsor and calculation agent of the Bond Constituent, will make all determinations and take all action in relation to the Bond Constituent acting in good faith, it should be noted that JPMS may have interests adverse to the interests of investors in an investment or instrument linked to the Index and the policies and judgments for which JPMS is responsible could have an impact, positive or negative, on the level of the Index.

JPMS has no obligation to consider any person’s interests in taking any actions that might affect the performance of the Index. Furthermore, the inclusion of any Bond Constituent ETF in the Bond Constituent is not an investment recommendation by JPMS of that Bond Constituent ETF or any of the securities or other assets held by that Bond Constituent ETF. See “Background on the J.P. Morgan Core Bond Index.”

The securities of JPMorgan Chase & Co., the ultimate parent company of JPMS, are currently held by the Vanguard Short-Term Corporate Bond ETF, the Vanguard Intermediate-Term Corporate Bond ETF and the Vanguard Long-Term Corporate Bond ETF, but, to JPMorgan Chase & Co.’s knowledge, the securities of JPMorgan Chase & Co. are not currently held by any other Bond Constituent ETF.

JPMS will have no ability to control the actions of the issuers of those securities, including actions that could affect the value of the securities held by any Bond Constituent ETF. None of JPMorgan Chase & Co. and those issuers will have any obligation to consider any person’s interests as an investor in an investment or instrument linked to the Index in taking any actions that might affect the performance of the Index. In the event that the securities of JPMorgan Chase & Co. are held by any Bond Constituent ETF, JPMorgan Chase & Co. will have no obligation to consider any person’s interests as an investor in an investment or instrument linked to the Index in taking any action that might affect the performance of the Index.

US-12

JPMorgan Chase & Co. is affiliated with the sponsor of the reference index of one of the Bond Constituent ETFs.

An affiliate of JPMorgan Chase & Co. developed and maintains and calculates the J.P. Morgan Emerging Markets Bond Index Global CORE, which is the reference index of the iShares® J.P. Morgan USD Emerging Markets Bond ETF, one of the Bond Constituent ETFs. Accordingly, conflicts of interest exist between JPMorgan Chase & Co’s affiliate and any investor in an investment or instrument linked to the Index. JPMorgan Chase & Co.’s affiliate will have no obligation to consider any person’s interests as an investor in an investment or instrument linked to the Index in taking any actions that might affect the performance of the Index.

In addition, the J.P. Morgan Emerging Markets Bond Index Global CORE makes use of certain weights, prices, values, levels or dates that are determined by PricingDirect Inc. (“PricingDirect”). PricingDirect is JPMorgan Chase & Co.’s wholly owned subsidiary and provides valuation and other metrics data for fixed-income securities and derivatives. PricingDirect determines these prices through a proprietary evaluation process that takes into account market-based evaluations (such as market intelligence for traded, quoted securities). In addition, under some circumstances, the pricing information provided by PricingDirect on the bonds held by the J.P. Morgan Emerging Markets Bond Index Global CORE may be derived solely from price quotations or internal valuations made by one or more of JPMorgan Chase & Co.’s affiliates. Accordingly, conflicts of interest exist between PricingDirect and any investor in an investment or instrument linked to this Index. PricingDirect will have no obligation to consider any person’s interests as an investor in an investment or instrument linked to the Index in taking any actions that might affect the performance of the Index.

The Bond Constituent may not be successful or outperform any alternative strategy that might be employed in respect of the Bond Constituent ETFs.

The Bond Constituent follows a notional rules-based proprietary strategy that operates on the basis of pre-determined rules. No assurance can be given that the investment strategy on which the Bond Constituent is based will be successful or that the Bond Constituent will outperform any alternative strategy that might be employed in respect of the Bond Constituent ETFs.

There are risks associated with the Bond Constituent’s momentum investment strategy.

The Bond Constituent construction reflects a momentum investment strategy. Momentum investing generally seeks to capitalize on positive trends in the returns of financial instruments. As such, the weights of the Bond Constituent ETFs in the Bond Constituent are based in part on the recent performance of the Bond Constituent ETFs. However, there is no guarantee that recent performance trends will continue in the future. In addition, the caps and floors on the Bond Constituent ETF weights applied at the individual and sector levels will results in lower weights for the Bond Constituent ETFs with the best recent performance than would be the case if those caps and floors were not applied. Moreover, the minimum individual or aggregate assigned weights applicable to many of the Bond Constituent ETFs will result in allocations to those Bond Constituent ETFs, even in cases where the recent performance of those Bond Constituent ETFs is significantly worse than the recent performance of the remaining Bond Constituent ETFs.

Furthermore, due to the “long-only” construction of the Bond Constituent, the weight of each Bond Constituent ETF will not fall below zero at any time even if the relevant Bond Constituent ETF has displayed a negative recent performance period. The Bond Constituent will maintain 100% long exposure to the Bond Constituent ETFs at all times, even when most or all Bond Constituent ETFs are displaying negative performance. Moreover, once a selected portfolio has been identified and implemented, the Bond Constituent will track the performance of the relevant Bond Constituent ETFs until the next re-weighting, even when the values of those Bond Constituent ETFs are trending downwards or when those Bond Constituent ETFs are otherwise performing significantly worse than their recent performance, or than the remaining Bond Constituent ETFs.

In addition, due to the Bond Constituent’s momentum investment strategy, the Bond Constituent may fail to realize gains that could occur as a result of obtaining exposures to financial instruments that have

US-13

experienced negative returns, but which subsequently experience a recovery or a sudden spike in positive returns. As a result, if market conditions do not represent a continuation of prior observed trends, the level of the Bond Constituent, which is rebalanced based on prior trends, may decline.

The Bond Constituent may perform poorly during periods characterized by short-term volatility.

The Bond Constituent’s strategy is based on momentum investing. In non-trending, sideways markets, momentum investment strategies are subject to “whipsaws.” A whipsaw occurs when the market reverses and does the opposite of what is indicated by the trend indicator, resulting in a trading loss during the particular period. Consequently, the Bond Constituent may perform poorly in non-trending, “choppy” markets characterized by short-term volatility.

The Bond Constituent may not approximate its initial volatility threshold of 5%.

No assurance can be given that the Bond Constituent will maintain an annualized realized volatility that approximates its initial volatility threshold of 5%. The actual realized volatility of the Bond Constituent will depend on the performance of the Bond Constituent ETFs included in the selected portfolio(s) from time to time, and, at any time or for extended periods, may be greater than 5%, perhaps significantly, or less than 5%. Furthermore, the volatility threshold is subject to upward adjustment and, thus, the realized volatility threshold used to determine any selected portfolio may be greater than 5%, perhaps significantly. While the assigned weights of the notional portfolio(s) tracked by the Bond Constituent are based in part on the recent historical volatility of the relevant notional portfolio, there is no guarantee that trends existing in the relevant measurement periods will continue in the future. The volatility of the notional portfolio on any day may change quickly and unexpectedly. Accordingly, the actual realized annualized volatility of the Bond Constituent on a daily basis may be greater than or less than the volatility threshold used to select to the relevant selected portfolio(s), which may adversely affect the level of the Bond Constituent and the level of the Index.

The Bond Constituent should not be compared to any other index or strategy sponsored by any of JPMorgan Chase & Co.’s affiliates and cannot necessarily be considered a revised, enhanced or modified version of any other J.P. Morgan Index.

The Bond Constituent follows a notional rules-based proprietary strategy that may have objectives, features and/or constituents that are similar to those of other J.P. Morgan Indices. No assurance can be given that these similarities will form a basis for comparison between the Bond Constituent and any other J.P. Morgan Index, and no assurance can be given that the Bond Constituent would be more successful than or outperform any other J.P. Morgan Index. The Bond Constituent operates independently and does not necessarily revise, enhance, modify or seek to outperform any other J.P. Morgan Index.

Correlation of performances among the Bond Constituent ETFs may reduce the performance of the Index.

Performances of the Bond Constituent ETFs may become highly correlated from time to time, including, but not limited to, a period in which there is a substantial decline in a particular sector or asset type represented by the Bond Constituent ETFs and which has a higher weighting in the Bond Constituent relative to any of the other sectors or asset types, as determined by the Bond Constituent’s strategy. High correlation during periods of negative returns among Bond Constituent ETFs representing any one sector or asset type and which Bond Constituent ETFs have a substantial percentage weighting in the Bond Constituent could have an adverse effect on the performance of the Index.

Changes in the values of the Bond Constituent ETFs may offset each other.

The Bond Constituent ETFs collectively represent a diverse range of sectors of the U.S. dollar fixed-income market, and price movements between the Bond Constituent ETFs representing different sectors of the U.S. dollar fixed-income market may not correlate with each other. At a time when the value of a Bond Constituent ETF representing a particular sector of the U.S. dollar fixed-income market increases, the value of other Bond Constituent ETFs representing a different sector may not increase as much or may decline. Therefore, in calculating the level of the Bond Constituent, increases in the values of some of the

US-14

Bond Constituent ETFs may be moderated, or more than offset, by lesser increases or declines in the values of other Bond Constituent ETFs.

If the values of the Bond Constituent ETFs included in the Bond Constituent change, the level of the Bond Constituent and the performance of the Index may not change in the same manner.

Changes in the values of the Bond Constituent ETFs included in the Bond Constituent may not result in a comparable change in the level of the Bond Constituent or the performance of the Index.

The Bond Constituent comprises notional assets and liabilities.

The exposures to the Bond Constituent ETFs are purely notional and will exist solely in the records maintained by or on behalf of the index calculation agent of the Bond Constituent. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Consequently, any investor in an investment or instrument linked to this Index will not have any claim against any of the reference assets that compose the Bond Constituent.

The Bond Constituent has a limited operating history and may perform in unanticipated ways.

The Bond Constituent was established on August 28, 2020 and therefore has a limited operating history. Past performance should not be considered indicative of future performance.

The Bond Constituent is subject to market risks.

The performance of the Bond Constituent is dependent on the total return performance of the 10 Bond Constituent ETFs. As a consequence, any investment or instrument linked to the Index is exposed to the total return performance of the Bond Constituent ETFs.

The investment strategy used to construct the Bond Constituent involves monthly rebalancing and weighting constraints that are applied to the Bond Constituent ETFs.

The Bond Constituent ETFs are subject to rebalancing at least once a month and weighting constraints by asset type and on subsets of assets based on historical volatility. By contrast, a notional portfolio that does not rebalance at least once a month and is not subject to any weighting constraints could see greater compounded gains over time through exposure to a consistently and rapidly appreciating portfolio consisting of the Bond Constituent ETFs. Therefore, the return on an investment or instrument linked to the Index may be less than the return on an alternative investment in the Bond Constituent ETFs that is not subject to rebalancing at least once a month or weighting constraints. No assurance can be given that the investment strategy used to construct the Bond Constituent will outperform any alternative investment in the Bond Constituent ETFs.

The Bond Constituent ETFs composing the Bond Constituent may be replaced by a substitute upon the occurrence of certain extraordinary events.

As described under “Background on the J.P. Morgan Core Bond Index — Succession and Extraordinary Events” below, following the occurrence of certain extraordinary events with respect to a Bond Constituent ETF, the affected Bond Constituent ETF may be replaced by a substitute ETF or the calculation agent of the Bond Constituent may cease calculation and publication of the Bond Constituent on a date determined by the calculation agent of the Bond Constituent. These extraordinary events generally include events that could materially interfere with the ability of market participants to transact in, or events that could materially change the underlying economic exposure of, positions with respect to the Bond Constituent, any Bond Constituent ETF or any reference index, where that material interference or change is not acceptable to the calculation agent of the Bond Constituent. See “Background on the J.P. Morgan Core Bond Index — Succession and Extraordinary Events” below for a summary of events that could trigger an extraordinary event.

Investors in an investment or instrument linked to this Index should realize that the changing of a Bond Constituent ETF may affect the performance of the Bond Constituent, and therefore, the performance of the Index, as the replacement Bond Constituent ETF may perform significantly better or worse than the

US-15

original Bond Constituent ETF. For example, the substitute or successor Bond Constituent ETF may have higher fees or worse performance than the original Bond Constituent ETF. Moreover, the policies of the sponsor of the substitute index or ETF concerning the methodology and calculation of the substitute index or ETF, including decisions regarding additions, deletions or substitutions of the assets underlying the substitute index or ETF, could affect the level or price of the substitute index or ETF and therefore the performance of the Index. The performance of the Index could also be affected if the sponsor of a substitute index or the sponsor of the reference index of a substitute ETF discontinues or suspends calculation or dissemination of the relevant index, in which case it may become difficult to determine the level of the Index. The sponsor of the substitute index or ETF will have no obligation to consider any person’s interests in calculating or revising such substitute index or ETF.

Risks Relating to the Currency Constituent

The Currency Constituent may not provide a diversification benefit to the Index and may adversely affect the level of the Index.