0000916540false00009165402023-02-272023-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

Date of report (Date of earliest event reported) | February 27, 2023 |

| | | | | | | | | | | | | | |

DARLING INGREDIENTS INC. |

| (Exact Name of Registrant as Specified in Charter) |

| | | | | | | | |

| Delaware | 001-13323 | 36-2495346 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

5601 N. MacArthur Blvd., Irving, Texas 75038

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (972) 717-0300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock $0.01 par value per share | DAR | New York Stock Exchange | (“NYSE”) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 27, 2023, Darling Ingredients Inc. (the “Company”) issued a press release announcing financial results for the fourth quarter and fiscal year ended December 31, 2022. A copy of this press release is attached hereto as Exhibit 99.1.

The Company will hold a conference call and webcast on Tuesday, February 28, 2023 to discuss these financial results. The Company will have a slide presentation available to augment management's formal presentation, which will be accessible via the investor relations section of the Company's website. A copy of this slide presentation is attached hereto as Exhibit 99.2.

The Company is making reference to non-GAAP financial measures in both the press release and the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release.

The information in this Item 2.02, including the exhibits attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| 99.1 | | | |

| 99.2 | | | |

| 104 | | | Cover Page Interactive Data File (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | DARLING INGREDIENTS INC. | |

| | | | |

| Date: February 27, 2023 | By: | /s/ John F. Sterling | |

| | | John F. Sterling | |

| | | Executive Vice President,

General Counsel | |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Feb. 27, 2023

Darling Ingredients Inc. Reports Fourth Quarter and Fiscal Year 2022 Results

Fiscal Year 2022 Highlights

•Generated net income of $737.7 million, or $4.49 per GAAP diluted share

•Delivered record combined adjusted EBITDA of $1.541 billion

•Started up third renewable diesel plant, making Diamond Green Diesel North America’s largest renewable diesel producer at 1.2 billion gallons a year

•Grew global footprint with three strategic acquisitions, strengthening company’s vertical integration for renewable diesel production

•Record Food Segment results driven by growth of hydrolyzed collagen business

•Repurchased $125.5 million of common stock

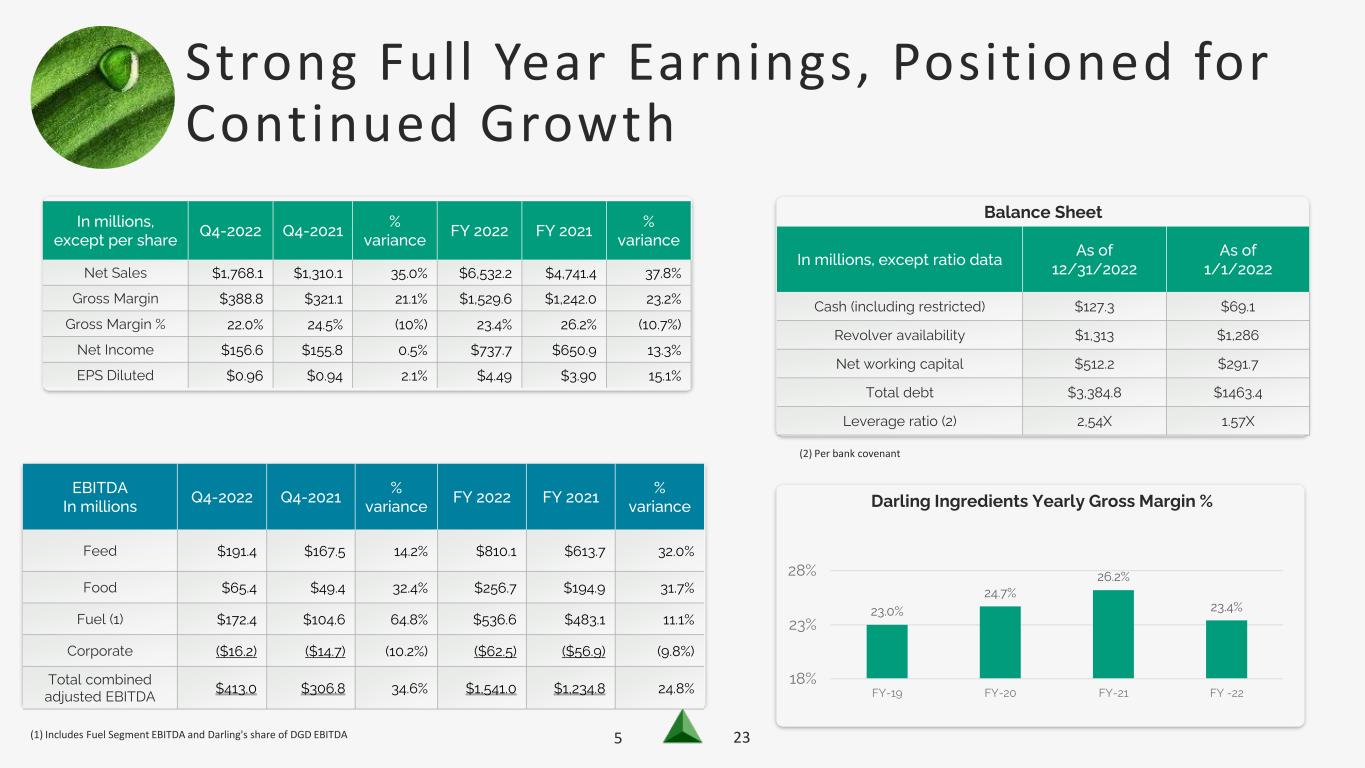

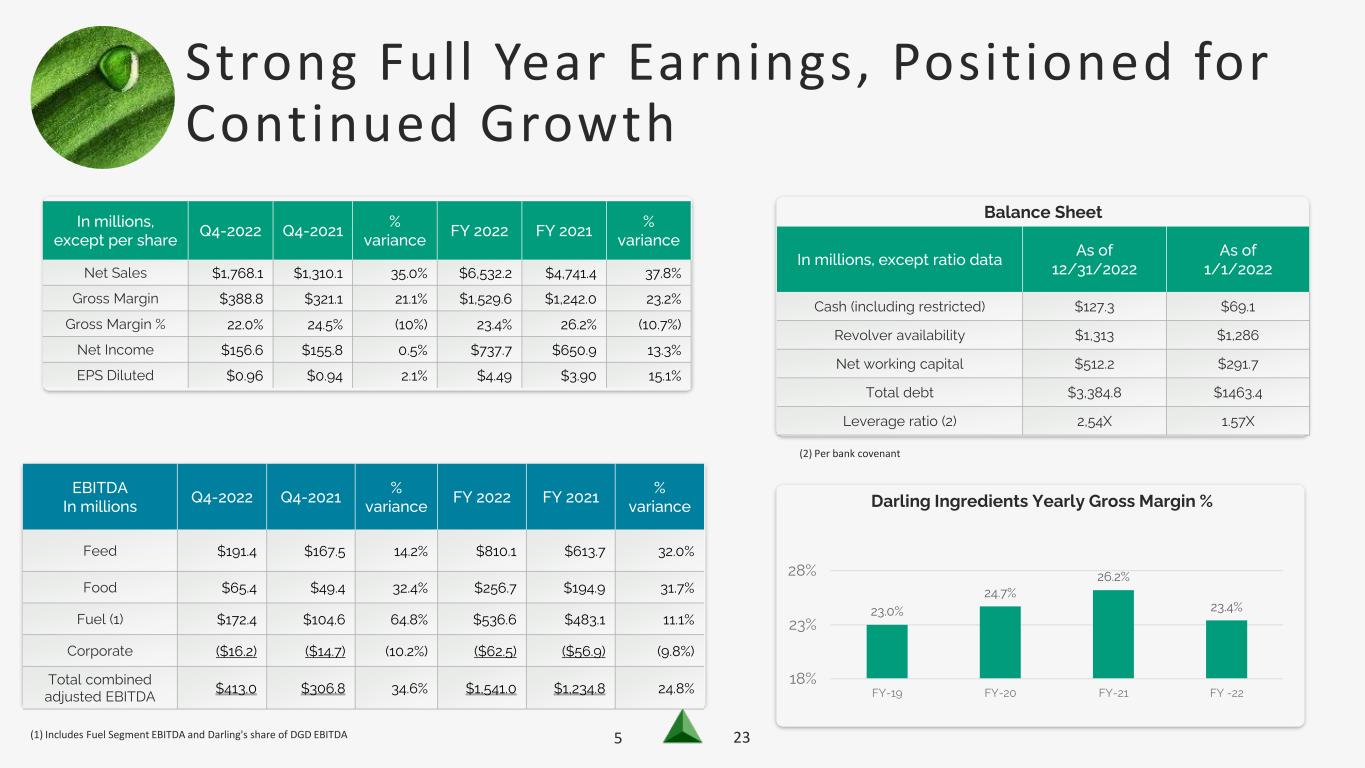

IRVING, TEXAS - Darling Ingredients Inc.(NYSE: DAR) today reported net income of $156.6 million, or $0.96 per diluted share for fourth quarter 2022, compared to net income of $155.8 million, or $0.94 per diluted share, for fourth quarter 2021. The company also reported net sales of $1.8 billion for the fourth quarter of 2022, as compared with net sales of $1.3 billion for the same period a year ago.

For the 2022 fiscal year, Darling Ingredients reported net income of $737.7 million, or $4.49 per diluted share, as compared to $650.9 million, or $3.90 per diluted share for 2021. Net sales for fiscal year 2022 were $6.5 billion, as compared with net sales of $4.7 billion in 2021.

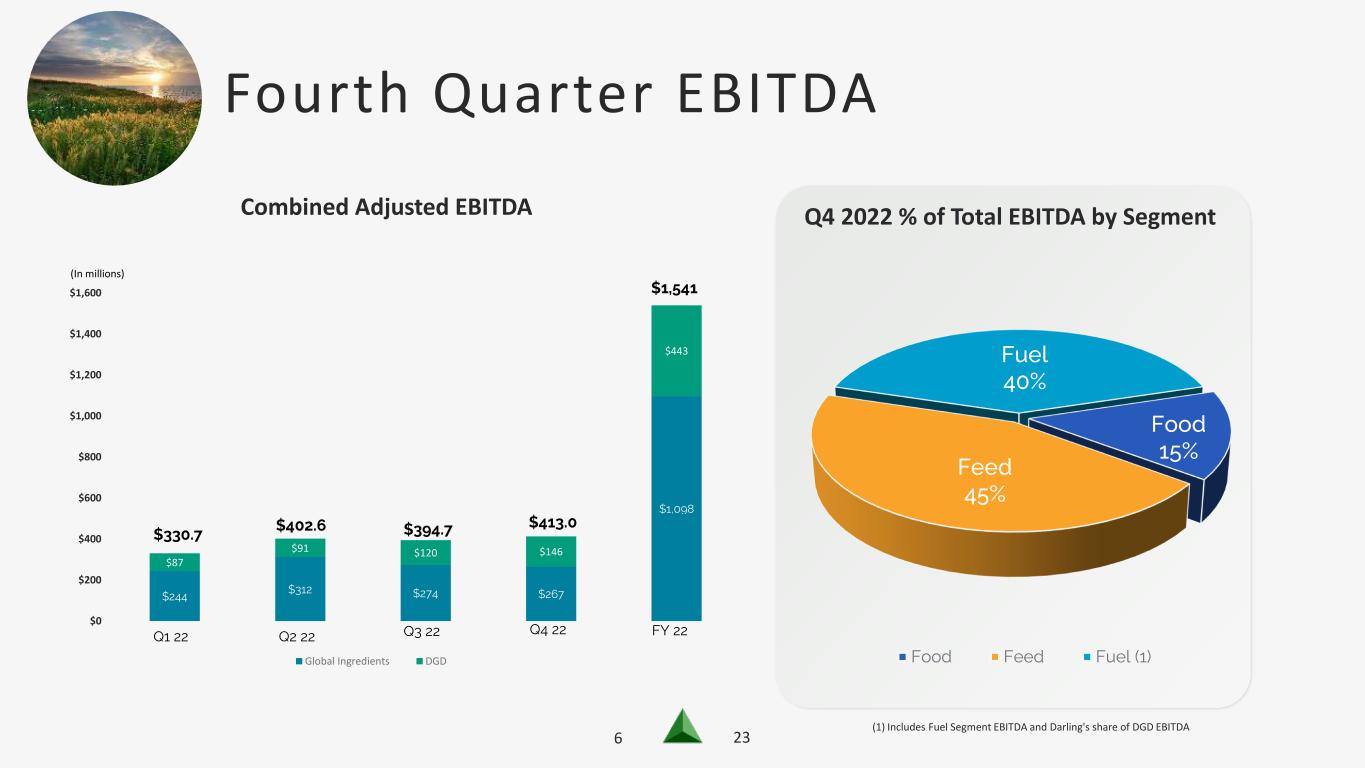

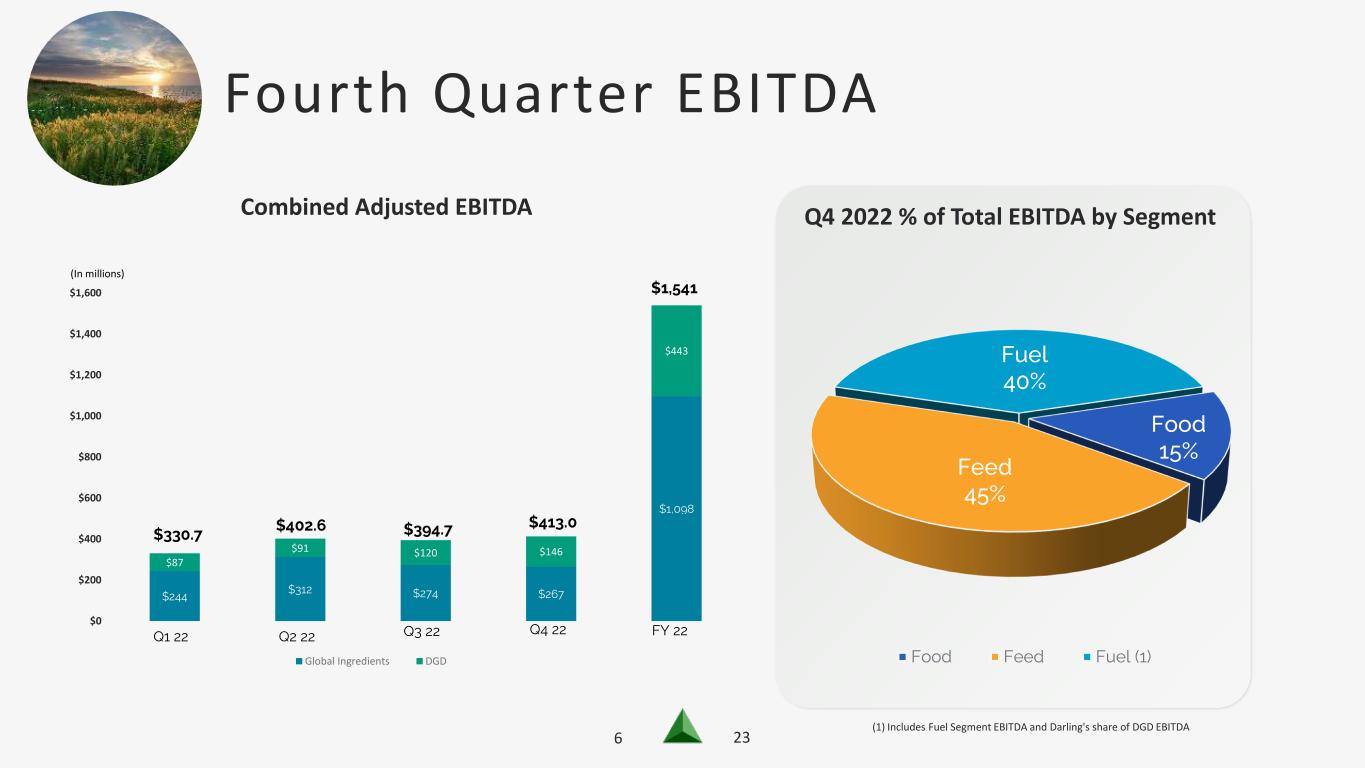

Combined adjusted EBITDA for the fourth quarter 2022 was $413.0 million, compared to $306.8 million for the same period in 2021. Fiscal year 2022 combined adjusted EBITDA was $1.541 billion, compared to $1.235 billion for full year 2021.

Diamond Green Diesel (DGD) sold a record 754 million gallons of renewable diesel for fiscal year 2022, at an average $1.18 EBITDA per gallon. DGD began operations at its Port Arthur, Texas, plant in the fourth quarter of 2022, bringing DGD’s total renewable diesel capacity to 1.2 billion gallons per year. On Jan. 31, 2023, the company announced approval of a new sustainable aviation fuel project at Port Arthur, Texas.

“For the fifth consecutive year, Darling Ingredients has delivered superior earnings growth driven by our market presence, vertical integration and diverse, but synergistic segments,” said Randall C. Stuewe, Darling Ingredients Chairman and Chief Executive Officer. “We are well positioned to execute and integrate the investments we have made in our four growth areas: the core rendering business, collagen peptides, green energy in Europe and soon sustainable aviation fuel at Diamond Green Diesel. Our value proposition is simple, we eliminate waste from the meat industry and upcycle those products to their highest value. Darling is not just participating in the circular economy, we are the circular economy.”

These acquisitions are key to our vertical integration, company strength and strong market position.

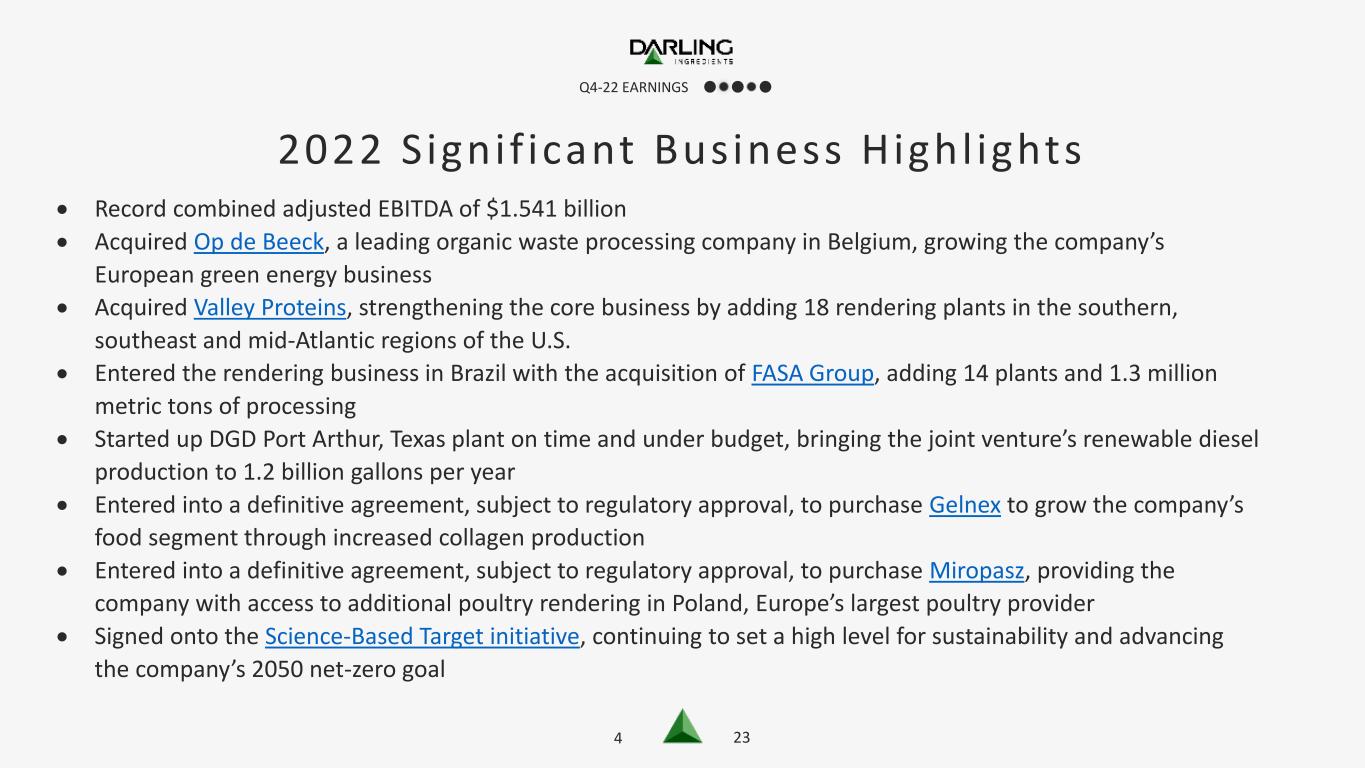

The company’s significant business highlights in 2022 include:

•Acquired Op de Beeck, a leading organic waste processing company in Belgium, growing the company’s European green energy business;

•Acquired Valley Proteins, strengthening the core business by adding 18 rendering plants in the southern, southeast and mid-Atlantic regions in the U.S.;

•Entered into the rendering business in Brazil with the acquisition of FASA Group, adding 14 plants and 1.3 million metric tons of processing;

•Started up DGD Port Arthur, Texas, plant, bringing the joint venture’s renewable diesel production to 1.2 billion gallons per year;

•Entered into a definitive agreement to purchase Gelnex in Brazil to grow the company’s food business through increased collagen production;

•Entered into a definitive agreement to purchase Miropasz, providing the company with access to additional poultry rendering in Poland, Europe’s largest poultry provider; and

•Signed onto the Science-Based Target initiative, continuing to set a high level for sustainability and advancing the company’s 2050 net-zero goal.

Under the company’s share repurchase program, the company repurchased approximately 336,000 shares of common stock during the fourth quarter of 2022 for a total of approximately $22.5 million, bringing the total common stock repurchased for 2022 to approximately 1.9 million shares for a total of approximately $125.5 million.

As of Dec. 31, 2022, Darling Ingredients had $127.0 million in cash and cash equivalents, and $1.3 billion available under its committed revolving credit agreement. Total debt outstanding as of Dec. 31, 2022, was $3.4 billion. The leverage ratio as measured by the company’s bank covenant was 2.54X as of Dec. 31, 2022. Capital expenditures were $134.1 million for the fourth quarter and $391.3 million for fiscal year 2022.

The company expects continued growth, and sets guidance for fiscal year 2023 at $1.80-$1.85 billion combined adjusted EBITDA.

Segment Financial Tables (in thousands)

| | | | | | | | | | | | | | | | | |

| Feed Ingredients | Food Ingredients | Fuel Ingredients | Corporate | Total |

| Three Months Ended December 31, 2022 | | | | | |

| Net sales | $ | 1,216,073 | | $ | 387,733 | | $ | 164,277 | | $ | — | | $ | 1,768,083 | |

| Cost of sales and operating expenses | 950,778 | | 294,417 | | 134,093 | | — | | 1,379,288 | |

| Gross Margin | 265,295 | | 93,316 | | 30,184 | | — | | 388,795 | |

| | | | | |

| Loss (gain) on sale of assets | 169 | | (117) | | 14 | | — | | 66 | |

| Selling, general and administrative expenses | 73,736 | | 28,073 | | 3,769 | | 16,142 | | 121,720 | |

| Restructuring and asset impairment charges | — | | 21,109 | | — | | — | | 21,109 | |

| Acquisition and integration costs | — | | — | | — | | 2,738 | | 2,738 | |

| Depreciation and amortization | 91,282 | | 14,722 | | 8,606 | | 2,774 | | 117,384 | |

| Equity in net income of Diamond Green Diesel | — | | — | | 123,448 | | — | | 123,448 | |

| Segment operating income/(loss) | $ | 100,108 | | $ | 29,529 | | $ | 141,243 | | $ | (21,654) | | $ | 249,226 | |

| Equity in net loss of other unconsolidated subsidiaries | (831) | | — | | — | | — | | (831) | |

| Segment income/(loss) | $ | 99,277 | | $ | 29,529 | | $ | 141,243 | | $ | (21,654) | | $ | 248,395 | |

| | | | | |

| Segment EBITDA | $ | 191,390 | | $ | 65,360 | | $ | 26,401 | | $ | (16,142) | | $ | 267,009 | |

| DGD adjusted EBITDA (Darling's Share) | — | | — | | 145,984 | | — | | 145,984 | |

| Combined adjusted EBITDA | $ | 191,390 | | $ | 65,360 | | $ | 172,385 | | $ | (16,142) | | $ | 412,993 | |

| | | | | | | | | | | | | | | | | |

| Feed Ingredients | Food Ingredients | Fuel Ingredients | Corporate | Total |

| Three Months Ended January 1, 2022 | | | | | |

| Net sales | $ | 846,498 | | $ | 344,677 | | $ | 118,893 | | $ | — | | $ | 1,310,068 | |

| Cost of sales and operating expenses | 621,581 | | 272,972 | | 94,371 | | — | | 988,924 | |

| Gross Margin | 224,917 | | 71,705 | | 24,522 | | — | | 321,144 | |

| | | | | |

| Gain on sale of assets | (60) | | (87) | | (18) | | — | | (165) | |

| Selling, general and administrative expenses | 57,484 | | 22,405 | | 3,177 | | 14,667 | | 97,733 | |

| | | | | |

| Acquisition and integration costs | — | | — | | — | | 1,396 | | 1,396 | |

| Depreciation and amortization | 56,538 | | 15,263 | | 6,222 | | 2,782 | | 80,805 | |

| Equity in net income of Diamond Green Diesel | — | | — | | 69,663 | | — | | 69,663 | |

| Segment operating income/(loss) | $ | 110,955 | | $ | 34,124 | | $ | 84,804 | | $ | (18,845) | | $ | 211,038 | |

| Equity in net income of other unconsolidated subsidiaries | 1,554 | | — | | — | | — | | 1,554 | |

| Segment income/(loss) | $ | 112,509 | | $ | 34,124 | | $ | 84,804 | | $ | (18,845) | | $ | 212,592 | |

| | | | | |

| Segment EBITDA | $ | 167,493 | | $ | 49,387 | | $ | 21,363 | | $ | (14,667) | | $ | 223,576 | |

| DGD adjusted EBITDA (Darling's Share) | — | | — | | 83,192 | | — | | 83,192 | |

| Combined adjusted EBITDA | $ | 167,493 | | $ | 49,387 | | $ | 104,555 | | $ | (14,667) | | $ | 306,768 | |

Segment EBITDA consists of segment income (loss), less equity in net income/loss from unconsolidated subsidiaries, less equity in net income of Diamond Green Diesel, plus depreciation and amortization, plus acquisition and integration costs, plus restructuring and asset impairment charges, plus Darling’s share of DGD Adjusted EBITDA.

Segment Financial Tables (in thousands) continued

| | | | | | | | | | | | | | | | | |

| Feed Ingredients | Food Ingredients | Fuel Ingredients | Corporate | Total |

| Twelve Months Ended December 31, 2022 | | | | | |

| Net sales | $ | 4,539,000 | | $ | 1,459,630 | | $ | 533,574 | | $ | — | | $ | 6,532,204 | |

| Cost of sales and operating expenses | 3,473,506 | | 1,102,250 | | 426,853 | | — | | 5,002,609 | |

| Gross Margin | 1,065,494 | | 357,380 | | 106,721 | | — | | 1,529,595 | |

| | | | | |

| Gain on sale of assets | (3,426) | | (1,008) | | (60) | | — | | (4,494) | |

| Selling, general and administrative expenses | 258,781 | | 101,681 | | 13,690 | | 62,456 | | 436,608 | |

| Restructuring and asset impairment charges | 8,557 | | 21,109 | | — | | — | | 29,666 | |

| Acquisition and integration costs | — | | — | | — | | 16,372 | | 16,372 | |

| Depreciation and amortization | 295,249 | | 59,029 | | 29,500 | | 10,943 | | 394,721 | |

| Equity in net income of Diamond Green Diesel | — | | — | | 372,346 | | — | | 372,346 | |

| Segment operating income/(loss) | $ | 506,333 | | $ | 176,569 | | $ | 435,937 | | $ | (89,771) | | $ | 1,029,068 | |

| Equity in net income of other unconsolidated subsidiaries | 5,102 | | — | | — | | — | | 5,102 | |

| Segment income/(loss) | $ | 511,435 | | $ | 176,569 | | $ | 435,937 | | $ | (89,771) | | $ | 1,034,170 | |

| | | | | |

| Segment EBITDA | $ | 810,139 | | $ | 256,707 | | $ | 93,091 | | $ | (62,456) | | $ | 1,097,481 | |

| DGD adjusted EBITDA (Darling's Share) | — | | — | | 443,487 | | — | | 443,487 | |

| Combined adjusted EBITDA | $ | 810,139 | | $ | 256,707 | | $ | 536,578 | | $ | (62,456) | | $ | 1,540,968 | |

| | | | | | | | | | | | | | | | | |

| Feed Ingredients | Food Ingredients | Fuel Ingredients | Corporate | Total |

| Twelve Months Ended January 1, 2022 | | | | | |

| Net sales | $ | 3,039,500 | | $ | 1,271,629 | | $ | 430,240 | | $ | — | | $ | 4,741,369 | |

| Cost of sales and operating expenses | 2,206,248 | | 979,232 | | 313,905 | | — | | 3,499,385 | |

| Gross Margin | 833,252 | | 292,397 | | 116,335 | | — | | 1,241,984 | |

| | | | | |

| Gain on sale of assets | (550) | | (88) | | (320) | | — | | (958) | |

| Selling, general and administrative expenses | 220,078 | | 97,555 | | 16,999 | | 56,906 | | 391,538 | |

| Restructuring and asset impairment charges | — | | — | | 778 | | — | | 778 | |

| Acquisition and integration costs | — | | — | | — | | 1,396 | | 1,396 | |

| Depreciation and amortization | 218,942 | | 60,929 | | 25,436 | | 11,080 | | 316,387 | |

| Equity in net income of Diamond Green Diesel | — | | — | | 351,627 | | — | | 351,627 | |

| Segment operating income/(loss) | $ | 394,782 | | $ | 134,001 | | $ | 425,069 | | $ | (69,382) | | $ | 884,470 | |

| Equity in net income of other unconsolidated subsidiaries | 5,753 | | — | | — | | — | | 5,753 | |

| Segment income/(loss) | $ | 400,535 | | $ | 134,001 | | $ | 425,069 | | $ | (69,382) | | $ | 890,223 | |

| | | | | |

| Segment EBITDA | $ | 613,724 | | $ | 194,930 | | $ | 99,656 | | $ | (56,906) | | $ | 851,404 | |

| DGD adjusted EBITDA (Darling's Share) | — | | — | | 383,419 | | — | | 383,419 | |

| Combined adjusted EBITDA | $ | 613,724 | | $ | 194,930 | | $ | 483,075 | | $ | (56,906) | | $ | 1,234,823 | |

Segment EBITDA consists of segment income (loss), less equity in net income from unconsolidated subsidiaries, less equity in net income of Diamond Green Diesel, plus depreciation and amortization, plus acquisition and integration costs, plus restructuring and asset impairment charges, plus Darling’s share of DGD Adjusted EBITDA.

Darling Ingredients Inc. and Subsidiaries

Consolidated Balance Sheets

December 31, 2022 and January 1, 2022

(thousands)

| | | | | | | | | | | |

| | | |

| | December 31, 2022 | January 1, 2022 |

| ASSETS | | |

| Current assets: | | |

| Cash and cash equivalents | $ | 127,016 | | $ | 68,906 | |

| Restricted cash | 315 | | 166 | |

| Accounts receivable, net | 676,573 | | 469,092 | |

| Inventories | 673,621 | | 457,465 | |

| Prepaid expenses | 85,665 | | 53,711 | |

| Income taxes refundable | 18,583 | | 1,075 | |

| Other current assets | 56,324 | | 38,599 | |

| Total current assets | 1,638,097 | | 1,089,014 | |

| | |

| Property, plant and equipment, net | 2,462,082 | | 1,840,080 | |

| Intangible assets, net | 865,122 | | 397,801 | |

| Goodwill | 1,970,377 | | 1,219,116 | |

| Investment in unconsolidated subsidiaries | 1,926,395 | | 1,349,247 | |

| Operating lease right-of-use assets | 186,141 | | 155,464 | |

| Other assets | 136,268 | | 66,795 | |

| Deferred income taxes | 17,888 | | 16,211 | |

| | $ | 9,202,370 | | $ | 6,133,728 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | |

| Current liabilities: | | |

| Current portion of long-term debt | $ | 69,846 | | $ | 24,407 | |

| Accounts payable, principally trade | 472,491 | | 307,118 | |

| Income taxes payable | 44,851 | | 32,310 | |

| Current operating lease liabilities | 49,232 | | 38,168 | |

| Accrued expenses | 432,023 | | 350,681 | |

| Total current liabilities | 1,068,443 | | 752,684 | |

| Long-term debt, net of current portion | 3,314,969 | | 1,438,974 | |

| Long-term operating lease liabilities | 141,703 | | 120,314 | |

| Other non-current liabilities | 298,933 | | 111,029 | |

| Deferred income taxes | 481,832 | | 362,942 | |

| Total liabilities | 5,305,880 | | 2,785,943 | |

| Commitments and contingencies | | |

| Stockholders' equity: | | |

| Common stock, $0.01 par value; | 1,736 | | 1,717 | |

| Additional paid-in capital | 1,660,084 | | 1,627,816 | |

| Treasury stock, at cost | (554,451) | | (374,721) | |

| Accumulated other comprehensive income | (383,874) | | (321,690) | |

| Retained earnings | 3,085,528 | | 2,347,838 | |

| Total Darling's stockholders' equity | 3,809,023 | | 3,280,960 | |

| Noncontrolling interests | 87,467 | | 66,825 | |

| Total stockholders' equity | 3,896,490 | | 3,347,785 | |

| | $ | 9,202,370 | | $ | 6,133,728 | |

Darling Ingredients Inc. and Subsidiaries

Consolidated Operating Results

For the Three-Month and Twelve-Month Periods Ended December 31, 2022 and January 1, 2022

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | | | |

| | | $ Change | | | | | | $ Change | | | | | | | | | | | | |

| December 31, | | January 1, | | Favorable | | December 31, | | January 1, | | Favorable | | | | | | | | | | | | |

| 2022 | | 2022 | | (Unfavorable) | | 2022 | | 2022 | | (Unfavorable) | | | | | | | | | | | | |

| Net sales | $ | 1,768,083 | | | $ | 1,310,068 | | | $ | 458,015 | | | $ | 6,532,204 | | | $ | 4,741,369 | | | $ | 1,790,835 | | | | | | | | | | | | | |

| Costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of sales and operating expenses | 1,379,288 | | | 988,924 | | | (390,364) | | | 5,002,609 | | | 3,499,385 | | | (1,503,224) | | | | | | | | | | | | | |

| (Gain) loss on sale of assets | 66 | | | (165) | | | (231) | | | (4,494) | | | (958) | | | 3,536 | | | | | | | | | | | | | |

Selling, general and administrative expenses | 121,720 | | | 97,733 | | | (23,987) | | | 436,608 | | | 391,538 | | | (45,070) | | | | | | | | | | | | | |

| Restructuring and asset impairment charges | 21,109 | | | — | | | (21,109) | | | 29,666 | | | 778 | | | (28,888) | | | | | | | | | | | | | |

| Acquisition and integration costs | 2,738 | | | 1,396 | | | (1,342) | | | 16,372 | | | 1,396 | | | (14,976) | | | | | | | | | | | | | |

| Depreciation and amortization | 117,384 | | | 80,805 | | | (36,579) | | | 394,721 | | | 316,387 | | | (78,334) | | | | | | | | | | | | | |

| Total costs and expenses | 1,642,305 | | | 1,168,693 | | | (473,612) | | | 5,875,482 | | | 4,208,526 | | | (1,666,956) | | | | | | | | | | | | | |

| Equity in net income of Diamond Green Diesel | 123,448 | | | 69,663 | | | 53,785 | | | 372,346 | | | 351,627 | | | 20,719 | | | | | | | | | | | | | |

| Operating income | 249,226 | | | 211,038 | | | 38,188 | | | 1,029,068 | | | 884,470 | | | 144,598 | | | | | | | | | | | | | |

| Other expense: | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense | (46,139) | | | (14,972) | | | (31,167) | | | (125,566) | | | (62,077) | | | (63,489) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency losses | (5,272) | | | (900) | | | (4,372) | | | (11,277) | | | (2,199) | | | (9,078) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Other income (expense), net | 242 | | | (1,341) | | | 1,583 | | | (3,609) | | | (4,551) | | | 942 | | | | | | | | | | | | | |

| Total other expense | (51,169) | | | (17,213) | | | (33,956) | | | (140,452) | | | (68,827) | | | (71,625) | | | | | | | | | | | | | |

| Equity in net income (loss) of other unconsolidated subsidiaries | (831) | | | 1,554 | | | (2,385) | | | 5,102 | | | 5,753 | | | (651) | | | | | | | | | | | | | |

| Income from operations before income taxes | 197,226 | | | 195,379 | | | 1,847 | | | 893,718 | | | 821,396 | | | 72,322 | | | | | | | | | | | | | |

| Income tax expense | 37,995 | | | 37,782 | | | (213) | | | 146,626 | | | 164,106 | | | 17,480 | | | | | | | | | | | | | |

| Net income | 159,231 | | | 157,597 | | | 1,634 | | | 747,092 | | | 657,290 | | | 89,802 | | | | | | | | | | | | | |

Net income attributable to noncontrolling interests | (2,671) | | | (1,843) | | | (828) | | | (9,402) | | | (6,376) | | | (3,026) | | | | | | | | | | | | | |

| Net income attributable to Darling | $ | 156,560 | | | $ | 155,754 | | | $ | 806 | | | $ | 737,690 | | | $ | 650,914 | | | $ | 86,776 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Basic income per share: | $ | 0.98 | | | $ | 0.96 | | | $ | 0.02 | | | $ | 4.58 | | | $ | 4.01 | | | $ | 0.57 | | | | | | | | | | | | | |

| Diluted income per share: | $ | 0.96 | | | $ | 0.94 | | | $ | 0.02 | | | $ | 4.49 | | | $ | 3.90 | | | $ | 0.59 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of diluted common shares: | 163,504 | | | 166,267 | | | | | 164,121 | | | 167,096 | | | | | | | | | | | | | | | |

Darling Ingredients Inc. and Subsidiaries

Consolidated Statement of Cash Flows

Twelve-Month Periods Ended December 31, 2022 and January 1, 2022

(in thousands)

| | | | | | | | | | | |

| Twelve Months Ended |

| | | |

| December 31, | | January 1, |

| Cash flows from operating activities: | 2022 | | 2022 |

| Net income | $ | 747,092 | | | $ | 657,290 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 394,721 | | | 316,387 | |

| Gain on sale of assets | (4,494) | | | (958) | |

| | | |

| Restructuring and asset impairment | 29,666 | | | 138 | |

| | | |

| Deferred taxes | 46,734 | | | 96,812 | |

| Decrease in long-term pension liability | (7,037) | | | (4,742) | |

| Stock-based compensation expense | 25,005 | | | 21,837 | |

| Write-off deferred loan costs | — | | | 1,130 | |

| Deferred loan cost amortization | 4,984 | | | 4,038 | |

| Equity in net income of Diamond Green Diesel and other unconsolidated subsidiaries | (377,448) | | | (357,380) | |

| Distribution of earnings from Diamond Green Diesel and other unconsolidated subsidiaries | 95,546 | | | 4,611 | |

| Changes in operating assets and liabilities, net of effects from acquisitions: | | | |

| Accounts receivable | (56,543) | | | (79,954) | |

| Income taxes refundable/payable | (3,495) | | | 18,826 | |

| Inventories and prepaid expenses | (130,170) | | | (72,919) | |

| Accounts payable and accrued expenses | 65,936 | | | 84,580 | |

| Other | (16,758) | | | 14,724 | |

| Net cash provided by operating activities | 813,739 | | | 704,420 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (391,309) | | | (274,126) | |

| Acquisition, net of cash acquired | (1,772,437) | | | (2,059) | |

| Investment in Diamond Green Diesel | (264,750) | | | (189,000) | |

| Investment in other unconsolidated subsidiaries | — | | | (4,449) | |

| Loan to Diamond Green Diesel | (50,000) | | | (25,000) | |

| Loan repayment from Diamond Green Diesel | 50,000 | | | — | |

| | | |

| Gross proceeds from sale of property, plant and equipment and other assets | 13,442 | | | 4,645 | |

| | | |

| Payments related to routes and other intangibles | (1,492) | | | (274) | |

| Net cash used in investing activities | (2,416,546) | | | (490,263) | |

| Cash flows from financing activities: | | | |

| Proceeds from long-term debt | 1,934,885 | | | 43,824 | |

| Payments on long-term debt | (63,078) | | | (142,133) | |

| Borrowings from revolving credit facility | 1,873,795 | | | 620,601 | |

| Payments on revolving credit facility | (1,897,280) | | | (515,424) | |

| Net cash overdraft financing | 24,069 | | | (3,845) | |

| Deferred loan costs | (16,780) | | | (3,809) | |

| Issuance of common stock | — | | | 50 | |

| Repurchase of common stock | (125,531) | | | (167,708) | |

| Minimum withholding taxes paid on stock awards | (46,944) | | | (46,894) | |

| | | |

| Distributions to noncontrolling interests | (4,532) | | | (6,022) | |

| Net cash provided/(used) in financing activities | 1,678,604 | | | (221,360) | |

| Effect of exchange rate changes on cash flows | 5,299 | | | (5,445) | |

| Net increase/(decrease) in cash, cash equivalents and restricted cash | 81,096 | | | (12,648) | |

| Cash, cash equivalents and restricted cash at beginning of period | 69,072 | | | 81,720 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 150,168 | | | $ | 69,072 | |

Diamond Green Diesel Joint Venture

Condensed Consolidated Balance Sheets

December 31, 2022 and December 31, 2021

(in thousands)

| | | | | | | | | | | |

| December 31, | | December 31, |

| 2022 | | 2021 |

| | | |

| Assets: | | | |

| Total current assets | $ | 1,304,805 | | | $ | 686,294 | |

| Property, plant and equipment, net | 3,866,854 | | | 2,710,747 | |

| Other assets | 61,665 | | | 51,514 | |

| Total assets | $ | 5,233,324 | | | $ | 3,448,555 | |

| | | |

| Liabilities and members' equity: | | | |

| Total current portion of long term debt | $ | 217,066 | | | $ | 165,092 | |

| Total other current liabilities | 515,023 | | | 295,860 | |

| Total long term debt | 774,783 | | | 344,309 | |

| Total other long term liabilities | 17,249 | | | 17,531 | |

| Total members' equity | 3,709,203 | | | 2,625,763 | |

| Total liabilities and members' equity | $ | 5,233,324 | | | $ | 3,448,555 | |

Diamond Green Diesel Joint Venture

Operating Financial Results

For the Three-Month and Twelve-Month Periods Ended December 31, 2022 and December 31, 2021

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | | | |

| | | $ Change | | | | $ Change | | | | | | | | | | | | |

| December 31, | | December 31, | | Favorable | | December 31, | | December 31, | | Favorable | | | | | | | | | | | | |

| 2022 | | 2021 | | (Unfavorable) | | 2022 | | 2021 | | (Unfavorable) | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenues | $ | 1,594,552 | | | $ | 936,940 | | | $ | 657,612 | | | $ | 5,501,166 | | | $ | 2,342,332 | | | $ | 3,158,834 | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | | | | |

Total costs and expenses less depreciation, amortization and accretion expense | 1,302,584 | | | 770,555 | | | (532,029) | | | 4,614,192 | | | 1,575,494 | | | (3,038,698) | | | | | | | | | | | | | |

Depreciation, amortization and accretion expense | 36,054 | | | 23,653 | | | (12,401) | | | 125,656 | | | 58,326 | | | (67,330) | | | | | | | | | | | | | |

| Total costs and expenses | 1,338,638 | | | 794,208 | | | (544,430) | | | 4,739,848 | | | 1,633,820 | | | (3,106,028) | | | | | | | | | | | | | |

| Operating income | 255,914 | | | 142,732 | | | 113,182 | | | 761,318 | | | 708,512 | | | 52,806 | | | | | | | | | | | | | |

| Other income | 1,244 | | | 154 | | | 1,090 | | | 3,170 | | | 678 | | | 2,492 | | | | | | | | | | | | | |

| Interest and debt expense, net | (10,262) | | | (3,560) | | | (6,702) | | | (19,796) | | | (5,936) | | | (13,860) | | | | | | | | | | | | | |

| Net income | $ | 246,896 | | | $ | 139,326 | | | $ | 107,570 | | | $ | 744,692 | | | $ | 703,254 | | | $ | 41,438 | | | | | | | | | | | | | |

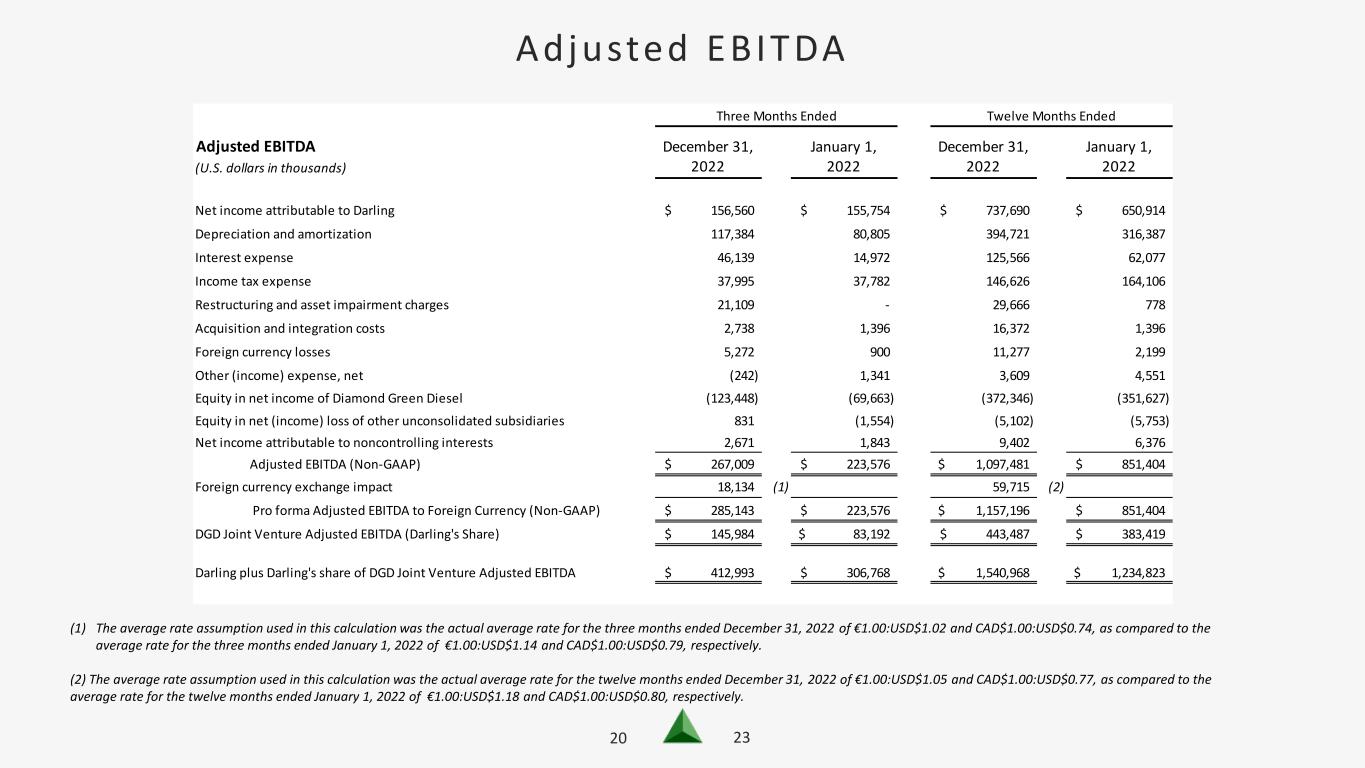

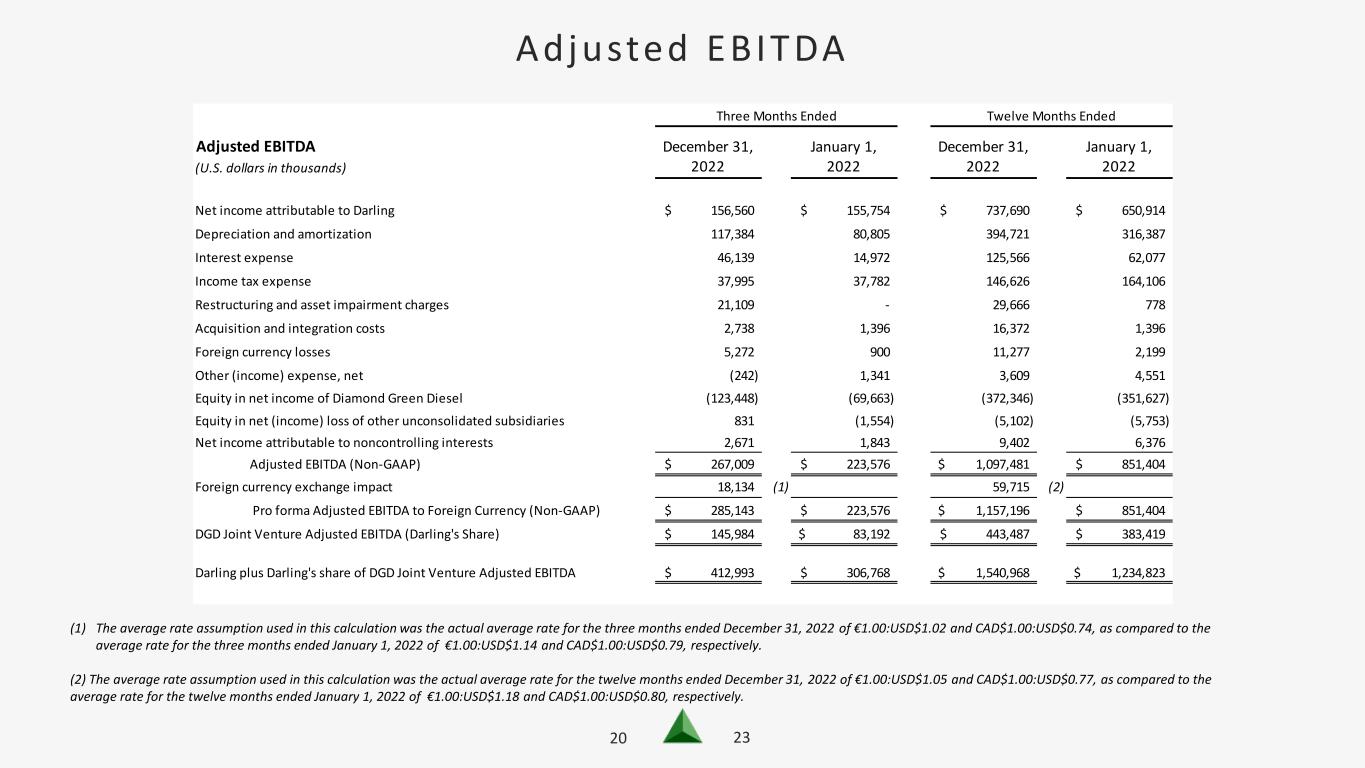

Darling Ingredients Inc. reports Adjusted EBITDA results, which is a Non-GAAP financial measure, as a complement to results provided in accordance with generally accepted accounting principles (GAAP) (for additional information, see “Use of Non-GAAP Financial Measures” included later in this media release). The Company believes that Adjusted EBITDA provides additional useful information to investors. Adjusted EBITDA, as the Company uses the term, is calculated below:

Reconciliation of Net Income to (Non-GAAP) Adjusted EBITDA and (Non-GAAP) Pro forma Adjusted EBITDA For the Three-Month and Twelve-Month Periods Ended December 31, 2022 and January 1, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | | | |

| Adjusted EBITDA | December 31, | | January 1, | | December 31, | | January 1, | | | | | | | | |

| (U.S. dollars in thousands) | 2022 | | 2022 | | 2022 | | 2022 | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net income attributable to Darling | $ | 156,560 | | | $ | 155,754 | | | $ | 737,690 | | | $ | 650,914 | | | | | | | | | |

| Depreciation and amortization | 117,384 | | | 80,805 | | | 394,721 | | | 316,387 | | | | | | | | | |

| Interest expense | 46,139 | | | 14,972 | | | 125,566 | | | 62,077 | | | | | | | | | |

| Income tax expense | 37,995 | | | 37,782 | | | 146,626 | | | 164,106 | | | | | | | | | |

| Restructuring and asset impairment charges | 21,109 | | | — | | | 29,666 | | | 778 | | | | | | | | | |

| Acquisition and integration costs | 2,738 | | | 1,396 | | | 16,372 | | | 1,396 | | | | | | | | | |

| Foreign currency losses | 5,272 | | | 900 | | | 11,277 | | | 2,199 | | | | | | | | | |

| Other (income) expense, net | (242) | | | 1,341 | | | 3,609 | | | 4,551 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Equity in net income of Diamond Green Diesel | (123,448) | | | (69,663) | | | (372,346) | | | (351,627) | | | | | | | | | |

| Equity in net (income) loss of other unconsolidated subsidiaries | 831 | | | (1,554) | | | (5,102) | | | (5,753) | | | | | | | | | |

| Net income attributable to noncontrolling interests | 2,671 | | | 1,843 | | | 9,402 | | | 6,376 | | | | | | | | | |

| Adjusted EBITDA (Non-GAAP) | $ | 267,009 | | | $ | 223,576 | | | $ | 1,097,481 | | | $ | 851,404 | | | | | | | | | |

| Foreign currency exchange impact | 18,134 | | (1) | | | 59,715 | | (2) | | | | | | | | | |

| Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP) | $ | 285,143 | | | $ | 223,576 | | | $ | 1,157,196 | | | $ | 851,404 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| DGD Joint Venture Adjusted EBITDA (Darling's share) | $ | 145,984 | | | $ | 83,192 | | | $ | 443,487 | | | $ | 383,419 | | | | | | | | | |

| Darling plus Darling's share of DGD Joint Venture Adjusted EBITDA | $ | 412,993 | | | $ | 306,768 | | | $ | 1,540,968 | | | $ | 1,234,823 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| (1) The average rate assumption used in the calculation was the actual average rate for the three months ended December 31, 2022 of €1.00:USD$1.02 and CAD$1.00:USD$0.74 as compared to the average rate for the three months ended January 1, 2022 of €1.00:USD$1.14 and CAD$1.00:USD $0.79, respectively. |

| (2) The average rate assumption used in this calculation was the actual average rate for the twelve months ended December 31, 2022 of €1.00:USD$1.05 and CAD$1.00:USD$0.77 as compared to the average rate for the twelve months ended January 1, 2022 of €1.00:USD$1.18 and CAD$1.00:USD $0.80, respectively. |

About Darling Ingredients

Darling Ingredients Inc. (NYSE: DAR) is the largest publicly traded company turning edible by-products and food waste into sustainable products and a leading producer of renewable energy. Recognized as a sustainability leader, the company operates more than 260 facilities in 17 countries and repurposes approximately 15% of the world's meat industry waste streams into value-added products, such as green energy, renewable diesel, collagen, fertilizer, animal proteins and meals, and pet food ingredients. To learn more, visit darlingii.com. Follow us on LinkedIn.

Darling Ingredients Inc. will host a conference call to discuss the Company’s fourth quarter and fiscal year 2022 financial results at 9 a.m. Eastern Time (8 a.m. Central Time) on Tuesday, Feb. 28, 2023. To listen to the conference call, participants calling from within North America should dial 1-844-868-8847, international participants should dial 1-412-317-6593, and ask to be connected to the Darling Ingredients Inc. call. Please call approximately ten minutes before the start of the call to ensure that you are connected.

The call will also be available as a live audio webcast that can be accessed on the Company website at http://ir.darlingii.com. Beginning one hour after its completion, a replay of the call can be accessed through March 7, 2023, by dialing 1-877-344-7529 (U.S. callers), 1-855-669-9658 (Canada) and 1-412-317-0088 (international callers). The access code for the replay is 6860343. The conference call will also be archived on the Company’s website.

Use of Non-GAAP Financial Measures:

Adjusted EBITDA is not a recognized accounting measurement under GAAP; it should not be considered as an alternative to net income, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity and is not intended to be a presentation in accordance with GAAP. Adjusted EBITDA is presented here not as an alternative to net income, but rather as a measure of the Company’s operating performance. Since EBITDA (generally, net income plus interest expense, taxes, depreciation and amortization) is not calculated identically by all companies, this presentation may not be comparable to EBITDA or Adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated in this presentation and represents, for any relevant period, net income/(loss) plus depreciation and amortization, goodwill and long-lived asset impairment, interest expense, income tax provision, other income/(expense) and equity in net (income)/loss of unconsolidated subsidiaries. Management believes that Adjusted EBITDA is useful in evaluating the Company’s operating performance compared to that of other companies in its industry because the calculation of Adjusted EBITDA generally eliminates the effects of financing, income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance.

Pro forma Adjusted EBITDA to Foreign Currency is not a recognized accounting measurement under GAAP. The Company evaluates the impact of foreign currency on its adjusted EBITDA. DGD Joint Venture Adjusted EBITDA (Darling's share) is not reflected in the Adjusted EBITDA or the Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP).

The Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other discretionary purposes. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities, 6.0% Notes, 5.25% Notes and 3.625% Notes that were outstanding at December 31, 2022. However, the amounts shown in this presentation for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities, 6.0% Notes, 5.25% Notes and 3.625% Notes, as those definitions permit further adjustments to reflect certain other non-recurring costs, non-cash charges and cash dividends from

the DGD Joint Venture. Additionally, the Company evaluates the impact of foreign exchange impact on operating cash flow, which is defined as segment operating income (loss) plus depreciation and amortization.

Information reconciling forward-looking combined adjusted EBITDA to net income is unavailable to the Company without unreasonable effort. The Company is not able to provide reconciliations of combined adjusted EBITDA to net income because certain items required for such reconciliations are outside of the Company’s control and/or cannot be reasonably predicted, such as the impact of volatile commodity prices on the Company’s operations, impact of foreign currency exchange fluctuations, depreciation and amortization and the provision for income taxes. Preparation of such reconciliations for Darling Ingredients Inc. and the Company’s joint venture, Diamond Green Diesel, would require a forward-looking balance sheet, statement of operations and statement of cash flows, prepared in accordance with GAAP for each entity, and such forward-looking financial statements are unavailable to the Company without unreasonable effort. The Company provides a range for its combined adjusted EBITDA outlook that it believes will be achieved; however, it cannot accurately predict all the components of the combined adjusted EBITDA calculation.

EBITDA per gallon is not a recognized accounting measurement under GAAP; it should not be considered as an alternative to net income or equity in income of Diamond Green Diesel, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity and is not intended to be a presentation in accordance with GAAP. EBITDA per gallon is presented here not as an alternative to net income or equity in income of Diamond Green Diesel, but rather as a measure of Diamond Green Diesel’s operating performance. Since EBITDA per gallon (generally, net income plus interest expense, taxes, depreciation and amortization divided by total gallons sold) is not calculated identically by all companies, this presentation may not be comparable to EBITDA per gallon presentations disclosed by other companies. Management believes that EBITDA per gallon is useful in evaluating Diamond Green Diesel’s operating performance compared to that of other companies in its industry because the calculation of EBITDA per gallon generally eliminates the effects of financing, income taxes and certain non-cash and other items presented on a per gallon basis that may vary for different companies for reasons unrelated to overall operating performance.

Cautionary Statements Regarding Forward-Looking Information:

This media release contains “forward-looking” statements regarding the business operations and prospects of Darling Ingredients Inc. and industry factors affecting it. These statements are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “guidance,” “could,” “may,” “will,” “should,” “planned,” “potential,” “continue,” “momentum,” and other words referring to events that may occur in the future. These statements reflect Darling Ingredient’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, each of which could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished product prices, including a decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas(“GHG”) emissions that adversely affect programs like the U.S. government’s renewable fuel standard, low carbon fuel standards (“LCFS”) and tax credits for biofuels both in the United States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of 2009 H1N1 flu (initially known as “Swine Flu”), Highly pathogenic strains of avian influenza (collectively known as “Bird Flu”), severe acute respiratory

syndrome (“SARS”), bovine spongiform encephalopathy (or "BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the United States or elsewhere, such as the outbreak of African Swine Fever (“ASF”) in China and elsewhere; the occurrence of pandemics, epidemics or disease outbreaks, such as the current COVID-19 outbreak; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign (including, without limitation, China) regulations (including new or modified animal feed, Bird Flu, SARS, PED, BSE, ASF or similar or unanticipated regulations) affecting the industries in which the Company operates or its value added products; risks associated with the DGD Joint Venture, including possible unanticipated operating disruptions, a decline in margins on the products produced by the DGD Joint Venture, and issues relating to the announced SAF upgrade project; failure to close on strategic acquisitions; risks and uncertainties relating to international sales and operations, including imposition of tariffs, quotas, trade barriers and other trade protections imposed by foreign countries; difficulties or a significant disruption in our information systems or failure to implement new systems and software successfully, risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere; uncertainty regarding the exit of the U.K. from the European Union; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, inflation rates, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could cause actual results to vary materially from the forward looking statements included in this release or negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

# # #

Darling Ingredients Contacts

Investors: Suann Guthrie

Senior VP, Investor Relations, Sustainability & Communications

(469) 214-8202; suann.guthrie@darlingii.com

Media: Jillian Fleming

Director, Global Communications

(972) 541-7115; jillian.fleming@darlingii.com

1 23 EARNINGS REPORT Q 4 | F E B R U A R Y 2 7 , 2 0 2 3 Exhibit 99.2

2 23 SAFE HARBOR STATEMENT This presentation contains “forward-looking” statements that are subject to risks and uncertainties that could cause the actual results of Darling Ingredients Inc. (the “Company”) to differ materially from those expressed or implied in the statements. Statements that are not statements of historical facts are forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “planned,” “contemplate,” “potential,” “possible,” “proposed,” “intend,” “believe,” “anticipate,” “expect,” “may,” “will,” “would,” “should,” “could” “combined adjusted EBITDA guidance” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on the Company’s current expectations and assumptions regarding its business, the economy and other future conditions. The Company cautions readers that any such forward-looking statements it makes are not guarantees of future performance and that actual results may differ materially from anticipated results or expectations expressed in its forward-looking statements as a result of a variety of factors, including many that are beyond the Company’s control. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished product prices, including a decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas(“GHG”) emissions that adversely affect programs like the U.S. government’s renewable fuel standard, low carbon fuel standards (“LCFS”) and tax credits for biofuels both in the United States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of 2009 H1N1 flu (initially known as “Swine Flu”), Highly pathogenic strains of avian influenza (collectively known as “Bird Flu”), severe acute respiratory syndrome (“SARS”), bovine spongiform encephalopathy (or "BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the United States or elsewhere, such as the outbreak of African Swine Fever (“ASF”) in China and elsewhere; the occurrence of pandemics, epidemics or disease outbreaks, such as the current COVID-19 outbreak; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign (including, without limitation, China) regulations (including new or modified animal feed, Bird Flu, SARS, PED, BSE, ASF or similar or unanticipated regulations) affecting the industries in which the Company operates or its value added products; risks associated with the DGD Joint Venture, including possible unanticipated operating disruptions, a decline in margins on the products produced by the DGD Joint Venture, and issues relating to the announced SAF upgrade project; failure to close on strategic acquisitions; risks and uncertainties relating to international sales and operations, including imposition of tariffs, quotas, trade barriers and other trade protections imposed by foreign countries; difficulties or a significant disruption in our information systems or failure to implement new systems and software successfully, risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer- sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere, including the Russia-Ukraine war; uncertainty regarding the exit of the U.K. from the European Union; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, inflation rates, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could cause actual results to vary materially from the forward looking statements included in this release or negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise. Q4 - 22 EARNINGS

3 23 Solid Financial Performance SUMMARY HIGHLIGHTS Q4 - 22 EARNINGS Growing Shareholder Value Definitive agreement to purchase Gelnex – Oct. 18, 2022 De Jong Recycling acquisition – Oct. 31, 2022 Definitive agreement to purchase Miropasz Group – Nov. 2, 2022 Diamond Green Diesel Port Arthur, Texas start up – Nov. 2022 Investment decision on sustainable aviation fuel – Jan. 2023 Q4-2022 FY-2022 Net Sales $1,768.1 $6,532.2 Net Income $156.6 $737.7 EPS Diluted $0.96 $4.49 Combined Adjusted EBITDA $413.0 $1,541.0 Global Ingredients EBITDA $267.0 $1,097.5 Feed Ingredients EBITDA $191.4 $810.1 Food Ingredients EBITDA $65.4 $256.7 Fuel Ingredients EBITDA $172.4 $536.6 Share Repurchase Program $22.5 million $125.5 million

4 23 Q4-22 EARNINGS 2022 Signif icant Business Highl ights • Record combined adjusted EBITDA of $1.541 billion • Acquired Op de Beeck, a leading organic waste processing company in Belgium, growing the company’s European green energy business • Acquired Valley Proteins, strengthening the core business by adding 18 rendering plants in the southern, southeast and mid-Atlantic regions of the U.S. • Entered the rendering business in Brazil with the acquisition of FASA Group, adding 14 plants and 1.3 million metric tons of processing • Started up DGD Port Arthur, Texas plant on time and under budget, bringing the joint venture’s renewable diesel production to 1.2 billion gallons per year • Entered into a definitive agreement, subject to regulatory approval, to purchase Gelnex to grow the company’s food segment through increased collagen production • Entered into a definitive agreement, subject to regulatory approval, to purchase Miropasz, providing the company with access to additional poultry rendering in Poland, Europe’s largest poultry provider • Signed onto the Science-Based Target initiative, continuing to set a high level for sustainability and advancing the company’s 2050 net-zero goal

5 23 Strong Full Year Earnings, Positioned for Continued Growth In millions, except per share Q4-2022 Q4-2021 % variance FY 2022 FY 2021 % variance Net Sales $1,768.1 $1,310.1 35.0% $6,532.2 $4,741.4 37.8% Gross Margin $388.8 $321.1 21.1% $1,529.6 $1,242.0 23.2% Gross Margin % 22.0% 24.5% (10%) 23.4% 26.2% (10.7%) Net Income $156.6 $155.8 0.5% $737.7 $650.9 13.3% EPS Diluted $0.96 $0.94 2.1% $4.49 $3.90 15.1% EBITDA In millions Q4-2022 Q4-2021 % variance FY 2022 FY 2021 % variance Feed $191.4 $167.5 14.2% $810.1 $613.7 32.0% Food $65.4 $49.4 32.4% $256.7 $194.9 31.7% Fuel (1) $172.4 $104.6 64.8% $536.6 $483.1 11.1% Corporate ($16.2) ($14.7) (10.2%) ($62.5) ($56.9) (9.8%) Total combined adjusted EBITDA $413.0 $306.8 34.6% $1,541.0 $1,234.8 24.8% (1) Includes Fuel Segment EBITDA and Darling's share of DGD EBITDA Darling23.0% 24.7% 26.2% 23.4% 18% 23% 28% FY-19 FY-20 FY-21 FY -22 Balance Sheet In millions, except ratio data As of 12/31/2022 As of 1/1/2022 Cash (including restricted) $127.3 $69.1 Revolver availability $1,313 $1,286 Net working capital $512.2 $291.7 Total debt $3,384.8 $1463.4 Leverage ratio (2) 2,54X 1.57X Darling Ingredients Yearly Gross Margin % (2) Per bank covenant

6 23 Food 15% Feed 45% Fuel 40% Food Feed Fuel (1) Combined Adjusted EBITDA Q4 2022 % of Total EBITDA by Segment $244 $312 $274 $267 $1,098 $87 $91 $120 $146 $443 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 Global Ingredients DGD (In millions) $330.7 $394.7 Q2 22Q1 22 Q3 22 $402.6 FY 22 $1,541 $413.0 Q4 22 (1) Includes Fuel Segment EBITDA and Darling's share of DGD EBITDA Fourth Quarter EBITDA

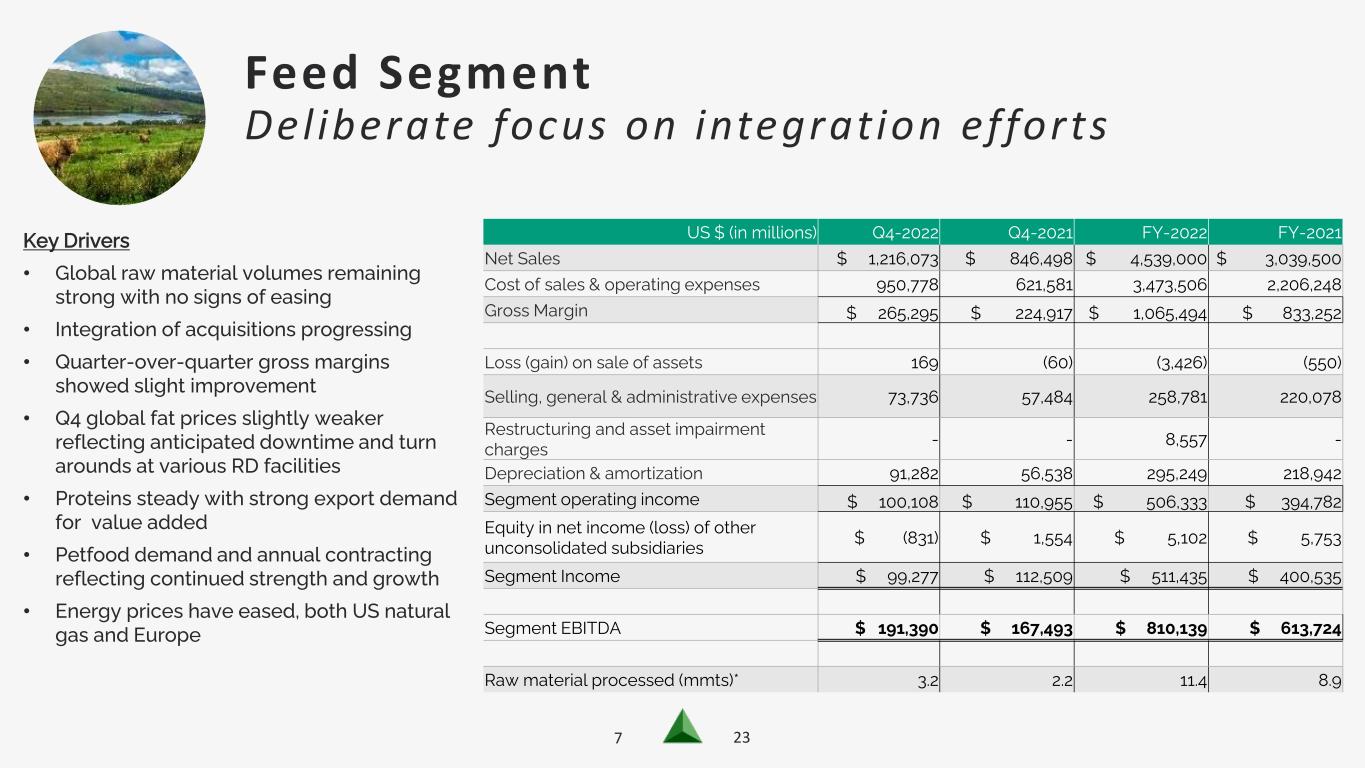

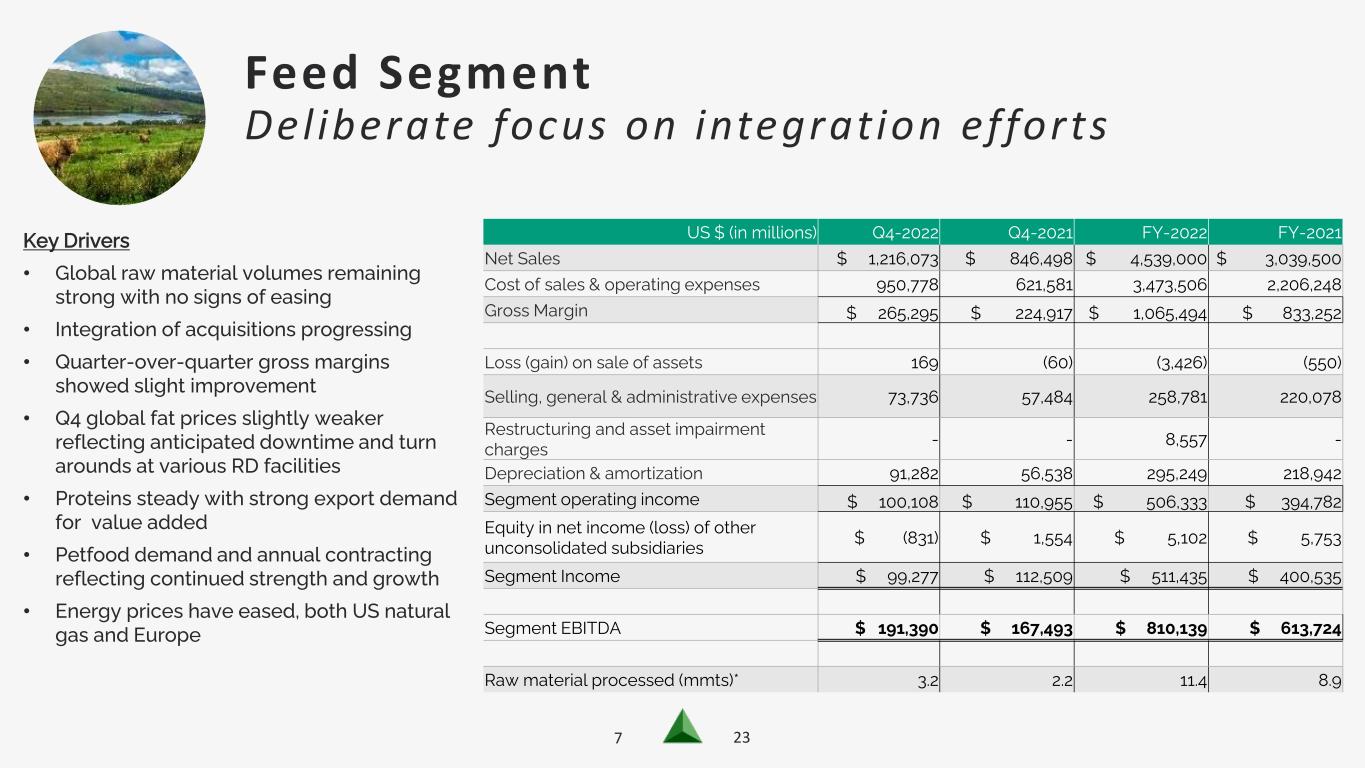

7 23 Key Drivers • Global raw material volumes remaining strong with no signs of easing • Integration of acquisitions progressing • Quarter-over-quarter gross margins showed slight improvement • Q4 global fat prices slightly weaker reflecting anticipated downtime and turn arounds at various RD facilities • Proteins steady with strong export demand for value added • Petfood demand and annual contracting reflecting continued strength and growth • Energy prices have eased, both US natural gas and Europe Feed Segment Deliberate focus on integration efforts US $ (in millions) Q4-2022 Q4-2021 FY-2022 FY-2021 Net Sales $ 1,216,073 $ 846,498 $ 4,539,000 $ 3,039,500 Cost of sales & operating expenses 950,778 621,581 3,473,506 2,206,248 Gross Margin $ 265,295 $ 224,917 $ 1,065,494 $ 833,252 Loss (gain) on sale of assets 169 (60) (3,426) (550) Selling, general & administrative expenses 73,736 57,484 258,781 220,078 Restructuring and asset impairment charges - - 8,557 - Depreciation & amortization 91,282 56,538 295,249 218,942 Segment operating income $ 100,108 $ 110,955 $ 506,333 $ 394,782 Equity in net income (loss) of other unconsolidated subsidiaries $ (831) $ 1,554 $ 5,102 $ 5,753 Segment Income $ 99,277 $ 112,509 $ 511,435 $ 400,535 Segment EBITDA $ 191,390 $ 167,493 $ 810,139 $ 613,724 Raw material processed (mmts)* 3.2 2.2 11.4 8.9

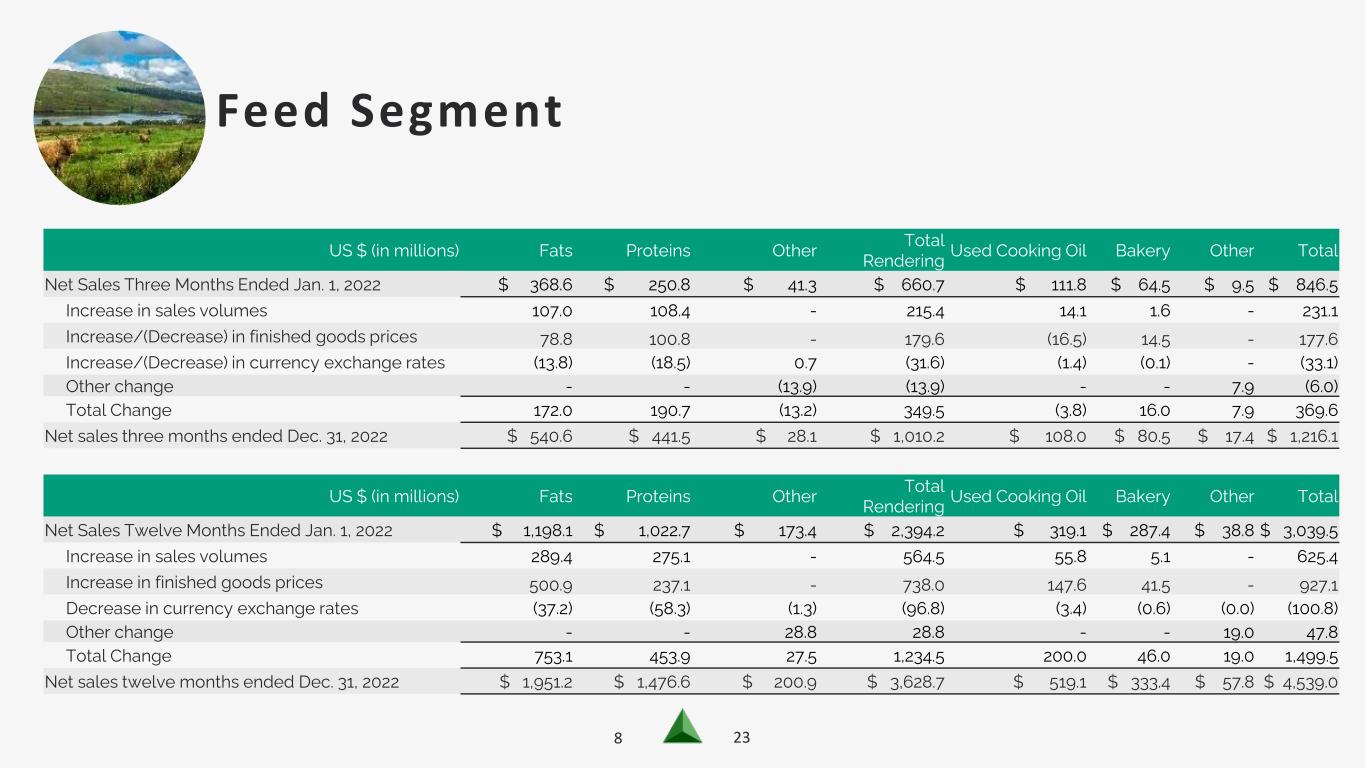

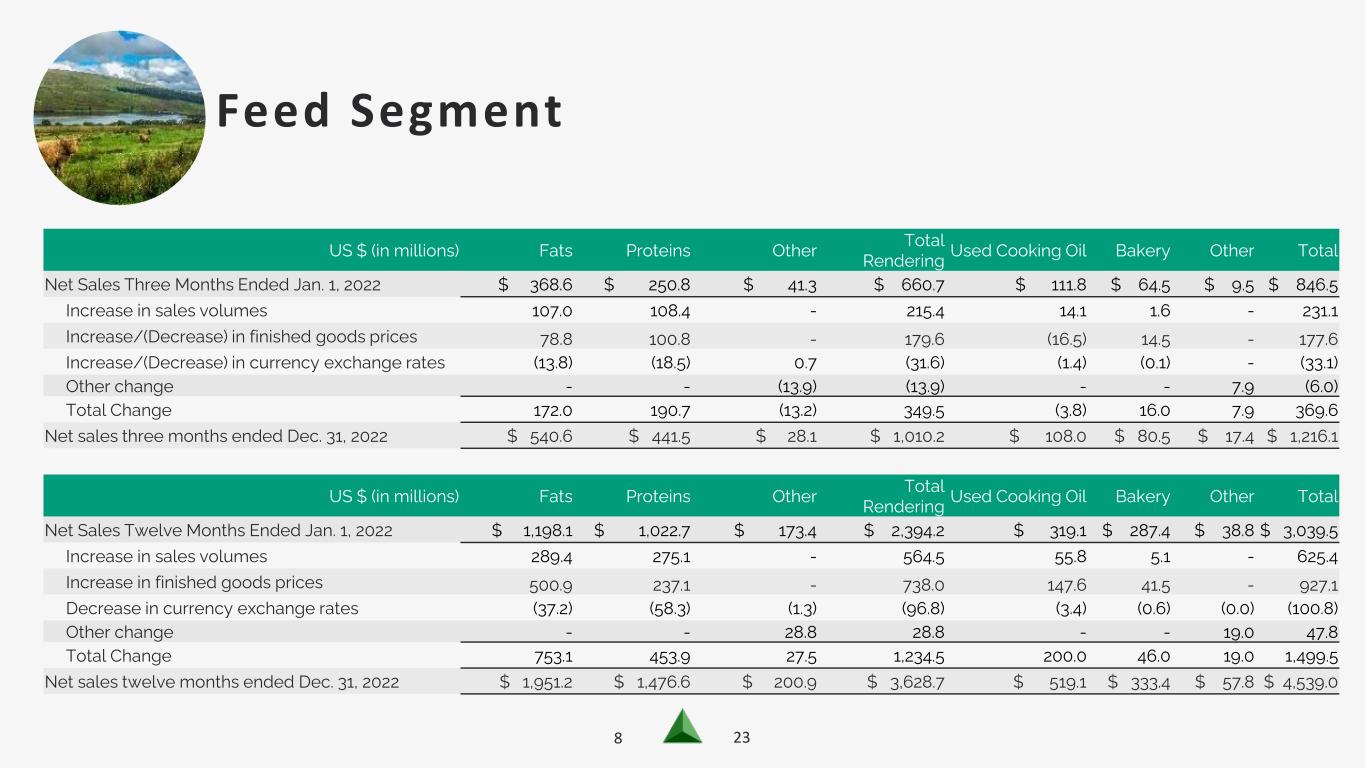

8 23 Feed Segment US $ (in millions) Fats Proteins Other Total Rendering Used Cooking Oil Bakery Other Total Net Sales Twelve Months Ended Jan. 1, 2022 $ 1,198.1 $ 1,022.7 $ 173.4 $ 2,394.2 $ 319.1 $ 287.4 $ 38.8 $ 3,039.5 Increase in sales volumes 289.4 275.1 - 564.5 55.8 5.1 - 625.4 Increase in finished goods prices 500.9 237.1 - 738.0 147.6 41.5 - 927.1 Decrease in currency exchange rates (37.2) (58.3) (1.3) (96.8) (3.4) (0.6) (0.0) (100.8) Other change - - 28.8 28.8 - - 19.0 47.8 Total Change 753.1 453.9 27.5 1,234.5 200.0 46.0 19.0 1,499.5 Net sales twelve months ended Dec. 31, 2022 $ 1,951.2 $ 1,476.6 $ 200.9 $ 3,628.7 $ 519.1 $ 333.4 $ 57.8 $ 4,539.0 US $ (in millions) Fats Proteins Other Total Rendering Used Cooking Oil Bakery Other Total Net Sales Three Months Ended Jan. 1, 2022 $ 368.6 $ 250.8 $ 41.3 $ 660.7 $ 111.8 $ 64.5 $ 9.5 $ 846.5 Increase in sales volumes 107.0 108.4 - 215.4 14.1 1.6 - 231.1 Increase/(Decrease) in finished goods prices 78.8 100.8 - 179.6 (16.5) 14.5 - 177.6 Increase/(Decrease) in currency exchange rates (13.8) (18.5) 0.7 (31.6) (1.4) (0.1) - (33.1) Other change - - (13.9) (13.9) - - 7.9 (6.0) Total Change 172.0 190.7 (13.2) 349.5 (3.8) 16.0 7.9 369.6 Net sales three months ended Dec. 31, 2022 $ 540.6 $ 441.5 $ 28.1 $ 1,010.2 $ 108.0 $ 80.5 $ 17.4 $ 1,216.1

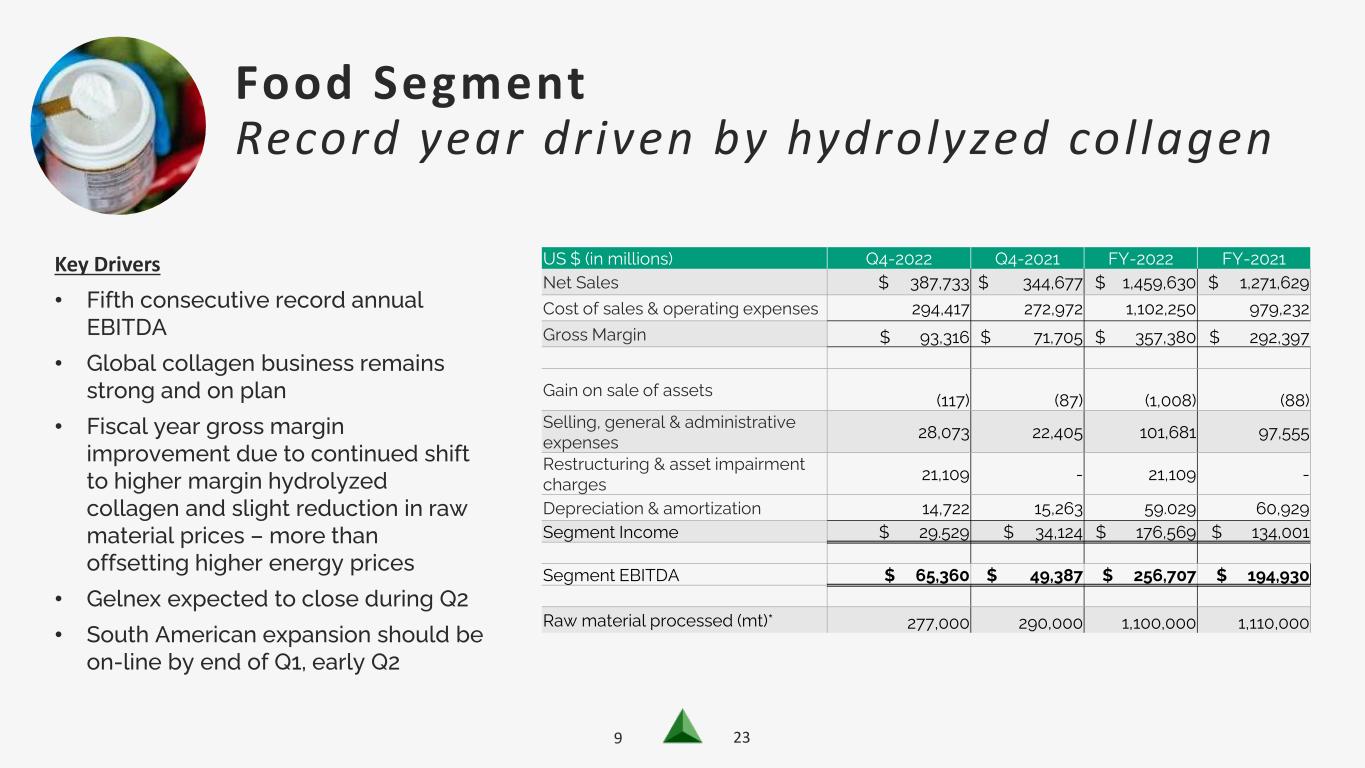

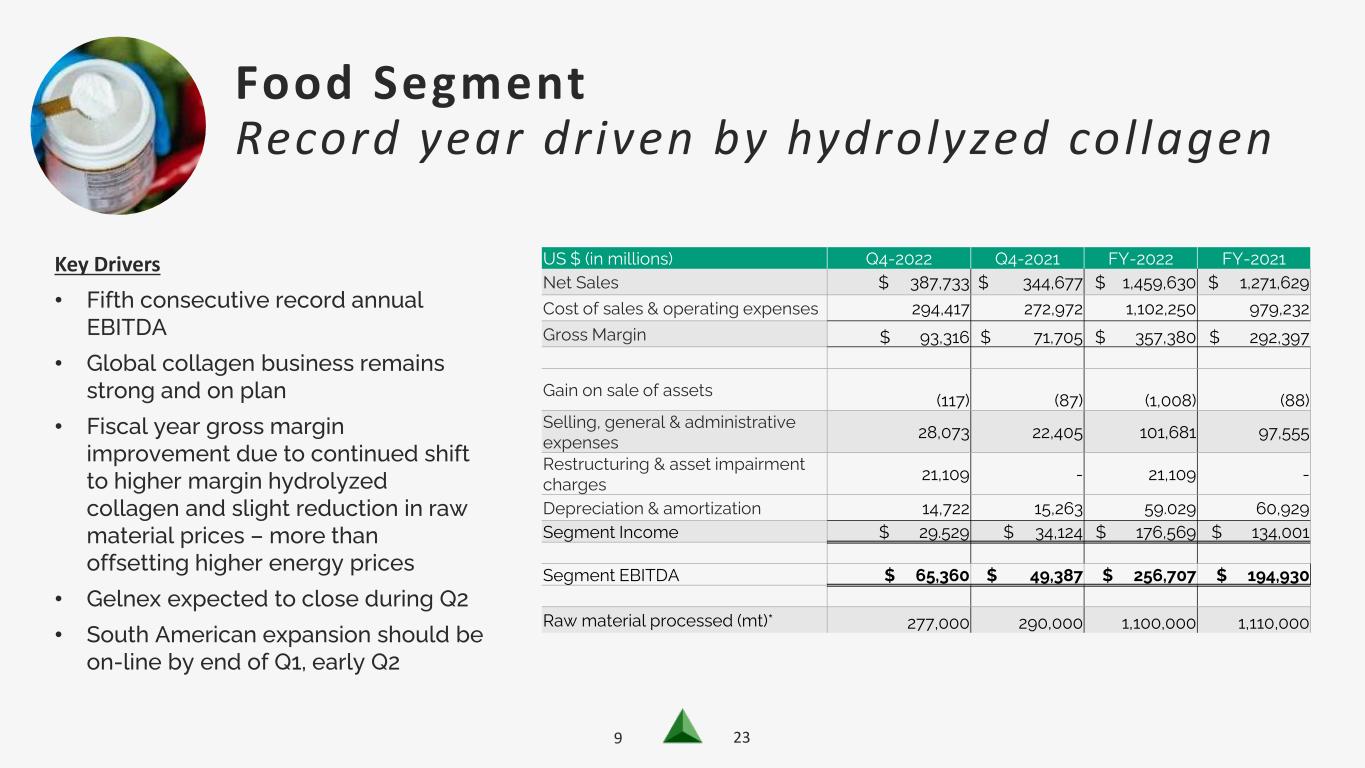

9 23 Key Drivers • Fifth consecutive record annual EBITDA • Global collagen business remains strong and on plan • Fiscal year gross margin improvement due to continued shift to higher margin hydrolyzed collagen and slight reduction in raw material prices – more than offsetting higher energy prices • Gelnex expected to close during Q2 • South American expansion should be on-line by end of Q1, early Q2 Food Segment Record year driven by hydrolyzed collagen US $ (in millions) Q4-2022 Q4-2021 FY-2022 FY-2021 Net Sales $ 387,733 $ 344,677 $ 1,459,630 $ 1,271,629 Cost of sales & operating expenses 294,417 272,972 1,102,250 979,232 Gross Margin $ 93,316 $ 71,705 $ 357,380 $ 292,397 Gain on sale of assets (117) (87) (1,008) (88) Selling, general & administrative expenses 28,073 22,405 101,681 97,555 Restructuring & asset impairment charges 21,109 - 21,109 - Depreciation & amortization 14,722 15,263 59.029 60,929 Segment Income $ 29.529 $ 34,124 $ 176,569 $ 134,001 Segment EBITDA $ 65,360 $ 49,387 $ 256,707 $ 194,930 Raw material processed (mt)* 277,000 290,000 1,100,000 1,110,000

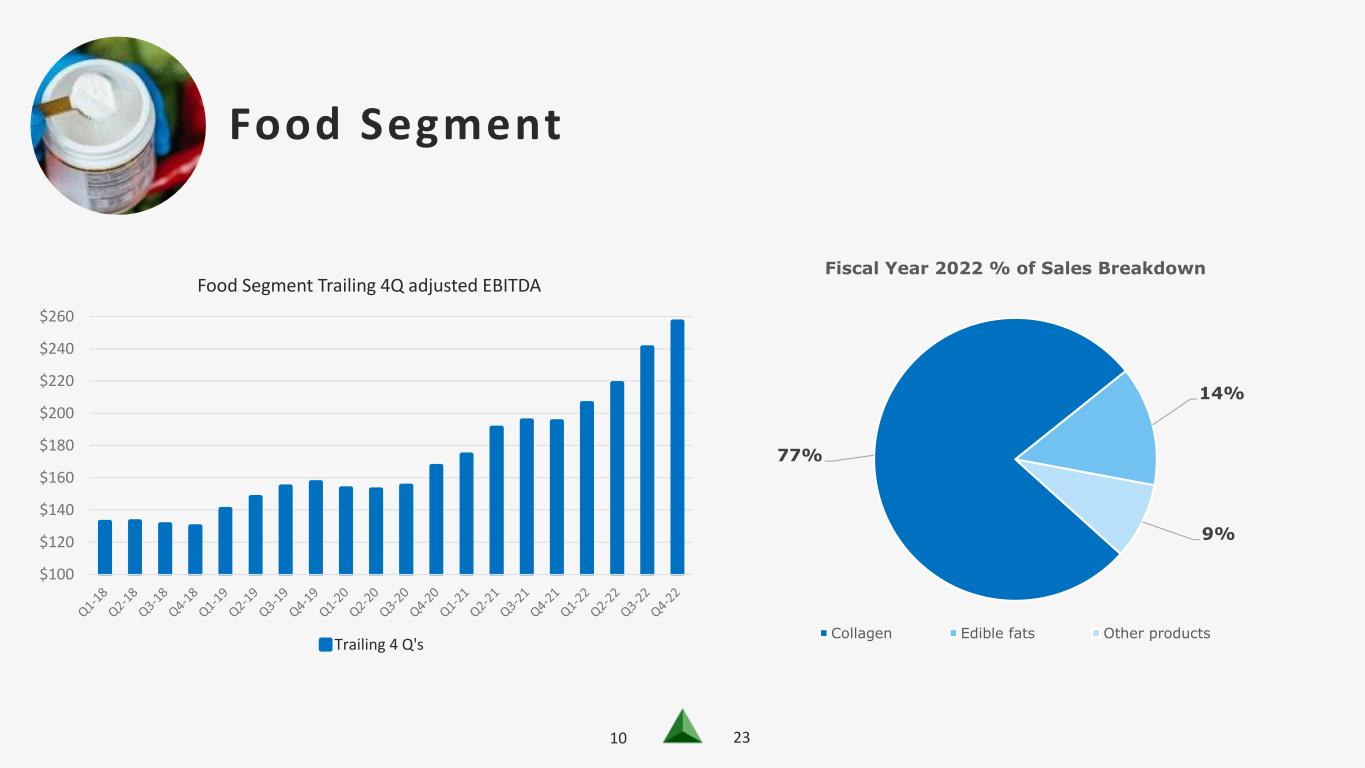

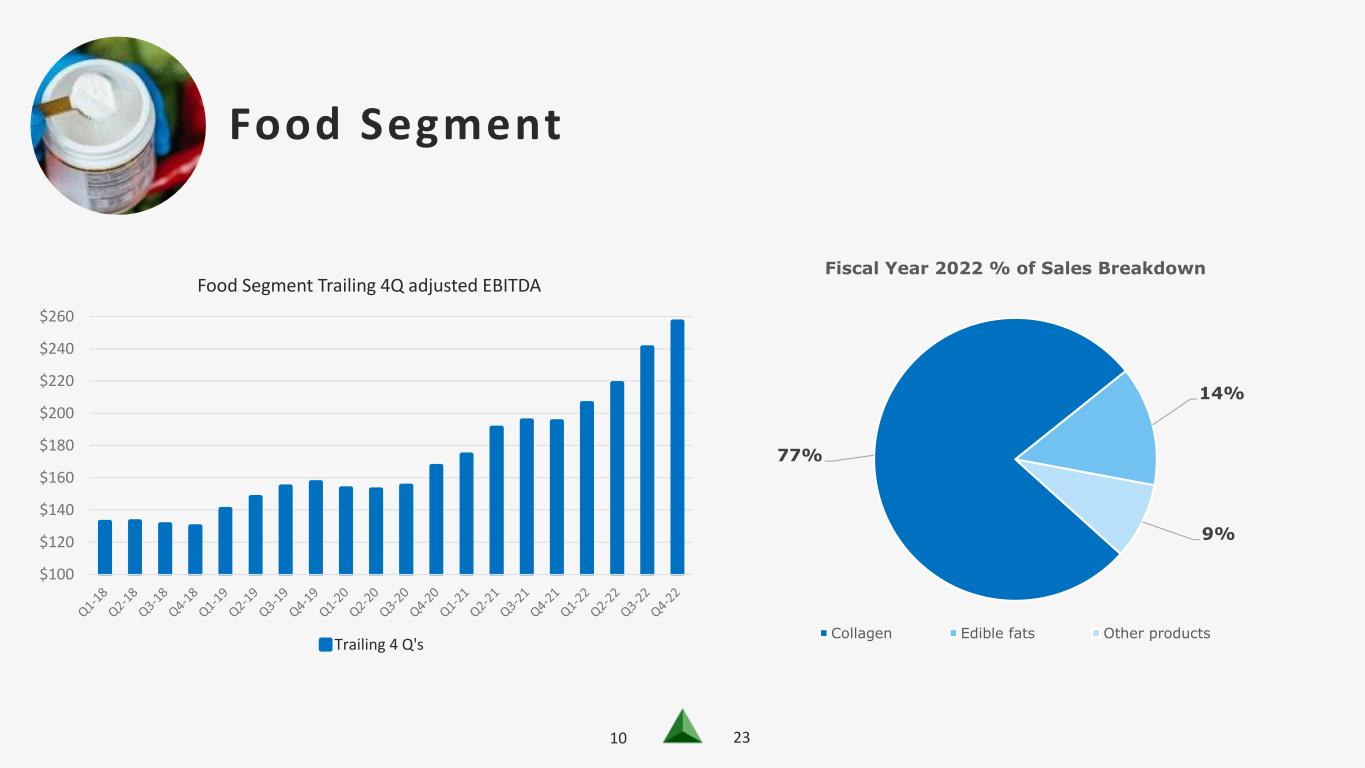

10 23 Food Segment $100 $120 $140 $160 $180 $200 $220 $240 $260 Food Segment Trailing 4Q adjusted EBITDA Trailing 4 Q's 77% 14% 9% Fiscal Year 2022 % of Sales Breakdown Collagen Edible fats Other products

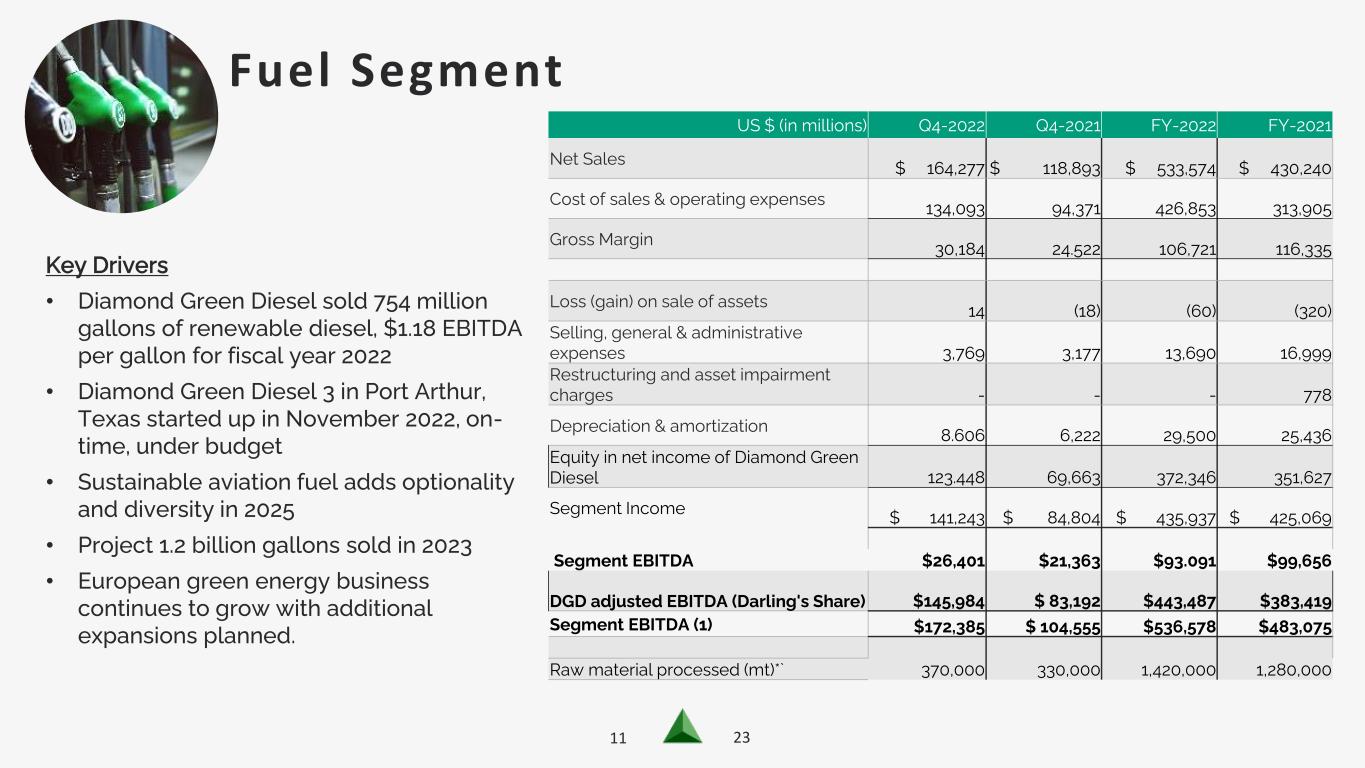

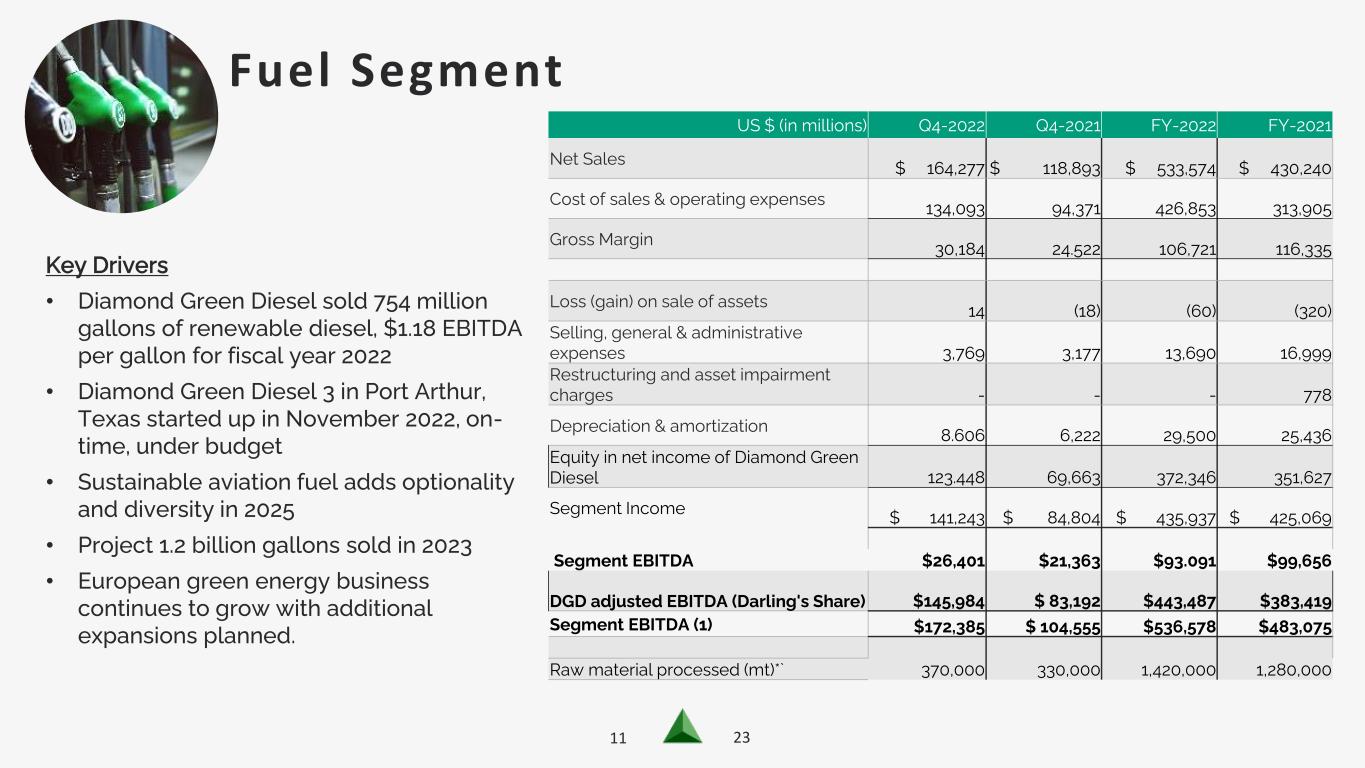

11 23 Fuel Segment Key Drivers • Diamond Green Diesel sold 754 million gallons of renewable diesel, $1.18 EBITDA per gallon for fiscal year 2022 • Diamond Green Diesel 3 in Port Arthur, Texas started up in November 2022, on- time, under budget • Sustainable aviation fuel adds optionality and diversity in 2025 • Project 1.2 billion gallons sold in 2023 • European green energy business continues to grow with additional expansions planned. US $ (in millions) Q4-2022 Q4-2021 FY-2022 FY-2021 Net Sales $ 164,277 $ 118,893 $ 533,574 $ 430,240 Cost of sales & operating expenses 134,093 94,371 426,853 313,905 Gross Margin 30,184 24.522 106,721 116,335 Loss (gain) on sale of assets 14 (18) (60) (320) Selling, general & administrative expenses 3,769 3,177 13,690 16,999 Restructuring and asset impairment charges - - - 778 Depreciation & amortization 8.606 6,222 29,500 25,436 Equity in net income of Diamond Green Diesel 123.448 69,663 372,346 351,627 Segment Income $ 141,243 $ 84,804 $ 435,937 $ 425,069 Segment EBITDA $26,401 $21,363 $93.091 $99,656 DGD adjusted EBITDA (Darling's Share) $145,984 $ 83,192 $443,487 $383,419 Segment EBITDA (1) $172,385 $ 104,555 $536,578 $483,075 Raw material processed (mt)*` 370,000 330,000 1,420,000 1,280,000

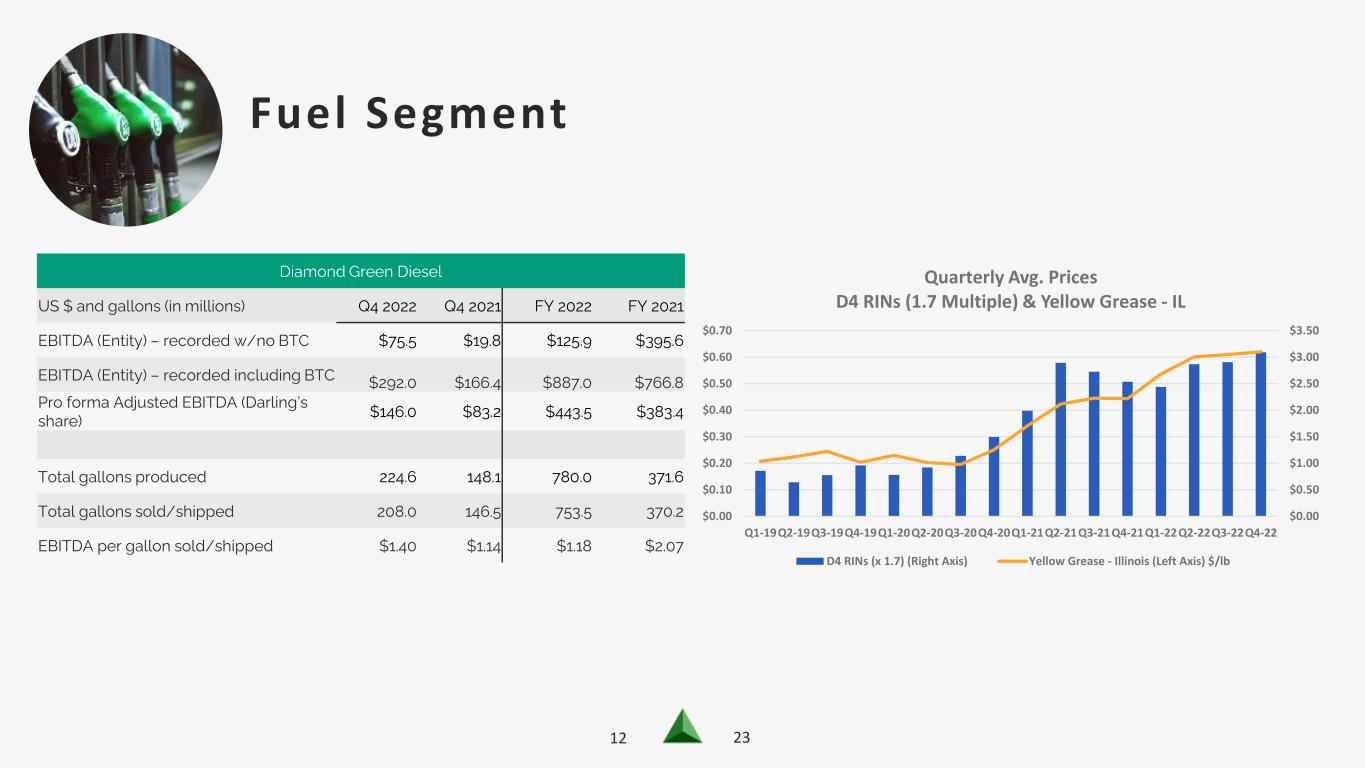

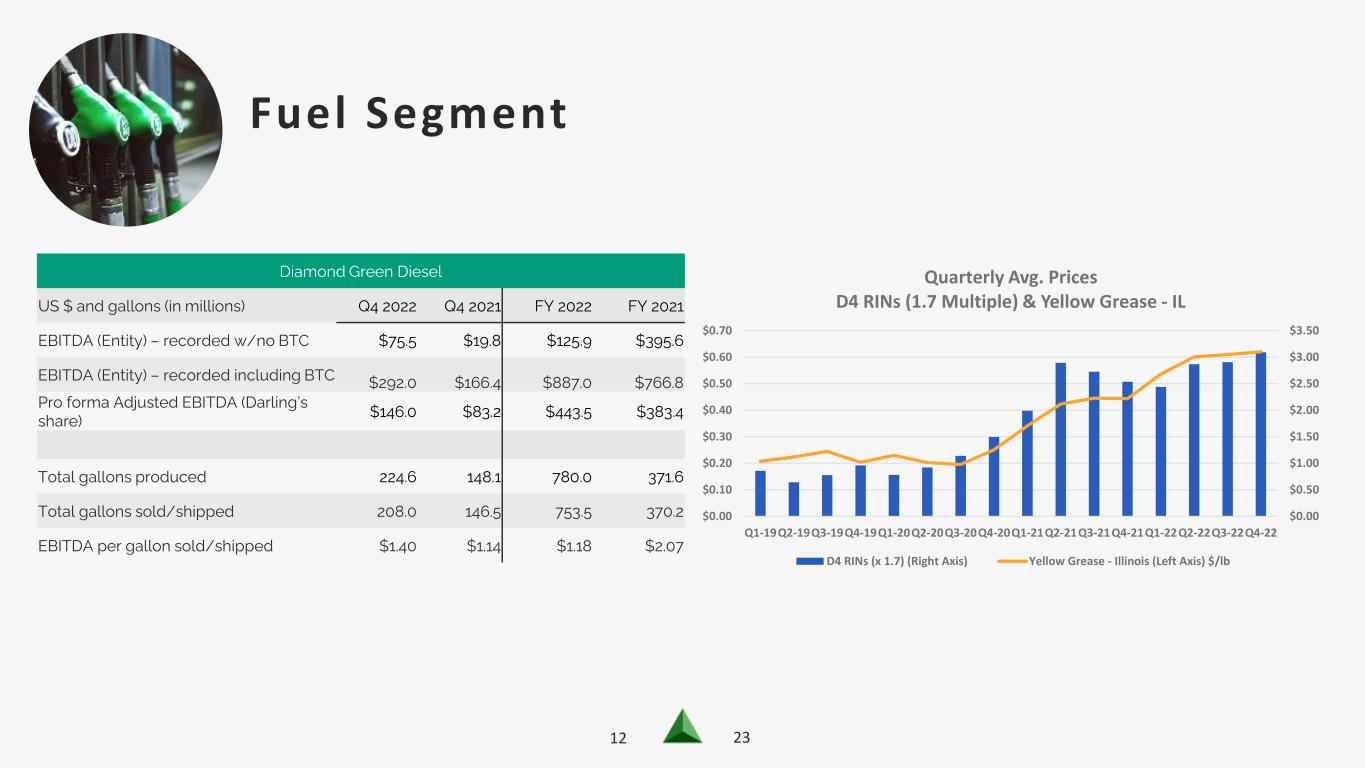

12 23 Fuel Segment Diamond Green Diesel US $ and gallons (in millions) Q4 2022 Q4 2021 FY 2022 FY 2021 EBITDA (Entity) – recorded w/no BTC $75.5 $19.8 $125.9 $395.6 EBITDA (Entity) – recorded including BTC $292.0 $166.4 $887.0 $766.8 Pro forma Adjusted EBITDA (Darling’s share) $146.0 $83.2 $443.5 $383.4 Total gallons produced 224.6 148.1 780.0 371.6 Total gallons sold/shipped 208.0 146.5 753.5 370.2 EBITDA per gallon sold/shipped $1.40 $1.14 $1.18 $2.07 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 Q1-19Q2-19Q3-19Q4-19Q1-20Q2-20Q3-20Q4-20Q1-21Q2-21Q3-21Q4-21Q1-22Q2-22Q3-22Q4-22 Quarterly Avg. Prices D4 RINs (1.7 Multiple) & Yellow Grease - IL D4 RINs (x 1.7) (Right Axis) Yellow Grease - Illinois (Left Axis) $/lb

13 23 Q4-22 EARNINGS 2023: Growing Shareholder Value • Laser focus on integration efforts, both operationally, geographically and administratively • Expected DGD dividends in 2023 will help to reduce debt • Work toward investment grade • Continue opportunistic share repurchase program, $374.5 million remaining as of year end • Expansion projects to drive profitable growth • Grow green energy in Europe • Expand existing US plants to accommodate customer growth and increase waste feedstock supply • Additional spray dry capacity for hydrolyzed collagen production • Expect continued growth; fiscal year 2023 guidance $1.80-$1.85 billion combined adjusted EBITDA

14 23 APPENDIX ADDITIONAL INFORMATION Q4-22 EARNINGS

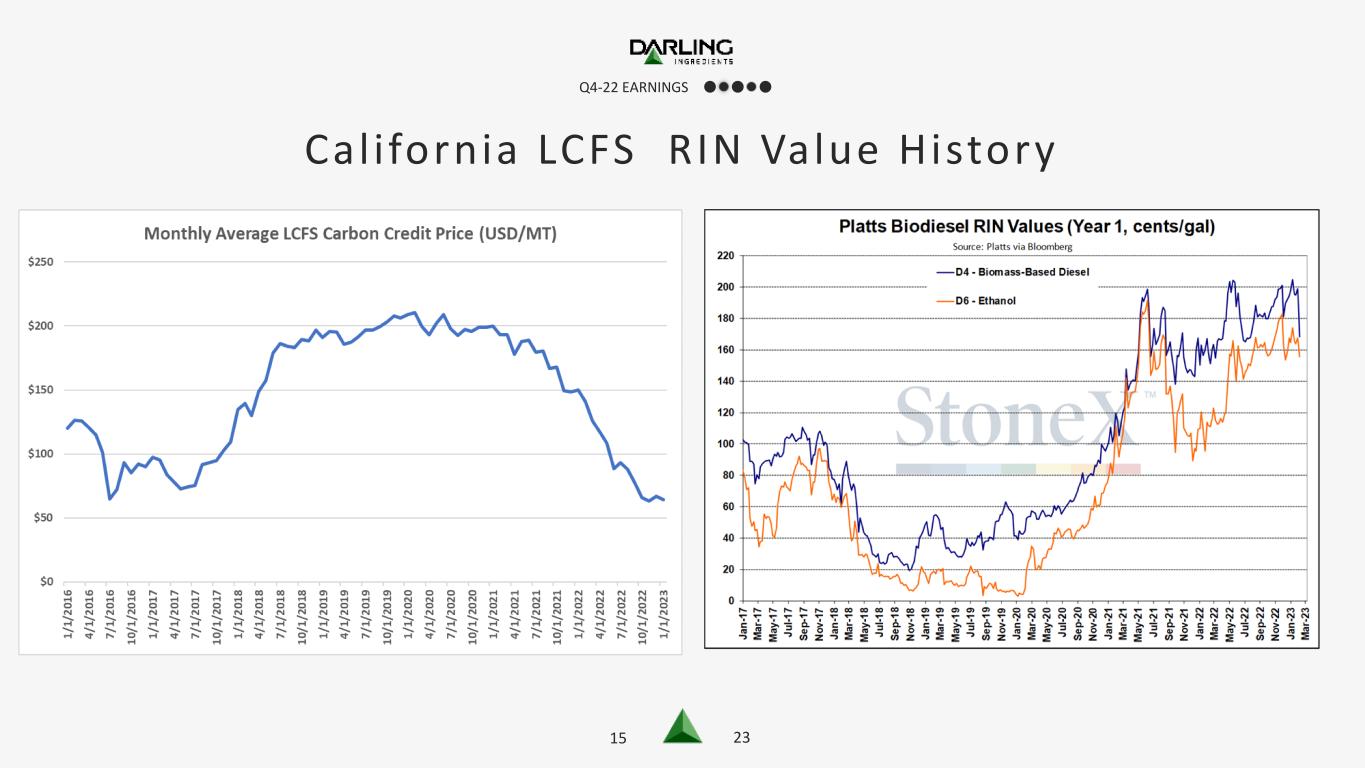

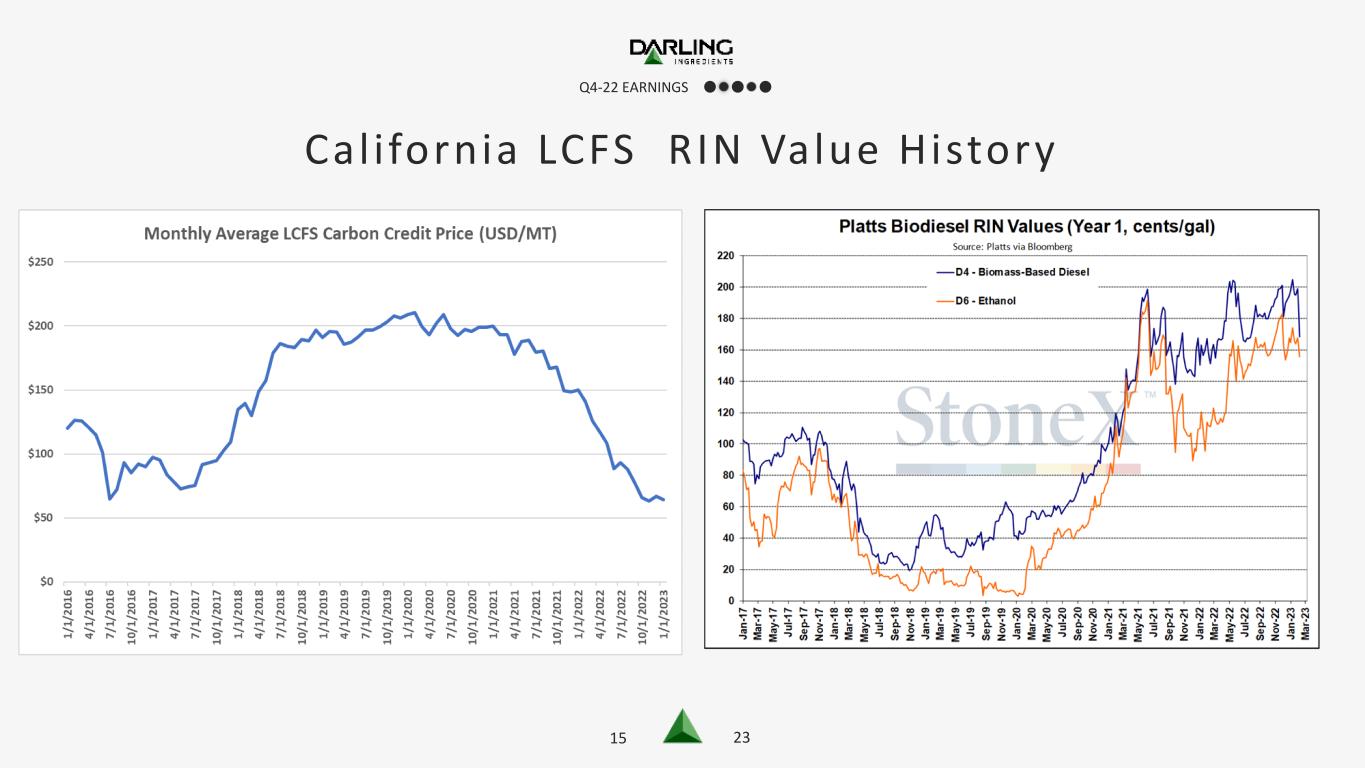

15 23 Q4-22 EARNINGS Cal i fornia LCFS RIN Value History

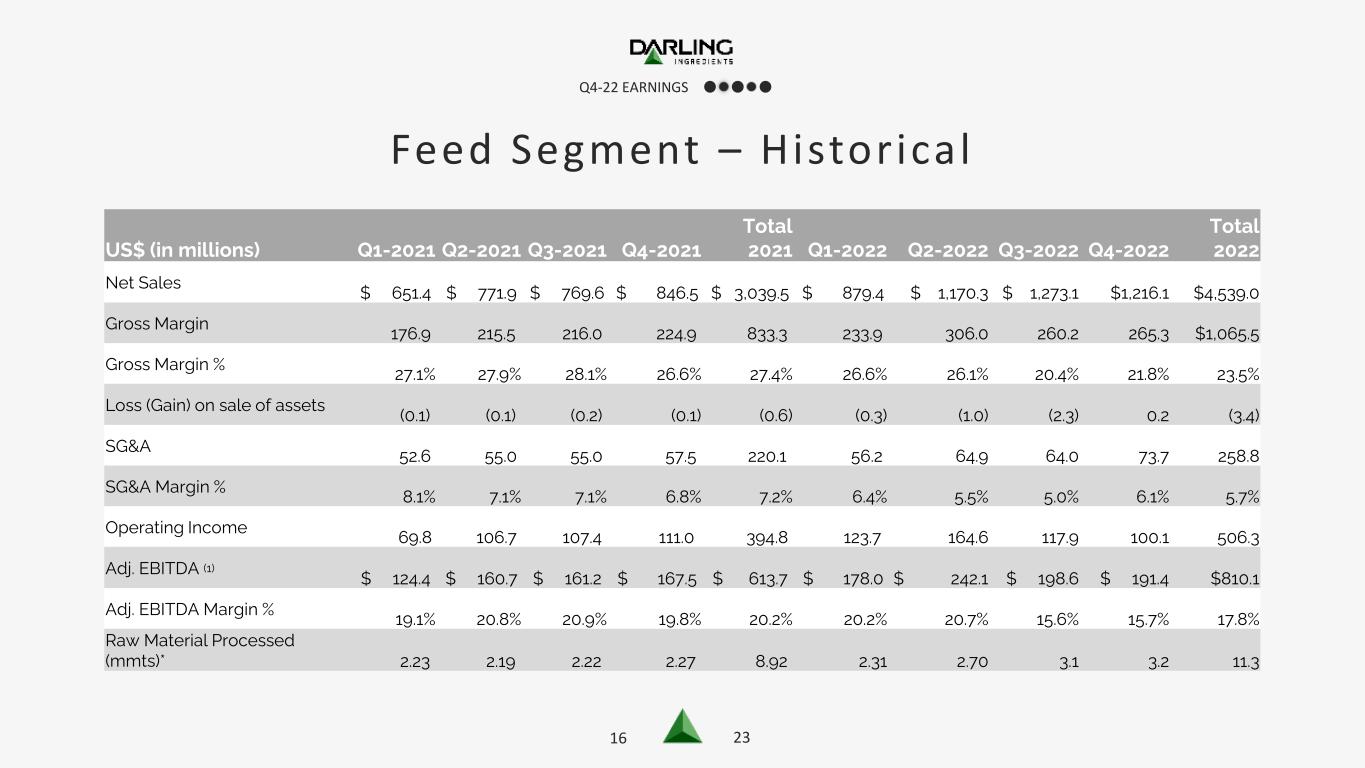

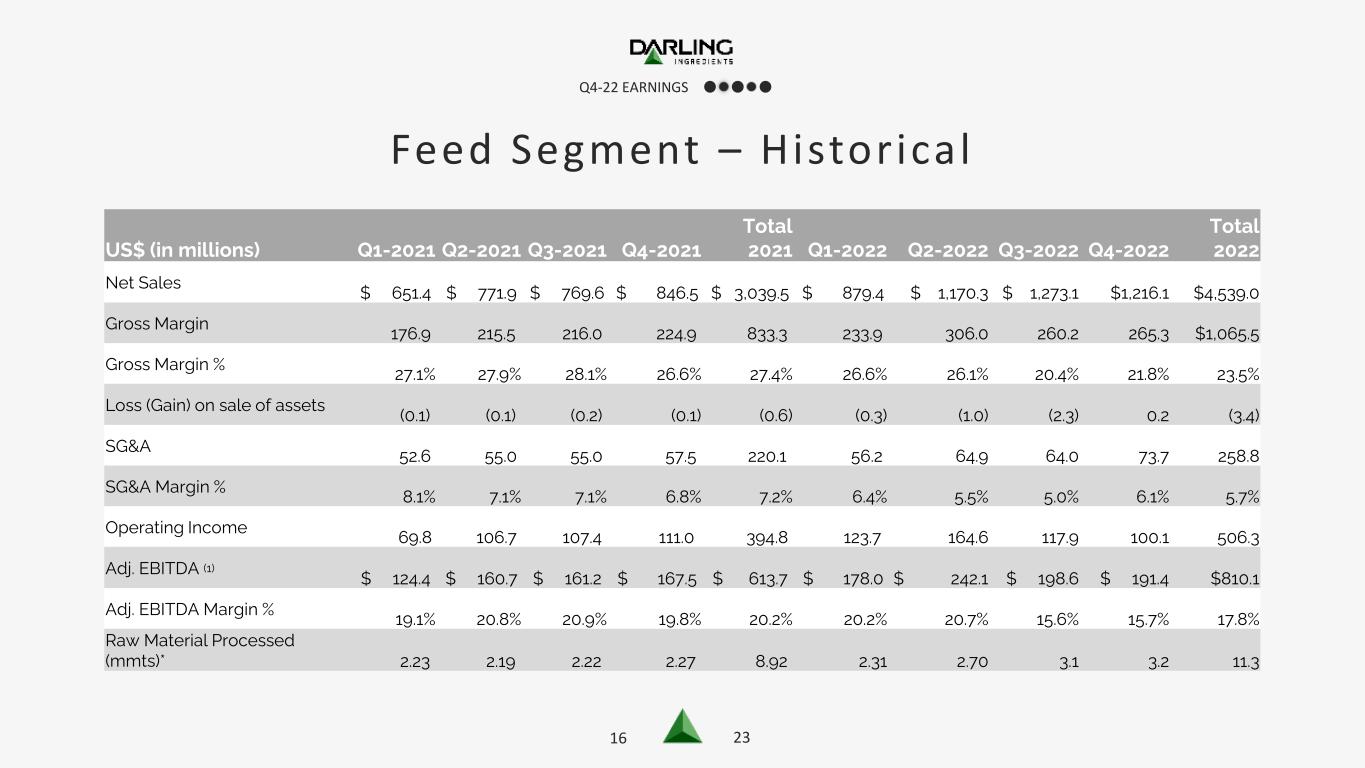

16 23 Q4-22 EARNINGS Feed Segment – Historical US$ (in millions) Q1-2021 Q2-2021 Q3-2021 Q4-2021 Total 2021 Q1-2022 Q2-2022 Q3-2022 Q4-2022 Total 2022 Net Sales $ 651.4 $ 771.9 $ 769.6 $ 846.5 $ 3,039.5 $ 879.4 $ 1,170.3 $ 1,273.1 $1,216.1 $4,539.0 Gross Margin 176.9 215.5 216.0 224.9 833.3 233.9 306.0 260.2 265.3 $1,065.5 Gross Margin % 27.1% 27.9% 28.1% 26.6% 27.4% 26.6% 26.1% 20.4% 21.8% 23.5% Loss (Gain) on sale of assets (0.1) (0.1) (0.2) (0.1) (0.6) (0.3) (1.0) (2.3) 0.2 (3.4) SG&A 52.6 55.0 55.0 57.5 220.1 56.2 64.9 64.0 73.7 258.8 SG&A Margin % 8.1% 7.1% 7.1% 6.8% 7.2% 6.4% 5.5% 5.0% 6.1% 5.7% Operating Income 69.8 106.7 107.4 111.0 394.8 123.7 164.6 117.9 100.1 506.3 Adj. EBITDA (1) $ 124.4 $ 160.7 $ 161.2 $ 167.5 $ 613.7 $ 178.0 $ 242.1 $ 198.6 $ 191.4 $810.1 Adj. EBITDA Margin % 19.1% 20.8% 20.9% 19.8% 20.2% 20.2% 20.7% 15.6% 15.7% 17.8% Raw Material Processed (mmts)* 2.23 2.19 2.22 2.27 8.92 2.31 2.70 3.1 3.2 11.3

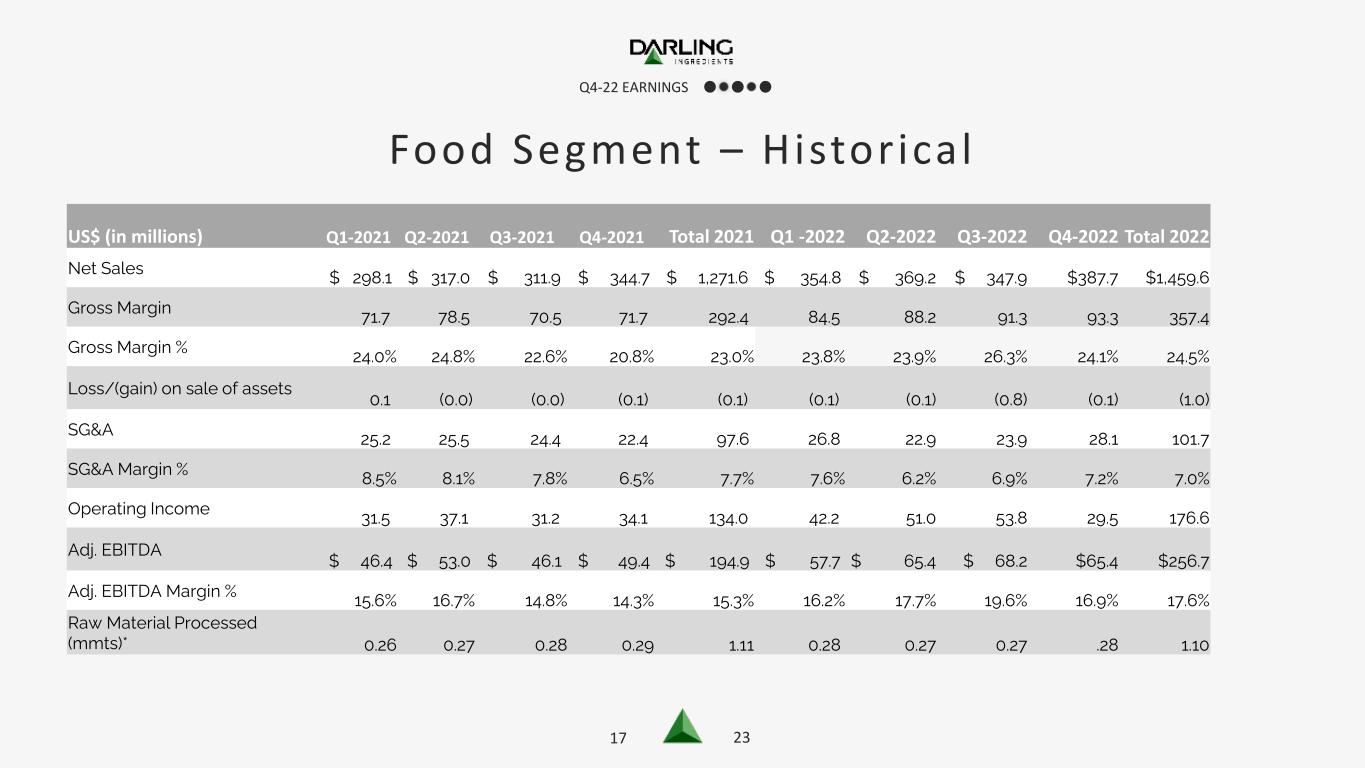

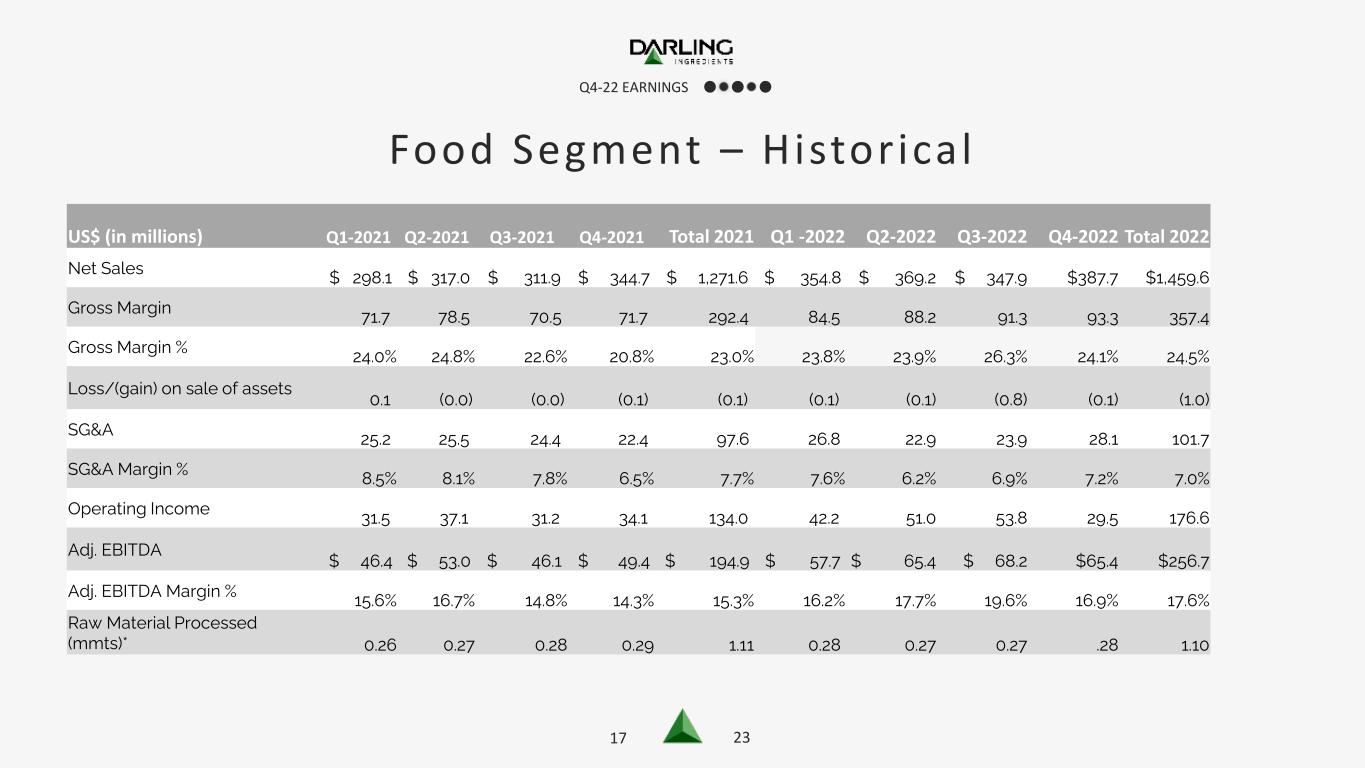

17 23 Q4-22 EARNINGS Food Segment – Historical US$ (in millions) Q1-2021 Q2-2021 Q3-2021 Q4-2021 Total 2021 Q1 -2022 Q2-2022 Q3-2022 Q4-2022 Total 2022 Net Sales $ 298.1 $ 317.0 $ 311.9 $ 344.7 $ 1,271.6 $ 354.8 $ 369.2 $ 347.9 $387.7 $1,459.6 Gross Margin 71.7 78.5 70.5 71.7 292.4 84.5 88.2 91.3 93.3 357.4 Gross Margin % 24.0% 24.8% 22.6% 20.8% 23.0% 23.8% 23.9% 26.3% 24.1% 24.5% Loss/(gain) on sale of assets 0.1 (0.0) (0.0) (0.1) (0.1) (0.1) (0.1) (0.8) (0.1) (1.0) SG&A 25.2 25.5 24.4 22.4 97.6 26.8 22.9 23.9 28.1 101.7 SG&A Margin % 8.5% 8.1% 7.8% 6.5% 7.7% 7.6% 6.2% 6.9% 7.2% 7.0% Operating Income 31.5 37.1 31.2 34.1 134.0 42.2 51.0 53.8 29.5 176.6 Adj. EBITDA $ 46.4 $ 53.0 $ 46.1 $ 49.4 $ 194.9 $ 57.7 $ 65.4 $ 68.2 $65.4 $256.7 Adj. EBITDA Margin % 15.6% 16.7% 14.8% 14.3% 15.3% 16.2% 17.7% 19.6% 16.9% 17.6% Raw Material Processed (mmts)* 0.26 0.27 0.28 0.29 1.11 0.28 0.27 0.27 .28 1.10

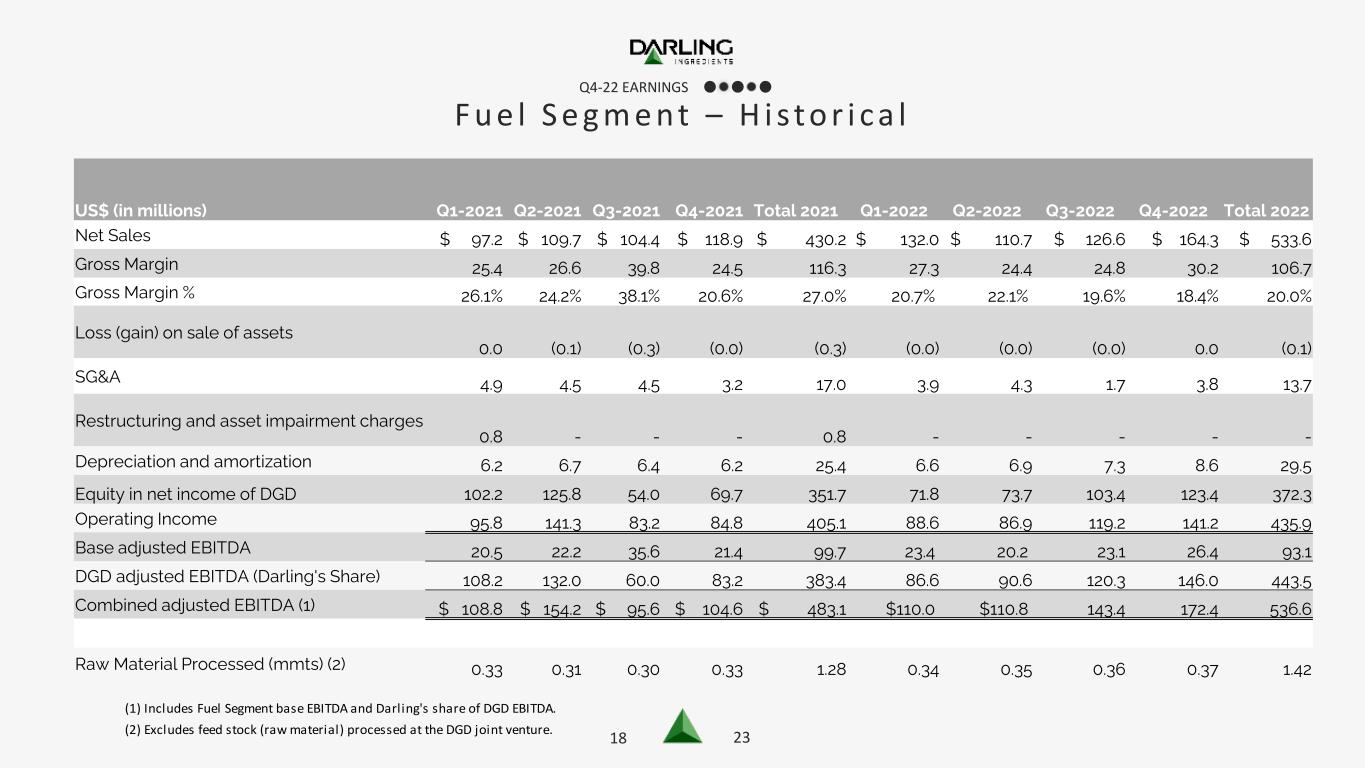

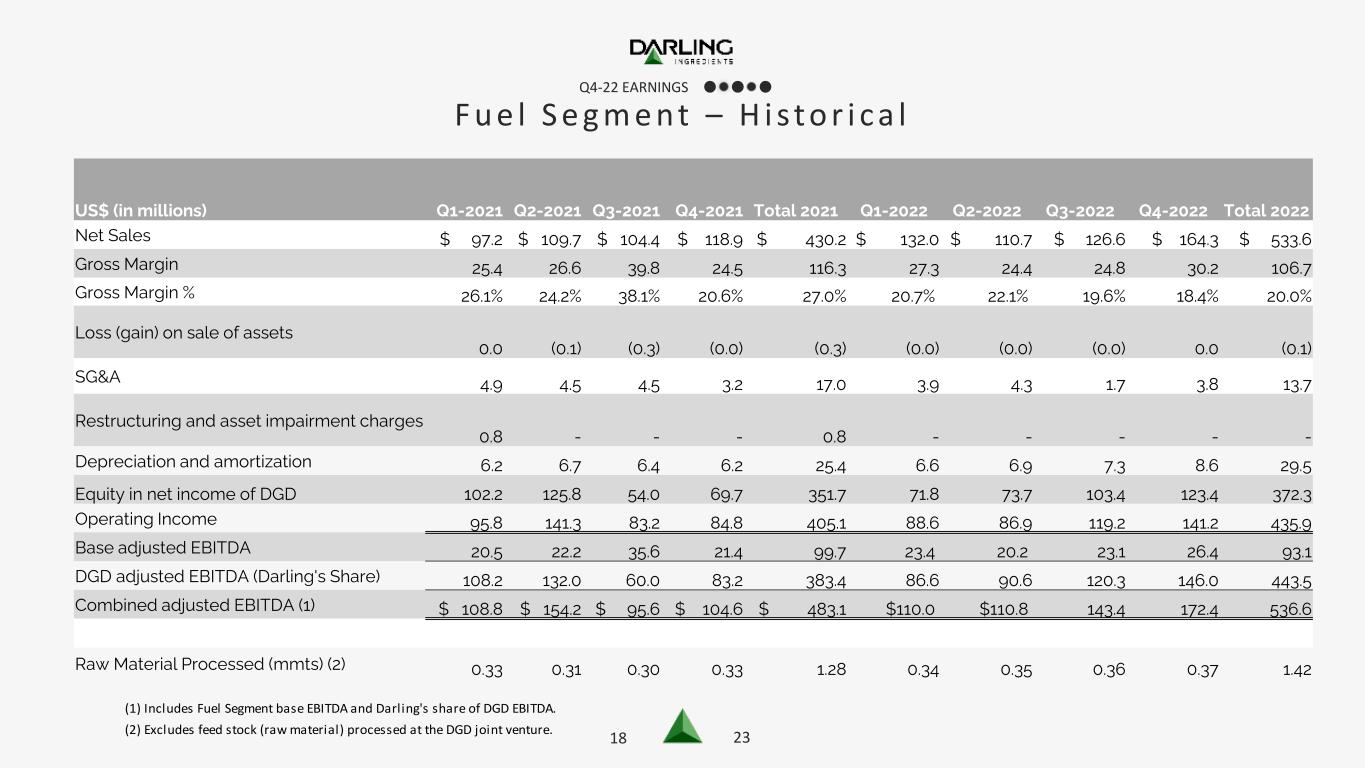

18 23 Q4-22 EARNINGS F u e l S e g m e n t – H i s t o r i c a l (1) Includes Fuel Segment base EBITDA and Darling's share of DGD EBITDA. (2) Excludes feed stock (raw material) processed at the DGD joint venture. US$ (in millions) Q1-2021 Q2-2021 Q3-2021 Q4-2021 Total 2021 Q1-2022 Q2-2022 Q3-2022 Q4-2022 Total 2022 Net Sales $ 97.2 $ 109.7 $ 104.4 $ 118.9 $ 430.2 $ 132.0 $ 110.7 $ 126.6 $ 164.3 $ 533.6 Gross Margin 25.4 26.6 39.8 24.5 116.3 27.3 24.4 24.8 30.2 106.7 Gross Margin % 26.1% 24.2% 38.1% 20.6% 27.0% 20.7% 22.1% 19.6% 18.4% 20.0% Loss (gain) on sale of assets 0.0 (0.1) (0.3) (0.0) (0.3) (0.0) (0.0) (0.0) 0.0 (0.1) SG&A 4.9 4.5 4.5 3.2 17.0 3.9 4.3 1.7 3.8 13.7 Restructuring and asset impairment charges 0.8 - - - 0.8 - - - - - Depreciation and amortization 6.2 6.7 6.4 6.2 25.4 6.6 6.9 7.3 8.6 29.5 Equity in net income of DGD 102.2 125.8 54.0 69.7 351.7 71.8 73.7 103.4 123.4 372.3 Operating Income 95.8 141.3 83.2 84.8 405.1 88.6 86.9 119.2 141.2 435.9 Base adjusted EBITDA 20.5 22.2 35.6 21.4 99.7 23.4 20.2 23.1 26.4 93.1 DGD adjusted EBITDA (Darling's Share) 108.2 132.0 60.0 83.2 383.4 86.6 90.6 120.3 146.0 443.5 Combined adjusted EBITDA (1) $ 108.8 $ 154.2 $ 95.6 $ 104.6 $ 483.1 $110.0 $110.8 143.4 172.4 536.6 Raw Material Processed (mmts) (2) 0.33 0.31 0.30 0.33 1.28 0.34 0.35 0.36 0.37 1.42

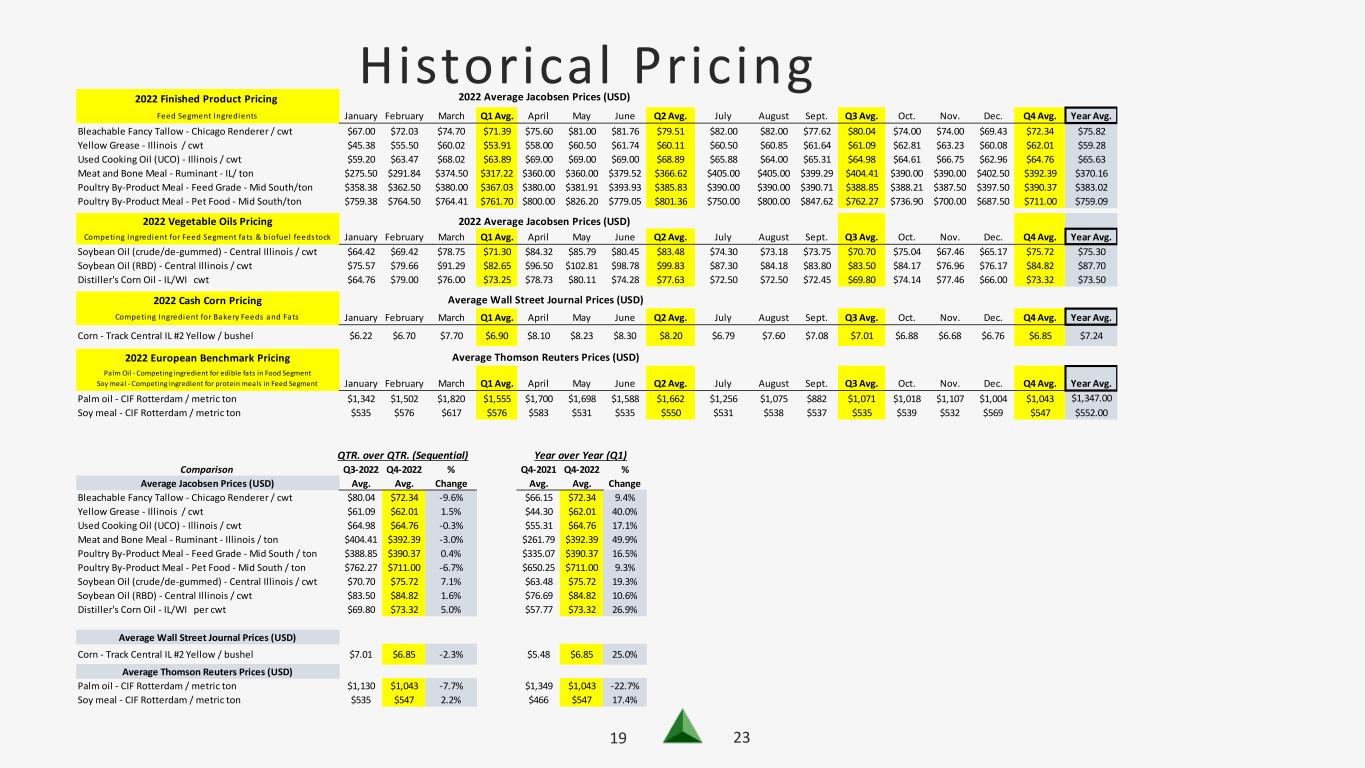

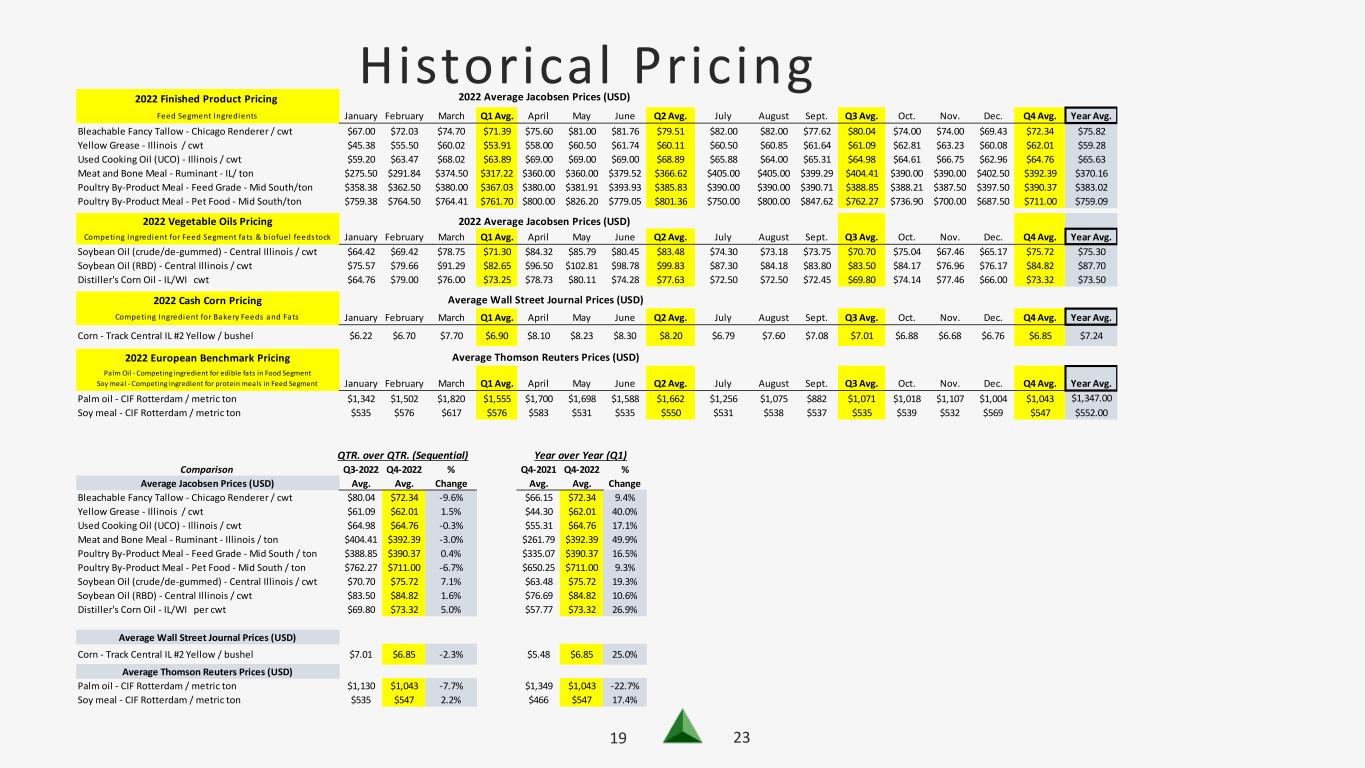

19 23 Historical Pricing 2022 Finished Product Pricing Feed Segment Ingredients January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. Bleachable Fancy Tallow - Chicago Renderer / cwt $67.00 $72.03 $74.70 $71.39 $75.60 $81.00 $81.76 $79.51 $82.00 $82.00 $77.62 $80.04 $74.00 $74.00 $69.43 $72.34 $75.82 Yellow Grease - Illinois / cwt $45.38 $55.50 $60.02 $53.91 $58.00 $60.50 $61.74 $60.11 $60.50 $60.85 $61.64 $61.09 $62.81 $63.23 $60.08 $62.01 $59.28 Used Cooking Oil (UCO) - Illinois / cwt $59.20 $63.47 $68.02 $63.89 $69.00 $69.00 $69.00 $68.89 $65.88 $64.00 $65.31 $64.98 $64.61 $66.75 $62.96 $64.76 $65.63 Meat and Bone Meal - Ruminant - IL/ ton $275.50 $291.84 $374.50 $317.22 $360.00 $360.00 $379.52 $366.62 $405.00 $405.00 $399.29 $404.41 $390.00 $390.00 $402.50 $392.39 $370.16 Poultry By-Product Meal - Feed Grade - Mid South/ton $358.38 $362.50 $380.00 $367.03 $380.00 $381.91 $393.93 $385.83 $390.00 $390.00 $390.71 $388.85 $388.21 $387.50 $397.50 $390.37 $383.02 Poultry By-Product Meal - Pet Food - Mid South/ton $759.38 $764.50 $764.41 $761.70 $800.00 $826.20 $779.05 $801.36 $750.00 $800.00 $847.62 $762.27 $736.90 $700.00 $687.50 $711.00 $759.09 2022 Vegetable Oils Pricing Competing Ingredient for Feed Segment fats & biofuel feedstock January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. Soybean Oil (crude/de-gummed) - Central Illinois / cwt $64.42 $69.42 $78.75 $71.30 $84.32 $85.79 $80.45 $83.48 $74.30 $73.18 $73.75 $70.70 $75.04 $67.46 $65.17 $75.72 $75.30 Soybean Oil (RBD) - Central Illinois / cwt $75.57 $79.66 $91.29 $82.65 $96.50 $102.81 $98.78 $99.83 $87.30 $84.18 $83.80 $83.50 $84.17 $76.96 $76.17 $84.82 $87.70 Distiller's Corn Oil - IL/WI cwt $64.76 $79.00 $76.00 $73.25 $78.73 $80.11 $74.28 $77.63 $72.50 $72.50 $72.45 $69.80 $74.14 $77.46 $66.00 $73.32 $73.50 2022 Cash Corn Pricing Competing Ingredient for Bakery Feeds and Fats January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. Corn - Track Central IL #2 Yellow / bushel $6.22 $6.70 $7.70 $6.90 $8.10 $8.23 $8.30 $8.20 $6.79 $7.60 $7.08 $7.01 $6.88 $6.68 $6.76 $6.85 $7.24 2022 European Benchmark Pricing Palm Oil - Competing ingredient for edible fats in Food Segment Soy meal - Competing ingredient for protein meals in Feed Segment January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg. Palm oil - CIF Rotterdam / metric ton $1,342 $1,502 $1,820 $1,555 $1,700 $1,698 $1,588 $1,662 $1,256 $1,075 $882 $1,071 $1,018 $1,107 $1,004 $1,043 $1,347.00 Soy meal - CIF Rotterdam / metric ton $535 $576 $617 $576 $583 $531 $535 $550 $531 $538 $537 $535 $539 $532 $569 $547 $552.00 QTR. over QTR. (Sequential) Year over Year (Q1) Comparison Q3-2022 Q4-2022 % Q4-2021 Q4-2022 % Average Jacobsen Prices (USD) Avg. Avg. Change Avg. Avg. Change Bleachable Fancy Tallow - Chicago Renderer / cwt $80.04 $72.34 -9.6% $66.15 $72.34 9.4% Yellow Grease - Illinois / cwt $61.09 $62.01 1.5% $44.30 $62.01 40.0% Used Cooking Oil (UCO) - Illinois / cwt $64.98 $64.76 -0.3% $55.31 $64.76 17.1% Meat and Bone Meal - Ruminant - Illinois / ton $404.41 $392.39 -3.0% $261.79 $392.39 49.9% Poultry By-Product Meal - Feed Grade - Mid South / ton $388.85 $390.37 0.4% $335.07 $390.37 16.5% Poultry By-Product Meal - Pet Food - Mid South / ton $762.27 $711.00 -6.7% $650.25 $711.00 9.3% Soybean Oil (crude/de-gummed) - Central Illinois / cwt $70.70 $75.72 7.1% $63.48 $75.72 19.3% Soybean Oil (RBD) - Central Illinois / cwt $83.50 $84.82 1.6% $76.69 $84.82 10.6% Distiller's Corn Oil - IL/WI per cwt $69.80 $73.32 5.0% $57.77 $73.32 26.9% Average Wall Street Journal Prices (USD) Corn - Track Central IL #2 Yellow / bushel $7.01 $6.85 -2.3% $5.48 $6.85 25.0% Average Thomson Reuters Prices (USD) Palm oil - CIF Rotterdam / metric ton $1,130 $1,043 -7.7% $1,349 $1,043 -22.7% Soy meal - CIF Rotterdam / metric ton $535 $547 2.2% $466 $547 17.4% 2022 Average Jacobsen Prices (USD) 2022 Average Jacobsen Prices (USD) Average Wall Street Journal Prices (USD) Average Thomson Reuters Prices (USD)

20 23 Adjusted EBITDA (1) The average rate assumption used in this calculation was the actual average rate for the three months ended December 31, 2022 of €1.00:USD$1.02 and CAD$1.00:USD$0.74, as compared to the average rate for the three months ended January 1, 2022 of €1.00:USD$1.14 and CAD$1.00:USD$0.79, respectively. (2) The average rate assumption used in this calculation was the actual average rate for the twelve months ended December 31, 2022 of €1.00:USD$1.05 and CAD$1.00:USD$0.77, as compared to the average rate for the twelve months ended January 1, 2022 of €1.00:USD$1.18 and CAD$1.00:USD$0.80, respectively. Adjusted EBITDA December 31, January 1, December 31, January 1, (U.S. dollars in thousands) 2022 2022 2022 2022 Net income attributable to Darling 156,560$ 155,754$ 737,690$ 650,914$ Depreciation and amortization 117,384 80,805 394,721 316,387 Interest expense 46,139 14,972 125,566 62,077 Income tax expense 37,995 37,782 146,626 164,106 Restructuring and asset impairment charges 21,109 - 29,666 778 Acquisition and integration costs 2,738 1,396 16,372 1,396 Foreign currency losses 5,272 900 11,277 2,199 Other (income) expense, net (242) 1,341 3,609 4,551 Equity in net income of Diamond Green Diesel (123,448) (69,663) (372,346) (351,627) Equity in net (income) loss of other unconsolidated subsidiaries 831 (1,554) (5,102) (5,753) Net income attributable to noncontrolling interests 2,671 1,843 9,402 6,376 Adjusted EBITDA (Non-GAAP) 267,009$ 223,576$ 1,097,481$ 851,404$ Foreign currency exchange impact 18,134 (1) 59,715 (2) Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP) 285,143$ 223,576$ 1,157,196$ 851,404$ DGD Joint Venture Adjusted EBITDA (Darling's Share) 145,984$ 83,192$ 443,487$ 383,419$ Darling plus Darling's share of DGD Joint Venture Adjusted EBITDA 412,993$ 306,768$ 1,540,968$ 1,234,823$ (1) The average rate assumption used in this calculation was the actual average rate for the three months ended December 31, 2022 of €1.00:USD$1.02 and CAD$1.00:USD$0.74, as compared to the average rate for the three onths ended January 1, 2022 of €1.00:USD$1.14 and CAD$1.00:USD$0.79, respectively. (2) The average rate assumption used in this calculation was the actual average rate for the twelve months ended December 31, 2022 of €1.00:USD$1.05 and CAD$1.00:USD$0.77, as compared to the average rate for the twelve months ended January 1, 2022 of €1.00:USD$1.18 and CAD$1.00:USD$0.80, respectively. Three Months Ended Twelve Months Ended

21 23 EVENT CALENDAR Q4 – 22 Earnings Bank of America Global Ag and Minerals Conference March 1 – Fort Lauderdale, Florida Raymond James Annual Institutional Investors Conference March 7 – Orlando, Florida Scotia Howard Weil Energy Conference March 8 – Miami, Florida 35th Annual Roth Conference March 13 – Dana Point, California Piper Sandler Annual Energy Conference March 21 – Las Vegas, Nevada

22 23 Non-U.S. GAAP Measures Adjusted EBITDA is not a recognized accounting measurement under GAAP; it should not be considered as an alternative to net income, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity and is not intended to be a presentation in accordance with GAAP. Adjusted EBITDA is presented here not as an alternative to net income, but rather as a measure of the Company’s operating performance. Since EBITDA (generally, net income plus interest expense, taxes, depreciation and amortization) is not calculated identically by all companies, this presentation may not be comparable to EBITDA or Adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated in this presentation and represents, for any relevant period, net income/(loss) plus depreciation and amortization, goodwill and long- lived asset impairment, interest expense, income tax provision, other income/(expense) and equity in net loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in evaluating the Company’s operating performance compared to that of other companies in its industry because the calculation of Adjusted EBITDA generally eliminates the effects of financing, income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance. Pro forma Adjusted EBITDA to Foreign Currency is not a recognized accounting measurement under GAAP. The Company evaluates the impact of foreign currency on its adjusted EBITDA. DGD Joint Venture Adjusted EBITDA (Darling's share) is not reflected in the Adjusted EBITDA or the Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP). As a result, the Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other discretionary purposes. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities, 6% Notes, 5.25% Notes and 3.625% Notes that were outstanding at Dec. 31, 2022. However, the amounts shown in this presentation for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities, 6% Notes, 5.25% Notes and 3.625% Notes, as those definitions permit further adjustments to reflect certain other non-recurring costs, non-cash charges and cash dividends from the DGD Joint Venture. Additionally, the Company evaluates the impact of foreign exchange impact on operating cash flow, which is defined as segment operating income (loss) plus depreciation and amortization. Q4– 22 EARNINGS

23 23 Q 4 | F E B R U A R Y 2 7 , 2 0 2 3 EARNINGS REPORT

v3.22.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |