UNITED STATES

SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

|

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934. |

|

For the fiscal year ended: July 29, 2017 |

|

COMMISSION FILE NUMBER: 0-33360 |

VILLAGE SUPER MARKET, INC.

(Exact name of registrant as specified in its charter)

|

| |

NEW JERSEY | 22-1576170 |

(State or other jurisdiction of incorporation or organization) | (I. R. S. Employer Identification No.) |

| |

733 MOUNTAIN AVENUE, SPRINGFIELD, NEW JERSEY | 07081 |

(Address of principal executive offices) | (Zip Code) |

| |

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: (973) 467-2200 |

| |

Securities registered pursuant to Section 12(b) of the Act: |

| |

Class A common stock, no par value | The NASDAQ Stock Market |

(Title of Class) | (Name of exchange on which registered) |

| |

Securities registered pursuant to Section 12(g) of the Act: NONE |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§299.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer o | | Accelerated filer x |

| | |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the Class A common stock of Village Super Market, Inc. held by non-affiliates was approximately $211.8 million and the aggregate market value of the Class B common stock held by non-affiliates was approximately $0.7 million based upon the closing price of the Class A shares on the NASDAQ on January 28, 2017, the last business day of the second fiscal quarter. There are no other classes of voting stock outstanding.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of latest practicable date.

|

| |

| Outstanding at |

Class | October 12, 2017 |

| |

Class A common stock, no par value | 10,078,689 Shares |

Class B common stock, no par value | 4,303,748 Shares |

DOCUMENTS INCORPORATED BY REFERENCE

Information contained in the 2017 definitive Proxy Statement to be filed with the Commission and delivered to security holders in connection with the Annual Meeting scheduled to be held on December 15, 2017 are incorporated by reference into this Form 10-K at Part II, Item 5 and Part III.

PART I

(All dollar amounts are in thousands, except per share and per square foot data).

ITEM I. BUSINESS

GENERAL

Village Super Market, Inc. (the “Company” or “Village”) was founded in 1937. Village operates a chain of 29 ShopRite supermarkets, eighteen of which are located in northern New Jersey, eight in southern New Jersey, two in Maryland and one in northeastern Pennsylvania. The Company is a member of Wakefern Food Corporation ("Wakefern"), the nation's largest retailer-owned food cooperative and owner of the ShopRite name. This relationship provides Village many of the economies of scale in purchasing, distribution, private label products, advanced retail technology, marketing and advertising associated with chains of greater size and geographic coverage.

Village competes by using low pricing, providing a superior customer experience and a broad range of consistently available quality products, including ShopRite private labeled products. The ShopRite Price Plus preferred customer program enables Village to offer continuity programs, focus on target marketing initiatives and to offer discounts and attach digital coupons directly to a customer's Price Plus card.

During fiscal 2017, sales per store were $55,330 and sales per average square foot of selling space were $1,186. The Company gives ongoing attention to the décor and format of its stores and tailors each store's product mix to the preferences of the local community.

Below is a summary of the range of store sizes at July 29, 2017:

|

| |

Total Square Feet | Number of Stores |

| |

Greater than 60,000 | 15 |

50,001 to 60,000 | 7 |

40,000 to 50,000 | 5 |

Less than 40,000 | 2 |

Total | 29 |

These larger store sizes enable the Company’s stores to provide a “one-stop” shopping experience and to feature expanded higher margin specialty departments such as an on-site bakery, an expanded delicatessen, a variety of natural and organic foods, ethnic and international foods, prepared foods and pharmacies. Our stores emphasize a Power Alley, which features high margin, fresh, convenience offerings in an area within the store that provides quick customer entry and exit for those customers shopping for today's lunch or dinner. Certain of our stores include a Village Food Garden, featuring a restaurant style kitchen and a wide variety of store prepared specialty foods for both take-home and in-store dining.

Village also has on-site registered dieticians in seventeen stores that provide customers with free, private consultations on healthy meals and proper nutrition, as well as leading health related events both in store and in the community as part of the Well Everyday program. Expanded services such as a culinary classroom, fitness studio and a learning and childcare center have been incorporated into certain new and expanded stores.

We have thirteen stores that offer ShopRite from Home covering most of the communities served by our stores. ShopRite from Home is an online ordering system that provides for in-store pickup or home delivery. Customers can browse our circular, create and edit shopping lists and use ShopRite from Home through shoprite.com or on their smart phones or tablets through the ShopRite app.

The following table shows the percentage of the Company's sales allocable to various product categories during each of the periods indicated:

|

| | | | | | | | |

Product Categories | |

| 2017 | | 2016 | | 2015 |

Groceries | 36.3 | % | | 36.1 | % | | 36.4 | % |

Dairy and Frozen | 16.8 |

| | 17.0 |

| | 17.3 |

|

Produce | 12.1 |

| | 12.1 |

| | 11.7 |

|

Meats | 10.0 |

| | 10.2 |

| | 10.6 |

|

Non-Foods | 8.4 |

| | 8.4 |

| | 8.2 |

|

Deli and Prepared Food | 7.0 |

| | 6.8 |

| | 6.7 |

|

Pharmacy | 4.5 |

| | 4.5 |

| | 4.2 |

|

Seafood | 2.4 |

| | 2.4 |

| | 2.4 |

|

Bakery | 2.1 |

| | 2.1 |

| | 2.1 |

|

Liquor | 0.4 |

| | 0.4 |

| | 0.4 |

|

| 100 | % | | 100 | % | | 100 | % |

A variety of factors affect the profitability of each of the Company's stores, including competition, size, access and parking, lease terms, management supervision, and the strength of the ShopRite trademark in the local community. Village continually evaluates individual stores to determine if they should be closed, remodeled or replaced.

DEVELOPMENT AND EXPANSION

The Company has an ongoing program to upgrade and expand its supermarket chain. This program has included store remodels as well as the opening or acquisition of additional stores. When remodeling, Village has sought, whenever possible, to increase the amount of selling space in its stores.

Village has budgeted $50 million for capital expenditures for fiscal 2018. Planned expenditures include the construction of a new store in the Bronx, New York, a replacement store, two major remodels, several smaller remodels and various technology upgrade projects.

In fiscal 2017, Village completed a substantial portion of the remodel of the Chester, New Jersey store, several smaller remodels and energy efficient lighting projects in multiple stores.

In fiscal 2016, Village completed the expansion and remodel of the Stirling, New Jersey store, substantially completed one major remodel and completed several smaller remodels.

In fiscal 2015, Village completed a substantial portion of the expansion and remodel of the Stirling, New Jersey store and completed several smaller remodels.

In fiscal 2014, Village completed the construction of a replacement store in Union, New Jersey, and a replacement store in Hanover Township, New Jersey that serves the greater Morristown area and replaced the Morris Plains, New Jersey store.

In fiscal 2013, Village began construction of the replacement store in Hanover Township, New Jersey and completed three major remodels.

Additional store remodels and sites for new stores are in various stages of development. Village will also consider additional acquisitions should appropriate opportunities arise.

WAKEFERN FOOD CORPORATION

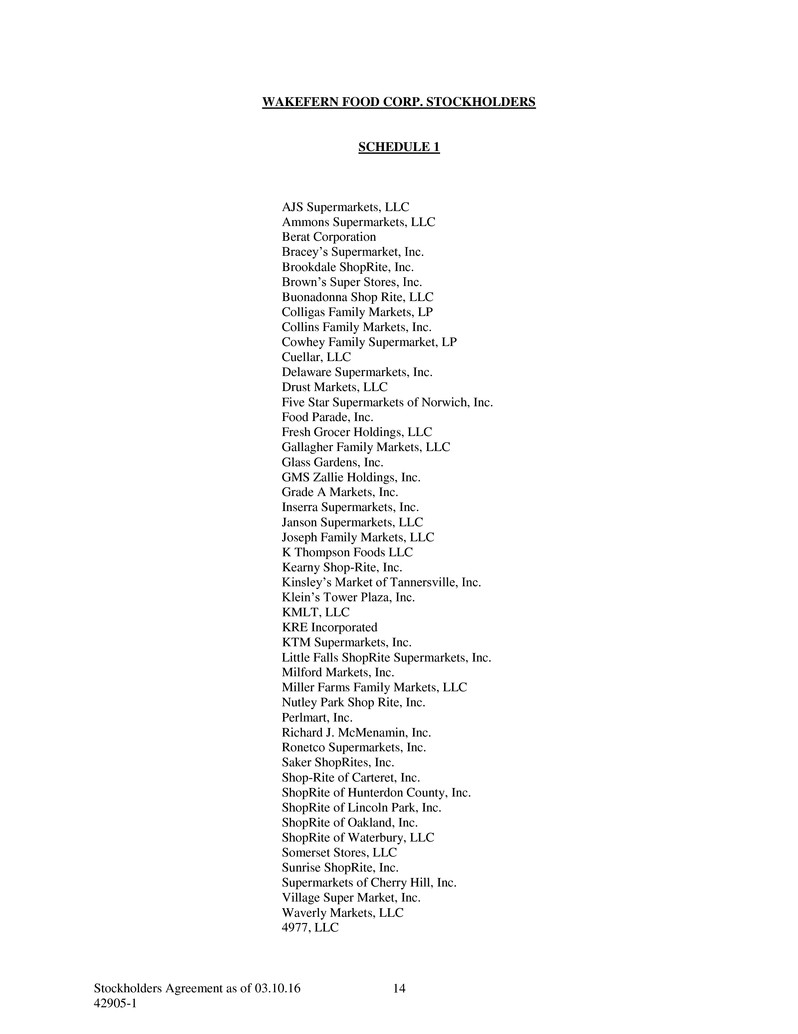

The Company is the second largest member of Wakefern and owns 12.9% of Wakefern’s outstanding stock as of July 29, 2017. Wakefern, which was organized in 1946, is the nation’s largest retailer-owned food cooperative. Wakefern and its 49 shareholder members operate 345 supermarkets and other retail formats, including 96 stores operated by Wakefern. Only Wakefern and its members are entitled to use the ShopRite name and trademark, and to participate in ShopRite advertising and promotional programs.

The principal benefits to the Company from its relationship with Wakefern are the use of the ShopRite name and trademark, volume purchasing, ShopRite private label products, distribution and warehousing economies of scale, ShopRite advertising and promotional programs (including the ShopRite Price Plus card) and the development of advanced retail technology. The Company believes that the ShopRite name is widely recognized by its customers and is a factor in their decisions about where to shop. ShopRite private label products accounted for approximately 11.5% of sales in fiscal 2017.

Wakefern distributes as a "patronage dividend" to each of its stockholders a share of substantially all of its earnings in proportion to the dollar volume of purchases by the stockholder from Wakefern during each fiscal year.

While Wakefern has a substantial professional staff, it operates as a member owned cooperative. Executives of most members make contributions of time to the business of Wakefern. Executives of the Company spend a significant amount of their time working on various Wakefern committees, which oversee and direct Wakefern purchasing, merchandising and other programs. In addition, Nicholas Sumas, the Company’s Chief Marketing Officer, is a member of the Wakefern Board of Directors.

Most of the Company's advertising is developed and placed by Wakefern's professional advertising staff. Wakefern is responsible for all television, radio and major newspaper advertisements. Wakefern bills its members using various formulas which allocate advertising costs in accordance with the estimated proportional benefits to each member from such advertising. The Company also places Wakefern developed materials with local newspapers. In addition, Wakefern and its affiliates provide the Company with other services including liability and property insurance, supplies, certain equipment purchasing, coupon processing, certain financial accounting applications, retail technology support, including shoprite.com and the ShopRite smart phone app, and other store services.

Wakefern operates warehouses and distribution facilities in Elizabeth, Keasbey, Whitehouse, Dayton, Newark and Jamesburg, New Jersey and Gouldsboro and Breinigsville, Pennsylvania. The Company and all other members of Wakefern are parties to the Wakefern Stockholders' Agreement which provides for certain commitments by, and restrictions on, all shareholders of Wakefern. This agreement extends until ten years from the date that stockholders representing 75% of Wakefern sales notify Wakefern that those stockholders request the Wakefern Stockholders' Agreement be terminated. Each member is obligated to purchase from Wakefern a minimum of 85% of its requirements for products offered by Wakefern. If this purchase obligation is not met, the member is required to pay Wakefern's profit contribution shortfall attributable to this failure. The Company fulfilled this obligation in fiscal 2017, 2016 and 2015. This agreement also requires that in the event of unapproved changes in control of the Company or a sale of the Company or of individual Company stores, except to a qualified successor, the Company in such cases must pay Wakefern an amount equal to the annual profit contribution shortfall attributable to the sale of a store or change in control. No payments are required if the volume lost by a shareholder as a result of the sale of a store is replaced by such shareholder by increased volume in existing or new stores. A "qualified successor" must be, or agree to become, a member of Wakefern, and may not own or operate any supermarkets, other than ShopRite, PriceRite or The Fresh Grocer supermarkets, in the states of New York, New Jersey, Pennsylvania, Delaware, Maryland, Virginia, Connecticut, Massachusetts, Rhode Island, Vermont, New Hampshire, Maine or the District of Columbia, or own or operate more than 25 non-ShopRite supermarkets in any other locations in the United States.

Wakefern, under circumstances specified in its bylaws, may refuse to sell merchandise to, and may repurchase the Wakefern stock of, any member. Such circumstances include a member's bankruptcy filing, certain unapproved transfers by a member of its supermarket business or its capital stock in Wakefern, unapproved acquisition by a member of certain supermarket or grocery wholesale supply businesses, the material breach by a member of any provision of the bylaws of Wakefern or any agreement with Wakefern, or a failure to fulfill financial obligations to Wakefern.

Any material change in Wakefern's method of operation or a termination or material modification of the Company's relationship with Wakefern following termination of the above agreements, or otherwise, might have an adverse impact on the conduct of the Company's business and could involve additional expense for the Company. The failure of any Wakefern member to fulfill its obligations under these agreements or a member's insolvency or withdrawal from Wakefern could result in increased costs to remaining members.

Wakefern does not prescribe geographical franchise areas to its members. The specific locations at which the Company, other members of Wakefern, or Wakefern itself, may open new units under the ShopRite, PriceRite and The Fresh Grocer names are, however, subject to the approval of Wakefern's Site Development Committee. This committee is composed of persons who are not employees or members of Wakefern. Committee decisions to deny a site application may be appealed to the Wakefern Board of Directors. Wakefern assists its members in their site selection by providing appropriate demographic data, volume projections and estimates of the impact of the proposed store on existing member supermarkets in the area.

Each of Wakefern's members is required to make capital contributions to Wakefern based on the number of stores operated by that member and the purchases from Wakefern generated by those stores. As additional stores are opened or acquired by a member, additional capital must be contributed by it to Wakefern. The Company’s investment in Wakefern and affiliates was $27,093 at July 29, 2017. The total amount of debt outstanding from all capital pledges to Wakefern is $406 at July 29, 2017. The maximum per store capital contribution increased from $900 to $925 in fiscal 2017, resulting in an additional $626 capital pledge, which was paid in fiscal 2017.

As required by the Wakefern bylaws, the Company’s investment in Wakefern is pledged to Wakefern to secure the Company’s obligations to Wakefern. In addition, five members of the Sumas family have guaranteed the Company’s obligations to Wakefern. These personal guarantees are required of any 5% shareholder of the Company who is active in the operation of the Company. Wakefern does not own any securities of the Company or its subsidiaries. The Company’s investment in Wakefern entitles the Company to enough votes to elect one member to the Wakefern Board of Directors due to cumulative voting rights.

LABOR

As of July 29, 2017, the Company employed approximately 6,552 persons with approximately 74% working part-time. Approximately 91% of the Company’s employees are covered by collective bargaining agreements. Contracts with the Company’s seven unions have expiration dates between July 2017 and July 2021. Approximately 6% of our associates are represented by unions whose contracts have expired or will expire within one year. Most of the Company’s competitors are similarly unionized.

SEASONALITY

The majority of our revenues are generally not seasonal in nature. However, revenues tend to be higher during the major holidays throughout the year.

REGULATORY ENVIRONMENT

The Company’s business requires various licenses and the registration of facilities with state and federal health and drug regulatory agencies. These licenses and registration requirements obligate the Company to observe certain rules and regulations, and a violation of these rules and regulations could result in a suspension or revocation of licenses or registrations and fines or penalties. In addition, most licenses require periodic renewals. The Company has not experienced material difficulties with respect to obtaining or retaining licenses and registrations.

COMPETITION

For the disclosure related to our competition, see Item 1A under the heading “Competitive Environment.”

AVAILABLE INFORMATION

As a member of the Wakefern cooperative, Village relies upon our customer focused website, shoprite.com, for interaction with customers and prospective employees. This website is maintained by Wakefern for the benefit of all ShopRite supermarkets, and therefore does not contain any financial information related to the Company.

The Company will provide paper copies of the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and press releases free of charge upon request to any shareholder. In addition, electronic copies of these filings can be obtained at sec.gov.

ITEM 1A. RISK FACTORS

COMPETITIVE ENVIRONMENT

The supermarket business is highly competitive and characterized by narrow profit margins. Results of operations may be materially adversely impacted by competitive pricing and promotional programs, industry consolidation and competitor store openings. Village competes directly with multiple retail formats both in-store and online, including national, regional and local supermarket chains as well as warehouse clubs, supercenters, drug stores, discount general merchandise stores, fast food chains, restaurants, dollar stores and convenience stores. Some of the Company's principal competitors include Acme, Aldi, Amazon, BJs, Costco, Foodtown, Giant, Kings, Safeway, Stop & Shop, Target, Wal-Mart, Wegmans, Weis and Whole Foods. Competition with

these outlets is based on price, store location, convenience, promotion, product assortment, quality and service. Some of these competitors have greater financial resources, lower merchandise acquisition costs and lower operating expenses than we do.

GEOGRAPHIC CONCENTRATION AND MARKET CONDITIONS

The Company’s stores are concentrated in New Jersey, with two stores in Maryland and one in northeastern Pennsylvania. We are vulnerable to economic downturns in New Jersey in addition to those that may affect the country as a whole. Economic conditions such as inflation, deflation, interest rate fluctuations, movements in energy costs, social programs, minimum wage legislation, unemployment rates and changing demographics may adversely affect our sales and profits. Further, since our store base is concentrated in densely populated metropolitan areas, opportunities for future store expansion may be limited, which may adversely affect our business and results of operations.

WAKEFERN RELATIONSHIP

Village purchases substantially all of its merchandise from Wakefern. In addition, Wakefern provides the Company with support services in numerous areas including advertising, liability and property insurance, supplies, certain equipment purchasing, coupon processing, certain financial accounting applications, retail technology support, and other store services. Further, Village receives patronage dividends and other product incentives from Wakefern.

Any material change in Wakefern’s method of operation or a termination or material modification of Village’s relationship with Wakefern could have an adverse impact on the conduct of the Company’s business and could involve additional expense for Village. The failure of any Wakefern member to fulfill its obligations to Wakefern or a member’s insolvency or withdrawal from Wakefern could result in increased costs to the Company. Additionally, an adverse change in Wakefern’s results of operations could have an adverse effect on Village’s results of operations.

LABOR RELATIONS

Approximately 91% of the Company’s employees are covered by collective bargaining agreements with unions. Contracts with the Company’s seven unions have expiration dates between July 2017 and July 2021. Approximately 6% of our associates are represented by unions whose contracts have expired or will expire within one year. In future negotiations with labor unions, we expect that rising health care and pension costs, among other issues, will continue to be important topics for negotiation. Upon the expiration of our collective bargaining agreements, work stoppages by the affected workers could occur if we are unable to negotiate acceptable contracts with labor unions. This could significantly disrupt our operations or have an adverse impact on our financial results. Further, if we are unable to control health care and pension costs provided for in collective bargaining agreements, we may experience increased operating costs and an adverse impact on our results of operations.

FOOD SAFETY

The Company could be adversely affected if consumers lose confidence in the safety and quality of the food supply chain. Adverse publicity about these types of concerns, whether or not valid, could discourage consumers from buying our products. The real or perceived sale of contaminated food products by us could result in a loss of consumer confidence and product liability claims, which could have a material adverse effect on our sales and operations.

MULTI-EMPLOYER PENSION PLANS

The Company is required to make contributions to multi-employer pension plans in amounts established under collective bargaining agreements. Pension expense for these plans is recognized as contributions are funded. Benefits generally are based on a fixed amount for each year of service. Based on the most recent information available to us, certain of these multi-employer plans are underfunded. As a result, we expect that contributions to these plans may increase. Additionally, the benefit levels and related items will be issues in the negotiation of our collective bargaining agreements. Under current law, an employer that withdraws or partially withdraws from a multi-employer pension plan may incur a withdrawal liability to the plan, which represents the portion of the plan’s underfunding that is allocable to the withdrawing employer under complex actuarial and allocation rules. The failure of an employer to fund these obligations can impact remaining employers. The amount of any increase or decrease in our required contributions to these multi-employer pension plans will depend upon the outcome of collective bargaining, actions taken by trustees who manage the plans, government regulations and the actual return on assets held in the plans, among other factors. See Note 8 to the Consolidated Financial Statements for more information relating to our participation in multi-employer pension plans.

INSURANCE

The Company uses a combination of insurance and self-insurance to provide for potential liability for workers’ compensation, automobile and general liability, property, director and officers’ liability, and certain employee health care benefits. Any projection of losses is subject to a high degree of variability. Changes in legal claims, trends and interpretations, variability in inflation rates, changes in the nature and method of claims settlement, benefit level changes due to changes in applicable laws, and insolvency of insurance carriers could all affect our financial condition, results of operations, or cash flows.

IMPAIRMENT OF LONG-LIVED ASSETS

Our long-lived assets, primarily store property, equipment and fixtures, are subject to periodic testing for impairment. Failure of our asset groups to achieve sufficient levels of cash flow could result in impairment charges on long-lived assets.

TAXES

The Company’s effective tax rate may be impacted by the results of tax examinations and changes in tax laws.

INFORMATION TECHNOLOGY

Wakefern provides all members of the cooperative with information system support that enables us to effectively manage our business data, customer transactions, inventory management, communications and other business processes. These information systems are subject to damage or interruption from power outages, computer or telecommunications failures, computer viruses and related malicious software, catastrophic weather events, or human error. Any material interruption of our or Wakefern’s information systems could have a material adverse impact on our results of operations.

Due to the nature of our business, personal information about our customers, vendors and associates is received and stored in these information systems. In addition, confidential information is transmitted through our ShopRite from Home online business at shoprite.com and through the ShopRite app. Unauthorized parties may attempt to access information stored in or to sabotage or disrupt these systems. Wakefern and the Company maintain substantial security measures to prevent and detect unauthorized access to such information, including utilizing third-party service providers for monitoring our networks, security reviews, and other functions. It is possible that computer hackers, cyber terrorists and others may be able to defeat the security measures in place at the Company, Wakefern or those of third-party service providers.

Any breach of these security measures and loss of confidential information, which could be undetected for a period of time, could damage our reputation with customers, vendors and associates, cause Wakefern and Village to incur significant costs to protect any customers, vendors and associates whose personal data was compromised, cause us to make changes to our information systems and could result in government enforcement actions and litigation against Wakefern and Village from outside parties. Any such breach could have a material adverse impact on our operations, consolidated financial condition, results of operations, and liquidity if the related costs to Wakefern and Village are not covered by or are in excess of carried insurance policies. In addition, a security breach could require Wakefern and Village to devote significant management resources to address problems created by the security breach and restore our reputation.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

As of July 29, 2017, Village owns the sites of six of its supermarkets (containing 412,000 square feet of total space), all of which are freestanding stores, except the Egg Harbor store, which is part of a shopping center. The remaining 23 supermarkets (containing 1,305,000 square feet of total space) and the corporate headquarters are leased, with initial lease terms generally ranging from 20 to 30 years, usually with renewal options. Sixteen of these leased stores are located in shopping centers and the remaining seven are freestanding stores. In October 2015, the Company sold the land and building of a closed store in Washington, New Jersey for $900.

The annual rent, including capitalized leases and closed stores, for all of the Company's leased facilities for the year ended July 29, 2017 was approximately $17,484.

Village is a limited partner in two partnerships, one of which owns a shopping center in which one of our leased stores is located. The Company is also a general partner in a partnership that is a lessor of one of the Company's freestanding stores.

ITEM 3. LEGAL PROCEEDINGS

In prior years, the state of New Jersey issued two separate tax assessments related to nexus beginning in fiscal 2000 and the deductibility of certain payments between subsidiaries beginning in fiscal 2002. The Company had contested both of these assessments through the state’s conference and appeals process and Tax Court. On February 27, 2015, the Company reached an agreement with the New Jersey Division of Taxation (the "Division") whereby the Company paid $33,000 in March 2015 to settle the disputes with the Division for fiscal years 2000 through 2014. The dispute and related settlement with the Division is described in Note 5 to the Consolidated Financial Statements.

Superstorm Sandy devastated our area on October 29, 2012 and resulted in the closure of almost all of our stores for periods of time ranging from a few hours to eight days. Village disposed of substantial amounts of perishable product and also incurred repair, labor and other costs as a result of the storm. The Company has property, casualty and business interruption insurance, subject to deductibles and coverage limits. During fiscal 2013, Wakefern began the process of working with our insurers to recover the damages and Village recorded estimated insurance recoveries of $4,913. In October 2013, Wakefern, as the policy holder, filed suit against the carrier seeking payment of the remaining claims due for all Wakefern members. The suit was the result of different interpretations of policy terms, including whether the policy's named storm deductible applied. On October 29, 2014, the Court issued its opinion on the matter in favor of the carrier. Based on this decision and its related impact, the Company concluded that recovery of further proceeds was not probable and recorded a $2,270 charge to Operating and administrative expense in the first quarter of fiscal 2015 to write-off the remaining insurance receivable. Wakefern continues to pursue further recovery of uncollected amounts from the carrier and other sources. As a result, the Company received an additional $940 in insurance proceeds in February 2016 which was recognized as a reduction in Operating and administrative expense in fiscal 2016. Any further proceeds recovered will be recognized as they are received. As of July 29, 2017, Village has collected $3,583.

The Company is involved in other litigation incidental to the normal course of business. Company management is of the opinion that the ultimate resolution of these legal proceedings should not have a material adverse effect on the consolidated financial position, results of operations or liquidity of the Company.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

(All dollar amounts are in thousands, except per share data).

Stock Price and Dividend Information

The Class A common stock of Village Super Market, Inc. is traded on the NASDAQ Global Select Market under the symbol “VLGEA.” The table below sets forth the high and low last reported sales price for the fiscal quarter indicated.

|

| | | | | | | |

2017 | High | | Low |

4th Quarter | $ | 27.05 |

| | $ | 23.96 |

|

3rd Quarter | 31.03 |

| | 25.98 |

|

2nd Quarter | 36.39 |

| | 29.90 |

|

1st Quarter | 32.84 |

| | 30.02 |

|

2016 | High | | Low |

4th Quarter | $ | 31.64 |

| | $ | 24.40 |

|

3rd Quarter | 26.51 |

| | 23.54 |

|

2nd Quarter | 27.45 |

| | 23.43 |

|

1st Quarter | 29.36 |

| | 23.61 |

|

As of October 1, 2017, there were approximately 790 holders of Class A common stock.

During fiscal 2017, Village paid cash dividends of $12,788. Dividends in fiscal 2017 consist of $1.00 per Class A common share and $.65 per Class B common share.

During fiscal 2016, Village paid cash dividends of $12,634. Dividends in fiscal 2016 consist of $1.00 per Class A common share and $.65 per Class B common share.

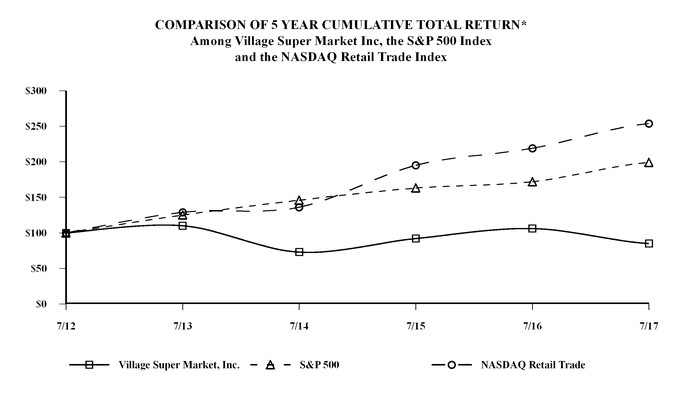

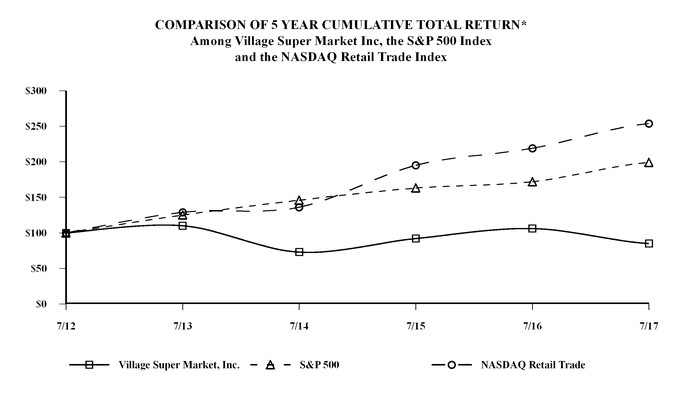

Performance Graph

Set forth below is a graph comparing the cumulative total return on the Company’s Class A stock against the cumulative total return of the S&P 500 Composite Stock Index and the NASDAQ Retail Trade index for the Company’s last five fiscal years. The comparison assumes $100 was invested on July 31, 2012, in shares of our common stock and in each of the indices shown and assumes that all of the dividends were reinvested.

|

| | |

| *$100 invested on July 31, 2012 Assumes dividends are reinvested Fiscal years ending July 31 | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Jul-12 | | Jul-13 | | Jul-14 | | Jul-15 | | Jul-16 | | Jul-17 |

Village Super Market, Inc. | $ | 100 |

| | $ | 110 |

| | $ | 73 |

| | $ | 92 |

| | $ | 106 |

| | $ | 85 |

|

S&P 500 | $ | 100 |

| | $ | 125 |

| | $ | 146 |

| | $ | 163 |

| | $ | 172 |

| | $ | 199 |

|

NASDAQ Retail Trade | $ | 100 |

| | $ | 129 |

| | $ | 136 |

| | $ | 195 |

| | $ | 219 |

| | $ | 254 |

|

The number and average price of shares purchased in each fiscal month of the fourth quarter of fiscal 2017 are set forth in the table below:

|

| | | | | | | | |

Period(1) | | Total Number of Shares Purchased(2) | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

April 30, 2017 to May 27, 2017 | | 9,752 | | $25.76 | | 9,752 | | $2,988,514 |

May 28, 2017 to June 24, 2017 | | 18,524 | | $24.77 | | 18,524 | | $2,529,590 |

June 25, 2017 to July 29, 2017 | | 15,289 | | $23.96 | | 15,289 | | $2,163,277 |

Total | | 43,565 | | $24.71 | | 43,565 | | $2,163,277 |

| |

(1) | The reported periods conform to our fiscal calendar. |

(2) Includes shares repurchased under a $5.0 million repurchase program of the Company's Class A Common Stock authorized by the Board of Directors and announced on June 12, 2015. Repurchases may be made from time-to-time through a variety of methods, including open market purchases and other negotiated transactions, including through plans designed to comply with Rule 10b5-1 under the Securities Exchange Act of 1934.

ITEM 6. SELECTED FINANCIAL DATA

Selected Financial Data

(Dollars in thousands, except per share data and per square foot data).

Fiscal 2016 contains 53 weeks, with the additional week included in the fourth quarter. All other fiscal years contain 52 weeks.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

For year | July 29, 2017 | | July 30,

2016 | | July 25,

2015 | | July 26,

2014 | | July 27,

2013 | |

Sales | $ | 1,604,574 |

| | $ | 1,634,904 |

| | $ | 1,583,789 |

| | $ | 1,518,636 |

| | $ | 1,476,457 |

| |

Net income | 22,921 |

| (1) | 25,044 |

| (2 | ) | 30,620 |

| (3 | ) | 5,045 |

| (4 | ) | 25,784 |

| (5 | ) |

Net income as a % of sales | 1.43 | % | | 1.53 | % | | 1.93 | % | | 0.33 | % | | 1.75 | % | |

Net income per share: | |

| | |

| | |

| | |

| | |

| |

Class A common stock: | |

| | |

| | |

| | |

| | |

| |

Basic | $ | 1.80 |

| | $ | 1.98 |

| | $ | 2.44 |

| | $ | 0.41 |

| | $ | 2.18 |

| |

Diluted | 1.60 |

| | 1.77 |

| | 2.16 |

| | 0.36 |

| | 1.85 |

| |

Class B common stock: | |

| | |

| | |

| | |

| | |

| |

Basic | 1.16 |

| | 1.29 |

| | 1.58 |

| | 0.26 |

| | 1.36 |

| |

Diluted | 1.16 |

| | 1.29 |

| | 1.58 |

| | 0.26 |

| | 1.36 |

| |

Cash dividends per share: | |

| | |

| | |

| | |

| | |

| |

Class A | 1.000 |

| | 1.000 |

| | 1.000 |

| | 1.000 |

| | 2.000 |

| |

Class B | 0.650 |

| | 0.650 |

| | 0.650 |

| | 0.650 |

| | 1.300 |

| |

| | | | | | | | | | |

At year-end | |

| | |

| | |

| | |

| | |

| |

Total assets | $ | 455,225 |

| | $ | 450,254 |

| | $ | 431,889 |

| | $ | 457,412 |

| | $ | 427,412 |

| |

Long-term debt | 42,646 |

| | 43,561 |

| | 44,425 |

| | 45,242 |

| | 42,738 |

| |

Working capital | 85,279 |

| | 60,538 |

| | 41,760 |

| | 16,782 |

| | 94,299 |

| |

Shareholders’ equity | 286,820 |

| | 271,735 |

| | 252,767 |

| | 233,136 |

| | 244,560 |

| |

Book value per share | 19.93 |

| | 19.20 |

| | 17.84 |

| | 16.59 |

| | 17.66 |

| |

| | | | | | | | | | |

Other data | |

| | |

| | |

| | |

| | |

| |

Same store sales trend (6) | 0.0 | % | | 1.4 | % | | 2.1 | % | | 0.2 | % | | 2.9 | % | |

Total square feet | 1,717,000 |

| | 1,717,000 |

| | 1,717,000 |

| | 1,700,000 |

| | 1,644,000 |

| |

Average total sq. ft. per store | 59,000 |

| | 59,000 |

| | 59,000 |

| | 59,000 |

| | 57,000 |

| |

Selling square feet | 1,353,000 |

| | 1,353,000 |

| | 1,353,000 |

| | 1,339,000 |

| | 1,295,000 |

| |

Sales per average square foot of selling space | $ | 1,186 |

| | $ | 1,208 |

| | $ | 1,177 |

| | $ | 1,153 |

| | $ | 1,140 |

| |

Number of stores | 29 |

| | 29 |

| | 29 |

| | 29 |

| | 29 |

| |

Sales per average number of stores | $ | 55,330 |

| | $ | 56,376 |

| | $ | 54,613 |

| | $ | 52,367 |

| | $ | 50,912 |

| |

Capital expenditures and acquisitions | 27,726 |

| | 19,971 |

| | 23,517 |

| | 50,322 |

| | 21,888 |

| |

(1) Includes a $465 (net of tax) non-recurring credit received related to multi-employer health and welfare benefits.

(2) Includes estimated net income of $280 due to the fiscal year including a 53rd week and a $545 (net of tax) gain due to the recovery of insurance receivables related to Superstorm Sandy.

(3) Includes a charge to write-off insurance receivables related to Superstorm Sandy of $1,340 (net of tax), a $316 (net of tax) impairment charge related to the property of a closed store and a tax benefit of $6,452 related to settlement of the New Jersey tax dispute, net of interest and penalties accrued prior to settlement.

(4) Includes a $10,052 charge related to tax positions taken in prior years due to an unfavorable ruling by the New Jersey Tax Court, a higher tax rate due to $1,557 of accrued interest and penalties related to the New Jersey tax dispute, a charge for future

lease obligations due to the closure of the Morris Plains and Union stores of $2,551 (net of tax) and pre-opening costs for the replacement stores in greater Morristown and Union of $1,141 (net of tax).

(5) Includes income from a partnership distribution of $840 (net of tax), income from the national credit card lawsuit of $693 (net of tax) and a charge for the settlement of a landlord dispute of $376 (net of tax).

(6) The change in same store sales in fiscal 2017 and 2016 excludes the impact of the 53rd week in fiscal 2016.

Unaudited Quarterly Financial Data

(Dollars in thousands except per share amounts).

|

| | | | | | | | | | | | | | | | | | | |

| First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter (1) | | Fiscal Year |

2017 | | | | | | | | | |

Sales | $ | 389,692 |

| | $ | 412,215 |

| | $ | 391,984 |

| | $ | 410,683 |

| | $ | 1,604,574 |

|

Gross profit | 104,648 |

| | 111,238 |

| | 108,336 |

| | 112,489 |

| | 436,711 |

|

Net income | 4,109 |

| | 5,992 |

| | 6,015 |

| | 6,805 |

| | 22,921 |

|

Net income per share: | |

| | |

| | |

| | |

| | |

|

Class A common stock: | |

| | |

| | |

| | |

| | |

|

Basic | 0.32 |

| | 0.47 |

| | 0.47 |

| | 0.53 |

| | 1.80 |

|

Diluted | 0.29 |

| | 0.42 |

| | 0.42 |

| | 0.47 |

| | 1.60 |

|

Class B common stock: | |

| | |

| | |

| | |

| | |

|

Basic | 0.21 |

| | 0.31 |

| | 0.30 |

| | 0.34 |

| | 1.16 |

|

Diluted | 0.21 |

| | 0.31 |

| | 0.30 |

| | 0.34 |

| | 1.16 |

|

| | | | | | | | | |

2016 | |

| | |

| | |

| | |

| | |

|

Sales | $ | 389,529 |

| | $ | 420,170 |

| | $ | 387,905 |

| | $ | 437,300 |

| | $ | 1,634,904 |

|

Gross profit | 105,487 |

| | 112,726 |

| | 106,738 |

| | 120,079 |

| | 445,030 |

|

Net income | 4,430 |

| | 6,284 |

| | 5,882 |

| | 8,448 |

| | 25,044 |

|

Net income per share: | |

| | |

| | |

| | |

| | |

|

Class A common stock: | |

| | |

| | |

| | |

| | |

|

Basic | 0.35 |

| | 0.50 |

| | 0.47 |

| | 0.67 |

| | 1.98 |

|

Diluted | 0.31 |

| | 0.44 |

| | 0.42 |

| | 0.60 |

| | 1.77 |

|

Class B common stock: | |

| | |

| | |

| | |

| | |

|

Basic | 0.23 |

| | 0.32 |

| | 0.30 |

| | 0.43 |

| | 1.29 |

|

Diluted | 0.23 |

| | 0.32 |

| | 0.30 |

| | 0.43 |

| | 1.29 |

|

(1) The Fourth Quarter of fiscal 2016 contains 14 weeks.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Dollars in thousands, except per share and per square foot data).

OVERVIEW

Village Super Market, Inc. (the “Company” or “Village”) operates a chain of 29 ShopRite supermarkets in New Jersey, Maryland and northeastern Pennsylvania. Village is the second largest member of Wakefern Food Corporation (“Wakefern”), the nation’s largest retailer-owned food cooperative and owner of the ShopRite name. This ownership interest in Wakefern provides Village with many of the economies of scale in purchasing, distribution, advanced retail technology, marketing and advertising associated with larger chains.

The supermarket industry is highly competitive and characterized by narrow profit margins. The Company competes directly with multiple retail formats, both in-store and online, including national, regional and local supermarket chains as well as warehouse clubs, supercenters, drug stores, discount general merchandise stores, fast food chains, restaurants, dollar stores and convenience stores. Village competes by using low pricing, providing a superior customer experience and a broad range of consistently available

quality products, including ShopRite private labeled products. The ShopRite Price Plus preferred customer program enables Village to offer continuity programs, focus on target marketing initiatives and to offer discounts and attach digital coupons directly to a customer's Price Plus card.

The Company’s stores, six of which are owned, average 59,000 total square feet. These larger store sizes enable the Company’s stores to provide a “one-stop” shopping experience and to feature expanded higher margin specialty departments such as an on-site bakery, an expanded delicatessen, a variety of natural and organic foods, ethnic and international foods, prepared foods and pharmacies.

Many of our stores emphasize a Power Alley, which features high margin, fresh, convenience offerings in an area within the store that provides quick customer entry and exit for those customers shopping for today's lunch or dinner. Certain of our stores include the Village Food Garden concept featuring a restaurant style kitchen, and several kiosks offering a wide variety of store prepared specialty foods for both take-home and in-store dining.

Village also has on-site registered dieticians in seventeen stores that provide customers with free, private consultations on healthy meals and proper nutrition, as well as leading health related events both in store and in the community as part of the Well Everyday program. We have thirteen stores that offer ShopRite from Home covering most of the communities served by our stores. ShopRite from Home is an online ordering system that provides for in-store pickup or home delivery. Customers can browse our circular, create and edit shopping lists and use ShopRite from Home through shoprite.com or on their smart phones or tablets through the ShopRite app.

We consider a variety of indicators to evaluate our performance, such as same store sales; percentage of total sales by department (mix); shrink; departmental gross profit percentage; sales per labor hour; units per labor hour; and hourly labor rates.

The Company utilizes a 52 - 53 week fiscal year, ending on the last Saturday in the month of July. Fiscal 2017 and 2015 contain 52 weeks. Fiscal 2016 contains 53 weeks.

RESULTS OF OPERATIONS

The following table sets forth the components of the Consolidated Statements of Operations of the Company as a percentage of sales:

|

| | | | | | | | |

| July 29, 2017 | | July 30, 2016 | | July 25, 2015 |

Sales | 100.00 | % | | 100.00 | % | | 100.00 | % |

Cost of sales | 72.78 | % | | 72.78 | % | | 72.65 | % |

Gross profit | 27.22 | % | | 27.22 | % | | 27.35 | % |

Operating and administrative expense | 23.15 | % | | 23.04 | % | | 23.13 | % |

Depreciation and amortization | 1.53 | % | | 1.47 | % | | 1.47 | % |

Operating income | 2.54 | % | | 2.71 | % | | 2.75 | % |

Interest expense | (0.28 | )% | | (0.27 | )% | | (0.29 | )% |

Interest income | 0.18 | % | | 0.15 | % | | 0.15 | % |

Income before income taxes | 2.44 | % | | 2.59 | % | | 2.61 | % |

Income taxes | 1.01 | % | | 1.06 | % | | 0.68 | % |

Net income | 1.43 | % | | 1.53 | % | | 1.93 | % |

SALES

Sales were $1,604,574 in fiscal 2017, a decrease of $30,330, or 1.9% from fiscal 2016. Sales decreased due primarily to fiscal 2016 containing 53 weeks. Same store sales, excluding the impact of the 53rd week in fiscal 2016, were flat. Same store sales increased due primarily to three competitor store closings and sales growth in recently remodeled and expanded stores in Stirling and Chester. These increases were offset primarily by four competitor store openings and deflation, particularly in the meat, produce and dairy departments. New stores and replacement stores are included in same store sales in the quarter after the store has been in operation for four full quarters. Store renovations and expansions are included in same store sales immediately.

Sales were $1,634,904 in fiscal 2016, an increase of $51,115, or 3.2% from fiscal 2015. Sales increased $29,233, or 1.8%, due to fiscal 2016 containing 53 weeks. Same store sales, excluding the impact of the 53rd week, increased 1.4%. Same store sales increased due to the closing of two competitor stores and continued sales growth in the expanded or replaced stores in Stirling, Greater Morristown and Union. These increases were partially offset by six new competitor store openings, including stores formerly operated by A&P.

GROSS PROFIT

Gross profit as a percentage of sales was flat in fiscal 2017 compared to fiscal 2016. Increased departmental gross margin percentages (.09%) and more favorable product mix (.02%) were offset by decreased patronage dividends (.07%) and higher promotional spending (.04%).

Gross profit as a percentage of sales decreased .13% in fiscal 2016 compared to fiscal 2015 primarily due to decreased departmental gross margin percentages (.21%) and increased warehouse assessment charges from Wakefern (.04%). These decreases were partially offset by lower promotional spending (.07%), improved mix (.02%) and higher patronage dividends (.02%).

OPERATING AND ADMINISTRATIVE EXPENSE

Operating and administrative expense as a percentage of sales increased .11% in fiscal 2017 compared to fiscal 2016. Fiscal 2017 includes a non-recurring credit received related to multi-employer health and welfare benefits (.05%) and fiscal 2016 includes a gain for Superstorm Sandy insurance proceeds received (.06%). Excluding these items from both periods, operating and administrative expense as a percentage of sales increased .10% compared to fiscal 2016 primarily due to higher payroll (.30%) partially offset by decreased fringe benefit costs (.11%). Payroll costs increased due primarily to reduced operating leverage as a result of flat same store sales and investments in service departments, including the newly remodeled Chester store. Fringe benefit costs decreased due primarily to lower non-union pension expense (.15%) and lower healthcare costs (.08%).

Operating and administrative expense as a percentage of sales decreased .09% in fiscal 2016 compared to fiscal 2015. As described in note 9 to the consolidated financial statements, fiscal 2015 includes a charge to write-off all remaining Superstorm Sandy insurance receivables (.14%) and fiscal 2016 includes a gain related to recovery of a portion of those receivables (.06%). Excluding these items from both periods, Operating and administrative expense as a percentage of sales increased .11% due primarily to higher claim costs in our self-insured medical plan (.11%) and legal and consulting fees (.13%). These increases were partially offset by lower workers compensation costs (.14%).

DEPRECIATION AND AMORTIZATION

Depreciation and amortization expense was $24,482, $24,101 and $23,330 in fiscal 2017, 2016 and 2015, respectively. Depreciation and amortization expense increased in fiscal 2017 and 2016 compared to the prior years due to depreciation related to capital expenditures.

INTEREST EXPENSE

Interest expense was $4,452, $4,495 and $4,535, in fiscal 2017, 2016 and 2015, respectively. Interest expense was flat in fiscal 2017 compared to fiscal 2016 and fiscal 2015.

INTEREST INCOME

Interest income was $2,841, $2,506 and $2,399 in fiscal 2017, 2016 and 2015, respectively. Interest income increased in both fiscal 2017 and 2016 compared to fiscal 2015 due primarily to higher interest rates earned on variable rate investments and higher amounts invested.

INCOME TAXES

The Company’s effective income tax rate was 41.4%, 40.8% and 26.0% in fiscal 2017, 2016 and 2015, respectively.

Income taxes in fiscal 2015 include a tax benefit of $6,452 related to the settlement with the New Jersey Division of Taxation, net of $841 of interest and penalties accrued prior to settlement. Excluding these items, the effective income tax rate was 41.6% in fiscal 2015. The effective income tax rate in fiscal 2016 was lower than both fiscal 2017 and 2015 due primarily to increased Work Opportunity Tax Credits.

The dispute and related settlement with the New Jersey Division of Taxation is described in Note 5 to the Consolidated Financial Statements.

NET INCOME

Net income was $22,921 in fiscal 2017 compared to $25,044 in fiscal 2016. Fiscal 2017 includes a $465 (net of tax) non-recurring credit received related to multi-employer health and welfare benefits. Fiscal 2016 includes estimated net income of $280 due to the fiscal year including a 53rd week and a $545 (net of tax) gain due to the recovery of insurance receivables related to Superstorm Sandy. Excluding these items from both periods, net income decreased 7% in fiscal 2017 compared to fiscal 2016 due primarily to flat same store sales and increased operating expenses.

Net income was $25,044 in fiscal 2016 compared to $30,620 in fiscal 2015. Fiscal 2016 includes estimated net income of $280 due to the fiscal year including a 53rd week and a $545 (net of tax) gain due to the recovery of insurance receivables related to Superstorm Sandy. Fiscal 2015 includes a charge to write-off all remaining insurance receivables related to Superstorm Sandy of $1,340 (net of tax), a $316 (net of tax) impairment charge related to the property of a closed store and a tax benefit of $6,452 related to settlement of the New Jersey tax dispute, net of interest and penalties accrued prior to settlement. Excluding these items from both periods, net income decreased 6% in fiscal 2016 compared to the prior year primarily due to a lower gross profit percentage and higher operating and administrative expense.

CRITICAL ACCOUNTING POLICIES

Critical accounting policies are those accounting policies that management believes are important to the portrayal of the Company’s financial condition and results of operations. These policies require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

IMPAIRMENT

The Company reviews the carrying values of its long-lived assets, such as property, equipment and fixtures for possible impairment whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. Such review analyzes the undiscounted estimated future net cash flows from asset groups at the store level to determine if the carrying value of such assets are recoverable from their respective cash flows. If impairment is indicated, it is measured by comparing the fair value of the long-lived asset groups, which include long-term leases, to their carrying value.

Goodwill is tested for impairment at the end of each fiscal year, or more frequently if circumstances dictate. The Company utilizes valuation techniques, such as earnings multiples, in addition to the Company’s market capitalization, to assess goodwill for impairment. Calculating the fair value of a reporting unit requires the use of estimates. Management believes the fair value of Village’s one reporting unit exceeds its carrying value at July 29, 2017. Should the Company’s carrying value of its one reporting unit exceed its fair value, the amount of any resulting goodwill impairment may be material to the Company’s financial position and results of operations.

PATRONAGE DIVIDENDS

As a stockholder of Wakefern, Village earns a share of Wakefern’s earnings, which are distributed as a “patronage dividend.” This dividend is based on a distribution of substantially all of Wakefern’s operating profits for its fiscal year (which ends on or about September 30) in proportion to the dollar volume of purchases by each member from Wakefern during that fiscal year. Patronage dividends are recorded as a reduction of cost of sales as merchandise is sold. Village accrues estimated patronage dividends due from Wakefern quarterly based on an estimate of the annual Wakefern patronage dividend and an estimate of Village’s share of this annual dividend based on Village’s estimated proportional share of the dollar volume of business transacted with Wakefern that year. The patronage dividend receivable based on these estimates was $12,655 and $13,185 at July 29, 2017 and July 30, 2016, respectively.

PENSION PLANS

The determination of the Company’s obligation and expense for Company-sponsored pension plans is dependent, in part, on Village’s selection of assumptions used by actuaries in calculating those amounts. These assumptions are described in Note 8 to the Consolidated Financial Statements and include, among others, the discount rate, the expected long-term rate of return on plan assets and the rate of increase in compensation costs. Actual results that differ from the Company’s assumptions are accumulated and amortized over future periods and, therefore, generally affect recognized expense in future periods. While management believes that its assumptions are appropriate, significant differences in actual experience or significant changes in the Company’s assumptions may materially affect cash flows, pension obligations and future expense.

The objective of the discount rate assumption is to reflect the rate at which the Company’s pension obligations could be effectively settled based on the expected timing and amounts of benefits payable to participants under the plans. Our methodology for selecting the discount rate as of July 29, 2017 was to match the plans' cash flows to that of a yield curve on high-quality fixed-income investments. Based on this method, we utilized a weighted-average discount rate of 3.60% at July 29, 2017 compared to 3.08% at July 30, 2016. Changes in the discount rate and the mortality table utilized decreased the projected benefit obligation by approximately $7,567 at July 29, 2017. Village evaluated the expected long-term rate of return on plan assets of 7.5% and the expected increase in compensation costs of 4 to 4.5% and concluded no changes in these assumptions were necessary in estimating pension plan obligations and expense.

Sensitivity to changes in the major assumptions used in the calculation of the Company’s pension plans is as follows:

|

| | | | | | | | | | | | | | | |

| Percentage point change | | Projected benefit obligation decrease (increase) | | Expense decrease (increase) |

Discount rate | + / - 1.0 % | | $ | 9,503 |

| $ | (11,951 | ) | | $ | 605 |

| $ | (737 | ) |

Expected return on assets | + / - 1.0 % | | $ | — |

| — |

| | $ | 547 |

| $ | (550 | ) |

Village contributed $3,000 and $3,524 in fiscal 2017 and 2016, respectively, to these Company-sponsored pension plans. Village expects to contribute $3,500 in fiscal 2018 to these plans. Substantially all contributions in 2017 and 2016 are voluntary contributions.

UNCERTAIN TAX POSITIONS

The Company is subject to periodic audits by various taxing authorities. These audits may challenge certain of the Company’s tax positions such as the timing and amount of deductions and the allocation of income to various tax jurisdictions. Accounting for these uncertain tax positions requires significant management judgment. Actual results could materially differ from these estimates and could significantly affect the effective tax rate and cash flows in future years.

On February 27, 2015, the Company reached an agreement with the New Jersey Division of Taxation to settle the disputes related to nexus and the deductibility of certain payments between subsidiaries for fiscal years 2000 through 2014. See Note 5 to the Consolidated Financial Statements for further information.

RECENTLY ISSUED ACCOUNTING STANDARDS

For the disclosure related to recently issued accounting standards, see Note 1 to the Consolidated Financial Statements.

LIQUIDITY and CAPITAL RESOURCES

CASH FLOWS

Net cash provided by operating activities was $46,153 in fiscal 2017 compared to $64,101 in fiscal 2016 and $17,468 in fiscal 2015. Net cash provided by operating activities was generated primarily by changes in working capital and net income adjusted for non-cash items including depreciation and amortization, share-based compensation, deferred taxes and the provision to value inventories at LIFO.

The decrease in non-cash items in fiscal 2017 and 2016, compared to fiscal 2015, was primarily due to the impact on deferred taxes in fiscal 2015 resulting from the $33,000 settlement with the New Jersey Division of Taxation.

Working capital changes increased (decreased) net cash provided by operating activities by $(6,551), $12,002 and $(54,616) in fiscal 2017, 2016 and 2015, respectively. Working capital changes in income taxes receivable/payable, merchandise inventories, accounts payable to Wakefern and other assets and liabilities decreased cash provided by operating activities in fiscal 2017 compared to fiscal 2016. Working capital changes in income taxes receivable/payable, merchandise inventories, accounts payable to Wakefern and accrued wages and benefits increased cash provided by operating activities in fiscal 2016 compared to fiscal 2015. The decrease in income taxes receivable/payable in fiscal 2015 was due primarily to the $33,000 settlement with the New Jersey Division of Taxation.

During fiscal 2017, Village used cash to fund capital expenditures of $27,726, dividends of $12,788, treasury stock purchases of $4,081 and invested an additional $1,945 in notes receivable from Wakefern. Capital expenditures primarily includes costs associated with the completion of the remodel of the Chester, New Jersey store, several smaller remodels of other existing stores and certain energy efficient lighting projects.

During fiscal 2016, Village used cash to fund capital expenditures of $19,971, dividends of $12,634, treasury stock purchases of $978 and invested an additional $1,314 in notes receivable from Wakefern. Capital expenditures primarily includes costs associated with the completion of the remodel and expansion of the Stirling, New Jersey store, one major remodel and several smaller remodels of other existing stores. In October 2015, Village sold the land and building of a closed store in Washington, New Jersey for $900.

During fiscal 2015, Village used cash to fund capital expenditures of $23,517, dividends of $12,577 and invested an additional $823 in notes receivable from Wakefern. Capital expenditures primarily include costs associated with the major remodel and expansion of the Stirling, New Jersey store and smaller remodels of other existing stores.

LIQUIDITY and DEBT

Working capital was $85,279, $60,538, and $41,760 at July 29, 2017, July 30, 2016 and July 25, 2015, respectively. Working capital ratios at the same dates were 1.89, 1.61, and 1.44 to one, respectively. The increase in working capital in fiscal 2017 compared to fiscal 2016 is due primarily to $22,118 in notes receivable from Wakefern that have been reclassified to current assets as they are due on August 15, 2017. The increase in working capital in fiscal 2016 compared to fiscal 2015 is due primarily to operating cash flows in excess of capital expenditures and dividends. The Company’s working capital needs are reduced, since inventories are generally sold by the time payments to Wakefern and other suppliers are due.

Village has budgeted approximately $50,000 for capital expenditures in fiscal 2018. Planned expenditures include construction of a new store in the Bronx, New York, a replacement store, two major remodels, several smaller remodels and various technology upgrade projects. The Company’s primary sources of liquidity in fiscal 2018 are expected to be cash and cash equivalents on hand at July 29, 2017 and operating cash flow generated in fiscal 2018.

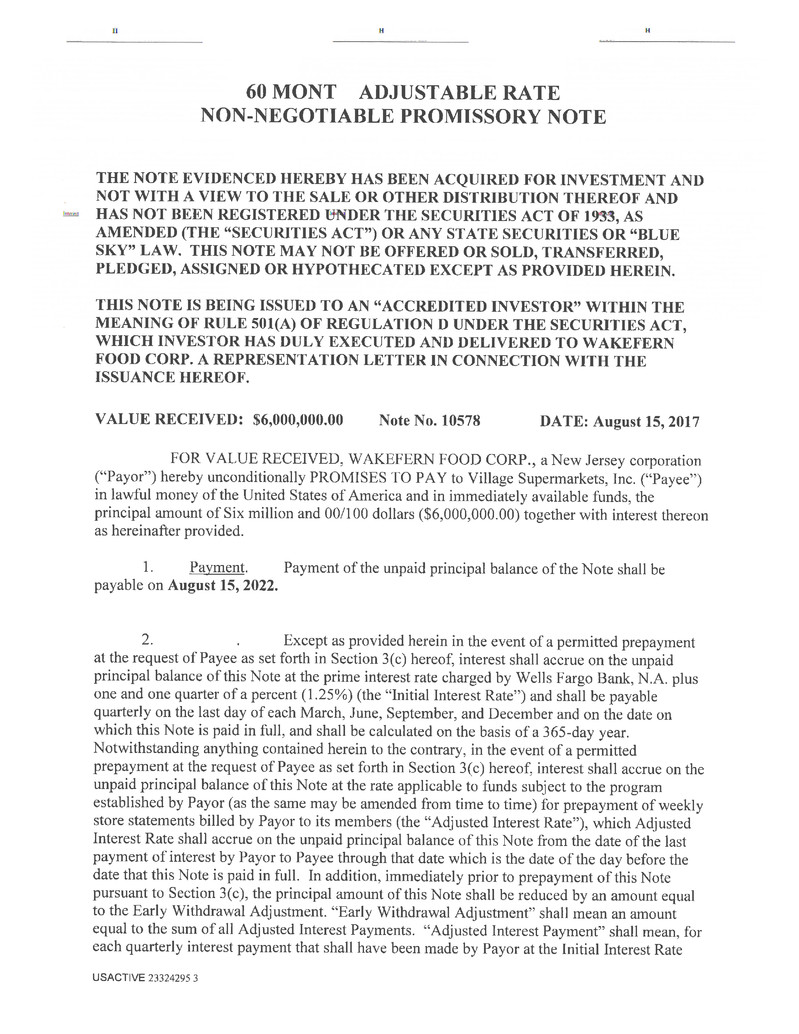

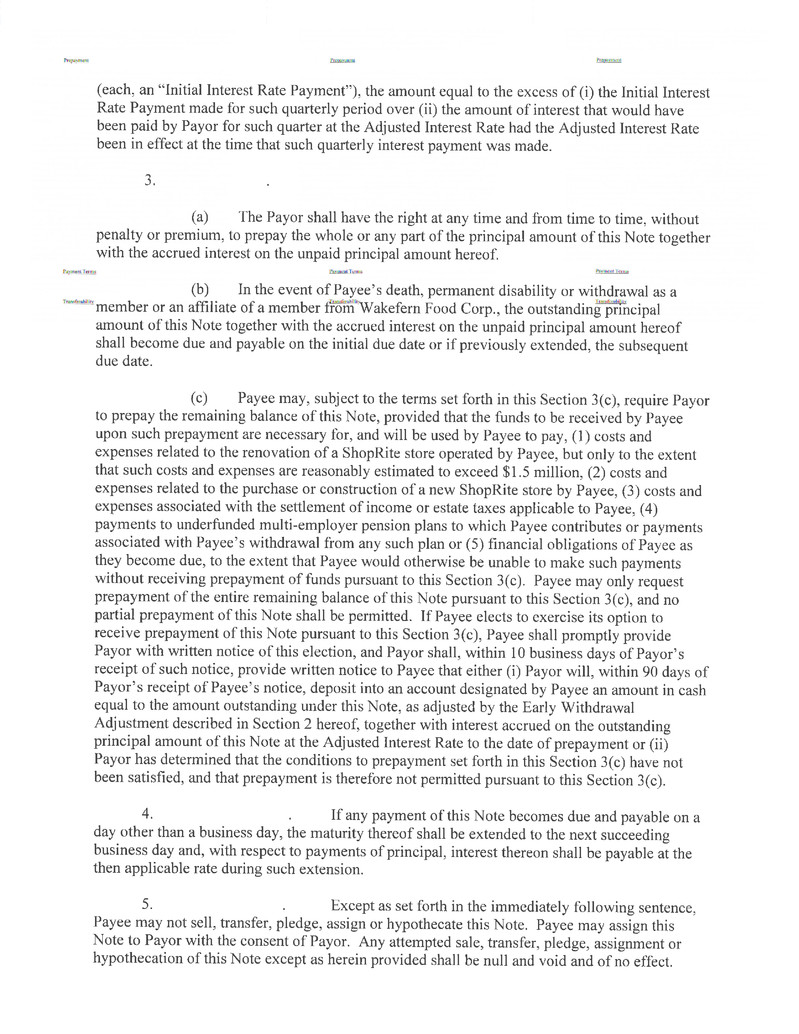

At July 29, 2017, the Company had $44,680 in notes receivable due from Wakefern. Half of these notes earned interest at the prime rate plus .25% and matured on August 15, 2017 and half earn interest at the prime rate plus 1.25% and mature on February 15, 2019. The Company invested $22,000 of the proceeds received from the notes that matured on August 15, 2017 in variable rate notes receivable from Wakefern that earn interest at the prime rate plus 1.25% and mature on August 15, 2022. Wakefern has the right to prepay these notes at any time. Under certain conditions, the Company can require Wakefern to prepay the notes, although interest earned since inception would be reduced as if it was earned based on overnight money market rates as paid by Wakefern on demand deposits.

At July 29, 2017, Village had demand deposits invested at Wakefern in the amount of $60,037. These deposits earn overnight money market rates.

Village has an unsecured revolving credit agreement providing a maximum amount available for borrowing of $25,000. This loan agreement expires on December 31, 2018. The revolving credit line can be used for general corporate purposes. Indebtedness under this agreement bears interest at the prime rate, or at the Eurodollar rate, at the Company’s option, plus applicable margins based on the Company’s fixed charge coverage ratio. There were no amounts outstanding at July 29, 2017 or July 30, 2016 under this facility.

The revolving loan agreement contains covenants that, among other conditions, require a maximum liabilities to tangible net worth ratio, a minimum fixed charge coverage ratio and a positive net income. At July 29, 2017, the Company was in compliance with all terms and covenants of the revolving loan agreement.

During fiscal 2017, Village paid cash dividends of $12,788. Dividends in fiscal 2017 consist of $1.00 per Class A common share and $.65 per Class B common share.

During fiscal 2016, Village paid cash dividends of $12,634. Dividends in fiscal 2016 consist of $1.00 per Class A common share and $.65 per Class B common share.

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

The table below presents significant contractual obligations of the Company at July 29, 2017:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Payments due by fiscal period |

| 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | Thereafter | | Total |

Capital and financing leases (2) | $ | 4,959 |

| | $ | 5,001 |

| | $ | 5,173 |

| | $ | 5,240 |

| | $ | 5,240 |

| | $ | 54,355 |

| | $ | 79,968 |

|

Operating leases (2) | 11,102 |

| | 9,131 |

| | 7,776 |

| | 6,450 |

| | 4,997 |

| | 38,046 |

| | 77,502 |

|

Notes payable to Wakefern | 292 |

| | 114 |

| | — |

| | — |

| | — |

| | — |

| | 406 |

|

| $ | 16,353 |

| | $ | 14,246 |

| | $ | 12,949 |

| | $ | 11,690 |

| | $ | 10,237 |

| | $ | 92,401 |

| | $ | 157,876 |

|

| |

(1) | In addition, the Company is obligated to purchase 85% of its primary merchandise requirements from Wakefern (see Note 3 to the Consolidated Financial Statements). |

| |

(2) | The above amounts for capital, financing and operating leases include interest, but do not include certain obligations under these leases for other charges. These charges consisted of the following in fiscal 2017: Real estate taxes - $5,050; common area maintenance - $2,038; insurance - $332; and contingent rentals - $668. |

| |

(3) | Pension plan funding requirements are excluded from the above table as estimated contribution amounts for future years are uncertain. Future contributions will be determined by, among other factors, actual investment performance of plan assets, interest rates required to be used to calculate pension obligations, and changes in legislation. The Company expects to contribute $3,500 in fiscal 2018 to fund Company-sponsored defined benefit pension plans compared to actual contributions of $3,000 in fiscal 2017. The table also excludes contributions under various multi-employer pension plans, which totaled $5,574 in fiscal 2017. |

OUTLOOK

This annual report contains certain forward-looking statements about Village’s future performance. These statements are based on management’s assumptions and beliefs in light of information currently available. Such statements relate to, for example: economic conditions; uninsured losses; expected pension plan contributions; projected capital expenditures; expected dividend payments; cash flow requirements; inflation expectations; and legal matters; and are indicated by words such as “will,” “expect,” “should,” “intend,” “anticipates,” “believes” and similar words or phrases. The Company cautions the reader that there is no assurance that actual results or business conditions will not differ materially from the results expressed, suggested or implied by such forward-looking statements. The Company undertakes no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof.

| |

• | We expect same store sales to range from a decrease of 2.0% to flat in fiscal 2018. We expect sales trends to be negatively impacted by several local competitor store openings and continued competitive pressure on retail price inflation. |

| |

• | We have budgeted $50,000 for capital expenditures in fiscal 2018. Planned expenditures include construction of a new store in the Bronx, New York, a replacement store, two major remodels, several smaller remodels and various technology upgrade projects. |

| |

• | The Board’s current intention is to continue to pay quarterly dividends in 2018 at the most recent rate of $.25 per Class A and $.1625 per Class B share. |

| |

• | We believe cash flow from operations and other sources of liquidity will be adequate to meet anticipated requirements for working capital, capital expenditures and debt payments for the foreseeable future. |

| |

• | We expect our effective income tax rate in fiscal 2018 to be in the range of 41.0% - 42.0%. |

| |

• | We expect operating expenses will be affected by increased costs in certain areas, such as medical and other fringe benefit costs. |

| |

• | We expect approximately $100 of net periodic pension costs in fiscal 2018 related to the four Company sponsored defined benefit pension plans. The Company expects to contribute $3,500 in cash to all defined benefit pension plans in fiscal 2018. |

Various uncertainties and other factors could cause actual results to differ from the forward-looking statements contained in this report. These include:

| |

• | The supermarket business is highly competitive and characterized by narrow profit margins. Results of operations may be materially adversely impacted by competitive pricing and promotional programs, industry consolidation and competitor store openings. Village competes directly with multiple retail formats both in-store and online, including national, regional and local supermarket chains as well as warehouse clubs, supercenters, drug stores, discount general merchandise stores, fast food chains, restaurants, dollar stores and convenience stores. Some of these competitors have greater financial resources, lower merchandise acquisition costs and lower operating expenses than we do. |

| |

• | The Company’s stores are concentrated in New Jersey, with two stores in Maryland and one in northeastern Pennsylvania. We are vulnerable to economic downturns in New Jersey in addition to those that may affect the country as a whole. Economic conditions such as inflation, deflation, interest rate fluctuations, movements in energy costs, social programs, minimum wage legislation, unemployment rates and changing demographics may adversely affect our sales and profits. |

| |

• | Village purchases substantially all of its merchandise from Wakefern. In addition, Wakefern provides the Company with support services in numerous areas including advertising, liability and property insurance, supplies, certain equipment purchasing, coupon processing, certain financial accounting applications, retail technology support, and other store services. Further, Village receives patronage dividends and other product incentives from Wakefern. |

Any material change in Wakefern’s method of operation or a termination or material modification of Village’s relationship with Wakefern could have an adverse impact on the conduct of the Company’s business and could involve additional expense for Village. The failure of any Wakefern member to fulfill its obligations to Wakefern or a member’s insolvency or withdrawal from Wakefern could result in increased costs to the Company. Additionally, an adverse change in Wakefern’s results of operations could have an adverse effect on Village’s results of operations.

| |

• | Approximately 91% of our employees are covered by collective bargaining agreements. Any work stoppages could have an adverse impact on our financial results. If we are unable to control health care and pension costs provided for in the collective bargaining agreements, we may experience increased operating costs. |

| |

• | The Company could be adversely affected if consumers lose confidence in the safety and quality of the food supply chain. The real or perceived sale of contaminated food products by us could result in a loss of consumer confidence and product liability claims, which could have a material adverse effect on our sales and operations. |

| |

• | Certain of the multi-employer plans to which we contribute are underfunded. As a result, we expect that contributions to these plans may increase. Additionally, the benefit levels and related items will be issues in the negotiation of our collective bargaining agreements. Under current law, an employer that withdraws or partially withdraws from a multi-employer pension plan may incur a withdrawal liability to the plan, which represents the portion of the plan’s underfunding that is allocable to the withdrawing employer under very complex actuarial and allocation rules. The failure of a withdrawing employer to fund these obligations can impact remaining employers. The amount of any increase or decrease in our required contributions to these multi-employer pension plans will depend upon the outcome of collective bargaining, actions taken by trustees who manage the plans, government regulations, withdrawals by other participating employers and the actual return on assets held in the plans, among other factors. |

| |

• | The Company uses a combination of insurance and self-insurance to provide for potential liability for workers’ compensation, automobile and general liability, property, director and officers’ liability, and certain employee health care benefits. Any projection of losses is subject to a high degree of variability. Changes in legal claims, trends and interpretations, variability in inflation rates, changes in the nature and method of claims settlement, benefit level changes due to changes in applicable laws, and insolvency of insurance carriers could all affect our financial condition, results of operations, or cash flows. |

| |

• | Our long-lived assets, primarily store property, equipment and fixtures, are subject to periodic testing for impairment. Failure of our asset groups to achieve sufficient levels of cash flow could result in impairment charges on long-lived assets. |

| |

• | Our effective tax rate may be impacted by the results of tax examinations and changes in tax laws. |

| |

• | Wakefern provides all members of the cooperative with information system support that enables us to effectively manage our business data, customer transactions, ordering, communications and other business processes. These information systems are subject to damage or interruption from power outages, computer or telecommunications failures, computer viruses and related malicious software, catastrophic weather events, or human error. Any material interruption of our or Wakefern’s information systems could have a material adverse impact on our results of operations. |