UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

ý | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2015

OR

|

| |

¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 033-90866

WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

| |

| |

Delaware | 25-1615902 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

|

| |

| |

1001 Air Brake Avenue Wilmerding, Pennsylvania 15148 | (412) 825-1000 |

(Address of principal executive offices, including zip code) | (Registrant’s telephone number) |

Securities registered pursuant to Section 12(b) of the Act: |

| |

| |

Title of Class | Name of Exchange on which registered |

Common Stock, par value $.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No ý.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ý No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No ý.

The registrant estimates that as of June 30, 2015, the aggregate market value of the voting shares held by non-affiliates of the registrant was approximately $8.8 billion based on the closing price on the New York Stock Exchange for such stock.

As of February 16, 2016, 91,930,671 shares of Common Stock of the registrant were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Proxy Statement for the registrant’s Annual Meeting of Stockholders to be held on May 11, 2016 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

|

| | |

| | |

| | Page |

| PART I | |

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

| | |

| PART II | |

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

| PART III | |

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

| PART IV | |

| | |

Item 15. | | |

PART I

General

Westinghouse Air Brake Technologies Corporation, doing business as Wabtec Corporation, is a Delaware corporation with headquarters at 1001 Air Brake Avenue in Wilmerding, Pennsylvania. Our telephone number is 412-825-1000, and our website is located at www.wabtec.com. All references to “we”, “our”, “us”, the “Company” and “Wabtec” refer to Westinghouse Air Brake Technologies Corporation and its subsidiaries. Westinghouse Air Brake Company (“WABCO”) was formed in 1990 when it acquired certain assets and operations from American Standard, Inc., now known as Trane (“Trane”). In 1999, WABCO merged with MotivePower Industries, Inc. (“MotivePower”) and adopted the name Wabtec.

Today, Wabtec is one of the world’s largest providers of value-added, technology-based equipment and services for the global rail industry. We believe we hold approximately a 50% market share in North America for our primary braking-related equipment and a leading position in North America for most of our other product lines. Our highly engineered products, which are intended to enhance safety, improve productivity and reduce maintenance costs for customers, can be found on virtually all U.S. locomotives, freight cars, subway cars and buses, and on many of these vehicles around the world. In 2015, the Company had sales of approximately $3.3 billion and net income of about $398.6 million. In 2015, sales of aftermarket parts and services represented about 62% of total sales, while sales to customers outside of the U.S. accounted for about 47% of total sales.

Industry Overview

The Company primarily serves the worldwide freight rail and passenger transit industries. As such, our operating results are largely dependent on the level of activity, financial condition and capital spending plans of the global railroad and transit industries. Many factors influence these industries, including general economic conditions; traffic volumes, as measured by freight tonnage and passenger ridership; government spending on public transportation; and investment in new technologies by freight rail and passenger transit systems.

According to a recent study by UNIFE, the Association of the European Rail Industry, the accessible global market for railway products and services is more than $100 billion, and it is expected to grow at about 2.7% annually through 2019. The three largest markets, which represent about 75% of the total market, are Europe, Asia-Pacific and North America. UNIFE projects the overall market to remain stable through 2020 as emerging markets show above-average growth due to overall economic growth and trends such as urbanization and increasing mobility, deregulation, investments in new technologies, energy and environmental issues, and increasing government support; while developed markets grow at a slower pace. UNIFE projects growth in all major product segments, with rail control and services expected to grow the fastest, at about 3% each.

By using various industry publications and market studies, we estimate that the global installed base of locomotives is about 110,000 units, with about 35% in Asia-Pacific, about 25% in Russia-CIS (Commonwealth of Independent States) and about 20% in North America. We estimate the global installed base of freight cars is about 5.2 million units, with about 30% each in Russia-CIS and North America, and about 20% in Asia-Pacific. We estimate the global installed base of transit cars is about 330,000 units, with about 55% in Asia-Pacific, about 20% in Europe and about 10% in Russia.

In North America, railroads carry about 40% of intercity freight, as measured by ton-miles, which is more than any other mode of transportation. They are an integral part of the continent’s economy and transportation system, serving nearly every industrial, wholesale and retail sector. Through direct ownership and operating partnerships, U.S. railroads are part of an integrated network that includes railroads in Canada and Mexico, forming what is regarded as the world’s most-efficient and lowest-cost freight rail service. There are more than 500 railroads operating in North America, with the largest railroads, referred to as “Class I,” accounting for more than 90% of the industry’s revenues. The railroads carry a wide variety of commodities and goods, including coal, metals, minerals, chemicals, grain, and petroleum. These commodities represent about 55% of total rail carloadings, with intermodal carloads accounting for the rest. Intermodal traffic—the movement of trailers or containers by rail in combination with another mode of transportation—has been the railroads’ fastest-growing market segment in the past 10 years. Railroads operate in a competitive environment, especially with the trucking industry, and are always seeking ways to improve safety, cost and reliability. New technologies offered by Wabtec and others in the industry can provide some of these benefits. Demand for our freight related products and services in North America is driven by a number of factors, including rail traffic, and production of new locomotives and new freight cars. In 2015, the Association of American Railroads (“AAR”) reported total carloads decreased 2.2%, as a 2.1% increase in intermodal traffic was more than offset by a 5.8% decrease in commodities carloads. Generally, a decrease in carloads reflects a slowing economy. Deliveries of new locomotives were about 1,200 units in 2015, compared to about 1,500 in 2014, and the average of about 1,200 in the past 10 years. Deliveries of new freight cars were about 82,000 units in 2015, compared to about 67,000 in 2014 and the average of about 50,000 in the past 10 years.

In the U.S., the passenger transit industry is dependent largely on funding from federal, state and local governments, and from fare box revenues. The New York City region is the largest passenger transit market in the U.S., but most major cities also offer either rail or bus transit services. Demand for North American passenger transit products is driven by a number of factors, including government funding, deliveries of new subway cars and buses, and ridership. The U.S. federal government provides money to local transit authorities, primarily to fund the purchase of new equipment and infrastructure for their transit systems. In 2015, the U.S. Congress passed a five-year transportation funding bill that includes transit spending of about $11.8 billion in fiscal 2016, an increase of about 10% compared to the prior year. The number of new transit cars delivered in 2015 was about 850, compared to about the same in 2014. The number of new buses delivered in 2015 was about 4,600 compared to about the same in 2014. In the past 10 years, the average number of new transit cars delivered annually is about 800, and the average number of new buses delivered annually is about 4,700. Public transit ridership provides fare box revenues to transit authorities, which use these funds, along with state and local money, primarily for equipment and system maintenance. Based on preliminary figures from the American Public Transportation Association, ridership on U.S. transit vehicles decreased about 1.0% in 2015.

Outside of North America, countries such as Australia, Brazil, China, India, Russia, and South Africa have been investing capital to expand and improve both their freight and passenger rail systems. Throughout the world, some government-owned railroads are being sold to private owners, who often look to improve the efficiency of the rail system by investing in new equipment and new technologies. According to UNIFE, emerging markets are expected to grow at above-average rates as global trade creates increases in freight volumes and urbanization leads to increased demand for efficient mass-transportation systems. As this growth occurs, Wabtec expects to have additional opportunities to provide products and services in these markets.

In Europe, the majority of the rail system serves the passenger transit market, which is expected to continue growing as energy and environmental factors encourage investment in public mass transit. France, Germany, the United Kingdom and Italy are the largest transit markets, representing about two-thirds of passenger traffic in the European Union. UNIFE projected the Western European rail market to grow at about 2.0% annually in the next few years, with the United Kingdom and France expected to invest in new rolling stock. According to the UK’s Office of Rail Regulation, passenger rail usage has steadily increased in the past decade, with the Office reporting a 1.4% increase in second quarter ridership in its most recent quarterly report. For the same time period, the Office also reported a decrease of 16.5% in freight volume, driven by a reduction in coal shipments. Germany has the largest rail network in Europe. About 75% of freight traffic in Europe is hauled by truck, while rail accounts for about 20%. The largest freight markets in Europe are Germany, Poland and the United Kingdom. In the first nine months of 2015, The Federal Statistical Office of Germany reported a 2.1% decrease in freight volumes compared to the same period in 2014. For the first six months of 2015, SNCF (French national railway) reported an increase of 4.0% in revenue for local and regional ridership, and flat freight-related revenue. We estimate that the European rail market consists of about 11,000 locomotives, about 750,000 freight cars and about 72,000 passenger transit cars.

The Asia/Pacific market is now the second-largest geographic segment, according to UNIFE. This market consists primarily of China, India and Australia. Growth has been driven by the continued urbanization of China and India, and by investments in freight rail infrastructure to serve the mining and natural resources markets in those countries. We estimate that this market consists of 35,000 locomotives and about 1.0 million freight cars. China is expected to increase spending on rail infrastructure and equipment, as it resumes investment in high-speed rail programs. In its most recent report, the Indian government reported that in the first six months of its fiscal 2015, freight rail volume increased about 26% and earnings from passenger rail traffic increased about 8.5%. India is expected to increase spending significantly in future years as it seeks to modernize its rail system; for example, it recently awarded a 1,000-unit locomotive order to a U.S. manufacturer.

Other key geographic markets include Russia-CIS, South Africa, and Brazil. With about 1.5 million freight cars and about 28,000 locomotives, Russia-CIS is among the largest freight rail markets in the world, and it’s expected to invest significantly in new rolling stock and infrastructure. Russian Railways, a state-owned company, provides both freight and passenger transportation. In 2015, Russian Railways announced a decrease of 1.2% in freight loadings and a decrease of 4.4% in passenger ridership. South Africa, in 2012, announced a major program to invest in its freight rail and passenger transit infrastructure during the next 20 years. As part of this program, PRASA, the Passenger Rail Agency of South Africa, plans to purchase about 3,600 new transit cars and about 1,000 new locomotives. Brazil has also been investing in its passenger transport systems in advance of hosting the 2016 Olympics.

Business Segments and Products

We provide our products and services through two principal business segments, the Freight Segment and the Transit Segment, both of which have different market characteristics and business drivers.

The Freight Segment primarily manufactures and services components for new and existing locomotive and freight cars, supplies railway electronics, positive train control equipment, signal design and engineering services, builds switcher

locomotives, rebuilds freight locomotives and provides heat exchangers and cooling systems for rail and other industrial markets. Customers include large, publicly traded railroads, leasing companies, manufacturers of original equipment such as locomotives and freight cars, and utilities. As discussed previously, demand in the freight market is primarily driven by rail traffic, and deliveries of new locomotives and freight cars. In 2015, the Freight Segment accounted for 62% of our total sales, with about 81% of its sales in North America and the remainder to international customers. In 2015, slightly more than half of the Freight Segment’s sales were in aftermarket.

The Transit Segment primarily manufactures and services components for new and existing passenger transit vehicles, typically subway cars and buses, builds new commuter locomotives and refurbishes subway cars. Customers include public transit authorities and municipalities, leasing companies, and manufacturers of subway cars and buses around the world. As discussed previously, demand in the transit market is primarily driven by government funding at all levels and passenger ridership. In 2015, the Transit Segment accounted for 38% of our total sales, with about 39% of its sales in North America and the remainder to international customers. About two-thirds of the Transit Segment’s sales are in the aftermarket with the remainder in the original equipment market.

Following is a summary of our leading product lines in both aftermarket and original equipment across both of our business segments:

Specialty Products & Electronics:

| |

• | Positive Train Control equipment and electronically controlled pneumatic braking products |

| |

• | Railway electronics, including event recorders, monitoring equipment and end of train devices |

| |

• | Signal design and engineering services |

| |

• | Freight car truck components |

| |

• | Draft gears, couplers and slack adjusters |

| |

• | Air compressors and dryers |

| |

• | Heat exchangers and cooling products for locomotives and power generation equipment |

| |

• | Track and switch products |

Brake Products:

| |

• | Railway braking equipment and related components for Freight and Transit applications |

| |

• | Friction products, including brake shoes and pads |

Remanufacturing, Overhaul and Build:

| |

• | New commuter and switcher locomotives |

| |

• | Transit car and locomotive overhaul and refurbishment |

Transit Products:

| |

• | Door and window assemblies for buses and subway cars |

| |

• | Accessibility lifts and ramps for buses and subway cars |

We have become a leader in the rail industry by capitalizing on the strength of our existing products, technological capabilities and new product innovation, and by our ability to harden products to protect them from severe conditions, including extreme temperatures and high-vibration environments. Supported by our technical staff of over 1,500 engineers and specialists, we have extensive experience in a broad range of product lines, which enables us to provide comprehensive, systems-based solutions for our customers.

Over the past several years, we introduced a number of significant new products, including electronic braking equipment and train control equipment that encompasses onboard digital data and global positioning communication protocols. In 2007, for example, the Federal Railroad Administration (FRA) approved the use of our Electronic Train Management System®, which offers safety benefits to the rail industry. In 2008, the U.S. federal government enacted a rail safety bill that mandates the use of Positive Train Control (“PTC”) technology, which includes on-board locomotive computer and related software, on a majority of the locomotives and track in the U.S. With our Electronic Train Management System®, we are the leading supplier of this on-board train control equipment, and we are working with the U.S. Class I railroads, commuter rail authorities and other industry suppliers to implement this technology. The rail safety bill included a deadline of December 31, 2015 for PTC

implementation, but the deadline has been extended until the end of 2018. The deadline extension is expected to affect the rate of industry spending on this technology. In 2015, Wabtec recorded about $400 million of revenue from freight and transit PTC projects.

For additional information on our business segments, see Note 20 of “Notes to Consolidated Financial Statements” included in Part IV, Item 15 of this report.

Competitive Strengths

Our key strengths include:

| |

• | Leading market positions in core products. Dating back to 1869 and George Westinghouse’s invention of the air brake, we are an established leader in the development and manufacture of pneumatic braking equipment for freight and passenger transit vehicles. We have leveraged our leading position by focusing on research and engineering to expand beyond pneumatic braking components to supplying integrated parts and assemblies for the locomotive through the end of the train. We are a recognized leader in the development and production of electronic recording, measuring and communications systems, positive train control equipment, highly engineered compressors and heat exchangers for locomotives, and a leading manufacturer of freight car components, including electronic braking equipment, draft gears, trucks, brake shoes and electronic end-of-train devices. We are also a leading provider of braking equipment, door assemblies, lifts and ramps, couplers and current collection equipment for passenger transit vehicles. |

| |

• | Breadth of product offering with a stable mix of original equipment market (OEM) and aftermarket business. Our product portfolio is one of the broadest in the rail industry, as we offer a wide selection of quality parts, components and assemblies across the entire train. We provide our products in both the original equipment market and the aftermarket. Our substantial installed base of products with end-users such as the railroads and the passenger transit authorities is a significant competitive advantage for providing products and services to the aftermarket because these customers often look to purchase safety- and performance-related replacement parts from the original equipment components supplier. In addition, as OEMs and railroad operators attempt to modernize fleets with new products designed to improve and maintain safety and efficiency, these products must be designed to be interoperable with existing equipment. On average, over the last several years, more than 60% of our total net sales have come from our aftermarket products and services business. |

| |

• | Leading design and engineering capabilities. We believe a hallmark of our relationship with our customers has been our leading design and engineering practice, which has, in our opinion, assisted in the improvement and modernization of global railway equipment. We believe both our customers and the government authorities value our technological capabilities and commitment to innovation, as we seek not only to enhance the efficiency and profitability of our customers, but also to improve the overall safety of the railways through continuous improvement of product performance. The Company has an established record of product improvements and new product development. We have assembled a wide range of patented products, which we believe provides us with a competitive advantage. Wabtec currently owns 2,312 active patents worldwide and 621 U.S. patents. During the last three years, we have filed for more than 403 patents worldwide in support of our new and evolving product lines. |

| |

• | Experience with industry regulatory requirements. The freight rail and passenger transit industries are governed by various government agencies and regulators in each country and region. These groups mandate rigorous manufacturer certification, new product testing and approval processes that we believe are difficult for new entrants to meet cost-effectively and efficiently without the scale and extensive experience we possess. |

| |

• | Experienced management team and the Wabtec Performance System. The Company has implemented numerous initiatives that enable us to manage successfully through cycles in the rail supply market. For example, the Wabtec Performance System (WPS), an ongoing program that focuses on lean manufacturing principles and continuous improvement across all aspects of our business, has been a part of the Company’s culture for more than 20 years. As a result, our management team has improved our cost structure, operating leverage and financial flexibility, and placed the Company in an excellent position to benefit from growth opportunities. |

Business strategy

Using WPS, we strive to generate sufficient cash to invest in our growth strategies and to build on what we consider to be a leading position as a low-cost producer in the industry while maintaining world-class product quality, technology and customer responsiveness. Through WPS and employee-directed initiatives such as Kaizen, a Japanese-developed team concept, we continuously strive to improve quality, delivery and productivity, and to reduce costs. These efforts enable us to streamline processes, improve product reliability and customer satisfaction, reduce product cycle times and respond more rapidly to market developments. Over time, these lean initiatives have enabled us to increase operating margins, improve cash flow and strengthen our ability to invest in the following growth strategies:

| |

• | Expand globally and into new product markets. We believe that international markets represent a significant opportunity for future growth. In 2015, sales to non-U.S. customers were $1.6 billion, including export sales from the Company’s U.S. operations of $508.4 million. We intend to increase our existing international sales through strategic acquisitions, direct sales of products through our existing subsidiaries and licensees, and joint ventures with railway suppliers which have a strong presence in their local markets. We are specifically targeting markets that operate significant fleets of U.S.-style locomotives and freight cars, including Australia, Brazil, China, India, Russia, South Africa, and other select areas within Europe and South America. In addition, we have opportunities to increase the sale of certain products that we currently manufacture for the rail industry into other industrial markets, such as mining, off-highway and energy. These products include heat exchangers and friction materials. |

| |

• | Expand aftermarket sales. Historically, aftermarket sales are less cyclical than OEM sales because a certain level of aftermarket maintenance and service work must be performed, even during an industry slowdown. In 2015, Wabtec’s aftermarket sales and services represented approximately 62% of the Company’s total sales across both of our business segments. Wabtec provides aftermarket parts and services for its components, and the Company is seeking to expand this business with customers who currently perform the work in-house. In this way, we expect to take advantage of the rail industry trend toward outsourcing, as railroads and transit authorities focus on their core function of transporting goods and people. |

| |

• | Accelerate new product development. We continue to emphasize research and development funding to create new and improved products. We are focusing on technological advances, especially in the areas of electronics, braking products and other on-board equipment, as a means of new product growth. We seek to provide customers with incremental technological advances that offer immediate benefits with cost-effective investments. |

| |

• | Seek acquisitions, joint ventures and alliances. We invest in acquisitions, joint ventures and alliances using a disciplined, selective approach and rigorous financial criteria. These transactions are expected to meet the financial criteria and contribute to our growth strategies of global expansion, new products and expanding aftermarket sales. All of these expansion strategies will help Wabtec to grow profitably, expand geographically, and dampen the impact from potential cycles in the North American rail industry. |

Recent Acquisitions and Joint Ventures

Wabtec has completed certain significant acquisitions in support of its growth strategies mentioned above:

| |

• | On October 30, 2015, the Company acquired Relay Monitoring Systems PTY Ltd. (“RMS”), an Australian manufacturer of electrical protection and control products for a purchase price of approximately $18.7 million, net of cash acquired. |

| |

• | On October 8, 2015, the Company acquired Track IQ, an Australian based manufacturer of wayside censor systems for the global rail industry for a purchase price of approximately $9.1 million, net of cash acquired. |

| |

• | On June 17, 2015 , the Company acquired Metalocaucho ("MTC"), a manufacturer of transit products, primarily rubber components for suspension and vibration control systems, for a purchase price of approximately $23.4 million, net of cash acquired. |

| |

• | On February 4, 2015, the Company acquired Railroad Controls L.P. (“RCL”), a U.S. based provider of railway signal construction services for a purchase price of approximately $78.0 million, net of cash acquired. |

| |

• | On September 3, 2014, the Company acquired C2CE Pty Ltd. (“C2CE”), a leading provider of railway signal design services in Australia, for a purchase price of approximately $25.5 million, net of cash acquired. |

| |

• | On August 21, 2014, the Company acquired Dia-Frag, a leading manufacturer of friction products in Brazil, for a purchase price of approximately $70.6 million, net of cash acquired. |

| |

• | On June 6, 2014, the Company acquired Fandstan Electric Group Ltd. (“Fandstan”), a leading rail and industrial equipment manufacturer for a variety of markets, including rail and tram transportation, industrial and energy, for a purchase price of approximately $199.4 million, net of cash acquired. |

Backlog

The Company’s backlog was about $2.1 billion at December 31, 2015. For 2015, about 62% of total sales came from aftermarket orders, which typically carry lead times of less than 30 days, and are not recorded in backlog for a significant period of time.

The Company’s contracts are subject to standard industry cancellation provisions, including cancellations on short notice or upon completion of designated stages. Substantial scope-of-work adjustments are common. For these and other

reasons, completion of the Company’s backlog may be delayed or cancelled. The railroad industry, in general, has historically been subject to fluctuations due to overall economic conditions and the level of use of alternative modes of transportation.

The backlog of firm customer orders as of December 31, 2015 and December 31, 2014, and the expected year of completion are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Total | | Expected Delivery | | Total | | Expected Delivery |

| | Backlog | | | | Other | | Backlog | | | | Other |

In thousands | | 12/31/2015 | | 2016 | | Years | | 12/31/2014 | | 2015 | | Years |

Freight Segment | | $ | 671,910 |

| | $ | 585,981 |

| | $ | 85,929 |

| | $ | 977,759 |

| | $ | 843,681 |

| | $ | 134,078 |

|

Transit Segment | | 1,474,974 |

| | 621,736 |

| | 853,238 |

| | 1,344,222 |

| | 659,211 |

| | 685,011 |

|

Total | | $ | 2,146,884 |

| | $ | 1,207,717 |

| | $ | 939,167 |

| | $ | 2,321,981 |

| | $ | 1,502,892 |

| | $ | 819,089 |

|

Engineering and Development

To execute our strategy to develop new products, we invest in a variety of engineering and development activities. For the fiscal years ended December 31, 2015, 2014, and 2013, we invested about $71.2 million, $61.9 million and $46.3 million, respectively, on product development and improvement activities. The engineering resources of the Company are allocated between research and development activities and the execution of original equipment customer contracts.

Our engineering and development program includes investment in train control and new braking technologies, with an emphasis on applying electronics to traditional pneumatic equipment. Electronic braking has been used in the transit industry for years, and freight railroads are conducting pilot programs to test its reliability and benefits. Freight railroads have generally been slower to accept the technology due to issues over interoperability, connectivity and durability. We are proceeding with efforts to enhance the major components for existing hard-wired braking equipment and development of new electronic technologies for the freight railroads. We are also investing in technology, such as advanced cooling systems that enable lower emissions from diesel engines used in rail and other industrial markets. Sometimes we conduct specific research projects in conjunction with universities, customers and other industry suppliers.

We use our Product Development System (PDS) to develop and monitor new product programs. The system requires the product development team to follow consistent steps throughout the development process, from concept to launch, to ensure the product will meet customer expectations and internal profitability targets.

Intellectual Property

We have 2,312 active patents worldwide. We also rely on a combination of trade secrets and other intellectual property laws, nondisclosure agreements and other protective measures to establish and protect our proprietary rights in our intellectual property.

Certain trademarks, among them the name WABCO®, were acquired or licensed from American Standard Inc., now known as Trane, in 1990 at the time of our acquisition of the North American operations of the Railway Products Group of Trane. Other trademarks have been developed through the normal course of business, or acquired as a part of our ongoing merger and acquisition program.

We have entered into a variety of license agreements as licensor and licensee. We do not believe that any single license agreement is of material importance to our business or either of our business segments as a whole.

We have issued licenses to the two sole suppliers of railway air brakes and related products in Japan, Nabtesco and Mitsubishi Electric Company. The licensees pay annual license fees to us and also assist us by acting as liaisons with key Japanese passenger transit vehicle builders for projects in North America. We believe that our relationships with these licensees have been beneficial to our core transit business and customer relationships in North America.

Customers

Our customers include railroads and passenger transit authorities throughout North America, as well as in the United Kingdom, Australia, Europe, Asia, South Africa and South America; manufacturers of transportation equipment, such as locomotives, freight cars, subway vehicles and buses; and lessors of such equipment.

Top customers can change from year to year. For the fiscal year ended December 31, 2015, our top five customers accounted for 22% of net sales: The BNSF Railway, CSX Corporation, General Electric Transportation, Trinity Industries, and Union Pacific Corporation. No one customer represents 10% or more of consolidated sales. We believe that we have strong relationships with all of our key customers.

Competition

We believe that we hold approximately a 50% market share in North America for our primary braking-related equipment and a leading market position in North America for most of our other product lines. On a global basis, our market shares are smaller. We operate in a highly competitive marketplace. Price competition is strong because we have a relatively small number of customers and they are very cost-conscious. In addition to price, competition is based on product performance and technological leadership, quality, reliability of delivery, and customer service and support.

Our principal competitors vary across product lines. Within North America, New York Air Brake Company, a subsidiary of the German air brake producer Knorr-Bremse AG (“Knorr”) and Amsted Rail Company, Inc., a subsidiary of Amsted Industries Corporation, are our principal overall OEM competitors. Our competition for locomotive, freight and passenger transit service and repair is mostly from the railroads’ and passenger transit authorities’ in-house operations, Electro-Motive Diesel, a division of Caterpillar, GE Transportation Systems, and New York Air Brake/Knorr. We believe our key strengths, which include leading market positions in core products, breadth of product offering with a stable mix of OEM and aftermarket business, leading design and engineering capabilities, significant barriers to entry and an experienced management team, enable us to compete effectively in this marketplace. Outside of North America, no individual company is our principal competitor in all of our operating locations. The largest competitors for Brake and Transit products are Faiveley Transport and Knorr. In addition, our competitors often include smaller, local suppliers in most international markets.

Employees

At December 31, 2015, we had approximately 13,000 full-time employees, approximately 30% of whom were unionized. A majority of the employees subject to collective bargaining agreements are outside North America and these agreements are generally effective from 2016 through 2018. Agreements expiring at various times during 2016 cover approximately 26% of the Company’s workforce. We consider our relations with employees and union representatives to be good, but cannot assure that future contract negotiations will be favorable to us.

Regulation

In the course of our operations, we are subject to various regulations of governments and other agencies in the U.S. and around the world. These entities typically govern equipment and safety standards for freight rail and passenger transit rolling stock, oversee a wide variety of rules and regulations governing safety and design of equipment, and evaluate certification and qualification requirements for suppliers. New products generally must undergo testing and approval processes that are rigorous and lengthy. As a result of these regulations and requirements, we must usually obtain and maintain certifications in a variety of jurisdictions and countries. The governing bodies include: FRA and AAR in the U.S., the International Union of Railways (“UIC”) and the European Railway Agency in Europe, the Federal Agency of Railway Transport in Russia, the Agencia Nacional de Transportes Terrestres in Brazil, the National Railway Administration, formerly the Ministry of Railway in China, and the Ministry of Railways in India.

Effects of Seasonality

Our business is not typically seasonal, although the third quarter results may be affected by vacation and scheduled plant shutdowns at several of our major customers during this period.

Environmental Matters

Information on environmental matters is included in Note 19 of “Notes to Consolidated Financial Statements” included in Part IV, Item 15 of this report.

Available Information

We maintain an Internet site at www.wabtec.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as the annual report to stockholders and other information, are available free of charge on this site. The Internet site and the information contained therein or connected thereto are not incorporated by reference into this Form 10-K. The following are also available free of charge on this site and are available in print to any shareholder who requests them: Our Corporate Governance Guidelines, the charters of our Audit, Compensation and Nominating and Corporate Governance Committees, our Code of Conduct, which is applicable to all employees, our Code of Ethics for Senior Officers, which is applicable to all of our executive officers, our Policies on Related Party Transactions and Conflict Minerals, and our Sustainability Report.

Prolonged unfavorable economic and market conditions could adversely affect our business.

Unfavorable general economic and market conditions in the United States and internationally could have a negative impact on our sales and operations. To the extent that these factors result in continued instability of capital markets, shortages of raw materials or component parts, longer sales cycles, deferral or delay of customer orders or an inability to market our products effectively, our business and results of operations could be materially adversely affected.

We are dependent upon key customers.

We rely on several key customers who represent a significant portion of our business. Our top customers can change from year to year. For the fiscal year ended December 31, 2015, our top five customers accounted for 22% of our net sales. While we believe our relationships with our customers are generally good, our top customers could choose to reduce or terminate their relationships with us. In addition, many of our customers place orders for products on an as-needed basis and operate in cyclical industries. As a result, their order levels have varied from period to period in the past and may vary significantly in the future. Such customer orders are dependent upon their markets and customers, and may be subject to delays and cancellations. As a result of our dependence on our key customers, we could experience a material adverse effect on our business, results of operations and financial condition if we lost any one or more of our key customers or if there is a reduction in their demand for our products.

Our business operates in a highly competitive industry.

We operate in a competitive marketplace and face substantial competition from a limited number of established competitors in the United States and abroad, some of which may have greater financial resources than we do. Price competition is strong and, coupled with the existence of a number of cost conscious customers, has historically limited our ability to increase prices. In addition to price, competition is based on product performance and technological leadership, quality, reliability of delivery and customer service and support. There can be no assurance that competition in one or more of our markets will not adversely affect us and our results of operations.

We intend to pursue acquisitions, joint ventures and alliances that involve a number of inherent risks, any of which may cause us not to realize anticipated benefits.

One aspect of our business strategy is to selectively pursue acquisitions, joint ventures and alliances that we believe will improve our market position, and provide opportunities to realize operating synergies. These transactions involve inherent risks and uncertainties, any one of which could have a material adverse effect on our business, results of operations and financial condition including:

| |

• | difficulties in achieving identified financial and operating synergies, including the integration of operations, services and products; |

| |

• | diversion of Management’s attention from other business concerns; |

| |

• | the assumption of unknown liabilities; and |

| |

• | unanticipated changes in the market conditions, business and economic factors affecting such an acquisition. |

We cannot assure that we will be able to consummate any future acquisitions, joint ventures or other business combinations. If we are unable to identify suitable acquisition candidates or to consummate strategic acquisitions, we may be unable to fully implement our business strategy, and our business and results of operations may be adversely affected as a result. In addition, our ability to engage in strategic acquisitions will be dependent on our ability to raise substantial capital, and we may not be able to raise the funds necessary to implement our acquisition strategy on terms satisfactory to us, if at all.

As we introduce new products and services, a failure to predict and react to consumer demand could adversely affect our business.

We have dedicated significant resources to the development, manufacturing and marketing of new products. Decisions to develop and market new transportation products are typically made without firm indications of customer acceptance. Moreover, by their nature, new products may require alteration of existing business methods or threaten to displace existing equipment in which our customers may have a substantial capital investment. There can be no assurance that any new products that we develop will gain widespread acceptance in the marketplace or that such products will be able to compete successfully with other new products or services that may be introduced by competitors. In addition, we may incur additional warranty or other costs as new products are tested and used by customers.

A portion of our sales are related to delivering products and services to help our U.S. railroad and transit customers meet the Positive Train Control (PTC) mandate from the U.S. federal government, which requires the use of on-board locomotive computers and software by the end of 2018.

For the year ended December 31, 2015, we had sales of about $400 million related to PTC. In 2015, the industry's PTC deadline was extended by three years, which could change the timing of our revenues and could cause us to reassess the staffing, resources and assets deployed in delivering Positive Train Control services.

Our revenues are subject to cyclical variations in the railway and passenger transit markets and changes in government spending.

The railway industry historically has been subject to significant fluctuations due to overall economic conditions, the use of alternate methods of transportation and the levels of federal, state and local government spending on railroad transit projects. In economic downturns, railroads have deferred, and may defer, certain expenditures in order to conserve cash in the short term. Reductions in freight traffic may reduce demand for our replacement products.

The passenger transit railroad industry is also cyclical. New passenger transit car orders vary from year to year and are influenced greatly by major replacement programs and by the construction or expansion of transit systems by transit authorities. A substantial portion of our net sales have been, and we expect that a material portion of our future net sales will be, derived from contracts with metropolitan transit and commuter rail authorities and Amtrak. To the extent that future funding for proposed public projects is curtailed or withdrawn altogether as a result of changes in political, economic, fiscal or other conditions beyond our control, such projects may be delayed or cancelled, resulting in a potential loss of business for us, including transit aftermarket and new transit car orders. There can be no assurance that economic conditions will be favorable or that there will not be significant fluctuations adversely affecting the industry as a whole and, as a result, us.

Our backlog is not necessarily indicative of the level of our future revenues.

Our backlog represents future production and estimated potential revenue attributable to firm contracts with, or written orders from, our customers for delivery in various periods. Instability in the global economy, negative conditions in the global credit markets, volatility in the industries that our products serve, changes in legislative policy, adverse changes in the financial condition of our customers, adverse changes in the availability of raw materials and supplies, or un-remedied contract breaches could possibly lead to contract termination or cancellations of orders in our backlog or request for deferred deliveries of our backlog orders, each of which could adversely affect our cash flows and results of operations.

A growing portion of our sales may be derived from our international operations, which exposes us to certain risks inherent in doing business on an international level.

In fiscal year 2015, approximately 47% of our consolidated net sales were to customers outside of the U.S. and we intend to continue to expand our international operations in the future. We currently conduct our international operations through a variety of wholly and majority-owned subsidiaries and joint ventures in Australia, Austria, Brazil, Canada, China, Czech Republic, France, Germany, India, Italy, Macedonia, Mexico, the Netherlands, Poland, Russia, Spain, South Africa, Turkey, and the United Kingdom. As a result, we are subject to various risks, any one of which could have a material adverse effect on those operations and on our business as a whole, including:

| |

• | lack of complete operating control; |

| |

• | lack of local business experience; |

| |

• | currency exchange fluctuations and devaluations; |

| |

• | foreign trade restrictions and exchange controls; |

| |

• | difficulty enforcing agreements and intellectual property rights; |

| |

• | the potential for nationalization of enterprises; and |

| |

• | economic, political and social instability and possible terrorist attacks against American interests. |

In addition, certain jurisdictions have laws that limit the ability of non-U.S. subsidiaries and their affiliates to pay dividends and repatriate cash flows.

We may incur increased costs due to fluctuations in interest rates and foreign currency exchange rates.

In the ordinary course of business, we are exposed to increases in interest rates that may adversely affect funding costs associated with variable-rate debt and changes in foreign currency exchange rates. We may seek to minimize these risks through the use of interest rate swap contracts and currency hedging agreements. There can be no assurance that any of these measures will be effective. Any material changes in interest or exchange rates could result in material losses to us.

We may have liability arising from asbestos litigation.

Claims have been filed against the Company and certain of its affiliates in various jurisdictions across the United States by persons alleging bodily injury as a result of exposure to asbestos-containing products. Most of these claims have been made against our wholly owned subsidiary, Railroad Friction Products Corporation (RFPC), and are based on a product sold by RFPC prior to the time that the Company acquired any interest in RFPC.

Most of these claims, including all of the RFPC claims, are submitted to insurance carriers for defense and indemnity or to non-affiliated companies that retain the liabilities for the asbestos-containing products at issue. We cannot, however, assure that all these claims will be fully covered by insurance or that the indemnitors or insurers will remain financially viable. Our ultimate legal and financial liability with respect to these claims, as is the case with most other pending litigation, cannot be estimated.

We are subject to a variety of environmental laws and regulations.

We are subject to a variety of environmental laws and regulations governing discharges to air and water, the handling, storage and disposal of hazardous or solid waste materials and the remediation of contamination associated with releases of hazardous substances. We believe our operations currently comply in all material respects with all of the various environmental laws and regulations applicable to our business; however, there can be no assurance that environmental requirements will not change in the future or that we will not incur significant costs to comply with such requirements.

Future climate change regulation could result in increased operating costs, affect the demand for our products or affect the ability of our critical suppliers to meet our needs.

The Company has followed the current debate over climate change and the related policy discussion and prospective legislation. The potential challenges for the Company that climate change policy and legislation may pose have been reviewed by the Company. Any such challenges are heavily dependent on the nature and degree of climate change legislation and the extent to which it applies to our industry. At this time, the Company cannot predict the ultimate impact of climate change and climate change legislation on the Company’s operations. Further, when or if these impacts may occur cannot be assessed until scientific analysis and legislative policy are more developed and specific legislative proposals begin to take shape. Any laws or regulations that may be adopted to restrict or reduce emissions of greenhouse gas could require us to incur increased operating costs, and could have an adverse effect on demand for our products. In addition, the price and availability of certain of the raw materials that we use could vary in the future as a result of environmental laws and regulations affecting our suppliers. An increase in the price of our raw materials or a decline in their availability could adversely affect our operating margins or result in reduced demand for our products.

Our manufacturer’s warranties or product liability may expose us to potentially significant claims.

We warrant the workmanship and materials of many of our products. Accordingly, we are subject to a risk of product liability or warranty claims in the event that the failure of any of our products results in personal injury or death, or does not conform to our customers’ specifications. In addition, in recent years, we have introduced a number of new products for which we do not have a history of warranty experience. Although we have not had any material product liability or warranty claims made against us and we currently maintain liability insurance coverage, we cannot assure that product liability claims, if made, would not exceed our insurance coverage limits or that insurance will continue to be available on commercially acceptable terms, if at all. The possibility exists for these types of warranty claims to result in costly product recalls, significant repair costs and damage to our reputation.

Labor disputes may have a material adverse effect on our operations and profitability.

We collectively bargain with labor unions that represent approximately 30% of our employees. Our current collective bargaining agreements are generally effective from 2016 through 2018. Agreements expiring at various times during 2016 cover approximately 26% of the Company’s workforce. Failure to reach an agreement could result in strikes or other labor protests which could disrupt our operations. If we were to experience a strike or work stoppage, it would be difficult for us to find a sufficient number of employees with the necessary skills to replace these employees. We cannot assure that we will reach any such agreement or that we will not encounter strikes or other types of conflicts with the labor unions of our personnel. Such labor disputes could have an adverse effect on our business, financial condition or results of operations, could cause us to lose revenues and customers and might have permanent effects on our business.

From time to time we are engaged in contractual disputes with our customers.

From time to time, we are engaged in contractual disputes with our customers regarding routine delivery and performance issues as well as adjustments for design changes and related extra work. These disputes are generally resolved in

the ordinary course of business without having a material adverse impact on us although we cannot guarantee that this will continue to occur.

Our indebtedness could adversely affect our financial health.

At December 31, 2015, we had total debt of $695.7 million. If it becomes necessary to access our available borrowing capacity under our 2013 Refinancing Credit Agreement, the $445.0 million currently borrowed under this facility and the $250.0 million 4.375% senior notes, being indebted could have important consequences to us. For example, it could:

| |

• | increase our vulnerability to general adverse economic and industry conditions; |

| |

• | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes; |

| |

• | limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate; |

| |

• | place us at a disadvantage compared to competitors that have less debt; and |

| |

• | limit our ability to borrow additional funds. |

The indenture for our $250 million 4.375% senior notes due in 2023 and our 2013 Refinancing Credit Agreement contain various covenants that limit our Management’s discretion in the operation of our businesses.

The indenture governing the notes and our credit agreement contain various covenants that limit our Management’s discretion.

The 2013 Refinancing Credit Agreement limits the Company’s ability to declare or pay cash dividends and prohibits the Company from declaring or making other distributions, subject to certain exceptions. The 2013 Refinancing Credit Agreement contains various other covenants and restrictions including the following limitations: incurrence of additional indebtedness; mergers, consolidations and sales of assets and acquisitions; additional liens; sale and leasebacks; permissible investments, loans and advances; certain debt payments; capital expenditures; and imposes a minimum interest expense coverage ratio and a maximum debt to cash flow ratio.

The indenture under which the senior notes were issued contains covenants and restrictions which limit among other things, the following: the incurrence of indebtedness, payment of dividends and certain distributions, sale of assets, change in control, mergers and consolidations and the incurrence of liens.

The integration of our recently completed acquisitions may not result in anticipated improvements in market position or the realization of anticipated operating synergies or may take longer to realize than expected.

In 2014 and 2015, we completed multiple acquisitions with a combined investment of $424.7 million. Although we believe that the acquisitions will improve our market position and realize positive operating results, including operating synergies, operating expense reductions and overhead cost savings, we cannot be assured that these improvements will be obtained or the timing of such improvements. The management and acquisition of businesses involves substantial risks, any of which may result in a material adverse effect on our business and results of operations, including:

| |

• | the uncertainty that an acquired business will achieve anticipated operating results; |

| |

• | significant expenses to integrate; |

| |

• | diversion of Management’s attention; |

| |

• | departure of key personnel from the acquired business; |

| |

• | effectively managing entrepreneurial spirit and decision-making; |

| |

• | integration of different information systems; |

| |

• | unanticipated costs and exposure to unforeseen liabilities; and |

|

| |

Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

Facilities

The following table provides certain summary information about the principal facilities owned or leased by the Company as of December 31, 2015. The Company believes that its facilities and equipment are generally in good condition and that, together with scheduled capital improvements, they are adequate for its present and immediately projected needs. Leases on the facilities are long-term and generally include options to renew. The Company’s corporate headquarters are located at the Wilmerding, PA site.

|

| | | | | | | | | | | | |

Location | | Primary Use | | Segment | | Own/Lease | | Approximate Square Feet |

Domestic | | | | | | | | | | |

Rothbury, MI | | Manufacturing/Warehouse/Office | | Freight | | Own | | 500,000 |

| | |

Wilmerding, PA | | Manufacturing/Service | | Freight | | Own | | 365,000 |

| | (1 | ) |

Lexington, TN | | Manufacturing | | Freight | | Own | | 170,000 |

| | |

Jackson, TN | | Manufacturing | | Freight | | Own | | 150,000 |

| | |

Berwick, PA | | Manufacturing/Warehouse | | Freight | | Own | | 150,000 |

| | |

Chicago, IL | | Manufacturing/Service | | Freight | | Own | | 123,140 |

| | |

Greensburg, PA | | Manufacturing | | Freight | | Own | | 113,000 |

| | |

Chillicothe, OH | | Manufacturing/Office | | Freight | | Own | | 104,000 |

| | |

Warren, OH | | Manufacturing | | Freight | | Own | | 102,650 |

| | |

Coshocton, OH | | Manufacturing/Warehouse/Office | | Freight | | Own | | 83,000 |

| | |

Germantown, MD | | Manufacturing | | Freight | | Own | | 80,000 |

| | |

Delray Beach, FL | | Warehouse | | Freight | | Lease | | 125,888 |

| | |

Kansas City, MO | | Service Center | | Freight | | Lease | | 95,900 |

| | |

Pittsburgh, PA | | Manufacturing/Office | | Freight | | Lease | | 90,000 |

| | |

Strongsville, OH | | Manufacturing/Warehouse/Office | | Freight | | Lease | | 80,000 |

| | |

Columbia, SC | | Service Center | | Freight | | Lease | | 71,400 |

| | |

Jacksonville, FL | | Office | | Freight | | Lease | | 59,518 |

| | |

Bensenville, IL | | Manufacturing/Warehouse/Office | | Freight | | Lease | | 58,230 |

| | |

Cedar Rapids, IA | | Office | | Freight | | Lease | | 36,568 |

| | |

Jacksonville, FL | | Warehouse | | Freight | | Lease | | 30,000 |

| | |

Clarksburg, MD | | Manufacturing/Warehouse | | Freight | | Lease | | 22,443 |

| | |

Carson City, NV | | Service Center | | Freight | | Lease | | 22,000 |

| | |

Salem, OH | | Manufacturing/Warehouse | | Freight | | Lease | | 20,000 |

| | |

Boise, ID | | Manufacturing | | Freight/Transit | | Own | | 326,000 |

| | |

Maxton, NC | | Manufacturing | | Freight/Transit | | Own | | 105,000 |

| | |

Willits, CA | | Manufacturing | | Freight/Transit | | Own | | 70,000 |

| | |

Brenham, TX | | Manufacturing/Office | | Transit | | Own | | 144,671 |

| | |

Wytheville, VA | | Manufacturing/Office | | Transit | | Own | | 82,400 |

| | |

Piedmont, SC | | Manufacturing/Office | | Transit | | Own | | 47,000 |

| | |

Spartanburg, SC | | Manufacturing/Service | | Transit | | Lease | | 183,600 |

| | |

Buffalo Grove, IL | | Manufacturing | | Transit | | Lease | | 115,570 |

| | |

Cleveland, OH | | Manufacturing/Warehouse/Office | | Transit | | Lease | | 87,407 |

| | |

San Fernando, CA | | Manufacturing | | Transit | | Lease | | 65,347 |

| | |

Plattsburgh, NY | | Manufacturing | | Transit | | Lease | | 64,000 |

| | |

Moorpark, CA | | Office/Warehouse | | Transit | | Lease | | 45,916 |

| | |

Cleveland, OH | | Manufacturing/Warehouse/Office | | Transit | | Lease | | 43,643 |

| | |

|

| | | | | | | | | | | |

Location | | Primary Use | | Segment | | Own/Lease | | Approximate Square Feet |

Export, PA | | Manufacturing | | Transit | | Lease | | 34,000 |

| | |

Elmsford, NY | | Service Center | | Transit | | Lease | | 28,000 |

| | |

Greer, SC | | Warehouse | | Transit | | Lease | | 20,000 |

| | |

International | | | | | | | | | | |

Wallaceburg (Ontario), Canada | | Manufacturing | | Freight | | Own | | 126,000 |

| | |

San Luis Potosi, Mexico | | Manufacturing/Service | | Freight | | Own | | 73,100 |

| | |

East Beijing, Hebei Province, China | | Manufacturing | | Freight | | Own | | 64,702 |

| | |

Daye City, Hebei Province, China | | Manufacturing | | Freight | | Own | | 59,147 |

| | |

Barneveld, Netherlands | | Manufacturing/Office | | Freight | | Own | | 53,443 |

| | |

Northampton, UK | | Manufacturing | | Freight | | Lease | | 300,000 |

| | |

Shenyang City, Liaoning Province, China | | Manufacturing | | Freight | | Lease | | 290,550 |

| | |

Lincolnshire, UK | | Manufacturing/Office | | Freight | | Lease | | 149,468 |

| | |

London (Ontario), Canada | | Manufacturing | | Freight | | Lease | | 103,540 |

| | |

Stoney Creek (Ontario), Canada | | Manufacturing/Service | | Freight | | Lease | | 47,940 |

| | |

Kolkata, India | | Manufacturing | | Freight | | Lease | | 36,965 |

| | |

Belo Horizonte, Brazil | | Manufacturing/Service | | Freight | | Lease | | 33,992 |

| | |

Juiz de Fora, Minas Gerais, Brazil | | Manufacturing/Office | | Freight | | Lease | | 33,992 |

| | |

Lachine (Quebec), Canada | | Service Center | | Freight | | Lease | | 25,455 |

| | |

Mulgrave, Australia | | Manufacturing/Office | | Freight | | Lease | | 21,528 |

| | |

Doncaster, UK | | Manufacturing/Service | | Freight/Transit | | Own | | 330,000 |

| | |

Kilmarnock, UK | | Manufacturing | | Freight/Transit | | Own | | 107,975 |

| | |

Loughborough, UK | | Manufacturing | | Freight/Transit | | Lease | | 245,245 |

| | |

Kempton Park, South Africa | | Manufacturing | | Freight/Transit | | Lease | | 156,077 |

| | |

Wetherill Park, Australia | | Manufacturing | | Freight/Transit | | Lease | | 70,600 |

| | |

Monte Alto, Brazil | | Manufacturing/Office | | Transit | | Own | | 244,081 |

| | |

Schuttorf, Germany | | Manufacturing/Office | | Transit | | Own | | 189,445 |

| | |

Chard, UK | | Manufacturing/Office | | Transit | | Own | | 141,610 |

| | |

Avellino, Italy | | Manufacturing/Office | | Transit | | Own | | 132,495 |

| | |

Tianjin, Hebebi Province, China | | Manufacturing/Office | | Transit | | Own | | 87,672 |

| | |

Recklinghausen, Germany | | Manufacturing | | Transit | | Own | | 86,390 |

| | |

Sable-sur-Sarthe, France | | Manufacturing | | Transit | | Own | | 51,667 |

| | |

Utrecht, The Netherlands | | Manufacturing | | Transit | | Own | | 48,438 |

| | |

Katy Wroclawskie, Poland | | Manufacturing/Office | | Transit | | Own | | 31,484 |

| | |

Soria, Spain | | Manufacturing/Office | | Transit | | Own | | 31,000 |

| | |

Burton on Trent, UK | | Manufacturing/Office | | Transit | | Lease | | 253,453 |

| | |

Camisano, Italy | | Manufacturing/Office | | Transit | | Lease | | 136,465 |

| | |

San Luis Potosi, Mexico | | Manufacturing/Office | | Transit | | Lease | | 112,825 |

| | |

St. Laurent (Quebec), Canada | | Office | | Transit | | Lease | | 38,926 |

| | |

Gipuzkoa, Spain | | Manufacturing/Office | | Transit | | Lease | | 37,049 |

| | |

Chard, UK | | Manufacturing/Office | | Transit | | Lease | | 35,282 |

| | |

Hangzhou City, Hunan Province, China | | Manufacturing | | Transit | | Lease | | 31,032 |

| | |

Sassuolo, Italy | | Manufacturing | | Transit | | Lease | | 30,000 |

| | |

| |

(1) | Approximately 250,000 square feet are currently used in connection with the Company’s corporate and manufacturing operations. The remainder is leased to third parties. |

Information with respect to legal proceedings is included in Note 19 of “Notes to Consolidated Financial Statements” included in Part IV, Item 15 of this report and incorporate by reference herein.

|

| |

Item 4. | MINE SAFETY DISCLOSURES |

Not applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table provides information on our executive officers. They are elected periodically by our Board of Directors and serve at its discretion.

|

| | | | |

Officers | | Age | | Position |

Albert J. Neupaver | | 65 | | Executive Chairman |

Raymond T. Betler | | 60 | | President and Chief Executive Officer |

Patrick D. Dugan | | 49 | | Senior Vice President and Chief Financial Officer |

R. Mark Cox | | 48 | | Senior Vice President, Corporate Development |

David L. DeNinno | | 60 | | Senior Vice President, General Counsel and Secretary |

Scott E. Wahlstrom | | 52 | | Senior Vice President, Human Resources |

Robert Bourg | | 54 | | Vice President and Group Executive |

Karl-Heinz Colmer | | 59 | | Vice President and Group Executive |

Michael E. Fetsko | | 50 | | Vice President and Group Executive |

John A. Mastalerz | | 49 | | Vice President of Finance, Corporate Controller and Principal Accounting Officer |

David Meyer | | 45 | | Vice President and Group Executive |

Timothy R. Wesley | | 54 | | Vice President, Investor Relations and Corporate Communications |

Albert J. Neupaver was named Executive Chairman of the Company in May 2014. Previously, Mr. Neupaver served as Chairman and CEO from May 2013 to May 2014 and as the Company’s President and CEO from February 2006 to May 2013. Prior to joining Wabtec, Mr. Neupaver served in various positions at AMETEK, Inc., a leading global manufacturer of electronic instruments and electric motors. Most recently he served as President of its Electromechanical Group for nine years.

Raymond T. Betler was named President and Chief Executive Officer in May 2014. Previously, Mr. Betler was President and Chief Operating Officer since May 2013 and the Company’s Chief Operating Officer since December 2010. Prior to that, he served as Vice President, Group Executive of the Company since August 2008. Prior to joining Wabtec, Mr. Betler served in various positions of increasing responsibility at Bombardier Transportation since 1979. Most recently, Mr. Betler served as President, Total Transit Systems from 2004 until 2008 and before that as President, London Underground Projects from 2002 to 2004.

Patrick D. Dugan was named Senior Vice President and Chief Financial Officer effective January 2014. Previously, Mr. Dugan was Senior Vice President, Finance and Corporate Controller from January 2012 until November 2013. He originally joined Wabtec in 2003 as Vice President, Corporate Controller. Prior to joining Wabtec, Mr. Dugan served as Vice President and Chief Financial Officer of CWI International, Inc. from December 1996 to November 2003. Prior to 1996, Mr. Dugan was a Manager with PricewaterhouseCoopers.

R. Mark Cox was named Senior Vice President, Corporate Development in January 2012, and has been with Wabtec since September 2006 as Vice President, Corporate Development. Prior to joining Wabtec, Mr. Cox served as Director of Business Development for the Electrical Group of Eaton Corporation since 2002. Prior to joining Eaton, Mr. Cox was an investment banker with UBS Warburg, Prudential and Stephens.

David L. DeNinno was named Senior Vice President, General Counsel and Secretary of the Company in February 2012. Previously, Mr. DeNinno served as a partner at K&L Gates LLP since May 2011 and prior to that with Reed Smith LLP.

Scott E. Wahlstrom was named Senior Vice President, Human Resources in January 2012. Mr. Wahlstrom has been Vice President, Human Resources, since November 1999. Previously, Mr. Wahlstrom was Vice President, Human Resources & Administration of MotivePower Industries, Inc. from August 1996 until November 1999.

Robert Bourg was named Vice President and Group Executive in February 2012. Prior to that, he was Vice President Rail Electronics from May 2010. Previously, he was Vice President and General Manager of Wabtec Railway Electronics from May 2006 to May 2010. Prior to that, he held various senior management positions within Wabtec since he was hired in August 1992.

Karl-Heinz Colmer was named Vice President and Group Executive in February 2012. Mr. Colmer served as Managing Director of Friction Products from January 2009 until February 2012. Prior to that position, Mr. Colmer served as Managing Director of Becorit GmbH since 2006 after joining Wabtec. Prior to joining Wabtec Mr. Colmer served in various management roles with BBA PLC.

Michael E. Fetsko was named Vice President and Group Executive in January 2014. Mr Fetsko joined Wabtec in July of 2011 as Vice President, Freight Pneumatics. Prior to joining Wabtec, Mr. Fetsko served in various executive management roles with Bombardier Transportation.

John A. Mastalerz was named Vice President of Finance, Corporate Controller and Principal Accounting Officer in January 2016. Mr. Mastalerz served as Vice President and Corporate Controller from January 2014 to January 2016. Prior to joining Wabtec, Mr. Mastalerz served in various executive management roles with the H.J. Heinz Company from January 2001 to December 2013, most recently as Corporate Controller and Principal Accounting Officer. Prior to 2001, Mr. Mastalerz was a Senior Manager with PricewaterhouseCoopers.

David Meyer was named Vice President and Group Executive in February 2012. Mr. Meyer served as Vice President, Freight Car Products from April 2007 until February 2012. Prior to this position, Mr. Meyer served in several Vice President and General Manager roles within Wabtec since 2003 and joined Wabtec as a Product Line Manager in 1999. Prior to joining Wabtec, Mr. Meyer served in various management roles with Eaton Corporation.

Timothy R. Wesley was named Vice President, Investor Relations and Corporate Communications in November 1999. Previously, Mr. Wesley was Vice President, Investor and Public Relations of MotivePower Industries, Inc. from August 1996 until November 1999.

PART II

|

| |

Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Common Stock of the Company is listed on the New York Stock Exchange under the symbol “WAB”. As of February 16, 2016, there were 91,930,671 shares of Common Stock outstanding held by 513 holders of record. On May 14, 2013, our stockholders approved an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of our common stock to 200.0 million shares. The high and low sales price of the shares and dividends declared per share were as follows:

|

| | | | | | | | | | | | |

2015 | | High | | Low | | Dividends |

First Quarter | | $ | 97.16 |

| | $ | 81.21 |

| | $ | 0.060 |

|

Second Quarter | | $ | 105.10 |

| | $ | 93.49 |

| | $ | 0.060 |

|

Third Quarter | | $ | 103.07 |

| | $ | 87.95 |

| | $ | 0.080 |

|

Fourth Quarter | | $ | 94.61 |

| | $ | 67.96 |

| | $ | 0.080 |

|

2014 | | High | | Low | | Dividends |

First Quarter | | $ | 82.42 |

| | $ | 69.55 |

| | $ | 0.040 |

|

Second Quarter | | $ | 83.77 |

| | $ | 69.45 |

| | $ | 0.040 |

|

Third Quarter | | $ | 87.14 |

| | $ | 78.51 |

| | $ | 0.060 |

|

Fourth Quarter | | $ | 92.20 |

| | $ | 70.20 |

| | $ | 0.060 |

|

The Company’s 2013 Refinancing Credit Agreement restricts the ability to make dividend payments, with certain exceptions. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and see Note 9 of “Notes to Consolidated Financial Statements” included in Part IV, Item 15 of this report.

At the close of business on February 16, 2016, the Company’s Common Stock traded at $67.49 per share.

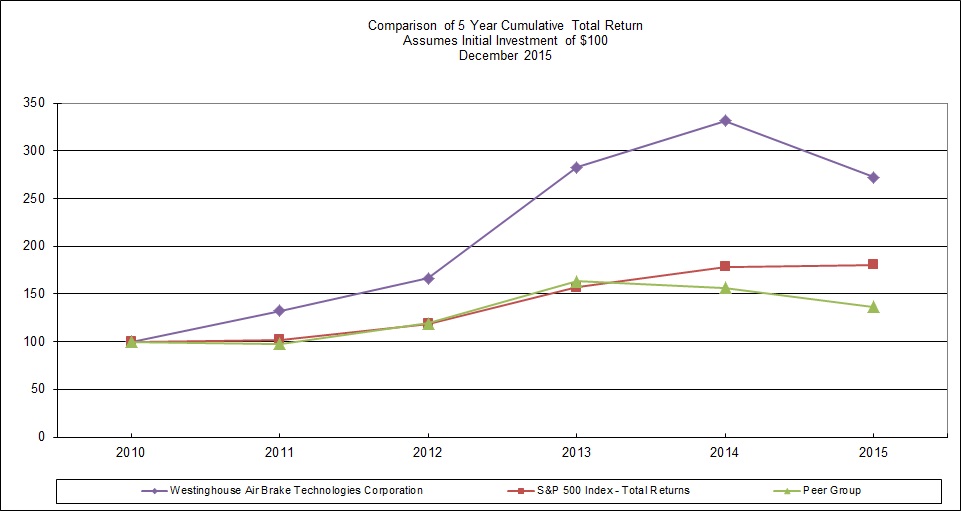

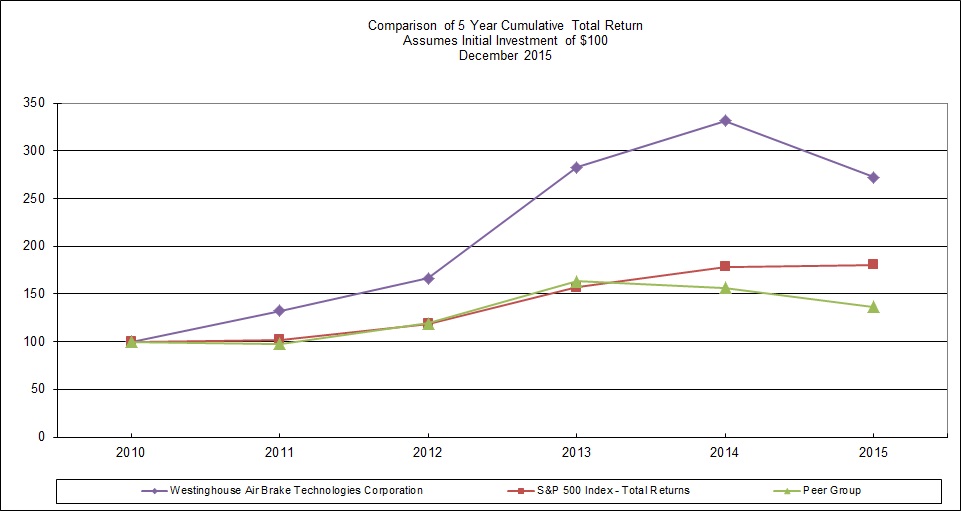

The following performance graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference to any future filings under the Securities Act of 1933 and the Securities Exchange Act of 1934, each as amended, except to the extent that Wabtec specifically incorporates it by reference into such filing. The graph below compares the total stockholder return through December 31, 2015, of Wabtec’s common stock to, (i) the S&P 500, (ii) our former peer group of manufacturing companies which consisted of the following publicly traded companies: The Greenbrier Companies, L.B. Foster, Trinity Industries and Freight Car America; and (iii) our new peer group of manufacturing companies which consists of the following publicly traded companies: The Greenbrier Companies, Trinity Industries, AMETEK, Regal Beloit, Harsco, Valmont, Lincoln Electric, Kennametal, Pall, Crane, Donaldson, WABCO, ITT, Briggs & Stratton, IDEX, Woodward, Titan Wheel, Actuant and Koppers. The peer group was revised to better match the operations and products of Wabtec.

On November 9, 2015, the Board of Directors amended its stock repurchase authorization to $350 million of the Company’s outstanding shares. This new stock repurchase authorization supersedes the previous authorization of $200 million of which about $100.0 million remained. Through December 31, 2015, 4,042,123 shares have been repurchased under the new authorization totaling $316.7 million leaving $33.3 million remaining under the authorization. All purchases were made on the open market.

On February 9, 2016 the Board of Directors amended its stock repurchase authorization to $350 million of the Company's outstanding shares. This new stock repurchase authorization supersedes the previous authorization of $350 million of which $33.3 million remained.

The Company intends to purchase shares on the open market or in negotiated or block trades. No time limit was set for the completion of the programs which conform to the requirements under the 2013 Refinancing Credit Agreement, as well as the senior notes currently outstanding.