DLA Piper Australia is part of DLA Piper, a global law firm, operating through various separate and distinct legal entities.

A list of offices and regulatory information can be found at dlapiper.com

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

(Exact Name of Registrant as Specified in its Charter)

| (State or other jurisdiction of incorporation) |

(Commission |

(I.R.S. Employer Identification No.) |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s

telephone number, including area code: (

N/A

(Former name, or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each

exchange on which registered | ||

| The Stock Market LLC | ||||

| The Stock Market LLC | ||||

| The Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry Into a Material Definitive Agreement.

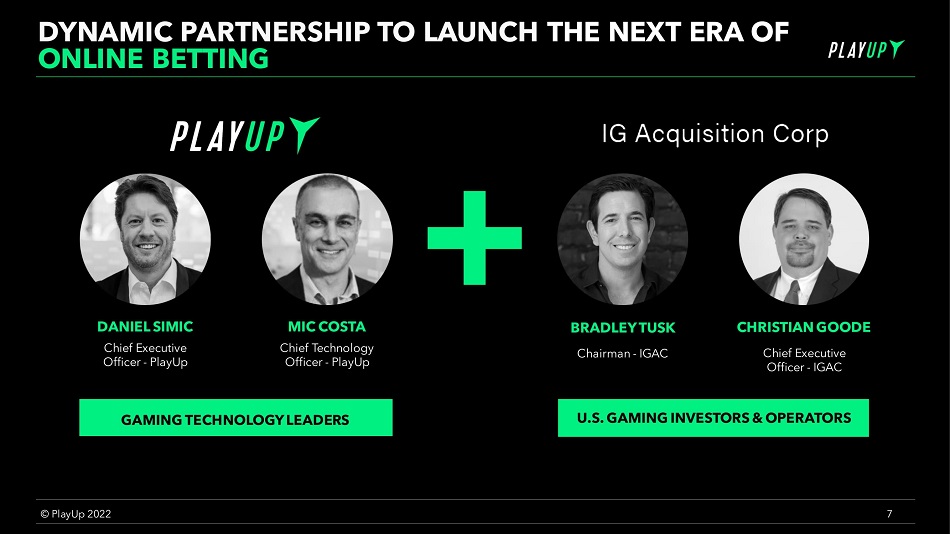

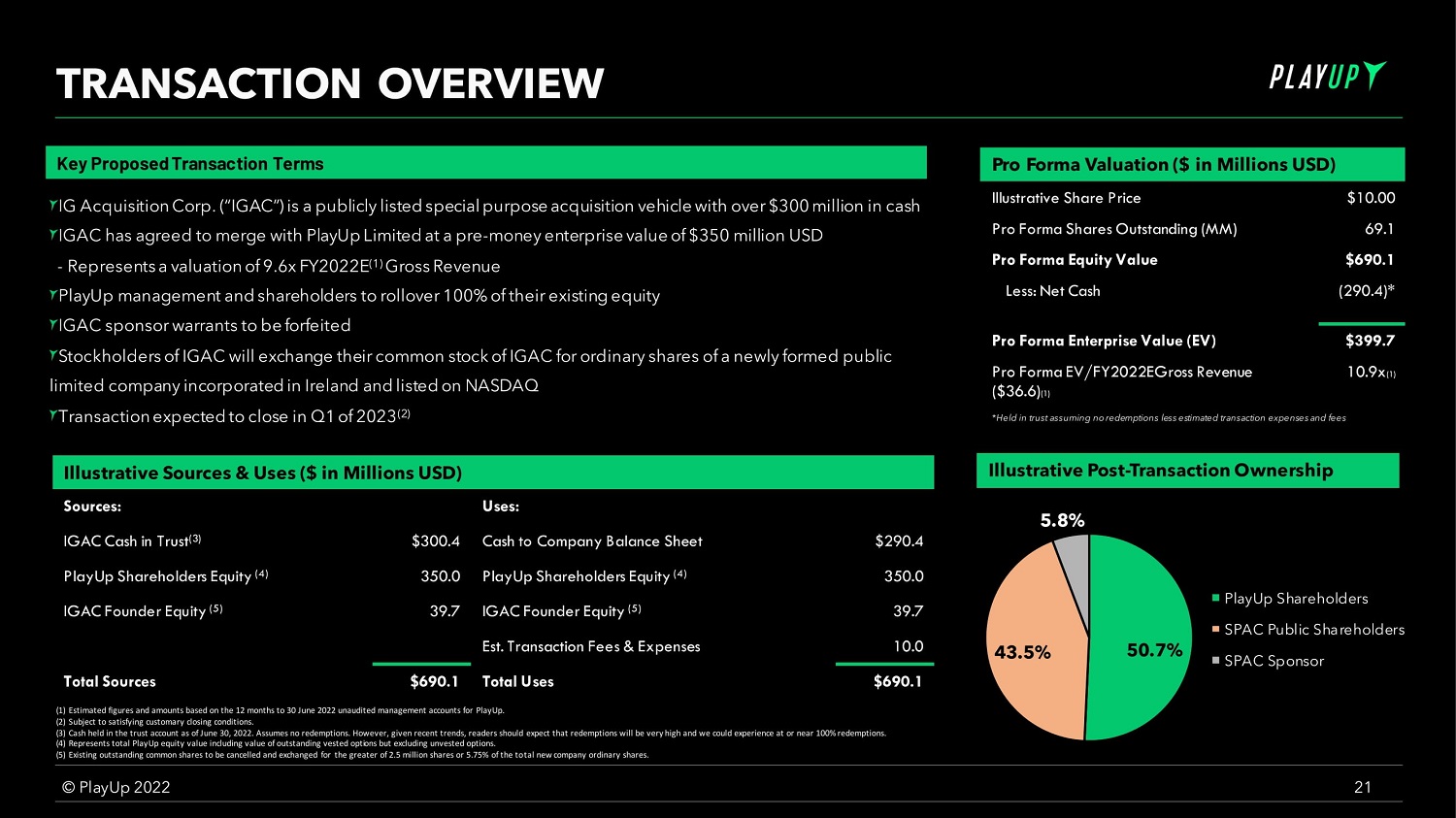

On September 22, 2022, IG Acquisition Corp., a Delaware corporation (“IGAC”), PlayUp Limited, an Australian public company (the “Company”), Maple Grove Holdings Public Limited Company, a public limited company incorporated in the Republic of Ireland (“Parent”), and Project Maple Merger Sub, LLC, a Delaware limited liability company and a direct, wholly-owned subsidiary of Parent (“Merger Sub”) entered into a Business Combination Agreement (the “BCA”) and IGAC, the Company and Parent entered into a Scheme Implementation Deed (“SID”). The following descriptions of the BCA and SID do not purport to be complete and are qualified in their entirety by reference to the full text of the BCA and SID, copies of which are included as Exhibit 2.1 and Exhibit 2.2 to this Current Report on Form 8-K, respectively, and incorporated herein by reference.

Business Combination Agreement and Scheme Implementation Deed

Subject to the terms and conditions set forth in the BCA and the SID, including the approval of IGAC’s stockholders, the parties thereto will enter into a business combination transaction (the “Proposed Business Combination”), pursuant to which, among other things Merger Sub shall be merged with and into IGAC with IGAC continuing as a direct, wholly-owned subsidiary of Parent.

Under the SID, the Company has agreed to propose a scheme of arrangement under Part 5.1 of the Corporations Act (“Scheme”) and capital reduction which, if implemented, will result in all shares in the Company being cancelled in return for the issue of ordinary shares of Parent (“Parent Shares”), with Parent then being issued a share in the Company (“Company Shares”) (resulting in the Company becoming a wholly owned subsidiary of Parent), subject to Company shareholder approval, Australian court approval and the satisfaction of various conditions.

Consideration

Subject to the terms and conditions set forth in the BCA and the SID, shareholders of the Company will receive, in exchange for each Company Share, a number of Parent Shares equal to (a) 35,000,000 divided by, (b) a number equal to, as of the Record Date (as defined in the SID), (i) the total number of Company Shares on issue plus (ii) the total number of Company Shares issuable upon the conversion of options (other than unvested options issued to the Company’s employees), convertible notes and any other outstanding securities or rights that are convertible into Company Shares.

Under the BCA, in connection with the merger of Merger Sub with and into IGAC, (a) each share of IGAC’s Class A common stock, par value $0.0001 per share (“IGAC Class A Stock”) (other than any shares of IGAC Class A Stock issued upon any automatic conversion of the IGAC’s Class B common stock, par value $0.0001 per share (“IGAC Class B Stock”) pursuant to Section 4.3(b) of IGAC’s Certificate of Incorporation (“Class A Conversion Stock”)) will be cancelled and converted into the right to receive one Parent Share, (b) all shares of IGAC’s Class B Stock (and any shares of Class A Conversion Stock) will be converted into the right to receive an aggregate number of Parent Shares equal to the greater of (i) 2,500,000 and (ii) 5.75% of the total number of Parent Shares outstanding as of the closing of the Proposed Business Combination, (c) warrants held by public stockholders of IGAC will become exercisable for Parent Shares following the consummation of the Proposed Business Combination (“Parent Warrants”) and (d) private placement warrants held by IG Sponsor LLC (the “Sponsor”) will be cancelled, in each case, in accordance with the terms of the BCA.

Representations and Warranties

The BCA and SID, collectively, contain customary representations and warranties of the parties thereto with respect to the parties, the transactions contemplated by the BCA and the SID and their respective business operations and activities. The representations and warranties in the BCA and SID shall terminate and expire upon the occurrence of the closing of the transactions contemplated thereby.

1

Covenants

The BCA and SID, collectively, contain customary covenants of the parties thereto, including: (a) the requirement to use reasonable best efforts to take, or cause to be taken, all actions, to file, or cause to be filed, all documents and to do, or cause to be done, all things necessary, proper or advisable to consummate the Proposed Business Combination and the Scheme, (b) preparation and filing of a Registration Statement on Form F-4 with respect to the Parent Shares and Parent Warrants issuable in connection with the Proposed Business Combination, which Form F-4 will contain the proxy statement/prospectus for IGAC stockholders (the “Proxy Statement/Prospectus”); (c) restrictions on the conduct of the Company’s, IGAC’s and Parent’s respective businesses and (d) exclusivity provisions requiring, subject to certain exceptions, that the Company ensure that neither it nor any of its representatives solicits, invites, facilitates, encourages or initiates any Competing Proposal (as defined in the SID) and that IGAC will not, and will direct its representatives acting on its behalf not to, directly or indirectly, (i) solicit or initiate any inquiry, indication of interest, proposal or offer from any third party relating to a SPAC Competing Transaction (as defined in the BCA), (ii) participate in any discussions or negotiations with a third party regarding, or furnish or make available to a third party any information relating to the IGAC with respect to, a SPAC Competing Transaction, or (iii) enter into any understanding, arrangement, agreement, agreement in principle or other commitment (whether or not legally binding) with a third party relating to a SPAC Competing Transaction.

Conditions to Closing

Consummation of the Proposed Business Combination and the Scheme is subject to conditions that are customary for a transaction of this type, including, among others: (a) there being no temporary, preliminary or final order, decision or decree issued by any court of competent jurisdiction or government agency which restrains, prohibits, or prevents, implementation of the Scheme or the Proposed Business Combination; (b) approval by IGAC’s stockholders of certain proposals to be set forth in the Proxy Statement/Prospectus; (c) approval by the Company shareholders of the Scheme; (d) approval by an Australian court of the Scheme; (e) the Parent Shares and Parent Warrants to be issued pursuant to the BCA and the SID being approved for listing on the Nasdaq Capital Market; (e) the Form F-4 containing the Proxy Statement/Prospectus being declared effective in accordance with the provisions of the Securities Act of 1933, as amended (the “Securities Act”); and (f) the receipt of proceeds from (i) IGAC’s trust account following redemptions, (ii) equity and debt financing, together with cash available to be drawn at closing from equity and debt financing, and (iii) committed but unfunded equity and debt financing, being equal to or greater than $60 million, with at least $36 million in funds available or available to be drawn at closing (the “Minimum Committed Funds Condition”).

Termination

The BCA and SID each include termination provisions.

The SID may be terminated under certain customary and limited circumstances prior to 8:00am on the Second Court Date (as defined in the SID), including: (a) by either party if the other party has materially breached the SID and the party in breach has failed to remedy the breach within ten business days (or such shorter period ending at 5:00pm on the business day before the Second Court Date) after receipt by it of a notice in writing from the terminating party setting out details of the relevant circumstances giving rise to the breach and requesting the party in breach of the SID to remedy the breach; (b) by either party if the Federal Court of Australia or another government agency (including any other court) has taken any action permanently restraining or otherwise prohibiting or preventing the Proposed Business Combination, or has refused to do anything necessary to permit the Proposed Business Combination, and the action or refusal has become final and cannot be appealed or reviewed or the party, acting reasonably, believes that there is no realistic prospect of a successful appeal or review succeeding by June 30, 2023 (the “End Date”); (c) by either or a given party under certain circumstances, when a condition to closing is not satisfied (including by the Company if the Minimum Committed Funds Condition is incapable of being satisfied by the End Date); (d) if the BCA is terminated in accordance with its terms; (e) by either party if the Effective Date (as defined in the SID) for the Scheme has not occurred, or will not occur, on or before the End Date (as defined in the SID) on or before the End Date; (f) by the Company if a director of the Company changes, withdraws, or modifies their recommendation in respect of the Scheme that shareholders of the Company vote in favour of the Scheme, provided that such director of the Company has determined in good faith (after having received advice from its external legal advisors and, if appropriate, financial advisors), that failing to change, withdraw or modify such recommendation would constitute a breach of such director’s fiduciary or statutory duties to the shareholders of the Company; or (g) if the Board of Directors of the Company determines that a Competing Proposal is a Superior Proposal (as defined in the SID).

2

The BCA may be terminated under certain customary and limited circumstances prior to the Second Court Date, including (a) upon termination of the SID in accordance with Section 11.1 or 11.2 thereof, with the party entitled to terminate the SID therein being entitled to terminate the BCA; (b) by mutual written consent of IGAC and the Company, (b) by either IGAC or the Company if the Effective Date has not occurred prior to the End Date, (c) by either IGAC or the Company if IGAC fails to obtain approval of certain proposals to be set forth in the Proxy Statement/Prospectus, (e) by either IGAC or the Company if the SID has been terminated in accordance with its terms, (f) by IGAC if the Company, Parent or Merger Sub has breached or failed to perform any of its covenants or agreements set forth in the BCA such that the condition requiring material compliance with covenants would not be satisfied (provided if such breach is curable by the Company, Parent or Merger Sub, IGAC may not terminate the BCA pursuant to this provision for so long as the Company, Parent or Merger Sub continues to exercise its reasonable efforts to cure such breach, unless such breach is not cured by the earlier of thirty (30) days after notice of such breach is provided by IGAC to the Company and the End Date) or (g) by the Company if IGAC has breached or failed to perform any of its covenants or agreements set forth in the BCA such that the condition requiring material compliance with covenants would not be satisfied (provided if such breach is curable by IGAC, the Company may not terminate the BCA pursuant to this provision for so long as IGAC continues to exercise its reasonable efforts to cure such breach, unless such breach is not cured by the earlier of thirty (30) days after notice of such breach is provided by the Company to IGAC and the End Date).

Related Agreements

Lock-Up Agreements

Prior to the Second Court Date, certain shareholders will enter into lock-up agreements (each, a “Lock-Up Agreement”) with Parent pursuant to which, among other things, such shareholders will agree not to offer, sell, contract to sell or otherwise dispose of, directly or indirectly, any Parent Shares beneficially owned by such shareholders immediately following the closing for a period of time beginning on the closing date of the Proposed Business Combination and ending on the one-year anniversary of the closing date. The foregoing description of the Lock-Up Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Lock-Up Agreement, a copy of which is included as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Sponsor Agreement

IGAC, the Company, Parent, Sponsor, and certain directors and officers of IGAC entered into a Sponsor Agreement (the “Sponsor Agreement”) pursuant to which the Sponsor and certain directors and officers of IGAC agreed with Parent to take, or not take, certain actions, including: (a) to vote any shares of common stock of IGAC owned by it (all such shares of common stock, the “Covered Shares”) in favor of the Proposed Business Combination and each other related proposal related at the IGAC stockholder meeting and any other special meeting of IGAC’s stockholders called for the purpose of soliciting the approval of IGAC’s stockholders in connection with the consummation of the Proposed Business Combination; (b) to vote the Covered Shares owned by it against any SPAC Competing Transaction, change in the capitalization of IGAC or any amendment of IGAC’s amended and restated certificate of incorporation except as contemplated by the BCA, and (c) not redeem any Covered Shares owned by it for redemption in connection with such shareholder approval.

Pursuant to the Sponsor Agreement, Sponsor and certain directors and officers of IGAC also agreed with Parent to certain standstill restrictions until the adjournment of third annual meeting of shareholders of Parent held following the closing of the Proposed Business Combination. These standstill restrictions include, but are not limited to, (a) engaging in any solicitation of proxies with respect to securities of Parent, (b) forming, joining or any way knowingly participating in any “group” (within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934) with respect to the Parent Shares, (c) depositing any Parent Shares in a voting trust or subjecting any Parent Shares to any voting agreement, (d) seeking to submit or knowingly encouraging any person or entity to seek or submit any nominations in furtherance of the appointment, election or removal of directors on the Parent board, (e) making any shareholder proposal or publicly encouraging, initiating or supporting any third party proposal in respect of business combination involving Parent, (f) seeking, alone or in concert with others, representation on the Parent board, (g) advising, knowingly encouraging, knowingly supporting or knowingly influencing any person or entity with respect to the voting or disposition of any securities Parent at a meeting of shareholders and (viii) making any request or submitting any proposal to amend the terms of the Sponsor Agreement.

3

The foregoing description of the Sponsor Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Sponsor Agreement, a copy of which is included as Exhibit 10.2 to this Current Report on Form 8-K, and incorporated herein by reference.

Registration Rights Agreement

The BCA contemplates that, prior to the Second Court Date, Parent, certain shareholders of Parent (after giving effect to the Transactions) will enter into an amended and restated registration rights agreement (the “A&R Registration Rights Agreement”) pursuant to which, among other things, Parent will agree to undertake certain shelf registration obligations in accordance with the Securities Act, and certain subsequent related transactions and obligations, including, among other things, undertaking certain registration obligations, and the preparation and filing of required documents. The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Registration Rights Agreement, a copy of which is included as Exhibit 10.3 to this Current Report on Form 8-K, and incorporated herein by reference.

Standby Equity Purchase Agreement

Concurrently with the parties entering into the BCA and SID, Parent entered into a Standby Equity Purchase Agreement (“SEPA”) with YA II PN, Ltd. (“Yorkville”) pursuant to which, subject to the consummation of the Proposed Business Combination, Parent has the option, but not the obligation, to issue, and Yorkville shall subscribe for, an aggregate amount of up to $70 million of Parent Shares at the time of Parent’s choosing during the term of the agreement, subject to certain limitations, including caps on issuance and subscriptions based on trading volumes. Each advance under the SEPA (an “Advance”) may be for an aggregate amount of Parent Shares purchased at 97% of the Market Price during a one- or three-day pricing period elected by Parent. The “Market Price” is defined in the SEPA as the VWAP (as defined below) during the trading day, in the case of a one day pricing period, or the lowest daily VWAP of the three consecutive trading days, in the case of a three day pricing period, commencing on the trading day on which Parent submits an Advance notice to Yorkville. “VWAP” means, for any trading day, the daily volume weighted average price of Parent Shares for such date on Nasdaq as reported by Bloomberg L.P. during regular trading hours. The SEPA will continue for a term of three years commencing from the sixth trading day following the closing of the Proposed Business Combination. The foregoing description of the SEPA does not purport to be complete and is qualified in its entirety by reference to the full text of the SEPA, a copy of which is included as Exhibit 10.4 to this Current Report on Form 8-K, and incorporated herein by reference.

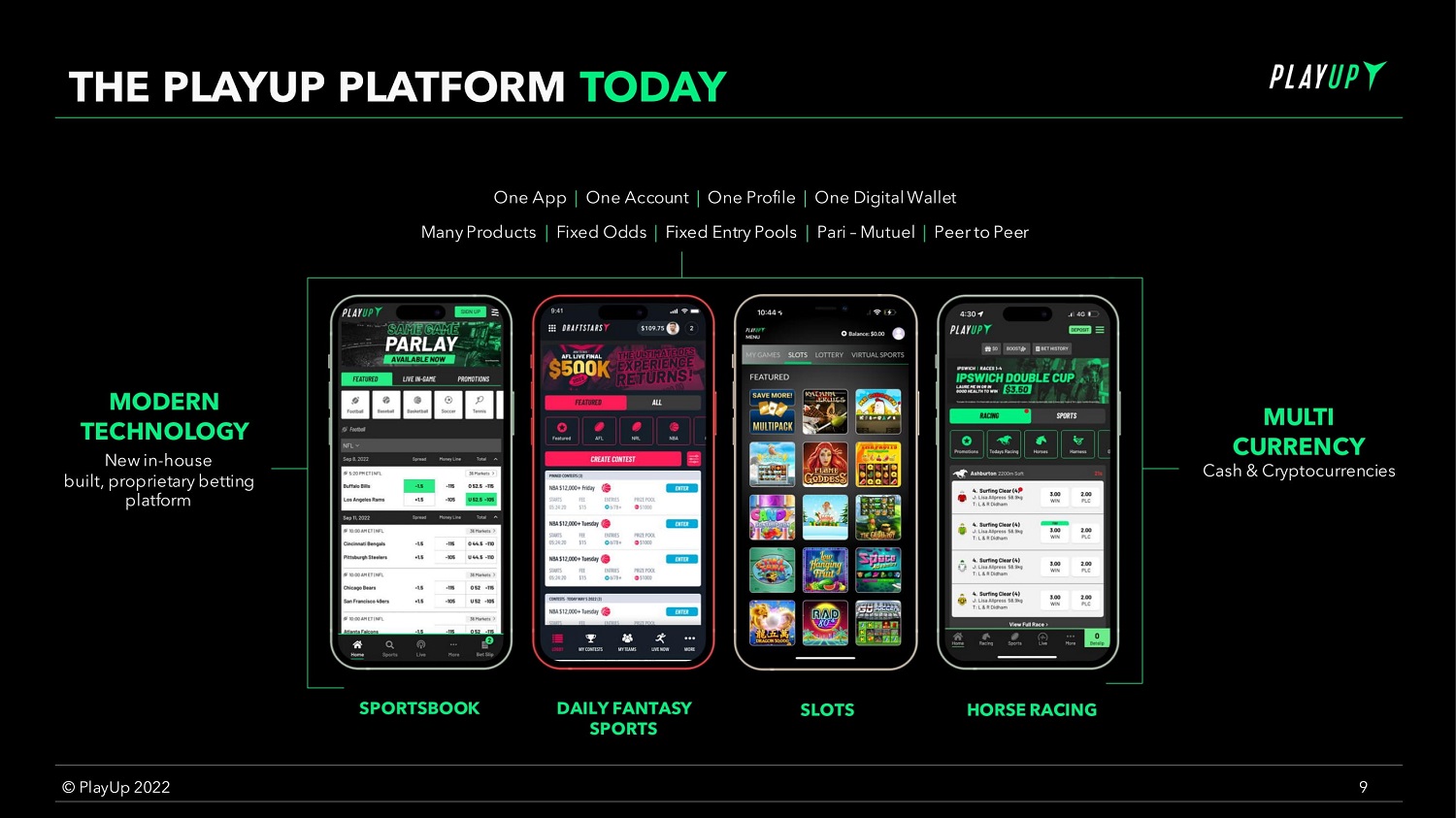

Item 7.01 Regulation FD Disclosure.

On September 22, 2022, IGAC and the Company issued a joint press release announcing the Proposed Business Combination. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

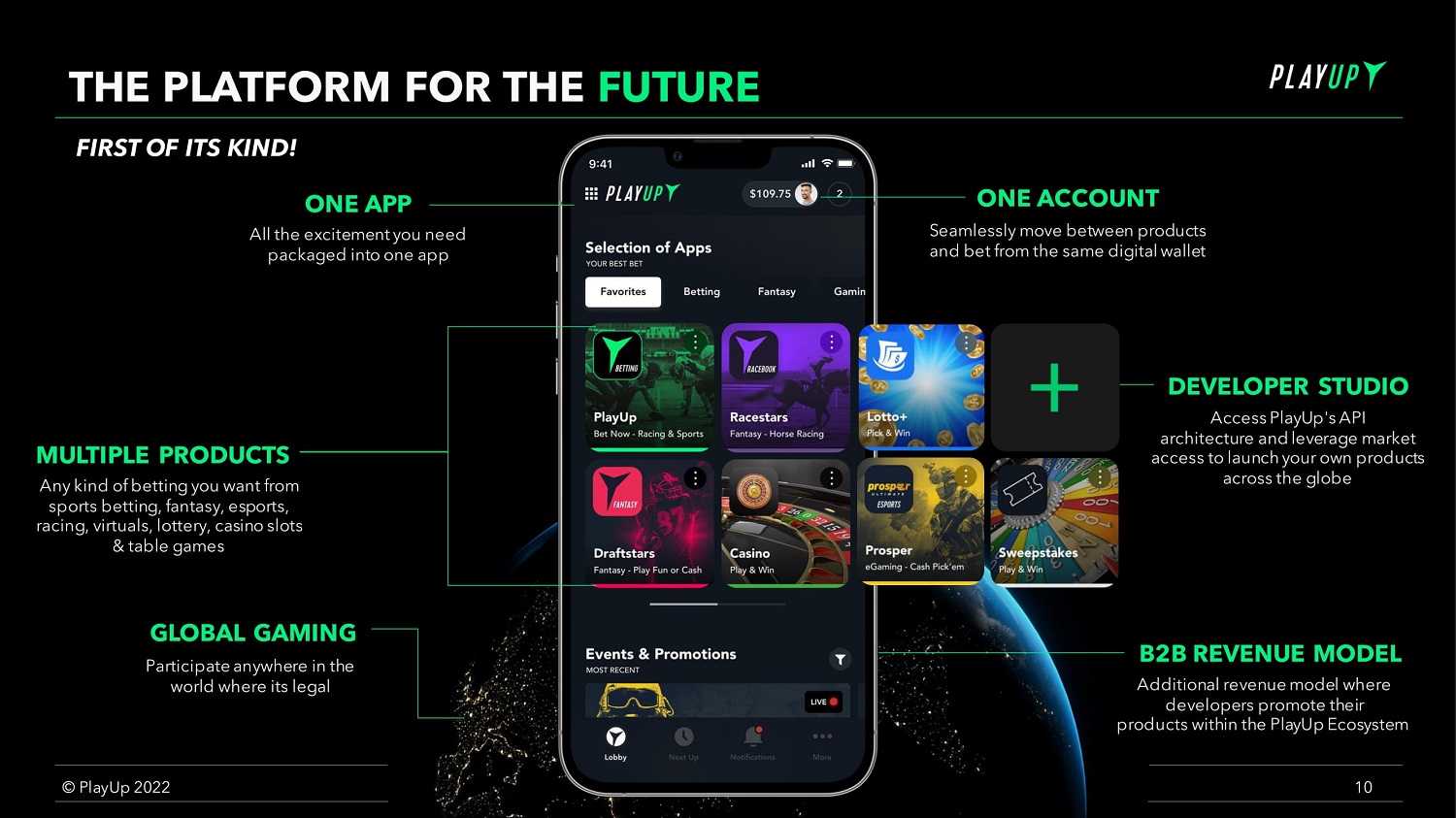

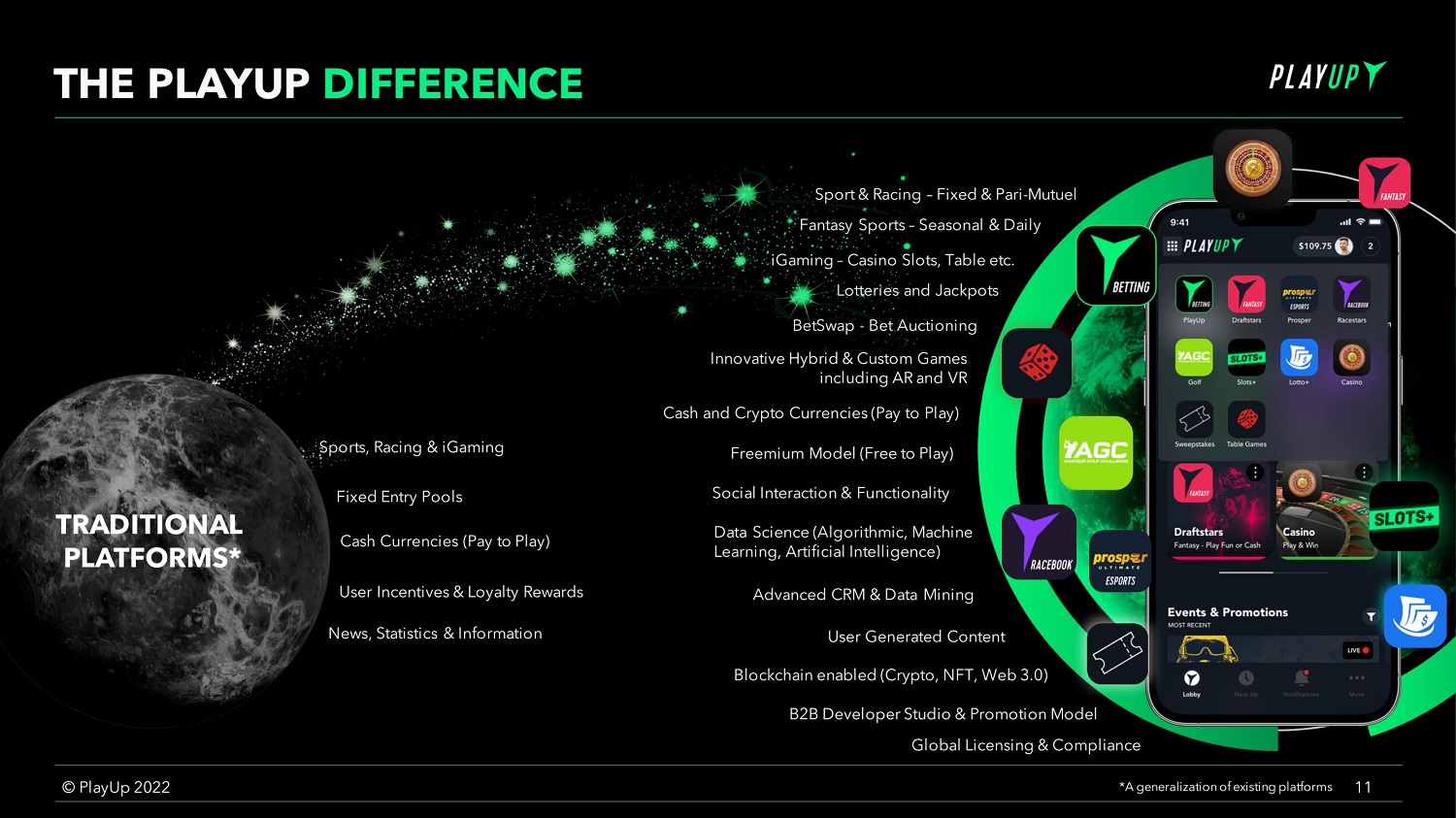

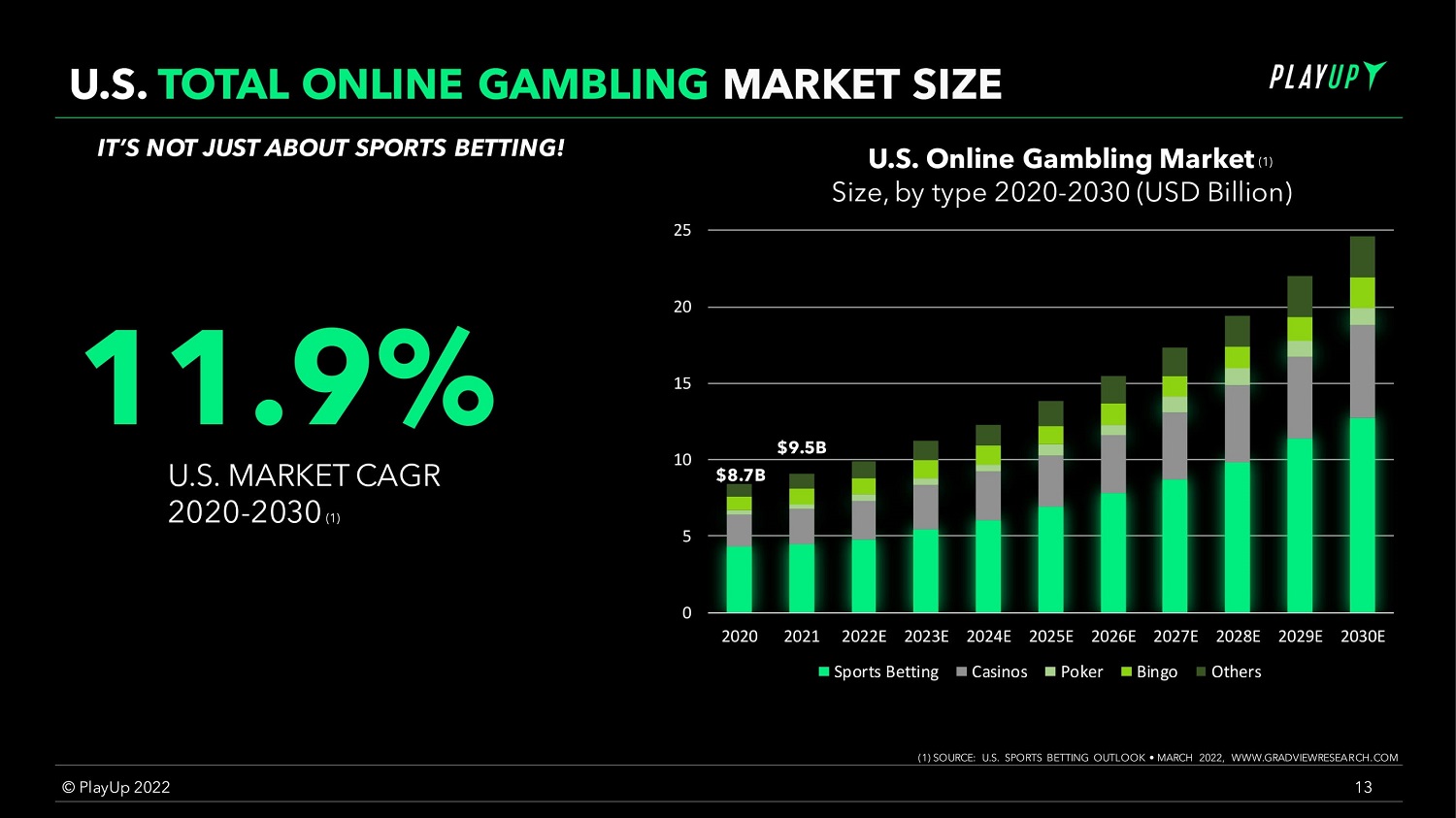

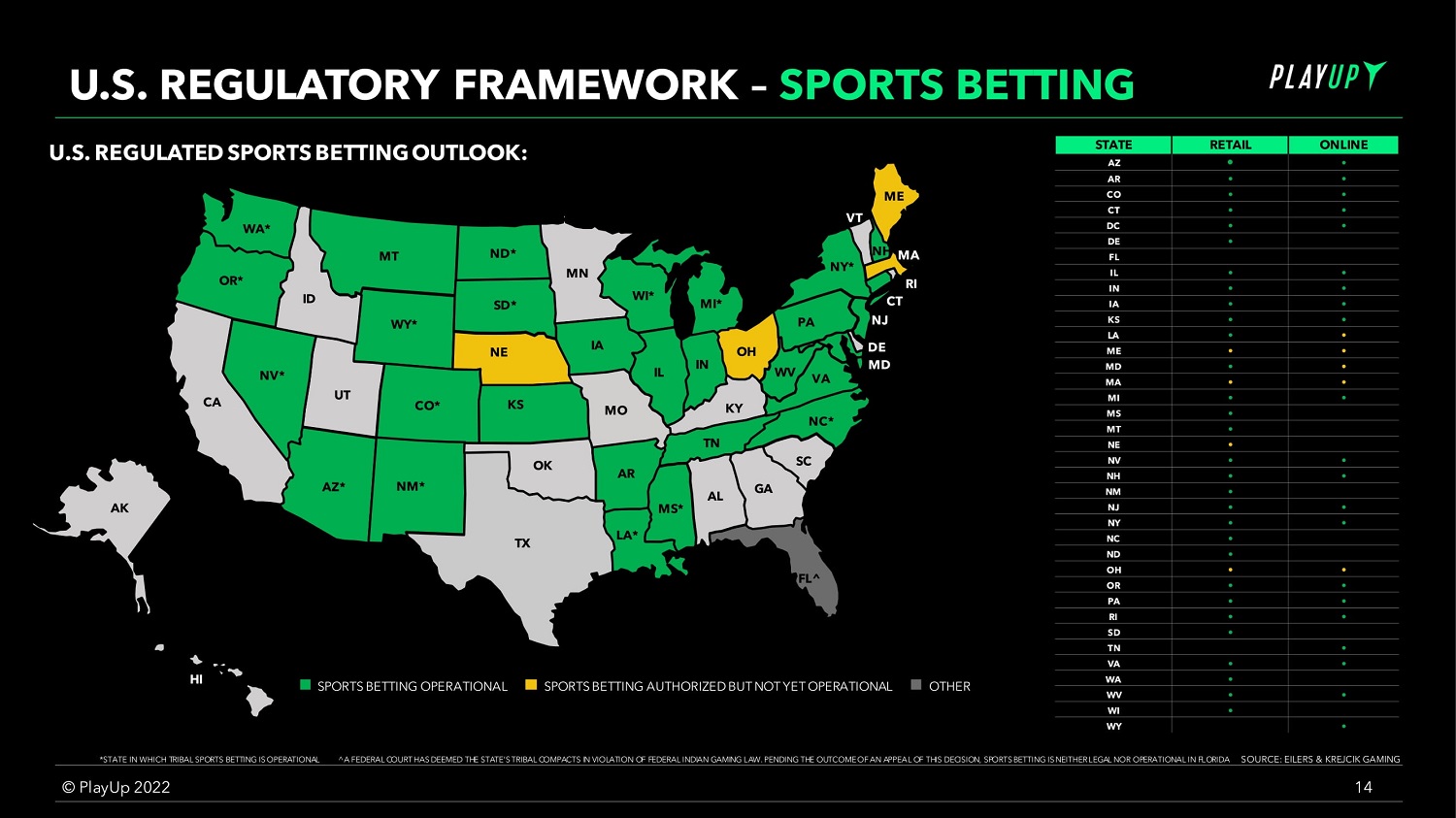

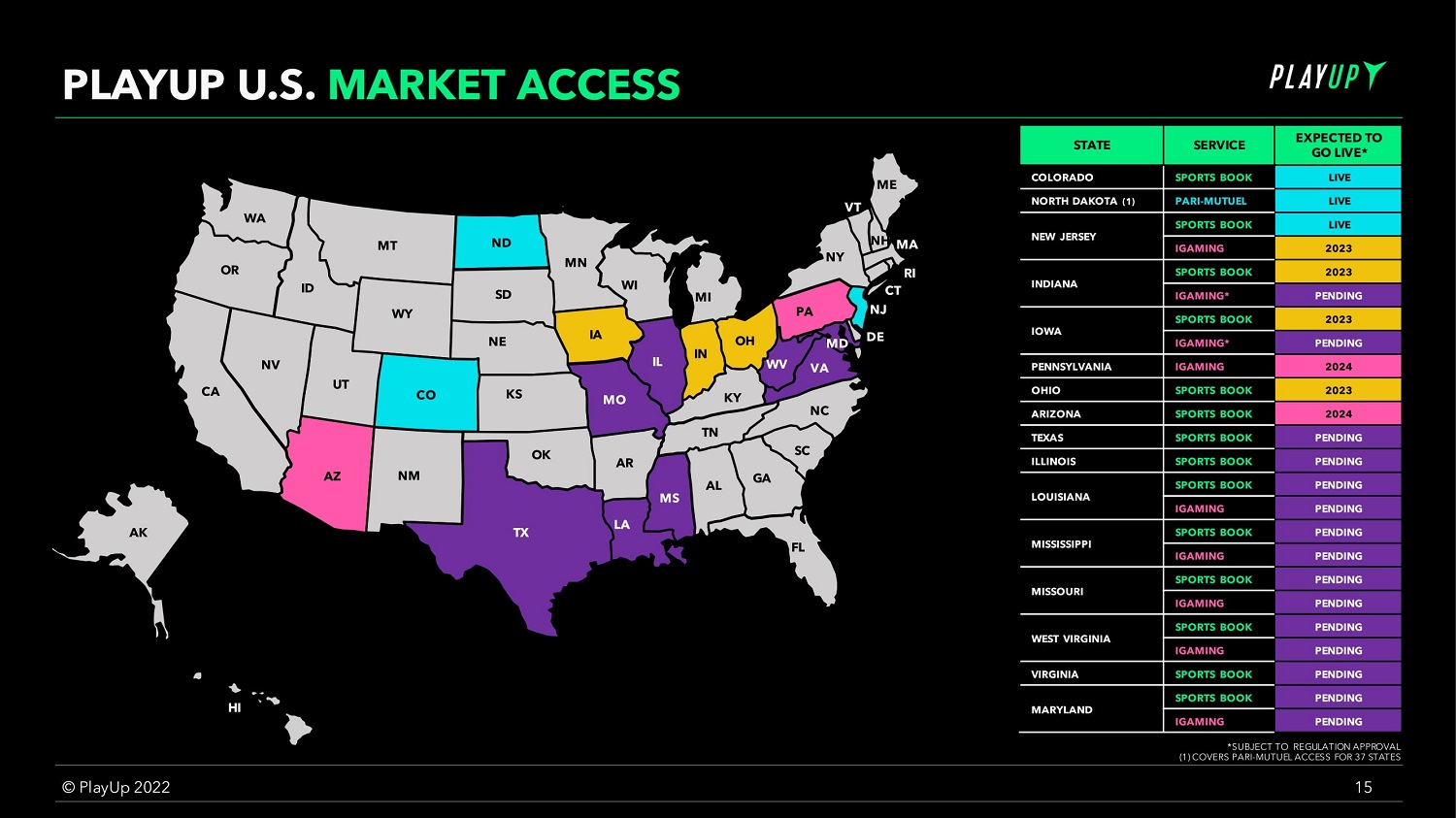

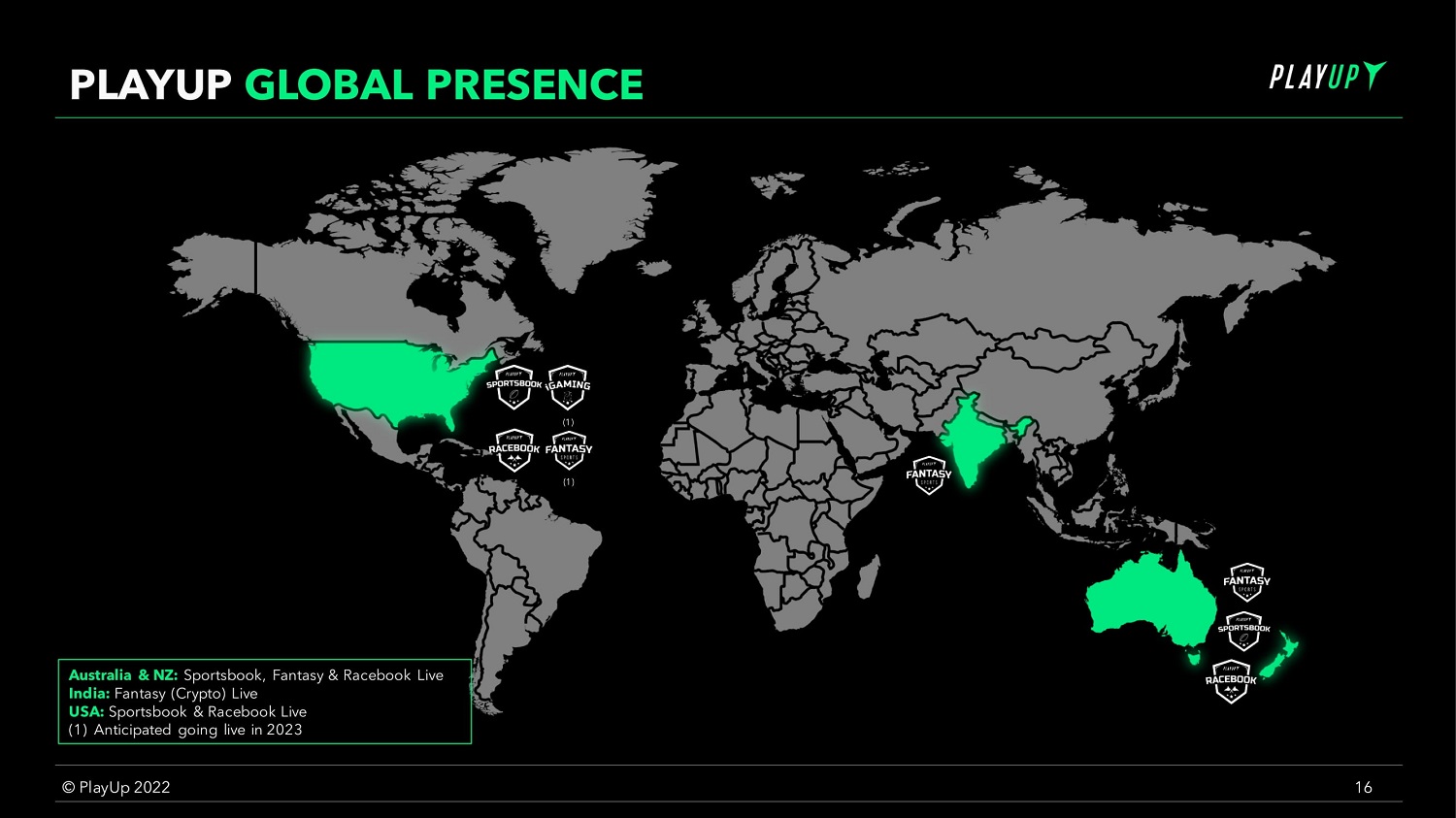

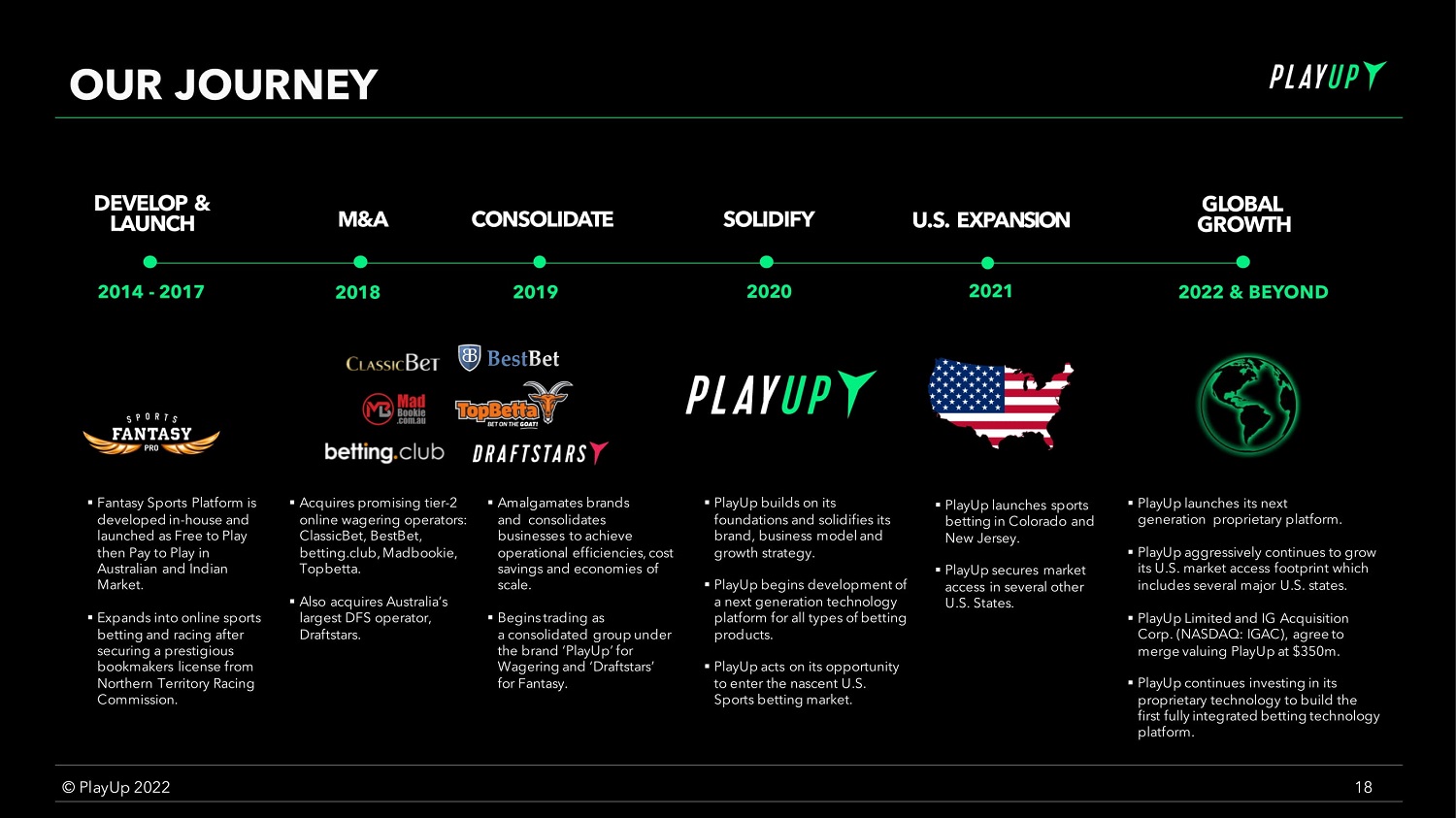

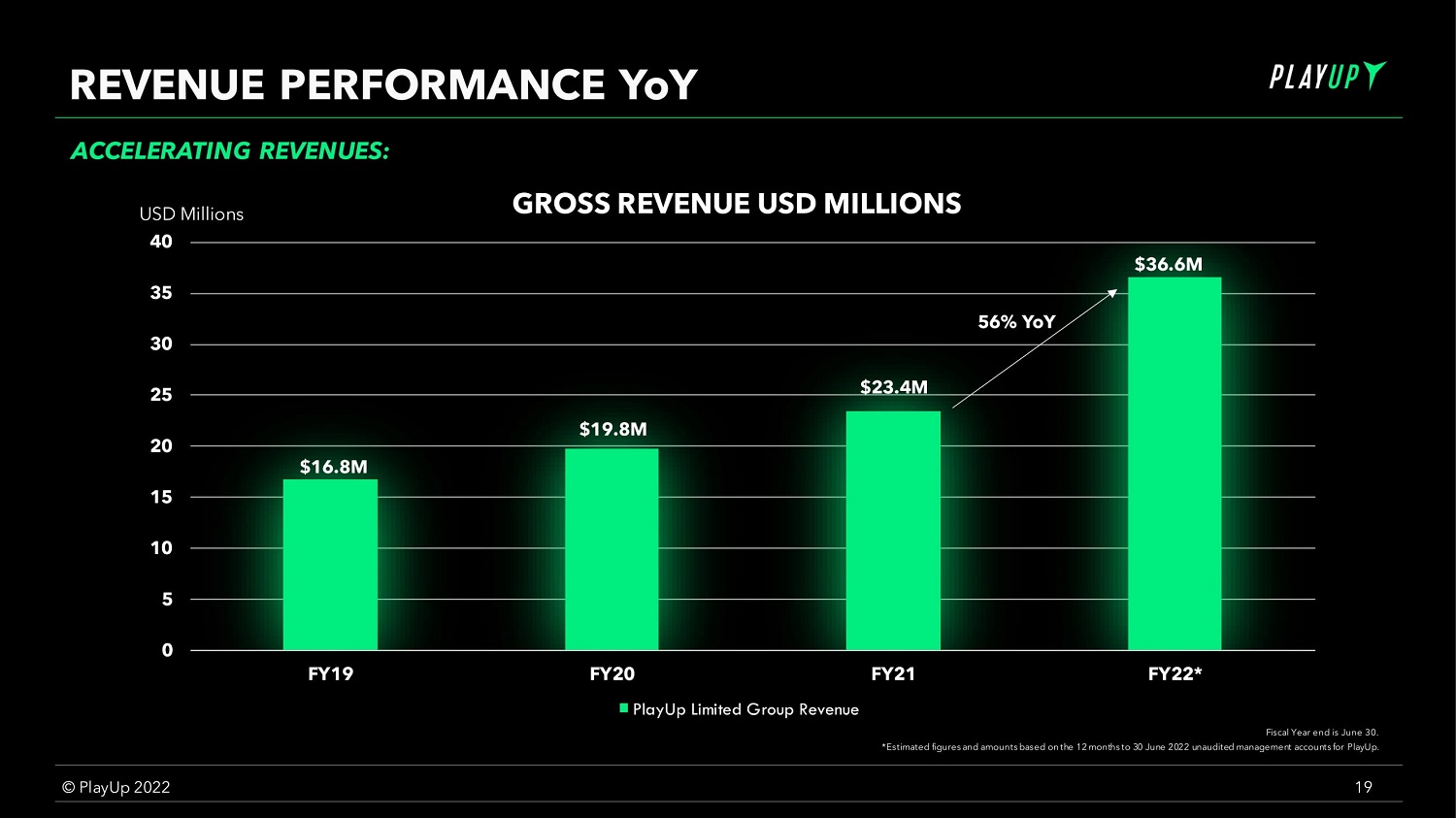

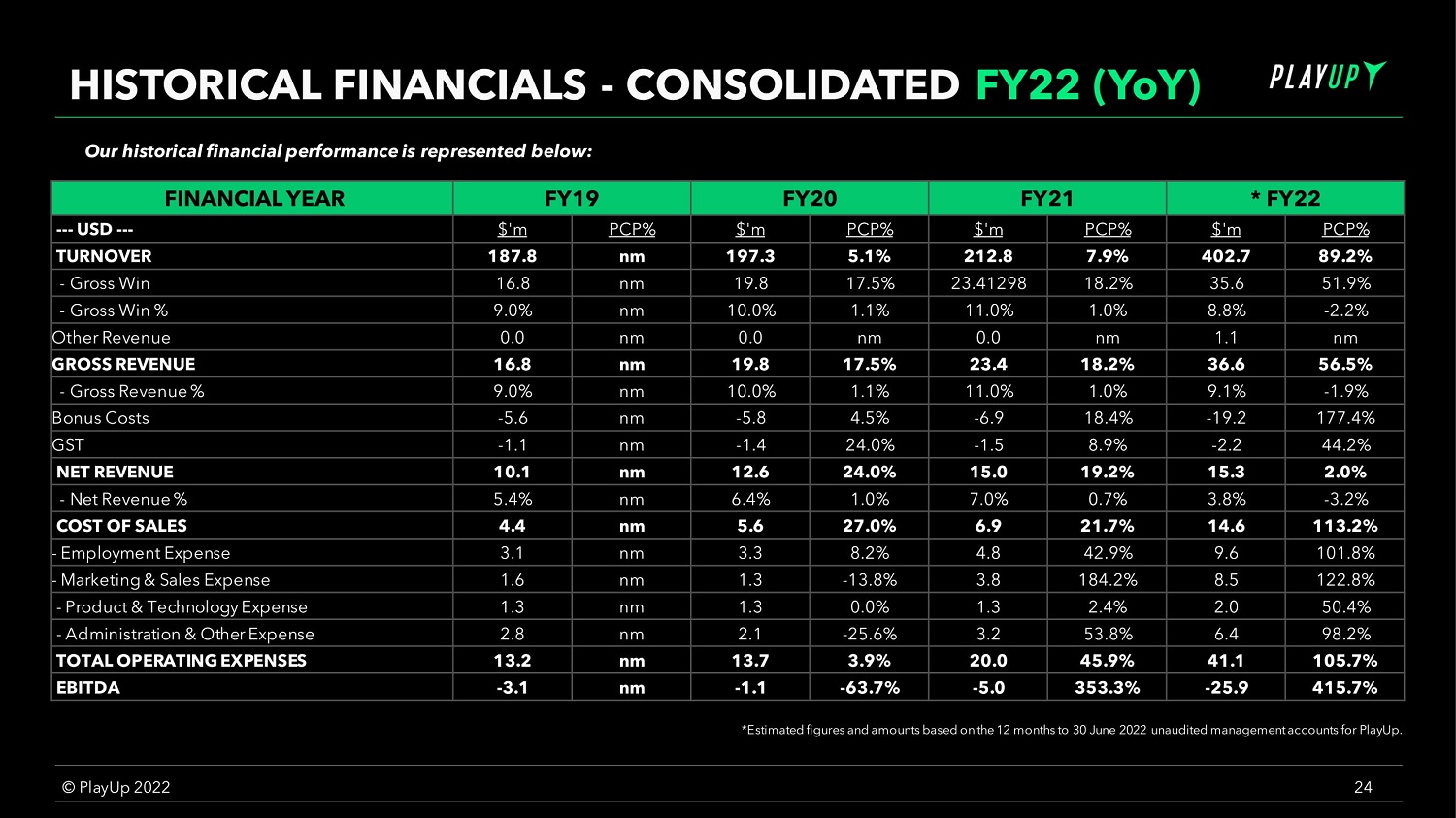

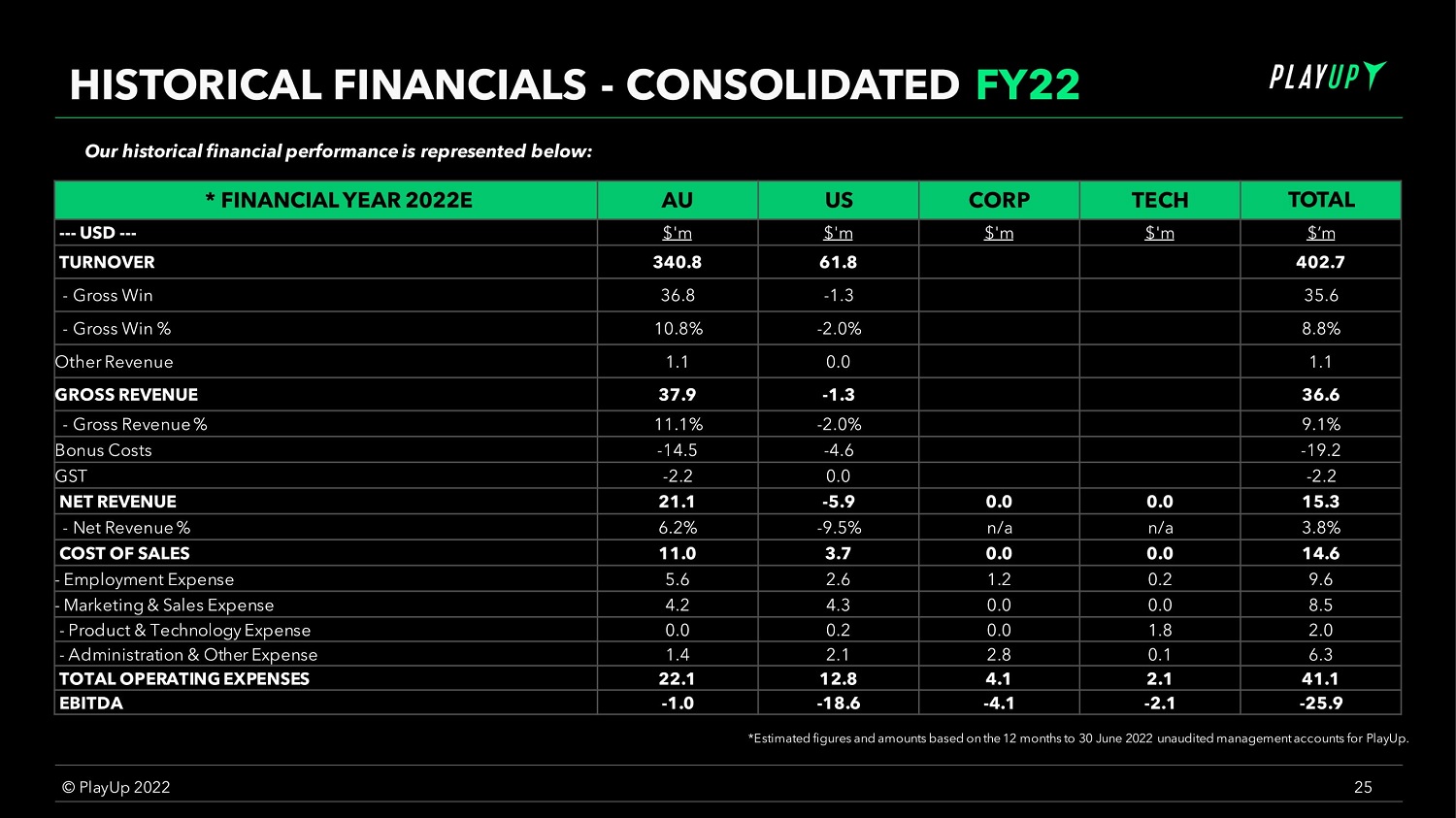

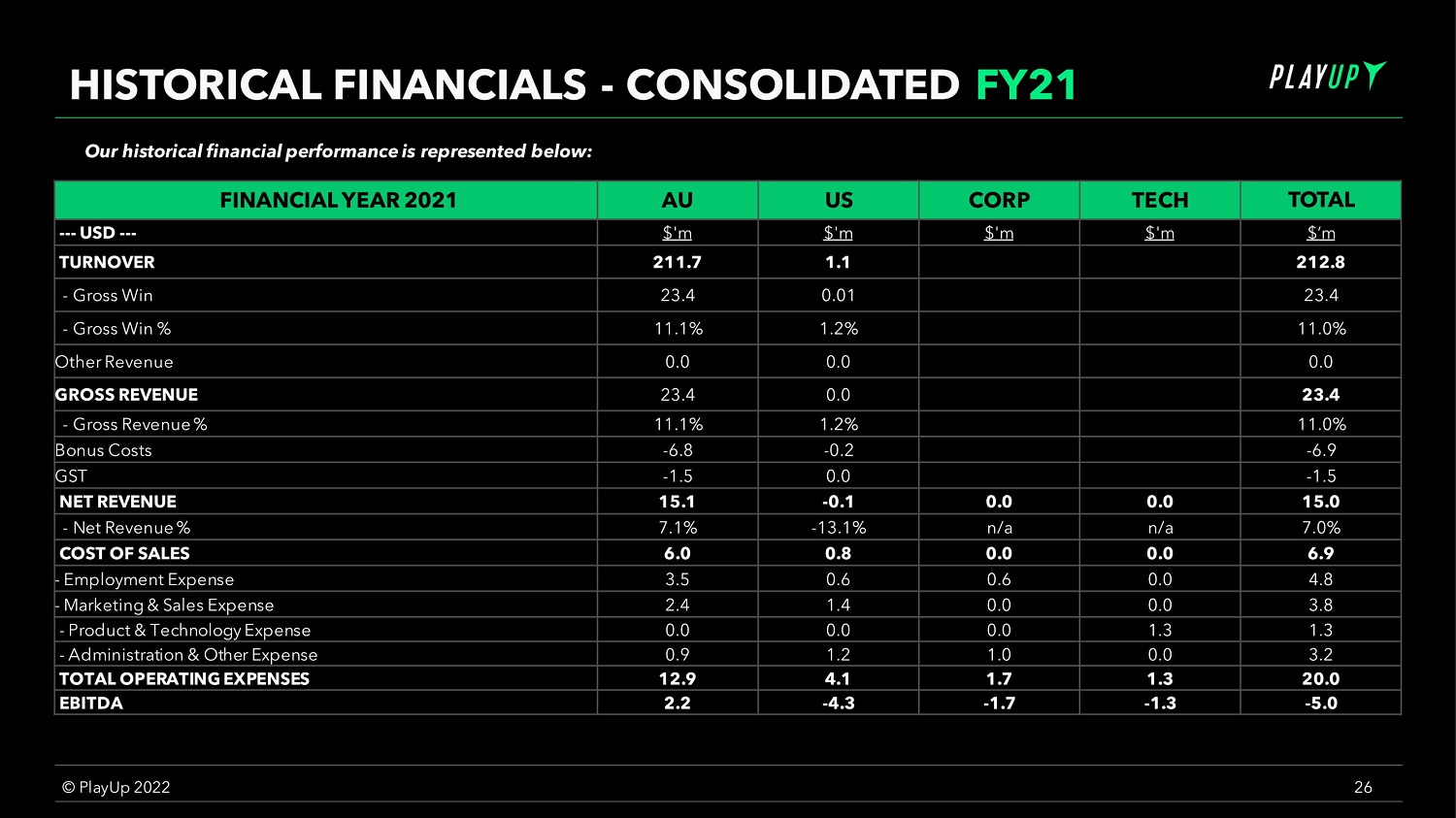

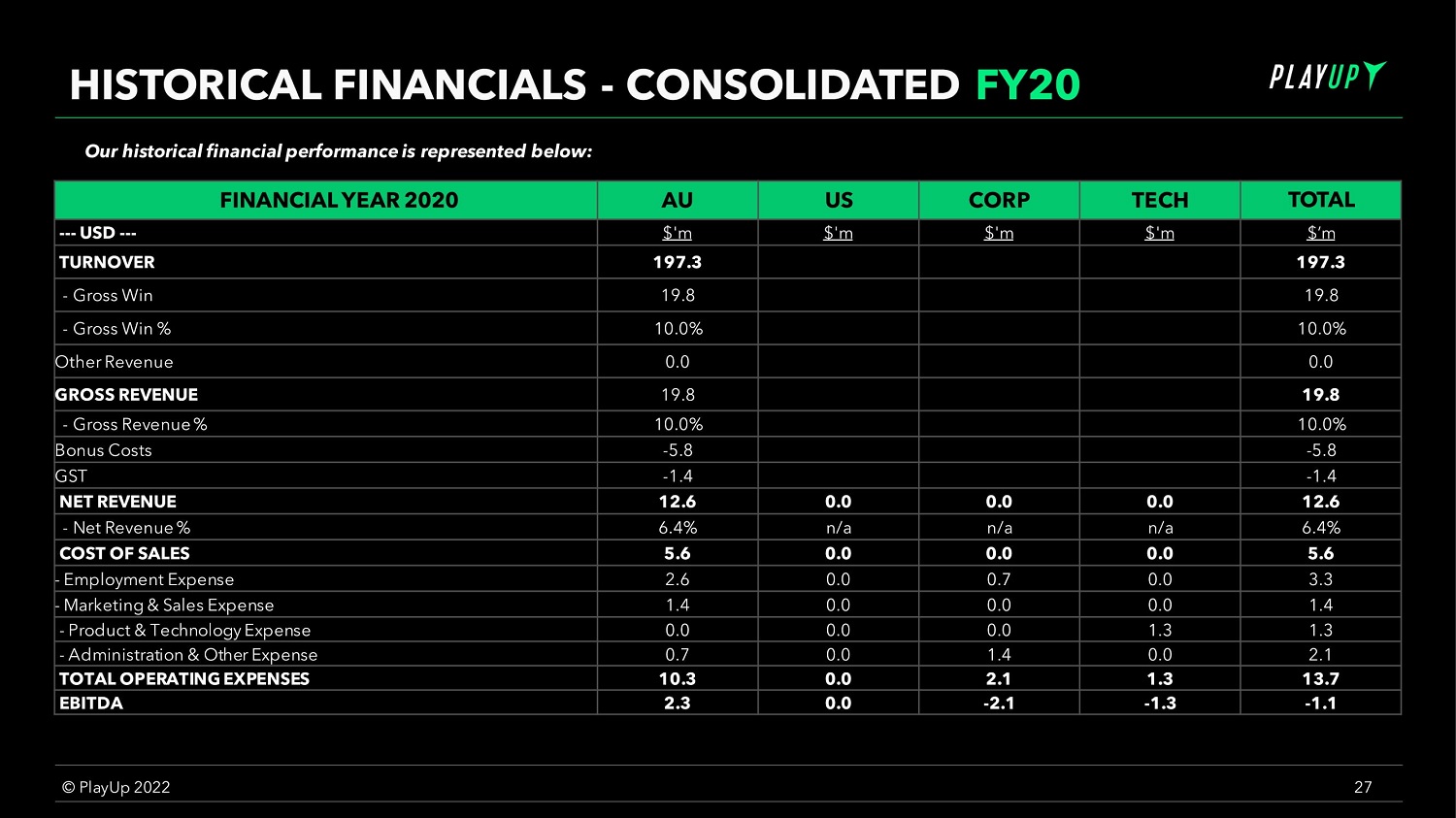

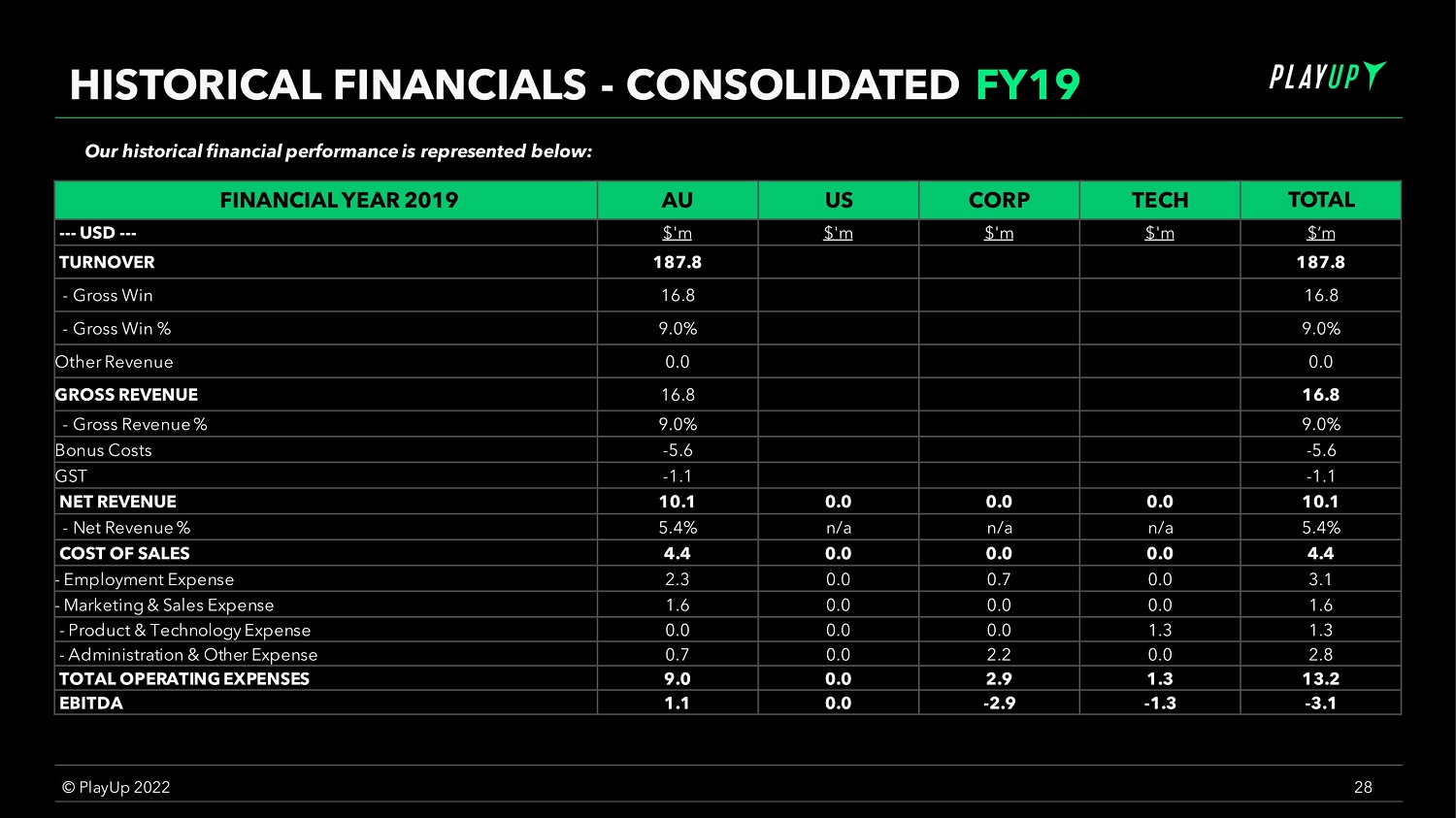

Furnished herewith as Exhibit 99.2 and incorporated into this Item 7.01 by reference is an investor presentation that may be used by IGAC and the Company to discuss the Proposed Business Combination.

The foregoing (including the information presented in Exhibits 99.1 and 99.2) is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act. The submission of the information set forth in this Item 7.01 shall not be deemed an admission as to the materiality of any information in this Item 7.01, including the information presented in Exhibit 99.1 and Exhibit 99.2, that is provided solely in connection with Regulation FD.

4

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements that are based on beliefs and assumptions, and on information currently available. In some cases, you can identify forward-looking statements by the following words: “positioned, ” “build,” “likely,” “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties, and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. We caution you that these statements are based on a combination of facts and factors currently known by us and our projections of the future, which are subject to a number of risks. Forward-looking statements in this Current Report on Form 8-K include, but are not limited to, statements regarding the Proposed Business Combination, including the timing and structure of the Proposed Business Combination; the listing of Parent’s shares; the amount and use of the proceeds of the Proposed Business Combination; the Company’s future growth and innovations and offerings; the market size for digital betting and the Company’s ability to capture a share of that market; the ability of the Company to expand its market reach, including its ability to obtain new licenses and meet regulatory suitability requirements; the initial market capitalization of Parent; the amount of funds available in IGAC’s trust account as a result of stockholder redemptions or otherwise; and the anticipated benefits of the Proposed Business Combination. We cannot assure you that the forward-looking statements in this Current Report on Form 8-K will prove to be accurate. These forward-looking statements are subject to a number of risks and uncertainties, including, among others, various factors beyond management’s control, including general economic conditions and other risks, uncertainties, and factors set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in IGAC’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 25, 2022, and in the proxy statement/prospectus to be filed by Parent in connection with the Proposed Business Combination, and other filings with the SEC, as well as factors associated with companies, such as the Company, that are engaged in digital betting, including anticipated trends, growth rates and challenges in those businesses and in the markets in which they operate; the ability to complete the Proposed Business Combination due to the failure to obtain required regulatory and stockholder approvals; the failure to satisfy other closing conditions in the definitive transaction agreement in respect of the transaction or otherwise; the occurrence of any event that could give rise to the termination of the definitive transaction agreement; risks related to the uncertainty of the forecasted financial information; the outcome of any legal proceedings that may be instituted against IGAC, the Company, or Parent related to the definitive transaction agreement or the Proposed Business Combination; risks related to the performance of the Company’s business and the timing of expected business or financial milestones; unanticipated technological or project development challenges, including with respect to the cost and or timing thereof; the performance of the Company’s products; the effects of competition on the Company’s business; the failure to realize the anticipated benefits of the Proposed Business Combination; the risk that the Company will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; the amount of redemption requests made by IGAC’s public stockholders; the risk that the Company may never achieve or sustain profitability; volatility in the price of IGAC’s securities; the risk that the transaction disrupts current plans and operations as a result of the announcement and consummation of the Proposed Business Combination; and the risk that Parent’s securities will not be approved for listing on the Nasdaq or, if approved, maintain the listing. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In addition, you are cautioned that past performance may not be indicative of future results. In light of the significant uncertainties in these forward-looking statements, you should not rely on these statements in making an investment decision or regard these statements as a representation or warranty by any person that the Company, IGAC or Parent will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements in this Current Report on Form 8-K represent our views as of the date of this Current Report on Form 8-K. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Current Report on Form 8-K.

Important Information About the Proposed Transaction and Where to Find It

A full description of the terms of the transaction will be provided in the Form F-4 to be filed with the SEC by Parent, which registration statement will include a prospectus with respect to Parent’s securities to be issued in connection with the transaction and a proxy statement with respect to the stockholder meeting of IGAC to vote on the transaction. Parent and IGAC urge investors, stockholders and other interested persons to read, when available, the preliminary proxy statement/prospectus, as well as other documents filed with the SEC, because these documents will contain important information about Parent, IGAC, the Company, and the transaction. After the registration statement is declared effective, the definitive proxy statement/prospectus to be included in the registration statement will be mailed to stockholders of IGAC as of a record date to be established for voting on the proposed business combination. Once available, stockholders will also be able to obtain a copy of the registration statement on Form F-4—including the proxy statement/prospectus and other documents filed with the SEC— without charge by directing a request to: Parent and IGAC at 251 Park Avenue South, 8th Floor New York, NY 10010 or via email at info@igacquisition.com . The preliminary and definitive proxy statement/prospectus to be included in the registration statement, once available, can also be obtained, without charge, at the SEC’s website (www.sec.gov).

5

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED THEREIN.

Participants in Solicitation

Parent, IGAC, the Company and their respective directors and executive officers, may be deemed participants in the solicitation of proxies of IGAC’s stockholders in respect of the transaction. Information about the directors and executive officers of IGAC is set forth in IGAC’s filings with the SEC. Information about the directors and executive officers of Parent and the Company and more detailed information regarding the identity of all potential participants, and their direct and indirect interests by security holdings or otherwise, will be set forth in the definitive proxy statement/prospectus for the transaction when available. Additional information regarding the identity of all potential participants in the solicitation of proxies to IGAC’s stockholders in connection with the Proposed Business Combination and other matters to be voted upon at the special meeting, and their direct and indirect interests, by security holdings or otherwise, will be included in the definitive proxy statement/prospectus, when it becomes available.

No Offer or Solicitation

This communication is for informational purposes only and does not constitute an offer or invitation for the sale or purchase of securities, assets, or the business described herein or a commitment to Parent, IGAC, or the Company, nor is it a solicitation of any vote, consent, or approval in any jurisdiction pursuant to or in connection with the transaction or otherwise, nor shall there be any sale, issuance, or transfer of securities in any jurisdiction in contravention of applicable law. Any such offer or solicitation will be made only in connection with the delivery of a prospectus meeting the requirements of the Securities Act or exemptions therefrom.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits.

| * | Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Company agrees to furnish supplementally a copy of all omitted exhibits and schedules to the Securities and Exchange Commission upon its request. |

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| IG ACQUISITION CORP. | ||

| Date: September 22, 2022 | By: | /s/ Christian Goode |

| Name: | Christian Goode | |

| Title: | Chief Executive Officer | |

7

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

by and among

IG Acquisition Corp.,

PLAYUP LIMITED,

Maple Grove Holdings Public Limited Company,

and

Project

Maple Merger Sub, LLC

Dated as of September 22, 2022

| Exhibit A | Form of SID |

| Exhibit B | Form of Amended and Restated Registration Rights Agreement |

| Exhibit C | Form of Lock-up Agreement |

| Exhibit D | Form of SPAC Second Amended and Restated Certificate of Incorporation |

| Exhibit E | Form of SPAC Amended and Restated Bylaws |

| Exhibit F | Form of Memorandum and Articles of Association |

| Schedule 1 | Registration Rights Agreement Signatories |

| Schedule 2 | Lock-up Agreement Signatories |

-i-

BUSINESS COMBINATION AGREEMENT

THIS BUSINESS COMBINATION AGREEMENT, dated as of September 22, 2022 (this “Agreement”), by and among IG Acquisition Corp., a Delaware corporation (“SPAC”), PlayUp Limited, an Australian public company with Australian Company Number (ACN) 612 529 307 (the “Company”), Maple Grove Holdings Public Limited Company, a public limited company incorporated in the Republic of Ireland with registered number 725881 (“Parent”), and Project Maple Merger Sub, LLC, a Delaware limited liability company and a wholly owned subsidiary of Parent (“Merger Sub”, and together with SPAC, the Company and Parent, collectively, the “Parties” and each a “Party”).

WHEREAS, upon the terms and subject to the conditions set forth in the Scheme Implementation Deed to be entered into by and among SPAC, the Company and Parent, substantially in the form attached hereto as Exhibit A (the “SID”), Parent will acquire the Company by means of the implementation of a scheme of arrangement under Part 5.1 of the Australian Corporations Act 2001 (Cth) (the “Corporations Act”) (the “PlayUp Scheme Acquisition”);

WHEREAS, the Board of Directors of the Company has unanimously (a) determined that the PlayUp Scheme Acquisition is fair to, and in the best interests of, the Company, declared its advisability and approved this Agreement and the SID, and proposes to seek the approval of its shareholders to approve the PlayUp Scheme Acquisition in accordance with the SID, and (b) recommended the approval of the PlayUp Scheme Acquisition by the shareholders of the Company;

WHEREAS, upon the terms and subject to the conditions set forth in this Agreement and in accordance with the General Corporation Law of the State of Delaware (the “DGCL”), Delaware Limited Liability Company Act (the “DLLCA”), the Irish Companies Act 2014 (the “ICA”), and the Corporations Act, Merger Sub will merge with and into SPAC (the “Merger”), with SPAC surviving the Merger as a wholly owned subsidiary of Parent;

WHEREAS, the Board of Directors of SPAC (the “SPAC Board”) has unanimously (a) determined that the Merger is fair to, and in the best interests of, SPAC and its stockholders and has approved and adopted this Agreement and declared its advisability and approved the Merger and the other transactions contemplated by this Agreement, and (b) recommended the approval and adoption of this Agreement and the Merger by the stockholders of SPAC;

WHEREAS, the sole member of Merger Sub has approved the Merger and the other transactions contemplated by this Agreement;

WHEREAS, the Board of Directors of Parent (the “Parent Board”) has (a) determined that the Merger is fair to, and in the best interests of, Parent and its shareholder and has approved and adopted this Agreement and declared its advisability and approved the Merger and the other transactions contemplated by this Agreement, and (b) recommended the approval and adoption of this Agreement and the Merger by the shareholder of Parent;

- 1 -

WHEREAS, the shareholder of Parent has approved the Merger and the other transactions contemplated by this Agreement;

WHEREAS, prior to the Second Court Date, Parent and certain shareholders of Parent (after giving effect to the Transactions) set forth on Schedule 1 shall enter into a registration rights agreement (the “Registration Rights Agreement”) substantially in the form attached hereto as Exhibit B;

WHEREAS, prior to the Second Court Date, Parent and certain shareholders of Parent (after giving effect to the Transactions) set forth on Schedule 2 shall enter into a lock-up agreement (the “Lock-up Agreement”) substantially in the form attached hereto as Exhibit C (which, for the avoidance of doubt, shall specify the term of lock-up and certain other provisions for each signatory);

WHEREAS, contemporaneously with the execution of this Agreement, the Sponsor has entered into an agreement with SPAC and the Company (the “Sponsor Support Agreement”) pursuant to which the Sponsor has agreed, among other things, to vote all of its SPAC Shares in favor of this Agreement and the Transactions; and

WHEREAS, on September 6, 2022, SPAC filed a definitive proxy statement with the SEC proposing to amend the SPAC’s amended and restated certificate of incorporation to extend the date by which the SPAC may consummate an initial business combination for six months, from October 5, 2022 to April 5, 2023 (the “Initial Extension Date”).

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants and agreements herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Parties hereby agree as follows:

Article

I

DEFINITIONS

Section 1.01. Certain Definitions. For purposes of this Agreement:

“Action” means litigation, suit, claim, charge, grievance, action, proceeding, audit, order, writ, judgment, injunction or investigation by or before any Governmental Agency.

“Affiliate” of a specified Person means a Person who, directly or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such specified Person.

“Ancillary Agreements” means the the Registration Rights Agreement, the Lock-up Agreement, the Sponsor Support Agreement, the SID, the Deed Poll, the SPAC Deed Poll, and all other agreements, certificates and instruments executed and delivered by SPAC, Parent, Merger Sub, or the Company in connection with the Transactions and specifically contemplated by this Agreement.

- 2 -

“Business Day” means any day on which the principal offices of the SEC in Washington, D.C. are open to accept filings and on which banks are not required or authorized to close in any of (i) the City of New York, United States of America, (ii) Sydney, Australia or (iii) Dublin, Ireland; provided that banks shall not be deemed to be authorized or obligated to be closed due to a “shelter in place,” “non-essential employee” or similar closure of physical branch locations at the direction of any Governmental Agency if such banks’ electronic funds transfer systems (including for wire transfers) are open for use by customers on such day.

“Code” means the Internal Revenue Code of 1986, as amended.

“control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, or as trustee or executor, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, as trustee or executor, by contract or otherwise.

“Deed Poll” has the meaning ascribed to such term in the SID.

“Effective Date” has the meaning ascribed to such term in the SID.

“Employee Benefit Plan” means any plan that is a bonus, stock option, stock purchase, restricted stock, phantom stock, other equity-based compensation arrangement, performance award, incentive, deferred compensation, pension scheme or insurance, retiree medical or life insurance, death or disability benefit, health or welfare, retirement, supplemental retirement, severance, retention, change in control, employment, consulting, fringe benefit, sick pay and vacation plans or arrangements or other employee benefit plans, programs or arrangements, whether written or unwritten.

“End Date” has the meaning ascribed to such term in the SID.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“GAAP” means generally accepted accounting principles as in effect in the United States from time to time.

“Governmental Agency” has the meaning ascribed to such term in the SID.

“IFRS” means international financial reporting standards, as adopted by the International Accounting Standards Board.

“Law” means any federal, national, state, county, municipal, provincial, local, foreign or multinational, statute, constitution, common law, ordinance, code, decree, order, judgment, rule, regulation, ruling or requirement issued, enacted, adopted, promulgated, implemented or otherwise put into effect by or under the authority of any Governmental Agency.

- 3 -

“Lien” means any lien, security interest, mortgage, pledge, charge, adverse claim or other encumbrance of any kind that secures the payment or performance of an obligation (other than those created under applicable securities laws).

“Merged Group” has the meaning ascribed to such term in the SID.

“non-assessable” means, in relation to Parent, that a holder of Parent Ordinary Shares will not by reason of merely being such a holder, be subject to assessment or calls by Parent or its creditors for further payment on such shares.

“Parent Ordinary Shares” means the ordinary shares of Parent, with a par value of $0.0001 each.

“Parent Public Warrant” means one warrant to acquire one (1) Parent Ordinary Share at an exercise price of $11.50 per share.

“Parent Registration Statement” means the registration statement on Form F-4 (or another applicable form if agreed by the Parties) to be filed by Parent in connection with the registration under the Securities Act of the Parent Ordinary Shares and Parent Public Warrants to be issued in connection with the Merger and the PlayUp Scheme Acquisition.

“PCAOB” means the Public Company Accounting Oversight Board.

“Person” means an individual, corporation, company, partnership, limited partnership, limited liability company, syndicate, person (including a “person” as defined in Section 13(d)(3) of the Exchange Act), trust, association or entity or government, political subdivision, agency or instrumentality of a government.

“PlayUp Material Adverse Effect” has the meaning ascribed to such term in the SID.

“Redemption Rights” means the redemption rights provided for in the SPAC formation documents.

“Registration Statement / Proxy Statement” means the Parent Registration Statement and SPAC Proxy Statement.

“Relevant Company” means a Relevant Company in the meaning of the Irish Takeover Panel Act, 1997.

“SEC” means the Securities and Exchange Commission.

“Second Court Date” has the meaning ascribed to such term in the SID.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations thereunder.

- 4 -

“SPAC Class A Common Shares” means shares of SPAC’s Class A common stock, par value $0.0001 per share.

“SPAC Class B Common Shares” means shares of SPAC’s Class B common stock, par value $0.0001 per share.

“SPAC Competing Transaction” means any (i) issuance to a third party in any newly issued equity interest, including options, warrants or other rights regarding equity interests, in SPAC outside the ordinary course of business, (ii) sale or transfer to a third party of more than 50% of the currently outstanding equity interests in SPAC, (iii) sale or transfer of all or a material portion of the assets of the SPAC and its subsidiaries on a consolidated basis to a third party, (iii) merger or business combination between SPAC or any of its subsidiaries, on the one hand, and a third party, on the other hand, (iv) any “initial business combination” under SPAC’s initial IPO prospectus with any third party (other than with the Company or its affiliates), (v) any competitive bid process (for example, processes known in the industry as a “SPAC-off”) in which SPAC participates, or (vi) SPAC’s entry into any non-disclosure agreement, preliminary indication of interest, exclusivity agreement or non-binding letter of intent, in each case, with respect to any of the foregoing.

“SPAC Deed Poll” has the meaning ascribed to such term in the SID.

“SPAC Private Warrants” means each warrant issued in private placements at the time of the consummation of the IPO, entitling the holder thereof to purchase one SPAC Class A Common Share at an exercise price of $11.50 per share.

“SPAC Proposals” has the meaning ascribed to such term in the SID.

“SPAC Proxy Statement” means the proxy statement to be sent to stockholders of SPAC for the purpose of obtaining approval of the SPAC Proposals.

“SPAC Public Units” means the units issued in the IPO, with each unit issued therein including (a) one SPAC Class A Common Share and (b) one-half of a warrant, with whole warrants entitling the holder thereof to purchase one SPAC Class A Common Share at an exercise price of $11.50 per share.

“SPAC Public Warrants” means each warrant issued as a component of SPAC Public Units.

“SPAC Stockholder Approval” has the meaning ascribed to such term in the SID.

“SPAC Stockholder Meeting” has the meaning ascribed to such term in the SID.

“SPAC Shares” means SPAC Class A Common Shares and SPAC Class B Common Shares.

- 5 -

“SPAC Stockholder Redemption Amount” means the aggregate amount of cash proceeds required to satisfy any exercise by stockholders of SPAC of the Redemption Rights.

“SPAC Warrants” means the SPAC Public Warrants and the SPAC Private Warrants.

“Sponsor” means IG Sponsor LLC.

“Subsidiary” or “Subsidiaries” of any Person means, with respect to such Person, any Affiliate in which such Person, directly or indirectly, through one or more intermediaries owns or controls more than fifty percent (50%) of such Affiliate’s equity interests measured by voting power.

“Tax” or “Taxes” means any and all taxes, levies, duties, withholdings, assessments, fees or other charges, in each case in the nature of taxes, imposed, administered or collected by any Governmental Agency, including wage taxes, income taxes, corporate taxes, capital gains taxes, franchise taxes, sales taxes, use taxes, payroll taxes, employment taxes, withholding taxes, value added taxes, gross receipts taxes, turnover taxes, environmental taxes, car taxes, energy taxes, customs and other import or export duties, escheat or unclaimed property obligations, excise duties, transfer taxes or duties, property taxes, capital taxes, or duties, social security or other similar contributions, together with all related interest, fines, penalties, costs, charges and surcharges, whether disputed or not.

“Transactions” means the Merger, the PlayUp Scheme Acquisition and the other transactions contemplated by this Agreement and the Ancillary Agreements.

“Treasury Regulations” means the final or temporary regulations issued by the United States Department of Treasury pursuant to its authority under the Code, and any successor regulations.

“Trust Fund” means the trust account maintained pursuant to that certain Investment Management Trust Agreement, by and between Continental Stock Transfer & Trust Company (the “Trustee”) and SPAC, dated as of September 30, 2020 (such agreement, the “Trust Agreement”).

“Virtual Data Room” means the virtual data room established by the Company, access to which was given to SPAC in connection with its due diligence investigation of the Company relating to the Transactions.

Section 1.02. Further Definitions. The following terms have the meaning set forth in the Sections set forth below:

| Additional Extension | Section 9.03(b) |

| Agreement | Preamble |

| Certificate of Merger | Section 2.02(a)(i) |

| Certificates | Section 2.04 |

| Chosen Courts | Section 10.06 |

| Claims | Section 6.02 |

- 6 -

| Class I Directors | Section 2.02(c)(iii)(A) |

| Class II Directors | Section 2.02(c)(iii)(B) |

| Class III Directors | Section 2.02(c)(iii)(C) |

| Closing | Section 2.02(a)(i) |

| Closing Date | Section 2.02(a)(i) |

| Company | Preamble |

| Contracting Parties | Section 10.11 |

| Corporations Act | Preamble |

| DGCL | Preamble |

| DLLCA | Preamble |

| Exchange Agent | Section 2.03(a) |

| Exchange Fund | Section 2.03(a) |

| Extension Fees | Section 9.03(b) |

| ICA | Preamble |

| Incentive Equity Plan | Section 7.10 |

| Initial Extension Date | Preamble |

| Intended Tax Treatment | Section 2.08 |

| Lock-up Agreement | Preamble |

| Merger | Preamble |

| Merger Sub | Preamble |

| Nonparty Affiliates | Section 10.11 |

| Outstanding Company Transaction Expenses | Section 2.05(a) |

| Outstanding SPAC Transaction Expenses | Section 2.05(b) |

| Parent | Preamble |

| Parent Amended and Restated Memorandum and Articles of Association | Section 2.02(b)(iii) |

| Parent Board | Preamble |

| Parties | Preamble |

| Party | Preamble |

| PlayUp Scheme Acquisition | Preamble |

| PlayUp Second Court Date Deliverables | Section 2.06(a)(iii) |

| Registration Rights Agreement | Preamble |

| SID | Preamble |

| SPAC | Preamble |

| SPAC Board | Preamble |

| SPAC Class A Conversion Shares | Section 2.02(e)(ii) |

| SPAC Merger Effective Time | Section 2.02(a)(i) |

| SPAC Second A&R Certificate of Incorporation | Section 2.02(b)(i) |

| SPAC Second Court Date Deliverables | Section 2.06(b)(iii) |

| Sponsor Support Agreement | Preamble |

| Surviving SPAC | Section 2.02(a)(i) |

| Terminating Company Breach | Section 9.01(e) |

| Terminating SPAC Breach | Section 9.01(f) |

- 7 -

Section 1.03. Construction.

(a) Unless the context of this Agreement otherwise requires, (i) words of any gender include each other gender, (ii) words using the singular or plural number also include the plural or singular number, respectively, (iii) the definitions contained in this agreement are applicable to the other grammatical forms of such terms, (iv) the terms “hereof,” “herein,” “hereby,” “hereto” and derivative or similar words refer to this entire Agreement, (v) the terms “Article,” “Section,” “Schedule” and “Exhibit” refer to the specified Article, Section, Schedule or Exhibit of or to this Agreement, (vi) the word “including” means “including without limitation,” (vii) the word “or” shall be disjunctive but not exclusive, (viii) references to agreements and other documents shall be deemed to include all subsequent amendments and other modifications thereto and (ix) references to any Law shall include all rules and regulations promulgated thereunder and references to any Law shall be construed as including all statutory, legal, and regulatory provisions consolidating, amending or replacing such Law.

(b) The language used in this Agreement shall be deemed to be the language chosen by the Parties to express their mutual intent and no rule of strict construction shall be applied against any Party.

(c) Whenever this Agreement refers to a number of days, such number shall refer to calendar days unless Business Days are specified, and when counting days, the date of commencement will not be included as a full day for purposes of computing any applicable time periods (except as otherwise may be required under any applicable Law). If any action is to be taken or given on or by a particular calendar day, and such calendar day is not a Business Day, then such action may be deferred until the next Business Day.

(d) All accounting terms used herein and not expressly defined herein shall have the meanings given to them under GAAP for matters with respect to SPAC or Merger Sub, and IFRS with respect to the Company and Parent.

(e) The phrases “provided to,” “furnished to,” “made available” and phrases of similar import when used herein, unless the context otherwise requires, means that a copy of the information or material referred to has been provided to the Party to which such information or material is to be provided or furnished (i) in the Virtual Data Room set up by the Company in connection with this Agreement or (ii) by delivery to such Party or its legal counsel via electronic mail or hard copy form, in each case no later than one (1) day prior to the date hereof.

(f) Cross-references in the provisions of the SID incorporated herein by reference shall remain references to the applicable provisions of the SID rather than provisions of this Agreement.

Article

II

MERGER and PlayUp Scheme Acquisition

Section 2.01. PlayUp Scheme Acquisition.

(a) Upon the terms and subject to the conditions set forth in the SID, the Parties shall consummate the PlayUp Scheme Acquisition.

- 8 -

Section 2.02. Merger.

(a) SPAC Merger Effective Time; Closing.

(i) SPAC shall cause the Merger to be consummated (such consummation, the “Closing” and the date on which the Closing occurs, the “Closing Date”) by filing a certificate of merger (the “Certificate of Merger”) with the Secretary of State of the State of Delaware, which shall become effective upon filing with the Secretary of State of Delaware or at such later time as agreed upon by the Parties and set forth therein (which such effective time shall in any event be immediately following the consummation of the PlayUp Scheme Acquisition (which, for the avoidance of doubt, shall be after the Effective Date and immediately prior to the issuance of the Scheme Consideration (as defined in the SID)) (such time, the “SPAC Merger Effective Time”). Upon the terms and subject to the conditions set forth in Article VIII, and in accordance with the DGCL and the DLLCA, at the SPAC Merger Effective Time, Merger Sub shall be merged with and into SPAC by operation of law. As a result of the Merger, the separate existence of Merger Sub shall cease and SPAC shall continue as the surviving entity of the Merger (the “Surviving SPAC”) by operation of the laws of the State of Delaware.

(ii) At the SPAC Merger Effective Time, the effects of the Merger shall be as provided in the applicable provisions of the DGCL, the DLLCA, this Agreement and the Certificate of Merger. Without limiting the generality of the foregoing, and subject thereto, at the SPAC Merger Effective Time, all the property, rights, privileges, immunities, powers, franchises, licenses and authority of SPAC and Merger Sub shall vest in the Surviving SPAC by operation of law, and all debts, liabilities, obligations, restrictions, disabilities and duties of each of SPAC and Merger Sub shall become the debts, liabilities, obligations, restrictions, disabilities and duties of the Surviving SPAC by operation of law.

(b) Certificate of Incorporation; Bylaws.

(i) At the SPAC Merger Effective Time, the amended and restated certificate of incorporation of SPAC shall be amended and restated to be in the form of Exhibit D attached hereto (the “SPAC Second A&R Certificate of Incorporation”) and, as so amended and restated, shall be the certificate of incorporation of the Surviving SPAC, until thereafter amended as provided by Law and such SPAC Second A&R Certificate of Incorporation.

(ii) Each of the Parties shall take all such action within its power as many be necessary or appropriate such that, at the SPAC Merger Effective Time, the bylaws of SPAC, as in effect immediately prior to the SPAC Merger Effective Time, shall be amended and restated in the form of Exhibit E attached hereto and, as so amended and restated, shall be the bylaws of the Surviving SPAC, until thereafter amended as provided by Law, the SPAC Second A&R Certificate of Incorporation of the Surviving SPAC and such bylaws, as applicable.

(iii) Each of the Parties shall take all such action within its power as may be necessary or appropriate such that, at the Closing, Parent’s existing Memorandum and Articles of Association shall be amended and restated in the form of Exhibit F attached hereto and, as so amended and restated, shall be the Memorandum and Articles of Association of Parent, until thereafter amended as provided by Law and the Memorandum and Articles of Association (the “Parent Amended and Restated Memorandum and Articles of Association”), which shall, among other matters, (A) provide that the name of Parent shall be changed to such name as is agreed by the Parties and (B) provide for size and structure of the Parent Board in accordance with Section 2.02(c).

- 9 -

(c) Directors and Officers; Advisory Committee.

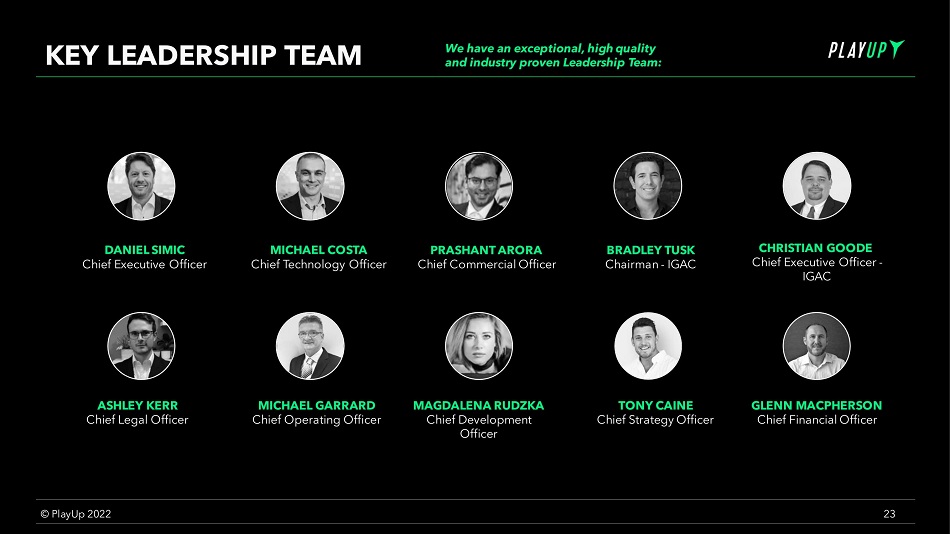

(i) Each of the Parties shall take all such action within its power as may be necessary or appropriate such that, effective as of the Closing, the Parent Board shall consist of seven (7) members, or such lesser number as may be determined by the Company in its sole discretion; (A) one (1) member of the Parent Board shall be designated by the Sponsor, which member shall be Bradley Tusk, and (B) the remaining members of the Parent Board shall be designated by the Company in advance of the Closing. Each of the Parties shall take all such action within its power as may be necessary or appropriate such that, effective as of the Closing, the Company shall designate Bradley Tusk as chairperson of the Parent Board and appoint Daniel Simic as Chief Executive Officer of the Company and Christian Goode as President of the Company’s U.S. business. Each of SPAC and the Company may, with the prior written consent of the other Party (such consent not to be unreasonably withheld, conditioned or delayed), replace any individual designated thereby with any other individual prior to the Closing.

(ii) Each of the Parties shall take all such action within its power as may be necessary or appropriate such that, prior to the filing of the Registration Statement / Proxy Statement with the SEC, the following persons shall be appointed to the following roles: (A) SPAC and the Company shall mutually agree (such agreement not to be unreasonably withheld, conditioned or delayed by either SPAC or the Company) on the directors to be appointed to serve, effective as of the Closing, on the compensation, audit and nominating and corporate governance committees of the Parent Board, and the chairs thereof; and (B) the Company shall designate the persons to be appointed officers of each entity of the Merged Group effective immediately after the Closing; provided, that current members of the Company’s management will continue to serve in their respective roles and capacities.

(iii) In accordance with the Parent Amended and Restated Memorandum and Articles of Association, the Parent Board shall be a classified board with three classes of directors, with:

(A) a first class of directors (the “Class I Directors”), consisting of two directors (both of whom shall be Company designees), initially serving a term effective from the Closing until the first annual meeting of the shareholders of Parent held after the Closing (but any subsequently elected Class I Directors serving a three (3)-year term);

(B) a second class of directors (the “Class II Directors”), consisting of three directors (two of whom shall be Company designees and one of whom shall be a Sponsor designee), initially serving a term effective from the Closing until the second annual meeting of the shareholders of Parent held following the Closing (but any subsequently elected Class II Directors serving a three (3)-year term); and

- 10 -

(C) a third class of directors (the “Class III Directors”), consisting of two directors (both of whom shall be Company designees), initially serving a term effective from the Closing until the third annual meeting of the shareholders of Parent held following the Closing (and any subsequently elected Class III Directors serving a three (3)-year term).

(d) Unit Separation. Each of the Parties shall take all such action within its power as many be necessary or appropriate such that, effective of the Closing, immediately prior to the SPAC Merger Effective Time, the holder of each SPAC Public Unit shall be deemed to hold such SPAC Public Unit’s constituent parts; provided that if a holder of SPAC Public Units would be entitled to receive a fractional SPAC Public Warrant upon the separation of such SPAC Public Units, then the number of SPAC Public Warrants that such holder shall be deemed to hold shall be rounded down to the nearest whole number.

(e) Conversion of SPAC Securities. Subject to Section 2.03(b) and the other terms of this Agreement, at the SPAC Merger Effective Time, by virtue of the Merger, the DGCL, the DLLCA and the ICA, and without any action on the part of any Party or the holder of any of their securities (other than the issuance and delivery of the relevant securities by Parent as provided for in Section 2.03), (i) SPAC Class A Common Shares and (ii) SPAC Class B Common Shares, in each case, issued and outstanding immediately prior to the SPAC Merger Effective Time, shall be automatically cancelled, exchanged or adjusted (as applicable) as follows:

(i) Each SPAC Class A Common Share (other than SPAC Class A Conversion Shares) shall, by virtue of the Merger, be automatically cancelled and converted into the right to receive one (1) validly issued, fully paid and non-assessable Parent Ordinary Share.

(ii) All outstanding SPAC Class B Common Shares (and any SPAC Class A Common Shares issued upon any automatic conversion of SPAC Class B Common Shares pursuant to Section 4.3(b) of the amended and restated certificate of incorporation of SPAC (“SPAC Class A Conversion Shares”) shall, by virtue of the Merger, be automatically cancelled and converted into the right to receive an aggregate number of validly issued, fully paid and non-assessable Parent Ordinary Shares equal to the greater of (A) 2,500,000 and (B) 5.75% of the total number of Parent Ordinary Shares outstanding as of the SPAC Merger Effective Time.

(f) Conversion of Merger Sub Shares. Each Merger Sub common unit issued and outstanding immediately prior to the SPAC Merger Effective Time shall be converted into and exchanged for one validly issued, fully paid and nonassessable share of common stock, par value $0.0001 per share, of the Surviving SPAC.

- 11 -

(g) Treatment of SPAC Public Warrants. Each of the Parties shall take all such action within its power as may be necessary or appropriate such that, effective as of the Closing, each SPAC Public Warrant shall remain outstanding but shall be automatically adjusted to become one (1) Parent Public Warrant. Each of the Parties shall take all such action within its power as may be necessary or appropriate such that, effective as of the Closing, each such Parent Public Warrant will continue to have, and be subject to, the same terms and conditions set forth in the warrant agreement pursuant to which such SPAC Public Warrant was issued immediately prior to the SPAC Merger Effective Time, except that each Parent Public Warrant will be exercisable (or will become exercisable in accordance with its terms) for that number of whole Parent Ordinary Shares equal to the number of SPAC Class A Common Shares that were issuable upon exercise of such SPAC Public Warrant that was outstanding immediately prior to the SPAC Merger Effective Time. Each of the Parties shall take all such action within its power as may be necessary or appropriate such that, effective as of the Closing, each SPAC Private Warrant shall be automatically cancelled.

Section 2.03. Delivery of Shares

(a) On the Closing Date, Parent shall deposit, or shall cause to be deposited, with a bank or trust company that shall be designated by SPAC and is reasonably satisfactory to the Company (the “Exchange Agent”), for the benefit of the stockholders of SPAC, for exchange in accordance with this Section 2.03, the certificates representing the number of Parent Ordinary Shares sufficient to deliver the aggregate consideration payable to stockholders of SPAC payable pursuant to this Agreement (such Parent Ordinary Shares being hereinafter referred to as the “Exchange Fund”). Parent shall cause the Exchange Agent, pursuant to irrevocable instructions, to pay the applicable consideration payable to stockholders of SPAC out of the Exchange Fund in accordance with Section 2.02(e). The Exchange Fund shall not be used for any other purpose.

(b) The consideration payable upon conversion of the SPAC Shares shall be adjusted to reflect appropriately the effect of any stock split, reverse stock split, stock dividend, reorganization, recapitalization, reclassification, combination, exchange of shares or other like change with respect to SPAC Shares occurring on or after the date hereof and prior to the SPAC Merger Effective Time.

(c) Any portion of the Exchange Fund that remains undistributed to the stockholders of SPAC for one year after the SPAC Merger Effective Time shall be delivered to Parent, upon demand, and any stockholders of SPAC who have not theretofore complied with this Section 2.03 shall thereafter look only to Parent for the consideration payable in accordance with Section 2.02(e). Any portion of the Exchange Fund remaining unclaimed by the applicable stockholders of SPAC as of a date which is immediately prior to such time as such amounts would otherwise escheat to or become property of any government entity shall, to the extent permitted by applicable law, become the property of Parent free and clear of any claims or interest of any person previously entitled thereto.

(d) None of the Exchange Agent, Parent or the Surviving SPAC shall be liable to any stockholder of SPAC for any such SPAC Shares (or dividends or distributions with respect thereto) or cash delivered to a public official pursuant to any abandoned property, escheat or similar Law in accordance with this Section 2.03.

Section 2.04. Stock Transfer Books. At the SPAC Merger Effective Time, the stock transfer books of SPAC shall be closed and there shall be no further registration of transfers of SPAC Shares outstanding immediately prior to the SPAC Merger Effective Time thereafter on the records of SPAC. From and after the SPAC Merger Effective Time, the holders of stock certificates representing SPAC Shares (“Certificates”) outstanding immediately prior to the SPAC Merger Effective Time shall cease to have any rights with respect to the SPAC Shares formerly represented by such Certificates, except as otherwise provided in this Agreement or by Law. Subject to Section 2.03, on or after the SPAC Merger Effective Time, any Certificates representing SPAC Shares outstanding immediately prior to the SPAC Merger Effective Time presented to the Exchange Agent or Parent for any reason shall be cancelled.

- 12 -

Section 2.05. Payment of Expenses.

(a) No sooner than five (5) or later than two (2) Business Days prior to the Closing Date, the Company shall provide to SPAC a certificate executed by an executive officer of the Company setting forth the Company’s calculation of all of the following fees, expenses and disbursements incurred by or on behalf of the Company, Parent or Merger Sub in connection with the preparation, negotiation and execution of this Agreement and the Ancillary Agreements and the consummation of the transactions contemplated hereby (together with written invoices and wire transfer instructions for the payment thereof), solely to the extent such fees and expenses are incurred and expected to remain unpaid as of the close of business on the Business Day immediately preceding the Closing Date: (i) the fees and disbursements of outside counsel to the Company, Parent and Merger Sub incurred in connection with the Transactions, and (ii) the fees and expenses of any other agent, advisor, consultant, expert, financial advisor and other service providers engaged by the Company, Parent or Merger Sub in connection with the Transactions (collectively, the “Outstanding Company Transaction Expenses”). Prior to the Closing, SPAC shall have an opportunity to review the Outstanding Company Transaction Expenses and discuss such certificate with the persons responsible for its preparation, and the Company and Parent shall reasonably cooperate with SPAC in good faith to timely respond to any questions and consider in good faith any comments regarding the certificate of Outstanding Company Transaction Expenses. On the Closing Date following the Closing, the Company shall pay or cause to be paid by wire transfer of immediately available funds all such Outstanding Company Transaction Expenses. For the avoidance of doubt, the Outstanding Company Transaction Expenses shall not include any fees and expenses of the Company’s stockholders.

(b) No sooner than five (5) or later than two (2) Business Days prior to the Closing Date, SPAC shall provide to the Company a certificate executed by an executive officer of SPAC setting forth SPAC’s calculation of all of the following fees, expenses and disbursements incurred by or on behalf of SPAC (together with written invoices and wire transfer instructions for the payment thereof), solely to the extent such fees and expenses are incurred and expected to remain unpaid as of the close of business on the Business Day immediately preceding the Closing Date: all fees and expenses incurred in connection with, or otherwise related to, the Transactions, the negotiation and preparation of this Agreement, the Ancillary Agreements and the other documents contemplated hereby and the performance and compliance with all agreements and conditions contained herein and therein, or otherwise in connection with SPAC’s operations including any prior transactions pursued by SPAC, including the fees, expenses and disbursements of legal counsel, auditors, accountants and notaries; due diligence expenses; advisory and consulting fees (including financial advisors) and expenses; and other third-party fees, in each case of SPAC (collectively, the “Outstanding SPAC Transaction Expenses”). Prior to the Closing, the Company shall have an opportunity to review the Outstanding SPAC Transaction Expenses and discuss such certificate with the persons responsible for its preparation, and SPAC shall reasonably cooperate with the Company in good faith to timely respond to any questions and consider in good faith any comments regarding the certificate of Outstanding SPAC Transaction Expenses. On the Closing Date following the Closing, SPAC shall pay or cause to be paid by wire transfer of immediately available funds all such Outstanding SPAC Transaction Expenses.

- 13 -

Section 2.06. Second Court Date Deliverables. Prior to 8:00am (in Sydney, Australia) on the Second Court Date:

(a) The Company shall deliver (or cause to be delivered) to SPAC:

(i) the Registration Rights Agreement, duly executed by Parent and each shareholder of Parent set forth on Schedule 1 (other than the holders of equity securities of SPAC prior to the Closing);

(ii) the Lock-up Agreement, duly executed by Parent and each shareholder of Parent set forth on Schedule 2 (other than the holders of equity securities of SPAC prior to the Closing); and

(iii) each other Ancillary Agreement to be executed after the date of this Agreement and prior to 8:00am (in Sydney, Australia) on the Second Court Date by the Company, Parent or Merger Sub or any of their respective Affiliates, duly executed by the Company, Parent or Merger Sub or their respective Affiliates, as applicable (the documents to be delivered pursuant to this Section 2.06(b), collectively, the “PlayUp Second Court Date Deliverables”).

(b) SPAC shall deliver (or cause to be delivered) to the Company:

(i) the Registration Rights Agreement, duly executed by each shareholder of Parent set forth on Schedule 1 (other than the holders of equity securities of the Company prior to the Closing);

(ii) the Lock-up Agreement, duly executed by each shareholder of Parent set forth on Schedule 2 (other than the holders of equity securities of the Company prior to the Closing); and

(iii) each other Ancillary Agreement to be executed after the date of this Agreement and prior to 8:00am (in Sydney, Australia) on the Second Court Date by the SPAC or any of its Affiliates, duly executed by the SPAC or its Affiliates, as applicable (the documents to be delivered pursuant to this Section 2.06(a), collectively, the “SPAC Second Court Date Deliverables”).

Section 2.07. Closing Deliverables. Prior to the Closing:

(a) The Company shall deliver (or cause to be delivered) to SPAC each Ancillary Agreement to be executed after the Second Court Date and prior to or at the Closing by the Company, Parent or Merger Sub or any of their respective Affiliates, duly executed by the Company, Parent or Merger Sub or their respective Affiliates, as applicable; and

(b) SPAC shall deliver (or cause to be delivered) to the Company each Ancillary Agreement to be executed after the Second Court Date but prior to or at the Closing by SPAC or any of its Affiliates, duly executed by SPAC or its Affiliates, as applicable.

- 14 -

Section 2.08. Tax Treatment of PlayUp Scheme Acquisition and Merger. The Parties intend that for U.S. federal income tax purposes (and any applicable U.S. state and local Tax purposes), (a) the PlayUp Scheme Acquisition shall be treated as a “reorganization” within the meaning of Section 368(a) of the Code and that the PlayUp Scheme Acquisition, together with the Merger, shall qualify as a transaction described in Section 351(a) of the Code, and (b) the Merger shall be treated as a “reorganization” within the meaning of Section 368(a) of the Code and that the Merger, together with the PlayUp Scheme Acquisition, shall qualify as a transaction described in Section 351(a) of the Code (the “Intended Tax Treatment”). The Parties agree that this Agreement shall constitute a “plan of reorganization” with respect to the PlayUp Scheme Acquisition, and a “plan of reorganization” with respect to the Merger, in each case, within the meaning of Treasury Regulations Section 1.368-2(g). In connection with the preparation and filing of the Registration Statement / Proxy Statement or the SEC’s review thereof, or a tax opinion with respect to the U.S. federal income tax consequences of the Transactions provided for purposes of the preparation and filing of the Registration Statement / Proxy Statement, each Party shall use reasonable best efforts to execute and deliver customary tax representation letters in support of the Intended Tax Treatment as their respective tax advisors may reasonably request in form and substance reasonably satisfactory to such advisor

Section 2.09. Withholding. Notwithstanding anything in this Agreement to the contrary, SPAC, Parent and Merger Sub shall be entitled to deduct and withhold from any consideration payable to any Person pursuant to this Agreement any amount required to be deducted or withheld under applicable Tax Law; provided, however, that the Parties agree to reasonably cooperate to eliminate or mitigate any such deductions or withholding Taxes; provided, further, that before a Party makes any deduction or withholding from any payments or amount to or with respect to a shareholder of the Company, such Party shall use commercially reasonable efforts to provide such shareholder with at least ten (10) Business Days advance written notice of the intention to make such deduction or withholding, which notice shall include the authority, basis and method of calculation for the proposed deduction or withholding Taxes and reasonably cooperate to eliminate or mitigate any such deductions or withholding Taxes as provided in this Section 2.09. To the extent that any such amounts are deducted or withheld by SPAC, Parent or Merger Sub, as the case may be, such deducted or withheld amounts shall be remitted to the appropriate Governmental Agency and shall be treated for all purposes of this Agreement as having been paid to the Person in respect of which such deduction or withholding was made.

Article

III

REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY

The Company hereby represents and warrants to SPAC, Parent and Merger Sub as follows:

Section 3.01. The representations and warranties set forth in Section 8.2 of the SID, as qualified by Section 8.3 of the SID, are incorporated herein by reference.

- 15 -

Section 3.02. Exclusivity of Representations and Warranties. Except as otherwise expressly provided in this Article III and Article V, the Company hereby expressly disclaims and negates, and SPAC, Parent and Merger Sub agree that they have not relied on, any other express or implied representation or warranty whatsoever (whether at Law or in equity) with respect to the Company, its affiliates, and any matter relating to any of them, or with respect to the accuracy or completeness of any other information made available to SPAC, Parent and Merger Sub, their respective affiliates or any of their respective representatives by, or on behalf of, the Company, and any such representations or warranties are expressly disclaimed. Without limiting the generality of the foregoing, except as expressly set forth in this Agreement, the SPAC, Parent and Merger Sub agree that they have not relied on, and neither the Company nor any other person on behalf of the Company has made or makes, any representation or warranty, whether express or implied, with respect to any projections, forecasts, estimates or budgets made available to SPAC, Parent and Merger Sub, their respective affiliates or any of their respective representatives of future revenues, future results of operations (or any component thereof), future cash flows or future financial condition (or any component thereof) of the Company (including the reasonableness of the assumptions underlying any of the foregoing), whether or not included in any management presentation or in any other information made available to SPAC, Parent and Merger Sub, their respective affiliates or any of their respective representatives or any other person, and that any such representations or warranties are expressly disclaimed and SPAC, Parent and Merger Sub agree that they have not relied on any representations or warranties not set forth in this Article III.

Article

IV

REPRESENTATIONS AND WARRANTIES OF SPAC

SPAC hereby represents and warrants to the Company, Parent and Merger Sub as follows:

Section 4.01. The representations and warranties set forth in Section 8.1 of the SID are incorporated herein by reference.