As filed with the Securities and Exchange Commission on July 8, 2020

| Registration Nos. | 333- |

| 811-21742 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-6

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. __ [ ]

Post-Effective Amendment No. __ [ ]

and

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 [X]

Amendment No. 32 [X]

FIRST INVESTORS LIFE SEPARATE ACCOUNT E

(Exact Name of Registrant)

NASSAU LIFE INSURANCE COMPANY

(Name of Depositor)

One American Row, Hartford, Connecticut 06115

(Address of Depositor’s Principal Executive Offices) (Zip Code)

860-403-5000

(Depositor’s Telephone Number, including Area Code)

The Corporation Trust Company (CT Corp)

1209 N Orange Street

Wilmington, Delaware 19801

(Name and Address of Agent for Service)

Copies of all communications to:

| Kostas Cheliotis | Dodie C. Kent, Esq. |

| Vice President, General Counsel, Secretary | Partner |

| Nassau Re | Eversheds Sutherland (US) LLP |

| One American Row | 1114 Avenue of the Americas, 40th Floor |

| Hartford, Connecticut 06115 | New York, New York 10036 |

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

Title of Securities Being Registered: Units of interest in First Investors Life Separate Account E supporting variable life insurance policies.

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until Registrant shall file a further amendment which specifically states that this Registration Statement shall become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

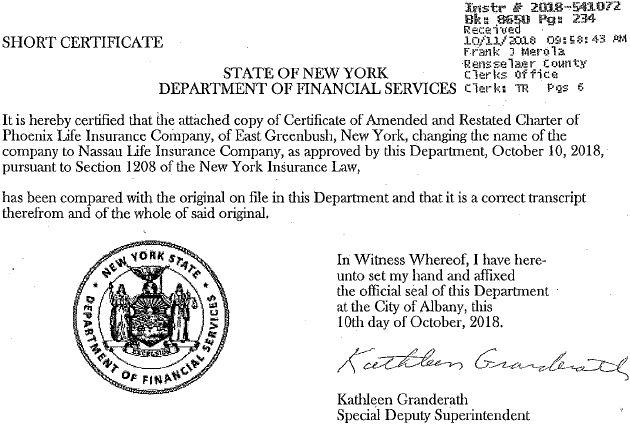

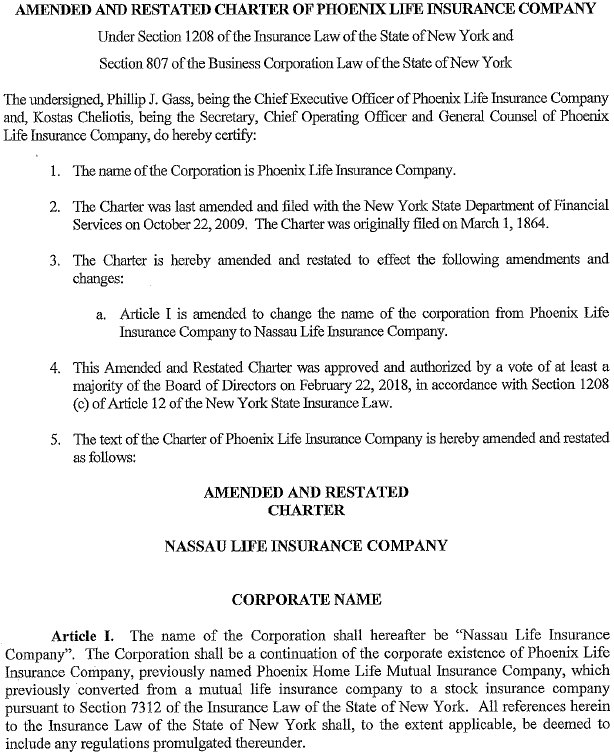

Explanatory Note: Units of interest supporting the variable life insurance policies issued through the Registrant were previously registered on Form N-6 (File Nos. 333-191937, 811-21742). Upon effectiveness of the merger of Foresters Life Insurance and Annuity Company with and into Nassau Life Insurance Company (“NNY”), NNY became the obligor of the policies and the depositor of Registrant, necessitating the filing of a new Registration Statement under the Securities Act of 1933 and an amendment to the Registration Statement under the Investment Company Act of 1940.

VARIABLE UNIVERSAL LIFE

An Individual Flexible Premium Adjustable Variable Life Insurance Policy

Issued By

Nassau Life Insurance Company

Through

First Investors Life Separate Account E

Supplement dated July 8, 2020 to the Prospectus dated May 1, 2020

Administrative Office

Address: Raritan Plaza 1, P.O. Box 7836, Edison, New Jersey 08818-7836

Phone Number: 1-800-832-7783 (9:00 A.M. and 5:00 P.M., Eastern Time)

Website: www.NSRE.com

This supplement updates certain information contained in the prospectus, dated May 1, 2020, for the Variable Universal Life flexible premium adjustable variable life insurance policy (the “Policy”). Please read this supplement carefully and retain it for future reference. Capitalized terms not otherwise defined in this supplement have the meanings given to them in the prospectus.

Nassau Life Insurance Company (“NNY”) is supplementing the prospectus for the Policy to provide information about the acquisition of the issuer of the Policies, Foresters Life Insurance and Annuity Company (“FLIAC”), by NNY and the subsequent merger (the “Merger”) of FLIAC with and into NNY.

As previously disclosed, NNY entered into an agreement with FLIAC whereby NNY would purchase FLIAC. The acquisition of FLIAC by NNY was completed on July 1, 2020. Following the acquisition, on July 8, 2020, FLIAC merged with and into NNY, with NNY as the surviving company. Upon completion of the Merger, FLIAC’s corporate existence ceased by operation of law. As the surviving company, NNY assumed all the rights, duties and obligations of FLIAC, including those related to the First Investors Life Separate Account E (the “Separate Account” or “Separate Account E”). The Separate Account became a separate account of NNY. NNY assumed legal ownership of the assets of the Separate Account and responsibility for the liabilities and obligations of all outstanding Policies.

The Merger did not affect the terms of, or the rights and obligations under, the Policies other than to change the insurance company that provides Policy benefits from FLIAC to NNY. The Policies continue to be funded by the Separate Account. Policy values did not change as a result of the Merger. No additional charges were imposed and no deductions were made as a result of the Merger. The Merger did not have any tax consequences for Policyowners.

Following the acquisition of FLIAC by NNY, an NNY affiliate, 1851 Securities, Inc., became the principal underwriter for the Policies.

The Policy is no longer available for new sales, but owners of outstanding Policies may continue to make premium payments.

1

Revisions to the Prospectus

The information below describes changes to the prospectus as a result of the Merger and otherwise updates the prospectus.

| I. | References to FLIAC (including references to “We,” “Us” and “Our”) throughout the prospectus that are not otherwise addressed below are replaced with references to NNY. |

| II. | References to FLIAC’s website, www.foresters.com, throughout the prospectus that are not otherwise addressed below are replaced with references to NNY’s website, www.NSRE.com. |

| III. | On page 4, the following is added to the end of “General Account Risk” under “SUMMARY OF BENEFITS AND RISKS OF THE POLICY”: |

How to Obtain More Information – We encourage Policyowners to read and understand Our financial statements. Our audited financial statements, as well as the audited financial statements of the Separate Account, are located in the Statement of Additional Information. See “FINANCIAL STATEMENTS” below for instructions on how to obtain the Statement of Additional Information free of charge.

| IV. | On page 10, the following replaces the information under “Who We Are and How to Contact Us” prior to “Separate Account E” under “DESCRIPTION OF THE POLICY”: |

Nassau Life Insurance Company

NNY, with its home office at One American Row, Hartford, Connecticut 06115, is a stock life insurance company organized under the laws of the State of New York. NNY is authorized to conduct life and annuity business in all 50 states, the District of Columbia, Puerto Rico and the U.S. Virgin Islands. The statutory home office of NNY is located at 15 Tech Valley Drive, East Greenbush, New York 12061.

NNY is part of Nassau Financial Group L.P. (the “Nassau Group”). NNY has been operating as an insurance company since 1851. It was acquired by the Nassau Group in 2016. Other affiliates of NNY include 1851 Securities, Inc. (or hereafter “1851”), which is the distributor for the Policies, and the Nassau Companies of New York, which will provide administrative services for the Policies.

For information or service concerning a Policy, You may contact Us in writing at Our Administrative Office located at Raritan Plaza 1, P.O. Box 7836, Edison, New Jersey 08818-7836. You may also call Us at 1-800-832-7783 between the hours of 9:00 A.M. and 5:00 P.M., Eastern Time, or fax Us at 732-510-4209. You may also contact Us through Our website at www.NSRE.com.

You should send any payments, notices, elections or requests (including requests for Fund prospectuses), as well as any other documentation that We require for any purpose in connection with Your Policy, to Our Administrative Office. No payment, notice, election, request or documentation will be treated as having been “received” by Us until We have actually received it, as well as any related forms and items that We require, all in complete and Good Order (i.e., in form and substance acceptable to Us) at Our Administrative Office. To meet Our requirements for processing transactions, We may require that You use Our forms. We will notify You and provide You with an address if We designate another office for receipt of information, payments and documents.

| V. | Beginning on page 42, the following replaces the section titled “DISTRIBUTION OF THE POLICY” under “DESCRIPTION OF THE POLICY”: |

2

DISTRIBUTION OF THE POLICY

The Policies are no longer offered for new sales, but existing Policyowners may continue to make premium payments. As such, the Policy is considered to be continuously offered by NNY and the Separate Account.

Prior to the acquisition of FLIAC by NNY, Foresters Financial Services, Inc., an affiliate of FLIAC, served as principal underwriter and distributor for the Policies. As a result of the acquisition of FLIAC by NNY, effective July 1, 2020, 1851 Securities, Inc., an affiliate of NNY, assumed the role of the principal underwriter and distributor for the Policies. 1851 also serves as principal underwriter and distributor for other variable insurance products issued by NNY and its affiliated companies. NNY or an affiliate thereof reimburses 1851 for expenses that 1851 incurs in distributing variable insurance products of NNY. 1851 does not receive or retain any fees imposed by NNY under variable insurance products issued by NNY; however, 1851 may receive 12b-1 fees or other payments from underlying funds or their affiliates.

1851’s principal executive offices are located at One American Row, PO Box 5056, Hartford, CT 06102. 1851 is registered as a broker-dealer with the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934 (the “1934 Act”), as well as the securities commissions in the states in which it operates and is a member of the Financial Industry Regulatory Authority (“FINRA”).

1851 and NNY have entered into a selling agreement with Cetera Investment Services LLC (“Cetera”) to cover Cetera’s continued servicing of Policies held by Cetera customers. This agreement also covers Cetera’s sale and servicing of other variable annuity contracts and variable life insurance policies issued by NNY (including those contracts and policies assumed by NNY in connection with the Merger of FLIAC into NNY). Cetera is registered as a broker-dealer with the SEC under the 1934 Act and is a member of FINRA.

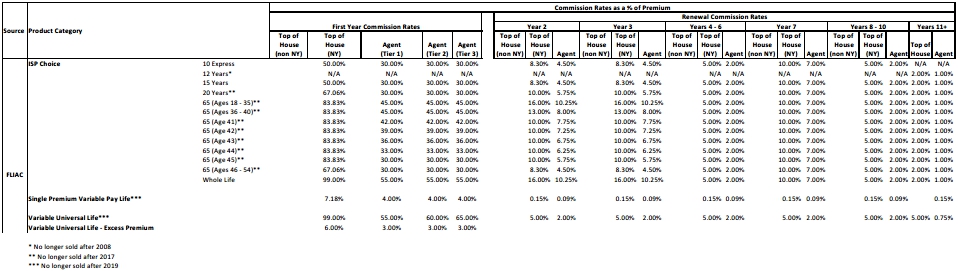

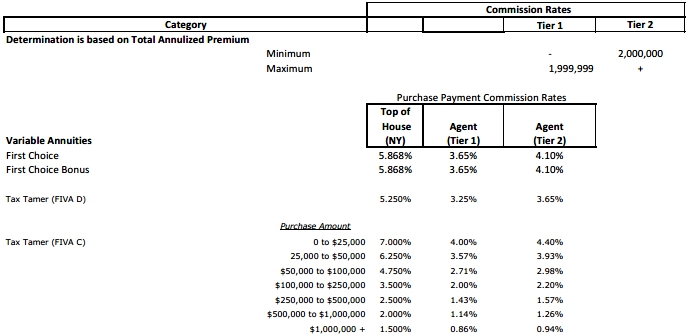

Compensation

Under Our agreement with Cetera, We generally pay compensation to Cetera in the form of commissions when a premium payment is made under a Policy. In the first Policy Year, We pay commissions of 99% on premiums paid up to the target premium and 6% on premiums paid in excess of the target premium. We pay commissions of 5% on all premiums paid thereafter. No other sales compensation is paid with respect to any other Policyowner transactions under the Policy. We do not pay compensation to Cetera based on the value of Your Policy.

A portion of the compensation paid by NNY to Cetera is used by Cetera to pay commissions or other compensation to its registered representatives who service the Policy, depending on the agreement between Cetera and the registered representative. Such representatives act as appointed agents of NNY under applicable state insurance law and must be licensed to sell variable insurance products. Cetera or a registered representative may receive different compensation for selling or servicing one variable insurance product compared to another.

To the extent permitted by FINRA rules, overrides and promotional incentives or cash and non-cash payments (including training reimbursement or training expenses) also may be made to Cetera based on premium payments invested in the Policy. Additional payments may be made to Cetera that are not directly related to the investment of additional premium payments in the Policy, such as payments related to the recruitment and training of personnel, production of promotional literature and similar services.

The Policy assesses a front-end sales charge on premium payments, so You directly pay for sales and distribution expenses of NNY when You make a premium payment. You also indirectly pay for sales and distribution expenses of NNY through the overall charges and fees assessed under the Policy. For example, any profits NNY may realize through receiving the separate account charge deducted under Your Policy may be used to pay for sales and distribution expenses. NNY may also pay for sales and distribution expenses out of any payments NNY or 1851 may receive for providing administrative, marketing and other support and services to the Funds. Currently, neither NNY nor 1851 receive such payments with respect to the Policies. Your Policy is subject to a surrender charge if You fully or partially surrender the Policy. See “FEES, CHARGES AND EXPENSES—Surrender Charges” under “DESCRIPTION OF THE POLICY.” Proceeds received by NNY from any surrender charges imposed under the Policy may be used to reimburse NNY for sales and distribution expenses.

3

| VI. | On page 49, the following is added immediately after the section titled “VOTING RIGHTS” under “OTHER INFORMATION”: |

CYBER SECURITY AND BUSINESS CONTINUITY RISKS

Our variable product business is dependent upon the effective operation of Our computer systems and those of Our business partners, and so Our business may be vulnerable to disruptions from utility outages and susceptible to operational and information security risks resulting from information system failures (e.g., hardware and software malfunctions) and cyber-attacks. These risks include, among other things, the theft, misuse, corruption and destruction of data maintained online or digitally, denial of service attacks on websites and other operational disruption and unauthorized release of confidential customer information. Such system failures and cyber-attacks affecting Us, the Funds, intermediaries and other affiliated or third-party service providers may adversely affect Us and Your interest in the Policy.

We are also exposed to risks related to natural and man-made disasters and catastrophes, such as (but not limited to) storms, fires, floods, earthquakes, public health crises, malicious acts and terrorist acts, any of which could adversely affect Our ability to conduct business. A natural or man-made disaster or catastrophe, including a pandemic (such as COVID-19), could affect the ability or willingness of Our employees or the employees of Our service providers to perform their job responsibilities.

LEGAL PROCEEDINGS

We, like other life insurance companies, are subject to regulatory and legal proceedings, including class action lawsuits, in the ordinary course of Our business. Such legal and regulatory matters include proceedings specific to Us and other proceedings generally applicable to business practices in the industry in which We operate. In some lawsuits and regulatory proceedings involving insurers, substantial damages have been sought and/or material settlement payments have been made. Although the outcome of any litigation or regulatory proceeding cannot be predicted with certainty, at the present time, We believe that there are no pending or threatened proceedings or lawsuits that are likely to have a material adverse impact on the Separate Account or on Our ability to meet Our obligations under the Policies or on 1851 in its role as principal underwriter.

| VII. | On page 49, the following replaces the section titled “FINANCIAL STATEMENTS” under “OTHER INFORMATION”: |

FINANCIAL STATEMENTS

Audited financial statements of the Separate Account and NNY are included in the Statement of Additional Information. For a free copy of the Statement of Additional Information, simply call or write to Our Administrative Office or contact Us through Our website at www.NSRE.com. The Statement of Additional Information is also available on the SEC’s website at www.sec.gov.

4

| Variable Universal Life |

| A Flexible Premium Adjustable |

| Variable Life Insurance Policy |

Offered By Foresters Life Insurance and Annuity Company Through First Investors Life Separate Account E.

40 Wall Street, New York, New York 10005 / (800) 832-7783

This prospectus describes an individual Flexible Premium Adjustable Variable Life Insurance Policy (the “Policy”) that is offered by Foresters Life Insurance and Annuity Company (“FLIAC”, “We”, “Us” or “Our”) through First Investors Life Separate Account E (“Separate Account E” or “Separate Account”). You can allocate Your Unloaned Accumulation Value to the series of the Delaware VIP® Trust (“Funds” or “VIP Series”) and/or to the Fixed Account (which credits a fixed interest rate We periodically declare).

The Policy is no longer available for new sales. Existing Policyowners may continue to make additional premium payments.

Please read this prospectus and keep it for future reference. It contains important information, including all material benefits, features, rights and obligations under a Policy, that You should know before buying or taking action under a Policy. This prospectus is valid only when accompanied by the current prospectus for the VIP Series.

The Securities and Exchange Commission ("SEC") has not approved or disapproved these securities or passed judgment on the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

FLIAC does not guarantee the performance of the investment options under Separate Account E that correspond to the series of the VIP Series. The Policy is not a deposit or obligation of, or guaranteed or endorsed by, any bank or depository institution, or federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency. The Policy involves investment risk, including possible loss of principal amount invested.

The Policy may not be available in all states or jurisdictions. This prospectus does not constitute an offering in any state or jurisdiction in which such offering may not lawfully be made. FLIAC does not authorize any information or representations regarding the offering described in this prospectus other than as contained in this prospectus or any supplement thereto or in any supplemental sales material authorized by FLIAC.

The date of this prospectus is May 1, 2020.

| CONTENTS |

| SUMMARY OF BENEFITS AND RISKS OF THE POLICY | 2 | |

| Policy Benefits | 2 | |

| Policy Risks | 3 | |

| Risks of the VIP Series | 5 | |

| FEE TABLES | 6 | |

| DESCRIPTION OF THE POLICY | 10 | |

| Who We Are and How to Contact Us | 10 | |

| How the Policy Works | 14 | |

| Policy Application Process | 15 | |

| Premiums | 15 | |

| Allocation of Net Premiums to Investment Options | 16 | |

| The Death Benefit | 20 | |

| Accumulation Value | 23 | |

| Surrenders and Partial Withdrawals | 24 | |

| Policy Loans | 26 | |

| Termination | 27 | |

| Settlement Options | 30 | |

| Optional Benefits and Insurance Riders | 31 | |

| Fees, Charges and Expenses | 35 | |

| Other Provisions | 39 | |

| FEDERAL TAX INFORMATION | 44 | |

| OTHER INFORMATION | 48 | |

| Voting Rights | 48 | |

| Reports | 49 | |

| Financial Statements | 49 | |

| APPENDIX A | 50 | |

| GLOSSARY | 51 |

| SUMMARY OF BENEFITS AND RISKS OF THE POLICY |

The following is a brief summary of certain features of the Policy. There are both benefits and risks associated with the Policy, and You should consider both the benefits and the risks before You purchase a Policy. More complete and detailed information about these features is provided later in this prospectus.

POLICY BENEFITS

The Policy provides life insurance protection on the named Insured, and pays Death Benefit proceeds when the Insured dies while the Policy is in effect. The Policy offers:

| ● | flexible premium payments where You decide the timing and amount of the payment; |

| ● | a choice of two Death Benefit Options; |

| ● | access to the Policy’s Surrender Value through loans, full surrenders and partial withdrawals (within limits); |

| ● | the ability to increase or decrease the Policy’s Face Amount of insurance; |

| ● | a guarantee that the Policy will not lapse during the first 10 Policy Years if the specified minimum monthly premiums have been paid; |

| ● | additional benefits through the use of optional riders; and |

| ● | a selection of investment options, consisting of twelve (12) Subaccounts and a Fixed Account with a guaranteed minimum interest rate. |

Death Benefit

Under the Policy, We will pay to Your designated Beneficiary the Death Benefit proceeds if the Policy is in effect when the Insured dies. During the first 10 Policy Years, We guarantee that the Policy will not lapse so long as the total amount of premiums paid (less any loans and partial withdrawals) is at least equal to the minimum monthly premium under Your Policy (which is determined by the Insured’s sex, age on the Issue Date, underwriting classification and the Face Amount of the Policy) multiplied by the number of months the Policy has been in force. Your Policy will stay in effect as long as the Net Surrender Value of Your Policy is sufficient to pay Your Policy’s Monthly Deduction.

The Policy offers You a choice of: (a) a level Death Benefit Option equal to the Face Amount of Your Policy, or (b) a Death Benefit Option which varies and is equal to the sum of Your Policy’s Face Amount and Total Accumulation Value (and, as a result, will increase or decrease depending on the performance of the investment options You select).

2

Investment Options

The Subaccounts invest in corresponding Funds of the VIP Series. Each Fund is a professionally managed mutual fund with its own investment objectives, strategies and risks. The Fixed Account, which is part of Our General Account, bears interest at a fixed guaranteed minimum interest rate, plus any additional interest that in Our sole discretion We may declare. Your Total Accumulation Value (see “Accumulation Value”) and Death Benefit (see “The Death Benefit”) will fluctuate based on a number of factors including the performance of the Subaccounts You select, the proportion of Your Total Accumulation Value which You allocate to the Fixed Account and the interest rate paid on the Fixed Account.

You may change Your allocation of future additional premiums subject to certain limitations. You may also change the allocation of Unloaned Accumulation Value among the Subaccounts, or among the Subaccounts and the Fixed Account, through Transfers of Unloaned Accumulation Value, Automated Subaccount Reallocations, or Systematic Transfers. Changes to the allocations of Unloaned Accumulation Values are subject to certain conditions and restrictions described elsewhere in this prospectus.

Policy Loans

You may borrow up to 75% of the Policy Surrender Value during the first three Policy Years and up to 90% of the Surrender Value thereafter, if You assign Your Policy to Us as sole security. While the receipt of the principal of a Policy loan is generally not taxable, the loan amount may become taxable under certain circumstances.

Surrenders and Partial Withdrawals

You may also fully surrender the Policy at any time while the Insured is living. The amount payable will be the Total Accumulation Value less the applicable surrender charge and any outstanding Policy loan balance, including any accrued loan interest. A surrender is a taxable event. You may request a partial withdrawal of a portion of the Policy’s Unloaned Total Accumulation Value at any time provided You meet Our requirements. Partial withdrawals may reduce Your Death Benefit and may have adverse tax consequences.

Additional Optional Benefits

Subject to availability in Your state, We offer optional benefits and insurance riders for additional benefits to the Policy. For any optional insurance rider You select, You will pay an additional monthly charge, and certain age, insurance underwriting requirements, limitations and restrictions may apply. The additional monthly charge for any optional rider You choose may impact the amount of the specified minimum monthly premiums associated with Your Policy’s no lapse guarantee. You may terminate a rider at any time and Your Monthly Deduction will be adjusted accordingly.

POLICY RISKS

Because of the insurance costs, the Policy is not suitable for You unless You need life insurance. If You have no need for life insurance, You should consider a different type of investment.

3

Risk of Lapse

The Policy involves a long-term commitment on Your part, and You should have the intention and financial ability to make the necessary premium payments. In order to pay the fees and charges associated with the Policy, We deduct certain amounts from Your Policy. Although the Policy provides You with flexibility regarding the timing and amount of the premium payments You make, You may risk a Policy lapse if You forego making sufficient premium payments.

The Policy is not suitable as a short-term savings vehicle.

Investment Risk

The Policy is different from fixed-benefit life insurance because You bear the investment risks and You can lose principal. The Death Benefit and the Total Accumulation Value will increase or decrease as a result of the investment experience of the Subaccounts You select. Each Subaccount has its own investment objectives and investment strategy. The performance of each will vary, and some Subaccounts may be riskier than others. We do not guarantee the investment performance of the Subaccounts. Your allocation choices should be consistent with Your personal investment objective and Your risk tolerance. We bear the investment risk that the Fixed Account will produce a return equal to at least principal plus the minimum guaranteed rate of return. Because You may allocate no more than 50% of Your premiums to the Fixed Account, investing in the Fixed Account does not eliminate investment risks.

General Account Risk

The assets of the General Account support Our insurance obligations and are subject to general liabilities from Our business operations and to claims by Our general creditors. Amounts allocated to the Fixed Account, and any guarantees under Your Policy that exceed Your Policy Value (such as those that may be associated with the Death Benefit), are paid from the General Account. Any such amounts that We are obligated to pay in excess of Your Policy Value are subject to Our financial strength and claims-paying ability. There is no guarantee that We will always be able to meet Our claims-paying obligations.

Tax Risks

If You take a partial withdrawal from Your Policy, reduce the Face Amount of the Policy, eliminate a rider, or make any other material change to the Policy after it is issued, this may convert the Policy into a modified endowment contract (“MEC”). See “Federal Tax Information – Surrenders and Loans” for more information. This can have adverse tax consequences to You.

4

Risks of Policy Loans

If You decide to take Policy loans, they may reduce the Death Benefit and Total Accumulation Value of Your Policy whether or not You repay the loans because loans may undermine the growth potential of Your Policy. In addition, a Policy loan may increase the risk of lapse by decreasing amounts available to pay the Monthly Deduction. While the receipt of the principal of a Policy loan is generally not taxable, it may be taxable if the loan is outstanding when the Policy is surrendered, exchanged, lapsed or converted to continued insurance, or the Policy has been converted into a MEC.

5

| FEE TABLES |

The following tables describe the fees and expenses that You will pay when buying, owning and surrendering the Policy. The cost of insurance charges and optional rider premiums shown may not be representative of what You will pay because these charges are based on the Insured’s age, sex and underwriting class. Your Policy will be accompanied by an illustration based on Your actual annual premium and Face Amount as determined by the Insured’s age, sex, underwriting classification, payment frequency and optional riders selected.

The table below describes the transaction fees and expenses that You will pay under the Policy.

| Transaction Fees | ||

| Charge | When Charge is Deducted | Amount Deducted |

| Maximum Premium Charge Percentage Imposed on Premiums (Load) |

Upon each premium payment | Guaranteed maximum: 8.00% of each Premium Payment Current: 5.00% of each Premium Payment |

| Surrender Charge(1) | Upon full surrender of or any partial withdrawal from the Policy |

Maximum Charge(2) $49.62 per $1,000 of Face Amount surrendered or decreased Minimum Charge(3) $0.97 per $1,000 of Face Amount surrendered or decreased Representative Case(4) $21.68 per $1,000 of Face Amount surrendered or decreased |

| Partial Withdrawal Processing Fee |

Upon any partial withdrawal from the Policy |

$25.00 |

| Transfer Fees(5) (Limit of 6 transfers in any 12- month period) |

Upon each transfer in excess of four (4) per Policy Year |

$10.00 |

| Optional Rider Accelerated Death Benefit Rider Administrative Fee |

Upon request for an accelerated death benefit (subject to the terms and conditions of the rider) |

$150.00 |

6

The next table describes the fees and expenses that We may deduct from Your Total Accumulation Value periodically over the life of the Policy. These fees and expenses do not include operating fees and expenses of the Funds.

| Periodic Charges Other Than Fund Operating Expenses | ||

| Charge | When Charge is Deducted | Amount Deducted |

| Policy Charge | Monthly, on the Issue Date and on each Monthly Deduction Date |

Guaranteed maximum: $10 Current: $10 |

| Cost of Insurance(1) | Monthly, on the Issue Date and on each Monthly Deduction Date |

Maximum Charge(2) Guaranteed maximum: $83.333 per $1,000 net amount at risk(3) Current: $41.250 per $1,000 net amount at risk(3) Minimum Charge(4) Guaranteed maximum: $0.015 per $1,000 net amount at risk(3) Current: $0.015 per $1,000 net amount at risk(3) Representative Case(5) Guaranteed maximum: $0.045 per $1,000 net amount at risk(3) Current: $0.035 per $1,000 net amount at risk(3) |

| Separate Account Charge | Monthly, on the Issue Date and on each Monthly Deduction Date |

Guaranteed maximum: Effective annual rate of 0.50% of Accumulation Value in the Subaccounts Current: Effective annual rate of 0.50% of Accumulation Value in the Subaccounts(6) |

| Face Amount Charge | Monthly, on the Issue Date and on each Monthly Deduction Date |

Maximum Charge(7) Guaranteed maximum: $0.100 per $1,000 of Face Amount Current: $0.100 per $1,000 of Face Amount for the first 10 Policy Years, $0.00 thereafter Minimum Charge(8) Guaranteed maximum: $0.017 per $1,000 of Face Amount Current: $0.017 per $1,000 of Face Amount for the first 10 Policy Years, $0.000 thereafter Representative Case(9) Guaranteed maximum: $0.017 per $1,000 of Face Amount Current: $0.017 per $1,000 of Face Amount for the first 10 Policy Years, $0.00 thereafter |

| Policy Loan Interest | Policy Anniversary | 6.00% of the outstanding loan(10) |

7

| Periodic Charges Other Than Fund Operating Expenses | ||

| Charge | When Charge is Deducted | Amount Deducted |

| Optional Riders | ||

| Waiver of Specified Monthly Deduction Rider(11)(12) |

On each Monthly Deduction Date following election of the Rider |

Maximum: 65.00% of Specified Monthly Deduction(13) Minimum: 2.00% of Specified Monthly Deduction(14) Representative Case: 5.50% of Specified Monthly Deduction(9) |

| Spouse Term Rider(12) | On each Monthly Deduction Date following election of the Rider |

Maximum: $5.214 per $1,000 of coverage(15) Minimum: $0.055 per $1,000 of coverage(16) Representative Case: $0.185 per $1,000 of coverage(17) |

| Children’s Term Rider(18) | On each Monthly Deduction Date following election of the Rider |

Maximum: $0.464 per $1,000 of coverage Minimum: $0.464 per $1,000 of coverage |

| Accidental Death Benefit Rider(12) |

On each Monthly Deduction Date following election of the Rider |

Maximum: $0.132 per $1,000 of coverage(19) Minimum: $0.088 per $1,000 of coverage(20) Representative Case: $0.088 per $1,000 of coverage(9) |

8

The next table below describes the range of fees and expenses for the Funds that You will indirectly pay during the time that You own the Policy. The table shows the minimum and maximum Total Annual Fund Operating Expenses as of December 31, 2019. These expenses may be higher or lower in the future. More detail concerning each Fund’s fees and expenses is contained in the accompanying prospectus for the Funds.

| Total Annual Fund Operating Expenses | ||

| Minimum | Maximum | |

| Range of expenses that are deducted from Fund assets, including management fees and other expenses |

0.73% | 1.42% |

9

| DESCRIPTION OF THE POLICY |

Who We Are and How to Contact Us

Foresters Life Insurance and Annuity Company (“FLIAC”, “We” and “Our”), with its home office located at 40 Wall Street, New York, New York 10005, is a stock life insurance company incorporated under the laws of the State of New York in 1962. We issue life insurance policies and annuity contracts.

FLIAC is part of Foresters Financial Holding Company, Inc. (“FFHC”), a holding company which owns all of the voting common stock of FLIAC. Foresters Financial Services, Inc. (“FFS”), an affiliate of FLIAC, is currently the distributor of the Policies.

On October 17, 2019, The Independent Order of Foresters announced that it had entered into a Purchase and Sale Agreement with Nassau Life Insurance Company (“Nassau Life”) whereby Nassau Life will purchase FFHC and, its sole subsidiary, FLIAC. FLIAC and Nassau Life expect to close the transaction on or about June 1, 2020 at which time, FLIAC will become a subsidiary of Nassau Life.

For information or service concerning a Policy, You can contact Us in writing at Our Administrative Office, located at Raritan Plaza 1, P.O. Box 7836, Edison, NJ 08818-7836. You can call Us at (800) 832-7783 between the hours of 9:00 a.m. to 6:00 p.m., Eastern Time, or fax Us at (732) 510-4209. You can also contact Us through Our website at www.foresters.com.

You should send any payments, Notices, elections, or requests, as well as any other documentation that We require for any purpose in connection with Your Policy to Our Administrative Office. No such payment, Notice, election or request will be treated as having been “received” by Us until We have actually received it, as well as any related forms and items that We require, all in complete and Good Order (i.e., in form and substance acceptable to Us) at Our Administrative Office. We will notify You and provide You with an address if We designate another office for receipt of information, payments and documents.

Separate Account E

We

issue the Policies described in this prospectus through First Investors Life Variable Account E (“Separate Account E”).

We established Separate Account E on September 30, 2004, under the provisions of the New York Insurance Law. Separate Account

E is registered with the SEC as a unit investment trust under the Investment Company Act of 1940, as amended (the “1940

Act”).

We segregate the assets of Separate Account E from the assets in Our general account (the “General Account”). The assets of Separate Account E fall into two categories: (1) assets equal to Our reserves and other liabilities under the Policies and (2) additional assets derived from expenses that We charge to Separate Account E. The assets equal to Our reserves and liabilities support the Policy. We cannot use these assets to satisfy any of Our other liabilities. The assets We derive from Our charges do not support the Policy, and We can transfer these assets in cash to Our General Account. Before making a transfer, We will consider any possible adverse impact that the transfer may have on Separate Account E.

10

All the income, gains and losses (realized or unrealized) allocated to Separate Account E are credited to or charged against Separate Account E without regard to Our other business. We are obligated to pay all amounts promised to Policyowners under the Policies even if these amounts exceed the assets in Separate Account E. Assets allocated to Separate Account E support the benefits under the Policy. The assets are in turn invested by each Subaccount of Separate Account E into a corresponding Fund at net asset value. Therefore, We own the shares of the underlying Funds, not You.

Each Subaccount reinvests any distributions it receives from a Fund by purchasing additional shares of the distributing Fund at net asset value. Accordingly, We do not expect to pay You any capital distributions from the Policies.

The Fixed Account

The Fixed Account is not part of Separate Account E. It is part of Our General Account. The General Account consists of all assets owned by Us, other than those in Separate Account E or in any other legally segregated separate accounts. The assets of the General Account support Our insurance obligations and are subject to general liabilities from Our business operations and to claims by Our general creditors. The assets of the General Account can be invested as We choose, subject to certain legal requirements. We guarantee that any assets that You choose to allocate to the Fixed Account will earn at least 2.00%, the minimum effective annual interest rate associated with Your Policy.

We may, but are not required to, declare interest in excess of this rate (“excess interest”). In the event that We declare excess interest, We are not required to guarantee that it will remain in effect for any specific period of time. Therefore, We may reduce or eliminate such excess interest at any time without prior notice to You. However any excess interest already credited to Your account is non-forfeitable. You do not share in any gains or losses that We experience in the Fixed Account or Our General Account. We bear the entire risk that the investments in Our General Account may not achieve the minimum guaranteed or declared rates of return.

Amounts allocated to the Fixed Account, and any guarantees under Your Policy that exceed Your Policy Value (such as those that may be associated with the Death Benefit), are paid from the General Account. Any such amounts that We are obligated to pay in excess of Your Policy Value are subject to Our financial strength and claims-paying ability. There is no guarantee that We will always be able to meet Our claims-paying obligations.

11

The interests in the Fixed Account are not registered under the Securities Act of 1933. Neither the Fixed Account nor the General Account is registered as an investment company under the 1940 Act. Disclosures regarding the Fixed Account, however, are subject to certain generally applicable provisions of the federal securities laws relating to the accuracy and completeness of statements made in the prospectus.

VIP Series

On October 4, 2019, each series of the First Investors Life Series Funds managed by Foresters Investment Management Company, Inc. an affiliate of FLIAC, which prior to that date were the only funds available to Contractowners, reorganized into a substantially similar series of the Delaware VIP® Trust, managed by Delaware Management Company (“DMC”), a series of Macquarie Investment Management Business Trust.

The Delaware VIP Trust is an open-end management investment company registered with the SEC under the 1940 Act. The VIP Series consist of a variety of separate Funds, twelve (12) of which are available to Contractowners. Each of the Funds currently offers its shares only through the purchase of a Contract or another variable life or variable annuity Contract issued by FLIAC or by other insurance companies. Each of the Funds reserves the right to offer its shares to other separate accounts or directly to Us. Although some of the Funds have similar names, the same portfolio manager and the same investment objectives as other publicly available mutual funds, they are separate and distinct from these mutual funds. The Funds will have different portfolio holdings and fees so their performances will vary from the other mutual funds.

12

The VIP Series are selected to provide an appropriate range of investment options for persons invested in the Policies from conservative to more aggressive investment strategies. DMC is the investment adviser of the VIP Series and receives investment management fees for its services. DMC pays a portion of its investment management fees to subadvisers who manage certain of the VIP Series. DMC is a series of Macquarie Investment Management Business Trust, a Delaware statutory trust, and is located at 2005 Market Street, Philadelphia, PA 19103. DMC has retained Smith Asset Management Group, L.P., 100 Crescent Court, Suite 1150, Dallas, TX 75201, to serve as the subadviser of the Delaware VIP Growth Equity Series and Ziegler Capital Management, LLC, 170 West Madison Street, 24th floor, Chicago, IL 60602 to serve as subadviser for the Delaware VIP Covered Call Strategy Series. In addition, DMC may seek investment advice, recommendations and/or allow security trades on its behalf for Funds in the VIP Series by certain of its affiliates which have specialized market knowledge in relevant areas and which it has engaged as a subadvisor to Funds in the VIP Series. These affiliated subadvisors include, Macquarie Investment Management Austria Kapitalanlage AG, Kaerntner Strasse 28, 1010 Vienna , Austria, with respect to the Delaware VIP Fund For Income Series, Delaware VIP Limited Duration Bond Series, Delaware VIP Total Return Series and Delaware VIP Investment Grade Series; Macquarie Investment Management Global Limited, 50 Martin Place, Sydney Australia with respect to the Delaware VIP Fund For Income Series, Delaware VIP Equity Income Series, Delaware VIP Growth and Income Series, Delaware VIP Opportunity Series, Delaware VIP Limited Duration Bond Series, Delaware VIP Special Situations Series, Delaware VIP International Series, Delaware VIP Total Return Series and Delaware VIP Investment Grade Series; Macquarie Investment Management Europe Limited, 28 Ropemaker Street, London, England with respect to the Delaware VIP Fund For Income Series, Delaware VIP Limited Duration Bond Series, Delaware VIP Total Return Series and Delaware VIP Investment Grade Series; Macquarie Funds Management Hong Kong Limited, Level 18, One International Finance Centre, One Harbour View Street, Central, Hong Kong, with respect to the Delaware VIP Equity Income Series, Delaware VIP Growth and Income Series, Delaware VIP Opportunity Series, Delaware VIP Special Situations Series, Delaware VIP International Series and Delaware VIP Total Return Series. See the VIP Series prospectus for more information about the investment adviser and subadvisers.

The following table includes the investment objective for each available Fund. There is no guarantee that any of the Funds will achieve its stated objective. There is a Subaccount with a similar name as its corresponding underlying Fund. The following table also identifies the Subaccount that corresponds with each Fund. The degree of investment risk You assume will depend on the Subaccounts You select. You should consider Your allocations carefully. The investment objectives, principal investment strategies, principal risks and management of the Funds are described in the attached VIP Series prospectus, which You should read carefully before investing. You may obtain a VIP Series prospectus by writing to Us at Our Administrative Office, located at Raritan Plaza 1, Edison, NJ 08837, calling Us at (800) 832-7783 between the hours of 9:00 a.m. to 6:00 p.m., Eastern Time, or faxing Us at (732) 510-4209. You also can obtain a VIP Series prospectus at www.delawarefunds.com/dcio/literature.

13

| Subaccount | Fund | Investment Objective | ||

| Covered Call Strategy Subaccount |

Delaware VIP Covered Call Strategy Series |

Long-term capital appreciation. | ||

| Equity Income Subaccount |

Delaware VIP Equity Income Series |

Total return. | ||

| Fund For Income Subaccount |

Delaware VIP Fund For Income Series |

High current income. | ||

| Government Cash Management Subaccount |

Delaware VIP Government Cash Management Series |

Current income consistent with the preservation of capital and maintenance of liquidity. | ||

| Growth and Income Subaccount |

Delaware VIP Growth and Income Series |

Long-term growth of capital and current income. | ||

| International Subaccount |

Delaware VIP International Series |

Long-term capital growth. | ||

| Investment Grade Subaccount |

Delaware VIP Investment Grade Series |

A maximum level of income consistent with investment primarily in investment grade debt securities. | ||

| Limited Duration Bond Subaccount |

Delaware VIP Limited Duration Bond Series |

Current income consistent with low volatility of principal. | ||

| Opportunity Subaccount |

Delaware VIP Opportunity Series |

Long-term capital growth. | ||

| Growth Equity Subaccount |

Delaware VIP Growth Equity Series |

Long-term growth of capital. | ||

| Special Situations Subaccount |

Delaware VIP Special Situations Series |

Long-term growth of capital. | ||

| Total Return Subaccount |

Delaware VIP Total Return Series |

Sustainable current income with potential for capital appreciation with moderate investment risk. |

HOW THE POLICY WORKS

The Policy provides life insurance protection on the named Insured, and pays Death Benefit proceeds when the Insured dies while the Policy is in effect. The Policy offers: (1) flexible premium payments where You decide the timing and amount of the payment; (2) a choice of two Death Benefit Options; (3) access to the Policy’s Surrender Value through loans, full surrenders and partial withdrawals (within limits); (4) the ability to increase or decrease the Policy’s Face Amount; (5) a guarantee that the Policy will not lapse during the first 10 Policy Years if the specified minimum monthly premiums have been paid; (6) additional benefits through the use of optional riders; and (7) a selection of investment options, consisting of twelve (12) Subaccounts and a Fixed Account with a guaranteed minimum interest rate. We will pay the designated Beneficiary the Death Benefit proceeds if the Policy is still in effect when the Insured dies. During the first 10 Policy Years, We guarantee that the Policy will not lapse so long as the total amount of premiums paid (less any loans and partial withdrawals) is at least equal to the minimum monthly premium under Your Policy (which is determined by the Insured’s sex, age on the Issue Date, underwriting classification and the Face Amount of the Policy) multiplied by the number of months the Policy has been in force. Your Policy will stay in effect as long as the Net Surrender Value of Your Policy is sufficient to pay Your Policy’s Monthly Deduction.

14

The Policy offers You a choice of: (a) a level Death Benefit Option equal to the Face Amount of Your Policy, or (b) a Death Benefit Option which varies and is equal to the sum of Your Policy’s Face Amount and Total Accumulation Value (and, as a result, will increase or decrease depending on the performance of the investment options You select). The Death Benefit proceeds will be reduced by any outstanding loans and accrued interest and any due and unpaid charges.

POLICY APPLICATION PROCESS

To purchase a Policy, You must submit a completed life insurance Application to Us and provide Us with evidence of insurability that is satisfactory to Us. Before issuing a Policy, We conduct underwriting to determine the proposed Insured's insurability.

We conduct, at our expense, standard underwriting, which may include, but is not limited to, the testing of blood and urine, a physical examination, communication with the proposed Insured’s physician or other tests We feel are necessary or appropriate. The amount of information We require for standard underwriting depends on the proposed Insured’s age and the amount of insurance for which the proposed Insured has applied.

If Your Application is accepted, We will credit Your Policy with the initial Net Premium on the Issue Date. Until such time, Your initial premium is held in Our General Account, during which time it may earn interest. If a Policy is not issued, We will return Your premium without interest. We reserve the right to reject any Application for any reason, including but not limited to failure to meet Our underwriting criteria. The Insured will be covered under the Policy as of the Policy’s Issue Date.

PREMIUMS

The initial premium is the premium due on the Issue Date. The minimum amount of the initial premium is the minimum amount necessary for us to issue a Policy and is determined by Your age, sex, underwriting classification and the Face Amount You select. Once You have purchased Your Policy, You can make premium payments as often as You like and for any amount You choose, within certain limits discussed below.

You will select a planned premium schedule in Your Application. The planned premium schedule is Our understanding of Your intention regarding premium payments at any particular time. You may change the amount and/or frequency of Your planned premium by giving us Notice.

Our acceptance of Your planned premium schedule does not in any way imply or guarantee insurance coverage or any other benefit provided by this Policy will continue.

15

If Your planned premium schedule payment frequency is annual, semi-annual or quarterly, We will send You a premium reminder notice for the amount of the planned premium.

Regardless of the planned premium schedule, additional premiums may be paid at any time and in any amount, within certain limits discussed below. However, You should note carefully that the amount and frequency of premiums paid will affect values in this Policy and may affect the amount and duration of insurance.

If You have a Policy loan balance and payment is intended by You to be a Policy loan repayment, You must designate the payment as a loan repayment; otherwise We will credit the payment amount to the Policy as a premium payment and allocate the premium according to the allocation instructions You previously provided.

Premium Limits

The following limits apply to the premiums you may make:

| ● | Except in the case of an exchange from another MEC, We will not accept, within the first Policy Year, a premium that will cause this Policy to become a MEC. Please see the discussion of “Federal Tax Information” below for more on certain federal income tax aspects of MECs. |

| ● | We will not accept a premium payment that is less than the minimum premium amount under Your Policy. |

| ● | We reserve the right to request that You provide evidence of insurability satisfactory to Us and We may limit or reject any additional premium payments. |

ALLOCATION OF NET PREMIUMS TO INVESTMENT OPTIONS

When You purchase a Policy, You select the percentage allocation of Your premium to the Subaccounts of Separate Account E and/or the Fixed Account.

Your allocations are subject to the following constraints:

| 1. | Allocation percentages must be in whole numbers; |

| 2. | Allocation percentages must add to 100%; and |

| 3. | The allocation percentage for the Fixed Account may not exceed 50%. |

On the Policy’s Issue Date, the proportion of the initial Net Premium You designated for the Fixed Account will be allocated to the Fixed Account. The remainder of the initial Net Premium You designated for the Subaccounts will be allocated to the Government Cash Management Subaccount for the Right to Examine Period. Upon the expiration of the Right to Examine Period, We will reallocate the Subaccount Accumulation Value in the Government Cash Management Subaccount to the Subaccounts You designated on Your Application. Subsequent premiums will be allocated to the Fixed Account and/or the Subaccounts according to Your allocation percentages on file, unless You request a change in Your allocation percentages. A change in the allocation percentages for future premiums will affect reallocations occurring under the Automated Subaccount Reallocation Option. See “Automated Subaccount Reallocation Option” for additional information.

16

The Net Premium is credited to Your Policy on the Policy's Issue Date and on the day We receive each additional premium from You. Your Net Premiums buy units of the Subaccounts and not shares of the Funds in which the Subaccounts invest.

Reallocating Your Policy Assets

Subject to the restrictions discussed below, You may change the allocation of Your Unloaned Accumulation Value (the value of the Subaccount Accumulation Value plus the Fixed Account Accumulation Value) among the Subaccounts, or among the Subaccounts and the Fixed Account, through a Transfer of Unloaned Accumulation Value by written Notice, by telephone, or through participation in Our Systematic Transfer Option or Our Automated Subaccount Reallocation Option. Only the Automated Subaccount Reallocation Option or the Systematic Transfer Option, but not both, may be in effect at the same time.

We charge a $10 fee for transfers in excess of four per Policy Year including those involving the Fixed Account. A transfer of Unloaned Accumulation Value made while the Automated Subaccount Reallocation Option is in effect automatically terminates the Automated Subaccount Reallocation Option. Requests for transfers are processed as of the Business Day We receive them, as described in “Processing Transactions”. We may defer transfers under the conditions described under “Payment and Deferment”.

17

We will not be liable for losses resulting from telephone requests that We believe are genuine. We reserve the right to revoke or limit Your telephone transaction privileges. Telephone privileges may be denied to market timers and frequent or disruptive traders.

We cannot guarantee that telephone transactions will always be available. For example, there may be interruptions in service beyond Our control such as weather-related emergencies.

Systematic Transfer Option

You may request that a specified dollar amount of Unloaned Accumulation Value be transferred from any one or more Subaccounts (the “originating Account(s)”) to any one or more other Subaccounts (the “receiving Account(s)”) at monthly or quarterly intervals, as selected. The first such systematic transfer occurs on the first Business Day of the Policy Month or Policy Quarter that next follows the date We receive Your request. Transfers under this option may not be designated either to or from the Fixed Account. The minimum amount that may be transferred either from or to any one Account is $100. All transferred amounts must be specified in whole dollars.

The Systematic Transfer Option will terminate as to an originating Account if and when that Account is depleted. Currently, transfers made under this option are not subject to any fee and are not included in the yearly transfer count for purposes of determining whether a transfer fee applies, see “Transfer of Unloaned Accumulation Value” above. However, We reserve the right to impose a charge in the future for this option not to exceed $10. The Systematic Transfer Option terminates if and when the Unloaned Accumulation Value remaining in the originating Subaccount is depleted. We may terminate this option or modify Our rules governing this option at Our discretion by giving You 31 days written notice.

Automated Subaccount Reallocation Option

If You request, We will automatically reallocate the Subaccount Accumulation Value every Policy Quarter according to the most recent premium allocation instructions on file with Us. The first such reallocation will occur on the first Business Day of the Policy Quarter that next follows the date on which We receive Your request.

Upon reallocation, the amount of Subaccount Accumulation Value allocated to each Subaccount is equal to (a) multiplied by (b), where:

| (a) | is equal to: | |

| 1. | The allocation percentage You have specified for that Subaccount; divided by | |

| 2. | The sum of the allocation percentages for all such Subaccounts; and, | |

| (b) | is equal to the sum of the Accumulation Values in all of the Subaccounts at the time of the reallocation. | |

18

Any requested changes in Your premium allocation instructions are reflected in the next quarterly reallocation following the change. The reallocation will only affect the allocation of Unloaned Accumulation Values among the Subaccounts. It will not affect the Fixed Account Accumulation Value. Reallocation transfers of Subaccount Accumulation Value made under this option are not subject to the minimum transfer amount described under “Transfer of Unloaned Accumulation Value”. Currently, transfers made under this option are not subject to any fee and are not included in the yearly transfer count for purposes of determining whether a transfer fee applies. However, We reserve the right to impose a charge for this option in the future not to exceed $10.

A transfer of Unloaned Accumulation Value made while this Automated Subaccount Reallocation Option is in effect automatically terminates the option. You may subsequently reelect this option by providing Us with Notice. We may terminate or modify Our rules governing this option by giving You 31 days written notice.

Our Policies on Frequent Reallocations Among Subaccounts

The Policy is designed for long-term insurance/investment purposes. It is not intended to provide a vehicle for frequent trading or market timing. We therefore limit reallocations to six in any 12-month period (not counting systematic and automated reallocations). We apply this limitation uniformly to all Policies.

We monitor Subaccount reallocations in an effort to prevent Policyowners from exceeding the annual limit on reallocations. We cannot guarantee that Our monitoring efforts will be effective in identifying or preventing all market timing or frequent trading activity in the Subaccounts.

We will only accept a transaction request that is in writing or by telephone, and that complies with Our requirements for such requests. We will not accept transaction requests by any other means, including, but not limited to, facsimile or e-mail requests. As described in the VIP Series prospectus, the Board of Trustees of the Funds has adopted policies and procedures to detect, deter and prevent frequent trading in the shares of the VIP Series and reject, without any prior notice, any purchase or exchange transaction if the Funds believe that the transaction is part of a market timing strategy. In order to protect Policyowners and to comply with the underlying Funds’ policies, it is Our policy to reject any reallocation request, without any prior notice, that appears to be part of a market timing strategy based upon the holding period of the investment, the amount of the investment being exchanged, and the Subaccounts involved.

The Risks to Policyowners of Frequent Reallocations

To the extent that Our policies are not successful in detecting and preventing frequent trading in the Subaccounts, frequent trading may: (a) interfere with the efficient management of the underlying Funds by, among other things, causing the underlying Funds to hold extra cash or to sell securities to meet redemptions; (b) increase portfolio turnover, brokerage expenses, and administrative costs; and (c) harm the performance of the Funds, particularly for long-term shareholders who do not engage in frequent trading. These risks may in turn adversely affect Policyowners who invest in the Funds through Our Subaccounts.

19

In the case of the Subaccounts that invest indirectly in high yield bonds and small cap stocks, the risk of frequent trading includes the risk that investors may attempt to take advantage of the fact that these securities may trade infrequently and therefore their prices may be slow to react to information. This could cause dilution in the value of the shares held by other shareholders.

In the case of the Subaccounts that invest indirectly in foreign securities, the risks of frequent trading include the risk of time zone arbitrage. Time zone arbitrage occurs when shareholders attempt to take advantage of the fact that the valuation of foreign securities held by a Fund may not reflect information or events that have occurred after the close of the foreign markets on which such securities principally trade but before the close of the New York Stock Exchange (“NYSE”). This could cause dilution in the value of the shares held by other shareholders.

THE DEATH BENEFIT

The Death Benefit is the amount We pay to the named Beneficiary upon the death of the Insured prior to the Maturity Date while this Policy is in force. The Death Benefit is the greater of the Basic Death Benefit or the Minimum Death Benefit, as described below. You may select between two options of the Basic Death Benefit.

The amount of the Death Benefit will depend upon the Face Amount of insurance coverage You select, the Death Benefit option You elect, the performance of the Subaccounts to which You allocate Your assets, the interest You earn on allocations, if any, to the Fixed Account, any optional riders You elect, and the amount of any Policy loans outstanding upon the death of the Insured.

Face Amount

You select the Face Amount of insurance coverage when You purchase the Policy. Our current minimum Face Amount for a Policy is $100,000. The Face Amount of Your Policy affects the Death Benefit to be paid and the fees and charges You will pay under the Policy. You may request to increase or decrease the Face Amount, but You may not decrease the Face Amount below the minimum Face Amount.

Increasing the Face Amount - You may request an increase in the Face Amount by giving us Notice. We will require evidence of insurability acceptable to Us, based on Our current published underwriting standards. The attained age of the Insured at the time of request must be less than the maximum issue age for this Policy. The minimum Face Amount increase is $50,000. The cost of insurance for each increase in the Face Amount will be based on the Insured’s attained age and underwriting risk class at the time the increase takes effect. An increase in Face Amount will result in a new table of surrender charges applicable to that increase (see “Surrender Charges”).

20

Before requesting an increase in the Face Amount, You should consider that any increase in the Face Amount will result in additional cost of insurance charges, additional surrender charges, and a new period for incontestability or certain suicide provisions applicable to the increase.

Decreasing the Face Amount - You may request a decrease in the Face Amount by giving us Notice. You may not decrease the Face Amount below the minimum Face Amount of $100,000. Any decrease will go into effect on the Monthly Deduction Date that falls on or next follows receipt by Us of Your request. The decrease will first reduce prior increases in Face Amount in the reverse chronological order in which the increases occurred. After all prior increases in the Face Amount have been reduced, any additional decreases in the Face Amount will reduce the initial Face Amount provided under the original Application.

A decrease in Face Amount will be subject to surrender charges according to the table of surrender charges applicable to that portion of the Face Amount (see “Surrender Charges”).

Before requesting a decrease in the Face Amount, You should consider that any decrease in the Face Amount may result in a surrender charge and a reduced Death Benefit.

Death Benefit

The Death Benefit is the greater of the Basic Death Benefit or the Minimum Death Benefit. You may select between two options of the Basic Death Benefit.

Basic Death Benefit, Option A - the Face Amount of Your Policy on the date of the Insured’s death.

Basic Death Benefit, Option B - the Face Amount of Your Policy on the date of the Insured’s death plus the Total Accumulation Value on the date of the Insured’s death.

Minimum Death Benefit - The Minimum Death Benefit at any time is equal to the Total Accumulation Value divided by the net single premium per dollar of insurance. The net single premium per dollar of insurance is the amount that would be required to purchase one dollar of paid up whole life insurance, based on the Insured’s sex, attained age, and underwriting classification, based on the 2001 CSO Table for Policies for the Insured’s sex and smoking status, and assuming a 4% rate of interest.

A Policy with a lower net single premium per dollar of insurance will have a higher Minimum Death Benefit than an otherwise comparable Policy that has a higher net single premium per dollar of insurance. The amount of the net single premium will generally be lower for a younger Insured than for an older Insured, lower for a female Insured than for a comparable male Insured, and lower for an Insured who does not use tobacco than for an Insured who does. If the Insured presents other special risks, net single premiums will reflect upward adjustments from the mortality table that otherwise would be applicable.

21

The net single premium per dollar of insurance increases over the period of time that a Policy is in force, as the Insured’s age increases. This means that each year that Your Policy is in force, the Minimum Death Benefit will be smaller in relation to the Policy’s Total Accumulation Value than it was the year before.

Effect of Partial Withdrawals on the Death Benefit

The Death Benefit will be reduced by the amount of any partial withdrawal from the Policy. Thus, under Basic Death Benefit, Option A, the Face Amount will be correspondingly reduced to the excess, if any, of the Face Amount over the result of (a) – (b) where:

| (a) | Is the Death Benefit immediately prior to the partial withdrawal; and |

| (b) | Is the amount of the partial withdrawal and any charge for the partial withdrawal. |

Changing the Death Benefit Option

You may request a change in the Death Benefit Option by giving us Notice. The change will go into effect on the Monthly Deduction Date on or next following the date We receive the request for change. We may require evidence of insurability prior to approving any change in Death Benefit Option that results in an increase in the net amount at risk at the time of such option change.

The following Death Benefit Option changes will not require evidence of insurability subject to the conditions outlined.

If You request a change from Basic Death Benefit, Option B to Basic Death Benefit, Option A, the Face Amount under Death Benefit, Option A will be increased to equal the Death Benefit available under Basic Death Benefit, Option B on the effective date of change.

If You request a change from Basic Death Benefit, Option A to Basic Death Benefit, Option B, and the Face Amount exceeds the Death Benefit less the Total Accumulation Value, the Face Amount will be decreased so that it equals the Death Benefit less the Accumulation Value on the effective date of the change. Such a change will not be allowed if the resulting Face Amount is less than Our minimum Face Amount.

No more than one Death Benefit Option change will be permitted in a 12 month period.

Death Benefit Proceeds

The Death Benefit proceeds under this Policy will be the sum of:

| 1. | The Death Benefit; plus |

| 2. | Any insurance on the life of the Insured provided by optional benefit riders; less |

| 3. | The amount needed to keep this Policy in force to the end of the Policy Month of death, if the Insured died during the Policy Grace Period; less |

| 4. | Any Policy loan balance. |

22

Generally, We pay the Death Benefit within seven days after We receive due proof of death and/or any other documentation We require at Our Administrative Office. We credit interest on the Death Benefit proceeds from the date of death until We pay the Death Benefit. The Death Benefit proceeds will be paid in one lump sum, unless the Policy’s death benefit proceeds exceed $1,000 and You elect a settlement option described below (see “Settlement Options”). Prior to the Insured’s death, You can elect the settlement option or change a previously elected settlement option. At the time of the Insured’s death, if You did not make an election, the Beneficiary may apply the Death Benefit proceeds to one of the settlement options. We must receive an election of or a change to a settlement option in writing at Our Administrative Office in a form acceptable to Us.

ACCUMULATION VALUE

Determining Your Total Accumulation Value

The Total Accumulation Value of this Policy at any time is equal to the Subaccount Accumulation Value plus the Fixed Account Accumulation Value plus the Loan Account Accumulation Value. This amount is allocated based on the instructions You give Us. A number of factors affect Your Policy’s Total Accumulation Value, including, but not limited to:

| ● | the amount and frequency of Your premium payments; |

| ● | the investment experience of the Subaccounts You choose; |

| ● | the interest credited on the amount You allocate to the Fixed Account, if any; |

| ● | the Policy loan balance; |

| ● | the amount of any partial withdrawals You make (including any charges You incur as a result of such withdrawals); and |

| ● | the amount of charges We deduct. |

The Subaccount Accumulation Value plus the Fixed Account Accumulation Value is referred to as the Unloaned Accumulation Value.

Determining Your Subaccount Accumulation Value

The value You have in each Subaccount at any time is equal to the number of units Your Policy has in that Subaccount, multiplied by that Subaccount’s unit value. The Subaccount Accumulation Value is equal to the sum of the value You have in each Subaccount.

We determine the unit value for each Subaccount at the regularly scheduled close of business of the NYSE, on each day the NYSE is open for regular trading (“Business Day”). The NYSE is closed on most national holidays and Good Friday. We value shares of each Fund at the net asset value per share as determined by the Fund and reported to us by the Fund’s investment adviser. Each Fund determines the net asset value of its shares as described in the VIP Series prospectus.

23

The unit value of a Subaccount on any Valuation Day is equal to the unit value on the previous Valuation Day, multiplied by the net investment factor for that Valuation Day.

The net investment factor for a Subaccount on any Business Day is equal to (a) divided by (b) where:

| (a) | is the net asset value per share of the designated Fund at the end of the Business Day, plus the per share amount of any dividend or capital gain distribution declared by the Fund since the previous Business Day, less the per share amount of any taxes deducted by us; and |

| (b) | is the net asset value per share of the designated Fund on the previous Business Day. |

Determining Your Fixed Account Accumulation Value

On the Issue Date, the Fixed Account Accumulation Value is equal to the portion of the initial Net Premium less the portion of the Monthly Deduction for the first Policy Month that is allocated to the Fixed Account.

The Fixed Account Accumulation Value on succeeding Monthly Deduction Dates is equal to:

| 1. | the Fixed Account Accumulation Value on the previous Monthly Deduction Date; |

| plus the sum of the following transactions that have occurred since the last Monthly Deduction Date: | |

| 2. | any additional Net Premiums allocated to the Fixed Account; |

| 3. | any transfers into the Fixed Account, including transfers due to the repayment of a loan; and |

| 4. | interest accrued on the Fixed Account Accumulation Value, at the daily equivalent of the Fixed Account interest rate; |

| less the sum of the following transactions that have occurred since the last Monthly Deduction Date: | |

| 5. | the portion of the Monthly Deduction for the current Policy Month allocated to the Fixed Account; |

| 6. | any transfers out of the Fixed Account, including transfers due to the making of a loan; and |

| 7. | any partial withdrawals allocated to the Fixed Account. |

SURRENDERS AND PARTIAL WITHDRAWALS

Policy Surrenders

You may fully surrender the Policy at any time while the Insured is living for its Total Accumulation Value less the applicable surrender charge and any outstanding Policy loans and loan interest (“Net Surrender Value”). A full surrender will be effective on the date that We receive both the Policy and a written request in a form acceptable to Us. The amount payable will be the Net Surrender Value that We next compute after We receive the surrender request at Our Administrative Office. You should note that because the Total Accumulation Value of the Policy fluctuates with the performance of the Subaccounts and the interest credited to the Fixed Account, and because a surrender charge may apply, the Net Surrender Value may be more or less than the total premium payments You have made less any applicable fees and charges. Upon a full surrender, Your Policy will terminate.

24

Partial Withdrawals

You may request a partial withdrawal of a portion of the Unloaned Accumulation Value under Your Policy at any time after the first Policy Anniversary while the Insured is living. The partial withdrawal will be effective on the date We receive Your Notice.

The Amount and Frequency Permitted for Partial Withdrawals

The minimum amount that You must request for a partial withdrawal is set forth in Your Policy Schedule. The maximum partial withdrawal amount is 90% of Your Unloaned Accumulation Value, however in no case can You withdraw an amount which would:

| (a) | reduce the Face Amount to less than the minimum Face Amount for the Policy ($100,000); |

| (b) | reduce the Surrender Value to less than six times the most recent Monthly Deduction; or |

| (c) | reduce the Loan Value to less than the Policy loan balance. |

The amount of the partial withdrawal and any charge for the partial withdrawal will be deducted from the Total Accumulation Value. Unless You instruct Us otherwise, We will withdraw these amounts from the Subaccounts and/or Fixed Account in the same proportion as the Subaccount Accumulation Value in each Subaccount and the Fixed Account Accumulation Value bears to the Unloaned Accumulation Value.

The maximum number of partial withdrawals allowed in a Policy Year is 12.

The Effect of Partial Withdrawals

The Death Benefit will be reduced by the amount of the partial withdrawal. Thus, under Death Benefit, Option A, the Face Amount will be correspondingly reduced to the excess, if any, of the Face Amount over the result of (a) – (b) where:

| (a) | is the Death Benefit immediately prior to the partial withdrawal; and |

| (b) | is the amount of the partial withdrawal and any charge for the partial withdrawal. |

The Face Amount reduction, if any, resulting from a partial withdrawal will be subject to a surrender charge as described under “Decreases in Face Amount.” However, there is no surrender charge associated with a partial withdrawal under Basic Death Benefit, Option B.

For example, under Basic Death Benefit, Option A, a policyholder with an Unloaned Accumulation Value of $50,000 and Face Amount equal to the Death Benefit of $150,000 may choose to take a partial withdrawal of $5,000. Including the $25 partial withdrawal fee, the Death Benefit would be reduced by $5,025. After taking the withdrawal, the Policy would have an Unloaned Accumulation Value of $44,975, a Face Amount of $144,975, and a Death Benefit of $144,975.

25

We will deduct any applicable surrender charge from the Unloaned Accumulation Value that remains after deducting Your partial withdrawal, so that You receive the full amount of the Partial Withdrawal requested. The surrender charge will be apportioned and the Face Amount of the Policy will be reduced on the same basis and in the same order as described above under “Surrender Charge.”

We charge a $25.00 partial withdrawal processing fee to process each partial withdrawal. We will deduct this charge from the Total Accumulation Value remaining after the partial withdrawal. To the extent there is a balance remaining, the charge will be deducted from each Subaccount and/or the Fixed Account in the proportion that such account bears to the Total Accumulation Value prior to the partial withdrawal. Any portion of this charge that cannot be assessed due to insufficient value in any account will be allocated proportionally to the balances in the remaining accounts. We may defer payment of partial withdrawal proceeds under the conditions described in “Payment and Deferment”.

A request for a partial withdrawal in an amount that would result in a failure to continue to qualify the Policy for the Monthly No Lapse Premium Guarantee will not be processed without Your consent to terminate the Monthly No Lapse Premium Guarantee as of the date the partial withdrawal is made.

POLICY LOANS

If You meet the terms of the Policy and Our procedures, You may borrow up to 75% of the Surrender Value of the Policy during the first three Policy Years and 90% of the Surrender Value of the Policy after the first three Policy Years (We refer to these amounts as the “Loan Value”), if You assign Your Policy to Us as sole security. The amount available to You as a loan at any time is the Loan Value less any existing Policy loan balance, any loan interest to the next Policy Anniversary, and the Monthly Deductions to the next Policy Anniversary.