Exhibit 99.1

For Immediate Release

Citigroup Inc. (NYSE: C)

April 11, 2007

Citi Announces Actions to

Streamline Organization,

Reduce Expense Growth and Drive Future Expansion

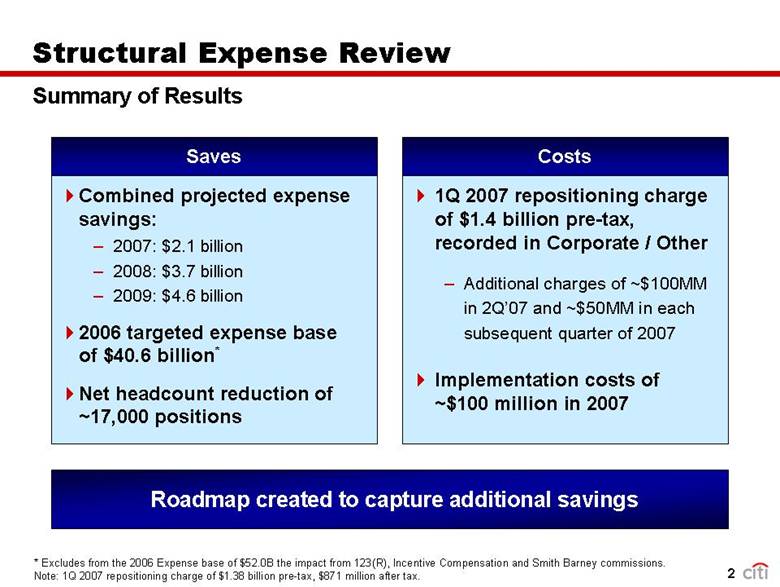

Projected Savings of Approximately $2.1 Billion in

2007,

Growing to $4.6 Billion in 2009

First Quarter 2007 Pre-Tax Charge of $1.38 Billion

New York – Citi today announced its plan to create a more streamlined organization, reduce expense growth, and drive future expansion. The plan is a result of a structural expense review conducted over the past three months in every business, as well as the previously announced IT optimization program.

“In December, I charged Bob Druskin and our management team with a simple directive: eliminate organizational, technology, and administrative costs that do not contribute to our ability to efficiently deliver products and services to our clients,” said Charles Prince, Chairman and Chief Executive Officer. “The recommendations that emerged from the structural expense review will improve business integration, as well as our ability to move quickly and seize new growth opportunities.”

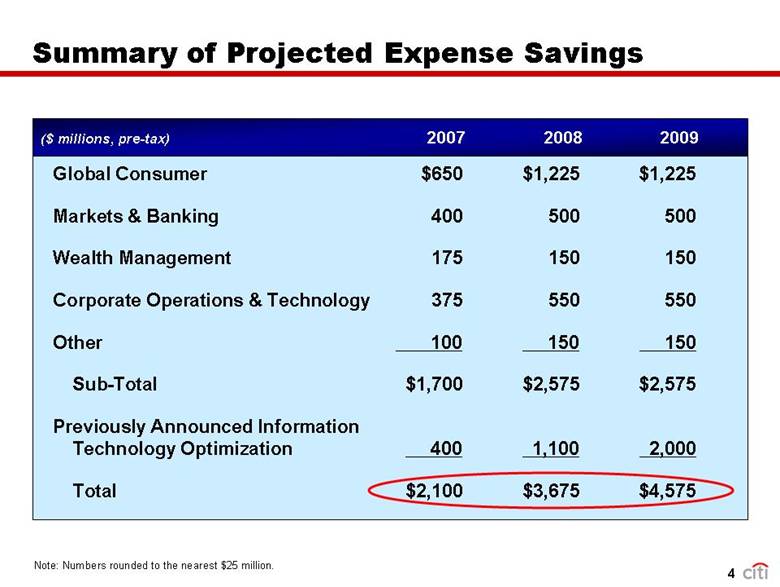

With previously announced information technology savings, the structural expense review is expected to generate total expense savings of approximately $2.1 billion in 2007, $3.7 billion in 2008, and $4.6 billion in 2009. The company will record a charge of $1.38 billion pre-tax, $871 million after-tax, in the first quarter of 2007, and additional charges totaling approximately $200 million pre-tax over the subsequent quarters of 2007.

“We undertook this review to create a consistent level of best-in-class expense discipline in every part of our company,” said Robert Druskin, Chief Operating Officer, who managed the structural expense review process. “We did not simply give the entire organization an arbitrary number to cut. Instead, we looked objectively at each of our businesses and functions based on the opportunities we saw, benchmarking them against their peers.”

He continued, “We have been very careful to maintain our revenue generating capability – in fact, this effort should enhance our capacity to grow. There will be very little impact on client-facing functions, other than additional efforts to enhance our service levels. We remain as committed as ever to our investment objectives and will continue to add resources in areas targeted for growth.

“Through this effort, we are adopting a process of continuous improvement, recognizing that strong ongoing expense discipline is an essential part of being a great company and achieving our goals. We expect this discipline to produce additional savings in the months and years ahead,” concluded Mr. Druskin.

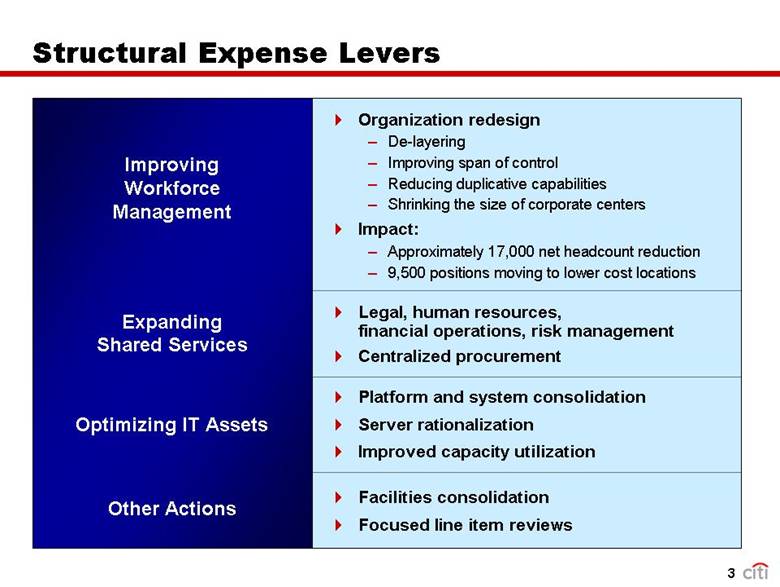

The review process focused on structural changes that improve our operations. As a result of this review, the company will:

· Eliminate layers of management, bringing those interacting with clients closer to those responsible for running the businesses. In many businesses the company will increase the average number of employees that report to each manager. This will enable Citi to make decisions more quickly, reinforcing a culture of ideas and intelligent business risk taking, and enabling people to use their time more productively in service to clients. The company is also reducing corporate center.

· Consolidate certain back-office, middle-office and corporate functions at the business, regional and headquarters levels to eliminate duplication of effort and to focus instead on building truly efficient, world-class back-office and support functions. More than 9,500 jobs will be moved to lower-cost locations, both domestically and internationally, with about two-thirds through attrition.

· Increase the use of shared services across sectors to obtain greater efficiencies by leveraging scale and better sharing expertise across business groups. This effort includes the creation of utilities in areas such as legal, human resources, risk management, and financial operations, as well as the sharing of regional and country middle office functions in international markets.

· Expand centralized procurement. At the end of 2006, the company had centralized 65% of its overall purchases. That amount is expected to increase to 80% by the end of 2007 and close to 100% by the end of 2009.

· Continue to rationalize operational spending on technology. Simplification and standardization of Citi’s information technology platform will be critical to increase efficiency and drive lower costs as well as decrease time to market. Examples of this are: consolidation of data centers; improved capacity utilization of technical assets and optimizing global voice and data networks; standardizing how the company develops, deploys and runs applications; and maximizing value by limiting the number of software vendors to operate at scale.

2

As a result of the structural changes identified in the review, Citi will eliminate approximately 17,000 positions. Citi’s total headcount will continue to grow in 2007, but the rate of growth, excluding acquisitions, new branches and other investments, will slow significantly.

“Ultimately these changes will streamline Citi and make us leaner, more efficient, and better able to take advantage of high revenue opportunities,” Prince said.

###

Citi, the leading global financial services company, has some 200 million customer accounts and does business in more than 100 countries, providing consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, and wealth management. Citi’s major brand names include Citibank, CitiFinancial, Primerica, Citi Smith Barney and Banamex. Additional information may be found at www.citigroup.com or www.citi.com.

Certain statements in this document are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from those included in these statements due to a variety of factors. More information about these factors is contained in Citigroup’s filings with the Securities and Exchange Commission.

Contacts

|

Media: |

Christina Pretto |

(212) 559-9560 |

|

|

Michael Hanretta |

(212) 559-9466 |

|

|

Shannon Bell |

(212) 793-6206 |

|

|

|

|

|

Equity Investors: |

Arthur Tildesley |

(212) 559-2718 |

|

|

|

|

|

Fixed Income Investors: |

Maurice Raichelson |

(212) 559-5091 |

3