Exhibit 99.1

Filed Pursuant to Rule 433

Registration Statement Nos. 333-103545-03 & 333-190926

Subject to Completion and Modification

NAVIENT FUNDING, LLC HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC FOR THE OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU

SHOULD READ THE REGISTRATION STATEMENT AND THE OTHER DOCUMENTS NAVIENT FUNDING, LLC HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT NAVIENT FUNDING, LLC AND THIS OFFERING. YOU MAY GET THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE

SEC WEB SITE AT WWW.SEC.GOV.

Free-Writing Prospectus

relating to the remarketing of

(up to)

$265,847,482

CLASS A-5 NOTES

SLM Student Loan Trust 2005-5

Issuing Entity

Navient Funding, LLC

Depositor

Navient Solutions, LLC

Sponsor, Servicer and Administrator

Student Loan-Backed Notes

The remarketing agent is remarketing, on behalf of SLM Student Loan Trust 2005-5, the class A-5 notes (the “class A-5 notes”). The class A-5 notes were originally issued by the trust on June 29, 2005. If

successfully remarketed on January 27, 2025, the class A-5 notes will have the following terms:

|

Class

|

Outstanding Principal Amount

|

Interest Rate

|

Price

|

Next Reset Date

|

Legal Maturity Date

|

|||||

|

Class A-5 Notes

|

$265,847,482.87

|

SOFR Rate

plus %

|

100%

|

April 25, 2025

|

October 25, 2040

|

All existing class A-5 noteholders are hereby advised that if you want to retain your class A-5 notes you are required to submit a hold notice prior to 12:00 p.m. (noon), New

York City time, on January 22, 2025, to the remarketing agent. Otherwise your notes will be deemed to have been tendered for remarketing.

The class A-5 notes have not been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”), any state securities commission or any other regulatory authority, nor have any of the

foregoing authorities passed upon or endorsed the merits of this remarketing or the accuracy or adequacy of this free-writing prospectus. Any representation to the contrary is a criminal offense.

You should consider carefully the risk factors on page 21 of this free-writing prospectus.

We are not offering the class A-5 notes in any state or other jurisdiction where the offer is prohibited.

This document constitutes a “free-writing prospectus” within the meaning of Rule 405 under the Securities Act of 1933, as amended.

The notes are asset-backed securities and are obligations of the issuing entity, which is a trust. They are not obligations of or interests in Navient Corporation, the sponsor, the remarketing agent, the depositor,

any seller of loans to the depositor, the administrator, the servicer or any of their respective affiliates.

The notes are not guaranteed or insured by the United States or any governmental agency.

The trust relies on an exclusion or exemption from the Investment Company Act of 1940 contained in Rule 3a-7 under the Investment Company Act of 1940, although there may be additional exclusions or exemptions

available to the trust. The trust was structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in this free-writing prospectus).

Remarketing Agent

Goldman Sachs & Co. LLC

January , 2025

REMARKETING TERMS SUMMARY

On January 27, 2025 (absent a Failed Remarketing, or the exercise by Navient Corporation or one of its wholly‑owned subsidiaries of its call option), the class A-5 notes will be reset from their

current terms to the following terms, which terms will be applicable until the next reset date for the class A-5 notes (definitions for certain capitalized terms may be found in the Glossary at the end of this free-writing prospectus):

|

Original principal amount

|

$350,000,000

|

|

Current outstanding principal balance

|

$265,847,482.87

|

|

Principal amount being remarketed

|

$265,847,482.87 (1)

|

|

Remarketing Terms Determination Date

|

January 14, 2025

|

|

Notice Date(2)

|

January 17, 2025

|

|

Spread Determination Date(3)

|

On or before January 22, 2025

|

|

Current Reset Date

|

January 27, 2025

|

|

All Hold Rate

|

SOFR Rate plus 0.75%

|

|

Next applicable reset date

|

April 25, 2025

|

|

Interest rate mode

|

Floating

|

|

Index

|

SOFR Rate(4)

|

|

Spread(5)

|

Plus %

|

|

Day-count basis

|

Actual/360

|

|

Weighted average remaining life

|

(6)

|

| (1) |

Subject to the receipt of timely delivered Hold Notices.

|

| (2) |

Unless an existing class A-5 noteholder submits a Hold Notice to the remarketing agent prior to 12:00 p.m. (noon), New York City time, on the Notice Date, such notes will be irrevocably deemed to have been tendered for remarketing.

|

| (3) |

The applicable Spread may be determined at any time after 12:00 p.m. (noon), New York City time, on the Notice Date but not later than 3:00 p.m., New York City time, on January 22, 2025.

|

| (4) |

The “SOFR Rate” will be a per annum rate equal to 90-day Average SOFR for such reset period plus a tenor spread adjustment equal to 0.26161% per annum. The SOFR Rate will be reset on each reset date in accordance with the procedures set

forth under “Description of the Notes—Determination of Indices—SOFR” in this free-writing prospectus.

|

| (5) |

To be determined on the spread determination date.

|

| (6) |

The projected weighted average remaining life to the April 25, 2025 reset date of the class A-5 notes (and assuming a successful remarketing of such notes on the current reset date) under various usual and customary prepayment scenarios

is approximately 0.25 years. More information may be found under “Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-5 Notes” to be included as Exhibit I to

the final remarketing free-writing prospectus to be distributed to potential investors on or prior to the spread determination date.

|

The remarketing agent may be contacted as follows:

Goldman Sachs & Co. LLC

200 West Street

New York, New York 10282

Attention: Angela Li and Xomie.Sukach

Telephone: (212) 902-0089 and (212) 357-2225

Email: Angela.Li@gs.com and Xomie.Sukach@gs.com

i

INTRODUCTION

The Student Loan-Backed Notes issued by SLM Student Loan Trust 2005-5 consist of the class A-5 notes (referred to as the “reset rate notes”) and the class A-1, class A-2, class A-3 and class A-4

notes (collectively referred to as the “floating rate class A notes”) and the class B notes (which, together with the floating rate class A notes, are referred to as the “floating rate notes” and the floating rate notes, together with the reset

rate notes, are referred to as the “notes”). As of the date of this remarketing free-writing prospectus (referred to as the “free-writing prospectus”), the class A-1 notes, the class A-2 notes, the class A-3 notes and the class A-4 notes have been

paid in full and are no longer outstanding. None of the classes of notes other than the class A-5 notes (collectively referred to as the “other notes”) are being offered under this free-writing prospectus. Any information contained herein with

respect to the other notes is provided only to present a better understanding of the class A-5 notes. The class A-5 notes were originally offered for sale pursuant to the prospectus supplement, dated June 22, 2005 and the related prospectus, dated

June 17, 2005.

Goldman Sachs & Co. LLC is serving as the remarketing agent (in such capacity, the “remarketing agent”) for the class A-5 notes.

The notes were issued on June 29, 2005 (referred to as the “closing date”), are obligations of an issuing entity known as SLM Student Loan Trust 2005-5 (referred to as the “trust”) and are secured

by the assets of the trust, which consist primarily of a pool of consolidation student loans (the “trust student loans”).

Principal of and interest on the notes are payable as described herein on the 25th day of each January, April, July and October or, if such day is not a business day, then on the next business day

(each, a “distribution date”). The “initial reset date” for the class A-5 notes was January 25, 2010. A failed remarketing was declared with respect to the initial reset date and each subsequent reset date. Pursuant to the terms of these failed

remarketings, (i) the holders of the class A-5 notes were required to retain their notes, (ii) the class A-5 notes were reset to bear interest at the failed remarketing rate, which is currently an annual rate equal to the SOFR Rate plus 0.75%,

which rate remained in effect after each failed remarketing, and (iii) a three-month reset period ending on the next distribution date was established. We refer to the January 27, 2025 reset date as the “current reset date” in this free-writing

prospectus. If successfully remarketed on the current reset date, interest will accrue on the class A-5 notes at the rate specified in the summary of this free-writing prospectus and will be calculated based on the actual number of days elapsed in

each accrual period and a 360‑day year until their next reset date which will occur on April 25, 2025. Interest will accrue on the outstanding principal balance of the class A-5 notes during three-month accrual periods and will be paid on each

distribution date. The first distribution date after the current reset date is scheduled to occur on April 25, 2025. Each accrual period will begin on a distribution date and end on the day before the next distribution date.

Investors in the class A-5 notes are strongly urged to keep in contact with the remarketing agent because notices and required information pertaining to the remarketing of the class A-5 notes sent

to the clearing agencies by the administrator or the remarketing agent, as applicable, may not be communicated in a timely manner to the related beneficial owners.

ii

iii

iv

TABLE OF CONTENTS

Free-Writing Prospectus

|

REMARKETING TERMS SUMMARY

|

i

|

|

INTRODUCTION

|

ii

|

|

NOTICES TO INVESTORS

|

vii

|

|

SUMMARY OF NOTE TERMS

|

1

|

|

RISK FACTORS

|

21

|

|

DEFINED TERMS

|

49

|

|

THE TRUST

|

49

|

|

USE OF PROCEEDS

|

53

|

|

AFFILIATIONS AND RELATIONS

|

53

|

|

THE DEPOSITOR

|

53

|

|

NAVIENT CORPORATION

|

54

|

|

THE SPONSOR, SERVICER, ADMINISTRATOR AND SUBSERVICERS

|

56

|

|

THE SELLERS

|

58

|

|

THE TRUST STUDENT LOAN POOL

|

58

|

|

THE COMPANIES’ STUDENT LOAN FINANCING BUSINESS

|

62

|

|

TRANSFER AGREEMENTS

|

66

|

|

SERVICING AND ADMINISTRATION

|

68

|

|

TRADING INFORMATION

|

76

|

|

DESCRIPTION OF THE NOTES

|

77

|

|

INDENTURE

|

109

|

|

CERTAIN LEGAL ASPECTS OF THE STUDENT LOANS

|

113

|

|

STATIC POOLS

|

117

|

|

PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE REMAINING LIFE AND EXPECTED MATURITY OF THE CLASS A-5 NOTES

|

117

|

|

RECENT DEVELOPMENTS

|

118

|

|

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

|

118

|

|

STATE AND LOCAL TAX CONSEQUENCES

|

124

|

|

ERISA CONSIDERATIONS

|

125

|

|

ACCOUNTING CONSIDERATIONS

|

127

|

|

REPORTS TO NOTEHOLDERS

|

127

|

|

REMARKETING

|

128

|

|

NOTICES TO INVESTORS

|

128

|

v

|

LISTING INFORMATION

|

130

|

|

DEPOSITOR AFFIRMATIONS

|

130

|

|

CERTAIN INVESTMENT COMPANY ACT CONSIDERATIONS

|

131

|

|

RATINGS

|

131

|

|

LEGAL PROCEEDINGS

|

131

|

|

LEGAL MATTERS

|

135

|

|

GLOSSARY

|

135

|

|

ANNEX A:

|

The Trust Student Loan Pool as of November 30, 2024

|

|

APPENDIX A:

|

Federal Family Education Loan Program

|

|

APPENDIX B:

|

Global Clearance, Settlement and Tax Documentation Procedures

|

|

EXHIBIT I:

|

Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-5 Notes

|

vi

The class A-5 notes may not be offered or sold to persons in the United Kingdom in a transaction that results in an offer to the public within the meaning of the securities laws of the United

Kingdom.

The class A-5 notes are currently listed on the Luxembourg Stock Exchange. You should consult with Deutsche Bank Luxembourg S.A., the Luxembourg listing agent for the class A-5 notes, for

additional information regarding their status.

This free-writing prospectus is not required to contain all information that is required to be included in the final prospectus supplement. The information in this free-writing

prospectus is preliminary and is subject to completion or change. The information in this free-writing prospectus, if conveyed prior to the time of your commitment to purchase any class of notes, supersedes any information contained in any prior

free-writing prospectus relating to the notes.

NOTICES TO INVESTORS

EUROPEAN ECONOMIC AREA

THIS FREE-WRITING PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSES OF REGULATION (EU) 2017/1129 (AS AMENDED, THE “EU PROSPECTUS REGULATION”).

THE CLASS A-5 NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY EU RETAIL INVESTOR IN

THE EUROPEAN ECONOMIC AREA (THE “EEA”). FOR THESE PURPOSES, AN “EU RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU (AS AMENDED, “MIFID II”); OR (II) A

CUSTOMER WITHIN THE MEANING OF DIRECTIVE (EU) 2016/97 (AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT A QUALIFIED INVESTOR AS DEFINED IN ARTICLE 2 OF

THE EU PROSPECTUS REGULATION.

CONSEQUENTLY, NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED, THE “EU PRIIPS REGULATION”) FOR OFFERING OR SELLING THE CLASS A-5 NOTES OR

OTHERWISE MAKING THEM AVAILABLE TO EU RETAIL INVESTORS IN THE EEA HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE CLASS A-5 NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY EU RETAIL INVESTOR IN THE EEA MAY BE UNLAWFUL UNDER THE EU PRIIPS

REGULATION.

UNITED KINGDOM

THIS FREE-WRITING PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSES OF REGULATION (EU) 2017/1129 AS IT FORMS PART OF UNITED KINGDOM (“UK”) DOMESTIC LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018 (AS AMENDED, THE “EUWA”) (AS AMENDED, THE “UK PROSPECTUS REGULATION”).

THE CLASS A-5 NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY UK RETAIL INVESTOR IN

THE UK. FOR THESE PURPOSES, A “UK RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2 OF COMMISSION DELEGATED REGULATION (EU) 2017/565 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF

THE EUWA, AND AS AMENDED; OR (II) A CUSTOMER WITHIN THE MEANING OF THE PROVISIONS OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (AS AMENDED, THE “FSMA”) AND ANY RULES OR REGULATIONS MADE UNDER THE FSMA TO IMPLEMENT DIRECTIVE (EU) 2016/97 (SUCH

RULES OR REGULATIONS, AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2(1) OF REGULATION (EU) NO 600/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA, AND AS AMENDED; OR

(III) NOT A QUALIFIED INVESTOR AS DEFINED IN ARTICLE 2 OF THE UK PROSPECTUS REGULATION.

CONSEQUENTLY, NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA (AS AMENDED, THE “UK PRIIPS

REGULATION”) FOR OFFERING OR SELLING THE CLASS A-5 NOTES OR OTHERWISE MAKING THEM AVAILABLE TO UK RETAIL INVESTORS IN THE UK HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE CLASS A-5 NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY UK RETAIL

INVESTOR IN THE UK MAY BE UNLAWFUL UNDER THE UK PRIIPS REGULATION.

vii

IN THE UK, THIS FREE-WRITING PROSPECTUS MAY ONLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED TO PERSONS WHO (A) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS

AND QUALIFY AS INVESTMENT PROFESSIONALS UNDER ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (AS AMENDED, THE “FINANCIAL PROMOTION ORDER”), (B) ARE PERSONS FALLING WITHIN ARTICLE 49(2)(A) THROUGH (D)

(HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS ETC.) OF THE FINANCIAL PROMOTION ORDER OR (C) ARE PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED (ALL SUCH PERSONS, “RELEVANT PERSONS”).

IN THE UK, THIS FREE-WRITING PROSPECTUS MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS

FREE-WRITING PROSPECTUS RELATES, INCLUDING THE CLASS A-5 NOTES, IS AVAILABLE IN THE UK ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN, IN THE UK, ONLY WITH RELEVANT PERSONS.

EUROPEAN ECONOMIC AREA INVESTORS AND UK INVESTORS

NONE OF THE SPONSOR, THE SELLERS, THE DEPOSITOR, THE INITIAL PURCHASERS NOR ANY OTHER PERSON WILL UNDERTAKE, OR INTENDS, TO RETAIN A MATERIAL NET ECONOMIC INTEREST IN THE

SECURITIZATION CONSTITUTED BY THE ISSUANCE OF THE NOTES IN A MANNER THAT WOULD SATISFY THE REQUIREMENTS OF (A) REGULATION (EU) 2017/2402 (AS AMENDED, THE “EU SECURITIZATION REGULATION”) OR (B) THE FRAMEWORK COMPRISING (I) THE SECURITISATION

REGULATIONS 2024 (AS AMENDED, THE “SR 2024”), (II) THE SECURITISATION SOURCEBOOK OF THE HANDBOOK OF RULES AND GUIDANCE ADOPTED BY THE FINANCIAL CONDUCT AUTHORITY (“FCA”) OF THE UK (THE “SECN”), (III) THE SECURITISATION PART OF THE RULEBOOK OF

PUBLISHED POLICY OF THE PRUDENTIAL REGULATION AUTHORITY OF THE BANK OF ENGLAND (THE “PRASR”) AND (IV) RELEVANT PROVISIONS OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (AS AMENDED, THE “FSMA”) (IN EACH CASE AS AMENDED, SUPPLEMENTED OR REPLACED

FROM TIME TO TIME AND, COLLECTIVELY, THE “UK SECURITIZATION FRAMEWORK”) OR TO TAKE ANY OTHER ACTION OR REFRAIN FROM TAKING ANY ACTION PRESCRIBED BY OR CONTEMPLATED IN THE EU SECURITIZATION REGULATION OR THE UK SECURITIZATION FRAMEWORK, OR FOR

PURPOSES OF, OR IN CONNECTION WITH, COMPLIANCE BY ANY INVESTOR WITH THE DUE DILIGENCE REQUIREMENTS OF THE EU SECURITIZATION REGULATION OR THE UK SECURITIZATION FRAMEWORK OR BY ANY PERSON WITH THE REQUIREMENTS OF ANY OTHER LAW OR REGULATION NOW OR

HEREAFTER IN EFFECT IN THE EUROPEAN UNION (THE “EU”), THE EEA OR THE UK IN RELATION TO RISK RETENTION, DUE DILIGENCE AND MONITORING, CREDIT GRANTING STANDARDS, TRANSPARENCY OR ANY OTHER CONDITIONS WITH RESPECT TO INVESTMENTS IN SECURITIZATION

TRANSACTIONS.

CONSEQUENTLY, THE CLASS A-5 NOTES MAY NOT BE A SUITABLE INVESTMENT FOR ANY PERSON THAT IS NOW OR MAY IN THE FUTURE BE SUBJECT TO ANY REQUIREMENT OF THE EU SECURITIZATION

REGULATION OR THE UK SECURITIZATION FRAMEWORK. AS A RESULT, THE PRICE AND LIQUIDITY OF THE CLASS A-5 NOTES IN THE SECONDARY MARKET MAY BE ADVERSELY AFFECTED.

viii

FOR ADDITIONAL INFORMATION REGARDING THE EU SECURITIZATION REGULATION AND THE UK SECURITIZATION FRAMEWORK, SEE “RISK FACTORS —THE NOTES MAY NOT BE A SUITABLE INVESTMENT FOR EU

AND UK INSTITUTIONAL INVESTORS SUBJECT TO THE EU OR UK DUE DILIGENCE REQUIREMENTS.”

FORWARD-LOOKING STATEMENTS

Certain statements contained in or incorporated by reference in this free-writing prospectus consist of forward-looking statements relating to future economic performance or projections and other

financial items. These statements can be identified by the use of forward-looking words such as “may,” “will,” “should,” “expects,” “believes,” “anticipates,” “estimates,” or other comparable words. Forward-looking statements are subject to a

variety of risks and uncertainties that could cause actual results to differ from the projected results. Those risks and uncertainties include, among others, general economic and business conditions, regulatory initiatives and compliance with

governmental regulations, customer preferences and various other matters, many of which are beyond our control. Because we cannot predict the future, what actually happens may be very different from what is contained in our forward-looking

statements.

ix

SUMMARY OF NOTE TERMS

This summary highlights selected information about the class A-5 notes. It does not contain all of the information that you might find important in making your investment

decision. It provides only an overview to aid your understanding. You should read the full description of this information appearing elsewhere in this document. We have provided information in this free-writing prospectus with respect to

the other notes in order to further the understanding by potential investors of the class A-5 notes.

ISSUING ENTITY

SLM Student Loan Trust 2005-5.

CLASS A-5 NOTES

The Reset Rate Class A-5 Student Loan‑Backed Notes that are being remarketed hereunder were originally issued by the trust on June 29, 2005 in the principal amount of $350,000,000 and are currently outstanding in the amount of

265,847,482.87.

The “initial reset date” for the class A-5 notes was January 25, 2010. A failed remarketing was declared with respect to the initial reset date and each subsequent reset date. Pursuant to the terms of these failed remarketings, (i)

the holders of the class A-5 notes were required to retain their notes, (ii) the class A-5 notes were reset to bear interest at the failed remarketing rate, which is an annual rate equal to the SOFR Rate plus 0.75%, which rate remained in

effect after each failed remarketing, and (iii) a three-month reset period ending on the next distribution date was established. We refer to the January 27, 2025 reset date as the “current reset date” in this free-writing prospectus.

The legal maturity date for the class A-5 notes is October 25, 2040.

Interest. During the reset period following the January 27, 2025 reset date, interest will accrue on the outstanding

principal balance of the class A-5 notes during each accrual period and will be paid on each distribution date.

If successfully remarketed on the January 27, 2025 reset date, the class A-5 notes, until the end of the accrual period relating to the January 27, 2025 reset date, will bear interest at an annual rate equal to the SOFR Rate plus

% based on the actual number of days elapsed in each accrual period and a 360-day year. Each accrual period during such reset period will begin on a distribution date and will end on the day before the next distribution date. The

next accrual period for the class A-5 notes will begin on January 27, 2025 and end on April 24, 2025.

For each subsequent reset period, the related currency, applicable accrual periods and applicable distribution dates will be determined on the related remarketing terms determination date as specified under “Description of the Notes—The Reset Rate Notes” and “—Reset Periods” in this free-writing prospectus.

Principal. The class A‑1 notes, the class A-2 notes, the class A-3 notes and the class A-4 notes, which were earlier in

the sequence of principal payments, have been paid in full and are no longer outstanding.

As of the October 2024 distribution date, no principal payments have been made to the class A-5 notes. There may be a payment of principal on the class A-5 notes from the trust on the January 27, 2025 reset date.

|

|

1

Payments of principal of the class A-5 notes will be made before the class B notes until retired.

Reset Date Procedures

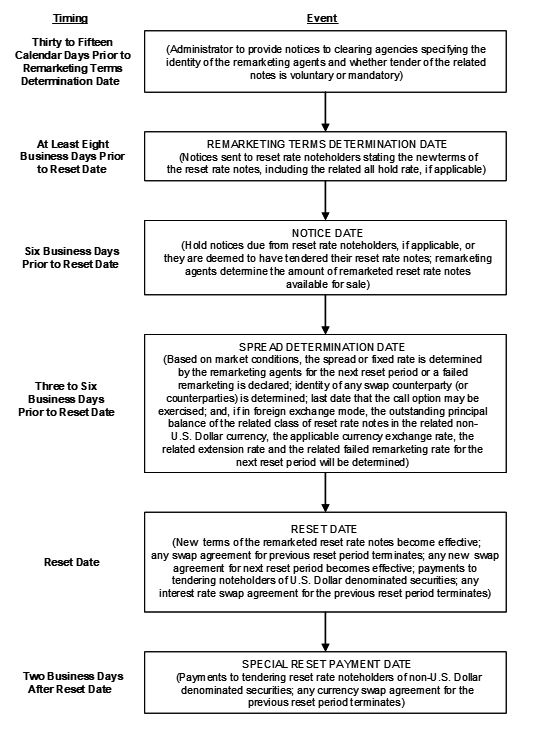

Remarketing Terms Determination Date. Not later than eight business days prior to the related reset date, which we

refer to as the remarketing terms determination date and which, for the class A-5 notes and with respect to the current reset date, is January 14, 2025, the remarketing agent, in consultation with the administrator, will determine for

the class A-5 notes, among other things, the applicable currency, the applicable interest rate mode, whether principal will be paid periodically or at the end of the related reset period, the index, if applicable, the length of the

reset period and the applicable distribution dates, the identities of any potential swap counterparties, if applicable, and the all hold rate.

See “Description of the Notes—The Reset Rate Notes” in this free-writing prospectus.

All Hold Rate. The all hold rate for the reset rate notes will be the interest rate applicable for the reset rate notes

for the next reset period if all holders of the reset rate notes choose not to tender their notes to the remarketing agent for remarketing, which for the class A-5 notes and the current reset date occurring on January 27, 2025 is equal

to an annual rate of the SOFR Rate plus 0.75%.

Tendered Notes. Absent a failed remarketing, holders of reset rate notes denominated in U.S. Dollars in the then-current

reset period and the immediately following reset period (as will be the case for the class A-5 notes assuming a successful remarketing on the January 27, 2025 reset date) that wish to sell some or all of their reset rate notes on a

reset date will be able to obtain a 100% repayment of principal by tendering the applicable amount of their reset rate notes pursuant to the remarketing process. Holders of reset rate notes denominated in a non-U.S. Dollar currency in

the then-current reset period or the immediately following reset period will be deemed to have tendered their reset rate notes pursuant to the remarketing process.

Hold Notices. In connection with the current reset date, holders of the class A-5 notes will be given until the notice

date, which is 12:00 p.m. (noon), New York City time, on the date not less than six business days prior to the related reset date, to choose whether to hold their notes by delivering a hold notice to the remarketing agent. The notice

date with respect to the class A-5 notes and the current reset date is January 22, 2025. Any class A-5 notes for which a hold notice is not timely received on or prior to the notice date, will be deemed to be tendered and will be

remarketed on the related reset date.

Spread Determination Date. Absent receipt by the remarketing agent of hold notices from 100% of the holders of the

class A-5 notes or an exercise of the related call option by Navient Corporation or one of its wholly-owned subsidiaries, the spread will be determined by the remarketing agent at any time after the notice date but no later than 3:00

p.m., New York City time, on the date which is three business days prior to the related reset date, which we refer to as the spread determination date and which, for the class A-5 notes and with respect to the current reset date, is any

time during the period beginning after 12:00 p.m. (noon), New York City time, on January 22, 2025 and ending at 3:00 p.m., New York City time, on January 22, 2025. The spread for the current reset date will be the lowest spread to the

SOFR Rate, but not less than the all hold rate (which is equal to an annual rate of the SOFR Rate plus 0.75% for the class A-5 notes), which would enable all tendering noteholders to receive a payment equal to 100% of the outstanding

principal balance of their reset rate notes. Absent a failed remarketing or an exercise of the related call option by Navient Corporation or one of its wholly-owned subsidiaries with respect to the January 27, 2025 reset date, the

class A-5 notes will be reset to bear interest until April 25, 2025, the next reset date, at an annual floating rate equal to the sum of the SOFR Rate plus %. The SOFR Rate will be determined as specified under “Description of the Notes—The Notes—Distributions of Interest” in this free-writing prospectus.

|

|

2

Reset Date. Reset dates always occur on a distribution date and reset periods always end on a distribution date and

may not extend beyond the maturity date of the reset rate notes. The current reset date for the class A-5 notes is January 27, 2025. The next scheduled reset date for the class A-5 notes is April 25, 2025. Holders of class A-5

notes that wish to be repaid on the current reset date will be able to obtain a 100% repayment of principal by tendering their reset rate notes pursuant to the remarketing process. Tender is mandatory for any reset rate notes that

are denominated in a non-U.S. Dollar currency during either the then-current or the immediately following reset period and all holders of such reset rate notes will be deemed to have tendered their notes on the related reset date. If

there is a failed remarketing of the reset rate notes with respect to such reset date, existing holders of such notes will not be permitted to exercise any remedies as a result of the failure of their reset rate notes to be remarketed

on such reset date.

Failed Remarketing. There will be a failed remarketing for the class A-5 notes with respect to the January 27, 2025

reset date if:

| • |

the remarketing agent, in consultation with the administrator, cannot determine the applicable required reset terms on or before the remarketing terms determination date;

|

| • |

the remarketing agent cannot establish the required spread on the spread determination date;

|

| • |

the remarketing agent is unable to remarket some or all of the tendered reset rate notes at the spread set by the remarketing agent, or one or more committed purchasers default on their purchase obligations and the

remarketing agent chooses not to purchase such reset rate notes itself;

|

| • |

any rating agency then rating the notes has not confirmed or upgraded its then-current rating of any class of notes, if such confirmation is required; or

|

| • |

certain other conditions specified in the remarketing agreement are not satisfied.

|

See “Description of the Notes—The Reset Rate Notes—Tender of Reset Rate Notes; Remarketing Procedures” in this free-writing prospectus.

In the event a failed remarketing is declared with respect to the class A-5 notes:

| • |

all holders of the class A-5 notes will retain their notes, including in all deemed mandatory tender situations;

|

| • |

the related interest rate for the class A-5 notes will be reset to a failed remarketing rate of the SOFR Rate plus 0.75% per annum; and

|

| • |

the related reset period will be set at three months.

|

|

|

3

Call Option. Navient Corporation, or one of its wholly-owned subsidiaries (to whom it has the right at any time to

transfer such call option), has the option to purchase the class A-5 notes in their entirety as of any reset date. If this right is exercised, the interest rate for the reset rate notes, which we refer to as the call rate, will be

(1) if no related swap agreement was in effect with respect to the reset rate notes during the previous reset period (as has been the case with respect to the class A-5 notes and the reset period ending on January 27, 2025), the

floating rate applicable for the most recent reset period during which the failed remarketing rate was not in effect, or (2) if one or more related swap agreements were in effect with respect to the reset rate notes during the

previous reset period, an annual SOFR-based interest rate equal to the weighted average of the floating rates of interest that the trust paid to the swap counterparties hedging the currency risk and/or basis risk for the reset rate

notes during the preceding reset period.

The call rate will continue to apply for each reset period while Navient Corporation, or any of its wholly-owned subsidiaries, if applicable, retains the reset rate notes pursuant to its exercise of the call option. In either

case, the next reset date for the reset rate notes will occur on the next distribution date.

The administrator will notify the Luxembourg Stock Exchange of any exercise of the call option and will cause a notice to be published in a leading newspaper having general circulation in Luxembourg, which is expected to be Luxemburger Wort, and/or on the Luxembourg Stock Exchange’s website at http://www.bourse.lu.

See “Description of the Notes—The Reset Rate Notes” in this free-writing prospectus for a more complete discussion of the remarketing process.

Denominations. The class A-5 notes will be available for purchase in

minimum denominations of $100,000 and additional increments of $1,000 in excess thereof. The class A-5 notes will be available only in book-entry form through The Depository Trust Company, Clearstream, Luxembourg and the Euroclear

System. You will not receive a certificate representing your class A-5 notes except in very limited circumstances.

DATES

The closing date for the original offering was June 29, 2005. We refer to this date as the closing date.

The statistical cutoff date for the original offering was May 30, 2005. We refer to this date as the statistical cutoff date.

Unless otherwise indicated, all information provided in this free-writing prospectus regarding the notes and the pool of trust student loans is presented as of November 30, 2024. We refer to this date as the statistical disclosure

date.

A distribution date for each class of notes is the 25th of each January, April, July and October. If any January 25, April 25, July 25 or October 25 is not a business day, the distribution date will be the next business day.

Each reset date will occur on a distribution date for the class A-5 notes. The related reset period will always end on a distribution date and may not extend beyond the maturity date of the class A-5 notes.

|

|

4

Interest and principal will be payable to holders of record as of the close of business on the record date, which is the day before the related distribution date.

A collection period is the three-month period ending on the last day of March, June, September or December, in each case for the distribution date in the following month.

PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE REMAINING LIFE AND EXPECTED MATURITY OF THE CLASS A-5 NOTES

The projected weighted average remaining life to the April 25, 2025 reset date of the class A-5 notes (and assuming a successful remarketing of such notes on the current reset date) under various usual and customary prepayment

scenarios is approximately 0.25 years. More information may be found under “Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-5 Notes,” to be included as Exhibit I to the final remarketing prospectus supplement to be distributed to potential investors on or prior to the spread determination date.

THE OTHER NOTES

On the closing date, the trust also issued its class A-1, class A-2, class A-3, class A-4 and class B notes, as more specifically described below.

Floating Rate Class A Notes:

| • |

Class A-1 Student Loan-Backed Notes in the original principal amount of $672,000,000, none of which remain outstanding;

|

| • |

Class A-2 Student Loan-Backed Notes in the original principal amount of $420,000,000, none of which remain outstanding;

|

| • |

Class A-3 Student Loan-Backed Notes in the original principal amount of $420,000,000, none of which remain outstanding; and

|

| • |

Class A-4 Student Loan-Backed Notes in the original principal amount of $361,844,000, none of which remain outstanding.

|

Class B Notes:

| • |

Class B Student Loan-Backed Notes in the original principal amount of $68,779,000, and currently outstanding in the amount of $17,894,136.67.

|

We sometimes refer to:

| • |

the floating rate class A notes and the reset rate notes collectively as the class A notes;

|

| • |

the floating rate class A notes and the class B notes as the floating rate notes; and

|

| • |

the floating rate notes and the reset rate notes as the notes.

|

Interest Rates. The outstanding floating rate notes bear interest at an annual rate equal to the sum of the SOFR

Rate and the applicable spread listed in the table below:

|

Class

|

Spread

|

|

|

Class B

|

plus 0.25%

|

For all classes of notes, the administrator determines the SOFR Rate as specified under “Description of the Notes—The Notes—Distributions of Interest” in

this free-writing prospectus. For the floating rate notes, interest is calculated based on the actual number of days elapsed in each accrual period and a 360-day year.

|

|

5

ALL NOTES

Interest Payments. Interest accrues on the outstanding principal balance of the notes during each accrual period

and is payable on the related distribution date.

An accrual period for the floating rate notes begins on a distribution date and ends on the day before the next distribution date.

An accrual period for reset rate notes that bear a fixed rate of interest will begin on the 25th day of the month of the immediately preceding distribution date and end on the 24th day of the month of the

current distribution date.

Principal Payments. Principal will be payable or allocable on each distribution date in an amount generally

equal to (a) the principal distribution amount for that distribution date plus (b) any shortfall in the payment of principal as of the preceding distribution date.

Priority of Principal Payments. We will apply or allocate principal sequentially on each distribution date as

follows:

| • |

first, the class A noteholders’ principal distribution amount, to the class A-5 notes until their

principal balance is reduced to zero; provided, that either (a) if the class A-5 notes are then denominated in a currency other than U.S. Dollars, any payments due to the reset rate noteholders will be made to the

currency swap counterparty or (b) if the class A-5 notes are then structured not to receive a payment of principal until the end of the related reset period, any payments due to the reset rate noteholders will be

allocated to the accumulation account; and

|

| • |

second, on each distribution date on and after the stepdown date, and provided that no trigger event is

in effect on such distribution date, the class B noteholders’ principal distribution amount, to the class B notes, until their principal balance is reduced to zero.

|

On each distribution date prior to the stepdown date, which occurred on the October 2011 distribution date, the class B notes were not entitled to any payments of principal. On each distribution date on and after the stepdown

date, provided that no trigger event is in effect, the class B notes will continue to be entitled to their pro rata share of principal, subject to the existence of sufficient available funds.

The stepdown date occurred on the October 2011 distribution date.

The class A noteholders’ principal distribution amount is equal to the principal distribution amount times the class A percentage, which is equal to 100% minus the class B percentage. The class B noteholders’ principal

distribution amount is equal to the principal distribution amount times the class B percentage.

The class B percentage was 0% prior to the stepdown date and will be 0% on any distribution date when a trigger event is in effect. On each other distribution date, the class B percentage is the percentage obtained by dividing

(x) the aggregate principal balance of the class B notes, by (y) the aggregate principal balance, or U.S. Dollar equivalent, of all outstanding notes less all amounts on deposit, exclusive of any investment earnings, in the

accumulation account, in each case determined immediately prior to that distribution date.

|

|

6

A trigger event will be in effect on any distribution date if the outstanding principal balance of the notes, less amounts on deposit in the accumulation account, exclusive of any investment earnings and after giving effect

to distributions to be made on that distribution date, would exceed the adjusted pool balance for that distribution date.

See “Description of the Notes—Distributions” in this free-writing prospectus for a more detailed description of principal payments.

Maturity Dates.

The class A-1 notes were repaid in full on the July 2009 distribution date. The class A-2 notes were repaid in full on the January 2014 distribution date. The class A-3 notes were repaid in full on the July 2018

distribution date. The class A-4 notes were repaid in full on the July 2023 distribution date.

Each class of outstanding notes will mature no later than the date set forth in the table below for that class:

|

Class

|

Maturity Date

|

|

|

Class A-5

|

October 25, 2040

|

|

|

Class B

|

October 25, 2040

|

The actual maturity of any class of outstanding notes could occur earlier if, for example:

| • |

there are prepayments on the trust student loans;

|

| • |

the servicer exercises its option to purchase all remaining trust student loans, which will not occur until the first distribution date on which the pool balance is 10% or less of the initial pool balance; or

|

| • |

the indenture trustee auctions all remaining trust student loans, which absent an event of default under the indenture, will not occur until the first distribution date on which the pool balance is 10% or less of the

initial pool balance.

|

The initial pool balance is equal to the sum of: (i) the pool balance as of the closing date and (ii) all amounts deposited into the supplemental purchase account and the add‑on consolidation loan account on the closing date.

Subordination of the Class B Notes. Payments of interest on the class B notes will be subordinate to payments

of interest on the class A notes and to certain trust swap payments due to any swap counterparty, if applicable. In general, payments of principal on the class B notes will be subordinate to the payment of both interest and

principal on the class A notes, trust swap payments due to any swap counterparty, if applicable, and any deposits required to be made into any supplemental interest account or any investment reserve account. See “Description of the Notes—The Notes— The Class B Notes—Subordination of the Class B Notes” in this free-writing prospectus.

Security for the Notes. The notes are secured by the assets of the trust, primarily the trust student loans.

|

|

7

Potential Future Interest Rate Cap Agreement. At any time, at the written direction of the administrator,

the trust may enter into one or more interest rate cap agreements (collectively, the “potential future interest rate cap agreement”) with one or more eligible swap counterparties (collectively, the “potential future cap

counterparty”) to hedge some or all of the interest rate risk of the notes. Any payment due by the trust to a potential future cap counterparty would be payable only out of funds available for distribution under clause

(p)(1) of “Description of the Notes—Distributions—Distributions from the Collection Account” in this free-writing prospectus. Any payments received from a potential future cap

counterparty would be included in available funds. It is not anticipated that the trust would be required to make any payments to any potential future cap counterparty under any potential future interest rate cap agreement

other than an upfront payment and, in some circumstances, a termination payment. See “Description of the Notes—Potential Future Interest Rate Cap Agreement” in this free-writing

prospectus.

As of the January 27, 2025 reset date, the trust will not have entered into any potential future interest rate cap agreements.

INDENTURE TRUSTEE AND PAYING AGENT

The trust issued the notes under an indenture dated as of June 1, 2005. Under the indenture, Deutsche Bank National Trust Company acts as successor indenture trustee for the benefit of, and to protect the interests of, the

noteholders and acts as paying agent for the notes.

LUXEMBOURG PAYING AGENT

If the rules of the Luxembourg Stock Exchange require a Luxembourg paying agent, the depositor will cause one to be appointed.

ELIGIBLE LENDER TRUSTEE

Deutsche Bank Trust Company Americas, a New York banking corporation, is the successor eligible lender trustee under the trust agreement. It holds legal title to the assets of the trust.

DELAWARE TRUSTEE

BNY Mellon Trust of Delaware, a Delaware banking corporation, is the Delaware trustee. The Delaware trustee acts in the capacities required under the Delaware Statutory Trust Act and under the trust agreement. Its

principal Delaware address is 301 Bellevue Parkway, 3rd Floor, Wilmington, Delaware 19809.

REMARKETING AGENT

The remarketing agent will be entitled to a fee on each reset date in connection with a successful remarketing of the reset rate notes from amounts on deposit in the remarketing fee account. In connection with a successful

remarketing of the class A-5 notes on the January 27, 2025 reset date, the remarketing agent will be paid a remarketing fee by the trust in an amount that will not exceed $972,538.72. As of the October 2024 distribution date,

there was $972,538.72 on deposit in the remarketing fee account. The trust will also be obligated to reimburse the remarketing agent, on a subordinated basis, for certain out-of-pocket expenses incurred in connection with each

reset date.

ADMINISTRATOR AND SPONSOR

Navient Solutions, LLC (formerly known as Navient Solutions, Inc.) is the sponsor of the trust and acts as the administrator of the trust under an administration agreement dated as of the closing

date. Navient Solutions, LLC is a Delaware limited liability company and a wholly-owned subsidiary of Navient Corporation. Subject to certain conditions, Navient Solutions, LLC may transfer its obligations as administrator

to an affiliate. We sometimes refer to Navient Solutions, LLC as Navient Solutions.

|

|

8

INFORMATION ABOUT THE TRUST

The trust is a Delaware statutory trust created under a trust agreement dated as of June 9, 2005.

The only activities of the trust that are currently permitted are acquiring, owning and managing the trust student loans and the other assets of the trust, issuing and making payments on the notes, entering into any

required swap agreements or potential future interest rate cap agreements and other related activities. See “The Trust—General” in this free-writing prospectus.

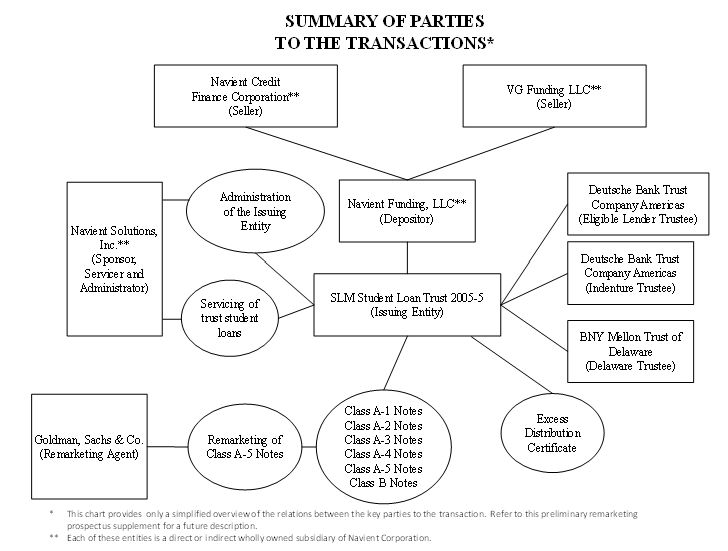

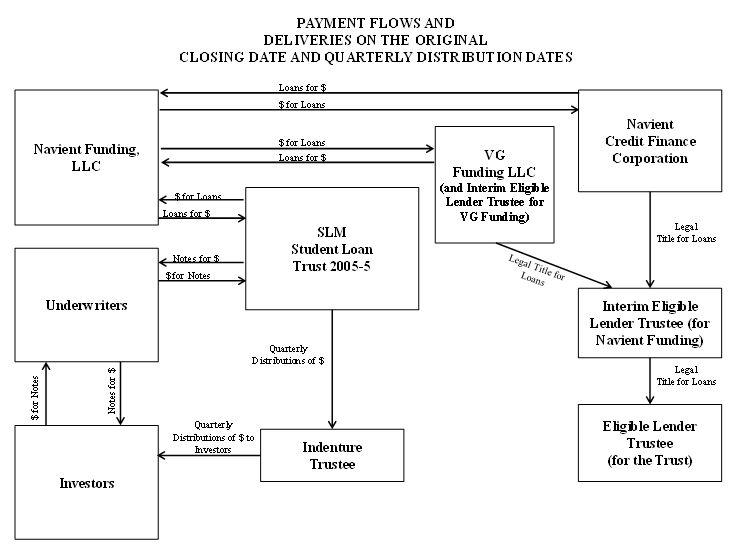

Navient Funding, LLC (formerly known as SLM Funding LLC), as depositor, after acquiring the student loans from one of VG Funding LLC (“VG Funding”) or Navient Credit Finance Corporation (formerly known as “SLM Education

Credit Finance Corporation”) (“Navient CFC”) under separate purchase agreements, sold them to the trust on the closing date under a sale agreement (we sometimes refer to Navient CFC and VG Funding as the “sellers”). The

depositor is a limited liability company of which Navient CFC is the sole member. Chase Bank USA, National Association, as interim eligible lender trustee, initially held legal title to the student loans for the depositor

under an interim trust arrangement prior to their transfer to the trust and then as eligible lender trustee for the benefit of the trust under the trust agreement. Deutsche Bank Trust Company Americas now serves as

successor interim eligible lender trustee for the depositor and successor eligible lender trustee on behalf of the trust.

Its Assets

The assets of the trust include:

| • |

the trust student loans;

|

| • |

collections and other payments on the trust student loans;

|

| • |

funds it currently holds or will hold from time to time in its trust accounts, including a collection account; a reserve account; an accumulation account; a supplemental interest account; an investment reserve

account; an investment premium purchase account; a remarketing fee account; and if the class A-5 notes are denominated in a currency other than U.S. Dollars, a currency account;

|

| • |

its rights under the transfer and servicing agreements, including the right to require VG Funding (or Navient Solutions, LLC, as servicer, acting on its behalf), Navient CFC, the depositor or the servicer to

repurchase trust student loans from it or to substitute loans under certain conditions;

|

| • |

its rights under any swap agreement or potential future interest rate cap agreement, as applicable; and

|

| • |

its rights under the guarantee agreements with guarantors.

|

The rest of this section more fully describes the trust student loans and trust accounts.

Trust Student Loans. The trust student loans (including the initial trust student loans, any additional

trust student loans and any add-on consolidation loans) are education loans to students and parents of students made under the Federal Family Education Loan Program, known as the FFELP. All of the trust student loans are

consolidation loans.

Consolidation loans are used to combine a borrower’s or borrowers’ obligations under various federally authorized student loan programs into a single loan. See

“Appendix A—Federal Family Education Loan Program” in this free-writing prospectus.

|

|

9

The trust student loans were selected from student loans owned by Navient CFC or VG Funding, or their affiliates, based on the criteria established by the depositor, as described in this free-writing prospectus.

Guaranty agencies described in this document guarantee all of the trust student loans. They are also reinsured by the Department of Education (which we refer to as the Department of Education).

Initial Trust Student Loans. The initial trust student loans had a pool balance of approximately

$2,219,695,622.97 as of the closing date. On the closing date, $5,800,325.68 was deposited into the supplemental purchase account and during the supplemental purchase period, $5,773,827.55 aggregate principal balance of

trust student loans was added to the pool balance through the purchase of additional student loans using funds on deposit in the supplemental purchase account. On the closing date, $10,000,000 was deposited into the

add-on consolidation loan account and during the consolidation loan add-on period, $7,069,998.12 aggregate principal balance of trust student loans was added to the pool balance through the purchase of add-on

consolidation loans using funds on deposit in the add-on consolidation loan account. The trust student loans have a pool balance of approximately $279,030,756 as of the

statistical disclosure date.

As of the statistical disclosure date, (i) the weighted average annual borrower interest rate of the trust student loans was approximately 4.07% and (ii) their weighted average remaining term to scheduled maturity was

approximately 164 months.

Special allowance payments on 0.29% of the trust student loans by principal balance (as of the statistical disclosure date) are based on the 91-day treasury bill rate. Special allowance payments on 99.71% of the trust

student loans by principal balance (as of the statistical disclosure date) are based on the 30-day SOFR index.

For more details concerning the trust student loans as of the statistical disclosure date, see “Annex A—The Trust Student Loan Pool” attached to this free-writing prospectus.

Collection Account. The administrator established and maintains the collection account as an asset of the

trust in the name of the indenture trustee. The administrator will deposit collections on the trust student loans, interest subsidy payments and special allowance payments into the collection account, as described in

this free-writing prospectus.

Reserve Account. The administrator established and maintains the reserve account as an asset of the

trust in the name of the indenture trustee. As of the October 2024 distribution date, the amount on deposit in the reserve account was $3,353,244.00. Funds in the reserve account may be replenished on each distribution

date by additional funds available after all prior required distributions have been made. See “Description of the Notes—Distributions.”

The specified reserve account balance is the amount required to be maintained in the reserve account. The specified reserve account balance for any distribution date will be equal to the greater of (a) 0.25% of the

pool balance at the end of the related collection period and (b) $3,353,244.00. The specified reserve account balance will be subject to adjustment as described in this free-writing prospectus. In no event will it exceed

the outstanding principal balance of the notes, less all amounts then on deposit in the accumulation account (exclusive of investment earnings), if any.

|

|

10

Amounts remaining in the reserve account in excess of the specified reserve account balance on any distribution date, after the payment of amounts described below, will be deposited into the collection account for

distribution on that distribution date.

The reserve account will be available to cover any shortfalls in payments of the primary servicing fee, the administration fee, the remarketing fees, if any, the class A noteholders’ interest distribution amount (but

only up to an annual interest rate equal to the SOFR Rate plus 0.75% in the case of the class A-5 notes), the class B noteholders’ interest distribution amount, payments due to any swap counterparty with respect to

interest, if applicable, and certain swap termination payments. As of the October 2024 distribution date, amounts on deposit in the reserve account have not been required for these purposes.

In addition, the reserve account will be available:

| • |

on the related maturity date for each class of class A notes and upon termination of the trust, to cover shortfalls in payments of the class A noteholders’ principal and accrued interest to the related class

of notes; and

|

| • |

on the class B maturity date and upon termination of the trust, to cover shortfalls in payments of the class B noteholders’ principal and accrued interest, any carryover servicing fees, any remaining swap

termination payments and remarketing fees and expenses.

|

The reserve account enhances the likelihood of payment to noteholders. In certain circumstances, however, the reserve account could be depleted which could result in shortfalls in distributions to noteholders.

On any distribution date, if the market value of the reserve account, together with amounts on deposit in any supplemental interest account, is sufficient to pay the remaining principal and interest accrued on the

notes and any carryover servicing fees, amounts on deposit in those accounts will be so applied on that distribution date. See “Description of the Notes—Credit Enhancement—Reserve

Account” in this free-writing prospectus.

Capitalized Interest Account. All funds on deposit in the capitalized interest account that was

created and funded on the closing date were transferred to the collection account on the October 2006 distribution date. No additional sums were subsequently or will be deposited into this account.

Remarketing Fee Account. The administrator established and maintains a remarketing fee account as an

asset of the trust in the name of the indenture trustee, for the benefit of the remarketing agent and the class A noteholders. On the January 2009 distribution date, which was the distribution date one year prior to

the initial reset date for the class A-5 notes, the trust began to deposit into the remarketing fee account available funds up to the related quarterly required amount. The trust is required to make such deposits on

each related distribution date until the balance on deposit in the remarketing fee account reaches the targeted level for the related reset date, prior to the payment of interest on the notes. As of the January 27,

2025 reset date, the required amount for this account will not exceed $972,538.72. As of the October 2024 distribution date, there was $972,538.72 on deposit in the remarketing fee account.

|

|

11

Investment earnings on deposit in the remarketing fee account are withdrawn on each distribution date, deposited into the collection account and included in available funds for that distribution date. In addition,

if on any distribution date, a class A note interest shortfall would exist, or if on the maturity date for any class of class A notes, available funds would not be sufficient to reduce the principal balance of that

class to zero, the amount of that class A note interest shortfall or principal deficiency, as applicable, may be withdrawn from the remarketing fee account and used for payment of interest or principal on the class A

notes, to the extent sums are on deposit in that account. See “Description of the Notes—The Reset Rate Notes—Tender of Reset Rate Notes; Remarketing Procedures” in this

free-writing prospectus.

Accumulation Account. The administrator will establish and maintain, in the name of the indenture

trustee, an accumulation account for the benefit of the class A-5 notes whenever such notes are structured not to receive a payment of principal until the end of the related reset period (as will be the case in any

future reset period during which the class A-5 notes are reset to bear interest at a fixed rate or are denominated in a currency other than U.S. Dollars). With respect to each related reset period, on each

distribution date, the indenture trustee will deposit any payments of principal allocated to the class A-5 notes, in U.S. Dollars, into the accumulation account. All sums on deposit in the accumulation account,

including any amounts deposited into the accumulation account on the related distribution date, but exclusive of investment earnings, will be paid either:

| • |

if the class A-5 notes are then denominated in U.S. Dollars, on the next reset date, to the reset rate noteholders, after all other required distributions have been made on that reset date; or

|

| • |

if the class A-5 notes are then denominated in a currency other than U.S. Dollars, on or about the next reset date, to the currency swap counterparty or counterparties, which will in turn pay the applicable

currency equivalent of those amounts to the trust, for payment to the reset rate noteholders on the second business day following the related reset date, after all other required distributions have been made on

that reset date.

|

Amounts on deposit in the accumulation account (exclusive of investment earnings) may be used only to pay principal on the class A-5 notes or to the currency swap counterparty or counterparties and for no other

purpose. Investment earnings on deposit in the accumulation account will be withdrawn on each distribution date, deposited into the collection account and included as a part of available funds for that distribution

date.

Amounts on deposit in the accumulation account may be invested in eligible investments that can be purchased at a price equal to par, at a discount, or at a premium. Eligible investments may be purchased at a

premium over par only if there are sufficient amounts on deposit in the investment premium purchase account described below to pay the amount of the purchase price in excess of par.

As of the October 2024 distribution date there were no amounts on deposit in the accumulation account.

|

|

12

Investment Premium Purchase Account. When required, the administrator will establish and maintain,

in the name of the indenture trustee, an investment premium purchase account related to the accumulation account. On each distribution date when funds are deposited into the accumulation account, the indenture

trustee will be required to deposit, subject to sufficient available funds, an amount generally equal to 1.0% of the amount deposited into the accumulation account into the investment premium purchase account,

together with any carryover amounts from previous distribution dates if there were insufficient available funds on any previous distribution date to make the required deposits in full.

Amounts on deposit in the investment premium purchase account may be used from time to time to pay amounts in excess of par on eligible investments purchased with funds on deposit in the accumulation account.

Amounts not used to pay such premium purchase amounts will become a part of available funds on future distribution dates pursuant to a formula set forth in the administration agreement.

As of the October 2024 distribution date there were no amounts on deposit in the investment premium purchase account.

Investment Reserve Account. When required, the administrator will establish and maintain, in the

name of the indenture trustee, an investment reserve account related to the accumulation account. On any distribution date, and to the extent of available funds, if the ratings of any eligible investments in the

accumulation account have been downgraded by one or more rating agencies, the indenture trustee will deposit into the investment reserve account an amount, if any, to be set by each applicable rating agency in

satisfaction of the rating agency condition, which amount will not exceed the amount of the unrealized loss on the related eligible investments. On each distribution date, all amounts on deposit in the investment

reserve account either will be withdrawn from the investment reserve account and deposited into the accumulation account in an amount required to offset any realized losses on eligible investments related to the

accumulation account, or will be deposited into the collection account to be included as a part of available funds on that distribution date.

As of the October 2024 distribution date there were no amounts on deposit in the investment reserve account.

Supplemental Interest Account. When required, the administrator will establish and maintain, in

the name of the indenture trustee, a supplemental interest account related to the accumulation account.

On each distribution date when amounts are deposited into or are on deposit in the accumulation account, the administrator will cause the indenture trustee, subject to sufficient available funds, to make a deposit

into the supplemental interest account. This deposit will equal the amount sufficient to pay either to the reset rate noteholders or to each swap counterparty, as applicable, the floating rate payments due to the

reset rate noteholders or the swap counterparty, as applicable, through the next distribution date at the related SOFR-based floating rate on all amounts on deposit in the accumulation account, after giving effect to

an assumed rate of investment earnings on that account.

All amounts on deposit in the supplemental interest account will be withdrawn on or before each distribution date, deposited into the collection account and included as a part of available funds for that

distribution date.

|

|

13

As of the October 2024 distribution date there were no amounts on deposit in the supplemental interest account.

ADMINISTRATION OF THE TRUST

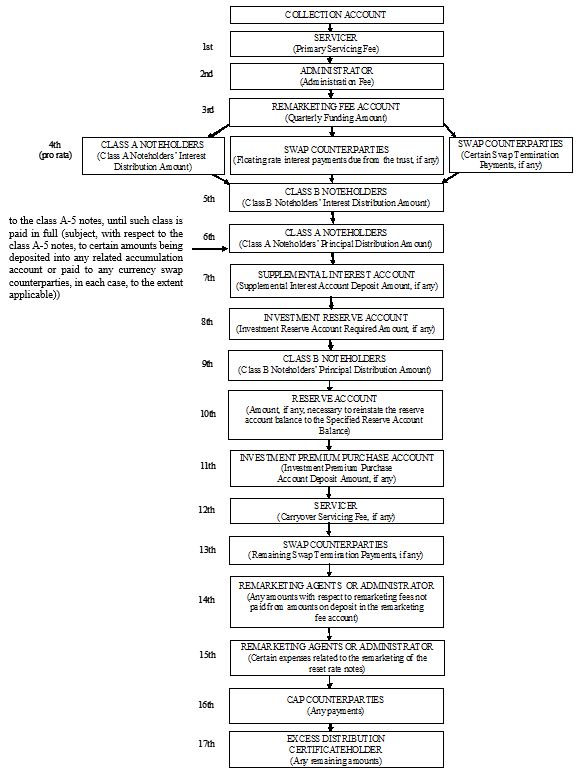

Distributions

Navient Solutions, LLC, as administrator, will instruct the indenture trustee to withdraw funds on deposit in the collection account and the other accounts, as described above. These funds will be applied on or

before each applicable distribution date generally as shown in the chart on the following page. Funds on deposit in the collection account and, to the extent required, the reserve account will be applied monthly to

the payment of the primary servicing fee.

See “Description of the Notes— Distributions” in this free-writing prospectus for a more detailed description of distributions.

|

|

14

15

Transfer of the Assets to the Trust

Under a sale agreement, the depositor sold the trust student loans to the trust, with the eligible lender trustee holding legal title to the trust student loans.

If the depositor breaches a representation under the sale agreement regarding a trust student loan, generally the depositor will have to cure the breach, repurchase or replace that trust student loan or

reimburse the trust for losses resulting from the breach.

Each seller has similar obligations under the purchase agreements. See “Transfer and Servicing Agreements—Purchase of Student Loans by the Depositor; Representations and

Warranties of the Sellers” in this free-writing prospectus.

Servicing of the Assets

Under a servicing agreement, Navient Solutions, LLC, as servicer, is responsible for servicing, maintaining custody of and making collections on the trust student loans. It also bills and collects payments

from the guaranty agencies and the Department of Education.

The servicer manages and operates the loan servicing functions for the Navient Corporation family of companies. The servicer may enter into subservicing agreements with respect to some or all of its

servicing obligations, but these arrangements will not affect the servicer’s obligations to the trust. Under some circumstances, the servicer may transfer its obligations as servicer.

If the servicer breaches a covenant under the servicing agreement regarding a trust student loan, generally it will have to cure the breach, purchase that trust student loan or reimburse the trust for losses

resulting from the breach. See “The Trust Student Loan Pool—Insurance of Trust Student Loans; Guarantors of Trust Student Loans” in this free-writing prospectus.

Navient Solutions appointed Higher Education Loan Authority of the State of Missouri, a body politic and corporate and public instrumentality of the State of Missouri, to act as a subservicer to service

substantially all of the loan servicing functions of Navient Solutions, LLC pursuant to a subservicing agreement. We sometimes refer to Higher Education Loan Authority of the State of Missouri as MOHELA or a

subservicer. See “The Sponsor, Servicer, Administrator and Subservicers” in this free-writing prospectus.

Compensation of the Servicer

The servicer receives two separate fees: a primary servicing fee and a carryover servicing fee.

The primary servicing fee for any month is equal to 1/12th of an amount not to exceed 0.50% of the outstanding principal amount of the trust student loans.

The primary servicing fee is payable in arrears out of available funds and amounts on deposit in the reserve account on the 25th day of each month, or if the 25th day is not a business day, then on the next

business day. Fees are calculated as of the first day of the preceding calendar month. Fees include amounts from any prior monthly servicing payment dates that remain unpaid.

The carryover servicing fee is payable to the servicer on each distribution date out of available funds.

|

|

16

The carryover servicing fee is the sum of:

| • |

the amount of specified increases in the costs incurred by the servicer;

|

| • |

the amount of specified conversion, transfer and removal fees;

|

| • |

any amounts described in the first two bullets that remain unpaid from prior distribution dates; and

|

| • |

interest on any unpaid amounts.

|

See “Description of the Notes—Servicing Compensation” in this free-writing prospectus.

TERMINATION OF THE TRUST

The trust will terminate upon:

| • |

the maturity or other liquidation of the last trust student loan and the disposition of any amount received upon its liquidation; and

|

| • |

the payment of all amounts required to be paid to the noteholders.

|

Optional Purchase

The servicer may purchase or arrange for the purchase of all remaining trust student loans on any distribution date when the pool balance is 10% or less of the initial pool balance.

The exercise of this purchase option will result in the early retirement of the remaining notes, including an early distribution of all amounts then on deposit in the accumulation account. The purchase

price will equal the amount required to prepay in full, including all accrued and unpaid interest, the remaining trust student loans as of the end of the preceding collection period, but will not be less than

a prescribed minimum purchase amount.

This prescribed minimum purchase amount is the amount that would be sufficient to:

| • |

pay to noteholders the interest payable on the related distribution date; and

|

| • |

reduce the outstanding principal amount of each class of notes then outstanding on the related distribution date to zero, taking into account all amounts then on deposit in the accumulation

account.

|

For these purposes, if the class A-5 notes:

| • |

are then structured not to receive a payment of principal until the end of the related reset period, the outstanding principal balance of the class A-5 notes will be deemed to have been reduced by

any amounts on deposit, exclusive of any investment earnings, in the accumulation account; and/or

|

| • |

are then denominated in a non-U.S. Dollar currency, the U.S. Dollar equivalent of the then-outstanding principal balance of the class A-5 notes will be determined based upon the exchange rate

provided for in the currency swap agreement or agreements.

|

The pool balance as of the statistical disclosure date is approximately 12.41% of the initial pool balance.

Auction of Trust Assets

The indenture trustee will offer for sale all remaining trust student loans at the end of the first collection period when the pool balance is 10% or less of the initial pool balance.

|

|

17

The trust auction date will be the third business day before the related distribution date. An auction will be consummated only if the servicer has first waived its optional purchase right as described

above. The servicer will waive its option to purchase the remaining trust student loans if it fails to notify the eligible lender trustee and the indenture trustee, in writing, that it intends to exercise

its purchase option before the indenture trustee accepts a bid to purchase the trust student loans. The depositor and its affiliates, including Navient CFC and the servicer, and unrelated third parties may

offer bids to purchase the trust student loans. The depositor or any affiliate may not submit a bid representing greater than fair market value of the trust student loans.

If at least two bids are received, the indenture trustee will solicit and re-solicit new bids from all participating bidders until only one bid remains or the remaining bidders decline to resubmit bids.

The indenture trustee will accept the highest of the remaining bids if it equals or exceeds the higher of (a) the minimum purchase amount described under “—Optional

Purchase” above (plus any amounts owed to the servicer as carryover servicing fees); or (b) the fair market value of the trust student loans as of the end of the related collection period.

If at least two bids are not received or the highest bid after the re-solicitation process does not equal or exceed the amount in the immediately preceding paragraph, the indenture trustee will not

complete the sale. The indenture trustee may, and at the direction of the depositor will be required to, consult with a financial advisor, including any of the original underwriters of the notes, or the

administrator, to determine if the fair market value of the trust student loans has been offered. See “Description of the Notes—Auction of Trust Assets” in this

free-writing prospectus.

The net proceeds of any auction sale, plus all amounts, exclusive of investment earnings, then on deposit in the accumulation account, will be used to retire any outstanding notes on the related

distribution date.

If the sale is not completed, the indenture trustee may, but will not be under any obligation to, solicit bids for sale of the trust student loans after future collection periods upon terms similar to

those described above, including the servicer’s waiver of its option to purchase remaining trust student loans.

If the trust student loans are not sold as described above, on each subsequent distribution date, if the amount on deposit in the reserve account after giving effect to all withdrawals, except

withdrawals payable to the depositor, exceeds the specified reserve account balance, the administrator will direct the indenture trustee to distribute the amount of the excess as accelerated payments or

allocations of note principal.

The indenture trustee may or may not succeed in soliciting acceptable bids for the trust student loans either on the trust auction date or on subsequent distribution dates.

See “Description of the Notes—Auction of Trust Assets” in this free-writing prospectus.

TAX CONSIDERATIONS

Subject to important considerations described in this free-writing prospectus:

| • |

Special tax counsel to the trust is of the opinion that the class A-5 notes will be characterized as debt for U.S. federal income tax purposes.

|

|

|

18

| • |

Special tax counsel to the trust is of the opinion that the trust will not be characterized as an association taxable as a corporation or a publicly traded partnership taxable as a corporation

for U.S. federal income tax purposes.

|

| • |

Delaware tax counsel for the trust is of the opinion that the same characterizations will apply for Delaware state income tax purposes as for U.S. federal income tax purposes and noteholders

who were not otherwise subject to Delaware taxation on income would not become subject to Delaware tax as a result of their ownership of notes.

|

By acquiring a note, you agree to treat the note as indebtedness. See “Certain U.S. Federal Income Tax Considerations”

in this free writing prospectus and “U.S. Federal Income Tax Consequences” in the original prospectus.

ERISA CONSIDERATIONS

Subject to important considerations and conditions described in this free-writing prospectus, the class A-5 notes may, in general, be purchased by or on behalf of an employee benefit plan or other

retirement arrangement, including an insurance company general account, only if:

| • |

an exemption from the prohibited transaction provisions of Section 406 of the Employee Retirement Income Security Act of 1974, as amended, and Section 4975 of the Internal Revenue Code of 1986,

as amended, applies, so that the purchase or holding of the class A-5 notes will not result in a non-exempt prohibited transaction; and

|

| • |

the purchase or holding of the class A-5 notes will not cause a non-exempt violation of any substantially similar federal, state, local or foreign laws.

|

See “ERISA Considerations” in this free-writing prospectus for additional information concerning the application of ERISA.

RATINGS

The notes are currently rated as follows:

| • |

class A-5 notes: “AA+sf” by Fitch, “Aa3 (sf)” by Moody’s and “AA+ (sf)” by

S&P.

|

| • |

class B notes: “Asf” by Fitch, “Baa1 (sf)” by Moody’s and “AA (sf)” by S&P.

|

See “Ratings” in this free-writing prospectus.

CERTAIN INVESTMENT COMPANY ACT CONSIDERATIONS

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”),