false 0001901799 0001901799 2023-01-24 2023-01-24 0001901799 gsrm:UnitsEachConsistingOfOneShareOfClassACommonStockOneWarrantAndOneSixteenthOfOneRightMember 2023-01-24 2023-01-24 0001901799 gsrm:ClassACommonStockParValue0.0001PerShareMember 2023-01-24 2023-01-24 0001901799 gsrm:WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf11.50PerShareMember 2023-01-24 2023-01-24 0001901799 gsrm:RightsEachWholeRightEntitlingTheHolderToReceiveOneShareOfClassACommonStockMember 2023-01-24 2023-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 24, 2023

GSR II Meteora Acquisition Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-41305 |

|

87-3203989 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 418 Broadway, Suite N Albany, New York |

|

12207 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(561) 532-4682

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A common stock, one warrant and one sixteenth of one right |

|

GSRMU |

|

The Nasdaq Stock Market LLC |

| Class A common stock, par value $0.0001 per share |

|

GSRM |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

GSRMW |

|

The Nasdaq Stock Market LLC |

| Rights, each whole right entitling the holder to receive one share of Class A common stock |

|

GSRMR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

On January 24, 2023, an article was published and management from GSR II Meteora Acquisition Corp. (the “Company”) and Lux Vending, LLC dba Bitcoin Depot (“Lux Vending”) presented at a virtual event for investors, and on January 24, 2023 and January 25, 2023, the Company and Lux Vending released press releases, relating to, among other things, the proposed business combination between the Company and Lux Vending. The article is attached hereto as Exhibit 99.1, a transcript of the virtual investor event presentation is attached hereto as Exhibit 99.2, the investor presentation that was referred to by management during the virtual investor event is attached hereto as Exhibit 99.3 and the press releases are attached hereto as Exhibit 99.4 and Exhibit 99.5, and incorporated by reference herein.

The foregoing (including Exhibit 99.1, Exhibit 99.2, Exhibit 99.3, Exhibit 99.4 and Exhibit 99.5) are being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will they be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act regardless of any general incorporation language in such filings. This Current Report will not be deemed an admission of materiality of any of the information in this Item 7.01, including Exhibit 99.1, Exhibit 99.2, Exhibit 99.3, Exhibit 99.4 and Exhibit 99.5.

Additional Information

Important Information About the Business Combination and Where to Find It

In connection with the Business Combination, the Company has filed a preliminary proxy statement of the Company with the Securities and Exchange Commission (the “SEC”), copies of which will be mailed (if and when available) to all Company stockholders once definitive. The Company also plans to file other documents with the SEC regarding the Business Combination. The Company will mail copies of the definitive proxy statement and other relevant documents to its stockholders as of the record date established for voting on the Business Combination. This communication is not a substitute for the definitive proxy statement or any other document that the Company will send to its stockholders in connection with the Business Combination. The Company’s stockholders and other interested persons are advised to read the preliminary proxy statement and any amendments thereto and, once available, the definitive proxy statement, as well as all other relevant materials filed or that will be filed with the SEC, in connection with the Company’s solicitation of proxies for its special meeting of stockholders to be held to approve, among other things, the Business Combination, because these documents will contain important information about the Company, BT Assets, Inc. (“BT Assets”) and the Business Combination. Stockholders may also obtain a copy of the preliminary proxy statement or, when available, the definitive proxy statement, as well as other documents filed with the SEC regarding the Business Combination and other documents filed with the SEC by the Company, without charge, at the SEC’s website located at www.sec.gov or by directing a request to Cody Slach or Alex Kovtun, (949) 574-3860, GSRM@gatewayir.com.

Participants in the Solicitation

The Company, Lux Vending, BT Assets and certain of their respective directors, executive officers and other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of the Company’s stockholders in connection with the Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of the Company’s stockholders in connection with the Business Combination is set forth in the Company’s preliminary proxy statement that has been filed with the SEC. Investors and security holders may obtain more detailed information regarding the names of the Company’s directors and executive officers and a description of their interests in the Company in the Company’s filings with the SEC, including the Company’s prospectus dated February 24, 2022 relating to its initial public offering, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov. To the extent such holdings of the Company’s securities may have changed since that time, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the participants in the proxy statement and a description of their direct and indirect interests will be contained in the definitive proxy statement and other relevant materials to be filed with the SEC when they become available. Stockholders, potential investors and other interested persons should read the definitive proxy statement carefully when it becomes available before making any voting or investment decisions. Free copies of these documents may be obtained from the sources indicated above.

Forward-Looking Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics and expectations and timing related to potential benefits, terms and timing of the Business Combination. These statements are based on various assumptions, whether or not identified herein, and on the current expectations of BT Assets’, Lux Vending’s and the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of BT Assets, Lux Vending and the Company. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Business Combination or that the approval of the stockholders of the Company is not obtained; failure to realize the anticipated benefits of the Business Combination; risks relating to the uncertainty of the projected financial information with respect to the combined company; future global, regional or local economic and market conditions; the development, effects and enforcement of laws and regulations; the combined company’s ability to manage future growth; the combined company’s ability to develop new products and services, bring them to market in a timely manner, and make enhancements to its business; the effects of competition on the combined company’s future business; the amount of redemption requests made by the Company’s public stockholders; the ability of the Company or the combined company to issue equity or equity-linked securities in connection with the Business Combination or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; and those factors described or referenced in the Company’s final initial public offering prospectus dated February 24, 2022 and its most recent Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, in each case, under the heading “Risk Factors,” and other documents of the Company filed, or to be filed, from time to time with the SEC, including the definitive proxy statement. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-

looking statements. There may be additional risks that none of BT Assets, Lux Vending or the Company presently knows or that BT Assets, Lux Vending and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect BT Assets’, Lux Vending’s and the Company’s expectations, plans or forecasts of future events and views as of the date hereof. BT Assets, Lux Vending and the Company anticipate that subsequent events and developments will cause BT Assets’, Lux Vending’s and the Company’s assessments to change. However, while BT Assets, Lux Vending and the Company may elect to update these forward-looking statements at some point in the future, BT Assets, Lux Vending and the Company specifically disclaim any obligation to do so except as otherwise required by applicable law. These forward-looking statements should not be relied upon as representing BT Assets’, Lux Vending’s and the Company’s assessments as of any date subsequent to the date hereof. Accordingly, undue reliance should not be placed upon the forward-looking statements.

No Offer or Solicitation

This Current Report on Form 8-K is for informational purposes only and shall not constitute an offer to sell, nor a solicitation of an offer to buy, any securities in connection with the proposed Business Combination or otherwise, or the solicitation of a proxy, consent or authorization in any jurisdiction pursuant to the Business Combination or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction or otherwise in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom, and otherwise in accordance with applicable law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 25, 2023

|

|

|

| GSR II METEORA ACQUISITION CORP. |

|

|

| By: |

|

/s/ Gus Garcia |

| Name: |

|

Gus Garcia |

| Title: |

|

Co-Chief Executive Officer |

Exhibit 99.1

Bitcoin Depot could acquire Bitcoin ATM operators after public debut, CEO says

07:34 CST, January 24 2023

Lux Vending, a Bitcoin ATM operator and fintech

company doing business as Bitcoin Depot, expects to make acquisitions as it looks to expand globally after its public debut, said founder and CEO Brandon Mintz.

The Atlanta-based company anticipates a mid-February close of its merger with blank-check company GSR II Meteora

Acquisition [NASDAQ:GSRM]. It does not expect to sign any letters of intent until after that deal has closed, Mintz said.

Bitcoin Depot will likely first

target a Bitcoin ATM operator, according to Mintz. It could also look to acquire a technology provider that facilitates the purchase of Bitcoin at retail checkout counters or another software provider for Bitcoin ATMs, the CEO said. Last year, the

company acquired software provider Bitaccess, which eliminated a huge expense for the company, he explained.

It does not have a sweet spot in target size

and could consider a USD 500,000 purchase of a small Bitcoin ATM operator or more than USD 100m for the largest operators, Mintz said.

The SPAC merger

will result in around USD 170m of cash, assuming no redemptions. However, the average redemption rate in 4Q22 was around 87%, the highest quarter on record, according to Dealogic data.

While Bitcoin Depot is preparing for an average case scenario, it expects redemptions to come in lower than the average given its financial profile and

sponsor team, Mintz said.

Revenue for the first nine months of 2022 grew by 25.3% year over year to USD 497.2m, according to the company’s latest

earnings report. Net income dropped to USD 4.6m from USD 9.6m in the prior-year period, partly due to a sharp increase in interest expenses.

Bitcoin

Depot, which was founded in 2016, has around 7,000 ATM locations in North America. It operates in 48 states – excluding New York and Hawaii – as well as all Canadian provinces. The company applied for a BitLicense to operate in New York in

late 2020 and believes it’s in the final stages of that process, Mintz said.

With only one licensed operator and fewer than 200 Bitcoin ATMs in New

York, the state is underserved and represents a strong growth opportunity when Bitcoin Depot can begin to operate there, according to Mintz. He compared New York to Florida, which is similar in population size and has more than 3,100 Bitcoin ATMs

and dozens of operators.

While it hasn’t announced expansion plans beyond the US and Canada, Bitcoin Depot does expect to launch

internationally within the next two years. Since it could do so via acquisition, a precise timeframe is difficult to provide, Mintz said.

The company is

expanding via retail partnerships like what it has with Circle K. Bitcoin Depot is in nearly 2,000 of Circle K’s 10,000 retail locations in the US and Canada. The convenience store has an additional 5,000 locations outside of North America,

Mintz noted when discussing possible international expansion.

Bitcoin Depot announced today that it signed 440 new retail locations in the second half of

2022 from partnerships with convenience store brands including FastLane, Gas Express and High’s.

It typically partners with convenience and grocery

stores, though it does have some mall and other retail locations, Mintz said. Ideal partners have the physical space in their store for a kiosk, are not in a rural environment and believe that having a Bitcoin ATM will help drive foot traffic to

their store, he added.

The company pays the retailer a fixed monthly rent regardless of performance and offers an upside for performance, he explained.

It has between 110 and 125 employees.

Kirkland &

Ellis provided legal services to Bitcoin Depot on the SPAC merger. Oppenheimer was GSR’s financial advisor, and Latham & Watkins was its lawyer. KPMG is Bitcoin Depot’s auditor.

|

|

|

|

|

|

|

|

| by Rachel Stone in Charlottesville, Virginia |

|

|

|

|

Exhibit 99.2

Investor Day Transcript

Alex Kovtun – Gateway Group (Investor

Relations)

Hello everyone and welcome to the Bitcoin Depot Virtual Investor Day. My name is Alex Kovtun of Gateway Group and I’d like to thank

you for being here and your interest in Bitcoin Depot. Before we begin, I would like to remind everyone that today’s session will be recordedi.

I’m going to kick things off today and wanted to give you a brief overview of today’s event. In a moment, the Bitcoin Depot team will share an

updated investor presentation about their business and we’ll have some time afterward for a Q&A session. We encourage you to share your questions through the chat function at the bottom of the screen or email them to

GSRM@gatewayir.com throughout the presentation.

Slide 2:

Before I turn the event over to the speakers, I would like to begin by directing everybody to the disclaimers on the second slide and by reminding everyone

that this discussion may contain forward looking statements. Factors that could cause these results to differ materially are available in GSRM’s proxy statement filed with the SEC, which can be found on the SEC’s filing website,

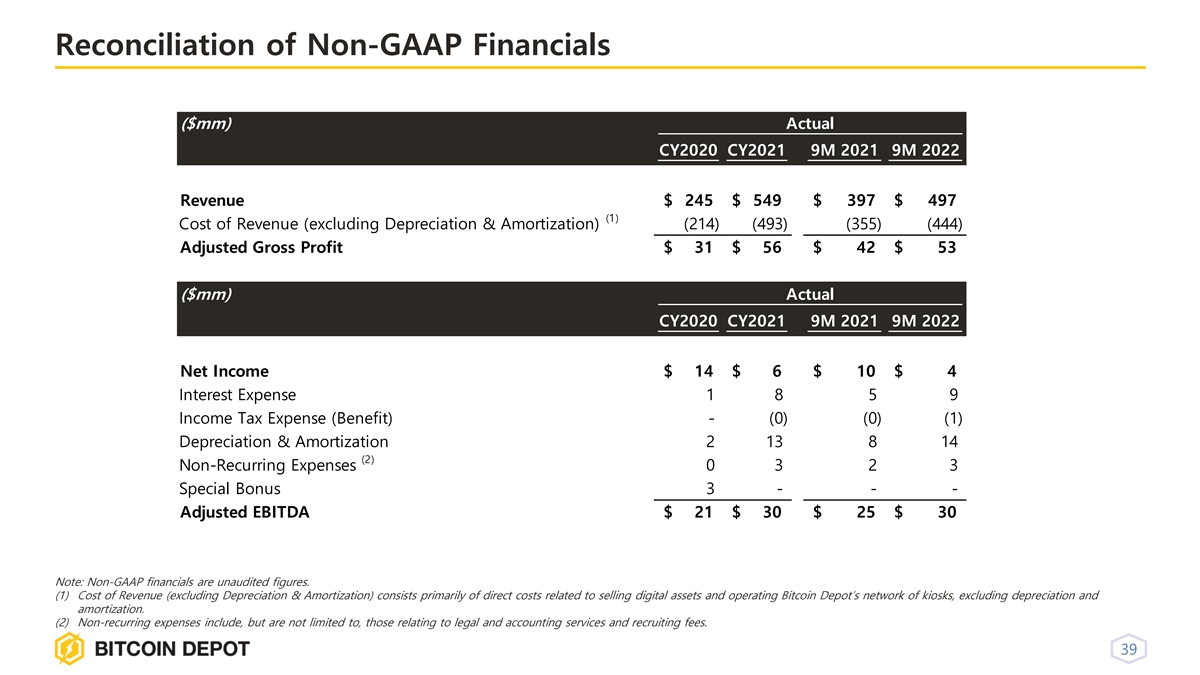

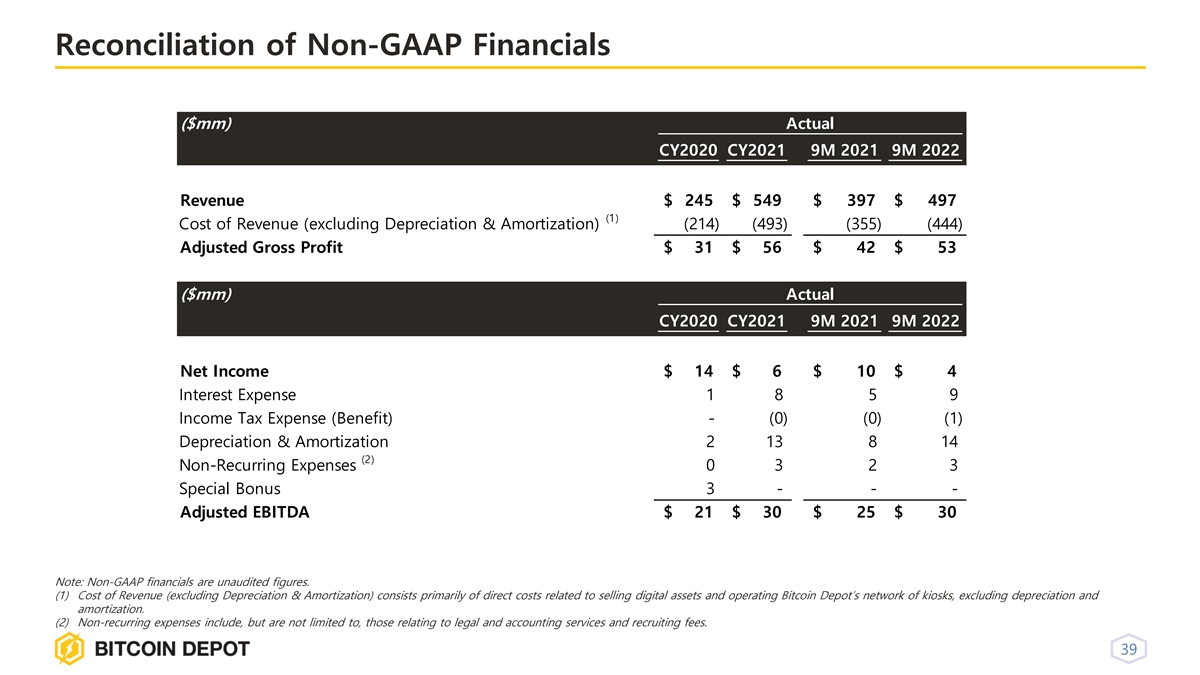

sec.gov/edgar. We encourage you to carefully review the disclaimers in the slide presentation. Today’s remarks also include certain non-GAAP financial measures, including but not limited to

adjusted EBITDA and adjusted gross profit. You can find a reconciliation of such measures in the appendix included in the slide presentation. This presentation does not constitute either advice or a recommendation regarding any securities.

So with that, I’d like to pass it over to Gus Garcia from the GSRM team to make some opening remarks. Gus?

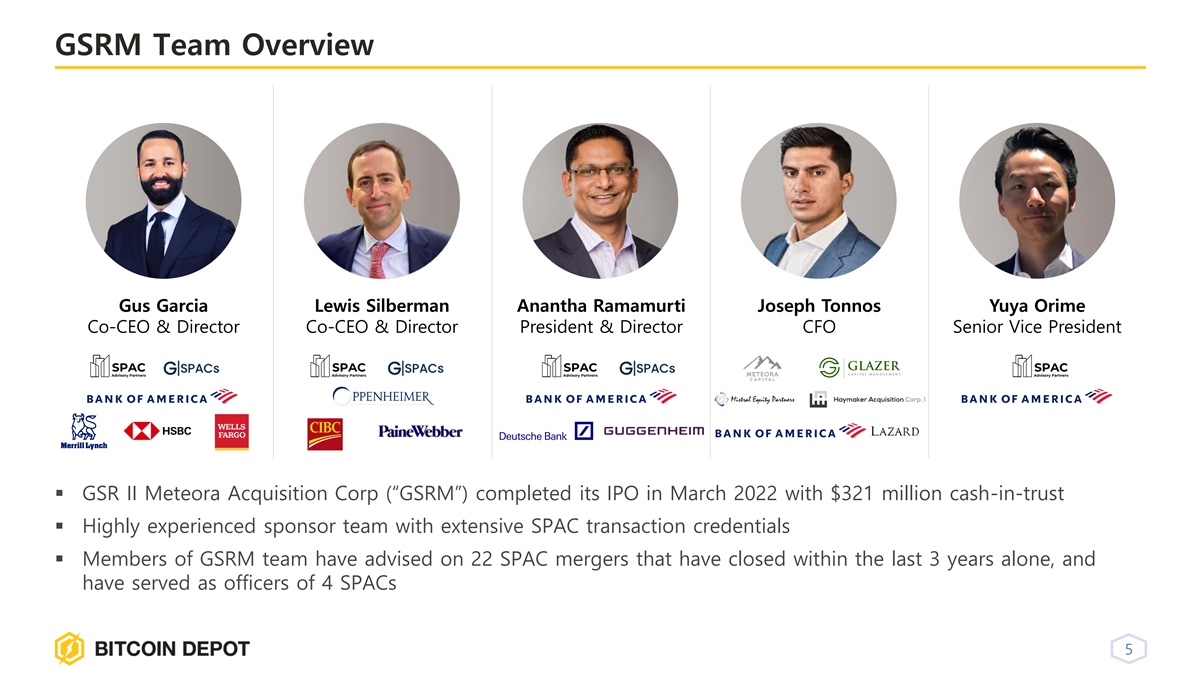

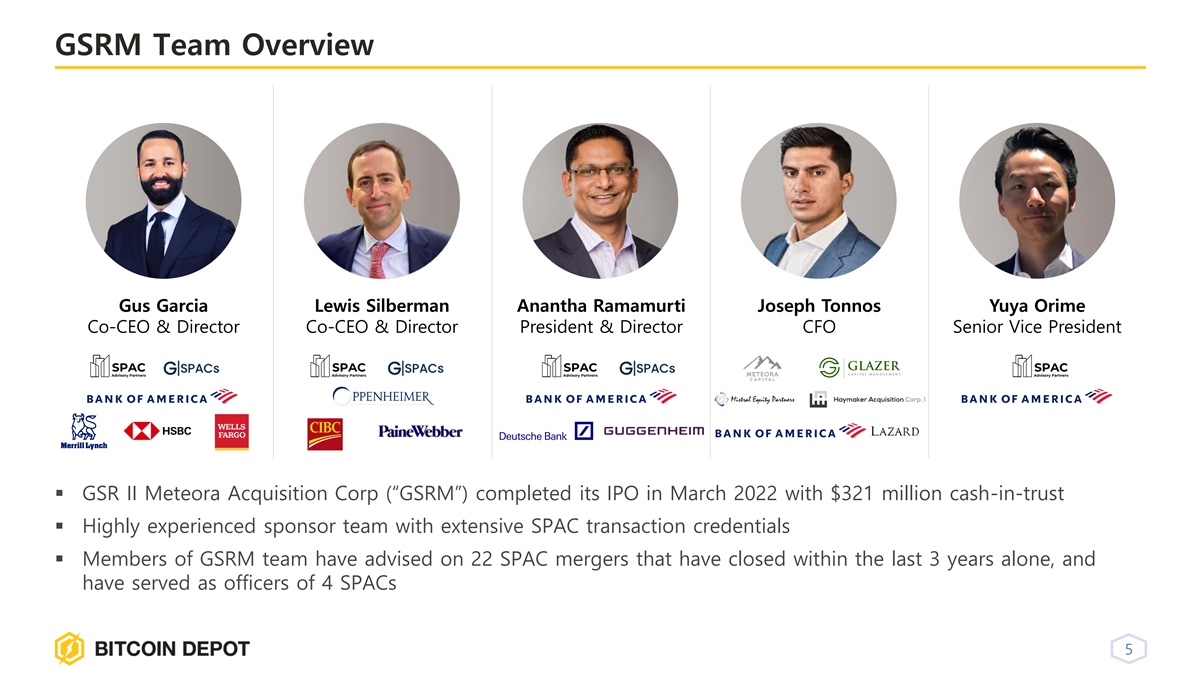

Gus Garcia – GSR II Meteora Acquisition Corp. (Co-CEO & Director)

Slide 5:

Thank you Alex. We are very pleased to be here

with everybody today to discuss our proposed business combination between GSR II Meteora Acquisition Corp. and Bitcoin Depot. I’m Gus Garcia, co-CEO of GSR II Meteora. This is our team page. In additional

to Lew Silberman who’s on this page, Co-CEO of GSR II Meteora with me. Also joining us are Brandon Mintz, Founder & CEO of Bitcoin Depot, and Scott Buchanan, COO of Bitcoin Depot.

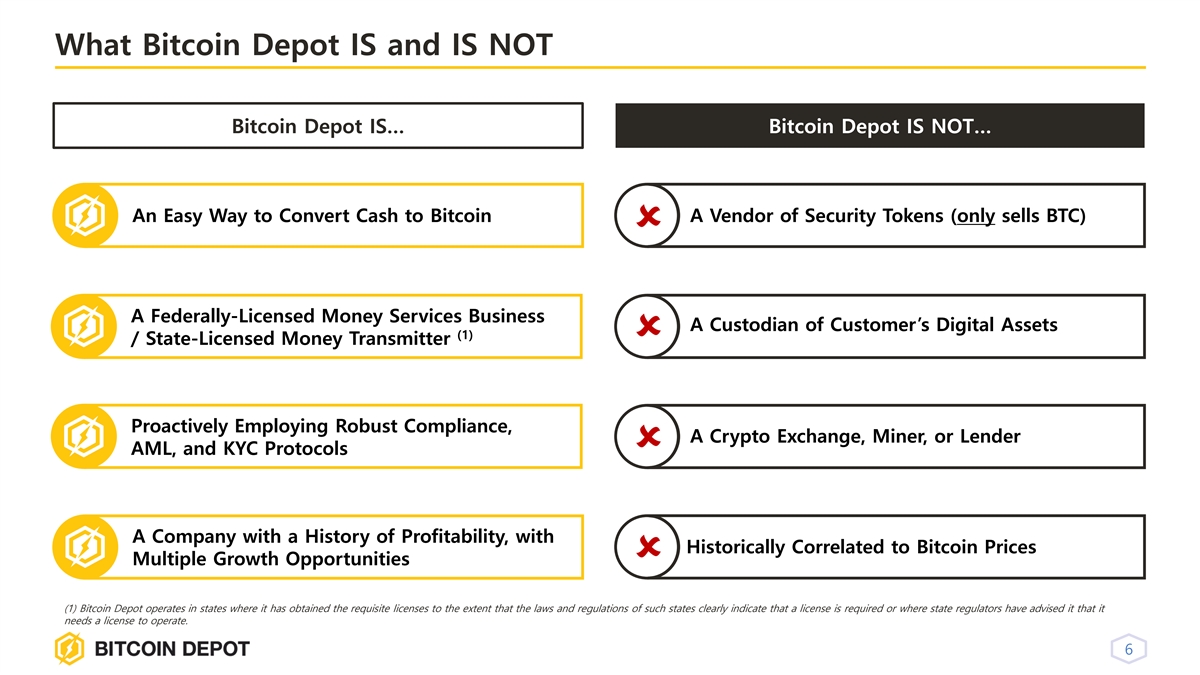

Slide 6:

Before I turn it over to the team, I just want

to briefly discuss the proposed business combination and why we decided to partner with this team. When we did our IPO, we didn’t set out to do a deal with a crypto company, that wasn’t our focus. But what we were focused on was combining

with a business that was a leader in its space, the number one player, and in an industry that was growing and that we believed would continue to grow over the long-term. And that’s exactly what we found in Bitcoin Depot; they’re the

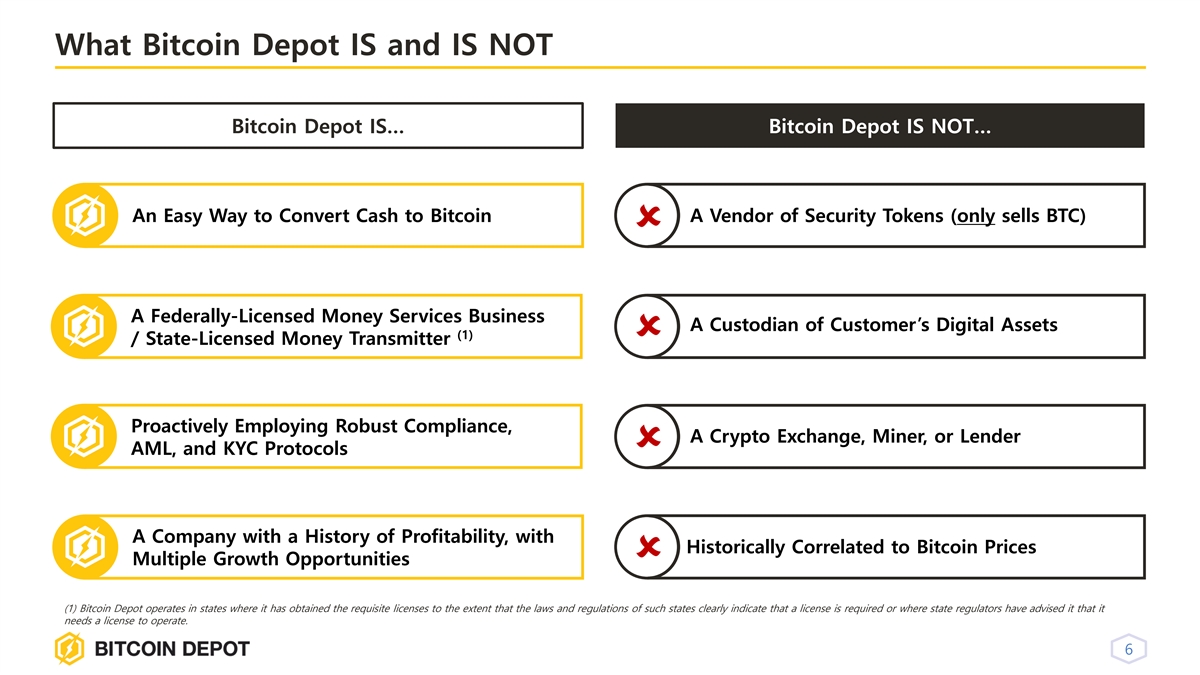

largest Bitcoin ATM operator in North America in an industry that has seen tremendous growth. So we said okay check that box, then we decided to dig deeper and we loved what we saw. So there’s four things to highlight on what Bitcoin Depot is.

Number 1, it’s easy to transact at a kiosk. You walk up to a Bitcoin ATM, insert cash and within minutes you have Bitcoin sent to your wallet. So very

|

|

|

|

|

|

|

|

|

|

low barriers to customer entry which we liked. Second thing we liked and were pleasantly surprised by is that

there is broad demand for Bitcoin Depot’s services. We on the SPAC side hadn’t used one of these ATMs before and so we initially had trouble visualizing who would want to use them. But the reality is that many people use these Bitcoin ATMs

not just for the purpose of obtaining Bitcoin, but rather for practical purposes. So based on user reviews, people use these ATMs as a way to send money to friends and family; it’s easy to send Bitcoin from one wallet to another. People use

these ATMs to make online purchases and pay their bills; there are many ways online to use Bitcoin directly or indirectly for these purposes. Bitcoin Depot is licensed in jurisdictions where required as a money services business, as a money

transmitter, so really think of anyone that needs to use cash or desires to use cash in their lives and are looking to access these types of services; those are all potential customers of Bitcoin Depot. Third, very important for us and any money

services business is compliance. This was one of the most important factors I would say in our decision to combine with Bitcoin Depot; they have a very strong compliance program so think of things like anti-money laundering, know-your customer; the

team will get into details around what the program looks like but needless to say we were very impressed with how robust their compliance program is and we think you will be too. And last thing, actually two things, you don’t tend to hear very

much in SPAC transactions these days, historical profitability and growth. Bitcoin Depot is a company that has both of those in spades. It generated about $6 million of net income and $30 million of Adjusted EBITDA in 2021 for the

full-year and generated $4 million of net income and $30 million of Adjusted EBITDA just in the first nine months of 2022. So a lot of growth embedded in a company with a long history of profitability.

And then it’s also just as important in our mind to talk about what Bitcoin Depot is not. It’s not a vendor of security tokens. Bitcoin is the only

crypto that Bitcoin Depot offers. It is not a custodian of customer’s digital assets, which is very important to all of us in the wake of news from FTX and others. Not an exchange, it’s not a miner or a lender in any sense of the word. And

most importantly, its historical results have not been correlated to the price of Bitcoin. And it makes sense to us when you think back to the use cases; people who are using these ATMs to send money to friends and family, to make online purchases,

to pay bills. That demand shouldn’t be driven by the price of Bitcoin in deciding whether to use Bitcoin for those transactions.

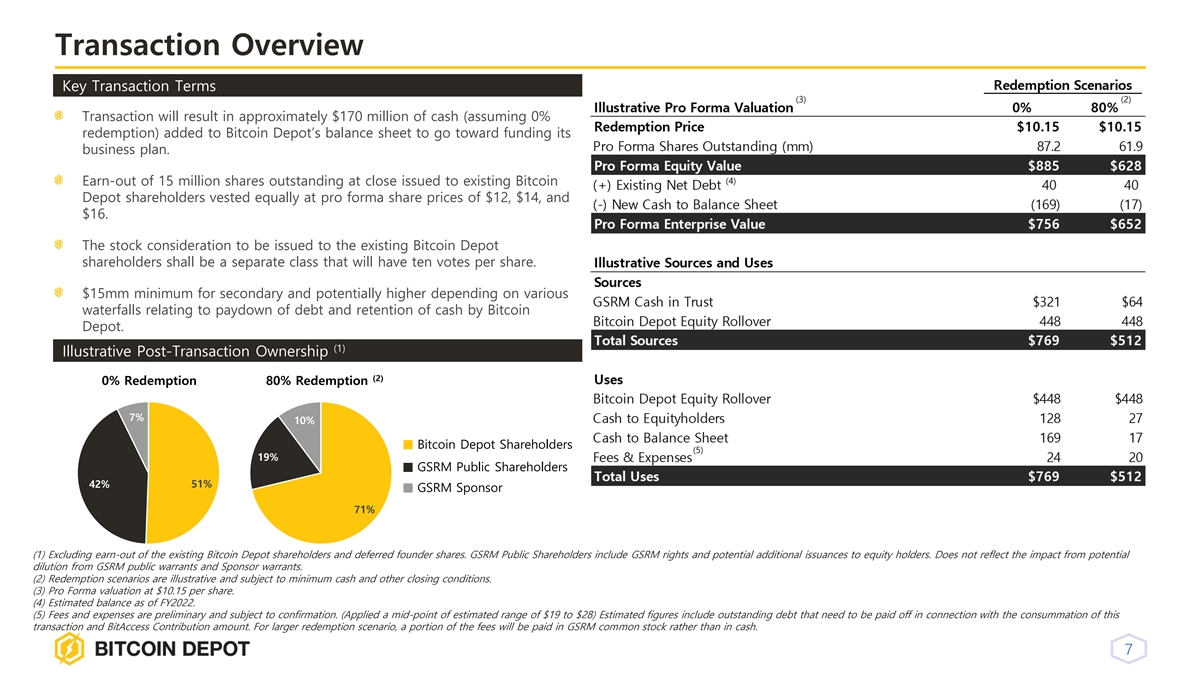

Slide 7:

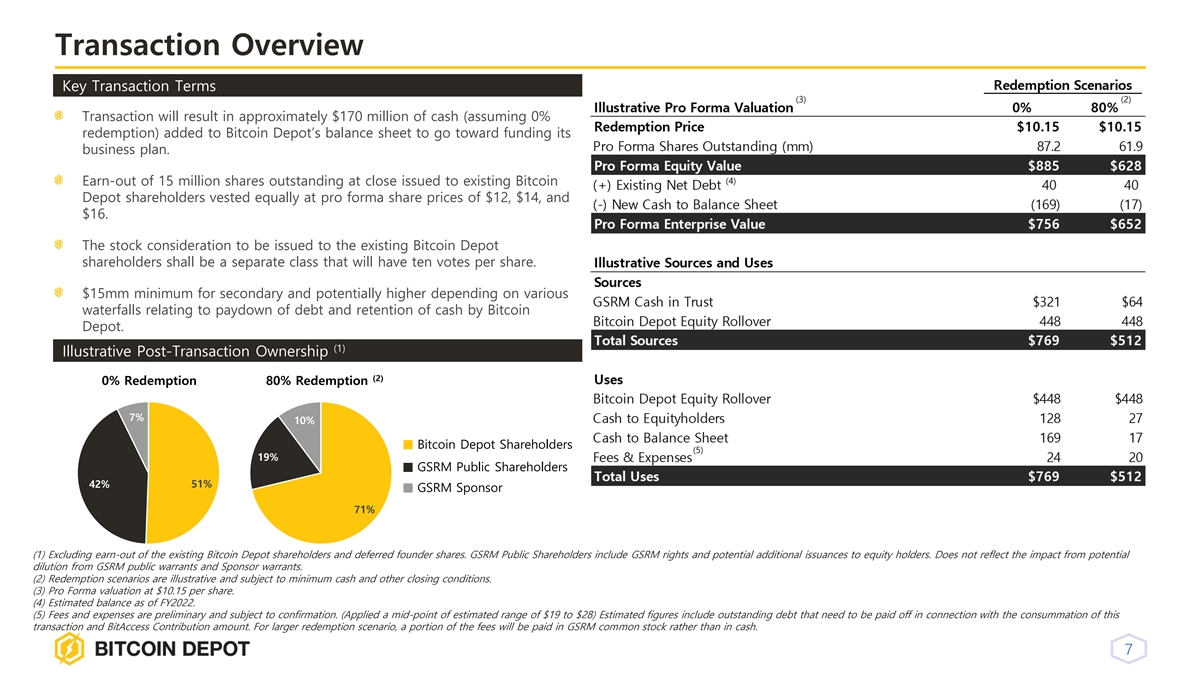

Moving on to the next slide, I’ll just briefly provide an overview of the transaction to set the stage. We entered into a definitive agreement

with Bitcoin Depot back in August of 2022. We remain on track to complete the transaction in the first quarter of this year, subject of course to regulatory and shareholder approval. This slide provides an illustrative summary which my colleague Lew

will get into more detail so suffice it to say we’re very excited about the transaction and with that, I’m very pleased to introduce Brandon Mintz, Founder & CEO of Bitcoin Depot.

Brandon Mintz – Bitcoin Depot (Founder & CEO)

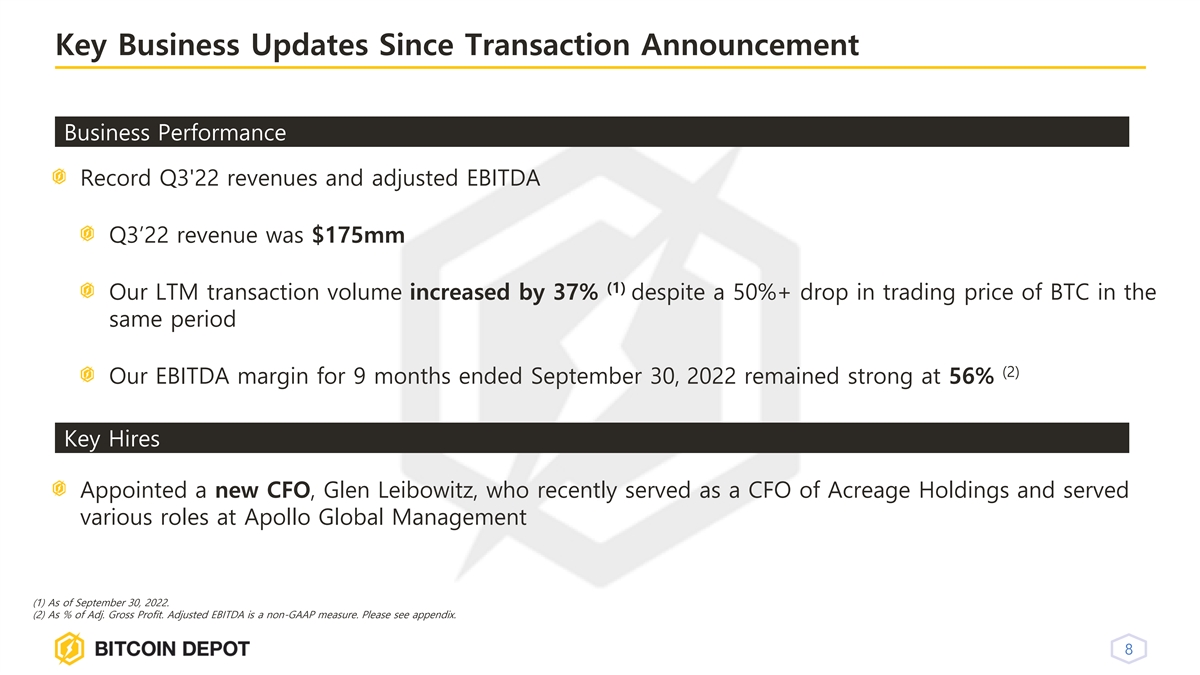

Slide 8:

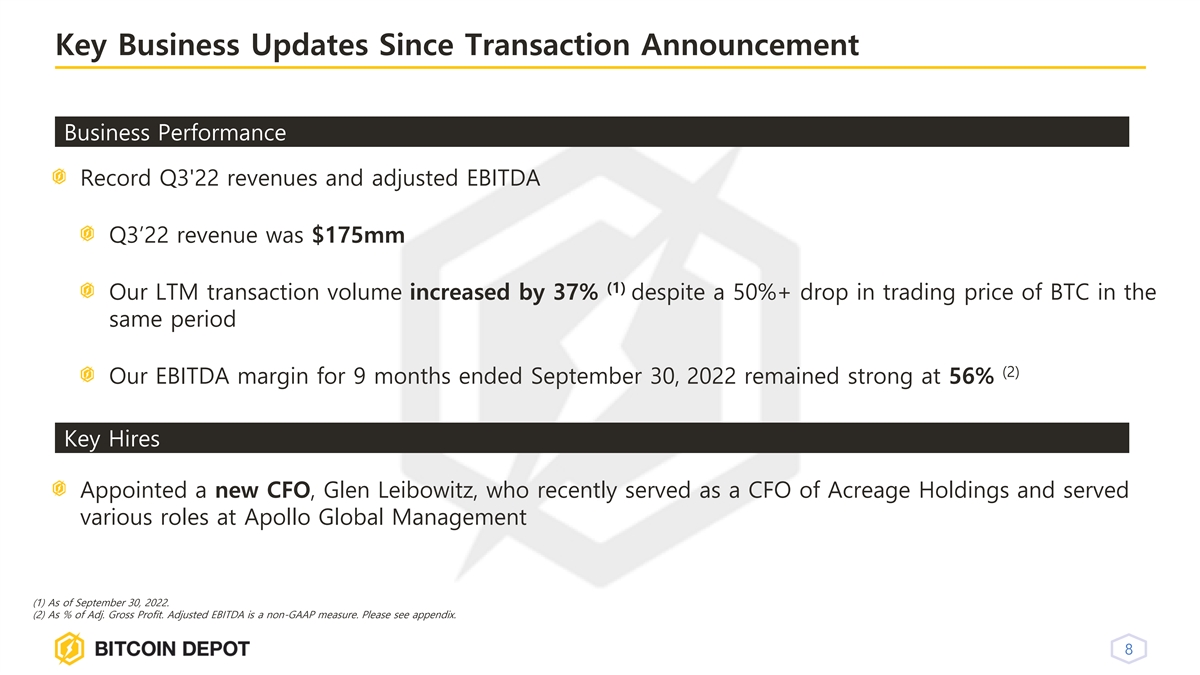

Thanks Gus and thank you everyone for joining

our investor day. We’re super excited to partner with the GSRM team and continue our mission of bringing Crypto to the Masses as a public company. And with that being said, I’m very happy as well to announce some of our Q3 22 results with

you which you can view on this slide. As you’ll see we produced very strong results even in light of extreme Bitcoin price volatility and decline during 2022. I’d also like to call out that we’ve recently appointed a new CFO, Glen

Leibowitz who just came from Acreage Holdings, a public company, and who also worked at Apollo Global Management and helped take them public over a decade ago.

Slide 10:

And with those recent developments in mind I’d like to give you a little history on how Bitcoin Depot was founded. Essentially once I had just heard about

Bitcoin I was very eager to buy it and I tried to buy it on a very well-known online exchange. I had a lot of difficulty in getting my verification approved, communicating back with support, etc. and ultimately after a few weeks I still didn’t

have my Bitcoin. I found another way to buy it with cash that was super easy, super quick, super convenient and removed a lot of the hurdles and frustrations that I had on the online exchange. So after discovering the solution and using it multiple

times, I wanted to bring this to a broader audience. And ultimately those events led me to start Bitcoin Depot in 2016 in Atlanta, Georgia with just a few machines and expand our mission of bringing crypto access to everyone. And therefore since

then, we’ve been trying to build the largest retail network of crypto access points possible.

Slide 11:

And here’s an overview of our executive team. They all have extremely deep industry experience and a few of them also have experience from Cardtronics,

which has really laid the foundation on how to complete M&A in the ATM space. So I’m very happy to have this experience on board and I think it’s going to be extremely useful for us in our consolidation strategy as a public company.

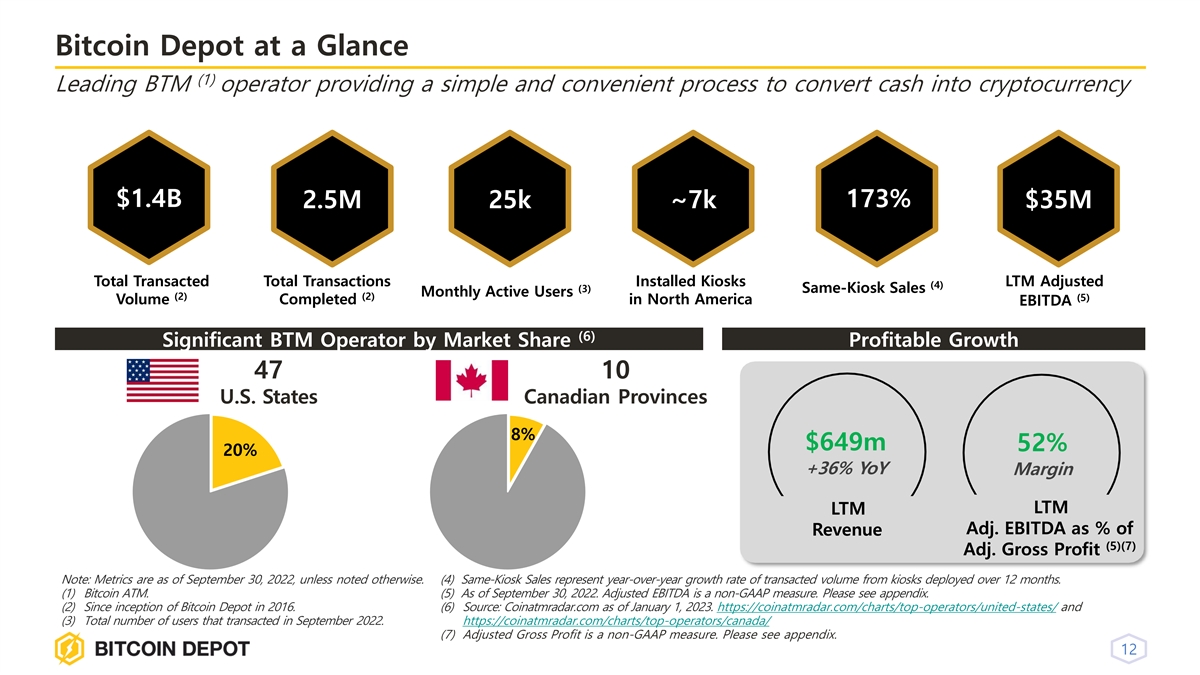

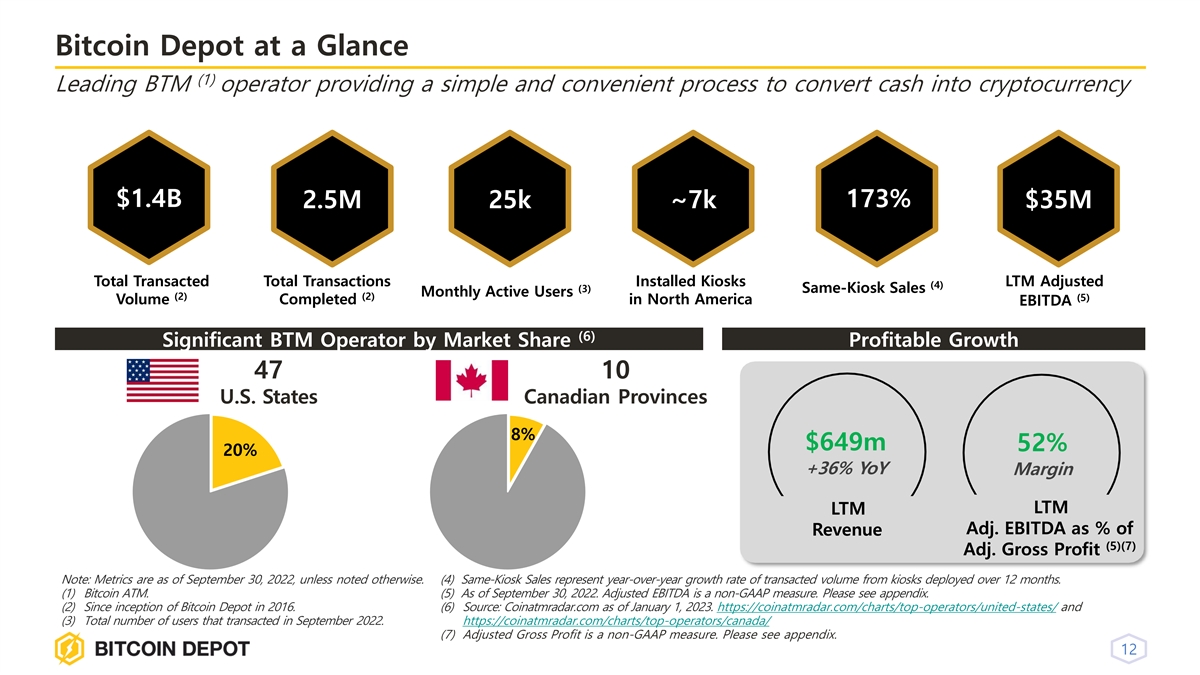

Slide 12:

This slide represents a snapshot of the

business with some interesting stats. Of course, you’ll notice we have 7,000 Bitcoin ATMs that are very widely distributed across the US and Canada with still potential to expand further in those markets and we’ll get into that opportunity

on a later slide. But you’ll also notice we’ve done nearly $1.5 billion and transaction volume since the company was founded with close to half of that $649 million happening in the last 12 months ending in Q3. And of course,

we’ve maintained our very strong margins as well at 52% you’ll see on the bottom right. We’ve also had very strong EBITDA in the last 12 month period ending in Q3 ending at $35 million.

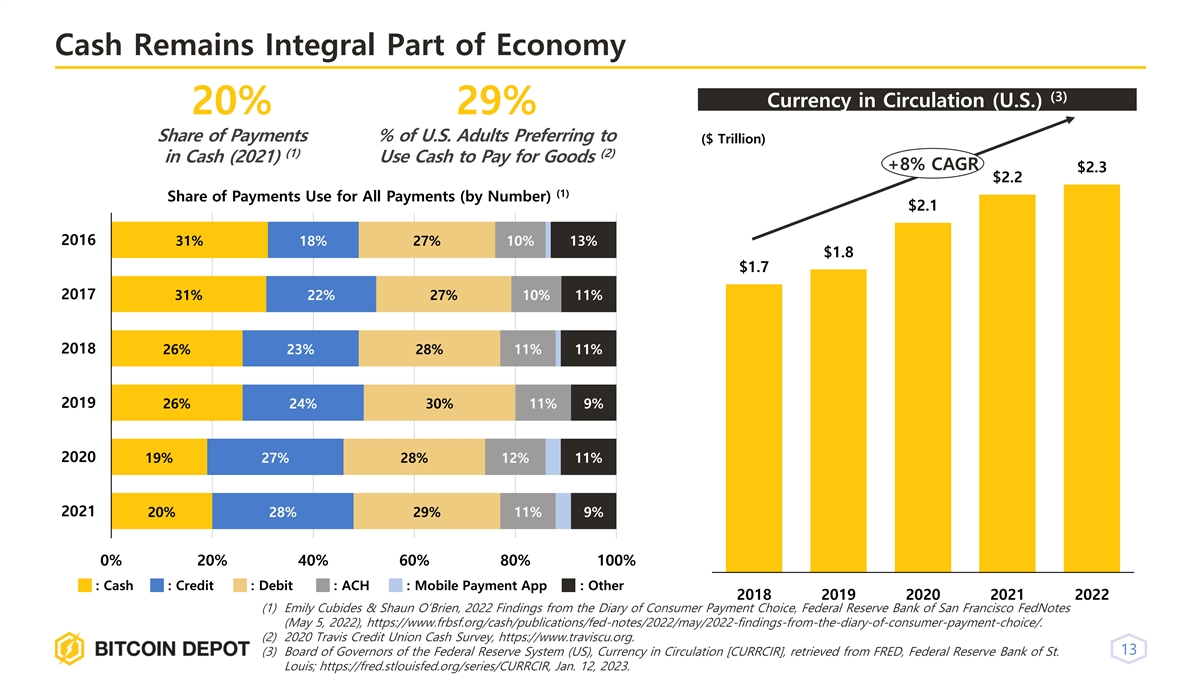

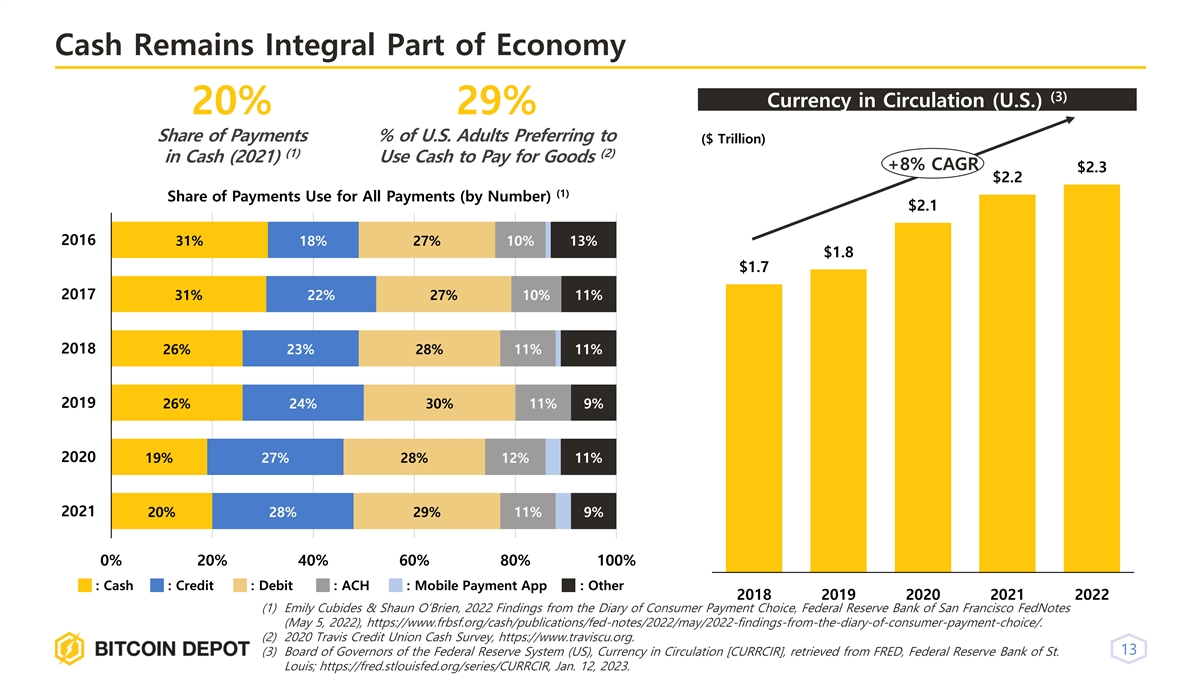

Slide 13:

Here’s some really interesting stats on

cash usage in the US. Contrary to certain beliefs, cash usage has actually increased 2021 versus 2020 at 20% of all payment transactions in the US and cash in circulation has also increased over recent years.

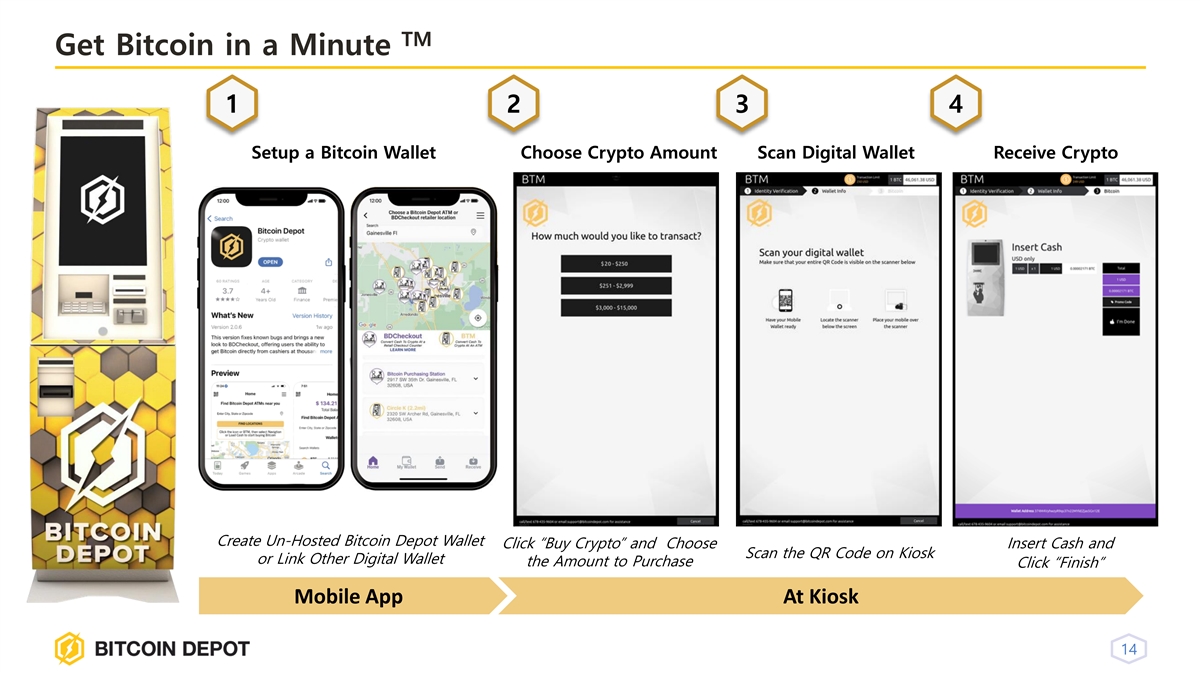

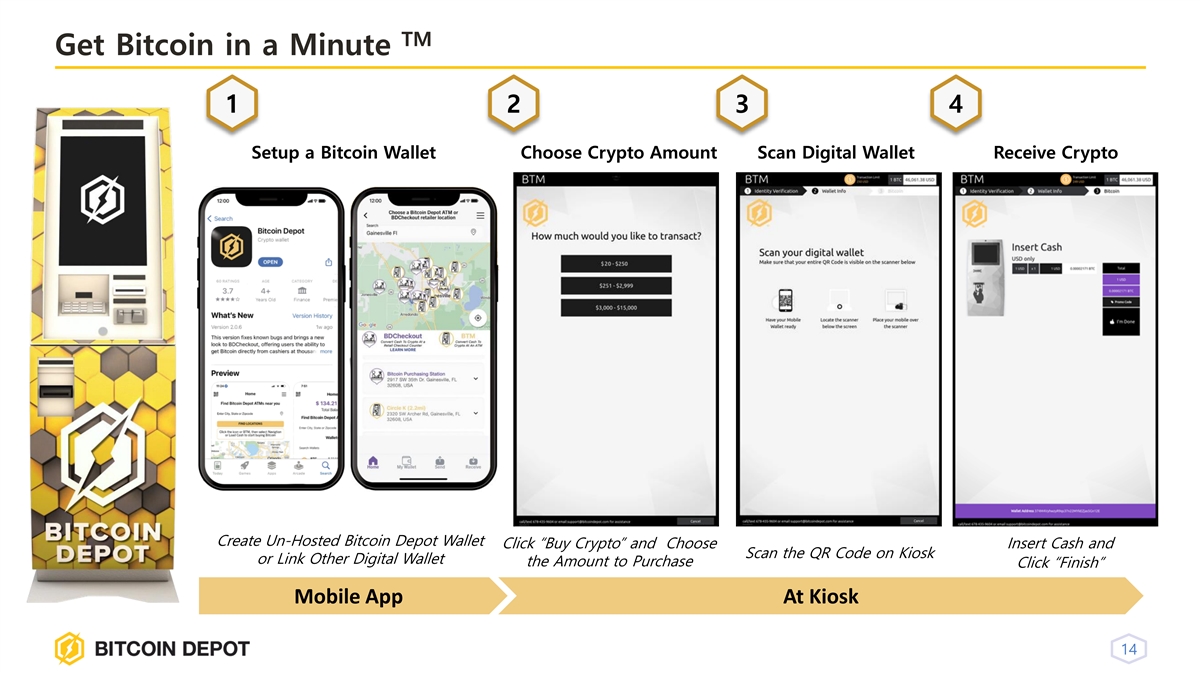

Slide 14:

And here is an illustrative overview on how

transactions are completed at our Bitcoin ATMs. It’s as simple as downloading the Bitcoin Depot Wallet app or any other bitcoin wallet app of your choosing. But we of course recommend the Bitcoin Depot wallet because it is completely

self-custodial. Bitcoin Depot does not maintain custody of user’s funds with this wallet. And regardless of what happens with Bitcoin depot as a company, that users funds can remain a lot safer versus other custodial options. But when you have

our wallet app, you’ll see all of our locations. You’ll see your BDCheckout locations, which is our no hardware solution to buy Bitcoin with cash that we’ll get into on a later slide. And you’ll see all of our Bitcoin ATM

locations. And once you find a location for a Bitcoin ATM do of course go there and you will complete the steps on the screen and one of the first steps is to choose the tier for

the amount you would like to purchase. And, and the reason why we have these tiers is because the KYC requirements vary per tier, and they get more sophisticated the higher amount somebody

purchases. So once you select how much you’re going to buy, you’ll then open your Bitcoin Depot Wallet app or the other app of your choice. You’ll open the QR code displayed on the screen you’ll scan it at our Bitcoin ATM,

you’ll insert cash and Bitcoin will be on the way to your wallet immediately and the whole process only takes about one to two minutes.

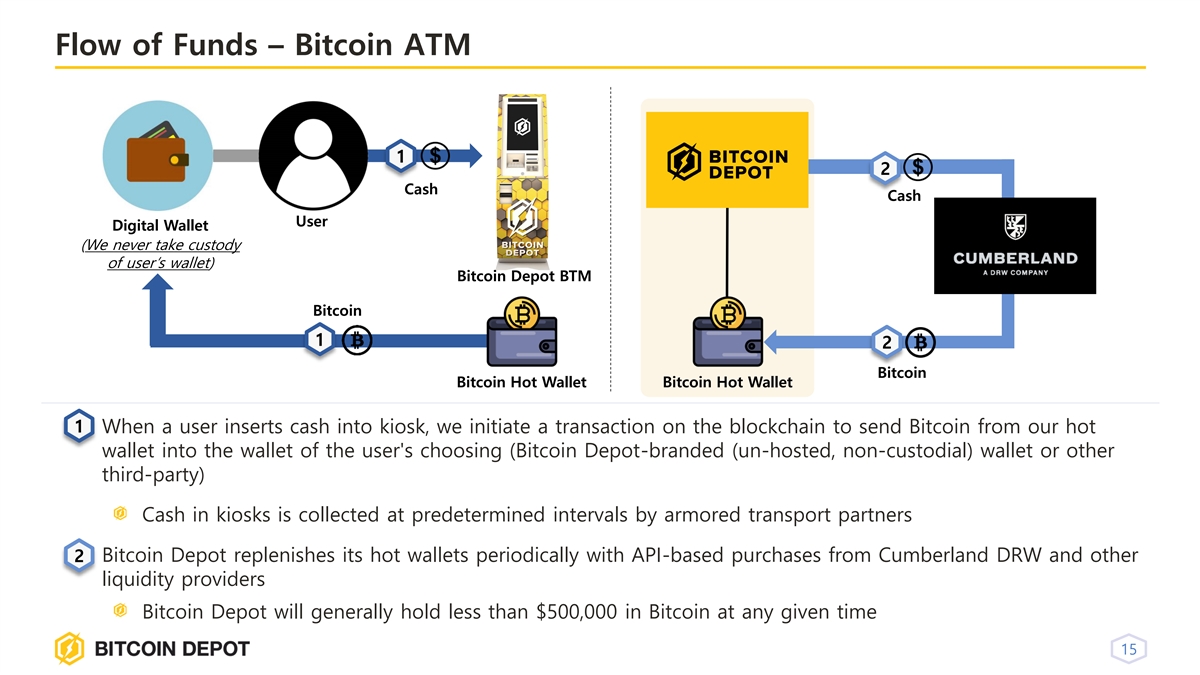

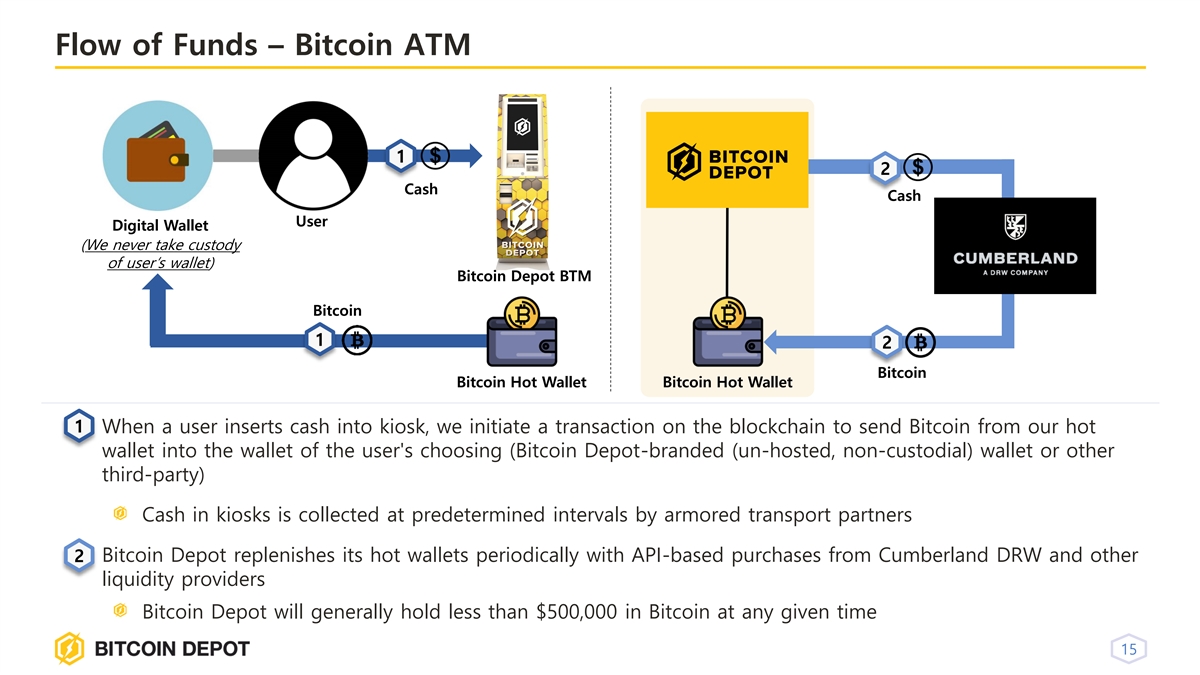

Slide

15:

On this side you’ll see an overview of our flow of funds. What’s very important to note is again that Bitcoin Depot does not hold

custody of any of our user’s funds. We only hold a small inventory of Bitcoin that we replenish throughout the day. It’s typically less than half a million dollars at any given time. And as transactions come in, and Bitcoin is sent to our

users, we replenish that hot wallet continuously throughout the day in very small increments through an API with our trading partner, Cumberland that you’ll see on the screen. So it allows us to take advantage of dollar cost averaging

techniques and really reduce our price exposure to Bitcoin.

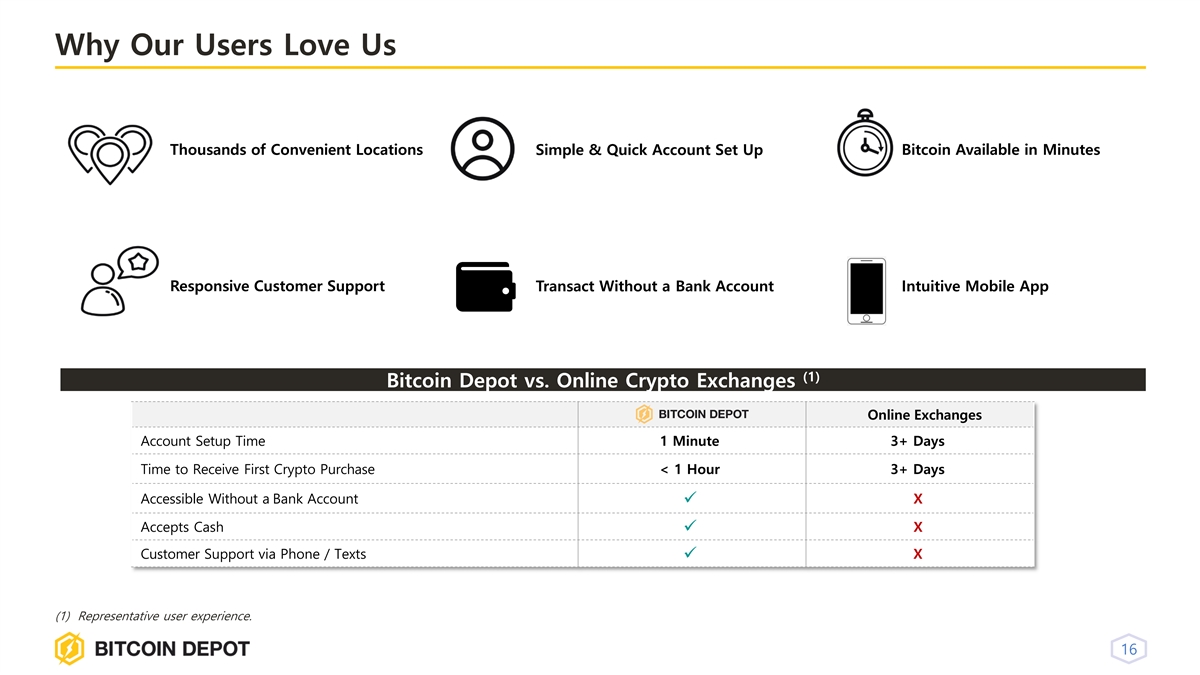

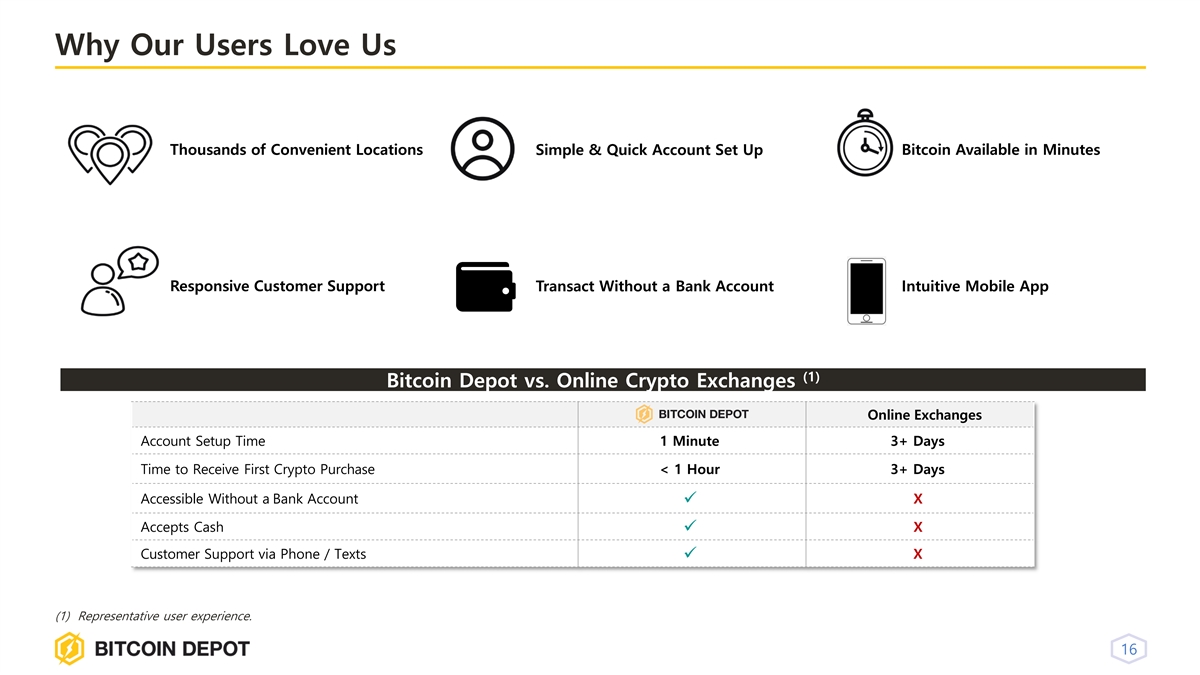

Slide 16:

On this screen, you’ll see many other reasons on why people like to use Bitcoin Depot. Most importantly it’s one of the only methods that allows

users to buy Bitcoin with cash and super convenient over 15,000 locations. 7,000 of them being our Bitcoin ATMs and over 8,000 being our BDCheckout locations. We also offer amazing customer support that is very quick to respond over email, over

text, or phone calls and chat so we really provide a more personalized and quick experience than a lot of the other industry options.

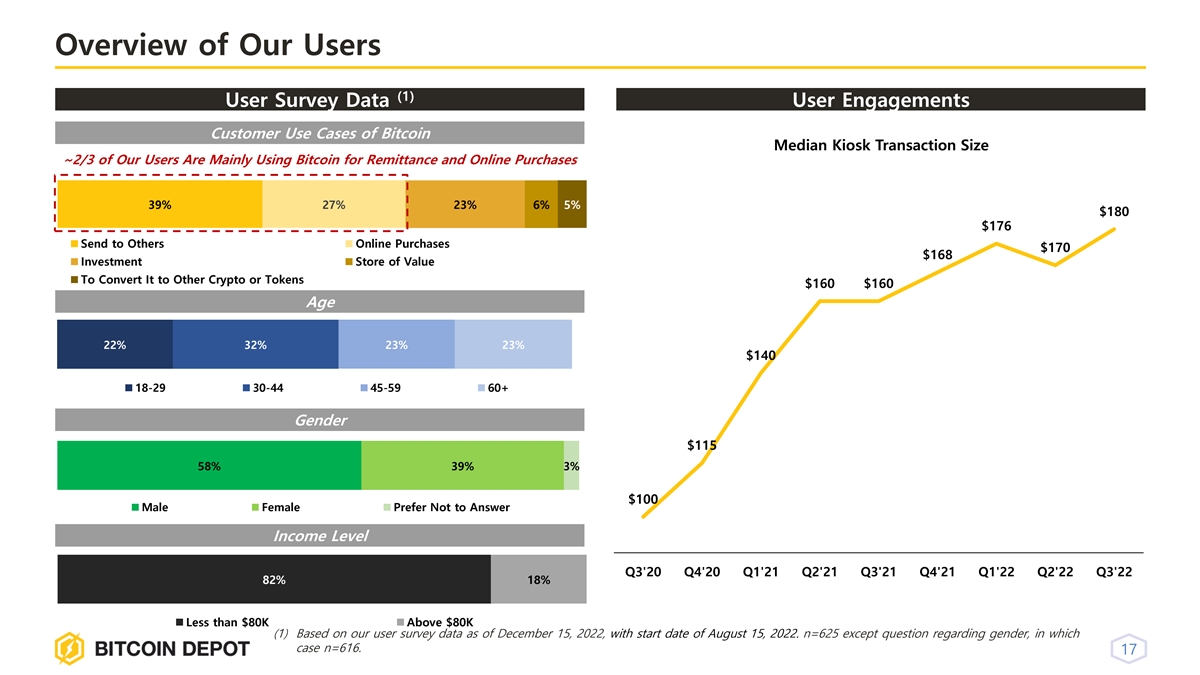

Slide 17:

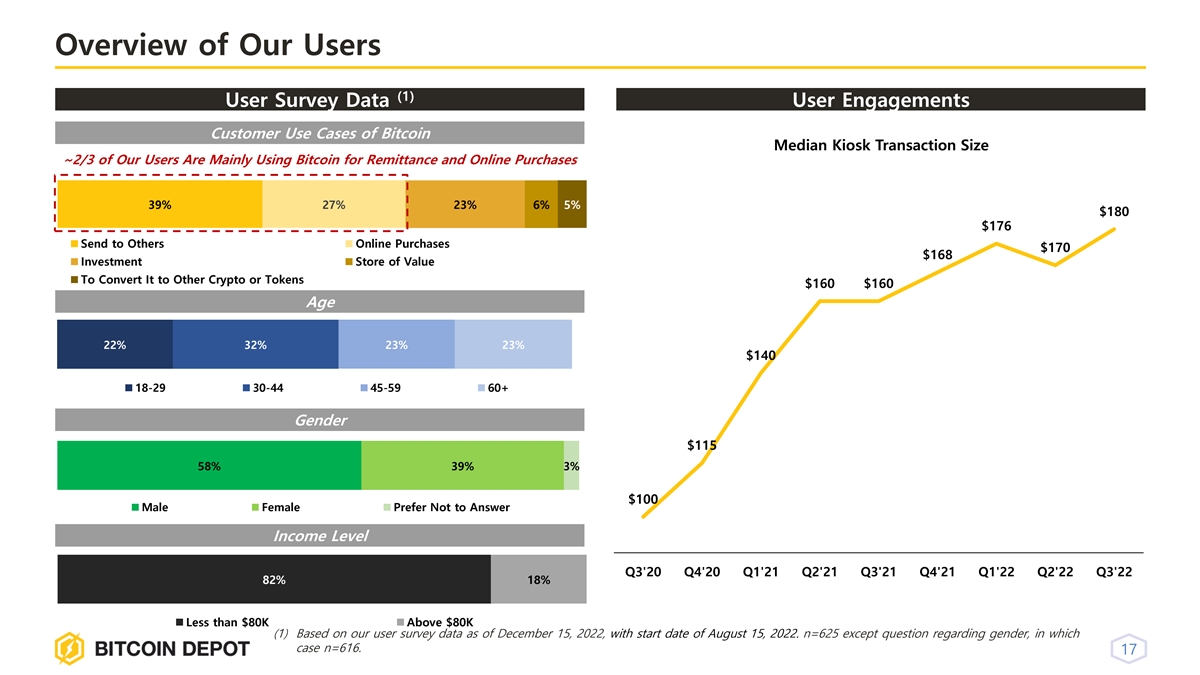

And here’s a slide showing some of our survey data and this is direct data provided from users that have completed transactions with us. You’ll

notice on the top left that between online purchases and money transfer or remittances, about two thirds of our users who answered these surveys say that they’re using Bitcoin for these purposes. So it really just shows that the customer base

for Bitcoin Depot ATMs are very different than that of an online exchange. We have a lot less people using Bitcoin ATMs and therefore Bitcoin for investment in store of value and converting to other cryptocurrencies versus a lot of other online

options. And on the right, you’ll notice our median transaction size has increased quite rapidly over the past couple years and that has translated to very strong revenue growth as well.

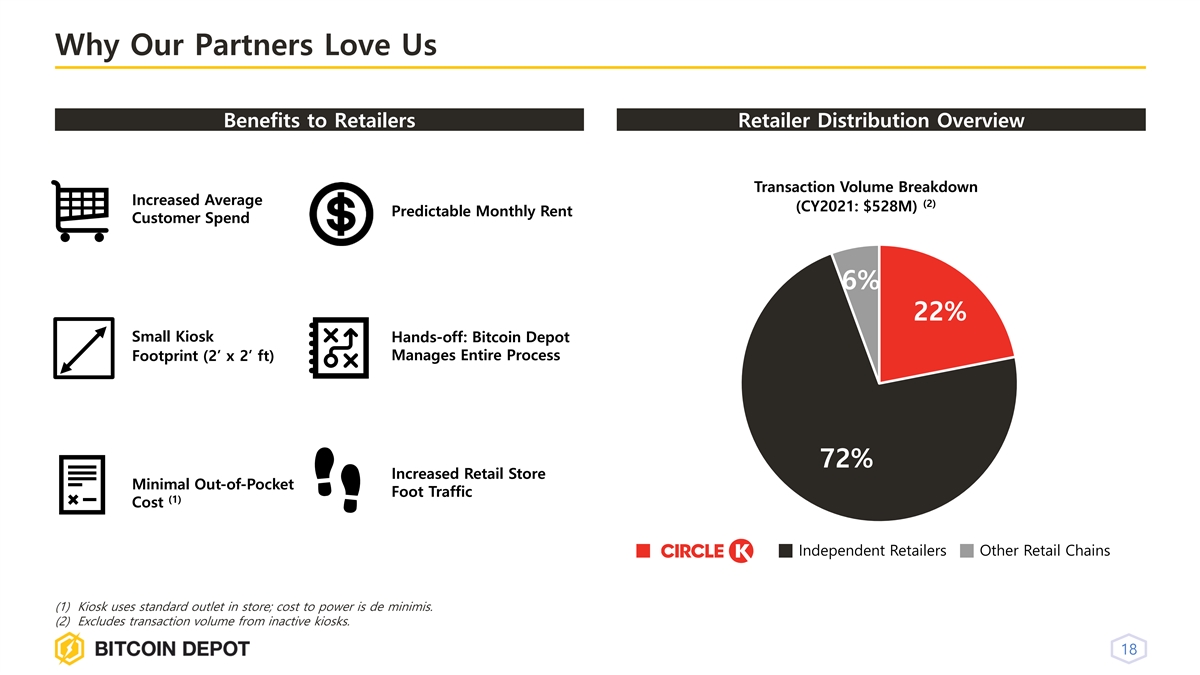

Slide 18:

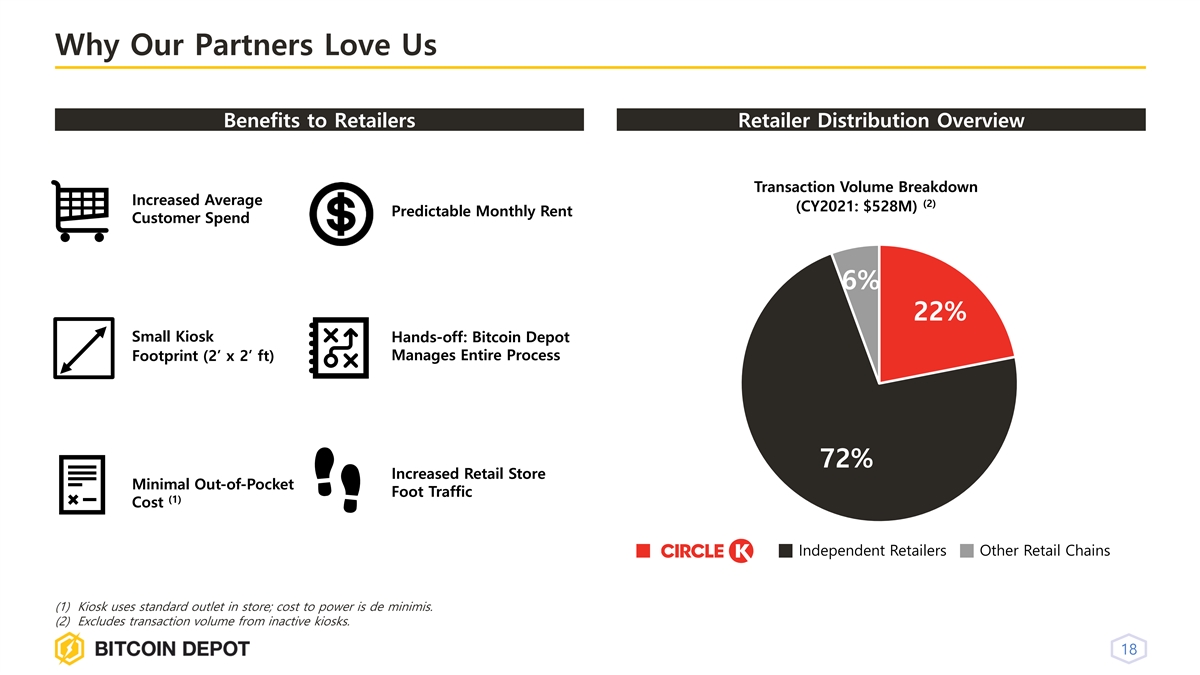

And here you’ll see a lot of the reasons

why retailers love working with Bitcoin Depot. One thing unique about our business model versus almost every other products and convenience and grocery store is that we typically pay a flat monthly rent to these retailers, regardless of the

performance of our Bitcoin ATMs. And so this really allows that retailer to understand the value that they’re going to receive for the space they provide. All they’re providing besides the space is just a power outlet and that’s

it. Our Bitcoin Depot ATMs are completely turnkey and we manage absolutely everything else. Of course another benefit that we provide to the retailers is the digital marketing that drives in the foot traffic that ultimately uses our Bitcoin

ATMs. And it’s possible that the foot traffic that is our customers also becomes customers of that retailer buying other products and using other services and their stores.

Slide 19:

We also take compliance extremely seriously and it’s one of our biggest differentiators in house we have 13 full time compliance people with some

additional personnel as contractors and combined we have over 100 years of compliance experience and this really helps us implement and manage the day to day processes from our AML Compliance Program, which includes monitoring transactions reporting

on potentially suspicious activity, responding to law enforcement requests, and supporting our operations.

Slide 20:

Here’s just a little bit more information on our compliance program and what exactly we do. It’s important to note that all of our transactions are

screened against various sanctions lists, including the OFAC list. Some of you are familiar CTRs which is what banks file when customers complete transactions of $10,000 or more. We have those same requirements and are required to report those

transactions as well. We also complete blockchain monitoring that allows us to see where the Bitcoin is being sent to on our IRS transactions. And we even employ advanced tools like case management to help organize your data as well as proactively

report suspicious activities.

Slide 22:

This slide

is really an overview on some of the highlights that we’ve touched on so far. Of course, the adoption of cryptocurrencies has grown dramatically over the past few years. And that’s really helped our business as well and helped us increase

revenues to allow us to grow to where we are today at roughly 7,000 Bitcoin ATMs. And one thing really unique about this business in this business model as well, compared to a lot of other targets of SPAC is that we have really strong

historical growth and profitability and our transaction volumes have historically not been correlated to the price and volatility of Bitcoin and many other cryptocurrencies. There’s also a ton of growth opportunities for us both organically and

inorganically through existing partnerships, like Circle K, for example. We’re in close to 2,000 of their stores today, but they have 15,000 stores globally. So we’ve already laid the foundation for growth ahead with the existing retail

relationships that we have with them and plenty of others. And with our new products BDCheckout being so scalable and being able to get into over 8,000 retail locations in just a few months there’s an opportunity to expand our partnerships

there with various payment processors and various retailers. And most importantly, is the conduct consolidation opportunity in front of us with so many operators in the space and the space being very fragmented with our vertically integrated

platform of owning our own software we think there is an enormous opportunity in front of us to roll up our competition and bring more and more Bitcoin ATMs in house on our existing software and lastly, international expansion. About 95% of all

Bitcoin ATMs in the world are in the US and Canada. And the international market is virtually untapped. So we think in the coming years, there’s a really good opportunity for us to expand outside of North America.

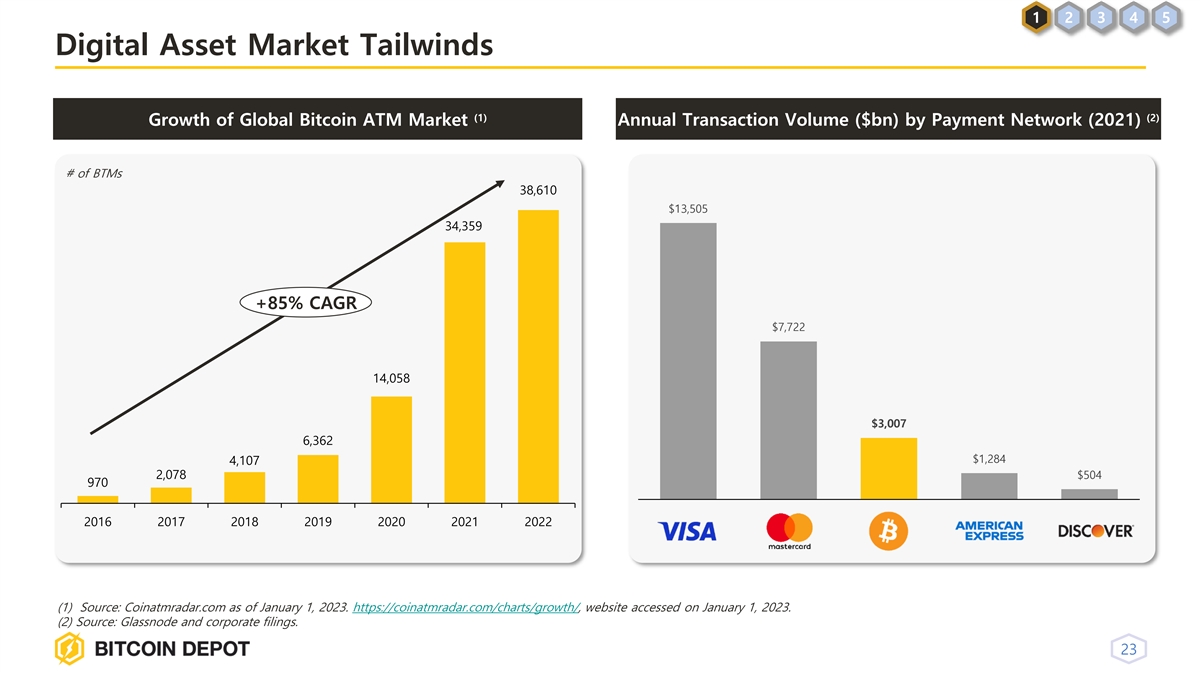

Slide 23:

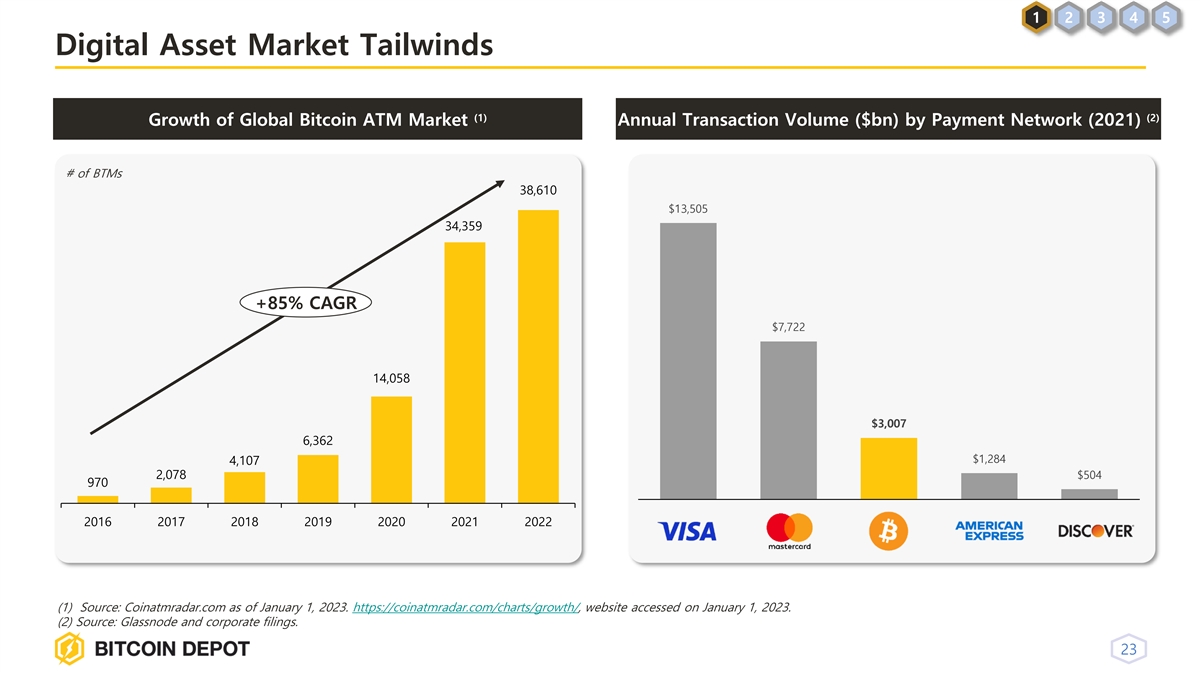

On the left side, you’ll see some of the

growth here of the entire Bitcoin ATM market over the years. It’s grown considerably fast and some estimates say it’s even grown faster than when ATMs first came out. And at this growth rate, it’s very possible that Bitcoin ATMs will

be as prevalent as cash ATMs within the next decade or so. And on the right side, you’ll see the annual transaction volumes of some of the largest payment networks in 2021. And you’ll notice that Bitcoin was actually processing more

transaction volume than both AmEx and discover combined.

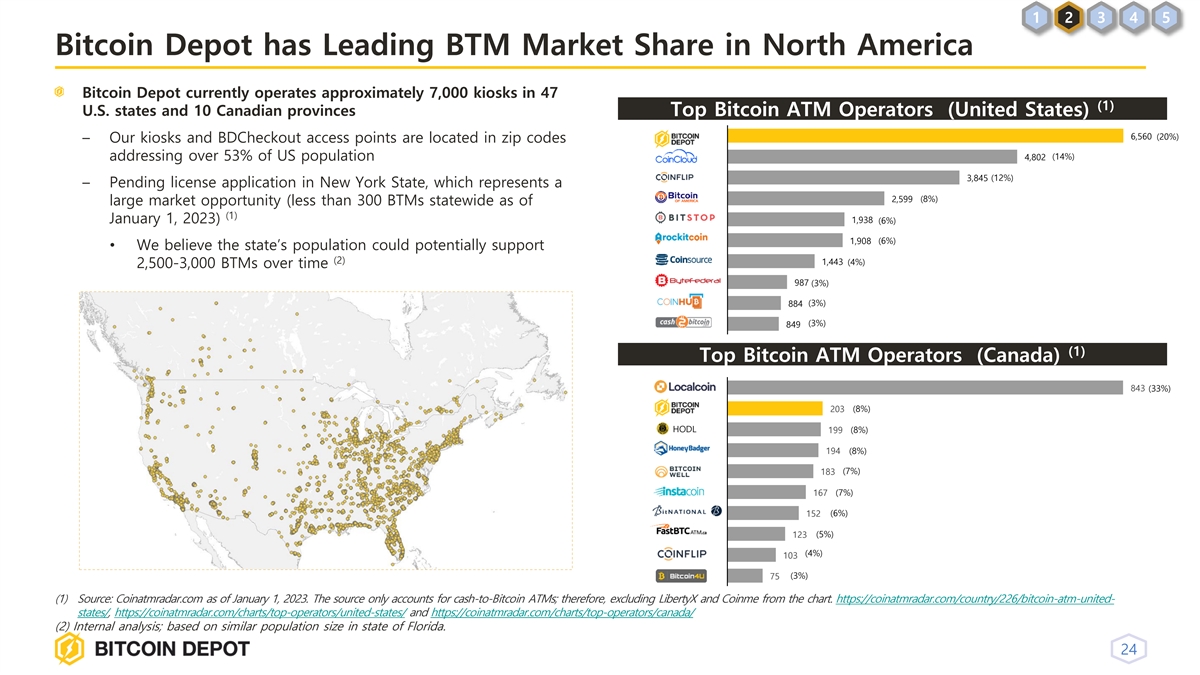

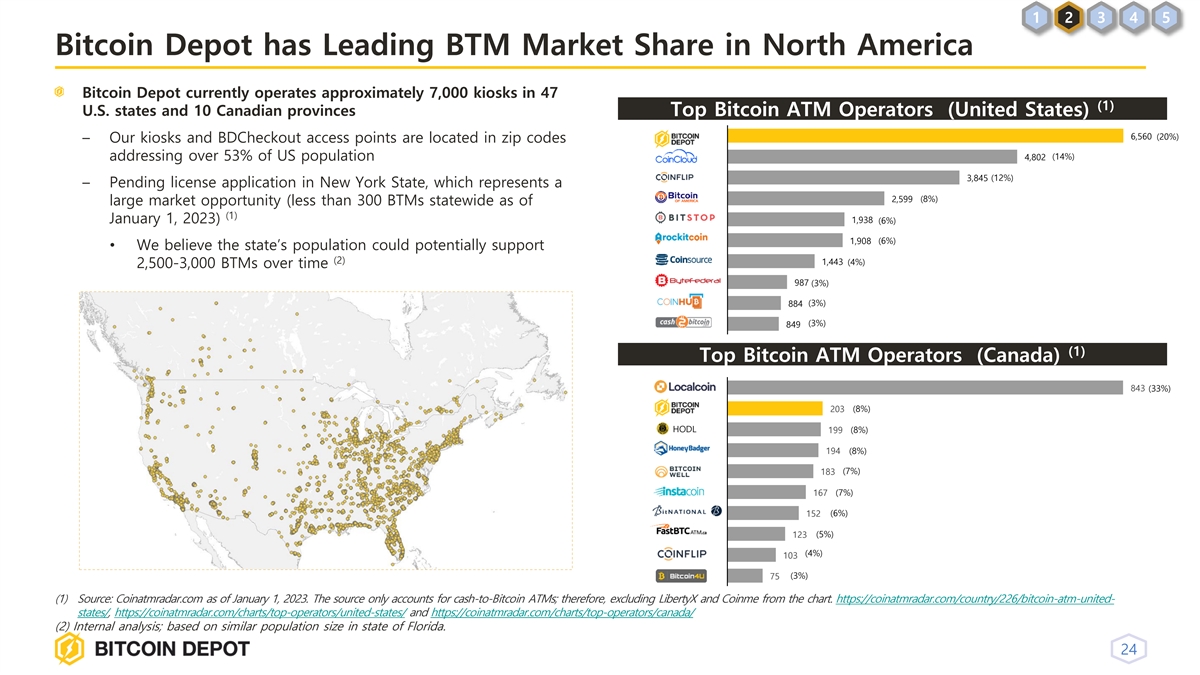

Slide 24:

On this slide, we highlight an attractive opportunity within the state of New York. This is where we’ve applied for a money transmitter type license

called Bitlicense. We currently have no estimates on being approved for that license, but we think it could happen at some point in the near future. However, we do believe that the New York market is very under supplied with Bitcoin

ATMs. Today, there’s less than 200 Bitcoin ATMs in New York. And if you look at Florida, which has roughly the same population as New York State, there’s over 3,000 Bitcoin ATMs. So this kind of tells us that there’s a lot

of potential demand for our products in New York State and we hope to be able to expand there at some point in the future. And on the right side, you’ll see the top 10 Bitcoin ATM operators in the US and Canada. And this is really just to give

you an idea of how large some of these other players are and where we can potentially expand our reach in addition to consolidating other smaller Bitcoin ATM operators as well.

Slide 25:

Here we highlight our relationship with Circle

K, like I mentioned on the previous slide we have close to 2,000 Bitcoin ATMs at their stores, and they’ve been extremely pleased with this program. It was a pretty competitive environment when we were first bidding on this contract and Circle

K called out they were very impressed with our compliance program and our ability to prove our scalability to that as well. And that ultimately led them to choose us as an operator, and you’ll see a quote from one of their most senior

executives on this slide and on the right you’ll see some descriptions of some of the other major retailers we work with as well.

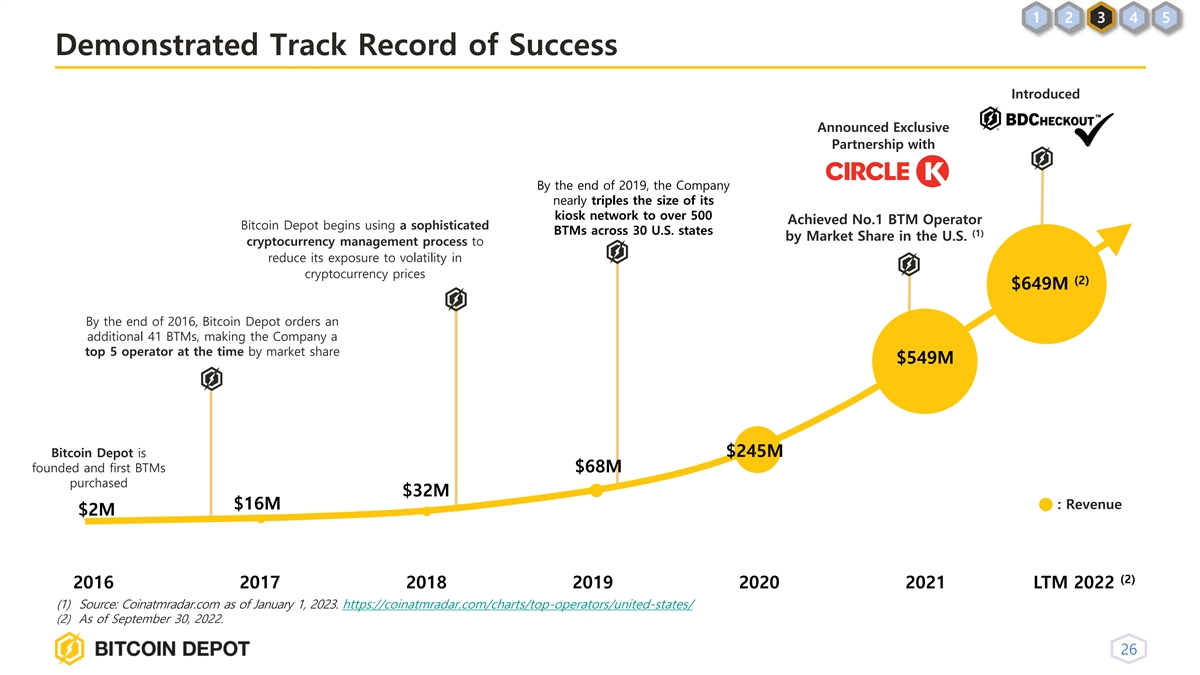

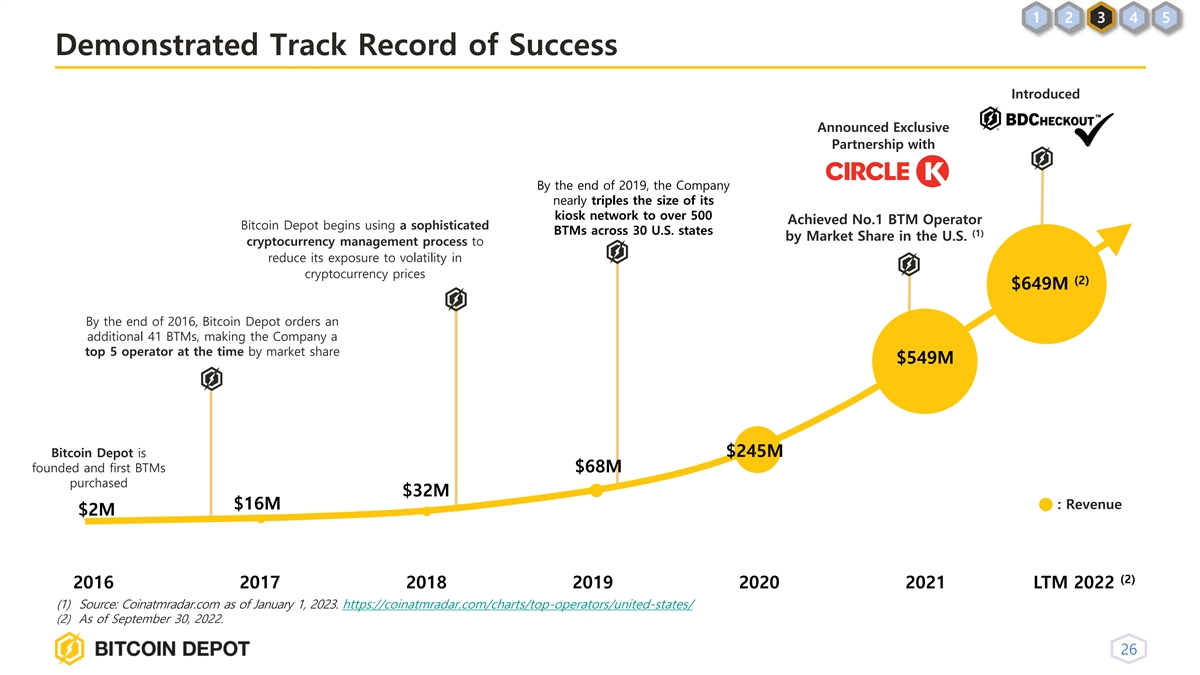

Slide 26:

On this slide, you’ll get an illustration of our revenue growth over the past few years and some of the important milestones that I’ve already

mentioned. But you’ll see we really kind of skyrocket in the past couple of years since 2020. And with that being said, I will pass it over to our COO Scott Buchanan to walk you through the business performance, the new product I touched on

BDCheckout, as well as our financials.

Scott Buchanan – Bitcoin Depot (COO)

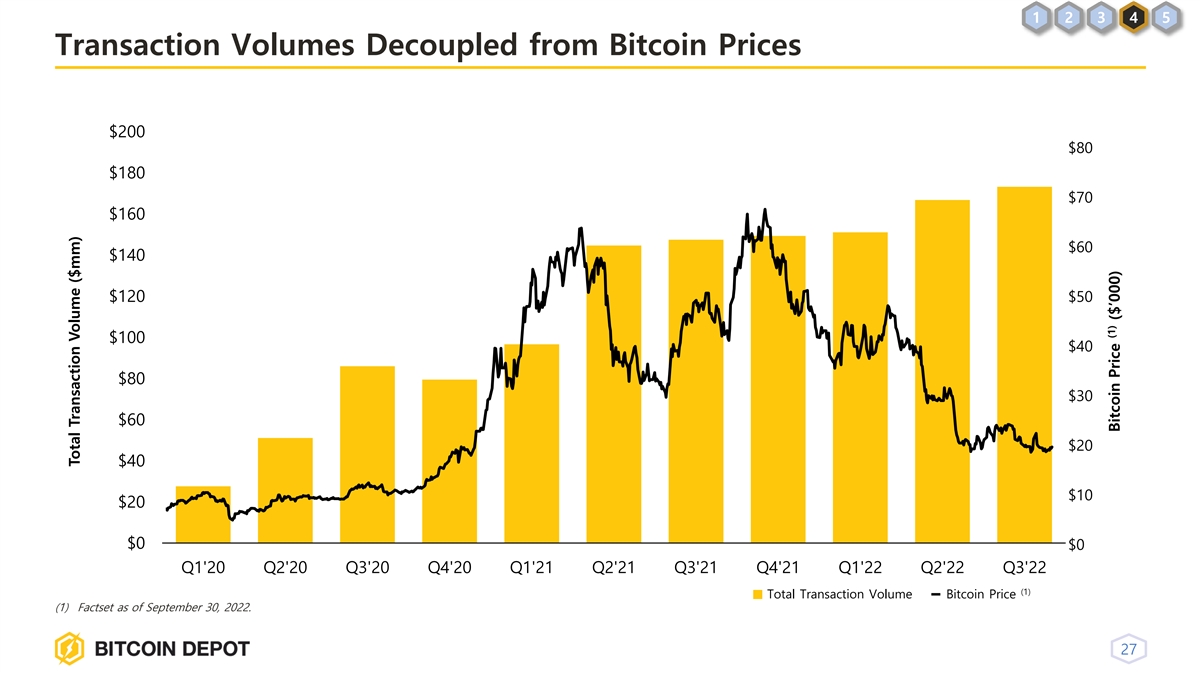

Slide

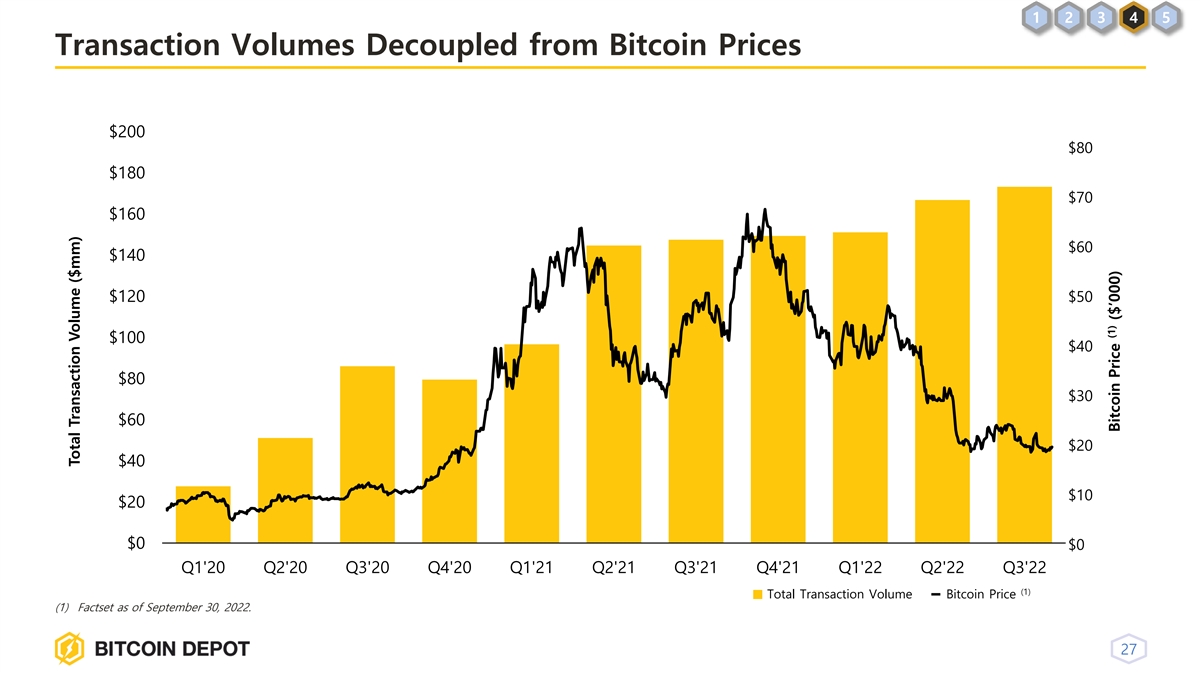

27:

Thanks, Brandon. The slide highlights how our transaction volumes have remained strong despite the volatility in the price of Bitcoin. If you look

at our historical transaction volume, it hasn’t been correlated to the overall price of Bitcoin. And as Brandon touched on earlier, this is driven by the various use cases for Bitcoin that our users purchase, such as remittance, money transfer,

online purchases, which make us less susceptible to the price movements of Bitcoin compared to other exchanges, where their customers are largely buying for price volatility and upside.

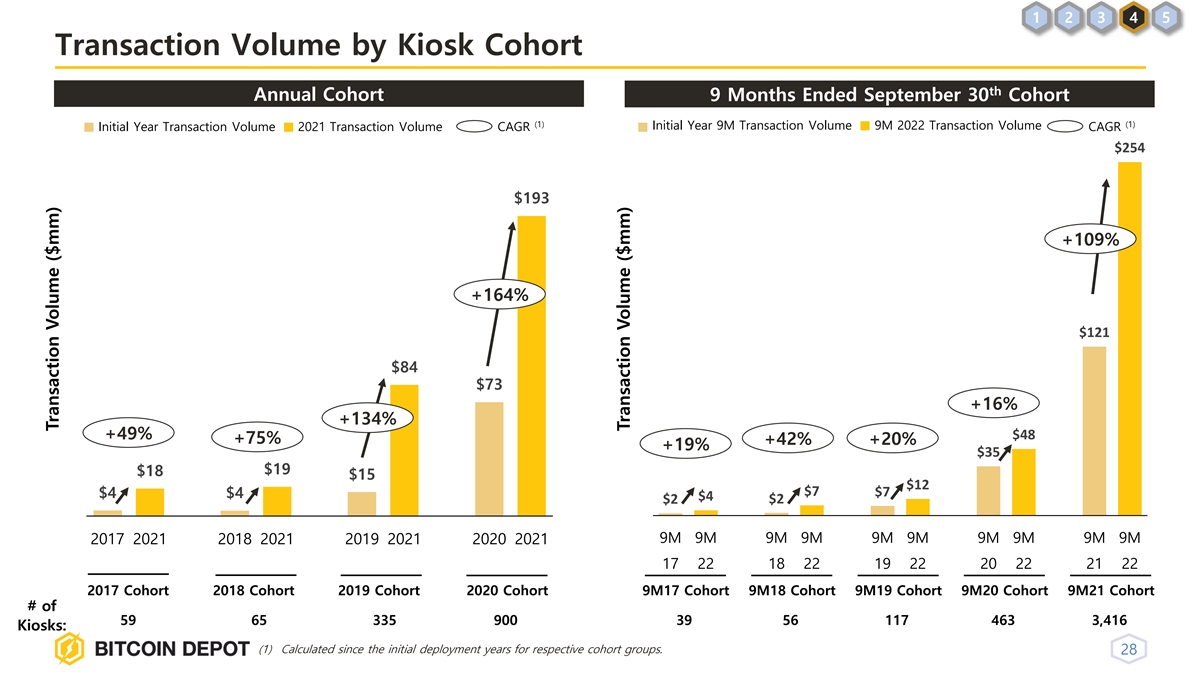

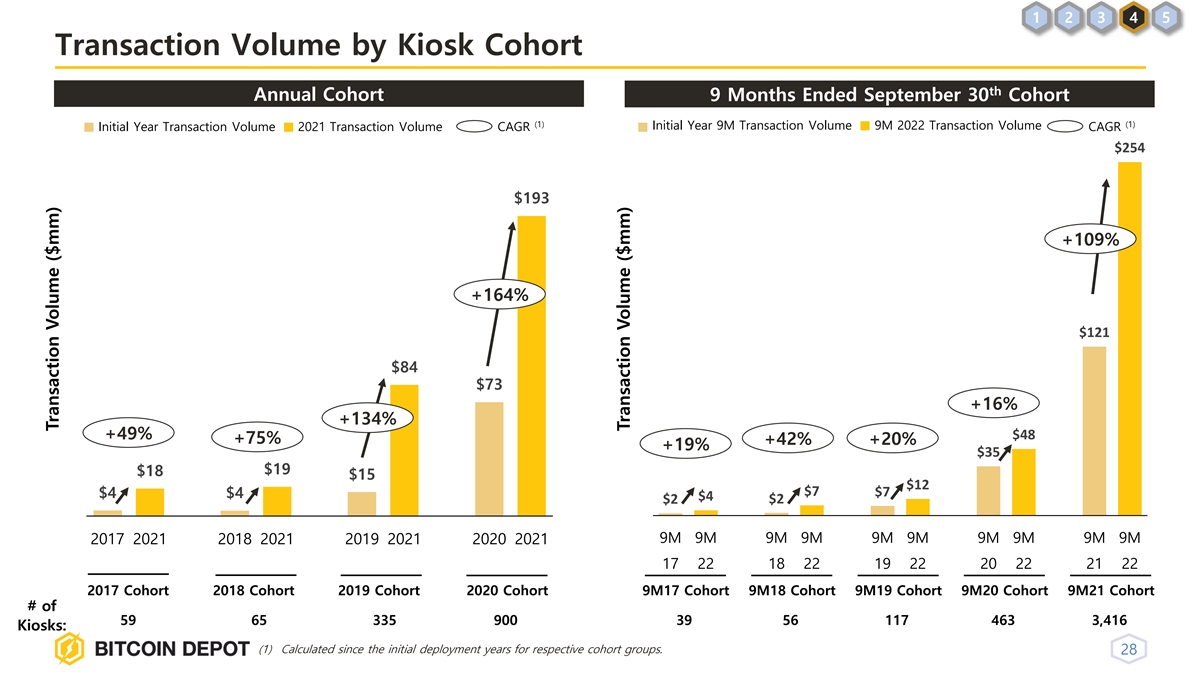

Slide 28:

On this slide, we wanted to highlight our

current user cohort analysis. So one of the questions we always get is how much of your growth is driven by the deployment of new kiosks but if you look on the left hand side, you can see that in 2020, we deployed 900 kiosk and those kiosks grew

substantially from their first year in operation in 2020, to the volume that they had in 2021. And this is a trend we continue to see with our new deployments in 2022 as well, where we see kiosks ramp up in volume over time as they continue to

attract customers and generate additional volume.

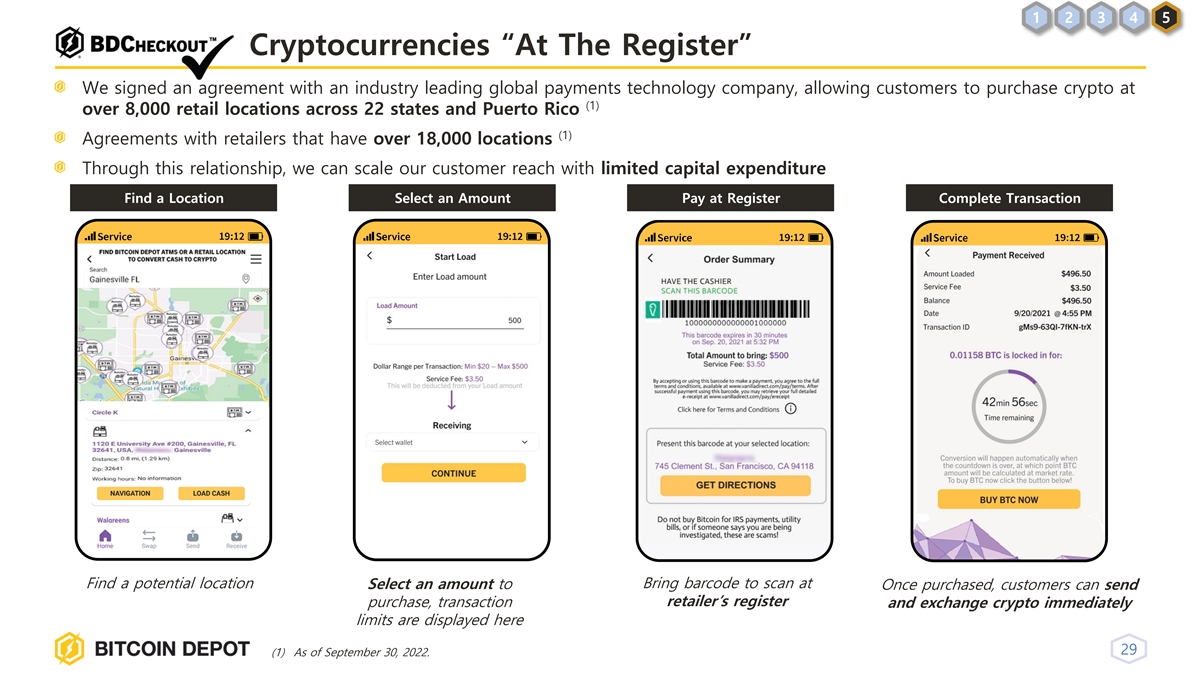

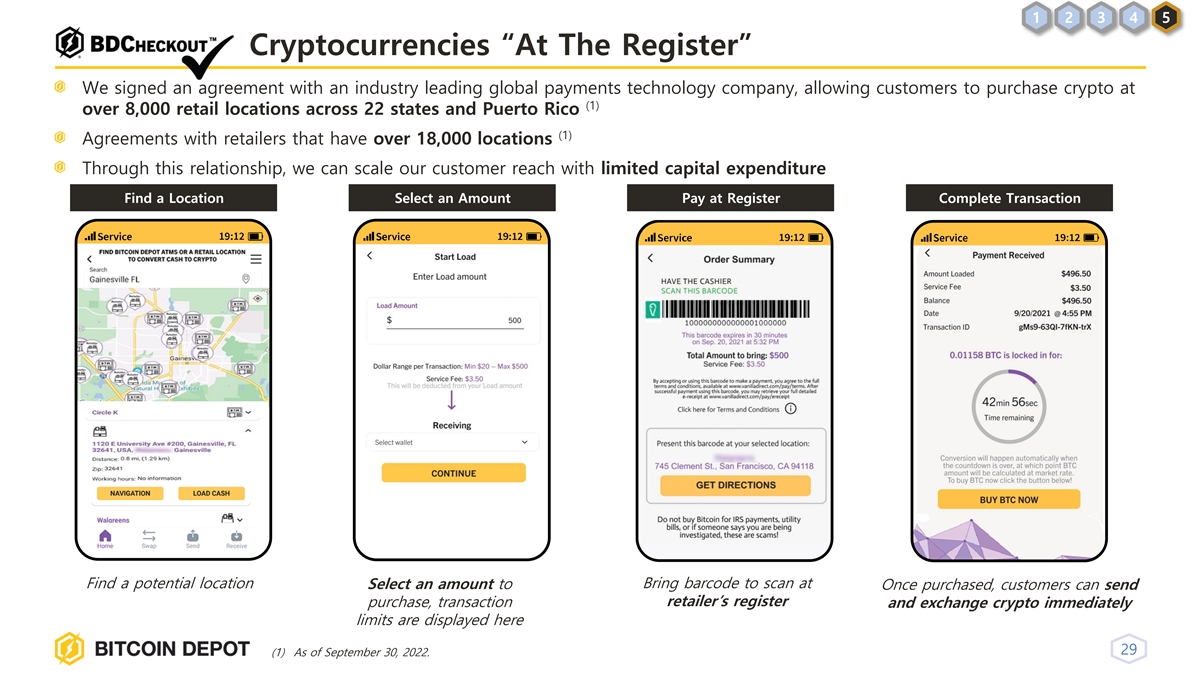

Slide 29:

On this slide, we highlight BDCheckout. As Brandon mentioned, this product allows customers to load cash to their digital wallet, where they can purchase

Bitcoin right at the counter at participating retailers. This product is currently in over 8,000 locations and it doesn’t require us to deploy a physical kiosk and this partnership with a leading global payments supplier company. This process

of BDCheckout is really straightforward. You just download our mobile app, you generate a barcode on the app and you scan it at the retail counter to checkout and this allows users to purchase cryptocurrency and many more locations than just where

we have kiosks deployed that’s allowing us to reach numerous customers much more quickly than we could through deploying kiosks alone.

Slide

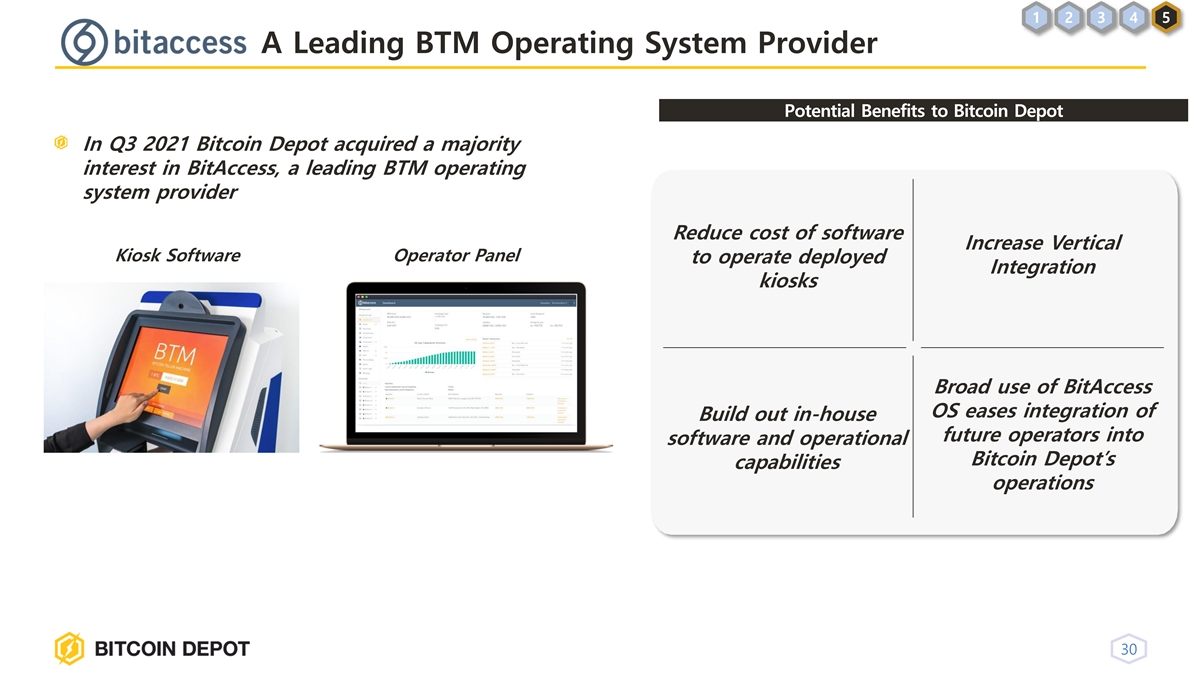

30:

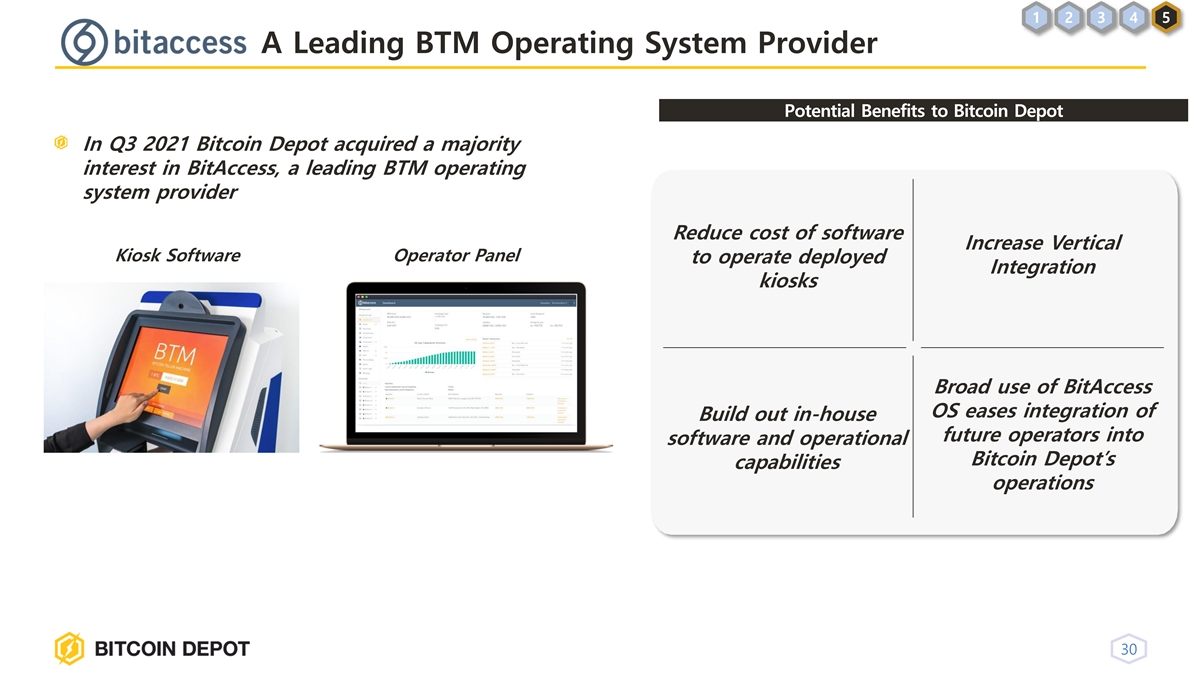

Another big recent development for us was our acquisition of BitAccess, BitAccess is a leading Bitcoin ATM operating software provider, and they

provide operating software to us and many other operators of Bitcoin ATMs around the world. The strategic acquisitions allowed us to own our software platform expand the product offerings significantly adding features to the kiosk. This is going to

continue to be strategic for us as we evaluate potential M&A activity, as well as expanding the use of BitAccess software platform for other operators. And we’re going to benefit from this economies of scale as we focus on our M&A

strategy and roll up other competitors with this technology.

Slide 31:

On this slide, we highlight some of the future growth opportunities including adding credit and debit functionality to the kiosks since currently they’re

focused on cash to crypto. We also believe there’s opportunities for international expansion as Brandon touched on earlier with North America currently being the vast majority of all Bitcoin ATMs. And then we’ve also got a focus on

industry consolidation, which we’ve highlighted a few times. There are operators in the space that we regularly evaluate for potential opportunities regarding our competitors and we believe there’s a lot of interest for the consolidation

of the space going forward. We’re also looking to add additional consumer facing financial services so we can continue to serve our core customer basis. And we’re always exploring new opportunities for our customers to use our kiosks with

additional functionality. And lastly, with the BitAccess, acquisition, we’re focused on offering other software products b2b to other Bitcoin ATM operators.

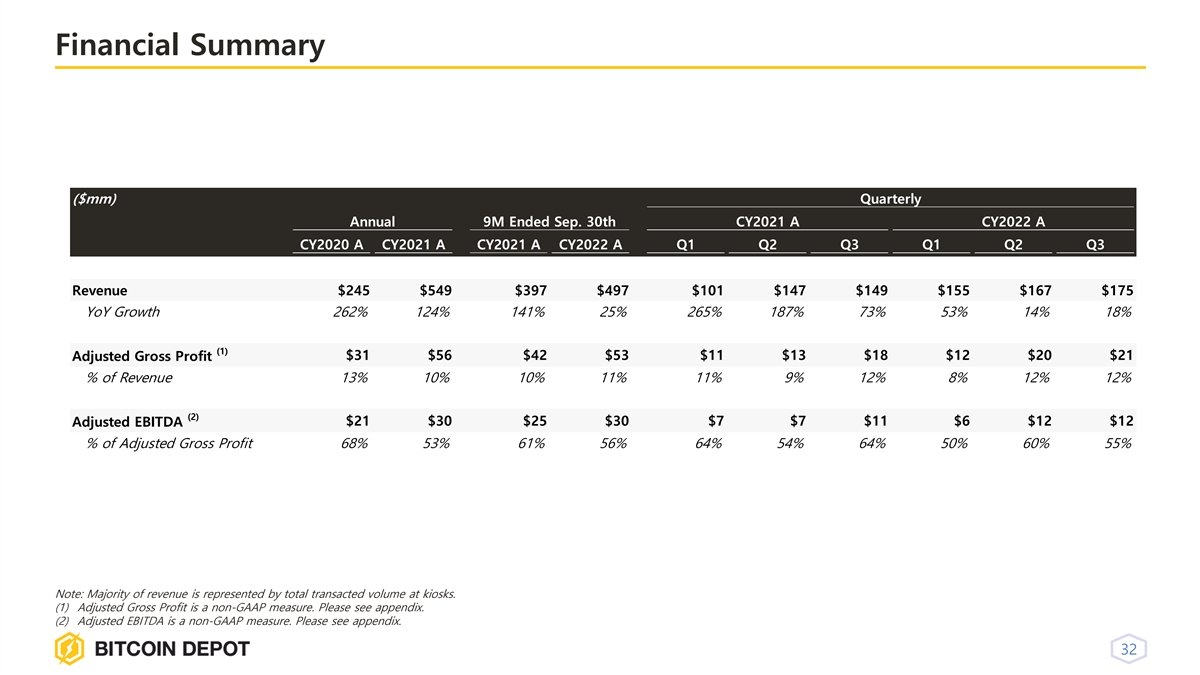

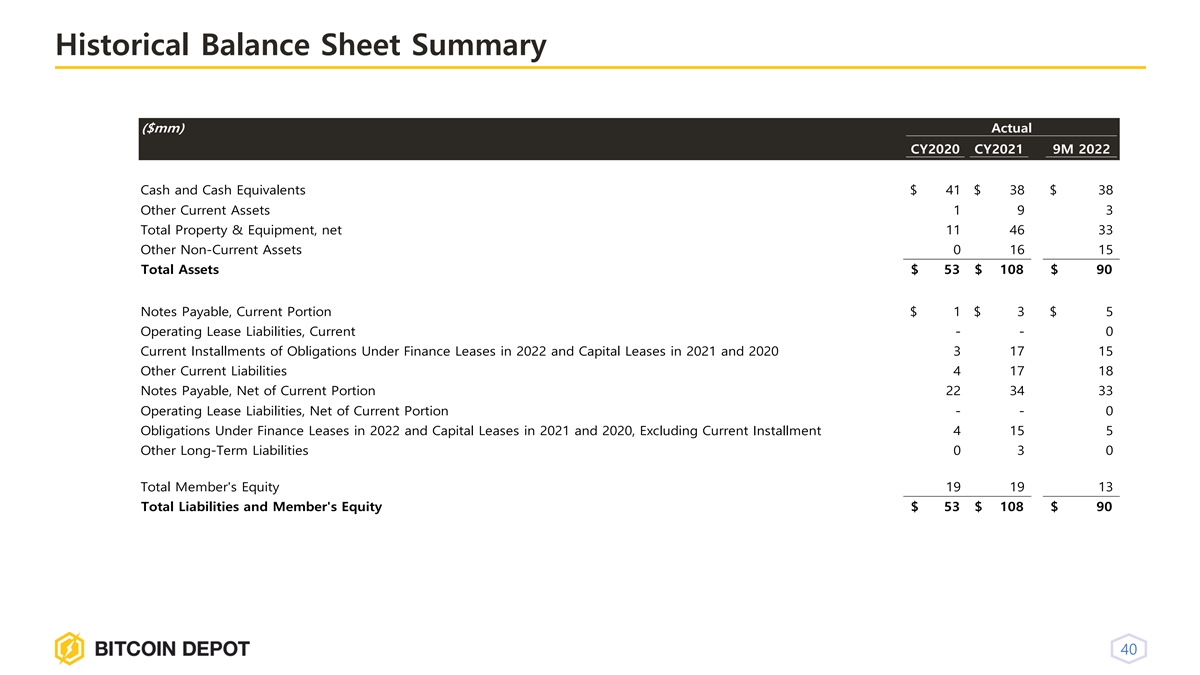

Slide 32:

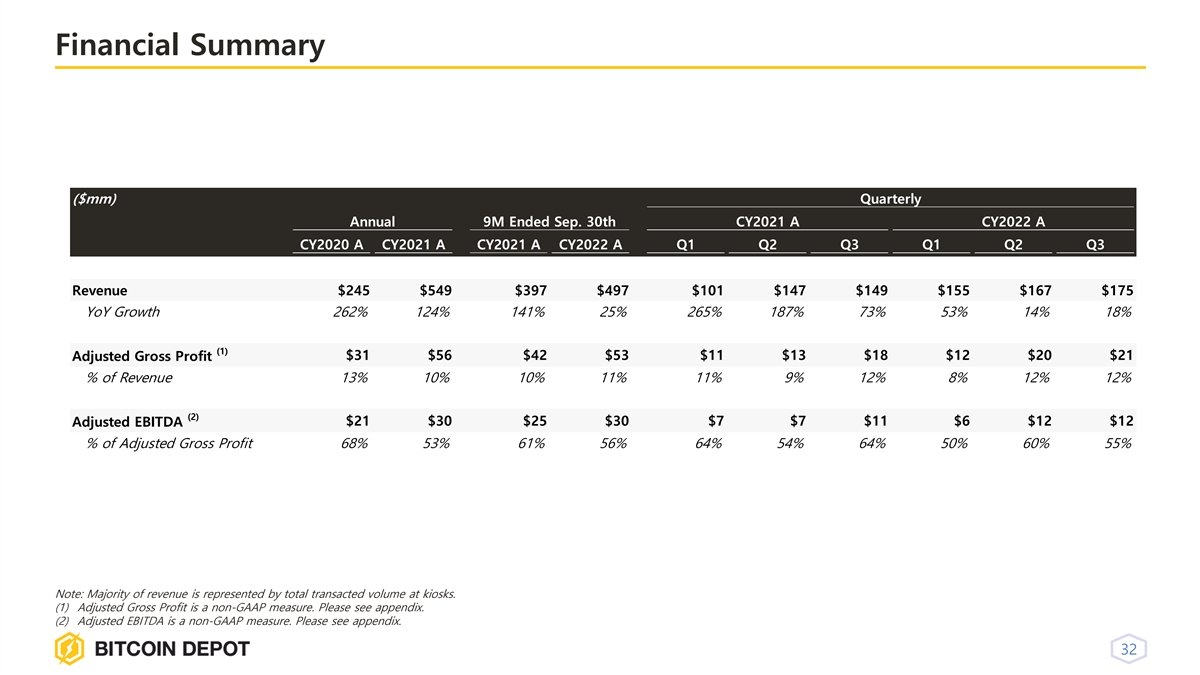

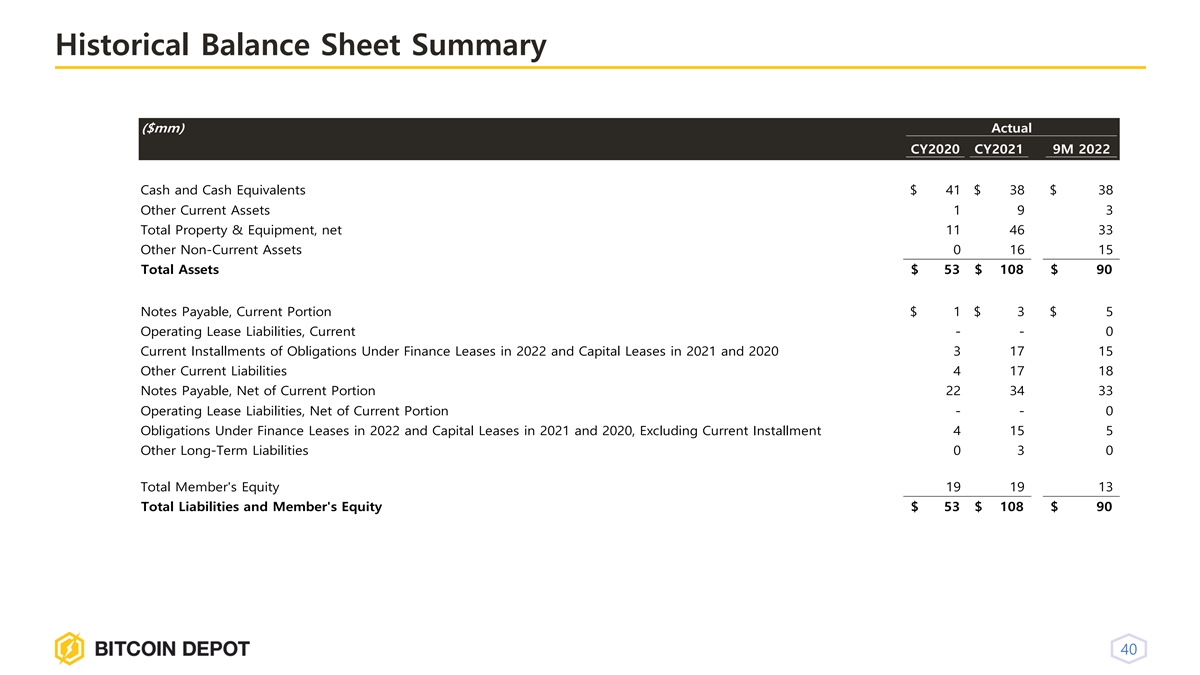

And lastly, a quick overview of our financial

results. In 2021. We achieved $549 million of revenue, $5.9 million of net income and $30 million of adjusted EBITDA. That momentums carried us into 2022 as we delivered $497 million of revenue, $4 million of net income and

$30 million of adjusted EBITDA during just the first nine months of 2022. I’ll now pass it over to Lew from the GSR team to cover the transaction process.

Lew Silberman – GSR II Meteora Acquisition Corp. (Co-CEO & Director)

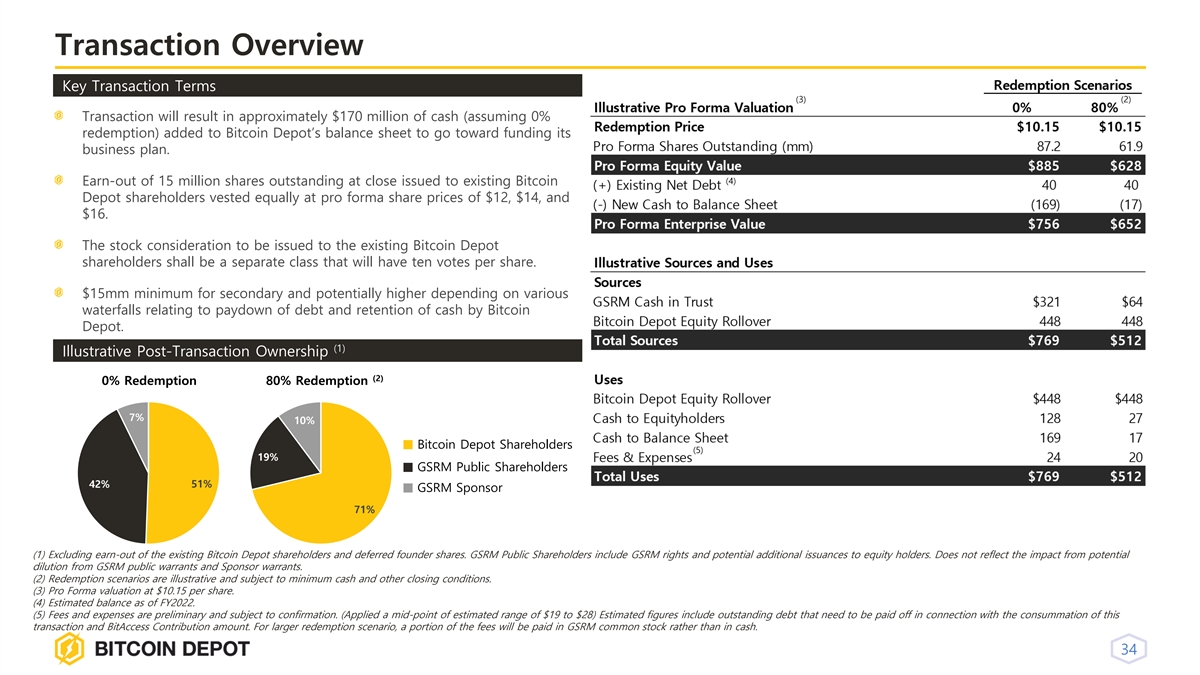

Slide 34:

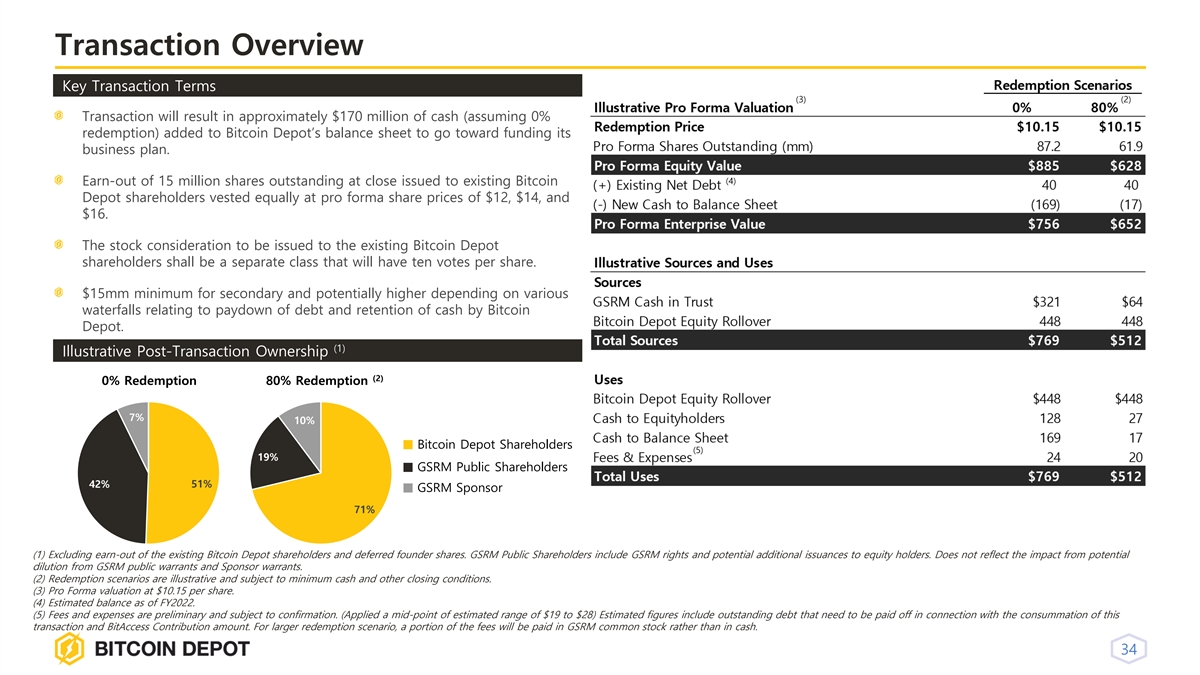

Thanks, Scott. So just moving back to highlight

some key aspects of the transaction. So we expect the business combination to result in up to approximately $170 million of cash added to Bitcoin Depot’s balance sheet, assuming no redemptions. From a valuation perspective that applies the

transaction value between roughly $650 and $750 million and an equity value of roughly between $625 and $885 million depending on the level of redemptions. The equity rollover to Bitcoin Depot will be about $450 million and that would

translate to between 51% and 71% ownership for existing Bitcoin Depot shareholders again depending on the level of redemptions. There’s also an earn out structure in the transaction with 5 million shares for existing Bitcoin Depot

shareholders at $12, $14, and $16. And finally, there’s a $15 million secondary minimum potentially more depending on proceeds generated, and that would be net of expenses and debt paid down. Happy to discuss the transaction more during

the Q&A portion as well.

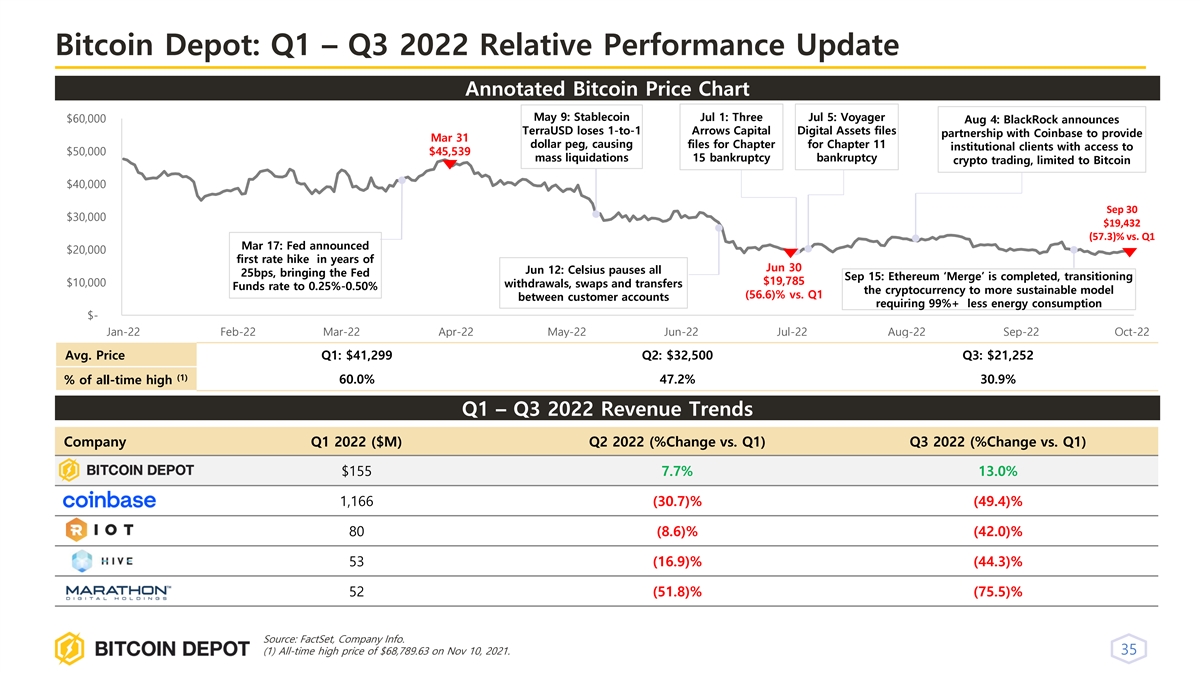

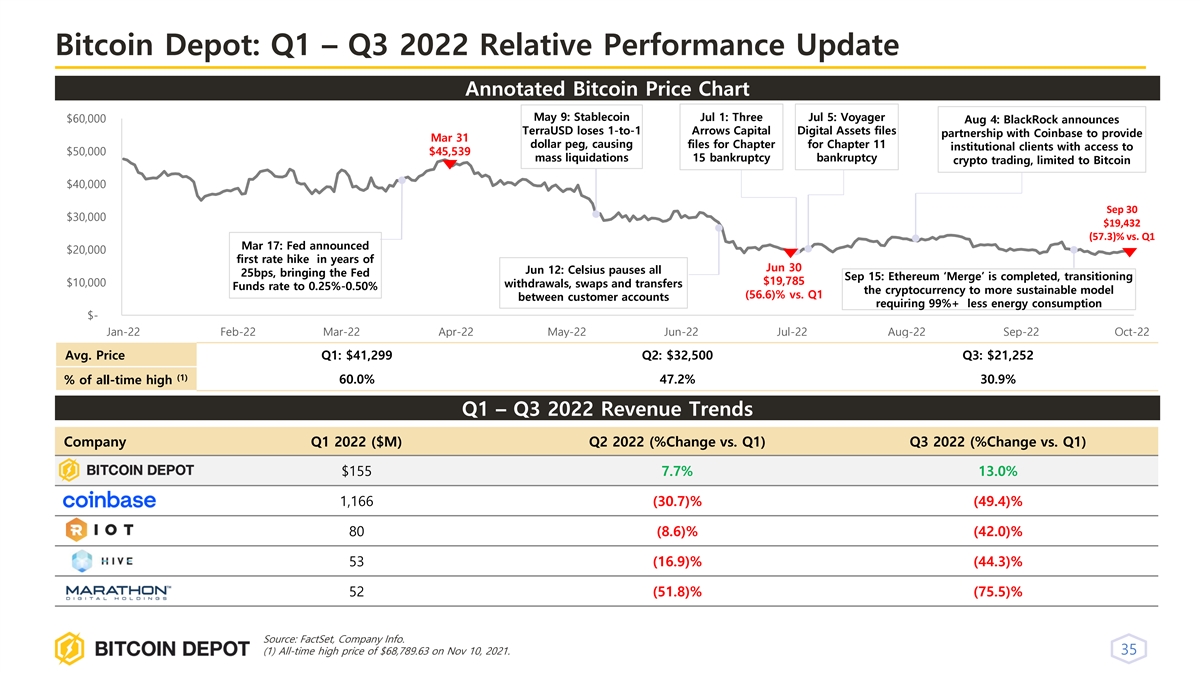

Slide 35:

This next

slide is really important because it underscores some of the key points that Brandon and Scott have talked about, which is the Bitcoin Depot has not historically been correlated to the price of Bitcoin and the underlying volatility in the crypto

market. So on the slide, you can clearly see that Bitcoin itself was down around 60% from the end of Q1 2022 to the end of Q3 2022. And actually if you look at it for the beginning of calendar year 22, it was down by even more. And over the course

of that period, we saw many, many headwinds in the market, such as the bankruptcies of Three Arrows, Voyager, the liquidation of Terra USD, and the issues that we saw at Celsius. So unsurprisingly, you can see that Coinbase for example, their

revenue was down 50% during that period, and of course, it’s not just Coinbase has been impacted it’s the miners, which is Riot, Hive, and Marathon have all been significantly down as well. So well, while the market has done that, despite

all these headwinds, we continued to deliver very strong performance. Our revenue was roughly 8% between Q1 and Q2 of last year and it was up 13% between Q1 and Q3 of last year. So again, this underscores just how robust the business is and how

it’s not correlated to the historical volatility in the crypto market.

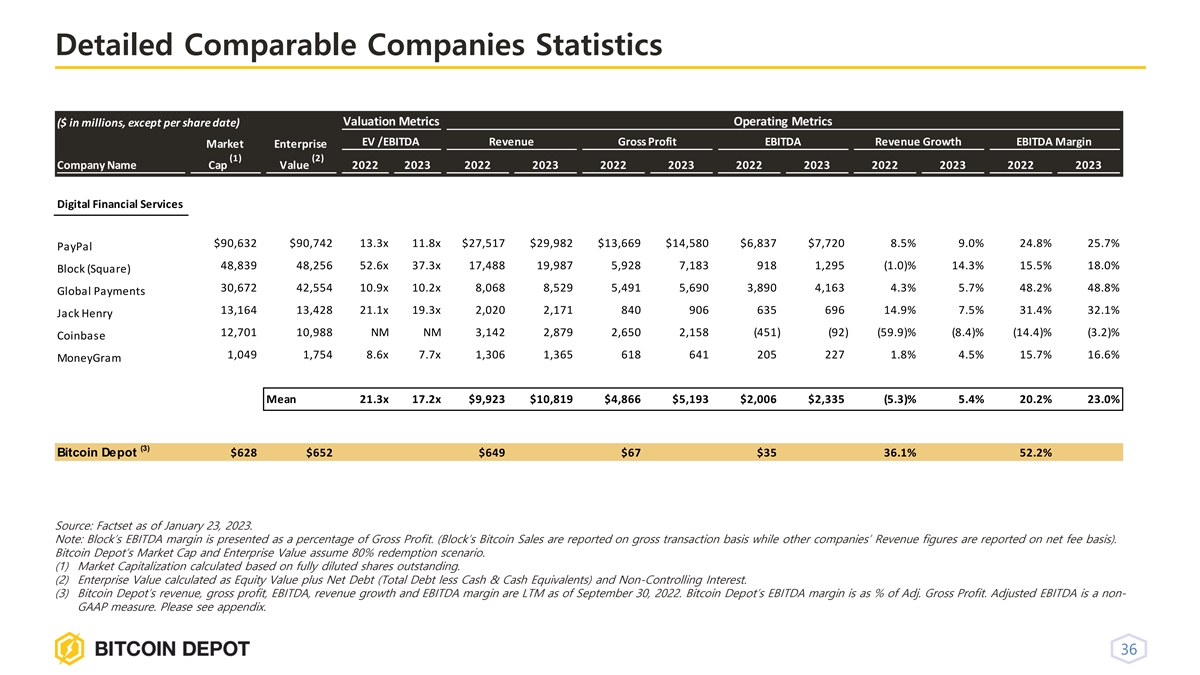

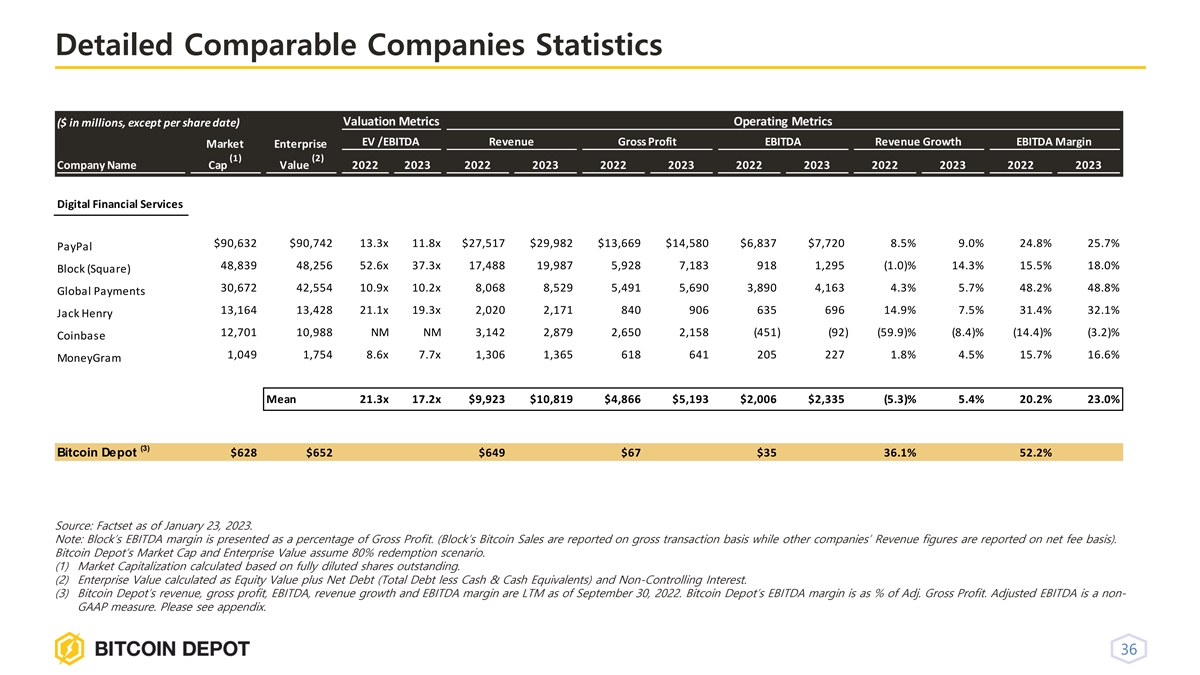

Slide 36:

Turning to valuation, the way that we thought about Bitcoin Depot was to compare it to other established money transfer payment processing businesses, like

MoneyGram, PayPal, and others. We think this makes sense because the mission of the company is to enable customers to transact on everyday activities using Bitcoin from payables to sending money transfers for a variety of other use cases. So we

believe this concept represents a very fair comparison to Bitcoin Depot’s business. Bitcoin Depot is already at a significant scale as you can see on the slide as of September 30th last year.

They generated about $650 million of LTM revenue with $100,000 net loss and nearly $35 million of LTM Adjusted EBITDA. Their LTM Adjusted EBITDA as a percentage of adjusted gross profit of 52% margins is also very strong and ultimately we

believe we’re pricing this transaction attractively relative to the peer metrics that you see on this slide.

Slide 37:

And finally, just to leave you with a few takeaways, the first we believe Bitcoin Depot is benefiting from the continued mainstreaming of Bitcoin into the

financial system. The company is very well positioned to capitalize on their position in the market. They’re supporting users that just prefer to use cash or need to use cash in order to purchase Bitcoin in very convenient ways. Second, they

are the largest Bitcoin ATM operator in North America with a network currently of seven thousand kiosks and 8,000 access

|

|

|

|

|

|

|

|

|

|

points under the BDCheckout product significantly ahead of their competition. Third, the company has very strong key retail relationships such as Circle K. They also have a number of name brand

retailers and pharmacies through BDCheckout. Fourth, the company’s evaluating number of expanded offerings as discussed earlier partnering with additional retailers such as the convenience store and gas station chains that we detailed in a

press release earlier this morning. Additionally, Bitcoin Depot’s considering paths for international expansion and opportunistic M&A, as discussed earlier and also we a see a potentially significant organic growth opportunity should we

successfully complete our New York Bitlicense application process. And finally, the company has been consistently profitable. It’s a testament to the fact that Bitcoin Depot transaction volumes have not historically been correlated with the

volatility of Bitcoin. And that is truly a unique attribute among cryptocurrency focused businesses. So that wraps up our presentation. Thank you again to everyone for your time and attention and we’re happy to take your questions from here.

It’s back to you, Alex.

Alex Kovtun – Gateway Group (Investor Relations)

Thanks Lew. We will now move to the Q&A portion of the investor day event. Participants can submit questions using the chat function on the lower portion

of your screen or email those questions to us at GSRM@gatewayir.com. We will take a moment to compile the list.

Alex Kovtun—So the first

question we have is for the Bitcoin Depot team. The question says, can you discuss Bitcoin Depot’s competitive advantage versus other crypto ATM operators? What role does your compliance team and acquisition of bid access plan that advantage?

Brandon Mintz—Thanks Alex. I’ll take that one. But for us, BitAccess really provides a cost structure advantage prior to BitAccess we were

paying a licensing fee to another software provider and we’ve now nearly eliminated that entire cost. And additionally, having that software in house and being vertically integrated, really provides us with a much better opportunity for M&A

activity and adding additional future functionality. And us being the largest Bitcoin ATM operator in the space we also have likely the best economies of scale with a large number of our vendors compared to smaller operators in the space. And of

course, you know, we believe we also have the strongest compliance team and most sound compliance infrastructure in the industry and along with our operations experience from Cardtronics and the Circle K contract we really believe that we are in the

strongest position.

Alex Kovtun – Great thanks Brandon. The next couple of questions focus on your kiosks and kiosk unit economics in more detail.

So can you touch on what is the typical revenue EBITDA, ROI and breakeven for a kiosk and what is the usual lead time to purchase a kiosk?

Scott

Buchanan—Thanks Alex. So revenue and EBITDA up for kiosk can actually be calculated at a high level using the KPIs and our proxy that we think are really informative. For example, in Q3, we had 6,700 kiosks installed at the end of the quarter.

And that works out to $26,000 of revenue for the quarter for a kiosk, and then $1,700 of EBITDA per kiosk for the quarter and that’s fully burdened with the SG&A costs. And then if you look at the kiosk profitability without SG&A, the

breakeven on a kiosk is about 13 months for us as a kiosk initially costs us around $7,000. As far as the lead time to purchase a kiosk, we can get new kiosks in a very short time, within a week or so. And then for larger quantities as long as we

plan in advance we haven’t seen any issues with supply chain of getting large quantities within a month or two.

Alex Kovtun - Great thank Scott. Couple questions came in specifically talking about active users and your

customer base. So the first question asks about the 25,000 monthly active users in September 2022 that was in the presentation. Can you provide additional details on what percent were repeat work versus new users?

Brandon Mintz - I’ll take that one. So off the top of my head, we don’t have exact data on that but what I do know is that the majority of our

repeat users of that number.

Alex Kovtun - Great thanks Brandon. And on that topic of your customers. Could you provide additional details on repeat

transactions across the key customer buckets that you highlighted? And are there any differences in how frequently they use your product?

Brandon Mintz -

We actually don’t have that broken out that way, readily available, so I won’t be able to go into further detail there.

Alex Kovtun - Got it

and then one more on the customer front. What is the customer acquisition cost for typical customer and the LTV?

Scott Buchanan - Yeah, so our typical

customer acquisition cost if we look at the past two quarters would work out to about $50 and the LTV is a roughly $1,000 of transaction fee revenue.

Alex Kovtun - Great thanks Scott. Another question that came in is asking you about your acquisition strategy. So can you discuss your acquisition strategy

going forward for kiosks and other services? And do you have a goal in mind for the number have installed kiosks as you consolidate the industry?

Brandon

Mintz - We plan to really focus horizontal acquisition of other Bitcoin kiosk operators and we’re really looking for the ones that have the strong retail contracts. And of course that are at attractive valuations and also making sure that they

followed similar compliance requirements to us.

Alex Kovtun – Thanks Brandon. The next question is asking about your sales force. So what is the

size of your sales force and will you add personnel as you scale?

Brandon Mintz - Our current sales force is around a dozen people. And the outbound

sales team really focuses on enterprise level contracts where we can get very large number of locations per person. So we don’t really expect to add material amounts of additional salespeople in the future.

Alex Kovtun - Great thanks Brandon. The next question coming in is asking about your retail partnerships. Can you discuss your retail partnership pipeline and

are you in discussion with any major grocers?

Brandon Mintz - So what I what I can say without speaking about the future and what’s not public is we

released a press release this morning with a lot of recent retailers that we’ve signed up or expanded into additional stores with over the last half of 2022. And we’re always in discussions with several convenience store chains and grocery

store chains and other types of retail outlets. And we believe our pipeline is very strong at the moment and will continue to be.

Alex Kovtun - Got it

the next question coming in is asking you about your BDCheckout offering. Can you speak to the rollout of your BD checkout offering and how’s that going? And can you share any recent progress? Are you seeing similar KPIs and utilization rates

as your kiosks?

Scott Buchanan - Thanks Alex. I’ll take that one. The rollout is going well. We’ve got the checkout

operational in over 8,000 locations now. In the most recent proxy filing you can see specific volumes for BDCheckout year to date. We’ve been happy with the results so far and we’re continuing to focus on expanding that product offering.

As far as similar KPIs to the kiosks we don’t expect to see the same volume per location look as BDCheckout as we can get with a physical kiosk presence. But we continue to focus on marketing and product and driving growth through BDCheckout.

Alex Kovtun - Great thanks Scott. Next question that we have is taking a look at the company’s growth. The question asks what does the company look

like in three to five years? Do you have any targets for long term growth, kiosk footprint or margins? And what levers do you have to enhance gross profit and Adjusted EBITDA margins as you scale?

Scott Buchanan - I’ll take that one as well. So we expect to expand geographically for sure. And that is within the US through M&A and other

acquisitions like Brandon’s touched on a few times and then also we’re going to explore International, but we haven’t made any decisions there yet. As far as releasing specific long term targets, we’re not ready to do that yet.

We’re focusing on long term planning and we may release more in the future, but right now, no specific targets long term, but we definitely do have numerous levers in our cost structure to increase margins. We’re already seeing that

we’re getting a better ratio of SG&A to revenue as we continue to expand vendor pricing. We’re always focusing on the best vendor pricing and renegotiating there and that’s continuing to prove as well. And then the markup

percentage can always be varied. We’re always running price experiments to make sure that we have the optimized pricing for customers to run profitably with our business.

Alex Kovtun - Great thanks Scott. Another question that came in is talking about some of your use cases. So you discuss money transfer and remittance being a

large use case for your customers. What are the barriers to entry from a competitive standpoint, if Western Union or MoneyGram wanted to enter the space?

Brandon Mintz - I’ll take that one. First of all, Western Union MoneyGram are large legacy businesses and it would be a massive pivot for them to expand

and to the Bitcoin space directly offering that to their customers. But also you got to understand money transfer slash remittances is just one part of the use cases on what people are using their Bitcoin for after they buy from Bitcoin Depot.

It’s not just about the use case and we don’t see ourselves as a competitor to Western Union and MoneyGram. A lot of it is the convenience of having Bitcoin and being able to do everything from your phone. And of course, we know

underbanked and unbanked users and people in the cash economy have to physically go out a lot of times to buy prepaid cards, use bill pay kiosks, check cashing services, use Western Union and MoneyGram to complete transactions. But now they can

complete nearly all of those alternative financial services transactions from the phone using just Bitcoin. So it’s not just comparing us to money remittance companies, you got to think about all of the convenience that is added by having a

Bitcoin wallet for those types of people.

Alex Kovtun - Thanks Brandon. The next question we’ve received is talking about the recent increase in the

price of Bitcoin. So have you seen any noticeable changes in transaction volumes year to date 2023 as the price of Bitcoin has increased to about 21,000?

Scott Buchanan - Yeah, I’ll take that one, Alex. So I think we just refer back to our slide that shows we’ve historically not been correlated the

price of cryptocurrency and then we just we aren’t ready to speak to 2023 results at this time as the price has just recently moved up and we’re still haven’t released Q4 yet.

Alex Kovtun – Great thanks Scott. The next question is just talking more broadly about going public. So can you talk about what made you decide that

now’s the right time to go public? Why would the GSRM team rather than IPO and how will becoming a public company help me competitively?

Brandon Mintz - I think we’re really at the point in the industry where consolidation is extremely

valuable and us as a company of Bitcoin Depot, we just wanted the fastest path to be able to complete a lot of that M&A and the SPAC route really just made the most sense for us and choosing the GSRM team with their vast experience over the past

decade or so in SPAC has really allowed us to navigate this process a lot quicker and better than we might have on our own. So all in all, you know, we think going public will really help us achieve that M&A strategy and accelerate our growth

tremendously.

Alex Kovtun – Great thanks Brandon. Follow up question about your retail partnerships. How does Bitcoin Depot select its retail

partners? Can you discuss what a typical retailer partnership looks like for your kiosks?

Brandon Mintz – Yeah sure. So we typically look for

retailers that have locations that are very accessible to our customers so long operating hours typically in medium to high populated areas and of course they have to have the space available to work with us. And typically our contract is around

five to seven years with those retailers and we usually pay a flat monthly rent for each store where we placed the kiosk.

Alex Kovtun - Got it. Another

question we have is just talking more broadly about some of your KPIs. So which KPI should investors be most focused on to measure the progress and ultimate success of the business going forward?

Scott Buchanan - Yeah, I’ll take that one. In our proxy filing, we’ve got four KPIs listed, which we think are good ones for investors to focus on.

And that’s the location counts for kiosks and at BDCheckout, the percentage of our customers that are returning customers, and then median transaction size, and we think those give a good sense of the pulse on the business and how we’re

performing over time.

Alex Kovtun - Great thanks Scott. Going back to some of your growth plans, how are you thinking about growth going forward, as it

relates to your kiosks versus your BDCheckout offering?

Brandon Mintz - We really foresee our kiosks still continuing to be the majority of our revenue

and profitability and our growth just because it’s been developed for so many years. We think this speedy BDCheckout product will be successful because it’s so scalable. We turned on over 8,000 locations in a matter of months, but we

don’t expect it to be quite as profitable on a per location basis and also the maximum transaction sizes are smaller. So we really plan to pursue a high hybrid approach of both products but still getting most of our revenue from the kiosk..

Alex Kovtun - Got it and moving on to your marketing strategy. Can you guys talk about your marketing strategy and how you’re able to attract users

to the kiosks? Is it mostly through word of mouth or do you spend any money to drive foot traffic?

Brandon Mintz - Well, since there aren’t Bitcoin

ATMs at every convenience store and gas station and grocery store like there are with ATMs typically today we do have to drive that traffic in and so we really focus on digital marketing, primarily through a Google search results and social media

where customers have the intent to purchase Bitcoin. And what we have seen as well is from our survey data once people use Bitcoin Depot ATMs, word of mouth does spread pretty heavily.

Alex Kovtun - Got it that’s helpful. If we could talk about the kiosks again for a moment. Another question we receive is asking what is the durability

of your kiosks and do they need a lot of maintenance once installed?

Scott Buchanan - I’ll take that one Alex. They typically need less than one service call per year where

we hire a third party tech support company to go out and perform a maintenance call. And over the six years of operations so far less than 1% of the kiosks have been taken out of service. So they’re shown to have a really long lifecycle and we

don’t have a lot of maintenance on the kiosks.

Alex Kovtun – Great thanks Scott. Moving on to your geographic expansion plans. Can you discuss

those and are you focused on North America or will you explore additional markets once public?

Brandon Mintz - I can take that one. So right now still

really focused on North America and just the M&A strategy there but we do hope to expand further internationally in the coming years. We just don’t know exactly when that would be and which countries exactly we would start.

Alex Kovtun - Got it. Moving on maybe to your compliance. Is your compliance team large enough to handle proper monitoring of transactions today?

Brandon Mintz - Yeah, definitely. The key for us is we’ve just automated a lot of systems to really cut down on the manual workload that these compliance

people have so that they can truly focus on monitoring accounts and reviewing activity and filing reports versus a lot of the kind of day to day admin work that other operators may have for this type of staff without the systems that we have in

place.

Alex Kovtun – Great and then touching on your capital allocation priorities going forward. Can you discuss those and how should investors

think about those once you’re a public company?

Scott Buchanan - Yeah, our primary priority for capital allocation is going to be the M&A

strategy again, we think that’s really key for us going forward and we want to primarily allocate capital to that priority.

Alex Kovtun - Great,

maybe moving on now to your financial performance. How should investors think about your financial performance in 2023 given the strong results that you’ve disclosed so far?

Scott Buchanan - Yeah, so we haven’t released formal guidance for 2023 yet or a full financial plan. But in the proxy that we have released we’re

targeting $48 million of EBITDA for 2023 and that includes all the extra costs of being a public company baked so more growth than that but burdened down by the public company costs.

Alex Kovtun - Okay great. We have a question here for the GSRM team. Can you guys touch on any updates on the shareholder vote? And what’s the next step

in the business combination process?

Gus Garcia - Good question. I think what we can say publicly is what we’ve said at the outset, which is closing

is expected Q1 of this year, so there hasn’t been a change to that. I encourage folks to review all of our SEC filing, keep track there when here is a shareholder vote. It will be communicated through the SEC. So everything’s on track is

what I would say. And just keep your eyes out for communications.

Alex Kovtun - Great thanks Gus. Looks like the last question we’ve received is

going back to the Bitcoin Depot team. Can you guys discuss what a potential recession effect would that have on your business?

Brandon Mintz - I can take

that one. It’s really hard to know for certain, but of course over the past year, there’s already been an economic decline to a certain extent and we’ve performed quite well but one thing that comes with a recession is usually less

consumer spending and less discretionary income as well. But given the use cases of our business for what people use their Bitcoin for, we think our revenues could be a lot more consistent versus a lot of other industry players.

Great thanks Brandon. So it appears we’ve answered all the questions that have come in so far. So that

does conclude our Q&A session. So thank you all for your time and questions. I wish everybody a great rest of the day.

###

Exhibit 99.3 Investor Day Presentation January 2023

Disclaimer For the purposes of this notice, this

“presentation” will mean and include the slides, any oral presentation of the slides by members of management of GSR II Meteora Acquisition Corp. (“GSRM”) or Lux Vending, LLC d/b/a Bitcoin Depot (the “Company” or

“Bitcoin Depot”) or any person on their behalf, any question-and-answer session that follows that oral presentation, hard copies of this document and any materials distributed at, or in connection with, that presentation. By attending

the meeting where the presentation is made, or by reading the presentation slides, you will be deemed to have (i) agreed to the following limitations and notifications and made the following undertakings and (ii) acknowledged that you understand the

legal and regulatory sanctions attached to the misuse, disclosure or improper circulation of this presentation. Confidentiality: This presentation is preliminary in nature and provided solely for informational and discussion purposes only and must

not be relied upon for any other purposes. This presentation is intended solely for investors that are qualified institutional buyers (as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)),

institutional accredited investors (as defined under Regulation D as promulgated under the Securities Act) and eligible institutional investors outside the U.S. and has been prepared for the purposes of familiarizing such investors with the

potential business combination (the “Business Combination”) between GSRM and the Company and related transactions, including the proposed private offering of GSRM’s or the Company’s securities (the “PIPE” and

together with the Business Combination, the “Proposed Transactions”) and for no other purpose. The release, reproduction, publication or distribution of this presentation, in whole or in part, or the disclosure of its contents, without

the prior consent of the Company and GSRM is unlawful and prohibited. Persons who possess this document should inform themselves about and observe any such restrictions. Each recipient acknowledges that it is (a) aware that the United States

securities laws prohibit any person who has material, non-public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is

reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange

Act”), and that the recipient will neither use, nor cause any third party to use, this presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b- 5 thereunder. By accepting

this presentation, each recipient agrees: (i) that the information included in this presentation is confidential and may constitute material non-public information, (ii) to maintain the confidentiality of all information that is contained in this

presentation and not already in the public domain and (iii) to use this presentation for the sole purpose of evaluating the Company and the Proposed Transactions. No Offer or Solicitation: This presentation and any oral statements made in connection

with this presentation do not constitute an offer to sell, or the solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, consent or approval in any jurisdiction in

connection with the Proposed Transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction.

This presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities pursuant to the PIPE will be made only pursuant to a definitive subscription or purchase agreement and will be made in

reliance on an exemption from registration under the Securities Act for offers and sales of securities that do not involve a public offering. GSRM and the Company reserve the right to withdraw or amend for any reason any offering and to reject any

subscription or purchase agreement for any reason. The communication of this presentation is restricted by law; in addition to any prohibitions on distribution otherwise provided for herein, this presentation is not intended for distribution to, or

use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. The contents of this presentation have not been reviewed by any regulatory authority in any jurisdiction. No Representations or

Warranties: No representations or warranties, express or implied, are given in, or in respect of, this presentation or as to the accuracy, reasonableness or completeness of the information contained in or incorporated by reference herein. To the

fullest extent permitted by law, in no circumstances will GSRM, the Company or any of their respective affiliates, directors, officers, employees, members, partners, shareholders, advisors or agents be responsible or liable for any direct, indirect

or consequential loss or loss of profit arising from the use of this presentation, its contents (including the internal economic models), its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto

or otherwise arising in connection therewith. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, none of the Company, GSRM or

any of their respective affiliates, directors, officers, employees, members, partners, shareholders, advisors or agents has independently verified the data obtained from these sources or makes any representation or warranty with respect to the

accuracy of such information. Recipients of this presentation are not to construe its contents, or any prior or subsequent communications from or with GSRM, the Company or their respective representatives as investment, legal or tax advice. In

addition, this presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of the Company, GSRM or the Proposed Transactions. Recipients of this presentation should each make

their own evaluation of the Company, GSRM or the Proposed Transactions and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Recipients are not entitled to rely on the accuracy or

completeness of this presentation and are entitled to rely solely on only those particular representations and warranties, if any, which may be made by GSRM or the Company to a recipient of this presentation or other third party in a definitive

written agreement, when, and if executed, and subject to the limitations and restrictions as may be specified therein. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters

described herein, and, by accepting this presentation, you confirm that you are not relying upon the information contained herein to make any decision. Any representations, warranties, agreements or covenants between the recipient and any parties

involved in the Proposed Transactions will be set forth in definitive agreements by and among such persons. The Company and GSRM expressly disclaim any duty to update the information contained in this presentation, whether as a result of new

information, future events or otherwise. 2

Disclaimer Forward-Looking Statements: This presentation includes

“forward-looking statements” within the meaning of the federal securities laws, including, but not limited to, opinions and projections prepared by the Company’s and GSRM’s management. Forward-looking statements generally

relate to future events or the Company’s or GSRM’s future financial or operating performance, including pro forma and estimated financial information, and other “forward-looking statements” (as such term is defined in the

Private Securities Litigation Reform Act of 1995). For example, projections of future EBITDA, Adjusted EBITDA and other metrics are forward-looking statements. The recipient can identify forward-looking statements because they typically contain

words such as “outlook,” “believes,” “expects,” “ will,” “projected,” “continue,” “increase,” “may,” “should,” “could,”

“seeks,” “predicts,” “intends,” “trends,” “plans,” “estimates,” “anticipates” or the negatives or variations of these words or other comparable words and/or similar

expressions (but the absence of these words and/or similar expressions does not mean that a statement is not forward-looking). These forward-looking statements specifically include, but are not limited to, statements regarding estimates and

forecasts of financial and performance metrics, projections of market opportunity and market share, potential benefits of the Proposed Transactions and the potential success of the Company’s strategy and expectations related to the terms and

timing of the Proposed Transactions. Forward-looking statements, opinions and projections are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s and GSRM’s current beliefs,

expectations and assumptions regarding the future of their respective businesses and of the combined company, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s or GSRM’s control. These uncertainties and risks

may be known or unknown. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: changes in domestic and foreign business, market, financial, political and legal conditions; the inability

of the parties to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the

combined company or the expected benefits of the proposed business combination or that the approval of the shareholders of GSRM or Bitcoin Depot is not obtained; failure to realize the anticipated benefits of the proposed business combination; risks

relating to the uncertainty of the projected financial information with respect to Bitcoin Depot; future global, regional or local economic and market conditions; the development, effects and enforcement of laws and regulations; Bitcoin

Depot’s ability to manage future growth; Bitcoin Depot’s ability to develop new products and services, bring them to market in a timely manner, and make enhancements to its platform; the effects of competition on Bitcoin Depot’s

future business; the amount of redemption requests made by GSRM’s public shareholders; the ability of GSRM or the combined company to issue equity or equity-linked securities in connection with the proposed business combination or in the