2022-09-30

0000105544

false

2023-01-30

2023-01-31

485BPOS

0.0919

0.0807

0.0128

0.0808

0.1020

0.0257

0.1639

0.0845

0.0850

0.0905

0000105544

2023-01-31

2023-01-31

0000105544

wellesley:RetailMember

wellesley:S000004405Member

2023-01-31

2023-01-31

0000105544

wellesley:RetailMember

wellesley:S000004405Member

wellesley:C000012161Member

2023-01-31

2023-01-31

0000105544

wellesley:RetailMember

wellesley:S000004405Member

wellesley:C000012162Member

2023-01-31

2023-01-31

0000105544

wellesley:RetailMember

wellesley:S000004405Member

wellesley:C000012161Member

wellesley:ReturnAfterTaxesonDistributionsMember

2023-01-31

2023-01-31

0000105544

wellesley:RetailMember

wellesley:S000004405Member

wellesley:C000012161Member

wellesley:ReturnAfterTaxesonDistributionsandSaleofFundSharesMember

2023-01-31

2023-01-31

0000105544

wellesley:RetailMember

wellesley:S000004405Member

wellesley:WellesleyIncomeCompositeIndexMember

2023-01-31

2023-01-31

0000105544

wellesley:RetailMember

wellesley:S000004405Member

wellesley:BloombergUSAggregateBondIndexMember

2023-01-31

2023-01-31

0000105544

wellesley:RetailMember

wellesley:S000004405Member

wellesley:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2023-01-31

2023-01-31

xbrli:pure

iso4217:USD

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT

(NO. 2-31333)

UNDER THE SECURITIES ACT OF 1933

☒

Pre-Effective Amendment No.

☐

Post-Effective Amendment No. 90

☒

and

REGISTRATION STATEMENT

(NO. 811-01766)

UNDER THE INVESTMENT COMPANY ACT OF 1940

VANGUARD WELLESLEY INCOME FUND

(Exact Name of Registrant as Specified in Declaration of Trust)

P.O. Box 2600, Valley Forge, PA 19482

(Address of Principal Executive Office)

Registrant’s Telephone Number (610) 669-1000

Anne E. Robinson, Esquire

P.O. Box 876

Valley Forge, PA 19482

It is proposed that this filing will become effective (check appropriate box)

☐

immediately upon filing pursuant to paragraph (b)

☒

on January 31, 2023, pursuant to paragraph (b)

☐

60 days after filing pursuant to paragraph (a)(1)

☐

on (date) pursuant to paragraph (a)(1)

☐

75 days after filing pursuant to paragraph (a)(2)

☐

on (date) pursuant to paragraph (a)(2) of rule 485

If appropriate, check the following box:

☐

This post-effective amendment designates a new effective date for a previously filed post-effective amendment.

Vanguard Wellesley® Income Fund

Prospectus

Investor Shares & Admiral™ Shares

Vanguard Wellesley Income Fund Investor Shares (VWINX)

Vanguard Wellesley Income Fund Admiral Shares (VWIAX)

This prospectus contains financial data for the Fund through the fiscal year ended September 30, 2022.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Fund Summary

Investment Objective

The Fund seeks to provide long-term growth of income and a high and sustainable level of current income, along with moderate long-term capital appreciation.

Fees and Expenses

The following table describes the fees and expenses you may pay if you buy, hold, and sell Investor Shares or Admiral Shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Shareholder Fees

(Fees paid directly from your investment)

|

|

|

|

Sales Charge (Load) Imposed on Purchases |

|

|

|

|

|

|

Sales Charge (Load) Imposed on Reinvested Dividends |

|

|

|

|

|

|

Account Service Fee Per Year

(for certain fund account balances below $1,000,000) |

|

|

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses |

|

|

Examples

The following examples are intended to help you compare the cost of investing in the Fund's Investor Shares or Admiral Shares with the cost of investing in other mutual funds. They illustrate the hypothetical expenses that you would incur over various periods if you were to invest $10,000 in the Fund's shares. These examples assume that the shares provide a return of 5% each year and that total annual fund operating expenses remain as stated in the preceding table. You would incur these hypothetical expenses whether or not you were to redeem your investment at the end of the given period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in more taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the previous expense examples, reduce the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 58% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests approximately 60% to 65% of its assets in investment-grade fixed income securities that the advisor believes will generate a reasonable level of current income, including corporate, U.S. Treasury, and government agency bonds, as well as mortgage-backed securities. The remaining 35% to 40% of Fund assets are invested in common stocks of companies that have a history of above-average dividends or expectations of increasing dividends.

Principal Risks

The Fund is subject to the risks associated with the stock and bond markets, any of which could cause an investor to lose money, and the level of risk may vary based on market conditions. However, because fixed income securities such as bonds usually are less volatile than stocks and because the Fund invests more than half of its assets in fixed income securities, the Fund’s overall level of risk is expected to be low to moderate.

• With approximately 60% to 65% of its assets allocated to bonds, the Fund is proportionately subject to the following bond risks: interest rate risk, which is the

chance that bond prices overall will decline because of rising interest rates; income risk, which is the chance that the Fund's income will decline because of falling interest rates; credit risk, which is the chance that a bond issuer will fail to pay interest or principal in a timely manner or that negative perceptions of the issuer's ability to make such payments will cause the price of that bond to decline; liquidity risk, which is the chance that the Fund may not be able to sell a security in a timely manner at a desired price; and call risk, which is the chance that during periods of falling interest rates, issuers of callable bonds may call (redeem) securities with higher coupon rates or interest rates before their maturity dates. The Fund would then lose any price appreciation above the bond's call price and would be forced to reinvest the unanticipated proceeds at lower interest rates, resulting in a decline in the Fund's income. Such redemptions and subsequent reinvestments would also increase the Fund's portfolio turnover rate. For mortgage-backed securities, this risk is known as prepayment risk.

• With approximately 35% to 40% of its assets allocated to stocks, the Fund is proportionately subject to the following stock risks: stock market risk, which is the chance that stock prices overall will decline; and investment style risk, which is the chance that returns from mid- and large-capitalization dividend-paying value stocks will trail returns from the overall stock market. Mid- and large-cap stocks each tend to go through cycles of doing better—or worse—than other segments of the stock market or the stock market in general. These periods have, in the past, lasted for as long as several years. Historically, mid-cap stocks have been more volatile in price than large-cap stocks. The stock prices of mid-size companies tend to experience greater volatility because, among other things, these companies tend to be more sensitive to changing economic conditions.

• Manager risk, which is the chance that poor security selection will cause the Fund to underperform relevant benchmarks or other funds with a similar investment objective.

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

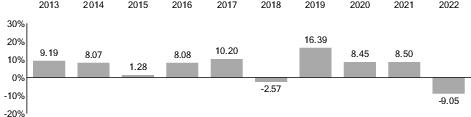

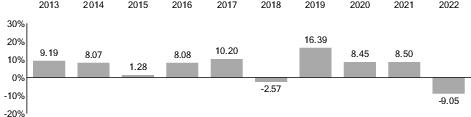

Annual Total Returns

The following bar chart and table are intended to help you understand the risks of investing in the Fund. The bar chart shows how the performance of the Fund's Investor Shares has varied from one calendar year to another over the periods shown. The table shows how the average annual total returns of the share classes presented compare with those of a composite bond/stock index and other relevant market indexes, which have investment characteristics similar to those of the Fund. The Wellesley Income Composite Index is weighted 65% in the Bloomberg U.S. Credit A or Better Bond Index and 35% in the FTSE High Dividend Yield Index. Keep in mind that the Fund's past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447.

Annual Total Returns — Vanguard Wellesley Income Fund Investor Shares

During the periods shown in the bar chart, the highest and lowest returns for a calendar quarter were:

Average Annual Total Returns for Periods Ended December 31, 2022

|

|

|

|

|

Vanguard Wellesley Income Fund Investor Shares |

|

|

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

Vanguard Wellesley Income Fund Admiral Shares |

|

|

|

|

|

|

|

|

Wellesley Income Composite Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

Bloomberg U.S. Aggregate Bond Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

Dow Jones U.S. Total Stock Market Float Adjusted Index

(reflects no deduction for fees, expenses, or taxes) |

|

|

|

Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding table. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capital gains or upon redemption. State and local income taxes are not reflected in the calculations. Please note that after-tax returns are shown only for the Investor Shares and may differ for each share class. After-tax returns are not relevant for a shareholder who holds fund shares in a tax-deferred account, such as an individual retirement account or a 401(k) plan. Also, figures captioned Return After Taxes on Distributions and Sale of Fund Shares may be higher than other figures for the same period if a capital loss occurs upon redemption and results in an assumed tax deduction for the shareholder.

Investment Advisor

Wellington Management Company LLP (Wellington Management)

Portfolio Managers

Matthew C. Hand, CFA, Senior Managing Director and Equity Portfolio Manager of Wellington Management. He has managed a portion of the Fund since July 2022 (co-managed since 2021).

Loren L. Moran, CFA, Senior Managing Director and Fixed Income Portfolio Manager of Wellington Management. She has managed the bond portion of the Fund since 2017.

Purchase and Sale of Fund Shares

You may purchase or redeem shares online through our website (vanguard.com), by mail (The Vanguard Group, P.O. Box 982901, El Paso, TX 79998-2901), or by telephone (800-662-2739). The minimum investment amount required to open and maintain a Fund account for Investor Shares or Admiral Shares is $3,000 or $50,000, respectively. The minimum investment amount required to add to an existing Fund account is generally $1. Financial intermediaries, institutional clients, and Vanguard-advised clients should contact Vanguard for information on special eligibility rules that may apply to them regarding Admiral Shares. If you are investing through an intermediary, please contact that firm directly for more information regarding your eligibility. If you are investing through an employer-sponsored retirement or savings plan, your plan administrator or your benefits office can provide you with detailed information on how you can invest through your plan.

Tax Information

The Fund’s distributions may be taxable as ordinary income or capital gain. If you are investing through a tax-advantaged account, such as an IRA or an employer-sponsored retirement or savings plan, special tax rules apply.

Payments to Financial Intermediaries

The Fund and its investment advisor do not pay financial intermediaries for sales of Fund shares.

More on the Fund

This prospectus describes the principal risks you would face as a Fund shareholder. It is important to keep in mind one of the main principles of investing: generally, the higher the risk of losing money, the higher the potential reward. The reverse, also, is generally true: the lower the risk, the lower the potential reward. As you consider an investment in any mutual fund, you should take into account your personal tolerance for fluctuations in the securities markets. Look for this

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

symbol throughout the prospectus. It is used to mark detailed information about the more significant risks that you would confront as a Fund shareholder. To highlight terms and concepts important to mutual fund investors, we have provided Plain Talk® explanations along the way. Reading the prospectus will help you decide whether the Fund is the right investment for you. We suggest that you keep this prospectus for future reference.

Share Class Overview

The Fund offers two separate classes of shares: Investor Shares and Admiral Shares.

Both share classes offered by the Fund have the same investment objective, strategies, and policies. However, different share classes have different expenses; as a result, their investment returns will differ.

Plain Talk About Fund Expenses |

All mutual funds have operating expenses. These expenses, which are

deducted from a fund’s gross income, are expressed as a percentage of the

net assets of the fund. Assuming that operating expenses remain as stated

in the Fees and Expenses section, Vanguard Wellesley Income Fund’s

expense ratios would be as follows: for Investor Shares, 0.23%, or $2.30 per

$1,000 of average net assets; for Admiral Shares, 0.16%, or $1.60 per

$1,000 of average net assets. The average expense ratio for mixed-asset

target allocation conservative funds in 2021 was 0.68%, or $6.80 per $1,000

of average net assets (derived from data provided by Lipper, a Thomson

Reuters Company, which reports on the mutual fund industry). |

Plain Talk About Costs of Investing |

Costs are an important consideration in choosing a mutual fund. That is

because you, as a shareholder, pay a proportionate share of the costs of

operating a fund and any transaction costs incurred when the fund buys or

sells securities. These costs can erode a substantial portion of the gross

income or the capital appreciation a fund achieves. Even seemingly small

differences in expenses can, over time, have a dramatic effect on a

fund’s performance. |

The following sections explain the principal investment strategies and policies that the Fund uses in pursuit of its investment objective. The Fund's board of trustees, which oversees the Fund's management, may change investment strategies or policies in the interest of shareholders without a shareholder vote, unless those strategies or policies are designated as fundamental. Note that the Fund’s investment objective is not fundamental and may be changed without a shareholder vote.

Plain Talk About Balanced Funds |

Balanced funds are generally investments that seek to provide some

combination of income and capital appreciation by investing in a mix of

stocks and bonds. Because prices of stocks and bonds can respond

differently to economic events and influences, a balanced fund should

experience less volatility than a fund investing exclusively in stocks, but may

experience more volatility than a fund investing exclusively in bonds. |

Market Exposure

Bonds

The Fund invests approximately 60% to 65% of its assets in bonds.

The Fund is subject to interest rate risk, which is the chance that bond prices overall will decline because of rising interest rates. Interest rate risk for the Fund is expected to be moderate because the average duration of the Fund’s bond portfolio is intermediate-term and also because the Fund’s equity portfolio consists primarily of income-generating stocks, which tend to be moderately sensitive to interest rate changes.

Although fixed income securities (commonly referred to as bonds) are often thought to be less risky than stocks, there have been periods when bond prices have fallen significantly because of rising interest rates. For instance, prices of long-term bonds fell by almost 48% between December 1976 and September 1981.

To illustrate the relationship between bond prices and interest rates, the following table shows the effect of a 1% and a 2% change (both up and down) in interest rates on the values of three noncallable bonds (i.e., bonds that cannot be redeemed by the issuer) of different maturities, each with a face value of $1,000.

How Interest Rate Changes Affect the Value of a $1,000 Bond1

|

|

|

|

|

|

|

|

|

|

|

|

Intermediate-Term (10 years) |

|

|

|

|

|

|

|

|

|

|

1 Assuming a 4% coupon rate.

These figures are for illustration only; you should not regard them as an indication of future performance of the bond market as a whole or the Fund in particular. Also, because bonds make up only a portion of the Fund’s assets, changes in interest rates may not have as dramatic an effect on the Fund as they would on a fund made up entirely of bonds.

Plain Talk About Bonds and Interest Rates |

As a rule, when interest rates rise, bond prices fall. The opposite is also true:

Bond prices go up when interest rates fall. Why do bond prices and interest

rates move in opposite directions? Let’s assume that you hold a bond

offering a 4% yield. A year later, interest rates are on the rise and bonds of

comparable quality and maturity are offered with a 5% yield. With

higher-yielding bonds available, you would have trouble selling your 4% bond

for the price you paid—you would probably have to lower your asking price.

On the other hand, if interest rates were falling and 3% bonds were being

offered, you should be able to sell your 4% bond for more than you paid. |

How mortgage-backed securities are different: In general, declining interest

rates will not lift the prices of mortgage-backed securities—such as those

guaranteed by the Government National Mortgage Association—as much as

the prices of comparable bonds. Why? Because when interest rates fall, the

bond market tends to discount the prices of mortgage-backed securities for

prepayment risk—the possibility that homeowners will refinance their

mortgages at lower rates and cause the bonds to be paid off prior to

maturity. In part to compensate for this prepayment possibility,

mortgage-backed securities tend to offer higher yields than other bonds of

comparable credit quality and maturity. In contrast, when interest rates rise,

prepayments tend to slow down, subjecting mortgage-backed securities to

extension risk—the possibility that homeowners will repay their mortgages

at slower rates. This will lengthen the duration or average life of

mortgage-backed securities held by a fund and delay the fund’s ability to

reinvest proceeds at higher interest rates, making the fund more sensitive to

changes in interest rates. |

Changes in interest rates can affect bond income as well as bond prices.

The Fund is subject to income risk, which is the chance that the Fund’s income will decline because of falling interest rates. A fund holding bonds will experience a decline in income when interest rates fall because the fund then must invest new cash flow and cash from maturing bonds in lower-yielding bonds. Income risk for the Fund is expected to be moderate because the average duration of the Fund's bond portfolio is intermediate-term.

Plain Talk About Bond Maturities |

A bond is issued with a specific maturity date—the date when the issuer

must pay back the bond’s principal (face value). Bond maturities range from

less than 1 year to more than 30 years. Typically, the longer a bond’s maturity,

the more price risk you, as a bond investor, will face as interest rates

rise—but also the higher the potential yield you could receive. Longer-term

bonds are generally more suitable for investors willing to take a greater risk

of price fluctuations to get higher and more stable interest income.

Shorter-term bond investors should be willing to accept lower yields and

greater income variability in return for less fluctuation in the value of their

investment. The stated maturity of a bond may differ from the effective

maturity of a bond, which takes into consideration that an action such as a

call or refunding may cause bonds to be repaid before their stated

maturity dates. |

Because bond and stock prices often move in different directions, the Fund’s stock holdings help to reduce—but not eliminate—some of the bond price fluctuations caused by changes in interest rates. Likewise, stock market volatility may not have as dramatic an effect on the Fund as it would on a fund made up entirely of stocks.

Stocks

The remaining 35% to 40% of the Fund's assets are invested in stocks.

The Fund is subject to stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

Stocks of publicly traded companies are often classified according to market capitalization, which is the market value of a company’s outstanding shares. These classifications typically include small-cap, mid-cap, and large-cap. It is important to understand that there are no “official” definitions of small-, mid-, and large-cap, even among Vanguard fund advisors, and that market capitalization ranges can change over time. The asset-weighted median market capitalization of the Fund's stock holdings as of September 30, 2022, was $101 billion.

Market disruptions can adversely affect local and global markets as well as normal market conditions and operations. Any such disruptions could have an adverse impact on the value of the Fund's investments and Fund performance.

Security Selection

Wellington Management, advisor to the Fund, invests approximately 60% to 65% of the Fund's assets in investment-grade bonds and approximately 35% to 40% of the Fund’s assets in dividend-paying common stocks. Although the mix of stocks and bonds varies from time to time, depending on the advisor’s view of economic and market conditions, generally bonds can be expected to represent at least 60% of the Fund’s holdings.

The Fund is managed according to traditional methods of active investment management. Securities are bought and sold based on the advisor’s judgments about companies and their financial prospects and about bond issuers and the general level of interest rates. The Fund's advisor may, at times, select securities that cause the Fund to focus in a particular market sector, which would subject the Fund to proportionately higher exposure to the risks of that sector.

The Fund is subject to manager risk, which is the chance that poor security selection will cause the Fund to underperform relevant benchmarks or other funds with a similar investment objective.

Bonds

Wellington Management selects investment-grade bonds that it believes will generate a reasonable and sustainable level of current income. These may include short-, intermediate-, and long-term corporate, U.S. Treasury, government agency, and asset-backed bonds, as well as mortgage-backed securities. The bonds are bought and sold according to the advisor’s judgment about bond issuers and the general direction of interest rates, within the context of the economy in general. Although the Fund does not have specific maturity guidelines, the average duration of the Fund’s bond portfolio as of September 30, 2022, was 6.7 years.

Plain Talk About Types of Bonds |

Bonds are issued (sold) by many sources: Corporations issue corporate

bonds; the federal government issues U.S. Treasury bonds; agencies of the

federal government issue agency bonds; financial institutions issue

asset-backed bonds; and mortgage holders issue “mortgage-backed”

pass-through certificates. Each issuer is responsible for paying back the

bond’s initial value as well as for making periodic interest payments. Many

bonds issued by government agencies and entities are neither guaranteed

nor insured by the U.S. government. |

A breakdown of the Fund’s bond holdings (which amounted to approximately 61.1% of the Fund’s net assets) as of September 30, 2022, follows:

|

|

Percentage of Fund’s

Bond Holdings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Government Mortgage-Backed |

|

|

|

|

|

|

|

Commercial Mortgage-Backed |

|

Keep in mind that, because the bond makeup of the Fund can change daily, this listing is only a “snapshot” at one point in time.

The Fund is subject to credit risk, which is the chance that a bond issuer will fail to pay interest or principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

The advisor purchases bonds that are of investment-grade quality—that is, bonds rated at least Baa3 by Moody‘s Investors Service, Inc., or BBB– by Standard & Poor‘s—or, if unrated, are determined to be of comparable quality by the advisor.

The U.S. government guarantees the timely payment of interest and principal for its U.S. Treasury bonds; some (but not all) agency bonds have the same guarantee. The government does not, however, guarantee its bonds’ prices. In other words, although U.S. Treasury and agency bonds may enjoy among the highest credit ratings, their prices—like the prices of other bonds in the Fund—will fluctuate with changes in interest rates.

Plain Talk About Credit Quality |

A bond’s credit quality rating is an assessment of the issuer’s ability to pay

interest on the bond and, ultimately, to repay the principal. The lower the

credit quality, the greater the perceived chance that the bond issuer will

default, or fail to meet its payment obligations. All things being equal, the

lower a bond’s credit quality, the higher its yield should be to compensate

investors for assuming additional risk. |

Although falling interest rates tend to strengthen bond prices, they can cause another problem for bond fund investors—bond calls.

The Fund is subject to call risk, which is the chance that during periods of falling interest rates, issuers of callable bonds may call (redeem) securities with higher coupon rates or interest rates before their maturity dates. The Fund would then lose any price appreciation above the bond’s call price and would be forced to reinvest the unanticipated proceeds at lower interest rates, resulting in a decline in the Fund‘s income. Such redemptions and subsequent reinvestments would also increase the Fund’s portfolio turnover rate. For mortgage-backed securities, this risk is known as prepayment risk. Call/prepayment risk is expected to be low to moderate for the Fund because it invests only a limited portion of its assets in callable bonds and mortgage-backed securities.

Bond issuers take advantage of falling interest rates by calling corporate bonds. With mortgage-backed securities, it is the mortgage holder—such as the U.S. homeowner—who benefits from lower rates.

The Fund is subject to liquidity risk, which is the chance that the Fund may not be able to sell a security in a timely manner at a desired price.

Corporate bonds are traded among dealers and brokers that connect buyers with sellers. Liquidity in the corporate bond market may be challenged depending on overall economic conditions and credit tightening. There may be little trading in the secondary market for particular bonds and other debt securities, which may make them more difficult to value or sell.

Stocks

The Fund’s stocks are chosen primarily for their dividend-paying capabilities, but they must also have the potential for moderate long-term capital appreciation. The advisor looks for stocks of companies that either offer significant dividends now or expect to increase their dividends in the future. This income orientation leads the Fund to invest in stocks with higher-than-market-average dividend yields. As a result, the Fund's equity holdings are expected to have more of a value orientation than a growth orientation.

Plain Talk About Growth Funds and Value Funds |

Growth investing and value investing are two styles employed by stock-fund

managers. Growth funds generally invest in stocks of companies believed to

have above-average potential for growth in revenue, earnings, cash flow, or

other similar criteria. These stocks typically have low dividend yields, if any,

and above-average prices in relation to measures such as earnings and book

value. Value funds typically invest in stocks whose prices are below average

in relation to those measures; these stocks often have above-average

dividend yields. Value stocks also may remain undervalued by the market for

long periods of time. Growth and value stocks have historically produced

similar long-term returns, though each category has periods when it

outperforms the other. |

The Fund is subject to investment style risk, which is the chance that returns from mid- and large-capitalization dividend-paying value stocks will trail returns from the overall stock market. Mid- and large-cap stocks each tend to go through cycles of doing better—or worse—than other segments of the stock market or the stock market in general. These periods have, in the past, lasted for as long as several years. Historically, mid-cap stocks have been more volatile in price than large-cap stocks. The stock prices of mid-size companies tend to experience greater volatility because, among other things, these companies tend to be more sensitive to changing economic conditions.

Other Investment Policies and Risks

In addition to investing in bonds and stocks, the Fund may make other kinds of investments to achieve its investment objective.

Although the Fund typically does not make significant investments in foreign securities, it reserves the right to invest up to 25% of its assets in foreign securities, which may include depositary receipts. Foreign securities may be traded on U.S. or foreign markets. To the extent that it owns foreign securities, the Fund is subject to country risk and currency risk. Country risk is the chance that world events—such as political upheaval, financial troubles, or natural disasters—will adversely affect the value and/or liquidity of securities issued by companies in foreign countries. In addition, the prices of foreign stocks and the prices of U.S. stocks have, at times, moved in opposite directions. Currency risk is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates.

The Fund may invest in securities that are convertible into common stocks, as well as invest modestly in collateralized mortgage obligations (CMOs).

The Fund may also invest, to a limited extent, in derivatives. Generally speaking, a derivative is a financial contract whose value is based on the value of a financial asset (such as a stock, a bond, or a currency), a physical asset (such as gold, oil, or wheat), a market index, or a reference rate. Investments in derivatives may subject the Fund to risks different from, and possibly greater than, those of investments directly in the underlying securities or assets. The Fund's derivative investments may include fixed income futures contracts, options, straddles, credit swaps, interest rate swaps, total return swaps, and other types of derivatives. The Fund will not use derivatives for speculation or for the purpose of leveraging (magnifying) investment returns.

The Fund may enter into foreign currency exchange forward contracts, which are a type of derivative. A foreign currency exchange forward contract is an agreement to buy or sell a currency at a specific price on a specific date, usually 30, 60, or 90 days in the future. In other words, the contract guarantees an exchange rate on a given date. Advisors of funds that invest in foreign securities can use these contracts to guard against unfavorable changes in currency exchange rates. These contracts, however, would not prevent the Fund’s securities from falling in value as a result of risks other than unfavorable currency exchange movements.

Plain Talk About Derivatives |

Derivatives can take many forms. Some forms of derivatives—such as

exchange-traded futures and options on securities, commodities, or

indexes—have been trading on regulated exchanges for decades. These

types of derivatives are standardized contracts that can easily be bought and

sold and whose market values are determined and published daily. On the

other hand, non-exchange-traded derivatives—such as certain swap

agreements and foreign currency exchange forward contracts—tend to be

more specialized or complex and may be more difficult to accurately value. |

Cash Management

The Fund's daily cash balance may be invested in Vanguard Market Liquidity Fund and/or Vanguard Municipal Cash Management Fund (each, a CMT Fund), which are low-cost money market funds. When investing in a CMT Fund, the Fund bears its proportionate share of the expenses of the CMT Fund in which it invests. Vanguard receives no additional revenue from Fund assets invested in a CMT Fund.

Redemption Requests

Methods used to meet redemption requests. Under normal circumstances, the Fund typically expects to meet redemptions with positive cash flows. When this is not an option, the Fund seeks to maintain its risk exposure by selling a cross section of the Fund’s holdings to meet redemptions, while also factoring in transaction costs. Additionally, the Fund may work with larger clients to implement their redemptions in a manner that is least disruptive to the portfolio; see “Potentially disruptive redemptions” under Redeeming Shares in the Investing With Vanguard section.

Under certain circumstances, including under stressed market conditions, there are additional tools that the Fund may use in order to meet redemptions, including advancing the settlement of market trades with counterparties to match investor redemption payments or delaying settlement of an investor’s transaction to match trade settlement within regulatory requirements. The Fund may also suspend payment of redemption proceeds for up to seven days; see “Emergency circumstances” under Redeeming Shares in the Investing With Vanguard section. Additionally under these unusual circumstances, the Fund may borrow money (subject to certain regulatory conditions and if available under board-approved procedures) through an interfund lending facility; through a bank line-of-credit, including a joint committed credit facility; or through an uncommitted line-of-credit from Vanguard in order to meet redemption requests.

Potential redemption activity impacts. At times, the Fund may experience adverse effects when certain large shareholders, or multiple shareholders comprising significant ownership of the Fund, redeem large amounts of shares of the Fund. Large redemptions may cause the Fund to sell portfolio securities at times when it would not otherwise do so. This may result in the Fund distributing capital gains or other taxable income to non-redeeming shareholders. Large redemptions may also increase the Fund's transaction costs. Redemption activity can occur for many reasons, including shareholder reactions to market movements or other events unrelated to Vanguard’s actions, or when Vanguard makes product changes that, for example, may result in a shareholder redeeming shares of the Fund to purchase shares of another similar fund or investment vehicle. When experiencing large redemptions, the Fund reserves the right to pay all or part of the redemption in-kind and/or delay payment of the redemption proceeds for up to seven calendar days; see “Potentially disruptive redemptions” under Redeeming Shares in the Investing With Vanguard section.

Temporary Investment Measures

The Fund may temporarily depart from its normal investment policies and strategies when the advisor believes that doing so is in the Fund's best interest, so long as the strategy or policy employed is consistent with the Fund's investment objective. For instance, the Fund may invest beyond its normal limits in derivatives or exchange-traded funds that are consistent with the Fund's investment objective when those instruments are more favorably priced or provide needed liquidity, as might be the case if the Fund is transitioning assets from one advisor to another or receives large cash flows that it cannot prudently invest immediately.

In addition, the Fund may take temporary defensive positions that are inconsistent with its normal investment policies and strategies—for instance, by allocating substantial assets to cash equivalent investments or other less volatile instruments—in response to adverse or unusual market, economic, political, or other conditions. In doing so, the Fund may succeed in avoiding losses but may otherwise fail to achieve its investment objective.

Frequent Trading or Market-Timing

Background. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. For funds holding foreign securities, investors may try to take advantage of an anticipated difference between the price of the fund’s shares and price movements in overseas markets, a practice also known as time-zone arbitrage. Investors also may try to engage in frequent trading of funds holding investments such as small-cap stocks and high-yield bonds. As money is shifted into and out of a fund by a shareholder engaging in frequent trading, the fund incurs costs for buying and selling securities, resulting in increased brokerage and administrative costs. These costs are borne by all fund shareholders, including the long-term investors who do not generate the costs. In addition, frequent trading may interfere with an advisor’s ability to efficiently manage the fund.

Policies to address frequent trading. The Vanguard funds (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) do not knowingly accommodate frequent trading. The board of trustees of each Vanguard fund (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) has adopted policies and procedures reasonably designed to detect and discourage frequent trading and, in some cases, to compensate the fund for the costs associated with it. These policies and procedures do not apply to ETF Shares because frequent trading in ETF Shares generally does not disrupt portfolio management or otherwise harm fund

shareholders. Although there is no assurance that Vanguard will be able to detect or prevent frequent trading or market-timing in all circumstances, the following policies have been adopted to address these issues:

• Each Vanguard fund reserves the right to reject any purchase request—including exchanges from other Vanguard funds—without notice and regardless of size. For example, a purchase request could be rejected because the investor has a history of frequent trading or if Vanguard determines that such purchase may negatively affect a fund’s operation or performance.

• Each Vanguard fund (other than money market funds and short-term bond funds, but including Vanguard Short-Term Inflation-Protected Securities Index Fund) generally prohibits, except as otherwise noted in the Investing With Vanguard section, an investor’s purchases or exchanges into a fund account for 30 calendar days after the investor has redeemed or exchanged out of that fund account.

• Certain Vanguard funds charge shareholders purchase and/or redemption fees on transactions.

See the Investing With Vanguard section of this prospectus for further details on Vanguard’s transaction policies.

Each Vanguard fund (other than retail and government money market funds), in determining its net asset value, will use fair-value pricing when appropriate, as described in the Share Price section. Fair-value pricing may reduce or eliminate the profitability of certain frequent-trading strategies.

Do not invest with Vanguard if you are a market-timer.

A precautionary note to investment companies: The Fund's shares are issued by a registered investment company, and therefore the acquisition of such shares by other investment companies and private funds is subject to the restrictions of Section 12(d)(1) of the Investment Company Act of 1940 (the 1940 Act). SEC Rule 12d1-4 under the 1940 Act permits registered investment companies to invest in other registered investment companies beyond the limits in Section 12(d)(1), subject to certain conditions, including that funds with different investment advisors must enter into a fund of funds investment agreement.

Turnover Rate

Although the Fund generally seeks to invest for the long term, it may sell securities regardless of how long they have been held. The Financial Highlights section of this prospectus shows historical turnover rates for the Fund. A turnover rate of 100%, for example, would mean that the Fund had sold and

replaced securities valued at 100% of its net assets within a one-year period. In general, the greater the turnover rate, the greater the impact transaction costs will have on a fund’s return. Also, funds with high turnover rates may be more likely to generate capital gains, including short-term capital gains, that must be distributed to shareholders and will be taxable to shareholders investing through a taxable account.

The Fund and Vanguard

The Fund is a member of The Vanguard Group, Inc. (Vanguard), a family of over 200 funds. All of the funds that are members of Vanguard (other than funds of funds) share in the expenses associated with administrative services and business operations, such as personnel, office space, and equipment.

Vanguard Marketing Corporation provides marketing services to the funds. Although fund shareholders do not pay sales commissions or 12b-1 distribution fees, each fund (other than a fund of funds) or each share class of a fund (in the case of a fund with multiple share classes) pays its allocated share of the Vanguard funds’ marketing costs.

Plain Talk About Vanguard’s Unique Corporate Structure |

Vanguard is owned jointly by the funds it oversees and thus indirectly by the

shareholders in those funds. Most other mutual funds are operated by

management companies that are owned by third parties—either public or

private stockholders—and not by the funds they serve. |

Investment Advisor

Wellington Management Company LLP, 280 Congress Street, Boston, MA 02210, a Delaware limited liability partnership, is an investment counseling firm that provides investment services to investment companies, employee benefit plans, endowments, foundations, and other institutions. Wellington Management and its predecessor organizations have provided investment advisory services for over 80 years. Wellington Management is owned by the partners of Wellington Management Group LLP, a Massachusetts limited liability partnership. As of September 30, 2022, Wellington Management and its investment advisory affiliates had investment management authority with respect to approximately $1.1 trillion in client assets. The firm manages the Fund subject to the supervision and oversight of the trustees and officers of the Fund.

The Fund pays the advisor a base fee plus or minus a performance adjustment. The base fee, which is paid quarterly, is a percentage of average daily net assets under management during the most recent fiscal quarter. The base fee has breakpoints, which means that the percentage declines as assets go up. The performance adjustment, also paid quarterly, is based on the cumulative total return of the Fund relative to that of the Wellesley Income Composite Index over the preceding 36-month period. The Index is a composite benchmark weighted 65% in the Bloomberg U.S. Credit A or Better Bond Index and 35% in the FTSE High Dividend Yield Index. When the performance adjustment is positive, the Fund’s expenses increase; when it is negative, expenses decrease.

For the fiscal year ended September 30, 2022, the advisory fee represented an effective annual rate of 0.05% of the Fund’s average net assets before a performance-based increase of 0.01%.

Under the terms of an SEC exemption, the Fund's board of trustees may, without prior approval from shareholders, change the terms of an advisory agreement with a third-party investment advisor or hire a new third-party investment advisor—either as a replacement for an existing advisor or as an additional advisor. Any significant change in the Fund’s advisory arrangements will be communicated to shareholders in writing. As the Fund's sponsor and overall manager, Vanguard may provide investment advisory services to the Fund at any time. Vanguard may also recommend to the board of trustees that an advisor be hired, terminated, or replaced or that the terms of an existing advisory agreement be revised. The Fund has filed an application seeking a similar SEC exemption with respect to investment advisors that are wholly owned subsidiaries of Vanguard. If the exemption is granted, the Fund may rely on the new SEC relief.

For a discussion of why the board of trustees approved the Fund's investment advisory agreement, see the most recent annual report to shareholders covering the fiscal year ended September 30.

The managers primarily responsible for the day-to-day management of the Fund are:

Matthew C. Hand, CFA, Senior Managing Director and Equity Portfolio Manager of Wellington Management. He has worked in investment management since joining Wellington Management in 2004, has managed investment portfolios since 2019, and has managed a portion of the Fund since July 2022 (co-managed since 2021). Education: B.A., University of Pennsylvania.

Loren L. Moran, CFA, Senior Managing Director and Fixed Income Portfolio Manager of Wellington Management. She has worked in investment management since 2001, has been with Wellington Management since 2014, and has managed the bond portion of the Fund since 2017. Education: B.S., Georgetown University.

The Fund's Statement of Additional Information provides information about each portfolio manager’s compensation, other accounts under management, and ownership of shares of the Fund.

Dividends, Capital Gains, and Taxes

Fund Distributions

The Fund distributes to shareholders virtually all of its net income (interest and dividends, less expenses) as well as any net short-term or long-term capital gains realized from the sale of its holdings. From time to time, the Fund may also make distributions that are treated as a return of capital. Income dividends generally are distributed quarterly in March, June, September, and December; capital gains distributions, if any, generally occur annually in December. In addition, the Fund may occasionally make a supplemental distribution at some other time during the year.

You can receive distributions of income or capital gains in cash, or you can have them automatically reinvested in more shares of the Fund. However, if you are investing through an employer-sponsored retirement or savings plan, your distributions will be automatically reinvested in additional Fund shares.

Plain Talk About Distributions |

As a shareholder, you are entitled to your portion of a fund’s income from

interest and dividends as well as capital gains from the fund’s sale of

investments. Income consists of both the dividends that the fund earns from

any stock holdings and the interest it receives from any money market and

bond investments. Capital gains are realized whenever the fund sells

securities for higher prices than it paid for them. These capital gains are

either short-term or long-term, depending on whether the fund held the

securities for one year or less or for more than one year. |

Basic Tax Points

Investors in taxable accounts should be aware of the following basic federal income tax points:

• Distributions are taxable to you whether or not you reinvest these amounts in additional Fund shares.

• Distributions declared in December—if paid to you by the end of January—are taxable as if received in December.

• Any dividend distribution or short-term capital gains distribution that you receive is taxable to you as ordinary income. If you are an individual and meet certain holding-period requirements with respect to your Fund shares, you may be eligible for reduced tax rates on “qualified dividend income,” if any, or a special tax deduction on “qualified REIT dividends,” if any, distributed by the Fund.

• Any distribution of net long-term capital gains is taxable to you as long-term capital gains, no matter how long you have owned shares in the Fund.

• Capital gains distributions may vary considerably from year to year as a result of the Fund's normal investment activities and cash flows.

• Your cost basis in the Fund will be decreased by the amount of any return of capital that you receive. This, in turn, will affect the amount of any capital gain or loss that you realize when selling or exchanging your Fund shares.

• Return of capital distributions generally are not taxable to you until your cost basis has been reduced to zero. If your cost basis is at zero, return of capital distributions will be treated as capital gains.

• A sale or exchange of Fund shares is a taxable event. This means that you may have a capital gain to report as income, or a capital loss to report as a deduction, when you complete your tax return.

• Any conversion between classes of shares of the same fund is a nontaxable event. By contrast, an exchange between classes of shares of different funds is a taxable event.

• Vanguard (or your intermediary) will send you a statement each year showing the tax status of all of your distributions.

Individuals, trusts, and estates whose income exceeds certain threshold amounts are subject to a 3.8% Medicare contribution tax on “net investment income.” Net investment income takes into account distributions paid by the Fund and capital gains from any sale or exchange of Fund shares.

Dividend distributions and capital gains distributions that you receive, as well as your gains or losses from any sale or exchange of Fund shares, may be subject to state and local income taxes.

This prospectus provides general tax information only. If you are investing through a tax-advantaged account, such as an IRA or an employer-sponsored retirement or savings plan, special tax rules apply. Please consult your tax advisor for detailed information about any tax consequences for you.

Plain Talk About Buying a Dividend |

Unless you are a tax-exempt investor or investing through a tax-advantaged

account (such as an IRA or an employer-sponsored retirement or savings

plan), you should consider avoiding a purchase of fund shares shortly before

the fund makes a distribution, because doing so can cost you money in

taxes. This is known as “buying a dividend.” For example: On December 15,

you invest $5,000, buying 250 shares for $20 each. If the fund pays a

distribution of $1 per share on December 16, its share price will drop to $19

(not counting market change). You still have only $5,000 (250 shares x $19 =

$4,750 in share value, plus 250 shares x $1 = $250 in distributions), but you

owe tax on the $250 distribution you received—even if you reinvest it in

more shares. To avoid buying a dividend, check a fund’s distribution schedule

before you invest. |

General Information

Backup withholding. By law, Vanguard must withhold 24% of any taxable distributions or redemptions from your account if you do not:

• Provide your correct taxpayer identification number.

• Certify that the taxpayer identification number is correct.

• Confirm that you are not subject to backup withholding.

Similarly, Vanguard (or your intermediary) must withhold taxes from your account if the IRS instructs us to do so.

Foreign investors. Vanguard funds offered for sale in the United States (Vanguard U.S. funds), including the Fund offered in this prospectus, are not widely available outside the United States. Non-U.S. investors should be aware that U.S. withholding and estate taxes and certain U.S. tax reporting requirements may apply to any investments in Vanguard U.S. funds. Foreign investors should visit the non-U.S. investors page on our website at vanguard.com for information on Vanguard’s non-U.S. products.

Invalid addresses. If a dividend distribution or capital gains distribution check mailed to your address of record is returned as undeliverable, Vanguard will automatically reinvest the distribution and all future distributions until you provide us with a valid mailing address. Reinvestments will receive the net asset value calculated on the date of the reinvestment.

Share Price

Share price, also known as net asset value (NAV), is calculated as of the close of regular trading on the New York Stock Exchange (NYSE), generally 4 p.m., Eastern time, on each day that the NYSE is open for business (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. Each share class has its own NAV, which is computed by dividing the total assets, minus liabilities, allocated to the share class by the number of Fund shares outstanding for that class. On U.S. holidays or other days when the NYSE is closed, the NAV is not calculated, and the Fund does not sell or redeem shares. However, on those days the value of the Fund’s assets may be affected to the extent that the Fund holds securities that change in value on those days (such as foreign securities that trade on foreign markets that are open).

Stocks held by a Vanguard fund are valued at their market value when reliable market quotations are readily available from the principal exchange or market on which they are traded. Such securities are generally valued at their official closing price, the last reported sales price, or if there were no sales that day, the mean between the closing bid and asking prices. Debt securities held by a fund are valued based on information furnished by an independent pricing service or market quotations. When a fund determines that pricing-service information or market quotations either are not readily available or do not accurately reflect the value of a security, the security is priced at its fair value (the amount that the owner might reasonably expect to receive upon the current sale of the security).

The values of any foreign securities held by a fund are converted into U.S. dollars using an exchange rate obtained from an independent third party as of the close of regular trading on the NYSE. The values of any mutual fund shares, including institutional money market fund shares, held by a fund are based on the NAVs of the shares. The values of any ETF shares or closed-end fund shares held by a fund are based on the market value of the shares.

A fund also will use fair-value pricing if the value of a security it holds has been materially affected by events occurring before the fund's pricing time but after the close of the principal exchange or market on which the security is traded. This most commonly occurs with foreign securities, which may trade on foreign exchanges that close many hours before the fund's pricing time. Intervening events might be company-specific (e.g., earnings report, merger announcement) or country-specific or regional/global (e.g., natural disaster, economic or political news, interest rate change, act of terrorism). Intervening events include price movements in U.S. markets that exceed a specified threshold or that are otherwise deemed to affect the value of foreign securities.

Fair-value pricing may be used for domestic securities—for example, if (1) trading in a security is halted and does not resume before the fund’s pricing time or a security does not trade in the course of a day and (2) the fund holds enough of the security that its price could affect the NAV. A fund may use fair-value pricing with respect to its fixed income securities on bond market holidays when the fund is open for business (such as Columbus Day and Veterans Day).

Fair-value prices are determined by Vanguard according to procedures adopted by the board of trustees. When fair-value pricing is employed, the prices of securities used by a fund to calculate the NAV may differ from quoted or published prices for the same securities.

The Fund has authorized certain financial intermediaries and their designees, and may, from time to time, authorize certain fund of funds for which Vanguard serves as the investment advisor (Vanguard Funds of Funds), to accept orders to buy or sell fund shares on its behalf. The Fund will be deemed to receive an order when accepted by the financial intermediary, its designee, or one of the Vanguard Funds of Funds, and the order will receive the NAV next computed by the Fund after such acceptance.

Vanguard fund share prices are published daily on our website at vanguard.com/prices.

Financial Highlights

Financial highlights information is intended to help you understand a fund’s performance for the past five years (or, if shorter, its period of operations). Certain information reflects financial results for a single fund share. Total return represents the rate that an investor would have earned or lost each period on an investment in a fund or share class (assuming reinvestment of all distributions). This information has been obtained from the financial statements audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, whose report, along with fund financial statements, is included in a fund’s most recent annual report to shareholders. You may obtain a free copy of a fund’s latest annual or semiannual report, which is available upon request.

Vanguard Wellesley Income Fund Investor Shares

|

|

|

For a Share Outstanding Throughout Each Period |

|

|

|

|

|

Net Asset Value, Beginning of Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Realized and Unrealized Gain (Loss) on Investments |

|

|

|

|

|

Total from Investment Operations |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends from Net Investment Income |

|

|

|

|

|

Distributions from Realized Capital Gains |

|

|

|

|

|

|

|

|

|

|

|

|

Net Asset Value, End of Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

|

|

|

|

|

Ratio of Total Expenses to Average Net Assets3 |

|

|

|

|

|

Ratio of Net Investment Income to Average Net Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculated based on average shares outstanding. |

|

|

Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses

provide information about any applicable account service fees. |

|

|

Includes performance-based investment advisory fee increases (decreases) of 0.01%, 0.01%, 0.01%, 0.01%, and

0.00%. |

|

|

The ratio of expenses to average net assets for the period net of reduction from custody fee offset and broker

commission abatement arrangements was 0.23%. |

|

|

Includes 10%, 4%, 7%, 2%, and 4%, respectively, attributable to mortgage-dollar-roll activity. |

Vanguard Wellesley Income Fund Admiral Shares

|

|

|

For a Share Outstanding Throughout Each Period |

|

|

|

|

|

Net Asset Value, Beginning of Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Realized and Unrealized Gain (Loss) on Investments |

|

|

|

|

|

Total from Investment Operations |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends from Net Investment Income |

|

|

|

|

|

Distributions from Realized Capital Gains |

|

|

|

|

|

|

|

|

|

|

|

|

Net Asset Value, End of Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets, End of Period (Millions) |

|

|

|

|

|

Ratio of Total Expenses to Average Net Assets3 |

|

|

|

|

|

Ratio of Net Investment Income to Average Net Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculated based on average shares outstanding. |

|

|

Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses

provide information about any applicable account service fees. |

|

|

Includes performance-based investment advisory fee increases (decreases) of 0.01%, 0.01%, 0.01%, 0.01%, and

0.00%. |

|

|

The ratio of expenses to average net assets for the period net of reduction from custody fee offset and broker

commission abatement arrangements was 0.16%. |

|

|

Includes 10%, 4%, 7%, 2%, and 4%, respectively, attributable to mortgage-dollar-roll activity. |

Investing With Vanguard

This section of the prospectus explains the basics of doing business with Vanguard. Vanguard fund shares can be held directly with Vanguard or indirectly through an intermediary, such as a bank, a broker, or an investment advisor. If you hold Vanguard fund shares directly with Vanguard, you should carefully read each topic within this section that pertains to your relationship with Vanguard. If you hold Vanguard fund shares indirectly through an intermediary (including shares held in a brokerage account through Vanguard Brokerage Services®), please see Investing With Vanguard Through Other Firms, and also refer to your account agreement with the intermediary for information about transacting in that account. If you hold Vanguard fund shares through an employer-sponsored retirement or savings plan, please see Employer-Sponsored Plans. Vanguard reserves the right to change the following policies without notice. Please call or check online for current information. See Contacting Vanguard.

For Vanguard fund shares held directly with Vanguard, each fund you hold in an account is a separate “fund account.” For example, if you hold three funds in a nonretirement account titled in your own name, two funds in a nonretirement account titled jointly with your spouse, and one fund in an individual retirement account, you have six fund accounts—and this is true even if you hold the same fund in multiple accounts. Note that each reference to “you” in this prospectus applies to any one or more registered account owners or persons authorized to transact on your account.

Purchasing Shares

Vanguard reserves the right, without notice, to increase or decrease the minimum amount required to open, convert shares to, or maintain a fund account or to add to an existing fund account.

Investment minimums may differ for certain categories of investors.

Account Minimums for Investor Shares

To open and maintain an account. $3,000.

To add to an existing account. Generally $1.

Account Minimums for Admiral Shares

To open and maintain an account. $50,000. If you request Admiral Shares when you open a new account but the investment amount does not meet the account minimum for Admiral Shares, your investment will be placed in Investor Shares of the Fund. Financial intermediaries, institutional clients, and Vanguard-advised clients should contact Vanguard for information on special

eligibility rules that may apply to them regarding Admiral Shares. If you are investing through an intermediary, please contact that firm directly for more information regarding your eligibility.

To add to an existing account. Generally $1.

How to Initiate a Purchase Request

Be sure to check Exchanging Shares, Frequent-Trading Limitations, and Other Rules You Should Know before placing your purchase request.

Online. You may open certain types of accounts, request a purchase of shares, and request an exchange through our website or our mobile application if your account is eligible and you are registered for online access.

By telephone. You may call Vanguard to begin the account registration process or request that the account-opening forms be sent to you. You may also call Vanguard to request a purchase of shares in your account or to request an exchange. See Contacting Vanguard.

By mail. You may send Vanguard your account registration form and check to open a new fund account. To add to an existing fund account, you may send your check with an Invest-by-Mail form (from a transaction confirmation or your account statement) or with a deposit slip (available online).

How to Pay for a Purchase

By electronic bank transfer. You may purchase shares of a Vanguard fund through an electronic transfer of money from a bank account. To establish the electronic bank transfer service on an account, you must designate the bank account online, complete a form, or fill out the appropriate section of your account registration form. After the service is set up on your account, you can purchase shares by electronic bank transfer on a regular schedule (Automatic Investment Plan), if eligible, or upon request. Your purchase request can be initiated online (if you are registered for online access), by telephone, or by mail.

By wire. Wiring instructions vary for different types of purchases. Please call Vanguard for instructions and policies on purchasing shares by wire. See Contacting Vanguard.

By check. You may make initial or additional purchases to your fund account by sending a check with a deposit slip or by utilizing our mobile application if your account is eligible and you are registered for online access. Also see How to Initiate a Purchase Request. Make your check payable to Vanguard and include the appropriate fund number (e.g., Vanguard—xx). For a list of Fund numbers (for share classes in this prospectus), see Additional Information.

By exchange. You may purchase shares of a Vanguard fund using the proceeds from the simultaneous redemption of shares of another Vanguard fund. You may initiate an exchange online (if you are registered for online access), by telephone, or by mail with an exchange form. See Exchanging Shares.

Trade Date

The trade date for any purchase request received in good order will depend on the day and time Vanguard receives your request, the manner in which you are paying, and the type of fund you are purchasing. Your purchase will be executed using the NAV as calculated on the trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. The time selected for NAV calculation in this rare event shall also serve as the conclusion of the trading day. See Share Price.

For purchases by check into all funds other than money market funds and for purchases by exchange, wire, or electronic bank transfer into all funds: If the purchase request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date for the purchase will be the same day. If the purchase request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date for the purchase will be the next business day.

For purchases by check into money market funds: If the purchase request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date for the purchase will be the next business day. If the purchase request is received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date for the purchase will be the second business day following the day Vanguard receives the purchase request. Because money market instruments must be purchased with federal funds and it takes a money market mutual fund one business day to convert check proceeds into federal funds, the trade date for the purchase will be one business day later than for other funds.

If applicable, orders by Vanguard Funds of Funds will be treated as received by the Fund at the same time that corresponding orders are received in proper form by the Vanguard Funds of Funds.

If your purchase request is not accurate and complete, it may be rejected. See Other Rules You Should Know—Good Order.

For further information about purchase transactions, consult our website at vanguard.com or see Contacting Vanguard.

Other Purchase Rules You Should Know

Admiral Shares. Admiral Shares generally are not available for SIMPLE IRAs and Vanguard Individual 401(k) Plans.

Check purchases. All purchase checks must be written in U.S. dollars, be drawn on a U.S. bank, and be accompanied by good order instructions. Vanguard does not accept cash, traveler’s checks, starter checks, or money orders. In addition, Vanguard may refuse checks that are not made payable to Vanguard.

New accounts. We are required by law to obtain from you certain personal information that we will use to verify your identity. If you do not provide the information, we may not be able to open your account. If we are unable to verify your identity, Vanguard reserves the right, without notice, to close your account or take such other steps as we deem reasonable. Certain types of accounts may require additional documentation.

Refused or rejected purchase requests. Vanguard reserves the right to stop selling fund shares or to reject any purchase request at any time and without notice, including, but not limited to, purchases requested by exchange from another Vanguard fund. This also includes the right to reject any purchase request because the investor has a history of frequent trading or because the purchase may negatively affect a fund’s operation or performance.

Large purchases. Call Vanguard before attempting to invest a large dollar amount.

No cancellations. Vanguard will not accept your request to cancel any purchase request once processing has begun. Please be careful when placing a purchase request.

Converting Shares

When a conversion occurs, you receive shares of one class in place of shares of another class of the same fund. At the time of conversion, the dollar value of the “new” shares you receive equals the dollar value of the “old” shares that were converted. In other words, the conversion has no effect on the value of your investment in the fund at the time of the conversion. However, the number of shares you own after the conversion may be greater than or less than the number of shares you owned before the conversion, depending on the NAVs of the two share classes.

Vanguard will not accept your request to cancel any self-directed conversion request once processing has begun. Please be careful when placing a conversion request.

A conversion between share classes of the same fund is a nontaxable event.

Trade Date

The trade date for any conversion request received in good order will depend on the day and time Vanguard receives your request. Your conversion will be executed using the NAVs of the different share classes on the trade date. NAVs are calculated only on days that the NYSE is open for trading (a business day). In the rare event the NYSE experiences unanticipated disruptions and is unavailable at the close of the trading day, NAVs will be calculated as of the close of regular trading on the Nasdaq (or another alternate exchange if the Nasdaq is unavailable, as determined at Vanguard’s discretion), generally 4 p.m., Eastern time. The time selected for NAV calculation in this rare event shall also serve as the conclusion of the trading day. See Share Price.

For a conversion request received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date will be the same day. For a conversion request received on a business day after the close of regular trading on the NYSE, or on a nonbusiness day, the trade date will be the next business day. See Other Rules You Should Know.

Conversions From Investor Shares to Admiral Shares

Self-directed conversions. If your account balance in the Fund is at least $50,000, you may ask Vanguard to convert your Investor Shares to Admiral Shares at any time. You may request a conversion through our website (if you are registered for online access), by telephone, or by mail. Financial intermediaries, institutional clients, and Vanguard-advised clients should contact Vanguard for information on special eligibility rules that may apply to them regarding Admiral Shares. See Contacting Vanguard. If you are investing through an intermediary, please contact that firm directly for more information regarding your eligibility.

Automatic conversions. Vanguard conducts periodic reviews of account balances and may, if your account balance in the Fund exceeds $50,000, automatically convert your Investor Shares to Admiral Shares. You will be notified before an automatic conversion occurs and will have an opportunity to instruct Vanguard not to effect the conversion. Financial intermediaries, institutional clients, and Vanguard-advised clients should contact Vanguard for information on special eligibility rules that may apply to them regarding Admiral Shares. If you are investing through an intermediary, please contact that firm directly for more information regarding your eligibility.

Mandatory Conversions to Investor Shares