| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) | ||||||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| Page | ||||||||||||||

| Term | Definition | |||||||

| 2021 364-Day Credit Agreement | The Company's $1,500 million credit agreement, which was entered into on March 26, 2021 and was terminated on February 23, 2022 | |||||||

| 2022 Revolving Credit Agreement | KDP’s $4 billion revolving credit agreement, which was executed in February 2022 and replaced the 2021 364-Day Credit Agreement and the KDP Revolver | |||||||

| Annual Report | Annual Report on Form 10-K for the year ended December 31, 2022 | |||||||

| AOCI | Accumulated other comprehensive income or loss | |||||||

| Athletic Brewing | Athletic Brewing Holding Company, LLC, an equity method investment of KDP | |||||||

| Bedford | Bedford Systems, LLC, an equity method investment of KDP and the maker of Drinkworks | |||||||

| Board | The Board of Directors of KDP | |||||||

| bps | Basis points | |||||||

| CSD | Carbonated soft drink | |||||||

| DIO | Days inventory outstanding | |||||||

| DPO | Days of payables outstanding | |||||||

| DPS | Dr Pepper Snapple Group, Inc. | |||||||

| DPS Merger | The combination of the business operations of Keurig and DPS that was consummated on July 9, 2018 through a reverse merger transaction, whereby a wholly-owned special purpose merger subsidiary of DPS merged with and into the direct parent of Keurig | |||||||

| DSD | Direct Store Delivery, KDP’s route-to-market whereby finished beverages are delivered directly to retailers | |||||||

| DSO | Days sales outstanding | |||||||

| EPS | Earnings per share | |||||||

| Exchange Act | Securities Exchange Act of 1934, as amended | |||||||

| FX | Foreign exchange | |||||||

| IRi | Information Resources, Inc. | |||||||

| KDP | Keurig Dr Pepper Inc. | |||||||

| KDP Revolver | The Company's $2,400 million revolving credit facility, which was entered into on February 28, 2018 and terminated on February 23, 2022 | |||||||

| Keurig | Keurig Green Mountain, Inc., a wholly-owned subsidiary of KDP, and the brand of our brewers | |||||||

| La Colombe | La Colombe Holdings, Inc., an equity method investment of KDP | |||||||

| LRB | Liquid refreshment beverages | |||||||

| NCB | Non-carbonated beverage | |||||||

| Notes | Collectively, the Company's senior unsecured notes | |||||||

| Nutrabolt | Woodbolt Holdings LLC, d/b/a Nutrabolt, an equity method investment of KDP | |||||||

| Revive | Revive Brands, a wholly-owned subsidiary of KDP | |||||||

| RSU | Restricted share unit | |||||||

| RTD | Ready to drink | |||||||

| RVG | Residual value guarantee | |||||||

| Tractor | Tractor Beverages, Inc., an equity method investment of KDP | |||||||

| SEC | Securities and Exchange Commission | |||||||

| SG&A | Selling, general and administrative | |||||||

| SOFR | Secured Overnight Financing Rate | |||||||

| U.S. GAAP | Accounting principles generally accepted in the U.S. | |||||||

| Veyron SPEs | Special purpose entities with the same sponsor, Veyron Global | |||||||

| VIE | Variable interest entity | |||||||

| Vita Coco | The Vita Coco Company, Inc. | |||||||

| WD | Warehouse Direct, KDP’s route-to-market whereby finished beverages are shipped to retailer warehouses, and then delivered by the retailer through its own delivery system to its stores | |||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions, except per share data) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| Cost of sales | |||||||||||||||||||||||

| Gross profit | |||||||||||||||||||||||

| Selling, general and administrative expenses | |||||||||||||||||||||||

| Impairment of intangible assets | |||||||||||||||||||||||

| Gain on litigation settlement | ( | ||||||||||||||||||||||

| Other operating income, net | ( | ( | ( | ||||||||||||||||||||

| Income from operations | |||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Loss on early extinguishment of debt | |||||||||||||||||||||||

| Gain on sale of equity method investment | ( | ||||||||||||||||||||||

| Impairment of investments and note receivable | |||||||||||||||||||||||

| Other (income) expense, net | ( | ( | |||||||||||||||||||||

| Income before provision for income taxes | |||||||||||||||||||||||

| Provision for income taxes | |||||||||||||||||||||||

| Net income including non-controlling interest | |||||||||||||||||||||||

| Less: Net loss attributable to non-controlling interest | ( | ( | |||||||||||||||||||||

| Net income attributable to KDP | $ | $ | $ | $ | |||||||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||

| Basic | $ | $ | $ | $ | |||||||||||||||||||

| Diluted | |||||||||||||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Net income including non-controlling interest | $ | $ | $ | $ | |||||||||||||||||||

| Other comprehensive (loss) income | |||||||||||||||||||||||

| Foreign currency translation adjustments | ( | ( | ( | ||||||||||||||||||||

Net change in pension and post-retirement liability, net of tax of $ | ( | ||||||||||||||||||||||

Net change in cash flow hedges, net of tax of $ | ( | ||||||||||||||||||||||

| Total other comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Comprehensive income (loss) including non-controlling interest | ( | ||||||||||||||||||||||

| Less: Comprehensive income attributable to non-controlling interest | |||||||||||||||||||||||

| Comprehensive income (loss) attributable to KDP | $ | $ | ( | $ | $ | ||||||||||||||||||

| September 30, | December 31, | |||||||||||||

| (in millions, except share and per share data) | 2023 | 2022 | ||||||||||||

| Assets | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Trade accounts receivable, net | ||||||||||||||

| Inventories | ||||||||||||||

| Prepaid expenses and other current assets | ||||||||||||||

| Total current assets | ||||||||||||||

| Property, plant and equipment, net | ||||||||||||||

| Investments in unconsolidated affiliates | ||||||||||||||

| Goodwill | ||||||||||||||

| Other intangible assets, net | ||||||||||||||

| Other non-current assets | ||||||||||||||

| Deferred tax assets | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| Liabilities and Stockholders' Equity | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | $ | ||||||||||||

| Accrued expenses | ||||||||||||||

| Structured payables | ||||||||||||||

| Short-term borrowings and current portion of long-term obligations | ||||||||||||||

| Other current liabilities | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Long-term obligations | ||||||||||||||

| Deferred tax liabilities | ||||||||||||||

| Other non-current liabilities | ||||||||||||||

| Total liabilities | ||||||||||||||

| Commitments and contingencies | ||||||||||||||

| Stockholders' equity: | ||||||||||||||

Preferred stock, $ | ||||||||||||||

Common stock, $ | ||||||||||||||

| Additional paid-in capital | ||||||||||||||

| Retained earnings | ||||||||||||||

| Accumulated other comprehensive income | ||||||||||||||

| Total stockholders' equity | ||||||||||||||

| Non-controlling interest | ( | |||||||||||||

| Total equity | ||||||||||||||

| Total liabilities and equity | $ | $ | ||||||||||||

| First Nine Months | |||||||||||

| (in millions) | 2023 | 2022 | |||||||||

| Operating activities: | |||||||||||

| Net income attributable to KDP | $ | $ | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation expense | |||||||||||

| Amortization of intangibles | |||||||||||

| Other amortization expense | |||||||||||

| Provision for sales returns | |||||||||||

| Deferred income taxes | ( | ( | |||||||||

| Employee stock-based compensation expense | |||||||||||

| Loss on early extinguishment of debt | |||||||||||

| Gain on sale of equity method investment | ( | ||||||||||

| Gain on disposal of property, plant and equipment | ( | ( | |||||||||

| Unrealized (gain) loss on foreign currency | ( | ||||||||||

| Unrealized loss on derivatives | |||||||||||

| Settlements of interest rate contracts | |||||||||||

| Equity in (earnings) loss of unconsolidated affiliates | ( | ||||||||||

| Impairment of intangible assets | |||||||||||

| Impairment on investments and note receivable of unconsolidated affiliate | |||||||||||

| Other, net | ( | ||||||||||

| Changes in assets and liabilities: | |||||||||||

| Trade accounts receivable | ( | ||||||||||

| Inventories | ( | ( | |||||||||

| Income taxes receivable and payables, net | ( | ( | |||||||||

| Other current and non-current assets | ( | ( | |||||||||

| Accounts payable and accrued expenses | ( | ||||||||||

| Other current and non-current liabilities | |||||||||||

| Net change in operating assets and liabilities | ( | ( | |||||||||

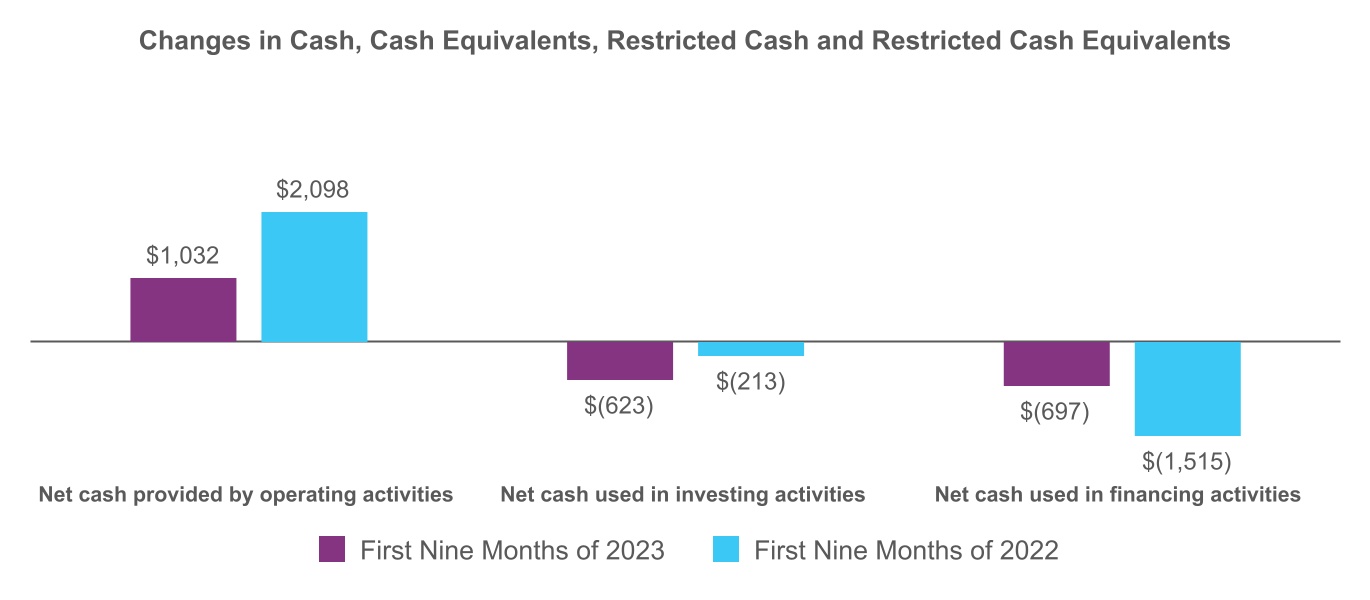

| Net cash provided by operating activities | |||||||||||

| Investing activities: | |||||||||||

| Proceeds from sale of investment in unconsolidated affiliates | |||||||||||

| Purchases of property, plant and equipment | ( | ( | |||||||||

| Proceeds from sales of property, plant and equipment | |||||||||||

| Purchases of intangibles | ( | ( | |||||||||

| Issuance of related party note receivable | ( | ||||||||||

| Investments in unconsolidated affiliates | ( | ( | |||||||||

| Other, net | |||||||||||

| Net cash (used in) provided by investing activities | $ | ( | $ | ( | |||||||

| First Nine Months | |||||||||||

| (in millions) | 2023 | 2022 | |||||||||

| Financing activities: | |||||||||||

Proceeds from issuance of Notes | $ | $ | |||||||||

Repayments of Notes | ( | ||||||||||

| Net issuance (repayment) of commercial paper | ( | ||||||||||

| Proceeds from structured payables | |||||||||||

| Repayments of structured payables | ( | ( | |||||||||

| Cash dividends paid | ( | ( | |||||||||

| Repurchases of common stock | ( | ( | |||||||||

| Tax withholdings related to net share settlements | ( | ( | |||||||||

| Payments on finance leases | ( | ( | |||||||||

| Other, net | ( | ( | |||||||||

| Net cash used in financing activities | ( | ( | |||||||||

| Cash, cash equivalents, and restricted cash and cash equivalents: | |||||||||||

| Net change from operating, investing and financing activities | ( | ||||||||||

| Effect of exchange rate changes | ( | ||||||||||

| Beginning balance | |||||||||||

| Ending balance | $ | $ | |||||||||

| Supplemental cash flow disclosures of non-cash investing activities: | |||||||||||

| Capital expenditures included in accounts payable and accrued expenses | $ | $ | |||||||||

| Transaction costs included in accounts payable and accrued expenses | |||||||||||

| Non-cash conversion of note receivable to investment in unconsolidated affiliate | |||||||||||

| Non-cash purchases of intangibles | |||||||||||

| Supplemental cash flow disclosures of non-cash financing activities: | |||||||||||

| Dividends declared but not yet paid | |||||||||||

| Supplemental cash flow disclosures: | |||||||||||

| Cash paid for interest | |||||||||||

| Cash paid for income taxes | |||||||||||

| Common Stock Issued | Additional Paid-In Capital | Retained Earnings | Accumulated Other Comprehensive Income | Total Stockholders' Equity | Non-controlling Interest | Total Equity | |||||||||||||||||||||||||||||||||||||||||

| (in millions, except per share data) | Shares | Amount | |||||||||||||||||||||||||||||||||||||||||||||

| Balance as of January 1, 2023 | $ | $ | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Repurchases of common stock, inclusive of excise tax obligation | ( | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Shares issued under employee stock-based compensation plans and other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Tax withholdings related to net share settlements | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation and stock options exercised | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Balance as of March 31, 2023 | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Repurchases of common stock, inclusive of excise tax obligation | ( | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Shares issued under employee stock-based compensation plans and other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Tax withholdings related to net share settlements | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation and stock options exercised | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Balance as of June 30, 2023 | $ | $ | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Repurchases of common stock, inclusive of excise tax obligation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Shares issued under employee stock-based compensation plans and other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Tax withholdings related to net share settlements | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation and stock options exercised | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Non-controlling interest surrender of shares | — | — | — | ( | — | ( | — | ||||||||||||||||||||||||||||||||||||||||

Balance as of September 30, 2023 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||

| Common Stock Issued | Additional Paid-In Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Total Stockholders' Equity | Non-controlling Interest | Total Equity | |||||||||||||||||||||||||||||||||||||||||

| (in millions, except per share data) | Shares | Amount | |||||||||||||||||||||||||||||||||||||||||||||

Balance as of January 1, 2022 | $ | $ | $ | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Shares issued under employee stock-based compensation plans and other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Tax withholdings related to net share settlements | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation and stock options exercised | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

Balance as of March 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Repurchases of common stock | ( | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Shares issued under employee stock-based compensation plans and other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Tax withholdings related to net share settlements | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation and stock options exercised | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Balance as of June 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

Dividends declared, $ | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Shares issued under employee stock-based compensation plans and other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Tax withholdings related to net share settlements | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation and stock options exercised | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Balance as of September 30, 2022 | $ | $ | $ | $ | ( | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||

| (in millions) | Prior Presentation | First Nine Months of 2022 | ||||||||||||

| Net issuance (repayment) of commercial paper | Proceeds from issuance of commercial paper | $ | ||||||||||||

| Net issuance (repayment) of commercial paper | Repayments of commercial paper | ( | ||||||||||||

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

Notes | $ | $ | |||||||||

| Less: current portion of long-term obligations | ( | ( | |||||||||

| Long-term obligations | $ | $ | |||||||||

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| Commercial paper notes | $ | $ | |||||||||

| Current portion of long-term obligations | |||||||||||

| Short-term borrowings and current portion of long-term obligations | $ | $ | |||||||||

| (in millions, except %) | ||||||||||||||||||||||||||

| Issuance | Maturity Date | Rate | September 30, 2023 | December 31, 2022 | ||||||||||||||||||||||

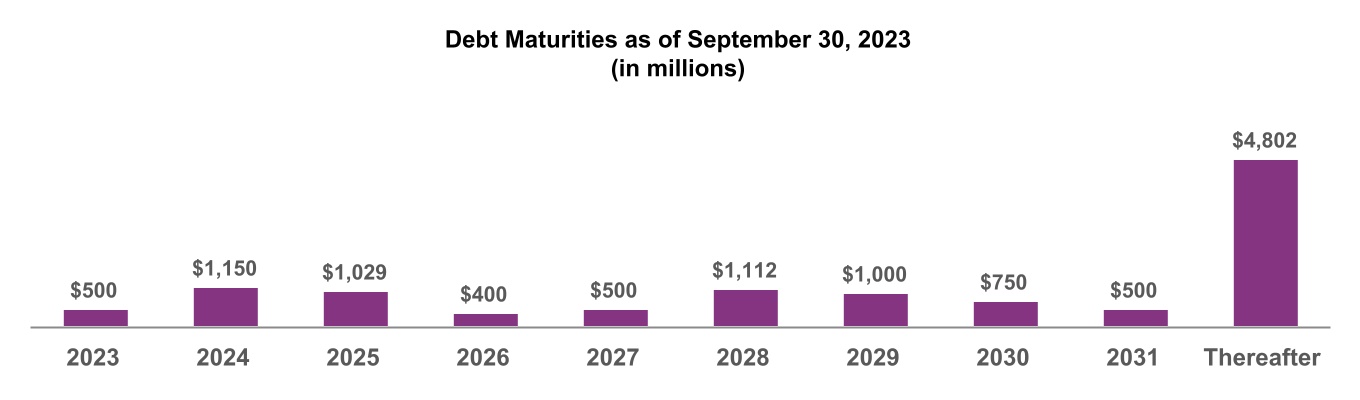

| 2023 Notes | December 15, 2023 | $ | $ | |||||||||||||||||||||||

| 2024 Notes | March 15, 2024 | |||||||||||||||||||||||||

| 2025 Merger Notes | May 25, 2025 | |||||||||||||||||||||||||

| 2025 Notes | November 15, 2025 | |||||||||||||||||||||||||

| 2026 Notes | September 15, 2026 | |||||||||||||||||||||||||

| 2027 Notes | June 15, 2027 | |||||||||||||||||||||||||

| 2028 Merger Notes | May 25, 2028 | |||||||||||||||||||||||||

| 2029 Notes | April 15, 2029 | |||||||||||||||||||||||||

| 2030 Notes | May 1, 2030 | |||||||||||||||||||||||||

| 2031 Notes | March 15, 2031 | |||||||||||||||||||||||||

| 2032 Notes | April 15, 2032 | |||||||||||||||||||||||||

| 2038 Merger Notes | May 25, 2038 | |||||||||||||||||||||||||

| 2045 Notes | November 15, 2045 | |||||||||||||||||||||||||

| 2046 Notes | December 15, 2046 | |||||||||||||||||||||||||

| 2048 Merger Notes | May 25, 2048 | |||||||||||||||||||||||||

| 2050 Notes | May 1, 2050 | |||||||||||||||||||||||||

| 2051 Notes | March 15, 2051 | |||||||||||||||||||||||||

| 2052 Notes | April 15, 2052 | |||||||||||||||||||||||||

| Principal amount | ||||||||||||||||||||||||||

Adjustment from principal amount to carrying amount(1) | ( | ( | ||||||||||||||||||||||||

| Carrying amount | $ | $ | ||||||||||||||||||||||||

| (in millions) | September 30, 2023 | December 31, 2022 | ||||||||||||||||||||||||

| Issuance | Maturity Date | Capacity | Carrying Value | Carrying Value | ||||||||||||||||||||||

2022 Revolving Credit Agreement(1) | February 23, 2027 | $ | $ | $ | ||||||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions, except %) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Weighted average commercial paper borrowings | $ | $ | $ | $ | |||||||||||||||||||

| Weighted average borrowing rates | % | % | % | % | |||||||||||||||||||

| (in millions) | U.S. Refreshment Beverages | U.S. Coffee | International | Total | |||||||||||||||||||

| Balance as of January 1, 2023 | $ | $ | $ | $ | |||||||||||||||||||

| Foreign currency translation | |||||||||||||||||||||||

| Balance as of September 30, 2023 | $ | $ | $ | $ | |||||||||||||||||||

| (in millions) | September 30, 2023 | December 31, 2022 | ||||||||||||

Brands(1) | $ | $ | ||||||||||||

| Trade names | ||||||||||||||

| Contractual arrangements | ||||||||||||||

Distribution rights(2) | ||||||||||||||

| Total | $ | $ | ||||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||

| (in millions) | Gross Amount | Accumulated Amortization | Net Amount | Gross Amount | Accumulated Amortization | Net Amount | |||||||||||||||||||||||||||||

| Acquired technology | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||

| Customer relationships | ( | ( | |||||||||||||||||||||||||||||||||

| Trade names | ( | ( | |||||||||||||||||||||||||||||||||

| Brands | ( | ( | |||||||||||||||||||||||||||||||||

| Contractual arrangements | ( | ( | |||||||||||||||||||||||||||||||||

| Distribution rights | ( | ( | |||||||||||||||||||||||||||||||||

| Total | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Amortization expense | $ | $ | $ | $ | |||||||||||||||||||

| Remainder of 2023 | For the Years Ending December 31, | ||||||||||||||||||||||||||||||||||

| (in millions) | 2024 | 2025 | 2026 | 2027 | 2028 | ||||||||||||||||||||||||||||||

| Expected amortization expense | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Reportable Segments | Reporting Units | |||||||

| U.S. Refreshment Beverages | U.S. Beverage Concentrates | |||||||

U.S. WD | ||||||||

DSD | ||||||||

| U.S. Coffee | U.S. Coffee | |||||||

| International | Canada Beverage Concentrates | |||||||

| Canada WD | ||||||||

| Canada Coffee | ||||||||

| Latin America Beverages | ||||||||

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| Interest rate contracts | |||||||||||

| Forward starting swaps, not designated as hedging instruments | $ | $ | |||||||||

| Forward starting swaps, designated as cash flow hedges | |||||||||||

| Receive-fixed, pay-variable interest rate swaps, not designated as hedging instruments | |||||||||||

| Swaptions, not designated as hedging instruments | |||||||||||

| FX contracts | |||||||||||

| Forward contracts, not designated as hedging instruments | |||||||||||

| Forward contracts, designated as cash flow hedges | |||||||||||

Commodity contracts, not designated as hedging instruments(1) | |||||||||||

| (in millions) | Balance Sheet Location | September 30, 2023 | December 31, 2022 | ||||||||||||||

| Assets: | |||||||||||||||||

| FX contracts | Prepaid expenses and other current assets | $ | $ | ||||||||||||||

| Commodity contracts | Prepaid expenses and other current assets | ||||||||||||||||

| Interest rate contracts | Other non-current assets | ||||||||||||||||

| FX contracts | Other non-current assets | ||||||||||||||||

| Commodity contracts | Other non-current assets | ||||||||||||||||

| Liabilities: | |||||||||||||||||

| Interest rate contracts | Other current liabilities | ||||||||||||||||

| FX contracts | Other current liabilities | ||||||||||||||||

| Commodity contracts | Other current liabilities | ||||||||||||||||

| Interest rate contracts | Other non-current liabilities | ||||||||||||||||

| Commodity contracts | Other non-current liabilities | ||||||||||||||||

| (in millions) | Balance Sheet Location | September 30, 2023 | December 31, 2022 | ||||||||||||||

| Assets: | |||||||||||||||||

| FX contracts | Prepaid expenses and other current assets | $ | $ | ||||||||||||||

| FX contracts | Other non-current assets | ||||||||||||||||

| Interest rate contracts | Other non-current assets | ||||||||||||||||

| Liabilities: | |||||||||||||||||

| FX contracts | Other current liabilities | ||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||||||||

| (in millions) | Income Statement Location | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||

| Interest rate contracts | Interest expense | $ | $ | $ | $ | ||||||||||||||||||||||||

| Interest rate contracts | Loss on early extinguishment of debt | ||||||||||||||||||||||||||||

| FX contracts | Cost of sales | ( | ( | ( | ( | ||||||||||||||||||||||||

| FX contracts | Other (income) expense, net | ( | ( | ( | ( | ||||||||||||||||||||||||

| Commodity contracts | Cost of sales | ( | |||||||||||||||||||||||||||

| Commodity contracts | SG&A expenses | ( | ( | ( | |||||||||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||||||||

| (in millions) | Income Statement Location | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||

Interest rate contracts(1) | Interest expense | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||

| FX contracts | Cost of sales | ( | |||||||||||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Operating lease cost | $ | $ | $ | $ | |||||||||||||||||||

| Finance lease cost | |||||||||||||||||||||||

| Amortization of right-of-use assets | |||||||||||||||||||||||

| Interest on lease liabilities | |||||||||||||||||||||||

Variable lease cost(1) | |||||||||||||||||||||||

| Short-term lease cost | |||||||||||||||||||||||

| Sublease income | ( | ( | |||||||||||||||||||||

| Total lease cost | $ | $ | $ | $ | |||||||||||||||||||

| First Nine Months | |||||||||||

| (in millions) | 2023 | 2022 | |||||||||

| Cash paid for amounts included in the measurement of lease liabilities: | |||||||||||

| Operating cash flows from operating leases | $ | $ | |||||||||

| Operating cash flows from finance leases | |||||||||||

| Financing cash flows from finance leases | |||||||||||

| Right-of-use assets obtained in exchange for lease obligations: | |||||||||||

| Operating leases | |||||||||||

| Finance leases | |||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| Weighted average discount rate | |||||||||||

| Operating leases | % | % | |||||||||

| Finance leases | % | % | |||||||||

| Weighted average remaining lease term | |||||||||||

| Operating leases | |||||||||||

| Finance leases | |||||||||||

| (in millions) | Operating Leases | Finance Leases | |||||||||

| Remainder of 2023 | $ | $ | |||||||||

| 2024 | |||||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| 2028 | |||||||||||

| Thereafter | |||||||||||

| Total future minimum lease payments | |||||||||||

| Less: imputed interest | ( | ( | |||||||||

| Present value of minimum lease payments | $ | $ | |||||||||

| (in millions) | Sale Proceeds | Carrying Value | Gain on Sale | |||||||||||||||||

March 31, 2023(1) | $ | $ | $ | |||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Segment Results – Net sales | |||||||||||||||||||||||

| U.S. Refreshment Beverages | $ | $ | $ | $ | |||||||||||||||||||

| U.S. Coffee | |||||||||||||||||||||||

| International | |||||||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| Segment Results – Income from operations | |||||||||||||||||||||||

| U.S. Refreshment Beverages | $ | $ | $ | $ | |||||||||||||||||||

| U.S. Coffee | |||||||||||||||||||||||

| International | |||||||||||||||||||||||

| Unallocated corporate costs | ( | ( | ( | ( | |||||||||||||||||||

| Income from operations | $ | $ | $ | $ | |||||||||||||||||||

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| Identifiable operating assets | |||||||||||

| U.S. Refreshment Beverages | $ | $ | |||||||||

| U.S. Coffee | |||||||||||

| International | |||||||||||

| Segment total | |||||||||||

| Unallocated corporate assets | |||||||||||

| Total identifiable operating assets | |||||||||||

| Investments in unconsolidated affiliates | |||||||||||

| Total assets | $ | $ | |||||||||

| (in millions) | U.S. Refreshment Beverages | U.S. Coffee | International | Total | |||||||||||||||||||

| For the third quarter of 2023: | |||||||||||||||||||||||

LRB | $ | $ | $ | $ | |||||||||||||||||||

| K-Cup pods | |||||||||||||||||||||||

| Appliances | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| For the third quarter of 2022: | |||||||||||||||||||||||

LRB | $ | $ | $ | $ | |||||||||||||||||||

| K-Cup pods | |||||||||||||||||||||||

| Appliances | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| For the first nine months of 2023: | |||||||||||||||||||||||

LRB | $ | $ | $ | $ | |||||||||||||||||||

| K-Cup pods | |||||||||||||||||||||||

| Appliances | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| For the first nine months of 2022: | |||||||||||||||||||||||

LRB | $ | $ | $ | $ | |||||||||||||||||||

| K-Cup pods | |||||||||||||||||||||||

| Appliances | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions, except per share data) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Net income attributable to KDP | $ | $ | $ | $ | |||||||||||||||||||

| Weighted average common shares outstanding | |||||||||||||||||||||||

| Dilutive effect of stock-based awards | |||||||||||||||||||||||

| Weighted average common shares outstanding and common stock equivalents | |||||||||||||||||||||||

| Basic EPS | $ | $ | $ | $ | |||||||||||||||||||

| Diluted EPS | |||||||||||||||||||||||

| Anti-dilutive shares excluded from the diluted weighted average shares outstanding calculation | |||||||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

Total stock-based compensation expense(1) | $ | $ | $ | $ | |||||||||||||||||||

| Income tax benefit | ( | ( | ( | ( | |||||||||||||||||||

| Stock-based compensation expense, net of tax | $ | $ | $ | $ | |||||||||||||||||||

| RSUs | Weighted Average Grant Date Fair Value | Weighted Average Remaining Contractual Term (Years) | Aggregate Intrinsic Value (in millions) | ||||||||||||||||||||

| Outstanding as of December 31, 2022 | $ | $ | |||||||||||||||||||||

| Granted | |||||||||||||||||||||||

| Vested and released | ( | ||||||||||||||||||||||

| Forfeited | ( | ||||||||||||||||||||||

| Outstanding as of September 30, 2023 | $ | $ | |||||||||||||||||||||

| (in millions) | Ownership Interest | September 30, 2023 | December 31, 2022 | |||||||||||||||||

Nutrabolt(1) | % | $ | $ | |||||||||||||||||

| La Colombe | % | |||||||||||||||||||

| Tractor | % | |||||||||||||||||||

| Athletic Brewing | % | |||||||||||||||||||

| Dyla LLC | % | |||||||||||||||||||

Force Holdings LLC(2) | % | |||||||||||||||||||

Beverage startup companies(3) | (various) | |||||||||||||||||||

| Other | (various) | |||||||||||||||||||

| Investments in unconsolidated affiliates | $ | $ | ||||||||||||||||||

| Third Quarter | First Nine Months | |||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||

| Effective tax rate | % | % | % | % | ||||||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Statutory federal income tax rate | % | % | % | % | |||||||||||||||||||

| State income taxes, net | % | % | % | % | |||||||||||||||||||

Impact of non-U.S. operations(1)(2) | ( | % | ( | % | ( | % | ( | % | |||||||||||||||

Tax credits(2) | ( | % | ( | % | ( | % | ( | % | |||||||||||||||

U.S. taxation of foreign earnings(2) | % | % | % | % | |||||||||||||||||||

Deferred rate change(3) | ( | % | ( | % | % | ( | % | ||||||||||||||||

| Uncertain tax positions | % | % | % | % | |||||||||||||||||||

| U.S. federal provision to return | % | % | % | % | |||||||||||||||||||

| Excess tax deductions on stock-based compensation | ( | % | % | ( | % | ( | % | ||||||||||||||||

| Other | % | % | % | % | |||||||||||||||||||

| Total provision for income taxes | % | % | % | % | |||||||||||||||||||

| (in millions) | Foreign Currency Translation Adjustments | Pension and Post-Retirement Benefit Liabilities | Cash Flow Hedges | Accumulated Other Comprehensive Income | |||||||||||||||||||

| For the third quarter of 2023: | |||||||||||||||||||||||

| Beginning balance | $ | $ | ( | $ | $ | ||||||||||||||||||

| Other comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Amounts reclassified from AOCI | |||||||||||||||||||||||

| Total other comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Balance as of September 30, 2023 | $ | $ | ( | $ | $ | ||||||||||||||||||

| For the third quarter of 2022: | |||||||||||||||||||||||

| Beginning balance | $ | $ | ( | $ | $ | ||||||||||||||||||

| Other comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Amounts reclassified from AOCI | ( | ( | |||||||||||||||||||||

| Total other comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Balance as of September 30, 2022 | $ | ( | $ | ( | $ | $ | ( | ||||||||||||||||

| For the first nine months of 2023: | |||||||||||||||||||||||

| Beginning balance | $ | ( | $ | ( | $ | $ | |||||||||||||||||

| Other comprehensive income (loss) | ( | ||||||||||||||||||||||

| Amounts reclassified from AOCI | ( | ( | |||||||||||||||||||||

| Total other comprehensive income (loss) | ( | ||||||||||||||||||||||

| Balance as of September 30, 2023 | $ | $ | ( | $ | $ | ||||||||||||||||||

| For the first nine months of 2022: | |||||||||||||||||||||||

| Beginning balance | $ | $ | ( | $ | ( | $ | ( | ||||||||||||||||

| Other comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Amounts reclassified from AOCI | |||||||||||||||||||||||

| Total other comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Balance as of September 30, 2022 | $ | ( | $ | ( | $ | $ | ( | ||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||||||||

| (in millions) | Income Statement Caption | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||

| Cash Flow Hedges: | |||||||||||||||||||||||||||||

Interest rate contracts(1) | Interest expense | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||

| FX contracts | Cost of sales | ( | |||||||||||||||||||||||||||

| Total | ( | ( | |||||||||||||||||||||||||||

| Income tax expense | |||||||||||||||||||||||||||||

| Total, net of tax | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||

| September 30, | December 31, | ||||||||||

| (in millions) | 2023 | 2022 | |||||||||

| Inventories: | |||||||||||

| Raw materials | $ | $ | |||||||||

| Work-in-progress | |||||||||||

| Finished goods | |||||||||||

| Total | |||||||||||

| Allowance for excess and obsolete inventories | ( | ( | |||||||||

| Total Inventories | $ | $ | |||||||||

| Prepaid expenses and other current assets: | |||||||||||

| Other receivables | $ | $ | |||||||||

| Prepaid income taxes | |||||||||||

| Customer incentive programs | |||||||||||

| Derivative instruments | |||||||||||

| Prepaid marketing | |||||||||||

| Spare parts | |||||||||||

| Income tax receivable | |||||||||||

| Other | |||||||||||

| Total prepaid expenses and other current assets | $ | $ | |||||||||

| Other non-current assets: | |||||||||||

| Operating lease right-of-use assets | $ | $ | |||||||||

| Customer incentive programs | |||||||||||

| Derivative instruments | |||||||||||

Equity securities(1) | |||||||||||

| Equity securities without readily determinable fair values | |||||||||||

| Other | |||||||||||

| Total other non-current assets | $ | $ | |||||||||

| September 30, | December 31, | ||||||||||

| (in millions) | 2023 | 2022 | |||||||||

| Accrued expenses: | |||||||||||

| Accrued customer trade | $ | $ | |||||||||

| Accrued compensation | |||||||||||

| Insurance reserve | |||||||||||

| Accrued interest | |||||||||||

| Accrued professional fees | |||||||||||

| Other accrued expenses | |||||||||||

| Total accrued expenses | $ | $ | |||||||||

| Other current liabilities: | |||||||||||

| Dividends payable | $ | $ | |||||||||

| Income taxes payable | |||||||||||

| Derivative instruments | |||||||||||

| Other | |||||||||||

| Total other current liabilities | $ | $ | |||||||||

| Other non-current liabilities: | |||||||||||

| $ | $ | ||||||||||

| Pension and post-retirement liability | |||||||||||

| Insurance reserves | |||||||||||

| Derivative instruments | |||||||||||

| Deferred compensation liability | |||||||||||

| Other | |||||||||||

| Total other non-current liabilities | $ | $ | |||||||||

| (in millions) | September 30, 2023(1) | December 31, 2022(2) | ||||||||||||

| Non-current assets | $ | $ | ||||||||||||

| Current liabilities | ||||||||||||||

| Non-current liabilities | ||||||||||||||

| Remainder of 2023 | For the Years Ending December 31, | ||||||||||||||||||||||||||||||||||

| (in millions) | 2024 | 2025 | 2026 | 2027 | 2028 | ||||||||||||||||||||||||||||||

| Fixed service fees | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Third Quarter | First Nine Months | ||||||||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| 2023 CEO Succession and Associated Realignment | $ | $ | $ | $ | |||||||||||||||||||

| DPS Integration Program | |||||||||||||||||||||||

| (in millions) | Restructuring Liabilities | ||||

| Balance as of January 1, 2023 | $ | ||||

Charges to expense | |||||

Cash payments | ( | ||||

| Balance as of September 30, 2023 | $ | ||||

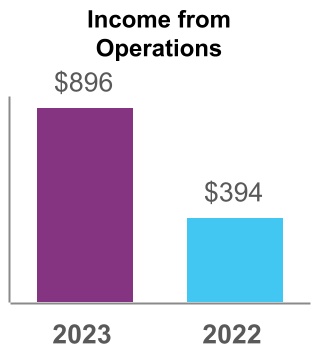

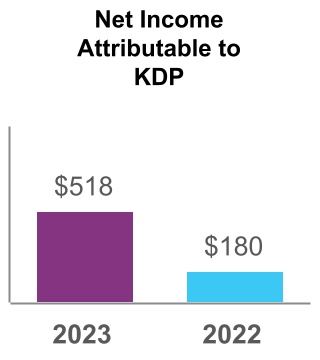

| Third Quarter | Dollar | Percentage | |||||||||||||||||||||

| ($ in millions, except per share amounts) | 2023 | 2022 | Change | Change | |||||||||||||||||||

| Net sales | $ | 3,805 | $ | 3,622 | $ | 183 | 5.1 | % | |||||||||||||||

| Cost of sales | 1,694 | 1,721 | (27) | (1.6) | |||||||||||||||||||

| Gross profit | 2,111 | 1,901 | 210 | 11.0 | |||||||||||||||||||

| Selling, general and administrative expenses | 1,217 | 1,196 | 21 | 1.8 | |||||||||||||||||||

| Impairment of intangible assets | 2 | 311 | (309) | NM | |||||||||||||||||||

| Other operating income, net | (4) | — | (4) | NM | |||||||||||||||||||

| Income from operations | 896 | 394 | 502 | 127.4 | |||||||||||||||||||

| Interest expense | 237 | 207 | 30 | 14.5 | |||||||||||||||||||

| Other (income) expense, net | (5) | 4 | (9) | NM | |||||||||||||||||||

| Income before provision for income taxes | 664 | 183 | 481 | 262.8 | |||||||||||||||||||

| Provision for income taxes | 146 | 4 | 142 | NM | |||||||||||||||||||

| Net income including non-controlling interest | 518 | 179 | 339 | 189.4 | |||||||||||||||||||

| Less: Net loss attributable to non-controlling interest | — | (1) | 1 | NM | |||||||||||||||||||

| Net income attributable to KDP | $ | 518 | $ | 180 | 338 | 187.8 | |||||||||||||||||

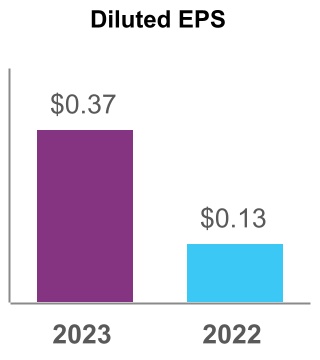

| Earnings per common share: | |||||||||||||||||||||||

| Basic | $ | 0.37 | $ | 0.13 | $ | 0.24 | 184.6 | % | |||||||||||||||

| Diluted | 0.37 | 0.13 | 0.24 | 184.6 | |||||||||||||||||||

| Gross margin | 55.5 | % | 52.5 | % | 300 bps | ||||||||||||||||||

| Operating margin | 23.5 | % | 10.9 | % | NM | ||||||||||||||||||

| Effective tax rate | 22.0 | % | 2.2 | % | NM | ||||||||||||||||||

| Percentage Change | ||||||||

| LRB | — | % | ||||||

| K-Cup pods | (6.3) | |||||||

Brewers | 8.7 | |||||||

| Third Quarter | |||||||||||

| (in millions) | 2023 | 2022 | |||||||||

| Segment Results — Net sales | |||||||||||

| U.S. Refreshment Beverages | $ | 2,270 | $ | 2,144 | |||||||

| U.S. Coffee | 1,012 | 1,045 | |||||||||

| International | 523 | 433 | |||||||||

| Net sales | $ | 3,805 | $ | 3,622 | |||||||

| Third Quarter | |||||||||||

| (in millions) | 2023 | 2022 | |||||||||

| Segment Results — Income from operations | |||||||||||

| U.S. Refreshment Beverages | $ | 676 | $ | 322 | |||||||

| U.S. Coffee | 293 | 272 | |||||||||

| International | 139 | 97 | |||||||||

| Unallocated corporate costs | (212) | (297) | |||||||||

| Income from operations | $ | 896 | $ | 394 | |||||||

| Third Quarter | Dollar Change | Percentage Change | |||||||||||||||||||||

| (in millions) | 2023 | 2022 | |||||||||||||||||||||

| Net sales | $ | 2,270 | $ | 2,144 | $ | 126 | 5.9 | % | |||||||||||||||

| Income from operations | 676 | 322 | 354 | 109.9 | |||||||||||||||||||

| Operating margin | 29.8 | % | 15.0 | % | NM | ||||||||||||||||||

| Third Quarter | Dollar Change | Percentage Change | |||||||||||||||||||||

| (in millions) | 2023 | 2022 | |||||||||||||||||||||

| Net sales | $ | 1,012 | $ | 1,045 | $ | (33) | (3.2) | % | |||||||||||||||

| Income from operations | 293 | 272 | 21 | 7.7 | |||||||||||||||||||

| Operating margin | 29.0 | % | 26.0 | % | 300 bps | ||||||||||||||||||

| Third Quarter | Dollar Change | Percentage Change | |||||||||||||||||||||

| (in millions) | 2023 | 2022 | |||||||||||||||||||||

| Net sales | $ | 523 | $ | 433 | $ | 90 | 20.8 | % | |||||||||||||||

| Income from operations | 139 | 97 | 42 | 43.3 | |||||||||||||||||||

| Operating margin | 26.6 | % | 22.4 | % | 420 bps | ||||||||||||||||||

| Percentage Change | ||||||||

| LRB | 8.7 | % | ||||||

| K-Cup pods | 8.2 | |||||||

Brewers | 15.9 | |||||||

| First Nine Months | Dollar Change | Percentage Change | |||||||||||||||||||||

| ($ in millions, except per share amounts) | 2023 | 2022 | |||||||||||||||||||||

| Net sales | $ | 10,947 | $ | 10,254 | $ | 693 | 6.8 | % | |||||||||||||||

| Cost of sales | 5,051 | 4,927 | 124 | 2.5 | |||||||||||||||||||

| Gross profit | 5,896 | 5,327 | 569 | 10.7 | |||||||||||||||||||

| Selling, general and administrative expenses | 3,654 | 3,418 | 236 | 6.9 | |||||||||||||||||||

| Impairment of intangible assets | 2 | 311 | (309) | NM | |||||||||||||||||||

| Gain on litigation settlement | — | (299) | 299 | NM | |||||||||||||||||||

| Other operating income, net | (9) | (35) | 26 | NM | |||||||||||||||||||

| Income from operations | 2,249 | 1,932 | 317 | 16.4 | |||||||||||||||||||

| Interest expense | 432 | 570 | (138) | (24.2) | |||||||||||||||||||

| Loss on early extinguishment of debt | — | 217 | (217) | NM | |||||||||||||||||||

| Gain on sale of equity method investment | — | (50) | 50 | NM | |||||||||||||||||||

| Impairment of investments and note receivable | — | 12 | (12) | NM | |||||||||||||||||||

| Other (income) expense, net | (41) | 22 | (63) | NM | |||||||||||||||||||

| Income before provision for income taxes | 1,858 | 1,161 | 697 | 60.0 | |||||||||||||||||||

| Provision for income taxes | 370 | 179 | 191 | 106.7 | |||||||||||||||||||

| Net income including non-controlling interest | 1,488 | 982 | 506 | 51.5 | |||||||||||||||||||

| Less: Net loss attributable to non-controlling interest | — | (1) | 1 | NM | |||||||||||||||||||

| Net income attributable to KDP | $ | 1,488 | $ | 983 | 505 | 51.4 | |||||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||

| Basic | $ | 1.06 | $ | 0.69 | $ | 0.37 | 53.6 | % | |||||||||||||||

| Diluted | 1.05 | 0.69 | 0.36 | 52.2 | |||||||||||||||||||

| Gross margin | 53.9 | % | 52.0 | % | 190 bps | ||||||||||||||||||

| Operating margin | 20.5 | % | 18.8 | % | NM | ||||||||||||||||||

| Effective tax rate | 19.9 | % | 15.4 | % | 450 bps | ||||||||||||||||||

| Percentage Change | ||||||||

| LRB | 0.2 | % | ||||||

| K-Cup pods | (4.7) | |||||||

Brewers | (7.4) | |||||||

| (in millions) | First Nine Months | ||||||||||

| Net sales | 2023 | 2022 | |||||||||

| U.S. Refreshment Beverages | $ | 6,607 | $ | 6,009 | |||||||

| U.S. Coffee | 2,913 | 3,017 | |||||||||

| International | 1,427 | 1,228 | |||||||||

| Total net sales | $ | 10,947 | $ | 10,254 | |||||||

| Income from operations | |||||||||||

| U.S. Refreshment Beverages | $ | 1,795 | $ | 1,554 | |||||||

| U.S. Coffee | 775 | 822 | |||||||||

| International | 331 | 259 | |||||||||

| Unallocated corporate costs | (652) | (703) | |||||||||

| Total income from operations | $ | 2,249 | $ | 1,932 | |||||||

| First Nine Months | Dollar Change | Percentage Change | |||||||||||||||||||||

| (in millions) | 2023 | 2022 | |||||||||||||||||||||

| Net sales | $ | 6,607 | $ | 6,009 | $ | 598 | 10.0 | % | |||||||||||||||

| Income from operations | 1,795 | 1,554 | 241 | 15.5 | |||||||||||||||||||

| Operating margin | 27.2 | % | 25.9 | % | 130 bps | ||||||||||||||||||

| First Nine Months | Dollar Change | Percentage Change | |||||||||||||||||||||

| (in millions) | 2023 | 2022 | |||||||||||||||||||||

| Net sales | $ | 2,913 | $ | 3,017 | $ | (104) | (3.4) | % | |||||||||||||||

| Income from operations | 775 | 822 | (47) | (5.7) | |||||||||||||||||||

| Operating margin | 26.6 | % | 27.2 | % | (60) bps | ||||||||||||||||||

| First Nine Months | Dollar Change | Percentage Change | |||||||||||||||||||||

| (in millions) | 2023 | 2022 | |||||||||||||||||||||

| Net sales | $ | 1,427 | $ | 1,228 | $ | 199 | 16.2 | % | |||||||||||||||

| Income from operations | 331 | 259 | 72 | 27.8 | |||||||||||||||||||

| Operating margin | 23.2 | % | 21.1 | % | 210 bps | ||||||||||||||||||

| Percentage Change | ||||||||

| LRB | 5.1 | % | ||||||

| K-Cup pods | 5.2 | |||||||

Brewers | 5.4 | |||||||

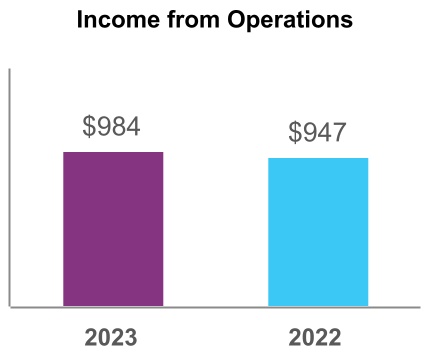

| Cost of sales | Gross profit | Gross margin | Selling, general and administrative expenses | Impairment of intangible assets | Income from operations | Operating margin | |||||||||||||||||||||||||||||||||||

| For the Third Quarter of 2023 | |||||||||||||||||||||||||||||||||||||||||

| Reported | $ | 1,694 | $ | 2,111 | 55.5 | % | $ | 1,217 | $ | 2 | $ | 896 | 23.5 | % | |||||||||||||||||||||||||||

| Items Affecting Comparability: | |||||||||||||||||||||||||||||||||||||||||

| Mark to market | 13 | (13) | 21 | — | (34) | ||||||||||||||||||||||||||||||||||||

| Amortization of intangibles | — | — | (34) | — | 34 | ||||||||||||||||||||||||||||||||||||

| Stock compensation | — | — | (4) | — | 4 | ||||||||||||||||||||||||||||||||||||

| Restructuring - 2023 CEO Succession and Associated Realignment | — | — | (27) | — | 27 | ||||||||||||||||||||||||||||||||||||

| Productivity | (25) | 25 | (27) | — | 52 | ||||||||||||||||||||||||||||||||||||

| Impairment of intangible assets | — | — | — | (2) | 2 | ||||||||||||||||||||||||||||||||||||

| Non-routine legal matters | — | — | (2) | — | 2 | ||||||||||||||||||||||||||||||||||||

| Transaction costs | — | — | (1) | — | 1 | ||||||||||||||||||||||||||||||||||||

| Adjusted | $ | 1,682 | $ | 2,123 | 55.8 | % | $ | 1,143 | $ | — | $ | 984 | 25.9 | % | |||||||||||||||||||||||||||

| Impact of foreign currency | — | % | — | % | |||||||||||||||||||||||||||||||||||||

| Constant currency adjusted | 55.8 | % | 25.9 | % | |||||||||||||||||||||||||||||||||||||

| For the Third Quarter of 2022 | |||||||||||||||||||||||||||||||||||||||||

| Reported | $ | 1,721 | $ | 1,901 | 52.5 | % | $ | 1,196 | $ | 311 | $ | 394 | 10.9 | % | |||||||||||||||||||||||||||

| Items Affecting Comparability: | |||||||||||||||||||||||||||||||||||||||||

| Mark to market | (51) | 51 | (55) | — | 106 | ||||||||||||||||||||||||||||||||||||

| Amortization of intangibles | — | — | (33) | — | 33 | ||||||||||||||||||||||||||||||||||||

| Stock compensation | — | — | (5) | — | 5 | ||||||||||||||||||||||||||||||||||||

| Restructuring and integration costs - DPS Merger | — | — | (33) | — | 33 | ||||||||||||||||||||||||||||||||||||

| Productivity | (30) | 30 | (27) | — | 57 | ||||||||||||||||||||||||||||||||||||

| Impairment of intangible assets | — | — | — | (311) | 311 | ||||||||||||||||||||||||||||||||||||

| Non-routine legal matters | — | — | (2) | — | 2 | ||||||||||||||||||||||||||||||||||||

| COVID-19 | (3) | 3 | (2) | — | 5 | ||||||||||||||||||||||||||||||||||||

| Foundational projects | — | — | (1) | — | 1 | ||||||||||||||||||||||||||||||||||||

| Adjusted | $ | 1,637 | $ | 1,985 | 54.8 | % | $ | 1,038 | $ | — | $ | 947 | 26.1 | % | |||||||||||||||||||||||||||

| Interest expense | Other (income) expense, net | Income before provision for income taxes | Provision for income taxes | Effective tax rate | Net income attributable to KDP | Diluted earnings per share | |||||||||||||||||||||||||||||||||||

| For the Third Quarter of 2023 | |||||||||||||||||||||||||||||||||||||||||

| Reported | $ | 237 | $ | (5) | $ | 664 | $ | 146 | 22.0 | % | $ | 518 | $ | 0.37 | |||||||||||||||||||||||||||

| Items Affecting Comparability: | |||||||||||||||||||||||||||||||||||||||||

| Mark to market | (114) | (2) | 82 | 20 | 62 | 0.04 | |||||||||||||||||||||||||||||||||||

| Amortization of intangibles | — | — | 34 | 9 | 25 | 0.02 | |||||||||||||||||||||||||||||||||||

| Amortization of fair value debt adjustment | (5) | — | 5 | 1 | 4 | — | |||||||||||||||||||||||||||||||||||

| Stock compensation | — | — | 4 | 3 | 1 | — | |||||||||||||||||||||||||||||||||||

| Restructuring - 2023 CEO Succession and Associated Realignment | — | — | 27 | 6 | 21 | 0.01 | |||||||||||||||||||||||||||||||||||

| Productivity | — | — | 52 | 12 | 40 | 0.03 | |||||||||||||||||||||||||||||||||||

| Impairment of intangible assets | — | — | 2 | — | 2 | — | |||||||||||||||||||||||||||||||||||

| Non-routine legal matters | — | — | 2 | — | 2 | — | |||||||||||||||||||||||||||||||||||

| Transaction costs | — | — | 1 | — | 1 | — | |||||||||||||||||||||||||||||||||||

| Change in deferred tax liabilities related to goodwill and other intangible assets | — | — | — | 3 | (3) | — | |||||||||||||||||||||||||||||||||||

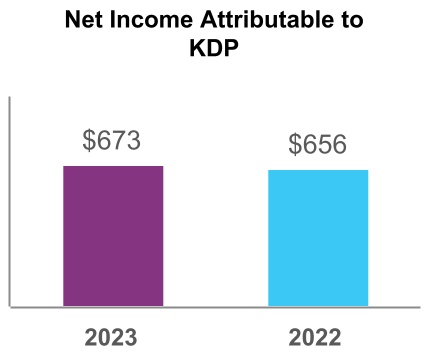

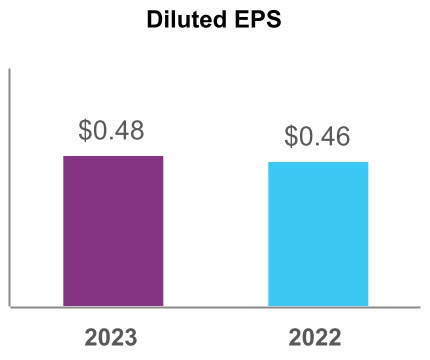

| Adjusted | $ | 118 | $ | (7) | $ | 873 | $ | 200 | 22.9 | % | $ | 673 | $ | 0.48 | |||||||||||||||||||||||||||

| Impact of foreign currency | (0.2) | % | |||||||||||||||||||||||||||||||||||||||

| Constant currency adjusted | 22.7 | % | |||||||||||||||||||||||||||||||||||||||

| For the Third Quarter of 2022 | |||||||||||||||||||||||||||||||||||||||||

| Reported | $ | 207 | $ | 4 | $ | 183 | $ | 4 | 2.2 | % | $ | 180 | $ | 0.13 | |||||||||||||||||||||||||||

| Items Affecting Comparability: | |||||||||||||||||||||||||||||||||||||||||

| Mark to market | (113) | 2 | 217 | 54 | 163 | 0.11 | |||||||||||||||||||||||||||||||||||

| Amortization of intangibles | — | — | 33 | 8 | 25 | 0.02 | |||||||||||||||||||||||||||||||||||

| Amortization of fair value of debt adjustment | (5) | — | 5 | 1 | 4 | — | |||||||||||||||||||||||||||||||||||

| Stock compensation | — | — | 5 | 2 | 3 | — | |||||||||||||||||||||||||||||||||||

| Restructuring and integration costs - DPS Merger | — | — | 33 | 8 | 25 | 0.02 | |||||||||||||||||||||||||||||||||||

| Productivity | — | — | 57 | 10 | 47 | 0.03 | |||||||||||||||||||||||||||||||||||

| Impairment of intangible assets | — | — | 311 | 77 | 234 | 0.16 | |||||||||||||||||||||||||||||||||||

| Non-routine legal matters | — | — | 2 | — | 2 | — | |||||||||||||||||||||||||||||||||||

| COVID-19 | — | — | 5 | 1 | 4 | — | |||||||||||||||||||||||||||||||||||

| Foundational projects | — | — | 1 | 1 | — | — | |||||||||||||||||||||||||||||||||||

| Change in deferred tax liabilities related to goodwill and other intangible assets | — | — | — | 31 | (31) | (0.02) | |||||||||||||||||||||||||||||||||||

| Adjusted | $ | 89 | $ | 6 | $ | 852 | $ | 197 | 23.1 | % | $ | 656 | $ | 0.46 | |||||||||||||||||||||||||||

| Change - adjusted | 32.6 | % | 2.6 | % | 4.3 | % | |||||||||||||||||||||||||||||||||||

| Impact of foreign currency | — | % | (0.8) | % | — | % | |||||||||||||||||||||||||||||||||||

| Change - constant currency adjusted | 32.6 | % | 1.8 | % | 4.3 | % | |||||||||||||||||||||||||||||||||||

| (in millions) | Reported | Items Affecting Comparability | Adjusted | ||||||||||||||

| For the third quarter of 2023: | |||||||||||||||||

| Income from operations | |||||||||||||||||

| U.S. Refreshment Beverages | $ | 676 | $ | 19 | $ | 695 | |||||||||||

| U.S. Coffee | 293 | 40 | 333 | ||||||||||||||

| International | 139 | 6 | 145 | ||||||||||||||

| Unallocated corporate costs | (212) | 23 | (189) | ||||||||||||||

| Total income from operations | $ | 896 | $ | 88 | $ | 984 | |||||||||||

| For the third quarter of 2022: | |||||||||||||||||

| Income from operations | |||||||||||||||||

| U.S. Refreshment Beverages | $ | 322 | $ | 333 | $ | 655 | |||||||||||

| U.S. Coffee | 272 | 43 | 315 | ||||||||||||||

| International | 97 | 7 | 104 | ||||||||||||||

| Unallocated corporate costs | (297) | 170 | (127) | ||||||||||||||

| Total income from operations | $ | 394 | $ | 553 | $ | 947 | |||||||||||

| Reported | Impact of Foreign Currency | Constant Currency | ||||||||||||||||||

| For the third quarter of 2023: | ||||||||||||||||||||

| Net sales | ||||||||||||||||||||

| U.S. Refreshment Beverages | 5.9 | % | — | % | 5.9 | % | ||||||||||||||

| U.S. Coffee | (3.2) | — | (3.2) | |||||||||||||||||

| International | 20.8 | (7.9) | 12.9 | |||||||||||||||||

| Total net sales | 5.1 | (1.0) | 4.1 | |||||||||||||||||

| Adjusted | Impact of Foreign Currency | Constant Currency Adjusted | ||||||||||||||||||

| For the third quarter of 2023: | ||||||||||||||||||||

| Income from operations | ||||||||||||||||||||

| U.S. Refreshment Beverages | 6.1 | % | — | % | 6.1 | % | ||||||||||||||

| U.S. Coffee | 5.7 | — | 5.7 | |||||||||||||||||

| International | 39.4 | (7.7) | 31.7 | |||||||||||||||||

| Total income from operations | 3.9 | (0.8) | 3.1 | |||||||||||||||||

| Reported | Items Affecting Comparability | Adjusted | Impact of Foreign Currency | Constant Currency Adjusted | ||||||||||||||||||||||||||||

| For the third quarter of 2023: | ||||||||||||||||||||||||||||||||

| Operating margin | ||||||||||||||||||||||||||||||||

| U.S. Refreshment Beverages | 29.8 | % | 0.8 | % | 30.6 | % | — | % | 30.6 | % | ||||||||||||||||||||||

| U.S. Coffee | 29.0 | 3.9 | 32.9 | — | 32.9 | |||||||||||||||||||||||||||

| International | 26.6 | 1.1 | 27.7 | 0.3 | 28.0 | |||||||||||||||||||||||||||

| Total operating margin | 23.5 | 2.4 | 25.9 | — | 25.9 | |||||||||||||||||||||||||||

| Cost of sales | Gross profit | Gross margin | Selling, general and administrative expenses | Impairment of intangible assets | Gain on litigation settlement | Other operating income, net | Income from operations | Operating margin | |||||||||||||||||||||||||||||||||||||||||||||

| For the First Nine Months of 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported | $ | 5,051 | $ | 5,896 | 53.9 | % | $ | 3,654 | $ | 2 | $ | — | $ | (9) | $ | 2,249 | 20.5 | % | |||||||||||||||||||||||||||||||||||

| Items Affecting Comparability: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mark to market | 18 | (18) | 14 | — | — | — | (32) | ||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangibles | — | — | (103) | — | — | — | 103 | ||||||||||||||||||||||||||||||||||||||||||||||

| Stock compensation | — | — | (13) | — | — | — | 13 | ||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring - 2023 CEO Succession and Associated Realignment | — | — | (27) | — | — | — | 27 | ||||||||||||||||||||||||||||||||||||||||||||||

| Productivity | (89) | 89 | (99) | — | — | — | 188 | ||||||||||||||||||||||||||||||||||||||||||||||

| Impairment of intangible assets | — | — | — | (2) | — | — | 2 | ||||||||||||||||||||||||||||||||||||||||||||||

| Non-routine legal matters | — | — | (5) | — | — | — | 5 | ||||||||||||||||||||||||||||||||||||||||||||||

| Transaction costs | — | — | (1) | — | — | — | 1 | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted | $ | 4,980 | $ | 5,967 | 54.5 | % | $ | 3,420 | $ | — | $ | — | $ | (9) | $ | 2,556 | 23.3 | % | |||||||||||||||||||||||||||||||||||

| Impact of foreign currency | — | % | 0.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Constant currency adjusted | 54.5 | % | 23.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| For the First Nine Months of 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported | $ | 4,927 | $ | 5,327 | 52.0 | % | $ | 3,418 | $ | 311 | $ | (299) | $ | (35) | $ | 1,932 | 18.8 | % | |||||||||||||||||||||||||||||||||||

| Items Affecting Comparability: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mark to market | (130) | 130 | (29) | — | — | — | 159 | ||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangibles | — | — | (100) | — | — | — | 100 | ||||||||||||||||||||||||||||||||||||||||||||||

| Stock compensation | — | — | (3) | — | — | — | 3 | ||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring and integration costs - DPS Merger | — | — | (89) | — | — | (2) | 91 | ||||||||||||||||||||||||||||||||||||||||||||||

| Productivity | (86) | 86 | (73) | — | — | — | 159 | ||||||||||||||||||||||||||||||||||||||||||||||

| Impairment of intangible assets | — | — | — | (311) | — | — | 311 | ||||||||||||||||||||||||||||||||||||||||||||||

| Non-routine legal matters | — | — | (9) | — | — | — | 9 | ||||||||||||||||||||||||||||||||||||||||||||||

| COVID-19 | (10) | 10 | (4) | — | — | — | 14 | ||||||||||||||||||||||||||||||||||||||||||||||

| Gain on litigation | — | — | — | — | 271 | — | (271) | ||||||||||||||||||||||||||||||||||||||||||||||

| Transaction costs | — | — | (1) | — | — | — | 1 | ||||||||||||||||||||||||||||||||||||||||||||||

| Foundational projects | — | — | (3) | — | — | — | 3 | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted | $ | 4,701 | $ | 5,553 | 54.2 | % | $ | 3,107 | $ | — | $ | (28) | $ | (37) | $ | 2,511 | 24.5 | % | |||||||||||||||||||||||||||||||||||

| Interest expense | Loss on early extinguishment of debt | Gain on sale of equity method investment | Impairment of investments and note receivable | Other (income) expense, net | Income before provision for income taxes | Provision for income taxes | Effective tax rate | Net income attributable to KDP | Diluted earnings per share | ||||||||||||||||||||||||||||||||||||||||||||||||||

| For the First Nine Months of 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported | $ | 432 | $ | — | $ | — | $ | — | $ | (41) | $ | 1,858 | $ | 370 | 19.9 | % | $ | 1,488 | $ | 1.05 | |||||||||||||||||||||||||||||||||||||||

| Items Affecting Comparability: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mark to market | (74) | — | — | — | 16 | 26 | 6 | 20 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangibles | — | — | — | — | — | 103 | 25 | 78 | 0.06 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of deferred financing costs | (1) | — | — | — | — | 1 | — | 1 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of fair value debt adjustment | (14) | — | — | — | — | 14 | 3 | 11 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock compensation | — | — | — | — | — | 13 | 6 | 7 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring - 2023 CEO Succession and Associated Realignment | — | — | — | — | — | 27 | 6 | 21 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Productivity | — | — | — | — | — | 188 | 45 | 143 | 0.10 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Impairment of intangible assets | — | — | — | — | — | 2 | — | 2 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-routine legal matters | — | — | — | — | — | 5 | 1 | 4 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction costs | — | — | — | — | — | 1 | — | 1 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in deferred tax liabilities related to goodwill and other intangible assets | — | — | — | — | — | — | 28 | (28) | (0.02) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted | $ | 343 | $ | — | $ | — | $ | — | $ | (25) | $ | 2,238 | $ | 490 | 21.9 | % | $ | 1,748 | $ | 1.24 | |||||||||||||||||||||||||||||||||||||||

| Impact of foreign currency | (0.1) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Constant currency adjusted | 21.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | Loss on early extinguishment of debt | Gain on sale of equity method investment | Impairment of investments and note receivable | Other (income) expense, net | Income before provision for income taxes | Provision for income taxes | Effective tax rate | Net income attributable to KDP | Diluted earnings per share | ||||||||||||||||||||||||||||||||||||||||||||||||||

| For the First Nine Months of 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reported | $ | 570 | $ | 217 | $ | (50) | $ | 12 | $ | 22 | $ | 1,161 | $ | 179 | 15.4 | % | $ | 983 | $ | 0.69 | |||||||||||||||||||||||||||||||||||||||

| Items Affecting Comparability: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mark to market | (247) | — | — | — | — | 406 | 101 | 305 | 0.21 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangibles | — | — | — | — | — | 100 | 25 | 75 | 0.05 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of deferred financing costs | (2) | — | — | — | — | 2 | — | 2 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of fair value of debt adjustment | (14) | — | — | — | — | 14 | 3 | 11 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock compensation | — | — | — | — | — | 3 | (1) | 4 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring and integration costs - DPS Merger | — | — | — | — | — | 91 | 22 | 69 | 0.05 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Productivity | — | — | — | — | — | 159 | 32 | 127 | 0.09 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Impairment of intangible assets | — | — | — | — | — | 311 | 77 | 234 | 0.16 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Impairment of investment | — | — | — | (12) | — | 12 | — | 12 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on early extinguishment of debt | — | (217) | — | — | — | 217 | 54 | 163 | 0.11 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-routine legal matters | — | — | — | — | — | 9 | 2 | 7 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| COVID-19 | — | — | — | — | — | 14 | 3 | 11 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Gain on litigation | — | — | — | — | — | (271) | (68) | (203) | (0.14) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Gain on sale of equity-method investment | — | — | 50 | — | — | (50) | (12) | (38) | (0.03) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction costs | — | — | — | — | — | 1 | — | 1 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Foundational projects | — | — | — | — | — | 3 | 1 | 2 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in deferred tax liabilities related to goodwill and other intangible assets | — | — | — | — | — | — | 81 | (81) | (0.06) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted | $ | 307 | $ | — | $ | — | $ | — | $ | 22 | $ | 2,182 | $ | 499 | 22.9 | % | $ | 1,684 | $ | 1.18 | |||||||||||||||||||||||||||||||||||||||

| Change - adjusted | 11.7 | % | 3.8 | % | 5.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impact of foreign currency | — | % | (0.6) | % | (1) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change - constant currency adjusted | 11.7 | % | 3.2 | % | 4.2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Reported | Items Affecting Comparability | Adjusted | ||||||||||||||

| For the first nine months of 2023: | |||||||||||||||||

| Income from operations | |||||||||||||||||

| U.S. Refreshment Beverages | $ | 1,795 | $ | 54 | $ | 1,849 | |||||||||||

| U.S. Coffee | 775 | 135 | 910 | ||||||||||||||

| International | 331 | 14 | 345 | ||||||||||||||

| Unallocated corporate costs | (652) | 104 | (548) | ||||||||||||||

| Total income from operations | $ | 2,249 | $ | 307 | $ | 2,556 | |||||||||||

| For the first nine months of 2022: | |||||||||||||||||

| Income from operations | |||||||||||||||||

| U.S. Refreshment Beverages | $ | 1,554 | $ | 103 | $ | 1,657 | |||||||||||

| U.S. Coffee | 822 | 136 | 958 | ||||||||||||||

| International | 259 | 20 | 279 | ||||||||||||||

| Unallocated corporate costs | (703) | 320 | (383) | ||||||||||||||

| Total income from operations | $ | 1,932 | $ | 579 | $ | 2,511 | |||||||||||

| Reported | Impact of Foreign Currency | Constant Currency | ||||||||||||||||||

| For the first nine months of 2023: | ||||||||||||||||||||

| Net sales | ||||||||||||||||||||

| U.S. Refreshment Beverages | 10.0 | % | — | % | 10.0 | % | ||||||||||||||

| U.S. Coffee | (3.4) | — | (3.4) | |||||||||||||||||

| International | 16.2 | (4.3) | 11.9 | |||||||||||||||||

| Total net sales | 6.8 | (0.6) | 6.2 | |||||||||||||||||

| Adjusted | Impact of Foreign Currency | Constant Currency Adjusted | ||||||||||||||||||

| For the first nine months of 2023: | ||||||||||||||||||||

| Income from operations | ||||||||||||||||||||

| U.S. Refreshment Beverages | 11.6 | % | — | % | 11.6 | % | ||||||||||||||

| U.S. Coffee | (5.0) | — | (5.0) | |||||||||||||||||

| International | 23.7 | (4.3) | 19.4 | |||||||||||||||||

| Total income from operations | 1.8 | (0.5) | 1.3 | |||||||||||||||||

| Reported | Items Affecting Comparability | Adjusted | Impact of Foreign Currency | Constant Currency Adjusted | ||||||||||||||||||||||||||||

| For the first nine months of 2023: | ||||||||||||||||||||||||||||||||

| Operating margin | ||||||||||||||||||||||||||||||||

| U.S. Refreshment Beverages | 27.2 | % | 0.8 | % | 28.0 | % | — | % | 28.0 | % | ||||||||||||||||||||||

| U.S. Coffee | 26.6 | 4.6 | 31.2 | — | 31.2 | |||||||||||||||||||||||||||

| International | 23.2 | 1.0 | 24.2 | — | 24.2 | |||||||||||||||||||||||||||

| Total operating margin | 20.5 | 2.8 | 23.3 | 0.1 | 23.4 | |||||||||||||||||||||||||||

| Component | Calculation (on a trailing twelve month basis) | |||||||

| DIO | (Average inventory divided by cost of sales) * Number of days in the period | |||||||

| DSO | (Accounts receivable divided by net sales) * Number of days in the period | |||||||

| DPO | (Accounts payable * Number of days in the period) divided by cost of sales and SG&A expenses | |||||||

| September 30, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| DIO | 72 | 64 | ||||||||||||

| DSO | 32 | 39 | ||||||||||||

| DPO | 127 | 174 | ||||||||||||

| Cash conversion cycle | (23) | (71) | ||||||||||||

| Rating Agency | Long-Term Debt Rating | Commercial Paper Rating | Outlook | |||||||||||||||||

| Moody's | Baa1 | P-2 | Stable | |||||||||||||||||

| S&P | BBB | A-2 | Stable | |||||||||||||||||

| (in millions) | For the First Nine Months of 2023 | ||||

| Net sales | $ | 6,849 | |||

| Income from operations | 952 | ||||

| Net income attributable to KDP | 1,488 | ||||

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| Current assets | $ | 1,707 | $ | 1,712 | |||||||

| Non-current assets | 46,442 | 45,721 | |||||||||

Total assets(1) | $ | 48,149 | $ | 47,433 | |||||||

| Current liabilities | $ | 6,146 | $ | 4,797 | |||||||

| Non-current liabilities | 16,640 | 17,463 | |||||||||

Total liabilities(2) | $ | 22,786 | $ | 22,260 | |||||||

| Amended and Restated Certificate of Incorporation of Dr Pepper Snapple Group, Inc. (filed as Exhibit 3.1 to the Company's Current Report on Form 8-K (filed on May 12, 2008) and incorporated herein by reference). | |||||

| Certificate of Amendment to Amended and Restated Certificate of Incorporation of Dr Pepper Snapple Group, Inc. effective as of May 17, 2012 (filed as Exhibit 3.2 to the Company's Quarterly Report on Form 10-Q (filed July 26, 2012) and incorporated herein by reference). | |||||

| Certificate of Second Amendment to Amended and Restated Certificate of Incorporation of Dr Pepper Snapple Group, Inc. effective as of May 19, 2016 (filed as Exhibit 3.1 to the Company's Current Report on Form 8-K (filed May 20, 2016) and incorporated herein by reference). | |||||

| Certificate of Third Amendment to the Amended and Restated Certificate of Incorporation of Dr Pepper Snapple Group, Inc. effective as of July 9, 2018 (filed as Exhibit 3.1 to the Company's Current Report on Form 8-K (filed July 9, 2018) and incorporated herein by reference). | |||||

| Amended and Restated By-Laws of Keurig Dr Pepper Inc. effective as of July 9, 2018 (filed as Exhibit 3.2 to the Company's Current Report on Form 8-K (filed July 9, 2018) and incorporated herein by reference). | |||||

10.1* | Letter Agreement by and between the Company and Timothy Cofer dated September 18, 2023.++ | ||||

31.1* | Certification of Chief Executive Officer of Keurig Dr Pepper Inc. pursuant to Rule 13a-14(a) or 15d-14(a) promulgated under the Exchange Act. | ||||

31.2* | Certification of Chief Financial Officer of Keurig Dr Pepper Inc. pursuant to Rule 13a-14(a) or 15d-14(a) promulgated under the Exchange Act. | ||||

32.1** | Certification of Chief Executive Officer of Keurig Dr Pepper Inc. pursuant to Rule 13a-14(b) or 15d-14(b) promulgated under the Exchange Act, and Section 1350 of Chapter 63 of Title 18 of the United States Code. | ||||

32.2** | Certification of Chief Financial Officer of Keurig Dr Pepper Inc. pursuant to Rule 13a-14(b) or 15d-14(b) promulgated under the Exchange Act, and Section 1350 of Chapter 63 of Title 18 of the United States Code. | ||||

| 101* | The following financial information from Keurig Dr Pepper Inc.'s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, formatted in Inline XBRL: (i) Condensed Consolidated Statements of Income, (ii) Condensed Consolidated Statements of Comprehensive Income, (iii) Condensed Consolidated Balance Sheets, (iv) Condensed Consolidated Statements of Cash Flows, (v) Condensed Consolidated Statement of Changes in Stockholders' Equity, and (vi) the Notes to Condensed Consolidated Financial Statements. The Instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | ||||

| 104* | The cover page from this Quarterly Report on Form 10-Q, formatted as Inline XBRL. | ||||

| Keurig Dr Pepper Inc. | |||||||||||

| By: | /s/ Sudhanshu Priyadarshi | ||||||||||

| Name: | Sudhanshu Priyadarshi | ||||||||||

| Title: | Chief Financial Officer | ||||||||||

| (Principal Financial Officer) | |||||||||||

| Date: October 26, 2023 | |||||||||||

| /s/ Robert J. Gamgort | ||||||||

| Date: October 26, 2023 | Robert J. Gamgort | |||||||

| Chief Executive Officer and President of Keurig Dr Pepper Inc. | ||||||||

| /s/ Sudhanshu Priyadarshi | ||||||||

| Date: October 26, 2023 | Sudhanshu Priyadarshi | |||||||

| Chief Financial Officer of Keurig Dr Pepper Inc. | ||||||||

| /s/ Robert J. Gamgort | ||||||||

| Date: October 26, 2023 | Robert J. Gamgort | |||||||

| Chief Executive Officer and President of Keurig Dr Pepper Inc. | ||||||||

| /s/ Sudhanshu Priyadarshi | ||||||||

| Date: October 26, 2023 | Sudhanshu Priyadarshi | |||||||

| Chief Financial Officer of Keurig Dr Pepper Inc. | ||||||||

Condensed Consolidated Statements of Income - USD ($) |

3 Months Ended | 9 Months Ended | ||

|---|---|---|---|---|

Sep. 30, 2023 |

Sep. 30, 2022 |

Sep. 30, 2023 |

Sep. 30, 2022 |

|

| Income Statement [Abstract] | ||||

| Net sales | $ 3,805,000,000 | $ 3,622,000,000 | $ 10,947,000,000 | $ 10,254,000,000 |

| Cost of sales | 1,694,000,000 | 1,721,000,000 | 5,051,000,000 | 4,927,000,000 |

| Gross profit | 2,111,000,000 | 1,901,000,000 | 5,896,000,000 | 5,327,000,000 |

| Selling, general and administrative expenses | 1,217,000,000 | 1,196,000,000 | 3,654,000,000 | 3,418,000,000 |

| Impairment of intangible assets | 2,000,000 | 311,000,000 | 2,000,000 | 311,000,000 |

| Gain (Loss) Related to Litigation Settlement | 0 | 0 | 0 | (299,000,000) |

| Other operating income, net | (4,000,000) | 0 | (9,000,000) | (35,000,000) |

| Income from operations | 896,000,000 | 394,000,000 | 2,249,000,000 | 1,932,000,000 |

| Interest expense | 237,000,000 | 207,000,000 | 432,000,000 | 570,000,000 |

| Loss on early extinguishment of debt | 0 | 0 | 0 | 217,000,000 |

| Equity Method Investment, Realized Gain (Loss) on Disposal | 0 | 0 | 0 | (50,000,000) |

| Impairment of investments and note receivable | 0 | 0 | 0 | 12,000,000 |

| Other (income) expense, net | (5,000,000) | 4,000,000 | (41,000,000) | 22,000,000 |

| Income (Loss) from Continuing Operations before Income Taxes, Noncontrolling Interest, Total | 664,000,000 | 183,000,000 | 1,858,000,000 | 1,161,000,000 |

| Provision for income taxes | 146,000,000 | 4,000,000 | 370,000,000 | 179,000,000 |

| Net income including non-controlling interest | 518,000,000 | 179,000,000 | 1,488,000,000 | 982,000,000 |

| Less: Net loss attributable to non-controlling interest | 0 | (1,000,000) | 0 | (1,000,000) |

| Net income attributable to KDP | $ 518,000,000 | $ 180,000,000 | $ 1,488,000,000 | $ 983,000,000 |

| Earnings per common share: | ||||

| Basic (in dollars per share) | $ 0.37 | $ 0.13 | $ 1.06 | $ 0.69 |

| Diluted (in dollars per share) | $ 0.37 | $ 0.13 | $ 1.05 | $ 0.69 |

| Weighted average common shares outstanding: | ||||

| Basic (in shares) | 1,397,400,000 | 1,416,100,000 | 1,401,300,000 | 1,417,300,000 |

| Diluted (in shares) | 1,406,200,000 | 1,427,200,000 | 1,410,800,000 | 1,428,800,000 |

Condensed Consolidated Balance Sheets (Parenthetical) - $ / shares |

Sep. 30, 2023 |

Dec. 31, 2022 |

|---|---|---|

| Stockholders' equity: | ||

| Preferred stock, par value (in dollars per share) | $ 0.01 | $ 0.01 |

| Preferred stock authorized (in shares) | 15,000,000 | 15,000,000 |

| Preferred stock issued (in shares) | 0 | 0 |

| Common stock, par value (in dollars per share) | $ 0.01 | $ 0.01 |

| Common stock authorized (in shares) | 2,000,000,000 | 2,000,000,000 |

| Common stock issued (in shares) | 1,398,322,033 | 1,408,394,293 |