UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 17, 2012

Arbitron Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1-1969 | 52-0278528 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) | ||

| 9705 Patuxent Woods Drive, Columbia, Maryland |

21046 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: 410-312-8000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement

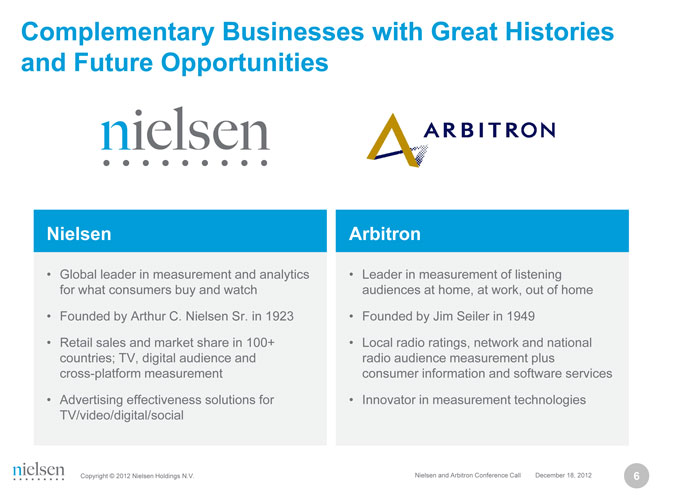

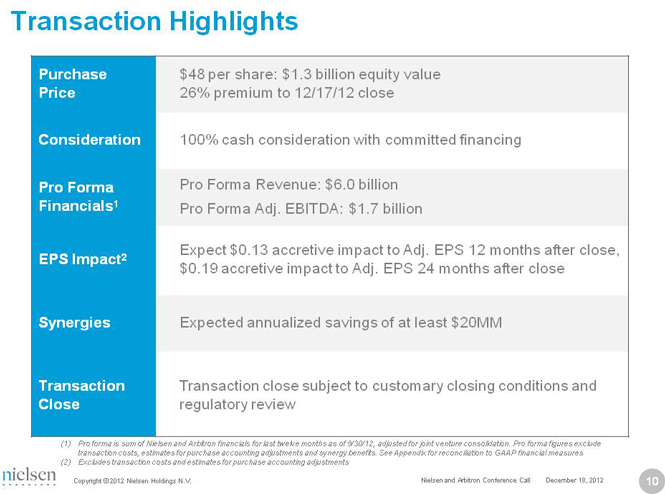

On December 17, 2012, Arbitron Inc., a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Nielsen Holdings N.V., a Dutch public company with limited liability (naamloze vennootschap) (“Parent”), and TNC Sub I Corporation, a Delaware corporation and an indirect wholly owned subsidiary of Parent (“Merger Sub”).

Merger Agreement

Pursuant to the terms of the Merger Agreement, subject to the satisfaction or waiver of certain conditions set forth in the Merger Agreement, Merger Sub will be merged with and into the Company (the “Merger”), and the Company will become an indirect wholly-owned subsidiary of Parent at the effective time of the Merger (the “Effective Time”). At the Effective Time, each share of the common stock of the Company, par value $0.50 per share (the “Common Stock”), issued and outstanding immediately prior to the Effective Time (other than shares held by the Company, Parent, Merger Sub or any Company stockholders who perfect their statutory rights of appraisal under Delaware law) will be converted into the right to receive $48.00 in cash (the “Merger Consideration”).

The boards of directors of each of the Company and Parent have approved the Merger Agreement and the Merger.

The Merger Agreement includes customary representations, warranties and covenants by the parties. The Company has agreed, among other things, to operate its business in the ordinary course until the Merger is consummated. The Company has agreed not to solicit or initiate discussions with third parties regarding other proposals to acquire the Company and has agreed to certain restrictions on its ability to respond to such proposals, subject to the fulfillment of the fiduciary duties of the Company’s board of directors. In addition, certain covenants require each of the parties to use reasonable best efforts to cause the Merger to be consummated.

Consummation of the Merger is subject to various customary closing conditions, including, (i) the receipt of the Company Stockholder Approval (as defined in the Merger Agreement), (ii) the absence of any law, injunction, judgment or ruling enjoining or prohibiting the Merger, (iii) the accuracy of the representations and warranties made by the parties, (iv) the performance by the parties in all material respects of their covenants, obligations and agreements under the Merger Agreement and (v) the expiration or early termination of the waiting period applicable to the Merger under the Hart-Scott Rodino Antitrust Improvements Act of 1976, as amended. Consummation of the Merger is not subject to any financing contingencies.

The Merger Agreement contains certain termination rights and provides that upon termination of the Merger Agreement by the Company or Parent upon specified conditions, including a termination prior to the requisite stockholder approval of the Merger by the Company to accept a “Superior Company Proposal” (as defined in the Merger Agreement) or by Parent upon a change in the recommendation of the Company’s board of directors, the Company will be required to pay Parent a termination fee of $32.7 million, and upon termination of the Merger Agreement by the Company or Parent upon specified conditions (including a failure to satisfy certain conditions relating to antitrust laws or Parent’s breach of certain of its covenants related to its efforts to obtain antitrust approvals), Parent will be required to pay the Company a termination fee of $131.0 million. In addition, subject to certain exceptions and limitations, either party may terminate the Merger Agreement if the Merger is not consummated by October 1, 2013 (as such date may be extended under certain circumstances).

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Merger Agreement has been included to provide investors and stockholders with information regarding its terms. It is not intended to provide any other factual information about the Company, Parent or Merger Sub. The Merger Agreement contains representations and warranties that the parties made to and solely for the benefit of each other. The assertions embodied in the representations and warranties in the Merger Agreement are qualified by information contained in the confidential disclosure letter that the Company delivered to Parent in connection with signing the Merger Agreement. This confidential disclosure letter contains information that modifies, qualifies and

creates exceptions to the representations and warranties set forth in the Merger Agreement. Investors are not third-party beneficiaries under the Merger Agreement and should not rely on such representations and warranties as characterizations of the actual state of facts or circumstances. Moreover, information concerning the subject matter of such representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s or Parent’s public disclosures.

Forward Looking Statements:

This written communication includes information that could constitute forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “will”, “expect”, “should”, “could”, “shall” and similar expressions. These statements are subject to risks and uncertainties concerning Parent’s proposed acquisition of the Company, the Company’s expected financial performance, as well as the Company’s strategic and operational plans and actual results and events could differ materially from what presently is expected. The potential risks and uncertainties include the possibility that the transaction will not close or that the closing may be delayed; the possibility that the Company may be unable to obtain stockholder approval as required for the transaction or that the other conditions to the closing of the transaction may not be satisfied; the transaction may involve unexpected costs, liabilities or delays; the outcome of any legal proceedings related to the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement; general economic conditions; conditions in the markets Parent and the Company are engaged in; behavior of customers, suppliers and competitors (including their reaction to the transaction); technological developments; as well as legal and regulatory rules affecting Parent’s and the Company’s business and specific risk factors discussed in other releases and public filings made by Parent and the Company (including the their respective filings with the Securities and Exchange Commission (the “SEC”)). This list of factors is not intended to be exhaustive. Such forward-looking statements only speak as of the date of this written communication, and we assume no obligation to update any written or oral forward-looking statement made by us or on our behalf as a result of new information, future events, or other factors.

Additional Information and Where You Can Find It:

In connection with the proposed acquisition by Parent of the Company pursuant to the terms of an Agreement and Plan of Merger by and among the Company, Parent, and a wholly-owned subsidiary of Parent, the Company will file a proxy statement with the SEC. Investors are urged to read the proxy statement (including all amendments and supplements to it) because it will contain important information. Investors may obtain free copies of the proxy statement when it becomes available, as well as other filings containing information about the Company, without charge, at the SEC’s Internet site (www.sec.gov). These documents may also be obtained for free from the Company’s Investor Relations web site (http://www.arbitron.com/investors) or by directing a request to the Company at: Arbitron Inc., 9705 Patuxent Woods Drive, Columbia, Maryland 21046.

The Company and its directors and executive officers and other members of management and employees are potential participants in the solicitation of proxies from the Company’s stockholders in respect of the proposed transaction.

Information regarding the Company’s directors and executive officers is available in the Company’s proxy statement for its 2012 annual meeting of stockholders, filed with the SEC on April 12, 2012. Additional information regarding the interests of such potential participants in the proposed transaction will be included in the proxy statement to be filed with the SEC in connection with the proposed transaction.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Company entered into a Waiver and Amendment of Executive Retention Agreement effective December 17, 2012 (collectively, the “Amendments”) with each of Debra Delman, Carol Hanley, Gregg Lindner and Timothy T. Smith (the “Executives”), which amend the Executives’ existing Executive Retention Agreements with the Company, as previously amended (as previously amended, the “Existing Agreements”).

Each Executive’s Existing Agreement is currently set to expire in August 2013. The Amendments extend the terms of the Existing Agreements of Debra Delman and Gregg Lindner through December 16, 2014 and Carol Hanley and Timothy T. Smith through the later of December 16, 2014 and the date that is 12 months following the date of a change in control of the Company that occurs prior to December 16, 2014. The Existing Agreements, as amended by the Amendments, provide for severance payments under certain circumstances, including termination without cause or resignation as a result of position diminishment and enhanced severance following a change in control of the Company.

The Company expects to file the Amendments as exhibits to its Annual Report on Form 10-K for the year ended December 31, 2012. The foregoing description of the Amendments does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendments.

Item 7.01. Regulation FD Disclosure.

The Company and Parent issued a joint press release on December 18, 2012 regarding the matters described in Item 1.01 of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

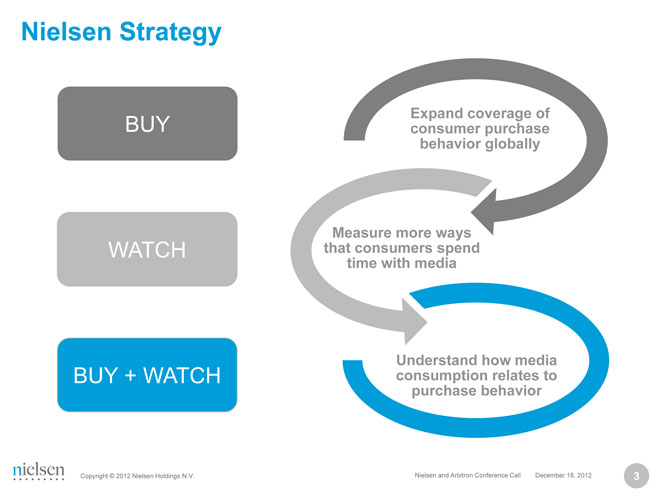

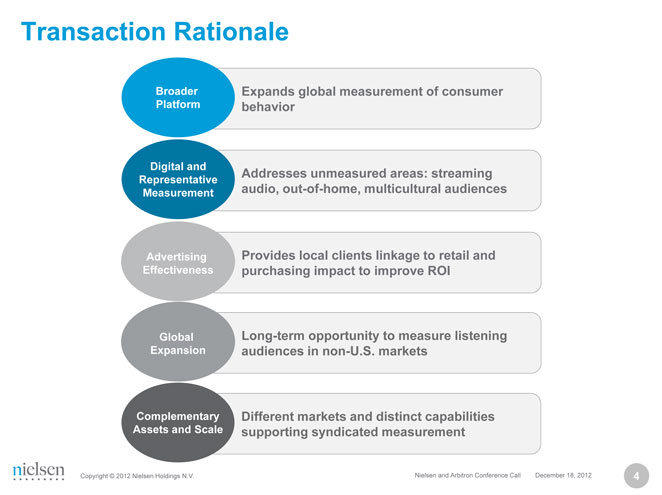

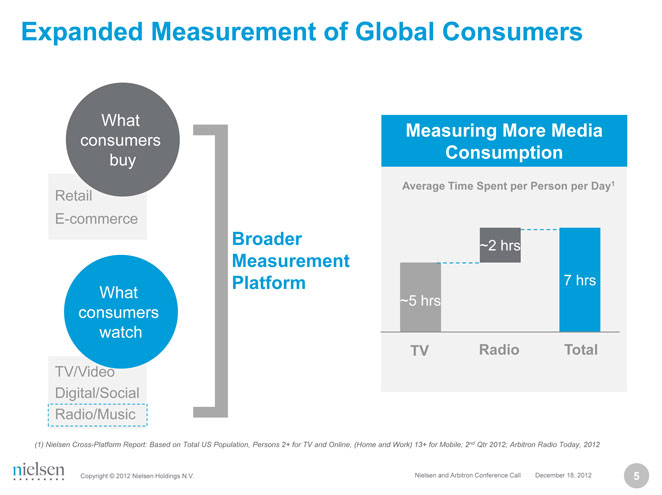

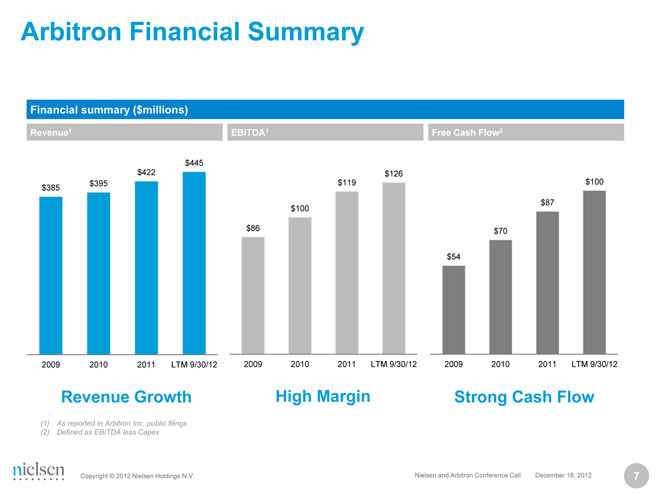

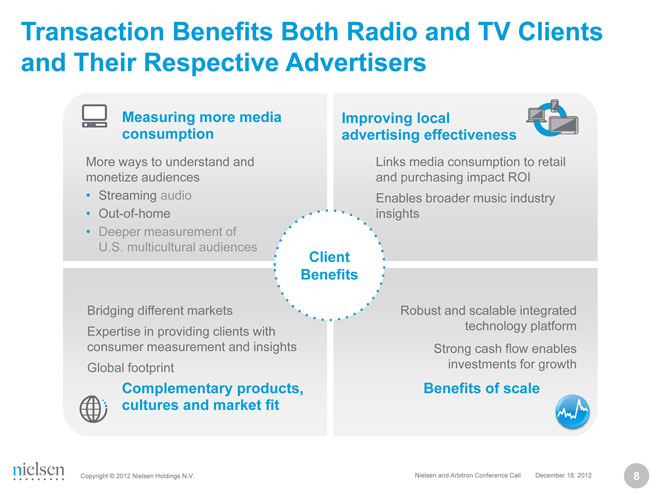

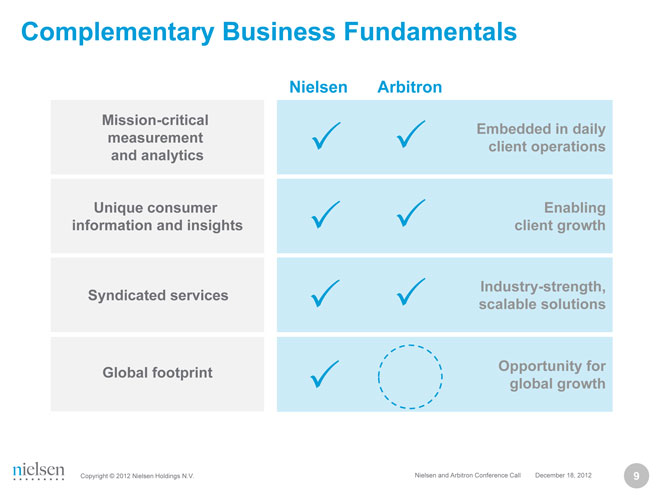

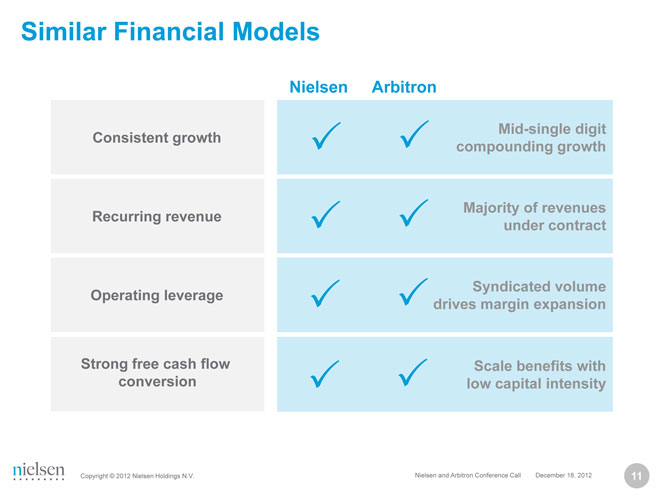

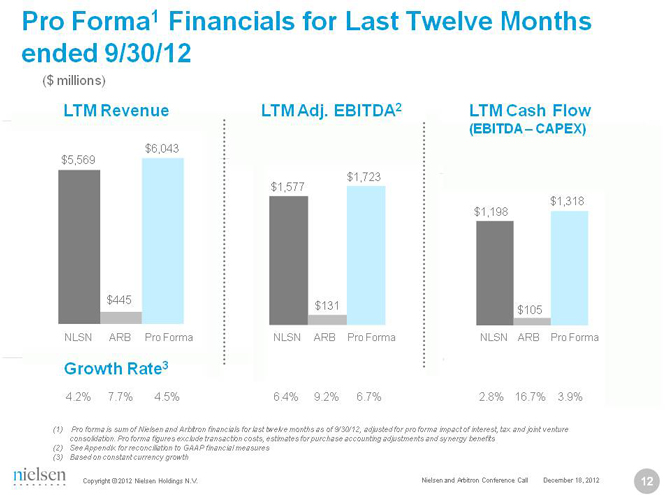

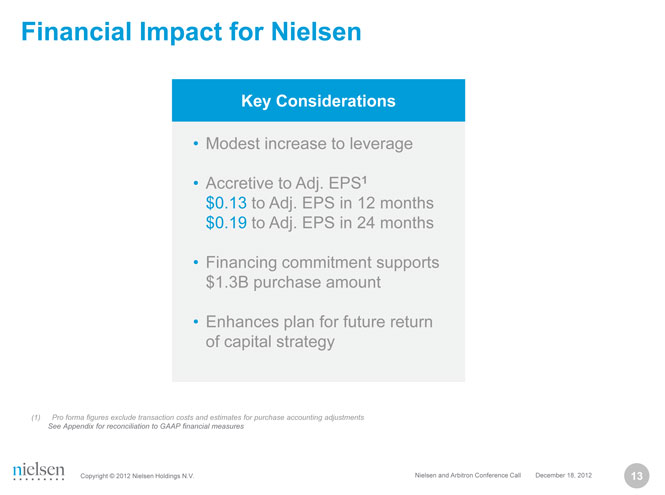

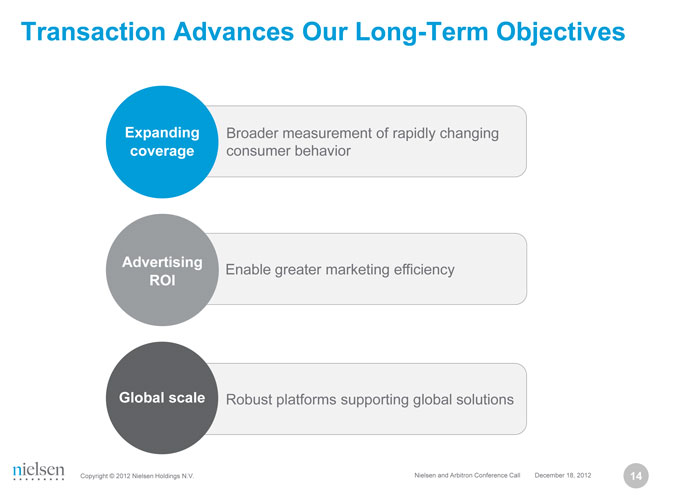

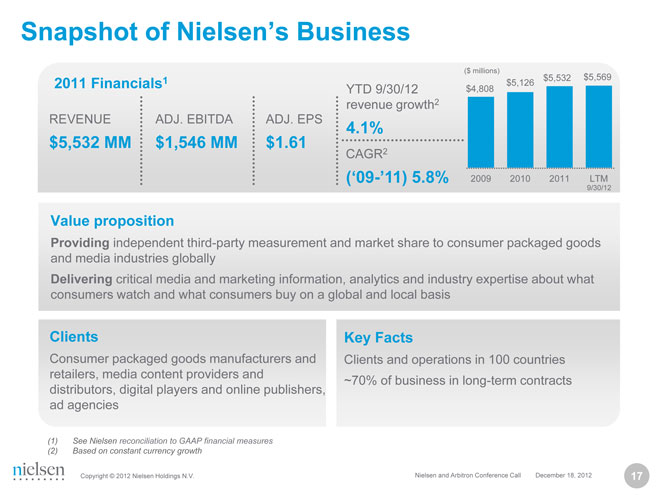

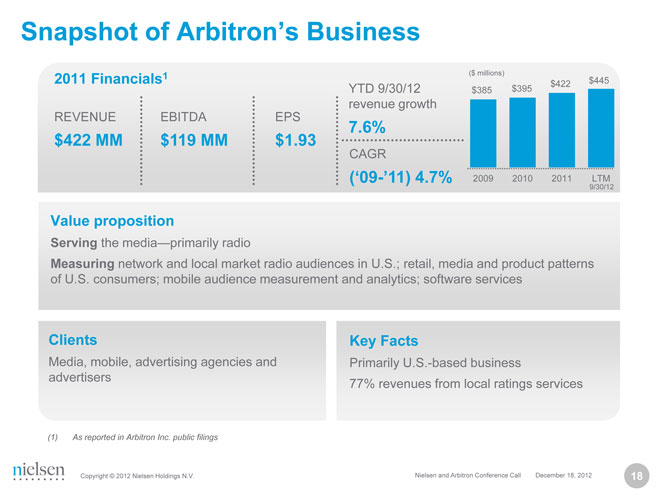

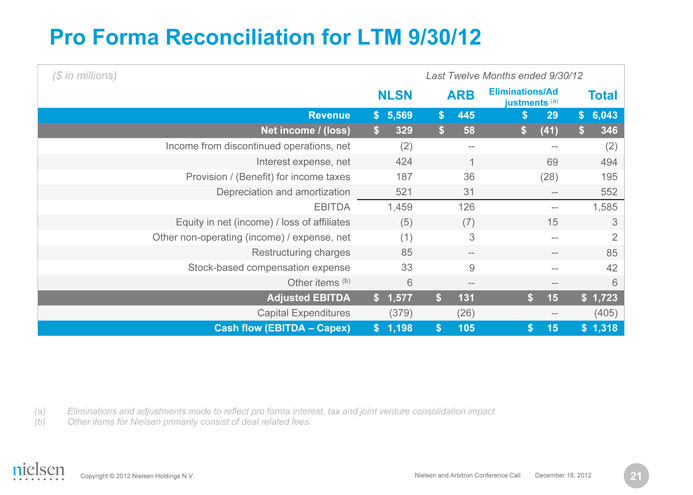

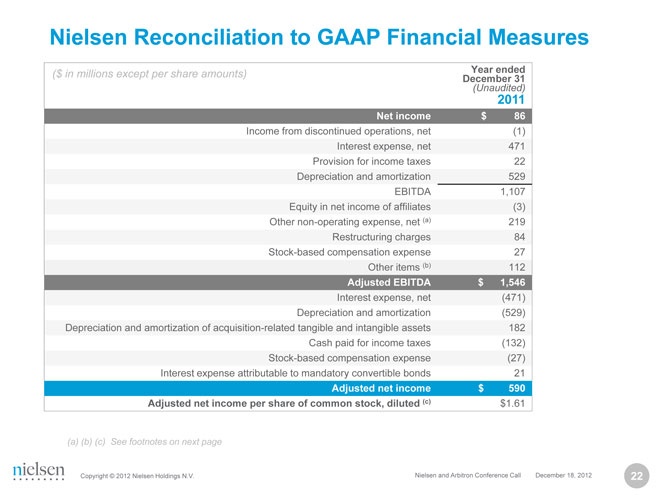

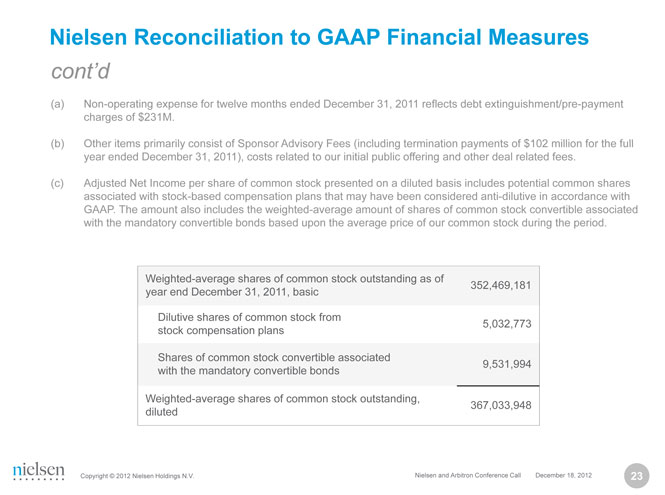

A copy of the joint investor presentation of the Company and Parent, dated December 18, 2012, regarding the matters described in Item 1.01 of this Current Report on Form 8-K is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

As provided in General Instruction B.2 of Form 8-K, the information in this Item 7.01 and Exhibit 99.1 and Exhibit 99.2 incorporated herein shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

| 2.1 | Agreement and Plan of Merger, dated as of December 17, 2012, among Arbitron Inc., Nielsen Holdings N.V. and TNC Sub I Corporation* | |

| 99.1 | Joint Press Release issued by Arbitron Inc. and Nielsen Holdings N.V., dated December 18, 2012 | |

| 99.2 | Investor Presentation of Arbitron Inc. and Nielsen Holdings N.V., dated December 18, 2012 | |

| 99.3 | Employee Communication, dated December 18, 2012 | |

| 99.4 | Client Communication, dated December 18, 2012 | |

| 99.5 | Joint Call Transcript, dated December 18, 2012 | |

| * | Certain of the schedules and exhibits to the Merger Agreement have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Arbitron Inc. hereby undertakes to furnish supplementally to the SEC copies of any omitted schedules and exhibits upon request therefor by the SEC. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Arbitron Inc. | ||||||

| December 18, 2012 |

By: | /s/ Timothy T. Smith | ||||

| Name: | Timothy T. Smith | |||||

| Title: | Executive Vice President, Business Development & Strategy, Chief Legal Officer & Secretary | |||||

Exhibit Index

| Exhibit |

Description | |

| 2.1 | Agreement and Plan of Merger, dated as of December 17, 2012, among Arbitron Inc., Nielsen Holdings N.V. and NC Sub I Corporation* | |

| 99.1 | Joint Press Release issued by Arbitron Inc. and Nielsen Holdings N.V., dated December 18, 2012 | |

| 99.2 | Investor Presentation of Arbitron Inc. and Nielsen Holdings N.V., dated December 18, 2012 | |

| 99.3 | Employee Communication, dated December 18, 2012 | |

| 99.4 | Client Communication, dated December 18, 2012 | |

| 99.5 | Joint Call Transcript, dated December 18, 2012 | |

| * | Certain of the appendices and exhibits to the Merger Agreement have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Arbitron Inc. hereby undertakes to furnish supplementally to the SEC copies of any omitted appendices and exhibits upon request therefore by the SEC. |

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

among

NIELSEN HOLDINGS N.V.,

TNC SUB I CORPORATION

and

ARBITRON INC.

Dated as of December 17, 2012

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I |

THE MERGER |

1 | ||||

| 1.01 |

The Merger |

1 | ||||

| 1.02 |

Closing |

1 | ||||

| 1.03 |

Effective Time |

2 | ||||

| 1.04 |

Effects |

2 | ||||

| 1.05 |

Certificate of Incorporation and Bylaws |

2 | ||||

| 1.06 |

Directors |

2 | ||||

| 1.07 |

Officers |

2 | ||||

| ARTICLE II |

EFFECT ON THE CAPITAL STOCK OF THE CONSTITUENT CORPORATIONS; EXCHANGE OF CERTIFICATES |

2 | ||||

| 2.01 |

Effect on Capital Stock |

2 | ||||

| 2.02 |

Exchange of Certificates |

4 | ||||

| ARTICLE III |

REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

6 | ||||

| 3.01 |

Organization, Standing and Power |

6 | ||||

| 3.02 |

Company Subsidiaries; Equity Interests |

6 | ||||

| 3.03 |

Capital Structure |

7 | ||||

| 3.04 |

Authority; Execution and Delivery; Enforceability |

8 | ||||

| 3.05 |

No Conflicts; Consents |

9 | ||||

| 3.06 |

SEC Documents; Financial Statements; Undisclosed Liabilities |

9 | ||||

| 3.07 |

Information Supplied |

11 | ||||

| 3.08 |

Absence of Certain Changes or Events |

12 | ||||

| 3.09 |

Taxes |

12 | ||||

| 3.10 |

Labor Relations |

14 | ||||

| 3.11 |

Employee Benefits |

14 | ||||

| 3.12 |

Litigation |

15 | ||||

| 3.13 |

Compliance with Applicable Laws |

16 | ||||

| 3.14 |

Environmental Matters |

16 | ||||

| 3.15 |

Title to Properties |

17 | ||||

| 3.16 |

Intellectual Property |

18 | ||||

| 3.17 |

Contracts |

19 | ||||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 3.18 |

Insurance |

21 | ||||

| 3.19 |

Interested Party Transactions |

21 | ||||

| 3.20 |

Brokers |

21 | ||||

| 3.21 |

Opinion of Financial Advisor |

22 | ||||

| 3.22 |

State Takeover Laws; Company Certificate Provisions |

22 | ||||

| 3.23 |

No Other Representations and Warranties |

22 | ||||

| ARTICLE IV |

REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB |

22 | ||||

| 4.01 |

Organization, Standing and Power |

22 | ||||

| 4.02 |

Merger Sub |

23 | ||||

| 4.03 |

Authority; Execution and Delivery; Enforceability |

23 | ||||

| 4.04 |

No Conflicts; Consents |

23 | ||||

| 4.05 |

Information Supplied |

24 | ||||

| 4.06 |

Brokers |

24 | ||||

| 4.07 |

Absence of Litigation |

24 | ||||

| 4.08 |

Ownership of the Company Common Stock |

24 | ||||

| 4.09 |

Financing |

25 | ||||

| 4.10 |

Absence of Certain Agreements |

25 | ||||

| 4.11 |

No Other Representations and Warranties |

26 | ||||

| ARTICLE V |

COVENANTS RELATING TO CONDUCT OF BUSINESS |

26 | ||||

| 5.01 |

Conduct of Business |

26 | ||||

| 5.02 |

Control of the Operations |

29 | ||||

| 5.03 |

No Solicitation |

29 | ||||

| ARTICLE VI |

ADDITIONAL AGREEMENTS |

33 | ||||

| 6.01 |

Preparation of Proxy Statement; Stockholders Meeting |

33 | ||||

| 6.02 |

Access to Information; Confidentiality |

34 | ||||

| 6.03 |

Reasonable Best Efforts; Notification |

35 | ||||

| 6.04 |

Treatment of Equity Compensation |

40 | ||||

| 6.05 |

Benefit Plans |

43 | ||||

| 6.06 |

Financing |

45 | ||||

-ii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 6.07 |

Indemnification |

46 | ||||

| 6.08 |

Fees and Expenses |

48 | ||||

| 6.09 |

Public Announcements |

50 | ||||

| 6.10 |

Transfer Taxes |

50 | ||||

| 6.11 |

Merger Sub Compliance |

50 | ||||

| 6.12 |

Stockholder Litigation |

50 | ||||

| ARTICLE VII |

CONDITIONS PRECEDENT |

51 | ||||

| 7.01 |

Conditions to Each Party’s Obligation to Effect the Merger |

51 | ||||

| 7.02 |

Additional Conditions to Obligations of Parent and Merger Sub |

51 | ||||

| 7.03 |

Additional Conditions to Obligations of the Company |

52 | ||||

| ARTICLE VIII |

TERMINATION, AMENDMENT AND WAIVER |

52 | ||||

| 8.01 |

Termination |

52 | ||||

| 8.02 |

Effect of Termination |

54 | ||||

| 8.03 |

Amendment |

55 | ||||

| 8.04 |

Extension; Waiver |

55 | ||||

| 8.05 |

Procedure for Termination, Amendment, Extension or Waiver |

55 | ||||

| ARTICLE IX |

GENERAL PROVISIONS |

55 | ||||

| 9.01 |

Nonsurvival of Representations and Warranties |

55 | ||||

| 9.02 |

Notices |

56 | ||||

| 9.03 |

Definitions |

56 | ||||

| 9.04 |

Interpretation; Exhibits and Disclosure Letters |

58 | ||||

| 9.05 |

Severability |

59 | ||||

| 9.06 |

Counterparts |

59 | ||||

| 9.07 |

Entire Agreement; No Third Party Beneficiaries |

59 | ||||

| 9.08 |

Governing Law |

60 | ||||

| 9.09 |

Assignment |

60 | ||||

| 9.10 |

Consents and Approvals |

60 | ||||

| 9.11 |

Enforcement |

60 | ||||

| 9.12 |

No Recourse |

61 | ||||

-iii-

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”) dated as of December 17, 2012, among Nielsen Holdings N.V., a Netherlands company (“Parent”), TNC Sub I Corporation, a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), and Arbitron Inc., a Delaware corporation (the “Company”).

WHEREAS, the respective Boards of Directors of Parent, Merger Sub and the Company have approved the acquisition of the Company by Parent on the terms and subject to the conditions set forth in this Agreement;

WHEREAS, the respective Boards of Directors of Parent, Merger Sub and the Company have approved this Agreement and the merger (the “Merger”) of Merger Sub into the Company, on the terms and subject to the conditions set forth herein;

WHEREAS, the Company Board (as defined below) has, subject to the terms of this Agreement, resolved to recommend adoption of this Agreement by the stockholders of the Company; and

WHEREAS, Parent, Merger Sub and the Company desire to make certain representations, warranties, covenants and agreements in connection with the Merger and also to prescribe various conditions to the Merger.

NOW, THEREFORE, the parties hereto agree as follows:

ARTICLE I

THE MERGER

1.01 The Merger. On the terms and subject to the conditions set forth in this Agreement, and in accordance with the General Corporation Law of the State of Delaware (the “DGCL”), Merger Sub shall be merged with and into the Company at the Effective Time. At the Effective Time, the separate corporate existence of Merger Sub shall cease and the Company shall continue as the surviving corporation (the “Surviving Corporation”).

1.02 Closing. The closing (the “Closing”) of the Merger shall take place at the offices of Morrison & Foerster LLP, 1650 Tysons Boulevard, Suite 400, McLean, Virginia, at 9:00 a.m. (Eastern Time) no later than the third (3rd) Business Day following the satisfaction (or, to the extent permitted by Law, waiver by all parties hereto) of the conditions set forth in Article VII (other than those that by their terms are to be satisfied or waived at the Closing) (such date, the “Original Date”), or at such other time and date as shall be agreed upon in writing among Parent and the Company; provided, however, that if the Marketing Period has not ended on or prior to the Original Date and Parent requests, in writing, an extension of the Original Date, the Closing shall occur on the date following the satisfaction or waiver of such conditions that is the earlier to occur of (a) such date during the Marketing Period specified by Parent on no fewer than three Business Days’ written notice to the Company, and (b) the first Business Day following the end of the Marketing Period. The date on which the Closing occurs is referred to in this Agreement as the “Closing Date”.

-1-

1.03 Effective Time. On the Closing Date, the parties hereto shall duly file with the Secretary of State of the State of Delaware a certificate of merger (the “Certificate of Merger”), executed in accordance with the relevant provisions of the DGCL, and shall make all other filings or recordings required under the DGCL. The Merger shall become effective at such time as the Certificate of Merger is duly filed with such Secretary of State of the State of Delaware, or at such other time as Parent and the Company shall agree and specify in the Certificate of Merger (the time that the Merger becomes effective being the “Effective Time”).

1.04 Effects. The Merger shall have the effects set forth herein and in Section 259 of the DGCL. Without limiting the generality of the foregoing and subject thereto, at the Effective Time, all the property, rights, privileges, immunities, powers and franchises of the Company and Merger Sub shall vest in the Surviving Corporation and all debts, liabilities and duties of the Company and Merger Sub shall become the debts, liabilities and duties of the Surviving Corporation.

1.05 Certificate of Incorporation and Bylaws.

(a) The certificate of incorporation of the Company (the “Company Certificate”), as in effect immediately prior to the Effective Time, shall be amended at the Effective Time to read in the form of Exhibit A and, as so amended, shall be the certificate of incorporation of the Surviving Corporation until thereafter changed or amended as provided therein or by applicable Law.

(b) The bylaws of the Company (the “Company Bylaws”), as in effect immediately prior to the Effective Time, shall be amended at the Effective Time so as to read in their entirety in the form of the bylaws of Merger Sub as in effect immediately prior to the Effective Time (which shall contain such provisions as are necessary to give full effect to the exculpation and indemnification provided for in Section 6.07) and, as so amended, shall be the bylaws of the Surviving Corporation until thereafter changed or amended as provided therein or by applicable Law.

1.06 Directors. The directors of Merger Sub immediately prior to the Effective Time shall, from and after the Effective Time, be the directors of the Surviving Corporation until their successors have been duly elected or appointed and qualified or until their earlier death, resignation or removal in accordance with the certificate of incorporation and bylaws of the Surviving Corporation.

1.07 Officers. The officers of the Company immediately prior to the Effective Time shall, from and after the Effective Time, be the officers of the Surviving Corporation until their successors have been duly elected or appointed and qualified or until their earlier death, resignation or removal in accordance with the certificate of incorporation and bylaws of the Surviving Corporation.

ARTICLE II

EFFECT ON THE CAPITAL STOCK OF THE

CONSTITUENT CORPORATIONS; EXCHANGE OF CERTIFICATES

2.01 Effect on Capital Stock. At the Effective Time, by virtue of the Merger and without any action on the part of the holder of any shares of the common stock of the Company, par value $0.50 per share (the “Company Common Stock”) or any shares of capital stock of Merger Sub:

(a) Capital Stock of Merger Sub. Each share of capital stock of Merger Sub issued and outstanding immediately prior to the Effective Time shall be automatically converted into and become one fully paid and nonassessable share of common stock, par value $0.01 per share, of the Surviving Corporation.

-2-

(b) Cancelation of Treasury Stock and Parent-Owned Stock. Each share of the Company Common Stock that is owned by the Company, Parent or Merger Sub immediately prior to the Effective Time shall no longer be outstanding and shall automatically be canceled and shall cease to exist, and no consideration shall be delivered or deliverable in exchange therefor.

(c) Conversion of the Company Common Stock.

(i) Subject to Sections 2.01(b) and 2.01(d), each share of the Company Common Stock issued and outstanding immediately prior to the Effective Time shall be automatically converted into the right to receive an amount equal to $48.00 per share of the Company Common Stock, in cash and without interest (the “Merger Consideration”).

(ii) As of the Effective Time, all such shares of the Company Common Stock shall no longer be outstanding and shall automatically be canceled and shall cease to exist, and each holder of a certificate, or evidence of shares held in book-entry form, representing any such shares of the Company Common Stock (a “Certificate”) shall cease to have any rights with respect thereto, except the right to receive the Merger Consideration upon surrender of such Certificate in accordance with Section 2.02, without interest.

(iii) As provided in Section 2.02(h), the right of any holder of a Certificate to receive the Merger Consideration shall be subject to and reduced by the amount of any withholding that is required under applicable Tax Laws.

(d) Appraisal Rights. Notwithstanding anything in this Agreement to the contrary, shares of the Company Common Stock that are outstanding immediately prior to the Effective Time and that are held by any person who is entitled to demand and properly demands appraisal of such shares of Company Common Stock (“Appraisal Shares”) pursuant to, and who complies in all respects with, Section 262 of the DGCL (“Section 262”) shall not be converted into the right to receive the Merger Consideration as provided in Section 2.01(c), but rather the holders of Appraisal Shares shall be entitled to payment of the fair value of such Appraisal Shares in accordance with Section 262; provided, however, that if any such holder shall fail to perfect or otherwise shall waive, withdraw or lose the right to appraisal under Section 262, then the right of such holder to be paid the fair value of such holder’s Appraisal Shares shall cease and such Appraisal Shares shall be deemed to have been converted as of the Effective Time into, and to have become exchangeable solely for the right to receive, the Merger Consideration as provided in Section 2.01(c). The Company shall serve prompt notice to Parent of any demands received by the Company for appraisal of any shares of the Company Common Stock. The Company shall give Parent the opportunity to participate in all negotiations and proceedings with respect to such demands. Prior to the Effective Time, the Company shall not, without the prior written consent of Parent (such consent not to be unreasonably withheld, conditioned or delayed), make any payment with respect to, settle or offer to settle, or waive any failure to timely deliver a written demand or timely take any other action with respect to any such demands, or agree to do any of the foregoing.

-3-

2.02 Exchange of Certificates.

(a) Paying Agent. Prior to the Effective Time, Parent shall select a bank or trust company reasonably acceptable to the Company to act as paying agent (the “Paying Agent”) for the payment of the Merger Consideration upon surrender of Certificates. At or prior to the Effective Time, Parent shall, or shall cause the Surviving Corporation to, deposit with the Paying Agent to be held in trust for the benefit of holders of Certificates all of the cash necessary to pay for the shares of the Company Common Stock converted into the right to receive the Merger Consideration pursuant to Section 2.01(c) (such cash being hereinafter referred to as the “Exchange Fund”). Parent shall, or shall cause the Surviving Corporation to, promptly deposit additional funds with the Paying Agent in an amount equal to any deficiency in the amount required to make such payment.

(b) Exchange Procedure. Promptly after the Effective Time (and in any event within two (2) Business Days), the Surviving Corporation or Parent shall cause the Paying Agent to mail to each holder of record of a Certificate that immediately prior to the Effective Time represented shares of the Company Common Stock that were converted into the right to receive the Merger Consideration pursuant to Section 2.01, (i) a letter of transmittal (which shall be in customary form and have such other provisions as Parent and the Company shall reasonably agree and which shall specify that delivery shall be effected, and risk of loss and title to the Certificates shall pass, only upon proper delivery of the Certificates, or affidavits of loss in lieu thereof as provided in Section 2.02(g), to the Paying Agent) and (ii) instructions for effecting the surrender of the Certificates in exchange for the Merger Consideration. Upon surrender of a Certificate to the Paying Agent for cancelation, together with such letter of transmittal, duly completed and validly executed, and such other documents as may reasonably be required by the Paying Agent, the holder of such Certificate shall be entitled to receive in exchange therefor the amount of Merger Consideration into which the shares of the Company Common Stock theretofore represented by such Certificate shall have been converted pursuant to Section 2.01, and the Certificate so surrendered shall forthwith be canceled. In the event of a transfer of ownership of the Company Common Stock that is not registered in the transfer records of the Company, payment may be made to a person other than the person in whose name the Certificate so surrendered is registered, if such Certificate shall be properly endorsed or otherwise be in proper form for transfer and the person requesting such payment shall pay any transfer or other Taxes required by reason of the payment to a person other than the registered holder of such Certificate or establish to the satisfaction of Parent that such Tax has been paid or is not applicable. Until surrendered as contemplated by this Section 2.02, each Certificate shall be deemed at any time after the Effective Time to represent only the right to receive upon such surrender the amount of Merger Consideration, without interest, into which the shares of the Company Common Stock theretofore represented by such Certificate have been converted pursuant to Section 2.01. No interest shall be paid or accrue on the cash payable upon surrender of any Certificate.

(c) No Further Ownership Rights in the Company Common Stock. The Merger Consideration paid in accordance with the terms of this Article II upon conversion of any shares of the Company Common Stock shall be deemed to have been paid in full satisfaction of all rights pertaining to such shares of the Company Common Stock, subject, however, to the Surviving Corporation’s obligation to pay any dividends or to make any other distributions with a record date prior to the Effective Time that may have been declared or made by the Company on such shares of

-4-

the Company Common Stock in accordance with the terms of this Agreement or prior to the date of this Agreement and that remain unpaid at the Effective Time; and after the Effective Time there shall be no further registration of transfers on the stock transfer books of the Surviving Corporation of shares of the Company Common Stock that were outstanding immediately prior to the Effective Time. If, after the Effective Time, any Certificates are presented to the Surviving Corporation or the Paying Agent for any reason, they shall be canceled and exchanged as provided in this Article II.

(d) Termination of Exchange Fund. Any portion of the Exchange Fund that remains undistributed to the holders of the Company Common Stock for twelve (12) months after the Effective Time shall be delivered to Parent upon demand, and any holder of the Company Common Stock who has not theretofore complied with this Article II shall thereafter look only to Parent and the Surviving Corporation (subject to abandoned property, escheat or similar Laws) as general creditors thereof with respect to the payment of its claim for Merger Consideration, without any interest thereon.

(e) No Liability. None of Parent, Merger Sub, the Surviving Corporation, the Company or the Paying Agent shall be liable to any person in respect of any cash from the Exchange Fund delivered to a public official pursuant to any applicable abandoned property, escheat or similar Law. If any Certificate has not been surrendered prior to the date on which the Merger Consideration in respect of such Certificate would otherwise escheat to or become the property of any Governmental Entity, any such Merger Consideration in respect of such Certificate shall, to the extent permitted by applicable Law, become the property of the Surviving Corporation, free and clear of all claims or interest of any person previously entitled thereto.

(f) Investment of Exchange Fund. The Paying Agent shall invest any cash included in the Exchange Fund, as directed by Parent; provided that such investments shall be in obligations of or guaranteed by the United States of America, in commercial paper obligations rated P-1 or A-1 or better by Moody’s Investors Service, Inc. or Standard & Poor’s Corporation, respectively, or a combination of the foregoing and, in any such case, no such instrument shall have a maturity exceeding three (3) months, or in money market funds having a rating in the highest investment category granted by a recognized credit rating agency at the time of investment. Any interest and other income resulting from such investments shall be paid to, or as directed by, Parent. In no event, however, shall such investment or any such payment of interest or income delay the receipt by holders of Certificates of the Merger Consideration, or otherwise impair such holders’ rights hereunder.

(g) Lost Certificates. If any Certificate shall have been lost, stolen, defaced or destroyed, upon the making of an affidavit of that fact in form and substance reasonably satisfactory to the Paying Agent by the person claiming such Certificate to be lost, stolen, defaced or destroyed and, if required by the Surviving Corporation, the posting by such person of a bond in such reasonable and customary amount as the Surviving Corporation may direct as indemnity against any claim that may be made against it with respect to such Certificate, the Paying Agent shall pay the Merger Consideration in respect of such lost, stolen, defaced or destroyed Certificate.

(h) Withholding Rights. Parent, the Surviving Corporation or the Paying Agent, as applicable, shall be entitled to deduct and withhold from the consideration otherwise payable

-5-

pursuant to this Agreement to any holder of shares of the Company Common Stock or any holder of a Company Stock-Based Award, such amounts as Parent, the Surviving Corporation or the Paying Agent is required to deduct and withhold with respect to the making of such payment under the Internal Revenue Code of 1986, as amended (the “Code”) or any provision of state, local or foreign Tax Law. To the extent that amounts are so withheld and paid over to the appropriate Governmental Entity by Parent, the Surviving Corporation or the Paying Agent, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the holder of shares of the Company Common Stock or the holder of a Company Stock-Based Award, as the case may be, in respect of which such deduction and withholding was made by Parent, the Surviving Corporation or the Paying Agent.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Except as set forth in (i) the Company SEC Documents filed with the U.S. Securities and Exchange Commission (“SEC”) and publicly available since January 1, 2010 but prior to the date of this Agreement (the “Filed Company SEC Documents”) or (ii) the corresponding sections of the letter, dated as of the date of this Agreement, from the Company to Parent and Merger Sub (the “Company Disclosure Letter”), the Company represents and warrants to Parent and Merger Sub that:

3.01 Organization, Standing and Power. Each of the Company and each of its wholly-owned subsidiaries (the “Company Subsidiaries”) is duly organized, validly existing and in good standing under the laws of the jurisdiction in which it is organized (in the case of good standing, to the extent the concept is recognized by such jurisdiction) and has full corporate power and authority to own, lease or otherwise hold and operate its properties and assets and to conduct its businesses as presently conducted, except with respect to the Company Subsidiaries, where the failure to be so organized, existing or in good standing or have such power or authority, individually or in the aggregate, would not reasonably be likely to have a Company Material Adverse Effect. Each of the Company and each Company Subsidiary is duly qualified or licensed to do business and is in good standing (to the extent the concept is recognized by such jurisdiction) in each jurisdiction where the nature of its business or its ownership, leasing or operation of its properties makes such qualification or licensing necessary, except where the failure to be so qualified or licensed or to be in good standing, individually or in the aggregate, would not reasonably be likely to have a Company Material Adverse Effect. The Company has made available to Parent, prior to the date of this Agreement, complete and accurate copies of the Company Certificate and Company Bylaws, in each case as amended to the date hereof. The Company Certificate and Company Bylaws so made available are in full force and effect, and the Company is not in violation of such Company Certificate or Company Bylaws.

3.02 Company Subsidiaries; Equity Interests.

(a) All of the outstanding shares of capital stock of each Company Subsidiary have been validly issued and are fully paid and nonassessable and are owned by the Company, by another Company Subsidiary or by the Company and another Company Subsidiary, free and clear of all pledges, liens, charges, mortgages, encumbrances and security interests of any kind or nature whatsoever (collectively, “Liens”) and free of any restriction on the right to vote, sell or otherwise dispose of such capital stock or other equity interests.

(b) Except for its interests in the Company Subsidiaries, the Company does not own, directly or indirectly, any capital stock, membership interest, partnership interest, joint venture interest or other equity or voting interest in any person.

-6-

3.03 Capital Structure.

(a) The authorized capital stock of the Company consists of 500,000,000 shares of the Company Common Stock and 750,000 shares of preferred stock, par value $100.00 per share (the “Company Preferred Stock”, and, together with the Company Common Stock, the “Company Capital Stock”). At the close of business on December 12, 2012 (the “Measurement Date”), (a) 26,173,968 shares of the Company Common Stock (which includes no shares of the Company Common Stock subject to vesting or other forfeiture conditions or repurchase by the Company (such shares, the “Company Restricted Stock”)) were issued and outstanding, (b) 6,164,495 shares of the Company Common Stock were held by the Company in its treasury, (c) no shares of the Company Common Stock were held by any Company Subsidiary, (d) 2,041,713 shares of the Company Common Stock were subject to outstanding Company Stock Options, 522,386.1933 shares of the Company Common Stock were subject to outstanding Company RSUs and Company DSUs, and 2,893,383 additional shares of the Company Common Stock were reserved and available for issuance pursuant to the Company Stock Plans, (e) no shares of Company Preferred Stock were issued or outstanding and (f) no other shares of capital stock or other voting securities of the Company were issued, reserved for issuance or outstanding. Except for shares of Company Common Stock issued upon exercise, vesting or settlement of Company Stock-Based Awards set forth above, no additional shares of Company Common Stock have been issued and no additional Company Stock-Based Awards have been granted between the Measurement Date and the date of this Agreement. There are no bonds, debentures, notes or other indebtedness of the Company having the right to vote (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which holders of the Company Common Stock may vote (“Voting Company Debt”). Except as set forth above, as of the date of this Agreement, there are no options, warrants, rights, convertible or exchangeable securities, commitments, or undertakings of any kind to which the Company or any Company Subsidiary is a party or by which any of them is bound (i) obligating the Company or any Company Subsidiary to issue, deliver or sell, or cause to be issued, delivered or sold, additional shares of capital stock or other equity interests in, or any security convertible or exercisable for or exchangeable into any capital stock of or other equity interest in, the Company or of any Company Subsidiary or any Voting Company Debt or (ii) obligating the Company or any Company Subsidiary to issue, grant, extend or enter into any such option, warrant, security, commitment or undertaking. All of the outstanding shares of capital stock of the Company have been validly issued and are fully paid and nonassessable.

(b) Except as set forth above, as of the date of this Agreement, there are no restricted shares, restricted share units, stock appreciation rights, performance shares, performance share units, contingent value rights, “phantom” stock or similar securities or rights that are derivative of, or provide economic benefits based, directly or indirectly, on the value or price of, any capital stock of, or other voting securities or ownership interests in, the Company or any Company Subsidiary. There are no (i) voting trusts, voting agreements, proxies or other similar agreements

-7-

or understandings to which the Company or any Company Subsidiary is a party or by which the Company or any Company Subsidiary is bound with respect to the voting of any shares of capital stock of the Company or any Company Subsidiary or (ii) contractual obligations or commitments of any character to which the Company or any Company Subsidiary is a party or by which the Company or any Company Subsidiary is bound restricting the transfer of, or requiring the registration for sale of, any shares of capital stock of the Company or any Company Subsidiary.

3.04 Authority; Execution and Delivery; Enforceability.

(a) The Company has all requisite corporate power and authority to execute and deliver this Agreement and to consummate the Merger and the other transactions contemplated by this Agreement (collectively, the “Transactions”). The execution and delivery by the Company of this Agreement and the consummation by the Company of the Transactions have been duly authorized by all necessary corporate action on the part of the Company, and no other corporate actions on the part of the Company are necessary to authorize this Agreement and to consummate the Transactions, subject to receipt of the Company Stockholder Approval. The Company has duly executed and delivered this Agreement, and, assuming due authorization, execution and delivery by Parent and Merger Sub, this Agreement constitutes the Company’s legal, valid and binding obligation, enforceable against it in accordance with its terms, except that such enforceability may be (i) limited by bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and other similar laws of general application relating to or affecting creditors’ rights generally and (ii) subject to general equitable principles (whether considered in a proceeding in equity or at law) and any implied covenant of good faith and fair dealing (clauses (i) and (ii), the “Bankruptcy and Equity Exception”).

(b) The Board of Directors of the Company (the “Company Board”), at a meeting duly called and held, duly adopted resolutions by a unanimous vote of all directors (i) approving and declaring advisable this Agreement, the Merger and the other Transactions, (ii) determining that the terms of the Merger and the other Transactions are advisable, fair to and in the best interests of the stockholders of the Company, (iii) directing that the Company submit the adoption of this Agreement to a vote by the Company’s stockholders at a special meeting of the stockholders, (iv) recommending that the Company’s stockholders adopt this Agreement (the “Company Recommendation”) and (v) approving this Agreement and the Merger for purposes of Section 203 of the DGCL such that, subject to the accuracy of the representations set forth in Section 4.08, no stockholder approval (other than the Company Stockholder Approval (as defined below)) shall be required to consummate the Merger or the other Transactions or to permit the Company to perform its obligations hereunder, which resolutions have not as of the date hereof been subsequently rescinded, modified or withdrawn in any way.

(c) Assuming the accuracy of the representations in Section 4.08, the only vote of holders of any class or series of Company Capital Stock necessary to adopt this Agreement and approve the Merger and the other Transactions is (i) assuming the Ownership Condition is satisfied, the affirmative vote of the holders of two-thirds of the outstanding Company Common Stock or (ii) if the Ownership Condition is not satisfied, the affirmative vote required under Article VIII of the Company Certificate (such applicable vote under this Section 3.04(c), the “Company Stockholder Approval”).

-8-

3.05 No Conflicts; Consents.

(a) The execution and delivery by the Company of this Agreement do not, and the consummation of the Merger and the other Transactions and compliance with the terms hereof will not, conflict with, or result in any violation or breach of or default (with or without notice or lapse of time, or both) under, or give rise to a right of, or result in, termination, cancelation or acceleration of any obligation or to loss of a material benefit under, or result in the creation of any Lien upon any of the properties or assets of the Company or any Company Subsidiary under, any provision of (i) the Company Certificate, the Company Bylaws or the comparable charter or organizational documents of any Company Subsidiary, (ii) any loan or credit agreement, debenture, contract, lease, license, indenture, note, bond, mortgage, agreement, concession, franchise or other obligation, commitment or instrument (a “Contract”) to which the Company or any Company Subsidiary is a party or by which any of their respective properties, rights or assets is bound or (iii) subject to the filings and other matters referred to in Section 3.05(b), any Federal, state, local or foreign judgment, injunction, order, writ, ruling or decree (“Judgment”) or any Federal, state, local or foreign statute, law, code, ordinance, rule or regulation (“Law”) applicable to the Company or any Company Subsidiary or their respective properties, rights or assets, other than, in the case of clauses (ii) and (iii) above, any such items that, individually or in the aggregate, would not reasonably be likely to have a Company Material Adverse Effect.

(b) No consent, approval, license, permit, order or authorization (“Consent”) of, or registration, declaration or filing with, or permit from, any Federal, state, local or foreign government or any court of competent jurisdiction, administrative, regulatory or other governmental agency, authority or commission, other governmental authority or instrumentality or any non-governmental self-regulatory agency, authority or commission, domestic or foreign (a “Governmental Entity”), is required to be obtained or made by or with respect to the Company or any Company Subsidiary in connection with the execution, delivery and performance of this Agreement or the consummation of the Transactions, other than (i) compliance with and filings under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), (ii) the filing with the SEC of (A) a proxy statement relating to the adoption of this Agreement by the Company’s stockholders (the “Proxy Statement”), and (B) such reports under the Securities Exchange Act of 1934, as amended, together with the rules and regulations promulgated thereunder (the “Exchange Act”) as may be required in connection with this Agreement, the Merger and the other Transactions, (iii) such filings as may be required under any state securities Laws, (iv) the filing of the Certificate of Merger with the Secretary of State of the State of Delaware and appropriate documents with the relevant authorities of the other jurisdictions in which the Company is qualified to do business, (v) such filings as may be required in connection with the Taxes described in Section 6.10, (vi) such filings as may be required under the rules and regulations of the New York Stock Exchange and (vii) such other items that, individually or in the aggregate, would not reasonably be likely to have a Company Material Adverse Effect.

3.06 SEC Documents; Financial Statements; Undisclosed Liabilities.

(a) The Company has timely filed or furnished, as applicable, all reports, schedules, forms, statements and other documents with the SEC required to be filed or furnished, as applicable, by the Company since January 1, 2010 under the Securities Act of 1933, as amended, together with the rules and regulations promulgated thereunder (the “Securities Act”) and the

-9-

Exchange Act (such documents, together with any documents and information incorporated therein by reference and together with any documents filed during such period by the Company with the SEC on a voluntary basis on Current Reports on Form 8-K, the “Company SEC Documents”).

(b) As of its respective date, each of the Company SEC Documents complied as to form in all material respects with the requirements of the Exchange Act, the Securities Act and the Sarbanes-Oxley Act of 2002 (including the rules and regulations promulgated thereunder, “SOX”), as the case may be, and the rules and regulations of the SEC promulgated thereunder applicable to such Company SEC Document, each as in effect on the date so filed. As of their respective dates (or, if amended prior to the date hereof, as of the date of such amendment), except to the extent revised or superseded by a later filed Company SEC Document prior to the date hereof, none of the Company SEC Documents contained any untrue statement of a material fact or omitted to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading.

(c) Each of the financial statements (including the related notes) of the Company as of December 31, 2009, 2010 and 2011 and September 30, 2012 and in each case for the periods then ended included in the Company SEC Documents (or incorporated therein by reference) complied as to form at the time it was filed in all material respects with the applicable accounting requirements and the published rules and regulations of the SEC with respect thereto in effect at the time of filing, has been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) in all material respects (except, in the case of unaudited financial statements, as permitted by the rules and regulations of the SEC) applied on a consistent basis during the periods involved (except as may be indicated in the notes thereto) and fairly presented in all material respects the consolidated financial position of the Company and its consolidated subsidiaries as of the dates thereof and the consolidated results of their operations and cash flows for the periods shown (subject, in the case of unaudited financial statements, to normal year-end audit adjustments, to the absence of notes and to any other adjustments described therein, including in any notes thereto).

(d) None of the Company or any Company Subsidiary has any liabilities or obligations of any nature (whether accrued, absolute, known or unknown, contingent or otherwise) except liabilities, obligations, conditions or circumstances (i) to the extent disclosed and provided for in the most recent financial statements included in the Filed Company SEC Documents, (ii) related to the future performance (but not breach) of any Contract in the ordinary course of business, (iii) incurred or arising in the ordinary course of business since the date of the most recent financial statements included in the Filed Company SEC Documents or in connection with the Transactions, (iv) of a subject matter covered by any of the other representations and warranties of the Company set forth in this Agreement (other than the representation and warranty contained in the first sentence of Section 3.08), (v) disclosed in Section 3.06(d) of the Company Disclosure Letter or (vi) as would not reasonably be likely to, individually or in the aggregate, have a Company Material Adverse Effect.

(e) The Company has established and maintained a system of internal control over financial reporting (as defined in Rule 13a-15 under the Exchange Act). Such internal controls provide reasonable assurance regarding the reliability of the Company’s financial reporting and

-10-

the preparation of the Company’s financial statements for external purposes in accordance with GAAP. Since January 1, 2012, the Company’s principal executive officer and its principal financial officer have disclosed to the Company’s auditors and the audit committee of the Company Board (i) all known significant deficiencies in the design or operation of internal controls over financial reporting that are reasonably likely to adversely affect in any material respect the Company’s ability to record, process, summarize and report financial information and have identified for the Company’s auditors any material weaknesses in internal controls, and (ii) any known fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal controls.

(f) The Company has established and maintains disclosure controls and procedures (as such term is defined in Rule 13a-15 under the Exchange Act); such disclosure controls and procedures are designed to ensure that material information relating to the Company required to be disclosed in reports the Company files under the Exchange Act is recorded and made known to the individuals responsible for the preparation of the Company’s filings with the SEC and other public disclosure documents. The Company has evaluated the effectiveness of the Company’s disclosure controls and procedures and, to the extent required by applicable Law, presented in any applicable Company SEC Document that is a report on Form 10-K or Form 10-Q or any amendment thereto its conclusions about the effectiveness of the disclosure controls and procedures as of the end of the period covered by such report or amendment based on such evaluation; and, to the extent required by applicable Law, disclosed in such report or amendment any change in the Company’s internal control over financial reporting that occurred during the period covered by such report or amendment that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

(g) Each of the principal executive officer of the Company and the principal financial officer of the Company (or each former principal executive officer of the Company and each former principal financial officer of the Company, as applicable) has made all certifications required by Rule 13a-14 or 15d-14 under the Exchange Act and Sections 302 and 906 of SOX with respect to the Company SEC Documents, and the statements contained in such certifications are true and accurate. For purposes of this Agreement, “principal executive officer” and “principal financial officer” shall have the meanings given to such terms in SOX. Neither the Company nor any of its Subsidiaries has outstanding, or has arranged any outstanding, “extensions of credit” to directors or executive officers in violation of SOX.

3.07 Information Supplied. None of the information supplied or to be supplied by the Company for inclusion or incorporation by reference in the Proxy Statement will, at the date that it is first mailed to the Company’s stockholders or at the time of the Company Stockholders Meeting, contain any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they are made, not misleading. The Proxy Statement, at the date such materials are first mailed to the Company’s stockholders and at the time of the Company Stockholders Meeting, will comply as to form in all material respects with the requirements of the Exchange Act and the rules and regulations thereunder, except that no representation or warranty is made by the Company with respect to statements made or incorporated by reference therein based on information supplied by Parent or Merger Sub or any of their respective Representatives for inclusion or incorporation by reference therein.

-11-

3.08 Absence of Certain Changes or Events. From January 1, 2012, there has not been any Event that, individually or together with any other Event, has had or would reasonably be likely to have a Company Material Adverse Effect. From October 1, 2012, (a) except in connection with this Agreement and the Transaction or as expressly contemplated or permitted by this Agreement, the Company and each Company Subsidiary has conducted its respective business in all material respects only in the ordinary course of business and (b) there has not been any action taken or committed to be taken by the Company or any Company Subsidiary which, if taken following entry by the Company into this Agreement, would have required the consent of Parent pursuant to Sections 5.01(iv), 5.01(vi), 5.01(vii), 5.01(viii), 5.01(ix), 5.01(x) or 5.01(xii).

3.09 Taxes.

(a) Each of the Company and each Company Subsidiary has filed, or has caused to be filed on its behalf, all material Tax Returns required to have been filed by it (giving effect to all applicable extensions), and all such Tax Returns are true, complete and accurate, except to the extent any failure to file or any inaccuracies in any filed Tax Returns would not reasonably be likely to result in a material increase in Tax liabilities to the Company and the Company Subsidiaries over Tax liabilities reported on Tax Returns required to have been filed. All Taxes shown to be due on such Tax Returns, or material Taxes otherwise required to have been paid by the Company or any Company Subsidiary, have been timely paid in full. There are no Liens for Taxes on the assets of the Company or any Company Subsidiary, other than Liens for Taxes not yet due and payable, that are payable without penalty or that are being contested in good faith by appropriate proceedings.

(b) The most recent financial statements included in the Filed Company SEC Documents reflect, to the extent required by GAAP, a reserve for all Taxes payable by the Company or the Company Subsidiaries (in addition to any reserve for deferred Taxes to reflect timing differences between book and Tax items) for all taxable periods and portions thereof through the closing date of such financial statements. Except as would not reasonably be likely to have a Company Material Adverse Effect, since the closing date of such financial statements, none of the Company or any Company Subsidiary has made, changed or revoked any Tax election, elected or changed any method of accounting for Tax purposes, amended any Tax Return, surrendered any right to claim a refund of Taxes, settled or compromised any claim by a Governmental Entity in respect of Taxes, or entered into any contractual obligation in respect of Taxes with any Governmental Entity.

(c) Except as would not reasonably be likely to result in a material increase in Tax liabilities to the Company and the Company Subsidiaries over Tax liabilities reported on filed Tax Returns, (i) no deficiency with respect to a material amount of any Taxes has been proposed, asserted or assessed against the Company or any Company Subsidiary that has not since been finally resolved, (ii) no audit or other proceeding with respect to Taxes due from the Company or any Company Subsidiary, or any Tax Return of the Company or any Company Subsidiary, is pending, being conducted or, to the knowledge of the Company, threatened by any Governmental Entity and (iii) and no agreement has been entered into by or on behalf of the Company or any of the Company Subsidiaries that has continuing effect to extend the statute of limitations for assessment or collection of any Tax for which the Company or any Company Subsidiary may be liable.

-12-

(d) Except as would not reasonably be likely to have a Company Material Adverse Effect, the Company and each Company Subsidiary has complied with all Tax Laws relating to (i) the classification for Federal income Tax purposes of service providers as independent contractors or employees and (ii) Tax information reporting and withholding (and payment to the appropriate Governmental Entity) of all Taxes required to be withheld (including such reporting and withholding in connection with payments for services).

(e) (i) Except for agreements solely among or between the Company and the Company Subsidiaries, none of the Company or the Company Subsidiaries is or has been a party to or is bound by or currently has any liability or obligation under any Tax allocation, Tax sharing or similar agreement or arrangement, and (ii) none of the Company or the Company Subsidiaries has been included on a consolidated, combined, unitary or similar basis with other entities (other than solely among the Company and the Company Subsidiaries) that have been or will be required to compute their Tax liability by filing Tax Returns on such a basis.

(f) None of the Company or any Company Subsidiary has constituted either a “distributing corporation” or a “controlled corporation” in a distribution of stock intended to qualify under Section 355 of the Code in the five (5) years prior to the date of this Agreement.

(g) None of the Company or any Company Subsidiary has entered into any closing agreement pursuant to Section 7121 of the Code, or any similar provision of state, local or foreign Law, the terms of which would apply to the computation of Tax liability for any taxable period of the Company or any Company Subsidiary that has not yet been filed.

(h) The Company has not been during the applicable period specified in Section 897(c)(1)(A)(ii) of the Code, a “United States real property holding corporation” within the meaning of Section 897(c)(2) of the Code.

(i) None of the Company or any Company Subsidiary has been a beneficiary of or participated in any “listed transaction” described in Treasury Regulations Section 1.6011-4(b)(2) that was, is, or to the knowledge of the Company will be, required to be disclosed under Treasury Regulations Section 1.6011-4.

(j) None of the Company or any Company Subsidiary has any liability for the Taxes of any person under Treasury Regulations Section 1.1502-6 (or any similar provision of state, local or foreign Law) (other than as a result of being included in consolidated, combined, unitary or similar filings of a group of entities of which the Company was the common parent).

(k) Since the ending date of the most recent financial statements included in the Filed Company SEC Documents, none of the Company or any Company Subsidiary has taken any action not in accordance with past practice that would have the effect of deferring to any material extent a measure of Tax from a period (or portion thereof) ending on or before the Closing Date to a period (or portion thereof) beginning after the Closing Date.

(l) For purposes of this Agreement:

“Tax” or “Taxes” means any tax or duty or similar governmental fee, levy, assessment or charge, of any kind whatsoever, imposed by a Governmental Entity together with any interest, fines, penalties, additions to tax or additional amounts arising with respect to the foregoing, and any interest on any of the foregoing.

-13-

“Tax Return” means any return, declaration, report, claim for refund, information return or statement in connection with any Tax that is required to have been with a Governmental Entity responsible for the administration of Taxes, including any schedule or attachment thereto, and including any amendment thereof.

3.10 Labor Relations. Section 3.10 of the Company Disclosure Letter contains a list, as of the date hereof, of all collective bargaining agreements to which the Company or any Company Subsidiary is a party. Since January 1, 2010, none of the Company or any Company Subsidiary has experienced any material strikes, work stoppages, slowdowns, lockouts or, to the knowledge of the Company, union organization attempts, and, to the knowledge of the Company, there is no such item threatened against the Company or any Company Subsidiary. Neither the Company nor any of its Subsidiaries is in material breach of any collective bargaining agreement or other agreement established with employees or a group thereof or representatives thereof.

3.11 Employee Benefits.

(a) Section 3.11(a) of the Company Disclosure Letter contains a list, as of the date hereof, of each Company Benefit Plan. To the knowledge of the Company, each Company Benefit Plan has been administered in material compliance with its terms and applicable Law and otherwise complies with applicable Law in all material respects. The Company has made available to Parent true, complete and correct copies of (i) each Company Benefit Plan or other plan set forth in Section 3.11(a) of the Company Disclosure Letter (or, in the case of any such Company Benefit Plan that is unwritten, a description thereof), (ii) the most recent summary plan description for each such plan for which such summary plan description is required and (iii) the most recent actuarial valuation reports for each such plan for which such valuation report is prepared. Section 3.11(a) of the Company Disclosure Letter contains a list of all Company Stock Options, Company RSUs, Company DSUs and Company Restricted Stock outstanding under the Company Stock Plans as of the date hereof.

(b) Section 3.11(b) of the Company Disclosure Letter contains a list, as of the date hereof, of all material written Company Benefit Agreements.

(c) All Company Benefit Plans intended to be qualified within the meaning of Section 401(a) of the Code have applied for, received, or are entitled to rely on favorable determination or opinion letters from the Internal Revenue Service, to the effect that such Company Benefit Plans are so qualified and exempt from Federal income Taxes under Section 401(a) of the Code.

(d) None of the Company, any Company Subsidiaries, any ERISA Affiliate or any predecessor thereof contributes to, or has in the past six (6) years contributed to, or has or had any liability or obligation in respect of, any Multiemployer Plan.

(e) With respect to each Company Benefit Plan (i) none of the Company, any Company Subsidiaries nor any ERISA Affiliate has any unsatisfied liability under Title IV of ERISA, (ii) to the knowledge of the Company, no condition exists that presents a material risk to

-14-

the Company or any ERISA Affiliate of incurring a material liability under Title IV of ERISA and (iii) to the knowledge of the Company, the Pension Benefit Guaranty Corporation has not instituted proceedings under Section 4042 of ERISA to terminate any Company Benefit Plan and, to the knowledge of the Company, no condition exists that presents a material risk that such proceedings will be instituted.

(f) Except (i) as contemplated by Section 6.04 of this Agreement or (ii) as set forth in Section 3.11(f) of the Company Disclosure Letter, no Company Benefit Plan or Company Benefit Agreement exists that, as a result of the execution of this Agreement, shareholder approval of this Agreement, or the Transactions (whether alone or in connection with any subsequent event(s): (w) will entitle any employee to severance pay or any increase in severance pay upon any termination of employment after the date of this Agreement, (x) will result in the acceleration of the time of payment or vesting or result in any payment or funding (through a grantor trust or otherwise) of compensation or benefits under, increase the amount payable or result in any other material obligation pursuant to, any of the Company Benefit Plans or Company Benefit Agreements, (y) will cause the Company to record additional compensation expense on its income statement with respect to any outstanding stock option or other equity-based award or (z) could result in payments under any of the Company Benefit Plans or Company Benefit Agreements which would not be deductible under Section 280G of the Code.

(g) Each Company Benefit Plan that is or has ever been a “nonqualified deferred compensation plan” (within the meaning of Section 409A(d)(1) of the Code) is, in all material respects, in documentary and operational compliance with Section 409A of the Code and associated Treasury Department guidance.

(h) As used in this Agreement, the term “Company Benefit Plan” means each Company Stock Plan, and each bonus, pension, profit sharing, deferred compensation, incentive compensation, retirement, vacation, severance, disability, death benefit, hospitalization, medical or other material plan, program or arrangement, whether or not subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), that is sponsored, maintained or contributed to by the Company or any Company Subsidiary for the benefit of any current or former employee, officer or director of the Company or any Company Subsidiary, other than (i) any “multiemployer plan” (within the meaning of Section 3(37) of ERISA) (a “Multiemployer Plan”), (ii) any plan, program or arrangement mandated by applicable Law or (iii) any Company Benefit Agreement. The term “Company Benefit Agreement” means each individual employment, retention, severance, change in control or termination agreement between the Company or any Company Subsidiary and any current or former employee, officer or director of the Company or any Company Subsidiary, other than any agreement mandated by applicable Law. The term “ERISA Affiliate” means any entity that, together with the Company, would be treated as a single employer under Section 414 of the Code.

3.12 Litigation. There are no claims, suits, actions, hearings, arbitrations, mediations or proceedings pending or, to the knowledge of the Company, threatened (including “cease and desist” letters or requests to take a patent license) against the Company or any Company Subsidiary or any of their respective assets, rights or properties or any of the officers or directors of the Company, except, for those that, individually or in the aggregate, would not reasonably be

-15-

likely to have a Company Material Adverse Effect. There is no Judgment outstanding against the Company or any Company Subsidiary or any of their respective assets, rights or properties that, individually or in the aggregate, would reasonably be likely to have a Company Material Adverse Effect. The Company has not received any written notification of, and to the knowledge of the Company there is no, investigation, audit or inquiry by any Governmental Entity involving the Company or any Company Subsidiary or any of their respective assets, rights or properties that, individually or in the aggregate, would reasonably be likely to have a Company Material Adverse Effect.

3.13 Compliance with Applicable Laws.

(a) Neither the Company nor any Company Subsidiary is in violation of, and since January 1, 2012, neither the Company nor any Company Subsidiary has been given written notice of or been charged with any violation of, any Law or order of any Governmental Entity or any Judgment (or any of its own policies with respect to privacy, personal information and data security), except for any such violations that would not, individually or in the aggregate, reasonably be likely to have a Company Material Adverse Effect. The Company and each Company Subsidiary has all permits, authorizations, approvals, registrations, certificates, orders, waivers and variances (each, a “Permit”) necessary to operate its properties and other assets and conduct its business as presently conducted except those the absence of which would not, individually or in the aggregate, reasonably be likely to have a Company Material Adverse Effect, and there has occurred no default under, or violation of, any such Permit, except for those violations which would not reasonably be likely to have a Company Material Adverse Effect. To the knowledge of the Company, neither the Company nor any Company Subsidiary has received notice that any such Permit will be terminated or modified or cannot be renewed in the ordinary course of business.

(b) To the knowledge of the Company, none of the Company, any Company Subsidiary, or any of their employees, directors or agents is, or since January 1, 2010, has been, in violation of any Law applicable to its business, properties or operations and relating to: (1) the use of corporate funds relating to political activity or for the purpose of obtaining or retaining business; (2) payments to government officials or employees from corporate funds; or (3) bribes, rebates, payoffs, influence payments, or kickbacks, except, in each case, for those violations which would not, individually or in the aggregate, reasonably be likely to have a Company Material Adverse Effect.

(c) To the knowledge of the Company, (a) it is in compliance in all material respects with the United States Foreign Corrupt Practices Act of 1977, as amended (the “Foreign Corrupt Practices Act”) and any other United States and foreign Laws concerning corrupt payments; and (b) the Company has not been investigated by any Governmental Entity with respect to, or given notice by a Governmental Entity of, any violation by the Company of the Foreign Corrupt Practices Act or any other United States or foreign Laws concerning corrupt payments.

3.14 Environmental Matters.

(a) Except as, individually or in the aggregate, would not reasonably be likely to have a Company Material Adverse Effect, (i) the Company and the Company Subsidiaries are in

-16-