13282 10175 12152 16825 9475 10000 12297 11514 16287 10000 15763 8496 11681 11168 9647 11501 20564 15376 15929 16979 13485 9755 15494 18882 16774 10000 10000 9692 10000 9744 8688 11843 10390 15759 22474 19176 8688 8574 10071 12752 14344 11681 10923 9755 11517 16156 19369 12283 11430 13692 14381 10041 9215 11375 18738 11335 13181 18826 20498 12159 13769 8182 9696 11775 17012 10390 0000922457 false 0000922457 2023-07-01 2024-06-30 0000922457 bragfi:C000007429Member 2019-07-01 2024-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2019-07-01 2024-06-30 0000922457 bragfi:C000007431Member 2019-07-01 2024-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2019-07-01 2024-06-30 0000922457 bragfi:C000007432Member 2019-07-01 2024-06-30 0000922457 bragfi:C000007433Member 2019-07-01 2024-06-30 0000922457 bragfi:C000199761Member 2019-07-01 2024-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2019-07-01 2024-06-30 0000922457 bragfi:C000007429Member 2023-07-01 2024-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2023-07-01 2024-06-30 0000922457 bragfi:C000007431Member 2023-07-01 2024-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2023-07-01 2024-06-30 0000922457 bragfi:C000007432Member 2023-07-01 2024-06-30 0000922457 bragfi:C000007433Member 2023-07-01 2024-06-30 0000922457 bragfi:C000199761Member 2023-07-01 2024-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2023-07-01 2024-06-30 0000922457 bragfi:C000007429Member 2014-07-01 2024-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2014-07-01 2024-06-30 0000922457 bragfi:C000007431Member 2014-07-01 2024-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2014-07-01 2024-06-30 0000922457 bragfi:C000007432Member 2014-07-01 2024-06-30 0000922457 bragfi:C000007433Member 2014-07-01 2024-06-30 0000922457 bragfi:C000199761Member 2014-07-01 2024-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2014-07-01 2024-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2014-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2014-06-30 0000922457 bragfi:C000007432Member 2014-06-30 0000922457 bragfi:C000007433Member 2014-06-30 0000922457 bragfi:C000199761Member 2014-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2014-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2015-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2015-06-30 0000922457 bragfi:C000007432Member 2015-06-30 0000922457 bragfi:C000007433Member 2015-06-30 0000922457 bragfi:C000199761Member 2015-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2015-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2016-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2016-06-30 0000922457 bragfi:C000007432Member 2016-06-30 0000922457 bragfi:C000007433Member 2016-06-30 0000922457 bragfi:C000199761Member 2016-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2016-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2017-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2017-06-30 0000922457 bragfi:C000007432Member 2017-06-30 0000922457 bragfi:C000007433Member 2017-06-30 0000922457 bragfi:C000199761Member 2017-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2017-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2018-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2018-06-30 0000922457 bragfi:C000007432Member 2018-06-30 0000922457 bragfi:C000007433Member 2018-06-30 0000922457 bragfi:C000199761Member 2018-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2018-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2019-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2019-06-30 0000922457 bragfi:C000007432Member 2019-06-30 0000922457 bragfi:C000007433Member 2019-06-30 0000922457 bragfi:C000199761Member 2019-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2019-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2020-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2020-06-30 0000922457 bragfi:C000007432Member 2020-06-30 0000922457 bragfi:C000007433Member 2020-06-30 0000922457 bragfi:C000199761Member 2020-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2020-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2021-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2021-06-30 0000922457 bragfi:C000007432Member 2021-06-30 0000922457 bragfi:C000007433Member 2021-06-30 0000922457 bragfi:C000199761Member 2021-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2021-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2022-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2022-06-30 0000922457 bragfi:C000007432Member 2022-06-30 0000922457 bragfi:C000007433Member 2022-06-30 0000922457 bragfi:C000199761Member 2022-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2022-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2023-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2023-06-30 0000922457 bragfi:C000007432Member 2023-06-30 0000922457 bragfi:C000007433Member 2023-06-30 0000922457 bragfi:C000199761Member 2023-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2023-06-30 0000922457 bragfi:C000007429Member 2024-06-30 0000922457 bragfi:C000007429Member bragfi:AlphabetIncClassAMember 2024-06-30 0000922457 bragfi:C000007429Member bragfi:AmazonComIncMember 2024-06-30 0000922457 bragfi:C000007429Member bragfi:AppleIncMember 2024-06-30 0000922457 bragfi:C000007429Member country:CA 2024-06-30 0000922457 bragfi:C000007429Member country:CH 2024-06-30 0000922457 bragfi:C000007429Member country:CN 2024-06-30 0000922457 bragfi:C000007429Member bragfi:ComcastCorpClassAMember 2024-06-30 0000922457 bragfi:C000007429Member country:DE 2024-06-30 0000922457 bragfi:C000007429Member country:DK 2024-06-30 0000922457 bragfi:C000007429Member country:ES 2024-06-30 0000922457 bragfi:C000007429Member country:IN 2024-06-30 0000922457 bragfi:C000007429Member bragfi:JohnsonAndJohnsonMember 2024-06-30 0000922457 bragfi:C000007429Member country:JP 2024-06-30 0000922457 bragfi:C000007429Member bragfi:LamResearchCorpMember 2024-06-30 0000922457 bragfi:C000007429Member bragfi:MicrosoftCorpMember 2024-06-30 0000922457 bragfi:C000007429Member bragfi:NVIDIACorpMember 2024-06-30 0000922457 bragfi:C000007429Member bragfi:OtherAssetsLessLiabilitiesMember 2024-06-30 0000922457 bragfi:C000007429Member bragfi:OtherMember 2024-06-30 0000922457 bragfi:C000007429Member bragfi:QUALCOMMIncMember 2024-06-30 0000922457 bragfi:C000007429Member bragfi:SAndPGlobalIncMember 2024-06-30 0000922457 bragfi:C000007429Member country:TW 2024-06-30 0000922457 bragfi:C000007429Member country:US 2024-06-30 0000922457 bragfi:C000007429Member oef:WithoutSalesLoadMember 2024-06-30 0000922457 bragfi:C000007431Member 2024-06-30 0000922457 bragfi:C000007431Member bragfi:AlphabetIncClassAMember 2024-06-30 0000922457 bragfi:C000007431Member bragfi:AmazonComIncMember 2024-06-30 0000922457 bragfi:C000007431Member bragfi:AppleIncMember 2024-06-30 0000922457 bragfi:C000007431Member country:CA 2024-06-30 0000922457 bragfi:C000007431Member country:CH 2024-06-30 0000922457 bragfi:C000007431Member country:CN 2024-06-30 0000922457 bragfi:C000007431Member bragfi:ComcastCorpClassAMember 2024-06-30 0000922457 bragfi:C000007431Member country:DE 2024-06-30 0000922457 bragfi:C000007431Member country:DK 2024-06-30 0000922457 bragfi:C000007431Member country:ES 2024-06-30 0000922457 bragfi:C000007431Member country:IN 2024-06-30 0000922457 bragfi:C000007431Member bragfi:JohnsonAndJohnsonMember 2024-06-30 0000922457 bragfi:C000007431Member country:JP 2024-06-30 0000922457 bragfi:C000007431Member bragfi:LamResearchCorpMember 2024-06-30 0000922457 bragfi:C000007431Member bragfi:MicrosoftCorpMember 2024-06-30 0000922457 bragfi:C000007431Member bragfi:NVIDIACorpMember 2024-06-30 0000922457 bragfi:C000007431Member bragfi:OtherAssetsLessLiabilitiesMember 2024-06-30 0000922457 bragfi:C000007431Member bragfi:OtherMember 2024-06-30 0000922457 bragfi:C000007431Member bragfi:QUALCOMMIncMember 2024-06-30 0000922457 bragfi:C000007431Member bragfi:SAndPGlobalIncMember 2024-06-30 0000922457 bragfi:C000007431Member country:TW 2024-06-30 0000922457 bragfi:C000007431Member country:US 2024-06-30 0000922457 bragfi:C000007431Member oef:WithoutSalesLoadMember 2024-06-30 0000922457 bragfi:C000007432Member 2024-06-30 0000922457 bragfi:C000007432Member bragfi:AlphabetIncClassAMember 2024-06-30 0000922457 bragfi:C000007432Member bragfi:AmazonComIncMember 2024-06-30 0000922457 bragfi:C000007432Member bragfi:AppleIncMember 2024-06-30 0000922457 bragfi:C000007432Member country:CA 2024-06-30 0000922457 bragfi:C000007432Member country:CH 2024-06-30 0000922457 bragfi:C000007432Member country:CN 2024-06-30 0000922457 bragfi:C000007432Member bragfi:ComcastCorpClassAMember 2024-06-30 0000922457 bragfi:C000007432Member country:DE 2024-06-30 0000922457 bragfi:C000007432Member country:DK 2024-06-30 0000922457 bragfi:C000007432Member country:ES 2024-06-30 0000922457 bragfi:C000007432Member country:IN 2024-06-30 0000922457 bragfi:C000007432Member bragfi:JohnsonAndJohnsonMember 2024-06-30 0000922457 bragfi:C000007432Member country:JP 2024-06-30 0000922457 bragfi:C000007432Member bragfi:LamResearchCorpMember 2024-06-30 0000922457 bragfi:C000007432Member bragfi:MicrosoftCorpMember 2024-06-30 0000922457 bragfi:C000007432Member bragfi:NVIDIACorpMember 2024-06-30 0000922457 bragfi:C000007432Member bragfi:OtherAssetsLessLiabilitiesMember 2024-06-30 0000922457 bragfi:C000007432Member bragfi:OtherMember 2024-06-30 0000922457 bragfi:C000007432Member bragfi:QUALCOMMIncMember 2024-06-30 0000922457 bragfi:C000007432Member bragfi:SAndPGlobalIncMember 2024-06-30 0000922457 bragfi:C000007432Member country:TW 2024-06-30 0000922457 bragfi:C000007432Member country:US 2024-06-30 0000922457 bragfi:C000007433Member 2024-06-30 0000922457 bragfi:C000007433Member bragfi:AlphabetIncClassAMember 2024-06-30 0000922457 bragfi:C000007433Member bragfi:AmazonComIncMember 2024-06-30 0000922457 bragfi:C000007433Member bragfi:AppleIncMember 2024-06-30 0000922457 bragfi:C000007433Member country:CA 2024-06-30 0000922457 bragfi:C000007433Member country:CH 2024-06-30 0000922457 bragfi:C000007433Member country:CN 2024-06-30 0000922457 bragfi:C000007433Member bragfi:ComcastCorpClassAMember 2024-06-30 0000922457 bragfi:C000007433Member country:DE 2024-06-30 0000922457 bragfi:C000007433Member country:DK 2024-06-30 0000922457 bragfi:C000007433Member country:ES 2024-06-30 0000922457 bragfi:C000007433Member country:IN 2024-06-30 0000922457 bragfi:C000007433Member bragfi:JohnsonAndJohnsonMember 2024-06-30 0000922457 bragfi:C000007433Member country:JP 2024-06-30 0000922457 bragfi:C000007433Member bragfi:LamResearchCorpMember 2024-06-30 0000922457 bragfi:C000007433Member bragfi:MicrosoftCorpMember 2024-06-30 0000922457 bragfi:C000007433Member bragfi:NVIDIACorpMember 2024-06-30 0000922457 bragfi:C000007433Member bragfi:OtherAssetsLessLiabilitiesMember 2024-06-30 0000922457 bragfi:C000007433Member bragfi:OtherMember 2024-06-30 0000922457 bragfi:C000007433Member bragfi:QUALCOMMIncMember 2024-06-30 0000922457 bragfi:C000007433Member bragfi:SAndPGlobalIncMember 2024-06-30 0000922457 bragfi:C000007433Member country:TW 2024-06-30 0000922457 bragfi:C000007433Member country:US 2024-06-30 0000922457 bragfi:C000199761Member 2024-06-30 0000922457 bragfi:C000199761Member bragfi:AlphabetIncClassAMember 2024-06-30 0000922457 bragfi:C000199761Member bragfi:AmazonComIncMember 2024-06-30 0000922457 bragfi:C000199761Member bragfi:AppleIncMember 2024-06-30 0000922457 bragfi:C000199761Member country:CA 2024-06-30 0000922457 bragfi:C000199761Member country:CH 2024-06-30 0000922457 bragfi:C000199761Member country:CN 2024-06-30 0000922457 bragfi:C000199761Member bragfi:ComcastCorpClassAMember 2024-06-30 0000922457 bragfi:C000199761Member country:DE 2024-06-30 0000922457 bragfi:C000199761Member country:DK 2024-06-30 0000922457 bragfi:C000199761Member country:ES 2024-06-30 0000922457 bragfi:C000199761Member country:IN 2024-06-30 0000922457 bragfi:C000199761Member bragfi:JohnsonAndJohnsonMember 2024-06-30 0000922457 bragfi:C000199761Member country:JP 2024-06-30 0000922457 bragfi:C000199761Member bragfi:LamResearchCorpMember 2024-06-30 0000922457 bragfi:C000199761Member bragfi:MicrosoftCorpMember 2024-06-30 0000922457 bragfi:C000199761Member bragfi:NVIDIACorpMember 2024-06-30 0000922457 bragfi:C000199761Member bragfi:OtherAssetsLessLiabilitiesMember 2024-06-30 0000922457 bragfi:C000199761Member bragfi:OtherMember 2024-06-30 0000922457 bragfi:C000199761Member bragfi:QUALCOMMIncMember 2024-06-30 0000922457 bragfi:C000199761Member bragfi:SAndPGlobalIncMember 2024-06-30 0000922457 bragfi:C000199761Member country:TW 2024-06-30 0000922457 bragfi:C000199761Member country:US 2024-06-30 0000922457 bragfi:MSCIAllCountryWorldIndexMember 2024-06-30 iso4217:USDiso4217:USDxbrli:sharesxbrli:purexbrli:sharesutr:Dbragfi:Holding

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Name of Fund:

BlackRock Advantage Global Fund, Inc.

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Advantage Global Fund, Inc., 50 Hudson Yards, New York, NY 10001

Registrant's telephone number, including area code:

Date of reporting period:

Item 1 — Report to Stockholders

(a) The Report to Shareholders is attached herewith

BlackRock Advantage Global Fund, Inc.

Institutional Shares | MAGCX

Annual Shareholder Report — June 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Global Fund, Inc. (the “Fund”) for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares |

$79 |

0.71% |

How did the Fund perform last year?

-

Global equities generally enjoyed strong performance over the period, as resilient macro and micro data combined with excitement around innovation in information technology and healthcare.

-

While U.S. market leadership trends exhibited persistence they also evolved and broadened over the period, helping alleviate concerns of a potential momentum reversal.

-

International markets kept pace with the United States while much broader market participation enabled value styles to keep pace with momentum.

What contributed to performance?

The Fund delivered strong gains as stock selection insights were able to identify and lean into the dominant market trends. These insights aligned with a soft-landing expectation and motivated positioning across the artificial intelligence (“AI”) and GLP-1 weight loss drug themes. Sentiment measures identifying trends across analyst and executive comments as well as smart money positioning were key performance drivers.

Fundamental quality and valuation measures provided a further source of returns as markets increasingly discerned AI winners versus losers. More broadly, valuation insights drove gains across the United States and Japan with measures evaluating cash flows, valuations and other financial statement metrics all contributing. Additionally, growth-oriented quality insights evaluating research expenditures helped the Fund benefit from AI optimism.

What detracted from performance?

Despite the strong gains, changing market leadership proved a headwind to trend-following industry insights over the period. In particular, industry measures picking up on price momentum and favoring defensive positioning performed poorly. In addition, select consumer intent-related measures were wrong-footed. In this vein, measures evaluating mobile app usage detracted by motivating exposure to the automobile industry.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

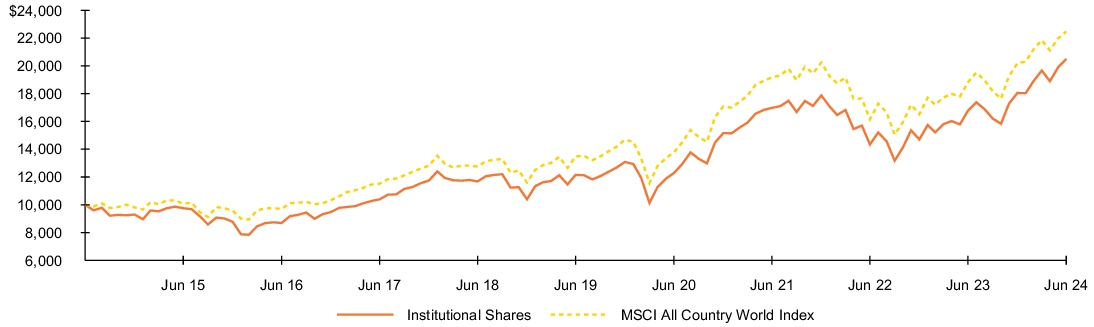

Fund performance

Cumulative performance: July 1, 2014 through June 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Institutional Shares |

22.20% |

11.02% |

7.44% |

| MSCI All Country World Index |

19.38% |

10.76% |

8.43% |

| Key Fund statistics |

|

| Net Assets |

$382,532,073% |

| Number of Portfolio Holdings |

$204% |

| Net Investment Advisory Fees |

$1,821,675% |

| Portfolio Turnover Rate |

$152% |

The Fund's returns shown prior to October 26, 2017, are the returns of the Fund when it followed a different investment objective and different investment strategies under the name BlackRock Global SmallCap Fund, Inc.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of June 30, 2024)

| Geographic allocation |

| Country/Geographic Region |

Percent of

Net Assets |

| United States |

69.7% |

| Japan |

4.3% |

| China |

3.0% |

| Taiwan |

2.9% |

| Switzerland |

2.7% |

| Spain |

2.2% |

| Canada |

1.9% |

| Denmark |

1.6% |

| Germany |

1.4% |

| India |

1.3% |

| Other# |

8.8% |

| Other Assets Less Liabilities |

0.2% |

| Ten largest holdings |

| Security |

Percent of

Net Assets(a) |

| Microsoft Corp. |

4.9% |

| Apple, Inc. |

4.8% |

| NVIDIA Corp. |

4.5% |

| Amazon.com, Inc. |

4.0% |

| Johnson & Johnson |

1.9% |

| Alphabet, Inc., Class A |

1.9% |

| S&P Global, Inc. |

1.7% |

| Lam Research Corp. |

1.7% |

| Comcast Corp., Class A |

1.7% |

| QUALCOMM, Inc. |

1.7% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Global Fund, Inc.

Institutional Shares | MAGCX

Annual Shareholder Report — June 30, 2024

MAGCX-06/24-AR

BlackRock Advantage Global Fund, Inc.

Investor A Shares | MDGCX

Annual Shareholder Report — June 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Global Fund, Inc. (the “Fund”) for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares |

$107 |

0.96% |

How did the Fund perform last year?

-

Global equities generally enjoyed strong performance over the period, as resilient macro and micro data combined with excitement around innovation in information technology and healthcare.

-

While U.S. market leadership trends exhibited persistence they also evolved and broadened over the period, helping alleviate concerns of a potential momentum reversal.

-

International markets kept pace with the United States while much broader market participation enabled value styles to keep pace with momentum.

What contributed to performance?

The Fund delivered strong gains as stock selection insights were able to identify and lean into the dominant market trends. These insights aligned with a soft-landing expectation and motivated positioning across the artificial intelligence (“AI”) and GLP-1 weight loss drug themes. Sentiment measures identifying trends across analyst and executive comments as well as smart money positioning were key performance drivers.

Fundamental quality and valuation measures provided a further source of returns as markets increasingly discerned AI winners versus losers. More broadly, valuation insights drove gains across the United States and Japan with measures evaluating cash flows, valuations and other financial statement metrics all contributing. Additionally, growth-oriented quality insights evaluating research expenditures helped the Fund benefit from AI optimism.

What detracted from performance?

Despite the strong gains, changing market leadership proved a headwind to trend-following industry insights over the period. In particular, industry measures picking up on price momentum and favoring defensive positioning performed poorly. In addition, select consumer intent-related measures were wrong-footed. In this vein, measures evaluating mobile app usage detracted by motivating exposure to the automobile industry.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

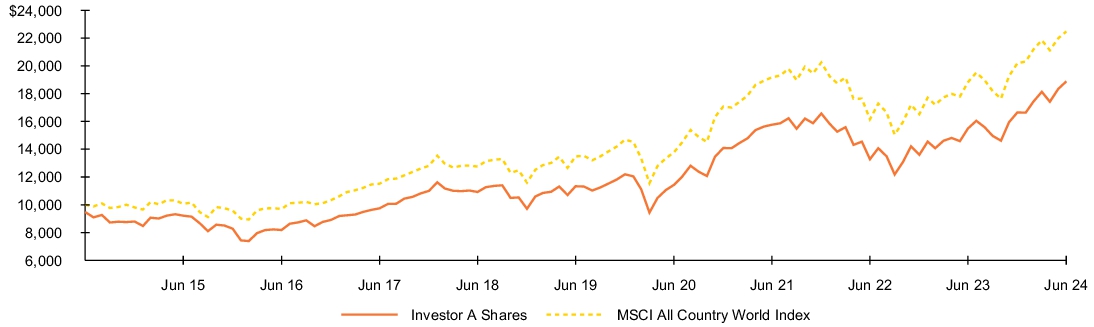

Fund performance

Cumulative performance: July 1, 2014 through June 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Investor A Shares |

21.87% |

10.75% |

7.14% |

| Investor A Shares (with sales charge) |

15.47% |

9.56% |

6.56% |

| MSCI All Country World Index |

19.38% |

10.76% |

8.43% |

| Key Fund statistics |

|

| Net Assets |

$382,532,073% |

| Number of Portfolio Holdings |

$204% |

| Net Investment Advisory Fees |

$1,821,675% |

| Portfolio Turnover Rate |

$152% |

The Fund's returns shown prior to October 26, 2017, are the returns of the Fund when it followed a different investment objective and different investment strategies under the name BlackRock Global SmallCap Fund, Inc.

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of June 30, 2024)

| Geographic allocation |

| Country/Geographic Region |

Percent of

Net Assets |

| United States |

69.7% |

| Japan |

4.3% |

| China |

3.0% |

| Taiwan |

2.9% |

| Switzerland |

2.7% |

| Spain |

2.2% |

| Canada |

1.9% |

| Denmark |

1.6% |

| Germany |

1.4% |

| India |

1.3% |

| Other# |

8.8% |

| Other Assets Less Liabilities |

0.2% |

| Ten largest holdings |

| Security |

Percent of

Net Assets(a) |

| Microsoft Corp. |

4.9% |

| Apple, Inc. |

4.8% |

| NVIDIA Corp. |

4.5% |

| Amazon.com, Inc. |

4.0% |

| Johnson & Johnson |

1.9% |

| Alphabet, Inc., Class A |

1.9% |

| S&P Global, Inc. |

1.7% |

| Lam Research Corp. |

1.7% |

| Comcast Corp., Class A |

1.7% |

| QUALCOMM, Inc. |

1.7% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Global Fund, Inc.

Investor A Shares | MDGCX

Annual Shareholder Report — June 30, 2024

MDGCX-06/24-AR

BlackRock Advantage Global Fund, Inc.

Investor C Shares | MCGCX

Annual Shareholder Report — June 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Global Fund, Inc. (the “Fund”) for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares |

$189 |

1.71% |

How did the Fund perform last year?

-

Global equities generally enjoyed strong performance over the period, as resilient macro and micro data combined with excitement around innovation in information technology and healthcare.

-

While U.S. market leadership trends exhibited persistence they also evolved and broadened over the period, helping alleviate concerns of a potential momentum reversal.

-

International markets kept pace with the United States while much broader market participation enabled value styles to keep pace with momentum.

What contributed to performance?

The Fund delivered strong gains as stock selection insights were able to identify and lean into the dominant market trends. These insights aligned with a soft-landing expectation and motivated positioning across the artificial intelligence (“AI”) and GLP-1 weight loss drug themes. Sentiment measures identifying trends across analyst and executive comments as well as smart money positioning were key performance drivers.

Fundamental quality and valuation measures provided a further source of returns as markets increasingly discerned AI winners versus losers. More broadly, valuation insights drove gains across the United States and Japan with measures evaluating cash flows, valuations and other financial statement metrics all contributing. Additionally, growth-oriented quality insights evaluating research expenditures helped the Fund benefit from AI optimism.

What detracted from performance?

Despite the strong gains, changing market leadership proved a headwind to trend-following industry insights over the period. In particular, industry measures picking up on price momentum and favoring defensive positioning performed poorly. In addition, select consumer intent-related measures were wrong-footed. In this vein, measures evaluating mobile app usage detracted by motivating exposure to the automobile industry.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

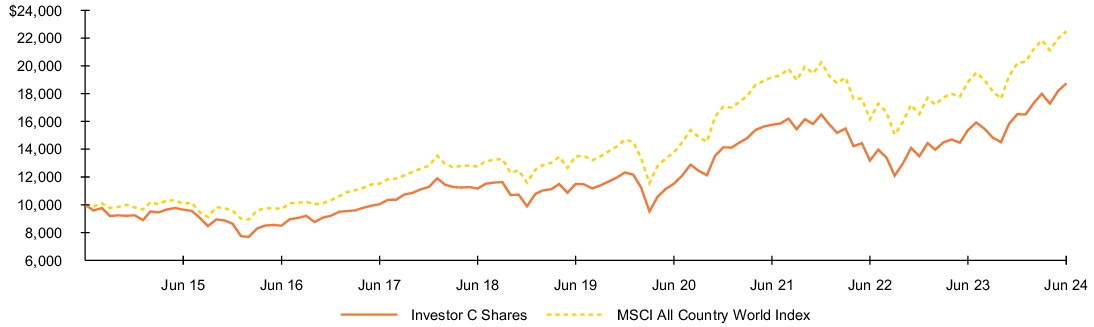

Fund performance

Cumulative performance: July 1, 2014 through June 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Investor C Shares |

20.91% |

9.92% |

6.48% |

| Investor C Shares (with sales charge) |

19.91% |

9.92% |

6.48% |

| MSCI All Country World Index |

19.38% |

10.76% |

8.43% |

| Key Fund statistics |

|

| Net Assets |

$382,532,073% |

| Number of Portfolio Holdings |

$204% |

| Net Investment Advisory Fees |

$1,821,675% |

| Portfolio Turnover Rate |

$152% |

The Fund's returns shown prior to October 26, 2017, are the returns of the Fund when it followed a different investment objective and different investment strategies under the name BlackRock Global SmallCap Fund, Inc.

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of June 30, 2024)

| Geographic allocation |

| Country/Geographic Region |

Percent of

Net Assets |

| United States |

69.7% |

| Japan |

4.3% |

| China |

3.0% |

| Taiwan |

2.9% |

| Switzerland |

2.7% |

| Spain |

2.2% |

| Canada |

1.9% |

| Denmark |

1.6% |

| Germany |

1.4% |

| India |

1.3% |

| Other# |

8.8% |

| Other Assets Less Liabilities |

0.2% |

| Ten largest holdings |

| Security |

Percent of

Net Assets(a) |

| Microsoft Corp. |

4.9% |

| Apple, Inc. |

4.8% |

| NVIDIA Corp. |

4.5% |

| Amazon.com, Inc. |

4.0% |

| Johnson & Johnson |

1.9% |

| Alphabet, Inc., Class A |

1.9% |

| S&P Global, Inc. |

1.7% |

| Lam Research Corp. |

1.7% |

| Comcast Corp., Class A |

1.7% |

| QUALCOMM, Inc. |

1.7% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Global Fund, Inc.

Investor C Shares | MCGCX

Annual Shareholder Report — June 30, 2024

MCGCX-06/24-AR

BlackRock Advantage Global Fund, Inc.

Class K Shares | MKGCX

Annual Shareholder Report — June 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Global Fund, Inc. (the “Fund”) for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class K Shares |

$73 |

0.66% |

How did the Fund perform last year?

-

Global equities generally enjoyed strong performance over the period, as resilient macro and micro data combined with excitement around innovation in information technology and healthcare.

-

While U.S. market leadership trends exhibited persistence they also evolved and broadened over the period, helping alleviate concerns of a potential momentum reversal.

-

International markets kept pace with the United States while much broader market participation enabled value styles to keep pace with momentum.

What contributed to performance?

The Fund delivered strong gains as stock selection insights were able to identify and lean into the dominant market trends. These insights aligned with a soft-landing expectation and motivated positioning across the artificial intelligence (“AI”) and GLP-1 weight loss drug themes. Sentiment measures identifying trends across analyst and executive comments as well as smart money positioning were key performance drivers.

Fundamental quality and valuation measures provided a further source of returns as markets increasingly discerned AI winners versus losers. More broadly, valuation insights drove gains across the United States and Japan with measures evaluating cash flows, valuations and other financial statement metrics all contributing. Additionally, growth-oriented quality insights evaluating research expenditures helped the Fund benefit from AI optimism.

What detracted from performance?

Despite the strong gains, changing market leadership proved a headwind to trend-following industry insights over the period. In particular, industry measures picking up on price momentum and favoring defensive positioning performed poorly. In addition, select consumer intent-related measures were wrong-footed. In this vein, measures evaluating mobile app usage detracted by motivating exposure to the automobile industry.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

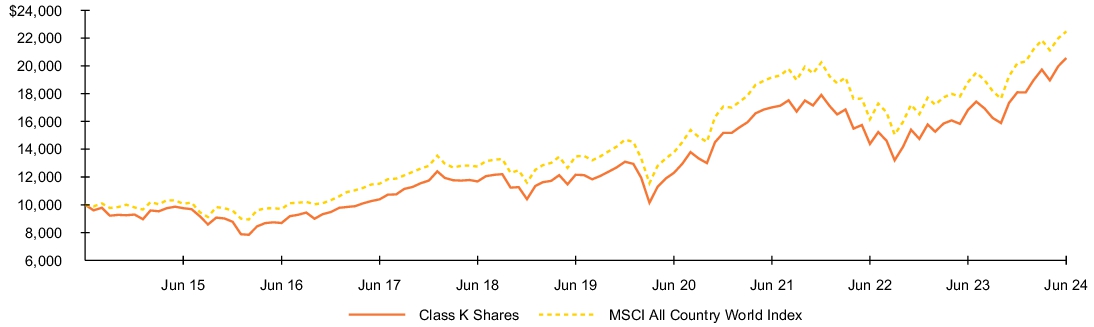

Fund performance

Cumulative performance: July 1, 2014 through June 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Class K Shares |

22.22% |

11.08% |

7.48% |

| MSCI All Country World Index |

19.38% |

10.76% |

8.43% |

| Key Fund statistics |

|

| Net Assets |

$382,532,073% |

| Number of Portfolio Holdings |

$204% |

| Net Investment Advisory Fees |

$1,821,675% |

| Portfolio Turnover Rate |

$152% |

The Fund's returns shown prior to October 26, 2017, are the returns of the Fund when it followed a different investment objective and different investment strategies under the name BlackRock Global SmallCap Fund, Inc.

Performance shown prior to the Class K Shares inception date of January 25, 2018 is that of Institutional Shares. The performance of Class K Shares would be substantially similar to Institutional Shares because Class K Shares and Institutional Shares invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Institutional Shares have different expenses. The actual returns of Class K Shares would have been higher than those of the Institutional Shares because Class K Shares have lower expenses than the Institutional Shares.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of June 30, 2024)

| Geographic allocation |

| Country/Geographic Region |

Percent of

Net Assets |

| United States |

69.7% |

| Japan |

4.3% |

| China |

3.0% |

| Taiwan |

2.9% |

| Switzerland |

2.7% |

| Spain |

2.2% |

| Canada |

1.9% |

| Denmark |

1.6% |

| Germany |

1.4% |

| India |

1.3% |

| Other# |

8.8% |

| Other Assets Less Liabilities |

0.2% |

| Ten largest holdings |

| Security |

Percent of

Net Assets(a) |

| Microsoft Corp. |

4.9% |

| Apple, Inc. |

4.8% |

| NVIDIA Corp. |

4.5% |

| Amazon.com, Inc. |

4.0% |

| Johnson & Johnson |

1.9% |

| Alphabet, Inc., Class A |

1.9% |

| S&P Global, Inc. |

1.7% |

| Lam Research Corp. |

1.7% |

| Comcast Corp., Class A |

1.7% |

| QUALCOMM, Inc. |

1.7% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Global Fund, Inc.

Class K Shares | MKGCX

Annual Shareholder Report — June 30, 2024

MKGCX-06/24-AR

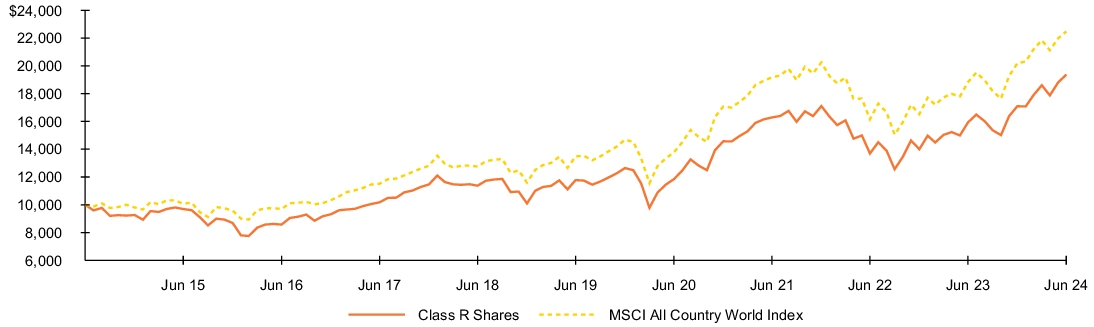

BlackRock Advantage Global Fund, Inc.

Class R Shares | MRGSX

Annual Shareholder Report — June 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Global Fund, Inc. (the “Fund”) for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class R Shares |

$134 |

1.21% |

How did the Fund perform last year?

-

Global equities generally enjoyed strong performance over the period, as resilient macro and micro data combined with excitement around innovation in information technology and healthcare.

-

While U.S. market leadership trends exhibited persistence they also evolved and broadened over the period, helping alleviate concerns of a potential momentum reversal.

-

International markets kept pace with the United States while much broader market participation enabled value styles to keep pace with momentum.

What contributed to performance?

The Fund delivered strong gains as stock selection insights were able to identify and lean into the dominant market trends. These insights aligned with a soft-landing expectation and motivated positioning across the artificial intelligence (“AI”) and GLP-1 weight loss drug themes. Sentiment measures identifying trends across analyst and executive comments as well as smart money positioning were key performance drivers.

Fundamental quality and valuation measures provided a further source of returns as markets increasingly discerned AI winners versus losers. More broadly, valuation insights drove gains across the United States and Japan with measures evaluating cash flows, valuations and other financial statement metrics all contributing. Additionally, growth-oriented quality insights evaluating research expenditures helped the Fund benefit from AI optimism.

What detracted from performance?

Despite the strong gains, changing market leadership proved a headwind to trend-following industry insights over the period. In particular, industry measures picking up on price momentum and favoring defensive positioning performed poorly. In addition, select consumer intent-related measures were wrong-footed. In this vein, measures evaluating mobile app usage detracted by motivating exposure to the automobile industry.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund performance

Cumulative performance: July 1, 2014 through June 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Class R Shares |

21.59% |

10.47% |

6.83% |

| MSCI All Country World Index |

19.38% |

10.76% |

8.43% |

| Key Fund statistics |

|

| Net Assets |

$382,532,073% |

| Number of Portfolio Holdings |

$204% |

| Net Investment Advisory Fees |

$1,821,675% |

| Portfolio Turnover Rate |

$152% |

The Fund's returns shown prior to October 26, 2017, are the returns of the Fund when it followed a different investment objective and different investment strategies under the name BlackRock Global SmallCap Fund, Inc.

Average annual total returns reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of June 30, 2024)

| Geographic allocation |

| Country/Geographic Region |

Percent of

Net Assets |

| United States |

69.7% |

| Japan |

4.3% |

| China |

3.0% |

| Taiwan |

2.9% |

| Switzerland |

2.7% |

| Spain |

2.2% |

| Canada |

1.9% |

| Denmark |

1.6% |

| Germany |

1.4% |

| India |

1.3% |

| Other# |

8.8% |

| Other Assets Less Liabilities |

0.2% |

| Ten largest holdings |

| Security |

Percent of

Net Assets(a) |

| Microsoft Corp. |

4.9% |

| Apple, Inc. |

4.8% |

| NVIDIA Corp. |

4.5% |

| Amazon.com, Inc. |

4.0% |

| Johnson & Johnson |

1.9% |

| Alphabet, Inc., Class A |

1.9% |

| S&P Global, Inc. |

1.7% |

| Lam Research Corp. |

1.7% |

| Comcast Corp., Class A |

1.7% |

| QUALCOMM, Inc. |

1.7% |

| (a) |

Excludes short-term securities. |

| # |

Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Global Fund, Inc.

Class R Shares | MRGSX

Annual Shareholder Report — June 30, 2024

MRGSX-06/24-AR

(b) Not Applicable

| Item 2 – |

Code of Ethics – The registrant (or the “Fund”) has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the code of ethics was amended to update certain information and to make other non-material changes. During the period covered by this report, there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, who calls 1-800-441-7762. |

| Item 3 – |

Audit Committee Financial Expert – The registrant’s board of directors (the “board of directors”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent: |

Neil A. Cotty

Henry R. Keizer

Kenneth L. Urish

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of directors.

| Item 4 – |

Principal Accountant Fees and Services |

The following table presents fees billed by Deloitte & Touche LLP (“D&T”) in each of the last two fiscal years for the services rendered to the Fund:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(a) Audit Fees |

|

(b) Audit-Related Fees1 |

|

(c) Tax Fees2 |

|

(d) All Other Fees |

| Entity Name |

|

Current Fiscal Year End |

|

Previous Fiscal Year End |

|

Current Fiscal Year End |

|

Previous Fiscal Year End |

|

Current Fiscal Year End |

|

Previous Fiscal Year End |

|

Current Fiscal Year End |

|

Previous Fiscal Year End |

| BlackRock Advantage Global Fund, Inc. |

|

$36,414 |

|

$36,414 |

|

$0 |

|

$44 |

|

$16,328 |

|

$18,700 |

|

$407 |

|

$0 |

The following table presents fees billed by D&T that were required to be approved by the registrant’s audit committee (the “Committee”) for services that relate directly to the operations or financial reporting of the Fund and that are rendered on behalf of BlackRock Advisors, LLC

(the “Investment Adviser” or “BlackRock”) and entities controlling, controlled by, or under common control with BlackRock (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund (“Affiliated Service Providers”):

|

|

|

|

|

| |

|

Current Fiscal Year End |

|

Previous Fiscal Year End |

| (b) Audit-Related Fees1 |

|

$0 |

|

$0 |

| (c) Tax Fees2 |

|

$0 |

|

$0 |

| (d) All Other Fees3 |

|

$2,149,000 |

|

$2,154,000 |

1 The nature of the services includes assurance and related services reasonably related to the performance of the audit or review of financial statements not included in Audit Fees, including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters, out-of-pocket expenses and internal control reviews not required by regulators.

2 The nature of the services includes tax compliance and/or tax preparation, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews, taxable income and tax distribution calculations.

3 Non-audit fees of $2,149,000 and $2,154,000 for the current fiscal year and previous fiscal year, respectively, were paid to the Fund’s principal accountant in their entirety by BlackRock, in connection with services provided to the Affiliated Service Providers of the Fund and of certain other funds sponsored and advised by BlackRock or its affiliates for a service organization review and an accounting research tool subscription. These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The Committee has adopted policies and procedures with regard to the pre-approval of services. Audit, audit-related and tax compliance services provided to the registrant on an annual basis require specific pre-approval by the Committee. The Committee also must approve other non-audit services provided to the registrant and those non-audit services provided to the Investment Adviser and Affiliated Service Providers that relate directly to the operations and the financial reporting of the registrant. Certain of these non-audit services that the Committee believes are (a) consistent with the SEC’s auditor independence rules and (b) routine and recurring services that will not impair the independence of the independent accountants may be approved by the Committee without consideration on a specific case-by-case basis (“general pre-approval”). The term of any general pre-approval is 12 months from the date of the pre-approval, unless the Committee provides for a different period. Tax or other non-audit services provided to the registrant which have a direct impact on the operations or financial reporting of the registrant will only be deemed pre-approved provided that any individual project does not exceed $10,000 attributable to the registrant or $50,000 per project. For this purpose, multiple projects will be aggregated to determine if they exceed the previously mentioned cost levels.

Any proposed services exceeding the pre-approved cost levels will require specific pre-approval by the Committee, as will any other services not subject to general pre-approval (e.g., unanticipated but permissible services). The Committee is informed of each service approved subject to general pre-approval at the next regularly scheduled in-person board meeting. At this meeting, an analysis of such services is presented to the Committee for ratification. The Committee may delegate to the Committee Chairman the authority to approve the provision of and fees for any specific engagement of permitted non-audit services, including services exceeding pre-approved cost levels.

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the Committee pursuant to the de minimis exception in paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not Applicable

(g) The aggregate non-audit fees, defined as the sum of the fees shown under “Audit-Related Fees,” “Tax Fees” and “All Other Fees,” paid to the accountant for services rendered by the accountant to the registrant, the Investment Adviser and the Affiliated Service Providers were:

|

|

|

|

|

| Entity Name |

|

Current Fiscal Year End |

|

Previous Fiscal Year End |

| BlackRock Advantage Global Fund, Inc. |

|

$16,735 |

|

$18,744 |

Additionally, the amounts billed by D&T in connection with services provided to the Affiliated Service Providers of the Fund and of other funds sponsored and advised by BlackRock or its affiliates during the current and previous fiscal years for a service organization review and an accounting research tool subscription were:

|

|

|

| Current Fiscal Year End |

|

Previous Fiscal Year End |

| $2,149,000 |

|

$2,154,000 |

These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(h) The Committee has considered and determined that the provision of non-audit services that were rendered to the Investment Adviser and the Affiliated Service Providers that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not Applicable

(j) Not Applicable

| Item 5 – |

Audit Committee of Listed Registrant – Not Applicable |

(a) The registrant’s Schedule of Investments is included as part of the Financial Statements and Financial Highlights for Open-End Management Investment Companies filed under Item 7 of this Form.

(b) Not Applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

| Item 7 – |

Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

June 30, 2024

2024 Annual Financial Statements |

BlackRock Advantage Global Fund, Inc. |

| |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Funds must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

Derivative Financial Instruments

3

Schedule of Investments

June 30, 2024

BlackRock Advantage Global Fund, Inc.

(Percentages shown are based on Net Assets)

| |

|

|

|

| |

| |

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

| |

|

|

|

B3 SA - Brasil Bolsa Balcao |

|

|

|

| |

|

|

|

Marfrig Global Foods SA(a) |

|

|

|

NU Holdings Ltd./Cayman Islands, Class A(a) |

|

|

|

Pagseguro Digital Ltd., Class A(a) |

|

|

|

Ultrapar Participacoes SA |

|

|

|

| |

|

|

|

| |

|

Brookfield Corp., Class A |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

BOE Technology Group Co. Ltd., Class A |

|

|

|

Oriental Pearl Group Co. Ltd., Class A |

|

|

|

SAIC Motor Corp. Ltd., Class A |

|

|

|

Shanghai Electric Group Co. Ltd., Class A(a) |

|

|

|

Shenwan Hongyuan Group Co. Ltd., Class A |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

Novo Nordisk A/S, Class B |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

Bayer AG, Class N, Registered Shares |

|

|

|

Siemens AG, Class N, Registered Shares |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

Jardine Matheson Holdings Ltd. |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

|

|

Dixon Technologies India Ltd. |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

SBI Life Insurance Co. Ltd.(b) |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

Check Point Software Technologies Ltd. |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

| |

|

|

|

Central Japan Railway Co. |

|

|

|

GMO Payment Gateway, Inc. |

|

|

|

| |

|

|

|

Japan Post Holdings Co. Ltd. |

|

|

|

| |

|

|

|

| |

|

|

|

Mitsubishi UFJ Financial Group, Inc. |

|

|

|

| |

|

|

|

Mizuho Financial Group, Inc. |

|

|

|

Oriental Land Co. Ltd./Japan |

|

|

|

Pan Pacific International Holdings Corp. |

|

|

|

| |

|

|

|

Recruit Holdings Co. Ltd. |

|

|

|

| |

|

|

|

| |

|

|

|

Sumitomo Mitsui Financial Group, Inc. |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

Rabigh Refining & Petrochemical Co.(a) |

|

|

|

| |

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

4 2024 BlackRock Annual Financial Statements

Schedule of Investments (continued)

June 30, 2024

BlackRock Advantage Global Fund, Inc.

(Percentages shown are based on Net Assets)

| |

|

|

|

| |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

|

|

Industria de Diseno Textil SA |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

ABB Ltd., Class N, Registered Shares |

|

|

|

Chocoladefabriken Lindt & Spruengli AG |

|

|

|

Novartis AG, Class N, Registered Shares |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

Elan Microelectronics Corp. |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Realtek Semiconductor Corp. |

|

|

|

Taiwan Semiconductor Manufacturing Co. Ltd. |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

Migros Ticaret A/S, Class A |

|

|

|

Turkcell Iletisim Hizmetleri A/S, Class A |

|

|

|

| |

|

|

|

| |

|

CK Hutchison Holdings Ltd. |

|

|

|

Direct Line Insurance Group PLC |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Advanced Micro Devices, Inc.(a) |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Arch Capital Group Ltd.(a) |

|

|

|

Arrow Electronics, Inc.(a) |

|

|

|

Berkshire Hathaway, Inc., Class B(a) |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

United States (continued) |

|

Builders FirstSource, Inc.(a) |

|

|

|

CACI International, Inc., Class A(a) |

|

|

|

Cadence Design Systems, Inc.(a) |

|

|

|

| |

|

|

|

| |

|

|

|

CBRE Group, Inc., Class A(a) |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Expeditors International of Washington, Inc. |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Honeywell International, Inc. |

|

|

|

| |

|

|

|

| |

|

|

|

Ionis Pharmaceuticals, Inc.(a) |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Manhattan Associates, Inc.(a) |

|

|

|

Marsh & McLennan Cos., Inc. |

|

|

|

Mastercard, Inc., Class A |

|

|

|

| |

|

|

|

Meta Platforms, Inc., Class A |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Regeneron Pharmaceuticals, Inc.(a) |

|

|

|

Reinsurance Group of America, Inc. |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Thermo Fisher Scientific, Inc. |

|

|

|

Schedule of Investments

5

Schedule of Investments (continued)

June 30, 2024

BlackRock Advantage Global Fund, Inc.

(Percentages shown are based on Net Assets)

| |

|

|

|

United States (continued) |

|

| |

|

|

|

| |

|

|

|

Uber Technologies, Inc.(a) |

|

|

|

United Airlines Holdings, Inc.(a) |

|

|

|

| |

|

|

|

Vertex Pharmaceuticals, Inc.(a) |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Total Common Stocks — 97.7%

(Cost: $286,506,896) |

|

| |

| |

| |

|

| |

|

|

|

CTEEP-Cia de Transmissao de Energia Eletrica Paulista |

|

|

|

| |

|

|

|

Usinas Siderurgicas de Minas Gerais S/A Usiminas |

|

|

|

| |

|

|

|

Total Preferred Securities — 0.3%

(Cost: $1,325,957) |

|

Total Long-Term Investments — 98.0%

(Cost: $287,832,853) |

|

| |

|

|

|

| |

Money Market Funds — 1.8% |

|

BlackRock Liquidity Funds, T-Fund, Institutional Shares, 5.19%(d)(e) |

|

|

|

Total Short-Term Securities — 1.8%

(Cost: $6,831,991) |

|

Total Investments — 99.8%

(Cost: $294,664,844) |

|

Other Assets Less Liabilities — 0.2% |

|

| |

|

| |

Non-income producing security. |

| |

Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| |

Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| |

|

| |

Annualized 7-day yield as of period end. |

Investments in issuers considered to be affiliate(s) of the Fund during the year ended June 30, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| |

|

|

|

|

Change in

Unrealized

Appreciation

(Depreciation) |

|

|

|

Capital Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Institutional, SL Agency Shares(a) |

|

|

|

|

|

|

|

|

|

BlackRock Liquidity Funds, T-Fund, Institutional Shares |

|

|

|

|

|

|

|

|

|

SL Liquidity Series, LLC, Money Market Series(a) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

As of period end, the entity is no longer held. |

| |

Represents net amount purchased (sold). |

| |

All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

Derivative Financial Instruments Outstanding as of Period End

| |

|

|

|

Value/

Unrealized

Appreciation

(Depreciation) |

| |

|

|

|

|

| |

|

|

|

|

6 2024 BlackRock Annual Financial Statements

Schedule of Investments (continued)

June 30, 2024

BlackRock Advantage Global Fund, Inc.

Futures Contracts (continued)

| |

|

|

|

Value/ Unrealized Appreciation (Depreciation) |

Long Contracts (continued) |

|

|

|

|

MSCI Emerging Markets Index |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| |

|

|

|

Foreign

Currency

Exchange

Contracts |

|

|

|

Assets — Derivative Financial Instruments |

|

|

|

|

|

|

|

Futures contracts

Unrealized appreciation on futures contracts(a) |

|

|

|

|

|

|

|

| |

Net cumulative unrealized appreciation (depreciation) on futures contracts and centrally cleared swaps, if any, are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day’s variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

For the period ended June 30, 2024, the effect of derivative financial instruments in the Statements of Operations was as follows:

| |

|

|

|

Foreign

Currency

Exchange

Contracts |

|

|

|

Net Realized Gain (Loss) from: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Net Change in Unrealized Appreciation (Depreciation) on: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| |

|

Average notional value of contracts — long |

|

Average notional value of contracts — short |

|

| |

Derivative financial instrument not held at any quarter-end. The risk exposure table serves as an indicator of activity during the period. |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

Schedule of Investments

7

Schedule of Investments (continued)

June 30, 2024

BlackRock Advantage Global Fund, Inc.