| Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||

| Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||||||||||||||||

| ☒ | Smaller Reporting Company | |||||||||||||||||||

| Emerging Growth Company | ||||||||||||||||||||

| Page Number | ||||||||

| PART I. FINANCIAL INFORMATION | ||||||||

| PART II. OTHER INFORMATION | ||||||||

| June 30, 2025 | December 31, 2024 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Receivables from collaborative partners | |||||||||||

| Short-term investments | |||||||||||

| Prepaid expenses and other current assets | |||||||||||

| Total current assets | |||||||||||

| Property and equipment, net | |||||||||||

| Operating lease right-of-use assets | |||||||||||

| Long-term investments | |||||||||||

| Other long-term assets | |||||||||||

| Total assets | $ | $ | |||||||||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued expenses | |||||||||||

| Current portion of operating lease liability | |||||||||||

| Total current liabilities | |||||||||||

| Liability related to sale of future royalties | |||||||||||

| Operating lease liability, net of current portion | |||||||||||

| Stockholders’ equity: | |||||||||||

Preferred stock, $ | |||||||||||

Common stock, $ | |||||||||||

| Additional paid in capital | |||||||||||

| Accumulated other comprehensive (loss) gain | ( | ||||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total stockholders’ (deficit) equity | ( | ||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| $ | $ | $ | $ | ||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Research and development | |||||||||||||||||||||||

| General and administrative | |||||||||||||||||||||||

| Total operating expenses | |||||||||||||||||||||||

| Loss from operations | ( | ( | ( | ( | |||||||||||||||||||

| Other income (expense), net: | |||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||

| Non-cash interest expense for the sale of future royalties | ( | ( | ( | ( | |||||||||||||||||||

| Other income (expense), net | ( | ||||||||||||||||||||||

| Total other expense, net | ( | ( | ( | ( | |||||||||||||||||||

| Loss before income taxes | ( | ( | ( | ( | |||||||||||||||||||

| Provision for income taxes | ( | ( | ( | ( | |||||||||||||||||||

| Net loss | ( | ( | ( | ( | |||||||||||||||||||

Unrealized (loss) gain on available for sale securities | ( | ( | |||||||||||||||||||||

| Comprehensive loss | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Net loss per common share: | |||||||||||||||||||||||

| Basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Weighted-average number of shares outstanding: | |||||||||||||||||||||||

| Basic and diluted | |||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Gain (Loss) | Accumulated Deficit | Total Stockholders’ (Deficit) Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance, December 31, 2024 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Issuance of common stock from exercises of options and employee stock purchase plan | — | — | — | ||||||||||||||||||||||||||||||||

| Issuance of common stock upon vesting of restricted stock units | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Net share settlement of restricted stock units | ( | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Repurchases and retirements of common stock | ( | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Comprehensive loss, net | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Balance, March 31, 2025 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Issuance of common stock from exercises of options and employee stock purchase plan | — | — | — | ||||||||||||||||||||||||||||||||

| Issuance of common stock upon vesting of restricted stock units | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Repurchases and retirements of common stock | ( | ( | ( | — | — | ( | |||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Comprehensive loss, net | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Balance, June 30, 2025 | $ | $ | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Gain (Loss) | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Issuance of common stock from exercises of options and employee stock purchase plan | — | — | — | ||||||||||||||||||||||||||||||||

| Issuance of common stock upon vesting of restricted stock units | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Net share settlement of restricted stock units | ( | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Comprehensive gain, net | — | — | — | — | |||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Issuance of common stock from exercises of options and employee stock purchase plan | — | — | — | ||||||||||||||||||||||||||||||||

| Issuance of common stock upon vesting of restricted stock units | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Comprehensive gain, net | — | — | — | — | |||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Balance, June 30, 2024 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Six Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Stock-based compensation | |||||||||||

| Accretion/amortization of investments, net | ( | ( | |||||||||

Amortization of right-of-use assets – operating | |||||||||||

| Non-cash interest expense | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Receivables from collaborative partners | ( | ||||||||||

| Prepaid expenses and other assets | |||||||||||

| Accounts payable and other liabilities | ( | ||||||||||

| Operating lease liabilities | ( | ( | |||||||||

| Net cash used in operating activities | ( | ( | |||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||||||

| Purchases of investments | ( | ( | |||||||||

| Sales and maturities of investments | |||||||||||

| Purchases of property and equipment | ( | ( | |||||||||

| Net cash provided by investing activities | |||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||||

| Proceeds from issuance of common stock | |||||||||||

| Repurchase and retirements of common stock | ( | ||||||||||

| Proceeds from the sale of future royalties | |||||||||||

| Payment for net share settlement of equity awards | ( | ( | |||||||||

| Principal repayment of liability for sale of future royalties | ( | ( | |||||||||

| Payments for debt issuance costs | ( | ||||||||||

| Net cash (used in) provided by financing activities | ( | ||||||||||

| Net (decrease) increase in cash and cash equivalents | ( | ||||||||||

| Cash and cash equivalents, beginning of period | |||||||||||

| Cash and cash equivalents, end of period | $ | $ | |||||||||

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | |||||||||||

| Interest portion of repayment for sale of future royalties | $ | $ | |||||||||

| Income taxes paid | $ | $ | |||||||||

| Non-cash investing and financing activities: | |||||||||||

| Amounts accrued for issuance costs related to the sale of future royalties | $ | $ | |||||||||

| Amounts accrued for repurchases of common stock | $ | $ | |||||||||

| Receivable related to issuance of common stock, upon exercise of stock options | $ | $ | |||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (in thousands) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Options to purchase common stock | |||||||||||||||||||||||

Stock awards | |||||||||||||||||||||||

| Total | |||||||||||||||||||||||

| (in thousands) | June 30, 2025 | December 31, 2024 | |||||||||

| Laboratory equipment | $ | $ | |||||||||

| Office furniture and equipment | |||||||||||

| Leasehold improvements | |||||||||||

| Property and equipment, gross | |||||||||||

| Less: accumulated depreciation and amortization | ( | ( | |||||||||

| Total property and equipment, net | $ | $ | |||||||||

| (in thousands) | June 30, 2025 | December 31, 2024 | |||||||||

| Accrued compensation and related expenses | $ | $ | |||||||||

| Accrued professional fees and other expenses | |||||||||||

| Accrued research, development and manufacturing expenses | |||||||||||

| Accrued for repurchases of common stock | |||||||||||

| Total accrued expenses | $ | $ | |||||||||

PD-1 (Jemperli/Dostarlimab) | TIM-3 (GSK4069889/Cobolimab) | ||||||||||||||||

| Milestone Event | Amount | Quarter Recognized | Amount | Quarter Recognized | |||||||||||||

Initiated in vivo toxicology studies using good laboratory practices (GLPs) | $ | Q2'15 | $ | Q4'15 | |||||||||||||

| IND clearance from the FDA | $ | Q1'16 | $ | Q2'16 | |||||||||||||

| Phase 2 clinical trial initiation | $ | Q2'17 | $ | Q4'17 | |||||||||||||

| Phase 3 clinical trial initiation - first indication | $ | Q3'18 | $ | Q4'22 | |||||||||||||

| Phase 3 clinical trial initiation - second indication | $ | Q2'19 | $ | — | |||||||||||||

Filing of the first BLA(1) - first indication | $ | Q1'20 | $ | — | |||||||||||||

Filing of the first MAA(2) - first indication | $ | Q1'20 | $ | — | |||||||||||||

Filing of the first BLA - second indication | $ | Q1'21 | $ | — | |||||||||||||

| First BLA approval - first indication | $ | Q2'21 | $ | — | |||||||||||||

First MAA approval - first indication | $ | Q2'21 | $ | — | |||||||||||||

| First BLA approval - second indication | $ | Q3'21 | $ | — | |||||||||||||

Filing of the first MAA - second indication(3) | $ | — | $ | — | |||||||||||||

First MAA approval - second indication(3) | $ | — | $ | — | |||||||||||||

First commercial sales milestone(3) | $ | Q3'24 | $ | — | |||||||||||||

Second commercial sales milestone(3) | $ | Q4'24 | $ | — | |||||||||||||

Third commercial sales milestone(3) | $ | — | $ | — | |||||||||||||

Fourth commercial sales milestone (4) | $ | — | $ | — | |||||||||||||

| Milestones recognized through June 30, 2025 | $ | — | $ | — | |||||||||||||

| Milestones that may be recognized in the future | $ | — | $ | — | |||||||||||||

Milestone Event | Amount | Quarter Recognized | ||||||

FDA regulatory approval for marketing of first licensed product in the USA for the treatment of active flares in GPP | $ | — | ||||||

Regulatory approval for marketing of the first licensed product in the EU | $ | — | ||||||

Commercial sales first exceed $ | $ | — | ||||||

| Milestones recognized through June 30, 2025 | — | |||||||

Milestones that may be recognized in the future | $ | — | ||||||

| (in thousands) | June 30, 2025 | |||||||

| Liability related to sale of future Jemperli royalties and milestones – balance at 12/31/2024 | $ | |||||||

| Amortization of issuance costs | ||||||||

| Royalty and milestone payments to Sagard | ( | |||||||

Non-cash interest expense recognized(1) | ||||||||

Liability related to sale of future royalties and milestones – ending balance | $ | |||||||

| (in thousands) | June 30, 2025 | |||||||

| Liability related to sale of future Zejula royalties and milestones – balance at 12/31/2024 | $ | |||||||

| Amortization of issuance costs | ||||||||

| Royalty and milestone payments to DRI | ( | |||||||

Non-cash interest expense recognized(1) | ||||||||

| Liability related to sale of future royalties and milestones – ending balance | $ | |||||||

| Fair Value Measurements at End of Period Using: | |||||||||||||||||||||||

| (in thousands) | Fair Value | Quoted Market Prices for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||||||||||

| At June 30, 2025 | |||||||||||||||||||||||

Money market funds(1) | $ | $ | $ | $ | |||||||||||||||||||

Mutual funds(1) | |||||||||||||||||||||||

U.S. Treasury securities(2) | |||||||||||||||||||||||

Agency securities(2) | |||||||||||||||||||||||

Commercial and corporate obligations(2) | |||||||||||||||||||||||

| At December 31, 2024 | |||||||||||||||||||||||

Money market funds(1) | $ | $ | $ | $ | |||||||||||||||||||

Mutual funds(1) | |||||||||||||||||||||||

U.S. Treasury securities(1)(2) | |||||||||||||||||||||||

Agency securities(2) | |||||||||||||||||||||||

Commercial and corporate obligations(2) | |||||||||||||||||||||||

| (in thousands) | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Total Fair Value | |||||||||||||||||||

Agency securities(1) | $ | $ | $ | ( | $ | ||||||||||||||||||

Commercial and corporate obligations(2) | ( | ||||||||||||||||||||||

U.S. Treasury securities(3) | ( | ||||||||||||||||||||||

| Total available for sale investments | $ | $ | $ | ( | $ | ||||||||||||||||||

| (in thousands) | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Total Fair Value | |||||||||||||||||||

Agency securities(1) | $ | $ | $ | ( | $ | ||||||||||||||||||

Commercial and corporate obligations(2) | |||||||||||||||||||||||

U.S. Treasury securities(3) | ( | ||||||||||||||||||||||

| Total available for sale investments | $ | $ | $ | ( | $ | ||||||||||||||||||

| June 30, 2025 | |||||||||||||||||||||||||||||||||||

| Less than 12 Months | 12 Months or Greater | Total | |||||||||||||||||||||||||||||||||

| (in thousands) | Fair Value | Gross Unrealized Losses | Fair Value | Gross Unrealized Losses | Fair Value | Gross Unrealized Losses | |||||||||||||||||||||||||||||

| Agency securities | $ | $ | ( | $ | $ | $ | $ | ( | |||||||||||||||||||||||||||

| Commercial and corporate obligations | ( | ( | |||||||||||||||||||||||||||||||||

| U.S. Treasury Securities | ( | ( | |||||||||||||||||||||||||||||||||

Total | $ | $ | ( | $ | $ | $ | $ | ( | |||||||||||||||||||||||||||

| December 31, 2024 | |||||||||||||||||||||||||||||||||||

| Less than 12 Months | 12 Months or Greater | Total | |||||||||||||||||||||||||||||||||

| (in thousands) | Fair Value | Gross Unrealized Losses | Fair Value | Gross Unrealized Losses | Fair Value | Gross Unrealized Losses | |||||||||||||||||||||||||||||

| Agency securities | $ | $ | ( | $ | $ | $ | $ | ( | |||||||||||||||||||||||||||

| U.S. Treasury Securities | ( | ( | |||||||||||||||||||||||||||||||||

Total | $ | $ | ( | $ | $ | $ | $ | ( | |||||||||||||||||||||||||||

| Total number of shares purchased | Average price paid per share | Approximate dollar value of shares purchased (in thousands) | |||||||||||||||

| First Quarter 2025 | $ | $ | |||||||||||||||

| Second Quarter 2025 | |||||||||||||||||

| Total | $ | ||||||||||||||||

Shares Subject to Options | Weighted-Average Exercise Price per Share | Weighted-Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands) | ||||||||||||||||||||

Outstanding at January 1, 2025 | $ | $ | |||||||||||||||||||||

| Granted | $ | ||||||||||||||||||||||

| Exercised | ( | $ | |||||||||||||||||||||

| Forfeitures and cancellations | ( | $ | |||||||||||||||||||||

| Outstanding at June 30, 2025 | $ | $ | |||||||||||||||||||||

| Exercisable at June 30, 2025 | $ | $ | |||||||||||||||||||||

| Number of Restricted Stock Units | Weighted-Average Grant Date Fair Value | Weighted-Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands) | ||||||||||||||||||||

| Outstanding at January 1, 2025 | $ | $ | |||||||||||||||||||||

| Granted | $ | ||||||||||||||||||||||

| Released | ( | $ | |||||||||||||||||||||

| Forfeitures and cancellations | ( | $ | |||||||||||||||||||||

| Outstanding at June 30, 2025 | $ | $ | |||||||||||||||||||||

| RSU expected to vest at June 30, 2025 | $ | $ | |||||||||||||||||||||

| Six months ended June 30, | ||||||||

| 2025 | ||||||||

| Volatility of common stock | % | |||||||

| Risk-free interest rate | % | |||||||

| Contract term (in years) | ||||||||

| Number of Performance Stock Units | Weighted-Average Grant Date Fair Value | Weighted-Average Remaining Contractual Term (in years) | |||||||||||||||

| Outstanding at January 1, 2025 | $ | ||||||||||||||||

| Granted | $ | ||||||||||||||||

| Released | $ | ||||||||||||||||

| Forfeitures | ( | $ | |||||||||||||||

| Outstanding at June 30, 2025 | $ | ||||||||||||||||

| Six Months Ended June 30, | |||||||||||||||||||||||

| 2025 | 2024 | ||||||||||||||||||||||

| Risk-free interest rate | % | % | |||||||||||||||||||||

| Expected volatility | % | % | |||||||||||||||||||||

| Expected dividend yield | % | % | |||||||||||||||||||||

| Expected term (in years) | |||||||||||||||||||||||

| Weighted-average grant date fair value per share | $ | $ | |||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| (in thousands) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Research and development | $ | $ | $ | $ | ||||||||||||||||||||||

| General and administrative | (1) | |||||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||

| Leases | Classification on the Cash Flow | 2025 | 2024 | |||||||||||||||||

| Operating lease cost | Operating | $ | $ | |||||||||||||||||

| Cash paid for amounts included in the measurement of lease liabilities | Operating | |||||||||||||||||||

| Years Ending December 31, | |||||

| 2025 | $ | ||||

| 2026 | |||||

| 2027 | |||||

| 2028 | |||||

| 2029 | |||||

| Thereafter | |||||

| Total minimum payments required | |||||

| Less imputed interest | ( | ||||

| Total | $ | ||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Collaboration revenue | $ | $ | $ | $ | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| External R&D | |||||||||||||||||||||||

| Rosnilimab | |||||||||||||||||||||||

| ANB033 | |||||||||||||||||||||||

| ANB101 | |||||||||||||||||||||||

| ANB032 | |||||||||||||||||||||||

| Imsidolimab | ( | ( | |||||||||||||||||||||

| Preclinical and other unallocated costs | |||||||||||||||||||||||

Total External R&D(1) | |||||||||||||||||||||||

Total Internal R&D(2) | |||||||||||||||||||||||

| Total R&D | |||||||||||||||||||||||

External G&A(3) | |||||||||||||||||||||||

Internal G&A(2) | |||||||||||||||||||||||

| Total G&A | |||||||||||||||||||||||

| Total operating expenses | |||||||||||||||||||||||

| Loss from operations | ( | ( | ( | ( | |||||||||||||||||||

| Interest income | |||||||||||||||||||||||

| Non-cash interest expense | ( | ( | ( | ( | |||||||||||||||||||

| Other income (expense), net | ( | ||||||||||||||||||||||

Total other expense, net | ( | ( | ( | ( | |||||||||||||||||||

| Loss before income taxes | ( | ( | ( | ( | |||||||||||||||||||

Provision for income taxes | ( | ( | ( | ( | |||||||||||||||||||

| Segment net loss | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| (in thousands) | 2025 | 2024 | Increase/(Decrease) | 2025 | 2024 | Increase/(Decrease) | |||||||||||||||||||||||||||||

| External Costs | |||||||||||||||||||||||||||||||||||

| Rosnilimab | $ | 15,614 | $ | 12,926 | $ | 2,688 | $ | 30,639 | $ | 22,965 | $ | 7,674 | |||||||||||||||||||||||

| ANB033 | 3,925 | 2,982 | 943 | 7,729 | 5,645 | 2,084 | |||||||||||||||||||||||||||||

| ANB101 | 2,040 | 544 | 1,496 | 3,521 | 944 | 2,577 | |||||||||||||||||||||||||||||

| ANB032 | 108 | 7,584 | (7,476) | 3,644 | 12,451 | (8,807) | |||||||||||||||||||||||||||||

| Imsidolimab | (967) | 1,867 | (2,834) | (1,156) | 6,363 | (7,519) | |||||||||||||||||||||||||||||

| Preclinical and other unallocated costs | 4,456 | 4,693 | (237) | 8,388 | 8,037 | 351 | |||||||||||||||||||||||||||||

| Total External Costs | 25,176 | 30,596 | (5,420) | 52,765 | 56,405 | (3,640) | |||||||||||||||||||||||||||||

| Internal Costs | 12,648 | 11,401 | 1,247 | 26,239 | 22,634 | 3,605 | |||||||||||||||||||||||||||||

| Total Costs | $ | 37,824 | $ | 41,997 | $ | (4,173) | $ | 79,004 | $ | 79,039 | $ | (35) | |||||||||||||||||||||||

| Six Months Ended June 30, | |||||||||||

| (in thousands) | 2025 | 2024 | |||||||||

| Net cash (used in) provided by: | |||||||||||

| Operating activities | $ | (50,944) | $ | (58,575) | |||||||

| Investing activities | 51,250 | 66,174 | |||||||||

| Financing activities | (79,088) | 28,257 | |||||||||

| Net (decrease) increase in cash and cash equivalents | $ | (78,782) | $ | 35,856 | |||||||

| Period | (a) Total number of shares repurchased | (b) Average price paid per share | (c) Total number of shares repurchased as part of publicly announced plans or programs | (d) Maximum approximate dollar value of shares that may yet be purchased under the plans or programs (in thousands) | ||||||||||||||||||||||

| April 1, 2025 - April 30, 2025 | 1,007,397 | $ | 18.19 | 1,007,397 | $ | 51,303 | ||||||||||||||||||||

| May 1, 2025 - May 31, 2025 | 1,456,709 | $ | 20.42 | 1,456,709 | $ | 21,555 | ||||||||||||||||||||

| June 1, 2025 - June 30, 2025 | 96,832 | $ | 21.45 | 96,832 | $ | 19,478 | ||||||||||||||||||||

| 2,560,938 | 2,560,938 | |||||||||||||||||||||||||

Exhibit Number | Exhibit Description | |||||||

| 31.1 | ||||||||

| 31.2 | ||||||||

32.1** | ||||||||

32.2** | ||||||||

101.INS | Inline XBRL Report Instance Document - The Instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document | |||||||

101.SCH | Inline XBRL Taxonomy Extension Schema Document | |||||||

101.CAL | Inline XBRL Taxonomy Calculation Linkbase Document | |||||||

101.LAB | Inline XBRL Taxonomy Label Linkbase Document | |||||||

101.PRE | Inline XBRL Presentation Linkbase Document | |||||||

101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | |||||||

| 104 | Cover Page Interactive Data File - (formatted in Inline XBRL and contained in Exhibit 101) | |||||||

| AnaptysBio, Inc. | |||||||||||

| Date: | August 6, 2025 | By: | /s/ Daniel Faga | ||||||||

| Daniel Faga | |||||||||||

| President and Chief Executive Officer | |||||||||||

| (Principal Executive Officer) | |||||||||||

| Date: | August 6, 2025 | By: | /s/ Dennis Mulroy | ||||||||

| Dennis Mulroy | |||||||||||

| Chief Financial Officer | |||||||||||

| (Principal Financial and Accounting Officer) | |||||||||||

| /s/ Daniel Faga | ||

| Daniel Faga | ||

| President and Chief Executive Officer | ||

(Principal Executive Officer) | ||

| /s/ Dennis Mulroy | ||

| Dennis Mulroy | ||

| Chief Financial Officer | ||

| (Principal Financial Officer) | ||

| /s/ Daniel Faga | ||

| Daniel Faga | ||

| President and Chief Executive Officer | ||

(Principal Executive Officer) | ||

| /s/ Dennis Mulroy | ||

| Dennis Mulroy | ||

| Chief Financial Officer | ||

| (Principal Financial Officer) | ||

Consolidated Balance Sheets (Parenthetical) - $ / shares |

Jun. 30, 2025 |

Dec. 31, 2024 |

|---|---|---|

| Statement of Financial Position [Abstract] | ||

| Preferred stock, par value (in dollars per share) | $ 0.001 | $ 0.001 |

| Preferred stock, shares authorized (in shares) | 10,000,000 | 10,000,000 |

| Preferred stock, shares issued (in shares) | 0 | 0 |

| Preferred stock, shares outstanding (in shares) | 0 | 0 |

| Common stock, par value (in dollars per share) | $ 0.001 | $ 0.001 |

| Common stock, shares authorized (in shares) | 500,000,000 | 500,000,000 |

| Common stock, shares issued (in shares) | 27,972,997 | 30,473,000 |

| Common stock, shares outstanding (in shares) | 27,972,997 | 30,473,000 |

Consolidated Statements of Operations and Comprehensive Loss - USD ($) shares in Thousands, $ in Thousands |

3 Months Ended | 6 Months Ended | ||

|---|---|---|---|---|

Jun. 30, 2025 |

Jun. 30, 2024 |

Jun. 30, 2025 |

Jun. 30, 2024 |

|

| Income Statement [Abstract] | ||||

| Revenue from Contract with Customer, Product and Service [Extensible Enumeration] | Collaboration Revenue [Member] | Collaboration Revenue [Member] | Collaboration Revenue [Member] | Collaboration Revenue [Member] |

| Collaboration revenue | $ 22,263 | $ 10,971 | $ 50,034 | $ 18,150 |

| Operating expenses: | ||||

| Research and development | 37,824 | 41,997 | 79,004 | 79,039 |

| General and administrative | 10,609 | 9,295 | 24,739 | 21,633 |

| Total operating expenses | 48,433 | 51,292 | 103,743 | 100,672 |

| Loss from operations | (26,170) | (40,321) | (53,709) | (82,522) |

| Other income (expense), net: | ||||

| Interest income | 3,654 | 4,623 | 8,067 | 9,207 |

| Non-cash interest expense for the sale of future royalties | (19,606) | (10,953) | (37,667) | (17,270) |

| Other income (expense), net | 3,531 | 0 | 5,433 | (2) |

| Total other expense, net | (12,421) | (6,330) | (24,167) | (8,065) |

| Loss before income taxes | (38,591) | (46,651) | (77,876) | (90,587) |

| Provision for income taxes | (39) | (9) | (83) | (9) |

| Net loss | (38,630) | (46,660) | (77,959) | (90,596) |

| Unrealized (loss) gain on available for sale securities | (167) | 209 | (311) | 382 |

| Comprehensive loss | $ (38,797) | $ (46,451) | $ (78,270) | $ (90,214) |

| Net loss per common share: | ||||

| Basic (in dollars per share) | $ (1.34) | $ (1.71) | $ (2.62) | $ (3.35) |

| Diluted (in dollars per share) | $ (1.34) | $ (1.71) | $ (2.62) | $ (3.35) |

| Weighted-average number of shares outstanding: | ||||

| Basic (in shares) | 28,810 | 27,356 | 29,722 | 27,079 |

| Diluted (in shares) | 28,810 | 27,356 | 29,722 | 27,079 |

Description of the Business |

6 Months Ended |

|---|---|

Jun. 30, 2025 | |

| Organization, Consolidation and Presentation of Financial Statements [Abstract] | |

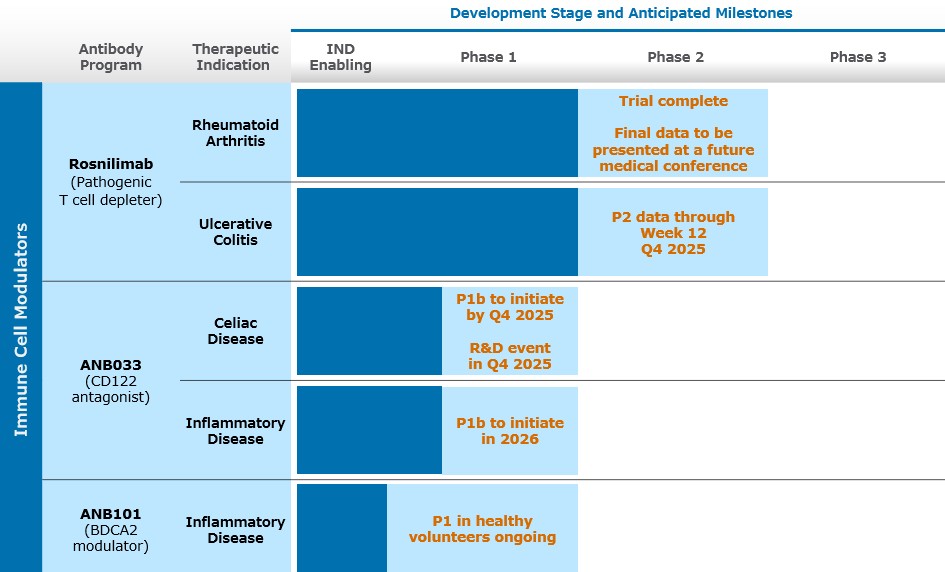

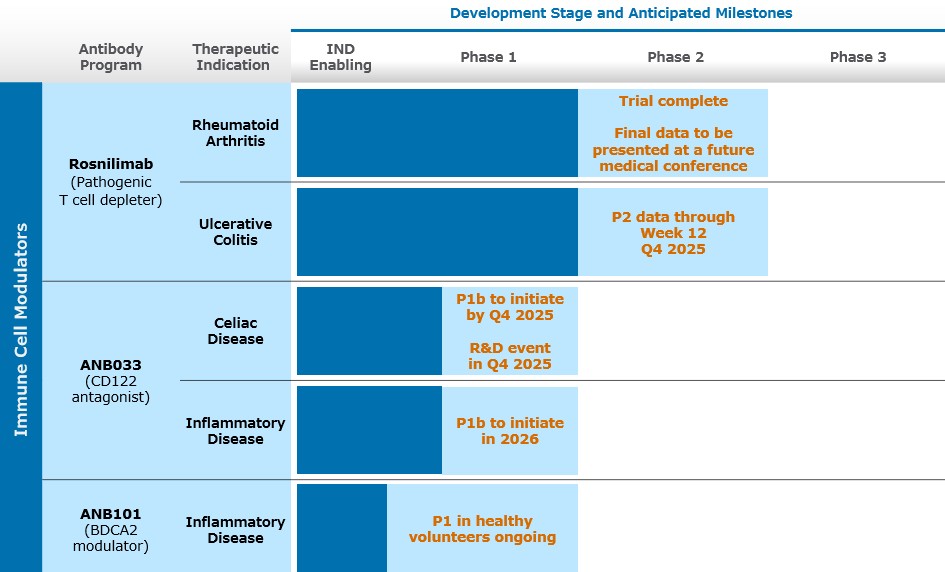

| Description of the Business | Description of the Business AnaptysBio, Inc. (“we,” “us,” “our,” or the “company”) was incorporated in the state of Delaware in November 2005. We are a clinical-stage biotechnology company focused on delivering innovative immunology therapeutics for autoimmune and inflammatory diseases. Our pipeline includes our lead program, rosnilimab, a selective and potent pathogenic T cell depleter, that completed a Phase 2b trial for the treatment of moderate-to-severe rheumatoid arthritis (“RA”) and is in a Phase 2 trial for the treatment of moderate-to-severe ulcerative colitis (“UC”). We also have other antibodies in our portfolio, including ANB033, a CD122 antagonist, in celiac disease (“CeD”), and ANB101, a BDCA2 modulator, both in Phase 1 trials. We have also discovered and out-licensed in financial collaborations multiple therapeutic antibodies, including a PD-1 antagonist (Jemperli (dostarlimab-gxly) or “Jemperli”) to GSK and an IL-36R antagonist (imsidolimab) to Vanda Pharmaceuticals Inc. (“Vanda”). We currently recognize revenue from milestones and royalties achieved under our immuno-oncology collaboration with GSK and license and transition services revenue from our collaboration with Vanda . Since our inception, we have devoted our primary effort to research and development activities. Our financial support has been provided primarily from the sale of our common stock and royalty monetizations, as well as through funds received under our collaborative research and development agreements. Going forward, as we continue our expansion, we may seek additional financing and/or strategic investments. However, there can be no assurance that any additional financing or strategic investments will be available to us on acceptable terms, if at all. If events or circumstances occur such that we do not obtain additional funding, we will most likely be required to reduce our plans and/or certain discretionary spending, which could have a material adverse effect on our ability to achieve our intended business objectives. Our management believes our currently available resources will provide sufficient funds to enable us to meet our operating plans for at least the next 12 months from the issuance of our consolidated financial statements. The accompanying consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

|

Summary of Significant Accounting Policies |

6 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jun. 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounting Policies [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Summary of Significant Accounting Policies | Summary of Significant Accounting Policies Basis of Presentation The accompanying unaudited consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and note disclosures normally included in annual financial statements prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) have been omitted. The accompanying unaudited consolidated financial statements include all known adjustments necessary for a fair presentation of the results of interim periods as required by U.S. GAAP. These adjustments consist primarily of normal recurring accruals and estimates that impact the carrying value of assets and liabilities. Operating results for the six months ended June 30, 2025 are not necessarily indicative of the results that may be expected for the year ending December 31, 2025. The financial statements should be read in conjunction with our audited financial statements for the year ended December 31, 2024 included in our Annual Report on Form 10-K. Basis of Consolidation The accompanying consolidated financial statements include us and our wholly owned Australian subsidiary, which was deregistered with the Australian Securities & Investments Commission as of June 30, 2025. The deregistration did not have a material impact on our consolidated financial statements. All intercompany accounts and transactions have been eliminated in consolidation. We operate in one reportable segment, and our functional and reporting currency is the U.S. dollar. Use of Estimates The preparation of the accompanying consolidated financial statements in conformity with U.S. GAAP requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. We base our estimates and assumptions on historical experience when available and on various factors that we believe to be reasonable under the circumstances. Significant estimates relied upon in preparing these financial statements include estimates related to revenue recognition, accrued research and development expenses, stock-based compensation, and the liability related to the sale of future royalties. We evaluate our estimates and assumptions on an ongoing basis. Our actual results could differ from these estimates under different assumptions or conditions. Net Loss Per Common Share Basic net loss per common share is computed by dividing net loss by the weighted-average number of common shares outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted-average number of common equivalent shares outstanding for the period, as well as any dilutive effect from outstanding stock options and warrants using the treasury stock method. For each period presented, there is no difference in the number of shares used to calculate basic and diluted net loss per share. The following table sets forth the weighted-average outstanding potentially dilutive securities that have been excluded in the calculation of diluted net loss per share because to do so would be anti-dilutive (in common stock equivalent shares):

Accounting Pronouncements We have implemented all new accounting pronouncements that are in effect and may have an impact on our consolidated financial statements. Unless otherwise discussed, we believe the impact of any recently issued and not yet effective pronouncements will not have a material impact on our consolidated financial statements. Recent Accounting Pronouncements Not Yet Adopted In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures Income Taxes, which improves the transparency of income tax disclosures by requiring consistent categories and greater disaggregation of information in the effective tax rate reconciliation and income taxes paid disaggregated by jurisdiction. It also includes certain other amendments to improve the effectiveness of income tax disclosures. This guidance will be effective for the annual periods beginning after December 15, 2024. Early adoption is permitted. Upon adoption, the guidance can be applied prospectively or retrospectively. We are currently assessing the impact that this standard will have on our consolidated financial statements. In November 2024, the FASB issued ASU No. 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses, which requires disclosure about the types of costs and expenses included in certain expense captions presented on the income statement. The new disclosure requirements are effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027. Early adoption is permitted. We are currently evaluating the provisions of this guidance and assessing the potential impact on our financial statement disclosures.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance Sheet Accounts and Supplemental Disclosures |

6 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jun. 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance Sheet Related Disclosures [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance Sheet Accounts and Supplemental Disclosures | Balance Sheet Accounts and Supplemental Disclosures Property and Equipment, Net Property and equipment, net consist of the following:

Accrued Expenses Accrued expenses consist of the following:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Collaborative Research and Development Agreements |

6 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jun. 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue from Contract with Customer [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collaborative Research and Development Agreements | Collaborative Research and Development Agreements GSK Collaboration In March 2014, we entered into a Collaboration and Exclusive License Agreement (the “GSK Agreement”) with TESARO, Inc. (“Tesaro”), an oncology-focused biopharmaceutical company now a part of GSK (Tesaro and GSK are hereinafter referred to, collectively, as “GSK”). Currently, under the GSK Agreement, GSK is developing Jemperli (dostarlimab) as a monotherapy, and in combination with additional therapies, for various solid tumor indications. For Jemperli and cobolimab, a TIM-3 antibody, each remaining development programs under the GSK Agreement, we are eligible to receive milestone payments if certain clinical trial events are achieved by GSK, if certain U.S. and European regulatory submissions and approvals in multiple indications are achieved, and upon the achievement of specified levels of annual worldwide net sales. We will also be eligible to receive tiered 4-8% royalties related to worldwide net sales of products developed under the collaboration. On October 23, 2020, Amendment No. 3 to the GSK Agreement (the “GSK Amendment No. 3”) was agreed to by both parties to permit GSK to conduct development and commercialization in combination with any third party molecules of Zejula, an oral, once-daily poly (ADP-ribose) polymerase (PARP) inhibitor (“Zejula”). Under GSK Amendment No. 3, we were granted increased royalties upon sales of Jemperli, equal to 8% of net sales (as defined in the GSK Agreement) below $1.0 billion, 12% of net sales between $1.0 billion and $1.5 billion, 20% of net sales between $1.5 billion and $2.5 billion and 25% of net sales above $2.5 billion. Unless earlier terminated by either party upon specified circumstances, the GSK Agreement will terminate, with respect to each specific developed product, upon the later of the 12th anniversary of the first commercial sale of the product or the expiration of the last to expire of any patent. We assessed these arrangements in accordance with Accounting Standards Codification (“ASC”) 606 and concluded that the contract counterparty, GSK, is a customer. We identified the following material promises under the GSK Agreement: (1) the licenses under certain patent rights and transfer of certain development and regulatory information, (2) research and development (“R&D”) services, and (3) joint steering committee meetings. We considered the research and discovery capabilities of GSK for these specific programs and the fact that the discovery and optimization of these antibodies is proprietary and could not, at the time of contract inception, be provided by other vendors, to conclude that the license does not have stand-alone functionality and is therefore not distinct. Additionally, we determined that the joint steering committee participation would not have been provided without the R&D services and GSK Agreement. Based on these assessments, we identified all services to be interrelated and therefore concluded that the promises should be combined into a single performance obligation at the inception of the arrangement. As of June 30, 2025, the transaction price for the GSK Agreement and its associated amendments includes the upfront payment, research reimbursement revenue and milestones and royalties earned to date, which are allocated in their entirety to the single performance obligation. We recognized $22.2 million and $40.4 million in royalty revenue during the three and six months ended June 30, 2025, respectively, related to GSK’s net sales of Jemperli and Zejula during the period, which we estimate based on either GSK’s prior sales experience or actuals. Of the royalty revenue recognized during the three and six months ended June 30, 2025, $21.1 million and $38.4 million, respectively, is Jemperli non-cash revenue related to the Jemperli Royalty Monetization Agreement (as amended) and $1.1 million and $2.0 million, respectively, is Zejula non-cash revenue related to the Zejula Royalty Monetization Agreement, each of such agreements as described in Note 5. We recognized $11.0 million and $18.2 million, in royalty revenue during the three and six months ended June 30, 2024, respectively, related to GSK’s net sales of Jemperli and Zejula during the period based on GSK’s prior sales experience or actuals. Of the royalty revenue recognized during the three and six months ended June 30, 2024, $10.1 million and $16.3 million, respectively, is Jemperli non-cash revenue related to the Jemperli Royalty Monetization Agreement (as amended) and $0.9 million and $1.9 million, respectively, is Zejula non-cash revenue related to the Zejula Royalty Monetization Agreement. GSK reports sales information to us on a one quarter lag and differences between actual and estimated royalty revenues will be adjusted in the following quarter. No clinical milestones were recognized during the three and six months ended June 30, 2025 and 2024. No other future clinical or regulatory milestones have been included in the transaction price, as all milestone amounts were subject to the revenue constraint. As part of the constraint evaluation, we considered numerous factors including the fact that the receipt of milestones is outside of our control and contingent upon success in future clinical trials, an outcome that is difficult to predict, and GSK’s efforts. Any consideration related to sales-based milestones, including royalties, will be recognized when the related sales occur as they were determined to relate predominantly to the intellectual property license granted to GSK and therefore have also been excluded from the transaction price. We will re-evaluate the variable transaction price in each reporting period and as uncertain events are resolved or other changes in circumstances occur. Milestones under the GSK Agreement are as follows:

(1)Biologics License Application (“BLA”) (2)Marketing Authorization Application (“MAA”) (3)For Jemperli, the filing and approval of the first MAA for a second indication and first three commercial sales milestones are included as part of the royalty monetization agreement with Sagard (as defined below), see Note 5. Cash is generally received within 30 days of milestone achievement. (4)For Jemperli, we retained the rights to a $75.0 million sales milestone when Jemperli annual net sales exceed $1.0 billion. Vanda Collaboration On January 31, 2025, we entered into an Exclusive License Agreement (the “Vanda License Agreement”) with Vanda pursuant to which we granted to Vanda an exclusive, global license for the development and commercialization of imsidolimab (IL-36R antagonist mAb), which has completed two registration-enabling global Phase 3 trials, GEMINI-1 and GEMINI-2, evaluating the safety and efficacy of imsidolimab in patients with Generalized Pustular Psoriasis (GPP). Pursuant to the terms of the Vanda License Agreement, we received an upfront payment of $10.0 million for the license and a $5.0 million payment for existing drug supply. We allocated the total transaction price of $15.0 million on a relative standalone selling price in accordance with ASC 606. During the six months ended June 30, 2025, we recognized $9.6 million of license revenue under ASC 606 and recognized no license revenue under ASC 606 during the three months ended June 30, 2025. During the three and six months ended June 30, 2025, we recognized less than $0.1 million and $0.1 million, respectively, of transition services revenue under ASC 606 and $3.5 million and $5.4 million, respectively, related to existing drug supply transferred to Vanda as other income under ASC 610. We expensed the $2.5 million of related transaction costs within general and administrative expenses, during the six months ended June 30, 2025, as we elected the practical expedient to expense the transaction costs as incurred as the expected amortization period was less than a year. We are also eligible to receive a 10% royalty on net sales, as well as the following milestones under the Vanda License Agreement:

Centessa On November 24, 2023, we entered into an exclusive license agreement (as amended, the “Centessa Agreement”) with Centessa Pharmaceuticals (UK) Limited (“Centessa”), pursuant to which we acquired the exclusive global development and commercialization rights to a blood dendritic cell antigen 2 (BDCA2) modulator antibody portfolio, including lead asset CBS004 (renamed ANB101), CBS008 (renamed ANB102) and the related family of backup antibodies, for the treatment of autoimmune and inflammatory diseases. In connection with the Centessa Agreement, we paid Centessa an upfront cash payment of $4.0 million and an additional cash payment of $3.0 million as reimbursement to Centessa for manufacturing costs incurred. There were $0.3 million in transaction costs incurred. The total transaction amount of $7.3 million was expensed as in-process research and development and classified as an operating activity in the statement of cash flows. We accounted for the transaction as an asset acquisition as the set of acquired assets did not constitute a business. Under the terms of the agreement, Centessa may be entitled to receive potential future payments of up to $10.0 million upon the achievement of a certain event-based milestone and would be entitled to receive on a product-by-product and country-by-country basis, a royalty of low single digits on annual net sales of any product in the territory in each calendar year. As of June 30, 2025, achievement of the milestone is not probable and, therefore, we have not recognized a liability for the associated $10.0 million contingent consideration.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Sale of Future Royalties |

6 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jun. 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Liabilities Disclosure [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sale of Future Royalties | Sale of Future Royalties Jemperli Royalty Monetization Agreement In October 2021, we signed a royalty monetization agreement (“Jemperli Royalty Monetization Agreement”) with Sagard Healthcare Royalty Partners, LP (“Sagard”). Under the terms of the Jemperli Royalty Monetization Agreement, we received $250.0 million in exchange for royalties and milestones payable to us under our GSK collaboration on annual global net sales of Jemperli. In May 2024, we entered into an amendment to the Jemperli Royalty Monetization Agreement, Amendment No. 1 (the “Jemperli Amendment”) under which we sold additional receivables to Sagard in exchange for $50.0 million. The Jemperli Amendment includes all Jemperli sales, including any product containing Jemperli, whether or not such product constitutes a combination product, and the threshold amounts of aggregate Jemperli royalties and milestones to be received by Sagard under the Jemperli Amendment is either $600.0 million if received by the end of March 31, 2031, or $675.0 million if received thereafter. Once either of these thresholds are met, the Jemperli Royalty Monetization Agreement and the Jemperli Amendment will expire, resulting in us regaining all subsequent Jemperli royalties and milestones. As of June 30, 2025, Sagard has received a total of $121.5 million in royalties and milestones. We retained the rights to a $75.0 million sales milestone when Jemperli annual net sales exceed $1.0 billion. The proceeds received from Sagard of $250.0 million and $50.0 million were recorded as a nonrecourse liability, net of transaction costs of $0.4 million and $0.1 million, which will be amortized over the estimated life of the arrangement using the effective interest rate method. The aggregate future estimated payments, less the $299.5 million, net of proceeds, will be recognized as non-cash interest expense over the life of the agreement. Royalty and milestone revenue will be recognized as earned on net sales of Jemperli, and these payments to Sagard will be recorded as a reduction of the liability when paid. As such payments are made to Sagard, the balance of the liability will be effectively repaid over the life of the Jemperli Royalty Monetization Agreement. We estimate the effective interest rate used to record non-cash interest expense under the Jemperli Royalty Monetization Agreement based on the estimate of future royalty payments to be received by Sagard. As of June 30, 2025, the estimated effective rate under the agreement was 28.9%. Over the life of the arrangement, the actual effective interest rate will be affected by the amount and the timing of the royalty payments received by Sagard and changes in our forecasted royalties. At each reporting date, we will reassess our estimate of total future royalty payments to be received and if such payments are materially different than our prior estimates, we will prospectively adjust the imputed interest rate and the related amortization of the royalty obligation. We recognized Jemperli non-cash royalty revenue of approximately $21.1 million and $38.4 million during the three and six months ended June 30, 2025, respectively and approximately $10.1 million and $16.3 million during the three and six months ended June 30, 2024, respectively. We recognized non-cash interest expense of approximately $19.3 million and $37.2 million during the three and six months ended June 30, 2025, respectively, and $10.7 million and $16.8 million during the three and six months ended June 30, 2024. The interest and amortization of issuance costs are reflected as non-cash interest expense for the sale of future royalties in the Consolidated Statements of Operations. The following table shows the activity within the liability account for the six months ended June 30, 2025:

(1) Of the non-cash interest expense recognized, $0.6 million was negative amortization for the six months ended June 30, 2025. Zejula Royalty Monetization Agreement In October 2020, in connection with GSK Amendment No. 3, GSK agreed, under the terms of a settlement agreement (the “GSK Settlement Agreement”), to pay us a royalty of 0.5% on all GSK net sales of Zejula starting January 1, 2021. In September 2022, we signed a purchase and sale agreement (the “Zejula Royalty Monetization Agreement”) with a wholly owned subsidiary of DRI to monetize all of our future royalties on global net sales of Zejula under the GSK Settlement Agreement. Under the terms of the Zejula Royalty Monetization Agreement, we received $35.0 million in exchange for all royalties payable by GSK to us under the GSK Settlement Agreement on global net sales of Zejula starting in July 2022. In addition, under the Zejula Royalty Monetization Agreement, we are entitled to receive an additional $10.0 million payment from DRI if Zejula is approved by the U.S. Food and Drug Administration for the treatment of endometrial cancer on or prior to December 31, 2025. The proceeds received from DRI of $35.0 million were recorded as a nonrecourse liability, net of transaction costs of $0.2 million, which will be amortized over the estimated life of the arrangement using the effective interest rate method. Royalty revenue will be recognized as earned on net sales of Zejula, and these royalty payments to DRI will be recorded as a reduction of the liability when paid. The aggregate future estimated payments, less the $34.8 million, of net proceeds, will be recorded as non-cash interest expense over the life of the agreement. As such payments are made to DRI, the balance of the liability will be effectively repaid over the life of the Zejula Royalty Monetization Agreement. We recognized Zejula non-cash royalty revenue of approximately $1.1 million and $2.0 million during the three and six months ended June 30, 2025, respectively, and $0.9 million and $1.9 million during the three and six months ended June 30, 2024, respectively. We recognized non-cash interest expense of approximately $0.3 million and $0.5 million during the three and six months ended June 30, 2025, respectively, and $0.2 million and $0.4 million during the three and six months ended June 30, 2024, respectively. The interest and amortization of issuance costs is reflected as non-cash interest expense for the sale of future royalties in the Consolidated Statements of Operations. The following table shows the activity within the liability account for the six months ended June 30, 2025:

(1) Of the non-cash interest expense recognized, none was negative amortization for the six months ended June 30, 2025.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fair Value Measurements and Available for Sale Investments |

6 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jun. 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair Value Disclosures [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair Value Measurements and Available for Sale Investments | Fair Value Measurements and Available for Sale Investments Fair Value Measurements Our financial instruments consist principally of cash, cash equivalents, short-term and long-term investments, receivables, and accounts payable. Certain of our financial assets and liabilities have been recorded at fair value in the consolidated balance sheet in accordance with the accounting standards for fair value measurements. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Accounting guidance also establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value: Level 1 – Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets. Level 2 – Inputs are observable, unadjusted quoted prices in active markets for similar assets or liabilities, unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the related assets or liabilities; and Level 3 – Unobservable inputs that are supported by little or no market activities, therefore requiring an entity to develop its own assumptions. Assets and Liabilities Measured at Fair Value on a Recurring Basis The following table summarizes our assets and liabilities that require fair value measurements on a recurring basis and their respective input levels based on the fair value hierarchy:

(1) Included in cash and cash equivalents in the accompanying consolidated balance sheets. (2) Included in short-term or long-term investments in the accompanying consolidated balance sheets depending on the respective maturity date. The following methods and assumptions were used to estimate the fair value of our financial instruments for which it is practicable to estimate that value: Marketable Securities. For fair values determined by Level 1 inputs, which utilize quoted prices in active markets for identical assets, the level of judgment required to estimate fair value is relatively low. For fair values determined by Level 2 inputs, which utilize quoted prices in less active markets for similar assets, the level of judgment required to estimate fair value is also considered relatively low. Fair Value of Other Financial Instruments The carrying amounts of certain of our financial instruments, including cash and cash equivalents, receivables, accounts payable, and accrued expenses approximate fair value due to their short-term nature. Available for Sale Investments We invest our excess cash in agency securities, debt instruments of financial institutions and corporations, commercial obligations, and U.S. Treasury securities, which we classify as available-for-sale investments. These investments are carried at fair value and are included in the tables above. The aggregate market value, cost basis, and gross unrealized gains and losses of available-for-sale investments by security type, classified in short-term and long-term investments as of June 30, 2025 are as follows:

(1) Of our outstanding agency securities, $5.1 million have maturity dates of less than one year and $2.5 million have maturity dates between to two years as of June 30, 2025. (2) Of our outstanding commercial and corporate obligations, $11.6 million have maturity dates of less than one year and $5.1 million have a maturity date of between to two years as of June 30, 2025. (3) Of our outstanding U.S. Treasury securities, $204.7 million have maturity dates of less than one year and $20.4 million have a maturity date of between to two years as of June 30, 2025. The aggregate market value, cost basis, and gross unrealized gains and losses of available for sale investments by security type, classified in short-term and long-term investments as of December 31, 2024 are as follows:

(1) Of our outstanding agency securities, $7.6 million have maturity dates of less than one year and $0.0 million have a maturity date of between to two years as of December 31, 2024. (2) Of our outstanding commercial and corporate obligations, $10.7 million have maturity dates of less than one year and $0.0 million have a maturity date of between to two years as of December 31, 2024. (3) Of our outstanding U.S. Treasury securities, $249.0 million have maturity dates of less than one year and $35.5 million have a maturity date of between to two years as of December 31, 2024. The following tables present gross unrealized losses and fair values for those investments that were in an unrealized loss position as of June 30, 2025 and December 31, 2024, aggregated by investment category and the length of time that individual securities have been in a continuous loss position:

As of June 30, 2025 and December 31, 2024, unrealized losses on available-for-sale investments were less than $0.1 million for both periods, with no available-for-sale investments that were in an unrealized loss position for greater than 12 months as of June 30, 2025. We do not intend to sell the investments and it is not more likely than not that we will be required to sell the investments before recovery of their amortized cost basis, accordingly, no allowance for credit losses was recorded.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Stockholders' Equity |

6 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jun. 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders' Equity | Stockholders’ Equity Common Stock Of the 500,000,000 shares of common stock authorized, 27,972,997 shares were issued and outstanding as of June 30, 2025. Stock Repurchase Program In March 2025, our Board of Directors authorized a stock repurchase program (the “2025 Repurchase Program”) to repurchase up to $75.0 million of our outstanding common stock. The following table presents the repurchase activity through June 30, 2025:

The repurchased common stock was subsequently retired after the repurchase and the par value of the shares was charged to common stock. The excess of the repurchase price over the par value was applied against additional paid in capital. As of June 30, 2025, $19.5 million remained available for future shares of common stock to be repurchased under the 2025 Repurchase Program. Open Market Sales Agreement In November 2024, we entered into a sales agreement with TD Securities (USA) LLC (“TD Cowen”), through which we may offer and sell shares of our common stock, having an aggregate offering of up to $100.0 million through TD Cowen as our sales agent. Our prior sales agreement with Cowen terminated upon effectiveness of the registration statement on the Form S-3 we filed in connection with our sales agreement with TD Cowen. As of June 30, 2025, we had sold no shares under this agreement. Underwriting Agreement In August 2024, we entered into an underwriting agreement with TD Securities (USA) LLC and Leerink Partners LLC as representatives to the several underwriters listed therein (the “Underwriters”), pursuant to which we issued and sold an aggregate of 2,750,498 shares of our common stock to the Underwriters, at an offering price of $36.50 per share. The net proceeds from these sales were approximately $93.9 million, net of underwriting discounts and commissions and offering expenses of $6.5 million, in the aggregate.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Equity Incentive Plans |

6 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||