| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| None | ||

| (Title of Class) | ||

5.125% Senior Notes due October 15, 2027 5.25% Senior Notes due December 15, 2029 5.65% Senior Notes due December 1, 2044 | ||

(Title of Class) | ||

No ☐ | ||||||||

No ☐ | ||||||||

☐ | ||||||||

| PCAOB Auditor Firm ID Number: | Auditor Name: | Auditor Location: | ||||||

☐ | ||||||||

| Document | Exhibit No. | ||||

| Annual Information Form of the Company for the year ended December 31, 2024 | 99.1 | ||||

| Management’s Discussion and Analysis of the Company for the year ended December 31, 2024 (the "2024 MD&A") | 99.2 | ||||

| Audited financial statements of the Company for the years ended December 31, 2024 and 2023, including the reports of Independent Registered Public Accounting Firm with respect thereto | 99.3 | ||||

| US$000s | 2024 | 2023 | ||||||

| Audit Fees | 2979 | 2415 | ||||||

| Audit-Related Fees | 155 | 160 | ||||||

| Tax Fees | 203 | 165 | ||||||

| All Other Fees | — | — | ||||||

| Total | 3337 | 2740 | ||||||

| Exhibit No | Description | ||||

| 23.1 | |||||

| 31.1 | |||||

| 31.2 | |||||

| 32.1 | |||||

| 32.2 | |||||

97 | |||||

| 99.1 | |||||

| 99.2 | |||||

| 99.3 | |||||

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | ||||

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | ||||

| 101.DEF | Inline XBRL Taxonomy Extension Definitions Linkbase Document | ||||

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document | ||||

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | ||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | ||||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 1 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 2 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 3 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 4 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 5 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 6 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 7 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 8 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

Revision # | BRIEF DESCRIPTION OF CHANGE | Revision Date | ||||||

2 | Published as CG1CP034 under Manage Legal & Compliance | 8-Nov-2014 | ||||||

3 | Moved to Manage People Processes as PP1GLBL1000; content updated. | 14-Dec-2023 | ||||||

Code: PP1GLBL1001 | Issue date: 14-Dec-2023 | Page 9 of 9 | ||||||

Approved: Kim Campbell, VP, Human Resources | Revision No. 3 | |||||||

Uncontrolled when printed | ||

| TABLE OF CONTENTS | Page | ||||

Trinidad and Tobago | |||||

APPENDIX "A" | |||||

Annual Operating Capacity(1) | 2024 Production | 2023 Production | |||||||||

| (000 tonnes/year) | (000 tonnes) | (000 tonnes) | |||||||||

| USA (Geismar) | 4,000 | 2,529 | 2,142 | ||||||||

Trinidad and Tobago (Methanex interest) (2) | 1,960 | 956 | 1,074 | ||||||||

New Zealand (3) | 1,720 | 670 | 1,381 | ||||||||

| Chile | 1,700 | 1,180 | 993 | ||||||||

| Egypt (50% interest) | 630 | 460 | 504 | ||||||||

| Canada (Medicine Hat) | 600 | 563 | 548 | ||||||||

| 10,610 | 6,358 | 6,642 | |||||||||

| Record Date | Payment Date | Dividend per Share | ||||||

| December 17, 2024 | December 31, 2024 | $0.185 | ||||||

| September 16, 2024 | September 30, 2024 | $0.185 | ||||||

| June 14, 2024 | June 28, 2024 | $0.185 | ||||||

| March 14, 2024 | March 28, 2024 | $0.185 | ||||||

| December 15, 2023 | December 29, 2023 | $0.185 | ||||||

| September 16, 2023 | September 30, 2023 | $0.185 | ||||||

| June 16, 2023 | June 30, 2023 | $0.185 | ||||||

| March 17, 2023 | March 31, 2023 | $0.175 | ||||||

| December 17, 2022 | December 31, 2022 | $0.175 | ||||||

| September 16, 2022 | September 30, 2022 | $0.175 | ||||||

| June 16, 2022 | June 30, 2022 | $0.145 | ||||||

| March 17, 2022 | March 31, 2022 | $0.125 | ||||||

Entity | Debt Rated/Outlook | S&P(1) | Moody’s(2) | Fitch(3) | ||||||||||

Methanex Corporation | Issuer Rating | BB | n/a(2) | BB+ | ||||||||||

Senior Unsecured Notes | BB | Ba1 | BB+ | |||||||||||

| Ratings Outlook | Stable | Under Review (4) | Stable | |||||||||||

| Last Reviewed | September 9, 2024 | September 13, 2024 | November 19, 2024 | |||||||||||

Methanex US Operations Inc.(5) | Issuer Rating | n/a(6) | n/a(2) | BB+ | ||||||||||

| Senior Unsecured Notes | BB | Ba2 | BB+ | |||||||||||

| Ratings Outlook | Stable | Stable | Stable | |||||||||||

| Last Reviewed | November 19, 2024 | November 19, 2024 | November 19, 2024 | |||||||||||

2024 Trading Volumes(1) | ||||||||||||||||||||

| Trading Symbol: MX | Trading Symbol: MEOH | Total Volume | ||||||||||||||||||

| The Toronto Stock Exchange | Other Canadian Trading | Nasdaq Global Select Market and Other US Trading | ||||||||||||||||||

| Month | High (CDN$) | Low (CDN$) | Volume | Volume | Volume | |||||||||||||||

| January | 63.47 | 57.82 | 1,487,517 | 916,444 | 4,178,767 | 6,582,728 | ||||||||||||||

| February | 63.81 | 56.23 | 2,496,144 | 1,684,661 | 7,708,420 | 11,889,225 | ||||||||||||||

| March | 61.89 | 56.00 | 1,610,240 | 1,053,579 | 4,809,339 | 7,473,158 | ||||||||||||||

| April | 69.85 | 60.23 | 2,826,081 | 1,609,064 | 8,942,246 | 13,377,391 | ||||||||||||||

| May | 74.25 | 64.99 | 1,944,710 | 1,090,619 | 5,626,912 | 8,662,241 | ||||||||||||||

| June | 73.15 | 65.02 | 1,995,271 | 958,996 | 3,549,159 | 6,503,426 | ||||||||||||||

| July | 73.18 | 63.90 | 1,877,393 | 1,098,275 | 4,711,603 | 7,687,271 | ||||||||||||||

| August | 67.29 | 55.80 | 2,251,468 | 1,286,220 | 7,566,137 | 11,103,825 | ||||||||||||||

| September | 62.48 | 49.21 | 3,468,948 | 2,793,648 | 8,796,455 | 15,059,051 | ||||||||||||||

| October | 61.83 | 54.01 | 2,668,407 | 1,459,761 | 6,774,296 | 10,902,464 | ||||||||||||||

| November | 66.12 | 53.93 | 2,527,081 | 1,485,711 | 6,562,157 | 10,574,949 | ||||||||||||||

| December | 72.00 | 64.24 | 2,747,643 | 1,737,635 | 7,395,522 | 11,880,800 | ||||||||||||||

| Name and Municipality of Residence | Office | Principal Occupations and Positions During the Last Five Years | Director Since(17) | ||||||||

| ARNELL, DOUG West Vancouver British Columbia Canada | Director and Chair of the Board | Chief Executive Officer of Cedar LNG LLC(5) since June 2021 and President and Chief Executive Officer of Helm Energy Advisors Inc.(6) since March 2015. | October 2016 | ||||||||

BERTRAM, JIM(2)(3) Calgary, Alberta Canada | Director | Corporate Director. | October 2018 | ||||||||

DOBSON, PAUL(1)(3) Naples, Florida USA | Director | Chief Financial Officer of EVgo Inc.(7) since October 2024. Prior to that Senior Vice President and Chief Financial Officer of Ballard Power Systems(8) from March 2021 to September 2024. Prior thereto Acting President and Chief Executive Officer of Hydro One Limited(9) from July 2018 to May 2019. | April 2019 | ||||||||

HOWE, MAUREEN(1)(2) Vancouver, British Columbia Canada | Director | Corporate Director. | June 2018 | ||||||||

KOSTELNIK, ROBERT(3)(4) Fulshear, Texas USA | Director | Corporate Director. Principal of GlenRock Recovery Partners, LLC(10) since February 2012. | September 2008 | ||||||||

O'DONOGHUE, LESLIE(1)(3) Calgary, Alberta Canada | Director | Corporate Director. Executive Vice President and Adviser to the Chief Executive Officer of Nutrien Ltd.(11) from June 2019 to December 2019. | April 2020 | ||||||||

PERREAULT, ROGER(1)(4) Six Mile, South Carolina USA | Director | Corporate Director. President and CEO of UGI Corporation(12) from 2021 to 2023; prior thereto Executive Vice President, Global LPG of UGI Corporation from 2018 to 2021. | April 2024 | ||||||||

RODGERS, KEVIN(2)(3) London UK | Director | Corporate Director. | July 2019 | ||||||||

SAMPSON, JOHN(3)(4) Midland, Michigan USA | Director | Senior Vice President, Operations, Manufacturing and Engineering of Dow Inc.(13) since 2020; prior thereto Executive Vice President, Business Operations of Olin Corporation(14) from 2019 to 2020. | October 2023 | ||||||||

| SUMNER, RICH North Vancouver British Columbia Canada | Director, President and Chief Executive Officer | President and Chief Executive Officer of the Company since January 2023. Prior thereto Senior Vice President, Global Marketing and Logistics of the Company since October 2021; prior thereto Regional President, Marketing and Logistics, Asia Pacific of the Company since February 2019. | January 2023 | ||||||||

WALKER, MARGARET(1)(4) Austin, Texas USA | Director | Corporate Director. Owner of MLRW Group, LLC(15) since 2011. | April 2015 | ||||||||

WARMBOLD, BENITA(1)(2) Toronto, Ontario Canada | Director | Corporate Director. | February 2016 | ||||||||

YANG, XIAOPING(2)(4) Henderson, Nevada USA | Director | Corporate Director. President and Chair of BP China(16) from November 2016 to September 2020. | January 2022 | ||||||||

| Name and Municipality of Residence | Office | Principal Occupations and Positions During the Last Five Years | ||||||

| ALLARD, MARK West Vancouver, British Columbia Canada | Senior Vice President, Low Carbon Solutions | Senior Vice President, Low Carbon Solutions of the Company since January 2023; prior thereto Vice President, North America of the Company since January 2019. | ||||||

| BOYD, BRAD West Vancouver, British Columbia Canada | Senior Vice President, Corporate Resources | Senior Vice President, Corporate Resources of the Company since January 2018. | ||||||

DELBARRE, KARINE Dallas, Texas USA | Senior Vice President, Global Marketing and Logistics | Senior Vice President, Global Marketing and Logistics of the Company since January 2023; prior thereto Vice President, Marketing and Logistics, North America of the Company since February 2019. | ||||||

| MALONEY, Kevin West Vancouver, British Columbia Canada | Senior Vice President, Corporate Development | Senior Vice President, Corporate Development of the Company since January 2023; prior thereto Vice President, Corporate Development of the Company since April 2018. | ||||||

PARRA, GUSTAVO Santiago, Chile | Senior Vice President, Manufacturing | Senior Vice President, Manufacturing of the Company since January 2023; prior thereto Vice President, Manufacturing Strategy and Planning of the Company since September 2019. | ||||||

| PRICE, KEVIN Vancouver, British Columbia Canada | Senior Vice President, General Counsel & Corporate Secretary | Senior Vice President, General Counsel and Corporate Secretary of the Company since January 2023; prior thereto General Counsel and Corporate Secretary of the Company since March 2016. | ||||||

| RICHARDSON, DEAN Vancouver, British Columbia Canada | Senior Vice President, Finance and Chief Financial Officer | Senior Vice President, Finance and Chief Financial Officer of the Company since February 2023; prior thereto Vice President, Corporate Finance of the Company since January 2022; prior thereto Managing Director, New Zealand of the Company since April 2018. | ||||||

| US$000s | 2024 | 2023 | ||||||

| Audit Fees | 2,979 | 2,415 | ||||||

| Audit-Related Fees | 155 | 160 | ||||||

| Tax Fees | 203 | 165 | ||||||

| All Other Fees | — | — | ||||||

| Total | 3,337 | 2,740 | ||||||

6 | Overview of the Business | 36 | Critical Accounting Estimates | ||||||||

8 | Our Strategy | 39 | Adoption of New Accounting Standards | ||||||||

10 | Financial Highlights | 39 | Anticipated Changes to International Financial Reporting Standards | ||||||||

11 | Production Summary | 39 | Non-GAAP Measures | ||||||||

12 | How We Analyze Our Business | 41 | Quarterly Financial Data (Unaudited) | ||||||||

13 | Financial Results | 41 | Selected Annual Information | ||||||||

19 | Liquidity and Capital Resources | 42 | Controls and Procedures | ||||||||

25 | Risk Factors and Risk Management | 43 | Forward-Looking Statements | ||||||||

($ Millions, except as noted) | 2024 | 2023 | ||||||

Production (thousands of tonnes) (attributable to Methanex shareholders) | 6,358 | 6,642 | ||||||

Sales volume (thousands of tonnes) | ||||||||

Methanex-produced methanol | 6,094 | 6,455 | ||||||

Purchased methanol | 3,471 | 3,527 | ||||||

Commission sales | 904 | 1,187 | ||||||

Total sales volume 1 | 10,469 | 11,169 | ||||||

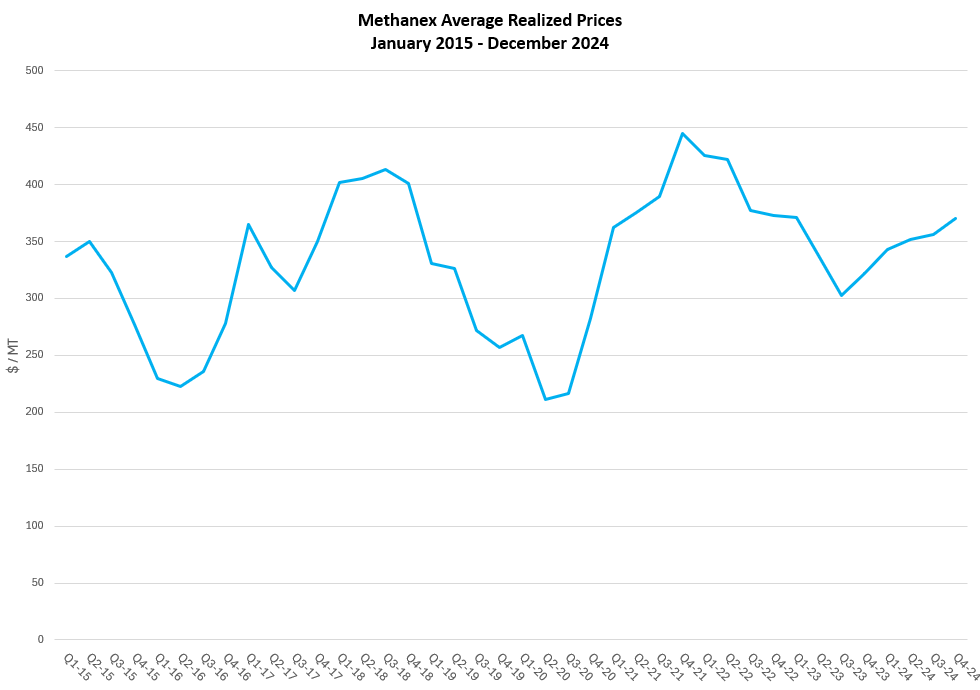

Methanex average non-discounted posted price ($ per tonne) 2 | 508 | 434 | ||||||

Average realized price ($ per tonne) 3 4 | 355 | 333 | ||||||

Revenue | 3,720 | 3,723 | ||||||

Net income (attributable to Methanex shareholders) | 164 | 174 | ||||||

Adjusted net income 4 | 252 | 153 | ||||||

Adjusted EBITDA 4 | 764 | 622 | ||||||

Cash flows from operating activities | 737 | 660 | ||||||

Basic net income per common share ($ per share) | 2.43 | 2.57 | ||||||

Diluted net income per common share ($ per share) | 2.39 | 2.57 | ||||||

Adjusted net income per common share ($ per share) 4 | 3.72 | 2.25 | ||||||

Common share information (millions of shares) | ||||||||

Weighted average number of common shares | 67 | 68 | ||||||

Diluted weighted average number of common shares | 68 | 68 | ||||||

Number of common shares outstanding, end of year | 67 | 67 | ||||||

(Thousands of tonnes) | Annual operating capacity 1 | 2024 Production | 2023 Production | ||||||||

USA (Geismar) 2 | 4,000 | 2,529 | 2,142 | ||||||||

Trinidad (Methanex interest) 3 | 1,960 | 956 | 1,074 | ||||||||

New Zealand 4 | 1,720 | 670 | 1,381 | ||||||||

Chile | 1,700 | 1,180 | 993 | ||||||||

Egypt (50% interest) | 630 | 460 | 504 | ||||||||

Canada (Medicine Hat) | 600 | 563 | 548 | ||||||||

| 10,610 | 6,358 | 6,642 | |||||||||

| PRICE | The change in Adjusted EBITDA as a result of changes in average realized price is calculated as the difference from period to period in the selling price of methanol multiplied by the current period total methanol sales volume, excluding commission sales volume. | ||||

| CASH COSTS | The change in Adjusted EBITDA as a result of changes in cash costs is calculated as the difference from period to period in cash costs per tonne multiplied by the current period total methanol sales volume, excluding commission sales volume in the current period. The cash costs per tonne is the weighted average of the cash cost per tonne of Methanex-produced methanol and the cash cost per tonne of purchased methanol. The cash cost per tonne of Methanex-produced methanol includes absorbed fixed cash costs per tonne and variable cash costs per tonne. The cash cost per tonne of purchased methanol consists principally of the cost of methanol itself. In addition, the change in Adjusted EBITDA as a result of changes in cash costs includes the changes from period to period in unabsorbed fixed production costs, consolidated selling, general and administrative expenses and fixed storage and handling costs. | ||||

| SALES VOLUME | The change in Adjusted EBITDA as a result of changes in sales volume is calculated as the difference from period to period in total methanol sales volume, excluding commission sales volume, multiplied by the margin per tonne for the prior period. The margin per tonne for the prior period is the weighted average margin per tonne of Methanex-produced methanol and margin per tonne of purchased methanol. The margin per tonne for Methanex-produced methanol is calculated as the selling price per tonne of methanol less absorbed fixed cash costs per tonne and variable cash costs per tonne. The margin per tonne for purchased methanol is calculated as the selling price per tonne of methanol less the cost of purchased methanol per tonne. | ||||

($ Millions, except number of shares and per share amounts) | 2024 | 2023 | ||||||

Net income attributable to Methanex shareholders | $ | 164 | $ | 174 | ||||

Mark-to-market impact of share-based compensation, net of tax | 2 | 13 | ||||||

Impact of Egypt and New Zealand gas contract revaluation, net of tax | (4) | (3) | ||||||

Asset impairment charge, net of tax | 90 | — | ||||||

Impact on earnings of associate of gas contract settlement, net of tax | — | (31) | ||||||

Adjusted net income | $ | 252 | $ | 153 | ||||

Diluted weighted average shares outstanding (millions) | 68 | 68 | ||||||

Adjusted net income per common share | $ | 3.72 | $ | 2.25 | ||||

($ Millions) | 2024 | 2023 | ||||||

Consolidated statements of income: | ||||||||

Revenue | $ | 3,720 | $ | 3,723 | ||||

Cost of sales and operating expenses | (3,009) | (3,068) | ||||||

| New Zealand gas sale net proceeds | 103 | — | ||||||

Egypt insurance recovery | 59 | — | ||||||

Mark-to-market impact of share-based compensation | 2 | 16 | ||||||

| Adjusted EBITDA attributable to associate | 82 | 135 | ||||||

Amounts excluded from Adjusted EBITDA attributable to non-controlling interests | (193) | (184) | ||||||

| Adjusted EBITDA | 764 | 622 | ||||||

Mark-to-market impact of share-based compensation | (2) | (16) | ||||||

Depreciation and amortization | (386) | (392) | ||||||

| Gas contract settlement, net of tax | — | 31 | ||||||

Finance costs | (133) | (117) | ||||||

Finance income and other | 12 | 40 | ||||||

Income tax expense | (30) | (1) | ||||||

| Asset impairment charge | (125) | — | ||||||

Earnings of associate adjustment 1 | (43) | (67) | ||||||

Non-controlling interests adjustment 1 | 107 | 74 | ||||||

Net income attributable to Methanex shareholders | $ | 164 | $ | 174 | ||||

Net income | $ | 250 | $ | 284 | ||||

($ Millions, except where noted) | 2024 | 2023 | ||||||||||||

China | $ | 828 | 22% | $ | 1,043 | 28% | ||||||||

Europe | 842 | 23% | 722 | 19% | ||||||||||

United States | 502 | 13% | 575 | 15% | ||||||||||

South America | 479 | 13% | 429 | 12% | ||||||||||

South Korea | 483 | 13% | 392 | 11% | ||||||||||

| Other Asia | 402 | 11% | 387 | 10% | ||||||||||

Canada | 184 | 5% | 175 | 5% | ||||||||||

| $ | 3,720 | 100% | $ | 3,723 | 100% | |||||||||

($ Millions) | 2024 vs. 2023 | ||||

Average realized price | $ | 206 | |||

Sales volume | (31) | ||||

| Geismar 3 delay costs | (22) | ||||

| New Zealand gas sale proceeds, net of gas and fixed costs during idle period | 91 | ||||

Total cash costs | (102) | ||||

Increase in Adjusted EBITDA | $ | 142 | |||

($ Millions) | 2024 vs. 2023 | ||||

Methanex-produced methanol costs | $ | 1 | |||

Proportion of Methanex-produced methanol sales | (7) | ||||

Purchased methanol costs | (39) | ||||

Logistics costs | (39) | ||||

Egypt insurance recovery | 30 | ||||

Other, net | (48) | ||||

Increase in Adjusted EBITDA due to changes in total cash costs | $ | (102) | |||

($ Millions, except share price) | 2024 | 2023 | ||||||

Methanex Corporation share price 1 | $ | 49.94 | $ | 47.36 | ||||

Grant date fair value expense included in Adjusted EBITDA and Adjusted net income | 21 | 19 | ||||||

Mark-to-market impact 2 | 2 | 16 | ||||||

Total share-based compensation expense, before tax | $ | 23 | $ | 35 | ||||

($ Millions) | 2024 | 2023 | ||||||

Finance costs before capitalized interest | $ | 184 | $ | 172 | ||||

Less capitalized interest | (51) | (55) | ||||||

Finance costs | $ | 133 | $ | 117 | ||||

($ Millions) | 2024 | 2023 | ||||||

| Finance income and other before gas supply contract mark-to-market impact | $ | 9 | $ | 31 | ||||

| New Zealand gas contract mark-to-market impact | 9 | — | ||||||

| Egypt gas supply contract mark-to-market impact | (6) | 9 | ||||||

| Finance income and other expenses | $ | 12 | $ | 40 | ||||

($ Millions, except where noted) | 2024 | 2023 | ||||||||||||

| Per consolidated statement of income | Adjusted 1 2 | Per consolidated statement of income | Adjusted 1 2 | |||||||||||

Net income before income tax | $ | 280 | $ | 325 | $ | 286 | $ | 199 | ||||||

Income tax expense | (30) | (73) | (2) | (46) | ||||||||||

Net income after income tax | $ | 250 | $ | 252 | $ | 284 | $ | 153 | ||||||

Effective tax rate | 11% | 22% | 1% | 23% | ||||||||||

($ Millions, except where noted) | 2024 | 2023 | ||||||

| Net income | $ | 250 | $ | 284 | ||||

| Adjusted for: | ||||||||

| Income tax expense | 30 | 1 | ||||||

| Earnings from associate | (38) | (99) | ||||||

| Share of associate's income before tax | 54 | 152 | ||||||

| Net income before tax of non-controlling interests | (93) | (103) | ||||||

| Mark-to-market impact of share-based compensation | 3 | 16 | ||||||

| Impact of Egypt gas contract revaluation | 3 | (5) | ||||||

| Impact of New Zealand gas contract revaluation | (9) | — | ||||||

| Asset impairment charge | 125 | — | ||||||

| Gas contract settlement | — | (47) | ||||||

| Adjusted net income before tax | $ | 325 | $ | 199 | ||||

| Income tax expense | $ | (30) | $ | (1) | ||||

| Adjusted for: | ||||||||

| Inclusion of our share of associate's adjusted tax expense | (15) | (37) | ||||||

| Removal of non-controlling interest's share of tax (recovery) expense | 6 | (7) | ||||||

| Tax (recovery) expense on mark-to-market impact of share-based compensation | — | (3) | ||||||

| Tax on impact of Egypt gas contract revaluation | (1) | 2 | ||||||

| Tax on impact of New Zealand gas contract revaluation | 2 | — | ||||||

| Tax on asset impairment charge | (35) | — | ||||||

| Adjusted income tax expense | $ | (73) | $ | (46) | ||||

($ Millions) | 2024 | 2023 | ||||||

Cash flows from/(used in) operating activities: | ||||||||

Cash flows from operating activities before changes in non-cash working capital | $ | 861 | $ | 719 | ||||

Changes in non-cash working capital related to operating activities | (124) | (59) | ||||||

| 737 | 660 | |||||||

Cash flows from/(used in) financing activities: | ||||||||

Payments for the repurchase of shares | — | (86) | ||||||

Dividend payments to Methanex Corporation shareholders | (50) | (49) | ||||||

Interest paid | (169) | (169) | ||||||

| Net proceeds on issue of long-term debt | 585 | — | ||||||

| Repayment of long-term debt and financing fees | (322) | (12) | ||||||

| Repayment of lease obligations | (141) | (118) | ||||||

| Distributions to non-controlling interests | (41) | (185) | ||||||

Proceeds on exercise of stock options and movements in restricted cash | 1 | (1) | ||||||

Changes in non-cash working capital relating to financing activities | (68) | 69 | ||||||

| (205) | (551) | |||||||

Cash flows from/(used in) investing activities: | ||||||||

Property, plant and equipment | (101) | (178) | ||||||

Geismar plant under construction | (73) | (270) | ||||||

| Proceeds of share capital reduction from associate | 13 | — | ||||||

| Loan repayment from associate | 76 | — | ||||||

Changes in non-cash working capital relating to investing activities | (15) | (60) | ||||||

| (100) | (509) | |||||||

Increase (decrease) in cash and cash equivalents | 432 | (400) | ||||||

Cash and cash equivalents, end of year | $ | 892 | $ | 458 | ||||

($ Millions) | 2024 | 2023 | ||||||

Net income | $ | 250 | $ | 284 | ||||

Deduct earnings of associate | (38) | (99) | ||||||

Add dividends received from associate | 32 | 112 | ||||||

Add (deduct) non-cash items: | ||||||||

Depreciation and amortization | 386 | 392 | ||||||

| Income tax expense | 30 | 1 | ||||||

Share-based compensation expense | 24 | 35 | ||||||

Finance costs | 133 | 117 | ||||||

| Mark-to-market impact of Level 3 derivatives | (3) | — | ||||||

| Asset impairment charge | 125 | — | ||||||

Interest received | 15 | 22 | ||||||

Income taxes paid | (53) | (82) | ||||||

Other | (40) | (63) | ||||||

Cash flows from operating activities before changes in non-cash working capital | 861 | 719 | ||||||

Changes in non-cash working capital: | ||||||||

Trade and other receivables | 62 | (33) | ||||||

Inventories | (12) | 16 | ||||||

Prepaid expenses | (3) | (19) | ||||||

Accounts payable and accrued liabilities | (171) | (23) | ||||||

| (124) | (59) | |||||||

Cash flows from operating activities | $ | 737 | $ | 660 | ||||

($ Millions, except where noted) | 2024 | 2023 | ||||||

Liquidity: | ||||||||

Cash and cash equivalents | $ | 892 | $ | 458 | ||||

Undrawn credit facility | 500 | 300 | ||||||

Total liquidity 1 | $ | 1,392 | $ | 758 | ||||

Capitalization: | ||||||||

Unsecured notes, including current portion | 2,274 | 1,986 | ||||||

Other limited recourse debt facilities, including current portion | 141 | 156 | ||||||

Total debt | 2,415 | 2,142 | ||||||

Non-controlling interests | 288 | 242 | ||||||

Shareholders’ equity | 2,094 | 1,931 | ||||||

Total capitalization | $ | 4,797 | $ | 4,315 | ||||

Total debt to capitalization 2 | 50% | 50% | ||||||

Net debt to capitalization 3 | 39% | 44% | ||||||

($ Millions) | 2025 | 2026-2027 | 2028-2029 | After 2029 | Total | |||||||||||||||

Long-term debt repayments | $ | 14 | $ | 729 | $ | 732 | $ | 968 | $ | 2,443 | ||||||||||

Long-term debt interest obligations | 135 | 261 | 192 | 347 | 935 | |||||||||||||||

Lease obligations | 169 | 264 | 226 | 423 | 1,082 | |||||||||||||||

Repayments of other long-term liabilities | 53 | 40 | 15 | 90 | 198 | |||||||||||||||

Natural gas and other | 518 | 728 | 551 | 766 | 2,563 | |||||||||||||||

Other commitments | 86 | 39 | 33 | 2 | 160 | |||||||||||||||

| $ | 975 | $ | 2,061 | $ | 1,749 | $ | 2,596 | $ | 7,381 | |||||||||||

($ Millions) | 2024 | 2023 | ||||||

Financial assets: | ||||||||

Financial assets measured at fair value: | ||||||||

Derivative instruments designated as cash flow hedges 1 | $ | 129 | $ | 121 | ||||

Fair value of Egypt gas supply contract derivative 2 | 14 | 20 | ||||||

Fair value of New Zealand gas supply contract derivative 3 | 9 | — | ||||||

Financial assets not measured at fair value: | ||||||||

Cash and cash equivalents | 892 | 458 | ||||||

Trade and other receivables, excluding tax receivable | 454 | 515 | ||||||

Restricted cash included in other assets | 14 | 16 | ||||||

Total financial assets 4 | $ | 1,512 | $ | 1,130 | ||||

Financial liabilities: | ||||||||

Financial liabilities measured at fair value: | ||||||||

Derivative instruments designated as cash flow hedges 1 | $ | 37 | $ | 92 | ||||

Financial liabilities not measured at fair value: | ||||||||

Trade, other payables and accrued liabilities, excluding tax payable | 430 | 672 | ||||||

| Lease obligations, including current portion | 818 | 872 | ||||||

Long-term debt, including current portion | 2,415 | 2,142 | ||||||

| Land mortgage | 27 | 28 | ||||||

Total financial liabilities | $ | 3,727 | $ | 3,806 | ||||

($ Millions) | 2024 | 2023 | ||||||

Net income attributable to Methanex shareholders | $ | 164 | $ | 174 | ||||

Mark-to-market impact of share-based compensation | 2 | 16 | ||||||

| Gas contract settlement, net of tax | — | (31) | ||||||

Depreciation and amortization | 386 | 392 | ||||||

Finance costs | 133 | 117 | ||||||

Finance income and other | (12) | (40) | ||||||

Income tax expense | 30 | 1 | ||||||

| Asset impairment charge | 125 | — | ||||||

Earnings of associate adjustment 1 | 43 | 67 | ||||||

Non-controlling interests adjustment 1 | (107) | (74) | ||||||

Adjusted EBITDA (attributable to Methanex shareholders) | $ | 764 | $ | 622 | ||||

($ Millions, except number of shares and per share amounts) | 2024 | 2023 | ||||||

Net income attributable to Methanex shareholders | $ | 164 | $ | 174 | ||||

Mark-to-market impact of share-based compensation, net of tax | 2 | 13 | ||||||

Impact on earnings of associate of gas contract settlement, net of tax | — | (31) | ||||||

Impact of Egypt and New Zealand gas contract revaluation, net of tax | (4) | (3) | ||||||

Asset impairment charge, net of tax | 90 | — | ||||||

Adjusted net income | $ | 252 | $ | 153 | ||||

Diluted weighted average shares outstanding (millions) | 68 | 68 | ||||||

Adjusted net income per common share | $ | 3.72 | $ | 2.25 | ||||

Three months ended | ||||||||||||||

($ Millions, except per share amounts) | Dec 31 | Sep 30 | Jun 30 | Mar 31 | ||||||||||

| 2024 | ||||||||||||||

Revenue | $ | 949 | $ | 935 | $ | 920 | $ | 916 | ||||||

Cost of sales and operating expenses | (734) | (794) | (745) | (736) | ||||||||||

Net income (attributable to Methanex shareholders) | 45 | 31 | 35 | 53 | ||||||||||

Basic net income per common share | 0.67 | 0.46 | 0.52 | 0.78 | ||||||||||

Diluted net income per common share | 0.67 | 0.35 | 0.52 | 0.77 | ||||||||||

Adjusted EBITDA 1 | 224 | 216 | 164 | 160 | ||||||||||

Adjusted net income 1 | 84 | 82 | 42 | 44 | ||||||||||

Adjusted net income per common share 1 | 1.24 | 1.21 | 0.62 | 0.65 | ||||||||||

| 2023 | ||||||||||||||

Revenue | $ | 922 | $ | 823 | $ | 939 | $ | 1,038 | ||||||

Cost of sales and operating expenses | (772) | (730) | (724) | (841) | ||||||||||

Net income (attributable to Methanex shareholders) | 33 | 24 | 57 | 60 | ||||||||||

Basic net income per common share | 0.50 | 0.36 | 0.84 | 0.87 | ||||||||||

Diluted net income per common share | 0.50 | 0.36 | 0.73 | 0.87 | ||||||||||

Adjusted EBITDA 1 | 148 | 105 | 160 | 209 | ||||||||||

Adjusted net income 1 | 35 | 1 | 41 | 76 | ||||||||||

Adjusted net income per common share 1 | 0.52 | 0.02 | 0.60 | 1.11 | ||||||||||

($ Millions, except per share amounts) | 2024 | 2023 | 2022 | ||||||||

Total assets | $ | 6,597 | $ | 6,427 | $ | 6,631 | |||||

Total long-term liabilities (excluding deferred income tax) | 3,247 | 2,733 | 3,032 | ||||||||

Revenue | 3,720 | 3,723 | 4,311 | ||||||||

Net income (attributable to Methanex shareholders) | 164 | 174 | 354 | ||||||||

Adjusted net income 1 | 252 | 153 | 343 | ||||||||

Adjusted EBITDA 1 | 764 | 622 | 932 | ||||||||

Basic net income per common share | 2.43 | 2.57 | 4.95 | ||||||||

Diluted net income per common share | 2.39 | 2.57 | 4.86 | ||||||||

Adjusted net income per common share 1 | 3.72 | 2.25 | 4.79 | ||||||||

Cash dividends declared per common share | 0.740 | 0.730 | 0.620 | ||||||||

|  |  | ||||||

Benita Warmbold Chair of the Audit, Finance and Risk Committee March 7, 2025 | Rich Sumner President and Chief Executive Officer | Dean Richardson Senior Vice President, Finance and Chief Financial Officer | ||||||

| As at | Dec 31 2024 | Dec 31 2023 | ||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Trade and other receivables (note 3) | ||||||||

| Inventories (note 4) | ||||||||

| Prepaid expenses | ||||||||

| Other assets (note 7) | ||||||||

| Non-current assets: | ||||||||

| Property, plant and equipment (note 5) | ||||||||

| Investment in associate (note 6) | ||||||||

| Deferred income tax assets (note 16) | ||||||||

| Other assets (note 7) | ||||||||

| $ | $ | |||||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities: | ||||||||

| Trade, other payables and accrued liabilities | $ | $ | ||||||

| Current maturities on long-term debt (note 8) | ||||||||

| Current maturities on lease obligations (note 9) | ||||||||

| Current maturities on other long-term liabilities (note 10) | ||||||||

| Non-current liabilities: | ||||||||

| Long-term debt (note 8) | ||||||||

| Lease obligations (note 9) | ||||||||

| Other long-term liabilities (note 10) | ||||||||

| Deferred income tax liabilities (note 16) | ||||||||

| Equity: | ||||||||

| Capital stock | ||||||||

| Unlimited authorization of common shares without nominal or par value | ||||||||

Issued and outstanding common shares at December 31, 2024 were | ||||||||

| Contributed surplus | ||||||||

| Retained earnings | ||||||||

| Accumulated other comprehensive income | ||||||||

| Shareholders’ equity | ||||||||

| Non-controlling interests | ||||||||

| Total equity | ||||||||

| $ | $ | |||||||

|  | ||||

| Benita Warmbold (Director) | Rich Sumner (Director) | ||||

For the years ended December 31 | 2024 | 2023 | ||||||

| Revenue | $ | $ | ||||||

| Cost of sales and operating expenses (note 11) | ( | ( | ||||||

| Depreciation and amortization (note 11) | ( | ( | ||||||

| New Zealand gas sale net proceeds (note 25) | ||||||||

| Egypt insurance recovery (note 26) | ||||||||

| Asset impairment charge (note 5) | ( | |||||||

| Operating income | ||||||||

| Earnings of associate (note 6) | ||||||||

| Finance costs (note 12) | ( | ( | ||||||

| Finance income and other | ||||||||

| Income before income taxes | ||||||||

| Income tax (expense) recovery (note 16): | ||||||||

| Current | ( | ( | ||||||

| Deferred | ||||||||

| ( | ( | |||||||

| Net income | $ | $ | ||||||

| Attributable to: | ||||||||

| Methanex Corporation shareholders | $ | $ | ||||||

| Non-controlling interests (note 24) | ||||||||

| $ | $ | |||||||

| Income per common share for the year attributable to Methanex Corporation shareholders: | ||||||||

| Basic net income per common share (note 13) | $ | $ | ||||||

| Diluted net income per common share (note 13) | $ | $ | ||||||

| Weighted average number of common shares outstanding (note 13) | ||||||||

| Diluted weighted average number of common shares outstanding (note 13) | ||||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Net income | $ | $ | ||||||

Other comprehensive income: | ||||||||

Items that may be reclassified to income: | ||||||||

| Change in cash flow hedges and excluded forward element (note 19) | ( | ( | ||||||

| Realized losses (gains) on foreign exchange hedges reclassified to revenue | ( | |||||||

| Amounts reclassified on discontinuation of hedging relationship (note 19) | ||||||||

Items that will not be reclassified to income: | ||||||||

| Actuarial gain (loss) on defined benefit pension plans (note 21(a)) | ( | |||||||

Taxes on above items | ( | |||||||

| ( | ( | |||||||

Comprehensive income | $ | $ | ||||||

Attributable to: | ||||||||

Methanex Corporation shareholders | $ | $ | ( | |||||

Non-controlling interests (note 24) | ||||||||

| $ | $ | |||||||

Number of common shares | Capital stock | Contributed surplus | Retained earnings | Accumulated other comprehensive income (loss) | Shareholders’ equity | Non-controlling interests | Total equity | ||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

Net income | — | — | — | — | |||||||||||||||||||||||||||||||

Other comprehensive loss | — | — | — | ( | ( | ( | — | ( | |||||||||||||||||||||||||||

Compensation expense recorded for stock options | — | — | — | — | — | ||||||||||||||||||||||||||||||

Issue of shares on exercise of stock options | — | — | — | — | |||||||||||||||||||||||||||||||

Reclassification of grant date fair value on exercise of stock options | — | ( | — | — | — | — | |||||||||||||||||||||||||||||

| Payments for repurchase of shares | ( | ( | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||

Dividend payments to Methanex Corporation shareholders ($ | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||

Distributions made and accrued to non-controlling interests | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||

Realized hedge losses recognized in cash flow hedges | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

Net income | — | — | — | — | |||||||||||||||||||||||||||||||

Other comprehensive income (loss) | — | — | — | ( | ( | — | ( | ||||||||||||||||||||||||||||

Compensation expense recorded for stock options | — | — | — | — | — | ||||||||||||||||||||||||||||||

Issue of shares on exercise of stock options | — | — | — | — | |||||||||||||||||||||||||||||||

Reclassification of grant date fair value on exercise of stock options | — | ( | — | — | — | — | |||||||||||||||||||||||||||||

Dividend payments to Methanex Corporation shareholders ($ | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||

Distributions made and accrued to non-controlling interests | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||

Realized hedge losses recognized in cash flow hedges | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Balance, December 31, 2024 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

For the years ended December 31 | 2024 | 2023 | ||||||

CASH FLOWS FROM (USED IN) OPERATING ACTIVITIES | ||||||||

| Net income | $ | $ | ||||||

Deduct earnings of associate | ( | ( | ||||||

Add dividends received from associate | ||||||||

Add (deduct) non-cash items: | ||||||||

Depreciation and amortization | ||||||||

Income tax expense | ||||||||

Share-based compensation expense | ||||||||

Finance costs | ||||||||

| Mark-to-market impact of Level 3 derivatives | ( | |||||||

| Asset impairment charge | ||||||||

Other | ( | ( | ||||||

Interest received | ||||||||

Income taxes paid | ( | ( | ||||||

Other cash payments, including share-based compensation | ( | ( | ||||||

Cash flows from operating activities before undernoted | ||||||||

Changes in non-cash working capital (note 17(a)) | ( | ( | ||||||

CASH FLOWS FROM (USED IN) FINANCING ACTIVITIES | ||||||||

| Payments for repurchase of shares | ( | |||||||

Dividend payments to Methanex Corporation shareholders | ( | ( | ||||||

Interest paid | ( | ( | ||||||

Net proceeds on issue of long-term debt | ||||||||

| Repayment of long-term debt and financing fees (note 8) | ( | ( | ||||||

Repayment of lease obligations | ( | ( | ||||||

Distributions to non-controlling interests | ( | ( | ||||||

Proceeds on issue of shares on exercise of stock options | ||||||||

| Restricted cash for debt service accounts | ( | |||||||

| Changes in non-cash working capital related to financing activities (note 17(a)) | ( | |||||||

| ( | ( | |||||||

CASH FLOWS FROM (USED IN) INVESTING ACTIVITIES | ||||||||

| Property, plant and equipment | ( | ( | ||||||

Geismar plant under construction | ( | ( | ||||||

Proceeds of share capital reduction from associate | ||||||||

Loan repayment from associate | ||||||||

Changes in non-cash working capital related to investing activities (note 17(a)) | ( | ( | ||||||

| ( | ( | |||||||

Increase (decrease) in cash and cash equivalents | ( | |||||||

Cash and cash equivalents, beginning of year | ||||||||

Cash and cash equivalents, end of year | $ | $ | ||||||

| As at | Dec 31 2024 | Dec 31 2023 | ||||||

| Trade | $ | $ | ||||||

| Value-added and other tax receivables | ||||||||

| Other | ||||||||

| $ | $ | |||||||

| Owned Assets (a) | Right-of-use assets (c) | Total | |||||||||

| Net book value at December 31, 2024 | $ | $ | $ | ||||||||

| Net book value at December 31, 2023 | $ | $ | $ | ||||||||

Buildings, plant installations and machinery | Plants Under Construction1 | Ocean vessels | Other | TOTAL | ||||||||||||||||

| Cost at January 1, 2024 | $ | $ | $ | $ | $ | |||||||||||||||

Additions | ||||||||||||||||||||

Disposals and other | ( | ( | ( | ( | ( | |||||||||||||||

Transfers | ( | |||||||||||||||||||

| Cost at December 31, 2024 | ||||||||||||||||||||

| Accumulated depreciation at January 1, 2024 | ||||||||||||||||||||

Depreciation | ||||||||||||||||||||

Asset impairment charge (b) | ||||||||||||||||||||

Disposals and other | ( | ( | ( | |||||||||||||||||

| Accumulated depreciation at December 31, 2024 | ||||||||||||||||||||

| Net book value at December 31, 2024 | $ | $ | $ | $ | $ | |||||||||||||||

Buildings, plant installations and machinery | Plants under construction | Ocean vessels | Other | TOTAL | ||||||||||||||||

Cost at January 1, 2023 | $ | $ | $ | $ | $ | |||||||||||||||

| Additions | ||||||||||||||||||||

Disposals and other | ( | ( | ( | ( | ||||||||||||||||

Cost at December 31, 2023 | ||||||||||||||||||||

Accumulated depreciation at January 1, 2023 | ||||||||||||||||||||

Depreciation | ||||||||||||||||||||

Disposals and other | ( | ( | ( | |||||||||||||||||

Accumulated depreciation at December 31, 2023 | ||||||||||||||||||||

Net book value at December 31, 2023 | $ | $ | $ | $ | $ | |||||||||||||||

| 2024 | 2025 | 2026 | 2027 | 2028 | Later | |||||||||||||||

| (Decrease) increase in depreciation expense | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | $ | |||||||||

| Sensitivities | |||||||||||

Valuation input | Input value or range | Change in input | Resulting change in valuation | ||||||||

| Methanol price forecast | $ | +/- $ | $+ | ||||||||

Natural gas availability | Annual estimates based on third party forecasts | +/- | $+ | ||||||||

| Discount rate (after-tax) | +/- | $+/- | |||||||||

| Ocean vessels | Terminals and tanks | Other | TOTAL | ||||||||||||||

| Cost at January 1, 2024 | $ | $ | $ | $ | |||||||||||||

Additions | |||||||||||||||||

Disposals and other | ( | ( | ( | ( | |||||||||||||

| Cost at December 31, 2024 | |||||||||||||||||

| Accumulated depreciation at January 1, 2024 | |||||||||||||||||

Depreciation | |||||||||||||||||

Disposals and other | ( | ( | ( | ( | |||||||||||||

| Accumulated depreciation at December 31, 2024 | |||||||||||||||||

| Net book value at December 31, 2024 | $ | $ | $ | $ | |||||||||||||

| Ocean vessels | Terminals and tanks | Other | TOTAL | ||||||||||||||

| Cost at January 1, 2023 | $ | $ | $ | $ | |||||||||||||

Additions | |||||||||||||||||

Disposals and other | ( | ( | ( | ( | |||||||||||||

| Cost at December 31, 2023 | |||||||||||||||||

| Accumulated depreciation at January 1, 2023 | |||||||||||||||||

Depreciation | |||||||||||||||||

Disposals and other | ( | ( | ( | ||||||||||||||

| Accumulated depreciation at December 31, 2023 | |||||||||||||||||

| Net book value at December 31, 2023 | $ | $ | $ | $ | |||||||||||||

Consolidated statements of financial position as at | Dec 31 2024 | Dec 31 2023 | ||||||

Cash and cash equivalents | $ | $ | ||||||

Other current assets1 | ||||||||

Non-current assets | ||||||||

Current liabilities1 | ( | ( | ||||||

Other long-term liabilities, including current maturities | ( | ( | ||||||

Net assets at | $ | $ | ||||||

Net assets at | $ | $ | ||||||

Long-term receivable from Atlas1 | ||||||||

Investment in associate | $ | $ | ||||||

Consolidated statements of income for the years ended December 31 | 2024 | 2023 | ||||||

Revenue1 | $ | $ | ||||||

Cost of sales and depreciation and amortization | ( | ( | ||||||

| Gas contract settlement | ||||||||

Operating income | ||||||||

Finance costs, finance income and other expenses | ( | ( | ||||||

Income tax expense (b) | ( | ( | ||||||

Net earnings at | $ | $ | ||||||

Earnings of associate at | $ | $ | ||||||

Dividends received from associate | $ | $ | ||||||

Share capital reduction | $ | $ | ||||||

As at | Dec 31 2024 | Dec 31 2023 | ||||||

Cash flow hedges (note 19) | $ | $ | ||||||

Chile VAT receivable | ||||||||

Restricted cash for debt service and major maintenance of vessels (a) | ||||||||

Fair value of Egypt gas supply contract derivatives (note 19) | ||||||||

| Fair value of New Zealand gas supply contract derivatives (note 19) | ||||||||

| Deposit for catalyst supply | ||||||||

Investment in Carbon Recycling International | ||||||||

Defined benefit pension plans (note 21) | ||||||||

Other | ||||||||

| Total other assets | ||||||||

Less current portion (b) | ( | ( | ||||||

| $ | $ | |||||||

| As at | Dec 31 2024 | Dec 31 2023 | ||||||

| Unsecured notes | ||||||||

(i) $ | $ | $ | ||||||

(ii) $ | ||||||||

(iii) $ | ||||||||

(iv) $ | ||||||||

(v) $ | ||||||||

| Other limited recourse debt facilities | ||||||||

(i) | ||||||||

(ii) | ||||||||

(iii) | ||||||||

Total long-term debt1 | ||||||||

Less current maturities1 | ( | ( | ||||||

| $ | $ | |||||||

| Other limited recourse debt facilities | Unsecured notes | Total | |||||||||||||||

| 2025 | $ | $ | $ | ||||||||||||||

| 2026 | |||||||||||||||||

| 2027 | |||||||||||||||||

| 2028 | |||||||||||||||||

| 2029 | |||||||||||||||||

Thereafter | |||||||||||||||||

| $ | $ | $ | |||||||||||||||

| 2024 | 2023 | |||||||

| Opening lease obligations | $ | $ | ||||||

| Additions, net of disposals | ||||||||

| Interest expense | ||||||||

| Lease payments | ( | ( | ||||||

| Effect of movements in exchange rates and other | ( | ( | ||||||

| Lease obligations at December 31 | ||||||||

| Less: current portion | ( | ( | ||||||

| Lease obligations - non current portion | $ | $ | ||||||

| Lease payments | Interest component | Lease obligations | ||||||||||||||||||

| 2025 | $ | $ | $ | |||||||||||||||||

| 2026 | ||||||||||||||||||||

| 2027 | ||||||||||||||||||||

| 2028 | ||||||||||||||||||||

| 2029 | ||||||||||||||||||||

Thereafter | ||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||

| Lease liabilities recognized (discounted) | Potential future lease payments not included in lease liabilities (undiscounted) | ||||||||||

| Ocean-going vessels | $ | $ | |||||||||

| Terminals and tanks | |||||||||||

| Other | |||||||||||

| Total | $ | $ | |||||||||

As at | Dec 31 2024 | Dec 31 2023 | ||||||

Share-based compensation liability (note 14) | $ | $ | ||||||

Site restoration costs | ||||||||

Land mortgage | ||||||||

Defined benefit pension plans (note 21) | ||||||||

Cash flow hedges (note 19) | ||||||||

Other | ||||||||

Less current maturities | ( | ( | ||||||

| $ | $ | |||||||

| 2024 | 2023 | |||||||

Balance at January 1 | $ | $ | ||||||

New or revised provisions | ( | |||||||

Accretion expense | ||||||||

Balance at December 31 | $ | $ | ||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Cost of sales | $ | $ | ||||||

Selling and distribution | ||||||||

Administrative expenses | ||||||||

Total expenses by function | $ | $ | ||||||

Cost of raw materials and purchased methanol | ||||||||

Ocean freight and other logistics | ||||||||

Employee expenses, including share-based compensation | ||||||||

Other expenses | ||||||||

Cost of sales and operating expenses | ||||||||

Depreciation and amortization | ||||||||

Total expenses by nature | $ | $ | ||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Finance costs before capitalized interest | $ | $ | ||||||

| Less capitalized interest related to Geismar plant under construction | ( | ( | ||||||

| Finance costs | $ | $ | ||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Numerator for basic net income per common share | $ | $ | ||||||

Adjustment for the effect of TSARs: | ||||||||

Cash-settled recovery included in net income | ||||||||

Equity-settled expense | ( | |||||||

Numerator for diluted net income per common share | $ | $ | ||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Denominator for basic net income per common share | ||||||||

Effect of dilutive stock options | ||||||||

Effect of dilutive TSARS | ||||||||

Denominator for diluted net income per common share | ||||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Basic net income per common share | $ | $ | ||||||

Diluted net income per common share | $ | $ | ||||||

| SARs | TSARs | ||||||||||||||||

| Number of units | Exercise price USD | Number of units | Exercise price USD | ||||||||||||||

| Outstanding at December 31, 2022 | $ | $ | |||||||||||||||

Granted | |||||||||||||||||

Exercised | ( | ( | |||||||||||||||

Cancelled | ( | ( | |||||||||||||||

| Outstanding at December 31, 2023 | $ | $ | |||||||||||||||

Granted | |||||||||||||||||

Exercised | ( | ( | |||||||||||||||

Cancelled | ( | ( | |||||||||||||||

Expired | ( | ( | |||||||||||||||

| Outstanding at December 31, 2024 | $ | $ | |||||||||||||||

| Units outstanding at December 31, 2024 | Units exercisable at December 31, 2024 | |||||||||||||||||||

Range of exercise prices | Weighted average remaining contractual life (years) | Number of units outstanding | Weighted average exercise price | Number of units exercisable | Weighted average exercise price | |||||||||||||||

SARs | ||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||

$ | ||||||||||||||||||||

$ | ||||||||||||||||||||

| $ | $ | |||||||||||||||||||

TSARs | ||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||

$ | ||||||||||||||||||||

$ | ||||||||||||||||||||

| $ | $ | |||||||||||||||||||

| 2024 | 2023 | |||||||

Risk-free interest rate | ||||||||

Expected dividend yield | ||||||||

Expected life of SARs and TSARs (years) | ||||||||

Expected volatility | ||||||||

Expected forfeitures | ||||||||

Weighted average fair value (USD per unit) | $ | $ | ||||||

Number of deferred share units | Number of restricted share units | Number of performance share units (new plan) | |||||||||||||||

| Outstanding at December 31, 2022 | |||||||||||||||||

Granted | |||||||||||||||||

Performance factor impact on redemption1 | |||||||||||||||||

Granted in lieu of dividends | |||||||||||||||||

Redeemed | ( | ( | ( | ||||||||||||||

Cancelled | ( | ( | |||||||||||||||

| Outstanding at December 31, 2023 | |||||||||||||||||

Granted | |||||||||||||||||

Performance factor impact on redemption1 | |||||||||||||||||

Granted in lieu of dividends | |||||||||||||||||

Redeemed | ( | ( | ( | ||||||||||||||

Cancelled | ( | ( | |||||||||||||||

| Outstanding at December 31, 2024 | |||||||||||||||||

Revenue | China | Europe | United States | South America | South Korea | Other Asia | Canada | TOTAL | |||||||||||||||||||||

| 2024 | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| % | % | % | % | % | % | % | % | ||||||||||||||||||||||

| 2023 | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| % | % | % | % | % | % | % | % | ||||||||||||||||||||||

Property, plant and equipment 1 | United States | Egypt | New Zealand | Canada | Chile | Trinidad | Waterfront Shipping | Other | TOTAL | |||||||||||||||||||||||

| December 31, 2024 | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

| December 31, 2023 | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Current tax (expense) recovery: | ||||||||

Current period before undernoted items | $ | ( | $ | ( | ||||

| Adjustments to prior years including resolution for certain outstanding audits | ||||||||

| ( | ( | |||||||

Deferred tax recovery (expense): | ||||||||

Origination and reversal of temporary differences | ||||||||

| Adjustments to prior years including resolution for certain outstanding audits | ( | |||||||

Changes in tax rates | ( | |||||||

Impact of foreign exchange and other | ( | |||||||

Total income tax expense | $ | ( | $ | ( | ||||

For the years ended December 31 | 2024 | 2023 | ||||||

Income before income taxes | $ | $ | ||||||

Deduct earnings of associate | ( | ( | ||||||

Canadian statutory tax rate | % | % | ||||||

Income tax expense calculated at Canadian statutory tax rate | ( | ( | ||||||

Decrease (increase) in income tax expense resulting from: | ||||||||

Impact of income and losses taxed in foreign jurisdictions | ||||||||

Utilization of unrecognized loss carryforwards and temporary differences | ||||||||

Impact of tax rate changes | ( | |||||||

Impact of foreign exchange | ||||||||

Other business taxes | ( | |||||||

Impact of items not taxable for tax purposes | ||||||||

| Adjustments to prior years including resolution for certain outstanding audits | ( | |||||||

Other | ( | ( | ||||||

Total income tax expense | $ | ( | $ | ( | ||||

As at | Dec 31, 2024 | Dec 31, 2023 | |||||||||||||||||||||

Net | Deferred tax assets | Deferred tax liabilities | Net | Deferred tax assets | Deferred tax liabilities | ||||||||||||||||||

Property, plant and equipment (owned) | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||

Right-of-use assets | ( | ( | ( | ( | ( | ( | |||||||||||||||||

Repatriation taxes | ( | ( | ( | ( | ( | ( | |||||||||||||||||

Other | ( | ( | ( | ( | ( | ( | |||||||||||||||||

| ( | ( | ( | ( | ( | ( | ||||||||||||||||||

Non-capital loss carryforwards | |||||||||||||||||||||||

Lease obligations | |||||||||||||||||||||||

Share-based compensation | |||||||||||||||||||||||

Other | |||||||||||||||||||||||

Net deferred income tax assets (liabilities) | $ | ( | $ | $ | ( | $ | ( | $ | $ | ( | |||||||||||||

| Dec 31 2024 | ||||||||

| Gross amount | Tax effect | |||||||

Expire | ||||||||

Losses generated in 2015 (expires 2035) | $ | $ | ||||||

Losses generated in 2016 (expires 2036) | ||||||||

Losses generated in 2017 (expires 2037) | ||||||||

No expiry | ||||||||

| Losses generated in 2019 | ||||||||

| Losses generated in 2020 | ||||||||

Losses generated in 2023 | ||||||||

Losses generated in 2024 | ||||||||

Total non-capital loss carryforwards | $ | $ | ||||||

| 2024 | 2023 | ||||||||||||||||||||||

| Net | Deferred tax assets | Deferred tax liabilities | Net | Deferred tax assets | Deferred tax liabilities | ||||||||||||||||||

Balance, January 1 | $ | ( | $ | $ | ( | $ | ( | $ | $ | ( | |||||||||||||

Deferred income tax recovery (expense) included in net income | ( | ||||||||||||||||||||||

Deferred income tax recovery (expense) included in other comprehensive income | ( | ( | ( | ||||||||||||||||||||

Other | ( | ( | |||||||||||||||||||||

Balance, December 31 | $ | ( | $ | $ | ( | $ | ( | $ | $ | ( | |||||||||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Changes in non-cash working capital: | ||||||||

Trade and other receivables | $ | $ | ( | |||||

Inventories | ( | |||||||

Prepaid expenses | ( | ( | ||||||

Trade, other payables and accrued liabilities | ( | ( | ||||||

| ( | ( | |||||||

Adjustments for items not having a cash effect and working capital changes relating to taxes and interest paid and interest received | ( | |||||||

Changes in non-cash working capital having a cash effect | $ | ( | $ | ( | ||||

These changes relate to the following activities: | ||||||||

Operating | $ | ( | $ | ( | ||||

Financing | ( | |||||||

Investing | ( | ( | ||||||

Changes in non-cash working capital | $ | ( | $ | ( | ||||

Long term debt (note 8) | Lease obligations (note 9) | |||||||

Balance at December 31, 2023 | $ | $ | ||||||

Changes from financing cash flows | ||||||||

Repayment of long-term debt and financing fees | ( | |||||||

Net proceeds on issue of long-term debt | ||||||||

Payment of lease obligations | ( | |||||||

| Total changes from financing cash flows | ( | |||||||

Liability-related other changes | ||||||||

Finance costs | ||||||||

New lease obligations | ||||||||

Other | ( | |||||||

Total liability-related other changes | ||||||||

Balance at December 31, 2024 | $ | $ | ||||||

As at | Dec 31 2024 | Dec 31 2023 | ||||||

Liquidity: | ||||||||

Cash and cash equivalents | $ | $ | ||||||

Undrawn credit facility | ||||||||

Total liquidity | $ | $ | ||||||

Capitalization: | ||||||||

Unsecured notes, including current portion | ||||||||

Other limited recourse debt facilities, including current portion | ||||||||

Total debt | ||||||||

Non-controlling interests | ||||||||

Shareholders’ equity | ||||||||

Total capitalization | $ | $ | ||||||

Total debt to capitalization 1 | ||||||||

Net debt to capitalization 2 | ||||||||

As at | Dec 31 2024 | Dec 31 2023 | ||||||

Financial assets: | ||||||||

Financial assets measured at fair value: | ||||||||

Derivative instruments designated as cash flow hedges 1 | $ | $ | ||||||

Fair value of Egypt gas supply contract derivative 2 | ||||||||

Fair value of New Zealand gas supply contract derivative 3 | ||||||||

Financial assets not measured at fair value: | ||||||||

Cash and cash equivalents | ||||||||

Trade and other receivables, excluding tax receivable | ||||||||

Restricted cash included in other assets | ||||||||

Total financial assets 4 | $ | $ | ||||||

Financial liabilities: | ||||||||

Financial liabilities measured at fair value: | ||||||||

Derivative instruments designated as cash flow hedges 1 | $ | $ | ||||||

Financial liabilities not measured at fair value: | ||||||||

Trade, other payables and accrued liabilities, excluding tax payable | ||||||||

| Lease obligations, including current portion | ||||||||

Long-term debt, including current portion | ||||||||

| Land mortgage | ||||||||

Total financial liabilities | $ | $ | ||||||

| As at | Dec 31 2024 | Dec 31 2023 | ||||||

| Maturities | 2025-2032 | 2024-2032 | ||||||

Notional quantity 1 | ||||||||

Notional quantity per day, annualized 1 | ||||||||

| Notional amount | $ | $ | ||||||

| Net fair value | $ | $ | ||||||

| As at | Dec 31 2024 | Dec 31 2023 | ||||||

| Other current assets | $ | $ | ||||||

| Other non-current assets | ||||||||

| Other current liabilities | ( | ( | ||||||

| Other long-term liabilities | ( | ( | ||||||

| Net fair value | $ | $ | ||||||

| For the years ended December 31 | 2024 | 2023 | ||||||

| Change in fair value of cash flow hedges | $ | $ | ( | |||||

| Forward element excluded from hedging relationships | ( | ( | ||||||

| $ | ( | $ | ( | |||||

As at | Dec 31 2024 | Dec 31 2023 | ||||||

Within one year | $ | $ | ||||||

1-3 years | ||||||||

3-5 years | ||||||||

More than 5 years | ||||||||

| $ | $ | |||||||

As at | December 31, 2024 | December 31, 2023 | ||||||||||||

Carrying value | Fair value | Carrying value | Fair value | |||||||||||

Long-term debt excluding deferred financing fees | $ | $ | $ | $ | ||||||||||

| Sensitivities | |||||||||||

| Valuation input | Input value or range | Change in input | Resulting change in valuation | ||||||||

| Methanol price volatility (before impact of mean reversion) | +/- | $+/- | |||||||||

| Methanol price forecast | $ | +/- $ | $- | ||||||||

| Discount rate | +/- | $+/- | |||||||||

| Sensitivities | |||||||||||

| Valuation input | Input value or range | Change in input | Resulting change in valuation | ||||||||

| New Zealand forward electricity pricing | $ | +/- $ | $-/+ | ||||||||

| Methanol price forecast | $ | +/- $ | $-/+ | ||||||||

Natural gas availability | Annual estimates based on third party forecasts | +/- | $+/- | ||||||||

As at | Dec 31 2024 | Dec 31 2023 | ||||||

Fixed interest rate debt: | ||||||||

Unsecured notes | $ | $ | ||||||

Other limited recourse debt facilities | ||||||||

| $ | $ | |||||||

| As at December 31, 2024 | Carrying amount | Contractual cash flows | 1 year or less | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||||

Trade and other payables 1 | $ | $ | $ | $ | $ | $ | |||||||||||||||||

Lease obligations 2 | |||||||||||||||||||||||

Other long-term liabilities2 | |||||||||||||||||||||||

Long-term debt 2 | |||||||||||||||||||||||

Cash flow hedges 3 | |||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | ||||||||||||||||||

As at | Dec 31 2024 | Dec 31 2023 | ||||||

Accrued benefit obligations: | ||||||||

Balance, beginning of year | $ | $ | ||||||

Current service cost | ||||||||

Past service cost | ||||||||

Interest cost on accrued benefit obligations | ||||||||

Benefit payments | ( | ( | ||||||

Settlements | ( | ( | ||||||

Actuarial (gain) loss | ( | |||||||

Foreign exchange (gain) loss | ( | |||||||

Balance, end of year | ||||||||

Fair values of plan assets: | ||||||||

Balance, beginning of year | ||||||||

Interest income on assets | ||||||||

Contributions | ||||||||

Benefit payments | ( | ( | ||||||

Settlements | ( | ( | ||||||

Return on plan assets | ( | |||||||

Foreign exchange gain (loss) | ( | |||||||

Balance, end of year | ||||||||

Unfunded status | ||||||||

Minimum funding requirement | ||||||||

Defined benefit obligation, net | $ | $ | ||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Net defined benefit pension plan expense: | ||||||||

Current service cost | $ | $ | ||||||

Past service cost | ||||||||

Net interest cost | ||||||||

Cost of settlement | ( | |||||||

| Total net defined benefit pension plan expense | $ | $ | ||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Actuarial gain (loss) | $ | $ | ( | |||||

As at | Dec 31 2024 | Dec 31 2023 | ||||||

Equity securities | ||||||||

Debt securities | ||||||||

Cash and other short-term securities | ||||||||

Total | ||||||||

| 2025 | 2026 | 2027 | 2028 | 2029 | Thereafter | ||||||||||||

| $ | $ | $ | $ | $ | $ | ||||||||||||

| 2025 | 2026 | 2027 | 2028 | 2029 | Thereafter | ||||||||||||

| $ | $ | $ | $ | $ | $ | ||||||||||||

Name | Country of incorporation | Principal activities | Interest % | |||||||||||

| Dec 31 2024 | Dec 31 2023 | |||||||||||||

Significant subsidiaries: | ||||||||||||||

Methanex Asia Pacific Limited | Hong Kong | Marketing & distribution | ||||||||||||

Methanex Services (Shanghai) Co., Ltd. | China | Marketing & distribution | ||||||||||||

Methanex Europe NV | Belgium | Marketing & distribution | ||||||||||||

Methanex Methanol Company, LLC | United States | Marketing & distribution | ||||||||||||

Egyptian Methanex Methanol Company S.A.E. ("Methanex Egypt") | Egypt | Production | ||||||||||||

Methanex Chile SpA | Chile | Production | ||||||||||||

Methanex New Zealand Limited | New Zealand | Production | ||||||||||||

Methanex Trinidad (Titan) Unlimited | Trinidad and Tobago | Production | ||||||||||||

Methanex USA LLC | United States | Production | ||||||||||||

Methanex Louisiana LLC | United States | Production | ||||||||||||

Methanex Geismar III LLC | United States | Production | ||||||||||||

Waterfront Shipping Limited 1 | Canada | Shipping | ||||||||||||

Significant joint ventures: | ||||||||||||||

Atlas Methanol Company Unlimited 2 | Trinidad and Tobago | Production | ||||||||||||

For the years ended December 31 | 2024 | 2023 | ||||||

Short-term employee benefits | $ | $ | ||||||

Post-employment benefits | ||||||||

Other long-term employee benefits | ||||||||

Share-based compensation expense 1 | ||||||||

Total | $ | $ | ||||||

As at | Dec 31, 2024 | Dec 31, 2023 | |||||||||||||||||||||

| Methanex Egypt | Waterfront Shipping Limited | Total | Methanex Egypt | Waterfront Shipping Limited | Total | ||||||||||||||||||

Current assets | $ | $ | $ | $ | $ | $ | |||||||||||||||||

Non-current assets | |||||||||||||||||||||||

Current liabilities | ( | ( | ( | ( | ( | ( | |||||||||||||||||

Non-current liabilities | ( | ( | ( | ( | ( | ( | |||||||||||||||||

Net assets | |||||||||||||||||||||||

Carrying amount of Methanex non-controlling interests | $ | $ | $ | $ | $ | $ | |||||||||||||||||

For the years ended December 31 | 2024 | 2023 | |||||||||||||||||||||

| Methanex Egypt | Waterfront Shipping Limited | Total | Methanex Egypt | Waterfront Shipping Limited | Total | ||||||||||||||||||

Revenue | $ | $ | $ | $ | $ | $ | |||||||||||||||||

Net and total comprehensive income | |||||||||||||||||||||||

Net and total comprehensive income attributable to Methanex non-controlling interests | |||||||||||||||||||||||

Distributions made and accrued to non-controlling interests | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||

For the years ended December 31 | 2024 | 2023 | |||||||||||||||||||||

| Methanex Egypt | Waterfront Shipping Limited | Total | Methanex Egypt | Waterfront Shipping Limited | Total | ||||||||||||||||||

Cash flows from operating activities | $ | $ | $ | $ | $ | $ | |||||||||||||||||

Cash flows used in financing activities | ( | ( | ( | ( | ( | ( | |||||||||||||||||

Cash flows from (used in) investing activities | $ | ( | $ | ( | $ | ( | $ | ( | $ | $ | ( | ||||||||||||

Audit Information |

12 Months Ended |

|---|---|

Dec. 31, 2024 | |

| Audit Information [Abstract] | |

| Auditor Firm ID | 85 |

| Auditor Name | KPMG LLP |

| Auditor Location | Vancouver, British Columbia, Canada |

Consolidated Statements of Financial Position (Parenthetical) - shares |

Dec. 31, 2024 |

Dec. 31, 2023 |

|---|---|---|

| Preferred shares | ||

| Statement [Line Items] | ||

| Number of shares authorised (in shares) | 25,000,000 | 25,000,000 |

| Common shares | Capital stock | ||

| Statement [Line Items] | ||

| Number of shares issued (in shares) | 67,395,212 | 67,387,492 |

| Number of shares outstanding (in shares) | 67,395,212 | 67,387,492 |

Consolidated Statements of Comprehensive Income - USD ($) $ in Thousands |

12 Months Ended | |

|---|---|---|

Dec. 31, 2024 |

Dec. 31, 2023 |

|

| Statement of comprehensive income [abstract] | ||

| Net income | $ 250,245 | $ 284,122 |

| Items that may be reclassified to income: | ||

| Change in cash flow hedges and excluded forward element (note 19) | (23,211) | (310,456) |

| Realized losses (gains) on foreign exchange hedges reclassified to revenue | (3,604) | 3,105 |

| Amounts reclassified on discontinuation of hedging relationship (note 19) | 11,702 | 0 |

| Items that will not be reclassified to income: | ||

| Actuarial gain (loss) on defined benefit pension plans (note 21(a)) | 1,353 | (2,827) |

| Taxes on above items | (14,096) | 66,636 |

| Other comprehensive income (loss) | (27,856) | (243,542) |

| Comprehensive income | 222,389 | 40,580 |

| Attributable to: | ||

| Methanex Corporation shareholders | 136,130 | (69,402) |

| Non-controlling interests (note 24) | $ 86,259 | $ 109,982 |

Consolidated Statements of Changes in Equity (Parenthetical) - $ / shares |

12 Months Ended | |

|---|---|---|

Dec. 31, 2024 |

Dec. 31, 2023 |

|

| Statement of changes in equity [abstract] | ||

| Dividend payments to Methanex Corporation shareholders (in usd per share) | $ 0.740 | $ 0.730 |

Nature of operations |

12 Months Ended |

|---|---|

Dec. 31, 2024 | |

| Corporate information and statement of IFRS compliance [abstract] | |

| Nature of operations | Nature of operations: Methanex Corporation ("the Company") is an incorporated entity with corporate offices in Vancouver, Canada. The Company’s operations consist of the production and sale of methanol, a commodity chemical. The Company is the world’s largest producer and supplier of methanol and serves customers in Asia Pacific, North America, Europe and South America. |

Material accounting policies |

12 Months Ended |

|---|---|

Dec. 31, 2024 | |

| Corporate information and statement of IFRS compliance [abstract] | |