UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1−K

ANNUAL REPORT PURSUANT TO REGULATION A

OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2022

Forge Group, Inc.

(Exact name of registrant as specified in its charter)

|

Pennsylvania |

85-4184821 |

|

(State or other incorporation) |

(I.R.S. Employer Identification No.) |

P.O. Box 15033

Worcester, MA 01615

(Full mailing address of principal executive offices)

(202) 547-8700

(Issuer’s telephone number, including area code)

Common Stock

(Title of each class of securities issued pursuant to Regulation A)

PART II

Use of Terms

Unless the context otherwise requires, as used in this report:

|

● |

“ACIC Properties” refers to ACIC Consolidated Properties, LLC, a majority-owned subsidiary of FIC and the intermediate holding company for (i) 717 8th Street, LLC, (ii) 2805 M Street, LLC, and (iii) 810 5th Street, LLC, each of which directly own commercial real estate in the District of Columbia; |

|

● |

“the Company,” “we,” “us,” and “our” refer to Forge Insurance Company and its consolidated subsidiaries prior to March 11, 2022, and to Forge Group, Inc. and its consolidated subsidiaries after March 11, 2022; |

|

● |

“conversion” refers to a series of transactions by which FIC converted from mutual form to stock form and became a subsidiary of Forge Group, Inc. Given that the conversion did not occur until March 11, 2022, some of the information presented in this report is shown on a pre-conversion basis; |

|

● |

“Department” means the District of Columbia Department of Insurance, Securities and Banking; |

|

● |

“eligible member” refers to a person who was an owner of an insurance policy issued by FIC and in-force on February 3, 2021, the date the plan of conversion was adopted by the board of trustees of FIC; |

|

● |

“ESOP” means our employee stock ownership plan; |

|

● |

“FIC” refers to Forge Insurance Company, a licensed property and casualty insurer which was previously named Amalgamated Casualty Insurance Company, and its consolidated subsidiaries. Effective on March 18, 2022, Amalgamated Casualty Insurance Company changed its name to Forge Insurance Company; |

|

● |

“FRM” refers to Forge Risk Management, Inc., a licensed property and casualty insurance producer which was previously named American Risk Management, Inc. Effective on February 10, 2022, American Risk Management, Inc. changed its name to Forge Risk Management, Inc.; |

|

● |

“mutual form” refers to an insurance company organized as a mutual company, which is a form of organization in which the policyholders or members have certain membership rights in the mutual company, such as the right to vote with respect to the election of directors and approval of certain fundamental transactions, including the conversion from mutual to stock form; however, unlike shares held by shareholders, membership rights are not transferable and do not exist separately from the related insurance policy; |

|

● |

“offering” refers to the subscription offering and the public offering taken together; |

|

● |

“public offering” refers to the offering of up to 2,300,000 shares of our common stock to the general public under the plan of conversion; |

|

● |

“stock form” is a form of organization in which the only rights that policyholders have are contractual rights under their insurance policies and in which voting rights reside with shareholders under state corporate law; and |

|

● |

“subscription offering” refers to the offering of up to 2,300,000 shares of our common stock under the plan of conversion to eligible members, the ESOP, and trustees, officers, and employees of FIC. |

Special Note Regarding Forward Looking Statements

Certain information contained in this report includes forward-looking statements. The statements herein which are not historical reflect our current expectations and projections about our company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to our company and our management and our interpretation of what is believed to be significant factors affecting the businesses, including many assumptions regarding future events.

Forward-looking statements are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including matters described in this report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur.

Undue reliance should not be placed on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

ITEM 1. BUSINESS

Overview

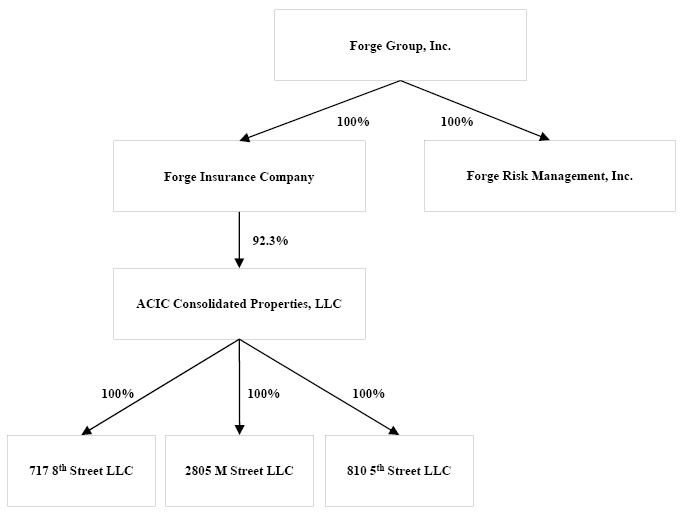

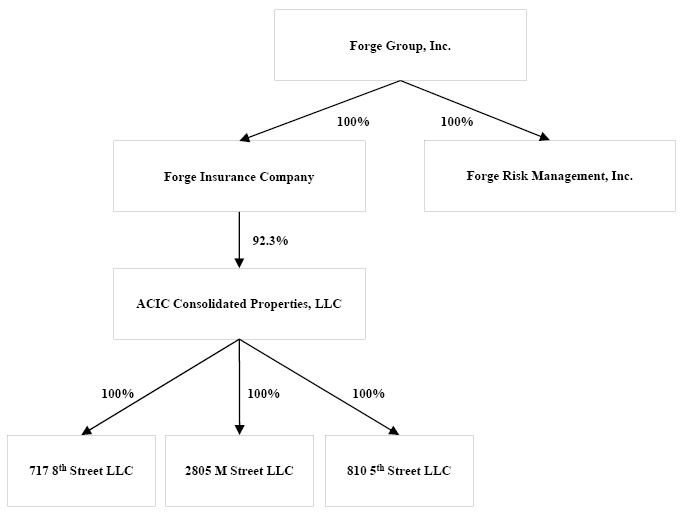

Forge Group, Inc. (the “Company”) is a Pennsylvania corporation that was organized in 2021. The Company was formed so that it could (i) acquire all of the capital stock of Forge Insurance Company (“FIC”) in a mutual to stock conversion and (ii) acquire FIC’s affiliated insurance agency, Forge Risk Management, Inc. (“FRM”). Prior to the conversion, the Company did not engage in any operations. After the conversion, the Company’s primary assets consisted of (i) the outstanding capital stock of FIC, (ii) the outstanding capital stock of FRM, and (iii) a portion of the net proceeds from the offering completed in connection with the conversion of FIC. ACIC Consolidated Properties, LLC (“ACIC Properties”) is a majority-owned subsidiary of FIC and the intermediate holding company for (i) 717 8th Street, LLC, (ii) 2805 M Street, LLC, and (iii) 810 5th Street, LLC, each of which directly own commercial real estate in the District of Columbia. The Company’s initial public offering, and the concurrent acquisition of FRM, were completed on March 11, 2022. Please see Item 1. Business — Completion of Offering, Conversion and Agency Acquisition for more information. References to the Company’s financial information in this report is to the financial information for Forge Group, Inc., FIC, and FRM on a consolidated basis after March 11, 2022. References to the Company’s financial information in this report is to the financial information for FIC on a consolidated basis prior to March 11, 2022. Our current corporate structure is as shown in the following chart:

Through our wholly owned subsidiaries, we operate as a specialist commercial automobile insurance business. FIC was incorporated in the District of Columbia in 1938 and is rated B++ by A.M. Best. As of December 31, 2022, FIC was licensed as a property and casualty insurer in 34 states and the District of Columbia. FIC’s insurance products are marketed and distributed through FRM, its appointed insurance producer. FRM solicits business directly from customers and works with insurance agency sub-producers, referred to as “distribution partners”. As of December 31, 2022, FRM was licensed as a property and casualty insurance producer in 34 states and the District of Columbia. Through our wholly owned subsidiaries, we market and underwrite commercial automobile insurance products. We are focused on delivering these commercial automobile insurance products to small business owners and operators that operate in (i) certain business class segments and (ii) in certain geographic markets in the U.S. Historically, we have focused on the public automobile business class segment (“public auto segment”) within the commercial automobile insurance line. In the public auto segment, vehicles are used to transport passengers from one location to another. Specifically, we have historically focused on the following public auto sub-segments: taxi cabs, passenger sedans, golf carts, school vans, and other light transportation vehicles. Recently, we have developed commercial auto insurance products targeting additional business class segments, namely trade and service providers such as electricians, plumbers, and carpenters (collectively, the “small business segment”).

Our executive offices are located at 7910 Woodmont Avenue, Suite 925, Bethesda, Maryland, 20814. Our mailing address is P.O. Box 15033, Worcester, Massachusetts, 01615. Our phone number is (202) 547-8700 and our website address is www.forgeinsurance.com.

Completion of Offering, Conversion and Agency Acquisition

On March 11, 2022, the Company completed the sale of 2,050,000 shares of common stock at $10.00 per share for a total gross offering of $20.5 million, thereby completing the conversion of Forge Insurance Company, previously named Amalgamated Casualty Insurance Company, from mutual form to stock form. Following the conversion, FIC became a wholly owned subsidiary of the Company. Pursuant to the amended and restated plan of conversion, upon completion of the conversion and the offering, FIC distributed $4,594 in cash to each of the eligible members, which totaled $7.3 million, and which was recorded as a dividend. In addition, on March 11, 2022, pursuant to a stock purchase agreement with MCW Holdings, Inc., the Company completed the acquisition of all the outstanding capital stock of FIC’s affiliated agency, FRM, previously named American Risk Management, Inc. Pursuant to the stock purchase agreement, the Company assumed $1.4 million of FRM’s outstanding debt and issued to MCW Holdings, Inc. 550,000 shares of the Company’s Series A 8.5% cumulative convertible preferred stock.

Market for Registrant’s Common Equity

“Buy” and “Sell” quotes for shares of the Company’s common stock are reported on the “OTC Pink” market under the symbol “FIGP”.

Business Segments

We manage our business through two segments: insurance and commercial real estate investments. Through our wholly owned subsidiaries, namely FIC and FRM, the Company engages in the principal business line of insurance. See Item 2. Management Discussion and Analysis of Financial Condition and Results of Operations — Real Estate Held for the Production of Income for more detailed information concerning our commercial real estate investment segment.

Our Market and Opportunities

We principally operate within the commercial automobile insurance line of business. We estimate that the U.S. commercial automobile insurance line of business is approximately $60 billion of annual premium written.

Historically, we have focused on the public auto segment within the commercial automobile insurance line. In the public auto segment, vehicles are used to transport passengers from one location to another. In this business class segment, operation of the commercial vehicle is generally the primary source of business revenue. Specifically, we have historically focused on the following public auto sub-segments: taxi cabs, passenger sedans, golf carts, school vans, and other light transportation vehicles. We estimate that the public auto segment in our target geographic markets is approximately $200 million of annual premium written.

Recently, we have developed commercial auto insurance products targeting additional business class segments, namely trade and service providers such as electricians, plumbers, and carpenters (collectively, the “small business segment”) that our research has indicated present lower loss risk and other favorable business characteristics. In the small business segment, operation of the commercial vehicle is generally not the primary source of business revenue; rather, the commercial vehicle is used as a tool in the overall business. We estimate that the small business segment in our target geographic markets is approximately $12 billion of annual premium written.

Our Competitive Strengths

We believe that we are strategically positioned to take advantage of the following competitive strengths:

|

● |

Experienced management team. Our management team, led by Patrick Bracewell and Richard Hutchinson, has considerable experience operating in the commercial automobile insurance line of business. |

|

● |

Rich history and strong reputation for service. We have been in business since 1938 and are recognized in the specialty commercial automobile insurance markets in which we operate for our strong customer service. |

|

● |

Scalable platform. We believe that we will be able to significantly increase our policy volume without a significant increase in administrative expense. We are currently making investments in our technology infrastructure and product design. We believe these investments will enable us to process and service additional policy volumes without a significant increase in personnel. |

Our Growth Strategies

We intend to use our competitive strengths to grow our business through the following strategies:

|

● |

Expand our product offerings. We have developed commercial auto insurance products that we will introduce to the small business segment, a segment that our research has indicated presents lower loss risk and other favorable business characteristics. In this market, the vehicle is a tool used in the overall business and is typically driven significantly fewer miles than in the public auto segment, where the operation of the commercial vehicle is generally the primary source of business revenue. |

|

● |

Grow our distribution capacity. We intend to continue to expand our relatively small force of distribution partners by recruiting a substantial number of additional distribution partners in the coming years. We also intend to explore relationships with agency networks, insurers, and other strategic partners that currently offer insurance products to the small business segment but do not have a commercial auto product. |

|

● |

Pursue acquisitions of insurance companies and related businesses. Over time, we intend to explore possible acquisitions of other insurance companies or related businesses to grow our business and leverage our existing available administrative capacity. |

|

● |

Focus on profitability and operating efficiency. We are committed to improving our profitability by remaining focused on our target segment within the commercial auto insurance line and continuously seeking efficiencies within our operations. We believe that the investments we are making in our technology infrastructure and product design will allow us to improve our processes, response times, and scalability. |

Our Challenges and Risks

Our Company and our business are subject to numerous challenges and risks, including:

|

● |

History of losses. We have experienced losses in the last two years primarily due to our elevated expenses. Our expenses have been elevated as we have been investing in our business in anticipation of future growth. We have added additional personnel and have invested in our technology platform. During the last two years we have also incurred additional costs related to supporting our ongoing reporting obligations as an SEC-registrant. |

|

● |

Lack of marketing resources. We are small in relation to many of the insurance companies with which we compete. Larger insurance companies have a substantial advantage with respect to the resources that they can devote to advertising, marketing, and agent recruitment. Furthermore, their larger surplus permits them to maintain a larger book of business and spread their administrative expenses over a larger revenue base. Our small size could inhibit our ability to devote adequate resources to advertising, marketing, and agent recruitment, which could have a material and adverse effect on our ability to grow our business. |

|

● |

Lack of multiple distribution channels. We rely primarily on FRM and FRM’s limited number of distribution partners to distribute our insurance products. Growth in our written premiums will depend on our ability to recruit new distribution partners to distribute our insurance products. Much of the competition for talent involves agent recruitment. If our competitors have higher A.M. Best ratings, provide the agents with better technology, or pay higher commissions, our ability to attract and retain agents may be impaired, which could have a material and adverse effect on our ability to profitably grow our business. |

|

● |

Intense competition for policyholders. We face intense competition for policyholders and compete with much larger insurance companies, many of which seek to sell commercial automobile insurance products to the same markets that we target. Most of these companies devote substantial resources to advertising and marketing to potential policyholders as well as to agent recruitment. Many of these companies have multiple distribution channels for their products and some employ in-house agents, which reduces their commission expense. In addition, several of these companies have well established Internet sales capabilities. If we are unable to effectively compete with larger insurance companies, we may be unable to attract additional policyholders, which could have a material and adverse effect on our ability to profitably grow our business. |

|

● |

Inability to manage growth effectively. We intend to continue to grow our business, which could require additional capital, systems development, and skilled personnel. We may be unable to locate profitable business opportunities, meet our capital needs, expand our systems and our internal controls effectively, allocate our human resources optimally, or identify qualified employees. The failure to manage our growth effectively and maintain underwriting discipline could have a material adverse effect on our business, financial condition and results of operations. |

|

● |

Inability to obtain reinsurance coverage at reasonable prices or on terms that provide us adequate protection. We purchase reinsurance to help manage our exposure to insurance risks that we underwrite and to reduce volatility in our results. The availability and cost of reinsurance are subject to prevailing market conditions, both in terms of price and available capacity, each of which can affect our business volume and profitability. The availability of reasonably affordable reinsurance is a critical element of our business plan. One important way we utilize reinsurance is to reduce volatility in claims payments by limiting our exposure to losses from large risks. As a result, our ability to manage volatility and avoid significant losses may be limited by the unavailability of reasonably priced reinsurance. We may not be able to obtain reinsurance on acceptable terms or from entities with satisfactory creditworthiness. Under such circumstances, we may have to reduce the level of our underwriting commitments, which would reduce our revenues. |

|

● |

Inability to retain key management and employees or recruit other qualified personnel. We believe that our future success depends, in large part, on our ability to retain our experienced management team and key employees. There can be no assurance that we can attract and retain the necessary employees to conduct our business activities on a timely basis or at all. Our competitors may offer more favorable compensation arrangements to our key management or employees to incentivize them to leave our Company. The loss of any of our executive officers or other key personnel, or our inability to recruit and retain additional qualified personnel as we grow, could materially and adversely affect our business and results of operations, and could prevent us from fully implementing our growth strategies. |

|

● |

Interruptions to third-party technology systems. Our business is highly dependent upon our ability to perform necessary business functions in an efficient and uninterrupted manner. The shut-down, disruption, degradation or unavailability of one or more of our systems or facilities, or the inability of our employees to communicate in a largely work-from-home environment, for any reason could significantly impair our ability to perform critical business functions on a timely basis. In addition, many of our critical business systems interface with and depend on third-party systems. An interruption or degradation of service from a third-party system for any reason, or a determination by a vendor to abandon or terminate support for a system, product, obligation, or service that is significant to our business, could significantly impair our ability to perform critical business functions, including, but not limited to, impeding customer interactions, preventing access to company or customer data, and interfering with our ability to send or accept electronic payments through credit card or debit card networks and the Automated Clearing House, among other payment systems. If sustained or repeated, and if an alternate system, process, or vendor is not immediately available to us, such events could result in a deterioration of our ability to write and process policies, provide high quality customer service, resolve claims in a timely manner, make payments when required, or perform other necessary business functions. Also, system redundancy and other continuity measures may be ineffective or inadequate, and our business continuity and disaster recovery planning may not be sufficient for all eventualities. Any such event could have a material adverse effect on our financial results and business prospects, as well as cause damage to our reputation, brand and customer goodwill. |

|

● |

Capital markets volatility and credit deterioration. Our results of operations depend, in part, on the performance of our investment portfolio. Our investments are subject to general economic conditions and market risks as well as risks inherent to particular securities. The value of our investment portfolio is subject to the risk that certain investments may default or become impaired due to deterioration in the financial condition of one or more issuers of the securities held, or due to deterioration in the financial condition of an entity that guarantees an issuer’s payments of such investments. Such defaults and impairments could reduce our net investment income and result in realized investment losses. A severe economic downturn could cause us to incur substantial realized and unrealized investment losses in future periods, which would have an adverse impact on our financial condition, results of operations, and financial strength ratings. In addition, losses in our investment portfolio may occur at the same time as underwriting losses and, therefore, exacerbate the adverse effect of the losses on us. |

|

● |

Decline in our financial strength rating. Participants in the insurance industry use ratings from independent ratings agencies, such as A.M. Best Company, Inc. (“A.M. Best”) as an important means of assessing the financial strength and quality of insurers. In setting their ratings, A.M. Best utilize a quantitative and qualitative analysis of a company’s balance sheet strength, operating performance and business profile. These analyses include comparisons to peers and industry standards as well as assessments of operating plans, philosophy and management. A.M. Best assigns ratings that are intended to provide an independent opinion of an insurance company’s ability to meet its financial obligations to policyholders and such ratings are not evaluations directed to investors. A.M. Best periodically reviews FIC’s rating and may revise its rating downward or revoke it at their sole discretion based primarily on their analyses of FIC’s balance sheet strength (including capital adequacy and loss and loss adjustment expense reserve adequacy), operating performance and business profile. A downgrade of FIC’s rating could cause our current and future distribution partners to choose other, more highly‑rated competitors. A downgrade of FIC’s rating could also increase the cost or reduce the availability of reinsurance to us. A downgrade or withdrawal of FIC’s rating could severely limit or prevent us from writing new and renewal insurance contracts and would have a material adverse effect on our financial condition and results of operations. |

|

● |

Inability to underwrite and price risks accurately and to charge adequate rates to policyholders. Our financial condition, cash flows, and results of operations depend on our ability to underwrite and set rates accurately for a full spectrum of risks. A primary role of the pricing function is to ensure that rates are adequate to generate sufficient premiums to pay losses, loss adjustment expenses, and underwriting expenses, and to earn a profit. Pricing involves the acquisition and analysis of historical data regarding vehicle accidents, other insured events, and associated losses, and the projection of future trends for such accidents and events, loss costs, expenses, and inflation, among other factors, for each of our products in different markets. Our ability to price accurately is subject to a number of risks and uncertainties which could result in our pricing being based on inadequate or inaccurate data or inappropriate analyses, assumptions, or methodologies, and may cause us to estimate incorrectly future changes in the frequency or severity of claims. As a result, we could underprice risks, which would negatively affect our underwriting profit margins, or we could overprice risks, which could reduce our competitiveness and growth prospects. In either event, our financial condition, cash flows, and results of operations could be materially adversely affected. In addition, underpricing insurance policies over time could erode the capital position, thereby constraining our ability to write new business. |

Business Operations – Insurance Segment

Our insurance segment engages in the principal business line of commercial automobile insurance. In our insurance segment, we market and underwrite commercial automobile insurance products targeted to small business owners and operators. Historically, we have focused on the public auto segment within the commercial automobile insurance line. We currently offer our commercial auto insurance products in the District of Columbia and 14 states. In 2021, we began developing commercial auto insurance products targeting the small business segment.

Products

Our product language is based on Insurance Services Offices (“ISO”) forms, which is an industry standard, but tailored to the specific needs of our customers. In 2021, we began developing commercial auto insurance products targeting additional business class segments, namely trade and service providers such as electricians, plumbers, and carpenters (collectively, the “small business class segment”).

Marketing and Distribution

Our products are marketed and distributed through FRM. FRM solicits business directly from customers and also works with insurance agency sub-producers, referred to as “distribution partners”. Our distribution partners access multiple insurance companies and are typically established businesses in the communities in which they operate. We view our distribution partners as our primary customers because they are in a position to recommend either our insurance products or those of a competitor to their customers. We consider our relationships with our distribution partners to be a core strength of the Company. Our distribution partners are generally compensated through a fixed commission specified in their agency agreement, generally 10% of premiums collected on business they generate. For the year ended December 31, 2022, 3 of our distribution partners were responsible for approximately 30.4% of our gross premiums written and our top 10 distribution partners accounted for approximately 69.8% of gross premiums written. We intend to significantly expand our force of active distribution partners (i.e., those distribution partners with which we write business). In 2022, we had 54 active distribution partners, compared to 39 active distribution partners in 2021, or an increase in the number of active distribution partners of 38%.

Underwriting, Risk Assessment and Pricing

Our underwriting philosophy is aimed at consistently generating acceptable loss ratios through sound risk selection, stringent loss control, and pricing discipline. One key element in sound risk selection is our use of data and analytics. We rely on both internal data, developed over years of operation, and external data. The use of data allows us to more effectively price risks, thereby improving our profitability and allowing us to compete favorably with other insurance carriers. Our philosophy is to understand our industry and be disciplined in our underwriting efforts. We will not compromise profitability for top line growth. Our competitive strategy in underwriting is:

|

● |

Maximize the use of available information acquired through a wide variety of industry resources; |

|

● |

Allow our internal metrics and rating to establish risk pricing and use sound underwriting judgment for risk selection and pricing modification; |

|

● |

Utilize our risk grading system, which combines both objective and subjective inputs, to quantify desirability of risks and improve our overall risk profile; and |

|

● |

Provide very high-quality service to our distribution partners and insureds by responding quickly and effectively to information requests and policy submissions. Treat our distribution partners as partners and have the same expectation of them. |

|

● |

We underwrite our accounts by evaluating each risk with consistently applied standards. Each policy undergoes a thorough evaluation process prior to every renewal. |

We strive to be disciplined in our pricing by pursuing targeted rate changes to continually improve our underwriting profitability while still being able to attract and retain profitable customers. Our pricing reviews involve evaluating our claims experience, loss trends, data acquired from inspections, applications and other data sources to identify characteristics that drive the frequency and severity of our claims. These results drive changes to rates and rating metrics as well as understanding what portions of our business are most profitable. This knowledge and analysis enables us to price risks accurately, improve account retention, and drive profitable new business.

Claims and Litigation Management

Our claims team supports our underwriting strategy by working to provide a timely, good faith claims handling response to our policyholders. Claims excellence is achieved by timely investigation and handling of claims, settlement of meritorious claims for equitable amounts, maintenance of adequate case reserves, and control of claims loss adjustment expenses. Claims on insurance policies are received directly from the insured or through our distribution partners. Our claims department supports our distribution partner relationship strategy by working to provide a consistently responsive level of claim service to our policyholders.

Technology

We utilize a third-party, cloud-based policy administration system that includes policy issuance, claims processing, accounting, loss payment, and document management. This cloud-based system provides online access to electronic copies of policies, quotes, inspections, and any other correspondence enabling our associates to quickly and efficiently underwrite policies and adjust claims as well as respond to our producers’ inquiries. Since the system integrates all aspects of the policy life cycle, from underwriting to billing to claims, we are able to better automate internal workflows through electronic routing thus lowering costs and providing better service to our customers. This system allows us to leverage loss control data for predictive analytics in both the claims and underwriting areas. This third-party system permits us to limit each employee’s access by functional area and managerial level to protect confidential data. Our third-party vendor implements virus and malware protections while still enabling our employees to work from any location. The system is tested on a periodic basis for vulnerability to outside penetration to ensure the system’s protections are sufficient. We have the ability to scale since we are almost entirely a paperless organization. This allows us to integrate off-site employees just as if they are in the office. We intend to remain a leader in the industry by utilizing technology and data analysis to price our coverage based on the risk assumed and to both reduce accidents and provide a prompt response to claims. Our third-party vendor maintains an off-site co-location facility with real-time, redundant data replication as part of its disaster recovery program. If our offices are affected by a natural disaster or other disruption, we can access this cloud-based system to continue our business operations with minimal interruption.

Reinsurance

In accordance with insurance industry practice, we reinsure a portion of our exposure and pay to the reinsurers a portion of the premiums received on all policies reinsured. Insurance policies written by us are reinsured with other insurance companies principally to:

|

● |

reduce net liability on individual risks; |

|

● |

mitigate the effect of individual loss occurrences (including catastrophic losses); |

|

● |

stabilize underwriting results; |

|

● |

decrease leverage; and |

|

● |

increase our underwriting capacity. |

Reinsurance can be facultative reinsurance or treaty reinsurance. Under facultative reinsurance, each policy or portion of a risk is reinsured individually. Under treaty reinsurance, an agreed-upon portion of a class of business is automatically reinsured. Reinsurance also can be classified as quota share reinsurance, pro rata reinsurance or excess of loss reinsurance. Under quota share reinsurance and pro rata reinsurance, the insurance company issuing the policy cedes a percentage of its insurance liability to the reinsurer in exchange for a like percentage of premiums, less a ceding commission. The company issuing the policy in turn recovers from the reinsurer the reinsurer’s share of all losses and loss adjustment expenses incurred on those risks. Under excess of loss reinsurance, an insurer limits its liability to all or a particular portion of the amount in excess of a predetermined deductible or retention. Regardless of type, reinsurance does not legally discharge the insurance company issuing the policy from primary liability for the full amount due under the reinsured policies. However, the assuming reinsurer is obligated to reimburse the company issuing the policy to the extent of the coverage ceded. We determine the amount and scope of reinsurance coverage to purchase each year based on a number of factors. These factors include the evaluation of the risks accepted, consultations with reinsurance intermediates and a review of market conditions, including the availability and pricing of reinsurance. A primary factor in the selection of reinsurers from whom we purchase reinsurance is their financial strength. Our reinsurance arrangements are generally renegotiated annually. For the year ended December 31, 2022, we ceded to reinsurers $625 thousand of premiums written, compared to $469 thousand of premiums written for the year ended December 31, 2021. Ceded premiums written as a percentage of gross premiums written were 5.1% in 2022, and 5.0% in 2021. The increase is primarily a result of a hardening reinsurance pricing environment. We expect the recent dislocation in the capital markets, which has reduced overall capital capacity in the reinsurance marketplace, and dislocation in certain segments of the insurance marketplace, to lead to further hardening of reinsurance pricing. We expect the cost of our reinsurance to increase over the next 12 months.

Losses and LAE Reserves

We are required by applicable insurance laws and regulations to maintain reserves for payment of losses and loss adjustment expenses (“LAE”). These reserves are established for both reported claims and for claims incurred but not reported (“IBNR”), arising from the policies we have issued. The laws and regulations require that provision be made for the ultimate cost of those claims without regard to how long it takes to settle them or the time value of money. The determination of reserves involves actuarial and statistical projections of what we expect to be the cost of the ultimate settlement and administration of such claims. The reserves are set based on facts and circumstances then known, estimates of future trends in claims severity, and other variable factors such as inflation and changing judicial theories of liability.

Estimating the ultimate liability for losses and LAE is an inherently uncertain process. Therefore, the reserve for losses and LAE does not represent an exact calculation of that liability. Our reserve policy recognizes this uncertainty by maintaining reserves at a level providing for the possibility of adverse development relative to the estimation process. We do not discount our reserves to recognize the time value of money.

When a claim is reported to us, our claims personnel establish a “case reserve” for the estimated amount of the ultimate payment. This estimate reflects an informed judgment based upon general insurance reserving practices and on the experience and knowledge of our claims staff. In estimating the appropriate reserve, our claims staff considers the nature and value of the specific claim, the severity of injury or damage, and the policy provisions relating to the type of loss. Case reserves are adjusted by our claims staff as more information becomes available. It is our policy to resolve each claim as expeditiously as possible. These estimates are reported net of amounts estimated to be recoverable from salvage and subrogation.

We maintain IBNR reserves to provide for already incurred claims that have not yet been reported and developments on reported claims. The IBNR reserve is determined by estimating our ultimate net liability for both reported and IBNR claims and then subtracting the case reserves and paid losses and LAE for reported claims.

Each quarter, we compute our estimated ultimate liability using principles and procedures applicable to the lines of business written. However, because the establishment of loss reserves is an inherently uncertain process, we cannot assure you that ultimate losses will not exceed the established loss reserves. Adjustments in aggregate reserves, if any, are reflected in the operating results of the period during which such adjustments are made.

The following table provides information about open claims, reserves, and paid losses and LAE as of December 31, 2022 and December 31, 2021, with dollars in thousands.

|

As of and for the year ending December 31, 2022 |

||||||||||||||||||||

|

Open |

Total |

Case |

IBNR |

Paid Losses |

||||||||||||||||

|

(dollars in thousands) |

Claims |

Reserves |

Reserves |

Reserves |

and LAE |

|||||||||||||||

|

Commercial auto liability |

314 | $ | 7,423 | $ | 4,984 | $ | 2,439 | $ | 5,129 | |||||||||||

|

Commercial auto physical damage |

8 | (13 | ) | (23 | ) | 10 | 727 | |||||||||||||

|

Total net amount |

322 | $ | 7,410 | $ | 4,961 | $ | 2,449 | $ | 5,856 | |||||||||||

|

Reinsurance ceded |

1,070 | 157 | 913 | 895 | ||||||||||||||||

|

Total gross amounts |

$ | 8,480 | $ | 5,118 | $ | 3,362 | $ | 6,751 | ||||||||||||

|

As of and for the year ending December 31, 2021 |

||||||||||||||||||||

|

Open |

Total |

Case |

IBNR |

Paid Losses |

||||||||||||||||

|

(dollars in thousands) |

Claims |

Reserves |

Reserves |

Reserves |

and LAE |

|||||||||||||||

|

Commercial auto liability |

340 | $ | 8,704 | $ | 6,014 | $ | 2,690 | $ | 4,477 | |||||||||||

|

Commercial auto physical damage |

11 | 50 | 25 | 25 | 597 | |||||||||||||||

|

Total net amount |

351 | $ | 8,754 | $ | 6,039 | $ | 2,715 | $ | 5,074 | |||||||||||

|

Reinsurance ceded |

924 | 319 | 605 | 345 | ||||||||||||||||

|

Total gross amounts |

$ | 9,678 | $ | 6,358 | $ | 3,320 | $ | 5,419 | ||||||||||||

The following tables provide a reconciliation of beginning and ending unpaid losses and LAE reserve balances for the years ended December 31, 2022 and 2021, prepared in accordance with GAAP with dollars in thousands.

|

(dollars in thousands) |

December 31, |

|||||||

|

2022 |

2021 |

|||||||

|

Unpaid losses and LAE at beginning of year: |

||||||||

|

Gross |

$ | 9,678 | $ | 9,861 | ||||

|

Ceded |

924 | 1,200 | ||||||

|

Net |

8,754 | 8,661 | ||||||

|

Increase (decrease) in incurred losses and LAE: |

||||||||

|

Current year |

5,933 | 6,070 | ||||||

|

Prior years |

(1,422 | ) | (903 | ) | ||||

|

Total incurred |

4,511 | 5,167 | ||||||

|

Loss and LAE payments for claims incurred: |

||||||||

|

Current year |

2,805 | 1,898 | ||||||

|

Prior years |

3,050 | 3,176 | ||||||

|

Total paid |

5,855 | 5,074 | ||||||

|

Net unpaid losses and LAE at end of year |

$ | 7,410 | $ | 8,754 | ||||

The estimation process for determining the liability for unpaid losses and LAE inherently results in adjustments each year for claims incurred (but not paid) in preceding years. Negative amounts reported for claims incurred related to prior years are a result of claims being settled for amounts less than originally estimated (favorable development). Positive amounts reported for claims incurred related to prior years are a result of claims being settled for amounts greater than originally estimated (unfavorable or adverse development).

Reconciliation of Reserve for Losses and Loss Adjustment Expenses

The following table shows the development of our reserves for unpaid losses and LAE from 2013 through 2022 on a GAAP basis. The top line of the table shows the liabilities at the balance sheet date, including losses incurred but not yet reported. The upper portion of the table shows the cumulative amounts subsequently paid as of successive years with respect to the liability. The lower portion of the table shows the re-estimated amount of the previously recorded liability based on experience as of the end of each succeeding year. The estimates change as more information becomes known about the frequency and severity of claims for individual years. The redundancy (deficiency) exists when the re-estimated liability for each reporting period is less (greater) than the prior liability estimate. The “cumulative redundancy (deficiency)” depicted in the table, for any particular calendar year, represents the aggregate change in the initial estimates over all subsequent calendar years. Gross deficiencies and redundancies may be significantly more or less than net deficiencies and redundancies due to the nature and extent of applicable reinsurance. As noted in the table below, since 2013 the Company has consistently selected initial ultimate loss picks that have proven to be redundant over time (dollars in thousands).

|

Year Ended December 31, |

||||||||||||||||||||||||||||||||||||||||

|

(dollars in thousands) |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

||||||||||||||||||||||||||||||

|

Liability for unpaid loss and LAE, net of reinsurance recoverables |

$ | 6,193 | $ | 5,678 | $ | 5,828 | $ | 6,230 | $ | 8,106 | $ | 11,877 | $ | 11,582 | $ | 8,661 | $ | 8,754 | $ | 7,410 | ||||||||||||||||||||

|

Cumulative amount of liability paid through: |

||||||||||||||||||||||||||||||||||||||||

|

One year later |

1,938 | 2,508 | 2,954 | 4,624 | 5,921 | 5,854 | 4,239 | 3,174 | 3,054 | |||||||||||||||||||||||||||||||

|

Two years later |

3,027 | 3,541 | 4,735 | 6,271 | 8,607 | 7,969 | 6,747 | 4,711 | ||||||||||||||||||||||||||||||||

|

Three years later |

3,414 | 3,905 | 5,241 | 6,923 | 8,909 | 8,858 | 7,894 | |||||||||||||||||||||||||||||||||

|

Four years later |

3,499 | 4,078 | 5,356 | 7,034 | 8,963 | 9,449 | ||||||||||||||||||||||||||||||||||

|

Five years later |

3,514 | 4,080 | 5,432 | 7,074 | 9,047 | |||||||||||||||||||||||||||||||||||

|

Six years later |

3,514 | 4,084 | 5,432 | 7,153 | ||||||||||||||||||||||||||||||||||||

|

Seven years later |

3,514 | 4,084 | 5,438 | |||||||||||||||||||||||||||||||||||||

|

Eight years later |

3,514 | 4,084 | ||||||||||||||||||||||||||||||||||||||

|

Nine years later |

3,514 | |||||||||||||||||||||||||||||||||||||||

|

Ten years later |

||||||||||||||||||||||||||||||||||||||||

|

Liability estimated after: |

||||||||||||||||||||||||||||||||||||||||

|

One year later |

5,729 | 5,408 | 5,873 | 7,264 | 9,959 | 10,882 | 9,066 | 7,758 | 7,336 | |||||||||||||||||||||||||||||||

|

Two years later |

4,498 | 4,323 | 5,717 | 7,242 | 9,671 | 10,226 | 9,489 | 6,842 | ||||||||||||||||||||||||||||||||

|

Three years later |

3,590 | 4,345 | 5,466 | 7,247 | 9,656 | 10,249 | 9,217 | |||||||||||||||||||||||||||||||||

|

Four years later |

3,594 | 4,110 | 5,484 | 7,246 | 9,470 | 10,140 | ||||||||||||||||||||||||||||||||||

|

Five years later |

3,514 | 4,128 | 5,473 | 7,263 | 9,349 | |||||||||||||||||||||||||||||||||||

|

Six years later |

3,514 | 4,117 | 5,482 | 7,199 | ||||||||||||||||||||||||||||||||||||

|

Seven years later |

3,514 | 4,117 | 5,444 | |||||||||||||||||||||||||||||||||||||

|

Eight years later |

3,514 | 4,086 | ||||||||||||||||||||||||||||||||||||||

|

Nine years later |

3,514 | |||||||||||||||||||||||||||||||||||||||

|

Ten years later |

||||||||||||||||||||||||||||||||||||||||

|

Cumulative total redundancy (deficiency) |

||||||||||||||||||||||||||||||||||||||||

|

Gross liability — end of year |

6,193 | 5,678 | 5,828 | 6,230 | 8,468 | 12,580 | 12,415 | 9,861 | 9,677 | 8,480 | ||||||||||||||||||||||||||||||

|

Reinsurance recoverable |

- | - | - | - | 362 | 703 | 833 | 1,200 | 923 | 1,070 | ||||||||||||||||||||||||||||||

|

Net liability — end of year |

6,193 | 5,678 | 5,828 | 6,230 | 8,106 | 11,877 | 11,582 | 8,661 | 8,754 | 7,410 | ||||||||||||||||||||||||||||||

|

Gross re-estimated liability — latest |

3,514 | 4,086 | 5,444 | 7,199 | 10,247 | 11,494 | 10,354 | 7,672 | 8,179 | 8,480 | ||||||||||||||||||||||||||||||

|

Re-estimated reinsurance recoverables — latest |

- | - | - | - | 898 | 1,354 | 1,137 | 830 | 843 | 1,070 | ||||||||||||||||||||||||||||||

|

Net re-estimated liability — latest |

3,514 | 4,086 | 5,444 | 7,199 | 9,349 | 10,140 | 9,217 | 6,842 | 7,336 | 7,410 | ||||||||||||||||||||||||||||||

|

Gross cumulative redundancy (deficiency) |

$ | 2,679 | $ | 1,592 | $ | 384 | $ | (969 | ) | $ | (1,779 | ) | $ | 1,086 | $ | 2,061 | $ | 2,189 | $ | 1,498 | $ | - | ||||||||||||||||||

Investments

Our investments in debt and equity securities are classified as available for sale and are carried at fair value with unrealized gains and losses reflected as a component of equity net of taxes. The goal of our investment activities is to complement and support our overall mission. As such, the investment portfolio’s goal is to maximize after-tax investment income and price appreciation while maintaining the portfolio’s target risk profile. An important component of our operating results has been the return on invested assets. Our investment objectives are (i) to preserve and grow capital and surplus, in order to improve our competitive position and allow for expansion of insurance operations; (ii) to ensure sufficient cash flow and liquidity to fund expected liability payments and otherwise support our underwriting strategy; (iii) to provide a reasonable and stable level of income; and (iv) to maintain a portfolio which will assist in attaining the highest possible rating from A.M. Best. See Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Quantitative and Qualitative Information about Market Risk. In addition to any investments prohibited by the insurance laws and regulations of District of Columbia and any other applicable states, our investment policy prohibits the following investments and investing activities:

|

● |

short sales; |

|

● |

purchase of securities on margin; |

|

● |

derivatives; |

|

● |

investment in commodities; |

|

● |

mortgage derivatives such as inverse floaters, interest only strips and principal only strips; |

|

● |

options, puts and futures contracts; and |

|

● |

any security that would not be in compliance with the regulations of the Department. |

Our board of directors developed our investment policy and reviews the policy periodically. Exceptions to prohibitions discussed above are allowed with express written authority of the investment committee of our board of directors, but under no circumstance may such exception exceed 10% of our invested assets. Our investment portfolio is managed internally. The following table sets forth information concerning our available for sale, fixed maturity investments (dollars in thousands).

|

At December 31, |

||||||||||||||||

|

2022 |

2021 |

|||||||||||||||

|

Cost or |

Cost or |

|||||||||||||||

|

Amortized |

Estimated |

Amortized |

Estimated |

|||||||||||||

|

(dollars in thousands) |

Cost |

Fair Value |

Cost |

Fair Value |

||||||||||||

|

U.S. government |

$ | 964 | $ | 920 | $ | - | $ | - | ||||||||

|

States, territories and possessions |

40 | 40 | 41 | 43 | ||||||||||||

|

Political subdivisions |

4,458 | 4,297 | 5,453 | 5,670 | ||||||||||||

|

Special revenue |

8,167 | 7,786 | 10,386 | 10,873 | ||||||||||||

|

Industrial and miscellaneous |

13,071 | 12,258 | 4,311 | 4,467 | ||||||||||||

|

Asset backed |

1,201 | 898 | 1,213 | 1,120 | ||||||||||||

|

Total rated securities |

27,901 | 26,199 | 21,404 | 22,173 | ||||||||||||

|

Redeemable preferred |

1,454 | 1,351 | 1,268 | 1,320 | ||||||||||||

|

Total available for sale securities |

$ | 29,355 | $ | 27,550 | $ | 22,672 | $ | 23,493 | ||||||||

The following table summarizes the distribution of our portfolio of fixed maturity investments as a percentage of total estimated fair value based on credit ratings assigned by Standard & Poor’s Financial Services, LLC (“S&P”) at December 31, 2022 and December 31, 2021 (dollars in thousands).

|

(dollars in thousands) |

December 31, 2022 |

December 31, 2021 |

||||||||||||||

|

Estimated |

Percent of |

Estimated |

Percent of |

|||||||||||||

|

Rating (1) |

Fair Value |

Total (2) |

Fair Value |

Total (2) |

||||||||||||

|

AAA |

$ | 618 | 2.4 | % | $ | 404 | 1.8 | % | ||||||||

|

AA |

12,132 | 46.3 | % | 12,337 | 55.6 | % | ||||||||||

|

A |

2,202 | 8.4 | % | 5,063 | 22.8 | % | ||||||||||

|

BBB |

8,204 | 31.3 | % | 1,940 | 8.7 | % | ||||||||||

|

BB |

2,848 | 10.9 | % | 2,429 | 11.0 | % | ||||||||||

|

B |

195 | 0.7 | % | - | 0.0 | % | ||||||||||

|

Total |

$ | 26,199 | 100.0 | % | $ | 22,173 | 100.0 | % | ||||||||

|

(1) |

The ratings set forth in this table are based on the ratings assigned by S&P. If S&P’s ratings were unavailable, the equivalent ratings supplied by Moody’s Investors Service, Inc., Fitch Ratings, Inc. or the Securities Valuation Office of the National Association of Insurance Commissioners were used, where available. |

|

(2) |

Represents percent of fair value for classification as a percent of the total portfolio. |

The table below sets forth the maturity profile of our investments in available for sale, fixed maturity securities by contractual maturities as of December 31, 2022. Expected maturities could differ from contractual maturities because borrowers may have the right to call or prepay obligations, with or without call or prepayment penalties (dollars in thousands).

|

December 31, 2022 |

||||||||

|

Amortized |

Estimated |

|||||||

|

(dollars in thousands) |

Cost |

Fair Value (1) |

||||||

|

Less than one year |

$ | 975 | $ | 965 | ||||

|

One through five years |

14,570 | 13,842 | ||||||

|

Five through ten years |

7,297 | 6,950 | ||||||

|

Greater than ten years |

3,858 | 3,543 | ||||||

|

MBS/ABS |

1,201 | 899 | ||||||

|

Total debt securities |

$ | 27,901 | $ | 26,199 | ||||

|

(1) |

Debt securities are carried at fair value in our financial statements. |

Other invested assets consist of (i) non-controlling interests in unaffiliated limited partnerships that invest primarily in small-cap public equities, (ii) an equity interest in Trustar Bank, a related entity, (iii) an investment in a limited liability company, and (iv) a non-controlling equity interest in a private company. The following table shows the cost and estimated fair values of such assets at December 31, 2022 and 2021 (dollars in thousands).

|

December 31, 2022 |

||||||||||||||||

|

Carrying |

Gross Unrealized |

|||||||||||||||

|

(dollars in thousands) |

Cost |

Value |

Gains |

Losses |

||||||||||||

|

Limited partnership investments |

$ | 3,701 | $ | 3,608 | $ | 336 | $ | (430 | ) | |||||||

|

Equity interest in Trustar Bank |

250 | 238 | - | (12 | ) | |||||||||||

|

Equity interest in CSE Opportunity Fund II, LLC |

55 | 55 | - | - | ||||||||||||

|

Equity interest in Stream-IT.app |

500 | 500 | - | - | ||||||||||||

|

Total other invested assets |

$ | 4,506 | $ | 4,401 | $ | 336 | $ | (442 | ) | |||||||

|

December 31, 2021 |

||||||||||||||||

|

Carrying |

Gross Unrealized |

|||||||||||||||

|

(dollars in thousands) |

Cost |

Value |

Gains |

Losses |

||||||||||||

|

Limited partnership investments |

$ | 3,701 | $ | 4,929 | $ | 1,246 | $ | (18 | ) | |||||||

|

Equity interest in Trustar Bank |

250 | 216 | - | (34 | ) | |||||||||||

|

Equity interest in CSE Opportunity Fund II, LLC |

128 | 128 | - | - | ||||||||||||

|

Equity interest in Stream-IT.app |

500 | 500 | - | - | ||||||||||||

|

Total other invested assets |

$ | 4,579 | $ | 5,773 | $ | 1,246 | $ | (52 | ) | |||||||

At December 31, 2022, the average maturity of our fixed maturity investment portfolio was 4.7 years and the average duration was 4.1 years. As a result, the fair value of our investments may fluctuate significantly in response to changes in interest rates. In addition, we may experience investment losses to the extent our liquidity needs require the disposition of fixed maturity securities in unfavorable interest rate environments.

We use quoted values and other data provided by independent pricing services as inputs in our process for determining fair values of our investments. The pricing services cover substantially all of the securities in our portfolio for which publicly quoted values are not available. The pricing services’ evaluations represent an exit price, a good faith opinion as to what a buyer in the marketplace would pay for a security in a current sale. The pricing is based on observable inputs either directly or indirectly, such as quoted prices in markets that are active, quoted prices for similar securities at the measurement date, or other inputs that are observable.

Our independent third-party investment management technology provider delivers to us pricing information that they obtain from independent pricing services to determine the fair value of our fixed maturity securities. After performing a detailed review of the information obtained from the pricing service, limited adjustments may be made by management to the values provided.

Our average cash and invested assets, net investment income, and return on average cash and invested assets for the years ended December 31, 2022 and 2021 were as follows (dollars in thousands):

|

(dollars in thousands) |

2022 |

2021 |

||||||

|

Average cash and invested assets (1) |

$ | 40,914 | $ | 41,559 | ||||

|

Net investment income |

$ | 1,157 | $ | 1,171 | ||||

|

Return on average cash and invested assets |

2.8 | % | 2.8 | % | ||||

|

(1) |

Average cash and invested assets does not include real estate held for the production of income. |

A.M. Best Rating

A.M. Best Company, Inc. (“A.M. Best”) rates insurance companies based on factors of concern to policyholders. The latest rating evaluation by A.M. Best was published on April 12, 2022. In its latest evaluation, A.M. Best affirmed FIC’s Financial Strength Rating of “B++” (Good). According to the A.M. Best guidelines, companies rated “B++” are considered by A.M. Best to have “a good ability to meet their ongoing insurance obligations.” In addition, in its most recent evaluation, A.M. Best upgraded FIC’s Long-Term Issuer Credit Rating to “bbb+” (Good) from “bbb” (Good). According to the A.M. Best guidelines, companies rated “bbb+” are considered by A.M. Best to have “a good ability to meet their ongoing senior financial obligations.” The outlook assigned to both the Financial Strength Rating and the Long-Term Issuer Credit Rating is stable. These ratings evaluate the claims paying ability and financial strength of a company and are not an investment recommendation. In evaluating a company’s financial and operating performance, A.M. Best reviews:

|

● |

the company’s profitability, leverage and liquidity; |

|

● |

its book of business; |

|

● |

the adequacy and soundness of its reinsurance; |

|

● |

the quality and estimated fair value of its assets; |

|

● |

the adequacy of its reserves and surplus; |

|

● |

its capital structure; |

|

● |

the experience and competence of its management; and |

|

● |

its marketing presence. |

In its ratings report on FIC, A.M. Best recognized FIC’s strong balance sheet position, noting its “Strongest” level of risk-adjusted capitalization, as measured by Best’s Capital Adequacy Ratio (“BCAR”). A.M. Best noted that FIC had experienced underwriting losses during the most recent five (5) years, primarily related to (i) discontinued operations (including coverage for non-emergency medical transportation vehicles and certain higher-severity states) and (ii) elevated fixed costs in 2021 as it has invested in its business ahead of anticipated premium growth. A.M. Best also noted FIC’s limited business profile as it is concentrated in the commercial auto segment. Finally, A.M. Best noted FIC’s enterprise risk management (“ERM”) as being appropriate for its business, citing improvements made in the ERM function since its prior rating evaluation. Specifically, A.M. Best noted that FIC had created a formal ERM committee, with representation across each department. A.M Best noted that the ERM committee held regular meetings, with documented meeting minutes and progress reports.

Competition

Given our focus on certain business class segments within the commercial automobile insurance line of business, the market conditions for our business varies geographically. The level of competition we face in each of our target geographies is based upon the number and nature of the other market participants that are also actively seeking to write business for the business class segments that we target. In states that have less competition, our primary competitors are Progressive and National Indemnity. In states with a high degree of competition such as Ohio, Wisconsin, and Maryland, we compete with the competitors listed above, in addition to other specialty carriers such as Philadelphia Insurance Company, Lancer Insurance Company, and New York Marine & General, as well as competition from other regional mutual carriers, excess and surplus lines companies, and risk retention groups. Despite significant competition, our management team believes the Company can continue to maintain and grow its market share.

Enterprise Risk Management

The enterprise risk management (“ERM”) function is the responsibility of our management team, the board of directors, and certain board committees. We have established ERM policies and procedures which have been approved by our board of directors. To ensure that the organization is operating in a manner consistent with these policies and procedures, we have established an ERM committee that consists of certain members of our senior management team, with each member representing a core functional area within the organization. The functional areas include: (i) strategic, (ii) investments, (iii) digital commerce and technology, (iv) finance, (v) business development, (vi) insurance operations, and (vii) product. Each member of the ERM committee is responsible for identifying and defining key risks and risk events for their respective functional area, prioritizing risks based on estimated impact and likelihood, establishing root cause analysis (“RCA”) maps, and developing risk mitigation action plans for each of the identified risks and risk events. The ERM committee meets on a regular basis and periodically reports to the board of directors and certain board committees throughout the year. To limit its exposure in the event of a lawsuit, the Company maintains a full line of insurance coverages, including errors and omissions, directors’ and officers’ liability, employment practices liability, and cyber liability insurance.

Legal Proceedings

We are, from time to time, involved in various legal proceedings in the ordinary course of business. While it is not possible to forecast the outcome of such legal proceedings, in light of existing insurance, reinsurance, and established reserves, we believe that there is no individual case pending that is likely to have a material adverse effect on our financial condition or results of operations.

Properties

We lease approximately 9,544 square feet of office space at 8401 Connecticut Avenue, Chevy Chase, Maryland. As of December 31, 2022, we subleased all of such space to three tenants. We have adopted a hybrid work-from-home employment model and anticipate needing less leased office than we have had historically. We entered into a new lease for one office suite, totaling 1,579 square feet, in Bethesda, Maryland under an operating lease that commenced September 1, 2022, and has a term expiring 41 months after commencement. We believe this office space will be adequate to accommodate the Company’s existing needs and any increase in workforce for the foreseeable future.

Employees

As of December 31, 2022 the Company had 19 employees, all of which are full-time. We provide health, dental, disability, vision, and life insurance to our full-time employees who have completed 90 days of full-time employment. Full-time employees are also eligible for paid vacation and to participate in the FIC 401(k) plan, which features a safe harbor contribution by FIC equal to 3% of the employee’s eligible compensation. We have the option to make an additional profit-sharing contribution to the plan. The Company’s Employee Stock Ownership Plan (“ESOP”) is an integral component of long-term compensation and is also a valuable employee retention tool. The Company’s ESOP is a qualified retirement plan that grants shares of the Company’s stock to eligible employees. The ESOP provides a mechanism whereby employees can actively participate in building long-term value in alignment with the interests of other shareholders. None of our employees are covered by a collective bargaining agreement. We believe that relations with our employees are good.

Federal Income Tax

We file a U.S. federal income tax return that includes the pass-through income or loss of majority owned direct and indirect subsidiaries. State tax returns are filed depending on applicable laws. We record adjustments related to prior years’ taxes during the period in which they are identified, generally when the tax returns are filed. The effect of these adjustments on the current and prior periods (during which the differences originated) is evaluated based upon quantitative and qualitative factors and are considered in relation to the consolidated financial statements taken as a whole for the respective years. The provision for income taxes for the years ended December 31, 2022 and 2021, is comprised of the following (dollars in thousands):

|

Years ended December 31, |

||||||||

|

(dollars in thousands) |

2022 |

2021 |

||||||

|

Current federal income tax expense |

$ | - | $ | - | ||||

|

Current state income tax expense |

42 | - | ||||||

|

Deferred federal and state income tax expense |

594 | 104 | ||||||

|

Income tax expense (benefit) |

$ | 636 | $ | 104 | ||||

A reconciliation of the expected income tax expense to the actual income tax expense and the reconciliation of the federal statutory rate to our effective tax rate for the periods ended December 31, 2022 and 2021 is presented below (dollars in thousands):

|

December 31, |

% of Pre-Tax |

|||||||

|

(dollars in thousands) |

2022 |

Income |

||||||

|

Provision for income taxes at the statutory federal rate |

$ | (2,412 | ) | 21.0 | % | |||

|

Increase (reduction) in taxes resulting from: |

||||||||

|

Permanent differences: |

||||||||

|

Dividends received deduction |

(6 | ) | 0.1 | % | ||||

|

Tax exempt interest |

(18 | ) | 0.2 | % | ||||

|

Gain on extinguishment of related party loan |

84 | -0.7 | % | |||||

|

Policyholder dividends |

1,534 | -13.4 | % | |||||

|

Pass-through entity income |

(32 | ) | 0.3 | % | ||||

|

Temporary differences: |

||||||||

|

Valuation allowance adjustment |

1,127 | -9.8 | % | |||||

|

Prior year true-ups and other |

359 | -3.2 | % | |||||

|

Actual income tax, as provided in the consolidated financial statements |

$ | 636 | -5.5 | % | ||||

|

December 31, |

% of Pre-Tax |

|||||||

|

(dollars in thousands) |

2021 |

Income |

||||||

|

Provision for income taxes at the statutory federal rate |

$ | (131 | ) | 21.0 | % | |||

|

Increase (reduction) in taxes resulting from: |

||||||||

|

Permanent differences: |

||||||||

|

Dividends received deduction |

(24 | ) | 3.8 | % | ||||

|

Tax exempt interest |

(26 | ) | 4.2 | % | ||||

|

Gain on extinguishment of related party loan |

- | 0.0 | % | |||||

|

Pass-through entity income |

(81 | ) | 13.0 | % | ||||

|

Temporary differences: |

||||||||

|

Valuation allowance adjustment |

145 | -4.9 | % | |||||

|

Prior year true-ups and other |

221 | -43.1 | % | |||||

|

Actual income tax, as provided in the consolidated financial statements |

$ | 104 | -6.0 | % | ||||

Significant components of our deferred tax assets and liabilities at December 31, 2022 and 2021 were as follows (dollars in thousands):

|

December 31, |

December 31, |

|||||||

|

(dollars in thousands) |

2022 |

2021 |

||||||

|

Deferred tax assets: |

||||||||

|

Unearned premiums |

$ | 265 | $ | 176 | ||||

|

Loss discounting |

64 | 119 | ||||||

|

Net operating loss carryforward |

2,526 | 2,479 | ||||||

|

Net unrealized loss on investments |

379 | - | ||||||

|

Lease liability |

152 | 191 | ||||||

|

Defined benefit plan |

101 | 58 | ||||||

|

Other |

202 | 201 | ||||||

|

Valuation allowance adjustment |

(1,493 | ) | (366 | ) | ||||

|

Total deferred tax assets |

2,196 | 2,858 | ||||||

|

Deferred tax liabilities: |

||||||||

|

Deferred policy acquisition costs |

290 | 155 | ||||||

|

Unrealized gains on investments |

- | 161 | ||||||

|

Deferred gain -- 1031 exchange |

1,879 | 1,879 | ||||||

|

Other |

27 | 663 | ||||||

|

Total deferred tax liabilities |

2,196 | 2,858 | ||||||

|

Net deferred tax liability |

$ | - | $ | - | ||||

At December 31, 2022, we had net operating loss (“NOL”) carry forwards available for tax purposes of $12.0 million that will begin to expire in 2037, and foreign tax credit carry-forwards of $1.0 thousand. In 2015, ACIC Consolidated Properties, LLC sold a building, placed the proceeds in trust and then reinvested the proceeds in similar use (like-kind) property, availing itself of the ability (pursuant to Section 1031 of the tax code) to defer the taxes that would otherwise have been due on the gain. As a result, we established a deferred tax liability of $1.9 million (as shown above). In assessing the valuation of deferred tax assets, we consider whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. A valuation allowance against deferred tax assets has been established, as we believe it is more likely than not the deferred tax assets will not be realized based on its historical taxable income, or be offset to deferred tax liabilities. We had no material unrecognized tax benefits and no adjustments to liabilities or operations were required. There were no interest or penalties related to income taxes that have been accrued or recognized as of and for the years ended December 31, 2022 and 2021. If any had been recognized, these would have been reported in income tax expense. Generally, taxing authorities may examine our tax returns for the three years from the date of filing. Our tax returns for the years ended December 31, 2020 through December 31, 2022 remain subject to examination.

Regulation

Our businesses are subject to a number of federal and state laws and regulations. These laws and regulations apply to FIC’s operations as an insurance company and FRM’s operations as a licensed insurance producer. Our operations are subject to extensive laws and governmental regulations, including administrative determinations, court decisions, and similar constraints. The purpose of the laws and regulations affecting our operations is primarily to protect our policyholders and not our shareholders. Many of the laws and regulations to which we are subject are regularly re-examined, and existing or future laws and regulations may become more restrictive or otherwise adversely affect our operations. State insurance laws regulate most aspects of our insurance business, and we are regulated by the insurance departments of the states in which we sell insurance policies. The NAIC assists the various state insurance regulators in the development, review, and implementation of a wide range of financial and other regulations over the insurance industry.

Insurance Regulation

FIC is licensed as a property and casualty insurer in 34 states and the District of Columbia. State insurance laws regulate many aspects of our business. Such regulation is vested primarily in state agencies having broad administrative and in some instances discretionary power dealing with many aspects of our business, which may include, among other things, required reserve liability levels, permitted classes of investments, transactions among affiliates, marketing practices, advertising, privacy, policy forms, reinsurance reserve requirements, acquisitions, mergers, and capital adequacy, and is concerned primarily with the protection of policyholders and other consumers rather than shareholders. We are subject to financial and market conduct examinations by insurance regulators from our domiciliary states and from other states in which we do business. State laws and regulations governing the financial condition of insurers apply to FIC, including standards of solvency, risk-based capital requirements, types, quality and concentration of investments, establishment and maintenance of reserves, required methods of accounting, reinsurance and minimum capital and surplus requirements, and the business conduct of insurers, including sales and marketing practices, claim procedures and practices, and policy form content. In addition, state insurance laws require licensing of insurers and their agents. State insurance regulators have the power to grant, suspend, and revoke licenses to transact business and to impose substantial fines and other penalties.

Agent Licensing

FIC sells its insurance products through FRM, its appointed insurance producer. FRM in turn also works with other independent distributors and independent agents. The states in which insurance agents operate require agents to obtain and maintain licenses to sell insurance products. In order to sell insurance products, the agents must be licensed by their resident state and by any other state in which they do business and must comply with regulations regarding licensing, sales and marketing practices, premium collection and safeguarding, and other market conduct practices. Consistent with various federal and state legal requirements, FRM monitors all of the agents that sell FIC policies, and FRM monitors the agencies with which the independent distributors and independent agents work in order to understand and evaluate the agencies’ training and general supervision programs relevant to regulatory compliance.

Financial Review

FIC is required to file detailed annual and quarterly financial reports with the insurance departments in the states in which we do business, and its business and accounts are subject to examination by such agencies at any time. These examinations generally are conducted under NAIC guidelines. Under the rules of these jurisdictions, insurance companies are examined periodically (generally every three to five years) by one or more of the supervisory agencies on behalf of the states in which they do business.

Market Conduct Regulation

The laws and regulations governing our insurance businesses include numerous provisions governing the marketplace activities of insurers, such as FIC, including regulations governing the form and content of disclosures to consumers, advertising, product replacement, sales and underwriting practices, complaint handling, and claims handling. State insurance regulators enforce compliance, in part, through periodic market conduct examinations.

Insurance Holding Company Regulation