As filed with the Securities and Exchange Commission on

Securities Act File No. 333-173306

Investment Company Act File No. 811-22545

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [X] |

| Pre-Effective Amendment No. | [ ] |

| Post Effective Amendment No. 35 | [X] |

and/or

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | [X] |

| Amendment No. 39 | [X] |

(Check appropriate box or boxes)

(Exact Name of Registrant as Specified in Charter)

48 Wall Street, Suite 1100, New York, New York 10005

(Address of Principal Executive Offices)

1-212-918-4705

(Registrant’s Telephone Number, including Area Code)

James Abate, 48 Wall Street, Suite 1100, New York, New York 10005

(Name and Address of Agent for Service)

Copies of Communications to:

JoAnn Strasser

Thompson Hines LLP

41 South High Street, Suite 1700

Columbus, Ohio 43215-6101

It is proposed that this filing will become effective:

| [X] | Immediately upon filing pursuant to paragraph (b) |

| [ ] | On (date) pursuant to paragraph (b) |

| [ ] | 60 days after filing pursuant to paragraph (a)(1) |

| [ ] | 75 days after filing pursuant to paragraph (a)(2) |

| [ ] | On (date) pursuant to paragraph (a)(1) |

| [ ] | On (date) pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

| [ ] | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

Centre American Select Equity Fund

| Investor Class (Ticker: ) | Institutional Class (Ticker: ) |

Centre Global Infrastructure Fund

| Investor Class (Ticker: ) | Institutional Class (Ticker: ) |

Each a series of

CENTRE FUNDS

PROSPECTUS

This prospectus contains information about the Centre American Select Equity Fund and Centre Global Infrastructure Fund, (each, a “Fund” and collectively, the “Funds”), each of which is a series of Centre Funds (the “Trust”), that you should know before investing. You should read this prospectus carefully before you invest or send money, and keep it for future reference. For questions or for Shareholder Services, please call 1-855-298-4236 or visit us online at www.centrefunds.com.

The U.S. Securities and Exchange Commission (the “SEC”) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

1

TABLE OF CONTENTS

| Page | |

| SUMMARY OF CENTRE AMERICAN SELECT EQUITY FUND | 4 |

| INVESTMENT OBJECTIVE | 4 |

| FEES AND EXPENSES OF THE FUND | 4 |

| PRINCIPAL INVESTMENT STRATEGIES | 5 |

| PRINCIPAL RISKS OF INVESTING IN THE FUND | 6 |

| PERFORMANCE INFORMATION | 7 |

| MANAGEMENT OF THE FUND’S PORTFOLIO | 9 |

| PURCHASE AND SALE OF FUND SHARES | 9 |

| TAX INFORMATION | 9 |

| FINANCIAL INTERMEDIARY COMPENSATION | 9 |

| SUMMARY OF CENTRE GLOBAL INFRASTRUCTURE FUND | 11 |

| INVESTMENT OBJECTIVE | 11 |

| FEES AND EXPENSES OF THE FUND | 11 |

| PRINCIPAL INVESTMENT STRATEGIES | 12 |

| PRINCIPAL RISKS OF INVESTING IN THE FUND | 13 |

| PERFORMANCE INFORMATION | 16 |

| MANAGEMENT OF THE FUND’S PORTFOLIO | 17 |

| PURCHASE AND SALE OF FUND SHARES | 17 |

| TAX INFORMATION | 18 |

| FINANCIAL INTERMEDIARY COMPENSATION | 18 |

| ADDITIONAL INVESTMENT POLICIES AND RISKS | 18 |

| MANAGEMENT OF THE FUNDS | 21 |

| THE INVESTMENT ADVISER | 21 |

| BOARD OF TRUSTEES | 22 |

| THE DISTRIBUTOR | 22 |

| INVESTING IN A FUND | 22 |

| PURCHASING SHARES OF THE FUNDS | 23 |

| REDEEMING SHARES OF THE FUNDS | 26 |

| BUYING OR SELLING SHARES THROUGH A FINANCIAL INTERMEDIARY | 27 |

| ADDITIONAL INVESTMENT INFORMATION | 28 |

| FREQUENT PURCHASES AND REDEMPTIONS | 29 |

| EXCHANGING SHARES | 30 |

| COMPENSATION FOR DISTRIBUTION AND SHAREHOLDER SERVICES | 30 |

| OTHER IMPORTANT INVESTMENT INFORMATION | 31 |

| DIVIDENDS, DISTRIBUTIONS, AND TAXES | 31 |

2

| ELECTRONIC DELIVERY OF DOCUMENTS | 32 |

| CODES OF ETHICS | 32 |

| IDENTITY THEFT PROCEDURES | 32 |

| PROXY VOTING POLICIES AND PROCEDURES | 32 |

| DISCLOSURE OF PORTFOLIO HOLDINGS | 32 |

| ANNUAL STATEMENTS | 32 |

| HOUSEHOLDING | 33 |

| FINANCIAL HIGHLIGHTS | 34 |

| ADDITIONAL INFORMATION | Back Cover |

3

The Centre American Select Equity Fund (the “Fund”) seeks long-term growth of capital.

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

(fees paid directly from your investment)

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | |

Redemption Fee (as a percentage of amount redeemed; charged upon any redemption of shares within 90 days of the purchase of such shares) |

% |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

Investor Class |

Institutional

Class | |

| Management Fees(1) | ||

| Distribution and/or Service (12b-1) Fees | ||

| Other Expenses | ||

| Shareholder Service Fees | ||

| Remaining Other Expenses | ||

| Total Annual Fund Operating Expenses | ||

| Fee Waiver and/or Expense Reimbursement(2) | ( | |

Net Annual Fund Operating Expenses (after fee waiver and/or expense reimbursements) |

| 1 | |

| 2 |

4

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same and the expense reduction/reimbursement described above remains in place for the contractual period only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor Class | $ |

$ |

$ |

$ |

| Institutional Class | $ |

$ |

$ |

$ |

Portfolio

Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over”

its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund

shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example,

affect the Fund’s performance. During the most recent fiscal year ended September 30, 2024, the Fund’s portfolio turnover

rate was

The investment objective of the Fund is to seek long-term growth of capital. This investment objective may be changed without shareholder approval. The Fund is a diversified fund that normally invests at least 80% of its net assets, plus borrowings for investment purposes, in equity securities of large capitalization U.S. companies. U.S. companies, for this purpose, consist of those companies that: (i) are incorporated in the U.S.; and (ii) list their common stock on, and principally trade on, the New York Stock Exchange (“NYSE”) (including NYSE Arca and NYSE American), the NASDAQ Global Select Market, the NASDAQ Select Market, or the NASDAQ Capital Market. The 80% portion of the Fund’s portfolio consists of investments in U.S. companies that are members of the S&P 500 Index or possess similar minimum market capitalization and trading volume attributes.1 The Fund’s common stock investments may include exchange-listed equities from companies across various sectors and industries. The remaining 20% of the Fund’s net assets, plus borrowings for investment purposes, may include small-cap and mid-cap companies, preferred stock, exchange-traded funds (“ETFs”), and preferred stock.

| 1 | Under current S&P Dow Jones Indices market capitalization guidelines, companies are required to have a market value of at least $20.5 billion for listing in the S&P 500 Index. S&P Dow Jones Indices typically makes adjustments to its benchmark indexes on an annual basis. |

In selecting investments for the Fund, the Adviser utilizes a “bottom-up” fundamental stock selection process that the Adviser believes yields a more accurate picture of a company’s intrinsic value. The Adviser analyzes a variety of factors when selecting investments for the Fund, such as a company’s operations, risk profile, growth expectations and valuation of its securities. The Adviser utilizes a disciplined, Economic Value Added2 framework to select investments. The framework focuses on the fundamentals of shareholder wealth creation and wealth destruction similar to the way a traditional, long-term focused corporate investor looking at all aspects of the business would assess a company’s value. In the shorter-term, markets often undervalue or overvalue a company’s ability to create or destroy shareholder wealth. The framework seeks to identify and exploit these investment opportunities. The approach is designed to capture excess returns when the market price of a stock converges toward the Adviser’s target price.

In determining whether a particular company or security may be a suitable investment for the Fund, the Adviser may focus on any number of different attributes that may include, without limitation: the company’s ability to generate favorable returns in light of current growth prospects, market position and expertise, brand value, pricing power, measures of financial strength (e.g., strong balance sheet), profit margin changes, return on capital improvement, sustainability of revenue growth, ability to generate cash flow, strong management, commitment to shareholders’ interests, dividends or current income, market share gains, innovation and reinvestment, corporate governance and other indications that a company or a security may be an attractive investment. Lastly, the Adviser integrates security selection with appropriate stock position sizing (determining the appropriate percentage of the Fund’s assets to commit to a particular investment) in order to maximize return relative to risk. The Adviser may sell or reduce the Fund’s position in a security when the facts or analysis surrounding the reasons for investing in the security have changed.

5

The Fund may purchase or sell exchange-traded derivative products, such as exchange-traded futures and options, for capital preservation, enhancement of returns, temporary cash management, or investment transition purposes. For example, the Adviser may utilize exchange-traded futures and options to hedge the risks of existing stock positions in the Fund’s portfolio against significant equity market declines that may occur over short periods of time. Such capital protection strategies will be used tactically when the Adviser’s current assessment of market valuation indicates forward returns as low relative to downside risk and the cost to upside potential from utilizing portfolio preservation tools reasonable. A protective put option strategy, when tactically employed, is executed using exchange-traded put options on U.S. large capitalization Indices such as the S&P 500 Index to hedge the portfolio and to reduce volatility. Generally, S&P 500 Index put options and others have an inverse relationship to their underlying Index level, meaning that the value of an index put option generally increases as the underlying securities in the Fund decrease in price and decreases as those securities increase in price. The Adviser may also seek to enhance returns by writing (selling) out of the money call options tailored with exercise prices generally above the current market prices of stocks held in the Fund or on U.S. large capitalization Indices such as the S&P 500 Index at the time of the call sale. As the seller of the call option, the Fund receives cash (the premium) from the purchaser. Furthermore, the Fund may also invest in S&P 500 Index futures to increase the Fund’s overall market exposure following cash inflows from new investments in the Fund.

| 2 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

The Fund generally maintains a fully-invested posture. As such, cash is typically held to a minimum. However, significant investor inflows may temporarily increase cash positions. The Fund may also, under unusual circumstances, take temporary defensive positions and hold up to 100% of its portfolio in cash or cash equivalent positions. The Fund may engage in frequent or active trading depending on market conditions, resulting in a high portfolio turnover rate. A high portfolio turnover rate may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance.

Common Stock Risk. The value of common stocks held by the Fund might decrease in response to the activities of a single company or in response to general market or economic conditions. If this occurs, the value of the Fund may also decrease.

Market Risk. Market risk refers to the possibility that the value of securities held by the Fund may decline due to daily fluctuations in the securities markets. Asset prices change daily as a result of many factors, including developments affecting the condition of individual companies, the sector or industries in which they operate, and the market in general. The price of a security or other instrument may even be affected by factors unrelated to the value or condition of its issuer, such as changes in interest rates, national and international economic and/or political conditions and general market conditions. In a declining stock market, security prices for all companies (including those in the Fund’s portfolio) may decline regardless of any company’s long-term prospects. The Fund’s performance per share will change daily in response to such factors. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. There is a risk that you may lose money by investing in the Fund.

6

Risks of Investing in Undervalued Securities. Undervalued securities are, by definition, out of favor with investors, and there is no way to predict when, if ever, the securities may return to favor or achieve the Adviser’s expectations with respect to the price of the security.

Sector Risk. To the extent that the Fund focuses its investments in the securities issued by companies in a particular market sector, such as materials, energy, and information technology, the Fund will be subject to the market or economic factors affecting such sector, including adverse economic, business, political, regulatory or environmental developments, to a greater extent than if the Fund’s investments were more diversified among various different sectors.

Derivative Risk. Loss may result from the Fund’s use of derivatives. The value of derivatives in which the Fund may invest may rise or fall more rapidly than other investments. Other risks of investments in derivatives include imperfect correlation between the value of these instruments and the underlying assets; risks of default by the other party to a non-exchange traded derivative transaction; risk that the transactions may result in losses that offset gains in portfolio positions; and risks that the derivative transactions may not be liquid. Derivatives may contain “inherent” leverage because derivative contracts may give rise to an obligation on the part of the Fund for future payment or liabilities that are larger than the initial margin or premiums required to establish such positions. Combined with the volatility of derivatives prices, the leveraged nature of derivatives trading could cause the Fund to sustain large and sudden losses.

Investment Adviser Risk. The Adviser’s implementation of the Fund’s strategy may fail to produce the intended results. The Adviser’s ability to choose suitable investments has a significant impact on the ability of the Fund to achieve its investment objective.

Political/Economic Risk. Changes in economic and tax policies, interest rates, high inflation rates, government instability, war or other political or economic actions or factors may have an adverse effect on the Fund’s investments.

Portfolio Turnover Risk. A higher portfolio turnover will result in higher transactional and brokerage costs.

Regulatory Risk. Governmental and regulatory actions, including tax law changes, may have unexpected or adverse consequences on particular markets, strategies, or investments, including the liquidity of investments. These actions and other developments may impact the Fund’s ability to invest or remain invested in certain securities and other assets. Legislation or regulation may also change the way in which the Fund itself is regulated. The Adviser cannot predict the effects of any new governmental regulation that may be implemented on the ability of the Fund to invest in certain assets, and there can be no assurance that any new governmental regulation will not adversely affect the Fund’s ability to achieve its investment objective.

7

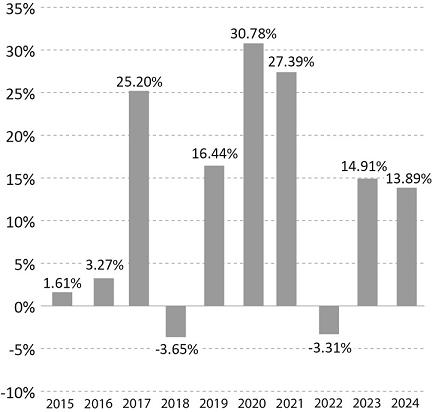

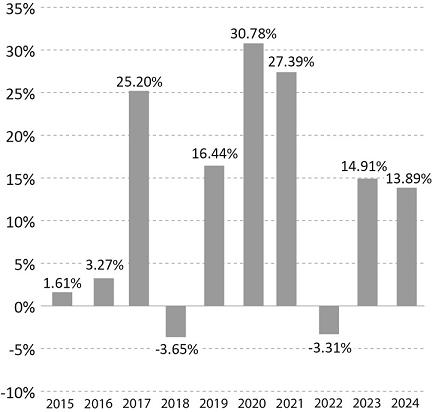

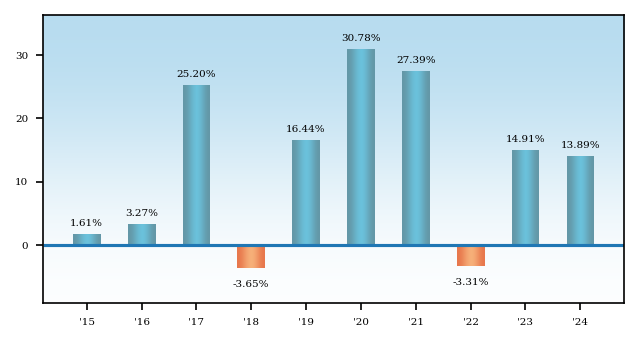

The following bar chart depicts changes in the Fund’s performance from year to year during the periods indicated for Investor Class shares only, since the Investor Class has the longest period of annual returns. The performance of the Institutional Class shares will differ from the performance shown because the Institutional Class shares have different expenses than the Investor Class shares.

8

Annual Total Returns (Years Ended December 31) - Investor Class Shares

| nd Quarter, 2020 | % | |

| nd Quarter, 2022 | % |

The following performance table compares the Fund’s average annual total returns for the periods indicated to those of a broad-based securities market index. The index is not actively managed and not available for direct investment.

Average Annual Total Returns

(for the periods ended December 31, 2024)

| 1 Year | 5 Years | 10 Years | Since

Inception* | |

| Investor Class Shares** | ||||

| Return Before Taxes** | ||||

| Return After Taxes on Distributions** | ||||

| Return After Taxes on Distributions and Sale of Fund Shares** | ||||

S&P 500 Total Return Index*** (reflects no deduction for fees, expenses, or taxes) |

||||

| Institutional Class Shares | ||||

| Return Before Taxes | ||||

| Return After Taxes on Distributions | |

|||

| Return After Taxes on Distributions and Sale of Fund Shares | |

|||

S&P 500 Total Return Index*** (reflects no deduction for fees, expenses, or taxes) |

|

| * | |

| ** | |

| *** |

MANAGEMENT OF THE FUND’S PORTFOLIO

Centre Asset Management, LLC, the Adviser, serves as the investment adviser to the Fund.

James A. Abate, Managing Director and Chief Investment Officer of the Adviser, has served as the portfolio manager of the Fund since its inception in December 2011.

PURCHASE AND SALE OF FUND SHARES

Shareholders may purchase or redeem shares directly from the Fund on any business day by contacting 1-855-298-4236, online at www.centrefunds.com or by writing to:

9

Centre Funds

Centre American Select Equity Fund

P.O. Box 219345

Kansas City, MO 64121-9345

The minimum initial investment is $5,000 for Investor Class Shares and $250,000 for Institutional Class shares, and the minimum subsequent investment is $1,000 for Investor Class Shares and $10,000 for Institutional Class shares. Exceptions to these minimum amounts may apply for certain investors, and the minimum amounts may otherwise be waived or reduced by the Adviser. The Fund has also authorized certain broker-dealers and other financial intermediaries to accept purchase and redemption orders on the Fund’s behalf. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the intermediary directly.

TAX INFORMATION

The Fund’s distributions will generally be taxed to you as ordinary income or capital gains, unless you are investing through a tax deferred arrangement, such as a 401(k) plan, 403(b) plan or an IRA. Distributions on investments made through tax deferred vehicles, such as 401(k) plans, 403(b) plans or IRAs, may be taxed later upon withdrawal of assets from those accounts.

FINANCIAL INTERMEDIARY COMPENSATION

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies, including the Fund's distributor or the Adviser, may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor or salesperson to recommend the Fund over another investment. You should ask your financial advisor, broker or intermediary for information about any payments it may receive in connection with the Fund, any services it provides to the Fund and any fees and/or commissions it charges.

10

The Centre Global Infrastructure Fund (the “Fund”) seeks long-term growth of capital and current income.

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

(fees paid directly from your investment)

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | |

Redemption Fee (as a percentage of amount redeemed; charged upon any redemption of shares within 90 days of the purchase of such shares) |

% |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

Investor Class |

Institutional Class | |

| Management Fees | ||

| Distribution and/or Service (12b-1) Fees | ||

| Other Expenses | ||

| Shareholder Service Fees | ||

| Remaining Other Expenses | ||

| Total Annual Fund Operating Expenses | ||

| Fee Waiver and/or Reimbursement (1) | ( |

( |

Total Annual Fund Operating Expenses (after fee waiver and/or expense reimbursement) |

| 1 |

11

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year that the Fund’s operating expenses remain the same and the expense reduction/reimbursement described above remains in place for the contractual period only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor Class | $ |

$ |

$ |

$ |

| Institutional Class | $ |

$ |

$ |

$ |

Portfolio

Turnover. The Fund may pay transaction costs, such as commissions, when it buys and sells certain securities (or “turns

over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes

when Fund shares are held in a taxable account. These costs, if any, which are not reflected in annual fund operating expenses

or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2024, the Fund’s

portfolio turnover rate was

The investment objective of the Fund is to seek long-term growth of capital and current income. This investment objective may be changed without shareholder approval. The Fund is a diversified fund that will normally invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities issued by U.S. and foreign (non-U.S.) infrastructure-related companies. For this purpose, an “infrastructure-related” company has (i) at least 50% of its assets (excluding cash) consisting of infrastructure assets, or (ii) 50% of its gross income or net profits attributable to, or derived (directly or indirectly) from the ownership, management, construction, development, operation, use, creation or financing of infrastructure assets. “Infrastructure assets” are the physical structures and networks that provide necessary services for society, including, but not limited to, transportation assets (e.g., railroads, toll roads, bridges, tunnels, airports, parking facilities and seaports); utility assets (e.g., electric transmission and distribution lines, power generation facilities, oil, gas and water distribution facilities and related midstream assets, communications networks and satellites, sewage treatment plants and critical internet networks) and social assets (e.g., hospitals, courts, schools, correctional facilities and subsidized housing). The Fund’s 80% investment policy (the “80% Policy”) is a non-fundamental investment policy that may be changed by the Fund upon 60 days’ prior written notice to shareholders. The Fund must comply with the 80% Policy at the time the Fund invests its assets. Accordingly, when the Fund no longer meets the 80% requirement as a result of circumstances beyond its control, such as changes in the value of portfolio holdings, it would not have to sell its holdings, but any new investments it makes would need to be consistent with the 80% Policy.

The remaining 20% of the Fund’s net assets, plus borrowings for investment purposes, may include infrastructure-related debt securities of U.S. and non-U.S. issuers (including municipal, corporate debt obligations and asset-backed securities), energy-related infrastructure companies organized as master limited partnerships (“MLPs”), common stock and convertible securities. The Fund’s common stock investments may consist of exchange-listed equities from companies across various industries, sectors and market capitalizations. The Fund may invest in convertible securities when the attributes of a particular company’s convertible security is superior, in terms of total return (interest or dividends plus capital appreciation), to the common shares of the same company.

Under normal market conditions, the Fund will invest at least 40% of its net assets, plus the amount of any borrowings for investment purposes, in securities of companies organized or located in at least three non-U.S. countries. Although the Fund may invest in emerging market securities without limit, under normal market conditions, the non-U.S. companies in which the Fund currently intends to invest will be organized or located primarily in developed market countries, such as Japan, Spain, Canada, and the United Kingdom. The Fund may also engage in transactions in foreign currencies. The Fund’s investments in securities of foreign issuers may include sponsored or unsponsored depositary receipts for such securities, such as American Depositary Receipts (“ADRs”) (which are typically issued by a U.S. financial institution (a depositary) and evidence ownership interests in a security or a pool of securities issued by a foreign company and deposited with the depositary) and Global Depositary Receipts (“GDRs”) (which are receipts issued outside the U.S., typically by non-U.S. banks and trust companies, and evidence ownership of either foreign or domestic securities).

12

The Fund intends to generally maintain a fully-invested posture. As such, cash will typically be held to a minimum. However, significant client inflows may temporarily increase cash positions. The Fund may engage in frequent or active trading depending on market conditions, resulting in a high portfolio turnover rate.

In selecting investments for the Fund, the Adviser utilizes a “bottom-up” fundamental stock selection process that the Adviser believes yields a more accurate picture of a company’s intrinsic value. The Adviser analyzes a variety of factors when selecting investments for the Fund, such as a company’s operations, risk profile, growth expectations and valuation of its securities. The Adviser utilizes a disciplined, Economic Value Added1 framework to select investments. The framework focuses on the fundamentals of wealth creation and wealth destruction similar to the way a traditional, long-term focused corporate investor looking at all aspects of the business would assess a company’s value. In the shorter-term, markets often undervalue or overvalue a company’s ability to create or destroy wealth. The framework seeks to identify and exploit these investment opportunities. The approach is designed to capture excess returns when the market price of a stock converges toward the Adviser’s target price.

In determining whether a particular company or security may be a suitable investment for the Fund, the Adviser may focus on any number of different attributes that may include, without limitation: the company’s ability to generate favorable returns in light of current growth prospects, market position and expertise, brand value, pricing power, measures of financial strength (e.g., strong balance sheet), profit margin changes, return on capital improvement, sustainability of revenue growth, ability to generate cash flow, strong management, commitment to shareholders interests, dividends or current income, market share gains, innovation and reinvestment, corporate governance and other indications that a company or a security may be an attractive investment. Lastly, the Adviser integrates security selection with appropriate stock position sizing (determining the appropriate percentage of the Fund’s assets to commit to a particular investment) in order to maximize return relative to risk. The Adviser may sell or reduce the Fund’s position in a security when the facts or analysis surrounding the reason to originally invest in the security have changed, such as a change in general market conditions, or in response to redemptions of Fund shares.

| 1 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

Common Stock Risk. The value of common stocks held by the Fund might decrease in response to the activities of a single company or in response to general market or economic conditions. If this occurs, the value of the Fund may also decrease.

Market Risk. Market risk refers to the possibility that the value of securities held by the Fund may decline due to daily fluctuations in the securities markets. Asset prices change daily as a result of many factors, including developments affecting the condition of individual companies, the sector or industries in which they operate, and the market in general. The price of a security or other instrument may even be affected by factors unrelated to the value or condition of its issuer, such as changes in interest rates, national and international economic and/or political conditions and general market conditions. In a declining stock market, security prices for all companies (including those in the Fund’s portfolio) may decline regardless of any company’s long-term prospects. The Fund’s performance per share will change daily in response to such factors. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. There is a risk that you may lose money by investing in the Fund.

13

Infrastructure-Related Company Investment Risk. The Fund’s investments in infrastructure-related companies will expose the Fund, and make it more susceptible, to adverse economic or regulatory occurrences affecting those companies. Infrastructure-related companies may be subject to a variety of factors that, individually or collectively, may adversely affect their business or operations, including general or local economic conditions and political developments, changes in government spending on infrastructure projects, general changes in market sentiment towards infrastructure assets, high interest costs in connection with capital construction and improvement programs, high degrees of leverage, difficulty in raising capital, costs associated with compliance with changes in environmental and other regulations, the deregulation of a particular industry or sector, environmental problems, technological changes, surplus capacity, casualty losses, threat of terrorist attacks, increased competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, and the effects of energy conservation policies. In addition, infrastructure-related companies may also be affected by governmental regulation of rates charged to customers, service interruption due to environmental, operational or other challenges and the imposition of special tariffs and changes in tax laws and accounting standards. A downturn in these companies would have a larger impact on the Fund than on a mutual fund that does not focus its investments in such companies.

Sector Risk. The Fund’s investments in securities issued by infrastructure-related companies may expose the Fund to the risks affecting a particular market sector, such as utilities, telecommunication services, energy or industrials. To the extent that the Fund’s investments are focused in such a sector, the Fund will be subject to the market or economic factors affecting such sector, including adverse economic, business, political, regulatory or environmental developments, to a greater extent than if the Fund’s investments were more diversified among various different sectors.

Fixed Income Securities Risk. Fixed income securities are obligations of the issuer of the securities to make payments of principal and/or interest on future dates. Fixed income securities include, but are not limited to, securities issued or guaranteed by the U.S. Government, its agencies or government-sponsored enterprises, corporate debt securities issued by U.S. and non-U.S. entities, mortgage-backed and other asset-backed securities, structured notes and inflation-indexed bonds issued both by governments and corporations. Fixed income securities are generally subject to the risk that the issuer will be unable to meet principal and interest payments, and the risk of price volatility due to a variety of factors, including interest rate sensitivity, market perception of the issuer’s creditworthiness and general market conditions. A period of economic conditions or monetary policy volatility leading to rising interest rates could adversely affect the market for these securities and reduce the Fund's ability to sell them. As interest rates rise, the value of fixed income securities typically declines.

Foreign and Emerging Market Securities Risk. The Fund will invest in foreign securities, which involve investment risks different from those associated with domestic securities. Foreign markets, particularly emerging markets, may be less liquid, more volatile, and subject to less government supervision than domestic markets. There may be difficulties enforcing contractual obligations, and it may take more time for trades to clear and settle. The value of the Fund’s investments may decline because of factors affecting a particular issuer, and/or factors affecting foreign markets and issuers generally, such as unfavorable or unsuccessful government actions, reduction of government or central bank support and political or financial instability. Lack of information may also affect the value of these securities. To the extent the Fund focuses its investments in a single country or only a few countries in a particular geographic region, economic, political, regulatory or other conditions affecting such country or region may have a greater impact on Fund performance relative to a more geographically diversified fund. The Fund’s investments in ADRs and GDRs entail similar investment risks to direct ownership of foreign securities traded outside the U.S.

Currency Risk. Currency risk is the chance that changes in currency exchange rates will negatively affect securities denominated in, and/or companies receiving revenues in, foreign currencies. Adverse changes in currency exchange rates (relative to the U.S. dollar) may erode or reverse any potential gains from a portfolio’s investment in securities denominated in a foreign currency or may widen existing losses. Currency gains and losses could occur regardless of the performance of the underlying investment.

14

Credit Risk. Credit risk is the risk that the issuer of a debt security will fail to repay principal and interest on the security when due, and that there could be a decline or perception of a decline in the credit quality of a security. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations. The default of a single holding could have the potential to adversely affect the Fund's net asset value. It is possible that a security held by the Fund could have its credit rating downgraded or could default.

Interest Rate Risk. Changes in interest rates will affect the value of the Fund’s investments in fixed income securities. When interest rates rise, the value of investments in fixed income securities tends to fall, and this decrease in value may not be offset by higher income from new investments. Interest rate risk is generally greater for fixed income securities with longer maturities or durations.

Maturity Risk. Longer-term securities generally have greater price fluctuations and are more sensitive to interest rate changes than shorter-term securities. Therefore, the Fund may experience greater price fluctuations when it holds securities with longer maturities.

Income Risk. Income risk is the risk that the income received by the Fund may decrease as a result of falling interest rates or dividend yields.

Municipal Obligations. The Fund may invest in municipal obligations, including securities of states, territories and possessions, of the U.S. and the District of Columbia, and their political subdivisions, agencies and instrumentalities (collectively, “Municipal Obligations”), the interest on which is exempt from federal income tax. Municipal Obligations include general obligation bonds (which are secured by the issuer’s pledge of its faith, credit and taxing power for the payment of principal and interest), revenue bonds (which are payable from the revenues derived from a particular facility or class of facilities or, in some cases, from the proceeds of a special excise or other specific revenue source, but not from the general taxing power of the issuer) and notes (which are short-term instruments issued by municipalities or agencies and are sold in anticipation of a bond sale, collection of taxes or receipt of other revenues). To the extent that the Fund invests more of its assets in a particular issuer’s municipal securities, the Fund is vulnerable to events adversely affecting that issuer, including economic, political and regulatory occurrences, court decisions, terrorism and catastrophic natural disasters. The Fund's investments in certain municipal securities with principal and interest payments that are made from the revenues of a specific project or facility, and not general tax revenues, may have increased risks. For example, factors affecting the project or facility, such as local business or economic conditions, could have a significant effect on the project's ability to make payments of principal and interest on these securities. From time to time Congress has enacted legislation for the purpose of restricting or eliminating the federal income tax exemption for interest on Municipal Obligations.

Liquidity Risk. Liquidity risk occurs when an investment becomes difficult to purchase or sell. Some assets held by the Fund may be impossible or difficult to sell, particularly during times of market turmoil. The Fund may also face liquidity risk as a result of, among other factors, low trading volumes, legal or contractual restrictions on resale, and substantial redemptions of the Fund’s shares.

Convertible Securities Risk. The market value of a convertible security performs like that of a regular debt security; that is, if market interest rates rise, the value of a convertible security usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock.

MLP Investment Risk. An MLP that invests in a particular industry (e.g. oil, gas and consumable fuels) may be adversely affected by detrimental economic events within that industry. As a partnership, an MLP may be subject to less regulation (and less protection for investors) under state laws than corporations. In addition, MLPs may be subject to state taxation in certain jurisdictions, which may reduce the amount of income an MLP pays to its investors, such as the Fund.

15

Investment Adviser Risk. The Adviser’s implementation of the Fund’s strategy may fail to produce the intended results. The Adviser’s ability to choose suitable investments has a significant impact on the ability of the Fund to achieve its investment objectives.

Political/Economic Risk. Changes in economic and tax policies, interest rates, high inflation rates, government instability, war or other political or economic actions or factors may have an adverse effect on the Fund’s investments.

Regulatory Risk. Governmental and regulatory actions, including tax law changes, may have unexpected or adverse consequences on particular markets, strategies, or investments, including the liquidity of investments. These actions and other developments may impact the Fund’s ability to invest or remain invested in certain securities and other assets. Legislation or regulation may also change the way in which the Fund itself is regulated. The Adviser cannot predict the effects of any new governmental regulation that may be implemented on the ability of the Fund to invest in certain assets, and there can be no assurance that any new governmental regulation will not adversely affect the Fund’s ability to achieve its investment objective.

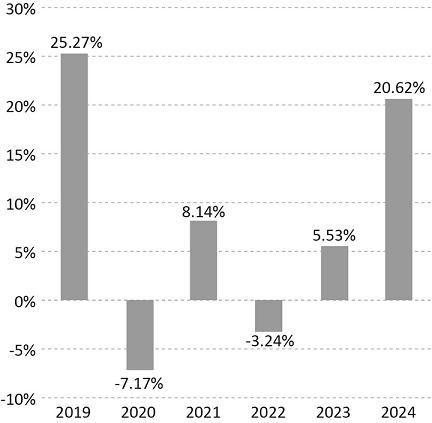

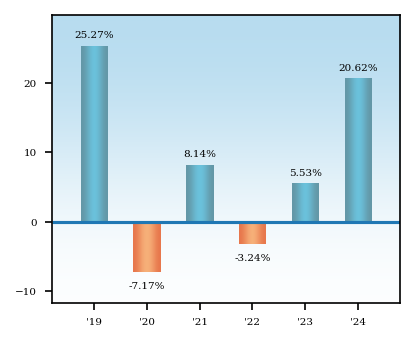

The following bar chart depicts changes in the Fund’s performance from year to year during the periods indicated for Investor Class shares only since the Investor Class has the longest period of annual returns. The performance of the Institutional Class shares will differ from the performance shown because the Institutional Class shares will differ from the performance shown because the Institutional Class shares have different expenses than the Investor Class shares.

16

Annual Total Returns (Years Ended December 31) – Investor Class Shares

| rd Quarter, 2024 | % | |

| st Quarter, 2020 | % |

17

The following performance table compares the Fund’s average annual total returns for the period indicated to those of a broad-based securities market index and a supplemental index. These indices are not actively managed and not available for direct investment.

| 1 Year | 5 Years | Since Inception* | |

| Investor Class Shares** | |||

| Return Before Taxes** | |||

| Return After Taxes on Distributions** | |||

| Return After Taxes on Distributions and Sale of Fund Shares** | |||

| Institutional Class Shares | |||

| Return Before Taxes | |||

| Return After Taxes on Distributions | |||

| Return After Taxes on Distributions and Sale of Fund Shares | |||

| MSCI World Index (reflects no deduction for fees, expenses, or taxes)*** | |||

| S&P Global Infrastructure Net Total Return Index (reflects no deduction for fees, expenses, or taxes)**** |

| * | |

| ** | |

*** |

|

|

****

|

|

MANAGEMENT OF THE FUND’S PORTFOLIO

The Adviser, Centre Asset Management, LLC, serves as the Fund’s investment adviser.

James A. Abate, Managing Director and Chief Investment Officer of the Adviser, has served as the portfolio manager of the Fund since its inception in January 2018.

Purchase And Sale Of Fund Shares

Shareholders may purchase or redeem shares directly from the Fund on any business day by contacting the Fund by telephone at 1-855-298-4236, online at www.centrefunds.com or in writing at:

18

Centre Funds

Centre

Global Infrastructure Fund

P.O. Box 219345

Kansas City, MO 64121-9345

The minimum initial investment is $5,000 for Investor Class shares and $250,000 for Institutional Class shares and the minimum subsequent investment is $1,000 for Investor Class shares and $10,000 for Institutional Class shares. Exceptions to these minimum amounts may apply for certain investors, and the minimum amounts may otherwise be waived or reduced by the Adviser.

The Fund has authorized certain broker-dealers and other financial intermediaries to accept purchase and redemption orders on the Fund’s behalf. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the intermediary directly.

Tax Information

The Fund’s distributions will generally be taxed to you as ordinary income or capital gains, unless you are investing through a tax deferred arrangement, such as a 401(k) plan, 403(b) plan or an IRA. Distributions on investments made through tax deferred vehicles, such as 401(k) plans, 403(b) plans or IRAs, may be taxed later upon withdrawal of assets from those accounts.

financial intermediarY COMPENSATION

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and the Fund's distributor or the Adviser may pay the intermediary for the sale of Fund shares and related services, such as certain shareholder-related services and, if applicable, distribution-related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the Fund over another investment. You should ask your financial advisor for information about any payments it may receive in connection with the Fund, any services it provides to the Fund and any fees and/or commissions it charges.

ADDITIONAL INVESTMENT POLICIES AND RISKS

An investment in the Centre American Select Equity Fund (the “American Equity Fund”) and the Centre Global Infrastructure Fund (the “Infrastructure Fund”) (each, a “Fund” and collectively, the “Funds”) should not be considered a complete investment program. Whether a Fund is an appropriate investment for an investor will depend largely on his or her financial resources and individual investment goals and objectives. Investors who engage in short-term trading or other speculative strategies and styles will not find the Funds to be appropriate investment vehicles if they want to invest in the Funds for a short period of time.

General. A Fund’s portfolio may be exposed to a variety of securities, including, as applicable, common stocks, preferred stocks, fixed income securities, securities in other investment companies and/or cash. To the extent that a Fund invests in common stock, such investments may include investments in exchange-listed equities issued by companies across various industries, sectors and market capitalizations. To the extent that a Fund is exposed to preferred stock, such investments may be represented by investments made when the attributes of a particular company’s preferred stock is superior, in terms of total return (dividends plus capital appreciation), to the common shares of the same company.

A Fund may also invest in derivatives, cash management instruments and other instruments to help manage interest rate exposure or sensitivity compared to the stock market, hedge or protect a Fund’s underlying assets, or enhance returns. A Fund may be exposed to exchange-traded derivative products, such as exchange-traded futures and options that are fully collateralized by cash or securities, for temporary cash management or investment transition purposes, or to hedge the risks of existing positions or overall capital protection.

19

Management. Each Fund is actively managed and could experience losses if the judgment of the Adviser about markets, interest rates or particular investments proves to be incorrect. There can be no guarantee that the investment decisions of the Adviser will produce the desired results. Additionally, the Adviser may be limited by legislative, regulatory, or tax developments in connection with its management of a Fund.

Temporary Defensive Positions and Cash Management. A Fund may, under unusual circumstances, deviate from its investment objective and principal investment strategies and take temporary defensive positions in an attempt to respond to adverse market, economic, political, or other conditions. During such circumstances, a Fund may hold up to 100% of its portfolio in cash or cash equivalent positions. In the event that a Fund, or any investment company in which a Fund invests, takes a temporary defensive position, the Fund may not be able to achieve its investment objective. A Fund may also use cash management instruments and other instruments to help manage interest rate duration or to protect the Fund’s assets or enhance returns.

Derivative Risk. A Fund may use derivatives, such as exchange-traded options and futures, that are related to stock market or bond indexes, foreign exchange, fixed income or other securities or be exposed to exchange-traded derivative products. Loss may result from a Fund’s investments in exchange-traded futures and options. The value of derivatives in which a Fund may invest may rise or fall more rapidly than other investments.

The use of derivatives, such as futures and options, can lead to losses, including those magnified by leverage, particularly when derivatives are used to enhance return rather than mitigate risk. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Certain derivative instruments may be difficult to sell when the Adviser believes it would be appropriate to do so.

Losses in a Fund’s derivative investments could result in a Fund being called upon to meet obligations in an amount more than the principal amount invested in a derivative instrument or in excess to that Fund’s net asset value, which could leave the Fund with no assets or insufficient assets to carry on operations, and could, as a result, cause the Fund to wind down its operations. A Fund’s use of derivatives may also increase the amount of taxes payable by shareholders.

Risks Related to Investing in Other Investment Companies.

A Fund may invest in other investment companies, as permitted by the Investment Company Act of 1940, as amended (the “1940 Act”) or the rules and regulations or exemptive orders thereunder. Each Fund may also invest up to 10% of the Fund’s net assets in other investment companies, such as ETFs and closed-end funds. Except as otherwise provided herein, the Funds may invest their cash holdings in affiliated or non-affiliated money market funds as part of a cash sweep program, and may purchase unlimited shares of affiliated or non-affiliated money market funds and of other funds managed by the Adviser, whether registered or unregistered entities, as permitted by the 1940 Act and rules promulgated thereunder and/or an SEC exemptive order.

To the extent that a Fund invests in other investment companies, your cost of investing in that Fund will generally be higher than the cost of investing directly in such other investment company shares. You may indirectly bear fees and expenses charged by the underlying investment companies in which the Fund invests in addition to the Fund’s direct fees and expenses. Furthermore, these types of investments by a Fund could affect the timing, amount and character of distributions to you and therefore may increase the amount of taxes payable by you.

Growth Style. A Fund may seek to invest in companies that, in the view of the Adviser, have potential for growth. Securities of companies perceived to be “growth” companies may be more volatile than other stocks and may involve special risks. If the perceived growth potential of a company is not realized, then the securities purchased by a Fund may not perform as expected and that Fund’s return will be reduced. A Fund’s performance may be adversely affected by its investment in growth stocks.

Value Style. A Fund may, at times, have an investment style that emphasizes “value stocks,” which means that the stocks trade at less than the prices at which the Adviser believes they would trade if the market reflected all factors relating to the issuers’ worth. A value investment style involves the risk that a stock’s price may not increase as expected, and may even decline in value. Undervalued securities are, by definition, out of favor with investors, and there is no way to predict when, if ever, the securities may return to favor or achieve the Adviser’s expectations with respect to the price of the security. To the extent that the performance of a Fund is adversely affected by its investment in value stocks, Fund performance may be negatively affected as a result.

20

Risks of Investing in Real Estate Investment Trusts. A Fund may, at times, invest in real estate investment trust (“REIT”) securities of a diversified nature (both commercial and residential) if the issuers are members of the S&P 500 Index or MSCI World Index or possess similar market capitalization characteristics and trading volume attributes. REITs are collective investment vehicles which are designed to invest in real estate. A Fund may also invest in exchange-traded notes (“ETNs”) and ETFs that have returns linked to REIT indices. An investment in REITs is subject to the risks associated with owning real estate and with the real estate industry generally, including difficulties in valuing and disposing of real estate; the risk of declines in real estate values and economic conditions; possible adverse changes in the climate for real estate; environmental liability risks; the risk that property taxes and operating expenses will increase; possible adverse changes in zoning laws; the risks of casualty or condemnation losses, rent limitations and adverse changes in interest rates and the credit markets; and the risk of pre-payment by borrowers. In addition, a REIT may default on its obligations or go bankrupt. To the extent that the Fund invests in REITs, the Fund will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests, in addition to the expenses of the Fund.

Natural Resources Investment Risk. A Fund may, at times, invest in securities of companies in natural resources industries that can be significantly affected by changes in supply of, or demand for, various natural resources. They may also be affected by changes in commodity prices, international political and economic developments, environmental incidents, resources conservation, the success of exploration projects, and tax and other government regulations.

Small-Cap and Mid-Cap Securities Risk. A Fund may, at times, invest in securities of small-capitalization (“small-cap”) and mid-capitalization (“mid-cap”) companies. Investing in such companies involves greater volatility than investing in larger and more established companies. Small-cap and mid-cap companies can be subject to more abrupt or erratic share price changes than larger, more established companies. Securities of small-cap and mid-cap companies have limited market liquidity, and their prices may be more volatile.

Preferred Stock. A Fund may, at times, invest in preferred stocks when the attributes of a particular company’s preferred stock is superior, in terms of total return (dividends plus capital appreciation), to the common shares of the same company. Preferred stock is subject to many of the risks associated with debt securities, including interest rate risk. In addition, preferred stock may not pay a dividend, an issuer may suspend payment of dividends on preferred stock at any time, and in certain situations an issuer may call or redeem its preferred stock or convert it to common stock. To the extent a Fund invests a substantial portion of its assets in convertible preferred stocks, declining common stock values may also cause the value of the Fund’s investments to decline.

Liquidity Risk. Liquidity risk occurs when an investment becomes difficult to purchase or sell. A Fund may face liquidity risk as a result of, among other factors, low trading volumes, legal or contractual restrictions on resale, substantial redemptions of the Fund’s shares and, with respect to fixed income securities, rising interest rates and lower a decreasing capacity of dealers in the secondary market to make markets in such securities. Liquidity risk generally increases (meaning that securities become more illiquid) as the number, or relative need, of investors seeking to liquidate in a given market increases.

Political/Economic Risk. Changes in economic and tax policies, high inflation rates, government instability, war or other political or economic actions or factors may have an adverse effect on the investments of the Funds.

Change of Investment Strategy. Each Fund has a policy to invest, under normal circumstances, at least 80% of the value of its “assets” in certain types of investments suggested by its name (the “80% Policy”). The 80% Policy is a non-fundamental investment policy that can be changed by a Fund upon 60 days’ prior written notice to shareholders. Each Fund must comply with its 80% Policy at the time the Fund invests its assets. Accordingly, when the Fund no longer meets the 80% requirement as a result of circumstances beyond its control, such as changes in the value of portfolio holdings, it would not have to sell its holdings, but any new investments it makes would need to be consistent with its 80% Policy.

21

Tax Treatment. For an investment in a Fund to qualify for favorable tax treatment as a regulated investment company, certain requirements under the Internal Revenue Code of 1986 (the “Code”), including asset diversification and income requirements, must be met. If a Fund were to fail to qualify as a regulated investment company under the Code, the Fund would be liable for federal, and possibly state, corporate taxes on its taxable income and gains.

MANAGEMENT OF THE FUNDS

THE INVESTMENT ADVISER

Adviser. Centre Asset Management, LLC (“Centre”, or the “Adviser”) is a New York limited liability company, with principal offices at 48 Wall Street, Suite 1100, New York, New York 10005. Centre is an investment adviser registered with the SEC under the Investment Advisers Act of 1940, as amended. Centre is a fundamentally-driven specialist active asset manager and offers investment advisory services to U.S. and foreign investment companies and manages differentiated products in fund advisory and sub-advisory mandates in institutional and investor share classes accessible in multiple jurisdictions and currencies. James A. Abate serves as the Managing Director of the Adviser and is primarily responsible for its day-to-day management. As of December 31, 2024, Centre had approximately $522 million in assets under management.

The Adviser serves as the investment adviser to each Fund pursuant to an investment advisory agreement with the Trust. Subject to the general oversight of the Board of Trustees of the Trust (the “Board” or the “Trustees”), the Adviser is responsible for, among other things, developing a continuing investment program for the Funds in accordance with their respective investment objectives and reviewing the investment strategies and policies of each Fund.

Portfolio Management

James A. Abate, MBA, CPA, CFA, is the Chief Investment Officer of Centre Asset Management, LLC, and the portfolio manager of the firm's American Select Equity and Global Listed Infrastructure strategies. He also serves as the firm's Managing Director and as the President and Trustee of the Centre Funds. Prior to founding Centre Asset Management, Mr. Abate was Investment Director, North America, for GAM Investments. Prior to GAM, Mr. Abate served as Managing Director & Fund Manager/Head of U.S. Active Equity at Credit Suisse Asset Management responsible for its U.S. Select Equity Strategy and stable of Global Sector Funds. Mr. Abate has achieved Standard & Poor's Funds Research AAA rating, received numerous "Category King" mentions in The Wall Street Journal, is the recipient of the Refinitiv Lipper Fund Award for Best US Equity Fund, as well as multiyear Investment Week award nominations. Prior to transitioning to asset management, he was a Manager in Price Waterhouse's Valuation/Corporate Finance Group, and served as a commissioned officer in the U.S. Army and Reserves, achieving the rank of Captain. Mr. Abate holds a B.S. in accounting from Fairleigh Dickinson University, an MBA in finance from St. John's University, and is a visiting Adjunct Professor in the graduate and honors academic programs at the Zicklin School of Business, Baruch College. He is a contributing author to several John Wiley published books, Applied Equity Valuation, Focus on Value, Short Selling and The Theory and Practice of Investment Management; has written articles that have appeared in The Journal of Portfolio Management, Investment Week, FT Investment Adviser, The Wall Street Journal and Mergers & Acquisitions, among other publications; and his writings with Professor J. Grant, Ph.D., on the economic value added approach to security analysis have been adopted by the CFA Institute candidate study programs. Mr. Abate is a former member of the editorial advisory board of The Journal of Portfolio Management.

The Funds’ Statement of Additional Information (the “SAI”) provides information about the portfolio manager’s compensation, other accounts managed by the portfolio manager, and the portfolio manager’s ownership of Fund shares.

Adviser Compensation

As compensation for the investment advisory services provided to the Funds, the Adviser is entitled to receive compensation. For the most recent fiscal year, advisory compensation as a percentage of daily net assets was as follows:

22

| Fund | Management Fee Rate | Aggregate Annual Advisory Fee Paid |

| American Equity Fund | 0.75%* | 0.73% |

| Infrastructure Fund | 0.85% | 0.57% |

| * | Under the investment advisory agreement, the Fund pays to the Adviser an investment advisory fee (accrued daily and payable monthly) at an annual rate of 0.75% of the Fund's average daily net assets for the first $1 billion and 0.70% of the Fund's average daily net assets thereafter. |

Disclosure Regarding Approval of Investment Advisory Contracts

A discussion regarding the Trustees’ basis for approving the investment advisory agreement relating to each Fund may be found in the annual Form N-CSR of the Funds for the period ended September 30, 2024. You may obtain a copy of the annual Form N-CSR, free of charge, by contacting the Funds by telephone at 1-855-298-4236 or in writing at: Centre Funds, P.O. Box 219345, Kansas City, MO 64121-9345.

BOARD OF TRUSTEES

Each Fund is a series of the Trust, an open-end management investment company that was organized as a Delaware statutory trust on March 17, 2011. Each series of the Trust is authorized to offer multiple classes of shares. The Trustees oversee the operations of the Funds and are responsible for the overall management of the Funds’ business affairs.

THE DISTRIBUTOR

ALPS Distributors, Inc. (the “Distributor”) distributes the shares of each Fund pursuant to a Distribution Agreement with the Trust. The Distributor offers each Fund’s shares on a continuous, best-efforts basis.

INVESTING IN A FUND

Determining a Fund’s Net Asset Value

The price at which you purchase or redeem shares is based on the next calculation of net asset value (“NAV”) per share after an order is received, subject to the order being received by the Fund in Good Form (as defined below). A Fund’s NAV per share is calculated by dividing the value of the Fund’s total assets, less liabilities (including Fund expenses, which are accrued daily), by the total number of outstanding shares of the Fund. The NAV per share of a Fund is calculated at the close of regular trading on the NYSE (ordinarily, 4:00 p.m. Eastern Time), only on business days that the NYSE is open for business. The NYSE is closed on weekends and New Year’s Day, Martin Luther King, Jr. Day, Presidents’ Day, Good Friday, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day. The pricing and valuation of portfolio securities is determined in good faith in accordance with procedures established by, and under the direction of, the Trustees.

Securities held by the Funds are generally calculated at market value by quotations from the primary market in which they are traded. The Funds normally use third-party pricing services to obtain market quotations. Securities and assets for which representative market quotations are not readily available or which cannot be accurately valued using the Trust’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. Fair value pricing may be used, for example, in situations where (i) an exchange-traded portfolio security is so thinly traded that there have been no transactions for that security over an extended period of time or the validity of a market quotation received is questionable; (ii) the exchange on which the portfolio security is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the NAV calculation. To the extent that a Fund invests in registered open-end investment companies, the Fund’s NAV calculations with respect to such investments will be based upon the net asset values reported by such other investment companies, and the prospectuses for such investment companies explain the circumstances under which those companies will use fair value pricing and the effects of using fair value pricing. To the extent that a Fund holds securities traded in foreign markets that close prior to U.S. markets, significant events, including company-specific developments or broad market moves, may affect the value of foreign securities held by the Fund. Consequently, a Fund’s NAV may be affected during a period when shareholders are unable to purchase or redeem their shares in the Fund.

23

PURCHASING SHARES OF THE FUNDS

Opening an Account

To purchase shares directly from a Fund, an application (“Account Application”) must be completed, signed and delivered to the Fund. If you have any questions about a Fund or need assistance with your Account Application, please call Shareholder Services at 1-855-298-4236. Certain types of investors, such as trusts, corporations, associations or partnerships, may be required to furnish additional documents when they open an account. These documents may include corporate resolutions, trusts and partnership documents, trading authorizations, powers of attorney, or other documents.

Unless specified differently, accounts with two or more owners will be registered as joint tenants with rights of survivorship. To make any ownership change to a joint account, all owners must agree in writing, regardless of the law in your state.

You may purchase shares of the Funds by mailing a completed Account Application with a check payable to the applicable Fund’s transfer agent (the “Transfer Agent”) at the following address:

Centre Funds P.O. Box 219345

Kansas City, MO 64121-9345

To obtain an Account Application, you can call 1-855-298-4236 or download an Account Application at www.centrefunds.com. Please indicate the class of shares in which you want to invest.

To open an account and make an initial investment by wire, please first complete an Account Application. After the Fund has received your completed Account Application, you will receive an account number for all subsequent wire transfers. Please ensure that your bank receives this account number as part of your wiring instructions. For more details on wiring instructions, please visit www.centrefunds.com or call 1-855-298-4236.

Please note that most banks charge fees when sending wires.

Initial investment purchases to open an account or subsequent investment purchases adding to your account made by ACH transfer may only be made in amounts up to $25,000. Purchases in amounts greater than $25,000 must be made by wire or check.

Note: There are specific Account Applications required for new IRA accounts, Roth IRA accounts, and transfers of IRA accounts from other custodians. Please call Shareholder Services at 1-855-298-4236 to obtain the correct Account Application. There is an annual IRA account maintenance fee of $10.00 that is charged by the IRA custodian on a per-account basis.

Important Information About Procedures For Opening A New Account

The Trust has established an Anti-Money Laundering Compliance Program (“AML Program”) as required by the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act ("USA PATRIOT Act"). To ensure compliance with this law, the AML Program provides for, among other things, the development of internal practices, procedures and controls and designation of an anti-money laundering compliance officer. The Trust's chief compliance officer serves as its Anti-Money Laundering Compliance Officer. In compliance with the USA PATRIOT Act, please note that the Transfer Agent will verify certain information on your Account Application as part of the AML Program. As requested on the Account Application, you must supply your full name, date of birth, social security number and permanent street address. Mailing addresses containing only a P.O. Box will not be accepted. Please contact Shareholder Services at 1-855-298-4236 if you need additional assistance when completing your Account Application. |

To open an account, the Fund or your financial intermediary is required to obtain certain information from you for identification purposes. Ownership/control information for a legal entity may include the name, date of birth, physical address, and identification number (generally a social security or taxpayer identification number) of the entity’s owners/controlling persons. If a Fund or any of its agents does not have a reasonable belief of the identity of an investor, the account will be rejected or the investor will not be allowed to perform a transaction on the account until such information is received. Each Fund reserves the right to reject any Account Application for any reason and to close an account within five (5) business days of a request for more information about an investor if clarifying information/documentation is not received.

24

Purchase Procedures

| Share Class | Minimum

Initial Investment Amount |

Minimum

Subsequent Investment Amount |

| Investor Class Shares | $5,000 | $1,000 |

| Institutional Class Shares | $250,000 | $10,000 |

Exceptions to these minimum amounts may apply for certain investors, and the minimum amounts may otherwise be waived or reduced by the Adviser. The Funds will accept purchases only in U.S. dollars drawn from U.S. financial institutions. Cashier’s checks, third party checks, money orders, credit card convenience checks, cash or equivalents or payments in foreign currencies are not acceptable forms of payment.

Your purchase order will be effected at the NAV per share of the Fund next determined after receipt of your purchase request in Good Form. Purchase requests received by the Transfer Agent or an authorized financial intermediary (i) before the close of the NYSE on any business day will be effected at the NAV per share of the Fund determined on that day or (ii) after the close of the NYSE on any business day, will be effected at the NAV per share of the Fund determined on the next business day. Purchase requests must be received in Good Form by the Transfer Agent or an authorized financial intermediary.

A purchase order is considered to be in “Good Form” if the request includes: (i) the name and class of the fund in which an investor wishes to invest; (ii) the amount the investor wishes to invest; (iii) the name in which the investor’s account is to be registered (or, in the case of subsequent investments, the investor’s account number); (iv) the signature of each person in whose name such account is (or is to be) registered; and (v) payment in full of the purchase amount.

Each Fund reserves the right to reject, in its sole discretion, any purchase order for any reason. In addition, each Fund reserves the right to cease offering its shares or a class thereof at any time and for any reason.

Purchases of Fund shares may be made through certain financial intermediaries authorized to receive your purchase request in accordance with the standards described above. If you purchase shares through a financial intermediary, you may be charged a fee by the financial intermediary and you may be subject to higher investment minimums.

Institutional Class shares may also be available on certain brokerage platforms. An investor transacting in Institutional Class shares through a broker acting as an agent for the investor may be required to pay a commission and/or other forms of compensation to the broker.

Adding to Your Account: You may add to your account with a Fund by sending a check for your additional investment payable to the Fund to the Transfer Agent at:

Centre Funds

P.O. Box 219345

Kansas City, MO 64121-9345

Please include a brief letter with your check that gives the name on your account and your account number. Please write your account number on your check.

25

To make an initial investment by wire, please call 1-855-298-4236 to inform us you will be wiring funds. Please ensure that your bank receives your Fund account number as part of your wiring instructions. For more details on wiring instructions, please visit www.centrefunds.com or call 1-855-298-4236.

Please note that most banks charge fees when sending wires.

Subsequent purchases may be made online. Before you can make a subsequent investment online, you must first establish online account access. In order to establish access, you will need to obtain your Fund account number and your Social Security Number, and then visit www.centrefunds.com. After selecting “Account Login,” you will be able to create a new login ID and password.

You may establish an automatic investment plan when you open your account. To do so, please complete the automatic investment plan section of the Account Application. You may also establish an automatic investment plan by completing an Account Options Form or by visiting www.centrefunds.com.

Additional Purchase Information for Investing in a Fund

Choosing a Share Class

Each Fund offers two classes of shares: Investor Class shares and Institutional Class shares. Each share class represents an ownership interest in the same investment portfolio as the other class of shares of the Fund. Each class has its own expense structure.

Investor Class shares are subject to a distribution plan (the “12b-1 Plan”) that, pursuant to Rule 12b-1 under the 1940 Act, permits each Fund to pay distribution and/or shareholder servicing fees of up to 0.25% per year to those intermediaries offering Investor Class shares and providing other services to Investor Class shareholders. Institutional Class shares are available without a Rule 12b-1 fee to those investors eligible to purchase such shares.