As filed with the Securities and Exchange Commission on May 7, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Expedia Group, Inc.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

4700

(Primary Standard Industrial

Classification Code Number)

|

|

|

20-2705720

(IRS Employer Identification

Number)

|

|

[SEE TABLE OF SUBSIDIARY GUARANTOR REGISTRANTS LISTED ON FOLLOWING PAGE]

1111 Expedia Group Way W.

Seattle, WA 98119

(206) 481-7200

(Address, including zip code, and telephone number, including area code, of each of the registrants’ principal executive offices)

Robert J. Dzielak, Esq.

Chief Legal Officer and Secretary

Expedia Group, Inc.

1111 Expedia Group Way W.

Seattle, WA 98119

(206) 481-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Mark A. Stagliano, Esq.

Neil M. Snyder, Esq.

Kathryn Gettles-Atwa, Esq.

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, NY 10019

(212) 403-1000

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☒

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☐

|

|

|

Smaller reporting company

☐

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

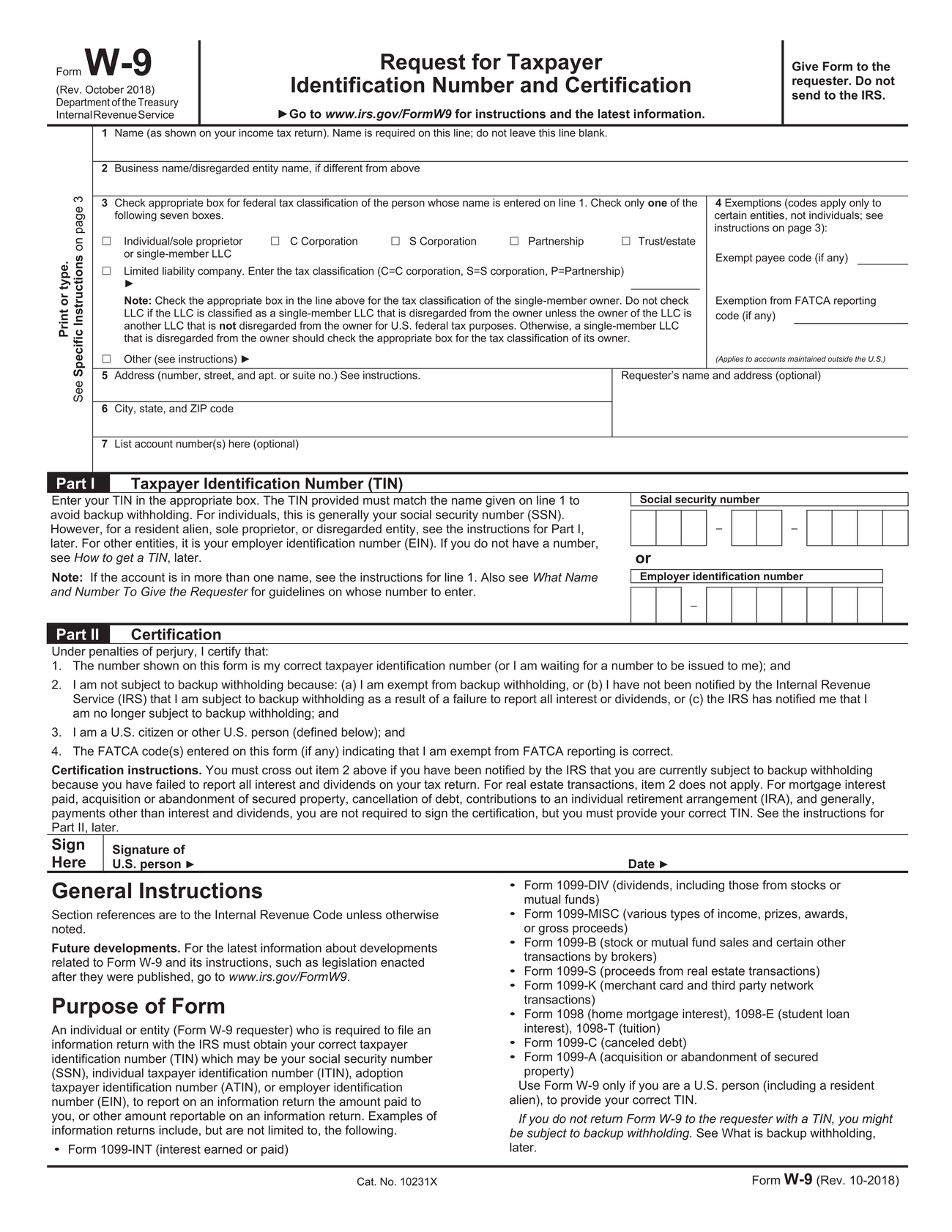

CALCULATION OF REGISTRATION FEE

| |

|

|

Title of Each Class of

Securities to be Registered

|

|

|

|

Amount

to be

Registered

|

|

|

|

Proposed

Maximum

Offering Price

per Unit

|

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

|

Amount of

Registration Fee(1)

|

|

|

3.600% Senior Notes due 2023

|

|

|

|

|

$ |

500,000,000 |

|

|

|

|

|

|

100% |

|

|

|

|

|

$ |

500,000,000 |

|

|

|

|

|

$ |

54,550 |

|

|

|

Guarantees of the 3.600% Senior Notes due 2023(2)

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

(3)

|

|

|

|

4.625% Senior Notes due 2027

|

|

|

|

|

$ |

750,000,000 |

|

|

|

|

|

|

100% |

|

|

|

|

|

$ |

750,000,000 |

|

|

|

|

|

$ |

81,825 |

|

|

|

Guarantees of the 4.625% Senior Notes due 2027(2)

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

(3)

|

|

|

|

2.950% Senior Notes due 2031

|

|

|

|

|

$ |

1,000,000,000 |

|

|

|

|

|

|

100% |

|

|

|

|

|

$ |

1,000,000,000 |

|

|

|

|

|

$ |

109,100 |

|

|

|

Guarantees of the 2.950% Senior Notes due 2031(2)

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

(3)

|

|

|

(1)

Calculated pursuant to Rule 457(f) under the Securities Act.

(2)

The entities listed on the Table of Subsidiary Guarantor Registrants on the following page have guaranteed the notes being registered hereby.

(3)

No separate consideration will be received for the guarantees, and pursuant to Rule 457(n) under the Securities Act, no additional registration fee is due for guarantees.

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

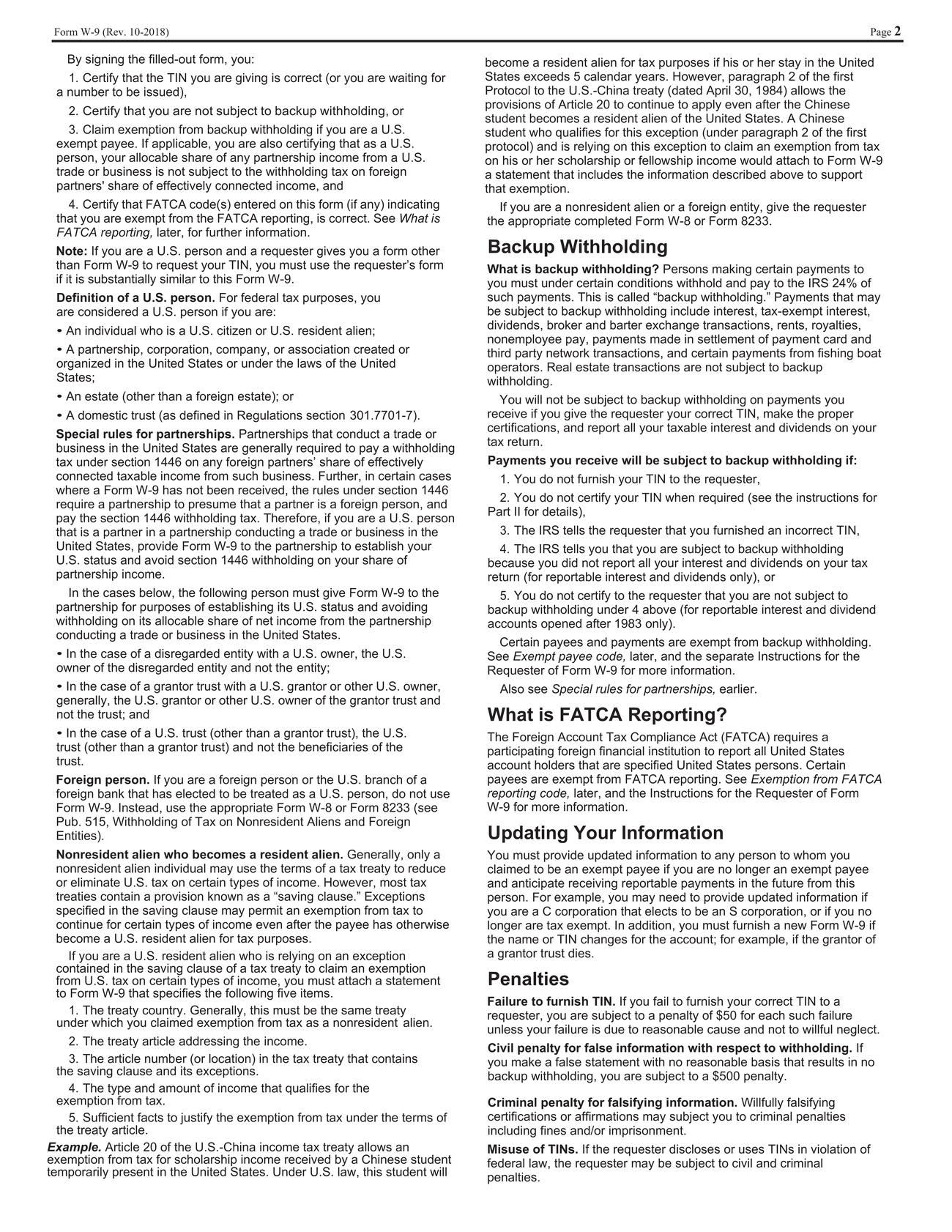

TABLE OF SUBSIDIARY GUARANTOR REGISTRANTS

Exact Name of Registrant

as Specified in its Charter

|

|

|

State or Other

Jurisdiction of

Incorporation or

Organization

|

|

|

Primary

Standard Industrial

Classification Code

Number

|

|

|

I.R.S.

Employer

Identification No.

|

|

|

BedandBreakfast.com, Inc.

|

|

|

|

|

CO |

|

|

|

|

|

4700 |

|

|

|

|

|

45-0489609 |

|

|

|

CarRentals.com, Inc.

|

|

|

|

|

NV |

|

|

|

|

|

4700 |

|

|

|

|

|

35-2519390 |

|

|

|

Cruise, LLC

|

|

|

|

|

WA |

|

|

|

|

|

4700 |

|

|

|

|

|

47-3225083 |

|

|

|

EAN.com, LP

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

42-1612329 |

|

|

|

Egencia LLC

|

|

|

|

|

NV |

|

|

|

|

|

4700 |

|

|

|

|

|

02-0629848 |

|

|

|

Expedia Group Commerce, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

35-2650158 |

|

|

|

Expedia, Inc.

|

|

|

|

|

WA |

|

|

|

|

|

4700 |

|

|

|

|

|

91-1996083 |

|

|

|

Expedia LX Partner Business, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

81-0854713 |

|

|

|

Higher Power Nutrition Common Holdings, LLC

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

20-5112832 |

|

|

|

HomeAway Software, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

27-3481581 |

|

|

|

HomeAway.com, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

20-2208029 |

|

|

|

Hotels.com GP, LLC

|

|

|

|

|

TX |

|

|

|

|

|

4700 |

|

|

|

|

|

75-2942059 |

|

|

|

Hotels.com, L.P.

|

|

|

|

|

TX |

|

|

|

|

|

4700 |

|

|

|

|

|

75-2942061 |

|

|

|

Hotwire, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

74-2938016 |

|

|

|

HRN 99 Holdings, LLC

|

|

|

|

|

NY |

|

|

|

|

|

4700 |

|

|

|

|

|

13-4179783 |

|

|

|

Interactive Affiliate Network, LLC

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

42-1612328 |

|

|

|

LEMS I LLC

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

84-2926169 |

|

|

|

LEXE Marginco, LLC

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

00-0000000 |

|

|

|

LEXEB, LLC

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

00-0000000 |

|

|

|

Liberty Protein, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

26-1632511 |

|

|

|

Neat Group Corporation

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

01-0774064 |

|

|

|

O Holdings Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

61-1463518 |

|

|

|

Orbitz Financial Corp.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

26-2353363 |

|

|

|

Orbitz for Business, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

20-5280097 |

|

|

|

Orbitz, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

52-2237052 |

|

|

|

Orbitz, LLC

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

36-4349713 |

|

|

|

Orbitz Travel Insurance Services, LLC

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

30-0452979 |

|

|

|

Orbitz Worldwide, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

20-5337455 |

|

|

|

Orbitz Worldwide, LLC

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

26-0331198 |

|

|

|

OWW Fulfillment Services, Inc.

|

|

|

|

|

TN |

|

|

|

|

|

4700 |

|

|

|

|

|

62-1149420 |

|

|

|

Travelscape, LLC

|

|

|

|

|

NV |

|

|

|

|

|

4700 |

|

|

|

|

|

88-0392667 |

|

|

|

Trip Network, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

22-3768144 |

|

|

|

VRBO Holdings, Inc.

|

|

|

|

|

DE |

|

|

|

|

|

4700 |

|

|

|

|

|

81-1215345 |

|

|

|

WWTE, Inc.

|

|

|

|

|

NV |

|

|

|

|

|

4700 |

|

|

|

|

|

20-3014378 |

|

|

*

All subsidiary guarantor registrants have the following principal executive office:

c/o Expedia Group, Inc.

1111 Expedia Group Way W.

Seattle, WA 98119

(206) 481-7200

The information in this prospectus is not complete and may be changed. We may not sell these securities or accept any offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 7, 2021

PRELIMINARY PROSPECTUS

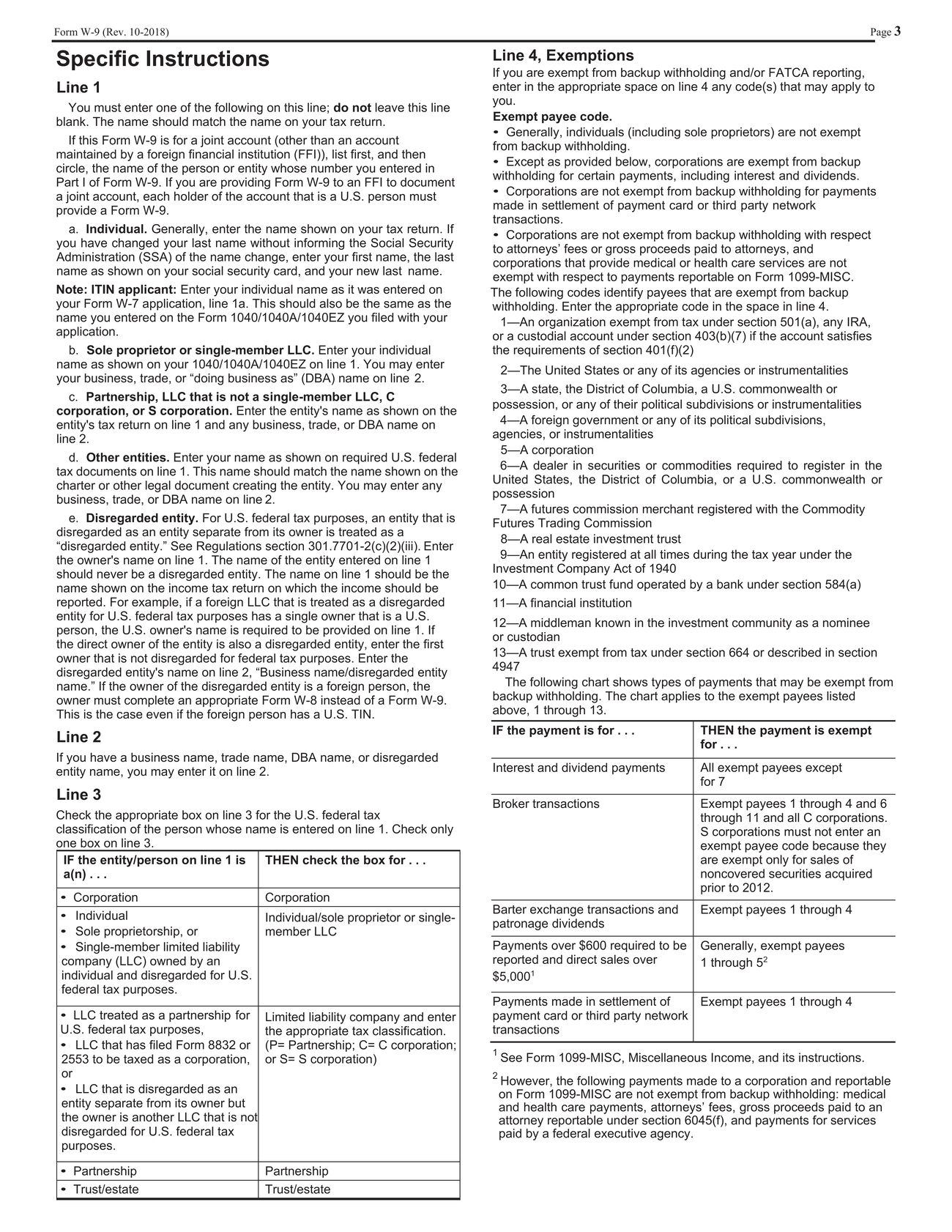

EXCHANGE OFFERS FOR NEW NOTES SET FORTH BELOW

REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, FOR

ANY AND ALL CORRESPONDING OUTSTANDING OLD NOTES

SET FORTH OPPOSITE BELOW

| |

New Notes

|

|

|

Old Notes

|

|

| |

$500,000,000 3.600% Senior Notes due 2023

(CUSIP: 30212PBJ3)

|

|

|

$500,000,000 3.600% Senior Notes due 2023

(CUSIP: 30212PAZ8 and U3010DAK6)

|

|

| |

$750,000,000 4.625% Senior Notes due 2027

(CUSIP: 30212PBK0)

|

|

|

$750,000,000 4.625% Senior Notes due 2027

(CUSIP: 30212PBB0 and U3010DAL4)

|

|

| |

$1,000,000,000 2.950% Senior Notes due 2031

(CUSIP: 30212PBH7)

|

|

|

$1,000,000,000 2.950% Senior Notes due 2031

(CUSIP: 30212PBF1, 30212PBF1 and U3010DAM2)

|

|

Expedia Group, Inc. is offering, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, to exchange an aggregate principal amount of up to (1) $500,000,000 of our 3.600% Senior Notes due 2023 (the “2023 exchange notes”) for an equal principal amount of our outstanding 3.600% Senior Notes due 2023 (the “old 2023 notes”), (2) $750,000,000 of our 4.625% Senior Notes due 2027 (the “2027 exchange notes”) for an equal principal amount of our outstanding 4.625% Senior Notes due 2027 (the “old 2027 notes”) and (3) $1,000,000,000 of our 2.950% Senior Notes due 2031 (the “2031 exchange notes” and together with the 2023 exchange notes and 2027 exchange notes, the “exchange notes”) for an equal principal amount of our outstanding 2.950% Senior Notes due 2031 (the “old 2031 notes” and together with the old 2023 notes and the old 2027 notes, the “old notes,” and the old notes together with the exchange notes, the “notes”). The exchange notes will represent the same debt as the old notes and we will issue the exchange notes under the same indentures as the old notes.

Each of the exchange offers expires at 5:00 p.m., New York City time, on , 2021, unless extended.

Terms of the Exchange Offers

•

We will issue exchange notes for all old notes that are validly tendered and not withdrawn prior to the expiration of the exchange offers.

•

You may withdraw tendered old notes at any time prior to the expiration of the exchange offers.

•

The terms of the exchange notes are identical in all material respects (including principal amount, interest rate, maturity and redemption rights) to the old notes for which they may be exchanged, except that the exchange notes generally will not be subject to transfer restrictions or be entitled to registration rights and the exchange notes will not have the right to earn additional interest under circumstances relating to our registration obligations.

•

Certain of our subsidiaries, which are the same subsidiaries that guarantee the old notes, will guarantee our obligations under the exchange notes, including the payment of principal of, premium, if any, and interest on the exchange notes (the “guarantee”). These guarantees of the exchange notes will be unsecured, unsubordinated obligations of the Subsidiary Guarantors (as hereinafter defined). Certain additional subsidiaries may be required to guarantee the exchange notes, and the guarantees of the Subsidiary Guarantors will terminate, in each case in the circumstances described under “Description of the Exchange Notes — Guarantees.”

•

The exchange of old notes for exchange notes pursuant to the exchange offers will not be a taxable event for U.S. federal income tax purposes. See the discussion under the caption “Certain U.S. Federal Income Tax Considerations.”

•

There is no currently existing trading market for the exchange notes to be issued, and we will not apply for listing on any securities exchange or to seek quotation on any automated dealer quotation system.

See “Risk Factors” beginning on page 11 for a discussion of the factors you should consider in connection with the exchange offers.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offers must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. The letter of transmittal relating to the exchange offers states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an underwriter within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date of the exchange offers, we will amend or supplement this prospectus in order to expedite or facilitate the disposition of any exchange notes by such broker-dealers. See “Plan of Distribution.”

The date of this prospectus is , 2021.

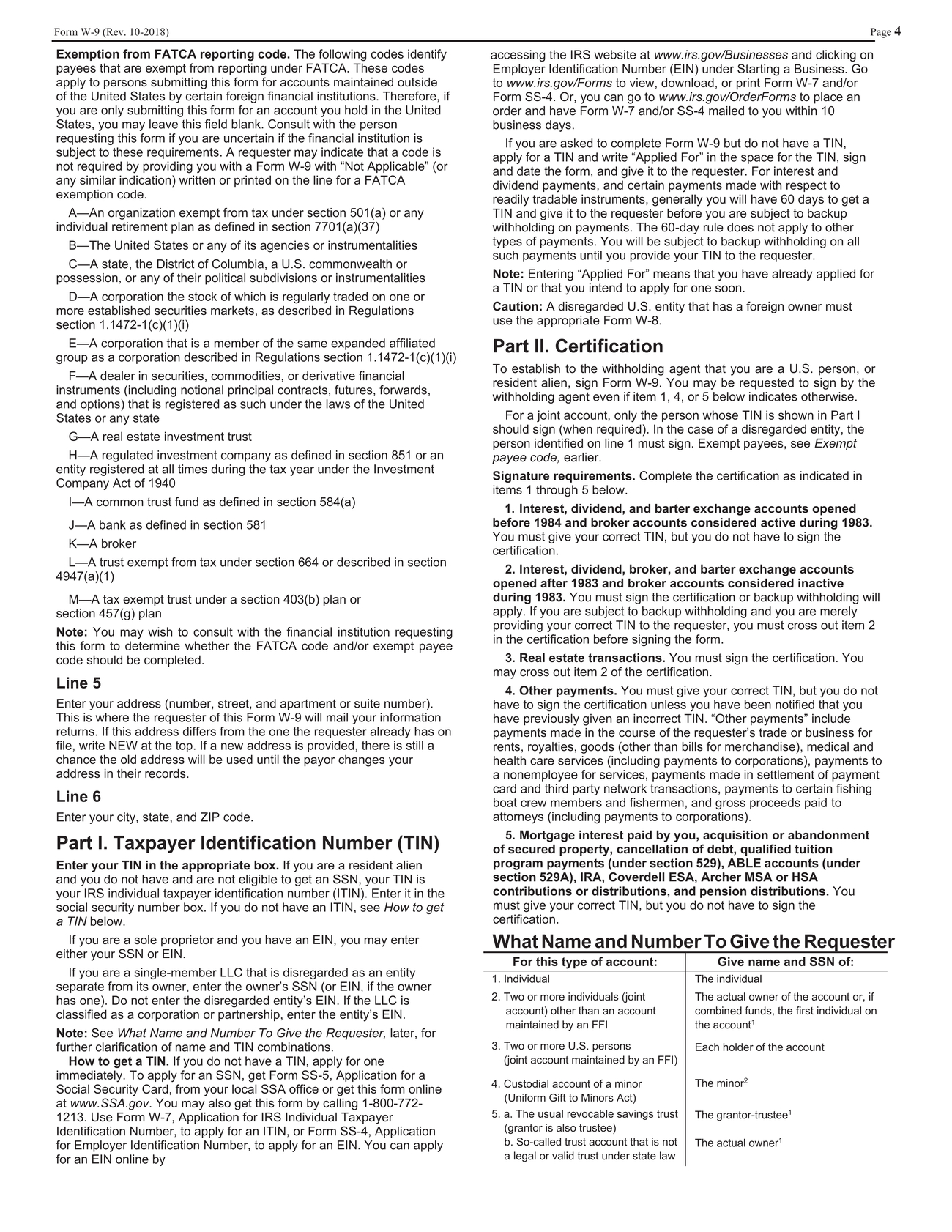

Table of Contents

| |

|

|

|

|

|

i |

|

|

| |

|

|

|

|

|

ii |

|

|

| |

|

|

|

|

|

ii |

|

|

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

7 |

|

|

| |

|

|

|

|

|

11 |

|

|

| |

|

|

|

|

|

18 |

|

|

| |

|

|

|

|

|

19 |

|

|

| |

|

|

|

|

|

42 |

|

|

| |

|

|

|

|

|

45 |

|

|

| |

|

|

|

|

|

54 |

|

|

| |

|

|

|

|

|

56 |

|

|

| |

|

|

|

|

|

57 |

|

|

| |

|

|

|

|

|

58

|

|

|

Expedia Group, Inc. is a Delaware corporation. The mailing address of our principal executive offices is 1111 Expedia Group Way W., Seattle WA 98119, and our telephone number at that location is (206) 481-7200.

In this prospectus, unless we indicate otherwise or the context requires, “we,” “us,” “our,” “it,” the “Issuer,” the “Company” and “Expedia” refer to Expedia Group, Inc., a Delaware corporation (and not its consolidated subsidiaries); the term “Subsidiary Guarantors” refers to those subsidiaries of the Company that guarantee the exchange notes and the old notes; the term “Expedia Group” refers to the Company and its consolidated subsidiaries (including the Subsidiary Guarantors); and “notes” collectively refers to the old notes and the exchange notes.

We have not authorized anyone to provide you with any information or represent anything about us other than what is contained or incorporated by reference in this prospectus or to which we have referred you. We do not take any responsibility for, and can provide no assurance as to the reliability of, information that others may provide you. We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. The information contained in or incorporated by reference into this prospectus is accurate as of the date of the document containing such information regardless of the time of any offer of the exchange notes. The business, financial condition, results of operations or cash flows of Expedia Group and its consolidated subsidiaries may have changed since such date.

Information Incorporated by Reference

The Securities and Exchange Commission (the “SEC”) allows us to “incorporate by reference” in this prospectus the information in other documents that we file with it, which means that we can disclose important information to you by referring you to those publicly filed documents. The information incorporated by reference is considered to be a part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede information contained in documents filed earlier with the SEC or contained in this prospectus or a prospectus supplement. Accordingly, we incorporate by reference in this prospectus the documents listed below and any future filings that we may make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) after the date of the initial registration statement and prior to the effectiveness of the registration statement and after the date of this prospectus and prior to the termination of the offering under this prospectus (excluding in each case information furnished pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K unless we specifically state in such Current Report that such information is to be considered “filed” under the Exchange Act, or we incorporate it by reference into a filing under the Securities Act or the Exchange Act):

•

•

Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, filed on May 7, 2021; and

•

Current Reports on Form 8-K filed on January 12, 2021, February 16, 2021, February 17, 2021, February 19, 2021, February 26, 2021, March 3, 2021, and April 7, 2021.

We will provide without charge to each person to whom a copy of this prospectus has been delivered, upon written or oral request, a copy of any or all of the documents we incorporate by reference in this prospectus, other than any exhibit to any of those documents, unless we have specifically incorporated that exhibit by reference into the information this prospectus incorporates. You may request copies by writing or telephoning us at the following address:

Expedia Group, Inc.

1111 Expedia Group Way W.

Seattle, WA 98119

(206) 481-7200

To obtain timely delivery of any of our filings, agreements or other documents, you must make your request to us no later than , 2021. In the event that we extend the exchange offers, you must submit your request at least five business days before the expiration date of the exchange offers, as extended. We may extend the exchange offers in our sole discretion. See “Exchange Offers” for more detailed information.

Except as expressly provided above, no other information is incorporated by reference into this prospectus.

Where You Can Find More Information

We have filed with the SEC a registration statement on Form S-4 (No. 333- ) under the Securities Act that registers the exchange notes that will be offered in exchange for the old notes. The registration statement, including the attached exhibits and schedules, contains additional relevant information about us and the exchange notes. The rules and regulations of the SEC allow us to omit from this document certain information included in the registration statement.

We are subject to the informational requirements of the Exchange Act and file reports and other information with the SEC. Our SEC filings are available to the public from the SEC’s website at http://www.sec.gov. In addition, the Company makes available, free of charge through its website at www.expediagroupinc.com, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (including related amendments) as soon as reasonably practicable after they have been electronically filed with (or furnished to) the SEC.

Neither the information on the Company’s website, nor the information on the website of any Expedia Group business, is incorporated by reference in this prospectus, or in any other filings with, or in any other information furnished or submitted to, the SEC.

Forward-Looking Information

This prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect the views of our management regarding current expectations and projections about future events and are based on currently available information. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, but not limited to, those discussed in our Annual Report on Form 10-K for the year ended December 31, 2020, Part I, Item 1A, “Risk Factors,” as well as those discussed in the Risk Factors section and elsewhere in this prospectus. The ongoing global coronavirus (COVID-19) pandemic, and the volatile regional and global economic conditions stemming from it, and additional or unforeseen effects from the COVID-19 pandemic, could also give rise to or aggravate these risk factors, which in turn could materially adversely affect our business, financial condition, liquidity, results of operations (including revenues and profitability) and/or stock price. Further, COVID-19 may also affect our operating and financial results in a manner that is not presently known to us or that we currently do not consider to present significant risks to our operations. Other unknown or unpredictable factors also could have a material adverse effect on our business, financial condition and results of operations. Accordingly, readers should not place undue reliance on these forward-looking statements. The use of words such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “goal,” “intends,” “likely,” “may,” “plans,” “potential,” “predicts,” “projected,” “seeks,” “should” and “will,” or the negative of these terms or other similar expressions, among others, generally identify forward-looking statements; however, these words are not the exclusive means of identifying such statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. We are not under any obligation to, and do not intend to, publicly update or review any of these forward-looking statements, whether as a result of new information, future events or otherwise, even if experience or future events make it clear that any expected results expressed or implied by those forward-looking statements will not be realized. Please carefully review and consider the various disclosures made in this prospectus and in our reports filed with the SEC that attempt to advise interested parties of the risks and factors that may affect our business, prospects and results of operations.

Summary

This summary highlights information that is contained elsewhere in this prospectus. It does not contain all the information that you may consider important in making your investment decision. Therefore, you should read the entire prospectus carefully, including the information in the section entitled “Risk Factors” and our financial statements and the related notes thereto and other financial data included elsewhere in this prospectus, as well as the information incorporated by reference into this prospectus.

Our Company

Expedia Group, Inc. is an online travel company, and our mission is to power global travel for everyone, everywhere. We believe travel is a force for good. Travel is an essential human experience that strengthens connections, broadens horizons and bridges divides. We leverage our supply portfolio, platform and technology capabilities across an extensive portfolio of consumer brands, and provide solutions to our business partners, to empower travelers to efficiently research, plan, book and experience travel. We seek to grow our business through a dynamic portfolio of travel brands, including our majority-owned subsidiaries, that feature a broad multi-product supply portfolio — with approximately 3.0 million lodging properties available, including over 2 million online bookable alternative accommodations listings and approximately 880,000 hotels, over 500 airlines, packages, rental cars, cruises, insurance, as well as activities and experiences across 200 countries and territories. Travel suppliers distribute and market products via our desktop and mobile offerings, as well as through alternative distribution channels, our business partnerships and our call centers in order to reach our extensive global audience. In addition, our advertising and media businesses help other businesses, primarily travel providers, reach a large multi-platform audience of travelers around the globe.

Our portfolio of brands includes:

•

Retail: Our Retail segment provides a full range of travel and advertising services to our worldwide customers through a number of consumer brands that target a variety of customer segments and geographic regions with tailored offerings. Our portfolio of retail brands include:

•

Brand Expedia, a leading full-service online travel brand with localized websites in over 40 countries covering 27 languages offers a wide selection of travel products and services;

•

Hotels.com, a marketing lodging accommodations provider with 90 localized websites worldwide in 41 languages worldwide and market leading mobile apps on all major platforms;

•

Vrbo (previously HomeAway), operates an online marketplace for the alternative accommodations industry, the portfolio of which includes the vacation rental website Vrbo, which operates localized websites around the world, and HomeAway;

•

Orbitz, connects travelers to the world by providing the best planning tools and travel rewards just for going;

•

CheapTickets, gives customers more ways to save on their next trip with last minute deals and discounts, and event tickets to top concerts, theater, sporting events and more;

•

Travelocity, a pioneer in the online travel industry and its famous Roaming Gnome encourage travelers in the United States and Canada to “Wander Wisely™”;

•

Ebookers, a leading online EMEA travel agent offering travelers an array of travel options across flights, accommodations, packages, car hire providers and destination activities;

•

Wotif Group, a leading Australian online travel agent, comprised of the Wotif.com, lastminute.com.au and travel.com.au brands in Australia, and Wotif.co.nz and lastminute.co.nz in New Zealand is the go-to for local travel and is committed to supporting the Australian tourism industry, destination marketing organizations and tourism operators to help attract tourists to their region;

•

Hotwire, offers a travel booking service that matches flexible, value-oriented travelers with suppliers who have excess seats, rooms and cars they offer at lower rates than retail. Hotwire’s

Hot Rate® Hotels, Hot Rate® Cars and Hot Rate® Flights offer travelers an extra low price as the supplier name is not revealed until after the traveler books and pays;

•

CarRentals.com, an online car rental marketing and retail firm offers a diverse selection of car rentals direct to consumers. CarRentals.com is able to provide our customers choices across the globe and help our supply partners expand their marketing reach;

•

Expedia Cruises, North America’s leading cruise specialist, provides a full range of travel products through its network of independently owned retail travel franchises. With over 285 points of sale across North America and a team of over 5,400 professionally-trained vacation consultants, the franchise company has been recognized as a top seller with every major cruise line and is consistently ranked as a top-rated franchise organization year after year.

•

B2B. Our B2B segment encompasses our Expedia Business Services organization, which has two components:

•

Expedia Partner Solutions is the partner-focused arm of Expedia Group and partners with businesses in over 70 countries across a wide range of travel and non-travel verticals including corporate travel management, airlines, travel agents, online retailers and financial institutions, who market Expedia Group rates and availabilities to their travelers;

•

Egencia, our full-service travel management company, offers travel products and services to businesses and their corporate travelers. Egencia maintains a global presence in more than 60 countries across North America, Europe and Asia Pacific and provides, among other things, a global technology platform coupled with assistance from expert travel consultants, relevant supply targeted at business travelers, and consolidated reporting for its clients;

•

Trivago. Our trivago segment generates advertising revenue primarily from sending referrals to online travel companies and travel service providers by giving travelers access to price comparisons from hundreds of booking websites for over 5.0 million hotels and other accommodations, including over 3.8 million units of alternative accommodations, in over 190 countries. Officially launched in 2005, trivago is a leading global brand in hotel search and can be accessed worldwide via 54 localized websites and apps in 32 languages.

Recent Developments

On May 4, 2021, we announced that American Express Global Business Travel (“GBT”) has made a binding offer to acquire Egencia LLC (“Egencia”), our corporate travel arm included within our B2B segment. As part of the transaction, the Company would become an approximately 14% shareholder in, and enter a 10-year lodging supply agreement with, GBT. The proposed deal is subject to consultation by the Company and Egencia with their applicable employee representatives, as well as customary closing conditions including regulatory approvals. It is anticipated that the proposed deal would close in nine to twelve months from time of the binding offer. We expect that Egencia will no longer guarantee the notes following the consummation of the transaction.

Expedia’s shares of common stock are traded on the NASDAQ Global Select Market under the ticker symbol “EXPE.”

The address of Expedia’s principal executive offices is 1111 Expedia Group Way W., Seattle, WA 98119. Expedia’s telephone number is (206) 481-7200.

Summary Terms of the Exchange Offers

Set forth below is a brief summary of some of the principal terms of the exchange offers. In this summary of the offering, “we,” “us,” “our,” “Expedia Group,” the “Issuer” and the “Company” refer only to Expedia Group, Inc. and any successor obligor, and not to any of its subsidiaries. You should also read the information in the section entitled “Exchange Offers” later in this prospectus for a more detailed description and understanding of the terms of the exchange notes.

We are offering to exchange:

•

the old 2023 notes for a like principal amount of the 2023 exchange notes;

•

the old 2027 notes for a like principal amount of the 2027 exchange notes; and

•

the old 2031 notes for a like principal amount of the 2031 exchange notes.

The exchange notes will be identical in all material respects to the old notes for which they will have been exchanged, except that the offer and sale of the exchange notes will have been registered under the Securities Act, and thus the exchange notes generally will not be subject to the restrictions on transfer applicable to the old notes or bear restrictive legends, the exchange notes will not be entitled to registration rights and the exchange notes will not have the right to earn additional interest under circumstances relating to our registration obligations.

Expiration of the Exchange Offers; Withdrawal of

Tender

Each of the exchange offers will expire at 5:00 p.m., New York City time, on , 2021, or a later date and time to which we may extend it. We do not currently intend to extend the expiration of the exchange offers. You may withdraw your tender of old notes in the exchange offers at any time before the expiration of the exchange offers. Any old notes not accepted for exchange for any reason will be returned without expense to you promptly after the expiration or termination of the exchange offers.

Conditions to the Exchange

Offers

The exchange offers are not conditioned upon any minimum aggregate principal amount of old notes being tendered for exchange. The exchange offers are subject to customary conditions, which we may waive. See “Exchange Offers — Conditions” for more information regarding the conditions to the exchange offers.

Procedures for Tendering Notes

To tender old notes held in book-entry form through the Depository Trust Company, or “DTC,” you must transfer your old notes into the exchange agent’s account in accordance with DTC’s Automated Tender Offer Program, or “ATOP” system. In lieu of delivering a letter of transmittal to the exchange agent, a computer-generated message, in which the holder of the old notes acknowledges and agrees to be bound by the terms of the letter of transmittal, must be transmitted by DTC on behalf of a holder and received by the exchange agent before 5:00 p.m., New York City time, on the expiration date. In all other cases, a letter of transmittal must be manually executed and received by the exchange agent before 5:00 p.m., New York City time, on the expiration date.

By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things:

•

any exchange notes to be received by you will be acquired in the ordinary course of your business;

•

you have no arrangement, intent or understanding with any person to participate in the distribution of the exchange notes (within the meaning of the Securities Act);

•

you are not engaged in and do not intend to engage in a distribution of the exchange notes (within the meaning of the Securities Act);

•

you are not our “affiliate” (as defined in Rule 405 under the Securities Act); and

•

if you are a broker-dealer that will receive exchange notes for your own account in exchange for old notes that were acquired as a result of market-making activities or other trading activities, you will deliver or make available a prospectus in connection with any resale of the exchange notes.

Special Procedures for Beneficial Owners

If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you want to tender old notes in the exchange offers, you should contact the registered owner promptly and instruct the registered holder to tender on your behalf. If you wish to tender on your own behalf, you must, before completing and executing the letter of transmittal and delivering your old notes, either make appropriate arrangements to register ownership of the old notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration of the exchange offers.

If you are a beneficial owner that holds old notes through Euroclear Bank S.A./N.V., as operator of the Euroclear System (“Euroclear”), or Clearstream Banking, société anonyme (“Clearstream”), and wish to tender your old notes, contact Euroclear or Clearstream directly to ascertain the procedure for tendering old notes and comply with such procedure.

See “Exchange Offers — Procedures for Tendering.”

Guaranteed Delivery

Procedures

If you wish to tender your old notes, and time will not permit your required documents to reach the exchange agent by the expiration date, or the procedure for book-entry transfer cannot be completed on time, you may tender your old notes under the procedures described under “Exchange Offers — Guaranteed Delivery Procedures.”

Consequences of Failure to Exchange

Any old notes that are not tendered in the exchange offers, or that are not accepted in the exchange offers, will remain subject to the restrictions on transfer. Since the old notes have not been registered

under the U.S. federal securities laws, you will not be able to offer or sell the old notes except under an exemption from the requirements of the Securities Act or unless the old notes are registered under the Securities Act. Upon the completion of the exchange offers, we will have no further obligations, except under limited circumstances, to provide for registration of the old notes under the U.S. federal securities laws. See “Exchange Offers — Consequences of Failure to Tender.”

Certain U.S. Federal Income Tax Considerations

The exchange of old notes for exchange notes in the exchange offers will not constitute a taxable exchange for U.S. federal income tax purposes. See “Certain U.S. Federal Income Tax Considerations.”

Under existing interpretations of the Securities Act by the staff of the SEC contained in several no-action letters to third parties, and subject to the immediately following sentence, we believe that the exchange notes will generally be freely transferable by holders after the exchange offers without further compliance with the registration and prospectus delivery requirements of the Securities Act (subject to certain representations required to be made by each holder of old notes, as set forth under “Exchange Offers — Procedures for Tendering”). However, any holder of old notes who:

•

is one of our “affiliates” (as defined in Rule 405 under the Securities Act),

•

does not acquire the exchange notes in the ordinary course of business,

•

distributes, intends to distribute, or has an arrangement or understanding with any person to distribute the exchange notes as part of the exchange offers, or

•

is a broker-dealer who purchased old notes from us in the initial offering of the old notes for resale pursuant to Rule 144A or any other available exemption under the Securities Act,

will not be able to rely on the interpretations of the staff of the SEC, will not be permitted to tender old notes in the exchange offers and, in the absence of any exemption, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes.

Our belief that transfers of exchange notes would be permitted without registration or prospectus delivery under the conditions described above is based on SEC interpretations given to other, unrelated issuers in similar exchange offers. We cannot assure you that the SEC would make a similar interpretation with respect to our exchange offers. We will not be responsible for or indemnify you against any liability you may incur under the Securities Act.

Each broker-dealer that receives exchange notes for its own account under the exchange offers in exchange for old notes that were acquired by the broker-dealer as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.”

We will not receive any cash proceeds from the issuance of the exchange notes pursuant to the exchange offers.

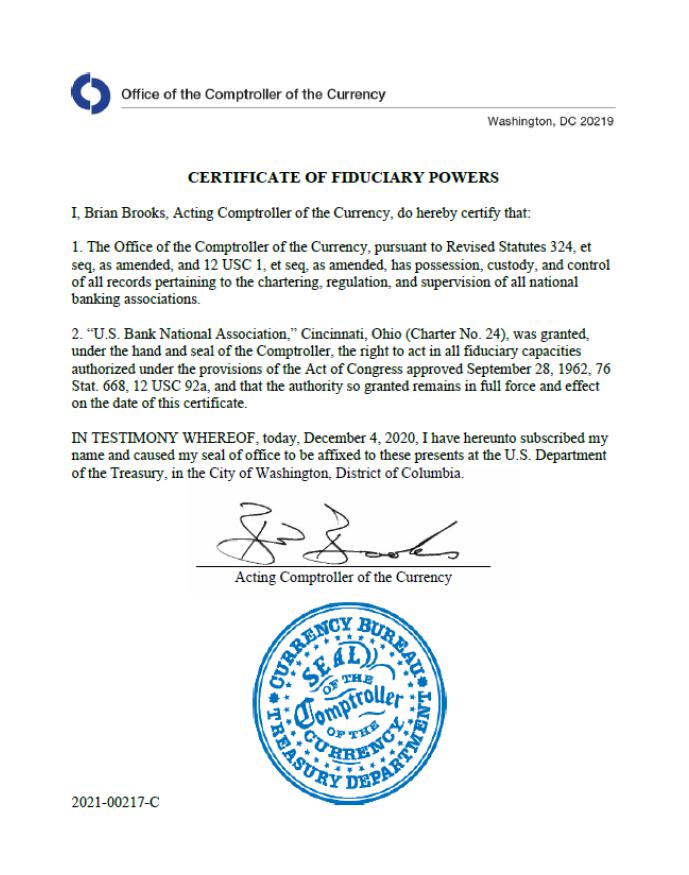

U.S. Bank National Association is the exchange agent for the exchange offers. The address and telephone number of the exchange agent are set forth under “Exchange Offers — Exchange Agent.”

Summary Terms of the Exchange Notes

Set forth below is a brief summary of some of the principal terms of the exchange notes. In this summary of the offering, “we,” “us,” “our,” “Expedia Group,” the “Issuer,” and the “Company” refer only to Expedia Group, Inc. and any successor obligor, and not to any of its subsidiaries. You should also read the information in the section entitled “Description of the Exchange Notes” later in this prospectus for a more detailed description and understanding of the terms of the exchange notes.

The exchange notes will be identical in all material respects to the old notes for which they will have been exchanged, except:

•

the offer and sale of the exchange notes will have been registered under the Securities Act, and thus the exchange notes generally will not be subject to the restrictions on transfer applicable to the old notes or bear restrictive legends,

•

the exchange notes will not be entitled to registration rights, and

•

the exchange notes will not have the right to earn additional interest under circumstances relating to our registration obligations.

Expedia Group, Inc., a Delaware corporation.

The exchange notes will be fully and unconditionally guaranteed by the Subsidiary Guarantors, which include each of our subsidiaries that guarantees the old notes and our existing 2.500% Senior Notes due 2022, 4.500% Senior Notes due 2024, 6.250% Senior Notes due 2025, 5.000% Senior Notes due 2026, 3.800% Senior Notes due 2028, 3.25% Senior Notes due 2030 and 0% Convertible Senior Notes due 2026 (collectively, the “Existing Notes”) and that is either a domestic borrower or guarantor under our Amended and Restated Credit Agreement, dated as of May 5, 2020 (as amended prior to the date hereof, the “Credit Facility”). Additional subsidiaries will be required to guarantee the exchange notes, and the guarantees of the Subsidiary Guarantors with respect to the exchange notes will terminate, in each case in the circumstances set forth under “Description of the Exchange Notes — Guarantees.” As set forth in the section entitled “Summarized Financial Information for Guarantors and the Issuer of Guaranteed Securities” in our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2021, which is incorporated by reference into this prospectus, as of and for the three months ended March 31, 2021, the Issuer and the Subsidiary Guarantors accounted for approximately $18.4 billion, or 84.1%, of our total consolidated assets and accounted for approximately $1.1 billion, or 85.6%, of our total consolidated revenue.

$500,000,000 aggregate principal amount of 3.600% Senior Notes due 2023 (the “2023 exchange notes”).

$750,000,000 aggregate principal amount of 4.625% Senior Notes due 2027 (the “2027 exchange notes”).

$1,000,000,000 aggregate principal amount of 2.950% Senior Notes due 2031 (the “2031 exchange notes” and, together with the 2023 exchange notes and the 2027 exchange notes, the “exchange notes”).

The 2023 exchange notes will mature on December 15, 2023.

The 2027 exchange notes will mature on August 1, 2027.

The 2031 exchange notes will mature on March 15, 2031.

The 2023 exchange notes will accrue interest at 3.600% per annum, the 2027 exchange notes will accrue interest at 4.625% per annum and the 2031 exchange notes will accrue interest at 2.950% per annum, payable semiannually in arrears on June 15 and December 15 of each year, beginning on December 15, 2021, with respect to the 2023 exchange notes, February 1 and August 1 of each year, beginning on August 1, 2021, with respect to the 2027 exchange notes, and March 15 and September 15 of each year, beginning on September 15, 2021, with respect to the 2031 exchange notes, in each case subject to adjustment as described in “Description of the Exchange Notes — Interest Rate Adjustment.”

The interest rate payable on each series of exchange notes will be subject to adjustment based on certain rating events. See “Description of the Exchange Notes — Interest Rate Adjustment.”

The exchange notes will be our unsecured, unsubordinated obligations and will rank equally in right of payment with each other and with all of our existing and future unsubordinated and unsecured obligations, including the Existing Notes. So long as the guarantees are in effect, each Subsidiary Guarantor’s guarantee will be the unsecured, unsubordinated obligation of such Subsidiary Guarantor and will rank equally in right of payment with each other and with all of such Subsidiary Guarantor’s existing and future unsubordinated and unsecured obligations, including such Subsidiary Guarantor’s guarantees of the Existing Notes. The exchange notes and the guarantees will be effectively subordinated to our and the Subsidiary Guarantors’ existing and future secured indebtedness, including a portion of the indebtedness under the Credit Facility, up to the extent of the value of the collateral securing such indebtedness. The collateral securing our Credit Facility consists of substantially all of our assets and the assets of the Subsidiary Guarantors under such facility (subject to certain exceptions, including for our new headquarters located in Seattle, WA). As of March 31, 2021, our total consolidated indebtedness was $8.5 billion, and we had no borrowed amounts outstanding and $15 million of outstanding letters of credit under the Credit Facility and no borrowed amounts outstanding under the Foreign Credit Facility (as defined below). In addition, the exchange notes and the guarantees will be structurally subordinated to all of the existing and future indebtedness and other liabilities of the Company’s subsidiaries that are not Subsidiary Guarantors and of those Subsidiary Guarantors whose guarantees of the exchange notes are released or terminated, including, without limitation, the obligations of such subsidiaries under our Credit Agreement, dated as of August 5, 2020 (as amended prior to the date hereof, the “Foreign Credit Facility”).

At our option, we may redeem all or part of either or both series of exchange notes at any time or from time to time, prior to their maturity. If we elect to redeem the 2023 exchange notes prior to November 15, 2023 (the date that is one month prior to the maturity date of the 2023 exchange notes), the 2027 exchange notes prior to May 1, 2027 (the date that is three months prior to the maturity date of the 2027 exchange notes) or the 2031 exchange notes prior to December 15, 2030 (the date that is three months prior to the maturity date of the 2031 exchange notes), we will pay a redemption price

in respect of the exchange notes to be redeemed at a specified “make-whole” premium as described under “Description of the Exchange Notes — Optional Redemption,” plus accrued and unpaid interest thereon to but excluding the redemption date.

If we elect to redeem the 2023 exchange notes on or after November 15, 2023 (the date that is one month prior to the maturity date of the 2023 exchange notes), the 2027 exchange notes on or after May 1, 2027 (the date that is three months prior to the maturity date of the 2027 exchange notes) or the 2031 exchange notes on or after December 15, 2030 (the date that is three months prior to the maturity date of the 2031 exchange notes), we will pay a redemption price equal to 100% of the principal amount of the exchange notes to be redeemed, plus accrued and unpaid interest thereon to but excluding the redemption date.

Upon the occurrence of a Change of Control Triggering Event (as defined in this prospectus), each holder of exchange notes will have the right to require us to repurchase such holder’s exchange notes, in whole or in part, at a purchase price in cash equal to 101% of the principal amount thereof, plus any accrued and unpaid interest to the date of purchase. See “Description of the Exchange Notes — Change of Control.”

The indenture that governs the 2023 exchange notes, the indenture that governs the 2027 exchange notes and the indenture that governs the 2031 exchange notes (together, the “indentures”), as applicable, contain covenants limiting (i) our ability and our subsidiaries’ ability to create certain liens and enter into sale and lease-back transactions and (ii) our ability and each Subsidiary Guarantor’s ability to consolidate or merge with, or convey, transfer or lease all or substantially all of our or its assets to, another person.

However, each of these covenants is subject to certain exceptions. You should read “Description of the Exchange Notes — Covenants” for a description of these covenants.

We will issue the exchange notes in fully registered form in denominations of $2,000 and integral multiples of $1,000 in excess thereof. Each of the exchange notes will be represented by one or more global securities registered in the name of a nominee of The Depository Trust Company (“DTC”). You will hold a beneficial interest in one or more of the exchange notes through DTC, and DTC and its direct and indirect participants will record your beneficial interest in their books. Except under limited circumstances, we will not issue certificated exchange notes.

We may create and issue additional notes having the same terms as, and ranking equally with, the 2023 exchange notes and the old 2023 notes, the 2027 exchange notes and the old 2027 notes and the 2031 exchange notes and the old 2031 notes, respectively, in all respects (or in all respects except for the date of issuance, issue price, the initial interest accrual date and amount of interest payable on the first payment date applicable thereto). These additional notes will be treated as a single class with the 2023 exchange notes and the old 2023 notes, the 2027 exchange notes and the old 2027 notes and the 2031 exchange notes and old 2031 notes, respectively, including for purposes of waivers, amendments and redemptions.

The indentures governing the exchange notes are, and the exchange notes will be, governed by, and construed in accordance with, the laws of the State of New York.

Absence of a Public Market for the Exchange Notes

The exchange notes generally are freely transferable but are also new securities for which there is not initially an existing trading market. There can be no assurance as to the development or liquidity of any market for the exchange notes. We will not apply for listing of the exchange notes on any securities exchange or to seek quotation of the exchange notes on any automated dealer quotation system.

See “Risk Factors” beginning on page 11 for a discussion of some of the key factors you should carefully consider before deciding to exchange your old notes for exchange notes.

Risk Factors

You should consider carefully various risks, including those described below and all of the information about risks included in the documents incorporated by reference in this prospectus, including under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020 along with the information provided elsewhere in this prospectus. These risks could adversely and materially affect our ability to meet our obligations under the exchange notes, and you, under the circumstances described in this section, could lose all or part of your investment in, and fail to achieve the expected return on, the exchange notes.

The risks and uncertainties described below and incorporated by reference into this prospectus are not the only ones that we face. Additional risks and uncertainties, including those generally affecting the industry in which we operate, risks that are unknown to us or that we currently deem immaterial and risks and uncertainties generally applicable to companies that have recently undertaken transactions similar to the exchange offers, may also impair our business, the value of your investment and our ability to pay interest on, and repay or refinance, the exchange notes.

For a discussion of risks relating to our business, see “Risk Factors” in Part 1, Item 1A, in our Annual Report on Form 10-K for the year ended December 31, 2020, which is incorporated by reference herein. The risk factors described below and the risks relating to our business incorporated by reference herein could materially impact our business, financial condition and results of operations.

Risks Related to the Exchange Notes and the Exchange Offers

We may not be able to generate sufficient cash to service all of our indebtedness. We may be forced to take other actions to satisfy our obligations under our indebtedness or we may experience a financial failure.

Our ability to make scheduled payments on or to refinance our debt obligations, including the exchange notes, the Existing Notes and our obligations under our Credit Facility and our Foreign Credit Facility, will depend on our financial and operating performance, which has been significantly impacted by the ongoing COVID-19 pandemic and is subject to other prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that we will achieve and maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness, including the exchange notes, the Existing Notes, our Credit Facility and our Foreign Credit Facility, especially in light of the fact that, as a result of the COVID-19 pandemic and the measures implemented to contain it, we are currently experiencing significant declines in new travel bookings and higher refund obligations to customers, which is negatively impacting cash flow, and we could face incremental pressure on cash flow if the COVID-19 pandemic worsens again and strict government travel restrictions and quarantine orders are put back in place globally. If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness, including the exchange notes, the Existing Notes, our Credit Facility and our Foreign Credit Facility. We cannot assure you that we would be able to take any of these actions, that these actions would be successful and permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements. In the absence of sufficient operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions or obtain sufficient proceeds from those dispositions to meet our debt service and other obligations then due.

We may incur additional indebtedness.

We may incur substantial additional indebtedness in the future. Pursuant to the terms of the Credit Facility, the Company and its subsidiaries that are borrowers or guarantors of the Credit Facility have granted liens on substantially all of their assets, subject to certain exceptions and limitations, to secure a portion of the obligations under the Credit Facility, which secured obligations are effectively senior in priority to the exchange notes and our Existing Notes to the extent of the value of such collateral. We are permitted to incur additional secured indebtedness subject to specified limitations, which indebtedness would be effectively senior in priority to the exchange notes and our Existing Notes. The Foreign Credit Facility is an

obligation of certain of our subsidiaries that will not guarantee the exchange notes and do not guarantee our Existing Notes and, accordingly, such obligations will be or are structurally senior to the exchange notes and our Existing Notes to the extent of the assets of the applicable subsidiaries. Moreover, if conditions related to the COVID-19 pandemic persist or worsen, we may be required to raise additional debt and/or financing in the short term to further bolster our liquidity, and we may need to incur additional debt financing in the future in order to maintain adequate liquidity for our business. There can be no assurance that such financing will be available on attractive terms or at all. Furthermore, certain investment agreements, dated as of April 23, 2020 (the “Investment Agreements”) under which we issued in a private placement on May 5, 2020 (the “May Private Placement”) shares of our Series A Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”) and warrants to purchase our common stock to each of AP Fort Holdings, L.P., an affiliate of Apollo Global Management, Inc. (the “Apollo Purchaser”) and SLP Fort Aggregator II, L.P. and SLP V Fort Holdings II, L.P., affiliates of Silver Lake Group, L.L.C. (together, the “Silver Lake Purchasers”) include certain participation rights for the Apollo Purchaser and Silverlake Purchasers in offerings of equity securities or securities convertible into equity securities. In addition, the certificates of designation that govern the terms of our Series A Preferred Stock contain certain restrictions on our ability to issue shares of capital stock that rank senior or pari passu to our Series A Preferred Stock, without the approval of the holders of at least two-thirds of the Series A Preferred Stock, voting together as a separate class. Such rights and restrictions could impede us from obtaining additional equity financing, even if the terms of such financing are favorable, and therefore could limit our ability to strengthen our financial position and/or liquidity position. Any debt financing we may seek may include secured indebtedness.

We have significant indebtedness, including secured indebtedness, which could adversely affect our business and financial condition and prevent us from fulfilling our obligations under our outstanding indebtedness and the exchange notes.

As of March 31, 2021, our total consolidated indebtedness was $8.5 billion, and we had no borrowed amounts outstanding and $15 million of outstanding letters of credit under the Credit Facility and no borrowed amounts outstanding under the Foreign Credit Facility. Indebtedness under the Foreign Credit Facility will be structurally senior to the exchange notes and the guarantees. Our indebtedness could have important consequences for you. For example, it could:

•

make it difficult for us to satisfy our obligations with respect to the exchange notes and our Existing Notes;

•

increase our vulnerability to general adverse economic and industry conditions;

•

require us to dedicate a portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of cash flow to fund working capital, capital expenditures, acquisitions and investments and other general corporate purposes;

•

make it difficult for us to optimally capitalize and manage the cash flow for our businesses;

•

limit our flexibility in planning for, or reacting to, changes in our businesses and the markets in which we operate;

•

place us at a competitive disadvantage compared to our competitors that have less debt; and

•

limit our ability to borrow additional funds or to borrow funds at rates or on other terms we find acceptable.

It is possible that we may need to incur additional indebtedness in the future, in the ordinary course of business or otherwise. The agreements governing our indebtedness allow, and future debt instruments may allow, us to incur additional debt subject to certain limitations. If new debt is added to current debt levels, the risks described above could intensify. In addition, the interest rate payable on our 9.5% Series A preferred stock could increase by 100 to 300 basis points if, as a result of certain additional borrowings (subject to certain exceptions), our leverage ratio under the credit agreement exceeds 5 to 1.

The agreements governing our indebtedness contain various covenants that limit our discretion in the operation of our business and also require us to meet financial maintenance tests and other covenants. The failure to comply with such tests and covenants could have a material adverse effect on us.

The agreements governing our indebtedness contain and future debt instruments may contain various covenants, including those that restrict our ability to, among other things:

•

borrow money, and guarantee or provide other support for indebtedness of third parties, including guarantees;

•

pay dividends on, redeem or repurchase our capital stock;

•

enter into certain asset sale transactions, including partial or full spin-off transactions;

•

enter into secured financing arrangements;

•

acquire businesses of, or make investments in, third parties;

•

move assets among our subsidiaries or restructure our group;

•

enter into sale and leaseback transactions; and

•

enter into unrelated businesses.

These covenants may limit our ability to effectively operate our businesses.

In addition, the Credit Facility and the Foreign Credit Facility require that we meet certain financial maintenance tests, including (i) to maintain minimum liquidity of $300 million prior to December 31, 2021 and (ii) on and after December 31, 2021, to maintain a specified maximum leverage ratio test.

Any failure to comply with the restrictions of the Credit Facility and/or the Foreign Credit Facility or any agreement governing our other indebtedness may result in an event of default under those agreements. Such default may allow the creditors to accelerate the related debt, which acceleration may trigger cross-acceleration or cross-default provisions in other debt. In addition, lenders may be able to terminate any commitments they had made to supply us with further funds (including periodic rollovers of existing borrowings).

We may not be able to repurchase the exchange notes upon a change of control triggering event.

We may not be able to repurchase the exchange notes upon a change of control triggering event because we may not have sufficient funds. Upon a change of control triggering event, holders of the exchange notes may require us to make an offer to purchase the exchange notes at a purchase price equal to 101% of the principal amount of the exchange notes plus accrued and unpaid interest, if any, to the purchase date.

The occurrence of a change of control triggering event itself would constitute an event of default under our Credit Facility and our Foreign Credit Facility, and could constitute an event of default under agreements governing our future indebtedness. Our failure to purchase tendered exchange notes of a series upon a change of control triggering event would result in an event of default under the applicable indenture governing such exchange notes and a cross-default under the agreements governing certain of our other indebtedness, which may result in the acceleration of such indebtedness requiring us to repay that indebtedness immediately. If a change of control triggering event were to occur, we may not have sufficient funds to repay any such accelerated indebtedness.

In addition, you may not be entitled to require us to repurchase the exchange notes of series under the change of control provisions in the applicable indenture in the event of certain important corporate events, such as a leveraged recapitalization (which would increase the level of our indebtedness), reorganization, restructuring, merger or other similar transaction, unless such transaction constitutes a “change of control” under such indenture, even if such event is accompanied by a “ratings event” under such indenture. Such a transaction may not involve a change in voting power or beneficial ownership or, even if it does, may not involve a change that constitutes a “change of control” that would potentially trigger our obligation to repurchase the exchange notes. If an event occurs that does not constitute a “change of control,” as defined in the applicable indenture, we will not be required to make an offer to repurchase the exchange notes and you may be required to continue to hold your exchange notes despite the event.

The definition of “change of control” includes a disposition of all or substantially all of the assets of the Company to any person. Although there is a limited body of case law interpreting the phrase “substantially all,” there is no precise established definition of the phrase under applicable law. Accordingly, in certain

circumstances there may be a degree of uncertainty as to whether a particular transaction would involve a disposition of “all or substantially all” of the assets of the Company. As a result, it may be unclear as to whether a change of control has occurred and whether a holder of exchange notes may require the Company to make an offer to repurchase the exchange notes. See “Description of the Exchange Notes — Change of Control.”

Our holding company structure may impact your ability to receive payment on the exchange notes.

We are a holding company with no significant operations or material assets other than the capital stock of our subsidiaries. As a result, our ability to repay our indebtedness, including the exchange notes, is dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. Unless they are Subsidiary Guarantors of the exchange notes, our subsidiaries do not have any obligation to pay amounts due on the exchange notes or to make funds available for that purpose. In addition, our subsidiaries may not be able to, or be permitted to, make distributions to enable us to make payments in respect of our indebtedness, including the exchange notes. Each of our subsidiaries is a distinct legal entity and, under certain circumstances, legal and contractual restrictions, as well as the financial condition and operating requirements of our subsidiaries, may limit our ability to obtain cash from our subsidiaries. Further, while the Subsidiary Guarantors will fully and unconditionally guarantee the exchange notes, such guarantees could be rendered unenforceable for the reasons described below under “— The guarantees may be unenforceable due to fraudulent conveyance statutes, and accordingly, you could have no claim against the Subsidiary Guarantors.”

Effective subordination of the exchange notes and the guarantees to our and our guarantors’ existing and future secured indebtedness and/or structurally senior indebtedness, including indebtedness under the Credit Facility and the Foreign Credit Facility, may reduce amounts available for payment of the exchange notes and the guarantees.

The exchange notes and the guarantees are unsecured. Accordingly, the exchange notes will be effectively subordinated to all of the Company’s existing and future secured obligations and, so long as the guarantees are in effect, a Subsidiary Guarantor’s guarantees will be effectively subordinated to all of that Subsidiary Guarantor’s existing and future secured obligations, including a portion of the indebtedness under the Credit Facility, in each case, up to the extent of the value of the collateral securing such indebtedness. The collateral securing the Credit Facility consists of substantially all of our assets and the assets of the Subsidiary Guarantors under such facility (subject to certain exceptions, including for our new headquarters located in Seattle, WA). In the event of a bankruptcy, liquidation or similar proceeding, or if payment under any secured obligation is accelerated, claims of any secured creditors, including the lenders under the Credit Facility, will be prior to any claim of the holders of the exchange notes. After the claims of the secured creditors are satisfied there may not be assets remaining to satisfy our obligations under the exchange notes or the guarantees. As of March 31, 2021, our total consolidated indebtedness was $8.5 billion, and we had no borrowed amounts outstanding and $15 million of outstanding letters of credit under the Credit Facility and no borrowed amounts outstanding under the Foreign Credit Facility. The indentures governing the exchange notes will will not prohibit us from incurring additional senior debt or secured debt, subject to certain limitations, nor will they prohibit any of our subsidiaries from incurring additional liabilities.

The exchange notes and the guarantees will also be structurally subordinated to all of the existing and future indebtedness and other liabilities of our subsidiaries that are not Subsidiary Guarantors and of those Subsidiary Guarantors whose guarantees of the exchange notes are released or terminated, including, without limitation, the obligations of such subsidiaries under the Foreign Credit Facility. Except to the extent that the Company or a Subsidiary Guarantor is a creditor with recognized claims against our other subsidiaries, all claims of creditors (including trade creditors) and holders of preferred stock, if any, of our other subsidiaries will have priority with respect to the assets of such subsidiaries over the Company’s and the Subsidiary Guarantors’ rights as owners of such other subsidiaries (and therefore the claims of our creditors, including holders of the exchange notes). As set forth in the section entitled “Summarized Financial Information for Guarantors and the Issuer of Guaranteed Securities” in our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2021, which is incorporated by reference into this prospectus, as of and for the three months ended March 31, 2021, the Issuer and the Subsidiary Guarantors accounted

for approximately $18.4 billion, or 84.1%, of our total consolidated assets and accounted for approximately $1.1 billion, or 85.6%, of our total consolidated revenue.

The guarantees may be unenforceable due to fraudulent conveyance statutes, and accordingly, you could have no claim against the Subsidiary Guarantors.

The obligations of each Subsidiary Guarantor under its guarantee will be limited with the intent to prevent that guarantee from constituting a fraudulent conveyance or fraudulent transfer under applicable law. However, a court could, under fraudulent conveyance law, subordinate or void the guarantee of any Subsidiary Guarantor if it found that such guarantee was incurred with actual intent to hinder, delay or defraud creditors, or such Subsidiary Guarantor did not receive fair consideration or reasonably equivalent value for the guarantee and that the guarantor was any of the following:

•

insolvent or rendered insolvent because of the guarantee;

•

engaged in a business or transaction for which its remaining assets constituted unreasonably small capital; or

•

intended to incur, or believed that it would incur, debts beyond its ability to pay such debts at maturity.