| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| OR | ||||||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the fiscal year ended | ||||||||

| OR | ||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| OR | ||||||||

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| Not applicable | The Kingdom of | ||||

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) | ||||

| Securities registered or to be registered pursuant to Section 12(b) of the Act: | |||||||||||

| Title of each class: | Trading Symbol(s): | Name of each exchange on which registered: | |||||||||

| * Not for trading, but only in connection with the registration of American Depositary Receipts, pursuant to the requirements of the Securities and Exchange Commission. | |||||||||||

| A shares, nominal value DKK 0.20 each: | |||||

| B shares, nominal value DKK 0.20 each: | |||||

| TABLE OF CONTENTS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| INTRODUCTION | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 3 KEY INFORMATION | ||

| Legal name: | Novo Nordisk A/S | |||||||

| Commercial name: | Novo Nordisk | |||||||

| Date of incorporation: | 28 November 1931 | |||||||

| Legal form of the Company: | A Danish public limited liability company | |||||||

| Legislation under which the Company operates: | Danish law | |||||||

| Country of incorporation: | Denmark | |||||||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 4 INFORMATION ON THE COMPANY | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 4 INFORMATION ON THE COMPANY | ||

| Total sales in 2022 (in DKK million) | International Operations | Hereof | North America Operations | Hereof | ||||||||||||||||||||||||||||||||||||||||

| Product | EMEA | Region China | Rest of World | USA | ||||||||||||||||||||||||||||||||||||||||

Victoza® | 12,322 | 46 | % | 22 | % | 12 | % | 12 | % | 54 | % | 52 | % | |||||||||||||||||||||||||||||||

Saxenda® | 10,676 | 55 | % | 34 | % | 1 | % | 20 | % | 45 | % | 41 | % | |||||||||||||||||||||||||||||||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 4 INFORMATION ON THE COMPANY | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 4 INFORMATION ON THE COMPANY | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 4 INFORMATION ON THE COMPANY | ||

| MAJOR PRODUCTION FACILITIES | Size of production area (square meters) | Major Production Activities | ||||||||||||

| Kalundborg, Denmark | 168,300 | Active pharmaceutical ingredients for diabetes and obesity as well as products for Diabetes care | ||||||||||||

| Active pharmaceutical ingredients for haemophilia. | ||||||||||||||

| Products for Rare disease | ||||||||||||||

| Hillerød, Denmark | 156,900 | Durable devices and components for disposable devices | ||||||||||||

| Products for diabetes and obesity | ||||||||||||||

| Active pharmaceutical ingredients for haemophilia | ||||||||||||||

| Bagsværd, Denmark | 111,200 | Products for diabetes and obesity | ||||||||||||

| Clayton, North Carolina, United States | 89,000 | Active pharmaceutical ingredients for diabetes and obesity (purification) | ||||||||||||

| Products for diabetes and obesity | ||||||||||||||

| Gentofte, Denmark | 70,800 | Active pharmaceutical ingredients for glucagon and growth hormone therapy | ||||||||||||

| Products for growth hormone therapy, glucagon and haemophilia | ||||||||||||||

| Tianjin, China | 67,200 | Products for diabetes | ||||||||||||

| Production of durable devices | ||||||||||||||

| Måløv, Denmark | 60,900 | Products for hormone replacement therapy | ||||||||||||

| Products for oral antidiabetic treatment | ||||||||||||||

| Products for oral diabetes treatment | ||||||||||||||

| Chartres, France | 58,700 | Products for diabetes | ||||||||||||

| Montes Claros, Brazil | 56,200 | Products for diabetes | ||||||||||||

| Gel production for active pharmaceutical ingredients | ||||||||||||||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 4 INFORMATION ON THE COMPANY | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 5 OPERATING AND FINANCIAL REVIEW AND PROSPECTS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 5 OPERATING AND FINANCIAL REVIEW AND PROSPECTS | ||

| COMPOUND / BRAND NAME / INDICATION | Year entered into phase 3 or filed with the regulatory authorities | Patent expiration | ||||||

| Somapacitan (NN8640) Once-weekly human growth hormone / Growth disorder | Regulatory submission of the children and adolescent indication occurred in 2022. | 20341 | ||||||

| Concizumab (NN7415) / Haemophilia A and B with or without inhibitors | Regulatory submission occurred in 2022 | 20342 | ||||||

| Nedosiran (NN7022) / An siRNA targeting lactate-dehydrogenase A (or LDHA) for once-montly subcutaneous treatment of Primary Hyperoxaluria | Regulatory submission occurred in 2022 | 2038 | ||||||

| Insulin Icodec (NN1436) / Once-weekly basal insulin analogue | Phase 3 completed in 2022 | 20363 | ||||||

| Semaglutide (oral) 25 mg and 50 mg diabetes (NN9924) / Diabetes | Phase 3 initiated in 2021 | 2032 | ||||||

| Semaglutide (oral) 50 mg / Obesity | Phase 3 initiated in 2021 | 2032 | ||||||

| Cagrisema (NN9838) | Phase 3 initiated in 2022 | 2037 | ||||||

| IcoSema (NN1535) / A combination of GLP-1 semaglutide and insulin icodec | Phase 3 initiated in 2021 | 20363 | ||||||

| Etavopivat / Second generation selective, small molecule PKR-activator intended for once-daily oral administration in sickle cell disease | Phase 3 initiated in 2022 | 20395 | ||||||

| Mim8 (NN7769) | Phase 3 initiated in 2021 | 20406 | ||||||

| Semaglutide in NASH (NN9931) | Phase 3 initiated in 2021 | 2032 | ||||||

| Semaglutide in Alzheimer's (NN6535) | Phase 3 initiated in 2021 | 2032 | ||||||

| Ziltivekimab (NN6018) / Cardiovascular disease | ||||||||

| Ziltivekimab (NN6018) / Cardiovascular disease | Phase 3 initiated in 2021 | 20357 | ||||||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 5 OPERATING AND FINANCIAL REVIEW AND PROSPECTS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 5 OPERATING AND FINANCIAL REVIEW AND PROSPECTS | ||

Lars Fruergaard Jørgensen President and chief executive officer (CEO) Mr Jørgensen joined Novo Nordisk in 1991 as an economist in Health Care, Economy & Planning and has over the years completed overseas postings in the Netherlands, the U.S. and Japan. In 2004 he was appointed senior vice president for IT & Corporate Development. In January 2013 he was appointed executive vice president and chief information officer assuming responsibility for IT, Quality & Corporate Development. In November 2014 he took over the responsibilities for Corporate People & Organisation and Business Assurance and became chief of staff. Mr Jørgensen was appointed president and chief executive officer in January 2017. | ||

Monique Carter Executive vice president, People & Organisation Ms Carter joined Novo Nordisk in November 2018 as SVP for Global People and Organisation and was promoted to executive vice president in August 2019. Prior to joining Novo Nordisk Ms Carter was group HR director and member of the executive committee at GKN plc, UK. Ms Carter was at GKN plc from 2014 to 2018. Ms Carter worked in the chemicals industry from 2005 to 2014 starting with ICI plc, UK (which later became part of Akzo Nobel, the Netherlands). Ms Carter later moved to Singapore to head up the APAC regional HR while in the decorative paints division of ICI plc. In 2010 Ms Carter became leader of HR for the specialty chemicals businesses of AkzoNobel in the Netherlands after the acquisition of ICI plc by Akzo Nobel. Prior to ICI plc, Ms Carter held HR positions in a number of international companies. | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 6 DIRECTORS, EXECUTIVE MANAGEMENT AND EMPLOYEES | ||

Maziar Mike Doustdar Executive vice president, International Operations Mr Doustdar joined Novo Nordisk in 1992 as an office clerk in Vienna, Austria. From 1993 through 2007 he took up various positions in finance, IT, logistics, operations and marketing, within various parts of Novo Nordisk’s emerging markets, first in Vienna and subsequently in Athens and Zurich before he was appointed general manager of Novo Nordisk Near East, based in Turkey, in 2007. In 2010 Mr Doustdar was promoted to vice president of Business Area Near East and in 2012 he re-located to Malaysia to head the Business Area Oceania South East Asia. In 2013 he was promoted to senior vice president of Novo Nordisk’s International Operations, and in April 2015 Mr Doustdar was promoted to executive vice president, continuing his responsibility for Novo Nordisk’s International Operations. In September 2016 Mike Doustdar assumed additional geographical responsibility and was promoted to executive vice president for an expanded International Operations, leading all commercial units globally, except for the U.S. and Canada. | ||

Ludovic Helfgott Executive vice president, Rare disease Mr Helfgott joined Novo Nordisk in April 2019 as executive vice president for Rare disease (then named Biopharm). Mr Helfgott joined Novo Nordisk from AstraZeneca, UK, where he was global vice president in charge of the company's cardiovascular, metabolism and renal global franchise. He joined AstraZeneca in 2005 in an international sales effectiveness role and has since held operational leadership roles with increasing responsibilities in Italy, Spain and at corporate headquarters. Prior to this, Mr Helfgott was with McKinsey & Company in Paris, Moscow and Brussels from 1998 to 2005. | ||

Karsten Munk Knudsen Executive vice president and chief financial officer (CFO) Mr Knudsen joined Novo Nordisk in 1999 as a business analyst in NNIT A/S, previously a subsidiary of Novo Nordisk, and has since held finance positions of growing size and complexity throughout the Novo Nordisk value chain. From 2010 to 2014 Mr Knudsen was corporate vice president for Finance & IT at Novo Nordisk Inc. in the U.S. and in 2014 he was appointed senior vice president of Corporate Finance in Novo Nordisk. In February 2018 Mr Knudsen was promoted to executive vice president and chief financial officer. In 2019 Mr Knudsen assumed further responsibilities as his area was expanded to cover Finance, Legal & Procurement, followed by a further expansion in 2022 when he assumed responsibility for Global Solutions. | ||

Doug Langa Executive vice president, North America Operations Mr Langa joined Novo Nordisk in 2011 as senior director of Managed Markets. In 2015 Mr Langa was promoted to corporate vice president of Market Access in the U.S. and in 2016 he was appointed senior vice president of Market Access in the U.S. In March 2017 Mr Langa was appointed senior vice president, head of North America Operations and president of Novo Nordisk Inc., and in August 2017 Mr Langa was promoted to executive vice president, continuing his responsibilities for North America Operations and president of Novo Nordisk Inc. Mr. Langa represents Novo Nordisk Inc. on the board of directors of the trade association PhRMA. Mr Langa joined Novo Nordisk from GlaxoSmithKline, where he was the senior director of payer marketing. Prior to GlaxoSmithKline Mr Langa spent the majority of his career at Johnson and Johnson, where he held various roles of increasing responsibility within managed markets, sales leadership and marketing. | ||

Martin Holst Lange Executive vice president, Development Mr Lange joined Novo Nordisk in 2002, as first operationally and subsequently medically responsible for several projects within Global Development. From 2006 to 2008 Mr Lange worked in Novo Nordisk Inc., USA, in the Medical Department as senior medical director. In 2008, he moved back to Denmark and became vice president, Medical & Science liraglutide, transferring in 2010 to insulin degludec in a similar position. From 2013 to 2017, he served as corporate project vice president for Insulin & Diabetes Outcomes and subsequently Insulin & Devices. In January 2018, he was appointed senior vice president for Global Development. In March 2021, Mr Lange was appointed executive vice president for Development. From 1997 to 2002, Mr Lange did clinical work as well as clinical research of which the latter, three years at the Department of Endocrinology, National University Hospital, Denmark. Mr Lange has served on the board of directors of Beta Bionics Inc., USA. | ||

Marcus Schindler Executive vice president, Research & Early Development and chief scientific officer (CSO) Mr Schindler joined Novo Nordisk in January 2018 as senior vice president for External Innovation and Strategy. From March 2018 to 2021 he was senior vice president for Global Drug Discovery and in March 2021, Mr Schindler was appointed executive vice president for Research & Early Development and chief scientific officer. Prior to joining Novo Nordisk Mr Schindler was vice president, head of cardiovascular and metabolic diseases innovative medicines at AstraZeneca, Sweden. From 2009 to 2012, he was head of research at (OSI) Prosidion, Oxford, UK. From 2000 to 2008, he worked in various leadership roles at Boehringer Ingelheim, Germany after having started his career with Glaxo Wellcome/GSK, UK in 1997. | ||

Camilla Sylvest Executive vice president, Commercial Strategy & Corporate Affairs Ms Sylvest joined Novo Nordisk in 1996 as a trainee. From 1997 to 2008 Ms Sylvest had roles in headquarters and regions within pricing, health economics, marketing and sales effectiveness. In 2003, she was appointed vice president of sales and marketing effectiveness in Region Europe. From 2008 to 2015 Ms Sylvest headed up subsidiaries and business areas of growing size and complexity in Europe and Asia and in 2013 she was also appointed corporate vice president. In August 2015 Ms Sylvest was appointed senior vice president and general manager of Novo Nordisk’s Region China. In October 2017, Ms Sylvest was promoted to executive vice president for Commercial Strategy & Corporate Affairs. | ||

Henrik Wulff Executive vice president, Product Supply, Quality Assurance, Digital Data & IT Mr Wulff joined Novo Nordisk in 1998 in the logistic and planning function. From 2001 to 2008 he held different managerial roles within Novo Nordisk’s manufacturing organization, Product Supply, before being appointed senior vice president of Diabetes API in Product Supply, Denmark. In 2012 Mr Wulff was appointed senior vice president of the worldwide division Diabetes Finished Products. In 2013 he was promoted senior vice president of Product Supply globally. In April 2015 Mr Wulff was promoted executive vice president and in 2019 his area of responsibility expanded to also cover Quality Assurance, Digital Data & IT. | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 6 DIRECTORS, EXECUTIVE MANAGEMENT AND EMPLOYEES | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 6 DIRECTORS, EXECUTIVE MANAGEMENT AND EMPLOYEES | ||

| Novo Nordisk Form 20-F 2022 | |||||

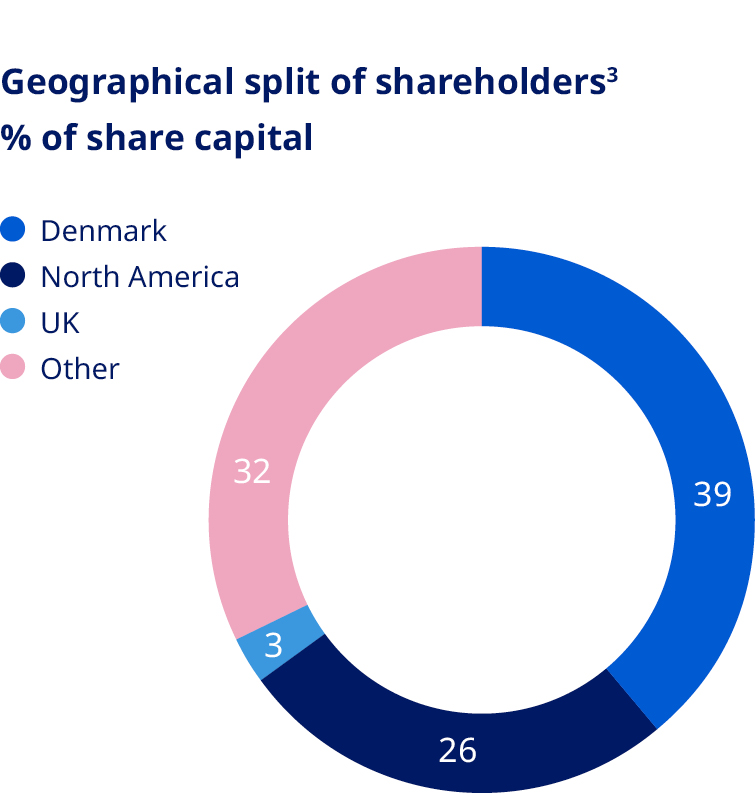

| ITEM 7 MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | ||

| Title of class | Identity of person or group | Shares owned | Percent of class | Percent of total votes | ||||||||||||||||||||||

| A shares | Novo Holdings A/S | 537,436,000 | 100.00 | 75.20 | ||||||||||||||||||||||

| B shares | Novo Holdings A/S | 102,104,000 | 5.76 | 1.43 | ||||||||||||||||||||||

| B shares | Novo Nordisk A/S and subsidiaries (treasury shares) | 31,631,497 | * | 1.82 | 0.44 | |||||||||||||||||||||

| B shares | Board of Directors and Executive Management | 559,431 | 0.03 | 0.01 | ||||||||||||||||||||||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 8 FINANCIAL INFORMATION | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 10 ADDITIONAL INFORMATION | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 10 ADDITIONAL INFORMATION | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 10 ADDITIONAL INFORMATION | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 12 DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | ||

| Service | Fee | |||||||

| Issuance or delivery of an ADR, surrendering of an ADR for delivery of a Novo Nordisk B share, cancellation of an ADR, including issuance, delivery, surrendering or cancellation in connection with share distributions, stock splits, rights and mergers | A maximum of USD 5.00 for each 100 ADRs (or portion thereof), to be paid to the Depositary | |||||||

| Distribution of dividend to the holder of the ADR | A maximum of USD 0.05 per ADR (or portion thereof), to be paid to the Depositary | |||||||

| Transfer of the Novo Nordisk B shares from the Danish custodian bank to the holder of the ADR’s account in Denmark | USD 20.00 cabling fee per transfer, to be paid to the Depositary | |||||||

| Taxes and other governmental charges the holder of the ADR has to pay on any ADR or share underlying the ADR | As necessary | |||||||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 13 DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 16A AUDIT COMMITTEE FINANCIAL EXPERTS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 16D EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | ||

| Total Number of Shares Purchased (a)* | Average Price Paid per Share in DKK (b) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (c) | Maximum Approximate Value of Shares that may yet be purchased under the Plans or Programs in DKK (d) | |||||||||||||||||||||||

| 2021 repurchase program | ||||||||||||||||||||||||||

| Status year end 2021** | 32,345,725 | 569.54 | 32,345,725 | 1,577,776,013 | ||||||||||||||||||||||

| January 1-31, 2022 | 2,317,445 | 649.19 | 34,663,170 | 73,317,375 | ||||||||||||||||||||||

| February 1, 2022 | 110,000 | 665.70 | 34,773,170 | 90,377 | ||||||||||||||||||||||

| Total*** | 34,773,170 | 575.15 | 34,773,170 | 90,377 | ||||||||||||||||||||||

| 2022 repurchase program | 24,000,000,000 | |||||||||||||||||||||||||

| February 3-28, 2022 | 2,069,151 | 665.09 | 2,069,151 | 22,623,837,354 | ||||||||||||||||||||||

| March 1-31, 2022 | 2,318,099 | 715.55 | 4,387,250 | 20,965,119,939 | ||||||||||||||||||||||

| April 1-30, 2022 | 1,643,000 | 789.12 | 6,030,250 | 19,668,589,067 | ||||||||||||||||||||||

| May 1-31, 2022 | 5,876,568 | 794.91 | 11,906,818 | 14,997,236,434 | ||||||||||||||||||||||

| June 1-30, 2022 | 1,920,000 | 773.60 | 13,826,818 | 13,511,929,807 | ||||||||||||||||||||||

| July 1-31, 2022 | 1,899,514 | 821.02 | 15,726,332 | 11,952,397,412 | ||||||||||||||||||||||

| August 1-31, 2022 | 1,960,367 | 789.38 | 17,686,699 | 10,404,915,590 | ||||||||||||||||||||||

| September 1-30, 2022 | 1,979,210 | 767.59 | 19,665,909 | 8,885,684,470 | ||||||||||||||||||||||

| October 1-31, 2022 | 1,866,223 | 797.02 | 21,532,132 | 7,398,274,395 | ||||||||||||||||||||||

| November 1-30, 2022 | 5,727,558 | 847.55 | 27,259,690 | 2,543,856,237 | ||||||||||||||||||||||

| December 1-31, 2022 | 1,154,999 | 910.29 | 28,414,689 | 1,492,474,236 | ||||||||||||||||||||||

| Total | 28,414,689 | 792.11 | 28,414,689 | 1,492,474,236 | ||||||||||||||||||||||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 16F CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 16G CORPORATE GOVERNANCE | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 16H MINE SAFETY DISCLOSURE | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 17 FINANCIAL STATEMENTS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 18 FINANCIAL STATEMENTS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 18 FINANCIAL STATEMENTS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 18 FINANCIAL STATEMENTS | ||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 19 EXHIBITS | ||

| Page(s) in our Annual Report | ||||||||

| Management Discussion and Analysis | ||||||||

| Introducing Novo Nordisk | 3-9 | |||||||

| Strategic Aspirations | 10-43 | |||||||

| Corporate Governance | 21-22 | |||||||

| Pipeline overview | 30 | |||||||

| 2022 performance and 2023 outlook | 36-40 | |||||||

| Shares and capital structure | 41-42 | |||||||

| Risk management | 45-46 | |||||||

| Board of Directors | 48-50 | |||||||

| Executive Management | 51 | |||||||

| Consolidated Financial Statements | ||||||||

| Consolidated Income statement and Statement of comprehensive income for the years ended 31 December 2022, 2021 and 2020 | 54 | |||||||

| Consolidated Cash flow statement for the years ended 31 December 2022, 2021 and 2020 | 55 | |||||||

| Consolidated Balance sheet as of 31 December 2022 and 2021 | 56 | |||||||

| Consolidated Equity statement at 31 December 2022, 2021 and 2020 | 57 | |||||||

| Notes sections in the Consolidated financial statements | 58-85 | |||||||

| Companies in the Novo Nordisk Group | 85 | |||||||

| Page(s) in the Remuneration Report | ||||||||

| 2.2 Remuneration composition | 5-6 | |||||||

| 2.4 Board and committee fee levels 2022 | 7 | |||||||

| 2.5 Board remuneration 2022 | 7 | |||||||

| 2.6 Shareholdings by the Board | 8 | |||||||

| 3.1 Remuneration policy | 9 | |||||||

| 3.2 Remuneration composition | 9-10 | |||||||

| 3.4 Executive remuneration in 2022 | 11-12 | |||||||

| 3.6 Short-term incentive programme 2022 | 13-14 | |||||||

| 3.7 Long-term incentive programme 2021 and 2022 | 14-15 | |||||||

| 3.8 Long-term incentive programme 2019 – vested shares | 16 | |||||||

| 3.9 Long-term incentive programs 2020, 2021 and 2022 – unvested shares | 16-17 | |||||||

| 3.10 Shareholdings by Executive Management | 18 | |||||||

| Novo Nordisk Form 20-F 2022 | |||||

| ITEM 19 EXHIBITS | ||

| Exhibit No. | Description | Method of filing | ||||||||||||

| Articles of Association of Novo Nordisk A/S | Incorporated by reference to the Registrant’s Report furnished to the SEC on Form 6-K on March 24, 2022. | |||||||||||||

| Description of the rights of American Depositary Shares registered under Section 12 of the Securities Exchange Act of 1934 | Incorporated by reference to the description of the rights of American Depositary Shares included in Exhibit 2.1 to the Registrant's Report on Form 20-F for the year ended December 31, 2019. | |||||||||||||

| Description of the rights of B Shares registered under Section 12 of the Securities Exchange Act of 1934 | Filed together with this Form 20-F 2022. | |||||||||||||

| Companies in the Novo Nordisk Group | Incorporated by reference to page 85 of the Annual Report 2022, filed as Exhibit 15.1 to this Form 20-F 2022. | |||||||||||||

| Certification of Lars Fruergaard Jørgensen, president and chief executive officer of Novo Nordisk, pursuant to Section 302 of the Sarbanes–Oxley Act of 2002. | Filed together with this Form 20-F 2022 | |||||||||||||

| Certification of Karsten Munk Knudsen, executive vice president and chief financial officer of Novo Nordisk, pursuant to Section 302 of the Sarbanes–Oxley Act of 2002. | Filed together with this Form 20-F 2022 | |||||||||||||

| Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes–Oxley Act of 2002. | Filed together with this Form 20-F 2022 | |||||||||||||

| The Registrant's Annual Report for the fiscal year ended December 31,2022. | Filed together with this Form 20-F 2022. Certain of the information included within Exhibit 15.1, which is provided pursuant to Rule 12b-23(a)(3) of the Securities Exchange Act of 1934, as amended, is incorporated by reference in this Form 20-F, as specified elsewhere in this Form 20-F. With the exception of the items and pages so specified, Exhibit 15.1 is not deemed to be filed as part of this Form 20-F. | |||||||||||||

| Consent of independent registered public accounting firm. | Filed together with this Form 20-F 2022 | |||||||||||||

| Consent of independent registered public accounting firm. | Filed together with this Form 20-F 2022 | |||||||||||||

15.4 | The Registrant's Remuneration Report for the fiscal year ended December 31, 2022. | Incorporated by reference to the portions of the Registrant’s Report furnished to the SEC on Form 6-K on February 1, 2023 identified in Item 19.b of this Form 20-F. | ||||||||||||

| EX-101.SCH | XBRL Taxonomy Extension Schema Document | Filed together with this Form 20-F 2022. | ||||||||||||

| EX-101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document | Filed together with this Form 20-F. 2022 | ||||||||||||

| EX-101.DEF | XBRL Taxonomy Extension Definition Linkbase Document | Filed together with this Form 20-F 2022. | ||||||||||||

| EX-101.LAB | XBRL Taxonomy Extension Labels Linkbase Document | Filed together with this Form 20-F 2022. | ||||||||||||

| EX-101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document | Filed together with this Form 20-F 2022. | ||||||||||||

| Novo Nordisk Form 20-F 2022 | |||||

| SIGNATURES | ||

| /s/ Lars Fruergaard Jørgensen | /s/ Karsten Munk Knudsen | |||||||||||||

| Name: | Lars Fruergaard Jørgensen | Name: | Karsten Munk Knudsen | |||||||||||

| Title: | President and chief executive officer | Title: | Executive vice president and chief financial officer | |||||||||||

| Novo Nordisk Form 20-F 2022 | |||||

| Exhibit 2.2 2022 - Novo Nordisk | |||||

| Exhibit 2.2 2022 - Novo Nordisk | |||||

| /s/ Lars Fruergaard Jørgensen | |||||

Lars Fruergaard Jørgensen President and chief executive officer | |||||

| /s/ Karsten Munk Knudsen | |||||

Karsten Munk Knudsen Executive vice president and chief financial officer | |||||

| /s/ Lars Fruergaard Jørgensen | /s/ Karsten Munk Knudsen | |||||||

Lars Fruergaard Jørgensen President and chief executive officer | Karsten Munk Knudsen Executive vice president and chief financial officer | |||||||

| Novo Nordisk Annual Report 2022 | 2 | |||||||

| PAGE 03-51 |  | PAGE 52-103 | ||||||||||||||||||

| Management review | Consolidated statements and additional information | |||||||||||||||||||

| 03 | Introducing Novo Nordisk | |||||||||||||||||||

| 04 | Letter from the Chair and the CEO | |||||||||||||||||||

| 06 | Novo Nordisk at a glance | 54 | Consolidated financial statements | |||||||||||||||||

| 07 | Our value creation | 54 | Income statement and Statement of comprehensive income | |||||||||||||||||

| 08 | Performance highlights | |||||||||||||||||||

| 55 | Cash flow statement | |||||||||||||||||||

| 10 | Strategic Aspirations | 56 | Balance sheet | |||||||||||||||||

| 11 | Purpose and sustainability (ESG) | 57 | Equity statement | |||||||||||||||||

| 27 | Innovation and therapeutic focus | 58 | Notes to the consolidated financial statements | |||||||||||||||||

| 33 | Commercial execution | |||||||||||||||||||

| 36 | Financials | 89 | Consolidated ESG statement | |||||||||||||||||

| 89 | Statement of Environmental, Social and Governance (ESG) performance | |||||||||||||||||||

| 44 | Key risks | |||||||||||||||||||

| 45 | Risk management | 90 | Notes to the consolidated ESG statement | |||||||||||||||||

| 47 | Management | 98 | Statements and Auditor's Reports | |||||||||||||||||

| 48 | Board of Directors | 98 | Statement by the Board of Directors and Executive Management | |||||||||||||||||

| 51 | Executive Management | |||||||||||||||||||

| 99 | Independent Auditor's Report on the Financial Statements | |||||||||||||||||||

| 101 | Independent Assurance Report on the ESG statement | |||||||||||||||||||

| 102 | Additional information | |||||||||||||||||||

| 102 | More information | |||||||||||||||||||

| 103 | Product overview | |||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 3 | |||||||

| Novo Nordisk Annual Report 2022 | 4 | |||||||

| LETTER FROM THE CHAIR AND THE CEO | ||||||||

| Novo Nordisk Annual Report 2022 | 5 | |||||||

| LETTER FROM THE CHAIR AND THE CEO | ||||||||

| Novo Nordisk Annual Report 2022 | 6 | |||||||

| Novo Nordisk at a glance | Our corporate strategy Our business is built around our clear purpose: driving change to defeat diabetes and other serious chronic diseases. Our key contribution is to discover and develop innovative medicines and make them accessible to patients throughout the world. We aim to strengthen our leadership and treatment options in diabetes and obesity, secure a leading | position within Rare Disease, and establish a strong presence in other serious chronic diseases, such as cardiovascular disease (CVD), non-alcoholic steatohepatitis (NASH), chronic kidney disease (CKD) and Alzheimer’s disease (AD), and provide curative therapies based on our cell therapy platform. | ||||||||||||

Novo Nordisk is a global healthcare company, headquartered in Denmark. Our key contribution is to discover and develop innovative biological medicines and make them accessible to patients throughout the world. | ||||||||||||||

| ||||||||||||||

| 176,954 | 55,185 | |||||||||||||

| DKK million in net sales | employees worldwide | |||||||||||||

| 74,809 | 80 | |||||||||||||

| DKK million in operating profit | countries with affiliates | |||||||||||||

| 57,362 | 5 | |||||||||||||

| DKK million in free cash flow | countries with R&D facilities | |||||||||||||

| Novo Nordisk Annual Report 2022 | 7 | |||||||

| Novo Nordisk Annual Report 2022 | 8 | |||||||

| PERFORMANCE HIGHLIGHTS | ||||||||||||||||||||

| Our strategic progress |  | |||||||||||||||||||

| 2022 Highlights | Strategic Aspirations 20251 | |||||||||||||||||||

| Purpose and sustainability (ESG) | |||||||||||||||||||

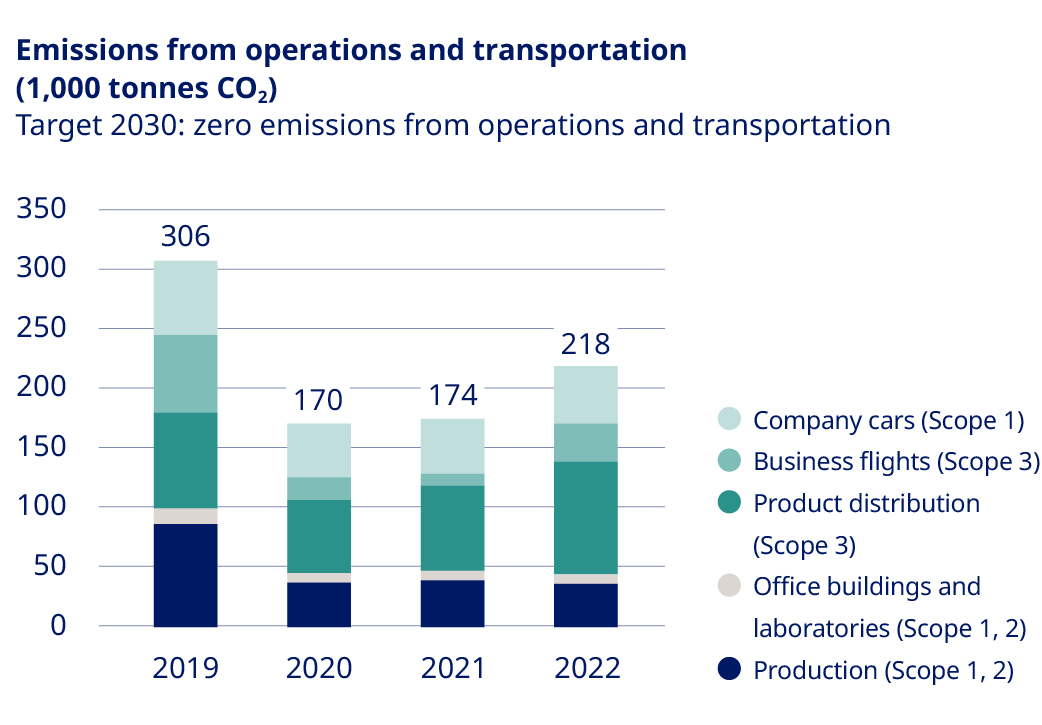

Progress towards zero environmental impact: –Carbon emissions from operations and transportation decreased by 29% compared to 2019 Adding value to society: –Progress on Defeat Diabetes strategy –Medical treatment provided to 36.3 million people living with diabetes –Reaching more than 41,000 children in Changing Diabetes® in Children programme | –Diabetes and haemophilia medications donated to the Ukrainian Ministry of Healthy –Positive scientific opinion from EMA on human insulin with more flexible storage without refrigeration Being recognised as a sustainable employer –Share of women in senior leadership positions has increased to 39% from 36% in 2021 | 1.Progress towards zero environmental impact 2.Being respected for adding value to society 3.Being recognised as a sustainable employer | ||||||||||||||||||

| Innovation and therapeutic focus | |||||||||||||||||||

Further raise innovation bar for diabetes treatment: –Approval of Ozempic® 2.0 mg in the US –Successful completion of phase 3a trials with once-weekly insulin icodec –Successful completion of phase 2 trial with CagriSema in people with type 2 diabetes –Phase 1 trials with Ideal Pump insulin successfully completed –Phase 1 trial initiated with a once-daily oral GLP-1/GIP agonist and once-weekly oral semaglutide Develop superior treatment solutions for obesity: –STEP TEENs phase 3 trial successfully completed –Phase 3a initiation with CagriSema in people with obesity –Phase 1 initiation of oral amycretin | Strengthen and progress Rare Disease pipeline: –Concizumab phase 3 trials completed in people with haemophilia A and B with inhibitors and in people without inhibitors –Dosing initiated in phase 3a trial with Mim8 –Phase 2 trial initiated with NDec in sickle cell disease –Acquisition of Forma Therapeutics to expand pipeline in sickle cell disease Establish presence in other serious chronic diseases: –Phase 2 trial initiated with NNC6019 in cardiomyopathy –Phase 1 trials initiated in NASH utilising the siRNA platform | 1.Further raise the innovation bar for diabetes treatment 2.Develop a leading portfolio of superior treatment solutions for obesity 3.Strengthen and progress the Rare Disease pipeline 4.Establish presence in other serious chronic diseases focusing on cardiovascular disease (CVD), non-alcoholic steatohepatitis (NASH) and chronic kidney disease (CKD) | ||||||||||||||||||

| Commercial execution | |||||||||||||||||||

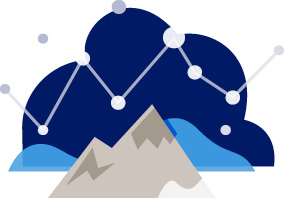

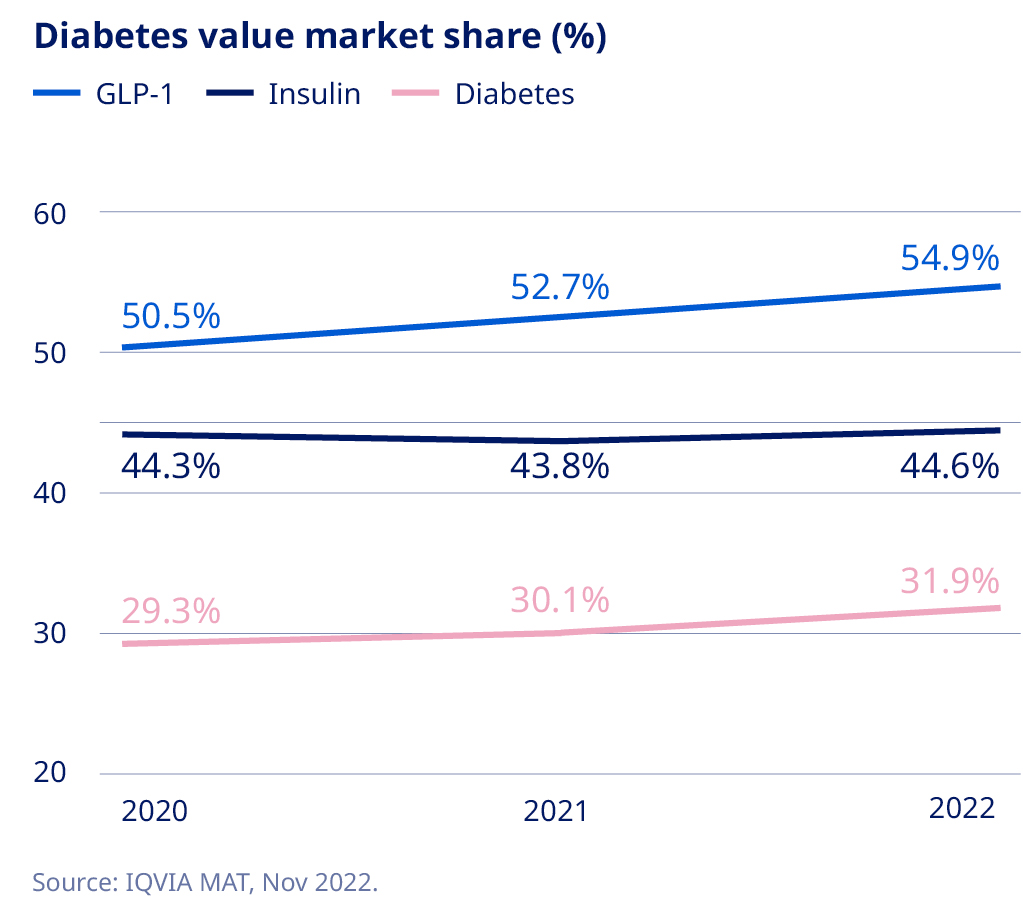

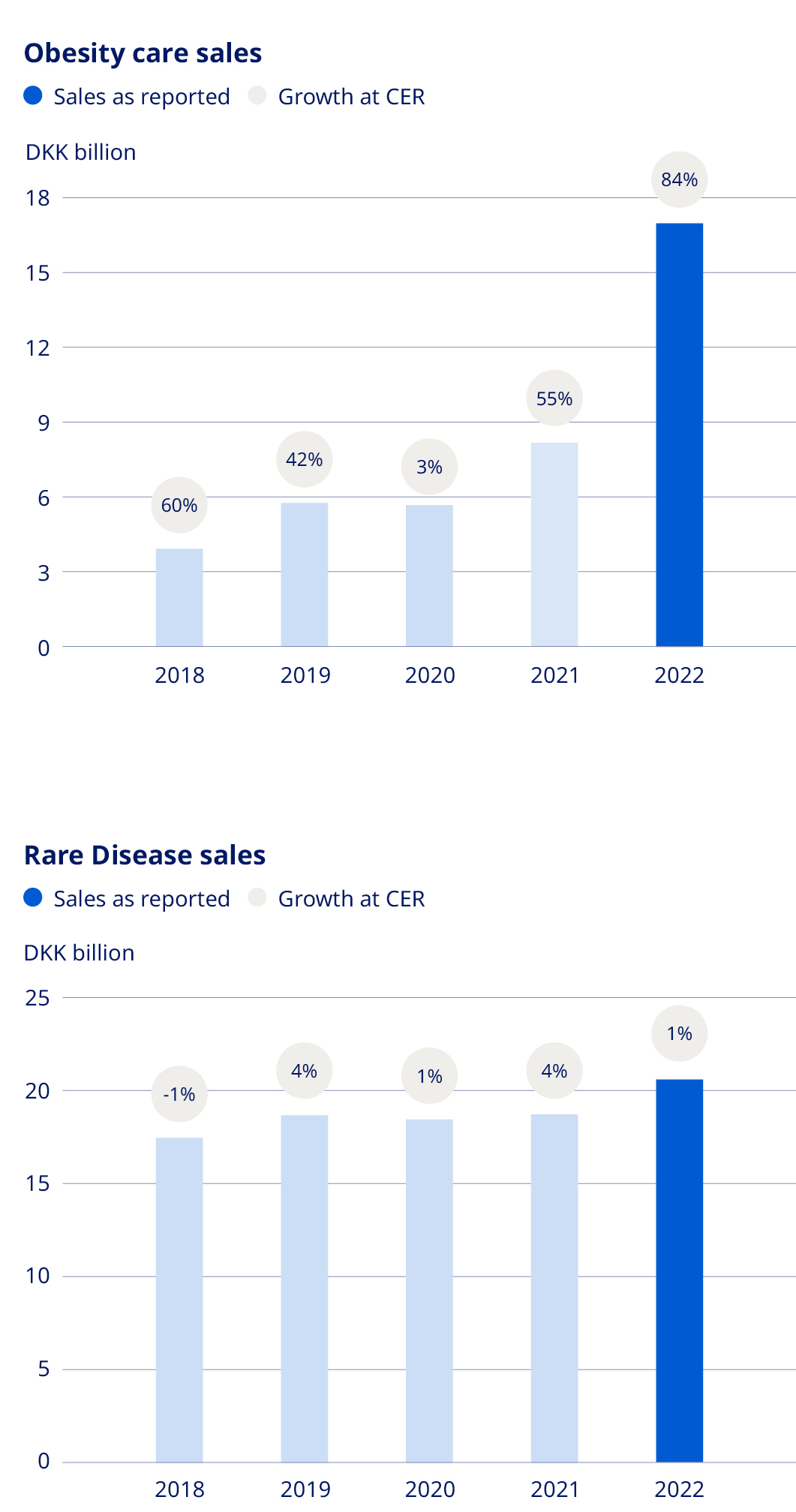

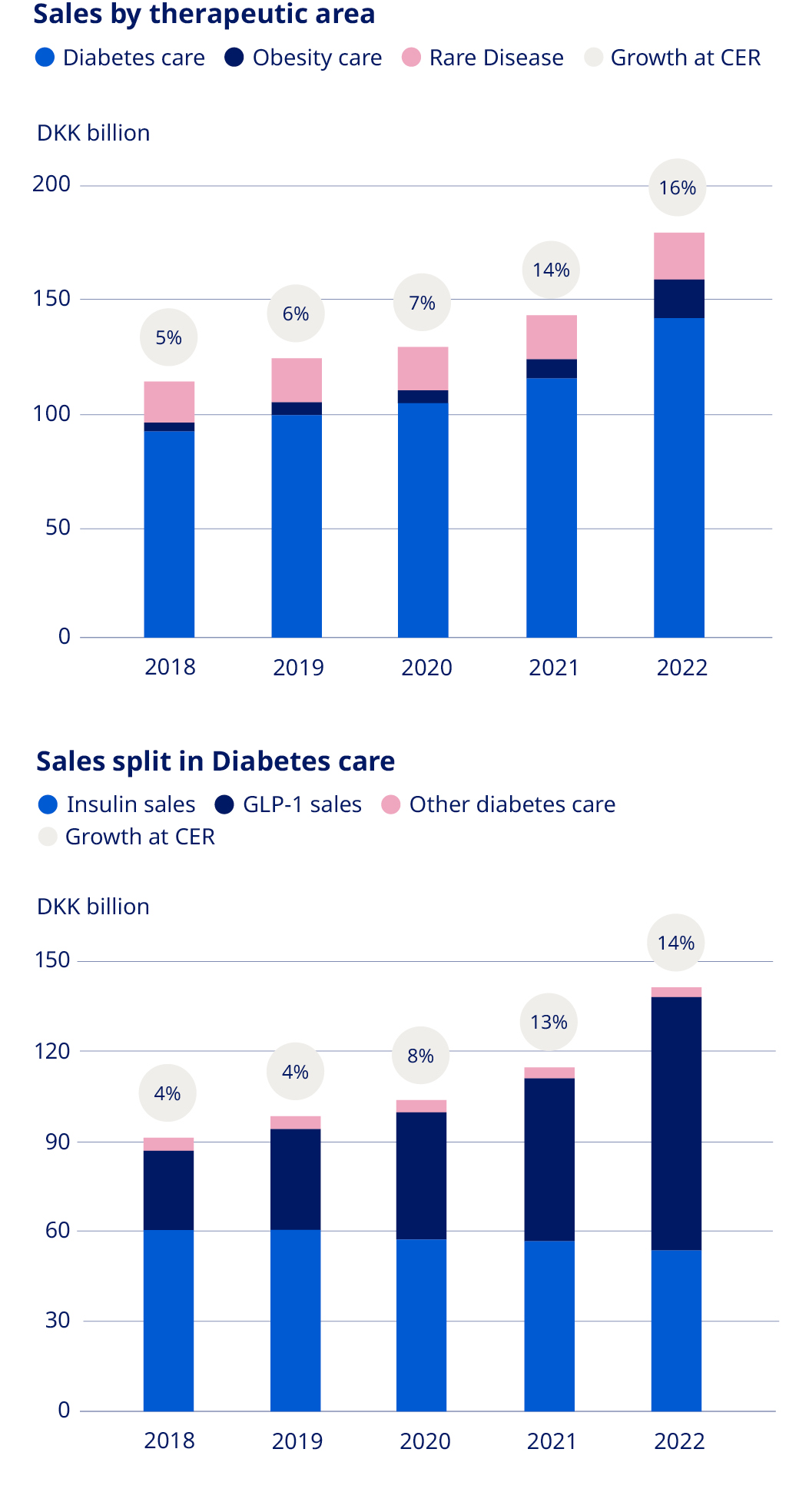

Strengthen diabetes leadership to more than one-third: –Diabetes value market share increased by 1.8 percentage points to 31.9% (MAT) | More than DKK 25 billion in Obesity sales by 2025: –Obesity care sales increased by 84% (CER) to DKK 16.9 billion Secure a sustained growth outlook for Rare Disease: –Rare Disease sales increased by 1% (CER) to DKK 20.5 billion | 1.Strengthen diabetes leadership – aim at global value market share of more than 1/3 2.More than DKK 25 billion in Obesity sales by 2025 3.Secure a sustained growth outlook for Rare Disease | ||||||||||||||||||

| Financials | |||||||||||||||||||

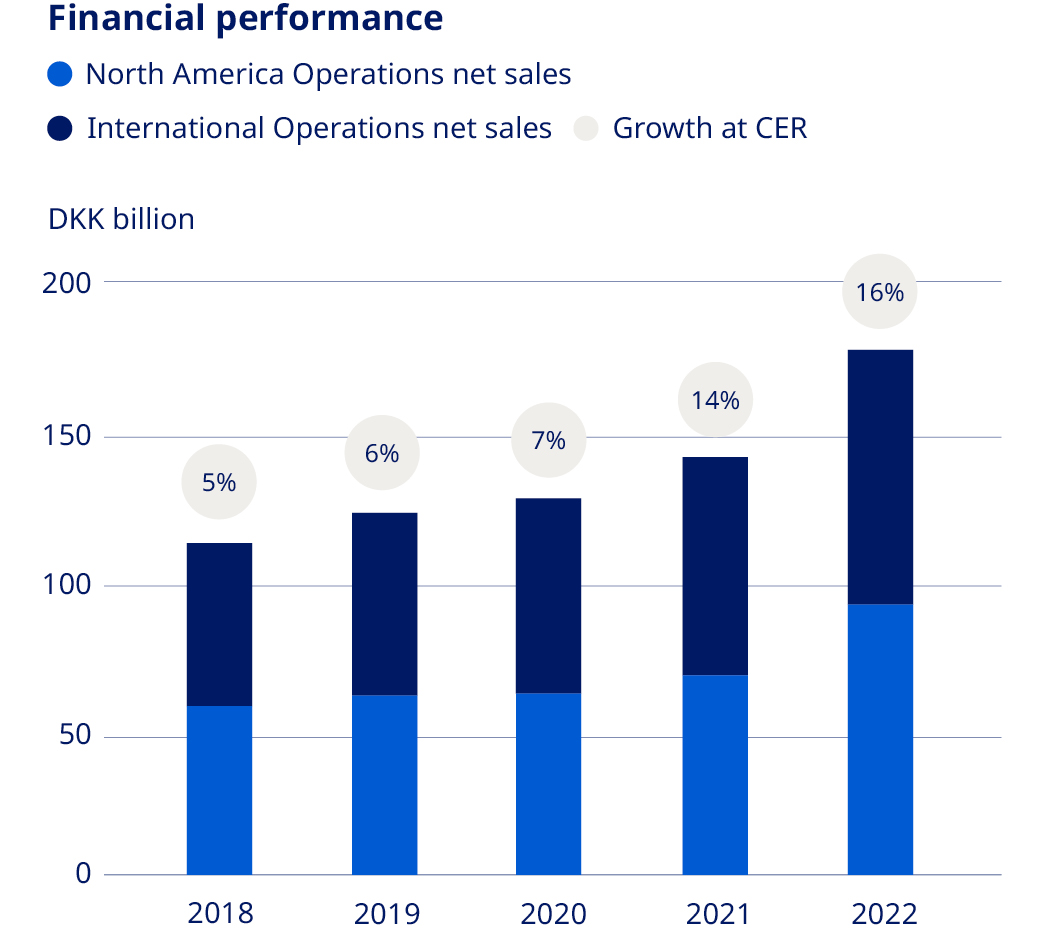

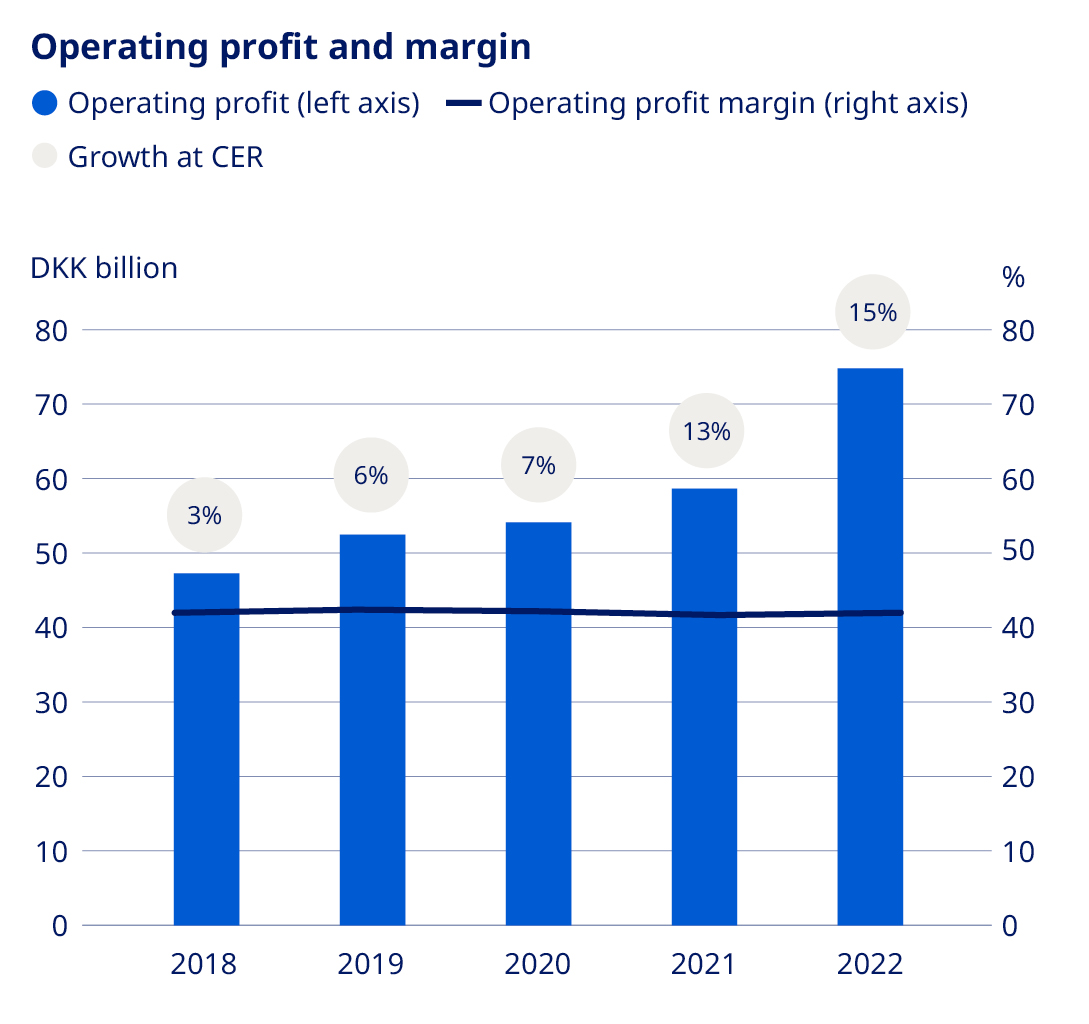

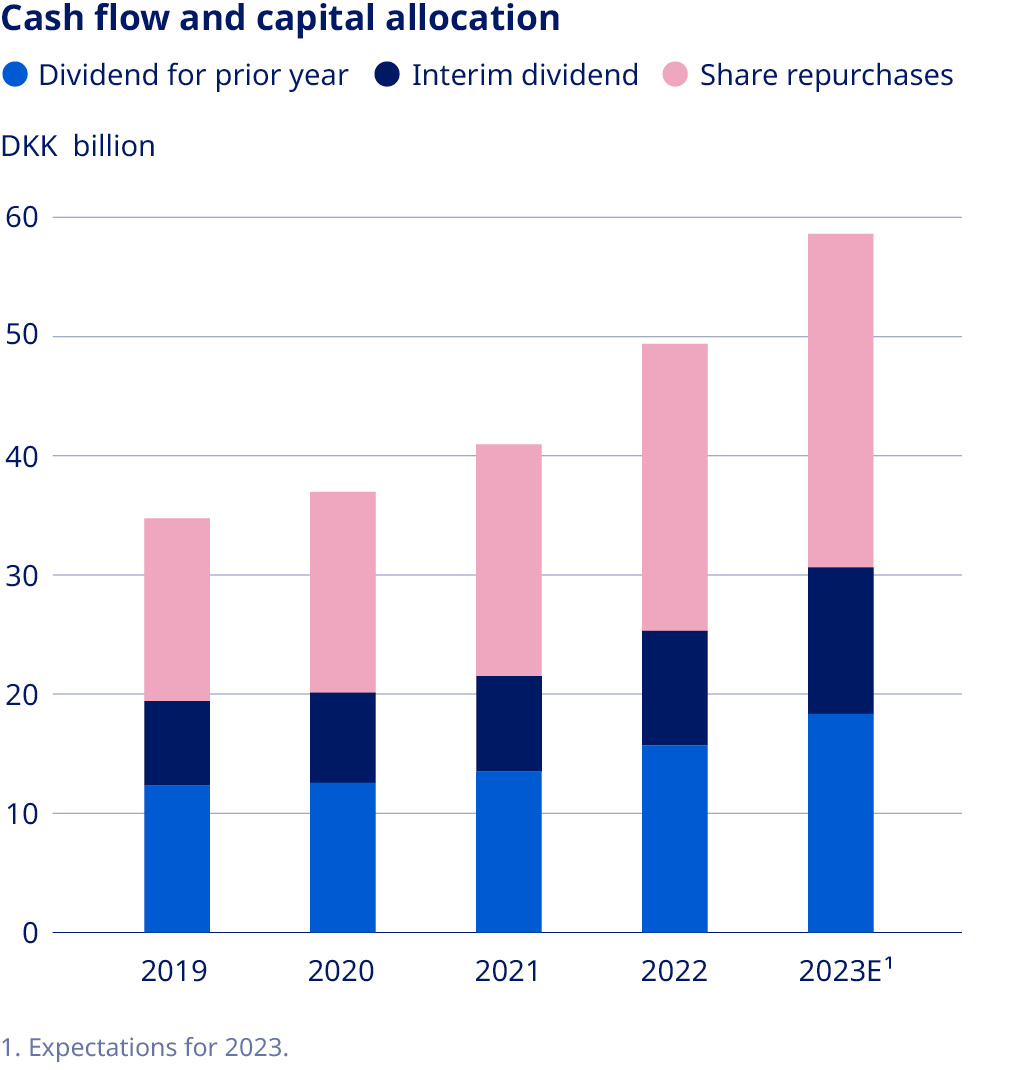

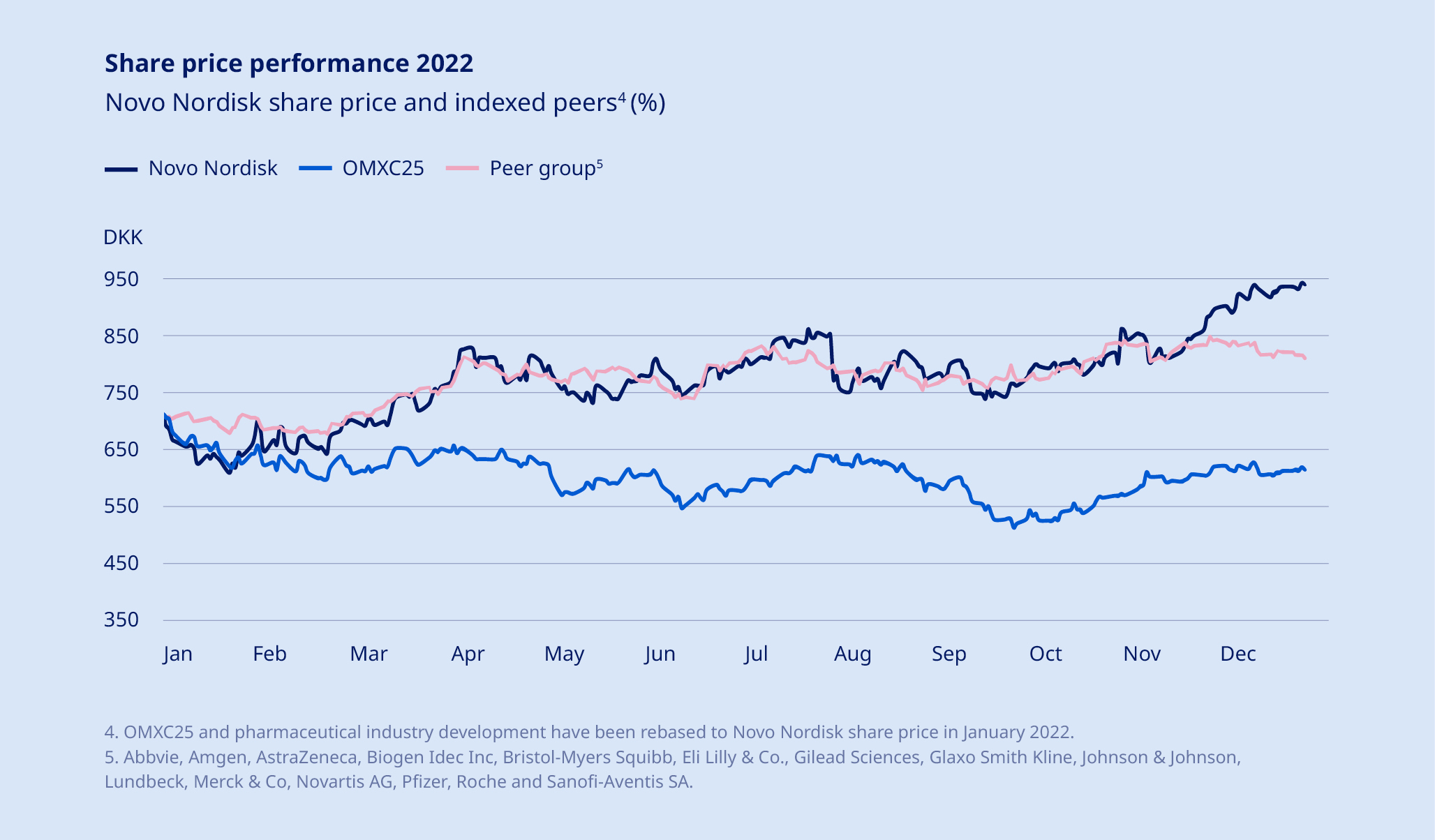

Deliver solid sales and operating profit growth: –Sales growth at 16% (CER) –International Operations sales growth of 13% (CER) –US sales growth of 19% (CER) with 73% of sales coming from products launched since 2015 –Operating profit growth of 15% (CER) | Drive operational efficiencies: –Continued productivity gains in Product Supply Enable attractive capital allocation to shareholders: –Free cash flow of DKK 57.4 billion –DKK 49.4 billion returned to shareholders in 2022 | 1.Deliver solid sales and operating profit growth: –Deliver 6–10% sales growth in International Operations –Transform 70% of sales in the US (from 2015 to 2022) 2.Drive operational efficiencies across the value chain to enable investments in future growth assets 3.Deliver free cash flow to enable attractive capital allocation to shareholders | ||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 9 | |||||||

| PERFORMANCE HIGHLIGHTS | |||||||||||||||||||||||||||||

| Financial highlights | DKK million | 2018 | 2019 | 2020 | 2021 | 2022 | 2021-22 | ||||||||||||||||||||||

| Financial performance | Change | ||||||||||||||||||||||||||||

| Net sales | 111,831 | 122,021 | 126,946 | 140,800 | 176,954 | 26 | % | ||||||||||||||||||||||

| Sales growth as reported | 0.1 | % | 9.1 | % | 4.0 | % | 10.9 | % | 25.7 | % | |||||||||||||||||||

Sales growth in constant exchange rates (CER)1 | 4.6 | % | 5.6 | % | 6.7 | % | 13.8 | % | 16.4 | % | |||||||||||||||||||

| Operating profit | 47,248 | 52,483 | 54,126 | 58,644 | 74,809 | 28 | % | ||||||||||||||||||||||

| Operating profit growth as reported | (3.5 | %) | 11.1 | % | 3.1 | % | 8.3 | % | 27.6 | % | |||||||||||||||||||

Operating profit growth in constant exchange rates (CER)1 | 2.8 | % | 5.6 | % | 6.8 | % | 12.7 | % | 14.6 | % | |||||||||||||||||||

| Depreciation, amortisation and impairment losses | 3,925 | 5,661 | 5,753 | 6,025 | 7,362 | |||||||||||||||||||||||

| Net financials | 367 | (3,930) | (996) | 436 | (5,747) | ||||||||||||||||||||||||

| Profit before income taxes | 47,615 | 48,553 | 53,130 | 59,080 | 69,062 | 17 | % | ||||||||||||||||||||||

Effective tax rate2 | 18.9 | % | 19.8 | % | 20.7 | % | 19.2 | % | 19.6 | % | |||||||||||||||||||

| Net profit | 38,628 | 38,951 | 42,138 | 47,757 | 55,525 | 16 | % | ||||||||||||||||||||||

Purchase of intangible assets2 | 2,774 | 2,299 | 16,256 | 1,050 | 2,607 | 148 | % | ||||||||||||||||||||||

Purchase of property, plant and equipment2 | 9,636 | 8,932 | 5,825 | 6,335 | 12,146 | 92 | % | ||||||||||||||||||||||

| Cash used for acquisition of businesses | — | — | — | 18,283 | 7,075 | (61 | %) | ||||||||||||||||||||||

Free cash flow1 | 32,536 | 34,451 | 28,565 | 29,319 | 57,362 | 96 | % | ||||||||||||||||||||||

| Total assets | 110,769 | 125,612 | 144,922 | 194,508 | 241,257 | 24 | % | ||||||||||||||||||||||

| Equity | 51,839 | 57,593 | 63,325 | 70,746 | 83,486 | 18 | % | ||||||||||||||||||||||

| Financial ratios | |||||||||||||||||||||||||||||

Gross margin2 | 84.2 | % | 83.5 | % | 83.5 | % | 83.2 | % | 83.9 | % | |||||||||||||||||||

| Sales and distribution costs in percentage of sales | 26.3 | % | 26.1 | % | 25.9 | % | 26.3 | % | 26.1 | % | |||||||||||||||||||

| Research and development costs in percentage of sales | 13.2 | % | 11.7 | % | 12.2 | % | 12.6 | % | 13.6 | % | |||||||||||||||||||

Operating margin2 | 42.2 | % | 43.0 | % | 42.6 | % | 41.7 | % | 42.3 | % | |||||||||||||||||||

Net profit margin2 | 34.5 | % | 31.9 | % | 33.2 | % | 33.9 | % | 31.4 | % | |||||||||||||||||||

Cash to earnings1 | 84.2 | % | 88.4 | % | 67.8 | % | 61.4 | % | 103.3 | % | |||||||||||||||||||

ROIC1 | 116,7% | 98.0 | % | 82.8 | % | 69.0 | % | 73.6 | % | ||||||||||||||||||||

| Share performance and capital allocation | |||||||||||||||||||||||||||||

Basic earnings per share/ADR in DKK2 | 15.96 | 16.41 | 18.05 | 20.79 | 24.51 | 18 | % | ||||||||||||||||||||||

Diluted earnings per share/ADR in DKK2 | 15.93 | 16.38 | 18.01 | 20.74 | 24.44 | 18 | % | ||||||||||||||||||||||

| Total number of shares (million), 31 December | 2,450 | 2,400 | 2,350 | 2,310 | 2,280 | (1 | %) | ||||||||||||||||||||||

Dividend per share in DKK3 | 8.15 | 8.35 | 9.10 | 10.40 | 12.40 | 19 | % | ||||||||||||||||||||||

Total dividend (DKK million)3 | 19,547 | 19,651 | 21,066 | 23,711 | 27,950 | 18 | % | ||||||||||||||||||||||

Dividend payout ratio2 | 50.6 | % | 50.5 | % | 50.0 | % | 49.6 | % | 50.3 | % | |||||||||||||||||||

| Share repurchases (DKK million) | 15,567 | 15,334 | 16,855 | 19,447 | 24,086 | 24 | % | ||||||||||||||||||||||

| Closing share price (DKK) | 298 | 387 | 427 | 735 | 938 | 28 | % | ||||||||||||||||||||||

| 1. See "Non-IFRS financial measures". 2. See "Financial definitions". 3. Total dividend for the year including interim dividend of DKK 4.25 per share, corresponding to DKK 9,613 million, which was paid in August 2022. The remaining DKK 8.15 per share, corresponding to DKK 18,337 million, will be paid subject to approval at the Annual General Meeting. | |||||||||||||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 10 | |||||||

| Novo Nordisk Annual Report 2022 | 11 | |||||||

| Novo Nordisk Annual Report 2022 | 12 | |||||||

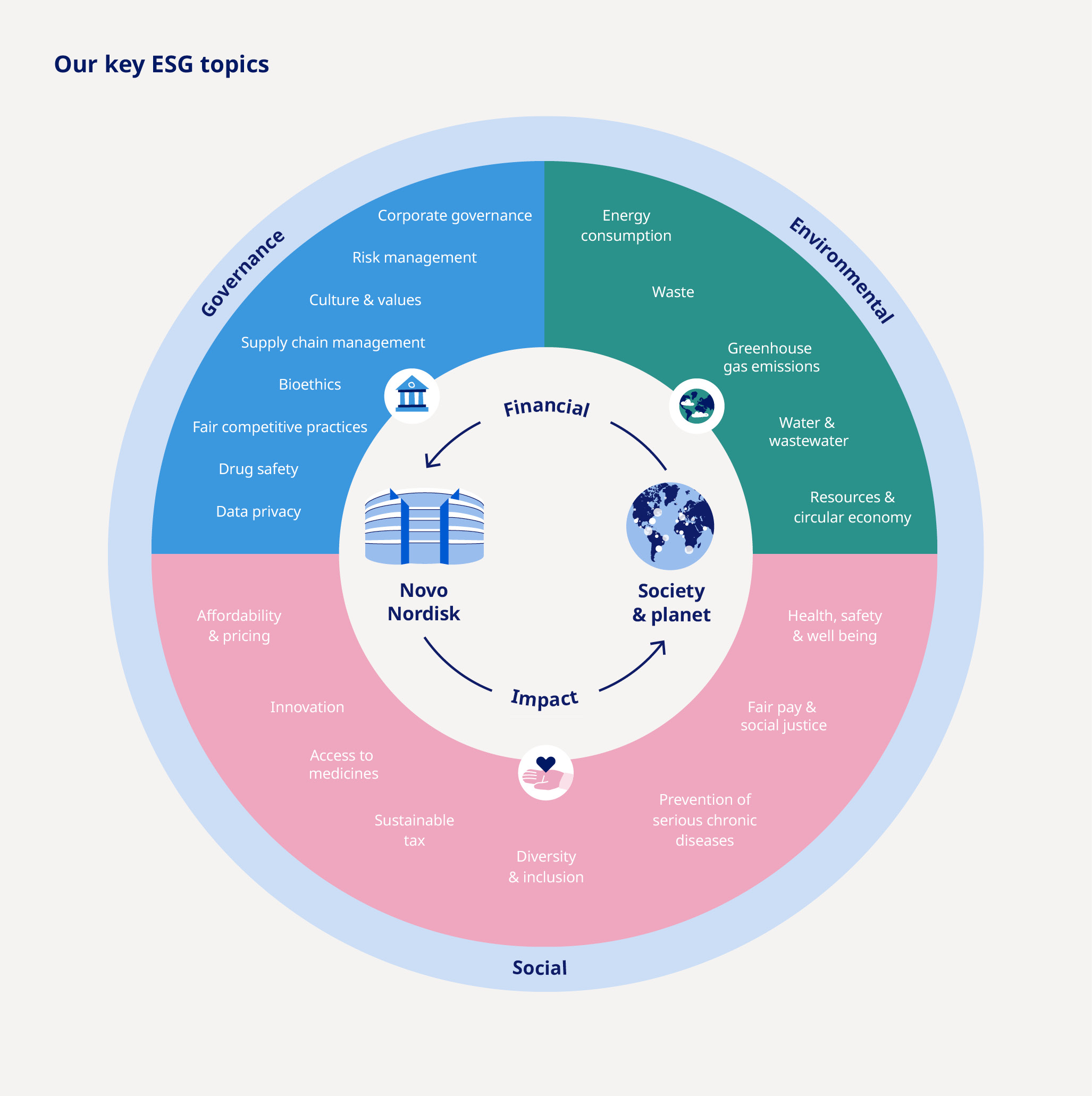

| PURPOSE AND SUSTAINABILITY (ESG) | ||||||||

| Novo Nordisk Annual Report 2022 | 13 | |||||||

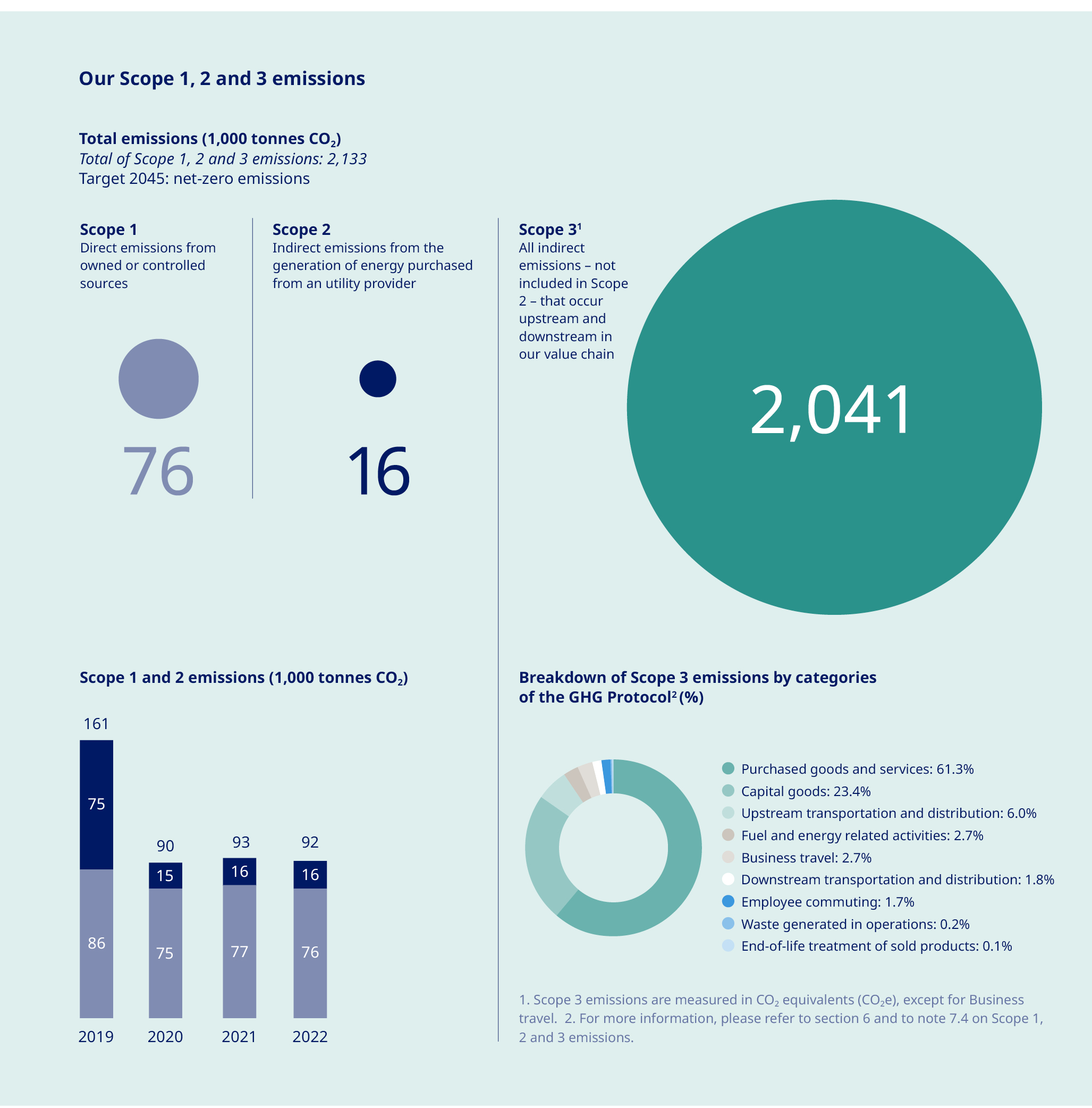

| PURPOSE AND SUSTAINABILITY (ESG) / ENVIRONMENTAL | ||||||||

| Our environmental responsibility: zero environmental impact | ||||

| |||||

Decarbonising health systems through public-private partnerships |  | ||||

A promising partnership addressing supply chain challenges and overall decarbonisation of healthcare is the Sustainable Markets Initiative – Health Systems Taskforce. This public-private partnership brings together CEOs from leading organisations in the pharmaceutical sector, such as AstraZeneca, GSK, Merck KGaA, Roche, Sanofi, as well as the World Health Organization (WHO), UNICEF, NHS England and leading health research institutions. While initiated by HRH King Charles III in the UK, the partnership is global in scope. By agreeing on a set of concrete commitments and initiatives, launched ahead of COP27, the group seeks to harness its collective influence to urgently address the need to make the healthcare sector more sustainable. This entails overall efforts towards decarbonisation, but also for prevention of disease onset and efficient delivery of care. | |||||

| Novo Nordisk Annual Report 2022 | 14 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / ENVIRONMENTAL | ||||||||

| Novo Nordisk Annual Report 2022 | 15 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / SOCIAL | ||||||||

| Our social responsibility: being respected for adding value to society | ||||

| Novo Nordisk Annual Report 2022 | 16 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / SOCIAL | ||||||||

Access and affordability initiatives in the United States My$99Insulin: 30-day supply of a combination of our insulin products (up to three vials or two packs of pens) for USD 99 for eligible patients. Unbranded Biologics: Unbranded versions of fast-acting (NovoLog®), premix (NovoLog® Mix) and long-acting (Tresiba®) insulins are available from Novo Nordisk Pharma, Inc. (NNPI), at considerable list price discounts versus branded versions. Human insulin: Available for about USD 25 per vial at national pharmacies, including Walmart and CVS. Over 752,000 people in the US continue to obtain our human insulin through these retailers. Patient Assistance Program: Offers free diabetes medication to people in need who meet certain eligibility criteria, including annual household income at or below 400% of the government-defined poverty level. Almost 63,000 people in the US received free insulin from this program in 2022. This was expanded during the pandemic to offer 90-day free insulin to those impacted by job loss due to COVID-19. Immediate Supply Program: A free, one-time, immediate supply of our insulin (up to three vials or two packs of pens) to eligible patients who may be at risk of rationing. Copay Savings Cards: Defray high out-of-pocket costs for commercially insured patients. In 2022, we provided around DKK 640 million in copay assistance for insulin to patients. | ||

| Novo Nordisk Annual Report 2022 | 17 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / SOCIAL | ||||||||

| |||||

Cities Changing Diabetes and C40 Cities collaborate on urban development |  | ||||

Since 2015, we have been partnering with the climate organisation C40 Cities, with the purpose of testing and advocating for how cities can achieve increased climate and health benefits through urban investments. In 2019, this research-based partnership applied its learnings to the development of a walking and cycling benefits Excel-based tool that enables users to estimate the health, climate and economic benefits of urban investments aimed at shifting people’s mode of transport from inactive to active. Since then, more than 20 cities have used it. Building on this initiative, we are expanding the tool to improve its usability across new city-planning methods. These include the 15-minute city interventions, a recent concept that cities are applying to increase proximity and thus decrease emissions through less transport. We continue to facilitate the integration of health in cities’ climate work through our Cities Changing Diabetes network and drive change for a healthier and more sustainable society. | |||||

| Novo Nordisk Annual Report 2022 | 18 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / SOCIAL | ||||||||

| Women in leadership (%) | |||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | |||||||||||||

| EVP/SVP | 13 | 18 | 24 | 28 | 29 | ||||||||||||

| CVP | 31 | 33 | 37 | 39 | 40 | ||||||||||||

| VP | 35 | 35 | 36 | 36 | 40 | ||||||||||||

| Senior leadership | 32 | 33 | 35 | 36 | 39 | ||||||||||||

| Director | 41 | 43 | 41 | 44 | 44 | ||||||||||||

| Manager | 40 | 40 | 42 | 43 | 45 | ||||||||||||

| All leaders | 40 | 40 | 41 | 43 | 44 | ||||||||||||

| Novo Nordisk Annual Report 2022 | 19 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / SOCIAL | ||||||||

Status and targets for the share of the underrepresented gender in Novo Nordisk A/S (2022)6 | |||||||||||

| Total / share of the underrepresented gender in % | Target for the share of the underrepresented gender / target date | ||||||||||

Board of Directors7 | 9 / 33% | Not required | |||||||||

Upper management8 | 19 / 38% | Min. 45% / 2025 | |||||||||

| Novo Nordisk Annual Report 2022 | 20 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / SOCIAL | ||||||||

| Novo Nordisk Annual Report 2022 | 21 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / GOVERNANCE | ||||||||

| Our governance responsibility: maintaining and building trust | ||||

| Novo Nordisk Annual Report 2022 | 22 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / GOVERNANCE | ||||||||

| Novo Nordisk Annual Report 2022 | 23 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / GOVERNANCE | ||||||||

| Novo Nordisk Annual Report 2022 | 24 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / GOVERNANCE | ||||||||

| Novo Nordisk Annual Report 2022 | 25 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / GOVERNANCE | ||||||||

| Raters and rankers performance | ||

| ||

MSCI: MSCI’s ESG Rating is designed to measure a company’s resilience to long-term, industry-material ESG risks. Novo Nordisk maintained an AAA leadership ESG rating in line with the past five years. | ||

| ||

Sustainalytics: Sustainalytics' ESG Risk Ratings score the ESG performance of more than 12,000 companies from “negligible” to “severe”. Novo Nordisk ranked 132 out of 1,008 companies in the "Pharmaceuticals" industry group with a medium ESG risk. | ||

| ||

CDP: CDP scores companies from “D-“ to “A”. In 2022, Novo Nordisk maintained an “A” leadership ranking in CDP Climate and improved from a “B” to an “A-” leadership ranking in CDP Water. | ||

| ||

ATMI: The ATMI evaluates 20 of the world’s largest pharmaceutical companies in areas where they have the biggest potential and responsibility to effectuate change. Novo Nordisk ranked 11th, with the strongest performance in the governance of access area, where a score of 4.43 out of 5 was achieved. | ||

| ||

S&P CSA: S&P Global’s CSA drives corporate sustainability disclosures. At the end of 2022, Novo Nordisk ranked in the 87th percentile within its pharma peer group with a score of 58 (out of 100). The average score among our peer group was 29. | ||

| We strive to follow and adhere to international standards, recommendations and commitments including: | ||||||||

Standards –Value Reporting Foundation / Sustainability Accounting Standards Board (now part of the International Financial Reporting Standards Foundation) –Taskforce on Climate-related Financial Disclosures –Science Based Targets initiative –World Economic Forum's "Core" Stakeholder Capitalism Metrics –World Economic Forum’s Good Work Framework | ||||||||

Recommendations and commitments –UN Global Compact Ten Principles –UN Guiding Principles on Business and Human Rights –UN Political Declaration on Universal Health Coverage –UN Sustainable Development Goals –OECD Guidelines for Multinational Enterprises on Responsible Business Conduct –Danish Corporate Governance Recommendations | ||||||||

| ||||||||

| Novo Nordisk Annual Report 2022 | 26 | |||||||

| PURPOSE AND SUSTAINABILITY (ESG) / GOVERNANCE | ||||||||

| EU Taxonomy eligibility and alignment | |||||||||||||||||

| Economic activity | Total (DKK million) | Eligible (DKK million) | Eligible (%) | Aligned (DKK million) | Aligned (%) | ||||||||||||

| Turnover | 176.954 | 0 | 0 | 0 | 0 | ||||||||||||

| OpEx | 23.348 | 0 | 0 | 0 | 0 | ||||||||||||

| CapEx | 23.961 | 3.173 | 13 | % | 0 | 0 | |||||||||||

Hereof 7.1 Construction of new buildings | 1.166 | 5% | 0 | 0 | |||||||||||||

Hereof 7.2 Renovation of existing buildings | 2.007 | 8% | 0 | 0 | |||||||||||||

| Novo Nordisk Annual Report 2022 | 27 | |||||||

A pipeline

A pipeline

| Novo Nordisk Annual Report 2022 | 28 | |||||||

| INNOVATION AND THERAPEUTIC FOCUS | ||||||||

| Novo Nordisk Annual Report 2022 | 29 | |||||||

| INNOVATION AND THERAPEUTIC FOCUS | ||||||||

| Novo Nordisk Annual Report 2022 | 30 | |||||||

| INNOVATION AND THERAPEUTIC FOCUS | ||||||||

| Diabetes care | |||||||||||

| Project | Indication | Description | Phase | ||||||||

| Oral semaglutide HD 1 NN9924 | Type 2 diabetes | A long-acting oral GLP-1 analogue, 25 and 50 mg, intended for once-daily oral treatment. |  | ||||||||

| Icodec NN1436 | Type 1 and 2 diabetes | A long-acting basal insulin analogue intended for once-weekly treatment. |  | ||||||||

| IcoSema NN1535 | Type 2 diabetes | A combination of GLP-1 analogue semaglutide and basal insulin analogue icodec intended for once-weekly treatment. |  | ||||||||

| FDC Sema – OW GIP NN9389 | Type 2 diabetes | A combination of semaglutide and a long acting GIP analogue intended for once-weekly treatment. |  | ||||||||

| CagriSema in T2D NN9388 | Type 2 diabetes | A combination of amylin analogue cagrilintide and GLP-1 analogue semaglutide intended for once-weekly treatment. |  | ||||||||

| Glucose-sensitive insulin NN1845 | Type 1 and 2 diabetes | A glucose-sensitive insulin analogue intended for once-daily treatment. |  | ||||||||

| Pumpsulin NN1471 | Type 1 diabetes | A novel insulin analogue ideal for use in a closed loop pump device. |  | ||||||||

| DNA Immunotherapy NN9041 | Type 1 diabetes | A novel plasmid encoding pre- and pro-insulin intended for preservation of beta cell function. |  | ||||||||

| Oral GLP-1 GIP NN9541 | Type 2 diabetes | A combination of GLP-1/GIP co-agonist intended for once-daily oral treatment. |  | ||||||||

| OW Oral Semaglutide NN9904 | Type 2 diabetes | A pro-drug of semaglutide intended for once-weekly treatment. |  | ||||||||

| SemaDapa FDC NN9917 | Type 2 diabetes | A fixed dose combination of oral semaglutide and dapagliflozin, a SGLT2 inhibitor. |  | ||||||||

| SOMA oral device DV3395 | Type 1 and 2 diabetes | A device for the oral delivery of peptides and proteins. |  | ||||||||

| Obesity care | |||||||||||

| Oral Sema Obesity NN9932 | Obesity | A long acting GLP-1 analogue intended for once-daily treatment. |  | ||||||||

| CagriSema NN9838 | Obesity | A combination of amylin analogue cagrilintide and GLP-1 analogue semaglutide intended for once-weekly treatment. |  | ||||||||

| PYY1875 NN9775 | Obesity | A novel analogue of the appetite-regulating hormone, PYY, intended for once-weekly treatment. |  | ||||||||

| Oral Amycretin NN9487 | Obesity | A long-acting co-agonist of GLP-1 and amylin intended for once-daily oral treatment. |  | ||||||||

| |||||||||||

| Rare Disease | |||||||||||

| Project | Indication | Description | Phase | ||||||||

| Somapacitan NN8640 | GHD2 | A long-acting HGH 3 derivative intended for once-weekly subcutaneous administration in children. |  | ||||||||

| Concizumab NN7415 | Haemophilia A or B w/wo inhibitors | A monoclonal antibody against tissue factor pathway inhibitor (TFPI) intended for subcutaneous prophylaxis. |  | ||||||||

| Nedosiran NN7022 | Primary Hyperoxaluria | An siRNA targeting lactate dehydrogenase A (LDHA) for once-monthly subcutaneous treatment. |  | ||||||||

| Mim8 NN7769 | Haemophilia A w/wo inhibitors | A next generation FVIII-mimetic bispecific antibody for subcutaneous prophylaxis of haemophilia A regardless of inhibitor status. |  | ||||||||

| Etavopivat NN7535 | Sickle cell disease | Second generation selective, small molecule PKR-activator intended for once-daily oral administration. |  | ||||||||

| NDec NN7533 | Sickle cell disease | An oral combination of decitabine and tetrahydrouridine. Project is developed in collaboration with EpiDestiny. |  | ||||||||

| Other serious chronic diseases | |||||||||||

Semaglutide7 NN9931 | NASH4 | A long-acting GLP-1 analogue for once-weekly subcutaneous treatment. |  | ||||||||

| Semaglutide Alzheimer NN6535 | Alzheimer's | A long-acting GLP-1 analogue for once-daily treatment. |  | ||||||||

| Ziltivekimab NN6018 | CVD5 | A once-monthly monoclonal antibody intended for inhibition of IL-6 activity. |  | ||||||||

| Belcesiran NN6021 | AATD6 | An siRNA targeting Alpha-1-AntiTrypsin (AAT) for once monthly subcutaneous treatment. |  | ||||||||

| FGF21 NASH NN9500 | NASH4 | A long-acting FGF21 analogue for once-weekly treatment. |  | ||||||||

| ATTR-CM NN6019 | CVD5 | An anti-amyloid immunotherapy treatment. |  | ||||||||

| DCR-AUD NN6020 | Alcohol Use Disorder | An siRNA targeting ALDH2 for once-monthly subcutaneous treatment. |  | ||||||||

| LXRa NN6582 | NASH4 | An siRNA targeting LXRa for once-monthly subcutaneous treatment. |  | ||||||||

| MARC1 NN6581 | NASH4 | An siRNA targeting MARC1 for once-monthly subcutaneous treatment. |  | ||||||||

| 1. High dose. 2. GHD: Growth hormone deficiency. 3. HGH: Human growth hormone. 4. NASH: Non-alcoholic steatohepatitis. 5. CVD: Cardiovascular disease. 6. Alpha-1-AntiTrypsin Deficiency related liver disease. 7. This project also includes a phase 2b study in F4 in collaboration with Gilead. | |||||||||||

| Novo Nordisk Annual Report 2022 | 31 | |||||||

| INNOVATION AND THERAPEUTIC FOCUS | ||||||||

| Research and development progress | |||||||||||||||||||||||||||||

| Diabetes care | Obesity care | Rare Disease | Other serious chronic diseases | ||||||||||||||||||||||||||

Regulatory events –Ozempic® 2.0 mg was approved by the EMA. –Market authorisation application was submitted to the NMPA for approval of Rybelsus® for treatment of adults with type 2 diabetes (T2D). –Actrapid® and Insulatard® were included in WHO prequalification list of essential medicines. –Label extension for Insulatard® and Actrapid® received positive opinion from the EMA increasing the non-refrigerated storage time. Clinical progress –Phase 3a programme, ONWARDS, investigating basal insulin icodec in people with type 1 (T1D) and type 2 diabetes (T2D), was completed. –Phase 2 trial investigating the effects of the combination of semaglutide and cagrilintide in people with T2D was completed. –Phase 2 trial investigating the effects of 8.0mg and 16.0mg semaglutide administrated subcutaneously in people with T2D was initiated. –Phase 1 trial investigating Pumpsulin for treatment of T1D was completed. –Phase 1 trial investigating the effects of the fixed dose combination of semaglutide and GIP in people with T2D was completed. –Phase 1 trial investigating the effects of the combination of semaglutide and SGLT2i inhibitor dapagliflozin in people with T2D was initiated. –Phase 1 trial investigating once-weekly oral semaglutide for treatment of T2D was initiated. –Phase 1 trial investigating the SOMA device for oral treatment currently done by tablets was initiated. –Phase 1 trial investigating the effects of insulin 965 in T2D was completed. The project was terminated. –Phase 1 trial investigating oral GLP-1/GIP co-agonist for treatment of T2D was initiated. | Regulatory events –Wegovy® was approved in the EU as an adjunct to diet and exercise for the use of weight management in adults with obesity. –Wegovy® was approved in the US for the treatment of obesity in teens aged 12 years and older, making it the first-and-only prescription anti-obesity medicine for adolescents with once-weekly treatment. Clinical progress –Phase 3a programme, REDEFINE, investigating once-weekly combination of cagrilintide and semaglutide in people with obesity was initiated. –Following interim analysis, the SELECT cardiovascular outcome trial continues in accordance with the trial protocol. –Phase 1 trial investigating once-daily oral amycretin for the treatment of obesity was initiated. –Phase 1 trial for long-acting GDF15 analogue was completed. The project was terminated. | Regulatory events –NovoSeven® was approved for use in women with severe postpartum hemorrhage by the EMA. –Marketing authorisation application was submitted to the FDA and PMDA for the approval of concizumab for treatment of haemophilia A or B with inhibitors. –Marketing authorisation application was submitted to the FDA for approval of nedosiran for treatment of primary hyperoxaluria. –Marketing authorisation application was submitted to the EMA, FDA and PMDA for approval of somapacitan for treatment of growth hormone deficiency in children. –REBINYN® was approved for prophylactic use in the treatment of haemophilia B by the FDA and for pediatric prophylaxis by Health Canada. Clinical progress –Phase 3a trials investigating concizumab prophylaxis in people with haemophilia A or B with or without inhibitors, were completed. –Phase 3a trial investigating somapacitan in paediatric non-replacement indications was initiated. –Phase 1/2 trial investigating the effects of Mim8 in people with haemophilia A was completed. Phase 3 trial programme was initiated. –Phase 2 trial investigating NDec in people with sickle cell disease was initiated. –Novo Nordisk acquired Forma Therapeutics Holding Inc., with the lead compound etavopivat, a phase 3 asset for treatment of sickle cell disease and thalassemia. | Clinical progress –Phase 2 trial investigating antibody ATTR-CM in people with rare heart disease ATTR cardiomyopathy was initiated. –Phase 2 trial investigating the dose response of oral PCSK9i was completed. The project was terminated. –Phase 1 trial investigating the siRNA MARC1 for treatment of NASH was initiated. –Phase 1 trial investigating the siRNA LXRa for treatment of NASH was initiated. –Collaboration with Staten Biotechnology was terminated. | ||||||||||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 32 | |||||||

| INNOVATION AND THERAPEUTIC FOCUS | ||||||||

| Patent status for products with marketing authorisation | ||||||||||||||||||||

The patent expiry dates for the products are shown in the table on the right. The dates provided are for expiry in the US, China, Japan and Europe of patents on the active ingredient, unless otherwise indicated, and include actual and estimated extensions of patent term, when applicable. For several products, in addition to the active ingredient patent, Novo Nordisk holds other patents on manufacturing processes, formulations or uses that may be relevant for exclusivity beyond the expiration of the active ingredient patent. Furthermore, regulatory data protection and/or orphan exclusivity may apply. | US | China | Japan | Europe8 | ||||||||||||||||

| Diabetes care | Human insulin and Modern insulins9 | Expired | Expired | Expired | Expired | |||||||||||||||

Victoza® 10 | 2023 | Expired | Expired | 2023 | ||||||||||||||||

Tresiba® | 2029 | 2024 | 2027 | 2028 | ||||||||||||||||

Ryzodeg® | 2029 | 2024 | 2024 11 | 2028 | ||||||||||||||||

Xultophy® | 2029 | 2024 | 2024 11 | 2028 | ||||||||||||||||

Fiasp® | 2030 12 | 2030 12 | 2030 12 | 2030 12 | ||||||||||||||||

Ozempic® | 2032 | 2026 13 | 2031 | 2031 | ||||||||||||||||

Rybelsus® | 2032 14 | 2026 14, 13 | 2031 14 | 2031 14 | ||||||||||||||||

Zegalogue® | 2035 | 2033 | 2033 | 2033 | ||||||||||||||||

| Obesity care | Saxenda® | 2023 | Expired | Expired | 2023 | |||||||||||||||

Wegovy® | 2032 | 2026 13 | 2031 | 2031 | ||||||||||||||||

| Rare Disease | Norditropin® (SimpleXx®) | Expired | Expired | Expired | Expired | |||||||||||||||

Sogroya® | 2034 | 2031 | 2036 | 2036 | ||||||||||||||||

NovoSeven® | Expired 15 | Expired 15 | Expired 15 | Expired 15 | ||||||||||||||||

NovoEight® | No patent | No patent | No patent | No patent | ||||||||||||||||

NovoThirteen® (TRETTEN®) | Expired | No patent | No patent | No patent | ||||||||||||||||

Refixia® (REBINYN®) | 2028 | 2027 | 2032 | 2027 | ||||||||||||||||

Esperoct® | 2032 | 2029 | 2034 | 2034 | ||||||||||||||||

Vagifem® 10 mcg | Expired | No patent | Expired | Expired | ||||||||||||||||

8. Patent status varies from country to country. The figures in the table are based on Germany. 9. Modern insulins are NovoRapid® (NovoLog®), NovoMix® 30 (NovoLog® Mix 70/30), Levemir® and NovoNorm® (Prandin®). 10. We have granted and pending patents covering the Victoza® formulation. These patents generally expire in November 2024, except for the US where the formulation patent expires in February 2026. 11. Patent term extension until 2027 may apply. 12. Formulation patent; active ingredient patent has expired. 13. Patent was subject to invalidation actions and has been held invalid by the Patent Office. This decision has been appealed to the Beijing IP Court. 14. Tablet formulation and once-daily treatment regimen are protected by additional patents expiring in 2031-2034. 15. Room temperature-stable formulation patent until 2023 in China, Japan and Germany and, until 2025, in the US. | ||||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 33 | |||||||

Commercial excellence in exceptional times

Commercial excellence in exceptional times | Novo Nordisk Annual Report 2022 | 34 | |||||||

| COMMERCIAL EXECUTION | ||||||||

| Novo Nordisk Annual Report 2022 | 35 | |||||||

| COMMERCIAL EXECUTION | ||||||||

| Novo Nordisk Annual Report 2022 | 36 | |||||||

2022

2022

| Novo Nordisk Annual Report 2022 | 37 | |||||||

| FINANCIALS | ||||||||

| Novo Nordisk Annual Report 2022 | 38 | |||||||

| FINANCIALS | ||||||||

| Novo Nordisk Annual Report 2022 | 39 | |||||||

| FINANCIALS | ||||||||

| Novo Nordisk Annual Report 2022 | 40 | |||||||

| FINANCIALS | ||||||||

| Expectations are as reported, if not otherwise stated | Expectations 1 February 2023 | ||||

| Sales growth | |||||

| at CER | 13% to 19% | ||||

| as reported | Around 4 percentage points lower than at CER | ||||

| Operating profit growth | |||||

| at CER | 13% to 19% | ||||

| as reported | Around 5 percentage points lower than at CER | ||||

| Financial items (net) | Gain of around DKK 2.4 billion | ||||

| Effective tax rate | 19% to 21% | ||||

| Capital expenditure (PP&E) | Around DKK 25 billion | ||||

| Depreciation, amortisation and impairment losses | Around DKK 8 billion | ||||

| Free cash flow (excluding impact from business development) | DKK 60-68 billion | ||||

| Novo Nordisk Annual Report 2022 | 41 | |||||||

| FINANCIALS | ||||||||

| Novo Nordisk Annual Report 2022 | 42 | |||||||

| FINANCIALS | ||||||||

| 2023 financial calendar | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

23 March 2023 Annual General Meeting 2023 | 27 March 2023 Record date | 4 April 2023 Payment, ADRs | 10 August 2023 Financial statement for the first six months of 2023 | 21 August 2023 Record date | 29 August 2023 Payment, ADRs | 31 January 2024 Financial statement for 2023 and Annual Report 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

24 March 2023 Ex-dividend | 28 March 2023 Payment, B-shares | 4 May 2023 Financial statement for the first three months of 2023 | 18 August 2023 Ex-dividend | 22 August 2023 Payment, B shares | 2 November 2023 Financial statement for the first nine months of 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 43 | |||||||

| FINANCIALS | ||||||||

| Novo Nordisk Annual Report 2022 | 44 | |||||||

| Novo Nordisk Annual Report 2022 | 45 | |||||||

| Novo Nordisk Annual Report 2022 | 46 | |||||||

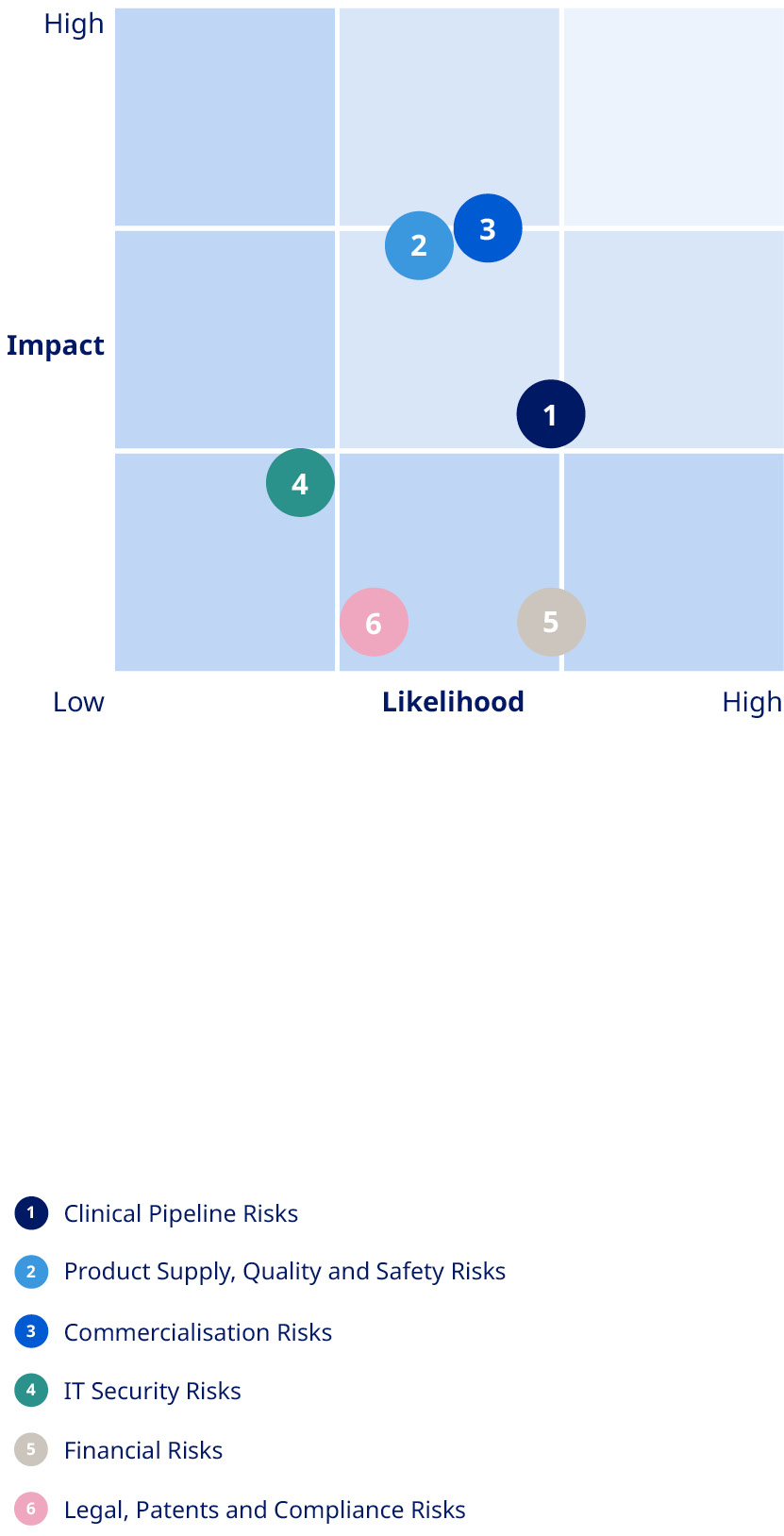

Key operational risks (Illustrative) | Risk area | Description | Impact | Mitigating actions | |||||||||||||

Clinical Pipeline Risks | Findings in clinical activities, regulatory processes or misunderstanding of commercial potential, leading to delays or failure of products in the pipeline | –Patients would not benefit from innovative treatments –Could have an adverse impact on sales, profits and market position | –Pre-clinical and clinical activities to demonstrate safety and efficacy –Consultations with regulators to review pre-clinical and clinical findings and obtain guidance on development path | ||||||||||||||

|  Product Supply, Quality and Safety Risks | Disruption of product supply due to, e.g., geopolitical instability or quality failures may compromise the availability of products, ultimately impacting the health of patients and represent a lost commercial opportunity | –Product shortages could have potential implications for patients –Could put patients' health and lives at risk and jeopardise reputation and license to operate if regulatory compliance is not ensured –Could have an adverse impact on sales, profits and market position | –Establishing global production with multiple facilities and safety stock to reduce supply risk –Regular quality audits of internal units and suppliers and annual inspections by authorities document Good Manufacturing Practice (GMP) compliance –Identification and correction of root causes when issues are identified. If necessary, products are recalled | |||||||||||||

Commercialisation Risks | Market dynamics and geopolitical, macroeconomic, or healthcare crises (e.g., pandemics) leading to reduced payer ability and willingness to pay | –Market dynamics could impact price levels and patient access –Could have an adverse impact on sales, profits and market position | –Innovation of novel products, clinical trial data and real-world evidence demonstrate added value of new products –Payer negotiations to ensure improved patients' access –Increased and new access and affordability initiatives | ||||||||||||||

IT Security Risks | Disruption to IT systems, such as cyber-attacks or infrastructure failure, resulting in business disruption or breach of data confidentiality | –Could limit our ability to produce and safeguard product quality –Could compromise patients' or other individuals' privacy –Could limit our ability to maintain operations or limit future business opportunities if proprietary information is lost –Could have an adverse impact on sales, profits and market position | –Company-wide information security awareness activities –Contingency plans for non-availability of IT systems –Company-wide internal audit of IT security controls –Detection and protection mechanisms in IT systems and business processes | ||||||||||||||

Financial Risks | Exchange rate fluctuations (mainly in USD, CNY and JPY), disputes with tax authorities and changes to tax legislation and interpretation | –Could lead to significant tax adjustments, fines and higher than expected tax level –Could have an adverse impact on sales, profits and market position | –Hedging for selected currencies –Integrated treasury management –Applicable taxes paid in jurisdictions where business activity generates profits and multi-year Advance Pricing Agreements with tax authorities | ||||||||||||||

Legal, Patents and Compliance Risks | Breach of legislation, industry codes, or company policies. Competitors asserting patents against Novo Nordisk or challenging patents critical for protection of commercial product and pipeline candidates | –Potential exposure to investigations, criminal and civil sanctions and other penalties –Could compromise our reputation and the rights and integrity of individuals involved –Unexpected loss of exclusivity for or injunctions against existing and pipeline products could have an adverse impact on future sales –Could have an adverse impact on sales, profits and market position | –Legal review of key activities –Business Ethics Code of Conduct integrated in our business, Compliance hotline in place –Internal Audit of compliance with business ethics standards –Internal controls to minimise vulnerability to patent infringement and invalidity actions | ||||||||||||||

| Novo Nordisk Annual Report 2022 | 47 | |||||||

| Novo Nordisk Annual Report 2022 | 48 | |||||||

| Board of Directors | |||||||||||||||||||||||||||||||||||||||||||||||

|  |  |  |  | |||||||||||||||||||||||||||||||||||||||||||

| As of 31 December 2022, the Board of Directors consisted of 13 members, 7 men and 6 women. | Helge Lund Chair Norwegian. Born October 1962. Male. First elected 2017.1 Term 2023. Chair of the Nomination Committee and the Chair Committee. Positions and management duties: Chair of the board of directors and chair of the people & governance committee of BP p.l.c. Chair of the board of directors of Inkerman AS. Member of the board of directors and member of the remuneration committee of Belron SA and of the board of directors of P/F Tjaldur. Operating advisor to Clayton Dubilier & Rice. Member of the board of trustees of the International Crisis Group. Competences: Global corporate leadership; healthcare & pharma industry; finance & accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social & governance (ESG). 1. In addition, Helge Lund was a member of the Board for one year in 2014-2015. | Henrik Poulsen Vice Chair Danish. Born September 1967. Male. First elected 2021. Term 2023. Member of the Audit Committee, the Remuneration Committee and the Chair Committee. Positions and management duties: Chair of the supervisory board and chair of the nomination committee and member of the remuneration committee of Carlsberg A/S. Member of the board of directors of Novo Holdings A/S and Ørsted A/S. Senior advisor to A.P. Møller Holding A/S and chair of the board of directors of Faerch A/S. Member of the supervisory board of Bertelsmann SE & Co. KGaA. Competences: Global corporate leadership; finance & accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social & governance (ESG). | Elisabeth Dahl Christensen Danish. Born November 1965. Female. First elected 2022. Term 2026. Employee representative. Member of the Remuneration Committee. Positions and management duties: Full-time union representative at Novo Nordisk A/S. Competences: Not mapped for employee representatives. | Jeppe Christiansen Danish. Born November 1959. Male. First elected 2013. Term 2023. Chair of the Remuneration Committee. Positions and management duties: Chief executive officer of Maj Invest Holding A/S and executive director of two wholly owned subsidiaries. Chair of the board of directors of Haldor Topsøe A/S, Emlika Holding ApS, and two wholly owned subsidiaries of the latter company, and chair of the board of directors of JEKC Holding ApS. Member of the board of directors of Novo Holdings A/S, KIRKBI A/S, A/S United Shipping & Trading Company (USTC), BellaBeat Inc., Pluto Naturfonden and Randers Regnskov. Member of the board of governors of Det Kgl. Vajsenhus. Adjunct Professor, department of finance, Copenhagen Business School. Competences: Healthcare & pharma industry; finance & accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social & governance (ESG). | Laurence Debroux French. Born July 1969. Female. First elected 2019. Term 2023. Chair of the Audit Committee and member of the Remuneration Committee. Positions and management duties: Member of the board of directors, chair of the audit committee and member of the ESG committee of Exor N.V. Member of the board of directors and member of the audit committee of Solvay S.A. Member of the board of directors of HEC Paris Business School and of Kite Insights (The Climate School). Competences: Global corporate leadership; healthcare & pharma industry; finance & accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social & governance (ESG). | ||||||||||||||||||||||||||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 49 | |||||||

|  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||

Andreas Fibig German. Born February 1962. Male. First elected 2018. Term 2023. Member of the Research & Development Committee. Positions and management duties: Member of the board of directors of Indigo Agriculture Inc. Member of the board of directors of Evodiabio ApS. Member of the board of directors of ExlService Holdings, Inc. Honorary director of the German American Chamber of Commerce. Competences: Global corporate leadership; healthcare & pharma industry; technology, data & digital; finance & accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social & governance (ESG). | Sylvie Grégoire Canadian and American. Born November 1961. Female. First elected 2015. Term 2023. Member of the Audit Committee, the Research & Development Committee and the Nomination Committee. Positions and management duties: Co-founder and executive chair of the board of directors of EIP Pharma, Inc. Member of the board of directors and member of the nominating & corporate governance committee and the compensation & benefits committee of Perkin Elmer Inc. Member of the board of directors of F2G Ltd. Advisor to the Soffinova Telethon Fund. Competences: Global corporate leadership; healthcare & pharma industry; medicine & science; finance & accounting; business development, M&A and external innovation sourcing; human capital management. | Liselotte Hyveled Danish. Born January 1966. Female. First elected 2022.2 Term 2026. Employee representative. Member of the Research & Development Committee. Positions and management duties: Chief patient officer and principal vice president of Patient Voice Strategy & Alliances, Novo Nordisk A/S. Competences: Not mapped for employee representatives. 2. In addition, Liselotte Hyveled was an employee-elected member of the Board in 2014-2018. | Mette Bøjer Jensen Danish. Born December 1975. Female. First elected 2018. Term 2026. Employee representative. Member of the Audit Committee. Positions and management duties: Wash & Sterilisation specialist in Product Supply, Novo Nordisk A/S. Competences: Not mapped for employee representatives. | Kasim Kutay British. Born May 1965. Male. First elected 2017. Term 2023. Member of the Nomination Committee and the Research & Development Committee. Positions and management duties: Chief executive officer of Novo Holdings A/S. Member of the board of directors and member of the nomination and remuneration committee of Novozymes A/S. Competences: Global corporate leadership; healthcare & pharma industry; finance & accounting; business development, M&A and external innovation sourcing; human capital management. | Christina Law Chinese. Born January 1967. Female. First elected 2022. Term 2023. Member of the Audit Committee. Positions and management duties: Group CEO of Raintree Group of Companies. Member of the board of directors and member of the nomination and compensation committee of INSEAD Business School. Member of the boards of Raintree Group Limited, Raintree Investment Pte Ltd. and La Fondation des Champions. Competences: Global corporate leadership; technology, data & digital; business development, M&A and external innovation sourcing; human capital management. | ||||||||||||||||||||||||||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 50 | |||||||

|  | ||||||||||||||||

Martin Mackay American and British. Born April 1956. Male. First elected 2018. Term 2023. Chair of the Research & Development Committee and member of the Remuneration Committee. Positions and management duties: Co-founder, chair and CEO of Rallybio LLC. Senior advisor to New Leaf Venture Partners, LLC. Member of the board of directors and member of the science & technology committee and the finance committee of Charles River Laboratories International, Inc. Competences: Global corporate leadership; healthcare & pharma industry; medicine & science; technology, data & digital; business development, M&A and external innovation sourcing; human capital management. | Thomas Rantzau Danish. Born March 1972. Male. First elected 2018. Term 2026. Employee representative. Member of the Nomination Committee. Positions and management duties: Area specialist in Product Supply, Novo Nordisk A/S. Competences: Not mapped for employee representatives. | ||||||||||||||||

| Independence and meeting attendance overview | |||||||||||||||||||||||

Meeting attendance in 20223 | |||||||||||||||||||||||

| Name | Independence4 | Board of Directors | Chair Committee | Audit Committee9 | Nomination Committee | Remuneration Committee | R&D Committee | ||||||||||||||||

| Helge Lund | Independent | 10/10 | 7/7 | 4/4 | |||||||||||||||||||

| Henrik Poulsen | Not independent 5,6,7,10 | 9/10 | 5/5 | 4/5 | 3/4 | ||||||||||||||||||

| Elisabeth Dahl Christensen | Not independent 8 | 7/7 | 4/4 | ||||||||||||||||||||

| Jeppe Christiansen | Not independent 5 | 10/10 | 2/2 | 5/5 | |||||||||||||||||||

| Laurence Debroux | Independent 6,7,10 | 10/10 | 5/5 | 4/5 | |||||||||||||||||||

| Andreas Fibig | Independent | 9/10 | 1/1 | 4/4 | |||||||||||||||||||

| Sylvie Grégoire | Independent 6 | 9/10 | 5/5 | 4/4 | 5/5 | ||||||||||||||||||

| Liselotte Hyveled | Not independent 8 | 7/7 | 4/4 | ||||||||||||||||||||

| Mette Bøjer Jensen | Not independent 6,8 | 10/10 | 4/4 | 1/1 | |||||||||||||||||||

| Kasim Kutay | Not independent 5 | 10/10 | 4/4 | 5/5 | |||||||||||||||||||

| Christina Law | Independent 6 | 7/7 | 4/4 | ||||||||||||||||||||

| Martin Mackay | Independent | 10/10 | 5/5 | 5/5 | |||||||||||||||||||

| Thomas Rantzau | Not independent 8 | 10/10 | 3/3 | 1/1 | |||||||||||||||||||

| Board members who stepped down at the Annual General Meeting in March 2022 | |||||||||||||||||||||||

| Anne Marie Kverneland | Not independent | 3/3 | 1/1 | ||||||||||||||||||||

| Stig Strøbæk | Not independent | 3/3 | 1/1 | ||||||||||||||||||||

| 3. Number of meetings attended by each Board member out of the total number of meetings within the member's term. 4. In accordance with recommendation 3.2.1 of the Danish Corporate Governance Recommendations as designated by Nasdaq Copenhagen. 5. Member of the board of directors or executive management of Novo Holdings A/S. 6. Pursuant to the US Securities Exchange Act, Ms Debroux, Ms Grégoire and Ms Law qualify as independent Audit Committee members, while Ms Bøjer Jensen and Mr Poulsen rely on an exemption from the independence requirements. 7. Ms Debroux and Mr Poulsen possess the qualifications within accounting and auditing required under part 8 of the Danish Act on Approved Auditors and Audit Firms. 8. Elected by employees of Novo Nordisk. 9. Collectively, the members have relevant industry expertise. 10. Designated as financial experts as defined by the US Securities and Exchange Commission (SEC). | |||||||||||||||||||||||

| Novo Nordisk Annual Report 2022 | 51 | |||||||