CONFIDENTIAL SUBMISSION

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A/A

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

|

ASHAREX FINE ART, LLC |

|

(Exact name of issuer as specified in its charter) |

|

Delaware |

|

(State of other jurisdiction of incorporation or organization) |

|

|

10990 Wilshire Blvd.

Suite 1150

Los Angeles, California 90024

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

J. Nicholson Thomas

General Counsel

aShareX Fine Art, LLC

10990 Wilshire Blvd., Suite 1150

Los Angeles, California 90024

(424) 402 8093

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Alison M. Pear, Esq.

Buchalter, A Professional Corporation

805 SW Broadway, Suite 1500

Portland, Oregon 97205

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this preliminary offering circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Securities and Exchange Commission is qualified. This preliminary offering circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a final offering circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the offering circular may be obtained.

ASHAREX FINE ART, LLC

(A Delaware Series Limited Liability Company)

Preliminary Offering Circular

March 17, 2023

Subject to Completion

Best Efforts Offering of Class A Shares

Representing Class A Limited Liability Company Membership Interests

aShareX Fine Art, LLC (“we” or the “Company”) is a Delaware series limited liability company formed on January 13, 2023, to facilitate factionalized investments in fine art. This Offering Circular relates to the offer and sale on a best efforts basis of Class A membership interests (“Class A Shares”) of each series (each a “Series” and collectively, the “Series” as the context may require) of the Company as set forth in the Series Offering Table included as Appendix B. The Company intends to make subsequent offerings of Class A Shares in newly established Series of the Company to acquire additional fine art. See “Description of Shares” for additional information regarding the Class A Shares.

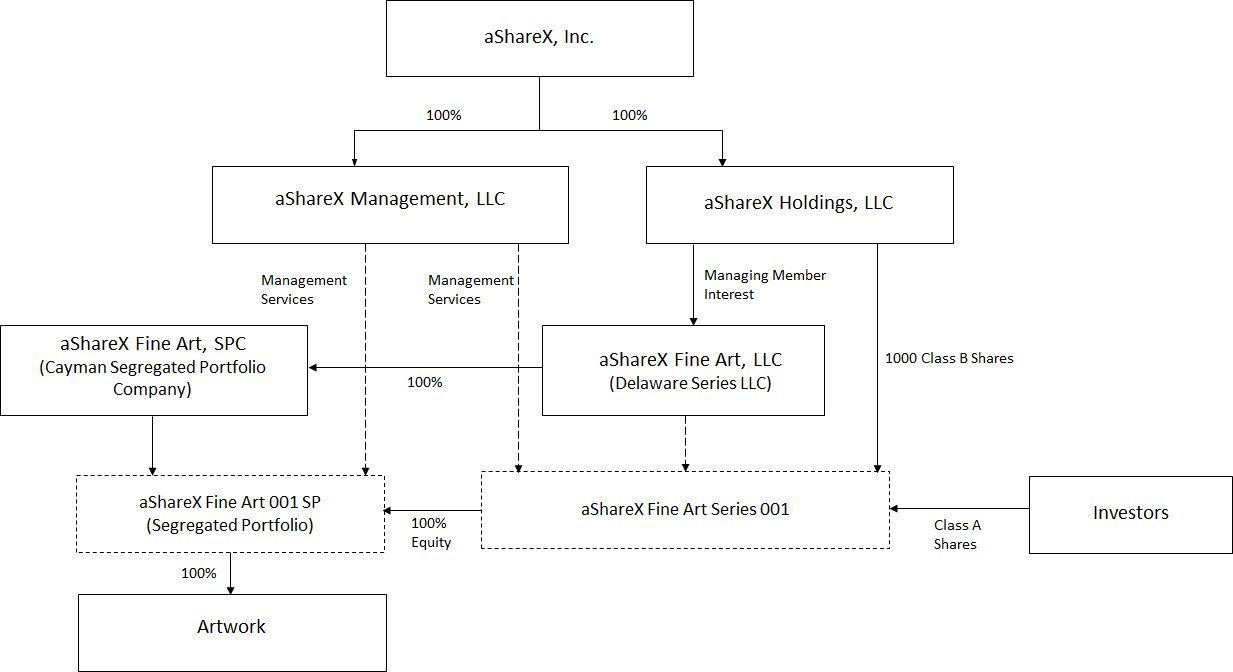

Each Series established by the Company will own museum quality, investment grade art (the “Artwork”). The Artwork will be identified by the Company from collections being sold through auctions (each, an “Auction”) to be conducted by established and highly reputable auction houses (each, an “Auction House”) or by the Company itself. The Series Offering Table also identifies the Artwork associated with each Series. Potential investors who are pre-registered and qualified with the Company on its proprietary investor platform (the “Investor Platform”) will bid as an individual or a group to acquire the Artwork at an Auction through the Company’s proprietary, online bidding platform (the “Auction Platform”). Each potential investor may submit a bid to acquire a fractional interest in the Artwork or to acquire entire ownership. See “Description of Business – Auction Platform” for a more detailed explanation of the Auction. If the fractional bidders as a group (each, a “Fractional Bidder”) submit the winning bid in the Auction, they will be issued Class A Shares in the Series associated with the Artwork in proportion to their fractional bids upon the closing of the Offering for such Series. Such Class A Shares represent, indirectly, a fractionalized ownership in the underlying Artwork. The price of each Class A Share will be equal to the amount of the price of the Artwork represented by the winning bid (known as the “Hammer Price”), the standard fee paid to the Auction House known as the “Buyer’s Premium,” sales or similar taxes incurred on the purchase, and the Sourcing Fee (collectively, the “Acquisition Cost”), divided by the number of Class A Shares issued by the Company for the Series.

The Company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to act as the broker-dealer of record in connection with this Offering, but not for underwriting or placement agent services. This includes the 1% commission, but it does not include the one-time set-up fee and consulting fee payable by the Company to Dalmore. See “Plan of Distribution” for more details. To the extent that the Company’s officers and directors make any communications in connection with the Offering they intend to conduct such efforts in accordance with an exemption from registration contained in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, therefore, none of them is required to register as a broker-dealer.

We do not currently intend to list the Class A Shares for trading on a national securities exchange. Secondary transactions in Class A Shares (the “Secondary Market”) will be facilitated through the Public Private Execution Network Alternative Trading System, or PPEX ATS (the “Trading Platform”). When trading through the Trading Platform, Investors will submit bid and ask quotes on the Investor Platform to purchase or sell Class A Shares, with any transactions to be executed by the executing broker-dealer through the non-discretionary matching procedure established by the Trading Platform.

| 2 |

The Company and each Series is managed by aShareX Holdings, LLC (the “Managing Member”), a Delaware limited liability company wholly owned by aShareX, Inc. (“aShareX”). The Managing Member, either directly or through its affiliate aShareX Management, LLC (“Asset Manager”), will provide each Series with routine operational, administrative, management, advisory, consulting and other services with respect to their respective operations and routine services related to the Artwork, including authentication and valuation services, storage, transportation and insurance. The Managing Member will also provide extraordinary services such as positioning the Artwork for sale, obtaining appraisals, and conversation or restoration work appropriate to increase the value of the Artwork. For more information about the services provided by our Managing Member and our Asset Manager, see “Management” below.

The holders of the Class A Shares in a Series (the “Class A Members”), by a majority vote of those voting, control whether the associated Artwork is to be sold prior to the seventh anniversary of its acquisition. The Class A Members will be asked to vote on selling the Artwork in the sixth and seventh years following its acquisition, and the Company may solicit their approval prior to such time if a materially compelling offer presents itself. During the eighth year following the Artwork’s acquisition date, the Managing Member must sell the Artwork using commercially reasonable efforts to achieve a favorable price and terms. Any sale must be for cash and the Managing Member intends to distribute the resulting net proceeds promptly following the sale. The Managing Member may, in its discretion, form an investor group to bid on the Artwork should it be sold through a public Auction, provided the Managing Member and its affiliates will not participate in the bidding.

In sum, the aShareX innovative approach and proprietary technology allows potential investors to participate in heretofore cost-prohibitive fine art purchases by (i) providing rarely available, fact based knowledge concerning the Artwork, including initial and periodic third party appraisals, (ii) enabling an Investor to participate directly in the purchase without expensive middlemen and with real-time, market based, competitive pricing, (iii) providing the Investor with a low-cost liquidity alternative to an investment that is otherwise illiquid, (iv) allowing the Investor to benefit from the experience, expertise and sourcing capabilities of the aShareX principals and its advisory board (the “Advisory Board”), (v) enabling the Investor group to cause the Artwork to be sold in either the sixth or seventh years following its acquisition, and (vi) assuring the Investor of an exit event no later than the eighth anniversary of the Acquisition Date.

In addition to the foregoing, an investment in the Series offers attractive tax benefits. Subject to the more detailed discussion in “Material Federal Income Tax Considerations,” under current tax law, a sale of the Artwork and a distribution of the resulting proceeds should not be subject to an entity level tax. Taxable gain recognized in such transaction by Investors subject to U.S. tax who own less than ten percent (10%) of the Class A shares and who have timely filed a “QEF election” with the Internal Revenue Service (the “IRS”), should be subject to tax at preferable long-term capital gain rates of a maximum 31.8% for individuals, trusts and estates, and if their Class A shares are sold prior to the sale of the Artwork, the tax rate should be reduced to a maximum of 23.8%. Non-U.S. Investors and tax-exempt investors will generally not be subject to tax on the gain recognized on the sale of the Artwork or upon an earlier sale of their Class A Shares.

A potential investor may not submit a bid in the Auction until this Offering Circular has been qualified by the SEC and the investor has executed an Auction Agreement (available for review on the Investor Platform) confirming, among other matters, (i) its status as a “qualified purchaser” (as defined below), (ii) it has read and understands this Offering Circular and its exhibits, including the Company’s Limited Liability Company Agreement (the “Operating Agreement) and the bidding rules for the Auction, and (iii) its commitment to fund the portion of the winning bid it submits utilizing the Auction Platform.

We do not anticipate that any Series will own any assets other than interests of the segregated portfolio holding the underlying Artwork associated with such Series. The Series will be the sole owner of such segregated portfolio. The Investors in a particular Series are not expected to receive any economic benefit from the assets of, or be subject to the liabilities of, any other Series established by the Company. The interests of all Series described above may collectively be referred to herein as the “Class A Shares” and the offerings of the Class A Shares may collectively be referred to herein as the “Offerings.” See “Description of Shares” for additional information regarding the Class A Shares.

| 3 |

There will be a separate closing with respect to each Offering with respect to a Series (each, a “Closing”). The closing of an Offering will occur on the date determined by the Managing Member in its sole discretion, but is expected to occur within 35 days of the Auction for the particular Artwork. Each Offering is being conducted on a “best efforts” basis pursuant to Regulation A of Section 3(6) of the Securities Act of 1933, as amended ( the “Securities Act”), for Tier 2 offerings. The subscription funds advanced by prospective investors as part of the subscription process will be held in a non-interest bearing, segregated escrow account with the escrow agent engaged by the Company (the “Escrow Agent”) and will not be commingled with the monies of the Escrow Agent or any other Series. If a Closing does not occur, the funds will be returned to the investors without interest. The Managing Member will pay for all costs associated with an unsuccessful Offering (other than costs personally incurred by the potential investors for legal, investment or tax advice and credit card or wire fees incurred by the investors in transmitting their funds).

|

|

|

Price to public1 |

|

|

Underwriting discount and commissions2 |

|

|

Proceeds to Issuer2 |

| |||

|

aShareX Fine Art Series ___, SP |

|

|

|

|

|

|

|

|

| |||

|

Per Interest |

|

$ |

9.60 - 12.00 |

|

|

$ |

0.096 - 0.12 |

|

|

$ |

9.60 - $12.00 |

|

|

Total Minimum (1,000,000 Class A Shares) |

|

$ |

9,600,000 |

|

|

$ |

96,000 |

|

|

$ |

9,600,000 |

|

|

Total Maximum (1,000,000 Class A Shares) |

|

$ |

12,000,000 |

|

|

$ |

120,000 |

|

|

$ |

12,000,000 |

|

|

|

(1) |

Price range included here is for example purposes only. Actual price range will be included by amendment, once the actual Artwork to be included for the initial Series is identified. |

|

|

|

|

|

|

(2) |

The Company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to act as the broker-dealer of record in connection with this Offering, but not for underwriting or placement agent services. This includes the 1% commission, but it does not include the one-time set-up fee and consulting fee payable by the Company to Dalmore. See “Plan of Distribution” for more details. To the extent that the Company’s officers and directors make any communications in connection with the Offering they intend to conduct such efforts in accordance with an exemption from registration contained in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, therefore, none of them is required to register as a broker-dealer. The fees and associated expenses of Dalmore will be paid by the Managing Member and will not be directly deducted from proceeds. The Class A Shares of each Series will be represented by unregistered certificates held in digital form by Vertalo, Inc., the Company’s transfer agent (the “Transfer Agent”). Each Investor’s Class A Shares will be recorded on the Investor Platform. See “Plan of Distribution” below for further details. |

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and, as such, may elect to comply with certain reduced reporting requirements for this Offering Circular and future filings after completion of the Offerings.

An investment in the Class A Shares involves a high degree of risk. See “Risk Factors” on page 16 for a description of some of the risks that should be considered before investing in the shares.

Generally, no sale may be made to you in any Offering if you are not an “accredited investor” and the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THE SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF ANY OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED BY THE COMPANY ARE EXEMPT FROM REGISTRATION.

| 4 |

WE ARE OFFERING TO SELL, AND SEEKING OFFERS TO BUY, OUR CLASS A SHARES ONLY IN JURISDICTIONS WHERE SUCH OFFERS AND SALES ARE PERMITTED. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH ANY INFORMATION OTHER THAN THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR. THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR IS ACCURATE ONLY AS OF ITS DATE, REGARDLESS OF THE TIME OF ITS DELIVERY OR OF ANY SALE OR DELIVERY OF OUR CLASS A SHARES. NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE OR DELIVERY OF OUR CLASS A SHARE SHALL, UNDER ANY CIRCUMSTANCES, IMPLY THAT THERE HAS BEEN NO CHANGE IN THE COMPANY’S AFFAIRS SINCE THE DATE OF THIS OFFERING CIRCULAR. THIS OFFERING CIRCULAR WILL BE UPDATED AND MADE AVAILABLE FOR DELIVERY TO THE EXTENT REQUIRED BY THE FEDERAL SECURITIES LAWS.

Our principal office is located at 10990 Wilshire Blvd., Suite 1150, Los Angeles, California 90024, and our phone number is (424) 402-8093. Our corporate website address is located at www.asharex.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this Offering Circular.

This Offering Circular is following the Offering Circular format described in Part II of Form 1-A.

The date of this Offering Circular is March 17, 2023.

| 5 |

|

|

|

Pages |

|

|

|

8 |

| |

|

|

8 |

| |

|

|

8 |

| |

|

|

9 |

| |

|

|

9 |

| |

|

|

9 |

| |

|

|

9 |

| |

|

|

9 |

| |

|

|

12 |

| |

|

|

16 |

| |

|

|

16 |

| |

|

|

30 |

| |

|

|

31 |

| |

|

|

36 |

| |

|

|

36 |

| |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

47 |

|

|

|

49 |

| |

|

|

55 |

| |

|

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS |

|

57 |

|

|

|

58 |

| |

|

|

64 |

| |

|

|

64 |

| |

|

|

72 |

| |

|

|

73 |

| |

|

|

73 |

|

| 6 |

| Table of Contents |

We have not authorized anyone to provide any information other than that contained, or incorporated by reference, in this Offering Circular. We do not take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This Offering Circular is an offer to sell only the Class A Shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular is current only as of its date, regardless of the time of delivery of this Offering Circular or any sale of Class A Shares.

For investors outside the United States: We have not taken any action that would permit this Offering or possession or distribution of this Offering Circular in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to the Offering and the distribution of this Offering Circular.

| 7 |

| Table of Contents |

Certain data included in this Offering Circular is derived from information provided by third parties that we believe to be reliable. The discussions contained in this Offering Circular relating to the Artwork, the artist and the art market and industry are taken from third-party sources that the Company believes to be reliable and reasonable, and that the factual information is fair and accurate. Certain data is also based on our good faith estimates which are derived from management’s knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified such third-party information, nor have we ascertained the underlying economic assumptions relied upon therein. The statistical data relating to the art market is difficult to obtain, may be incomplete, out-of-date, or inconsistent and you should not place undue reliance on any statistical or general information related to the art market included in this Offering Circular. The art market data used in this Offering Circular involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. While we are not aware of any material misstatements regarding any market, industry or similar data presented herein, such data was derived from third party sources and reliance on such data involves risks and uncertainties.

aShareX, the sole member of the Managing Member, owns or has applied for rights to trademarks or trade names that we use or intend to use in connection with the operation of our business, including our names, logos and website names. In addition, aShareX owns or has the rights to patent applications, copyrights, trade secrets and other proprietary rights that protect the intellectual property used in our business, including the Investor Platform and Auction Platform. We have the right to use such trademarks, trade names and other intellectual property rights under royalty free, non-exclusive licenses granted by aShareX. This Offering Circular may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this Offering Circular is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this Offering Circular are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “plan,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this offering circular. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this offering circular, whether as a result of new information, future events or otherwise.

| 8 |

| Table of Contents |

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Potential investors utilizing our Auction Platform to bid on the Artwork, and subscribing to the Class A Shares pursuant to this Offering, must be Qualified Purchasers. “Qualified Purchasers” generally consist of Accredited Investors and all other investors so long as their investment in the Class A Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Benefit Plan Investors in the aggregate may not purchase more than 24.9% of the Class A Shares in any Series, and it may not purchase any Class A Shares in a Series sold in the Secondary Market. A “Benefit Plan Investor” means (a) any “employee benefit plan” (as defined in Section 3(3) of ERISA) that is subject to Title I of ERISA, (b) any “plan” (as defined in Section 4975 of the Code) that is subject to Section 4975 of the Code, (c) any entity that is deemed to hold plan assets of any plan described in (a) or (b) by virtue such plan’s investment in that entity.

As a Tier 2 offering pursuant to Regulation A, this Offering is exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Class A Shares offered hereby are offered and sold only to Qualified Purchasers or at a time when the Class A Shares are listed on a national securities exchange. Accordingly, we reserve the right to reject any potential investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such potential investor is not a Qualified Purchaser or its subscription exceeds its investment limitations for purposes of Regulation A.

USE OF CERTAIN TERMS AND DEFINITIONS

Throughout this Offering Circular, we will use certain defined terms. While these terms will generally be defined in context, for convenience, these terms will also be contained in a “Glossary” attached as Appendix A.

Key information related to the Offering of Class A Shares for each Series is set forth in Appendix B. Please also refer to “Artwork” and “Use of Proceeds” for further details.

This summary highlights selected information contained elsewhere in this Offering Circular. This summary does not contain all of the information you should consider before investing in the Class A Shares. You should read this entire Offering Circular carefully, especially the risks of investing in the Class A Shares discussed under “Risk Factors,” before making an investment decision.

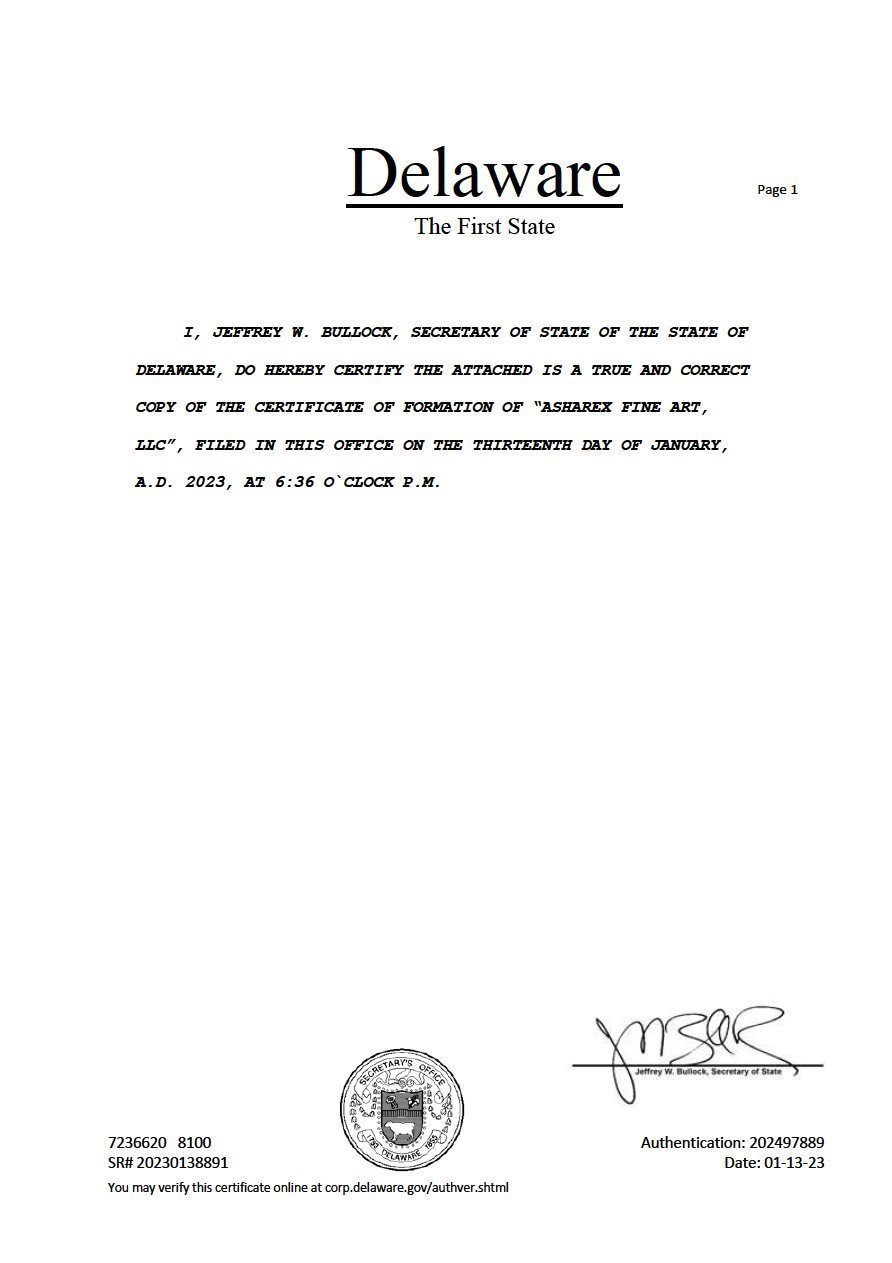

Formation and Overview

We were formed as a Delaware series limited liability company on January 13, 2023 to facilitate an investment in museum quality, blue chip, fine art by allowing Investors to potentially acquire a fractional interest in the artwork through use of our proprietary Auction Platform, which is described in greater detail under “Description of Business- Auction Platform” below.

If the investors are the successful bidder as a group at the Auction, the Series we establish will use the funds received from issuing its Class A Shares to such Investors to purchase the Artwork. Title to the Artwork will be held by a segregated portfolio (each an “SP”) established for such purpose by the Company’s wholly owned subsidiary, aShareX Fine Art, SPC, a Cayman Islands segregated portfolio company (“Cayman”). Each Series’ sole asset will consist of its ownership of the SP, and the SP’s sole asset will be the Artwork. The Artwork itself will be insured and stored in the United States. Neither the Company nor Cayman are anticipated to use borrowings or leverage to purchase or hold the Artwork or to incur any material indebtedness, except in extraordinary circumstances as described in greater detail under “Management-Asset Management-Funding and Reimbursement of Expenses” below.

| 9 |

| Table of Contents |

The Artwork for each Series will be held for appreciation and will be sold prior to the eighth year following its acquisition if approved by a majority vote of those Class A Shares of that Series entitled to vote on such matter (“Majority Vote”), or in the eighth year if it has not been previously sold. No material revenues or profits are expected to be realized, and no distributions are anticipated to be made, prior to the sale. Promptly following the sale of the Artwork, the Net Sales Proceeds (as defined below under “Distributions Policy”) from the sale shall be distributed to the holders of the Class A and B Shares of the associated Series in proportion to their respective interests. The Class B Shares, if not previously converted to Class A Shares, will receive distributions equal to 10% of the amount by which the Artwork appreciated over its Purchase Price (as described in greater detail under “Description of Business – Art Market – Auction Sales”), and the remaining distributions will be distributed pro rata to the holders of the Class A Shares. All of the Class B Shares will be held by the Managing Member. Accordingly, if there is no appreciation in the value of the Artwork from its Purchase Price, all of the distributions will be made to the holders of the Class A Shares (the “Class A Members”). There can be no assurance that the Artwork will appreciate in value or that there will be significant or any distributions to be made to the Class A Members. Distributions to the Members are discussed in greater detail under “Description of Shares” below.

Related Parties

aShareX Inc. (“aShareX”) is the parent of the Managing Member and Asset Manager, as described below. Its core business is to enable investors and collectors to bid on and own, through fractionalized interests, previously unattainable artwork, jewelry, vintage automobiles and other collectibles with enduring value, thereby bringing a new market of buyers to high end art. aShareX is essentially comprised of two functional exchanges – the Auction Platform, an auction-based primary market to bid on interests which indirectly represent a fractionalized share of Artwork, and the Trading Platform, a match-based secondary market for ongoing investor-controlled liquidity--both of which are licensed for use by the Company on a royalty-free basis. Pursuant to the terms of a License Agreement attached as an Exhibit to the Offering Statement of which this Offering Circular is an integral party, aShareX will license to the Company, each Series and SP a non-exclusive, royalty free, worldwide right to utilize the aShareX trademarks and intellectual property rights associated with use of the Investor Platform and the Auction Platform.

aShareX Holdings, LLC (“Managing Member”) is a Delaware limited liability company and a wholly-owned subsidiary of aShareX. It is the Managing Member of the Company and each Series, and, in such capacity, it will control all activities of the Series and its SP. The Managing Member acts through its Board of Directors currently comprised of three individuals, Alan Snyder, Eric Arinsburg and Nick Thomas. See “Management” below for more details. They will also serve as the initial members of Cayman’s Board of Directors. The Managing Member, either directly or through the Asset Manager, will (i) provide factual information concerning each Artwork, including its history and provenance, (ii) obtain annual third party valuations of the Artwork as part of the Company’s securities filings, (iii) oversee the Auction process to facilitate the purchase of the Artwork, (iv) provide strategic oversight to the Company to best position the Artwork for appreciation and eventual sale, (v) negotiate and transact the sales terms for the Artwork, and (vi) following such sale, attend to the distribution of the Net Sales Proceeds and liquidation of the Series and the SP. In the event Extraordinary Expenses are incurred (see discussion below under “Management-Asset Management-Funding and Reimbursement of Expenses”), the Managing Member shall use commercially reasonable efforts to find financing to pay for such expenses or it may elect to fund the Extraordinary Expenses itself by way of a loan bearing interest at the prime rate of interest published by the Wall Street Journal (“Prime Rate”) at the time the loan is funded plus two percentage points. The Managing Member will be issued 1,000 Class B Shares by each Series in exchange for its funding the fees and other expenses payable to Dalmore (or any successor broker subsequently appointed by the Managing Member, the “Broker”) for each successful Offering or the costs and expenses incurred in connection with any failed Offering.

aShareX Management, LLC (the “Asset Manager”) is a Delaware limited liability company and a wholly-owned subsidiary of aShareX. Asset Manager will attend to all of the day-to-day administrative and asset management functions associated with holding and preserving the Artwork, including storage, security, transportation and insurance and the day to day costs of operating each Series and SP. The Asset Manager may exhibit or display the Artwork with museums, galleries or private parties to enhance its value. The Asset Manager will be paid by the Investors in each Series a sourcing fee equal to four percent (4%) of the Purchase Price of the Artwork acquired by such Series (the “Sourcing Fee”). The Asset Manager will then use the Sourcing Fee to pay for all Offering Expenses (other than the fees and other expenses payable to the Broker (“Broker Fees”) paid by the Managing Member) and Operating Expenses of the Series and SP for their day to day operations (including audit, accounting and tax preparation fees, SEC and state registration and filing fees, the costs of insuring, storing and transporting the Artwork) prior to the date the Artwork is sold. The services rendered by the Asset Manager and the Offering and Operating Expenses it is obligated to fund are discussed in greater detail under “Management – Asset Manager” below.

Alan Snyder Alan Snyder is the founder of aShareX, Inc. and the founder and main principal of Shinnecock Partners, a boutique investment family office. Shinnecock entered the fine art lending space six years ago as part of its specialty lending practice and its business is transacted through a California lender license. The current loan book is approximately $96 million in outstanding financings distributed across 33 loans against art appraised for $260 million comprised of 192 pieces of artwork with an average value of $1.4 million. The artwork and borrowers receive a detailed due diligence and underwriting, including valuations and examination of authenticity and provenance. Most loans are for a duration of one year and thus are a form of inventory finance for major dealers and gallerists. The artwork is subject to UCC filings, storage in vetted art warehouses under the lender’s control, and insured. The art is all museum quality, for example, Picasso, Sargent, Rothko, Botero, Condo, Fontana and Titian. Mr. Snyder and his executive team intend to apply these same principles to the acquisition and holding of the Artwork by the Company and each of its Series.

| 10 |

| Table of Contents |

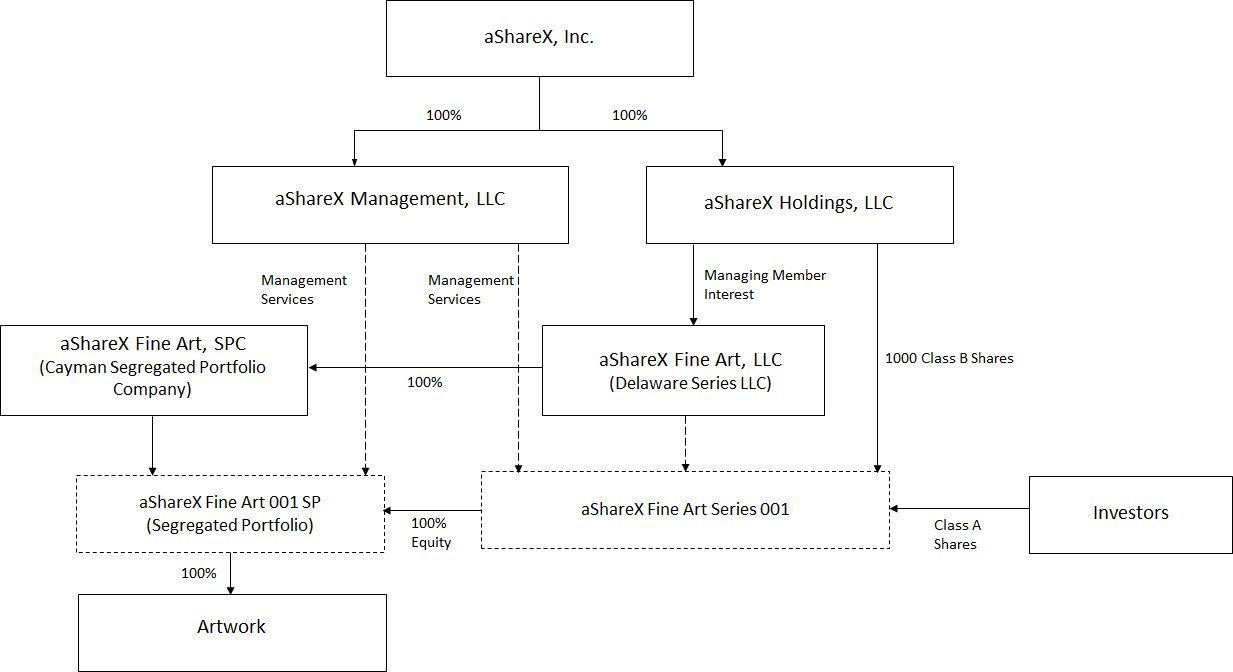

Organizational Structure

The following diagram reflects the planned organizational structure and the material relationships between the Company, each aShareX entity and each affiliate of the Series that will exist following the Offering:

*All entities are Delaware limited liability companies, except aShareX, Inc. which is a Delaware corporation, and aShareX Fine Art, SPC which is a Cayman Islands segregated portfolio company.

Further Information

For additional information, our principal office is located at 10990 Wilshire Blvd., Suite 1150, Los Angeles, California 90024, and our phone number is (424) 402-8093. Our corporate website address is at www.asharex.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this Offering Circular.

| 11 |

| Table of Contents |

|

Securities Offered

|

We will be offering Class A Shares in each Series on a “best efforts” basis. Investors in the Class A Shares will become members of the Series. In the event an issuance would result in an Investor holding a fractional number of Class A Shares, the number of Class A Shares to be received by such holder will be rounded up or down to the nearest whole Class A Share, and the Investor’s purchase price for the Class A Shares will be appropriately adjusted.

|

|

Offering Price per Class A Share

|

The Company will set an estimated price range for the Class A Shares of each Series in its Preliminary Offering Circular in the Series Offering Table. This estimated price range will be used to launch the Offering as soon as possible after qualification. The exact price will be set in an Auction held by the Company and utilizing the Company’s proprietary, online bidding platform (the “Auction Platform”). The Company anticipates that the Auction for each Series will be held within 60 days of the Offering for the Series being qualified. The price of each Class A Share will be equal to the amount of the price of the Artwork represented by the winning bid (known as the “Hammer Price”), the standard fee paid to the Auction House (known as the “Buyer’s Premium”), sales or similar taxes incurred on the purchase, and the Sourcing Fee (collectively, the “Acquisition Cost”), divided by the number of Class A Shares issued by the Company for the Series. The Auction process is described in greater detail under “Description of Business – Auction Platform” below.

|

|

Investor Platform

|

aShareX owns, and has licensed to the Company on a royalty free basis, a web browser-based investment platform located at https://www.asharex.com (the “Investor Platform”). Once an Investor establishes a user profile on the Investor Platform, it can browse and screen potential art investments, be informed as to their history, provenance and appraised value, view details of its investment and sign contractual documents online, such as the Auction Agreement and Subscription Agreements. Investors can also post bid or ask requests concerning the potential trade of their Class A Shares.

|

|

Use of Proceeds

|

The gross proceeds from each Offering will be used exclusively to fund the Acquisition Cost of the Artwork, including the Sourcing Fee.

|

|

Artwork

|

The Artwork to be held will be identified by the Company from Artwork that is being sold through an auction (the “Auction”) to be conducted by an Auction House or by the Managing Member itself through fine art it has sourced and has available on consignment. If the Artwork is purchased through a third party Auction House, it will be pursuant to such Auction House’s standard terms and conditions for such purchase. The specific Artwork associated with each Series will be described in an Appendix of this Offering Circular as identified in the Series Offering Table. We do not anticipate that any Series will own any assets other than interests of the segregated portfolio holding the underlying Artwork associated with such Series. The Series will be the sole owner of such segregated portfolio.

|

|

Capitalization and Outstanding Securities

|

The Company’s Operating Agreement as it relates to each Series provides for two classes of equity: Class A Shares and Class B Shares. There will be no Class A Shares outstanding prior to the Offering for such Series.

The Managing Member is the sole member of the Company and will initially be the sole member of each Series, holding 1,000 Class B Shares that will be issued to it for paying the Broker Fee upon the Closing of an Offering and for any costs and expenses incurred in connection with any Offering that is not completed. Each Series has no other securities outstanding (or options to acquire same), nor will any other securities be issued other than Class A and B Shares.

The Class B Shares in each Series equate in value to 10% of the associated Artwork’s appreciation in value over its Purchase Price. If there is no increase in the value of the Artwork from its Purchase Price, the Class B Shares will have no value and the entire amount of Net Sales Proceeds distributable upon the sale of the Artwork will be distributed solely to the Class A Members.

The Class B Shares in each Series are convertible into the Series’ Class A Shares prior to the sale of the Artwork pursuant to a formula set forth in the Operating Agreement. The Class A Shares issued to the Managing Member in such conversion, assuming conversion of all of the Class B Shares, are intended to approximate 10% of the appreciation between the current market price of the Class A Shares at the time of conversion and their aggregate offering price.

|

|

Minimum and Maximum Investment Amount

|

The minimum investment in each Series is $5,000. Some Investors may have a maximum investment limit imposed at the time of the Auction based on their net worth or liquidity. Benefit Plan Investors may not acquire in the aggregate more than 24.9% of the Class A Shares in any Series. Investors that are not “accredited investors” as such term is defined under Rule 501(a) of Regulation D (“Accredited Investors”) may not acquire Class A Shares in an Offering that would result in their investment in the Company exceeding 10% of the greater of the individual’s annual income or net worth, or in the case of an entity, 10% of its net income or net worth, in each case as certified by the Investor in its Auction and Subscription Agreements. An Investor who purchases 10% or more of the Class A Shares in an Offering (i) will be subject to certain disclosure requirements in the Company’s SEC filings, and (ii) if it is subject to U.S. taxation, the gain recognized on the sale of the associated Artwork will likely be treated as ordinary income.

|

|

Subscribing Online

|

Investors can review and execute their Auction Agreements and Subscription Agreement online by accessing the Investor Platform at https://www.asharex.com/.

|

|

Broker-Dealers

|

Dalmore will act as the broker-dealer in connection with this Offering and in executing trades of the Class A Shares on the Trading Platform. Dalmore is a registered, broker-dealer with the SEC and FINRA and in each state where the Offering will be made. |

| 12 |

| Table of Contents |

|

Payment for Class A Shares

|

Investors successfully submitting Winning Bids (as defined below) in an Auction can make payment for their Class A Shares in the form of ACH debit transfer, wire transfer or credit card payment into a segregated non-interest bearing account held by the Escrow Agent. The Company will only accept fiat currency and will not accept any crypto currencies, including Bitcoin and Ethereum. On the Closing of the associated Offering, the funds in the escrow account will be released to acquire the Artwork and the associated Class A Shares will be issued to the Investors. If the Closing does not occur for any reason, any funds deposited in the escrow account will be returned to the subscribers without interest. Investors will be required to reimburse the Company for costs incurred in receiving their funds, such as wire fees or credit card charges.

|

|

Worldwide

|

While the Class A Shares of each Series will be offered worldwide, the Company may elect not to sell the securities in particular jurisdictions for regulatory or other reasons. No sale of Class A Shares will be made anywhere in the world prior to the qualification of this Offering Circular by the SEC in the United States and FINRA’s issuance of a “No Objections Letter.” All Class A Shares will be offered at the same U.S. dollar price.

|

|

Voting Rights; Sale of the Artwork

|

The Class A Shares issued by each Series have no voting rights other than to approve (i) amendments to the Operating Agreement that are materially adverse to their interests, (ii) the removal of the Managing Member and Asset Manager for “cause,” or (iii) the sale of the Artwork prior to the eighth year following the date of its acquisition. See “Description of Shares” for more details. The Class A Members of each Series will be asked to vote on selling its Artwork in the sixth and seventh years following the date the Artwork is acquired, and the Managing Member may solicit their approval in its discretion prior to such time if a materially compelling offer to purchase the Artwork is tendered by a third-party. During the eighth year following the date of the Artwork’s acquisition, the Managing Member must sell the Artwork using commercially reasonable efforts to achieve a favorable price and terms.

|

|

Risk Factors

|

Investing in the Class A Shares involves risks. See the section entitled “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in the Class A Shares.

|

|

Expenses

|

The Managing Member and Asset Manager will pay all of the Offering Expenses associated with each Offering, including the Broker Fee due to Dalmore, and the ongoing Operating Expenses of each Series and its SP. See “Management-Asset Management-Funding and Reimbursement of Expenses” for further details. |

| 13 |

| Table of Contents |

|

Closing or Termination

|

A single Closing of each Offering for a particular Series is assumed and will occur on the date determined by Dalmore and the Managing Member once the Investors submitting winning bids (“Winning Bids”) execute their Subscription Agreements, certify they are Qualified Purchasers, and fund to the Escrow Agent a total amount equal to the Acquisition Cost of the Artwork. The Closing shall occur as soon as possible following completion of the Auction and it is intended to occur within the timeframe fixed by the Auction House to acquire the Artwork. It is anticipated that the Closing will generally take place within 35 days of the Auction.

The Managing Member reserves the right to terminate an Offering for any reason at any time prior to its Closing, including, for example, because (i) the potential investors submitting Fractional Bids do not win the bid because a single party submitting a 100% Bid wins the Auction, (ii) the Auction fails in that the bids do not exceed the minimum purchase price set by the Seller, or (iii) one or more potential investors who submitted Winning Bids do not timely fund amounts equating to their bids, they are determined not to be “Qualified Purchasers,” or their bids exceed the financial limitations imposed by the Company, and in each case the Managing Member is unable to remedy the funding deficiency through other means.

If any of the Class A Shares offered remain unsold, the seller of the Artwork will be asked to either reduce the Purchase Price or accept Class A Shares (assuming the seller is a Qualified Purchaser) for the deficient amount. To the extent there remains a deficient amount, the unsubscribed Class A Shares will be offered (i) first, to the Investors already participating in the Offering, (ii) second, to aShareX, the Managing Member, the Asset Manager and their respective directors, officers and direct and beneficial owners (collectively, the “aShareX Parties”), and (iii) finally, to any other Qualified Purchaser (including an aShareX Party) with preference given to registered Investor Platform users. Notwithstanding the foregoing, none of the aShareX Parties may purchase Class A Shares in an Offering, and if offered shares pursuant to the procedure outlined in the immediately preceding sentence, they may not purchase more than 10% of the Class A Shares sold in the Offering. If any unsold Class A Shares remain unsold and the deficiency cannot be remedied as set forth above, the Series may not be able to purchase the Artwork and there may not be a Closing. See “Plan of Distribution” for further discussion.

If a Closing has not occurred, an Offering shall be terminated upon (i) the date which is one year from the date such Offering Circular or amendment thereof, as applicable, is qualified by the SEC, which period may be extended with respect to a particular series by an additional six months by our Managing Member in its sole discretion, or (ii) any date on which our Managing Member elects to terminate the Offering for a particular Series in its sole discretion. The Company anticipates that the Managing Member will terminate the Offering shortly after the Auction is concluded and the Fractional Bidders have not submitted the winning bid for the Artwork, or if the Fractional Bidders have submitted the winning bid for the Artwork but are unable to complete the purchase of the Artwork within the time frame fixed by the Auction House for any other reason. |

| 14 |

| Table of Contents |

|

Transfer Restrictions

|

The Class A Shares may only be transferred by operation of law, with the consent of the Managing Member or:

· To an immediate family member or an affiliate of the transferor, · To a trust or other entity for estate or tax planning purposes if the transferor maintains control of the trust or entity, · As a charitable gift, · On the Trading Platform.

An otherwise permitted transfer, to be effective, must be reported to the Managing Member and the Company’s Transfer Agent, and the transferee must have registered on the Investor Platform, passed “know your customer” (KYC) and anti-money laundering (AML) screening, and executed the documentation required of any transferee.

An Investor may pledge its Class A Shares as collateral for a loan, provided that lien is extinguished prior to the transfer of the shares, and the pledgor and lender agree that, if there is a foreclosure on the lien, the lender will notify the Managing Member and Transfer Agent of the transfer, register the lender (or other transferee) on the Investor Platform and execute the documentation required of any transferee.

|

|

Transfer Agent

|

Vertalo, Inc., an SEC-licensed transfer agent, has been engaged by the Company to act as “Transfer Agent” to register ownership of the Class A Shares for each Series and to record their transfer in the Company’s register for the Series.

|

|

Distributions

|

The Company does not expect that any Series will generate material revenues or profits until its associated Artwork is sold. At such time, the Net Sales Proceeds will be distributed (i) to the Managing Member in payment of the Class B Shares to the extent of 10% of the Artwork’s appreciation in value over its Purchase Price, and (ii) the balance of the proceeds will be distributed to the Class A Members in proportion to their Class A Shares in the Series. If there is no appreciation in value of the Artwork because the proceeds from the sale are less than the Purchase Price for the Artwork, the Class B Shares will not receive any distributions and they will all be paid to the Class A Members. |

| 15 |

| Table of Contents |

We have not declared or paid distributions since our formation and do not anticipate paying distributions for any Series until the associated Artwork is sold. At that point, we will apply the gross proceeds from the sale to pay (i) any loans made to the Company to fund Extraordinary Expenses, (ii) the costs incurred in connection with the sale, (iii) the costs of liquidating the Series and its SP and (iv) the amount, if any, needed to fund a reserve for contingent liabilities (such net proceeds, the “Net Sales Proceeds”). The Net Sales Proceeds (together with any funds subsequently released from reserves will be distributed to the holders of the Class A and B Shares as their interests may appear. There can be no assurance as to the amount or timing of a liquidating distribution (although it is expected to occur by the eighth anniversary of the date of the Artwork’s acquisition). There are no contractual restrictions on our ability to declare or pay distributions. The decision as to the amount and timing of the distributions will be at the discretion of the Managing Member and will depend on our then current financial condition and other relevant factors, but the intent is to distribute the proceeds as quickly as possible following the sale.

The purchase of the Class A Shares offered hereby involves a high degree of risk. Each prospective investor should consult his, her or its own counsel, accountant and other advisors as to the legal, tax, business, financial, and related aspects of an investment in the securities offered hereby. Prospective investors should carefully consider the following specific risk factors, in addition to the other information set forth in this Offering Circular, before purchasing the securities offered hereby.

Risks Related to our Business Model

The Company is Newly Formed and our Business Model is Untested. The Company is a new company that was formed on January 13, 2023 and has no operating history. We cannot make any assurance that our business model can be successful. Since inception, the scope of our operations has been limited to our formation. Our operations will be dedicated to (i) sourcing potential, pre-qualified investors, (ii) engaging them in the auction process, through each Series, to bid as a group to purchase the Artwork associated with a specific Series we establish, (iii) if the bid from the Series is successful, issuing the Class A Shares to the Investors, and (iv) maintaining and preserving the Artwork to facilitate its ultimate sale. We do not expect any Series to generate any material amount of revenues or cash flow until the Artwork is sold and no profits will be realized by the Investors in such Series unless the Artwork is sold for more than its Acquisition Cost plus any Extraordinary Expenses that may be incurred. Few companies have issued securities that represent indirect ownership in fine art with the sole goal of realizing appreciation in its value, and none to our knowledge have engaged in such an investment through an on-line bidding process. It is difficult to predict whether this business model will succeed or if there will ever be any profits realized from an investment in the Class A Shares.

We Do Not Expect to Generate any Material Amount of Revenues Until the Artwork is Sold. We do not expect any Series to generate any material amount of revenues or cash flow until the associated Artwork is sold. No profits can be realized by the Investors in such Series unless the Artwork is sold for more than its Acquisition Cost plus any Extraordinary Expenses that may be incurred by the Series.

| 16 |

| Table of Contents |

Each Series Will Rely on the Asset Manager to Fund its Operations. We must rely on the Asset Manager to fund any Operating Expenses that exceed the Sourcing Fee and for the Managing Member or another aShareX affiliate to lend funds or find the financing necessary to pay any Extraordinary Expenses, which it has no obligation to do. Accordingly, we will be completely reliant on the Asset Manager and the Managing Member to fund or finance these items, and there is no assurance that they will maintain sufficient liquidity to fund these items.

We are Extremely Undiversified since our Strategy is for each Series to Achieve Capital Appreciation from a Single Work of Art. Each Series will be established to facilitate an investment in the individual work of art. The Series will not invest in any other art or assets or conduct any other operations that could generate income. Such lack of diversification creates a concentration risk that may make an investment in the Class A Shares riskier than an investment in a diversified pool of assets or a business with more varied, revenue generating operations. The aggregate returns realized by Investors will correlate to the change in value of the Artwork, which may not correlate to changes in the overall art market or any segment thereof, or in the investment community at large.

An Investment in an Offering Constitutes only an Investment in a Particular Series and not in the Company, Another Series or the Underlying Artwork. A purchase of Class A Shares in a Series does not constitute an investment in either the Company, another Series or the underlying Artwork directly. Because the Class A Shares of a Series do not constitute an investment in the Company as a whole, or any other Series, holders of a Class A Shares in a particular Series of interests will not receive any economic benefit from, or be subject to the liabilities of, the assets of the Company or any other Series. In addition, the economic interest of a holder of Class A Shares in a Series will not be identical to owning a direct, undivided interest in the underlying Artwork due to the layer of entity ownership.

The Artwork may be Sold at a Loss or at a Price that Results in a Distribution that is below the Purchase Price of the Class A Shares, or no Distribution at all. Any sale of the Artwork by a Series could be effected at an inopportune time, at a loss or at a price that would result in a distribution of cash less than the amount paid by Investors to purchase their Class A Shares in the associated Series. We intend each Series to hold its Artwork for an extended period of time, although the Series will be required to sell the Artwork (i) in the sixth or seventh years following its acquisition date upon approval by Majority Vote, or (ii) in the eighth year following the acquisition date if there has not been a prior sale. Any sale at such times may be less than optimal due to market conditions. Although the value of the Artwork may decline in the future, we have no current intention or economic incentive to cause a Series to sell the Artwork at a loss, but will be required to do so if a sale is required under the conditions set forth in clauses (i) or (ii). We may also be required to sell the Artwork prior to the eighth year following the Artwork’s acquisition date without any vote by the Class A Shares if necessary to pay for Extraordinary Expenses that cannot be funded through loans under reasonable terms or to repay any such loans that mature and cannot be refinanced. In the future, we may recommend that the Class A Members of a Series approve a sale of the Artwork prior to the sixth anniversary of its acquisition date if we consider market conditions opportune, but there is no assurance that such approval will be obtained, or that the Artwork will not decline in value thereafter. Lastly, circumstances may arise that may compel a Series to sell Artwork at an inopportune time and potentially at a loss, such as if it faces litigation, regulatory challenges or Extraordinary Expenses that cannot be financed or funded. There can be no assurance that the Class A Shares or the associated Artwork can be sold at a price that results in proceeds in excess of the amount paid by an Investor for its Class A Shares, or any proceeds at all.

The Timing and Potential Price of a Sale of the Artwork are Impossible to Predict, so Investors Need to be Prepared to Own the Class A Shares for an Uncertain or Even Indefinite Period of Time. Each Series intends to hold the Artwork for an indefinite period, though it is the Company’s intention that a sale will occur no later than the eighth anniversary of Artwork’s acquisition, and it will be sold sooner under the conditions set forth in the immediately preceding paragraph. Accordingly, a risk of investing in the Class A Shares is the unpredictability of the date the Artwork will be sold and the amount of funds generated by such sale. Investors should be prepared for the possibility they will not receive a cash distribution for many years and hence they should be prepared to hold their Class A Shares for an indefinite period of time. There can be no assurance that the Class A Shares can be resold or that the Artwork can be sold within any specific timeframe, or at all.

| 17 |

| Table of Contents |

Our Business Model Involves the Issuance of Class B Shares and Possibly Class A Shares that may have a Dilutive Effect on the Holders of the Class A Shares

. Each Series will issue Class B Shares to the Managing Member that equate to 10% of the amount by which the Artwork appreciates in value over its Purchase Price. In addition, the Class B Shares can be converted into Class A Shares based on a formula which is intended to represent 10% of the appreciation in the per share price of the Series’ Class A Shares from their Offering Price on the Closing. Moreover, if the Managing Member or a commercial lender makes a loan to a Series to pay for Extraordinary Expenses, the Managing Member may subsequently repay such loans by from proceeds derived through the issuance of additional Class A Shares in the Series. Such transactions may have a dilutive effect on the Series’ Class A Shares depending on the value appreciation in the Class A Shares or the Artwork, as applicable, or the amount of Extraordinary Expenses being funded, and may effectively reduce the tangible book value per Class A Share over time.

Your Potential Investment Returns May be Lower than the Actual Appreciation in Value of the Artwork Due to Applicable Commissions and Expenses. The amount funded by Investors to purchase the Artwork associated with a Series will include, in addition to the Hammer Price, a standard Buyer’s Premium paid to the Auction House (as to which the Asset Manager may receive a portion), taxes, and the Sourcing Fee. In addition, the Series may incur commissions, fees and expenses in marketing and selling the Artwork. Transaction costs incurred as part of the sale of the Artwork will differ depending on whether we choose or are able to sell the Artwork privately or through a public auction. In a public auction, the principal transaction costs are a Seller’s Commission and the fact that a buyer may discount the price due to its obligation to pay a Buyer’s Premium. A Seller typically receives the Hammer Price less the Seller’s Commission, if any. The economic terms negotiated between the Seller and the Auction House can vary widely depending on a number of factors, including the value and importance of the specific work, whether the work is sold as an individual piece or part of a larger collection, anticipated demand levels, and other factors. In addition, the proceeds receivable by a Seller are less favorable if the work is subject to a pre-auction guaranty. If we sell the Artwork in a private transaction, there may be sales commissions payable to third parties who arrange for the sale transaction or, if no seller’s agent is engaged in connection with such sale, the Asset Manager may charge a sales commission in connection with such sale. While we believe we may be able to substantially reduce the transaction costs of selling the Artwork, they will not be entirely eliminated. In addition, the Managing Member, as the holder of the Series’ Class B Shares, will be entitled to its 10% of the amount by which the associated Artwork appreciates in value over its Purchase Price. Accordingly, your investment returns upon a sale of the Artwork may be significantly lower than the actual rate of appreciation in the Artwork’s value.

Potential Breach of the Security measures of the Investor, Auction or Trading Platforms could have a Material Adverse Effect on the Company and the Value of your Investment. The highly automated nature of the Investor, Auction and Trading Platforms through which Investors acquire or transfer Class A Shares may make it an attractive target and potentially vulnerable to cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions. The Investor, Auction and Trading Platforms process certain confidential information about Investors. While we intend to take commercially reasonable measures to protect our confidential information and maintain appropriate cybersecurity, the security measures of the Investor, Auction and Trading Platforms, the Company, the Managing Member or our service providers could be breached. Any accidental or willful security breaches or other unauthorized access to the Investor, Auction or Trading Platforms could cause confidential information to be stolen and used for criminal purposes or have other harmful effects. Security breaches or unauthorized access to confidential information could also expose us to liability related to the loss of the information, time-consuming and expensive litigation and negative publicity, or loss of the proprietary nature of our intellectual property and trade secrets. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in the Investor, Auction or Trading Platforms’ software are exposed and exploited, the relationships between the Company and the Investors could be severely damaged, and the Company and other aShareX Parties could incur significant liability or have their attention significantly diverted from utilization of the Artwork, which could have a material negative impact on the value of the Class A Shares or the potential for distributions to be made on the interests. Any costs incurred in any such matter would be considered Extraordinary Expenses of the associated Series.

Because techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until they are launched against a target, we, the third-party hosting the Investor and Trading Platforms and other third-party service providers may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, federal regulators and many federal and state laws and regulations require companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach are costly to implement and often lead to widespread negative publicity, which may cause Investors or service providers within the industry to lose confidence in the effectiveness of the secure nature of the Investor, Auction and Trading Platforms. Any security breach, whether actual or perceived, would harm our reputation and that of the Investor, Auction and Trading Platforms, and we could lose investors and service providers. This would impair our ability to achieve our objectives.

| 18 |

| Table of Contents |

The Investor, Auction and Trading Platforms are highly Technical and may be at Risk of Malfunctioning. The Investor, Auction and Trading Platforms are complex systems with components and highly complex software, and our business is dependent upon the hosts’ or service providers’ ability to prevent system interruptions to operation. The software may now, or in the future, contain undetected errors, bugs or vulnerabilities, which may only be discovered after the code has been released or may never be discovered. Problems with or limitations of the software, misconfigurations of the systems or unintended interactions between systems may cause downtime that would impact the availability of the Investor, Auction and Trading Platforms. These platforms rely on third-party datacenters for operation. If such datacenters fail, users of the platforms may experience downtime. Any errors, bugs, vulnerabilities or sustained or repeated outages could reduce the attractiveness of the Investor, Auction and Trading Platforms to Investors, cause a negative experience for Investors or result in negative publicity and unfavorable media coverage, damage to our reputation, loss of the platform users, loss of revenue, liability for damages, regulatory inquiries or other proceedings, any of which could adversely affect our business and financial results.

Our Success Depends in Large Part Upon aShareX and the Ability of its Principals to Execute Our Business Plan. The successful operation of the Company (and therefore, the success of each Series) is in part dependent on the ability of our Managing Member and Asset Manager to source, acquire and manage the underlying Artwork. Both of these entities are only recently formed and will need to rely on the expertise and experience of their parent, aShareX and its directors, officers and principals.

There can be no assurance that these individuals will continue to be associated with aShareX and hence the Managing Member and Asset Manager. The loss of the services of one or more of these individuals could have a material adverse effect on the underlying assets, in particular, their ongoing management and use to support the investment of the holders of the series interests.

Risks Associated with an Investment in the Artwork

There is no Assurance of Appreciation of the Artwork or Sufficient Cash Distributions Resulting from the Ultimate Sale of the Artwork. There is no assurance that the Artwork will appreciate, maintain its present value, or be sold at a profit. The marketability and value of the Artwork will depend upon many factors beyond our control. There can be no assurance that there will be a ready market for the Artwork, since investment in artwork is generally illiquid, nor is there any assurance that sufficient cash will be generated from the sale of the Artwork to compensate investors for their investment. Even if the Artwork does appreciate in value, the rate of appreciation may be insufficient to cover our selling costs or other Extraordinary Expenses.

The Value of the Artwork is Subjective. The value of the Artwork is inherently subjective given its unique character. While the acquisition of the Artwork based on the bidding process engaged in by potential investors armed with knowledge of its history, provenance and appraised value, is intended to represent the best evidence of the Artwork’s current market value, there can be no assurance that this is the case or that the Artwork could be immediately resold for its Purchase Price. The future realizable value of fine artwork may differ widely from its estimated or appraised value for a variety of reasons, many of which are unpredictable and impossible to discern. In addition, the net realizable value to a seller at auction is often significantly lower than the published sale price because the net proceeds are typically reduced by all or a portion of the Buyer’s Premium and there may also be a sales commission. For non-cash generating assets, such as fine art, valuation is heavily reliant on an analysis of sales history of similar artwork. Experts often differ on which historical sales are comparable and the degree of comparability. The attempt to discern value from historical sales data is extremely challenging for a variety of reasons, including, without limitation:

| 19 |

| Table of Contents |

|

|

· |

Qualitative Factors. Differences in perceived quality or condition between the subject work and the so-called “comparable” sale. Perceived differences in the physical quality and condition of the respective works require subjective judgements as to the valuation impact attributable to such differences. |

|

|

|

|

|

|

· |

Lack of Reliable Data. Data from non-auction sales, comprising a majority of all sales, is largely unavailable and historical sales data may be inaccurate. Also, data may be stale or unavailable to the public because comparable works may remain off market for extended periods of time, often for generations. Even for public auctions, sale prices may be incorrectly reported due to credits for guarantees entered into with buyers (though under current rules in certain jurisdictions, these are required to be deducted from the reported sale price), or other credits provided to potential buyers. |

|

|

|

|

|

|

· |

Idiosyncratic Factors. Idiosyncratic motivations of a buyer or seller may significantly affect the sale price. These motivations may relate to an emotional attachment to the work, ego, financial, estate or tax planning objectives, the desire to enhance or complete a specific collection objective, perceptions of supply and scarcity and other factors. |

|

|

|

|

|

|

· |

Timing Differences. Historical transactions must be viewed in light of market conditions at the time compared to current conditions. Overall market conditions are difficult to track in recent periods and extremely difficult to discern for historical periods. Harder still, is the ability to track the relative popularity of specific works, artists and genres over historical periods. |

|

|

|

|

|

|

· |

Market Depth. Sale prices only reflect the price a single buyer was willing to pay for a work, so it is very difficult to determine the depth of demand, as defined by the number of potential buyers that are ready, willing and able to purchase an artwork at or below a given price level. |

|

|

|

|

|

|

· |

Entanglements. It is not uncommon in the art market for buyers, sellers and intermediaries to enter into private contractual arrangements that may affect the sales price of a specific transaction. It is often impossible to know of the existence or terms of any such contractual arrangements. |

Accordingly, due to the inherent subjectivity involved in estimating the realizable value of the Artwork, any appraisal or estimate of realizable value may prove, with the benefit of hindsight, to be different than the amount ultimately realized upon sale and such differences can be, and often are, material.

Since the Valuation of High-End Art Relies in Large Part on an Analysis of Historical Auction Sales, it is more Difficult to Accurately Determine Fair Value of Artwork by Artists that have Fewer Auction Sales. Certain artists (e.g. Monet, Renoir or Van Gogh) have a relatively large global collector base and a well-established track record of auction sales over a lengthy period. These artists were also extremely prolific during their careers, so their art is frequently bought and sold at auction. This relatively large volume of data makes estimates of historical pricing trends and fair value ranges for art produced by these artists more reliable. By contrast, the valuation of works by other artists who have a smaller collector base and or a shorter track record of auction sales, such as the artist who authored the Artwork, is comparatively more difficult and such assessments are generally prone to wider margins of error. As a general matter, historical pricing trends and fair value estimates are more likely to be more accurate for artists with higher volumes of prior auction sales than pricing trends and estimates for artists that have fewer historical auction sales. Accordingly, there is a higher risk that we may overpay for, or misprice, the Artwork notwithstanding that it is subject to a public auction and arguably market-based pricing.

Our Third-Party Valuation of the Fair Value of the Artwork may not be Reflective of its Value at any Point in Time and Hence the Value of the Class A Shares or its Realizable Value upon Eventual Sale. We will engage experienced, third-party appraisers to value the Artwork currently and in conjunction with filing our annual financial statements with the SEC. For the reasons set forth elsewhere in this “Risk Factors” section, any such valuation is inherently subjective and may not represent the actual realizable value of the Artwork. In addition, because the timing of the Artwork’s sale is unknown, the value of the associated Class A Shares may be significantly different than the proportionate indirect ownership of the Artwork that they represent. In addition, the Managing Member will consider a variety of factors in making any determination as to the Artwork’s price and terms of a sale and therefore its appraised value may not be indicative of the price at which the Managing Member determines to sell the Artwork.

| 20 |

| Table of Contents |

An Investment in the Art is Subject to Various Risks, any of which could Materially Impair the Value of the Art and the Market Value of the Class A Shares. Investing in the Artwork is subject to the following risks:

|

|

· |

Authenticity. Claims with respect to the authenticity of the Artwork may result from incorrect attribution, uncertain attribution, lack of certification proving authenticity, forgery or falsification of the artist’s signature. Under the terms of an Auction sale, we will obtain representations of authenticity from the Seller, but in any event such representations do not effectively eliminate the risk. |

|

|

|

|

|

|

· |

Provenance. Claims related to provenance, or history of ownership, are relatively common and allege that an Artwork has an uncertain or false origin. Future buyers may also negatively perceive some elements of the prior ownership history, or whether the work is considered to have sold too often in the past. With respect to the Artwork, future buyers may negatively perceive our fractionalized ownership in the Artwork when considering a purchase. |

|

|

|

|

|

|

· |

Condition. The physical condition of the Artwork over time is dependent on technical aspects of artistic workmanship, including the materials used, the manner and skill of application, as well as handling and storage of the Artwork and other factors. |

|

|

|

|

|

|

· |

Physical Risks. The Artwork is subject to potential damage, destruction, devastation, vandalism or loss as a result of natural disasters (flood, fire, hurricane), crime or theft, notwithstanding the insurance coverage we will maintain. |

|

|

|

|

|

|

· |

Legal Risks. Ownership of the Artwork is prone to a variety of legal challenges, including challenges to title, nationalization, purchase from unauthorized persons, risk of cheating, money laundering, violation of legal regulations and restitution issues. Purchasing from a major auction house such as Bonhams, Christies and Sotheby’s can reduce but not eliminate these risks. |

|

|

|

|

|

|

· |

Market Risks. The art market is prone to change due to a variety of factors, including changes in transaction costs, substantial changes in fees, tax law changes, export licenses, changes in legal regulations, changes in attitudes toward art as an investment, changes in tastes, changes in supply, such as the liquidation of a major collection. These risks can be specific to certain geographies. |

|

|

|

|

|