As filed with the Securities and Exchange Commission on June 16, 2017

Investment Company Act File No. 811-23264

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM N-2

☒ Registration Statement under the Investment Company Act of 1940

☐ Amendment No.

ALTABA INC.

(Exact Name of Registrant as Specified in Charter)

140 East 45th

Street, 15th Floor

New York, New York 10017

(Address of Principal Executive Offices)

646-679-2000

(Registrant’s Telephone Number, Including Area Code)

Arthur Chong

Altaba

Inc.

140 East 45th Street, 15th Floor

New York, New York 10017

(Name and Address of Agent for Service)

Copies to:

Michael K. Hoffman, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

4 Times Square

New York,

New York 10036

TABLE OF CONTENTS

i

SUMMARY

Altaba Inc. (the “Fund”) is an independent, publicly traded, non-diversified, closed-end management investment company registered

under the 1940 Act. The Fund is organized as a Delaware corporation. Its common stock is listed on The NASDAQ Global Select Market (“Nasdaq”) and its ticker symbol is “AABA.”

Prior to registering as an investment company on June 16, 2017, the Fund was an operating company named Yahoo! Inc. (“Yahoo”).

Yahoo sold its operating business to Verizon Communications Inc. on June 13, 2017 (such sale, the “Sale Transaction”) pursuant to a Stock Purchase Agreement entered into by Yahoo and Verizon Communications Inc.

(“Verizon”) on July 23, 2016, as amended as of February 20, 2017 (the “Stock Purchase Agreement”). The purchase price that Verizon paid to the Fund at the closing in connection with the Sale Transaction was

approximately $4.5 billion in cash, subject to certain pre-closing and post-closing adjustments as provided in the Stock Purchase Agreement. On June 16, 2017, Yahoo changed its name to Altaba Inc. and changed its Nasdaq ticker symbol to

“AABA.”

Assuming the Sale Transaction had closed on December 31, 2016, the Fund’s investment assets immediately after

the Sale Transaction would have consisted of:

| |

• |

|

383,565,416 ordinary shares, par value $0.000025 per share (“Alibaba Shares”), of Alibaba Group Holding Limited (“Alibaba”), which had an aggregate market value of approximately $33.7

billion on December 31, 2016 based on the closing market price of Alibaba American Depositary Shares (“Alibaba ADS”) on the New York Stock Exchange (the “NYSE”) on December 30, 2016 (the last trading day

prior to December 31, 2016) and would have represented approximately 61.9 percent of the Fund’s total assets if the Sale Transaction had closed on such date; |

| |

• |

|

2,025,923,000 shares of common stock, no par value per share (the “Yahoo Japan Shares”), of Yahoo Japan Corporation (“Yahoo Japan”), which had an aggregate market value of approximately

¥909,639,427,000 or approximately $7.7 billion on December 31, 2016 based on the closing market price of Yahoo Japan Shares on the Tokyo Stock Exchange on December 30, 2016 (the last trading day prior to December 31, 2016) and the

Yen/USD foreign exchange rate on such date and would have represented approximately 14.2 percent of the Fund’s total assets if the Sale Transaction had closed on such date; |

| |

• |

|

cash, cash equivalents, and marketable debt securities (the “Marketable Debt Securities Portfolio”) which had an aggregate market value of approximately $12 billion on December 31, 2016 (including the

proceeds from the Sale Transaction subject to certain pre-closing and post-closing adjustments and which will be reduced by amounts used to repurchase Yahoo common stock pursuant to Yahoo’s tender offer that will expire on June 16, 2017

(the “Tender Offer”)) and would have represented approximately 22.5 percent of the Fund’s total assets if the Sale Transaction had closed on December 31, 2016; |

| |

• |

|

investments in certain additional companies (the “Minority Investments”), which had an aggregate carrying value of approximately $130 million on December 31, 2016 and would have represented less

than 0.2 percent of the Fund’s total assets if the Sale Transaction had closed on such date; and |

| |

• |

|

all of the equity interests in Excalibur IP, LLC (“Excalibur”), a wholly owned subsidiary of the Fund that owns a portfolio of patent assets that are not core to Yahoo’s operating business (the

“Excalibur IP Assets”), which had an approximate fair value of $740 million as of December 31, 2016 and would have represented approximately 1.4 percent of the Fund’s total assets if the Sale Transaction had closed on such

date. As part of the Sale Transaction, Verizon received for its benefit and that of its current and certain of its future affiliates a non-exclusive, worldwide, perpetual, royalty free license to the Excalibur IP Assets. |

1

We refer to the Fund’s assets held immediately after the completion of the Sale Transaction as its

“Initial Assets.”

As of December 31, 2016, Yahoo’s 383,565,416 Alibaba Shares represented an approximate 15 percent

equity interest in Alibaba and its 2,025,923,000 Yahoo Japan Shares represented an approximate 36 percent equity interest in Yahoo Japan. Because the Fund’s assets consist primarily of its Alibaba Shares and its Yahoo Japan Shares, an

investment in the Fund may be particularly subject to risks relating to Alibaba and Yahoo Japan. See the section of this registration statement entitled “Risk Factors.”

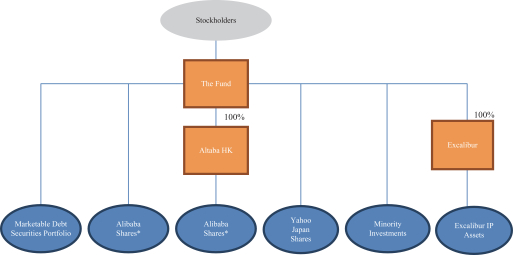

The Fund continues to hold 290,938,700 of its Alibaba Shares through Altaba Holdings Hong Kong Limited (“Altaba HK”), a Hong Kong

private company limited by shares and a wholly owned subsidiary of the Fund that engages in no other business or operations, and owns no other assets other than de minimis cash. The balance of the Alibaba Shares continues to be held directly by the

Fund.

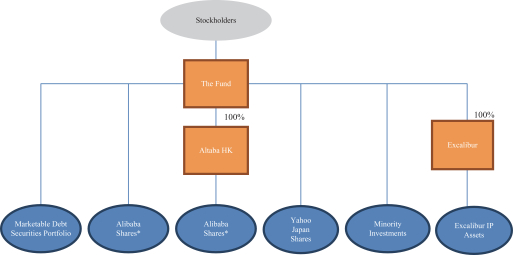

A diagram depicting the Fund and its holdings as of the date of this registration statement is set forth below:

Fund Structure

| * |

Approximately 24 percent of the Fund’s shares in Alibaba are held directly by the Fund and approximately 76 percent are held indirectly through Altaba HK. |

The Tender Offer commenced on May 16, 2017 and will expire on June 16, 2017 at 11:59 p.m., New York City time, unless it is withdrawn by Altaba or extended.

The Fund offered to purchase for cash up to $3,000,000,000 of shares of its common stock at prices equal to (A) the daily volume-weighted average price of the Alibaba ADS (the “Alibaba VWAP”), multiplied by (B) multiples specified

by tendering stockholders not greater than 0.420 nor less than 0.370, less applicable withholding taxes and without interest. The terms and conditions of the Tender Offer are set forth in an Offer to Purchase, Letter of Transmittal and related

documentation filed with the SEC. The purpose of the Tender Offer is to provide liquidity to stockholders that are forced to sell their shares because the Fund is required to register as an investment company under the 1940 Act and its shares will

be removed from the Standard and Poor’s 500 Composite Index and other indices.

Unless the tender offer is extended, the Alibaba VWAP to be used in

determining the purchase price to be paid in the Tender Offer is equal to $137.1017, which was the daily volume-weighted average price for an Alibaba ADS on June 14, 2017, the second trading day prior to the expiration date. Assuming that the

conditions to the Tender Offer are satisfied or waived, based on the Alibaba VWAP of $137.1017, at the minimum purchase price of

2

$50.73 per share, the maximum number of shares that will be purchased is 59,136,605 if the Tender Offer is fully subscribed, and the Fund does not increase the amount of shares sought in the

Tender Offer. When the Tender Offer expires, the Fund will determine a single purchase price that it will pay for the shares by determining the lowest multiple within the specified range at which shares have been tendered or have been deemed to be

tendered that when multiplied by the Alibaba VWAP that will enable the company to purchase the maximum number of shares properly tendered in the tender offer and not properly withdrawn having an aggregate purchase price not exceeding $3,000,000,000.

3

ANNUAL FUND OPERATING EXPENSES

The purpose of the table and the example below is to help you understand the fees and expenses that you, as a holder of the Fund’s common stock, would

bear directly or indirectly on an annual basis. The expenses shown in the table are based on estimated amounts for the Fund’s first year of operations as an investment company and assume that the Fund has approximate net assets attributable to

the Fund’s common stock of $37 billion during its first full year of operations after registering as an investment company. The Fund’s actual expenses may vary from the estimated expenses shown in the table.

|

|

|

|

|

| Common Stockholder Transaction Expenses |

|

|

|

|

| Sales load (as a percentage of offering price) |

|

|

N/A |

|

| Dividend reinvestment and cash purchase plan

fees(1) |

|

|

None |

|

|

|

|

|

|

| |

|

Percentage of

Net Assets

Attributable to

Common Stock |

|

| Annual Expenses (as a percentage of net assets attributable to the Fund’s Common Stock)(2) |

|

|

|

|

| Management fees(3) |

|

|

0.02 |

% |

| Interest payments on borrowed

funds(4) |

|

|

0.17 |

% |

| Other expenses(5) |

|

|

0.06 |

% |

| Tax expense(6) |

|

|

1.97 |

% |

|

|

|

|

|

| Total annual expenses |

|

|

2.22 |

% |

|

|

|

|

|

| (1) |

The Fund has not adopted a dividend reinvestment or cash purchase plan. |

| (2) |

Net assets attributable to the Fund’s common stock estimated based on total Initial Assets less total liabilities as of December 31, 2016. |

| (3) |

The Fund estimates paying management fees at the annual rate of 0.05 percent of the average daily value of the Marketable Debt Securities Portfolio, which is an annual rate of approximately 0.02 percent of the

Fund’s net assets attributable to common stock. This figure assumes a Marketable Debt Securities Portfolio of $12 billion. |

| (4) |

Represents debt amortization expense on the Convertible Notes. Yahoo historically amortized debt discount within “other expenses” over the term of the Convertible Notes based on an effective interest rate of

5.26 percent. Future borrowing costs may differ based on varying market conditions and depending on the type of borrowing being used. |

| (5) |

The “Other expenses” percentage is based on an estimate of annual expenses (primarily compensation of employees and directors, custody fees, rent, insurance, audit fees, and compliance costs) representing all

of the Fund’s operating expenses (except fees and expenses reported in other items of this table) that will be deducted from the Fund’s operating income and reflected as operating expenses in the Fund’s statement of operations, net of

interest expense, for the Fund’s first full year of operations as an investment company, divided by net assets attributable to the Fund’s common stock as of December 31, 2016. |

| (6) |

For purposes of determining the estimated income tax expense, an estimated assumed 5 percent annual growth rate was used to calculate unrealized gains on investments, and an estimated assumed effective tax rate of 36.5

percent was applied to the Fund’s income and realized and unrealized gains. The Fund does not currently qualify for pass-through status under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and the

Fund anticipates that it will be taxed as a corporation for applicable income tax purposes. As a result, the net asset value of the Fund’s common stock will be impacted by the deferred tax liability applicable to any of its assets.

|

4

As required by relevant U.S. Securities and Exchange Commission (the “SEC”) regulations,

the following example illustrates the expenses that you would pay on a $1,000 investment in the Fund’s common stock, assuming (1) “Total Annual Expenses” of 2.22 percent of net assets attributable to the Fund’s common stock

and (2) a five percent annual return:*

|

|

|

|

|

|

|

| 1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

| $23 |

|

$69 |

|

$119 |

|

$256 |

| * |

The example should not be considered a representation of future expenses or returns. The example assumes that the amount estimated above for “Total Annual Expenses” is accurate. Actual expenses may be

higher or lower than those assumed. Moreover, the Fund’s actual rate of return may be higher or lower than the hypothetical five percent return shown in the example. |

5

FINANCIAL STATEMENTS

The fund will file audited financial statements by amendment within 90 days of the filing of this registration statement.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies that will be followed by the Fund. These policies are in conformity with accounting

principles generally accepted in the United States of America (“GAAP”). The Fund will follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting

Standard Codification Topic 946 Financial Services—Investing Companies.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at the date of the unaudited pro forma consolidated statement of assets and liabilities. Actual amounts could differ from those estimates.

Federal Income Taxes

The Fund is not eligible to be

treated as a “regulated investment company” under the Code as a result of the Fund’s concentrated ownership of Alibaba Shares. Instead, the Fund is treated as a regular corporation, or a “C” corporation, for U.S. federal

income tax purposes and, as a result, unlike most investment companies, will be subject to corporate income tax to the extent the Fund recognizes taxable income and taxable gains. The Fund will recognize tax expense on its taxable income and taxable

gains on investments.

Deferred income taxes are determined based on the differences between the financial reporting and tax bases of assets and

liabilities and are measured using the currently enacted tax rates and laws. Significant judgment will be required in evaluating the Fund’s uncertain tax positions and determining its provision for income taxes. The Fund establishes liabilities

for tax-related uncertainties based on estimates of whether, and the extent to which, additional taxes will be due. These liabilities are established when the Fund believes that certain positions might be challenged despite its belief that its tax

return positions are in accordance with applicable tax laws. To the extent that the final tax outcome of these matters is different than the amounts recorded, such differences will affect the provision for income taxes in the period in which such

determination is made.

Distribution of Cash

The Fund currently intends to return substantially all of its cash to stockholders over time through stock repurchases and distributions, although the

Fund will retain sufficient cash to satisfy its obligations to creditors and for working capital. The timing and method of any return of capital will be determined by the Board of Directors of the Fund (the “Board”). Stock

repurchases may take place in the open market, including under Rule 10b5-1 plans or tender offers, or in privately negotiated transactions, including structured and derivative transactions such as accelerated share repurchase transactions. The

Fund currently anticipates that the amount of cash to be retained by the Fund will be at least $1.4 billion, which is the minimum amount necessary to satisfy the Fund’s obligations under the Convertible Notes. However, the Fund’s

obligations to creditors and working capital requirements may vary over time and may be materially greater than such amount, depending upon, among other factors, the cost of cash-settling any conversion obligations under the Convertible Notes, the

Fund’s potential obligations with respect to potential liabilities and whether the income from the Fund’s investments is sufficient to cover its expenses.

6

Securities Valuations Process and Structure

The Board will adopt methods for valuing securities and other derivative instruments, including in circumstances in which market quotes are not readily

available, and will generally delegate authority to management of the Fund to apply those methods in making fair value determinations, subject to Board oversight. Fund management will administer, implement, and oversee the fair valuation process,

and will make fair value decisions. Fund management will review changes in fair value measurements from period to period and may, as deemed appropriate, obtain approval from the Board to changes the fair valuation guidelines to better reflect the

results of comparisons of fair value determinations with actual trade prices and address new or evolving issues. The Board and Audit Committee will periodically review reports that describe fair value determinations and methods.

Hierarchy of Fair Value Inputs

The Fund will categorize

the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level

1—Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2—Observable

inputs other than quoted prices included in level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar

instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3—Unobservable inputs for the

asset or liability to the extent that relevant observable inputs are not available, representing management’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based

on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors,

including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or

inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the

fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The Fund intends to recognize transfers between level

1, level 2, and level 3 as of the beginning of the fiscal year.

Fair Value Measurements

A description of the valuation techniques anticipated to be applied to the Fund’s major categories of assets measured at fair value on a recurring basis

follows.

| |

• |

|

Equity securities (common and preferred stock)—Securities traded on a national securities exchange will be stated at the last reported sales price on the day of valuation. To the extent these securities are

actively traded, and valuation adjustments are not applied, they will be categorized in level 1 of the fair value hierarchy. Preferred stock and other equities traded on inactive markets will be categorized in level 3. |

7

| |

• |

|

Fixed Income Securities—The fair value of this investment class will be estimated using various techniques, which may consider recently executed transactions in securities of the issuer or comparable issuers,

market price quotations (when observable), bond spreads, fundamental data relating to the issuer and credit default swap spreads adjusted for any basis differences between cash and derivative instruments. Although most corporate debt securities,

commercial paper and bank certificates of weight is placed on transaction prices, quotations, or similar observable inputs, they will be categorized in level 3. U.S. government securities are normally valued using a model that incorporates market

observable data, such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities will be valued principally using dealer quotations. |

| |

• |

|

Money market funds will be valued at their respective publicly available net asset value at December 31, 2016. |

| |

• |

|

Excalibur IP Assets—The fair value of the Excalibur IP Assets will be estimated using a combination of the market approach and income approaches, giving equal weighting to each approach. This combination is deemed

to be the most indicative of the Excalibur IP Assets estimated fair value in an orderly transaction between market participants. Under the market approach, the Fund utilizes publicly-traded comparable market transaction information to determine a

price per patent that is used to value the patent portfolio. Under the income approach, the Fund determines fair value based on estimated future cash flows of the patent portfolio discounted by an estimated weighted-average cost of capital,

reflecting the overall level of inherent risk of the patent portfolio and the rate of return a market participant would expect to earn. The Fund will base cash flow projections for the patent portfolio using a forecast of cash flows over the

expected life of the patent portfolio. The forecast and related assumptions were derived from market reports and publicly available market information. |

| |

• |

|

Warrants will be valued using the Black-Scholes model using assumptions for the expected dividend yield, risk-free interest rate, expected volatility and expected life. The warrants will be categorized in level 3.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fair Value Accounting Policies $ in

000s June 16, 2017* |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Investment shares in non-controlled affiliates |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Investment shares of unaffiliated

issuers(1)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Warrants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment in securities of unaffiliated

issuers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Money Market Funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed Income Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial Paper |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Certificates of Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Agency Bonds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US Government Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sovereign Government Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment in controlled affiliate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Excalibur(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Assets at Fair Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized loss on forward foreign currency contracts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Financial Assets and Liabilities at Fair Value |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Table to be completed by amendment filed within 90 days of the date of this filing. |

8

| (1) |

Recorded as part of “Investments in securities of unaffiliated issuers” in the Unaudited Pro Forma Consolidated Statement of Assets and Liabilities of the Fund Reflecting Investment Company Accounting

Principles. |

| (2) |

The Alibaba Shares were valued at the closing price of the Alibaba ADS traded on the NYSE as of June 16, 2017. The Yahoo Japan Shares were valued at the closing price of the Yahoo Japan Shares on the Tokyo Stock

Exchange on June 16, 2017. |

| (3) |

Excalibur assets relate to the Fund’s patent portfolio. The Excalibur IP Assets are valued based on market inputs and annual valuation reports conducted by advisory firms which specialize in such activities.

|

Foreign Currency

Foreign-denominated

assets, including investment securities, will be translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies will be

translated into U.S. dollars at the exchange rate in effect on the transaction date. The Fund may hedge against Yen currency risk in connection with dividends received or expected to be received from Yahoo Japan, which are denominated in Yen.

The effects of exchange rate fluctuations on investments will be included with the net realized and unrealized gain (loss) on investment securities. Other

foreign currency transactions resulting in realized and unrealized gain (loss) will be disclosed separately.

Convertible Senior Notes

The Convertible Notes will be carried at their original issuance value, net of unamortized debt discount, and will not be marked to market each period. The

estimated fair value of the Convertible Notes as of December 31, 2016 was approximately $1.3 billion. The estimated fair value of the Convertible Notes was determined on the basis of quoted market prices observable in the market.

Other

The Fund will record security transactions based

on the trade date. Dividend income will be recognized on the ex-dividend date, and interest income will be recognized on an accrual basis. Discounts and premiums on securities purchased will be accreted and amortized over the lives of the respective

securities. Withholding taxes on foreign dividends will be provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Realized gains and losses from security transactions will be based on the

identified costs of the securities involved.

Approximately 24 percent of the Fund’s Alibaba Shares are held directly by the Fund and approximately

76 percent are held indirectly through Altaba HK, a wholly owned subsidiary of the Fund that engages in no other business or operations, and owns no other assets other than de minimis cash. The Fund will consolidate Altaba HK.

Fund expenses will be accrued in the period to which they relate based on estimates performed by management and adjustments are made when actual amounts are

known.

9

INVESTMENT OBJECTIVE AND POLICIES

Investment Objective

The Fund seeks to track the

combined investment return of the Alibaba Shares and the Yahoo Japan Shares it owns.

In addition to the Alibaba Shares and the Yahoo Japan Shares, the

Fund also owns the Minority Investments, Excalibur (which owns the Excalibur IP Assets) and the Marketable Debt Securities Portfolio. The Fund currently intends to seek to sell the Minority Investments over time. The Fund also currently intends to

seek to sell Excalibur, though the Fund may seek to separately sell certain of the Excalibur IP Assets or to license the Excalibur IP Assets if the Board believes that doing so is in the best interest of the Fund’s stockholders. The Fund

currently intends to return substantially all of its cash to stockholders over time through stock repurchases and distributions, although the Fund will retain sufficient cash to satisfy its obligations to creditors and for working capital. The

timing and method of any return of capital will be determined by the Board. Stock repurchases may take place in the open market, including under Rule 10b5-1 plans or in a tender offer, or in privately negotiated transactions, including structured

and derivative transactions such as accelerated share repurchase transactions. The Fund currently anticipates that the amount of cash to be retained by the Fund will be at least $1.4 billion, which is the minimum amount necessary to satisfy the

Fund’s obligations under the Convertible Notes. However, the Fund’s obligations to creditors and working capital requirements may vary over time and may be materially greater than such amount, depending upon, among other factors, the cost

of cash-settling any conversion obligations under the Convertible Notes, the Fund’s potential obligations with respect to respect to potential liabilities, and whether the income from the Fund’s investments is sufficient to cover its

expenses. Until the Minority Investments, Excalibur (or the Excalibur IP Assets), the Marketable Debt Securities Portfolio, and any other assets are sold and until any cash is returned to investors, these assets may cause the Fund’s returns to

deviate from its current investment policy of tracking the combined investment return of the Alibaba Shares and the Yahoo Japan Shares. No assurance can be given that all or any portion of the Minority Investments or the Excalibur IP Assets will be

sold or licensed or that the Fund will achieve its investment objective. The Fund may hold all or any portion of its assets, including cash, for an indefinite period of time.

The Fund’s investment objective is not fundamental and may be changed without notice to stockholders.

Investment Policies

Consistent with its current

investment objective, the Fund currently does not intend to sell its Alibaba Shares or Yahoo Japan Shares in response to changes in the market price of those shares, though it reserves the right to do so. The Fund may, however, sell all or a portion

of such shares to return capital to its stockholders or to seek to reduce any discount or increase any premium from net asset value at which the Fund’s common stock may trade if the Board believes the benefit to stockholders would outweigh the

cost, including any taxes payable by the Fund, of doing so. The Fund also may sell such shares to satisfy its obligations to creditors or to pay expenses. The Board currently believes that it is more likely that capital may be returned from a sale

of Yahoo Japan Shares than Alibaba Shares, though no assurance can be given in this regard or that any such shares will be sold to return capital. The Fund does not currently anticipate making new investments other than the purchase of short term

investment grade debt securities due to turnover in its Marketable Debt Securities Portfolio, for ordinary course cash management purposes or to protect or enhance the value of an Initial Asset.

Investment Guidelines for the Marketable Debt Securities Portfolio

The Fund has hired BlackRock Advisors, LLC (“BlackRock”) and Morgan Stanley Smith Barney LLC (“Morgan Stanley” and,

together with BlackRock, the “External Advisers”) as external investment advisers to manage the Marketable Debt Securities Portfolio. Each External Adviser will manage approximately half of the Marketable Debt Securities Portfolio.

The following guidelines apply to each External Adviser, individually, without reference to the portion of the Marketable Debt Securities Portfolio managed by the other.

10

The Fund’s objectives in managing the Marketable Debt Securities Portfolio are preservation of capital,

maintenance of liquidity and achieving optimum yields in relation to the applicable guidelines. The Marketable Debt Securities Portfolio is not traded for short-term speculative purposes. The guidelines limit the weighted average effective duration

of the Marketable Debt Securities Portfolio to 2 years.

Permitted investments include U.S. government and U.S. government-sponsored agency securities

(excluding mortgage-backed securities), repurchase agreements with maturities not in excess of seven days collateralized by U.S. government securities and permitted U.S. government-sponsored agency securities, debt securities of corporations and

commercial banks, non-U.S. sovereign debt rated Aaa/AAA by Moody’s, S&P and/or Fitch (denominated in U.S. dollars and traded in the U.S.), direct obligations of supranational organizations rated Aaa/AAA by Moody’s, S&P and/or Fitch

(denominated in U.S. dollars and traded in the U.S.), foreign agency securities guaranteed by foreign governments rated Aaa/AAA by Moody’s, S&P and/or Fitch (denominated in U.S. dollars and traded in the U.S.), tax exempt securities and

money market funds.

Ineligible investments include mortgage-backed securities, asset-backed securities, auction rate securities, variable rate demand

obligations, extendable debt securities, subordinated corporate debt securities, taxable securities with maturities in excess of 3 years + 2 weeks, tax-exempt securities with maturities in excess of 2 years +2 weeks, securities with short-term

ratings below P-1/A-1/F-1 by Moody’s, S&P and/or Fitch, securities with maturities less than or equal to 2 years with ratings below A3/A- by Moody’s, S&P and/or Fitch, securities with maturities greater than 2 years and less than 3

years with ratings below A2/A by Moody’s, S&P and/or Fitch and investments in non-U.S. sovereign debt, direct obligations of supranational organizations and foreign agency securities guaranteed by foreign governments in each case rated

below Aaa/AAA by Moody’s, S&P and/or Fitch or which are not denominated in U.S. dollars or not traded in the U.S.

The guidelines require all

debt securities to be rated by at least two of Moody’s, S&P and Fitch, and that split-rated securities will be deemed to have the lower rating. The Fund expects that ratings will be monitored on a continuous basis and the External Advisers

will be required to notify the Fund in the event of any downgrades. With respect to tax-exempt securities, the guidelines apply the minimum ratings requirements described in the forgoing to the underlying assets of the municipal security and

disregard any ratings enhancement obtained through insurance provided by monoline insurance companies. Additionally, the guidelines require that any investment included in the Marketable Debt Securities Portfolio be denominated in U.S. dollars and

any corporate debt have a minimum issue size of $200 million.

Hedging and

Derivative Instruments

Consistent with the Fund’s current investment policies, the Fund currently does not intend to hedge its risk of owning the

Alibaba Shares and Yahoo Japan Shares or otherwise enter into derivative transactions. Notwithstanding this current intention, the Fund reserves the right to hedge such risk generally and specifically in connection with transactions relating to the

Alibaba Shares or Yahoo Japan Shares, in connection with dividends received or expected to be received from Yahoo Japan denominated in Yen, or in connection with repurchases of the Fund’s common stock to return capital to investors.

Loans of Portfolio Securities

The Fund may lend

its Alibaba Shares, Yahoo Japan Shares, or other eligible portfolio securities (collectively, the “Eligible Portfolio Securities”) to generate income. Such income may be used for working capital purposes, to pay dividends to

stockholders, or to repurchase the Fund’s common stock if and to the extent authorized by the Board from time to time. The Fund has no current intention of lending its Eligible Portfolio Securities to generate income to be used to purchase

additional investment securities, though it retains the right to do so. Lending Eligible Portfolio Securities may cause the Fund’s returns to deviate from its investment objective of tracking the combined investment return of the Alibaba Shares

and the Yahoo Japan Shares.

11

Consistent with applicable regulatory requirements, the Fund may lend Eligible Portfolio Securities to

broker-dealers or financial institutions; provided that such loans are callable at any time by the Fund (subject to notice provisions described below), and are at all times secured by cash or cash equivalents, which are earmarked or segregated

pursuant to applicable regulations, and that are at least equal to the market value, determined daily, of the loaned Eligible Portfolio Securities. Any loans of the Eligible Portfolio Securities by the Fund will be collateralized in accordance with

applicable regulatory requirements and no loan will cause the value of all loaned Eligible Portfolio Securities to exceed one-third of the value of the Fund’s total assets.

A loan of Eligible Portfolio Securities generally may be terminated by the borrower on one business day’s notice, or by the Fund on five business

days’ notice. If the borrower fails to deliver the loaned Eligible Portfolio Securities within five days after receipt of notice, the Fund could use the collateral to purchase replacement Eligible Portfolio Securities while holding the borrower

liable for any excess of replacement cost over collateral. As with any extensions of credit, there are risks of delay in recovery, and in some cases even loss of rights in the collateral should the borrower of the Eligible Portfolio Securities fail

financially. However, loans of Eligible Portfolio Securities will be made only to firms deemed by the Fund’s management to be creditworthy and when the income that can be earned from such loans justifies the attendant risks. The Board will

oversee the creditworthiness of the contracting parties on an ongoing basis.

Upon termination of the loan, the borrower is required to return the

Eligible Portfolio Securities to the Fund. Any gain or loss in the market price during the loan period would inure to the Fund. If the counterparty to the loan petitions for bankruptcy or becomes subject to the U.S. Bankruptcy Code, the law

regarding the rights of the Fund is unsettled. As a result, under extreme circumstances, there may be a restriction on the Fund’s ability to sell the collateral, and the Fund would suffer a loss. When voting or consent rights that accompany

loaned Eligible Portfolio Securities pass to the borrower, the Fund will follow the policy of calling the loaned securities, to be delivered within one day after notice, to permit the exercise of such rights if the matters involved would have a

material effect on the Fund’s investment in the Eligible Portfolio Securities. The Fund will pay reasonable finder’s, administrative, and custodial fees in connection with a loan of its Eligible Portfolio Securities.

The Fund’s Alibaba Shares are currently in the form of ordinary shares. Alibaba ordinary shares are not listed for trading on the NYSE or any

other national securities exchange. In order to lend Alibaba Shares to investors, the Fund must first deposit the ordinary shares with the Depositary (as defined in the section of this registration statement entitled “Description of Initial

Assets—Alibaba”) in exchange for Alibaba ADS and then lend the Alibaba ADS. The Fund would incur expenses in connection with exchanging its Alibaba ordinary shares for Alibaba ADS which would reduce the gross income earned from lending

the Alibaba ADS.

Market Price of Shares

Shares of closed-end management investment companies like the Fund frequently trade at a discount from net asset value. The Board may seek to reduce any such

discount or increase any premium to net asset value at which the Fund’s common stock may trade through repurchases of the Fund’s common stock in the open market, through tender offers or through any other means available to the Fund. The

determination of whether to repurchase shares of the Fund or to engage in any other actions to seek to reduce a discount or increase a premium will be in the sole discretion of the Board and there can be no assurance that the Fund will repurchase

its shares or take any other actions to seek to reduce any discount or increase a premium at which its shares may trade.

Non-Diversified Status

The Fund’s investment in the Alibaba Shares and the Yahoo Japan Shares cause it to be a non-diversified investment company. As a result, there is

no limit on the proportion of the Fund’s assets that may be invested in securities of a single issuer and the Fund’s assets are primarily invested in Alibaba Shares and Yahoo Japan Shares. To the extent that the Fund’s investments in

Alibaba and Yahoo Japan are a large portion of its assets, the

12

Fund’s returns may fluctuate as a result of any single economic, political, or regulatory occurrence affecting, or in the market’s assessment of, Alibaba or Yahoo Japan to a greater

extent than would be the case for a diversified investment company.

Industry Concentration

The Fund’s investment in the Alibaba Shares and the Yahoo Japan Shares cause it to concentrate its investments in securities issued by companies in the

online services and e-commerce industry. The 1940 Act requires the Fund to obtain stockholder approval to invest less than 25 percent of its total assets in companies in the online services and e-commerce industry. The Fund has no current intention

of investing less than 25 percent of its total assets in companies in the online services and e-commerce industry.

Taxation of the Fund

The Fund is currently not eligible to be treated as a “regulated investment company” under the Code, as a result of the Fund’s

concentrated ownership of Alibaba Shares. Instead, the Fund is currently treated as a regular corporation, or a “C” corporation, for U.S. federal income tax purposes and, unlike most registered investment companies, will be subject to

corporate income tax to the extent the Fund recognizes taxable income. As a result, the Fund will take into account the tax consequences of any change to its investment portfolio. The Fund will record a deferred tax liability based on an assumed

effective combined federal and state corporate tax rate on capital gains which will impact the net asset value of the Fund’s common stock. In addition, for U.S. federal income tax purposes, distributions by the Fund of cash or property in

respect of the Fund’s common stock will generally be taxable to stockholders that are U.S. holders (as defined in the section of this registration statement entitled “U.S. Federal Income Tax Considerations”).

Changes to Current Investment Objective and Policies

The

Fund’s current investment objective and policies described above were adopted based on current statutes, regulations, and policies applicable to United States financial markets and institutions, corporation taxation, and international trade.

The Fund cannot predict which statutes, regulations, or policies will be changed or repealed or, if changes are made, their effect on the value of the Fund’s assets. Because the Fund’s investment objective and policies stated above are not

fundamental, the Fund retains the right to change them in response to any such changes or for any other reason if the Board of Directors determines such changes to be in the best interests of stockholders. Examples of potential changes to the

Fund’s investment objective and policies include: retaining assets that otherwise would have been sold; selling assets that otherwise would have been retained; selling assets on an accelerated or delayed time frame; diversifying the Fund’s

assets to seek to minimize losses, to enhance gains or to seek to become a “regulated investment company” under the Code; and changing the way the Fund uses derivatives.

Subsidiaries of the Fund

The Fund’s investment

policies and risks as described in this registration statement reflect the aggregate operations of the Fund, Altaba HK, and Excalibur. The Fund will comply with the provisions of the 1940 Act governing investment policies, capital structure, and

borrowings on an aggregate basis with Altaba HK and Excalibur. Altaba HK and Excalibur will comply with the provisions of Section 17 of the 1940 Act relating to affiliated transactions. The Fund and Altaba HK will comply with the requirements

of the 1940 Act relating to the custody of a registered investment company’s assets.

13

DESCRIPTION OF INITIAL ASSETS

Alibaba

Alibaba is an online and mobile commerce

company. Alibaba’s businesses are comprised of core commerce, cloud computing, mobile media and entertainment, and other innovation initiatives. Alibaba’s core commerce business is comprised of marketplaces operating in three areas: retail

commerce in the People’s Republic of China (the “PRC”); wholesale commerce in the PRC; and international and cross-border commerce.

| |

• |

|

PRC Retail Commerce: In its public filings, Alibaba described its retail commerce business in the PRC as being comprised of (1) Taobao Marketplace, the PRC’s largest mobile commerce destination by

monthly active users in 2015, (2) Tmall, the PRC’s largest third-party platform for brands and retailers by monthly active users in 2015, (3) Juhuasuan (clauses (1), (2) and (3) collectively, the “PRC Retail

Marketplaces”), (4) Rural Taobao, and (5) merchant services that enable merchants to manage engagement with their customers. Alibaba reported that there were 454 million active buyers on the PRC Retail

Marketplaces for the 12 months ended March 31, 2017. Alibaba also reported that the PRC Retail Marketplaces generated a combined gross merchandise volume of RMB3,092 billion ($485 billion) in the 12 months ended March 31, 2016.

|

| |

• |

|

PRC Wholesale Commerce: Alibaba operates 1688.com, a PRC wholesale marketplace. |

| |

• |

|

International Commerce: Alibaba operates Alibaba.com, which Alibaba reports was the PRC’s largest global online wholesale marketplace in 2015 by revenue, and AliExpress, a global consumer marketplace.

Alibaba also acquired a controlling stake in Lazada, which operates e-commerce platforms in Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. |

Alibaba operates Alibaba Cloud Computing, which Alibaba reported was the PRC’s largest provider of public cloud services in 2015 by revenue. Alibaba also

reported that Alibaba Cloud Computing had over 2.3 million customers, as of March 31, 2016. As of March 31, 2017, Alibaba also reported that Alibaba Cloud Computing had 874,000 paying customers.

Alibaba has also developed an emerging business in mobile media and entertainment through three distribution platforms, UCWeb mobile media, game publishing

and multi-screen entertainment, and content creation and production companies in film, music, and sports.

Alibaba’s other innovation initiatives

include YunOS Operating System, a cloud-based mobile operating system for smartphones and other devices, AutoNavi, a provider of digital map, navigation and location-based services in the PRC, DingTalk, its proprietary enterprise communications app,

and Alibaba Health, its vehicle to bring innovative solutions to the healthcare industry.

Alibaba provides fundamental technology infrastructure and

marketing reach to help merchants, brands, and other businesses that provide products, services, and digital content to leverage the power of the Internet to engage with their users and customers.

The foregoing description of Alibaba’s business was derived from Alibaba’s annual report for the fiscal year ended March 31, 2016, (the

“Alibaba 2016 Annual Report”), which is filed with the SEC and

available on the SEC’s website at

https://www.sec.gov/Archives/edgar/data/1577552/000104746916013400/a2228766z20-f.htm and certain figures were updated according to Alibaba’s quarterly report for the quarter ended March 31, 2017, (the “Alibaba March 2017

Quarterly Report”), which is filed with the SEC and available on the SEC’s website at https://www.sec.gov/Archives/edgar/data/1577552/000110465917033787/a17-13821_16k.htm. The foregoing description is qualified in

its entirety by reference to the Alibaba 2016 Annual Report and the Alibaba March 2017 Quarterly Report.

14

In September 2014, Alibaba completed an initial public offering of the Alibaba ADS. As a public company,

Alibaba files reports with the SEC containing financial and other material information about its business and risks relating to its business. This information may be obtained at the SEC’s website at

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001577552&owner=exclude&count=40. You should review information filed by Alibaba with the SEC because the value of the Fund’s common stock will be heavily

dependent upon and influenced by the value of Alibaba Shares. All information with respect to Alibaba in this registration statement is derived from Alibaba’s public filings with the SEC. Such information is provided for informational purposes

only and Yahoo makes no representation and assumes no responsibility for the accuracy or completeness of such information.

The Alibaba ADS

are traded on the NYSE under the ticker symbol “BABA.” On December 30, 2016, the closing price of the Alibaba ADS on the NYSE was $87.81 per share. Each Alibaba ADS represents one Alibaba Share. Citibank N.A., as the depositary

for the Alibaba ADS, is the holder of the Alibaba Shares underlying the Alibaba ADS. Alibaba ADS holders have rights granted to them in the deposit agreement among Alibaba, the depositary, and holders and beneficial owners of Alibaba ADS from time

to time. The Fund’s Alibaba Shares are currently in the form of ordinary shares. Alibaba ordinary shares are not listed for trading on the NYSE or any other national securities exchange. Accordingly, in order to sell Alibaba Shares through the

NYSE or to lend them to investors, the Fund must first deposit the ordinary shares with Citibank, N.A. Hong Kong branch, as custodian for Citibank, N.A. (the “Depositary”), in exchange for Alibaba ADS. The Fund may then sell or lend

the Alibaba ADS in open market transactions without registration in reliance on Rule 144 under the Securities Act of 1933 (the “1933 Act”). The Fund would incur expenses in connection with exchanging its Alibaba ordinary shares

for Alibaba ADS which would reduce the Fund’s total return from a sale of the Alibaba ADS on the NYSE.

Yahoo Japan

Yahoo Japan provides a wide range of online services to Internet users in Japan, from search and information listing to community and e-commerce.

Yahoo Japan was formed as a joint venture between Yahoo and SoftBank Group Corp. (“SoftBank”) in 1996. As of December 31, 2016,

Yahoo and SoftBank (including its subsidiaries) owned approximately 36 percent and 43 percent, respectively, of outstanding Yahoo Japan Shares. In addition, pursuant to the joint venture agreement between Yahoo and SoftBank, each of Yahoo and

SoftBank has the right to appoint two representatives to the Board of Directors of Yahoo Japan as long as such party continues to hold at least five percent of Yahoo Japan’s issued and outstanding shares, although currently five of Yahoo

Japan’s directors are officers or directors of SoftBank.

Yahoo Japan’s business operations are categorized into the following three

segments: (1) Marketing Solutions Business, (2) Consumer Business, and (3) Other Business.

| |

• |

|

The Marketing Solutions Business segment is chiefly comprised of advertising-related services such as paid search and display advertising. |

| |

• |

|

The Consumer Business segment provides e-commerce related services such as auction services and Internet shopping, membership services, information listing services, game-related services, and real-estate related

services. |

| |

• |

|

The Other Business segment offers financial and payment related services, which include Yahoo Japan’s credit card business and online payment system, cloud-related services, and corporate services, including data

center-related operations. |

The foregoing description of Yahoo Japan’s business was derived from information available on Yahoo

Japan’s English language website (the “Yahoo Japan Website”) at http://ir.yahoo.co.jp/en/. This description is qualified in its entirety by reference to the information on the Yahoo Japan Website.

15

You are encouraged to review the information set forth on the Yahoo Japan Website for additional

information about Yahoo Japan’s business, management, results of operations, financial condition, and risks. This information may be obtained on the Yahoo Japan Website on the Investor Relations page at http://ir.yahoo.co.jp/en/. You

should review the risk factors affecting the businesses and operations of Yahoo Japan available on the Yahoo Japan Website at http://ir.yahoo.co.jp/en/policy/risk.html. You should also review Yahoo Japan’s English language press releases

available on the Yahoo Japan Website on the Press Releases page at http://pr.yahoo.co.jp/en/. You should review information made available by Yahoo Japan because the value of the Fund’s common stock will be influenced by the value of the

Yahoo Japan Shares. All information with respect to Yahoo Japan in this registration statement is derived from information available on the Yahoo Japan Website. Such information is provided for informational purposes only, and Yahoo makes no

representation and assumes no responsibility for the accuracy or completeness of such information.

Yahoo Japan Shares are traded on the Tokyo

Stock Exchange. On December 30, 2016 (the last trading day before December 31, 2016), the closing price of the Yahoo Japan Shares on the Tokyo Stock Exchange was ¥449.00 per share, or approximately $3.82 per share based on the

closing Yen/USD foreign exchange rate on such date. Yahoo Japan declared a year-end cash dividend of ¥8.86 or approximately $0.0792 (based on the Yen/USD foreign exchange rate as of March 31, 2017) per Yahoo Japan Share for the fiscal

year ended March 2017 and has publicly stated that it intends to maintain its annual per-share dividends at this level until March 2019.

Marketable

Debt Securities Portfolio

As of December 31, 2016, the Marketable Debt Securities Portfolio consisted of cash equivalents and marketable debt

securities with a fair value totaling approximately $7.2 billion. The Marketable Debt Securities Portfolio consists chiefly of investments in commercial paper, short-term and long-term corporate debt, certificates of deposit and shares of money

market investment vehicles. The Marketable Debt Securities Portfolio also consists, to a lesser degree, of investments in U.S. agency bonds, other U.S. Treasuries and foreign sovereign debt. The corporate debt and commercial paper included in the

Marketable Debt Securities Portfolio is allocated among a variety of issuers in the financial, industrial and utility sectors, and the certificates of deposits are allocated among a variety of banks.

The net proceeds of the Sale Transaction, approximately $4.5 billion (subject to certain pre-closing and post-closing adjustments and which will be

reduced by amounts used to repurchase Yahoo common stock pursuant to the Tender Offer), will be added to the Marketable Debt Securities Portfolio and will be invested in accordance with the investment policies and guidelines applicable to the

Marketable Debt Securities Portfolio (See “Investment Objective and Policies—Investment Guidelines for the Marketable Debt Securities Portfolio”). The Fund has hired the External Advisers to manage the Marketable Debt

Securities Portfolio.

Excalibur IP Assets

The Excalibur IP Assets consist of a portfolio of patent assets that are not core to Yahoo’s operating business and that are substantially concentrated in

the following categories: Search/Information Retrieval; Online Advertising; Cloud Computing; Network Infrastructures; Communication Technologies; Data Center Cooling; Machine Learning; Mobile; User Interface; and E-Commerce. The Excalibur IP Assets

were identified as not core to Yahoo’s operating business because they were redundant with similar assets that remained with Yahoo’s operating business for defensive protection.

Verizon Communications Inc. has received, for its benefit and that of its current and certain of its future affiliates, a non-exclusive, worldwide, perpetual,

royalty-free license to the Excalibur IP Assets.

16

FUNDAMENTAL INVESTMENT RESTRICTIONS

The Fund has adopted restrictions and policies relating to the investment of its assets and its activities. As required by the 1940 Act, certain of the

restrictions are fundamental and may not be changed without the approval of a 1940 Act Majority of the Fund’s outstanding voting securities, including the approval of a 1940 Act Majority of the Fund’s outstanding shares of preferred stock,

if any, voting as a separate class. A “1940 Act Majority” means the lesser of (a) 67 percent or more of the Fund’s outstanding voting securities present at a stockholders meeting, if the holders of more than 50 percent of

the Fund’s outstanding voting securities are present or represented by proxy at the meeting, or (b) more than 50 percent of the Fund’s outstanding voting securities. Under these fundamental investment restrictions, the Fund may not:

| |

(1) |

Concentrate its investments in a particular industry, as that term is used in the 1940 Act, except that the Fund will concentrate its investments in companies operating in the online services and e-commerce industry.

|

| |

(2) |

Borrow money, except as permitted under the 1940 Act. |

| |

(3) |

Issue senior securities to the extent such issuance would violate the 1940 Act. |

| |

(4) |

Purchase or hold real estate, other than for use in the operations of the Fund and its subsidiaries. |

| |

(5) |

Underwrite securities issued by others, except to the extent that the sale of portfolio securities (including without limitation the Alibaba Shares and Yahoo Japan Shares) by the Fund may be deemed to be an underwriting

or as otherwise permitted by applicable law. |

| |

(6) |

Purchase or sell commodities or commodity contracts, except as permitted by the 1940 Act. |

| |

(7) |

Make loans, except to the extent permitted by the 1940 Act. |

The following explanations of the Fund’s

fundamental investment restrictions are not considered to be part of the Fund’s fundamental investment restrictions, and are subject to change without stockholder approval.

With respect to the fundamental policy relating to concentration set forth in (1) above, the 1940 Act does not define what constitutes

“concentration” in an industry. The SEC staff has taken the position that investment of 25 percent or more of an investment company’s total assets in one or more issuers conducting their principal activities in the same industry

or group of industries constitutes concentration. It is possible that interpretations of concentration could change in the future. The policy will be interpreted to permit unlimited investment in pooled investment vehicles such as exchange-traded

funds that invest primarily in securities of companies operating in the online services and e-commerce industry. The policy in (1) above will be interpreted to refer to concentration as that term may be interpreted from time to time. The policy

also will be interpreted to permit investment without limit in the following, if and to the extent the Fund were to invest more than 25 percent of its total assets in any of the following instruments: securities of the U.S. government and its

agencies or instrumentalities; tax exempt securities of state, territory, possession, or municipal governments and their authorities, agencies, instrumentalities, or political subdivisions; and repurchase agreements collateralized by any such

obligations. Accordingly, issuers of the foregoing securities will not be considered to be members of any industry. There also will be no limit on investment in issuers domiciled in a single jurisdiction or country. Finance companies will be

considered to be in the industries of their parents if their activities are primarily related to financing the activities of the parents. Each foreign government will be considered to be a member of a separate industry. The policy also will be

interpreted to give broad authority to the Fund as to how to classify issuers within or among industries. Compliance with any percentage limitations in the Fund’s investment policies will be determined at the time of investment. The Fund will

not be required to purchase or sell securities to comply with such percentage limitations due to changes in the value of its investments.

With respect to

the fundamental policy relating to borrowing money set forth in (2) above, the 1940 Act permits the Fund to borrow money in amounts of up to one-third of the Fund’s total assets for any purpose, and to borrow up to five percent of the

Fund’s total assets for temporary purposes. The Fund’s total assets include the amounts

17

being borrowed and retained by the Fund in cash, securities, or other property. To limit the risks attendant to borrowing, the 1940 Act requires the Fund to maintain at all times an “asset

coverage” of at least 300 percent of the amount of its borrowings and of at least 200 percent of the liquidation preference of any preferred stock that it issues. The Fund currently has no shares of preferred stock outstanding, and the Fund has

no current intention to issue preferred stock. Asset coverage means the ratio that the value of the Fund’s total assets (including amounts borrowed), minus liabilities other than borrowings, bears to the aggregate amount of all borrowings.

Borrowing money to increase portfolio holdings is known as “leveraging.” Certain trading practices and investments, such as reverse repurchase agreements, may be considered to be borrowings or involve leverage, and thus are subject to the

1940 Act restrictions. In accordance with SEC staff guidance and interpretations, when the Fund engages in borrowings or trading practices, the Fund, instead of maintaining asset coverage of at least 300 percent, may segregate or earmark liquid

assets, or enter into an offsetting position, in an amount at least equal to the Fund’s exposure, on a mark-to-market basis, to the transaction (as calculated pursuant to requirements of the SEC). The policy in (2) above will be

interpreted to permit the Fund to engage in borrowing or trading practices and investments that may be considered to be borrowing or to involve leverage to the extent permitted by the 1940 Act, and to permit the Fund to segregate or earmark liquid

assets or enter into offsetting positions in accordance with SEC staff guidance and interpretations. Short-term credits necessary for the settlement of securities transactions and arrangements with respect to securities lending will not be

considered to be borrowings under the policy. Practices and investments that may involve leverage but are not considered to be borrowings are not subject to the policy. Although the Fund reserves the right to borrow money to the extent permitted by

the 1940 Act and has outstanding Convertible Notes, it currently intends to borrow additional money to fund working capital and pay other expenses of the Fund. The Fund also may borrow to repurchase its common stock and pay dividends to its

stockholders if and to the extent authorized by the Board from time to time. The Fund does not currently intend to use the proceeds of any borrowing to purchase additional investment securities, though it retains the right to do so.

With respect to the fundamental policy relating to underwriting set forth in (5) above, the 1940 Act does not prohibit the Fund from engaging in the

underwriting business or from underwriting the securities of other issuers. A fund engaging in transactions involving the acquisition or disposition of portfolio securities may be considered to be an underwriter under the 1933 Act. Although it is

not believed that the application of the 1933 Act provisions described above would cause the Fund to be engaged in the business of underwriting, the policy in (5) above will be interpreted not to prevent the Fund from engaging in transactions

involving the acquisition or disposition of portfolio securities, regardless of whether the Fund may be considered to be an underwriter under the 1933 Act or is otherwise engaged in the underwriting business to the extent permitted by applicable

law.

With respect to the fundamental policy relating to lending set forth in (7) above, the 1940 Act does not prohibit the Fund from making loans

(including lending its securities); however, SEC staff interpretations currently prohibit registered investment companies from lending more than one-third of their total assets (including lending their securities), except through the purchase of

debt obligations or the use of repurchase agreements. In addition, collateral arrangements with respect to options, forward currency, futures transactions, and other derivative instruments (as applicable), as well as delays in the settlement of

securities transactions, if the Fund were ever to use such derivative instruments, would not be considered loans. The Fund currently does not intend to make loans, except that it may lend its Eligible Portfolio Securities to generate income for

working capital, to pay dividends to stockholders or to repurchase the Fund’s common stock if and to the extent authorized by the Board from time to time.

18

LEVERAGE

Convertible Notes

As of the date of this filing, the

Fund has approximately $1.4 billion in principal amount of the Convertible Notes outstanding. The Fund reserves the right to repurchase the Convertible Notes from time to time, including through tender offers.

The Convertible Notes are senior unsecured obligations of the Fund that rank senior in right of payment to any Fund indebtedness that is expressly

subordinated in right of payment to the Convertible Notes. The Convertible Notes do not bear regular interest, and the principal amount of the Convertible Notes will not accrete. The Convertible Notes mature on December 1, 2018, unless

previously purchased or converted in accordance with their terms prior to such date. The Fund may not redeem the Convertible Notes prior to maturity. No sinking fund is provided for the Convertible Notes. The Convertible Notes are convertible,

subject to certain conditions, into shares of the Fund’s common stock at an initial conversion rate of 18.7161 shares per $1,000 principal amount of Convertible Notes (which is equivalent to an initial conversion price of approximately $53.43

per share), subject to adjustment upon the occurrence of certain events. Upon conversion of the Convertible Notes, holders will receive cash, shares of the Fund’s common stock or a combination thereof, at the Fund’s election.

Holders of the Convertible Notes may convert them at certain times and upon the occurrence of certain events in the future, as described in the

Indenture, dated as of November 26, 2013 (the “Indenture”), between the Fund and The Bank of New York Mellon Trust Company, N.A., as trustee. Prior to the close of business on the business day immediately preceding

September 1, 2018, the Convertible Notes will be convertible only upon the occurrence of certain events and during certain periods. These events include the following: (i) the price per $1,000 principal amount of the Convertible Notes

falls below a certain threshold compared to the price of the Fund’s common stock multiplied by the applicable conversion rate for a certain period of time; (ii) the Fund issues rights, options, or warrants to all or substantially all of

the Fund’s common stockholders entitling them for a period of not more than 45 calendar days after the announcement date of such issuance, to subscribe for or purchase shares of the Fund’s common stock at a price that is less than the

average price of the Fund’s common stock over the last 10 consecutive trading days ending on and including the trading day immediately prior to the date of the announcement of the issuance; (iii) the Fund elects to distribute to

substantially all of the Fund’s common stockholders the Fund’s assets, securities, or rights to purchase securities of the Fund, which distribution has a per share value, as determined in good faith by the Board or a committee thereof,

exceeding 10 percent of the last reported sale price of the Fund’s common stock on the trading day immediately prior to the date of the announcement of the distribution; (iv) the occurrence of certain fundamental transactions or

events (each, a “Fundamental Change”); (v) the Fund is a party to a consolidation, merger, binding share exchange, or transfer or lease of all or substantially all of its assets pursuant to which the Fund’s common stock

would be converted into cash, securities, or other assets; or (vi) the price of the Fund’s common stock for at least 20 trading days (whether or not consecutive) during the period of 30 consecutive trading days ending on the last trading

day of the immediately preceding calendar quarter is greater than or equal to 130 percent of the conversion price on each trading day. On or after September 1, 2018 until the close of business on the second scheduled trading day immediately

preceding December 1, 2018, holders may convert the Convertible Notes at any time, regardless of the foregoing circumstances.

As of the date

of this registration statement, none of the conditions allowing holders of the Convertible Notes to convert had been met.

If the Fund undergoes a

Fundamental Change, subject to certain conditions, holders of the Convertible Notes may require the Fund to purchase for cash all or any portion of the Convertible Notes. The Fundamental Change purchase price would be 100 percent of the principal

amount of the Convertible Notes to be purchased.

19

The Indenture contains customary terms and covenants, including that upon certain events of default occurring and

continuing, either the Indenture trustee or the holders of at least 25 percent in principal amount of the outstanding Convertible Notes may declare 100 percent of the principal of and accrued and unpaid special interest, if any, on all the

Convertible Notes to be due and payable. Events of default include the following: (i) default in any payment of certain special interest on any Convertible Note and the default continues for a period of 30 days; (ii) default in the payment

of principal of any Convertible Note when such payment is due and payable according to the terms of the Indenture; (iii) failure by the Fund to comply with its obligation to convert the Convertible Notes in accordance with the Indenture and

such failure continues for a period of five business days; (iv) failure by the Fund to issue notice regarding a Fundamental Change or a specified corporate event in accordance with the Indenture when due; (v) failure by the Fund to comply

with its obligations under Article 11 of the Indenture related to consolidations, mergers and sales of assets; (vi) failure by the Fund for 60 days after written notice has been received by the Fund to comply with any of its agreements

contained in the Convertible Notes or the Indenture; (vii) under certain circumstances, a default by the Fund or any subsidiary of the Fund with respect to any mortgage, agreement or other instrument under which there may be outstanding, or by

which there may be secured or evidenced, any indebtedness for money borrowed in excess of $100,000,000 (or its foreign currency equivalent); or (viii) certain events of bankruptcy, insolvency or reorganization involving the Fund or any of its

material subsidiaries.

The above description of the Indenture and the Convertible Notes is a summary only and is qualified in its entirety by reference

to the Indenture (and the Form of Note included therein), which was filed as Exhibit 4.2 to Yahoo’s Annual Report on Form 10-K for the year ended December 31, 2013.

The Fund is a party to convertible note hedge transactions (“Hedge Transactions”) with certain option counterparties (the

“Option Counterparties”) to reduce the potential dilution with respect to the Fund’s common stock upon conversion of the Convertible Notes or offset any cash payment the Fund is required to make in excess of the principal

amount of converted Convertible Notes. The Hedge Transactions include call options giving the Fund the right to purchase, subject to customary anti-dilution adjustments, a certain amount of the Fund’s common stock. Separately, the Fund is also

a party to privately negotiated warrant transactions with the Option Counterparties giving them the right to purchase common stock from the Fund (the “Warrant Transactions”). The Warrant Transactions could have a dilutive effect

with respect to the Fund’s common stock to the extent that the price per share of its common stock exceeds the applicable strike price of the warrants on or prior to the expiration date of the warrants. The initial strike price of the warrants

was $71.24. Counterparties to the warrants may make adjustments to certain terms of the warrants upon the occurrence of specified events, including the announcement of the Stock Purchase Agreement, if the event results in a material change to the

trading price of Yahoo’s common stock or the value of the warrants. To date, three counterparties have given notices of adjustments reducing their warrant exercise prices. The warrants begin to expire in March 2019.

In connection with establishing their Hedge Transactions and Warrant Transactions, the Option Counterparties or their respective affiliates may have purchased

shares of the Fund’s common stock and/or entered into various derivative transactions with respect to the Fund’s common stock concurrently with or shortly after the pricing of the Convertible Notes. In addition, the Option Counterparties