UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-K

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For

the fiscal year ended December 31, 2004

OR

o TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

Commission

file number: 001-31902

SIRVA, INC.

(Exact name of registrant

as specified in its charter)

|

Delaware

|

|

52-2070058

|

|

(State of

incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

|

700 Oakmont Lane

|

|

|

|

Westmont,

Illinois

|

|

60559

|

|

(Address of

principal executive offices)

|

|

(Zip code)

|

Registrant’s telephone number, including area code:

(630) 570-3000

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Name of each exchange on which registered

|

|

Common stock, par

value $0.01 per share

|

|

New York Stock

Exchange

|

Securities registered

pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past

90 days. Yes o No x

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K is not contained herein, and

will not be contained, to the best of registrant’s knowledge, in definitive

proxy or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is an

accelerated filer (as defined in Rule 12b-2 of the

Act). Yes x No o

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting common stock

held by non-affiliates of the registrant, computed by reference to the price at

which the common stock was sold as of the close of business on June 30,

2005, was $416,771,931. Registrant does not have any nonvoting equity

securities.

As

of October 31, 2005, 73,935,717 shares of the Registrant’s common stock

were outstanding.

TABLE

OF CONTENTS

When we refer to “SIRVA”, “our company”, “the Company”,

“our”, “we” or “us”, we are referring to SIRVA, Inc., together with its

subsidiaries and their predecessors, except where the context otherwise

requires.

2

ITEM

1. BUSINESS

General

Our Securities and

Exchange Commission (“SEC”) filings, which include this Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K

and all related amendments, are available free of charge on our website at www.sirva.com and can be found by clicking on “Investors” or

“For Investors” and then “SEC Filings.” Our SEC filings are available as soon

as reasonably practicable after we electronically submit this material to the

SEC. Last year, we filed our annual Chief Executive Officer certification,

dated June 1, 2004, with the New York Stock Exchange. Attached as exhibits

to this Form 10-K, you will find certifications of our Chief

Executive Officer and Chief Financial Officer as required under Sections 302 and

906 of the Sarbanes-Oxley Act of 2002.

Global Relocation

Solutions

We are a world leader in the global relocation

industry, providing our relocation solutions (relocation services and moving

services) to a well-established and diverse customer base, including more than

10,000 corporate clients and governmental agencies, as well as thousands of

individual consumers around the world. Our goal is to deliver comprehensive,

customizable relocation solutions that improve transferees’ relocation

experience, streamline administration, reduce risk exposure and lower

relocation costs. The services that we provide include counseling to the

transferee, referrals to real estate brokers and agents for assisting the

transferees with the sale and purchase of their home, mortgage originations,

expense management, movement of household goods, global program management and

the provision of destination “settling in” services. We market and deliver

these services globally under the SIRVA® Relocation brand and under a variety of

household goods moving brands worldwide.

We deliver our relocation services through our

operating centers located in the United States (ten centers), the United

Kingdom (three centers), continental Europe (six centers), Australia,

(two centers), New Zealand (one center) and Asia (five centers). In each

of these locations, our customer service and account management teams interact

with our corporate clients and their transferring employees on a regular basis

to meet their global relocation needs. Most corporate relocations originate

from the United States and the United Kingdom.

We are also a world leader in handling the movement of

household goods. We operate in more than 40 countries under well-recognized

brand names, including Allied®, northAmerican®, and Global® in North America;

Pickfords, Hoults and Allied Pickfords in the United Kingdom; Maison Huet in

France; Kungsholms in Sweden; ADAM in Denmark; Majortrans Flytteservice in

Norway; Allied Arthur Pierre in Belgium, Luxembourg, Holland and France;

Rettenmayer in Germany and Allied Pickfords in the Asia Pacific region. Our

moving services for corporate, military/government and consumer clients are

provided through our worldwide proprietary agent network. In North America, we

provide moving services through our branded network of 735 agents who own the

trucks and trailers used in moves and are responsible for the packing, hauling,

storage and distribution of household goods. We act as a network manager for

our agents, providing, among other services, brand management, sales and

marketing support, interstate dispatch and planning, billing, collection and

claims handling. Outside of North America, we provide moving services through a

network of company-operated, agent-owned and franchised locations in Europe and

the Asia Pacific region.

We are redefining the

global relocation market by combining our relocation service offerings with our

proprietary moving services network on a global basis. Our relocation and

moving services are provided by a team of more than 6,000 employees around the

world.

3

Historical

Development

We were organized by Clayton, Dubilier & Rice

Fund V Limited Partnership, a Cayman Islands exempted limited partnership (“Fund

V”) and our largest stockholder, to acquire North American Van Lines, Inc.

in March 1998. North American Van Lines, originally organized in 1933, is

one of the leading providers of household goods moving services in North

America. We then acquired the Allied Van Lines, Inc. (“Allied”) and the

Pickfords and Allied Pickfords businesses from Exel Investments Limited

(formerly NFC plc) in November 1999. Allied is a leading provider of

household goods moving services in North America, and the Pickfords and Allied

Pickfords brands operate in Europe and the Asia Pacific region. The combination

of North American Van Lines, Allied Van Lines, Pickfords and Allied Pickfords

created one of the largest household goods moving companies globally. As we

expanded our moving services footprint, we identified a significant opportunity

to leverage our services to become a leading provider of comprehensive

relocation solutions for our corporate moving customers. To take advantage of

this opportunity, in 2002, we received additional capital from Clayton,

Dubilier & Rice Fund VI Limited Partnership, a Cayman Islands exempted

limited partnership (“Fund VI”), to acquire the relocation services businesses

of Cooperative Resource Services, Ltd (“CRS”). We acquired Rowan Simmons

Relocation Ltd later in 2002, which in combination with CRS, established

the basis for the Global Relocation Services segment.

We have continued to

pursue strategic acquisitions since that time in order to strengthen our core

operations. Through December 31, 2004, we have completed twelve acquisitions

each with a purchase price exceeding $1.0 million. The latest acquisition of

Executive Relocation Corporation was completed in December 2004. This

acquisition significantly enhances our scale and overall market share. For a

more detailed discussion on our acquisitions, please see Note 3, in the

accompanying consolidated financial statements contained in Item 8 below. The

table below reflects our acquisition history for the years ended December 31,

2004, 2003 and 2002.

|

Revenue from continuing operations

|

|

|

|

Type of

Business—

Region(3)

|

|

Acquisition

Date

|

|

2004

|

|

Restated(1)

2003

|

|

Restated(1)

2002

|

|

|

North American Van

Lines, Allied Van Lines, Pickfords and Allied Pickfords

|

|

MS—NA,

EU, AP

|

|

March 1998 and

November 1999

|

|

$

|

1,710.5

|

|

|

$

|

1,578.4

|

|

|

|

$

|

1,507.8

|

|

|

|

Core Moving

Services Business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage change

from prior year

|

|

|

|

|

|

8.4%

|

|

|

4.7%

|

|

|

|

(11.5)%

|

|

|

|

Cooperative

Resource Services (CRS)

|

|

RS—US

|

|

May 2002

|

|

1,448.1

|

|

|

986.6

|

|

|

|

454.5

|

|

|

|

Rowan Simmons(2)

|

|

RS—EU

|

|

July 2002

|

|

7.0

|

|

|

6.6

|

|

|

|

2.7

|

|

|

|

Core Relocation

Services Business

|

|

|

|

|

|

1,455.1

|

|

|

993.2

|

|

|

|

457.2

|

|

|

|

Insurance Services

|

|

NS—US

|

|

November 1999

|

|

119.7

|

|

|

95.9

|

|

|

|

74.8

|

|

|

|

Fleet and Driver

Services

|

|

NS—US

|

|

March 1998

|

|

52.9

|

|

|

52.0

|

|

|

|

43.5

|

|

|

|

Core Network

Services Business

|

|

|

|

|

|

172.6

|

|

|

147.9

|

|

|

|

118,3

|

|

|

|

National

Association of Independent Truckers (NAIT)

|

|

NS—US

|

|

April 2002

|

|

24.2

|

|

|

21.6

|

|

|

|

9.3

|

|

|

|

Maison Huet

|

|

MS—EU

|

|

June 2002

|

|

9.2

|

|

|

8.5

|

|

|

|

4.8

|

|

|

|

Scanvan

(Kungsholms, Adams, MajorTrans)

|

|

MS—EU

|

|

June 2003

|

|

57.6

|

|

|

37.0

|

|

|

|

—

|

|

|

|

PRS Europe NV

|

|

RS—EU

|

|

December 2003

|

|

4.1

|

|

|

—

|

|

|

|

—

|

|

|

|

Move-Pak

|

|

NS—US

|

|

December 2003

|

|

14.0

|

|

|

—

|

|

|

|

—

|

|

|

|

Relocation

Dynamics, Inc. (RDI)

|

|

RS—US

|

|

March 2004

|

|

3.5

|

|

|

—

|

|

|

|

—

|

|

|

|

Rettenmayer(2)

|

|

MS—EU

|

|

April 2004

|

|

16.5

|

|

|

—

|

|

|

|

—

|

|

|

|

D.J.

Knight & Co., Ltd. (DJK)

|

|

RS—US

|

|

September 2004

|

|

2.0

|

|

|

—

|

|

|

|

—

|

|

|

|

Executive

Relocation Corporation (ERC)

|

|

RS—US

|

|

December 2004

|

|

1.0

|

|

|

—

|

|

|

|

—

|

|

|

|

Total SIRVA

|

|

|

|

|

|

$

|

3,470.3

|

|

|

$

|

2,786.6

|

|

|

|

$

|

2,097.4

|

|

|

4

(1) SIRVA’s financial statements contained within this

report have been restated to reflect the correction of errors in previously

issued financial statements. For a full explanation of the restatement,

together with the circumstances and processes surrounding the restatement,

please refer to Item 7, Management’s Discussion and Analysis of Financial

Results, Note 2 in the consolidated financial statements contained in Item 8

and in Management’s Assessment of Internal Controls located in Item 9A of this

annual report on Form 10-K.

(2) The Rowan Group PLC and SIRVA Conveyancing Limited

(formerly Simmons Conveyancing Limited) are referred to collectively throughout

this report as Rowan Simmons. Rettenmayer Internationale Umzugslogistik GmbH is

referred to as Rettenmayer throughout this report. The primary operations of

Rettenmayer were purchased in April 2004. In addition, in August 2004,

we completed the purchase of the Rettenmayer operation with the acquisition of

Eduard Löhle Sen. GmbH Internationaler Möbeltransport.

(3) Regional specifications include: NA

denoting North America, EU denoting Europe, US denoting United States, and AP

denoting Asia Pacific. Business specifications include: MS denoting Moving

Services, RS denoting Relocation Services and NS denoting Network Services.

Capital Structure

We began the initial public offering (“the Offering”)

of shares of our common stock on November 25, 2003. In connection with the

Offering, we refinanced our senior credit facility with a new senior credit

facility, which permits us and certain of our foreign subsidiaries to borrow

funds.

In connection with the Offering, we offered to

repurchase all of the 133¤8%

senior subordinated notes due in 2009 issued by North American Van Lines, Inc.

A portion of the net proceeds from the Offering and borrowings under the new

senior credit facility were used to finance the note repurchase. In connection

with the tender offer, we received the requisite consents to amend the

indenture governing such notes to eliminate substantially all of the

restrictive covenants and certain other provisions. Approximately 93% of the

notes were tendered in connection with the repurchase offer. In 2004, we

redeemed the remaining $11.0 million of 133¤8% senior

subordinated notes.

In June 2004, we

completed a secondary public offering that consisted of shares held by our

three largest stockholders, reducing their ownership from approximately 68% to

37%. We did not receive any proceeds from this offering. In conjunction with

the offering, one of the selling stockholders fully exercised its warrants.

These were our only outstanding warrants and resulted in proceeds to us of

$35.0 million and the issuance of an additional 2,773,116 common shares.

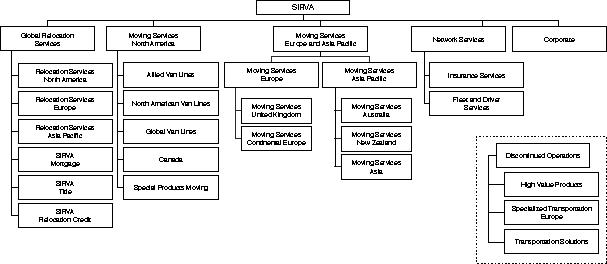

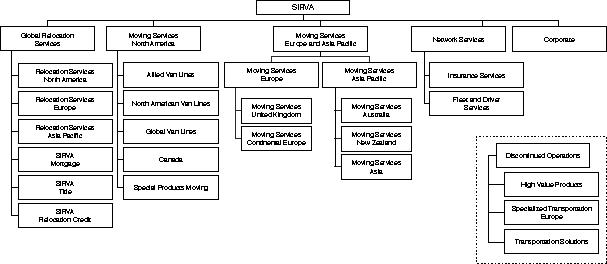

Business Segments

In determining reportable

segments, we periodically review several qualitative and quantitative factors

associated with our operating segments. These factors include management

reporting, organizational structure, operating revenues, income from continuing

operations, assets, customers, services, operating margins and other economic

characteristics. Reflecting the increasing importance that the Relocation

business plays in our overall financial performance, we began in the fourth

quarter of 2004 to report our results in the following five reportable segments:

Global Relocation Services, Moving Services North America, Moving Services

Europe and Asia Pacific, Network Services and Corporate.

Global Relocation Services

We offer our corporate customers complete outsourcing

of the administration of their employee relocation programs. These services

include home sale and home purchase assistance, global program consultation and

management, expense tracking, compliance reporting, tax reporting and payroll

interface services. We have the ability to aggregate data across all of the

corporation’s relocation activities, providing clients a valuable overview of

their relocation program expenses and suggest ways to cut costs and improve

services.

5

Our goal is to meet the needs of transferees with a

full suite of customer-focused, innovative service offerings. These

services include:

Home

Sale. On

behalf of our corporate customers, we appraise the value and arrange for the

sale of a transferring employee’s home. In most cases, we provide an advance on

the equity in the home enabling the employee to purchase a new home before the

existing home is sold. In addition, under some programs, if an employee’s home

is not sold within a specified time frame, we purchase the home based on an

objective appraised value and continue to market the property until it is sold.

We provide these services under two different product offerings. Under a

traditional model, we provide all services on a cost plus basis, and any loss

on the home sale and all holding costs incurred while the house is “in

inventory” are borne by the corporate customer. Under a “fixed fee” model, we

provide all of these services to our U.S. corporate customers for a fixed fee,

set as a percentage of the transferee’s home value.

In the fixed fee offering, we take responsibility for

all costs in the home sale process and agree to purchase the home if it is not

sold within the pre-determined, contractual time frame agreed upon with the

corporate customer or if a third-party sale falls through. When we take a home

into inventory, which, in our experience, occurs approximately 11% of the time,

we are responsible for all carrying costs and any loss on resale of the home. When

we purchase the transferee’s home, we either continue to service the transferee’s

mortgage until the home is sold or, in the case of government service agencies

and some corporate clients, we immediately pay off the mortgage. We have a

comprehensive and sophisticated process for minimizing our risk and cost of

providing the fixed fee offering and have experienced acceptable home sale

losses on individual properties over the history of the program. We believe

this model better aligns our interests with those of our customer, as it is in

our mutual interests to avoid holding houses in inventory for long periods of

time and incurring losses on resale. Our fixed fee product has grown at a

significant rate, and for the year ended December 31, 2004 represented approximately

54% of our corporate relocations. We expect this percentage to decline in the

future due to the late December 2004 acquisition of Executive Relocation

Corporation, which did not offer a fixed fee product at the time of

acquisition.

Under both programs, we utilize our network of

independent real estate brokers to assist with the transferee home sale and in

the United States receive a referral fee from the broker.

Home

Purchase. Our

home finding service provides transferees with the tools to empower them

throughout the home purchasing process. At each stage of the process, we

provide appropriate information, guidance and materials to make the transferee

an informed buyer. As with the home sale process, we utilize our network of

independent real estate brokers to assist corporate transferees in locating a

new home at the destination location. In the United States, we provide this

service at no cost to our customer, but receive a referral fee from the real

estate broker for any home purchase. In Europe, we perform this service for an

agreed upon set fee. We actively monitor and rate our real estate brokers to

ensure cost-effective, high-quality service.

Mortgage

Origination. SIRVA

Mortgage, Inc. (“SIRVA Mortgage”) focuses on the mortgage needs of the

transferring employee. Our mortgage services complement our home finding

services and simplify the overall relocation process for the transferee while

reducing total relocation costs for our corporate client. We simplify

relocation lending by providing free consultation, quick pre-approval, minimal

paperwork, relocation-specific loan programs, direct bill arrangements and

one-stop shopping through our multi-lender network. SIRVA Mortgage’s

multi-lender approach allows us to research rates and loan options offered by

national lenders and help the consumer make an informed decision. We provide

mortgage services to our customers’ transferees, underwriting the mortgage for

a transferee’s home purchase. Before a mortgage is underwritten, we obtain the

agreement of one of various third-party financial institutions to

purchase the mortgage from us. There typically is a processing lag of 20 to

30 days from the time we write the mortgages to the time we complete the

sale. During this time, the mortgages

6

are carried as current

assets and are financed through our mortgage warehouse facility. For the years

ended December 31, 2004 and 2003, we originated $1,035.1 million and

$836.6 million of mortgages, respectively.

Destination

Services. We

assist corporations in making relocations more successful by providing a range

of services that reduces the inconvenience to transferees (and their families)

and facilitates their integration into the new location. These services include

city orientation, school selection, visa and immigration management, language

and cultural training and other services. We provide these services through a

combination of third-party contractors and SIRVA employees, depending, in part,

upon the custom for such services in the local market. In cases where we

utilize third parties for these services, we typically receive a referral fee

from the local service provider.

Global

Services. We

have Global Service Centers in 12 countries, with a network of certified

business suppliers in over 150 countries, enabling us to provide global

solutions to local issues. Through these global offices, we offer a full suite

of specialized global relocation services to corporate clients and assignees,

including assignment management, process management, visa and immigration

services, complete destination services and expense management.

Move

Management. We

provide move management services to corporate transferees, coordinating the

packing, storage and moving of a transferee’s household goods, as well as

assistance with questions and claims. We provide these services through our own

fulfillment network, described below under “Household Goods Moving Services,”

or, at a corporate customer’s election, through a non-SIRVA moving company.

We provide all of these relocation services through

operating centers located in and around major metropolitan areas throughout the

world: ten in the United States (Cleveland, Ohio; Chicago, Illinois;

Minneapolis, Minnesota; St. Louis, Missouri; Denver, Colorado; Bridgewater, New

Jersey; Bethel, Connecticut; Shelton, Connecticut; New York, New York; Detroit,

Michigan), three in the United Kingdom (Swindon, Leyland and Aberdeen), six in

continental Europe (Brussels, Paris, Munich, Antwerp, The Hague and Geneva),

two in Australia (Melbourne and Sydney), one in New Zealand (Auckland) and five

in Asia (Hong Kong, Shanghai, Beijing, Singapore and Kuala Lumpur). We have a

staff of over 650 key relocation specialists dedicated to serving the needs of

our clients and transferees. Speaking more than 25 languages and representing

many nationalities, this staff coordinates our extended network of service

providers, including moving services companies, real estate brokers, appraisers

and destination service providers.

Corporate clients expect a

streamlined communication process between their human resource managers,

transferees and us. To meet these needs, account managers provide this single point

of contact and accountability for our clients. For individual transferring

employees, we provide the full range of relocation services through a lead

relocation counselor who draws on other specialists as needed during the

relocation process.

Moving Services North America

Through our Allied, northAmerican and Global branded

networks, we provide interstate moving services, including household goods

packing, storage and transportation services throughout the United States and

Canada and have a leadership position in the industry. Our Allied® and

northAmerican® trademarks are considered two of the most widely recognized and

respected brand names in moving services.

Household

Goods Moving Services. Our

household goods moving services in North America are primarily provided through

our network of 735 branded agents. Agents are independently-owned local moving

companies that provide customers with the local packing, warehousing and the

majority of the

7

hauling required to

support household moves. Our network of agents and their drivers owns most of

the equipment used in our moving operations. We act as a network manager for

our agents, providing, among other services, brand management, sales and

marketing support, interstate dispatch and planning, billing, collection and

claims handling. We hold U.S. licensing authority for all interstate moves and

have entered into contracts with local agents with respect to their interstate

moves and recognize revenues accordingly. In contrast, our agents generally

conduct intrastate moves under their own licenses using our brands, except in

certain states such as Texas and California where we hold intrastate licenses.

Therefore, we are not a party to most intrastate transactions and do not

recognize operating revenues and associated costs in connection with such

transactions.

Agent

Network. We have developed long-term

relationships with our branded agent network, which on an individual basis have

often extended to a multi-generation affiliation with us. Our

relationship with the agent network is governed by an agency contract that

defines the terms and conditions of the agents’ exclusive representation of us

in all interstate household goods shipments, as well as the compensation

structure for services provided. While we enter into certain short-term

contracts, we will often enter into long-term contracts, which typically extend

from 3 to 15 years in duration, with selected agents. Our long-term

contracts provide security to both parties and ensure us long-term

representation and operating revenues in key markets. We have long-term

contracts in place with agents who represent approximately 81% of the 2004

operating revenues for our Moving Services North America business. Our Allied

agents have been included within this classification of agents with long-term

contracts. In May 2005, a new three-year contract was signed by more than 94% of our Allied agents representing 96%

of the transportation revenue. As a result of these arrangements, we have

historically experienced relatively low agent turnover. No single agent

accounted for more than 4% of our operating revenues for our Moving Services

North America business in 2004.

Owner Operators. Owner operators are independent

contractors who work with our agent network and us, and provide household goods

and specialty transportation fulfillment services. In most circumstances, they

own the trucks and coordinate obtaining the labor needed to service customer

moves. Across our network in North America at December 31, 2004, there

were approximately 2,150 owner operators contracted almost exclusively by

agents in household goods moving and approximately 300 owner operators

contracted by us primarily in our specialty transportation business units.

Those business units include Special Products, Blanketwrap and Flatbed which

provide for the transportation of non-household goods freight.

Moving Services Europe and Asia Pacific

Through our multiple brands in Europe and the Asia

Pacific region, we provide international household goods packing, storage and

moving services. The combination of these operations, together with our North

American moving services operations, provides us with a leadership position in

the moving services industry around the world.

In Europe and Asia

Pacific, we provide household goods moving services, office and industrial

moving, records management and storage through a combination of our

company-operated locations, our proprietary agent network and our network of

affiliated preferred providers. We operate a majority of the fulfillment assets

in Europe and the Asia Pacific regions. During 2004, we disposed of a number of

U.K. owned properties, thereby shifting towards a less capital intensive

business model. We have continued this shift as we implement the use of more

service providers who maintain their own equipment.

8

Customers—Global

Relocation Services, Moving Services North America and Moving Services Europe

and Asia Pacific

We serve a diverse range of customers around the

world, including corporations of all sizes, military and government agencies

and individual consumers. This diverse client base helps to lower our exposure

to downturns or volatility in any one industry or region.

Corporate

Customers. Our

corporate customers range from small businesses to large multinational

companies. Many of our contracts with corporate customers are terminable by the

customer on short notice, and generally do not specify a minimum transaction

volume. Our customers cut across a variety of industries, including consumer

packaged goods, automotive, manufacturing, business and financial services,

retail, technology and pharmaceuticals. They are based throughout the United

States, Canada, Europe and Asia Pacific. No single corporate customer accounted

for more than 6% of our 2004 revenues.

Military/Government

Agencies. We

provide household goods moving services to State and Federal government

agencies in the United States, including the U.S. Department of Agriculture,

the Drug Enforcement Administration and the Federal Bureau of Investigation,

all branches of the U.S. military and government agencies of other countries

around the world. These military and government agencies have traditionally

represented a stable source of demand for our services and are less subject to

economic cycles than our corporate customers. We also provide relocation

services to certain U.S. government agencies.

Consumer Market. We provide domestic and

international household goods moving services to consumers around the world. The

individual household market has traditionally been stable in terms of both

volume and price. Selection of a moving company is generally driven by brand,

quality, price and capacity. We also offer consumers a range of relocation

services via employee programs through corporate customers and member programs

through associations and member service organizations. These services currently

include home buying and selling assistance, mortgage financing and moving

services. We have a centralized consumer contact center in the United States,

which we believe is unique in the moving industry, that facilitates direct

consumer inquiries from a broad range of internet and third-party-based

marketing activities. The contact center provides immediate customer response,

service qualification, and real time connection to a preferred local agent. The

contact center also delivers qualified leads to the agent network, and as such,

has quickly grown to represent over 15% of our U.S. consumer moving volume.

Sales and Marketing—Global

Relocation Services, Moving Services North America and Moving Services Europe

and Asia Pacific

We believe we have the largest sales and marketing

group in the relocation industry with a corporate sales and marketing team of

approximately 125 members and a network of over 1,700 agent sales personnel

serving the corporate and consumer channels. We address the consumer market

through multiple channels, including a customer contact center, printed

telephone directories and various internet-based efforts. In addition, we have

a dedicated sales team for the military/government market.

While we strive to grow our business in each market,

we believe our largest opportunity for continued growth is in the corporate

market. Because of our long-standing moving services relationships with many of

our corporate clients, we have a history of delivery that enables us to offer

related relocation services to many of them. This combined offering of

relocation and moving services can often reduce their costs, while maintaining

or improving the quality of service, and simplifying their administrative

effort.

In our corporate

market, our sales and marketing groups work in conjunction with our service

delivery personnel to pursue four broad objectives:

· Attract

new clients with our customizable relocation solutions that streamline

administration, reduce risk exposure and reduce relocation costs;

9

· Retain

existing customers by delivering an increasing level of satisfaction;

· Develop

innovative new products and services; and

· Continually strengthen and

support our branded network of agents and their salespeople.

Competition—Global

Relocation Services, Moving Services North America and Moving Services Europe

and Asia Pacific

Global

Relocation Services. The

relocation services business is highly competitive, and includes a number of

major companies that provide a full suite of relocation services, including

Cendant Mobility, Prudential Financial, Weichert Relocation, Primacy and GMAC.

The remainder of the relocation business is highly fragmented, with a variety

of companies, including real estate brokers, moving companies, accounting

firms, mortgage firms, destination service providers and business process

outsourcing firms, offering individual services.

We believe the basis for competing successfully in

this market rests on a company’s ability to meet the needs of corporate

customers, including high quality, low cost, low risk, simplified

administration and effective knowledge management. The majority of our major

competitors approach the market based on their strength in real estate. We

approach the market based on our innovative service offerings and our global

capabilities.

Moving

Services North America. The moving services business is highly competitive

and fragmented within North America. A number of large moving companies provide

national services. The remainder of the industry remains extremely fragmented

with many small private companies that have strong positions in local markets.

We compete primarily with national moving companies, including Unigroup (United

and Mayflower), Atlas, Graebel and Bekins. In the Moving Services North America

segment, we also face competition from other types of competitors. These

competitors include independent movers, self-storage and self-haul service

providers. Quality, customer service, price and capacity are key factors in the

mover selection process.

Moving Services Europe and

Asia Pacific. Within

Europe and the Asia Pacific region, the industry is also extremely fragmented

among regional, national and local companies. Many of these companies may

specialize in segments of the moving market such as international, domestic or

office moving. Our chief competitors in the Europe and Asia Pacific regions

include Crown Relocations, Santa Fe, Britannia, Team Relocations (formerly

TransEuro and Amertrans), Sterling, Michael Gerson, White & Company

and Interdean in corporate and consumer moving, Harrow Green, Edes and Business

Moves in office moving, and Iron Mountain and Recall in records management.

Network Services

The Network Services segment offers a range of

services to U.S. moving and storage agents, independent owner operators and

small fleet operators to assist them in the daily operation of their businesses.

Canadian-based entities are also customers when they operate in the United

States. The customer base includes both those inside and outside the SIRVA

network.

These services include a

broad range of commercial property and casualty coverages, as well as truck

maintenance and repair services, emergency breakdown assistance and group

purchasing. Group purchasing opportunities include fuel and tire discounts,

corrugated boxes, uniforms and other ancillary items used in our customers’

businesses. We developed these services using the knowledge of the needs of

truck drivers, fleet owners, motor carriers and moving and storage agents that

we have accumulated from managing our proprietary agent network, operating our

own fleets and from our frequent interactions with independent owner operators.

10

Insurance Services

Through Transguard

Insurance Company of America, Inc. (“TransGuard”), we offer U.S. insurance

services, such as auto liability, occupational accident, physical damage,

worker’s compensation and inland marine coverages to moving agents, small fleet

owners, and owner-operators. Due to the historical relationship with our moving

services companies, TransGuard has focused on insurance services that meet the

needs of our U.S. fulfillment network. We have used the market knowledge

acquired from serving our network to extend insurance offerings to

non-affiliated agents, drivers and small fleet owners. The acquisition of the

National Association of Independent Truckers (“NAIT”) in April 2002 opened

up a new customer channel of independent owner operators. Our insurance

products are distributed primarily through a network of third-party

insurance brokers. In November 2004, we discontinued our small fleet

program, as this business offered unacceptable returns on invested capital. For

the year ended December 31, 2004, this unit represented $19.3 million, or

12.5%, of operating revenue for our Network Services segment. As discussed

below in “Disposal Plan,” we entered into a definitive agreement on

September 21, 2005 to sell our U.S. insurance operations.

NAIT

NAIT is an association of

independent owner operators, fleet owners, couriers and limo drivers. In

exchange for annual membership dues, NAIT offers access to a broad array of

services, designed to improve the profitability and quality of life of the

independent driver. These services include fuel and tire discounts, emergency

breakdown assistance, calling cards and overnight delivery. TransGuard also

offers NAIT members a range of insurance services. Since we acquired NAIT in April 2002,

we have been successful in selling its services both to our network and to

non-affiliated customers. Membership has grown from approximately 10,700 in April 2002,

when we acquired NAIT, to approximately 32,000 at December 31, 2004. NAIT

membership has declined slightly to approximately 30,000 during 2005 due in

part to the ratings downgrade actions taken by A. M. Best.

Fleet Services and Group Purchasing

We use the scale of our

fulfillment network to offer our own, as well as non-affiliated, agents and

drivers discount purchase programs and emergency breakdown assistance through a

nationwide network of independent repair centers to meet their needs when on

the road. Historically, we have also offered tractor/trailer maintenance and

repair services through Fleet Services Operations in two owned facilities in

Fontana, California and Fort Wayne, Indiana. We sold the Fontana facility in

the second quarter of 2004 and the Fort Wayne facilities in the first quarter

of 2005 (see “Disposal Plan” below). In early 2005, we transferred the group

purchasing and emergency breakdown assistance activities into the Moving

Services North America business segment, leaving the Network Services business

segment to consist of solely U.S. insurance related activities and NAIT.

Competition—Network Services

Our competition in the

insurance industry is composed of large, general lines insurance companies,

such as AIG and Firemans’ Fund, as well as smaller companies that focus on our

moving and storage and transportation markets. The basis for competition in

this industry is primarily price, product offerings and perceived quality of

the insurance company, including A.M. Best rating. Fleet services is a

highly fragmented industry with many service providers. Competition for fleet

services is on the basis of service offering, price, geographic location and

geographic scope. NAIT faces competition from other membership-based

organizations, most notably the Owner Operator Independent Driver Association. Competition

in this membership-based area is on the basis of breadth of service offering,

price and ease of use for members.

11

Disposal Plan

On September 9, 2004, our Board of Directors

authorized, approved and committed us to a disposal plan (the “Disposal Plan”)

involving our North American High Value Products and homeExpress business

(“HVP” or “High Value Products Division”), as well as certain other logistics

businesses, which include Specialized Transportation in Europe (“STEU”) and our

Transportation Solutions (“TS”) segment in North America. In October 2004,

we completed the sale of the High Value Products Division. In December 2004,

we announced that a material definitive agreement had been executed to sell

STEU, and, in July 2005, we announced that a material definitive agreement

had been executed to sell TS as outlined in the disposal plan. The STEU

transaction closed in February 2005, while the TS transaction closed in

August 2005.

While not included in the initial disposal plan

authorized by the Board of Directors, we have identified purchasers for our

Fleet Service operations (Network Services segment), as well as our Blanketwrap

and Flatbed truckload freight operations (Moving Services North America

segment). In March 2005, we completed the sale of our Fleet Service

operation, which had annual revenues of $14.8 million in 2004. In May and

August 2005, we completed the sale of our Blanketwrap and Flatbed

truckload operations, which had annual 2004 revenues of $29.5 million and $9.1

million, respectively. This completed our exit from the former North American

Van Lines’ commercial freight/logistics businesses.

In March 2005, we announced our intention to

review strategic options for our U.S. insurance related businesses. The review

was intended to identify alternatives that would facilitate an improvement to

the financial characteristics associated with our insurance industry ratings or

to otherwise maximize the value of the business for us. The strategic review

resulted in the signing of a definitive agreement on September 21, 2005 to

sell our U.S. insurance operations to IAT Reinsurance Company Ltd.

On October 14, 2005, we entered into a Share Sale

Agreement with IM Australia Holdings Pty Ltd, IM New Zealand Holdings ULC and

Iron Mountain Incorporated to sell our Australian and New Zealand operations of

Pickfords Records Management, part of our Moving Services Europe and Asia

Pacific segment.

The completion of our 2004

Disposal Plan, combined with the 2005 transactions referenced above, completes

a strategic restructuring that allows us to focus on our Relocation Redefined®

business model.

Discontinued Operations

Each of the above referenced divested business units

were identifiable components of our company, as their operations and cash flows

could be clearly distinguished, operationally and for financial reporting

purposes, from the rest of our business. As a result of the Disposal Plan, the

assets and liabilities of HVP, STEU and TS were classified as held for sale at September 30,

2004 and the results of these businesses have been reported in discontinued

operations in our consolidated financial statements for all periods presented

in which they were owned. As part of the classification of these businesses as

discontinued operations, general corporate overhead expenses, that were

previously allocated to these businesses but will remain after their disposal,

have been reclassified to other segments in our consolidated financial

statements for all periods presented.

As a result of the Board of Directors’ approval of the

sale of Fleet Service, Blanketwrap and Flatbed operations, the assets and

liabilities of those businesses will be reclassified as held for sale, and the

results of these businesses will be reported in discontinued operations in our

consolidated financial statements for all periods presented effective in March 2005.

As a result of the Board

of Directors’ approval of the sale of our U.S. insurance related businesses,

the assets and liabilities of these businesses will be reclassified as held for

sale, and the results of these

12

businesses

will be reported in discontinued operations in our consolidated financial

statements for all periods presented effective in September 2005.

Government

Regulation

Our operations are subject to various federal, state,

local and foreign laws and regulations that in many instances require permits

and licenses. Our U.S. interstate motor carrier operations, as a common and

contract carrier, are regulated by the Surface Transportation Board and the

Federal Motor Carrier Safety Administration, which are independent agencies

within the U.S. Department of Transportation. The Surface Transportation Board

has jurisdiction similar to the former Interstate Commerce Commission over such

issues as rates, tariffs, antitrust immunity and undercharge and overcharge

claims. The Department of Transportation, and in particular the Federal Motor

Carrier Safety Administration, also has jurisdiction over such matters as

safety, the registration of motor carriers, freight forwarders and brokers,

insurance (financial responsibility) matters, financial reporting requirements

and enforcement of leasing and loading and unloading practices. In addition to

motor carrier operations, we also conduct domestic operations as a licensed or

permitted freight forwarder and property broker. Many of the licenses and

permits that we hold were issued by the Interstate Commerce Commission, which

was eliminated in 1996; some of its regulatory functions are now performed by

the Department of Transportation, the Surface Transportation Board and the

Federal Motor Carrier Safety Administration. With respect to interstate motor

carrier operations, the Federal Motor Carrier Safety Administration is the

principal regulator in terms of safety, including carrier and driver

qualification, drug and alcohol testing of drivers, hours of service

requirements and maintenance and qualification of equipment.

We are an ocean transportation intermediary pursuant

to the Shipping Act of 1984, as amended. As such, we hold ocean freight

forwarder licenses issued by the Federal Maritime Commission (“FMC”), and are

subject to FMC bonding requirements applicable to ocean freight forwarders. We

also conduct certain operations as a non-vessel-operating common carrier

and are subject to the regulations relating to FMC tariff filing and bonding

requirements, and under the Shipping Act of 1984, particularly with respect to

terms thereof proscribing rebating practices. The FMC does not currently

regulate the level of our fees in any material respect.

Our U.S. Customs brokerage activities are licensed by

the U.S. Department of the Treasury and are regulated by the U.S. Bureau of

Customs and Border Protection. We are also subject to similar regulations by

the regulatory authorities of foreign jurisdictions in which we operate.

With respect to U.S. state and Canadian provincial

licenses, the permitting and licensing structure largely parallels the U.S.

federal licensing regulatory structure.

In Europe, including the United Kingdom, we hold

operator licenses and international transport licenses in 11 of the countries

in which we run trucks. Across Europe, we are required to comply with data

protection legislation to insure the safe guarding of customers’ information.

In the United Kingdom since January 2005, we are authorized and regulated

under the Financial Services Authority in order to sell insurance-style

products to our customers. In the United Kingdom, SIRVA Conveyancing Limited is

licensed under the Administration of Justice Act 1985 to carry out the legal

process for the transfer of real property. Operating licenses are not required

in all European countries in which we operate. Operating licenses are approvals

from the relevant local authority permitting the operation of commercial

vehicles from specified bases. One of the prerequisites for these licenses is

the employment by the relevant business of individuals who hold certain

certificates of professional competence concerning their management of the

business’s fleet of vehicles. In the United Kingdom and continental Europe, we

hold licenses for bonded warehouses at certain major ports of entry in connection

with our receipt of imported goods.

In the Asia Pacific region, we hold various commercial

vehicle licenses. In Australia we hold licenses for international relocation

for our customs, quarantine and air freight operation and to store dangerous

13

goods in connection with

our management and operation of gas refueling tanks. We are licensed under

Australia’s Financial Services Reform Act so that we can comply with a 2004

requirement that applies to our sale of insurance-style products within

our moving business. In New Zealand, we hold a goods service license to operate

as a removalist, licenses for bonded warehouses at major ports of entry in

connection with our receipt of imported goods, and government approvals in

connection with our establishment as a customs bonded area and an approved

facility for exams.

TransGuard and our other insurance subsidiaries such

as The Baxendale Insurance Company Ltd., which is part of our Moving

Services Europe and Asia Pacific segment, are subject to extensive supervision

and regulation by insurance regulators in their respective jurisdictions,

including regulations limiting the transfer of assets, loans, or the payments

of dividends from such insurance subsidiaries to their affiliates, including

us. Such regulation could limit our ability to draw on these insurance

subsidiaries’ assets to repay our indebtedness.

SIRVA Title Agency, Inc. is licensed in Ohio and

provides support to the relocations managed within SIRVA Relocation. In

addition, in order to receive referral fees, SIRVA Relocation is currently

licensed, through individual employees, as a real estate broker in Ohio and

other states. Each state has a varying degree of regulatory and annual

reporting requirements. Various governmental (including the federal, state and

local jurisdictions of the many countries in which we operate) laws, rules and

regulations, including, but not limited to, those laws, rules and

regulations concerning tax obligations, privacy of information, financial

controls and real estate also have a significant impact on our Global

Relocation Services segment.

SIRVA Mortgage is authorized to conduct first lien

mortgage lending activity as a mortgage banker in all fifty states and the

District of Columbia and second lien mortgage activity in 42 states and the

District of Columbia. SIRVA Mortgage has obtained a mortgage lending license

and is licensed in good standing (or has received an exemption from regulation)

in all states where required. Second lien mortgage activity may be limited in

some states due to the type of license SIRVA Mortgage holds. State mortgage

licensing laws and regulation activities have a significant impact on our

mortgage lending activities.

Furthermore, in the United States, North American Van

Lines, Allied and Global have been participants in certain collective

activities, including collective rate-making with other motor carriers pursuant

to an exemption from the antitrust laws as currently set forth in The Motor

Carrier Act of 1980. Over the years, the scope of the antitrust exemption has

decreased and there can be no assurance that such exemption from the antitrust

laws will continue in the future. The loss of such exemption could result in an

adverse effect on our operations for financial condition.

Any violation of the laws and regulations discussed

above could increase claims and/or liabilities, including claims for uninsured

punitive damages. Failure to maintain required permits or licenses, or to

comply with applicable regulations could subject us to fines or, in the event

of a serious violation, suspension or revocation of operating authority or

criminal penalties. All of these regulatory authorities have broad powers

generally governing activities such as authority to engage in motor carrier

operations, rates and charges and certain mergers, consolidations and

acquisitions. Although compliance with these regulations has not had a

materially adverse effect on our operations or financial condition in the past,

there can be no assurance that such regulations or any changes to such

regulations will not materially adversely impact our operations in the future.

Our international

operations are conducted primarily through local branches owned or leased by

various subsidiaries, as well as franchises in over 40 countries outside the

United States and in a number of additional countries through agents and

non-exclusive representatives. We are subject to certain customary risks

inherent in carrying on business abroad, including the effect of regulatory and

legal restrictions imposed by foreign governments.

14

Environmental

Matters

Our facilities and operations are subject to

environmental laws and regulations in the various foreign, U.S., state and

local jurisdictions in which we operate. These requirements govern, among other

things, discharges of pollutants into the air, water and land, the management

and disposal of solid and hazardous substances and wastes, and the cleanup of

contamination. In some parts of Europe, we are subject to regulations governing

the extent to which we recycle waste. Some of our operations require permits

intended to prevent or reduce air and water pollution and these may be

reviewed, modified or revoked by the issuing authorities.

We actively monitor our compliance with environmental

laws and regulations and management believes that we are presently in material

compliance with all applicable requirements. Compliance costs are included in

our results of operations and are not material. We will continue to incur

ongoing capital and operating expenses to maintain or achieve compliance with

applicable environmental requirements, upgrade existing equipment at our

facilities as necessary and meet new regulatory requirements. While it is not

possible to predict with certainty future environmental compliance requirements,

management believes that future expenditures relating to environmental

compliance requirements will not materially adversely affect our financial

condition or results of operations.

We have been, and in the future may be, responsible

for investigating or remediating contamination at our facilities or at off-site

locations to which we sent wastes for disposal. For example, because we own or

lease or have in the past owned or leased facilities at which underground

storage tanks are located and operated, we are subject to regulations governing

the construction, operation and maintenance of underground storage tanks and

for preventing or cleaning up releases from these tanks. We have incurred, and

in the future may incur, costs related to our investigation and cleanup of

releases of materials from underground storage tanks, though such costs are not

expected to have a materially adverse effect on our financial position or

results of operations. Contaminants have been detected at certain of our

present or former sites principally in connection with historical operations.

We could incur significant costs if we were required to investigate and

remediate these sites.

We have also been named as a potentially responsible

party (“PRP”) in two environmental cleanup proceedings brought under the

Comprehensive Environmental Response, Compensation, and Liability Act of 1980,

as amended (“CERCLA”), or similar state statutes. Based on all known

information, we estimate that the cost to resolve liability at these sites

would not be materially or significantly larger than the reserves established. We

are not presently able to reasonably estimate additional potential losses, if

any, related to these proceedings. We could incur unanticipated costs, however,

if additional contamination is found at these sites, or if we are named as a

PRP in other proceedings.

Based on our assessment of

facts and circumstances now known, management believes it is unlikely that any

identified environmental matters, either individually or in aggregate, will

have a materially adverse effect on our financial position, results of

operations, or liquidity. As conditions may exist on our properties related to

environmental problems that are latent or as yet unknown, however, there can be

no assurance that we will not incur liabilities or costs, the amount and

significance of which cannot be reliably estimated at this time.

Trademarks

We have registered the marks SIRVA®, northAmerican®,

Allied®, Relocation Redefined®, Home Touch!®, and Worldtrac®. Other brand or

product names used in this report are trademarks or registered trademarks of

their respective companies.

We have been highly active

in seeking protection for numerous marks and logos relating to the “SIRVA”, “northAmerican”,

“Allied”, “Global”, “Pickfords” and several of our other brands. We have

actively contested unauthorized use of the “northAmerican”, “Global” and “Allied”

marks. We have

15

largely

been successful in protecting our marks, but in a few exceptional circumstances

have tolerated some third-party use of similar marks in transport-related

commerce where we felt that there was no confusion by such use and no confusion

was likely to occur in the future.

Employees

At December 31, 2004,

our workforce comprised approximately 7,580 employees. Of these employees,

approximately 6,530 were engaged within continuing operations, while

approximately 1,050 were employed within discontinued operations. Approximately

2,360 employees were covered by union agreements, while not all covered employees

have elected membership within those unions. The employees covered by union

agreements are located in the United Kingdom, Sweden, Norway, Denmark,

Australia and New Zealand. We believe our relationships with our employees are

good. We have not experienced any major work stoppages in the last ten

years.

Business Risks

If any of the following

risks or uncertainties actually occurs, our business, financial condition and

operating results could be materially and adversely affected. The trading price

of our common stock could decline. In addition, this report contains

forward-looking statements that involve risks and uncertainties. Our actual

results could differ materially from those anticipated in those forward-looking

statements as a result of certain factors, including the risks faced by us

described below and elsewhere in this report. See “Management’s Discussion and

Analysis of Financial Condition and Results of Operations—Forward-Looking

Statements” on page 82.

Material

weaknesses in internal control over financial reporting resulted in a

restatement of our financial statements, and the transitional changes to our

control environment may be insufficient to effectively remediate these

deficiencies.

Management has identified

a number of material weaknesses in our internal control over financial

reporting. As a result of these weaknesses, we have restated our audited

consolidated financial statements for the years ended December 31, 2000,

2001, 2002 and 2003, as well as our unaudited condensed consolidated financial

statements for the quarters ended March 31, June 30 and September 30,

2004 and all quarters in 2003. Although we have begun to remediate these

weaknesses by implementing changes to our control environment, the process is

not yet complete. Consequently, there remains a risk that the transitional

procedures on which we currently rely will fail to be sufficiently effective to

assess the effectiveness of our internal controls. The ineffectiveness of these

remedial measures, or a delay in their implementation, could affect the

accuracy or timing of our future filings with the SEC or other regulatory

authorities. See Item 9A, “Controls and Procedures” for a further discussion on

these matters.

Because

we have not filed our annual report for the year ended December 31, 2004,

or any of our quarterly reports in 2005 on a timely basis, we may suffer

adverse business consequences, including the delisting of our common stock by

the New York Stock Exchange.

We have not filed any of our periodic reports with the

SEC on a timely basis since we last filed our quarterly report on Form 10-Q

for the quarter ended September 30, 2004. As a result, we have had to

obtain amendments to both our credit agreement and our receivables sale

agreement to provide us with more time to make these filings. If we cannot meet

these extended deadlines for filing our quarterly reports for 2005, we will

have to seek further amendments and waivers. Although we have previously

received such amendments and waivers, we cannot give assurance that we will be

able to do so again.

Our continued failure to file our quarterly reports

for 2005 on a timely basis also could jeopardize our relocation and moving

service agreements with the U.S. military. Under the terms of these agreements,

our failure to timely file such periodic reports provides the different

departments of the U.S. military with the

16

right to terminate such

agreements. If the U.S. military were to terminate any of these agreements, our

revenues would be materially and adversely impacted.

Furthermore, our continued failure to timely file our

quarterly reports for 2005 exposes us to the risk that the New York Stock

Exchange (the “NYSE”) may delist our common stock from trading. If our common

stock were delisted from trading on the NYSE, investors would be adversely

affected because our common stock would be less liquid.

In addition, we are delinquent in filing our financial

statements, which are prepared on a statutory basis, with the insurance

regulatory commissions of the various states in which we conduct our network

services business. As a result, such state insurance commissions may impose

penalties or suspend our authority to conduct our insurance business in their

states. We already have received notices from certain states that indicated

such penalties may be assessed. Two states, Ohio and Oregon, already have

suspended our authority to renew existing policies or write new ones. We cannot

give assurance that other states will not follow suit and suspend our authority

to conduct our insurance business in their state.

The occurrence of any of

these events, or other unanticipated events resulting from our failure to

timely file our quarterly reports in 2005, could harm our overall business and

financial results.

Our

insurance operations expose us to some of the risks of the insurance industry.

As part of our Network Services segment, we have a

wholly owned subsidiary TransGuard, which is an insurance company organized

under the laws of Illinois. The potential for growth of our Network Services

business may be offset by the risks of engaging in the insurance business.

Investment returns are an important part of the overall profitability of our

insurance business, and therefore fluctuations in the fixed income or equity

markets could have a materially adverse effect on our results of operations.

Our investment returns are also susceptible to changes in the general

creditworthiness of the specific issuers of debt securities and equity

securities held in our portfolio. Where the credit rating of an issuer falls so

low that we are forced to dispose of our investment, we may realize a

significant loss on our investment.

The reserves we maintain in our insurance business may

prove to be inadequate to cover our actual losses sustained. Claim reserves do

not represent an exact calculation of liability, but rather are estimates of

the expected liability. To the extent that reserves are insufficient to cover

actual losses, loss adjustment expenses or future policy benefits, we would

have to add to our claim reserves and incur a charge to our current earnings.

TransGuard is a party to reinsurance agreements

pursuant to which it cedes the liabilities under a portion of its issued

insurance policies. These agreements may be terminated by the reinsurer upon

notice or upon a change of control of our insurance subsidiary. If any of these

reinsurance agreements are terminated, we cannot assure you that we can replace

them on short notice or on favorable terms, in which case our exposure to

claims under the underlying policies would be increased. Endurance Re, with

whom we have a quota-share agreement on worker’s compensation for 80% of the

first $1.0 million of exposure, recently cancelled the agreement and we agreed

an effective cancellation date of September 23, 2005 due to our claims

loss development and the recent downgrades by A.M. Best described below.

Upon cancellation of the Endurance Re agreement, its coverage still applies to

existing policies in-force and also any policies for which we are obligated to

offer renewal due to our inability to comply with cancellation notification

periods. For any new business or renewals that do not fit the condition

previously described, we have entered into a reinsurance agreement with three

participating carriers for losses of $0.75 million in excess of $0.25 million

to limit our exposure for our workers compensation program.

On September 21, 2005, we announced a definitive

agreement to sell the stock of TransGuard, NAIT, Vanguard Insurance Agency, Inc.,

and other related companies of the U.S. insurance services group to IAT

Reinsurance Company Ltd. (“IAT”). At that time, we also announced that an

affiliate of IAT will provide a cut-through endorsement for all lines of

business, including worker’s compensation (excluding

17

the small fleet program)

to provide TransGuard’s customers with “A-” rated paper through closing of the

transaction. The Hanover 100 percent quota share arrangement, previously put in

place, will be replaced with the cut-through endorsement arrangement. Both the

signing of the definitive agreement and the cut-through are intended to

mitigate the marketability risk caused by the A.M. Best downgrades.

Customers may react unfavorably to these arrangements and opt to move their

insurance coverage to another provider.

The divestiture, which is

expected to close by the end of 2005, is subject to customary closing

conditions and the receipt of various regulatory approvals, including state

insurance commission approval and expiration of the waiting period under the

Hart-Scott-Rodino Antitrust Improvements Act. If approvals are not obtained, we

may not be able to close the transaction, and customers may react unfavorably.

Our

U.S. insurance subsidiary is subject to financial ratings by third-party firms.

Changes in these ratings expose us to loss of customers.

The A.M. Best rating of TransGuard was downgraded

in 2003 from A to A- with negative implications due, in large part, to our

financial leverage prior to our initial public offering. In November 2004,

the negative implications element of the rating was removed. In April 2005

and again in August 2005, A.M. Best downgraded TransGuard’s rating,

which now stands at B with negative implications. Any downgrade could affect

the marketability of the insurance policies underwritten by TransGuard, from

which we derive the vast majority of the income for our Network Services

segment, and thereby adversely affect our profitability.

After the April 2005

downgrade, to reduce the impact of the rating action on its customers,

TransGuard entered into two new arrangements. As a solution for its customers

doing business with the military, TransGuard entered into an agreement with

Avalon Risk Management to place the military portion of its Moving and Storage

line with Lincoln General Insurance Company, part of the Kingsway Financial

Group. We entered into a contract with Hannover Reinsurance Ltd. (“Hannover”)

and E & S Reinsurance Ltd. (“E & S”) as of June 1, 2005,

reinsuring our net retention for all lines other than workers compensation and

transportation services. Hannover, rated “A” by A.M. Best, assumes 100

percent of TransGuard’s business risk on a first-dollar basis for coverage

provided to the members of NAIT and for the moving and storage (non-military)

business. We received approval by the Illinois Department of Financial and

Professional Regulation, Department of Insurance (“DOI”) on September 29,

2005 and we are in the process of commutation with Hannover for a final payment

amount of $2.1 million. Customers may react unfavorably to these arrangements

and opt to move their insurance coverage to another provider.

We

are subject to litigation and governmental investigations as a result of our

operations.

We are subject to litigation resulting from our

operations, including litigation resulting from accidents involving our agents

and drivers. These accidents have involved, and in the future may involve,

serious injuries or the loss of lives. This litigation may result in liability

to us or harm our reputation. While the impact of this litigation is typically

immaterial to our operations and financial condition, there can be no assurance

that its impact will not be material in the future.

In addition, we are being investigated by the

Department of Justice Antitrust Division, European antitrust regulators, and

the Australian Competition & Consumer Commission regarding potential

antitrust violations in the United States, Europe and Australia, respectively.

We have established a reserve for the Department of Justice and European

antitrust investigations in accordance with the guidelines set forth in SFAS No. 5,

“Accounting for Contingencies” (“SFAS 5”) that we consider appropriate in the

circumstances. We have not established a reserve for the Australian antitrust

investigation because an unfavorable outcome for us is considered neither

probable nor remote at this time and an estimate of

18

probable loss or range of

probable loss cannot currently be made. We believe that, based on information

currently available, the outcome of the Department of Justice, European and

Australian antitrust investigations will not have a material adverse impact on

our overall operations or financial condition, although there can be no

assurance that they will not. Any potential penalties, however, may have a

material impact on our earnings in the period in which they are recognized.

Furthermore, we are the subject of a securities class

action filed in November 2004 on behalf of all persons who acquired our

common stock between November 25, 2003 and November 9, 2004, as well

as a second lawsuit brought by an individual plaintiff against us and certain

of our directors and officers. Each complaint alleges, among other things, that

we made false and misleading statements in certain SEC filings, including the

prospectuses to our initial and secondary public offerings, and press releases.

Each case is in the preliminary stages, the outcome of each is not predictable

at this time, and we are not presently able to reasonably estimate potential

losses, if any, related to either lawsuit. Therefore, no amounts have been

accrued for these claims. An unfavorable outcome in either case could have a

material adverse effect on our business, financial condition, results of