00-0000000 false 0001805890 0001805890 2023-02-10 2023-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2023

FUSION PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Canada |

|

001-39344 |

|

Not Applicable |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

270 Longwood Road South

Hamilton, Ontario, Canada, L8P 0A6

(Address of principal executive offices, including zip code)

(289) 799-0891

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trade Symbol(s) |

|

Name of each exchange on which registered |

| Common shares, no par value per share |

|

FUSN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Option and Asset Purchase Agreement

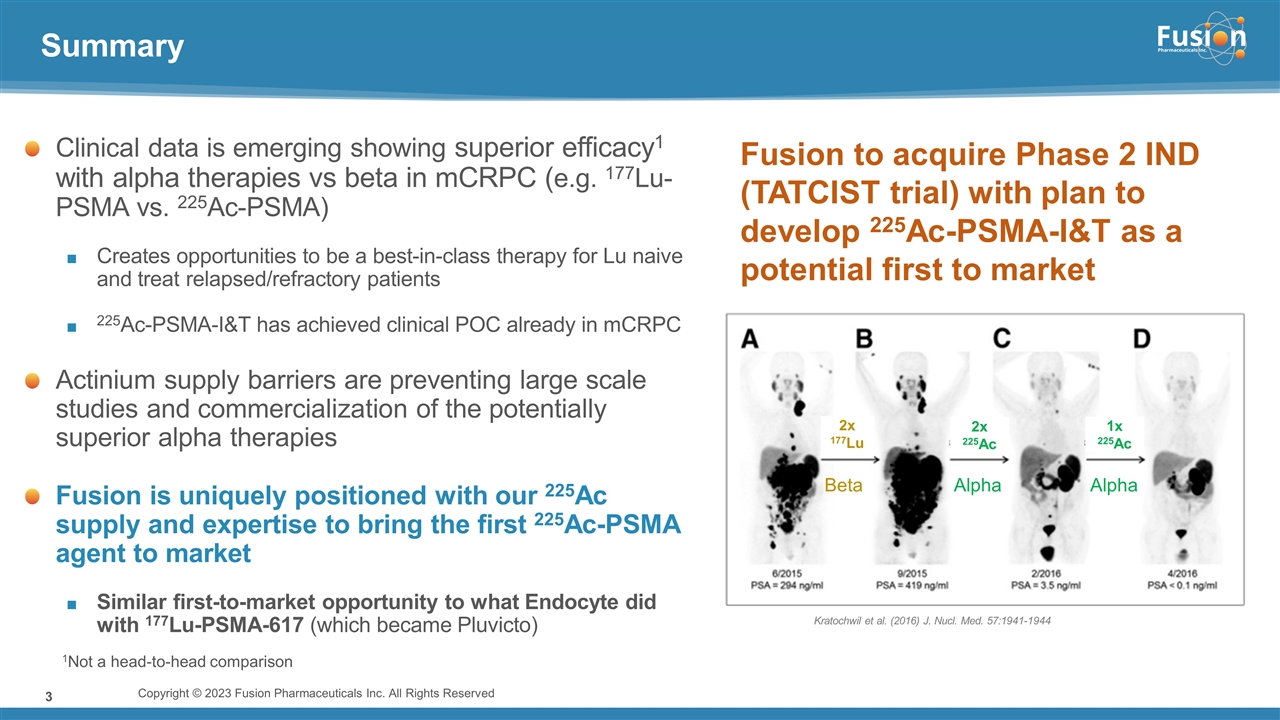

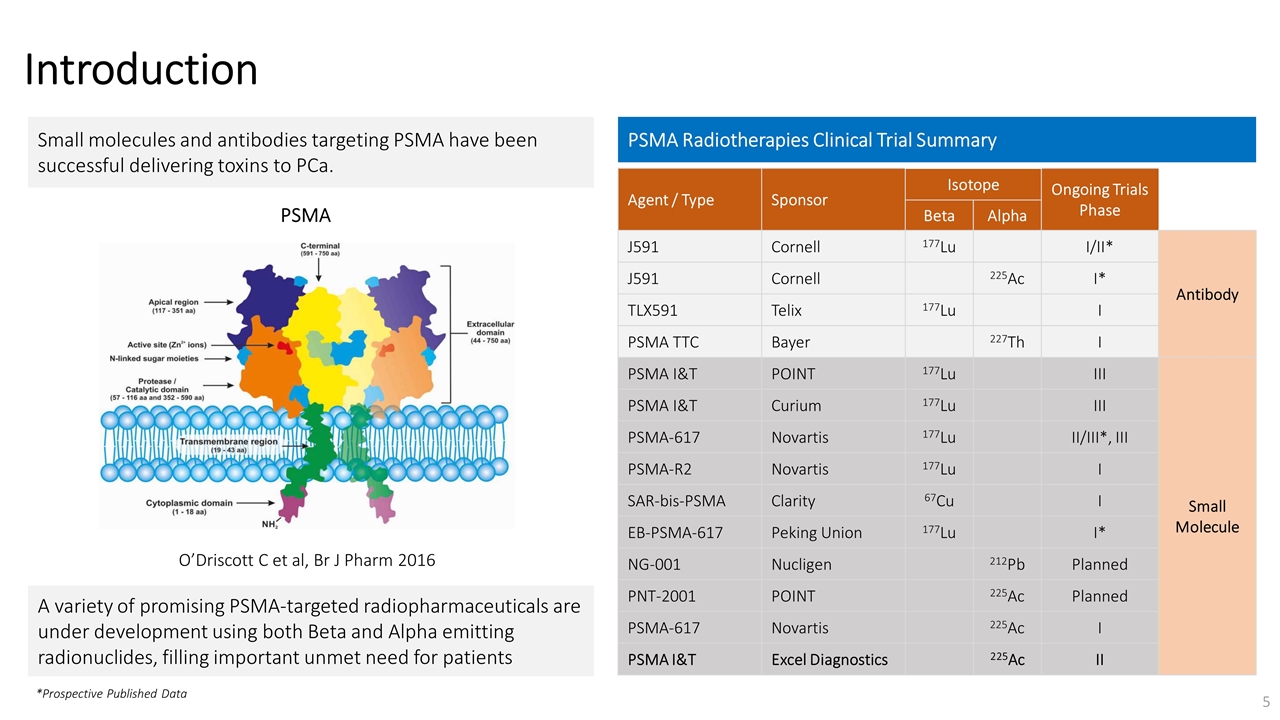

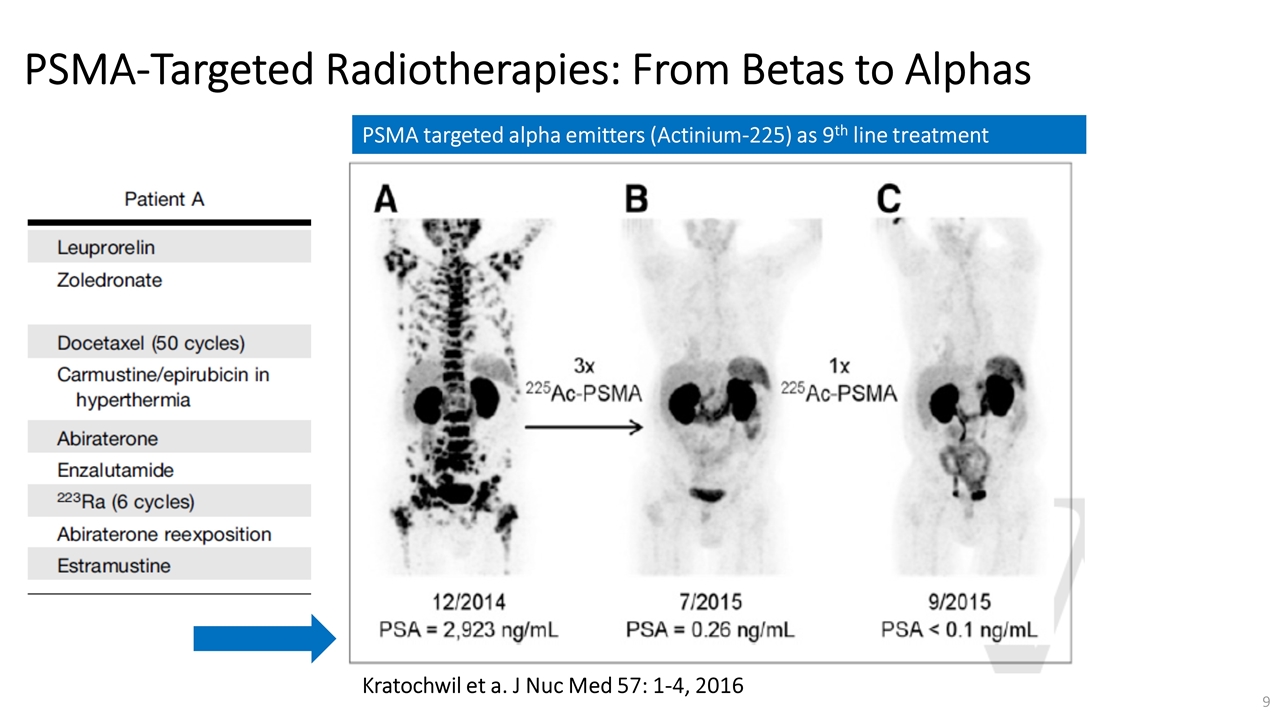

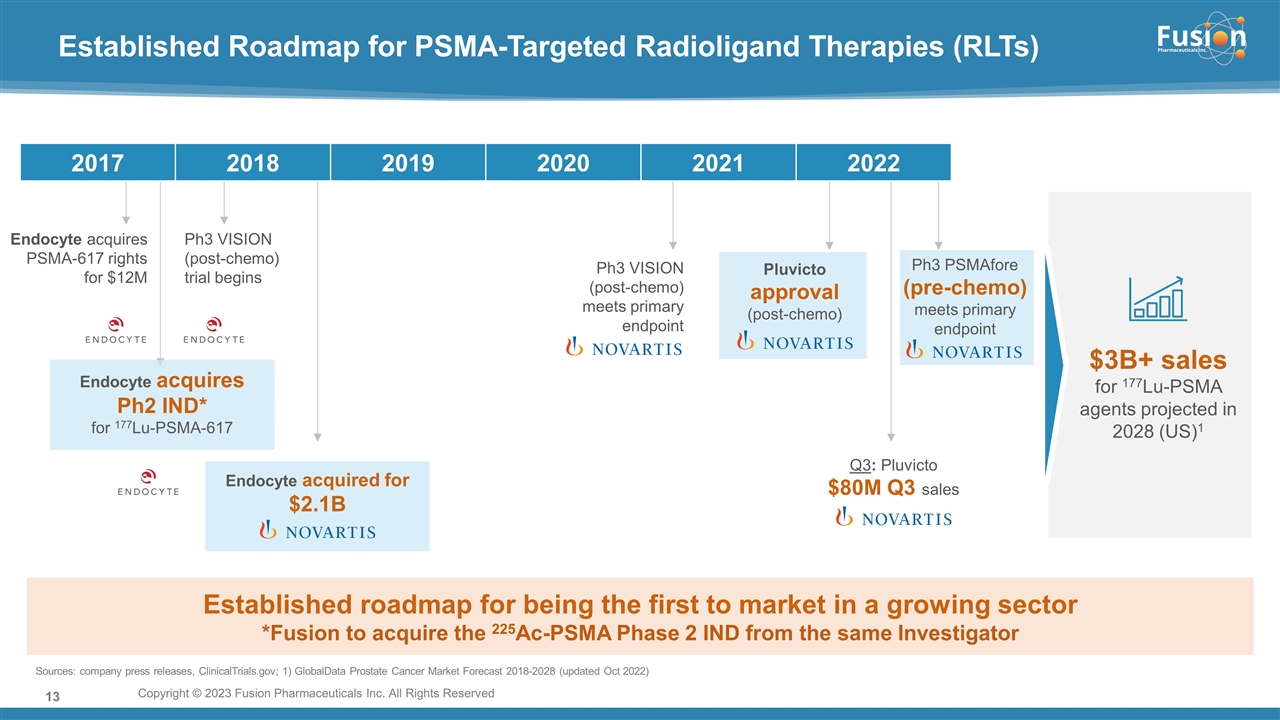

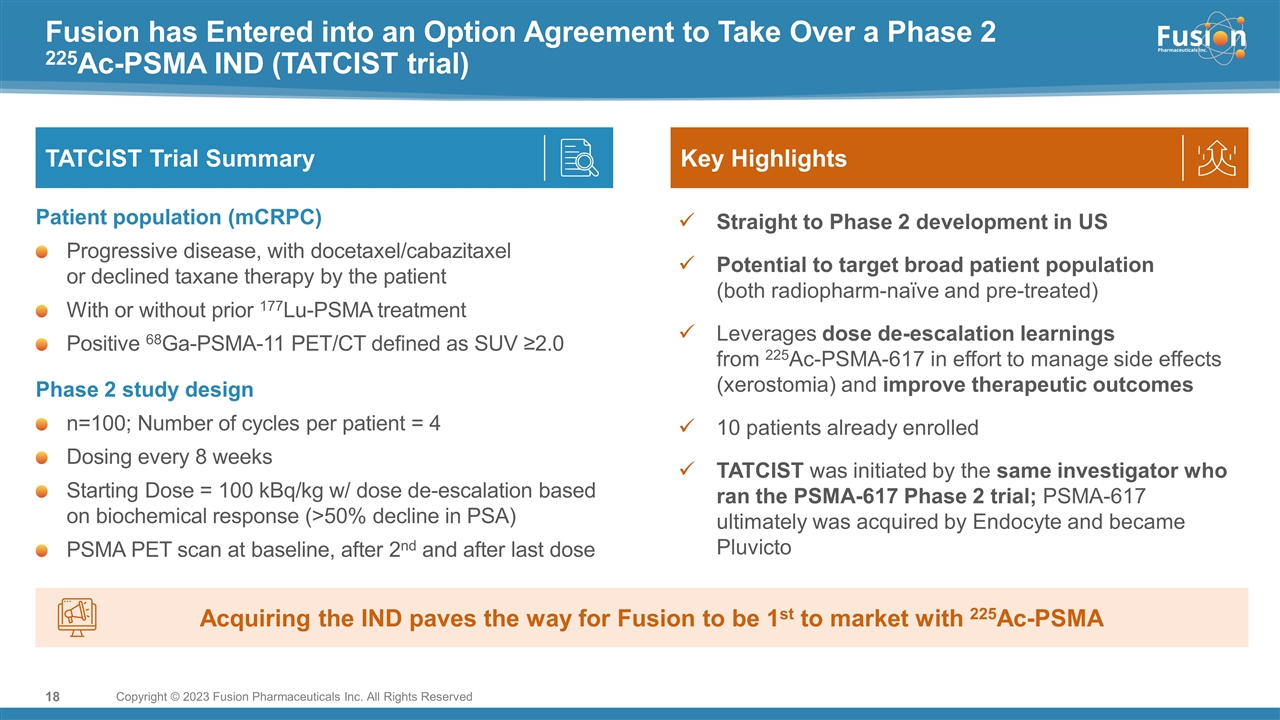

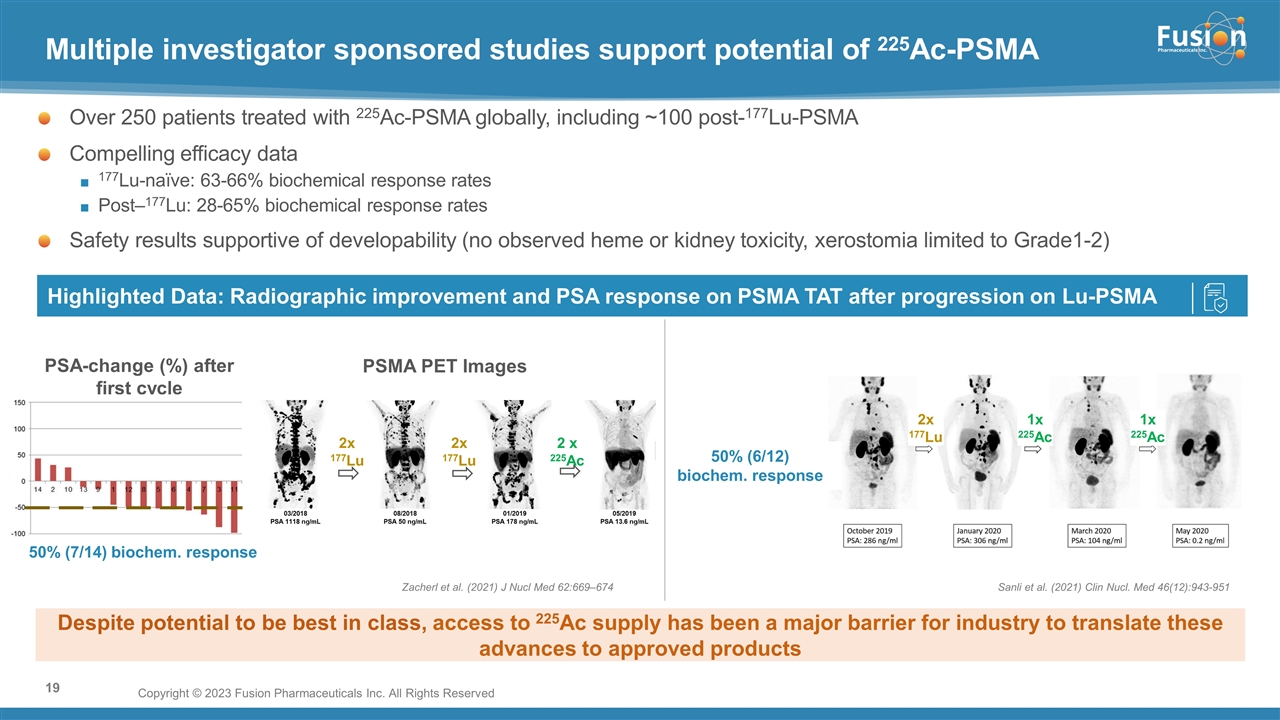

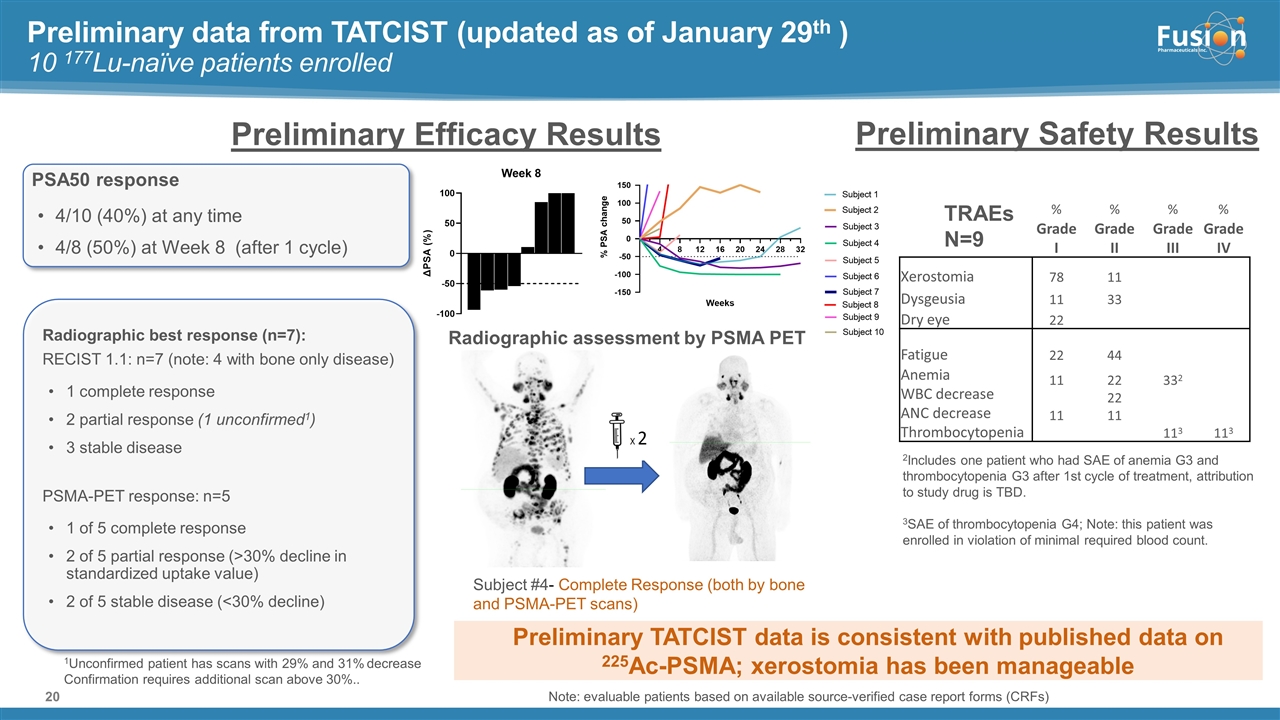

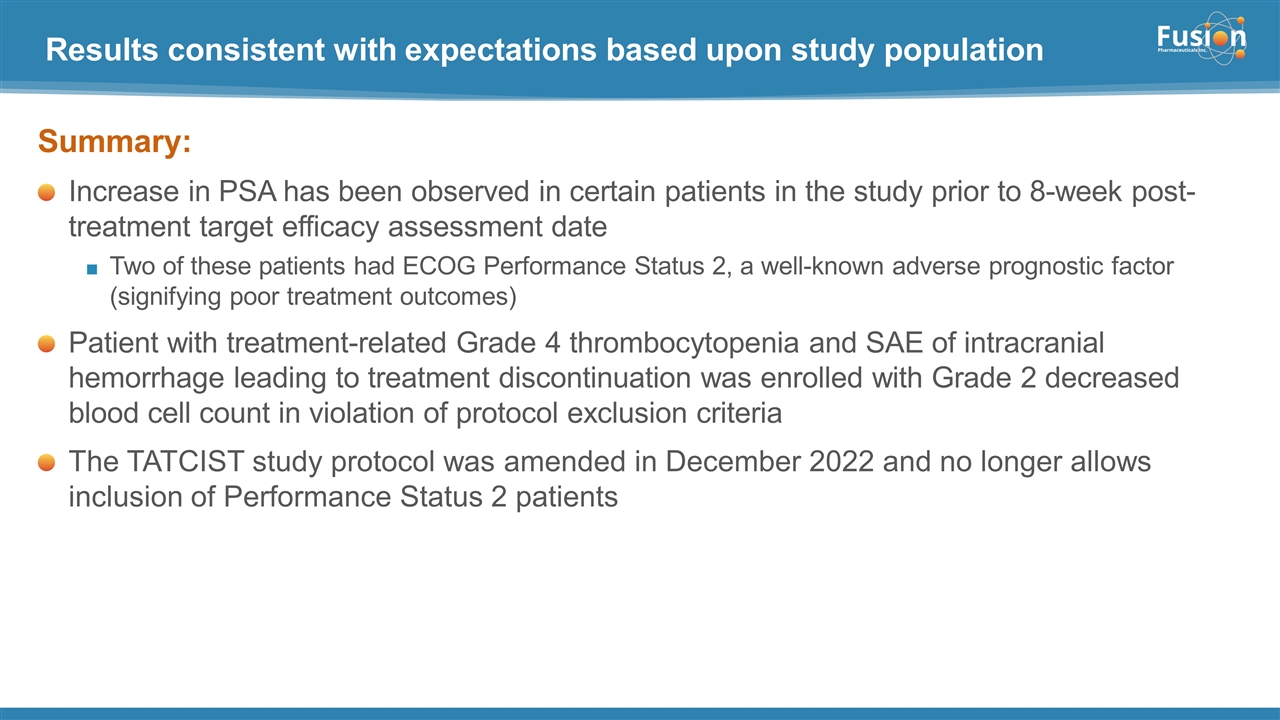

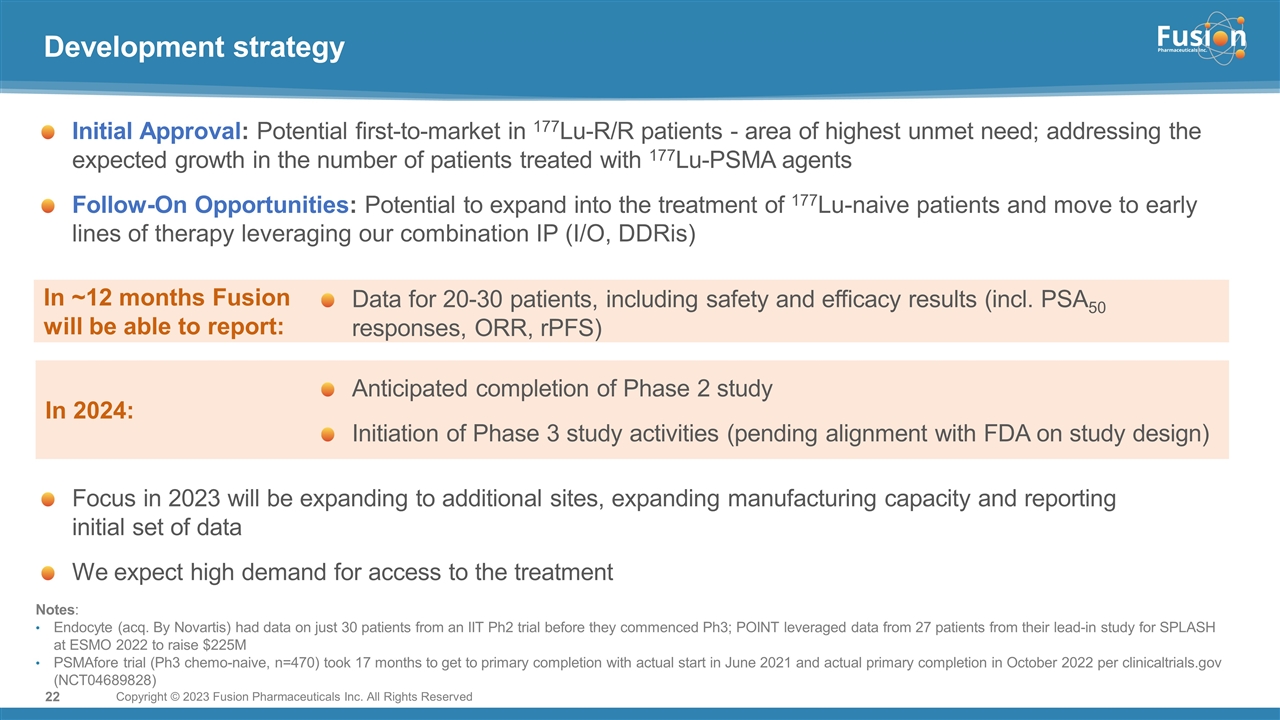

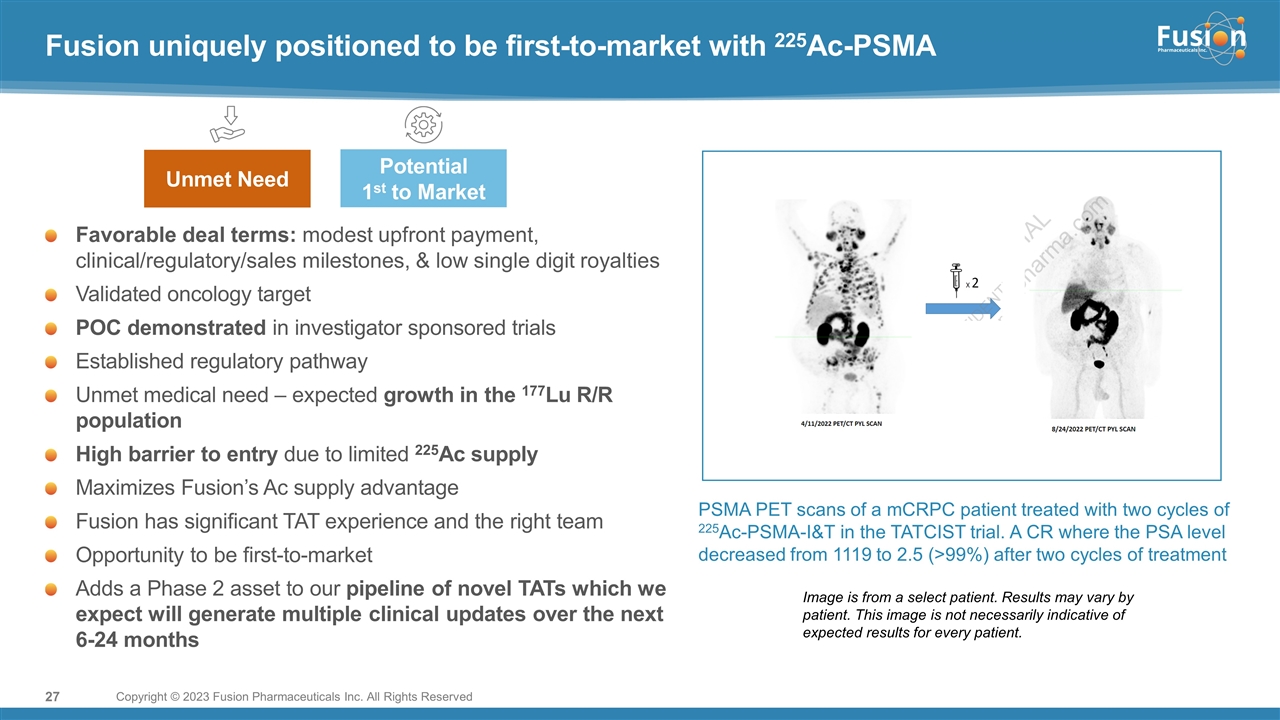

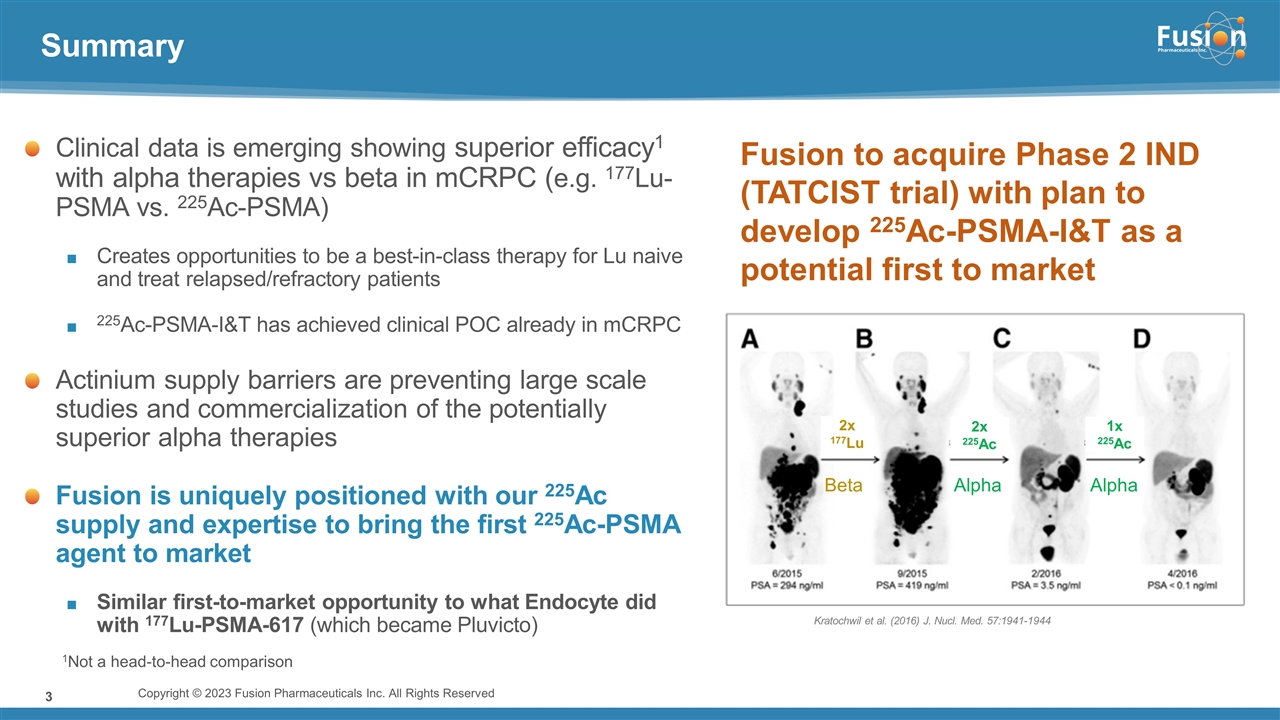

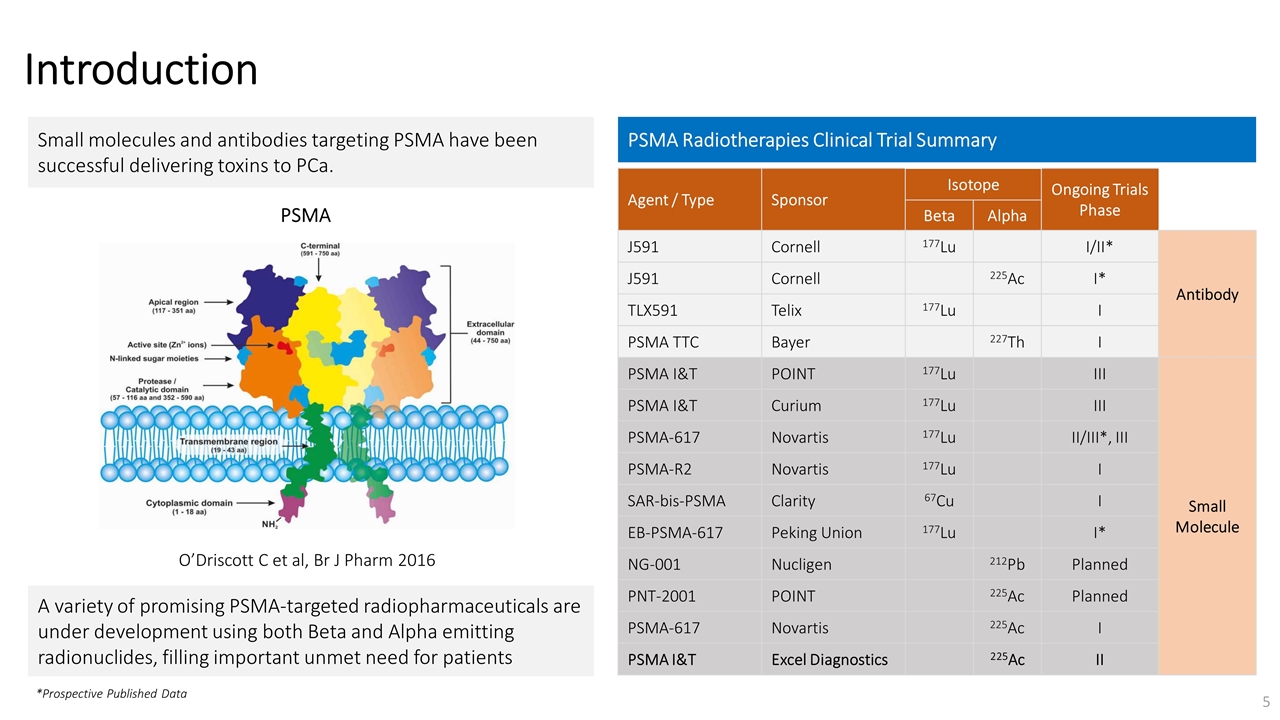

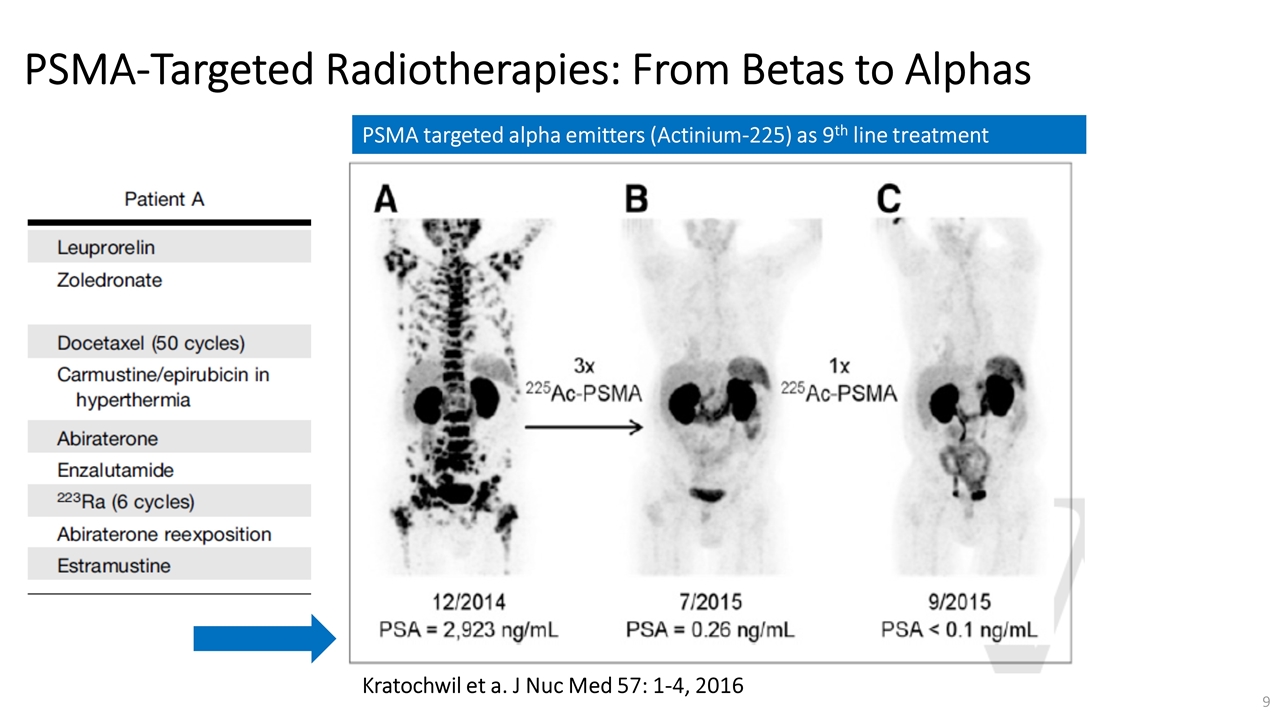

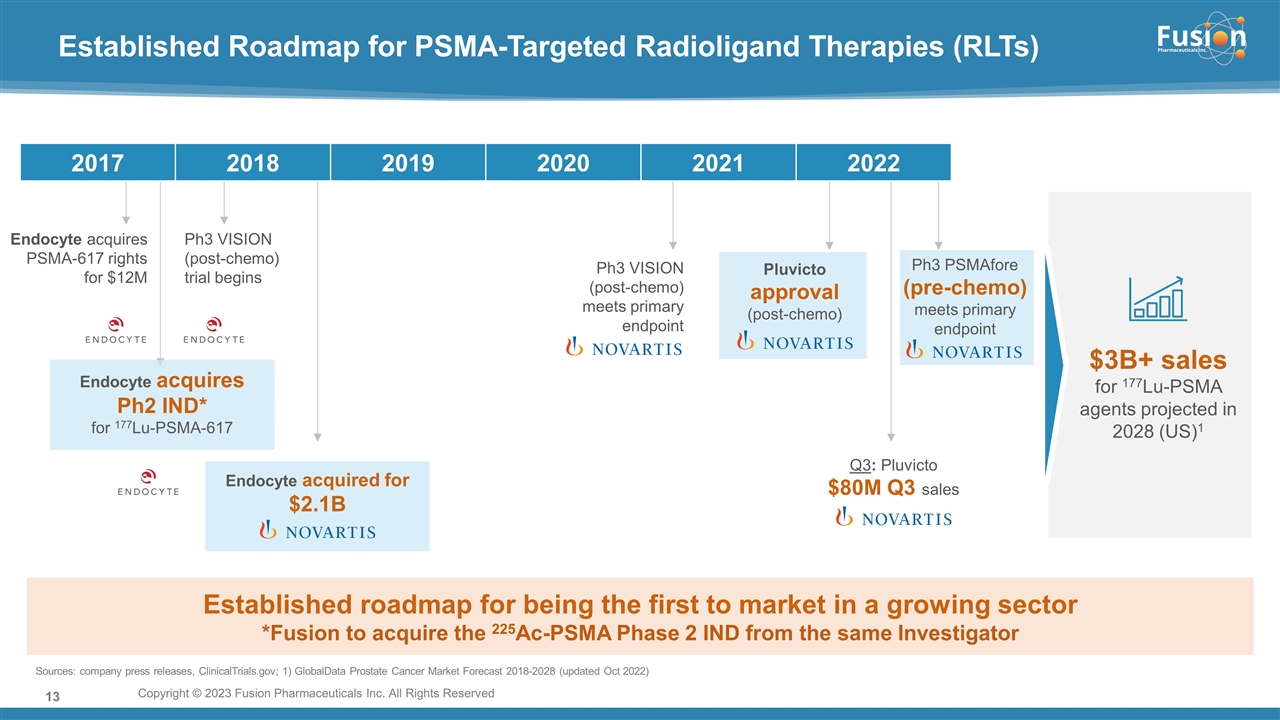

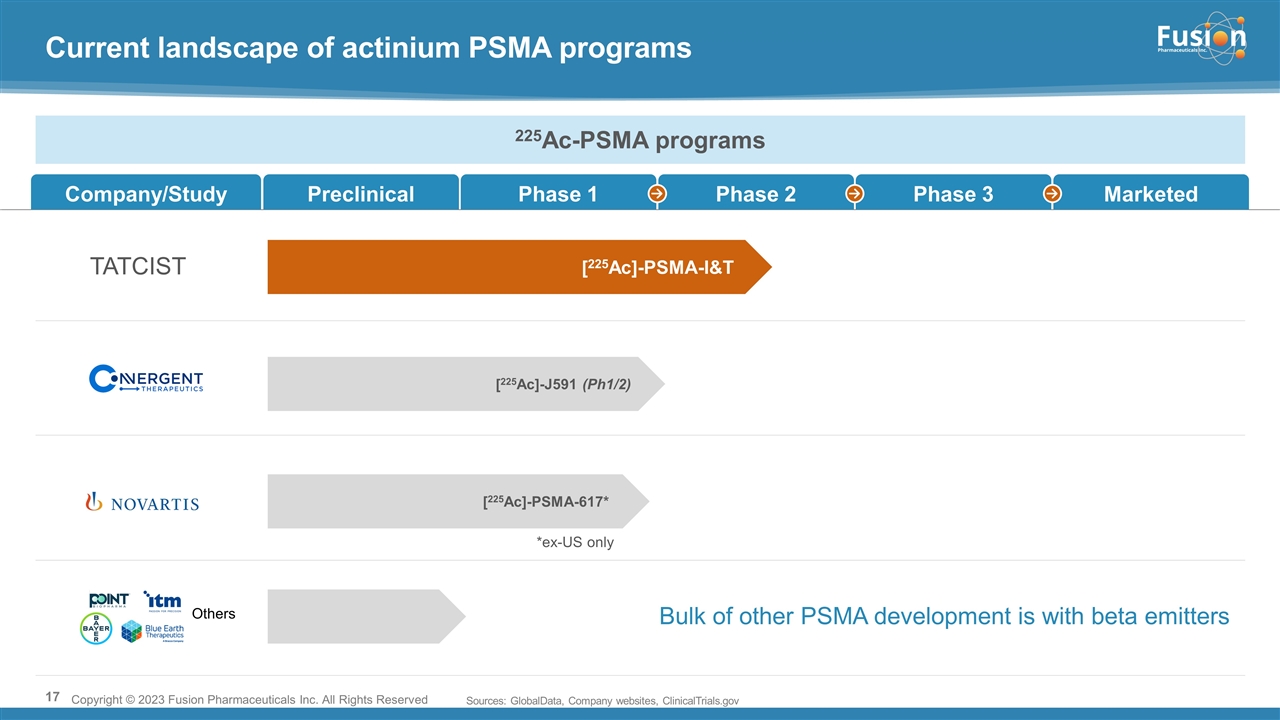

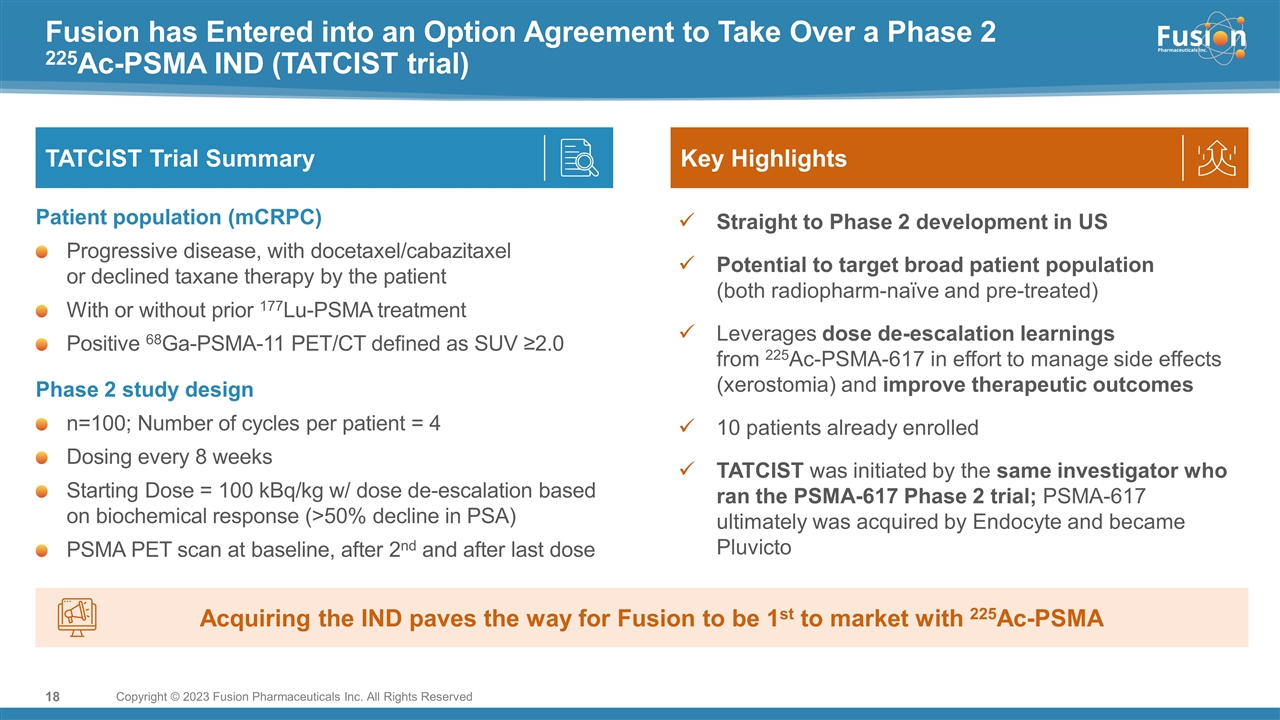

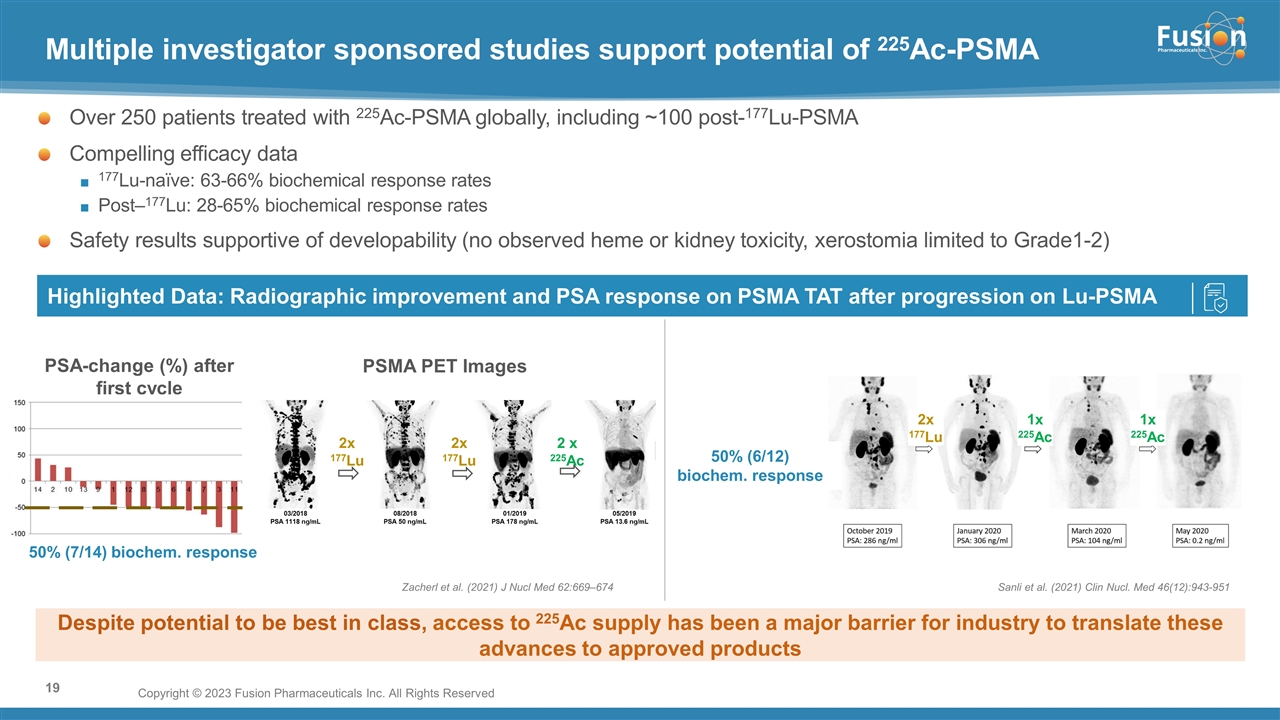

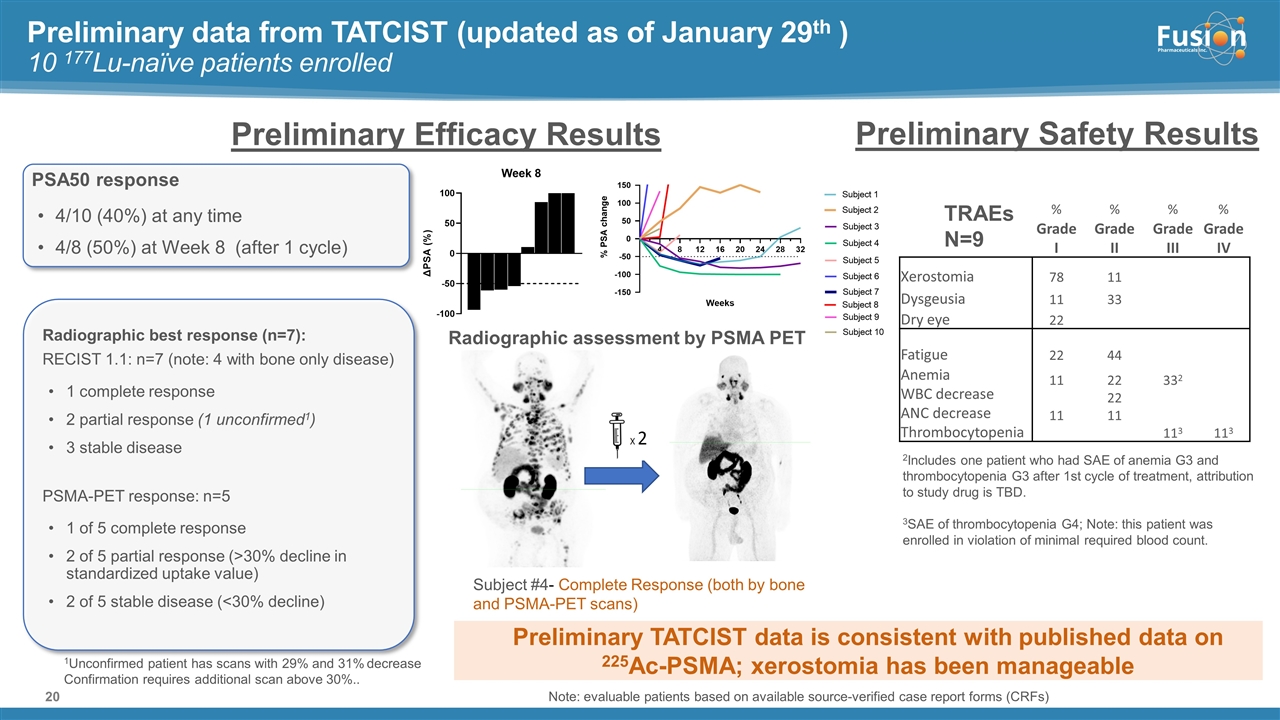

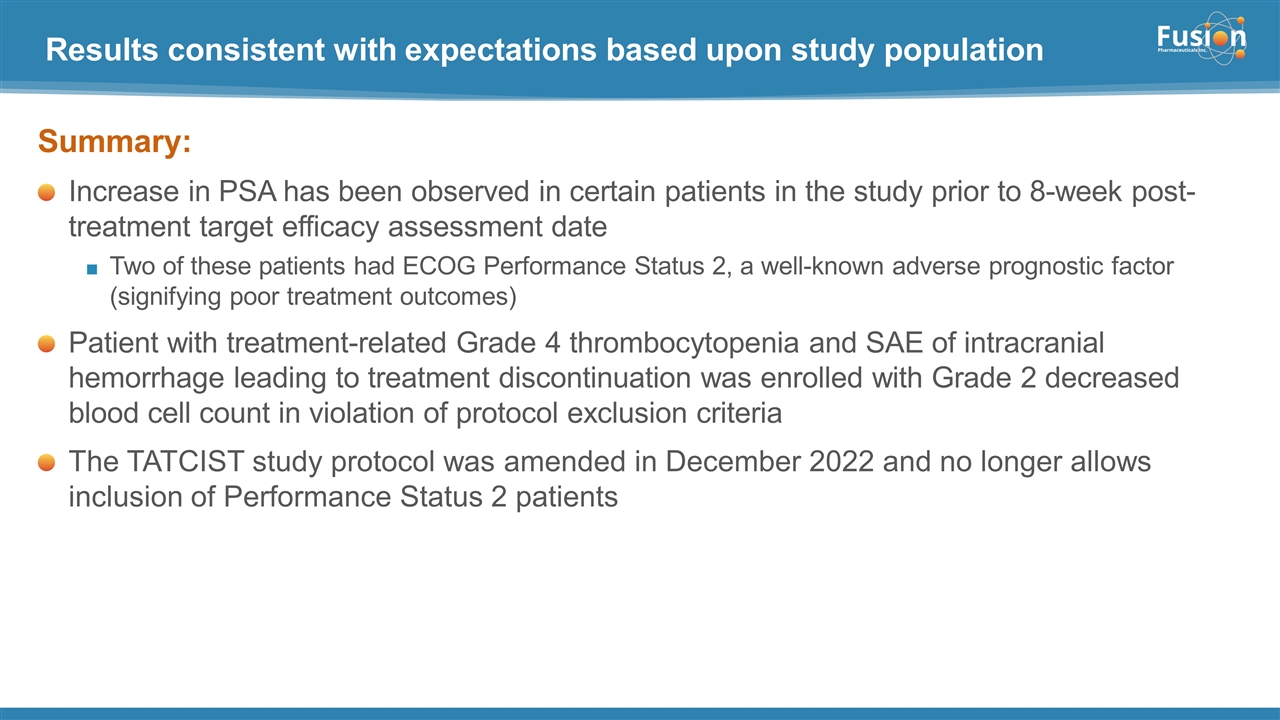

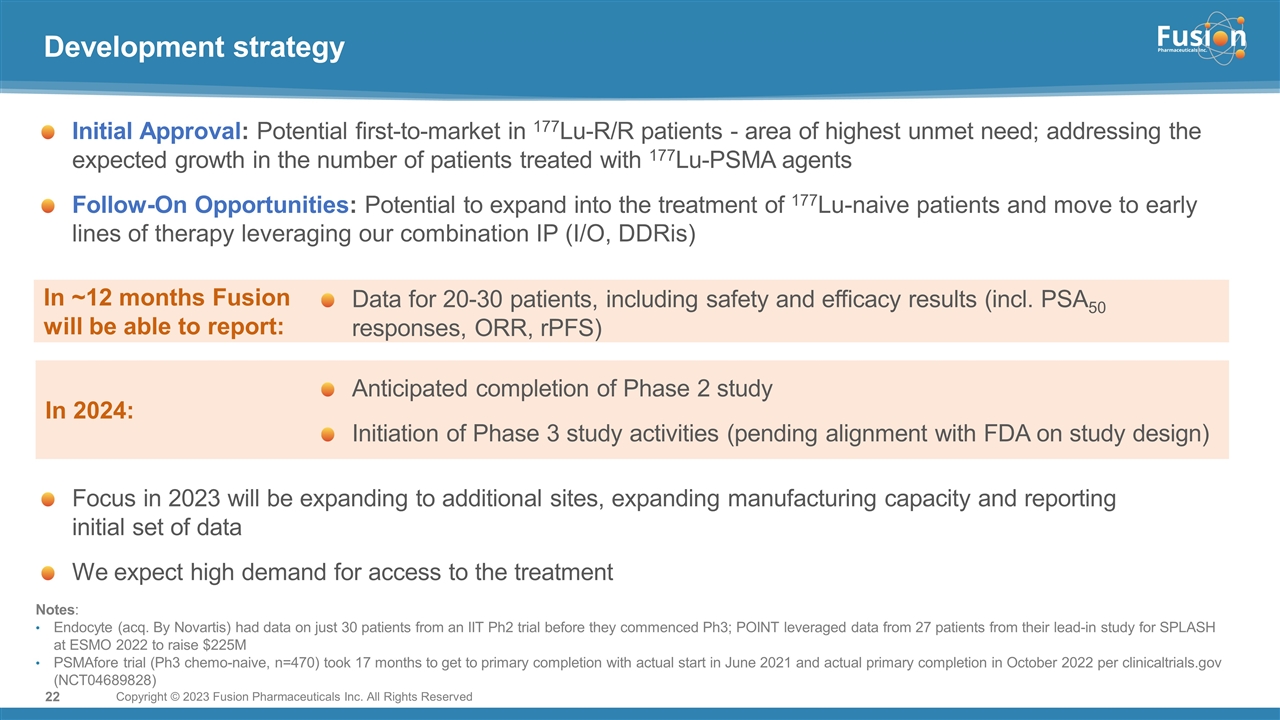

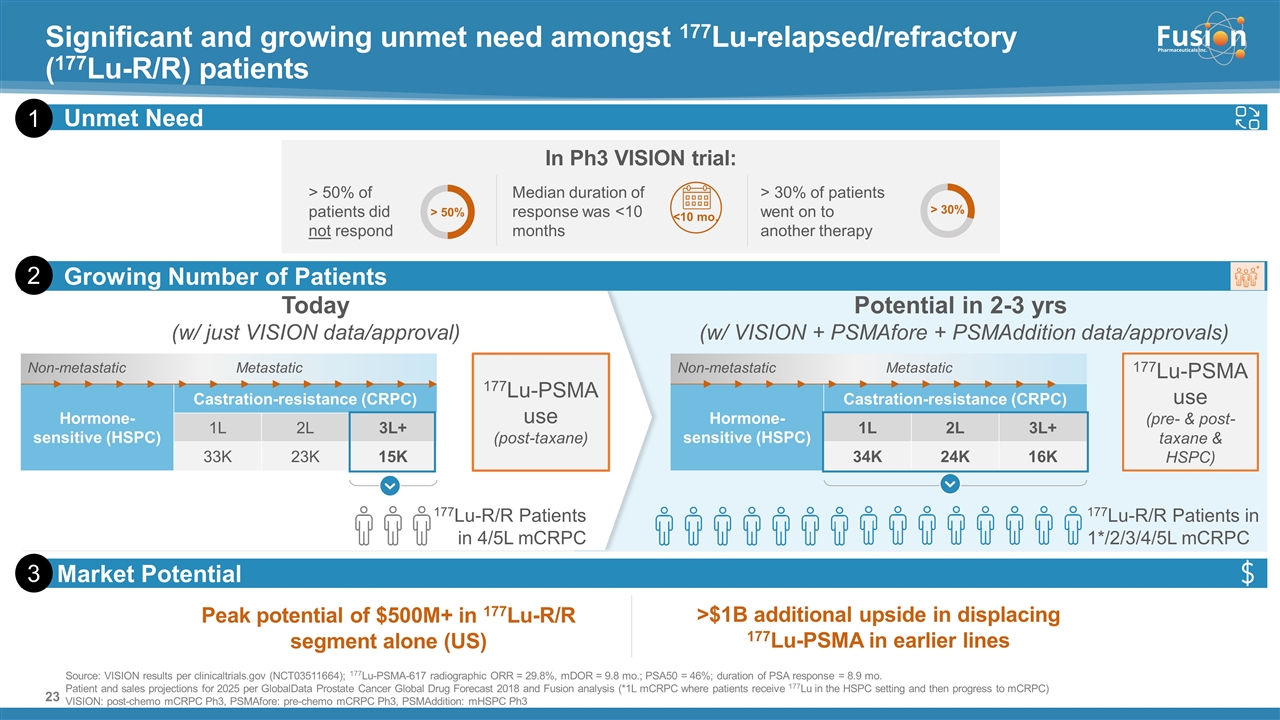

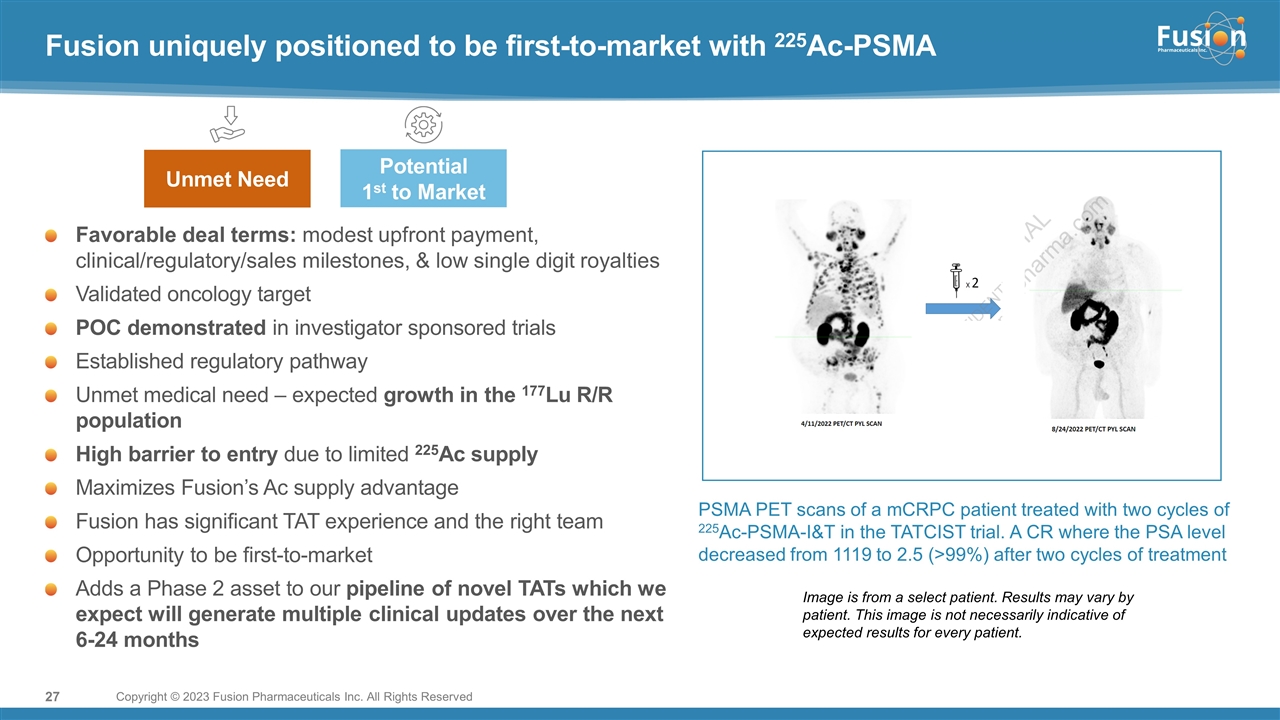

On November 14, 2022, Fusion Pharmaceuticals Inc. (the “Company”) and RadioMedix, Inc. (“RadioMedix”) entered into an option and asset purchase agreement (the “Option and Asset Purchase Agreement”), pursuant to which RadioMedix granted to Fusion the exclusive right, but not the obligation (the “Option”), to acquire certain of RadioMedix’s assets related to its on-going Phase 2 clinical trial evaluating 225-actinium PSMA I&T (the “TATCIST Study”), a small molecule targeting prostate specific membrane antigens, expressed on prostate tumors. Such assets include, among other things, the investigational new drug application for the TATCIST Study, and all governmental authorizations and materials related thereto, all know-how, intellectual property and information of RadioMedix related to 225-actinium PSMA, any third-party license held, or later acquired, by RadioMedix relating to 225-actinium PSMA, and clinical and other data for the TATCIST Study (collectively, the “Assets”). In exchange for the Option, the Company paid RadioMedix an option fee of $750,000 upon the execution of the Option Asset and Purchase Agreement. The Option has an exercise fee of $1.5 million payable to RadioMedix (the “Exercise Fee”). Pursuant to the terms of the Option and Asset Purchase Agreement, the Company must exercise the Option within a specified time period following the delivery by RadioMedix of specified data related to the TATCIST Study (the “Option Trigger”), though the Company has the right to exercise the Option prior to achievement of the Option Trigger.

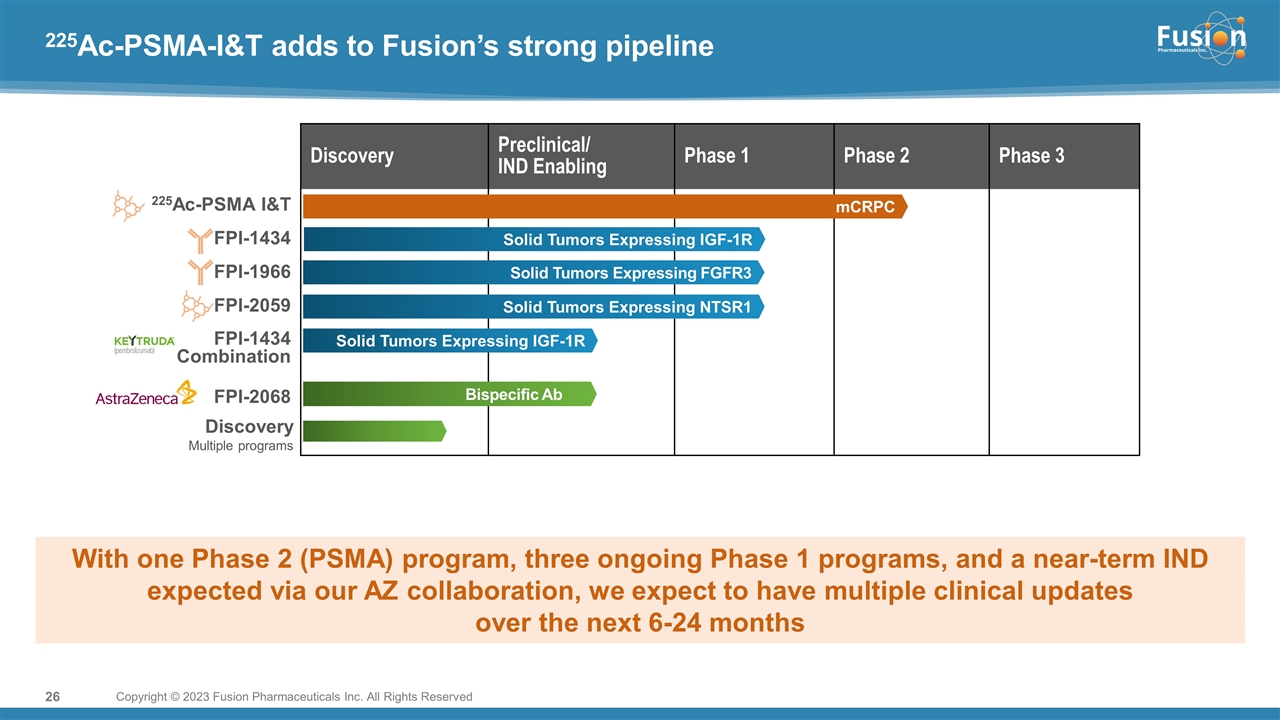

On February 10, 2023 (the “Option Exercise Date”), the Company notified RadioMedix of its decision to exercise the Option and paid the Exercise Fee. The acquisition closed on February 10, 2023 (the “Closing”). Following the Closing, the alpha-emitting radiopharmaceutical being evaluated in the TATCIST Study is referred to as FPI-2265.

Pursuant to the terms of the Option and Asset Purchase Agreement, the Company will be obligated to pay RadioMedix (i) up to an additional $10.5 million upon the achievement of certain clinical and regulatory milestones, (ii) low single-digit royalties on potential future net sales, subject to specified reductions, and (iii) up to an additional $50.0 million in net sales milestones; in each case, relating to products covered by the Option and Asset Purchase Agreement. In addition, in the event RadioMedix or the Company is successful in obtaining certain intellectual property rights from a third party relating to 225-actinium PSMA I&T (the “Third Party IP Rights”), the amount of the clinical and regulatory milestone payments will be increased by up to an aggregate of $4.0 million and the royalty rates will increase but remain in the low- to mid-single digits.

Pursuant to the Option and Asset Purchase Agreement, the Company is prohibited from terminating or deprioritizing the development of 225-actinium PSMA I&T, subject to specified exceptions, including, but not limited to regulatory, safety, efficacy, market exclusivity and competition and patentability developments. If the Company terminates or deprioritizes the development of 225-actinium PSMA I&T, and does not sell, license or otherwise transfer its rights to a third-party within 12 months of such termination, the Company and RadioMedix are required to negotiate the return of 225-actinium PSMA I&T and related assets to RadioMedix in return for specified reimbursement costs to the Company.

The Option and Asset Purchase Agreement includes representations, warranties and covenants of the parties customary for a transaction of this nature. Among other things, RadioMedix has agreed, subject to certain exceptions, not to develop or research a molecule that targets PSMA I&T for a certain period of time following the Closing.

The Option and Asset Purchase Agreement also contains customary termination provisions, including termination (i) by mutual written agreement of the parties, (ii) by either party in the event that the applicable conditions for termination of the TATCIST Study set forth in the TATCIST Study protocol are met, and (iii) by either party upon a material breach of the Agreement by the other party.

To date, Excel Diagnostics and Nuclear Oncology Center (“Excel”), an affiliate of RadioMedix, has been the only clinical trial site dosing patients in the TATCIST Study. At the Closing, the Company and Excel entered into a clinical trial agreement, pursuant to which Excel shall remain a clinical trial site following the Closing. Additionally, at the Closing, the Company and RadioMedix entered into manufacturing agreements under which RadioMedix will supply FPI-2265 to the Company for use in clinical trials.

The description of the Option and Asset Purchase Agreement contained herein does not purport to be complete and is qualified in its entirety by reference to the complete text of the Option and Asset Purchase Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Securities Purchase Agreement

On February 13, 2023, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the purchasers named therein (the “Investors”).

Pursuant to the Purchase Agreement, the Company agreed to sell an aggregate of 17,648,596 of its common shares (the “Shares”), no par value per share (the “Common Shares”), at a purchase price equal to $3.40 per share, which represents the closing price on the Nasdaq Global Select Market on February 10, 2023, to the Investors for aggregate gross proceeds of approximately $60 million (collectively, the “Offering”). The Offering is expected to close on or about February 16, 2023, subject to the satisfaction of certain customary closing conditions.

Upon the closing of the Offering, the Company anticipates having $248.0 million in cash and cash equivalents, which it believes will be sufficient to fund its planned operating expenses and capital expenditure requirements into the first quarter of 2025.

Registration Rights Agreement

On February 13, 2023, in connection with the Purchase Agreement, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors. Pursuant to the Registration Rights Agreement, the Company agreed to prepare and file a registration statement with the Securities and Exchange Commission (the “SEC”) within 45 calendar days after the closing of the Offering for purposes of registering the resale of the Shares and any Common Shares as a dividend or other distribution with respect to the Shares. The Company agreed to use its commercially reasonable efforts to cause this registration statement to be declared effective by the SEC within 60 days after the filing of the registration statement.

The Company has also agreed, among other things, to indemnify the Investors, their officers, directors, members, employees and agents, successors and assigns under the registration statement from certain liabilities and to pay all fees and expenses (excluding any legal fees of the selling holder(s), and any underwriting discounts and selling commissions) incident to the Company’s obligations under the Registration Rights Agreement.

The Offering was exempt from registration pursuant to Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder, as a transaction by an issuer not involving a public offering. The Investors have acquired the securities not with a view to or for sale in connection with any distribution thereof, and appropriate legends have been affixed to the securities issued in this transaction.

The foregoing summaries of the Purchase Agreement and Registration Rights Agreement do not purport to be complete and are qualified in their entirety by reference to the Purchase Agreement and Registration Rights Agreement, which are filed as Exhibits 10.2 and 10.3, respectively, to this Current Report on Form 8-K.

| Item 3.02 |

Sale of Unregistered Securities. |

The information contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

| Item 7.01 |

Regulation FD Disclosure. |

On February 13, 2023, the Company issued a press release announcing, among other things, the Offering, its exercise of the Option under the Option and Asset Purchase Agreement and the Closing. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information set forth in this Item 7.01 is “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

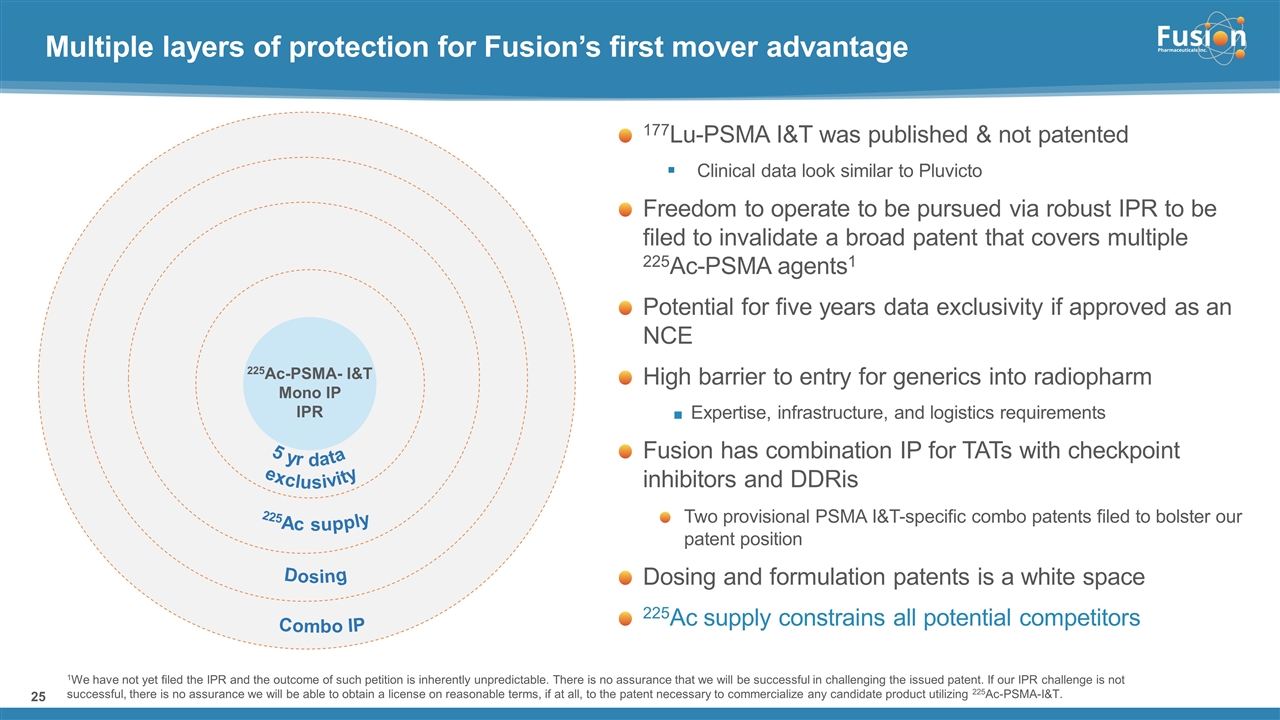

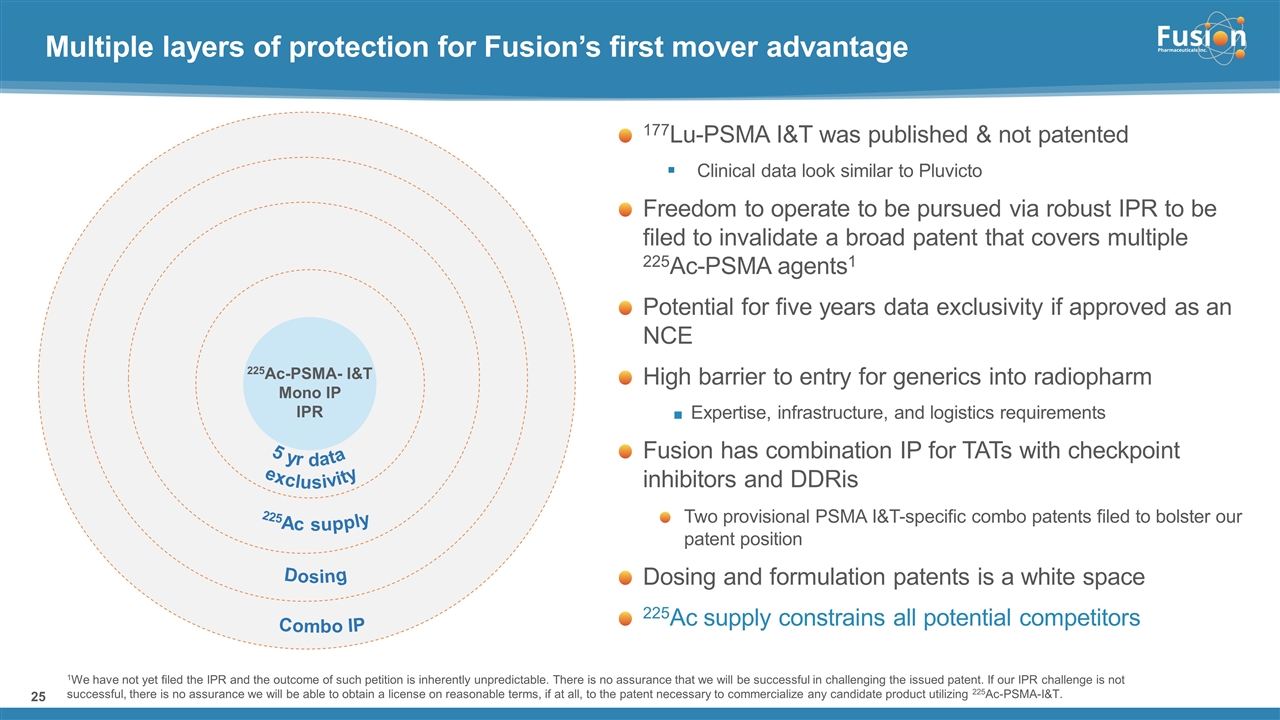

On February 13, 2023, the Company filed an inter partes review with the Patent Trial and Appeal Board to invalidate an issued U.S. patent with claims directed to methods for treating PSMA expressing cancers with multiple 225Ac-PSMA targeting agents issued to the University of Heidelberg (the “IPR”).

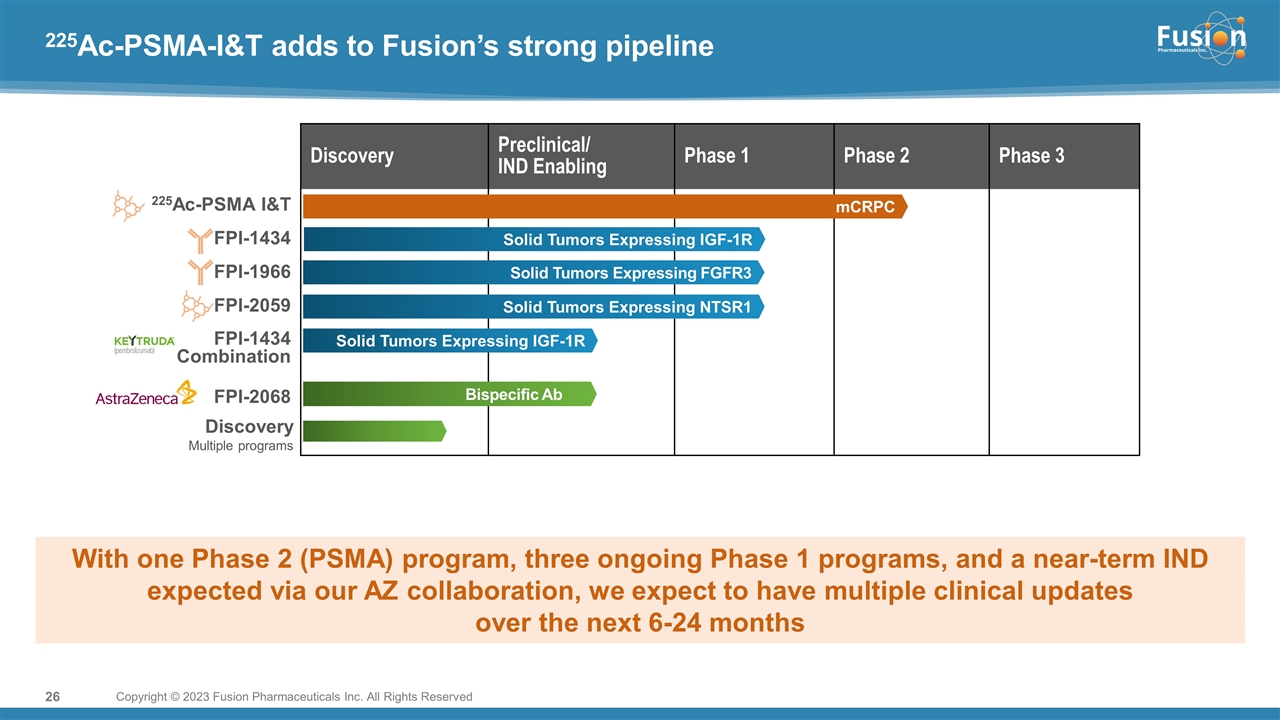

On February 13, 2023, the Company will host an investor call regarding FPI-2265. A copy of the presentation to be presented is filed as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

In connection with the exercise of the Option and the IPR, the Company is filing this information with this Current Report on Form 8-K for the purpose of supplementing and updating disclosures contained in the Company’s prior filings with the SEC including those discussed under the heading “Item 1A. Risk Factors,” in the Company’s most recent Quarter Report on Form 10-Q for the quarter ended September 30, 2022. The supplemental risk factors are filed herewith as Exhibit 99.3 and are incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995, including but not limited to the statements regarding the Company’s future business and financial performance. For this purpose, any statements contained herein that are not statements of historical fact may be deemed forward-looking statements. Without limiting the foregoing, the words “expect,” “plans,” “anticipates,” “intends,” “will,” and similar expressions are also intended to identify forward-looking statements, as are expressed or implied statements with respect to the Company’s potential drug candidates, including any expressed or implied statements regarding the successful development of its product candidates. Actual results may differ materially from those indicated by such forward-looking statements as a result of risks and uncertainties, including but not limited to the following: the Company’s ability to close the Offering; the timing and advancement of current and planned clinical trials, the Company’s ability to replicate results achieved in its preclinical studies or clinical trials, or that of RadioMedix in any future studies or trials; the Company’s ability to maintain its intellectual property portfolio, including through its IPR; and the timing and success of the Company’s development and commercialization of its product candidates; risks relating to the regulatory process; unexpected patient recruitment delays or regulatory actions or delays; the Company’s ability to obtain additional funding required to conduct its research, development and commercialization activities; changes in the Company’s business plan or objectives; and the Company’s ability to obtain, maintain and enforce patent and other intellectual property protection for its product candidates and its discoveries. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results, performance or achievements expressed or implied by such statements. These and other risks which may impact management’s expectations are described in greater detail under the heading “Risk Factors” in the Company’s quarterly report on Form 10-Q for the quarter ended September 30, 2022, as filed with the SEC and in any subsequent periodic or current report that the Company files with the SEC. All forward-looking statements reflect the Company’s estimates only as of the date of this release (unless another date is indicated) and should not be relied upon as reflecting the Company’s views, expectations or beliefs at any date subsequent to the date of this release. While the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so, even if the Company’s estimates change.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1†* |

|

Option and Asset Purchase Agreement by and between Fusion Pharmaceuticals Inc. and RadioMedix, Inc., dated November 14, 2022 |

|

|

| 10.2#* |

|

Securities Purchase Agreement, dated February 13, 2023, by and among Fusion Pharmaceuticals Inc. and the Investors named therein |

|

|

| 10.3#* |

|

Registration Rights Agreement, dated February 13, 2023, by and among Fusion Pharmaceuticals Inc. and the Investors named therein |

|

|

| 99.1 |

|

Press Release, issued by Fusion Pharmaceuticals Inc., dated February 13, 2023 |

|

|

| 99.2 |

|

Investor Presentation |

|

|

| 99.3 |

|

Updated Corporate Disclosure |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| † |

Certain portions of this exhibit (indicated by asterisks) were omitted in accordance with the rules of the Securities and Exchange Commission. |

| * |

Exhibits and/or schedules to this exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The registrant agrees to furnish supplementally copies of any omitted exhibits or schedules to the U.S. Securities and Exchange Commission upon request; provided, however, that the registrant may request confidential treatment pursuant to Rule 24b-2 of the Exchange Act for any exhibits or schedules so furnished. |

| # |

The representations and warranties contained in this agreement were made only for purposes of the transactions contemplated by the agreement as of specific dates and may have been qualified by certain disclosures between the parties and a contractual standard of materiality different from those generally applicable under securities laws, among other limitations. The representations and warranties were made for purposes of allocating contractual risk between the parties to the agreement and should not be relied upon as a disclosure of factual information relating to the Company, the Investors or the transactions described in this Current Report on Form 8-K. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Fusion Pharmaceuticals Inc. |

|

|

|

|

| Date: February 13, 2023 |

|

|

|

By: |

|

/s/ Maria Stahl |

|

|

|

|

|

|

Maria Stahl |

|

|

|

|

|

|

Chief Legal Officer |

Exhibit 10.1

CERTAIN CONFIDENTIAL PORTIONS OF THIS EXHIBIT HAVE BEEN OMITTED AND REPLACED WITH “[***]”. SUCH IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS

EXHIBIT BECAUSE IT IS (I) NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM TO THE COMPANY IF DISCLOSED.

OPTION AND ASSET PURCHASE AGREEMENT

dated as of November 14, 2022

by and between

RADIOMEDIX, INC.

and

FUSION PHARMACEUTICALS INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| ARTICLE I DEFINITIONS |

|

|

1 |

|

|

|

|

| 1.1 |

|

Definitions |

|

|

1 |

|

| 1.2 |

|

Construction |

|

|

13 |

|

| 1.3 |

|

Performance of Obligations by Affiliates |

|

|

13 |

|

|

|

| ARTICLE II OPTION GRANT AND EXERCISE |

|

|

14 |

|

|

|

|

| 2.1 |

|

Grant of Option |

|

|

14 |

|

| 2.2 |

|

TATCIST Study |

|

|

14 |

|

| 2.3 |

|

Additional Site Payments |

|

|

16 |

|

| 2.4 |

|

Exercise of Option |

|

|

16 |

|

|

|

| ARTICLE III PURCHASE AND SALE |

|

|

17 |

|

|

|

|

| 3.1 |

|

Agreement to Purchase and Sell |

|

|

17 |

|

| 3.2 |

|

Excluded Assets |

|

|

18 |

|

| 3.3 |

|

Assumed Liabilities |

|

|

19 |

|

| 3.4 |

|

Excluded Liabilities |

|

|

19 |

|

| 3.5 |

|

Procedures for Assignments |

|

|

20 |

|

| 3.6 |

|

Wrong Pocket Assets |

|

|

21 |

|

| 3.7 |

|

Purchase Price |

|

|

21 |

|

| 3.8 |

|

Deferred Payments |

|

|

22 |

|

| 3.9 |

|

Allocation of Purchase Price |

|

|

26 |

|

| 3.10 |

|

Withholding and Other Taxes |

|

|

26 |

|

| 3.11 |

|

Third Party Patent |

|

|

27 |

|

|

|

| ARTICLE IV CLOSING |

|

|

29 |

|

|

|

|

| 4.1 |

|

Closing |

|

|

29 |

|

| 4.2 |

|

Transactions at Closing |

|

|

29 |

|

|

|

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF SELLER |

|

|

30 |

|

|

|

|

| 5.1 |

|

Qualification, Organization, etc. |

|

|

30 |

|

| 5.2 |

|

Authority; Binding Effect |

|

|

30 |

|

| 5.3 |

|

No Conflicts; Consents |

|

|

31 |

|

| 5.4 |

|

Consents and Governmental Approvals |

|

|

31 |

|

| 5.5 |

|

Title to Assets |

|

|

31 |

|

| 5.6 |

|

Absence of Certain Changes or Events |

|

|

31 |

|

| 5.7 |

|

Orders; Litigation |

|

|

32 |

|

| 5.8 |

|

Compliance with Laws; Regulatory Matters |

|

|

32 |

|

| 5.9 |

|

Tax Matters |

|

|

34 |

|

-i-

|

|

|

|

|

|

|

| 5.10 |

|

Intellectual Property |

|

|

35 |

|

| 5.11 |

|

Insurance |

|

|

36 |

|

| 5.12 |

|

Brokers |

|

|

36 |

|

| 5.13 |

|

Solvency |

|

|

36 |

|

| 5.14 |

|

No Reliance |

|

|

36 |

|

|

|

| ARTICLE VI REPRESENTATIONS AND WARRANTIES OF BUYER |

|

|

37 |

|

|

|

|

| 6.1 |

|

Qualification, Organization, etc. |

|

|

37 |

|

| 6.2 |

|

Authority; Binding Effect |

|

|

37 |

|

| 6.3 |

|

No Conflicts; Consents |

|

|

38 |

|

| 6.4 |

|

Consents and Governmental Approvals |

|

|

38 |

|

| 6.5 |

|

Orders; Litigation |

|

|

38 |

|

| 6.6 |

|

Solvency |

|

|

38 |

|

| 6.7 |

|

Brokers |

|

|

38 |

|

| 6.8 |

|

No Reliance |

|

|

38 |

|

|

|

| ARTICLE VII PRE-CLOSING COVENANTS |

|

|

39 |

|

|

|

|

| 7.1 |

|

Conduct Prior to the Closing |

|

|

39 |

|

| 7.2 |

|

Efforts; Execution of Transfer Documents |

|

|

40 |

|

| 7.3 |

|

Access |

|

|

41 |

|

| 7.4 |

|

Exclusivity |

|

|

41 |

|

| 7.5 |

|

Notification of Certain Matters |

|

|

42 |

|

| 7.6 |

|

Insurance |

|

|

42 |

|

| 7.7 |

|

Manufacturing Diligence |

|

|

42 |

|

| 7.8 |

|

Manufacturing and Quality Agreements |

|

|

43 |

|

| 7.9 |

|

Manufacturing Technology Transfer |

|

|

43 |

|

| 7.10 |

|

Delivery of Data Site Copies |

|

|

44 |

|

| 7.11 |

|

Biweekly Data Reports and Pre-Closing Data License |

|

|

44 |

|

| 7.12 |

|

Clinical Trial Agreement |

|

|

44 |

|

|

|

| ARTICLE VIII OTHER AGREEMENTS |

|

|

45 |

|

|

|

|

| 8.1 |

|

Books and Records; Access; Assistance |

|

|

45 |

|

| 8.2 |

|

Privileged Matters |

|

|

46 |

|

| 8.3 |

|

Non-Competition |

|

|

46 |

|

| 8.4 |

|

TATCIST Study and Regulatory Transfers |

|

|

46 |

|

| 8.5 |

|

Additional TATCIST Transfer Services |

|

|

46 |

|

| 8.6 |

|

Further Assurances |

|

|

47 |

|

| 8.7 |

|

[***]. |

|

|

47 |

|

| 8.8 |

|

Residual Know-How License |

|

|

48 |

|

|

|

| ARTICLE IX TAX MATTERS |

|

|

48 |

|

|

|

|

| 9.1 |

|

Transfer Taxes |

|

|

48 |

|

| 9.2 |

|

VAT |

|

|

48 |

|

| 9.3 |

|

Tax Cooperation |

|

|

48 |

|

-ii-

|

|

|

|

|

|

|

| 9.4 |

|

Straddle Period Allocation |

|

|

48 |

|

| 9.5 |

|

Section 56.4 Election |

|

|

49 |

|

| 9.6 |

|

Tax Provision Priority |

|

|

49 |

|

|

|

| ARTICLE X CONDITIONS TO CLOSING |

|

|

49 |

|

|

|

|

| 10.1 |

|

Conditions to Each Party’s Obligations |

|

|

49 |

|

| 10.2 |

|

Conditions to Seller’s Obligations |

|

|

49 |

|

| 10.3 |

|

Conditions to Buyer’s Obligations |

|

|

50 |

|

| 10.4 |

|

Frustration of Closing Conditions |

|

|

50 |

|

|

|

| ARTICLE XI TERMINATION |

|

|

51 |

|

|

|

|

| 11.1 |

|

Termination Prior to the Closing |

|

|

51 |

|

| 11.2 |

|

Procedure and Effect of Termination |

|

|

52 |

|

|

|

| ARTICLE XII INDEMNIFICATION |

|

|

52 |

|

|

|

|

| 12.1 |

|

Survival; Effect of Materiality Qualifiers; Losses |

|

|

52 |

|

| 12.2 |

|

Indemnification by Seller |

|

|

53 |

|

| 12.3 |

|

Indemnification by Buyer |

|

|

54 |

|

| 12.4 |

|

Third Party Claims |

|

|

55 |

|

| 12.5 |

|

Direct Claims |

|

|

57 |

|

| 12.6 |

|

Set-Off |

|

|

57 |

|

| 12.7 |

|

Adjustment to Losses |

|

|

57 |

|

| 12.8 |

|

Characterization of Indemnification Payments |

|

|

57 |

|

| 12.9 |

|

Exclusive Remedy |

|

|

57 |

|

| 12.10 |

|

Satisfaction of Indemnification Claims |

|

|

58 |

|

|

|

| ARTICLE XIII MISCELLANEOUS |

|

|

58 |

|

|

|

|

| 13.1 |

|

Assignment |

|

|

58 |

|

| 13.2 |

|

Public Announcements |

|

|

58 |

|

| 13.3 |

|

Confidentiality |

|

|

59 |

|

| 13.4 |

|

Expenses |

|

|

61 |

|

| 13.5 |

|

Severability |

|

|

61 |

|

| 13.6 |

|

No Third-Party Beneficiaries |

|

|

61 |

|

| 13.7 |

|

Waiver |

|

|

61 |

|

| 13.8 |

|

Governing Law |

|

|

61 |

|

| 13.9 |

|

Consent to Jurisdiction; Venue; Waiver of Jury Trial |

|

|

62 |

|

| 13.10 |

|

Specific Performance |

|

|

62 |

|

| 13.11 |

|

Representation by Counsel |

|

|

62 |

|

| 13.12 |

|

English Language |

|

|

63 |

|

| 13.13 |

|

Bulk Transfers |

|

|

63 |

|

| 13.14 |

|

Notices |

|

|

63 |

|

| 13.15 |

|

Counterparts; Signature Pages |

|

|

64 |

|

| 13.16 |

|

Entire Agreement; Amendment |

|

|

64 |

|

-iii-

SCHEDULES

Schedule 1.1(A) – Expert Dispute Resolution

Schedule

1.1(B) – Permitted Liens

Schedule 2.2(a) – TATCIST Study Protocol

Schedule 3.1(d) – Transferred Regulatory Materials

Schedule

3.1(j) – Other Acquired Assets

Schedule 3.11 – Patent at Issue

Schedule 7.9(a) – Licensed Manufacturing Know-How

EXHIBITS

Exhibit A – Bill of Sale

and Assignment and Assumption Agreement

Exhibit B – Compound

Exhibit C – Data Package

-iv-

Exhibit 10.1

OPTION AND ASSET PURCHASE AGREEMENT

This Option and Asset Purchase Agreement (this “Agreement”), dated as of November 14, 2022, is entered into by and

between Fusion Pharmaceuticals Inc., a Canadian federal corporation (“Buyer”), and RadioMedix, Inc., a Texas corporation (“Seller”). Seller and Buyer are

sometimes referred to in this Agreement collectively as the “Parties” and individually as a “Party”.

WHEREAS, Seller is engaged in, among other things, the Business;

WHEREAS, upon the terms and subject to the conditions set forth herein, Buyer desires to acquire from Seller an exclusive option to purchase,

at the Closing, the Acquired Assets (the “Option”), upon the terms and conditions set forth herein, and in connection therewith, if the Option is exercised, the Parties wish to enter into the additional transactions contemplated by

this Agreement and by the Ancillary Agreements (collectively, the “Transactions”);

WHEREAS, Seller is willing to grant

the Option to Buyer for an option fee of Seven Hundred and Fifty Thousand Dollars ($750,000) (the “Option Fee”), which will be paid by Buyer to Seller in accordance with the terms and conditions set forth herein; and

WHEREAS, if the Option is exercised by Buyer, at the Closing, Seller shall sell, transfer and deliver to Buyer, and Buyer shall purchase from

Seller, the Acquired Assets, and Buyer shall assume the Assumed Liabilities, each upon the terms and conditions set forth herein.

NOW,

THEREFORE, in consideration of the premises and mutual covenants, agreements and provisions herein contained, the Parties agree as follows:

ARTICLE I

DEFINITIONS

1.1 Definitions. In addition to the terms defined above and other terms defined in other Sections of this Agreement, the

following capitalized terms have the following meanings when used herein:

“Additional Site Dosing” means the dosing of a

patient in the TATCIST Study with the Compound at a clinical site at which no TATCIST Study patient has previously received a dose of the Compound.

“Adverse Law or Order” means (a) any Law enacted, promulgated or enforced by any Governmental Authority of competent

jurisdiction which prohibits or makes illegal the consummation of the Transactions or (b) any Order preventing the consummation of the Transactions, whether preliminary or final.

“Affiliate” means, with respect to any Person, any other Person which, at

the time of determination, directly or indirectly controls, is controlled by, or is under common control with, such first Person. For purposes of this definition, “control” (including, with correlative meanings, the terms

“controlled by” and “under common control with”), as used with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person,

whether through the ownership of voting securities, by Contract or otherwise. Excel Diagnostics and Nuclear Oncology Center are each an “Affiliate” of Seller for all purposes of this Agreement. Notwithstanding the foregoing, as it pertains

to the representations and warranties in Article V of this Agreement and the covenants contained in Section 8.3 of this Agreement, “Affiliate” of Seller shall be limited to Excel Diagnostics and Nuclear

Oncology Center and any Subsidiaries of Seller. Notwithstanding the foregoing, during any period in which any class of Buyer’s equity securities are listed on one or more stock exchanges, no Person shall be deemed an “Affiliate” of

Buyer solely due to such Person’s ownership of securities of Buyer, except if such Person owns, directly or indirectly, a majority of the outstanding voting securities of Buyer.

“Ancillary Agreements” means the Transfer Documents, the Clinical Trial Agreement, the Manufacturing Agreement and the

Quality Agreement.

“Annual Net Sales” means the total, aggregate Net Sales of all Products by all Payment Obligors in a

particular calendar year.

“Bill of Sale and Assignment and Assumption Agreement” means a bill of sale and assignment and

assumption agreement to be entered into between Seller and Buyer at the Closing substantially in the form of Exhibit A.

“Books and Records” means original or, if originals do not exist, true and complete copies, of all books, records, files

(including data files), work papers and other documents, including (a) supplier lists, purchase orders and invoices, inventory records, quality control records and manuals, and product development, stability, clinical study and manufacturing

processes records; (b) all files relating to the filing, prosecution, issuance, maintenance, enforcement or defense of any intellectual Property; (c) records (including trial master file, case report forms and all other clinical study

documentation), files (including data files, PSMA PET, CT/MRI and bone imaging data and DICOM imaging files) and documents related to research, pre-clinical and clinical testing and studies (including in

vivo and in vitro studies), including pre-clinical data files arising out of the development of compounds or any precursors or derivatives thereof, laboratory notebooks, dosage information, safety

and efficacy and study protocols; (d) investigators brochures and (e) all pharmacovigilance and other safety records, in each case in all forms, including electronic, in which they are stored or maintained.

“Business” means that portion of the business of Seller and its Affiliates consisting of researching, developing and

manufacturing any Compound or Product.

“Business Day” means any day other than (a) a Saturday or Sunday, or

(b) a day on which commercial banks in New York, NY; Ontario, Canada; or Houston, Texas are authorized or required to remain closed.

“Cap” means the sum of $[***] and [***]% of the Deferred Fixed Payments actually paid upon achievement of the Development and

Regulatory Events.

“Claim” means any claim, demand, cause of

action, chose in action, suit, litigation, Proceeding, arbitration, hearing or investigation.

-2-

“Code” means the means the United States Internal Revenue Code of 1986, as

amended.

“Combination Product” means (a) a product that contains the Compound as a therapeutically active

ingredient and at least one (1) other therapeutically active ingredient that is not the Compound; or (b) a product consisting of one or more separate drugs, devices, tests, kits or biological products and sold together with a Product in a

single package or as a unit at a single price.

“Competing Product” means any

Ac-225 labeled PSMA ligand.

“Compound” means that which is described in

Exhibit B.

“Confidentiality Agreement” means that certain Confidentiality Agreement, dated February 15,

2022, by and between the Parties.

“Consent” means any consent, approval, ratification, authorization, waiver, grant,

agreement, license, certificate, exemption, order, registration, declaration, filing or notice of, with or to any Person.

“Contract” means any contract, agreement, lease, instrument, note, indenture, license or sublicense, or other legally binding

commitment. “Contractual” has the correlative meaning.

“Controlled” means, with respect to any Know-How and Information the possession of the right, whether directly or indirectly, and whether by license, covenant not to sue or otherwise, to grant a license, sublicense or other right (including a covenant not

to sue) to or under such Know-How and Information as provided for herein without violating the terms of any agreement with any Third Party.

“Cover”, “Covering” or “Covered” means, with respect to a Valid Claim of a patent and a

compound or product, that the manufacture, use, offer for sale, sale or importation of such compound or product would infringe a Valid Claim of such patent in the country in which such activity occurred.

“Deductible” means $[***].

“Deferred Variable Payment Term” means, subject to Section 3.11(d), the time period beginning on

the First Commercial Sale of a Product anywhere in the Territory following the Closing and ending on the [***]; provided that if FDA grants Buyer or any of its Affiliates [***] for the Compound under U.S. 21 C.F.R. § [***], the Deferred

Variable Payment Term will expire [***].

“Development and Regulatory

Events” means Deferred Fixed Payment Events (1) through (4).

-3-

“Direct Claim” has the meaning set forth in

Section 12.5.

“Distributor” means any Person appointed by a Payment Obligor to distribute,

market and sell any Product with or without packaging rights, in one or more countries in the Territory, in circumstances where such Person purchases its requirements of Product from a Payment Obligor but does not otherwise make any royalty or other

payment to such Payment Obligor with respect to its intellectual property rights with respect to such Product.

“EMA”

means the European Medicines Agency and any successor agency thereto.

“FDA” means the U.S. Food and Drug Administration

and any successor agency thereto.

“FDCA” means the Federal Food, Drug, and Cosmetic Act (21 U.S.C. § 301 et

seq.), as amended from time to time, and any successor statute.

“Final Determination” means any final

determination of liability in respect of a Tax that, under applicable Law, is not subject to further appeal, review or modification through Proceedings or otherwise, including the expiration of a statute of limitations or a period for the filing of

claims for refunds, amended Tax Returns or appeals from adverse determinations including, for the avoidance of doubt, in the case of United States federal Taxes, a “determination” as defined in Section 1313(a) of the Code or execution

of an IRS Form 870-AD (or successor form).

“First Commercial Sale” means the

first invoiced sale by a Payment Obligor to a Third Party of any Product for therapeutic use after obtaining all Regulatory Approvals therefor in and for the country in which such sale occurred, including, where required by applicable Law, pricing

and reimbursement approval; provided, that any disposal or transfer of Product for any compassionate use or named patient access program or other similar programs prior to receipt of pricing or reimbursement approvals shall not constitute

“First Commercial Sale”.

“Fraud” means (i) actual fraud with intent to deceive (as determined under

Delaware law) by Seller perpetrated by a breach or inaccuracy of any representation or warranty set forth in Article V or in the certificate delivered by Seller pursuant to Section 10.3(d)(ii) or (ii) the actual

fraud with intent to deceive (as determined under Delaware law) by the Buyer perpetrated by a breach or inaccuracy of any representation or warranty of the Buyer set forth in Article VI or in the certificate delivered by Buyer pursuant to

Section 10.2(c)(ii) (and, in each case, for the avoidance of doubt does not include any fraud based on negligent misrepresentation, recklessness or a similar theory).

“GAAP” means generally accepted accounting principles, as applied in the United States.

“GCP” means the current standards for the design, conduct, performance, monitoring, auditing, recording, analysis and

reporting of clinical trials required by FDA or any other applicable U.S. Governmental Authority, including U.S. 21 C.F.R. §§ 11, 50, 54, 56, 312 and 314, Directive 2005/28/EC laying down principles and detailed guidelines for good

clinical practice, the ICH Guideline for Good Clinical Practice (E6), and the World Medical Association Declaration of Helsinki entitled “Ethical Principles for Medical Research Involving Human Subjects”, each as amended from time to time.

-4-

“GMP” means the current Good Manufacturing Practices officially published

and interpreted by the EMA, FDA and other applicable Regulatory Authorities that may be in effect from time to time and are applicable to the Manufacture of the Compound.

“Governmental Authority” means (a) any nation or government, including any federal, state, local or non-U.S. international or supranational organization or body thereof, municipality, principality, commonwealth, province, territory, county, district or other jurisdiction of any nature or other political

subdivision thereof in which Buyer, Seller, the Compound or any Product is subject to its jurisdiction; or (b) any entity, department, commission, bureau, agency, authority, board, court, arbitral tribunal, official or officer, U.S. or non-U.S., exercising executive, judicial, regulatory, administrative, police, military, or taxing governmental functions in which Buyer, Seller, the Compound or any Product is subject to its jurisdiction.

“Governmental Authorizations” means all licenses, consents, permits, certificates, filings, registrations, notifications,

franchises, concessions, authorizations, approvals, ratifications, permissions, clearances, confirmations, exemptions, endorsements, waivers, designations (including orphan drug designations) or qualifications issued, granted, given or otherwise

made available by or under the authority of any Governmental Authority or pursuant to any requirement under the applicable Laws of any Governmental Authority, including INDs but excluding Regulatory Approvals.

“IND” means an investigational new drug application submitted to the FDA pursuant to U.S. 21 C.F.R. § 312 or an

investigational device exemption application submitted to, or considered approved by, the FDA pursuant to U.S. 21 C.F.R. § 812, including any amendments thereto, and any comparable filing(s) with a Governmental Authority outside of the

U.S. for the purpose of obtaining permission to conduct clinical trials, including a clinical trial application.

“Independent

Accountant” means an independent accounting firm that Seller and Buyer shall mutually agree upon, and, if Seller and Buyer cannot agree, mutually chosen by their respective independent accounting firms.

“Information” means either Buyer Information or Seller Information, as applicable.

“Inventory Price” means, with respect to each unit of Inventory to be purchased by Buyer in accordance with

Section 3.1(g), an amount equal to [***].

“Intellectual Property” means intellectual property

or other proprietary rights anywhere in the world, including registered, unregistered, applied for and pending: (a) patents, patent applications, including provisional applications, statutory invention registrations, inventions, discoveries and

invention disclosures (whether or not patented), and related continuations, continuations-in-part, divisions, reissues,

re-examinations, substitutions, and extensions thereof (collectively, “Patent Rights”); (b) Know-How and Information; (c) trademarks, service

marks, trade names, trade dress, corporate names, logos, in each case whether or not registered, together with derivations and combinations thereof, and common law rights

-5-

thereto, and the goodwill associated with the foregoing, and applications (including intent to use applications), registration and renewals of the foregoing (collectively,

“Trademarks”); and (d) published and unpublished works of authorship including computer software programs, applications, source code and object code, and databases, copyrights in and to the foregoing, together with common law

rights and moral rights therein, and any applications and registrations therefor, including extensions, renewals, restorations, reversions, derivatives, translations, localizations, adaptations and combinations of the above.

“IRS” means the United States Internal Revenue Service.

“ITA” means the Income Tax Act (Canada), R.S.C., 1985, c. 1 (5th supplement).

“Know-How and Information” means data (biologic, chemical, CMC, non-clinical, pre-clinical, clinical and otherwise), information, know-how, proprietary information, trade secrets, prototypes,

techniques, research results, inventions, discoveries, other technology (including any proprietary models and any routes and methods for synthesis), procedures, tests, criteria for patient selection, and all other data and information, in each case

whether or not patentable or copyrightable.

“Law” means each provision of any national, territorial, multinational,

supranational, federal, state, provincial, local, municipal or foreign, civil and criminal law, common law, constitution, statute, regulation, legislation, ordinance, Order, code, proclamation, treaty, convention, rule, ruling, directive,

requirement, determination, decision, opinion or interpretation, promulgated, adopted, enacted, implemented, issued, passed, approved, or otherwise put into effect by or under the authority of any Governmental Authority.

“Liability” means any debt, liability, duty or obligation of such Person, whether known or unknown, absolute or contingent,

accrued or unaccrued, matured or unmatured, disputed or undisputed, liquidated or unliquidated, secured or unsecured, joint or several, due or to become due, vested or unvested, executory, determined, determinable or otherwise.

“Lien” means any lien, encumbrance, mortgage, security interest, pledge, conditional sale agreement or other title retention

agreement, or other charge or encumbrance on any property or property interest.

“Liquidation Event” means (i) a

merger or consolidation in which Seller is a constituent party or a Subsidiary of Seller is a constituent party and Seller issues shares of its capital stock pursuant to such merger or consolidation, except any such merger or consolidation involving

Seller or a Subsidiary in which the shares of capital stock of Seller outstanding immediately prior to such merger or consolidation continue to represent, or are converted into or exchanged for shares of capital stock that represent, immediately

following such merger or consolidation, at least a majority, by voting power, of the capital stock of (1) the surviving or resulting corporation; or (2) if the surviving or resulting corporation is a wholly owned subsidiary of another

corporation immediately following such merger or consolidation, the parent corporation of such surviving or resulting corporation; (ii) the sale, lease, transfer, exclusive license or other disposition, in a single transaction or series of

related transactions, by Seller or any Subsidiary of all or substantially all the assets of Seller and its subsidiaries taken as a whole; or (iii) the sale or

-6-

disposition (whether by merger, consolidation or otherwise, and whether in a single transaction or a series of related transactions) of one (1) or more subsidiaries of Seller if

substantially all of the assets of Seller and its subsidiaries taken as a whole are held by such Subsidiary or Subsidiaries, except where such sale, lease, transfer, exclusive license or other disposition is to a wholly owned Subsidiary of Seller,

in each case solely to the extent that the surviving entity in the preceding clause (i) or the acquirer, transferee or licensee, as applicable, in the case of the preceding clause (ii) or (iii), agrees in writing for the benefit of Buyer

to assume this Agreement and all of Seller’s rights and obligations hereunder.

“Litigation Matters” means all

Proceedings that have been or may be asserted by a Third Party against Seller or its Affiliates and the Compound or the TATCIST Study.

“Losses” means damages, Liabilities, losses, payments, fines, fees, penalties, interest, charges, judgments, settlements,

assessments, Taxes, costs and expenses (including reasonable attorneys’, accountants’ and other experts’ fees, and out-of-pocket disbursements, including

reasonable costs and expenses of investigation); provided, however, that Losses shall not include punitive, exemplary or consequential damages (including any such damages based on lost profit, business opportunity, diminution of value

or business multiples), except to the extent required to be paid to a Third Party not affiliated with the applicable Indemnified Party in connection with a Third Party claim.

“made available” when used in Article V means delivered (in physical or electronic form) to Buyer or its legal counsel

or made available in the electronic data room maintained by Digify for Seller in connection with the Transactions (the “Data Site”), in any case, not less than two days prior to the date of this Agreement or, with respect to any

representation or warranty in Article V made as of the Closing Date, not later than the 10th day after the date on which the Option Trigger Notice is given.

“Major European Market” means each of the following: [***].

“Manufacture” and “Manufacturing” means all activities related to the synthesis, making, production,

processing, filling, finishing, packaging, labeling, shipping, and holding of the Compound, any Product, or any intermediate thereof, including process development, process qualification and validation,

scale-up, pre-clinical, clinical and commercial production and analytic development, product characterization, stability testing, quality assurance, and quality control.

“Material Adverse Effect” means any change, effect, development, circumstance, condition, state of facts or occurrence

that [***].

“Net Sales” means [***].

“Order” means any writ, judgment, edict, decree, injunction, ruling, pronouncement, order, determination or other binding

obligation of any Governmental Authority (whether preliminary or final).

-7-

“Organizational Documents” means, with respect to any Person, collectively,

its organizational documents, including any certificate of incorporation, notarial deed of incorporation, certificate of formation, articles of organization, articles of association, business rules and regulations, bylaws, operating agreement,

certificate of limited partnership, partnership agreement, equityholders’ agreement or certificates of existence, or any non-U.S. equivalent of any of the foregoing, as applicable.

“Payment Obligor” means Buyer, its Affiliates, any of their successors, and any transferee, assignee, licensee or sublicensee

(and any of their transferees, assignees, licensees or sublicensees) of rights to develop and commercialize the Compound or any Product. Distributors are not Payment Obligors.

“Permitted Lien” means (a) statutory Liens for Taxes and other governmental charges and assessments that are not yet due

and payable or that are being contested in good faith by appropriate proceedings and for which the appropriate reserves have established in accordance with GAAP, (b) mechanics’, materialmen’s, carriers’, workers’,

repairers’ and similar statutory Liens arising or incurred in the ordinary course of Business, and (c) Liens specifically identified on Schedule 1.1(B).

“Person” means any natural person, individual, corporation (including any non-profit

corporation), partnership, joint venture, limited liability company, estate, trust, cooperative, foundation, society, political party, union, other unincorporated organization, joint stock company or Governmental Authority.

“Personally Identifiable Information” means any information that alone or in combination with other information held by

Seller or any of its Affiliates can be used to specifically identify an individual Person and any individually identifiable health information.

“Phase 2 Clinical Trial” means a human clinical trial of a compound or product that would meet the description in U.S. 21

C.F.R. § 312.21(b), as amended, or ICH Guidelines E8, and is intended to explore a variety of doses, dose response, and duration of effect, and to generate evidence of clinical safety and effectiveness for a particular indication or indications

in a target patient population.

“Pivotal Clinical Trial” means a human clinical trial of a compound or product that

would meet the description in U.S. 21 C.F.R. § 312.21(c), as amended, or ICH Guidelines E8, and is intended to (a) gather the additional information about effectiveness and safety that is needed to evaluate the overall benefit-risk

relationship of the compound or product and to provide an adequate basis for physician labeling, and (b) support Regulatory Approval for such compound or product.

“Post-Closing Tax Period” means any taxable period (or portion thereof) beginning after the Closing Date and ending on or

before [***].

“Pre-Closing Tax Period” means any taxable period (or portion

thereof) ending on or before the Closing Date and any taxable period (or portion thereof) beginning after [***].

-8-

“Privileged Information” means, with respect to each Party, information

regarding such Party or its Affiliates, or any of its operations, assets or liabilities (whether in documents or stored in any other form or known to its employees or agents) that is protected from disclosure pursuant to the attorney-client

privilege, the work product doctrine or another applicable legal privilege, in each case that the other Party or its Affiliates may come into possession of or obtain access to in connection with this Agreement or the Ancillary Agreements.

“Proceeding” or “Proceedings” means any claim, action, arbitration, audit, hearing, inquiry, prosecution,

contest, examination, proceeding, investigation, litigation, suit (whether civil, criminal, administrative, or investigative or appellate proceeding) commenced, brought, conducted, or heard by or before any Governmental Authority, arbitrator or

arbitration panel, or commenced or brought by any other Third Party.

“Product” means any product that contains or is

comprised of the Compound, including all formulations, modes of administration and dosage forms thereof.

“Regulatory

Approvals” means all permits, licenses, registrations and authorizations of the applicable Regulatory Authority, including approvals by FDA of new drug applications (as defined in U.S. 21 C.F.R. § 314.3(b)) and biologics license

applications (as described in U.S. 21 C.F.R. § 601.2), necessary for the marketing, labeling, distribution, commercialization and sale of a pharmaceutical product for a particular indication in a country or other jurisdiction in the world

(including separate pricing or reimbursement approvals, if required by applicable Law). INDs are not Regulatory Approvals.

“Regulatory Authority” means any Governmental Authority that is responsible for issuing technical, medical, scientific,

labeling and similar licenses, registrations, authorizations, permits, certifications, variances, exemptions, orders and approvals necessary for the manufacture, commercialization, labeling, distribution, use, storage, import, export, transport,

marketing or sale of any Product.

“Regulatory Materials” means all submissions, supporting materials, and related

correspondence to or from any Regulatory Authority in support of a Governmental Authorization or Regulatory Approval for the research, development, manufacture, distribution or commercialization of a biological or pharmaceutical product in a

regulatory jurisdiction, and all documents referenced in the complete regulatory chronology for each Governmental Authorization and Regulatory Approval, including all Drug Master Files (as defined in U.S. 21 C.F.R. § 314.420), INDs, pricing and

reimbursement approvals, and any non-U.S. equivalents of any of the foregoing.

“Representatives” means, with respect to any Person, any officers, directors, employees, attorneys, investment bankers,

financial advisors, agents and other representatives of such Person or such Person’s Affiliates.

“Review Board”

means all institutional review boards, privacy boards, data safety monitoring boards, or ethics committees responsible for review, oversight, or approval of any clinical trial involving a Compound or Product in any jurisdiction.

“Sales Events” means Deferred Fixed Payment Events (5) through (8).

-9-

“Seller’s Knowledge” means the actual knowledge of [***] and the

knowledge such Persons would have after performing a reasonably diligent investigation with respect to the relevant matter; provided, however, that, a reasonably diligent investigation shall not include the commissioning of a

“freedom to operate” or similar non-infringement or patent invalidity analysis.

“Subsidiary” means, with respect to any specified Person, any other Person of which such specified Person, directly or

indirectly through one or more Subsidiaries, (a) owns at least 50% of the outstanding equity interests entitled to vote generally in the election of the board of directors or similar governing body of such other Person, or (b) has the

power to generally direct the business and policies of that other Person as a general partner, managing member, manager or in similar capacity.

“TATCIST Study” means the Targeted Alpha Therapy With 225-Actinium-PSMA I&T of

Castration-resISTant Prostate Cancer (TATCIST) Phase 2 Clinical Trial, identified as NCT05219500 as the IND number assigned by the FDA and sponsored by Excel Diagnostics and Nuclear Oncology Center.

“Tax Return” means any return (including estimated returns), declaration, filing, report, claim for refund, information

return or other statement relating to Taxes (whether in tangible, electronic or other form), including any schedule, supplement, appendices and exhibits or attachment thereto and any amendment thereof made, prepared, filed or required to be made,

with any Taxing Authority.

“Taxes” means all U.S. federal, Canadian federal, state, provincial, local and non-U.S. and non-Canadian taxes, assessments, charges, duties, fees, levies or other similar amounts in the nature of a tax payable to a Taxing Authority, including all

income, franchise, profits, capital gains, capital stock, transfer, sales, use, occupation, property, excise, severance, windfall profits, stamp, stamp duty reserve, license, payroll, withholding, ad valorem, value added, alternative minimum,

environmental, customs, customs duties and import and export taxes, social security (or similar), unemployment, employment insurance, health insurance, sick pay, disability, registration, escheat, unclaimed property and other taxes, assessments,

charges, duties, fees, levies or other similar amounts and Canada, Quebec and other government pension plan premiums or contributions, together with all estimated taxes, deficiency assessments, additions to tax, penalties and interest with respect

thereto.

“Taxing Authority” means any Governmental Authority exercising any authority to impose, regulate or administer

the imposition of, or collect Taxes.

“Territory” means worldwide.

“Third Party” means any Person other than Buyer or Seller that is not an Affiliate of Buyer or Seller.

“Third Party Product” means any product containing or comprised of a 225-Ac-PSMA molecule, inclusive of any competitor molecules, that is not a Product.

“Transaction Proposal” means any inquiry, proposal or offer from any Person (other than Buyer or its Affiliates) with respect

to, or that would reasonably be expected to lead to, any direct or indirect acquisition, sale, transfer or license of the Compound or any Product or any rights (including any right to research, develop, manufacture or commercialize) to the Compound

or any Product or any material part of the Acquired Assets (other than (i) any license or grant of rights permitted to be made under Section 7.1(b), or (ii) a Liquidation Event).

-10-

“Transfer Documents” means, collectively, any and all agreements,

assignments, deeds, notarial forms, certificates and other instruments of sale, conveyance, transfer, assignment or assumption, as the case may be, between Seller or any of its Affiliates and Buyer as necessary under the Law of the relevant

jurisdiction or contemplated by this Agreement in order to transfer all right, title and interest of Seller and its Affiliates in and to the Acquired Assets, and for the Assumed Liabilities to be effectively assumed by and transferred to Buyer, in

accordance with the terms hereof, including the Bill of Sale and Assignment and Assumption Agreement.

“Transfer Taxes”

means any transfer, conveyance, documentary, real estate transfer, mortgage recording, use, stamp, registration, and other similar Taxes and fees (including any penalties and interest in respect thereof) imposed with respect to the Transactions

other than VAT.

“United States” and “U.S.” mean the United States of America (including its territories

and possessions).

“Valid Claim” means a claim of an issued patent that has not expired, lapsed, been cancelled or

abandoned, or been dedicated to the public, disclaimed, or held unenforceable, invalid, revoked or cancelled by a court or administrative agency of competent jurisdiction in an order or decision from which no appeal has been or can be taken,

including through opposition, reexamination, reissue, disclaimer, inter partes review, post grant review, other post grant procedures or similar proceedings.

“VAT” means any sales, use, value added, goods and services, and similar gross margin or turnover Tax incurred or imposed in

respect of the transfer of the Acquired Assets or the grant of the Option pursuant to this Agreement.

The following terms shall have the

meanings assigned to them in the corresponding Section below:

|

|

|

| Term |

|

Section |

| Acquired Assets |

|

3.1 |

| After Acquired Assets |

|

2.4(b) |

| Agreement |

|

Preamble |

| Allocation Schedule |

|

3.9(a) |

| Assumed Liabilities |

|

3.3 |

| Buyer |

|

Preamble |

| Buyer Disclosure Letter |

|

Article VI |

| Buyer Indemnified Parties |

|

12.2 |

| Buyer Information |

|

13.3(d) |

| Buyer Product Information |

|

13.3(d) |

| Claim Notice |

|

12.4(a) |

| Clinical Trial Agreement |

|

7.12 |

-11-

|

|

|

| Closing |

|

4.1 |

| Closing Date |

|

4.1 |

| Data Package |

|

2.4(b) |

| Data Site |

|

Definitions |

| Deferred Fixed Payment |

|

3.8(a) |

| Deferred Fixed Payment Event |

|

3.8(a) |

| Deferred Variable Payment |

|

3.8(b) |

| Development Report |

|

3.8(d) |

| Direct Claim |

|

12.5 |

| Excluded Assets |

|

3.2 |

| Excluded Liabilities |

|

3.4 |

| Fundamental Representations |

|

12.1 |

| Health Care Laws |

|

5.8 |

| Indemnified Party |

|

12.3(a) |

| Indemnifying Party |

|

12.4(a) |

| Invalidation Date |

|

3.11(d)(ii) |

| Licensed Manufacturing Know-How |

|

7.9(a) |

| Manufacturing Agreement |

|

7.8 |

| Option |

|

Recitals |

| Option Exercise Price |

|

4.2(b) |

| Option Exercise Notice |

|

2.4(c) |

| Option Fee |

|

Recitals |

| Option Period |

|

2.4(c) |

| Option Trigger |

|

2.4(b) |

| Option Trigger Notice |

|

2.4(b) |

| Other Licensed Know-How |

|

8.8 |

| Outside Date |

|

11.1(b) |

| Parties or Party |

|

Preamble |

| Patent at Issue |

|

3.11(a) |

| Permitted Uses |

|

13.3(b) |

| Pre-Closing Period |

|

7.1(a) |

| Pre-Commercial Termination |

|

8.7(b) |

| Proceeds |

|

12.7(a) |

| Prohibited Information |

|

3.2(j) |

| Purchase Price |

|

3.7 |

| Quality Agreement |

|

7.8 |

| Restrictive Covenants |

|

9.5 |

| [***] |

|

8.7(b) |

| Seller |

|

Preamble |

| Seller Disclosure Letter |

|

Article V |

| Seller Indemnified Parties |

|

12.3(a) |

| Seller Information |

|

13.3(g) |

| Straddle Period |

|

9.4 |

-12-

|

|

|

| Study Termination Event |

|

2.2(b) |

| TATCIST Study Protocol |

|

2.2(a) |

| Termination-Period Exercise |

|

11.2 |

| Third Party Claim |

|

12.4(a) |

| Third Party Grantee |

|

3.8(c) |

| Transactions |

|

Recitals |

| Transferred Books and Records |

|

3.1(e) |

| Transferred Governmental Authorizations |

|

3.1(c) |

| Transferred Know-How |

|

3.1(b) |

| Transferred Regulatory Materials |

|

3.1(d) |

1.2 Construction. The table of contents, articles, titles and headings to sections herein are inserted

for convenience of reference only and are not intended to be part of or to affect the meaning or interpretation of this Agreement. Unless expressly specified otherwise, whenever used in this Agreement, the terms “Article,”

“Exhibit,” “Schedule” and “Section” refer to articles, exhibits, schedules and sections of this Agreement (and, for the avoidance of doubt, do not refer to appendices, articles, sections, schedules and exhibits of any

Ancillary Agreement). Whenever used in this Agreement, the terms “hereby,” “hereof,” “herein” and “hereunder” and words of similar import refer to this Agreement as a whole, including all articles, sections,

schedules and exhibits hereto. Whenever used in this Agreement, the terms “include,” “includes” and “including” mean “include, without limitation,” “includes, without limitation” and “including,

without limitation,” respectively. The word “or” is not exclusive, and as used in this Agreement shall mean “and/or”. Whenever the context of this Agreement permits, the masculine, feminine or neuter gender, and the singular

or plural number, are each deemed to include the others. “Days” means calendar days unless otherwise specified. Unless expressly specified otherwise, all payments to be made in accordance with or under this Agreement (or any Ancillary

Agreement) shall be made in U.S. dollars. References in this Agreement to particular sections of a Law shall be deemed to refer to such sections or provisions as they may be amended after the date of this Agreement. Unless otherwise specified in

this Agreement, in computing any period of time described in this Agreement, the date that is the reference date in calculating such period, or the day of the act or event after which the designated period of time begins to run, will be excluded,

and the last day of the period so computed will be included. The Parties have participated jointly in the negotiation and drafting of this Agreement and in the event an ambiguity or question of intent or interpretation arises, this Agreement shall

be construed as if drafted jointly by the Parties and no presumption or burden of proof shall arise favoring or disfavoring any Party (or any Affiliate thereof) by virtue of the authorship of any of the provisions of this Agreement.

1.3 Performance of Obligations by Affiliates. Any obligation of Seller under or pursuant to this Agreement may be satisfied, met or

fulfilled, in whole or in part, at Seller’s sole and exclusive option, either by Seller directly or by any Affiliate of Seller that Seller causes to satisfy, meet or fulfill such obligation, in whole or in part; provided, that no such

action shall relieve Seller of any obligation under this Agreement. Any obligation of Buyer under or pursuant to this Agreement may be satisfied, met or fulfilled, in whole or in part, at Buyer’s sole and exclusive option, either by Buyer

directly or by any Affiliate of Buyer that Buyer causes to satisfy, meet or fulfill such obligation, in whole or in part; provided, that no such action shall relieve Buyer

-13-

of any obligation under this Agreement. With respect to any particular action, the use of the words “Seller shall” and “Seller agrees to,” and any similar variation with

respect to any action, also means “Seller shall cause” the particular action to be performed, and the use of the words “Buyer shall,” “Buyer agrees to” and any similar variation with respect to any action, also means

“Buyer shall cause” the particular action to be performed, irrespective of whether an Affiliate is referenced in that particular instance, because Seller and Buyer each understand, agree and acknowledge that they are entering into this

Agreement on behalf of themselves and certain of their respective Affiliates. In case Seller undertakes any actions, agreements and obligations that should be performed by any Affiliates of Seller under the terms and conditions of this Agreement,

Seller shall be deemed to be acting on behalf of such Affiliates.

ARTICLE II

OPTION GRANT AND EXERCISE

2.1 Grant of Option.

(a)

Seller hereby grants to Buyer, and Buyer hereby accepts the grant from Seller of, the Option, in exchange for the consideration set forth in Section 2.1(b).

(b) In consideration for the grant of the Option, Buyer shall promptly, and in any event within [***], following the execution and delivery of

this Agreement, deposit, or cause to be deposited, with Seller by wire transfer of immediately available funds to the account designated by Seller on the date hereof, an amount in cash equal to the Option Fee.

2.2 TATCIST Study.

(a)

During the Pre-Closing Period, Seller and its Affiliates shall, subject to Section 2.2(b) below, (i) use commercially reasonable efforts to execute the TATCIST Study in

accordance with the expected clinical timelines made available to Buyer prior to the date hereof and fund all aspects to the TATCIST Study, including the potential expansion of such study to additional clinical sites and the manufacturing

responsibilities for such study, and shall not decrease the level of funding below that which is required to progress the TATCIST Study in the ordinary course and in accordance in all material respects with the study protocol made available to Buyer

prior to the date hereof and attached as Schedule 2.2(a) (the “TATCIST Study Protocol”); (ii) subject to Section 7.1, retain decision-making rights and responsibilities for the TATCIST Study;

(iii) provide Buyer with biweekly updates on the progress of the TATCIST Study, including clinical and imaging data, for purposes of facilitating Buyer’s decision with respect to the exercise of the Option; (iv) enter all patient data

obtained during a clinical visit by a patient as part of the TATCIST Study into the primary database for such study within five Business Days of such visit; (v) permit representatives of Buyer to review and monitor the source documents

containing TATCIST Study patient data at the trial sites for the TATCIST Study; and (vi) subject to the second sentence of Section 2.2(b), (x) not take, or permit to be taken, any actions designed to avoid or

(y) except to the extent events beyond the control of Seller or any of its Affiliates (and that occur without the fault or as a result of the actions of Seller or any of its Affiliates) necessitate the taking of any such actions, materially

delay, achieving the Option Trigger.

-14-

(b) Seller and its Affiliates shall not have any obligation to expand the TATCIST Study

pursuant to Section 2.2(a) to more than [***] patients who have received at least the [***] dose of the Compound in such study as provided in the TATCIST Study Protocol. Furthermore, Seller and its Affiliates shall not have

any obligation to continue conducting the TATCIST Study if the applicable conditions for termination set forth in Section 6.10 of the TATCIST Study Protocol are met (a “Study Termination Event”). Seller shall notify Buyer

promptly, and in any case within five days, following the occurrence of any Study Termination Event.

(c) Seller and its Affiliates shall

maintain complete and accurate records with respect to the TATCIST Study and their other development and manufacturing activities with respect to the Compound and in accordance with GMPs and GCPs, as appropriate. Such records shall fully and

properly reflect all work done and results achieved in the development and manufacture of the Compound in sufficient detail and in a manner that would reasonably be expected to enable use of such documents to seek or challenge Patent Rights with

respect to the Compound or the manufacture, sale or use thereof or Regulatory Approval of any Product.

(d) Without limiting the generality

of Section 2.2(a), during the Pre-Closing Period, Seller shall keep Buyer informed on a biweekly basis regarding the schedule and process for any submissions to applicable

Governmental Authorities or Review Boards related to the Compound or the TATCIST Study. Seller shall furnish Buyer with drafts of all such submissions at least five Business Days in advance of being filed with or submitted to the applicable

Governmental Authority or Review Board and will consider in good faith any comments Buyer provides to such drafts. Seller will provide Buyer with at least five Business Days’ prior notice (or, such lesser period of notice if Seller is not

provided with five Business Days’ prior notice) of (i) any scheduled meeting (including any advisory committee meetings) with any Regulatory Authority relating to the Compound and (ii) any inspection by any Regulatory Authority of

Seller or any Third Party contracted by Seller relating to the Compound, or any facility at which the Compound (or any component thereof) is manufactured, and, in each case ((i) and (ii)), to the extent permitted by applicable Law, permit

representatives of Buyer to be present at, and participate in, such meeting or inspection. Seller shall also provide to Buyer, promptly, and in any event within 10 Business Days following Seller’s or any of its Affiliates’ receipt

thereof (A) written copies of any meeting minutes or other written records of any meetings, conferences, or discussions (including any advisory committee meetings) with any Governmental Authority or Review Board relating to the Compound,

(B) written inspectional observations (e.g., observations on Form FDA 483) that the FDA or any other Governmental Authority issues to Seller, any of its Affiliates or any Third Party contracted by Seller as a result of any such inspection

relating to the Compound or any facility at which the Compound, (or any component thereof) is manufactured and (C) other material correspondence or communications received from any Governmental Authority or Review Board relating to the Compound

(including, with respect to any written correspondence or communication, a copy thereof). Seller shall further provide to Buyer, within twenty-four (24) hours, following Seller’s or any of its Affiliates’ receipt thereof of a partial

or full clinical hold imposed upon the TATCIST Study by any Regulatory Authority.

-15-

(e) Except as required by Law or legal or administrative process to be disclosed or as

otherwise contemplated in Section 2.2(d), neither Seller nor any of its Affiliates shall publish or otherwise publicly disclose or present or submit for publication or other public disclosure, including by way of