As filed with the Securities and Exchange Commission on December 1, 2016

Registration File Nos. 333-134820 and 811-21907

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-4

| REGISTRATION STATEMENT UNDER |

||||

| THE SECURITIES ACT OF 1933 | ☐ | |||

| Pre-Effective Amendment No. | ☐ | |||

| Post-Effective Amendment No. 12 | ☒ | |||

| and/or | ||||

| REGISTRATION STATEMENT UNDER |

||||

| THE INVESTMENT COMPANY ACT OF 1940 | ☐ | |||

| Amendment No. 13 | ☒ |

(Check appropriate box or boxes.)

TIAA Separate Account VA-3

(Exact Name of Registrant)

Teachers Insurance and

Annuity Association of America

(Name of Insurance Company)

730 Third Avenue

New York, New York 10017

(Address of Insurance Company’s Principal Executive Offices)

Insurance Company’s Telephone Number, Including Area Code: (212) 490-9000

| Name and Address of Agent for Service: | Copy to: | |

| Rachel D. Mendelson, Esquire Teachers Insurance and Annuity Association of America 730 Third Avenue |

Stephen E. Roth, Esquire Sutherland Asbill & Brennan LLP 700 Sixth Street, N.W., Suite 700 Washington, DC 20001-3980 | |

| New York, New York 10017 | ||

It is proposed that this filing will become effective (check appropriate box)

| ☐ | immediately upon filing pursuant to paragraph (b) of Rule 485 |

| ☒ | on December 1, 2016, pursuant to paragraph (b) of Rule 485 |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) of Rule 485 |

| ☐ | on (date) pursuant to paragraph (a)(1) of Rule 485 |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

| Title of Securities Being Registered: | Interests in a separate account funding variable annuity contracts. |

TIAA Separate Account VA-3

Teachers Insurance and Annuity Association of America

SUPPLEMENT NO. 1

dated December 1, 2016

to the Prospectus Level 1 dated May 1, 2016

This supplement amends certain disclosure in the prospectus for the TIAA Access individual and group variable annuity contracts. Please keep this supplement with your prospectus for future reference.

1. The following Funds are added as underlying investments for investment accounts available under the terms of your contract. You may only invest in those investment accounts available under the terms of your employer’s plan.

| Fund | Investment Advisor | Investment Objective / Benchmark | ||

| American Beacon Holland Large Cap Growth Fund (Institutional Shares) |

American Beacon Advisers, Inc. | The Fund primarily seeks long-term growth of capital. The receipt of dividend income is a secondary consideration. | ||

| Ariel Appreciation Fund (Institutional Class) |

Ariel Investments, LLC | The Fund seeks long-term capital appreciation. | ||

| Champlain Mid Cap Fund (Institutional Shares) |

Champlain Investment Partners, LLC | The Fund seeks capital appreciation. | ||

| Delaware Emerging Markets Fund (Class R6) |

Delaware Management Company | The Fund seeks long-term capital appreciation. | ||

| JP Morgan Small Cap Value Fund (Class R6) |

J.P. Morgan Investment Management Inc. | The Fund seeks long-term capital growth primarily by investing in equity securities of small-capitalization companies. | ||

| Lazard International Equity Portfolio (R6 Shares) |

Lazard Asset Management LLC | The Fund seeks long-term capital appreciation. | ||

| Lord Abbett High Yield Fund (Class R6) |

Lord, Abbett & Co. LLC | The Fund seeks a high current income and the opportunity for capital appreciation to produce a high total return. | ||

| MFS Mid Cap Value Fund (Class R5) |

Massachusetts Financial Services Company | The Fund seeks capital appreciation. | ||

| Nationwide Geneva Small Cap Growth Fund (Institutional Class) |

Nationwide Fund Advisors | The Fund seeks long-term capital appreciation. | ||

| Parnassus Fund (Institutional Shares) |

Parnassus Investments | The Fund seeks long-term capital appreciation. | ||

| Templeton Global Bond Fund (Class R6) |

Franklin Advisors, Inc. | The Fund seeks current income with capital appreciation and growth of income. |

| Fund | Investment Advisor | Investment Objective / Benchmark | ||

| T. Rowe Price QM U.S. Small-Cap Growth Equity Fund | T. Rowe Price Associates, Inc. | The Fund seeks long-term growth of capital by investing primarily in common stocks of small growth companies. | ||

| Vanguard 500 Index Fund (Admiral Shares) |

The Vanguard Group, Inc. | The Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The Fund primarily invests its assets in securities selected to track the S&P 500 Index. | ||

| Vanguard Equity Income Fund (Admiral Shares) |

Wellington Management Company, LLP and The Vanguard Group, Inc. | The Fund seeks to provide an above-average level of current income and reasonable long-term capital appreciation. | ||

| Vanguard Extended Market Index Fund (Admiral Shares) |

The Vanguard Group, Inc. | The Fund seeks to track the performance of a benchmark index that measures the investment return of small- and mid- capitalization stocks. The Fund primarily invests its assets in securities selected to track the S&P Completion Index. | ||

| Vanguard Total Bond Market Index Fund (Admiral Shares) |

The Vanguard Group, Inc. | The Fund seeks to track the performance of a broad, market-weighted bond index. The Fund primarily invests its assets in securities selected to track the Bloomberg Barclays U.S. Aggregate Float Adjusted Index. |

2. The Range of Total Annual Fund Operating Expenses is updated to reflect a Net Annual Fund Operating Expenses minimum of 0.05% and a maximum of 1.32%.

3. The Total Annual Fund Operating Expense By Fund table is updated with the following information about the Funds listed above.

TOTAL ANNUAL FUND OPERATING EXPENSES BY FUND

| Management Fees |

12b-1 Fees |

Other Expenses |

Acquired Fund |

Total Annual Fund Operating Expenses |

Expense ments/ |

Net Annual Fund |

||||||||||||||||||||

| American Beacon Holland Large Cap Growth Fund (Institutional Shares) |

0.45% | — | 0.43% | 0.01% | 0.89% | — | 0.90% | |||||||||||||||||||

| Ariel Appreciation Fund (Institutional Class) |

0.69% | — | 0.10% | — | 0.79% | — | 0.79% | |||||||||||||||||||

| Champlain Mid Cap Fund (Institutional Shares) |

0.73% | — | 0.23% | — | 0.96% | 0.01% | 0.95% | |||||||||||||||||||

| Delaware Emerging Markets Fund (Class R6) |

1.18% | — | 0.17% | — | 1.35% | 0.03% | 1.32% | |||||||||||||||||||

| JP Morgan Small Cap Value Fund (Class R6) |

0.65% | — | 0.12% | 0.01% | 0.78% | 0.01% | 0.77% | |||||||||||||||||||

| Lazard International Equity Portfolio (R6 Shares) |

0.75% | — | 0.17% | — | 0.92% | 0.12% | 0.80% | |||||||||||||||||||

| Lord Abbett High Yield Fund (Class R6) |

0.54% | — | 0.14% | — | 0.68% | — | 0.68% | |||||||||||||||||||

| MFS Mid Cap Value Fund (Class R6) |

0.72% | — | 0.06% | — | 0.78% | 0.01% | 0.77% | |||||||||||||||||||

| Nationwide Geneva Small Cap Growth Fund (Institutional Class) |

0.84% | — | 0.15% | — | 0.99% | — | 0.99% | |||||||||||||||||||

| Parnassus Fund (Institutional Shares) |

0.62% | — | 0.08% | — | 0.70% | — | 0.70% | |||||||||||||||||||

2

| Management Fees |

12b-1 Fees |

Other Expenses |

Acquired Fund |

Total Annual Fund Operating Expenses |

Expense ments/ |

Net Annual Fund |

||||||||||||||||||||

| T. Rowe Price QM U.S. Small-Cap Growth Equity Fund |

0.64% | — | 0.18% | — | 0.82% | — | 0.82% | |||||||||||||||||||

| Templeton Global Bond Fund (Class R6) |

0.48% | — | 0.04% | 0.01% | 0.53% | 0.02% | 0.51% | |||||||||||||||||||

| Vanguard 500 Index Fund (Admiral Shares) |

0.04% | — | 0.01% | — | 0.05% | — | 0.05% | |||||||||||||||||||

| Vanguard Equity Income Fund (Admiral Shares) |

0.16% | — | 0.01% | — | 0.17% | — | 0.17% | |||||||||||||||||||

| Vanguard Extended Market Index Fund |

0.08% | — | 0.01% | — | 0.09% | — | 0.09% | |||||||||||||||||||

| Vanguard Total Bond Market Index Fund |

0.05% | — | 0.01% | — | 0.06% | — | 0.06% | |||||||||||||||||||

| † | The most recently ended fiscal year for the American Beacon Holland Large Cap Growth Fund is December 31, 2015; most recently ended fiscal year for the Ariel Appreciation Fund is September 30, 2016; most recently ended fiscal year for the Champlain Mid Cap Fund is November 30, 2016 (the expenses reflected in the table are for the fiscal year ended November 30, 2015); most recently ended fiscal year for the Delaware Emerging Markets Fund is November 30, 2016 (the expenses reflected in the table are for the fiscal year ended November 30, 2015); most recently ended fiscal year for the JP Morgan Small Cap Value Fund is June 30, 2016; most recently ended fiscal year for the Lazard International Equity Portfolio is December 31, 2015; most recently ended fiscal year for the Lord Abbett High Yield Fund is November 30, 2016 (the expenses reflected in the table are for the fiscal year ended November 30, 2015); most recently ended fiscal year for the MFS Mid Cap Value Fund is September 30, 2016; most recently ended fiscal year for the Nationwide Geneva Small Cap Growth Fund is October 31, 2016 (the expenses reflected in the table are for fiscal year ended October 31, 2015); most recently ended fiscal year for the Parnassus Fund is December 31, 2015; most recently ended fiscal year for the T. Rowe Price QM U.S. Small-Cap Growth Equity Fund is December 31, 2015; most recently ended fiscal year for the Templeton Global Bond Fund is September 30, 2016; most recently ended fiscal year for the Vanguard 500 Index Fund is December 31, 2015; most recently ended fiscal year for the Vanguard Equity Income Fund is September 30, 2016; most recently ended fiscal year for the Vanguard Extended Market Index Fund is December 31, 2015; most recently ended fiscal year for the Vanguard Total Bond Market Index Fund is December 31, 2015. More information concerning each fund’s fees and expenses is contained in the prospectus for the fund. |

4. The Market timing/excessive trading policy section is updated to include Delaware Emerging Markets Fund, Lazard International Equity Portfolio, and Templeton Global Bond Fund in the list of portfolios where the risk of pricing inefficiencies can be particularly acute for portfolios invested primarily in foreign securities.

3

5. New share classes of the following Vanguard Funds will be available on January 20, 2017 as underlying investments for investment accounts available under the terms of your contract. You may only invest in those investment accounts available under the terms of your employer’s plan.

| Fund | Old Share Class | New Share Class | ||

| Vanguard Emerging Markets Stock Index Fund |

Admiral Shares | Institutional Shares | ||

| Vanguard Explorer Fund |

Investor Shares | Admiral Shares | ||

| Vanguard Intermediate-Term Treasury Fund |

Investor Shares | Admiral Shares | ||

| Vanguard Small-Cap Value Index Fund |

Investor Shares | Institutional Shares | ||

| Vanguard Wellington Fund |

Investor Shares | Admiral Shares |

A15659 (12/16)

TIAA Separate Account VA-3

Teachers Insurance and Annuity Association of America

SUPPLEMENT NO. 1

dated December 1, 2016

to the Prospectus Levels 2, 3, 4 dated May 1, 2016

This supplement amends certain disclosure in the prospectus for the TIAA Access individual and group variable annuity contracts. Please keep this supplement with your prospectus for future reference.

New share classes of the following Vanguard Funds will be available on January 20, 2017 as underlying investments for investment accounts available under the terms of your contract. You may only invest in those investment accounts available under the terms of your employer’s plan.

| Fund | Old Share Class | New Share Class | ||

| Vanguard Emerging Markets Stock Index Fund |

Admiral Shares | Institutional Shares | ||

| Vanguard Explorer Fund |

Investor Shares | Admiral Shares | ||

| Vanguard Intermediate-Term Treasury Fund |

Investor Shares | Admiral Shares | ||

| Vanguard Small-Cap Value Index Fund |

Investor Shares | Institutional Shares | ||

| Vanguard Wellington Fund |

Investor Shares | Admiral Shares |

A15660 (12/16)

Part A and Part B of Post-Effective Amendment No. 11 to the Registration Statement (File Nos. 333-134820, 811-21907), which was filed with the Securities and Exchange Commission on April 25, 2016, are incorporated by reference into this Post-Effective Amendment No. 12 to the Registration Statement.

Part C — OTHER INFORMATION

Item 24. Financial Statements and Exhibits

| (a) | Financial statements | |||

| Part A: None | ||||

| Part B: Includes all required financial statements of TIAA Separate Account VA-3 and Teachers Insurance and Annuity Association of America | ||||

| (b) | Exhibits: | |||

| (1)(a) | Resolutions of the Board of Trustees of Teachers Insurance and Annuity Association of America establishing the Registrant (Incorporated by reference to Registrant’s Pre-Effective Amendment No. 1 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed September 29, 2006.) | |||

| (b) | Amended Resolutions of the Board of Trustees of Teachers Insurance and Annuity Association of America establishing the Registrant (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (c) | Amended Resolutions of the Board of Trustees of Teachers Insurance and Annuity Association of America establishing the Registrant (Incorporated by reference to Registrant’s Post-Effective Amendment No. 6 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 22, 2011.) | |||

| (2) | None | |||

| (3) | Form of Distribution Agreement (Incorporated by reference to Registrant’s Initial Registration Statement on Form N-4, Registration No. 333-134820 Filed June 7, 2006.) | |||

| (4) | (A) | RA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Initial Registration Statement on Form N-4, Registration No. 333-134820 Filed June 7, 2006.) | ||

| (A.1) | Amended and Restated RA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (B) | SRA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Initial Registration Statement on Form N-4, Registration No. 333-134820 Filed June 7, 2006.) | |||

| (B.1) | Amended and Restated SRA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Post- Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (C) | GRA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Initial Registration Statement on Form N-4, Registration No. 333-134820 Filed June 7, 2006.) | |||

| (C.1) | Amended and Restated GRA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (D) | GSRA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Initial Registration Statement on Form N-4, Registration No. 333-134820 Filed June 7, 2006.) | |||

| (D.1) | Amended and Restated GSRA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (E) | GA Annuity Wrap Endorsement (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (E.1) | Group Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 4 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2009.) | |||

| (E.2) | Endorsement to Group Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 4 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2009.) | |||

C-1

| (E.3) | Endorsement to TIAA Group Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 4 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2009.) | |||

| (F) | RC Annuity Wrap Endorsement and Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (G) | RCP Annuity Wrap Endorsement and Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (H) | Minimum Distribution Annuity Contract Endorsement – Cashable (Incorporated by reference to Registrant’s Post-Effective Amendment No. 4 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2009.) | |||

| (I) | Minimum Distribution Annuity Contract Endorsement – Non-Cashable (Incorporated by reference to Registrant’s Post-Effective Amendment No. 4 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2009.) | |||

| (J) | Separate Account One-Life Annuity Supplemental Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 5 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2010.) | |||

| (K) | Separate Account Two-Life Annuity Supplemental Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 5 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2010.) | |||

| (L) | Separate Account Fixed-Period Annuity Supplemental Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 5 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2010.) | |||

| (M) | Endorsement to TIAA Deferred Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (N) | Endorsement to TIAA Group Deferred Annuity Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (O) | Endorsement to TIAA Retirement Choice Annuity Contract or TIAA Retirement Choice Plus Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (P) | Endorsement to TIAA Group Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (Q) | Endorsement to TIAA Immediate Annuity Contract Applicable to Minimum Distribution Annuity and Installment Refund Contracts (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (R) | Endorsement to TIAA Immediate Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (S) | Endorsement to TIAA Deferred Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (T) | Endorsement to TIAA Deferred Annuity Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (U) | Endorsement to TIAA Group Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

C-2

| (V) | Endorsements to TIAA Deferred Annuity Contract – Minimum Distribution Annuity Election (Incorporated by reference to Registrant’s Post-Effective Amendment No. 9 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2014.) | |||

| (W) | Supplement to TIAA Retirement Choice Annuity Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (X) | Supplement to TIAA Retirement Choice Annuity Plus Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (Y) | Supplement to TIAA Retirement Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (Z) | Supplement to TIAA Supplemental Retirement Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (A1) | Supplement to TIAA Group Retirement Annuity Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (A2) | Supplement to TIAA Group Supplemental Retirement Annuity Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (A3) | Endorsement to TIAA Retirement Choice Annuity Contract or TIAA Retirement Choice Plus Annuity Contract (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (A4) | Endorsement to TIAA Retirement Choice Annuity Certificate or TIAA Retirement Choice Plus Annuity Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (A5) | Supplement to TIAA Retirement Choice Annuity Certificate(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (A6) | Supplement to TIAA Retirement Choice Plus Annuity Certificate(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (A7) | Supplement to TIAA Retirement Annuity Contract(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (A8) | Endorsement to TIAA Retirement Choice Annuity Contract or TIAA Retirement Choice Plus Annuity Contract(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (A9) | Endorsement to TIAA Retirement Choice Annuity Certificate or TIAA Retirement Choice Plus Annuity Certificate(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (A10) | Endorsement to TIAA Retirement Choice Annuity Certificate or TIAA Retirement Choice Plus Annuity Certificate(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (A11) | Endorsement to TIAA Retirement Choice Annuity Contract or TIAA Retirement Choice Plus Annuity Contract(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (A12) | Endorsement to TIAA Retirement Choice Annuity Contract or TIAA Retirement Choice Plus Annuity Contract(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

C-3

| (A13) | Endorsement to TIAA Retirement Choice Annuity Certificate or TIAA Retirement Choice Plus Annuity Certificate (Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (5) | Form of Application (Incorporated by reference to Registrant’s Post-Effective Amendment No. 2 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed May 1, 2007.) | |||

| (6) | (A) | Restated Charter of Teachers Insurance and Annuity Association of America (as amended) (Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | ||

| (B) | Bylaws of Teachers Insurance and Annuity Association of America (as amended) (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (7) | None | |||

C-4

| (8) | (A) | Form of Participation Agreement among Teachers Insurance and Annuity Association of America, TIAA-CREF Institutional Mutual Funds, Teachers Advisors, Inc., and Teachers Personal Investors Services, Inc. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 1 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed December 22, 2006.) | ||

| (B) | Form of Participation Agreement among Legg Mason Investor Services, LLC, Western Asset Management Company, and Teachers Insurance and Annuity Association of America (Incorporated by reference to Registrant’s Post-Effective Amendment No. 1 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed December 22, 2006.) | |||

| (C) | Form of Participation Agreement among T. Rowe Price Investment Services, Inc., T. Rowe Price Associates, Inc., and Teachers Insurance and Annuity Association of America (Incorporated by reference to Registrant’s Post- Effective Amendment No. 1 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed December 22, 2006.) | |||

| (D) | Form of Participation Agreement between Teachers Insurance and Annuity Association of America, TIAA-CREF Individual & Institutional Services, LLC, American Funds Distributors, Inc., American Funds Service Company, and Capital Research and Management Company (Incorporated by reference to Registrant’s Post-Effective Amendment No. 1 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed December 22, 2006.) | |||

| (E) | Form of Amendment to Participation Agreements re: Rule 22c-2 (Incorporated by reference to Registrant’s Post-Effective Amendment No. 2 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed May 1, 2007.) | |||

| (F) | Form of Amendment to Participation Agreements re: Rule 22c-2 (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (G) | Form of Amendment to Participation Agreements (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (H) | Form of Investment Accounting Agreement by and between State Street Bank and Trust Company and Teachers Insurance and Annuity Association of America and TIAA-CREF Life Insurance Company on behalf of the separate account. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (I) | Form of Domestic Custody Agreement by and between JPMorgan Chase Bank, N.A. and Teachers Insurance and Annuity Association of America on behalf of the separate account. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 3 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2008.) | |||

| (J) | Amendment to Participation Agreement among Teachers Insurance and Annuity Association of America, TIAA- CREF Institutional Mutual Funds, and Teachers Personal Investors Services, Inc. re: Rule 22c-2. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 4 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2009.) | |||

| (K) | Third Amendment to Fund Participation and Service Agreement by and among Teachers Insurance and Annuity Association of America, TIAA-CREF Individual & Institutional Services, LLC, American Funds Distributors, Inc., American Funds Service Company, and Capital Research and Management Company (Incorporated by reference to Registrant’s Post-Effective Amendment No. 5 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2010.) | |||

| (L) | Amendment to Participation Agreement among Teachers Insurance and Annuity Association of America, TIAA-CREF Institutional Mutual Funds, and Teachers Personal Investors Services, Inc. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 6 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 22, 2011.) | |||

| (M) | Participation Agreement among Teachers Insurance and Annuity Association of America, DFA Investment Dimensions Group Inc., Dimensional Fund Advisors LP and DFA Securities LLC (Incorporated by reference to Registrant’s Post-Effective Amendment No. 6 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 22, 2011.) | |||

C-5

| (N) | Participation Agreement by and between Teachers Insurance and Annuity Association of America and Dodge & Cox Funds (Incorporated by reference to Registrant’s Post-Effective Amendment No. 6 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 22, 2011.) | |||

| (O) | Defined Contribution Clearance & Settlement Agreement by and between The Vanguard Group, Inc., Teachers Insurance and Annuity Association of America and JPMorgan Chase Bank, N.A. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 6 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 22, 2011.) | |||

| (P) | Amendment to Participation Agreement among Teachers Insurance and Annuity Association of America, TIAA-CREF Institutional Mutual Funds, and Teachers Personal Investors Services, Inc. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (Q) | First Amendment to the Defined Contribution Clearance & Settlement Agreement between The Vanguard Group, Inc. and Teachers Insurance and Annuity Association of America (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (R) | Amendment to Participation Agreement by and among Teachers Insurance and Annuity Association of America, Legg Mason Investor Services, LLC, and Western Asset Management Company (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (S) | Amendment to Fund Participation and Service Agreement by and among Teachers Insurance and Annuity Association of America, TIAA-CREF Individual & Institutional Services, LLC, American Funds Distributors, Inc., American Funds Service Company, and Capital Research and Management Company (Incorporated by reference to Registrant’s Post-Effective Amendment No. 7 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 23, 2012.) | |||

| (T) | Amendment to Fund Participation and Service Agreement among Teachers Insurance and Annuity Association of America, DFA Investment Dimensions Group Inc., Dimensional Fund Advisors LP and DFA Securities LLC (Incorporated by reference to Registrant’s Post-Effective Amendment No. 8 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 25, 2013.) | |||

| (U) | Amendment to Fund Participation and Service Agreement by and between Teachers Insurance and Annuity Association of America and Dodge & Cox Funds (Incorporated by reference to Registrant’s Post-Effective Amendment No. 8 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 25, 2013.) | |||

| (V) | Amendment to Participation Agreement among Teachers Insurance and Annuity Association of America, TIAA-CREF Funds, Teachers Advisors, Inc. and Teachers Personal Investors Services, Inc. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 8 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 25, 2013.) | |||

| (W) | Third Amendment to Participation Agreement by and among Teachers Insurance and Annuity Association of America, Legg Mason Investor Services, LLC, and Western Asset Management Company (Incorporated by reference to Registrant’s Post-Effective Amendment No. 8 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 25, 2013.) | |||

| (X) | Fifth Amendment to Fund Participation and Service Agreement by and among Teachers Insurance and Annuity Association of America, TIAA-CREF Individual & Institutional Services, LLC, American Funds Distributors, Inc., American Funds Service Company, and Capital Research and Management Company (Incorporated by reference to Registrant’s Post-Effective Amendment No. 8 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 25, 2013.) | |||

| (Y) | Amendment to Fund Participation and Service Agreement among T. Rowe Price Investment Services, Inc., T. Rowe Price Associates, Inc., and Teachers Insurance and Annuity Association of America (Incorporated by reference to Registrant’s Post-Effective Amendment No. 8 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 25, 2013.) | |||

| (Z) | Amendment to the Agreement by and among The Vanguard Group, Inc., Teachers Insurance and Annuity Association of America, and JPMorgan Chase Bank, N.A. (Incorporated by reference to Registrant’s Post- Effective Amendment No. 8 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 25, 2013.) | |||

C-6

| (A1) | Amendment to Participation Agreement by and among Teachers Insurance and Annuity Association of America, TIAA-CREF Funds, Teachers Advisors, Inc. and Teachers Personal Investors Services, Inc. (Incorporated by reference to Registrant’s Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 24, 2015.) | |||

| (A2) | Form of Participation Agreement among American Beacon Advisors, Inc., Foreside Fund Services, LLC, and Teachers Insurance and Annuity Association of America* | |||

| (A3) | Form of Participation Agreement among Ariel Distributors, LLC and Teachers Insurance and Annuity Association of America* | |||

| (A4) | Form of Participation Agreement among The Advisors’ Inner Circle Fund II, Champlain Investment Partners LLC, SEI Investment Distribution Co., and Teachers Insurance and Annuity Association of America* | |||

| (A5) | Form of Participation Agreement among Delaware Investments Family of Funds, Delaware Management Company, a series of Delaware Management Business Trust, Delaware Distributors, L.P., and Teachers Insurance and Annuity Association of America* | |||

| (A6) | Form of Participation Agreement among JPMorgan Trust II, JPMorgan Distribution Services, Inc., and Teachers Insurance and Annuity Association of America* | |||

| (A7) | Form of Participation Agreement among The Lazard Funds, Inc., Lazard Asset Management LLC, Lazard Asset Management Securities LLC, and Teachers Insurance and Annuity Association of America* | |||

| (A8) | Form of Participation Agreement among Lord Abbett Investment Trust, Lord Abbett & Co. LLC, Lord Abbett Distributor LLC, and Teachers Insurance and Annuity Association of America* | |||

| (A9) | Form of Participation Agreement among MFS Series Trust XI, MFS Fund Distributors, Inc. and Teachers Insurance and Annuity Association of America* | |||

| (A10) | Form of Participation Agreement among Nationwide Mutual Funds, Nationwide Fund Distributors LLC, and Teachers Insurance and Annuity Association of America* | |||

| (A11) | Form of Participation Agreement among Parnassus Fund, Parnassus Investments, Parnassus Funds Distributor, and Teachers Insurance and Annuity Association of America* | |||

| (A12) | Form of Participation Agreement among Franklin Templeton Distributors, Inc. and Teachers Insurance and Annuity Association of America* | |||

| (A13) | Amendment to Fund Participation and Service Agreement among T. Rowe Price Investment Services, Inc., T. Rowe Price Associates, Inc., and Teachers Insurance and Annuity Association of America* | |||

| (A14) | Amendment to the Agreement by and among The Vanguard Group, Inc., Teachers Insurance and Annuity Association of America, and JPMorgan Chase Bank, N.A.* | |||

| (A15) | Form of Administrative Services Agreement among Ariel Investment Trust and Teachers Insurance and Annuity Association of America* | |||

| (A16) | Form of Administrative Services Agreement among Parnassus Investments and Teachers Insurance and Annuity Association of America* | |||

| (9) | Opinion and consent of Meredith Kornreich, Esquire(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (10) | (A) | Consent of Sutherland Asbill & Brennan LLP(Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | ||

| (B) | Consents of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm (Incorporated by reference to Registrant’s Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No 333-134820 Filed April 25, 2016.) | |||

| (11) | None | |||

| (12) | None | |||

| (13) | (A) Powers of Attorney (Incorporated by reference to Registrant’s Post-Effective Amendment No. 9 to the Registration Statement Filed April 25, 2014, Post-Effective Amendment No. 10 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 24, 2015, and Post-Effective Amendment No. 11 to the Registration Statement on Form N-4, Registration No. 333-134820 Filed April 25, 2016.) | |||

| * | Filed herewith |

C-7

Item 25. Directors and Officers of the Depositor

| Name and Principal Business Address* |

Positions and Offices with Insurance Company | |

| Ronald L. Thompson |

Trustee and Chairman | |

| Jeffrey R. Brown |

Trustee | |

| James R. Chambers |

Trustee | |

| Lisa W. Hess |

Trustee | |

| Edward M. Hundert, M.D. |

Trustee | |

| Lawrence H. Linden |

Trustee | |

| Maureen O’ Hara |

Trustee | |

| Donald K. Peterson |

Trustee | |

| Sidney A. Ribeau |

Trustee | |

| Dorothy K. Robinson |

Trustee | |

| Kim M. Sharan |

Trustee | |

| David L. Shedlarz |

Trustee | |

| Marta Tienda |

Trustee | |

| Roger W. Ferguson, Jr. |

President and Chief Executive Officer and Trustee | |

| Kathie Andrade |

Executive Vice President | |

| Scott Blandford |

Executive Vice President | |

| Richard S. Biegen |

Chief Compliance Officer of the Separate Account | |

| Douglas Chittenden |

Executive Vice President | |

| Sue A. Collins |

Senior Vice President and Chief Actuary | |

| Carol Deckbar |

Executive Vice President | |

| Phillip Goff |

Senior Vice President, Corporate Controller | |

| Stephen B. Gruppo |

Executive Vice President | |

| Alice Hocking |

Executive Vice President | |

| Robert G. Leary |

Executive Vice President | |

| Rahul Merchant |

Executive Vice President | |

| J. Keith Morgan |

Executive Vice President and Chief Legal Officer | |

| Ronald R. Pressman |

Executive Vice President | |

| Glenn Richter |

Executive Vice President | |

| Phillip Rollock |

Senior Managing Director, Corporate Secretary | |

| Otha Spriggs |

Executive Vice President | |

| Paul J. Van Heest |

Executive Vice President | |

| Constance K. Weaver |

Executive Vice President | |

| Virginia M. Wilson |

Executive Vice President |

| * | The principal business address for each individual is: |

| TIAA |

| 730 | Third Avenue |

| New | York, New York 10017-3206 |

C-8

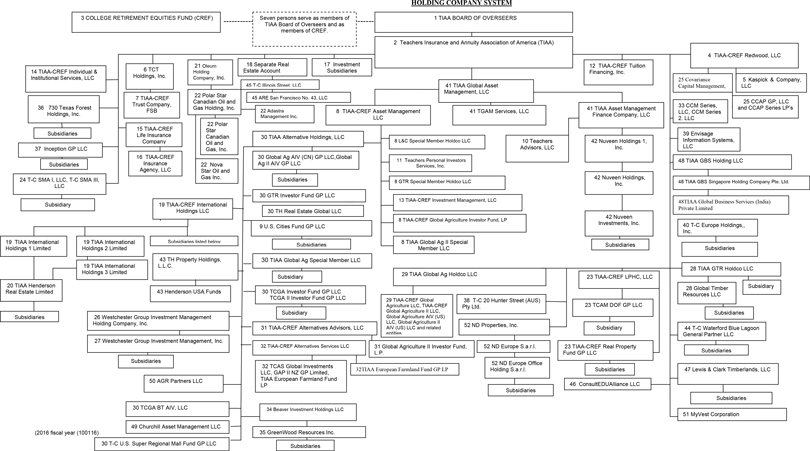

Item 26. Persons Controlled by or under Common Control with the Depositor or Registrant

The following chart indicates subsidiaries of Teachers Insurance and Annuity Association of America. These subsidiaries are included in the consolidated financial statements of Teachers Insurance and Annuity Association of America.

All Teachers Insurance and Annuity Association of America subsidiary companies are Delaware corporations, except as indicated.

EXHIBIT C

|

C-9

Exhibit A

| (1) | TIAA Board of Overseers is a New York not-for-profit corporation established to further education and other non-profit purposes by holding the stock of TIAA. TIAA’s capital stock, constituting all of its authorized shares of stock, was originally issued to the Carnegie Corporation of New York. The shares were transferred to Trustees of T.I.A.A. Stock, renamed TIAA Board of Overseers, after the enactment of the Laws of 1937, Chapter 880, New York State Law, approved by the Governor on June 3, 1937. |

| (2) | Teachers Insurance and Annuity Association of America (“TIAA”) is a New York domiciled life insurance company that issues guaranteed and variable annuities and life insurance for nonprofit and government institutions and their employees. TIAA employs all TIAA entities’ staff except for those employed by Adastra Management, Inc., AGR Partners LLC, Churchill Asset Management, LLC, Envisage Information Systems, LLC, GreenWood Resources, Inc. and its subsidiaries, Kaspick & Company, LLC, ND Europe S.a.r.l., Nuveen Investments, Inc. and its subsidiaries, Polar Star Canadian Oil and Gas, Inc., REA Europe S.a.r.l., TCAM Global Australia Pty Ltd, TCAM Global UK Limited, TIAA-CREF Alternatives Services, LLC, TIAA-CREF Trust Company, FSB, TIAA Henderson Real Estate Limited and its subsidiaries, and Westchester Group Investment Management, Inc. and its subsidiaries. The TIAA Board of Overseers elects TIAA’s trustees. |

| • | TIAA Separate Account VA-1 (“VA-1”) is a separate account registered with the U.S. Securities and Exchange Commission (“SEC”) as an open-end management investment company that offers individual, variable, after-tax annuities. VA-1 has only one investment portfolio, the Stock Index Account. |

| • | TIAA Real Estate Account VA-2 (“VA-2”) is a separate account of TIAA that allows TIAA to offer a variable investment option based on real estate investments for TIAA’s pension annuities. |

| • | TIAA Separate Account VA-3 (“VA-3”) is registered with the SEC as an investment company under the Investment Company Act of 1940 and operates as a unit investment trust. VA-3 is designed to fund individual and group variable contracts in retirement plans. |

| • | TIAA Stable Value Separate Account – 1 (SVSA-1) created to support the obligations of TIAA under a group annuity contract offered to TIAA’s pension customers. |

| (3) | College Retirement Equities Fund is a New York not-for-profit corporation and an SEC registered investment company that issues variable annuity contracts for employees of nonprofit and government institutions. Art. II, Sec. 1 of CREF’s Constitution limits eligibility of the members of CREF to those persons who are members of TIAA Board of Overseers. The trustees of CREF are elected by CREF policyholders. |

| (4) | TIAA-CREF Redwood, LLC was established for the purpose of owning the membership interests in Kaspick & Company, LLC and Covariance Capital Management, Inc. |

| (5) | Kaspick & Company, LLC a registered investment adviser providing investment advice and gift administration services to charitable organizations and other non-profit institutions through investment management and gift administration agreements with charitable organizations, which act as trustees for donors (and their beneficiaries) participating in their planned giving programs. |

| (6) | TCT Holdings, Inc. is organized for the purpose of holding the stock of TIAA-CREF Trust Company, FSB, a federal savings bank. |

1

Exhibit A

| (7) | TIAA-CREF Trust Company, FSB (“TIAA-FSB”) is a federally chartered savings bank that provides individual and institutional asset management and investment advice and retail banking and lending products for its customers. TIAA-FSB provides custodial trustee and administrative services to TIAA for TIAA’s customers. TIAA-FSB provides investment advisory services to TIAA-CREF Individual & Institutional Services, LLC. (“TC Services”) as well as a deposit sweep program to TC Services’ clients. TIAA-FSB also serves as trustee or custodian for certain TIAA investment funds. |

| (8) | TIAA-CREF Asset Management LLC, formerly, TIAA-CREF Asset Management, Inc. and TIAA-CREF Enterprises, Inc. is organized for the purpose of holding (i) the stock of Teachers Personal Investors Services, Inc. and (ii) the membership interests of GTR Special Member Holdco LLC, L&C Special Member Holdco, LLC, TIAA Alternative Holdings, LLC, TIAA Global Ag II Special Member LLC, TIAA-CREF Global Agriculture Investor Fund, LP and TIAA-CREF Investment Management, LLC. |

| (9) | U.S. Cities Fund GP LLC was established to act as the general partner of U.S. Cities Fund LP, which was organized as an open-end private investment fund which owns an interest in U.S. Cities Fund REIT LLC (“REIT”). The REIT owns membership interests in U.S. Cities Fund Operating GP LLC (“GP”), T-C Coronado LLC and U.S. Cities Fund Operating LP. GP was organized to act as the general partner of U.S. Cities Fund Operating LP, which is an unregistered fund organized as a vehicle for direct real estate investment. |

| (10) | Teachers Advisors, LLC (“TAI”) is a registered investment advisor organized for the purpose of providing investment advice and management services to the TIAA Separate Account VA-1, the TIAA-CREF Funds, the TIAA-CREF Life Funds, and other products. It provides investment adviser services for set contractual fees, with the intent of making a profit. TAI provides investment advice and other investment-related services to TIAA-CREF Trust Company, FSB. TAI acts as Manager of TIAA CLO I, Ltd., organized in the Cayman Islands, which acts as a private investment vehicle that will offer debt securities to third party investors. |

| (11) | Teachers Personal Investors Services, Inc. is a registered broker-dealer which distributes registered and unregistered investment products for its affiliated entities. |

| (12) | TIAA-CREF Tuition Financing, Inc. (“TFI”) provides program management services on behalf of state entities to qualified tuition programs (“529 Plans”) formed pursuant to Section 529 of the Internal Revenue Code (“IRC”). Under Section 529 of the IRC, only states and educational institutions may establish and maintain 529 Plans. TFI, with permission from the states, subcontracts with other entities to perform certain of its program management services. |

| (13) | TIAA-CREF Investment Management, LLC is a registered investment advisor, and provides investment management services for College Retirement Equities Fund. |

| (14) | TIAA-CREF Individual & Institutional Services, LLC (“Services”) is a registered broker-dealer and investment advisor, and provides distribution and related services for College Retirement Equities Fund, TIAA Real Estate Account and TIAA Separate Account VA-3, distribution services for the TIAA and Nuveen Families of Funds, the TIAA-CREF Life Funds, TIAA-CREF Life Insurance Company’s fixed and variable annuity and variable life products, and third party funds within retirement and savings plans and administrative services to tuition savings products. Services also introduces self-directed brokerage accounts cleared through Pershing, LLC. Services also provides certain broker-dealer, referral and support services to TIAA-FSB. |

2

Exhibit A

| (15) | TIAA-CREF Life Insurance Company is a New York domiciled life insurance company that issues guaranteed and variable annuities, funding agreements, and life insurance, including variable life insurance, to the general public. TIAA-CREF Life Insurance Company is the sole member of TIAA-CREF Insurance Agency, LLC. |

| • | TIAA-CREF Life Separate Account VA-1 is registered with the SEC as a unit investment trust under the Investment Company Act of 1940 and qualifies as a separate account within the meaning of the federal securities laws. TC Life VA-1 offers variable investment options for its after-tax annuities. The Separate Account is divided into Investment Accounts, each of which invests in shares of one portfolio of affiliated and third-party mutual funds; |

| • | TIAA-CREF Life Separate Account VLI-1 is registered with the SEC as a unit investment trust under the Investment Company Act of 1940 and qualifies as a separate account within the meaning of the federal securities laws. TC Life VLI-1 is used to provide values and benefits for life insurance policies. The Separate Account is divided into Investment Accounts, each of which invests in shares of one portfolio of affiliated and third-party mutual funds. |

| • | TIAA-CREF Life Separate Account VLI-2 is registered with the SEC as a unit investment trust under the Investment Company Act of 1940 and qualifies as a separate account within the meaning of the federal securities laws. TC Life VLI-2 is used to provide values and benefits for life insurance policies. The Separate Account is divided into Investment Accounts, each of which invests in shares of one portfolio of affiliated and third-party mutual funds. |

| • | TIAA-CREF Life Separate Account (MVA-1) is a non-unitized separate account that will support a flexible premium deferred fixed annuity contract subject to withdrawal charges and a market value adjustment feature (“MVA Contract”). Since the MVA Contract is viewed as a security under the Securities Act of 1933, TC Life has filed a Registration Statement Form S-1 for TC Life MVA-1 with the SEC. |

| • | TIAA-CREF Life Stable Value Separate Account 1, TIAA-CREF Life Stable Value Separate Account 2, and TIAA-CREF Life Stable value Separate Account 3 are each an insulated, non-unitized separate account. The Separate Account will support one or more book value separate account agreements, group annuity contracts, guaranteed investment contracts or similar contracts (each a “Contract”). The Contract is intended to be issued in connection with pooled investment funds, stable value funds, retirement and other employee welfare, pension or college savings plans with a stable value investment option, and Qualified Trusts. |

| (16) | TIAA-CREF Insurance Agency, LLC is a licensed life insurance agent offering insurance services and products. |

3

Exhibit A

| (17) | Investment Subsidiaries: |

| • | The following corporations, trusts, and limited liability companies (“LLCs”) were organized by TIAA to hold real estate, mortgage, and securities investments for the General Account. Some may no longer hold any assets. All issued and outstanding stock of the corporations, trusts, and membership interests in the LLCs are owned, directly or indirectly, by TIAA. |

| Entity Name |

Domestic Jurisdiction | |

| 1000 Waterford Operating LP |

DE | |

| 485 Properties, LLC |

DE | |

| 5200 Waterford Operating LP |

DE | |

| 5201-5301 Waterford Operating LP |

DE | |

| 701-703 Waterford Operating LP |

DE | |

| 730 Carroll, LLC |

DE | |

| 730 Catsolar, LLC |

DE | |

| 730 Cricket, LLC |

DE | |

| 730 Orion, LLC |

DE | |

| 730 Power Development, LLC |

DE | |

| 730 Telecom LLC |

DE | |

| 730 Texas Timberlands II, Ltd. |

TX | |

| 730 Texas Timberlands, Ltd. |

TX | |

| 8 Spruce Street GA Investor LLC |

DE |

4

Exhibit A

| Actgas, LLC |

DE | |

| Active Extension Fund I, LLC |

DE | |

| Active Extension Fund III, LLC |

DE | |

| Actoil Bakken, LLC |

DE | |

| Actoil Colorado, LLC |

DE | |

| Actoil Utica, LLC |

DE | |

| Actoil, LLC |

DE | |

| AGR Agricultural Investments LLC |

DE | |

| Almond Processors, LLC |

DE | |

| Alta Loma Vineyard LLC |

CA | |

| Arroyo Loma, LLC |

DE | |

| Boca 10 A & B LLC |

DE | |

| Boca 10 C & D LLC |

DE | |

| Boca 11 A LLC |

DE | |

| Boca 54 Land Associates LLC |

DE | |

| Boca 54 North LLC |

DE | |

| Bridge View Land, LLC |

CA |

5

Exhibit A

| Broadleaf Timberland Investments, LLC |

DE | |

| CCM Series 2, LLC |

DE | |

| CCM Series, LLC |

DE | |

| Ceres Agricultural Properties, LLC |

DE | |

| Chalk Ridge Vineyard, LLC |

CA | |

| Churchill MMSLF Funding 1, LLC |

DE | |

| Churchill MMSLF Funding 2, LLC |

DE | |

| Clarendon Virginia IV, LLC |

DE | |

| CPPIB-TIAA U.S. Real Property Fund, L.P. |

DE | |

| C-T REIT LLC |

DE | |

| C-T Shenandoah LLC |

DE | |

| Demeter Agricultural Properties II, LLC |

DE | |

| Demeter Agricultural Properties, LLC |

DE | |

| Dionysus Properties, LLC |

DE | |

| Global AG II FFI LLC |

DE | |

| Global AG II US Corp. |

DE | |

| Global AG Properties II USA LLC |

DE |

6

Exhibit A

| Global AG Properties USA LLC |

DE | |

| Global AG US Corp. |

DE | |

| Global Agriculture AIV (US) LLC |

DE | |

| Global Agriculture II AIV (US) LLC |

DE | |

| Global Agriculture II AIV, LP |

DE | |

| Global Timber International, LLC |

DE | |

| Global Timber SA LLC |

DE | |

| Growth Capital Fund I, L.P. |

DE | |

| GTR Special Member Holdco LLC |

DE | |

| Hassett Lane Vineyard, LLC |

CA | |

| Hobson Avenue Vineyard, LLC |

CA | |

| I 595 Toll Road, LLC |

DE | |

| IAI USA Fund II, LLC |

DE | |

| IAI USA, LLC |

DE | |

| Inception Partners III, LP |

DE | |

| Inception Partners IV, LP |

DE | |

| Inception Partners V, LP |

DE |

7

Exhibit A

| Infra Alpha LLC |

DE | |

| International Agricultural Investors Fund II, LLC |

DE | |

| International Agricultural Investors, LLC |

DE | |

| JWL Properties, Inc. |

DE | |

| L&C Special Member Holdco, LLC |

DE | |

| L&C Tree Farms, LLC |

DE | |

| L&C TRS LLC |

DE | |

| Loma del Rio Vineyards LLC |

DE | |

| Loma Verde, LLC |

DE | |

| Marsino Vineyard, LLC |

CA | |

| ND 70SMA LLC |

DE | |

| ND Festival Place LLC |

DE | |

| ND Properties, Inc. |

DE | |

| Oak Knoll Napa Vineyards, LLC |

CA | |

| Occator Agricultural Properties, LLC |

DE | |

| Pennmuni-TIAA U.S. Real Estate Fund, LLC |

DE | |

| Premiere Agricultural Properties, LLC |

DE |

8

Exhibit A

| Premiere Columbia Properties, LLC |

DE | |

| Premiere Farm Properties, LLC |

DE | |

| Quercus Forestland Account, LLC |

NC | |

| Quercus Panama LLC |

DE | |

| Quercus West Virginia LLC |

DE | |

| Renewable Timber Resources LLC |

DE | |

| Rodgers Creek Vineyard LLC |

CA | |

| Silverado Gonzales Vineyards, LLC |

CA | |

| Silverado Los Alamos Vineyards, LLC |

CA | |

| Silverado Monterey Vineyards, LLC |

CA | |

| Silverado Premium Properties, LLC |

DE | |

| Silverado SLO Vineyards, LLC |

CA | |

| Silverado Sonoma Vineyards, LLC |

CA | |

| Silverado Suscol, LLC |

CA | |

| Silverado Sweetwater Vineyards, LLC |

CA | |

| Silverado Winegrowers Holdings, LLC |

DE | |

| Silverado WineGrowers, LLC |

CA |

9

Exhibit A

| Social Infra, LLC |

DE | |

| SPP Napa Vineyards, LLC |

DE | |

| Stage Gulch Ridge Vineyard, LLC |

CA | |

| Stanly Ranch Vineyards, LLC |

CA | |

| Sugarloaf East Vineyard, LLC |

DE | |

| Sugarloaf Vineyard, LLC |

DE | |

| Suscol Mountain Vineyards, LLC |

CA | |

| SWG Delta Vineyards, LLC |

CA | |

| SWG Paso Vineyards, LLC |

CA | |

| T-C 101 Miller Street Holding Company LLC |

DE | |

| T-C 101 Miller Street LLC |

DE | |

| T-C 1101 Pennsylvania Avenue LLC |

DE | |

| T-C 1101 Pennsylvania Avenue Owner LLC |

DE | |

| T-C 1101 Pennsylvania Avenue Venture LLC |

DE | |

| T-C 1608 Chestnut General Partner LLC |

DE | |

| T-C 1608 Chestnut Limited Partner LLC |

DE | |

| T-C 2 Herald Square Member LLC |

DE |

10

Exhibit A

| T-C 2 Herald Square Owner LLC |

DE | |

| T-C 2 Herald Square Venture LLC |

DE | |

| T-C 20 Hunter Street (US) LLC |

DE | |

| T-C 2300 Broadway LLC |

DE | |

| T-C 33 Arch Street LLC |

DE | |

| T-C 33 Arch Street Member LLC |

DE | |

| T-C 33 Arch Street Venture LLC |

DE | |

| T-C 3333 Wisconsin Avenue, LLC |

DE | |

| T-C 40 Broad Street LLC |

DE | |

| T-C 400 Montgomery, LLC |

DE | |

| T-C 470 Park Avenue South Member LLC |

DE | |

| T-C 470 Park Avenue South Owner LLC |

DE | |

| T-C 470 Park Avenue South Venture LLC |

DE | |

| T-C 475 Fifth Avenue LLC |

DE | |

| T-C 475 Fifth Avenue Member LLC |

DE | |

| T-C 475 Fifth Avenue Venture LLC |

DE | |

| T-C 51 Sleeper Street LLC |

DE |

11

Exhibit A

| T-C 526 Route 46 LLC |

DE | |

| T-C 636 Sixth Avenue Retail LLC |

DE | |

| T-C 680 Belleville LLC |

DE | |

| T-C 685 Third Avenue Member LLC |

DE | |

| T-C 699 Bourke Street LLC |

DE | |

| T-C 77 Central LLC |

DE | |

| T-C 800 17th Street NW Member LLC |

DE | |

| T-C 800 17th Street NW Owner LLC |

DE | |

| T-C 800 17th Street NW Venture LLC |

DE | |

| T-C 888 Brannan Member LLC |

DE | |

| T-C 888 Brannan Owner LLC |

DE | |

| T-C 888 Brannan TRS LLC |

DE | |

| T-C 888 Brannan Venture LLC |

DE | |

| T-C 919 N. Michigan Avenue Retail LLC |

DE | |

| T-C Aspira LLC |

DE | |

| T-C Australia RE Holdings I, LLC |

DE | |

| T-C Australia RE Holdings II, LLC |

DE |

12

Exhibit A

| T-C Barton Springs LLC |

DE | |

| T-C Century Plaza LLC |

DE | |

| T-C Copley, LLC |

DE | |

| T-C Coronado LLC |

DE | |

| T-C Cypress Park West LLC |

DE | |

| T-C Des Peres Corners LLC |

DE | |

| T-C Ellington, LLC |

DE | |

| T-C Fairway Center II LLC |

DE | |

| T-C Falls Center Townhouses LLC |

DE | |

| T-C Fort Point Creative Exchange LLC |

DE | |

| T-C Franklin Square Member LLC |

DE | |

| T-C Franklin Square Venture LLC |

DE | |

| T-C GA Real Estate Holdings LLC |

DE | |

| T-C Hall of States Member LLC |

DE | |

| T-C Hall Of States Owner LLC |

DE | |

| T-C Hall Of States Venture LLC |

DE | |

| T-C H-T REIT LLC |

DE |

13

Exhibit A

| T-C H-T Venture LLC |

DE | |

| T-C HV Member LLC |

DE | |

| T-C Illinois Street, LLC |

DE | |

| T-C JK I LLC |

DE | |

| T-C JK II LLC |

DE | |

| T-C King Street Station LLC |

DE | |

| T-C Kings Crossing LLC |

DE | |

| T-C Legacy Place Member LLC |

DE | |

| T-C Lux Fund Holdings LLC |

DE | |

| T-C Mt. Ommaney Centre Holding Company LLC |

DE | |

| T-C Mt. Ommaney Centre LLC |

DE | |

| T-C Newbury Common LLC |

DE | |

| T-C Ocean Air LLC |

DE | |

| T-C Park 19 LLC |

DE | |

| T-C Pearl Reit 2 LLC |

DE | |

| T-C Port Northwest Development LLC |

DE | |

| T-C Potomac Promenade LLC |

DE |

14

Exhibit A

| T-C RDC, LLC |

DE | |

| T-C Republic Square Member LLC |

DE | |

| T-C Republic Square Mezzanine LLC |

DE | |

| T-C Republic Square Owner LLC |

DE | |

| T-C Republic Square Reit LLC |

DE | |

| T-C Republic Square Venture LLC |

DE | |

| T-C Roosevelt Square LLC |

DE | |

| T-C Savier Street Flats LLC |

DE | |

| T-C SBMC Joint Venture LLC |

DE | |

| T-C Scripps Ranch LLC |

DE | |

| T-C Shoppes At Monarch Lakes LLC |

DE | |

| T-C SMA 2, LLC |

DE | |

| T-C State House On Congress Apartments LLC |

DE | |

| T-C Stonecrest LLC |

DE | |

| T-C The Edge At Flagler Village LLC |

DE | |

| T-C Trio Apartments LLC |

DE | |

| T-C UK RE Holdings I, LLC |

DE |

15

Exhibit A

| T-C UK RE Holdings II, LLC |

DE | |

| T-C UK RE Holdings III, LLC |

DE | |

| T-C Uptown Apartments, LLC |

DE | |

| T-C Waterford Blue Lagoon LLC |

DE | |

| TCAM Core Property Fund REIT 2 LLC |

DE | |

| TCPC Associates, LLC |

DE | |

| Teachers Mayflower, LLC |

DE | |

| Terra Ventosa Vineyards, LLC |

CA | |

| TGA Japan Holdings, LLC |

DE | |

| The Flats 130 DC Residential LLC |

DE | |

| The Flats 140 DC Residential LLC |

DE | |

| The Flats DC Grocery LLC |

DE | |

| The Flats Holding Company LLC |

DE | |

| The Plata Wine Partners Trust |

CA | |

| THRE Global Investments LLC |

DE | |

| TIAA 485 Boca 54 LLC |

DE | |

| TIAA 485 Clarendon, LLC |

DE |

16

Exhibit A

| TIAA CMBS I, LLC |

DE | |

| TIAA Diamond Investor, LLC |

DE | |

| TIAA Diversified Public Investments, LLC |

DE | |

| TIAA Franklin Square, LLC |

DE | |

| TIAA Gemini Office, LLC |

DE | |

| TIAA Global AG II Special Member LLC |

DE | |

| TIAA Global AG Special Member LLC |

DE | |

| TIAA Global Equity Income, LLC |

DE | |

| TIAA Global Public Investments, LLC |

DE | |

| TIAA Infrastructure Investments, LLC |

DE | |

| TIAA Oil And Gas Investments, LLC |

DE | |

| TIAA Park Evanston, LLC |

DE | |

| TIAA Realty, LLC |

DE | |

| TIAA SF One, LLC |

DE | |

| TIAA SMA Strategies LLC |

DE | |

| TIAA Stafford-Harrison LLC |

DE | |

| TIAA Super Regional Mall Member Sub LLC |

DE |

17

Exhibit A

| TIAA SynGas, LLC |

DE | |

| TIAA Timberlands I, LLC |

DE | |

| TIAA Timberlands II, LLC |

DE | |

| TIAA Union Place Phase I, LLC |

DE | |

| TIAA Wind Investments LLC |

DE | |

| TIAA-CPPIB Commercial Mortgage Company REIT LLC |

DE | |

| TIAA-CPPIB Commercial Mortgage Company, L.P. |

DE | |

| TIAA-Stonepeak Investments I, LLC |

DE | |

| TIAA-Stonepeak Investments II, LLC |

DE | |

| T-Investment Properties Corp. |

DE | |

| True Oak Napa Vineyard, LLC |

DE | |

| U.S. Cities Fund Operating LP |

DE | |

| U.S. Cities Fund REIT LLC |

DE | |

| U.S. Cities Retail Fund Operating LP |

DE | |

| U.S. Cities Retail Fund REIT LLC |

DE | |

| Union Place Phase I, LLC |

DE | |

| W R C Properties, LLC |

DE |

18

Exhibit A

| Waterford Blue Lagoon Reit LP |

DE | |

| Waterford Core Operating LP |

DE | |

| Westland At Waterford Operating LP |

DE | |

| Westland At Waterford Reit LP |

DE |

| • | The following INTERNATIONAL entities were organized by TIAA to hold investments for the General Account and Separate Accounts. All issued and outstanding stock is owned indirectly by TIAA. |

| Entity Name |

Domestic Jurisdiction | |

| 154 rue de l’Université |

France | |

| 36 rue La Fayette |

France | |

| 70 St Mary Axe Unit Trust |

Jersey | |

| A-30 Canadian Transport Inc. |

QC, Canada | |

| Abford House Unit Trust |

Jersey | |

| Adeoti Empreendimentos Imobiliários Ltda |

Brazil | |

| BCIMC (TCGA II) Investment Trust |

Canada | |

| Brusno Maszyny Sp. z.o.o. |

Poland | |

| Brusno Resort Spolka Z Organiczona Odpowiedzialnoscia w Organizacji |

Poland |

19

Exhibit A

| Bruyeres I SAS |

France | |

| Bruyeres II SAS |

France | |

| CD (TCGA II) Investment Trust |

BC, Canada | |

| Cityhold Nymphe S.à r.l |

Luxembourg | |

| Cityhold Participations S.à r.l |

Luxembourg | |

| Cityhold Peak Participations S.à r.l |

Luxembourg | |

| Cityhold Peak S.à r.l |

Luxembourg | |

| Cityhold Propco 10 S.à r.l |

Luxembourg | |

| Cityhold Propco 11 S.à r.l |

Luxembourg | |

| Cityhold Propco 12 S.à r.l |

Luxembourg | |

| Cityhold Propco 6 S.à r.l |

Luxembourg | |

| Cityhold Propco 7 S.à r.l |

Luxembourg | |

| Cityhold Propco 9 S.à r.l |

Luxembourg | |

| Cityhold UK Investment S.à r.l |

Luxembourg | |

| CLOF Victoria Nominee 1 Limited |

United Kingdom |

20

Exhibit A

| CLOF Victoria Nominee 2 Limited |

United Kingdom | |

| Courcelles 70 |

France | |

| Cranston Investments SP. z.o.o. |

Poland | |

| Easley Investments SP. z.o.o. |

Poland | |

| Eko Topola Sp. z o.o. |

Poland | |

| Erlangen Arcaden GmbH & Co. KG |

Germany | |

| Erlangen Arcaden Verwaltungs GmbH |

Germany | |

| EURL Olympe |

France | |

| EURL Servin |

France | |

| Forestal GTR Chile Limitada |

Chile | |

| Forestal Monterrey Colombia SAS |

Colombia | |

| Forestal y Agricola Silvoligna Chile Limitada |

Chile | |

| Global Timber Spain, S.L. |

Spain | |

| Gropius KG |

Germany | |

| Gropius Passagen Verwaltungs GmbH |

Germany |

21

Exhibit A

| Gropius S.a.r.l. |

Luxembourg | |

| HV Freehold S.à r.l |

Luxembourg | |

| HV Properties S.à r.l |

Luxembourg | |

| IAI Australia Fund II Trust |

Australia | |

| IAI Australia Trust |

Australia | |

| IPOPEMA 87 Fundusz Inwestycyjny Zamknięty Aktywów Niepublicznych |

Poland | |

| Ipopema 95 Fundusz Inwestycyjny Zamknięty Aktywów Niepublicznych (“FIZAN”) |

Poland | |

| KS Freehold S.à r.l |

Luxembourg | |

| KS Leasehold S.à r.l |

Luxembourg | |

| London Belgrave Unit Trust |

Jersey | |

| Mandala Food Co-Investment Holdings II SPV |

Mauritius | |

| Mansilla Participacoes Ltda |

Brazil | |

| Monterrey Forestal GWR SAS |

Colombia | |

| ND Europe S.a.r.l. |

Luxembourg | |

| Neptune Annopol SP Zo.o. |

Poland |

22

Exhibit A

| Neptune Holding Spain, S.L. |

Spain | |

| Neptune Krakow SP Z .O.O. |

Poland | |

| Neptune OPCI |

France | |

| Neptune Polish Property Venture BV |

Netherlands | |

| Neptune Property Venture S.à r.l. |

Luxembourg | |

| Neptune Roppenheim 1 S.à r.l. |

Luxembourg | |

| Neptune Roppenheim 2 S.à r.l. |

Luxembourg | |

| Neptune Roppenheim Holding S.à r.l |

Luxembourg | |

| New Fetter Lane Unit Trust |

Jersey | |

| Nightingale LuxCo S.à r.l. |

Luxembourg | |

| Norteshopping Centro Comercial S.A. Portuguese SA |

Portugal | |

| Norteshopping Retail & Leisure B.V. |

Netherlands | |

| Olympe (Holding) |

France | |

| Paddington Central III Unit Trust |

Jersey | |

| Promcat Alternativa, S.L. |

Spain |

23

Exhibit A

| Quercus Algoma Corporation |

Canada | |

| Quercus Algoma Land Corporation |

Canada | |

| Roosevelt Participation S.à r.l |

Luxembourg | |

| Roppenheim Holding SAS |

France | |

| Roppenheim Outlet SNC |

France | |

| Rue de L’Universite 154 |

France | |

| SARL Des Brateaux |

France | |

| SARL Servin (Holding) |

France | |

| SAS Malachite |

France | |

| SAS Roosevelt |

France | |

| SNC Garnet-TIAA |

France | |

| SNC La Défense |

France | |

| SNC Lazuli |

France | |

| SNC Péridot |

France | |

| SNC Roosevelt |

France |

24

Exhibit A

| Sweden Nova Lund 1 AB |

Sweden | |

| Sweden Nova Lund 2 AB |

Sweden | |

| T-C 20 Hunter Street (AUS) Trust |

Australia | |

| T-C Europe S.à.r.l. |

Luxembourg | |

| T-C Luxembourg Neptune Holding S.à r.l. |

Luxembourg | |

| T-C Neptune Holdings S.à r.l. |

Luxembourg | |

| T-C Neuperlach Development S.a.r.l. |

Luxembourg | |

| T-C Nordics Investment AB |

Sweden | |

| T-C PEP Asset S.a.r.l. |

Luxembourg | |

| T-C PEP Holding S.à r.l |

Luxembourg | |

| T-C PEP Property S.a.r.l. |

Luxembourg | |

| Thurrock Retail Park Unit Trust |

Jersey | |

| TIAA Australia Real Estate Trust |

Australia | |

| TIAA Lux 11 S.a.r.l. |

Luxembourg | |

| TIAA Lux 5 S.a.r.l. |

Luxembourg |

25

Exhibit A

| TIAA Lux 8 S.a.r.l. |

Luxembourg | |

| TIAA Melbourne Retail Asset 1 Trust |

Australia | |

| TIAA Melbourne Retail Holding 1 Trust |

Australia | |

| UK PPP Investments LP |

United Kingdom | |

| Villabe SAS |

France | |

| Wigg (Holdings) Limited |

United Kingdom | |

| Wigg Investments Limited |

United Kingdom |

| (18) | Separate Real Estate Account Subsidiaries: |

| • | The following subsidiaries own real estate or hold partnership interests in joint ventures that own commercial real estate for the benefit of the Separate Real Estate Account (VA-2). |

| Entity Name |

Domestic Jurisdiction | |

| Blue Ridge PP Condominium Association, Inc. |

CO | |

| BRKLYN NY 250 N 10th Street Owner LLC |

DE | |

| Green River PP Condominium Association, Inc. |

CO | |

| Light Street Partners, LLP |

MD | |

| MDR L&M Apartments, LLC |

DE | |

| Mima Investor Member LLC |

DE | |

| One Boston Place LLC |

DE | |

| One Boston Place Real Estate Investment Trust |

MD | |

| Pepper Building Associates LP |

PA | |

| Provence 110 |

France | |

| Red Canyon PP Condominium Association, Inc. |

CO | |

| Seneca Industrial Holdings, LLC |

DE | |

| T-C 1500 Owens, LLC |

DE |

26

Exhibit A

| T-C 1619 Walnut Street GP LLC |

DE | |

| T-C 200 Milik Street LLC |

DE | |

| T-C 200 W 72nd Street LLC |

DE | |

| T-C 225 Binney, LLC |

DE | |

| T-C 401 West 14th Street Member LLC |

DE | |

| T-C 425 Park Avenue LLC |

DE | |

| T-C 430 West 15th Street LLC |

DE | |

| T-C 4th & Madison LLC |

DE | |

| T-C 501 Boylston Street LLC |

DE | |

| T-C 55 Second Street, LLC |

DE | |

| T-C 701 Brickell LLC |

DE | |

| T-C 780 Third Avenue Member LLC |

DE | |

| T-C 780 Third Avenue Owner LLC |

DE | |

| T-C Ashford Meadows LLC |

DE | |

| T-C Ashton Judiciary LLC |

DE | |

| T-C Charleston Plaza, LLC |

DE | |

| T-C Five Oaks LLC |

DE | |

| T-C Forum At Carlsbad LLC |

DE | |

| T-C Foundry Square II Member LLC |

DE | |

| T-C Foundry Square II Owner LLC |

DE | |

| T-C Foundry Square II Venture LLC |

DE | |

| T-C Four Oaks General Partner LLC |

DE | |

| T-C Four Oaks Place LLC |

DE | |

| T-C Legacy At Westwood LLC |

DE | |

| T-C Legend At Kierland LLC |

DE | |

| T-C Mass Court, LLC |

DE | |

| T-C Montecito LLC |

DE | |

| T-C Palatine LLC |

DE | |

| T-C Palomino Blue Ridge LLC |

DE | |

| T-C Palomino Green River LLC |

DE | |

| T-C Palomino Red Canyon LLC |

DE | |

| T-C Pepper Building GP LLC |

DE | |

| T-C Phoenician LLC |

DE | |

| T-C REA 400 Fairview Investor LLC |

DE | |

| T-C Regents Court LLC |

DE | |

| T-C San Montego TX LLC |

DE |

27

Exhibit A

| T-C Southside At Mcewen Retail LLC |

DE | |

| T-C SP, Inc. |

DE | |

| T-C The Caruth LLC |

DE | |

| T-C The Colorado LLC |

DE | |

| T-C The Manor at Flagler Village LLC |

DE | |

| T-C The Manor LLC |

DE | |

| T-C Tradition At Kierland LLC |

DE | |

| T-C Valencia Town Center General Partner LLC |

DE | |

| T-C Valencia Town Center Limited Partner LLC |

DE | |

| T-C Wisconsin Place Member LLC |

DE | |

| T-C Wisconsin Place Owner LLC |

DE | |

| TC Rancho Cucamonga LLC |

DE | |

| Teachers REA II, LLC |

DE | |

| Teachers REA, LLC |

DE | |

| The Louis DC Residential LLC |

DE | |

| The Woodley DC Residential LLC |

DE | |

| TIAA Florida Mall, LLC |

DE | |

| TIAA Miami International Mall, LLC |

DE | |

| TIAA Separate Account VA-1 (VA-1) |

DE | |

| TIAA West Town Mall, LLC |

DE | |

| TIAA-CREF Global Separate Real Estate Company LLC |

DE | |

| TREA 1401 H, LLC |

DE | |

| TREA 32 South State Street LLC |

DE | |

| TREA 9625 Town Center, LLC |

DE | |

| TREA Campus Pointe 1, LLC |

DE | |

| TREA Campus Pointe 2, LLC |

DE | |

| TREA Fashion Show Investor Member LLC |

DE | |

| TREA Florida Retail, LLC |

DE | |

| Trea Greene Crossing LLC |

DE | |

| TREA Hub Investor Member LLC |

DE | |

| TREA Pacific Center LLC |

DE | |

| TREA Pacific Plaza, LLC |

DE | |

| TREA Retail Property Portfolio 2006 LLC |

DE | |

| TREA Weston, LLC |

DE | |

| TREA Wilshire Rodeo, LLC |

DE | |

| Walnut Street Retail Investors, L.P. |

PA |

28

Exhibit A