UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

Boxabl Inc.

(Exact Name of Registrant As Specified In Its Charter)

Nevada

|

| 85-2511929

|

(State or other jurisdiction of

incorporation or organization)

|

| (I.R.S. Employer

Identification No.)

|

|

|

|

5345 E. N. Belt Road

North Las Vegas, NV

|

| 89115

|

(Address of Principal Executive Offices)

|

| (ZIP Code)

|

Registrant’s telephone number, including area code: (702) 500-9000

Please send copies of all correspondence to:

CrowdCheck Law LLP

700 12th Street NW, Suite 700

Washington, DC 20005

Securities to be registered under Section 12(b) of the Act:

None.

Securities to be registered under Section 12(g) of the Act:

Non-Voting Series A-2 Preferred Stock, $0.00001 par value

Non-Voting Series A-1 Preferred Stock, $0.00001 par value

Non-Voting Series A Preferred Stock, $0.00001 par value

Common Stock, $0.00001 par value

(Title of Class)

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨

| Accelerated filer ¨

|

Non-accelerated filer x

| Smaller reporting company x

|

| Emerging growth company x

|

1

If an emerging growth company, indicate by check mark if the Company has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

TABLE OF CONTENTS

In this Form 10, the term “Boxabl”, “we”, “us”, “our”, or “the company” refers to Boxabl Inc.

THIS FILING MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

2

Implications of Being an Emerging Growth Company

We are currently not subject to the ongoing reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) because we did not register our securities under the Exchange Act. Rather, we are subject to the more limited reporting requirements under the Regulation A reporting regime until this Registration Statement is declared effective.

When we become subject to the ongoing reporting requirements of the Exchange Act, as an issuer with less than $1.07 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| ·

| will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

|

| ·

| will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”);

|

| ·

| will not be required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes);

|

| ·

| will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure;

|

| ·

| may present only two years of consolidated audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and

|

| ·

| will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards.

|

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under Section 107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our consolidated financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, or such earlier time that we no longer meet the definition of an emerging growth company. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we also qualify, once this Registration Statement is declared effective, as a “smaller reporting company” under the SEC’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are

3

not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited consolidated financial statements and related MD&A disclosure.

Item 1. Business.

Boxabl Overview

Boxabl is on a mission to bring building construction in line with modern manufacturing processes by creating a superior residential and commercial building that can be completed in far less time and cost than traditional construction.

The core product that we offer is the “Building Box", which consists of room modules that ship to site at a low cost and can be stacked and connected to build most any shape and style of finished buildings. We are currently evaluating market demand, but anticipate that available dimensions will be 19x20 ft., 19x30 ft., 19x40 ft., and 19x60 ft. Our first product available for sale is our 19x19 ft. Casita Box, featuring a full-size kitchen, bathroom, and living area.

We believe there is significant market interest in our product based on receiving reservations of interest from over 170,000 customers through our Room Module Order Agreement, some of whom have placed small deposits to formalize their pre-order of the Casita when production begins. We have also completed delivery of an order received from ADS, Inc. for 156 Casitas. In order to meet our understanding of the potential demand, we are undertaking our current capital raise to secure raw materials ahead of need, to fund additional buildout of our initial factory, and to accelerate production.

Boxabl was first organized as a limited liability company in Nevada on December 2, 2017, and reorganized as a Nevada corporation on June 16, 2020. Our core technology was invented by our Chief Executive Officer, Paolo Tiramani, Director of Marketing, Galiano Tiramani, and our lead engineer, Kyle Denman. Until recently, the technology was owned by Build IP LLC, a Nevada limited liability company specially formed as a holding company for the intellectual property (“Build IP”), owned by our CEO, Paolo Tiramani. Under an exclusive licensing agreement, Boxabl paid Build IP a license fee equivalent to 1% of the net selling price generated by the sale of Casitas. On June 15, 2023, Boxabl merged with 500 Group, Inc., a Nevada corporation that is controlled by Paolo Tiramani and parent to Build IP (“500 Group”). As a result of this merger, all of the intellectual property held by Build IP now belongs to Boxabl and the licensing agreement is now void. For details, see Item 7. Certain Relationships and Related Transactions and Director Independence.

Our Mission and Innovation

Over the past several hundred years, little has changed in the construction industry. Most buildings are built by hand, one at a time. Modern construction has not yet adopted advantages of the assembly line, robotics, or economies of scale. Even in housing developments with substantially similar homes, while components may be purchased in bulk, the work still involves construction by hand, one at a time. To compound this problem, labor shortages are rising, and new entries to the building construction workforce are slowing. These factors all contribute to a significant backlog of housing demand and price increases that are putting affordable housing out of the reach of common Americans.

One of the prime drivers of the limitations on construction is the ability to ship finished product to a job site. At Boxabl, we realized that innovation in modular construction would not be possible without innovation in shipping. Boxabl’s patented shipping technology allows us to serve large geographic areas from one Boxabl factory. With this shipping technology, we believe that the location of our flagship factory in North Las Vegas, Nevada will be able to produce products that can be delivered to anywhere in the US, and even international markets.

Our innovations in shipping are only possible because of our unique methods for constructing our building modules. Our “Building Box" system and Box design were created specifically to maximize repeatability in manufacturing. In addition, our reimagined manufacturing process is simplified and efficient. This is achieved in part, by dramatically reducing the individual components in the build compared to traditional building, which requires stacks of lumber and thousands of nails. Significantly fewer components result in significantly less labor costs during manufacturing.

4

We believe the resulting product boasts many benefits over traditional construction for the end user. Not only does the Boxabl solution have the potential to reduce building costs and build time compared to traditional home building, but we simultaneously improve upon other metrics that can be used to evaluate building solutions, such as installation speed, fire resistance, energy ratings, mold resistance, environmental impact, wind ratings, flood resistance, pest resistance, impact resistance and much more.

Market Opportunity

Stick framing, invented over 100 years ago, is still the most popular residential building method. Stick framing means laborers build homes one at a time, by hand, using simple tools. This is a slow, expensive and labor-intensive process that has failed to adapt to modern manufacturing processes.

Stick framing includes no mass production, no robotics, no economies of scale, no assembly line, and costs that are dependent on the availability of construction labor, which has experienced shortages in recent years. According to the Associated General Contractors of America, 81% of construction firms have reported difficulty in filling salaried and hourly craft positions. The discussions contained in this registration statement relating to the market conditions and industry of the Company represent the opinions of management informed by third-party sources that we believe to be reliable. Our management has not independently verified the information, and any third-party sources are not incorporated by reference into this registration statement.

During 2022 and into 2023, the construction market has been slowing. According to the US Census Bureau, privately owned housing stats in December 2022 were at a seasonally adjusted annual rate of 1,382,000, which represents a 21.8% reduction from the housing stats in December 2021 of 1,768,000. We anticipate the economic impact of inflation and rising interest rates has resulted in a decrease in housing stats generally. For instance, the US Census Bureau reported 1,330,000 seasonally adjusted building permits in December 2022, which is 1.6% below the November 2022 estimate of 1,351,000, and 29.9% below the December 2021 rate of 1,896,000.

Changes in zoning laws designed to increase housing density and solve housing affordability are allowing people around the country, and especially in California, to build accessory dwelling units (“ADUs”) for use and rent. In the city of Los Angeles alone, 5,188 permits were issued by the end of 2021 and 4,999 ADU permits were issued in the first eight months of 2022. This is a burgeoning market for which the Boxabl product is well positioned.

While we believe ADUs are an easy way to enter the market, Boxabl is not limited to small residential units. We expect the Boxabl product can be used in a wide range of building types — residential, commercial, high rise, multi-family, apartment, disaster relief, military, labor housing and more.

Our Products

The Boxabl Solution

The Boxabl product represents a new take on modular construction. It is a factory-finished room module system that can be quickly stacked and arranged on site (the “Boxes”), and that provides the majority of the building envelope and functions. This allows builders to dramatically reduce build time and costs while increasing quality and features.

The Boxabl product is a large, almost 20 ft. in width room that folds down to 8.5 ft. wide for shipping, and still has sufficient space for factory-installed kitchens, bathrooms and more. Each unit is a separate Box. Our Boxes take the heavy lifting of a building’s construction out of the field and moves it into the factory, where it belongs.

Once the Boxes arrive at the jobsite, Boxes are assembled together in a plug-and-play manner by builders to create a finished home of almost any size and style. A typical Box can be assembled in one day. The goal is for the speed, quality, features and price of the Boxabl product to be superior to traditional building methods.

To date, the Casita is the main model of Box we have been producing. We recently announced a new prototype with three-bedrooms, two-and-a-half bathrooms and an outdoor deck, which we believe will expand public understanding of Boxabl beyond tiny houses.

5

Shipping Solution

The first step in factory manufacturing of large buildings is creating a feasible shipping solution. Our goal was to ship without the need for oversized loads. Oversized loads have extra permitting, follow cars, police escorts, restricted routes and other problems that increase costs dramatically. Our design achieves the largest possible room that is able to fit into standard shipping dimensions, meeting highway, sea and rail transportation requirements. It also allows us to use our own drivers, as well as third parties, for delivery of our Casitas.

Smart Manufacturing

Boxabl Boxes are not built like traditional homes, they have been engineered with mass production in mind. This redesign includes a significant reduction in the number of components involved in the manufacturing process. Boxabl Boxes will be built with a laminated panel technology instead of a standard stick frame construction. This means each wall panel that Boxabl manufactures only consists of a few individual components. A comparable traditional wall has thousands of individual components and requires 3 or more separate skilled trades to complete (e.g., framing, sheetrock, exterior finish, etc.). Many raw materials in the Boxabl Boxes will be processed by off-the-shelf computer numerical control (CNC) equipment. The use of CNC equipment will give us a degree of automation right away, which we intend to expand to allow for the manufacturing process to be more fully automated.

The System

Efficient factory environments thrive on repeatability. We can achieve the lowest cost by building the same product over and over, leaving it to the final assembly to create unique structures. The Boxabl factory can build our Boxes in different sizes, with different floorplans, and the builder can stack, arrange and dress the boxes however they desire for a custom building.

Building Materials

Our wall design doesn't use standard lumber framing, instead, we use a laminated panel technology that includes steel skin, expanded polystyrene (EPS) foam, and magnesium oxide board. We are able to source these materials from multiple vendors, and are not reliant on any particular vendor. Our product is compatible with automation, CNC, and the factory environment.

Boxabl has differentiated certain building designs into “Generation 1.0” and “Generation 2.0”. In Generation 1.0, we utilized a proprietary structurally insulated panel design with steel and magnesium oxide skins, EPS core, and a hybrid lumber-PVC frame. In Generation 2.0 we are utilizing a hybrid fiber-cement and steel skin with a reinforced EPS core and lumber frame.

Product Features

The Boxabl building system is planned to have many features and solutions that reduce pain points for builders and offer an attractive product for consumers.

6

Resilience

·Fire resistant

·Flood resistant

·Bug resistant

·Mold resistant

|

Structural

·Snow load rated

·Hurricane wind load rated

·Seismic rated

·Light weight requiring smaller equipment to move

·Unit to unit connection – unlimited connection horizontally, 3 unit tall stack allowance

|

Design and Engineering

·Connects to any foundation

·Packs down for low cost shipping – unfolds to 2x volume

·Sealing gaskets at joints

·Crane pick points for faster setting

·MEP network channel – precut chase network for all utilities in walls, roof, and floor for low-cost retrofit of electrical, sprinkler system, HVAC, etc.

·20x20 up to 20x60 room modules

·Multiple floor plans of room modules for millions of combinations

·Reduced components designed for factory automation

·Streamlined production process similar to automotive assembly rather than modular

·Weatherproof roofing membrane ships with unit

·Simple field assembly does not require skilled labor apart from site work

·Pre-plumbed for on-site hook up – does not require crawl space

·All finishing work, paint, trim, etc., inside and out ships complete

|

Energy

·Will qualify for top energy rating

·Reduced energy bills

·Smaller sized HVAC

·Minimal thermal bridging

·Tight building envelope

·High R values continuous EPS insulation

·High efficiency appliances and LED lights for minimal energy requirement

|

Approval

·Applied for pre-approval of our modular design

·Mix and stack building system for easy custom plans

·Full testing, fire, energy, structural

|

|

7

Applicable Regulation

Our Boxes fall under different state certification requirements for housing depending on their end use. For instance, we are seeking to obtain state certifications under modular home building (or factory-built building) codes, with an initial emphasis on Arizona, Nevada, and California. Eventually, we plan to obtain approvals for every state’s modular home building program. Boxabl currently has a manufacturer license in Arizona, and we are currently waiting for the state to approve reconstruction plans to bring our buildings into compliance with Arizona Department of Housing requirements, which we believe is the last stage of obtaining the factory build certification in Arizona. For information please see Item 8. Legal Proceedings – Arizona Department of Housing Settlement. Once Boxabl is certified in Arizona, Boxabl believes that it will be easier to obtain certification in other states as there are similarities in the certification requirements across states. In the meantime, Boxabl has manufactured 173 Casitas during 2023 so far, and intends to sell those units for other projects. As discussed below, we plan to resume sales to customers in states where there is no state modular program as well as for projects that are under a different classification such as park model RVs or government projects.

For modular homes, some states require the approval of a third-party testing and inspection company, which will conduct product testing and factory inspections. There are a number of services to provide such testing, and we have engaged a third party, NTA, to do that testing. In May 2023 we received a panel listing from NTA which indicates our building panels meet the international building codes https://icc-es.org/report-listing/ESR-4725/.

Some states like Alaska, Oklahoma, Utah, Wyoming, Hawaii, Delaware, West Virginia, and Vermont do not have state modular house programs. In those states, we believe Boxabl buildings can be deployed right now by obtaining a permit from the local building department.

We can also deliver Casitas to customers under “park model” recreational vehicle rules in all 50 states. This is done through the ANSI 119.5 code; manufacturers are required to self-certify that they meet these requirements. By adding a permanent trailer/chassis, Boxabl Casitas do meet this code.

Builders will still be required to obtain local building permits, as well as those necessary for tying into local water and electric services.

Price

We believe that our production and shipping advantages will allow us to sell our Boxabl Boxes at competitive prices. The retail price for our initial product, the Casita, is projected to be $60,000, representing about $166/sq. ft. Shipping, setup, land development and connection to water and electric services would be in addition to this amount, increasing the total price by approximately $5,000 to $50,000 depending on the specific project. However, compared to building costs in states like California that can be on the order of $400/sq. ft., the Boxabl solution is an attractive option for cost-conscious purchasers. Additionally, we think our large waitlist indicates our price is very desirable.

As we are able to increase our bulk purchasing and introduce greater amounts of automation in the production process, we may be able to reduce the consumer price in the future to capture a larger market.

In fact, our costs have consistently come down since we began our manufacturing, May 2023 was our lowest cost yet, approximately $32,532 for direct material and $10,739 for direct labor.

Core Technology

The core technology covering the structure of the Boxes and transportation system used by the Company was developed by its founder, Paolo Tiramani. Innovations created by Paolo Tiramani have previously led to the creation of new billion-dollar product categories in the tool storage space.

8

Patents

Boxabl has patents for the structure and transportation of the Boxabl building system, covering all important aspects of its commercial designs, as well as the foreseeable alternatives. The filings closely track and reflect the product designs as they are updated. Further, the scope of protection sought extends beyond the design of the building structures themselves and includes innovative delivery and assembly equipment and techniques.

Structure Patents (1)

JURIS

| TITLE

| STATUS

| APP. NO.

| APP. DATE

| PAT. NO.

| PATENT

DATE

|

US

| Modular Prefabricated House

| Patented

| 10/653,523

| 9/2/2003

| 8,474,194

| 7/2/2013

|

US

| Modular Prefabricated House

| Patented

| 13/900,579

| 5/23/2013

| 8,733,029

| 5/27/2014

|

CA

| Modular Pre-Fabricated House

| Patented

| 2,442,403

| 9/24/2003

| 2442403

| 12/2/2008

|

US

| Customizable Transportable Structures and Components Therefor

| Patented

| 16/143,598

| 9/27/2018

| 10,688,906

| 6/23/2020

|

US

| Customizable Transportable Structures and Components Therefor

| Patented

| 16/804,473

| 2/28/2020

| 10,829,029

| 11/10/2020

|

US

| Customizable Transportable Structures and Components Therefor

| Patented

| 15/931,768

| 5/14/2020

| 10,926,689

| 2/23/2021

|

PCT

| Customizable Transportable Structures and Components Therefor

| --

| PCT/US18/53006

| 9/27/2018

|

|

|

EU

| Customizable Transportable Structures and Components Therefor

| Pending

| 18 864 413.2

| 4/30/2020

|

|

|

CA

| Customizable Transportable Structures and Components Therefor

| Patented

| 3,078,484

| 4/3/2020

| 3,078,484

| 7/13/2021

|

US

| Foldable Building Structures with Utility Channels . . . .

| Patented

| 16/786,130

| 2/10/2020

| 11,118,344

| 9/14/2021

|

US

| Foldable Building Structures with Utility Channels . . . .

| Allowed

| 17/245,187

| 4/30/2021

|

|

|

US

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 18/071,902

| 11/30/2022

|

|

|

9

US

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 18/071,905

| 11/30/2022

|

|

|

PCT

| Foldable Building Structures with Utility Channels . . . .

| --

| PCT/US20/17524

| 2/10/2020

|

|

|

AU

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 2020221056

| 7/2/2021

|

|

|

CA

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 3,129,693

| 8/9/2021

|

|

|

CN

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 202080014606.4.

| 8/13/2021

|

|

|

CN

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 202211067336.0

| 9/01/2022

|

|

|

EU

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 20 755 992.3

| 9/14/2021

|

|

|

JP

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 2021-547830

| 8/13/2021

|

|

|

MX

| Foldable Building Structures with Utility Channels . . . .

| Pending

| MX/a/

2021/0097120

| 8/12/2021

|

|

|

SA

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 521422646

| 7/28/2021

|

|

|

SA

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 522441248

| 11/08/2022

|

|

|

SA

| Foldable Building Structures with Utility Channels . . . .

| Pending

| 522441249

| 11/08/2022

|

|

|

US

| Enclosure Component Perimeter Structures

| Patented

| 16/786,202

| 2/10/2020

| 11,560,707

| 01/24/2023

|

US

| Foldable Enclosure Members Joined by Hinged I-Beam

| Issuing

| 17/592,984

| 2/04/2022

| 11,578,482

| 02/14/2023

|

US

| Enclosure Members Joined by Hinged I-Beam to Fold Flat

| Patented

| 17/592,988

| 2/04/2022

| 11,566,413

| 01/31/2023

|

US

| Foldable Enclosure Members Joined by Tongue-and-Groove Structure

| Patented

| 17/592,990

| 2/04/2022

| 11,566,414

| 01/31/2023

|

10

US

| Foldable Enclosure Members Joined by Hinged Perimeter Sections

| Patented

| 17/592,986

| 2/04/2022

| 11,525,256

| 12/13/2022

|

US

| Perimeter Structures for Joining Abutting Enclosure Components

| Pending

| 17/971,230

| 10/21/2022

|

|

|

PCT

| Enclosure Component Perimeter Structures

| --

| PCT/US20/17527

| 2/10/2020

|

|

|

CA

| Enclosure Component Perimeter Structures

| Pending

| 3,129,882

| 8/9/2021

|

|

|

CN

| Enclosure Component Perimeter Structures

| Pending

| 202080014607.9

| 8/13/2021

|

|

|

CN

| Enclosure Component Perimeter Structures

| Pending

| 202211434625.X

| 11/16/2022

|

|

|

EU

| Enclosure Component Perimeter Structures

| Pending

| 20 755 993.1

| 9/14/2021

|

|

|

JP

| Enclosure Component Perimeter Structures

| Pending

| 2021-547829

| 8/13/2021

|

|

|

US

| Equipment . . . for Erecting a Transportable Foldable Building Structure

| Patented

| 16/786,315

| 2/10/2020

| 11,220,816

| 1/11/2022

|

PCT

| Equipment . . . for Erecting a Transportable Foldable Building Structure

| --

| PCT/US20/17528

| 2/10/2020

|

|

|

US

| Enclosure Component Edge Seal Systems

| Pending

| 17/513,176

| 10/28/2021

|

|

|

US

| Enclosure Component Compression Seal Systems

| Pending

| 17/513,207

| 10/28/2021

|

|

|

US

| Enclosure Component Shear Seal Systems

| Pending

| 17/513,266

| 10/28/2021

|

|

|

PCT

| Enclosure Component Sealing Systems

| Pending

| PCT/US21/56415

| 10/25/2021

|

|

|

US

| Folding Beam Systems

| Pending

| 17/527,520

| 11/16/2021

|

|

|

PCT

| Folding Beam Systems

| Pending

| PCT/US21/59440

| 11/16/2021

|

|

|

US

| Enclosure Component Panel Structures

| Pending

| 17/539,706

| 12/01/2021

|

|

|

11

PCT

| Enclosure Component Panel Structures

| Pending

| PCT/US21/61343

| 12/01/2021

|

|

|

PCT

| Foldable Transportable Buildings

| Pending

| PCT/US22/16999

| 2/18/2022

|

|

|

US

| Liftable Foldable Transportable Buildings

| Pending

| 17/675,653

| 2/18/2022

|

|

|

US

| Stackable Foldable Transportable Buildings

| Pending

| 17/675,646

| 2/18/2022

|

|

|

US

| Sheet/Panel Design for Enclosure Component Manufacture

| Pending

| 17/504,883

| 10/19/2021

|

|

|

PCT

| Sheet/Panel Design for Enclosure Component Manufacture

| Pending

| PCT/US21/58912

| 11/11/2021

|

|

|

US

| Wall Component Appurtenances

| Pending

| 17/587,051

| 1/28/2022

|

|

|

US

| Wall Component Appurtenances

| Pending

| PCT/US22/14224

| 1/28/2022

|

|

|

US

| Improved Folding Roof Component

| Pending

| 17/569,962

| 1/06/2022

|

|

|

PCT

| Improved Folding Roof Component

| Pending

| PCT/US22/011415

| 1/06/2022

|

|

|

US

| Uni-Tool for Foldable Transportable Structure Deployment

| Pending

| 63/344,116

| 05/20/2022

|

|

|

US

| Couch

| Pending

| 63/356,771

| 06/29/2022

|

|

|

US

| Universal Panel

| Pending

| 63/388,366

| 07/12/2022

|

|

|

US

| Quick-Assembly Storage Bed

| Pending

| 63/395,936

| 08/08/2022

|

|

|

US

| Subassembly for Enclosure Component Manufacture

| Pending

| 63/399,389

| 08/19/2022

|

|

|

US

| Universal Edge Structures

| Pending

| 63/480,164

| 01/17/2023

|

|

|

US

| Vacuum Insulated Enclosure Components

| Pending

| 63/440,797

| 01/24/2023

|

|

|

12

Transport Patents

JURIS.

| TITLE

| STATUS

| APP. NO.

| APP. DATE

| PAT. NO.

| PATENT

DATE

|

US

| Wheeled Assembly for Item Transport

| Patented

| 16/143,628

| 9/27/2018

| 11,007,921

| 5/18/2021

|

PCT

| Wheeled Assembly for Item Transport

| --

| PCT/US18/53015

| 9/27/2018

|

|

|

Europe

| Wheeled Assembly for Item Transport

| Pending

| 18 863 822.5

| 4/30/2020

|

|

|

Canada

| Wheeled Assembly for Item Transport

| Patented

| 3,078,486

| 4/3/2020

| 3,078,486

| 11/2/2021

|

US

| Transport System

| Pending

| 63/324,940

| 3/29/2022

|

|

|

US

| Transport System

| Pending

| 63/335,880

| 4/28/2022

|

|

|

Factory Patents

JURIS.

| TITLE

| STATUS

| APP. NO.

| APP. DATE

| PAT. NO.

| PATENT

DATE

|

US

| Enclosure Component Fabrication Facility

| Pending

| 17/552,108

| 12/15/2021

|

|

|

PCT

| Enclosure Component Fabrication Facility

| Pending

| PCT/US21/63581

| 12/15/2021

|

|

|

US

| Enclosure Component Assembly Line

| Pending

| 63/426,563

| 11/18/2022

|

|

|

US

| Tilt Cart

| Pending

| 63/386,186

| 12/06/2022

|

|

|

Explanatory Endnotes

1.All listed patents and patent applications were previously owned by Build IP LLC (a Nevada LLC) and licensed to Boxabl Inc. (a Nevada Corp.), except for U.S. provisional patent application nos. 63/324,940, 63/335,880, 63/344,116, 63/356,771, 63/388,366, 63/395,936 and 63/399,389. The assignee of record of U.S. provisional patent application no. 63/344,116 is Boxabl Inc. In June 2023, Boxabl acquired all patents and patent applications owned by Build IP when it merged with Build IP’s parent company, 500 Group Inc. For details see Item 7. Certain Relationships and Related Transactions, and Director Independence.

2.Expired U.S. provisional patent applications are not listed.

3.The status of PCT applications having a priority date within 31 months of the date of this table are listed as “pending.” PCT applications having a priority date more than 31 months from the date of this table are listed with no status provided (e.g., “—“).

4.Jurisdictions (patent offices) are abbreviated as follows: Australia – AU, Canada – CA, China – CN, European Union – EU, Japan – JP, Mexico – MX, South Africa – SA, United States – US, and Patent Cooperation Treaty – PCT.

13

Trademarks

Boxabl has acquired the Boxabl trademark through its merger with 500 Group as described above. The Boxabl trademark is registered in the United States, the European Union, and in multiple other countries around the world. Boxabl intends to aggressively enforce its rights in the Boxabl trademark whenever third-party uses of similar names are encountered. Consequently, we believe that the Boxabl brand has developed a secondary meaning and has come to represent valuable goodwill.

Strategy

Boxabl intends to create a factory franchise business model. After our flagship factory in Las Vegas is scaled up, we want to expand internationally by setting up franchisees to build their own factories. We will use this first production-style factory to identify procedures, data, costs, raw materials, equipment, labor numbers and more to build a blueprint for future factories.

We believe a franchise model would let us rapidly scale worldwide. Under this scenario, Boxabl becomes a logistics company with franchisees constructing factories around the world. We would supply franchisees with raw materials, custom equipment, branding, proprietary components, quality control, and other services. We have received what we believe to be a significant number of inquiries from potential factory franchisees who have indicated that they have substantial amounts of capital to spend on factory startups. Over 2,273 parties from around the world have indicated that they would like to partner with us as factory franchisees through our web form at boxabl.com/partner, which allows them to also check a box indicating that they have at least $5 million to spend on startups of these factories. To date, we have not requested any payment from any of these parties as we feel it is premature. We do not yet have controls or procedures for evaluating potential franchisees, and will develop these procedures after evaluating the operations of our starter factory.

While these initial stages for the Company will be capital intensive as we develop our operations and outfit our starter factory, once moving into a focus on the factory franchise business model, we believe that we will be able to scale operations with less capital.

While the Company has received a considerable amount of positive media coverage, that coverage has been mostly prospective and has not included detailed looks and reviews of our Casita. To remedy that, we are considering construction of a showcase community in the Las Vegas area to allow for evaluation of our Boxes through a controlled, real-world test. We have not yet committed to this idea and have not allocated any proceeds from our public capital-raising activities under Regulation A or Regulation Crowdfunding to the showcase community.

We also recently announced a collaboration with Elevate.Money, Inc., a Delaware corporation operating in California (“Elevate”), that identifies, acquires and manages commercial real estate through real estate investment trusts (“REIT”). Through this collaboration, Elevate plans to raise funds for the purpose of developing communities utilizing Boxabl’s Casitas. Our non-exclusive agreement with Elevate includes granting Elevate a right of first refusal to purchase a minimum of 10% of Boxabl’s production of Casitas.

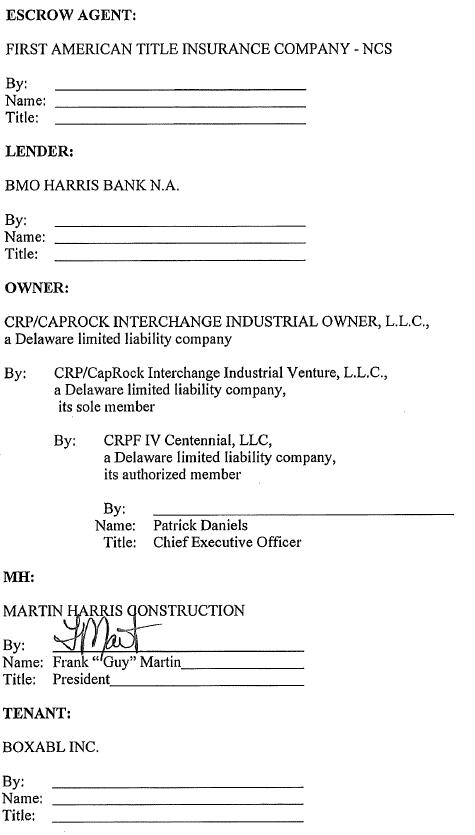

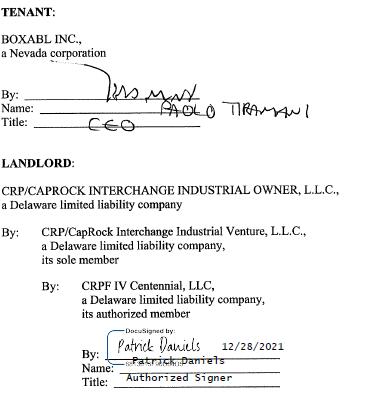

Our Manufacturing Facilities

Our starter production facility has now been built and is expected to produce six Boxes per shift once we ramp up production. We worked with industry-leading consultants to develop a plan for maximizing production efforts through automation, process efficiency, and supply chain considerations. The Boxes and panels will move through 20 main assembly stations in the factory where different sections are completed similar to an automotive production process. We entered into a lease for our starter production facility on December 29, 2020, which we took possession of on May 1, 2021, on a sixty-five-month lease. The facility features 173,720 square feet of usable floor space, which we have begun to outfit with capital equipment necessary for the construction of our Boxes. We believe this factory should create approximately 300 new direct jobs when fully staffed. Many more indirect jobs will be created on the building sites by our customers when they use our modules to build.

14

We will also support operations of our starter facility with a second facility nearby, for which we have entered into a lease agreement on June 13, 2022. This second facility will allow us to better stage inventory and in-house component fabrication. The new factory is 132,960 square feet.

With the move into our second facility, we are also making some significant improvements. During 2023, we plan to spend approximately $15,000,000 on equipment upgrades. These include equipment such as a new automated panel lamination system, CNC cutting equipment, a conveyor system that moves houses down our assembly line, and a new paint booth system.

During 2022, operations in our facilities allowed us to better see where improvements could be made to the design of the Casita. These improvements will be part of our “next gen” Casita, which we expect to simplify the design, reduce components, reduce labor and increase structural ratings. Over the next six months, as we ramp up production utilizing our second facility and refine processes in our first facility, we believe we will be able to achieve gains in our unit economics and production rate.

Between the second half of 2021, when we were able to begin production in our starter facility, to the date of this registration statement, we have produced over 420 homes. In May 2023, we signed a lease for our third manufacturing facility. For details see Item 3. Properties.

Boxzilla Factory

We have allocated funds from our capital-raising activities for research and development expenditures relating to the planning for expansion into additional production facilities. In this regard, Boxabl is currently in the planning stages to launch a new factory that will be significantly larger and more advanced than the current operations. We believe we have proven the basic principles of the Company in our current manufacturing facility and are ready to take things to the next level of scale. The anticipated “Boxzilla” factory will require approximately $1 billion in funding; we believe it could be the world’s largest and most advanced mass production of housing ever attempted.

The knowledge gained from our manufacturing facilities and any additional production facilities will assist with the expansion into the franchise model.

Our Customers

In 2019, Boxabl delivered the first prototype at the International Builders’ Show in Las Vegas and received an overwhelming response. Builders were ecstatic to see the development of a solution to many issues they struggle with. We received the equivalent of 6,000,000+ sq. ft. of “reservations” from hundreds of professional builders. These reservations were simply an indication of interest and we did not take any deposits. They are not a guarantee of future revenues.

After the show, we ordered basic manufacturing equipment and continued to perfect the system and address feedback we got from the builder community. We were invited back to the 2020 show through a sponsorship with Professional Builder Magazine. Once we decided our initial building product focus would be the ADU market, we built three more units for the show. In January 2020, we debuted the “Casita” at the Builders’ Show and again received a high level of interest from potential customers.

Rather than just making available “reservations”, we began taking deposits for positions on our waitlist. We currently have two options of deposit amounts to complete a pre-order on our waitlist: 1) free; 2) $200 deposits; As of June 30, 2023, we have over 170,000+ names on our customer waitlist, with many of those potential customers indicating they want to purchase more than 1 Casita. Although most of the names on this waitlist have not paid a deposit, we currently have deposits from over 8,300 unique persons to purchase one or more Casitas.

Further, if each of the 170,000 potential customers purchases a single Casita, that extrapolates to potential revenue of more than $10 billion. While it is unlikely that we will receive these orders or revenue from most of these potential customers, even the ones who have placed deposits, it shows the excitement and interest in the Casita. Conversion of even a small percentage of these potential customers will allow for full production of our planned production facility.

We delivered one Casita to a customer in Texas as part of a demonstration project, but no revenues were recorded for that order and delivery.

15

Initial Purchase Orders

In December 2020, the Company received two purchase orders from ADS, Inc., to deliver 156 Casitas to the federal government. These purchase orders and related agreements are included as Exhibit 10.2 to this registration statement.

Boxabl received $9,245,574 from ADS, the full amount due under the terms of the contract, as final delivery has been completed.

We have also begun production and delivery on a 227 Casita order to a customer in the United States. The order was for a total price of $13.2 million. So far, we have delivered 51 units from this order during 2022. Subsequently, the Company has entered into a settlement agreement with the Arizona Department of Housing and the other parties to the agreement regarding reconstruction for the purpose of bringing the Casitas into compliance with Arizona regulations. For more details, see Item 8. Legal Proceedings – Arizona Department of Housing Settlement.

We intend to bring production and final sales to our retail and home builder potential customers once we are able to build at our desired production rates, and obtain state certifications. The initial ADS order and 227 Casita order allow us to continue development of our manufacturing procedures, and obtain end user feedback which we intend to utilize for further developments to the Casita product. Although we have manufactured 173 Casitas during 2023, none have been paid for or delivered in 2023. Our inventory of manufactured Casitas was intended to be delivered pursuant to an agreement in Arizona. However, our deliveries under that agreement have been on hold while we and our partners remedy issues that need to be addressed pursuant to the Arizona Department of Housing. See Item 8. Legal Proceedings – Arizona Department of Housing Settlement. In the meantime, we intend to resume sales to customers in states where there is no state modular program as well as for projects that are under a different classification such as park model RV’s or government projects. Nevertheless, these new sales may face delays due to the time needed to prepare the site for installation of the Casitas, arranging capital for payment of amounts due to the Company by the purchaser, and other preparatory steps that need to be taken in order to arrange delivery and installation of the units.

Boxabl is now scheduling delivery of Casitas to people on its waitlist. We have hired a sales manager and implemented a sales process where we sort through our waitlist to determine which customers and projects are viable.

Competition

Our competition can be broken into the following categories:

| ●

| Stick built: Traditional home building method, accounts for the majority of the market. Raw materials are brought to site and built by hand into finished buildings. This market is made up of many small builders. We think this group represents our likely customer base, as we provide them with a better solution.

|

| ●

| Manufactured: Manufactured homes are standardized homes built in a factory and shipped to site. These homes are generally built to a lower baseline standard of construction and attempt to come in at the lowest cost possible. The defining factor with this product is that they are generally deemed personal property and not real property. Only a few large companies dominate this category.

|

| ●

| Modular: Modular homes are factory-built homes required to be built to the same or higher building code standards of stick-built homes. These homes are generally more customizable than a manufactured home.

|

| ●

| Panelized systems: Wall panels with different levels of finish are built in a factory and then assembled onsite, usually by those doing stick-built construction.

|

Employees

As of July 5, 2023, the Company had 89 direct hourly employees, 47 indirect salaried employees, 33 indirect hourly employees, and 5 direct salaried employees. This number experiences some fluctuation, and we expect to increase hiring as we continue to scale up production at our facility. Boxabl provides employees a share incentive plan to be awarded at the discretion of the Board of Directors (the “Board”). For details, see Item 6. Executive Compensation – Equity Incentive Plan.

16

Item 1A. Risk Factors.

We have a limited operating history with a history of losses and we may not achieve or maintain profitability in the future. The Company has operated at a loss since inception and historically relied on contributions from its founders and proceeds from its offerings of securities to meet its growth needs. Further, we have only recently begun to record revenue from the sale of Boxes, our sole intended product. We expect to make significant future investments in order to develop and expand our business, which we believe will result in additional capital expenses, marketing and general and administrative expenses that will require raising funds in this and other securities offerings to cover these additional costs until we are able to generate significant revenue.

If we cannot raise sufficient funds, we will not succeed. To date, our primary source of funding has been from offerings of our securities. Until we generate enough revenue from our operations to fund our working capital and other business plans, we are likely to need additional funds in the future in order to continue to grow, including from offerings of securities, loans or other types of financing. If we cannot raise those funds for whatever reason, including reasons relating to the Company itself or to the broader economy, the Company may not survive. If we are unable to raise enough funds to develop our Company as outlined herein, we will have to find other sources of funding.

We are dependent on our ability to receive debt financing and fully draw down our potential future debt financing, which may restrict our ability to conduct our business. Our plan for manufacturing our room modules that are stacked and connected to almost any shape and style of finished buildings, and for developing the world’s largest and most advanced house factory (the “Boxzilla”) depends on our ability to receive sufficient financing. We are anticipating applying for a loan. There is no assurance this loan will move past the application stages. If the loan is approved, we anticipate the need to fully draw down on the potential loan facility. We may not, however, access all of these funds at once, but only over a period through periodic draws as eligible costs are incurred. Our ability to draw down these potential funds may be conditioned upon several draw conditions, including the potential achievement of progress milestones relating to the design and development of the Boxzilla, and any positive covenants, such as completed and approved facility assessments. Additionally, we anticipate the loan facility, if accepted, will require us to comply with certain operating covenants and will place additional restrictions on our ability to operate our business. We are unaccustomed to managing our business with such restrictions and others that are associated with a significant credit agreement. If we are unable to draw down the anticipated funds under the potential loan facility, or our ability to make such draw downs is delayed, we may need to obtain additional or alternative financing to operate our facilities to the extent our cash on hand is insufficient. Any failure to obtain the loan or secure other alternative funding could materially and adversely affect our business and prospects. Such additional or alternative financing may not be available on attractive terms, if at all, and could be more costly for us to obtain. As a result, our plans for building our Boxes and Boxzilla could be significantly delayed which would adversely affect our business, prospects, financial condition, and operating results.

There is no assurance that Boxabl will be able to finalize the Boxzilla manufacturing facility at all or to achieve the described square footage and size it intends. A smaller manufacturing facility than anticipated poses several risks, including reduced production capacity, increased production costs per unit, competitive disadvantages, and negative market perceptions. A smaller manufacturing facility may have limited production capacity, which could lead to reduced output and sales. This could impact the Company’s ability to meet market demand and generate profits, potentially resulting in a decrease in the Company’s value. A smaller manufacturing facility may not benefit from economies of scale, leading to higher production costs per unit. This could result in lower profit margins and potentially reduced shareholder returns. If the Company’s competitors build larger, more efficient manufacturing facilities, the Company may struggle to compete in terms of price and quality. This could result in lower sales and reduced market share. If the Company creates a smaller manufacturing facility than anticipated, then it may expect a lower ability to execute its business plan. This could lead to a negative perception among investors, potentially resulting in reduced interest in the Company’s potential future financing rounds. Overall, the anticipated Boxzilla carries significant risks for investors, which should be carefully considered before making any investment decisions.

17

The Company has realized significant operating losses to date and expects to incur losses in the future. The Company has operated at a loss since inception, and these losses are likely to continue. Boxabl’s net loss for the fiscal years ended December 31, 2022 and 2021, as reflected in our audited consolidated financial statements, was $610,748,564 and $13,584,157, respectively. A significant amount of the increased loss for the fiscal year ended December 31, 2022, was the result of the conversion of outstanding Convertible Promissory Notes being accounted as extinguishment of debt at fair market value. See Item 2. Financial Information – Overview. Nevertheless, we expect to continue to see a net loss in connection with our results of operations as we continue to increase production, expand our manufacturing facilities, and develop our manufacturing processes. Until the company achieves profitability, it will have to seek other sources of capital in order to continue operations.

The Company has incurred much higher production costs during 2021 and 2022, and those costs may continue. From October 2021, when we first began producing Casitas, through December 2022, the Company’s cost of goods sold increased significantly for various reasons, including the following:

·Inefficiencies due to new machinery and newness of product and procedures which required significant training of the workforce.

·In order to catch up with its delivery obligation under the ADS sales contract, the Company hired additional outside labor and paid overtime and double-time shifts.

·Tight skilled labor market which caused higher labor rate.

·Supply chain delivery issues which caused the purchase of several items of material from local vendors with a substantially higher price.

·The Company is still undertaking major research and development activities to streamline its production, substitute new material, and upgrade its equipment in order to automate its production.

The regular one-shift production capacity of the factory was two per day. The actual units produced in the last quarter of 2021 was 35 units and 259 units were produced during 2022 due to the above factors. We have expanded our production capacity by leasing a second factory during 2022 and seek to automate our manufacturing process. More recently, we leased a third manufacturing facility in May 2023. However, there is no guarantee that our efforts will resolve all of the challenges we face in ramping up production of Casitas sufficient to meet demand. If we fail to successfully scale up our production, or incorrectly estimated the cost of production related to the price of each Casita, the Company’s results of operations and financial condition may be adversely impacted. Moreover, if we fail to produce enough Casitas to meet demand, we may lose potential customers who have indicated interest in our products.

The Company is the process of becoming a reporting company with the SEC. Pursuant to this Registration Statement, the Company is registering its Non-Voting Series A Preferred Stock, Non-Voting Series A-1 Preferred Stock, Non-Voting Series A-2 Preferred Stock, and its Common Stock with the SEC and becoming a reporting public company. Becoming a reporting company will subject the Company to additional initial and ongoing compliance and reporting costs and administrative burdens, additional professional fees (legal and accounting) as well as costs associated with internal staff. Therefore, the costs for these functions in previous years are not indicative of future costs.

As we grow our business, we may not be able to manage our growth successfully, including development of our internal controls. As we build and scale up our factories, develop our automated processes for building casitas, increase the output of our casitas and other products, and grow our customer base, we will face business risks commonly associated with rapidly growing companies, including the risk that existing management, information systems and financial and internal controls may be inadequate to support our growth. We cannot predict whether we will be able to respond on a timely basis, or at all, to the changing demands that our growth may impose on our existing management and infrastructure. For example, increasing demands on our infrastructure and management could cause any of the following to occur or increase:

18

| ·

| inadequate internal controls required for a regulated entity;

|

| ·

| inadequate financial controls needed as we transition to become a reporting company;

|

| ·

| delays in our ability to handle the volume of customers; and

|

| ·

| failure to properly review and supervise personnel to make sure we are compliant with our duties as a public company.

|

We have found it difficult to hire and retain qualified persons to manage our internal controls and reporting functions, including roles such as chief financial officer, controller and other accounting positions. In terms of employee oversight, we have become aware of at least one instance in which an employee engaged in fraudulent conduct. As part of our work in establishing strong internal controls, we have undertaken an internal audit for compliance with all applicable laws. If we fail to adapt our management, information systems and financial and internal controls to our growth, or if we encounter other unexpected difficulties, our business, financial condition and operating results will suffer.

Our future success is dependent on the continued service of our senior management and in particular our Founder and Chief Executive Officer Paolo Tiramani. Any loss of key members of our executive team could have a negative impact on our ability to manage and grow our business effectively. This is particularly true of our Founder and Chief Executive Officer Paolo Tiramani, who designed and patented our core intellectual property. We do not maintain “key person” life insurance coverage for our CEO. The experience, technical skills and commercial relationships of our key personnel provide us with a competitive advantage, particularly as we are building our brand recognition and reputation.

We may not be able to effectively manage our growth, and any failure to do so may have an adverse effect on our business and operating results. We have received substantial interest in our Casita Boxes and will strive to meet that demand. This will require significant scaling up of operations, including acquiring additional facilities space, and skilled labor. To date, we have limited experience manufacturing our products at a commercial scale. If we are unable to effectively manage our scaling up in operations, we could face unanticipated slowdowns, problems and costs that harm our ability to meet production demands.

We may not succeed in developing our business plans, or our business plans may not work as we intend. There is no assurance that the Company will be successful in marketing any of its products, or that the revenues from the sale of such products will be significant. Consequently, the Company’s revenues may vary by quarter, and its operating results may experience fluctuations. If our business plans do not succeed, our Company may liquidate, dissolve or declare bankruptcy and our investors may receive nothing.

Decreased demand in the housing industry would adversely affect our business. Demand for new housing construction is tied to the broader economy and factors outside the Company’s control. Should factors such as the post-COVID-19 economy, including rising interest rates, a slowdown in the housing market, concerns regarding the health of the U.S. economy, and a continued loss of general economic activity, we could experience a slower growth in demand for our Boxes.

We are subject to different macro-economic sensitivity. The Company’s business is subject to the impact of changes in global economic conditions, including, but not limited to, recessionary or inflationary trends, market conditions, consumer credit availability, interest rates, consumers’ disposable income and spending levels, job security and unemployment, and overall consumer confidence. These economic conditions may be further affected by political events throughout the world that cause disruptions in the financial markets, either directly or indirectly. Adverse economic and political developments could have a material adverse effect on the Company’s profitability, results of operations and financial condition.

Insufficient or delayed supply of materials for manufacturing and assembling our products threatens our ability to meet customer demands while over capacity threatens our ability to generate profits. Any failure by us to properly manage our supply chain could have a material adverse effect on our business, financial condition, and results of operations. As we increase the scale of our operations, we may need to change partners and suppliers on a frequent basis to ensure quality control, manage costs, and production schedules. Changing partners or suppliers could result in delays or other unintended consequences, such as an increase in costs and/or a decrease in quality. Additionally, any border restriction, delays, or closures may threaten our ability to meet customer demands, earn revenues, or impact

19

our ability to either continue or develop relationships with partners and suppliers. The extent of the impact of natural disasters, climate events, COVID-19 or other epidemics, war, inflation, and other potential macroeconomic events on future periods will depend on future developments, all of which are uncertain and cannot be predicted; including the duration or resurgence of the pandemic, government responses and health and safety measures or directives put in place by public health authorities, and sustained pressure on global supply chains causing supply and demand imbalances. Limited or disrupted supply of our products, including key raw materials to make these products could have an adverse effect on our business. There is a risk of the inability to scale production and manage our supply chain. Overall, the ongoing effects of COVID-19 could have a material adverse impact on our business, results of operations, financial condition and cash flows.

The global COVID-19 pandemic and containment measures taken in response to it have adversely impacted our business, results of operations, capital spending, business planning, and financial condition, and may continue to do so depending on uncertain future developments. Global health concerns relating to the COVID-19 outbreak have impacted the macroeconomic environment, and the outbreak has significantly increased economic uncertainty. The outbreak resulted in governments in countries across the globe implementing measures to try to contain the virus, such as travel restrictions, social distancing, and restrictions on business operations which have impacted consumers and businesses. These measures have adversely impacted and may further impact our workforce and operations and the operations of our business partners, customers, stakeholders, and suppliers. While some of these measures have eased in certain jurisdictions, others have remained in place. The extent to which current health measures are removed or new measures are put in place will depend on how the pandemic evolves, as well as the progress of the local and global roll-out and acceptance of vaccines. Even after the COVID-19 pandemic has subsided, we may continue to experience material adverse impacts on our business and our results of operations because of its global economic impact, including any recession that has occurred or may occur in the future.

If we do not protect our brand and reputation for quality and reliability, or if consumers associate negative impressions of our brand, our business will be adversely affected. As a new entrant in the highly competitive home construction market, our ability to successfully grow our business is highly dependent on the reputation we establish for quality and reliability. To date, we have built a positive reputation based on our demonstration products for trade shows and conferences. As we expand operations to selling Boxes, we will need to deliver on the quality and reliability that is expected of us. If potential customers create a negative association about our brand, whether warranted or not, our business could be harmed.

Public perception is important as a public company engaged in equity crowdfunding, potentially making Boxabl susceptible to negative postings and false allegations about the Company and its products. As a company raising money from the crowd, Boxabl’s funding is highly dependent upon investors who get information from a wide variety of sources that rely on user-generated content (e.g., social media, Reddit, message boards, blogs, etc.). These sources often have little to no standards for posting, and many of them allow people to post without even requiring a real name. As a result, these mediums can be susceptible to misinformation, disinformation, and campaigns where individuals using bots and/or fake accounts can create the illusion of “social proof.” For instance, Boxabl and its management have previously been the subject of negative postings, including misinformation and false allegations, made on multiple social media platforms. To the extent the Company becomes the target of a negative PR campaign from one or more individuals, the negative publicity may have an adverse impact on the Company, its fundraising, its reputation, and has the potential to distract management’s attention from the Company’s business.

Our business depends upon our patents and trademarks. Any failure to protect those intellectual property rights, or any claims that our technology infringes upon the rights of others may adversely affect our competitive position and brand equity. Our future success depends significantly on the intellectual property created by our founder and CEO. If the Company is unable to protect that intellectual property from infringement, or if it is found to infringe on others, our business would be materially harmed as competitors could utilize our same building and shipping designs.

20

Inability to license other intellectual property rights. The technology we use may require the use of other existing technologies and processes, which are currently, or in the future, will be, subject to patents, copyrights, trademarks, trade secrets or other intellectual property rights held by other parties, in which case we will need to obtain one or more licenses to use those other technologies. If we are unable to obtain licenses on reasonable commercial terms from the holders of such other intellectual property rights, we could be required to halt development and manufacturing or redesign our technology, failing at which it could bear a substantial risk of litigation for misuse of the other technologies. In any such event, our business and operations could be materially adversely affected.

Additional engineering is required for our manufacturing facility to begin production as the scale necessary to make the business viable. We are in the process of outfitting our initial manufacturing space, and second facility in the Las Vegas area for our Boxes and to refine the manufacturing process. Our business relies on being able to produce our Boxes at scale, which can only be done once we refine our manufacturing process for specialization of functions. If we are not able to refine our processes to achieve production at scale, our financial results may be negatively impacted.

We have accepted deposits for a product we are not yet able to produce at scale. As of the date of this registration statement, we currently hold deposits ranging from $100, $200, $1,200 or $5,000 from approximately 8,300 prospective customers as of June 30, 2023. These deposits are being recorded as liabilities of the Company and have not been maintained in a segregated account. As such, if the Company is not able to deliver the requested product, we will be obligated to return the deposit, whether funds are available or not. If the prospective purchaser merely decides to not purchase a Box once they are available, they will forfeit their deposit.

Volatility in commodity prices and product shortages may adversely affect our gross margins. Volatility in commodity prices and product shortages may adversely affect our gross margins. Our Boxes contain commodity-priced materials. Commodity prices and supply levels affect our costs. For example, steel is a key material in our Casita. The price of steel will vary based on the level of supply in the market, and demand from other users. Any shortages could adversely affect our ability to produce our Boxes and significantly raise the cost of their production. Further, our ability to pass on such increases in costs in a timely manner depends on market conditions, and the inability to pass along cost increases could result in lower gross margins.

We will rely on third-party builders to construct our Boxes on site as well as we intend to rely on third-party franchisees. The failure of those builders to properly construct homes and franchisee manufacturers to properly manufacture Boxes could damage our reputation, result in costly litigation and materially impact our ability to succeed. We sell our Boxes to Boxabl trained and certified builders, who are then responsible for on-site building and assembly. Purchasers can also order directly from us, and they will need to engage their own builders. We may discover that builders are engaging in improper construction practices, negatively impacting the reliability of our Boxes. Further, we not only intend to manufacture the Boxes at our own factories but also to rely on third-party franchisees to manufacture our Boxes. To the extent that we do, we cannot be certain that any such franchisees will act in a manner consistent with our standards and requirements and produce Boxes in accordance with our quality standards. We may discover that our franchisees do not end up operating their franchises in accordance with our standards or applicable law. The occurrence of such events by the builders or franchisees could result in liability to us, or reputational damage.

If an unknown defect was detected in our Boxes or Box designs, our business would suffer and we may not be able to stay in business. In the ordinary course of our business, we could be subject to home warranty and construction defect claims. Defect claims may arise for a significant period of time after a building with our Boxes has been completed. Although we maintain general liability insurance that we believe is adequate and may be reimbursed for losses by subcontractors that we engage to assemble our homes, an increase in the number of warranty and construction defect claims could have a material adverse effect on our results of operations. Furthermore, any design defect in our components may require us to correct the defect in all of the projects sold up until that time. Depending on the nature of the defect, we may not have the financial resources to do so and would not be able to stay in business. Even a defect that is relatively minor could be extremely costly to correct in every home and could impair our ability to operate profitably.

21

We may be subject to litigation arising out of our operations. Damages claimed under such litigation may be material, and the outcome of such litigation may materially impact our operations and the value of the Company’s securities. While we will assess the merits of any lawsuits and defend such lawsuits accordingly, we may be required to incur significant expenses or devote significant financial resources to such defenses. In addition, the adverse publicity surrounding such claims may have a material adverse effect on our operations. Some potential examples include the following: reputational damage, legal action, regulatory scrutiny, financial impacts, and operational impacts. Additionally, a negative outcome could make it more difficult for Boxabl to secure financing or investment in the future. The various risks and material impacts may result in lower revenue and market shares, financial penalties, legal fees, potential litigation that could be costly and time-consuming, potential restrictions on business operations, refunds, returns, or other forms of compensation to the customer. Furthermore, a negative outcome to the complaint may require us to make changes to our business practices, processes, or products which could be time-consuming and costly and impact our ability to deliver on our commitments to other customers.

The Company’s activities will generally be taxable in the jurisdictions in which it operates. Changes to taxation laws in any jurisdiction where the Company operates could materially affect the business. No assurance can be given that new taxation rules will not be enacted or that existing rules will not be applied in a manner that could materially affect the Company’s profits and that may result in a material adverse effect on the Company’s profitability, results of operations and financial condition.

Interest-bearing financial instruments can pose risks with any changes in market interest rates. The Company may hold both cash and loans payable with variable interest rates as well as loans receivable, loans payable, or other forms of debt securities. These interest-bearing financial instruments pose risks with any changes in market interest rates of the period in which they are held.

A significant uninsured loss or a loss that significantly exceeds the limits of the Company’s insurance policies could have a material adverse effect on our operations. We maintain insurance policies covering usual and customary risks associated with our business. A large-scale manufacturer is generally exposed to the risks inherent in the construction and operation of manufacturing facilities, such as breakdowns, manufacturing defects, natural disasters, theft, terrorist attacks and sabotage. We rely on our own insurance policies to cover losses as a result of force majeure, natural disasters, terrorist attacks or sabotage among other things. While we perform a review of insurance policies, a significant uninsured loss or a loss that significantly exceeds the limits of such insurance policies or the failure to renew such insurance policies on similar or favorable terms could have a material adverse effect on our operations and ability to continue as a going concern.

The housing industry is highly competitive and many of our competitors have greater financial resources than we do. Increased competition may make it difficult for us to operate and grow our business. The housing industry is highly competitive and we compete with traditional custom builders, manufactured and modular home builders, and other innovative entrants. In addition, we compete with existing homes that are offered for sale, which can reduce the interest in new construction. Many of our competitors have significantly greater resources than we do, a greater ability to obtain financing and the ability to accept more risk than we can prudently manage. If we are unable to compete effectively in this environment, we may not be able to continue to operate our business or achieve and maintain profitability.