|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02741

Fidelity Court Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | November 30 |

Date of reporting period: | November 30, 2024 |

Item 1.

Reports to Stockholders

ANNUAL SHAREHOLDER REPORT | AS OF

|

||

|

|

||

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

||

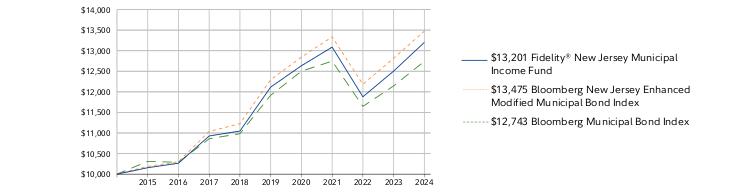

Fidelity® New Jersey Municipal Income Fund

|

$

|

|

1 Year

|

5 Year

|

10 Year

|

|

Fidelity® New Jersey Municipal Income Fund

|

|||

Bloomberg New Jersey Enhanced Modified Municipal Bond Index

|

|||

Bloomberg Municipal Bond Index

|

Visit www.fidelity.com for more recent performance information.

|

KEY FACTS

|

||

Fund Size

|

$

|

|

Number of Holdings

|

||

Total Advisory Fee

|

$

|

|

Portfolio Turnover

|

REVENUE SOURCES

(% of Fund's net assets)

|

||

General Obligations

|

||

Transportation

|

||

Education

|

||

Health Care

|

||

Others(Individually Less Than 5%)

|

||

100.0

|

||

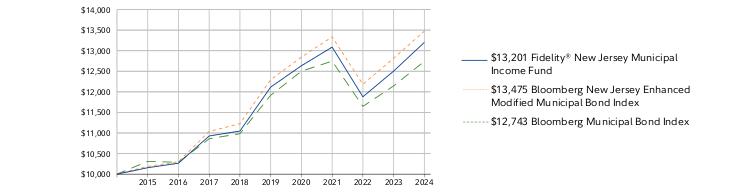

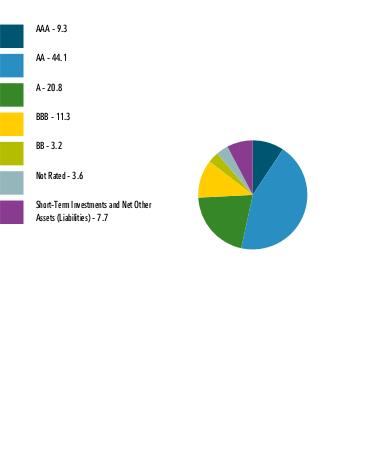

QUALITY DIVERSIFICATION (% of Fund's net assets)

|

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

|

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee.

|

Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved.

|

||

|

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec

1.9914086.100 416-TSRA-0125

|

|

ANNUAL SHAREHOLDER REPORT | AS OF

|

||

|

|

||

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

||

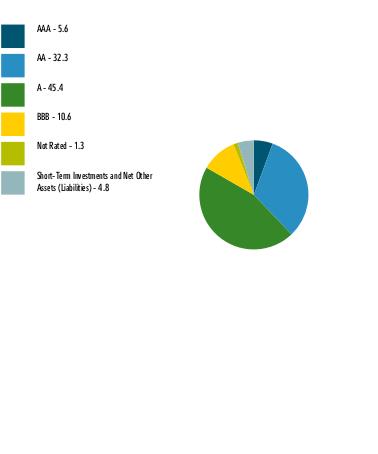

Fidelity® Connecticut Municipal Income Fund

|

$

|

|

1 Year

|

5 Year

|

10 Year

|

|

Fidelity® Connecticut Municipal Income Fund

|

|||

Bloomberg Connecticut 2 + Year Enhanced Municipal Bond Index Linked

|

|||

Bloomberg Municipal Bond Index

|

Visit www.fidelity.com for more recent performance information.

|

KEY FACTS

|

||

Fund Size

|

$

|

|

Number of Holdings

|

||

Total Advisory Fee

|

$

|

|

Portfolio Turnover

|

REVENUE SOURCES

(% of Fund's net assets)

|

||

General Obligations

|

||

Health Care

|

||

Education

|

||

Housing

|

||

Special Tax

|

||

Others(Individually Less Than 5%)

|

||

100.0

|

||

QUALITY DIVERSIFICATION (% of Fund's net assets)

|

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

|

Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved.

|

||

|

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec

1.9914085.100 407-TSRA-0125

|

|

Item 2.

Code of Ethics

As of the end of the period, November 30, 2024, Fidelity Court Street Trust (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Laura M. Bishop is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Ms. Bishop is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by PricewaterhouseCoopers LLP (“PwC”) in each of the last two fiscal years for services rendered to Fidelity Connecticut Municipal Income Fund and Fidelity New Jersey Municipal Income Fund (the “Funds”):

Services Billed by PwC

November 30, 2024 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity Connecticut Municipal Income Fund | $45,500 | $3,600 | $5,500 | $1,600 |

Fidelity New Jersey Municipal Income Fund | $42,100 | $3,300 | $5,500 | $1,400 |

November 30, 2023 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity Connecticut Municipal Income Fund | $45,700 | $3,800 | $5,500 | $1,600 |

Fidelity New Jersey Municipal Income Fund | $42,200 | $3,500 | $5,500 | $1,500 |

A Amounts may reflect rounding.

The following table(s) present(s) fees billed by PwC that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by PwC

November 30, 2024A | November 30, 2023A | |

Audit-Related Fees | $9,701,800 | $8,881,200 |

Tax Fees | $61,000 | $1,000 |

All Other Fees | $35,000 | $- |

A Amounts may reflect rounding

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by PwC for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

Billed By | November 30, 2024A | November 30, 2023A |

PwC | $15,312,000 | $14,407,700 |

A Amounts may reflect rounding.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by PwC to Fund Service Providers to be compatible with maintaining the independence of PwC in its(their) audit of the Fund(s), taking into account representations from PwC, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Contents

Municipal Bonds - 92.3%

|

|||

Principal

Amount (a)

|

Value ($)

|

||

Connecticut - 91.4%

|

|||

Branford Gen. Oblig. Series 2019, 2.25% 10/15/34

|

2,400,000

|

2,066,607

|

|

Bridgeport Gen. Oblig.:

|

|||

Series 2016 D:

|

|||

5% 8/15/31 (Assured Guaranty Muni. Corp. Insured)

|

1,000,000

|

1,034,157

|

|

5% 8/15/32 (Assured Guaranty Muni. Corp. Insured)

|

3,090,000

|

3,193,661

|

|

Series 2019 A:

|

|||

5% 2/1/32 (Build America Mutual Assurance Insured)

|

1,000,000

|

1,079,287

|

|

5% 2/1/37 (Build America Mutual Assurance Insured)

|

1,000,000

|

1,065,456

|

|

5% 2/1/39 (Build America Mutual Assurance Insured)

|

1,000,000

|

1,060,427

|

|

Series 2021 A:

|

|||

4% 8/1/38

|

800,000

|

812,718

|

|

4% 8/1/41

|

1,050,000

|

1,057,516

|

|

4% 8/1/46

|

375,000

|

375,532

|

|

4% 8/1/51

|

575,000

|

568,566

|

|

5% 8/1/35

|

450,000

|

495,952

|

|

Series 2024 A:

|

|||

5% 7/1/32 (Build America Mutual Assurance Insured)

|

1,000,000

|

1,136,152

|

|

5% 7/1/35 (Build America Mutual Assurance Insured)

|

300,000

|

346,220

|

|

5% 7/1/36 (Build America Mutual Assurance Insured)

|

250,000

|

287,758

|

|

5% 7/1/37 (Build America Mutual Assurance Insured)

|

775,000

|

888,048

|

|

5% 7/1/39 (Build America Mutual Assurance Insured)

|

1,000,000

|

1,135,948

|

|

5% 7/1/40 (Build America Mutual Assurance Insured)

|

300,000

|

338,304

|

|

5% 7/1/41 (Build America Mutual Assurance Insured)

|

1,000,000

|

1,119,334

|

|

5% 7/1/43 (Build America Mutual Assurance Insured)

|

1,250,000

|

1,386,467

|

|

Brookfield Gen. Oblig. Series 2020, 2% 8/15/35

|

365,000

|

305,544

|

|

Connecticut Arpt. Auth. Customer Facility Charge Rev. (Ground Trans. Ctr. Proj.) Series 2019 A, 4% 7/1/49 (b)

|

2,000,000

|

1,896,410

|

|

Connecticut Gen. Oblig.:

|

|||

Series 2015 B, 5% 6/15/27

|

4,825,000

|

4,876,320

|

|

Series 2015 F, 5% 11/15/31

|

4,000,000

|

4,070,707

|

|

Series 2018 A, 5% 4/15/30

|

2,500,000

|

2,677,896

|

|

Series 2018 C, 5% 6/15/31

|

725,000

|

777,547

|

|

Series 2019 A:

|

|||

5% 4/15/35

|

2,000,000

|

2,155,892

|

|

5% 4/15/36

|

2,300,000

|

2,472,698

|

|

5% 4/15/39

|

2,450,000

|

2,619,138

|

|

Series 2020 A, 3% 1/15/39

|

5,500,000

|

5,091,033

|

|

Series 2020 C, 3% 6/1/40

|

3,380,000

|

3,074,156

|

|

Series 2021 A:

|

|||

3% 1/15/32

|

335,000

|

328,067

|

|

3% 1/15/34

|

3,000,000

|

2,903,417

|

|

3% 1/15/35

|

1,850,000

|

1,778,469

|

|

3% 1/15/36

|

9,130,000

|

8,693,790

|

|

3% 1/15/37

|

2,875,000

|

2,697,988

|

|

3% 1/15/38

|

1,000,000

|

929,328

|

|

Series 2021 B, 3% 6/1/39

|

1,400,000

|

1,282,068

|

|

Series 2022 A, 4% 1/15/34

|

400,000

|

423,902

|

|

Series 2022 B, 2% 1/15/38

|

320,000

|

246,195

|

|

Series 2023 A, 5% 5/15/27

|

900,000

|

949,870

|

|

Series 2023 B, 5% 8/1/27

|

1,835,000

|

1,945,656

|

|

Series 2024 D:

|

|||

5% 5/1/29

|

1,625,000

|

1,779,196

|

|

5% 5/1/30

|

1,000,000

|

1,113,084

|

|

5% 5/1/31

|

1,000,000

|

1,129,876

|

|

5% 5/1/32

|

1,250,000

|

1,430,927

|

|

5% 5/1/33

|

500,000

|

579,427

|

|

5% 5/1/34

|

500,000

|

584,631

|

|

5% 5/1/35

|

1,000,000

|

1,163,186

|

|

Series 2024 E, 5% 9/1/31

|

3,000,000

|

3,404,805

|

|

Series 2024 F, 5% 11/15/31

|

2,500,000

|

2,845,019

|

|

Series 2024:

|

|||

5% 3/1/28

|

2,000,000

|

2,144,298

|

|

5% 1/15/29

|

2,000,000

|

2,178,261

|

|

5% 3/1/29

|

1,855,000

|

2,024,966

|

|

5% 1/15/30

|

1,335,000

|

1,478,876

|

|

5% 3/1/30

|

2,500,000

|

2,775,190

|

|

Connecticut Health & Edl. Facilities Auth. Rev.:

|

|||

(Fairfield Univ.):

|

|||

Series 2017 R:

|

|||

5% 7/1/31

|

1,825,000

|

1,903,452

|

|

5% 7/1/32

|

1,000,000

|

1,042,929

|

|

Series 2017, 5% 7/1/30

|

2,400,000

|

2,506,572

|

|

(Sacred Heart Univ., CT. Proj.) Series 2017 I-1:

|

|||

5% 7/1/27

|

80,000

|

83,910

|

|

5% 7/1/28

|

1,150,000

|

1,203,190

|

|

5% 7/1/29

|

350,000

|

365,907

|

|

5% 7/1/30

|

1,100,000

|

1,146,903

|

|

5% 7/1/31

|

1,300,000

|

1,352,284

|

|

5% 7/1/32

|

1,050,000

|

1,092,168

|

|

5% 7/1/33

|

700,000

|

727,621

|

|

5% 7/1/34

|

750,000

|

779,046

|

|

Bonds Series 2024 B, 5%, tender 7/1/29 (c)

|

1,630,000

|

1,764,633

|

|

Series 2015 L, 5% 7/1/29

|

1,500,000

|

1,512,130

|

|

Series 2015, 5% 7/1/32

|

205,000

|

206,430

|

|

Series 2016 K, 4% 7/1/46

|

7,000,000

|

6,609,949

|

|

Series 2018 K3, 5% 7/1/38

|

985,000

|

1,002,804

|

|

Series 2019 A:

|

|||

4% 7/1/49

|

1,365,000

|

1,265,703

|

|

5% 7/1/26

|

310,000

|

315,892

|

|

5% 7/1/29

|

1,290,000

|

1,360,111

|

|

5% 7/1/49 (d)(e)

|

6,000,000

|

3,900,000

|

|

Series 2019 Q1, 3% 11/1/33

|

1,000,000

|

983,252

|

|

Series 2020 A, 4% 7/1/40

|

1,250,000

|

1,234,241

|

|

Series 2020 C, 4% 7/1/45

|

1,800,000

|

1,743,821

|

|

Series 2020 K:

|

|||

5% 7/1/36

|

1,000,000

|

1,082,178

|

|

5% 7/1/37

|

1,750,000

|

1,888,476

|

|

5% 7/1/39

|

2,830,000

|

3,034,295

|

|

Series 2021 A, 3% 7/1/39

|

5,000,000

|

4,303,675

|

|

Series 2021 L, 3% 7/1/41

|

1,340,000

|

1,208,471

|

|

Series 2022 M:

|

|||

4% 7/1/36

|

250,000

|

254,758

|

|

4% 7/1/37

|

260,000

|

264,157

|

|

4% 7/1/39

|

2,600,000

|

2,604,621

|

|

4% 7/1/40

|

3,300,000

|

3,276,388

|

|

4% 7/1/41

|

1,195,000

|

1,196,444

|

|

4% 7/1/42

|

1,750,000

|

1,699,330

|

|

Series 2023 E:

|

|||

5% 7/15/38

|

900,000

|

978,950

|

|

5% 7/15/39

|

1,360,000

|

1,472,684

|

|

5% 7/15/40

|

1,300,000

|

1,401,554

|

|

Series E, 5% 7/1/28

|

1,250,000

|

1,253,208

|

|

Series G:

|

|||

5% 7/1/29 (d)

|

1,055,000

|

1,083,232

|

|

5% 7/1/30 (d)

|

275,000

|

282,070

|

|

5% 7/1/34 (d)

|

695,000

|

708,120

|

|

5% 7/1/39 (d)

|

2,600,000

|

2,619,643

|

|

5% 7/1/50 (d)

|

1,000,000

|

962,324

|

|

Series K1:

|

|||

5% 7/1/25

|

1,240,000

|

1,244,391

|

|

5% 7/1/27

|

250,000

|

257,475

|

|

Series L:

|

|||

5% 7/1/26

|

1,000,000

|

1,010,872

|

|

5% 7/1/27

|

2,000,000

|

2,019,064

|

|

Series L1:

|

|||

4% 7/1/25

|

600,000

|

600,089

|

|

4% 7/1/26

|

1,175,000

|

1,183,062

|

|

4% 7/1/27

|

700,000

|

714,356

|

|

Series N:

|

|||

4% 7/1/39

|

1,850,000

|

1,587,486

|

|

5% 7/1/25

|

340,000

|

340,248

|

|

5% 7/1/27

|

430,000

|

435,343

|

|

5% 7/1/31

|

500,000

|

505,449

|

|

5% 7/1/32

|

550,000

|

554,197

|

|

5% 7/1/33

|

720,000

|

723,444

|

|

5% 7/1/34

|

675,000

|

676,313

|

|

Series R:

|

|||

5% 6/1/37

|

1,000,000

|

1,089,827

|

|

5% 6/1/38

|

1,045,000

|

1,132,444

|

|

5% 6/1/39

|

1,595,000

|

1,722,204

|

|

5% 6/1/40

|

1,125,000

|

1,205,617

|

|

Connecticut Higher Ed. Supplemental Ln. Auth. Rev. (Chesla Ln. Prog.):

|

|||

Series 2024 B:

|

|||

5% 11/15/26 (b)

|

400,000

|

411,339

|

|

5% 11/15/27 (b)

|

665,000

|

693,422

|

|

5% 11/15/28 (b)

|

1,020,000

|

1,075,369

|

|

5% 11/15/29 (b)

|

1,080,000

|

1,148,727

|

|

5% 11/15/30 (b)

|

1,075,000

|

1,151,757

|

|

5% 11/15/31 (b)

|

750,000

|

809,193

|

|

5% 11/15/32 (b)

|

725,000

|

780,252

|

|

5% 11/15/33 (b)

|

540,000

|

584,500

|

|

Series B:

|

|||

5% 11/15/25 (b)

|

400,000

|

404,584

|

|

5% 11/15/26 (b)

|

600,000

|

615,865

|

|

5% 11/15/27 (b)

|

610,000

|

631,043

|

|

5% 11/15/28 (b)

|

525,000

|

552,310

|

|

5% 11/15/29 (b)

|

490,000

|

515,275

|

|

Series D:

|

|||

5% 11/15/25 (Escrowed to Maturity)

|

250,000

|

254,825

|

|

5% 11/15/26 (Escrowed to Maturity)

|

180,000

|

187,685

|

|

Connecticut Hsg. Fin. Auth.:

|

|||

Series 2016 F, 3.5% 5/15/39 (b)

|

235,000

|

233,144

|

|

Series 2018 E1, 4.25% 5/15/42

|

825,000

|

831,633

|

|

Series 2019 B1, 4% 5/15/49

|

1,900,000

|

1,920,567

|

|

Series 2019 F, 3.5% 11/15/43

|

1,725,000

|

1,714,505

|

|

Series 2020 A2, 2.2% 5/15/31 (b)

|

1,350,000

|

1,176,964

|

|

Series 2020 C1, 1.95% 11/15/35

|

1,520,000

|

1,224,257

|

|

Series 2021 A1:

|

|||

1.3% 5/15/30

|

2,000,000

|

1,694,402

|

|

1.6% 5/15/32

|

1,500,000

|

1,223,702

|

|

Series 2021 A3, 1.6% 5/15/32

|

2,240,000

|

1,827,394

|

|

Series 2021 B1, 3% 11/15/49

|

1,860,000

|

1,824,445

|

|

Series 2022 A1, 3.5% 11/15/51

|

845,000

|

839,906

|

|

Series A2:

|

|||

5% 11/15/26 (b)

|

840,000

|

863,190

|

|

5% 5/15/27 (b)

|

1,890,000

|

1,956,468

|

|

5% 11/15/27 (b)

|

860,000

|

896,785

|

|

5% 5/15/28 (b)

|

615,000

|

644,183

|

|

5% 11/15/28 (b)

|

225,000

|

237,054

|

|

Series C:

|

|||

5% 5/15/26 (b)

|

1,820,000

|

1,857,900

|

|

5% 5/15/27 (b)

|

800,000

|

828,134

|

|

5% 11/15/28 (b)

|

580,000

|

611,071

|

|

5% 5/15/29 (b)

|

1,115,000

|

1,178,919

|

|

Connecticut Spl. Tax Oblig. Trans. Infrastructure Rev.:

|

|||

Series 2021 A, 5% 5/1/35

|

1,000,000

|

1,112,605

|

|

Series 2021 C:

|

|||

5% 1/1/28

|

1,600,000

|

1,709,904

|

|

5% 1/1/30

|

3,500,000

|

3,874,763

|

|

5% 1/1/31

|

3,410,000

|

3,835,028

|

|

5% 1/1/32

|

2,500,000

|

2,849,740

|

|

Series A:

|

|||

5% 5/1/28

|

1,000,000

|

1,075,620

|

|

5% 9/1/33

|

1,000,000

|

1,000,140

|

|

Danbury Gen. Oblig. Series 2019 B, 2.25% 11/1/32

|

50,000

|

44,649

|

|

East Lyme Gen. Oblig. Series 2020, 3% 7/15/38

|

530,000

|

484,741

|

|

Greater New Haven Wtr. Poll. Cont. Auth. Reg'l. Wastewtr. Sys. Rev. Series 2005 A, 5% 8/15/35 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

10,000

|

10,006

|

|

Hamden Gen. Oblig. Series 2017 A, 5% 8/15/27

|

1,000,000

|

1,055,580

|

|

Hartford County Metropolitan District Gen. Oblig. Series 2018:

|

|||

5% 7/15/31

|

1,000,000

|

1,076,082

|

|

5% 7/15/32

|

1,250,000

|

1,340,802

|

|

5% 7/15/33

|

1,000,000

|

1,070,612

|

|

5% 7/15/34

|

1,000,000

|

1,068,139

|

|

Hbr. Point Infrastructure Impt. District Series 2017, 5% 4/1/39 (d)

|

2,000,000

|

2,025,385

|

|

Meriden Gen. Oblig.:

|

|||

Series 2020 B, 2% 7/1/36

|

680,000

|

536,169

|

|

Series 2023:

|

|||

3% 6/15/35

|

1,165,000

|

1,112,865

|

|

3.25% 6/15/36

|

565,000

|

553,756

|

|

Milford Gen. Oblig. Series 2021 A:

|

|||

2% 11/1/33

|

330,000

|

280,123

|

|

2% 11/1/35

|

1,285,000

|

1,044,681

|

|

2% 11/1/36

|

1,285,000

|

1,020,534

|

|

Naugatuck Ctfs. of Prtn. (Naugatuck Incineration Facilities Proj.) Series 2021 A, 4% 8/15/38 (b)

|

3,330,000

|

3,327,674

|

|

New Britain Gen. Oblig.:

|

|||

Series 2015 A:

|

|||

5% 3/1/30

|

600,000

|

602,768

|

|

5% 3/1/30 (Pre-Refunded to 3/1/25 @ 100)

|

1,260,000

|

1,265,511

|

|

5% 3/1/31 (Pre-Refunded to 3/1/25 @ 100)

|

1,955,000

|

1,963,551

|

|

Series 2017 C:

|

|||

5% 3/1/32 (Assured Guaranty Muni. Corp. Insured)

|

1,635,000

|

1,700,962

|

|

5% 3/1/33 (Assured Guaranty Muni. Corp. Insured)

|

1,900,000

|

1,975,328

|

|

Series 2020, 3% 9/1/44 (Assured Guaranty Muni. Corp. Insured)

|

1,190,000

|

1,009,153

|

|

New Haven Gen. Oblig.:

|

|||

Series 2015 B:

|

|||

5% 8/15/26 (Build America Mutual Assurance Insured)

|

615,000

|

622,904

|

|

5% 8/15/27 (Build America Mutual Assurance Insured)

|

765,000

|

775,437

|

|

Series 2015:

|

|||

5% 9/1/29 (Assured Guaranty Muni. Corp. Insured)

|

2,655,000

|

2,694,546

|

|

5% 9/1/31 (Assured Guaranty Muni. Corp. Insured)

|

1,430,000

|

1,449,435

|

|

Series 2016 A:

|

|||

5% 8/15/27 (Pre-Refunded to 8/15/26 @ 100)

|

35,000

|

36,309

|

|

5% 8/15/28 (Assured Guaranty Muni. Corp. Insured)

|

1,500,000

|

1,552,335

|

|

5% 8/15/30 (Assured Guaranty Muni. Corp. Insured)

|

1,000,000

|

1,033,123

|

|

5% 8/15/34 (Assured Guaranty Muni. Corp. Insured)

|

1,000,000

|

1,027,962

|

|

5% 8/15/35 (Assured Guaranty Muni. Corp. Insured)

|

1,000,000

|

1,027,325

|

|

Series 2017 B, 5% 8/1/25

|

500,000

|

505,227

|

|

Series 2021 A, 4% 8/1/32

|

950,000

|

975,632

|

|

Series 2023:

|

|||

5% 8/1/36 (Build America Mutual Assurance Insured)

|

400,000

|

445,121

|

|

5% 8/1/37 (Build America Mutual Assurance Insured)

|

550,000

|

609,747

|

|

5% 8/1/38 (Build America Mutual Assurance Insured)

|

300,000

|

330,440

|

|

5.25% 8/1/43 (Build America Mutual Assurance Insured)

|

1,900,000

|

2,095,554

|

|

Norwalk Conn Hsg. Auth. Multi-family Bonds Series 2024, 3.05%, tender 9/1/27 (c)

|

3,000,000

|

2,995,558

|

|

South Windsor Gen. Oblig. Series 2023, 3% 2/1/36

|

765,000

|

736,728

|

|

Steelpointe Hbr. Infrastructure Impt. District (Steelpointe Hbr. Proj.) Series 2021:

|

|||

4% 4/1/31 (d)

|

390,000

|

390,576

|

|

4% 4/1/36 (d)

|

485,000

|

473,417

|

|

4% 4/1/41 (d)

|

660,000

|

616,008

|

|

4% 4/1/51 (d)

|

1,225,000

|

1,050,230

|

|

Stratford Gen. Oblig. Series 2019, 5% 1/1/27

|

1,990,000

|

2,081,463

|

|

Univ. of Connecticut Gen. Oblig.:

|

|||

Series 2018 A, 5% 4/15/28

|

4,400,000

|

4,731,425

|

|

Series 2023 A:

|

|||

5% 8/15/29

|

1,500,000

|

1,653,384

|

|

5% 8/15/30

|

1,325,000

|

1,486,008

|

|

West Haven Gen. Oblig.:

|

|||

Series 2017 A:

|

|||

5% 11/1/25

|

635,000

|

645,071

|

|

5% 11/1/26

|

635,000

|

655,427

|

|

Series 2017 B, 5% 11/1/32

|

400,000

|

415,873

|

|

Series 2021, 4% 9/15/41

|

1,125,000

|

1,112,210

|

|

Series 2024:

|

|||

4% 2/15/44 (Build America Mutual Assurance Insured)

|

300,000

|

295,148

|

|

5% 2/15/25 (Build America Mutual Assurance Insured)

|

500,000

|

501,404

|

|

5% 2/15/27 (Build America Mutual Assurance Insured)

|

400,000

|

416,002

|

|

5% 2/15/29 (Build America Mutual Assurance Insured)

|

500,000

|

537,546

|

|

5% 2/15/31 (Build America Mutual Assurance Insured)

|

450,000

|

496,417

|

|

5% 2/15/33 (Build America Mutual Assurance Insured)

|

450,000

|

503,703

|

|

5% 2/15/35 (Build America Mutual Assurance Insured)

|

300,000

|

334,974

|

|

TOTAL CONNECTICUT

|

289,692,659

|

||

Puerto Rico - 0.9%

|

|||

Puerto Rico Commonwealth Aqueduct & Swr. Auth. Series 2021 B, 5% 7/1/37 (d)

|

335,000

|

350,941

|

|

Puerto Rico Commonwealth Pub. Impt. Gen. Oblig. Series 2021 A1:

|

|||

0% 7/1/33 (h)

|

863,283

|

597,068

|

|

5.625% 7/1/27

|

100,000

|

104,622

|

|

5.625% 7/1/29

|

310,000

|

334,444

|

|

5.75% 7/1/31

|

735,000

|

819,234

|

|

Puerto Rico Sales Tax Fing. Corp. Sales Tax Rev. Series 2018 A1, 0% 7/1/31

|

855,000

|

662,572

|

|

TOTAL PUERTO RICO

|

2,868,881

|

||

|

TOTAL MUNICIPAL BONDS

(Cost $298,381,599)

|

292,561,540

|

||

Money Market Funds - 6.6%

|

|||

Shares

|

Value ($)

|

||

Fidelity Municipal Cash Central Fund 2.98% (f)(g)

(Cost $21,076,941)

|

21,072,727

|

21,076,941

|

|

|

TOTAL INVESTMENT IN SECURITIES - 98.9%

(Cost $319,458,540)

|

313,638,481

|

NET OTHER ASSETS (LIABILITIES) - 1.1%

|

3,497,661

|

NET ASSETS - 100.0%

|

317,136,142

|

(a)

|

Amount is stated in United States dollars unless otherwise noted.

|

(b)

|

Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

|

(c)

|

Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

|

(d)

|

Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $14,461,946 or 4.6% of net assets.

|

(e)

|

Level 3 security

|

(f)

|

Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund.

|

(g)

|

Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

|

(h)

|

Security initially issued in zero coupon form which converts to coupon form at a specified rate and date. The rate shown is the rate at period end.

|

Affiliate

|

Value,

beginning

of period ($)

|

Purchases ($)

|

Sales

Proceeds ($)

|

Dividend

Income ($)

|

Realized

Gain (loss) ($)

|

Change in

Unrealized

appreciation

(depreciation) ($)

|

Value,

end

of period ($)

|

% ownership,

end

of period

|

Fidelity Municipal Cash Central Fund 2.98%

|

9,227,996

|

95,566,781

|

83,716,670

|

261,670

|

(1,166)

|

-

|

21,076,941

|

0.6%

|

Total

|

9,227,996

|

95,566,781

|

83,716,670

|

261,670

|

(1,166)

|

-

|

21,076,941

|

|

Valuation Inputs at Reporting Date:

|

||||

Description

|

Total ($)

|

Level 1 ($)

|

Level 2 ($)

|

Level 3 ($)

|

Investments in Securities:

|

||||

Municipal Securities

|

292,561,540

|

-

|

288,661,540

|

3,900,000

|

Money Market Funds

|

21,076,941

|

21,076,941

|

-

|

-

|

Total Investments in Securities:

|

313,638,481

|

21,076,941

|

288,661,540

|

3,900,000

|

Investments in Securities:

|

|||

Beginning Balance

|

$

|

-

|

|

Net Realized Gain (Loss) on Investment Securities

|

-

|

||

Net Unrealized Gain (Loss) on Investment Securities

|

(1,039,604)

|

||

Cost of Purchases

|

-

|

||

Proceeds of Sales

|

-

|

||

Amortization/Accretion

|

(33,461)

|

||

Transfers into Level 3

|

4,973,065

|

||

Transfers out of Level 3

|

-

|

||

Ending Balance

|

$

|

3,900,000

|

|

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at November 30, 2024

|

$

|

(1,039,604)

|

|

|

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions, corporate actions or exchanges. Transfers into Level 3 were attributable to a lack of observable market data resulting from decreases in market activity, decreases in liquidity, security restructurings or corporate actions. Transfers out of Level 3 were attributable to observable market data becoming available for those securities. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations.

|

|||

Statement of Assets and Liabilities

|

||||

As of November 30, 2024

|

||||

Assets

|

||||

Investment in securities, at value - See accompanying schedule:

|

||||

Unaffiliated issuers (cost $298,381,599)

|

$

|

292,561,540

|

||

Fidelity Central Funds (cost $21,076,941)

|

21,076,941

|

|||

Total Investment in Securities (cost $319,458,540)

|

$

|

313,638,481

|

||

Cash

|

100,001

|

|||

Receivable for fund shares sold

|

43,789

|

|||

Interest receivable

|

3,709,291

|

|||

Distributions receivable from Fidelity Central Funds

|

33,786

|

|||

Prepaid expenses

|

299

|

|||

Other receivables

|

14

|

|||

Total assets

|

317,525,661

|

|||

Liabilities

|

||||

Payable for fund shares redeemed

|

$

|

46,428

|

||

Distributions payable

|

179,795

|

|||

Accrued management fee

|

113,753

|

|||

Audit fee payable

|

48,411

|

|||

Other payables and accrued expenses

|

1,132

|

|||

Total liabilities

|

389,519

|

|||

Net Assets

|

$

|

317,136,142

|

||

Net Assets consist of:

|

||||

Paid in capital

|

$

|

324,936,979

|

||

Total accumulated earnings (loss)

|

(7,800,837)

|

|||

Net Assets

|

$

|

317,136,142

|

||

Net Asset Value, offering price and redemption price per share ($317,136,142 ÷ 28,752,255 shares)

|

$

|

11.03

|

||

Statement of Operations

|

||||

|

Year ended November 30, 2024

|

||||

Investment Income

|

||||

Interest

|

$

|

9,446,023

|

||

Income from Fidelity Central Funds

|

261,670

|

|||

Total income

|

9,707,693

|

|||

Expenses

|

||||

Management fee

|

$

|

1,239,325

|

||

Transfer agent fees

|

67,252

|

|||

Accounting fees and expenses

|

19,348

|

|||

Custodian fees and expenses

|

5,366

|

|||

Independent trustees' fees and expenses

|

804

|

|||

Registration fees

|

28,008

|

|||

Audit fees

|

53,922

|

|||

Legal

|

12,133

|

|||

Miscellaneous

|

1,445

|

|||

Total expenses before reductions

|

1,427,603

|

|||

Expense reductions

|

(7,206)

|

|||

Total expenses after reductions

|

1,420,397

|

|||

Net Investment income (loss)

|

8,287,296

|

|||

Realized and Unrealized Gain (Loss)

|

||||

Net realized gain (loss) on:

|

||||

Investment Securities:

|

||||

Unaffiliated issuers

|

(423,999)

|

|||

Fidelity Central Funds

|

(1,166)

|

|||

Total net realized gain (loss)

|

(425,165)

|

|||

Change in net unrealized appreciation (depreciation) on investment securities

|

6,498,094

|

|||

Net gain (loss)

|

6,072,929

|

|||

Net increase (decrease) in net assets resulting from operations

|

$

|

14,360,225

|

||

Statement of Changes in Net Assets

|

||||

Year ended

November 30, 2024

|

Year ended

November 30, 2023

|

|||

Increase (Decrease) in Net Assets

|

||||

Operations

|

||||

Net investment income (loss)

|

$

|

8,287,296

|

$

|

7,774,339

|

Net realized gain (loss)

|

(425,165)

|

(1,581,508)

|

||

Change in net unrealized appreciation (depreciation)

|

6,498,094

|

4,266,298

|

||

Net increase (decrease) in net assets resulting from operations

|

14,360,225

|

10,459,129

|

||

Distributions to shareholders

|

(7,851,773)

|

(7,563,399)

|

||

Share transactions

|

||||

Proceeds from sales of shares

|

73,845,915

|

57,343,626

|

||

Reinvestment of distributions

|

5,928,073

|

5,784,378

|

||

Cost of shares redeemed

|

(67,904,382)

|

(73,627,936)

|

||

Net increase (decrease) in net assets resulting from share transactions

|

11,869,606

|

(10,499,932)

|

||

Total increase (decrease) in net assets

|

18,378,058

|

(7,604,202)

|

||

Net Assets

|

||||

Beginning of period

|

298,758,084

|

306,362,286

|

||

End of period

|

$

|

317,136,142

|

$

|

298,758,084

|

Other Information

|

||||

Shares

|

||||

Sold

|

6,751,970

|

5,340,689

|

||

Issued in reinvestment of distributions

|

542,322

|

541,660

|

||

Redeemed

|

(6,202,331)

|

(6,916,326)

|

||

Net increase (decrease)

|

1,091,961

|

(1,033,977)

|

||

Fidelity® Connecticut Municipal Income Fund |

Years ended November 30,

|

2024

|

2023

|

2022

|

2021

|

2020

|

|||||

Selected Per-Share Data

|

||||||||||

Net asset value, beginning of period

|

$

|

10.80

|

$

|

10.68

|

$

|

11.94

|

$

|

11.96

|

$

|

11.78

|

Income from Investment Operations

|

||||||||||

Net investment income (loss) A,B

|

.299

|

.274

|

.246

|

.247

|

.279

|

|||||

Net realized and unrealized gain (loss)

|

.214

|

.112

|

(1.232)

|

.035

|

.190

|

|||||

Total from investment operations

|

.513

|

.386

|

(.986)

|

.282

|

.469

|

|||||

Distributions from net investment income

|

(.283)

|

(.266)

|

(.244)

|

(.247)

|

(.279)

|

|||||

Distributions from net realized gain

|

-

|

-

|

(.030)

|

(.055)

|

(.010)

|

|||||

Total distributions

|

(.283)

|

(.266)

|

(.274)

|

(.302)

|

(.289)

|

|||||

Net asset value, end of period

|

$

|

11.03

|

$

|

10.80

|

$

|

10.68

|

$

|

11.94

|

$

|

11.96

|

Total Return C

|

4.81 % |

3.67%

|

(8.31)%

|

2.39%

|

4.04%

|

|||||

Ratios to Average Net Assets B,D,E

|

||||||||||

Expenses before reductions

|

.47%

|

.49%

|

.49%

|

.48%

|

.49%

|

|||||

Expenses net of fee waivers, if any

|

.47 % |

.49%

|

.49%

|

.48%

|

.49%

|

|||||

Expenses net of all reductions

|

.47%

|

.49%

|

.49%

|

.48%

|

.49%

|

|||||

Net investment income (loss)

|

2.74%

|

2.56%

|

2.23%

|

2.07%

|

2.37%

|

|||||

Supplemental Data

|

||||||||||

Net assets, end of period (000 omitted)

|

$

|

317,136

|

$

|

298,758

|

$

|

306,362

|

$

|

358,584

|

$

|

354,094

|

Portfolio turnover rate F

|

20 % |

15%

|

13%

|

13%

|

16%

|

Fidelity Central Fund

|

Investment Manager

|

Investment Objective

|

Investment Practices

|

Expense RatioA

|

Fidelity Money Market Central Funds

|

Fidelity Management & Research Company LLC (FMR)

|

Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity.

|

Short-term Investments

|

Less than .005%

|

Asset Type

|

Fair Value

|

Valuation Technique(s)

|

Unobservable Input

|

Amount or Range/Weighted Average

|

Impact to Valuation from an Increase in InputA

|

Municipal Securities

|

$3,900,000

|

Recovery value

|

Recovery value

|

$65.00

|

Increase

|

Gross unrealized appreciation

|

$4,106,630

|

Gross unrealized depreciation

|

(9,246,796)

|

Net unrealized appreciation (depreciation)

|

$(5,140,166)

|

Tax Cost

|

$318,778,647

|

Undistributed tax-exempt income

|

$30,247

|

Undistributed ordinary income

|

$4,542

|

Capital loss carryforward

|

$(2,695,461)

|

Net unrealized appreciation (depreciation) on securities and other investments

|

$(5,140,166)

|

Short-term

|

$(73,284)

|

Long-term

|

(2,622,177)

|

Total capital loss carryforward

|

$(2,695,461)

|

November 30, 2024

|

November 30. 2023

|

|

Tax-exempt Income

|

7,851,773

|

7,563,399

|

Purchases ($)

|

Sales ($)

|

|

Fidelity Connecticut Municipal Income Fund

|

61,486,320

|

58,011,479

|

Maximum Management Fee Rate %

|

|

Fidelity Connecticut Municipal Income Fund

|

.43

|

Total Management Fee Rate %

|

|

Fidelity Connecticut Municipal Income Fund

|

.43

|

% of Average Net Assets

|

|

Fidelity Connecticut Municipal Income Fund

|

.0259

|

Amount ($)

|

|

Fidelity Connecticut Municipal Income Fund

|

478

|

|

Contents

Municipal Bonds - 93.2%

|

|||

Principal

Amount (a)

|

Value ($)

|

||

Delaware - 0.5%

|

|||

Delaware River & Bay Auth. Rev. Series 2024 B:

|

|||

5% 1/1/41

|

500,000

|

562,447

|

|

5% 1/1/42

|

800,000

|

896,555

|

|

5% 1/1/43

|

600,000

|

669,861

|

|

5% 1/1/44

|

425,000

|

473,022

|

|

TOTAL DELAWARE

|

2,601,885

|

||

Delaware, New Jersey - 0.4%

|

|||

Delaware River & Bay Auth. Rev. Series 2022, 5% 1/1/42

|

2,075,000

|

2,279,452

|

|

New Jersey - 75.8%

|

|||

Audubon Scd Series 2022, 2.75% 8/15/33 (Assured Guaranty Muni. Corp. Insured)

|

1,160,000

|

1,062,976

|

|

Bergen County Gen. Oblig. Series 2021 ABC, 2% 6/1/28

|

285,000

|

270,449

|

|

Berkely Township Series 2023, 3.25% 8/15/35

|

1,255,000

|

1,233,391

|

|

Casino Reinvestment Dev. Auth. N:

|

|||

Series 2024 A:

|

|||

4% 11/1/44 (Assured Guaranty Muni. Corp. Insured)

|

3,000,000

|

2,954,381

|

|

5% 11/1/27 (Assured Guaranty Muni. Corp. Insured)

|

750,000

|

792,706

|

|

5% 11/1/28 (Assured Guaranty Muni. Corp. Insured)

|

1,000,000

|

1,073,513

|

|

Series 2024 B:

|

|||

5% 11/1/27 (Assured Guaranty Muni. Corp. Insured)

|

300,000

|

317,082

|

|

5% 11/1/28 (Assured Guaranty Muni. Corp. Insured)

|

350,000

|

375,729

|

|

5% 11/1/37 (Assured Guaranty Muni. Corp. Insured)

|

750,000

|

849,119

|

|

5% 11/1/44 (Assured Guaranty Muni. Corp. Insured)

|

900,000

|

985,192

|

|

Englewood Gen. Oblig. Series 2021, 2% 2/1/29

|

560,000

|

515,890

|

|

Essex County Gen. Oblig. Series 2020, 2% 9/1/31

|

995,000

|

894,210

|

|

Gloucester County Impt. Auth. Rev. (Rowan Univ. Projs.) Series 2024, 5% 7/1/54 (Build America Mutual Assurance Insured)

|

4,650,000

|

4,996,123

|

|

Hanover Park Reg'l. High School Series 2023, 3.5% 3/15/31

|

1,120,000

|

1,132,547

|

|

Hillsborough Township Scd Series 2020, 2% 7/15/40

|

1,240,000

|

915,805

|

|

Howell Township Gen. Oblig. Series 2020, 2% 10/1/31

|

1,000,000

|

874,256

|

|

Hudson County Gen. Oblig. Series 2020, 3% 11/15/32

|

485,000

|

475,173

|

|

Hudson County Impt. Auth. (Hudson County Courthouse Proj.) Series 2020, 3% 10/1/36

|

2,950,000

|

2,803,657

|

|

Jersey City Gen. Oblig. Series 2022 A, 3% 2/15/37

|

1,000,000

|

927,309

|

|

Lyndhurst Township Gen. Oblig. Series 2021, 2% 3/1/35

|

2,850,000

|

2,314,353

|

|

Mercer County Gen. Oblig. Series 2021, 2.375% 2/15/30

|

2,280,000

|

2,138,404

|

|

Millburn Township Board of Ed. Series 2023:

|

|||

1% 8/15/27

|

1,430,000

|

1,346,450

|

|

1% 8/15/28

|

1,100,000

|

1,013,553

|

|

Monmouth County Impt. Auth. Rev. Series 2021 A, 3% 3/1/33

|

385,000

|

381,054

|

|

Montclair Township N J Board Ed. Series 2023, 3.25% 1/15/38 (Build America Mutual Assurance Insured)

|

1,825,000

|

1,753,245

|

|

Morris County Gen. Oblig. Series 2021, 2% 2/1/29

|

1,085,000

|

1,013,820

|

|

New Jersey Econ. Dev. Auth.:

|

|||

(White Horse HMT Urban Renewal LLC Proj.) Series 2020, 5% 1/1/40 (b)

|

1,000,000

|

669,581

|

|

Series 2015, 5.25% 6/15/27

|

1,395,000

|

1,408,658

|

|

Series 2024 SSS:

|

|||

5% 6/15/33

|

1,725,000

|

1,971,231

|

|

5.25% 6/15/37

|

1,570,000

|

1,819,436

|

|

5.25% 6/15/38

|

2,000,000

|

2,309,356

|

|

5.25% 6/15/39

|

3,000,000

|

3,450,560

|

|

Series A, 5% 11/1/35

|

5,000,000

|

5,377,171

|

|

Series QQQ:

|

|||

4% 6/15/46

|

1,250,000

|

1,256,448

|

|

4% 6/15/50

|

1,000,000

|

1,001,537

|

|

Series WW, 5.25% 6/15/40 (Pre-Refunded to 6/15/25 @ 100)

|

105,000

|

106,247

|

|

New Jersey Econ. Dev. Auth. Lease Rev. (Health Dept. and Taxation Division Office Proj.) Series 2018 A, 5% 6/15/31

|

2,555,000

|

2,683,876

|

|

New Jersey Econ. Dev. Auth. Motor Vehicle Rev.:

|

|||

Series 2017 A, 3.375% 7/1/30

|

3,705,000

|

3,577,928

|

|

Series 2017 B, 3.125% 7/1/29

|

1,335,000

|

1,289,207

|

|

New Jersey Econ. Dev. Auth. Rev.:

|

|||

(Black Horse EHT Urban Renewal LLC Proj.) Series 2019 A, 5% 10/1/39 (b)

|

1,250,000

|

1,004,649

|

|

(Goethals Bridge Replacement Proj.) Series 2013, 5.125% 1/1/34 (c)

|

1,500,000

|

1,501,522

|

|

(Provident Montclair Proj.) Series 2017:

|

|||

5% 6/1/30 (Assured Guaranty Muni. Corp. Insured)

|

1,500,000

|

1,558,831

|

|

5% 6/1/31 (Assured Guaranty Muni. Corp. Insured)

|

1,500,000

|

1,557,416

|

|

5% 6/1/37 (Assured Guaranty Muni. Corp. Insured)

|

4,000,000

|

4,126,546

|

|

New Jersey Econ. Dev. Auth. Spl. Facilities Rev. (Port Newark Container Term. LLC. Proj.) Series 2017, 5% 10/1/37 (c)

|

1,430,000

|

1,468,628

|

|

New Jersey Econ. Dev. Auth. Wtr. Facilities Rev.:

|

|||

(Middlesex Wtr. Co. Proj.) Series 2019:

|

|||

4% 8/1/59 (c)

|

1,000,000

|

935,631

|

|

5% 8/1/59 (c)

|

1,000,000

|

1,028,747

|

|

Bonds (New Jersey- American Wtr. Co., INC. Proj.) Series 2020 B, 3.75%, tender 6/1/28 (c)(d)

|

5,000,000

|

5,025,721

|

|

New Jersey Edl. Facilities Auth. Rev.:

|

|||

Series 2021 C, 2% 3/1/36

|

2,000,000

|

1,671,607

|

|

Series 2024 A:

|

|||

5% 7/1/26 (Assured Guaranty Muni. Corp. Insured)

|

1,200,000

|

1,239,541

|

|

5% 7/1/27 (Assured Guaranty Muni. Corp. Insured)

|

1,445,000

|

1,525,249

|

|

5% 7/1/44 (Assured Guaranty Muni. Corp. Insured)

|

1,400,000

|

1,573,999

|

|

New Jersey Edl. Facility:

|

|||

(Stevens Institute of Techonolgy Proj.) Series 2017 A:

|

|||

5% 7/1/25

|

600,000

|

605,044

|

|

5% 7/1/26

|

945,000

|

968,369

|

|

5% 7/1/29

|

865,000

|

903,360

|

|

Series 2015 B, 5% 7/1/31

|

3,000,000

|

3,027,309

|

|

Series 2016 A:

|

|||

5% 7/1/27

|

2,875,000

|

2,953,451

|

|

5% 7/1/29

|

1,000,000

|

1,024,782

|

|

5% 7/1/32

|

600,000

|

613,902

|

|

Series 2016 E, 5% 7/1/32 (Build America Mutual Assurance Insured)

|

3,335,000

|

3,433,639

|

|

Series A:

|

|||

4% 7/1/50

|

3,000,000

|

2,812,444

|

|

5% 7/1/32

|

420,000

|

451,958

|

|

5% 7/1/33

|

675,000

|

723,981

|

|

5% 7/1/34

|

540,000

|

577,231

|

|

5% 7/1/35

|

570,000

|

606,937

|

|

5% 7/1/36

|

1,095,000

|

1,161,998

|

|

5% 7/1/37

|

1,095,000

|

1,157,363

|

|

5% 7/1/38

|

985,000

|

1,036,959

|

|

5% 7/1/39

|

1,040,000

|

1,090,000

|

|

5% 7/1/40

|

1,035,000

|

1,081,410

|

|

5% 7/1/45

|

3,500,000

|

3,625,951

|

|

New Jersey Gen. Oblig.:

|

|||

Series 2020 A, 3% 6/1/32

|

4,240,000

|

4,193,637

|

|

Series 2021:

|

|||

2% 6/1/26

|

6,300,000

|

6,162,057

|

|

2% 6/1/27

|

2,000,000

|

1,916,731

|

|

2% 6/1/29

|

3,110,000

|

2,864,416

|

|

New Jersey Health Care Facilities Fing. Auth. Rev.:

|

|||

(St Joseph Hosp. & Med. Ctr., Proj.) Series 2016, 5% 7/1/25

|

700,000

|

703,078

|

|

Series 2014 A, 4% 7/1/45

|

1,300,000

|

1,239,805

|

|

Series 2015 A, 4.125% 7/1/38 (Assured Guaranty Muni. Corp. Insured)

|

1,000,000

|

1,001,856

|

|

Series 2016 A:

|

|||

5% 7/1/27

|

100,000

|

103,333

|

|

5% 7/1/39

|

11,000,000

|

11,251,686

|

|

Series 2016:

|

|||

4% 7/1/48

|

425,000

|

392,941

|

|

5% 7/1/26

|

800,000

|

811,886

|

|

5% 7/1/31

|

400,000

|

417,078

|

|

5% 7/1/41

|

4,225,000

|

4,274,117

|

|

Series 2017 A, 5% 7/1/25

|

110,000

|

111,240

|

|

Series 2019:

|

|||

3% 7/1/49

|

9,640,000

|

7,745,673

|

|

5% 7/1/34

|

960,000

|

1,033,159

|

|

Series 2021 A, 5% 7/1/25

|

3,000,000

|

3,032,945

|

|

Series 2021:

|

|||

3% 7/1/46

|

7,140,000

|

5,932,790

|

|

4% 7/1/35

|

750,000

|

776,991

|

|

4% 7/1/37

|

700,000

|

720,110

|

|

5% 7/1/33

|

1,420,000

|

1,565,590

|

|

5% 7/1/34

|

1,250,000

|

1,376,481

|

|

Series 2024 A:

|

|||

4.125% 7/1/54

|

6,000,000

|

6,003,708

|

|

5% 7/1/27

|

735,000

|

776,000

|

|

5% 7/1/28

|

1,000,000

|

1,076,886

|

|

5% 7/1/29

|

455,000

|

498,591

|

|

New Jersey Higher Ed. Student Assistance Auth. Student Ln. Rev.:

|

|||

Series 2016 1A, 5% 12/1/25 (c)

|

1,400,000

|

1,419,009

|

|

Series 2017 1A:

|

|||

5% 12/1/25 (c)

|

3,000,000

|

3,040,733

|

|

5% 12/1/27 (c)

|

2,500,000

|

2,573,812

|

|

Series 2018 B:

|

|||

5% 12/1/26 (c)

|

255,000

|

262,727

|

|

5% 12/1/28 (c)

|

2,355,000

|

2,475,918

|

|

Series 2019 A:

|

|||

5% 12/1/27

|

2,000,000

|

2,109,021

|

|

5% 12/1/28

|

700,000

|

735,942

|

|

Series 2021 A:

|

|||

5% 12/1/26 (c)

|

325,000

|

334,848

|

|

5% 12/1/27 (c)

|

325,000

|

339,209

|

|

5% 12/1/28 (c)

|

400,000

|

423,315

|

|

5% 12/1/29 (c)

|

1,050,000

|

1,116,849

|

|

Series 2021 B:

|

|||

5% 12/1/27 (c)

|

1,325,000

|

1,372,986

|

|

5% 12/1/28 (c)

|

1,450,000

|

1,534,516

|

|

5% 12/1/29 (c)

|

1,415,000

|

1,505,087

|

|

Series 2023 A:

|

|||

5% 12/1/25 (c)

|

575,000

|

582,807

|

|

5% 12/1/26 (c)

|

1,275,000

|

1,313,633

|

|

Series 2023 B:

|

|||

5% 12/1/25 (c)

|

1,850,000

|

1,875,119

|

|

5% 12/1/26 (c)

|

7,000,000

|

7,212,103

|

|

Series 2024 A:

|

|||

5% 12/1/29 (c)

|

1,900,000

|

2,020,965

|

|

5% 12/1/30 (c)

|

1,875,000

|

2,006,550

|

|

5% 12/1/31 (c)

|

1,270,000

|

1,367,411

|

|

Series 2024 B, 5% 12/1/28 (c)

|

1,900,000

|

2,010,746

|

|

Series 2024 C, 5.25% 12/1/54 (c)

|

2,225,000

|

2,266,119

|

|

New Jersey Hsg. & Mtg. Fin. Agcy. Multi-family Rev. Series 2023 C:

|

|||

5% 11/1/28 (c)

|

1,875,000

|

1,954,259

|

|

5% 5/1/29 (c)

|

1,885,000

|

1,969,428

|

|

5% 11/1/29 (c)

|

1,950,000

|

2,041,022

|

|

5% 5/1/30 (c)

|

2,000,000

|

2,095,596

|

|

5% 11/1/30 (c)

|

2,045,000

|

2,143,688

|

|

New Jersey Hsg. & Mtg. Fin. Agcy. Rev.:

|

|||

Series 2020 E, 1.75% 4/1/30

|

900,000

|

798,434

|

|

Series 2021 H:

|

|||

5% 4/1/28

|

300,000

|

317,252

|

|

5% 10/1/28

|

480,000

|

511,368

|

|

5% 4/1/29

|

500,000

|

537,731

|

|

Series 2022 I, 5% 10/1/53

|

3,165,000

|

3,283,063

|

|

New Jersey Institute of Technology Series A:

|

|||

5% 7/1/31

|

375,000

|

406,905

|

|

5% 7/1/32

|

375,000

|

407,368

|

|

5% 7/1/33

|

170,000

|

184,613

|

|

New Jersey Tobacco Settlement Fing. Corp.:

|

|||

Series 2018 A:

|

|||

5% 6/1/26

|

5,000,000

|

5,116,201

|

|

5% 6/1/27

|

1,000,000

|

1,041,031

|

|

5% 6/1/28

|

2,000,000

|

2,113,290

|

|

Series 2018 B, 5% 6/1/46

|

5,570,000

|

5,596,110

|

|

New Jersey Tpk. Auth. Tpk. Rev. Series 2024, 5% 1/1/30

|

6,345,000

|

7,027,567

|

|

New Jersey Trans. Trust Fund Auth.:

|

|||

Series 2006 C:

|

|||

0% 12/15/26 (AMBAC Insured)

|

10,000,000

|

9,364,453

|

|

0% 12/15/34

|

5,800,000

|

4,108,664

|

|

Series 2008 A, 0% 12/15/36

|

25,000,000

|

16,069,353

|

|

Series 2009 A:

|

|||

0% 12/15/33

|

1,135,000

|

828,735

|

|

0% 12/15/38

|

13,900,000

|

8,183,005

|

|

Series 2010 A:

|

|||

0% 12/15/27

|

3,000,000

|

2,716,317

|

|

0% 12/15/28

|

9,800,000

|

8,575,560

|

|

0% 12/15/30

|

14,795,000

|

12,082,062

|

|

0% 12/15/32

|

355,000

|

269,100

|

|

Series 2010 A3, 0% 12/15/34

|

10,775,000

|

7,565,450

|

|

Series 2014 AA:

|

|||

5% 6/15/38

|

770,000

|

771,467

|

|

5% 6/15/44

|

555,000

|

556,057

|

|

Series 2016 A, 5% 6/15/29

|

750,000

|

770,756

|

|

Series 2019 BB, 4% 6/15/38

|

1,035,000

|

1,044,124

|

|

Series 2020 AA:

|

|||

3% 6/15/50

|

7,500,000

|

6,117,979

|

|

5% 6/15/50

|

780,000

|

824,258

|

|

5% 6/15/50 (Pre-Refunded to 12/15/30 @ 100)

|

220,000

|

247,587

|

|

Series 2022 AA, 5% 6/15/38

|

6,440,000

|

7,141,455

|

|

Series 2023 BB, 5.25% 6/15/50

|

10,000,000

|

11,034,996

|

|

Series 2024 A, 5% 6/15/37

|

10,000,000

|

11,445,048

|

|

Series A:

|

|||

0% 12/15/31

|

365,000

|

287,269

|

|

5% 12/15/33

|

2,850,000

|

3,100,354

|

|

Series AA, 4% 6/15/50

|

4,300,000

|

4,238,391

|

|

Newark Port Auth. Hsg. Auth. Rev. Series 2007, 5.25% 1/1/25 (Nat'l. Pub. Fin. Guarantee Corp. Insured)

|

200,000

|

200,173

|

|

Ocean City Gen. Oblig. Series 2019, 2.25% 9/15/32

|

455,000

|

404,846

|

|

Passaic County Gen. Oblig.:

|

|||

Series 2020 C, 2% 11/1/33

|

685,000

|

582,184

|

|

Series 2021 AB:

|

|||

2% 11/1/34

|

1,840,000

|

1,528,108

|

|

2% 11/1/36

|

1,230,000

|

983,370

|

|

Passaic County N J Impt. Auth. Cha:

|

|||

(Paterson Arts & Science Charter School Proj.) Series 2023, 4.25% 7/1/33

|

570,000

|

582,410

|

|

(Paterson Arts and Science Charter School Proj.) Series 2023:

|

|||

5.25% 7/1/43

|

670,000

|

706,197

|

|

5.375% 7/1/53

|

1,000,000

|

1,044,384

|

|

5.5% 7/1/58

|

635,000

|

665,749

|

|

Piscataway Township Gen. Oblig. Series 2020, 2% 10/15/34

|

1,485,000

|

1,241,989

|

|

Princeton Borough Gen. Oblig. Series 2021, 2.5% 9/15/32

|

835,000

|

762,235

|

|

Rahway Board of Ed. Series 2021:

|

|||

2.125% 7/15/32

|

2,400,000

|

2,091,172

|

|

2.125% 7/15/37 (Build America Mutual Assurance Insured)

|

1,110,000

|

877,096

|

|

2.125% 7/15/38 (Build America Mutual Assurance Insured)

|

1,400,000

|

1,084,721

|

|

River Vale Township School District Series 2021, 2% 6/15/30

|

1,020,000

|

915,475

|

|

Rumson Boro N J School District Series 2020:

|

|||

2% 7/15/34

|

680,000

|

570,649

|

|

2% 7/15/35

|

865,000

|

712,520

|

|

2% 7/15/36

|

1,185,000

|

958,121

|

|

Salem County Indl. Poll. Cont. Fing. Auth. Poll. Cont. Rev. Bonds (Philadelphia Elec. Co. Proj.) Series 1993 A, 4.45%, tender 3/1/25 (c)(d)

|

3,200,000

|

3,205,779

|

|

Sayreville N J Series 2021:

|

|||

2% 11/1/33

|

1,925,000

|

1,621,949

|

|

2% 11/1/34

|

1,935,000

|

1,597,688

|

|

South Jersey Port Corp. Rev. (New Jersey Gen. Oblig. Proj.) Series 2017 B:

|

|||

5% 1/1/29 (c)

|

955,000

|

999,590

|

|

5% 1/1/31 (c)

|

1,950,000

|

2,040,810

|

|

5% 1/1/33 (c)

|

750,000

|

780,553

|

|

5% 1/1/35 (c)

|

2,000,000

|

2,071,568

|

|

South Jersey Trans. Auth. Trans. Sys. Rev.:

|

|||

Series 2019 A:

|

|||

5% 11/1/28 (Assured Guaranty Muni. Corp. Insured)

|

200,000

|

213,855

|

|

5% 11/1/31 (Assured Guaranty Muni. Corp. Insured)

|

1,500,000

|

1,620,428

|

|

5% 11/1/32 (Assured Guaranty Muni. Corp. Insured)

|

1,230,000

|

1,326,123

|

|

5% 11/1/33 (Assured Guaranty Muni. Corp. Insured)

|

750,000

|

807,064

|

|

Series 2020 A:

|

|||

5% 11/1/45

|

7,000,000

|

7,319,902

|

|

5% 11/1/45 (Build America Mutual Assurance Insured)

|

2,000,000

|

2,137,929

|

|

The Board of Ed. of Newark Series 2021:

|

|||

4% 7/15/36 (Build America Mutual Assurance Insured)

|

775,000

|

800,200

|

|

4% 7/15/37 (Build America Mutual Assurance Insured)

|

725,000

|