UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1/A

Amendment No. 3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Tian’an Technology Group Ltd.

(Exact name of Registrant as specified in its charter)

| British Virgin Islands | 3621 | Not applicable | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

Tian’an Technology Group Ltd. Room 104, Building 1-B, No. 3500 Xiupu Road, Pudong New Area, Shanghai, China |

| (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) |

Mark E. Crone, Esq. The Crone Law Group, PC 420 Lexington Avenue, Suite 2446 New York, NY 10170 (646) 861-7891 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

COPIES OF COMMUNICATIONS TO:

Mark Crone, Esq. Eric Mendelson, Esq. The Crone Law Group P.C. 420 Lexington Ave, Suite 2446 New York, NY 10170 Phone: (646) 861-7891 |

Lixia Zhang, Esq. Jiangsu Shishan Law Firm Building A, No. 65 Yushan Road High-tech Zone, Suzhou, China Phone: +86 512-68780109 |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the United States Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated ____, 2023

TIAN’AN TECHNOLOGY GROUP LTD.

5,000,000 Ordinary Shares

___________________

This prospectus relates to the offer and resale of an aggregate 5,000,000 Ordinary Shares, no par value (the “Shares”), of Tian’an Technology Group Ltd., all of which were issued by us in a private placement transaction pursuant to securities purchase agreements (each a “Purchase Agreement”) at a purchase price of $0.10 per share. The holders of the shares are each referred to herein as a “Selling Stockholder” and collectively as the “Selling Stockholders.”

The Selling Stockholders, or their respective transferees, pledgees, donees or other successors-in-interest, will offer and sell their Shares at a fixed price until the Shares are listed on a national securities exchange or quoted on the OTC Bulletin Board, OTCQX, or OTCQB, at which time the Shares may be sold through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling Stockholders may sell any, all or none of the securities offered by this prospectus, and we do not know when or in what amount the Selling Stockholders may sell their Shares hereunder following the effective date of this registration statement. We provide more information about how a Selling Stockholder may sell its Shares in the section titled “Plan of Distribution” on page 48.

We are registering the Shares on behalf of the Selling Stockholders, to be offered and sold by them from time to time. We will not receive any proceeds from the sale of the Shares by the Selling Stockholders in the offering described in this prospectus. We have agreed to bear all of the expenses incurred in connection with the registration of the Shares. The Selling Stockholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of the Shares.

Tian’an Technology Group Ltd. (“Tian’an”) is a holding company that was incorporated under the laws of the British Virgin Islands on April 8, 2021. As a holding company with no material operations of our own, we conduct our operations through Yunke Jingrong Information Technology Co., Ltd. (“Yunke”), our wholly owned subsidiary. Shanghai Qige Power Technology Co., Ltd. (“Shanghai Qige”) is a wholly owned subsidiary of Yunke and our operating company in China. Through our subsidiary, Shanghai Qige, we are engaged in the technology driven sales of power control and service systems solutions. The ordinary shares offered by the Selling Stockholders are shares of Tian’an, a British Virgin Islands holding company, and not shares of Yunke or Shanghai Qige. Accordingly, purchasers of Shares in Tian’an will not directly hold equity interests in said operating subsidiaries.

We are a British Virgin Islands holding company that conducts all of its operations through our wholly owned subsidiary. Tian’an and Yunke are holding companies and do not have any actual operations. Shanghai Qige is located in China where all of our assets are held and all of our operations are conducted. Investors in this offering will receive Ordinary Shares in Tian’an Technology Group Ltd., the British Virgin Islands holding company, and will not hold direct investments in our Chinese operating company, Shanghai Qige, a wholly owned subsidiary of Yunke. This structure involves unique risks to investors, as further described below. See “You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in the British Virgin Islands against us or our management named in the prospectus based on foreign laws”.

The structure of cash flows within our organization, and the applicable regulations, are as follows:

1. Our equity structure is a direct shareholding structure, that is, the overseas entity to be listed in the U.S., Tian’an, directly controls Yunke and Shanghai Qige. See “Corporate History and Structure” for additional details.

2. Within our direct holding structure, the use of funds within our corporate group is legal and compliant with the laws and regulations of the PRC. Because Tian’an and Yunke have no actual operations, there is no funding for these entitles and all the revenue that is generated by Shanghai Qige is used to operate Shanghai Qige. After foreign investors’ funds enter the Company at the close of this offering, the funds can be directly transferred to our PRC subsidiary Shanghai Qige through a WFOE structure.

3. At present the Company has no restrictions on the use of its cash. We have a fund management policy in place which has corresponding internal control rules that are compliant with the laws and regulations of the PRC.

4. At present, we have never distributed any dividends and do not intend to in the future. However, if the Company decides to distribute dividends to its shareholders, the Company will transfer the dividends from the operating subsidiary in accordance with the laws and regulations of the PRC and other countries. Then the subsidiary will transfer the dividends to Tian’an, and the dividends will be distributed from Tian’an to all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions.

As of the date of this registration statement, no transfers, dividends, or distributions have been made between the holding company, its subsidiaries, and consolidated entities, or to investors.

Since our business operations are conducted in China through our operating subsidiary Shanghai Qige, the Chinese government may exercise significant oversight and discretion over the conduct of our business in China and may intervene in or influence our subsidiary’s operations at any time, which could result in a material change in its operations and/or the value of our Ordinary Shares.

China’s economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Further, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. It is possible what we do not receive or maintain appropriate permissions or approvals, inadvertently conclude that such permissions or approvals are not required, or applicable laws, regulations, or interpretations could change and we will be required to obtain such permissions or approvals in the future. Changes in any of these policies, laws and regulations could adversely affect the economy in China and could have a material adverse effect on our business. Any actions by the Chinese government to exert more oversight and control over this offering, or any of our business operations could significantly limit or completely hinder our ability to offer or continue to offer securities to investors.

The Chinese government may intervene or influence the operation of our PRC operating entity and may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence Shanghai Qige’s operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares.

Recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China-based issuers. Any future action or control by the Chinese government over offerings conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.

Recently, the People’s Republic of China (“PRC” or “China”) government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. These statements and regulatory actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations or detailed implementation rules and interpretations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and continue to be listed on an U.S. exchange.

| (1) | On December 28, 2021, the Cyberspace Administration of China (“CAC”) adopted and promulgated the Cybersecurity Review Measures (2021), which became effective on February 15, 2022. This regulation provides that any “online platform operators” controlling the personal information of more than one million users which seek to list on a foreign stock exchange should also be subject to cybersecurity review. On November 14, 2021, the CAC published the Network Internet Data Protection Draft Regulations (draft for comments), which reiterates that data handlers that process the personal information of more than one million users listing in a foreign country should apply for a cybersecurity review. It is uncertain that whether Shanghai Qige will be deemed as the “online platform operators” as mentioned above, even though Shanghai Qige does not operate any online platforms. Tian’an and Yunke do not have any operations. We do not believe that Shanghai Qige is directly subject to these regulatory actions or statements, as (a) the Company does not have a variable interest entity structure, and this listing does not refer to the case of an overseas special purpose company directly or indirectly controlled by Chinese companies or individuals controlling the Chinese domestic companies via contractual arrangements; and (b) the business of Shanghai Qige does not involve the collection of user data, implicate cybersecurity, or involve any other type of restricted industry. |

| (2) | The Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (“M&A Rules”) and Anti-Monopoly Law of the People’s Republic of China promulgated by the Standing Committee of the Standing Committee of the National People’s Congress which became effective in 2008 (“Anti-Monopoly Law”), established additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex. Such regulation requires, among other things, that State Administration for Market Regulation (“SAMR”) be notified in advance of any change-of-control transaction in which a foreign investor acquires control of a PRC domestic enterprise or a foreign company with substantial PRC operations, if certain thresholds under the Provisions of the State Council on the Standard for Declaration of Concentration of Business Operators, issued by the State Council in 2008, are triggered. Moreover, the Anti-Monopoly Law requires that transactions which involve the national security, the examination on the national security shall also be conducted according to the relevant provisions of the State. In addition, PRC Measures for the Security Review of Foreign Investment which became effective in January 2021 require acquisitions by foreign investors of PRC companies engaged in military-related or certain other industries that are crucial to national security be subject to security review before consummation of any such acquisition. China has recently witnessed landscape reform in the antitrust regime at the end of 2021: the draft amendment (“Draft Amendment”) to the Anti-Monopoly Law was published for public comments on October 23 and the national anti-monopoly bureau (“Anti-monopoly Bureau”) was inaugurated in Beijing on November 18. With the law amendment and the institutional reshuffle, some widely held perception of antitrust practice in China should be refreshed. Among other things, all types of monopoly agreements can be exempted if the market share threshold is met, which will be stipulated by the authority in separate regulations. Also, abuse of data, algorithm, technologies, and platform rules that leading to imposition of unfair restrictions on undertakings is expressly listed as abuse of dominant market position. In addition, the Draft Amendment expressly prohibit hub-and-spoke cartel and provide for the same legal liabilities for both the hub and spoke. China is determined to strengthen enforcement against monopolistic practices in all industries. |

| (3) | On December 24, 2021, China Securities Regulatory Commission, or the China Securities Regulatory Commission (the “CSRC”) issued the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”, collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listing”), which were published for comments only with the comment period expiring on January 23, 2022. The Draft Rules Regarding Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listings, and clarify the determination criteria for indirect overseas listing in overseas market. Among other things, if a domestic enterprise intends to indirectly offer and list securities in an overseas market, the record-filing obligation is with a major operating entity incorporated in the PRC and such filing obligation shall be completed within three working days after the overseas listing application is submitted. Up to the issuance of this prospectus, the Draft Rules Regarding Overseas Listing have not yet come into effect, and accordingly the Company and our subsidiaries are currently not affected. |

We are both an “emerging growth company” and a “foreign private issuer” under applicable U.S. Securities and Exchange Commission rules and are subject to reduced public company disclosure requirements. See “Summary-Implications of Being an ‘Emerging Growth Company’ and a ‘Foreign Private Issuer’” on page 9 of this prospectus.

There has been no market for our securities and a public market may not develop, or, if any market does develop, it may not be sustained. We intend to seek quotation of our ordinary shares on The OTC Markets Group, Inc. OTCQX or the OTCQB Venture after effectiveness of the registration statement of this prospectus. Quotation of our Ordinary Shares on the OTC Markets will require a market maker filing an application to quote our ordinary shares and approval of that application. We do not have a market maker willing to file the necessary application for quoting our Ordinary Shares on the OTC Markets as of the date of this prospectus. There is a risk that no public market will develop for our Ordinary Shares.

The audit report included in this prospectus was issued by HHC (“HHC”) a United States based accounting firm that is registered with the PCAOB and can be inspected by the PCAOB. We have no intention of dismissing HHC in the future or of engaging any auditor not subject to regular inspection by the PCAOB. There is no guarantee, however, that any future auditor engaged by the Company would remain subject to full PCAOB inspection during the entire term of our engagement. The PCAOB is currently unable to conduct inspections in China without the approval of Chinese government authorities. If it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate. In addition, under the HFCAA, our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges if our auditor is not inspected by the PCAOB for three consecutive years, and this ultimately could result in our Ordinary Shares being delisted. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”), which, if enacted, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.

Pursuant to the HFCAA, the PCOAB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China, because a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition the PCOAB’s report identified the specific registered public accounting firms which are subject to these determinations. Our registered public accounting firm HHC is not headquartered in mainland China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determination.

Investing in our Ordinary Shares involves a high degree of risk. See section entitled “Risk Factors” starting on page 10. We directly hold equity interests in our operating subsidiaries in China, and we do not currently use a variable interest entity (“VIE”) structure. We are subject to legal and operational risks associated with having our subsidiaries’ operations in China, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and Hong Kong and China and the United States, or Chinese or United States regulations, which risks could result in a material change in our operations and/or cause our Ordinary Shares to significantly decline in value or become worthless and affect our ability to offer or continue to offer securities to investors. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We may be subject to these regulatory actions or statements. Although we have not engaged in any monopolistic behavior, our business does not involve in the collection of user data and may not subject to cybersecurity reviews. We currently expect that these new regulations may not have an impact on our operating subsidiaries or this offering. As of the date of this prospectus, no effective laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”) or any other PRC governmental authorities for our overseas listing plan, nor has our Company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding our planned overseas listing from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation rules have not been issued, the potential impact that such modified or new laws and regulations will have on our daily business operations, or on our ability to accept foreign investments and be quoted on the OTC Markets, is highly uncertain. The Standing Committee of the National People’s Congress (the “SCNPC”) or other PRC regulatory authorities may, in the future, promulgate laws, regulations or implementing rules that require our Company, or any of our subsidiaries, to obtain regulatory approval from Chinese authorities before being quoted in the U.S. See “Risk Factors” beginning on page 10 for a discussion of these legal and operational risks and other information that should be considered before making a decision to purchase our Ordinary Shares.

We are an “emerging growth company” under applicable U.S. federal securities laws and are eligible for reduced public company reporting requirements.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

You should rely only on the information contained in this prospectus. Neither we, nor the Selling Stockholders have authorized anyone to provide information different from that contained in this prospectus. We and the Selling Stockholders are offering to sell, and seeking offers to buy, Ordinary Shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Shares.

| i |

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements appearing elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our Shares discussed under “Risk Factors,” before deciding whether to invest in our Shares.

Conventions that Apply to this Prospectus

Our financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“US GAAP”). We present our consolidated financial statements in U.S. dollars.

Our fiscal year ends on December 31 of each year. References to fiscal 2021 are references to the fiscal year ended December 31, 2021 and references to fiscal 2020 are references to the fiscal year ended December 31, 2020. Some amounts in this prospectus may not total due to rounding. All percentages have been calculated using unrounded amounts.

Throughout this prospectus, we provide a number of key performance indicators used by our management and often used by competitors in our industry. These and other key performance indicators are discussed in more detail in the section entitled “Management’s discussion and analysis of financial condition and results of operations—Key financial and operating metrics.” We define certain terms used in this prospectus as follows:

Unless otherwise indicated or the context otherwise requires, references in this prospectus to:

| ● | “Shares” are to our Ordinary Shares, no par value per share; | |

| ● | “PWM” is to pulse width modulation; | |

| ● | “China” or the “PRC” are to the People’s Republic of China, excluding, for the purposes of this prospectus only, Hong Kong, Macau and Taiwan; | |

| ● | “DC is to direct current motors; | |

| ● | “Stator” is to the stationary part of the rotary electromagnetic devices, such as the alternator, electric motor or generator; | |

| ● | “BVI” is to the British Virgin Islands; | |

| ● | “AC” is to alternating current motors (or eclectic motors); | |

| ● | “EC” is to electronically commutated series brushless motor controller; | |

| ● | “PWM” is to pulse with modulation control; | |

| ● | “CNC” is to computer numerical control; | |

| ● | “PLC” is to programmable logic controller; | |

| ● | “RMB” or “Renminbi” are to the legal currency of the People’s Republic of China; | |

| ● | “Yuan” or “¥” are to the primary unit of account of the Renminbi (RMB), the legal currency of the People’s Republic of China; | |

| ● | “US$,” “U.S. dollars,” “$,” or “dollars” are to the legal currency of the United States; | |

| ● | Tian’an Technology Group Ltd., is a limited company organized under the laws of the British Virgin Islands and is the holding company of Yunke Jingrong Information Technology Co., Ltd., its wholly owned subsidiary; | |

| ● | Yunke Jingrong Information Technology Co, Ltd. is a limited company organized under the laws of China and is the parent company for Shanghai Qige Power Technology Co., Ltd., its wholly owned subsidiary; | |

| ● | Shanghai Qige Power Technology Co., Ltd., which is the operating company for Tian’an Technology Group Ltd., is a limited company organized under the laws of China and is the wholly owned subsidiary of Yunke Jingrong Information Technology Co., Ltd.; and | |

| ● | Unless the context provides otherwise, “we,” “us,” “our company” or “our,” “the Company” and “Tian’an” are to Tian’an Technology Group Ltd. a corporation formed under the laws of the British Virgin Islands, and to our two wholly-owned subsidiaries, Yunke and Shanghai Qige. |

Our reporting currency is the U.S. Dollar. The functional currency of the Company in the PRC is the Renminbi.

| 1 |

This disclosure contains translations of certain Renminbi amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. The relevant exchange rates are listed below:

| For the Year Ended December 31, 2021 | For the Year Ended December 31, 2020 | |||||||

| Year ended RMB: USD exchange rate | 0.1573 | 0.1531 | ||||||

| Average yearly RMB: USD exchange rate | 0.1550 | 0.1449 | ||||||

| For the Six Months Ended June 30, 2022 | For the Six Months Ended June 30, 2021 | |||||||

| Year ended RMB: USD exchange rate | 0.1493 | 0.1549 | ||||||

| Average yearly RMB: USD exchange rate | 0.1543 | 0.1545 | ||||||

Market and industry data

Unless otherwise indicated, information in this prospectus concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, information from independent industry analysts and publications, as well as our own estimates and research.

Our estimates are derived from publicly available information released by third-party sources, as well as data from our internal research, which we believe to be reasonable. None of the independent industry publications used in this prospectus were prepared on our behalf.

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements appearing elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our Shares discussed under “Risk Factors,” before deciding whether to invest in our Shares.

Our Business

Tian’an Technology Group Ltd. (“Tian’an”) is a holding company that was incorporated under the laws of the British Virgin Islands on April 8, 2021. Yunke Jingrong Information Technology Co., Ltd. (“Yunke”) is our wholly owned subsidiary. Shanghai Qige Power Technology Co., Ltd. (“Shanghai Qige”) is a wholly owned subsidiary of Yunke and our operating company in China. Through our subsidiary, Shanghai Qige, we are engaged in the technology driven sales of power control and service systems solutions. These products are used in low-speed electric vehicles, such as electric forklifts, golf carts, street sweepers and other types of specialized field vehicles.

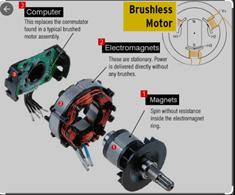

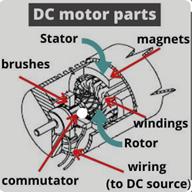

Shanghai Qige’s main product is a series of brushless DC motor controllers. Brushless DC motors, for which its controllers are commonly paired with, are common in industrial applications across the world. At the most basic level, there are brushed and brushless motors and there are direct current motors (“DC”) and alternating current motors (“AC”), or eclectic motors. Brushless DC motors do not contain brushes and use a DC current.

| 2 |

In a brushed DC motor, the rotor spins 180-degrees when an electric current is run to the armature, a device through which electric current is passed for generating torque. To go any further, the poles of the electromagnet must flip. The brushes, as the rotor spins, make contact with the stator (the coil of wire housed inside the engine case), flipping the magnetic field and allowing the rotor to spin a full 360-degrees. A brushless DC motor is essentially flipped inside out, eliminating the need for brushes to flip the electromagnetic field. In brushless DC motors, the permanent magnets are on the rotor, and the electromagnets are on the stator. A computer then charges the electromagnets in the stator to rotate the rotor a full 360-degrees.

Brushless DC motors typically have an efficiency of 80-85%, while brushed motors are usually only 75-80% efficient. Brushes eventually wear out, sometimes causing dangerous sparking, limiting the lifespan of a brushed motor. Brushless DC motors are quiet, lighter and have much longer lifespans. Because computers control the electrical current, brushless DC motors can achieve much more precise motion control.

Because of all these advantages, brushless DC motors are often used in modern devices where low noise and low heat are required, especially in devices that run continuously.

Our Brushless DC Motor Controller

The majority of Shanghai Qige’s sales during the six months ended June 30, 2022 and 2021, and the years ended December 31, 2021 and 2020 were derived from its Brushless DC Motor Controller. While brushless DC motors are mechanically relatively simple, they do require sophisticated control electronics and regulated power supplies. Brushless motor controllers differ according to the method they use to detect the rotor’s position. Depending on the rotor’s placement, brushless DC motors can be of two types (1) inrunner motor (the rotor is internal, and the stator is on the outside of the motor); or (2) outrunner motor (the rotor is external, so the permanent magnets spin around the stator together with the motor’s case).

Inrunner motors have a more lightweight construction and a better rotational speed because of their smaller rotating diameter. On the other hand, outrunner motors have a higher torque because of the longer arm and greater electromotive force applied to the rotor.

DC motor speed control is perhaps the most common manipulation used in controllers. This speed can be controlled in four different ways: flux variation, armature voltage variation, a change in the supply voltage, and pulse width modulation (“PWM”). PWM is the technique commonly used for achieving speed control in a DC motor. It delivers energy through a series of pulses rather than a continuous signal. By altering the pulse width, the DC motor controller is able to regulate the energy flow to keep it consistent.

While less popular, DC motor torque control is achieved by a DC motor drive regulating the armature current. Since the armature current isn’t regulated, the motor can operate at whatever speed necessary to achieve the desired torque level. The torque level can remain constant achieving a “taper tension effect” for a fixed input reference and torque mode center winders. However, the machine operator can in some circumstances increase the torque set-point as diameter increases.

| 3 |

Shanghai Qige offers an electronically commutated (“EC”) series of brushless DC motor controllers. An EC motor is designed to run on an alternating current (“AC”) power supply, but it in fact bears a closer resemblance to a direct current (“DC”) motor. It is essentially a permanent magnet, brushless DC motor that incorporates on-board electronics. The added electronics allow an EC motor to combine the best features from both AC and DC motors, and then improve on them. Shanghai Qige’s Brushless DC Controller has a fast response, high precision and wide speed regulation system, meeting the trend of high-performance general-purpose driver. By optimizing a pulse with modulation (“PWM”) control technology, and an electromagnetic compatibility design, our motor controller has lower noise and lower electromagnetic interference performance. This allows Shanghai Qige to meet the personalized needs of a variety of customers.

Shanghai Qige’s customers purchase its products mainly via sales agreements, similar to a purchase order (each a “Sales Agreement”). Each Sales Agreement outlines the purchasing terms and conditions to which both Shanghai Qige and the customer must adhere. Shanghai Qige’s customers generally purchase from it in bulk, though Shanghai Qige allows for small or singular purchases. Shanghai Qige’s delivery and payment terms vary depending on the amount of products being purchased. However, in all cases, Shanghai Qige requires payment in full prior to the delivery of its products. Shanghai Qige’s products also have a standard warranty of twelve (12) months, which is customary for the brushless motor industry.

Shanghai Qige manufactures or maintains a limited amount of its products. Shanghai Qige engages third parties to design and produce its products and then delivers directly to its customers. Under certain exceptional situations, Shanghai Qige will provide assistance to its outsourced suppliers for the logistics and transportation management.

As of the date of this prospectus, Shanghai Qige does not have outstanding Sale Agreements due to impact of COVID-19. However, we believe that as the economy continues to recover from the pandemic, Shanghai Qige’s operations will improve.

Shanghai Qige’s Products

DC Brushless Motor Controller

The controller receives the start, stop and braking signals of the motor to control the start, stop and braking of the motor itself. It also receives the position sensor signal and the forward and reverse signals to control the on-off of each power tube of the inverter bridge and generates continuous torque. The controller will receive speed commands and speed feedback signals to control and adjust speed.

Encoder

The encoder is a rotary sensor that converts rotary displacement into a series of digital pulse signals. These pulses can be used to control angular displacement. After the encoder generates electrical signals, it is processed by a computer numerical control (“CNC”) or programmable logic controller (“PLC”) control system.

Cover Assembly

The cover assembly refers to using a transition piece to indirectly connect the cover body to the shell so that the cover body is set at the top opening of the shell without affecting the appearance of the shell. A mounting cavity is formed between the cover body and the transition piece, and a plurality of elements can be installed in the mounting cavity to realize the function of installing elements on the cover body.

Handheld Programmer

The handheld programmer is a tool for programmable integrated circuits to write data. Handheld programming startups are mainly used for chip programming such as single chip microcomputer (including embedded, memory and basic input/output systems). It mainly modifies the program in the read-only memory. The handheld is usually connected with the computer and other equipment and used in conjunction with the programming software.

Shanghai Qige’s products are used in low-speed electric vehicles, such as electric forklifts, golf carts, street sweepers and other types of specialized field vehicles.

| 4 |

Shanghai Qige’s Suppliers

Shanghai Qige uses third-party suppliers to manufacture its products. In late February 2022, Russia launched a large-scale military attack on Ukraine. The invasion significantly amplified already existing geopolitical tensions among Russia, Ukraine, Europe, NATO and the West, including the U.S. In response to the military action by Russia, various countries, including the U.S., the United Kingdom, and the European Union issued broad-ranging economic sanctions against Russia. The Company believes these sanctions will affect companies in other countries (particularly those that have done business with Russia and Ukraine) and in various sectors, industries and markets, such as oil and natural gas.

Shanghai Qige has established, and continues to maintain, long-term cooperative relationships with its third-party suppliers such that the shipping costs of Shanghai Qige have not risen during the COVID-19 pandemic. The third-party suppliers that Shanghai Qige engages are all located in China as is Shanghai Qige’s customer base.

It is possible that the conflict in Ukraine could result in additional repercussions such as the risk of price rise of raw materials, the risk of labor cost increase, and the depression of our industry. However, none of Shanghai Qige’s products rely on materials from Russia, Belarus or the Ukraine.

Shanghai Qige’s Market Opportunity

The Global Brushless DC (BLDC) Motor Drivers Market reported that Brushless DC motor drivers market size was valued at $6.25 billion in 2019 and is projected to reach $11.89 billion by 2027, growing at a compound annual growth rate of 8.3% from 2020 to 2027. With Shanghai Qige’s product lines, Shanghai Qige is well positioned to meet this market demand. Shanghai Qige’s products, specifically its brushless DC motor controllers, are designed to be technologically efficient, have lower energy consumption, higher output, and less weight. The ability of brushless motors to save energy and increase the operational efficiency of equipment in which they are used is expected to drive the growth of the market over the forecast period. These motors offer optimum efficiency and reliability at the same time, which proves to be economical in the majority of their applications. These motors are thermally resistant, require low maintenance, and operate at low temperatures, eliminating any threat of sparks. Shanghai Qige’s brushless DC motor controllers in conjunction with motors are high level performance motors and have shown to be reliable. Shanghai Qige offers customized integrated circuit technology that allows for very promising market prospects. Revenue from sales of our products for the six months ended June 30, 2022 and 2021 were 0 and $22,008, respectively, and the years ended December 31, 2021 and 2020 were $37,065 and $26,309, respectively.

Shanghai Qige’s products and operations have been materially impacted by the recent pandemic-related lockdowns in China such that its revenues for the six months ended June 30, 2022 were $0. In order to mitigate the adverse impacts on Shanghai Qige’s business, we intend to actively embrace marketplace changes. We will review our internal structure and policies, areas of business and business model and aim to adjust how Shanghai Qige engages in its current industry and possibly look to enter into differentiated or new business fields. We believe the decrease in Shanghai Qige’s revenue will be temporary.

Strengths

Shanghai Qige is dedicated to the production of high quality products that are tailored to customers’ requirements and commercial needs. Our competitive strengths include:

| ● | Shanghai Qige offers complete product solutions in the form of a multi-segment product system, covering the main markets of the motion control industry. At the same time, Shanghai Qige has core technologies suitable for different application fields that have been tested through independent research and development. | |

| ● | Shanghai Qige focuses on the different and various needs of customers, and has realized, through the organic combination of core technology for different products, how to provide its customers with comprehensive and integrated drive solutions and one-stop services, thereby reducing customers’ procurement costs and enhancing Shanghai Qige’s competitiveness. |

Shanghai Qige has been deeply involved in the low-speed, electric vehicle controller industry for many years and has a solid understanding of the needs of downstream customers. Shanghai Qige has tailored its technology research and development and product design around its customers’ needs.

Shanghai Qige’s marketing strategy is based on this research and the needs of its key customers. Shanghai Qige continues to review its customers’ purchasing trends and power and overall demands. Shanghai Qige maintains communication with its customers and makes offers based on what it believes their current and future need sets are. Shanghai Qige offers preferential pricing when it believes it will be most effective and to maintain long term relationships with its customers.

Shanghai Qige’s products are designed to provide customized settings and functional optimization. Shanghai Qige believes the industrial application of its advanced technological achievements improves the quality of its products, and also contributes to the control of product costs, both of which benefit its customers.

After years of research, Shanghai Qige has developed a marketing strategy targeting the brushless DC motor driver industry where customers looking to lower their carbon footprint while saving energy and increasing the operational efficiency of equipment in which they use. Shanghai Qige’s target customer will likely purchase the controller for motors in items such as: electric forklifts, golf carts, sightseeing vehicles, urban sweepers, simple customers, off-road vehicles, trucks and other special tool vehicles. We believe Shanghai Qige’s motion control products are also well received by its customers.

Continuous Technology Development

Since its inception, Shanghai Qige has focused on providing downstream equipment manufacturers with cost-effective motion control products that suit their individual needs. Subdivision fields, such as motors, have come a long way with their technological advantages.

At the same time, Shanghai Qige is actively researching and developing high-speed and high-precision drive control technology and other research technologies. Shanghai Qige also researches intelligence and integration of the driver system, and constantly aims to enrich its own technical reserves and enhances the level of competition. Shanghai Qige’s research and development management system is focused toward current market needs such that it can meet those needs with technological innovation as a core solution.

Strict Quality Control

Shanghai Qige has established a top-down integrated quality management system to carry out enhanced quality control, quality planning and quality improvement implementations for its product design process which ensure the effectiveness of the entire process. Shanghai Qige aims to be a responsible product supplier; and, in order to ensure the stability and reliability of product quality, in addition to strengthening routine manufacturing process testing, Shanghai Qige also implements a strict testing system to test its products.

| 5 |

Service Network Advantages

Shanghai Qige’s target customers are those who are seeking brushless motors required thermally resistance, low maintenance, low operating temperature, and high efficiency for their equipment. With consideration of the geographical and customer demographic characteristics of its target industry, Shanghai Qige has established a “regional distribution” sales system to satisfy its customers at customized services and rapid responses to their issues.

The application of controller and motor products in market segments not only requires customization of product shape, structure, and interface, but also requires suppliers to provide timely personalized services. Foreign-funded brands generally provide standardized general-purpose products in the domestic market, while their research and development teams may be located overseas. The responsiveness to the individualized needs of domestic customers can be slow, and it can be difficult to meet the emerging needs of customers. In addition, the products provided by foreign brands can have higher prices with multiple functionalities, while domestic downstream customers need products that are suitable for their own specific requirements and have lower comprehensive costs. We believe Shanghai Qige’s products offer more specific individual need-sets at cost-effective rates for domestic downstream industry customers. Shanghai Qige also offers more flexible, personalized, and cost effective service solutions which allow us to build a rapport with its customers.

Growth Strategy

Shanghai Qige will continue to adhere to its business principles of providing high quality and safe products to its consumers and promote social responsibility. We believe that Shanghai Qige’s pursuit of these goals will lead to sustainable growth driven by its capacity expansion based on market demand, solidify its position in the industry, and create long-term value for shareholders, employees and other stakeholders.

| ● | Technological innovation. Shanghai Qige intends to closely track and study the development trend of domestic and international industrial automation control technology, focusing on the breakthrough of synchronous control, high speed range of magnetic weakening control, motion position control, high-speed bus communication technology, high precision torque technology and other technology research so it can maintain its technological standards to meet consumer needs. | |

| ● | Establish a new research and development center in Shanghai. Shanghai Qige intends to uphold its commitment to product quality and to ensure consistently high standards throughout its operations. Shanghai Qige aims to construct a laboratory to further its research and development in Shanghai, China so it can increase its investment in research and development and equipment, accelerate the speed of technology development and talent training, and further improve its current innovation technology research and industrial application capacity. | |

| ● | Market development. Shanghai Qige hopes to expand its sales and distribution network to penetrate new geographic markets, further gaining market share in existing markets and accessing a broader range of customers. Shanghai Qige will continue to expand its sales network, leveraging its local resources to quickly enter new markets, while also minimizing requirements for capital outlay. Shanghai Qige plans to focus on brand customers and concentrate on high-end industry upgrades to its existing marketing system. | |

| ● | Industrial merger and acquisition plan. Shanghai Qige’s goal is to strengthen its market position and accelerate its expansion by expanding its scale and gaining additional market share. Shanghai Qige plans to increase investment in its business and expand its production capacity through horizontal or vertical acquisitions, strategic partnership and joint venture. Shanghai Qige plans to invest additional capital in technology research and development. With more exposure and promotion, Shanghai Qige’s product and brand will be better recognized. Currently Shanghai Qige has no agreements or letters of intent for any acquisitions, partnerships or ventures. | |

| ● | Human resource development. We believe Shanghai Qige’s success greatly depends on its ability to attract, incentivize and retain talented professionals. With a view to maintaining and improving its competitive advantage in the market, Shanghai Qige plans to implement a series of initiatives to attract additional and retain mid- to high-level personnel, including formulating a market-oriented employee compensation structure and implementing a standardized multi-level performance review mechanism. |

| 6 |

Research and Development

Shanghai Qige currently allocates most of its research and development towards advancing the technology and capability of its brushless DC motor controller. According to the CnR.cn, the market size of the electric vehicle controller industry in 2021 was about RMB $32.2 billion, with a year-on-year growth of approximately 6.3%. Shanghai Qige’s current controller is suitable for low-speed electric vehicles (generally the maximum speed is 50km/h). We believe that if Shanghai Qige focuses its efforts on an advanced controller, it will be able to expand its market size and increase its revenue. Shanghai Qige’s current target market is China.

Shanghai Qige believes its advanced controllers will be able to increase the torque and power of brushless DC motors, as well as other brushless motors that have compatibility with its controllers. Shanghai Qige’s advanced brushless DC motor controller are designed to control and maintain the position, speed, or torque of a DC-powered motor and easily reverses, so the DC motor drive current runs in the opposite direction. This will allow the user to enjoy higher starting torque, quick starting and stopping, reversing, variable speeds with voltage input and more. Shanghai Qige intends to have an updated and improved controller within 2-3 years from the date of this prospectus.

Sales and Marketing

Shanghai Qige’s experienced sales and marketing team is equipped with professional technical support personnel familiar with different application fields. We believe Shanghai Qige has sufficient business personnel in the regions it does business and employs a multi-dimensional marketing network system that supports customer service.

At present, Shanghai Qige has two methods by which it markets:

| 1. | Many of Shanghai Qige’s sales are from current customer introductions, references and word-of-mouth promotion. Its marketing model is designed to drive organic growth, leverage positive word-of-mouth, and remove friction from the evaluation and purchasing process. | |

| 2. | Shanghai Qige also employs a sales and marketing team. Its team will actively contact their potential customers, not limited to phone calls. |

Shanghai Qige also has technical support personnel that are experienced and knowledgeable in its industry. They respond quickly and provide customers with comprehensive and in-depth professional services through technical hotlines, door-to-door services, new product seminars and technical training programs.

Challenges

Shanghai Qige’s projects are based on research of current market trends and its judgment of market demand and forecasting. In general, it takes a minimum of 6 months or longer to launch a new product. Although Shanghai Qige conducts detailed market research and technical pre-research before product development and implementation, the ultimate success of its ability to launch a successful product is also affected by the product development cycle, launch timing, customer preferences, competitors’ product strategies, and need of the applicable market. Shanghai Qige’s industry is influenced by many factors, most of which can be difficult to predict. If Shanghai Qige’s research and development is inaccurate, or fails altogether, its projects may not achieve the expected economic benefits, which may lead to a decline in Shanghai Qige’s profitability.

At present, the conflict in Ukraine has not affected Shanghai Qige’s supply chain, material costs or internal staffing. However, in the face of the sudden outbreak of war, the Company has looked to reexamine Shanghai Qige’s business and development plans, such as possibly adjusting its strategy to look for high-quality customers, targeting procurement based on sales, and actively expanding new businesses in order to reduce the threat posed by such risks.

Risk Factor Summary

Shanghai Qige is subject to numerous risks and uncertainties that you should be aware of before making a decision to invest in the Company’s Ordinary Shares. These risks are more fully described in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, among others, the following:

| ● | The industry in which Shanghai Qige operates is a technology-intensive industry, and Shanghai Qige’s core competitiveness depends on its technological research and development capabilities and continuous innovation capabilities; | |

| ● | Because the majority of our operations are in China, our business is subject to the complex and rapidly evolving laws and regulations there, which could have a material adverse on our business. See the risk factors beginning on page 17 in the section entitled “Risks Related to Doing Business in China”; The PRC government exerts substantial influence over the manner in which we must conduct our business activities in China. Please see the risk factors beginning on page 17 in the section entitled “Risks Related to Doing Business in China”; | |

| ● | The Chinese government plays a significant role in regulating industry development by imposing industrial policies and also exercises significant control over China’s economic growth through allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, and providing preferential treatment to particular industries or companies which could have a material adverse on our business and/or the value of the securities we are registering. See the risk factors beginning on page 17 in the section entitled “Risks Related to Doing Business in China”; | |

| ● | Any actions taken by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue securities to investors and cause the value of such securities to significantly decline or be worthless. See the risk factors beginning on page 17 in the section entitled “Risks Related to Doing Business in China”; | |

| ● | Loss of core technical personnel; | |

| ● | The current COVID-19 pandemic, as well as other epidemics, natural disasters, terrorist activities, political unrest, and other outbreaks could disrupt our delivery and operations, which could materially and adversely affect our business, financial condition, and results of operations; |

| 7 |

| ● | Shanghai Qige faces intense competition in its industry in general. If it fail to compete effectively, it may lose market share and customers, and our business, financial condition and results of operations may be materially and adversely affected; | |

| ● | Failure to maintain the quality and safety of its products could have a material and adverse effect on its reputation, financial condition and results of operations; | |

| ● | If the Company does not obtain substantial additional financing for Shanghai Qige, Shanghai Qige’s ability to execute on its business plan as outlined in this prospectus will be impaired. |

Corporate History and Structure

The following diagram illustrates our corporate structure, including our holding company, as of the date of this prospectus:

Corporate Information

Our address is 3500 1B1 104 Room 104, 1F, Building B, Building 1, No. 3500 Xiupu Road, Pudong New Area, Shanghai China. The Company does not have a website. Our agent for service of process in the United States is The Crone Law Group P.C.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. As long as we remain an emerging growth company, we may rely on exemptions from some of the reporting requirements applicable to public companies that are not emerging growth companies. These exemptions include: (1) being permitted to provide only two years of selected financial data (rather than five years) and only two years of audited financial statements (rather than three years), in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; (2) not being required to comply with the auditor attestation requirements of the Sarbanes-Oxley Act of 2002 in the assessment of our internal control over financial reporting; and (3) not being required to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards. We have taken, and may continue to take, advantage of some of these exemptions until we are no longer an emerging growth company. The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards. However, we have elected to “opt out” of this provision and, as a result, we will comply with new or revised accounting standards as required when they are adopted for public companies. This decision to opt out of the extended transition period under the JOBS Act is irrevocable.

| 8 |

We will remain an emerging growth company until the earliest of: (1) the last day of our fiscal year during which we have total annual gross revenues of at least $1.07 billion; (2) the last day of our fiscal year following the fifth anniversary of the completion of our initial public offering; (3) the date on which we have, during the previous three-year period, issued more than $1.00 billion in non-convertible debt; or (4) the date on which we become a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if we have been a public company for at least 12 months and the market value of our Ordinary Shares held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter. We will not be entitled to the above exemptions if we cease to be an emerging growth company.

Implications of Our Foreign Private Issuer Status

Because we are a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including: (i) the rules under the Exchange Act requiring the filing of quarterly reports on Form 10-Q or current reports on Form 8-K with the SEC; (ii) the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; (iii) the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and (iv) the selective disclosure rules by issuers of material nonpublic information under Regulation FD.

We will be required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, if we are successful at having our shares quoted on the OTCQB, we will publish our results on a quarterly basis through press releases, distributed pursuant to the rules and regulations of the OTCQB. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information, which would be made available to you, were you investing in a U.S. domestic issuer.

The Offering

| Ordinary Shares Offered By Selling Stockholders: | 5,000,000 Ordinary Shares

| |

Ordinary Shares Issued and Outstanding After Completion of this Offering: |

45,000,000

| |

| Ordinary Shares Issued and Outstanding Before Completion of this Offering | 45,000,000 | |

| Use of Proceeds: | The Selling Stockholders will receive all of the net proceeds from the sale of Ordinary Shares. | |

Market for our Ordinary Shares:

|

There is no market for our securities. Our Ordinary Shares are not traded on any exchange or quoted on the OTC Markets. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application for our shares to be eligible for quotation on the OTC Markets. We do not yet have a market maker who has agreed to file such application.

There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our Ordinary Shares may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale. |

| Risk Factors: | See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Ordinary Shares. | |

| Listing: | We intend to apply to quote our Ordinary Shares on the OTCQB. There is no assurance that we will be successful at having our shares quoted. |

| 9 |

Summary Consolidated Financial Data

The following summary consolidated financial data for the years ended December 31, 2021 and 2020 has been derived from our audited consolidated financial statements included elsewhere in this prospectus. Our consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United States of America, or US GAAP. Our historical results are not necessarily indicative of results expected for future periods. You should read this Summary Consolidated Financial Data section together with our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Balance Sheet Data | Six Months Ended June 30, 2022 (unaudited) | Six Months Ended June 30, 2021 (unaudited) | ||||||

| Cash | $ | 13,863 | $ | 28,834 | ||||

| Total Assets | $ | 74,235 | $ | 109,568 | ||||

| Liabilities | $ | 250,646 | $ | 625,256 | ||||

| Total Stockholder’s Equity | $ | (176,411 | ) | $ | (515,688 | ) | ||

| Statement of Operations | Six Months Ended June 30, 2022 (unaudited) | Six Months Ended June 30, 2021 (unaudited) | ||||||

| Revenues | $ | - | $ | 22,008 | ||||

| Net Loss for Reporting Periods | $ | (146,468 | ) | $ | (72,004 | ) | ||

| Balance Sheet Data | Fiscal Year Ended December 31, 2021 (audited) | Fiscal Year Ended December 31, 2020 (audited) | ||||||

| Cash | $ | 456 | $ | 7,998 | ||||

| Total Assets | $ | 78,467 | $ | 62,242 | ||||

| Liabilities | $ | 649,995 | $ | 500,715 | ||||

| Total Stockholder’s Equity | $ | (571,528 | ) | $ | (438,473 | ) | ||

| Statement of Operations | Fiscal Year Ended December 31, 2021 (audited) | Fiscal Year Ended December 31, 2020 (audited) | ||||||

| Revenues | $ | 37,065 | $ | 26,309 | ||||

| Net Loss for Reporting Periods | $ | (119,255 | ) | $ | (108,158 | ) | ||

An investment in our Shares involves significant risks. You should consider carefully all of the information in this prospectus, including the risks and uncertainties described below, before making an investment in our Shares. Any of the following risks could have a material and adverse effect on our business, financial condition and results of operations. In any such case, the market price of our Shares could decline, and you may lose all or part of your investment.

| 10 |

Risks Related To Our Financial Condition and Business Model

The Company’s independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

As of June 30, 2022 the Company has incurred an accumulated deficit of $680,290 and a negative working capital of $184,075. At December 31, 2021, the Company’s accumulated deficit was $533,822 and the negative working capital is $580,013. The Company will require additional funding to meet its ongoing obligations and to fund anticipated operating losses. The ability of the Company to continue as a going concern is dependent on raising capital to fund its business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern from a period of one year from the issuance of these financial statements. The Company intends to continue to fund its business by way of private placements and financing supports from related parties as may be required. As a result, the Company’s independent registered public accounting firm included an explanatory paragraph in its report on our financial statements for the years ended December 31, 2021 and 2020 with respect to this uncertainty. If the Company is unable to raise capital when needed or on acceptable terms, Shanghai Qige could be forced to delay, reduce, or eliminate its technology development programs, commercialization efforts, general hiring, or to cease operations.

Because the Company is an “emerging growth company,” the Company may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.”

The Company is an “emerging growth company” as defined under the Jumpstart our Business Startups Act (“JOBS Act”). We will remain an “emerging growth company” for up to five years, or until the earliest of:

| (i) | the last day of the first fiscal year in which our total annual gross revenues exceed $1.07 billion, | |

| (ii) | the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our Ordinary Shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or | |

| (iii) | the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. |

As an “emerging growth company”, the Company may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to:

| ● | not being required to comply with the auditor attestation requirements of section 404(b) of the Sarbanes-Oxley Act (“Sarbanes Oxley”) (we also will not be subject to the auditor attestation requirements of section 404(b) as long as we are a “smaller reporting company”, which includes issuers that had a public float of less than $75 million as of the last business day of their most recently completed second fiscal quarter); | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and | |

| ● | exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

In addition, section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in section 7(a)(2)(B) of the Securities Act of 1933 (the “Securities Act”) for complying with new or revised accounting standards. Under this provision, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, the Company choosing to “opt out” of such extended transition period and, as a result, the Company will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that the Company’s decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

| 11 |

Defects, errors or any other problems associated with Shanghai Qige’s products and services could diminish demand for its products or services, harm its business and results of operations and subject us to liability.

Shanghai Qige’s customers use its products and services for important aspects of their businesses, and any errors, defects or disruptions to its products and services and any other performance problems with its products and services could damage its customers’ businesses and, in turn, hurt its brand and reputation. Real or perceived errors, failures, bugs or security vulnerabilities in Shanghai Qige’s products could result in negative publicity, loss of or delay in market acceptance, loss of competitive position, lower customer retention or claims by customers for losses sustained by them. In such an event, Shanghai Qige may be required, or may choose, for customer relations or other reasons, to expend additional resources in order to help correct the problem. As a result, its reputation and brand could be harmed, and the business, operating results and financial condition may be adversely affected. Shanghai Qige uses third-party suppliers to manufacture its products. Such finished products may contain defects, errors or other product issues, which may negatively impact the performance of Shanghai Qige’s products and services, and smart devices, damage its reputation, harm its ability to attract new and existing customers, and incur significant support, repair or replacement costs even if Shanghai Qige can be reimbursed from the third-party suppliers.

Shanghai Qige generates a significant portion of its revenues from a limited number of major customers and any loss of business from these customers could have a negative impact on revenues and harm our business.

Shanghai Qige derives a significant portion of its revenues from a limited number of major customers. Its five largest customers in the six months ended June 30, 2022 and 2021 accounted for 0% and approximately 95% of its revenues, respectively. Its five largest customers in the years ended December 31, 2021 and 2020 accounted for approximately 98.5% and 100% of its revenues, respectively. Shanghai Qige’s ability to maintain close relationships with major customers is essential to the success of its business. The purchase orders placed by specific customers may vary from period to period, and typically does not have long-term purchase commitments from its customers. As a result, most of its customers could reduce or cease their use of Shanghai Qige’s products and services at any time without any penalty or termination charges. A major customer in one year may not provide the same level of revenues in any subsequent year. In addition, reliance on any individual customer for a significant portion of revenues may give that customer a degree of pricing leverage when negotiating contracts and terms of service with Shanghai Qige.

Many factors not within Shanghai Qige’s control could cause the loss of, or reduction in, business or revenues from any customer, and these factors are not predictable. These factors include, among others, pricing pressure from competitors, a change in a customer’s business strategy, or failure of a module supplier to develop competitive products. Customers may choose to pursue alternative technologies and develop alternative products in addition to, or in lieu of, Shanghai Qige’s products, either on their own or in collaboration with others, including competitors. The loss of any major customer, or a significant decrease in the volume of customer demand or the price at which Shanghai Qige sells its products to customers, could materially adversely affect the Company’s financial condition and results of operations.

If the Company is unable to retain key personnel and hire new key personnel, it may not be able to implement our business plan.

The Company’s ability to succeed depends upon the experience and contributions of our key personnel, and in particular, our founder and CEO, Mr. Heng Fei Yang. The loss of the services of these individuals, if they are not adequately replaced, could have a substantial adverse effect on the Company’s financial condition, results of operations, and prospects. The Company’s future success will also depend on our ability to identify, attract, and retain additional qualified personnel as we expand our operations. There is no guarantee that we will be successful in identifying, attracting, and retaining such personnel. Consequently, the loss of any of those individuals may have a substantial effect on our future success or failure. The Company may have to recruit qualified personnel with competitive compensation packages, equity participation, and other benefits that may affect the working capital available for our operations. Management may have to seek to obtain outside independent professionals to assist them in assessing the merits and risks of any business proposals as well as assisting in the development and operation of company projects. No assurance can be given that the Company will be able to obtain such needed assistance on terms acceptable to us. Our failure to attract additional qualified employees or to retain the services of key personnel could have a material adverse effect on our operating results and financial condition.

| 12 |

Shanghai Qige’s ability to appropriately respond to changing consumer preferences and demand for new products or product enhancements could significantly harm its customer relationships and product sales and harm our financial condition and operating results.

Shanghai Qige’s industry is subject to changing consumer trends and preferences, especially with respect to technological advancement. Shanghai Qige’s continued success depends in part on its ability to anticipate and respond to these changes, and it may not respond in a timely or commercially appropriate manner to such changes. Its failure to accurately predict these trends could negatively impact consumer opinion of its products and cause the loss of sales. The success of Shanghai Qige’s new product offerings and enhancements depends upon a number of factors, including its ability to:

| ● | accurately anticipate customer needs; | |

| ● | innovate and develop new products or product enhancements that meet these needs; | |

| ● | successfully commercialize new products or product enhancements in a timely manner; | |

| ● | price our products competitively; | |