As filed with the Securities and Exchange Commission on December 9, 2025.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EquipmentShare.com Inc

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Texas | 7359 | 47-2405753 |

(State or Other Jurisdiction of

Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer

Identification Number) |

5710 Bull Run Drive Columbia, MO, 65201 (573) 299-5222 |

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

| | |

Jabbok Schlacks Co-Founder and Chief Executive Officer EquipmentShare.com Inc 5710 Bull Run Drive Columbia, MO, 65201 (573) 299-5222 |

| (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) |

| | |

| Copies to: | |

Michael Kaplan Pedro J. Bermeo Claudia Carvajal Lopez Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 | | Marc D. Jaffe Ian D. Schuman Alexa M. Berlin Latham & Watkins LLP 1271 Avenue of the Americas New York, New York 10020 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| | |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine. |

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2025

PRELIMINARY PROSPECTUS

Shares

EquipmentShare.com Inc

Class A Common Stock

$ per share

This is an initial public offering of shares of Class A common stock by EquipmentShare.com Inc. We are offering shares of Class A common stock and the selling shareholders identified in this prospectus are offering shares of Class A common stock. We anticipate that the initial public offering price will be between $ and $ per share. We will not receive any proceeds from the sale of shares of Class A common stock by the selling shareholders.

Prior to this offering, there has been no public market for our Class A common stock. We have applied to list our Class A common stock on the Nasdaq Global Select Market (the “Exchange” or “Nasdaq”) under the symbol “EQPT.”

Upon completion of this offering, we will have two classes of common stock, Class A common stock, which is entitled to one vote per share, and Class B common stock, which is entitled to 20 votes per share. Holders of our common stock will vote together as a single class on all matters, except as otherwise set forth in our amended and restated certificate of formation or as required by applicable law. Our Class B common stock is convertible into Class A common stock on a one-for-one basis at the option of the holder. In addition, our Class B common stock will automatically convert into Class A common stock on a one-for-one basis upon any transfer, except for permitted transfers described in our amended and restated certificate of formation, and in certain other circumstances described in our amended and restated certificate of formation. Our Class B common stock, which will be held by Jabbok and William Schlacks (our “Co-Founders”), who have agreed to vote together as a group, will represent approximately % of the total voting power of our outstanding common stock following this offering. Upon the completion of this offering, we will be a “controlled company” within the meaning of Nasdaq’s corporate governance standards and intend to avail ourselves of certain exemptions from Nasdaq’s corporate governance standards available to controlled companies.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 21. | | | | | | | | | | | |

| Per Share | | Total |

Initial public offering price | $ | | $ |

Underwriting discounts and commissions(1) | $ | | $ |

Proceeds to us before expenses | $ | | $ |

Proceeds to the selling shareholders before expenses | $ | | $ |

_________________

(1)See “Underwriting” for a description of all compensation payable to the underwriters. The selling shareholders have granted the underwriters the option for a period of 30 days from the date of this prospectus to purchase an additional shares of Class A common stock at the initial public offering price less underwriting discounts and commissions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock to purchasers on or about , 2025.

Lead Book-Running Managers

| | | | | | | | | | | | | | |

| Goldman Sachs & Co. LLC | | Wells Fargo Securities | | UBS Investment Bank |

| | | | | |

| Citigroup | Guggenheim Securities |

Joint Bookrunners

| | | | | | | | |

| Citizens Capital Markets | | Truist Securities |

| | | | | | | | |

| Baird | Oppenheimer & Co. | KeyBanc Capital Markets |

| | | | | | | | | | | | | | | | | |

| Fifth Third Securities | SMBC Nikko | M&T Securities | Regions Securities LLC | BTIG | Wedbush Securities |

, 2025

TABLE OF CONTENTS

In this prospectus, unless otherwise indicated or the context otherwise requires, “EquipmentShare,” the “Company,” “we,” “us” and similar terms refer to EquipmentShare.com Inc and its consolidated subsidiaries.

We, the selling shareholders, and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We, the selling shareholders, and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We and the selling shareholders are offering to sell, and seeking offers to buy, shares of Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of Class A common stock. Our business, financial condition, results of operations, and prospects may have changed since the date of this prospectus.

Until , 2025 (25 days after the date of this prospectus), all dealers that buy, sell or trade our Class A common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Market and Industry Data

This prospectus includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, filings of public companies in our industry and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein.

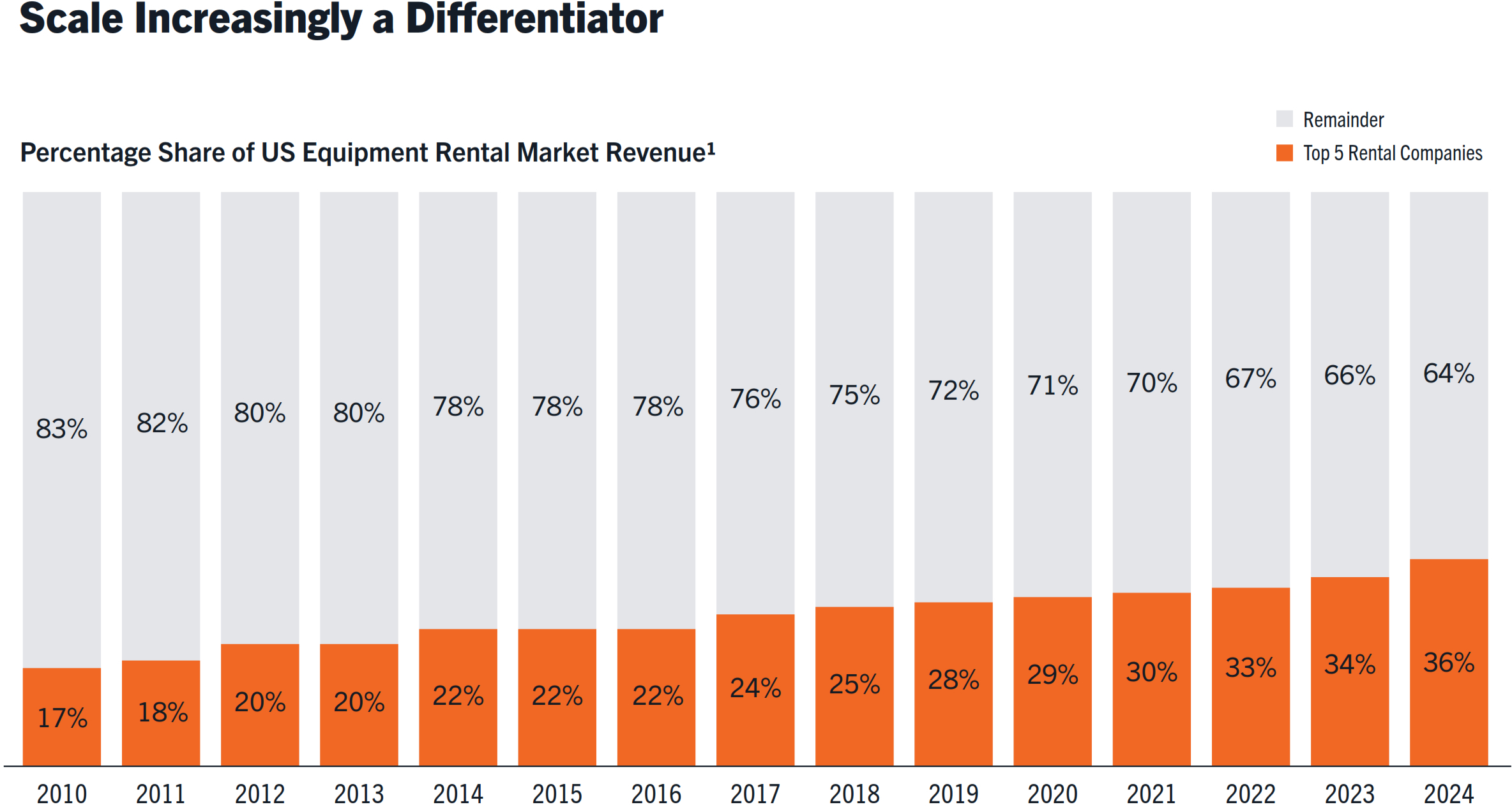

Unless otherwise specified, all comparative statements in this prospectus refer to our comparative position in the construction equipment rental industry in the U.S., which is the industry in which we compete. Our industry has three other large players (who we refer to as our top equipment rental peers): United Rentals, Inc., Sunbelt Rentals (Ashtead Group plc), and Herc Holdings Inc., which are the highest revenue earners in the equipment rental industry based on reports from ARA Rental Management, as well as public filings of peer companies in the construction equipment rental industry. Such peers and we collectively represent approximately 40% of the construction equipment rental market share in the U.S. based on revenue in 2024. The rest of the construction equipment rental industry in the U.S. is highly fragmented. Statements regarding our competitive position, such as our statement that we are one of the largest integrated equipment rental and equipment asset management companies in the United States, are based on market share as calculated by revenue. In determining our market position as calculated by revenue, we compared our 2024 revenue to the 2024 revenues of our top equipment rental peers. Statements regarding our competitive position with respect to growth, such as our statement that we are one of the fastest growing integrated equipment rental and equipment asset management companies in the United States, that our ability to capture market share is in excess of the market average, and that we achieve year-over-year growth at multiples of the industry average are based on our growth from 2022 to 2024 calculated by our revenues compared to the revenue growth of our top equipment rental peers for the same period.

In this prospectus we include statements regarding our technology capacities or data connectivity, such as our belief that our T3 platform is our advantage driving our market share gains, that our scale and vertically integrated tech platform has positioned us to excel on the largest, most demanding projects in the country, that our in-house technology team is the largest in the industry, that we have the largest access-controlled construction rental fleet in the world, and that we have the leading sensor-to-cloud fleet management tool in the commercial construction industry. These statements are based on management’s belief utilizing its industry knowledge, including that adoption of the T3 platform, a rental-integrated technology platform, is unprecedented in the equipment rental industry, as well as internal company research, information from our customers and suppliers, trade and business organizations and other contacts in the markets in which we operate.

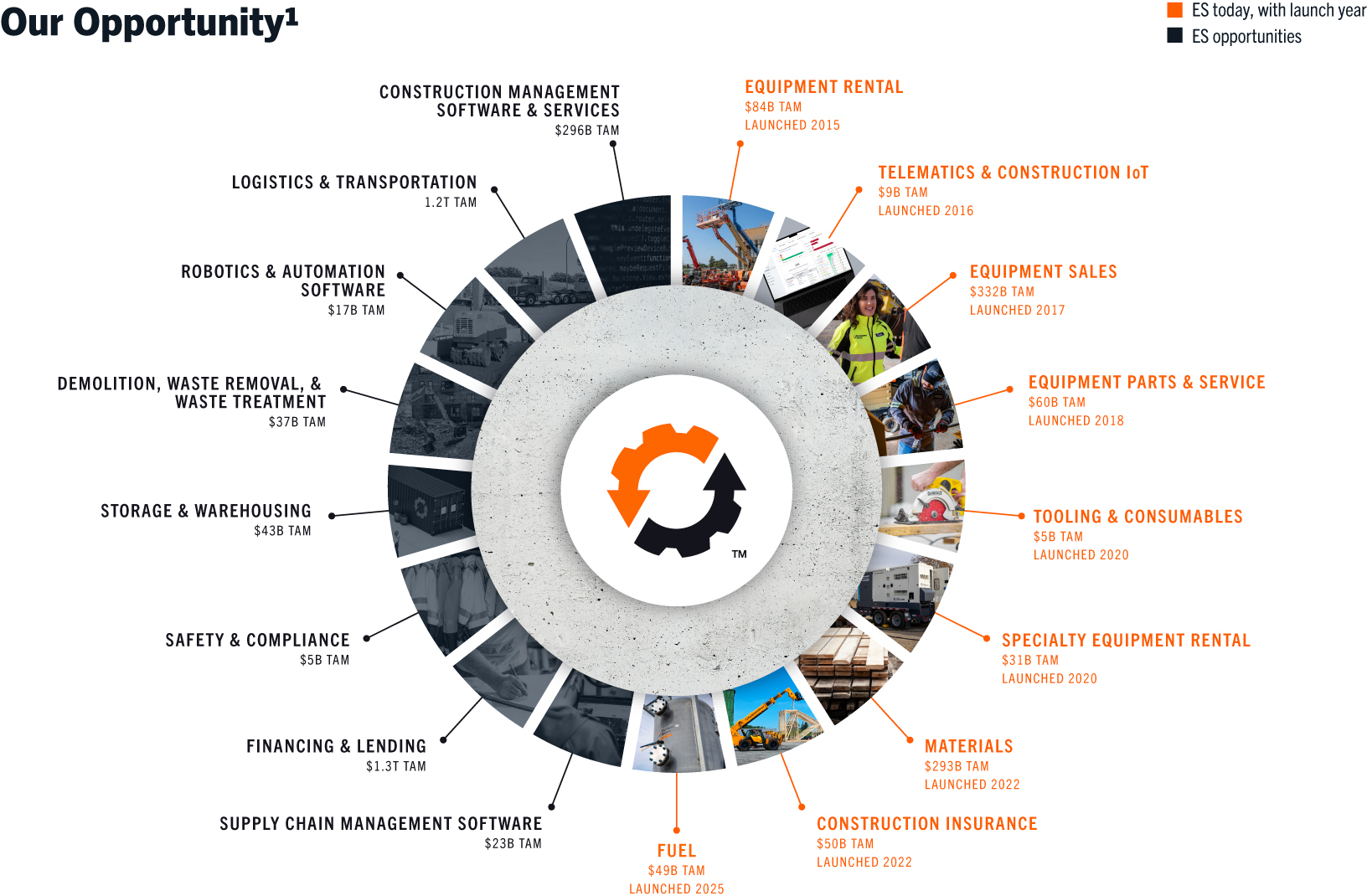

Statistics and estimates related to our total addressable market, as a whole and the various categories therein, are based on publicly available information. Our total addressable market in various categories is based on the following: equipment rental (which is inclusive of specialty equipment rental) is based on “ARA’s latest US and Canada economic forecast released at The ARA Show” made available by ARA Rental Management on January 30, 2025; telematics and construction IoT is based on “Fleet Telematics Systems in the US” published by IBISWorld in April 2025; equipment sales is based on “Industrial Machinery & Equipment Wholesaling in the US” published by IBISWorld in April 2025; equipment parts & service is based on “Machinery Maintenance & Heavy Equipment Repair Services” published by IBISWorld in May 2025; tooling and consumables is based on “Tool & Equipment Rental in the US” published by IBISWorld in April 2025; specialty equipment rental is based on “Industrial Equipment Rental & Leasing in the US” published by IBISWorld in April 2025; materials is based on “Home Improvement Stores in the US” published by IBISWorld in May 2025; construction insurance is based on “Commercial Construction Insurance in the US” published by IBISWorld in May 2024; fuel is based on “Fuel Dealers in the US” published by IBISWorld in April 2025; supply chain management software is based on “Business Analytics & Enterprise Software Publishing in the US” published by IBISWorld in May 2025; financing and lending is based on “Equipment Leasing & Finance Industry Horizon Report 2024” published by Equipment

Leasing & Finance Foundation; safety and compliance is based on “Personal Protective Equipment Manufacturing in the US” published by IBISWorld in April 2025; storage and warehousing is based on “General Warehousing & Storage in the US” published by IBISWorld in February 2025; demolition, waste removal, and waste treatment is based on “Waste Treatment & Disposal Services in the US” and “Demotion & Wrecking in the US” published by IBISWorld in March 2025 and April 2025, respectively; robotics and automation software is based on “Electronic Design Automation Software Developers in the US” published by IBISWorld in April 2025 and “Construction Robots Market Report (2025)” published by IMARC Group; logistics and transportation is based on “Transportation and Warehousing in the US” published by IBISWorld in May 2024; and construction management software and services is based on “Construction Project Management Services in the US” published by IBISWorld in September 2024.

Data regarding the industries in which we compete and our market position and market share within the industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position, and market share within the industries. Assumptions and estimates of our and our industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

Trademarks, Trade Names and Service Marks

This prospectus contains references to a number of trademarks and service marks which we have registered, such as “EquipmentShare” and “T3,” or for which we have pending applications or common law rights. Solely for convenience, the trademarks and service marks referenced in this prospectus may appear without the TM and ® symbols, but the absence of such symbols is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and service marks. This prospectus also contains trademarks, trade names, and service marks of third parties which, to our knowledge, are the property of their respective holders. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Non-GAAP Financial Measure and Other Key Performance Metrics

We refer in this prospectus to EBITDA, a non-GAAP financial measure that is not prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). It is a supplemental financial measure of our performance only, and should not be considered a substitute for net income, commissions and fees or any other measure derived in accordance with GAAP.

As used in this prospectus, EBITDA is calculated as net income before interest expense, income taxes, depreciation and amortization and non-cash stock compensation expense, which we believe, when excluded, provide investors with a more useful representation of our ongoing operations and performance.

EBITDA is a key metric used by management and our board of directors to assess our financial performance. Certain items excluded from EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are reflected in EBITDA. Our presentation of EBITDA should not be construed as an indication that results will be unaffected by the items excluded from EBITDA. For a reconciliation of EBITDA to the nearest GAAP measure, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Metrics—Non-GAAP Financial Measure.”

Our use of the term EBITDA may vary from the use of similar terms by other companies in our industry and accordingly may not be comparable to similarly titled measures used by other companies. The non-GAAP financial measure used in this prospectus has not been reviewed or audited by our or any independent registered public accounting firm.

We refer in this prospectus to the following other key performance metrics:

•Equipment Rental Segment Adjusted EBITDA; and

•Equipment Rental Segment Adjusted EBITDA Margin.

Equipment Rental Segment Adjusted EBITDA and Equipment Rental Segment Adjusted EBITDA Margin are key performance metrics used by management and our board of directors to assess financial performance of our Equipment Rental and Services Operations segment. Equipment Rental Segment Adjusted EBITDA is the measure of our Equipment Rental and Services Operations segment’s profitability required to be disclosed in accordance with the requirements of ASC 280, Segment Reporting (“ASC 280”). Equipment Rental Segment Adjusted EBITDA includes direct operating costs (excluding equipment and vehicle operating lease expense) and selling, general, and administrative expenses (excluding depreciation expense related to our property and other fixed assets). Equipment and vehicle operating lease expense was $19.2 million and $72.5 million for the nine months ended September 30, 2025 and 2024, respectively, and $84.8 million, $110.8 million, and $90.0 million for the years ended December 31, 2024, 2023, and 2022, respectively. Depreciation expense related to our property and other fixed assets was $29.0 million and $11.9 million for the nine months ended September 30, 2025 and 2024, respectively, and $27.4 million, $9.3 million, and $4.3 million for the years ended December 31, 2024, 2023, and 2022, respectively. Equipment Rental Segment Adjusted EBITDA also excludes operating expenses related to OWN Program payouts, depreciation expense on rental equipment, and amortization expense on capitalized software. These excluded expenses are significant: OWN Program payouts, depreciation expense on rental equipment, and amortization expense on capitalized software was $512.3 million, $217.7 million, and $14.9 million, respectively, for the nine months ended September 30, 2025, and $287.7 million, $225.6 million, and $7.1 million, respectively, for the nine months ended September 30, 2024. OWN Program payouts, depreciation expense on rental equipment, and amortization expense on capitalized software was $420.1 million, $293.0 million, and $11.8 million, respectively, for the year ended December 31, 2024, $209.2 million, $279.7 million, and $6.0 million, respectively, for the year ended December 31, 2023, and $95.8 million, $205.4 million, and $2.1 million, respectively, for the year ended December 31, 2022. Equipment Rental Segment Adjusted EBITDA is used by management as a meaningful metric to compare operating performance to industry peers who do not source their equipment fleet through lease arrangements (and who therefore record depreciation for their equipment rather than lease expense). Equipment Rental Segment Adjusted EBITDA Margin is Equipment Rental Segment Adjusted EBITDA divided by Equipment Rental and Services Operations segment total revenues. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Metrics—Other Key Financial Metrics—Equipment Rental Segment Adjusted EBITDA and Equipment Rental Segment Adjusted EBITDA Margin” and Note 23 to our audited consolidated financial statements for the year ended December 31, 2024 and Note 18 to our unaudited condensed consolidated financial statements for the nine months ended September 30, 2025 included elsewhere in this prospectus.

GLOSSARY

We provide this glossary to help those reading this prospectus understand the industry and other technical terms that are used in this prospectus. For many of these terms, there is no generally accepted definition; in this glossary, we present our definition of such terms as used in this prospectus.

•“ABS” refers to asset-backed securities.

•“AI” refers to artificial intelligence.

•“assets,” “equipment,” “fleet,” and “machines” are terms that are used interchangeably to refer to construction equipment managed by EquipmentShare and used by our customers.

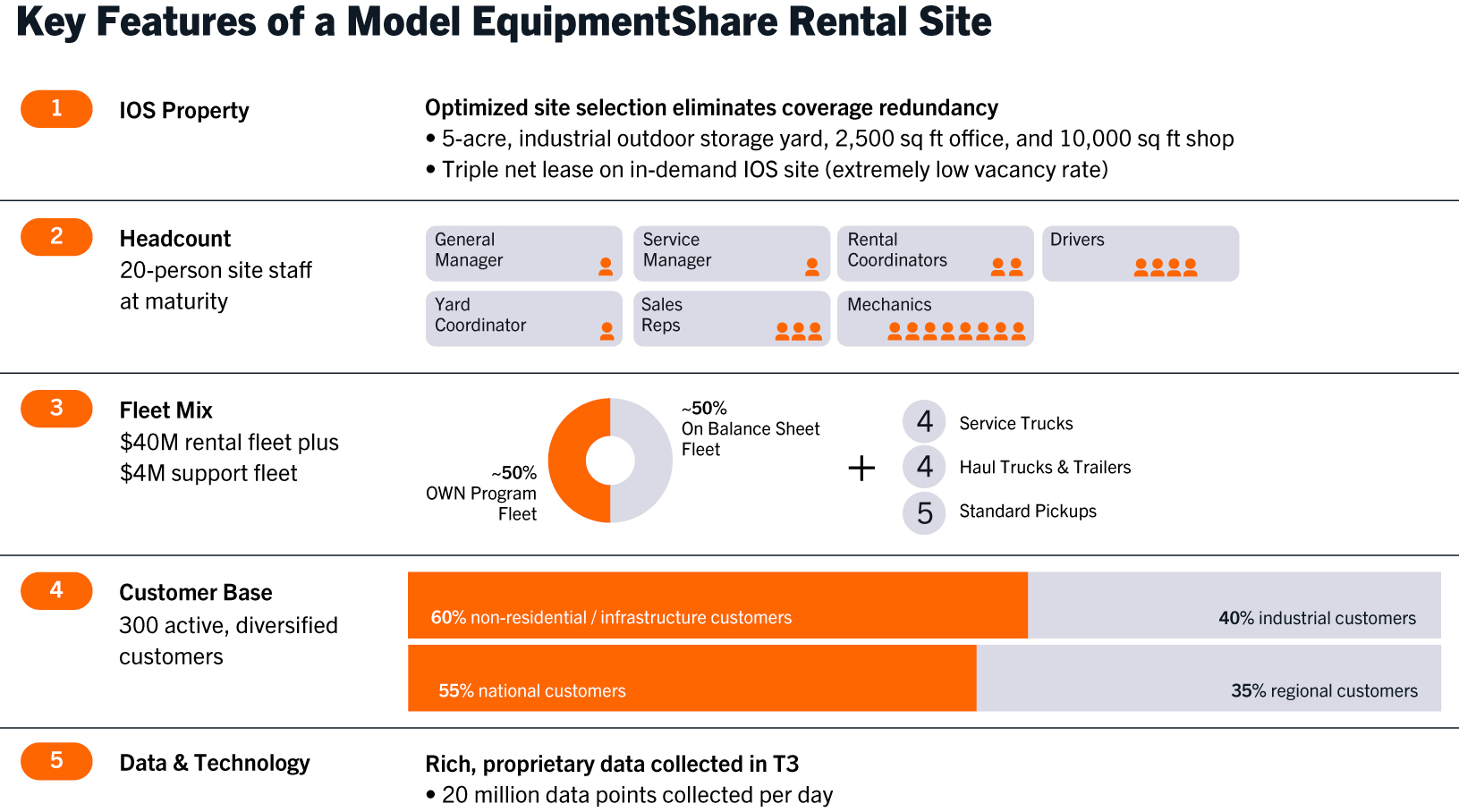

•“branch location,” “full-service branch location,” “rental location,” and “rental site” are terms that are used interchangeably to refer to EquipmentShare locations whose primary business function is equipment rentals.

•“ENR” refers to Engineering News-Record.

•“EquipmentShare Owned” or “owned rental equipment” OEC is defined as the total original cost of equipment that is under our management that we own or have the rights to rent or sell to customers under our manufacturer purchase agreements, and excludes certain costs incurred to prepare equipment for its intended use and costs incurred to transport the asset from one location to another prior to its first rental.

•“general rental equipment” refers to the core category of EquipmentShare’s rental fleet, encompassing standard construction equipment used across a broad range of job types and industries, including excavators, telehandlers, scissor lifts, boom lifts, skid steers, among others.

•“growth sites” refers to full-service branch locations opened 24 months or less before the start of each measurement period unless otherwise specified.

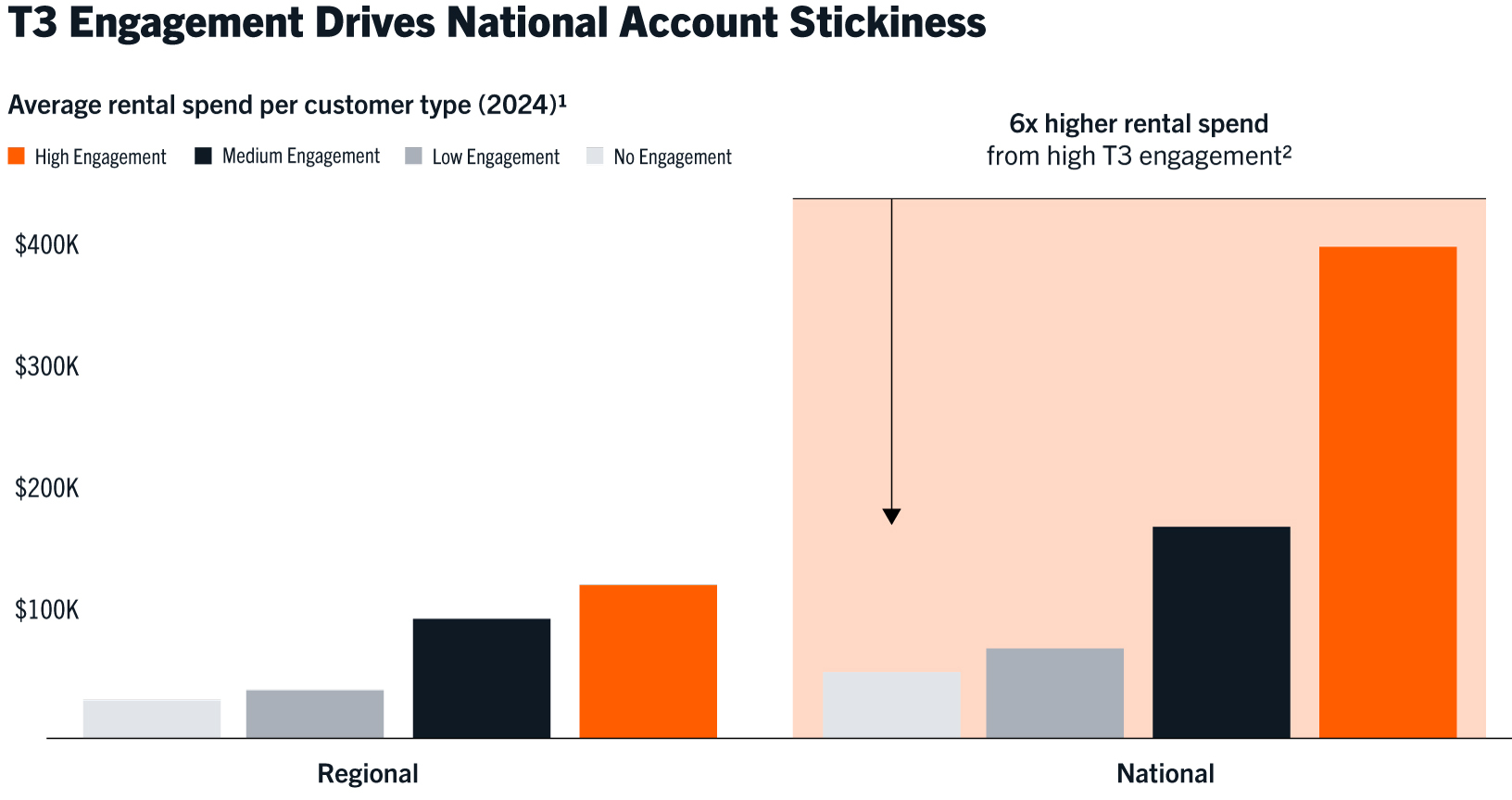

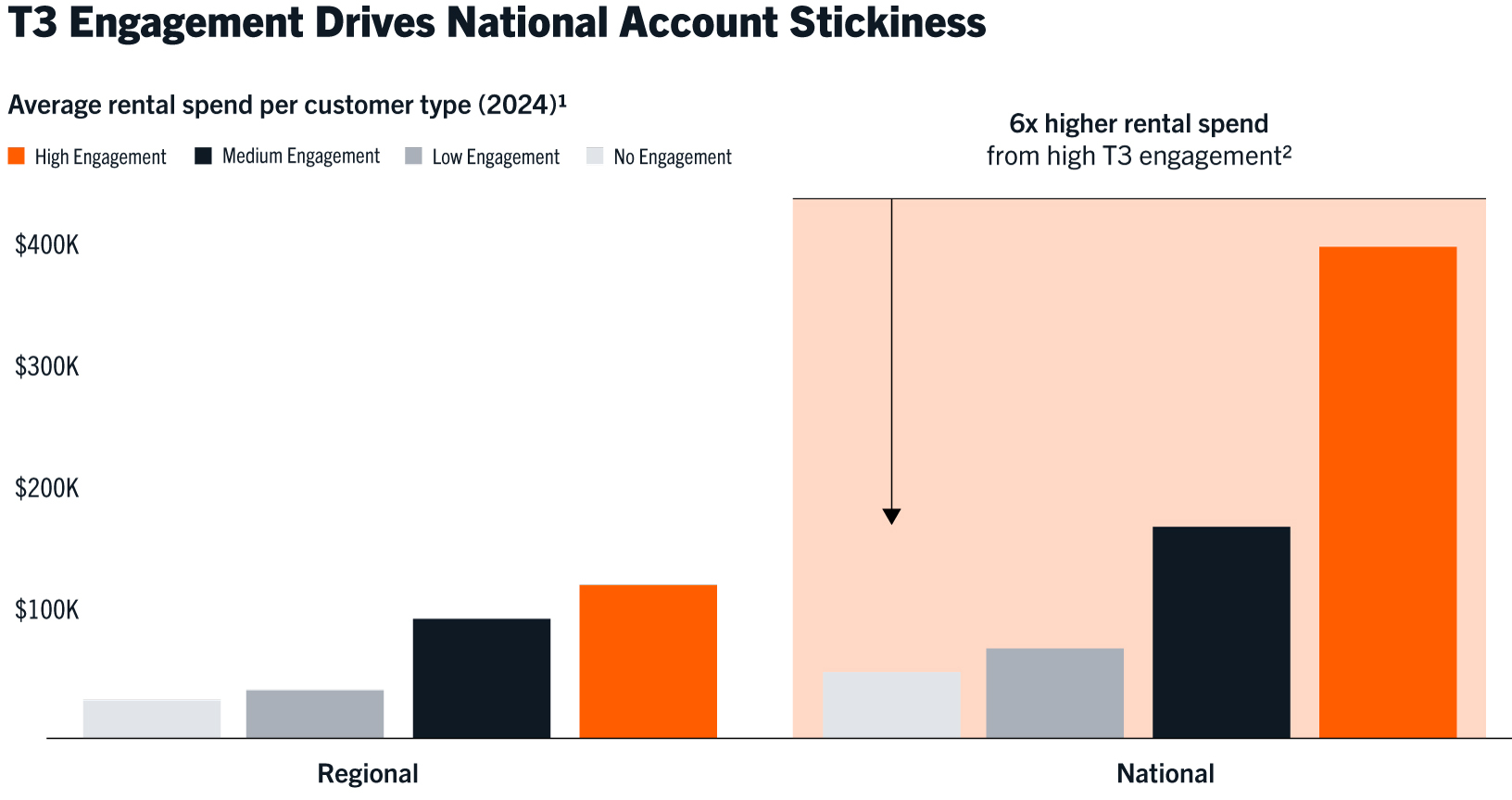

•“High and Medium Engagement cohort customers” refers to the cohort of customers with High Engagement or Medium Engagement as of December 31, 2024.

•“High Engagement” refers to an engagement level within the top 20% of applicable customers with detectable digital engagement with our T3 platform based on their T3 Engagement Score, which demonstrates strong digital activity and clear operational intent through active subscription or device usage.

•“industry” refers to the equipment rental industry.

•“IoT” refers to Internet of Things.

•“jobsite” refers to a customer’s location or project site where physical work is carried out.

•“local customer” refers to a customer who has rented from one market.

•“Low Engagement” refers to an engagement level within the bottom 40% of applicable customers with detectable digital engagement with our T3 platform based on their T3 Engagement Score, which displays minimal, but non-zero, digital activity within the T3 platform.

•“market” refers to a defined MSA in which EquipmentShare operates or plans to operate.

•“mature sites” refers to full-service branch locations opened greater than 24 months before the start of each measurement period unless otherwise specified.

•“meaningful actions on the platform” refers to a range of activities customers perform on the platform, which include, but are not limited to, asset data streaming (sharing, viewing, or managing live data streaming from a machine equipped with T3), assess control (actively managing and creating keycodes on the T3 keypad), camera (utilizing and monitoring AI dashcam video feeds and safety alerts), fleet map (leveraging the live fleet map in T3 to monitor assets in real time) and reporting and alerts (creating, scheduling, and managing reports).

•“Medium Engagement” refers to an engagement level that falls below the top 20% but above the bottom 40% of applicable customers with detectable digital engagement with our T3 platform based on their T3 Engagement Score, which exhibits measurable but moderate digital activity.

•“megaproject” or “mega site” refers to a project or jobsite with projected spend meeting or exceeding $300 million.

•“MSA” refers to a metropolitan statistical area as designated by the U.S. Office of Management and Budget.

•“national customer” refers to a customer who has rented equipment from two or more regions.

•“No Engagement” refers to an engagement level in which customers have a rental history, but no detectable digital engagement with our T3 platform.

•“OEC” or “Original Equipment Cost” in EquipmentShare’s rental fleet is the total original cost of equipment when purchased from a manufacturer, or the estimated fair value of used equipment acquired in a business combination. OEC is a widely used industry metric to compare fleet dollar value independent of depreciation.

•“OEC under management” is defined as the OEC of the equipment that we manage on our T3 platform, including (i) EquipmentShare Owned OEC, (ii) OEC of equipment we lease as lessee and lease under the OWN Program, and (iii) OEC of equipment we lease as lessee under operating lease arrangements with third-party lessors such as OEMs and financial institutions.

•“OEM” or “Original Equipment Manufacturer” refers to the company that designs and produces the original equipment.

•“operational location” refers to any active, revenue-generating site operated by EquipmentShare. This includes rental, building materials, and equipment dealership locations.

•“OWN Program” or “OWN” refers to our innovative capital-light fleet growth model.

•“region” refers to a group of two or more markets.

•“regional customer” refers to a customer who has rented equipment from two or more markets.

•“RPP” refers to a Rental Protection Plan.

•“serviceable footprint” refers to the geographic area within approximately a 50-mile radius of one of our full-service rental branches.

•“specialty Equipment” refers to a subset of EquipmentShare’s rental fleet consisting of specialized equipment tailored to specific jobsite applications which include HVAC units, industrial pumps, and power generation, among others.

•“support fleet” refers to non-rental equipment that supports the operation, delivery, and service of rental equipment and jobsite solutions which include service trucks, haul trucks and trailers, and maintenance vehicles, among others.

•“T3 Engagement Score” refers to an engagement score that we assign to customers who have at least two rentals within the designated period (which ensures that only customers with a minimum level of transactional activity are evaluated for T3 engagement insights). The T3 Engagement Score is calculated using a weighted formula that blends three key metrics: (i) how often users take “meaningful actions on the platform,” (ii) how many users at the company are taking “meaningful actions on the platform” during the period, and (iii) how much time users spend in active use (versus idle or passive time) during their sessions.

•“top equipment rental peers” refers to United Rentals, Inc., Sunbelt Rentals (Ashtead Group plc), and Herc Holdings Inc. Discussion of these companies in this prospectus is based on public filings by these companies.

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” along with our consolidated financial statements and the related notes included elsewhere in this prospectus, before deciding whether to purchase shares of our Class A common stock.

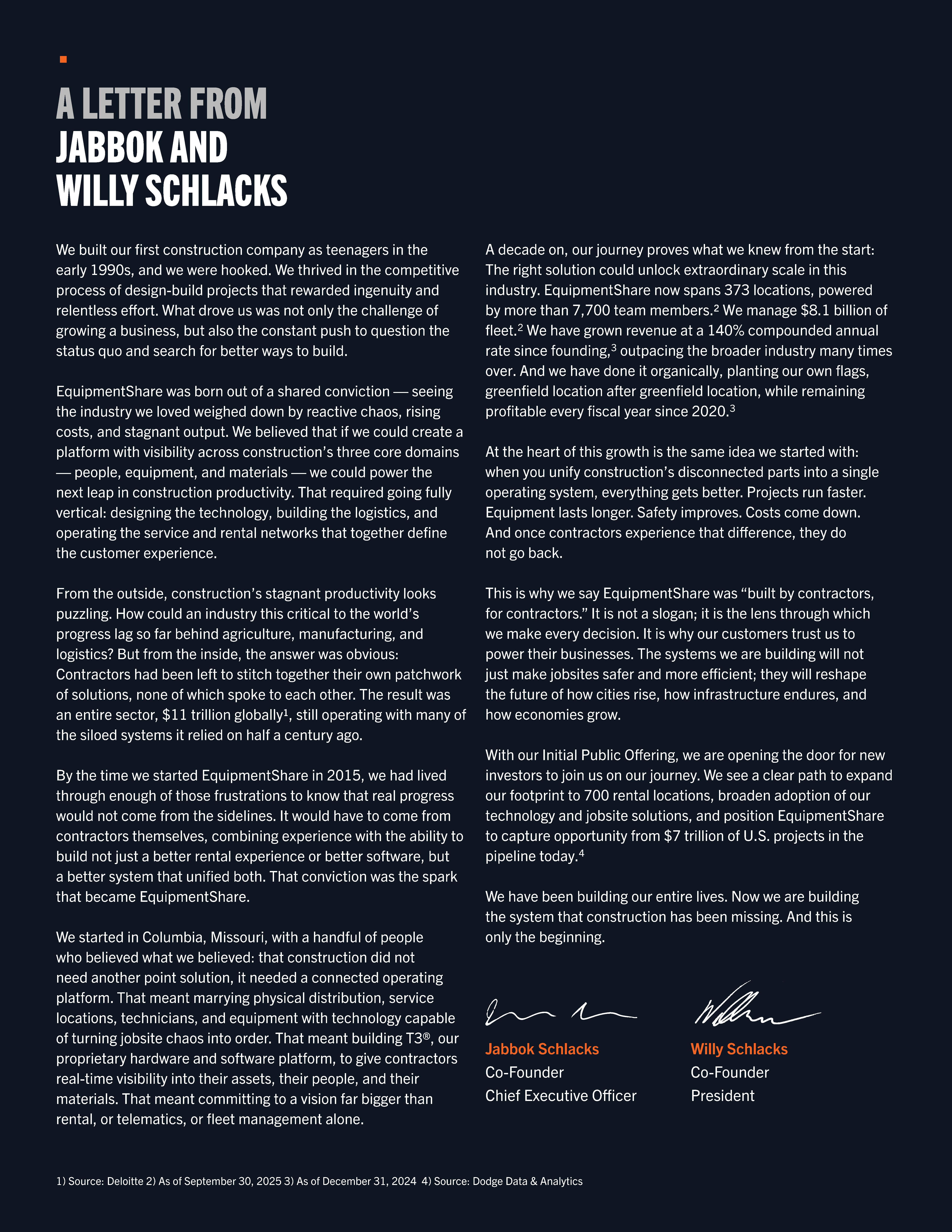

Our Company

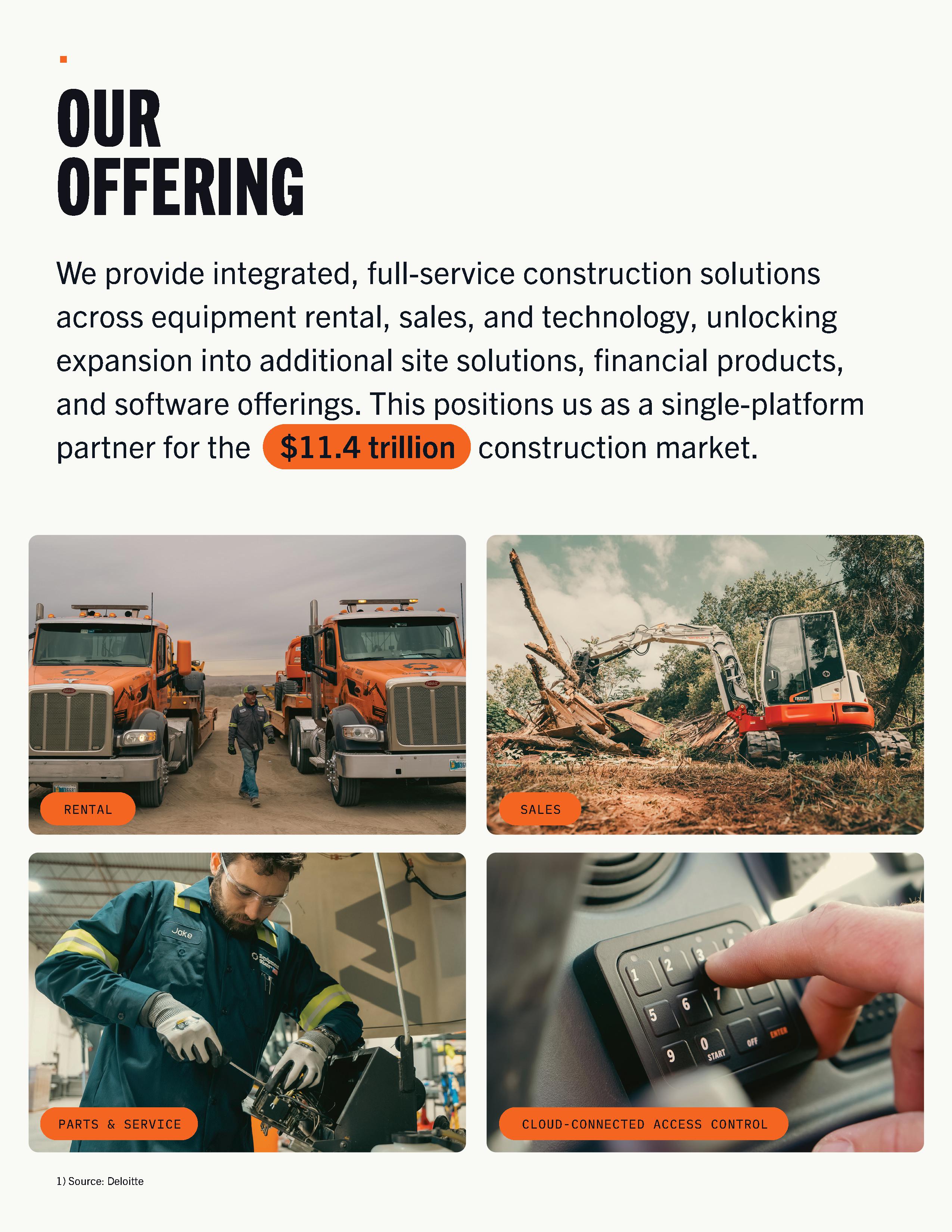

We are building the platform to connect the construction industry

Founded in 2015, EquipmentShare is a digitally-native equipment rental platform servicing the largest jobsites nationwide. As lifelong contractors, Co-Founders Jabbok and Willy Schlacks knew the jobsite didn’t break down from lack of effort, but from lack of connection. There was no holistic operating system to bring the moving parts of a complex jobsite together in real time. Lost or stolen equipment, phone-tag coordination, and underutilized fleets were the norm. Their answer was to build T3, a proprietary, interoperable, vertically integrated software platform that connects assets, materials, and people. Combined with world-class operations and a nationwide footprint, EquipmentShare serves customers with an integrated solution designed to make their jobsites more efficient, safer, and lower cost.

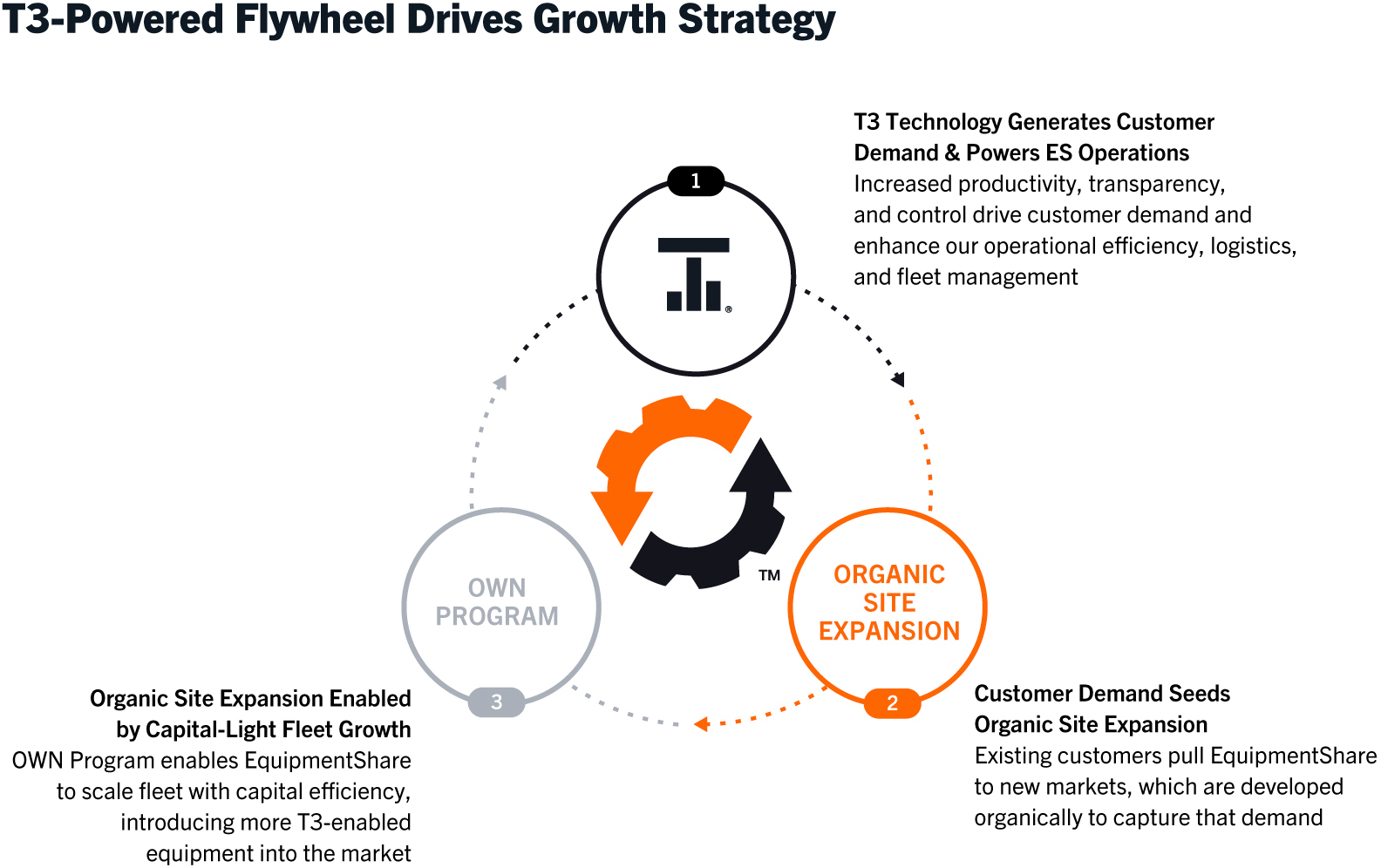

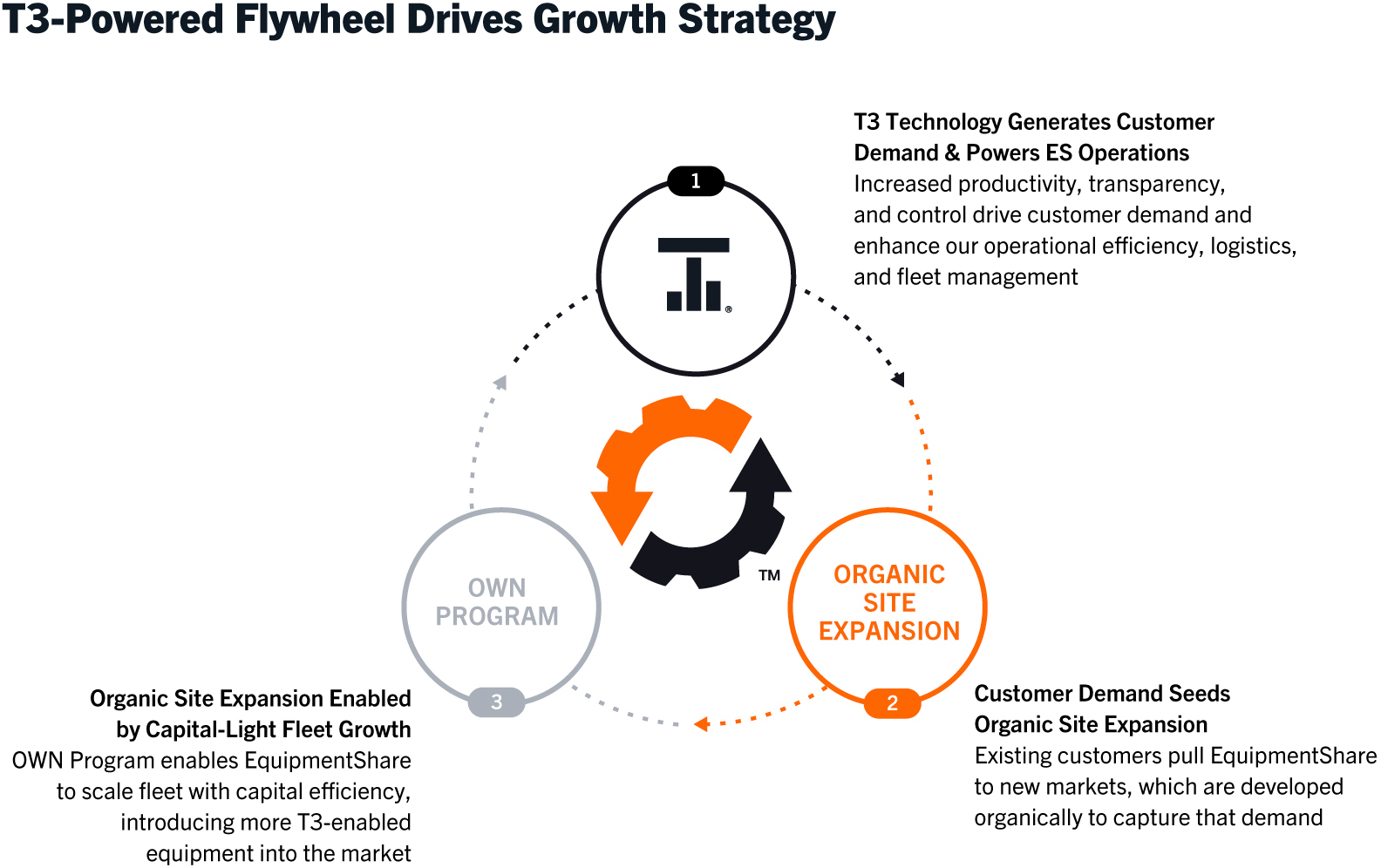

The engine behind our growth is a three‑part flywheel:

1.T3 technology generates customer demand. All of our assets are managed and operated on our T3 platform, giving our customers and branch teams real‑time location, health, utilization, and insights to reduce downtime. We believe that there is no other rental-integrated technology platform like it in the industry. We believe it is our advantage driving our market share gains.

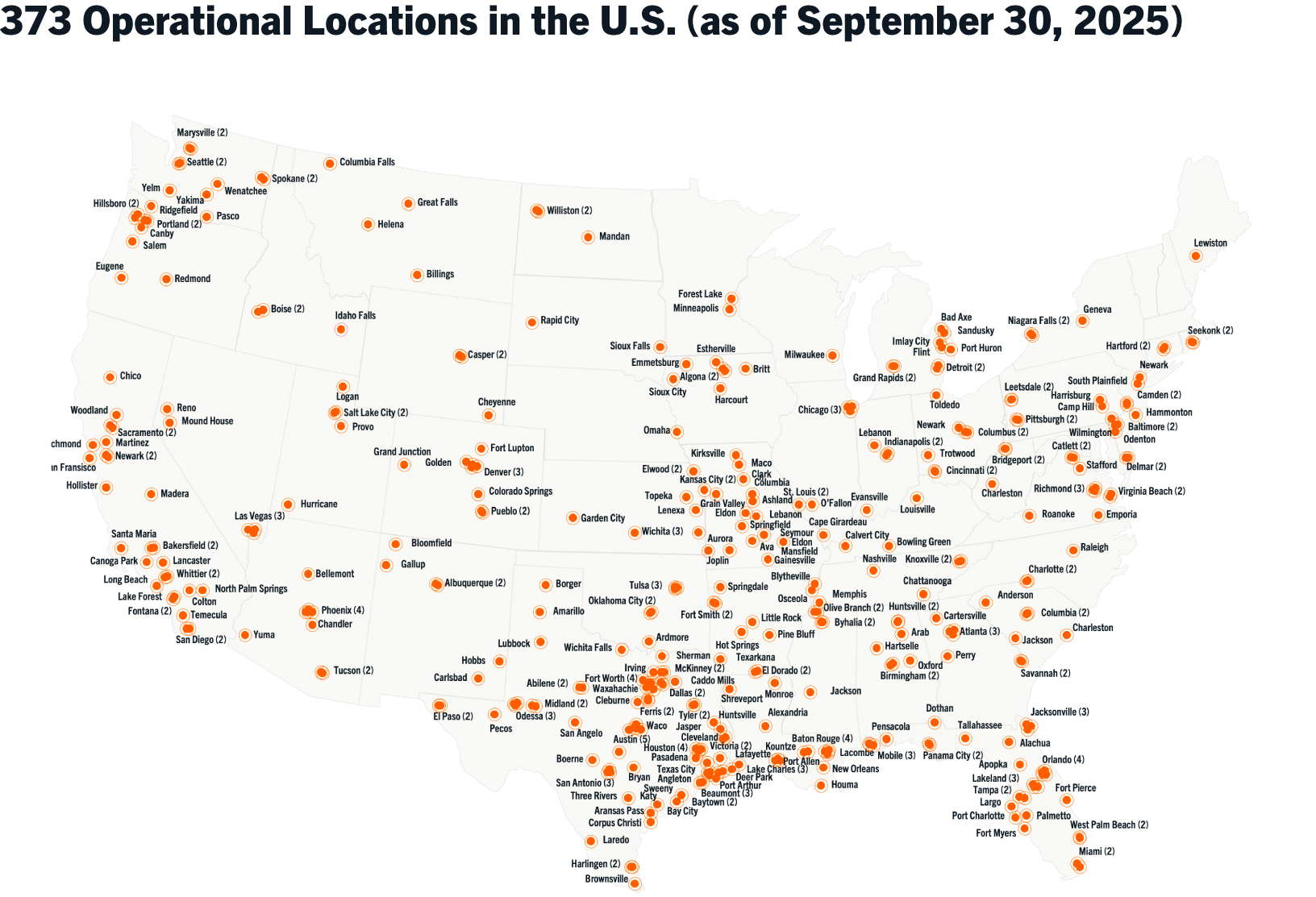

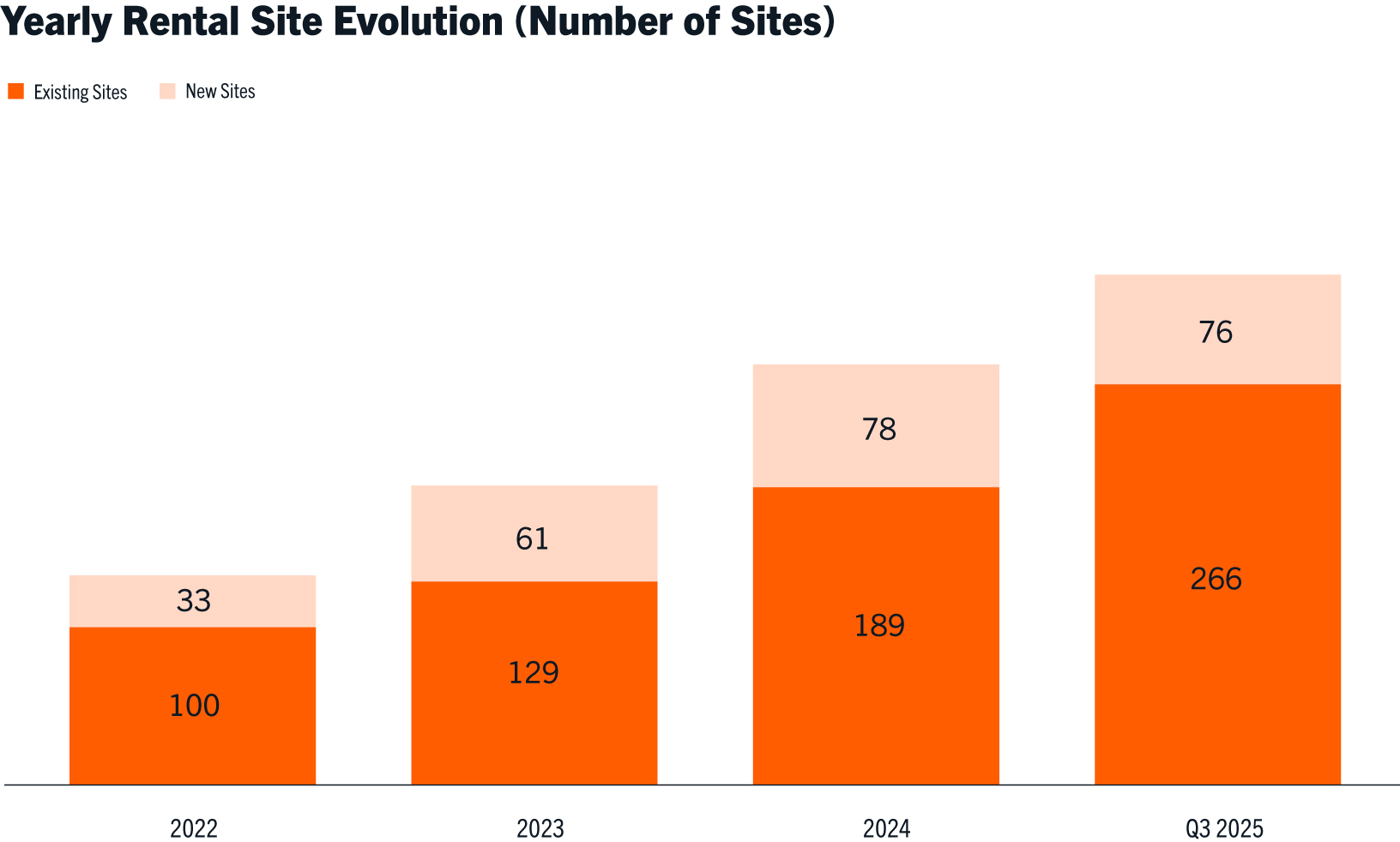

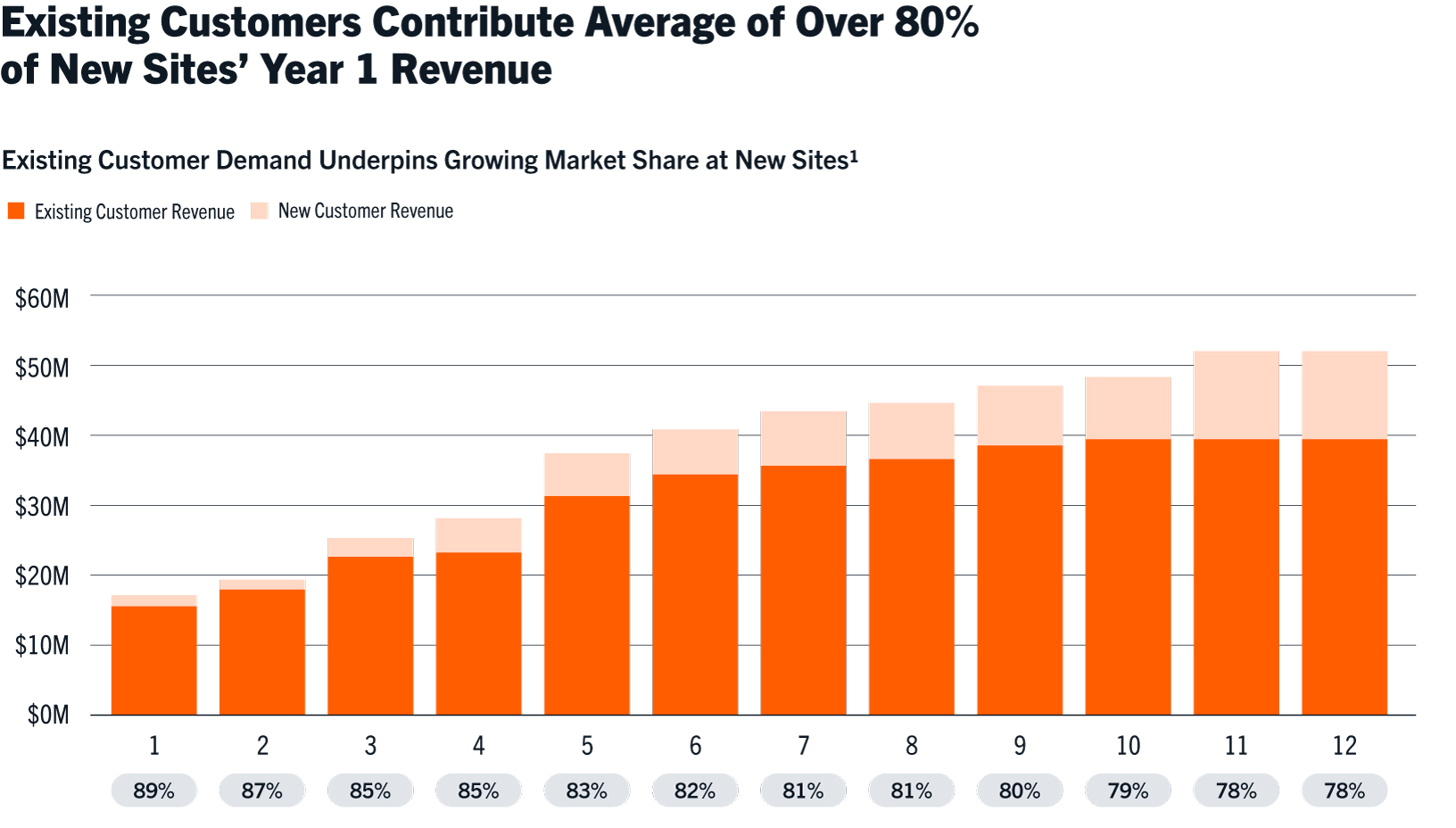

2.Customer demand seeds organic site expansion. Our customers pull us into new markets, where we open locations organically as we believe this is the most effective way to scale our rental operations financially and operationally. On average, 75% of new site revenue is generated from our existing customers in the first year of operation. As of September 30, 2025, we have 342 full-service rental locations nationwide, nearly all of which we started organically.

3.Organic site expansion enabled by capital-light fleet growth. The OWN Program, our innovative capital-light fleet growth model, leverages third-party capital and supplies more than half of our rental equipment, as of September 30, 2025. This allows us to preserve balance-sheet strength while achieving year-over-year site growth at multiples of the industry average to meet our customer demand. The OWN Program is enabled by T3, which manages third-party assets seamlessly. In return, owners get real-time data on usage, health, and performance of the machines rented exclusively by EquipmentShare and re-rented to our customers.

Designing the telematics hardware, writing the platform software, and owning physical distribution of machines end to end allows us to optimize uptime, reduce misuse and theft, and lower total cost of operation for contractors compared to incumbent solutions.

We believe our scale and vertically integrated tech platform have positioned us to excel on the largest, most demanding projects in the country, as evidenced by our deep involvement with megaprojects. We currently rent to over 80% of active megaprojects inside our serviceable footprint. For example, on one hyperscale datacenter project, a customer replaced an incumbent provider with EquipmentShare and expanded from less than 20 to over 2,000 machines within four months. This expansion reflected both the customer’s underlying project growth and its adoption of our T3 platform, which the customer cited as a factor in its decision to transition from the prior provider. While this is among our larger customer engagements and is not representative of all customer experiences, we believe it is illustrative of similar dynamics we see with other national customers. T3 coordinates thousands of machines across trades, unlocking efficiency on complex jobs.

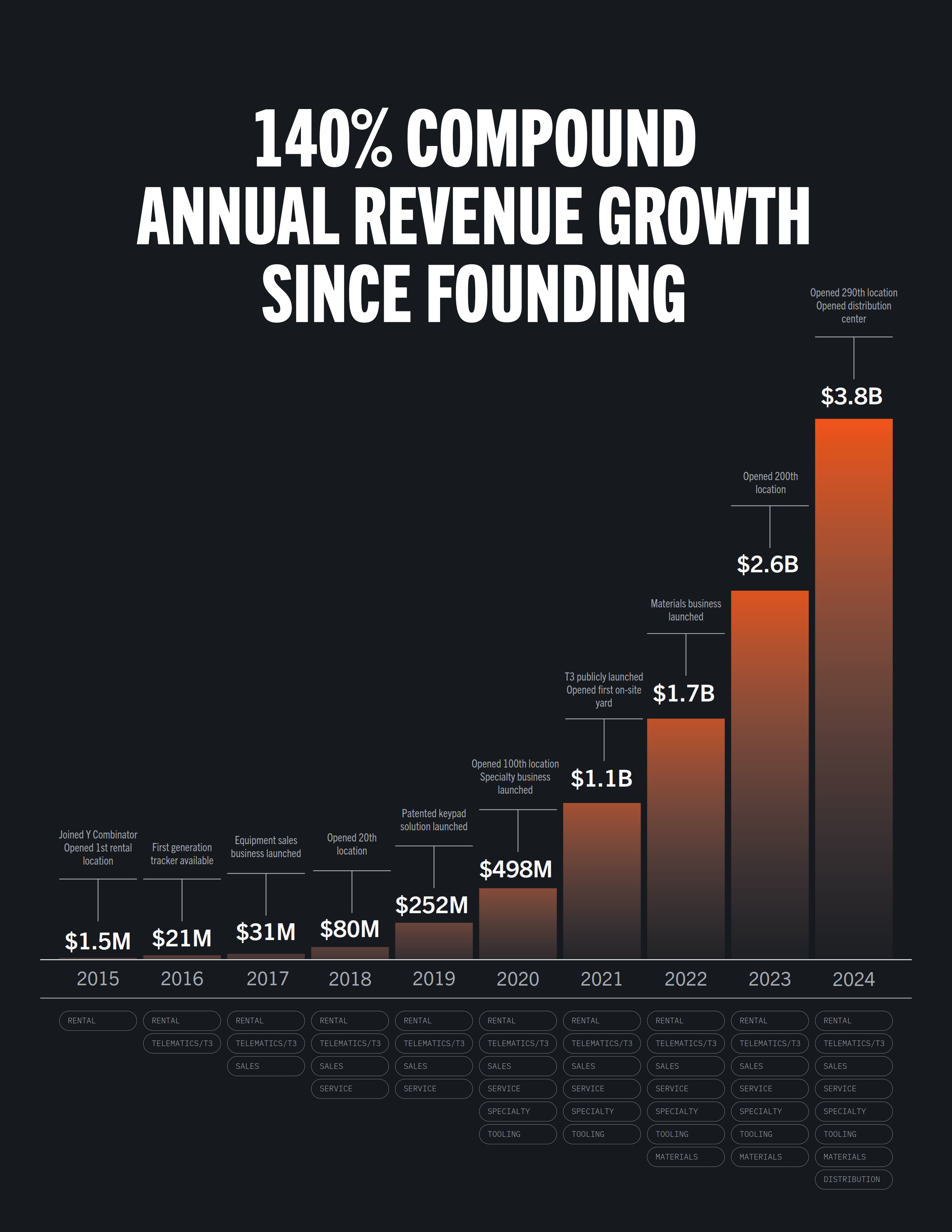

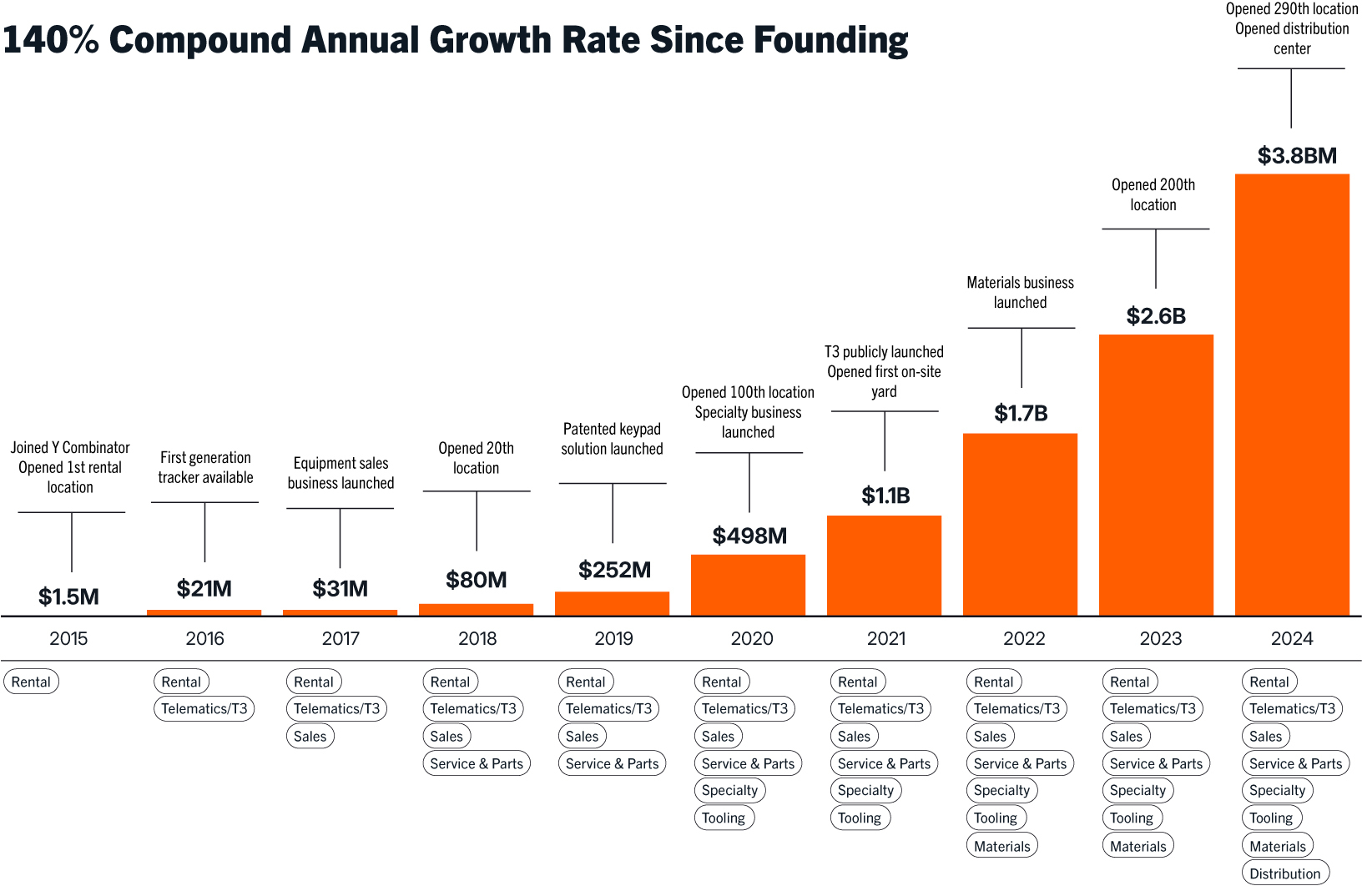

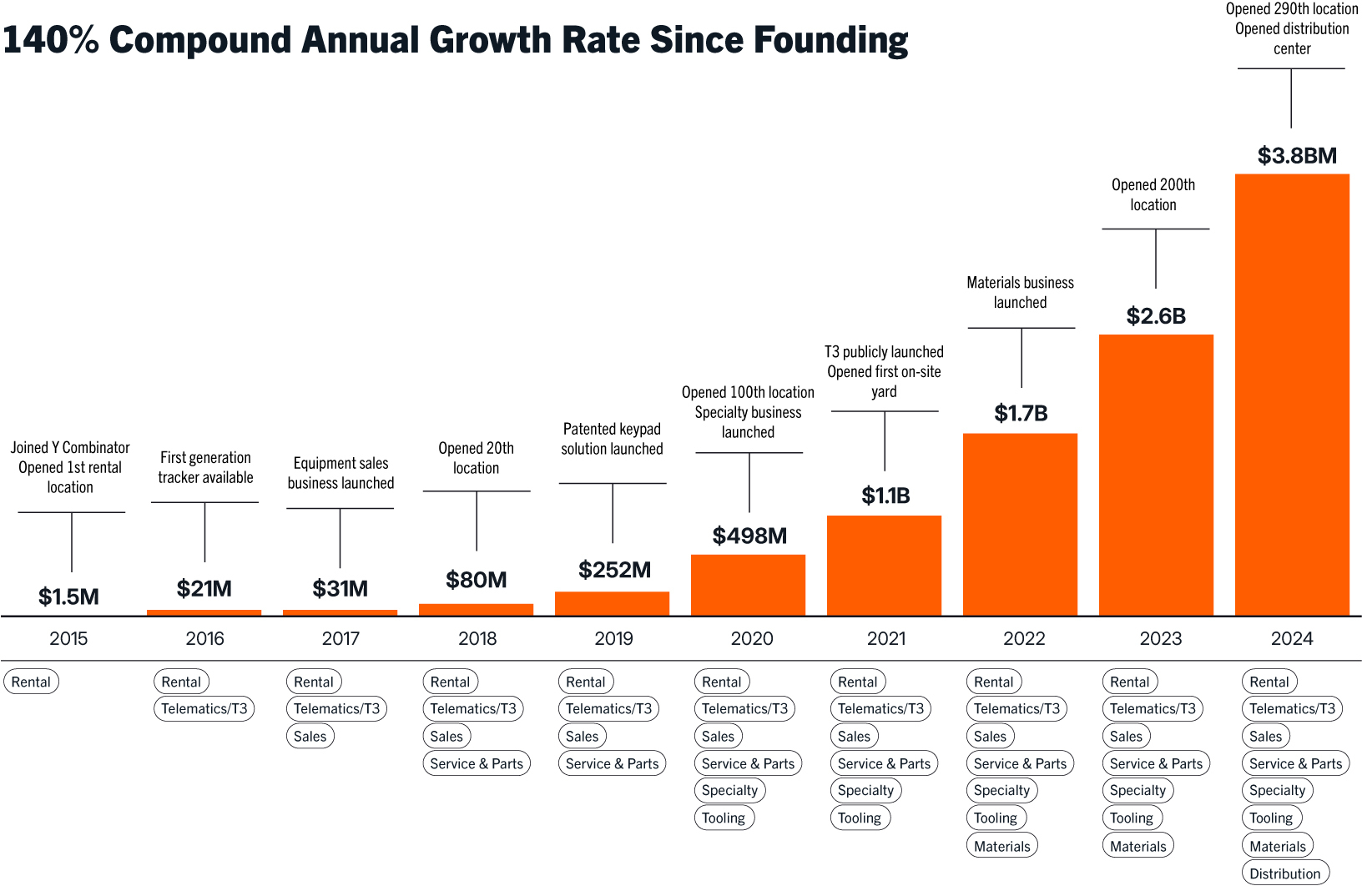

Approximately 140% Compound Annual Revenue Growth Rate Since Founding

We have grown rapidly by meeting customer demand through disciplined, organic expansion. As of September 30, 2025, nearly 100% of our 342 full-service rental locations across 45 states were built from the ground up by leveraging a proven, repeatable playbook, and we estimate that 98% of our rental revenue since our founding has been driven by organic site growth. We aim to launch new sites across high-potential markets in response to existing customer demand and long-term trends. Our locations are close to megaprojects with over $5 trillion in active and planned spend expected over the next decade.

To support this growth, we developed the OWN Program, a first-of-its-kind, capital-light fleet growth model. Participants in the OWN Program including institutional investors and ABS entities, as well as high-net-worth individuals, family offices, and other third parties, purchase equipment from EquipmentShare. We then exclusively deploy, operate, and service equipment seamlessly through our rental platform pursuant to the terms of a lease to us for such equipment. In return for their participation, OWN Program participants receive a share of rental revenue, while EquipmentShare retains control of customer relationships, equipment rental pricing, and operations throughout the entire life of the lease. There are no minimum payments in the program and revenue sharing payments are only paid when the machine rents. T3 platform’s flexibility and robustness empowers the OWN Program, allowing us to manage OWN equipment seamlessly alongside company-owned assets. As of September 30, 2025, OWN represented $4.2 billion of our OEC, or 52% of our total equipment rental fleet. The OWN Program has expanded and diversified our access to equipment, while maintaining lifetime cash flows substantially similar to on balance sheet equipment.

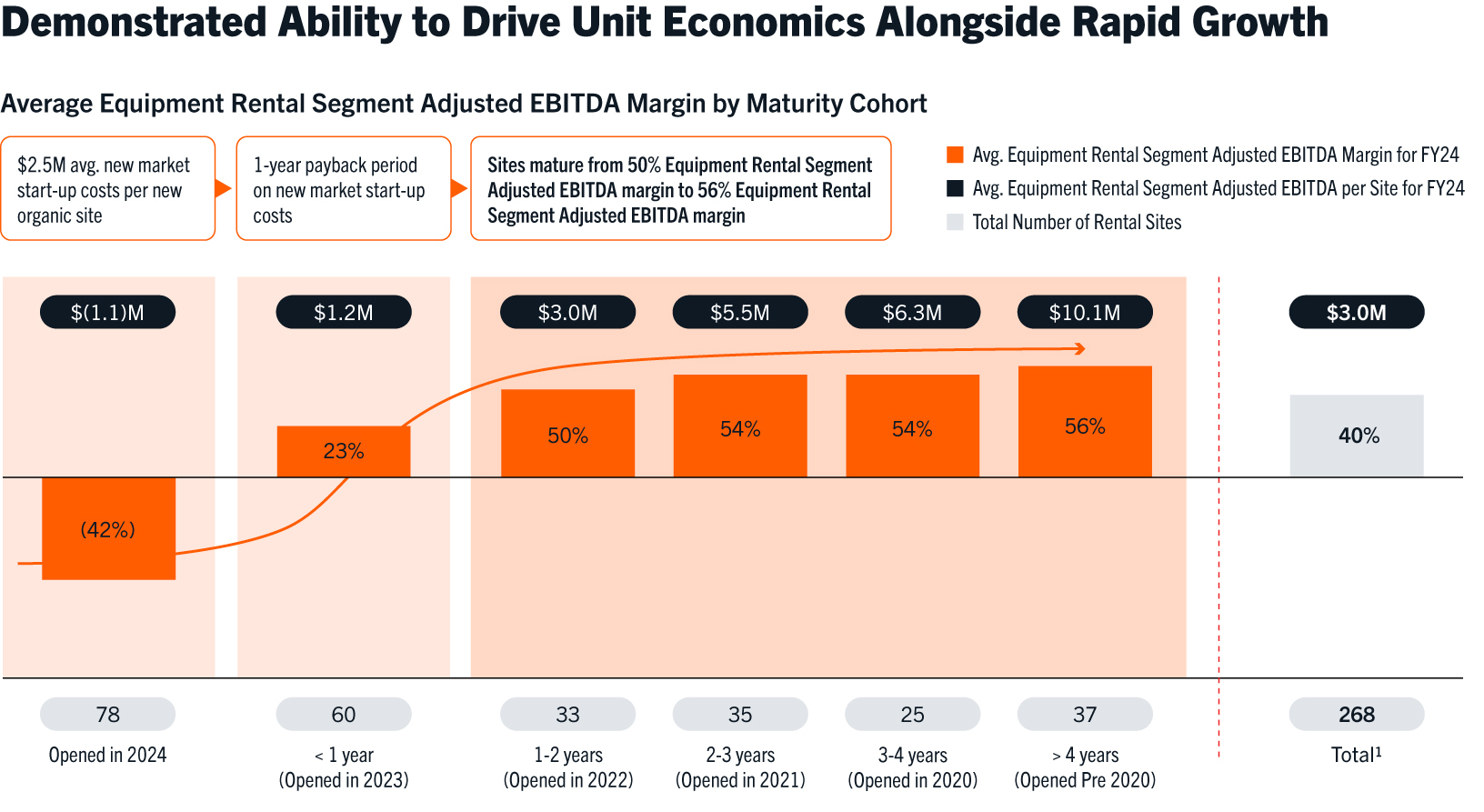

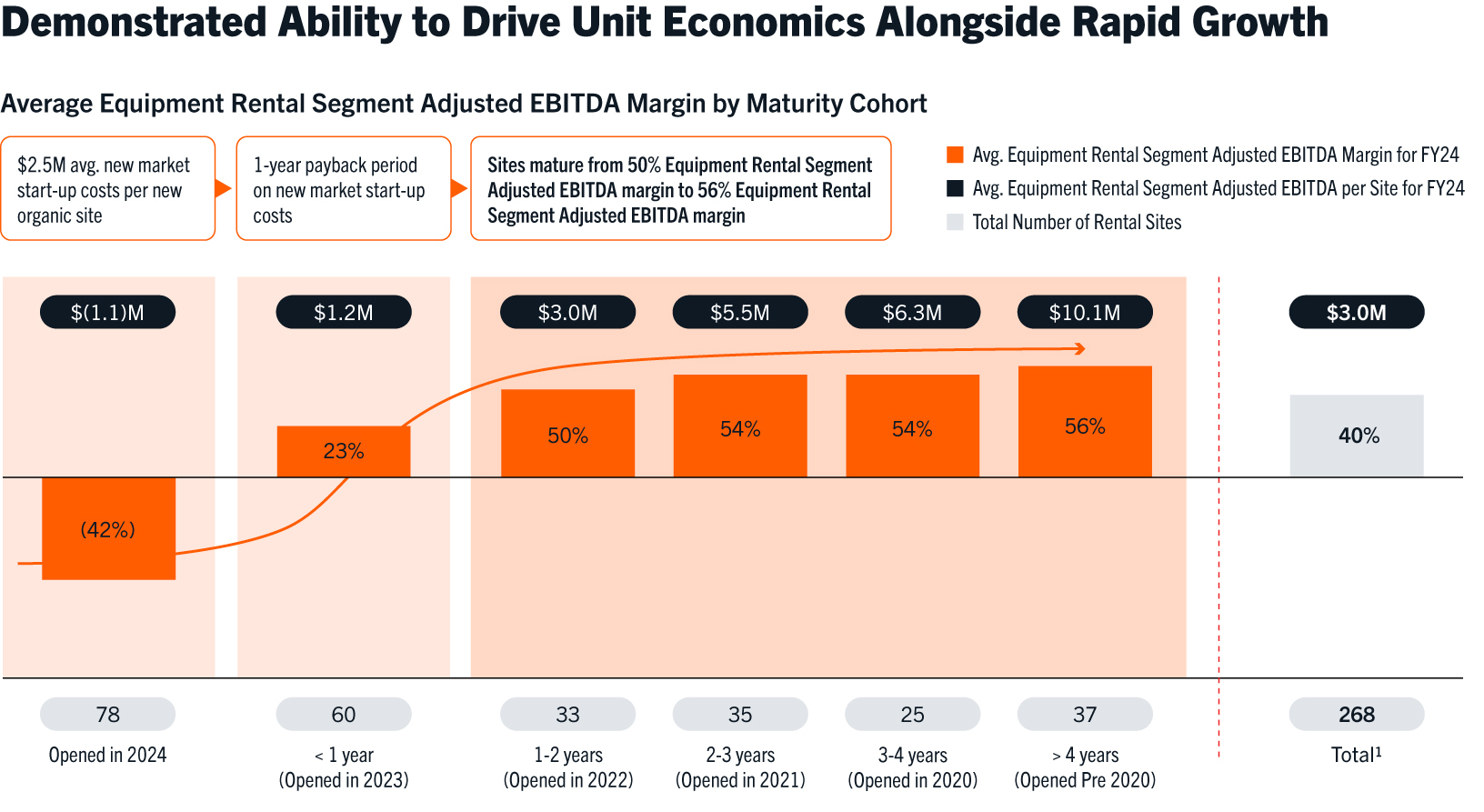

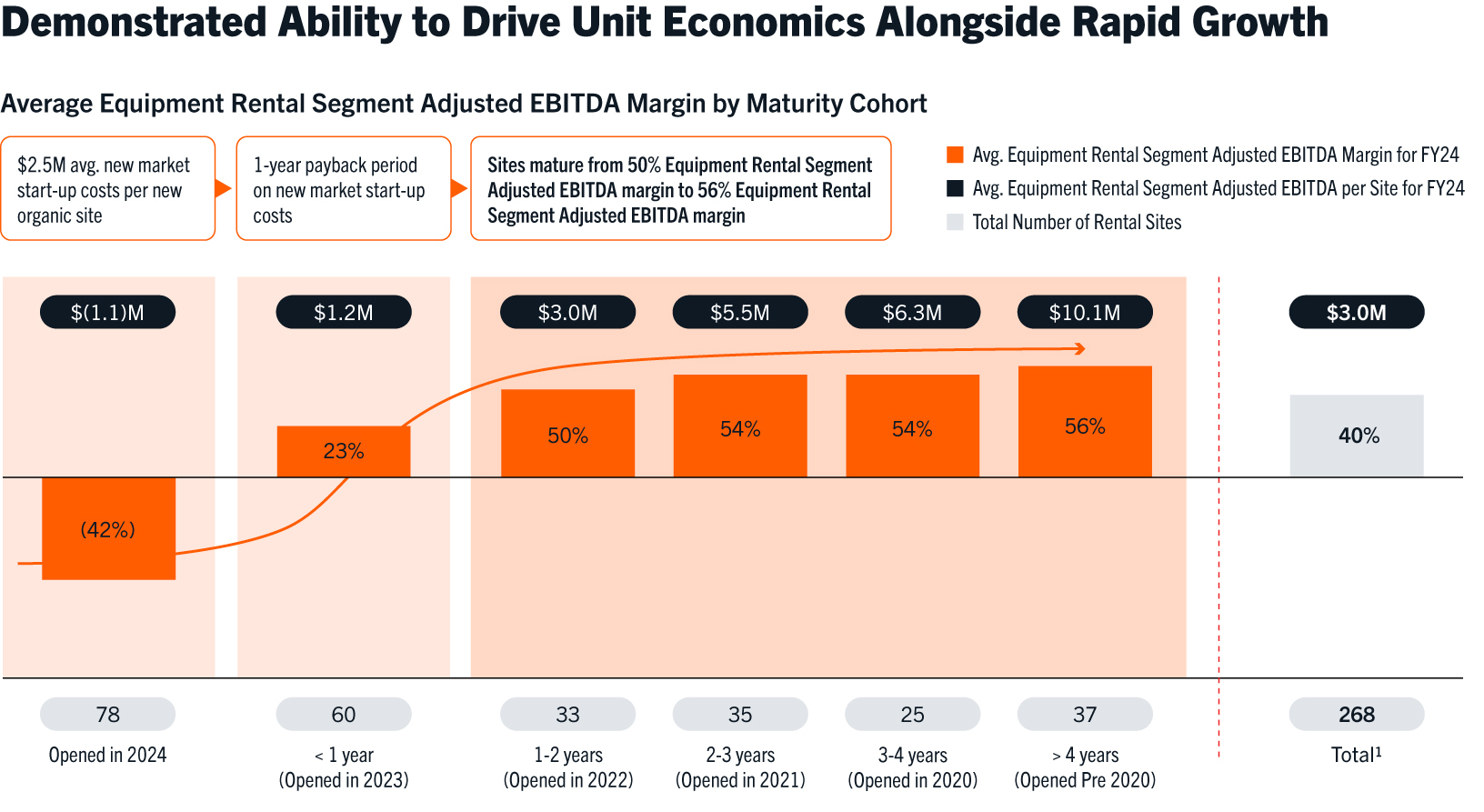

This three-part flywheel differentiates our business model and has enabled us to realize exceptional financial performance. In 2024, we generated approximately $3.8 billion in revenue, up from $1.7 billion in 2022, reflecting a two-year revenue CAGR of 47% highlighting our ability to capture market share in excess of the 10.6% market average and the 15.6% average of our top equipment rental peers. For the years ended December 31, 2024, 2023, and 2022, our consolidated net income was $2.4 million, $17.4 million, and $49.6 million, respectively, with our

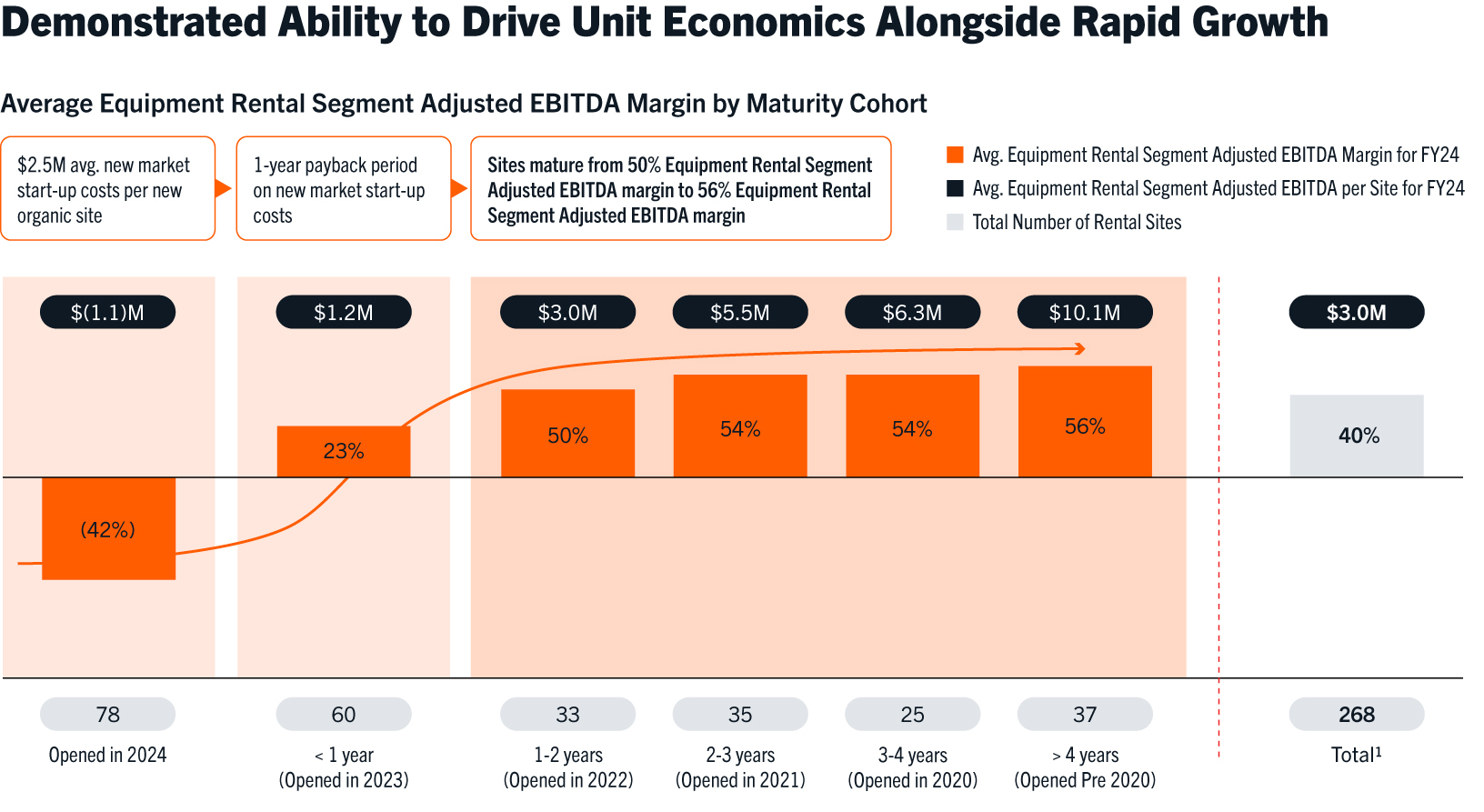

mature sites contributing Equipment Rental Segment Adjusted EBITDA margins greater than 50% for the same periods. For all sites, Equipment Rental Segment Adjusted EBITDA margins were 41.8%, 46.3%, and 40.1% for these periods, reflecting the impact of significant new site openings as new sites typically have lower margins due to associated start-up costs. For additional information about our Equipment Rental Segment Adjusted EBITDA, see “Prospectus Summary—Summary Consolidated Financial and Other Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Metrics—Other Key Financial Metrics—Equipment Rental Segment Adjusted EBITDA and Equipment Rental Segment Adjusted EBITDA Margin.”

Premium Financial Profile at Scale

The combination of our T3 platform and repeatable organic growth model drives a powerful economic engine built on strong site-level growth, durable margins, and attractive returns on capital. Since December 31, 2021, we have launched 240 rental sites, representing the majority of our 342-location network as of September 30, 2025. These sites are still in the early stages of maturity, and we expect them to follow a historically proven ramp pattern of growing customer density, expanding margins, and increasing cash flow. As younger sites scale, they consistently contribute substantial incremental earnings. We believe this represents a structural advantage and provides a clear runway for continued margin expansion and cash generation.

(1)Represents total average Equipment Rental Segment Adjusted EBITDA Margin for all sites. Equipment Rental Segment Adjusted EBITDA includes direct operating costs (excluding equipment and vehicle operating lease expense) and selling, general, and administrative expenses (excluding depreciation expense related to our property and other fixed assets). Equipment and vehicle operating lease expense was $84.8 million for the year ended December 31, 2024. Depreciation expense related to our property and other fixed assets was $27.4 million for the year ended December 31, 2024. Equipment Rental Segment Adjusted EBITDA also excludes operating expenses related to OWN Program payouts, depreciation expense on rental equipment, and amortization expense on capitalized software. These excluded expenses are significant: OWN Program payouts, depreciation expense on rental equipment, and amortization expense on capitalized software was $420.1 million for the year ended December 31, 2024. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Metrics—Other Key Financial Metrics—Equipment Rental Segment Adjusted EBITDA and Equipment Rental Segment Adjusted EBITDA Margin.”

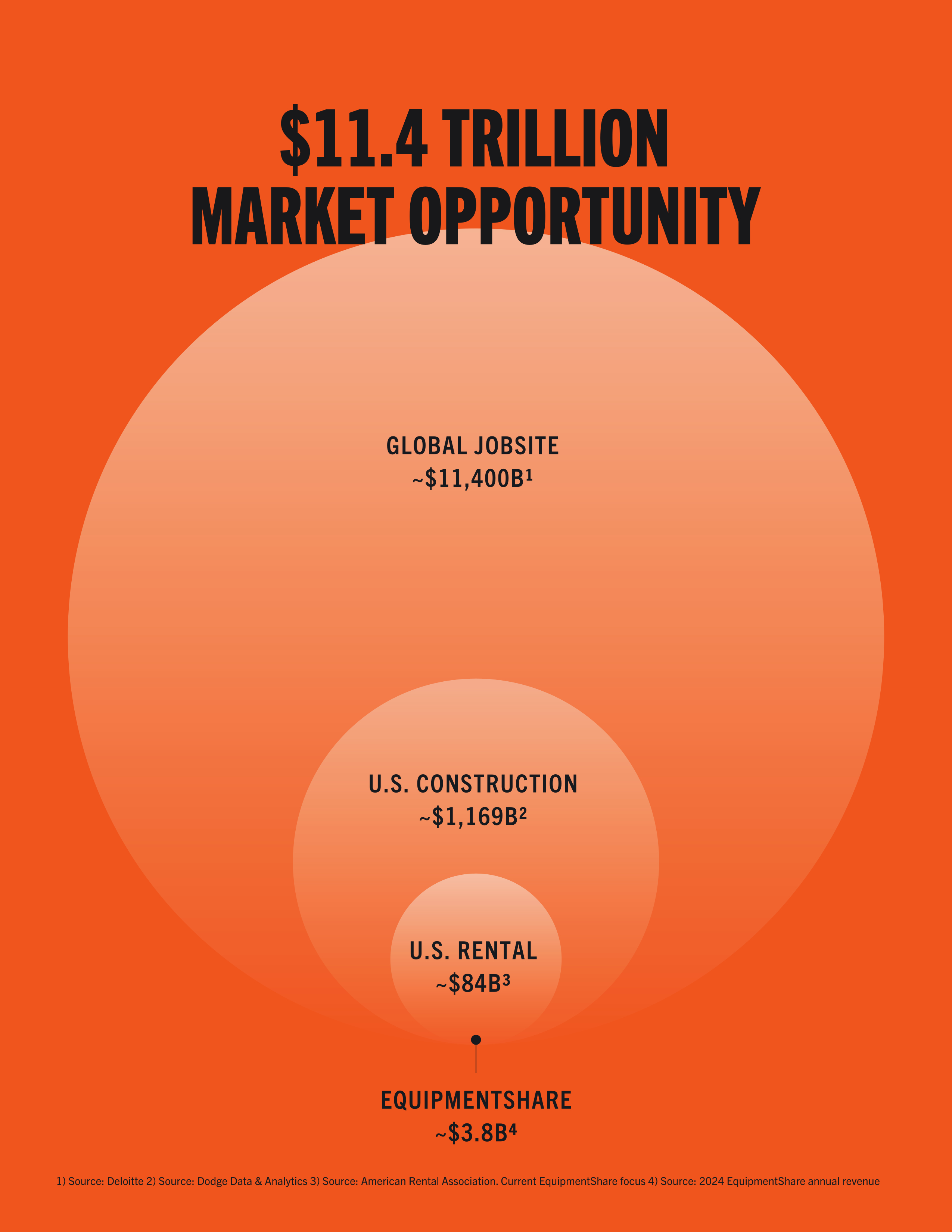

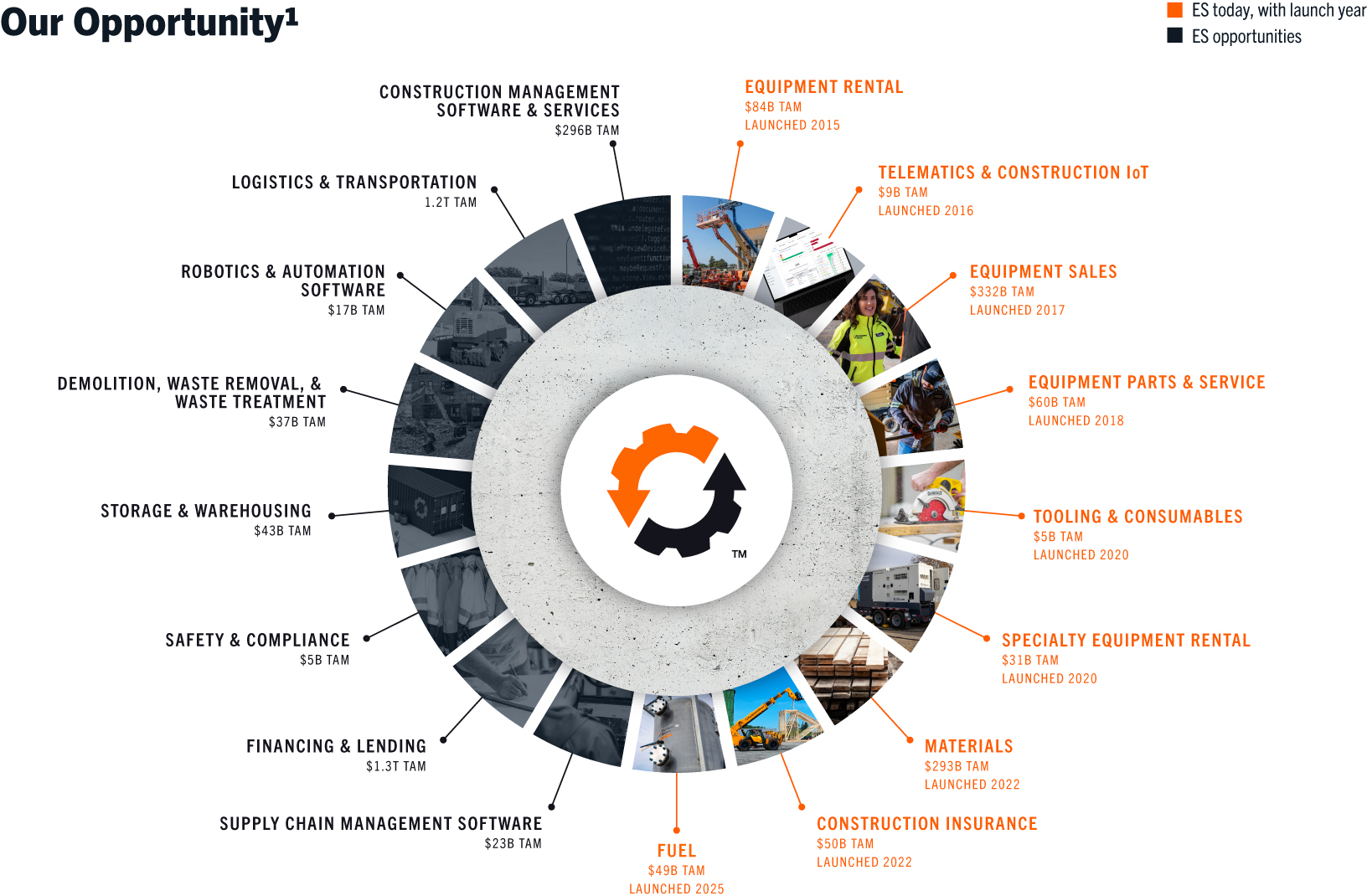

Our Market Opportunity

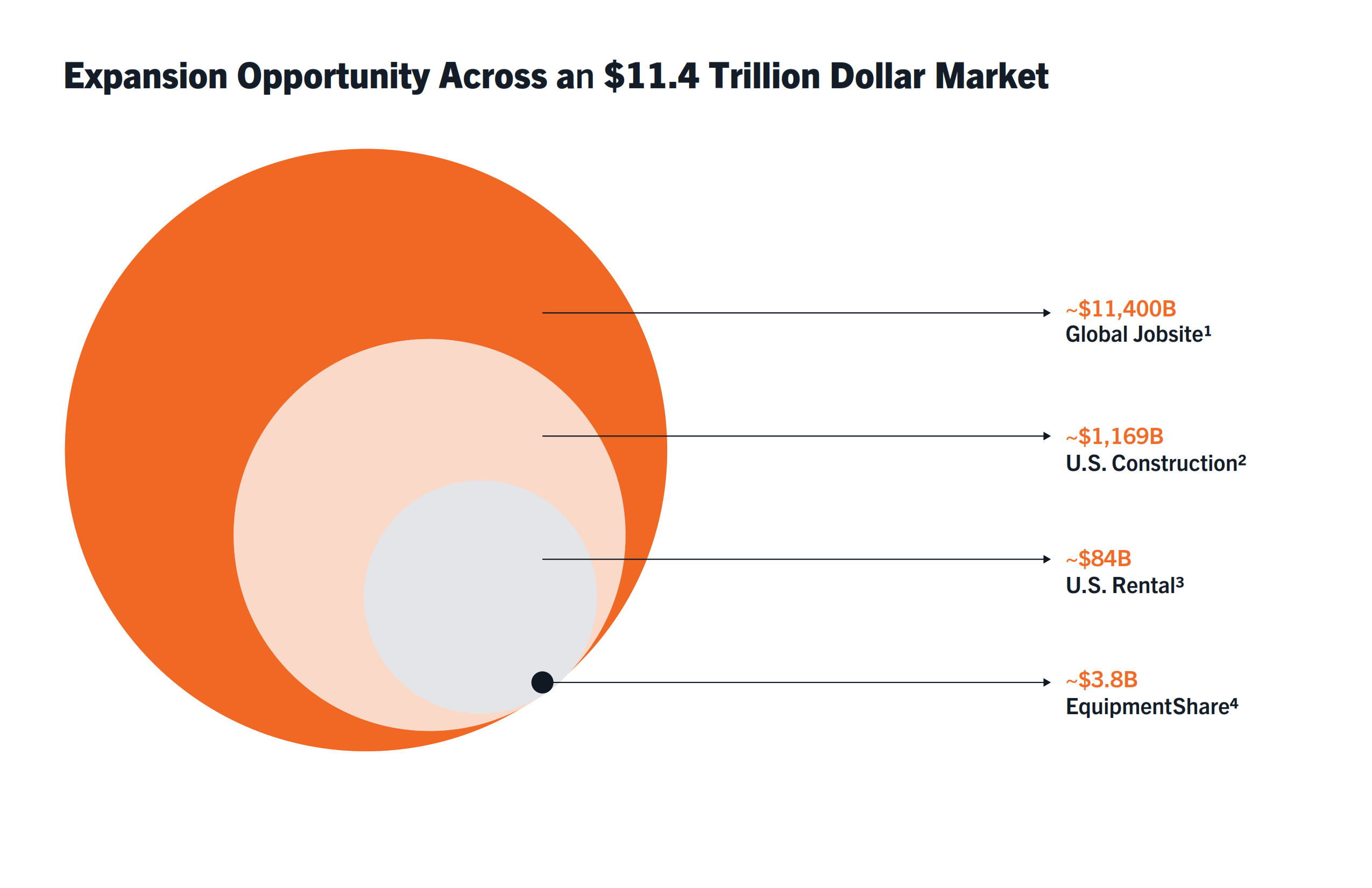

EquipmentShare operates in a massive and growing total addressable market that is significantly underpenetrated by technology. The industry is large, with nearly $11.4 trillion of output in construction projects

globally in 2024 according to Deloitte. Annual world construction spend grew at a 2.6% CAGR from 2000 to 2023 and, as of August 2024, was forecasted to grow at a 3.2% CAGR from 2023 to 2040.

Within the broader U.S. construction industry, estimated at approximately $1.17 trillion as of 2024 according to Dodge Data & Analytics, we started with a focus specifically on the U.S. construction equipment and general tool rental industry, which was estimated at approximately $84 billion as of 2024, an 8% increase from 2023. As of May 2025, this market was expected by the American Rental Association to grow approximately 3% to 4% annually through 2027.

In the $84 billion (and growing) equipment rental industry, with trillions of dollars in infrastructure and industrial capital projects planned, we believe contractors require a better way to manage their assets, people, and jobsites. There is a clear market need for an operating model that combines physical scale with digital intelligence and offers contractors the tools and transparency needed to run more efficient, more profitable, and more resilient businesses.

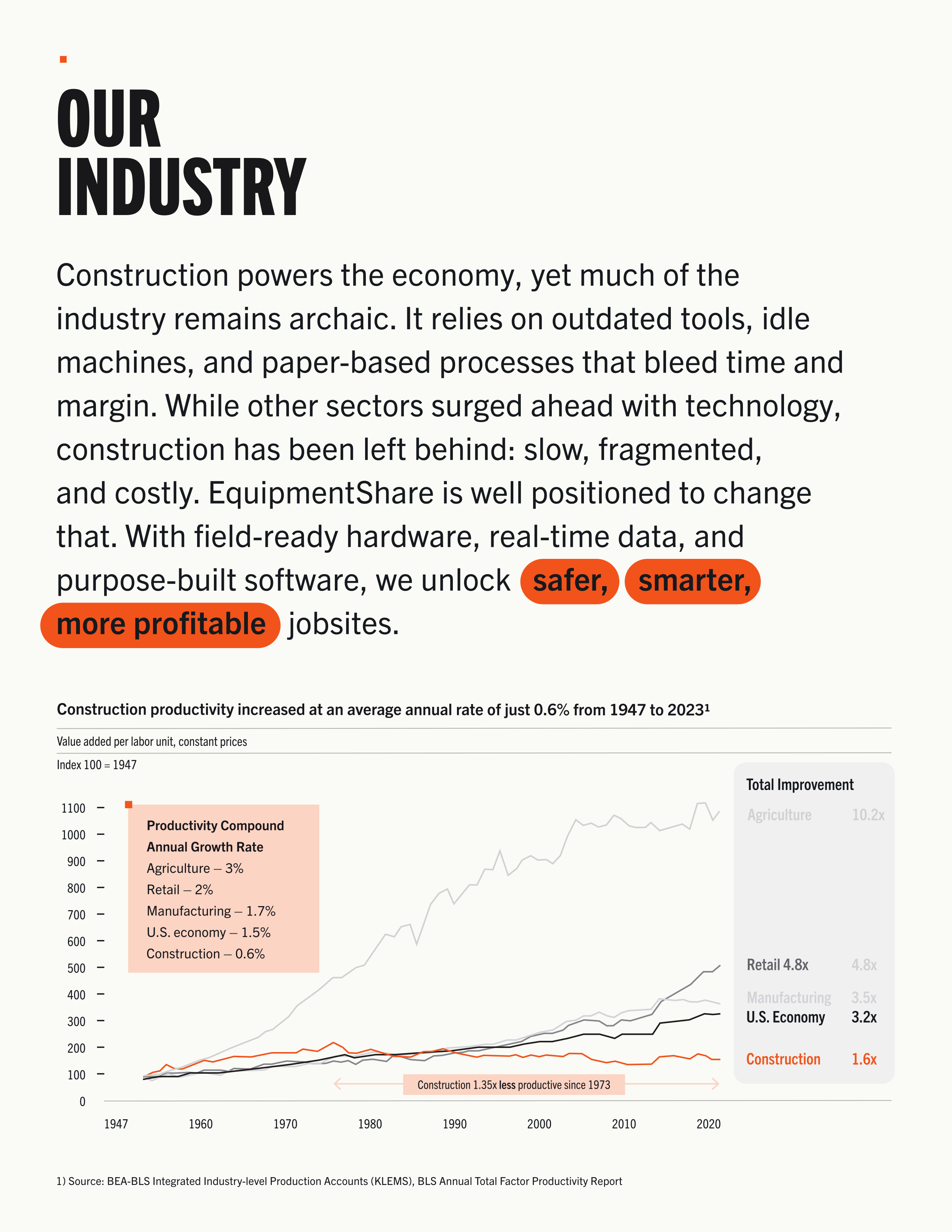

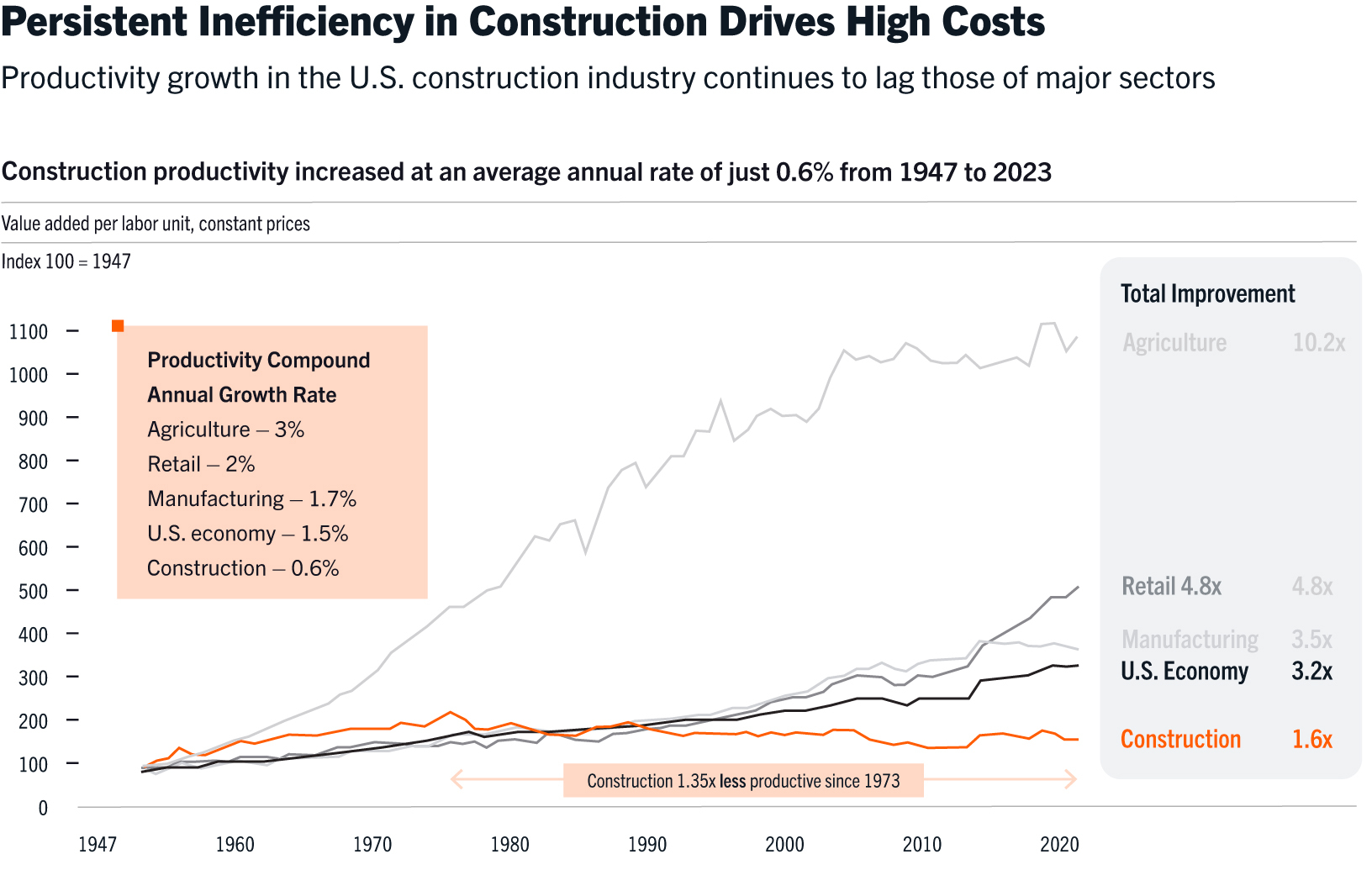

Factors Impacting Our Industry

1.Increasing rental penetration, supported by customers’ desire for an integrated service, capital discipline, and operating flexibility;

2.High demand for rental over ownership driven by the size and complexity of jobsites and contractors’ limited ability to supply equipment by themselves;

3.Multi decade public and private investments in infrastructure, energy, and domestic manufacturing;

4.Continued shortage of labor with aging workforce population while the cost of capital remains high, and inflation driving up expenses across all verticals of an active project; and

5.Lack of productivity improvements and digitization in the construction industry, which remains largely analog and fragmented.

Our Platform

The EquipmentShare platform is characterized by our large and growing footprint, diverse and technology-enabled fleet, revolutionary T3 software platform, and differentiated OWN Program.

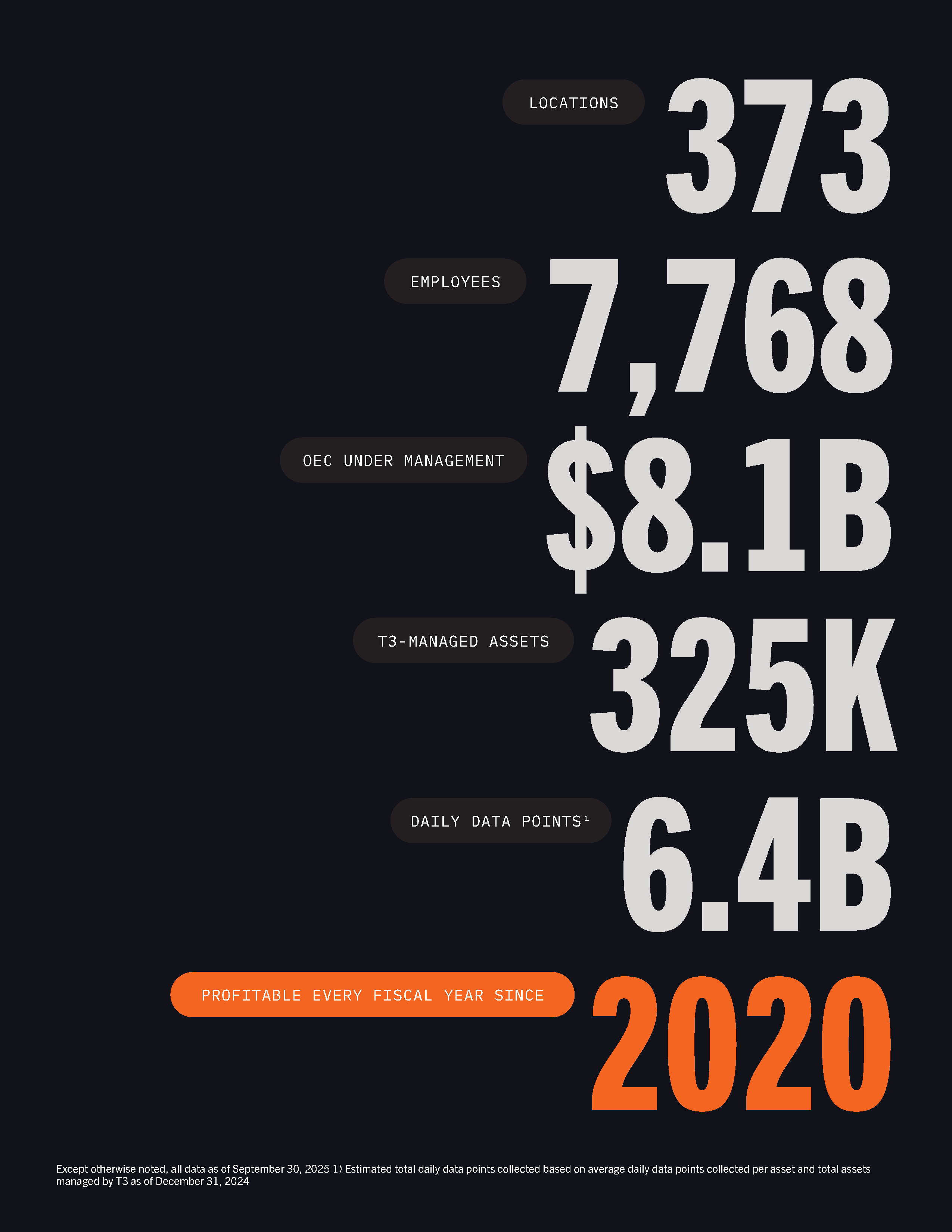

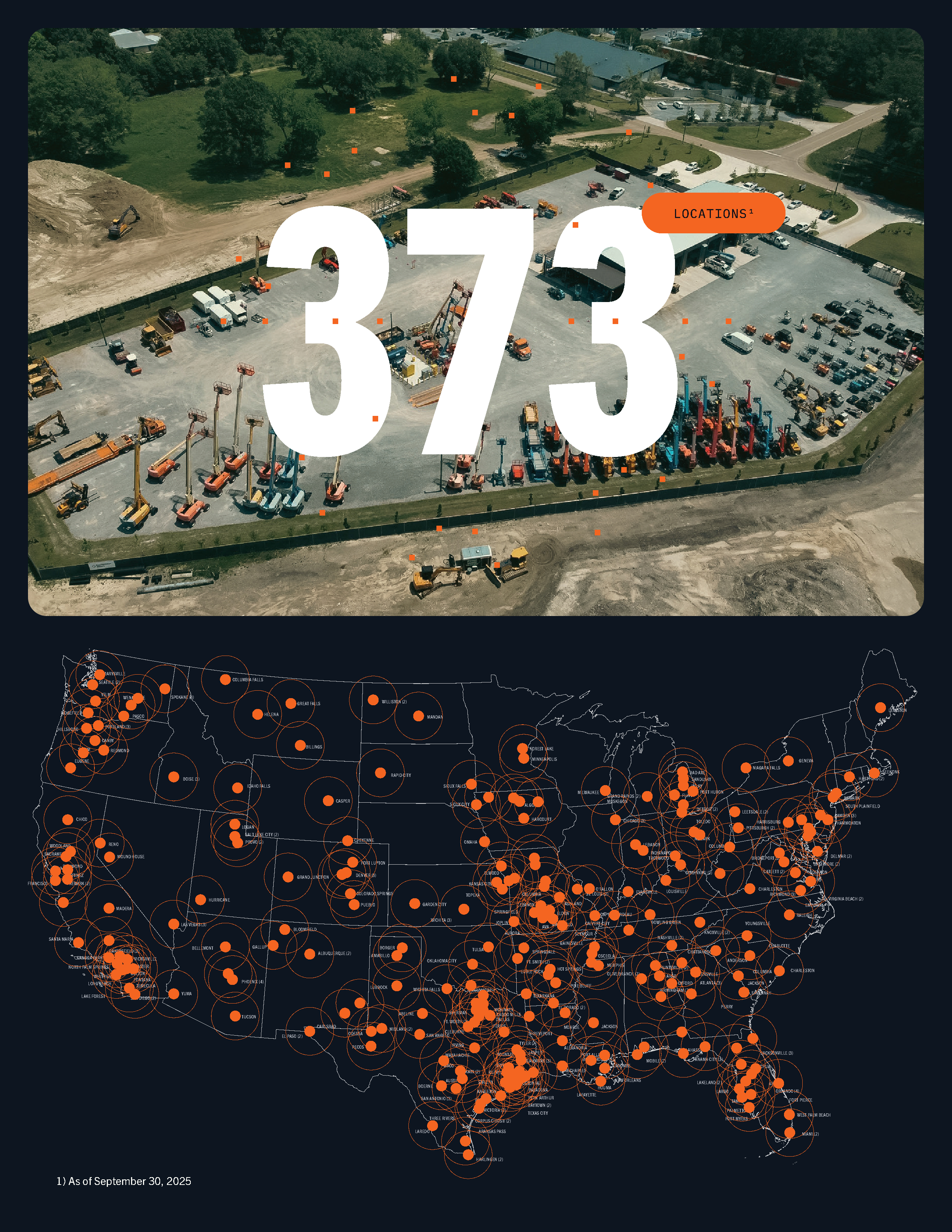

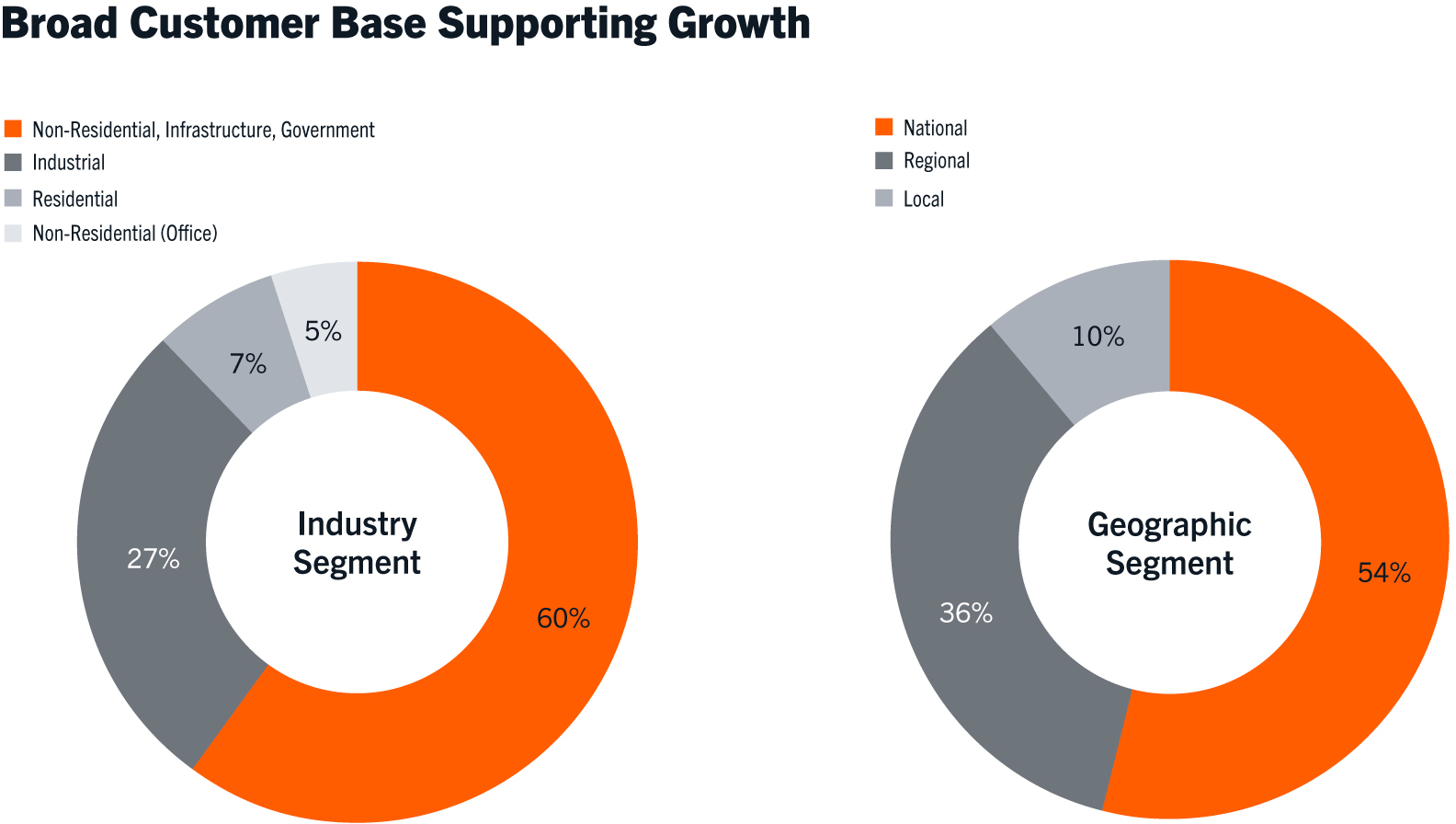

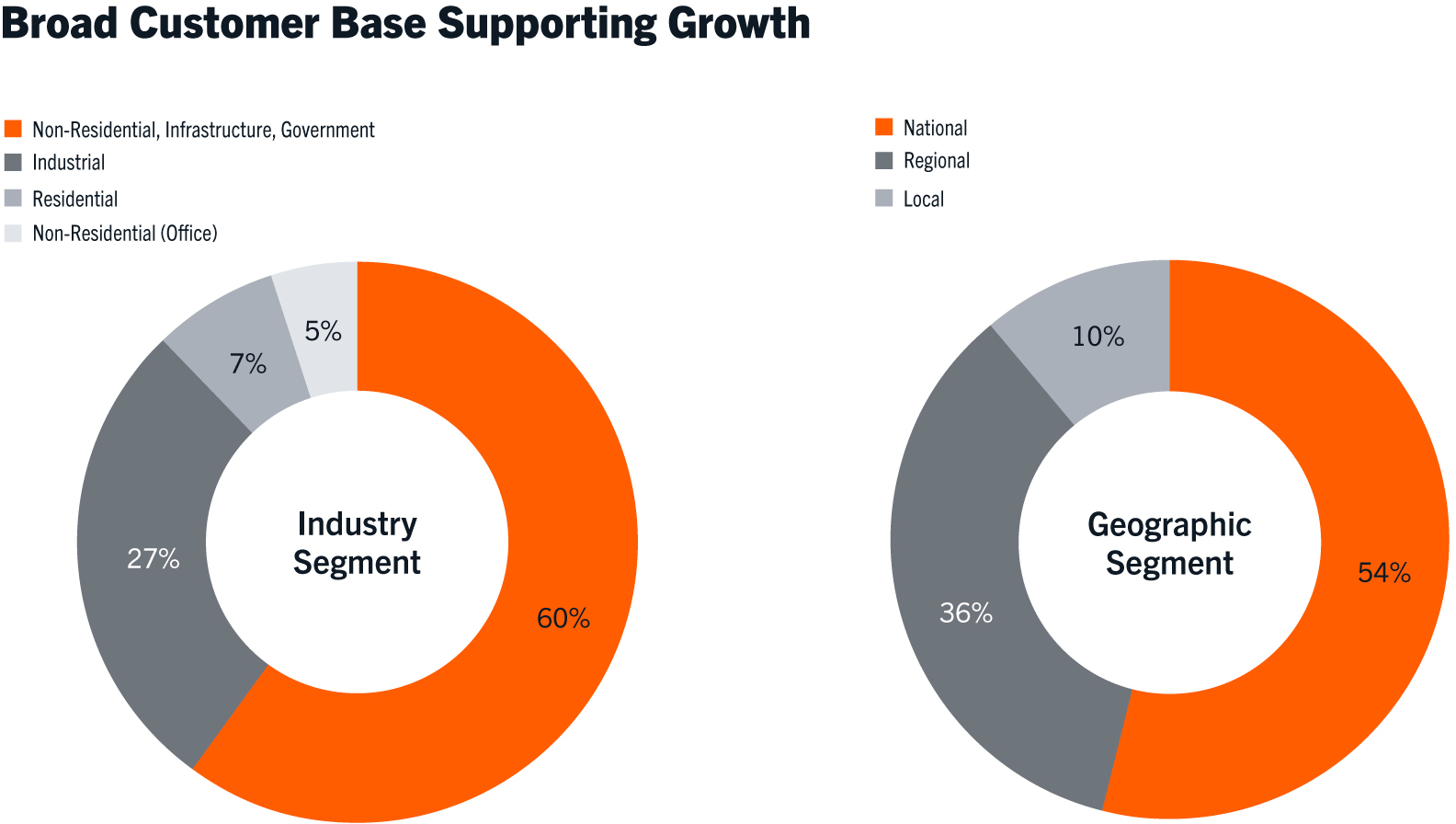

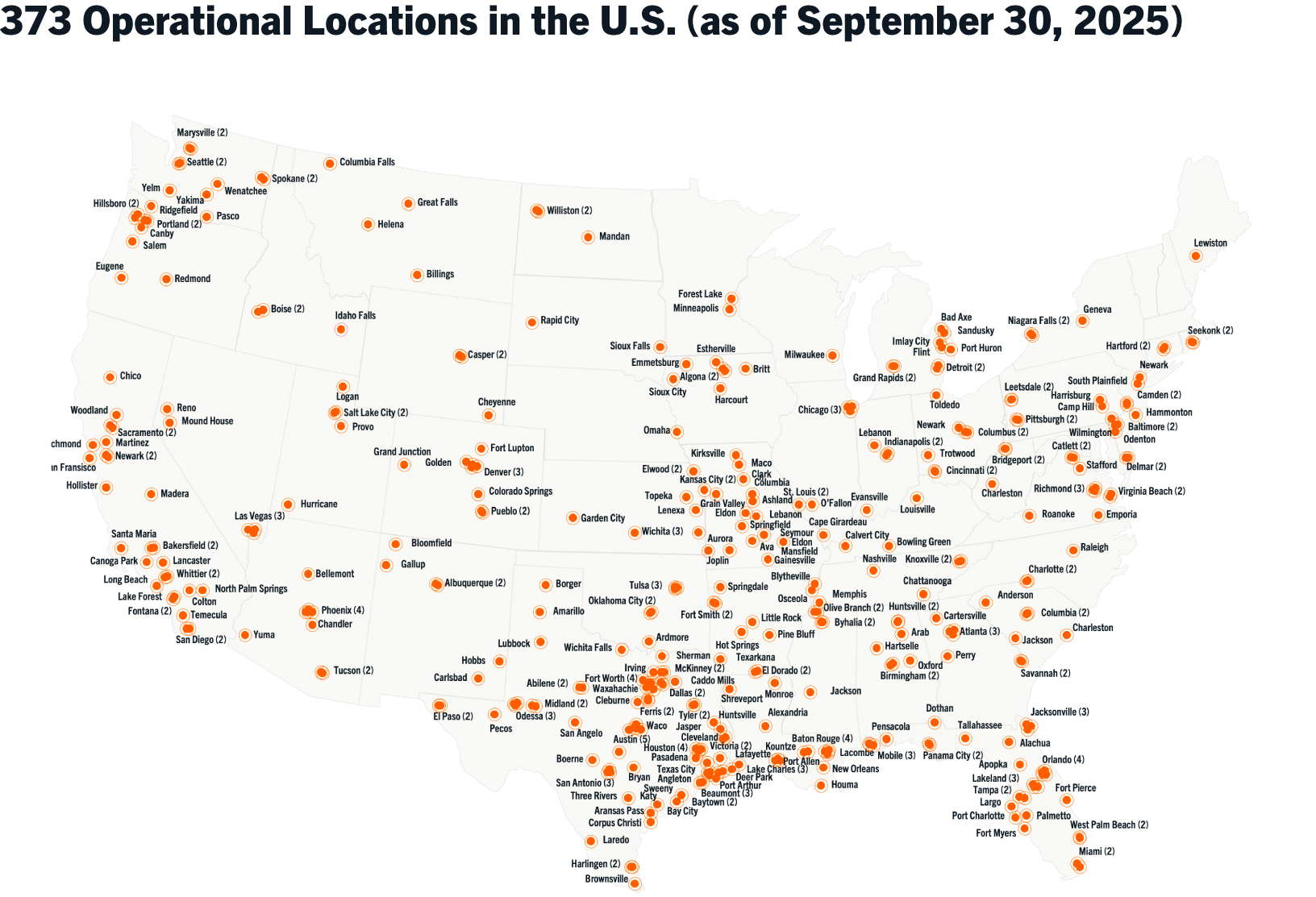

Our Footprint

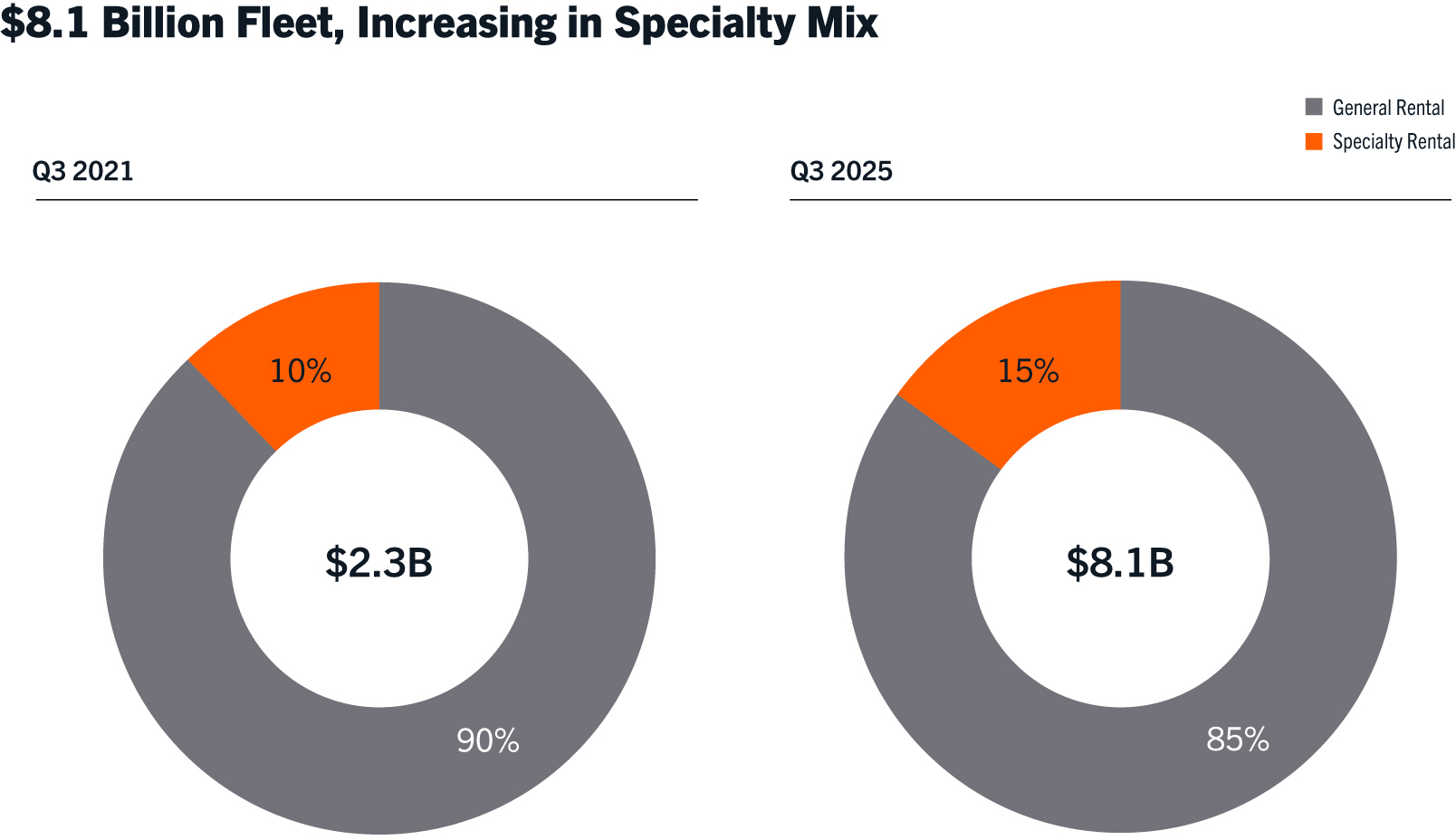

We are one of the fastest-growing and largest equipment rental providers in the United States based on revenue, with 373 operational locations (which includes 342 full-service rental locations, 22 building materials locations, and 9 dealerships) across 45 states and $8.1 billion in OEC as of September 30, 2025. Our footprint spans major metros, industrial corridors, and emerging construction markets across the U.S. We continue to deepen our presence in regions with long-term infrastructure and industrial tailwinds, including the Gulf Coast, Southwest, Midwest, and Southeast. At the same time, we see meaningful white space in underpenetrated regions such as the West Coast and Northeast, where our pipeline includes targeted site launches aligned with large-scale project demand and national customer pull-through. Our network allows us to serve a broad customer base of local and regional contractors, national builders, and blue-chip industrial companies with scale, speed, and seamless coordination.

Our rental network has been built nearly entirely through organic expansion. This approach allows us to deploy capital exactly where it’s needed, build density in high-potential markets, and maintain full control over operational standards. We are not burdened by legacy sites or overlap resulting from acquisitions, and as such, each of our locations is aligned to our fleet strategy, service model, and technology stack from day one.

Our Fleet

We have a large and diverse fleet sourced from premium brands, including John Deere, JLG, CASE, Genie, JCB, Cummins, Toyota, and Hitachi. We are one of the largest purchasers of equipment in the industry, as

evidenced by our equipment spend of $1.6 billion in 2024, which helps us negotiate competitive pricing terms and satisfy growing demand. Our fleet is 18-months younger than rental peers on average on an original cost basis and one of the youngest in the industry and we believe our fleet also has the highest level of connectivity and data collection given our T3 platform, reducing replacement capital expenditures and providing us significant fleet management flexibility during an economic cycle.

We rent a broad general construction lineup (earthmoving, aerial, material handling) and a growing specialty portfolio. As of September 30, 2025, we estimate that approximately 15% of our rental OEC is specialty, including power generation, pumps, HVAC, and industrial tooling solutions.

We are able to make smarter equipment purchase decisions as a result of having our fleet connected across our T3 platform. T3 enables real-time visibility into equipment efficiency, customer utilization, and the optimum time for disposal out of the rental fleet. This allows us to be more efficient and targeted with new purchases, while effectively delivering the types of equipment that our customers demand ahead of our competition.

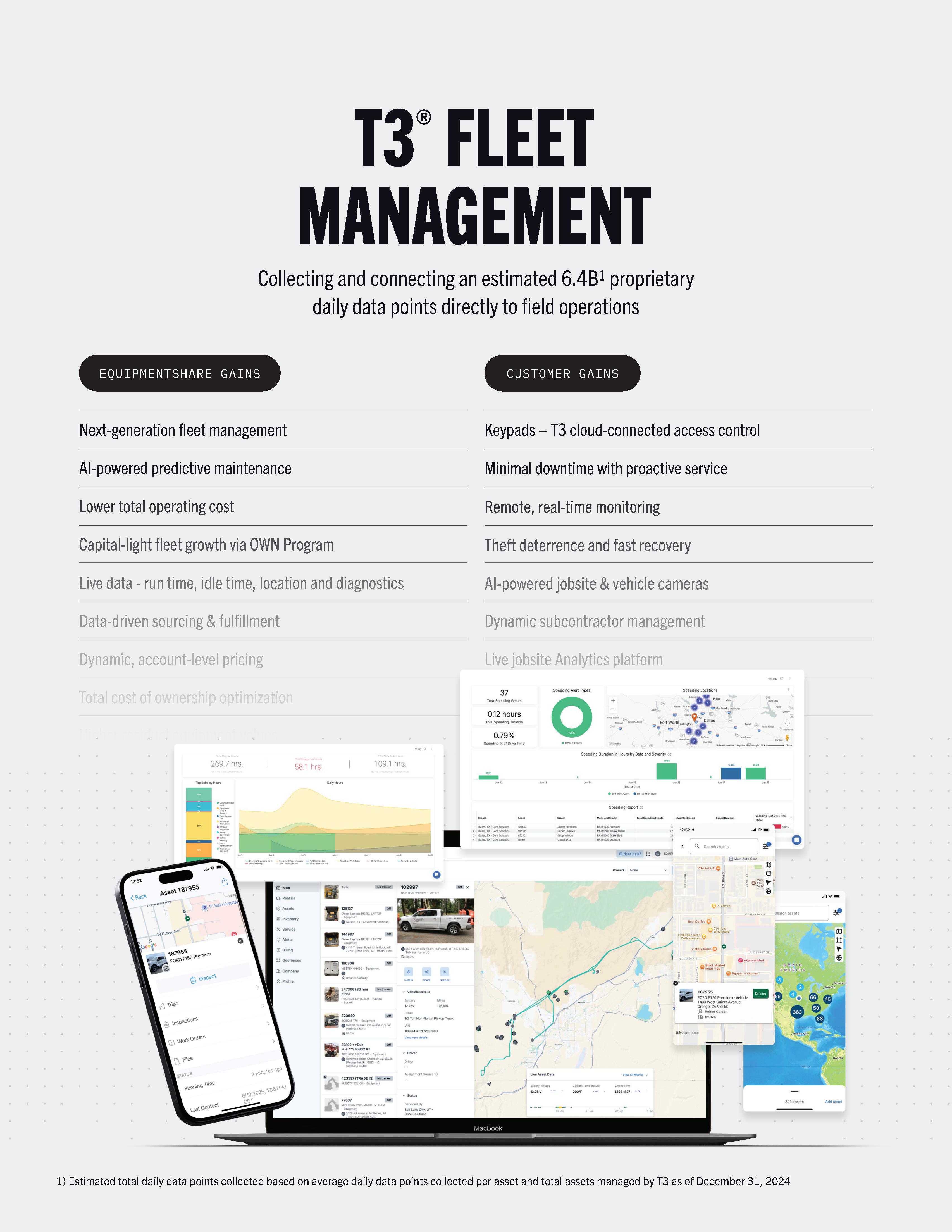

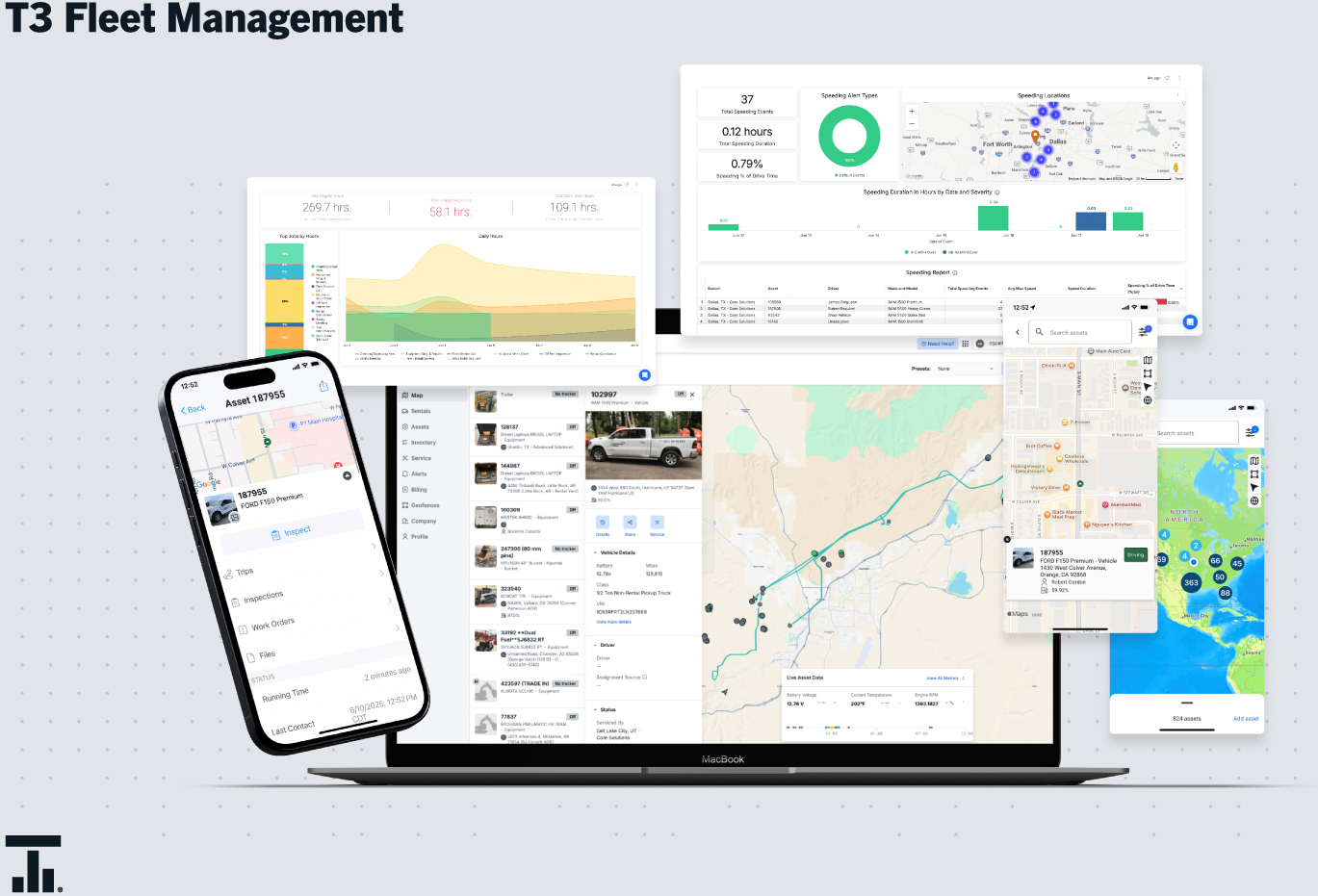

T3: Our Proprietary Full-Stack Hardware and Software Platform

We built EquipmentShare to solve the persistent inefficiencies that contractors face every day and to do so at scale. Our solution brings together a nationwide physical rental network, a vertically integrated technology platform, and a capital model designed to support long-term, high-return growth. At the center of this solution is T3, our proprietary jobsite management platform. Unlike GPS-based tracking tools or software-only point solutions, T3 is a full-stack platform that integrates hardware, firmware, software, and data across every layer of our operations. We design and manufacture our own embedded hardware, including telematics trackers and cloud-based access control keypads, giving us full control over device durability, real-time connectivity, and interoperability across OEMs. We incorporate AI in our platform features to enhance data analysis on the over 6.4 billion data points produced per day by our devices, automate service workflows, and provide jobsite intelligence for both EquipmentShare and our customers. Our cloud infrastructure and front-end applications are designed to enable rapid iteration and the ability to tailor workflows directly to field conditions. The embedded nature of T3 in our operations makes EquipmentShare fundamentally different from traditional rental companies, which focus on fleet distribution without integrated technology. We are also distinct from software or IoT providers that lack the physical infrastructure to translate data into action. Our extensive team of over 300 field-oriented engineers, which is the largest in-house technology team in the industry, builds and rapidly iterates on these capabilities.

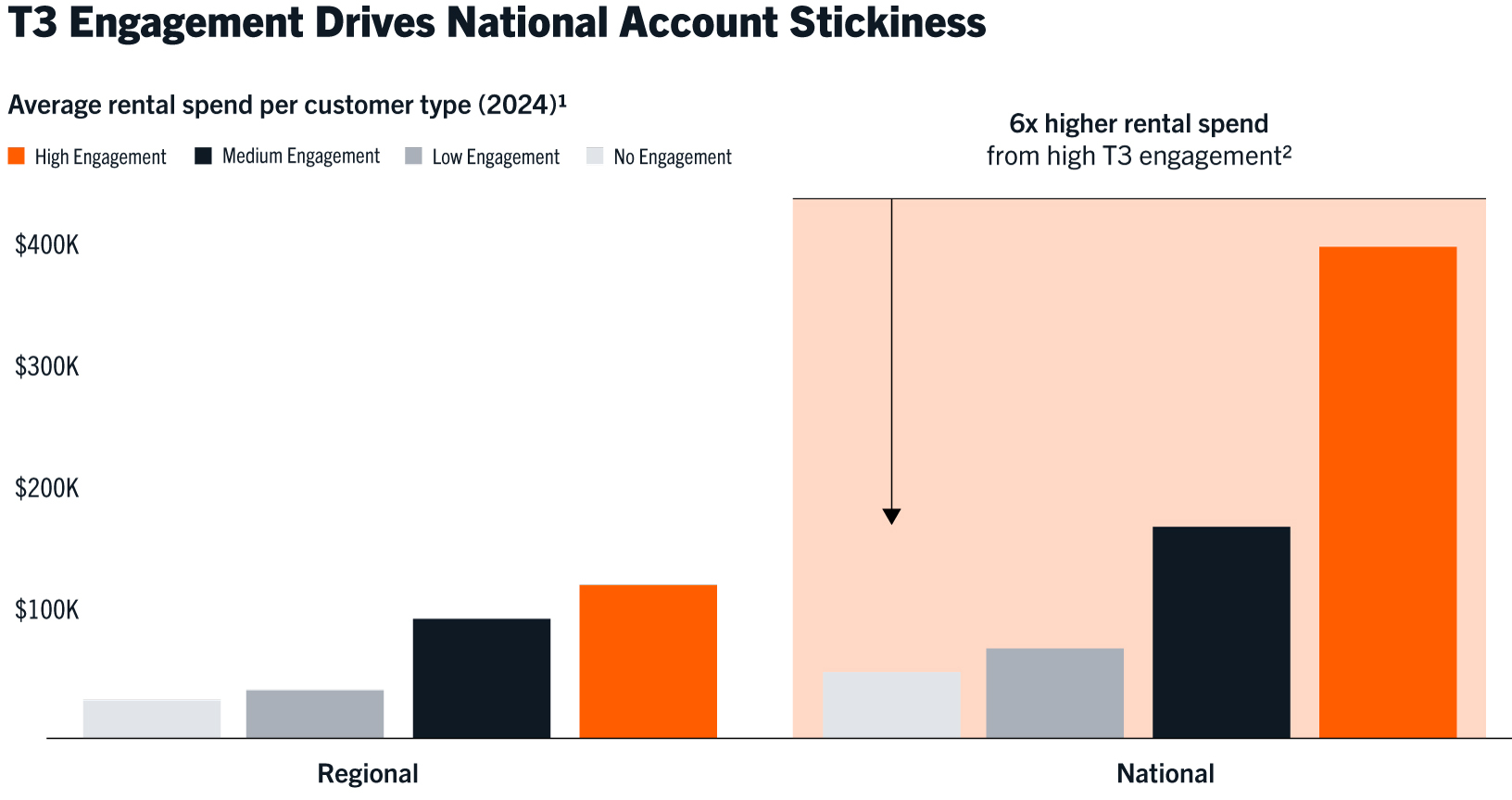

Because T3 is fully integrated into our rental fleet and day-to-day operations, every EquipmentShare rental customer receives access to T3, without requiring additional licenses or modules. T3’s advanced telematics are embedded in the machines we rent, enabling real-time visibility into jobsite activity through a digital twin of customers’ fleets. Access control keypads allow site managers to see exactly who is operating equipment and when, improving safety, reducing theft, and driving operational transparency. Customers can access the T3 platform from mobile or desktop devices, giving them remote control over machine access, employee status, and service workflows through a seamless, single interface designed specifically for the field. We believe T3’s efficiency drives customer stickiness, and high T3 engagement national customers spend approximately six times more per customer on average on rentals compared to national customers who do not use T3.

__________________

(1)For the fiscal years ended December 31, 2024, 2023 and 2022, High and Medium Engagement cohort customers made up 61.0%, 59.6%, and 54.3% of equipment rental and related services revenues, respectively.

(2)On a national per customer basis

For customers with a mix of owned and rented equipment, we offer T3 hardware and software subscriptions for their owned fleet, enabling seamless, side-by-side management of all assets through a single, unified platform.

T3 Fleet Management

Internally, T3 powers essentially every aspect of EquipmentShare’s operations. It drives our dispatch and service workflows, informs fleet investment decisions, and enables predictive maintenance and real-time logistics. By reducing unnecessary service calls, rebalancing underutilized assets, and improving technician productivity across hundreds of sites, T3 helps us operate more efficiently and at greater scale. This operational intelligence not only improves customer outcomes, but also drives stronger margins and return on invested capital across our business.

T3 is purpose-built to manage a wide range of asset ownership models and rental use cases within a single, unified system. Whether equipment is owned by EquipmentShare or managed by us through the OWN Program, T3 delivers consistent visibility, control, and performance across our fleet. This flexibility unlocks the OWN Program by allowing third-party-owned assets to operate seamlessly within our rental network, without compromising the customer experience. By decoupling ownership from operations, T3 enables capital-light fleet growth while maintaining service, quality, and operational efficiency.

Powering the largest access-controlled construction rental fleet in the world, EquipmentShare’s cloud-based access control technology (T3 keypad) is developed and manufactured in-house to ensure only authorized personnel can operate machines using operator-specific access codes, digital credentials, or keycards. Unlike traditional construction equipment—often accessible with universal keys that haven’t changed in decades—this system prevents unauthorized use at the source, delivering critical safety benefits by keeping unqualified or unapproved individuals off machines. It also protects against theft, fuel loss, and equipment misuse. Access control ties machines to trained operators and logs usage in real time, helping contractors enforce safety protocols and accountability. General contractors can issue access codes to subcontractors and align billing with actual machine time, improving job-costing accuracy. This creates new ways to monetize equipment access and turn machines into trackable, revenue-generating assets on every jobsite.

Machines equipped with EquipmentShare’s T3 keypad accumulate significantly fewer annual operating hours, typically 20% less than comparable non-controlled units. By eliminating unauthorized use and reducing idle or after-hours operation, these machines experience less wear and tear, resulting in reduced operating cost, extended lifespans, and higher residual values. Over time, this translates into substantial cost savings for EquipmentShare, OWN Program participants, and contractor’s owned fleet.

Further, integrating the T3 keypad into new equipment requires deep collaboration with OEMs, as it replaces traditional ignition systems with cloud-connected access control. This process demands extensive engineering coordination and validation, often taking years to reach final approval and achieve factory-level installation. Since launching its first keypad in 2017, EquipmentShare has successfully integrated T3 across hundreds of makes and models, creating a significant competitive moat and establishing itself as the industry leader in connected access controlled jobsite technology.

The OWN Program: A Capital-Efficient Fleet Model

To support our growth, we developed the OWN Program, a differentiated fleet growth model that enables third-party participants to own rental equipment deployed and managed by EquipmentShare. This model allows us to scale our fleet to meet customer demand with reduced capital intensity, while maintaining full operational control and generating similar lifetime cash flows as equipment financed on our balance sheet.

The OWN Program currently operates as follows: EquipmentShare purchases new equipment at industry-leading prices through our OEM relationships and deploys it immediately into our rental fleet operations. Subsequently, we offer for sale rental equipment to OWN Program participants, which include institutional investors financing equipment purchases through ABS, as well as high-net-worth individuals, family offices, and other third parties. Concurrent with the equipment sale, we enter into arrangements with the OWN Program participant for the right-to-use the rental equipment. Throughout the term of each lease arrangement to us as lessee, EquipmentShare exclusively manages the equipment’s rental, dispatch, service, and customer experience. When the equipment rents, OWN Program participants receive a portion of the rental revenue generated by the equipment. In certain arrangements, EquipmentShare retains an option to repurchase the equipment at the end of the OWN Program term at the appraised value of the equipment. OWN Program agreements are typically five to seven years in duration, contain customary renewal and termination provisions, and provide for monthly payouts to participants based on the rental activity of their enrolled equipment. As of September 30, 2025, there were approximately 1,300 OWN Program participants.

The OWN Program has consistently benefited from robust demand across multiple, deep pockets of capital. OWN Program participants typically finance their purchases with a combination of equity and leverage.

From an operational standpoint, OWN Program equipment is fully integrated into our rental fleet and managed through T3. Customers receive a consistent rental experience regardless of whether the equipment is company-owned or in the OWN Program. Our field teams deploy and service OWN equipment identically to company-owned assets. Importantly, there are no utilization guarantees or fixed lease payments to OWN Program participants. This structure preserves EquipmentShare’s operational flexibility and ensures alignment across customer needs, asset deployment, and economic performance.

The OWN Program enhances our capital efficiency, expands our access to equipment, and allows us to scale our platform with reduced balance sheet investment. In addition, the OWN Program reflects our broader strategy to align operational excellence, platform integration, and capital efficiency, positioning us to capture share and compound value in an asset-intensive industry.

The expansion of our OWN Program impacts our results of operations, gross profit, and EBITDA margins. When equipment is included in the OWN Program rather than purchased and owned or leased directly by us, depreciation and interest expense associated with that equipment are reduced, while OWN Program payouts are recorded as cost of revenues. This shift increases cost of revenues and decreases depreciation and interest expense, which in turn affects gross profit and EBITDA margins. Specifically, OWN Program payouts were $512.3 million and $287.7 million for the nine months ended September 30, 2025 and 2024, respectively, a 78.1% increase, as compared to a 27.0% increase in total revenue over this same period. OWN Program payouts were $420.1 million

and $209.2 million for the years ended December 31, 2024 and 2023, respectively, a 100.1% increase, as compared to a 47.2% increase in total revenue over this same period. During the year ended December 31, 2023, OWN Program payouts increased 118.4% from OWN Program payouts of $95.8 million, as compared to a 47.5% increase in total revenue over this same period. We expect to further increase our usage of the OWN Program, which will increase our related costs and reduce gross profit (before depreciation) and EBITDA margins, as compared to purchasing equipment. For additional information on the expansion of our OWN Program and its impact on our results of operations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Factors Affecting Our Performance—Expansion of OWN Program.”

Equipment sales through the OWN Program to entities owned or controlled by the Co-Founders represented 10%, 17%, 9% and 14% of equipment sales revenues for the nine months ended September 30, 2025 and the years ended December 31, 2024, 2023 and 2022, respectively. Revenue sharing payments, commensurate with other third-party OWN Program arrangements, that were made by the Company to such related party entities represented 10% and 20% of total OWN Program payouts for the nine months ended September 30, 2025 and 2024, respectively, and 16%, 22%, and 30% of total OWN Program payouts for the years ended December 31, 2024, 2023, and 2022, respectively. The corresponding average equipment OEC enrolled in the OWN Program owned by these entities represented approximately 4%, 19%, 13%, 22% and 23% of the total corresponding equipment rental fleet that we lease (as lessee) as of September 30, 2025 and 2024 and December 31, 2024, 2023, and 2022, respectively. The Company intends to substantially reduce these transactions following the offering and has begun to do so: in recent months, entities owned or controlled by the Co-Founders have sold a substantial portion of their equipment enrolled in the OWN Program and as of September 30, 2025, entities owned or controlled by the Co-Founders hold approximately $7.4 million of equipment enrolled in the OWN Program.

Our Competitive Strengths and Advantages

EquipmentShare is building the most advanced and integrated platform in the equipment rental industry by combining proprietary technology, physical distribution, and direct customer relationships in a way that we believe is fundamentally difficult to replicate. We are a purpose-built platform that combines the infrastructure of an incumbent with the innovation of a technology leader. This allows us to deliver better outcomes for customers today and positions us to capture share as the industry becomes more digitized, complex, and execution-driven.

Repeatable organic expansion playbook

We have a proven organic expansion strategy that has allowed us to open 222 rental locations over the past four years using a standardized, technology-driven playbook. We believe this is the most efficient model operationally and from a return on capital perspective. This approach gives us full control over market selection, fleet mix, customer engagement, and operational standards from day one. This organic strategy has created a higher quality, more unified platform that scales more efficiently over time.

Technology-enabled fleet

EquipmentShare operates with the core physical advantages of an industry incumbent: a large owned and operated fleet, deep buying power with OEM partners, and a national branch network capable of delivering equipment and service to the jobsite within hours. These elements—scale, sourcing, and physical proximity—are critical in a field-intensive industry where projects are larger than ever before and increasingly challenging for rental companies without similar scale to fulfill and service.

In addition, our fleet is digitally connected by design. Our proprietary T3 technology is installed by our OEM partners on the factory floor. This gives us a structural advantage that is difficult to replicate, even with significant investment. Through long-term collaboration with OEM partners, we have developed a superior ability to interpret machine and engine-level data. This integration enables faster deployment, smarter asset allocation, and more responsive service across the country’s most demanding jobsites.

Digitally native, fully-integrated platform

While most traditional rental providers focus on fleet availability and software vendors stop at data collection, we bridge the gap between insight and execution. As a digitally native platform, we design and control the entire technology stack: from embedded hardware, to cloud software, to the field teams that act on the data, ensuring seamless integration and unmatched efficiency. Every rental we deliver is tracked, dispatched, and serviced through T3, and every EquipmentShare asset is operated on the platform from day one. We have developed AI-powered tools within T3 to enhance service workflows, both internally and for our customers, by diagnosing issues more accurately, reducing unplanned downtime, and improving technician efficiency across the network.

We can address persistent job-site problems like equipment misuse, downtime, operator accountability, and underutilization because T3 is fully integrated. Data and real-world execution are connected in a closed loop. T3 gives us real-time visibility into equipment and jobsite activity, allowing our customers and teams to act quickly and effectively across hundreds of locations. These advantages don’t just improve unit economics, they compound as the platform grows, reinforcing the performance of every new branch, customer, jobsite, and machine added to the network. Software-only providers may offer dashboards and alerts, but they lack the ability to drive real change in the field. We combine the intelligence of a technology platform with the infrastructure of a rental operator, delivering measurable outcomes, not just tools. That’s why many contractors don’t just adopt T3, they build their workflows around it.

Full ownership over customer relationship

We take pride in directly managing all our customer relationships. Over time, our commitment to building strong connections allows us to seamlessly integrate additional offerings such as parts, tooling, fuel, site solutions, and financing.

This approach drove 95% retention among national and regional accounts in the trailing twelve months as of December 31, 2024 and significantly enhances the overall customer experience without adding complexity or introducing fragmentation.

All data based on revenue trailing twelve months as of September 30, 2025

Led by founders with deep industry expertise

EquipmentShare is led by its Co-Founders, Jabbok and Willy Schlacks, each of whom brings decades of firsthand experience in the construction industry. They founded the company to solve the persistent jobsite challenges they encountered as contractors: lack of visibility, lost time, fragmented systems, and inefficient fleet management. That deep operational understanding has shaped EquipmentShare’s DNA as a company built to solve real customer problems. Under their leadership, we have maintained a relentless focus on execution, customer outcomes, and long-term value creation. This combination of field experience and strategic vision continues to guide how we design our platform, serve our customers, and scale our business.

Our Growth Strategy

Expand Site and Geographic Footprint

We believe our business model is uniquely positioned to scale across both geography and service lines. We expect to expand our national footprint from 342 rental sites to more than 700 over time. This growth will enhance our proximity to customers and further embed our platform into the operations of construction businesses across the U.S. As we expand our presence, we expect to broaden our platform’s reach into additional verticals and deepen our share across customer workflows.

Our expansion strategy is fundamentally demand-led. Our new sites are opened in response to pull-through demand from existing customers, particularly national contractors and programmatic builders seeking consistent access to fleet, service, and T3 platform capabilities in new geographies. This allows us to enter markets with embedded demand, reducing go-to-market risk and accelerating ramp to profitability, with over 75% of a new organic site’s revenue in its first two years coming from existing customers, based on data from 2022 through 2024.

Grow Market Share

The U.S. private and public sectors are estimated to collectively invest trillions of dollars over the next several years to upgrade vital infrastructure, support energy demands, and facilitate onshore semiconductor manufacturing. Contractors are increasingly reliant on scaled equipment rental providers, including EquipmentShare, who can meet the volume and diverse fleet demands of megaprojects.

At the same time, labor and jobsite productivity are not keeping pace with rising construction demand, and technology is essential to close the gap. As the jobsite becomes more complex, EquipmentShare continues to displace incumbents, driven by the efficiencies and cost savings offered to our customers through T3.

Unlock Further Monetization Opportunities Across the Jobsite

As our footprint grows, we are unlocking a range of new revenue streams by delivering more value to the jobsite, enabled by our proprietary T3 platform and integrated physical network. These offerings are not separate from our core rental business; they are embedded extensions of our jobsite presence and increasingly integrated into how we serve our customers. Each is monetized through the same unified platform, physical distribution, and customer relationship model that powers our rental operations.

Because we own the full capability stack—hardware, software, and field operations—we can distribute these products efficiently, at scale, and with low marginal cost. As we deepen platform adoption, we expect these services

to represent a growing share of our revenue mix. Together, they enhance our unit economics, improve customer retention, and position EquipmentShare to capture long-term value across every layer of the jobsite.

(1)See “Market and Industry Data” for our sources and other information related to our total addressable market in various categories.

Equipment Rental TAM inclusive of Specialty Equipment Rental.

1.Integrated Products and Services

•By leveraging our established distribution network and the T3 platform, we are able to deliver integrated services to our customers—including new and used equipment sales, aftermarket parts and service, tooling and consumables, fueling, and site-based supply chain solutions including warehousing and just-in-time fulfillment—driving revenue growth through cross-selling and deepening customer engagement.

2.Parts and Service

•We are expanding our parts, service, and consumables offerings to support construction contractors, with real-time visibility and recurring revenue enabled by our T3 platform and distribution network—supported by our e-commerce and distribution infrastructure, this offering generates recurring revenue with room to scale.

3.Site Solutions

•Site Solutions leverages our on-site presence to efficiently bundle infrastructure services like fencing, sanitation, and lighting, deepening customer relationships and boosting revenue with minimal added cost.

4.Data as a Revenue Engine

•T3 generates a uniquely rich dataset across the jobsite which our contractors rely on for insights such as total cost of ownership, machine efficiency, and predictive maintenance—we expect this

subscription business to continue expanding meaningfully as we unlock new analytics modules, predictive insights, and AI-powered decision tools that help contractors lower cost and improve fleet performance.

5.Embedded Financial Products

•We are poised to capture growing demand for jobsite-specific financial services and equipment financing solutions as a result of the data we collect —as we scale, we expect embedded insurance, equipment lending, and underwriting support to become a meaningful stream of recurring and high-margin revenue enabled by the T3 platform. Our goal is to become the Carfax for equipment.

6.Hardware and Telematics Infrastructure

•We see a meaningful opportunity to commercialize third-party hardware and subscription revenue which has already scaled to $20.7 million in annual revenue in 2024, across third-party fleets and platforms from our proprietary IoT hardware built specifically for this field and integrated software capabilities.

The Opportunity Ahead

The conditions that have enabled today’s most successful technology platforms are present in construction: a massive and underserved market, fragmented incumbents unable to modernize, and a growing demand for visibility, efficiency, and integration. Trillions of dollars are expected to be invested in infrastructure, energy, and industrial projects in the coming decade. This spend will benefit from a new class of platform partner who can meet the complexity and scale of modern construction.

EquipmentShare is building the first fully-integrated, technology-enabled platform for the jobsite that combines physical distribution, digital infrastructure, and embedded services to modernize how contractors manage every facet of their projects. Our platform unifies equipment, data, and workflows across the jobsite, creating a system of record that is able to drive better outcomes for contractors and deeper, recurring engagements with our customers.

Rental is our foundation, and our physical footprint is what puts us on the jobsite, close to the customer, responsive to their needs, and embedded in their workflows. We have demonstrated our ability to displace legacy incumbents and redefine what contractors expect from a jobsite partner. The combination of hyper-local service, national scale, and integrated intelligence from a full-stack, industry-specific platform has never been delivered effectively to our marketplace until now.

Today, our reach extends well beyond rental and includes materials, tooling, site solutions, parts, fueling, service, and software. All of these are delivered through a single platform that customers rely on to run their jobsites. Our customers demand a unified, intelligent solution to manage the full complexity of the jobsite. As we expand our offerings and deepen platform integration, we are leading the digital transformation of construction.

Risk Factors Summary

An investment in shares of our Class A common stock involves substantial risks and uncertainties that may adversely affect our business, financial condition and results of operations and cash flows. Some of the more significant challenges and risks relating to an investment in our Class A common stock include those associated with the following:

•The construction equipment rental industry is highly competitive, and competitive pressures could lead to a decrease in our market share or in the prices that we can charge;

•Our dependence on relationships with certain equipment suppliers to obtain equipment for our business;

•Our OWN Program subjects us to a number of risks, many of which are beyond our control;

•Our suppliers of new equipment may appoint additional distributors, sell directly to our customers or unilaterally terminate our distribution agreements with them, any of which could have a material adverse effect on our equipment sales due to a loss of such sales;

•Our ability to effectively manage our workforce and operations, which have grown substantially since our inception, and we expect will continue to do so in the future;

•We may not be able to facilitate our growth strategy by identifying and opening attractive new branch locations, which could limit our revenues and profitability;

•We may encounter substantial competition or other difficulties in our efforts to expand our operations;

•A decline in construction and industrial activities, a downturn in the economy in general or other macroeconomic or environmental factors could lead to decreased demand for our equipment, depressed equipment rental rates and lower equipment sales prices;

•Disruptions in our supply chain could result in adverse effects on our results of operations and financial performance;

•Our ability to collect on contracts with customers;

•Conditions that adversely affect related parties with which we have entered into equipment sale and rental arrangements;

•Our reliance upon communications networks and centralized information technology systems and the concentration of our systems which creates or increases risks for us, such as the risk of the misuse or theft of information, including personal information, as a result of cybersecurity breaches or otherwise;

•Our T3 platform is highly technical, and any prolonged undetected errors could adversely affect our business;

•Our reliance on third parties maintaining open marketplaces to distribute our T3 platform and to provide the software we use in certain of our products and offerings;

•The dependence of our business upon the interoperability of our T3 platform across devices, operating systems, and third-party applications that we do not control;

•Trends in oil and natural gas prices, which could adversely affect the level of exploration, development and production activity of certain of our customers and the demand for our services, and products;

•Risks related to heightened inflation, recessionary conditions, and financial and capital market disruptions that may adversely impact business conditions, the availability of credit and access to capital;

•Fluctuations in fuel costs or reduced supplies of fuel, which could harm our business;

•Our exposure to a variety of claims and losses arising from our operations, which our insurance may not cover all or any portion of such claims; and

•Holders of our Class A common stock will have limited or no ability to influence corporate matters due to the dual class structure of our common stock and the ownership of Class B common stock by our Co-Founders, which will have the effect of concentrating voting control with our Co-Founders for the foreseeable future.

Before you invest in our Class A common stock, you should carefully consider all the information in this prospectus, including matters set forth under “Risk Factors.”

Controlled Company

Immediately prior to the completion of this offering, all shares of our common stock, including shares of common stock issuable upon the automatic conversion of our preferred stock (other than shares of perpetual preferred (as defined herein) which will not convert into common stock but remain outstanding) will be reclassified into shares of Class A common stock, and immediately thereafter all shares of Class A common stock then held by our Co-Founders will be exchanged into shares of Class B common stock (the “Conversion”). Additionally, Class A shares will be issuable upon exercise or vesting of all outstanding options and restricted stock units (“RSUs”), as applicable, except that Class B shares will be issuable upon exercise or vesting of options and RSUs held by our Co-Founders as of closing and upon vesting of performance stock units (“PSUs”) granted to our Co-Founders as IPO Founder Awards (as defined herein). For additional information, see “Compensation Discussion and Analysis—Equity Incentive Compensation Plans and Arrangements—2025 IPO Founder Awards.”

Our Class B common stock, which will be held by our Co-Founders, who have agreed to vote together as a group, will represent approximately % of the total voting power of our outstanding common stock following this offering. Upon the completion of this offering, we will be a “controlled company” within the meaning of Nasdaq corporate governance standards and we intend to avail ourselves of certain exemptions from Nasdaq’s corporate governance standards available to controlled companies. For additional information, see “Risk Factors—Risks Related to Our Class A Common Stock and this Offering—We will be a “controlled company” within the meaning of Nasdaq’s corporate governance standards and, as a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to shareholders of companies that are subject to such requirements.”

Company and Corporate Information

We were incorporated in the State of Delaware in 2014 and converted to a Texas corporation on June 30, 2025. Our principal executive office is located at 5710 Bull Run Drive, Columbia, MO, 65201 and our telephone number is (573) 299-5222. Our website is www.equipmentshare.com. The reference to our website is an inactive textual reference only and information contained therein or connected thereto are not incorporated into this prospectus or the registration statement of which it forms a part.

THE OFFERING

This summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider before investing in our Class A common stock. You should carefully read this entire prospectus before investing in our Class A common stock, including “Risk Factors” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| | | | | |

Class A common stock offered by us | shares |

| |

Class A common stock offered by the selling shareholders | shares (or shares if the underwriters exercise their option to purchase additional shares of Class A common stock in full) |

| |

Underwriters’ option to purchase additional shares of Class A common stock | The selling shareholders have granted the underwriters an option to purchase up to and additional shares of Class A common stock, respectively, at the initial public offering price, less underwriting discounts, and commissions. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| |

Class A common stock to be outstanding after this offering | shares |

| |

| Class B Common stock to be outstanding after this offering | shares |

| |

Total shared Common stock to be outstanding after this offering | shares |

Perpetual preferred stock to be outstanding after this offering | shares |

| |

Perpetual-1 preferred stock to be outstanding after this offering | shares |

| |

Voting rights after giving effect to this offering | Upon completion of this offering, we will have two classes of voting common stock, Class A common stock, which is entitled to one vote per share, and Class B common stock, which is entitled to 20 votes per share. All shares of our outstanding common stock will be converted into shares of Class A common stock, except shares held by our Co-Founders, which will be converted into shares of Class B common stock. Holders of Class A common stock and Class B common stock will vote together as a single class on all matters, except as otherwise set forth in our amended and restated certificate of formation or as required by applicable law. The holders of our perpetual preferred stock (our “perpetual preferred stock”) and our perpetual-1 preferred stock (our “perpetual-1 preferred stock” and together with our perpetual preferred stock, our “perpetual preferred”) will be entitled to vote on specific matters. See “Description of Capital Stock.” |

| |