| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the fiscal year ended December 31, 2022. | |||||

| or | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to . | |||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||||||||

| Accelerated Filer | Non-Accelerated Filer | Smaller Reporting Company | Emerging Growth Company | |||||||||||

| ☑ | ☐ | ☐ | ||||||||||||

| Fundamentals of Our Business | Page | |||||||

| Availability of Company Information | ||||||||

| Introduction to Our Business | ||||||||

| A Year in Review | ||||||||

| Our Strategy | ||||||||

| Our Capital | ||||||||

| Management's Discussion and Analysis | ||||||||

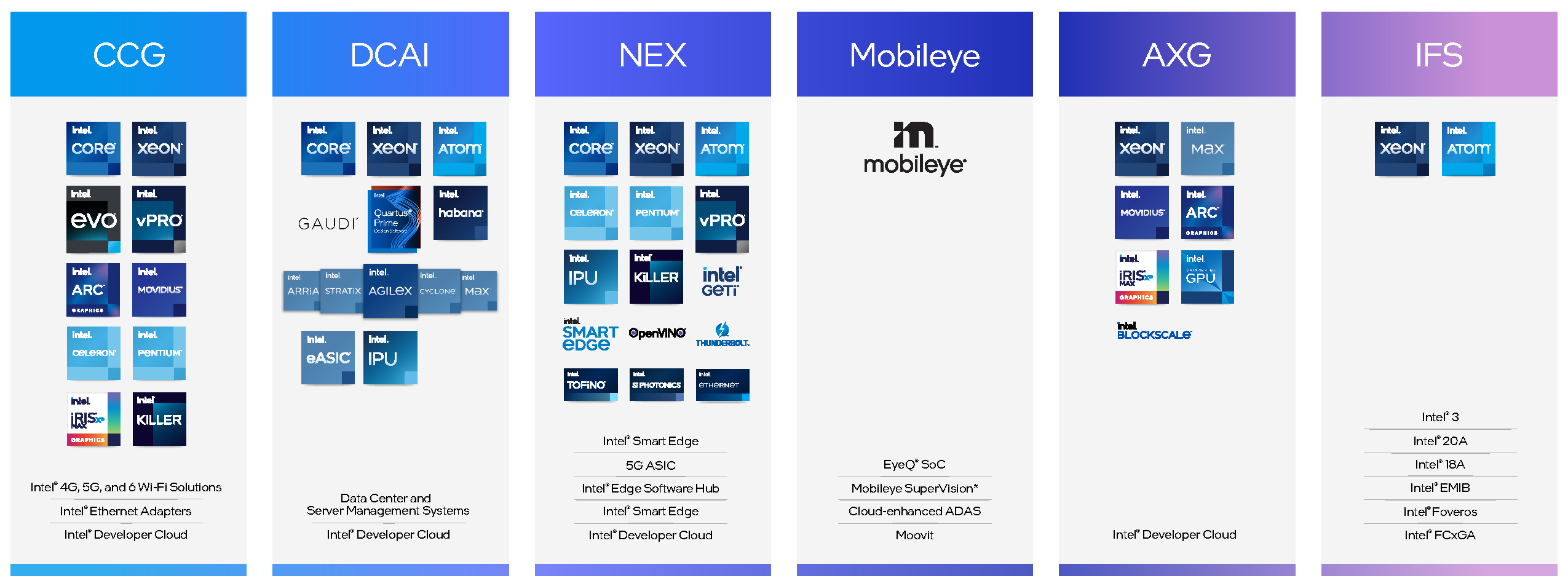

Our Products | ||||||||

| Segment Trends and Results | ||||||||

| Consolidated Results of Operations | ||||||||

| Liquidity and Capital Resources | ||||||||

Critical Accounting Estimates | ||||||||

| Non-GAAP Financial Measures | ||||||||

| Other Key Information | ||||||||

Sales and Marketing | ||||||||

| Quantitative and Qualitative Disclosures About Market Risk | ||||||||

Risk Factors | ||||||||

Properties | ||||||||

| Market for Our Common Stock | ||||||||

| Information About Our Executive Officers | ||||||||

| Disclosure Pursuant to Section 13(r) of the Securities Exchange Act of 1934 | ||||||||

| Financial Statements and Supplemental Details | ||||||||

| Auditor's Reports | ||||||||

| Consolidated Financial Statements | ||||||||

Notes to Consolidated Financial Statements | ||||||||

| Key Terms | ||||||||

| Controls and Procedures | ||||||||

| Exhibits | ||||||||

| Form 10-K Cross-Reference Index | ||||||||

| 1 | |||||||

| 2 | |||||||

A Year in Review | |||||

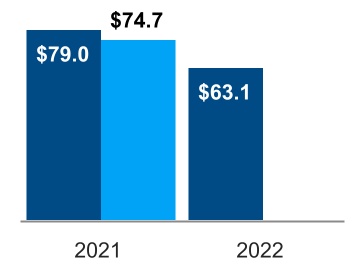

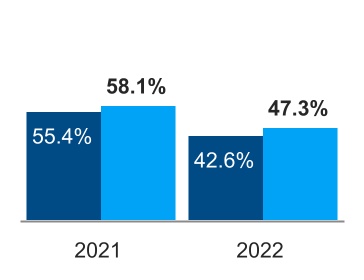

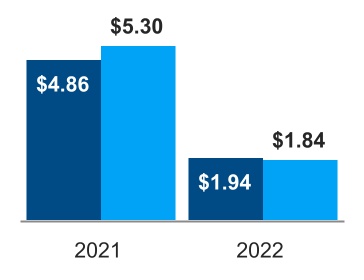

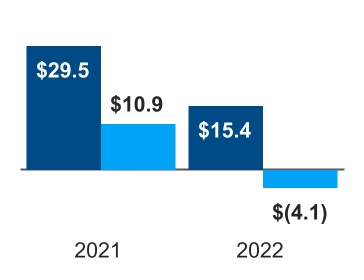

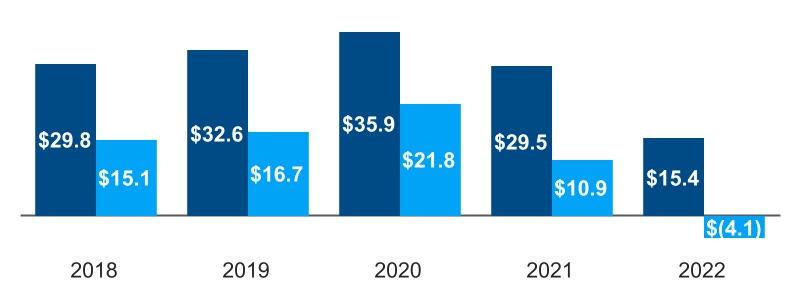

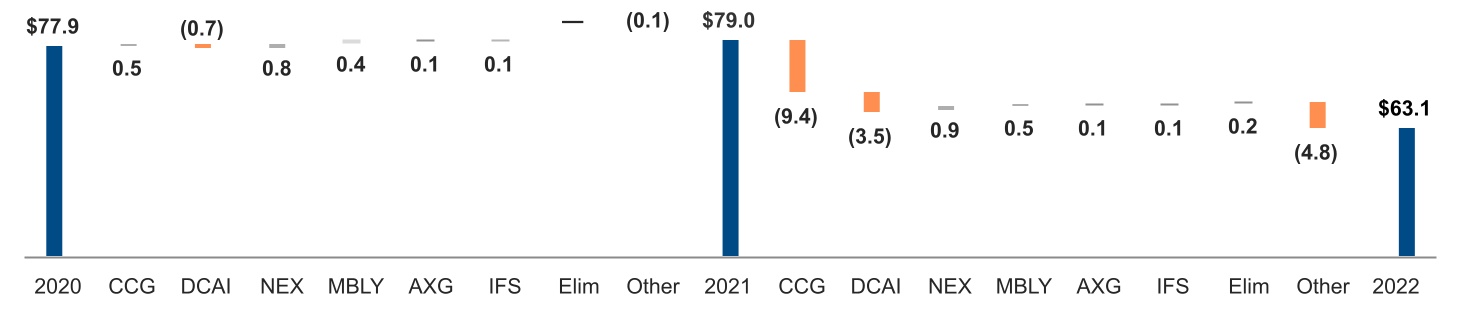

2022 revenue was $63.1 billion, down $16.0 billion, or 20%, from 2021 as CCG revenue decreased 23%, DCAI revenue decreased 15%, and NEX revenue increased 11%. 2022 results were impacted by an uncertain macroeconomic environment—with slowing consumer demand, persistent inflation, and higher interest rates—that we believe impacts our target markets and creates a high level of uncertainty with our customers. CCG revenue was down on lower notebook and desktop volume in the consumer and education market segments, while notebook and desktop ASPs were higher due to a resulting change in product mix. DCAI server volume decreased, led by enterprise customers, and due to customers tempering purchases to reduce existing inventories in a softening data center market. Server ASPs decreased due to customer and product mix. NEX revenue increased primarily due to Ethernet ASPs and increased demand for 5G products, partially offset by lower demand for Network Xeon. We invested $17.5 billion in R&D, made capital investments of $24.8 billion, and generated $15.4 billion in cash from operations and $(4.1) billion of adjusted free cash flow. | ||

| Revenue | Gross Margin | Diluted EPS Attributable to Intel | Cash Flows | |||||||||||||||||

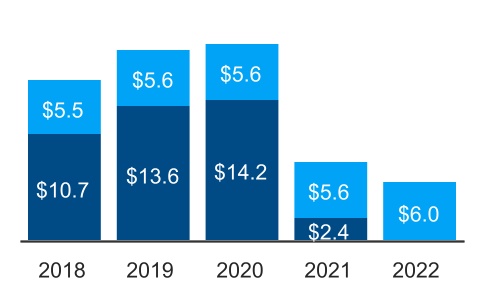

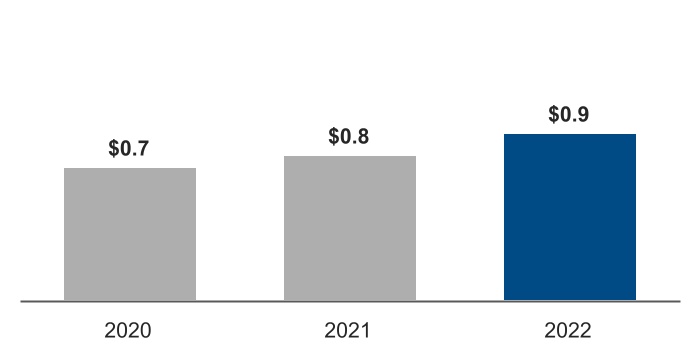

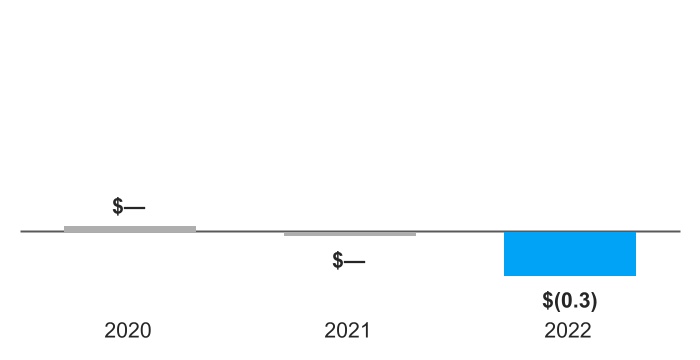

■ GAAP $B ■ Non-GAAP $B | ■ GAAP ■ Non-GAAP | ■ GAAP ■ Non-GAAP | ■ Operating Cash Flow $B ■ Adjusted Free Cash Flow1 $B | |||||||||||||||||

| $63.1B | 42.6% | 47.3% | $1.94 | $1.84 | $15.4B | $(4.1)B | |||||||||||||||||||||||||||||||||||

| GAAP | GAAP | non-GAAP1 | GAAP | non-GAAP1 | GAAP | non-GAAP1 | |||||||||||||||||||||||||||||||||||

| Revenue down 16% from 2021 non-GAAP revenue | Gross margin down 12.8 ppts from 2021 | Gross margin down 10.8 ppts from 2021 | Diluted EPS down $2.92 or 60% from 2021 | Diluted EPS down $3.46 or 65% from 2021 | Operating cash flow down $14B or 48% | Adjusted free cash flow down $15B or 137% | |||||||||||||||||||||||||||||||||||

| Lower revenue in CCG and DCAI, higher revenue in NEX, and lack of NAND revenue compared to 2021 due to the divestiture in Q1 2022. | Lower gross margin from lower revenue, higher unit cost, lack of NAND gross margin, higher period charges from the ramp of Intel 4, and higher inventory reserves. | Lower EPS from lower gross margin, higher operating expenses from additional investment in R&D, partially offset by higher gains on equity investments and a tax benefit. | Lower operating cash flow driven by lower operating income; partially offset by favorable working capital changes. | ||||||||||||||||||||||||||||||||||||||

| Fundamentals of Our Business | 5 | ||||||

| Fundamentals of Our Business | 6 | ||||||

Our Strategy | |||||

| Product Leadership | ||

| Fundamentals of Our Business | 7 | ||||||

| Open Platforms | ||

| Manufacturing at Scale | ||

| Our People | ||

| Fundamentals of Our Business | 8 | ||||||

| Fundamentals of Our Business | 9 | ||||||

Our Capital | |||||

| Capital | Strategy | Value | ||||||

| Financial | ||||||||

| Leverage financial capital to invest in ourselves and drive our strategy, provide returns to stockholders and supplement and strengthen our capabilities through acquisitions. | We strategically invest financial capital to create long-term value and provide returns to our stockholders. | ||||||

| Intellectual | ||||||||

| Invest significantly in R&D and IP to enable us to deliver on our accelerated process technology roadmap, introduce leading x86 and xPU products, and develop new businesses and capabilities. | We develop IP to enable next-generation products, create synergies across our businesses, expand into new markets, and establish and support our brands. | ||||||

| Manufacturing | ||||||||

| Build manufacturing capacity efficiently to meet the growing long-term global demand for semiconductors, aligned with our IDM 2.0 strategy. | Our geographically balanced manufacturing scope and scale enable us to provide our customers with a broad range of leading-edge products. | ||||||

| Human | ||||||||

| Build a diverse, inclusive, and safe work environment to attract, develop, and retain top talent needed to build transformative products. | Our talented employees enable the development of solutions and enhance the intellectual and manufacturing capital critical to helping our customers win the technology inflections of the future. | ||||||

| Social and Relationship | ||||||||

| Build trusted relationships for both Intel and our stakeholders, including employees, suppliers, customers, local communities, and governments. | We collaborate with stakeholders on programs to empower underserved communities through education and technology, and on initiatives to advance accountability and capabilities across our global supply chain, including accountability for the respect of human rights. | ||||||

| Natural | ||||||||

| Strive to reduce our environmental footprint through efficient and responsible use of natural resources and materials used to create our products. | With our proactive efforts, we seek to mitigate climate and water impacts, achieve efficiencies, and lower costs, and position ourselves to respond to the expectations of our stakeholders. | ||||||

| Fundamentals of Our Business | Our Capital | 10 | ||||||||

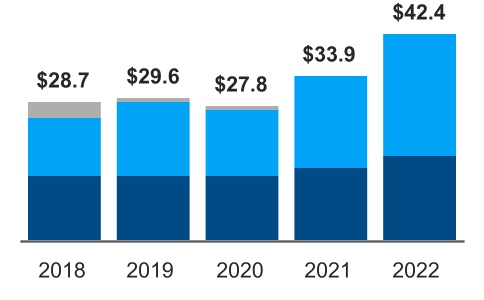

| Financial Capital | ||||

| Cash from Operating Activities $B | ||

■ Cash from Operating Activities | ■ Adjusted Free Cash Flow1 | |||||||

| R&D and Capital Investments $B | Cash to Stockholders $B | |||||||

■ R&D | ■ Logic | ■ Memory2 | ■ Repurchases | ■ Dividend | ||||||||||||||||||||||

| Fundamentals of Our Business | Our Capital | 11 | ||||||||

| Intellectual Capital | ||||

Process and packaging. Our leading-edge process and packaging technology and world-class IP portfolio are key to the success of our strategy. This year, we have reaffirmed our commitment to achieving process technology leadership in 2025 by planning to deliver five technology nodes in four years. In addition, we have solidified our process and packaging offerings to external customers through IFS. | |||||

▪We introduced further optimizations to our Intel 7 process node, which is now in production for our 13th Gen Intel Core processors (Raptor Lake). ▪Intel 4, taking advantage of EUV, is a node that is designed to deliver significant density scaling and approximately 20% performance-per-watt improvement over Intel 7. Meteor Lake is scheduled to be our first high-volume client product on Intel 4. ▪We expect Intel 3 to deliver further logic scaling and up to 18% performance-per-watt improvement over Intel 4. Intel 3 is our first advanced node offered to IFS customers and is optimized for the needs of Data Center products. ▪Intel 20A will follow Intel 3 and will introduce two breakthrough technologies that we expect will deliver up to 15% performance-per-watt improvement over Intel 3: RibbonFET and PowerVia. RibbonFET, our implementation of a gate-all-around transistor, is designed to deliver faster transistor switching speeds while achieving the same drive current as multiple fins, but in a smaller footprint. PowerVia is our unique industry-first implementation of backside power delivery that is designed to optimize signal transmission by eliminating the need for power routing on the front side of the wafer. ▪Intel 18A, our second IFS advanced node offering, improves on Intel 20A by delivering ribbon innovation for design optimization and line width reduction. Intel 18A is on schedule and expected to deliver an additional 10% improvement in performance per watt over Intel 20A. ▪Beyond Intel 18A, we have already initiated definition and development of our next two process nodes and continue to define, build, and develop the next-generation High Numerical Aperture EUV lithography into our process technology roadmap. ▪Our family of 3D advanced packaging technology will usher in the next generation of Foveros technology, enabling us to mix multiple top die tiles with multiple base tiles across mixed fab nodes, giving Intel and our customers greater flexibility for disaggregated chip designs. Our future Foveros Direct technology should scale interconnect pitch below 10µm, enable direct copper-to-copper bonding for low-resistance interconnects, and blur the boundary between wafer and package. | |||||

xPU architecture. We believe the future is a diverse mix of scalar, vector, matrix, and spatial architectures deployed in CPU, GPU, accelerator, and FPGA sockets, enabled by a scalable software stack and integrated into systems by advanced packaging technology. We are building processors that span several major computing architectures, moving toward an era of heterogeneous computing: | |||||

| Fundamentals of Our Business | Our Capital | 12 | ||||||||

| Fundamentals of Our Business | Our Capital | 13 | ||||||||

| Manufacturing Capital | ||||

| Fundamentals of Our Business | Our Capital | 14 | ||||||||

| Human Capital | ||||

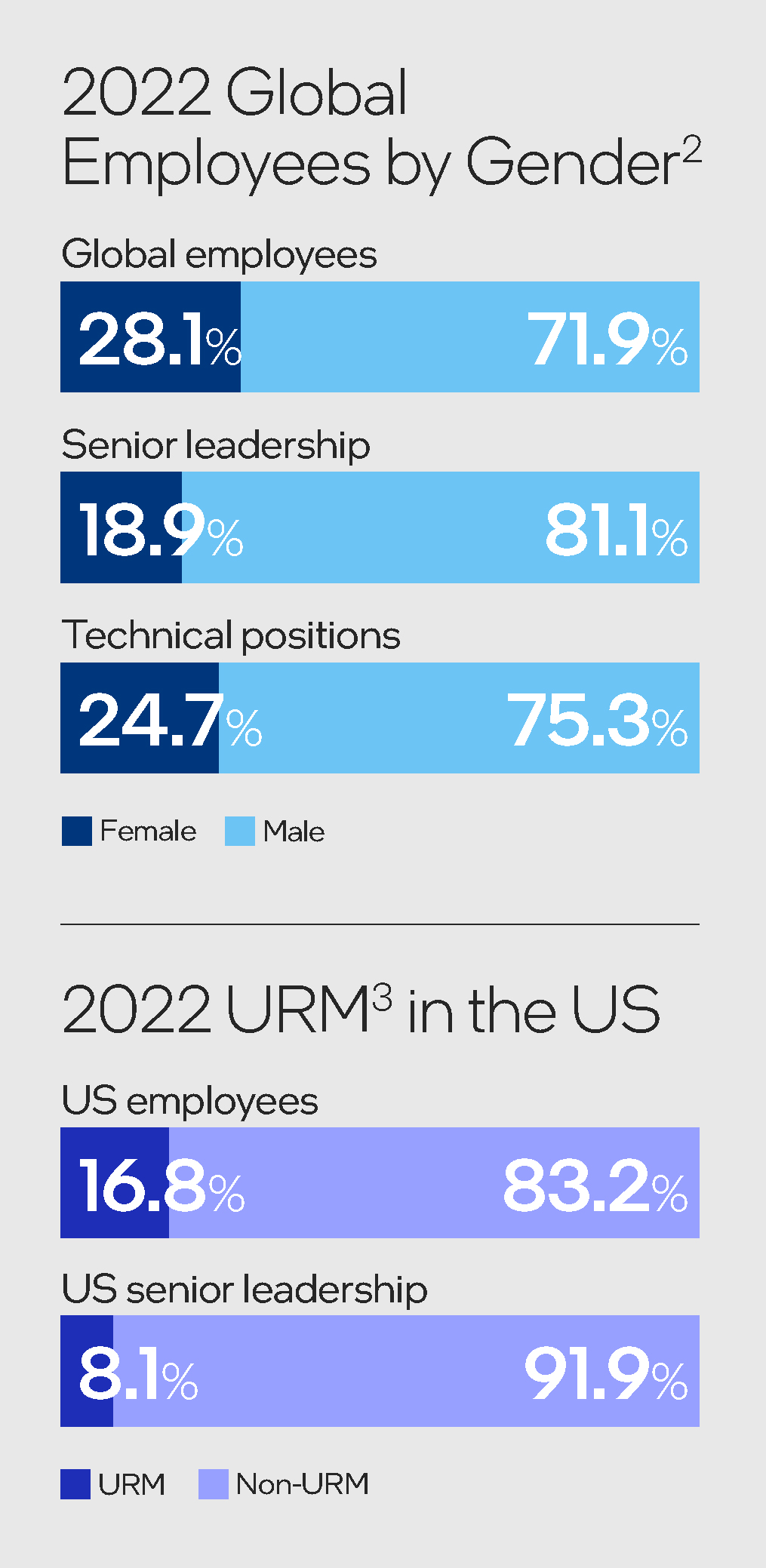

| Inclusion |  | ||||

Diversity and inclusion are core elements of Intel's values and instrumental to driving innovation and positioning us for growth. Over the past decade, we have taken actions to integrate diversity and inclusion expectations into our culture, performance and management systems, leadership expectations, and annual bonus metrics. We are proud of what we have accomplished to advance diversity and inclusion, but we recognize we can achieve more, including beyond the walls of Intel. Our RISE strategy and 2030 goals set our global ambitions for the rest of the decade, including doubling the number of women in senior leadership; doubling the number of underrepresented minorities in US senior leadership; increasing the percentage of employees who self-identify as having a disability to 10%; and exceeding 40% representation of women in technical roles, including engineering positions and other roles with technical job requirements. To drive accountability, we continue to link a portion of our executive and employee compensation to diversity and inclusion metrics. We have committed our scale, expertise, and reach through our comprehensive RISE strategy to work with customers and other stakeholders to accelerate the adoption of inclusive business practices across industries. As part of the Alliance for Global Inclusion, we worked with a coalition of technology companies to create a Global Inclusion Index Survey, which serves as a benchmark for companies to track diversity and inclusion improvements, provide information on current best practices, and highlight opportunities to improve outcomes across industries. The results of the second Global Inclusion Index Survey were published in 2022 and shared with business leaders across industries. The number of companies that completed the inclusion index in 2022 nearly doubled compared to in 2021. This collective effort will allow the industry to more clearly identify actions needed to advance progress on closing persistent gaps and advancing more inclusive practices in workplaces, industry, and society. The survey results for 2022 showed participants making progress in many of these areas. We will also continue to collaborate on initiatives that expand the diverse pipeline of talent for our industry, advance social equity, make technology fully inclusive, and expand digital readiness for millions of people around the world. | |||||

| Fundamentals of Our Business | Our Capital | 15 | ||||||||

| Social and Relationship Capital | ||||

| Fundamentals of Our Business | Our Capital | 16 | ||||||||

| Natural Capital | |||||||||||||

| Fundamentals of Our Business | Our Capital | 17 | ||||||||

| Fundamentals of Our Business | Our Capital | 18 | ||||||||

Management's Discussion and Analysis | |||||

| MD&A | 19 | ||||||

| Overview | % Intel Revenue | |||||||

We are committed to advancing PC experiences by delivering an annual cadence of leadership products and deepening our relationships with industry partners to co-engineer and deliver leading platform innovation. We engage in an intentional effort focused on long-term operating system, system architecture, hardware, and application integration that enables industry-leading PC experiences. We will embrace these opportunities by simplifying and focusing our roadmap, ramping PC capabilities even more aggressively, and designing PC experiences even more deliberately. By doing this, we believe we will continue to fuel innovation across Intel, providing a growing source of IP, scale, and cash flow. |  | |||||||

| Key Developments | ||||||||

■ | Our revenue was $31.7 billion, down 23% in 2022, driven by macroeconomic weakness that negatively impacted PC TAM, particularly in the consumer, education and small/medium business markets. Operating margin was $6.3 billion, down 60% year over year primarily due to lower notebook and desktop revenue, higher unit costs, increased investments in leadership products, and higher inventory reserves. | |||||||

■ | COVID-related dynamics like work- and learn-from-home solidified the PC as an essential tool in the post-pandemic world. We launched our 12th Gen Intel Core H, S, U, and P-series processors and introduced our 13th Gen Intel Core processor family starting with our desktop processors, the second iteration of our performance hybrid architecture built on Intel 7 process technology. | |||||||

■ | We worked with industry partners to co-engineer and deliver more than 153 verified Intel® Evo™ designs and grew the commercial market segment with the launch of our Intel vPro® platform with the 12th Gen Intel Core processor and commercial offerings. | |||||||

| MD&A | 20 | ||||||

| MD&A | 21 | ||||||

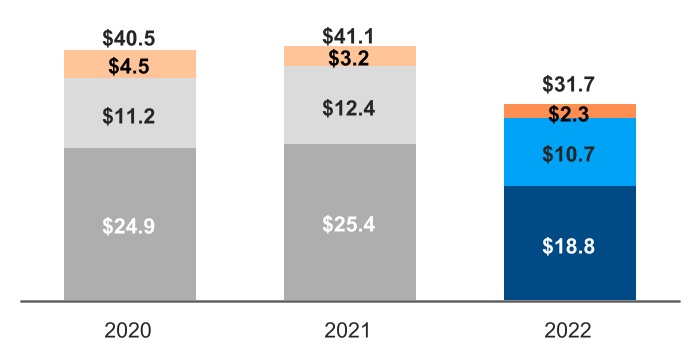

| CCG Revenue $B | CCG Operating Income $B | |||||||||||||

■ | ■ Notebook | ■ | ■ Desktop | ■ | ■ Other | ||||||||||||

| Revenue Summary | ||

| MD&A | 22 | ||||||

| Operating Income Summary | ||

| (In Millions) | ||||||||||||||

| $ | 6,266 | 2022 Operating Income | ||||||||||||

| (3,047) | Lower gross margin from notebook revenue | |||||||||||||

| (2,183) | Higher notebook and desktop unit cost primarily from increased mix of Intel 7 products | |||||||||||||

| (1,306) | Lower gross margin from desktop revenue | |||||||||||||

| (1,284) | Higher operating expenses driven by increased investments in leadership products | |||||||||||||

| (969) | Higher period charges primarily driven by inventory reserves taken in 2022 | |||||||||||||

| (320) | Lower CCG other product gross margin driven by lower demand for our wireless and connectivity products and the continued ramp down from the exit of our 5G smartphone modem business | |||||||||||||

| (262) | Higher period charges primarily associated with the ramp of Intel 4 | |||||||||||||

| (162) | Higher period charges related excess capacity charges | |||||||||||||

| 192 | Lower period charges due to a benefit related to insurance proceeds received for business interruption and property damage that occurred in 2020 | |||||||||||||

| (97) | Other | |||||||||||||

| $ | 15,704 | 2021 Operating Income | ||||||||||||

| (840) | Higher period charges primarily associated with ramp up of Intel 4 and subsequent ramp down of 14nm | |||||||||||||

| (675) | Higher operating expenses driven by increased investment in leadership products | |||||||||||||

| (290) | Lower gross margin from notebook revenue | |||||||||||||

| (140) | Higher period charges driven by less sell-through of reserves on products in 2021 as compared to in 2020, and additional reserves taken in 2021 | |||||||||||||

| 1,080 | Higher gross margin from desktop revenue | |||||||||||||

| 660 | Lower unit cost primarily due to cost improvements in 10nm SuperFin | |||||||||||||

| 165 | Lower period charges primarily driven by a decrease in engineering samples | |||||||||||||

| (56) | Other | |||||||||||||

| $ | 15,800 | 2020 Operating Income | ||||||||||||

| MD&A | 23 | ||||||

| Overview | % Intel Revenue | |||||||

DCAI delivers industry-leading workload-optimized solutions to cloud service providers and enterprise customers, along with silicon devices for communications service providers and high-performance computing customers. We are uniquely positioned to deliver solutions to help solve our customers’ most complex challenges with the depth and breadth of our hardware and software portfolio combined with silicon and platforms, advanced packaging, and at-scale manufacturing made possible by being the world’s only IDM at scale. Our customers and partners include cloud hyperscalers, MNCs, small and medium-sized businesses, independent software vendors, systems integrators, communications service providers, and governments around the world. |  | |||||||

| Key Developments | ||||||||

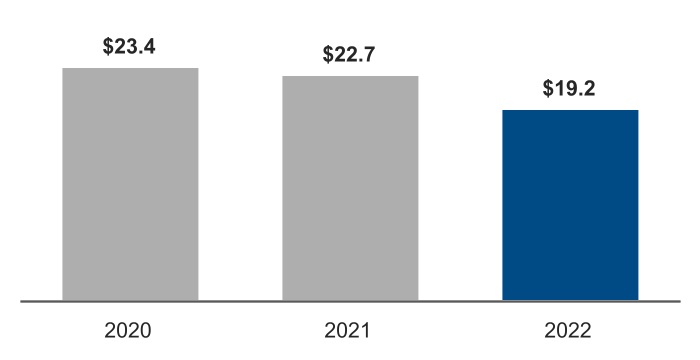

■ | Our revenue was $19.2 billion, down 15% in 2022, driven by challenging macroeconomic conditions and industry supply constraints, that both negatively impacted TAM, in addition to competitive pressures and product execution delays. Operating margin was $2.3 billion, down 73% year over year, primarily due to top-line headwinds paired with process node acceleration and increased investments in leadership products. | |||||||

■ | We began high-volume manufacturing of 4th Gen Intel Xeon Scalable processors and started shipping to customers, including Amazon Web Services and Google Cloud. | |||||||

■ | We launched five new Intel FPGA products, including the Intel® Agilex™ FPGA, which extends capabilities to cost-optimized, lower-power, and small-form factor applications, including embedded and edge. We also launched Habana Gaudi2 and Habana Greco, our second-generation deep-learning processors for training and inference. | |||||||

■ | We introduced an innovative service-based security implementation, named Project Amber, which provides customers and partners with a secure foundation for confidential computing, secure and responsible AI, and quantum-resistant crypto in the quantum era. | |||||||

| MD&A | 24 | ||||||

■ | A portfolio of hardware, including Intel Xeon processors, Intel Agilex and Intel® Stratix® FPGAs, Intel® eASIC™ devices, Habana Gaudi and Habana Greco AI accelerators. | ||||

■ | Platform enabling and validation in partnership with ODMs, OEMs, and independent software vendors. | ||||

■ | Optimized solutions for leading workloads such as AI, cryptography, security, and networking, leveraging differentiated features supporting diverse compute environments. | ||||

| MD&A | 25 | ||||||

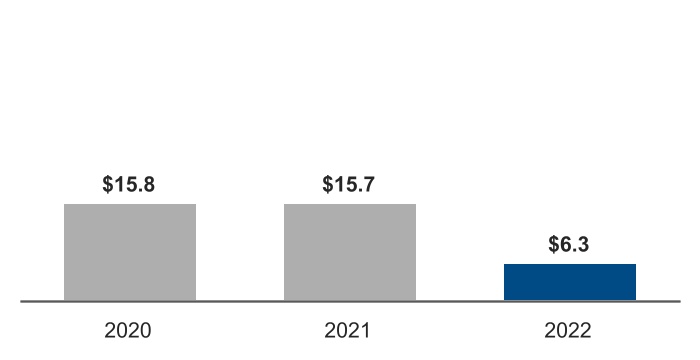

| DCAI Revenue $B | DCAI Operating Income $B | |||||||||||||

| Revenue Summary | ||

| Operating Income Summary | ||

| (In Millions) | ||||||||||||||

| $ | 2,288 | 2022 Operating Income | ||||||||||||

| (3,330) | Lower gross margin from server revenue | |||||||||||||

| (1,139) | Higher period charges primarily associated with the ramp up of Intel 4 | |||||||||||||

| (1,001) | Higher operating expenses driven by increased investments in leadership products | |||||||||||||

| (671) | Higher server unit cost from increased mix of 10nm SuperFin products | |||||||||||||

| (441) | Higher period charges driven by inventory reserves taken in 2022 | |||||||||||||

| (305) | Higher other period charges primarily related to product development costs | |||||||||||||

| (189) | Higher period charges related to excess capacity charges | |||||||||||||

| 702 | Higher gross margin from DCAI other product revenue | |||||||||||||

| 223 | Lower period charges due to a benefit related to insurance proceeds received for business interruption and property damage that occurred in 2020 | |||||||||||||

| $ | 8,439 | 2021 Operating Income | ||||||||||||

| (1,050) | Higher DCAI server unit cost primarily from increased mix of 10nm SuperFin products | |||||||||||||

| (820) | Higher period charges primarily driven by ramp up of Intel 4 and subsequent ramp down of 14nm | |||||||||||||

| (725) | Lower gross margin from server revenue | |||||||||||||

| (475) | Higher operating expenses driven by investment in leadership products | |||||||||||||

| (65) | Higher period charges driven by increased engineering samples | |||||||||||||

| 375 | Higher gross margin from other DCAI product revenue | |||||||||||||

| 130 | Lower period charges driven by absence of reserves taken in 2020, partially offset by reserves recorded in 2021 | |||||||||||||

| (7) | Other | |||||||||||||

| $ | 11,076 | 2020 Operating Income | ||||||||||||

| MD&A | 26 | ||||||

| Overview | % Intel Revenue | |||||||

NEX lifts the world's networks and edge compute systems from inflexible fixed-function hardware to general-purpose compute, acceleration, and networking devices running cloud native software on programmable hardware. We work with partners and customers to deliver and deploy intelligent edge platforms that allow software developers to achieve agility and to drive automation using AI for efficient operations while securing the integrity of their data at the edge. We have a broad portfolio of hardware and software platforms, tools, and ecosystem partnerships for the rapid digital transformation happening from the cloud to the edge. We are leveraging our core strengths in process, software, and manufacturing at scale to grow traditional markets and to accelerate entry into emerging ones. |  | |||||||

| Key Developments | ||||||||

■ | Our revenue was $8.9 billion, up 11% in 2022, driven by the cloud networking and telecommunications market segments. Most notably, we saw strength in our Ethernet ASPs and in 5G product demand. Operating margin was $740 million, down $971 million year over year primarily due to higher investments in product roadmap leadership and process node acceleration, and higher inventory reserves. | |||||||

■ | We announced the Mount Evans IPU, Intel's first dedicated ASIC-based IPU, the Intel Xeon D-1700 series, the Intel Xeon D-2700 series, and the 4th Gen Intel Xeon processor with Intel® vRAN Boost. | |||||||

■ | We continue to update solutions to improve developers' digital strategies and to accelerate market adoption of edge and AI applications. We announced 12th Gen Intel Core Processors for Internet of Things Edge and the Intel® Geti™ computer vision platform with OpenVINO toolkit built in. | |||||||

■ | We continue to work with our ecosystem partners like Ericsson, Nokia, Cisco, Dell Technologies, HPE, Lenovo, Amazon, Google, and Microsoft to drive the software defined transformation of the world’s network and edge infrastructure and accelerate AI driven automation of physical operations. | |||||||

| MD&A | 27 | ||||||

| MD&A | 28 | ||||||

| NEX Revenue $B | NEX Operating Income $B | |||||||||||||

| Revenue Summary | ||

| Operating Income Summary | ||

| (In Millions) | ||||||||||||||

| $ | 740 | 2022 Operating Income | ||||||||||||

| (530) | Higher operating expenses driven by increased investments in leadership products | |||||||||||||

| (461) | Higher period charges primarily associated with the ramp up of Intel 4 | |||||||||||||

| (359) | Higher period charges driven by reserves taken in 2022 and lack of sell-through of reserves compared to 2021 | |||||||||||||

| (150) | Higher period charges primarily due to other product enhancements | |||||||||||||

| (98) | Lower gross margin from Network Xeon revenue | |||||||||||||

| 522 | Higher gross margin from Ethernet revenue | |||||||||||||

| 191 | Lower unit cost primarily from10nm SuperFin products | |||||||||||||

| (86) | Other | |||||||||||||

| $ | 1,711 | 2021 Operating Income | ||||||||||||

| 895 | Lower NEX unit cost due to cost improvements in the 10nm SuperFin process | |||||||||||||

| 285 | Lower period charges due to reserve sell through and a decrease in engineering samples | |||||||||||||

| 215 | Higher gross margin from NEX revenue, primarily driven by Ethernet and Edge | |||||||||||||

| (300) | Higher operating expenses primarily due to roadmap investments | |||||||||||||

| (220) | Higher period charges primarily associated with the ramp of Intel 4 | |||||||||||||

| (10) | Other | |||||||||||||

| $ | 846 | 2020 Operating Income | ||||||||||||

| MD&A | 29 | ||||||

| Overview | % Intel Revenue | |||||||

Mobileye is a global leader in driving assistance and self-driving solutions. Our product portfolio is designed to encompass the entire stack required for assisted and autonomous driving, including compute platforms, computer vision, and machine learning-based perception; mapping and localization, driving policy, and active sensors in development. We pioneered ADAS technology more than 20 years ago, and have continuously expanded the scope of our ADAS offerings while leading the evolution to autonomous driving solutions. Our unique assets in ADAS allow for building a scalable self-driving stack that meets the requirements for both robotaxi and consumer-owned autonomous vehicles. Our customers and strategic partners include major global OEMs, Tier 1 automotive system integrators, and public transportation operators. |  | |||||||

| Key Developments | ||||||||

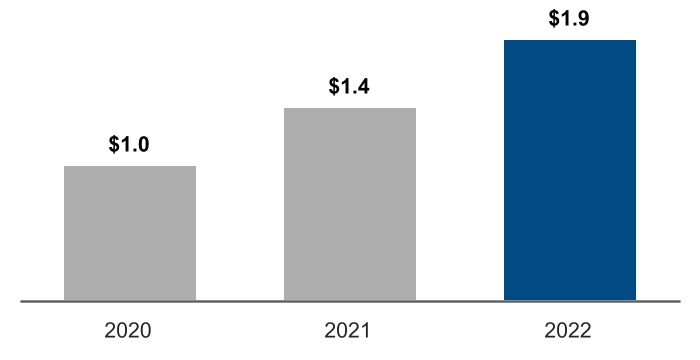

■ | We achieved record revenue in 2022 of $1.9 billion, up 35%, primarily driven by higher demand for EyeQ® products and the introduction of Mobileye SuperVision*. Operating income was $690 million, up 25%, primarily due to higher revenues partially offset by increased investments in leadership products. | |||||||

■ | 2022 was a very active year as we launched EyeQ-based systems into 233 different vehicle models, achieved a record-setting volume of projected future design wins, including wins for our next-generation EyeQ6 chip, and advanced solutions such as Cloud-enhanced ADAS and Mobileye SuperVision*. | |||||||

■ | On October 26, 2022, we completed the IPO of Mobileye class A common shares (class A shares), and certain other equity financing transactions, which represented approximately 6% of the capital stock of Mobileye, and our class A shares began trading on the Nasdaq Global Select Market under the symbol “MBLY”. | |||||||

| MD&A | 30 | ||||||

| MD&A | 31 | ||||||

| Mobileye Revenue $B | Mobileye Operating Income $B | |||||||||||||

| Revenue and Operating Income Summary | ||

| MD&A | 32 | ||||||

| Overview | % Intel Revenue | |||||||

AXG delivers products and technologies designed to help our customers solve the toughest computational problems. Our vision is to enable persistent and immersive computing, at scale and accessible by billions of people within milliseconds, which drives an incredible demand for compute—from endpoints to data centers. Our portfolio includes CPUs for high-performance computing and GPUs targeted for a range of workloads and platforms, from gaming and content creation on client devices to delivering media and gaming in the cloud, and the most demanding high-performance computing and AI workloads on supercomputers. To address new market opportunities and emerging workloads, we also develop solutions such as custom accelerators with blockchain acceleration. |  | |||||||

| Key Developments | ||||||||

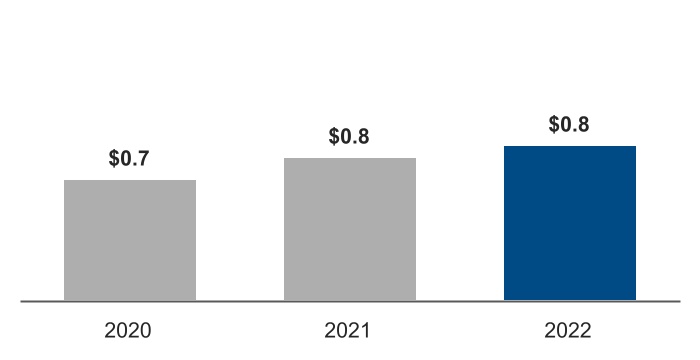

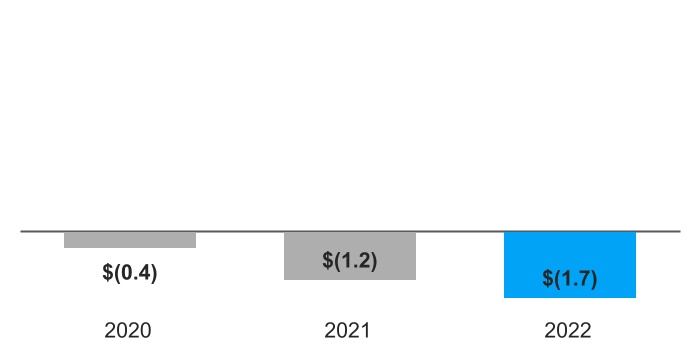

■ | Our revenue was $837 million, up 8% in 2022. Operating loss was $1.7 billion, compared to a loss of $1.2 billion in 2021, primarily due to increased inventory reserves taken and investments in our product roadmap. | |||||||

■ | We launched our Intel Arc A-series GPUs, also known as Alchemist, which offer industry-leading advanced features, including hardware accelerated ray tracing, Xe Super Sampling AI-driven upscaling technology, and Intel® Deep Link technology. | |||||||

■ | We launched Ponte Vecchio, the first Xe-based GPU optimized for high-performance computing and AI workloads. | |||||||

| MD&A | 33 | ||||||

| MD&A | 34 | ||||||

| AXG Revenue $B | AXG Operating Income (Loss) $B | |||||||||||||

| Revenue and Operating Income (Loss) Summary | ||

| MD&A | 35 | ||||||

| Overview | % Intel Revenue | |||||||

As the first Open System Foundry, we offer customers differentiated full stack solutions created from the best of Intel and the foundry industry ecosystem, delivered from a secure and sustainable source of supply with an array of flexible business models to enable customers to lead in their industry. In addition to a world-class foundry offering enabled by a rich ecosystem, customers have access to our expertise and technologies, including cores, accelerators, and advanced packaging such as EMIB. Our early customers and strategic partners include traditional fabless customers, cloud service providers, automotive customers, and military, aerospace, and defense firms. We also offer mask-making equipment for advanced lithography used by many of the world’s leading-edge foundries. |  | |||||||

| Key Developments | ||||||||

■ | Our revenue was $895 million, up 14% in 2022, primarily driven by higher sales of MBMW tools. Operating loss was $320 million, compared to a loss of $23 million in 2021, primarily due to increased spending to drive strategic growth. | |||||||

■ | We have secured anchor customers and are engaged with seven of ten of the industry’s largest foundry customers. Since beginning production in late 2021 with Amazon Web Services as our lead customer, our packaging business expanded to other customers during the year. We expect Mediatek to be a lead silicon customer using Intel 16 process technology to create smart edge devices, with production expected to begin in 2024. | |||||||

■ | We launched the IFS Accelerator program, a comprehensive ecosystem alliance designed to help foundry customers seamlessly bring their silicon products from idea to implementation. IFS Accelerator taps the leading capabilities available in the industry to accelerate customer innovation on IFS manufacturing platforms. It features innovative ecosystem partner companies across each of the five alliances of the program: EDA, IP, Design Services, Cloud, and USMAG Alliances. | |||||||

■ | In Q1 2022, we entered into a definitive agreement to acquire Tower in a cash-for-stock transaction. The acquisition is expected to advance our IDM 2.0 strategy by accelerating our global end-to-end open systems foundry business. While we continue to work to close within the first quarter of 2023, the transaction may close in the first half of 2023, subject to certain regulatory approvals and customary closing conditions. Tower is a leading foundry for analog semiconductor solutions. | |||||||

■ | We continue to grow the Foundry organization and have hired over 50 leaders from the foundry and fabless industry to complement the talent recruited within Intel. The pending acquisition of Tower would further expand our talent pool. This combination of internal and external talent will help us deliver the best of Intel and the foundry industry to our customers. | |||||||

| MD&A | 36 | ||||||

| MD&A | 37 | ||||||

| IFS Revenue $B | IFS Operating Income (Loss) $B | |||||||||||||

| Revenue and Operating Income (Loss) Summary | ||

| MD&A | 38 | ||||||

Consolidated Results of Operations | |||||

| Years Ended (In Millions, Except Per Share Amounts) | December 31, 2022 | December 25, 2021 | December 26, 2020 | |||||||||||||||||||||||||||||||||||

| Amount | % of Net Revenue | Amount | % of Net Revenue | Amount | % of Net Revenue | |||||||||||||||||||||||||||||||||

| Net revenue | $ | 63,054 | 100.0 | % | $ | 79,024 | 100.0 | % | $ | 77,867 | 100.0 | % | ||||||||||||||||||||||||||

| Cost of sales | 36,188 | 57.4 | % | 35,209 | 44.6 | % | 34,255 | 44.0 | % | |||||||||||||||||||||||||||||

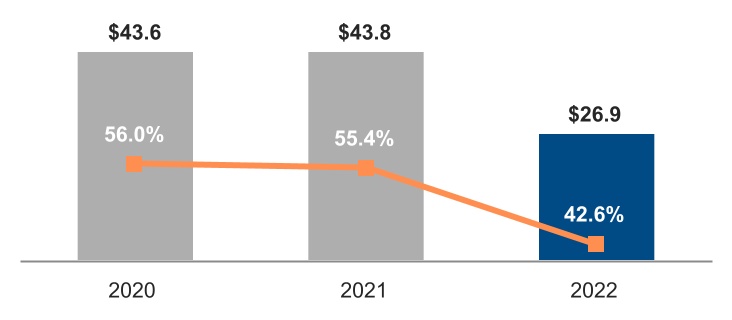

| Gross margin | 26,866 | 42.6 | % | 43,815 | 55.4 | % | 43,612 | 56.0 | % | |||||||||||||||||||||||||||||

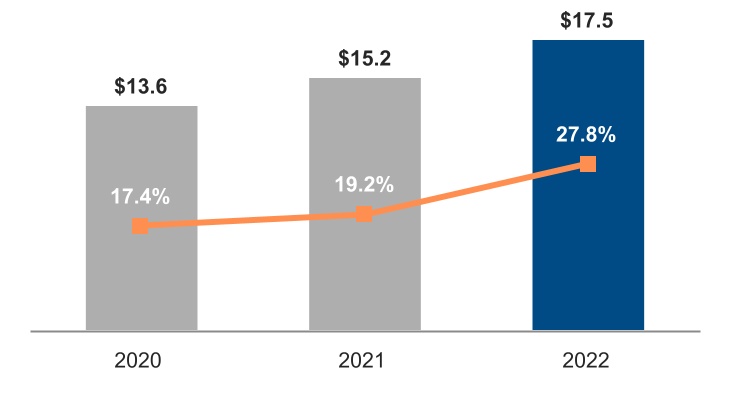

| Research and development | 17,528 | 27.8 | % | 15,190 | 19.2 | % | 13,556 | 17.4 | % | |||||||||||||||||||||||||||||

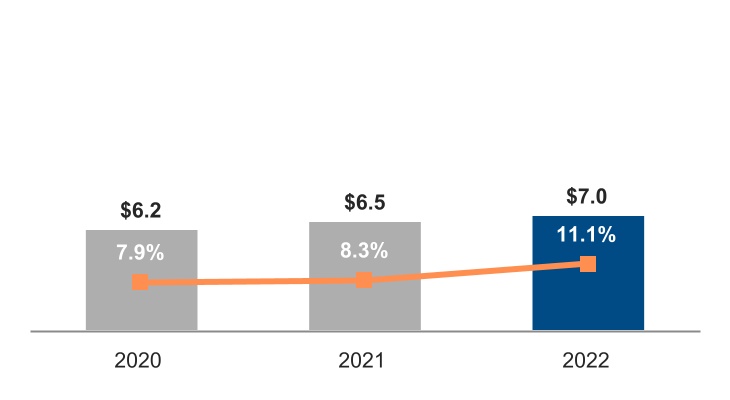

| Marketing, general and administrative | 7,002 | 11.1 | % | 6,543 | 8.3 | % | 6,180 | 7.9 | % | |||||||||||||||||||||||||||||

| Restructuring and other charges | 2 | — | % | 2,626 | 3.3 | % | 198 | 0.3 | % | |||||||||||||||||||||||||||||

| Operating income | 2,334 | 3.7 | % | 19,456 | 24.6 | % | 23,678 | 30.4 | % | |||||||||||||||||||||||||||||

| Gains (losses) on equity investments, net | 4,268 | 6.8 | % | 2,729 | 3.5 | % | 1,904 | 2.4 | % | |||||||||||||||||||||||||||||

| Interest and other, net | 1,166 | 1.8 | % | (482) | (0.6) | % | (504) | (0.6) | % | |||||||||||||||||||||||||||||

| Income before taxes | 7,768 | 12.3 | % | 21,703 | 27.5 | % | 25,078 | 32.2 | % | |||||||||||||||||||||||||||||

| Provision for (benefit from) taxes | (249) | (0.4) | % | 1,835 | 2.3 | % | 4,179 | 5.4 | % | |||||||||||||||||||||||||||||

| Net income | 8,017 | 12.7 | % | 19,868 | 25.1 | % | 20,899 | 26.8 | % | |||||||||||||||||||||||||||||

| Less: Net income attributable to non-controlling interests | 3 | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Net income attributable to Intel | $ | 8,014 | — | $ | 19,868 | — | $ | 20,899 | — | |||||||||||||||||||||||||||||

| Earnings per share attributable to Intel—diluted | $ | 1.94 | $ | 4.86 | $ | 4.94 | ||||||||||||||||||||||||||||||||

| MD&A | 39 | ||||||

| Segment Revenue Walk $B | ||

| MD&A | 40 | ||||||

| Gross Margin $B | ||

| (Percentages in chart indicate gross margin as a percentage of total revenue) | ||

| (In Millions) | ||||||||

| $ | 26,866 | 2022 Gross Margin | ||||||

| (4,673) | Lower gross margin from CCG revenue, driven by notebook and desktop revenue | |||||||

| (3,330) | Lower gross margin from DCAI server revenue | |||||||

| (2,663) | Higher unit cost primarily from increased mix of Intel 7 products and 10nm SuperFin | |||||||

| (2,159) | Higher period charges primarily driven by inventory reserves taken in 2022 | |||||||

| (2,012) | Higher period charges primarily associated with the ramp up of Intel 4 and other product enhancements | |||||||

| (1,995) | Lower gross margin related to the divested NAND memory business | |||||||

| (723) | Optane inventory impairment related to the wind down of our Intel Optane memory business | |||||||

| (584) | Lack of revenue recognized in Q1 2021 from a prepaid customer supply contract | |||||||

| (313) | Higher stock-based compensation | |||||||

| (423) | Higher period charges due to excess capacity charges | |||||||

| (204) | Corporate charges from patent settlement | |||||||

| 484 | Lower period charges due to a benefit related to insurance proceeds received for business interruption and property damage that occurred in 2020 | |||||||

| 522 | Higher gross margin from NEX Ethernet revenue | |||||||

| 702 | Higher gross margin from DCAI other product revenue | |||||||

| 422 | Other | |||||||

| $ | 43,815 | 2021 Gross Margin | ||||||

| 790 | Higher gross margin from CCG revenue, driven by desktop revenue partially offset by notebook | |||||||

| 584 | Prepaid customer supply agreement settled and recognized to revenue in Q1 2021 | |||||||

| 505 | Lower unit cost primarily due to cost improvements in 10nm SuperFin | |||||||

| 471 | Higher gross margin related to the NAND memory business | |||||||

| 375 | Higher gross margin from DCAI other product revenue | |||||||

| 262 | Lower period charges due to reserve sell through, partially offset by reserves taken in 2021 | |||||||

| 215 | Higher gross margin from NEX revenue, primarily driven by Ethernet and Edge | |||||||

| (1,880) | Higher period charges primarily associated with ramp up of Intel 4 and subsequent ramp down of 14nm | |||||||

| (725) | Lower gross margin from DCAI server revenue | |||||||

| (394) | Other | |||||||

| $ | 43,612 | 2020 Gross Margin | ||||||

| MD&A | 41 | ||||||

| Research and Development $B | Marketing, General and Administrative $B | |||||||

| (Percentages indicate expenses as a percentage of total revenue) | ||||||||

| MD&A | 42 | ||||||

| Research and Development | ||

| 2022 vs. 2021 | |||||

| R&D spending increased by $2.3 billion, or 15%, driven by the following: | |||||

| + | Investments in our process technology | ||||

| + | Increase in corporate spending | ||||

| + | Investments in our businesses to drive strategic growth | ||||

| - | Incentive-based cash compensation | ||||

| 2021 vs. 2020 | |||||

| R&D spending increased by $1.6 billion, or 12%, driven by the following: | |||||

| + | Investments in our businesses to drive strategic growth | ||||

| + | Investments in our process technology | ||||

| + | Incentive-based cash compensation | ||||

| Marketing, General and Administrative | ||

| 2022 vs. 2021 | |||||

| MG&A spending increased by $459 million, or 7%, driven by the following: | |||||

| + | Increase in corporate spending | ||||

| - | Incentive-based cash compensation | ||||

| 2021 vs. 2020 | |||||

| MG&A spending increased by $363 million, or 6%, driven by the following: | |||||

| + | Increase in corporate spending | ||||

| + | Incentive-based cash compensation | ||||

| Years Ended (In Millions) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | |||||||||||||||||

| Employee severance and benefit arrangements | $ | 1,038 | $ | 48 | $ | 124 | ||||||||||||||

| Litigation charges and other | (1,187) | 2,291 | 67 | |||||||||||||||||

| Asset impairment charges | 151 | 287 | 7 | |||||||||||||||||

| Total restructuring and other charges | $ | 2 | $ | 2,626 | $ | 198 | ||||||||||||||

| MD&A | 43 | ||||||

| Years Ended (In Millions) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | |||||||||||||||||

| Ongoing mark-to-market adjustments on marketable equity securities | $ | (787) | $ | (130) | $ | (133) | ||||||||||||||

| Observable price adjustments on non-marketable equity securities | 299 | 750 | 176 | |||||||||||||||||

| Impairment charges | (190) | (154) | (303) | |||||||||||||||||

Sale of equity investments and other | 4,946 | 2,263 | 2,164 | |||||||||||||||||

| Gains (losses) on equity investments, net | $ | 4,268 | $ | 2,729 | $ | 1,904 | ||||||||||||||

| Interest and other, net | $ | 1,166 | $ | (482) | $ | (504) | ||||||||||||||

| Years Ended (Dollars in Millions) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | |||||||||||||||||

| Income before taxes | $ | 7,768 | $ | 21,703 | $ | 25,078 | ||||||||||||||

| Provision for (benefit from) taxes | $ | (249) | $ | 1,835 | $ | 4,179 | ||||||||||||||

| Effective tax rate | (3.2) | % | 8.5 | % | 16.7 | % | ||||||||||||||

| MD&A | 44 | ||||||

| (In Millions) | Dec 31, 2022 | Dec 25, 2021 | ||||||||||||

| Cash and cash equivalents | $ | 11,144 | $ | 4,827 | ||||||||||

| Short-term investments | 17,194 | 24,426 | ||||||||||||

| Loans receivable and other | 463 | 240 | ||||||||||||

Total cash and investments1 | $ | 28,801 | $ | 29,493 | ||||||||||

| Total debt | $ | 42,051 | $ | 38,101 | ||||||||||

| MD&A | 45 | ||||||

| Years Ended (In Millions) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | |||||||||||||||||

| Net cash provided by operating activities | $ | 15,433 | $ | 29,456 | $ | 35,864 | ||||||||||||||

| Net cash used for investing activities | (10,477) | (24,449) | (21,524) | |||||||||||||||||

| Net cash provided by (used for) financing activities | 1,361 | (6,045) | (12,669) | |||||||||||||||||

| Net increase (decrease) in cash and cash equivalents | $ | 6,317 | $ | (1,038) | $ | 1,671 | ||||||||||||||

| MD&A | 46 | ||||||

| Non-GAAP adjustment or measure | Definition | Usefulness to management and investors | ||||||

| NAND memory business | We completed the first closing of the divestiture of our NAND memory business to SK hynix on December 29, 2021 and fully deconsolidated our ongoing interests in the NAND OpCo Business in the first quarter of 2022. | We exclude the impact of our NAND memory business in certain non-GAAP measures. While the second closing of the sale is still pending and subject to closing conditions, we deconsolidated this business in Q1 2022 and management does not view the historical results of the business as a part of our core operations. We believe these adjustments provide investors with a useful view, through the eyes of management, of our core business model and how management currently evaluates core operational performance. In making these adjustments, we have not made any changes to our methods for measuring and calculating revenue or other financial statement amounts. | ||||||

| MD&A | 47 | ||||||

| Non-GAAP adjustment or measure | Definition | Usefulness to management and investors | ||||||

| Acquisition-related adjustments | Amortization of acquisition-related intangible assets consists of amortization of intangible assets such as developed technology, brands, and customer relationships acquired in connection with business combinations. Charges related to the amortization of these intangibles are recorded within both cost of sales and MG&A in our US GAAP financial statements. Amortization charges are recorded over the estimated useful life of the related acquired intangible asset, and thus are generally recorded over multiple years. | We exclude amortization charges for our acquisition-related intangible assets for purposes of calculating certain non-GAAP measures because these charges are inconsistent in size and are significantly impacted by the timing and valuation of our acquisitions. These adjustments facilitate a useful evaluation of our current operating performance and comparison to our past operating performance and provide investors with additional means to evaluate cost and expense trends. | ||||||

| Share-based compensation | Share-based compensation consists of charges related to our employee equity incentive plans. | We exclude charges related to share-based compensation for purposes of calculating certain non-GAAP measures because we believe these adjustments provide better comparability to peer company results and because these charges are not viewed by management as part of our core operating performance. We believe these adjustments provide investors with a useful view, through the eyes of management, of our core business model, how management currently evaluates core operational performance, and additional means to evaluate expense trends, including in comparison to other peer companies. | ||||||

| Patent settlement | A portion of the charge from our IP settlements represents a catch-up of cumulative amortization that would have been incurred for the right to use the related patents in prior periods. This charge related to prior periods is excluded from our non-GAAP results; amortization related to the right to use the patents in the current and ongoing periods is included. | We exclude the catch-up charge related to prior periods for purposes of calculating certain non-GAAP measures because this adjustment facilitates comparison to past operating results and provides a useful evaluation of our current operating performance. | ||||||

| Optane inventory impairment | Beginning in 2022, we initiated the wind-down of our Intel Optane memory business. | We exclude these impairments for purposes of calculating certain non-GAAP measures because these charges do not reflect our current operating performance. This adjustment facilitates a useful evaluation of our current operating performance and comparisons to past operating results. | ||||||

| Restructuring and other charges | Restructuring charges are costs associated with a formal restructuring plan and are primarily related to employee severance and benefit arrangements. Other charges include a benefit in Q1 2022 related to the annulled EC fine, a charge in Q1 2021 related to the VLSI litigation, periodic goodwill and asset impairments, certain pension charges, and costs associated with restructuring activity. | We exclude restructuring and other charges, including any adjustments to charges recorded in prior periods, for purposes of calculating certain non-GAAP measures because these costs do not reflect our core operating performance. These adjustments facilitate a useful evaluation of our core operating performance and comparisons to past operating results and provide investors with additional means to evaluate expense trends. | ||||||

| (Gains) losses on equity investments, net | (Gains) losses on equity investments, net consists of ongoing mark-to-market adjustments on marketable equity securities, observable price adjustments on non-marketable equity securities, related impairment charges, and the sale of equity investments and other. | We exclude these non-operating gains and losses for purposes of calculating certain non-GAAP measures because it provides better comparability between periods. The exclusion reflects how management evaluates the core operations of the business. | ||||||

| Gains (losses) from divestiture | Gains (losses) are recognized at the close of a divestiture, or over a specified deferral period when deferred consideration is received at the time of closing. Based on our ongoing obligation under the NAND wafer manufacturing and sale agreement entered into in connection with the first closing of the sale of our NAND memory business on December 29, 2021, a portion of the initial closing consideration was deferred and will be recognized between first and second closing. | We exclude gains or losses resulting from divestitures for purposes of calculating certain non-GAAP measures because they do not reflect our current operating performance. These adjustments facilitate a useful evaluation of our current operating performance and comparisons to past operating results. | ||||||

| MD&A | 48 | ||||||

| Non-GAAP adjustment or measure | Definition | Usefulness to management and investors | ||||||

| Tax Reform | Adjustments for Tax Reform reflect the impact of a change in tax law from 2017 Tax Reform related to the capitalization of R&D costs. | We exclude the impacts of this 2022 change in US tax treatment of R&D costs for purposes of calculating certain non-GAAP measures as we believe these adjustments facilitate a better evaluation of our current operating performance and comparison to past operating results. | ||||||

| Adjusted free cash flow | We reference a non-GAAP financial measure of adjusted free cash flow, which is used by management when assessing our sources of liquidity, capital resources, and quality of earnings. Adjusted free cash flow is operating cash flow adjusted for (1) additions to property, plant and equipment, net of proceeds from capital grants and partner contributions, (2) payments on finance leases, and (3) proceeds from the McAfee equity sale. | This non-GAAP financial measure is helpful in understanding our capital requirements and sources of liquidity by providing an additional means to evaluate the cash flow trends of our business. Since the 2017 divestiture, McAfee equity distributions and sales have contributed to operating and free cash flow, and while the McAfee equity sale in Q1 2022 would typically be excluded from adjusted free cash flow as an equity sale, we believe including the sale proceeds in adjusted free cash flow facilitate a better, more consistent comparison to past presentations of liquidity. | ||||||

| Total cash and investments | Total cash and investments is used by management when assessing our sources of liquidity, which include cash and cash equivalents, short-term investments, and loans receivable and other. | This non-GAAP measure is helpful in understanding our capital resources and liquidity position. | ||||||

| Years Ended (In Millions, Except Per Share Amounts) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | ||||||||||||||

| Net revenue | $ | 63,054 | $ | 79,024 | $ | 77,867 | |||||||||||

| NAND memory business | — | (4,306) | (4,967) | ||||||||||||||

| Non-GAAP net revenue | $ | 63,054 | $ | 74,718 | $ | 72,900 | |||||||||||

| Gross margin percentage | 42.6 | % | 55.4 | % | 56.0 | % | |||||||||||

| Acquisition-related adjustments | 2.1 | % | 1.6 | % | 1.6 | % | |||||||||||

| Share-based compensation | 1.0 | % | 0.4 | % | 0.4 | % | |||||||||||

| Patent settlement | 0.3 | % | — | % | — | % | |||||||||||

| Optane inventory impairment | 1.1 | % | — | % | — | % | |||||||||||

| NAND memory business | — | % | 0.6 | % | 1.8 | % | |||||||||||

| Non-GAAP gross margin percentage | 47.3 | % | 58.1 | % | 59.8 | % | |||||||||||

Earnings per share—diluted1 | $ | 1.94 | $ | 4.86 | $ | 4.94 | |||||||||||

| Acquisition-related adjustments | 0.37 | 0.36 | 0.33 | ||||||||||||||

| Share-based compensation | 0.76 | 0.50 | 0.44 | ||||||||||||||

| Patent settlement | 0.05 | — | — | ||||||||||||||

| Optane inventory impairment | 0.18 | — | — | ||||||||||||||

| Restructuring and other charges | — | 0.64 | 0.05 | ||||||||||||||

| (Gains) losses on equity investments, net | (1.04) | (0.67) | (0.45) | ||||||||||||||

| (Gains) losses from divestiture | (0.28) | — | — | ||||||||||||||

| NAND memory business | — | (0.33) | (0.22) | ||||||||||||||

| Tax Reform | (0.20) | — | — | ||||||||||||||

| Income tax effects | 0.06 | (0.06) | (0.03) | ||||||||||||||

| Non-GAAP earnings per share—diluted | $ | 1.84 | $ | 5.30 | $ | 5.06 | |||||||||||

| MD&A | 49 | ||||||

| Years Ended (In Millions) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | Dec 28, 2019 | Dec 29, 2018 | |||||||||||||||||||||||||||

| Net cash provided by operating activities | $ | 15,433 | $ | 29,456 | $ | 35,864 | $ | 32,618 | $ | 29,757 | ||||||||||||||||||||||

| Net additions to property, plant, and equipment | (23,724) | (18,567) | (14,086) | (15,948) | (14,649) | |||||||||||||||||||||||||||

| Payments on finance leases | (345) | — | — | — | — | |||||||||||||||||||||||||||

| Sale of equity investment | 4,561 | — | — | — | — | |||||||||||||||||||||||||||

| Adjusted free cash flow | $ | (4,075) | $ | 10,889 | $ | 21,778 | $ | 16,670 | $ | 15,108 | ||||||||||||||||||||||

| Net cash used for investing activities | $ | (10,477) | $ | (24,449) | $ | (21,524) | $ | (13,579) | $ | (11,638) | ||||||||||||||||||||||

| Net cash provided by (used for) financing activities | $ | 1,361 | $ | (6,045) | $ | (12,669) | $ | (17,864) | $ | (18,533) | ||||||||||||||||||||||

| MD&A | 50 | ||||||

Other Key Information | |||||

| MD&A | 51 | ||||||

| Other Key Information | 52 | ||||||

| Other Key Information | 53 | ||||||

| Other Key Information | 54 | ||||||

| Other Key Information | 55 | ||||||

| Other Key Information | 56 | ||||||

| Other Key Information | 57 | ||||||

| Other Key Information | 58 | ||||||

| Other Key Information | 59 | ||||||

| Other Key Information | 60 | ||||||

| Other Key Information | 61 | ||||||

| Other Key Information | 62 | ||||||

| Other Key Information | 63 | ||||||

| Other Key Information | 64 | ||||||

| Other Key Information | 65 | ||||||

| Other Key Information | 66 | ||||||

| (Square Feet in Millions) | United States | Other Countries | Total | |||||||||||||||||

| Owned facilities | 34 | 25 | 59 | |||||||||||||||||

| Leased facilities | 1 | 5 | 6 | |||||||||||||||||

| Total facilities | 35 | 30 | 65 | |||||||||||||||||

| Other Key Information | 67 | ||||||

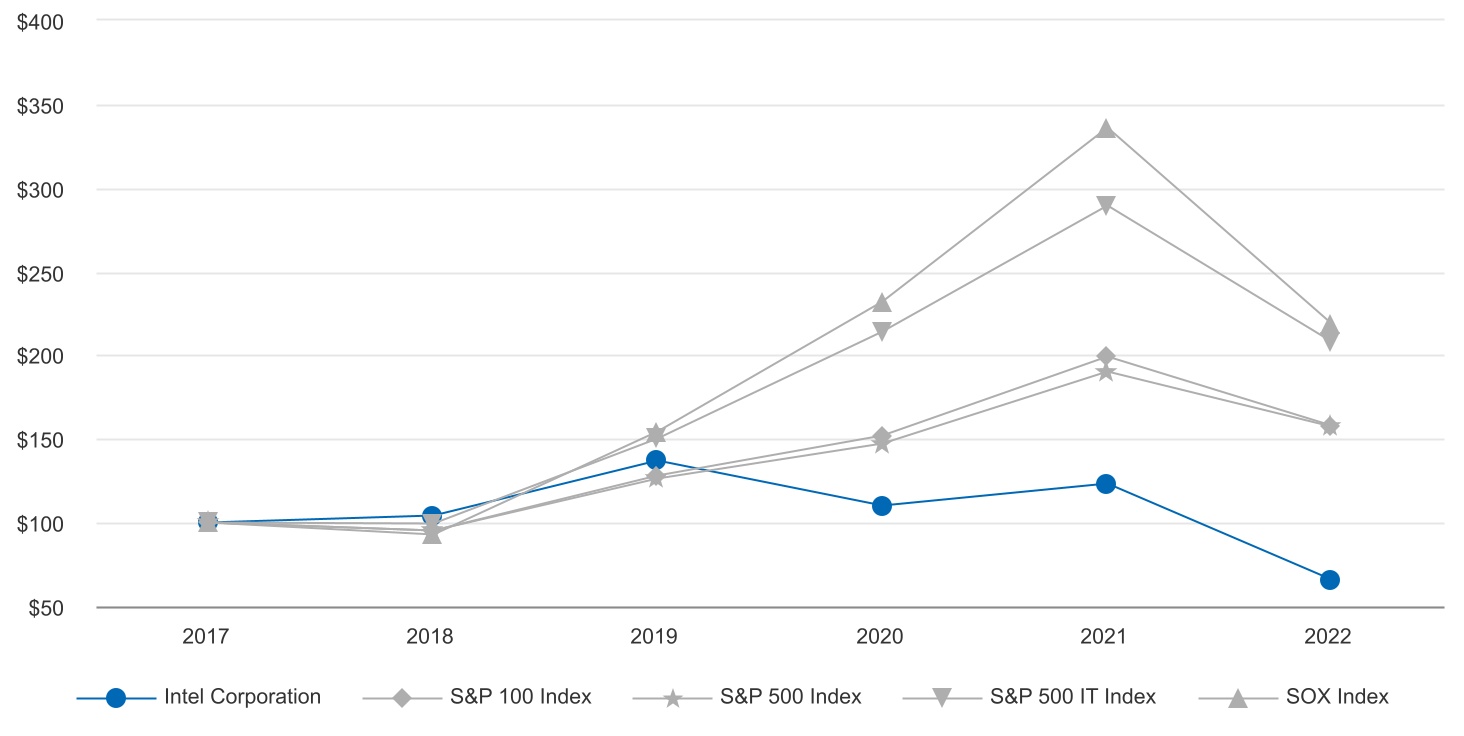

| Years Ended | Dec 30, 2017 | Dec 29, 2018 | Dec 28, 2019 | Dec 26, 2020 | Dec 25, 2021 | Dec 31, 2022 | ||||||||||||||||||||||||||||||||

| Intel Corporation | $ | 100 | $ | 104 | $ | 137 | $ | 110 | $ | 123 | $ | 66 | ||||||||||||||||||||||||||

| S&P 100 Index | $ | 100 | $ | 95 | $ | 128 | $ | 152 | $ | 199 | $ | 158 | ||||||||||||||||||||||||||

| S&P 500 Index | $ | 100 | $ | 95 | $ | 126 | $ | 147 | $ | 190 | $ | 157 | ||||||||||||||||||||||||||

| S&P 500 IT Index | $ | 100 | $ | 99 | $ | 150 | $ | 214 | $ | 289 | $ | 208 | ||||||||||||||||||||||||||

| SOX Index | $ | 100 | $ | 93 | $ | 154 | $ | 232 | $ | 336 | $ | 219 | ||||||||||||||||||||||||||

| Other Key Information | 68 | ||||||

| Other Key Information | 69 | ||||||

Name Current Title | Age | Experience | ||||||||||||

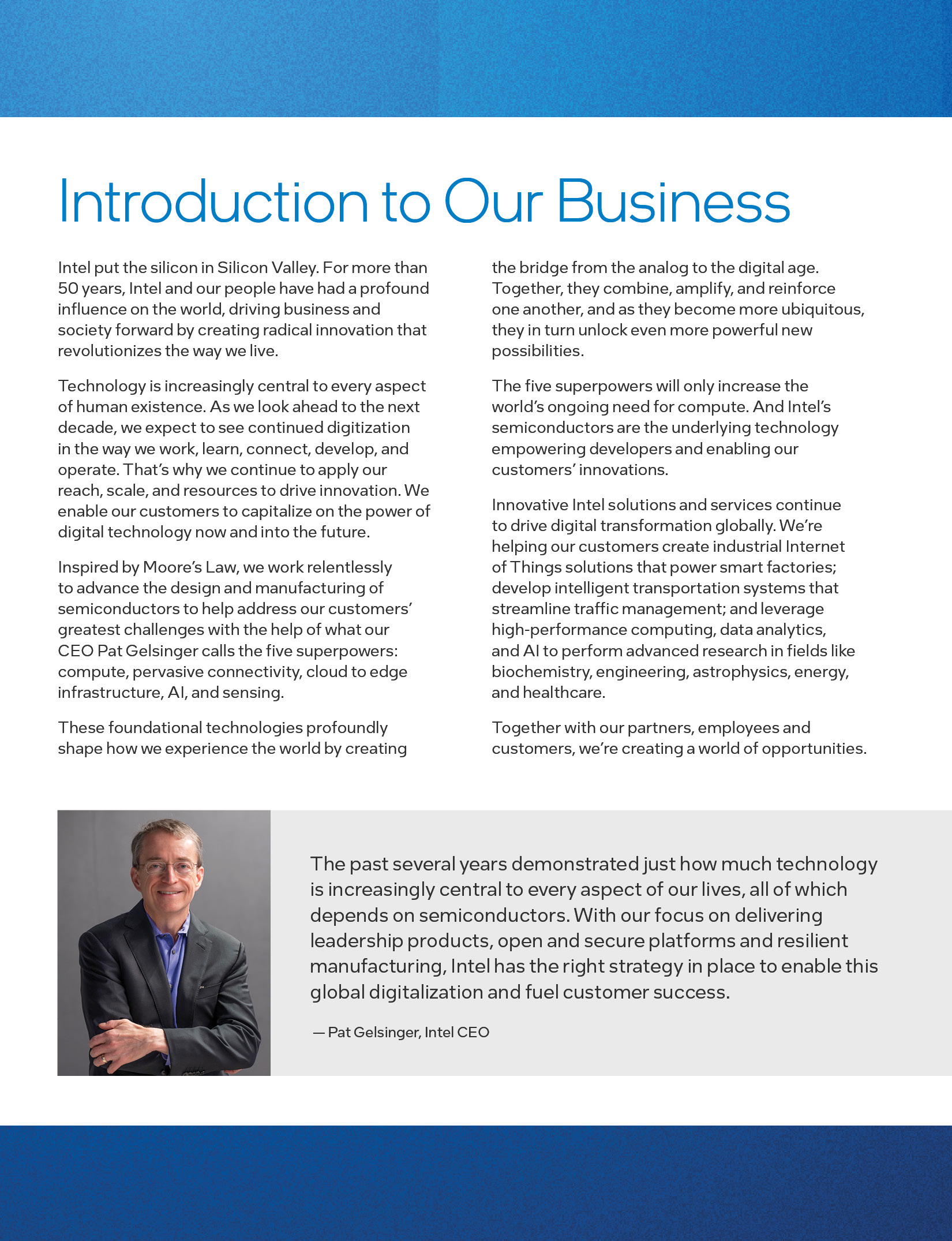

| Patrick P. Gelsinger | 61 | Mr. Gelsinger has been our Chief Executive Officer and a member of our Board of Directors since February 2021. He has also served as a member and Chair of the Board of Directors of Mobileye, a subsidiary of Intel, since September 2022. He joined Intel from VMware, Inc., a provider of cloud computing and virtualization software and services, where he served as Chief Executive Officer from September 2012 to February 2021. Prior to VMware, Mr. Gelsinger served as President and Chief Operating Officer, EMC Information Infrastructure Products at EMC Corp., a data storage, information security, and cloud computing company, from September 2009 to August 2012. Mr. Gelsinger’s career began at Intel, where he spent 30 years before joining EMC Corp. During his initial tenure at Intel, Mr. Gelsinger served in a number of roles, including Senior Vice President and Co-General Manager of the Digital Enterprise Group from 2005 to September 2009, Senior Vice President, Chief Technology Officer from 2002 to 2005, and leader of Desktop Products Group prior to that. | ||||||||||||

| Chief Executive Officer | ||||||||||||||

| Michelle Johnston Holthaus | 49 | Ms. Johnston Holthaus has been our Executive Vice President and General Manager of the Client Computing Group since April 2022. She is responsible for running and growing the client business, including strategy, financial performance, and product development for the full portfolio of client technologies and platforms designed to enable exceptional personal computing experiences across mobile, desktop, and workstation devices. Ms. Johnston Holthaus previously served as Executive Vice President, Chief Sales Officer and General Manager, Sales, Marketing and Communications Group, from September 2019 to January 2022, and as Senior Vice President of Sales and Marketing and Acting Chief Marketing Officer from September 2017 to September 2019. In these roles, she was responsible for global sales and revenue and leading the company’s efforts to foster innovative sales and marketing approaches that broaden Intel’s business opportunities and enhance customer relationships worldwide. Ms. Johnston Holthaus joined Intel in 1996 and has served in a variety of sales and marketing, channel mobile, and channel desktop positions. | ||||||||||||

| Executive Vice President and General Manager, Client Computing Group | ||||||||||||||

| April Miller Boise | 54 | Ms. Miller Boise has been our Executive Vice President and Chief Legal Officer since July 2022 and Corporate Secretary since August 2022. Ms. Miller Boise leads Intel’s global legal, trade, and government affairs team, is a member of Intel's Executive Leadership Team, and is a strategic advisor to the Company and the Board of Directors. Prior to joining Intel, she was Executive Vice President and Chief Legal Officer at Eaton Corp. Before joining Eaton in 2020, she was Senior Vice President, Chief Legal Officer, and Corporate Secretary at Meritor Inc. Ms. Miller Boise has more than 25 years of experience and has served in executive leadership roles, including Chief Legal Officer, General Counsel, and Head of Global Mergers and Acquisitions. | ||||||||||||

| Executive Vice President and Chief Legal Officer | ||||||||||||||

| Sandra L. Rivera | 58 | Ms. Rivera is Executive Vice President and General Manager of the Data Center and AI Group, serving in this role since July 2021. She leads strategy and product development for Intel's data center solutions, including Intel Xeon processor line, Intel Agilex FPGA and Habana Gaudi AI Accelerators. She also leads overall AI strategy and product execution. Before her current role, Ms. Rivera served as our Chief People Officer from June 2019 to July 2021. Prior to that, she oversaw strategy and product development for network infrastructure solutions, serving as General Manager of Intel's Network Platforms Group from January 2015 to June 2019. She also led Intel's 5G strategy and execution. Ms. Rivera joined Intel in 2000 and has served in a variety of engineering, marketing and business development positions. Before joining Intel, she held management positions with Dialogic Corporation and Catalyst Telecom, Inc. and was co-founder and President of The CTI Authority, Inc. Ms. Rivera holds a bachelor’s degree in electrical engineering from the Pennsylvania State University. She sits on the Equinix, Inc. board of directors, is a member of U.C. Berkeley’s engineering advisory board and a member of the Intel Foundation Board, and she is part of Intel’s Latinx Leadership Council. | ||||||||||||

| Executive Vice President and General Manager, Data Center and AI Group | ||||||||||||||

| Other Key Information | 70 | ||||||

| Christoph Schell | 51 | Mr. Schell has been our Executive Vice President and Chief Commercial Officer since March 2022. In his role, he oversees Intel’s global sales, business management, marketing, communications, corporate planning, customer support, and customer success teams, leading the company’s efforts to foster innovative go-to-market approaches that broaden Intel’s business opportunities and deepen customer and partner relationships and outcomes worldwide. Prior to joining Intel, Mr. Schell served as the Chief Commercial Officer of HP Inc., an American multinational information technology company, from November 2019 to March 2022. During his 25 years with HP, Mr. Schell held various senior management roles across the globe, including President of 3D Printing and Digital Manufacturing from November 2018 to October 2019 and President of the Americas region from November 2015 to November 2018. Prior to rejoining HP in 2014, Mr. Schell served as Executive Vice President of Growth Markets for Philips, a lighting solutions company, where he led the lighting business across Asia Pacific, Japan, Africa, Russia, India, Central Asia, and the Middle East. He started his career in his family’s distribution and industrial solutions company before working in brand management at Procter & Gamble. | ||||||||||||

| Executive Vice President and Chief Commercial Officer, Sales, Marketing and Communications | ||||||||||||||

| David Zinsner | 54 | Mr. Zinsner has been our Executive Vice President and Chief Financial Officer since January 2022, overseeing our global finance organization. He joined Intel from Micron Technology, Inc., a manufacturer of memory and storage products, where he most recently served as Executive Vice President and Chief Financial Officer. From February 2018 to October 2021, he served as Senior Vice President and Chief Financial Officer of Micron. From April 2017 to February 2018, he served as President and Chief Operating Officer of Affirmed Networks, Inc. From January 2009 to April 2017, he served as Senior Vice President of Finance and Chief Financial Officer of Analog Devices, Inc. From July 2005 to January 2009, Mr. Zinsner served as Senior Vice President and Chief Financial Officer of Intersil Corporation. | ||||||||||||

| Executive Vice President and Chief Financial Officer | ||||||||||||||

| Other Key Information | 71 | ||||||

| Index to Consolidated Financial Statements | Page | ||||||||||

| Reports of Independent Registered Public Accounting Firm | (PCAOB ID: | ||||||||||

| Consolidated Statements of Income | |||||||||||

| Consolidated Statements of Comprehensive Income | |||||||||||

| Consolidated Balance Sheets | |||||||||||

| Consolidated Statements of Cash Flows | |||||||||||

| Consolidated Statements of Stockholders' Equity | |||||||||||

| Notes to Consolidated Financial Statements | |||||||||||

| Basis | |||||||||||

| Note 1: Basis of Presentation | |||||||||||

| Note 2: Accounting Policies | |||||||||||

| Performance and Operations | |||||||||||

| Note 3: Operating Segments | |||||||||||

| Note 4: Non-Controlling Interests | |||||||||||

| Note 5: Earnings Per Share | |||||||||||

| Note 6: Other Financial Statement Details | |||||||||||

| Note 7: Restructuring and Other Charges | |||||||||||

| Note 8: Income Taxes | |||||||||||

| Investments, Long-Term Assets, and Debt | |||||||||||

| Note 9: Investments | |||||||||||

| Note 10: Acquisitions and Divestitures | |||||||||||

| Note 11: Goodwill | |||||||||||

| Note 12: Identified Intangible Assets | |||||||||||

| Note 13: Borrowings | |||||||||||

| Note 14: Fair Value | |||||||||||

| Risk Management and Other | |||||||||||

| Note 15: Other Comprehensive Income (Loss) | |||||||||||

| Note 16: Derivative Financial Instruments | |||||||||||

| Note 17: Retirement Benefit Plans | |||||||||||

| Note 18: Employee Equity Incentive Plans | |||||||||||

| Note 19: Commitments and Contingencies | |||||||||||

| Key Terms | |||||||||||

| Index to Supplemental Details | |||||||||||

| Controls and Procedures | |||||||||||

| Exhibits | |||||||||||

| Form 10-K Cross-Reference Index | |||||||||||

| 72 | |||||||

| Report of Independent Registered Public Accounting Firm | |||||

| Auditor's Reports | 73 | ||||||

| Inventory Valuation | ||||||||

| Description of the Matter | The Company's net inventory totaled $13.2 billion as of December 31, 2022, representing 7.3% of total assets. As explained in "Note 2: Accounting Policies" within the Consolidated Financial Statements, the Company computes inventory cost on a first-in, first-out basis, and applies judgment in determining saleability of products and the valuation of inventories. The Company assesses inventory at each reporting date in order to assert that it is recorded at net realizable value, giving consideration to, among other factors: whether the products have achieved the substantive engineering milestones to qualify for sale to customers; the determination of normal capacity levels in its manufacturing process to determine which manufacturing overhead costs can be included in the valuation of inventory; whether the product is valued at the lower of cost or net realizable value; and the estimation of excess and obsolete inventory or that which is not of saleable quality. | |||||||

| Auditing management's assessment of net realizable value for inventory was challenging because the determination of lower of cost or net realizable value and excess and obsolete inventory reserves is judgmental and considers a number of factors that are affected by market and economic conditions, such as customer forecasts, dynamic pricing environments, and industry supply and demand. Additionally, for certain new product launches there is limited historical data with which to evaluate forecasts. | ||||||||

| How We Addressed the Matter in Our Audit | We evaluated and tested the design and operating effectiveness of the Company's internal controls over the costing of inventory, the determination of whether inventory is of saleable quality, the calculation of lower of cost or net realizable value reserves including related estimated costs and selling prices, and the determination of demand forecasts and related application against on hand inventory. | |||||||

| Our audit procedures included, among others, testing the significant assumptions (e.g., estimated product costs and selling prices, and product demand forecasts) and the underlying data used in management's inventory valuation assessment. We compared the significant assumptions used by management to current industry and economic trends. We assessed whether there were any potential sources of contrary information, including historical forecast accuracy or history of significant revisions to previously recorded inventory valuation adjustments, and performed sensitivity analyses over significant assumptions to evaluate the changes in inventory valuation that would result from changes in the assumptions. | ||||||||

| Auditor's Reports | 74 | ||||||

| Report of Independent Registered Public Accounting Firm | |||||

| Auditor's Reports | 75 | ||||||

| Consolidated Statements of Income | |||||

| Years Ended (In Millions, Except Per Share Amounts) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | |||||||||||||||||

| Net revenue | $ | $ | $ | |||||||||||||||||

| Cost of sales | ||||||||||||||||||||

| Gross margin | ||||||||||||||||||||

| Research and development | ||||||||||||||||||||

| Marketing, general and administrative | ||||||||||||||||||||

| Restructuring and other charges | ||||||||||||||||||||

| Operating expenses | ||||||||||||||||||||

| Operating income | ||||||||||||||||||||

| Gains (losses) on equity investments, net | ||||||||||||||||||||

| Interest and other, net | ( | ( | ||||||||||||||||||

| Income before taxes | ||||||||||||||||||||

| Provision for (benefit from) taxes | ( | |||||||||||||||||||

| Net income | ||||||||||||||||||||

| Less: Net income attributable to non-controlling interests | ||||||||||||||||||||

| Net income attributable to Intel | $ | $ | $ | |||||||||||||||||

| Earnings per share attributable to Intel—basic | $ | $ | $ | |||||||||||||||||

| Earnings per share attributable to Intel—diluted | $ | $ | $ | |||||||||||||||||

| Weighted average shares of common stock outstanding: | ||||||||||||||||||||

| Basic | ||||||||||||||||||||

| Diluted | ||||||||||||||||||||

| Financial Statements | Consolidated Statements of Income | 76 | ||||||||

| Consolidated Statements of Comprehensive Income | |||||

| Years Ended (In Millions) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | |||||||||||||||||

| Net income | $ | $ | $ | |||||||||||||||||

| Changes in other comprehensive income, net of tax: | ||||||||||||||||||||

| Net unrealized holding gains (losses) on derivatives | ( | ( | ||||||||||||||||||

| Actuarial valuation and other pension benefits (expenses), net | ( | |||||||||||||||||||

| Translation adjustments and other | ( | ( | ||||||||||||||||||

| Other comprehensive income (loss) | ( | |||||||||||||||||||

| Total comprehensive income | ||||||||||||||||||||

| Less: Comprehensive income attributable to non-controlling interests | ||||||||||||||||||||

| Total comprehensive income attributable to Intel | $ | $ | $ | |||||||||||||||||

| Financial Statements | Consolidated Statements of Comprehensive Income | 77 | ||||||||

| Consolidated Balance Sheets | |||||

| (In Millions, Except Par Value) | Dec 31, 2022 | Dec 25, 2021 | ||||||||||||

| Assets | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Short-term investments | ||||||||||||||

| Accounts receivable, net | ||||||||||||||

| Inventories | ||||||||||||||

| Assets held for sale | ||||||||||||||

| Other current assets | ||||||||||||||

| Total current assets | ||||||||||||||

| Property, plant and equipment, net | ||||||||||||||

| Equity investments | ||||||||||||||

| Goodwill | ||||||||||||||

| Identified intangible assets, net | ||||||||||||||

| Other long-term assets | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| Liabilities and stockholders' equity | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Short-term debt | $ | $ | ||||||||||||

| Accounts payable | ||||||||||||||

| Accrued compensation and benefits | ||||||||||||||

| Income taxes payable | ||||||||||||||

| Other accrued liabilities | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Debt | ||||||||||||||

| Long-term income taxes payable | ||||||||||||||

| Deferred income taxes | ||||||||||||||

| Other long-term liabilities | ||||||||||||||

| Commitments and Contingencies (Note 19) | ||||||||||||||

| Stockholders' equity: | ||||||||||||||

| Preferred stock, $0.001 par value, 50 shares authorized; none issued | ||||||||||||||

| Common stock, $0.001 par value, 10,000 shares authorized; 4,137 shares issued and outstanding (4,070 issued and outstanding in 2021) and capital in excess of par value | ||||||||||||||

| Accumulated other comprehensive income (loss) | ( | ( | ||||||||||||

| Retained earnings | ||||||||||||||

| Total Intel stockholders' equity | ||||||||||||||

| Non-controlling interests | ||||||||||||||

| Total stockholders’ equity | ||||||||||||||

| Total liabilities and stockholders' equity | $ | $ | ||||||||||||

| Financial Statements | Consolidated Balance Sheets | 78 | ||||||||

| Consolidated Statements of Cash Flows | |||||

| Years Ended (In Millions) | Dec 31, 2022 | Dec 25, 2021 | Dec 26, 2020 | |||||||||||||||||

| Cash and cash equivalents, beginning of period | $ | $ | $ | |||||||||||||||||

| Cash flows provided by (used for) operating activities: | ||||||||||||||||||||

| Net income | ||||||||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||||||||||||||

| Depreciation | ||||||||||||||||||||

| Share-based compensation | ||||||||||||||||||||

| Restructuring and other charges | ||||||||||||||||||||

| Amortization of intangibles | ||||||||||||||||||||

| (Gains) losses on equity investments, net | ( | ( | ( | |||||||||||||||||

| (Gains) losses on divestitures | ( | ( | ||||||||||||||||||

| Changes in assets and liabilities: | ||||||||||||||||||||

| Accounts receivable | ( | |||||||||||||||||||

| Inventories | ( | ( | ( | |||||||||||||||||

| Accounts payable | ( | |||||||||||||||||||

| Accrued compensation and benefits | ( | |||||||||||||||||||

| Prepaid customer supply agreements | ( | ( | ( | |||||||||||||||||

| Income taxes | ( | ( | ||||||||||||||||||

| Other assets and liabilities | ( | ( | ||||||||||||||||||

| Total adjustments | ||||||||||||||||||||

| Net cash provided by operating activities | ||||||||||||||||||||

| Cash flows provided by (used for) investing activities: | ||||||||||||||||||||

| Additions to property, plant and equipment | ( | ( | ( | |||||||||||||||||

| Additions to held for sale NAND property, plant and equipment | ( | ( | ( | |||||||||||||||||

| Purchase of short-term investments | ( | ( | ( | |||||||||||||||||

| Maturities and sales of short-term investments | ||||||||||||||||||||

| Purchases of equity investments | ( | ( | ( | |||||||||||||||||

| Sales of equity investments | ||||||||||||||||||||

| Proceeds from divestitures | ||||||||||||||||||||

| Other investing | ( | ( | ||||||||||||||||||

| Net cash used for investing activities | ( | ( | ( | |||||||||||||||||

| Cash flows provided by (used for) financing activities: | ||||||||||||||||||||

| Issuance of commercial paper, net of issuance costs | ||||||||||||||||||||

| Payments on finance leases | ( | |||||||||||||||||||

| Partner contributions | ||||||||||||||||||||

| Proceeds from Mobileye IPO | ||||||||||||||||||||

| Issuance of term debt, net of issuance costs | ||||||||||||||||||||

| Repayment of term debt and debt conversions | ( | ( | ( | |||||||||||||||||

| Proceeds from sales of common stock through employee equity incentive plans | ||||||||||||||||||||

| Repurchase of common stock | ( | ( | ||||||||||||||||||

| Payment of dividends to stockholders | ( | ( | ( | |||||||||||||||||

| Other financing | ( | ( | ||||||||||||||||||

| Net cash provided by (used for) financing activities | ( | ( | ||||||||||||||||||

| Net increase (decrease) in cash and cash equivalents | ( | |||||||||||||||||||

| Cash and cash equivalents, end of period | $ | $ | $ | |||||||||||||||||

| Supplemental disclosures: | ||||||||||||||||||||

| Acquisition of property, plant and equipment included in accounts payable and accrued liabilities | $ | $ | $ | |||||||||||||||||

| Cash paid during the year for: | ||||||||||||||||||||

| Interest, net of capitalized interest | $ | $ | $ | |||||||||||||||||

| Income taxes, net of refunds | $ | $ | $ | |||||||||||||||||

| Financial Statements | Consolidated Statements of Cash Flows | 79 | ||||||||

| Consolidated Statements of Stockholders' Equity | |||||

| Common Stock and Capital in Excess of Par Value | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Non-Controlling Interests | Total | ||||||||||||||||||||||||||||||||||

| (In Millions, Except Per Share Amounts) | Number of Shares | Amount | ||||||||||||||||||||||||||||||||||||

| Balance as of December 28, 2019 | $ | $ | ( | $ | — | $ | ||||||||||||||||||||||||||||||||

| Components of comprehensive income, net of tax: | ||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total comprehensive income | ||||||||||||||||||||||||||||||||||||||

| Employee equity incentive plans and other | — | — | ||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Temporary equity reduction | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Convertible debt | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||

| Restricted stock unit withholdings | ( | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||

| Cash dividends declared ($1.32 per share of common stock) | — | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||

| Balance as of December 26, 2020 | ( | — | ||||||||||||||||||||||||||||||||||||

| Adjustment to opening balance from change in accounting principle | ||||||||||||||||||||||||||||||||||||||

| Opening balance as of December 27, 2020 | ( | — | ||||||||||||||||||||||||||||||||||||

| Components of comprehensive income, net of tax: | ||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||

| Total comprehensive income | ||||||||||||||||||||||||||||||||||||||

| Employee equity incentive plans and other | — | — | — | |||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||

| Restricted stock unit withholdings | ( | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||

| Cash dividends declared ($1.39 per share of common stock) | — | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||

| Balance as of December 25, 2021 | ( | |||||||||||||||||||||||||||||||||||||

| Components of comprehensive income, net of tax: | ||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | |||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total comprehensive income | ||||||||||||||||||||||||||||||||||||||

| Net proceeds received from IPO and partner contributions | — | — | — | |||||||||||||||||||||||||||||||||||

| Employee equity incentive plans and other | — | — | — | |||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | |||||||||||||||||||||||||||||||||||

| Restricted stock unit withholdings | ( | ( | — | — | ( | |||||||||||||||||||||||||||||||||

| Cash dividends declared ($1.46 per share of common stock) | — | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||