Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

UNLEASHING ENERGY. . .

[GRAPHIC]

PENN WEST

ENERGY TRUST

2006 ANNUAL REPORT

CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management’s Discussion and Analysis |

|

|

|

|

Management’s Report |

|

|

|

|

Auditors’ Report to the Unitholders |

|

|

|

|

Consolidated Financial Statements |

|

|

|

|

Notes to the Consolidated Financial Statements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Information |

|

|

|

As the largest conventional oil and natural gas producing trust in North America, Penn West has a high quality base of production and long-life reserves diversified by geography, size, capital intensity, commodity and play type. Penn West’s large scale mitigates risks and contributes to stability and sustainability.

NYSE Disclosure of Governance Differences

As a Canadian trust listed on the New York Stock Exchange (“NYSE”), Penn West is not required to comply with most of the NYSE corporate governance standards, so long as it complies with Canadian corporate governance practices. In order to claim such an exemption, however, Penn West must disclose the significant difference between its corporate governance practices and those required to be followed by U.S. domestic companies under the NYSE corporate governance standards. Penn West’s Statement of Significant Governance Differences can be found on Penn West’s website at www.pennwest.com.

Executive Certifications

Penn West has included, as Exhibits to its Annual Report on Form 40-F for the fiscal year ended December 31, 2006 filed with the U.S. Securities and Exchange Commission, certificates of the President and Chief Executive Officer and the Senior Vice President and Chief Financial Officer regarding the quality of Penn West’s public disclosure. Penn West has also submitted to the New York Stock Exchange a certificate of the President and Chief Executive Officer certifying that he is not aware of any violation by Penn West of NYSE corporate governance listing standards.

[GRAPHIC]

FROM HIGH QUALITY, LONG-LIFE, DIVERSIFIED ASSETS

[GRAPHIC]

UNLEASHING ENERGY

from a business model that works hard for us

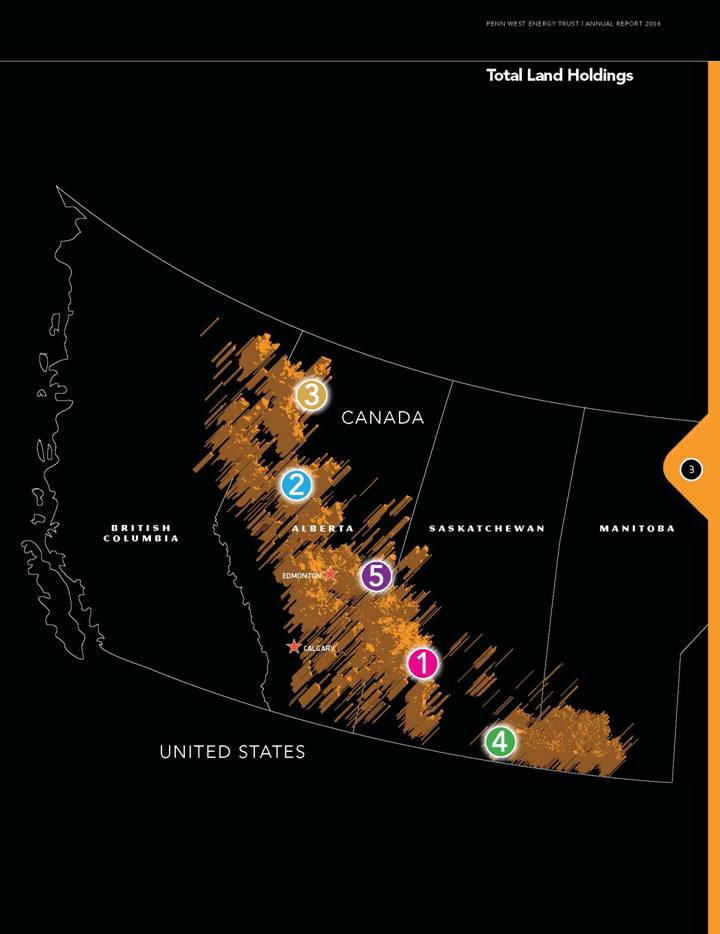

1. Continuous reinvestment in lower risk development drilling opportunities.

Of the many such opportunities offered by Penn West’s asset base, an excellent example was the successful 23-well development program at the 100 percent-owned Glidden project, highlighted, in the Hoosier-Coleville area. The project added 1,500 barrels per day of new production at a capital cost of only $15,000 per daily flowing barrel.

2. Measured, sustained investment in large-scale projects offering long-term value creation.

Penn West is alone among Canadian energy trusts in having three long-term projects (detailed on pages 32-39) offering upside potential through sustained internal investment. A prime example is the Peace River Oil Sands Project, centred on Seal, highlighted. In 2007, over 50 new wells are targeted to grow production to 5,000-7,000 barrels per day by year-end.

3. Farming out prospective exploration lands to E&P companies to unleash future upside.

Since 2005, Penn West has made nearly 200 farm-out agreements covering 1 million net acres of land, triggering drilling of more than 300 exploration wells by February 2007. One of the largest was a 50-well deal with a senior oil and natural gas producer in northwest Alberta, highlighted.

4. Maintaining a strong balance sheet to take advantage of growth opportunities.

Penn West’s financial strength enabled the $3.7 billion merger with Petrofund Energy Trust in June 2006. The transaction substantially grew the Trust’s production, reserves and development opportunities. Petrofund brought a number of high-quality assets into the Trust, including the Weyburn and Midale CO2 enhanced oil recovery projects, highlighted.

5. Sound corporate responsibility practices that embrace all stakeholders and the environment.

One prime example of many environmental protection projects Penn West is pursuing was the Trust’s five new solution gas conservation projects completed in 2006. One of these projects was at Wainwright in the Plains area, where Penn West is pipelining approximately 150 mcf per day of otherwise flared volumes, highlighted.

2

Total Land Holdings

[GRAPHIC]

3

UNLEASHING ENERGY

through exceptional performance

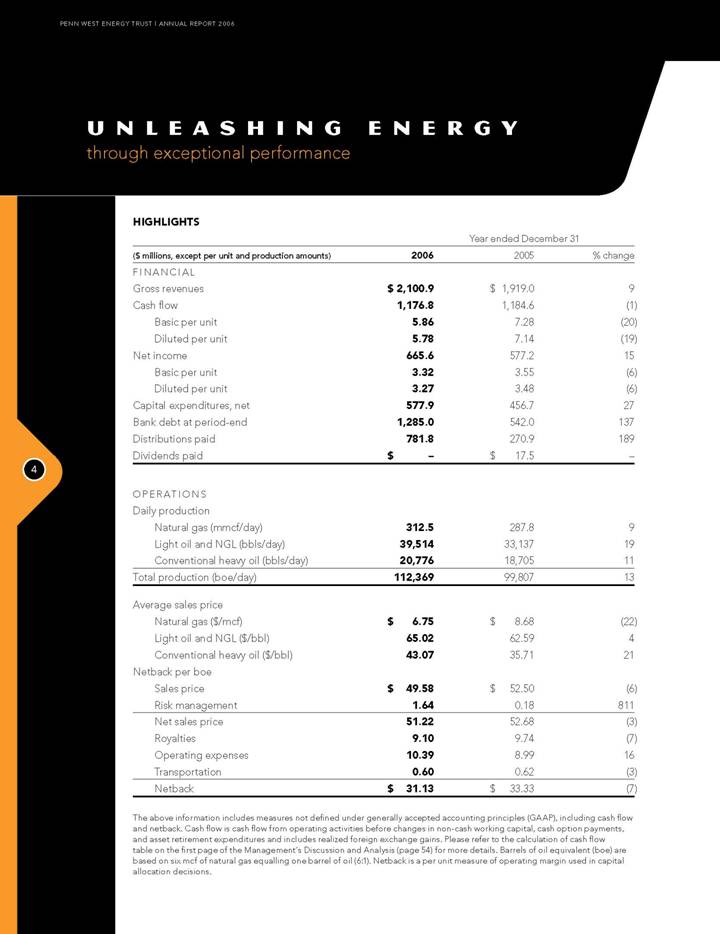

|

|

|

Year ended December 31 |

|

||||||

|

($ millions, except per unit and production amounts) |

|

2006 |

|

2005 |

|

% change |

|

||

|

FINANCIAL |

|

|

|

|

|

|

|

||

|

Gross revenues |

|

$ |

2,100.9 |

|

$ |

1,919.0 |

|

9 |

|

|

Cash flow |

|

1,176.8 |

|

1,184.6 |

|

(1 |

) |

||

|

Basic per unit |

|

5.86 |

|

7.28 |

|

(20 |

) |

||

|

Diluted per unit |

|

5.78 |

|

7.14 |

|

(19 |

) |

||

|

Net income |

|

665.6 |

|

577.2 |

|

15 |

|

||

|

Basic per unit |

|

3.32 |

|

3.55 |

|

(6 |

) |

||

|

Diluted per unit |

|

3.27 |

|

3.48 |

|

(6 |

) |

||

|

Capital expenditures, net |

|

577.9 |

|

456.7 |

|

27 |

|

||

|

Bank debt at period-end |

|

1,285.0 |

|

542.0 |

|

137 |

|

||

|

Distributions paid |

|

781.8 |

|

270.9 |

|

189 |

|

||

|

Dividends paid |

|

$ |

— |

|

$ |

17.5 |

|

— |

|

|

|

|

|

|

|

|

|

|

||

|

OPERATIONS |

|

|

|

|

|

|

|

||

|

Daily production |

|

|

|

|

|

|

|

||

|

Natural gas (mmcf/day) |

|

312.5 |

|

287.8 |

|

9 |

|

||

|

Light oil and NGL (bbls/day) |

|

39,514 |

|

33,137 |

|

19 |

|

||

|

Conventional heavy oil (bbls/day) |

|

20,776 |

|

18,705 |

|

11 |

|

||

|

Total production (boe/day) |

|

112,369 |

|

99,807 |

|

13 |

|

||

|

|

|

|

|

|

|

|

|

||

|

Average sales price |

|

|

|

|

|

|

|

||

|

Natural gas ($/mcf) |

|

$ |

6.75 |

|

$ |

8.68 |

|

(22 |

) |

|

Light oil and NGL ($/bbl) |

|

65.02 |

|

62.59 |

|

4 |

|

||

|

Conventional heavy oil ($/bbl) |

|

43.07 |

|

35.71 |

|

21 |

|

||

|

Netback per boe |

|

|

|

|

|

|

|

||

|

Sales price |

|

$ |

49.58 |

|

$ |

52.50 |

|

(6 |

) |

|

Risk management |

|

1.64 |

|

0.18 |

|

811 |

|

||

|

Net sales price |

|

51.22 |

|

52.68 |

|

(3 |

) |

||

|

Royalties |

|

9.10 |

|

9.74 |

|

(7 |

) |

||

|

Operating expenses |

|

10.39 |

|

8.99 |

|

16 |

|

||

|

Transportation |

|

0.60 |

|

0.62 |

|

(3 |

) |

||

|

Netback |

|

$ |

31.13 |

|

$ |

33.33 |

|

(7 |

) |

The above information includes measures not defined under generally accepted accounting principles (GAAP), including cash flow and netback. Cash flow is cash flow from operating activities before changes in non-cash working capital, cash option payments, and asset retirement expenditures and includes realized foreign exchange gains. Please refer to the calculation of cash flow table on the first page of the Management’s Discussion and Analysis (page 54) for more details. Barrels of oil equivalent (boe) are based on six mcf of natural gas equalling one barrel of oil (6:1). Netback is a per unit measure of operating margin used in capital allocation decisions.

4

|

|

|

|

|

|

|

|

|

|

|

|

Average Production |

|

Probable Reserves* |

|

Return on Equity (1) |

|

|

|

|

(boe/day) |

|

(mmboe) |

|

(%) |

|

|

|

|

|

|

|

|

|

|

|

$4.05 |

|

[CHART] |

|

[CHART] |

|

[CHART] |

|

|

Per unit distribution in 2006 at 69 percent payout ratio |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

* Gross interest reserves (before royalty burden) |

|

|

|

|

|

|

|

|

|

|

|

|

|

125.7 |

|

Cash Flow (1) |

|

Debt to Cash Flow Ratio (1) |

|

Netback (1) |

|

|

Million boe in proved plus probable reserves added in 2006 |

|

($/basic unit*) |

|

(times) |

|

($/boe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

[CHART] |

|

[CHART] |

|

[CHART] |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

$31.13 |

|

|

|

|

|

|

|

|

Per boe average netback in 2006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

* Per basic equivalent share for 2002, 2003 and 2004 |

|

|

|

|

|

(1) NON-GAAP MEASURES

Management uses cash flow and cash flow per unit derived from cash flow from operating activities before changes in non-cash working capital to analyze operating performance and leverage. Cash flow as presented does not have any standardized meaning prescribed by Canadian generally accepted accounting principles, (“GAAP”) and therefore it may not be comparable with the calculation of similar measures for other entities. Cash flow as presented is not intended to represent operating cash flow or operating profits for the period nor should it be viewed as an alternative to cash flow from operating activities, net earnings or other measures of financial performance calculated in accordance with Canadian GAAP.

A reconciliation of cash flow from operating activities to cash flow can be found in our Management’s Discussion and Analysis on page 54 of this document.

Management uses certain key performance indicators and industry benchmarks such as payout ratio, netbacks, return on equity and debt to cash flow to analyze financial and operating performance. Management feels that these indicators and benchmarks are a key measure of profitability and overall sustainability for the Trust. These indicators and benchmarks as presented do not have any standardized meaning prescribed by Canadian GAAP and therefore may not be comparable with the calculation of similar measures for other entities.

5

PRESIDENT’S LETTER TO UNITHOLDERS

Fellow Unitholders

Penn West’s first full year as an energy trust was all about unleashing our energy. Penn West had converted to an energy trust in 2005 with three main competitive advantages: financial depth including a strong balance sheet, diversified and high-quality assets including extensive undeveloped lands, and a range of opportunities to maintain or enhance production and create additional value for our unitholders.

[GRAPHIC]

6

LAYING THE FOUNDATION TO UNLEASH OUR ENERGY

As an energy trust, our focus was guided by the primary goal of improving our capital efficiencies.

To achieve this goal, we first changed our structure to multi-discipline teams organized along geographical areas. This change gave team members greater input into developing an area’s operating plan, opened up a much better flow of ideas, and drove our performance goals down to the field level. This has proven successful. It has helped us improve capital efficiencies during a period of generally rising costs across the industry.

Second, we reviewed all producing properties and undeveloped lands. We listed and ranked lands having the largest inventory of current and planned activities. The rest were retained for future exploration or actively marketed as farm-in opportunities for other companies. By encouraging capital expenditures and imaginative thinking on these farm-out lands, our idea was to bring about successful drilling and generate a new stream of royalty revenues – all at no cost to our unitholders.

Third, we classified our assets according to the nature of their opportunities. These opportunities include everything from rationalizing facilities to adding production from new horizons within existing wellbores. Nearly all our properties also offer a conventional drilling focus, where Penn West can generate new production volumes while utilizing existing facilities.

The final category of opportunity is found with several large projects promising new value creation for our unitholders, following a sustained effort of exploration, operational research and capital investment. They include enhanced oil recovery (EOR) projects using carbon dioxide (CO2) flood, a large-scale underground or in situ project in the Peace River Oil Sands that can be initially produced with conventional methods, and unconventional natural gas plays focused on coalbed methane (CBM).

2006 FINANCIAL AND OPERATING RESULTS

Last year Penn West made strides in all opportunity categories. The results illustrate our competitive advantages at work: financial strength, high-quality assets and upside opportunities. Highlights from the year include:

• Penn West began 2006 as Canada’s largest conventional energy trust, with production of 97,900 boe per day;

• Following the Petrofund merger, we exited 2006 with record volumes of approximately 130,000 boe per day, balanced between natural gas and crude oil production;

• Cash flow of $1.18 billion, or $5.86 per unit, was approximately flat from 2005, and lower on a per unit basis. Cash flow was within range of the budget forecast. Natural gas prices were lower than forecast, while crude oil prices were higher;

• Capital efficiencies averaging $29,500 per new daily flowing boe were added through internal development, since the trust conversion, an improvement of 19 percent compared to the 18-month period preceding the conversion;

• Proved plus probable reserves were 483 million boe, or 2.04 boe per outstanding unit, at year-end 2006;

• Distributions totalling $812 million, or $4.05 per unit were declared for the year;

• The payout ratio was 69 percent in 2006;

• Capital expenditures were $578 million, excluding acquisitions, funding a total of 270 net wells;

• Approximately 20,000 boe per day in new production volumes were added through internal development; and

• Bank debt at year-end was $1.3 billion, for a pro forma debt-to-trailing cash flow ratio of 0.9 times, leaving available debt capacity of $0.6 billion going into 2007.

FINANCIAL STRENGTH

The trust sector’s evolution demonstrates that scale matters. But large size must be combined with financial strength, high-quality assets and operational excellence to create a successful, sustainable trust. Going into 2006, we had a strong cash flow stream and a robust unit price that made our equity a powerful currency to deploy in support of further growth.

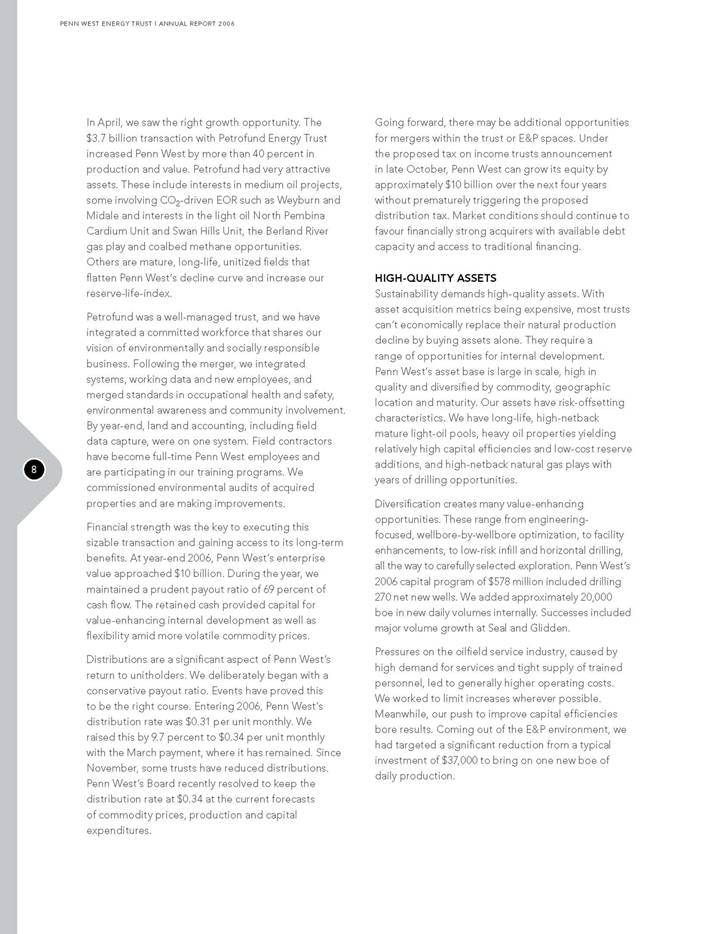

7

In April, we saw the right growth opportunity. The $3.7 billion transaction with Petrofund Energy Trust increased Penn West by more than 40 percent in production and value. Petrofund had very attractive assets. These include interests in medium oil projects, some involving CO2-driven EOR such as Weyburn and Midale and interests in the light oil North Pembina Cardium Unit and Swan Hills Unit, the Berland River gas play and coalbed methane opportunities. Others are mature, long-life, unitized fields that flatten Penn West’s decline curve and increase our reserve-life-index.

Petrofund was a well-managed trust, and we have integrated a committed workforce that shares our vision of environmentally and socially responsible business. Following the merger, we integrated systems, working data and new employees, and merged standards in occupational health and safety, environmental awareness and community involvement. By year-end, land and accounting, including field data capture, were on one system. Field contractors have become full-time Penn West employees and are participating in our training programs. We commissioned environmental audits of acquired properties and are making improvements.

Financial strength was the key to executing this sizable transaction and gaining access to its long-term benefits. At year-end 2006, Penn West’s enterprise value approached $10 billion. During the year, we maintained a prudent payout ratio of 69 percent of cash flow. The retained cash provided capital for value-enhancing internal development as well as flexibility amid more volatile commodity prices.

Distributions are a significant aspect of Penn West’s return to unitholders. We deliberately began with a conservative payout ratio. Events have proved this to be the right course. Entering 2006, Penn West’s distribution rate was $0.31 per unit monthly. We raised this by 9.7 percent to $0.34 per unit monthly with the March payment, where it has remained. Since November, some trusts have reduced distributions. Penn West’s Board recently resolved to keep the distribution rate at $0.34 at the current forecasts of commodity prices, production and capital expenditures.

Going forward, there may be additional opportunities for mergers within the trust or E&P spaces. Under the proposed tax on income trusts announcement in late October, Penn West can grow its equity by approximately $10 billion over the next four years without prematurely triggering the proposed distribution tax. Market conditions should continue to favour financially strong acquirers with available debt capacity and access to traditional financing.

HIGH-QUALITY ASSETS

Sustainability demands high-quality assets. With asset acquisition metrics being expensive, most trusts can’t economically replace their natural production decline by buying assets alone. They require a range of opportunities for internal development. Penn West’s asset base is large in scale, high in quality and diversified by commodity, geographic location and maturity. Our assets have risk-offsetting characteristics. We have long-life, high-netback mature light-oil pools, heavy oil properties yielding relatively high capital efficiencies and low-cost reserve additions, and high-netback natural gas plays with years of drilling opportunities.

Diversification creates many value-enhancing opportunities. These range from engineering-focused, wellbore-by-wellbore optimization, to facility enhancements, to low-risk infill and horizontal drilling, all the way to carefully selected exploration. Penn West’s 2006 capital program of $578 million included drilling 270 net new wells. We added approximately 20,000 boe in new daily volumes internally. Successes included major volume growth at Seal and Glidden.

Pressures on the oilfield service industry, caused by high demand for services and tight supply of trained personnel, led to generally higher operating costs. We worked to limit increases wherever possible. Meanwhile, our push to improve capital efficiencies bore results. Coming out of the E&P environment, we had targeted a significant reduction from a typical investment of $37,000 to bring on one new boe of daily production.

8

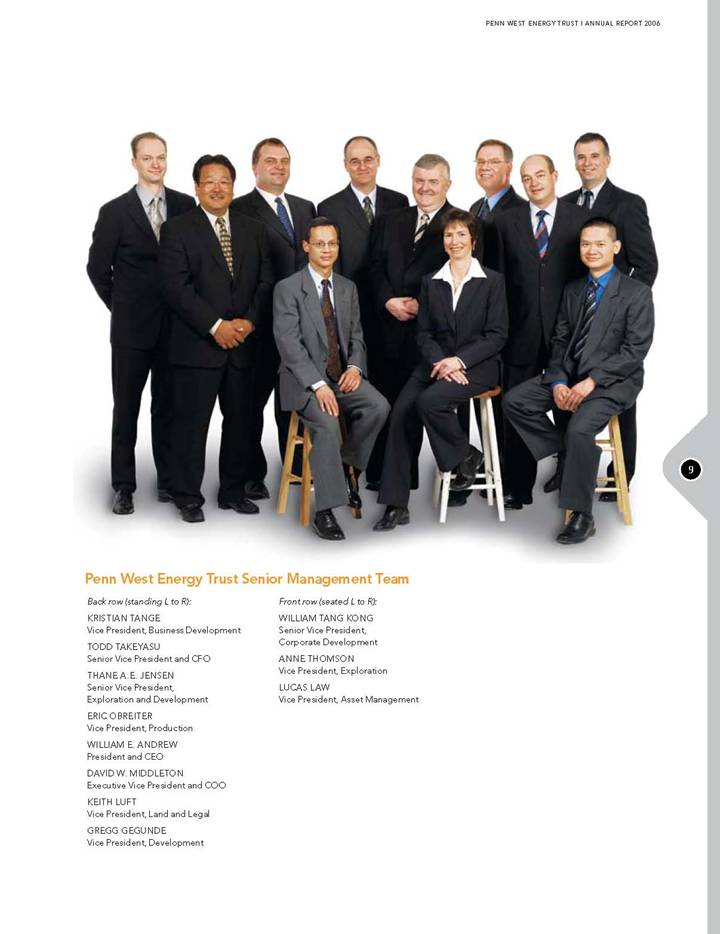

[GRAPHIC]

Penn West Energy Trust Senior Management Team

|

Back row (standing L to R): |

|

|

|

KRISTIAN TANGE |

|

Vice President, Business Development |

|

|

|

Senior Vice President and CFO |

|

|

|

THANE A.E. JENSEN |

|

Senior Vice President, |

|

Exploration and Development |

|

|

|

ERIC OBREITER |

|

Vice President, Production |

|

|

|

WILLIAM E. ANDREW |

|

President and CEO |

|

|

|

DAVID W. MIDDLETON |

|

Executive Vice President and COO |

|

|

|

KEITH LUFT |

|

Vice President, Land and Legal |

|

|

|

GREGG GEGUNDE |

|

Vice President, Development |

|

Front row (seated L to R): |

|

|

|

WILLIAM TANG KONG |

|

Senior Vice President, |

|

Corporate Development |

|

|

|

ANNE THOMSON |

|

Vice President, Exploration |

|

|

|

LUCAS LAW |

|

Vice President, Asset Management |

9

We averaged approximately $31,000 per daily boe in 2006 and $29,500 since the trust conversion. This was a satisfying result given that most industry operators experienced increased capital costs. These efficiencies maximize cash available for distribution, and increase the range of viable opportunities for internal development. We’re targeting further improvements in 2007.

As an E&P company, Penn West had amassed a huge undeveloped land position. By year-end 2006, Penn West still held 28.5 net acres of undeveloped land per producing boe of production – much higher than the energy trust sector’s average of 23.2 acres per producing boe. Our program to monetize up to two million net acres of these lands continued in 2006 with good results. Farm-out partners drilled 169 wells, making a number of discoveries.

By year-end 2006, Penn West still held 28.5 net acres of undeveloped land per boe of production – much higher than the energy trust sector’s average of 23.2 acres per boe.

LONG-TERM UPSIDE OPPORTUNITIES

More than anything, it’s the long-term projects with material upside that distinguish Penn West from most energy trusts.

The project with the fastest near-term growth is our Peace River Oil Sands play (currently centred on Seal Main, Seal Cadotte and Seal North). After spending several years confirming Seal’s technical attributes and positive economics, last year we ramped up the pace of development. Thirty-five new horizontal wells brought production to 3,200 barrels per day by year-end. In addition, 15 new exploratory wells were drilled over our 300,000 net acres of land and speak to the play’s further growth potential. We believe that continuous investment over the next four years has the potential to bring Seal to a planned 20,000 barrels per day using primary recovery techniques.

On February 9, 2007, we announced that we signed an agreement to acquire a package of assets that will significantly bolster our infrastructure and operating presence in the Peace River Oil Sands, including a sales line connected 10,000 barrel per day oil processing facility, a natural gas plant and compression facility with a design capacity of 33 mmcf per day, and associated all weather roads. Following this, there will be further opportunities for infill drilling on developed lands, plus exploration on significant undeveloped acreage. We are planning pilot projects to test enhanced recovery methods involving waterflood, polymer or steam and other thermal processes. Achieving Seal’s full potential will require expanded pipeline capacity running from this rapidly growing oil sands supply region to Edmonton. We’re examining industry interest and potential options. Looking five to 10 years out, we can also see capacity issues related to upgrading/refining bitumen into synthetic light oil. Penn West and other active regional operators may need to consider an upgrader in the producing region or around Edmonton.

The Pembina Cardium is one of the largest conventional light-oil pools ever discovered in Canada, with discovered oil resources in place estimated at 7.8 billion barrels*. Penn West controls approximately 40 percent of the pool and produces substantial high-quality, high-netback, light crude oil under secondary recovery. For several years, we’ve been preparing a long-term program to transform more of the unrecovered resource into marketable reserves using CO2 miscible flooding. This could add to the productivity of this long-life field.

At our Pembina CO2 pilot project, we achieved good injection rates and containment within the target zone, a key technical point. While the pilot oil production using vertical wells continues to increase, we will be expanding our pilot project to apply horizontal well technology to accelerate the production response and improve the capital payout time period.

As a result of delays associated with securing an economic supply of CO2, we estimate that the commercial startup of the project will not occur until 2012.

The Petrofund transaction included participation in several new long-term projects. We gained a prominent working interest in the Weyburn project, the largest commercial CO2 flood in Canada, and an

* Refer to page 103 – Reserve Definitions; note 1.

10

increased interest in the Midale project, a recently launched CO2 flood that uses the same CO2 source as Weyburn (a coal gasification plant in North Dakota).

In 2006, we initiated a pilot project at South Swan Hills for horizontal CBM production from the Mannville coals. Petrofund also increased our unconventional natural gas exposure, a 50-well, commercial-scale CBM project at Three Hills focused on the Horseshoe Canyon coal seams. With our large land and infrastructure positions and ownership of shallower mineral rights, Penn West has a keen interest in the unconventional gas business. While we’re just beginning along the learning curve, we believe it could offer material long-term opportunities.

TAXATION OF INCOME TRUSTS

On October 31, 2006, the Government of Canada announced proposed changes to the taxation of income trusts, including a proposed tax on distributions by income trusts commencing in 2011. The market reaction to the announcement was swift. As an active member of the Canadian Coalition of Energy Trusts, we continue to be involved in informing the Canadian public about the negative impact and potential future consequences of the tax proposal.

UNLEASHING MORE ENERGY – 2007 PLANS AND OUTLOOK

In 2007, Penn West is using its competitive strengths to continue creating value for unitholders. Due to the promising 2007 exploration results in the Peace River Oil Sands, our Board approved an increase in the budgeted capital program in the area. With a capital program currently budgeted at $600-$700 million, excluding acquisitions, we’re pursuing a full range of opportunities. For the short term, we’re optimizing all areas of the conventional business. For the medium term, we’re developing the conventional properties with drilling focused in southern Saskatchewan, southern Alberta, Pembina, and Swan Hills. Work on the long-term projects will continue, with a particular focus on exploration and volume growth in the Peace River Oil Sands. Altogether we expect to drill 260-280 net wells in 2007. Further undeveloped lands will be farmed-out to exploration companies.

Looking forward, commodity prices appear more volatile than in the recent past. Penn West’s 2007 working assumptions are for average benchmark prices of US$59.00 per barrel of West Texas Intermediate crude oil and Cdn$7.25 per thousand cubic feet of natural gas at AECO, with a currency exchange rate averaging US$0.86 equals CAD$1.00. Since converting to an income trust, Penn West has maintained an active commodity risk management program, as summarized on our website at www.pennwest.com.

At these benchmarks and our planned rate of capital spending, Penn West’s production should be 131,000-135,000 boe per day in 2007. This would yield cash flow of $1.3-$1.5 billion using current forward strip prices. With a potentially more active market for the transaction of assets and companies or trusts, we will remain alert for opportunities that would lever our competitive advantages and enable Penn West to acquire strategic assets or dispose of non-core ones.

While our near-term focus is on the tax proposal, our long-term focus is on having a strong business plan that incorporates several of the possible outcomes of the proposal. Meanwhile, we will continue to execute plans for 2007 that will see Penn West work to maintain production volumes and improve capital efficiencies.

At a time when our industry faces greater challenges in attracting and retaining high-quality employees, it’s simply tremendous to witness the commitment, enthusiasm and loyalty of our growing team at Penn West. My thanks go out to all of you for delivering another year of excellent performance and returns for our unitholders. I look forward with optimism to the year ahead.

On behalf of the Board of Directors,

|

/s/ William E. Andrew |

|

|

William E. Andrew |

|

|

President and Chief Executive Officer |

|

|

|

|

|

February 28, 2007 |

|

11

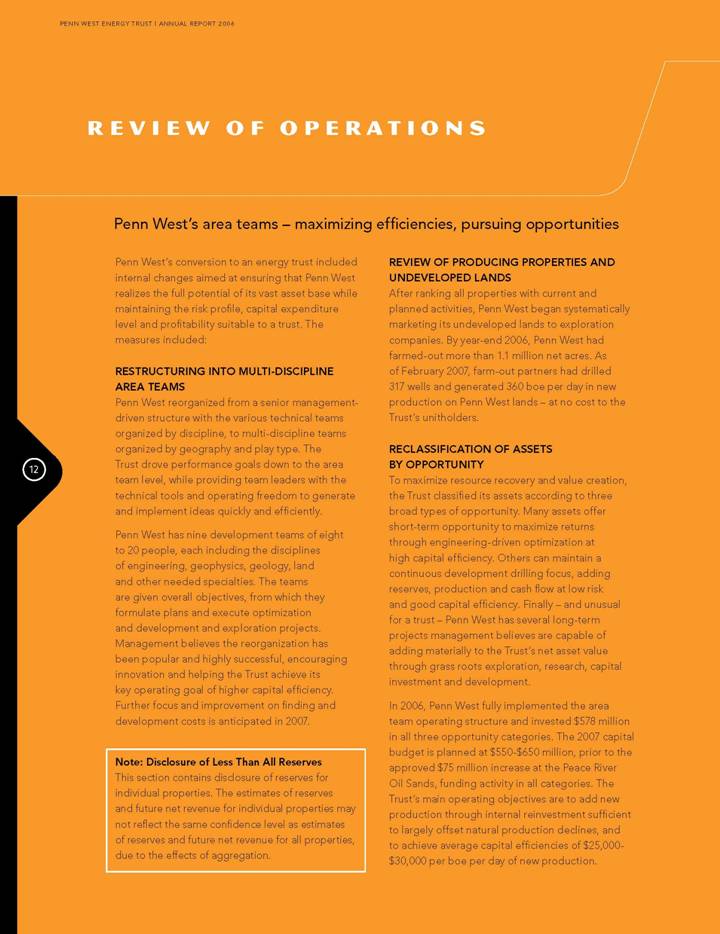

Penn West’s area teams – maximizing efficiencies, pursuing opportunities

Penn West’s conversion to an energy trust included internal changes aimed at ensuring that Penn West realizes the full potential of its vast asset base while maintaining the risk profile, capital expenditure level and profitability suitable to a trust. The measures included:

RESTRUCTURING INTO MULTI-DISCIPLINE AREA TEAMS

Penn West reorganized from a senior management-driven structure with the various technical teams organized by discipline, to multi-discipline teams organized by geography and play type. The Trust drove performance goals down to the area team level, while providing team leaders with the technical tools and operating freedom to generate and implement ideas quickly and efficiently.

Penn West has nine development teams of eight to 20 people, each including the disciplines of engineering, geophysics, geology, land and other needed specialties. The teams are given overall objectives, from which they formulate plans and execute optimization and development and exploration projects. Management believes the reorganization has been popular and highly successful, encouraging innovation and helping the Trust achieve its key operating goal of higher capital efficiency. Further focus and improvement on finding and development costs is anticipated in 2007.

REVIEW OF PRODUCING PROPERTIES AND UNDEVELOPED LANDS

After ranking all properties with current and planned activities, Penn West began systematically marketing its undeveloped lands to exploration companies. By year-end 2006, Penn West had farmed-out more than 1.1 million net acres. As of February 2007, farm-out partners had drilled 317 wells and generated 360 boe per day in new production on Penn West lands – at no cost to the Trust’s unitholders.

RECLASSIFICATION OF ASSETS BY OPPORTUNITY

To maximize resource recovery and value creation, the Trust classified its assets according to three broad types of opportunity. Many assets offer short-term opportunity to maximize returns through engineering-driven optimization at high capital efficiency. Others can maintain a continuous development drilling focus, adding reserves, production and cash flow at low risk and good capital efficiency. Finally – and unusual for a trust – Penn West has several long-term projects management believes are capable of adding materially to the Trust’s net asset value through grass roots exploration, research, capital investment and development.

In 2006, Penn West fully implemented the area team operating structure and invested $578 million in all three opportunity categories. The 2007 capital budget is planned at $550-$650 million, prior to the approved $75 million increase at the Peace River Oil Sands, funding activity in all categories. The Trust’s main operating objectives are to add new production through internal reinvestment sufficient to largely offset natural production declines, and to achieve average capital efficiencies of $25,000- $30,000 per boe per day of new production.

Note: Disclosure of Less Than All Reserves

This section contains disclosure of reserves for individual properties. The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation.

12

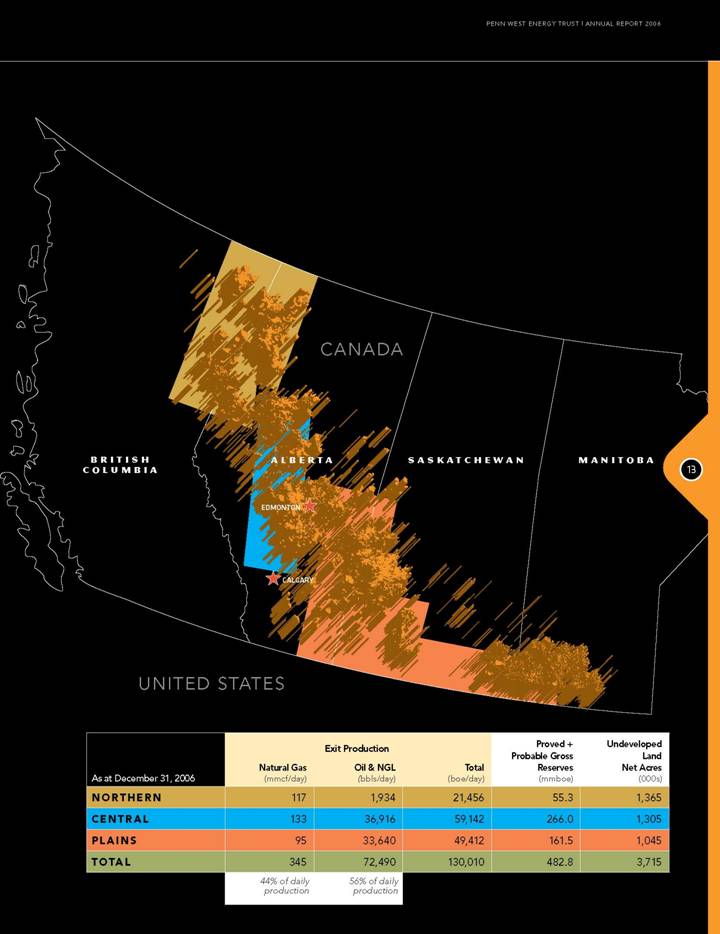

[GRAPHIC]

|

|

|

|

|

|

|

|

|

Proved + |

|

Undeveloped |

|

|

|

|

Exit Production |

|

Probable Gross |

|

Land |

|

||||

|

As at December 31, 2006 |

|

Natural Gas |

|

Oil & NGL |

|

Total |

|

Reserves |

|

Net Acres |

|

|

|

|

(mmcf/day) |

|

(bbls/day) |

|

(boe/day) |

|

(mmboe) |

|

(000s) |

|

|

NORTHERN |

|

117 |

|

1,934 |

|

21,456 |

|

55.3 |

|

1,365 |

|

|

CENTRAL |

|

133 |

|

36,916 |

|

59,142 |

|

266.0 |

|

1,305 |

|

|

PLAINS |

|

95 |

|

33,640 |

|

49,412 |

|

161.5 |

|

1,045 |

|

|

TOTAL |

|

345 |

|

72,490 |

|

130,010 |

|

482.8 |

|

3,715 |

|

|

|

|

44% of daily |

|

56% of daily |

|

|

|

|

|

|

|

13

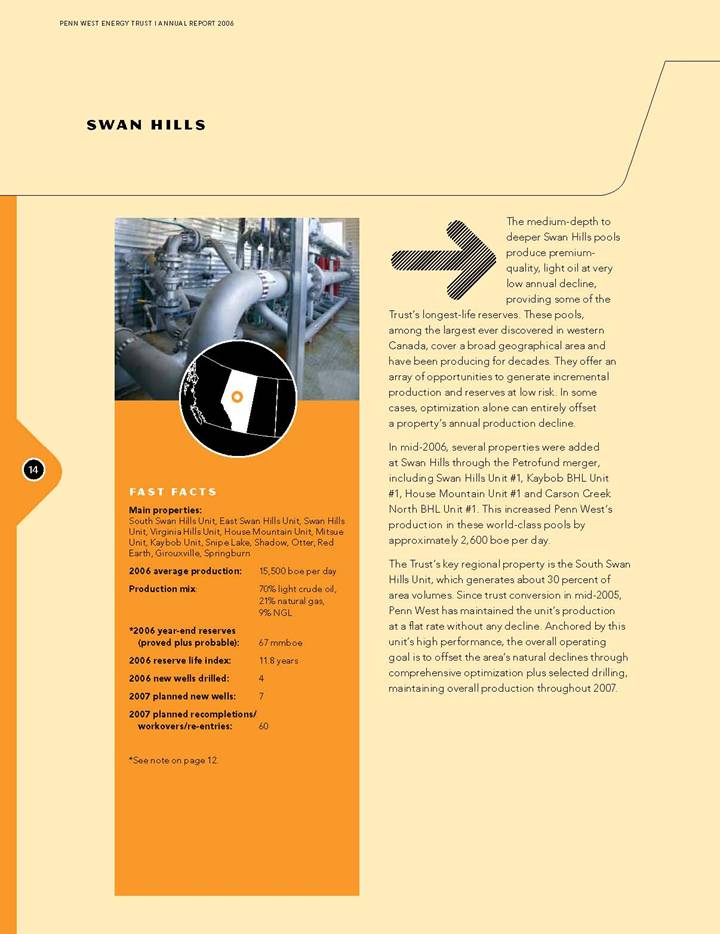

SWAN HILLS

[GRAPHIC]

FAST FACTS

Main properties:

South Swan Hills Unit, East Swan Hills Unit, Swan Hills Unit, Virginia Hills Unit, House Mountain Unit, Mitsue Unit, Kaybob Unit, Snipe Lake, Shadow, Otter, Red Earth, Girouxville, Springburn

|

2006 average production: |

15,500 boe per day |

|

|

|

|

Production mix: |

70% light crude oil, |

|

|

|

|

*2006 year-end reserves (proved plus probable): |

67 mmboe |

|

|

|

|

2006 reserve life index: |

11.8 years |

|

|

|

|

2006 new wells drilled: |

4 |

|

|

|

|

2007 planned new wells: |

7 |

|

|

|

|

2007 planned recompletions/ |

60 |

*See note on page 12.

[GRAPHIC]

The medium-depth to deeper Swan Hills pools produce premium-quality, light oil at very low annual decline, providing some of the Trust’s longest-life reserves. These pools, among the largest ever discovered in western Canada, cover a broad geographical area and have been producing for decades. They offer an array of opportunities to generate incremental production and reserves at low risk. In some cases, optimization alone can entirely offset a property’s annual production decline.

In mid-2006, several properties were added at Swan Hills through the Petrofund merger, including Swan Hills Unit #1, Kaybob BHL Unit #1, House Mountain Unit #1 and Carson Creek North BHL Unit #1. This increased Penn West’s production in these world-class pools by approximately 2,600 boe per day.

The Trust’s key regional property is the South Swan Hills Unit, which generates about 30 percent of area volumes. Since trust conversion in mid-2005, Penn West has maintained the unit’s production at a flat rate without any decline. Anchored by this unit’s high performance, the overall operating goal is to offset the area’s natural declines through comprehensive optimization plus selected drilling, maintaining overall production throughout 2007.

14

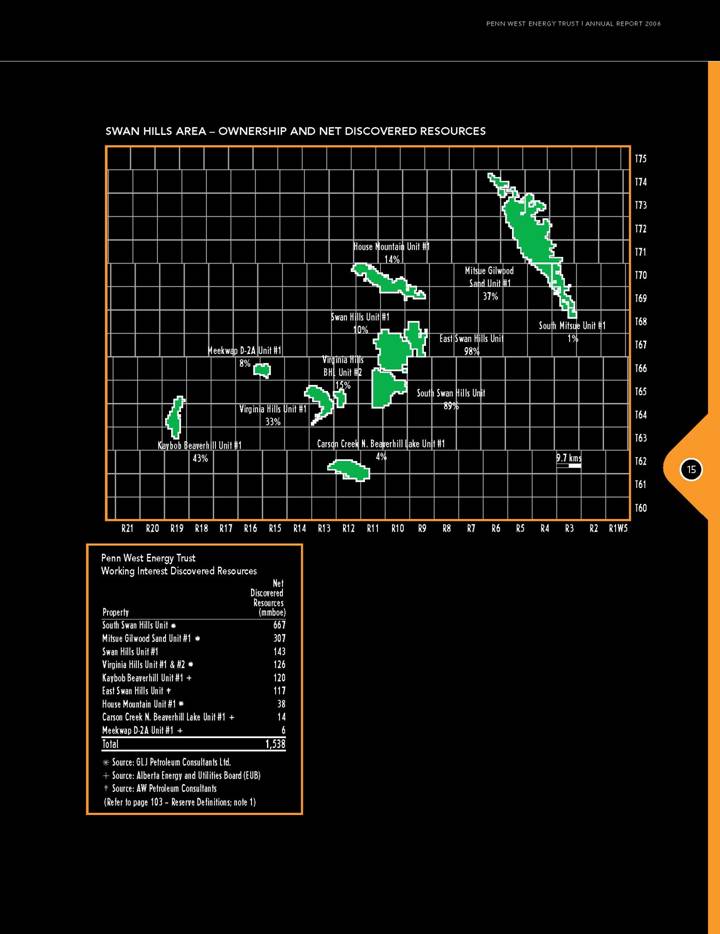

SWAN HILLS AREA – OWNERSHIP AND NET DISCOVERED RESOURCES

[CHART]

Penn West Energy Trust

Working Interest Discovered Resources

|

|

|

Net |

|

|

|

|

Discovered |

|

|

Property |

|

Resources |

|

|

|

|

(mmboe) |

|

|

South Swan Hills Unit * |

|

667 |

|

|

Mitsue Gilwood Sand Unit #1 * |

|

307 |

|

|

Swan Hills Unit #1 |

|

143 |

|

|

Virginia Hills Unit #1 & #2 * |

|

126 |

|

|

Kaybob Beaverhill Unit #1 + |

|

120 |

|

|

East Swan Hills Unit ‡ |

|

117 |

|

|

House Mountain Unit #1 * |

|

38 |

|

|

Carson Creek N. Beaverhill Lake Unit #1 + |

|

14 |

|

|

Meekwap D-2A Unit #1 + |

|

6 |

|

|

Total |

|

1,538 |

|

* Source: GLJ Petroleum Consultants Ltd.

+ Source: Alberta Energy and Utilities Board (EUB)

‡ Source: AW Petroleum Consultants

(Refer to page 103 – Reserve Definitions; note 1)

15

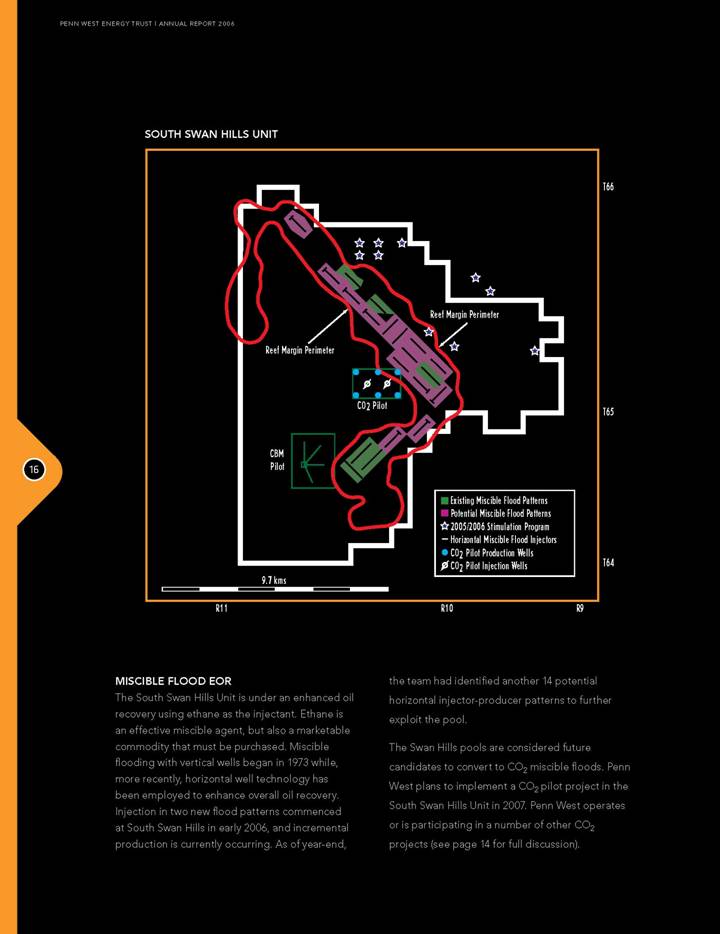

SOUTH SWAN HILLS UNIT

[GRAPHIC]

MISCIBLE FLOOD EOR

The South Swan Hills Unit is under an enhanced oil recovery using ethane as the injectant. Ethane is an effective miscible agent, but also a marketable commodity that must be purchased. Miscible flooding with vertical wells began in 1973 while, more recently, horizontal well technology has been employed to enhance overall oil recovery. Injection in two new flood patterns commenced at South Swan Hills in early 2006, and incremental production is currently occurring. As of year-end, the team had identified another 14 potential horizontal injector-producer patterns to further exploit the pool.

The Swan Hills pools are considered future candidates to convert to CO2 miscible floods. Penn West plans to implement a CO2 pilot project in the South Swan Hills Unit in 2007. Penn West operates or is participating in a number of other CO2 projects (see page 14 for full discussion).

16

CBM POTENTIAL

South Swan Hills is also the site of a coalbed methane (CBM) pilot project that Penn West intends to expand to commercial scale (see page 38 for details). The project overlies existing oil-producing reservoirs, levering Penn West’s extensive legacy infrastructure and experienced staff to limit development and operating costs. The first four CBM wells were on production at the beginning of 2007 and management believes that with success, full-scale development of 30 wells per year has the potential to eventually push production to a planned peak of 40-60 mmcf per day of natural gas. Penn West intends to use saline water produced during the CBM dewatering phase as injectant water for the ongoing secondary recovery waterflood program at Swan Hills, improving efficiencies and reducing unit costs for both projects.

OPTIMIZATION

Altogether Penn West has an inventory of approximately 75 optimization projects throughout the extensive Swan Hills properties. A program of stimulating approximately seven producing wells through acidization or refracturing met with great success in 2006.

In 2006, overall capital efficiencies at Swan Hills were $12,000 per daily boe of new production. There are further optimization opportunities going forward. Single-well batteries will be eliminated and production consolidated in centralized batteries to reduce operating costs, eliminate trucking and increase production ontime. Non-core properties may be rationalized to reduce costs.

DRILLING

Swan Hills holds opportunities to add value through the drillbit. Pools at Otter and Loon can be fully exploited through infill drilling. At Otter, the team sees potential to consolidate fragmented working interests, which would enable consolidation of facilities to improve efficiencies. At Snipe Lake and Shadow, the Gilwood oil potential will be fully realized through infill drilling and improvement of the waterflood. At Mitsue there are under-drilled shallow gas pools that can be infill-drilled to add incremental production.

[GRAPHIC]

17

PEMBINA

[GRAPHIC]

FAST FACTS

Main operated properties:

Pembina Cardium, Carrot Creek, Cherhill, Bigoray, Lobstick, Berland River, North Pembina Cardium Unit, Hanlan

|

2006 average production: |

20,700 boe per day |

|

|

|

|

Production mix: |

55% light crude oil, |

|

|

|

|

*2006 year-end reserves (proved plus probable): |

115 mmboe |

|

|

|

|

2006 reserve life index: |

15.2 years |

|

|

|

|

2006 new wells drilled: |

18 gross wells |

|

|

|

|

2007 planned new wells: |

15 gross wells |

|

|

|

|

2007 planned recompletions/workovers/re-entries: |

Target ~$15 million for projects |

*See note on page 12.

[GRAPHIC]

Pembina produces high-netback, long-life, low-decline light oil and liquids-rich natural gas. Approximately 1,150 operated producing wellbores accounted for 14,400 boe per day or 11 percent of the Trust’s 2006 production. The Petrofund merger further consolidated Penn West’s land position in the area, lifting the average working interest to approximately 87 percent and increasing overall operated volumes by about one-fifth or approximately 2,900 boe per day. Currently the Pembina area is producing approximately 20,700 boe per day when combining operated and non-operated volumes.

The group of properties is centred on the large, long-life Cardium oil pool. The pool’s secondary recovery phase is currently being optimized while the Trust’s EOR team prepares the plans to expand the CO2 flood to other areas (see page 35).

The Pembina field team’s overall focus is on low-risk drilling and low-cost optimization opportunities that are aimed at maximizing income for the Trust’s unitholders and reinvestment capital for Penn West’s long-term growth plays. Costs are kept down and returns maximized by exploiting Penn West’s extensive and dominant network of operated infrastructure, which includes seven gas plants, numerous oil batteries and over 3,000 kilometres of oil and gas gathering lines.

The Pembina Cardium pool is surrounded by lightly drilled lands that management believes have many years worth of opportunities for conventional exploration and development of shallow and deep targets. Pembina has an array of multi-zone potential throughout the area, including the Edmonton Sands, Belly River, Cardium, Glauconite, Ellerslie, Rock Creek, Pekisko, Banff and some deep Swan Hills zones.

18

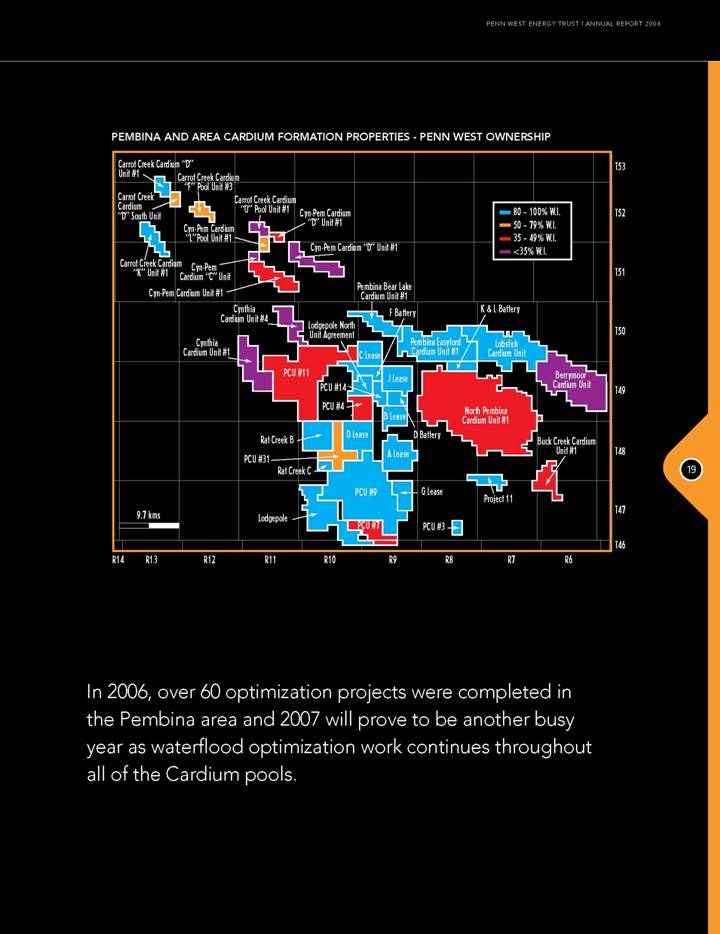

PEMBINA AND AREA CARDIUM FORMATION PROPERTIES - PENN WEST OWNERSHIP

[GRAPHIC]

In 2006, over 60 optimization projects were completed in the Pembina area and 2007 will prove to be another busy year as waterflood optimization work continues throughout all of the Cardium pools.

19

PEMBINA

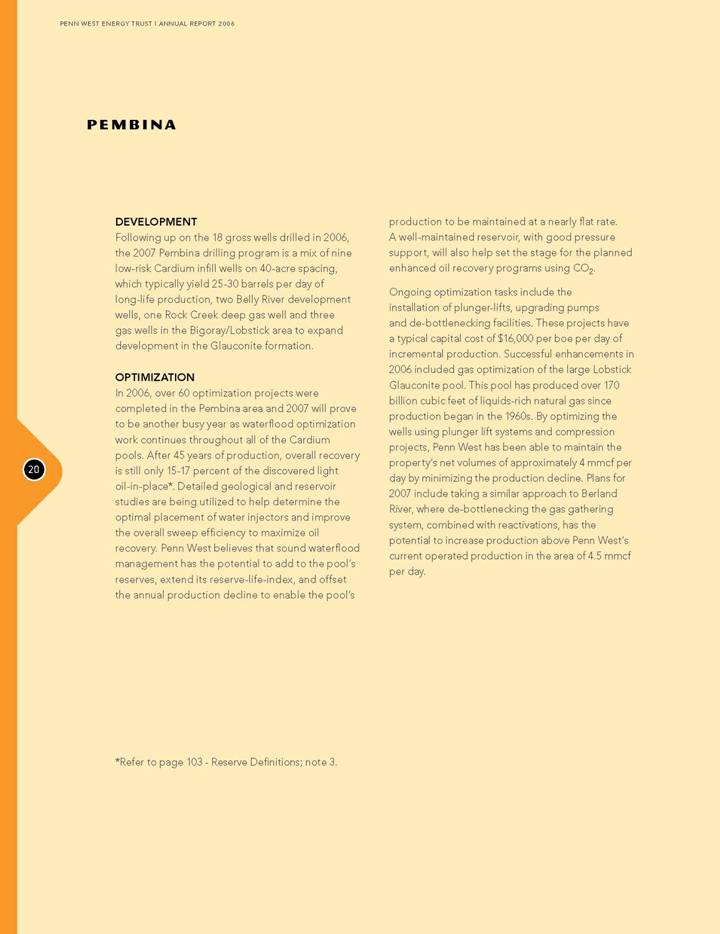

DEVELOPMENT

Following up on the 18 gross wells drilled in 2006, the 2007 Pembina drilling program is a mix of nine low-risk Cardium infill wells on 40-acre spacing, which typically yield 25-30 barrels per day of long-life production, two Belly River development wells, one Rock Creek deep gas well and three gas wells in the Bigoray/Lobstick area to expand development in the Glauconite formation.

OPTIMIZATION

In 2006, over 60 optimization projects were completed in the Pembina area and 2007 will prove to be another busy year as waterflood optimization work continues throughout all of the Cardium pools. After 45 years of production, overall recovery is still only 15-17 percent of the discovered light oil-in-place*. Detailed geological and reservoir studies are being utilized to help determine the optimal placement of water injectors and improve the overall sweep efficiency to maximize oil recovery. Penn West believes that sound waterflood management has the potential to add to the pool’s reserves, extend its reserve-life-index, and offset the annual production decline to enable the pool’s production to be maintained at a nearly flat rate. A well-maintained reservoir, with good pressure support, will also help set the stage for the planned enhanced oil recovery programs using CO2.

Ongoing optimization tasks include the installation of plunger-lifts, upgrading pumps and de-bottlenecking facilities. These projects have a typical capital cost of $16,000 per boe per day of incremental production. Successful enhancements in 2006 included gas optimization of the large Lobstick Glauconite pool. This pool has produced over 170 billion cubic feet of liquids-rich natural gas since production began in the 1960s. By optimizing the wells using plunger lift systems and compression projects, Penn West has been able to maintain the property’s net volumes of approximately 4 mmcf per day by minimizing the production decline. Plans for 2007 include taking a similar approach to Berland River, where de-bottlenecking the gas gathering system, combined with reactivations, has the potential to increase production above Penn West’s current operated production in the area of 4.5 mmcf per day.

* Refer to Page 103 - Reserve Definitions; note 3.

20

WILLESDEN GREEN

[GRAPHIC]

FAST FACTS

Main properties:

Willesden Green, Minnehik-Buck Lake, Redwater, Alder Flats, Crystal, Three Hills, Leafland, Strachan/ Sunchild, Garrington, Fort Saskatchewan

|

2006 average production: |

22,400 boe per day |

|

|

|

|

Production mix: |

26% light crude oil, |

|

|

62% natural gas, |

|

|

12% NGL |

|

|

|

|

*2006 year-end reserves (proved plus probable): |

75 mmboe |

|

|

|

|

2006 reserve life index: |

9.2 years |

|

|

|

|

2006 new wells drilled: |

10 |

|

|

|

|

2007 planned new wells: |

17 |

|

|

|

|

2007 planned recompletions/workovers/re-entries: |

57 wells |

*See note on page 12.

[GRAPHIC]

Located south of Pembina, Willesden Green is also an area of long-life and low-decline light oil and liquids-rich natural gas produced from multiple zones. Control of key legacy infrastructure, including the Minnehik-Buck Lake sour gas processing plant, solidifies the Trust’s regional operating dominance.

The Willesden Green property is an active development area. The 17 new development and exploitation wells planned this year – up from 10 in 2006 – are intended to fully offset natural production declines. The Trust retains deep mineral rights nearly everywhere in the area, enhancing longer-term exploration potential for Penn West or our drilling partners.

The Willesden Green field team also achieved Penn West’s best capital efficiencies in 2006, adding new production through optimization at an average cost of $4,500 per daily boe. Accordingly, the area optimization budget has been doubled for 2007.

DEVELOPMENT

Over the past two years, the production from the Willesden Green property has remained relatively constant due to oil and natural gas well drilling and optimization of the area’s wells and infrastructure. The property has one of the highest netbacks due to its mix of light oil, liquids-rich natural gas, low royalty rates and extremely low operating costs. Penn West controls the area’s oil and natural gas gathering infrastructure that is centred on the 100 percent owned Willesden Green gas plant. In 2006, Penn West de-bottlenecked the plant’s gas gathering and gas processing infrastructure, increasing the capacity to process additional Penn West and third-party volumes. Custom processing of third-party gas generates approximately $3 million per year in revenue, after plant expenses, and results in top quartile operating costs.

21

In 2006, seven infill wells were drilled focusing on the 100 percent working interest Cardium oil and Belly River natural gas pools. Incremental production was more than 800 boe per day and reserves were added for only $10 per boe. Cardium wells are extremely long-life. For example, Penn West’s Cardium production at Willesden Green Cardium Unit #9 had a reserve-life-index of over 22 years at year-end 2006.

In 2007, the team will drill eight wells and will pursue a multi-year program to downspace the Cardium from one well per 80-160 acres to one per 40 acres. The long-term target is to increase recovery in this portion of the pool from 9 percent to 19 percent. A third-party reservoir study will help to optimize infill locations and waterflood performance.

EXPLORATION

At Minnehik-Buck Lake and Crystal, exploration partners are eager to drill the deeper, higher-risk and higher-reward Pekisko and Viking targets. At Strachan, Penn West is working to lever its land base and lower drilling density into a longer-term exploration and development inventory focused on Glauconitic and Mannville targets.

Willesden Green Unit #9 and Non-Unit Production

[CHART]

OPTIMIZATION

With 1,800 wellbores, the Willesden Green area offers extensive potential for well recompletions and stimulation. A typical example would be a well originally drilled into the Basal Belly River, which later became a waterflood injector, and now has uphole potential in the Mannville. Based on historical results, Penn West believes that for approximately $350,000 including fracturing, such wells have the potential to yield 500-600 mcf per day and, being already connected to infrastructure, can be brought on-stream immediately. On the oil side, management believes that refracturing selected Cardium oil wells has the potential to significantly increase production. Six Cardium re-fracs are planned this year.

Gas gathering and compression are also being optimized. The Minnehik-Buck Lake sour gas plant, with a rated capacity of 150 mmcf per day, was upgraded through the installation of on-site power co-generation and electrification of its compressor engines. These projects will reduce the gas plant’s various air pollutants such as nitrogen oxides, carbon monoxide and volatile organic compounds by at least 59 percent. Penn West also increased its interest in the production and plant to approximately 60 percent through the Petrofund merger. Like the Willesden Green plant, it gathers and processes gas for third parties, generating custom fees of $3.25 million to Penn West last year. This increased the plant’s operating efficiency and produced top quartile lifting costs on Penn West’s own production. Penn West sees the potential to add a further 6-10 mmcf per day in custom processing throughput by adding field compression and extending its vast gas gathering infrastructure.

22

WAINWRIGHT

[GRAPHIC]

FAST FACTS

Main properties:

Wainwright, Provost, Marwayne, Wildmere, Lloydminster, Marsden, Sugden

|

2006 average production: |

10,800 boe per day |

|

|

|

|

Production mix: |

6% light crude oil, |

|

|

55% heavy crude oil, |

|

|

39% natural gas |

|

|

|

|

* 2006 year-end reserves (proved plus probable): |

23 mmboe |

|

|

|

|

2006 reserve life index: |

6 years |

|

|

|

|

2006 new wells drilled and put on production: |

27 |

|

|

|

|

2007 planned new wells: |

25 |

|

|

|

|

2007 planned recompletions/workovers/re-entries: |

24 |

*See note on page 12.

[GRAPHIC]

Key characteristics of the Wainwright property group include: extensive developed and undeveloped lands totalling 675,000 net acres, low-decline heavy oil and Viking natural gas production, and widespread infrastructure ownership. These advantages allow Penn West to continually fine-tune operations while adding new production at low risk and cost throughout the area.

In 2006, investment of $17 million funded 200 separate optimization projects. Development drilling added 640 boe per day in new volumes. Complemented by properties acquired at Sugden, Consort, and Ribstone through the Petrofund merger, the long-standing fields of the Wainwright group generated overall volumes of 10,800 boe per day or approximately 8 percent of the Trust’s 2006 exit production.

OIL OPTIMIZATION

With hundreds of producing wellbores, some dating to the late 1940s, the Wainwright region holds a very large optimization inventory. In 2006, the area team focused on older heavy oil wells to improve productivity and reduce costs. Well-by-well field engineering analysis determined the optimal production rate and downhole equipment required this to minimize sand production, reduce watercut and maximize overall efficiency.

23

Hayter, which produces approximately 625 barrels of heavy oil per day, is an optimization success story. Historically, this property had a production decline rate of 15 percent. In 2006, the decline rate was arrested by adding production of 95 barrels of oil per day through six well recompletions in the Sparky and Cummings zones and several reactivations and pump optimization projects. This was accomplished with an investment of $1.1 million resulting in an attractive capital efficiency of $11,500 per barrel of incremental oil production.

As in other regions, the Wainwright team is moving to consolidate single-well batteries. Centralized, pipeline-accessed batteries eliminate crude oil trucking, increase the Trust’s level of solution gas conservation and reduce flaring and venting of otherwise marginal gas production. Battery consolidation typically saves $1,600 per well in monthly trucking costs, making some otherwise marginal wells economical.

NATURAL GAS OPTIMIZATION

Multi-zone shallow gas formations combined with region-wide legacy infrastructure and hundreds of existing wellbores create a large inventory of natural gas optimization projects, well recompletions and low-risk drilling opportunities. Penn West has over 430 wellbores in the regionally extensive Viking Formation and over 290,000 gross acres of prospective Viking land. Based on past experience, Viking wells can produce for decades at low decline rates of typically 15 percent per year.

Historically, a well recompletion yielding production of 30-100 mcf per day can be performed for $75,000-$125,000, if the well is already tied into a gathering system. In addition to the Viking, the team focuses on Mannville, Colorado and Second White Specks zones uphole of the original producing pool. The Colorado is comparable to the “tight gas” plays that other resource players are aggressively pursuing.

At Misty/Monitor, “unloading” water from natural gas wells using small, low-cost pump-jacks raised natural gas production from 2.3 mmcf per day to 3.5 mmcf per day. At Acadia, the Trust relocated gas compressors to optimize field production and purchased rented compressors to cut operating costs. At Esther, a single, centralized, $2 million compressor replaced less efficient multiple compression sites and lifted liquids out of natural gas wellbores to optimize production.

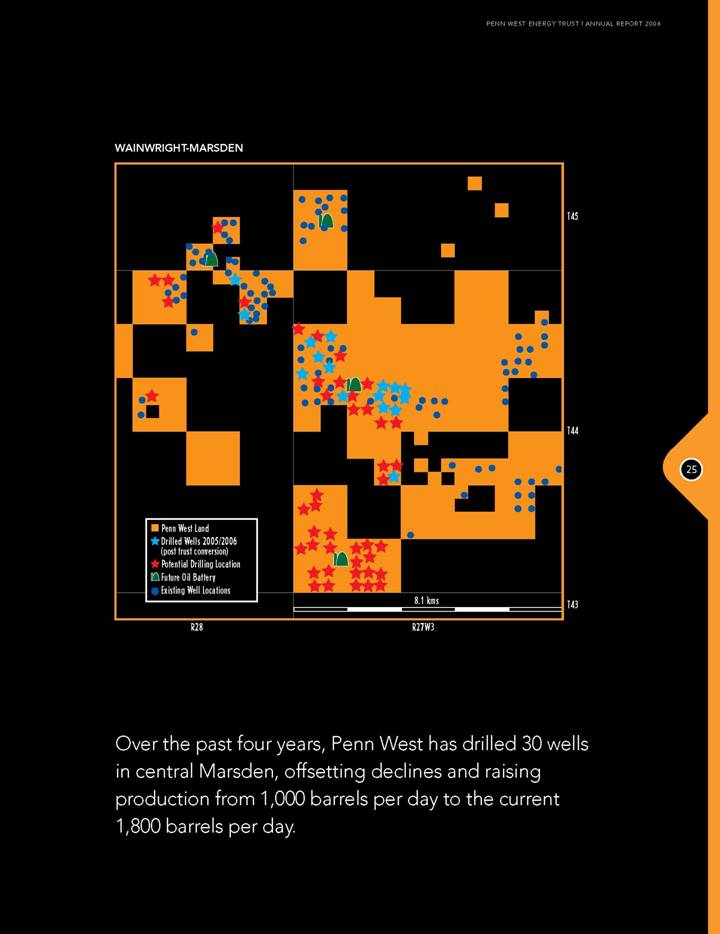

DEVELOPMENT

The Marsden field lies east of the Alberta- Saskatchewan border and consists of approximately 30 sections of mostly 100 percent interest land. In the past, low-risk, low-cost Sparky wells have averaged 30-40 barrels per day of 14° API oil, achieving average capital efficiencies below $20,000 per daily boe added. Over the past four years, Penn West has drilled 30 wells in central Marsden, offsetting declines and raising production from 1,000 barrels per day to the current 1,800 barrels per day. Penn West’s land is relatively underdeveloped and has the potential for 40-50 additional well locations. In 2007, 3-D seismic will be used to identify 15-20 well locations to further extend the pool and identify development well locations for 2008.

In order to reduce operating costs and prepare for secondary recovery employing proven waterflood technology, Penn West intends to undertake an extensive pipeline infrastructure project in 2007. The project is intended to eliminate over 100 individual well tanks and significantly reduce trucking expenses, reduce downtime associated with wet weather road restrictions and increase road safety. It is also intended that natural gas, currently vented, will be gathered and used as fuel at new central facilities or sold. Penn West plans to electrify all wells, reducing propane fuel and maintenance costs and improving reliability.

On the gas side, 10 low-cost gas wells to develop shallow Viking and Mannville gas are planned at Sugden. Success could generate a 100-well Mannville/Viking infill drilling program over the next five to 10 years. In addition, the Trust continues to drill carefully selected new prospects near existing pipelines.

24

WAINWRIGHT-MARSDEN

[GRAPHIC]

Over the past four years, Penn West has drilled 30 wells in central Marsden, offsetting declines and raising production from 1,000 barrels per day to the current 1,800 barrels per day.

25

HOOSIER-COLEVILLE

[GRAPHIC]

FAST FACTS

Main properties:

Hoosier, Milton, Denzil, Coleville Main, Coleville South, Dodsland, Esther, Kerrobert, Glidden

|

2006 average production: |

22,500 boe per day |

|

|

|

|

Production mix: |

8% light crude oil, |

|

|

58% heavy crude oil, |

|

|

34% natural gas |

|

|

|

|

*2006 year-end reserves (proved plus probable): |

58 mmboe |

|

|

|

|

2006 reserve life index: |

7.1 years |

|

|

|

|

2006 new wells drilled: |

97 |

|

|

|

|

2007 planned new wells: |

59 |

|

|

|

|

2007 planned recompletions/workovers/re-entries: |

100 |

*See note on page 12.

[GRAPHIC]

The more than 20 producing properties near the Hoosier field forms one of Penn West’s most active development areas. These mostly Penn West-operated assets include approximately 4,210 producing wellbores, a high average working interest of over 95 percent, extensive Penn West infrastructure and a combined 917,839 net acres of land, of which 395,559 net acres are undeveloped. The Petrofund acquisition added geographically and technically complementary properties to the Hoosier group, increasing the area’s production by 12 percent and reserves by 14 percent.

Hoosier’s primary commodity is cold-pumped conventional heavy oil. The main geological targets are the seismically defined Mannville Group, Bakken and geographically vast Viking horizons, all at depths shallower than 850 metres. Most Bakken wells have two, and sometimes three, zones of interest. These characteristics, combined with the extensive, Penn West-controlled infrastructure, contributes to historically high capital efficiency on development and optimization projects. In addition, Hoosier continues to yield new opportunities for grassroots exploration and development that have the potential to drive meaningful growth.

Penn West drilled 97 wells throughout Hoosier- Coleville in 2006, including 34 vertical oil wells, 16 horizontal oil wells and 47 natural gas wells, demonstrating the breadth of the area’s opportunities. The program added 1,550 barrels per day of crude oil and 4 mmcf per day of natural gas, with additional new capacity “behind-pipe” to be tied-in during 2007.

26

Hoosier continues to yield new opportunities for grassroots exploration and development that have the potential to drive meaningful growth.

EXPLORATION

In 2006, Penn West followed up its Basal Mannville pool discovery made at Glidden in 2005. The 23-well development program grew production to 1,500 barrels per day by the 2006 year-end. Capital costs averaged just $15,000 per boe per day of new production in 2006. Penn West is currently building a $12 million central battery and production gathering network to eliminate trucking costs and initiate a waterflood. Management’s expectations are that the waterflooding of the pool will increase oil recovery from approximately 5 percent to 20 percent.

Glidden Production

[CHART]

Additionally, approximately 1 mmcf per day of vented solution gas will be conserved. It is intended that this solution gas, plus the gas production from a proposed 2007 Viking gas well, will be sold through a new compression facility. The wells in this area have also been electrified to improve reliability. Glidden is the latest of many Penn West growth plays in the Plains area. Penn West is currently exploring a new, seismically defined ont-rend prospect to continue its success in the area.

DEVELOPMENT

At Dodsland, Penn West is evaluating an infill-drilling project for Viking gas. As in Wainwright, the Viking sand is a tighter formation with long reserve life. Typically, the wells initially produce over 150 mcf per day and decline to 50 mcf per day over a long period of time. Six infill wells were drilled and brought on-stream in late 2006. Penn West plans to drill an additional seven downspaced wells with the objective of adding 1 mmcf per day of new natural gas volumes for 2007.

At Denzil, Penn West became active after competitors had become less active. With good results on initial test wells, the team drilled 11 natural gas wells and six oil wells in 2006. In addition to adding natural gas volumes, the program discovered two new oil pools, planned for development in 2007.

At Druid, Penn West followed up on a horizontal Lloydminster Basal Mannville test well drilled in 2005. The new well was drilled up-structure, came on production in December 2006, and is currently pumping at a good oil rate and low watercut. If the two wells continue to perform, they could trigger a large, low-risk development project of several closely spaced horizontal wells.

OPTIMIZATION

In 2006, Penn West launched a comprehensive, area-wide program of electrification in conjunction with SaskPower. A total of 400 producing wells and two facilities were converted from solution gas and propane power to electricity. The combined 20-megawatt load represents the largest stand-alone rural electrification and distribution project in SaskPower’s history. This project was viable because of Penn West’s concentrated and dominant working interest over a large geographic area of west central Saskatchewan.

27

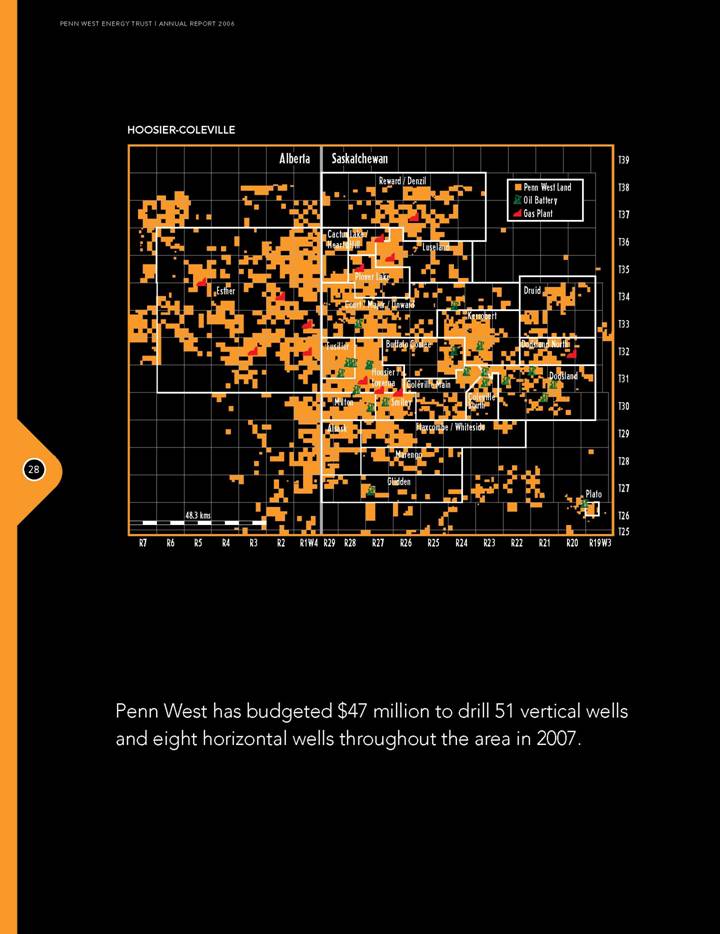

HOOSIER-COLEVILLE

[GRAPHIC]

Penn West has budgeted $47 million to drill 51 vertical wells and eight horizontal wells throughout the area in 2007.

28

This project benefits Penn West and the environment. Electrification will reduce Penn West’s greenhouse gas emissions by an estimated 56,000 tonnes of carbon dioxide-equivalent per year, approximately equivalent to removing 10,000 cars from the road. Operating efficiencies should be improved through reduced downtime of operating equipment and removing the need to refuel individual well motors. Improved ontime alone is estimated to yield incremental production of 5 percent or 400 barrels per day.

In addition, Penn West intends that approximately 1.6 mmcf per day of solution gas, previously flared or burned to power inefficient gas motors, will ultimately be conserved, processed and marketed further reducing greenhouse gas emissions. Solution gas conservation and waterflood optimization will begin this year at Coleville Main under a two-phase, $12 million program.

In Coleville, a significant opportunity remains in the legacy, long-life, low-decline Bakken heavy oil pools. The Coleville Main and South pools are estimated to contain over 0.5 billion barrels* of discovered oil resources in place with only 15 percent recovered since the pools were discovered in 1951. The first task at hand is the fine-tuning of waterflood parameters to maximize production, minimize watercut and control costs. These two pools also offer potential new reserves through heavy oil enhanced recovery methods such as surfactant flooding.

At Kerrobert and Dodsland, long-life, high-netback Viking light oil production is being optimized using small, lower-cost pumpjacks. Penn West will reactivate waterfloods in some of the recently acquired properties in the area. Penn West is also participating in a study being conducted by the Saskatchewan Research Council into improved waterfloods.

2007 PROGRAM

Penn West has budgeted $47 million to drill 51 vertical wells and eight horizontal wells this year throughout the area. The main focus will be oil development, driven by the scope of medium-term opportunities.

Penn West will also continue a medium-term natural gas play begun at Luseland in 2006. Five new wells are planned in the area around a successful 2006 test well that was too far from infrastructure to justify a stand-alone tie-in. Success with this group of wells could open a multi-year natural gas development on an even larger area with current 3-D seismic coverage.

* Refer to page 103 – Reserve Definitions; note 4.

[GRAPHIC]

29

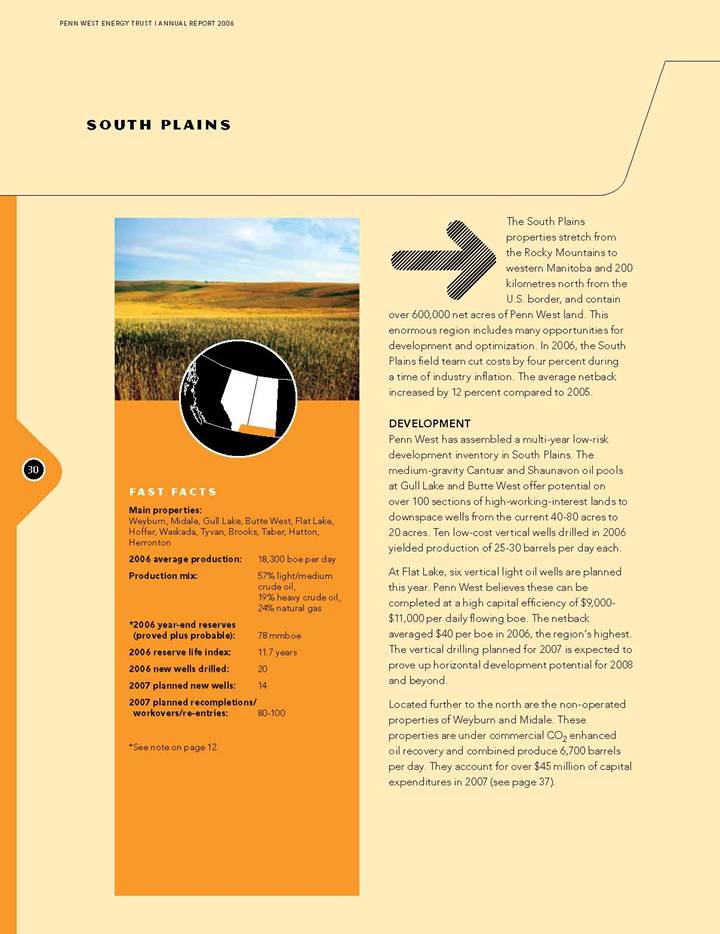

SOUTH PLAINS

[GRAPHIC]

FAST FACTS

Main properties:

Weyburn, Midale, Gull Lake, Butte West, Flat Lake, Hoffer, Waskada, Tyvan, Brooks, Taber, Hatton, Herronton

|

2006 average production: |

|

18,300 boe per day |

|

|

|

|

|

Production mix: |

|

57% light/medium |

|

|

|

crude oil, |

|

|

|

19% heavy crude oil, |

|

|

|

24% natural gas |

|

|

|

|

|

*2006 year-end reserves (proved plus probable): |

|

78 mmboe |

|

|

|

|

|

2006 reserve life index: |

|

11.7 years |

|

|

|

|

|

2006 new wells drilled: |

|

20 |

|

|

|

|

|

2007 planned new wells: |

|

14 |

|

|

|

|

|

2007 planned recompletions/ workovers/re-entries: |

|

80-100 |

*See note on page 12.

[GRAPHIC]

The South Plains properties stretch from the Rocky Mountains to western Manitoba and 200 kilometres north from the U.S. border, and contain over 600,000 net acres of Penn West land. This enormous region includes many opportunities for development and optimization. In 2006, the South Plains field team cut costs by four percent during a time of industry inflation. The average netback increased by 12 percent compared to 2005.

DEVELOPMENT

Penn West has assembled a multi-year low-risk development inventory in South Plains. The medium-gravity Cantuar and Shaunavon oil pools at Gull Lake and Butte West offer potential on over 100 sections of high-working-interest lands to downspace wells from the current 40-80 acres to 20 acres. Ten low-cost vertical wells drilled in 2006 yielded production of 25-30 barrels per day each.

At Flat Lake, six vertical light oil wells are planned this year. Penn West believes these can be completed at a high capital efficiency of $9,000-$11,000 per daily flowing boe. The netback averaged $40 per boe in 2006, the region’s highest. The vertical drilling planned for 2007 is expected to prove up horizontal development potential for 2008 and beyond.

Located further to the north are the non-operated properties of Weyburn and Midale. These properties are under commercial CO2 enhanced oil recovery and combined produce 6,700 barrels per day. They account for over $45 million of capital expenditures in 2007 (see page 37).

30

In 2006, the South Plains team cut costs by four percent during a time of industry inflation.

EXPLORATION

Penn West will participate in the emerging regional deep Bakken oil play. Historically, the 2,800-metre-deep Bakken zone has produced very light oil at typical production rates of 50 barrels per day, with a long reserve life. A successful Bakken test was recently drilled on lands offsetting Penn West’s. The Trust plans to drill several deep Bakken exploration wells at Flat Lake and Tyvan in 2008.

OPTIMIZATION

The South Plains are among Penn West’s most active optimization areas. Under a general program to eliminate single-well batteries, the team is aiming to cut $2 million or $4 per boe in operating costs at Brooks by consolidating three heavy oil batteries into a single super-battery. It is intended that production from the two other fields will be pipelined to the super-battery, eliminating trucking, saving fuel gas, and avoiding road-related seasonal downtime.

At Taber, the team plans to optimize the 40-year-old Mannville oil pools at what management excepts to be a very low capital cost by fine-tuning pump sizing, pump speeds and water injection. Waterflood improvements, including increased injection rates, are planned at several Saskatchewan properties including Flat Lake.

[GRAPHIC]

31

PEACE RIVER OIL SANDS PROJECT

[GRAPHIC]

FAST FACTS

|

*2006 year-end reserves (proved plus probable): |

|

8 million bbls |

|

|

|

|

|

2005 year-end production: |

|

800 bbls per day |

|

|

|

|

|

2006 year-end production: |

|

3,200 bbls per day |

|

|

|

|

|

2007 year-end production target: |

|

5,000-7,000 bbls per day |

|

|

|

|

|

Production mix: |

|

cold-producible heavy oil |

|

|

|

|

|

Development and optimization budget: |

|

$100-$150 million |

|

|

|

|

|

2007 planned new wells: |

|

60-90 horizontal production wells; 20-25 stratigraphic exploration wells |

*See note on page 12.

[GRAPHIC]

Five years ago, Penn West’s Peace River Oil Sands, or Seal, project was a foothold on a few sections of exploratory lands with no production. It is now Penn West’s most exciting project. Activity was ramped up in 2006; production was increased by four-fold and the area saw the completion of critical production facilities. The construction of all-weather access roads, additional exploratory drilling and further land acquisition was also completed in 2006.

Penn West’s Seal development team was formalized on July 1, 2006 when production was 800 barrels per day from 23 producing wells. By year-end, the team had drilled 30 new horizontal wells and production was increased to 3,200 barrels per day. Five stratigraphic wells were drilled to identify new pools for additional phases. Land purchases totalling $13.4 million added 176 sections, bringing Penn West’s land base to 475 sections of oil sands leases at 100 percent working interest. Capital efficiencies to date have averaged $23,000 per barrel per day of production added.

LONG-TERM SCOPE

The Peace River Oil Sands is one of Alberta’s emerging oil sands plays. The reservoir lies at 700 metres average depth. Oil recovery is in situ (not mined), generally using horizontal wells. The heavy oil around Seal is unique as it can be cold-pumped on primary recovery prior to the addition of steam or other modes of heat. The potential of the area was demonstrated when a competitor was recently acquired by an international major company at a price of approximately $180,000 per daily flowing barrel of production.

32

PEACE RIVER OIL SANDS PROJECT

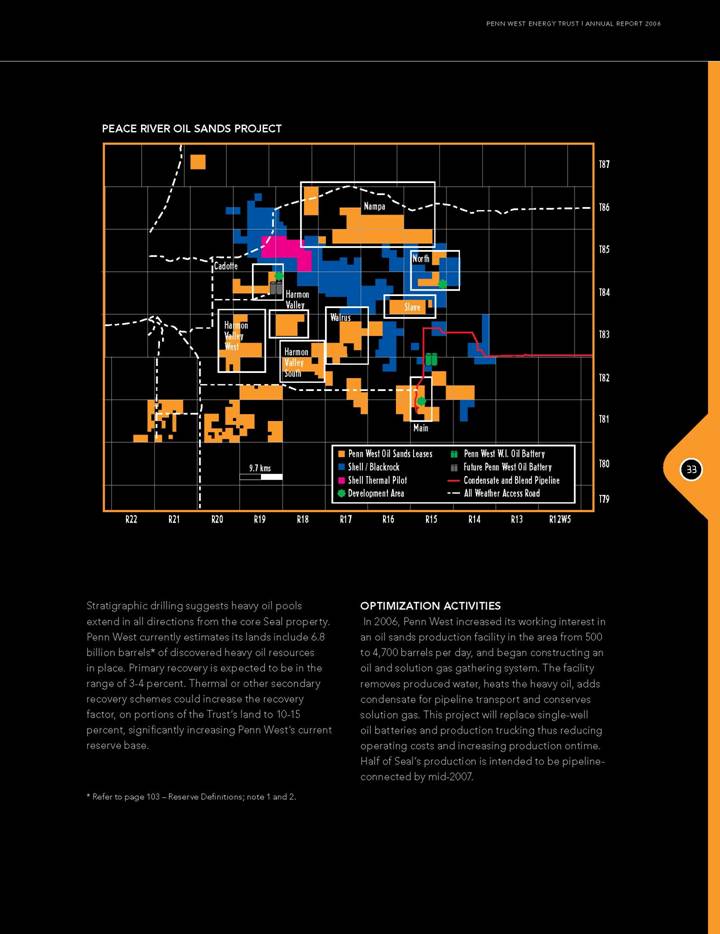

[GRAPHIC]

Stratigraphic drilling suggests heavy oil pools extend in all directions from the core Seal property. Penn West currently estimates its lands include 6.8 billion barrels* of discovered heavy oil resources in place. Primary recovery is expected to be in the range of 3-4 percent. Thermal or other secondary recovery schemes could increase the recovery factor, on portions of the Trust’s land to 10-15 percent, significantly increasing Penn West’s current reserve base.

* Refer to page 103 – Reserve Definitions; note 1 and 2.

OPTIMIZATION ACTIVITIES

In 2006, Penn West increased its working interest in an oil sands production facility in the area from 500 to 4,700 barrels per day, and began constructing an oil and solution gas gathering system. The facility removes produced water, heats the heavy oil, adds condensate for pipeline transport and conserves solution gas. This project will replace single-well oil batteries and production trucking thus reducing operating costs and increasing production ontime. Half of Seal’s production is intended to be pipeline-connected by mid-2007.

33

PEACE RIVER OIL SANDS PROJECT

Other optimization included electrifying operations and maximizing production from existing wells. The Seal team doubled the number of producing wells in 2006 – but quadrupled production. New wells are currently averaging 60 barrels per day, with some producing at 120 barrels per day.

MEDIUM-TERM DEVELOPMENT